Exhibit (c)(i)

REPORT OF THE AUDITOR-GENERAL OF QUEENSLAND

The books, accounts and financial records relating to the Public Accounts of Queensland prepared by the State Treasury Department, for the years 1989-90 through 2003-2004 inclusive and Queensland Treasury Corporation for the years 1989-90 through 2003-2004 inclusive have been audited in accordance with recognised professional Australian Auditing Standards and practices and the relevant provisions of the Financial Administration and Audit Act 1977 (Queensland legislation governing State financial administration and practice).

Audit Certificates were subsequently provided to the Legislative Assembly of Queensland that, inter alia, all explanations and information required had been obtained in respect of these audits and that, in the opinion of the Auditor General, the various financial statements had been properly drawn up so as to present a true and fair view of transactions for the financial years concerned and the position of the accounts at the close of the respective years. There were no material audit qualifications to these accounts for any of the periods referred to with the exception of the Queensland Treasury Corporation financial statements for the periods 1 July 1989 to 30 June 1990 and 1 July 1990 to 30 June 1991. These qualifications related to the validity of specific significant assumptions and the outcome of certain litigation which, having been resolved, did not materially impact upon the accounts of Queensland Treasury Corporation for the subsequent years and accordingly an unqualified opinion was given in respect of these subsequent years.

In relation to the Statement of Financial Performance, Statement of Cashflows and the Statement of Financial Position of the Queensland Treasury Corporation for the year ended 30 June 2004 set out in the Queensland Treasury Corporation Annual Report for 2003-2004, I hereby certify that these Statements are an accurate reproduction of the financial statements duly certified in accordance with paragraph two of this Report and, in my opinion, have been properly drawn up so as to show a true and fair view of the transactions of the Corporation for the periods shown and the financial position of the Corporation as at 30 June 2003 and 30 June 2004.

Dated December 14, 2004

| | | | |

| | |

/s/ L J Scanlan | | | | |

L J SCANLAN | | | | Queensland Audit Office |

Auditor General of Queensland Brisbane | | | | |

QUEENSLAND TREASURY CORPORATION

ANNUAL REPORT 2003-04

FOR THE YEAR ENDED 30 JUNE 2004

CONTENTS

3

QUEENSLAND TREASURY CORPORATION

As the State’s corporate treasury services provider, our role is to implement the operational functions of a corporate treasury for the benefit of our customers and the State. In performing this role, our primary responsibilities include:

| | • | providing financial risk management services and advice to the State and its public sector organisations |

| | • | sourcing the State’s long-term debt funding requirements in the most cost effective manner, and |

| | • | investing the State’s short to medium-term cash surpluses with the aim of maximising returns to Queensland’s public sector bodies within a conservative risk management framework. |

We do not formulate Government policy, but work within the policy frameworks developed by Queensland Treasury and the Government.

DEBT FUNDING

In our funding role, we borrow funds in the domestic and international markets in a manner that minimises the State’s and QTC’s liquidity and rollover risk. We then lend these funds to our customers, or use them to manage our customers’ debt or refinance maturing debt.

Through our responsibility for more than 99% of the State’s debt raisings, we are able to capture significant economies of scale and scope in the issuance, management and administration of debt.

These economies, together with our AAA rating (from the State of Queensland’s guarantee of our securities), result in a low cost of debt for Queensland’s public sector. This funding is used to provide tailored financial solutions for our customers.

SHORT TO MEDIUM-TERM INVESTMENTS

We use our financial markets expertise, developed through our relationships with the domestic and international markets, together with our understanding of debt management and experience in implementing systems, to provide our customers with investment solutions that achieve a high return within a conservative risk environment. Customers have a choice of a managed short-term fund, an overnight facility, or fixed term facilities.

FINANCIAL RISK MANAGEMENT SERVICES

We work closely with our public sector customers, using our combined skills and knowledge, to assist them to manage risk in their financial transactions and achieve the best financial solution for their organisations and the State. In assisting our customers, we do not provide advice that is contrary to the interests of the State.

We encourage our customers and Queensland Treasury, our major stakeholder, to use our organisation as an extension of their resources, by:

| | • | Providing them with access, on a cost-recovery basis, to professional skills and resources to ensure that their financial risks are identified and managed on a consistent basis. |

| | • | Acting as a central store of knowledge and expertise on financial structures and transactions, and the risks and benefits that they encompass. |

| | • | Providing Queensland Treasury with independent advice on matters of financial and commercial policy and financial and commercial risk relating to the State and its entities. |

| | • | Working as a conduit between the Government and the private sector, using our economies of scale and scope to ensure that the best possible solutions are obtained. |

4

VISION, MISSION AND VALUES

Our Vision

Efficient and effective financial risk management practices across our customers and the State.

Our Mission

To provide corporate treasury services to our customers and the State, by striving to understand our customers’ current and future needs and by delivering solutions to meet those needs.

Our Values

We value:

| | • | respect for the individual |

| | • | integrity and honesty in all our dealings |

| | • | good corporate citizenship, and |

| | • | strong commitment and valuable contributions. |

5

HIGHLIGHTS

In 2003-04, Queensland Treasury Corporation performed strongly for its customers and the State, as the State’s corporate treasury services provider.

This strengthened performance was organisation-wide and resulted from improved teamwork and cooperation across teams and a greater focus on core value-adding activities.

FINANCIAL PERFORMANCE

A key aspect of the value QTC provides its customers is the hard dollar savings generated through efficient borrowing activities, and the ongoing management of these liabilities.

During the 2003-04 financial year, QTC achieved, for its customers, savings on borrowing margins of $63.1 million and savings from portfolio management of $54.6 million. This brought total savings in relation to QTC’s funding and management of the public sector’s debt to $1.3 billion since 1991.

QTC further assists its customers in the management of their financial risks by providing a vehicle for the investment of their surplus cash balances. The QTC Cash Fund has outperformed its benchmark in every year since 1991 and in financial year 2003-04 achieved $7.2 million in additional benefits for customers.

Customers also benefited from the flexibility provided by QTC’s debt management products. Their ability to take timely advantage of market opportunities generated savings in excess of $19 million this financial year.

QTC achieved an operating surplus, before payments in lieu of income tax, of $35.8 million.

In reaffirming the State’s credit rating, Standard & Poor’s stated that it considers QTC’s operations and risk-management practices are positive factors in Queensland’s AAA rating.

FINANCIAL MARKETS ACTIVITIES

In 2003-04, QTC was once again the foremost Australian semi-government issuer of A$ denominated bonds in both the domestic and offshore markets.

Our dealer panels and investors have continued to support our various funding facilities. These facilities form the building blocks on which our customers’ financial solutions are based.

Our Investor and Market Relations Program, designed to maintain and enhance the State’s and QTC’s reputation in both the domestic and offshore markets, continued with meetings held throughout Australia, Asia, the United States, the United Kingdom and Europe. QTC representatives also conducted an Asian central banks roadshow and participated in the Fixed Link Forum in Hong Kong and Singapore, and the Nomura Central Bankers Seminar in Tokyo.

In August, we hosted our biennial conference for representatives of domestic investor institutions to strengthen communication channels between QTC and some of the ultimate lenders to the State, and to ensure we remain well informed of investor requirements.

In July, we elevated our 2015 domestic preferred bond line to domestic benchmark bond status and simultaneously launched a global tranche maturing in 2015. This increased the amount of 2015 domestic bonds on issue to more than A$1.0 billion. The 2015 domestic bond is currently QTC’s longest benchmark maturity.

We experienced significant demand—issuing more than A$3.0 billion—from offshore investors for our benchmark bonds in 2003-04. Solid demand for both global and domestic bonds particularly evident from investors in Japan, the UK and continental Europe. We also completed three bond issues, totalling A$357 million, in the Japanese retail (uridashi) market, which provided additional attractive medium-term funding.

6

PROVIDING TREASURY SERVICES

Our relationships with customers continue to strengthen, as evidenced by our customers’ feedback on completed projects, and increasing involvement with our customers in a range of matters. On a scale of one to seven, our customers consistently rated our overall work on their advisory assignments as a six.

Our customers have increasingly involved us, at an early stage, in their business matters, particularly their procurement projects.

In addition to the savings created from borrowing margins ($63.1M) and portfolio management ($54.6M), we generated a further $52.9 million in value for our customers. This can be broken down as follows:

| | • | The management of long-term liquidity and refinancing risk on behalf of our customers: $18.9 million. |

| | • | The provision of strategic interest rate risk advice: $19 million. |

| | • | The provision of advice to our customers with respect to the management of financial risk: around $15 million. |

We met a significant increase in demand for our employees to work on secondment with our customers. Over the past year, 10 of QTC’s 130 employees took the opportunity to work within our customers’ organisations, adding value to their projects, as well as gaining a better understanding of those customers’ businesses. Following the success of these short-to-medium term placements, we anticipate that demand for customer secondments is likely to continue to increase.

During the year, QTC has assisted customers with financial training, conducting programs in Brisbane and a number of regional areas in Queensland. One key program, developed and delivered in conjunction with the Department of Local Government, provided customers with information and practical training in Project Evaluation. This course was well attended and received positive feedback from customers.

In November, we hosted our inaugural Departments and Agencies Financial Forum. This one-day Forum provided an opportunity for our Queensland Government customers to share knowledge, experiences and ideas regarding financial and project risk management issues.

QTC has facilitated risk workshops and training seminars for customers to assist them with risk identification, assessment and management. We also completed a number of risk assessment assignments for customers, and assisted them to establish risk assessment and analysis as part of their processes.

In response to the National Competition Policy reforms, we have provided our Local Government customers with advice, training and support on the issues of capital structure, cost of capital and pricing, for various commercialised business units.

On behalf of Queensland Treasury, we completed credit reviews of the larger Government Owned Corporations (GOCs), as well as a number of ad hoc reviews in relation to proposed GOC investments.

QTC was involved in providing financial advice with respect to all major procurement projects, and provided assistance on a number of significant whole-of-State risk issues including resolution of the arrangements between the State and Australian Magnesium Corporation, and consultation with the Commonwealth and other stakeholders on the proposed introduction of Division 250 tax law changes.

CORPORATE

We reviewed our Corporate Plan to ensure our direction and focus is in line with the issues facing our customers. Our primary objective is to build customer loyalty through developing and delivering solutions that provide value from a whole-of-State perspective.

7

During the year, we developed a strategy to achieve our vision for our information management—to provide staff, customers and stakeholders with seamless and secure access to quality information. An enterprise architecture plan is being developed to define those projects essential to achieving our vision.

The Employee Survey was completed with a very positive outcome for QTC. Feedback from a global human resources consultancy specialising in organisational climate surveys indicated that QTC was in the top 10% of employee organisations, with the highest ‘engagement’ score ever recorded for any participant in the firm’s survey.

The team based performance system, together with a new remuneration system, was implemented.

The office refurbishment was completed. From a staff and teamwork perspective this has been very positive.

Our Chief Executive was awarded ‘Public Sector Financial Manager of the Year’ by CFO magazine.

We operated within budget, and our overall control environment has operated soundly with no significant issues being raised by internal or external audit.

8

CHAIRMAN’S REPORT

In a year of rising market interest rates, Queensland Treasury Corporation (QTC) maintained its position as Australia’s premier semi-government issuer, with interest rates on our new money raisings better on average than any other Australian semi-government issuer.

The global economic climate steadily improved over the past year. Furthermore, Government and monetary policy stimulated economic growth, and confidence in the economic outlook seems to have become less susceptible to geo-political threats and activity. The net result in the financial markets has been higher share prices, rising commodity prices and a lift in market interest rates.

In this environment of rising interest rates, QTC’s active portfolio management sought to minimise the interest costs incurred by its customers. It was successful to the extent that the total interest savings for Queensland over the past twelve months were $117.7 million, bringing the cumulative total of savings to more than $1.3 billion since QTC’s establishment in 1991.

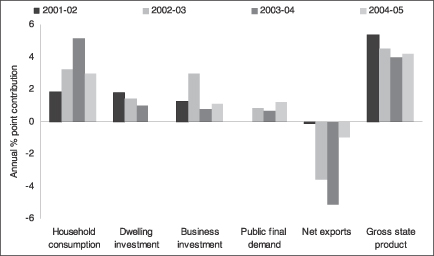

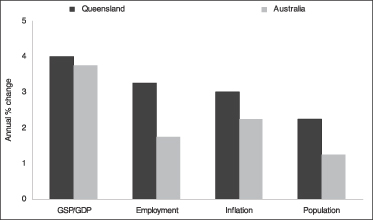

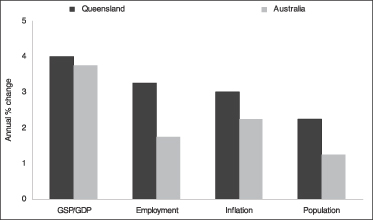

Queensland’s Economy

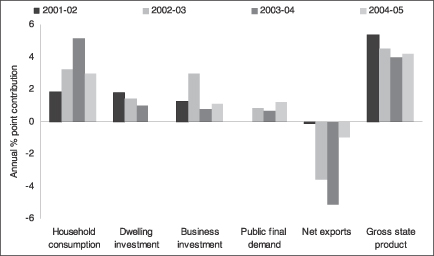

The Queensland economy performed strongly during 2003-04, despite a number of factors adversely affecting the State’s trade sector. Queensland is estimated to have recorded economic growth of 4% in 2003-04, compared with 3 3/4% nationally. During this year, the domestic sector has driven overall economic growth, with household consumption growing at a near-record rate, underpinned by continued strength in the housing sector.

However, the surge in consumer spending, along with continuing growth in business investment, has led to a rapid increase in imports in 2003-04, while the high A$ exchange rate and continuing impact of the drought on rural production have restrained export growth. The resulting trade sector detraction from the State’s aggregate growth figures made the strong performance of the domestic sector through the year all the more important and impressive.

Borrowing Requirements

Solid economic growth in Queensland and higher returns on world financial markets were the main drivers of a better than expected Budget outcome for 2003-04. As a result, the State’s debt funding requirements were less in the year relative to earlier years. However, strong economic outcomes continue to place growing demands on existing infrastructure. The Government has allocated some of its recent Budget surplus towards meeting this enhanced capital requirement but the capital works needed in South East Queensland and other areas of rapid population growth in the State mean that borrowing programs will be maintained or increased well into the foreseeable future.

Financial Markets Relationships

In 2003-04, QTC maintained its overall position as the strongest semi-government issuer of Australian dollar (A$) denominated bonds both in Australia and overseas.

To maintain and enhance the State’s and QTC’s reputation in both the domestic and offshore markets, we continued our Investor and Market Relations Program, conducting meetings in Australia, Asia, Japan, the United States, the United Kingdom and Europe. Attended by representatives of QTC and the Queensland Government, these meetings are key to ensuring that the markets are fully informed on matters concerning the State and QTC’s operations and borrowing strategies. Additionally, of course, we continue our good relations and understanding in the domestic market, which included, this year, our biennial conference for domestic institutional investors.

9

Looking Ahead

In 2004-05, we will pursue opportunities to work with our customers as an extension of their resources, assisting them to manage risk in their financial transactions and achieve the best financial solutions for their organisations and for the State.

Acknowledgments

With the retirement of Elizabeth Nosworthy from the Board in October, and Bernie Fraser and Bill Norton retiring as Board Members at the end of their terms (on 30 June), I thank them for their vision, contribution and support to QTC over the past years. Into these vacancies, I am pleased to welcome Gillian Brown, David Coe and Bill Shields, who have been appointed to the Board for the period 2004-07.

I also mention the achievements of our Chief Executive, Stephen Rochester, who was awarded the CFO Magazine’s prestigious national ‘Public Sector Financial Manager of the Year’ award. It was a well deserved recognition.

On behalf of the Board, I thank QTC’s management and employees for their achievement of positive financial results for Queensland and its public sector organisations for 2003-04. The Board acknowledges the staff’s ongoing commitment to this objective.

Sir Leo Hielscher AC

10

CHIEF EXECUTIVE’S REPORT

Queensland Treasury Corporation (QTC) has had a very successful year, providing corporate advisory, risk management, debt funding and short-to-medium term investment services to meet unprecedented demand from Queensland’s public sector. This organisation-wide improvement in performance resulted from a greater focus on core value-adding activities, teamwork and cooperation.

At 30 June 2004, QTC funded almost all of the Queensland public sector’s borrowings, with total borrowings of $21.70 billion, and $4.16 billion of refinancings and new capital being raised in the 2003-04 financial year. QTC also had $4.48 billion of funds invested for customers in competitively priced and strongly performing vehicles for short to medium term cash or investment requirements.

Global Demand Increases

During the past year, we have experienced renewed interest from global financial markets for Australian dollar (A$) denominated assets. With many industrialised countries experiencing historically low interest rates, international investors have sought higher quality, higher yielding Australian investments, and we issued more than A$3.0 billion of benchmark bonds to offshore investors. This has diversified our funding sources and improved our ability to provide competitively-priced funding solutions to our customers.

Building Customer Franchise

Our relationships with customers continued to strengthen, as our customers have expanded the use of our corporate treasury services. On corporate advisory assignments, our customers have consistently rated our overall work as a six, on a scale of one to seven.

Similarly, our customers have sought to involve us at an early stage in an increasing range of business matters, particularly their major procurement projects, and 10 of our employees have been seconded into our customers’ organisations to assist with key projects.

With Government’s focus on ensuring value for money outcomes, we have seen a continued trend towards the use of whole-of life-financial analysis as a means of assessing value for money. In the past year, QTC has applied its specialist competencies in whole-of-life financial analysis for the benefit of its customers by assisting with specific projects, and participating in the development of a consistent Government approach to the use of these financial analysis tools.

Strategic Planning

In recognition of the increasingly complex and risky business environment in which our customers operate, we have continued to focus on developing our services to best meet the needs of our public sector customers. We reviewed our strategic and corporate plan to ensure our direction and focus is in line with the issues facing our customers, so that we can better build customer loyalty through developing and delivering solutions that provide value from a whole-of-State perspective.

Corporate Achievements

Following the completion of our employee survey, which provided positive results and feedback from our staff, the surveyor indicated that QTC was in the top 10% of employee organisations, with the highest ‘engagement’ score ever recorded for any participant in the consultancy’s survey.

During the year, we completed our office refurbishment, providing facilities that encourage and support teamwork and cooperation, and implemented a new team-based performance and remuneration system.

11

We also developed and began implementation of a strategy to achieve our vision for our information management—to provide staff, customers and stakeholders with seamless and secure access to quality information.

Acknowledgments

QTC’s success in the past year is clearly attributable to the expertise and dedication of our employees. With their ongoing commitment to developing and delivering financial solutions to meet our customers’ current and emerging needs, QTC is well placed to continue to deliver value for money outcomes for Queensland and its public sector entities.

Stephen Rochester

12

FINANCIAL SUMMARY

| | | | |

| | | 2002-03 $000

| | 2003-04 $000

|

Operating Surplus from ordinary activities before payment in lieu of income tax | | 60 098 | | 35 830 |

Payment in lieu of income tax | | 13 176 | | 12 553 |

| | |

| |

|

Operating Surplus from ordinary activities after payment in lieu of income tax | | 46 922 | | 23 277 |

| | |

Distribution paid to Consolidated Fund | | 33 000 | | — |

Total Assets | | 26 866 311 | | 26 809 429 |

Total Liabilities | | 26 657 745 | | 26 477 586 |

Equity | | 208 566 | | 231 843 |

Onlendings | | 19 670 526 | | 17 714 737 |

Managed Deposit Funds | | 4 148 083 | | 4 476 280 |

Savings due to portfolio management | | 13 618 | | 54 632 |

Savings due to borrowing margin | | 56 094 | | 63 061 |

13

FIVE-YEAR BUSINESS SUMMARY

| | | | | | | | | | | | |

| | | Financial Year 99-00

| | Financial Year 00-01

| | | Financial Year 01-02

| | Financial

Year 02-03

| | | Financial

Year 03-04

|

FINANCIAL | | | | | | | | | | | | |

Operating Statement ($000) | | | | | | | | | | | | |

Interest from onlendings | | 940 476 | | 1 203 279 | | | 1 092 077 | | 1 826 847 | | | 371 737 |

Management fees | | 18 321 | | 20 945 | | | 21 970 | | 24 318 | | | 22 144 |

Fees from professional services | | 644 | | 371 | | | 377 | | 873 | | | 505 |

Interest on borrowings | | 1 169 658 | | 1 437 089 | | | 1 295 279 | | 2 157 121 | | | 468 243 |

Income distribution | | 148 114 | | 141 402 | | | 149 264 | | 166 529 | | | 239 933 |

Operating surplus before abnormal items and payment in lieu of income tax | | 31 299 | | 40 117 | | | 42 610 | | 60 098 | | | 35 830 |

Abnormal items | | 8 717 | | — | | | — | | — | | | — |

Payment in lieu of income tax | | 14 518 | | 15 156 | | | 13 694 | | 13 176 | | | 12 553 |

Operating surplus after payment in lieu of income tax | | 25 498 | | 24 961 | | | 28 916 | | 46 922 | | | 23 277 |

| | | | | |

Balance Sheet ($000) | | | | | | | | | | | | |

Total assets | | 22 107 020 | | 24 880 096 | | | 26 039 139 | | 26 866 311 | | | 26 809 429 |

Total liabilities | | 21 916 253 | | 24 714 368 | | | 25 844 495 | | 26 657 745 | | | 26 577 586 |

Net assets | | 190 767 | | 165 728 | | | 194 644 | | 208 566 | | | 231 843 |

| | | | | |

CUSTOMER | | | | | | | | | | | | |

Savings for Customers ($M) | | | | | | | | | | | | |

Savings due to portfolio management | | 38.0 | | (26.5 | ) | | 17.9 | | 13.6 | | | 54.6 |

Savings due to borrowing margin | | 71.0 | | 67.7 | | | 53.3 | | 56.1 | | | 63.1 |

Total savings for customers | | 109.0 | | 41.2 | | | 71.2 | | 69.7 | | | 117.7 |

Cumulative savings for customers | | 999.0 | | 1 040.2 | | | 1 111.4 | | 1 181.1 | | | 1 298.8 |

| | | | | |

Onlendings | | | | | | | | | | | | |

Onlendings ($000) | | 16 734 769 | | 17 347 345 | | | 18 419 899 | | 19 670 526 | | | 17 714 737 |

Number of onlending customers | | 337 | | 374 | | | 383 | | 363 | | | 342 |

Outperformance of benchmark (% pa semi-annual) | | | | | | | | | | | | |

Floating Rate Debt Pool | | 0.24 | | 0.41 | | | 0.46 | | 0.14 | | | 0.18 |

3 Year Debt Pool | | 0.21 | | (0.27 | ) | | 0.20 | | (0.02 | ) | | 0.22 |

6 Year Debt Pool | | 0.21 | | (0.29 | ) | | 0.04 | | 0.00 | | | 0.28 |

9 Year Debt Pool | | 0.27 | | (0.29 | ) | | 0.00 | | 0.06 | | | 0.28 |

12 Year Debt Pool | | 0.33 | | (0.26 | ) | | 0.01 | | 0.07 | | | 0.34 |

15 Year Debt Pool | | 0.33 | | (0.25 | ) | | 0.02 | | 0.05 | | | 0.36 |

| | | | | |

Managed Funds | | | | | | | | | | | | |

Deposits ($000) | | 2 197 252 | | 1 611 255 | | | 3 171 913 | | 4 148 083 | | | 4 476 280 |

Number of depositors | | 194 | | 202 | | | 215 | | 223 | | | 353 |

Outperformance of benchmark (% pa semi-annual) | | | | | | | | | | | | |

Cash Fund | | 0.19 | | 0.18 | | | 0.17 | | 0.18 | | | 0.18 |

| | | | | |

FINANCIAL MARKETS | | | | | | | | | | | | |

Debt outstanding ($000) | | 19 031 349 | | 22 203 640 | | | 22 025 716 | | 22 219 443 | | | 21 702 155 |

QTC bond rates (% at 30 June) | | | | | | | | | | | | |

July 1999 | | — | | — | | | — | | — | | | — |

August 2001 | | 6.10 | | 4.95 | | | — | | — | | | — |

May 2003 | | 6.26 | | 5.50 | | | 5.25 | | — | | | — |

June 2005 | | 6.36 | | 5.99 | | | 5.81 | | 4.51 | | | 5.45 |

September 2007 | | 6.48 | | 6.18 | | | 6.03 | | 4.78 | | | 5.70 |

July 2009 | | 6.52 | | 6.30 | | | 6.18 | | 4.98 | | | 5.87 |

June 2011 | | 6.57 | | 6.39 | | | 6.29 | | 5.13 | | | 5.98 |

August 2013 | | — | | — | | | 6.38 | | 5.24 | | | 6.07 |

October 2015 | | 6.61 | | 6.46 | | | 6.42 | | 5.30 | | | 6.12 |

June 2021 | | 6.62 | | 6.52 | | | 6.47 | | 5.38 | | | 6.18 |

Basis point margin over C’wealth bonds | | 32.7 | | 29.5 | | | 24.3 | | 16.7 | | | 19.3 |

Basis point margin under NSW TCorp bonds | | 5.1 | | 2.6 | | | 3.3 | | 2.1 | | | 3.1 |

QTC global & domestic bonds on issue ($M) | | 16 723 | | 18 463 | | | 19 148 | | 18 406 | | | 20 486 |

| | | | | |

CORPORATE | | | | | | | | | | | | |

Number of employees | | 121 | | 126 | | | 121 | | 129 | | | 130 |

Administration expenses ($000) | | 20 725 | | 23 415 | | | 23 716 | | 24 555 | | | 28 403 |

14

ACHIEVING WHOLE-OF-STATE OUTCOMES

In supporting the implementation of the State’s value-for-money framework, we provided ongoing support and input on matters of commercial and financial risk to Queensland Treasury, our major stakeholder, in relation to a variety of transactions, including the:

| | • | Southbank Education Precinct Redevelopment |

| | • | Gateway Duplication Project, and |

| | • | Brisbane City Council North/South Tunnel Project. |

We also assisted the State in the resolution of arrangements between the Government stakeholders and the Australian Magnesium Corporation.

We again conducted stakeholder feedback sessions with senior representatives of our major stakeholder, Queensland Treasury. The objective of these sessions was to gain feedback on the extent of our value delivery to Treasury and Government and to identify their emerging needs in terms of our provision of advice.

CREDIT REVIEWS

On behalf of Queensland Treasury, we completed annual credit reviews of the larger Queensland Government Owned Corporations (GOCs) to assist with assessing the GOCs’ applications for funding under the State Borrowing Program. We also completed a number of ad hoc credit reviews in relation to proposed GOC investments.

PROCUREMENT

We continue to provide financial risk management support to our public sector customers who are undertaking record Government capital expenditure activities.

With the Government’s focus on ensuring value for money outcomes, we have seen a continued trend towards the use of whole-of-life financial analysis as a means of assessing value for money.

QTC has applied its specialist competencies in whole-of-life financial analysis for the benefit of its customers by:

| | • | assisting with specific projects, and |

| | • | participating in the development of a consistent Government approach to the use of these financial analysis tools. |

Whole-of-life financial analysis is a powerful analytical tool for the evaluation of projects; however, it needs to be used carefully, particularly when assessing long-term government projects. Current topical issues that can affect the outcome of this analysis include the appropriate use of discounted cash flow analysis techniques (especially in relation to discount rate and cash flow determination for very long-term projects involving payment streams from Government), and the implications of various specific funding instruments on the comparison of delivery alternatives.

We have also continued to work closely with relevant agencies in progressing issues associated with tax reform relating to private sector participation in public infrastructure projects. This is a significant issue for both the State and Federal Government, particularly as so much of the financial benefit from State infrastructure projects flows to the Federal Government in the form of tax receipts.

Another critical issue has been the ongoing misconception that budget-funded PPPs allow projects that would otherwise not be considered as affordable government priorities to be undertaken.

15

We are continuing to work closely with Queensland Treasury and our customers across a broad spectrum of projects and issues to ensure that private sector involvement in projects contributes to the objective of delivering value for money for the State.

INTEREST RATE RISK

QTC worked closely with the State’s regulated entities to manage their interest rate risk for the current regulatory cycle, as well as plan for the management of similar financial risks in the next cycle. QTC has sought to coordinate ongoing discussions with customers, key stakeholders and industry participants to ensure funding and market risks are managed appropriately.

16

ADDING VALUE TO OUR CUSTOMERS’ BUSINESSES

QTC’s primary objective is to build customer loyalty through developing and delivering solutions that provide value.

It is through strong relationships with our customers that we gain a better understanding of their current and emerging needs, which then assists us in designing, developing and delivering tailored solutions for each customer. These solutions are designed to add value to our customers’ businesses and, ultimately, ensure the best financial outcomes for Queensland.

During the past 12 months, our relationships with our customers have continued to strengthen, as evidenced by our customers’ feedback on completed projects, and our increasing involvement with our customers in a range of matters. On a scale of one to seven, our customers consistently rated our overall work on their advisory assignments as a six.

CORPORATE ADVISORY AND RISK MANAGEMENT

QTC has experienced increased demand for our corporate advisory and risk management services across all of our customer groups, completing more projects of a wider variety over the past 12 months.

We advised the public sector on operating and financial risk matters and worked with them to identity and develop optimal value for money solutions in transactions in a range of projects, including the:

| | • | Department of Natural Resources, Mines and Energy’s Water Metering Project |

| | • | National Housing Project: Developing Options for a National Approach to Affordable Housing |

| | • | Tennyson Riverside Development, and |

| | • | Smart Driver Licence Project. |

We provided the State’s Government Owned Corporations (GOCs), and their Boards, with updates on the current economic and interest rate environment, enabling effective management of their debt portfolios. In addition, we continued to provide specialist advice and assistance in the areas of:

| | • | liability benchmark structuring |

| | • | implementing and monitoring their liability management |

| | • | foreign exchange exposure management, and |

We assisted a number of GOCs in implementing their business plans, including risk management and funding advice.

We provided advice on capital structure, cost of capital and pricing to:

| | • | South-East Queensland Councils’ Feasibility Study into the Establishment of a Shared Fleet Model |

| | • | Gladstone Area Water Board, and |

| | • | a number of regional councils in relation to their commercialised business units. |

We also assisted a number of customers in the development of policy frameworks to improve their risk management practices.

17

MANAGING OUR CUSTOMERS’ DEBT

Many of our customers authorise QTC to manage the interest rate risk inherent in their debt. This management is undertaken within customer approved parameters in the form of a duration benchmark and defined duration management range. Our management performance is subject to monthly review by the QTC Capital Markets Board, as well as by our customers.

The 2003-04 financial year was characterised by a somewhat less volatile geo-political environment than that experienced in the previous twelve months. Although uncertainties relating to the Middle East and terrorism in general were still apparent, there were no major incidents to significantly shake global confidence.

The United States Federal Reserve Board added to the generally positive environment by maintaining relatively easy monetary and fiscal conditions throughout the year. With countries such as China and India exhibiting strong economic growth even Japan appeared to have entered into a long awaited period of sustained economic recovery.

Against this backdrop, global interest rates took on a decidedly bearish tone as central banks adjusted their focus towards anticipated inflation.

Within this environment, we used our portfolio management skills to generate an aggregate $54.6 million in interest cost savings for its customers. Our customers also benefited by a further $19 million, as they took advantage of duration benchmark management opportunities we identified and facilitated in the market.

MANAGING OUR CUSTOMERS’ SURPLUS CASH

QTC offers a number of facilities for our customers to deposit their surplus cash. Terms of these facilities range from one day out to three years. One such facility is the Capital Guaranteed Cash Fund where QTC’s Board approves the benchmark and defined management ranges. Through our management of this fund QTC added $7.2 million, when compared to benchmark, during financial year 2003-04.

PROVIDING AN OPERATING LEASE FACILITY

An analysis of operating leases undertaken over the past several years indicates that they typically do not represent value for money relative to financing through debt funding. This is mainly due to:

| | • | customers not returning the equipment on time |

| | • | customers returning the equipment in damaged condition |

| | • | there being no residual risk transfer from the customer, or |

| | • | the equipment having a useful life significantly longer than the lease period. |

Although these factors limit the value of leasing in the public sector, there are occasions when our customers prefer to use leases.

Established in 2002-03, QTC’s Whole-of-Government Leasing Facility provides our customers with a lower cost and risk alternative than those provided by the private sector. This has been achieved through access to our low cost funding, balanced leasing terms and on-going customer communications regarding our customers’ end of lease intentions.

The demand for this facility is now decreasing as our customers’ compare the value of leasing to the debt financing alternative. QTC frequently assists its customers in conducting such evaluations. During the year, we completed significant assignments for the Police, Environmental Protection Agency, CITEC and many local councils.

18

KNOWLEDGE SHARING

In November 2003, we held our inaugural Departments and Agencies Financial Forum. This one-day forum highlighted key strategic financial and project risk management issues facing departments and agencies, as well as strategies for managing these risks. It also provided an opportunity for our customers to share their knowledge, experiences and ideas.

In addition, we conducted our Central Treasury Management course and Foreign Exchange Hedging workshop. A series of Financial Evaluation and Procurement workshops was conducted with branches of Queensland Treasury.

Together with the Department of Local Government, Planning, Sport and Recreation, we ran a series of one-day project evaluation courses for our regional local government customers in Toowoomba, Cairns, Longreach and Bundaberg.

RELATIONSHIP MANAGEMENT

Our customer calling program for customers in regional Queensland remained an integral component in establishing strong relationships. This program provides our employees with an opportunity to better understand our regional Queensland customers’ unique business needs and operating environments, and has assisted them in providing better customer solutions. It has in the past 12 months also seen our employees travel more than 140,000 kms, visiting customers as far west as Mt Isa and Winton, north to Normanton, Etheridge, Cairns and south-west to Charleville.

Over the past year, we have participated in a number of industry and project working groups and provided 10 employees on secondments to our customers’ organisations. We have also continued to support and sponsor a range of Local Government conferences throughout Queensland, and maintained our support of the Finance and Treasury Association (FTA) annual conference.

During the year, QTC has supported and assisted customers with financial training programs, risk assessment workshops and risk training seminars, sharing skills to assist customers to better manage their projects.

At the request of the Department of Local Government, QTC presented at the Department’s Accounting and Audit forums, in various locations across the State. These forums provide Local Governments with information of a financial nature, and an opportunity to discuss common issues and share experiences.

PRODUCTS AND SERVICES FRAMEWORK

Recognising that QTC’s products and services are the building blocks through which we can deliver value to our customers, a project to review our products and services for alignment to our customers’ needs is now underway.

Initially, the project focused on reviewing our core funding and investment products and services to ensure they satisfy our customer needs, and reviewing product guidelines to ensure customers are provided with a consistent level of service. Under this project, new products and services have also been identified and these will be further developed over the next year.

19

RAISING FUNDS FOR QUEENSLAND

Queensland Treasury Corporation continues to offer its customers the lowest cost of funds available from any of Australia’s semi-government issuers.

Our global approach to funding and our diverse range of funding facilities enable us to maintain flexibility to source the most cost-effective funds.

The strength of QTC’s securities has been underpinned by our commitment to:

| | • | maximising the benefits flowing from Queensland’s AAA credit rating |

| | • | maintaining liquid bond lines supported by a strong Distribution Group |

| | • | ensuring the financial markets are kept well informed on Queensland’s economic and fiscal standing, and our business direction |

| | • | maintaining transparency, integrity and credibility in our relationships with the domestic and international markets, and |

| | • | issuing debt instruments that meet investors’ needs whenever possible. |

QTC does not compete with financial intermediaries as a price-maker or trader, and does not use Queensland’s superior borrowing position for pure arbitrage activities.

Queensland’s strong credit rating, combined with QTC’s expert financial management skills and issuing flexibility, have helped ensure we attract a broad base of Australian and international investors.

CREDIT RATINGS OF QTC SECURITIES

| | | | |

Local Currency (A$)

| | Short-Term Rating

| | Long-Term Rating

|

Standard & Poor’s | | A-1+ | | AAA |

Moody’s Investor Services | | P1 | | Aaa |

| | |

Foreign Currency

| | Short Term Rating

| | Long Term Rating

|

Standard & Poor’s | | A-1+ | | AAA |

Moody’s Investor Services | | P1 | | Aaa |

FUNDING FACILITIES

Domestic and Global $A Bonds

QTC currently offers investors:

| | • | domestic and global benchmark bonds maturing every two years, from 2005 to 2015, and |

| | • | a preferred domestic bond line maturing in 2021. |

These bond facilities are our core source of funds. In July and October 2003, QTC increased the amount on issue of the domestic 2015 bond, by way of a tender and consolidation switches, to promote the line to benchmark status. The global tranche of the 2015 bond line was launched in September 2003.

20

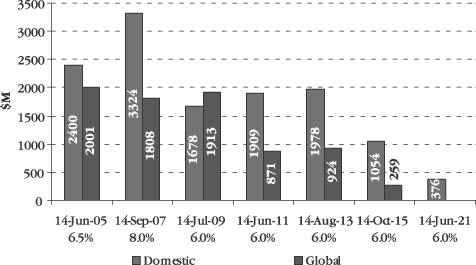

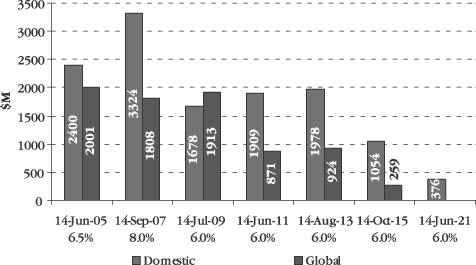

Domestic and global QTC bonds on issue are detailed in the following graph and table:

QTC Benchmark Bonds as at 30 June 2004

| | | | | | | | | | | | | |

Facility

| | Size $M

| | Governing

Law

| | Maturities

| | Currencies

| | Amount on

Issue $M

| | Placement

|

| Domestic A$ Bond | | Unlimited | | Queensland | | 6 benchmark

lines

2005 - 2015 | | A$ | | | 12,344 | | By tap or tender through Distribution Group |

| | | | | | |

| | | | | | | Preferred

Line 2021 | | A$ | | | 376 | | Reverse enquiry through Distribution Group |

| | | | | | |

| Global A$ Bond | | A$10,000 | | New York &

Queensland | | 6 benchmark

lines

2005 - 2015 | | A$ | | | 7,776 | | Continuously offered through Distribution Group |

Treasury Notes, Commercial Paper and Medium Term Notes

Supplementing the domestic and global bond facilities are our various short-term and medium-term note facilities.

The QTC Treasury Note facility is an electronic issuance facility and is our chief source of short-term domestic A$ funds. QTC’s main offshore programs are the Commercial Paper (CP) and Medium Term Note (MTN) facilities in both the Euro and the US markets.

21

The following table details these facilities:

| | | | | | | | | | | | |

Facility

| | Size $M

| | Governing

Law

| | Maturities

| | Currencies

| | Amount on

Issue $M

| | Placement

|

| Domestic Treasury Note | | Unlimited | | Queensland | | 7 – 365

days | | A$ | | A$130 | | By tap or tender through Dealer Panel |

| | | | | | |

Euro CP | | US$3,000 | | English &

Queensland | | 7 – 365

days | | Multicurrency | | US$310 | | By tap through Dealer Panel |

| | | | | | |

US CP | | US$1,500 | | New York &

Queensland | | 1 – 270

days | | Multicurrency | | US$0 | | By tap through Dealer Panel |

| | | | | | |

Euro MTN | | US$3,000 | | English &

Queensland | | Subject to

market

regulations | | Multicurrency | | US$506 | | Reverse enquiry through Dealer Panel |

| | | | | | |

US MTN | | US$500 | | New York &

Queensland | | 9 months

to 30 years | | Multicurrency | | US$0 | | Reverse enquiry through Dealer Panel |

These funding facilities are supplemented with public issues and private placements.

Appendix B details the Distribution and Dealer Groups for QTC’s funding facilities at 30 June 2004.

More detailed information on QTC’s funding facilities and outstanding indebtedness is available on request from QTC’s Financial Markets Team (see Appendix C for details).

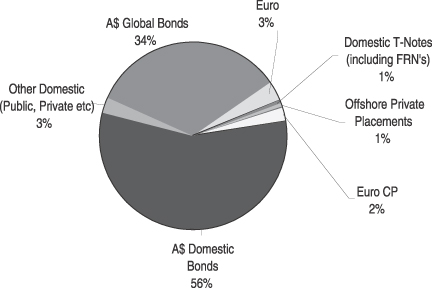

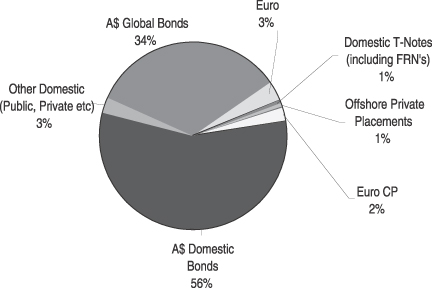

Percentage outstandings under QTC’s various funding facilities, as at 30 June 2004, are shown in the following chart:

QTC Funding Facilities

30 June 2004

22

BORROWING PROGRAM

QTC reviews its borrowing requirements as at 30 June and 31 December each year to provide a funding estimate for the following 12 months.

Financial Year 2003-04

In 2003-04, QTC estimated that its gross borrowing requirement would be $3,819 million.

With no benchmark bond maturity to be refinanced during 2003-04, the estimated demand on the market for funding was approximately $1,719 million less than actual raisings of $5,537 million in the previous year.

QTC’S INDICATIVE BORROWING PROGRAM 2003-04

| | | | | | |

Borrowing Estimate 2002-03 A$M

| | | | Borrowing Estimate

2003-04 A$M

| |

| | | Refinancings—Commercial Paper: | | | | |

| 596 | | Domestic T-Notes 1 | | | 1,344 | |

| 1,363 | | Euro Commercial Paper 1 | | | 1,072 | |

| 313 | | US Commercial Paper 1 | | | 165 | |

| | | Refinancings—Term Debt: | | | | |

| 2,388 | | Bonds | | | 90 | |

| 1,412 | | A$ Global Bonds and MTNs | | | 0 | |

| 16 | | Foreign Currency Loans and MTNs | | | 135 | |

| 6,088 | | SUBTOTAL | | | 2,806 | |

| | | New Raisings: | | | | |

| 2,648 | | Capital Works Program | | | 1,800 | |

| | | Adjustments: | | | | |

| (795) | | Debt repayments from QTC customers | | | (787 | ) |

| (1,500) | | Decrease in funding reserves due to expected reduced liability management requirement. | | | — | |

| $ 6,441 | | TOTAL | | $ | 3,819 | |

| 1 | Commercial Paper outstanding estimate as at 30 June 2003 (including FRNs). |

The 2003-04 funding estimate of $3,819 million was expected to be financed as follows:

FUNDING SOURCE

| | | | | | | | |

Actual Raisings 2002-03 $M

| | | | Expected Raisings 2003-04

|

| | | | Range %

| | Low $M

| | High $M

|

| | | Commercial Paper Raisings: | | | | | | |

| 2,467 | | Domestic CP, ECP, USCP | | 40 – 60 | | 1,528 | | 2,291 |

| | | Term Raisings: | | | | | | |

| 2,570 | | A$ Benchmark Bonds 2 | | 40 – 60 | | 1,528 | | 2,291 |

| 500 | | Multicurrency Loans and MTNs | | 0 – 10 | | 0 | | 382 |

| $5,537 | | | | | | | | |

| 2 | Includes benchmark Domestic and Global A$ Bonds, 2015 and 2021 preferred lines and other term issuance. |

23

Actual raisings for 2003-04 of $4,163 million were above expected raisings, due mainly to an improvement in State revenue raisings against budget and reduced capital requirements by government-owned corporations, together with stronger offshore investor demand for QTC Global Bonds.

Over the last financial year, funding was sourced principally from:

| | |

• Commercial Paper | | $ 643 million |

• Domestic A$ Benchmark Bonds | | $ 284 million |

• Global A$ Benchmark Bonds | | $2,893 million |

• Euro MTNs | | $ 343 million |

During 2003-04, QTC increased the amount of the October 2015 domestic bond on issue to elevate it to benchmark status and also launched the global tranche of the same bond line.

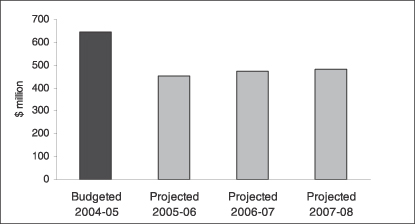

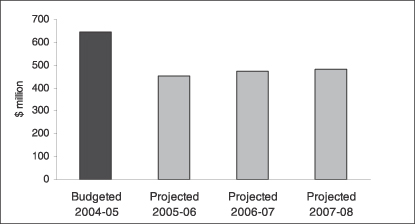

Financial Year 2004-05 Estimate

QTC estimates its borrowing requirement for the next financial year will be $6,819 million 3.

With the maturity of the 2005 benchmark bonds in June, the demand on the market for funding will be approximately $2,656 million more than last year’s actual raisings of $4,163 million.

QTC INDICATIVE BORROWING PROGRAM FOR 2004-05

| | | | | | |

Borrowing Estimate

2003-04 A$M

| | | | Borrowing Estimate

2004-05 A$M

| |

| | | Refinancing—Commercial Paper: | | | | |

| 1,344 | | Domestic T-Notes 4 | | | 198 | |

| 1,072 | | Euro Commercial Paper 1 | | | 513 | |

| 165 | | US Commercial Paper 1 | | | 0 | |

| | | Refinancing—Term Debt: | | | | |

| 90 | | Domestic Bonds | | | 2,515 | |

| 0 | | A$ Global Bonds and MTNs | | | 1,990 | |

| 135 | | Foreign Currency Loans and MTNs | | | 154 | |

| 2,806 | | SUBTOTAL | | | 5,369 | |

| 1,800 | | New Raisings | | | 2,050 | |

| (787) | | Principal Repayments from QTC Customers | | | (600 | ) |

| $3,819 | | TOTAL | | $ | 6,819 | |

| 3 | Actual financial market activity and funding requirements may vary depending upon customer requirements and financial market conditions. |

| 4 | Commercial Paper outstanding as at 30 June 2004 (includes FRNs). |

24

The 2004-05 funding estimate of $6,819 million is expected to be financed as follows:

FUNDING SOURCE

| | | | | | | | |

Actual Raisings

2003-04 $M

| | | | Expected Raisings 2004-05

|

| | | | Range %

| | Low $M

| | High $M

|

| | | Commercial Paper Raisings: | | | | | | |

| 643 | | T-Notes, ECP, USCP | | 40 – 50 | | 2,728 | | 3,410 |

| | | Term Raisings: | | | | | | |

| 3,177 | | A$ Benchmark Bonds 5 | | 45 – 55 | | 3,069 | | 3,751 |

| 343 | | Multicurrency Loans and MTNs | | 0 - 10 | | 0 | | 682 |

| $4,163 | | TOTAL | | | | | | |

| 5 | Includes benchmark Domestic and Global A$ Bonds and other term issuance. |

We anticipate that approximately 50% of this year’s program ($3,410 million) will be funded through the issuance of term debt, utilising domestic and global benchmark bonds with the balance funded via commercial paper and Medium Term Note (MTN) issuance.

Actual financial market activity and funding requirements may vary, depending on customer requirements and financial market conditions.

25

ACHIEVING OUR GOALS THROUGH TEAMWORK

Over the past year, our teams continued to demonstrate a commitment to our core strategy of achieving customer loyalty. We use this framework to build customer relationships so that teams have a better understanding of their customers’ specific needs and are then able to develop and deliver tailored solutions that meet those needs.

Following the review of our Corporate Plan, work was done to identify and establish the following cultural statement that supports our direction and focus and our people.

We encourage and support:

| | • | developing and implementing ideas to both improve customer outcomes and our processes |

| | • | listening to and understanding our stakeholders, staff and customers |

| | • | learning from successes and mistakes through reflection |

| | • | taking responsibility for our actions and being personally accountable |

| | • | developing the potential of our people, and |

| | • | being challenged at work, achieving our career and personal objectives through a healthy work/life balance. |

PERFORMANCE-BASED REMUNERATION SYSTEM REVIEW

In the year under review, QTC’s existing team based performance and remuneration systems were reviewed and a new system was implemented as part of the integrated suite of programs that support QTC’s strategy. The new system reflects the market and environment in which QTC operates, aligns with our strategic direction and operating structure, and reinforces QTC’s values and culture.

QTC’s reward philosophy is to be market competitive and align with other large conservative financial institutions. Accordingly, QTC has set its remuneration policy at the market median for large conservative industry organisations.

Team Reward Policy

As part of the integrated remuneration system, QTC implemented a team-based reward model that recognises each team for its collective contribution to organisational and team outcomes and delivering customer value. All teams members are eligible for a reward.

FLEXIBLE WORK POLICY

We introduced a flexible work/life policy, which has received positive feedback. In a recent work/life benchmarking study, which involved more than 300 organisations, QTC was ranked in the top 25 Australian organisations for work/life initiatives.

EMPLOYEE SURVEY

We conducted an employee survey in December 2003, which was voluntarily completed by 81% of all staff. The outcomes of this year’s survey were positive and feedback from the consulting firm that conducted the survey indicated that QTC was in the top 10% of surveyed employee organisations in Australia. Many of the recommendations resulting from the survey have since been implemented, and the next employee survey is planned for 2005.

26

SECONDMENTS AND GRADUATES

QTC continued to develop and implement an internal and external secondment program, which provides employees with relevant career development opportunities, the ability to share and exchange knowledge, and an opportunity to enhance customer loyalty through experiencing our customers’ business operations. Several employees participated in the external secondment program to assist customers in meeting their business needs as well as developing and transferring skills.

We also continued our support of the Queensland University of Technology’s Corporate Partners in Excellence program for undergraduates in finance and related fields.

OFFICE ACCOMMODATION

During 2003-04, our office accommodation was refurbished to create an open-plan work environment to further enhance our team-based structure and improve communication within the organisation. Completed in February, the new office environment has provided increased meeting, project and training space for our teams and customers. The project achieved its objectives and received positive feedback from employees.

STAFF DEVELOPMENT

During the year, all employees were invited to participate in a number of initiatives to further develop their skills in the workplace. One key initiative to enhance self-awareness used the Herrmann Brain Dominance Instrument (HBDI) to identify and understand the unique attributes that each employee brings to QTC, enabling teams to then leverage those attributes to achieve successful outcomes. This instrument was also used to assist team leaders with their day-to-day approach to team management. To further support team leaders, we established a panel of experienced coaches, which many of our team leaders have accessed.

The Team Align leadership tool and Team Leaders’ Forum continued to be an effective way of consulting with team leaders and ensuring that all teams were regularly updated on our focus and direction.

CORPORATE WELLBEING

We established a corporate wellbeing program to inform and educate our people on issues relating to health, stress management and general wellbeing.

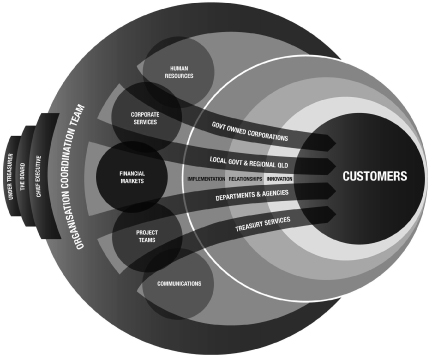

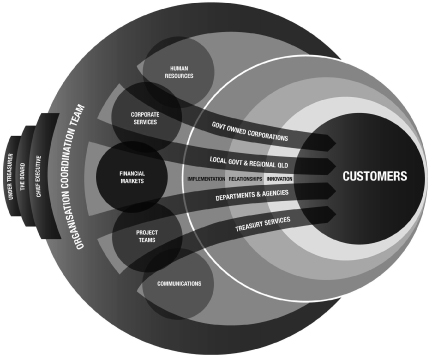

OPERATIONAL STRUCTURE

QTC is structured to reflect our overarching value-delivering strategy of customer loyalty, recognising that we achieve our corporate goals through the efforts of our teams. This diagram depicts our organisational structure, showing how all teams work together to deliver value to our customers.

Our teams work in an integrated and collaborative way to implement the three core processes of the customer loyalty operating model—developing and maintaining relationships, solution design and development, and the delivery of tailored solutions. The diagram demonstrates that, through these processes and supporting teams, our customer-focused teams work directly with our customers to assist them in maximising outcomes and appropriately managing risks for their organisations and Queensland.

27

QTC’s ORGANISATION CHART

QTC Operational Structure

28

DELIVERING BETTER SYSTEMS AND PROCESSES

Across the organisation, our teams strive to continually improve their own abilities to deliver value to our customers. This process of continual improvement drives QTC’s strategic goal to ensure that all internal systems and business processes are cost-effective, reliable, flexible and relevant.

ENTERPRISE RISK MANAGEMENT

QTC’s organisation-wide risk management system has continued to ensure that significant risks were identified and managed consistently and appropriately. In 2003-04, after its first year of implementation, we reviewed the framework for risk management to ensure that it was operating effectively. Next year, the focus will be on ensuring consistency of risk management practices across all teams in the organisation.

FINANCIAL RISK MANAGEMENT

We have undertaken a number of key financial risk projects in the past year, including an internal review of the relevance to QTC of the issues surrounding the National Australia Bank’s foreign exchange trading losses.

This review, while highlighting some areas where we could enhance our controls, confirmed that we have in place appropriate risk management procedures to support our business activities; all of our exposures are subject to appropriate control by the Board; and our corporate governance procedures are appropriate, given our business activities. We have either implemented or are in the process of implementing the enhancements.

In addition to our internal review, independent assessments by both internal and external audit raised no significant issues.

BUSINESS CONTINUITY PLANNING

As part of QTC’s Business Continuity Plan, scenario-based tests of QTC’s readiness to deal with major crises and disruptions to business operations were conducted in August 2003 and February 2004, with no significant issues identified. During the year, the Plan was further bolstered by the development of a ‘worst case contingency plan’, and over the next year it will be incorporated into a new crisis management plan, in line with the Government Agency Preparedness program requirements.

COMPLIANCE

We continued our commitment to a strong compliance program to assist us in managing compliance risk and delivering the best outcomes for our customers and the State. During the year, a significant amount of work in monitoring and reviewing QTC’s compliance was completed. This included an internal audit and the conduct of a legal compliance audit by an external law firm of various areas of QTC (and which for some areas is continuing past the year under review). Both audits have delivered strong and positive outcomes about the nature of QTC’s compliance.

QTC also undertook a review of its fraud risks, which identified QTC’s fraud risks, established that QTC’s fraud risks were being appropriately managed and controlled, and identified some improvements that are currently being considered.

IT STRATEGY

During the year, we developed a new vision for QTC’s information management—to provide staff, customers and stakeholders with seamless and secure access to quality information. Established in conjunction with the corporate planning process, this vision statement provided direction to the current IT Strategy, which presents a series of initiatives to:

| | • | strategically direct IT investment |

| | • | establish a robust IT governance framework |

29

| | • | emphasise the alignment of IT with corporate objectives, and |

| | • | manage the development of staff competencies in relation to JAVA/J2EE. |

Cornerstone initiatives under the IT Strategy include the formal adoption of JAVA/J2EE as QTC’s application environment and the commencement of an Enterprise Architecture Planning project, which will define those projects essential to achieving our vision for information management.

PROGRAM MANAGEMENT PRACTICES

QTC’s internal Project Management Office (PMO) promotes, develops and implements consistent and pragmatic project management practices across QTC. In the past year, PMO has worked with QTC’s teams to introduce program management practices to ensure the effective management of risks and opportunities across related projects. This is particularly necessary where the related projects require broad contribution from across the organisation and have a significant change management component.

QTC recognises program management as an effective means of managing the delivery of these complex undertakings while also supporting effective resource management and benefits realisation objectives.

CAPITAL FRAMEWORK

Our policy is to monitor the level of capital required to operate as a corporate treasury services provider. In line with conventional capital adequacy models, we monitor the level of capital required for credit, market and operational risk. With respect to credit risk, we calculate our capital requirements using the risk weightings outlined in the New Basel Capital Accord, released in January 2001 for comment by the Bank of International Settlements. The capital required for market risk is calculated based on JP Morgan’s value-at-risk methodology. To date, no substantive methodology has been developed to calculate capital required for operating risk. As a consequence, a notional amount has been allocated to cover operational risk.

No capital is set aside to reflect the risk of the loans to the State and its public sector entities as the risk of these loans is directly or indirectly carried by the State. As a consequence, and in line with our corporate treasury services provider role, we lend to the State and its public sector entities at cost (QTC’s borrowing cost) plus an administration fee.

Our capital requirements based on portfolio holdings at 30 June 2004 were $228.9 million.

In determining its capital holdings, QTC treats its equity as Tier One Capital and Cross Border Lease Deferred Income as Tier Two Capital. As at 30 June 2004, QTC held $230.5 million in Tier One Capital and $153.5 million in Tier Two Capital, resulting in a total capital of $384 million.

While QTC monitors the level of capital required and currently has adequate capital coverage, there are no requirements to hold capital to cover this capital requirement.

30

POSITIONING FOR THE FUTURE

QTC’S CORPORATE PLAN

During the first half of the year, we reviewed our Corporate Plan to ensure our direction and focus remained appropriate, given the issues facing our customers either internally or as a consequence of changes in their business environment. The key customer issues identified were:

| | • | With the growing complexity of the business environment due to increasing globalisation, improved communication, and increasing regulation, many of our customers have a great deal of difficulty acquiring the specialist resources needed to address the issues arising from this increasing complexity. |

| | • | The strain on financial resources, together with the capacity of our customers to operate and manage significant infrastructure, has led many of our customers to consider the merits of alternative procurement models. In many instances, these models involve the bundling of several important activities. While there is merit in considering all procurement alternatives our customers’ capacity to assess these alternatives, and quantify the risks associated with each alternative needs to be enhanced. |

| | • | The public is demanding a greater range of services at higher performance levels and lower cost, thereby placing greater strain on the financial and human resources of our customers. |

Our response to these issues was reflected in the Corporate Plan. In addition, the structure of the Plan was changed to better reflect our operating model and to ensure greater focus of our teams and staff on the attainment of our overall objective, which is to build customer loyalty through developing and delivering solutions that provide value from a whole-of-State perspective.

Achieving customer loyalty involves three key processes:

| | • | Relationship management: This relates to the development of close relationships with our customers as a basis for understanding their needs. |

| | • | Solution design and development: With information regarding our customers’ current and emerging needs, we need to design and develop solutions that meet those needs, within the scope of our role as corporate treasury services provider. |

| | • | Solution delivery: Once developed, we need to be able to deliver the solutions to our customers in a cost-effective and timely manner, in a form they can understand and apply to their businesses. |

Our teams found that the restructuring of the Corporate Plan better enabled them to express their core activities in terms of one or more of these processes.

An additional section entitled ‘Alignment’ was also created in the Corporate Plan to address the three key competencies underpinning these core processes. The three key competencies are:

| | • | Knowledge management, which is central to developing a level of understanding of our customers, and their businesses in order to develop and deliver solutions that meet their requirements. |

| | • | Teamwork, which is seen as integral to achieving our outcomes, by empowering our teams to proactively find ways to deliver customer value within the scope of our corporate treasury services provider model. Teamwork and empowerment are essential steps in optimising our intellectual capital. |

| | • | Risk management, which ensures that the risks created by our business activities and operating model are identified and managed on a whole of QTC basis. Failure to do this will impede our ability to deliver value to our customers. |

Other areas addressed in this section of the Plan are compliance, reputation and people.

31

Where do we want to be?

In reviewing our Corporate Plan, we arrived at what we believe would be an appropriate vision for our organisation in 2006:

| | • | Our corporate treasury services provider role is clearly understood by employees, our customers, our stakeholder and the financial markets. |

| | • | Our customers and stakeholder report that we are their first choice financial services provider, as an outcome of being highly professional and consistently delivering value. |

| | • | Our information is current, readily accessible and valuable to both our staff and our customers. |

| | • | Our customers and stakeholder willingly share their knowledge with us. |

| | • | The financial markets report that we know the markets and that we are proactive in dealing with issues. |

| | • | Our processes to manage our risks continue to be enhanced and do not expose us to unnecessary risk. |

| | • | A culture of self, team and organisational improvement is evident throughout the organisation. |

| | • | Teams work together efficiently and effectively to address issues. |

| | • | Our employees are seen as an excellent source of financial risk management skills by our customers and stakeholder. Access to these skills is facilitated through secondment, and training and development programs. |

| | • | Our culture and systems support the access to, and the use, of our information. |

32

BOARD

The Board Directors of Queensland Treasury Corporation to 30 June 2004 were:

Sir Leo Hielscher AC

B.Comm., D Univ Griffith (Hon), AAUQ, AASA, FAIM, FCPA, FFTP (Hon)

Chairman

Chairman, Risk Management Committee

Appointed in 1988. Tenure 30 June 2007

Sir Leo Hielscher has more than fifty years’ experience in the areas of Government, banking and finance, domestic and global financial markets, superannuation and as an independent Company Director. He was the Under Treasurer of Queensland for 14 years (1974–1988) before his appointment as Chairman of the Queensland Treasury Corporation (Advisory Board) in 1988. In 1991, the Advisory Board became the Queensland Treasury Corporation Board and Sir Leo was appointed as its inaugural Chairman. Sir Leo is also Chairman of Austsafe Ltd, Independent Superannuation Preservation Fund, a Director of the Australian Institute of Commercialisation, and Chairman of Trustees of the General Douglas MacArthur Memorial Trust. As a Company Director, Sir Leo has considerable experience at Board level and has been associated with a number of public and private sector Boards. Sir Leo was awarded an Eisenhower Fellowship in 1973, a Knight Bachelor in 1987, an Honorary Doctorate of Griffith University in 1993, and a Companion in the Order of Australia (AC) in the General Division in 2004.

Gerard Bradley

B.Comm., Dip Adv Acc., CPA., FAICD, FAIM

Deputy Chairman

Member, Accounts and Audit Committee

Member, Risk Management Committee

Member, Human Resources Committee

Appointed in 2000. Tenure 30 June 2007

Gerard Bradley is currently Under Treasurer and Under Secretary of Queensland Treasury Department, a position he has held since 1998, and has extensive experience in public sector finance gained in both the Queensland and South Australian treasury departments. He was Under Treasurer for the South Australian Department of Treasury and Finance during 1996–1998 and of Queensland Treasury during 1995–1996. Mr Bradley held various positions in Queensland Treasury from 1976–1995 encompassing responsibility for the preparation and management of the State Budget and the fiscal and economic development of Queensland. He holds Directorships with Queensland Treasury Holdings Pty Ltd and related companies, and is the Chair of the QSuper Board of Trustees.

Marian Micalizzi

B.Bus, FCA, SIA (Associate)

Chairman, Accounts and Audit Committee

Member, Risk Management Committee

Appointed in 2000. Tenure 30 June 2007

Marian Micalizzi is a chartered accountant with more than 20 years’ experience, a Company Director and a consultant in both the public and private sector. She is a former Partner of PricewaterhouseCoopers (until 2000), having been admitted as a Partner of its predecessor firm in 1986. Ms Micalizzi brings considerable expertise and knowledge of specialist corporate financial and advisory services, financial institutions’ regulation and prudential supervision, and valuation related assessments. She is also currently a Director of Queensland Investment Corporation, Enertrade, Opera Queensland, Australian Reinsurance Pool Corporation and a Member of

33

Corporations and Markets Advisory Committee, the Takeovers Panel, Independent Investment Committee of Queensland Development Fund, Fund Management Committee of the Industry Research and Development Board, and a Councillor of the Australian Institute of Company Directors (Qld Div.).

Shauna Tomkins

B.Sc., MBA

Member, Risk Management Committee

Appointed in 2000. Tenure 30 June 2007

Shauna Tomkins is a consultant who works internationally in the development and implementation of regulatory frameworks for prudential supervision and corporate regulation of deposit taking, funds management, insurance and lending institutions. Ms Tomkins has a thorough understanding of Australia’s financial system, risk management analysis, prudential supervision and corporate and structured finance. She also has a strong background in long-term policy and strategic management and planning and has a working familiarity with Government objectives and processes. Ms Tomkins is also a Member of the Advisory Committee to Queensland’s Motor Accident Insurance Commission.

Elizabeth Nosworthy

BA, LLB, LLM

Chairman, Human Resources Committee

Member, Risk Management Committee

Appointed in 1991. Resigned from Board October 2003

Elizabeth Nosworthy has more than 20 years’ experience as a commercial lawyer, specialising in banking and finance, corporations, major projects and tax-based financing arrangements before leaving the law to follow a career as a full time non-executive Director. Ms Nosworthy has considerable experience at Board level in public and private sectors and is currently Chairman of Prime Infrastructure Management Limited, Commander Communications Limited, and Stanwell Corporation Limited. She is a Director of GPT Management Limited (General Property Trust) and Ventracor Limited. Ms Nosworthy is an adjunct Professor of Law at the University of Queensland. She holds degrees in Arts and Law from the University of Queensland and a Master of Laws from London School of Economics.

Ms Nosworthy was a member of the Queensland Treasury Corporation Board since its establishment in 1991. She resigned from the Board effective 3 October 2003.

Bernie Fraser

BA, MEcon., D Univ New England (Hon), D Univ Charles Sturt (Hon)

Member, Accounts and Audit Committee

Member, Risk Management Committee

Appointed in 1999. Tenure to 30 June 2004

Bernie Fraser had a long career in the Commonwealth Public Service, particularly the Commonwealth Treasury, and extensive exposure to the superannuation industry, and domestic and global financial markets. He was appointed Secretary to the Commonwealth Treasury in September 1984 and was Governor of the Reserve Bank of Australia from 1989 to 1996. Mr Fraser is Chairman of Members Equity Bank, and President of the Government Superannuation Office (Victoria). He is also a Director of three large industry superannuation funds (ARF, STA, and Cbus). Mr Fraser has received Honorary Doctorates from the University of New England and Charles Sturt University and is an Adjunct Professor of Economics at the University of Canberra.

Mr Fraser retired from the Board at the expiry of his term on 30 June 2004.

34

Dr William Norton

B.Comm, MA (Econ), Ph.D.

Member, Risk Management Committee

Appointed in 2000. Tenure to 30 June 2004

Dr Norton held the position of Professor and Director at Macquarie University Applied Finance Centre from mid 1991 to the end of 2003. He has extensive knowledge and experience in education and research in economics and finance. Previously, Dr Norton had 23 years experience in senior positions in economics and finance at the Reserve Bank of Australia, including six years as the Head of Financial Markets. Throughout his career, he has participated in numerous professional publications on economics and finance. Dr Norton is regarded as a leader in that field, having built the Macquarie University postgraduate program in finance to a recognised world-class standard.

Dr Norton retired from the Board at the expiry of his term on 30 June 2004.

35

CORPORATE GOVERNANCE

The Board of QTC and QTC’s management team endorse and are committed to achieving high standards of corporate governance, accountability, compliance, and financial and ethical behaviour. The Board guides this commitment, which is critical for maintaining our strong market reputation, as well as our ability to achieve success as Queensland’s corporate treasury services provider. During the year, we reviewed the Principles of Good Corporate Governance and Best Practice Recommendations issued by the Australian Stock Exchange (ASX) Corporate Governance Council and the Australian Standard 8000/2003—Good Governance Principles. While these are not mandatory for QTC, QTC has implemented changes to its corporate governance practices based on the ASX principles and standards, so far as they are relevant and appropriate to QTC. Our corporate governance practices include:

| | • | QTC’s Chairman is a non-executive Director, and the Board is entirely constituted of non-executive Directors. |

| | • | The Board has its own Charter, which specifies a commitment to corporate governance, the Board’s responsibilities, operations, and the roles and responsibilities of Directors. It also provides for self assessment, and guidelines for managing conflicts of interest. |

| | • | The Board has three Committees—Risk Management Committee, Accounts and Audit Committee and Human Resources Committee—each with its own Charter and which assist in oversight and control. |

| | • | Board Directors are appointed by the Governor-in-Council, who considers each person’s qualifications and experience, and their ability to contribute to QTC’s strategic direction and performance. |

| | • | A commitment to a continuous disclosure regime with its key stakeholders. |

| | • | A Code of Conduct that applies to all staff. |