| FREE WRITING PROSPECTUS | ||

| FILED PURSUANT TO RULE 433 | ||

| REGISTRATION FILE NO.: 333-226486-15 | ||

|  |

Free Writing Prospectus

Structural and Collateral Term Sheet

$560,539,656

(Approximate Initial Pool Balance)

$464,547,000

(Approximate Aggregate Certificate Balance of Offered Certificates)

Wells Fargo Commercial Mortgage Trust 2020-C57

as Issuing Entity

Wells Fargo Commercial Mortgage Securities, Inc.

as Depositor

UBS AG

LMF Commercial, LLC

Wells Fargo Bank, National Association

Ladder Capital Finance LLC

as Sponsors and Mortgage Loan Sellers

Commercial Mortgage Pass-Through Certificates

Series 2020-C57

August 12, 2020

WELLS FARGO

Co-Lead Manager and Joint Bookrunner | UBS SECURITIES

Co-Lead Manager and Joint Bookrunner | ||

Academy Securities Co-Manager | Drexel Hamilton Co-Manager |

STATEMENT REGARDING THIS FREE WRITING PROSPECTUS

The depositor has filed a registration statement (including a prospectus) with the Securities and Exchange Commission (“SEC”) (SEC File No. 333-226486) for the offering to which this communication relates. Before you invest, you should read the prospectus in the registration statement and other documents the depositor has filed with the SEC for more complete information about the depositor, the issuing entity and this offering. You may get these documents for free by visiting EDGAR on the SEC Web site at www.sec.gov. Alternatively, the depositor, any underwriter, or any dealer participating in the offering will arrange to send you the prospectus after filing if you request it by calling toll free 1-800-745-2063 (8 a.m. – 5 p.m. EST) or by emailing wfs.cmbs@wellsfargo.com.

Nothing in this document constitutes an offer of securities for sale in any jurisdiction where the offer or sale is not permitted. The information contained herein is preliminary as of the date hereof, supersedes any such information previously delivered to you and will be superseded by any such information subsequently delivered and ultimately by the final prospectus relating to the securities. These materials are subject to change, completion, supplement or amendment from time to time.

This free writing prospectus has been prepared by the underwriters for information purposes only and does not constitute, in whole or in part, a prospectus for the purposes of Regulation (EU) 2017/1129 and/or Part VI of the Financial Services and Markets Act 2000, as amended, or other offering document.

STATEMENT REGARDING ASSUMPTIONS AS TO SECURITIES, PRICING ESTIMATES AND OTHER INFORMATION

The attached information contains certain tables and other statistical analyses (the “Computational Materials”) which have been prepared in reliance upon information furnished by the Mortgage Loan Sellers. Numerous assumptions were used in preparing the Computational Materials, which may or may not be reflected herein. As such, no assurance can be given as to the Computational Materials’ accuracy, appropriateness or completeness in any particular context; or as to whether the Computational Materials and/or the assumptions upon which they are based reflect present market conditions or future market performance. The Computational Materials should not be construed as either projections or predictions or as legal, tax, financial or accounting advice. You should consult your own counsel, accountant and other advisors as to the legal, tax, business, financial and related aspects of a purchase of these securities. Any weighted average lives, yields and principal payment periods shown in the Computational Materials are based on prepayment and/or loss assumptions, and changes in such prepayment and/or loss assumptions may dramatically affect such weighted average lives, yields and principal payment periods. In addition, it is possible that prepayments or losses on the underlying assets will occur at rates higher or lower than the rates shown in the attached Computational Materials. The specific characteristics of the securities may differ from those shown in the Computational Materials due to differences between the final underlying assets and the preliminary underlying assets used in preparing the Computational Materials. The principal amount and designation of any security described in the Computational Materials are subject to change prior to issuance. None of Wells Fargo Securities, LLC, UBS Securities LLC, Academy Securities, Inc., Drexel Hamilton, LLC, or any of their respective affiliates, make any representation or warranty as to the actual rate or timing of payments or losses on any of the underlying assets or the payments or yield on the securities. The information in this presentation is based upon management forecasts and reflects prevailing conditions and management’s views as of this date, all of which are subject to change. In preparing this presentation, we have relied upon and assumed, without independent verification, the accuracy and completeness of all information available from public sources or which was provided to us by or on behalf of the Mortgage Loan Sellers or which was otherwise reviewed by us.

This free writing prospectus contains certain forward-looking statements. If and when included in this free writing prospectus, the words “expects”, “intends”, “anticipates”, “estimates” and analogous expressions and all statements that are not historical facts, including statements about our beliefs or expectations, are intended to identify forward-looking statements. Any forward-looking statements are made subject to risks and uncertainties which could cause actual results to differ materially from those stated. Those risks and uncertainties include, among other things, declines in general economic and business conditions, increased competition, changes in demographics, changes in political and social conditions, regulatory initiatives and changes in customer preferences, many of which are beyond our control and the control of any other person or entity related to this offering. The forward-looking statements made in this free writing prospectus are made as of the date stated on the cover. We have no obligation to update or revise any forward-looking statement.

Wells Fargo Securities is the trade name for the capital markets and investment banking services of Wells Fargo & Company and its subsidiaries, including but not limited to Wells Fargo Securities, LLC, a member of NYSE, FINRA, NFA and SIPC, Wells Fargo Prime Services, LLC, a member of FINRA, NFA and SIPC, and Wells Fargo Bank, N.A. Wells Fargo Securities, LLC and Wells Fargo Prime Services, LLC are distinct entities from affiliated banks and thrifts.

IMPORTANT NOTICE REGARDING THE OFFERED CERTIFICATES

The information herein is preliminary and may be supplemented or amended prior to the time of sale. In addition, the Offered Certificates referred to in these materials and the asset pool backing them are subject to modification or revision (including the possibility that one or more classes of certificates may be split, combined or eliminated at any time prior to issuance or availability of a final prospectus) and are offered on a “when, as and if issued” basis.

The underwriters described in these materials may from time to time perform investment banking services for, or solicit investment banking business from, any company named in these materials. The underwriters and/or their affiliates or respective employees may from time to time have a long or short position in any security or contract discussed in these materials.

The information contained herein supersedes any previous such information delivered to any prospective investor and will be superseded by information delivered to such prospective investor prior to the time of sale.

IMPORTANT NOTICE RELATING TO AUTOMATICALLY-GENERATED EMAIL DISCLAIMERS

Any legends, disclaimers or other notices that may appear at the bottom of any email communication to which this free writing prospectus is attached relating to (1) these materials not constituting an offer (or a solicitation of an offer), (2) any representation that these materials are accurate or complete and may not be updated or (3) these materials possibly being confidential, are not applicable to these materials and should be disregarded. Such legends, disclaimers or other notices have been automatically generated as a result of these materials having been sent via Bloomberg or another system.

THE INFORMATION IN THIS COLLATERAL TERM SHEET IS NOT COMPLETE AND MAY BE AMENDED PRIOR TO THE TIME OF SALE. THIS TERM SHEET IS NOT AN OFFER TO SELL THESE SECURITIES AND IT IS NOT A SOLICITATION OF AN OFFER TO BUY THESE SECURITIES IN ANY JURISDICTION WHERE THE OFFER OR SALE IS NOT PERMITTED.

2

| Wells Fargo Commercial Mortgage Trust 2020-C57 | Certificate Structure |

I. Certificate Structure

| Class | Expected Ratings (Fitch/KBRA/Moody’s)(1) | Approximate Initial Certificate Balance or Notional Amount(2) |

Approx. Initial Credit Support(3) | Pass-Through Rate Description | Weighted Average Life (Years)(4) | Expected Principal Window(4) | Certificate Principal to Value Ratio(5) | Certificate Principal U/W NOI Debt Yield(6) | ||

| Offered Certificates | ||||||||||

| A-1 | AAAsf/AAA(sf)/Aaa(sf) | $23,372,000 | 30.500% | (7) | 2.93 | 09/20 – 08/25 | 45.2% | 14.5% | ||

| A-SB | AAAsf/AAA(sf)/Aaa(sf) | $38,042,000 | 30.500% | (7) | 7.20 | 08/25 – 12/29 | 45.2% | 14.5% | ||

| A-3(8) | AAAsf/AAA(sf)/Aaa(sf) | (8)(9) | 30.500% | (7) | (9) | (9) | 45.2% | 14.5% | ||

| A-4(8) | AAAsf/AAA(sf)/Aaa(sf) | (8)(9) | 30.500% | (7) | (9) | (9) | 45.2% | 14.5% | ||

| X-A | AAAsf/AAA(sf)/Aaa(sf) | $389,575,000(10) | N/A | Variable(11) | N/A | N/A | N/A | N/A | ||

| X-B | A-sf/AAA(sf)/NR | $74,972,000(12) | N/A | Variable(13) | N/A | N/A | N/A | N/A | ||

| A-S(8) | AA+sf/AAA(sf)/Aa2(sf) | $28,727,000(8) | 25.375% | (7) | 9.97 | 08/30 – 08/30 | 48.6% | 13.5% | ||

| B | AA-sf/AAA(sf)/NR | $15,415,000 | 22.625% | (7) | 9.97 | 08/30 – 08/30 | 50.4% | 13.1% | ||

| C | A-sf/AA-(sf)/NR | $30,830,000 | 17.125% | (7) | 9.97 | 08/30 – 08/30 | 54.0% | 12.2% | ||

| Non-Offered Certificates | ||||||||||

| X-D(14) | BBBsf/AAA(sf)/NR | $12,738,000(15) | N/A | Variable(16) | N/A | N/A | N/A | N/A | ||

| D(14) | BBBsf/A(sf)/NR | $12,738,000 | 14.853% | (7) | 9.97 | 08/30 – 08/30 | 55.5% | 11.9% | ||

| Risk Retention Certificates | ||||||||||

| E-RR(14) | BBB-sf/A-(sf)/NR | $14,588,000 | 12.250% | (7) | 9.97 | 08/30 – 08/30 | 57.1% | 11.5% | ||

| F-RR | BBB-sf/BBB(sf)/NR | $10,510,000 | 10.375% | (7) | 9.97 | 08/30 – 08/30 | 58.4% | 11.3% | ||

| G-RR | BB+sf/BBB(sf)/NR | $5,606,000 | 9.375% | (7) | 9.97 | 08/30 – 08/30 | 59.0% | 11.2% | ||

| H-RR | BBsf/BBB-(sf)/NR | $6,306,000 | 8.250% | (7) | 9.97 | 08/30 – 08/30 | 59.7% | 11.0% | ||

| J-RR | BB-sf/BB(sf)/NR | $6,306,000 | 7.125% | (7) | 9.97 | 08/30 – 08/30 | 60.5% | 10.9% | ||

| K-RR | B-sf/B+(sf)/NR | $7,707,000 | 5.750% | (7) | 9.97 | 08/30 – 08/30 | 61.4% | 10.7% | ||

| L-RR | NR/B-(sf)/NR | $5,606,000 | 4.750% | (7) | 9.97 | 08/30 – 08/30 | 62.0% | 10.6% | ||

| M-RR | NR/NR/NR | $26,625,655 | 0.000% | (7) | 9.97 | 08/30 – 08/30 | 65.1% | 10.1% | ||

| Notes: | ||||||||||

| (1) | The expected ratings presented are those of Fitch Ratings, Inc. (“Fitch”), Kroll Bond Rating Agency, LLC (“KBRA”) and Moody’s Investors Service, Inc. (“Moody’s”), which the depositor hired to rate the Offered Certificates. One or more other nationally recognized statistical rating organizations that were not hired by the depositor may use information they receive pursuant to Rule 17g-5 under the Securities Exchange Act of 1934, as amended (the “Exchange Act”) or otherwise, to rate or provide market reports and/or published commentary related to the Offered Certificates. We cannot assure you as to what ratings a non-hired nationally recognized statistical rating organization would assign or that its reports will not express differing, possibly negative, views of the mortgage loans and/or the Offered Certificates. The ratings of each Class of Offered Certificates address the likelihood of the timely distribution of interest and, except in the case of the Class X-A and X-B Certificates, the ultimate distribution of principal due on those Classes on or before the Rated Final Distribution Date. See “Risk Factors—Other Risks Relating to the Certificates—Nationally Recognized Statistical Rating Organizations May Assign Different Ratings to the Certificates; Ratings of the Certificates Reflect Only the Views of the Applicable Rating Agencies as of the Dates Such Ratings Were Issued; Ratings May Affect ERISA Eligibility; Ratings May Be Downgraded” and “Ratings” in the Preliminary Prospectus, expected to be dated August 12, 2020 (the “Preliminary Prospectus”). Fitch, KBRA and Moody’s have informed us that the “sf” designation in their ratings represents an identifier for structured finance product ratings. | |||||||||

| (2) | The Certificate Balances and Notional Amounts set forth in the table are approximate. The actual initial Certificate Balances and Notional Amounts may be larger or smaller depending on the initial pool balance of the mortgage loans definitively included in the pool of mortgage loans, which aggregate cut-off date balance may be as much as 5% larger or smaller than the amount presented in the Preliminary Prospectus. In addition, the Notional Amounts of the Class X-A, X-B and X-D Certificates may vary depending upon the final pricing of the Classes of Principal Balance Certificates (as defined below) or trust components whose Certificate Balances comprise such Notional Amounts, and, if, as a result of such pricing, the pass-through rate of the Class X-A, X-B or X-D Certificates, as applicable, would be equal to zero at all times, such Class of Certificates may not be issued on the closing date of this securitization. | |||||||||

| (3) | The approximate initial credit support with respect to the Class A-1, A-SB, A-3 and A-4 Certificates represents the approximate credit enhancement for the Class A-1, A-SB, A-3 and A-4 Certificates in the aggregate, taking into account the Certificate Balances of the Class A-3 and Class A-4 trust components. The approximate initial credit support set forth for the Class A-S certificates represents the approximate initial credit enhancement for the underlying Class A-S trust component. | |||||||||

| (4) | Weighted Average Lives and Expected Principal Windows are calculated based on an assumed prepayment rate of 0% CPR and the “Structuring Assumptions” described under “Yield and Maturity Considerations—Weighted Average Life” in the Preliminary Prospectus. | |||||||||

| (5) | The Certificate Principal to Value Ratio for each Class of Certificates (other than the Class A-1, A-SB, A-3 and A-4 Certificates) is calculated as the product of (a) the weighted average Cut-off Date LTV Ratio for the mortgage loans and (b) a fraction, the numerator of which is the total initial Certificate Balance of such Class of Certificates and all Classes of Principal Balance Certificates (or, with respect to the Class A-3, Class A-4 or Class A-S Certificates, the trust component with the same alphanumeric designation) senior to such Class of Certificates and the denominator of which is the total initial Certificate Balance of all of the Classes of Principal Balance Certificates (or, with respect to the Class A-3, Class A-4 or Class A-S Certificates, the trust component with the same alphanumeric designation). The Certificate Principal to Value Ratio for each of the Class A-1, A-SB, A-3 and A-4 Certificates is calculated in the aggregate for those Classes as if they were a single Class and is calculated as the product of (a) the weighted average Cut-off Date LTV Ratio for the mortgage loans and (b) a fraction, the numerator of which is the total initial Certificate Balance of such Classes of Certificates (or, with respect to the Class A-3 or A-4 Certificates, the trust component with the same alphanumeric designation) and the denominator of which is the total initial Certificate Balance of all of the Classes of Principal Balance Certificates (or, with respect to the Class A-3, Class A-4 or Class A-S Certificates, the trust component with the same alphanumeric designation). In any event, however, excess mortgaged property value associated with a mortgage loan will not be available to offset losses on any other mortgage loan. | |||||||||

THE INFORMATION IN THIS COLLATERAL TERM SHEET IS NOT COMPLETE AND MAY BE AMENDED PRIOR TO THE TIME OF SALE. THIS TERM SHEET IS NOT AN OFFER TO SELL THESE SECURITIES AND IT IS NOT A SOLICITATION OF AN OFFER TO BUY THESE SECURITIES IN ANY JURISDICTION WHERE THE OFFER OR SALE IS NOT PERMITTED.

3

| Wells Fargo Commercial Mortgage Trust 2020-C57 | Certificate Structure |

| (6) | The Certificate Principal U/W NOI Debt Yield for each Class of Certificates (other than the Class A-1, A-SB, A-3 and A-4 Certificates) is calculated as the product of (a) the weighted average U/W NOI Debt Yield for the mortgage loans and (b) a fraction, the numerator of which is the total initial Certificate Balance of all of the Classes of Principal Balance Certificates (or, with respect to the Class A-3, Class A-4 or Class A-S Certificates, the trust component with the same alphanumeric designation) and the denominator of which is the total initial Certificate Balance of such Class of Certificates and all Classes of Principal Balance Certificates (or, with respect to the Class A-3, Class A-4 or Class A-S Certificates, the trust component with the same alphanumeric designation) senior to such Class of Certificates. The Certificate Principal U/W NOI Debt Yield for each of the Class A-1, A-SB, A-3 and A-4 Certificates is calculated in the aggregate for those Classes as if they were a single Class and is calculated as the product of (a) the weighted average U/W NOI Debt Yield for the mortgage loans and (b) a fraction, the numerator of which is the total initial Certificate Balance of all of the Classes of Principal Balance Certificates (or, with respect to the Class A-3, Class A-4 or Class A-S Certificates, the trust component with the same alphanumeric designation) and the denominator of which is the total initial Certificate Balance of such Classes of Certificates (or, with respect to the Class A-3 and Class A-4 Certificates, the trust component with the same alphanumeric designation). In any event, however, cash flow from each mortgaged property supports only the related mortgage loan and will not be available to support any other mortgage loan. | |||||||||

| (7) | The pass-through rates for the Class A-1, A-SB, A-3, A-4, A-S, B, C, D, E-RR, F-RR, G-RR, H-RR, J-RR, K-RR, L-RR and M-RR Certificates in each case will be one of the following: (i) a fixed rate per annum, (ii) a variable rate per annum equal to the weighted average of the net mortgage interest rates on the mortgage loans for the related distribution date, (iii) a variable rate per annum equal to the lesser of (a) a fixed rate and (b) the weighted average of the net mortgage interest rates on the mortgage loans for the related distribution date or (iv) a variable rate per annum equal to the weighted average of the net mortgage interest rates on the mortgage loans for the related distribution date minus a specified percentage. For purposes of the calculation of the weighted average of the net mortgage interest rates on the mortgage loans for each distribution date, the mortgage interest rates will be adjusted as necessary to a 30/360 basis. | |||||||||

| (8) | The Class A-3-1, A-3-2, A-3-X1, A-3-X2, A-4-1, A-4-2, A-4-X1, A-4-X2, A-S-1, A-S-2, A-S-X1 and A-S-X2 Certificates are also offered certificates. Such Classes of Certificates, together with the Class A-3, Class A-4 and Class A-S Certificates, constitute the “Exchangeable Certificates”. The Class A-1, A-SB, B, C, D, E-RR, F-RR, G-RR, H-RR, J-RR, K-RR, L-RR and M-RR Certificates, together with the Exchangeable Certificates with a Certificate Balance, are referred to as the “Principal Balance Certificates.” Each class of Exchangeable Certificates will have the Certificate Balance or Notional Amount and pass-through rate described below under “Exchangeable Certificates.” | |||||||||

| (9) | The exact initial Certificate Balances or Notional Amounts of the Class A-3, Class A-3-X1, Class A-3-X2, Class A-4, Class A-4-X1 and Class A-4-X2 trust components (and consequently, the exact aggregate initial Certificate Balances or Notional Amounts of the Exchangeable Certificates with an “A-3” or “A-4” designation) are unknown and will be determined based on the final pricing of the Certificates. However, the initial Certificate Balances, weighted average lives and principal windows of the Class A-3 and Class A-4 trust components are expected to be within the applicable ranges reflected in the following chart. The aggregate initial Certificate Balance of the Class A-3 and Class A-4 trust components is expected to be approximately $328,161,000, subject to a variance of plus or minus 5%. The Class A-3-X1 and Class A-3-X2 trust components will have initial Notional Amounts equal to the initial Certificate Balance of the Class A-3 trust component. The Class A-4-X1 and Class A-4-X2 trust components will have initial Notional Amounts equal to the initial Certificate Balance of the Class A-4 trust component. In the event that the Class A-4 Certificates are issued at $328,161,000, the Class A-3 Certificates will not be issued. Trust Components Expected Range of Approximate Initial Certificate Balance Expected Range of Weighted Average Life (Years) Expected Range of Principal Window Class A-3 $0 - $160,000,000 N/A – 9.47 N/A / 12/29 – 03/30 Class A-4 $168,161,000 - $328,161,000 9.56 – 9.64 12/29 – 08/30 / 03/30 – 08/30 | |||||||||

Trust Components | Expected Range of | Expected Range of | Expected Range of Principal Window |

| Class A-3 | $0 - $160,000,000 | N/A – 9.47 | N/A / 12/29 – 03/30 |

| Class A-4 | $168,161,000 - $328,161,000 | 9.56 – 9.64 | 12/29 – 08/30 / 03/30 – 08/30 |

| (10) | The Class X-A Certificates are notional amount certificates. The Notional Amount of the Class X-A Certificates will be equal to the aggregate Certificate Balance of the Class A-1 and A-SB Certificates and the Class A-3 and A-4 trust components outstanding from time to time. The Class X-A Certificates will not be entitled to distributions of principal. | |||||||||

| (11) | The pass-through rate for the Class X-A Certificates for any distribution date will be a per annum rate equal to the excess, if any, of (a) the weighted average of the net mortgage interest rates on the mortgage loans for the related distribution date, over (b) the weighted average of the pass-through rates on the Class A-1 and A-SB Certificates and the Class A-3, A-3-X1, A-3-X2, A-4, A-4-X1 and A-4-X2 trust components for the related distribution date, weighted on the basis of their respective Certificate Balances or Notional Amounts outstanding immediately prior to that distribution date (but excluding trust components with a Notional Amount in the denominator of such weighted average calculation). For purposes of the calculation of the weighted average of the net mortgage interest rates on the mortgage loans for each distribution date, the mortgage interest rates will be adjusted as necessary to a 30/360 basis. | |||||||||

| (12) | The Class X-B Certificates are notional amount certificates. The Notional Amount of the Class X-B Certificates will be equal to the aggregate Certificate Balance of the Class A-S trust component and the Class B and C Certificates outstanding from time to time. The Class X-B Certificates will not be entitled to distributions of principal. | |||||||||

| (13) | The pass-through rate for the Class X-B Certificates for any distribution date will be a per annum rate equal to the excess, if any, of (a) the weighted average of the net mortgage interest rates on the mortgage loans for the related distribution date, over (b) the weighted average of the pass-through rates on the Class A-S, A-S-X1 and A-S-X2 trust components and the Class B and C Certificates for the related distribution date, weighted on the basis of their respective Certificate Balances or Notional Amounts outstanding immediately prior to that distribution date (but excluding trust components with a Notional Amount in the denominator of such weighted average calculation). For purposes of the calculation of the weighted average of the net mortgage interest rates on the mortgage loans for each distribution date, the mortgage interest rates will be adjusted as necessary to a 30/360 basis. | |||||||||

| (14) | The initial Notional Amount of the Class X-D Certificates and the initial Certificate Balance of each of the Class D and E-RR Certificates are subject to change based on final pricing of all Certificates and the final determination of the Class E-RR, F-RR, G-RR, H-RR, J-RR, K-RR, L-RR and M-RR Certificates (collectively, the “horizontal risk retention certificates”) that will be retained by the retaining sponsor through a third party purchaser as part of the U.S. risk retention requirements. For more information regarding the methodology and key inputs and assumptions used to determine the sizing of the horizontal risk retention certificates, see “Credit Risk Retention” in the Preliminary Prospectus. | |||||||||

| (15) | The Class X-D Certificates are notional amount certificates. The Notional Amount of the Class X-D Certificates will be equal to the Certificate Balance of the Class D Certificates outstanding from time to time. The Class X-D Certificates will not be entitled to distributions of principal. | |||||||||

| (16) | The pass-through rate for the Class X-D Certificates for any distribution date will be a per annum rate equal to the excess, if any, of (a) the weighted average of the net mortgage interest rates on the mortgage loans for the related distribution date, over (b) the pass-through rate on the Class D Certificates for the related distribution date. For purposes of the calculation of the weighted average of the net mortgage interest rates on the mortgage loans for each distribution date, the mortgage interest rates will be adjusted as necessary to a 30/360 basis. | |||||||||

THE INFORMATION IN THIS COLLATERAL TERM SHEET IS NOT COMPLETE AND MAY BE AMENDED PRIOR TO THE TIME OF SALE. THIS TERM SHEET IS NOT AN OFFER TO SELL THESE SECURITIES AND IT IS NOT A SOLICITATION OF AN OFFER TO BUY THESE SECURITIES IN ANY JURISDICTION WHERE THE OFFER OR SALE IS NOT PERMITTED.

4

| Wells Fargo Commercial Mortgage Trust 2020-C57 | Transaction Highlights |

II. Transaction Highlights

Mortgage Loan Sellers:

Mortgage Loan Seller | Number of | Number of | Aggregate Cut-off | % of Initial |

| UBS AG | 12 | 17 | $194,331,499 | 34.7% |

| LMF Commercial, LLC | 12 | 28 | 164,873,789 | 29.4 |

| Wells Fargo Bank, National Association | 7 | 7 | 141,071,000 | 25.2 |

| Ladder Capital Finance LLC | 9 | 19 | 60,263,368 | 10.8 |

Total | 40 | 71 | $560,539,656 | 100.0% |

Loan Pool:

| Initial Pool Balance: | $560,539,656 |

| Number of Mortgage Loans: | 40 |

| Average Cut-off Date Balance per Mortgage Loan: | $14,013,491 |

| Number of Mortgaged Properties: | 71 |

| Average Cut-off Date Balance per Mortgaged Property(1): | $7,894,925 |

| Weighted Average Mortgage Interest Rate: | 4.048% |

| Ten Largest Mortgage Loans as % of Initial Pool Balance: | 56.9% |

| Weighted Average Original Term to Maturity or ARD (months): | 120 |

| Weighted Average Remaining Term to Maturity or ARD (months): | 117 |

| Weighted Average Original Amortization Term (months)(2): | 360 |

| Weighted Average Remaining Amortization Term (months)(2): | 359 |

| Weighted Average Seasoning (months): | 3 |

| (1) | Information regarding mortgage loans secured by multiple properties is based on an allocation according to relative appraised values or the allocated loan amounts or property-specific release prices set forth in the related loan documents or such other allocation as the related mortgage loan seller deemed appropriate. |

| (2) | Excludes any mortgage loan that does not amortize. |

Credit Statistics:

| Weighted Average U/W Net Cash Flow DSCR(1)(2): | 1.80x |

| Weighted Average U/W Net Operating Income Debt Yield(1)(2): | 10.1% |

| Weighted Average Cut-off Date Loan-to-Value Ratio(1)(2): | 65.1% |

| Weighted Average Balloon or ARD Loan-to-Value Ratio(1)(2): | 57.1% |

| % of Mortgage Loans with Additional Subordinate Debt(3): | 5.4% |

| % of Mortgage Loans with Single Tenants(4): | 13.9% |

| (1) | With respect to any mortgage loan that is part of a whole loan, loan-to-value ratio, debt service coverage ratio and debt yield calculations include the related pari passu companion loan(s) but exclude any related subordinate companion loan(s) (unless otherwise stated). The debt service coverage ratio, debt yield and loan-to-value ratio information do not take into account any subordinate debt (whether or not secured by the related mortgaged property), that currently exists or is allowed under the terms of any mortgage loan. See “Description of the Mortgage Pool—Mortgage Pool Characteristics” in the Preliminary Prospectus and Annex A-1 to the Preliminary Prospectus. |

| (2) | For many of the mortgage loans, underwritten net cash flow, underwritten net operating income and appraised values of the related mortgaged properties were determined, or were calculated based on information as of a date, prior to the emergence of the novel coronavirus pandemic and the economic disruption resulting from measures to combat the pandemic, and the loan-to-value, debt service coverage and debt yield metrics presented in this term sheet may not reflect current market conditions. |

| (3) | The percentage figure expressed as “% of Mortgage Loans with Additional Subordinate Debt” is determined as a percentage of the initial pool balance and does not take into account any future subordinate debt (whether or not secured by the mortgaged property), if any, that may be permitted under the terms of any mortgage loan or the pooling and servicing agreement. See “Description of the Mortgage Pool—Additional Indebtedness” in the Preliminary Prospectus. |

| (4) | Excludes mortgage loans that are secured by multiple single tenant properties. |

THE INFORMATION IN THIS COLLATERAL TERM SHEET IS NOT COMPLETE AND MAY BE AMENDED PRIOR TO THE TIME OF SALE. THIS TERM SHEET IS NOT AN OFFER TO SELL THESE SECURITIES AND IT IS NOT A SOLICITATION OF AN OFFER TO BUY THESE SECURITIES IN ANY JURISDICTION WHERE THE OFFER OR SALE IS NOT PERMITTED.

5

| Wells Fargo Commercial Mortgage Trust 2020-C57 | Transaction Highlights |

Loan Structural Features:

Amortization: Based on the Initial Pool Balance, 78.8% of the mortgage pool (28 mortgage loans) has scheduled amortization, as follows:

49.3% (12 mortgage loans) provides for an interest-only period followed by an amortization period; and

29.5% (16 mortgage loans) requires amortization during the entire loan term.

Interest-Only: Based on the Initial Pool Balance, 21.2% of the mortgage pool (12 mortgage loans) provides for interest-only payments during the entire loan term through maturity or ARD. The Weighted Average Cut-off Date Loan-to-Value Ratio and Weighted Average U/W Net Cash Flow DSCR for those mortgage loans are 59.6% and 2.40x, respectively.

Hard Lockboxes: Based on the Initial Pool Balance, 41.6% of the mortgage pool (17 mortgage loans) have hard lockboxes in place.

Reserves: The mortgage loans require amounts to be escrowed monthly as follows (excluding any mortgage loans with springing provisions):

| Real Estate Taxes: | 79.7% of the pool |

| Insurance: | 60.6% of the pool |

| Capital Replacements: | 80.0% of the pool |

| TI/LC: | 44.6% of the pool(1) |

| (1) The percentage of Initial Pool Balance for mortgage loans with TI/LC reserves is based on the aggregate principal balance allocable to loans that include office, retail and industrial properties. | |

Call Protection/Defeasance: Based on the Initial Pool Balance, the mortgage pool has the following call protection and defeasance features:

82.1% of the mortgage pool (28 mortgage loans) features a lockout period, then defeasance only until an open period;

11.5% of the mortgage pool (5 mortgage loans) features a lockout period, then the greater of a prepayment premium (1%) or yield maintenance until an open period;

4.5% of the mortgage pool (1 mortgage loan) features a lockout period, then the greater of a prepayment premium (2%) or yield maintenance until an open period;

1.0% of the mortgage pool (1 mortgage loan) features a lockout period, then the greater of a prepayment premium (1%) or yield maintenance, or defeasance until an open period; and

0.8% of the mortgage pool (5 mortgage loans) features yield maintenance, then yield maintenance or defeasance until an open period.

Prepayment restrictions for each mortgage loan reflect the entire life of the mortgage loan. Please refer to Annex A-1 to the Preliminary Prospectus and the footnotes related thereto for further information regarding individual loan call protection.

THE INFORMATION IN THIS COLLATERAL TERM SHEET IS NOT COMPLETE AND MAY BE AMENDED PRIOR TO THE TIME OF SALE. THIS TERM SHEET IS NOT AN OFFER TO SELL THESE SECURITIES AND IT IS NOT A SOLICITATION OF AN OFFER TO BUY THESE SECURITIES IN ANY JURISDICTION WHERE THE OFFER OR SALE IS NOT PERMITTED.

6

| Wells Fargo Commercial Mortgage Trust 2020-C57 | Transaction Highlights |

III. COVID-19 Update

The following table contains information regarding the status of the mortgage loans and mortgaged properties provided by the respective borrowers as of the date set forth in the “Information As Of Date” column. The cumulative effects of the COVID-19 emergency on the global economy may cause tenants to be unable to pay their rent and borrowers to be unable to pay debt service under the mortgage loans. As a result, we cannot assure you that the information in the following table is indicative of future performance or that tenants or borrowers will not seek rent or debt service relief (including forbearance arrangements) or other lease or loan modifications in the future. Such actions may lead to shortfalls and losses on the certificates. Any information in the following table will be superseded by the information contained under the heading “Description of the Mortgage Pool—COVID-19 Considerations” in the Preliminary Prospectus.

| Mortgage Loan Seller | Information As Of Date | Origination Date | Mortgaged Property Name | Mortgaged Property Type | June Debt Service Payment Received (Y/N) | July Debt Service Payment Received (Y/N) | August Debt Service Payment Received (Y/N) | Forbearance or Other Debt Service Relief Requested (Y/N) | Other Loan Modification Requested (Y/N) | Lease Modification or Rent Relief Requested (Y/N) | Total SF or Unit Count Making Full June Rent Payment (%) | UW June Base Rent Paid (%) | Total SF or Unit Count Making Full July Rent Payment (%) | UW July Base Rent Paid (%) |

| LMF | 7/28/2020 | 7/21/2020 | PGH17 Self Storage Portfolio | Self Storage | NAP(1) | NAP(1) | NAP(1) | N | N | NAV | (2) | (2) | (2) | (2) |

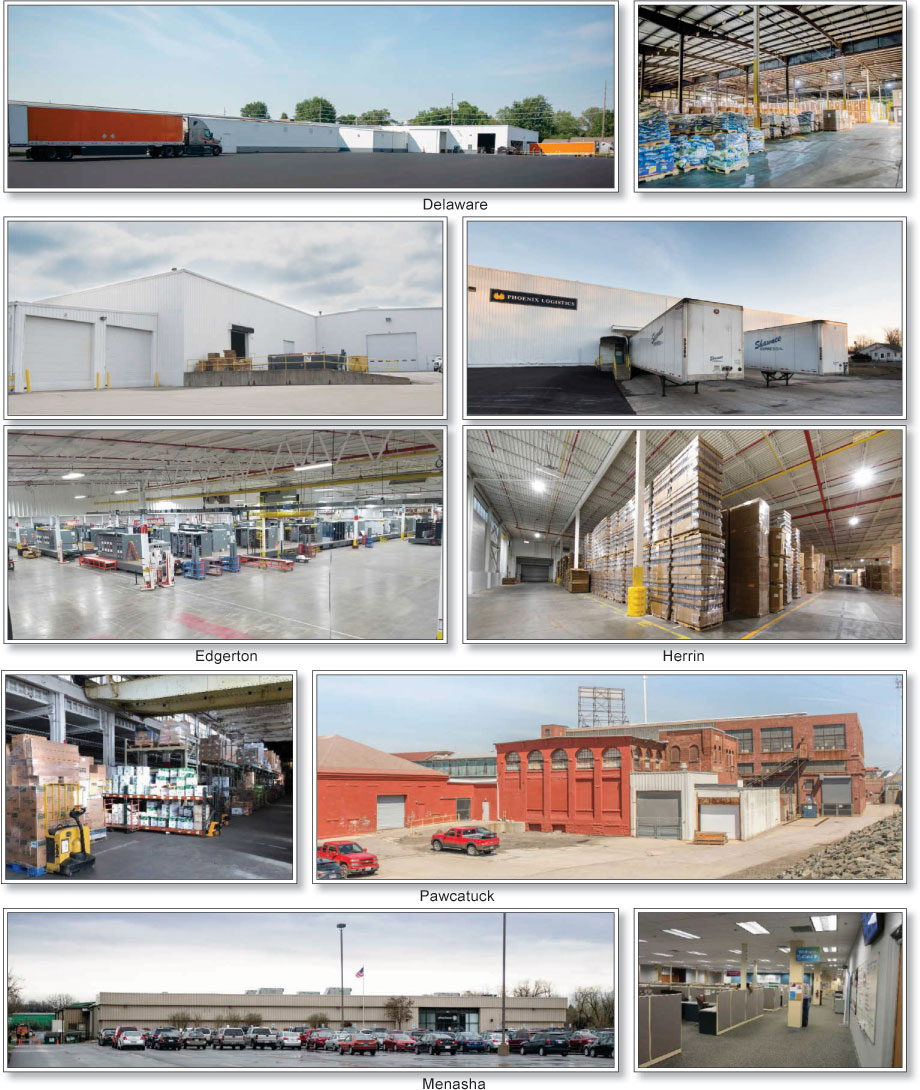

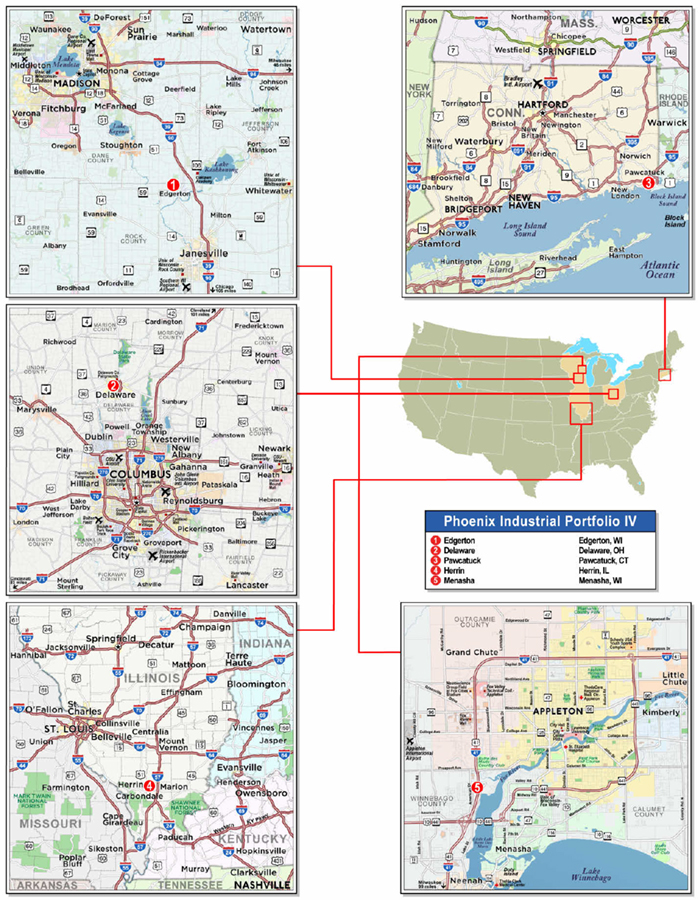

| UBS AG | 6/30/2020 | 2/7/2020 | Phoenix Industrial Portfolio IV | Industrial | Y | Y | Y | N | N | N | 100.0% | 100.0% | 99.6% | 98.8% |

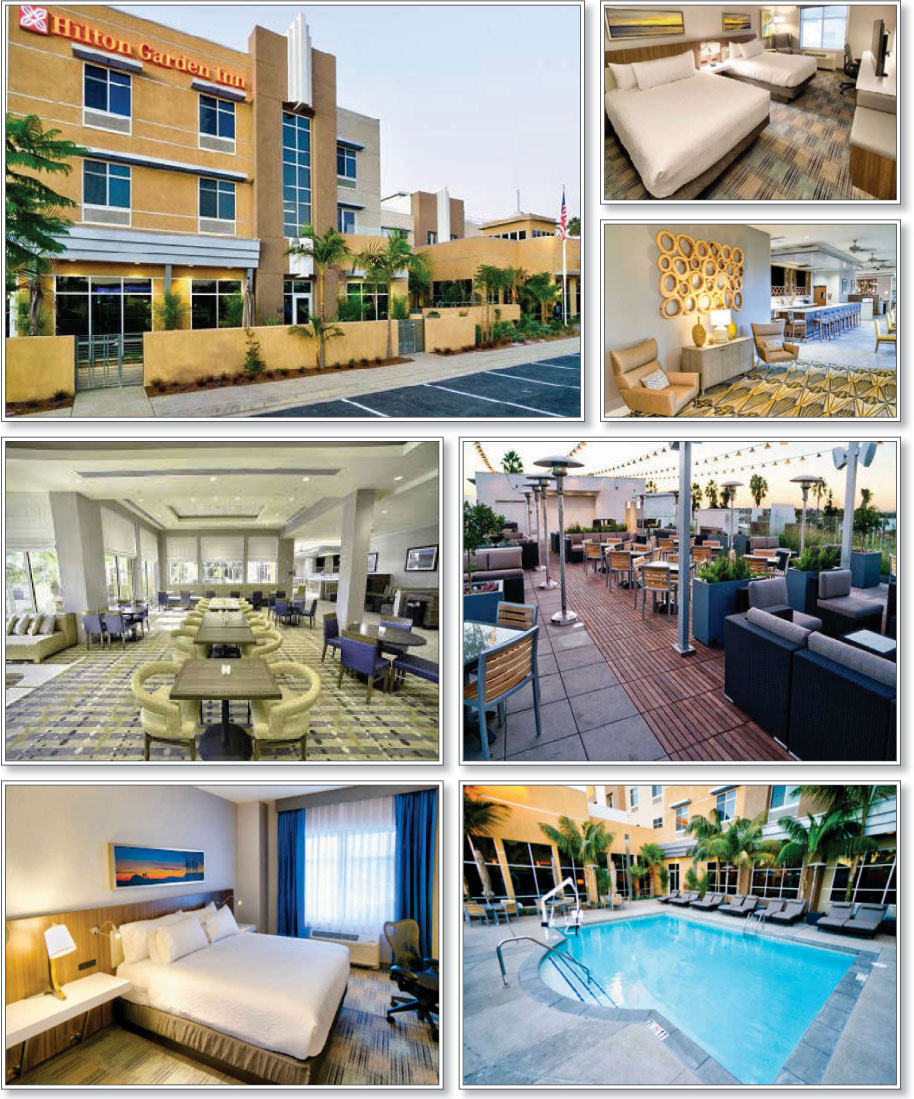

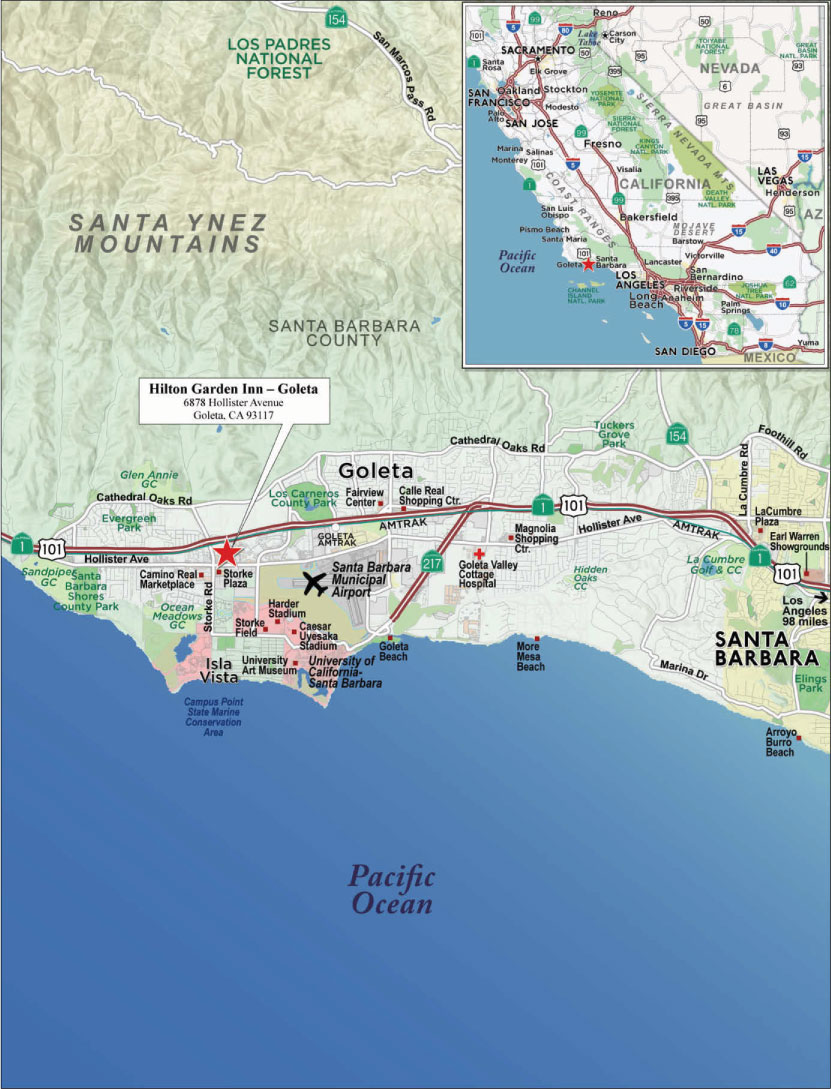

| WFB | 7/20/2020 | 3/10/2020 | Hilton Garden Inn – Goleta | Hospitality | Y | Y | (3) | N | N | N | (4) | (4) | NAV | NAV |

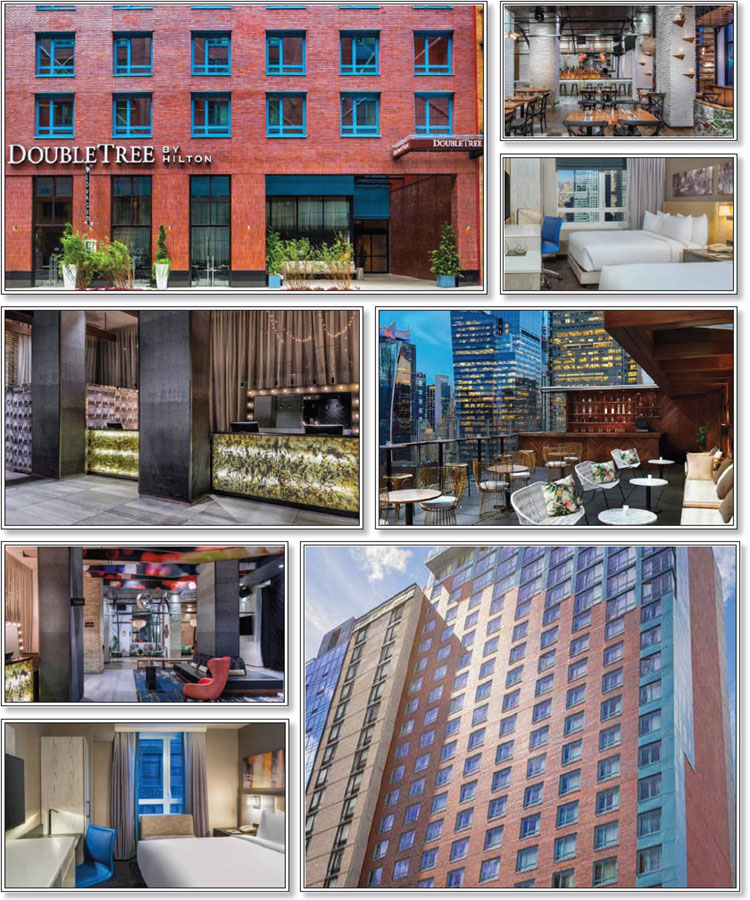

| UBS AG | 7/21/2020 | 11/25/2019 | DoubleTree New York Times Square West Leased Fee | Other | Y | Y | Y | Y(5) | N | N | 100.0%(6)(7) | 100.0%(6)(7) | 100.0%(6)(7) | 100.0%(6)(7) |

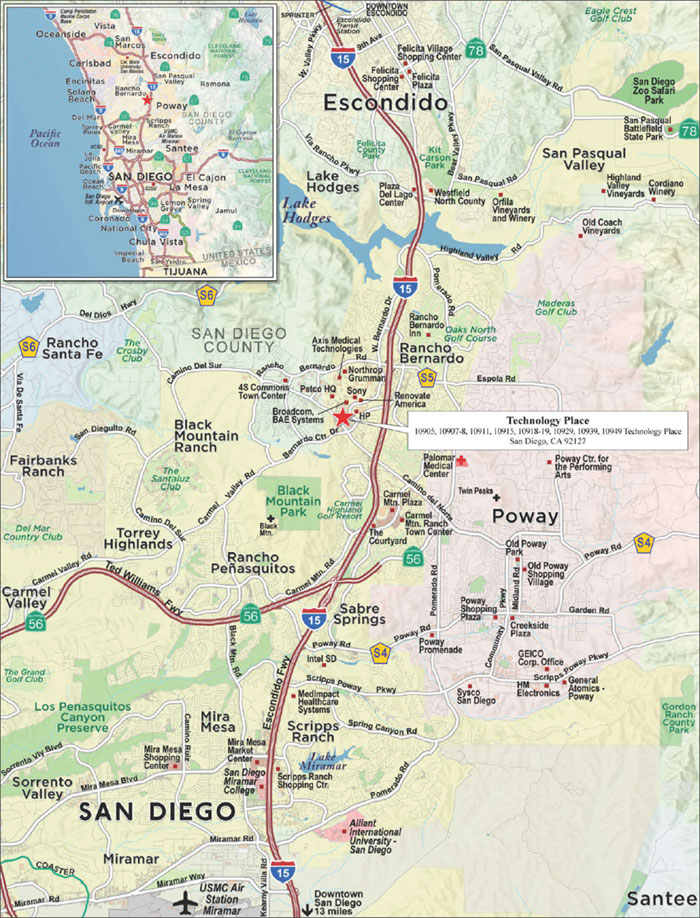

| WFB | 7/13/2020 | 7/16/2020 | Technology Place | Office | NAP(1) | NAP(1) | NAP(1)(3) | N | N | Y(8) | 88.4%(8) | 94.0%(8) | 100.0% | 100.0% |

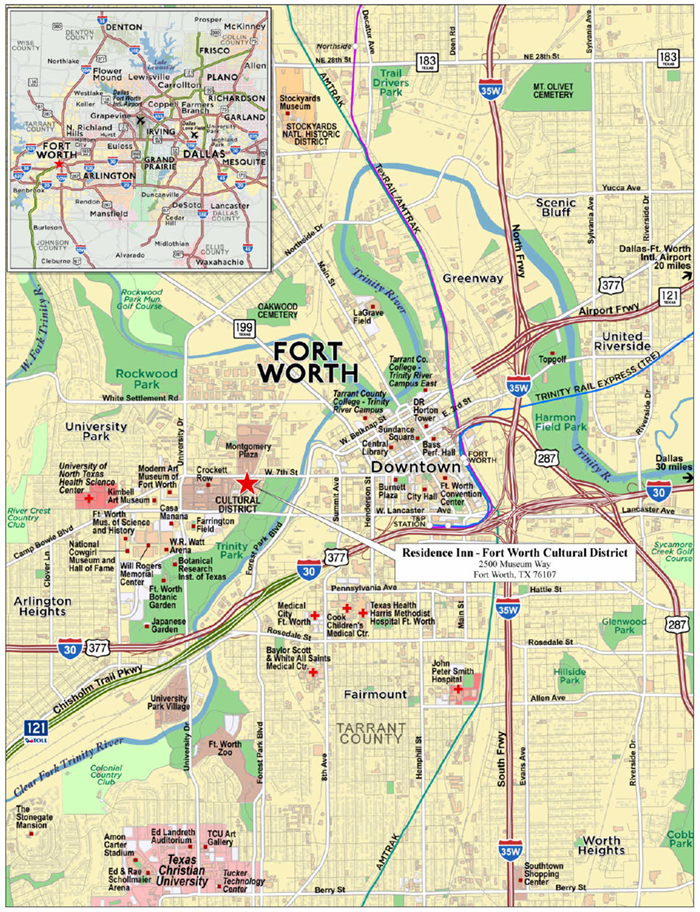

| WFB | 8/5/2020 | 2/28/2020 | Residence Inn – Fort Worth Cultural District | Hospitality | Y | Y | Y(3) | Y(9) | Y(9) | N | (10) | (10) | NAV | NAV |

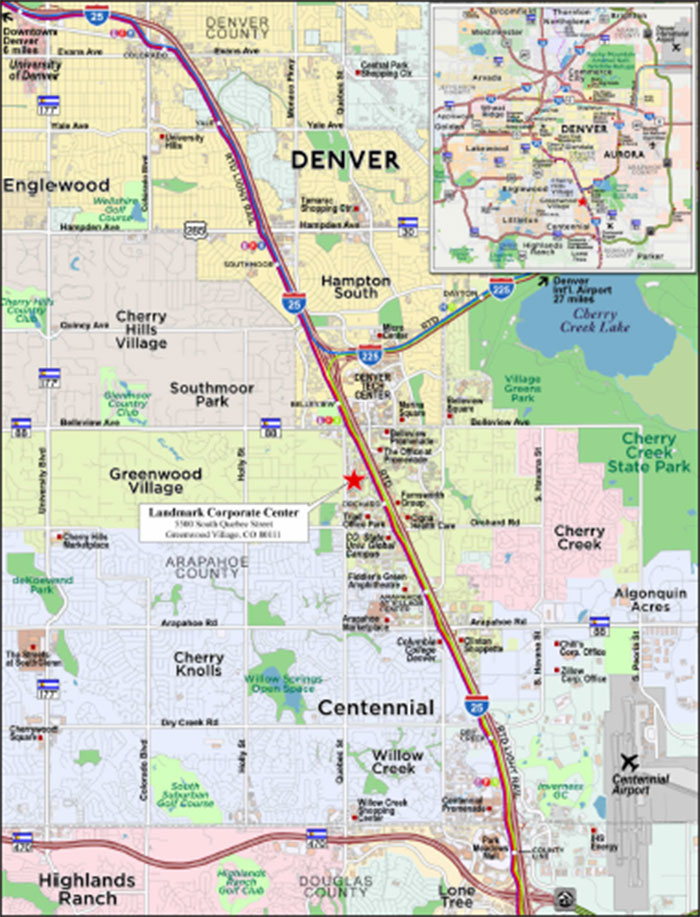

| UBS AG | 7/23/2020 | 7/30/2020 | Landmark Corporate Center | Office | NAP(1) | NAP(1) | NAP(1) | N | N | N | 100.0% | 100.0% | 100.0% | 100.0% |

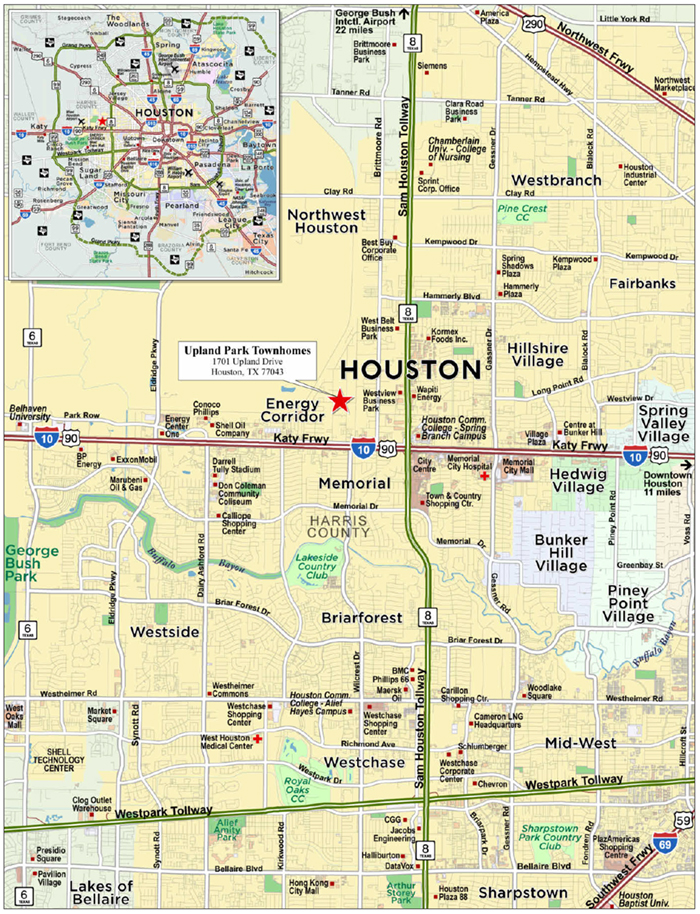

| LMF | 7/17/2020 | 2/13/2020 | Upland Park Townhomes | Multifamily | Y | Y | Y | N | N | NAV | 94.4% | 98.0% | 87.7% | 95.0% |

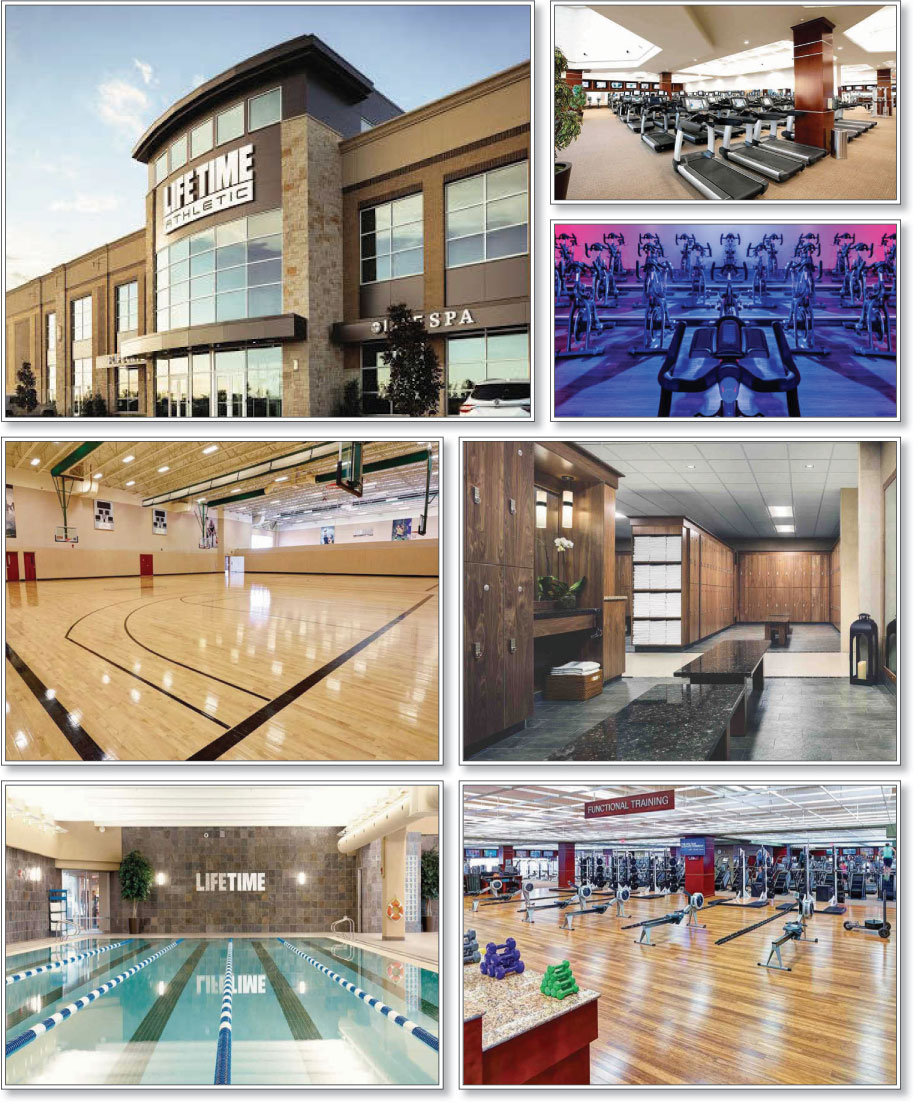

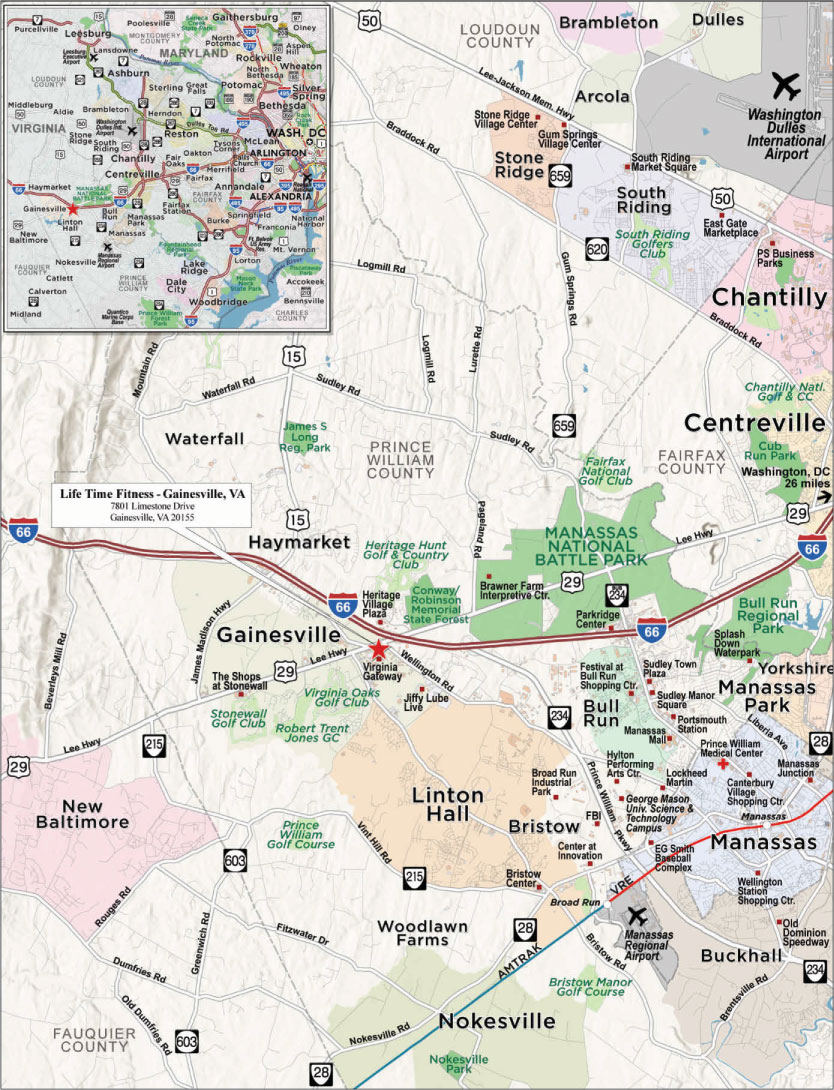

| WFB | 7/20/2020 | 3/3/2020 | Life Time Fitness – Gainesville, VA | Retail | Y | Y | (3) | N | N | N | 100.0% | 100.0% | 100.0% | 100.0% |

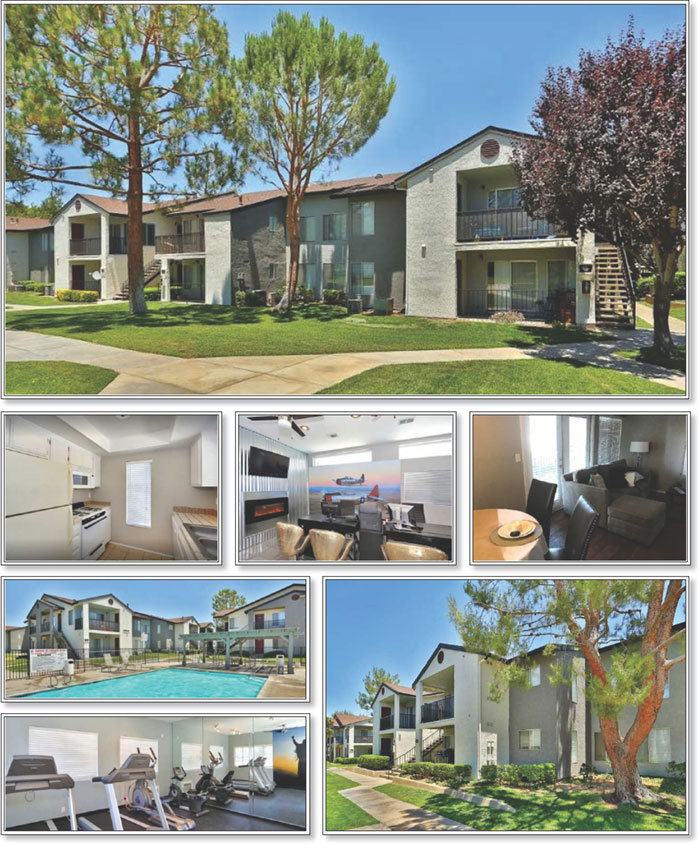

| UBS AG | 7/22/2020 | 7/31/2020 | Town Square Apartments | Multifamily | NAP(1) | NAP(1) | NAP(1) | N | N | N | 94.1%(11) | 93.5% | 95.8%(11) | 95.8% |

| LCF | 8/6/2020 | 2/20/2020 | Konica Minolta Phase II | Office | Y | Y | Y | N | N | N | 100.0% | 100.0% | 100.0%(12) | 100.0%(12) |

| WFB | 8/7/2020 | 2/21/2020 | 501 3rd Street | Office | Y | Y | Y(3) | N | N | Y(13) | 100.0% | 100.0% | 100.0% | 100.0% |

| LMF | 8/6/2020 | 1/29/2020 | TownePlace Suites Tacoma Lakewood | Hospitality | N(14) | Y | Y | Y(14) | N | NAP | (15) | (15) | (15) | (15) |

| LMF | 7/20/2020 | 7/21/2020 | Southlake Cove Apartments | Multifamily | NAP(1) | NAP(1) | NAP(1) | N | N | NAV | 92.8% | 91.9% | 86.4% | 90.6% |

| LCF | 7/29/2020 | 3/11/2020 | 122nd Street Portfolio | Multifamily | Y | Y | Y | N | N | Y(16) | NAV(17) | 93.5%(18) | NAV(19) | NAV(19) |

| LCF | 7/28/2020 | 3/11/2020 | The Grid | Multifamily | Y | Y | Y | Y(20) | N | Y(21) | NAV(17) | 97.0%(22) | NAV(17) | 96.0%(23) |

| UBS AG | 7/22/2020 | 1/17/2020 | Bass Pro - Birmingham | Retail | Y | Y | Y | N | N | Y(24) | 100.0% | 100.0% | 100.0% | 100.0% |

| UBS AG | 7/14/2020 | 8/3/2020 | Chesapeake | Industrial | NAP(1) | NAP(1) | NAP(1) | N | N | N | 100.0% | 100.0% | 100.0% | 100.0% |

| LMF | 7/23/2020 | 7/23/2020 | Martin Door Industrial | Industrial | NAP(1) | NAP(1) | NAP(1) | N | N | N | 100.0% | 100.0% | 100.0% | 100.0% |

| UBS AG | 7/23/2020 | 2/11/2020 | TownePlace Suites - Macon | Hospitality | Y | Y | Y | N | N | N | (25) | (25) | NAV | NAV |

| UBS AG | 7/23/2020 | 2/21/2020 | 570 Taxter Road | Office | Y | Y | Y | N | N | Y(26) | 100.0% | 100.0%(27) | 100.0% | 100.0%(27) |

| UBS AG | 6/25/2020 | 6/25/2020 | South Carolina Industrial Portfolio | Industrial | NAP(28) | NAP(28) | Y | N | N | N | 100.0% | 100.0% | NAV | NAV |

| UBS AG | 7/23/2020 | 8/3/2020 | Luxor Garden Apartments | Multifamily | NAP(1) | NAP(1) | NAP(1) | N | N | N | 85.8%(11)(29) | 94.5% | 78.6%(11)(29) | 92.8% |

| LCF | 8/6/2020 | 12/27/2019 | Walgreens Burlington | Retail | Y | Y | Y | N | N | N | 100.0% | 100.0% | 100.0% | 100.0% |

| LMF | 7/22/2020 | 7/2/2020 | Spacebox Storage – Niceville | Self Storage | NAP(28) | NAP(28) | NAP(28) | N | N | NAV | 100.0% | 100.0% | (30) | (30) |

| LMF | 7/29/2020 | 7/23/2020 | Jefferson Apartments | Multifamily | NAP(1) | NAP(1) | NAP(1) | N | N | NAV | 98.3% | 98.8% | 98.3% | 98.3% |

| LMF | 7/23/2020 | 12/27/2019 | Kennedy Center | Retail | Y | Y | Y | Y(31) | N | Y(32) | 91.8% | 91.8% | 91.8% | 91.8% |

| LMF | 7/22/2020 | 6/17/2020 | Outback 98 West Storage | Self Storage | NAP(28) | NAP(28) | NAP(28) | N | N | NAV | (33) | (33) | (33) | (33) |

| UBS AG | 7/9/2020 | 7/9/2020 | Old Meridian Professional Center | Office | NAP(28) | NAP(28) | Y | N | N | N | 100.0% | 100.0% | 100.0% | 100.0% |

| WFB | 8/4/2020 | 7/23/2020 | SPS Fresno Marks | Self Storage | NAP(1) | NAP(1) | NAP(1)(3) | N | N | N | (34) | (34) | (34) | (34) |

| LMF | 7/21/2020 | 7/21/2020 | Vineyard Pointe Apartments | Multifamily | NAP(1) | NAP(1) | NAP(1) | N | N | NAV | 95.4% | 95.8% | 100.0% | 100.0% |

| LMF | 7/23/2020 | 2/13/2020 | Commons at Southtowne IV | Retail | Y | Y | Y | Y(35) | N | Y(36) | 93.1% | 86.7% | 93.1% | 86.7% |

| UBS AG | 7/21/2020 | 7/15/2020 | Tower Storage – Fayetteville | Self Storage | NAP(1) | NAP(1) | NAP(1) | N | N | N | 99.2%(11) | 99.4% | 97.9%(11) | 98.4% |

| LMF | 7/22/2020 | 7/30/2020 | 613 Oakfield Drive | Office | NAP(1) | NAP(1) | NAP(1) | N | N | N | 100.0% | 100.0% | 100.0% | 100.0% |

| WFB | 8/6/2020 | 3/11/2020 | Corner Plaza | Retail | Y | Y | Y(3) | Y(37) | N | Y(38) | 87.5%(38) | 92.4%(38) | 100.0% | 100.0% |

| LCF | 8/6/2020 | 8/6/2020 | Dollar General- Isanti | Retail | NAP(1) | NAP(1) | NAP(1) | N | N | N | 100.0% | 100.0% | 100.0% | 100.0% |

| LCF | 8/6/2020 | 8/6/2020 | Dollar General- Sioux City | Retail | NAP(1) | NAP(1) | NAP(1) | N | N | N | 100.0% | 100.0% | 100.0% | 100.0% |

| LCF | 8/6/2020 | 8/6/2020 | Dollar General- Newburgh | Retail | NAP(1) | NAP(1) | NAP(1) | N | N | N | 100.0% | 100.0% | 100.0% | 100.0% |

| LCF | 8/6/2020 | 8/6/2020 | Dollar General- Waterloo | Retail | NAP(1) | NAP(1) | NAP(1) | N | N | N | 100.0% | 100.0% | 100.0% | 100.0% |

| LCF | 8/6/2020 | 8/6/2020 | Dollar General- Little Falls | Retail | NAP(1) | NAP(1) | NAP(1) | N | N | N | 100.0% | 100.0% | 100.0% | 100.0% |

| (1) | The related mortgage loan has its first due date in September 2020. |

| (2) | Tenant due dates are based on the date in the month of their start date (which in most cases is not the 1st of month), so collections are not tracked on calendar month basis. As of 7/28/2020, 4.0% of monthly rents were 31-60 days past due and 2.7% of monthly rents were 61-90 days past due. |

| (3) | The Hilton Garden Inn – Goleta, Technology Place, Residence Inn – Fort Worth Cultural District, Life Time Fitness – Gainesville, VA, 501 3rd Street, SPS Fresno Marks and Corner Plaza mortgage loans have scheduled debt service payments due on the 11th of each month. |

THE INFORMATION IN THIS COLLATERAL TERM SHEET IS NOT COMPLETE AND MAY BE AMENDED PRIOR TO THE TIME OF SALE. THIS TERM SHEET IS NOT AN OFFER TO SELL THESE SECURITIES AND IT IS NOT A SOLICITATION OF AN OFFER TO BUY THESE SECURITIES IN ANY JURISDICTION WHERE THE OFFER OR SALE IS NOT PERMITTED.

7

| Wells Fargo Commercial Mortgage Trust 2020-C57 | Transaction Highlights |

| (4) | May and June 2020 occupancy, ADR and RevPAR information was 17.5%, $131.05 and $22.86 and 35.1%, $148.49 and $52.11, respectively. Occupancy, ADR and RevPAR information is due to the lender 30 days after month’s end; therefore July 2020 information is not available. |

| (5) | On May 1, 2020, the borrower contacted the lenders to request forbearance on the $90 million whole loan. The request included a modification of the related ground lease so as to permit the deferral of interest payments under the Whole Loan for May, June and July of 2020, which would be repaid in equal installments on each monthly payment date in 2021. Pursuant to the co-lender agreement for the whole loan, all major decisions (which would include the modification of the ground lease and any forbearance request) rest with the holder of the related subordinate companion loan. On May 7, 2020, the holder of the related subordinate companion loan formally denied the request. The borrower has made all debt service payments through July 2020. |

| (6) | June and July 2020 occupancy, ADR and RevPAR information was 30.5%, $91.41 and $27.91 and 15.5%, $83.18 and $12.91, respectively. |

| (7) | The mortgaged property consists of a leased fee interest, which is leased under a ground lease to an affiliate of the borrower. The affiliated ground lessee paid all rent payments on a net basis (i.e., the ground lessee paid an amount equal solely to the debt service on the related mortgage loan, and the borrower sponsor retained the remainder of the ground rent payment, which would otherwise have been paid to the borrower and distributed to the borrower sponsor as the borrower’s ultimate equity owner). The borrower sponsor has stated that going forward it will cause the ground lessee to pay the full rent payment, and that it will also cause the ground lessee to pay the remaining ground rent payment for prior months (which is then expected to be distributed to the borrower sponsor). |

| (8) | One tenant, representing 11.6% of NRA and 11.8% of UW Base Rent, received 50% rent deferral for April, May and June 2020, which was paid back in July 2020. |

| (9) | The borrower and lender entered into a forbearance agreement, dated April 10, 2020, and a loan modification, dated April 30, 2020, providing for the following, among other things: (i) a debt service reserve in the amount of $400,000, which can be released to the borrower to the extent that property cash flows are insufficient to make monthly debt service payments; (ii) suspension of FF&E monthly deposits from May through October 2020 (approximately $73,308); resumption of FF&E monthly deposits in November 2020 for the duration of the loan term; and 24-month replenishment of the FF&E reserve funds by an additional $3,055 monthly beginning November 2020 and ending in October 2022; (iii) deferral of cash management testing through April 2021, and, when resumed, a 9.0% debt yield trigger (tested quarterly); (iv) if the Franchisor modifies the scope of required PIP work, transfer of any PIP reserve funds exceeding 100% of the estimated cost to the debt service reserve; and (v) the borrower's obtaining a PPP loan subject to specified conditions. See "Description of the Mortgage Pool—Additional Indebtedness—Other Unsecured Indebtedness". |

| (10) | May and June 2020 occupancy, ADR and RevPAR information was 37.2%, $121.62 and $45.20 and 48.7%, $121.00 and $58.93, respectively. Occupancy, ADR and RevPAR information is due to the lender 30 days after month’s end; therefore July 2020 information is not available. |

| (11) | Calculated based on the number of units for which rent was fully paid divided by the total number of occupied units. |

| (12) | The related sole tenant makes quarterly lease payments, with the third quarter payment made in July 2020. Only the warehouse was operational as of July 2020. As the State of New Jersey provides additional guidance for reopening, the related sole tenant has expressed an intent to slowly bring back workers, gradually building back to full staff. |

| (13) | The retail tenant, representing 25% of NRA and 17.6% of UW Base Rent, has requested rent relief. The retail tenant has paid rent in full for April, May, June, July and August 2020. |

| (14) | The borrower paid April 2020 debt service in full. The borrower requested relief, and the borrower and the lender subsequently executed a forbearance agreement on May 14, 2020, which provided for the forbearance of payments in May and June 2020 and the waiver of capital expenditure deposits, subject to certain exceptions, during the forbearance period. In July 2020, the borrower paid in full debt service for July 2020 and deferred accrued interest from May and June 2020. Regular debt service payments are required to continue in August 2020 and thereafter. See “Description of the Mortgage Pool—Additional Indebtedness—Other Unsecured Indebtedness”. |

| (15) | June and July 2020 occupancy, ADR and RevPAR information was 85.1%, $126.15 and $107.39 and 82.0%, $125.00 and $102.50, respectively. |

| (16) | Although requests for residential rent relief have been made and granted, the related mortgage loan seller does not have exact statistics. There is no current rent relief with respect to the commercial space. |

| (17) | Information based on total square footage or unit count not available. |

| (18) | Represents the percentage of total billed residential rent collected for June 2020 and excludes rent collected (if any) for such month from the retail portion of the subject Mortgaged Property. |

| (19) | As of the July 6, 2020 payment, the residential portion of the portfolio of related Mortgaged Properties was open and operating. The residential portion of the portfolio of related Mortgaged Properties was 91.7% occupied as of July 2020. Given the collection and reporting timing, it is difficult to determine the percentage of residential tenants who have not paid rent for July 2020. Three of the related Mortgaged Properties also collectively include approximately 2,400 square feet of ground floor retail space, which accounts for approximately 5.1% of total underwritten gross potential rent for the portfolio and had an economic occupancy of 80.1% as of July 2020. Two of the three retail spaces (deli/grocery and ice cream shop) are partially or fully operational. |

| (20) | Pursuant to a letter dated June 24, 2020 and addressed to the Non-Serviced Master Servicer under the WFCM 2020-C56 PSA, the related borrower requested that The Grid Whole Loan be converted to interest-only debt service payments commencing no later than August 6, 2020 and to continue as such for a period of 18 to 24 months. Such request has been denied. |

| (21) | There was no residential rent relief granted for the month of July 2020. Requests for residential rent relief have been made and may have been granted for prior months. Four commercial retail tenants, representing less than 2.0% of total gross potential rent at the subject Mortgaged Property, have received rent deferrals. All deferral periods have expired. Bamsi has deferred 50% of its rent for May 2020, June 2020 and July 2020, which deferred rent is to be repaid in three installments in the first quarter of 2021. Pirates Pro Shop has deferred 100% of its rent payments for April 2020 and May 2020, which deferred rent is to be repaid in three installments in the first quarter of 2021. Rakel Nail Salon has deferred 100% of its rent payments for April 2020, May 2020 and June 2020, which deferred rent is to be repaid in either August 2020 or upon receipt of an approved grant through the City of Worcester. Sierra Salon has deferred 100% of its rent payments for April 2020, May 2020 and June 2020. The repayment schedule for Sierra Salon has not been established and is pending approval of a grant through the City of Worcester. |

| (22) | Represents the percentage of total billed residential rent collected for June 2020 and excludes rent collected (if any) for such month from the retail portion of the subject Mortgaged Property. Residential occupancy for June 2020 was approximately 88.0%. |

| (23) | Represents the percentage of total billed residential rent collected for July 2020 as of July 28, 2020 and excludes rent collected (if any) for such month from the retail portion of the subject Mortgaged Property. Residential occupancy for July 2020 was approximately 90.6%. All of the commercial tenants had closed by reason of state order on or about March 15, 2020. As of late July 2020, all commercial tenants (except for two restaurants with limited outdoor seating) had reopened and were fully or partially operational. |

| (24) | The single tenant representing 100.0% of UW rent and 100.0% of NRA, Bass Pro Shops, requested rent deferment for base rent for the month of May 2020 (totaling $105,896) to be repaid in three equal monthly installments in January, February, and March 2021. The mortgage loan seller approved a lease addendum dated May 1, 2020 providing for such deferment and the tenant resumed regular rent payments on June 1, 2020. |

| (25) | June 2020 occupancy, ADR and RevPAR information was 87.5%, $108.01 and $94.56, respectively. |

| (26) | Four tenants, representing 11.1% of UW rent and 9.9% of NRA, requested rent deferment in May 2020 (totaling $14,163); however, none of the four tenants received approval and paid full rent for the month of May 2020. All four tenants have paid their outstanding rent balance and are current through the month of July 2020. One tenant, representing 3.3% of UW rent and 2.3% of NRA, is currently delinquent on February 2020 rent. The tenant is current on all other months through July 2020. |

| (27) | Calculated based on UW Base Rent including any underwritten rent steps and percentage rent, but excluding any underwritten straight-line rent. |

| (28) | The related mortgage loan has its first due date in August 2020. |

| (29) | Total SF or Unit Count Making Full Rent Payments excluding tenants that are less than or equal to $50.00 late or delinquent on monthly rent is 90.4% for June 2020 and 86.0% for July 2020, respectively. |

| (30) | As of July 22, 2020, there were no delinquencies past 30 days. |

| (31) | The borrower sponsor submitted a request for loan relief, but subsequently retracted the request. No requests are currently outstanding. |

| (32) | One tenant, representing approximately 10.8% of NRA, has agreed to a payment plan, allowing repayment of outstanding base rent for April and May (totaling $10,188) over 12 payments beginning in September 2020. |

| (33) | As of July 22, 2020, 0.3% of tenants (by monthly rent) were 31-60 days delinquent and 0.1% of tenants (by monthly rent) were 60+ days delinquent. |

| (34) | Given the timing of collection and reporting, an accurate estimate of the percentage of tenants who have not paid is not available. For the month of June 2020, rent collections were reported to be equal to UW Base Rent. For the month of July 2020, rent collections were reported to be approximately 3.8% greater than UW Base Rent. |

| (35) | The borrower sponsor submitted a request for loan relief but subsequently retracted the request. No requests are currently outstanding. |

THE INFORMATION IN THIS COLLATERAL TERM SHEET IS NOT COMPLETE AND MAY BE AMENDED PRIOR TO THE TIME OF SALE. THIS TERM SHEET IS NOT AN OFFER TO SELL THESE SECURITIES AND IT IS NOT A SOLICITATION OF AN OFFER TO BUY THESE SECURITIES IN ANY JURISDICTION WHERE THE OFFER OR SALE IS NOT PERMITTED.

8

| Wells Fargo Commercial Mortgage Trust 2020-C57 | Transaction Highlights |

| (36) | On April 28, 2020, PetSmart, representing 32.5% of UW Base Rent and 41.6% of NRA, requested an unspecified amount of reduced base rent beginning in May 2020. The request has been abandoned and full rents have been paid each month. PGA Tour Superstore, representing 33.1% of UW Base Rent and 41.2% of NRA, submitted a formal rent relief request on May 1, 2020. As of July 2020, the request has been abandoned and full rents have been paid. On May 18, 2020, Costa Vida, representing 7.8% of UW Base Rent and 5.1% of NRA, and landlord agreed to base rent deferral for June 2020, July 2020 and August 2020, to be repaid over 12 months, with NNN paid current. As of July 22, 2020, Costa Vida $12,545 of base rent is outstanding. Rumbi Island Grill, representing 8.1% of UW Base Rent and 4.1% of NRA, has paid 50% of rent for April 2020 through July 2020. The tenant and landlord are in close talks to determine a relief plan. As of July 22, 2020, $20,437.48 of base rent is outstanding. |

| (37) | The borrower requested relief on April 8, 2020; however, the request was withdrawn on April 27, 2020. |

| (38) | One tenant, representing 12.5% of NRA and 15.5% of UW Base Rent, paid half of its June 2020 rent. The tenant made full July 2020 rent payments and began paying back unpaid June 2020 rent. |

THE INFORMATION IN THIS COLLATERAL TERM SHEET IS NOT COMPLETE AND MAY BE AMENDED PRIOR TO THE TIME OF SALE. THIS TERM SHEET IS NOT AN OFFER TO SELL THESE SECURITIES AND IT IS NOT A SOLICITATION OF AN OFFER TO BUY THESE SECURITIES IN ANY JURISDICTION WHERE THE OFFER OR SALE IS NOT PERMITTED.

9

| Wells Fargo Commercial Mortgage Trust 2020-C57 | Issue Characteristics |

| IV. | Issue Characteristics |

| Securities Offered: | $464,547,000 approximate monthly pay, multi-class, commercial mortgage REMIC pass-through certificates consisting of twenty-one classes (Classes A-1, A-SB, A-3, A-3-1, A-3-2, A-3-X1, A-3-X2, A-4, A-4-1, A-4-2, A-4-X1, A-4-X2, A-S, A-S-1, A-S-2, A-S-X1, A-S-X2, B, C, X-A and X-B), which are offered pursuant to a registration statement filed with the SEC (such classes of certificates, the “Offered Certificates”). | |

| Mortgage Loan Sellers: | UBS AG, by and through its branch office at 1285 Avenue of the Americas, New York, New York (“UBS AG”), LMF Commercial, LLC (“LMF”), Wells Fargo Bank, National Association (“WFB”) and Ladder Capital Finance LLC (“LCF”). | |

| Joint Bookrunners and Co-Lead Managers: | Wells Fargo Securities, LLC and UBS Securities LLC | |

| Co-Manager: | Academy Securities, Inc. and Drexel Hamilton, LLC | |

| Rating Agencies: | Fitch Ratings, Inc., Kroll Bond Rating Agency, LLC and Moody’s Investors Service, Inc. | |

| Master Servicer: | Wells Fargo Bank, National Association | |

| Special Servicer: | Midland Loan Services, a Division of PNC Bank, National Association | |

| Certificate Administrator: | Wells Fargo Bank, National Association | |

| Trustee: | Wilmington Trust, National Association | |

| Operating Advisor: | Pentalpha Surveillance LLC | |

| Asset Representations Reviewer: | Pentalpha Surveillance LLC | |

| Initial Majority Controlling Class Certificateholder: | KKR CMBS II Aggregator Type 2 L.P. | |

| U.S. Credit Risk Retention: | For a discussion on the manner in which the U.S. credit risk retention requirements will be satisfied by Wells Fargo Bank, National Association, as the retaining sponsor, see “Credit Risk Retention” in the Preliminary Prospectus.

This transaction is being structured with a “third party purchaser” that will acquire an “eligible horizontal residual interest”, which will be comprised of the Class E-RR, F-RR, G-RR, H-RR, J-RR, K-RR, L-RR and M-RR Certificates (the “horizontal risk retention certificates”). KKR CMBS II Aggregator Type 2 L.P. (in satisfaction of the retention obligations of Wells Fargo Bank, National Association, as the retaining sponsor) will be contractually obligated to retain (or to cause its “majority-owned affiliate” to retain) the horizontal risk retention certificates for a minimum of five years after the closing date, subject to certain permitted exceptions provided for under the risk retention rules. During this time, KKR CMBS II Aggregator Type 2 L.P. will agree to comply with hedging, transfer and financing restrictions that are applicable to third party purchasers under the credit risk retention rules. For additional information, see “Credit Risk Retention” in the Preliminary Prospectus. | |

| EU Credit Risk Retention | None of the sponsors, the depositor, the underwriters, or their respective affiliates, or any other party to the transaction intends or is required to retain a material net economic interest in the securitization constituted by the issue of the Certificates in a manner that would satisfy the requirements of the European Union Regulation (EU) 2017/2402. In addition, no such person undertakes to take any other action which may be required by any investor for the purposes of its compliance with any applicable requirement under such Regulation. Furthermore, the arrangements described under “Credit Risk Retention” in the Preliminary Prospectus have not been structured with the objective of ensuring compliance by any person with any requirements of such Regulation. | |

| Cut-off Date: | The Cut-off Date with respect to each mortgage loan is the due date for the monthly debt service payment that is due in August 2020 (or, in the case of any mortgage loan that has its first due date in September 2020, the date that would have been its due date in August 2020 under the terms of that mortgage loan if a monthly debt service payment were scheduled to be due in that month). | |

| Expected Closing Date: | On or about August 26, 2020. | |

| Determination Dates: | The 11th day of each month (or if that day is not a business day, the next succeeding business day), commencing in September 2020. |

THE INFORMATION IN THIS COLLATERAL TERM SHEET IS NOT COMPLETE AND MAY BE AMENDED PRIOR TO THE TIME OF SALE. THIS TERM SHEET IS NOT AN OFFER TO SELL THESE SECURITIES AND IT IS NOT A SOLICITATION OF AN OFFER TO BUY THESE SECURITIES IN ANY JURISDICTION WHERE THE OFFER OR SALE IS NOT PERMITTED.

10

| Wells Fargo Commercial Mortgage Trust 2020-C57 | Issue Characteristics |

| Distribution Dates: | The 4th business day following the Determination Date in each month, commencing in September 2020. | |

| Rated Final Distribution Date: | The Distribution Date in August 2053. | |

| Interest Accrual Period: | With respect to any Distribution Date, the calendar month immediately preceding the month in which such Distribution Date occurs. | |

| Day Count: | The Offered Certificates will accrue interest on a 30/360 basis. | |

| Minimum Denominations: | $10,000 for each Class of Offered Certificates (other than the Class X-A and X-B Certificates) and $1,000,000 for the Class X-A and X-B Certificates. Investments may also be made in any whole dollar denomination in excess of the applicable minimum denomination. | |

| Clean-up Call: | 1.0% | |

| Delivery: | DTC, Euroclear and Clearstream Banking | |

| ERISA/SMMEA Status: | Each Class of Offered Certificates is expected to be eligible for exemptive relief under ERISA. No Class of Offered Certificates will be SMMEA eligible. | |

| Risk Factors: | THE CERTIFICATES INVOLVE CERTAIN RISKS AND MAY NOT BE SUITABLE FOR ALL INVESTORS. SEE THE “RISK FACTORS” SECTION OF THE PRELIMINARY PROSPECTUS. | |

| Bond Analytics Information: | The Certificate Administrator will be authorized to make distribution date statements, CREFC® reports and certain supplemental reports (other than confidential information) available to certain financial modeling and data provision services, including Bloomberg, L.P., Trepp, LLC, Intex Solutions, Inc., Interactive Data Corp., Markit Group Limited, BlackRock Financial Management, Inc., CMBS.com, Inc., Moody’s Analytics, Inc., KBRA Analytics, Inc., MBS Data, LLC, Thomson Reuters Corporation and RealINSIGHT. | |

| Tax Treatment | For U.S. federal income tax purposes, the issuing entity will consist of two or more REMICs arranged in a tiered structure and a trust (the “grantor trust”). The upper-most REMIC will issue REMIC regular interests some of which will be held by the grantor trust (such grantor trust-held REMIC regular interests, the “trust components”). The Offered Certificates (other than the Exchangeable Certificates) will represent REMIC regular interests (other than the trust components). The Exchangeable Certificates will represent beneficial ownership of one or more of the trust components held by the grantor trust. |

THE INFORMATION IN THIS COLLATERAL TERM SHEET IS NOT COMPLETE AND MAY BE AMENDED PRIOR TO THE TIME OF SALE. THIS TERM SHEET IS NOT AN OFFER TO SELL THESE SECURITIES AND IT IS NOT A SOLICITATION OF AN OFFER TO BUY THESE SECURITIES IN ANY JURISDICTION WHERE THE OFFER OR SALE IS NOT PERMITTED.

11

| Wells Fargo Commercial Mortgage Trust 2020-C57 | Characteristics of the Mortgage Pool |

V. Characteristics of the Mortgage Pool(1)

A. Ten Largest Mortgage Loans

| Mortgage Loan Seller | Mortgage Loan Name | City | State | Number of Mortgage Loans / Mortgaged Properties | Mortgage Loan Cut-off Date Balance ($) | % of Initial Pool Balance (%) | Property Type | Number of SF/ Units/ Rooms | Cut-off Date Balance Per SF/Unit/ Room | Cut-off Date LTV Ratio (%) | Balloon or ARD LTV Ratio (%) | U/W NCF DSCR (x) | U/W NOI Debt Yield (%) | |||||||||||||

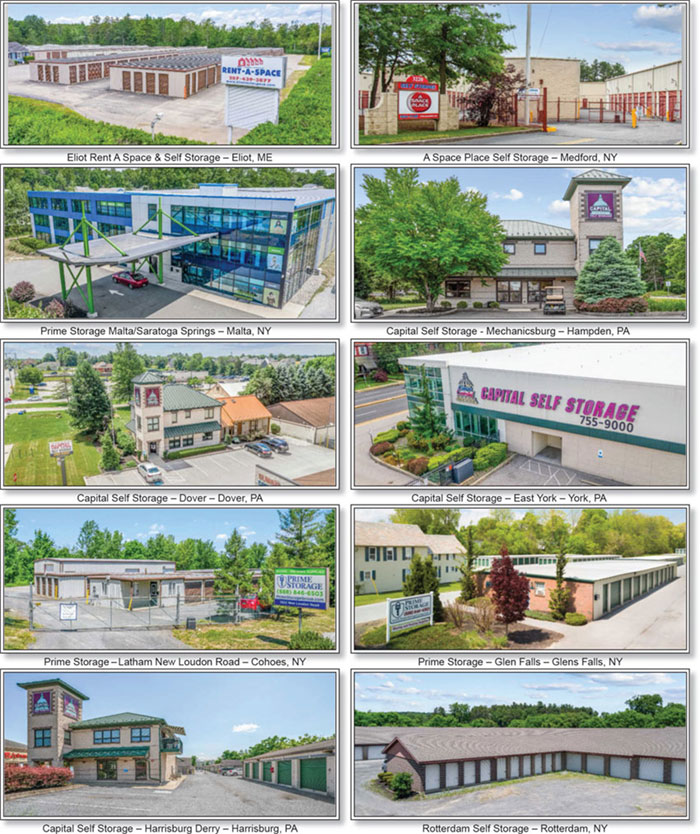

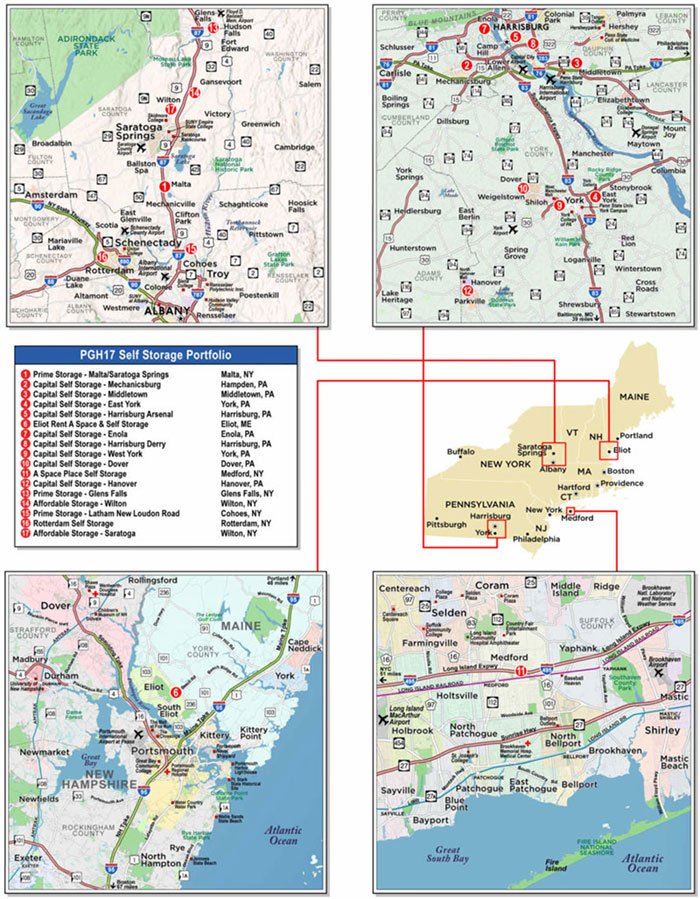

| LMF | PGH17 Self Storage Portfolio | Various | Various | 1 / 17 | $56,000,000 | 9.99% | Self Storage | 924,956 | $101 | 68.6% | 63.1% | 1.27x | 8.1% | |||||||||||||

| UBS AG | Phoenix Industrial Portfolio IV | Various | Various | 1 / 5 | 46,000,000 | 8.2 | Industrial | 2,125,525 | 22 | 72.9 | 61.9 | 1.66 | 11.3 | |||||||||||||

| WFB | Hilton Garden Inn - Goleta | Goleta | CA | 1 / 1 | 35,000,000 | 6.2 | Hospitality | 142 | 246,479 | 59.9 | 51.3 | 2.04 | 12.4 | |||||||||||||

| UBS AG | DoubleTree New York Times Square West Leased Fee | New York | NY | 1 / 1 | 30,000,000 | 5.4 | Other | 612 | 94,771 | 43.7 | 43.7 | 2.53 | 9.4 | |||||||||||||

| WFB | Technology Place | San Diego | CA | 1 / 1 | 29,250,000 | 5.2 | Office | 145,214 | 201 | 74.1 | 58.8 | 1.40 | 8.6 | |||||||||||||

| WFB | Residence Inn - Fort Worth Cultural District | Fort Worth | TX | 1 / 1 | 27,725,000 | 4.9 | Hospitality | 149 | 186,074 | 73.0 | 62.6 | 2.21 | 13.2 | |||||||||||||

| UBS AG | Landmark Corporate Center | Greenwood Village | CO | 1 / 1 | 25,480,000 | 4.5 | Office | 211,106 | 121 | 65.0 | 59.2 | 1.80 | 11.6 | |||||||||||||

| LMF | Upland Park Townhomes | Houston | TX | 1 / 1 | 24,000,000 | 4.3 | Multifamily | 285 | 84,211 | 65.0 | 56.5 | 1.37 | 8.3 | |||||||||||||

| WFB | Life Time Fitness - Gainesville, VA | Gainesville | VA | 1 / 1 | 23,000,000 | 4.1 | Retail | 125,157 | 184 | 62.0 | 62.0 | 2.28 | 9.6 | |||||||||||||

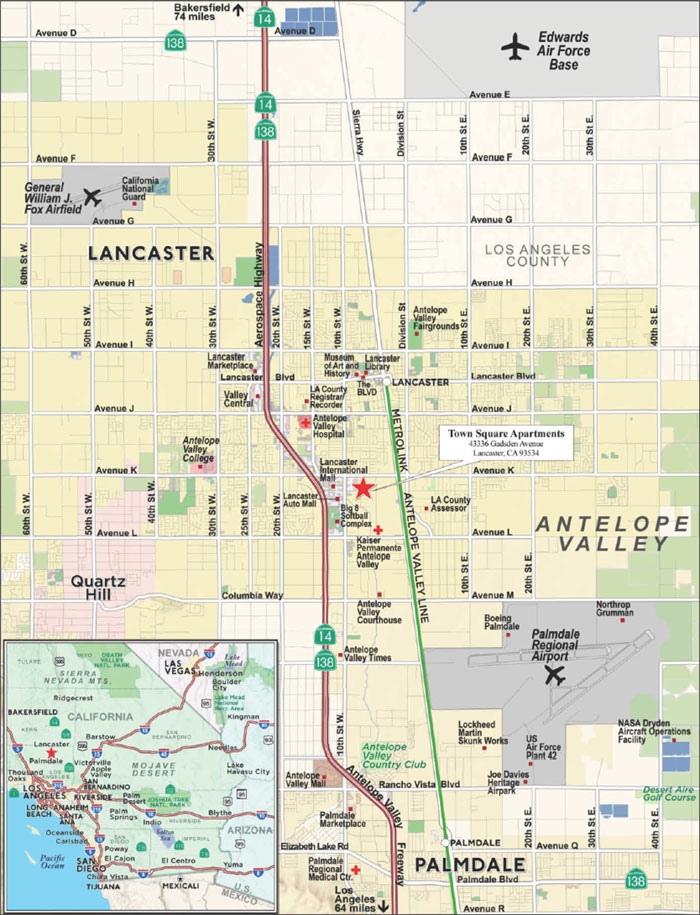

| UBS AG | Town Square Apartments | Lancaster | CA | 1 / 1 | 22,500,000 | 4.0 | Multifamily | 216 | 104,167 | 63.4 | 57.4 | 1.60 | 9.4 | |||||||||||||

| Top Three Total/Weighted Average | 3 / 23 | $137,000,000 | 24.4% | 67.8% | 59.7% | 1.60x | 10.3% | |||||||||||||||||||

| Top Five Total/Weighted Average | 5 / 25 | $196,250,000 | 35.0% | 65.1% | 57.1% | 1.71x | 9.9% | |||||||||||||||||||

| Top Ten Total/Weighted Average | 10 / 30 | $318,955,000 | 56.9% | 65.4% | 58.1% | 1.77x | 10.1% | |||||||||||||||||||

| Non-Top Ten Total/Weighted Average | 30 / 41 | $241,584,656 | 43.1% | 64.7% | 55.7% | 1.85x | 10.1% | |||||||||||||||||||

| (1) | With respect to any mortgage loan that is part of a whole loan, Cut-off Date Balance Per SF/Unit/Room, loan-to-value ratio, debt service coverage ratio and debt yield calculations include the related pari passu companion loan(s) (unless otherwise stated). With respect to each mortgage loan, debt service coverage ratio, debt yield and loan-to-value ratio information do not take into account subordinate debt (whether or not secured by the related mortgaged property), if any, that currently exists or is allowed under the terms of such mortgage loan. |

THE INFORMATION IN THIS COLLATERAL TERM SHEET IS NOT COMPLETE AND MAY BE AMENDED PRIOR TO THE TIME OF SALE. THIS TERM SHEET IS NOT AN OFFER TO SELL THESE SECURITIES AND IT IS NOT A SOLICITATION OF AN OFFER TO BUY THESE SECURITIES IN ANY JURISDICTION WHERE THE OFFER OR SALE IS NOT PERMITTED.

12

| Wells Fargo Commercial Mortgage Trust 2020-C57 | Characteristics of the Mortgage Pool |

B. Summary of the Whole Loans

| No. | Loan Name | Mortgage Loan Seller in WFCM 2020-C57 | Trust Cut-off Date Balance | Aggregate Pari Passu Companion Loan Cut-off Date Balance(1) | Controlling Pooling/Trust & Servicing Agreement | Master Servicer | Special Servicer | Related Pari Passu Companion Loan(s) Securitizations | Related Pari Passu Companion Loan(s) Original Balance |

| 1 | PGH17 Self Storage Portfolio | LMF | $56,000,000 | $93,000,000 | WFCM 2020-C57 | Wells Fargo Bank, National Association | Midland Loan Services, a Division of PNC Bank, National Association | Future Securitization(s) | $37,000,000 |

| 4 | DoubleTree New York Times Square West Leased Fee | UBS AG | $30,000,000 | $58,000,000 | WFCM 2020-C57 | Wells Fargo Bank, National Association | Midland Loan Services, a Division of PNC Bank, National Association | UBS 2019-C18 | $28,000,000 |

| 15 | 122nd Street Portfolio | LCF | $15,000,000 | $23,000,000 | WFCM 2020-C57 | Wells Fargo Bank, National Association | Midland Loan Services, a Division of PNC Bank, National Association | Future Securitization(s) | $8,000,000 |

| 16 | The Grid | LCF | $14,913,167 | $67,109,250 | WFCM 2020-C56 | Wells Fargo Bank, National Association | Midland Loan Services, a Division of PNC Bank, National Association | WFCM 2020-C56 | $52,500,000 |

| (1) | The Aggregate Pari Passu Companion Loan Cut-off Date Balance excludes the related Subordinate Companion Loans. |

THE INFORMATION IN THIS COLLATERAL TERM SHEET IS NOT COMPLETE AND MAY BE AMENDED PRIOR TO THE TIME OF SALE. THIS TERM SHEET IS NOT AN OFFER TO SELL THESE SECURITIES AND IT IS NOT A SOLICITATION OF AN OFFER TO BUY THESE SECURITIES IN ANY JURISDICTION WHERE THE OFFER OR SALE IS NOT PERMITTED.

13

| Wells Fargo Commercial Mortgage Trust 2020-C57 | Characteristics of the Mortgage Pool |

| C. | Mortgage Loans with Additional Secured and Mezzanine Financing |

| Loan No. | Mortgage Loan Seller | Mortgage Loan Name | Mortgage Loan Cut-off Date Balance ($) | % of Initial Pool Balance (%) | Sub Debt Cut-off Date Balance ($) | Mezzanine Debt Cut-off Date Balance ($) | Total Debt Interest Rate (%)(1) | Mortgage Loan U/W NCF DSCR (x)(2) | Total Debt U/W NCF DSCR (x) | Mortgage Loan Cut-off Date U/W NOI Debt Yield (%)(2) | Total Debt Cut-off Date U/W NOI Debt Yield (%) | Mortgage Loan Cut-off Date LTV Ratio (%)(2) | Total Debt Cut-off Date LTV Ratio (%) |

| 4 | UBS AG | DoubleTree New York Times Square West Leased Fee | $30,000,000 | 5.4% | $32,000,000 | NAP | 3.7490% | 2.53x | 1.59x | 9.4% | 6.1% | 43.7% | 67.9% |

| Total/Weighted Average | $30,000,000 | 5.4% | $32,000,000 | NAP | 3.7490% | 2.53x | 1.59x | 9.4% | 6.1% | 43.7% | 67.9% | ||

| (1) | Total Debt Interest Rate for any specified mortgage loan reflects the weighted average of the interest rates on the respective components of the total debt. |

| (2) | With respect to any mortgage loan that is part of a whole loan, the loan-to-value ratio, debt service coverage ratio and debt yield calculations include the related pari passu companion loan(s) but excludes any related subordinate companion loan. |

THE INFORMATION IN THIS COLLATERAL TERM SHEET IS NOT COMPLETE AND MAY BE AMENDED PRIOR TO THE TIME OF SALE. THIS TERM SHEET IS NOT AN OFFER TO SELL THESE SECURITIES AND IT IS NOT A SOLICITATION OF AN OFFER TO BUY THESE SECURITIES IN ANY JURISDICTION WHERE THE OFFER OR SALE IS NOT PERMITTED.

14

| Wells Fargo Commercial Mortgage Trust 2020-C57 | Characteristics of the Mortgage Pool |

| D. | Previous Securitization History(1) |

| Loan No. | Mortgage Loan Seller | Mortgage Loan or Mortgaged Property Name | City | State | Property Type | Mortgage Loan or Mortgaged Property Cut-off Date Balance ($) | % of Initial Pool Balance (%) | Previous Securitization |

| 1.01 | LMF | Prime Storage - Malta/Saratoga Springs | Malta | NY | Self Storage | $5,612,043 | 1.0% | CGCMT 2015-GC31 |

| 1.02 | LMF | Capital Self Storage - Mechanicsburg | Hampden | PA | Self Storage | 5,527,742 | 1.0 | WFCM 2015-C27 |

| 1.03 | LMF | Capital Self Storage - Middletown | Middletown | PA | Self Storage | 5,184,516 | 0.9 | WFCM 2015-C27 |

| 1.04 | LMF | Capital Self Storage - East York | York | PA | Self Storage | 4,600,430 | 0.8 | WFCM 2015-C27 |

| 1.05 | LMF | Capital Self Storage - Harrisburg Arsenal | Harrisburg | PA | Self Storage | 4,413,763 | 0.8 | WFCM 2015-C27 |

| 1.06 | LMF | Eliot Rent A Space & Self Storage | Eliot | ME | Self Storage | 4,070,538 | 0.7 | WFRBS 2014-LC14 |

| 1.07 | LMF | Capital Self Storage - Enola | Enola | PA | Self Storage | 4,070,538 | 0.7 | WFCM 2015-C27 |

| 1.08 | LMF | Capital Self Storage - Harrisburg Derry | Harrisburg | PA | Self Storage | 3,805,591 | 0.7 | WFCM 2015-C27 |

| 1.09 | LMF | Capital Self Storage - West York | York | PA | Self Storage | 3,582,796 | 0.6 | WFCM 2015-C27 |

| 1.10 | LMF | Capital Self Storage - Dover | Dover | PA | Self Storage | 3,510,538 | 0.6 | WFCM 2015-C27 |

| 1.11 | LMF | A Space Place Self Storage | Medford | NY | Self Storage | 3,143,226 | 0.6 | CGCMT 2015-GC31 |

| 1.12 | LMF | Capital Self Storage - Hanover | Hanover | PA | Self Storage | 2,998,710 | 0.5 | WFCM 2015-C27 |

| 1.13 | LMF | Prime Storage - Glens Falls | Glens Falls | NY | Self Storage | 1,836,559 | 0.3 | CGCMT 2015-GC31 |

| 1.14 | LMF | Affordable Storage - Wilton | Wilton | NY | Self Storage | 1,113,978 | 0.2 | CGCMT 2015-GC31 |

| 1.15 | LMF | Prime Storage - Latham New Loudon Road | Cohoes | NY | Self Storage | 1,047,742 | 0.2 | CGCMT 2015-GC31 |

| 1.16 | LMF | Rotterdam Self Storage | Rotterdam | NY | Self Storage | 764,731 | 0.1 | CGCMT 2015-GC31 |

| 1.17 | LMF | Affordable Storage - Saratoga | Wilton | NY | Self Storage | 716,559 | 0.1 | CGCMT 2015-GC31 |

| 2.01 | UBS AG | Edgerton | Edgerton | WI | Industrial | 20,800,000 | 3.7 | SGCP 2018-FL1 |

| 2.02 | UBS AG | Delaware | Delaware | OH | Industrial | 7,725,000 | 1.4 | SGCP 2018-FL1 |

| 2.03 | UBS AG | Pawcatuck | Pawcatuck | CT | Industrial | 6,975,000 | 1.2 | SGCP 2018-FL1 |

| 6 | WFB | Residence Inn - Fort Worth Cultural District | Fort Worth | TX | Hospitality | 27,725,000 | 4.9 | COMM 2012-CR3 |

| 7 | UBS AG | Landmark Corporate Center | Greenwood Village | CO | Office | 25,480,000 | 4.5 | MSC 2007-HQ11 |

| 8 | LMF | Upland Park Townhomes | Houston | TX | Multifamily | 24,000,000 | 4.3 | BANC 2016-CRE1 |

| 10 | UBS AG | Town Square Apartments | Lancaster | CA | Multifamily | 22,500,000 | 4.0 | FREMF 2015-K47; FREMF 2017-KJ17 |

| 16 | LCF | The Grid(2) | Worcester | MA | Multifamily | 14,913,167 | 2.7 | LCCM 2017-FL1 |

| Total | $206,118,167 | 36.8% | ||||||

| (1) | The table above represents the most recent securitization with respect to the mortgaged property securing the related mortgage loan, based on information provided by the related borrower or obtained through searches of a third-party database. While loans secured by the above mortgaged properties may have been securitized multiple times in prior transactions, mortgage loans in this securitization are only listed in the above chart if the mortgage loan paid off a loan in another securitization. The information has not otherwise been confirmed by the mortgage loan sellers. |

| (2) | Of the five buildings comprising The Grid mortgaged property, only two such buildings, representing 71.0% of the total residential units, were collateral for the previously securitized loan. Additional collateral (135 units and approximately 28,000 square feet of commercial space), which previously secured a loan with another lender, was included as part of the mortgaged property for The Grid Mortgage Loan at origination. |

THE INFORMATION IN THIS COLLATERAL TERM SHEET IS NOT COMPLETE AND MAY BE AMENDED PRIOR TO THE TIME OF SALE. THIS TERM SHEET IS NOT AN OFFER TO SELL THESE SECURITIES AND IT IS NOT A SOLICITATION OF AN OFFER TO BUY THESE SECURITIES IN ANY JURISDICTION WHERE THE OFFER OR SALE IS NOT PERMITTED.

15

| Wells Fargo Commercial Mortgage Trust 2020-C57 | Characteristics of the Mortgage Pool |

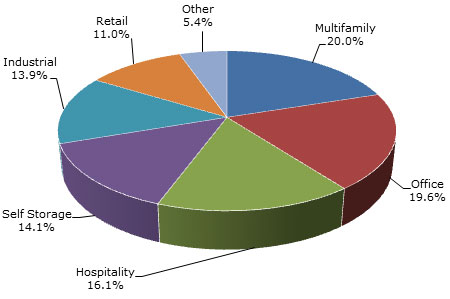

| E. | Property Type Distribution(1) |

| Property Type | Number of Mortgaged Properties | Aggregate Cut-off Date Balance ($) | % of Initial Pool Balance (%) | Weighted Average Cut-off Date LTV Ratio (%) | Weighted Average Balloon LTV Ratio (%) | Weighted Average U/W NCF DSCR (x) | Weighted Average U/W NOI Debt Yield (%) | Weighted Average U/W NCF Debt Yield (%) | Weighted Average Mortgage Rate (%) |

| Multifamily | 18 | $112,213,167 | 20.0% | 65.8% | 56.6% | 1.54x | 8.8% | 8.4% | 4.044% |

| Garden | 6 | 82,300,000 | 14.7 | 65.9 | 55.8 | 1.50 | 9.1 | 8.7 | 4.115 |

| Mid Rise | 12 | 29,913,167 | 5.3 | 65.4 | 58.5 | 1.65 | 7.9 | 7.6 | 3.850 |

| Office | 7 | 109,743,393 | 19.6 | 68.9 | 61.2 | 1.92 | 10.0 | 9.4 | 3.919 |

| Suburban | 4 | 83,230,000 | 14.8 | 68.9 | 60.1 | 1.76 | 10.0 | 9.3 | 4.020 |

| CBD | 1 | 17,871,000 | 3.2 | 69.0 | 69.0 | 2.72 | 9.5 | 9.2 | 3.350 |

| Medical | 2 | 8,642,393 | 1.5 | 68.4 | 56.2 | 1.84 | 10.9 | 10.7 | 4.126 |

| Hospitality | 4 | 90,043,771 | 16.1 | 65.3 | 55.0 | 2.07 | 12.7 | 11.5 | 3.751 |

| Extended Stay | 3 | 55,043,771 | 9.8 | 68.8 | 57.3 | 2.09 | 12.9 | 11.8 | 3.867 |

| Select Service | 1 | 35,000,000 | 6.2 | 59.9 | 51.3 | 2.04 | 12.4 | 11.1 | 3.570 |

| Self Storage | 21 | 79,067,856 | 14.1 | 65.5 | 58.8 | 1.42 | 8.8 | 8.7 | 4.573 |

| Self Storage | 21 | 79,067,856 | 14.1 | 65.5 | 58.8 | 1.42 | 8.8 | 8.7 | 4.573 |

| Industrial | 9 | 78,070,511 | 13.9 | 68.8 | 57.2 | 1.60 | 10.7 | 9.9 | 4.120 |

| Warehouse | 6 | 55,740,511 | 9.9 | 69.4 | 57.6 | 1.62 | 10.9 | 10.1 | 4.004 |

| Manufacturing | 2 | 18,730,000 | 3.3 | 66.2 | 55.1 | 1.51 | 10.1 | 9.5 | 4.522 |

| Flex | 1 | 3,600,000 | 0.6 | 72.9 | 61.9 | 1.66 | 11.3 | 10.2 | 3.840 |

| Retail | 11 | 61,400,957 | 11.0 | 62.1 | 57.6 | 2.08 | 10.1 | 9.6 | 4.144 |

| Single Tenant | 8 | 47,352,532 | 8.4 | 63.5 | 60.3 | 2.07 | 9.5 | 9.1 | 4.118 |

| Unanchored | 2 | 9,131,863 | 1.6 | 61.1 | 52.9 | 2.04 | 10.4 | 10.0 | 4.291 |

| Anchored | 1 | 4,916,562 | 0.9 | 51.0 | 41.0 | 2.28 | 14.6 | 13.4 | 4.120 |

| Other | 1 | 30,000,000 | 5.4 | 43.7 | 43.7 | 2.53 | 9.4 | 9.4 | 3.661 |

| Leased Fee | 1 | 30,000,000 | 5.4 | 43.7 | 43.7 | 2.53 | 9.4 | 9.4 | 3.661 |

| Total/Weighted Average: | 71 | $560,539,656 | 100.0% | 65.1% | 57.1% | 1.80x | 10.1% | 9.5% | 4.048% |

| (1) | Because this table presents information relating to the mortgaged properties and not the mortgage loans, the information for mortgage loans secured by more than one mortgaged property is based on allocated loan amounts (allocating the principal balance of the mortgage loan to each of those properties according to the relative appraised values of the mortgaged properties or the allocated loan amounts or property-specific release prices set forth in the related mortgage loan documents or such other allocation as the related mortgage loan seller deemed appropriate). With respect to any mortgage loan that is part of a whole loan, the loan-to-value ratio, debt service coverage ratio and debt yield calculations include the related pari passu companion loan(s) but exclude any related subordinate secured loan(s) (unless otherwise stated). With respect to each mortgage loan, debt service coverage ratio, debt yield and loan-to-value ratio information do not take into account any subordinate debt (whether or not secured by the related mortgaged property) that currently exists or is allowed under the terms of such mortgage loan. See Annex A-1 to the Preliminary Prospectus. |

THE INFORMATION IN THIS COLLATERAL TERM SHEET IS NOT COMPLETE AND MAY BE AMENDED PRIOR TO THE TIME OF SALE. THIS TERM SHEET IS NOT AN OFFER TO SELL THESE SECURITIES AND IT IS NOT A SOLICITATION OF AN OFFER TO BUY THESE SECURITIES IN ANY JURISDICTION WHERE THE OFFER OR SALE IS NOT PERMITTED.

16

| Wells Fargo Commercial Mortgage Trust 2020-C57 | Characteristics of the Mortgage Pool |

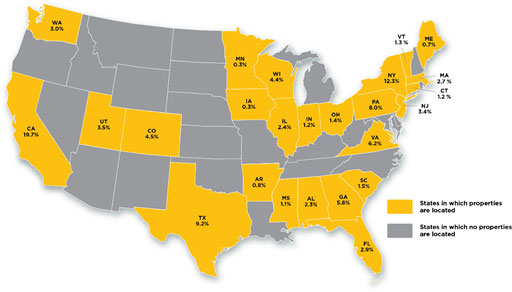

| F. | Geographic Distribution(1) |