As filed with the Securities and Exchange Commission on December 18, 2009

File No. 333-

United States

Securities and Exchange Commission

Washington, D.C. 20549

FORM N-14

REGISTRATION STATEMENT UNDER THE SECURITIES ACT OF 1933

Pre-Effective Amendment No.

Post-Effective Amendment No.

(Check appropriate box or boxes)

DOMINI SOCIAL INVESTMENT TRUST

(Exact Name of Registrant as Specified in Charter)

212-217-1100

(Area Code and Telephone Number)

532 Broadway, 9th Floor, New York, New York 10012

(Address of Principal Executive Offices: Number, Street, City, State, Zip Code)

Amy Domini Thornton

Domini Social Investments LLC

532 Broadway, 9th Floor

New York, New York 10012

(Name and Address of Agent for Service)

Copies to: Roger P. Joseph, Esq.

Bingham McCutchen LLP

One Federal Street

Boston, Massachusetts 02110

Approximate Date of Proposed Public Offering: As soon as practicable after the effective date of this Registration Statement.

Calculation of Registration Fee under the Securities Act of 1933: No filing fee is due because of reliance on Section 24(f) of the Investment Company Act of 1940, which permits registration of an indefinite number of securities.

Title of Securities Being Registered: Shares of beneficial interest of Domini International Social Equity Fund, a series of the Registrant.

It is proposed that this registration statement will become effective on January 18, 2010, pursuant to Rule 488 under the Securities Act of 1933, as amended.

COMBINED PROXY STATEMENT

OF

DOMINI EUROPEAN SOCIAL EQUITY FUNDSM

AND

DOMINI PACASIA SOCIAL EQUITY FUNDSM

(each an “Acquired Fund,” and collectively the “Acquired Funds”)

AND

PROSPECTUS FOR

DOMINI INTERNATIONAL SOCIAL EQUITY FUNDSM

(the “Acquiring Fund” and, together with the Acquired Funds, the “Domini Funds”)

The address and telephone number of each Domini Fund is:

532 Broadway, 9th Floor

New York, NY 10012-3939

1-800-582-6757

www.domini.com

DOMINI EUROPEAN SOCIAL EQUITY FUND

DOMINI PACASIA SOCIAL EQUITY FUND

Domini Social Investments LLC

532 Broadway, 9th Floor

New York, New York 10012

www.domini.com

January , 2010

Dear Fellow Shareholder:

Thank you for your investment in the Domini Funds and for your commitment to making a difference in the world through your investment decisions.

I am writing today to request your vote for an important proposal concerning the Domini European Social Equity Fund and the Domini PacAsia Social Equity Fund.

Please read through the proxy statement and prospectus carefully. We have also prepared a brief overview section to assist you as you make your decision. We hope that you find it helpful.

This package contains the following materials necessary to place your vote:

| | • | | Overview of Proxy Statement: presented in a question and answer format to provide you with a basic understanding of what you are being asked to decide. |

| | • | | Notice of Combined Special Meeting: provides the date and location of a Special Meeting of Shareholders of the Funds, as well as the proposal to be considered at the meeting. |

| | • | | Combined Proxy Statement/Prospectus: contains information you should know about the proposal that will be considered at the meeting. |

The Special Meeting will be held on March 9, 2010, at 11:30 a.m., Eastern Time, at the offices of Bingham McCutchen LLP, One Federal Street, Boston, Massachusetts. You are receiving the proxy statement and prospectus because you were a shareholder of the Domini European Social Equity Fund or the Domini PacAsia Social Equity Fund on January 15, 2010, and are entitled to vote.

I certainly understand your temptation to set this proxy aside for another day, or to simply ignore it altogether. I strongly encourage you to resist this temptation. You will save Fund shareholders additional costs if you vote promptly. Your vote is important, and voting only takes a few minutes. If the Funds do not receive your vote, you may be contacted to help you cast your vote.

You are not required to attend the Special Meeting in order to cast your vote. You may use one of three options to vote your proxy. Please read the enclosed materials and then cast your vote as follows:

| | • | | Mail: Complete, sign, and return the enclosed card in the enclosed postage-paid envelope, or |

| | • | | Phone: Call the toll-free number printed on your proxy card and follow the instructions, or |

| | • | | Online: Visit the web address printed on your proxy card and follow the instructions. |

Each shareholder will cast one vote for each dollar of net asset value they hold (number of shares owned multiplied by the net asset value per share).

The Funds’ Board of Trustees has carefully reviewed the proposal and has determined that it is fair and reasonable and in shareholders’ best interests. The Funds’ Board of Trustees is composed of seven individuals, six of whom are unaffiliated with Domini Social Investments LLC, the manager and administrator of the Funds. Their job is to protect your interests as a shareholder.

The Board unanimously recommends that you vote “For” this proposal.

Your vote is important. Please take a moment now to vote by completing and mailing your proxy card, or by calling the toll-free number or visiting the web address printed on your proxy card. If you choose to vote by mail, please be sure to sign your proxy card and return it in the enclosed postage-paid envelope. If you have any questions regarding the issue to be voted on, or need assistance in completing your proxy card, please call 1-800-582-6757.

Thank you in advance for your participation in this important process.

|

| Sincerely yours, |

|

|

| Amy L. Domini |

| Chair and President |

OVERVIEW OF COMBINED PROXY STATEMENT/PROSPECTUS

A combined Special Meeting of Shareholders of the Domini European Social Equity Fund and the Domini PacAsia Social Equity Fund (together, at times referred to below as the “Funds,” “the Acquired Funds,” and individually as a “Fund” or an “Acquired Fund”) will be held on March 9, 2010, at 11:30 a.m., Eastern Time, at the offices of Bingham McCutchen LLP, One Federal Street, Boston, Massachusetts, for the purposes described in the proxy statement.

You are being asked to vote FOR the following proposal:

A proposal to approve an Agreement and Plan of Reorganization providing for (i) the acquisition of all of the assets and the assumption of the liabilities of each Acquired Fund, in exchange for shares of Domini International Social Equity Fund to be distributed to the shareholders of the Acquired Fund, and (ii) the subsequent liquidation and dissolution of the Acquired Fund.

We encourage you to read the combined proxy statement/prospectus carefully before casting your vote.

We have prepared the following questions and answers to help make your decision easier. If you have any further questions, please feel free to call us at 1-800-582-6757.

| | Q. | What am I being asked to approve? |

| | A. | You are being asked to approve a reorganization of the Funds whereby the Domini International Social Equity Fund will acquire all of the assets and liabilities of the Domini European Social Equity Fund and the Domini PacAsia Social Equity Fund. After the completion of the transaction, the Domini European Social Equity Fund and the Domini PacAsia Social Equity Fund will be dissolved and will no longer be available for investment. |

| | | Prior to November 27, 2009, the Domini International Social Equity Fund was known as the Domini European PacAsia Social Equity Fund. |

| | Q. | How will this affect my investment? |

| | A. | At the completion of the transaction, you will become a shareholder in the Domini International Social Equity Fund. You will receive shares in the Domini International Social Equity Fund equal in value to your current investment in the Domini European Social Equity Fund and/or the Domini PacAsia Social Equity Fund. |

| | Q. | Why are shareholders of the Domini European Social Equity Fund and Domini PacAsia Social Equity Fund being asked to approve a reorganization of the Funds? |

| | A. | The Board of Trustees believes that reorganizing each Acquired Fund into Domini International Social Equity Fund offers shareholders a number of potential benefits. |

| | | It is more cost-effective and efficient to manage one large fund than three small funds. |

The larger size of the combined Fund may result in greater economies of scale. Any such economies of scale would benefit the combined Fund in two ways. First, a larger Fund, which trades in larger blocks of securities, will be able to hold larger positions in individual securities and, consequently, may be able to obtain better net prices on securities trades. And second, each Fund incurs substantial operating costs for accounting, legal, and custodial services. The combined Fund resulting from each Reorganization would spread fixed expenses over a larger asset base, potentially contributing to a lower expense ratio in the long term than each Acquired Fund could achieve separately. In addition, the combined Fund may be better positioned to attract assets than each Acquired Fund.

Please note that approval of the proposal will not result in any immediate reduction in the expenses paid by shareholders, and there is no guarantee that the expense ratio will be reduced in the future.

| | Q. | What are the similarities between the Domini International Social Equity Fund and the two Acquired Funds? |

| | A. | The three funds share the following similarities: |

All three Funds are managed by Domini, submanaged by Wellington Management Company, LLP, and use an investment approach that incorporates Domini’s social and environmental standards. The management fee schedule for the three funds is identical.

Each Fund has identical investment objectives and fundamental investment policies.

Each Fund invests in non-U.S. securities.

Each Fund has the same net expense ratio.

A comparison of each Fund’s investment objective and strategies, expenses, and performance is set forth in the “Summary” section of the Combined Proxy Statement/Prospectus.

| | Q. | What are the differences between the Domini International Social Equity Fund and the two Acquired Funds? |

| | A. | The Domini European Social Equity Fund and Domini PacAsia Social Equity Funds are regional funds, focusing on the securities of companies located in Europe and the Asia-Pacific region, respectively. |

| | | Unlike these Funds, Domini International Social Equity Fund invests in securities of companies located throughout the world, including securities of companies located both in Europe and in the Asia-Pacific region. Currently, there is substantial overlap between the portfolio of the Domini International Social Equity Fund and the two Acquired Funds. |

| | Q. | What is the performance benchmark for the Domini International Social Equity Fund? |

| | A. | The Morgan Stanley Capital International Europe Australasia Index (MSCI EAFE), a free float-adjusted market capitalization weighted index that is designed to measure the equity market performance of developed markets, excluding the U.S. and Canada. |

| | Q. | Will the reorganization result in lower expenses to shareholders? |

| | A. | The net expense ratio for each class of shares of the combined Fund will be the same as the corresponding class of the Acquired Funds. Domini has contractually agreed to waive fees and reimburse expenses in order to limit the combined Fund’s ordinary operating expenses to 1.60% and 1.57% of the average daily net assets attributable to Investor shares and Class A shares, respectively. Assuming shareholders approve the Reorganization with respect to an Acquired Fund, these expense limitations will be in effect for the combined Fund with respect to that Reorganization for one year from the Closing Date of that Reorganization. There can be no assurance that Domini will extend the expense limits beyond such time. The gross expense ratio for each class of shares of the combined fund is expected to be the same or lower than the corresponding class of the Acquired Funds. |

| | Q. | Will this transaction be a taxable event to shareholders? |

| | A. | The Fund reorganizations are not expected to result in a taxable sale of your Fund shares. The Reorganizations generally will not result in income, gain, or loss being recognized for federal income tax purposes by any Domini Fund or its shareholders, except as set forth in the combined Proxy Statement/Prospectus under the heading “Tax Status of Each Reorganization,” and will not take place unless each Domini Fund involved in the applicable Reorganization receives an opinion concerning the tax consequences of the Reorganization from Bingham McCutchen LLP, counsel to the Domini Funds, as further described in the Combined Proxy Statement/Prospectus statement under the heading “Tax Status of Each Reorganization.” |

| | Q. | What is the role of the Board of Trustees? |

| | A. | The Board of Trustees has the important responsibility of protecting your interests as a Domini Funds shareholder. One board consisting of seven individuals, six of whom are “independent,” oversees the operations of each of the Funds. The Trustees act as your representatives, and base their decisions on your best interests as a Fund shareholder. In addition, the independent Trustees are represented by independent legal counsel to provide counsel and guidance in connection with determining the best interests of shareholders. |

| | Q. | How does the Board of Trustees recommend that I vote? |

| | A. | The Board of Trustees has carefully reviewed the proposal presented in the proxy statement, and unanimously recommends that shareholders vote FOR the proposal on the enclosed proxy card(s). A discussion of the factors that the Trustees considered before granting their approval is included in the “Summary” section of the Combined Proxy Statement/Prospectus. |

| | A. | You can vote one of four ways: |

| | |

| 1. | | Mail: Complete, sign, and mail your proxy card using the enclosed postage-paid envelope. |

| 2. | | Phone: Call the toll-free number printed on your proxy card and follow the instructions. |

| 3. | | Online: Visit the web address printed on your proxy card, and follow the instructions. |

| 4. | | In person at the Special Meeting of Shareholders. |

This page intentionally left blank

NOTICE OF COMBINED SPECIAL MEETING OF SHAREHOLDERS

SCHEDULED FOR MARCH 9, 2010

To the Shareholders of Domini European Social Equity Fund and Domini PacAsia Social Equity Fund (each an “Acquired Fund,” and collectively the “Acquired Funds”):

This is the formal agenda for the combined special meeting of shareholders of each of the Acquired Funds (the “meeting”). It tells you what matters will be voted on and the time and place of the meeting, in case you want to attend in person.

The meeting will be held at the offices of Bingham McCutchen LLP, One Federal Street, Boston, Massachusetts on March 9, 2010, at 11:30 am, Eastern Time, to consider the following:

| | 1. | A proposal to approve an Agreement and Plan of Reorganization providing for (i) the acquisition of all of the assets of each Acquired Fund in exchange for shares of Domini International Social Equity Fund to be distributed to the shareholders of the Acquired Fund and the assumption of the liabilities of the Acquired Fund by Domini International Social Equity Fund, and (ii) the subsequent liquidation and dissolution of the Acquired Fund. |

| | 2. | Any other business that may properly come before the meeting or any adjournments or postponements thereof. |

YOUR TRUSTEES RECOMMEND THAT YOU VOTE IN FAVOR OF THE PROPOSAL.

Shareholders of record as of the close of business on January 15, 2010, are entitled to vote at the meeting and any adjournments or postponements thereof.

|

By Order of the Board of Trustees, |

|

Megan L. Dunphy |

Secretary |

New York, New York

, [ ]

WHETHER OR NOT YOU EXPECT TO ATTEND THE MEETING, PLEASE COMPLETE AND RETURN THE ENCLOSED PROXY. If shareholders do not return their proxies in sufficient numbers, your Fund may be required to make additional solicitations.

COMBINED PROXY STATEMENT

OF

DOMINI EUROPEAN SOCIAL EQUITY FUNDSM

AND

DOMINI PACASIA SOCIAL EQUITY FUNDSM

(each an “Acquired Fund,” and collectively the “Acquired Funds”)

AND

PROSPECTUS FOR

DOMINI INTERNATIONAL SOCIAL EQUITY FUNDSM

(the “Acquiring Fund” and, together with the Acquired Funds, the “Domini Funds”)

The address and telephone number of each Domini Fund is:

532 Broadway, 9th Floor

New York, NY 10012-3939

1-800-582-6757

www.domini.com

Shares of the Domini Funds have not been approved or disapproved by the Securities and Exchange Commission (the “SEC”). The SEC has not passed on the adequacy of this prospectus. Any representation to the contrary is a criminal offense.

An investment in a Domini Fund (each sometimes referred to herein as a “Fund”) is not a bank deposit and is not insured or guaranteed by the Federal Deposit Insurance Corporation or any other government agency.

This Proxy Statement/Prospectus sets forth information about the Domini Funds that an investor needs to know before investing or voting. Please read this Proxy Statement/Prospectus carefully before investing and keep it for future reference.

- 1 -

TABLE OF CONTENTS

- 2 -

INTRODUCTION

This combined proxy statement/prospectus, dated (the “Proxy Statement/Prospectus”), is being furnished to shareholders of Domini European Social Equity Fund and Domini PacAsia Social Equity Fund (each an “Acquired Fund,” and collectively the “Acquired Funds”) in connection with the solicitation by the Board of Trustees (the “Board” or the “Trustees”) of each Acquired Fund of proxies to be used at a combined special meeting of the shareholders of each Acquired Fund to be held at the offices of Bingham McCutchen LLP, One Federal Street Boston, Massachusetts on March 9, 2010, at 11:30 a.m., Eastern Time. The Proxy Statement/Prospectus is being mailed to shareholders of each Acquired Fund on or about .

The purpose of this Proxy Statement/Prospectus is to obtain shareholder approval to reorganize each Acquired Fund into Domini International Social Equity Fund (the “Acquiring Fund”). Each of the Acquired Funds and the Acquiring Fund is a series of Domini Social Investment Trust, an open-end management investment company organized as a Massachusetts business trust.

The Proxy Statement/Prospectus contains information you should know before voting on the Agreement and Plan of Reorganization that provides for the reorganization of your Acquired Fund into Domini International Social Equity Fund (each a “Reorganization”). With respect to each Acquired Fund, the Agreement and Plan of Reorganization is subject to approval by the shareholders of that Acquired Fund. A copy of the Agreement and Plan of Reorganization is attached to this Proxy Statement/Prospectus as Exhibit A. Shareholders should read this entire Proxy Statement/Prospectus, including Exhibit A, carefully.

For each Reorganization, all shareholders of the applicable Acquired Fund, regardless of the class of shares held, will vote together as a single class with respect to approval of the Agreement and Plan of Reorganization.

The date of this Proxy Statement/Prospectus is .

For more complete information about each Domini Fund, please read the Funds’ prospectus and statement of additional information, as they may be amended and/or supplemented. The Domini Funds’ prospectus and statement of additional information has been filed with the SEC (http://www.sec.gov) and is available upon oral or written request and without charge. See “Where to Get More Information” below.

| | |

Where to Get More Information |

| Each Domini Fund’s current prospectus, statement of additional information, and any applicable supplements. | | On file with the SEC (http://www.sec.gov) and available at no charge at www.domini.com by calling our toll-free number: 1-800-582-6757 |

| Each Domini Fund’s most recent annual and semi-annual reports to shareholders. | | On file with the SEC (http://www.sec.gov) and available at no charge at www.domini.com or by calling our toll-free number: 1-800-582-6757. See “Available Information.” |

| A statement of additional information for this Proxy Statement/Prospectus (the “SAI”), dated . It contains additional information about the Domini Funds. | | On file with the SEC (http://www.sec.gov) and available at no charge at www.domini.com or by calling our toll-free number: 1-800-582-6757. This SAI is incorporated by reference into this Proxy Statement/Prospectus. |

| To ask questions about this Proxy Statement/Prospectus. | | Call our toll-free telephone number: 1-800-582-6757. |

The Domini Funds’ prospectus and statement of additional information dated November 27, 2009, as supplemented, are incorporated by reference into this Proxy Statement/Prospectus.

- 3 -

Background to the Reorganizations

After considering the viability of each Acquired Fund in light of its current size (for Domini European Social Equity Fund, approximately $59.6 million as of November 30, 2009; for Domini PacAsia Social Equity Fund, approximately $23.3 million as of November 30, 2009) and the uncertainty of future asset growth, Domini Social Investments LLC (“Domini”) recommended the reorganization of each Acquired Fund into Domini International Social Equity Fund to the Board of Trustees. The Acquired Funds and Domini International Social Equity Fund have the same investment adviser, Domini, and the same investment submanager, Wellington Management Company, LLP (“Wellington Management”). Each Fund is managed using an investment approach that incorporates Domini’s social and environmental standards. Each Fund has identical investment objectives and fundamental investment policies. Each Fund invests in non-U.S. securities, although, unlike the Acquired Funds, Domini International Social Equity Fund is not limited to investing primarily in securities of companies located in a single geographic region.

How Will the Reorganizations Work?

| | • | | Each Reorganization is scheduled to occur on or about March 19, 2010, but may occur on such later date as the applicable Acquired Fund and the Domini International Social Equity Fund may agree in writing (the “Closing Date”). |

| | • | | Each Acquired Fund will transfer all of its assets to Domini International Social Equity Fund, and Domini International Social Equity Fund will assume all of the liabilities of each Acquired Fund. The net asset value of each Domini Fund will be computed as of the close of regular trading on the New York Stock Exchange on the Closing Date. |

| | • | | Domini International Social Equity Fund will issue Investor Shares to each Acquired Fund in amounts equal to the aggregate net asset value of the Acquired Fund’s Investor Shares. Domini International Social Equity Fund will issue Class A Shares to each Acquired Fund in amounts equal to the aggregate net asset value of the Acquired Fund’s Class A Shares. |

| | • | | Shareholders of each Acquired Fund will receive shares of Domini International Social Equity Fund in proportion to the relative net asset value of their shareholdings in the Acquired Fund on the Closing Date, determined class by class. Therefore, on the Closing Date, you will hold shares of each class of Domini International Social Equity Fund with the same aggregate net asset value as your holdings of shares of the corresponding class of your Acquired Fund immediately prior to the Reorganization. The net asset value attributable to a class of shares of each Domini Fund will be determined using the Fund’s valuation policies and procedures. Each Fund’s valuation policies and procedures are identical. |

| | • | | No sales load, commission, redemption fee or other transactional fee will be charged as a result of a Reorganization. After the applicable Reorganization, any contingent deferred sales charge that applied to your Class A shares (if applicable) at the time of the Reorganization will continue to apply for the remainder of the applicable holding period at the time of the Reorganization. In calculating any applicable contingent deferred sales charges, the holding periods applicable to certain purchases of Class A Shares will be included in the holding period of the shares of Domini International Social Equity Fund you receive as a result of the applicable Reorganization. |

- 4 -

Why Does the Board of Trustees Recommend Each Reorganization?

In recommending each Reorganization, the Board of Trustees, including all of the Trustees who are not “interested” persons (as defined in the Investment Company Act of 1940, as amended (the “1940 Act”)) of the Domini Funds, Domini, or DSIL Investment Services LLC, the Domini Funds’ principal underwriter and distributor (“DSIL”) (the “Independent Trustees”), has determined the Reorganization is in the best interest of the applicable Fund and will not dilute the interests of shareholders of that Domini Fund. The Board of Trustees believes that reorganizing each Acquired Fund into Domini International Social Equity Fund offers shareholders a number of potential benefits. The potential benefits of, and considerations regarding, each Reorganization include:

| | • | | The Reorganization would enhance the potential for the combined Fund to achieve growth in assets. The combined Fund may be better positioned to attract assets than the applicable Acquired Fund. The larger size of the combined Fund may result in greater economies of scale. Any such economies of scale would benefit the combined Fund in two ways. First, a larger Fund, which trades in larger blocks of securities, will be able to hold larger positions in individual securities and, consequently, may be able to obtain better net prices on securities trades. And second, each Fund incurs substantial operating costs for accounting, legal, and custodial services. The combined Fund resulting from the Reorganization would decrease the total cost of certain fees and then allocate the reduced fixed costs over a larger asset base, potentially contributing to a lower expense ratio in the long term than the applicable Acquired Fund could achieve separately. |

| | • | | The applicable Acquired Fund and Domini International Social Equity Fund are managed by Domini and submanaged by Wellington Management using an investment approach that incorporates Domini’s social and environmental standards. |

| | • | | The applicable Acquired Fund and the Acquiring Fund have identical investment objectives and fundamental investment policies. Each Fund invests in non-U.S. securities. Unlike the Acquired Fund, Domini International Social Equity Fund is not limited to investing primarily in the securities of companies located in a specific geographic region. Domini International Social Equity Fund invests in securities of companies located throughout the world, including securities of companies located both in Europe and in the Asia-Pacific region, the regions in which Domini European Social Equity Fund and Domini PacAsia Social Equity Fund focus their respective investments. |

| | • | | The pro forma gross expense ratios are expected to be the same or lower for each class of shares of the combined Fund as compared to the same classes of the applicable Acquired Funds. |

| | • | | The pro forma net expense ratios will be the same for each class of shares of the combined Fund as compared to the same classes of the applicable Acquired Fund. Domini has contractually agreed to waive fees and reimburse expenses in order to limit the combined Fund’s ordinary operating expenses to 1.60% and 1.57% of the average daily net assets attributable to Investor Shares and Class A Shares, respectively. Assuming shareholders of an Acquired Fund approve the Reorganization of that Fund, these expense limitations will be in effect for the combined Fund for one year from the Closing Date of the Reorganization. There can be no assurance that Domini will extend the expense limits beyond such time. |

| | • | | The management fee schedule for the applicable Acquired Fund and Domini International Social Equity Fund is the same (1.00% of the first $250 million of net assets managed; 0.94% of the next $250 million of net assets managed; and 0.88% of net assets managed in excess of $500 million), and therefore there will be no increase in management fees (as a percentage of average daily net assets) as a result of the Reorganization. |

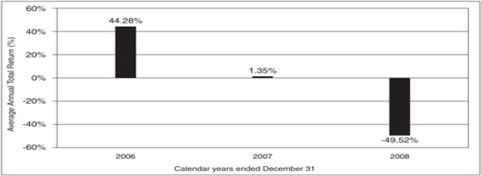

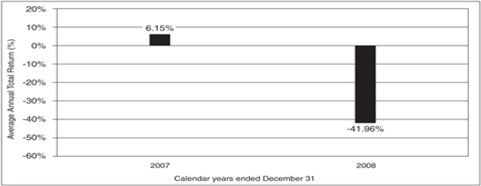

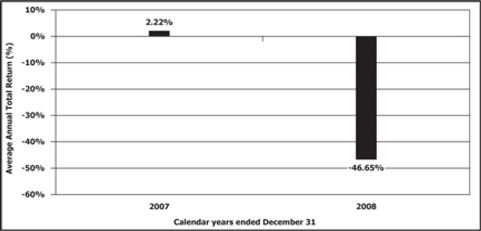

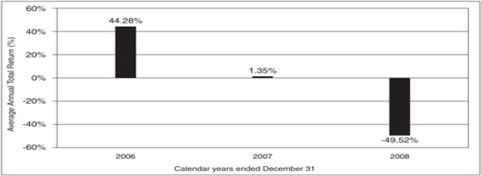

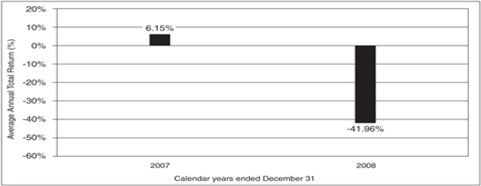

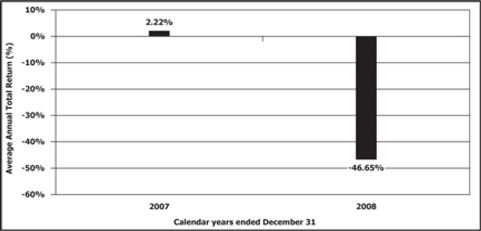

| | • | | Domini PacAsia Social Equity Fund performed moderately better than Domini International Social Equity Fund for the one-year periods ended December 31, 2007, and December 31, 2008. Domini International Social Equity Fund performed slightly better than Domini European Social Equity Fund for the one year |

- 5 -

| | periods ended December 31, 2007 and 2008. For the period from January 1, 2009, through September 30, 2009, the Domini European Social Equity Fund and the Domini PacAsia Social Equity Fund performed slightly better than the Domini International Social Equity Fund. Please note that prior to November 27, 2009, Domini International Social Equity Fund was known as Domini European PacAsia Social Equity Fund, and invested primarily in stocks of European and Asia-Pacific companies. |

| | • | | There is substantial overlap in the portfolio securities held by Domini International Social Equity Fund and the respective portfolio securities held by Domini European Social Equity Fund and Domini PacAsia Social Equity Fund, and accordingly it is not necessary for an Acquired Fund to dispose of its portfolio securities to effect the applicable Reorganization. Although the combined Fund is not required to dispose of either Acquired Fund’s portfolio securities following the applicable Reorganization, the portfolio manager of the combined Fund may conclude that some of the holdings of the applicable Acquired Fund are not consistent with the combined Fund’s long-term investment strategy and may dispose of such positions. The disposition of securities following a Reorganization could result in capital gains to the combined Fund. The actual tax consequences of any disposition of portfolio securities will vary depending upon the specific security(ies) being sold. The disposition of portfolio securities also would result in brokerage expense to the combined Fund. |

| | • | | The Reorganization is expected to be treated as a reorganization under Section 368(a) of the Internal Revenue Code of 1986, as amended (the “Code”), and therefore is not expected to result in a taxable sale of your Acquired Fund shares. |

Therefore, your Fund’s Board of Trustees recommends that you vote FOR the applicable Reorganization.

What are the Federal Income Tax Consequences of Each Reorganization?

As a condition to the closing of each Reorganization, the applicable Acquired Fund and Domini International Social Equity Fund must receive an opinion of Bingham McCutchen LLP to the effect that the Reorganization will constitute a “reorganization” within the meaning of Section 368(a) of the Code. Accordingly, subject to the limited exceptions described below under the heading “Tax Status of Each Reorganization,” it is expected that neither you nor your Acquired Fund will recognize gain or loss as a direct result of the applicable Reorganization, and that the aggregate tax basis of Domini International Social Equity Fund shares that you receive in the applicable Reorganization will be the same as the aggregate tax basis of the shares that you surrender in that Reorganization. In addition, the holding period of Domini International Social Equity Fund shares you receive in the applicable Reorganization will include the holding period of the shares of your Acquired Fund that you surrender in that Reorganization, provided that you held the shares of your Acquired Fund as capital assets on the date of that Reorganization. However, in accordance with the Domini Funds’ policy that each Domini Fund distributes its investment company taxable income (computed without regard to the dividends-paid deduction), net tax-exempt income and net capital gains for each taxable year (in order to qualify for tax treatment as a regulated investment company and avoid federal income tax thereon at the fund level), your Acquired Fund will declare and pay a distribution of such income and gains, if any, to its shareholders shortly before the applicable Reorganization. Such distribution may affect the amount, timing, or character of taxable income that you realize in respect of your Acquired Fund shares. Domini currently estimates that the distribution of taxable income before each Reorganization will be approximately [$XX] and [$XX] per share for the Investor and Class A shares of the Domini European Social Equity Fund, respectively, and [$XX] and [$XX] per share for the Investor and Class A shares of the Domini PacAsia Social Equity Fund, respectively. Domini International Social Equity Fund may make a comparable distribution to its shareholders shortly before the applicable Reorganization. Additionally, following the applicable Reorganization, Domini International Social Equity Fund will declare and pay to its shareholders a distribution of any income and gains not previously distributed for the taxable year in which the Reorganization occurs in accordance with the Domini Funds’ policy that each Domini Fund distributes its investment company taxable income, net tax-exempt income and net capital gains for each taxable year (in order to qualify for tax treatment as a regulated investment company and avoid federal income tax thereon at the fund level). Dividends from net income (excluding capital gains), if any, are

- 6 -

typically paid semi-annually (usually in June and December). Any capital gain dividends are distributed annually in December. Those distributions will be reportable to you for tax purposes, even though those distributions may include a portion of Domini International Social Equity Fund’s income and gains that were accrued and/or realized before the Closing Date.

Who Bears the Expenses Associated with Each Reorganization?

The expenses incurred in connection with each Reorganization (including, but not limited to, preparing, printing and mailing of any shareholder communications, including this Proxy Statement/Prospectus, any filings with the SEC and other governmental agencies in connection with the Reorganization, and any proxy solicitation costs) will be allocated among the applicable Acquired Fund and the Acquiring Fund pro rata based on each Fund’s net assets immediately prior to the closing of the Reorganization. If both Reorganizations are consummated on the same Closing Date, the expenses incurred in connection with the Reorganizations shall be allocated among the Acquired Funds and the Acquiring Fund pro rata based on each Fund’s net assets immediately prior to the closing of the Reorganizations. The Board estimates that these expenses in the aggregate will not exceed $150,000 If both Reorganizations are consummated on the same Closing Date, Domini European Social Equity Fund will bear approximately $78,310 of the Reorganization costs (this and all of the following estimates are based on net assets as of July 31, 2009), Domini PacAsia Social Equity Fund will bear approximately $31,804 of the Reorganization costs, and Domini International Social Equity Fund will bear approximately $39,866 of the Reorganization costs. If only the Domini European Social Equity Fund Reorganization is consummated, Domini European Social Equity Fund will bear approximately $99,382 of the Reorganization costs and Domini International Social Equity Fund will bear approximately $50,618 of the Reorganization costs. If only the Domini PacAsia Social Equity Fund Reorganization is consummated, Domini PacAsia Social Equity Fund will bear approximately $66,545 of the Reorganization costs and Domini International Social Equity Fund will bear approximately $83,455 of the Reorganization costs.

What Happens if a Reorganization Is Not Approved?

If the required approval of shareholders of your Acquired Fund is not obtained, the meeting may be adjourned with respect to your Acquired Fund as more fully described in this Proxy Statement/Prospectus, and your Acquired Fund will continue to engage in the business as a separate mutual fund and the Board will consider what further action may be appropriate. The consummation of a Reorganization is not contingent on consummation of the other Reorganization.

Who Is Eligible to Vote?

Shareholders of record of your Acquired Fund on January 15, 2010, are entitled to attend and vote at the meeting or any adjourned meeting. For each Reorganization, all shareholders of the applicable Acquired Fund, regardless of the class of shares held, will vote together as a single class with respect to approval of the Agreement and Plan of Reorganization. With respect to the Reorganization of your Acquired Fund, you are entitled to one vote for each dollar of net asset value represented by the shares you own (number of shares owned multiplied by the net asset value per share) in your Acquired Fund. Shares represented by properly executed proxies, unless revoked before or at the meeting, will be voted according to shareholders’ instructions. If you sign a proxy but do not fill in a vote, your shares will be voted to approve the Agreement and Plan of Reorganization. If any other business comes before the meeting, your shares will be voted at the discretion of the persons named as proxies.

- 7 -

SUMMARY

The following is a summary of more complete information appearing later in this Proxy Statement/Prospectus or incorporated herein. You should read carefully the entire Proxy Statement/Prospectus, including the form of Agreement and Plan of Reorganization attached as Exhibit A, because it contains details that are not in the summary and is a part of this Proxy Statement/Prospectus. For a discussion of the terms of the Agreement and Plan of Reorganization, please see the section titled “Terms of The Agreement and Plan of Reorganization.”

Each Acquired Fund and Domini International Social Equity Fund are managed by Domini and submanaged by Wellington Management using an investment approach that incorporates Domini’s social and environmental standards. Each Acquired Fund and Domini International Social Equity Fund have identical investment objectives and fundamental investment policies. Each Fund invests in non-U.S. securities. Unlike the Acquired Funds, Domini International Social Equity Fund is not limited to investing in the securities of companies located in a specific geographic region. Domini International Social Equity Fund invests in securities of companies located throughout the world, including securities of companies located both in Europe and in the Asia-Pacific region. Domini European Social Equity Fund focuses on investments in stocks of European companies. Domini PacAsia Social Equity Fund focuses on investments in stocks of companies tied economically to the Asia-Pacific Region. The table below provides a comparison of the three funds. In the table below, if a row extends across the entire table, the policy disclosed applies to each Domini Fund.

Comparison of Domini European Social Equity Fund, Domini PacAsia Social Equity Fund,

and Domini International Social Equity Fund

| | | | | | |

| | | Domini European Social Equity Fund | | Domini PacAsia Social Equity Fund | | Domini International Social Equity Fund |

| Business | | A diversified series of Domini Social Investment Trust, an open-end management investment company organized as a Massachusetts business trust. |

Net assets (as of November 30, 2009) | | $59,639,750 | | $23,302,230 | | $33,216,254 |

Investment adviser | | Domini |

Investment submanager | | Wellington Management |

Portfolio manager | | David J. Elliott, CFA, vice president and director of quantitative portfolio management of Wellington Management, has been a member of the quantitative management group supporting each Fund since 2005, and has served on the portfolio management team responsible for each Fund since May 2009. Mr. Elliott joined Wellington Management in 1995 and has been an investment professional since 1999. |

Investment objective | | Long-term total return. |

- 8 -

| | | | | | |

| | | Domini European Social Equity Fund | | Domini PacAsia Social Equity Fund | | Domini International Social Equity Fund |

| Primary investments | | Under normal circumstances, at least 80% of the Fund’s assets will be invested in equity securities and related investments of European companies. For purposes of this policy, European companies include (1) companies organized or principally traded in a European country; (2) companies having at least 50% of their assets in, or deriving 50% or more of their revenues or profits from, a European country; and (3) issuers who are European governments and agencies or underlying instrumentalities of European governments. For purposes of this policy, European countries include those countries represented by companies in the MSCI All Country Europe Index. The Fund will provide shareholders with at least 60 days’ prior written notice if it changes this 80% policy. | | Under normal circumstances, at least 80% of the Fund’s assets will be invested in equity securities and related investments of companies tied economically to the Asia-Pacific region. For purposes of this policy, these companies may include, but are not limited to, (1) companies organized or principally traded in an Asia-Pacific country; (2) companies having at least 50% of their assets in, or deriving 50% or more of their revenues or profits from, an Asia-Pacific country; and (3) issuers who are Asia-Pacific governments and agencies or underlying instrumentalities of Asia-Pacific governments. For purposes of this policy, Asia-Pacific countries include those countries represented by companies in the MSCI All Country Asia Pacific Index. The Fund will provide shareholders with at least 60 days’ prior notice if it changes this 80% policy. | | Under normal circumstances, the Fund primarily invests in the equity securities of mid- and large-capitalization companies located in Europe, the Asia-Pacific region, and throughout the rest of the world. The fund’s investments will normally be tied economically to at least 10 countries other than the U.S. Under normal circumstances, at least 80% of the Fund’s assets will be invested in equity securities and related investments with similar economic characteristics. The Fund will provide shareholders with at least 60 days’ prior written notice if it changes this 80% policy. |

| | | Each Fund may invest in companies of any capitalization, but under normal market conditions will invest primarily in mid-cap to large-cap companies. Domini defines mid- and large-cap companies to be those companies with a market capitalization at the time of purchase between $2 and $10 billion, or greater than $10 billion, respectively. It is expected that at least 80% of the Fund’s assets will be invested in mid- to large-cap companies under normal market conditions. |

| | | The Fund may invest in securities of both developed and emerging market countries. While the Fund’s submanager expects that most of the securities held by the Fund will be traded in European securities markets (or in equivalent shares such as American Depository Receipts, European Depository Receipts, Global Depository Receipts, or other securities representing underlying shares of foreign companies), some could be traded outside the region. | | The Fund may invest in securities of both developed and emerging market countries. While the Fund’s submanager expects that most of the securities held by the Fund will be traded in Asia-Pacific securities markets (or in equivalent shares such as American Depository Receipts, European Depository Receipts, Global Depository Receipts, or other securities representing underlying shares of foreign companies), some could be traded outside the region. | | The Fund will primarily invest in securities of developed market countries throughout the world (or in equivalent shares such as American Depository Receipts, European Depository Receipts, Global Depository Receipts, or other securities representing underlying shares of foreign companies) but may invest up to 10% of its assets in emerging-markets countries. |

- 9 -

| | | | | | |

| | | Domini European Social Equity Fund, Domini PacAsia Social Equity Fund, and Domini International Social Equity Fund |

Investment strategies | | As a primary strategy, the investment approach of each Fund incorporates Domini’s social and environmental standards. Each Fund’s investments are selected from a universe of securities that Domini has identified as eligible for investment based on its evaluation against Domini’s social and environmental standards. Domini evaluates a Fund’s potential investments against its social and environmental standards based on the businesses in which they engage, as well as on the quality of their relations with key stakeholders, including communities, customers, ecosystems, employees, investors, and suppliers. For additional information about the standards Domini uses to evaluate potential investments and the securities held by a Fund, and certain limitations on investments, please see “Socially Responsible Investing.” Domini reserves the right to alter its social and environmental standards or the application of those standards, or to add new standards, at any time without shareholder approval. Each Fund’s submanager uses a proprietary quantitative model to select investments from among those which Domini has notified the subadviser are eligible for investment. The portfolio construction process seeks to manage risk and ensure that a Fund’s holdings and characteristics are consistent with the Fund’s investment objective. The submanager’s quantitative stock selection process uses multiple factors to determine a security’s attractiveness. The factors can be grouped loosely into “value” and “momentum” categories. Valuation factors compare securities within sectors based on measures such as price ratios and balance sheet strength. Momentum focuses on stocks with favorable earnings and stock price momentum to assess the appropriate time for purchase. The quantitative analysis favors stocks that appear to be both inexpensive according to the value factors and well-positioned according to earnings growth and price momentum factors. The weight of each factor and category varies by industry and region. The subadviser will seek to buy the most attractive stocks and sell the least attractive stocks, within reasonable turnover constraints. Portfolio sector weights are managed relative to a Fund’s benchmark; consequently, the Fund may invest a significant percentage of its assets in a single sector if that sector represents a large proportion of the benchmark. Under normal circumstances, the submanager will seek to remove a security from a Fund’s portfolio within 90 days after receiving a notification from Domini that an investment in such security is not consistent with its social and environmental standards. Such notifications may cause the Fund to dispose of a security at a time when it may be disadvantageous to do so. As an additional strategy, each Fund may reserve a portion of its portfolio for various reasons including to invest in companies with strong social or environmental profiles or to support shareholder advocacy initiatives at Domini’s discretion. Such investments are not subject to the submanager’s quantitative model. |

- 10 -

| | | | | | |

| | | Domini European Social Equity Fund, Domini PacAsia Social Equity Fund, and Domini International Social Equity Fund |

Socially Responsible Investing | | In the course of pursuing their financial objectives, socially responsible investors seek to use their investments to create a more fair and sustainable world. Domini believes that by factoring sustainability standards into their investment decisions, investors can encourage greater corporate accountability. The use of social and environmental standards may also help to identify companies that are led by more enlightened management, are focused on the creation of long-term value, and are better able to meet the needs of their stakeholders and of the planet. Each of the Domini Funds incorporates Domini’s social and environmental standards into its investment process. Domini believes the use of these standards in the investment process helps to more effectively align the financial markets with societal needs, build demand for data on corporate social and environmental performance, and communicate the expectations of socially responsible investors to issuers and the broader investment community. When appropriate, Domini engages in dialogue with the management of companies urging them to address the social and environmental impacts of their operations. In addition, Domini seeks to vote all company proxies in accordance with Domini’s published guidelines, which cover a wide range of social, environmental, and corporate governance matters. The Social and Environmental Standards Applied to the Domini Funds Domini believes that its standards can help identify strong long-term investments, as well as highlight companies and other issuers that enrich society and the environment. Domini seeks to understand each company’s response to what Domini determines to be key social and environmental challenges it faces. Domini evaluates potential investments against its standards based on the businesses in which they engage, as well as on the quality of the company’s relations with key stakeholders, including communities, customers, ecosystems, employees, investors, and suppliers. Domini believes that certain goods and services are misaligned with its standards. Therefore, Domini will seek to avoid investment in firms that it determines to be sufficiently involved with such goods and services to warrant their exclusion. These goods and services include, but may not be limited to, alcohol, tobacco, gambling, nuclear power, and military weapons. Domini will often determine that an investment is consistent with its standards even when the issuer’s profile reflects a mixture of positive and negative social and environmental characteristics. Domini recognizes that relationships with key stakeholders are complicated and that even the best of companies often run into problems day to day. Domini’s approach recognizes that a company with a mixed record may still be effectively grappling with the important issues in its industry. The Funds will invest in companies with a combination of controversies and praiseworthy initiatives. Domini’s standards may also limit a Fund’s investment in certain geographic areas due to prevailing political conditions that Domini believes affect the social and environmental performance of companies in those regions. In addition, Domini’s standards currently prohibit investment by the Funds in U.S. Treasuries, the general obligation securities issued by the U.S. government. While Domini recognizes that these securities support many public goods essential for our society, it has adopted this policy to reflect serious concerns about the risks posed by our country’s nuclear weapons arsenal and continuing large military expenditures. Domini’s interpretation and application of its social and environmental standards are subjective and may evolve over time. In addition, in response to business practices in different regions of the world Domini may determine that it is necessary to reinterpret or customize its social and environmental standards for a particular region. Domini’s social and environmental standards are designed to reflect many of the standards widely used by socially responsible investors. However, you may find that some Fund holdings do not reflect your social or environmental standards. You may wish to review a list of the holdings in a Fund’s portfolio to decide if they meet your personal standards. To learn how to obtain portfolio holdings information, please refer to “Portfolio Holdings Information.” |

- 11 -

| | | | | | |

| | | Domini European Social Equity Fund, Domini PacAsia Social Equity Fund, and Domini International Social Equity Fund |

| | | Engagement Each year, the Domini Funds seek to raise issues of social and environmental performance with the management of certain companies through proxy voting, dialogue with management, and by filing shareholder resolutions, where appropriate. In foreign regions including European and Asia-Pacific countries, various barriers, including regulatory systems, geography, and language, may impair a Fund’s ability to use its influence effectively. In particular, due to onerous regulatory barriers, the Domini Funds do not generally expect to file shareholder resolutions outside the United States. *** Domini may, at its discretion, choose to change its social or environmental standards, add additional standards, or modify the application of the standards to a Fund at any time, without shareholder approval. This will impact investments held by a Fund, and may cause certain companies, sectors, industries, or countries to be dropped from or added to a Fund’s portfolio. In addition, Domini reserves the right to vary the application of these standards to a Fund, depending, for example, on such factors as asset class, industry and sector representation, market capitalization, investment style, access to quality data on an issuer’s social or environmental performance, and cultural and political factors that may vary by region or country. |

Other investments – | | |

Use of Depository Receipts | | Securities of foreign issuers may be purchased directly or through depository receipts, such as American Depository Receipts (ADRs), European Depository Receipts (EDRs), and Global Depository Receipts (GDRs), or other securities representing underlying shares of foreign companies. Generally, ADRs, in registered form, are designed for use in U.S. securities markets, and EDRs and GDRs, in bearer form, are designed for use in European and global securities markets. ADRs are receipts typically issued by a U.S. bank or trust company evidencing ownership of the underlying securities. EDRs and GDRs are European and global receipts, respectively, evidencing a similar arrangement. The use of all such instruments is subject to Domini’s social and environmental standards. |

Use of Options, Futures, and Other Derivatives | | Although it is not a principal investment strategy, each Fund may purchase and sell options, enter into futures contracts, currency forwards, and/or utilize other derivative contracts and securities with respect to stocks, bonds, groups of securities (such as financial indexes), foreign currencies, interest rates, or inflation indexes. A Fund may also utilize derivative instruments, such as equity-linked securities, to gain exposure to certain emerging markets, but not as a principal investment strategy. These techniques, which are incidental to a Fund’s primary strategy, permit the Fund to gain exposure to a particular security, group of securities, currency, interest rate, or index, and thereby have the potential for a Fund to earn returns that are similar to those that would be earned by direct investments in those securities or instruments. The use of all such instruments is subject to Domini’s social and environmental standards. These techniques are also used to hedge against adverse changes in the market prices of securities, interest rates, or currency exchange rates. Hedging techniques may not always be available to a Fund, and it may not always be feasible for a Fund to use hedging techniques even when they are available. Derivatives have risks, however. If the issuer of the derivative instrument does not pay the amount due, the Fund could lose money on the instrument. In addition, the underlying security or investment on which the derivative is based, or the derivative itself, may not perform the way the Fund’s subadviser expected. As a result, the use of these techniques may result in losses to the Fund or increase volatility in the Fund’s performance. Some derivatives are sophisticated instruments that typically involve a small investment of cash relative to the magnitude of risks assumed. Derivative securities are subject to market risk, which could be significant for those that have a leveraging effect. |

- 12 -

| | | | | | |

| | | Domini European Social Equity Fund, Domini PacAsia Social Equity Fund, and Domini International Social Equity Fund |

| Cash Reserves | | Although each of the Funds seek to be fully invested at all times, each keeps a small percentage of its assets in cash or cash equivalents. These reserves provide each Fund with flexibility to meet redemptions and expenses, and to readjust its portfolio holdings. Each Fund may hold these cash reserves uninvested or may invest them in high-quality, short-term debt securities issued by agencies or instrumentalities of the U.S. government, bankers’ acceptances, commercial paper, certific\ates of deposit, bank deposits, or repurchase agreements. Some of the investments may be with community development banks and financial institutions and may not be insured by the FDIC. All such securities are subject to Domini’s social and environmental standards. |

Illiquid Securities | | Each Fund may not invest more than 15% of its net assets in illiquid securities, which may be difficult to value properly and may involve greater risks than liquid securities. Illiquid securities include those legally restricted as to resale, and may include commercial paper issued pursuant to Section 4(2) of the Securities Act of 1933 and securities eligible for resale pursuant to Rule 144A thereunder. Certain Section 4(2) and Rule 144A securities may be treated as liquid securities if the adviser determines that such treatment is warranted. Even if determined to be liquid, holdings of these securities may increase the level of Fund illiquidity if eligible buyers become uninterested in purchasing them. |

| Temporary Investments | | Each Fund may temporarily use a different investment strategy for defensive purposes in response to market conditions, economic factors, or other occurrences. This may adversely affect a Fund’s performance. You should note, however, that the Funds have not used a different investment strategy for defensive purposes in the past and may decide not to do so in the future — even in the event of deteriorating market conditions. |

Securities Lending | | Consistent with applicable regulatory policies, including those of the Board of Governors of the Federal Reserve System and the SEC, each of the Funds may make loans of its securities to member banks of the Federal Reserve System and to broker-dealers. These loans would be required to be secured continuously by collateral consisting of securities, cash, or cash equivalents maintained on a current basis at an amount at least equal to the market value of the securities loaned. A Fund would have the right to terminate a loan and obtain the securities loaned at any time on three days’ notice. During the existence of a loan, a Fund would continue to collect the equivalent of the dividends paid by the issuer on the securities loaned and would also receive interest on investment of cash collateral. A Fund may pay finder’s and other fees in connection with securities loans. A Fund will continue to have market risk and other risks associated with owning the securities on loan, as well as the risks associated with the investment of the cash collateral received in connection with the loan. Securities lending also is subject to other risks, including the risk that the borrower fails to return a loaned security, and/or there is a shortfall on the collateral posted by the borrower, and the risk that the Fund is unable to recall a security in time to exercise valuable rights or sell the security. |

Portfolio Turnover | | Each Fund pays transaction costs, such as commissions, when it buys and sells securities (or “turns over” its portfolio). A higher portfolio turnover rate may indicate higher transaction costs and may result in higher taxes when Fund shares are held in a taxable account. These costs, which are not reflected in annual Fund operating expenses or in the example, affect the Fund’s performance.. |

- 13 -

| | | | | | |

| | | Classes of Shares, Fees and Expenses |

| | | Domini European Social Equity Fund | | Domini PacAsia

Social Equity Fund | | Domini International

Social Equity Fund |

Portfolio Turnover Rate as of 7/31/2009 | | 98% | | 88% | | 85% |

Payments to broker-dealers and other financial intermediaries | | Each Fund and its related companies may pay broker-dealers or other financial intermediaries (such as a bank) for the sale of Fund shares and related services. These payments may create a conflict of interest by influencing your broker-dealer or other intermediary or its employees or associated persons to recommend the Fund over another investment. Ask your financial adviser or visit your financial intermediary’s website for more information. |

| | | Domini European Social Equity Fund, Domini PacAsia Social Equity Fund, and Domini International Social Equity Fund |

Investor Shares sales charges and fees | | Investor Shares of each Domini Fund have the same characteristics and fee structure. • Investor Shares are offered without a front-end sales charge or contingent deferred sales charge. • Investor Shares are subject to distribution and service (12b-1) fees of up to 0.25% of average daily net assets. These fees are paid out of a Domini Fund’s assets on an ongoing basis. Over time these fees will increase the cost of investments and may cost more than other types of sales charges. • Investor Shares are subject to a redemption fee of 2.00% of average daily net assets on shares held less than 30 days (as a percentage of amount redeemed). |

Class A Shares sales charges and fees | | Class A Shares of each Domini Fund have the same characteristics and fee structure. • You buy Class A Shares at the offering price, which is the net asset value per share plus a front-end sales charge of up to 4.75%. You pay a lower sales charge as the size of your investment increases to certain levels (called breakpoints). The initial sales charge may be reduced or waived for large purchases and certain types of investors. You do not pay a sales charge on Class A Share dividends or distributions that you reinvest in Class A Shares. The table below shows the rate of sales charge you pay, depending on the amount of Class A Shares you purchase. As provided in the table, the percentage sales charge declines based upon the dollar value of Class A Shares you purchase. Your Service Organization receives a percentage of these sales charges as compensation for the services it provides to you. at a rate of up to 0.25% of the average daily net assets represented by the Fund shares it services. |

| | | | | Front-End Sales Charge |

| | Amount of Purchase | | Percentage of Offering Price | | Percentage of Net Amount Invested |

| | Less than $50,000 | | 4.75% | | 4.99% |

| | $50,000 but less than $100,000 | | 3.75% | | 3.90% |

| | $100,000 but less than $250,000 | | 2.75% | | 2.83% |

| | $250,000 but less than $500,000 | | 1.75% | | 1.78% |

| | $500,000 but less than $1 million | | 1.00% | | 1.01% |

| | $1 million and over | | None | | None |

| | • Class A Shares are subject to distribution and service (12b-1) fees of up to 0.25% of average daily net |

- 14 -

| | |

| | | assets. These fees are paid out of a Domini Fund’s assets on an ongoing basis. Over time these fees will increase the cost of investments and may cost more than other types of sales charges. Your Service Organization may receive the distribution fee payable on Class A Shares. • You do not pay an initial sales charge when you invest $1 million or more in the Class A shares of a Fund. However, you may be subject to a contingent deferred sales charge of up to 1.00% of the lesser of the cost of the shares at the date of purchase or the value of the shares at the time of redemption if you redeem within one year of purchase. The Fund’s distributor may pay up to 1.00% to a Service Organization for Class A share purchase amounts of $1 million or more. In such cases, starting in the 13th month after purchase, the Service Organization will also receive the distribution fee of up to 0.25% of the average daily net assets of the Class A Shares of a Fund held by its clients. Prior to the 13th month, the Fund’s distributor will retain the service fee. Where the Service Organization does not receive the payment of up to 1.00% from the Fund’s distributor, the Service Organization will instead receive the annual service fee starting immediately after purchase. In certain cases, the Service Organization may receive both a payment of up to 1.00% from the distributor as well as the annual distribution and service fee starting immediately after purchase. • Class A Shares are subject to a redemption fee of 2.00% of average daily net assets on shares held less than 30 days (as a percentage of amount redeemed). |

- 15 -

| | | | | | |

| | | Classes of Shares, Fees and Expenses |

| | | Domini European Social Equity Fund, Domini PacAsia Social Equity Fund, and Domini International Social Equity Fund |

Management fees | | For the services Domini and Wellington Management provide to each of the Funds, they receive aggregate fees at the following rates: 1.00% of the first $250 million of net assets managed, 0.94% of the next $250 million of net assets managed, and 0.88% of net assets managed in excess of $500 million. For the services Domini and Wellington Management provided to the Domini International Social Equity Fund, Domini European Social Equity Fund, and Domini PacAsia Social Equity Fund during the fiscal period November 28, 2008, through July 31, 2009, they received a total of 1.00%, 1.00%, and 1.00%, respectively, of the average daily net assets of each Fund. For the services Domini and Wellington Management provided during the fiscal period August 1, 2008, through November 27, 2008, to the Domini International Social Equity Fund and the Domini European PacAsia Social Equity Trust, the master trust in which the Fund formerly invested substantially all of its assets, they received a total of 1.00% of the average daily net assets of the Fund. For the services Domini and Wellington Management provided during the fiscal period August 1, 2008, through November 27, 2008, to the Domini European Social Equity Fund and the Domini European Social Equity Trust, the master trust in which the Fund formerly invested substantially all of its assets, they received a total of 1.00% of the average daily net assets of the Fund. For the services Domini and Wellington Management provided during the fiscal period August 1, 2008, through November 27, 2008, to the Domini PacAsia Social Equity Fund and the Domini PacAsia Social Equity Trust, the master trust in which the Fund formerly invested substantially all of its assets, they received a total of 1.00% of the average daily net assets of the Fund. A discussion regarding the basis of the Board of Trustees’ approval of the continuance of the Funds’ Management and Submanagement Agreements with Domini and Wellington Management, respectively, is available in the Funds’ Annual Report to shareholders for the fiscal year ended July 31, 2009. |

| | | For a comparison of the gross and net expenses of each of the Domini Funds, please see the fee tables in “The Domini Funds’ Fees and Expenses” section starting on page [ ]. |

- 16 -

| | | | | | | | | | | | |

| | | Classes of Shares, Fees and Expenses |

| | | Domini European Social Equity Fund, Domini PacAsia Social Equity Fund, and Domini International Social Equity Fund |

Buying shares | | You may buy Investor Shares directly from the Funds by mail, online or by telephone. You may buy Class A Shares from any investment firm that has a sales agreement with DSIL, the Domini Funds’ distributor (a Service Organization), or under certain circumstances, directly from the Funds. You buy or sell shares at the share price. When you buy Class A Shares, you pay an initial sales charge unless you qualify for a waiver or reduced sales charge. When you sell Class A Shares, you may pay a contingent deferred sales charge depending on how long you have owned your shares. |

Minimum initial and additional investments | | • The minimum initial investment in each Fund is as follows: • $2,500 for regular accounts ($1,500 if using Domini’s Automatic Investment Plan) • $1,500 for Retirement Accounts (Automatic Investment Plan also available) • $1,500 for UGMA/UTMA Accounts (Automatic Investment Plan also available) • $1,500 for Coverdell Education Savings Accounts (Automatic Investment Plan also available) • The minimum to buy additional shares of each Fund is as follows: • $50 for accounts using our Automatic Investment Plan • $100 for all other accounts • Each Fund may waive minimums for initial and subsequent purchases for investors who purchase shares through omnibus accounts. If you purchase through a broker-dealer, financial intermediary, or firm that has entered into an agreement with the Funds’ distributor or affiliates, your transaction may be subject to transaction charges or investment minimums established by that entity. Investors in the Funds do not pay such transaction charges if shares are purchased directly from the Funds. |

Exchanging shares | | You may exchange your shares for shares of the same class of any other available Domini Fund. Each Domini Fund allows you to exchange your shares at net asset value without charging you either an initial or contingent deferred sales charge at the time of the exchange. Shares you acquire as part of an exchange will continue to be subject to any contingent deferred sales charge that applies to the shares you originally purchased. When you ultimately sell your shares, the date of your original purchase will determine your contingent deferred sales charge. An exchange generally is treated as a sale and a new purchase of shares for federal income tax purposes. |

Selling shares | | Your shares will be sold at net asset value per share next calculated after a Domini Fund receives your request in good order. If the shares you are selling are subject to a contingent deferred sales charge, it will be deducted from the sale proceeds. |

Net asset value | | The price of your shares is based on the net asset value of the applicable class of shares of the Fund that you hold. The net asset value (or NAV) of each class of shares of each Fund is determined as of the close of regular trading on the New York Stock Exchange, normally 4 pm, Eastern Time, on each day the Exchange is open for trading. This calculation is made by deducting the amount of the liabilities (debts) of the applicable class of shares of the applicable Fund, from the value of its assets, and dividing the difference by the number of outstanding shares of the applicable class of the Fund. |

| | | | | | | Net Asset Value (NAV) = | | Total Assets – Total Liabilities | | |

| | | | | | | | | Number of Shares Outstanding | | |

| | |

| | | To calculate the value of your investment, simply multiply the NAV by the number of shares of the Fund you own. |

- 17 -

Comparison of Principal Risks of Investing in the Domini Funds

Each Domini Fund is subject to similar principal risks. Risk is inherent in all investing. The value of your investment in a Domini Fund, as well as the amount of return you receive on your investment, may fluctuate significantly in the short and long term. You may lose all or part of your investment in a Fund or your investment may not perform as well as other similar investments. The following is a description of certain risks of investing in each Fund.

Country Risk. Each Fund expects to diversify its investments primarily among various countries throughout the world, including in the European and/or Asia-Pacific regions, as applicable. Each may hold a large number of securities in a single country. If a Fund concentrates its investments in a particular country, it bears the risk that economic, political, and social conditions in that country will have a significant impact on Fund performance.

Currency Risk. The share price of each Fund is denominated in U.S. dollars. Fluctuations between the U.S. dollar and foreign currency exchange rates could negatively affect the value of a Fund’s investments. A Fund will benefit when foreign currencies strengthen against the dollar and will be hurt when foreign currencies weaken against the dollar.

Emerging Markets Risk. Each Fund may hold companies that are tied economically to emerging-market countries including those in Central and Eastern Europe and/or in the Asia-Pacific region. The securities markets in these and other emerging countries are less liquid, are subject to greater price volatility, have smaller market capitalizations, may have less government regulation, and are not subject to as extensive and frequent accounting, financial, and other reporting requirements as the securities markets of more-developed countries. Further, investment in equity securities of issuers located in emerging countries involves risk of loss resulting from problems in share registration and custody, and substantial economic and political disruptions. These risks are not normally associated with investments in more-developed countries.

Foreign Investing Risk. Each Fund’s investments in securities of companies tied economically to a foreign country or foreign regions may represent a greater degree of risk than investment in U.S. securities due to political, social, and economic developments, such as nationalization or expropriation of assets, imposition of currency controls or restrictions, confiscatory taxation, and political or financial instability. Additionally, there is risk resulting from the differences between the regulations to which U.S. and foreign issuers and markets are subject, such as accounting, auditing, and financial reporting standards and practices, and the degree of government oversight and supervision. These factors can make foreign investments more volatile and potentially less liquid than U.S. investments. In addition, foreign markets can perform differently from the U.S. market.

Geographic Concentration Risk. The Domini European Social Equity Fund and Domini PacAsia Social Equity Fund will be largely invested in companies based in Europe or the Asia-Pacific region, as applicable. Market changes or other factors affecting these regions, including political instability and unpredictable economic conditions, could have a significant impact on each Fund due to its regional concentration.

Information Risk. To evaluate an issuer’s social and environmental performance and/or certain industries, markets, sectors, or regions, Domini generally relies on information that is provided by third parties or is self-reported by issuers. Therefore, there is a risk in certain circumstances (e.g., Asia-Pacific and emerging-market regions) that sufficient information may not be readily available, complete, or accurate, or may be biased. This may affect the way Domini’s standards are applied in a particular situation. In certain circumstances, this may also lead Domini to avoid certain issuers, markets, industries, sectors, or regions.

Market Risk. The market prices of Fund securities may go up or down due to general market conditions, such as real or perceived adverse economic or political conditions, inflation, changes in interest rates, lack of liquidity in the markets, or adverse investor sentiment. When market prices fall, the value of your investment will go down. The recent financial crisis caused a significant decline in the value and liquidity of many securities. To the extent that a Fund concentrates more of its investments in a particular sector of a market, the Fund will be more susceptible to any economic, social, or political factor affecting that sector.

- 18 -

Mid- to Large-Cap Companies Risk. Under normal circumstances, each Fund will invest primarily in mid-cap to large-cap U.S. companies. Mid-cap and large-cap stocks tend to go through cycles when they do better, or worse, than other asset classes or the stock market overall. The performance of each shareholder’s investment will be affected by these market trends. Each Fund reserves the right to invest in companies of any capitalization, including small-cap companies that are more likely to have more limited product lines, fewer capital resources, and less depth of management than larger companies.

Sector Concentration Risk. Each Fund may hold a large percentage of securities in a single sector (e.g., financials). If a Fund holds a large percentage of securities in a single sector, its performance will be tied closely to and affected by the performance of that sector.

Socially Responsible Investing Risk. Each Fund seeks to make sustainable investments that are consistent with Domini’s social and environmental standards. It may choose to sell, or not purchase, investments that are otherwise consistent with its investment objective. In general, the application of Domini’s social and environmental standards will affect each Fund’s exposure to certain issuers, industries, sectors, regions, and countries and may impact the relative financial performance of the Fund — positively or negatively — depending on whether such investments are in or out of favor.