EXHIBIT (c)(i)

Consolidated Financial Statements of the Registrant

1

2

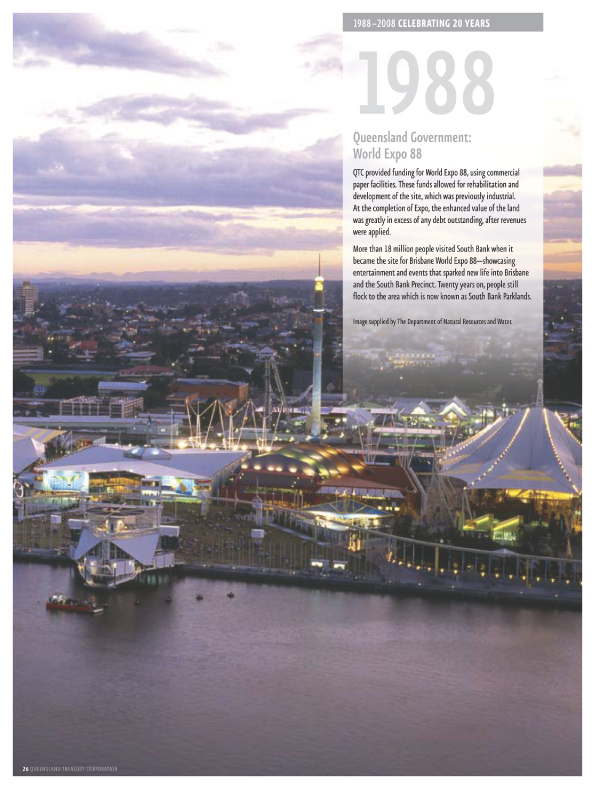

In 2008, Queensland Treasury Corporation (QTC) celebrates its twentieth year of operations.

With its inaugural Chairman, Sir Leo Hielscher AC, and Chief Executive, Stephen Rochester, at the helm, QTC has navigated Queensland through the challenges of the financial markets, and maintained its course providing low cost funding and independent financial and risk management advice to ten State Treasurers and their respective governments.

QTC determines its own worth by the value it has created for its customers and for the State. Over the past twenty years, QTC has maintained its AAA credit rating and generated more than $1.7 billion in savings for customers in the raising of their capital requirements alone. While total savings are not completely quantifiable, they are estimated to be much greater. Today, QTC employs 160 people and has more than $43 billion of debt on issue.

This is the story of QTC’s journey so far.

Autonomous and accountable

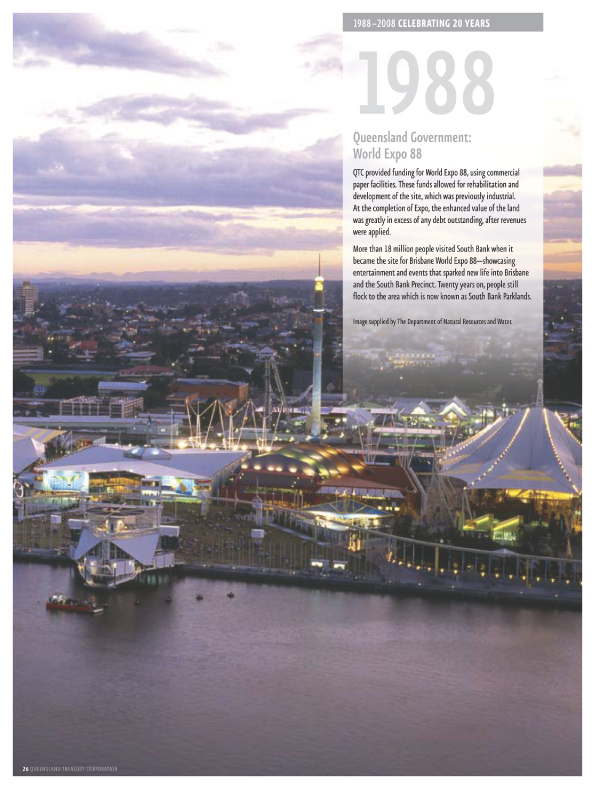

Created to provide a range of independent financial services to the Government and its public sector entities, QTC was established on 1 July 1988. It brought together the financial operations of its predecessor, the Queensland Government Development Authority, the Investment Branch of the Queensland Treasury department, and the debt of the Brisbane City Council and the Queensland Electricity Commission.

QTC was formed as a separate entity (a ‘corporation sole’), reporting to the Treasurer and Queensland Parliament via the Under Treasurer, with responsibility for implementing the Government’s fiscal policy through the services it provides.

In 1991, QTC became an autonomous and accountable central financing authority, when responsibility for the State’s wholesale and medium-to long-term investments was transferred to the Queensland Investment Corporation. In August 1991, Sir Leo Hielscher AC was appointed Chairman and the QTC Capital Markets Board was established.

QTC is unique in the Australian government marketplace, with an operating model designed to provide the services of a corporate treasury (ie, debt funding, short-to medium-term investments, and financial and risk management advice), not to maximise profits for itself. While QTC is required to operate profitably, its objective is to maximise value for the State and its entities. QTC makes it more efficient and less risky for the State and its public sector bodies to benefit from the considerable advantages associated with operating in global wholesale debt and investment markets, without having to access those markets themselves. It acts in the interests of Queensland and its public sector customers, aiming to provide truly professional advice.

QTC’s customers are the departments, Government-owned corporations, statutory authorities and local governments of Queensland.

3

Extracting economies of scale

In the initial years, QTC focused on consolidating the State’s debt, taking on the role as Queensland’s single debt issuer, rationalising the number of approaches to the debt markets and eliminating competition between the various issuing local and semi-government authorities. The economies of scale generated by this consolidation, together with QTC’s commitment to open and transparent communication with the markets, translated into well sought after, liquid debt products that have ultimately provided customers with the lowest cost of funds.

In its early days, QTC achieved many firsts. It was the first to establish a global transferable note (TRN) program, specifically targeted at offshore investors, and to issue global bonds at yields below those achievable in the domestic market. Concurrently, it established multi currency medium-term note programs in Europe and the United States to supplement the Global TRN Program and, in 1992, became the lowest priced Australian semi-government issuer, a position it still holds today.

Similarly, QTC’s Cash Fund, which was established to assist customers with the management of their short-term cash balances, has consistently out performed the UBS Bank Bill Index (ie, the industry benchmark for comparing cash funds) and delivered competitive returns for customers’ short-to medium-term investments.

QTC continues to evolve in response to the demands of the changing financial markets and the dynamic environment in which its customers operate.

Expanding economies of scope

Building on its success in delivering value to customers from its debt funding economies of scale, QTC broadened its capabilities and established an independent corporate advisory service in 1994. Introducing these complementary services allowed QTC to achieve economies of scope in the provision of quality, independent financial and risk management advice.

Customer demand for these advisory services has grown enormously, and QTC now offers a full range of services including financial and risk management advice, financial modelling and credit analysis.

QTC has advised, in some capacity, on most of the State’s key infrastructure projects. It played a lead role in negotiating the merger of Suncorp, the Queensland Industry and Development Corporation, and Metway Bank, joining public and private corporations and bringing them into public ownership.

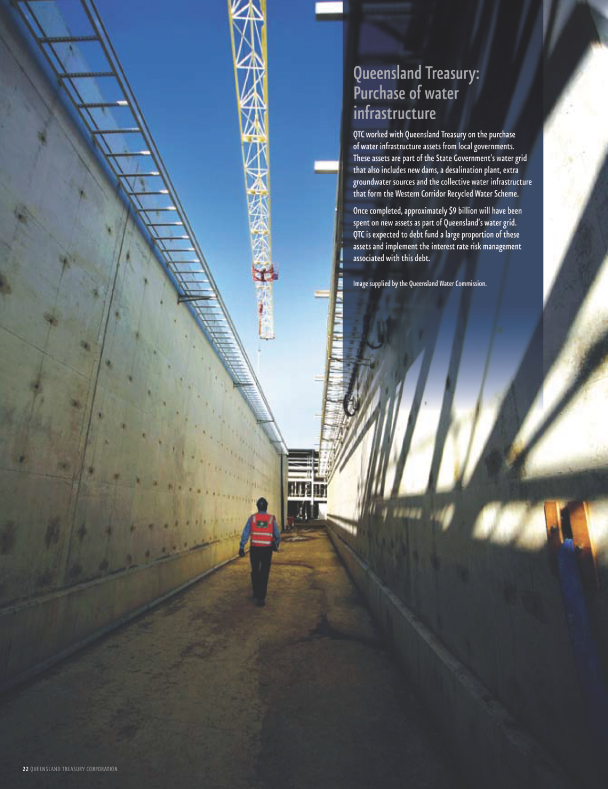

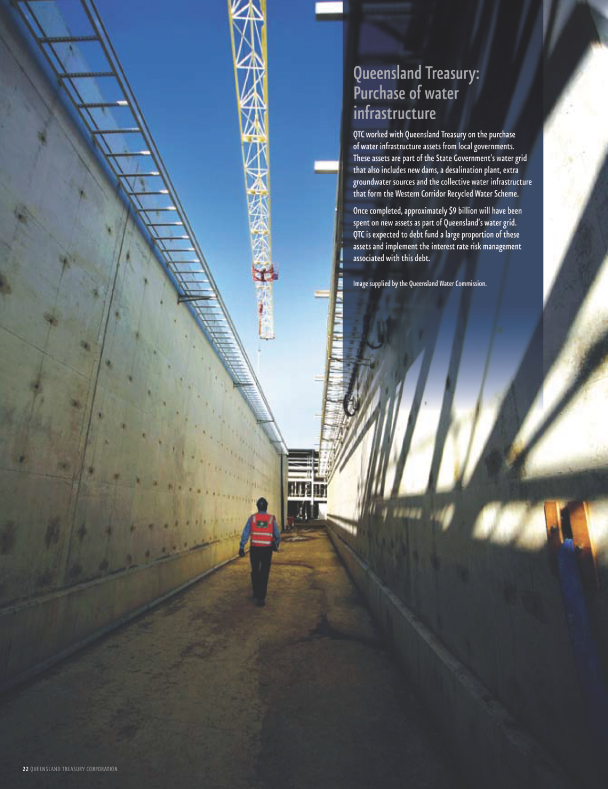

It has also advised on the sale of some of Queensland’s major assets, including Dalrymple Bay Coal Terminal and the State’s retail electricity assets, and also on the recent acquisition by the State Government of the previously local government-owned water assets.

In 1995, QTC arranged a cross border lease for Stanwell Corporation Limited’s turbines, with a transaction size of $1.365 billion. It was, at the time, the largest cross border lease ever undertaken, and generated a benefit to the State of $94 million. The success of this project led to other cross border lease arrangements for major assets, including power lines and rolling stock.

In its role as the State’s provider of corporate treasury services, QTC has strived to provide valuable and independent insight and analysis into crucial areas of financial risk for the State.

4

In particular, QTC has taken a long-standing position on the criticality of managing risk when procuring infrastructure. Neither for nor against public private partnerships, QTC has been championing the crucial issue of risk management and its evaluation in these major deals since the late 1990s. Addressing these issues in major projects is even more relevant today with the Government’s commitment to its significant infrastructure program.

In 2007, QTC collaborated with Government stakeholders and contributed to the development of the Supported Debt Model. This model is a financing variant of the traditional privately-financed public private partnership model, and provides governments with a viable and responsible option to use public private partnerships to achieve their infrastructure objectives, despite the increasingly challenging market environment.

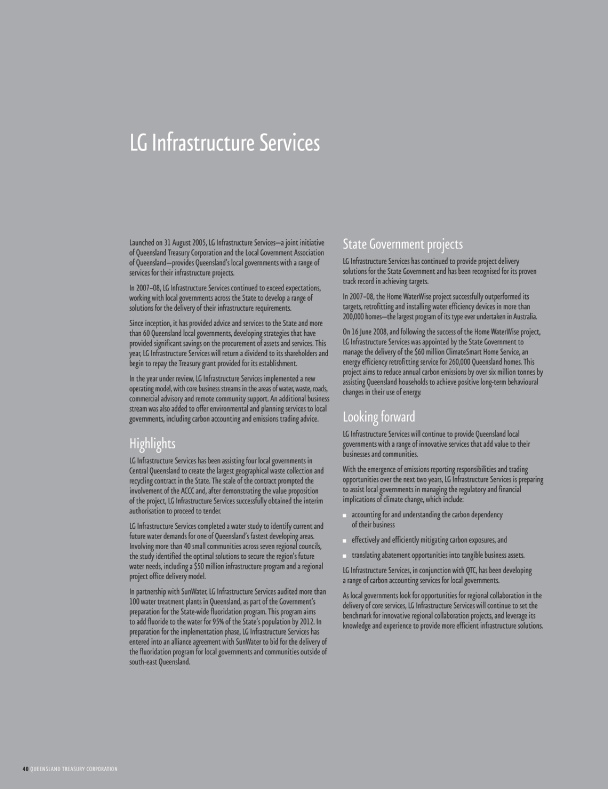

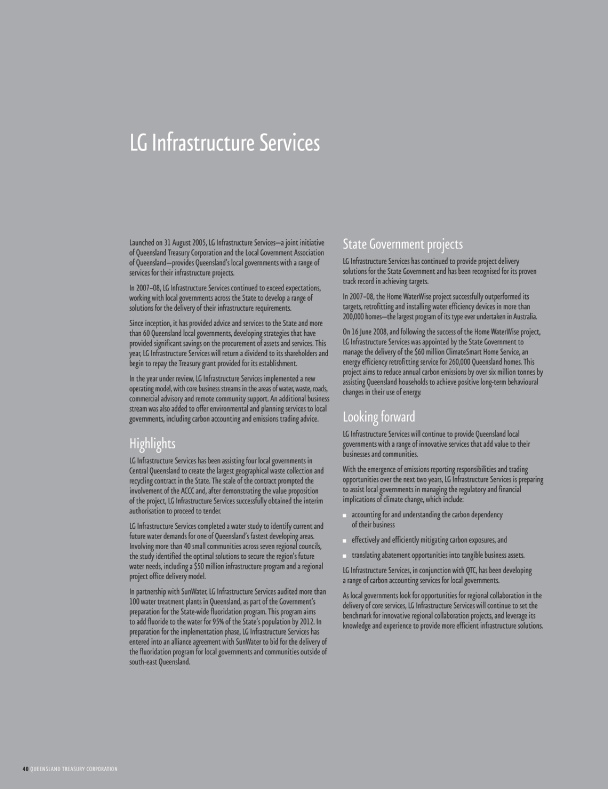

Similarly, to provide targeted support to the procurement of local government infrastructure development, QTC joined with the Local Government Association of Queensland in 2005 to establish LG Infrastructure Services Pty Ltd. LG Infrastructure Services provides assistance to local government in evaluating and delivering infrastructure projects in a cost effective and efficient manner. This joint venture was the first of its kind in Australia, and has achieved considerable success in its work with Queensland’s local governments.

Focusing on customers

In 1996, having achieved significant economies of scale and scope for customers, QTC reconsidered its strategic approach and embraced a customer loyalty operating model.

Recognising QTC’s ongoing success and viability was contingent on its ability to add real value to customers’ businesses, QTC set about developing a comprehensive understanding of customers, their businesses, challenges and future directions. This understanding, which is an evolving journey, is used to develop and deliver customised financial and risk management solutions for customers.

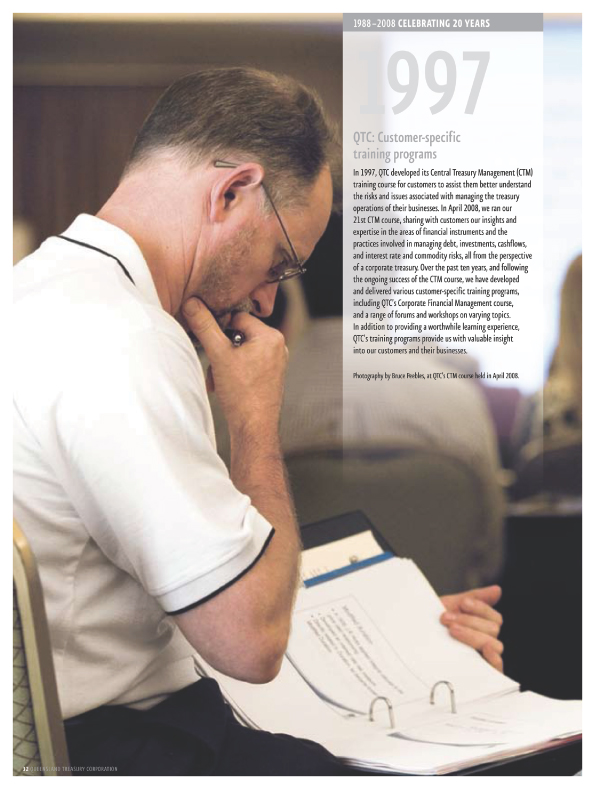

In 1997, QTC established its Central Treasury Management course to assist customers’ understanding of the concepts, financial instruments and practices involved in managing debt and interest rate risk. In 2002, QTC hosted its first Corporate Financial Management course, to assist customers in considering the key issues in financial management including determining capital structure, estimating cost of capital, evaluating projects and assessing risks, and establishing a framework for interest rate risk management. To encourage participation and reinforce learnings, QTC developed simulated models for both of these courses.

With greater understanding of its customers’ requirements, QTC has customised its lending products, establishing client specific debt pools for larger borrowers to give them complete flexibility and increased capacity to manage the risks inherent in their debt portfolios.

To provide more targeted support on customers’ major projects, QTC established a secondment program in 2002, and has now placed QTC employees in more than 100 key strategic and operational roles within customers’ businesses since that time.

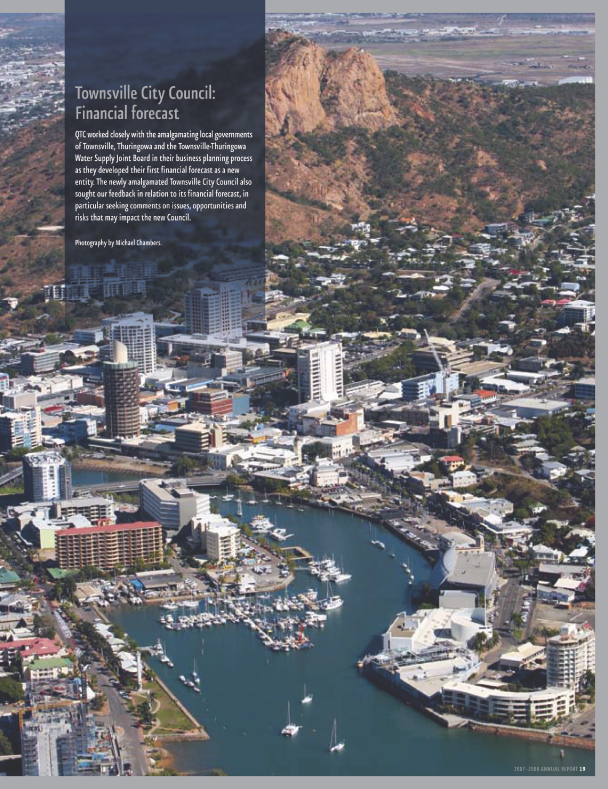

In one of its most significant projects to date, QTC completed a major review of the financial sustainability of 109 of Queensland’s local governments in July 2007. The review provided valuable information that the Local Government Reform Commission used to assist it in determining the boundaries for the historic amalgamation that reduced existing local governments from 156 to 72.

QTC has had many achievements in its first 20 years of operations, funding vital infrastructure for the State’s development on terms and conditions second only to those achievable by the Commonwealth Government of Australia, and providing advice on key projects that have added real value to the lives of everyday Queenslanders.

By maintaining its relationships with the financial markets, understanding its customers’ needs and staying true to its corporate treasury services provider role, QTC intends to continue this success for many years to come.

5

6

7

Queensland Treasury Corporation

Queensland Treasury Corporation is the Queensland Government’s central financing authority and corporate treasury services provider, with responsibility to:

| | • | | source and manage the debt funding to finance Queensland’s infrastructure requirements in the most cost-effective manner |

| | • | | provide financial and risk management advice and services to the Queensland Government and its Queensland public sector customers, and |

| | • | | invest the State’s short- to medium-term cash surpluses, maximising returns to customers through a conservative risk management framework. |

QTC does not formulate Government policy, but works within the policy frameworks developed by the Government and Queensland Treasury. QTC’s role is not to take direct equity in projects, however, it may, at the direction of the Government, invest equity in special purpose vehicles established to achieve a specific outcome for the State.

Debt funding and management

QTC borrows funds in the domestic and international markets in a manner that minimises the State’s, and QTC’s, liquidity and refinancing risk. We then lend these funds to our customers, or use them to manage our customers’ debt or to refinance maturing debt.

With responsibility for all of the State’s debt raisings, QTC is able to capture significant economies of scale and scope in the issuance, management and administration of debt.

These economies, together with our AAA credit rating, result in a low cost of debt for Queensland’s public sector.

Financial advisory and risk management services

QTC works closely with its public sector customers to assist in managing their risk in financial transactions and achieve the best financial solutions for their organisations and for Queensland. In assisting customers, QTC does not provide advice that is contrary to the interests of the State.

We encourage our customers and Queensland Treasury, our major stakeholder, to use our organisation as an extension of their resources, by:

| | • | | providing them with low cost access to professional skills and resources to ensure that their financial risks are identified and managed on a consistent basis |

| | • | | acting as a central store of knowledge and expertise on financial structures and transactions, and the risks and benefits they encompass |

| | • | | providing Queensland Treasury with advice on matters of financial and commercial policy and risk relating to the State and its entities, and |

| | • | | working as a conduit between the Government and the private sector, using our economies of scale and scope to ensure that the best possible solutions are obtained. |

Short- to medium-term investments

QTC uses its financial markets expertise, developed through strong relationships with the domestic and international markets, together with its understanding of debt management and the management of financial risk, to provide customers with investment solutions that achieve a high return within a conservative risk environment.

8

Customers can choose from an overnight facility, a managed short-term fund, or fixed-term facilities. Alternatively, we can assist them to source appropriate solutions from the marketplace.

Vision

Efficient and effective financial risk management practices across our customers and the State.

Mission

To provide corporate treasury services to our customers and the State, by striving to understand our customers’ current and future needs and delivering solutions to meet those needs.

Values

Open communication, respect for the individual, integrity and honesty in all our dealings, good corporate citizenship, strong commitment, and valuable contributions.

9

10

11

Five-year Business Summary

| | | | | | | | | | | | | |

| | | Financial Year

2003–04 | | Financial Year

2004–05 | | | Financial Year

2005–06 | | Financial Year

2006–07 | | | Financial Year

2007–08 | |

Financial | | | | | | | | | | | | | |

| | | | | |

OPERATING ($000) | | | | | | | | | | | | | |

Interest from onlendings | | 371,737 | | 1,442,995 | | | 572,306 | | 768,624 | | | 1,489,666 | |

Management fees | | 22,144 | | 22,993 | | | 22,698 | | 24,820 | | | 31,504 | |

Interest on borrowings | | 468,243 | | 1,849,012 | | | 857,281 | | 1,144,884 | | | 2,077,211 | |

Interest as deposits | | 239,933 | | 262,307 | | | 302,987 | | 316,880 | | | 471,014 | |

Operating (loss)/surplus before payment in lieu of income tax | | 35,830 | | 57,735 | | | 62,310 | | 59,589 | | | (65,024 | ) |

Payment in lieu of income tax | | 12,553 | | 11,647 | | | 12,741 | | 13,740 | | | 15,681 | |

Operating (loss)/surplus after payment in lieu of income tax | | 23,277 | | 46,088 | | | 49,569 | | 45,849 | | | (80,705 | ) |

| | | | | |

BALANCE SHEET ($000) | | | | | | | | | | | | | |

Total assets | | 26,809,429 | | 30,345,228 | | | 33,492,178 | | 40,612,318 | | | 49,915,436 | |

Total liabilities | | 26,577,586 | | 30,067,297 | | | 33,164,678 | | 40,238,969 | | | 49,622,792 | |

Net assets | | 231,843 | | 277,931 | | | 327,500 | | 373,349 | | | 292,644 | |

| | | | | |

Customer | | | | | | | | | | | | | |

| | | | | |

SAVINGS FOR CUSTOMERS ($m) | | | | | | | | | | | | | |

Savings due to portfolio management | | 54.6 | | (9.1 | ) | | 46.5 | | (13.1 | ) | | 18.7 | |

Savings due to borrowing margin | | 63.1 | | 55.8 | | | 74.4 | | 82.1 | | | 145.2 | |

Total savings for customers | | 117.7 | | 46.7 | | | 120.9 | | 69.0 | | | 163.9 | |

Cumulative savings for customers | | 1,298.8 | | 1,345.5 | | | 1,466.4 | | 1,535.4 | | | 1,699.3 | |

| | | | | |

LOANS TO CUSTOMERS | | | | | | | | | | | | | |

Loans ($000) | | 17,714,737 | | 18,905,621 | | | 19,831,582 | | 24,268,854 | | | 32,911,506 | |

Number of onlending customers | | 308 | | 292 | | | 321 | | 313 | | | 280 | * |

Outperformance of benchmark

(% pa semi-annual) | | | | | | | | | | | | | |

Floating Rate Debt Pool | | 0.18 | | 0.16 | | | 0.19 | | 0.21 | | | 0.20 | |

3 Year Debt Pool | | 0.22 | | (0.02 | ) | | 0.27 | | 0.00 | | | 0.08 | |

6 Year Debt Pool | | 0.28 | | (0.07 | ) | | 0.23 | | (0.06 | ) | | 0.05 | |

9 Year Debt Pool | | 0.28 | | (0.14 | ) | | 0.20 | | (0.18 | ) | | (0.05 | ) |

12 Year Debt Pool | | 0.34 | | (0.13 | ) | | 0.24 | | (0.22 | ) | | (0.04 | ) |

15 Year Debt Pool | | 0.36 | | (0.15 | ) | | 0.23 | | (0.12 | ) | | 0.01 | |

| | | | | |

MANAGED FUNDS | | | | | | | | | | | | | |

Deposits ($000) | | 4,476,280 | | 5,220,644 | | | 5,329,329 | | 7,698,426 | | | 8,251,872 | |

Number of depositors | | 258 | | 270 | | | 253 | | 254 | | | 214 | |

Outperformance of benchmark

(% pa semi-annual) | | | | | | | | | | | | | |

Cash Fund | | 0.18 | | 0.17 | | | 0.16 | | 0.17 | | | 0.22 | |

12

| | | | | | | | | | |

| | | Financial Year

2003–04 | | Financial Year

2004–05 | | Financial Year

2005–06 | | Financial Year

2006–07 | | Financial Year

2007–08 |

| | | | | |

Financial Markets | | | | | | | | | | |

Debt outstanding** ($000) | | 21,702,155 | | 24,582,052 | | 27,519,577 | | 32,074,526 | | 40,728,150 |

QTC bond rates (% at 30 June) | | | | | | | | | | |

July 2009 | | 5.87 | | 5.31 | | 5.99 | | 6.68 | | 7.40 |

May 2010 | | — | | 5.34 | | 6.00 | | 6.72 | | 7.39 |

June 2011 | | 5.98 | | 5.35 | | 6.01 | | 6.74 | | 7.31 |

April 2012 | | — | | — | | — | | — | | 7.26 |

August 2013 | | 6.07 | | 5.36 | | 6.00 | | 6.69 | | 7.17 |

October 2015 | | 6.12 | | 5.37 | | 6.02 | | 6.66 | | 7.04 |

September 2017 | | — | | — | | — | | 6.64 | | 7.00 |

June 2021 | | 6.18 | | 5.40 | | 6.02 | | 6.58 | | 6.94 |

QTC Capital-Indexed Bond rates

(% at 30 June) | | | | | | | | | | |

August 2030 | | — | | — | | 2.51 | | 2.79 | | 2.32 |

Basis point margin over Commonwealth bonds | | 19.3 | | 22.5 | | 21.8 | | 33.1 | | 56.9 |

Basis point margin under NSW TCorp bonds | | 3.1 | | 2.5 | | 3.9 | | 1.8 | | 0.9 |

QTC global and domestic bonds on issue at face value ($000) | | 20,496,653 | | 22,186,715 | | 26,903,063 | | 33,000,416 | | 41,833,356 |

| | | | | |

Corporate | | | | | | | | | | |

Number of employees | | 130 | | 122 | | 132 | | 148 | | 160 |

Administration expenses ($000) | | 28,403 | | 30,021 | | 30,249 | | 32,958 | | 33,398 |

| * | The number of customers reduced from the previous year due to the amalgamation of local governments in March 2008. |

| ** | QTC holds its own stock and these holdings have been excluded from the debt outstanding figures. |

13

14

Chairman’s and Chief Executive’s report

In a year characterised by turmoil within the global financial markets caused by the fall-out from the credit and liquidity crises, Queensland Treasury Corporation completed its largest ever funding program of $13.8 billion, which included partial funding of next year’s program.

Despite the challenges faced in financial markets, QTC’s management of portfolios and borrowing margins alone achieved savings for customers of $163.9 million, bringing cumulative savings since inception to approximately $1.7 billion.

The significant widening of interest rate spreads in the financial markets, as a result of the global credit and liquidity crises, resulted in QTC recording its first-ever accounting loss before tax of $65 million for 2007–08, although QTC’s underlying operations continued to be profitable. It is important to note that this loss is modest in the context of QTC’s strong financial position, and is due to unrealised mark-to-market accounting losses of $116 million. These losses have no impact on QTC’s liquidity and are expected to be fully reversed in future years as financial instruments, affected by the movement in market spreads, mature. In the normal course of its business, QTC will hold these financial instruments to maturity and the accounting loss now recorded will unwind, as their face value is realised and the term to maturity shortens.

Fundamental transformation in the financial markets landscape

The global financial markets landscape was fundamentally transformed in 2007–08, primarily as a result of the United States’ sub-prime mortgage crisis, which began in August 2007. The major effects of this crisis continue to be large-scale downgrades of mortgage-backed securities, and acute illiquidity in debt securitisation and commercial paper markets, which has led to a sharp increase in the cost of funds for all borrowers. This phenomenon spread rapidly to other credit markets, effectively creating market failure in some market segments and challenging the capital adequacy of many major US and European banks. The desire for liquidity, along with increasing counterparty risk concerns, also created unprecedented pressure within global inter-bank money markets.

This has created an environment of greater market risk and volatility, along with a higher cost of funds (relative to Commonwealth Government issues) for QTC, which we expect to continue for the foreseeable future.

For QTC, adjusting to this transformation within the financial markets, which effectively saw the markets move from a ‘traded’ to a ‘brokered’ model, was made easier given the strong, long-term relationships we maintain with the members of our financial markets distribution group and, through them, our investors.

While the effects of this crisis have been wide-reaching in other jurisdictions, the Queensland Government’s established investment guidelines have ensured that no Government-owned corporations, statutory authorities or local governments have had exposure to the sub-prime mortgage market, or have invested in collateralised debt obligations. The guidelines for local governments were developed by QTC, Queensland Treasury and the Department of Local Government, Sport and Recreation to guide local governments in their investments, and have proven effective.

In addition, QTC had no exposure to the sub-prime market or to collateralised debt obligations.

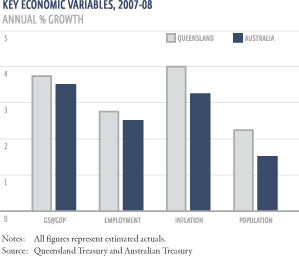

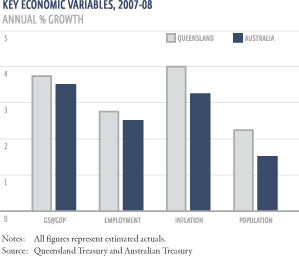

Queensland economy: exceeding the national average for the twelfth consecutive year

Amid the global financial markets turmoil, the Queensland economy is estimated by Treasury to have grown by 3.75 per cent in 2007–08, against expectations of national average economic growth of 3.50 per cent over the same period. Such an outcome would mean Queensland’s annual economic growth outpaced that of the nation for the twelfth consecutive year.

15

Looking ahead, annual Queensland economic growth is forecast to rise to 4.25 per cent in 2008–09, in contrast to an anticipated easing in national economic growth to 2.75 per cent. Indeed, the Queensland economy is the only State economy expected to record an increase in annual growth in 2008–09 over 2007–08, according to each of the latest state treasury department estimates. This acceleration in growth is expected to be underpinned by a significant strengthening in exports and business investment growth, due to high commodity prices, partially offset by an easing in consumer-demand growth, due to higher mortgage interest rates.

Notwithstanding this backdrop of solid economic growth, financial conditions have been tightened considerably in Australia, due to the Reserve Bank of Australia’s monetary policy actions. This has had a positive impact on inflation, but the consequential negative effect on consumption and investments has reduced somewhat the economic growth expectations of the State.

Significant funding task ahead

QTC now has more than $43 billion of debt on issue, a significant increase on the $34 billion, as at 30 June 2007. In the recent announcement of Queensland’s State Budget for 2008–09, Treasurer Andrew Fraser forecast a strong rise in Queensland Government investment in infrastructure, with more than $17 billion allocated for capital works in the coming year. Total capital expenditure in the State, including local authorities, is expected to be more than $20 billion, with the debt portion of $12.4 billion to be funded by QTC.

It is estimated that QTC’s funding task for the financial year 2008–09 will be $16.3 billion, with $6.7 billion required to refinance maturing debt (particularly the maturity of the July 2009 Benchmark Bond) and the balance required to fund new capital works expenditure of the Queensland public sector. It is anticipated that our AUD benchmark bonds will once again provide the bulk of the funding for next year, as relatively high domestic interest rates and a strong Australian dollar continue to encourage investor support both domestically and internationally. QTC will also continue to seek issuance in other markets, through its diverse range of funding facilities, as the complexities of the current credit and liquidity crises give rise to a more challenging operating environment.

Innovative financing solutions for infrastructure

In pursuit of the best value for money outcomes for the State’s expanding infrastructure development program, QTC responded to the Government’s request for innovative financing solutions and, in collaboration with Government stakeholders, contributed to the development of the Supported Debt Model (SDM).

The SDM is a financing variant of the traditional privately-financed public private partnership (PPP) model, and seeks to deliver a better value for money solution for the State. Under a SDM, a state government’s borrowing authority (in Queensland, QTC) provides the notionally risk free level of senior debt for a project upon completion of the construction phase and for the term of the lower risk operational phase. The amount of senior debt would vary depending on the risk profile of a specific project.

Initially developed for the South East Queensland Schools project, the SDM is a potential alternative financing option for the State’s other major social infrastructure projects. Its use in Queensland will be considered on a case-by-case basis under the Government’s Value for Money Framework.

With the significant widening of credit margins, and the resulting hike in the cost of funds, the SDM provides governments with a viable and responsible option to use PPPs to achieve their infrastructure objectives, despite the increasingly adverse market environment.

16

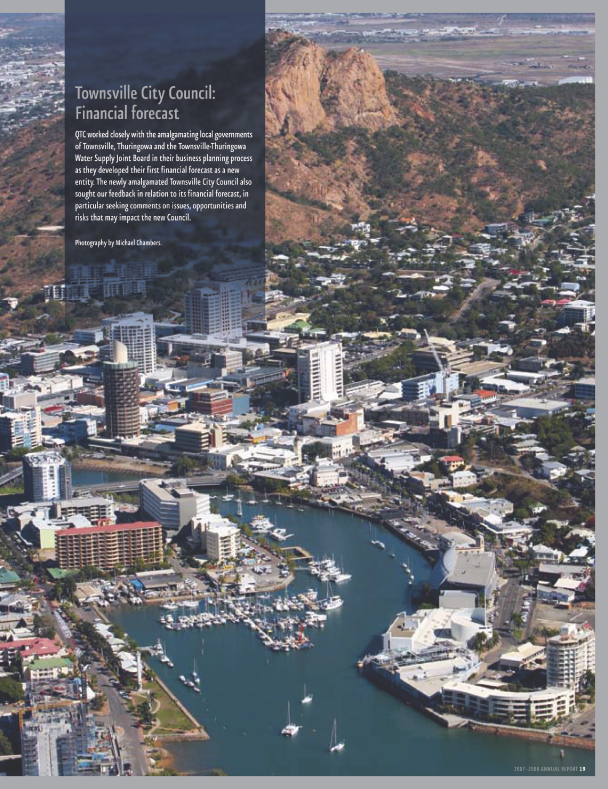

Support for local government

During the year, QTC fulfilled an integral role in the significant reform of Queensland’s local governments. In July 2007, the State Government announced that it would reduce existing local governments from 156 to 72 to create stronger councils to better manage the changing demographics, including population growth, and the demands of industry and other interest groups. QTC’s Chairman was appointed to the Local Government Reform Commission, and two senior employees were seconded to the project to assist with data analysis.

During this challenging time for the industry, QTC worked closely with local government customers, providing financial and risk management advice to assist them with their financial sustainability prior to and during the reform process.

Since its establishment in 2005, LG Infrastructure Services—QTC’s joint initiative with the Local Government Association of Queensland to support Queensland’s local governments to achieve their infrastructure developments—has provided advice and services to more than 60 local governments throughout the State, representing more than 80% of local governments in Queensland. In 2007–08, LG Infrastructure Services will return a dividend to its shareholders and begin repayment of the Treasury grant provided for its establishment in 2005.

17

Transfer of State’s long-term financial assets to QTC

On 1 July 2008, the Government transferred to QTC approximately $21 billion of the State’s long-term financial assets, which are held to meet future superannuation and other long-term obligations of the State. In return for this transfer, QTC entered into a financial arrangement to provide a fixed rate note to the General Government sector, at a rate initially set at 7.5% per annum, which is the actuarially assessed long-term average rate of return for a managed diversified portfolio of investments. The purpose of the transfer is to reduce the volatility in the State Budget as a result of the fluctuation in returns from the investment of these assets.

QTC will incur accounting profits or losses in the future, due to the volatility in investment returns in the market, although the return on the assets is expected to match the long-term average of 7.5% per annum.

As the transfer has no effect on cashflow, there will be no impact, positive or negative, on QTC’s capacity to meet its financial obligations. The liability for superannuation has not been transferred to QTC, and remains with the Government. With no impact from a whole-of-Government perspective, rating agencies Moody’s and Standard & Poor’s have confirmed that this transfer will not affect the State’s, or QTC’s, AAA credit rating or Stable Outlook.

Looking ahead

In the year that we celebrate our twentieth year of operations, and following the significant changes of the past year to the world’s financial environment, it will be more important than ever for us to continue to attract the support of the world’s financial institutions for QTC’s debt issuance, and the other support services they provide. It will also be important for us to continue to understand our customers and their evolving financial and risk management needs, given the dynamic environments in which they operate.

Following sound results from our biennial customer survey, which was completed in July 2007, we will be reinvigorating our organisation-wide customer loyalty program and updating our strategic plan. Development will continue on our customer lending and administration system, which is one of the most significant corporate projects QTC has undertaken and is expected to be completed in 2009–10.

With the State’s commitment to achieving major infrastructure development, we will focus our efforts on adding real value to those projects, either as advisors or as secondees within our customers’ project teams, and to supporting our customers in the achievement of their business goals.

It is the demonstrable expertise, professionalism and enthusiasm of our employees that has ensured QTC’s success over time, and we thank each and every one of our staff for their valued input. In the year to come, QTC will again focus on attracting and retaining the high calibre of people we are so fortunate to employ.

On a final note, we gratefully acknowledge the guidance and wisdom of our Board, and thank them for their ongoing support. Our sincere thanks also to David Coe, who resigned from the Board in February 2008, for his valuable contribution.

18

19

Customer report

As the world’s financial markets struggled through 2007–08, QTC was able to clearly demonstrate the bottom-line value it adds to the Queensland public sector, managing the State’s borrowing program to ensure customers had access to the funds they required at a competitive rate.

Our financial and risk management expertise created $212.6 million in quantifiable benefits for customers, including $145.2 million from issuing debt and $18.7 million from managing debt. We saved our customers $27.5 million from managing their liquidity and refinancing risk, and $5.8 million from structuring transactions. Our financial advisory services and strategic interest rate risk management advice generated customer savings of around $15.4 million.

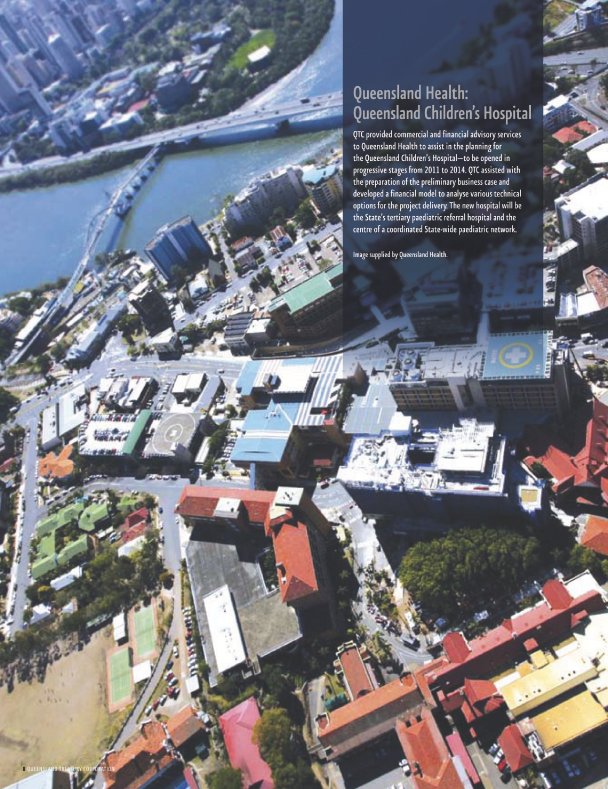

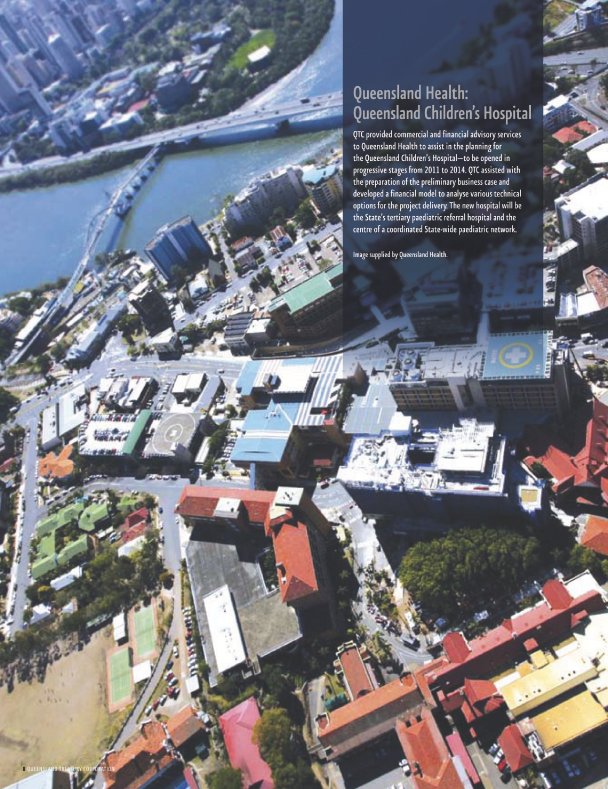

QTC’s corporate commitment to achieving the best financial outcomes for our customers and the State was progressed through our involvement in a significant number of key Government projects, including the proposed Queensland Children’s Hospital and North Bank developments, the establishment of the SEQ Water entities, the water infrastructure purchased from local governments, the proposed sale of the airports, and the evaluation of carbon emissions across Government.

After completing the review of local government financial sustainability in June 2007, we received a rating of 6 out of 7 in our biennial customer survey for adding real value to local governments through our understanding of their businesses and presenting material that could be easily understood. We also provided support to the Government in implementing the reform of the local government boundaries, and to our local government customers during the reform process. See page 18 for further details on the assistance QTC provided to the State’s local government reform process.

In collaboration with Government stakeholders, we contributed to the development of the Supported Debt Model—a financing variant of the traditional privately financed Public Private Partnership procurement model—to assist the State in its pursuit of innovative financing solutions for its expanding infrastructure development program. See page 12 for further details on the Supported Debt Model.

As LG Infrastructure Services completed its third successful year of operations, it broadened its reach into the local government industry and has now worked with more than 80 per cent of the State’s local governments and regional local government collaboration groups. See page 40 for further details on the LG Infrastructure Services initiative.

Funding the State

In the year under review, largely as a result of the demise of the US sub-prime mortgage market, the global financial markets’ environment was particularly challenging with global liquidity tightening to almost unprecedented levels. This led to greater uncertainty in funding markets, particularly those relating to asset-backed securities, which in turn led to a significant widening of market credit spreads. QTC was positively impacted by the changed market conditions in that it experienced the benefit of investors seeking high credit quality assets. However, there were also some less positive influences and, as a result, QTC was constantly adapting its issuance strategies to best suit the changing market circumstances.

During this period, QTC pursued a number of funding strategies to achieve the best possible outcomes for our customers and the State. Some of these strategies and initiatives included:

| | • | | issuing debt on demand from our investors, rather than through our normal tender process, in order to better manage our cost of funds |

| | • | | increasing the supply of inflation-linked bonds on issue, providing suitable funding for customer projects which have long asset lives and revenue linked to inflation |

20

| | • | | identifying offsetting cashflows of customers and managing the timing of market transactions to minimise transaction costs |

| | • | | issuing a new benchmark bond to mature in 2012 to further minimise interest rate risk for some of our customers, including Powerlink |

| | • | | raising funds in advance of requirements to deliver interest cost certainty for customers involved in the delivery of significant infrastructure projects, and |

| | • | | extending our borrowing horizon for terms longer than previously contemplated, by issuing a new bond maturing in 2033 to meet discreet investor requirements. |

21

22

Greater involvement in customer projects

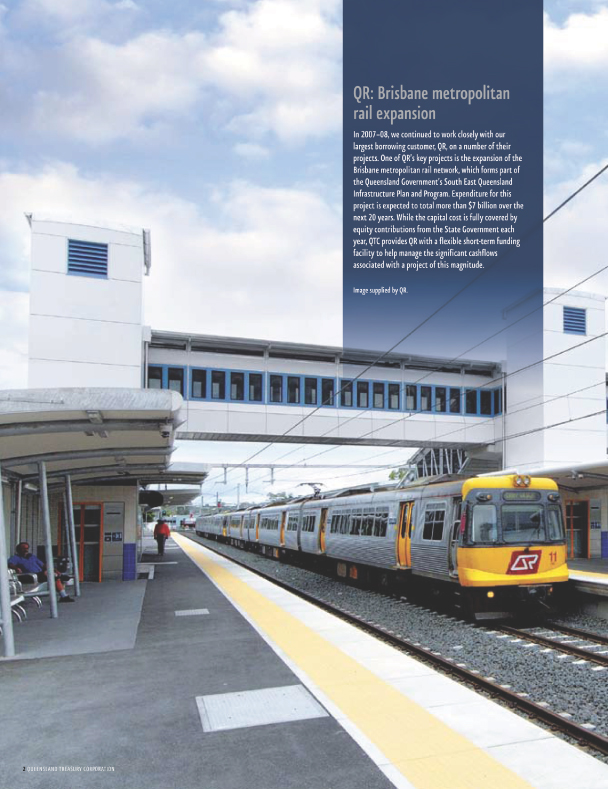

Our established secondment program continued to add significant value to our customers’ businesses through the placement and contributions of 27 of our employees into their organisations. In addition to the value provided to customers on their projects and teams, QTC benefited from an increased understanding of the issues effecting our customers and the specific industries they work in, and our employees benefited from the unique development opportunities of working on some of the most significant projects in the State.

In the past year, our employees have worked as secondees on some of the State’s most important projects which have delivered, or have the potential to deliver, significant economic value to customers and the State. These projects included the reform of local government boundaries, the Government’s purchase of the SEQ local governments’ bulk water and water treatment assets, the sale of the Government’s gas assets, and the proposed sale of the Cairns and Mackay airports and the Government’s remaining shareholding in the Brisbane airport.

We also placed secondees into the Office of Government Owned Corporations, the Department of Main Roads, the Department of Infrastructure and Planning, Queensland Health, Tarong Energy Corporation, Ergon Energy Corporation Ltd, and QR Limited to assist with their major projects.

More and varied customer assignments

As implementation and delivery of the State’s major infrastructure program gathered momentum, we identified opportunities and promoted innovative solutions to help minimise costs and ensure an appropriate level of project risk transfer between the Government and private sector. It was a year characterised by increased demand for debt funding for infrastructure, as well as increased demand for advisory assistance in areas including business case and financial model reviews, and debt and capital structuring arrangements.

FINANCIAL MODELLING

Our financial modelling capability continued to expand. In recognition of the expertise of our team, several customers sought multiple financial model build services during the year, including Ergon Energy Corporation Ltd, QR Limited, Queensland Treasury and LG Infrastructure Services. In particular, we

| | • | | developed financial models including the financial model for QR Limited access network |

| | • | | tailored forecasting models for several local governments including Gold Coast City Council, Gold Coast Water, Logan City Council; as well as for QR Limited and QFleet |

| | • | | developed a benchmark model for Government to assist in assessing the North Bank development proposal |

| | • | | developed a financial model to assist Queensland Health in evaluating the capital and operating costs of the various delivery options for the Queensland Children’s Hospital, and |

| | • | | reviewed the financial models of Powerlink Queensland, Ports Corporation of Queensland, Ergon Energy, Port of Brisbane Corporation and QFleet. |

REVIEWING CREDIT AND FINANCIAL SUSTAINABILITY REVIEWS

To assist the Government in its approval process for the Government-owned corporations’ (GOC) annual borrowings, we completed annual credit reviews of each corporation to determine their individual capacities to service their existing and proposed new debt. We provided Treasury with specific recommendations based on the finding of these reviews. We also completed credit analyses on a project-by-project basis for our GOC customers, and reviewed the capital structure on behalf of various borrowing customers.

Our Government department customers also sought our assistance to complete financial and commercial viability assessments, including the Department of Education, Training and the Arts’ ‘Solar for Schools’ program, and the Department of Public Works’ development of the Roma Street Parklands. We also worked with Brisbane City Council (BCC) to perform an annual assessment of their borrowing capacity, and have since been requested by BCC to undertake their credit reviews on a semi-annual basis.

23

24

RISK MANAGEMENT

We provided cash management advice around the optimal management of the Government’s cash balances and debt in light of the current market environment, ensuring sound debt management practices were in place to reduce the vulnerability of the State to economic and financial shocks over the short-, medium- and long-term.

We also advised on interest rate risk management and funding strategies for most of the State’s major projects, including the Gateway Bridge duplication, Hale Street Bridge, Airport Link, the State’s various water companies and SEQ Schools, and developed a commodity and foreign exchange risk management framework for Energex Ltd, Ergon Energy Corporation Ltd, and CS Energy.

In consultation with Queensland Treasury, the Department of the Premier and Cabinet and the Office of Climate Change, we led the initial development of a whole-of-Government program for identifying, quantifying and understanding the potential risks and costs for our customers associated with the proposed introduction of the Carbon Pollution Reduction Scheme in 2010.

SUPPORTING INFRASTRUCTURE DEVELOPMENT

During the year, we contributed to various procurement phases on many of the State’s major projects, including Queensland Children’s Hospital (master planning and business case), North Bank (planning and evaluation of preferred private sector proponent’s proposal), SEQ Schools (planning, Supported Debt Model development, and financial advice), Carbon Pollution Reduction Scheme (planning and pilot review), Solar for Schools (planning and feasibility), and the Sunshine Coast Hospital (Supported Debt Model feasibility).

We are also working with the Department of Infrastructure and Planning to develop Contract Management Guidelines for inclusion in the State’s Value for Money Framework, based on the assistance we provided in 2007 to the Southbank Institute of Technology in the development of a long-term contract administration manual.

Seeking customer feedback

QTC engaged an independent consultant to conduct our seventh biennial customer survey in 2007, seeking feedback from a cross-section of our customer base. Overall, customer feedback was generally very positive, particularly in relation to our responsiveness to issues our customers consider important. The customer survey, and anecdotal feedback on projects, indicated that our customers recognise our understanding of Government and engagement with our customers. Specifically, our stakeholders identified our core expertise of sourcing and managing the debt funding to finance the State, our strong reputation and credibility, and our focus on building strong relationships with our customers, as key examples of our high level of performance. The feedback provided by our customers and stakeholders through the surveys and post-assignment evaluations has now been incorporated into our annual planning processes to guide our provision of services in 2008–09.

One of the key areas for development that came through the survey was the need for customer training. To assist our customers with their training needs, we ran our Central Treasury Management in April 2008 and Cost of Capital courses in July and August 2007. We have also focused on leveraging the diverse range of expertise available from the banks in our Distribution Group to host forums on climate change and the hedging of financial risk, including foreign exchange and commodity price risk, and various economic events during the year.

25

26

27

28

Investor report

Solid domestic and foreign investor demand for all lines of Queensland Treasury Corporation’s (QTC) AUD benchmark bonds and commercial paper continued during 2007–08, as investors sought high credit quality, liquid assets in the uncertain global market environment.

As a result of investor ‘flight-to-quality’ following the market’s credit and liquidity crises, QTC was able to source funds from an even broader range of investors seeking secure, AAA rated, government-guaranteed bonds. We completed our borrowing program some months prior to year end, with actual borrowings for 2007–08 totalling $13.8 billion.

Relationships with members of our Distribution Group of bankers were further strengthened, as we faced the challenges of 2007–08 together. Our commitment to ensuring openness and transparency in these relationships assisted our Distribution Group members to consistently make markets in QTC bonds at competitive prices. As a result, we were able to enhance liquidity by issuing more bonds than we had initially intended. With investor interest in semi-government bonds continuing to grow, we also increased the size of our Distribution Group, with the addition of JP Morgan Australia Limited. At the end of June 2008, our Distribution Group included 12 of the world’s leading financial institutions, providing our investors with even greater depth in terms of their ability to transact QTC bonds.

The global credit and liquidity crises led to a sharp widening of all credit spreads, and the spread of QTC bonds to the Commonwealth Government curve (like the spreads of the other Australian semi-government issuers) was not immune. At one point during the year, we witnessed semi-government versus Commonwealth Government spreads trading at margins of more than 80 basis points, the largest margin in more than a decade. This move in spreads was accentuated by the prevailing ‘scarcity’ premium built into Commonwealth Government securities and reflected the high degree of uncertainty in the financial markets at the time.

In May 2008, the Commonwealth Government announced three key structural changes to the Australian government bond markets. The first involved its intention to make all semi-government debt issued onshore eligible for exemption from Interest Withholding Tax. This is in-line with the existing exemption available for semi-government debt issued offshore. QTC sees this as very positive for the semi-government bond market, broadening the global investor base and enhancing the overall depth and liquidity of our market.

The Government’s second announcement involved its intention to increase the issuance of Commonwealth Government securities by up to $25 billion over the next four years. With $5 billion of this additional issuance already confirmed for 2008–09, we believe this initiative will further strengthen Australia’s financial markets.

The third announcement of structural change to the Australian Government bond markets involved the widening of the investment mandate of the Australian Office of Financial Management, to enable it to invest the proceeds from the increased Commonwealth Government securities issuance in the most appropriate manner. Importantly, this will include investment in semi-government bonds. We believe the aggregate impact of these structural changes will be positive for the semi-government bond market, and anticipate it will lead to increased demand for QTC bonds from both onshore and offshore investors.

Investor highlights

| | • | | QTC’s debt on issue reached more than $43 billion, at 30 June 2008. |

| | • | | QTC’s bonds and paper continued to experience strong demand, despite the credit and liquidity crises. |

| | • | | QTC’s AAA/Aaa ratings and Stable Outlook were affirmed by both Standard and Poor’s and Moody’s. |

| | • | | QTC executives visited investors in Canada, China, France, Hong Kong, Japan, New Zealand, Qatar, Singapore, United Arab Emirates, United Kingdom and the United States of America. They were supported by the State’s Treasurer and Under Treasurer on certain visits. |

29

| | • | | QTC continued to diversify its funding sources, issuing a NZD375 million New Zealand dollar denominated ‘Kauri’ bond, and adding to its inflation-linked bond outstandings. |

QTC’s credit rating

| | | | | | |

LOCAL CURRENCY | | LONG-TERM | | SHORT-TERM | | OUTLOOK |

Moody’s | | Aaa | | P1 | | Stable |

Standard & Poor’s | | AAA | | A-1+ | | Stable |

| | | |

FOREIGN CURRENCY | | LONG-TERM | | SHORT-TERM | | OUTLOOK |

Moody’s | | Aaa | | P1 | | Stable |

Standard & Poor’s | | AAA | | A-1+ | | Stable |

30

31

Review of 2007–08 funding activity

QTC increased the size of its debt issuance program in order to meet the growing borrowing requirement for Queensland’s spend on infrastructure projects. Actual borrowings for 2007–08 totalled $13.8 billion, compared to $5.9 billion in 2006–07.

Solid domestic and foreign investor demand saw the issuance of QTC’s AUD benchmark bonds provide the majority of required funding, contributing more than $11 billion in 2007–08. QTC’s diversified funding facilities, including commercial paper and medium-term notes, also enabled debt issuance denominated in foreign currencies despite the uncertain and volatile credit and liquidity conditions prevailing in global markets. As is QTC’s policy, all foreign currency proceeds were swapped into Australian dollars.

Funding related activities for QTC in 2007–08 included:

| | • | | Refinancing the maturity of QTC’s 14 September 2007 benchmark bond, with a total of $3.2 billion outstanding as at 30 June 2007. |

| | • | | In September 2007, QTC became the first Australian government entity to issue a bond in the New Zealand dollar denominated ‘Kauri’ format. The ten-year deal, issued under our Euro medium-term note program, was for a total size of NZD375 million, with a coupon of 7.125% and a maturity date of 18 September 2017. The issue was well received by global investors and added further diversification to QTC’s funding base. |

| | • | | In November 2007, the amount on issue of QTC’s 2.75%, 20 August 2030 Capital Indexed Bond was increased by AUD275 million, taking total issuance to AUD543 million. Investor demand for this inflation-linked bond was strong, with total investor interest significantly greater than the amount allotted. |

| | • | | In March 2008, a new long-dated QTC domestic preferred bond line maturing in 2033 was established through an initial issue of AUD500 million. |

| | • | | In May 2008, QTC launched a new AUD domestic benchmark bond with a coupon of 6.5% and a maturity date of 16 April 2012. The issue was very well supported by the market, with the volume on issue building to almost $2 billion in the first week. |

The following table details the change in net issuance in QTC’s principal funding sources over the year:

| | | | | | |

FUNDING FACILITY | | 30 JUNE 07 | | 30 JUNE 08 | | NET CHANGE |

| | | AUD | | AUD | | AUD |

Domestic | | | | | | |

Benchmark Bonds | | 20,468 | | 26,275 | | 5,807 |

| | | |

Global | | | | | | |

Benchmark Bonds | | 11,659 | | 14,380 | | 2,721 |

Capital Indexed Bonds | | 268 | | 543 | | 275 |

Other Domestic Bonds | | 598 | | 596 | | -2 |

Euro MTN | | 159 | | 399 | | 240 |

CP | | 602 | | 1,452 | | 850 |

| | | | | | |

TOTAL | | 33,754 | | 43,645 | | 9,891 |

| | | | | | |

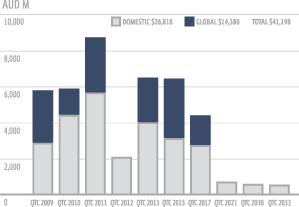

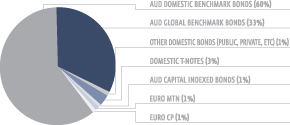

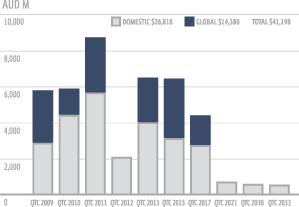

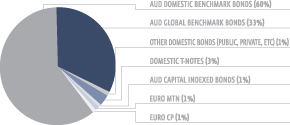

Funding facilities at 30 June 2008

A$ BENCHMARK BONDS—DOMESTIC AND GLOBAL

QTC currently offers investors domestic and global benchmark bonds maturing in 2009, 2010, 2011, 2012*, 2013, 2015 and 2017, and preferred domestic bond lines maturing in 2021 and 2033.

32

In addition, QTC also has an inflation-linked capital indexed bond maturing in 2030 issued under the AUD domestic bond facility.

The QTC benchmark bonds are our core source of funds, comprising in excess of 90% of total borrowings as at 30 June 2008.

DOMESTIC AND GLOBAL QTC BONDS ON ISSUE, AS AT 30 JUNE 2008

33

34

Funding Facilities details, as at 30 June 2008

| | | | | | | | | | | | |

FACILITY | | SIZE $M | | GOVERNING LAW | | MATURITIES | | CURRENCIES | | ISSUE

AUD M | | PLACEMENT |

Domestic AUD Bond | | Unlimited | | Queensland | | 7 benchmark lines: 2009 to 2017 | | AUD | | 25,110 | | By tap or tender through Distribution Group |

| | | | | | 2 preferred lines: 2021 and 2033 | | AUD | | 1,166 | | Reverse enquiry through Distribution Group |

| | | | | | Capital Indexed Bond: 2030 | | AUD | | 543 | | By tap or tender through Distribution Group |

Global AUD Bond | | 18,000 | | New York and Queensland | | 6 benchmark lines: 2009 to 2017 (transferable to domestic bonds) | | AUD | | 14,380 | | Continuously offered through Distribution Group |

Treasury Notes, Commercial Paper and Medium-Term Notes

The QTC treasury note (T-Note) facility is a domestic electronic issuance facility and is our chief source of short-term domestic AUD funds. QTC’s main offshore programs are the multicurrency commercial paper (CP) and medium-term note (MTN) facilities in both the Euro and US markets.

| | | | | | | | | | | | |

FACILITY | | SIZE $M | | GOVERNING LAW | | MATURITIES | | CURRENCIES | | ISSUE

AUD M | | PLACEMENT |

Domestic T-Note | | Unlimited | | Queensland | | 7 to 365 days | | AUD | | 1,000 | | By tap through Dealer Panel |

Euro CP | | USD 3,000 | | English and Queensland | | 7 to 365 days | | Multicurrency | | 401 | | Continuously offered through Dealer Panel |

US CP | | USD 1,500 | | New York and Queensland | | 1 to 270 days | | Multicurrency | | 52 | | Continuously offered through Dealer Panel |

Multicurrency Euro MTN | | USD 3,000 | | English and Queensland | | Subject to market regulations | | Multicurrency | | 398 | | Reverse enquiry through Dealer Panel |

Multicurrency US MTN | | USD 500 | | New York and Queensland | | 9 months to 30 years | | Multicurrency | | 0 | | Reverse enquiry through Dealer Panel |

QTC’s funding facilities are supplemented with public issues and private placements.

35

36

All funding facilities

PERCENTAGE OUTSTANDINGS UNDER QTC’S FUNDING FACILITIES, AS AT 30 JUNE 2008

Borrowing program

QTC announces its borrowing requirement annually in June to provide a funding estimate for the following year, after the release of the Queensland Government budget. A half-year review, and update of the borrowing requirement, is provided in January.

QTC’S INDICATIVE BORROWING PROGRAM FOR 2008–09 FINANCIAL YEAR

| | | | | | |

BORROWING DETAILS | | 2008–09 | | | 2007–08

(REVISED*) | |

| | | AUD M | | | AUD M | |

REFINANCING OF MATURING DEBT: | | | | | | |

| | |

AUD benchmark bonds | | 0 | | | 3,173 | |

AUD non-benchmark bonds | | 69 | | | 101 | |

Medium-term notes (MTNs) | | 0 | | | 52 | |

Commercial paper1 | | 1,457 | | | 613 | |

| | | | | | |

TOTAL MATURING DEBT | | 1,526 | | | 3,939 | |

| | | | | | |

ADJUSTMENTS: | | | | | | |

| | |

Prefunding of Sep 2007 | | | | | | |

Benchmark Bond maturity | | — | | | (1,500 | ) |

Prefunding of Jul 2009 | | | | | | |

Benchmark Bond maturity | | 5,741 | | | — | |

Principal repayments from QTC customers | | (600 | ) | | (600 | ) |

| | | | | | |

TOTAL REFINANCING | | 6,667 | | | 1,839 | |

| | | | | | |

NEW BORROWING: | | | | | | |

| | |

Capital works and asset procurement | | 12,365 | | | 10,772 | |

Funding in advance of customer borrowings | | (2,700 | ) | | (3,219 | ) |

| | | | | | |

TOTAL NEW BORROWING | | 9,665 | | | 7,553 | |

| | | | | | |

TOTAL BORROWING PROGRAM2 | | 16,332 | | | 9,392 | ** |

| | | | | | |

37

The 2008–09 borrowing estimate of $16,332 million is expected to be funded as follows:

| | | | | | |

| | | EXPECTED RAISINGS 2008–09 |

FUNDING SOURCE | | RANGE | | LOW | | HIGH |

| | | % | | AUD M | | AUD M |

TERM RAISINGS: | | | | | | |

AUD bonds3 | | 60–70 | | 9,800 | | 11,430 |

MTNs and other currency loans | | 5–15 | | 820 | | 2,450 |

| | | |

COMMERCIAL PAPER RAISINGS: | | | | | | |

T-Notes, ECP, USCP | | 20–30 | | 3,270 | | 4,900 |

Notes:

| 1. | Estimated commercial paper outstanding as at 30 June. |

| 2. | Funding activity may vary depending upon actual customer requirements, the State’s fiscal position and financial market conditions. |

| 3. | Includes AUD domestic and global benchmark bonds, capital indexed bonds and other term issuance. |

| * | Based on the State’s Mid Year Fiscal and Economic Review released on 14 December 2007. |

| ** | Actual borrowing totalled AUD13,828 million to meet increased liquidity and customer requirements. |

38

39

Economic and Fiscal report

Queensland’s economic outlook

ECONOMIC GROWTH

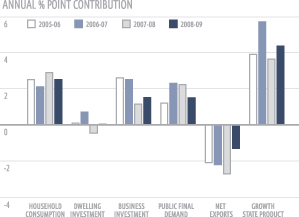

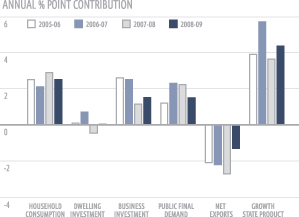

| | • | | Growth in the Queensland economy is forecast to accelerate slightly to 4 1/4 per cent in 2008–09, in contrast to an anticipated easing in national growth to 2 3/4 per cent. A significant strengthening in exports growth, combined with stronger growth in business investment, is anticipated to more than offset an easing in growth in consumer demand, facilitating some rebalancing in the composition of economic growth. |

| | • | | Growth in private consumption is forecast to ease to 4 1/2 per cent in 2008–09. A fall in dwelling investment in 2007–08 is forecast to slow growth in housing-related spending in 2008–09, while more moderate asset price growth should ease growth in wealth related spending. However, ongoing growth in wages and employment is forecast to support growth in incomes. |

| | • | | Growth in business investment is forecast to strengthen slightly to 9 1/4 per cent in 2008–09. Growth in investment in other buildings and structures is forecast to accelerate, led by mining and major commercial development projects. |

CONTRIBUTIONS TO GROWTH IN QUEENSLAND’S GROSS STATE PRODUCT

| Notes: | Contributions for 2007–08 represent estimated actuals while contributions for 2008–09 represent forecasts. |

| Source: | Queensland Treasury |

TRADE SECTOR

| | • | | Capacity expansions and a return to normal seasonal and operating conditions are forecast to see exports growth improve substantially in 2008–09, to a four-year high of 4 1/4 per cent. |

| | • | | In contrast, an easing in growth in private consumption and machinery and equipment investment is forecast to moderate growth in total imports to 6 3/4 per cent in 2008–09. As a result, net exports are forecast to detract only 1 1/4 percentage points from overall growth in 2008–09. |

INFLATION

| | • | | Inflation is forecast to ease to 3 1/2 per cent in 2008–09. This reflects a return to normal seasonal conditions, which should ease domestic food price growth, as well as an assumed stabilisation in global credit conditions, which is expected to dampen growth in the cost of financial services. However, the tight labour market, high capacity utilisation and growth in rents will limit downward pressure on inflation over the year. |

40

EMPLOYMENT

| | • | | Jobs growth is forecast to moderate marginally, to 2 1/2 per cent in 2008–09. While supported by non-dwelling construction and the rise in the terms of trade, jobs growth is anticipated to ease slightly, in line with forecast slower growth in consumer spending. However, jobs growth is forecast to match labour force growth, leaving the year-average unemployment rate at a generational low of 3 3/4 per cent. |

2007–08 ECONOMIC HIGHLIGHTS

| | • | | The Queensland economy is estimated to have expanded by 3 3/4 per cent in 2007–08 and exceed growth nationally for the twelfth successive year. |

| | • | | Reflecting strong growth in consumer incomes and house prices, household consumption growth is estimated to have strengthened to 5 1/4 per cent in 2007–08. |

| | • | | Limited spare capacity in the economy is estimated to have driven further growth in private and public investment, albeit at more modest rates than in recent years. |

| | • | | Jobs growth is expected to have surpassed labour force growth, reducing the State’s unemployment rate for the sixth consecutive year, to 3 3/4 per cent in 2007–08, the lowest year-average rate in 34 years. |

| | • | | Employment is estimated to have risen by 2 3/4 per cent, or 55,000 persons, in 2007–08, supported by higher levels of business and consumer spending over the year. |

41

42

Queensland’s fiscal environment

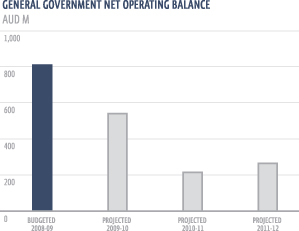

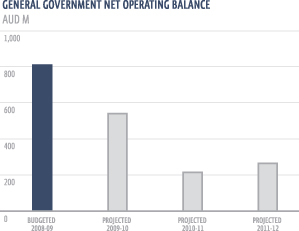

2008–09 BUDGETED RESULT

| | • | | On an accrual basis, the Queensland State Budget provides for a General Government operating surplus of $809 million in 2008–09. The General Government forward estimates project continuing surpluses over the State Budget forecast horizon, consistent with the fiscal principles outlined in the Charter of Social and Fiscal Responsibility. |

| | • | | The 2007–08 Budget also provides for cash deficits in the General Government sector across the forward estimates as a result of the State’s significant planned capital expansion. |

2007–08 ESTIMATED ACTUAL RESULT

| | • | | The estimated headline operating deficit of $995 million in 2007–08 reflects the subdued performance of investment markets, which has impacted on the returns the State receives on the substantial funds set aside to meet future liabilities. |

| | • | | Investment market volatility impacts more on the Queensland Budget than it does for other states. This is due to differences in the way Queensland’s public sector superannuation arrangements are structured and the size of Queensland’s investments compared to other States. If Queensland’s superannuation arrangements were structured on the same basis as that which generally applies in other states, the General Government sector underlying operating result for 2007–08 would be a surplus of $272 million. |

43

KEY FINANCIAL AGGREGATES (UNIFORM PRESENTATION FRAMEWORK BASIS)

| | | | | | | | | | | | | | | |

| | | 2007–08

EST. ACTUAL | | | 2008–09

BUDGET | | | 2009–10

PROJECTED | | | 2010–11

PROJECTED | | | 2011–12

PROJECTED | |

| | | AUD M | | | AUD M | | | AUD M | | | AUD M | | | AUD M | |

GENERAL GOVERNMENT SECTOR | | | | | | | | | | | | | | | |

Revenue | | 32,276 | | | 36,582 | | | 37,240 | | | 38,638 | | | 40,385 | |

Expenses | | 33,271 | | | 35,772 | | | 36,700 | | | 38,422 | | | 40,120 | |

Net operating balance | | (995 | ) | | 809 | | | 540 | | | 215 | | | 265 | |

Cash surplus/(deficit) | | (3,547 | ) | | (1,970 | ) | | (2,654 | ) | | (2,669 | ) | | (2,059 | ) |

Capital purchases | | 5,223 | | | 6,651 | | | 6,693 | | | 6,590 | | | 5,824 | |

Net worth | | 123,095 | | | 128,563 | | | 132,708 | | | 136,490 | | | 140,243 | |

44

45

| | • | | The Queensland Government has decided to remove investment return volatility from the General Government net operating balance through transferring certain Consolidated Fund assets held to meet long-term liabilities such as superannuation to QTC. The outcome of this will mean that in future years, like other states, there will be no difference between the underlying and headline surplus. |

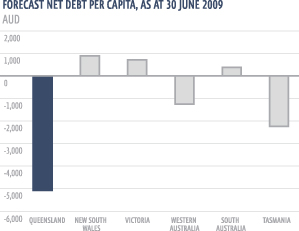

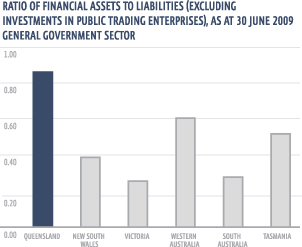

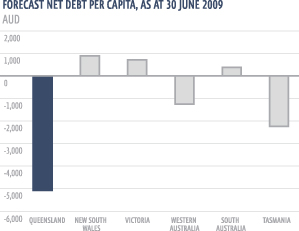

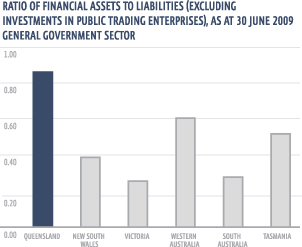

Balance Sheet

| | • | | Queensland continues to maintain a strong balance sheet compared with the other states. At 30 June 2009, Queensland’s estimated net debt in the General Government sector is negative, implying a strong net asset position. Queensland’s negative net debt of $5,082 per capita compares to the average net debt of $401 per capita in the other states. |

| | • | | The State’s net financial asset position remains sound. Based on current projections, the General Government sector will continue to meet the commitment in the Government’s Charter to ensure that financial assets cover all accruing and expected future liabilities in all years through to 30 June 2012. |

| | • | | Queensland has consistently pursued sound long-term fiscal policies such as the full funding of employee superannuation entitlements. The strong balance sheet and high levels of liquidity in the General Government sector clearly demonstrate the success of these policies. |

46

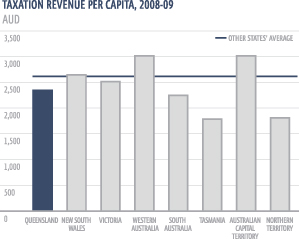

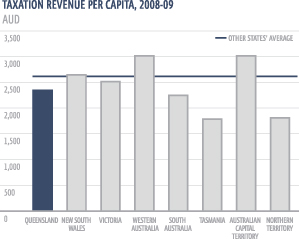

Competitive Tax Environment

| | • | | One of the Queensland Government’s key fiscal objectives is to maintain a competitive tax environment while raising sufficient revenue to meet the infrastructure and government service delivery needs of the people of Queensland. |

| | • | | In 2008–09, state tax collections per capita in Queensland are expected to be $2,342, which compares to an estimated average state tax collection of $2,585 per capita for the other states and territories. Queensland’s per capita taxation for 2008–09 is 9.4 per cent lower than the average tax per capita of the other states and territories. |

47

Corporate report

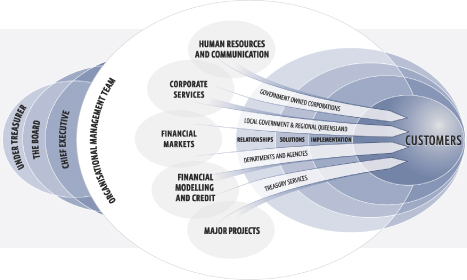

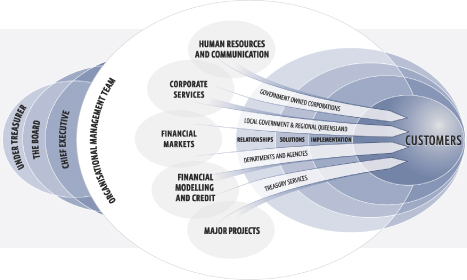

QTC is structured to reflect our overarching, value-delivering strategy of customer loyalty, recognising that we achieve our corporate goals through the efforts of our people and teamwork.

Our teams work in an integrated and collaborative way to implement the three core processes of our customer loyalty operating model—developing and maintaining relationships, designing and developing customer-specific solutions, and delivering tailored solutions that meet our customers’ needs.

The diagram on page 35 demonstrates that, through these core processes and supporting teams, our customer teams work directly with customers to optimise outcomes and appropriately manage risk for the benefit of their organisation and for the State.

Our people

Since its introduction in 1994, QTC’s customer loyalty model has underpinned our strategic direction and culture. The ongoing development and implementation of our customer focus across all areas of our business is paramount to the success of our people and the organisation and, moreover, the value created for customers.

In 2008, QTC decided to revisit and reinvigorate its customer loyalty operating model. Following targeted training for all employees, we identified a number of strategic insights and are now implementing a strategic review of our customer loyalty model. As part of the review, QTC is working closely with customers to identify their priorities for the future, and we will use this information to develop and deliver the best possible products and services to our customers.

Our corporate resourcing strategy and structure will underpin the success of this strategic review. While the labour market has remained competitive, QTC has maintained its establishment number for permanent employees at 170, and vacancies have generally been filled within required timeframes. Equally important has been our focus on further improving our retention rate and we have focused on a number of initiatives to further this objective, including:

| | • | | reviewing the way performance is rewarded, and implementing changes to our reward structure to improve the employee value proposition |

| | • | | developing engagement strategies |

| | • | | promoting new positions within the organisation |

| | • | | providing access to coaching and talent management |

| | • | | providing rotational assignments or secondments |

| | • | | providing leadership training for existing and potential leaders |

| | • | | improving interviewing and selection techniques, and |

| | • | | enhancing staff development, career development and training programs. |

Looking ahead, we will continue to focus on our learning and development program, and will review our performance management processes and systems to ensure they continue to support our people in the achievement of QTC’s corporate objectives.

Risk management

For some years now, QTC has managed its risks within an enterprise-wide risk management framework. The framework supports the achievement of QTC’s corporate strategies and objectives by providing assurance that QTC’s risks are being appropriately and effectively identified and managed, using a consistent and well understood approach for evaluating and reporting risks.

48

As part of the framework, QTC periodically identifies its key or significant risks, which are reported to the Risk Management Team and the Risk Management Committee, and risks are added or removed from time-to-time. For instance, the risks related to developing a new IT system to manage its loans to and deposits of customers, as well as other transactions, have been identified as a significant risk category for QTC and are being managed within the risk framework. The rigorous management of this project’s risks gives QTC the confidence to embrace the opportunity to undertake this significant project to obtain a system tailored to QTC’s lending and investment administration needs.

During the year, QTC reviewed the risk management framework, including a review of QTC’s highest risks and improvement of team planning processes. In addition, teams reviewed their risks and how these relate to QTC’s significant risks. Teams then developed a map of the independent assurance activities surrounding each significant risk and a map of the accountabilities for each significant risk.

QTC’s audit and compliance processes ensure that our business processes are appropriate and effective. Under our compliance program, based on Australian Standard 3806, compliance is an integral part of our operating procedures, and is the responsibility of all employees. Despite the secondment of a number of senior staff during the year, no issues of significant non-compliance were identified in internal or external audits during the year.

49

Operational risks associated with the processing and administration of financial markets and customer transactions (loans, investments and leases) were managed prudently during the year. QTC managed 99,836 transactions during the year, with only 46 errors attributable to our organisation. The cost of settlement, leasing and cash flow management errors was $165,916.76, compared to $31,345 for 2006–07. The dollar value of transactions increased by $36 billion to $900 billion.

Critical system availability was 99.95%, with a total downtime of 40 minutes across all critical systems.

Information management

The Onlending and Investment Administration (OLIA) project has dominated QTC’s information management resources for the year, as it is the largest and most significant internal project that QTC has ever undertaken. The significant risks of the project have been effectively managed and, where necessary, decisive action was taken to keep the management of the project and development of the system on track. We are now in the process of determining the optimal solution to implement the design phase to complete the project.

In addition to the OLIA Project, the year saw significant progress made to several strategic information initiatives:

| • | | A pilot business intelligence project was completed, improving data management and reporting practices associated with our customers’ debt pool position and performance reporting. |

| • | | Customer information was centralised, with an emphasis on improving the classification of historical information to support planned initiatives and improve information accessibility through QTC’s intranet. |

| • | | A number of significant systems upgrades were completed to ensure the currency of business systems, and to offset risk and improve organisational efficiency. |

| • | | Additional intellectual property (eg, formulae) is now centrally controlled, ensuring the integrity of critical calculations. |

| • | | The Citi settlements system (CitiDirect) was successfully implemented, following the appointment of Citi as QTC’s futures clearing provider. |

| • | | The Financial Case Management system was upgraded, as was the Gold Coast City Council’s treasury management system—Capix. |

Carbon Pollution Reduction

In line with the Queensland Government’s new standard for Government departments and Government-owned corporations to measure and report their greenhouse gas emissions, QTC compiled its inventory of greenhouse gas emissions for the year.

QTC’s total greenhouse gas emissions for 2007–08 was 1,559 tonnes of carbon dioxide equivalent (CO2-e). Emissions from electricity use comprised 1,156 tonnes or 74 percent of the total. The calculation of a comprehensive and accurate emissions inventory is an important first step in managing our greenhouse gas emissions and reducing energy consumption and costs. With an accurate measure of emissions, QTC has identified areas for better energy efficiency and emission reductions that will allow us to track and measure performance in subsequent years.

| | | | |

EMISSION SOURCE | | PERCENTAGE

OF TOTAL | | TONNES

OF CO2-e |

Electricity consumption | | 74.2 | | 1,156 |

Air travell | | 11.1 | | 175 |

Motor vehicles | | | | |

(cabs, hire cars, work cars) | | 1.5 | | 23 |

Staff commuting | | 12.2 | | 192 |

Air-conditioning gases | | 0.5 | | 6 |

Waste disposal | | 0.5 | | 7 |

| | | | |

TOTAL | | 100 | | 1,559 |

| | | | |

In addition, QTC’s role and expertise in this area has evolved, and we are now assisting our customers to estimate and manage their greenhouse gas emissions and providing guidance and technical advice on energy efficiency and carbon trading. This is part of a service to assist our customers identify and prepare for the introduction of the Australian Carbon Pollution Reduction Scheme in 2010 and its likely impacts on their organisations.

50

QTC Board

The composition of our Board equips QTC with diverse corporate, financial, commercial, economic and legal skills. The Board guides our commitment to achieving high standards of corporate governance, accountability, compliance and financial and ethical behaviour, which is critical for maintaining our strong market reputation and the confidence of our customers and stakeholders.

At 30 June, there was a board vacancy due to the resignation of David Coe in February 2008.

Sir Leo Hielscher AC

BCOMM, D UNIV GRIFFITH (HON), AAUQ, AASA, FAIM, FCPA, FFTP (HON)

CHAIRMAN

APPOINTED IN 1988. TENURE TO 30 JUNE 2010.

BOARD COMMITTEES

CHAIRMAN, HUMAN RESOURCES COMMITTEE

MEMBER, RISK MANAGEMENT COMMITTEE

Sir Leo Hielscher AC has more than fifty years’ experience in the areas of Government, the banking and finance industry, domestic and global financial markets, superannuation industry and as an independent company director.

He was the Under Treasurer of Queensland for 14 years ( 1974–1988) before his appointment as Chairman of the Queensland Treasury Corporation (Advisory Board) in 1988. In 1991, the Advisory Board became the Queensland Treasury Corporation Board and Sir Leo was appointed as its inaugural Chairman. Sir Leo is also Chairman of Austsafe Ltd, the Independent Superannuation Preservation Fund, and a Director of the American Australian Association Ltd. As a company director, Sir Leo has considerable experience at board level and has been associated with a number of public and private sector boards.

Sir Leo was awarded an Eisenhower Fellowship in 1973, a Knight Bachelor in 1987, an Honorary Doctorate of Griffith University in 1993, and a Companion in the Order of Australia (AC) in the General Division in 2004. He was honoured as a ‘Queensland Great’ by the Queensland Government in 2007.

Tim Spencer

BSC (ECON) (HONS)

DEPUTY CHAIRMAN

APPOINTED IN JULY 2007. TENURE TO 30 JUNE 2011.

BOARD COMMITTEES

MEMBER, RISK MANAGEMENT COMMITTEE

MEMBER, ACCOUNTS AND AUDIT COMMITTEE

MEMBER, HUMAN RESOURCES COMMITTEE

Tim Spencer is the Deputy Under Treasurer of the Queensland Treasury Department, a position he has held since 2001. In this role, he has worked extensively with Queensland’s Government-owned corporations, various commercial and major infrastructure projects, asset sales and structure, and market reforms.

Mr Spencer has previously held other senior management and executive positions in the public sector in Queensland, South Australia and the Australian Capital Territory, where his responsibilities have spanned economic policy research and development, establishment of market arrangements and the long-term leases of electricity assets, restructuring of government- owned electricity businesses, investment and borrowing activities, and the implementation of National Competition Policy. He is also a Director of Queensland Motorways Ltd.

Gillian Brown

LLB (HONS), GRAD DIP APPLIED FINANCE AND INVESTMENT, SIA

APPOINTED IN JULY 2004. TENURE TO 30 JUNE 2011.

Board committees

CHAIRMAN, RISK MANAGEMENT COMMITTEE

Gillian Brown has more than 18 years’ experience as a specialist finance lawyer and has gained extensive corporate, financing and major project experience.

She is national Chairman of Minter Ellison Lawyers and a partner of the firm in Queensland (admitted as partner 1994), heading the finance practice. Ms Brown’s principal areas of practice include corporate finance, investment and financial services, financial markets, project and infrastructure finance, and property finance.

Ms Brown has advised government bodies on a number of project and transactional arrangements and has an indepth knowledge of the mechanics of government and its objectives. Ms Brown is also a Director of Dalrymple Bay Coal Terminal Holdings Pty Ltd, and a committee member of the Law Council of Australia.

51

David Coe

BA (HONS), LLB

APPOINTED IN JULY 2004. RESIGNED ON 18 FEBRUARY 2008.

BOARD COMMITTEES

MEMBER, RISK MANAGEMENT COMMITTEE

David Coe was Executive Chairman of Allco Finance Group Limited, and a former partner of law firm Mallesons Stephen Jacques where he specialised in international financing and leasing. He has a diverse blend of specialist legal, corporate and finance knowledge, and extensive experience as a company director of a number of public and private companies.

Mr Coe resigned from the Board on 18 February 2008.

Marian Micalizzi

BBUS, FCA

APPOINTED IN JULY 2000. TENURE TO 30 JUNE 2010.

BOARD COMMITTEES

MEMBER, ACCOUNTS AND AUDIT COMMITTEE

MEMBER, RISK MANAGEMENT COMMITTEE

Marian Micalizzi is a chartered accountant with more than 20 years’ experience, a company director and a consultant in both the public and private sector. Ms Micalizzi is a former partner of PricewaterhouseCoopers (until 2000) having been admitted as a partner of its predecessor firm in 1986.

Ms Micalizzi brings considerable expertise and knowledge of specialist corporate financial and advisory services, financial institutions’ regulation and prudential supervision, and valuation related assessments.