Exhibit (17)(f)

| | |

| ANNUAL REPORT 2009 | | JULY 31, 2009 |

| | |

DOMINI SOCIAL EQUITY FUND®

INVESTOR SHARES, CLASS R SHARES, CLASS A SHARES & INSTITUTIONAL SHARES

DOMINI EUROPEAN SOCIAL EQUITY FUNDSM

INVESTOR SHARES & CLASS A SHARES

DOMINI PACASIA SOCIAL EQUITY FUNDSM

INVESTOR SHARES & CLASS A SHARES

DOMINI EUROPEAN PACASIA SOCIAL EQUITY FUNDSM

INVESTOR SHARES & CLASS A SHARES

DOMINI SOCIAL BOND FUND®

INVESTOR SHARES

KEEP IN TOUCH WITH DOMINI

A report like this comes twice a year, but your dollars work for change all year long. Sign up for Domini Updates at www.domini.com to receive:

| • | | Our e-newsletter Investing Matters, with news on how your funds are making a difference. |

| • | | Domini Action Alerts that help you speak out on issues from child labor to global warming. |

We will never sell or rent your email address to anyone, for any reason. (Please visit our website for more information about our Privacy Policy.) And you can, of course, unsubscribe at any time.

SIGN UP FOR E-DELIVERY

If you invest directly with Domini, you can also avoid an annual fee of $15 by signing up for paperless E-Delivery of your statements and reports – just log into your account and select E-Delivery from the “Account Maintenance” drop-down menu. If you invest through a financial advisor, brokerage firm, or employer-sponsored retirement plan, why not ask your advisor or plan sponsor how to receive your documents electronically? It can reduce your carbon footprint, save trees, and unclutter your life, all with just a few strokes of your keyboard!

TABLE OF CONTENTS

| | |

| | LETTER FROM THE PRESIDENT Dear Fellow Shareholders: The year ended July 31, 2009, is one most investors would like to forget. For the twelve-month period the Standard & Poor’s 500 was down 20%. This dismal performance was matched in other parts of the world. In Japan the Nikkei was down 19.5% and in Europe, the MSCI Europe index was down 25%. This would be troubling enough, but added to this is the volatility factor. Each of these regions of the world was actually much worse six months ago, and each has rallied in excess of over 45% since their lows. What is an investor to do? The year proved that our global system of finance deeply affects the day-to-day lives of individuals. The phrase “sophisticated investment vehicles” gets bandied about by those on Wall Street who earn their fortunes trading credit default swaps on rapid trading platforms, but to the millions who lost their homes, lost their jobs, and lost hope for their children, these vehicles were just irresponsible tricks to siphon money out of the real economy and into the pockets of a few. Last July 31 we were in the midst of an election to select the 44th President of the United States. On that date, Quinnipiac University published results from their most recent poll. Their report indicated that most Americans were concerned about energy prices, the war in Iraq, and the upcoming election. They were not thinking about a global financial meltdown of cataclysmic proportions. The month of August saw markets holding fairly steady, but then September hit. That month U.S. markets saw a decline of almost 9%, contributing to a loss of almost 22% for the year ending September 30. The cause had nothing to do with either fluctuations in the price of oil (which we recently learned was caused by speculators and not supply and demand) or the war in Iraq. The cause, we discovered, was that there was far too little regulation of speculators on Wall Street and no regulation of “sophisticated investment vehicles.” By late March 2009 we began to see signs of hope. They were fragile, mostly just indicators that the rate of decline was slowing, and not much to cheer about generally. But with the markets so battered, it was enough to bring some investors back to the stock market. By April real signs of improvement began. By April 15, 2009, Goldman Sachs issued a statement that it believed it would be able to return bailout funds shortly. Wells Fargo, another major recipient of TARP money, announced earnings that far exceeded analysts’ expectations due to strong increases in its lending business. The market had been anxiously awaiting any sign that our banks were improving, and this earnings report was taken as a broad sign that the frozen credit markets may finally be thawing. The bull market had begun. |

| |

| |

| |

| |

| |

| |

| |

2

| | |

Responsible investors were absolutely correct in calling on Congress and thought leaders to address predatory lending. Had our calls been heeded it would have removed the peg that failed, leading to this mess. But there is a more important lesson to be learned. Disclosure and transparency are essential to maintaining a competitive and functional economy. The events of the past year were largely precipitated by practices not widely known and nowhere tracked. And the same can be said for the climate crisis and continuing widespread human rights abuses. This cannot be allowed to go on. At Domini Social Investments we have a long history of pushing for greater disclosure and have seen tremendous effect. But more needs to be done. While social investors have opened up many company practices, there is no systematic set of regulations or even standard industry practice in the United States to allow stakeholders to accurately measure what a company adds or detracts from society. We believe that the Global Reporting Initiative is the best model in place and have been asking companies to follow its guidelines, but voluntary reporting is not sufficient. We would like to see government recognize that the events of the past year were exacerbated by the secrecy financial institutions were allowed to operate under. We hope that a broad set of new mandatory disclosure requirements, including the social and environmental impact of corporate practices, will be instituted, and after many years, we believe our voices are now being heard. Thank you for your continued support of socially responsible investing and of Domini Social Investments. We appreciate the opportunity to serve you. Very truly yours,

Amy Domini amy@domini.com | |  |

| |

| |

| |

| |

3

| | |

| | DOMINI NEWS Amy Domini Receives Award for Professional Ethics On March 31, Amy Domini received Villanova University’s 2009 Praxis Award in Professional Ethics. Recipients exemplify ethical behavior in their respective fields, promote and encourage integrity, work toward a greater good, conduct research in the field of ethics, or influence the practice of ethics through professional works or leadership. Domini’s Foreign Funds Are Going International The Domini European Social Equity Fund, Domini PacAsia Social Equity Fund, and Domini European PacAsia Social Equity Fund will be changing their investment strategies and reorganizing into one new international Domini fund. The new fund will have the same investment objective, policies and restrictions, investment management personnel, services, net expenses, and distribution arrangements as each of the existing funds. Its new international strategy will permit investment in the stocks of companies located in Europe, the Asia-Pacific region, and throughout the rest of the world, including emerging-market countries. These changes are scheduled to be effective after the close of business on November 27, 2009. How will this affect me? If you are a shareholder in one of Domini’s foreign funds on November 27, 2009, you will become a shareholder of a new international Domini fund, receiving shares of the international fund equal in value to your foreign fund shares as of the close of business on November 27. The reorganization is expected to be a tax-free transaction for federal income tax purposes and will not trigger any redemption fees. Do I need to do anything? No. The exchange of your shares for international fund shares will happen automatically. Will fund expenses go up? No. The net operating expenses of the international fund will be the same as those of Domini’s foreign funds. Will the managers change? No. The international fund will continue to be managed by Domini, with Wellington Management acting as the subadvisor. What is the benchmark for the international strategy? The Morgan Stanley Capital International Europe Australasia Far East Index (MSCI EAFE). Who pays for the costs of these changes? Domini Social Investments LLC. Investing internationally involves special risks, such as currency fluctuations, social and economic instability, differing securities regulations and accounting standards, limited public information, possible changes in taxation, and periods of illiquidity. |

| |

| |

| |

| |

| |

| |

| |

4

| | |

DOMINI ACTIVISM Celebrating 15 Years of Shareholder Activism Domini filed its first shareholder resolution fifteen years ago, in 1994. Since then, we have filed a total of 200 resolutions with 83 companies, and engaged in numerous long-term dialogues with corporate management on a range of social, environmental, and governance issues. Working with a variety of committed people and organizations, Domini has worked on your behalf to alleviate poverty among coffee farmers, improve conditions for factory workers, and protect forests. Visit the Shareholder Activism section of our website to read our second-quarter Social Impact Update reviewing highlights of the past 15 years: • Procter & Gamble Markets Fair Trade Coffee • Gap Releases First Social Responsibility Report • JPMorgan Adopts Comprehensive Environmental Policy • Apple Adopts Code of Conduct • Domini Raises Alert on Nanomaterials, Toxics • Lifting the Veil on Corporate Political Contributions None of these successes would have been possible without your support. We thank you for your commitment to make a difference in the world through the way you invest. To receive email updates, please sign up for “Domini Updates” on our home page. Domini Executive Selected for SEC Investor Advisory Committee Domini Social Investments’ Managing Director and General Counsel, Adam Kanzer, has been appointed to the Securities and Exchange Commission’s newly formed Investor Advisory Committee. The 18-member committee was established to provide the SEC with the views of a broad spectrum of investors on the Commission’s regulatory agenda. Committee members will serve for a term of two years. Domini Advises U.K. Parliamentary Committee on Human Rights In June, Domini was invited to meet with the United Kingdom’s Joint Parliamentary Committee on Human Rights to provide evidence in its current inquiry into business and human rights. We provided several written reports and responded to a range of questions relating to human rights investment criteria, the influence of social investors, shareholder activism tactics, and the merits of mandatory social and environmental corporate disclosure. The Committee expects to produce a report to the U.K. government in the fall. | |  |

| |

| |

| |

| |

5

| | |

| | SUSTAINABILITY REPORTING Sustainability reporting by corporations has long been one of Domini’s key areas of focus. After more than a decade of advocacy on the part of social investors, environmentalists, labor and community groups — and dramatic changes by governments around the world — the Securities and Exchange Commission is reexamining its environmental disclosure rules and we are optimistic that our call for greater disclosure of corporate social performance will get a fair hearing as well. For those who care about corporate accountability, the stakes are high. The Power of Information The value of increased disclosure by corporations has long been clear. In 1913, future Supreme Court justice Louis Brandeis wrote that “sunlight is said to be the best of disinfectants; electric light the most efficient policeman.” Publicity, he wrote, is “justly commended as a remedy for social and industrial diseases.” Provide investors with useful information, Brandeis believed, and they will use it to steer away from trouble. At the same time, the act of disclosure itself will help to reform harmful practices. In 1933 and 1934, in the midst of the Great Depression, the Roosevelt administration created the Securities and Exchange Commission (SEC) and instituted securities regulations to address the broad social and economic harm caused by unregulated capital markets. These regulations required publicly traded companies to disclose their financial status and to publicly discuss risks that may affect the firm. Today, corporate sustainability reports provide investors and other stakeholders with a more complete picture of a company’s business prospects, as well as its impact on society and the environment. These reports can also drive improvements within a company by providing a means for management to measure and benchmark their progress towards publicly stated goals. The best reports can create an opportunity for dialogue. Kimberly-Clark, for example, provides detailed information on the forestry certification systems it utilizes in the production of its paper products. This information allowed Domini to identify gaps in the company’s forestry policies. Our engagement, in collaboration with Greenpeace, helped to convince the company to improve its forestry policies and study how to increase the use of recycled materials. A Boom In Reporting Throughout the world we are seeing a dramatic growth in voluntary corporate social responsibility and sustainability reporting. According to the Corporate Register, the number of such reports released by corporations has grown from approximately 26 in 1992 to over 3,000 today. These |

| |

| |

| |

| |

| |

| |

| |

6

| | |

REPORTING AS YOU GO Timberland is an example of a company taking innovative steps to draw attention to its sustainability data. The company now reports on social and environmental key performance indicators on a quarterly basis, with occasional updates in between. These reports are published on the social networking website JustMeans. For a quick overview, Timberland provides a quarterly “dashboard” that offers metrics in what it calls its “four pillars”: Energy, Product, Workplace, and Service. For the first quarter of 2009, Timberland reported 5,308 tons of carbon emissions, 38.6% of cotton sourced that is organic, and 1% of product purchased from “high risk” factories (down from 34% in 2007). reports, issued in response to a variety of pressures, vary widely in quality, but the trend is towards increasingly transparent and reliable reports. Much of this progress is taking place outside the U.S. In December 2008, Domini and the Social Investment Forum released Innovations in Social and Environmental Disclosure Outside the United States, a detailed report that presents case studies of five countries where governments and stock exchanges have taken the lead in requiring corporate social and environmental disclosure: Brazil, France, Malaysia, South Africa, and Sweden. In a number of countries, sustainability reporting is actually required. France requires key sustainability data to be published in corporate annual reports, and the Swedish government decided in 2007 to require all 55 fully or partially state-owned companies to produce reports in accordance with GRI guidelines. GLOBAL REPORTING INITIATIVE The Global Reporting Initiative (GRI), founded in 1997-1998 by Ceres, has become the de facto global standard for corporate sustainability reporting. By providing a framework for consistent reporting, the GRI seeks to make “disclosure on economic, environmental, and social performance ... as commonplace and comparable as financial reporting.” More than 1,000 companies and organizations worldwide currently use the GRI framework as the basis for their reporting. However, only about 100 U.S. companies do so. Social Investors Move the U.S. Forward For decades, investors have been asking companies to report on their social and environmental impact. Many of these requests have come in the form of shareholder resolutions filed since the early 1970s by members of the Interfaith Center on Corporate Responsibility (ICCR), a pioneer | |  |

| |

| |

| |

| |

7

| | |

| | in the use of shareholder resolutions to address corporate social and environmental performance. In the early years, most of these proposals received votes in the single-digit range. Over the past five years, however, shareholder resolutions asking for sustainability reports have averaged 25% support. These votes convey a strong message to management and government regulators that a broad range of investors now consider this information to be “material” to their investment decisions. When the Domini Social Equity Fund was launched in 1991, it was still relatively uncommon for investors to consider social and environmental factors. The investment landscape has changed dramatically since then. For example, in 2005 UN Secretary General Kofi Annan launched the Principles for Responsible Investment, a set of six principles committing investors to consider social and environmental factors in their decisions and to engage directly with companies on these issues. Investors managing $18 trillion have signed on to the principles. We believe that a combination of mandatory and voluntary sustainability reporting is essential for the implementation of responsible investment practices in the 21st century. Mandatory reporting will ensure that all companies report consistently and reliably on the sustainability issues of greatest importance. Voluntary reporting will allow companies to tell their stories in their own words. A Critical Moment A critical moment in this long path toward greater corporate sustainability reporting has now arrived. In 2007, the Investor Network on Climate Risk (INCR), a project of Ceres, petitioned the SEC asking for improved GAP RAISES THE BAR In May 2004, after two years of dialogue between Gap and a coalition of socially responsible investors including Domini and ICCR, the company released its first Social Responsibility Report. For the first time, a clothing retailer had publicly rated the way its suppliers treated their employees. Gap’s report presented a rating system for evaluating factory performance on a broad range of labor rights. The report provided regional compliance indicators, revealed the number of supplier facilities it had audited by region and, perhaps most importantly, discussed problems that were found and what the company was doing to correct them. Gap set a high bar — not only for its competitors in the apparel industry, but for companies in other industries, many of which provide no data at all. In July, Gap issued its fourth report. |

| |

| |

| |

| |

| |

| |

| |

8

| | |

“climate risk” disclosure from public companies and subsequently met with the SEC to press its case. In June 2009, INCR again submitted a letter to the SEC with the backing of investors managing $1.4 trillion, restating its call for climate risk disclosure, and advocating mandatory sustainability reporting using the GRI format. In March 2009, Domini participated in a Social Investment Forum (SIF, the trade association for the socially responsible investing community) meeting at the SEC to discuss the merits of mandatory sustainability reporting. We then worked with SIF to submit a proposal in July 2009 seeking a rule that would require companies to produce an annual sustainability report consistent with the GRI guidelines. The proposal also asks the Commission to clarify that companies are already required to disclose the long-term risks imposed by various social and environmental issues. The proposal was endorsed by 50 investment groups, including ICCR and Ceres, and the number has since grown to 85. In June 2009, the SEC announced the creation of an Investor Advisory Committee, including a Domini executive tasked to represent social investors. The committee began its work in July, addressing among other things the question of expanded social and environmental reporting. We’re returning to first principles by asking the SEC to institute mandatory social and environmental disclosure. Although voluntary reporting serves a valuable role, we believe that investors, workers, and communities cannot continue to rely only on voluntary, anecdotal, and spotty data on these crucial issues. The holdings discussed above can be found in the portfolio of the Domini Social Equity Fund, included herein. The composition of the Fund’s portfolio is subject to change. Investing internationally involves special risks, such as currency fluctuations, social and economic instability, differing securities regulations and accounting standards, limited public information, possible changes in taxation, and periods of illiquidity. The preceding profiles should not be deemed an offer to sell or a solicitation of an offer to buy the stock of any of the companies noted, or a recommendation concerning the merits of any of these companies as an investment. Domini’s General Counsel is a member of the Securities and Exchange Commission’s Investor Advisory Committee. This essay represents Domini’s views and does not necessarily reflect either the views of the committee, or the views or regulatory agenda of the Commission, the Commissioners, or Commission staff. This material must be preceded or accompanied by the Fund’s current prospectus. DSIL Investment Services LLC, Distributor. 09/09 | |  |

| |

| |

| |

| |

9

DOMINI SOCIAL EQUITY FUND

Performance Commentary

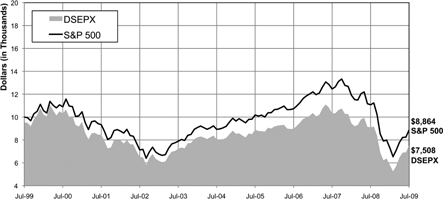

For the year ended July 31, 2009, the Fund’s Investor shares declined -17.48%, outperforming the S&P 500, which fell -19.96%.

The following were among the companies held in the Fund’s portfolio that helped performance the most, relative to the S&P 500:

| | • | | Shares of Citigroup fell in October 2008 amid fears about its viability, and stabilized in late November when the government provided additional capital and limited the company’s losses on certain toxic assets. The stock fell again in the first quarter of 2009. Not holding the stock during the first half of the year helped performance. |

| | • | | McDonald’s benefited from increasing global and U.S. sales, and its stock lost considerably less than the index. |

| | • | | Verizon Communications significantly outperformed the benchmark, with a small positive return for the year. |

The following were among the companies in the portfolio that hurt the Fund’s relative performance the most:

| | • | | The stock of Genworth Financial fell after the company said it was examining strategic alternatives for its U.S. mortgage insurance business. The company was downgraded by Moody’s. |

| | • | | The oil and gas company Unit was hurt as oil prices declined. |

| | • | | Shares of American Capital fell in the latter half of 2008 when the company announced it would pay no further dividends for the year, given the volatile market and increasing write-downs. |

The Fund was helped by its stock selection in the financial, materials, and energy sectors. The Fund was hurt by weak stock selection in the industrials and consumer staples sectors.

10

TEN LARGEST HOLDINGS

| | | | | | | | |

COMPANY | | % NET

ASSETS | | | COMPANY | | % NET

ASSETS | |

Johnson & Johnson | | 4.6 | % | | JPMorgan Chase | | 2.7 | % |

Microsoft | | 3.6 | % | | AT&T | | 2.4 | % |

IBM | | 3.4 | % | | Apache | | 2.0 | % |

Amgen | | 2.9 | % | | Google | | 2.0 | % |

Apple | | 2.8 | % | | Southwestern Energy | | 1.8 | % |

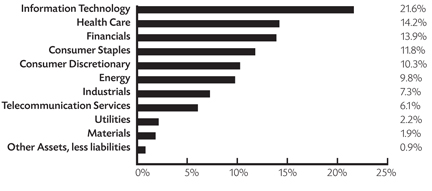

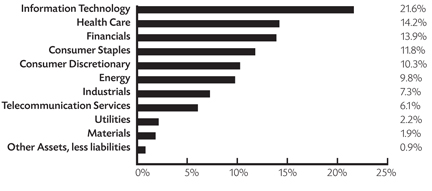

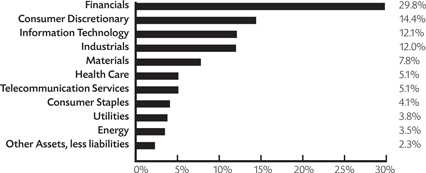

PORTFOLIO HOLDINGS BY INDUSTRY SECTOR (% OF NET ASSETS)

11

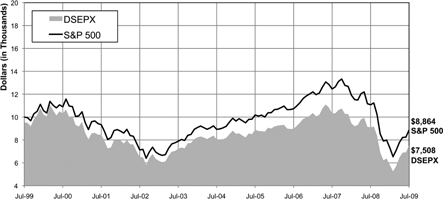

AVERAGE ANNUAL TOTAL RETURNS

| | | | | | | | |

| | | | | Investor shares | | | S&P 500 | |

| As of 7-31-09 | | 1 Year | | -17.48 | % | | -19.96 | % |

| | 5 Year | | -1.37 | % | | -0.14 | % |

| | 10 Year | | -2.35 | % | | -1.19 | % |

| | Since Inception (6-3-91) | | 6.75 | % | | 7.40 | % |

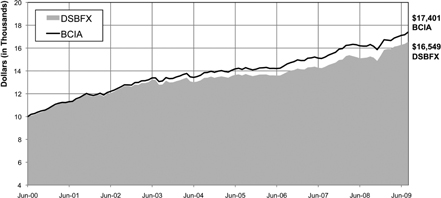

COMPARISON OF $10,000 INVESTMENT IN THE DOMINI SOCIAL EQUITY FUND INVESTOR SHARES AND S&P 500

Past performance is no guarantee of future results. The Fund’s returns quoted above represent past performance after all expenses. Economic and market conditions change, and both will cause investment return, principal value, and yield to fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost. Current performance may be lower or higher than the performance data quoted. For performance information current to the most recent month-end, call 1-800-582-6757 or visit www.domini.com. A 2.00% redemption fee is charged on sales or exchanges of shares made less than 30 days after the settlement of purchase or acquisition through exchange, with certain exceptions. Performance data quoted above does not reflect the deduction of this fee, which would reduce the performance quoted. See the Fund’s prospectus for further information.

For the period reported in its current prospectus, the Fund’s gross annual operating expenses totaled 1.24% of net assets. Until November 26, 2009, Domini has contractually agreed to waive certain fees and/or reimburse certain expenses, including management fees, so that expenses paid by the Fund will not exceed, on a per annum basis, 1.20% of its average daily net assets representing Investor shares, absent an earlier modification by the Board of Trustees, which oversees the Funds.

The table and the graph do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the redemption of Fund shares. Total return for the Domini Social Equity Fund is based on the Fund’s net asset values and assumes all dividends and capital gains were reinvested. An investment in the Fund is not a bank deposit and is not insured. You may lose money. Certain fees payable by the Fund were waived during the period, and the Fund’s average annual total returns would have been lower had these not been waived. The Standard & Poor’s 500 Index (S&P 500) is an unmanaged index of common stocks. Investors cannot invest directly in the S&P 500.

12

AVERAGE ANNUAL TOTAL RETURNS

| | | | | | | | |

| | | | | Class R

Shares1 | | | S&P

500 | |

| As of 7-31-09 | | 1 Year | | -17.23 | % | | -19.96 | % |

| | 5 Year | | -1.05 | % | | -0.14 | % |

| | 10 Year | | -2.18 | % | | -1.19 | % |

| | Since Inception (6-3-91) | | 6.85 | % | | 7.40 | % |

COMPARISON OF $10,000 INVESTMENT IN THE DOMINI SOCIAL EQUITY FUND CLASS R SHARES AND S&P 5001

Past performance is no guarantee of future results. The Fund’s returns quoted above represent past performance after all expenses. Economic and market conditions change, and both will cause investment return, principal value, and yield to fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost. Current performance may be lower or higher than the performance data quoted. For performance information current to the most recent month-end, call 1-800-582-6757 or visit www.domini.com. A 2.00% redemption fee is charged on sales or exchanges of shares made less than 30 days after the settlement of purchase or acquisition through exchange, with certain exceptions. Performance data quoted above does not reflect the deduction of this fee, which would reduce the performance quoted. See the Fund’s prospectus for further information.

For the period reported in its current prospectus, the Fund’s gross annual operating expenses totaled 0.85% of net assets. Until November 30, 2009, Domini has contractually agreed to waive certain fees and/or reimburse certain expenses, including management fees, so that expenses paid by the Fund will not exceed, on a per annum basis, 0.90% of its average daily net assets representing Class R shares, absent an earlier modification by the Board of Trustees, which oversees the Funds.

The table and the graph do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the redemption of Fund shares. Total return for the Domini Social Equity Fund is based on the Fund’s net asset values and assumes all dividends and capital gains were reinvested. An investment in the Fund is not a bank deposit and is not insured. You may lose money. Certain fees payable by the Fund were waived during the period, and the Fund’s average annual total returns would have been lower had these not been waived.

The Standard & Poor’s 500 Index (S&P 500) is an unmanaged index of common stocks. Investors cannot invest directly in the S&P 500.

| 1 | Reflects the performance of the Investor shares for periods prior to the offering of Class R shares, which commenced operations November 28, 2003. This performance has not been adjusted to take into account the lower expenses applicable to Class R shares. |

13

AVERAGE ANNUAL TOTAL RETURNS

| | | | | | | | | | | |

| | | Class A shares

(with 4.75%

maximum

Sales Charge) 1 | | | Class A

shares (without

Sales Charge) 1 | | | S&P

500 | |

| As of 7-31-09 | | 1 Year | | -21.40 | % | | -17.48 | % | | -19.96 | % |

| | 5 Year | | -2.32 | % | | -1.37 | % | | -0.14 | % |

| | 10 Year | | -2.83 | % | | -2.35 | % | | -1.19 | % |

| | Since Inception (6-3-91) | | 6.46 | % | | 6.75 | % | | 7.40 | % |

COMPARISON OF $10,000 INVESTMENT IN THE DOMINI SOCIAL EQUITY FUND CLASS A SHARES AND S&P 500 (with 4.75% maximum sales charge)1

Past performance is no guarantee of future results. The Fund’s returns quoted above represent past performance after all expenses. Economic and market conditions change, and both will cause investment return, principal value, and yield to fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost. Current performance may be lower or higher than the performance data quoted. For performance information current to the most recent month-end, call 1-800-582-6757 or visit www.domini.com. A 2.00% redemption fee is charged on sales or exchanges of shares made less than 30 days after the settlement of purchase or acquisition through exchange, with certain exceptions. Performance data quoted above does not reflect the deduction of this fee, which would reduce the performance quoted. See the Fund’s prospectus for further information.

For the period reported in its current prospectus, the Fund’s gross annual operating expenses totaled 4.11% of net assets. Until November 30, 2009, Domini has contractually agreed to waive certain fees and/or reimburse certain expenses, including management fees, so that expenses paid by the Fund will not exceed, on a per annum basis, 1.18% of its average daily net assets representing Class A shares, absent an earlier modification by the Board of Trustees, which oversees the Funds.

The table and the graph do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the redemption of Fund shares. Total return for the Domini Social Equity Fund is based on the Fund’s net asset values and assumes all dividends and capital gains were reinvested. An investment in the Fund is not a bank deposit and is not insured. You may lose money. Certain fees payable by the Fund were waived during the period, and the Fund’s average annual total returns would have been lower had these not been waived.

The Standard & Poor’s 500 Index (S&P 500) is an unmanaged index of common stocks. Investors cannot invest directly in the S&P 500.

| 1 | Class A shares were not offered prior to November 28, 2008. All performance information for time periods beginning prior to November 28, 2008, is the performance of the Investor shares. This performance has not been adjusted to reflect the lower expenses of the Class A shares. |

14

AVERAGE ANNUAL TOTAL RETURNS

| | | | | | | | |

| | | Institutional

Shares1 | | | S&P

500 | |

| As of 7-31-09 | | 1 Year | | -17.48 | % | �� | -19.96 | % |

| | 5 Year | | -1.37 | % | | -0.14 | % |

| | 10 Year | | -2.35 | % | | -1.19 | % |

| | Since Inception (6-3-91) | | 6.75 | % | | 7.40 | % |

COMPARISON OF $2 MILLION INVESTMENT IN THE DOMINI SOCIAL EQUITY FUND INSTITUTIONAL SHARES AND S&P 5001

Past performance is no guarantee of future results. The Fund’s returns quoted above represent past performance after all expenses. Economic and market conditions change, and both will cause investment return, principal value, and yield to fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost. Current performance may be lower or higher than the performance data quoted. For performance information current to the most recent month-end, call 1-800-582-6757 or visit www.domini.com. A 2.00% redemption fee is charged on sales or exchanges of shares made less than 30 days after the settlement of purchase or acquisition through exchange, with certain exceptions. Performance data quoted above does not reflect the deduction of this fee, which would reduce the performance quoted. See the Fund’s prospectus for further information.

For the period reported in its current prospectus, the Fund’s gross annual operating expenses totaled 0.85% of net assets. Until November 26, 2009, Domini has contractually agreed to waive certain fees and/or reimburse certain expenses, including management fees, so that expenses paid by the Fund will not exceed, on a per annum basis, 0.65% of its average daily net assets representing Institutional shares, absent an earlier modification by the Board of Trustees, which oversees the Funds.

The table and the graph do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the redemption of Fund shares. Total return for the Domini Social Equity Fund is based on the Fund’s net asset values and assumes all dividends and capital gains were reinvested. An investment in the Fund is not a bank deposit and is not insured. You may lose money. Certain fees payable by the Fund were waived during the period, and the Fund’s average annual total returns would have been lower had these not been waived.

The Standard & Poor’s 500 Index (S&P 500) is an unmanaged index of common stocks. Investors cannot invest directly in the S&P 500.

| 1 | Institutional shares were not offered prior to November 28, 2008. All performance information for time periods beginning prior to November 28, 2008, is the performance of the Investor shares. This performance has not been adjusted to reflect the lower expenses of the Institutional shares. |

15

DOMINI SOCIAL EQUITY FUND

PORTFOLIOOF INVESTMENTS

July 31, 2009

| | | | | |

SECURITY | | SHARES | | VALUE |

| Consumer Discretionary - 10.3% | | | | | |

Amazon.com Inc (a) | | 81,500 | | $ | 6,989,439 |

American Eagle Outfitters Inc | | 1,004 | | | 14,448 |

AutoNation Inc (a) | | 83,000 | | | 1,716,440 |

AutoZone Inc (a) | | 34,947 | | | 5,366,810 |

Best Buy Co Inc | | 78,972 | | | 2,951,184 |

Big Lots Inc (a) | | 132,900 | | | 3,062,016 |

Black & Decker Corp | | 600 | | | 22,560 |

Centex Corp (a) | | 226,300 | | | 2,468,933 |

Coach Inc | | 200,100 | | | 5,920,959 |

Comcast Corp Cl A | | 5,067 | | | 75,296 |

DIRECTV Group Inc/ The (a) | | 129,100 | | | 3,343,690 |

DR Horton Inc | | 217,839 | | | 2,524,754 |

Expedia Inc (a) | | 119,700 | | | 2,478,987 |

Gap Inc/The | | 266,197 | | | 4,344,335 |

Home Depot Inc | | 3,244 | | | 84,149 |

JC Penney Co Inc | | 67,924 | | | 2,047,909 |

Johnson Controls Inc | | 1,648 | | | 42,650 |

Kohl’s Corp (a) | | 85,700 | | | 4,160,735 |

Liz Claiborne Inc | | 5,757 | | | 18,192 |

Lowe’s Cos Inc | | 2,876 | | | 64,595 |

Ltd Brands Inc | | 1,668 | | | 21,584 |

Macy’s Inc | | 314,600 | | | 4,376,086 |

McDonald’s Corp | | 74,720 | | | 4,114,083 |

Meredith Corp | | 1,350 | | | 35,735 |

NIKE Inc Cl B | | 1,070 | | | 60,605 |

Nordstrom Inc | | 895 | | | 23,664 |

Office Depot Inc (a) | | 455,100 | | | 2,070,705 |

Pulte Homes Inc | | 1,079 | | | 12,268 |

Radio One Inc Cl A (a) | | 18,076 | | | 10,936 |

Ross Stores Inc | | 85,500 | | | 3,769,695 |

Scholastic Corp | | 884 | | | 19,934 |

Staples Inc | | 2,258 | | | 47,463 |

Starbucks Corp (a) | | 2,578 | | | 45,631 |

Target Corp | | 1,523 | | | 66,433 |

Tiffany & Co | | 692 | | | 20,642 |

Timberland Co/The Cl A (a) | | 995 | | | 13,572 |

Time Warner Cable Inc (a) | | 554 | | | 18,315 |

Time Warner Inc | | 221,374 | | | 5,901,831 |

VF Corp | | 554 | | | 35,838 |

Viacom Inc Cl B (a) | | 1,481 | | | 34,300 |

Walt Disney Co/The | | 3,915 | | | 98,345 |

Washington Post Co/ The Cl B | | 95 | | | 42,893 |

Whirlpool Corp | | 500 | | | 28,545 |

| | | | | |

| | | | | 68,567,184 |

| | | | | |

| | |

| Consumer Staples - 11.8% | | | | | |

Avon Products Inc | | 2,173 | | | 70,362 |

Bunge Ltd | | 64,400 | | | 4,506,067 |

Coca-Cola Co/The | | 163,128 | | | 8,130,300 |

Colgate-Palmolive Co | | 97,016 | | | 7,027,839 |

Costco Wholesale Corp | | 2,126 | | | 105,237 |

CVS Caremark Corp | | 138,600 | | | 4,640,328 |

Hershey Co/The | | 2,246 | | | 89,728 |

Kimberly-Clark Corp | | 89,101 | | | 5,207,953 |

Kraft Foods Inc Cl A | | 5,682 | | | 161,028 |

Kroger Co/The | | 160,277 | | | 3,426,722 |

PepsiCo Inc/NC | | 180,959 | | | 10,269,423 |

Procter & Gamble Co/The | | 211,223 | | | 11,724,989 |

Safeway Inc | | 258,900 | | | 4,900,977 |

Sara Lee Corp | | 567,700 | | | 6,040,328 |

SUPERVALU Inc | | 315,100 | | | 4,672,933 |

Sysco Corp | | 331,800 | | | 7,883,568 |

Whole Foods Market Inc (a) | | 1,587 | | | 38,390 |

| | | | | |

| | | | | 78,896,172 |

| | | | | |

| | |

| Energy - 9.8% | | | | | |

Anadarko Petroleum Corp | | 4,531 | | | 218,394 |

Apache Corp | | 155,662 | | | 13,067,825 |

Devon Energy Corp | | 40,600 | | | 2,358,454 |

ENSCO International Inc | | 72,800 | | | 2,758,392 |

EOG Resources Inc | | 3,418 | | | 253,035 |

National Oilwell Varco Inc (a) | | 136,200 | | | 4,895,028 |

Nexen Inc | | 112,200 | | | 2,334,882 |

Noble Corp (a) | | 92,100 | | | 3,118,506 |

Pioneer Natural Resources Co | | 72,400 | | | 2,067,020 |

Southwestern Energy Co (a) | | 293,600 | | | 12,163,848 |

Talisman Energy Inc | | 453,400 | | | 6,982,805 |

Tidewater Inc | | 87,600 | | | 3,942,000 |

XTO Energy Inc | | 276,500 | | | 11,123,595 |

| | | | | |

| | | | | 65,283,784 |

| | | | | |

| | |

| Financials - 13.9% | | | | | |

American Express Co | | 4,919 | | | 139,355 |

Annaly Capital Management Inc | | 296,000 | | | 4,987,600 |

Banco Santander SA ADR | | 194,800 | | | 2,816,808 |

Bank of America Corp | | 382,842 | | | 5,662,233 |

16

DOMINI SOCIAL EQUITY FUND / PORTFOLIOOF INVESTMENTS

July 31, 2009

| | | | | |

SECURITY | | SHARES | | VALUE |

Financials (Continued) | | | | | |

Bank of New York Mellon Corp/The | | 258,900 | | $ | 7,078,326 |

Chubb Corp | | 79,100 | | | 3,652,838 |

Citigroup Inc | | 10,300 | | | 32,651 |

Comerica Inc | | 114,300 | | | 2,724,912 |

First Horizon National Corp (a) | | 267,800 | | | 3,433,196 |

Genworth Financial Inc | | 334,300 | | | 2,306,670 |

Goldman Sachs Group Inc/The | | 64,000 | | | 10,451,200 |

Hudson City Bancorp Inc | | 365,600 | | | 5,140,336 |

JPMorgan Chase & Co | | 466,395 | | | 18,026,167 |

Keycorp | | 221,100 | | | 1,277,958 |

MetLife Inc | | 199,700 | | | 6,779,815 |

NYSE Euronext | | 139,652 | | | 3,763,621 |

Popular Inc | | 11,219 | | | 14,248 |

State Street Corp | | 66,700 | | | 3,355,010 |

US Bancorp | | 5,831 | | | 119,011 |

Wells Fargo & Co | | 426,356 | | | 10,428,668 |

| | | | | |

| | | | | 92,190,623 |

| | | | | |

| | |

| Health Care - 14.2% | | | | | |

Amgen Inc (a) | | 307,265 | | | 19,145,683 |

Becton Dickinson and Co | | 54,955 | | | 3,580,318 |

Biogen Idec Inc (a) | | 56,300 | | | 2,677,065 |

Boston Scientific Corp (a) | | 233,600 | | | 2,508,864 |

Forest Laboratories Inc (a) | | 199,700 | | | 5,158,251 |

Gilead Sciences Inc (a) | | 151,110 | | | 7,393,812 |

Intuitive Surgical Inc (a) | | 8,900 | | | 2,023,148 |

Johnson & Johnson | | 501,027 | | | 30,507,534 |

King Pharmaceuticals Inc (a) | | 355,100 | | | 3,220,757 |

McKesson Corp | | 131,500 | | | 6,726,225 |

Medtronic Inc | | 205,683 | | | 7,285,292 |

Watson Pharmaceuticals Inc (a) | | 129,500 | | | 4,497,535 |

| | | | | |

| | | | | 94,724,484 |

| | | | | |

| | |

| Industrials - 7.3% | | | | | |

3M Co | | 103,828 | | | 7,321,950 |

Cooper Industries Ltd Cl A | | 205,888 | | | 6,784,010 |

CSX Corp | | 107,000 | | | 4,292,840 |

Cummins Inc | | 59,236 | | | 2,547,740 |

Emerson Electric Co | | 3,634 | | | 132,205 |

First Solar Inc (a) | | 12,346 | | | 1,906,099 |

Flowserve Corp | | 25,400 | | | 2,051,558 |

Herman Miller Inc | | 2,241 | | | 37,223 |

Illinois Tool Works Inc | | 3,600 | | | 145,980 |

Interface Inc Cl A | | 5,681 | | | 39,426 |

JetBlue Airways Corp (a) | | 4,861 | | | 24,840 |

Norfolk Southern Corp | | 92,400 | | | 3,996,300 |

Pitney Bowes Inc | | 104,900 | | | 2,166,185 |

Quanta Services Inc (a) | | 171,000 | | | 3,986,010 |

RR Donnelley & Sons Co | | 431,668 | | | 6,000,185 |

Ryder System Inc | | 122,300 | | | 4,296,399 |

Southwest Airlines Co | | 5,734 | | | 45,012 |

SunPower Corp Cl A (a) | | 479 | | | 15,424 |

United Parcel Service Inc Cl B | | 45,950 | | | 2,468,894 |

| | | | | |

| | | | | 48,258,280 |

| | | | | |

| | |

| Information Technology - 21.6% | | | | | |

Agilent Technologies Inc (a) | | 1,560 | | | 36,223 |

Apple Inc (a) | | 114,465 | | | 18,702,435 |

Applied Materials Inc | | 6,140 | | | 84,732 |

Cisco Systems Inc (a) | | 483,859 | | | 10,649,737 |

Dell Inc (a) | | 360,185 | | | 4,819,275 |

eBay Inc (a) | | 91,776 | | | 1,950,240 |

EMC Corp/ Massachusetts (a) | | 4,400 | | | 66,264 |

Google Inc (a) | | 29,395 | | | 13,023,455 |

Hewlett-Packard Co | | 101,998 | | | 4,416,513 |

Intel Corp | | 414,386 | | | 7,976,931 |

International Business Machines Corp | | 191,918 | | | 22,632,890 |

JDS Uniphase Corp (a) | | 545,900 | | | 3,198,974 |

Juniper Networks Inc (a) | | 1,500 | | | 39,195 |

Micron Technology Inc (a) | | 567,200 | | | 3,624,408 |

Microsoft Corp | | 1,019,927 | | | 23,988,683 |

Motorola Inc | | 7,500 | | | 53,700 |

National Semiconductor Corp | | 343,500 | | | 5,173,110 |

Oracle Corp | | 427,400 | | | 9,458,362 |

Power Integrations Inc | | 1,419 | | | 41,563 |

QUALCOMM Inc | | 3,351 | | | 154,850 |

Salesforce.com Inc (a) | | 73,900 | | | 3,202,826 |

17

DOMINI SOCIAL EQUITY FUND / PORTFOLIOOF INVESTMENTS

July 31, 2009

| | | | | |

SECURITY | | SHARES | | VALUE |

Information Technology (Continued) | | | | | |

SanDisk Corp (a) | | 98,700 | | $ | 1,758,834 |

Symantec Corp (a) | | 272,800 | | | 4,072,904 |

Texas Instruments Inc | | 4,455 | | | 107,143 |

Total System Services Inc | | 300,200 | | | 4,406,936 |

Xerox Corp | | 4,497 | | | 36,830 |

| | | | | |

| | | | | 143,677,013 |

| | | | | |

| | |

| Materials - 1.9% | | | | | |

Eastman Chemical Co | | 99,300 | | | 4,931,237 |

International Paper Co | | 7,165 | | | 134,774 |

Lubrizol Corp | | 124,400 | | | 7,206,492 |

MeadWestvaco Corp | | 4,506 | | | 87,822 |

Nucor Corp | | 1,282 | | | 57,011 |

| | | | | |

| | | | | 12,417,336 |

| | | | | |

| | |

| Telecommunication Services - 6.1% | | | | | |

AT&T Inc | | 618,819 | | | 16,231,622 |

France Telecom SA ADR | | 254,930 | | | 6,482,870 |

Sprint Nextel Corp (a) | | 268,859 | | | 1,075,436 |

Telefonica SA ADR | | 44,300 | | | 3,306,552 |

United States Cellular Corp (a) | | 52,100 | | | 1,866,222 |

Verizon Communications Inc | | 363,091 | | | 11,644,328 |

| | | | | |

| | | | | 40,607,030 |

| | | | | |

| | |

| Utilities - 2.2% | | | | | |

AES Corp/The (a) | | 516,600 | | | 6,607,314 |

National Grid PLC ADR | | 88,000 | | | 4,120,160 |

Pepco Holdings Inc | | 286,300 | | | 4,116,994 |

| | | | | |

| | | | | 14,844,468 |

| | | | | |

| | |

| Total Investments - 99.1% | | | | | |

(Cost $620,886,836) (b) | | | | $ | 659,466,374 |

| | |

Other Assets, less liabilities - 0.9% | | | | | 6,022,513 |

| | | | | |

| | |

| Net Assets - 100.0% | | | | $ | 665,488,887 |

| | | | | |

| (a) | Non-income producing security. |

| (b) | The aggregate cost for federal income tax purposes is $623,332,417. The aggregate gross unrealized appreciation is $83,683,988 and the aggregate gross unrealized depreciation is $47,550,031, resulting in net unrealized appreciation of $36,133,957. |

ADR - American Depository Receipt

SEE NOTES TO FINANCIAL STATEMENTS

18

THIS PAGE INTENTIONALLY LEFT BLANK

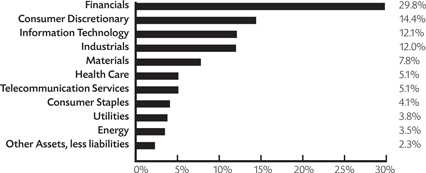

DOMINI EUROPEAN SOCIAL EQUITY FUND

Performance Commentary

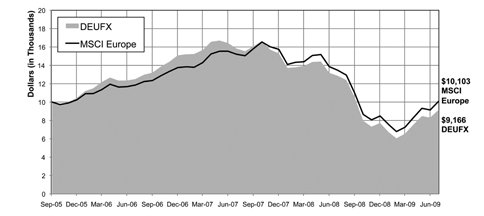

For the year ended July 31, 2009, the Fund’s Investor shares declined -28.70%, lagging the MSCI Europe index, which fell by -24.96%.

The following were among the companies held in the Fund’s portfolio that helped performance the most, relative to the MSCI Europe:

| | • | | Stock in the French pharmaceutical company Sanofi-Aventis rose in the first half of the period on speculation that it would acquire the Czech pharmaceutical company Zentiva. |

| | • | | The Italian bank UniCredit saw shares decline in the first half of the year, but gained in the second half during which the Fund held its stock. |

| | • | | France Telecom lost less than the benchmark, helped by increasing confidence in cash flow generation and an attractive dividend yield. |

The following were among the companies in the portfolio that hurt the Fund’s relative performance the most:

| | • | | Royal Bank of Scotland and Bank of Ireland were badly hurt by the continuing credit crisis. |

| | • | | The stock of Swiss Reinsurance declined as a result of weak 2008 results and the company’s announcement of a capital raise. |

The Fund’s relative performance was helped by its stock selection in the materials sector and by its overweighting to the telecommunications and healthcare sectors. The Fund was hurt the most by weak stock selection in the financial, consumer discretionary, and industrials sectors.

20

TEN LARGEST HOLDINGS

| | | | | | | | |

COMPANY | | % NET

ASSETS | | | COMPANY | | % NET

ASSETS | |

| Novartis | | 4.0 | % | | GlaxoSmithKline | | 2.9 | % |

| Banco Santander | | 3.6 | % | | Vivendi | | 2.7 | % |

| Vodafone Group | | 3.5 | % | | StatoilHydro | | 2.5 | % |

| Sanofi-Aventis | | 3.1 | % | | Roche Holdings | | 2.5 | % |

| BG Group | | 3.0 | % | | Telefonica | | 2.3 | % |

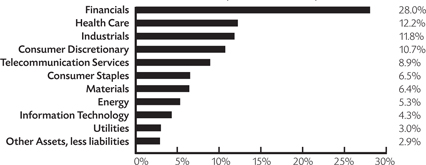

PORTFOLIO HOLDINGS BY INDUSTRY SECTOR (% OF NET ASSETS)

PORTFOLIO HOLDINGS BY COUNTRY (% OF NET ASSETS)

21

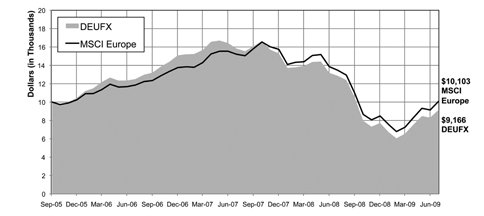

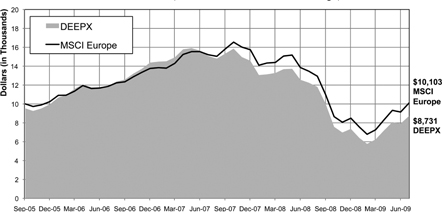

AVERAGE ANNUAL TOTAL RETURNS

| | | | | | | | |

| | | | | Investor shares | | | MSCI

Europe | |

| As of 7-31-09 | | 1 Year | | -28.70 | % | | -24.96 | % |

| | 3 Year | | -9.84 | % | | -5.20 | % |

| | Since Inception (10-3-05) | | -2.25 | % | | 0.27 | % |

COMPARISON OF $10,000 INVESTMENT IN THE DOMINI EUROPEAN SOCIAL EQUITY FUND INVESTOR SHARES AND MSCI EUROPE1

Past performance is no guarantee of future results. The Fund’s returns quoted above represent past performance after all expenses. Economic and market conditions change, and both will cause investment return, principal value, and yield to fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost. Current performance may be lower or higher than the performance data quoted. For performance information current to the most recent month-end, call 1-800-582-6757 or visit www.domini.com. A 2.00% redemption fee is charged on sales or exchanges of shares made less than 30 days after the settlement of purchase or acquisition through exchange, with certain exceptions. Performance data quoted above does not reflect the deduction of this fee, which would reduce the performance quoted. See the Fund’s prospectus for further information.

For the period reported in its current prospectus, the Fund’s gross annual operating expenses totaled 1.80% of net assets. Until November 30, 2009, Domini has contractually agreed to waive certain fees and/or reimburse certain expenses, including management fees, so that expenses paid by the Fund will not exceed, on a per annum basis, 1.60% of its average daily net assets representing Investor shares, absent an earlier modification by the Board of Trustees, which oversees the Funds.

Investing internationally involves special risks, such as currency fluctuations, social and economic instability, differing securities regulations and accounting standards, limited public information, possible changes in taxation, and periods of illiquidity.

The table and the graph do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the redemption of Fund shares. Total return for the Domini European Social Equity Fund is based on the Fund’s net asset values and assumes all dividends and capital gains were reinvested. An investment in the Fund is not a bank deposit and is not insured. You may lose money. Certain fees payable by the Fund were waived during the period, and the Fund’s average annual total returns would have been lower had these not been waived.

The Morgan Stanley Capital International (MSCI Europe) is an unmanaged index of common stocks. Investors cannot invest directly in the MSCI Europe.

22

AVERAGE ANNUAL TOTAL RETURNS

| | | | | | | | | | | |

| | | | | Class A shares shares

(with 4.75% maxi-

mum Sales Charge)1 | | | Class A shares

shares (without

Sales Charge)1 | | | MSCI Europe | |

As of 7-31-09 | | 1 Year | | -32.08 | % | | -28.70 | % | | -24.96 | % |

| | 3 Year | | -11.30 | % | | -9.84 | % | | -5.20 | % |

| | Since Inception (10-3-05) | | -3.48 | % | | -2.25 | % | | 0.27 | % |

COMPARISON OF $10,000 INVESTMENT IN THE DOMINI EUROPEAN SOCIAL EQUITY FUND CLASS A SHARES AND MSCI EUROPE (with 4.75% maximum sales charge)1

Past performance is no guarantee of future results. The Fund’s returns quoted above represent past performance after all expenses. Economic and market conditions change, and both will cause investment return, principal value, and yield to fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost. Current performance may be lower or higher than the performance data quoted. For performance information current to the most recent month-end, call 1-800-582-6757 or visit www.domini.com. A 2.00% redemption fee is charged on sales or exchanges of shares made less than 30 days after the settlement of purchase or acquisition through exchange, with certain exceptions. Performance data quoted above does not reflect the deduction of this fee, which would reduce the performance quoted. See the Fund’s prospectus for further information.

For the period reported in its current prospectus, the Fund’s gross annual operating expenses totaled 3.71% of net assets. Until November 30, 2009, Domini has contractually agreed to waive certain fees and/or reimburse certain expenses, including management fees, so that expenses paid by the Fund will not exceed, on a per annum basis, 1.57% of its average daily net assets representing Class A shares, absent an earlier modification by the Board of Trustees, which oversees the Funds.

Investing internationally involves special risks, such as currency fluctuations, social and economic instability, differing securities regulations and accounting standards, limited public information, possible changes in taxation, and periods of illiquidity.

The table and the graph do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the redemption of Fund shares. Total return for the Domini European Social Equity Fund is based on the Fund’s net asset values and assumes all dividends and capital gains were reinvested. An investment in the Fund is not a bank deposit and is not insured. You may lose money. Certain fees payable by the Fund were waived during the period, and the Fund’s average annual total returns would have been lower had these not been waived.

The Morgan Stanley Capital International (MSCI Europe) is an unmanaged index of common stocks. Investors cannot invest directly in the MSCI Europe.

| 1 | Class A shares were not offered prior to November 28, 2008. All performance information for time periods beginning prior to November 28, 2008, is the performance of the Investor shares. This performance has not been adjusted to reflect the lower expenses of the Class A shares. |

23

DOMINI EUROPEAN SOCIAL EQUITY FUND

PORTFOLIOOF INVESTMENTS

July 31, 2009

| | | | | | | |

COUNTRY/SECURITY | | INDUSTRY | | SHARES | | VALUE |

Austria – 1.8% | | | | | | | |

Immoeast AG (a) | | Real Estate | | 35,335 | | $ | 97,186 |

IMMOFINANZ AG (a) | | Real Estate | | 51,385 | | | 107,091 |

OMV AG | | Energy | | 19,758 | | | 780,132 |

| | | | | | | |

| | | | | | | 984,409 |

| | | | | | | |

Belgium – 1.9% | | | | | | | |

Delhaize Group | | Food & Staples Retailing | | 8,294 | | | 589,940 |

Fortis (a) | | Diversified Financials | | 77,101 | | | 298,416 |

KBC Ancora (a) | | Diversified Financials | | 11,437 | | | 130,367 |

| | | | | | | |

| | | | | | | 1,018,723 |

| | | | | | | |

Denmark – 0.9% | | | | | | | |

FLSmidth & Co A/S (a) | | Capital Goods | | 2,805 | | | 121,240 |

H Lundbeck A S | | Pharma, Biotech & Life Sciences | | 13,973 | | | 269,384 |

Novo Nordisk AS | | Pharma, Biotech & Life Sciences | | 1,888 | | | 110,544 |

| | | | | | | |

| | | | | | | 501,168 |

| | | | | | | |

Finland – 0.8% | | | | | | | |

Kone OYJ Cl B | | Capital Goods | | 5,962 | | | 201,764 |

Nokia OYJ | | Technology Hardware & Equipment | | 4,483 | | | 59,363 |

Tietoenator OYJ | | Software & Services | | 9,433 | | | 160,751 |

| | | | | | | |

| | | | | | | 421,878 |

| | | | | | | |

France – 17.8% | | | | | | | |

AXA SA | | Insurance | | 7,448 | | | 156,596 |

BNP Paribas | | Banks | | 14,706 | | | 1,066,449 |

Ciments Francais SA Cl A | | Materials | | 596 | | | 57,906 |

Credit Agricole SA | | Banks | | 22,376 | | | 317,712 |

Eiffage SA | | Capital Goods | | 5,670 | | | 376,007 |

France Telecom SA | | Telecommunication Services | | 37,371 | | | 927,728 |

Gecina SA | | Real Estate | | 1,189 | | | 97,366 |

Natixis (a) | | Banks | | 168,640 | | | 436,816 |

Peugeot SA (a) | | Automobiles & Components | | 15,850 | | | 478,190 |

PPR | | Retailing | | 3,223 | | | 357,282 |

Publicis Groupe SA | | Media | | 5,763 | | | 203,772 |

Sanofi-Aventis SA | | Pharma, Biotech & Life Sciences | | 25,144 | | | 1,638,378 |

Schneider Electric SA | | Capital Goods | | 6,812 | | | 615,583 |

SCOR SE | | Insurance | | 4,728 | | | 112,914 |

STMicroelectronics NV | | Semiconductors & Semiconductor Equipment | | 62,091 | | | 471,750 |

Unibail-Rodamco SE | | Real Estate | | 1,592 | | | 276,715 |

Vinci SA | | Capital Goods | | 9,145 | | | 462,992 |

Vivendi SA | | Media | | 55,600 | | | 1,420,855 |

Wendel | | Capital Goods | | 1,672 | | | 66,350 |

| | | | | | | |

| | | | | | | 9,541,361 |

| | | | | | | |

24

DOMINI EUROPEAN SOCIAL EQUITY FUND / PORTFOLIOOF INVESTMENTS

July 31, 2009

| | | | | | | |

COUNTRY/SECURITY | | INDUSTRY | | SHARES | | VALUE |

Germany – 9.2% | | | | | | | |

Allianz SE | | Insurance | | 5,906 | | $ | 579,427 |

Continental AG (a) | | Automobiles & Components | | 3,091 | | | 105,832 |

Deutsche Lufthansa AG | | Transportation | | 35,400 | | | 475,786 |

Deutsche Telekom AG | | Telecommunication Services | | 87,280 | | | 1,112,434 |

Hannover Rueckvers (a) | | Insurance | | 5,035 | | | 203,800 |

Henkel AG & Co KGaA | | Household & Personal Products | | 26,200 | | | 958,342 |

Infineon Technologies AG (a) | | Semiconductors & Semiconductor Equipment | | 32,077 | | | 131,429 |

Linde AG | | Materials | | 1,820 | | | 170,868 |

Metro AG | | Food & Staples Retailing | | 1,519 | | | 87,499 |

Muenchener Ruckvers AG | | Insurance | | 3,123 | | | 469,728 |

Prosiebensat1 Media AG | | Media | | 20,292 | | | 127,734 |

Suedzucker AG | | Food & Beverage | | 25,045 | | | 523,381 |

| | | | | | | |

| | | | | | | 4,946,260 |

| | | | | | | |

Greece – 0.9% | | | | | | | |

Public Power Corp (a) | | Utilities | | 22,585 | | | 489,904 |

| | | | | | | |

| | | | | | | 489,904 |

| | | | | | | |

Ireland – 0.8% | | | | | | | |

Anglo Irish Bank Ltd (a)(c) | | Banks | | 80,825 | | | 0 |

Kerry Group Cl A | | Food & Beverage | | 1,978 | | | 46,608 |

DCC Plc | | Capital Goods | | 4,183 | | | 88,957 |

Smurfit Kappa Group PLC | | Materials | | 53,973 | | | 313,733 |

| | | | | | | |

| | | | | | | 449,298 |

| | | | | | | |

Italy – 4.9% | | | | | | | |

Banco Popolare (a) | | Banks | | 12,593 | | | 101,231 |

Buzzi Unicem SPA | | Materials | | 17,964 | | | 267,673 |

Exor SPA | | Diversified Financials | | 3,335 | | | 55,887 |

Fiat SPA (a) | | Automobiles & Components | | 13,210 | | | 145,708 |

Intesa Sanpaolo SpA (a) | | Banks | | 14,473 | | | 53,606 |

Italcementi SpA | | Materials | | 35,479 | | | 461,506 |

Telecom Italia SpA | | Telecommunication Services | | 399,353 | | | 621,669 |

Unicredit SPA (a) | | Banks | | 317,243 | | | 924,280 |

| | | | | | | |

| | | | | | | 2,631,560 |

| | | | | | | |

Japan – 0.4% | | | | | | | |

Nippon Mining Holdings Inc | | Energy | | 33,500 | | | 158,359 |

Toyo Seikan Kaisha Ltd | | Materials | | 3,500 | | | 74,636 |

| | | | | | | |

| | | | | | | 232,995 |

| | | | | | | |

Netherlands – 4.1% | | | | | | | |

Corporate Express NV (a)(c) | | Commercial Services & Supplies | | 10,034 | | | 131,588 |

ING Groep NV | | Diversified Financials | | 22,190 | | | 283,076 |

Koninklijke Ahold NV | | Food & Staples Retailing | | 85,791 | | | 970,486 |

Koninklijke DSM NV | | Materials | | 4,790 | | | 170,319 |

SNS Reaal | | Diversified Financials | | 44,181 | | | 252,430 |

Unilever NV | | Food & Beverage | | 13,326 | | | 362,178 |

| | | | | | | |

| | | | | | | 2,170,077 |

| | | | | | | |

Norway – 3.2% | | | | | | | |

Fred Olsen Energy ASA | | Energy | | 7,500 | | | 271,641 |

Statoilhydro ASA | | Energy | | 62,674 | | | 1,333,728 |

TGS NopecGeophysical (a) | | Energy | | 7,800 | | | 88,037 |

| | | | | | | |

| | | | | | | 1,693,406 |

| | | | | | | |

25

DOMINI EUROPEAN SOCIAL EQUITY FUND / PORTFOLIOOF INVESTMENTS

July 31, 2009

| | | | | | | |

COUNTRY/SECURITY | | INDUSTRY | | SHARES | | VALUE |

Poland – 0.5% | | | | | | | |

Polskie Gornictwo Naftowe I Gazownictwo SA (a) | | Energy | | 172,992 | | $ | 263,432 |

| | | | | | | |

| | | | | | | 263,432 |

| | | | | | | |

Spain – 8.3% | | | | | | | |

Banco Santander SA | | Banks | | 133,096 | | | 1,917,160 |

Bankinter SA | | Banks | | 4,137 | | | 46,746 |

Banco Bilbao Vizcaya Argentaria SA | | Banks | | 65,267 | | | 1,065,972 |

Criteria Caixacorp SA | | Diversified Financials | | 38,803 | | | 185,669 |

Telefonica SA | | Telecommunication Services | | 48,808 | | | 1,207,843 |

| | | | | | | |

| | | | | | | 4,423,390 |

| | | | | | | |

Sweden – 4.3% | | | | | | | |

Assa Abloy AB Cl B | | Capital Goods | | 34,887 | | | 569,853 |

Boliden AB | | Materials | | 28,980 | | | 309,280 |

Electrolux AB Cl B (a) | | Consumer Durables & Apparel | | 16,315 | | | 302,325 |

Niscayah Group AB Cl B | | Commercial & Professional Services | | 77,254 | | | 135,732 |

Svenska Cellulosa Cl B | | Materials | | 37,136 | | | 472,783 |

Telefonaktiebolaget LM Ericsson Cl B | | Technology Hardware & Equipment | | 54,626 | | | 530,866 |

| | | | | | | |

| | | | | | | 2,320,839 |

| | | | | | | |

Switzerland – 8.3% | | | | | | | |

Baloise Holding AG | | Insurance | | 2,535 | | | 200,680 |

Clariant AG (a) | | Materials | | 23,722 | | | 176,331 |

Holcim Ltd (a) | | Materials | | 5,311 | | | 320,264 |

Novartis AG | | Pharma, Biotech & Life Sciences | | 47,373 | | | 2,154,179 |

Roche Holdings AG | | Pharma, Biotech & Life Sciences | | 8,482 | | | 1,327,960 |

Schindler Holding AG | | Capital Goods | | 3,940 | | | 252,599 |

| | | | | | | |

| | | | | | | 4,432,013 |

| | | | | | | |

United Kingdom – 28.1% | | | | | | | |

Antofagasta PLC | | Materials | | 52,209 | | | 655,220 |

Autonomy Corp PLC (a) | | Software & Services | | 3,900 | | | 75,971 |

Aviva PLC | | Insurance | | 117,713 | | | 684,490 |

Barclays PLC | | Banks | | 190,926 | | | 956,860 |

BG Group PLC | | Energy | | 96,924 | | | 1,605,247 |

Compass Group PLC | | Consumer Services | | 8,417 | | | 45,002 |

Experian PLC | | Commercial & Professional Services | | 98,814 | | | 809,265 |

GlaxoSmithKline PLC | | Pharma, Biotech & Life Sciences | | 82,887 | | | 1,578,889 |

Home Retail Group PLC | | Retailing | | 14,413 | | | 75,029 |

HSBC Holdings PLC | | Banks | | 112,043 | | | 1,125,183 |

ICAP PLC | | Diversified Financials | | 68,584 | | | 516,207 |

International Power PLC | | Utilities | | 110,296 | | | 466,735 |

Investec PLC | | Diversified Financials | | 30,010 | | | 200,998 |

J Sainsbury PLC | | Food & Staples Retailing | | 68,602 | | | 361,098 |

Kingfisher PLC | | Retailing | | 143,964 | | | 507,772 |

National Grid PLC | | Utilities | | 13,975 | | | 129,396 |

Next PLC | | Retailing | | 4,523 | | | 127,849 |

Old Mutual PLC | | Insurance | | 441,166 | | | 700,815 |

RSA Insurance Group PLC | | Insurance | | 84,727 | | | 177,828 |

Sage Group PLC/The | | Software & Services | | 33,344 | | | 108,016 |

Standard Chartered PLC | | Banks | | 17,772 | | | 418,674 |

Thomas Cook Group PLC | | Consumer Services | | 71,098 | | | 255,777 |

26

DOMINI EUROPEAN SOCIAL EQUITY FUND / PORTFOLIOOF INVESTMENTS

July 31, 2009

| | | | | | | |

COUNTRY/SECURITY | | INDUSTRY | | SHARES | | VALUE |

United Kingdom (Continued) | | | | | | | |

Thomson Reuters PLC | | Media | | 19,395 | | $ | 615,749 |

Travis Perkins PLC | | Capital Goods | | 4,849 | | | 65,477 |

Trinity Mirror Plc | | Media | | 75,285 | | | 102,033 |

Unilever PLC | | Food & Beverage | | 30,407 | | | 796,482 |

Vodafone Group PLC | | Telecommunication Services | | 909,715 | | | 1,850,525 |

| | | | | | | |

| | | | | | | 15,012,587 |

| | | | | | | |

United States – 2.2% | | | | | | | |

Eastman Chemical Co | | Materials | | 1,400 | | | 69,524 |

Lubrizol Corp | | Materials | | 1,900 | | | 110,067 |

Noble Corp (a) | | Energy | | 8,400 | | | 284,424 |

Rock Tenn Co Cl A | | Materials | | 1,200 | | | 53,952 |

Southwestern Energy Co (a) | | Energy | | 15,800 | | | 654,594 |

| | | | | | | |

| | | | | | | 1,172,561 |

| | | | | | | |

| | | |

Total Investments – 98.4% (Cost $55,730,636) (b) | | | | | | | 52,705,861 |

| | | | | | | |

| | | |

Other Assets, less liabilities – 1.6% | | | | | | | 837,281 |

| | | | | | | |

| | | |

Net Assets – 100.0% | | | | | | $ | 53,543,142 |

| | | | | | | |

| (a) | Non-income producing security. |

| (b) | The aggregate cost for federal income tax purposes is $56,279,089. The aggregate gross unrealized appreciation is $6,207,649 and the aggregate gross unrealized depreciation is $9,780,877, resulting in net unrealized depreciation of $3,573,228. |

| (c) | Securities for which there are no such quotations or valuations are valued at fair value as determined in good faith by or at the direction of the Fund’s Board of Trustees. |

SEE NOTES TO FINANCIAL STATEMENTS

27

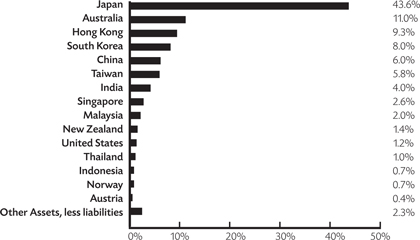

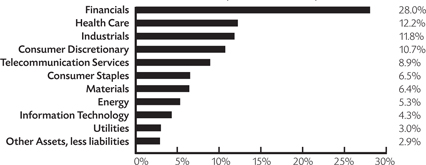

DOMINI PACASIA SOCIAL EQUITY FUND

Performance Commentary

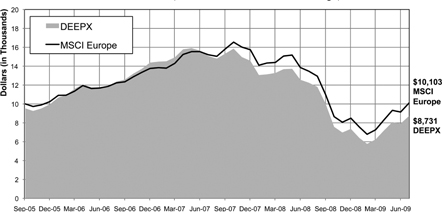

For the year ended July 31, 2009, the Fund’s Investor shares declined -14.56%, lagging the MSCI All Country Asia Pacific index, which fell -13.06%.

The following were among the companies held in the Fund’s portfolio that helped performance the most, relative to the MSCI All Country Asia Pacific index:

| | • | | The Hong Kong auto and electric appliance company BYD gained dramatically, helped by Chinese demand for automobiles and improved sales of handset telephones. |

| | • | | Despite mixed results in fiscal 2008, stock in the Chinese property developer Agile Property Holdings rose due to positive projections. |

| | • | | The Singaporean investment holding company Jardine Cycle & Carriage gained due to strong results in the first quarter of 2009 and improving fundamentals. |

The following were among the companies in the portfolio that hurt the Fund’s relative performance the most:

| | • | | Stock in the Australian company BlueScope Steel declined as previously solid domestic demand for steel turned weaker and overseas demand worsened. |

| | • | | Stock in the Japanese financial company Orix declined as the market became concerned about the company’s ability to obtain financing. |

| | • | | Stock in the Australian financial company Babcock & Brown declined in the latter half of 2008, mostly due to the ongoing credit crisis. |

The Fund’s relative performance was helped by its stock selection in the industrials, financial, and consumer discretionary sectors. The Fund was hurt by stock selection in the telecommunications and healthcare sectors.

28

TEN LARGEST HOLDINGS

| | | | | | | | |

COMPANY | | % NET

ASSETS | | | COMPANY | | % NET

ASSETS | |

Takeda Pharmaceutical | | 2.3 | % | | National Australia Bank | | 1.9 | % |

Honda Motor | | 2.1 | % | | LG Electronics | | 1.8 | % |

Astellas Pharma | | 2.0 | % | | Seven & I Holdings | | 1.8 | % |

Nissan Motor | | 2.0 | % | | Quanta Computer | | 1.6 | % |

Toppan Printing | | 2.0 | % | | AGL Energy | | 1.6 | % |

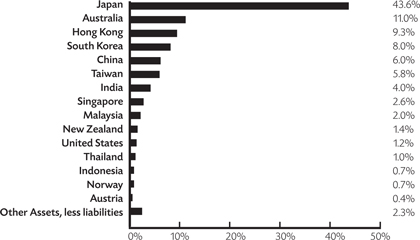

PORTFOLIO HOLDINGS BY INDUSTRY SECTOR (% OF NET ASSETS)

PORTFOLIO HOLDINGS BY COUNTRY (% OF NET ASSETS)

29

AVERAGE ANNUAL TOTAL RETURNS

| | | | | | | | |

| | | Investor

shares | | | MSCI AC

Asia Pacific | |

As of 7-31-09 | | 1 Year | | -14.56 | % | | -13.06 | % |

| | Since Inception (12-27-06) | | -9.70 | % | | -5.67 | % |

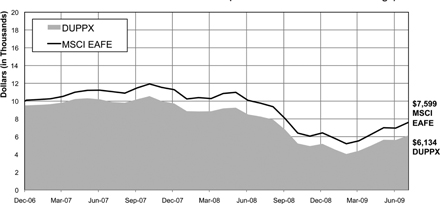

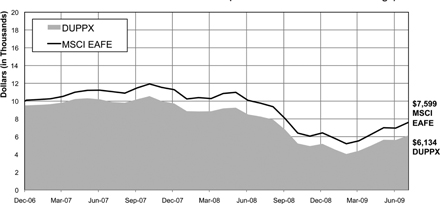

COMPARISON OF $10,000 INVESTMENT IN THE DOMINI PACASIA SOCIAL EQUITY FUND INVESTOR SHARES AND MSCI AC ASIA PACIFIC

Past performance is no guarantee of future results. The Fund’s returns quoted above represent past performance after all expenses. Economic and market conditions change, and both will cause investment return, principal value, and yield to fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost. Current performance may be lower or higher than the performance data quoted. For performance information current to the most recent month-end, call 1-800-582-6757 or visit www.domini.com. A 2.00% redemption fee is charged on sales or exchanges of shares made less than 30 days after the settlement of purchase or acquisition through exchange, with certain exceptions. Performance data quoted above does not reflect the deduction of this fee, which would reduce the performance quoted. See the Fund’s prospectus for further information.

For the period reported in its current prospectus, the Fund’s gross annual operating expenses totaled 2.48% of net assets. Until November 30, 2009, Domini has contractually agreed to waive certain fees and/or reimburse certain expenses, including management fees, so that expenses paid by the Fund will not exceed, on a per annum basis, 1.60% of its average daily net assets representing Investor shares, absent an earlier modification by the Board of Trustees, which oversees the Funds.

Investing internationally involves special risks, such as currency fluctuations, social and economic instability, differing securities regulations and accounting standards, limited public information, possible changes in taxation, and periods of illiquidity.

The table and the graph do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the redemption of Fund shares. Total return for the Domini PacAsia Social Equity Fund is based on the Fund’s net asset values and assumes all dividends and capital gains were reinvested. An investment in the Fund is not a bank deposit and is not insured. You may lose money. Certain fees payable by the Fund were waived during the period, and the Fund’s average annual total returns would have been lower had these not been waived.

The Morgan Stanley Capital International All Country Asia Pacific (MSCI AC Asia Pacific) index is an unmanaged index of common stocks. Investors cannot invest directly in an index.

30

AVERAGE ANNUAL TOTAL RETURNS

| | | | | | | | | | | |

| | | Class A shares (with

4.75% maximum

Sales Charge)1 | | | Class A shares

(without Sales

Charge)1 | | | MSCI AC Asia

Pacific | |

| As of 7-31-09 | | 1 Year | | -18.62 | % | | -14.56 | % | | -13.06 | % |

| | Since Inception (12-27-06) | | -11.38 | % | | -9.70 | % | | -5.67 | % |

COMPARISON OF $10,000 INVESTMENT IN THE DOMINI PACASIA SOCIAL EQUITY FUND CLASS A SHARES AND MSCI AC ASIA PACIFIC (with 4.75% maximum sales charge)1

Past performance is no guarantee of future results. The Fund’s returns quoted above represent past performance after all expenses. Economic and market conditions change, and both will cause investment return, principal value, and yield to fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost. Current performance may be lower or higher than the performance data quoted. For performance information current to the most recent month-end, call 1-800-582-6757 or visit www.domini.com. A 2.00% redemption fee is charged on sales or exchanges of shares made less than 30 days after the settlement of purchase or acquisition through exchange, with certain exceptions. Performance data quoted above does not reflect the deduction of this fee, which would reduce the performance quoted. See the Fund’s prospectus for further information.

For the period reported in its current prospectus, the Fund’s gross annual operating expenses totaled 9.30% of net assets. Until November 30, 2009, Domini has contractually agreed to waive certain fees and/or reimburse certain expenses, including management fees, so that expenses paid by the Fund will not exceed, on a per annum basis, 1.57% of its average daily net assets representing Class A shares, absent an earlier modification by the Board of Trustees, which oversees the Funds.

Investing internationally involves special risks, such as currency fluctuations, social and economic instability, differing securities regulations and accounting standards, limited public information, possible changes in taxation, and periods of illiquidity.

The table and the graph do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the redemption of Fund shares. Total return for the Domini PacAsia Social Equity Fund is based on the Fund’s net asset values and assumes all dividends and capital gains were reinvested. An investment in the Fund is not a bank deposit and is not insured. You may lose money. Certain fees payable by the Fund were waived during the period, and the Fund’s average annual total returns would have been lower had these not been waived.

The Morgan Stanley Capital International All Country Asia Pacific (MSCI AC Asia Pacific) index is an unmanaged index of common stocks. Investors cannot invest directly in an index.

| 1 | Class A shares were not offered prior to November 28, 2008. All performance information for time periods beginning prior to November 28, 2008, is the performance of the Investor shares. This performance has not been adjusted to reflect the lower expenses of the Class A shares. |

31

DOMINI PACASIA SOCIAL EQUITY FUND

PORTFOLIOOF INVESTMENTS

July 31, 2009

| | | | | | | |

COUNTRY/SECURITY | | INDUSTRY | | SHARES | | VALUE |

Australia – 11.0% | | | | | | | |

AGL Energy Ltd | | Utilities | | 27,660 | | $ | 342,628 |

Amcor Ltd/Australia | | Materials | | 8,640 | | | 35,555 |

Asciano Group (a) | | Transportation | | 45,947 | | | 61,117 |

Bendigo and Adelaide Bank Ltd | | Banks | | 13,131 | | | 89,515 |

BlueScope Steel Ltd | | Materials | | 83,457 | | | 233,817 |

CFS Retail Property Trust | | Real Estate | | 28,220 | | | 40,235 |

Computershare Ltd | | Software & Services | | 2,780 | | | 22,719 |

Fairfax Media Ltd | | Media | | 64,733 | | | 79,378 |

National Australia Bank Ltd | | Banks | | 20,278 | | | 410,158 |

OneSteel Ltd | | Materials | | 44,517 | | | 110,658 |

Origin Energy Ltd | | Energy | | 8,139 | | | 98,112 |

QBE Insurance Group Ltd | | Insurance | | 7,610 | | | 123,368 |

Suncorp-Metway Ltd | | Insurance | | 43,756 | | | 258,273 |

Telstra Corp Ltd | | Telecommunication Services | | 64,483 | | | 189,236 |

Westpac Banking Corp | | Banks | | 16,400 | | | 295,724 |

| | | | | | | |

| | | | | | | 2,390,493 |

| | | | | | | |

Austria – 0.4% | | | | | | | |

OMV AG | | Energy | | 2,445 | | | 96,539 |

| | | | | | | |

| | | | | | | 96,539 |

| | | | | | | |

China – 6.0% | | | | | | | |

Agile Property Holdings Ltd | | Real Estate | | 145,260 | | | 205,050 |

Byd Co Ltd (a) | | Capital Goods | | 21,846 | | | 120,927 |

Chaoda Modern Agriculture Holdings Ltd | | Food & Beverage | | 246,000 | | | 167,914 |

China Life Insurance Co Ltd | | Insurance | | 31,190 | | | 138,442 |

Guangzhou R&F Properties Co Ltd | | Real Estate | | 18,800 | | | 41,481 |

Hengan International Group Co Ltd | | Household & Personal Products | | 9,566 | | | 55,668 |

Hopson Development Holdings Ltd | | Real Estate | | 41,357 | | | 66,384 |

Ping An Insurance Group Co of China Ltd | | Insurance | | 2,500 | | | 22,113 |

Semiconductor Manufacturing International Corp (a) | | Semiconductors & Semiconductor Equipment | | 1,252,000 | | | 67,850 |

Shenzhen Investment Ltd | | Real Estate | | 64,000 | | | 31,711 |

Shimao Property Holdings Ltd | | Real Estate | | 81,000 | | | 163,044 |

Soho China Ltd | | Real Estate | | 215,000 | | | 136,767 |

TPV Technology Ltd | | Technology Hardware & Equipment | | 150,950 | | | 82,194 |

| | | | | | | |

| | | | | | | 1,299,545 |

| | | | | | | |

Hong Kong – 9.3% | | | | | | | |

Esprit Holdings Ltd | | Retailing | | 6,500 | | | 46,715 |

First Pacific Co | | Food & Beverage | | 78,389 | | | 50,067 |

Great Eagle Holdings Ltd | | Real Estate | | 27,874 | | | 64,523 |

Guoco Group Ltd | | Diversified Financials | | 10,000 | | | 94,193 |

Henderson Land Development Co Ltd | | Real Estate | | 29,733 | | | 197,004 |

Hongkong Land Holdings Ltd | | Real Estate | | 25,000 | | | 97,250 |

Hysan Development Co Ltd | | Real Estate | | 36,191 | | | 98,299 |

Jardine Matheson Holdings Ltd | | Capital Goods | | 6,111 | | | 175,997 |

32

DOMINI PACASIA SOCIAL EQUITY FUND / PORTFOLIOOF INVESTMENTS

July 31, 2009

| | | | | | | |

COUNTRY/SECURITY | | INDUSTRY | | SHARES | | VALUE |

Hong Kong (Continued) | | | | | | | |

Jardine Strategic Holdings Ltd | | Capital Goods | | 9,531 | | $ | 154,974 |

New World Development Ltd | | Real Estate | | 92,406 | | | 220,104 |

PCCW Ltd | | Telecommunication Services | | 79,000 | | | 21,508 |

Sino Land Co | | Real Estate | | 24,664 | | | 50,346 |

Sun Hung Kai Properties Ltd | | Real Estate | | 6,065 | | | 91,953 |

Swire Pacific Ltd Cl A | | Real Estate | | 24,167 | | | 270,669 |

Techtronic Industries Co | | Consumer Durables & Apparel | | 55,500 | | | 46,262 |

Wharf Holdings Ltd | | Real Estate | | 33,675 | | | 158,597 |

Wheelock & Co Ltd | | Real Estate | | 63,221 | | | 177,426 |

| | | | | | | |

| | | | | | | 2,015,887 |

| | | | | | | |

India – 4.0% | | | | | | | |

Hero Honda Motors Ltd | | Automobiles & Components | | 7,379 | | | 246,216 |

JSW Steel Ltd | | Materials | | 9,830 | | | 142,899 |

Mahanagar Telephone Nigam | | Telecommunication Services | | 48,494 | | | 103,663 |

Punjab National Bank Ltd | | Banks | | 13,468 | | | 193,804 |

Sterlite Industries India Ltd | | Materials | | 10,813 | | | 145,451 |

Videocon Industries Ltd | | Consumer Durables & Apparel | | 11,549 | | | 43,679 |

| | | | | | | |

| | | | | | | 875,712 |

| | | | | | | |

Indonesia – 0.7% | | | | | | | |

Perusahaan Gas Negara PT | | Utilities | | 433,000 | | | 152,695 |

| | | | | | | |

| | | | | | | 152,695 |

| | | | | | | |

Japan – 43.6% | | | | | | | |

Aeon Co Ltd | | Food & Staples Retailing | | 9,464 | | | 91,463 |

Alps Electric Co Ltd | | Technology Hardware & Equipment | | 6,600 | | | 36,606 |

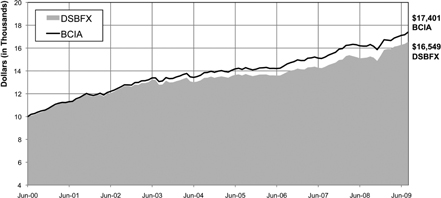

Amada Co Ltd | | Capital Goods | | 45,189 | | | 285,768 |