EXHIBIT (c)(ii)

Consolidated Financial Statements of the Co-registrant

1

2

Contents

| | |

| | | Page |

Message from the Treasurer | | 4 |

| |

Scope of the Report | | 5 |

| |

Outcomes Report—Uniform Presentation Framework | | |

| |

Overview and Analysis | | 7 |

| |

Operating Statement by Sector | | 15 |

| |

Balance Sheet by Sector | | 16 |

| |

Cash Flow Statement by Sector | | 17 |

| |

General Government Sector Taxes | | 18 |

| |

General Government Sector Dividend and Income Tax Equivalent Income | | 18 |

| |

General Government Sector Grant Revenue | | 19 |

| |

General Government Sector Grant Expense | | 19 |

| |

General Government Sector Expenses by Function | | 20 |

| |

General Government Sector Purchases of Non-financial Assets by Function | | 21 |

| |

Loan Council Allocation | | 21 |

| |

Certification of Outcomes Report | | 22 |

| |

Audited Consolidated Financial Statements | | |

| |

Overview and Analysis | | 24 |

| |

Income Statement | | 31 |

| |

Balance Sheet | | 32 |

| |

Statement of Changes in Equity | | 34 |

| |

Cash Flow Statement | | 35 |

| |

Notes to the Financial Statements | | 36 |

| |

Certification of Consolidated Financial Statements | | 110 |

| |

Independent Auditor’s Report to the Treasurer of Queensland | | 111 |

| |

Attachment A: Reconciliation of UPF and AAS Operating Result | | 114 |

3

Message from the Treasurer

As outlined in the Charter of Social and Fiscal Responsibility, the Government is committed to fiscal transparency and accountability. A key objective of this report is to facilitate a meaningful assessment of the State’s financial performance over the 2007-08 financial year and its net worth at balance date.

This report provides details of the State’s financial operations and position on both a Uniform Presentation Framework (Outcomes Report) and Australian Accounting Standards (Consolidated Financial Statements) basis.

In endorsing this report, I place on record my appreciation of the professionalism and co-operation extended to Queensland Treasury by agency personnel and of the Treasury staff involved in its preparation.

ANDREW FRASER MP

TREASURER

4

Scope of the Report

The Report on State Finances, incorporating the Outcomes Report and Consolidated Financial Statements, provides a comprehensive analysis of Government finances for the 2007-08 financial year.

These reports are prepared using different methodologies, each giving a view of government finances. The Outcomes Report outlines the operations of the Queensland Government excluding valuation adjustments to reflect costs more appropriately related to the underlying operations of government. The Consolidated Financial Statements include valuation adjustments on assets and liabilities.

The Outcomes Report

The Outcomes Report contains financial statements that are prepared and presented in accordance with the Uniform Presentation Framework (UPF) agreed to at the 1991 Premiers’ Conference and recently revised to align with AASB 1049 Whole of Government and General Government Sector Financial Reporting (see Future Developments below). The primary objective of the UPF is to provide uniform and comparable reporting of Commonwealth, State and Territory governments’ financial information.

Queensland’s annual Budget was prepared in accordance with the revised UPF, and the Outcomes Report compares achieved financial results with revised forecasts.

The UPF presentation is primarily structured on a sectoral basis with a focus on the General Government and Public Non-financial Corporations sectors.

The Consolidated Financial Statements

The Consolidated Financial Statements outline the operations of the Queensland Government on an accrual basis in accordance with Australian Accounting Standard AAS31 Financial Reporting by Governments and other applicable standards. The statements present the income statement, balance sheet and cash flows of the Queensland Total State sector on a consolidated basis.

Financial statements for the General Government, Public Non-financial Corporations and Public Financial Corporations sectors are disclosed in the disaggregated information note to the financial statements (Note 2).

Refer Note 52 for a full list of consolidated entities.

Where applicable, comparatives have been restated to agree with changes in presentation in the financial statements for the current reporting period and to correct timing differences and/or errors from prior periods.

Future Developments

AASB 1049 Whole of Government and General Government Sector Financial Reporting was released in October 2007 and is applicable for the year ended 30 June 2009. The standard aims to harmonise the Government Finance Statistics (GFS) and Accounting Standard frameworks. The GFS reporting framework, developed by the Australian Bureau of Statistics (ABS), is based on international statistical standards and allows comprehensive assessments to be made of the economic impact of government. A full set of financial statements will be required for both the General Government and Whole of Government sectors. The General Government sector financial statements require comparison between budget and actuals and an analysis of variances.

Related Publications

This report compliments other key publications relating to the financial performance of the Queensland Public Sector including:

| | • | | the annual Budget papers |

| | • | | the Treasurer’s Consolidated Fund Financial Report |

| | • | | the annual reports of the various departments, statutory bodies, Government-owned corporations and other entities that comprise the Queensland Government. |

5

2007 - 08

Outcomes Report

Uniform Presentation Framework of the

Queensland Government—30 June 2008

6

Outcomes Report—Overview and Analysis

Overview

The General Government UPF net operating balance for 2007-08 was a deficit of $1.559 billion, down $564 million over the forecast at the time of the 2008-09 Budget. The increased deficit is primarily the result of a further moderation in investment returns. The underlying net operating balance, which excludes investment returns below the long term rate, is a surplus of $339 million, $67 million higher than budgeted.

A cash deficit of $4.922 billion was recorded for 2007-08 in the General Government sector, as a result of the lower investment returns and higher capital expenditure than forecast.

The State’s net worth increased to $155.178 billion as at 30 June 2008, mainly due to revaluations of non-financial assets by the Department of Main Roads.

Capital purchases in the General Government sector exceeded the estimated actual forecast by $493 million, due to a lower level of under expenditure than anticipated. This increased capital spending has resulted in higher borrowings being undertaken in the General Government sector.

The Government has met all of its fiscal commitments under the Charter of Social and Fiscal Responsibility—see page 4-02.

Summary of Key UPF Financial Aggregates

Outlined in the table below are the key aggregates, by sector.

| | | | | | | | | | | | | | | | | | |

| | | General Government

Sector | | | Public Non-financial

Corporations Sector | | | Non-financial Public

Sector | |

| | | Est. Actual | | | Outcome | | | Est. Actual | | | Outcome | | | Est. Actual | | | Outcome | |

| | | $ million | | | $ million | | | $ million | | | $ million | | | $ million | | | $ million | |

Revenue | | 32,276 | | | 31,430 | | | 9,977 | | | 10,354 | | | 38,680 | | | 38,363 | |

Expenses | | 33,271 | | | 32,989 | | | 8,800 | | | 9,080 | | | 39,460 | | | 39,654 | |

Net operating balance | | (995 | ) | | (1,559 | ) | | 1,177 | | | 1,274 | | | (781 | ) | | (1,291 | ) |

Cash surplus/(deficit) | | (3,547 | ) | | (4,922 | ) | | (6,727 | ) | | (5,721 | ) | | (10,275 | ) | | (10,644 | ) |

Capital purchases | | 5,223 | | | 5,716 | | | 8,756 | | | 8,132 | | | 13,979 | | | 13,865 | |

Net worth | | 123,095 | | | 155,178 | | | 18,138 | | | 19,988 | | | 123,095 | | | 155,178 | |

Net debt | | (24,371 | ) | | (22,598 | ) | | 22,282 | | | 21,731 | | | (2,089 | ) | | (867 | ) |

Borrowing | | 3,531 | | | 4,175 | | | 5,797 | | | 5,067 | | | 9,328 | | | 9,243 | |

7

Outcomes Report—Overview and Analysis—(Continued)

Meeting the Government’s Fiscal Commitments

The Government has met all of its fiscal commitments under the Charter of Social and Fiscal Responsibility:

Achievement of Fiscal Principles of the Queensland Government

| | | | |

Principle | | Achievement | | Indicator |

Competitive tax environment The Government will ensure that State taxes and charges remain competitive with the other states and territories in order to maintain a competitive tax environment for business development and jobs growth. | | ü | | Taxation revenue per capita: Queensland: $2,258 Average of other States: $2,576 |

| | |

Affordable service provision The Government will ensure that its level of service provision is sustainable by maintaining an overall General Government operating surplus, as measured in Uniform Presentation Framework terms. | | ü | | Underlying net operating balance: $339 million surplus |

| | |

Sustainable borrowings for capital investment Borrowings or other financial arrangements will only be undertaken for capital investments and only where these can be serviced within the operating surplus, consistent with maintaining a AAA credit rating. | | ü | | General Government borrowings: $4.175 billion General Government total purchases of non-financial assets: $5.716 billion AAA credit rating confirmed by Moody’s and Standard & Poor’s (highest rating available). |

| | |

Prudent management of financial risk The Government will ensure that the State’s financial assets cover all accruing and expected future liabilities of the General Government sector. | | ü | | General Government net financial worth: $15.85 billion |

| | |

Building the State’s net worth The Government will maintain and seek to increase total State net worth. | | ü | | Net worth increased to $155.178 billion |

Net Operating Balance

The UPF net operating balance for 2007-08 in the General Government Sector is a deficit of $1.559 billion.

With approximately $26 billion in funds invested in a portfolio of equities, property, cash and fixed interest, primarily invested with Queensland Investment Corporation (QIC), the performance of domestic and international financial markets have a major influence on the actual result. Investment returns on these assets were -2.24% versus 2% expected at the time of the 2008-09 Budget and significantly below the long term expected rate of 7.5%.

8

Outcomes Report—Overview and Analysis—(Continued)

Investment market volatility impacts more on the Queensland net operating balance than it does for other states. This is in part due to differences in the way Queensland’s public sector superannuation arrangements are structured. If Queensland’s superannuation arrangements were structured on the same basis as generally applied in other states, the General Government sector underlying operating balance for 2007-08 would be a surplus of $339 million, as outlined below:

| | | |

Calculation of underlying net operating balance | | 2007-08

Outcome | |

| | | $ million | |

UPF net operating balance | | (1,559 | ) |

Add investment earnings below expected rate | | 1,898 | |

Underlying net operating balance | | 339 | |

Note:

| 1. | Numbers may not add due to rounding |

The effect of this volatility has been addressed for 2008-09 by the transfer of certain QIC investments set aside to meet future employee and other obligations, to the Queensland Treasury Corporation (QTC). In exchange, QTC has issued a debt instrument returning 7.5% per annum. Given QTC is outside the General Government sector, the transfer results in the investment volatility being borne by the Public Financial Corporations sector.

| | | | | |

Revenue | | 2007-08

Est. Actual | | 2007-08

Outcome | |

| | | $ million | | $ million | |

Taxation revenue | | 9,552 | | 9,546 | |

Grants revenue | | 15,492 | | 15,523 | |

Sales of goods and services | | 3,245 | | 3,341 | |

Interest income | | 841 | | (275 | ) |

Dividend and income tax equivalent income | | 1,217 | | 1,255 | |

Other revenue | | 1,930 | | 2,040 | |

| | | | | |

Total Revenue | | 32,276 | | 31,430 | |

| | | | | |

Note:

| 1. | Numbers may not add due to rounding |

Total revenue decreased by $846 million over the 2007-08 estimated actual. This was largely due to the return on investments being -2.24% rather than the 2% budgeted.

Other variations include:

| | • | | lower than forecast taxation revenue due to transfer duty collections slowing in a less active property market |

| | • | | higher grants revenue as a result of additional funding from the Australian Government for health related expenditure, marginally offset by lower than forecast GST revenue |

| | • | | other revenue is higher than forecast mainly as a result of more land being gifted to the State than estimated. |

9

Outcomes Report—Overview and Analysis—(Continued)

| | | | |

Expenses | | 2007-08

Est. Actual | | 2007-08

Outcome |

| | | $ million | | $ million |

Employee expenses | | 12,840 | | 13,171 |

Superannuation expenses | | | | |

Superannuation interest cost | | 996 | | 816 |

Other superannuation expenses | | 1,913 | | 1,865 |

Other operating expenses | | 6,240 | | 6,612 |

Depreciation and amortisation | | 2,257 | | 1,850 |

Other interest expenses | | 383 | | 346 |

Grant expenses | | 8,641 | | 8,328 |

| | | | |

Total Expenses | | 33,271 | | 32,989 |

| | | | |

Note:

| 1. | Numbers may not add due to rounding |

Total expenses were largely in line with that forecast at the time of the 2008-09 Budget. Major variances include:

| | • | | employee expenses are higher due to lower than forecast levels of under expenditure and higher than expected levels of Health staffing, which were partly funded by grants from the Australian Government |

| | • | | poorer than anticipated investment returns have resulted in lower than forecast superannuation interest expense, as certain superannuation liabilities vary with investment earnings |

| | • | | other operating expenses are higher than forecast as a result of the expensing of information technology costs and unforeseen disaster relief work on roads infrastructure and increased expenditure on health services which was offset by revenue from the Commonwealth |

| | • | | depreciation costs were lower than budgeted due to a change in the valuation methodology of roads infrastructure |

| | • | | grant expenses are lower than estimated at Budget time due to reduced community service obligations (CSOs) paid to Ergon and QR Limited (for electricity and rail subsidies) and lower grants paid to local governments. |

10

Outcomes Report—Overview and Analysis—(Continued)

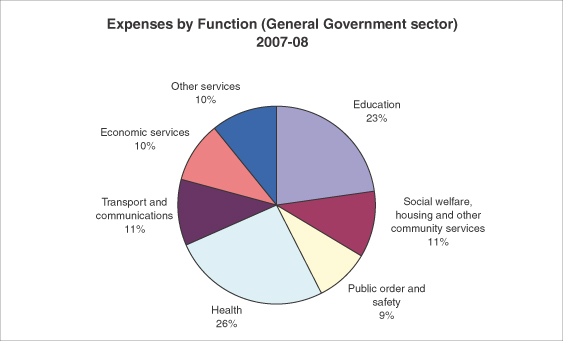

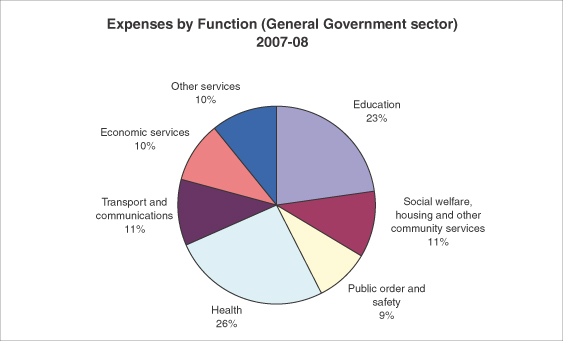

General Government expenditure is focussed on the delivery of core services to the community. As shown in the chart below, Education and Health account for the largest share of expenses.

Cash Flows

A cash deficit of $4.922 billion was recorded for the 2007-08 financial year in the General Government sector, compared to $3.547 billion for the 2007-08 estimated actual. This is the result of lower investment returns affecting operating cashflows and increased capital expenditure.

Capital Purchases and Borrowings

Purchases of non-financial assets (i.e. capital expenditure) totalled $5.716 billion, exceeding forecasts by $493 million. This increased expenditure is the result of a lower level of under expenditure than forecast.

Expenditure for the sector was mainly in the areas of transport, health, education and housing.

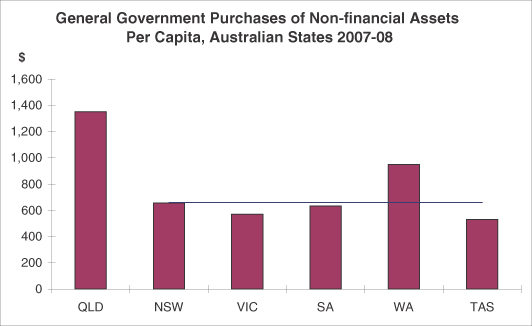

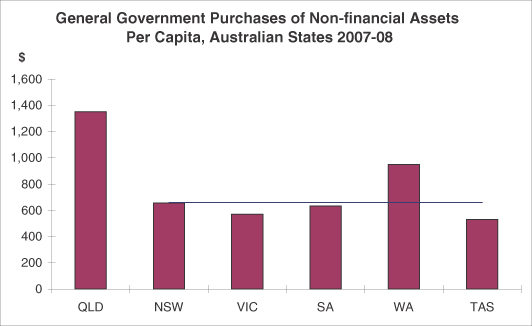

Queensland’s capital spend per capita is $1,352 which is more than double the average of the other states.

These purchases have been largely funded by borrowings of $4.175 billion during the year. Borrowings are $644 million more than forecast at Budget time due mostly to the higher capital spend.

Net Worth

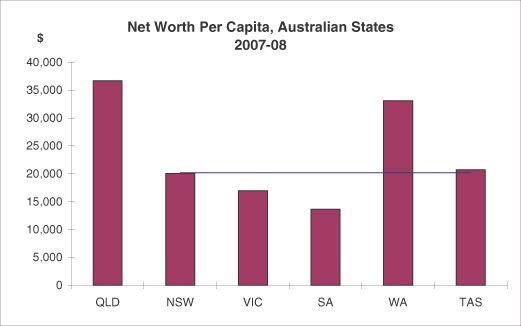

The State’s net worth increased to $155.178 billion as at 30 June 2008. The primary driver of the increase is the comprehensive revaluation of the road infrastructure assets.

11

Outcomes Report—Overview and Analysis—(Continued)

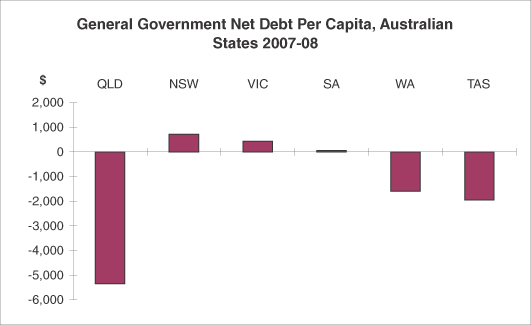

Source: New South Wales, Victoria, South Australia and Tasmania 2008-09 Budget Papers: Western Australia Outcome Results. Population data from ABS 3101.0.

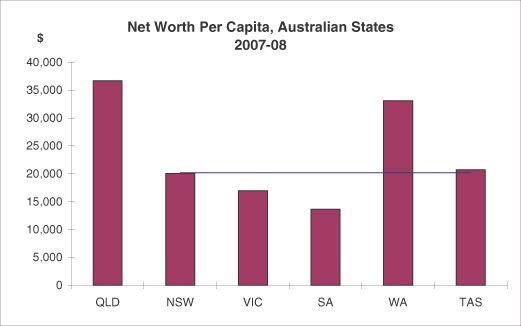

The chart below shows the State’s strong net worth compared with the other states.

Note:

| 1. | Western Australia values land under roads as part of its overall asset base. This has been adjusted to allow comparison with other jurisdictions which do not value land under roads. |

Source: New South Wales, Victoria, South Australia and Tasmania 2008-09 Budget Papers: Western Australia Outcomes Results. Population data from ABS 3101.0.

12

Outcomes Report—Overview and Analysis—(Continued)

Net Debt

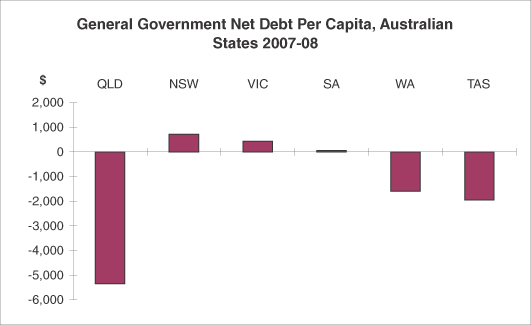

Net debt is the most common measure used to judge the overall strength of a jurisdiction’s fiscal position. High levels of net debt impose a call on future revenue flows to service that debt and can limit government flexibility to adjust outlays.

Queensland’s net debt is strongly negative due to the investments it holds for employee and other obligations.

The negative net debt reduced by $1.773 billion since budget to $22.598 billion as a result of lower investment returns.

Queensland’s negative net debt of $5,344 per capita compares to the average net debt of $180 per capita of the other states.

Source: New South Wales, Victoria, South Australia and Tasmania 2008-09 Budget Papers: Western Australia Outcomes Results. Population data from ABS 3101.0.

Operating Result

The operating result is a new requirement for the UPF and represents the result for the State under the Accounting Standards framework. The operating result of negative $354 million differs from the net operating balance as it includes valuation adjustments such as gains and losses on financial and non-financial assets, deferred tax revenue and dividends revenue on privatisations.

A full reconciliation between the net operating balance and the operating result is included in Attachment A.

Comprehensive Result—Total Change in Net Worth

The comprehensive result includes revaluation of assets taken to reserves. The increase between the estimated actual and the actual result is due to a revaluation of roads infrastructure which was undertaken subsequent to the release of the Budget.

13

Outcomes Report—Overview and Analysis—(Continued)

Public Non-financial Corporations (PNFC) Sector

The Public Non-financial Corporations sector comprises bodies such as Government-owned corporations that provide goods and services that are market, non-regulatory and non-financial in nature. PNFCs are financed through sales to consumers of their goods and services and may be supplemented by explicit government payments to fund community service obligations.

| | • | | The PNFC sector recorded a surplus of $1.274 billion, $97 million higher than forecast mainly due to lower than forecast finance costs. The accounting operating result is $2.212 billion and is higher than the net operating balance mainly due to market value interest derivative adjustments. |

| | • | | The cash deficit of $5.721 billion is less than forecast due to lower capital expenditure. |

| | • | | The net worth of the sector has increased due to the effect of lower pool prices improving its hedging position and the revaluation of electricity and road assets. |

State Financial Sector (Total State)

The Total State sector includes all State Government departments and statutory authorities, public non-financial corporations, public financial corporations and their controlled entities. All material inter-entity and intra-entity transactions and balances have been eliminated to the extent practicable.

| | • | | A net operating deficit of $1.058 billion was recorded in 2007-08, reflecting the impact of the deficit of the General Government sector as a result of poor investment returns. |

| | • | | The Total State cash deficit was $11.148 billion for 2007-08 after allowing for purchases of non-financial assets of $13.936 billion. |

| | • | | In 2007-08, the Total State’s net debt position is negative $4.089 billion. |

14

2007-08 Operating Statement by Sector ($million)

| | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | General Government

Sector | | | Public Non-financial

Corporations Sector | | | Non-financial Public

Sector | | | Public Financial

Corporations

Sector | | | State

Financial

Sector | |

| | | | | Est. Actual | | | Actual | | | Est. Actual | | | Actual | | | Est. Actual | | | Actual | | | Actual(b) | | | Actual(b) | |

| | Revenue from Transactions | | | | | | | | | | | | | | | | | | | | | | | | |

| | Taxation revenue | | 9,552 | | | 9,546 | | | — | | | — | | | 9,377 | | | 9,354 | | | — | | | 9,349 | |

| | Grants revenue | | 15,492 | | | 15,523 | | | 2,469 | | | 2,254 | | | 15,967 | | | 16,019 | | | — | | | 16,019 | |

| | Sales of goods and services | | 3,245 | | | 3,341 | | | 7,023 | | | 7,527 | | | 10,061 | | | 10,613 | | | 1,037 | | | 11,433 | |

| | Interest income | | 841 | | | (275 | ) | | 174 | | | 198 | | | 1,015 | | | (77 | ) | | 3,492 | | | 1,600 | |

| | Dividend and income tax equivalent income | | 1,217 | | | 1,255 | | | 12 | | | 12 | | | 39 | | | 54 | | | — | | | 26 | |

| | Other revenue | | 1,930 | | | 2,040 | | | 298 | | | 363 | | | 2,221 | | | 2,400 | | | 50 | | | 2,450 | |

| | | | | | | | | | | | | | | | | | | | | | | | | | |

| | Total Revenue from Transactions | | 32,276 | | | 31,430 | | | 9,977 | | | 10,354 | | | 38,680 | | | 38,363 | | | 4,578 | | | 40,877 | |

| | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | |

Less | | Expenses from Transactions | | | | | | | | | | | | | | | | | | | | | | | | |

| | Employee expenses | | 12,840 | | | 13,171 | | | 2,153 | | | 1,962 | | | 14,898 | | | 15,036 | | | 179 | | | 15,084 | |

| | Superannuation expenses | | | | | | | | | | | | | | | | | | | | | | | | |

| | Superannuation interest cost | | 996 | | | 816 | | | — | | | — | | | 996 | | | 816 | | | — | | | 816 | |

| | Other superannuation expenses | | 1,913 | | | 1,865 | | | 71 | | | 165 | | | 1,984 | | | 2,030 | | | 12 | | | 2,042 | |

| | Other operating expenses | | 6,240 | | | 6,612 | | | 3,115 | | | 3,757 | | | 9,136 | | | 10,103 | | | 1,216 | | | 11,230 | |

| | Depreciation and amoritsation | | 2,257 | | | 1,850 | | | 1,699 | | | 1,634 | | | 3,957 | | | 3,483 | | | 21 | | | 3,504 | |

| | Other interest expenses | | 383 | | | 346 | | | 1,478 | | | 1,328 | | | 1,779 | | | 1,592 | | | 2,889 | | | 2,666 | |

| | Grants expenses | | 8,641 | | | 8,328 | | | 54 | | | 21 | | | 6,710 | | | 6,591 | | | — | | | 6,591 | |

| | Other property expenses | | — | | | — | | | 230 | | | 213 | | | — | | | — | | | 26 | | | — | |

| | | | | | | | | | | | | | | | | | | | | | | | | | |

| | Total Expenses from Transactions | | 33,271 | | | 32,989 | | | 8,800 | | | 9,080 | | | 39,460 | | | 39,654 | | | 4,343 | | | 41,934 | |

| | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | |

Equals | | Net Operating Balance | | (995 | ) | | (1,559 | ) | | 1,177 | | | 1,274 | | | (781 | ) | | (1,291 | ) | | 235 | | | (1,058 | ) |

| | Other economic flows—included in operating result | | 1,374 | | | 1,205 | | | 511 | | | 938 | | | 620 | | | 863 | | | (573 | ) | | 291 | |

| | Operating Result | | 380 | | | (354 | ) | | 1,688 | | | 2,212 | | | (161 | ) | | (427 | ) | | (337 | ) | | (767 | ) |

| | Other economic flows—other movements in equity | | 4,868 | | | 37,701 | | | (763 | ) | | 592 | | | 5,276 | | | 37,675 | | | 13 | | | 38,014 | |

| | Comprehensive Result—Total Change in Net Worth | | 5,248 | | | 37,347 | | | 925 | | | 2,804 | | | 5,116 | | | 37,248 | | | (324 | ) | | 37,248 | |

| | | | | | | | | |

| | KEY FISCAL AGGREGATES | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | |

| | Net Operating Balance | | (995 | ) | | (1,559 | ) | | 1,177 | | | 1,274 | | | (781 | ) | | (1,291 | ) | | 235 | | | (1,058 | ) |

| | | | | | | | | |

Less | | Net Acquisition of Non-financial Assets | | | | | | | | | | | | | | | | | | | | | | | | |

| | Purchases of non-financial assets | | 5,223 | | | 5,716 | | | 8,756 | | | 8,132 | | | 13,979 | | | 13,865 | | | 71 | | | 13,936 | |

| | Less Sales of non-financial assets | | 434 | | | 410 | | | 18 | | | 286 | | | 452 | | | 713 | | | — | | | 713 | |

| | Less Depreciation | | 2,257 | | | 1,850 | | | 1,699 | | | 1,634 | | | 3,957 | | | 3,483 | | | 21 | | | 3,504 | |

| | Plus Change in inventories | | 45 | | | 41 | | | 134 | | | 118 | | | 179 | | | 160 | | | — | | | 160 | |

| | Plus Other movements in non-financial assets | | 6 | | | 169 | | | (14 | ) | | 25 | | | (9 | ) | | 194 | | | — | | | 194 | |

| | | | | | | | | | | | | | | | | | | | | | | | | | |

| | Equals Total Net Acquisition of Non-financial Assets | | 2,583 | | | 3,668 | | | 7,158 | | | 6,356 | | | 9,741 | | | 10,023 | | | 50 | | | 10,073 | |

| | | | | | | | | | | | | | | | | | | | | | | | | | |

| | Equals Net Lending / (Borrowing) | | (3,577 | ) | | (5,226 | ) | | (5,982 | ) | | (5,082 | ) | | (10,522 | ) | | (11,314 | ) | | 185 | | | (11,131 | ) |

| | | | | | | | | | | | | | | | | | | | | | | | | | |

Notes:

| (a) | Numbers may not add due to rounding. |

| (b) | In accordance with UPF requirements, estimates for Public Financial Corporations and State Financial sectors are not included in Budget documentation. |

15

2007-08 Balance Sheet by Sector ($ million)

| | | | | | | | | | | | | | | | | | | | | | | | |

| | | General Government

Sector | | | Public Non-financial

Corporations Sector | | | Non-financial Public

Sector | | | Public Financial

Corporations

Sector | | | State

Financial

Sector | |

| | | Est. Actual | | | Actual | | | Est. Actual | | | Actual | | | Est. Actual | | | Actual | | | Actual(b) | | | Actual(b) | |

Assets | | | | | | | | | | | | | | | | | | | | | | | | |

Financial assets | | | | | | | | | | | | | | | | | | | | | | | | |

Cash and deposits | | 2,752 | | | 3,121 | | | 1,857 | | | 1,912 | | | 4,609 | | | 5,033 | | | 31 | | | 1,199 | |

Advances paid | | 743 | | | 561 | | | 291 | | | 344 | | | 1,016 | | | 888 | | | — | | | 888 | |

Investments, loans and placements | | 27,069 | | | 25,749 | | | 383 | | | 626 | | | 27,451 | | | 26,375 | | | 52,329 | | | 49,051 | |

Receivables | | 2,817 | | | 3,332 | | | 1,319 | | | 1,672 | | | 3,010 | | | 3,807 | | | 164 | | | 3,933 | |

Equity | | | | | | | | | | | | | | | | | | | | | | | | |

Investments in other public sector entities | | 20,000 | | | 21,519 | | | — | | | — | | | 1,896 | | | 1,564 | | | — | | | — | |

Investments—other | | 39 | | | 39 | | | 278 | | | 310 | | | 318 | | | 348 | | | 1 | | | 349 | |

| | | | | | | | | | | | | | | | | | | | | | | | |

Total financial assets | | 53,420 | | | 54,320 | | | 4,128 | | | 4,864 | | | 38,301 | | | 38,016 | | | 52,525 | | | 55,421 | |

| | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | |

Non-financial Assets | | | | | | | | | | | | | | | | | | | | | | | | |

Land and other fixed assets | | 99,876 | | | 133,473 | | | 46,534 | | | 48,554 | | | 146,375 | | | 181,993 | | | 174 | | | 182,167 | |

Other non-financial assets | | 5,562 | | | 5,855 | | | 1,538 | | | 1,573 | | | 522 | | | 545 | | | 128 | | | 510 | |

| | | | | | | | | | | | | | | | | | | | | | | | |

Total Non-financial Assets | | 105,437 | | | 139,329 | | | 48,073 | | | 50,127 | | | 146,897 | | | 182,537 | | | 302 | | | 182,677 | |

| | | | | | | | | | | | | | | | | | | | | | | | |

Total assets | | 158,857 | | | 193,649 | | | 52,201 | | | 54,990 | | | 185,198 | | | 220,553 | | | 52,828 | | | 238,097 | |

| | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | |

Liabilities | | | | | | | | | | | | | | | | | | | | | | | | |

Deposits held | | — | | | 4 | | | 57 | | | — | | | 58 | | | 4 | | | 7,936 | | | 3,779 | |

Advances received | | 545 | | | 501 | | | — | | | — | | | 545 | | | 501 | | | — | | | 501 | |

Borrowing | | 5,648 | | | 6,328 | | | 24,755 | | | 24,613 | | | 30,385 | | | 30,925 | | | 41,202 | | | 42,769 | |

Superannuation liability | | 20,849 | | | 21,913 | | | (279 | ) | | (54 | ) | | 20,570 | | | 21,860 | | | — | | | 21,860 | |

Other employee benefits | | 3,499 | | | 3,813 | | | 716 | | | 750 | | | 4,214 | | | 4,563 | | | 63 | | | 4,626 | |

Payables | | 2,449 | | | 2,652 | | | 2,058 | | | 2,760 | | | 3,395 | | | 4,232 | | | 186 | | | 4,379 | |

Other liabilities | | 2,774 | | | 3,260 | | | 6,755 | | | 6,933 | | | 2,936 | | | 3,291 | | | 1,877 | | | 5,005 | |

| | | | | | | | | | | | | | | | | | | | | | | | |

Total liabilities | | 35,762 | | | 38,471 | | | 34,062 | | | 35,002 | | | 62,103 | | | 65,375 | | | 51,263 | | | 82,920 | |

| | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | |

Net Worth | | 123,095 | | | 155,178 | | | 18,138 | | | 19,988 | | | 123,095 | | | 155,178 | | | 1,564 | | | 155,178 | |

Net Financial Worth | | 17,658 | | | 15,849 | | | (29,934 | ) | | (30,139 | ) | | (23,802 | ) | | (27,359 | ) | | 1,262 | | | (27,499 | ) |

Net Financial Liabilities | | 2,342 | | | 5,670 | | | 29,934 | | | 30,139 | | | 25,698 | | | 28,924 | | | (1,262 | ) | | 27,499 | |

Net Debt | | (24,371 | ) | | (22,598 | ) | | 22,282 | | | 21,731 | | | (2,089 | ) | | (867 | ) | | (3,222 | ) | | (4,089 | ) |

Notes:

| (a) | Numbers may not add due to rounding. |

| (b) | In accordance with UPF requirements, estimates for Public Financial Corporations and State Financial sectors are not included in Budget documentation. |

| (c) | Estimated Actuals have been restated where subsequent changes in classification have occurred, to ensure comparability with estimates. |

16

2007-08 Cash Flow Statement by Sector ($ million)

| | | | | | | | | | | | | | | | | | | | | | | | |

| | | General Government

Sector | | | Public Non-financial

Corporations Sector | | | Non-financial Public

Sector | | | Public Financial

Corporations

Sector | | | State

Financial

Sector | |

| | | Est. Actual | | | Actual | | | Est. Actual | | | Actual | | | Est. Actual | | | Actual | | | Actual(b) | | | Actual(b) | |

Cash Receipts from Operating Activities | | | | | | | | | | | | | | | | | | | | | | | | |

Taxes received | | 9,551 | | | 9,522 | | | — | | | — | | | 9,376 | | | 9,332 | | | — | | | 9,326 | |

Grants and subsidies received | | 15,396 | | | 15,544 | | | 2,064 | | | 1,920 | | | 15,467 | | | 15,644 | | | — | | | 15,644 | |

Sales of goods and services | | 3,667 | | | 3,967 | | | 7,833 | | | 8,418 | | | 11,292 | | | 12,114 | | | 1,114 | | | 13,000 | |

Interest receipts | | 832 | | | (273 | ) | | 171 | | | 205 | | | 1,003 | | | (68 | ) | | 2,982 | | | 1,096 | |

Dividends and income tax equivalents | | 931 | | | 985 | | | 12 | | | 12 | | | 50 | | | 29 | | | — | | | 17 | |

Other receipts | | 2,455 | | | 2,919 | | | 825 | | | 1,024 | | | 3,273 | | | 3,940 | | | 19 | | | 3,959 | |

| | | | | | | | | | | | | | | | | | | | | | | | |

Total | | 32,833 | | | 32,664 | | | 10,906 | | | 11,580 | | | 40,461 | | | 40,992 | | | 4,115 | | | 43,042 | |

| | | | | | | | | | | | | | | | | | | | | | | | |

Cash Payments for Operating Activities | | | | | | | | | | | | | | | | | | | | | | | | |

Payments for employees | | (15,092 | ) | | (15,094 | ) | | (2,256 | ) | | (2,095 | ) | | (17,253 | ) | | (17,092 | ) | | (141 | ) | | (17,101 | ) |

Payments for goods and services | | (6,714 | ) | | (7,718 | ) | | (3,791 | ) | | (4,703 | ) | | (10,310 | ) | | (12,158 | ) | | (43 | ) | | (12,121 | ) |

Grants and subsidies | | (8,704 | ) | | (8,279 | ) | | (12 | ) | | (11 | ) | | (6,731 | ) | | (6,477 | ) | | (3 | ) | | (6,480 | ) |

Interest paid | | (383 | ) | | (359 | ) | | (1,226 | ) | | (1,198 | ) | | (1,528 | ) | | (1,478 | ) | | (3,121 | ) | | (2,937 | ) |

Other payments | | (697 | ) | | (829 | ) | | (896 | ) | | (739 | ) | | (1,387 | ) | | (1,278 | ) | | (1,077 | ) | | (2,328 | ) |

| | | | | | | | | | | | | | | | | | | | | | | | |

Total | | (31,590 | ) | | (32,280 | ) | | (8,181 | ) | | (8,745 | ) | | (37,209 | ) | | (38,483 | ) | | (4,385 | ) | | (40,968 | ) |

| | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | |

Net Cash Inflows from Operating Activities | | 1,242 | | | 384 | | | 2,724 | | | 2,835 | | | 3,252 | | | 2,509 | | | (270 | ) | | 2,074 | |

| | | | | | | | |

Cash Flows from Investments in Non-financial Assets | | | | | | | | | | | | | | | | | | | | | | | | |

Purchases of non-financial assets | | (5,223 | ) | | (5,716 | ) | | (8,756 | ) | | (8,132 | ) | | (13,979 | ) | | (13,865 | ) | | (71 | ) | | (13,936 | ) |

Sales of non-financial assets | | 434 | | | 410 | | | 18 | | | 286 | | | 452 | | | 713 | | | — | | | 713 | |

| | | | | | | | | | | | | | | | | | | | | | | | |

Total | | (4,789 | ) | | (5,307 | ) | | (8,738 | ) | | (7,847 | ) | | (13,527 | ) | | (13,152 | ) | | (71 | ) | | (13,223 | ) |

| | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | |

Net Cash Flows from Investments in Financial Assets for Policy Purposes | | 1,020 | | | 751 | | | 536 | | | 419 | | | 287 | | | 172 | | | (1 | ) | | 178 | |

| | | | | | | | |

Net Cash Flows for Investments in Financial Assets for Liquidity Purposes | | 716 | | | 2,074 | | | 10 | | | 45 | | | 726 | | | 1,838 | | | (834 | ) | | 1,170 | |

| | | | | | | | |

Receipts from Financing Activities | | | | | | | | | | | | | | | | | | | | | | | | |

Advances received (net) | | (1 | ) | | (3 | ) | | — | | | — | | | (1 | ) | | (3 | ) | | — | | | (3 | ) |

Borrowing (net) | | 3,531 | | | 4,175 | | | 5,797 | | | 5,067 | | | 9,328 | | | 9,243 | | | (8,376 | ) | | 833 | |

Dividends paid | | — | | | — | | | (713 | ) | | (709 | ) | | — | | | — | | | (7 | ) | | — | |

Deposits received (net) | | — | | | 4 | | | 23 | | | (4 | ) | | 17 | | | (1 | ) | | 1,176 | | | 755 | |

Other financing (net) | | (8 | ) | | — | | | (1,262 | ) | | (1,378 | ) | | 6 | | | (100 | ) | | 8,398 | | | 8,291 | |

| | | | | | | | | | | | | | | | | | | | | | | | |

Total | | 3,522 | | | 4,176 | | | 3,843 | | | 2,975 | | | 9,349 | | | 9,139 | | | 1,191 | | | 9,876 | |

| | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | |

Net Increase/(Decrease) in Cash Held | | 1,711 | | | 2,078 | | | (1,624 | ) | | (1,573 | ) | | 86 | | | 505 | | | 15 | | | 75 | |

| | | | | | | | |

Net cash from operating activities | | 1,242 | | | 384 | | | 2,724 | | | 2,835 | | | 3,252 | | | 2,509 | | | (270 | ) | | 2,074 | |

Net cash from investments in non-financial assets | | (4,789 | ) | | (5,307 | ) | | (8,738 | ) | | (7,847 | ) | | (13,527 | ) | | (13,152 | ) | | (71 | ) | | (13,223 | ) |

Dividends paid | | — | | | — | | | (713 | ) | | (709 | ) | | — | | | — | | | (7 | ) | | — | |

Cash Surplus/(Deficit) | | (3,547 | ) | | (4,922 | ) | | (6,727 | ) | | (5,721 | ) | | (10,275 | ) | | (10,644 | ) | | (347 | ) | | (11,148 | ) |

Derivation of ABS GFS Cash Surplus/Deficit | | | | | | | | | | | | | | | | | | | | | | | | |

Cash surplus/(deficit) | | (3,547 | ) | | (4,922 | ) | | (6,727 | ) | | (5,721 | ) | | (10,275 | ) | | (10,644 | ) | | (347 | ) | | (11,148 | ) |

Acquisitions under finance leases and similar arrangements | | (80 | ) | | (179 | ) | | — | | | (5 | ) | | (80 | ) | | (184 | ) | | — | | | (184 | ) |

ABS GFS Cash Surplus/(Deficit) Including Finance Leases and Similar Arrangements | | (3,627 | ) | | (5,102 | ) | | (6,727 | ) | | (5,726 | ) | | (10,355 | ) | | (10,828 | ) | | (347 | ) | | (11,333 | ) |

Notes:

| (a) | Numbers may not add due to rounding. |

| (b) | In accordance with UPF requirements, estimates for Public Financial Corporations and State Financial sectors are not included in Budget documentation. |

17

Other General Government UPF Data

Data in the following tables is presented in accordance with the Uniform Presentation Framework.

General Government Sector Taxes

| | |

| | | 2007-08

Outcome |

| | | $ million |

Taxes on employers’ payroll and labour force | | 2,493 |

| |

Taxes on property | | |

Land taxes | | 610 |

Stamp duties on financial and capital transactions | | 3,240 |

Other | | 367 |

| |

Taxes on the provision of goods and services | | |

Taxes on gambling | | 889 |

Taxes on insurance | | 449 |

| |

Taxes on use of goods and performance of activities | | |

Motor vehicle taxes | | 1,369 |

Other | | 130 |

| | |

Total Taxation Revenue | | 9,546 |

| | |

Note:

| 1. | Numbers may not add due to rounding. |

General Government Sector

Dividend and Income Tax Equivalent Income

| | |

| | | 2007-08

Outcome |

| | | $ million |

Dividend and Income Tax Equivalent income from PNFC sector | | 1,213 |

Dividend and Income Tax Equivalent income from PFC sector | | 28 |

Other Dividend income | | 14 |

| | |

Total Dividend and Income Tax Equivalent income | | 1,255 |

| | |

Note:

| 1. | Numbers may not add due to rounding. |

18

Other General Government UPF Data—(Continued)

General Government Sector Grant Revenue

| | |

| | | 2007-08

Outcome |

| | | $ million |

Current grant revenue | | |

| |

Current grants from the Commonwealth | | |

General purpose grants | | 11,029 |

Specific purpose grants | | 1,406 |

Specific purpose grants for on-passing | | 1,624 |

Total current grants from the Commonwealth | | 14,059 |

Other contributions and grants | | 472 |

| | |

Total current grant revenue | | 14,531 |

| | |

| |

Capital grant revenue | | |

| |

Capital grants from the Commonwealth | | |

Specific purpose grants | | 949 |

Specific purpose grants for on-passing | | 25 |

Total capital grants from the Commonwealth | | 974 |

Other contributions and grants | | 17 |

| | |

Total capital grant revenue | | 992 |

| | |

Total grant revenue | | 15,523 |

| | |

Note:

| 1. | Numbers may not add due to rounding. |

General Government Sector Grant Expense

| | |

| | | 2007-08

Outcome |

| | | $ million |

Current grant expense | | |

| |

Private and Not-for-profit sector | | 3,192 |

Private and Not-for-profit sector on-passing | | 1,275 |

Local Government | | 223 |

Local Government on-passing | | 348 |

Grants to other sectors of Government | | 1,804 |

Other | | 417 |

| | |

Total current grant expense | | 7,259 |

| | |

| |

Capital grant expense | | |

| |

Private and Not-for-profit sector | | 232 |

Private and Not-for-profit sector on-passing | | 25 |

Local Government | | 438 |

Grants to other sectors of Government | | 155 |

Other | | 219 |

| | |

Total capital grant expense | | 1,069 |

| | |

Total grant expense | | 8,328 |

| | |

Note:

| 1. | Numbers may not add due to rounding. |

19

General Government Sector Expenses by Function

| | |

| | | 2007-08

Outcome |

| | | $ million |

General Public Services | | 1,522 |

Other general public services | | 1,522 |

| |

Public Order and Safety | | 2,871 |

Police and fire protection services | | 1,761 |

Law courts and legal services | | 581 |

Prisons and corrective services | | 492 |

Other public order and safety | | 36 |

| |

Education | | 7,553 |

Primary and secondary education | | 5,823 |

Tertiary education | | 765 |

Pre-school education and education not definable by level | | 655 |

Transportation of students | | 162 |

Education n.e.c. | | 148 |

| |

Health | | 8,537 |

Acute care institutions | | 5,707 |

Mental health institutions | | 239 |

Nursing homes for the aged | | 191 |

Community health services | | 1,899 |

Public health services | | 280 |

Health research | | 103 |

Health administration n.e.c. | | 116 |

| |

Social Security and Welfare | | 1,700 |

Welfare services | | 1,666 |

Social security and welfare n.e.c. | | 34 |

| |

Housing and Community Amenities | | 1,127 |

Housing and community development | | 835 |

Water supply | | 180 |

Sanitation and protection of the environment | | 112 |

| |

Recreation and Culture | | 741 |

Recreation facilities and services | | 488 |

Cultural facilities and services | | 253 |

| |

Fuel and Energy | | 1,285 |

Fuel affairs and services | | 675 |

Electricity and other energy | | 610 |

| |

Agriculture, Forestry, Fishing and Hunting | | 1,027 |

Agriculture | | 909 |

Forestry, fishing and hunting | | 118 |

| |

Mining, manufacturing and construction | | 194 |

Mining and mineral resources other than fuels | | 76 |

Construction | | 118 |

| |

Transport and Communications | | 3,624 |

Road transport | | 1,745 |

Water transport | | 109 |

Rail transport | | 805 |

Air transport | | 13 |

Other transport | | 928 |

Communications | | 25 |

| |

Other Economic Affairs | | 780 |

Tourism and area promotion | | 87 |

Labour and employment affairs | | 443 |

Other economic affairs | | 250 |

| |

Other Purposes | | 2,029 |

Nominal superannuation interest | | 816 |

Public debt transactions | | 356 |

General purpose inter-government transactions | | 704 |

Natural disaster relief | | 153 |

| | |

Total | | 32,989 |

| | |

20

General Government Sector Purchases of Non-financial Assets by

Function and Loan Council Allocation

General Government Sector

Purchases of Non-financial Assets by Function

| | |

| | | 2007-08

Outcome |

| | | $ million |

General public services | | 464 |

Public order and safety | | 609 |

Education | | 524 |

Health | | 678 |

Social security and welfare | | 51 |

Housing and community amenities | | 396 |

Recreation and culture | | 90 |

Fuel and energy | | 7 |

Agriculture, forestry, fishing and hunting | | 51 |

Mining, manufacturing and construction | | 8 |

Transport and communications | | 2,793 |

Other economic affairs | | 44 |

| | |

Total | | 5,716 |

| | |

Note:

| 1. | Numbers may not add due to rounding |

Loan Council Allocation

The Australian Loan Council requires all jurisdictions to advise the Loan Council Allocations (LCA) outcome for the last financial year as part of the annual Outcomes Report. The LCA represents each government’s call on financial markets for a given financial year. A tolerance limit of two percent of non-financial public sector receipts applies between the LCA budget update and the outcome. The LCA outcome exceeds the Budget estimate by more than this.

The LCA Outcome deficit reflects the effect of investment returns well below the long term rate of 7.5%, as well as increased superannuation beneficiary payments due to changes in Commonwealth legislation governing superannuation.

| | | | | | |

| | | 2007-08

Budget | | | 2007-08

Outcome | |

| | | $ million | | | $ million | |

General Government sector cash deficit/(surplus)1 | | 892 | | | 4,922 | |

PNFC sector cash deficit/(surplus)1 | | 6,218 | | | 5,721 | |

Non-financial Public Sector cash deficit/(surplus)1 | | 7,110 | | | 10,644 | |

| | |

Net cash flows from investments in financial assets for policy purposes | | (25 | ) | | 172 | |

Memorandum items2 | | 77 | | | (12 | ) |

| | |

LOAN COUNCIL ALLOCATION | | 7,212 | | | 10,460 | |

Notes:

| 1. | Figures in brackets represent surpluses |

| 2. | Other memorandum items include operating leases and local government borrowings |

21

Certification of Outcomes Report

Management Certification

The foregoing Outcomes Report contains financial statements prepared and presented in accordance with the Uniform Presentation Framework (UPF) agreed to at the 1991 Premiers’ Conference and revised in October 2007 to align with AASB 1049 Whole of Government and General Government Sector Financial Reporting.

The Report separately discloses outcomes for the General Government, Public Non-financial Corporations, Public Financial Corporations and State Financial sectors within Queensland. Entities excluded from this report include local governments. Queensland public sector entities consolidated for this report are listed in the Consolidated Financial Statements, taking into account intra and inter-agency eliminations.

Only those agencies considered material by virtue of their financial transactions and balances are consolidated in this report.

In our opinion, we certify that the Outcomes Report has been properly drawn up, in accordance with UPF requirements, to present a true and fair view of:

| | (i) | the operating statement and cash flows of the Queensland State Government for the financial year; and |

| | (ii) | the balance sheet of the Government at 30 June 2008. |

At the date of certification of this report, we are not aware of any material circumstances that would render any particulars included in the Outcomes Report misleading or inaccurate.

| | |

| Leigh Pickering | | Gerard Bradley, CPA FCA |

| Director | | Under Treasurer |

| Fiscal and Taxation Policy | | Queensland Treasury |

| Queensland Treasury | | |

| |

| Date 7 October 2008 | | |

22

2007 - 08

Consolidated Financial Statements

of the Queensland Government—30 June 2008

23

Consolidated Financial Statements—Overview and Analysis

The following analysis compares current year Total State performance on an accounting basis with last year’s balances, restated for changes in accounting policies, presentational and timing differences and errors.

Overview

| | • | | The State recorded a deficit for the year of $767 million, compared to a surplus from continuing operations in the previous year of $3.619 billion. |

| | • | | The State’s net assets position increased to $155.178 billion at 30 June 2008, an increase of $36.539 billion over the restated 2007 net assets of $118.639 billion. |

Summary of Key Financial Aggregates of the Consolidated Financial Statements

The table below provides aggregate information under Australian Accounting Standards:

| | | | | |

Total State | | 2008 | | | 2007 |

| | | $ million | | | $ million |

Revenue from operations | | | | | |

Commonwealth and other grants | | 16,120 | | | 14,479 |

Sales of goods and services | | 10,517 | | | 10,524 |

Taxes, fees and fines | | 10,440 | | | 9,286 |

Investment income | | 1,239 | | | 4,737 |

Royalties and other territorial revenue | | 1,462 | | | 1,430 |

Other | | 716 | | | 702 |

| | | | | |

| | 40,494 | | | 41,158 |

| | | | | |

Expenses from operations | | | | | |

Employee expenses | | 18,112 | | | 15,977 |

Supplies and services | | 9,567 | | | 9,090 |

Depreciation and amortisation | | 3,512 | | | 3,430 |

Grants and other contributions | | 6,432 | | | 6,024 |

Finance costs | | 2,419 | | | 1,538 |

Share of net losses of associates using the equity method | | 4 | | | 3 |

Other | | 1,567 | | | 1,954 |

| | | | | |

| | 41,613 | | | 38,016 |

| | | | | |

Gains | | 953 | | | 1,345 |

| | | | | |

Losses | | 601 | | | 868 |

| | | | | |

Surplus/(Deficit) from continuing operations | | (767 | ) | | 3,619 |

| | | | | |

Surplus/(Deficit) from discontinued operations | | — | | | 1,925 |

| | | | | |

Net Surplus/(Deficit) | | (767 | ) | | 5,544 |

| | | | | |

Assets | | 238,150 | | | 192,789 |

Liabilities | | 82,972 | | | 74,150 |

| | | | | |

Net Assets | | 155,178 | | | 118,639 |

| | | | | |

Operating Result

The whole-of-Government operating result from continuing operations for the 2007-08 year was a deficit of $767 million (2007, $3.619 billion surplus).

24

Consolidated Financial Statements—Overview and Analysis—(Continued)

Revenue

Revenue from continuing operations for 2007-08 was $40.494 billion, a decrease of $664 million from 2006-07 ($41.158 billion) as a result of poor investment returns.

Changes in revenues by type are shown in the following chart:

Commonwealth and other grants comprised 40% of Total State revenue in 2007-08 and grew from $14.479 billion in 2006-07 to $16.12 billion in 2007-08 (an increase of $1.641 billion). The major contributors to this increase were Commonwealth grants for road and water infrastructure and health and community services. GST revenue also increased from 2006-07 ($457 million), primarily reflecting stronger consumption expenditure in the economy.

Taxes, fees and fines grew by $1.154 billion (12.4%) reflecting high levels of employment and continued growth of the property sector particularly in the early part of the financial year. Transfer duty grew by $370 million and payroll tax increased by $258 million. The sale of Golden Casket to Tattersall’s in 2006-07 resulted in the transfer in of lotteries tax of $206 million in 2007-08 (previously sales of goods and services), with land tax ($117 million) and motor vehicle registrations ($114 million) also strengthening.

Investment income decreased by $3.498 billion as returns on assets invested with the Queensland Investment Corporation decreased from a positive 14.1% in 2006-07 to negative 2.24% in 2007-08. This was partly offset by interest income from onlendings to bodies such as local governments which increased $350 million.

25

Consolidated Financial Statements—Overview and Analysis—(Continued)

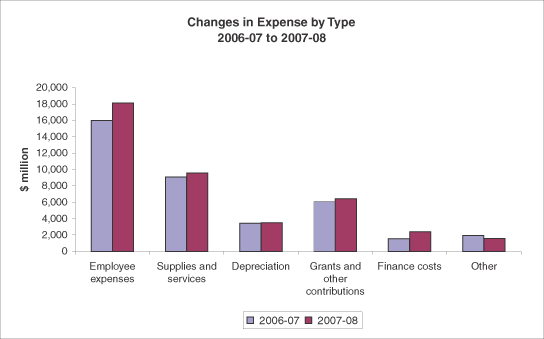

Expenses

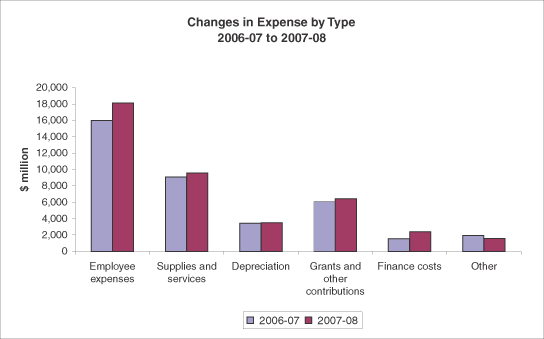

The State’s expenses for 2007-08 in relation to continuing operations totalled $41.613 billion, an increase of $3.597 billion (9.5%) from 2006-07 ($38.016 billion).

Changes in expenses by type are shown in the following chart:

Employee expenses for 2007-08 increased $2.135 billion to $18.112 billion compared with $15.977 billion in 2006-07. This growth reflects wage increases from established enterprise bargaining agreements and additional staffing associated with service growth and enhancements, including the Health Action Plan.

Supplies and services have increased $477 million (5%) to $9.567 billion in 2007-08 mainly due to expenditure on health and transport.

The increase in grants and other contributions of $408 million (6.8%) primarily represents grant payments to non-state schools, health and disability beneficiary payments.

Finance costs have increased by $881 million to $2.419 billion, due to higher levels of borrowings by the State to fund capital expansion.

Other expenses have decreased in 2007-08 by $387 million primarily due to lower superannuation expenses for ex-employees. This movement is offset by a matching reduction in interest earnings.

26

Consolidated Financial Statements—Overview and Analysis—(Continued)

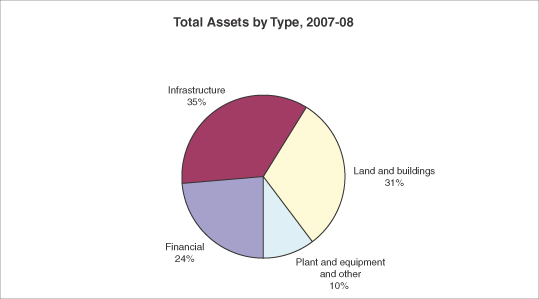

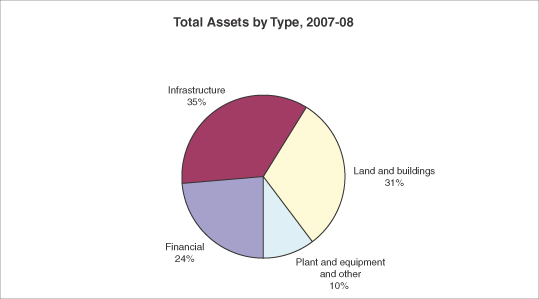

Assets

Assets controlled by the Government at 30 June 2008 totalled $238.15 billion (2007, $192.789 billion). The increase of $45.361 billion in assets is a result of:

| | • | | higher property, plant and equipment balances of $47.847 billion, primarily reflecting the result of the comprehensive revaluation of the road infrastructure assets ($27.897 billion). Other upward revaluations of non-financial assets include the departments, Natural Resources and Water ($3.447 billion), Housing ($1.917 billion), Education, Training and the Arts ($1.107 billion) and Public Works ($658 million). Capital purchases primarily on water, roads, electricity and transport infrastructure were $13.936 billion. |

| | • | | decreased holdings of financial assets, down $2.996 billion. The decrease results from lower investment returns and the liquidation of investments to cover beneficiary payments (mainly superannuation). |

The main types of assets owned by the State are detailed in the following chart:

27

Consolidated Financial Statements—Overview and Analysis—(Continued)

Liabilities

Liabilities of the Queensland Government at 30 June 2008 totalled $82.972 billion, an increase of $8.822 billion (11.9%) over 2006-07 ($74.15 billion). The increase is largely due to:

| | • | | an increase in interest bearing liabilities ($9.642 billion) reflecting increased borrowing by the State to fund major capital projects |

| | • | | employee entitlement obligations such as superannuation and long service leave increasing by $2.251 billion mainly as a result of actuarial revaluations |

| | • | | other liabilities decreased by $3.013 billion mainly due to the current value of derivatives in the electricity sector. |

The components of State liabilities are shown in the following chart:

Maintenance of Credit Ratings

Queensland’s strong credit rating position is illustrated in the following table:

| | | | |

| | | Moody’s

Investors

Service | | Standard

& Poor’s |

Long-term local currency rating | | Aaa | | AAA |

Short-term rating | | P-1 | | A-1+ |

Long-term foreign currency rating | | Aaa | | AAA |

These ratings are the highest available.

Because of these strong ratings, the Queensland Treasury Corporation continues to be in a position to borrow at advantageous rates.

28

Consolidated Financial Statements—Overview and Analysis—(Continued)

Queensland’s debt ratio (total liabilities to total assets) at 30 June 2008 was 34.84 percent (2007, 38.46 percent).

The State’s gearing ratio (interest bearing liabilities to net assets) was 22.69 percent at 30 June 2008 (2007, 23.23 percent).

It is anticipated these ratios will increase over time as the State increases its borrowings to fund the capital program.

Cash Flow Statement

The Cash Flow Statement is split between the Non-financial Public sector on page 5-11 and the Public Financial Corporations sector (refer Note 39 (b)).

The Non-financial Public sector recorded net cash flows from operating activities for the 2007-08 financial year of $2.509 billion.

Capital purchases were $13.865 billion, up $3.377 billion from 2006-07 mainly due to outlays by the State’s commercial entities.

An increase in net borrowings for the State of $9.32 billion was undertaken in 2007-08 to partially fund growth in capital outlays by the State.

29

2007 - 08

Audited Information

Consolidated Financial Statements of the Queensland Government

30 June 2008

30

Income Statement

for the year ended 30 June 2008

| | | | | | | |

| | | Notes | | 2008 | | | 2007 |

| | | | | $M | | | $M |

Revenue from Continuing Operations | | | | | | | |

Commonwealth and other grants | | 3 | | 16,120 | | | 14,479 |

Sales of goods and services | | 4 | | 10,517 | | | 10,524 |

Taxes, fees and fines | | 5 | | 10,440 | | | 9,286 |

Investment income | | 6 | | 1,239 | | | 4,737 |

Royalties and other territorial revenue | | 7 | | 1,462 | | | 1,430 |

Other | | 8 | | 716 | | | 702 |

| | | | | | | |

| | | | 40,494 | | | 41,158 |

| | | | | | | |

Expenses from Continuing Operations | | | | | | | |

Employee expenses | | 9 | | 18,112 | | | 15,977 |

Supplies and services | | | | 9,567 | | | 9,090 |

Depreciation and amortisation | | 10 | | 3,512 | | | 3,430 |

Grants and other contributions | | | | 6,432 | | | 6,024 |

Finance costs | | 11 | | 2,419 | | | 1,538 |

Share of net losses of associates using the equity method | | 40 | | 4 | | | 3 |

Other | | 12 | | 1,567 | | | 1,954 |

| | | | | | | |

| | | | 41,613 | | | 38,016 |

| | | | | | | |

Gains | | | | | | | |

Net gains on sale of assets | | 13 | | 631 | | | 1,053 |

Revaluation increments and impairment reversals | | 14 | | 322 | | | 292 |

| | | | | | | |

| | | | 953 | | | 1,345 |

Losses | | | | | | | |

Loss on revaluation of assets | | 15 | | 194 | | | 417 |

Impairment losses | | 16 | | 111 | | | 22 |

Other losses | | 17 | | 296 | | | 429 |

| | | | | | | |

| | | | 601 | | | 868 |

| | | |

Surplus/(Deficit) before Income Tax Expense | | | | (767 | ) | | 3,619 |

Income tax credit/(expense) | | 2 | | — | | | — |

| | | | | | | |

Surplus/(Deficit) from continuing operations | | | | (767 | ) | | 3,619 |

Surplus/(Deficit) from discontinued operations | | 54 | | — | | | 1,925 |

| | | | | | | |

Net Surplus/(Deficit) | | | | (767 | ) | | 5,544 |

| | | | | | | |

This Income Statement should be read in conjunction with the accompanying notes.

Note 2 provides disaggregated information in relation to the components of the net surplus/(deficit).

31

Balance Sheet

as at 30 June 2008

| | | | | | |

| | | Notes | | 2008 | | 2007 |

| | | | | $M | | $M |

Assets | | | | | | |

| | | |

Current Assets | | | | | | |

Cash and cash equivalents | | 18 | | 1,199 | | 1,123 |

Receivables and loans | | 19 | | 3,665 | | 4,111 |

Financial assets at fair value through profit or loss | | 20 | | 13,108 | | 13,483 |

Other investments | | 21 | | 492 | | 680 |

Derivative financial instruments | | 22 | | 460 | | 805 |

Inventories | | 23 | | 1,120 | | 945 |

Other | | 26 | | 461 | | 412 |

| | | | | | |

| | | | 20,505 | | 21,559 |

| | | |

Non-current assets classified as held for sale | | 27 | | 374 | | 399 |

| | | | | | |

| | | | 20,879 | | 21,958 |

| | | | | | |

Non-Current Assets | | | | | | |

Receivables and loans | | 19 | | 4,540 | | 4,541 |

Financial assets at fair value through profit or loss | | 20 | | 31,560 | | 32,813 |

Other investments | | 21 | | 24 | | 84 |

Derivative financial instruments | | 22 | | 224 | | 500 |

Investments accounted for using the equity method | | 40 | | 87 | | 68 |

Investment properties | | 24 | | 1,184 | | 972 |

Biological assets | | 25 | | 1,183 | | 1,092 |

Property, plant and equipment | | 28 | | 177,266 | | 129,419 |

Intangibles | | 29 | | 1,040 | | 981 |

Other | | 26 | | 163 | | 361 |

| | | | | | |

| | | | 217,271 | | 170,831 |

| | | | | | |

Total Assets | | | | 238,150 | | 192,789 |

| | | | | | |

Liabilities | | | | | | |

| | | |

Current Liabilities | | | | | | |

Payables | | 31 | | 4,374 | | 4,738 |

Employee benefit obligations | | 32 | | 3,169 | | 2,592 |

Financial liabilities held at fair value through profit or loss | | 33 | | 7,309 | | 8,519 |

Financial liabilities held at amortised cost | | 34 | | 323 | | 247 |

Derivative financial instruments | | 22 | | 856 | | 2,706 |

Provisions | | 36 | | 1,174 | | 1,069 |

Other | | 37 | | 1,044 | | 971 |

| | | | | | |

| | | | 18,249 | | 20,842 |

| | | | | | |

32

Balance Sheet—(Continued)

as at 30 June 2008

| | | | | | |

| | | Notes | | 2008 | | 2007 |

| | | | | $M | | $M |

Non-Current Liabilities | | | | | | |

Payables | | 31 | | 6 | | 6 |

Employee benefit obligations | | 32 | | 23,371 | | 21,697 |

Financial liabilities held at fair value through profit or loss | | 33 | | 37,194 | | 26,575 |

Financial liabilities held at amortised cost | | 34 | | 717 | | 560 |

Derivative financial instruments | | 22 | | 650 | | 1,378 |

Provisions | | 36 | | 2,205 | | 2,001 |

Other | | 37 | | 580 | | 1,091 |

| | | | | | |

| | | | 64,723 | | 53,308 |

| | | | | | |

Total Liabilities | | | | 82,972 | | 74,150 |

| | | | | | |

Net Assets | | | | 155,178 | | 118,639 |

| | | | | | |

Equity | | | | | | |

Accumulated surplus | | 38 | | 56,047 | | 57,561 |

Reserves | | 38 | | 99,131 | | 60,978 |

| | | | | | |

State interest | | | | 155,178 | | 118,539 |

| | | | | | |

Minority interest | | 38 | | — | | 100 |

| | | | | | |

Total Equity | | | | 155,178 | | 118,639 |

| | | | | | |

This Balance Sheet should be read in conjunction with the accompanying notes.

Note 2 provides disaggregated information in relation to the components of the net assets.

33

Statement of Changes in Equity for the year ended 30 June 2008

| | | | | | | | |

| | | Notes | | 2008 | | | 2007 | |

| | | | | $M | | | $M | |

Total equity at the beginning of the financial year before accounting policy changes and error corrections | | | | 118,639 | | | 104,446 | |

| | | |

Effect of error correction/timing adjustments in opening balances on: | | | | | | | | |

Accumulated surplus | | 38 | | — | | | 63 | |

Assets revaluation reserve | | 38 | | — | | | (147 | ) |

| | | | | | | | |

Total adjusted equity at the beginning of the financial year | | | | 118,639 | | | 104,362 | |

| | | | | | | | |

| | | |

Revaluation increment/(decrement) of non-financial assets | | | | 37,730 | | | 11,123 | |

Impairment losses and reversals | | | | (50 | ) | | (54 | ) |

Revaluation of financial instruments | | | | (326 | ) | | 73 | |

Revaluation of cash flow hedges | | | | 1,691 | | | (2,226 | ) |

Actuarial gain/(loss) on superannuation | | | | (1,645 | ) | | (282 | ) |

Other | | | | 6 | | | — | |

| | | | | | | | |

Net income recognised directly in equity | | | | 37,406 | | | 8,634 | |

| | | |

Net surplus/(deficit) | | | | (767 | ) | | 5,543 | |

| | | | | | | | |

| | | |

Total recognised income and expense for the period | | | | 36,639 | | | 14,177 | |

| | | | | | | | |

| | | |

Transactions with owners as owners | | | | | | | | |

| | | |

Minority interest | | | | (100 | ) | | 100 | |

| | | | | | | | |

Total equity at the end of the financial year | | | | 155,178 | | | 118,639 | |

| | | | | | | | |

This Statement of Changes in Equity should be read in conjunction with the accompanying notes.

34

Cash Flow Statement

for the year ended 30 June 2008

| | | | | | | | |

| | | Notes | | 2008 | | | 2007 | |

| | | | | $M | | | $M | |

Cash Flows from Operating Activities | | | | | | | | |

Receipts | | | | | | | | |

Grants and subsidies received | | | | 15,644 | | | 14,790 | |

Sales of goods and services | | | | 11,063 | | | 11,376 | |

Taxes, fees and fines | | | | 10,377 | | | 9,225 | |

Investment income | | | | (68 | ) | | 3,524 | |

Royalties and other territorial receipts | | | | 1,290 | | | 1,489 | |

Dividends received | | | | 23 | | | 51 | |

GST input tax credits received | | | | 2,046 | | | 1,651 | |

Other | | | | 617 | | | 867 | |

| | | |

Payments | | | | | | | | |

Employee expenses | | | | (17,092 | ) | | (13,947 | ) |

Supplies and services | | | | (12,158 | ) | | (11,987 | ) |

Grants and subsidies paid | | | | (6,468 | ) | | (5,904 | ) |

Borrowing costs paid | | | | (1,478 | ) | | (1,134 | ) |

GST remitted to the ATO | | | | (892 | ) | | (711 | ) |

Other | | | | (395 | ) | | (846 | ) |

| | | | | | | | |

Net Cash Inflow from Operating Activities | | 39(a) | | 2,509 | | | 8,444 | |

| | | | | | | | |

Cash Flows from Investing Activities | | | | | | | | |

Receipts | | | | | | | | |

Proceeds from sale of property, plant and equipment | | | | 713 | | | 754 | |

Proceeds from sale of subsidiaries | | | | 606 | | | 3,436 | |

Proceeds from sale of investments | | | | 4,047 | | | 1,864 | |

Loans and advances redeemed | | | | 145 | | | 105 | |

| | | |

Payments | | | | | | | | |

Acquisition of property, plant and equipment | | | | (13,865 | ) | | (10,488 | ) |

Acquisition of investments | | | | (2,210 | ) | | (6,062 | ) |

Acquisitions of businesses | | | | (433 | ) | | — | |

Loans and advances made | | | | (214 | ) | | (237 | ) |

| | | | | | | | |

Net Cash Outflow from Investing Activities | | | | (11,211 | ) | | (10,628 | ) |

| | | | | | | | |

Cash Flows from Financing Activities | | | | | | | | |

Receipts | | | | | | | | |

Proceeds from borrowings | | | | 12,012 | | | 5,464 | |

Capital issue—minority interest | | | | (100 | ) | | 100 | |

| | | |

Payments | | | | | | | | |

Repayment of borrowings | | | | (2,692 | ) | | (1,979 | ) |

Finance lease payments | | | | (12 | ) | | — | |

| | | �� | | | | | |

Net Cash from Financing Activities | | | | 9,208 | | | 3,585 | |

| | | | | | | | |

Net Cash Flows from Public Financial Corporations (PFC) | | 39(b) | | 15 | | | 7 | |

| | | | | | | | |

Net Increase/(Decrease) in Cash and Cash Equivalents | | | | 521 | | | 1,408 | |

Net increase/(decrease) in non-eliminated cash balances with PFC | | | | (445 | ) | | (1,070 | ) |

Cash at the beginning of the financial year | | | | 1,123 | | | 785 | |

| | | | | | | | |

Cash and Cash Equivalents Held at the End of the Financial Year | | 18 | | 1,199 | | | 1,123 | |

| | | | | | | | |

This Cash Flow Statement should be read in conjunction with the accompanying notes.

35

Notes to the Financial Statements

1. Significant Accounting Policies

The following summary presents the significant accounting policies that have been adopted in preparing and presenting the consolidated financial statements of the Government of Queensland.

(a) Basis of Accounting

These consolidated financial statements have been prepared in accordance with the Financial Administration and Audit Act 1977, applicable Australian Accounting Standards and Concepts, Urgent Issues Group Consensus Views and other authoritative pronouncements.

This financial report is a general purpose financial report.

New or revised accounting standards and interpretations applicable to the reporting entity which have been published and are not mandatory for 30 June 2008 reporting periods are set out below:

AASB 3: Business Combinations

AASB 101: Presentation of Financial Statements

AASB 123: Borrowing Costs

AASB 127: Consolidated and Separate Financial Statements

AASB 1004: Contributions

AASB 1049: Whole of Government and General Government Sector Financial Reporting

AASB 1050: Administered Items

AASB 1051: Land Under Roads

AASB 2007-2: Amendments to Australian Accounting Standards arising from AASB Interpretation 12 [AASB 1, AASB 117, AASB 118, AASB 120, AASB 121, AASB 127, AASB 131 & AASB 139]

AASB 2007-3: Amendments to Australian Accounting Standards arising from AASB 8 [AASB 5, AASB 6, AASB 102, AASB 107, AASB 119, AASB 127, AASB 134, AASB 136, AASB 1023 & AASB 1038]

AASB 2007-6: Amendments to Australian Accounting Standards arising from AASB 123 [AASB 1, AASB 101, AASB 107, AASB 111, AASB 116 & AASB 138 and Interpretations 1 & 12]

AASB 2007-8: Amendments to Australian Accounting Standards arising from AASB 101

AASB 2007-9: Amendments to Australian Accounting Standards arising from the Review of AASs 27, 29 and 31 [AASB 3, AASB 5, AASB 8, AASB 101, AASB 114, AASB 116, AASB 127 & AASB 137]

AASB 2007-10: Further Amendments to Australian Accounting Standards arising from AASB 101

AASB 2008-1: Amendments to Australian Accounting Standard—Share-based Payments: Vesting Conditions and Cancellations [AASB 2]

AASB 2008-2: Amendments to Australian Accounting Standards—Puttable Financial Instruments and Obligations arising on Liquidation [AASB 7, AASB 101, AASB 132, AASB 139 & Interpretation 2]

AASB 2008-3: Amendments to Australian Accounting Standards arising from AASB 3 and AASB 127 [AASBs 1, 2, 4, 5, 7, 101, 107, 112, 114, 116, 121, 128, 131, 132, 133, 134, 136, 137, 138, & 139 and Interpretations 9 & 107]

AASB 2008-5: Amendments to Australian Accounting Standards arising from the Annual Improvements Project [AASB 5, 7, 101, 102, 107, 108, 110, 116, 118, 119, 120, 123, 127, 128, 129, 131, 132, 134, 136, 138, 139, 140, 141, 1023 & 1038]

AASB 2008-6: Further Amendments to Australian Accounting Standards arising from the Annual Improvements Project [AASB1 & AASB 5]

36

Notes to the Financial Statements—(Continued)

AASB 2008-7: Amendments to Australian Accounting Standards—Cost of an Investment in a Subsidiary, Jointly Controlled Entity or Associate [AASB 1, AASB 118, AASB 121, AASB127 & AASB 136]

AASB 2008-8: Amendments to Australian Accounting Standards—Eligible Hedged Items [AASB 139]

Interpretation 1: Changes in Existing Decommissioning, Restoration and Similar Liabilities

Interpretation 4: Determining whether an Arrangement contains a Lease [revised]

Interpretation 12: Service Concession Arrangements

Interpretation 14: AASB 119—The Limit on a Defined Benefit Asset, Minimum Funding Requirements and their Interaction

Interpretation 129: Service Concession Arrangements: Disclosures [revised]

Interpretation 1038: Contributions by Owners Made to Wholly-Owned Public Sector Entities

The State has not adopted these standards and interpretations early. Application of these standards will not materially affect any of the amounts recognised in the financial statements, but will impact the type of information disclosed, with the following exceptions:

The revised version of AASB 1051 Land Under Roads applicable for reporting periods beginning on or after 1 July 2008 requires land under roads to be recognised as an asset and accounted for under AASB 116 Property, Plant and Equipment . The State is undertaking a process to develop a policy for recognition and measurement of land under roads. Currently land under roads is not recognised on the Balance Sheet and is expensed as road construction occurs. The impact this standard will have on the accounts is unable to be quantified.

The revised version of AASB 123 Borrowing Costs will not impact on the State until 2009-10. The main effect will be that all borrowing costs directly attributable to the acquisition, construction or production of qualifying assets, with a commencement date on or after 1 July 2009, will be capitalised into the acquisition cost of such assets. All other borrowing costs will be expensed. As the standard applies to projects with a commencement date on or after 1 July 2009, the impact of this standard can not be reliably quantified.

AASB 1049 Whole of Government and General Government Sector Reporting applies to annual reporting periods commencing on or after 1 July 2008. The standard aims to harmonise Government Finance Statistics (GFS) and Generally Accepted Accounting Principles reporting. AASB 1049 requires preparation of a whole of Government financial report and a General Government Sector financial report. The standard requires compliance with other applicable accounting standards, except as specified, and mandates disclosure of certain key fiscal aggregates. Explanations of major variances between original budget financial statements presented to parliament and actual amounts are also required. Application of AASB 1049 will result in the financial statements being presented in a different format to the existing statements.

The statements have been prepared on an accrual basis that recognises the financial effects of transactions and events when they occur.

(b) The Government Reporting Entity

In accordance with AASB 127 Consolidated and Separate Financial Statements, these consolidated financial statements include the values of all material assets, liabilities, equities, revenues and expenses controlled by the Government of Queensland.

Only those agencies considered material by virtue of the size of their financial transactions and/or resources managed are consolidated for the purposes of this report.

37

Notes to the Financial Statements—(Continued)

Where control of an entity is obtained during the financial year, its results are included in the Income Statement from the date control commences. Where control of an entity ceases during a financial year, its results are included for that part of the year during which control existed.

The Queensland Government economic entity includes all State Government departments, Public Non-financial Corporations, Public Financial Corporations and their controlled entities. Refer Note 52 for a full list of entities included in each sector.

In the process of reporting the Government of Queensland as a single economic entity, all material inter-entity and intra-entity transactions and balances have been eliminated to the extent practicable.

(c) Sectors

Assets, liabilities, revenues and expenses that are attributed reliably to each sector of the Queensland Government economic entity are disclosed in Note 2. For disclosure purposes, transactions and balances between sectors have not been eliminated, but those between entities within each sector have been eliminated. The financial impact of inter-sector transactions and balances is disclosed in Note 2, under the heading of Consolidation Adjustments.

A brief description of each broad sector of the Government’s activities, determined in accordance with the Government Financial Statistics Standards (Australian Bureau of Statistics), follows:

General Government Sector

The primary function of General Government sector agencies is to provide public services that:

| | • | | are non-trading in nature and that are for the collective benefit of the community; |

| | • | | are largely financed by way of taxes, fees and other compulsory charges; and |

| | • | | involve the transfer or redistribution of income. |

Public Non-financial Corporations Sector

The primary function of enterprises in the Public Non-financial Corporations sector is to provide goods and services that:

| | • | | are trading, non-regulatory or non-financial in nature; and |

| | • | | are financed by way of sales of goods and services to consumers. |

Public Financial Corporations Sector

The Public Financial Corporations sector comprises publicly owned institutions which provide financial services usually on a commercial basis.

Functions they perform may include:

| | • | | central bank functions; |

| | • | | accepting on-call, term or savings deposits; |

| | • | | investment fund management; |

| | • | | having the authority to incur liabilities and acquire financial assets in the market on their own account; or |

| | • | | providing insurance services. |

38

Notes to the Financial Statements—(Continued)

(d) Reporting Period

The reporting period of the consolidated entity is the year ended 30 June 2008.

(e) Basis of Measurement

The consolidated financial statements adopt the following valuation methodologies:

| | • | | superannuation, WorkCover, motor vehicle accident liabilities, Queensland Government Insurance Fund and the Queensland Government Long Service Leave Central Scheme provisions are based on actuarial valuations; |

| | • | | investments and other financial assets are recorded at market value; |

| | • | | borrowings and other financial liabilities are recorded at market value; |

| | • | | power purchase agreements are valued at fair value; |

| | • | | land, buildings, other infrastructure, major plant and equipment and heritage and cultural assets are valued at fair value. Other classes of assets are valued at cost; and |

| | • | | inventories (other than those held for distribution) are valued at the lower of cost and net realisable value under AASB 102 Inventories. |

Historical cost accounting principles are otherwise employed.

Unless otherwise stated, the accounting policies adopted for the reporting period are consistent with those of the previous reporting period. In accordance with AASB 101 Presentation of Financial Statements and AASB 108 Accounting Policies, Changes in Accounting Estimates and Errors, changes to accounting policies are applied retrospectively unless specific transitional provisions apply.

(f) Rounding

All amounts in the consolidated financial statements have been rounded to the nearest $1 million or where the amount is less than $500,000 to zero, unless otherwise indicated.

(g) Comparative Information