Exhibit (c)(ii)

2003-04 Report on State Finances

of the Queensland Government

year ended 30 June 2004

Contents

| | |

| | | Page

|

Message from the Treasurer | | 2 |

| |

Scope of the Report | | 3 |

| |

Outcomes Report - Uniform Presentation Framework | | |

| |

Overview and Analysis | | 4-01 |

| |

Operating Statement by Sector | | 4-08 |

| |

Balance Sheet by Sector | | 4-09 |

| |

Cash Flow Statement by Sector | | 4-10 |

| |

General Government Sector Expenses by Function | | 4-11 |

| |

General Government Sector Purchases of Non-financial Assets by Function | | 4-12 |

| |

Loan Council Allocation | | 4-12 |

| |

Certification of Outcomes Report | | 4-13 |

| |

Audited Consolidated Financial Statements | | |

| |

Overview and Analysis | | 5-01 |

| |

Statement of Financial Performance | | 5-06 |

| |

Statement of Financial Position | | 5-07 |

| |

Statement of Cash Flows | | 5-08 |

| |

Notes to the Financial Statements | | 5-09 |

| |

Certification of Consolidated Financial Statements | | 5-64 |

| |

Independent Audit Report to the Treasurer of Queensland | | 5-65 |

| |

Attachment A: Reconciliation of UPF and AAS Operating Result | | 6-01 |

| | |

Report on State Finances 2003-04 – Government of Queensland | | 1 |

Message from the Treasurer

Message from the Treasurer

As outlined in the Charter of Social and Fiscal Responsibility, the Government is committed to fiscal transparency and accountability. A key objective of this report is to facilitate a meaningful assessment of the State’s financial performance over the 2003-04 financial year and its net worth at balance date.

This report provides details of the State’s financial operations and position on both a Government Finance Statistics (Outcomes Report) and Australian Accounting Standards (Consolidated Financial Statements) basis.

Only those entities assessed as likely to impact materially on the State’s financial activities are accounted for in this report.

In endorsing this report, I place on record my appreciation of the co-operation extended to Queensland Treasury by agency personnel and of the work undertaken by Treasury staff involved in its preparation.

|

|

|

| Terry Mackenroth |

| Treasurer |

| | |

Report on State Finances 2003-04 – Government of Queensland | | 2 |

Scope of the Report

The State Finance Report, incorporating the Outcomes Report and Consolidated Financial Statements, provides a comprehensive analysis of Government finances for the 2003-04 financial year.

These reports are prepared using differing methodologies, each giving a view of Government finances. The Consolidated Financial Statements outline the operations of the Queensland Government including valuation adjustments on assets and liabilities. The Outcomes Report removes valuation adjustments to reflect costs more appropriately related to the underlying operations of Government.

The Outcomes Report

The Outcomes Report contains financial statements that are prepared and presented on a Government Finance Statistics (GFS) basis and in accordance with the Uniform Presentation Framework (UPF) agreed to at the 1991 Premiers’ Conference. The primary objective of the UPF is to ensure that Commonwealth, State and Territory governments provide a common ‘core’ of financial information. One of the Government’s key fiscal principles is the maintenance of a General Government operating surplus as measured in Government Finance Statistics terms.

Queensland’s annual Budget is prepared in accordance with the framework and the Outcomes Report compares achieved financial results with budget forecasts.

The UPF presentation is primarily structured on a sectoral basis with a focus on the General Government and Public Non-financial Corporations sectors.

The Consolidated Financial Statements

The Consolidated Financial Statements outline the operations of the Queensland Government on an accrual basis in accordance with Australian Accounting Standard AAS31 Financial Reporting by Governments and other applicable standards. Accordingly, the statements present the operating result, financial position and cash flows of the Queensland Total State sector on a consolidated basis (which includes aggregated results for General Government, Public Non-financial Corporations and Public Financial Corporations sectors).

Financial statements for the General Government, Public Non-financial Corporations and Public Financial Corporations sectors are disclosed in the disaggregated information note to the financial statements (Note 2).

Refer Note 39 for a full list of consolidated entities.

Related Publications

This report comprises one of a number of key publications relating to the financial performance of the Queensland Public Sector including:

| | • | the annual Budget papers |

| | • | the Treasurer’s Appropriation Statement |

| | • | the annual reports of the various departments, statutory bodies, Government-owned corporations and other entities that comprise the Queensland Government. |

| | |

Report on State Finances 2003-04 – Government of Queensland | | 3 |

2003-04 Outcomes Report

Uniform Presentation Framework of the Queensland Government

year ended 30 June 2004

Overview and Analysis

Overview

| | • | A GFS operating surplus of $3,340 million for 2003-04 was recorded in the General Government sector, an improvement of $966 million over that estimated at the time of the 2004-05 Budget, due largely to higher than anticipated investment returns and taxation revenues. Expenses for the year were $258 million lower than estimated at the time of the 2004-05 Budget. |

| | • | The underlying operating result for 2003-04 in the General Government sector (adjusted for superannuation arrangements comparable with other jurisdictions) is a surplus of $2,095 million, an increase of $658 million over the estimated actual. |

| | • | A GFS cash surplus of $3,490 million was recorded for 2003-04 in the General Government sector. This is $1,241 million higher than the estimated actual of $2,249 million. |

| | • | The State’s net worth increased to $77,723 million as at 30 June 2004, an improvement of $8,357 million over the estimated actual forecast of $69,366 million. |

| | • | The Government has met all of its fiscal commitments under the Charter of Social and Fiscal Responsibility. Refer page 4-02. |

Summary of Key GFS Financial Aggregates

Outlined in the table below are the GFS aggregates, by sector. The results show outcomes for Queensland much stronger than expected at the time of publishing the 2004-05 Budget:

| | | | | | | | | | | | | | | | | | |

| | | General Government Sector

| | | Public Non-financial

Corporations Sector

| | | Non-financial Public Sector

| |

| | | Est. Actual $ million

| | | Actual $ million

| | | Est. Actual

$ million

| | | Actual $ million

| | | Est. Actual $ million

| | | Actual

$ million

| |

Revenue | | 24,506 | | | 25,214 | | | 7,741 | | | 8,130 | | | 29,660 | | | 30,681 | |

Expenses | | 22,132 | | | 21,874 | | | 7,826 | | | 8,197 | | | 27,370 | | | 27,407 | |

Net Operating Balance | | 2,374 | | | 3,340 | | | (85 | ) | | (67 | ) | | 2,290 | | | 3,274 | |

Net Lending/(Borrowing) | | 1,716 | | | 2,838 | | | (453 | ) | | (249 | ) | | 1,265 | | | 2,589 | |

Cash Surplus/(Deficit) | | 2,249 | | | 3,490 | | | (147 | ) | | 133 | | | 2,103 | | | 3,622 | |

Gross Fixed Capital Formation | | 2,123 | | | 1,976 | | | 1,564 | | | 1,413 | | | 3,685 | | | 3,389 | |

Net Worth | | 69,366 | | | 77,723 | | | 12,325 | | | 13,733 | | | 69,366 | | | 77,723 | |

Net Debt | | (14,040 | ) | | (14,851 | ) | | 11,511 | | | 10,128 | | | (2,527 | ) | | (4,723 | ) |

| | |

Outcomes Report 2003-04 – Government of Queensland | | 4-01 |

Overview and Analysis

Meeting the Government’s Fiscal Commitments

The Government has met all of its fiscal commitments under the Charter of Social and Fiscal Responsibility:

Achievement of Fiscal Principles of the Queensland Government

| | | | |

Principle

| | Achievement

| | Indicator

|

Competitive tax environment The Government will ensure that State taxes and charges remain competitive with the other states and territories. | | ü | | Taxation revenue per capita: Qld: $1,700/capita Other States: $2,047/capita |

| | |

Affordable service provision The Government will ensure that its level of service provision is sustainable by maintaining an overall General Government operating surplus, as measured in Government Finance Statistics terms. | | ü | | GFS surplus of $3,340 million |

| | |

Capital Funding Borrowings or other financial arrangements will only be undertaken for capital investments and only where these can be serviced within the operating surplus, consistent with maintaining a AAA credit rating. | | ü | | GG repayment of borrowings $343 million while GG total purchases of non-financial assets $2,415 million. AAA credit rating confirmed by Fitch, Moody’s and Standard & Poor’s (highest rating available). |

| | |

Managing financial risk The Government will ensure that the State’s financial assets cover all accruing and expected future liabilities of the General Government sector. | | ü | | GG net financial worth: $15,742 million. |

| | |

Building the State’s net worth The Government will at least maintain and seek to increase Total State net worth. | | ü | | Net worth increased by $12,829 million to $77,723 million. |

Net Operating Balance

The GFS operating result for 2003-04 in the General Government sector is a surplus of $3,340 million, an improvement of $966 million over that estimated at the time of the 2004-05 Budget. This improvement was the result of stronger than expected revenue growth and lower expenses.

Investment returns on assets held to meet future employee entitlements were 3.06% higher than expected at the time of the 2004-05 Budget (18%), contributing to an overall increase in interest income of $391 million.

Investment market volatility impacts on the Queensland Budget more in GFS terms than it does for other states. This is in part due to differences in the way Queensland’s public sector superannuation arrangements are structured. If Queensland’s superannuation arrangements were structured on the same basis as generally applies in other states, the General Government sector underlying operating result for 2003-04 would be a surplus of $2,095 million, as outlined below:

| | |

Calculation of Underlying Result

| | 2003-04

Actual

$ million

|

GFS net operating balance | | 3,340 |

Less investment earnings on defined benefit superannuation assets | | 1,995 |

Plus nominal superannuation expense | | 750 |

Underlying Balance | | 2,095 |

| | |

Outcomes Report 2003-04 – Government of Queensland | | 4-02 |

Overview and Analysis

| | | | |

Revenue

| | Est. Actual

$ million

| | Actual

$ million

|

Taxation revenue | | 6,474 | | 6,676 |

Current grants and subsidies | | 11,036 | | 10,992 |

Capital grants | | 563 | | 553 |

Sales of goods and services | | 1,984 | | 2,105 |

Interest income | | 2,332 | | 2,723 |

Other | | 2,117 | | 2,165 |

Total Revenue | | 24,506 | | 25,214 |

Revenue increased by $708 million (2.9%) over the 2003-04 estimated actual:

| | • | Taxation revenue increased by $202 million, reflecting higher payroll tax and transfer duty collections. |

| | • | Strong end of year performance of investment markets resulted in a $391 million increase in interest income relative to estimates. |

| | | | |

Expenses

| | Est. Actual

$ million

| | Actual

$ million

|

Gross operating expenses | | | | |

Employee expenses | | 10,025 | | 10,004 |

Other operating expenses | | 4,177 | | 4,245 |

Depreciation | | 1,483 | | 1,460 |

Superannuation interest expense | | 745 | | 750 |

Other interest expense | | 224 | | 211 |

Current transfers | | 4,643 | | 4,500 |

Capital transfers | | 835 | | 704 |

Total Expenses | | 22,132 | | 21,874 |

Total expenses are broadly in line with that forecast at the time of the 2004-05 Budget:

| | • | Current and capital transfers include grants and subsidies to the community, community service obligation payments to the Government-owned corporations and capital grants to local governments and non-government entities. Expenditure is driven largely by demand and the meeting of conditions for these programs. |

The 2003-04 estimated actual also included the extinguishment of a loan made to Australian Magnesium Corporation Limited which will now be recognised in 2004-05.

| | |

Outcomes Report 2003-04 – Government of Queensland | | 4-03 |

Overview and Analysis

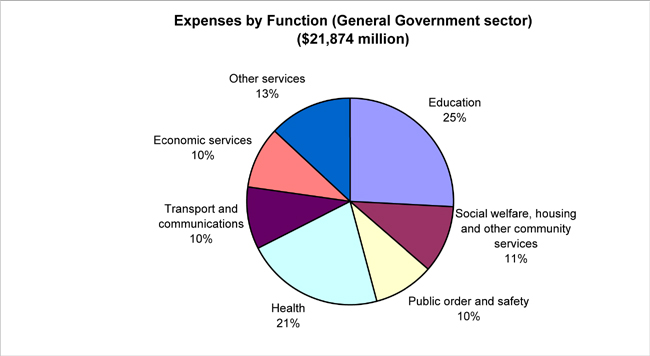

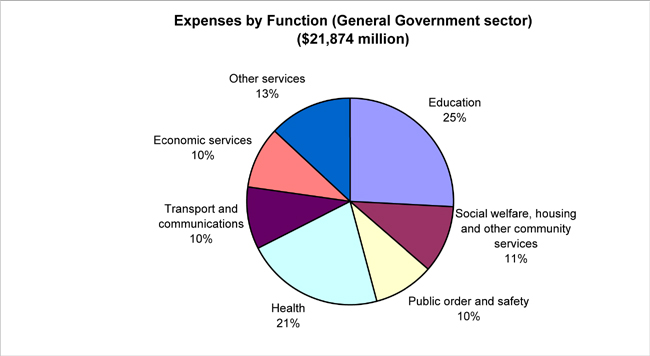

General Government expenditure is focussed on the delivery of core services to the community. As indicated in the chart, education accounts for the largest share of expenses (25%), followed by health (21%) and social welfare, housing and other community services (11%).

Cash Surplus

A cash surplus of $3,490 million was recorded for the 2003-04 financial year in the General Government sector, an increase of $1,241 million over the 2003-04 estimated actual. Net cash flows from operating activities were $1,102 million higher than estimated, again reflecting improvements across a range of revenue items. Lower than estimated purchases of non-financial assets reflect the end of year carryover of some capital allocations from 2003-04 to 2004-05.

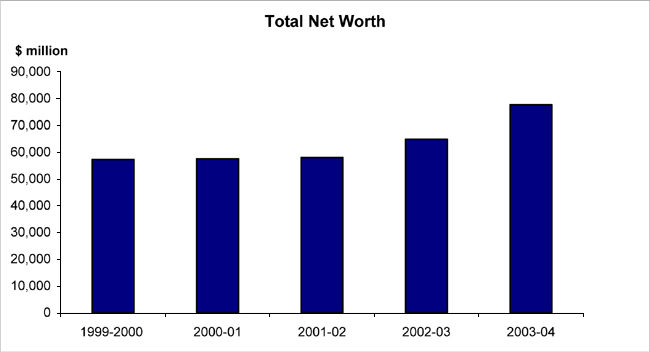

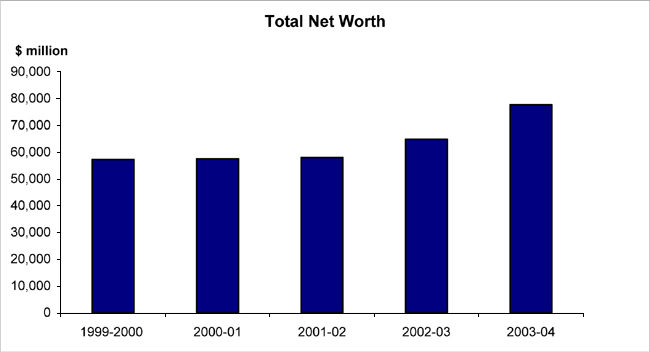

Net Worth

The State’s net worth increased to $77,723 million as at 30 June 2004. This is $8,357 million higher than the forecast of $69,366 million, and is $12,829 million higher than the net worth as at 30 June 2003. This increase reflects the large 2003-04 operating surplus, upward revaluations across a range of State assets and the flow through of improved investment returns leading to a reduction in the State’s defined benefit superannuation liability.

In 2003-04, investments in financial assets increased by $2,529 million, primarily due to the reinvestment of earnings on the State’s assets set aside to meet future employee entitlements and additional employer contributions during the year.

| | |

Outcomes Report 2003-04 – Government of Queensland | | 4-04 |

Overview and Analysis

Higher valuations of Crown land administered by the Department of Natural Resources ($1,594 million), land and dwellings controlled by the Department of Housing ($2,468 million) and roads and bridges infrastructure controlled by the Department of Main Roads ($1,313 million) contributed to the improved net worth recorded by the State.

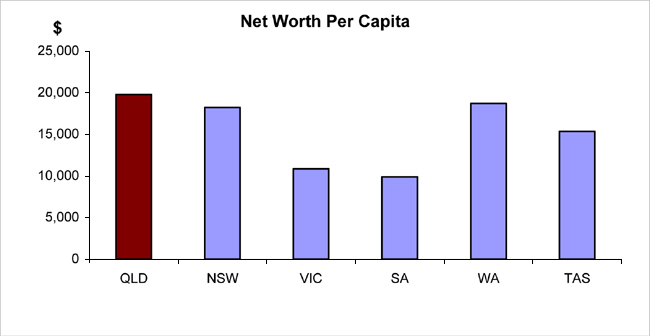

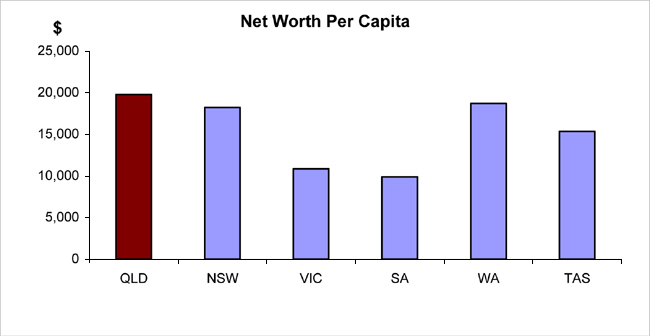

The chart below illustrates the State’s strong net worth compared with the other states.

| 1. | Western Australia values land under roads as part of its overall asset base. This has been adjusted to allow comparison with other jurisdictions which do not value land under roads. |

Source: WA Outcome Results; New South Wales, Victoria, South Australia and Tasmania 2004-05 Budget Papers. Population data from Australian Government Budget Paper 3.

| | |

Outcomes Report 2003-04 – Government of Queensland | | 4-05 |

Overview and Analysis

Net Debt

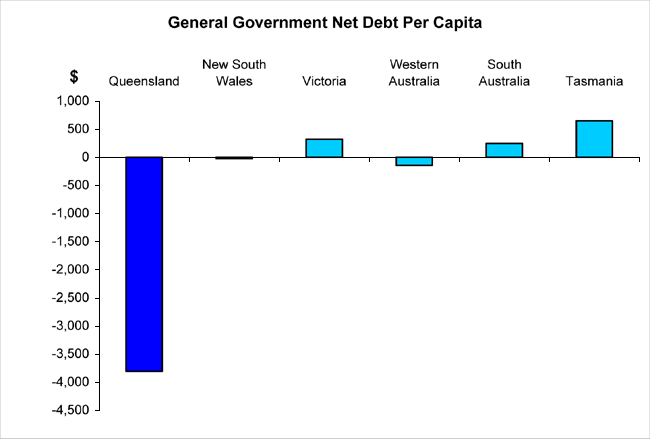

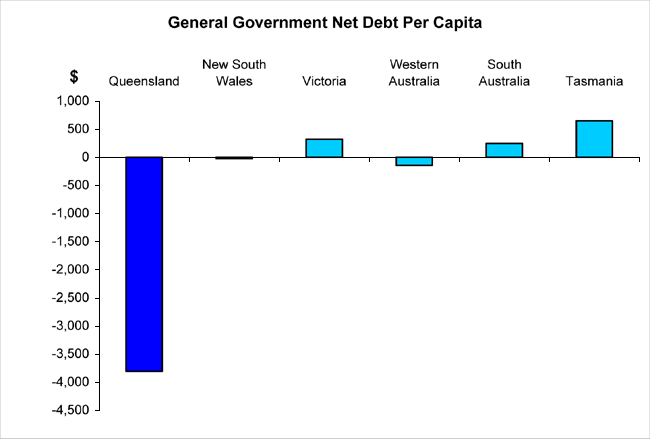

Net debt is the most common measure used to judge the overall strength of a jurisdiction’s fiscal position. High levels of net debt impose a call on future revenue flows to service that debt and meeting these payments can limit government flexibility to adjust outlays.

In 2003-04 there has been a further strengthening of the General Government sector’s already strong net debt position, from an estimated negative $14,040 million to a negative $14,851 million.

Queensland’s negative net debt of $3,806 per capita (net financial assets) compares to the average net debt of $210 per capita (net financial liabilities) in the other states.

Source: WA Outcome Results; New South Wales, Victoria, South Australia and Tasmania 2004-05 Budget Papers. Population data from Australian Government Budget Paper 3.

| | |

Outcomes Report 2003-04 – Government of Queensland | | 4-06 |

Overview and Analysis

Public Non-financial Corporations (PNFC) Sector

The PNFC sector comprises bodies such as Government-owned corporations that provide goods and services that are market, non-regulatory and non-financial in nature. PNFCs are financed through sales to consumers of their goods and services and may be supplemented by explicit government payments to fund community service obligations.

| | • | The net operating result improved from an estimated deficit of $85 million to a deficit of $67 million. The deficit for the sector primarily reflects the results recorded by Enertrade and Queensland Motorways Limited, which operate in deficit in the normal course of operations. |

| | • | A cash surplus of $133 million was recorded, an improvement of $280 million on the estimated deficit. |

| | • | The net worth of the PNFC sector increased from an estimated $12,325 million to $13,733 million, reflecting market value adjustments on borrowings, and additional capital injections of $460 million to electricity entities in support of capital investment plans. |

State Financial Sector (Total State)

The Total State includes all State Government departments and statutory authorities, public non-financial corporations, public financial corporations and their controlled entities. All material inter-entity and intra-entity transactions and balances have been eliminated to the extent practicable.

| | • | A net operating surplus of $3,518 million was recorded in 2003-04, reflecting the strong performance of the General Government sector. |

| | • | A Total State cash surplus of $3,121 million was achieved in 2003-04 after allowing for purchases of non-financial assets of $4,258 million. |

| | • | In 2003-04 there has been a further strengthening of the Total State’s net debt position to negative $7,364 million. |

| | |

Outcomes Report 2003-04 – Government of Queensland | | 4-07 |

Operating Statement by Sector

Operating Statement 2003-04 ($million) - by sector (b)

| | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | General Government

Sector

| | | Public Non-financial

Corporations Sector

| | | Non-financial Public

Sector

| | | Public Financial

Corporations

Sector Actual (a)

| | | State

Financial

Sector Actual

(a)

| |

| | | | | Est. Actual

| | | Actual

| | | Est. Actual

| | | Actual

| | | Est. Actual

| | | Actual

| | | |

| | | GFS Revenue | | | | | | | | | | | | | | | | | | | | | | | | |

| | | Taxation revenue | | 6,474 | | | 6,676 | | | — | | | — | | | 6,108 | | | 6,358 | | | — | | | 6,354 | |

| | | Current grants and subsidies | | 11,036 | | | 10,992 | | | 915 | | | 1,000 | | | 10,883 | | | 10,817 | | | — | | | 10,817 | |

| | | Capital grants | | 563 | | | 553 | | | 49 | | | 55 | | | 610 | | | 592 | | | — | | | 591 | |

| | | Sales of goods and services | | 1,984 | | | 2,105 | | | 6,362 | | | 6,625 | | | 8,171 | | | 8,622 | | | 816 | | | 9,262 | |

| | | Interest income | | 2,332 | | | 2,723 | | | 91 | | | 101 | | | 2,410 | | | 2,821 | | | 1,685 | | | 3,452 | |

| | | Other | | 2,117 | | | 2,165 | | | 324 | | | 350 | | | 1,478 | | | 1,470 | | | — | | | 1,366 | |

| | | Total Revenue | | 24,506 | | | 25,214 | | | 7,741 | | | 8,130 | | | 29,660 | | | 30,681 | | | 2,501 | | | 31,841 | |

| | | | | | | | | |

| less | | GFS Expenses | | | | | | | | | | | | | | | | | | | | | | | | |

| | | Gross operating expenses | | | | | | | | | | | | | | | | | | | | | | | | |

| | | Employee expenses | | 10,025 | | | 10,004 | | | 1,555 | | | 1,517 | | | 11,529 | | | 11,520 | | | 108 | | | 11,520 | |

| | | Other operating expenses | | 4,177 | | | 4,245 | | | 3,125 | | | 3,457 | | | 6,819 | | | 7,591 | | | 676 | | | 8,193 | |

| | | Depreciation | | 1,483 | | | 1,460 | | | 1,209 | | | 1,216 | | | 2,691 | | | 2,676 | | | 18 | | | 2,695 | |

| | | Superannuation interest expense | | 745 | | | 750 | | | — | | | — | | | 745 | | | 750 | | | — | | | 750 | |

| | | Other interest expense | | 224 | | | 211 | | | 768 | | | 742 | | | 979 | | | 952 | | | 1,344 | | | 1,246 | |

| | | Other property expenses | | — | | | — | | | 982 | | | 1,052 | | | — | | | — | | | 103 | | | — | |

| | | Current transfers | | 4,643 | | | 4,500 | | | 162 | | | 198 | | | 3,751 | | | 3,216 | | | 5 | | | 3,217 | |

| | | Capital transfers | | 835 | | | 704 | | | 25 | | | 16 | | | 856 | | | 703 | | | 2 | | | 703 | |

| | | Total Expenses | | 22,132 | | | 21,874 | | | 7,826 | | | 8,197 | | | 27,370 | | | 27,407 | | | 2,257 | | | 28,323 | |

| | | | | | | | | |

| equals | | GFS net operating balance | | 2,374 | | | 3,340 | | | (85 | ) | | (67 | ) | | 2,290 | | | 3,274 | | | 244 | | | 3,518 | |

| | | | | | | | | |

| less | | Net acquisition of non-financial assets | | | | | | | | | | | | | | | | | | | | | | | | |

| | | Purchases of non-financial assets | | 2,578 | | | 2,415 | | | 1,958 | | | 1,804 | | | 4,536 | | | 4,219 | | | 38 | | | 4,258 | |

| | | Sales of non-financial assets | | (380 | ) | | (356 | ) | | (394 | ) | | (384 | ) | | (775 | ) | | (740 | ) | | (1 | ) | | (742 | ) |

| | | less Depreciation | | 1,483 | | | 1,460 | | | 1,209 | | | 1,216 | | | 2,691 | | | 2,676 | | | 18 | | | 2,695 | |

| | | plus Change in inventories | | 18 | | | (13 | ) | | 13 | | | (15 | ) | | 31 | | | (28 | ) | | — | | | (28 | ) |

| | | plus Other movements in non-financial assets | | (75 | ) | | (83 | ) | | — | | | (7 | ) | | (76 | ) | | (90 | ) | | — | | | (90 | ) |

| | | equals Total net acquisition of non-financial assets | | 658 | | | 503 | | | 368 | | | 182 | | | 1,025 | | | 685 | | | 18 | | | 703 | |

| | | | | | | | | |

| equals | | GFS Net lending/(borrowing) (Fiscal balance) | | 1,716 | | | 2,838 | | | (453 | ) | | (249 | ) | | 1,265 | | | 2,589 | | | 226 | | | 2,814 | |

| (a) | In accordance with UPF requirements, estimates for Public Financial Corporations and State Financial sectors are not included in Budget documentation. |

| (b) | Numbers may not add due to rounding. |

| | |

Outcomes Report 2003-04 - Government of Queensland | | 4-08 |

Balance Sheet by Sector

Balance Sheet 2003-04 ($million) - by sector (b)

| | | | | | | | | | | | | | | | | | | | | | | | |

| | | General Government

Sector

| | | Public Non-financial

Corporations Sector

| | | Non-financial Public

Sector

| | | Public Financial

Corporations

Sector Actual (a)

| | | State Financial

Sector Actual (a)

| |

| | | Est. Actual

| | | Actual

| | | Est. Actual

| | | Actual

| | | Est. Actual

| | | Actual

| | | |

Assets | | | | | | | | | | | | | | | | | | | | | | | | |

Financial assets | | | | | | | | | | | | | | | | | | | | | | | | |

Cash and deposits | | 1,577 | | | 1,729 | | | 878 | | | 1,025 | | | 2,455 | | | 2,754 | | | 26 | | | 235 | |

Advances paid | | 181 | | | 173 | | | — | | | — | | | 165 | | | 157 | | | — | | | 157 | |

Investments, loans and placements | | 15,725 | | | 16,157 | | | 908 | | | 997 | | | 16,576 | | | 17,145 | | | 29,041 | | | 31,559 | |

Other non-equity assets | | 3,993 | | | 4,318 | | | 1,605 | | | 1,909 | | | 2,246 | | | 2,695 | | | 106 | | | 2,727 | |

Equity | | 13,005 | | | 14,633 | | | 58 | | | 60 | | | 771 | | | 993 | | | 2 | | | 96 | |

| | | | | | | | |

Total financial assets | | 34,481 | | | 37,010 | | | 3,449 | | | 3,992 | | | 22,213 | | | 23,745 | | | 29,175 | | | 34,773 | |

| | | | | | | | |

Non-financial assets | | 56,103 | | | 61,981 | | | 27,075 | | | 27,160 | | | 83,144 | | | 89,107 | | | 93 | | | 89,201 | |

| | | | | | | | |

Total assets | | 90,584 | | | 98,991 | | | 30,524 | | | 31,152 | | | 105,357 | | | 112,852 | | | 29,268 | | | 123,974 | |

| | | | | | | | |

Liabilities | | | | | | | | | | | | | | | | | | | | | | | | |

Deposits held | | — | | | — | | | 77 | | | 84 | | | 87 | | | 85 | | | 4,724 | | | 2,233 | |

Borrowing | | 3,443 | | | 3,208 | | | 13,220 | | | 12,066 | | | 16,582 | | | 15,248 | | | 21,702 | | | 22,353 | |

Superannuation liability | | 12,127 | | | 11,930 | | | — | | | — | | | 12,127 | | | 11,930 | | | — | | | 11,930 | |

Other employee entitlements and provisions | | 3,485 | | | 3,590 | | | 3,760 | | | 3,954 | | | 4,147 | | | 4,180 | | | 1,757 | | | 5,874 | |

Other non-equity liabilities | | 2,163 | | | 2,540 | | | 1,142 | | | 1,314 | | | 3,048 | | | 3,686 | | | 187 | | | 3,860 | |

| | | | | | | | |

Total liabilities | | 21,218 | | | 21,268 | | | 18,199 | | | 17,419 | | | 35,991 | | | 35,129 | | | 28,369 | | | 46,251 | |

| | | | | | | | |

Net Worth | | 69,366 | | | 77,723 | | | 12,325 | | | 13,733 | | | 69,366 | | | 77,723 | | | 899 | | | 77,723 | |

| | | | | | | | |

Net financial worth | | 13,263 | | | 15,742 | | | (14,750 | ) | | (13,427 | ) | | (13,778 | ) | | (11,384 | ) | | 806 | | | (11,478 | ) |

Net debt | | (14,040 | ) | | (14,851 | ) | | 11,511 | | | 10,128 | | | (2,527 | ) | | (4,723 | ) | | (2,641 | ) | | (7,364 | ) |

| (a) | In accordance with UPF requirements, estimates for Public Financial Corporations and State Financial sectors are not included in Budget documentation. |

| (b) | Numbers may not add due to rounding. |

| | |

Outcomes Report 2003-04 - Government of Queensland | | 4-09 |

Cash Flow Statement by Sector

Cash Flow Statement 2003-04 ($million) - by sector (b)

| | | | | | | | | | | | | | | | | | | | | | | | |

| | | General Government

Sector

| | | Public Non-financial

Corporations Sector

| | | Non-financial Public

Sector

| | | Public Financial

Corporations

Sector Actual (a)

| | | State Financial

Sector Actual (a)

| |

| | | Est. Actual

| | | Actual

| | | Est. Actual

| | | Actual

| | | Est. Actual

| | | Actual

| | | |

Receipts from operating activities | | | | | | | | | | | | | | | | | | | | | | | | |

Taxes received | | 6,473 | | | 6,635 | | | — | | | — | | | 6,107 | | | 6,318 | | | — | | | 6,313 | |

Grants and subsidies received | | 11,642 | | | 11,535 | | | 938 | | | 1,031 | | | 11,510 | | | 11,428 | | | — | | | 11,426 | |

Sales of goods and services | | 2,279 | | | 2,448 | | | 7,049 | | | 7,192 | | | 9,148 | | | 9,519 | | | 896 | | | 10,227 | |

Other receipts | | 4,711 | | | 5,104 | | | 810 | | | 747 | | | 4,751 | | | 5,074 | | | 1,076 | | | 5,025 | |

Total | | 25,105 | | | 25,721 | | | 8,797 | | | 8,970 | | | 31,516 | | | 32,339 | | | 1,972 | | | 32,991 | |

Payments for operating activities | | | | | | | | | | | | | | | | | | | | | | | | |

Payments for goods and services | | (14,514 | ) | | (14,305 | ) | | (4,730 | ) | | (4,696 | ) | | (19,011 | ) | | (18,885 | ) | | (225 | ) | | (18,936 | ) |

Grants and subsidies | | (5,250 | ) | | (4,954 | ) | | (151 | ) | | (129 | ) | | (4,329 | ) | | (3,985 | ) | | — | | | (3,984 | ) |

Interest | | (224 | ) | | (209 | ) | | (755 | ) | | (801 | ) | | (908 | ) | | (941 | ) | | (1,495 | ) | | (1,400 | ) |

Other payments | | (670 | ) | | (704 | ) | | (973 | ) | | (1,017 | ) | | (1,404 | ) | | (1,425 | ) | | (628 | ) | | (2,034 | ) |

Total | | (20,658 | ) | | (20,172 | ) | | (6,609 | ) | | (6,642 | ) | | (25,652 | ) | | (25,237 | ) | | (2,347 | ) | | (26,354 | ) |

| | | | | | | | |

Net cash inflows from operating activities | | 4,447 | | | 5,549 | | | 2,188 | | | 2,328 | | | 5,864 | | | 7,102 | | | (375 | ) | | 6,637 | |

| | | | | | | | |

Payments for investments in non-financial assets | | | | | | | | | | | | | | | | | | | | | | | | |

Purchases of non-financial assets | | (2,578 | ) | | (2,415 | ) | | (1,958 | ) | | (1,804 | ) | | (4,536 | ) | | (4,219 | ) | | (38 | ) | | (4,258 | ) |

Sales of non-financial assets | | 380 | | | 356 | | | 394 | | | 384 | | | 775 | | | 740 | | | 1 | | | 742 | |

Total | | (2,198 | ) | | (2,059 | ) | | (1,564 | ) | | (1,420 | ) | | (3,761 | ) | | (3,479 | ) | | (37 | ) | | (3,516 | ) |

| | | | | | | | |

Payments for investments in financial assets for policy purposes | | (135 | ) | | (632 | ) | | (1 | ) | | (6 | ) | | (1 | ) | | (30 | ) | | (2 | ) | | (31 | ) |

| | | | | | | | |

Payments for investments in financial assets for liquidity purposes | | (1,862 | ) | | (2,398 | ) | | (11 | ) | | (52 | ) | | (1,873 | ) | | (2,451 | ) | | (2,059 | ) | | (3,929 | ) |

| | | | | | | | |

Receipts from financing activities | | | | | | | | | | | | | | | | | | | | | | | | |

Borrowing (net) | | (288 | ) | | (343 | ) | | (181 | ) | | (823 | ) | | (468 | ) | | (1,108 | ) | | 1,697 | | | 27 | |

Deposits received (net) | | — | | | — | | | 5 | | | 2 | | | 5 | | | 3 | | | 524 | | | 390 | |

Distributions paid | | — | | | — | | | (771 | ) | | (774 | ) | | — | | | — | | | (69 | ) | | — | |

Other financing (net) | | — | | | — | | | 135 | | | 692 | | | — | | | 26 | | | 330 | | | 357 | |

Total | | (288 | ) | | (343 | ) | | (812 | ) | | (902 | ) | | (463 | ) | | (1,079 | ) | | 2,483 | | | 773 | |

| | | | | | | | |

Net increase/(decrease) in cash held | | (36 | ) | | 116 | | | (200 | ) | | (53 | ) | | (234 | ) | | 63 | | | 10 | | | (66 | ) |

| | | | | | | | |

Net cash from operating activities and investments in non-financial assets | | 2,249 | | | 3,490 | | | 624 | | | 907 | | | 2,103 | | | 3,622 | | | (412 | ) | | 3,121 | |

less Distributions paid | | — | | | — | | | (771 | ) | | (774 | ) | | — | | | — | | | (69 | ) | | — | |

GFS Surplus/(deficit) | | 2,249 | | | 3,490 | | | (147 | ) | | 133 | | | 2,103 | | | 3,622 | | | (481 | ) | | 3,121 | |

| (a) | In accordance with UPF requirements, estimates for Public Financial Corporations and State Financial sectors are not included in Budget documentation. |

| (b) | Numbers may not add due to rounding. |

| | |

Outcomes Report 2003-04 - Government of Queensland | | 4-10 |

General Government Sector Expenses by Function

| | |

| | | Actual

2003-2004

$ million

|

General Public Services | | 1,352 |

Other general public services | | 1,352 |

| |

Public Order and Safety | | 2,083 |

Police and fire protection services | | 1,197 |

Law courts and legal services | | 439 |

Prisons and corrective services | | 371 |

Other public order and safety | | 75 |

| |

Education | | 5,622 |

Primary and secondary education | | 4,359 |

Tertiary education | | 578 |

Pre-school education and education not | | |

definable by level | | 532 |

Transportation of students | | 127 |

Education n.e.c. | | 26 |

| |

Health | | 4,733 |

Acute care institutions | | 2,983 |

Mental health institutions | | 155 |

Nursing homes for the aged | | 132 |

Community health services | | 1,164 |

Public health services | | 155 |

Pharmaceuticals, medical aids and appliances | | 3 |

Health research | | 67 |

Health administration n.e.c. | | 74 |

| |

Social Security | | 882 |

Welfare services | | 873 |

Social security and welfare n.e.c. | | 9 |

| |

Housing and Community Amenities | | 870 |

Housing and community development | | 747 |

Water supply | | 8 |

Sanitation and protection of the | | |

environment | | 77 |

Other community amenities | | 39 |

| |

Recreation and Culture | | 566 |

Recreation facilities and services | | 384 |

Cultural facilities and services | | 182 |

| |

Fuel and Energy | | 749 |

Fuel affairs and services | | 499 |

Electricity and other energy | | 251 |

| |

Agriculture, Forestry, Fishing and Hunting | | 645 |

Agriculture | | 593 |

Forestry, fishing and hunting | | 52 |

| |

Mining, manufacturing and construction | | 92 |

Mining and mineral resources other | | |

than fuels | | 55 |

Construction | | 37 |

| |

Transport and Communications | | 2,113 |

Road transport | | 1,053 |

Water transport | | 71 |

Rail transport | | 677 |

Air transport | | 1 |

Other transport | | 282 |

Communications | | 30 |

| |

Other Economic Affairs | | 673 |

Tourism and area promotion | | 97 |

Labour and employment affairs | | 296 |

Other economic affairs | | 281 |

| |

Other Purposes | | 1,493 |

Nominal superannuation interest | | 750 |

Public debt transactions | | 166 |

General purpose inter-government | | |

transactions | | 509 |

Natural disaster relief | | 35 |

Other purposes n.e.c. | | 33 |

| | |

|

Total | | 21,874 |

| | |

|

| | |

Outcomes Report 2003-04 - Government of Queensland | | 4-11 |

General Government Purchase of Non-financial Assets by

Function & Loan Council Allocation

General Government Sector

Purchases of Non-financial Assets by Function

| | |

| | | 2003-04 Actual $ million

|

General public services | | 272 |

Public order and safety | | 234 |

Education | | 309 |

Health | | 256 |

Social security and welfare | | 15 |

Housing and community amenities | | 243 |

Recreation and culture | | 88 |

Agriculture, forestry, fishing and hunting | | 30 |

Mining, manufacturing and construction | | 4 |

Transport and communications | | 679 |

Other economic affairs | | 281 |

Other purposes | | 4 |

| |

Total | | 2,415 |

Loan Council Allocation

The Australian Loan Council requires all jurisdictions to advise the Loan Council Allocations (LCA) outcome for the

last financial year as part of the annual Outcomes Report. The LCA represents each government’s call on financial

markets for a given financial year. The LCA Outcome exceeds the upper bound of the LCA Budget estimate by

more than the two percent tolerance limit. A tolerance limit of two percent of non-financial public sector receipts

applies between the LCA Budget update and the outcome.

The LCA Outcome surplus is due largely to improvements in investment returns and higher revenue from taxation.

| | | | | | |

| | | 2003-04

Budget Estimate

$ million

| | | 2003-04

Outcome

$ million

| |

General Government sector cash deficit/(surplus)1 | | (152 | ) | | (3,490 | ) |

PNFC sector cash deficit/(surplus)1 | | 966 | | | (133 | ) |

Non-financial Public sector cash deficit/(surplus)1 | | 815 | | | (3,622 | ) |

| | |

Net cash flows from investments in financial assets for policy purposes | | — | | | 30 | |

Memorandum Items2 | | (157 | ) | | 138 | |

| | |

LOAN COUNCIL ALLOCATION | | 658 | | | (3,455 | ) |

Notes:

| 1. | Figures in brackets represent surpluses |

| 2. | Other memorandum items include operating leases and local government borrowings. |

| | |

Outcomes Report 2003-04 - Government of Queensland | | 4-12 |

Certification of Outcomes Report

Certification by the Under Treasurer and Assistant Under Treasurer

The foregoing Outcomes Report contains financial statements prepared and presented on a Government Finance Statistics (GFS) basis and is in accordance with the Uniform Presentation Framework (UPF) agreed to at the 1991 Premiers’ Conference. In addition, Queensland’s Loan Council Allocation and disclosure of General Government expenses by purpose are included.

The financial statements separately disclose outcomes for the General Government, Public Non-financial Corporations, Public Financial Corporations and State Financial sectors within Queensland. Entities excluded from this report include local governments. Queensland public sector entities consolidated for this report are listed in the Consolidated Financial Statements, taking into account intra and inter-agency eliminations.

Only those agencies considered material by virtue of their financial transactions and balances are consolidated in the report.

In our opinion, we certify that the Outcomes Report has been properly drawn up, in accordance with GFS principles and UPF requirements, to present a true and fair view of:

(i) the financial performance and cash flows of the Queensland State Government for the financial year; and

(ii) the financial position of the Government at 30 June 2004.

At date of certification of the report, we are not aware of any material circumstances that would render any particulars included in the Outcomes Report misleading or inaccurate.

| | | | |

| | |

| | | |

|

Walter Ivessa Assistant Under Treasurer | | | | Gerard Bradley Under Treasurer |

Date 12 October 2004

| | |

Outcomes Report 2003-04 – Government of Queensland | | 4-13 |

2003-04 Consolidated Financial Statements

of the Queensland Government

year ended 30 June 2004

Consolidated Financial Statements - Overview and Analysis

The following analysis compares current year Total State performance, on an accounting basis, with last year’s audited results.

Overview

| | • | An operating surplus for the State of $4,654 million for 2003-04 was recorded, an improvement of $5,944 million from 2002-03, reflecting revenue growth arising from the continued strength in the domestic economy and the recovery in global financial markets. |

| | • | The State’s net assets position increased to $77,723 million at 30 June 2004, an improvement of $12,829 million over 2002-03. This increase reflects the large 2003-04 operating surplus, upward revaluations across a range of State assets and the flow through of improved investment returns leading to a reduction in the State’s defined benefit superannuation liability. |

Summary of Key Financial Aggregates of the Consolidated Financial Statements

The table below provides aggregate information for 2003-04 under Australian Accounting Standards principles:

| | | | | |

Total State

| | 2004 $ million

| | 2003 $ million

| |

Revenue | | | | | |

Commonwealth and other grants | | 11,426 | | 10,574 | |

Sales of goods and services | | 8,643 | | 8,300 | |

Taxes, fees and fines | | 7,119 | | 5,936 | |

Investment income | | 3,298 | | 715 | |

Royalties and other territorial income | | 723 | | 769 | |

Other | | 1,403 | | 862 | |

| | |

| |

|

|

| | | 32,612 | | 27,156 | |

| | |

| |

|

|

Expenses | | | | | |

Employee expenses | | 11,709 | | 12,050 | |

Supplies and services | | 6,508 | | 6,290 | |

Depreciation and amortisation | | 2,714 | | 2,646 | |

Grants and other contributions | | 4,083 | | 3,800 | |

Borrowing costs expense | | 1,245 | | 1,392 | |

Share of deficit of associates using equity method | | 5 | | 18 | |

Other | | 1,694 | | 2,250 | |

| | |

| |

|

|

| | | 27,958 | | 28,446 | |

| | |

| |

|

|

Net Surplus/(Deficit) | | 4,654 | | (1,290 | ) |

| | |

| |

|

|

Assets | | 124,004 | | 110,466 | |

Liabilities | | 46,281 | | 45,572 | |

| | |

| |

|

|

Net Assets | | 77,723 | | 64,894 | |

| | |

| |

|

|

| | |

State Finances Report 2003-04 – Government of Queensland | | 5-01 |

Consolidated Financial Statements - Overview and Analysis

Operating Result

The whole-of-Government operating result after tax for the year 2003-04 was a surplus of $4,654 million (2002-03, $1,290 million deficit).

The surplus for 2003-04 reflects revenue growth across a range of categories. Significant market value adjustments relating to superannuation and interest/market value shifts were also experienced during 2003-04:

| | • | this year, investment returns on assets set aside to meet future defined benefit superannuation liabilities achieved a positive rate of return of 21.06%, compared to last year’s negative return of 1.86%. As the actuarially applied long-term earnings rate for superannuation liability is 7.5%, a reduced superannuation expense was recorded by the State in 2003-04. |

| | • | net unrealised gains on financial instruments were recorded in 2003-04 reflecting the impact of higher interest rates on the market value of the State’s debt portfolio. |

| | • | taxation revenue increased as the economy and the property market continued to perform strongly. |

| | • | Commonwealth grants increased as GST collections rose. |

Revenue

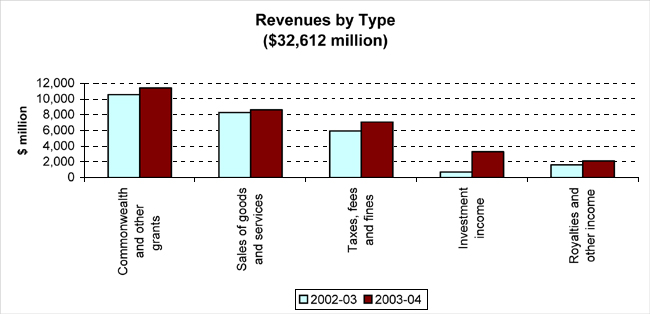

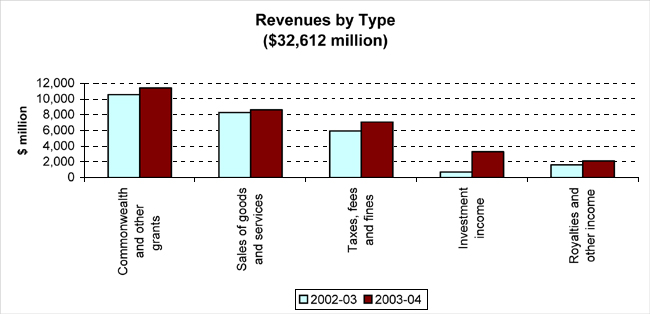

Total revenue from ordinary activities for 2003-04 was $32,612 million, an increase of $5,530 million (20.4%) from 2002-03 ($27,156 million).

Changes in revenues by type are illustrated in the following chart:

Commonwealth and other grants comprised 35.4% of total State revenue in 2003-04 and grew from $10,574 million in 2002-03 to $11,426 million in 2003-04 (an increase of $852 million). This primarily reflects growth in the GST pool commensurate with the strength of consumption expenditure in the economy, and the application of parameter adjustments.

Taxation revenue increased by $1,183 million during the year from $5,936 million in 2002-03 to $7,119 million with duty on property transfer transactions making the most significant contribution as the property market continued to perform strongly. In addition, increases in revenue from payroll tax and motor vehicle registrations were experienced during 2003-04.

Investment income increased by $2,583 million to $3,298 million in 2003-04, reflecting the improved performance of domestic and international equity markets.

| | |

State Finances Report 2003-04 – Government of Queensland | | 5-02 |

Consolidated Financial Statements - Overview and Analysis

Expenses

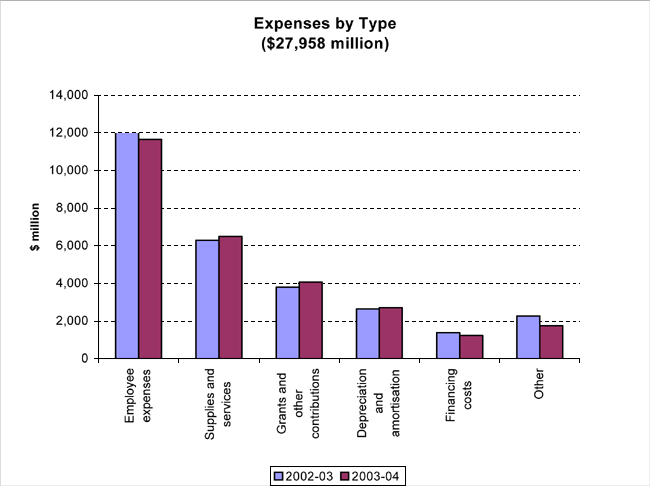

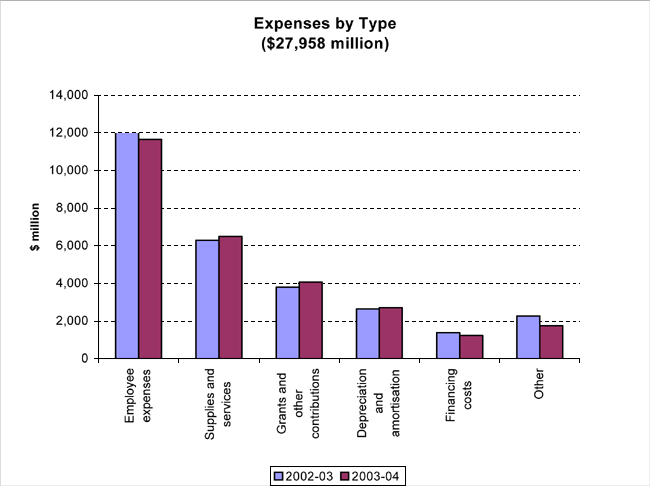

The State’s expenses for 2003-04 totalled $27,958 million, a decrease of $488 million (2%) from 2002-03 ($28,446 million).

Changes in expenses by type are illustrated in the following chart:

Employee expenses for 2003-04 decreased $341 million to $11,709 million compared to $12,050 million in 2002-03. This overall decrease represents the impact of the actuarial gain of $686 million on the superannuation expense component for 2003-04.

Investment income on assets set aside to meet future superannuation liabilities achieved a positive 21.06% rate of return in 2003-04, an improvement on the 2002-03 rate of negative 1.86%. As the actuarially applied long-term earning rate for superannuation liability is 7.5%, an actuarial gain for superannuation expense of $686 million was recorded by the State in 2003-04. In 2002-03, the State recorded an actuarial loss of $685 million which increased employee expenses.

Salaries, wages and associated costs were $10,481 million in 2003-04, an increase of $766 million (7.9%) over the 2002-03 figure of $9,715 million. This growth reflects higher wages as a combination of wage increases based on established enterprise bargaining agreements and additional staffing associated with service growth and enhancements in areas such as Health, Education and Police.

The decline in Other Expenses in 2003-04 reflects unrealised losses recorded in 2002-03 on the market value of debt portfolios which contributed an extra $625 million to other expenses in 2002-03. 2003-04 has seen an increase in interest rates resulting in net unrealised gains on the market value of the debt portfolio of $981 million which is reported as Other Revenue.

| | |

State Finances Report 2003-04 – Government of Queensland | | 5-03 |

Consolidated Financial Statements - Overview and Analysis

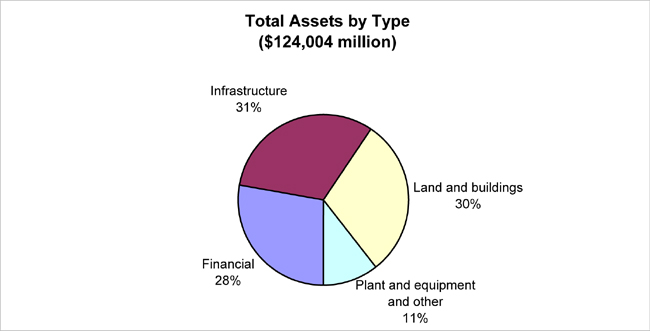

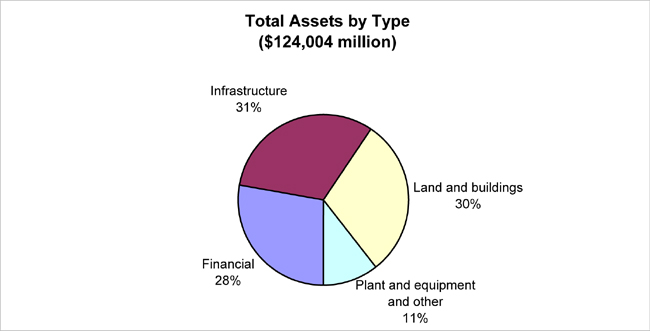

Assets

Assets controlled by the Government at 30 June 2004 totalled $124,004 million (2003, $110,466 million). The increase of $13,538 million in assets reflects:

| | • | increased holdings of financial investments, up $4,865 million. This increase primarily represents the reinvestment of earnings on the State’s assets set aside to meet future employee entitlements and standard employer contributions during 2003-04; and |

| | • | upward revaluations of land, infrastructure and plant and equipment assets under State control. This includes land administered by the Department of Natural Resources ($1,594 million), land and buildings maintained by the Departments of Housing ($2,468 million) and Education ($1,391 million) and roads/bridges infrastructure by Department of Main Roads ($1,313 million). |

The main types of assets are detailed in the following chart:

| | |

State Finances Report 2003-04 – Government of Queensland | | 5-04 |

Consolidated Financial Statements - Overview and Analysis

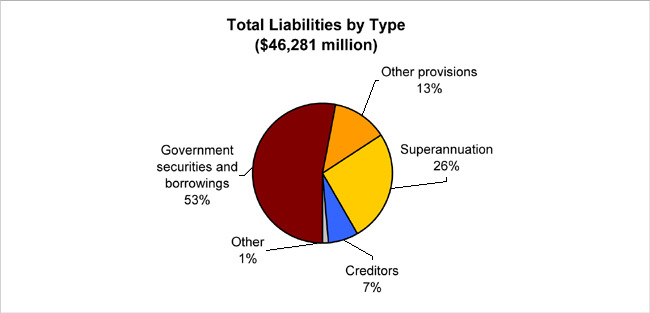

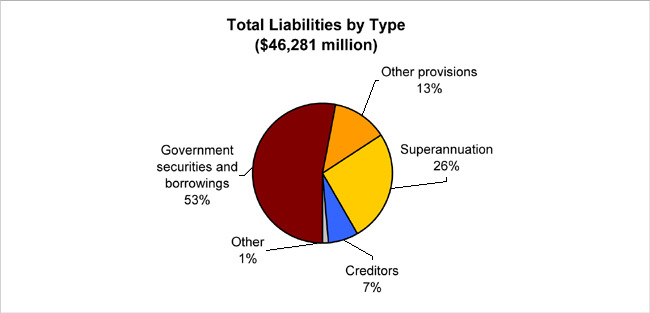

Liabilities

The total liabilities of the Queensland Government at 30 June 2004 were $46,281 million, an increase of $709 million over 2002-2003 ($45,572 million). The increase is largely due to Queensland Treasury Corporation holding a higher level of deposits from entities not consolidated (e.g. Local Government). These deposits have been invested in the financial assets above.

The components of State liabilities are illustrated in the following chart:

Maintenance of Credit Ratings

Queensland’s strong credit rating position is illustrated in the following table:

| | | | | | |

| | | Fitch Ratings

| | Moody’s Investors

Services

| | Standard & Poor’s

|

Long-term local currency rating | | AAA | | Aaa | | AAA |

Short-term rating | | F1+ | | P-1 | | A-1+ |

Long-term foreign currency rating | | AA+ | | Aaa | | AAA |

These ratings are the highest available.

Because of these strong ratings, the Queensland Treasury Corporation continues to be in a position to borrow at advantageous interest rates.

Queensland’s debt ratio (total liabilities to total assets) at 30 June 2004 was 37.3 percent (2003, 41.3 percent).

The State’s gearing ratio (borrowings to net assets) was 31.6 percent at 30 June 2004 (2003, 38.1 percent).

| | |

State Finances Report 2003-04 – Government of Queensland | | 5-05 |

2003-04 Audited Information

Consolidated Financial Statements of the Queensland Government

year ended 30 June 2004

Statement of Financial Performance

for the year ended 30 June 2004

| | | | | | | | |

| | | Notes

| | 2004

| | | 2003

| |

| | | | | $M | | | $M | |

Revenues from Ordinary Activities | | | | | | | | |

Commonwealth and other grants | | 3 | | 11,426 | | | 10,574 | |

Sales of goods and services | | 4 | | 8,643 | | | 8,300 | |

Taxes, fees and fines | | 5 | | 7,119 | | | 5,936 | |

Investment income | | 6 | | 3,298 | | | 715 | |

Royalties and other territorial income | | 7 | | 723 | | | 769 | |

Other | | 8 | | 1,403 | | | 862 | |

| | | | |

|

| |

|

|

Total Revenues from Ordinary Activities | | | | 32,612 | | | 27,156 | |

| | | | |

|

| |

|

|

Expenses from Ordinary Activities | | | | | | | | |

Employee expenses | | 9 | | 11,709 | | | 12,050 | |

Supplies and services | | | | 6,508 | | | 6,290 | |

Depreciation and amortisation | | 10 | | 2,714 | | | 2,646 | |

Grants and other contributions | | | | 4,083 | | | 3,800 | |

Borrowing costs expense | | 11 | | 1,245 | | | 1,392 | |

Share of loss of associates using the equity method | | 27 | | 5 | | | 18 | |

Other | | 12 | | 1,694 | | | 2,250 | |

| | | | |

|

| |

|

|

Total Expenses from Ordinary Activities | | | | 27,958 | | | 28,446 | |

Surplus/(Deficit) from Ordinary Activities before Income Tax Expense | | | | 4,654 | | | (1,290 | ) |

Income Tax Revenue/(Expense) relating to Ordinary Activities | | 2 | | — | | | — | |

| | | | |

|

| |

|

|

Net Surplus/(Deficit) | | | | 4,654 | | | (1,290 | ) |

| | | | |

|

| |

|

|

Asset revaluation reserve increments | | 25 | | 8,126 | | | 8,616 | |

Net amount of valuation adjustments recognised as a direct adjustment to equity in accordance with a standard | | 25 | | 87 | | | (526 | ) |

Changes in scope of consolidation | | 25 | | (28 | ) | | 1 | |

Other movements | | 25 | | (10 | ) | | — | |

| | | | |

|

| |

|

|

Total revenues, expenses and valuation adjustments attributable to members of the parent entity and recognised directly in equity | | | | 8,175 | | | 8,091 | |

| | | | |

|

| |

|

|

Total changes in equity other than those resulting from transactions with owners as owners | | | | 12,829 | | | 6,801 | |

| | | | |

|

| |

|

|

This Consolidated Statement of Financial Performance should be read in conjunction with the accompanying notes. Note 2 provides disaggregated information in relation to the components of the net surplus/(deficit).

| | |

Audited Consolidate Financial Statements 2003-04 - Government of Queensland | | 5-06 |

Statement of Financial Position

as at 30 June 2004

| | | | | | |

| | | Notes

| | 2004

| | 2003

|

| | | | | $M | | $M |

Assets | | | | | | |

Current Assets | | | | | | |

Cash assets | | 13 | | 235 | | 300 |

Receivables | | 14 | | 2,881 | | 2,497 |

Other financial assets | | 15 | | 7,424 | | 6,444 |

Inventories | | 16 | | 439 | | 563 |

Other | | 19 | | 433 | | 465 |

| | | | |

| |

|

Total Current Assets | | | | 11,412 | | 10,269 |

| | | | |

| |

|

Non-Current Assets | | | | | | |

Receivables | | 14 | | 4,021 | | 4,272 |

Investments accounted for using the equity method | | 27 | | 96 | | 84 |

Other financial assets | | 15 | | 19,650 | | 15,841 |

Inventories | | 16 | | 251 | | 155 |

Property, plant and equipment | | 17 | | 86,627 | | 77,890 |

Intangibles | | 18 | | 720 | | 670 |

Other | | 19 | | 1,227 | | 1,285 |

| | | | |

| |

|

Total Non-Current Assets | | | | 112,592 | | 100,197 |

| | | | |

| |

|

Total Assets | | | | 124,004 | | 110,466 |

| | | | |

| |

|

Liabilities | | | | | | |

Current Liabilities | | | | | | |

Payables | | 21 | | 2,948 | | 2,454 |

Interest-bearing liabilities | | 22 | | 7,391 | | 4,998 |

Provisions | | 23 | | 2,150 | | 2,399 |

Other | | 24 | | 401 | | 400 |

| | | | |

| |

|

Total Current Liabilities | | | | 12,890 | | 10,251 |

| | | | |

| |

|

Non-Current Liabilities | | | | | | |

Payables | | 21 | | 315 | | 246 |

Interest-bearing liabilities | | 22 | | 17,196 | | 19,726 |

Provisions | | 23 | | 15,659 | | 15,159 |

Other | | 24 | | 221 | | 190 |

| | | | |

| |

|

Total Non-Current Liabilities | | | | 33,391 | | 35,321 |

| | | | |

| |

|

Total Liabilities | | | | 46,281 | | 45,572 |

| | | | |

| |

|

Net Assets | | | | 77,723 | | 64,894 |

| | | | |

| |

|

Equity | | | | | | |

Accumulated surplus | | 25 | | 45,459 | | 40,844 |

Reserves | | 25 | | 32,264 | | 24,050 |

| | | | |

| |

|

Total Equity | | | | 77,723 | | 64,894 |

| | | | |

| |

|

This Consolidated Statement of Financial Position should be read in conjunction with the accompanying notes. Note 2 provides disaggregated information in relation to components of net assets.

| | |

Audited Consolidated Financial Statements 2003-04 - Government of Queensland | | 5-07 |

Statement of Cash Flows

for the year ended 30 June 2004

| | | | | | | | |

| | | Notes

| | 2004

| | | 2003

| |

| | | | | $M | | | $M | |

Cash Flows from Operating Activities | | | | | | | | |

Receipts | | | | | | | | |

Grants and subsidies received | | | | 11,428 | | | 10,556 | |

Sales of goods and services | | | | 8,786 | | | 8,238 | |

Taxes, fees and fines | | | | 7,048 | | | 5,897 | |

Interest received | | | | 2,799 | | | (68 | ) |

Royalties and other territorial receipts | | | | 699 | | | 795 | |

Dividends received | | | | 40 | | | 16 | |

GST input tax credits received | | | | 1,174 | | | 1,127 | |

Other | | | | 364 | | | 297 | |

Payments | | | | | | | | |

Employee expenses | | | | (11,548 | ) | | (10,297 | ) |

Supplies and services | | | | (7,378 | ) | | (7,160 | ) |

Grants and subsidies paid | | | | (4,088 | ) | | (3,781 | ) |

Borrowing costs paid | | | | (941 | ) | | (990 | ) |

GST remitted to the ATO | | | | (890 | ) | | (853 | ) |

Other | | | | (391 | ) | | (326 | ) |

| | | | |

|

| |

|

|

Net Cash from Operating Activities | | 26(a) | | 7,102 | | | 3,451 | |

| | | | |

|

| |

|

|

Cash Flows from Investing Activities | | | | | | | | |

Receipts | | | | | | | | |

Proceeds from sale of property, plant and equipment | | | | 740 | | | 778 | |

Proceeds from sale of investments | | | | 1,441 | | | 805 | |

Payments | | | | | | | | |

Acquisition of property, plant and equipment | | | | (4,219 | ) | | (4,308 | ) |

Acquisition of investments | | | | (3,846 | ) | | (729 | ) |

| | | | |

|

| |

|

|

Net Cash from Investing Activities | | | | (5,884 | ) | | (3,454 | ) |

| | | | |

|

| |

|

|

Cash Flows from Financing Activities | | | | | | | | |

Receipts | | | | | | | | |

Proceeds from borrowings | | | | 865 | | | 2,035 | |

Other | | | | 2 | | | 2 | |

Payments | | | | | | | | |

Repayment of borrowings | | | | (2,022 | ) | | (1,254 | ) |

| | | | |

|

| |

|

|

Net Cash from Financing Activities | | | | (1,155 | ) | | 783 | |

| | | | |

|

| |

|

|

Net Cash Flows from Public Financial Corporations (PFC) | | 26(b) | | 10 | | | 2 | |

| | | | |

|

| |

|

|

Net Increase/(Decrease) in Cash | | | | 73 | | | 782 | |

Net Increase/(Decrease) in non-eliminated Cash Balances with PFC | | | | (138 | ) | | (590 | ) |

Cash at the Beginning of the Financial Year | | | | 300 | | | 108 | |

| | | | |

|

| |

|

|

Cash Held at End of Year | | | | 235 | | | 300 | |

| | | | |

|

| |

|

|

This Consolidated Statement of Cash Flows should be read in conjunction with the accompanying notes.

| | |

Audited Consolidated Financial Statements 2003-04 - Government of Queensland | | 5-08 |

Notes to the Financial Statements

| 1. | Significant Accounting Policies |

The following summary presents the significant accounting policies that have been adopted in preparing and presenting the consolidated financial statements of the Government of Queensland.

These general purpose consolidated financial statements have been prepared in accordance with relevant Australian Accounting Standards, principally Australian Accounting Standard AAS 31 Financial Reporting by Governments and other authoritative pronouncements.

| (b) | The Government Reporting Entity |

In accordance with Australian Accounting Standard AAS 24 Consolidated Financial Reports, these consolidated financial statements include the values of all material assets, liabilities, equities, revenues and expenses controlled by the Government of Queensland.

Only those agencies considered material by virtue of the size of their financial transactions and/or resources managed are consolidated for the purposes of this report.

Where control of an entity is obtained during the financial year, its results are included in the Consolidated Statement of Financial Performance from the date control commences. Where control of an entity ceases during a financial year, its results are included for that part of the year during which control existed.

The Queensland Government economic entity includes all State Government departments, Public Non-financial Corporations, Public Financial Corporations and their controlled entities. Refer Note 39 for a full list of entities included in each sector.

In the process of reporting the Government of Queensland as a single economic entity, all material inter-entity and intra-entity transactions and balances have been eliminated to the extent practicable.

| | |

Audited Consolidated Financial Statements 2003-04 - Government of Queensland | | 5-09 |

Notes to the Financial Statements

| 1. | Significant Accounting Policies continued |

Assets, liabilities, revenues and expenses that are attributable reliably to each sector of the Government of Queensland economic entity are disclosed in Note 2. For disclosure purposes, transactions and balances between sectors have not been eliminated, but those between entities within each sector have been eliminated. The financial impact of inter-sector transactions and balances is disclosed in Note 2, under the heading of Consolidation Adjustments.

A brief description of each broad sector of the Government’s activities, determined in accordance with the Government Financial Statistics Standards, Australian Bureau of Statistics, follows:

General Government Sector

The primary function of General Government sector agencies is to provide public services that:

| | • | are non-trading in nature and that are for the collective benefit of the community; |

| | • | are largely financed by way of taxes, fees and other compulsory charges; and |

| | • | involve the transfer or redistribution of income. |

Public Non-financial Corporations Sector

The primary function of enterprises in the Public Non-financial Corporations sector is to provide goods and services that:

| | • | are trading, non-regulatory or non-financial in nature; and |

| | • | are financed by way of sales of goods and services to consumers. |

Public Financial Corporations Sector

The Public Financial Corporations sector comprises publicly owned institutions which provide financial services usually on a commercial basis.

Functions they perform may include:

| | • | accepting on-call, term or savings deposits; |

| | • | investment fund management; |

| | • | having the authority to incur liabilities and acquire financial assets in the market on their own account; or |

| | • | providing insurance services. |

A listing of the entities comprising each sector is provided in Note 39.

The reporting period of the consolidated entity is the year ended 30 June 2004.

These consolidated financial statements have been prepared in accordance with the Financial Administration and Audit Act 1977, applicable Australian Accounting Standards and Concepts, Urgent Issues Group Consensus Views and other authoritative pronouncements.

The statements have been prepared on an accrual basis that recognises the financial effects of transactions and events when they occur.

| | |

Audited Consolidated Financial Statements 2003-04 - Government of Queensland | | 5-10 |

Notes to the Financial Statements

| 1. | Significant Accounting Policies continued |

The consolidated financial statements adopt the following valuation methodologies:

| | • | superannuation, WorkCover, motor vehicle accident liabilities, Queensland Government Insurance Scheme and the Queensland Government Long Service Leave Central Scheme are based on actuarial valuations; |

| | • | investments held by Public Financial Corporations are recorded at market value; |

| | • | borrowings are recorded at market value; |

| | • | land, buildings, infrastructure, heritage and cultural assets are valued at fair value in accordance with AASB 1041 Revaluation of Non-Current Assets, other classes of assets are valued at cost or recoverable value as appropriate; and |

| | • | some inventories are valued at recoverable value. |

Historical cost accounting principles are otherwise employed.

Unless otherwise stated, the accounting policies adopted for the reporting period are consistent with those of the previous reporting period.

All amounts in the consolidated financial statements have been rounded to the nearest $1 million, unless otherwise indicated. Accordingly, numbers may not add due to rounding.

| (h) | Comparative Information |

Where applicable, comparatives have been restated to agree with changes in presentation in the financial statement for the current reporting period.

Commonwealth and other grants are normally recognised as revenue when the recipient entity obtains control over the grant, usually upon receipt. Where the grant is of a reciprocal nature, revenue is recognised as and when the obligation is fulfilled. When revenue, including grants, has been received in advance for services or work still to be completed at balance date, this revenue is considered to be unearned and is reported in other liabilities. Refer Note 24.

Assets received at below fair value, including those received free of charge and that can be measured reliably are recognised at their fair value as revenue when control over the assets is obtained, normally either on receipt of the assets or on notification that the assets have been secured.

Contributions of services are recognised only if the services would have been purchased if they had not been donated and their fair value can be reliably measured. Where this is the case, an equal amount is recognised as a revenue and an expense.

Non-repayable developer or customer contributions are recognised as revenue and as assets in accordance with Urgent Issues Group Abstract 17 Developer and Customer Contributions in Price Regulated Industries.

| | |

Audited Consolidated Financial Statements 2003-04 - Government of Queensland | | 5-11 |

Notes to the Financial Statements

| 1. | Significant Accounting Policies continued |

To the extent practicable, revenues from the sales of goods and services (including gas and electricity), fines and regulatory fees are recognised when the transaction or event, giving rise to the revenue, occurs.

State taxation is recognised as revenue upon the earlier of receipt by the responsible agency of a taxpayer’s self-assessment or, at the time the taxpayer’s obligation to pay arises pursuant to the issue of an assessment. The main types of taxation and fee revenue raised by the State Government are:

| | • | transfer and other duties; |

| | • | various gaming and lottery taxes. |

Investment income includes interest, dividends and other income earned during the financial year. Interest is recognised on an accrual basis and dividends when declared. Net realised gains from the sale of investments and unrealised gains from the revaluation of certain investments also form part of investment income.

Net increments in the market values of self-generating and regenerating assets (SGARAs) are recognised as revenues.

Borrowing costs are recognised as expenses in the period in which they are incurred.

General Provisions

A provision for onerous contracts is recognised when the expected benefits to be derived from a contract are less than the unavoidable costs of meeting the obligations under that contract, and only after any impairments to assets dedicated to that contract have been recognised.

The provision is recognised based on the excess of the estimated cash flows to meet the unavoidable costs under the contract over the estimated cash flows to be received in relation to the contract, having regard to the risks of the activities relating to the contract. The net estimated cash flows are discounted using market yields at balance date on national government guaranteed bonds with terms to maturity and currency that match, as closely as possible, the expected future payments, where the effect of discounting is material.

Power Purchase Agreement Provisions

A provision for onerous contracts has been realised in relation to a number of long-term power purchase agreements (PPAs) when the unavoidable costs of meeting the ongoing obligations under these agreements exceed the expected benefits to be received. Some of these PPAs have remaining terms which extend past the next ten years. Current conditions within the electricity market mean a number of the long-term power purchase agreements are considered to be onerous contracts.

The provision for onerous contracts reflects the least net cost of exiting these onerous PPAs which is the lower of the cost of fulfilling the agreements or the compensation payable as defined in these agreements for early termination.

| | |

Audited Consolidated Financial Statements 2003-04 - Government of Queensland | | 5-12 |

Notes to the Financial Statements

| 1. | Significant Accounting Policies continued |

Expected losses incurred on fulfilling the onerous PPAs are calculated as the net present value of the difference between the contracted purchase price for electricity and the estimated revenue to be derived from these agreements and anticipated hedge contracts. The extent of the future losses from the power purchase agreements will depend on future wholesale pool prices as well as the need for the State to meet its network support obligations. The future level of Queensland wholesale pool prices remains significantly uncertain. The critical determinants of future pool prices will be the bidding behaviour of participants in the National Electricity Market, load growth, network reliability and the introduction of new generation capacity.

The discount rate used of 9.4% (2003, 9.4%) reflects the current market assessments of the time value of money and the risks specific to these obligations.

Australian Magnesium Operations Pty Ltd

In October 2001, the State entered into a State Mezzanine Loan Agreement with Australian Magnesium Operations Pty Ltd (AMO) and Australian Magnesium Corporations Limited (AMC). The loan is for an advance up to $100 million to support payments to holders of Distribution Entitled Security (DES) who took up investments in AMC’s Stanwell Magnesium Project.

On 24 March 2004, Government stakeholders agreed to release their rights as secured creditors of AMC and withdraw from the Stanwell Magnesium Project. The deed of transfer was dated 6 July 2004.

A provision for onerous contracts exists in relation to the final payment to support payments to DES holders in November 2004.

Trade debtors are recognised at the nominal amount due, less any provision for doubtful debts.

Settlement by finance lease debtors is within the terms of the lease, ranging from 2 to 99 years. Title is passed to the purchaser on full repayment. Refer Note 14.

For the purposes of this report, investments held to fund the State’s liability for employee superannuation benefits and those held by Public Financial Corporations are recorded at market value. Other investments are recognised at cost.

Inventories are carried at the lower of cost, net realisable or net market value. For most agencies, cost is determined on either a first-in-first-out or average cost basis and includes expenditure incurred in acquiring the inventories and bringing them to their existing condition and location.

Net realisable value is the amount that could be expected to be received from the disposal of an asset in an orderly market, after deducting costs expected to be incurred in realising the proceeds of such a disposal.

Net market value is the amount that could be expected to be received in an active and liquid market, after deducting the costs expected to be incurred in realising the proceeds of the disposal.

| | |

Audited Consolidated Financial Statements 2003-04 - Government of Queensland | | 5-13 |

Notes to the Financial Statements

| 1. | Significant Accounting Policies continued |

| (o) | Property, Plant and Equipment |

Acquisition

Items of property, plant and equipment with a cost or other value greater than the asset recognition threshold of the agency are initially recorded at cost. Entity recognition thresholds for 2003-04 do not exceed $10,000 (unchanged from the previous year). Items with a cost or other value below each entity’s recognition threshold are expensed in the year of acquisition.

Assets acquired at no cost, or for nominal consideration, that can be measured reliably are recognised initially as assets and revenues at their fair value at the date of acquisition.

Recording and Valuation

Land, buildings, infrastructure, heritage and cultural assets are valued in accordance with AASB 1041 Revaluation of Non-Current Assets and Queensland Treasury’s Non-Current Asset Accounting Guidelines for the Queensland Public Sector. Reference should be made to individual agency reports for valuation methodologies and names and qualifications of relevant valuers, where appropriate.

All other non-current assets, principally plant and equipment and intangibles, are measured at cost.

Non-current physical assets measured at fair value are comprehensively revalued once every 5 years or as appropriate, with interim valuations using relevant indices being otherwise performed on an annual basis. Only those assets, the total values of which are material, compared to the value of the class of assets to which they belong, are comprehensively revalued.

In relation to the Queensland electricity and gas supply industry, power generation as well as electricity and gas transmission supply systems are valued at depreciated optimised replacement value or cost. This approach provides values based on the optimum set of replacement assets necessary to achieve the same service potential with no inappropriate surplus capacity.

Self-generating and regenerating assets (SGARAs) are recognised at net market value, which is the amount that could be expected to be received from the disposal of the asset in an active and liquid market, after deducting costs expected to be incurred in realising the proceeds of such a disposal. Where no active and liquid market is available, the net present value methodology has been adopted under the provisions of AAS 35 Self Generating and Regenerating Assets.

Non-reciprocal transfers of assets and liabilities between wholly-owned Queensland public sector entities, are accounted for as adjustments to contributed equity in accordance with UIG Abstract 38 Contributions by Owners Made to Wholly-owned Public Sector Entities.

Assets not Recognised

The following assets are not recognised in the Consolidated Statement of Financial Position:

Quarry Resources

The value of quarry resources held by the Department of Natural Resources, Mines and Energy and by the Department of Primary Industries and Fisheries is not included in the financial statements as it is not practical to determine reliably the quantum of the resources available for extraction. Revenue from the sale of quarry materials is recognised as extractions are made.

| | |

Audited Consolidated Financial Statements 2003-04 - Government of Queensland | | 5-14 |

Notes to the Financial Statements

| 1. | Significant Accounting Policies continued |

Native Forests

Under the provisions of the Forestry Act 1959, the Department of Primary Industries and Fisheries has a right to harvest forest products from certain forest areas through its Forestry Business Group. The current cash flows associated with these native forests are considered immaterial at this point and therefore, the value of the access rights has not been recognised in the Consolidated Statement of Financial Position. Seed orchards and nursery seedlings are not recognised on the grounds of materiality.

The value of plantation growing timber, managed by the Department of Primary Industries and Fisheries, Forestry Business Group, is recognised in the Consolidated Statement of Financial Position. Refer Note 19.

Land under Roads

Land under roads controlled by the departments of Main Roads and Natural Resources, Mines and Energy, is expensed as road construction occurs. The state does not value the area of land under gazetted roads.

Department of Natural Resources, Mines and Energy (DNR)

Under the Transport Infrastructure Act 1994, railway corridor land was rendered State land under the control of DNR, which for reporting purposes recorded the land at nil value. This land is on-leased to QR via Queensland Transport at no cost.

User Funded Assets

Certain wharf facilities, bulk sugar terminals, bulk molasses terminals, bulk grain terminals and grain loading facilities have been constructed on land controlled by Queensland port corporations. As the users of the assets have either fully or partially funded these facilities, they are not included in the Consolidated Statement of Financial Position, as they are either not considered to be controlled by the corporations, or no income will flow from the facilities.

Heritage Assets

Certain heritage assets, including artefacts, memorabilia and other historical objects held by agencies, have not been valued or included in the Consolidated Statement of Financial Position because of the unique nature of the items and the difficulty in determining a reliable value.

Library Collections

A number of entities expense the purchase of library acquisitions as they are incurred. Effective 1 July 2003 the Library Board of Queensland has changed their accounting policy to expense library collections that were previously capitalised. This has resulted in a write off of net assets of $18 million and a reduction in depreciation expense for 2003-04 of $2 million.

Intangibles

A number of public sector agencies have been unable to determine a reliable value for intangible items including internally developed software, intellectual property and trade names. Consequently, the value of these assets is excluded from these financial statements.

Water Licenses

The Mount Isa Water Board holds an interim resource allocation license. However, the Board has not been able to reliably measure the value of this asset and therefore, it has not been brought to account.

| | |

Audited Consolidated Financial Statements 2003-04 - Government of Queensland | | 5-15 |

Notes to the Financial Statements

| 1. | Significant Accounting Policies continued |

Depreciation and Amortisation

Land is not depreciated.

Other assets are normally depreciated or amortised on a straight-line basis from their date of acquisition (or in respect of internally constructed assets, from the time the asset is completed and held ready for use), and based on their estimated useful lives to the agency.

Where assets have separately identifiable components that are subject to regular replacement, these components are assigned useful lives distinct from the asset to which they relate and are depreciated accordingly.

In 2003-04, the Department of Housing revised its methodology for determining remaining useful lives of rental dwellings and other buildings. In prior years, the depreciation charge for buildings had been based on an estimated total useful life of 50 years. The new methodology, applied from the beginning of the financial year, involves the annual determination of remaining useful life estimates for building on the basis of comprehensive data maintained regarding the current condition of individual buildings. This has resulted in a reduction in depreciation charge for the year of $67 million.

Leasehold improvements are amortised over the estimated useful lives of the improvements or the unexpired period of the lease, whichever is shorter.

The following provides an indication of the estimated useful lives to agencies of the different asset classes:

| | |

| | | Useful Life

|

Asset Class | | |

Buildings | | 5 - 100 years |

Plant and equipment | | 2 - 50 years |

Infrastructure assets | | Up to 200 years |

Computer equipment | | 2 - 5 years |

Heritage and cultural assets | | 7 - 80 years |

| |

Intangibles | | |

Computer software | | 3 - 5 years |

Other intangibles (including goodwill, intellectual property, licences) | | 2 - 20 years |

Agency rights and obligations under finance leases, which are leases that effectively transfer most of the risks and benefits relating to ownership of the leased items to the lessee are recognised initially as assets and liabilities equal to the present value of the minimum lease payments. The assets are disclosed as leased plant and equipment and are amortised over the period during which the agency is expected to benefit from the use of the asset. Minimum lease payments are allocated between interest and reduction of the lease liability, according to the interest rate implicit in the lease.

For operating leases, where the lessor retains substantially all of the risks and benefits relating to ownership of the leased items, lease payments are expensed over the term of the lease.

Further disclosure on lease commitments is contained in Note 31.

| | |

Audited Consolidated Financial Statements 2003-04 - Government of Queensland | | 5-16 |

Notes to the Financial Statements