EXHIBIT (c)(iii)

Budget Papers of the Co-registrant for 2010-11

State Budget 2010—11

Budget Speech Budget Paper No. 1

Queensland Government

2010–11 State Budget Papers

1. Budget Speech

2. Budget Strategy and Outlook

3. Capital Statement

4. Budget Measures

5. Service Delivery Statements

Budget Highlights

This suite of Budget Papers is similar to that published in 2009–10.

The Budget Papers are available online at www.budget.qld.gov.au. They can be purchased through the Queensland Government Bookshop – individually or as a set – by phoning 1800 801 123 or at www.bookshop.qld.gov.au

© Crown copyright

All rights reserved

Queensland Government 2010

Excerpts from this publication may be reproduced, with appropriate

acknowledgement, as permitted under the Copyright Act.

Budget Speech

Budget Paper No.1

ISSN 1445-4890 (Print)

ISSN 1445-4904 (Online)

APPROPRIATION BILL 2010

(Second Reading Speech, 8 June 2010)

TREASURER

The Honourable Andrew Fraser MP

Treasurer and Minister for Employment

and Economic Development

APPROPRIATION BILL 2010

(Second Reading Speech, 8 June 2010)

TREASURER

The Honourable Andrew Fraser MP

Treasurer and Minister for Employment

and Economic Development

Mr Speaker.

Twelve months ago, this Government took the decision to fight for jobs, above all else.

We made some tough choices. About what to do, what not to do anymore, and what’s in the long-term interests of Queensland.

In this State Budget we report back and recommit ourselves to our true task, providing Queenslanders with a chance at the dignity of work.

It’s what we have always believed in. It’s what we said we would do. And it’s what we are delivering.

This is Labor’s first commitment and our calling.

It guides us and drives us, just like our determination to offer a quality education system for all children and to provide state-of-the art hospitals for the care of our sick.

The fair go... the advancement of all, regardless of where you line up at the start.

And in a world still riven with uncertainty, it is these fundamental beliefs that drive the Bligh Labor Government, and underpin the 2010-11 State Budget.

As global markets continue to shudder, we stand steadfast and determined.

For we know that our task today in 2010 remains as pressing as it was in 2009.

We must build, nurture and drive our economic recovery.

We must prepare for the future.

We must keep our shoulder to the wheel.

It is our desire to protect the lifestyle and livelihood of Queensland families that fuels our determination to deliver on our reforms.

The 2010-11 State Budget shows the architecture of our reforms, and the genesis of the Queensland recovery.

1

Mr Speaker,

The Budget I hand down today shows that the Bligh Labor Government’s economic strategy is delivering.

This Budget delivers lower deficits, lower debt, higher growth and more jobs.

It provides for more essential services, and the investment in the infrastructure our growing state needs.

Our strategy is fuelling growth in the economy, and delivering on Labor’s promise to create more jobs, sooner.

It is a strategy that applies a strong fiscal discipline, while lending a helping hand to Queenslanders who need it most.

It is a strategy that sees the balance sheet strengthened, as we build a stronger, more robust economy.

And it is a strategy not yet fulfilled, as we strive to build tomorrow’s Queensland.

THE ECONOMY: BUILDING A RECOVERY AND GENERATING JOBS

At last year’s Budget we forecast the Queensland economy would contract in 2009-10. This mirrored the forecast for the Australian economy by the Commonwealth Treasury.

As the first sustainable signs of recovery began to build this forecast was upgraded at the Mid-Year Review to positive, albeit marginal, growth of 1%.

The Budget today confirms the recovery underway, with estimated growth for 2009-10 now 3%. While this growth remains below trend, it does outpace the national estimate of 2%.

Central to this result has been our investment in our building program and the strength of our export sector.

Our building program represented almost 7% of the state’s economy in 2009-10 and supported the jobs of some 120,000 Queenslanders.

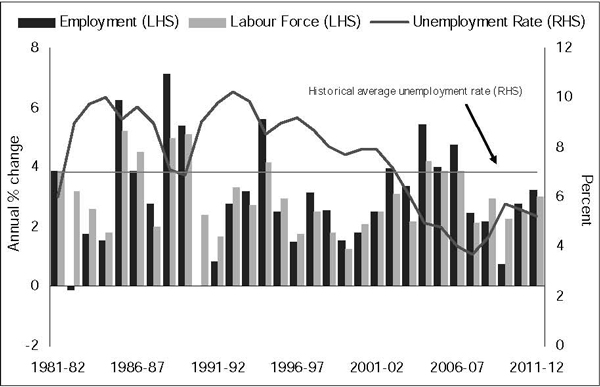

Most importantly we have delivered jobs growth for this financial year, where previously job losses were forecast.

Our determination to elevate the jobs of Queenslanders above all else has delivered where it matters: avoiding the heights of expected unemployment and reducing the impact on Queensland families from the devastation of job loss.

As we oversee the recovery now underway we look forward to accelerating jobs growth of 2 3/4% for the 2010-11 financial year.

This forecast is expected to outpace population growth and thus begin to drive unemployment down.

2

Our determination to deliver a net new 100,000 jobs by March 2012 has never wavered.

Central to that promise is our commitment to building.

Building means jobs, which is why in 2010-11 we will invest $17.1 billion in infrastructure.

It is an investment in jobs, it is an investment in local economies, and it is an investment in the future, as we cater for the demands of our growing population.

Mr Speaker,

The recovery underway has delivered additional revenues. At the delivery of the last Budget we adopted new fiscal rules to guide our recovery.

The rules were tough, and deliberately so. As the charter report within the Budget Papers details, we are delivering improved results. Expenditure constraint through the last financial year has helped deliver a materially better result.

We have met the zero net real per capita growth discipline for this financial year. Despite the high cost of natural disasters we are determined to meet it again in 2010-11.

The revenue wipeout still stands at more than $7 billion dollars as we rebuild. Transfer duty receipts from property still aren’t expected to recover to their 2007-08 level until 2013-14.

The task has not been easy, but we are seeing the results.

The forecast deficit for 2009-10 has been reduced to $287 million, or 0.1% of gross state product, down from the Mid-Year review forecast of $2.3 billion.

The deficit position across the forward estimates has been significantly reduced, with the deficit halved in 2010-11 to $1.74 billion from the $3.46 billion forecast last Budget.

Previously deficits totalling to $11.3 billion to 2012-13 were forecast. The job of repairing our position is well and truly underway, with that figure reduced by $6.3 billion.

Last year’s forecast for a return to surplus has been brought forward. We are now on track to deliver a solid surplus in 2015-16, in accordance with our charter.

With continued discipline we can see a return sooner. It will require all our resolve, something we have in spades.

Last year an efficiency dividend was introduced across the government and harvested upfront. This has required agencies to look at expenditure and make savings in their operations.

This Budget continues this dividend and increases it by $57 million as we continue our drive to direct funds to the front-line, where they are needed most.

3

HELPING QUEENSLAND HOUSEHOLDS

Last year we asked a lot of Queenslanders.

Tough decisions were required. And while a recovery is underway, we recognise that many are still doing it tough.

Inflation and rising interest rates are putting household budgets under pressure.

Our drive for greater budget discipline has not dampened our efforts to provide relief for Queenslanders where we can.

Our Compulsory Third Party Insurance scheme has operated well. CTP today is still lower than it was in 2003.

However in recent times insurers were all filing at the ceiling set by the Motor Accident Insurance Commission - reducing price competition.

In March I announced a review, to ensure the scheme was operating to benefit motorists given rising costs.

Today I announce that the CTP ceiling will be reduced by $24 from 1 October.

The review will ensure that motorists don’t bear the costs of commissions paid to other parties, including motor dealers, and will also bring forward the abolition of a levy surcharge put in place after the collapse of HIH.

This relief will apply across the board, including to pensioners who will continue to enjoy a full 50% discount on their registration: a concession that this year is worth $90 million.

We are determined to give Queensland families some relief – and this measure will help households and assist in keeping our CTP regime competitive and consumer focused.

Rising electricity prices in particular make it tough for some of our most vulnerable Queenslanders.

Lending a helping hand to those in need is fundamental to our core beliefs.

The Budget I deliver today will increase the electricity rebate for pensioners and seniors from $190 to $216 per household at a cost of $50.4 million over the next four years.

The Budget also delivers a new $6.7 million subsidy program to assist those vulnerable Queenslanders whose medical condition requires the extra use of air-conditioners, such as sufferers of multiple sclerosis.

A helping hand to those that need it most - as is our calling.

The Budget includes a $1.6 billion budget in the disabilities portfolio, including an extra $72 million over four years to provide additional support to those with a disability and their families, including two new autism services in Mackay and Bundaberg.

4

$28 million from these funds will go towards helping those with spinal cord injuries while $21 million is provided for young people transitioning out of school.

A major new $45 million four year program is being introduced in three pilot sites to provide secondary services in our child protection system. Along with the allocation of $12 million for additional frontline workers, this allocation will boost the system that supports those who most need our care and protection.

Mr Speaker,

In recent times the government has extended a land tax exemption to aged care facilities. Today I announce a new exemption to providers of supported accommodation for people with high care needs - services which house some of our most vulnerable Queenslanders.

I also announce a new tax exemption measure to assist Queenslanders with a disability, by excluding homes purchased through a disability trust from stamp duty.

Individually, these measures are modest, but they target assistance to some of our most deserving Queenslanders.

In total, this Budget provides around $1.3 billion worth of concessions to Queenslanders in need.

The protection and expansion of these concessions is a direct result of the reform program we have implemented.

It’s the dividend for the community, from the economic strategy we put in place.

A SUSTAINABLE FUTURE BY DOING THE BRIGHT THING

The future of our environment and our sustainability are central to our government’s policy agenda.

Queensland has enormous potential to develop solar energy and secure not only the environmental dividend, but support new industries of the future and the green jobs possible.

The Budget adds to our commitment to the solar industry through new measures, including:

| • | | our new $60 million Solar Hot Water Scheme which provides a subsidy of up to $1000 to assist Queenslanders cut their power bills, and reduce the costs on our environment |

| • | | $5.8 million Solar Kindy Program to install solar power at kindergartens |

| • | | $35 million for the solar boost project at Kogan Creek. |

Renewable energy reduces our call upon the resources of the planet, and so too can a concerted effort to recycle waste and reduce landfill.

5

The Government will introduce a new waste reform strategy to reduce waste and improve recycling levels. A commercial waste levy will apply from 1 July 2011 across 34 council areas along with a commitment to provide:

| • | | $159 million over four years to assist business and the community to reduce waste and implement the strategy |

| • | | $120 million over four years to assist local governments introduce waste reduction infrastructure and programs. |

All other mainland states of Australia have introduced a levy and we are in danger of becoming the dumping ground for other states without acting.

Unlike other states, funds from the levy will not benefit the budget bottom line. Every last cent will be put towards waste programs and environmental initiatives.

As a government we have committed to increasing our protected estate by 50% by 2020.

The Budget also funds programs to support the acquisition of National Park estate and habitat for koalas at a total of $80 million over the next four years.

This Budget provides the down payment on expanding the estate and dedicates future proceeds from the levy to protect more of our environment through programs such as the acquisition of further national parks.

Our natural heritage is vital to the nation’s heritage.

It’s vital also to industries like agriculture and investment in our biosecurity and our biodiversity are investments not only in our environment but in our economy.

The Budget also makes new investments in Hendra research and fire ant eradication to protect and preserve our biosecurity - so vital to our state and indeed to the nation.

INVESTING IN THE FUTURE: GIVING YOUNG QUEENSLANDERS A FLYING START

Mr Speaker, education is the cornerstone of our society, and the key to our future prosperity.

It is a core belief, and central to our strategy as a Government.

Our investment in education and training in this Budget will climb by almost $300 million this year.

This includes funding for up to 316 new teachers and teacher aides, as we deliver on our election commitments.

We will open five new schools for the 2011 school year, as this Budget funds the construction of new schools to meet our future growth.

6

Giving young Queenslanders a flying start through our commitment to build 240 kindergarten services is central to our investment in education.

We will bring forward the construction of an additional 40 kindies to be opened by 2012, bringing total new services to be opened by then to 108.

By taking the tough decisions we can make the investments that really matter – into schools and kindies to prepare young Queenslanders for their future.

We have listened to employers, and are working to avoid a repeat of the terrible skill shortages in growth sectors.

As the recovery builds, so does the need to get more Queenslanders to take up a trade, to get more Queenslanders to upskill, to get more Queenslanders contributing to the growth of our economy.

The Government will overhaul the skills system in this state through the creation of a new Skills Commission to drive investment in the skills the economy demands, particularly for industries like LNG.

We will also maintain the nation’s lowest payroll tax rate, and today I also announce an extension of our 125% payroll tax rebate for apprentices and trainees, as we support those businesses that are investing in skills for the future.

We are also co-investing with industry in a $10 million program to train thousands of workers needed for the new Coal Seam Gas and Liquefied Natural Gas industries.

Investment in innovation, along with new industries, remains central to our economic agenda. A new two-year, $2.5 million innovation vouchers program will provide Queensland firms with the opportunity to access assistance to develop their business.

Our economic reform agenda remains firmly committed to investing in innovation and skills and developing new industries for the future, to deliver the jobs of the future.

INVESTING IN HEALTH AND HOSPITALS

Five years ago our health budget was $5.35 billion.

It is hard to imagine that the budget could ever reach $10 billion – but this year the Queensland Health budget stands at $9.99 billion.

It has been, and remains, the single biggest budget allocation, and a key priority for this Government.

This year we will add another 1,200 doctors, nurses and health professionals to the front-line workforce.

Our record health building program, delivering 22 new and redeveloped hospitals across the state, continues with an allocation of $1.6 billion this year.

7

New hospitals in Mackay and the Gold Coast are under construction, redevelopments in Cairns, Townsville, Rockhampton and Bundaberg are underway.

This Budget provides funds of $137.7 million for new capacity and new services on the Sunshine Coast over the next four years, as well as locking in the funds for the new Sunshine Coast University Hospital due to open, as we committed last year, by 2016.

Our investment in health across the state also sees the Budget commit $374 million for new regional cancer services across the state, as we partner with the Australian Government to invest in our health system.

In this Budget I also announce a new initiative to assist Queenslanders who suffer from chronic pain, with a new four-year, $39 million initiative to provide four new persistent pain clinics.

Mr Speaker,

Queensland led the way in testing newborns for hearing loss, with universal screening now available.

For families who discover their newborn child suffers from hearing loss, the prospect of a cochlear implant can represent hope.

Cochlear has recently announced its intention to expand its facility and production here in Queensland and today I can announce new funding to provide more implants for more children and more funding for the Hear and Say Centre.

We will invest an additional $16.5 million to double the number of cochlear implants and expand children’s hearing services over the next four years.

It is through investment in research that the Cochlear implant has helped change lives.

We have committed more than $3.6 billion over the last decade to drive innovation and research, and we continue our commitment with an additional $31 million for medical research in this Budget.

The challenge of an ageing population and increasing medical technology costs requires us to undertake long-term reform to our health system.

This year the federal government’s specific health funding allocation to Queensland is $2.7 billion. The balance of this $10 billion commitment is met by the state from GST and other state revenue.

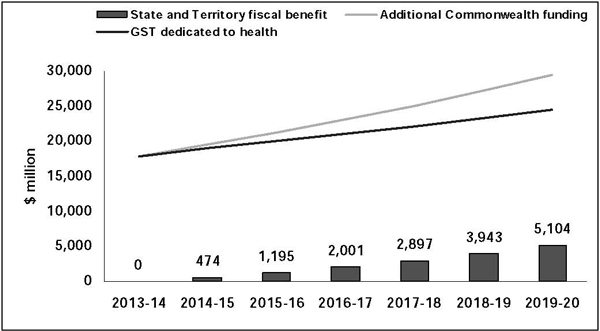

Queensland has signed up to the new health funding arrangements which dedicates a proportion of the GST to be locked in and the Commonwealth to fund the majority of growth.

8

Dedicating the GST towards this task reflects the current reality. And doing so harnesses the Commonwealth finally recognising its obligation to be the dominant funder of health into the future.

Given the Commonwealth collects 80% of all tax revenue in this nation it should and must be the dominant funder of health.

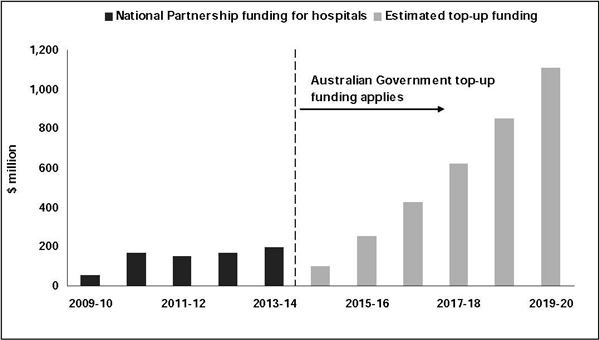

This Budget also delivers through the funds we negotiated as part of the health reform deal before the GST lock-in, including:

| • | | $150 million for emergency departments |

| • | | $160 million for elective surgery |

| • | | $327 million for sub-acute care. |

Funding health has to be the first priority of government. It is the first priority of the Bligh Government and this Budget demonstrates our priority and the choices we have made.

BUILDING FOR GROWTH, FOR TOMORROW’S QUEENSLAND

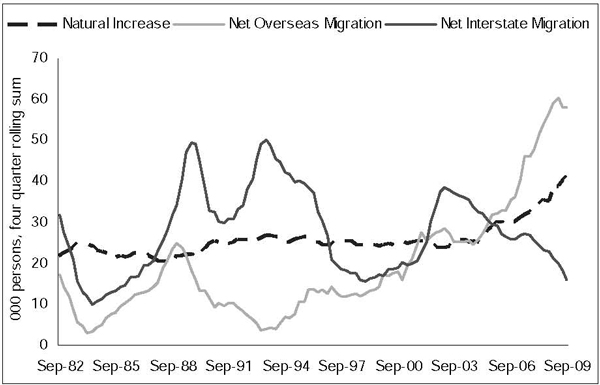

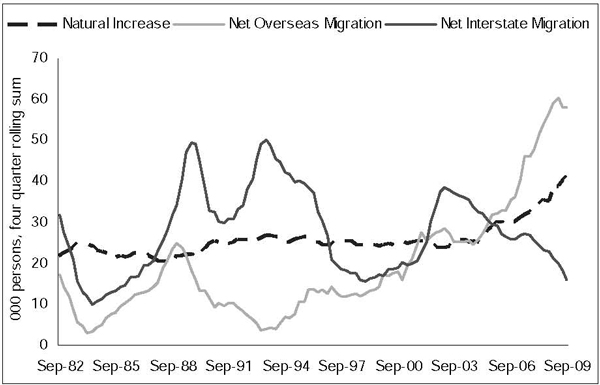

One vital statistic which has not been subject to the volatility of recent years has been our sustained population growth.

The forecast once again is that another 100,000 Queenslanders will call our state home through the next financial year.

That means we need to cater for that growth. And we are determined to guide the growth for the benefit of all of Queensland.

A growing population requires a commitment to building infrastructure and providing new services.

The Budget delivers the frontline services needed – 203 extra police, 316 new teachers and teacher aides, 1200 doctors, nurses and allied health professionals.

We are also delivering a $17.1 billion building program as we build Queensland’s future, and re-build our economic strength.

Our building program is delivering the support our economy needs today – and the infrastructure needed for tomorrow.

We need to target a building program that matches both economic imperatives and fiscal requirements. We should not yet step back.

This Budget sees new projects funded, and others on the drawing board brought onto the books, and ready to commence.

9

Projects like the $450 million Police Academy will go to the market in 2010-11, to ensure a pipeline of projects is delivered to help sustain our vital construction industry while private investment remains constrained by credit conditions.

As the massive $1.8 billion Gateway Bridge duplication and upgrade project heads towards the finish line, the Government has committed to the $240 million Gateway Upgrade South extension, which will deliver 6 lanes non-stop between Nudgee and Nerang.

The Port of Brisbane Motorway upgrade will also commence this financial year, with a funding commitment of $330 million allocated.

We will complete the $315 million Ted Smout Bridge to Redcliffe, the $148 million Forgan Smith Bridge in Mackay and construction on the $190 million Port Access Road in Townsville will continue.

One of the defining characteristics of the Queensland economy is its regionalised nature.

No two are the same, and across the board we are committed to providing the infrastructure our communities deserve.

There is no doubt that the Cairns region has done it tougher than many in recent times. That’s why we put in place a $116 million stimulus plan last year.

Today I announce our commitment to financially supporting the construction of a new Cairns cultural precinct.

The Budget sees $42.5 million allocated in land and funds towards this project, which has been proposed as a partnership between the Cairns Regional Council and the federal government.

We are committed to this project – for the long-term benefit of the Cairns economy.

The Budget includes our commitment to the $96 million new marine precinct in Townsville while funds are also allocated towards the Mackay Showgrounds and towards the next stage of the Rockhampton Riverbank Redevelopment.

Regional growth is also supported through a commitment to fund new access for the development of the industrial precinct at Gracemere, while funds are allocated to support airport upgrades in key regional centres such as Roma, Toowoomba and Bundaberg.

We will also fund key roadworks in regional Queensland, including an investment of $4.6 million in the Carnarvon Highway between Injune and Rolleston.

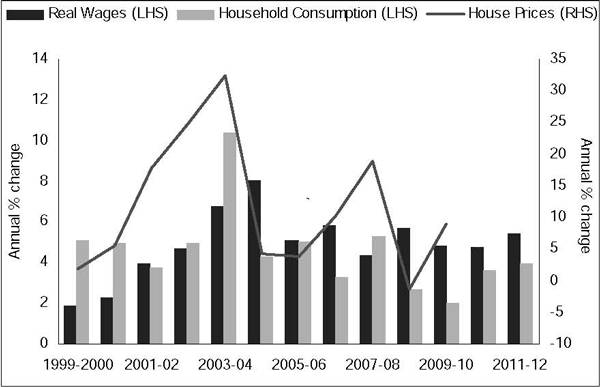

Our housing market is showing the first signs of recovery and we have led the way in abolishing mortgage duty and stamp duty for first home buyers of homes up to $500,000.

We have targeted the first home owner grant to homes under $750,000 to ensure it goes to those who need the assistance.

10

This Budget also includes a new Regional First Home Owner Boost, an extra $4,000 on top of the existing state funded $7,000 First Home Owner Grant.

This boost brings to $11,000 the assistance provided by the state for those building new homes outside the south east corner.

The regions of Queensland helped build the Queensland of today.

We are a government that remains committed to the whole of Queensland, and this is a Budget that continues to deliver for regional Queensland.

CONCLUSION

Mr Speaker,

The Budget I present today is Queensland’s 150th Budget.

A century and a half ago the first Budget of Queensland catered for six hospitals and two schools. The total health and education budget allocations comprised about 3% of the expenditure.

Today I present a Budget for a Queensland with 184 hospitals and health facilities and 1250 schools, which sees nearly half of the entire budget allocated on health and education.

Today I present a Budget for a very different Queensland.

The modern Queensland reveals the change and dynamism that has been at the core of our development and our prosperity.

It’s not accidental, it’s required leadership throughout our 150 years.

That much hasn’t changed.

Now remains the hour for this Labor Government to lead from the front, like Labor Governments have proudly done throughout our nation’s history.

With the courage to change. With the capacity to endure.

And with our eyes firmly on the future….

… firmly on the future of working class kids getting the best start in life because we invested in kindies, in prep, and in reducing class sizes – not in dedicated coal track for coal companies who pay for their own in other states.

… firmly on the future of kids born profoundly deaf getting access to a cochlear implant to change their whole world and make everything possible again – not the future of a commercial timber business milling pine for woodchip.

11

... firmly on the future jobs for the next generation of Queenslanders as we invest in the State’s new industries and new technology to create the jobs of tomorrow and provide the ultimate dignity for the individual – work.

Mr Speaker,

We have made our choices. This Budget again reflects them. They are the choices of a Labor Government in the best traditions.

We are a proud government, determined to continue the legacy of Labor in building a modern Queensland.

We are a proud government – proud of our commitment to jobs and to the workers of Queensland.

Through the tumult of the last two years, we have put the dignity of work as the guiding light for our policies.

We put job protection and job generation front and centre, and put in place a strategy to deliver.

We are delivering: this Budget delivers on our commitments. On building an economic recovery and delivering a strong economy.

On generating jobs.

On building infrastructure for the future.

On sustainable growth for all of Queensland.

On funding the front-line services.

On working to provide assistance to Queensland families and a helping hand to those most in need.

And on preparing this great state for a future it can capture, not just a reprise of its history.

To endure and prosper always require change.

We are a government determined to change Queensland... for the future... for a better future.

I commend the Bills to the House.

12

This page has been left blank

By authority: S. C. Albury, Acting Government Printer, Queensland 2010

State Budget 2010–11

Budget Speech

Budget Paper No.1

www.budget.qld.gov.au

Queensland

Government

State Budget 2010-11

Budget Speech

Budget Paper No.1

www.budget.qld.gov.au

State Budget 2010–11

Budget Strategy and Outlook

Budget Paper No.2

Queensland Government

2010–11 State Budget Papers

1. Budget Speech

2. Budget Strategy and Outlook

3. Capital Statement

4. Budget Measures

5. Service Delivery Statements

Budget Highlights

This suite of Budget Papers is similar to that published in 2009–10.

The Budget Papers are available online at www.budget.qld.gov.au. They can be purchased through the Queensland Government Bookshop – individually or as a set – by phoning 1800 801 123 or at www.bookshop.qld.gov.au

© Crown copyright

All rights reserved

Queensland Government 2010

Excerpts from this publication may be reproduced, with appropriate acknowledgement, as permitted under the Copyright Act.

Budget Strategy and Outlook

Budget Paper No.2

ISSN 1445-4890 (Print)

ISSN 1445-4904 (Online)

STATE BUDGET

2010-11

BUDGET STRATEGY AND

OUTLOOK

Budget Paper No. 2

TABLE OF CONTENTS

| | | | | | |

| 1 | | Fiscal Strategy, Performance and Outlook | | | 1 | |

| | |

| | Fiscal Strategy | | | 3 | |

| | Path Back to Surplus | | | 6 | |

| | Fiscal Principles | | | 7 | |

| | Summary of Key Financial Aggregates | | | 12 | |

| | Budget Outcomes 2009-10 | | | 13 | |

| | Budget 2010-11 and Outyear Projections | | | 16 | |

| | Reconciliation of Net Operating Balance | | | 19 | |

| | |

| 2 | | Economic Performance and Outlook | | | 21 | |

| | |

| | External Environment | | | 22 | |

| | The Queensland Economy | | | 26 | |

| | |

| 3 | | Economic Strategy for a Growing and Ageing Population | | | 43 | |

| | |

| | Queensland’s Demographic Challenges | | | 44 | |

| | Long Term Economic Strategy | | | 51 | |

| | |

| 4 | | Revenue | | | 63 | |

| | |

| | Introduction | | | 64 | |

| | Changes in Revenue since the 2009-10 Budget | | | 66 | |

| | Revenue by Operating Statement Category | | | 68 | |

| | Taxation Revenue | | | 70 | |

| | Queensland’s Competitive Tax Status | | | 78 | |

| | Grants Revenue | | | 80 | |

| | Sales of Goods and Services | | | 83 | |

| | Interest Income | | | 85 | |

| | Dividend and Income Tax Equivalent Income | | | 85 | |

| | Other Revenue | | | 86 | |

| | | | | | |

| 5 | | Expenses | | | 89 | |

| | |

| | Introduction | | | 89 | |

| | Expenses by Operating Statement Category | | | 92 | |

| | Details of Expenses | | | 93 | |

| | Operating Expenses by Purpose | | | 97 | |

| | Departmental Expenses | | | 101 | |

| | |

| 6 | | Balance Sheet and Cash Flows | | | 105 | |

| | |

| | Introduction | | | 105 | |

| | Balance Sheet | | | 106 | |

| | Cash Flows | | | 112 | |

| | Reconciliation of Operating Cash Flows to the Operating Statement | | | 120 | |

| | |

| 7 | | Intergovernmental Financial Relations | | | 121 | |

| | |

| | Federal Financial Arrangements | | | 122 | |

| | Australian Government Payments for Specific Purposes | | | 125 | |

| | GST Revenue Payments | | | 131 | |

| | Other Commonwealth Payments | | | 138 | |

| | Health Reforms | | | 138 | |

| | Review of Australia’s Tax System | | | 141 | |

| | State-Local Government Financial Relations | | | 143 | |

| | |

| 8 | | Public Non-financial Corporations Sector | | | 145 | |

| | |

| | Prior Year Key Performance Indicators | | | 146 | |

| | Net Flows to Government | | | 152 | |

| | Asset Sales Program | | | 154 | |

| | Capital Structure Review | | | 156 | |

| | GOC Reporting Reforms | | | 157 | |

| | Implementation of GOC Reforms | | | 158 | |

| | Energy Sector | | | 161 | |

| | Transport Sector | | | 163 | |

| | Water Sector | | | 168 | |

| | | | | | |

| 9 | | Uniform Presentation Framework | | | 171 | |

| | |

| | Introduction | | | 171 | |

| | General Government Sector | | | 171 | |

| | Public Non-Financial Corporations Sector | | | 172 | |

| | Uniform Presentation Framework Financial Information | | | 174 | |

| | Reconciliation of Net Operating Balance to Accounting Operating Result | | | 184 | |

| | General Government Time Series | | | 185 | |

| | Other General Government UPF Data | | | 186 | |

| | Contingent Liabilities | | | 192 | |

| | Background and Interpretation of Uniform Presentation Framework | | | 193 | |

| | Sector Classification | | | 195 | |

| | Reporting Entities | | | 196 | |

| |

| Appendix A – Tax Expenditure Statement | | | 199 | |

| |

| Appendix B – Concessions Statements | | | 207 | |

| |

| Appendix C – Statement of Risks and Sensitivity Analysis | | | 215 | |

| 1 | FISCAL STRATEGY, PERFORMANCE AND OUTLOOK |

FEATURES

| • | | The forecast General Government net operating balance is expected to be a deficit of $287 million in 2009-10 compared to a forecast deficit of $2.351 billion at the time of the Mid Year Fiscal and Economic Review in December 2009 and $1.954 billion at the time of the 2009-10 Budget. |

| • | | The improvement in the forecast net operating balance across the forward estimates since the Mid Year Fiscal and Economic Review primarily reflects an improvement in global economic conditions and the resulting revisions to royalty and GST revenue. |

| • | | The improvement in the 2009-10 net operating balance is also due to the bring forward of Australian Government payments for transport projects, such as the Ipswich Motorway, with funding brought forward primarily from 2010-11. Australian Government funding for Gold Coast Rapid Transit, which had previously been considered to be an equity contribution, will now be received as a grant in 2009-10. |

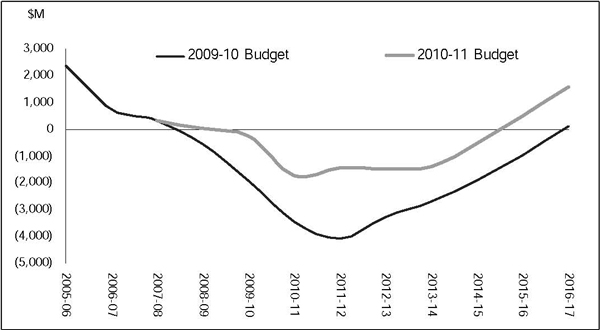

| • | | Despite an improved revenue outlook, the General Government sector is forecast to incur a net operating deficit in 2010-11 ($1.745 billion), associated with the withdrawal of Australian Government stimulus payments. Improvements in the operating position are expected across each of the forward estimate years, with a return to surplus now projected in 2015-16. |

| • | | Cash deficits in the General Government sector are projected for each year across the forward estimates, reflecting the State’s significant capital program. |

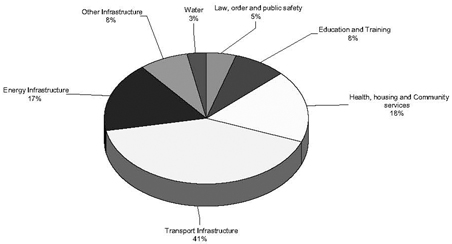

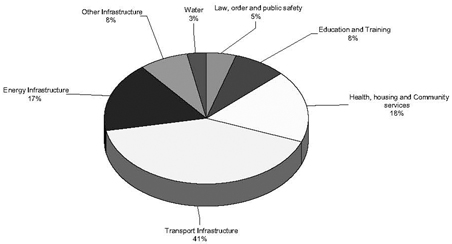

| • | | The State’s 2010-11 capital program is an estimated $17.1 billion, a 1.2% decrease on 2009-10 estimated outlays. The capital outlays of Public Non-financial Corporations (commercial) sector entities constitute approximately 41% of total outlays in 2010-11. |

| | | | |

| | Budget Strategy and Outlook 2010-11 | | 1 |

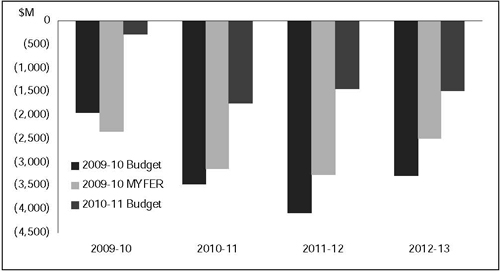

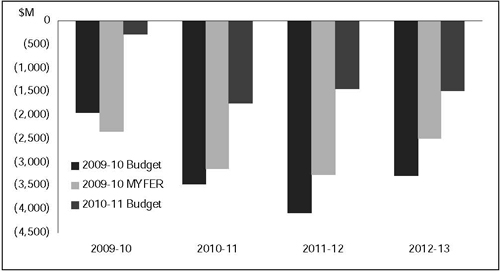

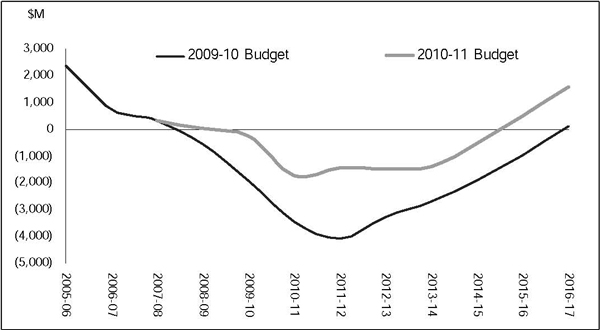

The operating balance expected for 2009-10 is a deficit of $287 million compared to a forecast deficit of $2.351 billion anticipated in the Mid Year Fiscal and Economic Review (MYFER). As identified in Table 1.1 below, the forecast General Government sector operating balances have improved across the forward estimates, with the forecast deficits more than halved from the 2009-10 Budget forecasts.

Table 1.1

General Government sector – revisions to net operating balance forecasts1

| | | | | | | | | | | | | | | | | | | | | | | | |

| | | 2008-09

$ million | | | 2009-10

$ million | | | 2010-11

$ million | | | 2011-12

$ million | | | 2012-13

$ million | | | 2013-14

$ million | |

2009-10 Budget | | | (574 | ) | | | (1,954 | ) | | | (3,459 | ) | | | (4,090 | ) | | | (3,290 | ) | | | n/a | |

2009-10 MYFER | | | 35 | | | | (2,351 | ) | | | (3,142 | ) | | | (3,264 | ) | | | (2,499 | ) | | | n/a | |

2010-11 Budget | | | 35 | | | | (287 | ) | | | (1,745 | ) | | | (1,442 | ) | | | (1,482 | ) | | | (1,395 | ) |

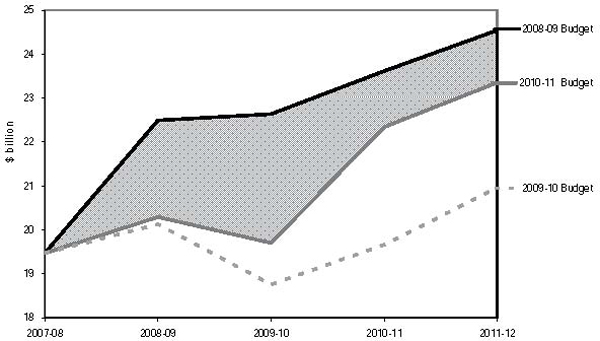

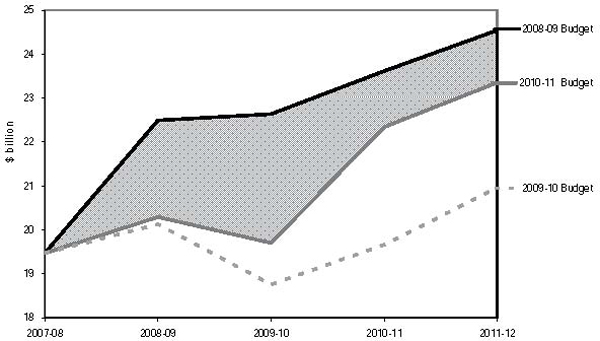

Chart 1.1 shows the forecast operating position at the 2009-10 Budget, 2009-10 MYFER and the 2010-11 Budget.

Chart 1.1

Revisions to net operating balance forecasts

| | | | |

| 2 | | Budget Strategy and Outlook 2010-11 | | |

FISCAL STRATEGY

While providing additional funding for high priority service needs, the 2010-11 Budget is firmly focussed on consolidating Queensland's financial position as the economy recovers. In particular, the 2010-11 Budget delivers a significant reduction in the State’s forecast borrowing levels, relative to MYFER projections, with projected borrowings to be further reduced on the completion of the asset sales program. This is critical in the current environment as international financial markets increasingly focus on the capacity of governments to meet their borrowing obligations.

The 2009-10 Budget introduced a number of structural budget reforms aimed at improving Queensland’s fiscal position to ensure the long term sustainability of the State’s finances. The total value of these initiatives, excluding asset sales, was estimated at around $5.4 billion over four years.

The Government also adopted a new fiscal strategy, setting out how it will restore Queensland’s traditionally strong financial position, while maintaining services and continuing to deliver its commitments to the community.

In building on the strong foundations established in the 2009-10 Budget, the 2010-11 Budget:

| • | | is consistent with the fiscal principles the Government committed to in the 2009-10 Budget, in particular prioritising funding to ensure that own-purpose expenditure grows at a slower rate than inflation and population growth, with own-purpose expenditure growth in 2009-10 of 3.74% being substantially below the real per capita constraint of 5% |

| • | | requires agencies to drive further efficiencies to support front line service delivery, such that the aggregate annual efficiency dividend from 2012-13 will reach about $400 million each year |

| • | | maintains a large capital program in 2010-11, to both boost productivity and support jobs as the economy gradually strengthens, but allows for a significant reduction in the size of the capital program across the forward estimates as private sector investment grows |

| • | | applies the majority of the forecast improvement in revenues, associated with a stronger economic outlook, to reducing deficits and borrowings. |

Queensland’s medium-term fiscal outlook has improved since the publication of the 2009-10 Budget. This reflects upward revisions to economic growth, both domestically and internationally, largely as a result of substantial monetary and fiscal stimulus, which reduced the severity and duration of the economic downturn. However, economic growth was below trend in 2008-09 and is expected to also be below trend in 2009-10 and 2010-11. As a result, economic activity has not returned to the same trajectory as prior to the global financial crisis, nor have Queensland’s revenues.

| | | | |

| | Budget Strategy and Outlook 2010-11 | | 3 |

While revenue is forecast to grow at a moderate rate across the forward estimates, the State’s key revenue streams of taxation, royalties and GST revenue continue to be impacted by the legacy of the global financial crisis. These revenues are expected to be $7.6 billion less than forecast in the 2008-09 Budget, contributing to the State’s ongoing operating deficits and borrowing requirements. Revenue forecasts are discussed in greater detail in Chapter 4.

Although the State’s fiscal and economic outlook has improved in the past 12 months, there is still a significant degree of uncertainty in regard to the strength and speed of recovery.

Within this context, the Government is committed to the infrastructure assets reform and sale program announced in June 2009, to protect the State’s capacity to deliver additional infrastructure in core government service delivery areas such as health, education and roads.

The asset sales package is designed to encourage the private sector to play a more active role in providing and funding the key economic infrastructure which is essential in promoting economic growth.

The sale program will deliver an estimated $15 billion in sale proceeds, and result in more than $10 billion in required capital investment being avoided. As is usual practice, the impact of the asset sales has not been factored into the Budget estimates, other than the sale of Forestry Plantations Queensland, the transaction for which has now been formally agreed.

Financial considerations of asset sales

The 2010-11 Budget focuses on supporting the continued delivery of key public infrastructure such as schools, hospitals and public transport, and the delivery of public services through these facilities.

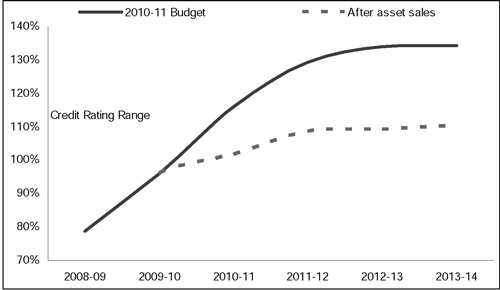

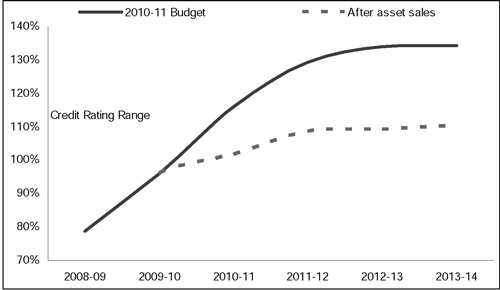

The following chart shows the overall favourable impact the expected sale proceeds will have on one of the key credit rating ratios (net financial liabilities to revenue), after accounting for forgone revenue. Chart 1.2 indicates that, in the absence of asset sales, the ratio is expected to rise to above 130% in 2013-14. However, taking the asset sales program into account results in the projected ratio reaching 110% across the period. Ratings agencies have indicated that the 100-110% range is one of the criteria required for a reassessment of the State’s credit rating, along with a demonstration of a solid surplus operating position.

| | | | |

| 4 | | Budget Strategy and Outlook 2010-11 | | |

Chart 1.2

Net financial liabilities to revenue ratio, before and after asset sales

The program of asset sales will play an important role in funding the Government’s infrastructure program, reducing State debt and encouraging private sector provision of infrastructure. The sales are designed to realise value, reduce risk and obviate the need to further fund the significant ongoing capital requirements of these businesses, where the private sector can fund those requirements.

This will improve the strength of the State’s balance sheet and demonstrate to ratings agencies and financial markets the Government’s commitment to return the State to a solid fiscal position.

Further detail about the restructuring and disposal processes is provided in Chapter 8.

The 2009-10 Budget included a commitment from the Queensland Government to reduce the capital program to levels below $10 billion per year from 2013-14, and to identify further policy measures to improve productivity and reduce expenditure.

The 2010-11 Budget delivers on this commitment with:

| • | | the Non-financial Public Sector capital program forecast to trend down over the forward estimates to be $9.6 billion by 2013-14 |

| • | | further efficiency measures |

| • | | expenditure offset by savings and revenue measures where appropriate. |

| | | | |

| | Budget Strategy and Outlook 2010-11 | | 5 |

PATH BACK TO SURPLUS

Returning the Budget to surplus is a central element of the Government’s revised fiscal principles. A number of key initiatives established in the 2009-10 Budget, such as the 2.5% limit on public sector wage increases and the abolition of the Queensland Fuel Subsidy Scheme, underpin the projected return to surplus. However, a return to surplus depends on economic growth in the State as well as the policy decisions of Government.

The fiscal principle relating to the General Government net operating balance requires the Government to achieve a General Government net operating surplus as soon as possible, but no later than 2015-16. Chart 1.3 below indicates the Government is now on track to achieve this goal by tracking solidly into surplus in 2015-16.

However, there remains a high degree of uncertainty about the pace and path of recovery. Queensland’s assumptions are for the operating deficit to peak in 2010-11, associated with the withdrawal of Australian Government stimulus payments, before improving across the forward estimates.

Chart 1.3

General Government Sector Net Operating Balance, 2005-06 to 2016-17

| | | | |

| 6 | | Budget Strategy and Outlook 2010-11 | | |

FISCAL PRINCIPLES

The Charter of Fiscal Responsibility outlines the Government’s fiscal principles and is an integral part of the Government’s commitment to the community. The fiscal principles were revised for the 2009-10 Budget and identified how the Government will restore Queensland’s traditionally strong financial position, while maintaining services and continuing to deliver its commitments to the community.

The fiscal principles of the Queensland Government are broadly based around three themes: fiscal sustainability; a competitive tax regime; and managing the State’s balance sheet.

The fiscal principles establish the basis for sustainability of the Government’s policies. They require services provided by Government be funded from tax and other revenue sources over the long term. The principles are supported by an accrual budgeting framework, which recognises future liabilities of the State and highlights the full cost of sustaining the Government’s operations on an ongoing basis.

The fiscal principles recognise the importance of a strong financial position for the State. A state government, because of its more limited tax base, does not have the same capacity as a national government to cushion economic and financial shocks. At the same time, state governments have a responsibility to provide continuity of services, such as health, police and education.

The Treasurer must report regularly to the Legislative Assembly on progress the Government has made against the outcomes stated in the Charter. This report will be tabled and published each year in the Budget papers, MYFER and Report on State Finances.

Fiscal sustainability

Governments must balance the cost of their activities with the revenues raised by taxation, royalties and income from business activities. It is not sustainable for governments to borrow to fund recurrent expenses, as the resultant interest costs and repayment of debt will be borne by future taxpayers, at the expense of other government services or through higher taxes.

However, capital investment benefits users and society more generally over the life of the asset. It can therefore be appropriate to borrow to fund capital investment, so that the costs of the investment are paid over the same time frame as the benefits are realised.

Principle

In the General Government sector, meet all operating expenses from operating revenue (where operating revenue is defined as total revenue from transactions and operating expenses are defined as total expenses from transactions less depreciation).

| | | | |

| | Budget Strategy and Outlook 2010-11 | | 7 |

In the current financial environment, with markets concerned about sovereign debt, fiscal discipline is critical. Until it achieves an operating surplus, growth in state own-purpose expenses (that is, excluding Commonwealth related expenses) will be limited to inflation and population growth.

Principle

Growth in own-purpose expenses in the General Government sector to not exceed real per capita growth.

Own-purpose expenditure growth of 3.74% is expected in 2009-10, substantially below the real per capita limit of 5%, reflecting the achievement of a number of measures introduced in the 2009-10 Budget, including public sector efficiency measures and the abolition of the Queensland Fuel Subsidy Scheme.

In 2010-11, own-purpose expenditure growth of 5.97% is anticipated, which is above the real per capita constraint of 5.25%. However, the estimated rate of growth in own-purpose expenses in 2010-11 is being impacted by anticipated spending to undertake reparation work associated with wide-scale flooding which occurred throughout Queensland in February and March 2010 and also one-off costs associated with the assets sale program. If spending associated with these events were excluded from the calculation, own-purpose expenditure in 2010-11 would be estimated to increase at a rate consistent with the real per capita constraint.

Over the period 2009-10 to 2013-14, own-purpose expenditure growth is expected to average 4.1%, compared with an expected real per capita limit of 5.1%. Further details on expenses projections are contained in Chapter 5.

Principle

Achieve a General Government net operating surplus as soon as possible, but no later than 2015-16.

This approach to expenses growth, together with allowing improvements in revenue forecasts to flow through to the bottom line, is aimed at achieving a net operating surplus in the General Government sector by 2015-16 and, depending on the strength of the recovery, possibly sooner.

| | | | |

| 8 | | Budget Strategy and Outlook 2010-11 | | |

Competitive tax regime

One of the Queensland Government’s key fiscal objectives is to maintain a competitive tax environment. While the Government will raise sufficient revenue to meet the service and infrastructure needs of the people of Queensland, it is important that business has a low cost environment, to promote economic development and jobs growth.

The competitiveness of a State’s tax system is usually assessed by using one of the following measures:

| • | | taxation revenue on a per capita basis |

| • | | taxation effort as assessed by the Commonwealth Grants Commission |

| • | | taxation revenue expressed as a percentage of gross state product (GSP). |

Queensland’s competitive tax position is confirmed on all three measures:

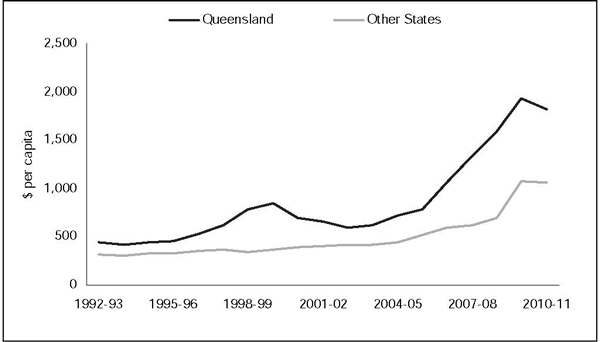

| • | | per capita tax collections in Queensland in 2010-11 are estimated at $2,225, compared with an estimated $2,643 for the average of the other states |

| • | | Commonwealth Grants Commission data indicate that Queensland’s taxation effort ratio was 86.9% of the standard for all states in 2008-09 |

| • | | Queensland’s tax collections were 3.64% of GSP in 2008-09, compared to 4.14% for the average of the other states. |

The 2010-11 Budget includes payroll tax and land tax measures. Details of these changes and other revenue items are provided in Chapter 4.

Principle

Maintain a competitive tax environment for business.

Managing the State’s balance sheet

The provision of adequate levels of infrastructure is an ongoing challenge for a state such as Queensland that continues to experience higher levels of economic and population growth than the national average over the long term. In meeting this challenge, the Government funds capital expenditure well above the average of the other states and territories, in per capita terms.

| | | | |

| | Budget Strategy and Outlook 2010-11 | | 9 |

As discussed above, given the current operating position Queensland funds its capital program substantially through borrowing, recognising the interest, operating and depreciation costs on the operating statement. While the balance sheet of the Queensland Government remains strong, the increased borrowing is expected to lead to an increase in the ratio of net financial liabilities1 to revenue, which is a measure used within financial markets to assess financial sustainability.

This ratio is expected to be 116% at the end of the 2010-11 financial year, which is lower than the forecast at the time of the MYFER. In the absence of asset sales, the ratio is projected to increase to above 130% by 2013-14. However, after completion of the asset sales program, it is expected to reach 110% by 2013-14. The 100-110% range has been identified by Standard and Poor’s as one of the trigger points for reassessment of the State’s credit rating.

Principle

Stabilise net financial liabilities as a proportion of revenue in the Non-financial Public sector.

Queensland has a long history of setting aside funds to accumulate financial assets sufficient to meet future liabilities, the largest being for future employee entitlements, in particular superannuation. Queensland is therefore better placed than other state governments to meet future accruing liabilities, as most other jurisdictions have substantial unfunded superannuation liabilities.

The State’s policy of setting aside funds to meet future liabilities and reinvesting all earnings provides the capacity to manage cycles in investment markets without affecting the Government’s ability to fund services to the community.

The most recent actuarial review, released in June 2008, found that accruing superannuation liabilities were fully funded. The State Actuary reviews the scheme every three years. Further information on balance sheet aggregates can be found in Chapter 6.

Principle

Target full funding of long-term liabilities such as superannuation in accordance with actuarial advice.

Table 1.2 provides an overview of the Government’s progress in meeting the fiscal principles.

| 1 | Net financial liabilities in this context is the term used by Standard & Poor’s ratings agency and differs from that used in the Uniform Presentation Framework tables in Chapter 9. |

| | | | |

| 10 | | Budget Strategy and Outlook 2010-11 | | |

Table 1.2

The fiscal principles of the Queensland Government

| | | | | | | | | | | | |

Principle | | Indicator | |

Fiscal sustainability | | | | | | | | | | | | |

| | | |

| | | | | | Operating

Revenue

($ million) | | | Operating expenses

less depreciation

($ million) | |

In the General Government sector, meet all operating expenses from operating revenue (where operating revenue is defined as total revenue from transactions and operating expenses are defined as total expenses from transactions less depreciation) | | | 2009-10 | | | | 39,689 | | | | 37,497 | |

| | | 2010-11 | | | | 40,606 | | | | 39,530 | |

| | | 2011-12 | | | | 41,938 | | | | 40,165 | |

| | | 2012-13 | | | | 43,453 | | | | 41,528 | |

| | | 2013-14 | | | | 45,298 | | | | 43,048 | |

| | | |

| | | Growth in: | | | Own purpose

expense | | | Inflation plus

population | |

| Growth in own-purpose expenses in the General Government sector to not exceed real per capita growth | | | 2009-10 | | | | 3.74 | % | | | 5.00 | % |

| | | 2010-11 | | | | 5.97 | % | | | 5.25 | % |

| | | 2011-12 | | | | 3.13 | % | | | 5.25 | % |

| | | 2012-13 | | | | 3.46 | % | | | 5.00 | % |

| | | 2013-14 | | | | 3.99 | % | | | 5.00 | % |

| | | Average | | | | 4.06 | % | | | 5.10 | % |

| |

| | | Net operating balance ($ million) | |

| Achieve a General Government net operating surplus as soon as possible, but no later than 2015-16 | | | 2009-10 | | | | (287) | |

| | | 2010-11 | | | | (1,745) | |

| | | 2011-12 | | | | (1,442) | |

| | | 2012-13 | | | | (1,482) | |

| | | 2013-14 | | | | (1,395) | |

Competitive tax regime | | | | | | | | | | | | |

| |

| | | Taxation revenue per capita, 2010-11 | |

| Maintain a competitive tax environment for business | | | Queensland: | | | | | | | $ | 2,225 | |

| |

| Average of other states

and territories: |

| | $ | 2,643 | |

Managing the State’s balance sheet | | | | | | | | | | | | |

| |

| | | Net Financial Liabilities/Revenue Non-financial Public Sector | |

| | | |

| | | | | | Before asset sales | | | After asset sales | |

| Stabilise net financial liabilities as a proportion of revenue in the Non-financial Public Sector | | | 2009-10 | | | | 96 | % | | | 96 | % |

| | | 2010-11 | | | | 116 | % | | | 102 | % |

| | | 2011-12 | | | | 129 | % | | | 109 | % |

| | | 2012-13 | | | | 134 | % | | | 109 | % |

| | | 2013-14 | | | | 134 | % | | | 110 | % |

| Target full funding of long-term liabilities such as superannuation in accordance with actuarial advice | |

| As at last actuarial review (released June

2008), accruing superannuation liabilities

were fully funded. The State Actuary

reviews the scheme every three years. |

|

| | | | |

| | Budget Strategy and Outlook 2010-11 | | 11 |

SUMMARY OF KEY FINANCIAL AGGREGATES

Table 1.3 provides aggregate actual outcome information for 2008-09, estimated actual outcome information for 2009-10, forecasts for 2010-11 and projections for the outyears.

Table 1.3

General Government sector – key financial aggregates1

| | | | | | | | | | | | | | | | | | | | | | | | |

| | | 2008-09

Actual2

$ million | | | 2009-10

Est. Act.

$ million | | | 2010-11

Budget

$ million | | | 2011-12

Projection

$ million | | | 2012-13

Projection

$ million | | | 2013-14

Projection

$ million | |

Revenue | | | 37,008 | | | | 39,689 | | | | 40,606 | | | | 41,938 | | | | 43,453 | | | | 45,298 | |

Expenses | | | 36,974 | | | | 39,976 | | | | 42,352 | | | | 43,380 | | | | 44,935 | | | | 46,693 | |

Net operating balance | | | 35 | | | | (287 | ) | | | (1,745 | ) | | | (1,442 | ) | | | (1,482 | ) | | | (1,395 | ) |

Cash surplus/(deficit) | | | (2,839 | ) | | | (5,254 | ) | | | (6,396 | ) | | | (4,648 | ) | | | (2,906 | ) | | | (1,507 | ) |

Capital purchases | | | 6,960 | | | | 8,626 | | | | 8,335 | | | | 7,490 | | | | 5,751 | | | | 4,628 | |

Net borrowing | | | 3,728 | | | | 5,182 | | | | 7,629 | | | | 6,733 | | | | 4,657 | | | | 3,191 | |

Gross borrowing | | | 10,278 | | | | 15,524 | | | | 23,250 | | | | 30,080 | | | | 34,756 | | | | 37,967 | |

Net worth | | | 184,619 | | | | 187,607 | | | | 188,564 | | | | 190,119 | | | | 192,017 | | | | 194,326 | |

Net debt | | | (19,281 | ) | | | (13,206 | ) | | | (6,743 | ) | | | (1,294 | ) | | | 2,095 | | | | 3,707 | |

Notes:

| 1. | Numbers may not add due to rounding. |

| 2. | Reflects published actuals. |

| | | | |

| 12 | | Budget Strategy and Outlook 2010-11 | | |

BUDGET OUTCOMES 2009-10

Key financial aggregates

Table 1.4

General Government sector – key financial aggregates1

| | | | | | | | | | | | |

| | | 2009-10

Budget $

million | | | 2009-10

MYFER

$ million | | | 2009-10

Est. Act.

$ million | |

Revenue | | | 37,192 | | | | 37,286 | | | | 39,689 | |

Expenses | | | 39,146 | | | | 39,637 | | | | 39,976 | |

Net operating balance | | | (1,954 | ) | | | (2,351 | ) | | | (287 | ) |

Cash surplus/(deficit) | | | (6,838 | ) | | | (7,363 | ) | | | (5,254 | ) |

Capital purchases | | | 9,270 | | | | 9,108 | | | | 8,626 | |

Net borrowing | | | 7,954 | | | | 6,722 | | | | 5,182 | |

Gross borrowing | | | 18,775 | | | | 17,063 | | | | 15,524 | |

Net worth | | | 151,144 | | | | 185,476 | | | | 187,607 | |

Net debt | | | (10,672 | ) | | | (11,566 | ) | | | (13,206 | ) |

Note:

| 1. | Numbers may not add due to rounding. |

Operating balance

The operating balance expected for 2009-10 is a deficit of $287 million compared to a deficit of $2.351 billion forecast in the MYFER. The improvement in the forecast net operating balance since the MYFER primarily reflects increased Australian Government payments, including funding for transport projects, such as the Ipswich Motorway, which has been brought forward, primarily from 2010-11. Australian Government funding for Gold Coast Rapid Transit, which had previously been considered to be an equity contribution, will now be received as a grant in 2009-10. There have also been upward revisions to royalty and GST revenue.

Expenses are also estimated to increase from the MYFER forecast primarily reflecting increased expenses associated with natural disaster recovery and relief and the provision of funding for the Townsville Marine Precinct, partly offset by lower depreciation expenses.

Further details on revenue and expenses projections are contained in Chapters 4 and 5 respectively.

Table 1.6 provides a reconciliation of the estimated net operating balance for 2009-10 to the MYFER forecast.

| | | | |

| | Budget Strategy and Outlook 2010-11 | | 13 |

Cash surplus/(deficit)

The General Government sector is now expected to record a lower cash deficit in 2009-10 of $5.254 billion compared to a $7.363 billion deficit forecast in the MYFER. The smaller than expected cash deficit is predominantly the result of the cash impact of the improvement in the net operating balance in 2009-10 and lower than anticipated capital purchases.

Capital purchases

General Government purchases of non-financial assets (that is, capital expenditure) in 2009-10 are estimated to be $8.626 billion. This is $482 million less than forecast in the MYFER due to changes in timing of cashflows for capital projects and delays associated with poor weather conditions.

The total capital program for 2009-10, including capital grants, is expected to be $17.307 billion, $893 million lower than expected at the time of the 2009-10 Budget. For further details see Budget Paper 3 – Capital Statement.

Borrowing

Net borrowings (additional borrowings each year as itemised in the Cash Flow Statement) of $5.182 billion are expected in 2009-10, $1.54 billion less than forecast in the MYFER and $2.772 billion less than forecast in the 2009-10 Budget, associated with the reduction in the cash deficit.

Similarly, gross borrowings (the stock of borrowings outstanding as stated in the Balance Sheet) of $15.524 billion are estimated at 30 June 2010, $1.539 billion less than the MYFER estimate, reflecting the improvement in the 2009-10 net cash balance since that time.

Net worth

The net worth, or equity, of the State is the amount by which the State’s assets exceed its liabilities. This is the value of the investment held on behalf of the people of Queensland by public sector entities.

The net worth of the General Government sector at 30 June 2010 is estimated at $187.6 billion. This is $36.5 billion higher than the forecast in the 2009-10 Budget, primarily due to the value of land under roads being included in the net worth calculation in June 2009 for the first time, in accordance with accounting standard AASB 1051 Land Under Roads.

| | | | |

| 14 | | Budget Strategy and Outlook 2010-11 | | |

Net worth is $2.988 billion higher than the 30 June 2009 audited actual and $2.131 billion higher than the net worth forecast at the time of the MYFER due to market value fluctuations, including those relating to investment returns on superannuation and other long term assets now held by Queensland Treasury Corporation.

Net debt

Net debt is the sum of advances received and borrowings less cash and deposits, advances paid and investments, loans and placements.

Net debt in the General Government sector at 30 June 2010 is estimated to be negative $13.206 billion, compared to negative $11.566 billion forecast at the time of the MYFER. The stronger position reflects the impact of lower borrowings.

| | | | |

| | Budget Strategy and Outlook 2010-11 | | 15 |

BUDGET 2010-11 AND OUTYEAR PROJECTIONS

Key financial aggregates

Table 1.5

General Government sector – key financial aggregates1

| | | | | | | | | | | | | | | | |

| | | 2010-11

Budget $

million | | | 2011-12

Projection

$ million | | | 2012-13

Projection

$ million | | | 2013-14

Projection

$ million | |

Revenue | | | 40,606 | | | | 41,938 | | | | 43,453 | | | | 45,298 | |

Expenses | | | 42,352 | | | | 43,380 | | | | 44,935 | | | | 46,693 | |

Net operating balance | | | (1,745 | ) | | | (1,442 | ) | | | (1,482 | ) | | | (1,395 | ) |

Cash surplus/(deficit) | | | (6,396 | ) | | | (4,648 | ) | | | (2,906 | ) | | | (1,507 | ) |

Capital purchases | | | 8,335 | | | | 7,490 | | | | 5,751 | | | | 4,628 | |

Net borrowing | | | 7,629 | | | | 6,733 | | | | 4,657 | | | | 3,191 | |

Gross borrowing | | | 23,250 | | | | 30,080 | | | | 34,756 | | | | 37,967 | |

Net worth | | | 188,564 | | | | 190,119 | | | | 192,017 | | | | 194,326 | |

Net debt | | | (6,743 | ) | | | (1,294 | ) | | | 2,095 | | | | 3,707 | |

Note:

| 1. | Numbers may not add due to rounding. |

Operating balance

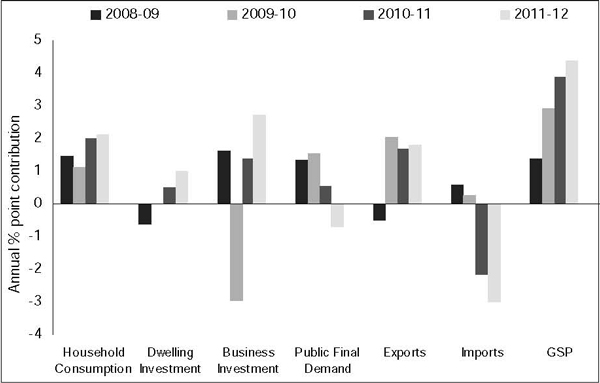

Significant upward revisions to royalty and GST revenues have resulted in a substantial improvement in the fiscal position since the MYFER. However, the General Government sector is still expected to record an operating deficit of $1.745 billion in 2010-11, with net operating deficits anticipated each year across the forward estimate years.

The improvement in the net operating balance reflects an improvement in the Australian Government’s estimates of GST collections and a stronger outlook for coal prices and tonnages. There is a modest improvement anticipated in taxation revenue.

The increase in expenditure relative to 2009-10 mainly relates to service enhancements in key service delivery areas including Australian Government partnerships, increases in wages, reflecting enterprise bargaining agreements and increased frontline service delivery staff, as well as higher levels of depreciation and interest expenses.

Further details on revenue and expenditure projections are contained in Chapters 4 and 5 respectively.

| | | | |

| 16 | | Budget Strategy and Outlook 2010-11 | | |

Cash surplus/(deficit)

A cash deficit of $6.396 billion is expected in 2010-11 for the General Government sector, reducing to $1.507 billion by 2013-14. The cash deficits reflect the Government’s significant planned capital program, with cash deficits forecast to decrease across the forward estimates, consistent with the planned reduction in the size of the capital program over time.

The reduction in the 2010-11 cash deficit since the MYFER primarily reflects the improved net operating balance and the receipt of proceeds from the sale of Forestry Plantations Queensland.

Capital purchases

Total General Government capital purchases of $8.335 billion are budgeted for 2010-11, $546 million lower than forecast in the MYFER. Budget Paper 3 – Capital Statement provides details of budgeted 2010-11 capital outlays, by portfolio.

Over the period 2010-11 to 2013-14, purchases of non-financial assets (capital purchases) in the General Government sector of $26.204 billion are planned.

Borrowing

Net borrowings of $7.629 billion are budgeted for 2010-11, a decrease of $2.319 billion compared to the MYFER estimate, mainly as a result of the improvement in the operating position and the receipt of proceeds from the sale of Forestry Plantations Queensland.

The reduction in the amount of borrowings required in 2010-11 leads to a decrease in borrowing costs of $129 million to $1.242 billion, compared to the MYFER forecast.

Gross borrowings of $23.25 billion are expected in the General Government sector at 30 June 2010, $3.803 billion less than forecast in the MYFER.

Total General Government borrowings in 2012-13 are expected to be $4.478 billion lower than forecast in the 2009-10 Budget and $3.518 billion lower than forecast in the MYFER. The comparable figures for the Non-financial Public Sector are a reduction in forecast borrowings of $6.548 billion relative to the 2009-10 Budget forecast and a $5.8 billion reduction compared with the MYFER forecast.

Over the Budget and forward estimates period, total General Government borrowings and advances of $22.154 billion are planned, with gross borrowings projected to increase to $37.967 billion and borrowing costs to $2.341 billion in 2013-14. However, these projections do not take into account the proceeds that will be realised from the remainder of the asset sales program, which will substantially reduce the borrowing requirements of the General Government and Public Non-financial Corporations Sectors (see Chart 1.2).

| | | | |

| | Budget Strategy and Outlook 2010-11 | | 17 |

Net worth

State net worth is forecast to be $188.6 billion at 30 June 2011, with moderate increases in net worth expected each year, reaching $194.3 billion by the end of 2013-14.

Net debt

Net debt in the General Government sector at 30 June 2011 is estimated to be negative $6.743 billion compared to the MYFER estimate of negative $2.964 billion. This improvement in the net debt position primarily reflects the General Government sector’s lower borrowing requirements as a result of improvements in the net operating balance. Net debt is expected to increase over the forward estimates to be $3.707 billion in 2013-14 reflecting planned increases in borrowings, although this projection does not factor in the proceeds of the asset sales program, other than Forestry Plantations Queensland.

More information on the State’s net worth, assets and liabilities is provided in Chapter 6.

| | | | |

| 18 | | Budget Strategy and Outlook 2010-11 | | |

RECONCILIATION OF NET OPERATING BALANCE

Table 1.6 provides a reconciliation of the current General Government sector net operating balances for 2009-10 and 2010-11 to the MYFER forecasts.

Table 1.6

Reconciliation of 2009-10 and 2010-11 net operating balance to MYFER1

| | | | | | | | |

| | | 2009-10

Est. Act.

$ million | | | 2010-11

Budget

$ million | |

2009-10 MYFER net operating balance | | | (2,351 | ) | | | (3,142 | ) |

Expenditure policy decisions2 | | | (215 | ) | | | (440 | ) |

Asset sales transaction costs | | | (18 | ) | | | (121 | ) |

Taxation revenue revisions | | | 79 | | | | 91 | |

Royalty revenue revisions | | | 405 | | | | 1,323 | |

GST revenue revisions | | | 403 | | | | 831 | |

Other significant variations impacting on operating balance | | | | | | | | |

Other Australian Government funding revisions3 | | | 1,362 | | | | (87 | ) |

Natural disaster relief expenditure | | | (237 | ) | | | (473 | ) |

Net flows from PNFC sector entities4 | | | (23 | ) | | | (172 | ) |

Actuarial revisions5 | | | 29 | | | | 26 | |

Other parameter adjustments6 | | | 279 | | | | 419 | |

2010-11 Budget | | | (287 | ) | | | (1,745 | ) |

Notes:

| 1. | Denotes impact on net operating balance. Numbers may not add due to rounding. |

| 2. | Reflects expenditure policy decisions taken since the MYFER, net of revenue offsets, the additional efficiency dividend and Australian Government funding where appropriate. Budget Paper 4 – Budget Measures outlines in detail the policy decisions taken since the 2009-10 Budget. |

| 3. | Represents the net impact of funding provided by the Australian Government primarily for Specific Purpose Payments, National Partnership Payments and the Nation Building and Jobs Plan. The bring forward of funding for the Ipswich Motorway results in an increase in Australian Government funding in 2009-10 and a reduction in 2010-11. |

| 4. | Represents revisions to dividend receipts from and community service obligation payments to Public Non-financial Corporations. |

| 5. | Represents actuarial revisions to superannuation and long service leave provisions and revisions to superannuation expense as a result of positive investment returns. |

| 6. | Refers to adjustments of a non-policy nature, primarily associated with reductions in depreciation and interest expenses. |

| | | | |

| | Budget Strategy and Outlook 2010-11 | | 19 |

| 2 | ECONOMIC PERFORMANCE AND OUTLOOK |

FEATURES

| • | | The global economy resumed growing in the second half of 2009, after experiencing the most severe and synchronised recession since the Great Depression. While advanced economies are expected to exhibit a modest recovery, the outlook is supported by strong prospects in non-Japan Asia. |

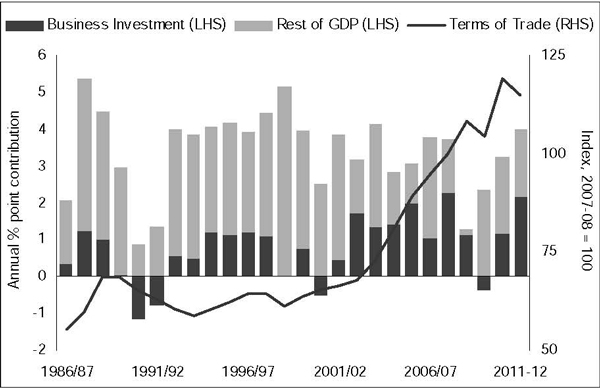

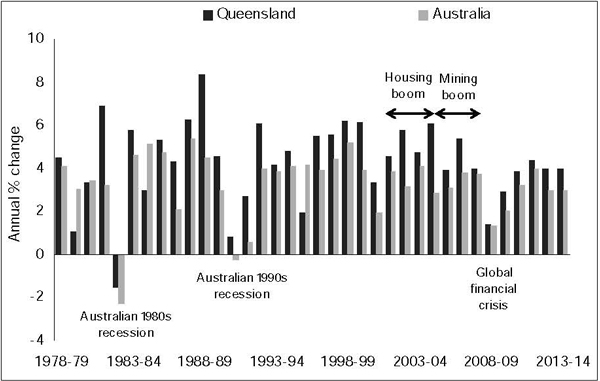

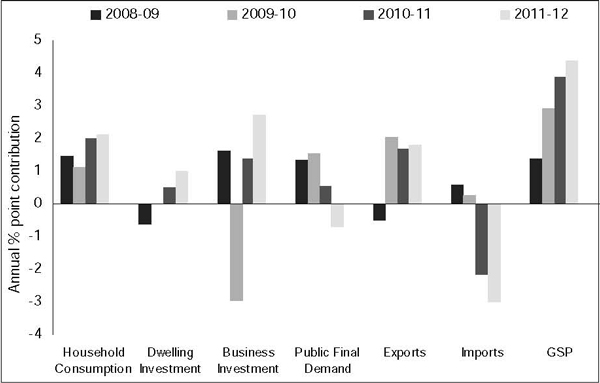

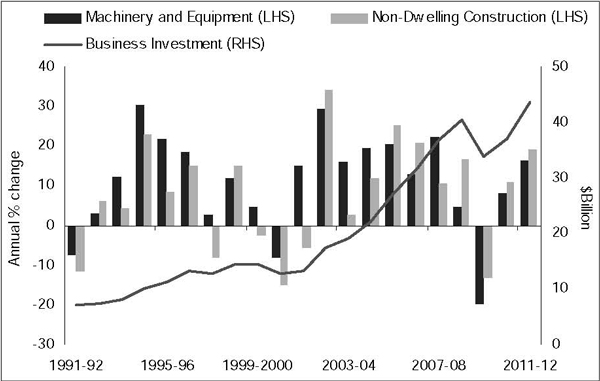

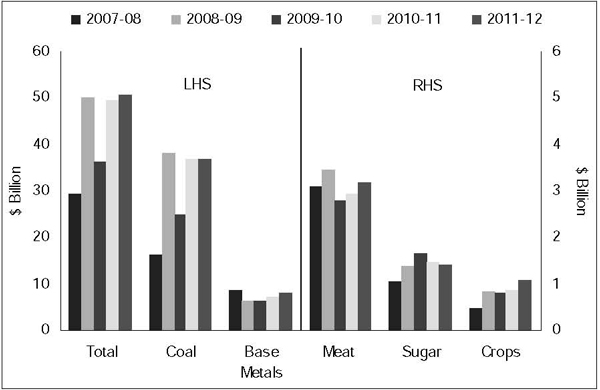

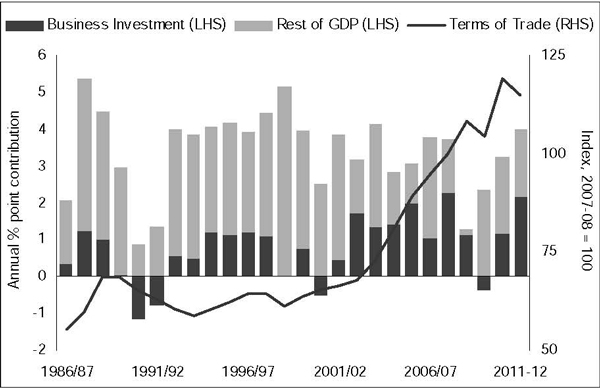

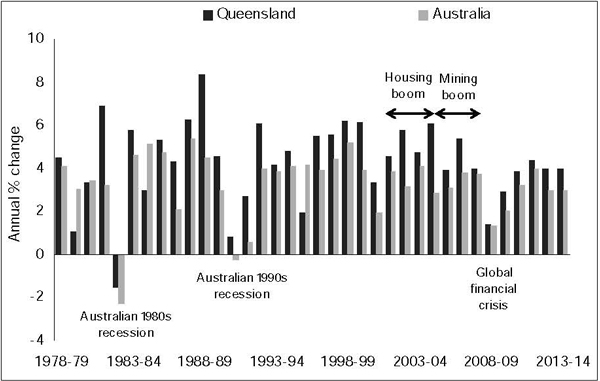

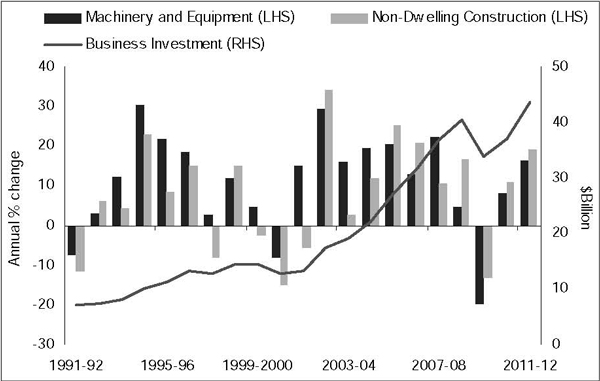

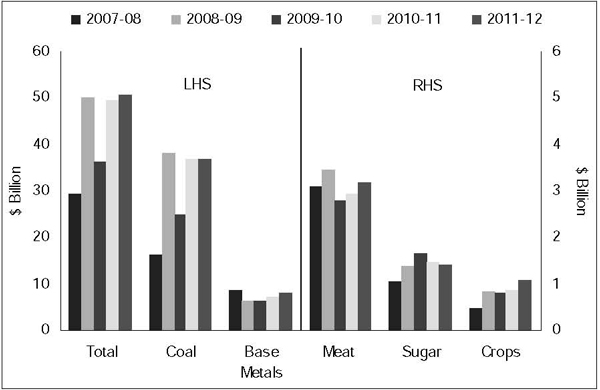

| • | | While the global financial crisis slowed growth in Queensland’s gross state product (GSP) to 1.4% in 2008-09, its weakest rate since 1990-91, economic growth is estimated to improve to 3% in 2009-10, with resilient demand from China boosting coal exports, and public stimulus helping to offset a decline in business investment. |

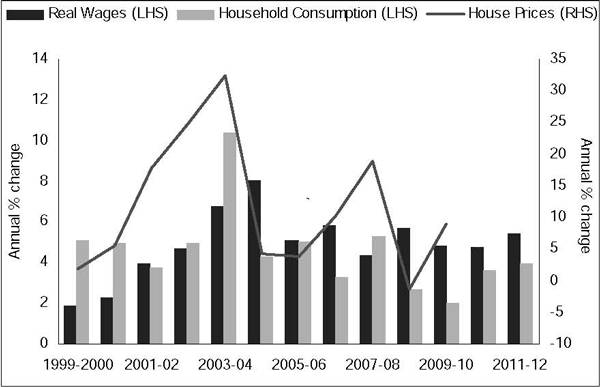

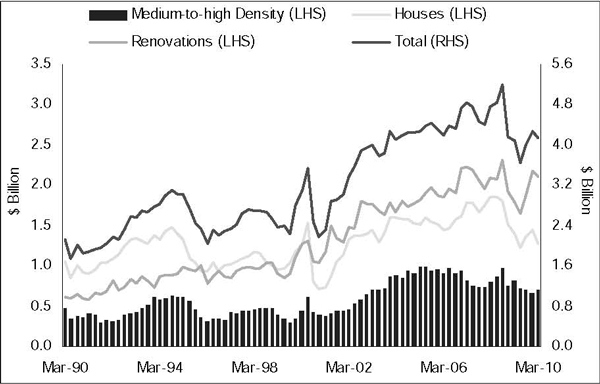

| • | | Economic growth is forecast to strengthen further, to 3 3/4% in 2010-11, reflecting ongoing investment in the resources sector. Dwelling investment is anticipated to pick up, in response to rising house prices. However, elevated household debt levels and rising interest rates are expected to result in below average growth in private consumption and overall economic activity. |

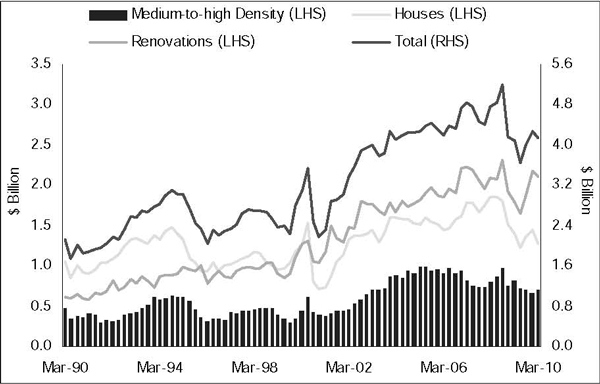

| • | | Growth in the State economy is forecast to accelerate to its long-run average of 4 1/2% in 2011-12, as improved credit conditions underpin a recovery in commercial and medium-to-high density residential construction, and investment activity related to major resource projects gathers momentum. |

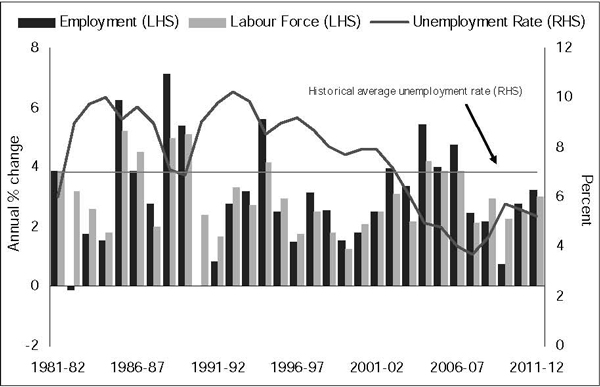

| • | | Weaker private sector demand is estimated to slow jobs growth to 3/4% in 2009-10 and increase the year-average unemployment rate to 5 3/4%. However, reflecting the flexibility of the labour market, this would represent a peak below previous downturns and an unemployment rate below the historic average of around 7%. |

| • | | In line with stronger economic growth, jobs growth is forecast to accelerate to 2 3/4% in 2010-11 and 3 1/4% in 2011-12, reducing the year-average unemployment rate to 5 1/4% by 2011-12. |

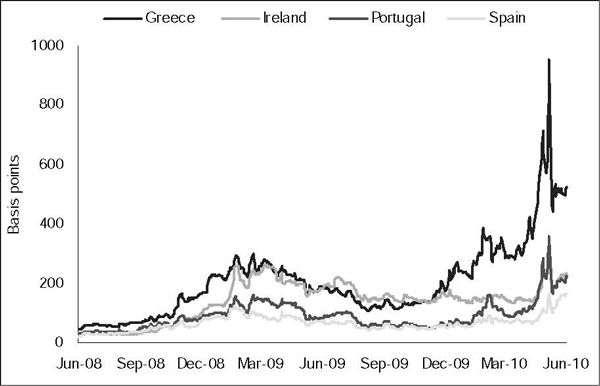

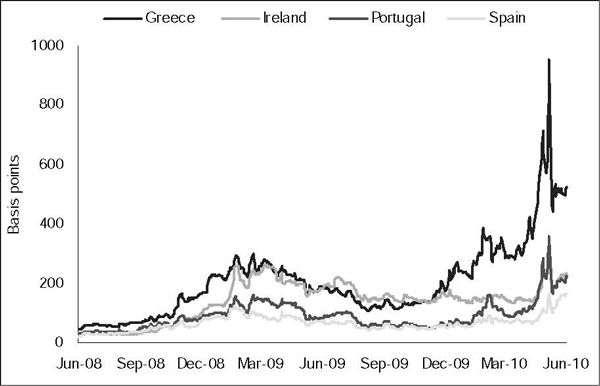

| • | | However, significant risks to the global economic outlook remain. In particular, concerns over sovereign debt in Europe have highlighted the fragility of sentiment and heightened financial market volatility. |

This chapter presents the economic context within which the 2010-11 State Budget has been prepared. It overviews developments in Queensland’s external environment, including the recovery in global economic activity following the financial crisis, and the national outlook. This chapter summarises the economic performance of, and outlook for, Queensland over 2009-10 to 2013-14. It provides estimates for 2009-10 and forecasts for 2010-11 and 2011-12 for detailed sectors of the economy and presents projections for key economic variables to 2013-14. The chapter also outlines key risks to economic growth over the forecast period.

| | | | |

| | Budget Strategy and Outlook 2010-11 | | 21 |

EXTERNAL ENVIRONMENT

International conditions

The world economy resumed growing in the second half of 2009, after experiencing the most severe and synchronised contraction since the Great Depression. An unprecedented degree of expansionary monetary and fiscal stimulus, improvements across equity and corporate debt markets and a turnaround in the inventory cycle in many countries have supported the recovery so far. However, there is a marked difference in the pace of recovery across regions, with the emerging economies forecast to continue to outperform advanced economies.

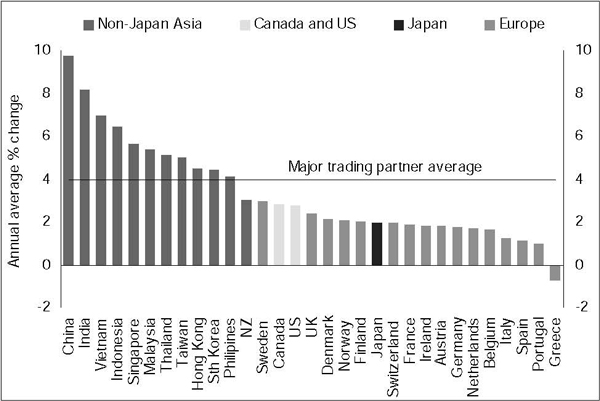

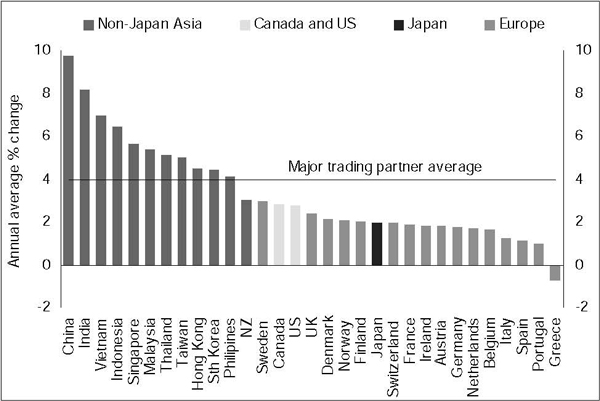

After contracting by an estimated 1 1/4% in 2009, Queensland’s major trading partner economies are forecast to grow by 4 1/4% in 2010 and 3 3/4% in 2011, before returning to long-run growth of 4% per annum between 2012 and 2014 (see Table 2.1). However, this would represent growth slightly below the 4 1/2% per annum averaged between 2004 and 2007. While non-Japan Asia is forecast to grow at a strong pace of 6 3/4% in 2010 and 6% in 2011, growth in advanced economies, particularly Europe, is expected to be subdued.

Emerging Asia was less affected by the global financial crisis than advanced economies, partly because their financial markets were less exposed to the deterioration in mortgage backed securities and other derivatives. Also, relatively stronger fiscal positions in some economies enabled governments to respond to weaker economic conditions with large fiscal stimulus. Domestic demand in China and India, the largest emerging economies in Asia, and Queensland’s second and third largest merchandise export markets, remained robust through the crisis. These factors resulted in estimated growth of 2 1/2% in non-Japan Asia in 2009. Most economies in this region had returned to pre-crisis peaks in activity by the end of 2009 and are now expanding at or near pre-crisis rates.

Table 2.1

Queensland major trading partner GDP outlook

(annual % change)

| | | | | | | | | | | | | | | | | | | | | | | | |

| | | Est. Act

2009 | | | Forecasts | |

| | | 2010 | | | 2011 | | | 2012 | | | 2013 | | | 2014 | |

World¹ | | | 1/2 | | | | 4 1/4 | | | | 4 1/4 | | | | 4 1/2 | | | | 4 1/2 | | | | 4 1/2 | |

Major trading partners² | | | -1 1/4 | | | | 4 1/4 | | | | 3 3/4 | | | | 4 | | | | 4 | | | | 4 | |

Non-Japan Asia | | | 2 1/2 | | | | 6 3/4 | | | | 6 | | | | 6 | | | | 6 | | | | 6 | |

Japan | | | -5 1/4 | | | | 2 1/2 | | | | 1 3/4 | | | | 2 | | | | 1 3/4 | | | | 1 3/4 | |

Europe | | | -4 | | | | 1 1/4 | | | | 1 3/4 | | | | 2 | | | | 2 | | | | 2 | |

US | | | -2 1/2 | | | | 3 1/4 | | | | 3 | | | | 2 1/2 | | | | 2 1/2 | | | | 2 1/2 | |

Notes:

| 1. | Sourced from the April 2010 IMF World Economic Outlook database. World GDP comprises 183 countries, weighted by purchasing-power-parity GDP. |

| 2. | Queensland’s major trading partner output comprises 31 countries, weighted by their share of merchandise exports in the three years to 2007-08. |

Sources: International Monetary Fund, Consensus Economics and Queensland Treasury.

| | | | |

| 22 | | Budget Strategy and Outlook 2010-11 | | |

The outlook for emerging Asia remains strong (see Chart 2.1). In the near term, household consumption is expected to be supported by high asset values, buoyant sentiment and employment growth, while improving rates of capacity utilisation should boost capital investment. Against this backdrop, and with inflation pressures building somewhat, the monetary authorities of China and India began unwinding monetary policy support in early 2010. Nevertheless, these measures should sustain longer term growth prospects. Furthermore, ongoing urbanisation and industrialisation in China and India are expected to increase their demand for imports and therefore support growth in other non-Japan Asian economies, including Australia and Queensland.

In contrast, the recovery in capital investment in advanced economies continues to be suppressed by excess capacity, while ongoing bank deleveraging and risk aversion have constrained financing and elevated credit costs. Private capital investment in December quarter 2009 was more than 20% below pre-crisis levels in the US, Japan and the UK and 15% below the pre-crisis peak in the Eurozone. Meanwhile, impaired household balance sheets, and relatively subdued growth in household incomes due to soft labour market conditions, are expected to remain a drag on consumer spending in coming years. Over eight million jobs have been shed in the US, around four million in the Eurozone, around one and a half million in Japan and one million in the UK.

Chart 2.1

Economic outlook for major trading partners, 2010 - 2014

Sources: International Monetary Fund, Consensus Economics and Queensland Treasury.

| | | | |

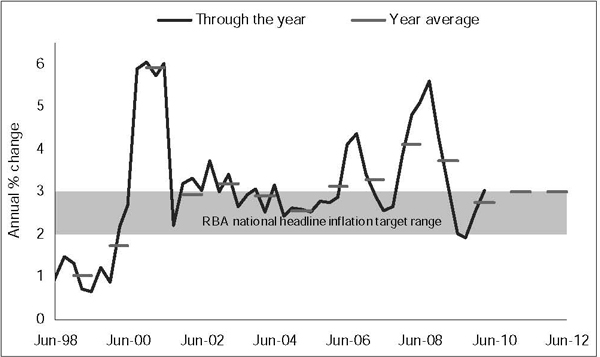

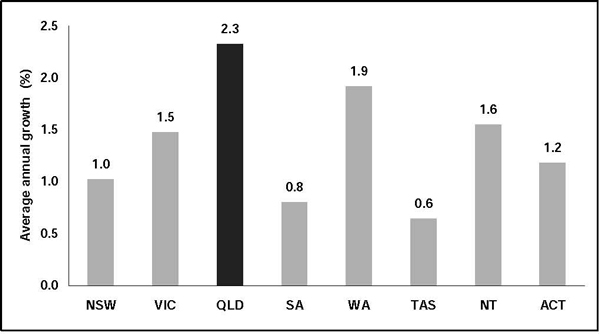

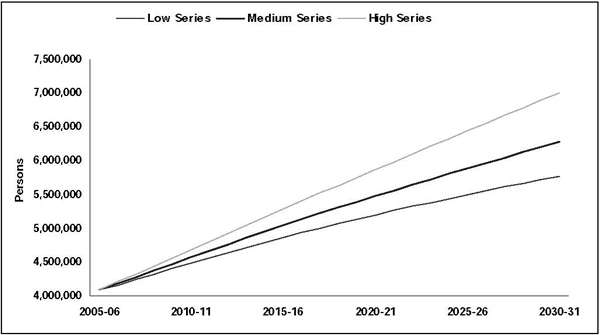

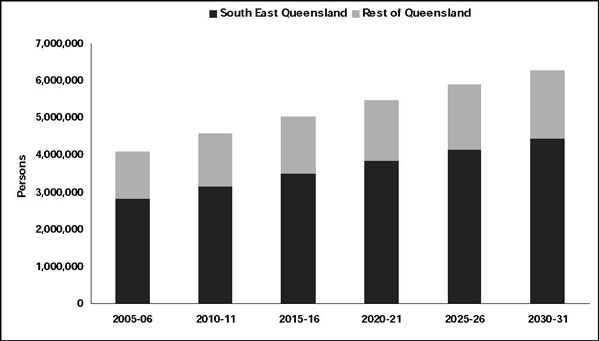

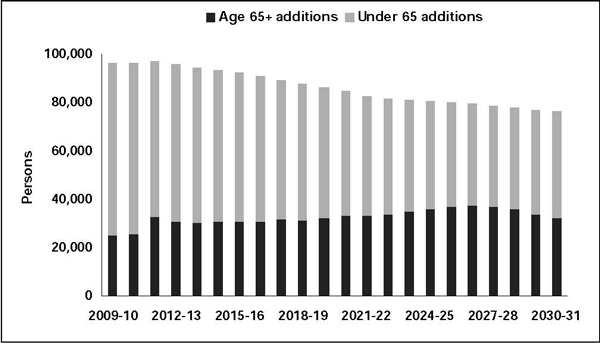

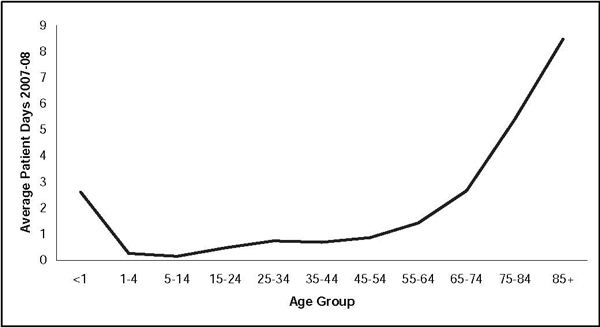

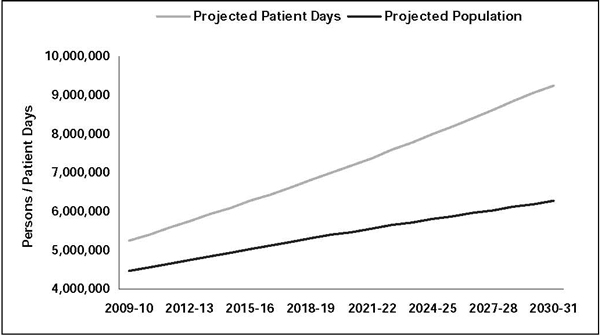

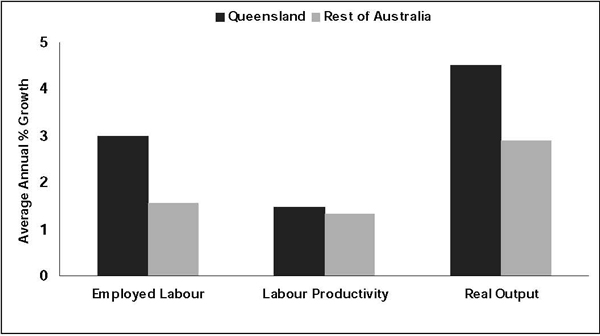

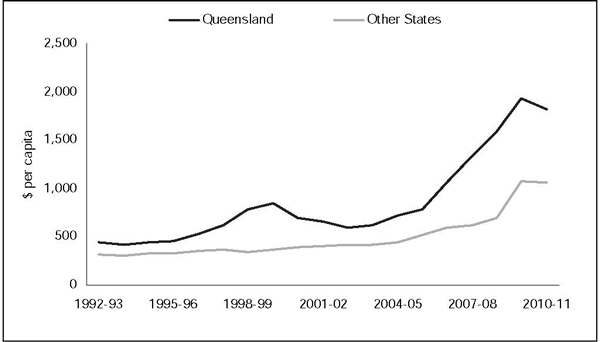

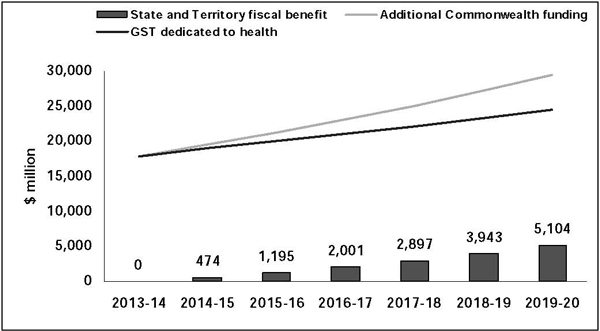

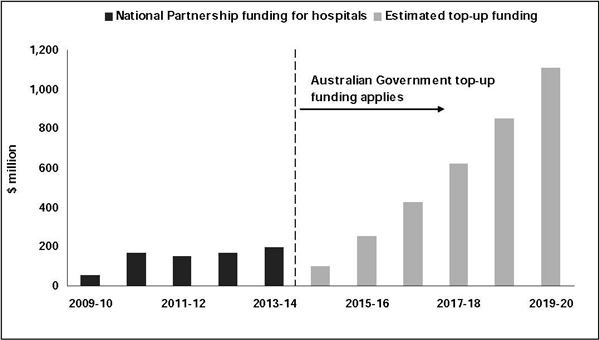

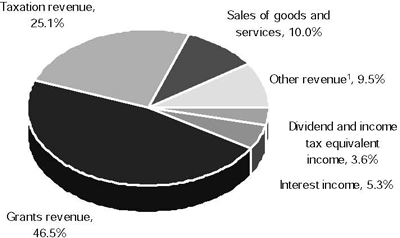

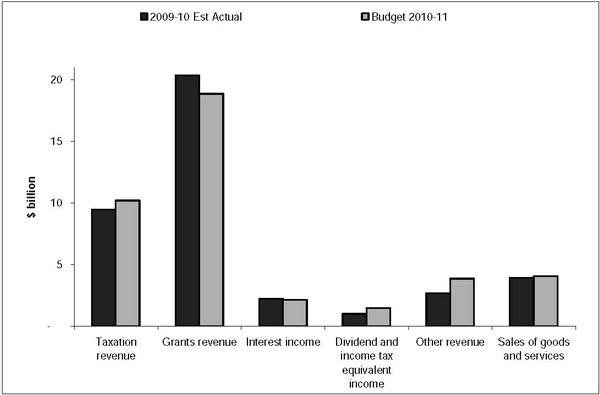

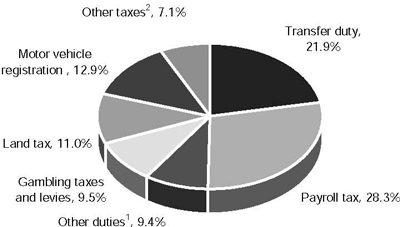

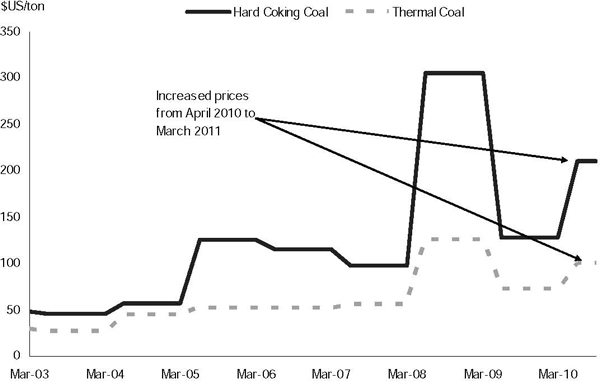

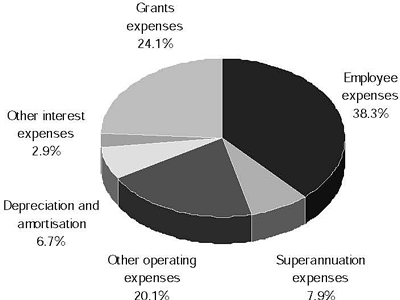

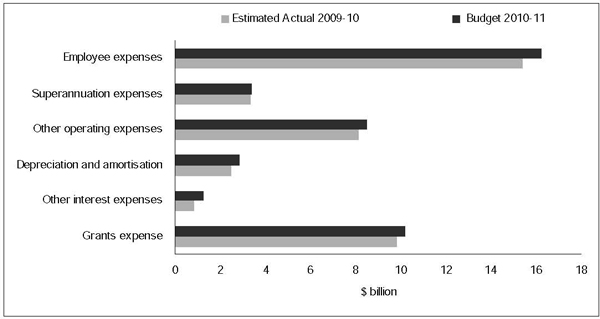

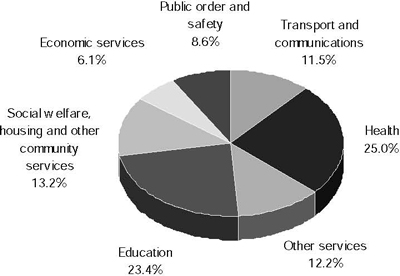

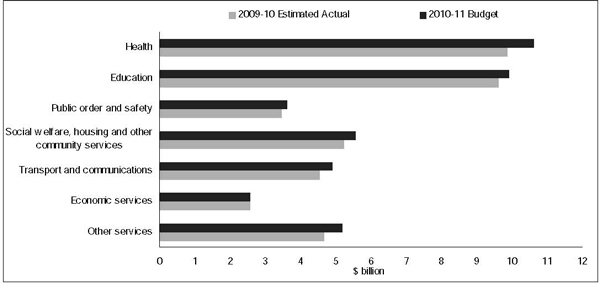

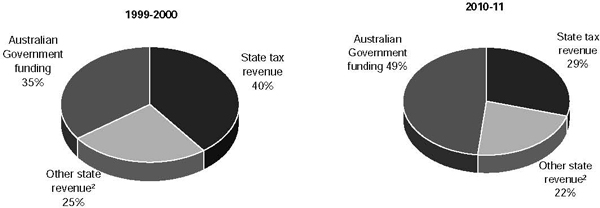

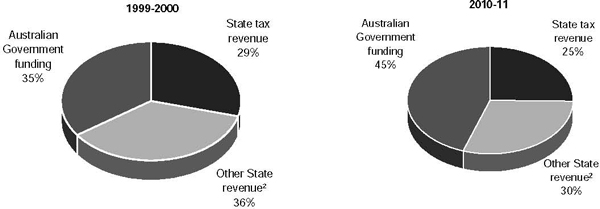

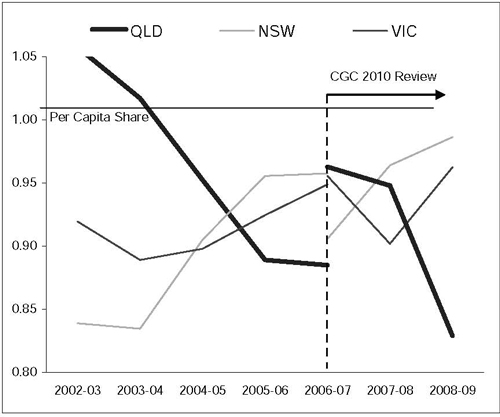

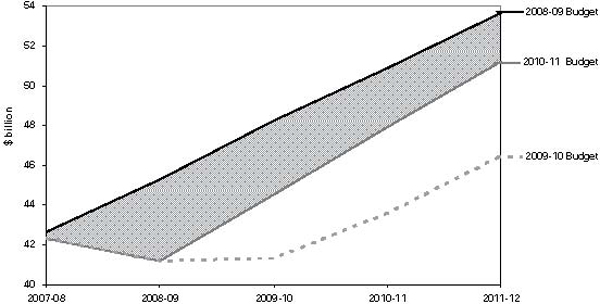

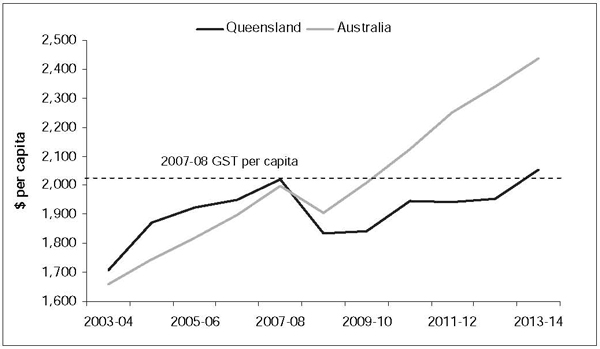

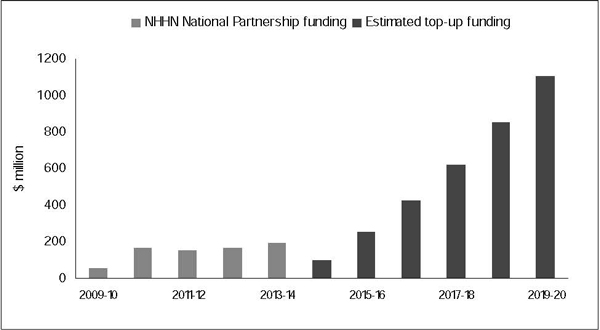

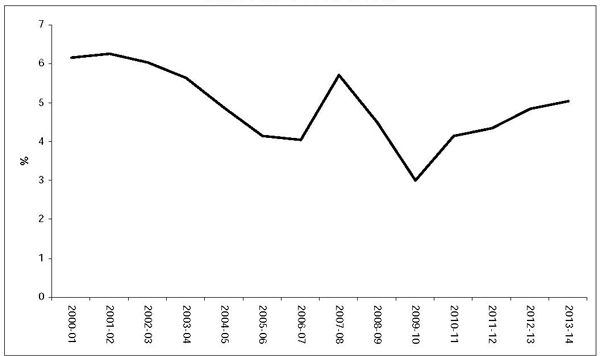

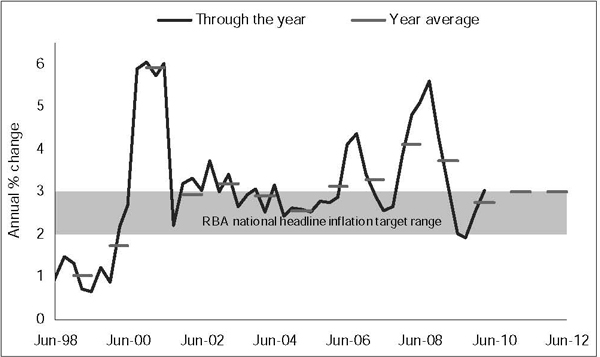

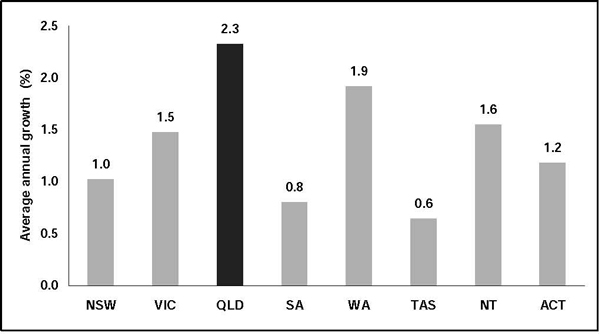

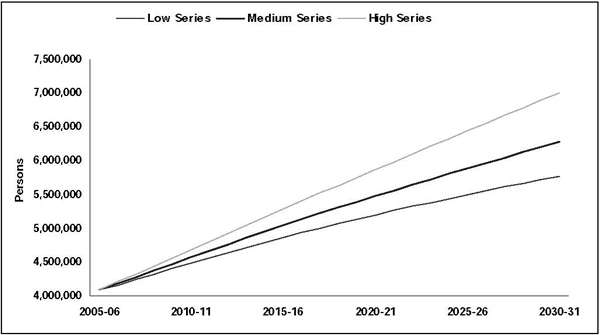

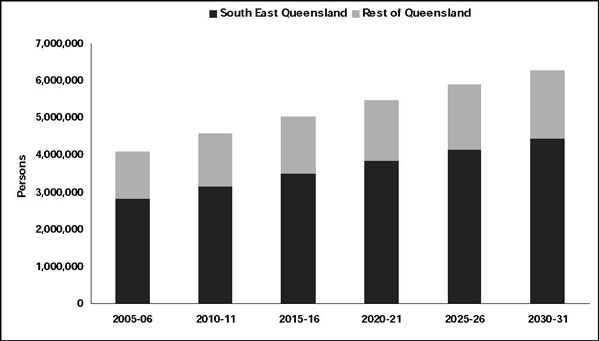

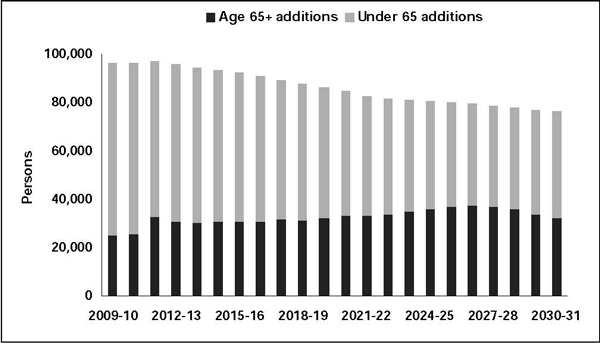

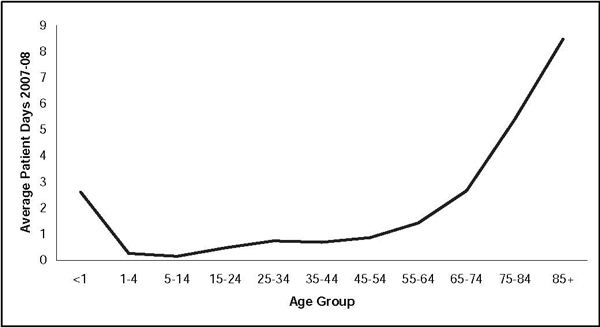

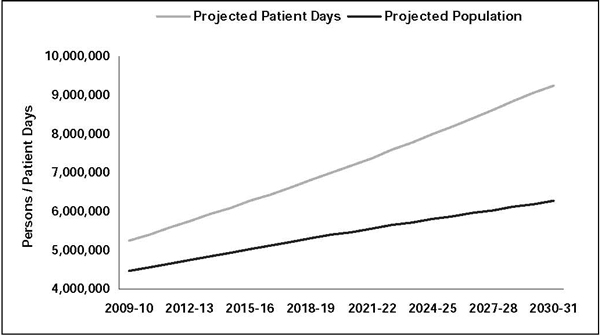

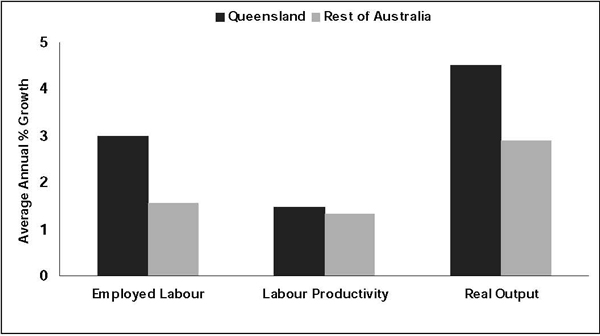

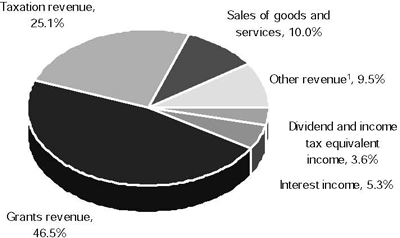

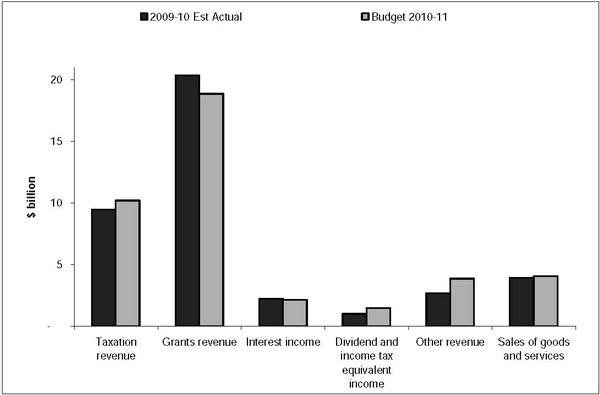

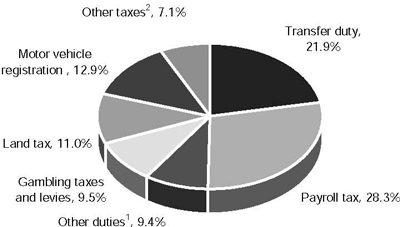

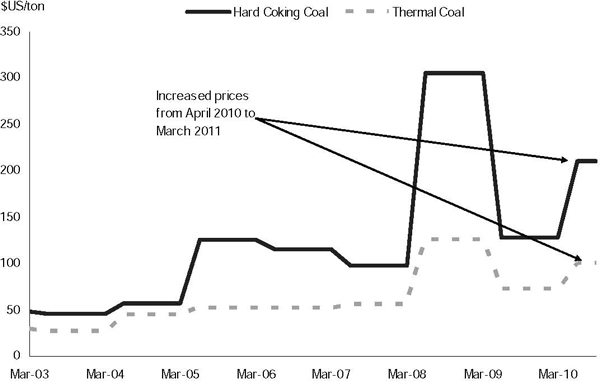

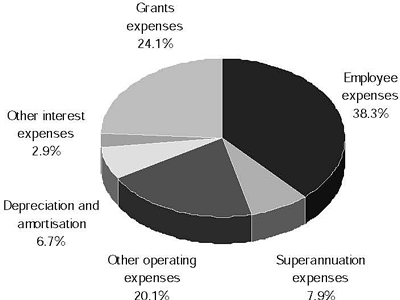

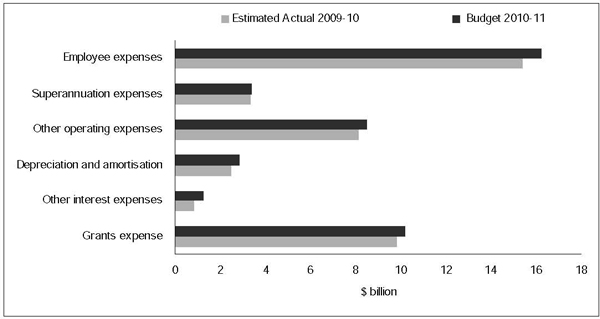

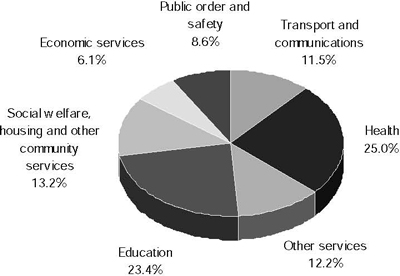

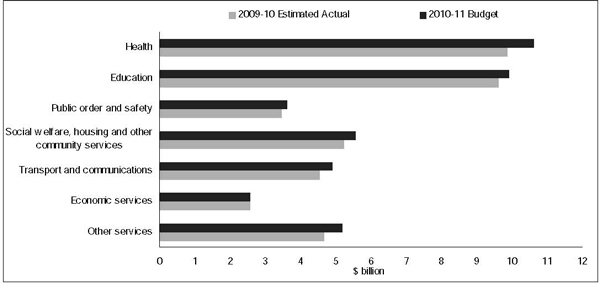

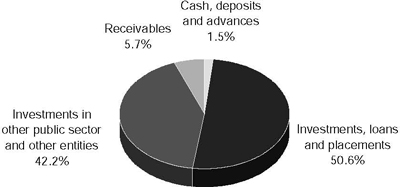

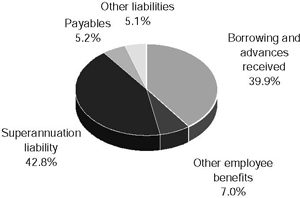

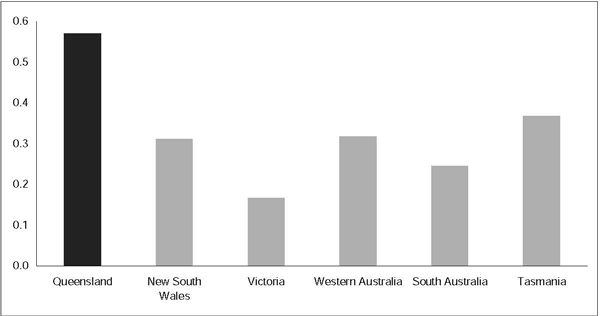

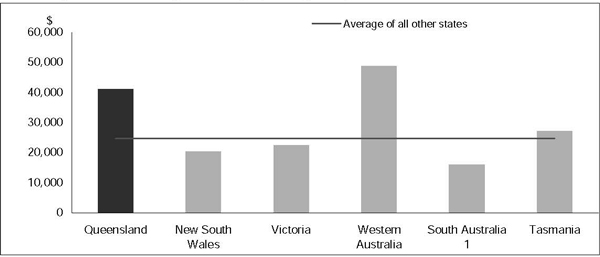

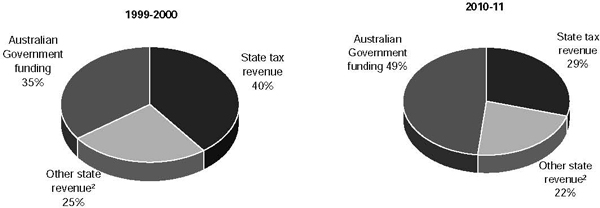

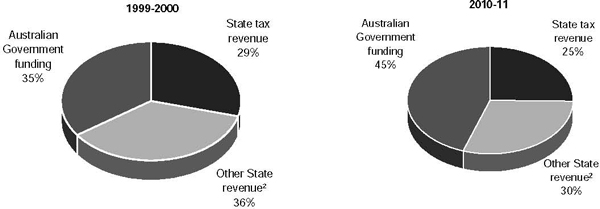

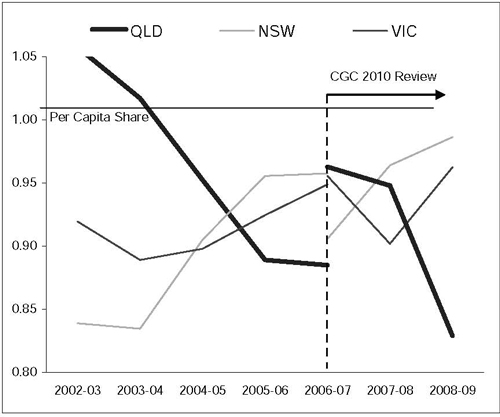

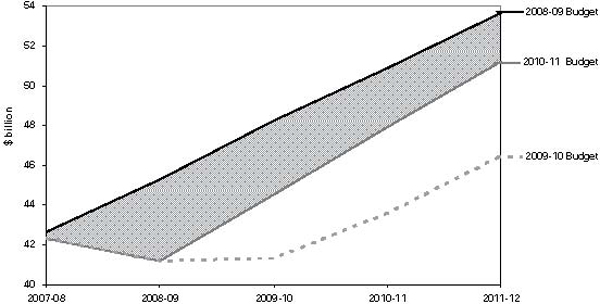

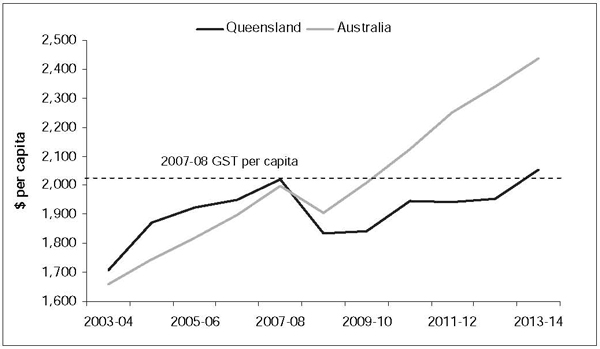

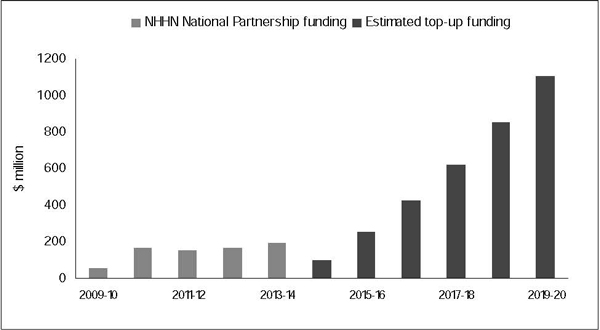

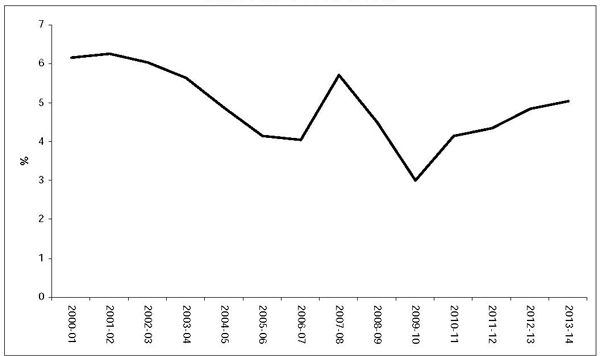

| | Budget Strategy and Outlook 2010-11 | | 23 |