EXHIBIT (c)(i)

Consolidated Financial Statements of the Registrant

AUDAX AT FIDELIS

QUEENSLAND TREASURY CORPORATION

CELEBRATING 25 YEARS EST. 1988

ANNUAL REPORT 2012-13

VISION

Securing Queensland’s financial success

MISSION

To deliver optimal financial outcomes through sound funding and financial risk management

VALUES

We are focused on our clients

We are passionate about Queensland

We value and respect our people

We are collaborative and seek continuous improvement

Above all else, we value integrity

Queensland Treasury Corporation is the Queensland Government’s central financing authority and corporate treasury services provider, with responsibility for:

| • | | sourcing and managing the debt funding to finance Queensland’s infrastructure requirements in the most cost-effective manner |

| • | | providing financial and risk management advice to the Queensland Government and its public sector clients on financial risk issues, and |

| • | | investing the State’s and clients’ short- to medium-term cash holdings, to maximise returns through a conservative risk management framework. |

QTC does not formulate Government policy, but works within the policy frameworks developed by the Government.

Debt funding and management

QTC borrows funds in the domestic and international markets in a way that minimises the State’s and QTC’s liquidity and refinancing risk. We then lend these funds to our clients, or use them to manage our clients’ debt or refinance maturing debt. With responsibility for virtually all of the State’s debt raising, QTC is able to capture significant economies of scale and scope to issue, manage and administer debt.

Financial advisory and risk management services

QTC works closely with its public sector clients to assist in managing their risk in financial transactions and achieve the best financial solutions for their organisations and for Queensland. In assisting clients, QTC does not provide advice that is contrary to the interests of the State. We encourage Queensland Treasury and Trade, our major stakeholder, and our clients to use our organisation as an extension of their resources, by:

| • | | providing access, on a cost-recovery basis, to professional skills and resources to ensure that their financial risks are identified and managed on a consistent basis |

| • | | acting as a central store of knowledge and expertise on financial structures and transactions, and the risks and benefits they encompass |

| • | | providing Queensland Treasury and Trade with advice on matters of financial and commercial policy and risk relating to the State and its entities |

| • | | working as a conduit between the Government and the private sector, and |

| • | | using our economies of scale and scope to ensure that the best possible solutions are obtained. |

Short- to medium-term investments

QTC uses its financial markets expertise, enhanced by strong relationships with the domestic and international markets, together with its understanding of debt management and the management of financial risk, to provide clients with investment solutions that achieve a high return within a conservative risk environment. Clients can choose from an overnight facility, a managed short-term fund or fixed-term facility. Alternatively, we can assist them to source appropriate solutions from the marketplace.

CONTENTS

| | | | |

Queensland Treasury Corporation | | | 1 | |

| |

Letter of Compliance | | | 2 | |

| |

Key Performance Highlights | | | 3 | |

| |

Five-Year Business Summary | | | 4 | |

| |

Chairman’s & Chief Executive’s Report | | | 6 | |

| |

Corporate Performance Report | | | 8 | |

| |

Corporate Governance | | | 12 | |

| |

Investor Report | | | 17 | |

| |

Financial Statements | | | 23 | |

| |

Appendices | | | 63 | |

| | |

| ANNUAL REPORT 2012–13 QUEENSLAND TREASURY CORPORATION | | 1 |

| | |

10 September 2013 The Honourable Tim Nicholls MP Treasurer and Minister for Trade GPO Box 611 Brisbane Qld 4001 | |  |

| | |

| | |

| | |

| | |

| | |

Dear Treasurer

| | |

| I am pleased to present the Annual Report 2012-13 and financial statements for Queensland Treasury Corporation. | | |

I certify that this Annual Report complies with: | | |

• the prescribed requirements of the Financial Accountability Act 2009 and the Financial and | | |

Performance Management Standard 2009, and | | |

• the requirements set out in the Annual Report requirements for Queensland Government agencies. | | |

A checklist outlining the annual reporting requirements can be accessed via our website at qtc.com.au. | | |

Sincerely

Gerard Bradley

Chairman

LEVEL 6, 123 ALBERT STREET, BRISBANE QUEENSLAND AUSTRALIA 4000

GPO BOX 1096, BRISBANE QUEENSLAND AUSTRALIA 4001

T: 07 3842 4600 • F: 07 3221 4122 •QTC.COM.AU

| | |

| 2 | | QUEENSLAND TREASURY CORPORATION ANNUAL REPORT 2012–13 |

| • | | Raised $17.9 billion to meet the State’s funding requirements, issuing three new, well-subscribed bond lines to complement our existing offering |

| • | | Managed QTC’s Capital Guaranteed Cash Fund, which outperformed its benchmark, the UBS Australian Bank Bill Index, by 86 basis points |

| • | | Provided analysis and advice to the Boundaries Commissioner on the financial impacts of proposed local government de-amalgamations |

| • | | Supported the Commission of Audit in its review of the State’s financial position with the objective of improving Queensland’s economy and financial position |

| • | | Seconded specialist staff to the Government’s Projects Queensland initiative to deliver key infrastructure for the State, including the 1 William Street development and the Queensland Schools Project |

| • | | Continued to support, through our Local Government Infrastructure Services (LGIS) operation, the State’s recovery from natural disasters, assisting councils with funding applications |

| • | | Played a central role in managing two partial sell-downs of the State’s shareholding in Aurizon Holdings Ltd, realising a net value of $400 million to the State |

| • | | Developed a series of submissions to the Australian Energy Market Commission’s review of electricity network economic regulations, in support of the State’s energy Government-owned corporations |

| • | | Launched the secure QTC Connect website, enhancing clients’ access to account data, business intelligence and financial toolkit |

| • | | Implemented an integrated suite of HR programs to encourage and promote individual, team and corporate high performance |

KEY PERFORMANCE HIGHLIGHTS

| | |

| ANNUAL REPORT 2012–13 QUEENSLAND TREASURY CORPORATION | | 3 |

FIVE-YEAR BUSINESS SUMMARY

| | | | | | | | | | | | | | | | | | | | |

| | | Financial

Year

2008-09 | | | Financial

Year

2009-10 | | | Financial

Year

2010-11 | | | Financial

Year

2011-12 | | | Financial

Year

2012-13 | |

| | | | | |

FINANCIAL | | | | | | | | | | | | | | | | | | | | |

CAPITAL MARKETS OPERATIONS | | | | | | | | | | | | | | | | | | | | |

OPERATING STATEMENT ($000) | | | | | | | | | | | | | | | | | | | | |

Interest from onlendings | | | 3 614 201 | | | | 4 062 092 | | | | 3 107 472 | | | | 7 799 422 | | | | 2 743 084 | |

Interest from other investments | | | 1 245 623 | | | | 1 216 538 | | | | 1 187 360 | | | | 1 628 002 | | | | 786 825 | |

Fees | | | 42 423 | | | | 51 288 | | | | 56 692 | | | | 58 514 | | | | 69 112 | |

Interest on borrowings | | | 4 431 033 | | | | 4 901 512 | | | | 4 071 085 | | | | 9 204 636 | | | | 3 156 860 | |

Interest on deposits | | | 394 238 | | | | 195 413 | | | | 189 027 | | | | 178 982 | | | | 169 696 | |

Profit before income tax | | | 53 430 | | | | 243 510 | | | | 66 831 | | | | 54 965 | | | | 238 795 | |

Income tax expense | | | 10 227 | | | | 34 074 | | | | 20 874 | | | | 8 056 | | | | 15 911 | |

Profit for the year | | | 43 203 | | | | 209 436 | | | | 45 957 | | | | 46 909 | | | | 222 884 | |

BALANCE SHEET ($000) | | | | | | | | | | | | | | | | | | | | |

Total assets | | | 71 517 525 | | | | 74 385 172 | | | | 79 576 098 | | | | 90 196 362 | | | | 100 435 486 | |

Total liabilities | | | 71 181 678 | | | | 73 839 889 | | | | 79 134 858 | | | | 89 708 213 | | | | 99 724 453 | |

Net assets | | | 335 847 | | | | 545 283 | | | | 441 240 | | | | 488 149 | | | | 711 033 | |

| | | | | |

CLIENT | | | | | | | | | | | | | | | | | | | | |

SAVINGS FOR CLIENTS ($M) | | | | | | | | | | | | | | | | | | | | |

Savings due to portfolio management | | | 6.2 | | | | -18.8 | | | | 10.3 | | | | 6.3 | | | | 319.6 | |

LOANS TO CLIENTS | | | | | | | | | | | | | | | | | | | | |

Loans ($000) | | | 44 407 516 | | | | 55 113 222 | | | | 59 452 522 | | | | 72 289 635 | | | | 79 118 832 | |

Number of onlending clients | | | 243 | | | | 275 | | | | 238 | | | | 205 | | | | 188 | |

OUTPERFORMANCE OF BENCHMARK (% PA) | | | | | | | | | | | | | | | | | | | | |

Floating Rate Debt Pool | | | 0.21 | | | | 0.21 | | | | 0.21 | | | | 0.21 | | | | 0.22 | |

3 Year Debt Pool | | | 0.07 | | | | -0.07 | | | | 0.02 | | | | -0.06 | | | | 0.22 | |

6 Year Debt Pool | | | 0.04 | | | | -0.08 | | | | 0 | | | | -0.10 | | | | 0.42 | |

9 Year Debt Pool | | | 0.01 | | | | -0.07 | | | | -0.01 | | | | -0.10 | | | | 0.37 | |

12 Year Debt Pool | | | 0.07 | | | | -0.08 | | | | -0.02 | | | | -0.13 | | | | 0.35 | |

15 Year Debt Pool | | | 0.16 | | | | -0.05 | | | | -0.01 | | | | -0.11 | | | | 0.37 | |

MANAGED FUNDS | | | | | | | | | | | | | | | | | | | | |

Deposits ($000) | | | 7 793 010 | | | | 4 660 960 | | | | 5 562 013 | | | | 5 077 143 | | | | 6 127 695 | |

Number of depositors | | | 214 | | | | 207 | | | | 194 | | | | 190 | | | | 193 | |

OUTPERFORMANCE OF BENCHMARK (% PA) | | | | | | | | | | | | | | | | | | | | |

Cash Fund | | | 0.04 | | | | 0.36 | | | | 0.50 | | | | 0.59 | | | | 0.86 | |

| | |

| 4 | | QUEENSLAND TREASURY CORPORATION ANNUAL REPORT 2012–13 |

| | | | | | | | | | | | | | | | | | | | |

| | | Financial

Year

2008-09 | | | Financial

Year

2009-10 | | | Financial

Year

2010-11 | | | Financial

Year

2011-12 | | | Financial

Year

2012-13 | |

| | | | | |

FINANCIAL MARKETS | | | | | | | | | | | | | | | | | | | | |

Debt outstanding# ($000) | | | 62 624 234 | | | | 68 885 406 | | | | 73 224 097 | | | | 84 268 842 | | | | 93 274 588 | |

QTC global and domestic bonds on issue at face value ($000) | | | 56 394 453 | | | | 61 424 032 | | | | 65 688 324 | | | | 73 184 241 | | | | 79 676 430 | |

QTC BOND RATES (% AT 30 JUNE) | | | | | | | | | | | | | | | | | | | | |

Guaranteed by the Australian and Queensland governments | | | | | | | | | | | | | | | | | | | | |

14 June 2011 | | | 4.32 | | | | 4.6 | | | | — | | | | — | | | | — | |

16 April 2012 | | | 4.95 | | | | 4.67 | | | | 4.8 | | | | — | | | | — | |

14 August 2013 | | | 5.54 | | | | 4.86 | | | | 4.88 | | | | 3.08 | | | | 2.71 | |

14 October 2015 | | | 5.86 | | | | 5.17 | | | | 5.1 | | | | 3.19 | | | | 2.81 | |

14 September 2017 | | | 6.11 | | | | 5.36 | | | | 5.27 | | | | 3.56 | | | | 3.33 | |

14 June 2019 | | | 6.29 | | | | 5.48 | | | | 5.46 | | | | 3.76 | | | | 3.75 | |

14 June 2021 | | | 6.34 | | | | 5.59 | | | | 5.59 | | | | 3.92 | | | | 4.16 | |

Guaranteed by the Queensland Government only | | | | | | | | | | | | | | | | | | | | |

14 July 2009 | | | 3.13 | | | | — | | | | — | | | | — | | | | — | |

14 May 2010 | | | 3.38 | | | | — | | | | — | | | | — | | | | — | |

23 April 2012 | | | — | | | | — | | | | 4.89 | | | | — | | | | — | |

21 August 2013 | | | — | | | | — | | | | 5.02 | | | | 3.17 | | | | 2.71 | |

21 November 2014 | | | — | | | | 5.26 | | | | 5.18 | | | | 3.27 | | | | 2.70 | |

21 October 2015 | | | — | | | | — | | | | 5.3 | | | | 3.54 | | | | 2.97 | |

21 April 2016 | | | — | | | | 5.49 | | | | 5.34 | | | | 3.68 | | | | 3.18 | |

21 September 2017 | | | — | | | | — | | | | — | | | | — | | | | 3.57 | |

21 February 2018 | | | — | | | | — | | | | 5.56 | | | | 4.05 | | | | 3.67 | |

21 June 2019 | | | — | | | | — | | | | — | | | | — | | | | 4.02 | |

21 February 2020 | | | — | | | | 5.77 | | | | 5.74 | | | | 4.34 | | | | 4.20 | |

21 June 2021 | | | — | | | | — | | | | — | | | | 4.47 | | | | 4.47 | |

21 July 2022 | | | — | | | | — | | | | 5.85 | | | | 4.54 | | | | 4.64 | |

21 July 2023 | | | — | | | | — | | | | — | | | | — | | | | 4.83 | |

22 July 2024 | | | — | | | | — | | | | 5.93 | | | | 4.70 | | | | 4.90 | |

14 March 2033 | | | 6.37 | | | | 5.79 | | | | 6.03 | | | | 4.70 | | | | 5.32 | |

QTC CAPITAL-INDEXED BOND RATES (% AT 30 JUNE) | | | | | | | | | | | | | | | | | | | | |

August 2030 | | | 3.67 | | | | 3.39 | | | | 3.26 | | | | 2.56 | | | | 2.93 | |

AVERAGE BASIS POINT MARGIN OF QTC AUD BONDS | | | | | | | | | | | | | | | | | | | | |

Guaranteed+ by both Australian and Queensland governments | | | | | | | | | | | | | | | | | | | | |

Commonwealth bonds | | | — | | | | 40 | | | | 29 | | | | 82 | | | | 39 | |

Swap | | | — | | | | -13 | | | | -23 | | | | -9 | | | | -2 | |

Guaranteed+ by the Queensland Government only | | | | | | | | | | | | | | | | | | | | |

Commonwealth bonds | | | 61 | | | | 64 | | | | 49 | | | | 122 | | | | 69 | |

Swap | | | 27 | | | | 11 | | | | -4 | | | | 38 | | | | 27 | |

| | | | | |

CORPORATE | | | | | | | | | | | | | | | | | | | | |

Number of employees (full-time equivalent) | | | 171 | | | | 170 | | | | 186 | | | | 213 | | | | 224 | |

Administration expenses ($000) | | | 39 156 | | | | 34 519 | | | | 42 523 | | | | 68 674 | | | | 57 159 | |

| + | Following the Australian Government’s announcement on 25 March 2009 to offer a temporary guarantee to the states for AUD issuance, QTC applied on 17 September 2009 to take up the guarantee on all AUD benchmark bond lines for maturities ranging from 2011 to 2021. The guarantee offer expired on 31 December 2010. |

| # | QTC holds its own stock and these holdings have been excluded from the debt outstanding figures. |

| | |

| ANNUAL REPORT 2012–13 QUEENSLAND TREASURY CORPORATION | | 5 |

CHAIRMAN’S & CHIEF EXECUTIVE’S REPORT 2012-13

In the context of a new political and economic landscape, QTC re-focused on its core mandate of providing debt funding for the State’s infrastructure needs in the most cost-effective manner, and supporting the public sector with specialist financial and risk management advice and support.

Enhancements to our products and services supported the programs of our clients and assisted them to increase their efficiency and effectiveness.

We also realigned our strategy, structure and operations in support of the Government’s primary fiscal objectives to restore the State’s financial strength and regain its AAA credit rating.

Funding objectives met

In a global economic environment that remained challenging, albeit marginally less volatile than in previous financial years, QTC’s strong reputation and relationship with investors helped ensure it met the State’s funding requirements.

QTC raised a total of $17.9 billion and launched three new benchmark bond lines, which attracted considerable investor interest. Issuance throughout the year contributed to stable benchmark bond spreads, as well as increased participation in each new bond line from investors based in the US, following the incorporation of US Rule 144A into our cornerstone Australian dollar benchmark bond program.

At 30 June 2013, 66 per cent of QTC’s new term debt raised had a duration of eight years or longer. Supporting its long-term debt programs, QTC maintained approximately $5 billion of short-term debt, with commercial paper being issued at an average seven basis points below bank bill levels.

In tandem with the issuance of new debt, we took the opportunity to lengthen the duration of clients’ debt portfolios to benefit from historically low interest rates. Active management of the debt portfolios, improved market risk management and a reduction in QTC’s cost-recovery fees also contributed to savings for clients.

On the investment side, clients investing surplus cash received strong returns from QTC’s Capital Guaranteed Cash Fund, which outperformed the benchmark UBS Bank Bill Index by 86 basis points, a saving of $60.7 million.

QTC continued its commitment to ensuring transparent communication and collaborative relationships with the markets, via the 15 domestic and global banks that make up its Fixed Income Distribution Group (FIDG). In July, QTC joined the State’s new Treasurer on a joint Treasury and Trade mission, meeting with institutional investors as part of our annual investor relations program. QTC will continue to build its relationship with its markets in order to maintain and diversify its investor base providing access to the most cost-effective funding.

Operating result

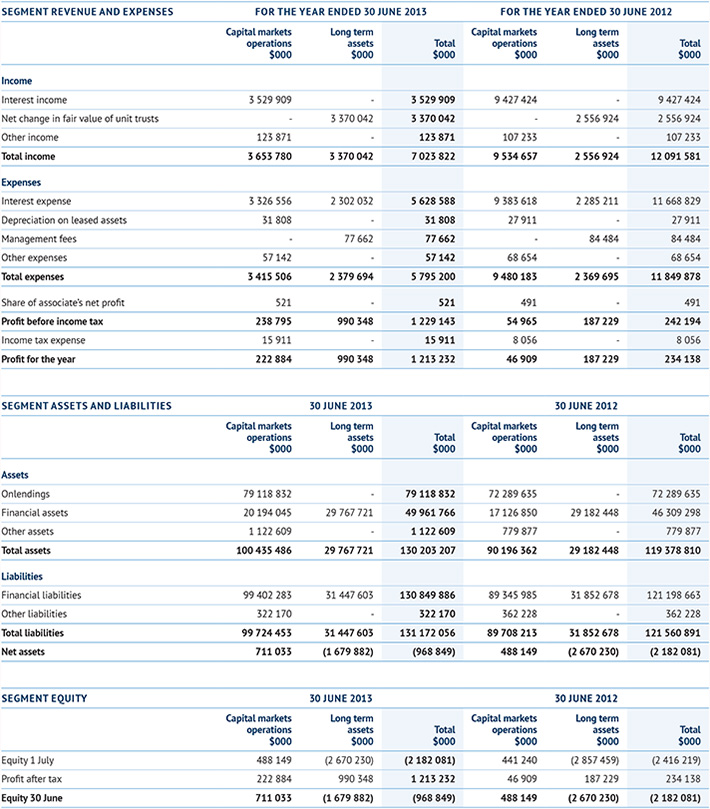

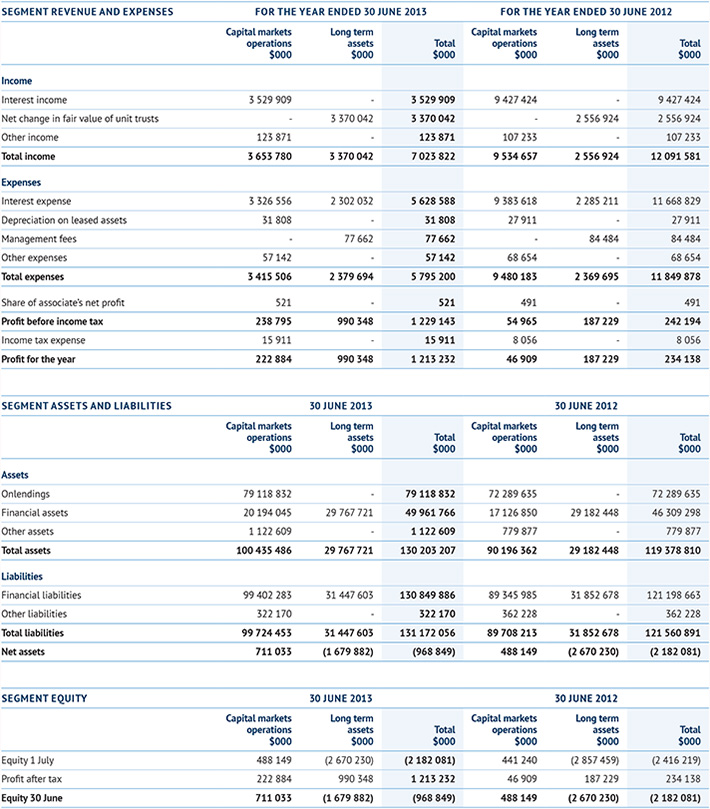

For the 2012-13 year, QTC recorded an operating profit after tax from its capital markets operations of $222.9 million (2011-12: $46.9 million) primarily due to fair value accounting gains, which, depending on market changes, may reverse in subsequent accounting periods.

Separate from QTC’s capital markets operations, the long-term assets operations recorded a profit of $990.3 million (2011-12: $187.2 million). This segment comprises the investments that fund the State’s defined benefit superannuation and other long-term obligations.

| | |

| 6 | | QUEENSLAND TREASURY CORPORATION ANNUAL REPORT 2012–13 |

Managed by QIC, these obligations were transferred to QTC by the Queensland Government under an administrative arrangement in 2008; in return, QTC issued the State with fixed-rate notes that provide a fixed rate of return. While QTC bears the fluctuations in the value and returns on the asset portfolio, there is no cash flow effect for QTC. Any accumulated losses incurred by this segment have no impact on QTC’s capital markets activities or its ability to meet its obligations.

Refocus and restructure

A substantial refocusing of our four-year strategic plan–underpinned by a new management framework that assesses performance against strategic priorities, and a reorganisation of our management structure–were two key initiatives undertaken to align our operations to the Government’s new priorities.

A renewed emphasis on delivering whole-of-State benefits, including the creation of a team specifically tasked with addressing financial risk management issues in this space, has already delivered real benefits.

In addition to the savings generated for clients from funding and liquidity management activities noted above, whole-of-State outcomes included the provision of resources to assist the Government’s Projects Queensland initiative and the Queensland Commission of Audit, and financial analysis to support the work of the local government Boundaries Commission.

The realignment of our client service groups, to ensure they are best placed to meet client priorities, puts QTC in a strong position to deliver tangible, structured and unique financial outcomes that support clients in the attainment of their objectives. Refinements to a number of products and services also offered benefits to clients.

QTC undertook an extensive program to strengthen collaborative relationships with clients that will enable it to identify and leverage opportunities to add value through product, service and organisational innovation. This also gave us an opportunity to reaffirm our role as the State’s provider of debt funding and financial risk management solutions.

These initiatives contributed to a notable increase in clients’ perceptions of QTC and the value we can add, revealed in our annual survey.

Operational efficiencies and enhancements

A particular emphasis of our drive to create operational efficiencies was on better managing our technology to improve quality and cost-effectiveness.

The enhancement of a ‘high-performance’ culture across the workplace to support our strategic objectives underpinned our human resources activities. Significant workplace improvement initiatives to enhance skills, build team capacity, develop employees, recognise superior performance and relocate all staff into one workplace combined to deliver a pleasing increase in both corporate performance and staff engagement.

Changes to the Board

In the year under review, we farewelled two long-standing Board members and welcomed two new ones.

Our sincere thanks and best wishes went to Marian Micalizzi and Shauna Tomkins for their significant contributions to QTC over the past twelve and a half years when they resigned from the Board in January.

To fill those vacancies, we were delighted to welcome two new Board members–Stephen Bizzell and Tonianne Dwyer– who have brought new skill sets, perspectives and more than four decades of experience in the executive management of public and private entities in Australia and internationally to the Board.

Looking ahead

QTC bonds remain a highly appealing proposition for investors given the attractive yield and the fact that they are guaranteed by the Queensland Government. We will continue to monitor offshore bond issuance opportunities, and in support of our markets activities, we will maintain our program of investor engagement activities with the objective of diversifying our investor base and accessing the most cost-effective funding for the State.

G P BRADLEY

Chairman

P C NOBLE

Chief Executive

| | |

| ANNUAL REPORT 2012–13 QUEENSLAND TREASURY CORPORATION | | 7 |

CORPORATE PERFORMANCE REPORT 2012-13

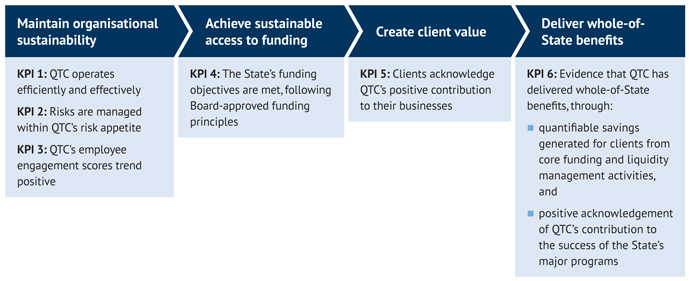

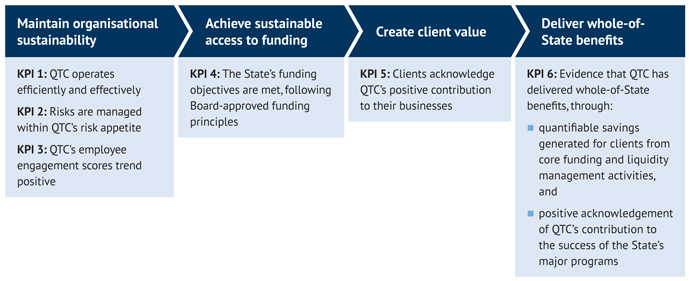

This Corporate Performance Report details QTC’s progress towards achieving its strategic goals in 2012-13 (see page 11 for Strategic Goals and Key Performance Indicators).

Funding the State

During the year under review, we raised $17.9 billion to meet the State’s funding requirements.

We issued approximately $1 billion of term debt each month, bringing the total term debt raised to $12.6 billion for the fiscal year. We funded the remaining $5.3 billion via our commercial paper programs. More than 66 per cent of the long-term debt raised as part of QTC’s borrowing program had a maturity of longer than eight years, providing funding to the State at historically low rates. QTC bond spreads narrowed by 0.53 per cent on average to Australian Government bonds.

QTC employed a variety of issuance methods during the year. Three new benchmark bond lines, with 144A capability, were successfully launched via syndication. The bonds, maturing 2017, 2019 and 2023, collectively raised significant volumes on issue (between $750 million and $1.65 billion). In addition to syndicated issuance, we conducted two online tenders to add to existing bond lines.

Our success in financial markets can be attributed in part to our consistent approach of being open and transparent with institutional investors–both domestically and across the globe–through the 15 global banks who act as our market intermediaries in the markets.

We continued to deliver significant quantitative and qualitative results for our clients and the State through our financial markets activities by:

| • | | lengthening client debt portfolios to enable them to take advantage of historically low interest rates |

| • | | aligning debt issuance opportunities and the timing of client drawdowns, reducing transaction costs |

| • | | identifying and monitoring opportunistic funding alternatives for clients (eg, foreign currency denominated private placements) |

| • | | facilitating market soundings to gauge appetite for alternative financing solutions to alleviate pressure on the State’s balance sheet |

| • | | providing pricing and market information in various financial markets (including swaps, foreign exchange, commodities and interest rates) |

| • | | sourcing global financial market risk expertise through QTC’s Fixed Income Distribution Group (FIDG) members and continuing to develop these broader, strategic relationships, and |

| • | | facilitating bespoke economic presentations (including those provided by QTC’s FIDG members), research pieces and market updates on a regular and ad-hoc basis. |

We continue to offer a range of products that enable clients to maximise the value of surplus funds. This past year, our Capital Guaranteed Cash Fund outperformed its benchmark, the UBS Australian Bank Bill Index, by 86 basis points.

We successfully completed approximately 88,000 transactions with a turnover $1.2 trillion.

| | |

| 8 | | QUEENSLAND TREASURY CORPORATION ANNUAL REPORT 2012–13 |

Advising the State and clients

In the year under review, QTC concentrated on aligning its activities to the Government’s new strategic approach and we undertook a significant corporate reorganisation to re-align our structure and resources and better position us to address client needs.

In particular, our commitment to supporting the Government to achieve whole-of-State objectives was strengthened to complement our ongoing focus on the needs of individual public sector clients.

Whole-of-State outcomes

A key priority for the year has been supporting the State to complete its major State-wide programs of work and meet its fiscal priorities and objectives.

To support the Government to address a range of financial risk management issues on a whole-of-State basis in order to achieve its aim of restoring the State’s finances and returning the State to AAA, QTC established a Whole-of-State Solutions practice and contributed significantly to a number of whole-of-State outcomes, including:

| • | | supporting the Queensland Commission of Audit in its review of the State’s financial position. This work will be a key input into future Government economic and fiscal policy with a view to improving and strengthening the State’s economy |

| • | | supporting the Boundaries Commissioner to evaluate the financial impacts of proposed local government de-amalgamations on the councils and their ratepayers, with a public commendation for this work by the Minister for Local Government, Community Recovery & Resilience (DLGCRR) |

| • | | seconding 17 commercial and financial specialists to Projects Queensland, a key election commitment of the new State Government. These employees have been involved in a number of projects that have delivered tangible outcomes for Government, including the 1 William Street development, Toowoomba Second Range Crossing Project, the Queensland Schools Project, the Port of Abbot Point development |

| • | | playing a central role in managing two partial sell-downs of the State’s shareholding in Aurizon Holdings Ltd that realised a net value to the State’s bottom line of $400 million, and |

| • | | simplifying the cost-recovery fee structures of its debt funding products, including the abolition of the capital markets fee, generating $7.5 million in net savings to our clients and the State. |

Client advisory

Following the significant post-2012 election changes at both State and local government levels, QTC implemented an extensive client relationship program. This priority program was undertaken to ensure robust, collaborative relationships were in place, enabling QTC to assist and leverage opportunities to add value to its clients through product, service and organisational innovation.

The success of these programs was indicated by pleasing results from our annual client survey: positive sentiment towards QTC was 8.3 out of 10 (against a target of 7 and compared with 8.2 in the previous survey).

We also saw an increase in the number of advisory assignments, the most significant of which included:

| • | | developing a series of submissions to the Australian Energy Market Commission’s review of the national rules governing the economic regulation of electricity network service providers, to help achieve a positive result in the long-term for the State’s energy Government-owned corporations (GOCs) |

| • | | assisting the State’s three bulk water providers to plan and manage the consolidation of their debt and investment facilities into a single entity |

| • | | completing the first two phases of the Logan Renewal Initiative Assessment for the Department of Housing and Public Works |

| • | | providing modelling support to the Department of Energy and Water Supply for its 30-year energy plans |

| • | | implementing an innovative funding strategy to allow Brisbane City Council to construct a regional public transport hub in the Trade Coast Industrial Precinct at Eagle Farm in the most cost-effective manner |

| • | | advising SunWater and the Department of Energy and Water Supply on the proposed transfer of irrigation channel assets to local management |

| • | | completing a commercial advisory assignment on the Aurukun Bauxite Lease tender for the Department of State Development, Infrastructure and Planning |

| • | | providing the Department of Transport and Main Roads with commercial advice in relation to the competitive tender process for Private Plates Queensland |

| • | | participating in the Mine Leases Competitive Cash bidding financial advisory panel for the Department of Natural Resources and Mines |

| | |

| ANNUAL REPORT 2012–13 QUEENSLAND TREASURY CORPORATION | | 9 |

| • | | providing financial and electricity market modelling to Queensland Treasury and Trade and the Department of Energy and Water Supply on a range of electricity and energy reform matters, and |

| • | | developing and delivering bespoke training to clients on cost of capital calculation, project evaluation and business case development. |

Client services

Improvements were made to the support services we offer clients, including the:

| • | | launch of QTC Connect, our secure client website that offers a range of new online functionality, including account and transaction information, the QTC Cash Management platform for agencies required to provide daily cash flow forecasts, and a range of useful tools such as the QTC loan calculator, and |

| • | | streamlining of client reports, such as market and economic reviews, to enhance the timeliness, quality and dissemination of business information. |

Local government

The year saw a growing emphasis on connecting with local government, highlighting the value QTC can add through its advisory and training services, as well as the services of its associated entity, Local Government Infrastructure Services (LGIS) in the areas of infrastructure procurement, tendering and waste management.

Key projects completed for local government clients included:

| • | | developing and delivering, in collaboration with the Department of Local Government, Community Recovery and Resilience and the Local Government Association of Queensland: |

| | • | | a State-wide series of training events for elected officials, including the large number of first-time councillors, following the local government elections in March 2012, and |

| | • | | a financial management course for the State’s 17 Indigenous and Torres Strait Island councils |

| • | | conducting comprehensive sustainability reviews of 10 councils to give them a better view of their financial health, assist them to more effectively plan for the future, and sharpen the sector’s focus on financial sustainability |

| • | | providing financial and strategic advice to local governments to assist them in preparing for the implementation of the carbon pricing scheme, including options to limit their financial liability |

| • | | continuing to assist councils with natural disaster recovery by supporting their applications for National Disaster Relief and Recovery Arrangements (NDRRA) funding assistance and subsequent infrastructure procurement, and |

| • | | reviewing and updating pro forma financial statements in relation to IFRS 7 disclosures for use by local government. |

Managing risk and services

During the year, QTC promoted a strong risk management culture with a continued focus on improving risk management practices, particularly in relation to portfolio management and market risk management, and the completion of a review to more succinctly identify QTC’s most significant risks.

The QTC Board approved the 2013 Risk Appetite Statement, which clearly defines QTC’s appetite for risk and provides clear organisational definitions on risk tolerance in setting and understanding its key strategic and business objectives.

Improvements to enterprise-wide practices for reviewing, monitoring and reporting risk support the achievement of strategic objectives by ensuring risks are effectively identified, evaluated, managed and reported using a consistent and well-understood approach.

A key priority has been the work to procure a new market and credit risk system. Given the importance of this system, QTC has implemented an external gateway review process for critical stages of this project, including the development of the business case. A request for proposals was issued in July 2013, and it is anticipated that the project will be completed in 2014-15.

Significant portfolio market risk exposures have been managed within Board-approved limits.

In the changing climate of global financial markets, QTC will continue to review its processes and practices to protect the integrity of our risk management environment and support our business objectives.

Creating operational efficiencies

QTC’s commitment to efficiency continued throughout the year, with an emphasis on improving the quality and cost-effectiveness of both client services and administrative activities.

A key initiative was the co-location of all employees into a single premises, providing greater efficiency in the use of space, improved organisational productivity due to better cross-collaboration, availability of efficient technologies and improved staff amenity. Sixty per cent of office furniture and equipment was reused to minimise fit-out costs.

The project to develop and implement a self-service platform for clients was completed using internal resources. Its launch as the secure QTC Connect website offers clients enhanced access to quality information and tools to support our client relationship management initiatives, as well as creating efficiencies for QTC.

A business information strategy will see development of a data warehouse to provide a single central source of data, reducing QTC’s reliance on a network of databases and spreadsheets while improving performance and reporting.

Finally, a number of initiatives to support mobile device usage were rolled out, including new policies and work practices to maximise the benefits while reducing costs.

QTC remains committed to continuous improvement in the way it does business and its capacity to add value in the services provided to clients.

| | |

| 10 | | QUEENSLAND TREASURY CORPORATION ANNUAL REPORT 2012–13 |

Driving a ‘high-performance’ culture

Work continued to embed a high-performance culture at QTC, with projects around communication, remuneration, recognition, career development and work-life balance contributing to the ‘investing in our people’ portfolio.

The development of a new performance framework, and introduction of a new online performance management system, supports performance improvement by clarifying objectives and measures at an individual, group and organisational level.

Individual development plans support employees to meet their targets and develop skills in readiness for future career opportunities.

During the year, a new organisation-wide learning and development framework was developed and the first component, an online learning management system, was implemented to streamline access to learning-related information, activities and online resources.

Our people leaders participated in a leadership program aimed at building capability in setting expectations, recognising and encouraging high performance, and supporting career development. This program will be further enhanced with additional capability development for leaders in the coming year.

In 2013-14, we will focus on strategic workforce planning to ensure we remain flexible and responsive to the changing environment and that we have ready successors for key leadership and business critical roles. Supporting this is the development of a promotions framework to ensure a formal, transparent and consistent approach to employee promotion.

External professional development is also encouraged, with QTC investing in its people through the provision of study support. Employees also benefit from our corporate health program, which supports participation in a range of activities including exercise, nutrition and wellbeing programs.

QTC continues to benefit from providing flexible work practices that support employees to balance work and life commitments. These practices contribute to our high retention rates.

Early indications are that these programs are beginning to have an impact, with the regular employee survey recording a significant – 14 per cent – increase in engagement across employee categories, including people leaders. Results showed a higher positive perception of our employees’ work experience, including rewards, communication and performance and change management.

QTC maintains its commitment to increasing employee engagement, with action plans focused on career opportunities, change management and innovation, and performance management.

QTC regularly reviews and updates its policies and procedures to comply with changes in the legislative and regulatory environment, and to ensure employees have access to avenues through which to raise concerns, including an internal grievance process. QTC employees are employed under individual employment agreements, which adhere to the legislated provisions of the Fair Work Act 2009.

| | | | |

Workforce profile | | FY 2012-13 | |

Establishment | | | 226 | |

Full-time equivalent staff | | | 224 | |

Permanent retention rate | | | 94.26 | % |

Permanent separation rate | | | 5.23 | % |

Permanent average tenure | | | 6.29 years | |

QTC’s Strategic Goals, as outlined in its Strategic Plan 2012-16.

| | |

| ANNUAL REPORT 2012–2013 QUEENSLAND TREASURY CORPORATION | | 11 |

CORPORATE GOVERNANCE 2012-13

QTC is committed to maintaining high standards of corporate governance to support its strong market reputation and ensure that organisational goals are met and risks are monitored and appropriately addressed.

QTC’s corporate governance practices are continually reviewed and updated in line with industry guidelines and standards.

QTC and its Boards

QTC was established by the Queensland Treasury Corporation Act 1988 (the QTC Act) as a corporation sole (ie, a corporation that consists solely of a nominated office holder). The Under Treasurer of Queensland is QTC’s nominated office holder. QTC has delegated its powers to its two boards:

| • | | the Queensland Treasury Corporation Capital Markets Board (the Board), which was established in 1991 and manages all of QTC’s operations except those relating to certain superannuation and other long-term assets, and |

| • | | the Long Term Asset Advisory Board, which was established in July 2008 and advises in relation to certain superannuation and other long-term assets that were transferred to QTC from Queensland Treasury on 1 July 2008. |

QTC Capital Markets Board

QTC and the Capital Markets Board have agreed the terms and administrative arrangements for the exercise of the powers that have been delegated to the Board by QTC (as the corporation sole).

The Board operates in accordance with its charter, which sets out its commitment to various corporate governance principles and standards, the roles and responsibilities of the Board and its members (based on its delegated powers), and the conduct of meetings. The charter provides that the role and functions of the Board include:

| • | | overseeing QTC’s operations, including its control and accountability systems |

| • | | developing and monitoring QTC’s strategic and corporate plans, operational policy and yearly budget |

| • | | monitoring and measuring financial and operational performance |

| • | | monitoring and measuring organisational and staff performance |

| • | | monitoring key risks and risk management processes, and |

| • | | ensuring that QTC’s compliance is appropriate for an organisation of its type. |

The Board holds monthly meetings (except in January) and may, whenever necessary, hold additional meetings.

Board appointments

The Board comprises seven directors who are appointed by the Governor-in-Council, pursuant to section 10(2) of the QTC Act, with consideration given to each Board member’s qualifications, experience, skills, strategic ability and commitment to contribute to QTC’s performance and achievement of its corporate objectives. QTC’s Board is entirely constituted of non-executive directors.

Conflict of interest

Board members are required to monitor and disclose any actual or potential conflicts of interest. Unless the Board determines otherwise, a conflicted Board member may not receive any Board papers, attend any meetings or take part in any decisions relating to declared interests.

Performance and remuneration

To ensure continuous improvement and to enhance overall effectiveness, the Board conducts an annual assessment of its performance as a whole. Board members’ remuneration is determined by the Governor-in-Council (details are disclosed in QTC’s financial statements).

Board committees

The Board has established three committees, each with its own terms of reference, to assist it in overseeing and governing various QTC activities.

| | |

| 12 | | QUEENSLAND TREASURY CORPORATION ANNUAL REPORT 2012–13 |

Accounts and Audit Committee

The Accounts and Audit Committee has responsibility for the:

| • | | adequacy and effectiveness of internal controls, including for the prevention of fraud |

| • | | integrity of financial statements |

| • | | adequacy and effectiveness of compliance monitoring, and |

The Accounts and Audit Committee must have at least three members and meet at least four times a year.

During the year the Accounts and Audit Committee recommended the adoption of the half year and annual financial statements, reviewed external and internal audit reports and the progress in implementing the recommendations from those reports, and reviewed the Queensland Audit Office’s Client Service Plan and Queensland Treasury and Trade’s Internal Audit Plan.

As required by the Audit Committee Guidelines: Improving Accountability and Performance issued by Queensland Treasury, QTC’s Accounts and Audit Committee has observed its terms of reference and has had due regard to the Audit Committee Guidelines.

Human Resources Committee

The Human Resources Committee has responsibility for:

| • | | the appropriateness of any new or amended human resources policy |

| • | | the framework for, and review of, employee remuneration and performance, and |

| • | | employment terms and conditions. |

The Human Resources Committee must have at least two members and meet at least two times a year.

The Human Resources Committee has observed its terms of reference.

Funding and Markets Committee

The Funding and Markets Committee has responsibility for monitoring and reviewing the management of the following key market areas and to make recommendations as it considers appropriate for changes to the strategy and policy for these areas:

| • | | funding accessibility (including liquidity) |

| • | | market counterparty credit |

to support QTC’s risk appetite with a focus on effectiveness and performance.

The Committee must have at least three members and meet at least six times a year.

The Funding and Markets Committee has observed its terms of reference.

| | | | | | | | | | | | | | | | |

| | | Board | | | Accounts

& Audit

Committee | | | Funding

&

Markets

Committee | | | Human

Resources

Committee | |

Meetings held | | | 11 | | | | 6 | | | | 7 | | | | 4 | |

Gerard Bradley | | | 11 | | | | — | | | | 7 | | | | 4 | |

Alex Beavers | | | 10 | | | | — | | | | — | | | | 3 | |

Stephen Bizzell^ | | | 4 | | | | 1 | | | | — | | | | — | |

Gillian Brown | | | 11 | | | | — | | | | 7 | | | | — | |

Tonianne Dwyer^ | | | 4 | | | | — | | | | — | | | | 2 | |

Neville Ide | | | 11 | | | | 6 | | | | 6 | | | | — | |

Marian Micalizzi* | | | 6 | | | | 4 | | | | — | | | | — | |

Bill Shields | | | 10 | | | | 6 | | | | — | | | | — | |

Shauna Tomkins* | | | 6 | | | | — | | | | — | | | | 1 | |

| * | Marian Micalizzi and Shauna Tomkins resigned from the Board in January 2013. |

| ^ | Stephen Bizzell and Tonianne Dwyer were appointed to the Board in February 2013. |

Long Term Asset Advisory Board

The Long Term Asset Advisory Board (LTAAB) was established in July 2008, following the transfer of certain superannuation and other long-term assets from Treasury to QTC (primarily for reasons relating to market volatility).

The LTAAB has power delegated from QTC to:

| • | | manage the sufficiency of the funding of the long-term assets |

| • | | set investment objectives and strategies for the long-term assets |

| • | | set the appropriate investment structure for the long-term assets, and |

| • | | monitor investment performance of the long-term assets. |

The LTAAB holds meetings at least four times per year and held seven in the year under review.

The LTAAB members are appointed by the Governor in Council, pursuant to section 10(2) of the QTC act. The members of LTAAB are:

| | |

Name | | Position |

| Under Treasurer | | Chairperson |

| Chief Executive, QSuper | | Member |

| Chief Executive, QTC | | Member |

| State Actuary | | Member |

| Assistant Under Treasurer | | Member |

| Assistant Under Treasurer | | Member |

| Deputy Under Treasurer | | Member |

The LTAAB has observed its terms of reference.

| | |

| ANNUAL REPORT 2012–13 QUEENSLAND TREASURY CORPORATION | | 13 |

QTC Board members 2012-13

| | |

| | GERARD BRADLEY BComm, Dip Adv Acc , FCA, FCPA, FAICD, FAIM Chairman Appointed 10 May 2012 with tenure to 30 June 2016 Board Committees • Chairman, Human Resources Committee • Member, Funding and Markets Committee |

Prior to his appointment as QTC’s Chairman, Mr Bradley was the Under Treasurer and Under Secretary of the Queensland Treasury Department, a position he held from 1998 to 2012. He was also a QTC Board member from 2000-2007.

Mr Bradley has extensive experience in public sector finance gained in both the Queensland and South Australian treasury departments. He was Under Treasurer of the South Australian Department of Treasury and Finance from 1996 to 1998, and of Queensland’s Treasury Department from 1995 to 1996. Mr Bradley held various positions in Queensland Treasury from 1976 to 1995, with responsibility for the preparation and management of the State Budget and the fiscal and economic development of Queensland. He is currently a Director and Chairman of Queensland Treasury Holdings Pty Ltd and related companies, and a Director of Echo Entertainment Group Ltd.

| | |

| | STEPHEN BIZZELL BCom, MAICD Appointed in February 2013 with tenure to 30 June 2015 Board Committees • Member, Accounts and Audit Committee |

Stephen Bizzell is an experienced company director with skills in accounting, finance, risk management and commercial management. Mr Bizzell has more than 20 years’ corporate, finance and public company management experience in the resources, energy and financial services sectors with public companies in Australia and Canada. He was a co-founder and, for 12 years, executive director of coal seam gas company Arrow Energy Ltd and is Chairman of boutique corporate advisory and funds management group Bizzell Capital Partners Pty Ltd.

Mr Bizzell currently holds company directorships on a number of ASX listed boards including Armour Energy Ltd, Dart Energy Ltd, Diversa Limited, Hot Rock Ltd, Laneway Resources Ltd, Renaissance Uranium Ltd, Stanmore Coal Ltd, and Titan Energy Services Ltd.

| | |

| | ALEXANDER BEAVERS B Comm, Dip Ec Deputy Chairman Appointed 1 September 2009 with tenure to 30 June 2015 Board Committees • Member, Human Resource Committee |

Alex Beavers was appointed Queensland’s Deputy Under Treasurer in June 2009. Prior to this appointment, he was Deputy Director-General, Policy, in the Department of the Premier and Cabinet, with responsibility for leading the Government’s policy coordination processes and managing policy advice preparation for the Premier.

Mr Beavers has also previously held the role of Assistant Under Treasurer with responsibility for Queensland’s fiscal strategy and taxation policy, as well as other senior roles within Queensland Treasury over the past 15 years.

| | |

| | GILLIAN BROWN LLB (Hons), Grad Dip Applied Finance and Investment, SIA Appointed 1 July 2004 with tenure to 30 June 2015 Board Committees • Chairman, Funding and Markets Committee |

Gillian Brown has more than 25 years’ experience as a specialist finance lawyer and has gained extensive corporate, financing and major project experience. She is a partner of Minter Ellison Lawyers in Queensland, heading the finance practice, and is a past Chairman of that firm. Ms Brown’s principal areas of practice include corporate finance, investment and financial services, financial markets, project and infrastructure finance, and property finance.

Ms Brown has advised government bodies on a number of project and transactional arrangements and has an in-depth knowledge of the mechanics of government and its objectives. Ms Brown is a director of the Australian Rail Track Corporation Limited (from 30 June 2010) and a committee member of the Law Council of Australia.

| | |

| 14 | | QUEENSLAND TREASURY CORPORATION ANNUAL REPORT 2012–13 |

| | |

| | TONIANNE DWYER B Juris (Hons), B Laws (Hons), GAICD Appointed 14 February 2013 with tenure to 30 June 2015 Board Committees • Member, Human Resources Committee |

Tonianne Dwyer is a lawyer by profession with a career of more than 25 years in international investment and finance in both executive management and board positions.

She has held senior roles with Harnbros Bank Limited and Societe Generale and was an Executive Director of Quintain Estates & Development PLC, a listed United Kingdom property company involved in investment and urban regeneration.

Ms Dwyer’s executive experience covers a broad range of sectors, including real estate investment and development, financial services, health and aged care, education, research and development, and media, including a role with the finance division of the UK Department of Health. She has extensive experience of financing social infrastructure and of leading teams on public private partnership bids. Her operational experience includes UK, Europe and Wall Street.

Ms Dwyer currently holds directorships on DEXUS Property Group, DEXUS Wholesale Property Fund and Cardno Limited.

| | |

| | BILL SHIELDS BEcon (Hons), MEc, MAICD Appointed 1 July 2004 with tenure to 30 June 2015 Board Committees • Chairman, Accounts and Audit Committee |

Bill Shields has extensive experience in the banking and finance industry, as well as government policy advice, specialising in economics. His career responsibilities have included economic and financial market research in Australia and overseas, and the provision of analytical and strategic advice on the Australian financial system and monetary policy, Australia’s exchange rate arrangements and international financial developments, as well as oversight of energy markets in Australia, New Zealand and Singapore.

Mr Shields was previously Chief Economist and Executive Director of Macquarie Bank Limited (1987–2001), and he has also held positions with the Reserve Bank of Australia (1983–1985), the International Monetary Fund (1973–75 and 1977–83), and the Australian Treasury. He was a Visiting Professor at the Macquarie Graduate School of Management of Macquarie University from 2001-09 and has recently taught at the Australian Catholic University in Brisbane. He is currently a director of the Sydney Anglican Schools Corporation and is Chair of its Education and Strategic Development Committee.

| | |

| | NEVILLE IDE BBus, MCom, FCPA, FAICD Appointed 1 July 2011 with tenure to 30 June 2015 Board Committees • Member, Accounts and Audit Committee • Member, Funding and Markets Committee |

Neville Ide has more than 30 years’ experience in the financial services industry, predominantly banking and insurance; his most recent executive position was as Suncorp Metway Group’s Treasurer. He has extensive commercial experience in liquidity management, debt funding, capital management and balance sheet structuring.

From 2010, Mr Ide has served on a number of boards and provided financial risk management advisory services. He is also a non-executive director of RACQ Insurance Ltd, Queensland Motorways Pty Limited and Queensland Police Credit Union Ltd.

| | |

| ANNUAL REPORT 2012–13 QUEENSLAND TREASURY CORPORATION | | 15 |

Auditors

In accordance with the provisions of the Auditor-General Act 2009, the Queensland Audit Office is the external auditor for QTC. The Queensland Audit Office has the responsibility for providing Queensland’s Parliament with assurances as to the adequacy of QTC’s discharge of its financial and administrative obligations.

QTC has an independent Internal Audit function that is currently outsourced to KPMG and reports to the Board’s Accounts and Audit Committee. Internal audit is conducted under an Internal Audit Charter that is consistent with the relevant audit and ethical standards. The role of internal audit is to support QTC’s corporate governance framework by providing the Board (through the Accounts and Audit Committee) with:

| • | | assurance that QTC has effective, efficient and economical internal controls in place to support the achievement of its objectives, including the management of risk, and |

| • | | advice with respect to QTC’s internal controls and business processes. |

Internal Audit is responsible for:

| • | | developing an annual audit plan, based on the assessment of financial and business risks (based on QTC’s approved significant risks and internal workshops) aligned with QTC’s strategic goals and objectives, and approved by the QTC Accounts and Audit Committee |

| • | | providing regular audit reports and periodic program management reports to the management team and the QTC Accounts and Audit Committee, and |

| • | | working constructively with QTC’s management team to challenge and improve established and proposed practices and to put forward ideas for process improvement. |

In the year under review, KPMG completed its internal audits in accordance with the approved annual audit plan.

QTC has had due regard to Treasury’s Audit Committee guidelines, in establishing and supervising its outsourced internal audit function and, together with the Accounts and Audit Committee, in overseeing and monitoring the internal audit function.

In the 2012-13 financial year, the Queensland Audit Office (QAO) audited controls and conducted some substantive testing of QTC’s systems used to complete the half year and full year annual financial statements. The QAO raised four low-rated issues that have been considered by the Accounts and Audit Committee. These issues have now been addressed.

Risk management

QTC manages its risks within an enterprise-wide risk management framework (EwRM). The framework supports the achievement of QTC’s

corporate strategies and objectives by providing assurance that QTC’s risks are being appropriately and effectively identified and managed, using a consistent and well-understood approach for evaluating and reporting risks.

As part of this framework, QTC periodically identifies its key or significant risks, which are reported to its Risk Management Team and to the Board through structured reporting processes.

QTC’s Chief Risk Officer is responsible for embedding QTC’s risk management policy and program in its business processes, to ensure a consistent organisation-wide approach to risk mitigation and an enhanced individual employee understanding of EwRM and what it means in their day-to-day work.

Strategy and structure

Our operating model links the strategy, culture, processes, people, leadership and systems of our organisation and outlines the key business processes we use to create value for our clients.

QTC’s organisational structure supports its operating model and achievement of the organisation’s strategies creating alignment throughout the organisation, linking appropriate staff expertise and accountabilities to the client value-creation process.

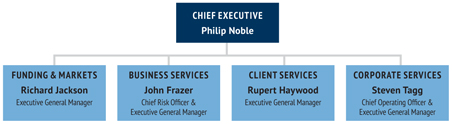

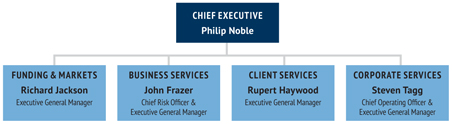

Management team

The responsibility for the day-to-day operation and administration of QTC is delegated by the Board to the Chief Executive and the executive team. The Chief Executive is appointed by the Board. Executives are appointed by the Chief Executive. As with the Board, all executive team appointments are made on the basis of qualifications, experience, skills, strategic ability, and commitment to contribute to QTC’s performance and achievement of its corporate objectives.

QTC’s Executive Management Team

| | |

| PHILIP NOBLE | | Chief Executive |

| STEVEN TAGG | | Chief Operating Officer |

| | Executive General Manager, Corporate Services |

| JOHN FRAZER | | Chief Risk Officer |

| | Executive General Manager, Business Services |

| RUPERT HAYWOOD | | Executive General Manager, Client Services |

| RICHARD JACKSON | | Executive General Manager, Funding and Markets |

| | |

| 16 | | QUEENSLAND TREASURY CORPORATION ANNUAL REPORT 2012–13 |

INVESTOR REPORT

AUDAX AT FIDELIS

QUEENSLAND TREASURY CORPORATION

CELEBRATING 25 YEARS EST. 1988

17

QTC has an intrinsic link with the State of Queensland as all of its debt securities’ and derivatives’ obligations are unconditionally guaranteed by the Treasurer of Queensland, on behalf of the State Government. Since 1988, QTC has funded the Queensland Government’s public sector capital works programs and remains an important part of Queensland’s economic growth story. QTC continues to maintain a high-quality asset portfolio of public sector loans and investments, with a loan portfolio covering almost 200 Government clients – all underpinned by Queensland’s AA+ credit rating.

QTC’S INVESTOR HIGHLIGHTS

Year in review: Meeting investor requirements

The newly elected Queensland Government postponed the annual release of the State Budget from June until September 2012 as it settled into its role of governing the State. Consequently, QTC also deferred the release of its annual borrowing program until September when it had already borrowed $3 billion in term debt, leaving $10.7 billion to raise before fiscal year end.

To complete its annual funding task QTC undertook a strategy of regular issuance of AUD benchmark bonds under its domestic bond program, which remains the cornerstone of its funding facilities. During 2012-13, QTC continued to build its domestic yield curve by issuing three new AUD benchmark bonds maturing in 2017, 2019 and 2023 respectively.

Each of these new Queensland Government-guaranteed bond lines was issued with US Rule 144A capability; meaning qualified institutional investors located in the United States were able to access the bonds at primary issuance (rather than having to wait the usual 40-day seasoning period). With each subsequent launch, we witnessed an increase in investor participation from the US as more investors became familiar with the program.

QTC remains committed to maintaining a diverse range of funding facilities so that it can offer investors a greater choice of debt securities, from long-term fixed rate bonds (public and private placements), to commercial paper denominated in a variety of currencies.

To better understand investors’ needs and to build strong partnerships in the markets, QTC is committed to engaging with investors and financial market intermediaries, both in Australia and globally. In July 2012, QTC travelled with Queensland’s newly elected Treasurer, The Hon. Tim Nicholls MP to meet with potential and existing investors in Tokyo, Beijing and New York. Providing regular comprehensive updates on Queensland’s economic and fiscal positions and QTC’s planned funding activities and annual borrowing requirements is one of QTC’s key funding principles.

A number of global institutional investors visited Queensland throughout the year to see first-hand the extensive capital works program being undertaken that will underpin the State’s future economic growth, currently forecast to accelerate to six per cent by 2015-16. In partnership with Fixed Income Distribution Group members (banks that act as intermediaries between investors and QTC), these visits also enable investors to learn more about the Australian fixed income market in general and QTC’s funding activities more specifically.

New AUD benchmark bond issues for 2012-13

QTC continued to build its domestic yield curve during the year by issuing three new AUD benchmark bonds raising a collective $3.4 billion. Investors are now offered a maturity option each calendar year out to 2024. All three bond lines have US Rule 144A capability.

| | | | | | | | | | | | | | | | |

Bond | | Maturity | | | Coupon | | | Date issued | | | Amount

(AUD) | |

Q2017 | | | 21 September 2017 | | | | 3.50 | % | | | 30 November 2012 | | | $ | 1 billion | |

Q2019 | | | 21 June 2019 | | | | 4.00 | % | | | 1 August 2012 | | | $ | 1.65 billion | |

Q2023 | | | 21 July 2023 | | | | 4.25 | % | | | 19 September 2012 | | | $ | 750 million | |

| | |

| 18 | | QUEENSLAND TREASURY CORPORATION ANNUAL REPORT 2012–13 |

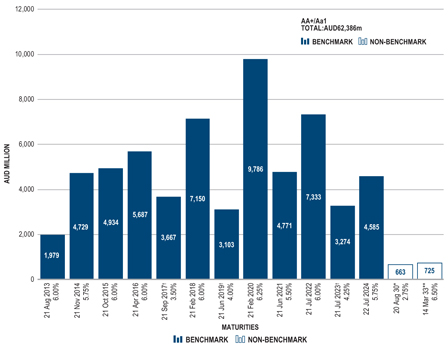

Credit ratings

Queensland/QTC maintained its AA+/Aa1 credit ratings from Standard & Poor’s and Moody’s Investors Service respectively. In November 2012, Moody’s Investors Service revised Queensland/QTC’s credit rating outlook from stable to negative.

QTC’S CREDIT RATINGS (AS AT 30 JUNE 2013)

| | | | | | | | | | | | |

| | | Long-term | | | Short-term | | | Outlook | |

LOCAL CURRENCY | | | | | | | | | | | | |

Moody’s | | | Aa1 | | | | P1 | | | | Negative | |

Standard & Poor’s | | | AA+ | | | | A-1+ | | | | Stable | |

FOREIGN CURRENCY | | | | | | | | | | | | |

Moody’s | | | Aa1 | | | | P1 | | | | Negative | |

Standard & Poor’s | | | AA+ | | | | A-1+ | | | | Stable | |

AUSTRALIAN GOVERNMENT GUARANTEED* | | | | | | | | | | | | |

Moody’s | | | Aaa | | | | N/A | | | | Stable | |

Standard & Poor’s | | | AAA | | | | N/A | | | | Stable | |

| * | Selected AUD denominated domestic and global benchmark bond lines issued by QTC are guaranteed by the Australian Government and carry a AAA/Aaa credit rating by Standard & Poor’s and Moody’s Investors Service respectively. |

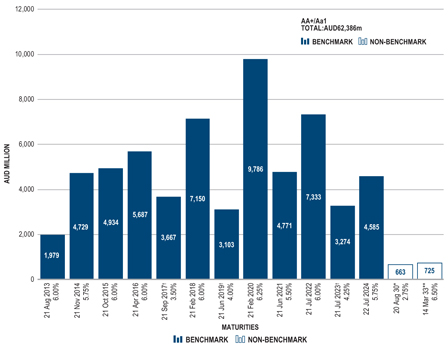

QTC AUD benchmark bonds#, outstandings by maturity, as at 30 June 2013

| # | Bonds maturing in 2030 and 2033 are non-benchmark |

| † | 2017, 2019 and 2023 have 144A capability |

| | |

| ANNUAL REPORT 2012–13 QUEENSLAND TREASURY CORPORATION | | 19 |

Strong global partnerships

DEDICATED DISTRIBUTION GROUP

QTC has dedicated dealer panels to ensure investors have choice and reliable access to trade in QTC’s debt securities.

QTC’s Fixed Income Distribution Group of 15 banks is committed to providing investors with two-way bond pricing in the secondary market, as well as supporting primary issuance activities.

QTC’s Fixed Income Distribution Group* includes:

| • | | ANZ Banking Group Limited |

| • | | Bank of America Merrill Lynch |

| • | | Commonwealth Bank of Australia |

| • | | National Australia Bank Limited |

| • | | Nomura International plc |

| • | | Westpac Banking Corporation |

| * | Actual dealer entities may vary depending on the facility and location of the dealer. See Appendix D for contact details. |

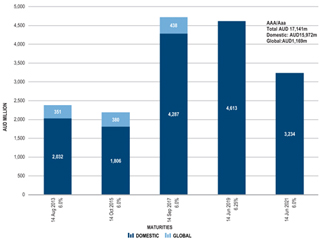

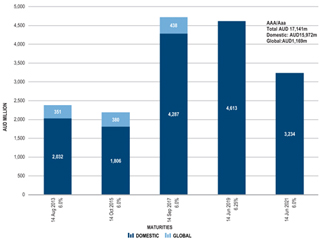

AUD Australian Government Guaranteed bonds

In 2009 QTC availed itself of a guarantee offered by the Australian Government as a result of the global economic and financial crisis. Over time, investors have switched most of these bonds into QTC AUD benchmark bonds. All remaining bonds under this guarantee will remain covered until maturity or retirement. These bonds are rated AAA/Aaa by Standard & Poor’s and Moody’s Investor Service respectively. The Guarantee was closed to new issuance after 31 December 2010.

Australian Government Guaranteed AUD bonds, outstandings by maturity, as at 30 June 2013

Access to funding

Overview of funding facilities as at 30 June 2013

| | | | | | | | | | | | |

Facility | | | | Size

(AUD M) | | Maturities | | Currencies | | On issue

(AUD M) | |

| | Domestic T-Note | | Unlimited | | 7-365 days | | AUD | | | 1,243 | |

Short-term | | Euro CP | | USD 10,000 | | 1-64 days | | Multi-currency | | | 2,004 | |

| | US CP | | USD 10,000 | | 1-270 days | | USD | | | 2,011 | |

| | | | | | 12 benchmark lines

2013-2024 | | AUD | | | 60,999 | |

| | AUD Bond | | Unlimited | | 5 AGG* lines

2013-2021 | | AUD | | | 15,972 | |

| | | | | | Preferred line 2033 | | AUD | | | 725 | |

| | | | | | Capital Indexed

Bond 2030# | | AUD | | | 663 | |

Long-term | | | | | | Floating Rate

Domestic Note

2014 | | AUD | | | 350 | |

| | Global AUD Bond | | AUD 20,000 | | 3 AGG* lines

2013-2017

(transferrable to

domestic bonds) | | AUD | | | 1,169 | |

| | Multi-currency Euro MTN | | USD 10,000 | | Any maturity

subject to market

regulations | | Multi-currency | | | 1,027 | |

| | Multi-currency US MTN | | USD 10,000 | | 9 months-30 years | | Multi-currency | | | 0 | |

| * | Australian Government Guarantee |

| | |

| 20 | | QUEENSLAND TREASURY CORPORATION ANNUAL REPORT 2012–13 |

Liquidity

| • | | QTC’s AUD benchmark bonds are its principal source of funding. |

| • | | QTC provides investors with a choice of 12 benchmark bonds, ranging in maturity from 2013 to 2024. |

| • | | Issuance is executed on a tap, tender, reverse enquiry, and/or syndication basis, depending on market conditions. |

| • | | As the largest sub-sovereign issuer in Australia, QTC has significant depth in the Australian fixed income market. |

Funding strategy

QTC has a diverse range of funding facilities in a variety of markets and currencies. The majority of QTC’s funding is sourced through long-term debt facilities, with QTC’s AUD benchmark bonds being the principal source of funding. QTC continues to issue into existing benchmark bond lines using a variety of methods. Funding is undertaken to meet clients’ borrowing requirements.

Future funding requirements

Following the release of Queensland’s 2013-14 State Budget on 4 June 2013, QTC estimated its total 2013-14 borrowing program to be $12.1 billion, which is $2 billion lower than the previous forecast in January 2013.

The decrease in QTC’s borrowing requirement next year, and over the forward estimates, reflects the Queensland Government’s commitment to fiscal repair, which includes reducing expenditure and stabilising the State’s level of debt, with a fiscal surplus forecast in the General Government sector by 2015-16.

With a total term debt requirement of $7.1 billion, QTC expects to fund the balance of its program through short-term debt issuance.

QTC’s 2013 – 14 Indicative Borrowing Program

| | | | |

Requirements | | AUD M* | |

New money | | | | |

State (includes General Government and Government owned corporations) | | | 8,500 | |

Local Government and other entities# | | | 1,000 | |

Total new money | | | 9,500 | |

Net term debt refinancing | | | 4,400 | |

Pre-funding | | | (6,800 | ) |

Total term debt requirement | | | 7,100 | |

| * | Numbers are rounded to the nearest $100 million. |

| # | Other entities include: retail water entities, universities, grammar schools and water boards. |

Note: Funding activity may vary depending upon actual client requirements, the State’s fiscal position and financial market conditions.

| | |

| ANNUAL REPORT 2011–12 QUEENSLAND TREASURY CORPORATION | | 21 |

Funding principles

CONSERVATIVE: Balanced debt maturity profile supported by liquid reserves

PRUDENT: Disciplined approach to financial risk management

TRANSPARENT: Comprehensive, regular market updates

COMMITTED: Valued long-term investor and intermediary relationships

Australian Government fiscal support

Australia is one of only eight countries currently rated AAA with a stable outlook from all three major credit rating agencies.

The Australian Government provides explicit financial support to all Australian states and territories in the form of:

| • | | the payment of grants under the principle of the Horizontal Fiscal Equalisation scheme, which seeks to reduce the revenue-raising and cost disparities between the Australian states and territories |

| • | | National Disaster Relief and Recovery Arrangements, which provides reimbursement for eligible costs for natural disasters, and |

| • | | the offer of a time-limited, voluntary guarantee over Australian state and territory borrowings from July 2009 to December 2010. |

Information for institutional investors

Core to its key funding principles, QTC is committed to being open and transparent with investors and its partners in the financial markets.

Through its website, QTC provides a range of information for investors on its various funding facilities and annual borrowing program. The website also hosts an analyst centre with information and links about Australia and Queensland to help investors gain a better understanding of:

| • | | the different levels of government in Australia |

| • | | the forms of fiscal support the Australian Government provides to the states and territories |

| • | | relevant governance practices, legislation and polices |

| • | | financial data and budget information, and |

| • | | economic and trade data. |

Understanding that many investors now use iPads as part of their daily business, a digital version of QTC’s investor booklet is available for iPad users from the iTunes store.

QTC also offers investor the ability to subscribe to quarterly funding updates in English, Japanese, as well as Modern and Traditional Chinese.

Quarterly investor updates: Email investorupdate@qtc.com.au to subscribe

Website: www.qtc.qld.gov.au/qtc/public/web/investors

Analyst centre: www.qtc.qld.gov.au/qtc/public/web/investors/analystcentre

Invest in QTC for iPad users: https://itunes.apple.com/au/app/queensland-treasury-corporation/id539372974?mt=8&uo=4

Bloomberg ticker: qtc Reuters: qtc1

Note: Investors with a US-based iTunes account do not have access to the Invest in QTC iPad application.

| | |

| 22 | | QUEENSLAND TREASURY CORPORATION ANNUAL REPORT 2012–13 |

FINANCIAL STATEMENTS

FOR THE YEAR ENDED 30 JUNE 2013

CONTENTS

Statement of comprehensive income 24

Balance sheet 25

Statement of changes in equity 26

Statement of cash flows 27

Notes to and forming part of the Financial Statements 28

Certificate of the Queensland Treasury Corporation 58

Independent auditor’s report 59

Management report 61

AUDAX AT FIDELIS

QUEENSLAND TREASURY CORPORATION

CELEBRATING 25 YEARS EST. 1988

23

Statement of comprehensive income

For the year ended 30 June 2013

| | | | | | | | | | | | |

| | | NOTE | | | 2013

$000 | | | 2012

$000 | |

| | | |

CAPITAL MARKETS OPERATIONS | | | | | | | | | | | | |

Net interest income | | | | | | | | | | | | |

Interest income | | | 4 | | | | 3 529 909 | | | | 9 427 424 | |

Interest expense | | | 4 | | | | (3 326 556 | ) | | | (9 383 618 | ) |

| | | | | | | | | | | | |

| | | | | | | 203 353 | | | | 43 806 | |

| | | | | | | | | | | | |

| | | |

Other income | | | | | | | | | | | | |

Fees | | | 6 | | | | 69 112 | | | | 58 514 | |

Lease income | | | | | | | 48 321 | | | | 42 281 | |

Amortisation of cross border lease deferred income | | | | | | | 6 438 | | | | 6 438 | |

| | | | | | | | | | | | |

| | | | | | | 123 871 | | | | 107 233 | |

| | | | | | | | | | | | |

| | | |

Expenses | | | | | | | | | | | | |

Administration expenses | | | 7 | | | | (57 159 | ) | | | (68 674 | ) |

Depreciation on leased assets | | | | | | | (31 808 | ) | | | (27 911 | ) |

Loss on sale of property, plant and equipment | | | | | | | (9 | ) | | | — | |

Other expenses | | | | | | | 26 | | | | 20 | |

| | | | | | | | | | | | |

| | | | | | | (88 950 | ) | | | (96 565 | ) |

| | | | | | | | | | | | |

Share of associate’s net profit | | | | | | | 521 | | | | 491 | |

| | | | | | | | | | | | |

Profit from capital markets operations before income tax | | | | | | | 238 795 | | | | 54 965 | |

| | | | | | | | | | | | |

Income tax expense | | | 8 | | | | (15 911 | ) | | | (8 056 | ) |

| | | | | | | | | | | | |

Profit from capital markets operations after income tax | | | | | | | 222 884 | | | | 46 909 | |

| | | | | | | | | | | | |

| | | |

LONG TERM ASSETS | | | | | | | | | | | | |

Net return from investments in long term assets | | | | | | | | | | | | |

Net change in fair value of unit trusts | | | 5 | | | | 3 370 042 | | | | 2 556 924 | |

Interest on fixed rate notes | | | | | | | (2 302 032 | ) | | | (2 285 211 | ) |

Management fees | | | | | | | (77 662 | ) | | | (84 484 | ) |

| | | | | | | | | | | | |

Profit from long term assets | | | | | | | 990 348 | | | | 187 229 | |

| | | | | | | | | | | | |

Total net profit for the year after tax | | | | | | | 1 213 232 | | | | 234 138 | |

| | | | | | | | | | | | |

Total comprehensive income attributable to the owner | | | | | | | 1 213 232 | | | | 234 138 | |

| | | | | | | | | | | | |

| | | |

Total comprehensive income derived from: | | | | | | | | | | | | |

Capital markets operations | | | 3 | | | | 222 884 | | | | 46 909 | |

Long term assets | | | 3 | | | | 990 348 | | | | 187 229 | |

| | | | | | | | | | | | |

Total comprehensive income | | | | | | | 1 213 232 | | | | 234 138 | |

| | | | | | | | | | | | |

The notes on pages 28 to 57 are an integral part of these financial statements.

Note: Throughout these financial statements the capital markets operations and the long term assets operations have been disclosed separately to distinguish between QTC’s main central treasury management role and its additional responsibilities following the transfer of the State’s superannuation and other long-term assets (refer notes 1 and 3).

| | |

| 24 | | QUEENSLAND TREASURY CORPORATION ANNUAL REPORT 2012–13 |

Balance sheet

As at 30 June 2013

| | | | | | | | | | | | |

| | | NOTE | | | 2013

$000 | | | 2012

$000 | |

| | | |

ASSETS | | | | | | | | | | | | |

Capital markets operations | | | | | | | | | | | | |

Cash | | | | | | | 197 | | | | 743 | |

Receivables | | | 9 | | | | 3 568 | | | | 9 022 | |

Financial assets at fair value through profit or loss | | | 10 | | | | 20 194 045 | | | | 17 126 850 | |

Derivative financial assets | | | 11 | | | | 788 461 | | | | 475 056 | |

Onlendings | | | 12 | | | | 79 118 832 | | | | 72 289 635 | |

Property, plant and equipment | | | 13 | | | | 322 697 | | | | 286 131 | |

Investments accounted for using the equity method | | | 30 | | | | 1 407 | | | | 1 377 | |

Intangible assets | | | 14 | | | | 4 147 | | | | 5 110 | |

Deferred tax asset | | | 8 | | | | 2 132 | | | | 2 438 | |

| | | | | | | | | | | | |

| | | | | | | 100 435 486 | | | | 90 196 362 | |

| | | | | | | | | | | | |

Long term assets | | | | | | | | | | | | |

| | | | | | | | | | | | |

Financial assets at fair value through profit or loss | | | 10 | | | | 29 767 721 | | | | 29 182 448 | |

| | | | | | | | | | | | |

| | | | | | | 29 767 721 | | | | 29 182 448 | |

| | | | | | | | | | | | |

Total Assets | | | | | | | 130 203 207 | | | | 119 378 810 | |

| | | | | | | | | | | | |

| | | |

LIABILITIES | | | | | | | | | | | | |

Capital markets operations | | | | | | | | | | | | |

Payables | | | 15 | | | | 138 809 | | | | 106 020 | |

Tax liabilities | | | 8 | | | | 15 635 | | | | 8 619 | |

Derivative financial liabilities | | | 16 | | | | 167 726 | | | | 247 589 | |

Financial liabilities at fair value through profit or loss | | | | | | | | | | | | |

– Interest bearing liabilities | | | 17 | | | | 93 274 588 | | | | 84 268 842 | |

– Client deposits | | | 17 | | | | 6 127 695 | | | | 5 077 143 | |

| | | | | | | | | | | | |

| | | | | | | 99 724 453 | | | | 89 708 213 | |

| | | | | | | | | | | | |