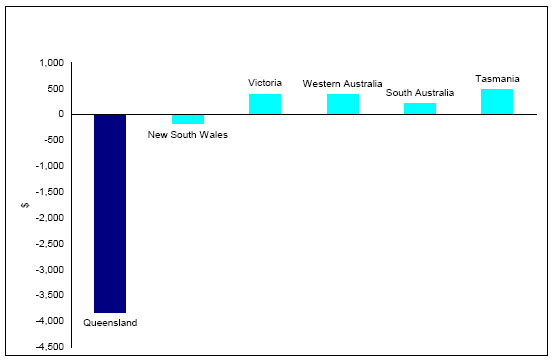

Exhibit (c)(iii)

APPROPRIATION BILL 2004

(Second Reading Speech, 15 June 2004)

TREASURER

The Honourable Terry Mackenroth MP

Deputy Premier, Treasurer and Minister for Sport

APPROPRIATION BILL 2004

(Second Reading Speech, 15 June 2004)

TREASURER

The Honourable Terry Mackenroth MP

Deputy Premier, Treasurer and Minister for Sport

Mr Speaker, I move that the Bill now be read a second time.

INTRODUCTION

The Budget that I present today sets the agenda for the third term of the Beattie Government.

A Government with a clear vision for building the new Queensland for all Queenslanders.

A strong stable Government which delivers disciplined fiscal and economic management.

A Government delivering on its promises to improve the quality and range of services and infrastructure to the Queensland community.

We clearly articulated our policies and priorities at the election and through this Budget we keep faith with the trust that Queenslanders placed in us.

Our election commitments were targeted at our key priorities and were affordable.

This Budget fully funds all of our election commitments to the Queensland community.

This Budget continues to build the Smart State.

1

Today I will announce substantial improvements in services and infrastructure for Queensland, including:

| | • | a record $6 billion capital program for 2004-05 to meet the challenges facing the growth State, including initiatives announced as part of our Smart State Building Fund; |

| | • | full implementation of child safety reforms which will involve additional funding of approximately $214 million per annum by 2006-07; and |

| | • | new funding of $220 million over four years to enhance disability services, well above our election commitment. |

Given the strength of our finances, this Budget also provides for $300 million of tax concessions involving the abolition of debits tax, the abolition of credit card duty, a reduced rate of duty on general insurance and stamp duty concessions for home purchases.

ECONOMIC OUTLOOK

In 2003-04 the Queensland economy has again outperformed the rest of the nation, with year-average growth in gross state product estimated to be 4%, the eighth consecutive year that Queensland has recorded higher growth than the rest of Australia.

This growth has been underpinned by the stellar performance of the domestic economy. Dwelling investment has continued to grow strongly driven by a mix of new house and unit construction and a surge in renovation activity as home owners have capitalised on exceptionally strong increases in house prices.

This increase in house prices and related activity in dwelling investment has also supported rapid growth in household consumption over the past year.

Businesses have also shared in the strength of domestic demand, with business confidence at record levels during the year and business investment enjoying another year of solid growth. Major projects investment also rose 4% to $56.8 billion in the March quarter, the highest growth of any State.

2

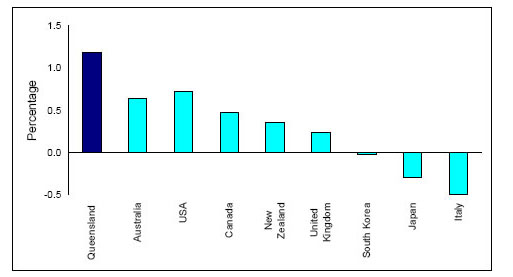

Queensland has once again been the engine room for job creation in Australia. Since our Government came to power in June 1998, more than a quarter of a million jobs have been created in Queensland.

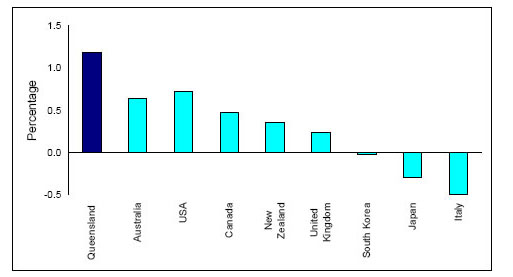

The State accounted for a quarter of the jobs created nationally over this period, compared with our population share of around 19%.

Employment in Queensland this year is expected to grow by an estimated 3¼%, more than double the estimated growth in the rest of Australia. In the eleven months to May this year, almost 65,000 jobs have been created in Queensland, almost 27,000 more than forecast for the entire year.

With such strong employment growth, the trend unemployment rate has continued to fall, reaching a 22 year low of 6% in May this year.

This has occurred despite strong population growth.

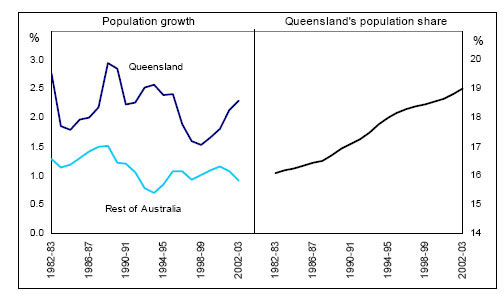

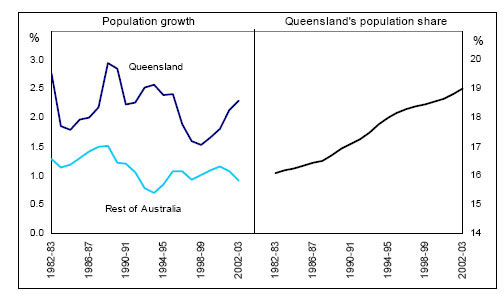

Queensland is currently experiencing population growth of 2.3%, more than double the rate of the rest of Australia.

In 2004-05 economic growth in Queensland will strengthen to 4¼%, underpinned by the expected improved performance of the State’s trade sector.

Increased world demand for our exports and improved competitiveness are forecast to lead to a 5% growth in exports of goods and services. Meanwhile, growth in imports is forecast to moderate in line with a return to more normal domestic demand conditions, with household consumption forecast to grow by 4¾% following its exceptionally strong growth of 8½% in 2003-04.

Dwelling investment is forecast to stay at its current record levels. Demand for new dwellings continues to be supported by our strong population growth, while demand for renovation activity by home owners will remain high.

Business investment is also forecast to continue to grow solidly with a further 8½% increase in 2004-05.

3

In line with the forecast of continued strong economic growth, employment growth in Queensland is once again expected to outperform the rest of Australia in 2004-05. Employment is forecast to grow by 2¼%, with the creation of more than 40,000 jobs, compared with forecast employment growth of 1¾% nationally. The State’s year-average unemployment rate is forecast to remain unchanged at 6¼%, the lowest since 1981-82.

Mr Speaker, I confidently expect that Queensland will maintain its reputation as Australia’s growth State.

GROWING A DIVERSE ECONOMY AND CREATING JOBS

Our Smart State vision is about using knowledge, creativity and innovation to maintain prosperity and quality of life for all Queenslanders.

The Beattie Government has established new world class research institutes in biotechnology, medical research, cancer research, fibre composites, nanotechnology and other emerging areas.

A range of Cooperative Research Centres with strong links to Queensland are driving innovation in agriculture, fisheries, forestry, mining, satellite communications, environmental management and medicine.

As announced earlier this year, our Government will invest $20 million in a new $60 million world-leading Brain Institute to be built at the University of Queensland to research diseases such as Alzheimer’s, stroke and mental illness.

The Premier recently announced the latest round of funding commitments under the Smart State Research Facilities Fund. These commitments, of $33.8 million, include:

| | • | $9.5 million for the Centre for Advanced Animal Science; |

| | • | $8.1 million for the Queensland Preclinical Drug Development Facility; and |

| | • | $5 million for the Medical Engineering Research Facility. |

4

The investments under this fund, $130 million since its establishment, are providing Queensland’s brightest students and researchers with the opportunity to realise their potential – opportunities that historically were sadly lacking in this State.

Additional funding of $3.2 million over four years has been provided for a range of programs to help grow Queensland’s small business sector, including the establishment of a technology incubator in Cairns.

The Beattie Government’s Manufacturing Strategy will be expanded with an additional $11 million over four years to develop manufacturing excellence, improve manufacturing training and education programs and to provide a more highly skilled workforce for the manufacturing sector.

The 2004-05 Budget includes an additional $3 million over four years to provide specialist advisory services to support Information and Communications Technology uptake by businesses and the development of industry clusters.

This Budget allocates $9.8 million over four years to support the Queensland Biotechnology Strategy which will include measures to promote the Clinical Trials Network to assess new drugs, vaccines and therapies.

The Beattie Government has a clear focus on creating jobs. Our unemployment rate has dropped to the lowest level in over 22 years. However, it is important that long term unemployed Queenslanders are able to get their share of the jobs being created.

The Breaking the Unemployment Cycle initiative commenced in 1998 with a key focus to help the most disadvantaged job seekers to get jobs and acquire new skills. Through this initiative more than 71,000 unemployed people have been placed in jobs.

An additional $3 million over three years will be invested in the Strategic Employment Development program, taking total funding for the Breaking the Unemployment Cycle initiative up to $278 million over three years.

5

REALISING THE SMART STATE THROUGH EDUCATION, SKILLS AND INNOVATION

Building on the success of our preparatory year trials, this Budget provides for the introduction of a universally available Prep Year in 2007.

Investing in the early years of schooling pays dividends throughout a person’s life and the Prep Year will strengthen the foundation of our education and training reforms.

As part of the move to full implementation in 2007, the Prep Year will be phased-in at a further 40 State schools and 10 non-state schools over the next two years.

Late last week, agreement was reached with the non-State schooling sector in relation to the capital funding for facilities for the implementation of the Prep Year. The findings of the Independent Review Team appointed by the Government were accepted with a total of $56 million being allocated for new and refurbished facilities for students attending independent and Catholic schools across the State.

Building on the Government’s commitment in the 2002-03 Budget to provide an additional $60 million over four years for students with disabilities, a further $14 million will be allocated in 2004-05, bringing 2004-05 funding up to $32 million for this important program.

This year a total of $329 million will be invested in Education capital including upgrades of classrooms, libraries and administration blocks, Prep Year requirements and to complete the air conditioning of up to 560 classrooms in the Cooler Schools zone.

This Budget provides additional new and growth funding of $118 million over three years for the SmartVET strategy – an approach to vocational education and training that targets skill shortages and the skilling and workforce needs of industry.

Over the next three years the SmartVET strategy will create an estimated 17,800 new training places in priority industry areas that are central to the economic growth of the Smart State. Approximately 11,800 of those new training places will be apprenticeships and traineeships.

6

New entrants to Queensland’s growing aviation industry will benefit from an additional $3.8 million over three years to fund aeroskills training.

This additional funding will bring total investment including specialist infrastructure and training funding over the next three years to an estimated $15.9 million under Queensland Takes Off – the Government’s Smart State strategy to establish Queensland as the aviation hub of the Asia Pacific region.

MANAGING URBAN GROWTH AND BUILDING QUEENSLAND’S REGIONS

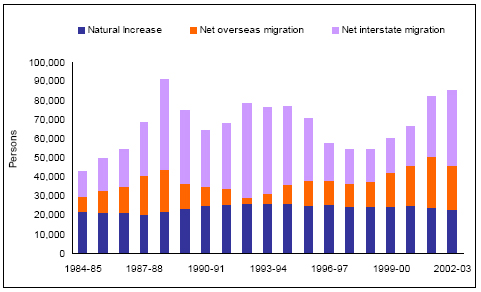

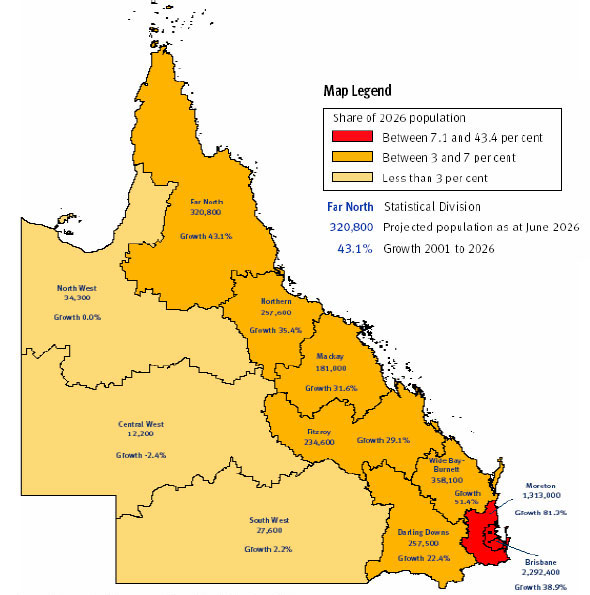

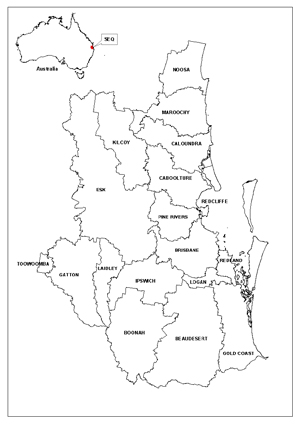

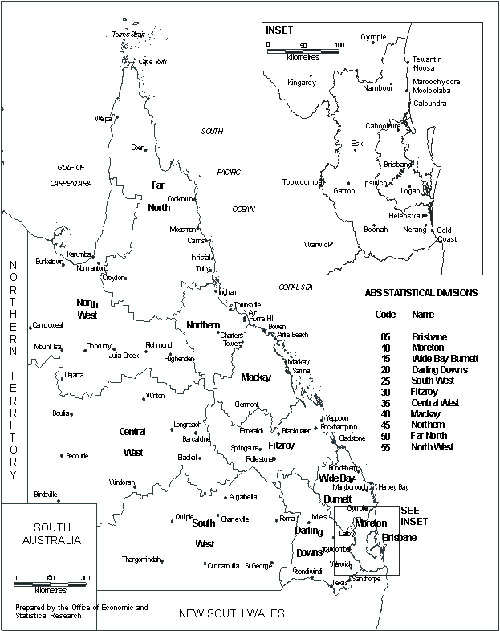

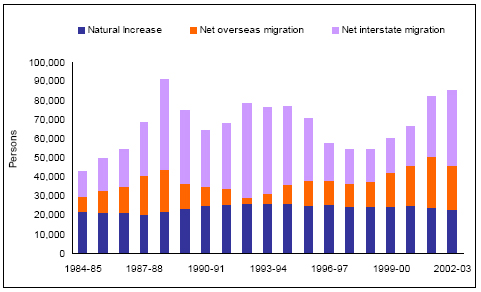

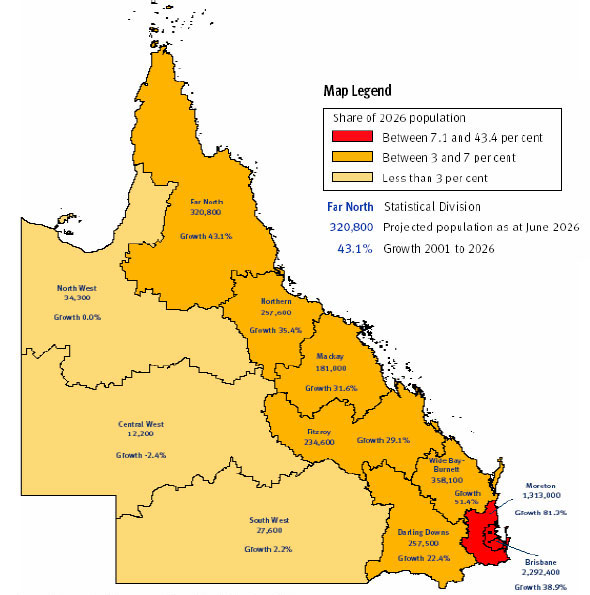

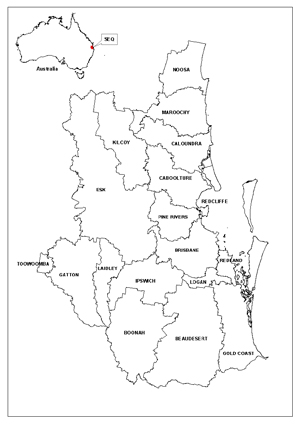

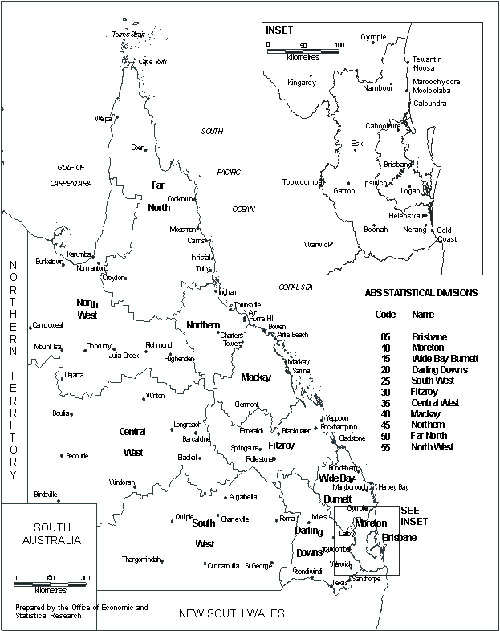

During 2003, Queensland’s population grew by an estimated 86,000 including 37,600 interstate migrants and 23,600 international migrants.

Queensland’s growth brings benefits but it also brings challenges for transport systems and other infrastructure, services and our environment.

With around 80% of this population growth occurring in south east Queensland, the Beattie Government is making the management and co-ordination of urban growth in south east Queensland a priority.

An Office of Urban Management has been established with funding of $6.7 million in 2004-05.

The Office will coordinate regional planning in south east Queensland and work with councils and the community to expedite the review of the existing framework for growth management and implement a South East Queensland 2021 Regional Plan.

Regional planning outside south east Queensland will be maintained and further enhanced with additional funding of $3.6 million over four years.

Last year we committed to an additional investment in infrastructure of $1.4 billion over three years through our Smart State Building Fund to assist in meeting the needs of a growing State. This additional investment was made possible by a prudent approach to managing the State’s finances through a period of difficult equity market conditions.

7

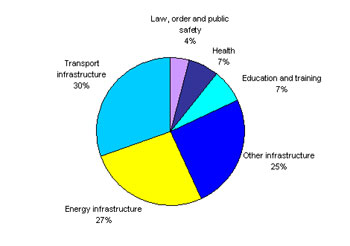

Reflecting this commitment and additional infrastructure initiatives in this Budget, our capital program for 2004-05 is $6 billion – a record capital program. Around 60% of this investment will be outside the Brisbane region.

Funding for the State’s roads program has been significantly increased. The Smart State Building Fund provided an extra $186 million for road projects over three years from 2004-05. An additional $301 million was committed in the election for road infrastructure.

This Budget provides a new four-year $571 million Arterial Roads Infrastructure Package, including $19.8 million in 2004-05.

Over the next four years the Beattie Government will spend an extra $1.9 billion on road and rail infrastructure while the Australian Government’s AusLink total five year funding to Queensland is less than $1.5 billion.

On current projections, passenger rail services in south east Queensland will require the capacity to carry an additional 13 million passengers a year by 2011. By 2007-08, over $900 million will be spent by our Government on increasing the capacity of Citytrain.

The Government will also continue its investment in the Busway network. In 2004-05, $27 million will be allocated as part of a $200 million, four-year program of bus infrastructure initiatives.

Mr Speaker, an efficient transport system is vital for our exporters operating in increasingly competitive markets.

In 2004-05, Queensland Rail will spend over $300 million on track infrastructure and rolling stock, largely to support the State’s coal industry.

The RG Tanna Coal Terminal at Gladstone will be expanded at a cost of $167 million over three years, and a further $34 million will be spent in 2004-05 on the Port of Brisbane expansion.

Reliable, inexpensive electricity is fundamental to Queensland’s ongoing development. Over the next 5 years, Queensland’s consumption of electricity is forecast to significantly increase.

8

In 2004-05 alone, energy GOCs will be spending approximately $1.7 billion on energy infrastructure throughout Queensland, including $1.2 billion on expanding and upgrading Queensland’s transmission and distribution network.

Another major highlight is the commencement of the $1.1 billion Kogan Creek power project near Chinchilla. Queensland continues to lead the country in investment in power generation.

IMPROVING HEALTH CARE AND STRENGTHENING SERVICES TO THE COMMUNITY

Queenslanders enjoy a world-class health system and the Beattie Government is committed to improving health services.

In contrast, the Australian Government is putting bulk-billing General Practitioners out of the reach of many Queenslanders, putting more pressure on our emergency departments and not putting in their fair share of hospital funding.

The Beattie Government wants to improve the standard and accessibility of hospital and health services for Queenslanders.

Consistent with this priority, the 2004-05 Health Budget will increase by $500 million or 10.8% over last year’s Budget.

After the State election we immediately began to implement our elective surgery commitment and Queenslanders today are benefiting from the extra $20 million injected this financial year with a further program of $90 million over the next three years.

Over the next four years this Budget provides for additional funding of:

| | • | $20 million for cardiac services; |

| | • | $44 million for cancer care; |

| | • | $13.2 million for oral health care; and |

| | • | $37.8 million to relieve pressure on public hospital emergency departments. |

9

There is also an additional $24.2 million over two years for replacement of three Royal Flying Doctor Service aircraft operating from bases in Brisbane, Rockhampton and Townsville.

In 2004-05, the Budget also includes funding for:

| | • | an additional $13 million for mental health services including the establishment of additional community, clinical and administrative support positions; |

| | • | an additional $8.5 million to ensure Queensland patients continue to have access to a safe and sufficient supply of blood and blood products; |

| | • | an increase in State funding for the Home and Community Care program of over $8 million; |

| | • | an additional $7.2 million for child health initiatives; and |

| | • | an additional $4 million to improve access to health services for Indigenous Queenslanders. |

The Beattie Government is also continuing to address the key infrastructure needed to deliver quality health services, beyond what we have delivered through our massive hospital building program.

Over the next three years more than $1 billion is allocated for the Health capital program including:

| | • | $77 million for a new emergency department and 120 extra beds at Prince Charles Hospital; |

| | • | $200 million as part of the Smart State Building Fund initiative for the integration of community and hospital based health services, hospital redevelopments and emergency department upgrades and staff accommodation upgrades across Queensland; |

| | • | $249 million will be invested in information and communication technologies to improve access to clinical information in both community care and hospital settings, and continue the development and replacement of technical infrastructure; |

10

| | • | $148 million for medical technology; |

| | • | $10 million to enhance renal services across the State; and |

| | • | $10 million to develop a 24 Hour Health Hotline to assist the community to access appropriate health services. |

The Government will also finance the $88 million public component of the Mater Hospital Reconstruction Project, which will include construction of a new Mater Mother’s Hospital, refurbishment of the Mater Adult Hospital and deliver an additional 112 public beds, 11 neonatal cots and 2 delivery suites.

Mr Speaker, in last year’s Budget the Beattie Government committed $200 million in new funding over four years as part of our agenda to deliver a better deal to people with disabilities, their families and carers.

Expenditure on disability services has been a priority of our Government so I am pleased to announce that this Budget provides an additional $220 million over four years to further advance our agenda for disability services. This goes much further than the commitment we made in the recent election.

This new funding will be targeted towards priority areas such as the Adult Lifestyle Program, Support for Children and Families, enhancing the viability of service providers, respite services and alternative services to support people with high support needs and challenging behaviours.

Safe, secure and affordable housing is essential to individual wellbeing and helps lay a foundation of stability in the lives of Queenslanders and the communities they live in.

This is why the Budget allocates:

| | • | $76.9 million for public rental housing allowing for the commencement of 320 dwellings and the completion of 285 dwellings; |

| | • | $11.9 million to the Brisbane Housing Company for the completion of approximately 150 units of accommodation, taking the total stock to over 300; |

11

| | • | $30 million over three years including $10 million in the first year to improve the supply of affordable housing; and |

| | • | $30 million over three years as part of the Smart State Building Fund initiative for the construction of Boarding Housing accommodation and for public housing upgrades across Queensland. |

The Beattie Government’s successful Community Renewal Program will continue at a cost of $75 million over five years and will be expanded into nine new areas from Cairns to the Gold Coast.

Infrastructure in the Torres Strait and the Northern Peninsula area will be further improved with funding of $16.2 million over three years, matched by the Australian Government. We will also be seeking the Australian Government’s support for infrastructure improvements in mainland aboriginal communities throughout the State.

PROTECTING OUR CHILDREN AND ENHANCING COMMUNITY SAFETY

The Crime and Misconduct Commission inquiry into the abuse of children in foster care identified that over a long period of time the Queensland child protection system had failed to deliver the necessary support and services.

The Beattie Government is absolutely committed to changing that by reforming foster care and enhancing the child protection system in Queensland.

We have a Blueprint for implementing the Crime and Misconduct Commission’s recommendations and are committed to its implementation.

The resources committed in this Budget and through the last Mid Year Budget Review involves approximately $214 million in additional annual funding by 2006-07.

This additional funding provides for a range of initiatives, including:

| | • | over 500 additional staff for the new Department of Child Safety; |

| | • | additional staff for the Commissioner for Children and Young People, including an expanded community visitor program; |

12

| | • | increasing the number of alternative care places to 680 over the next four years for young people not suited to conventional foster care; |

| | • | more training and recruitment and retention strategies for staff; |

| | • | staged increases in payments for foster carers; |

| | • | more therapeutic services such as counselling and disability support for children in care; and |

| | • | enhanced Suspected Child Abuse and Neglect Team arrangements. |

The Beattie Government is committed to ensuring our police are properly resourced and equipped.

In 2004-05 the number of sworn officers will grow by 350 reaching our target of 9,100 officers by September 2005. That represents over 2,300 extra police since we came to Government.

On achieving this target the Beattie Government will maintain the police to population ratio above the national average.

The Budget also provides $29.5 million for new and replacement facilities for the Queensland Police Service.

The Community Ambulance Cover is now giving the Queensland Ambulance Service a solid funding base.

Over the next three years ambulance services will be improved through:

| | • | the employment of 240 extra paramedics; |

| | • | 22 new or refurbished ambulance stations; and |

| | • | 200 new or refurbished ambulance vehicles. |

PROTECTING THE ENVIRONMENT FOR A SUSTAINABLE FUTURE

Mr Speaker, it is essential that we manage the development of our natural resources in an ecologically sustainable way.

13

The sustainable use of natural resources will secure the future of key industries and the maintenance of biodiversity will secure the integrity of the natural environment for future generations.

Historic new laws were recently passed to phase out broadscale land clearing in Queensland by December 2006.

This is the most significant environmental decision in Queensland’s history.

In the absence of Australian Government support, the Beattie Government will double its previous funding commitment to provide a $150 million adjustment assistance package.

This package will include funding to help landholders build up existing enterprises or establish new enterprises on their land, to support rural industry groups in promoting best practice sustainable agriculture and for incentives to support landholders willing to manage and maintain native vegetation as part of their operation.

To enhance the protection of Queensland’s natural heritage, this Budget commits funding of $15 million over three years to buy strategic parcels of high conservation value land to add to the protected estate. This includes $12.5 million for land acquisition in Cape York and the Daintree.

We will also contribute $5 million to the Queensland Trust for Nature to initiate the establishment of a public fund which will purchase land for conservation purposes.

An additional $6 million over three years is also provided to upgrade visitor facilities in our National Parks.

GOVERNMENT FINANCES

Mr Speaker, the fiscal principles that have been the foundation of successive Beattie Government budgets have allowed us to manage the effects of external factors, the impact of geopolitical events on equity markets and maintain our AAA credit rating.

14

While the equity markets in recent years adversely impacted our investment returns and our operating result, 2003-04 has seen a major upturn in global equity markets.

This equity market upturn, coupled with strong property market activity, has contributed to a revision to the forecast operating surplus for 2003-04 to over $2.3 billion. Even after adjusting for the structure of Queensland superannuation arrangements, our underlying surplus is estimated at over $1.4 billion.

This result more than offsets the two deficits recorded in 2000-01 and 2001-02.

Based on our longer term investment return expectations and allowing for a moderation in property market activity, the 2004-05 Budget provides for a net operating surplus of $646 million with surpluses of the order of $400-$500 million over the forward estimates period.

The improved operating result forecast for 2003-04 and over the forward estimates period has provided both the capacity for a major boost to the expansion and upgrading of our service infrastructure and an enhanced capacity to manage external impacts on our operating position.

REVENUES

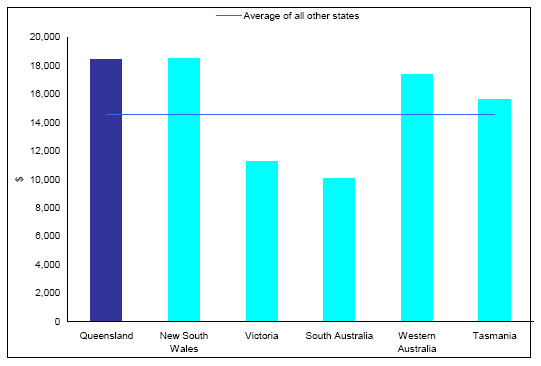

Mr Speaker, every Queenslander and every Queensland business benefits from our competitive tax regime.

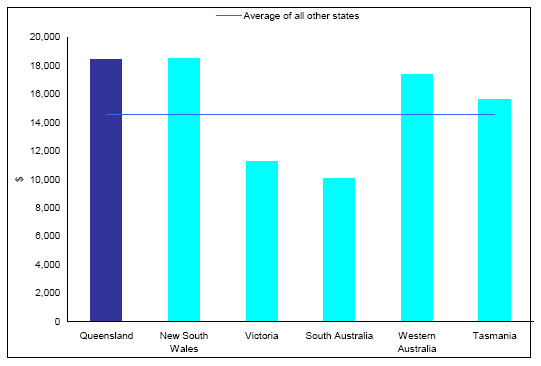

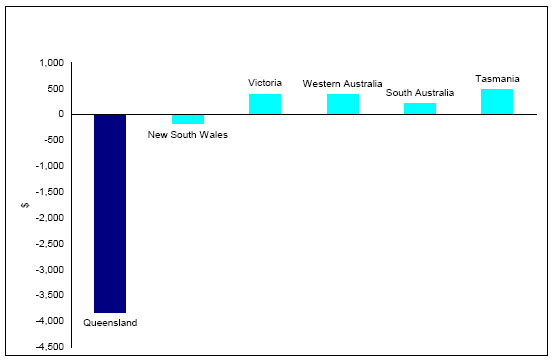

Based on Budget forecasts if you live in Queensland you will pay $1,614 per capita in State taxes compared with $2,056 per capita for the average of the other States. In other words taxpayers in other States pay 27% more than Queenslanders.

Our payroll tax rate is 4.75% - the lowest in Australia.

We have committed to abolishing the Bank Account Debits Tax from 1 July 2005 at a cost to revenue of around $190 million.

The Beattie Government has already honoured our election commitment to help young Queenslanders who are finding it hard to buy their first home by providing stamp duty relief.

15

From 1 May this year first home buyers buying a house up to $250,000 pay no transfer duty and no mortgage duty and between $250,000 and $500,000 receive a transfer duty rebate on a sliding scale.

Most states and territories in Australia do not provide a transfer duty concession for a home purchase that is not the first home.

Currently in Queensland a concessional transfer duty rate of 1% applies for the first $250,000 of the purchase price for homes other than first homes.

As announced from 1 August 2004 the threshold for this concessional duty rate will be increased from $250,000 to $300,000.

This enhanced concession will mean that Queenslanders purchasing a home valued at $300,000 or more will pay $1,250 less in transfer duty.

From 1 August 2004 the duty rate for Class 1 general insurance will be reduced from 8.5% to 7.5%. This reduced rate will particularly benefit policy-holders of building and contents cover.

In addition, credit card duty, currently applied at 10 cents per credit card transaction, will be abolished from 1 August 2004.

Together, the abolition of debits tax and credit card duty, the reduced rate of duty on general insurance and our stamp duty concessions for home purchases will save taxpayers approximately $300 million per annum from 1 July 2005.

DELIVERING RESPONSIVE GOVERNMENT

The Beattie Government is a responsive Government.

We listen to the community through our regional community forums and regional Cabinet meetings. We have held a history-making sitting of Parliament in Townsville and, as the Premier has already announced, we will be taking a sitting of Parliament to Rockhampton.

A number of e-democracy initiatives designed to use information technology to enhance community access to and participation in government decision making processes have been successfully trialled and will be continued.

16

A significant part of being responsive and accountable is ensuring that the community gets value for money through cost effective services.

We are continuing to develop and expand services available to the public through our single access point, Smart Service Queensland.

Value for money opportunities to deliver infrastructure are being pursued through our Public Private Partnerships framework.

Value for money is also being driven through our shared services model for the delivery of corporate services within Government.

CONCLUSION

Mr Speaker, at the State election we asked the voters to support the Beattie Government to keep our State moving and to keep building the new Queensland for all Queenslanders.

This Budget delivers on our election commitments and goes beyond that.

We are improving core services particularly for those most in need including vulnerable children and people with a disability.

We are boosting infrastructure spending, including essential transport infrastructure.

Our fiscal position is stronger and confirms the Government’s fiscal management over recent turbulent times.

Our economy is growing, diversifying and performing strongly.

We are building the new Queensland for all Queenslanders.

I commend the Bill to the House.

17

STATE BUDGET

2004-05

BUDGET STRATEGY AND OUTLOOK

Budget Paper No. 2

TABLE OF CONTENTS

| | | | |

| 1. | | Budget Strategy, Performance and Outlook | | |

| | |

| | | Introduction | | 1 |

| | | Fiscal Strategy | | 1 |

| | | Summary of Key Financial Aggregates | | 4 |

| | | Budget Outcomes 2003-04 | | 4 |

| | | Budget 2004-05 and Outyear Projections | | 8 |

| | | Reconciliation of Operating Result | | 9 |

| | |

| 2. | | Economic Performance and Outlook | | |

| | |

| | | Introduction | | 10 |

| | | External Environment | | 11 |

| | | The Queensland Economy | | 14 |

| | |

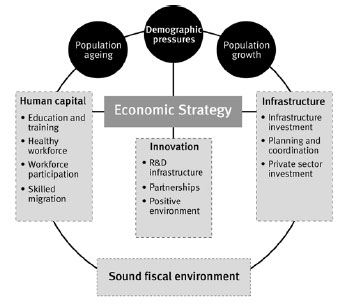

| 3. | | Economic Strategy | | |

| | |

| | | Positioning Queensland for Future Growth | | 25 |

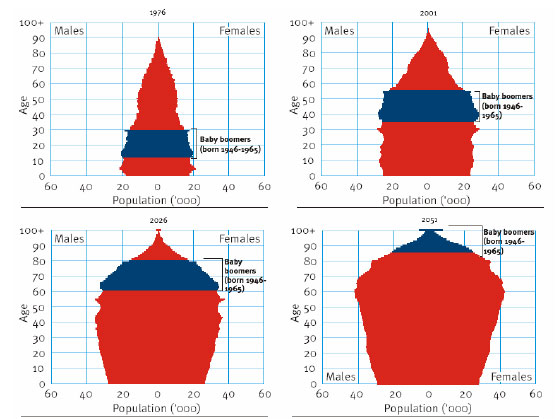

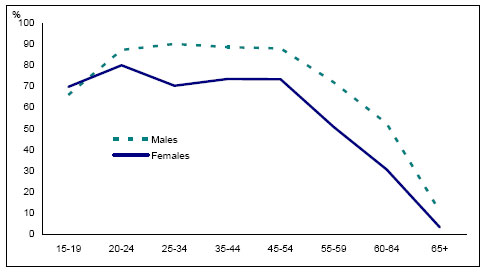

| | | Queensland’s Demographic Challenges | | 26 |

| | | Responding to Queensland’s Demographic Challenges | | 31 |

| | | Need for Collaboration Across Governments | | 39 |

| | |

| 4. | | Budget Priorities | | |

| | |

| | | Introduction | | 41 |

| | | Queensland Government Policy Priorities | | 42 |

| | | Service Delivery Highlights | | 43 |

| | | Financial Management and Governance | | 55 |

| | |

| 5. | | Revenue | | |

| | |

| | | Introduction | | 57 |

| | | Revenue by Operating Statement Category | | 58 |

| | | Taxation Revenue | | 58 |

| | | Queensland’s Competitive Tax Status | | 61 |

| | | Grants and Subsidies | | 62 |

| | | Sales of Goods and Services | | 66 |

| | | Interest Income | | 67 |

| | | Other Revenue | | 67 |

| | | | |

| 6. | | Expenses | | |

| | |

| | | Introduction | | 70 |

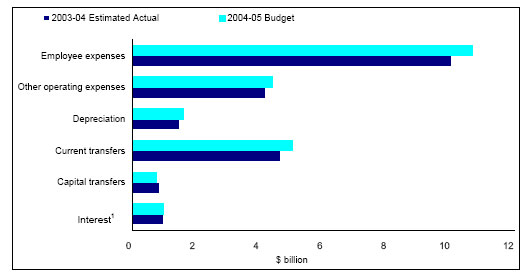

| | | Expenditure by Category | | 71 |

| | | Details of Expenses | | 71 |

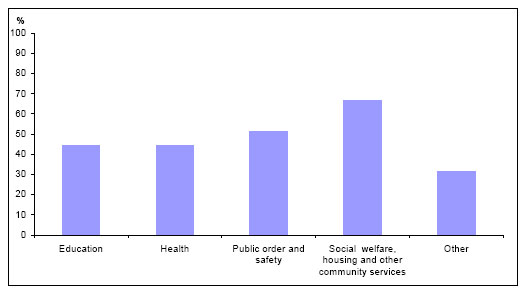

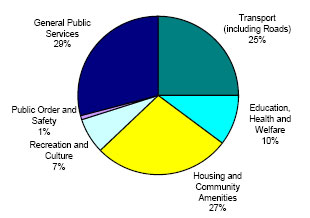

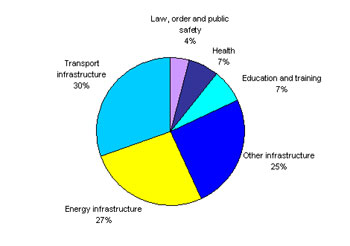

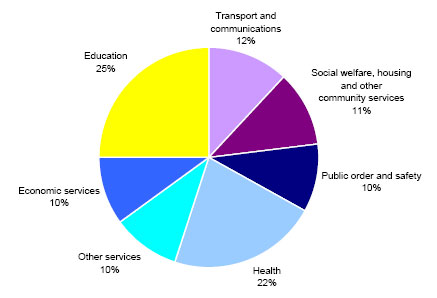

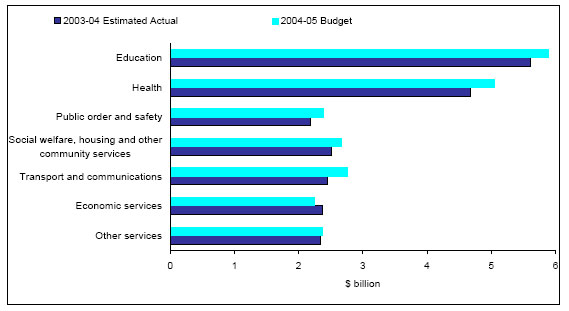

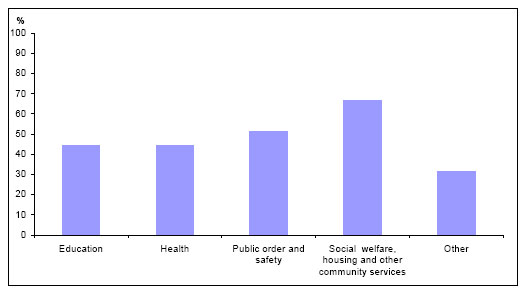

| | | Operating Expenses by Purpose | | 73 |

| | |

| 7. | | Balance Sheet and Cash Flows | | |

| | |

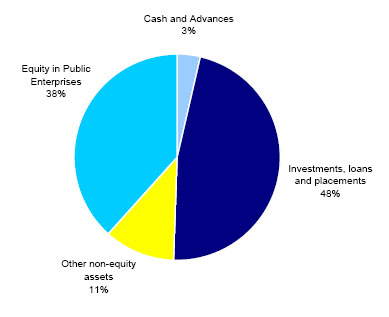

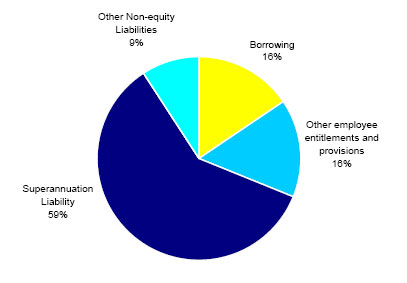

| | | Introduction | | 76 |

| | | Balance Sheet | | 76 |

| | | Cash Flows | | 79 |

| | | Reconciliation of Operating Cash Flows to the Operating Statement | | 83 |

| | |

| 8. | | Inter-Governmental Financial Relations | | |

| | |

| | | Commonwealth-State Financial Relations | | 84 |

| | | Australian Government Funding to the States | | 85 |

| | | State Shares of Australian Government Funding | | 86 |

| | | Queensland’s Share of Funding | | 86 |

| | | Institutional Arrangements | | 87 |

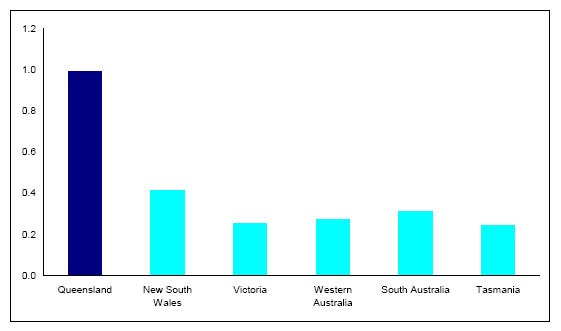

| | | Specific Purpose Payments | | 91 |

| | | State-Local Government Relations | | 95 |

| | | Queensland Government as a Taxpayer | | 97 |

| |

| Appendix A – Tax Expenditure Statement | | 99 |

| |

| Appendix B – Concessions Statement | | 105 |

| |

| Appendix C – Statement of Risks and Sensitivity Analysis | | 109 |

| |

| Appendix D – Government Finance Statistics | | 114 |

| |

| Appendix E – Departmental Expenses | | 122 |

| |

| Appendix F – Reconciliation of Government Finance Statistics Net Operating Balance to Accounting Surplus | | 123 |

| |

| Appendix G – General Government Times Series | | 124 |

| 1. | BUDGET STRATEGY, PERFORMANCE AND OUTLOOK |

KEY POINTS

| | • | In 2003-04, the General Government sector is forecast to have a net operating surplus of $2.374 billion. |

| | • | For 2004-05, there is a budgeted net operating surplus of $646 million, with a strong surplus position throughout the outyears. |

| | • | Cash surpluses are forecast for 2003-04, 2004-05 and the outyears in the General Government sector. |

| | • | The State’s net worth is forecast to increase in 2003-04, 2004-05 and the outyears to $80.3 billion. |

| | • | The State capital program in 2004-05 is budgeted to be $6.049 billion, a 19% increase on the estimated 2003-04 outlays. Sixty percent of the capital program will be spent outside the Brisbane region. |

INTRODUCTION

This chapter discusses:

| | • | the Government’s fiscal strategy as outlined under the Charter of Social and Fiscal Responsibility |

| | • | the summary financial aggregates of the 2004-05 Budget. |

FISCAL STRATEGY

The Charter of Social and Fiscal Responsibility outlines the Government’s fiscal principles, and is an integral part of the Government’s commitment to the community. The fiscal principles, which are detailed in Box 1.1, have been framed to meet a number of objectives, with the overriding requirement to maintain the integrity of the State’s finances.

The fiscal principles establish the basis for sustainability of the Government’s policies. They require that the services provided by Government be funded from tax and other revenue sources over the long-term. The principles are supported by an accrual budgeting framework, which recognises future liabilities of the State and highlights the full cost of sustaining the Government’s operations on an ongoing basis.

The principles recognise the importance of a strong financial position for the State. A state government, because of its more limited tax base, does not have the same capacity as a national government to cushion economic and financial shocks. At the same time, state governments have a responsibility to provide continuity of services, such as health, police and education.

A strong financial position, as indicated by a AAA credit rating, enables lower borrowing costs and is an indication of the soundness of the financial position and policies of the Government, rather than a goal in itself.

1

The success of Queensland’s financial and economic management has been consistently affirmed by international ratings agencies. These agencies have cited Queensland’s strong balance sheet, sound financial operations, modest debt levels and dynamic economic base as reasons underpinning the State’s AAA credit rating.

|

Box 1.1 The Fiscal Principles of the Queensland Government |

Competitive tax environment The Government has a key policy priority to maintain a competitive tax environment for business development and jobs growth. The Government will ensure that State taxes and charges remain competitive with the other states and territories. Affordable service provision The Government will ensure that its level of service provision is sustainable by maintaining an overall General Government operating surplus, as measured in Government Finance Statistics terms. Sustainable borrowings for capital investment Borrowings or other financial arrangements will only be undertaken for capital investments and only where these can be serviced within the operating surplus, consistent with maintaining a AAA credit rating. Prudent management of financial risk The Government will ensure that the State’s financial assets cover all accruing and expected future liabilities of the General Government sector. Building the State’s net worth The Government will maintain, and seek to increase, total State net worth. |

2

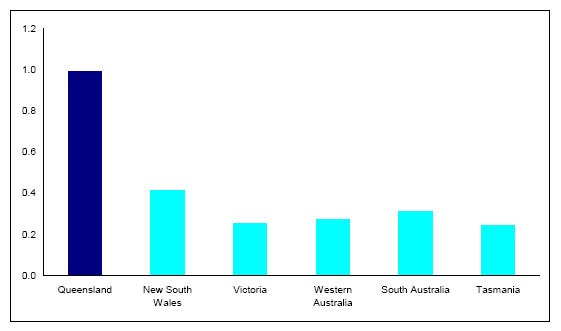

Competitive Tax Environment

One of the Queensland Government’s key social and fiscal objectives is to maintain a competitive tax environment which raises sufficient revenue to meet the infrastructure and Government service delivery needs of the people of Queensland, while at the same time providing a low cost environment for business to promote economic development and jobs growth.

The competitiveness of a state’s tax system is usually assessed by using one of the following measures:

| | • | taxation revenue on a per capita basis |

| | • | taxation relativities based on Commonwealth Grants Commission methodology |

| | • | taxation revenue expressed as a percentage of gross state product (GSP). |

Queensland’s competitive tax position is confirmed by all three measures.

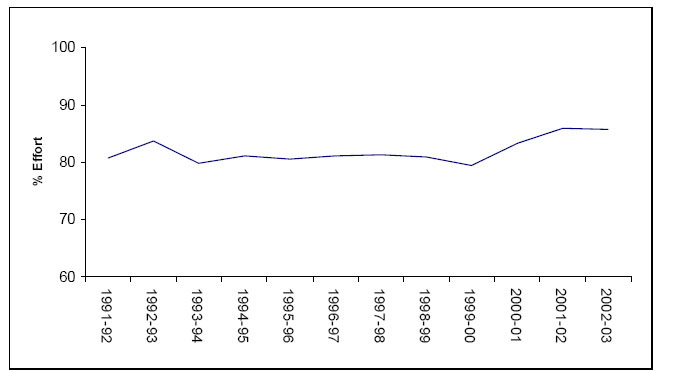

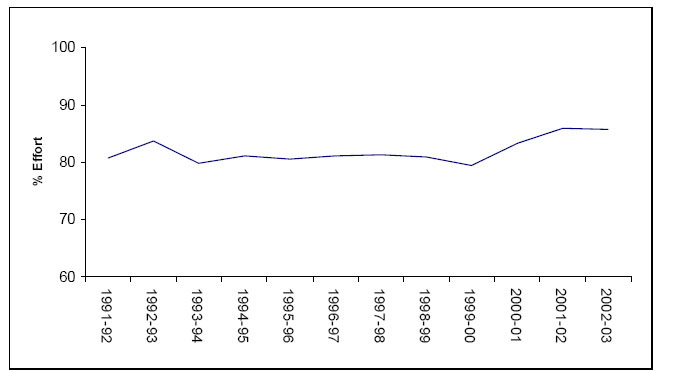

| | • | Per capita tax collections in Queensland in 2004-05 are estimated at $1,614, compared with an estimated $2,056 for the average of the other states. |

| | • | Commonwealth Grants Commission data indicates that Queensland’s taxation effort ratio of 85.8% is considerably less than the standard (100%). |

| | • | Latest Australian Bureau of Statistics data shows Queensland’s tax collections are 4.4% of GSP compared to 4.9% for the average of the other states. |

The 2004-05 Budget includes transfer duty, mortgage duty and insurance duty relief measures. The Budget also includes the abolition of credit card duty with effect from 1 August 2004. Details of this change and other revenue items are provided in Chapter 5.

Affordable Service Provision

The objective of maintaining affordable service provision requires the maintenance of a budget operating surplus, to ensure recurrent services can be funded from recurrent sources.

The Government’s expenditure strategy is based around providing targeted funding for high priority community services. The strategy is built upon the delivery of commitments made in the context of the recent State election which are reflected in the Government’s outcome and priorities for Queensland as outlined in its Charter of Social and Fiscal Responsibility.

Consistent with the Government’s stated priorities, the 2004-05 Budget provides for the implementation of a range of election commitments and other service enhancements in key areas including child safety, health and disability services.

The 2004-05 Budget and forward estimates also continues the implementation of the Government’s Education and Training Reforms for the Future including a preparatory year of schooling from 2007 and substantial investment in information and communication technology.

More information on these initiatives is provided in Chapter 4.

Queensland is already one of the more efficient providers of government services among the states. Nevertheless, further improving the efficiency and effectiveness of Government services is an essential element of delivering on these key policy priorities in a way that is both affordable and sustainable.

The Government has in place an ongoing Aligning Services and Priorities (ASAP) program which provides for a process of ongoing activity and process review to ensure that Government resources are used efficiently so that funding can be directed to the high priority areas outlined above.

In this context, the Government has implemented a Shared Service Initiative designed to achieve best practice in corporate services across Government, with the savings achieved from this initiative to be directed to service delivery.

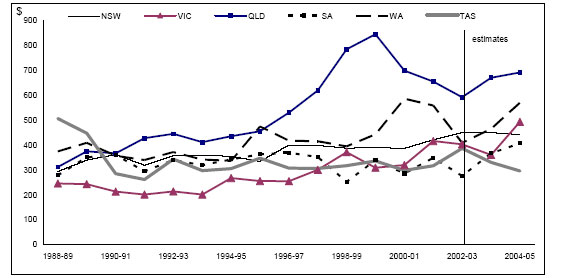

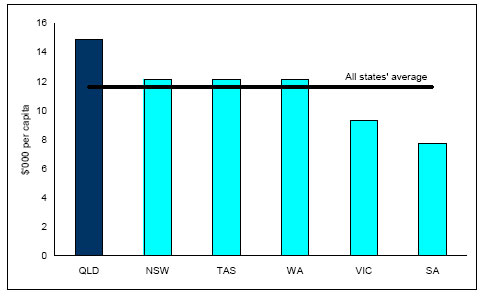

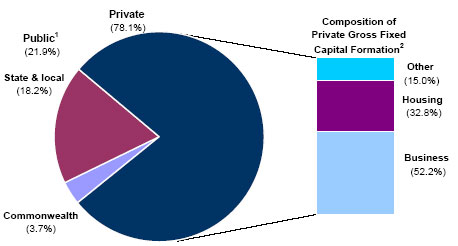

Capital Funding

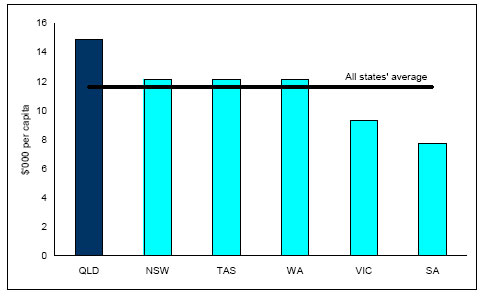

The provision of adequate levels of infrastructure is an ongoing challenge for a State such as Queensland which continues to experience high levels of economic and population growth. Meeting this challenge, the Government provides for consistently higher levels of capital expenditure per capita than any other State.

Investment in core infrastructure is a key feature of the 2004-05 Budget with a record capital program of over $6 billion.

In recognition of Queensland’s capital requirements, the Charter allows borrowing for capital only where the costs of the borrowing can be serviced within the context of an overall operating surplus.

Despite this capacity, the bulk of Queensland’s 2004-05 capital program will be funded from recurrent sources and the forward estimates provide for only modest levels of borrowing reflecting improved cash flows and operating surpluses.

Details of the State capital program for 2004-05 and sources of funds are provided in Budget Paper No. 3 – Capital Statement.

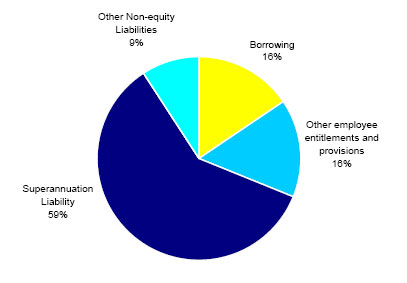

Managing Financial Risk

Queensland has a long-standing policy of setting aside funds to accumulate financial assets sufficient to meet future liabilities, the largest being for future employee entitlements, most notably superannuation.

In this respect, Queensland is far better placed than any of the other state or territory governments, or indeed the Australian Government, to fund future accruing liabilities as most other jurisdictions have substantial unfunded superannuation liabilities.

In common with other superannuation managers in both the public and private sectors Queensland experienced poor investment returns in recent years. However 2003-04 has seen

3

significant growth in equity markets which will produce investment returns well in excess of actuarially assumed long-term rates of return.

The State’s policy of managing financial risk and setting aside funds to meet future liabilities provides the capacity to manage cycles in investment markets without impacting on the Government’s ability to fund ongoing services to the community.

Building the State’s Net Worth

The Charter policy of building the State’s net worth is intended to ensure that infrastructure and other assets are not run-down to the detriment of future citizens and taxpayers. It is an important element in ensuring intergenerational equity.

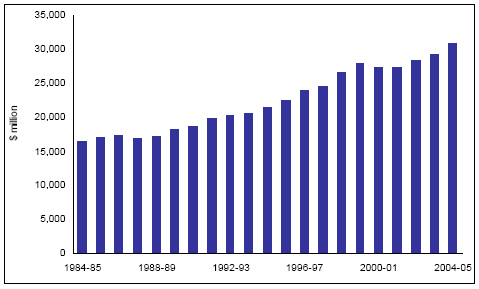

Queensland’s net worth is forecast to grow over the forward estimates. Queensland’s per capita net worth is expected to be 27% greater in 2004-05 than the average per capita net worth of the other states.

Further information on State net worth and other balance sheet aggregates can be found in Chapter 7.

Summary Of Key Financial Aggregates

Table 1.1 provides aggregate estimated actual outcome information for 2003-04 and projections for 2004-05 and the outyears.

| | | | | | | | | | | | |

Table 1.1 General Government sector – Key Financial Aggregates1 |

| | | 2003-04 Budget $ million | | 2003-04 Est. Act. $ million | | 2004-05 Budget $ million | | 2005-06 Projected $ million | | 2006-07 Projected $ million | | 2007-08 Projected $ million |

Revenue | | 21,382 | | 24,506 | | 24,009 | | 24,765 | | 26,033 | | 27,324 |

| | | | | | | |

Expenses | | 21,229 | | 22,132 | | 23,363 | | 24,311 | | 25,560 | | 26,842 |

| | | | | | | |

Net operating balance | | 153 | | 2,374 | | 646 | | 454 | | 473 | | 482 |

| | | | | | | |

Cash surplus | | 152 | | 2,249 | | 1,059 | | 438 | | 600 | | 909 |

| | | | | | | |

Capital purchases | | 2,545 | | 2,578 | | 2,718 | | 2,690 | | 2,492 | | 2,413 |

| | | | | | | |

Net worth | | 60,312 | | 69,366 | | 72,464 | | 74,976 | | 77,670 | | 80,336 |

Note: 1. Numbers may not add due to rounding. |

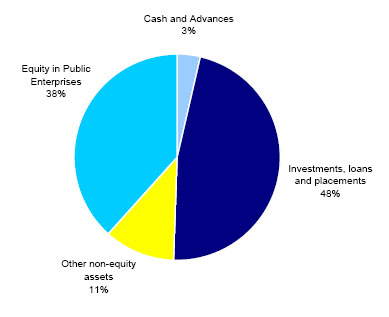

Budget Outcomes 2003-04

Operating Result

The operating result expected for 2003-04 is a surplus of $2.374 billion. The estimated 2003-04 surplus reflects the continuing strength of the property market and economy generally with higher taxation revenues, increased investment returns above the long-term assumed rate of return, and upward revisions to GST payments by the Australian Government.

Budget estimates for investment returns are based on the expected long-term average return for the portfolio of 7.5%.

With over $14.1 billion in funds invested in a portfolio of equities, property, cash and fixed interest, the performance of international financial markets has a major influence on the Budget result.

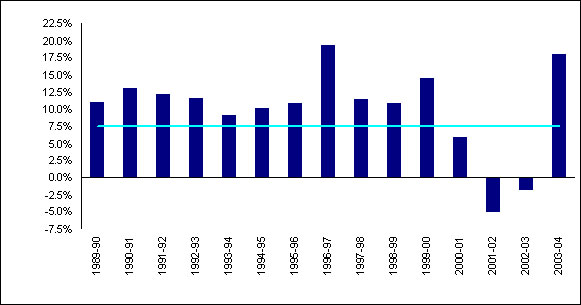

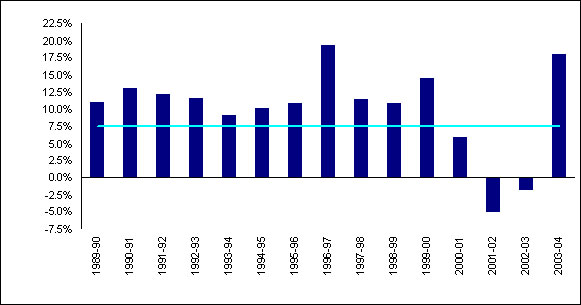

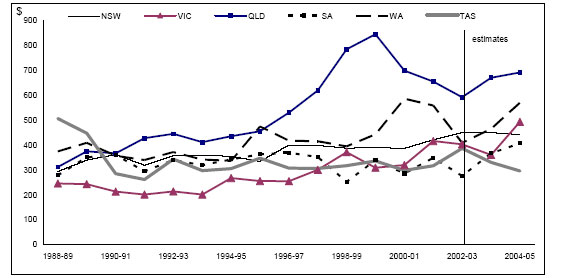

Following a period of very high returns in the 1990s, equity markets performed very poorly in recent years. However 2003-04 has seen a significant improvement in the performance of domestic and international equity markets resulting in an estimated investment return of 18%. Chart 1.1 illustrates the investment return rate achieved over time.

4

Chart 1.1

Investment Returns

1989-90 to 2003-041 (% per annum)

Note:

| 1. | 2003-04 is an estimate. |

Source: 1989-90 to 2002-03: Queensland Investment Corporation.

5

The Underlying Operating Result

Investment market volatility impacts on the Queensland Budget more in Government Finance Statistics (GFS) terms than it does for other states. This is in part due to differences in the way Queensland’s public sector superannuation arrangements are structured. Queensland’s financial assets set aside to meet future employer superannuation liabilities are held as General Government sector assets and associated superannuation liabilities are similarly recorded as General Government sector financial liabilities. In contrast, other jurisdictions generally have structures whereby only the net superannuation liability is recorded in the balance sheet.

The differing superannuation structure leads to a significant difference in GFS accounting treatment between states. For example, in other states poor investment returns are largely treated as negative asset revaluations, reflecting changes in the net superannuation liability. In contrast, poor investment returns impact directly on Queensland’s operating result as a decrease in revenue associated with the investment of financial assets held to meet future liabilities. Conversely, when investment returns exceed the expected long-term average return rate of 7.5%, Queensland’s operating result is improved.

If Queensland’s superannuation arrangements were structured on the same basis as generally applies in other states, the General Government sector underlying operating result for 2003-04 would be a surplus of approximately $1.4 billion, as outlined in Table 1.2 below. The underlying result concept is based on the treatment of variations between Budget and revised assumptions. For the 2004-05 Budget no adjustment is required to the forecast operating result as both the earnings rate on financial assets and the interest rate for the nominal superannuation interest expense are based on long-term actuarial assumptions.

| | |

Table 1.2 Calculation of Underlying Result |

| | | 2003-04 Est. Act. $ million |

Operating Balance | | 2,374 |

Less Investment Earnings 1 | | 1,682 |

Plus Nominal Superannuation Expense 2 | | 745 |

Underlying Balance | | 1,437 |

Notes: 1. Represents investment earnings on financial assets held to meet future defined benefit superannuation liabilities. 2. Represents the adjustment required to the nominal superannuation expense to be calculated on the basis of the net superannuation liability. |

Cash Surplus

The General Government sector is estimated to achieve a cash surplus in 2003-04 of $2.249 billion.

At Mid-Year Review, the cash surplus for 2003-04 was an estimated $216 million. Factors contributing to the improvement in the estimated surplus include the cash impact of upward revision to investment returns from 7.5% to 18%, higher receipts from duty on property transfer transactions resulting from significant growth within the housing and non-residential property sector, and upward revisions to specific purpose payments and GST payments.

The underlying strength of the General Government cash flow for 2003-04 is demonstrated through the borrowing requirement.

Borrowings for 2003-04 have been further revised down to a net repayment of $288 million, compared to net increase of $344 million at the Mid-Year Review 2003-04 (Budget estimate $570 million).

Capital Purchases

General Government investment in capital in 2003-04 is estimated to be $2.578 billion, broadly consistent with the amount forecast at Mid-Year Review.

Net Worth

The net worth, or equity, of the State is the amount by which the State’s assets exceed its liabilities. This is the value of the investment held on behalf of the people of Queensland by public sector instrumentalities. The net worth of the General Government sector at

6

30 June 2004 is estimated at $69.366 billion. This is $2.42 billion higher than net worth forecast at the Mid-Year Review, and reflects the improved operating position together with the impact of a downward revaluation of the Government’s accruing liabilities for employee superannuation.

7

Budget 2004-05 and Outyear Projections

Operating Result

The budgeted position for the General Government sector is for an operating surplus of $646 million in 2004-05, with continuing strong surpluses in the outyears.

The surpluses provide capacity to manage external factors that can impact on the Budget and also support a significant increase in infrastructure investment over the next four years.

The increase in expenditure relative to 2003-04 levels primarily relates to employee expenses, implementation of election commitments and other service enhancements and parameter based adjustments.

Taxation revenue growth is expected to decline in 2004-05 with an easing in property market activity, while investment returns are based on the assumption of long-term investment return rates.

Further details on revenue and expenditure projections are contained in chapters 5 and 6 respectively.

Cash Surplus

A cash surplus of $1.059 billion is expected in 2004-05 for the General Government sector. The cash surplus is forecast to decline in 2005-06 as a result of the abolition of debits tax and a resumption of superannuation beneficiary payments funding following a prepayment in 2003-04.

Growth in the cash surplus in the outyears is due to a moderation in net capital purchases from the high levels budgeted for 2004-05 and 2005-06.

Capital Purchases

This Budget continues the trend of sizeable State capital works programs in both nominal and per capita terms. General Government capital purchases are forecast to grow to approximately $2.7 billion per annum in 2004-05 and 2005-06 reflecting a range of infrastructure initiatives including the Smart State Building Fund. Budget Paper No. 3 – Capital Statement provides details by portfolio of 2003-04 estimated actual and budgeted 2004-05 capital outlays.

Net Worth

State net worth is projected to increase from the 2003-04 estimated actual by $3.098 billion to $72.464 billion at 30 June 2005. Net worth is also expected to increase in all forward estimate years.

More information on the State’s net worth, assets and liabilities is provided in Chapter 7.

8

Reconciliation of Operating Result

Table 1.3 provides a reconciliation of the General Government sector operating result for 2003-04 and 2004-05 published in the Mid-Year Fiscal and Economic Review (MYFER) and current Budget estimates.

| | | | | | |

Table 1.3 Reconciliation of 2003-04 and 2004-05 Operating Result to MYFER Estimates1 | |

| | | 2003-04 Est. Act. $ million | | | 2004-05 Budget $ million | |

MYFER Operating Result | | 401 | | | 192 | |

Expenditure Policy Decisions2 | | (47 | ) | | (381 | ) |

Revenue Policy Decisions3 | | (5 | ) | | (103 | ) |

Other Significant Variations Impacting on Operating Result | | | | | | |

- Investment Returns4 | | 1,181 | | | 141 | |

- Commonwealth General Revenue Grants5 | | 211 | | | 504 | |

- Government Owned Corporation net flows6 | | 201 | | | (2 | ) |

- Other Parameter Adjustments7 | | 432 | | | 295 | |

2004-05 Budget | | 2,374 | | | 646 | |

Notes: 1. Denotes impact on Operating Result. 2. Reflects expenditure policy decisions taken in the Budget context as well as election commitments. 3. Concessions to first home buyers, principal place of residence, insurance duty rate reductions and abolition of credit card duty provided in 2004-05 Budget – see Chapter 5. 4. Reflects revisions of estimated rate of return on investments from 7.5% to 18% in 2003-04. 5. Includes outcomes of Commonwealth Grants Commission 2003 Update, population changes and most recent estimates of GST revenue included in the 2004-05 Commonwealth Budget. 6. Includes revised dividend and tax equivalent revenues less community service obligation payments as a result of improved operating results by public enterprises. 7. Generally refers to adjustments relating to movements in underlying social and/or economic parameters or other no policy change adjustments to estimates. Includes upward revisions to taxation estimates of approximately $349 million in 2003-04 and $327 million in 2004-05. | |

9

| 2. | ECONOMIC PERFORMANCE AND OUTLOOK |

KEY POINTS

| | • | The Queensland economy is expected to grow by 4% in 2003-04, exceeding estimated national growth (3¾%) for the eighth consecutive year. |

| | • | The domestic sector has driven overall economic growth in 2003-04, with household consumption growing at a near-record rate, underpinned by continued strength in the housing sector. |

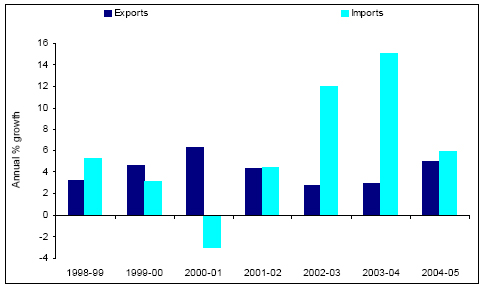

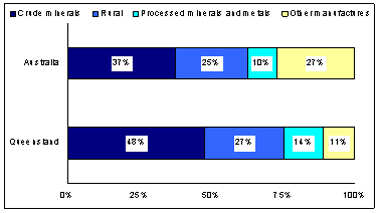

| | • | A surge in consumer spending, along with continuing growth in business investment, has led to a rapid increase in imports in 2003-04, while the high A$ exchange rate and continuing impact of the drought on rural production have restrained export growth. As a result, net exports are expected to detract 5¼ percentage points from overall growth in 2003-04. |

| | • | The strength of the domestic sector has seen further substantial job creation in 2003-04, with estimated employment growth of 3¼% (almost 60,000 jobs) reducing the year-average unemployment rate to 6¼%, the lowest since 1981-82. |

| | • | Queensland’s economic growth is forecast to strengthen to 4¼% in 2004-05, in contrast to national growth, which is forecast to ease to 3½%. However, the composition of growth in the State’s economy is expected to change considerably, with growth in domestic economic activity expected to moderate and the performance of the trade sector forecast to improve substantially. |

| | • | Consumer spending is forecast to return to more sustainable rates of growth and the level of dwelling investment is predicted to remain unchanged, following several years of strong growth. Offsetting these trends, net exports are anticipated to improve, with a continued recovery in the global economy leading to stronger growth in exports. Meanwhile, import growth is forecast to moderate in line with an easing in growth of domestic economic activity. |

| | • | With overall economic activity remaining strong in 2004-05, employment is forecast to grow a further 2¼%, maintaining unemployment at its lowest year-average rate in more than two decades. |

INTRODUCTION

This chapter presents the economic framework within which the 2004-05 Budget has been produced. It examines recent developments in Queensland’s external economic environment, reviews the performance and outlook for the Queensland economy, and highlights any risks and opportunities to economic growth in Queensland in the forecast horizon. The chapter details estimated actuals and forecasts for the major components of State economic activity for 2003-04 and 2004-05 respectively (see Table 2.2), and presents projections for key State economic variables over the medium-term to 2007-081 (see Table 2.3).

| 1 | Decimals have been used to describe actual outcomes, with fractions used for estimated actuals, forecasts and projections. |

10

EXTERNAL ENVIRONMENT

Current Conditions

International

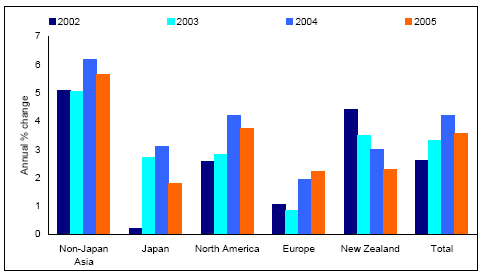

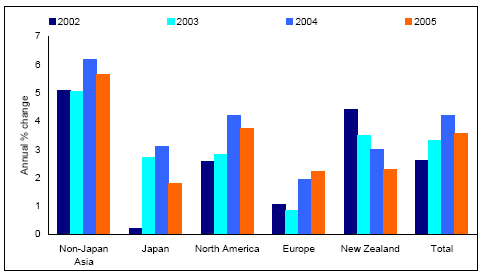

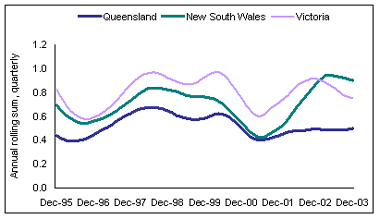

The outlook for growth in Queensland’s major trading partners has improved markedly over the past 12 months, as the world economy continues to recover from the economic slowdown experienced during 2001 and 2002. Remarkable growth in Asia, driven by a surging Chinese economy and a recovery in Japan, and a return to strong growth in North America have more than offset continuing sluggish growth in Europe. As a result, economic growth in Queensland’s major trading partners is likely to strengthen in 2004, before moderating slightly in 2005, as tightening monetary policy begins to affect the world’s major economies (see Chart 2.1).

Chart 2.1

Economic Growth in Queensland’s Major Trading Partners1

Note:

| 1. | Growth in calendar years 2004 and 2005 represent forecasts. |

Sources: Queensland Treasury and Consensus Forecasts.

The world’s largest economy, the United States, has grown strongly over recent quarters, providing substantial stimulus to the global economy. Stronger than expected employment growth in the United States in recent months has partially alleviated fears regarding the sustainability of the current recovery, while leading indicators in the United States have also risen considerably over the past 12 months and remain at high levels, implying a positive outlook for growth. Historically low interest rates and improving business sentiment have encouraged strong business investment, an important driver of economic growth in the United States.

However, the expected tightening of monetary policy in the United States over the second half of 2004 is likely to lead to a moderation of economic growth in 2005. Meanwhile, the persistence of large budget and trade deficits in the United States remains a concern and may result in either a tightening of fiscal policy or a moderation in foreign investment inflows, both of which may potentially have negative implications for growth in the United States. Growth in the Euro area is forecast to remain sluggish over 2004-05, as the leading economies in the region, including Germany and France, continue to experience subdued growth and high unemployment. The currently high value of the Euro also remains an impediment to an export-led recovery in the Euro area.

Non-Japan Asia has experienced a resurgence in growth as the global economy improves, with the rapidly expanding Chinese economy continuing to increase in importance as an export market and a stimulus to growth in the entire Asian region. Recent economic growth in China has been so strong that authorities have recently attempted to slow the economy by moderating credit growth to some sectors most at risk of overheating. Meanwhile, potential health risks such as Severe Acute Respiratory Syndrome and Avian Influenza appear to have abated and Asia is set to continue to outperform the global economy in terms of growth.

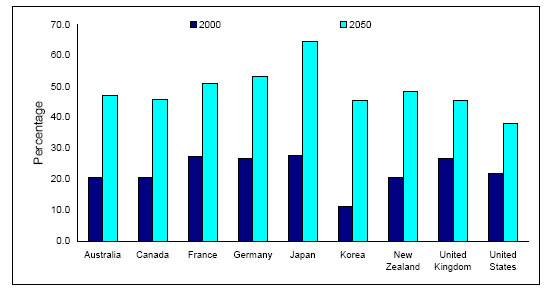

Japan has participated in the Asian region’s strengthening growth, with increased consumer spending and private investment in Japan now contributing to what was initially an export-led recovery. Concerns remain about the level of deflation, structural problems and the rapidly aging population in Japan. However, the short-term outlook for the world’s second largest economy has improved markedly, with Consensus Forecasts revising Japan’s expected growth in 2004 from 2.1% in its January 2004 survey to 3.1% in the May survey.

11

Overall, the outlook for the international economy in 2004 remains strong, although a slight moderation in growth is expected in 2005, following a tightening in global monetary conditions.

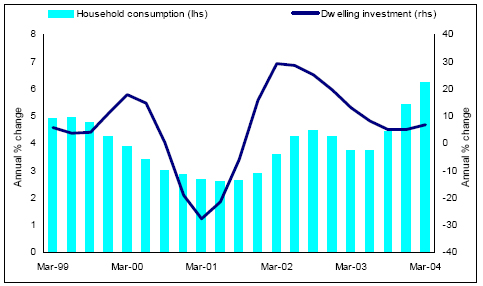

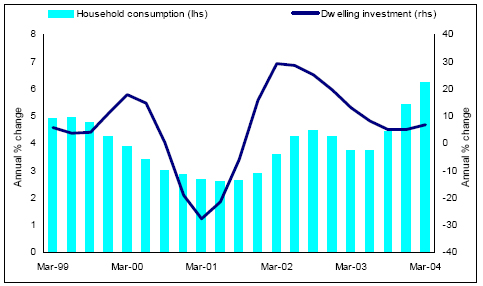

National

Strong domestic demand has been the primary driver of the Australian economy which is expected to grow by 3¾% in 2003-04. Household consumption is estimated to rise strongly in 2003-04, as increasing house prices and favourable employment conditions led to increases in both household wealth and household income. Business investment is also estimated to grow strongly in 2003-04 due to solid demand, higher profits, low interest rates and relatively less expensive imported machinery and equipment.

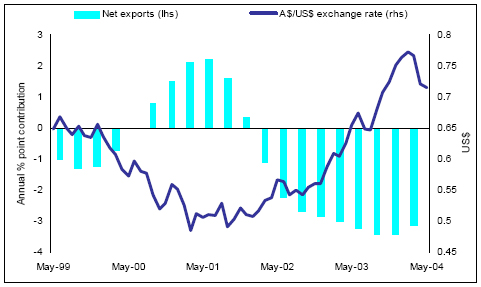

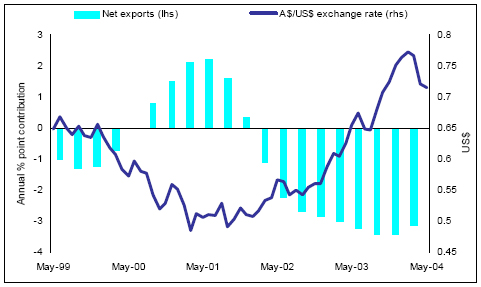

The strong growth in the domestic economy in 2003-04 has been partially offset by the weak performance of the trade sector. The combination of the drought and rising A$ are expected to result in subdued export growth in 2003-04, while imports have been bolstered by strong domestic demand and lower import prices. As a result, net exports are expected to detract 2¼ percentage points from growth in 2003-04.

This composition of growth is likely to slowly rebalance over the coming year, with an easing in national economic growth to 3½% expected in 2004-05. The gains in housing wealth appear to have peaked and employment growth is forecast to remain unchanged over the coming year, while the official interest rate increases at the end of 2003 may also impact on domestic demand and consumption in 2004-05. Business investment growth is also expected to ease in 2004-05 in line with slightly lower growth in domestic economic activity.

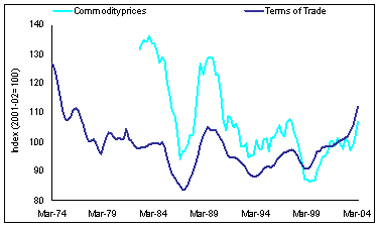

Export growth is forecast to strengthen in 2004-05, due to stronger global growth, rising commodity prices, the gradual recovery from drought conditions and the recent decline in the A$. Meanwhile, growth in imports is forecast to moderate slightly, in line with the expected easing in growth in domestic activity and stabilisation of import prices, resulting in an overall improvement in the trade sector in 2004-05.

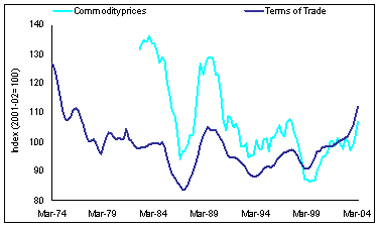

Chart 2.2

Household Consumption and Dwelling Investment, Australia1

Note:

| 1. | Chain volume measure, 2001-02 reference year. 2003-04 represents an estimated actual, 2004-05 represents a forecast. |

Source: Australian Bureau of Statistics (ABS) 5206.0.

Chart 2.3

The Exchange Rate and Net Exports, Australia1

Note:

| 1. | Net exports presented as contribution to annual growth in quarterly trend gross domestic product. Exchange rates have been calculated on an end of month basis. |

Sources: ABS 5206.0 and Reuters.

External Assumptions

Queensland is a vibrant, open economy with strong trade links with the rest of the world. The State’s economic performance is therefore partly dependent on the outlook for both the national and international economies. As a result, the forecasts for the Queensland economy in 2004-05 are based on a range of key assumptions about the State’s external environment, including the national economy, major trading partners and financial markets (see Table 2.1).

| | • | The economic performance of Queensland’s major trading partners is expected to continue to improve over the coming year, with forecast year-average growth of 3¾% in 2004-05, compared with estimated growth of 3½% in 2003-04. This recovery is expected to be driven largely by a return to solid economic growth in the United States, ongoing |

12

| | improvement in the Japanese economy and continued robust growth in China, which should continue to provide substantial economic stimulus to the Asian region. |

| | • | Inflation in Queensland’s major trading partners is forecast to remain at 1½% in 2004-05. |

| | • | Australian monetary policy is assumed to be broadly unchanged over 2004-05, with interest rates to remain around their current levels. |

| | • | The Australian Government’s economic forecasts and projections, as outlined in the Commonwealth Budget delivered on 11 May 2004, have been adopted as the basis for national economic performance over the forecast horizon, with national growth of 3¾% assumed for 2003-04 and 3½% in the subsequent years to 2007-08. |

| | • | Queensland economic forecasts have been based on an A$ exchange rate at around current levels, in both US$ and trade-weighted index terms. |

| | • | Forecasts and projections of rural production and exports are based on an assumption of a return to average seasonal conditions in Queensland in 2004-05 and beyond. |

A discussion of the risks to these assumptions is contained in a later section of this chapter.

| | | | | | | | |

Table 2.1 External Assumptions |

| | | Outcomes | | Est. Act. 2003-04 % | | Forecast 2004-05 % |

| | | 2001-02 % | | 2002-03 % | | |

International assumptions | | | | | | | | |

Major trading partner economic growth | | 1.5 | | 3.1 | | 3 1/2 | | 3 3/4 |

Major trading partner inflation | | 1.2 | | 1.4 | | 1 1/2 | | 1 1/2 |

| | | | | |

National assumptions | | | | | | | | |

Economic growth | | 3.9 | | 2.9 | | 3 3/4 | | 3 1/2 |

Inflation | | 2.9 | | 3.1 | | 2 1/4 | | 2 |

Sources: Queensland Treasury, ABS 5206.0, ABS 6401.0, Commonwealth Treasury and Consensus Forecasts. |

13

THE QUEENSLAND ECONOMY

Overall Economic Growth

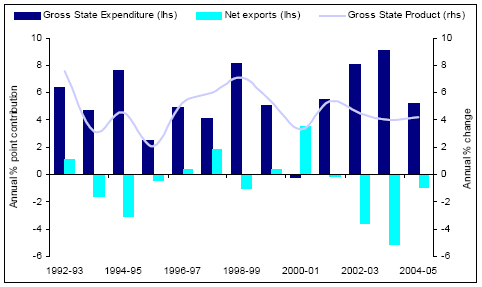

Rapid growth in domestic activity is expected to see Queensland maintain strong overall economic growth in 2003-04, despite a number of factors adversely affecting the economy’s trade sector. Gross state product in Queensland is expected to grow by 4% in 2003-04, outperforming estimated national growth for the eighth consecutive year.

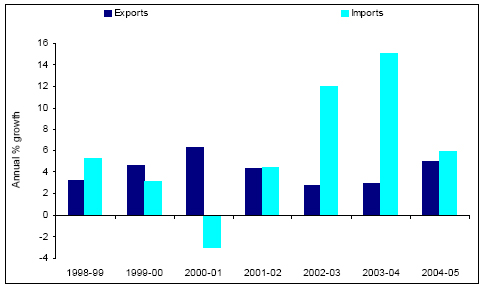

Household consumption is expected to grow by 8½% in 2003-04, the highest yearly growth rate since 1989-90. A strong housing sector has helped underpin spending on consumer durables while higher house prices have led to increased consumer wealth. However, the resulting record consumer spending, along with continued growth in business investment, has boosted growth in imports during the year. With a higher A$ exchange rate and low levels of rural production due to the drought restraining export growth, net exports are anticipated to detract 5¼ percentage points from overall growth in 2003-04.

Queensland’s economic growth is forecast to strengthen to 4¼% in 2004-05. Furthermore, the composition of growth is predicted to change over the coming year, with a general easing in the growth of domestic activity being more than offset by an improvement in the trade sector (see Chart 2.4). After growing strongly in previous years, dwelling investment is forecast to remain unchanged in 2004-05, while consumption growth is forecast to return to a more sustainable rate. In contrast, public final demand is forecast to grow more strongly, largely reflecting the State Government’s substantial capital spending planned for 2004-05.

The performance of the trade sector is forecast to improve significantly in 2004-05, with net exports anticipated to detract only one percentage point from overall growth. A continued recovery in the global economy, increasing demand for commodities and a partial recovery from the drought are expected to bolster growth in exports. Meanwhile, import growth is expected to ease in line with the forecast moderation in domestic demand in 2004-05.

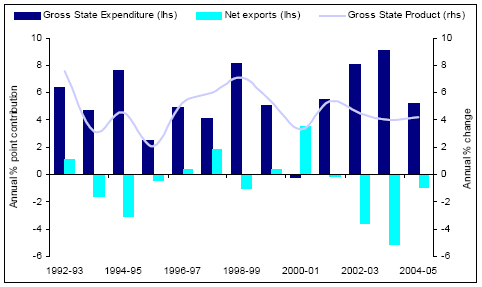

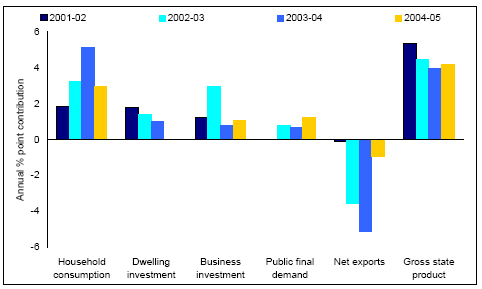

Chart 2.4

Queensland Economic Growth1

Note:

| 1. | Chain volume measure, 2001-02 reference year. 2003-04 represents an estimated actual, 2004-05 represents a forecast. |

Source: Queensland Treasury.

14

| | | | | | | | | | | | |

Table 2.2 State and National Economic Forecasts8 | |

| | | Outcomes | | | Est. Act. | | | Forecast | |

| | | 2001-02 % | | | 2002-03 % | | | 2003-04 % | | | 2004-05 % | |

Queensland forecasts | | | | | | | | | | | | |

Domestic production1 | | | | | | | | | | | | |

Household consumption | | 3 | | | 5.5 | | | 8 1/2 | | | 4 3/4 | |

Private investment2,3 | | 21 | | | 21.4 | | | 10 1/4 | | | 4 1/4 | |

Dwellings | | 32.9 | | | 20.8 | | | 12 1/2 | | | 0 | |

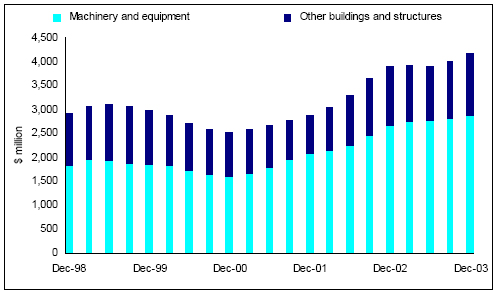

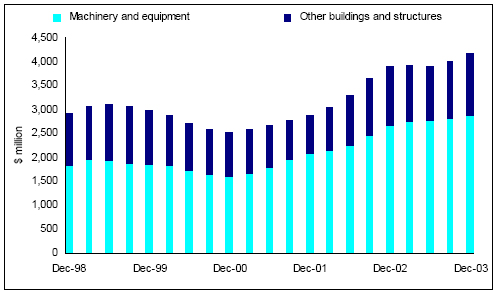

Business investment3, 4 | | 13.8 | | | 30.6 | | | 6 1/2 | | | 8 1/2 | |

Other buildings and structures3 | | (6.2 | ) | | 36.4 | | | 5 | | | 10 | |

Machinery and equipment3 | | 24.7 | | | 28.2 | | | 7 | | | 8 | |

Private final demand3 | | 7.0 | | | 9.5 | | | 9 | | | 4 3/4 | |

Public final demand3 | | 0.0 | | | 3.6 | | | 3 | | | 5 1/2 | |

Gross state expenditure5 | | 5.4 | | | 7.9 | | | 8 1/2 | | | 4 3/4 | |

Exports of goods and services | | 4.3 | | | 2.8 | | | 3 | | | 5 | |

Imports of goods and services | | 4.5 | | | 12.0 | | | 15 | | | 6 | |

Net exports6 | | (0.1 | ) | | (3.6 | ) | | (5 1/4 | ) | | (1 | ) |

Gross state product | | 5.4 | | | 4.5 | | | 4 | | | 4 1/4 | |

| | | | | |

Other state economic measures | | | | | | | | | | | | |

Population | | 2.1 | | | 2.3 | | | 2 1/4 | | | 2 1/4 | |

Inflation | | 2.9 | | | 3.2 | | | 3 | | | 2 1/2 | |

Average earnings (state accounts basis) 7 | | 2.8 | | | 3.4 | | | 3 1/2 | | | 4 | |

Employment (labour force survey) | | 2.4 | | | 3.7 | | | 3 1/4 | | | 2 1/4 | |

Unemployment rate (%, year-average) | | 8.0 | | | 7.2 | | | 6 1/4 | | | 6 1/4 | |

Labour force | | 2.4 | | | 2.8 | | | 2 1/4 | | | 2 1/4 | |

Participation rate | | 64.9 | | | 65.0 | | | 64 3/4 | | | 64 3/4 | |

| | | | | |

National forecasts | | | | | | | | | | | | |

Domestic production1 | | | | | | | | | | | | |

Household consumption | | 3.3 | | | 4.1 | | | 5 1/2 | | | 4 1/4 | |

Private investment | | na | | | na | | | na | | | na | |

Dwellings | | 19.2 | | | 15.5 | | | 6 | | | (3 | ) |

Business investment3,4 | | na | | | 16.8 | | | 11 | | | 7 | |

Other buildings and structures3 | | na | | | 31.9 | | | 16 | | | 6 | |

Machinery and equipment3 | | na | | | 16.4 | | | 10 | | | 8 | |

Private final demand3 | | na | | | 6.7 | | | 6 1/2 | | | 4 | |

Public final demand3 | | na | | | 4.3 | | | 2 3/4 | | | 3 1/2 | |

Gross national expenditure5 | | 4.6 | | | 6.2 | | | 6 | | | 3 3/4 | |

Exports of goods and services | | (1.1 | ) | | (0.5 | ) | | 2 | | | 8 | |

Imports of goods and services | | 2.2 | | | 13.5 | | | 12 | | | 9 | |

Net exports6 | | (0.7 | ) | | (3.0 | ) | | (2 1/2 | ) | | ( 1/2 | ) |

Gross domestic product | | 3.9 | | | 2.9 | | | 3 3/4 | | | 3 1/2 | |

| | | | | |

Other national economic measures | | | | | | | | | | | | |

Population | | 1.3 | | | 1.2 | | | 1 1/4 | | | 1 1/2 | |

Inflation | | 2.9 | | | 3.1 | | | 2 1/4 | | | 2 | |

Wage Cost Index7 | | 3.3 | | | 3.5 | | | 3 3/4 | | | 3 3/4 | |

Employment (labour force survey) | | 1.2 | | | 2.5 | | | 1 3/4 | | | 1 3/4 | |

Unemployment rate (%, year-average) | | 6.7 | | | 6.2 | | | 5 3/4 | | | 5 3/4 | |

Labour force | | 1.6 | | | 1.9 | | | 1 3/4 | | | 1 3/4 | |

Participation rate | | 63.4 | | | 63.7 | | | 63 1/2 | | | 63 1/2 | |

Notes: 1. Chain volume measure, 2001-02 reference year. 2. Private investment includes livestock, intangible fixed assets and ownership transfer costs. 3. Excluding private sector net purchases of second-hand public sector assets. 4. National calculations of business investment includes investment in livestock and intangible fixed assets, which are not included in the Queensland calculations. 5. Includes statistical discrepancy and change in inventories. 6. Percentage point contribution to growth in gross state or domestic product. 7. The Australian Government has moved to a measure of growth in wages based on the ABS Wage Cost Index, whereas the State measure of average earnings is still estimated on a State Accounts basis. 8. Unless otherwise stated, all figures are annual% changes. Decimal point figures indicate an actual outcome. na – Indicates not available. Sources: Queensland Treasury, Commonwealth Treasury and ABS 5206.0. | |

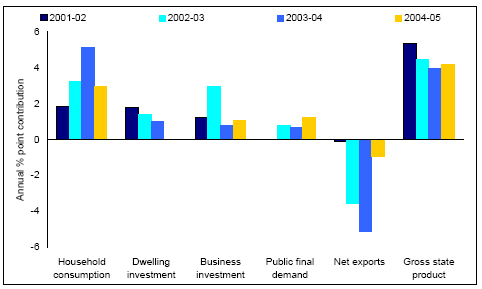

Chart 2.5

Contribution to Growth in Queensland’s Gross State Product1

Note:

| 1. | Chain volume measure, 2001-02 reference year. Contributions for 2003-04 represent estimated actuals while contributions for 2004-05 represent forecasts. |

Source: Queensland Treasury.

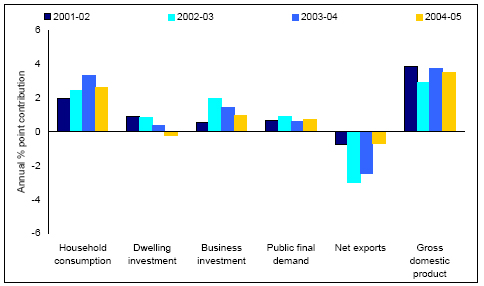

15

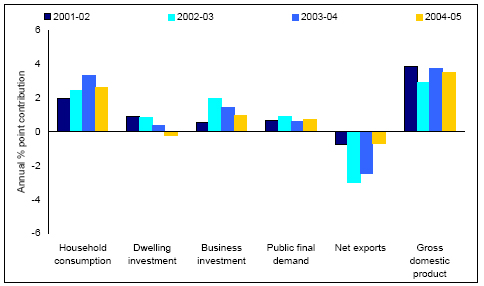

Chart 2.6

Contribution to Growth in Australia’s Gross Domestic Product1

Note:

| 1. | Chain volume measure, 2001-02 reference year. Contributions for 2003-04 represent estimated actuals while contributions for 2004-05 represent forecasts. |

Sources: Queensland Treasury and Commonwealth Treasury.

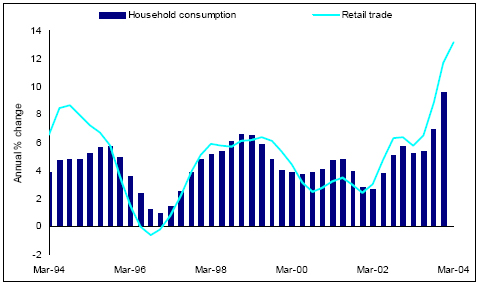

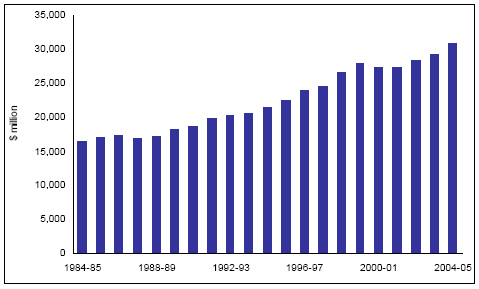

Household Consumption

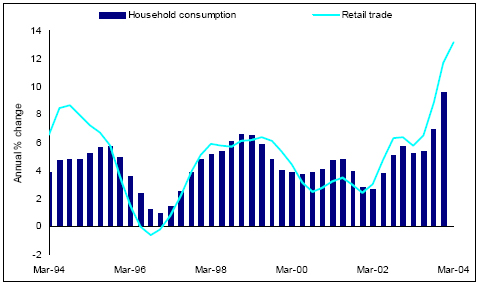

Household consumption has continued to be one of the key drivers of economic activity in Queensland over the last year and is expected to grow at a near-record rate in 2003-04. As the largest single component of the Queensland economy, household consumption is forecast to grow by 8 1/2% over the year, a rate of growth not seen since the late 1980s. Consumption expenditure has been largely underpinned by strong population and employment growth, as well as the robust housing market, which has resulted in increased household wealth and a higher level of consumer confidence. In addition, continuing low interest rates and a stronger A$, which has made imported consumption goods less expensive, have also contributed to this surge in consumption spending.

Retail trade, which accounts for approximately 40% of household consumption, experienced particularly strong growth during the first three quarters of 2003-04, reflecting strong growth in retail spending across all major industry groups.

Growth in household consumption is forecast to moderate in 2004-05, returning to a more sustainable rate of growth of 4 3/4%. This easing reflects an anticipated moderation in the growth of both housing-related consumer purchases and wealth-related spending, in line with the apparent peaking of the housing cycle and the recent stabilisation of house prices. The impact of interest rate increases in late 2003 may also dampen household consumption growth in 2004-05. However, underpinned by continued solid population growth and rising real incomes (with the increase in average earnings once again expected to outpace inflation), growth in consumption expenditure is expected to remain robust in 2004-05.

Chart 2.7

Household Consumption and Retail Trade, Queensland1

Note:

| 1. | Chain volume measure, 2001-02 reference year. |

Sources: Queensland Treasury and ABS 8501.0.

Dwelling Investment

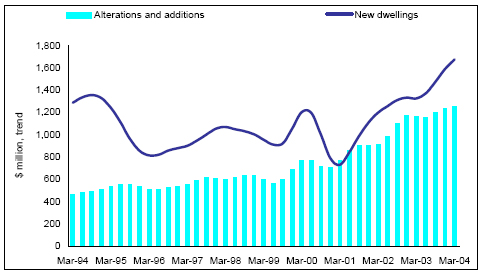

After very strong growth in 2001-02 and 2002-03, dwelling investment has continued to increase through the first half of 2003-04 and is expected to rise by 12 1/2% over the year.

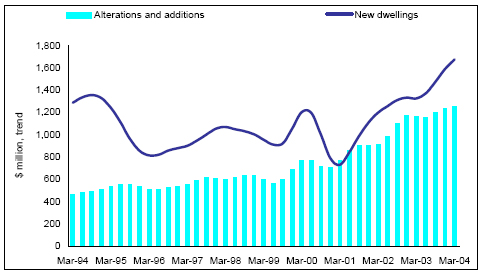

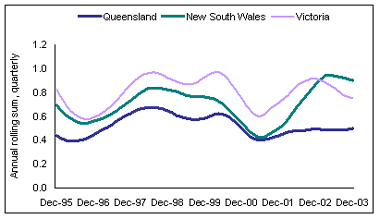

New dwelling construction grew strongly over the first three quarters of 2003-04, with owner occupied home construction buoyed by continued high population growth in Queensland and low home loan interest rates. The surge in demand for investment property throughout 2002-03 continued into 2003-04, supported by exceptionally strong house price growth. Building approvals data suggest that, while construction of owner-occupied and investment dwellings could moderate slightly during the final quarter of 2003-04, the overall level of activity should remain high. After record growth in 2002-03, alterations and additions spending has continued to increase in 2003-04, as home owners continued to utilise the increased equity in their properties resulting from the rapid house price growth.

Dwelling investment in 2004-05 is forecast to remain unchanged from the very high level expected in 2003-04. This compares with a forecast decline of 3% nationally in 2004-05. Box 2.1 highlights some of the reasons why the outlook for dwelling investment is stronger in Queensland compared with nationally.

Recent dwelling approvals data indicate new dwelling construction in Queensland may be nearing a peak, with the gradual easing in approvals of new dwellings likely to continue into 2004-05. In addition, the demand for investment property is expected to moderate in anticipation of more subdued growth in house prices in the coming year.

16

However, the anticipated decline in new housing construction is likely to be tempered by Queensland’s strong population growth which remains substantially higher than in the rest of Australia, and is expected to be offset by further growth in renovation-related construction. Alterations and additions activity currently represents almost half of total dwelling investment and is expected to continue to grow solidly in 2004-05, as home owners continue to draw on their increased equity to invest in their properties.

Chart 2.8

Alterations, Additions and New Dwelling Investment, Queensland

Source: ABS 5206.0

17

|

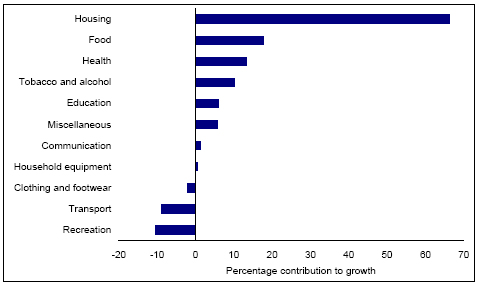

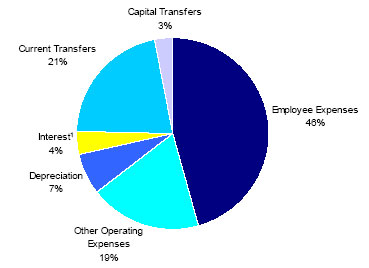

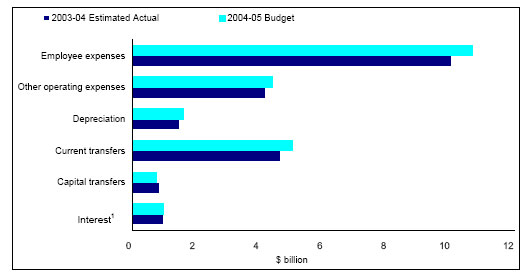

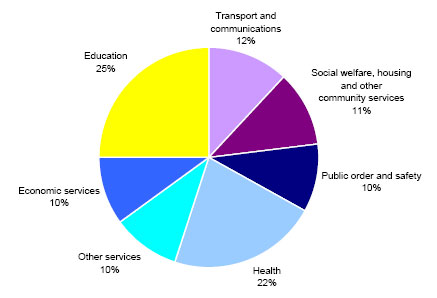

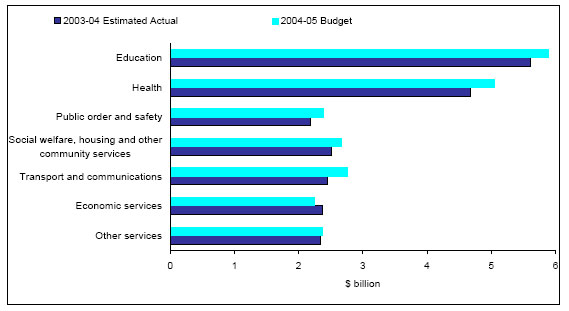

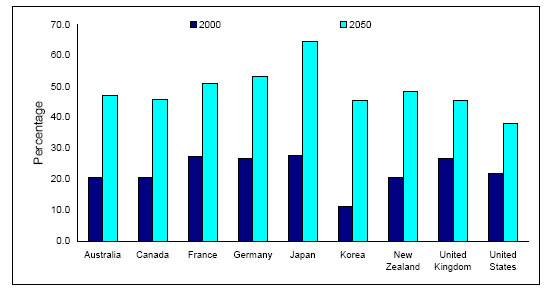

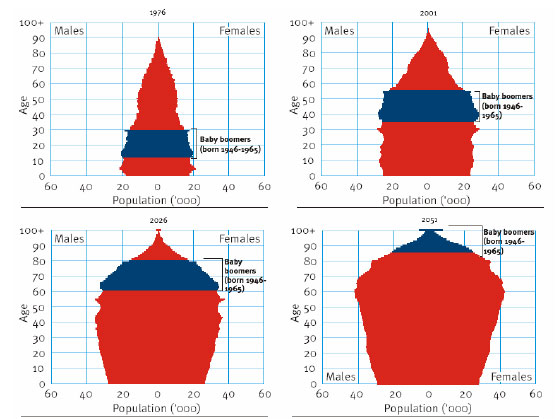

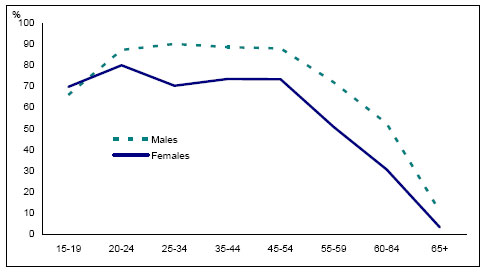

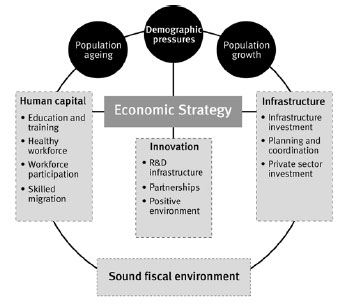

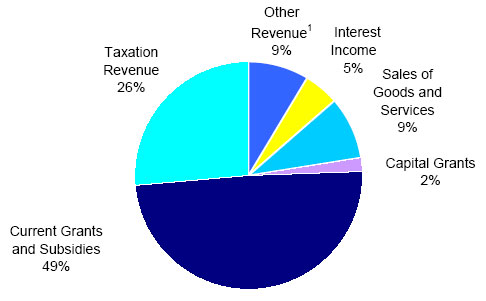

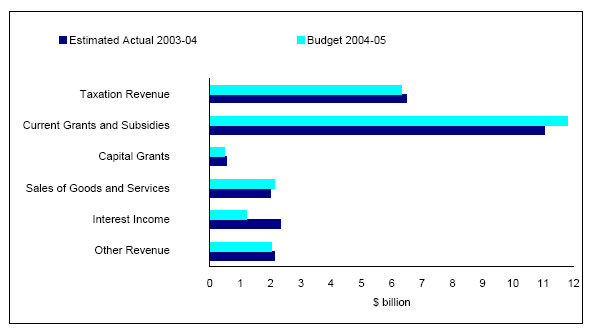

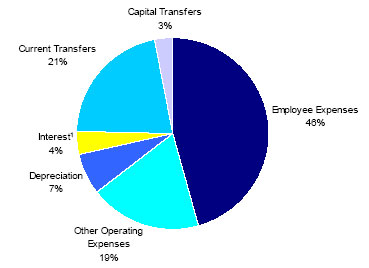

Box 2.1 The Queensland Housing Sector |