EXHIBIT (c)(iii)

Budget Papers of the Co-Registrant for 2013-14

State Budget 2013-14

Budget Speech

Budget Paper No. 1

AUDAX AT FIDELIS

Great state. Great opportunity.

AUDAX AT FIDELIS

Queensland Government

2013-14 State Budget Papers

| 2. | Budget Strategy and Outlook |

| 5. | Service Delivery Statements |

Appropriation Bills

Concessions Statement

The suite of Budget Papers is similar to that published in 2012-13.

The Budget Papers are available online at www.budget.qld.gov.au

© Crown copyright

All rights reserved

Queensland Government 2013

Excerpts from this publication may be reproduced, with appropriate acknowledgement, as permitted under the Copyright Act.

Budget Speech

Budget Paper No.1

ISSN 1445-4890 (Print)

ISSN 1445-4904 (Online)

APPROPRIATION BILL 2013

(First Reading Speech, 4 June 2013)

TREASURER

The Honourable Tim Nicholls MP

Treasurer and Minister for Trade

APPROPRIATION BILL 2013

(First Reading Speech, 4 June 2013)

TREASURER

The Honourable Tim Nicholls MP

Treasurer and Minister for Trade

Madam Speaker

I move that the Bill be now read a first time.

INTRODUCTION

In March 2012, the Queensland people voted overwhelmingly for change. They voted to break the cycle of waste and mismanagement, together with the debt and deficits that were the hallmark, indeed the habit, of the former Government.

Queensland had lost its way, surrounded by a fog of deficits and beset by a storm of debt, imperilling our future prosperity and future opportunities.

Madam Speaker, on the 11th of September last year I stood in this place and delivered the most important Budget in a generation.

That Budget charted the journey back to financial responsibility. It set out the way points to get Queensland’s finances back on track and back in the black. That Budget was to see us landing at a fiscal surplus in 2014-15. And at the time I said:

“Maintaining that balance, in the absence of extraordinary events, will complete the first stage in repairing Queensland’s finances”.

We are well on our way on that journey now, but we have run into extraordinary events. And our journey back to a fiscal surplus will be, perhaps, longer than we first planned and hoped for.

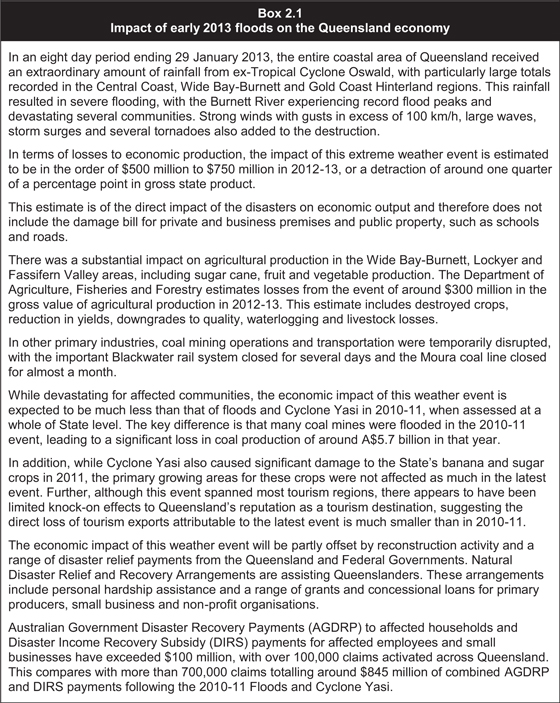

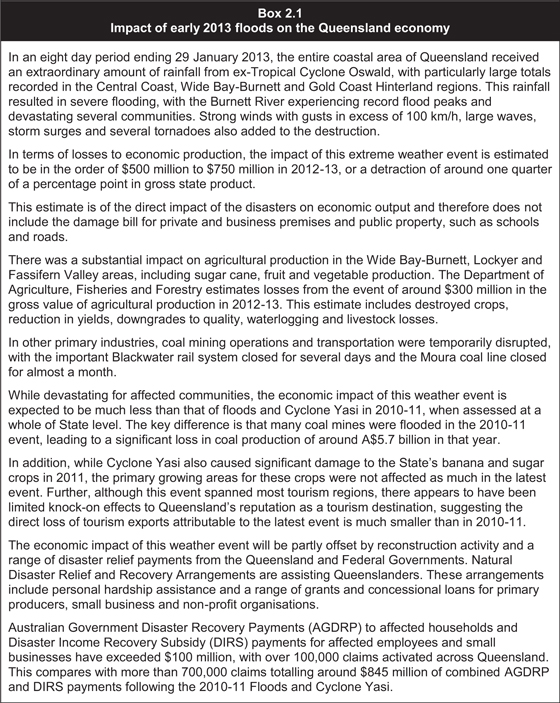

We know now with some accuracy that we were blown off course by ex-Tropical Cyclone Oswald and the summer of natural disasters to the extent of $2.5 billion in damage and between $500 million and $750 million in lost economic production.

More broadly, we have also been beset with falling revenues, as has much of Australia. And like the albatross around the neck of Coleridge’s Ancient Mariner, we still have the burden of Labor’s debt and the loss of the triple A credit rating.

While we meet this afternoon in the shadow of the natural disasters and a battered world economy, it is not the time to lament these misfortunes; it is time to pay the bill. We knew that this would be a long, sometimes treacherous journey but, Madam Speaker, if it was easy those opposite would have done it. That they failed to do so shows the magnitude of the task. But we

1

would be letting Queenslanders down if we didn’t continue with the journey and see it through to safe harbour.

In many respects this journey has become harder since last year’s Budget. This year’s Budget has again been framed in a challenging external environment. The revenue environment is weak and Queenslanders have again had to deal with the devastation of natural disasters.

The national economy is trying to manage the transition from an unprecedented peak in mining investment back to consumption in the broader economy on a more normal basis. It is a fine balancing act and confidence is the key.

Last year I concluded my first Budget speech around the theme that “confidence is everything”. That is as true today as it was then. The Queensland Government will do its part in building confidence by being unashamedly pro-growth. We will make Queensland the best place to invest and do business in the country.

Last year we took the steps necessary to improve our finances. I said that my hope was that no Queensland Government would need to undertake a repair task of such magnitude again. It would be disrespectful to Queenslanders if we simply threw those gains away. This Budget locks in those gains. It makes good on our promise to deliver frontline services. It is not a frivolous or fanciful Budget. It does the hard yards up the middle that Queenslanders need to get their State’s finances sorted out.

The Government will continue to be upfront about the challenges we face and take the community with us on the choices we need to make. The one thing we won’t do is kick the can down the road for our children to solve our problems.

But in 2013-14, our focus rightly turns to growth, rebuilding and the resilience of people and communities.

THE ECONOMY – GROWTH

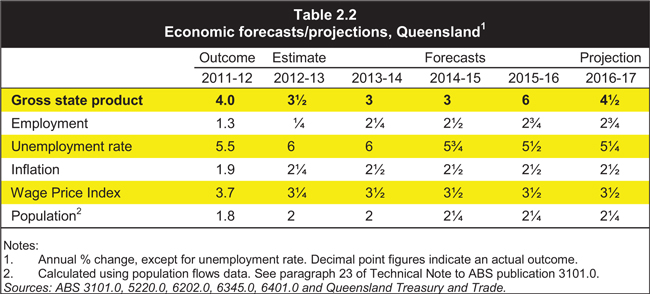

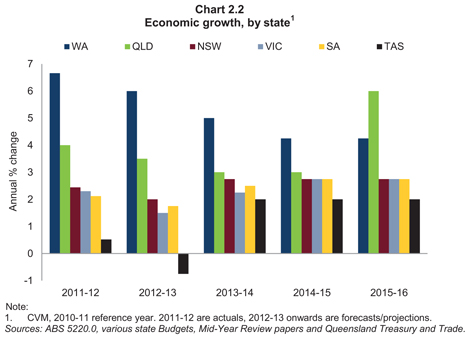

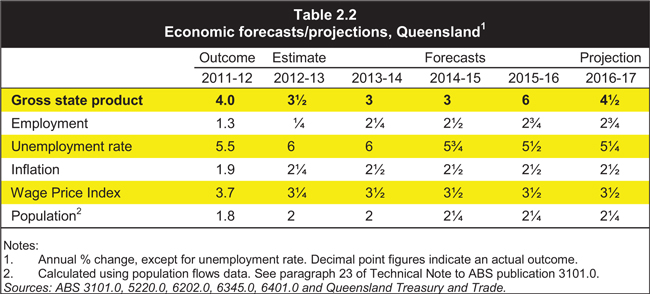

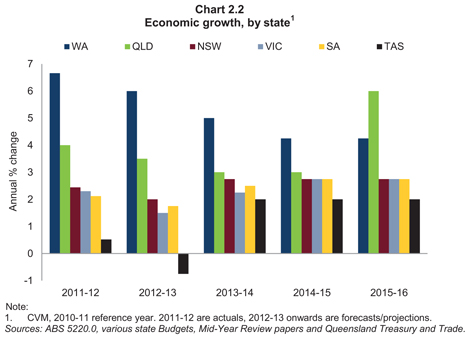

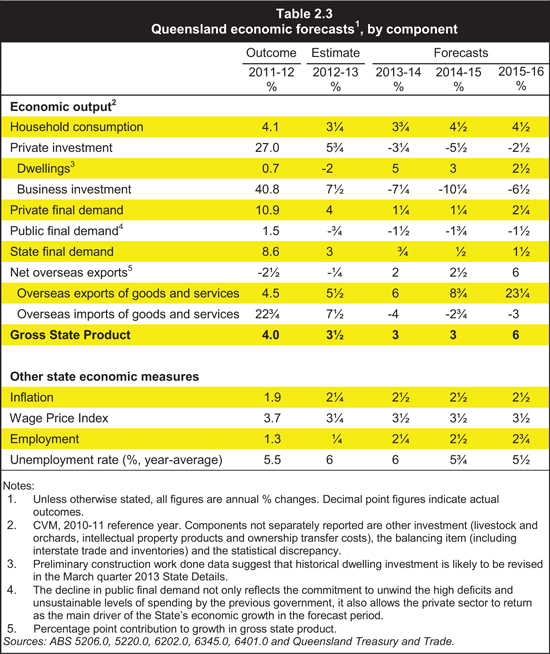

Madam Speaker, the Queensland economy grew strongly in 2011-12, recording growth of 4 per cent.

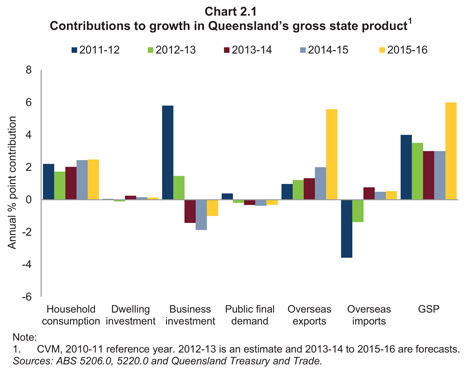

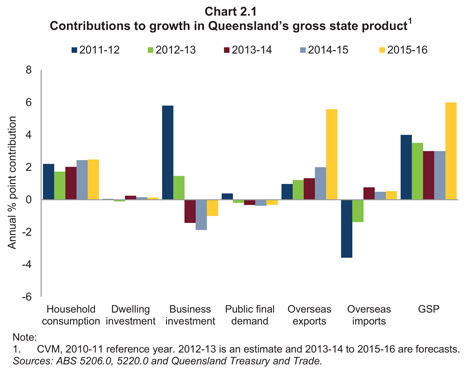

In 2012-13, spending by businesses and households is expected to contribute less to growth, as mining investment approaches its peak and the impact of the 2011-12 one-off boosts to consumption pass.

Despite these changes, a strengthening in exports will see overall economic growth ease only slightly in 2012-13, to 3.5 per cent.

Economic growth in Queensland’s major trading partners in 2013 is estimated to be 2.75 per cent, similar to that recorded in 2012. Growth is anticipated to strengthen to 3.25 per cent from 2014 onwards, with non-Japan Asia continuing to be the main driver of growth. However, these rates remain below the annual average of 3.7 per cent in the decade to 2007 immediately preceding the global financial crisis.

2

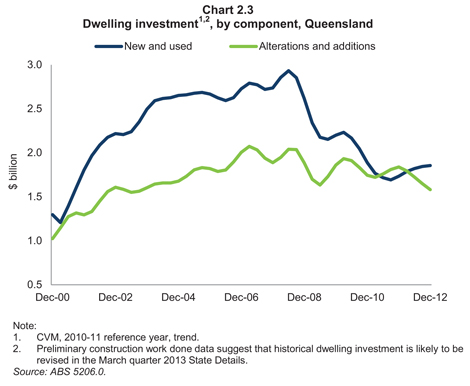

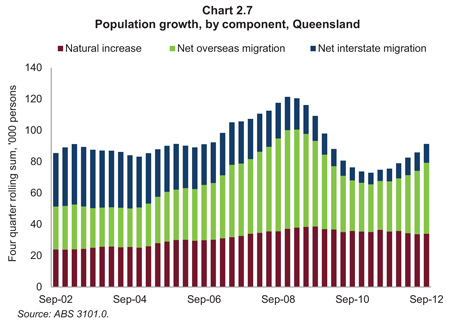

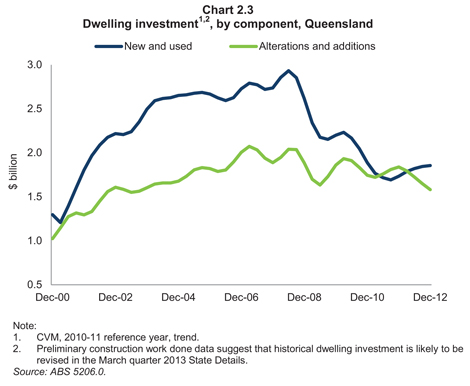

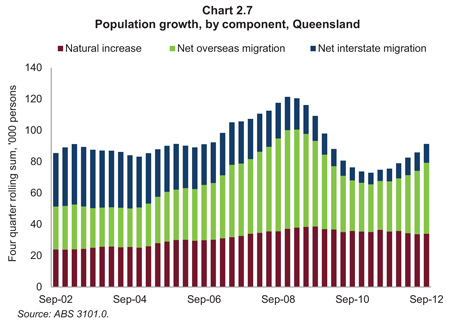

Looking ahead in Queensland, sustained low interest rates and stronger population growth are expected to strengthen spending by the household sector.

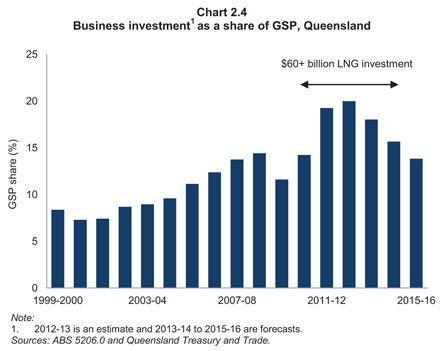

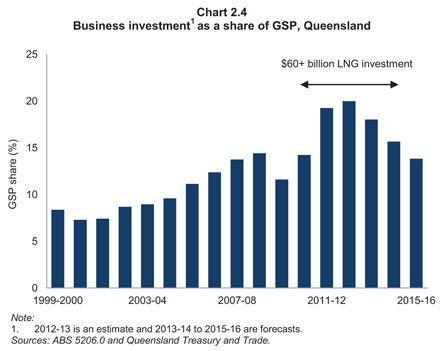

The pending completion of $60 billion in LNG projects will see business investment fall from its historic highs each year from 2013-14 to 2015-16. Business investment will continue to feature prominently, but not in the way it has in the previous decade.

This Budget forecasts economic growth of 3 per cent in 2013-14. This places Queensland with a State growth rate second only to WA and above the national growth rate of 2.75 per cent. Over the forward estimates economic growth is predicted to average over 4 per cent.

The ramp up in LNG production by 2015-16 will lead to growth in overseas exports of 23 per cent in 2015-16 which, combined with a stronger domestic sector, will boost economic growth to 6 per cent in that year. While these figures underpin our confidence for the future we need to recognise they are the product of the export of gas. We need to continue our work to strengthen and grow the other pillars of the economy that employ so many Queenslanders.

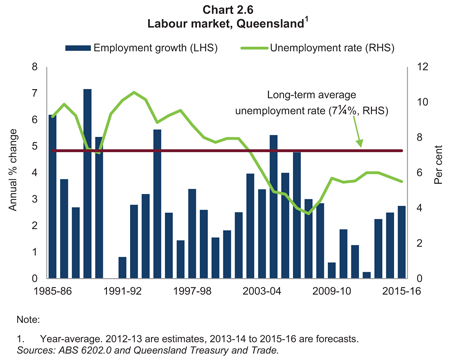

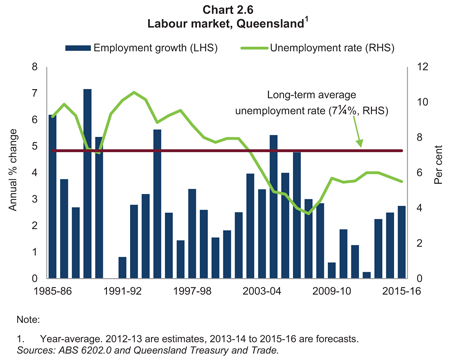

In this Budget, we see a strengthening household sector and increasing exports which will support a recovery in employment growth from 2013-14 onwards and a steady improvement in the unemployment rate, from 6 per cent in 2013-14 down to 5.5 per cent in 2015-16.

Employment growth is forecast to rise to 2.75 per cent per year by 2015-16.

The Queensland economy remains strong and is growing.

2013 NATURAL DISASTERS – REBUILDING

Madam Speaker, early this year, Queenslanders were once again cruelly confronted with the hardship and challenge of natural disasters.

Ex-Tropical Cyclone Oswald and the flooding that followed brought destruction to 57 Queensland local government areas from January to March 2013. Many of these same areas were just recovering from the loss and damage brought by the natural disasters of 2010 to 2012.

There was a substantial impact on agricultural production in the Wide Bay-Burnett, Lockyer and Fassifern Valley areas, including sugar cane, fruit and vegetable production.

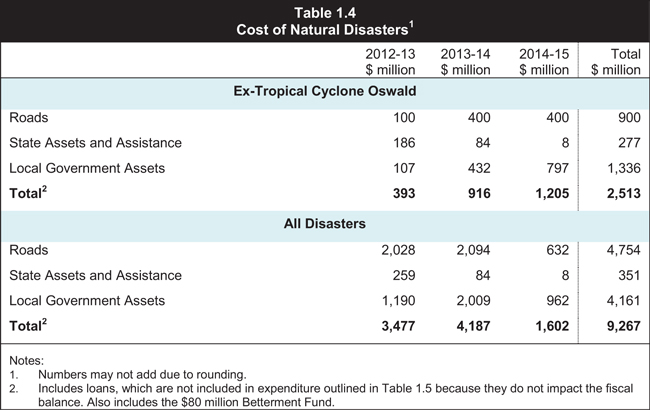

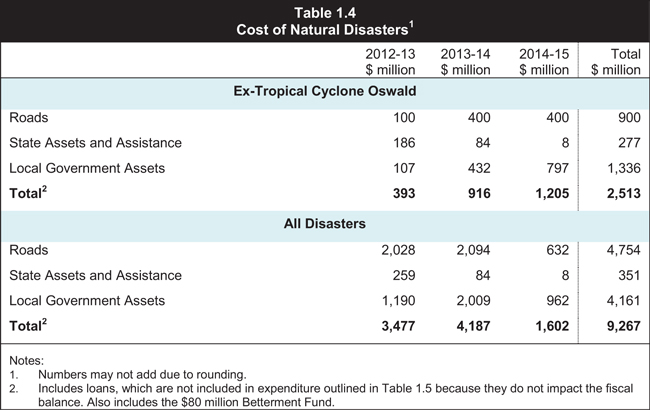

The Queensland Reconstruction Authority estimates the cost of the disaster to be $2.5 billion, of which the State’s contribution is in excess of $620 million.

The size and scale of the 2013 disaster is often misunderstood because it did not feature as prominently as earlier disasters but its scale and reach was equally as devastating to those affected. In fact, in terms of cost it was second only to the December 2010 and January 2011 disasters.

Over 2,000 residents were evacuated in the Bundaberg region, over 4,300 properties damaged, 750 businesses affected across the State, 390,000 homes and businesses left without power, 22 per cent of State controlled roads affected and 3,100 kilometres of the State rail network damaged.

3

The additional cost of repairs comes on top of the cost of other recent significant natural disasters. This Budget allocates total disaster spending over the three years from 2012-13 to 2014-15 of $9.3 billion.

The total cost of natural disasters since 2010 now stands at over $13.8 billion. This represents enough funds to have built two cross river rail projects and a second range crossing for Toowoomba or $3,010 per man, woman and child.

RESILIENCE

Madam Speaker, this Budget provides funding of $40 million, matched equally by the Australian Government, towards a Betterment Fund.

The Newman Government stood ready to make a contribution of $100 million to a Betterment Fund but the Australian Government was unwilling to match the funding. A fund with $200 million in it would have made a real dent in the backlog of betterment projects that local governments have put forward. But it was not to be.

There are obviously sound economic and public finance reasons to advocate for a new approach to disaster funding - we are about to repair some infrastructure for the second and third time in ten years.

Let’s take just one example. In 2011, the Gayndah water intake plant on the banks of the Burnett River was damaged. The intake is the only source of water for the town. At a cost of $1.22 million the water intake was repaired in its original place, to its original standard and specification. No flood proofing occurred. Along came the January 2013 floods and again, the Gayndah water intake plant, only a year old was severely damaged.

It is said that the definition of insanity is to keep doing the same thing but expect a different result. That was the Labor way.

This time it will be different, in partnership with the North Burnett Regional Council a new pumping station and intake will be built upstream at the Claude Wharton Weir, at a slightly greater cost, but a cost that is an investment in the future. It’s a smart investment.

Betterment makes sense, it is better that the town gets clean drinking water and it is better that both the State and Australian Governments don’t have to rebuild the same infrastructure twice.

This Budget puts a down payment on resilience, but it is unfinished business for the Newman Government and the Queensland community. It is the discussion we need to have and will continue to have over coming years.

DEBT

Madam Speaker, with fiscal deficits since 2006-07 totalling $45.3 billion, no one can deny that we inherited a debt and deficit problem from Labor.

The Budget sees that Labor debt in the General Government sector rising by $9.4 billion over the forward estimates but, importantly stabilising in 2015-16. From 2013-14 onwards debt in the General Government sector rises by only $800 million, as we rein it in.

4

Gross debt will reach $80.1 billion in 2014-15. This compares to Labor’s last projection of $85.4 billion, which the Commission of Audit found to be unrealistic. We have stopped the rot.

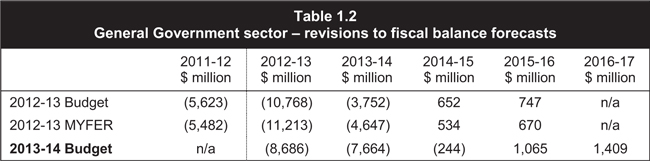

The General Government fiscal balance is estimated to be a deficit of $8.7 billion in 2012-13, compared to a forecast deficit of $11.2 billion in the 2012-13 MYFER.

The improvement in the forecast 2012-13 fiscal balance since the 2012-13 MYFER primarily reflects a government that can keep a tight rein on expenses, as well as a result of changes in the timing of disaster expenditure.

A fiscal deficit of $7.7 billion is budgeted for 2013-14, compared to a forecast of $4.6 billion in the 2012-13 MYFER. This largely reflects the incorporation of extra costs associated with recent flooding, a change in timing of Australian Government disaster recovery funding as a result of the changed expenditure profile, and lower royalty revenue.

As I have said consistently since becoming Treasurer, there is no magic pudding. Government must strive to live within its means, not simply because it’s a good thing to do, but to ensure we have the funds available to invest, create jobs and grow the Queensland economy.

The reality is Labor’s deficits are now catching up with us. They are restricting our ability to act.

Madam Speaker, in 2005, before the great debt binge began in earnest, a Queensland teenager leaving high school and commencing their adult life would have done so with a State debt burden of a modest $3,900. A student in Grade 9 this year, who will be leaving school at the end of 2016 - the point at which we finally stabilise the debt, will commence his or her adult life with a State debt burden of $16,000. That is Labor’s legacy.

In 2012-13 the interest payments on debt in the Government sector will rise by over 23 per cent. This robs the Budget of over $2.1 billion, which could have been spent on service delivery and infrastructure.

So we have to be smarter about delivering infrastructure because Labor has maxed out the credit card. We will continue to drive partnerships with the private and non-government sectors to use the limited funds that we do have to invest in new infrastructure and revitalise services, because the people of Queensland deserve better from their leaders than decades of debt.

Strong expenditure control means the forecast level of borrowings at 30 June 2015 is expected to be $6.2 billion lower than the comparable estimate in the Independent Commission of Audit’s Interim Report and $5.2 billion lower than final forecast by the previous Government in the 2011-12 MYFER. We are saving $750 million in interest. That’s money we can use to deliver services.

We have brought the previous Government’s debt spiral under control as we said we would before the election.

REVENUE & SAVINGS

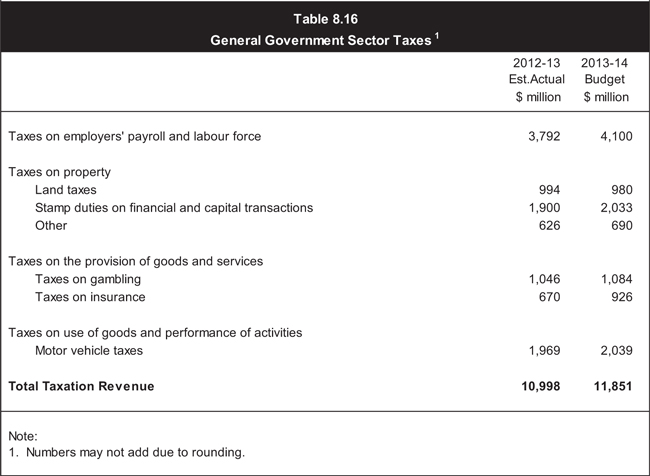

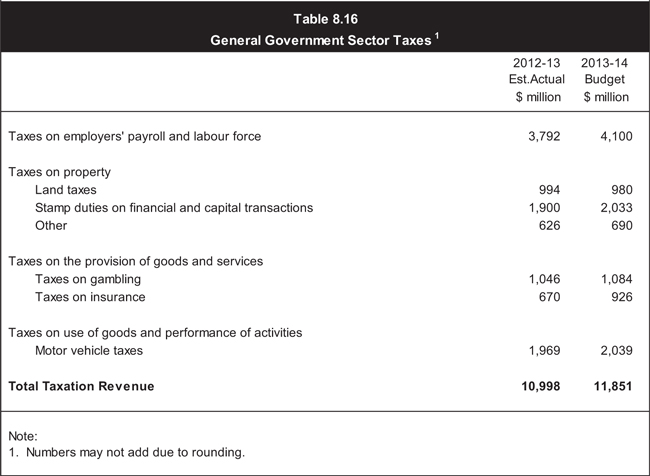

Forecasts of key own source revenues such as taxation, GST and mining royalties have fallen by $5.3 billion since we were elected in March 2012 and $2.6 billion since the 2012-13 MYFER.

5

To illustrate, land tax is down 6.4 per cent in Queensland - the first time a fall has been recorded since 1996-97. Gaming revenue from casinos has also fallen by 2.8 per cent since the last Budget.

This downturn also reflects the ongoing weakness of export coal prices, downward reductions in the GST pool distributed by the Australian Government and the impact of the slower than anticipated property market recovery on transfer duty and land tax.

If collected, the $5.3 billion in revenue would have negated the need for any tax increases. The Government would have had the funds to expand infrastructure and deliver new services.

We may lament this loss of revenue, but that won’t fix the problem. We have to toe the line and find ways to fix it. As the Premier often says “find the solution, don’t fight the problem!”.

Given the loss of revenue, the rebuilding task and the need to fund new services the Government has made the balanced and responsible decision to delay reaching a fiscal surplus in 2014-15. Instead we forecast a small fiscal deficit of $244 million that year and project a fiscal surplus of over $1 billion a year later in 2015-16. This is our best prediction but Madam Speaker I haven’t, this Government hasn’t, given up on reaching a fiscal balance sooner if we can.

In practical terms, the 2014-15 Budget result will depend heavily on the timing of payments from the Australian Government for its share of natural disaster costs.

The delay in reaching a fiscal surplus means that the Government will not have to raise taxes or cut spending by as much as it would have otherwise had to do.

The State Government has only a small range of taxation measures at its disposal. These are usually inefficient and are unpopular at the best of times, but when revenue falls, expenditures increase and debt is your problem, there is only one option.

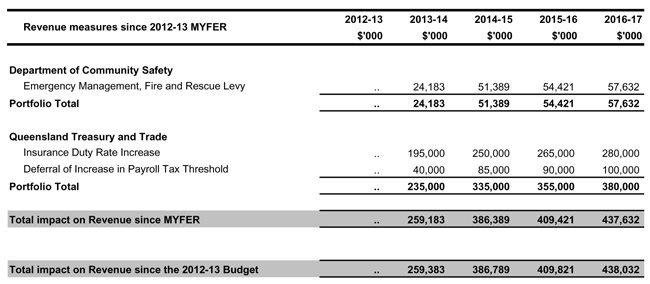

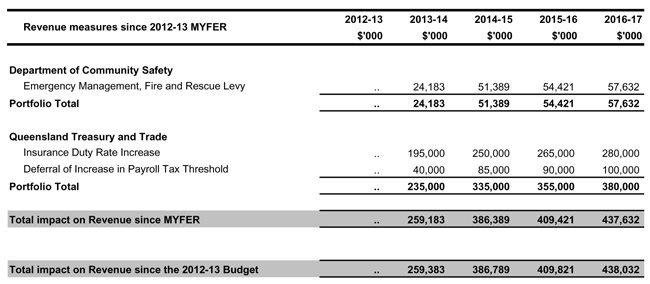

In this Budget we implement a small number of measures to help deal with the loss of revenue.

Remedial measures will improve the budget on average by $450 million per annum.

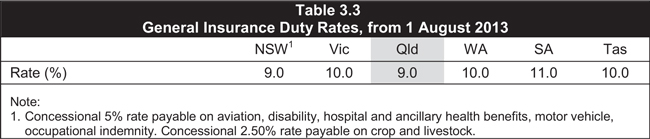

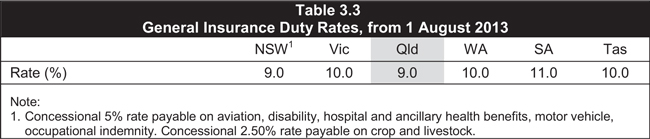

The rate of duty applicable to insurance premiums for general insurance products will increase to 9 per cent from 1 August 2013. There will be no increase in the duty rate applicable to workers’ compensation insurance premiums or Compulsory Third Party motor vehicle insurance premiums. Queensland’s insurance duty regime will, along with New South Wales, remain competitive with other States.

This measure will assist in meeting part of the State’s contribution to the implementation of the National Disability Insurance Scheme, known as DisabilityCare Australia.

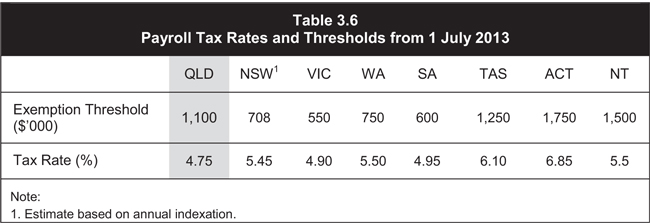

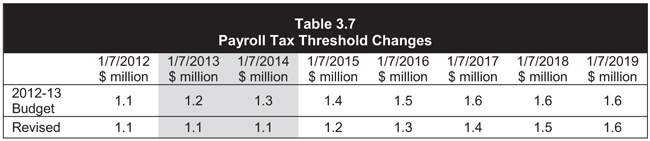

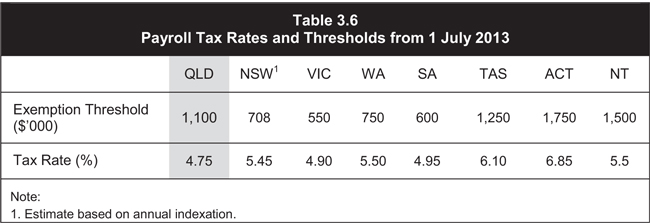

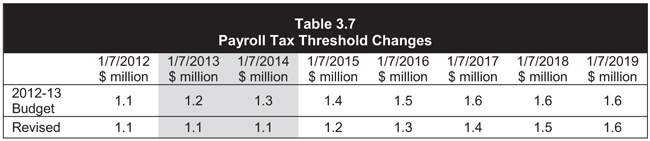

Queensland has a highly competitive payroll tax regime, with the lowest rate of payroll tax in Australia and the highest threshold of any mainland State. The Government has committed to further enhancing Queensland’s competitiveness by increasing the payroll tax threshold to $1.6 million. The next increase in the payroll tax threshold, to $1.2 million, which had been intended to take effect from 1 July 2013, will now be deferred until 1 July 2015.

6

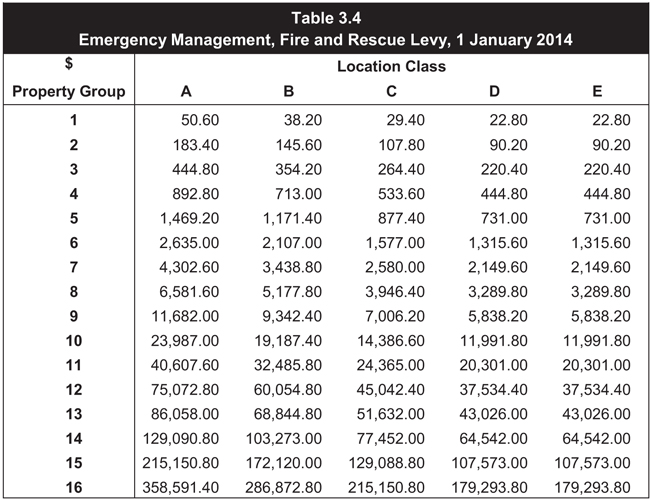

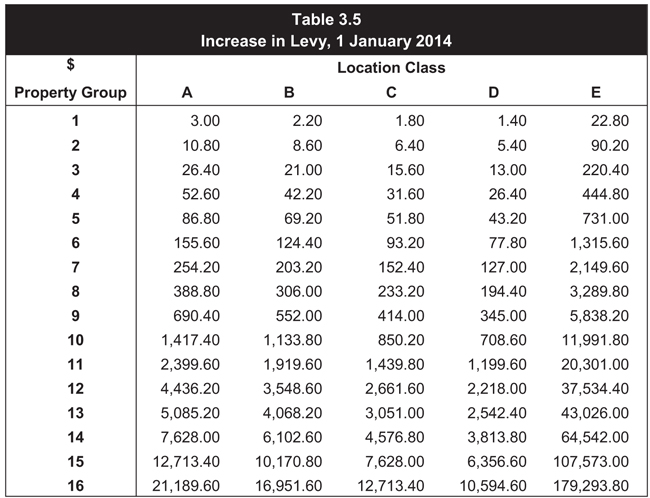

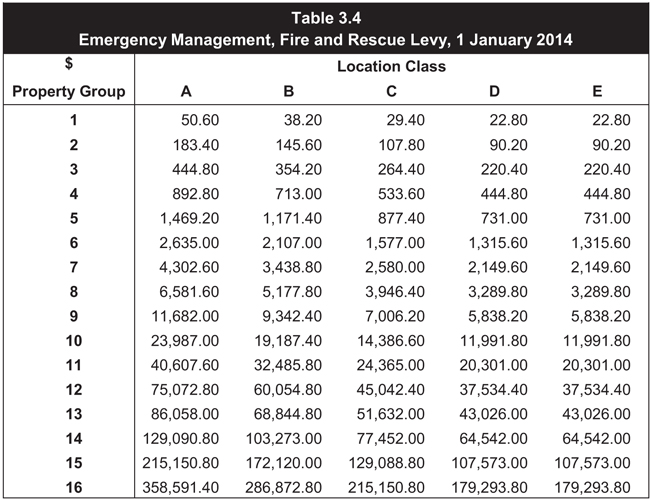

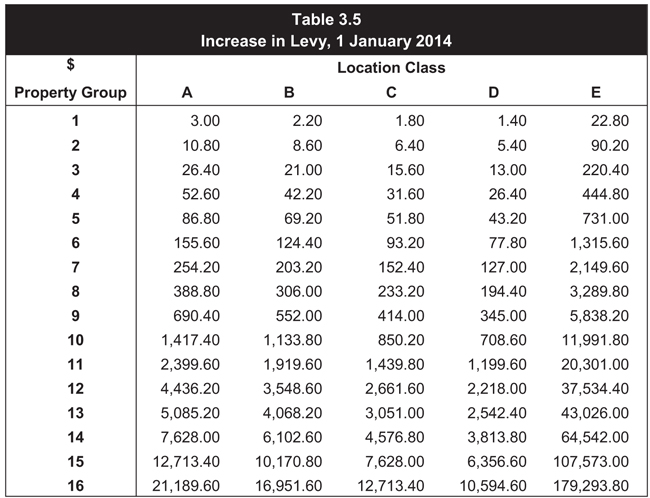

The Government will break with the past and recast the Urban Fire Levy first introduced in 1984. Currently, the cost of supplying Emergency Management, Fire and Rescue Services across Queensland is $587.3 million. The current levy raises $346.9 million, leaving a shortfall of $240.4 million.

From 1 January the renamed Emergency Management, Fire and Rescue Levy will be extended to all properties receiving a rates notice. It is appropriate that as all Queenslanders potentially benefit from the work of emergency management services across Queensland, whether it’s a helicopter rescue, water bombing, disaster co-ordination or swift water rescues they make a contribution to those services. The Levy will also rise by 6.5 per cent from 1 January 2014. The lowest category of the existing Levy, Class D, will apply to those areas in Queensland who are currently not making a contribution.

In 2013-14 the Levy will fund approximately 60 per cent of the operational costs of these services. More importantly, it will provide a more sustainable funding base for services into the future.

The Government will await the recommendations of the Keelty Review and detailed consideration of the review undertaken by the Member for Mirani before making any further changes to emergency services and related matters, as outlined in the Government’s response to the final Independent Commission of Audit report.

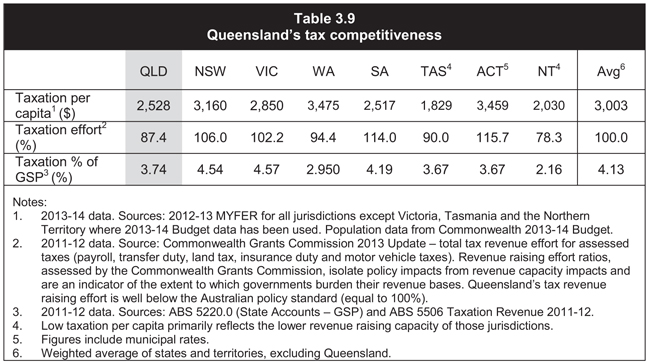

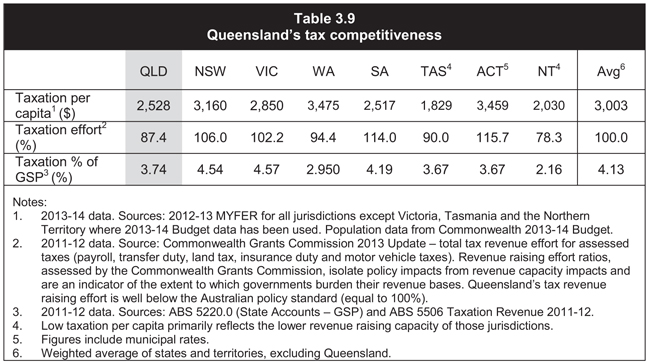

As a result of these balanced changes Queensland will retain its competitive tax status, with per capita state tax estimated at $2,528 in 2013-14, compared to an average of $3,003 for the other states and territories. A saving of $475 per capita.

EXPENSES

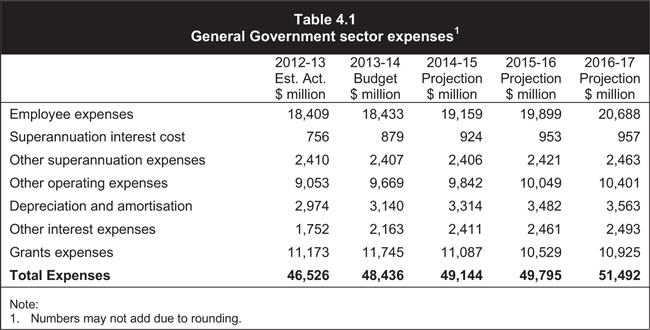

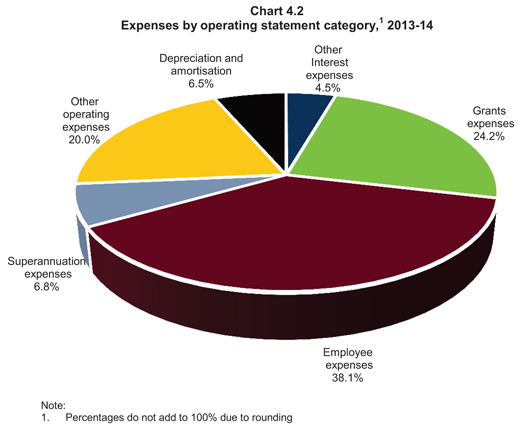

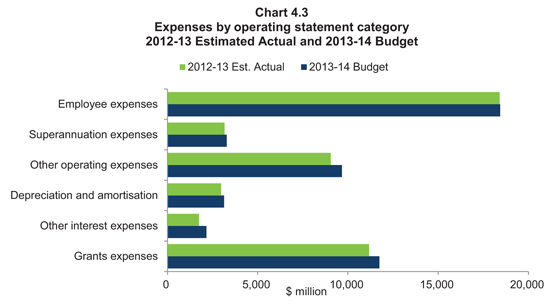

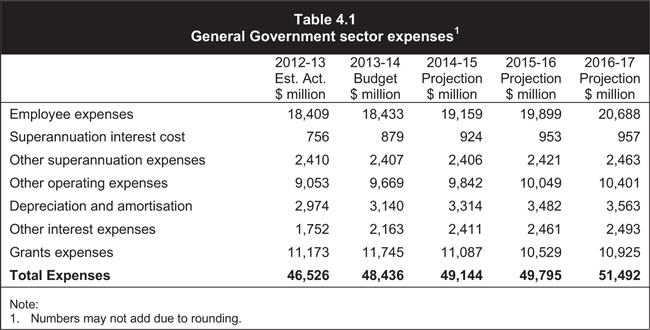

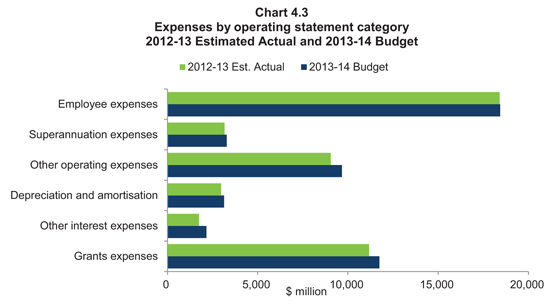

General Government expenses in 2012-13 are estimated to be only 1.1 per cent higher than in 2011-12. This is the lowest rate of expenses growth since the introduction of accrual accounting in the public sector in 1998-99, and contrasts with average rates of expenses growth of 8.9 per cent over the decade to 2011-12.

Employee expenses in 2012-13 are estimated to be only 0.9 per cent higher than in 2011-12. This is the smallest increase since 1998-99.

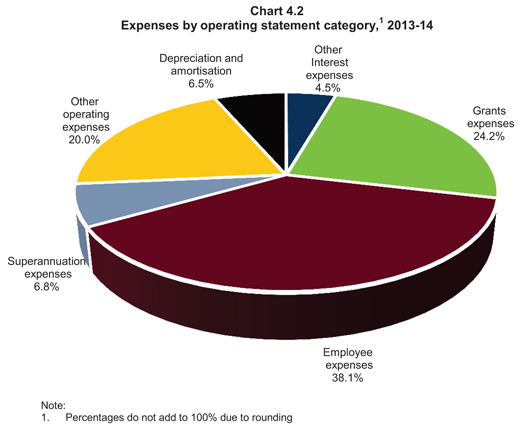

Total General Government sector expenses in 2013-14 are expected to increase by 4.1 per cent over the estimated actual for 2012-13, primarily as a result of natural disaster reconstruction works and for increased service delivery, including the provision of health and education services.

Expenses overall are projected to grow on average by 2.6 per cent over the period 2012-13 to 2016-17.

We value the taxpayer’s dollar and we will continue to ensure we keep a tight rein on expenses. This expenditure constraint comes at a time when we are still investing in core services like health, education and disability services.

7

COST OF LIVING & ELECTRICITY

Madam Speaker, this Government took to the last election a Contract with Queensland. This Government has delivered on that Contract and kept its promises.

We said that we would “Lower the Cost of Living for Families by Cutting Waste” and we have. In the Contract we said the following:

| | • | | We will abolish Labor’s $7,000 tax on buying the family home - it’s been delivered |

| | • | | We will freeze family car rego for our first term - it’s been delivered |

| | • | | Our four point plan will reduce household water prices - it’s been delivered |

| | • | | Cut Labor’s public transport fare increases by half in our first term - it’s been delivered, |

| | • | | Reward regular commuters by reintroducing discounted weekly fares for go card users - it’s been delivered, and |

| | • | | We will reform electricity tariffs to save families money and ensure the cost of carbon tax and green energy schemes are listed on power bills - work is well underway to deliver on this commitment, including the freeze to tariff 11 last year. |

Madam Speaker, the Government understands the shock and dismay of Queenslanders at the electricity price increase. It is indeed a kick in the guts for households and businesses. Frankly, it is also probably the single most difficult issue the Government has had to grapple with to date.

At its heart, the problems that we are dealing with are the consequences of decisions taken over a number of years where governments have either ignored, or papered over, the fact that those decisions would ultimately be paid for by electricity consumers. The truth is that when governments in Australia, be they State or Federal, pass laws or introduce schemes that move away from supplying electricity based on least cost, then under the rules that govern the Australian electricity market there can only be one outcome - consumers pay more.

The Beattie Government’s decision in the middle part of the last decade to spend billions on the network in the name of reliability - is being paid for by consumers now. The Federal Government’s 20 per cent Renewable Energy Target - is being paid for by consumers now. The former State Government’s so-called Solar Bonus Scheme - it is effectively a $3 billion solar tax being paid for by guess who? - Queensland consumers now. By 2015-16 the Solar Bonus is going to cost Queensland households an extra $276.

And the latest and most unnecessary increase of them all - the Carbon Tax.

We have to stop loading up the electricity industry with policies that increase costs only to be surprised when those same policies increase prices.

Faced with the latest increase, the Government had two choices - it could introduce a new subsidy for electricity prices. However, with a $7.7 billion deficit next year we would have to borrow the money to pay for it - meaning we would be asking taxpayers years down the track to pay off the debt for the electricity we are using today. That’s not fair.

8

Alternatively, we could have increased taxes to pay for the subsidy. That is, increase taxes on people only to recycle it in the form of a subsidy to those people and make it sound like a virtue - straight out of the Julia Gillard and Wayne Swan play book.

What we are doing is controlling what we can control. We are making sure those electricity businesses we control are operating as efficiently as possible. The savings we are asking Ergon and Energex to find from their capital and operating budgets are for the express purpose of delivering better price outcomes for consumers over the long run. We have found capital and operating expenditure savings totalling $3 billion out to 2019-20, but we are dealing with a massive network that can’t be turned on a dime.

KEY EXPENDITURES

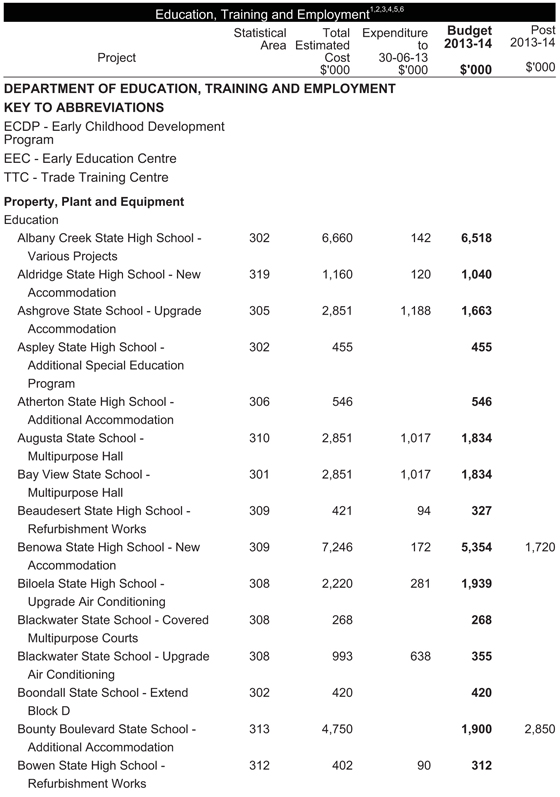

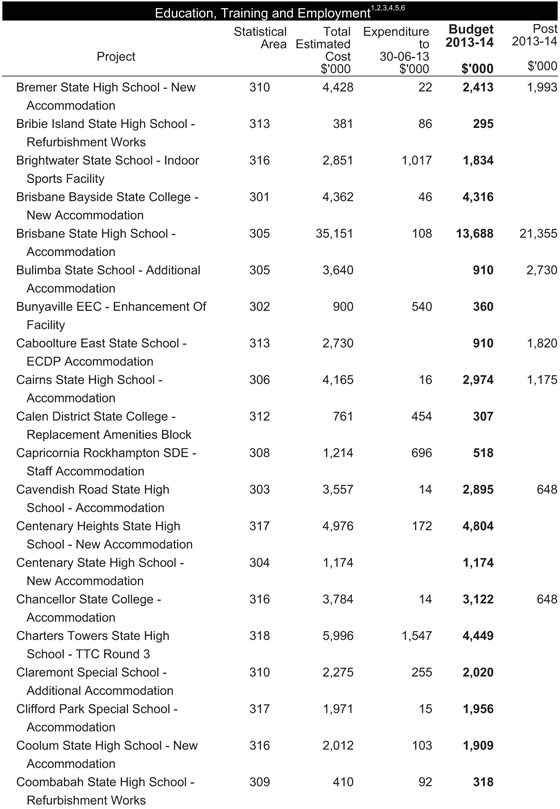

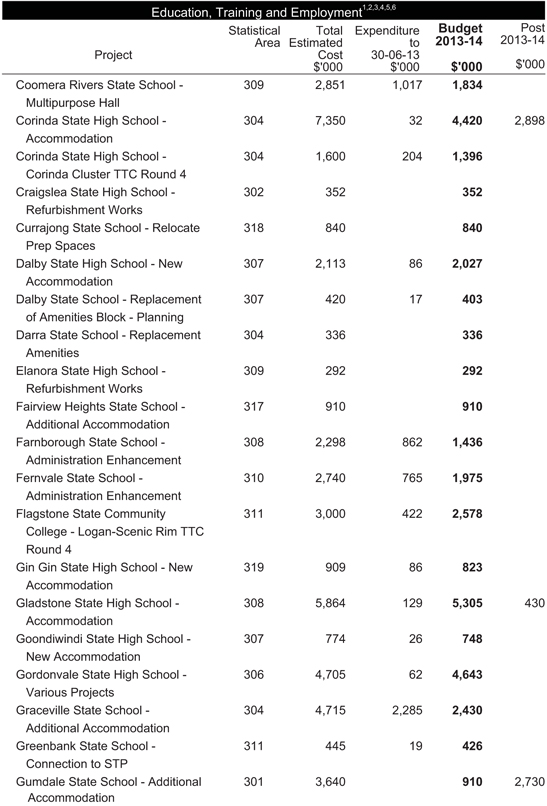

Madam Speaker, this is the Budget that invests in key frontline services - the education budget increases by $707 million, or 6.6 per cent - the disability services budget is up $64 million, or 4.7 per cent and the health budget is up $533 million or 4.5 per cent.

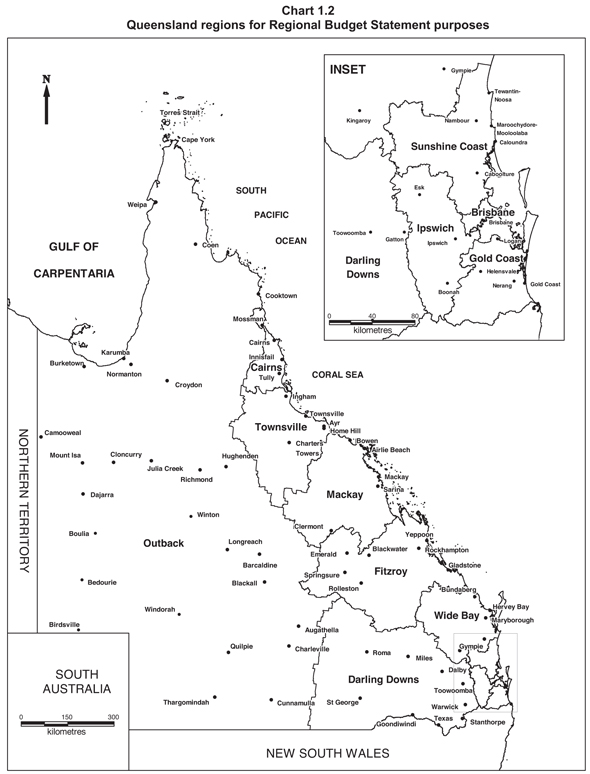

Being a Government for all Queenslanders is vitally important to those of us on this side of the House. The Government will again invest heavily in our regions, through both specific programs like “Royalties for the Regions” as well as ongoing expenditure directed to where it is needed most.

Again in 2013-14, over 75 per cent of the Government’s capital expenditure will take place outside Brisbane.

Disability Services

In December 2012, the Government announced a commitment to provide an additional $868 million over a period to 2018-19 to address the historical under-funding of disability services in Queensland and to support implementation of the NDIS in Queensland. This funding, coupled with the Australian Government’s commitment to provide the State with a share of the proposed 0.5 per cent Medicare Levy increase will contribute to the Queensland Government funding of $2.03 billion of scheme costs in 2019-20. This Budget makes the first allocation for the NDIS.

It also provides additional funding of $106 million over four years to assist with existing Disability Services demand pressures. This funding will help to ensure that young people with a disability exiting the care of the State, or leaving school, are supported. It will also help people with spinal cord injuries to leave hospital and live in the community.

This Budget brings forward $25 million into 2013-14 from 2015-16. This money will provide additional care packages in line with DisabilityCare Australia concepts.

Great Teachers = Great Results

The Queensland Government understands and values the contribution made by teachers - many a young life has been turned around or inspired to greatness through the intervention of a caring, motivated, teacher.

9

The Budget provides additional funding of $537 million over five years from 2013-14 to focus on professional excellence in teaching and increasing the autonomy of our schools. It comprises a range of initiatives such as mentoring for beginning teachers; accelerated progression and bonus payments for high performing teachers; paid post-graduate study and strategies to strengthen discipline in schools.

Fixing our Schools and Hospitals

Madam Speaker, good managers everywhere know how important it is to keep on top of your asset base and to make sure your equipment is properly maintained. We also routinely tell our children that we aren’t going to buy them something new until they look after what they already have.

The former Government found looking after the asset base all too boring in comparison to the excitement of new project announcements. For this reason, some of our schools and hospitals have toilets that don’t flush, windows that don’t shut, broken air conditioning - the list goes on. It borders on negligence.

This Government is making major inroads into the maintenance backlog in our schools and health facilities. This Budget allocates a further $100 million to fixing our schools, bringing the total additional funding under this Government to $300 million over three years. We also provide an additional $147 million over four years as part of a $327 million program to address the health maintenance backlog.

Queensland Health Rostering and Payroll System

Madam Speaker, it is not with any pleasure that I announce that the Government has had to provide increased funding of $384 million over four years to enable the Department to operate and improve the Queensland Health rostering and payroll system.

The Health payroll system will cost an estimated $1.25 billion, over seven years, since the failed implementation in 2010.

I know the Minister and departmental staff are working incredibly hard to enhance the payroll environment, improve pay outcomes for Queensland health employees and stem the financial bleeding. They need, and will continue to receive, our support.

Revitalisation of Regional, Rural and Remote Health Services

The Government is providing increased funding of $83 million over four years to support and enable better access to health care services for Queenslanders in regional, rural and remote communities. This will be achieved through the development of improved ambulatory and primary health care models, delivery of enhanced outreach services and establishment of the Rural Telehealth Service.

Hospital in the Home

As identified in the final report of the Independent Commission of Audit, hospital avoidance and substitution programs that drive a vastly improved community health care outcome are

10

desperately needed. Hospital in the Home is one such program. Studies have shown that Hospital in the Home is associated with reductions in mortality, readmission rates and cost, and increases in patient carer satisfaction.

The Government will provide increased funding of $28 million over four years for additional Hospital in the Home services to be provided by the private sector. This provides acute care by health professionals in the comfort of home as a substitute for inpatient care received at a hospital - better for patients and better for the system.

Economic Development and Reform

The Government is focussing on making Queensland the best business environment in Australia.

We are working hard on reducing the regulatory burden on industry and the timeframes for project approvals.

With support from the Deputy Premier, the Coordinator-General has made 145 statutory decisions since April 2012, a decision rate 3.25 times greater than the previous Government achieved in its last 12 month period.

Queensland is world famous for its mining resources and expertise, but there is much that remains to be known about the geology and mineral potential of the State. We want Queensland to be the exploration capital of Australia, and for quality geological data to be there for the world to see.

The Government will provide new funding of $30 million over three years for a range of initiatives to upgrade the Geological Survey of Queensland. This is a sound investment in Queensland’s future prosperity.

Trade and Investment Queensland, a function treated like a prize by the previous Government and catapulted from department to department, will be given the stability it deserves and Queensland business needs. It will be established as a separate stand-alone entity, governed by a Board that has practical export business experience.

Now more than ever, it is vital that Queensland businesses and industries maintain and develop their relationships with our major trading partners. Importantly, we need to focus on assisting small to medium enterprises establish footholds in new markets across Asia and the Americas.

We have great natural advantages within our trade exposed industries. We grow healthy and safe food in a region that is increasingly demanding food security. We supply world class primary products; our research and education industries take knowledge to the world and our manufacturers use Queensland’s smarts to deliver products to the world.

Queensland needs to be outwardly proud and promote our achievements and unique characteristics - effectively pushing our ‘Brand Queensland’ to the world. The Government sees Trade and Investment Queensland as an important driver of economic growth through export opportunities.

11

We are also proceeding with the implementation of our response to the independent Commission of Audit recommendations - recommendations for better services and a more dynamic economy. This Queensland Government wants to work with, not compete against, the private sector. We look forward to existing Queensland business growing new businesses to take advantage of the opportunities that will arise.

Whether it’s Economic Development Queensland, within the Deputy Premier’s department, or the Tourism Investment Attraction Unit within Minister Stuckey’s department, or the Contestability Unit within Queensland Health established by Minister Springborg or Projects Queensland in Treasury, the Government is determined to diversify the Queensland economy and grow its four pillars.

Fundamentally, the Government is moving from being the “doer” to the “enabler”.

Federal Financial Relations

Madam Speaker, there once was a Federal Member for the seat of Griffith who became Prime Minister in 2007. We were promised an end to the blame game.

The early signs showed some promise - over 90 specific purpose agreements were collapsed into five. There was to be a very small number of national partnership agreements, focussed on outcomes and not red tape.

Well guess what. Today we have nearly 74 separate national partnership agreements that are highly prescriptive - more and more Government red tape. The great news is that there are another 28 of these agreements under development now. More public servants in Canberra watching public servants in Brisbane - lead in the saddle bags of the teachers and nurses in the field who are just trying to do their jobs.

Many of these reporting requirements are designed by undoubtedly well-meaning people, but who are often far removed from the realities of Queensland life. Attending Floriade does not qualify you to lecture a grazier in north-west Queensland about keeping cattle alive during a drought. The drive from Queanbeyan to Capital Circuit does not qualify you to understand the tyranny of distance faced by the people of Longreach.

The way the current Commonwealth Government conducts its federal relations is based on the politics of the fiscal wedge. The Commonwealth makes an announcement via press conference and demands the States magically “find” the extra money. The States look bad if they don’t agree, so then have to raise taxes or reduce spending - both of which the Commonwealth publicly objects to - in order to fund the spending.

Government finances right around Australia are clearly stressed. In these difficult times, the most sensible thing we can do is to sit down and have an adult conversation about who is best placed to be responsible for what.

The Queensland Government is ready for that conversation. Governments have no right to be preaching to businesses about productivity and efficiency until they get the basics right themselves.

12

The best part about this reform is that it won’t cost taxpayers a cent, but it does take courage and a grown-up attitude as well as an acknowledgement of the reality that Governments can’t solve every problem. We really need a grown up in government in Canberra. Let’s hope we get that after September 14.

CONCLUSION

Madam Speaker, in March last year the new Government said how it would go about fixing Queensland’s finances and delivering services for Queensland. How we would be a “can do” Government for a “can do” State.

Last September, in our first Budget, I laid out the chart for the journey back to sound State finances, while at the same time supporting the four pillars of the economy and boosting confidence. I said it was the most important Budget in a generation. It started the hard work and reforms necessary to make sure Queensland is a better State, a stronger State, a great State.

This Budget is another way point on our journey.

It supports the growth we need to pay off the debts of the past while providing the jobs of the future.

It builds resilience, not just in our finances, but in our community. By lowering interest bills we can spend more on services and strengthen our communities by giving them the help they need when they need it.

It rebuilds not just the State’s balance sheet, but the facilities and infrastructure we all need and rely on every day - roads, schools, hospitals, parks and playgrounds. It empowers people to invest and grow with confidence.

Madam Speaker now is not the time to waver or change course. This Budget continues the journey of ensuring Queensland is a Great State with Great Opportunity.

I commend the Budget to the house.

13

State Budget 2013–14 Budget Speech Budget Paper No. 1 www.budget.qld.gov.au

State Budget 2013–14 Budget Speech Budget Paper No. 1 www.budget.qld.gov.au

State Budget 2013-14

Budget Strategy and Outlook

Budget Paper No.2

AUDAX AT FIDELIS

Great state. Great opportunity.

AUDAX AT FIDELIS

Queensland Government

2013–14 State Budget Papers

| 2. | Budget Strategy and Outlook |

| 5. | Service Delivery Statements |

Appropriation Bills

Concessions Statement

The suite of Budget Papers is similar to that published in 2012-13.

The Budget Papers are available online at www.budget.qld.gov.au

© Crown copyright

All rights reserved

Queensland Government 2013

Excerpts from this publication may be reproduced, with appropriate acknowledgement, as permitted under the Copyright Act.

Budget Strategy and Outlook

Budget Paper No.2

ISSN 1445-4890 (Print)

ISSN 1445-4904 (Online)

STATE BUDGET

2013-14

BUDGET STRATEGY AND

OUTLOOK

Budget Paper No. 2

TABLE OF CONTENTS

| | | | | | |

| 1. | | Fiscal strategy and outlook | | | 1 | |

| | |

| | Context | | | 3 | |

| | Overview | | | 5 | |

| | Budget outcomes 2012-13 | | | 10 | |

| | 2013-14 Budget and outyear projections | | | 13 | |

| | Fiscal strategy as a guiding principle for policy | | | 19 | |

| | Achievement of fiscal principles | | | 24 | |

| | |

2. | | Economic performance and outlook | | | 27 | |

| | |

| | External environment | | | 28 | |

| | Queensland economy | | | 31 | |

| | |

3. | | Revenue | | | 47 | |

| | |

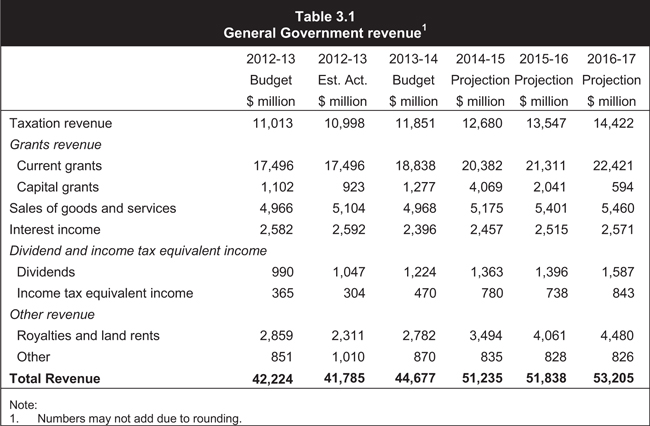

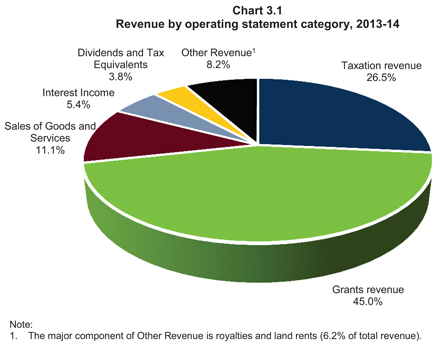

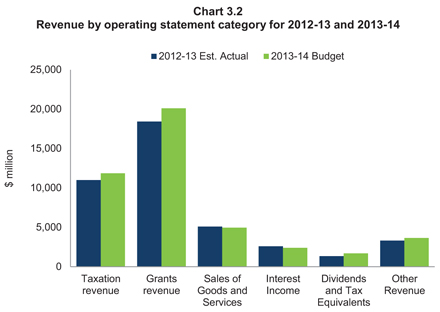

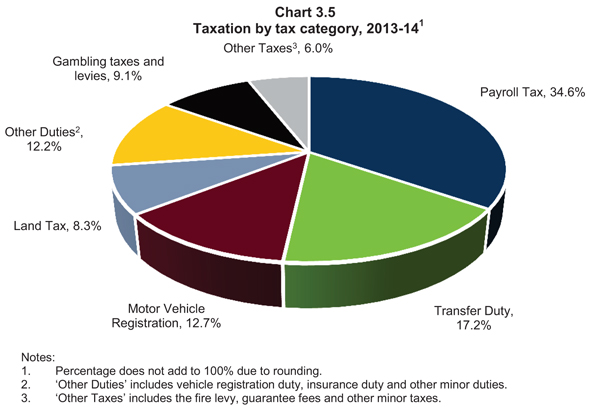

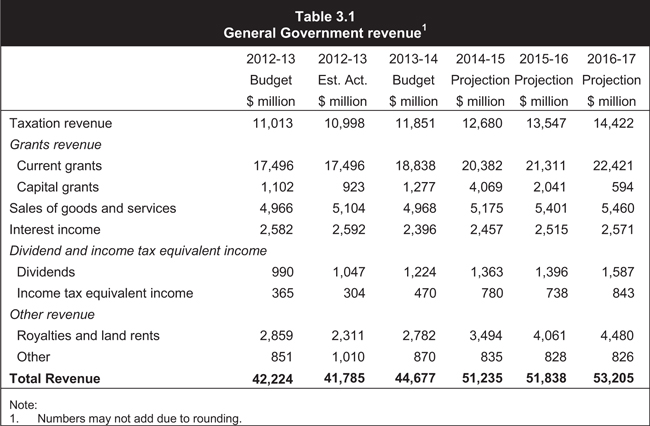

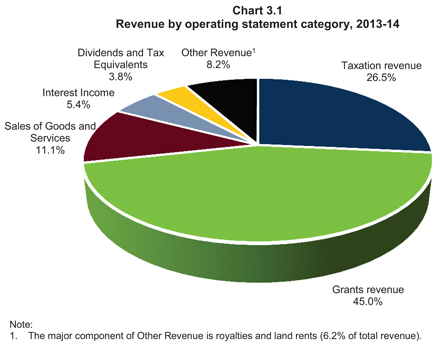

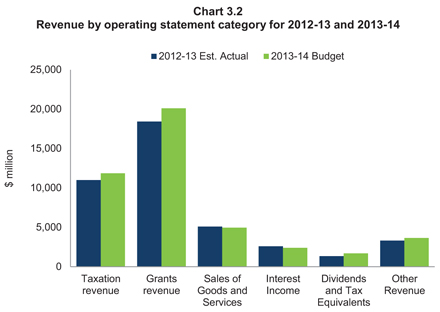

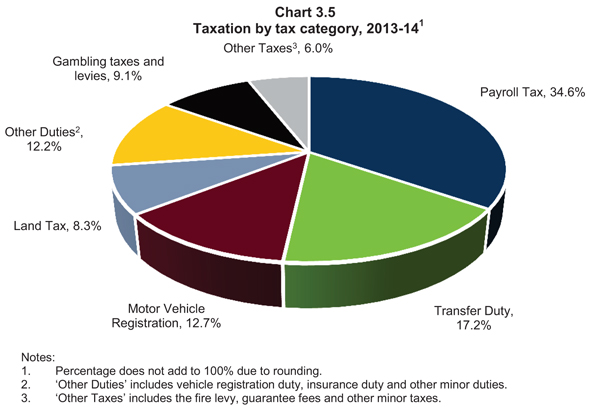

| | 2013-14 Revenue by category | | | 49 | |

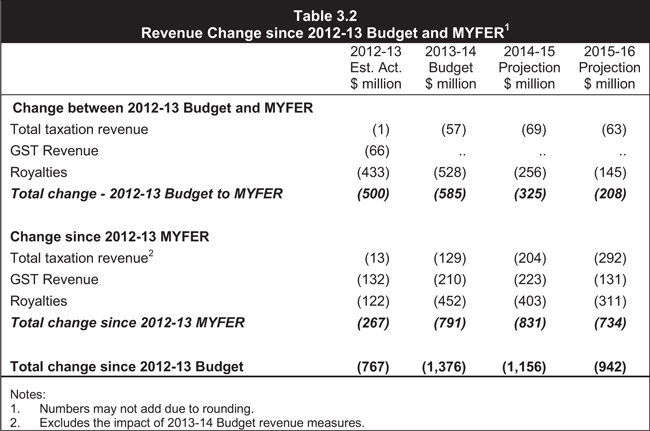

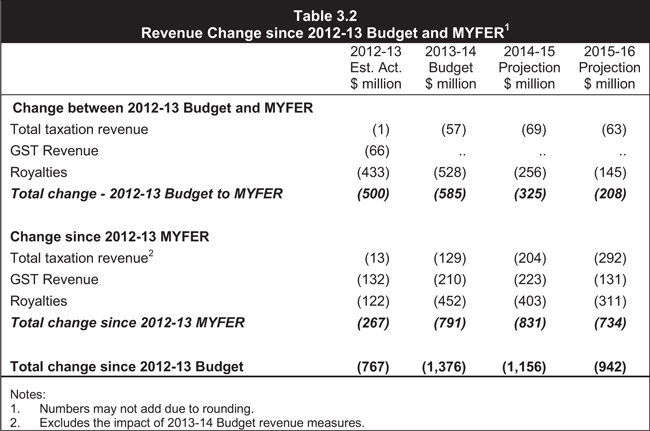

| | Revenue changes since the 2012-13 Budget and MYFER | | | 51 | |

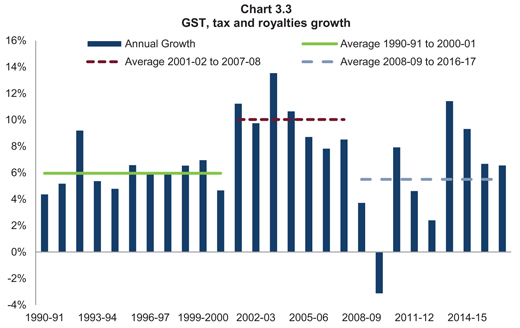

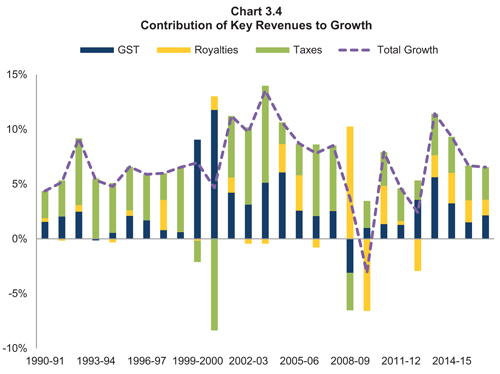

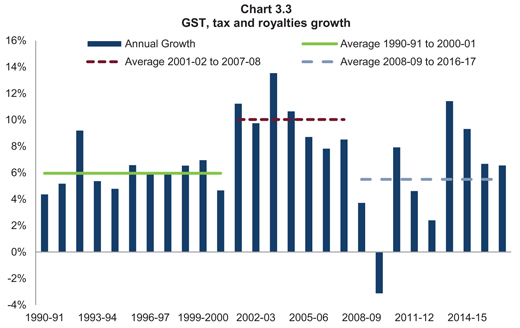

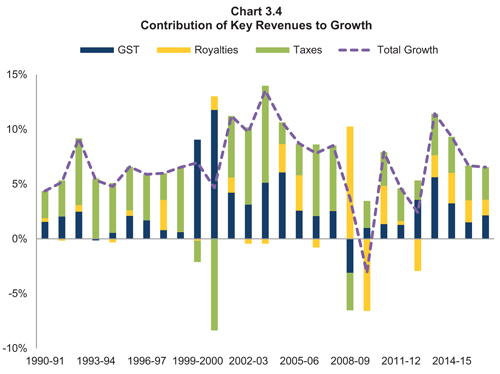

| | Queensland’s revenue trends | | | 52 | |

| | 2013-14 Budget initiatives | | | 55 | |

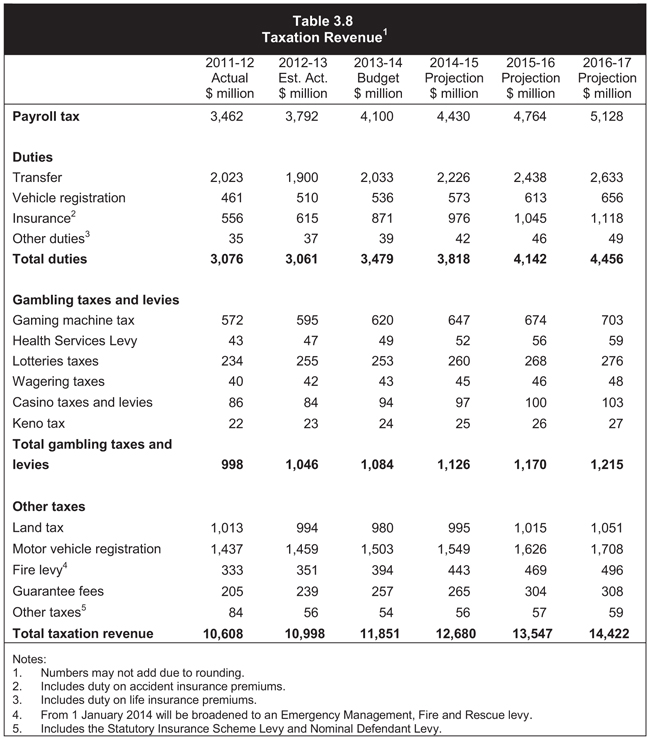

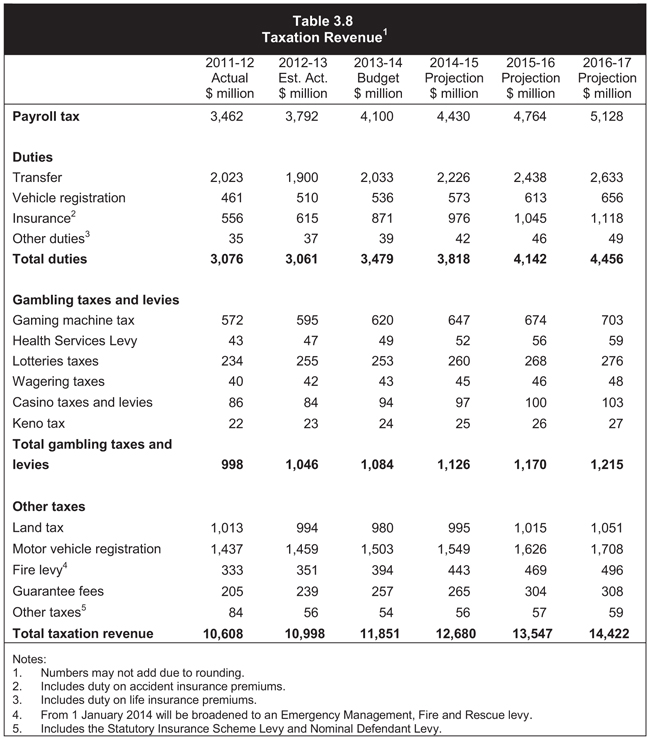

| | Taxation revenue | | | 59 | |

| | Queensland’s competitive tax status | | | 64 | |

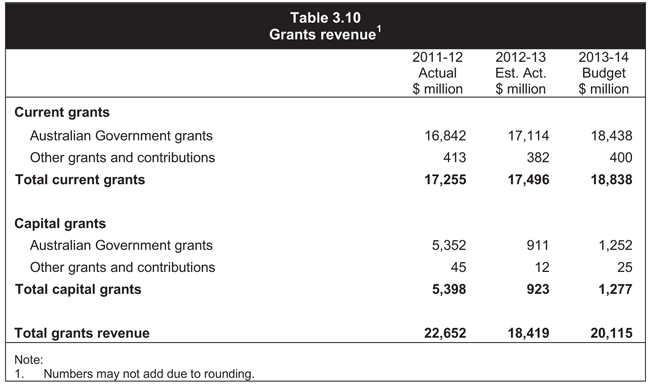

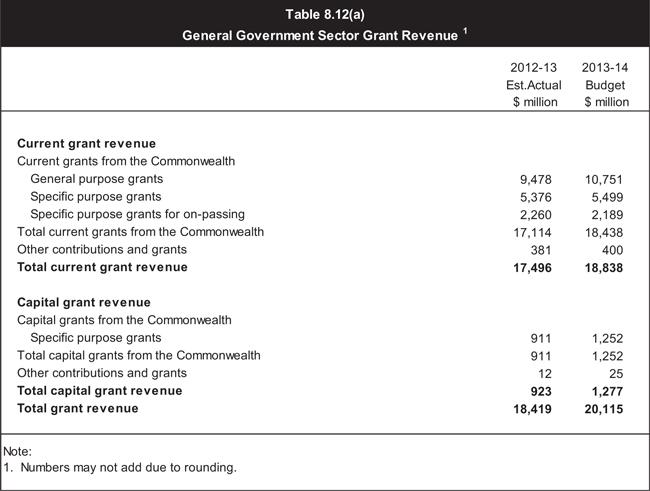

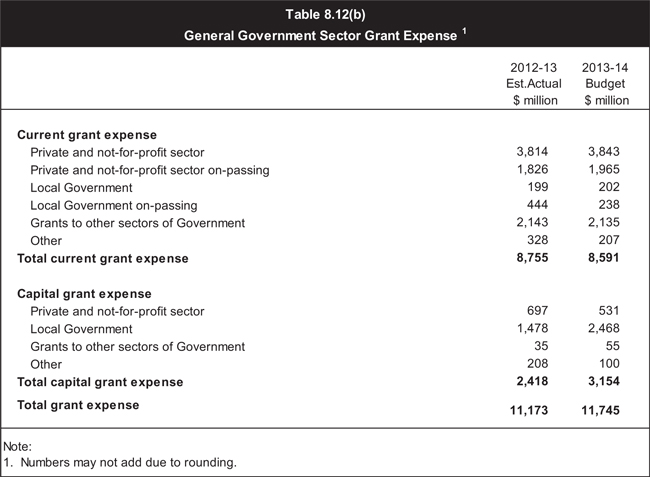

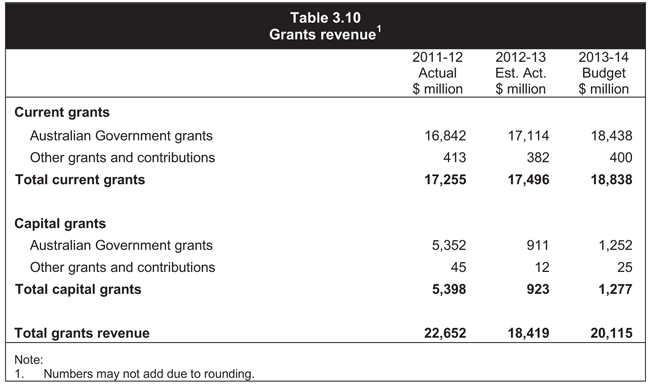

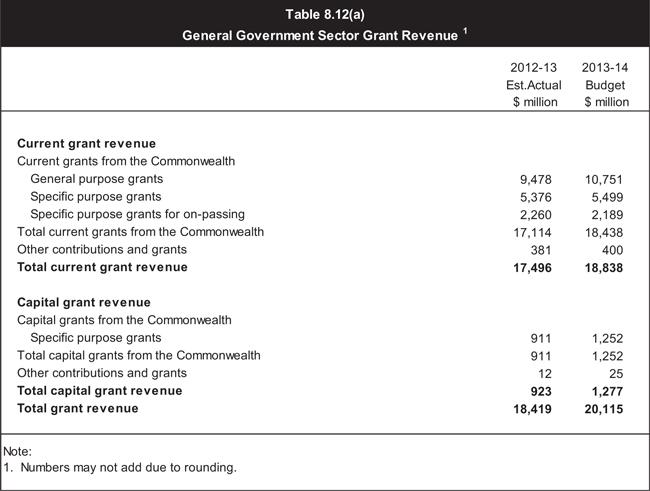

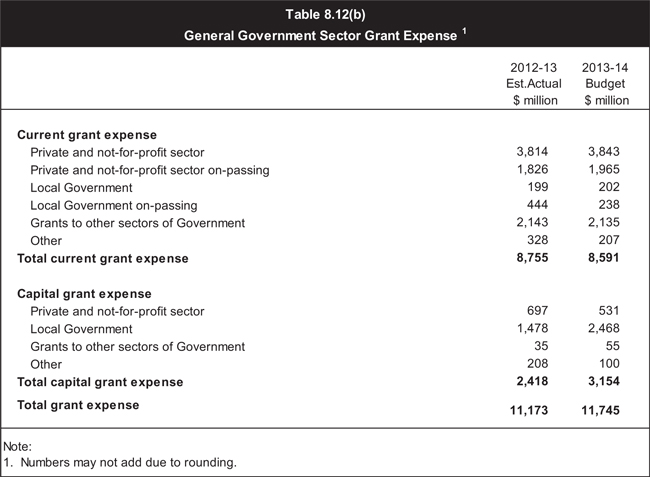

| | Grants revenue | | | 65 | |

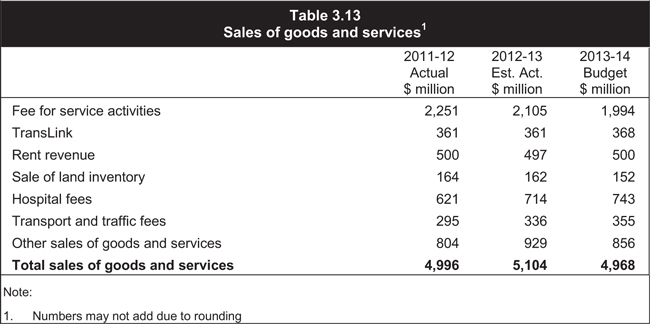

| | Sales of goods and services | | | 68 | |

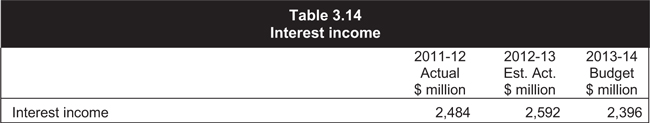

| | Interest income | | | 70 | |

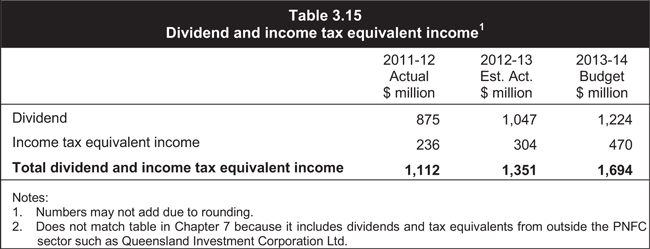

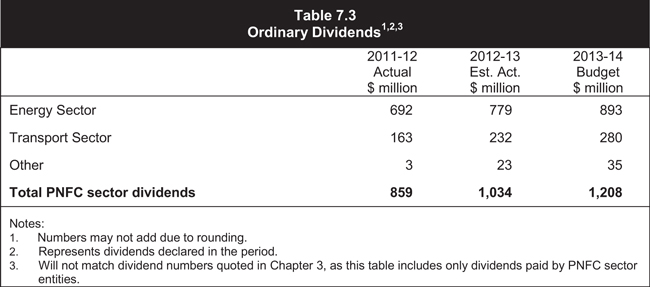

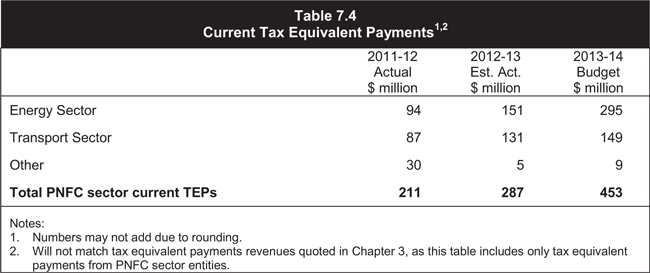

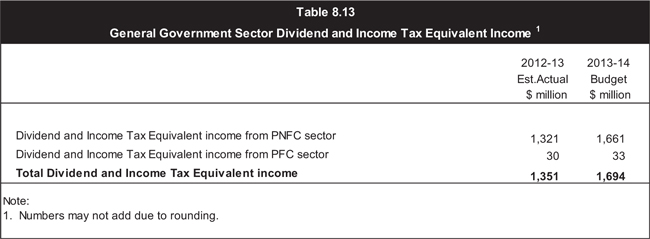

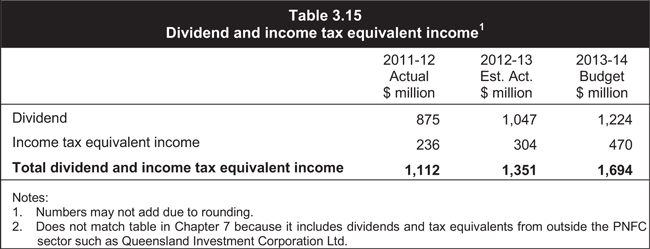

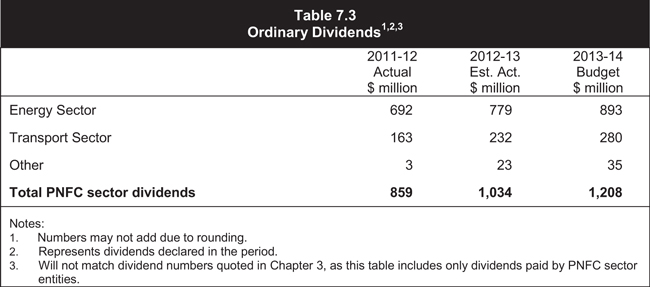

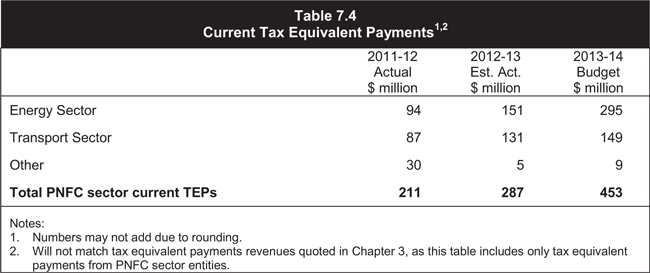

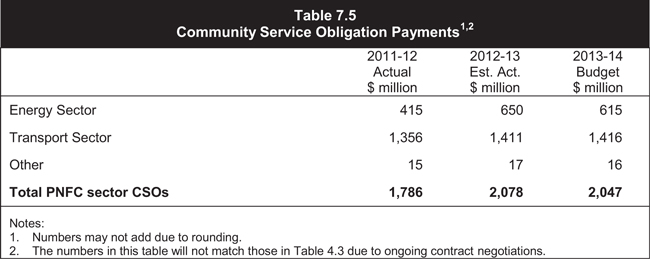

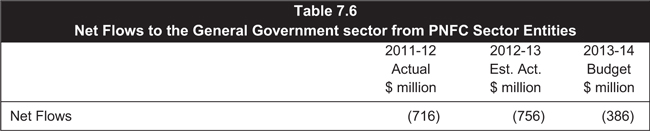

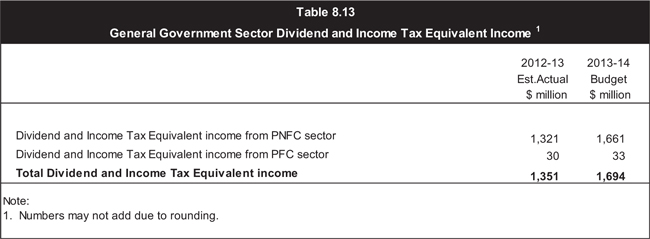

| | Dividend and income tax equivalent income | | | 71 | |

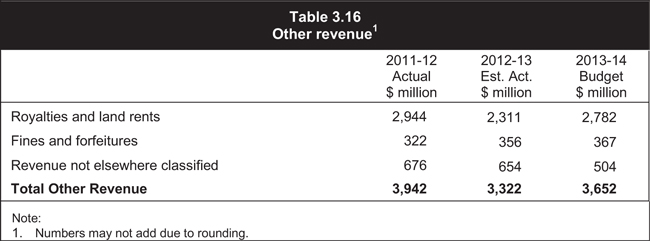

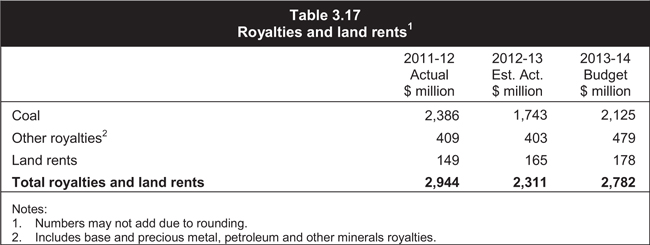

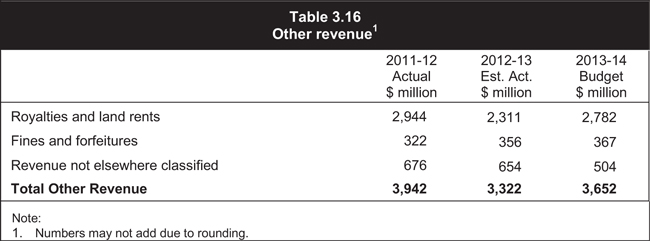

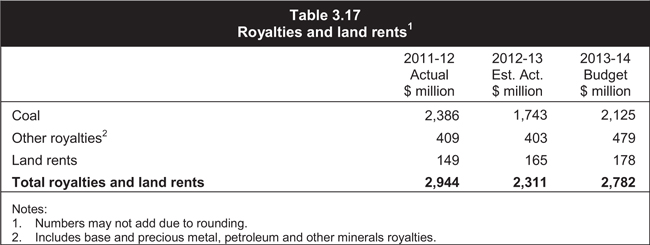

| | Other revenue | | | 71 | |

| | |

4. | | Expenses | | | 75 | |

| | |

| | 2012-13 estimated actual | | | 76 | |

| | 2013-14 Budget and outyears | | | 77 | |

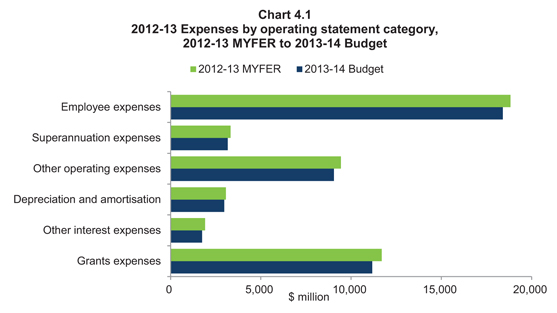

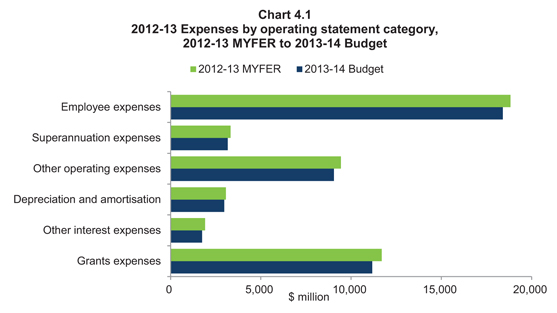

| | Expenses by operating statement category | | | 78 | |

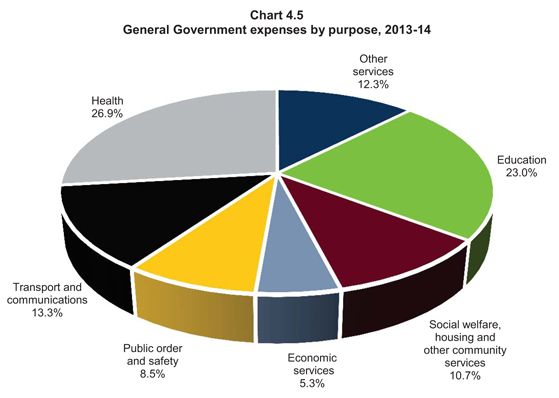

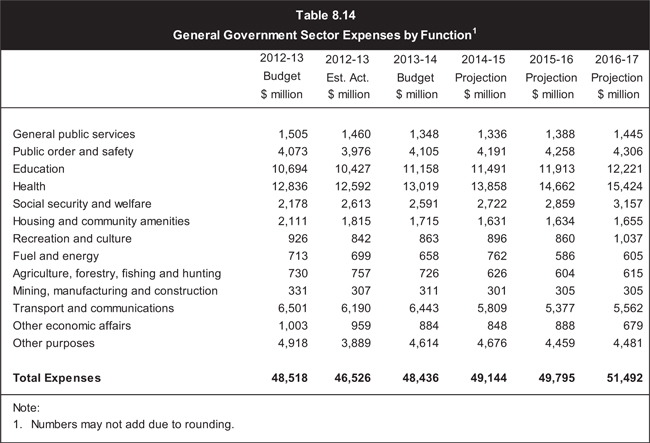

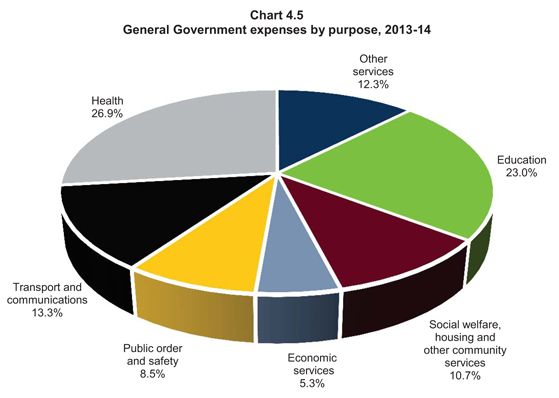

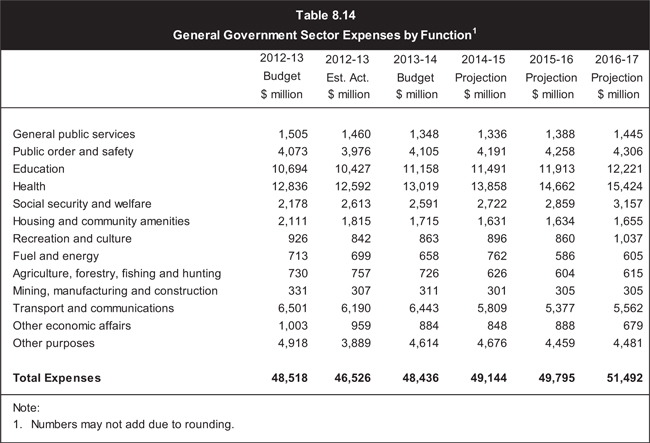

| | Operating expenses by purpose | | | 87 | |

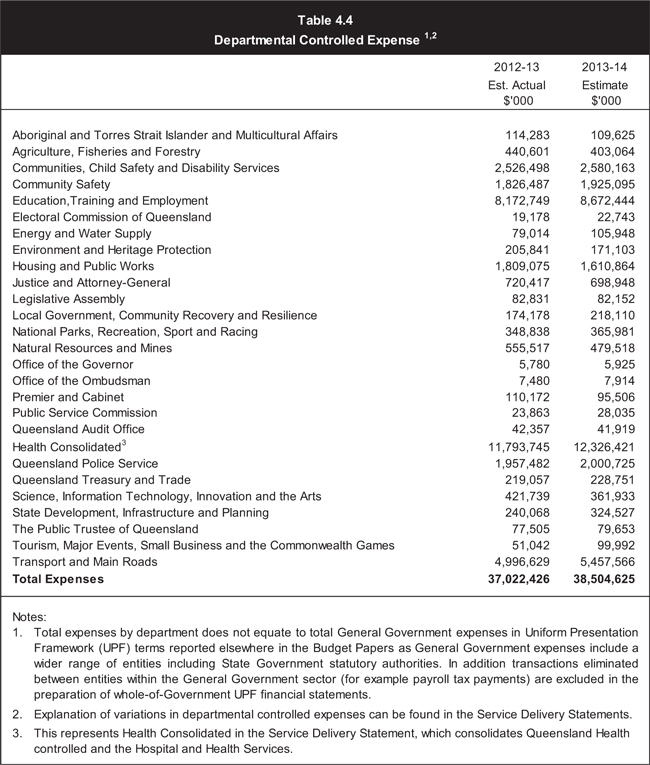

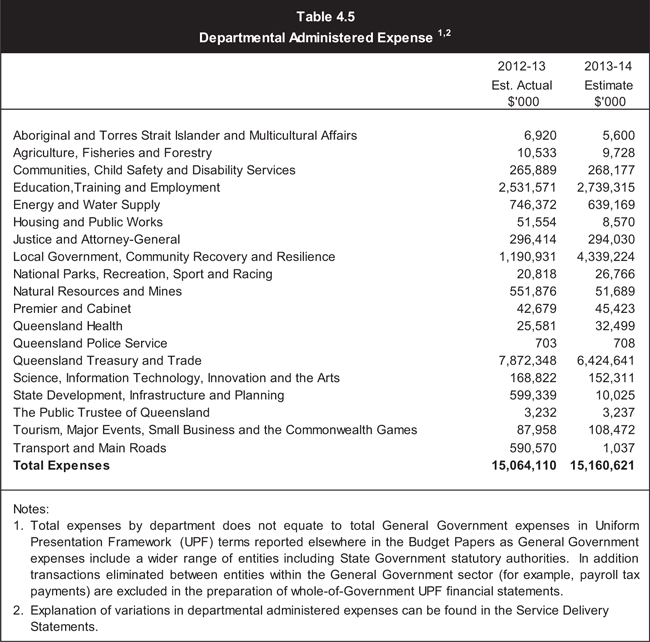

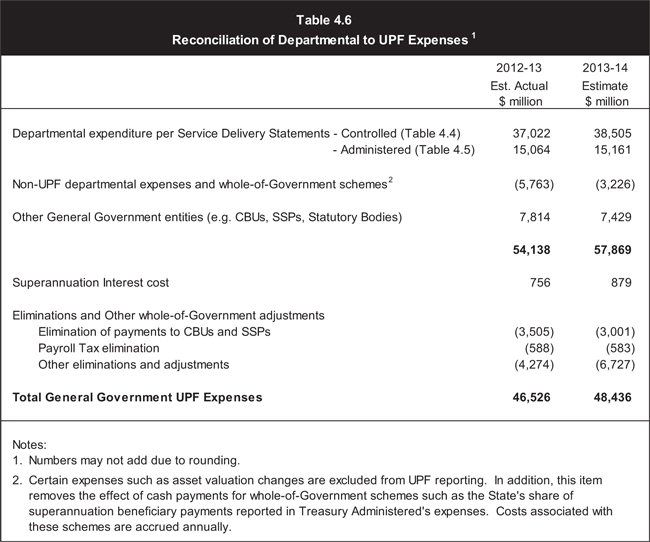

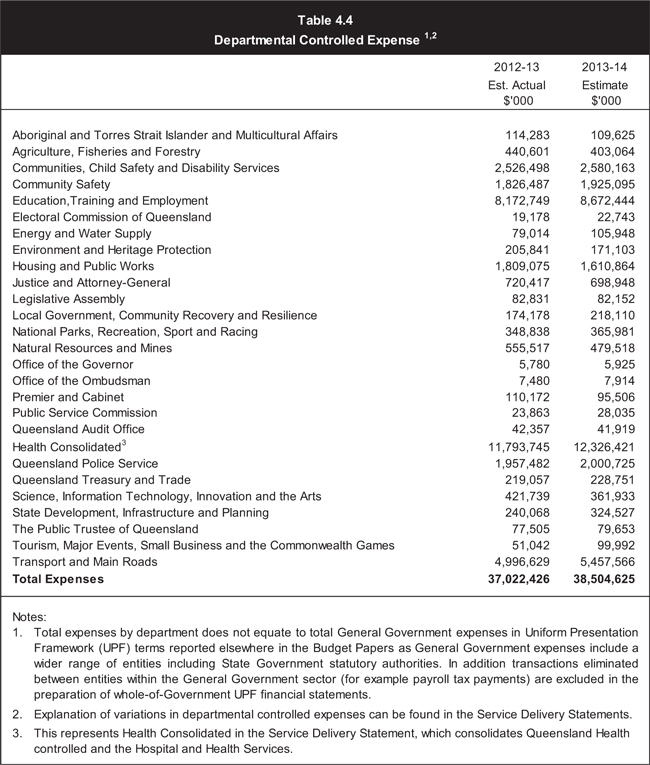

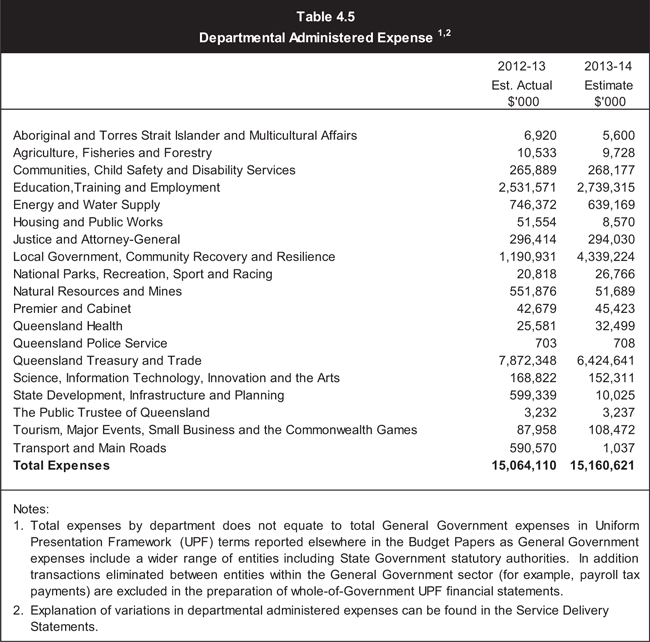

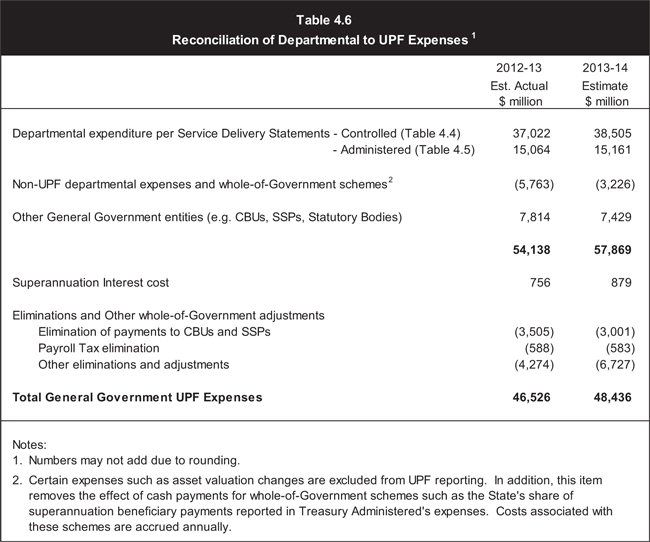

| | Departmental expenses | | | 88 | |

| | | | | | |

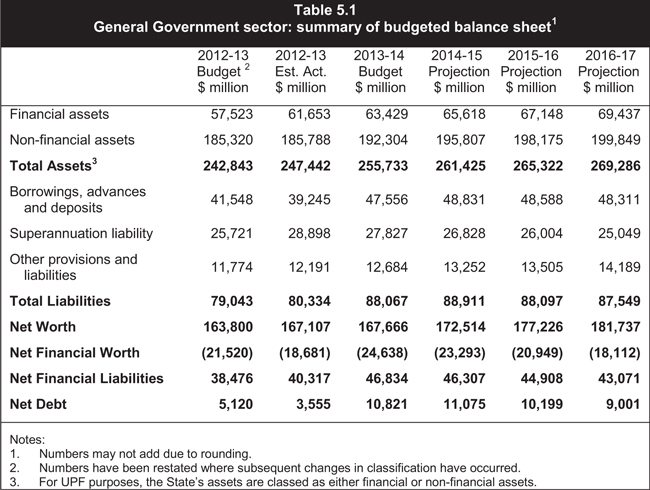

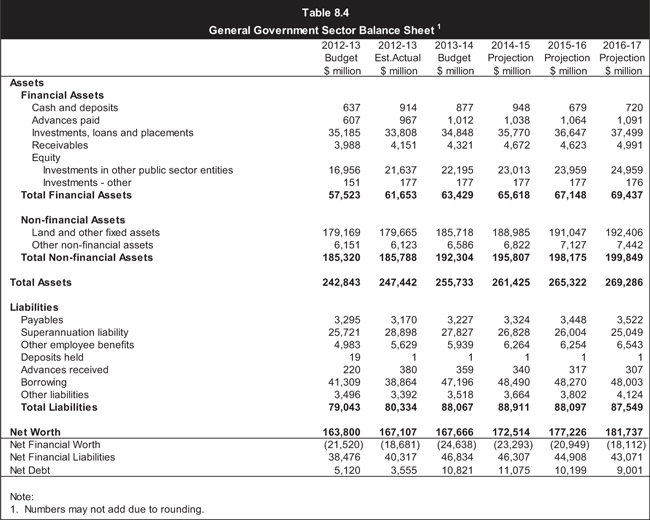

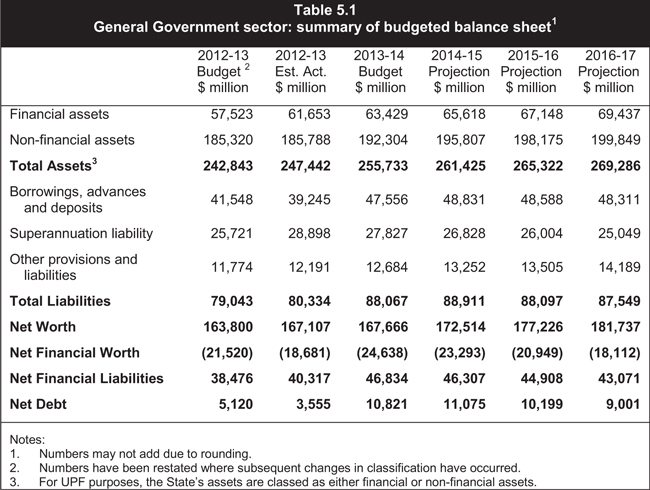

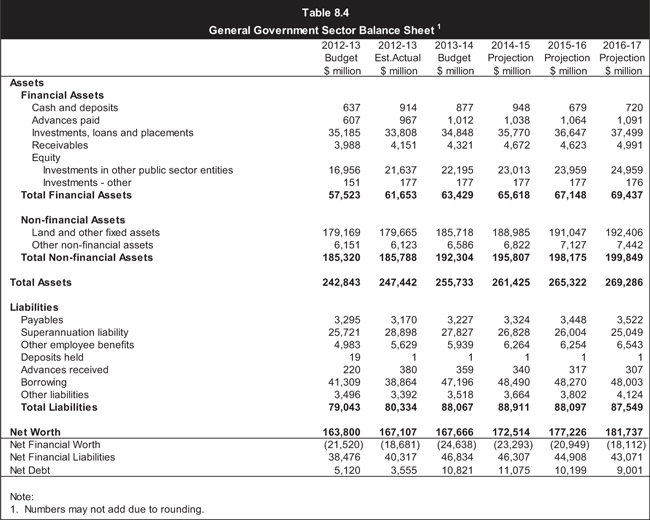

| 5. | | Balance sheet and cash flows | | | 91 | |

| | |

| | Background | | | 91 | |

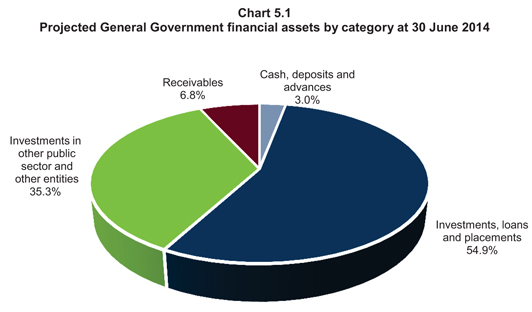

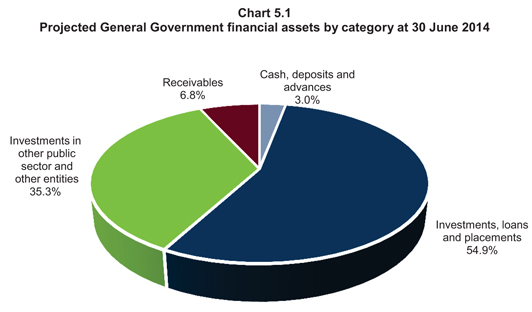

| | Balance sheet | | | 92 | |

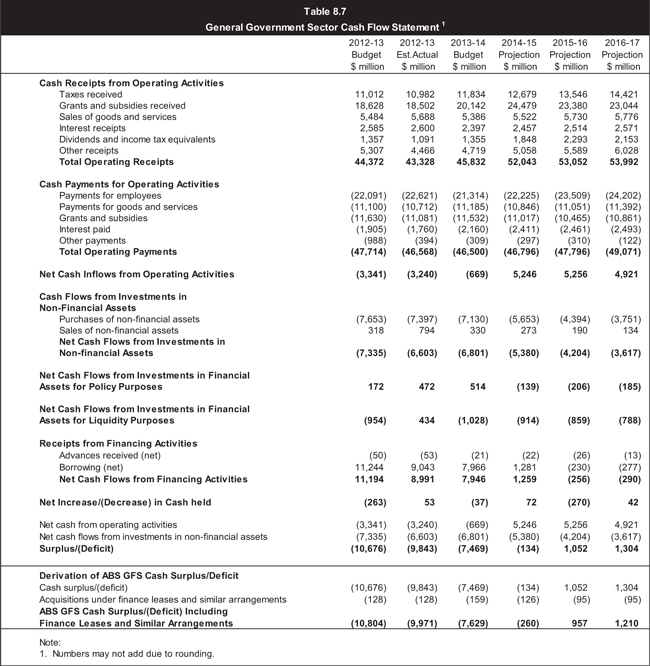

| | Cash flows | | | 100 | |

| | Reconciliation of operating cash flows to the operating statement | | | 102 | |

| | |

| 6. | | Inter-governmental financial relations | | | 103 | |

| | |

| | Federal financial arrangements | | | 104 | |

| | Australian Government funding to Queensland | | | 107 | |

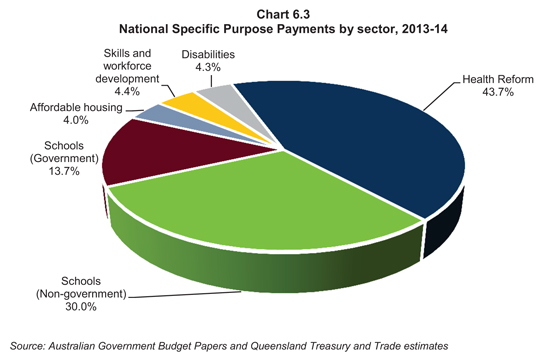

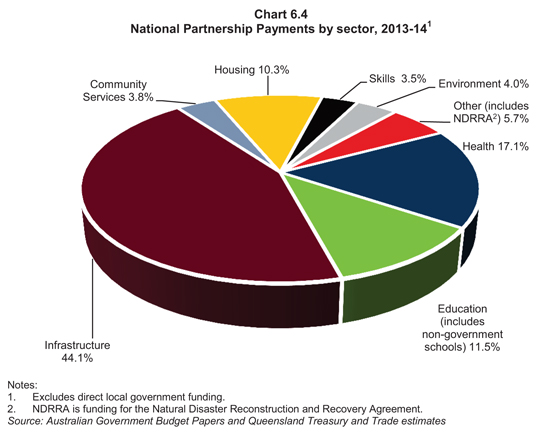

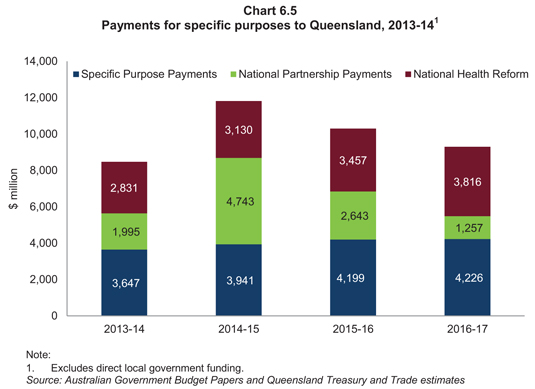

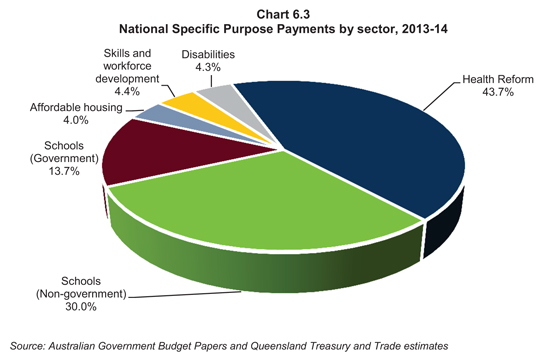

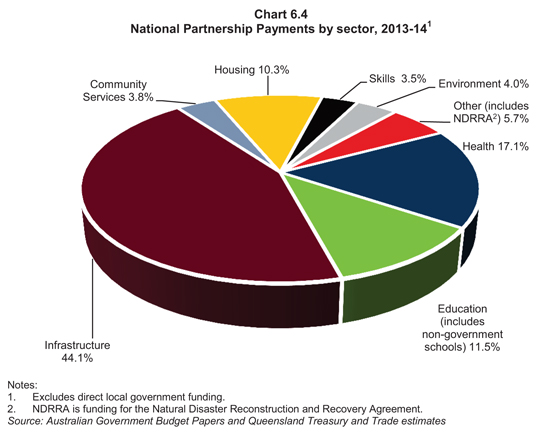

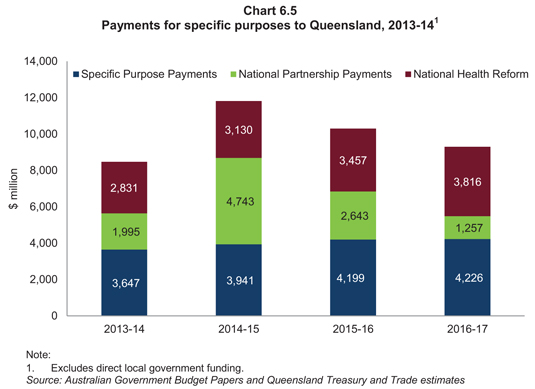

| | Payments to Queensland for specific purposes | | | 108 | |

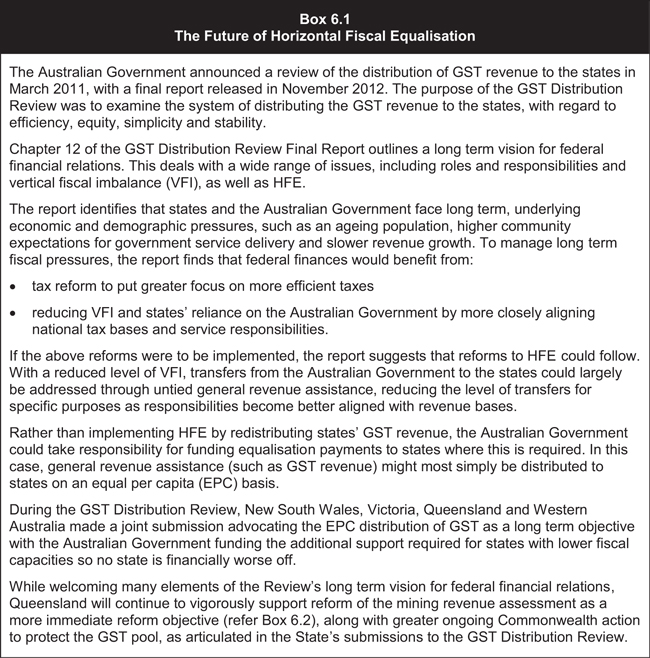

| | GST revenue payments | | | 115 | |

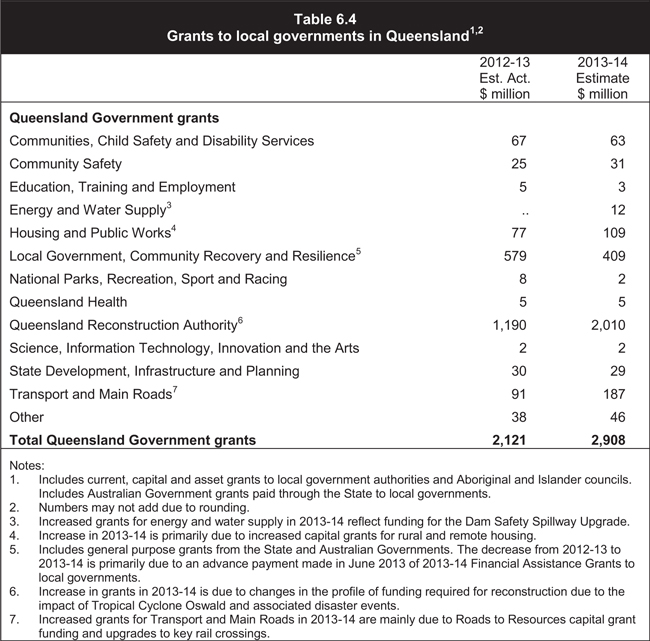

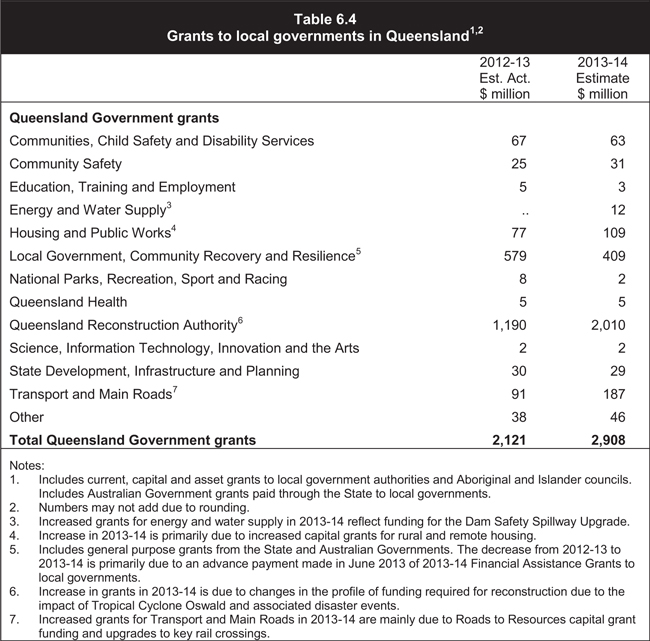

| | State-local government financial relations | | | 122 | |

| | |

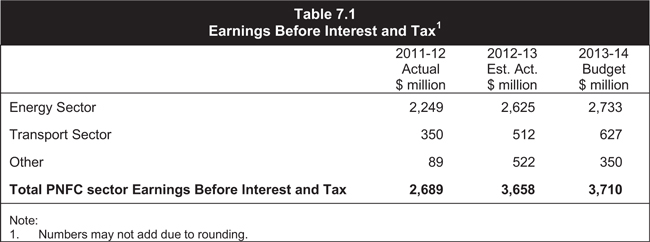

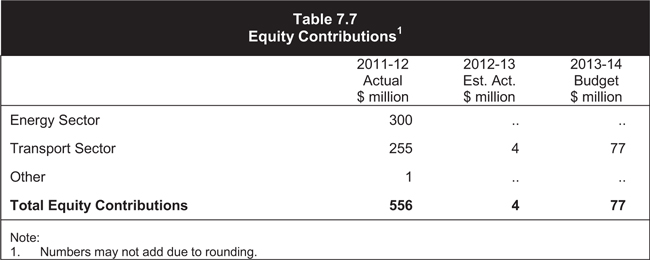

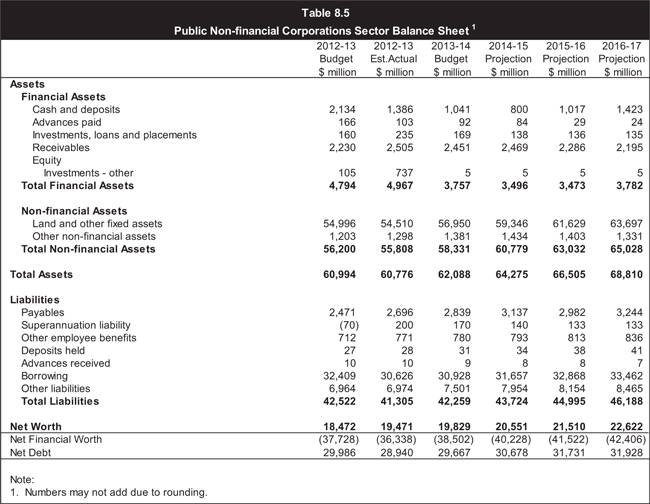

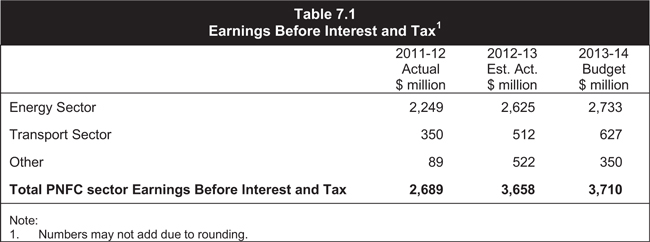

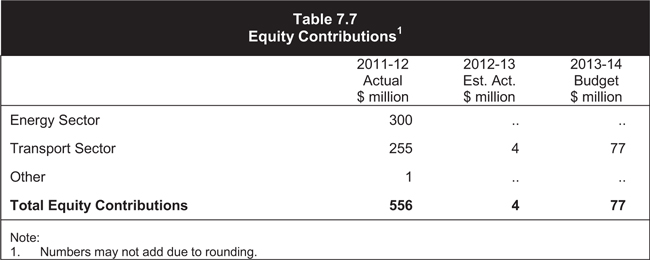

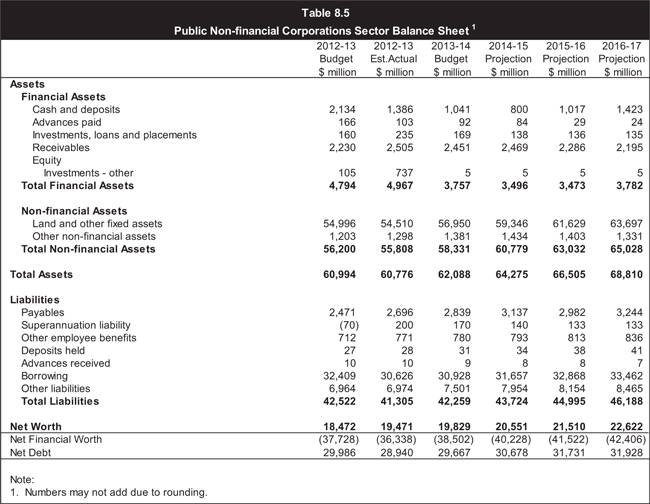

| 7. | | Public Non-financial Corporations sector | | | 123 | |

| | |

| | Context | | | 123 | |

| | Reform | | | 124 | |

| | Independent Commission of Audit | | | 125 | |

| | Finances and performance | | | 128 | |

| | |

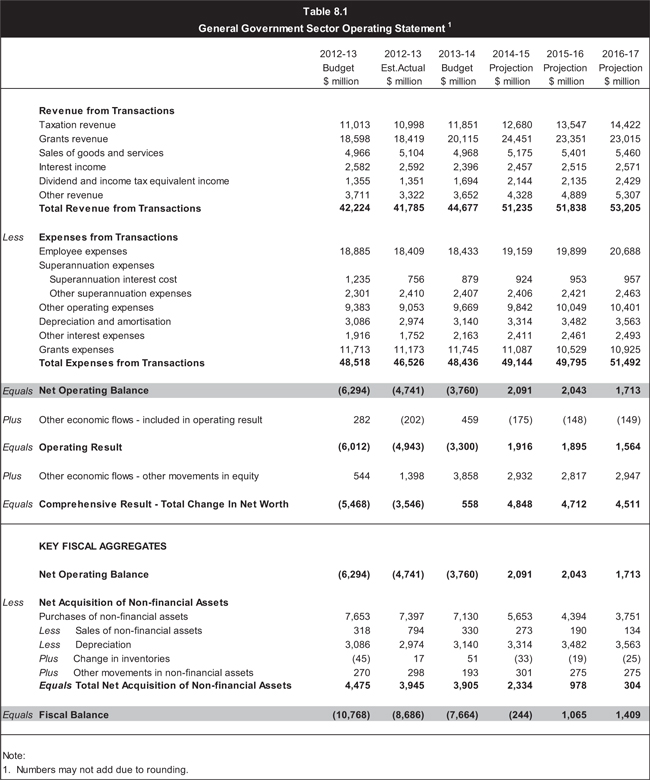

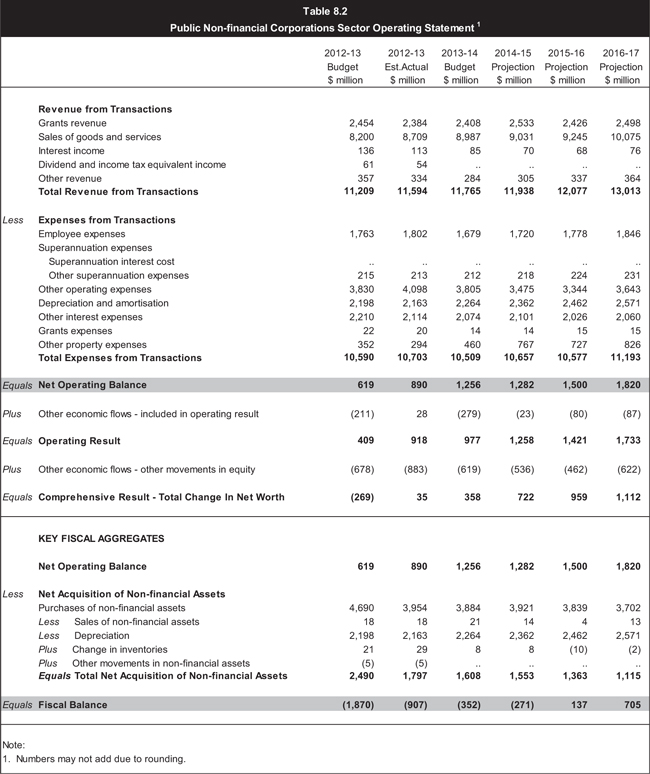

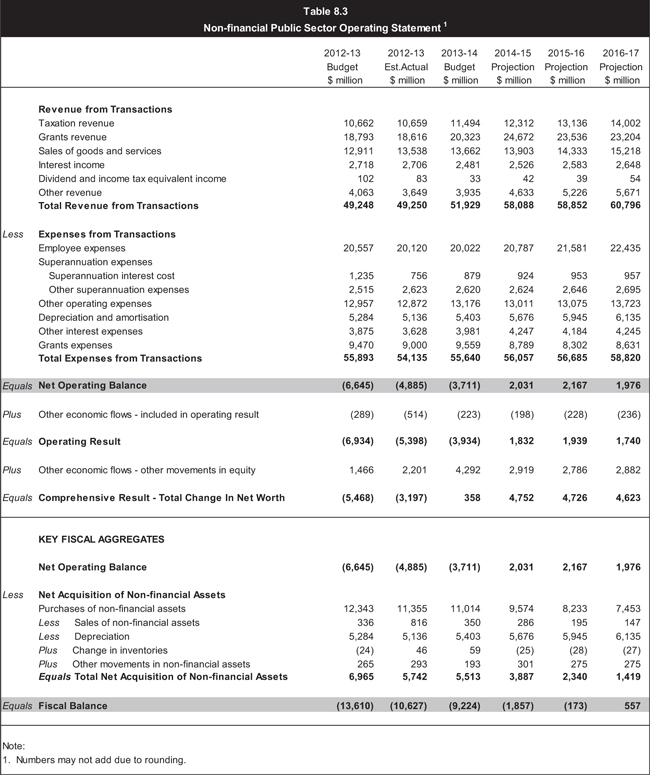

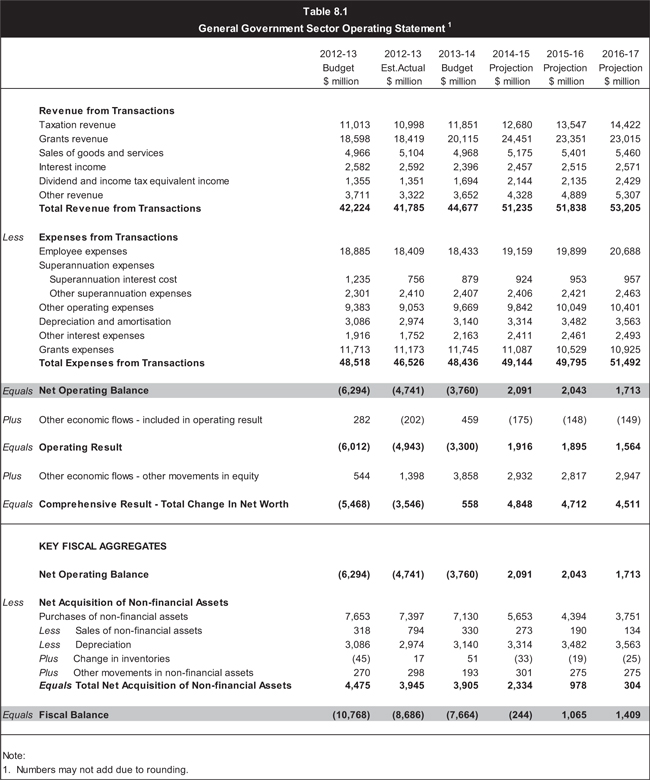

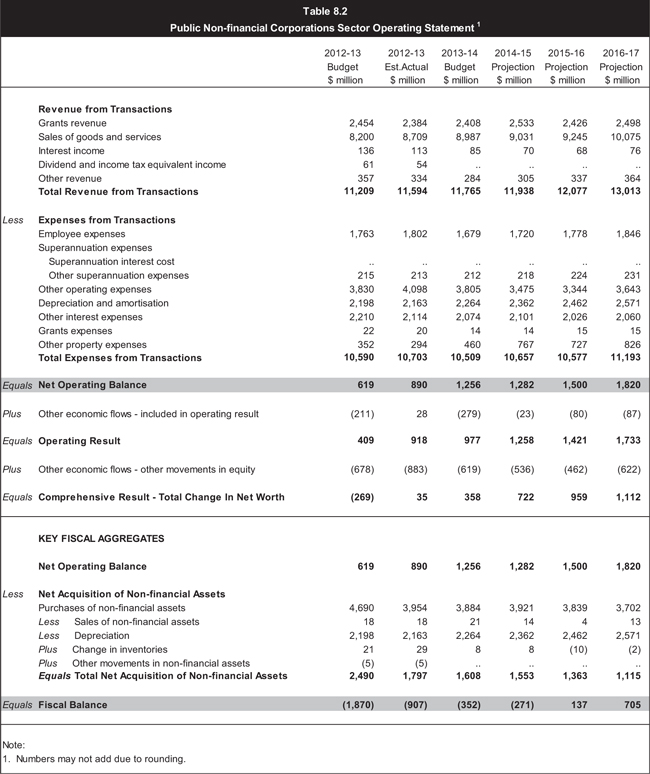

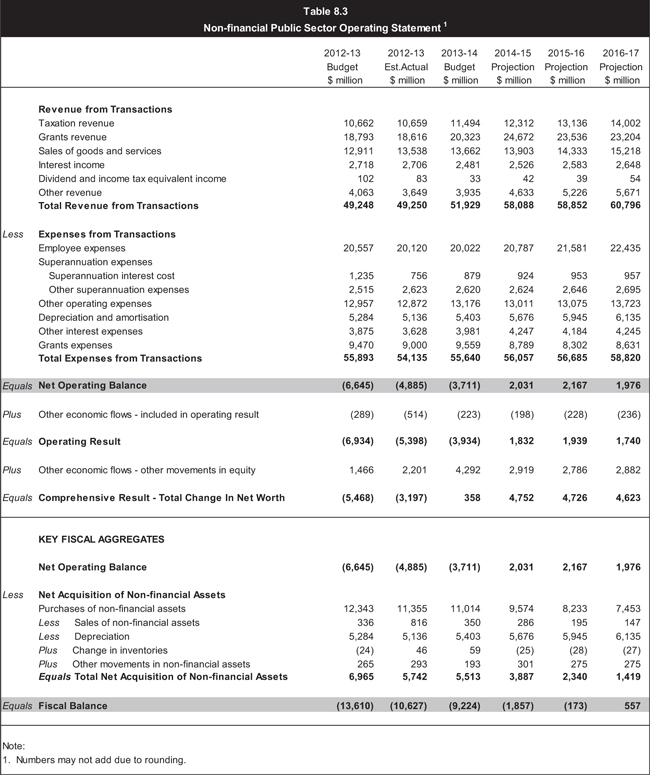

| 8. | | Uniform presentation framework | | | 137 | |

| | |

| | Introduction | | | 137 | |

| | Uniform presentation framework financial information | | | 137 | |

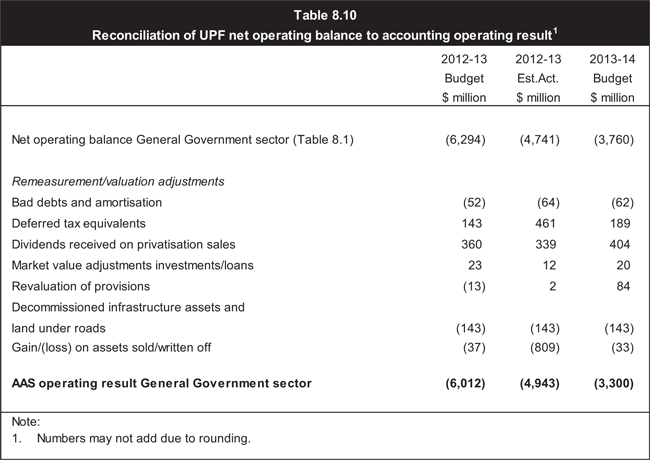

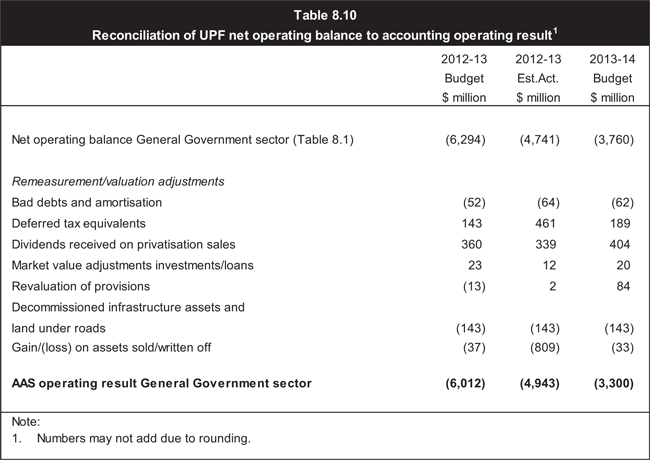

| | Reconciliation of net operating balance to accounting operating result | | | 147 | |

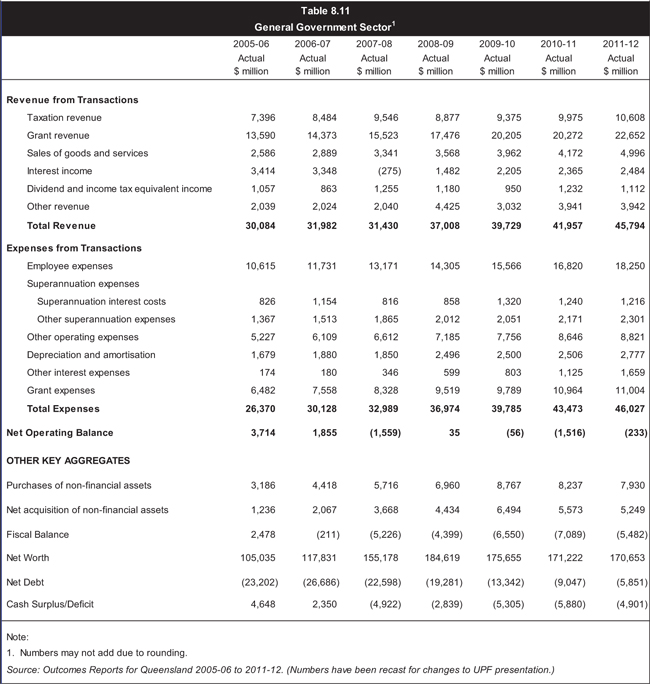

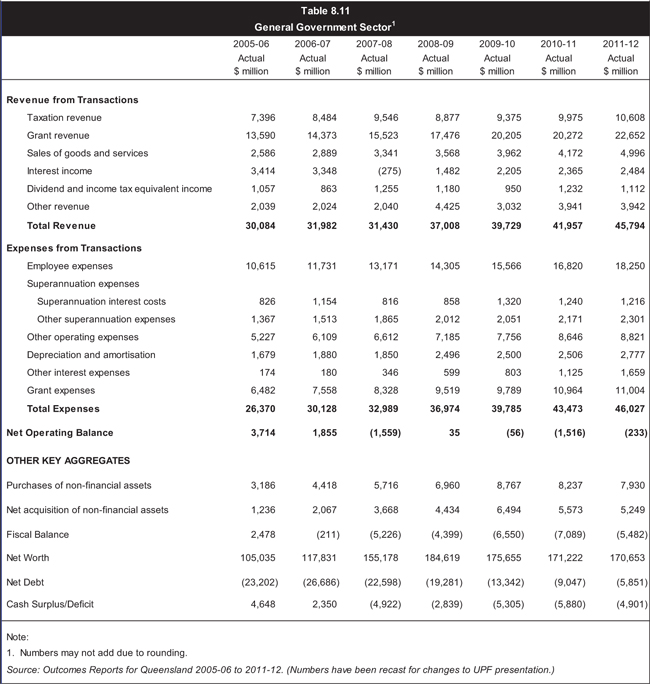

| | General Government time series | | | 148 | |

| | Other General Government uniform presentation framework data | | | 149 | |

| | Contingent liabilities | | | 155 | |

| | Background and interpretation of uniform presentation framework | | | 156 | |

| | Sector classification | | | 158 | |

| | Reporting entities | | | 159 | |

| | | | |

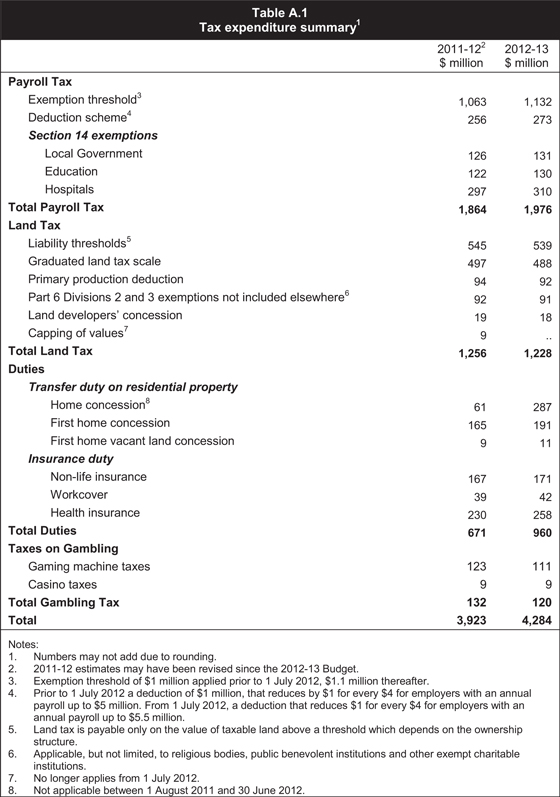

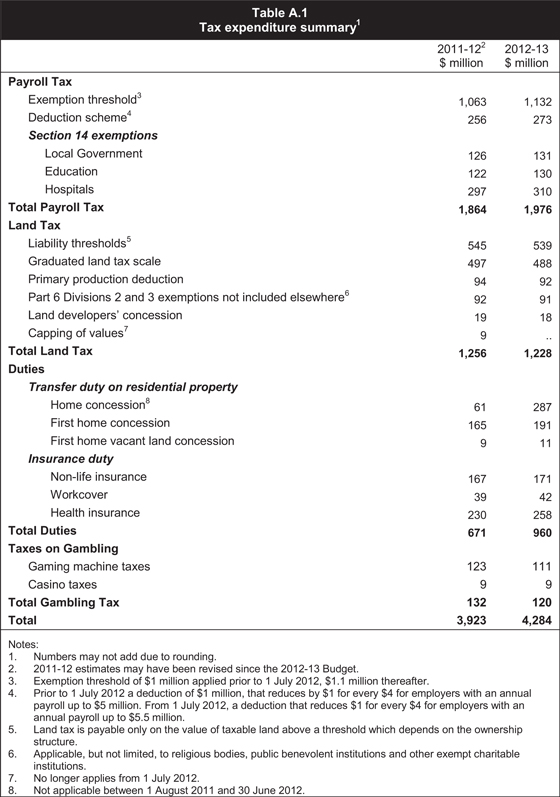

Appendix A – Tax expenditure statement | | | 163 | |

| |

| Overview | | | 163 | |

The Tax Expenditure Statement | | | 164 | |

Discussion of individual taxes | | | 166 | |

| |

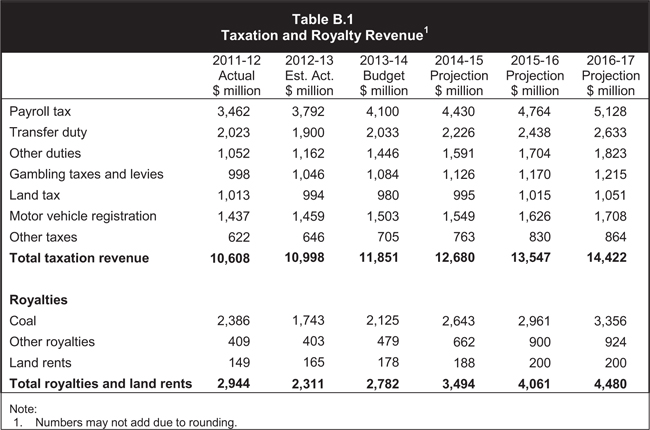

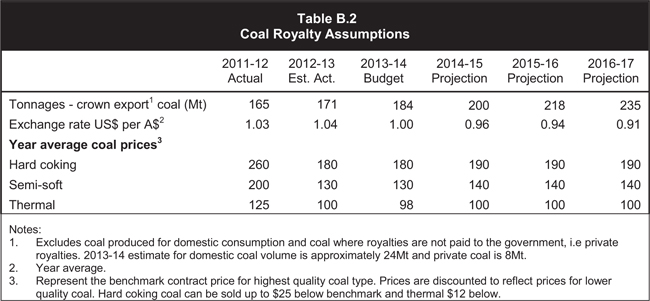

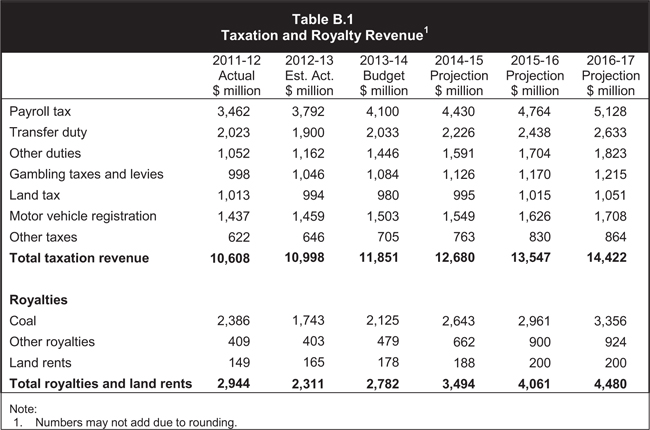

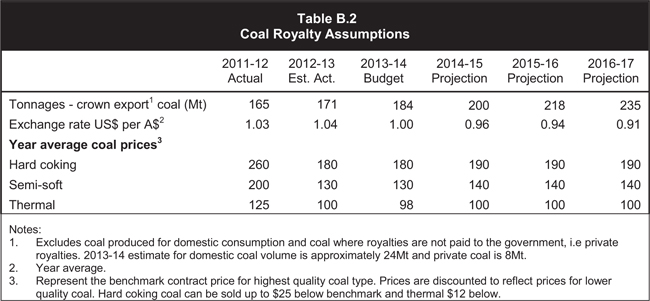

Appendix B – Revenue and expense assumptions and sensitivity analysis | | | 171 | |

| |

| Taxation revenue assumptions and revenue risks | | | 173 | |

| Royalty assumptions and revenue risks | | | 174 | |

| Sensitivity of expenditure estimates and expenditure risks | | | 176 | |

| 1 | FISCAL STRATEGY AND OUTLOOK |

FEATURES

| | • | | The General Government fiscal balance is estimated to be a deficit of $8.7 billion in 2012-13 compared to a forecast deficit of $11.2 billion in the 2012-13 Mid Year Fiscal and Economic Review (MYFER). |

| | • | | The improvement in the forecast 2012-13 fiscal balance since the 2012-13 MYFER primarily reflects lower than anticipated levels of operating expenditure across all expenditure categories, including as a result of changes in the timing of disaster expenditure. |

| | • | | Expenses in 2012-13 are estimated to have grown by only 1.1% on 2011-12. This represents the lowest growth since accrual accounting commenced in 1998-99 and contrasts with average expenses growth of 8.9% per annum in the decade to 2011-12. |

| | • | | A fiscal deficit of $7.7 billion is budgeted for 2013-14 compared to a forecast of $4.6 billion in the 2012-13 MYFER. This largely reflects the incorporation of costs associated with recent flooding, a change in timing of Australian Government disaster recovery funding as a result of the changed expenditure profile, and downward revisions to revenue. |

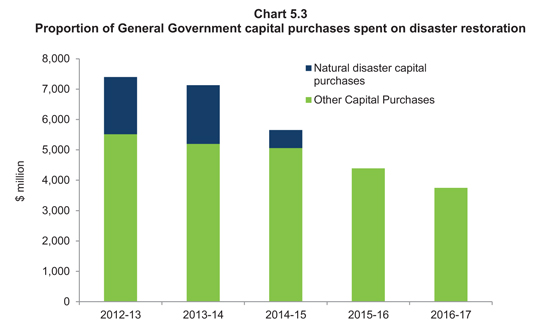

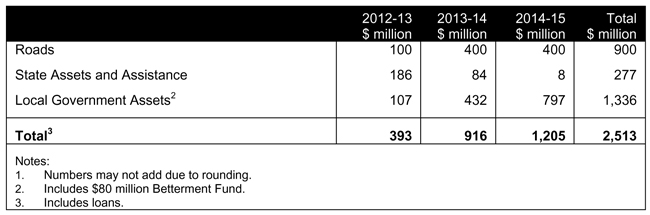

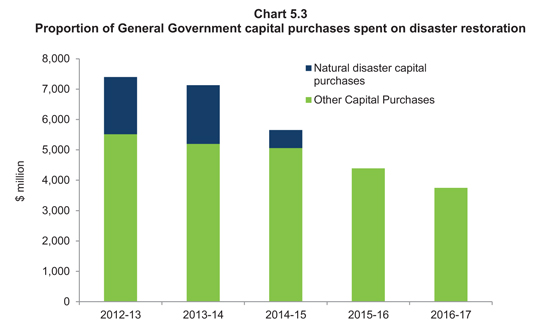

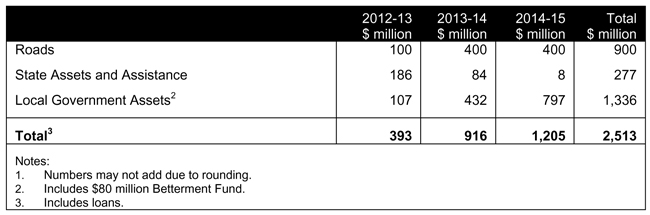

| | • | | The rebuilding effort as a result of the recent flooding caused by ex-Tropical Cyclone Oswald is forecast to cost $2.5 billion. The majority of this funding will be used to rebuild damaged roads and local government infrastructure. The cost of this disaster, coupled with other significant recent disasters, amounts to $9.3 billion over the 2012-13 to 2014-15 period. |

| | • | | Key revenue sources such as taxation, GST and mining royalties have fallen by $4.2 billion in underlying terms since the 2012-13 Budget, with $2.6 billion of this decline since 2012-13 MYFER. This reflects the ongoing weakness of export coal prices, downward reductions in the GST pool distributed by the Australian Government and the impact of the slower than anticipated property market recovery on transfer duty and land tax. Relative to the Independent Commission of Audit Interim Report, these revenue sources have fallen by $5.3 billion. |

| | • | | In the 2013-14 Budget, the Government is continuing to deliver the savings outlined in the 2012-13 Budget, as well implement savings and revenue measures that offset expenditure decisions made subsequent to the 2012-13 Budget. Nevertheless, the scale of natural disasters and revenue write-downs has resulted in a modest fiscal deficit of $244 million (or 0.5% of General Government revenue) being projected for 2014-15. The Government will continue to pursue a fiscal balance in 2014-15 as a policy objective. |

| | | | |

| | | Budget Strategy and Outlook 2013-14 | | 1 |

| | • | | The projected fiscal position continues to improve over the remainder of the forward estimates largely due to the fiscal repair measures implemented by Government since coming to Office and continued expenditure discipline. As a result, fiscal surpluses exceeding $1 billion are projected in both 2015-16 and 2016-17. |

| | • | | Despite a very difficult external environment making the fiscal consolidation task much tougher, the Government’s fiscal repair initiatives are still expected to result in General Government borrowings stabilising from 2014-15, with total non-financial public sector borrowings at 30 June 2015 expected to be $6.2 billion lower than the comparable estimate in the Independent Commission of Audit’s Interim Report. |

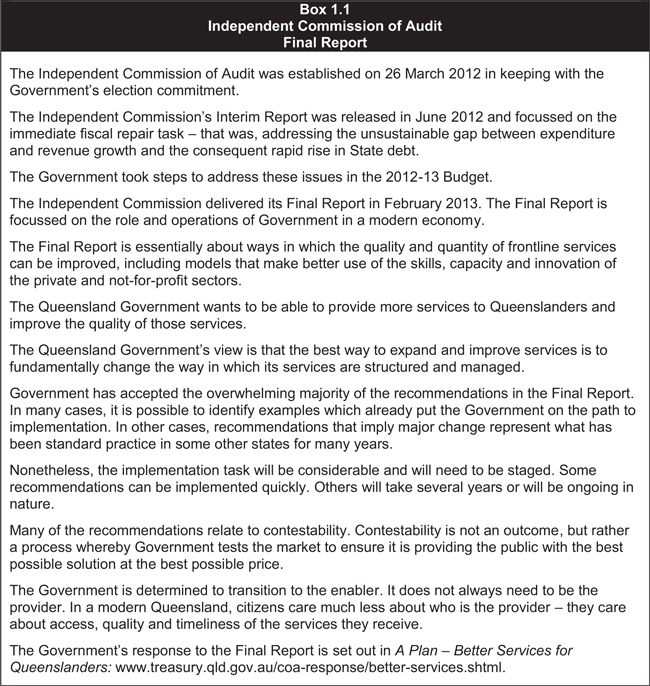

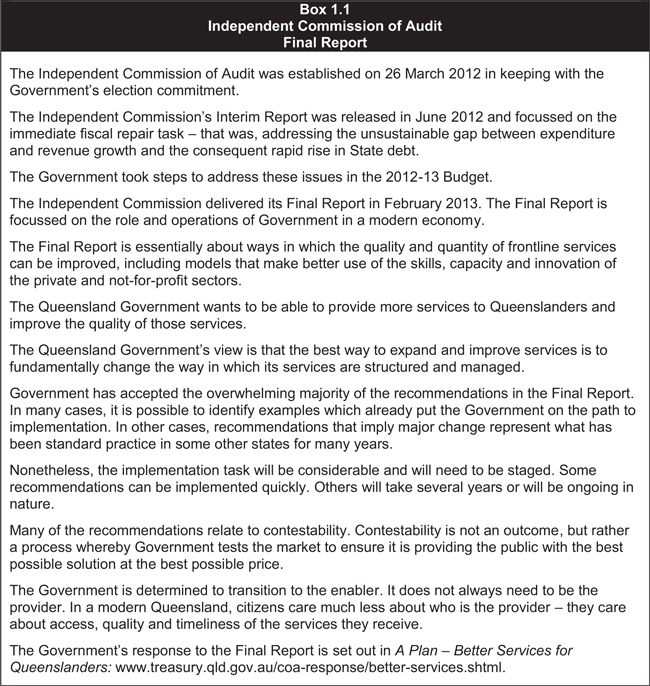

| | • | | The Government has accepted the majority of recommendations in the Final Report of the Independent Commission of Audit which is fundamentally about ways in which the quality and quantity of frontline services can be improved. Although the implementation of the Government’s response is expected to improve value for money in government service delivery, no savings from this have been incorporated in the 2013-14 Budget estimates. |

| | | | |

| 2 | | Budget Strategy and Outlook 2013-14 | | |

CONTEXT

The 2012-13 Budget implemented significant fiscal repair in Queensland. The 2012-13 Budget delivered measures totalling $7.8 billion over the 2012-13 to 2015-16 period. These savings were made by exiting activities that are not the domain of the Queensland Government, by reducing waste and inefficiency in Government activities and by implementing specifically targeted revenue measures.

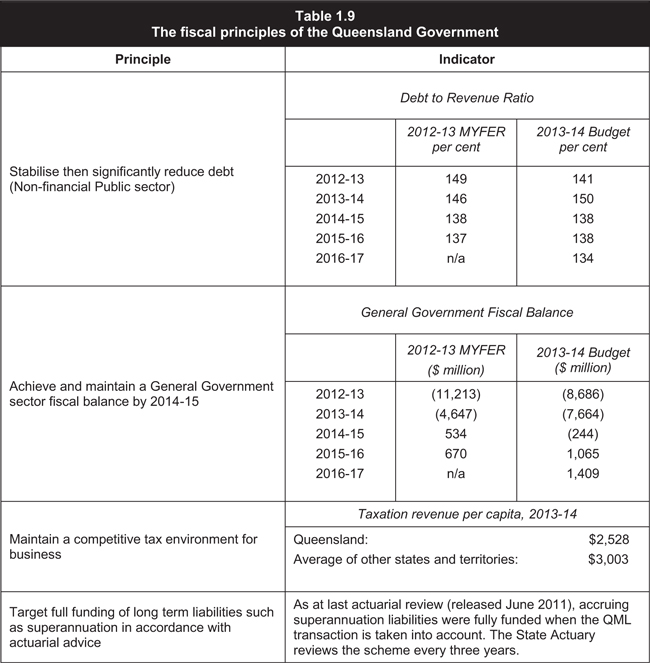

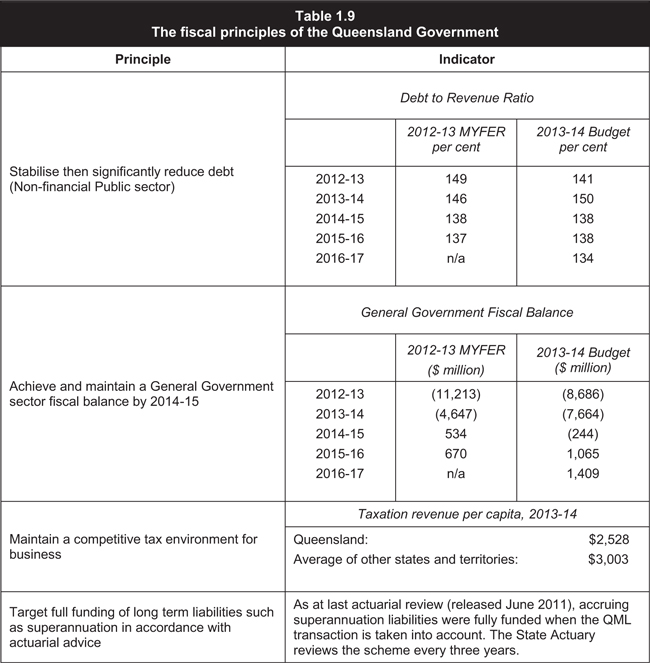

As part of this process of fiscal repair, the Government adopted a new set of fiscal principles clearly aimed at improving the sustainability of the State’s finances. These principles are:

| | • | | stabilise then significantly reduce debt |

| | • | | achieve and maintain a General Government sector fiscal balance by 2014-15 |

| | • | | maintain a competitive tax environment for business |

| | • | | target full funding of long term liabilities such as superannuation in accordance with actuarial advice. |

These fiscal principles guided Government decision making during the preparation of the 2012-13 Budget and continue to guide Government decisions including in the 2013-14 Budget.

Since coming to Office, the Government has clearly demonstrated its ability to manage expenditure, with operating expenses in 2012-13 estimated to be almost $2 billion lower than budgeted. This means expenses in 2012-13 are estimated to have grown by only 1.1% on 2011-12, which represents the lowest growth since accrual accounting commenced in 1998-99 and contrasts with average expenses growth of 8.9% per annum in the decade to 2011-12.

The Government will continue to focus its efforts on restraining expenditure growth both through ensuring that the fiscal repair measures in the 2012-13 continue to be achieved and by pursuing further reform.

However, the 2013-14 Budget has been made significantly more difficult by the rebuilding task following the widespread flooding arising from ex-Tropical Cyclone Oswald. This disaster has been estimated to cost $2.5 billion and comes on top of the significant natural disasters in 2010-11 and 2011-12 to bring total disaster spending over the 2012-13 to 2014-15 period to $9.3 billion.

In addition, key revenue sources such as taxation, GST and mining royalties have fallen by $4.2 billion in underlying terms since the 2012-13 Budget, with $2.6 billion of this decline since 2012-13 Mid Year Fiscal and Economic Review (MYFER). This reflects the ongoing weakness of export coal prices, downward reductions in the GST pool distributed by the Australian Government and the impact of the slower than anticipated property market recovery on transfer duty and land tax.

| | | | |

| | | Budget Strategy and Outlook 2013-14 | | 3 |

To keep a fiscal balance in 2014-15 within reach and ensure borrowings in the General Government sector stabilise, the Government has decided that some further measures will be implemented in the 2013-14 Budget including:

| | • | | a two year deferral of the planned increase in the payroll tax threshold, from $1.1 million to $1.2 million, to 1 July 2015 |

| | • | | an increase in duty rates on general insurance products, more closely aligning Queensland’s rates with those applied in other states |

| | • | | extending the Emergency Management, Fire and Rescue Levy (currently known as the Urban Fire Levy) to all rateable properties to ensure a sustainable funding base for emergency management services |

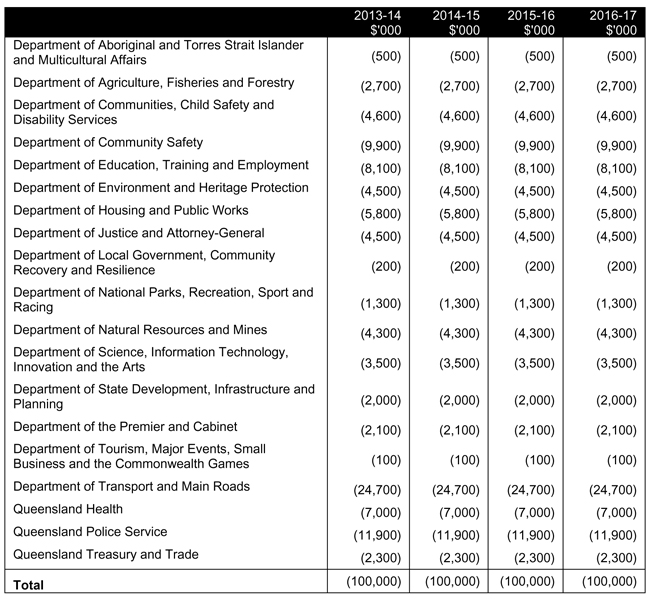

| | • | | additional departmental savings of $100 million per annum from 2013-14 onwards. |

Further detail on these measures is provided in the Revenue and Expense Chapters of this Budget Paper, with financial impacts detailed in Budget Paper 4 – Budget Measures.

In the absence of measures taken in the 2012-13 and 2013-14 Budgets, the fiscal deficit would be $10.1 billion in 2013-14.

In addition to these measures, the Government has accepted the majority of the recommendations outlined in the Final Report of the Independent Commission of Audit. The Final Report is fundamentally about examining ways in which the quality and quantity of frontline services can be improved, including models that make better use of the skills, capacity and innovation of the private and not-for-profit sectors.

The Government’s implementation of the accepted recommendations represents the next stage of public sector reform in Queensland and will guide how public services are delivered into the future. Many of the recommendations relate to contestability. Contestability is not an outcome, but rather a process whereby Government tests the market to ensure it is providing the public with the best possible solution at the best possible price. The Government is determined to transition to being the “enabler”. It does not always need to be the “doer”.

While there is a clear expectation that the associated reforms will result in improved value for money outcomes in the delivery of services, no associated savings have been factored into the forward estimates presented in the 2013-14 Budget.

| | | | |

| 4 | | Budget Strategy and Outlook 2013-14 | | |

OVERVIEW

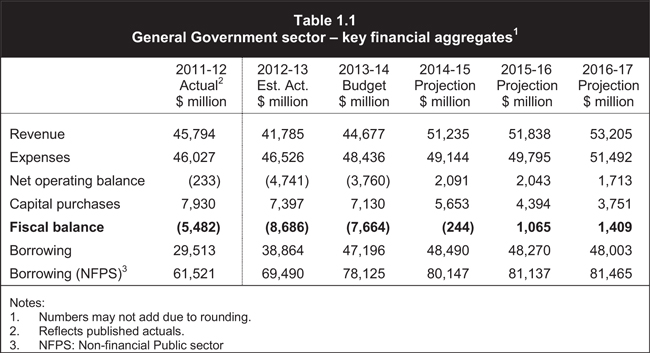

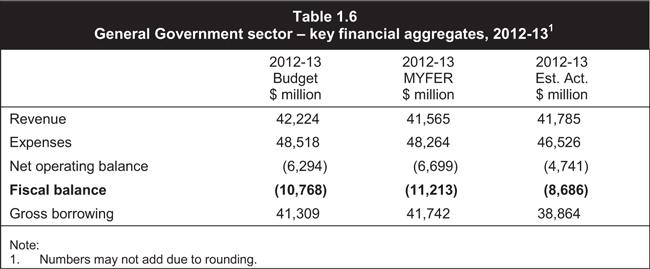

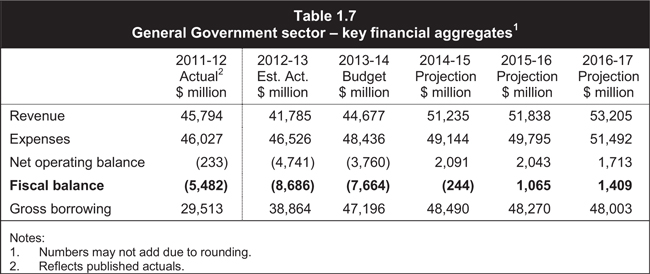

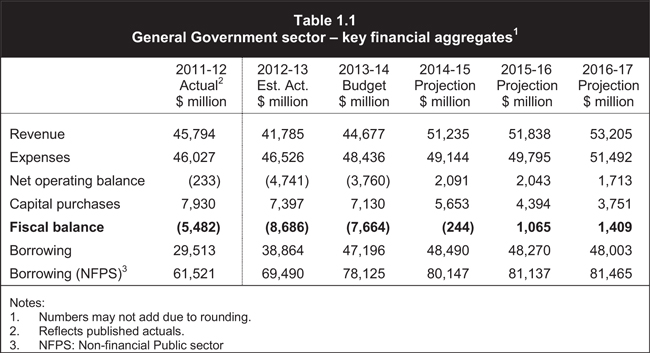

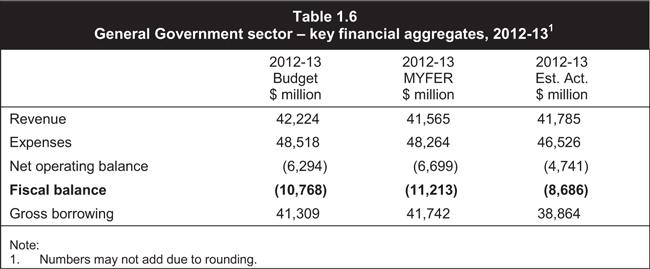

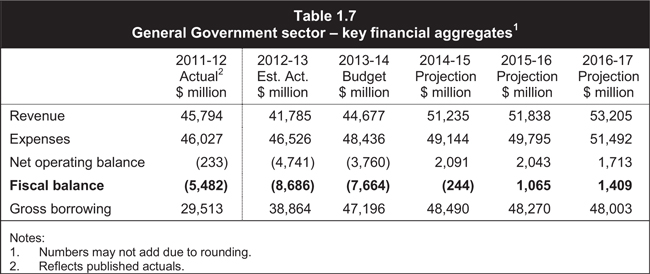

The key fiscal aggregates of the General Government sector for the 2013-14 Budget are outlined in Table 1.1 and are discussed in detail throughout this chapter.

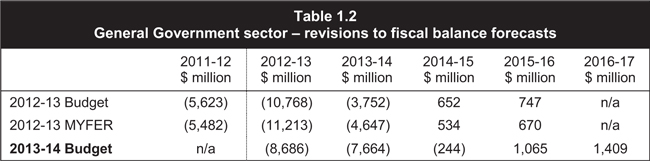

As identified in Table 1.2, the anticipated 2012-13 fiscal deficit of $8.686 billion compares with a forecast deficit of $11.213 billion expected in the 2012-13 MYFER. This improvement is largely the result of lower expenditure across all expense types and a small decrease in capital expenditure. There has been a change to the timing of reconstruction expenditure, partly due to the impact of ex-Tropical Cyclone Oswald, which has moved some expenditure from 2012-13 to later in the forward estimates period.

| | | | |

| | | Budget Strategy and Outlook 2013-14 | | 5 |

The estimated 2013-14 General Government sector fiscal balance is expected to be weaker than forecast in the 2012-13 MYFER. This is primarily a result of the widespread damage caused by ex-Tropical Cyclone Oswald, which occurred after the release of the 2012-13 MYFER. This event and the associated reprofiling of expenditure from previous disasters is responsible for around $2.7 billion of the deterioration in the 2013-14 fiscal balance since the 2012-13 MYFER. In addition, global economic conditions have been weaker than anticipated, which, in conjunction with flow-on impacts to the domestic economy, has resulted in further downward revisions to the State’s key revenues. In particular:

| | • | | royalty revenue estimates have been revised down by $1.288 billion over the period 2012-13 to 2015-16, primarily because of reductions in coal price forecasts and a higher exchange rate assumption |

| | • | | taxation revenue (not including taxation revenue measures) has been revised down by $638 million over the period 2012-13 to 2015-16, largely due to expectations of a slower recovery in property market activity reducing transfer duty estimates and lower land values reducing land tax estimates |

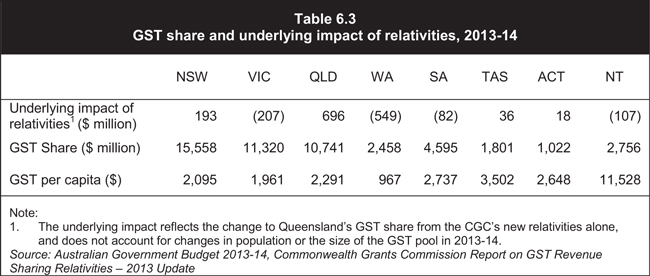

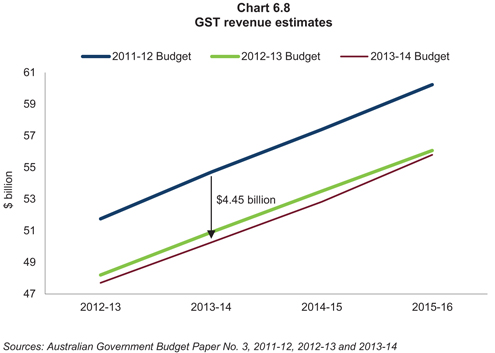

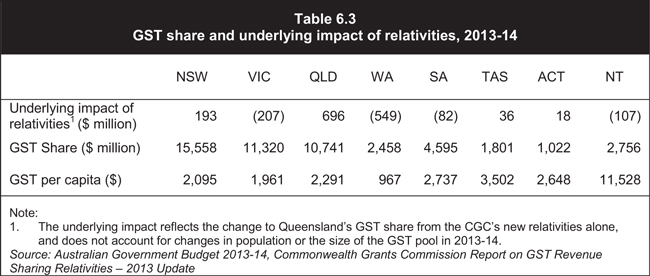

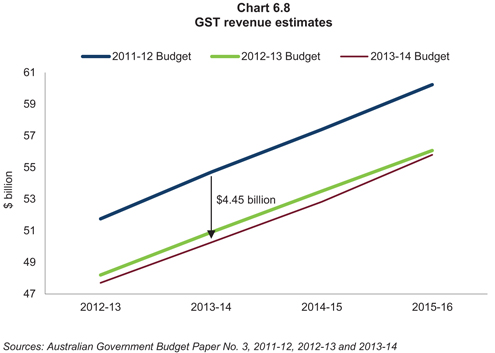

| | • | | Queensland’s share of GST revenue has been revised down by $696 million across 2012-13 to 2015-16 as a result of downward revisions in the Australian Government’s forecasts of both national GST collections and Queensland’s share of the national population. |

As can be seen in Table 1.2, while the impact of natural disasters and a weaker than anticipated revenue outlook have negatively impacted the fiscal outlook relative to the 2012-13 Budget and MYFER, the General Government fiscal balance continues to improve over the forward estimates period. This reflects the ongoing benefit of the Government’s fiscal repair measures and its continuing commitment to improve the State’s fiscal position.

| | | | |

| 6 | | Budget Strategy and Outlook 2013-14 | | |

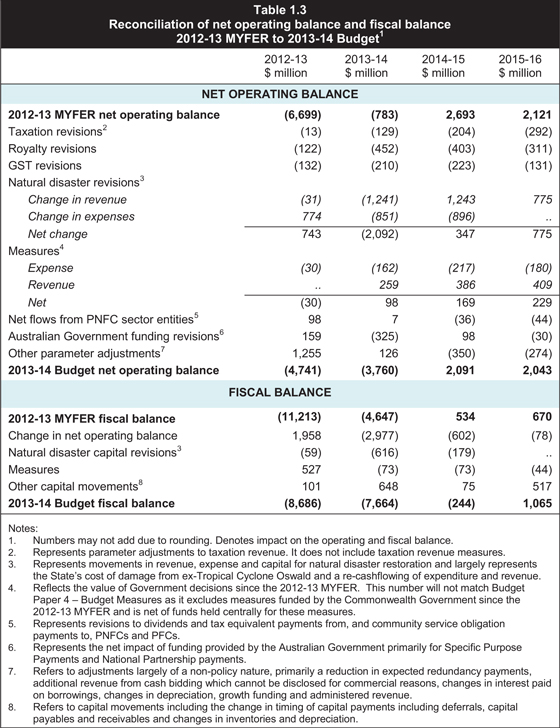

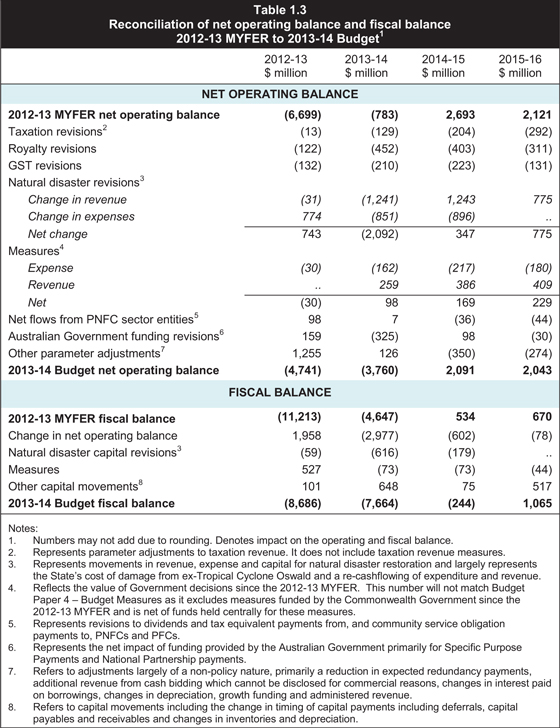

Table 1.3 provides a breakdown of the movements in the net operating balance and fiscal balance since the 2012-13 MYFER.

| | | | |

| | | Budget Strategy and Outlook 2013-14 | | 7 |

Responding to disasters

Ex-Tropical Cyclone Oswald, and the flooding that followed, brought destruction to 57 Queensland local government areas from January to March 2013. Many of these areas were still recovering from the enormous loss and damage brought by the natural disasters of 2010 to 2012.

While the magnitude and widespread nature of the disasters makes it difficult to calculate a precise fiscal impact, the Queensland Reconstruction Authority estimates the expenditure associated with ex-Tropical Cyclone Oswald at $2.5 billion. These repair and recovery costs are additional to the cost of other recent significant natural disasters and bring total disaster spending over the 2012-13 to 2014-15 period to $9.3 billion.

Betterment

On 8 February 2013, the Queensland Government signed the National Partnership Agreement with the Australian Government which recognised the need for a more streamlined process for the approval of Betterment funding. The Queensland Government asked the Australian Government to put $100 million on the table to build more resilient infrastructure. However, Queensland was offered $40 million which it has matched to create an $80 million Betterment Fund.

| | | | |

| 8 | | Budget Strategy and Outlook 2013-14 | | |

A number of roads and bridges have been rendered inaccessible on multiple occasions as a result of weather events in recent years. A map identifying the number of times sections of the State-controlled road network have been impacted by events is available at www.qldreconstruction.org.au.

The Queensland Government has identified a number of proposed betterment works, including sealing and strengthening road pavements and installing flood mitigation infrastructure. Betterment projects already benefiting from the Fund include:

| | • | | Gayndah Water Intake (North Burnett Regional Council) |

| | • | | Blacks Road, Isis River (Bundaberg Regional Council) |

| | • | | Barretts Road, Isis River (Bundaberg Regional Council) |

| | • | | Gentle Annie Bridge, Apple Tree Creek (Bundaberg Regional Council). |

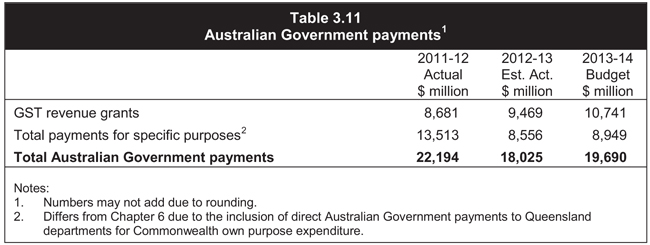

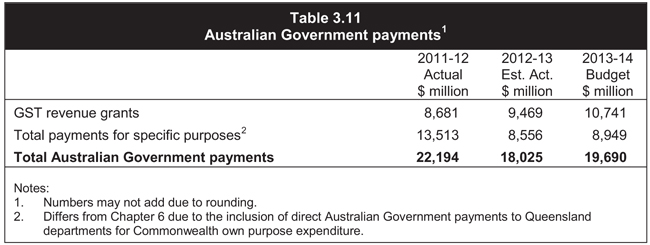

Australian Government payments

The Australian Government released its 2013-14 Budget on 14 May 2013. As well as reducing forecasts for Queensland’s share of GST revenue, the Australian Government again reduced forecasts for health payments. Since the 2012-13 Budget, the Australian Government has reduced health funding forecasts by approximately $476 million across the forward estimates.

In addition, the Australian Government has continued its practice of moving cash payments to suit its own fiscal requirements, rather than to align with the actual delivery of services. Funding from the Australian Government has a significant impact on Queensland’s fiscal position when it is not matched by an expense in the same financial year. This increases the volatility of the Queensland Budget estimate and makes it difficult to identify underlying trends over time.

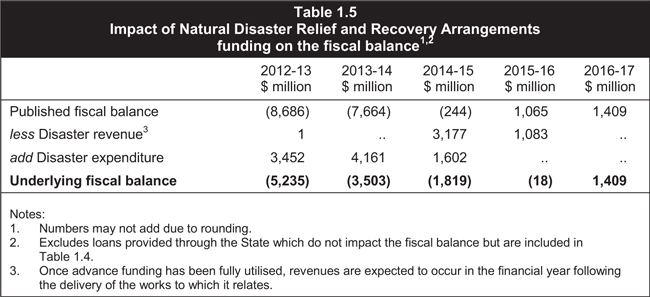

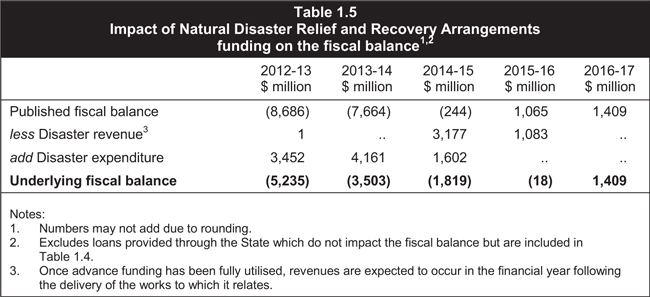

The timing of revenue and expenditure in relation to natural disasters has significantly impacted Queensland’s headline fiscal balance. In particular, the Australian Government provided significant natural disaster funding in 2010-11 and 2011-12 in advance of spending requirements with the remaining payments in arrears of expenditure. This timing mismatch had the effect of improving Queensland’s budget outcomes in 2011-12, but is negatively impacting the State’s fiscal position in 2012-13 and 2013-14.

| | | | |

| | | Budget Strategy and Outlook 2013-14 | | 9 |

Table 1.5 outlines the impact of natural disaster arrangements on Queensland’s fiscal balance.

Further, the Queensland Government is continuing to gather the evidence required to ensure that some previous Natural Disaster Relief and Recovery Arrangements expenditure meets the Australian Government’s eligibility requirements for entitlement to $725 million in disaster reimbursement payments. Should a resolution not be reached and the Australian Government fails to reimburse Queensland for these disaster works, the impact of disasters over the forward estimates will be worse than that indicated in Table 1.5.

BUDGET OUTCOMES 2012-13

Key financial aggregates

| | | | |

| 10 | | Budget Strategy and Outlook 2013-14 | | |

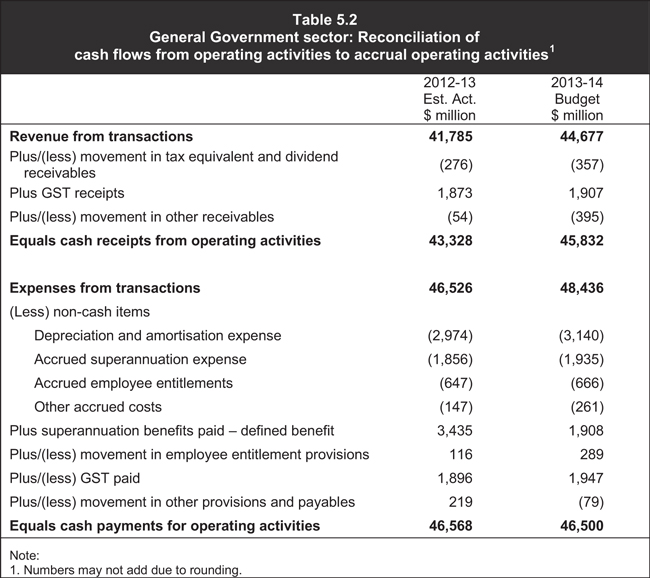

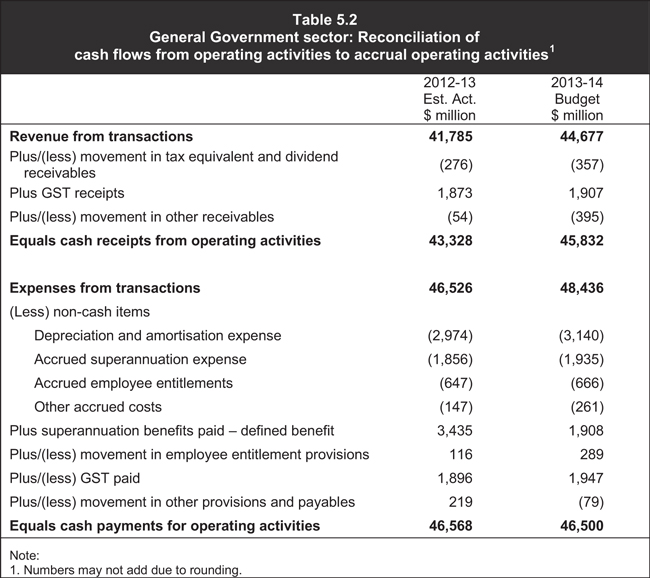

Operating balance

The net operating balance estimated for 2012-13 is a deficit of $4.741 billion, compared with a deficit of $6.699 billion forecast in the 2012-13 MYFER.

The improvement in the forecast net operating balance since MYFER primarily reflects significantly lower expenditure across all expense types. Total expenses in 2012-13 are estimated to be $1.738 billion lower than the MYFER forecast and are now estimated to be only 1.1% higher than the 2011-12 outcome.

Further details on revenue and expenses are contained in Chapters 3 and 4 respectively.

Fiscal balance

The fiscal balance estimated for 2012-13 is a deficit of $8.686 billion, compared with a deficit of $11.213 billion in the 2012-13 MYFER.

The improvement in the forecast fiscal balance since the 2012-13 MYFER primarily reflects the improvement in the operating position, combined with lower than expected capital expenditure, which largely reflects a change in the timing of capital spending as a result of the significant weather events in early 2013.

A reconciliation of the movements in the fiscal balance between the MYFER forecast and the 2013-14 Budget estimate of 2012-13 is provided in Table 1.3.

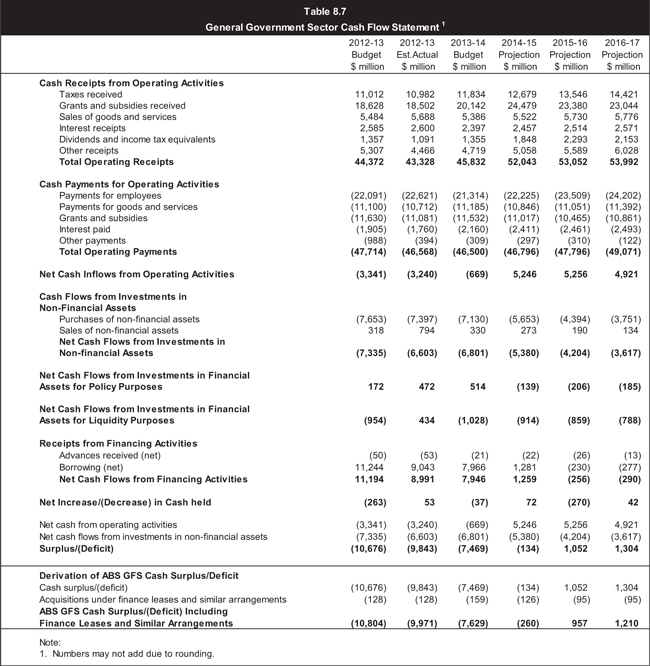

Cash Flows and Balance Sheet

General Government sector

Cash surplus/(deficit)

The General Government sector is expected to record a cash deficit in 2012-13 of $9.843 billion compared to an $11.314 billion deficit forecast in the MYFER. The smaller than expected cash deficit primarily reflects the improvement in the fiscal balance.

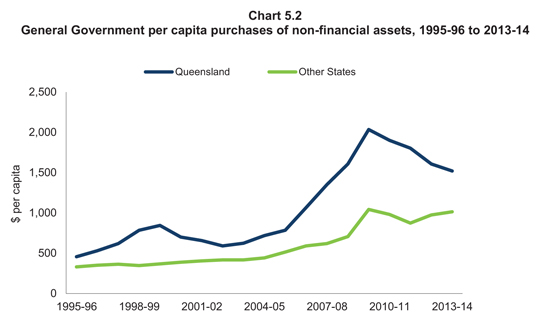

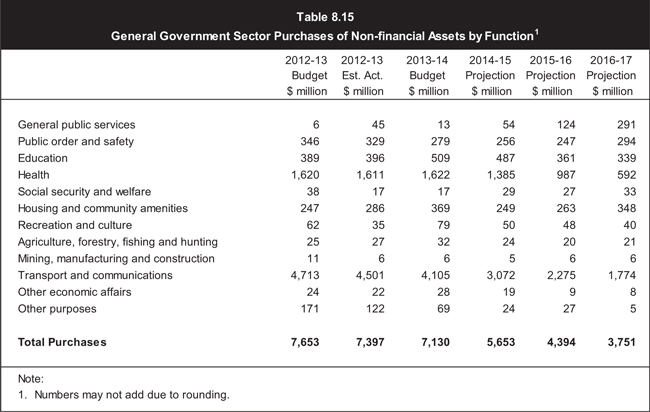

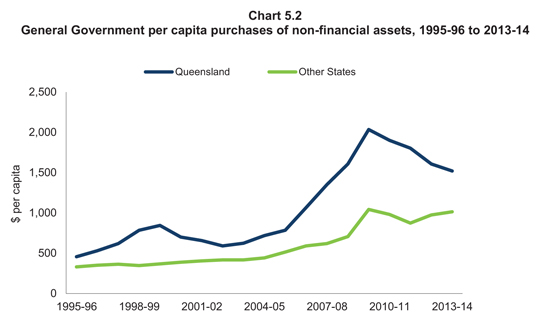

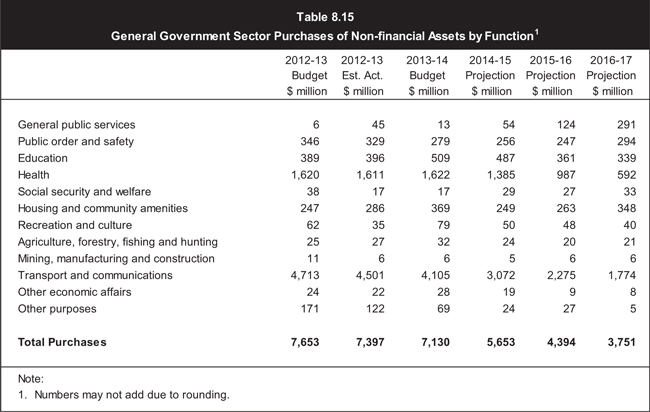

Capital purchases

General Government purchases of non-financial assets (capital spending) in 2012-13 are estimated to be $7.397 billion. This is $285 million less than forecast in the MYFER, due to the impact of severe weather conditions, including ex-Tropical Cyclone Oswald.

| | | | |

| | | Budget Strategy and Outlook 2013-14 | | 11 |

Borrowings

Net borrowings (additional borrowings for the year as itemised in the Cash Flow Statement) of $9.043 billion are expected in 2012-13, $3.056 billion less than forecast in the MYFER, primarily reflecting the lower cash deficit including the proceeds from the sale and leaseback of government office accommodation.

Gross borrowings (the stock of borrowings outstanding as stated in the Balance Sheet) of $38.864 billion are estimated at 30 June 2013. The reduction in net borrowing requirements as a result of the improved fiscal position is the key driver of the gross borrowings estimate being $2.878 billion less than the MYFER estimate.

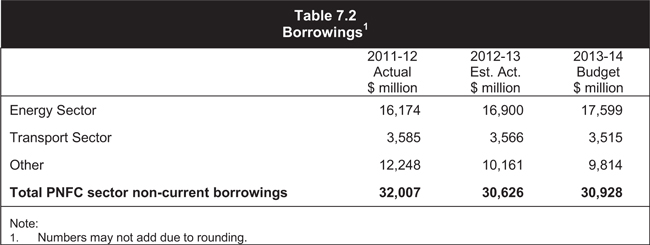

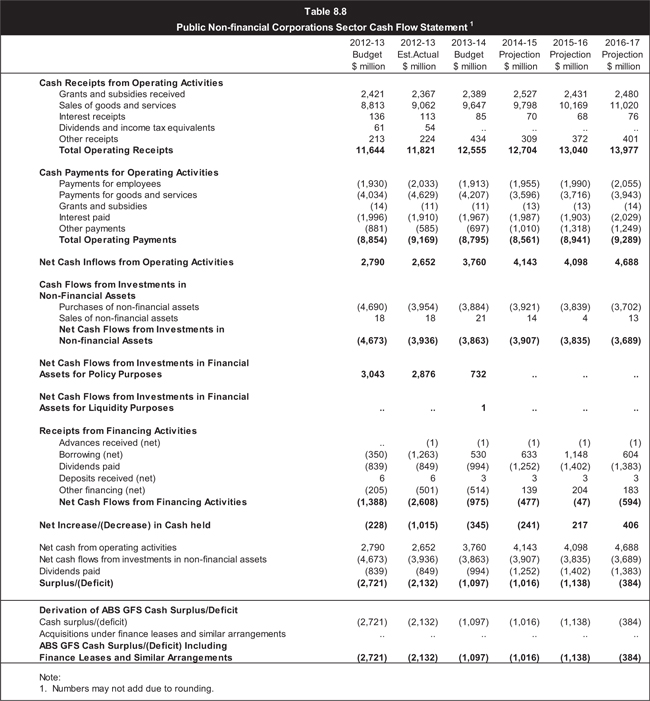

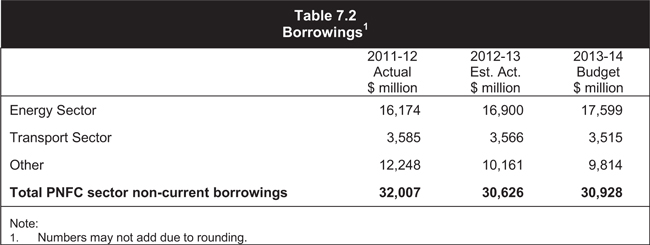

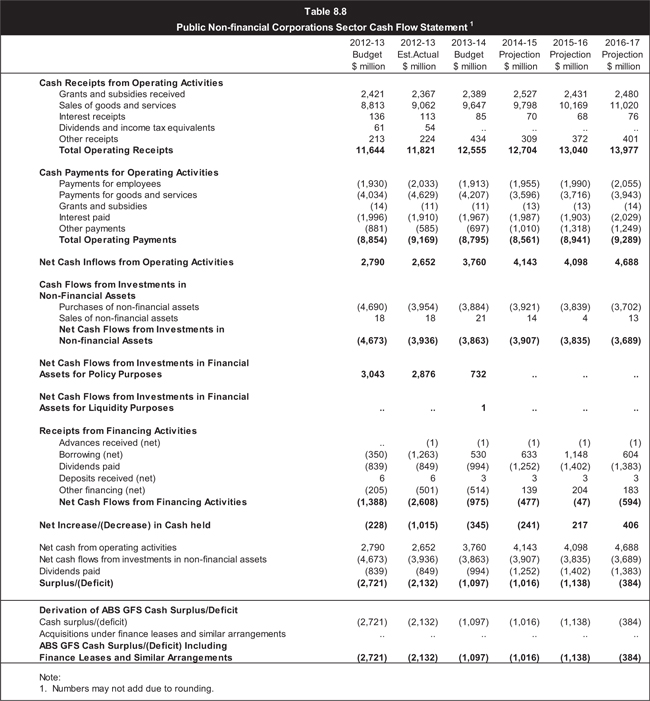

Public Non-financial Corporations sector

The Public Non-financial Corporations (PNFC) sector is comprised of the State’s commercial entities, such as those that operate in the energy, transport and water industries. Further detail on the PNFC sector is provided in Chapter 7.

The PNFC sector is expecting a net repayment of $1.263 billion of borrowings in 2012-13, similar to the $1.231 billion 2012-13 MYFER estimate, largely reflecting lower capital spending in the sector. Gross borrowings in the PNFC sector of $30.626 billion are projected at 30 June 2013, slightly below the MYFER estimate of $30.705 billion.

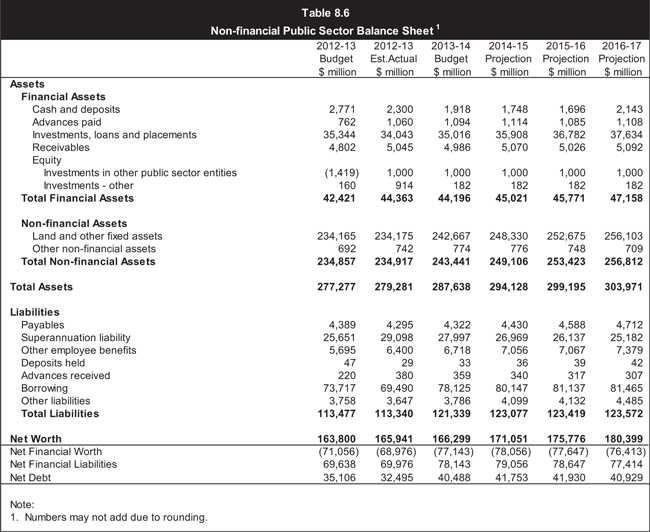

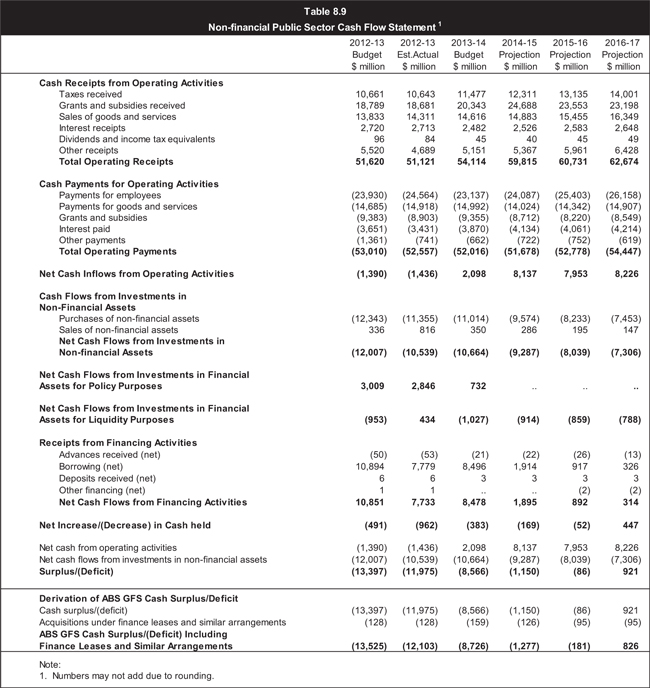

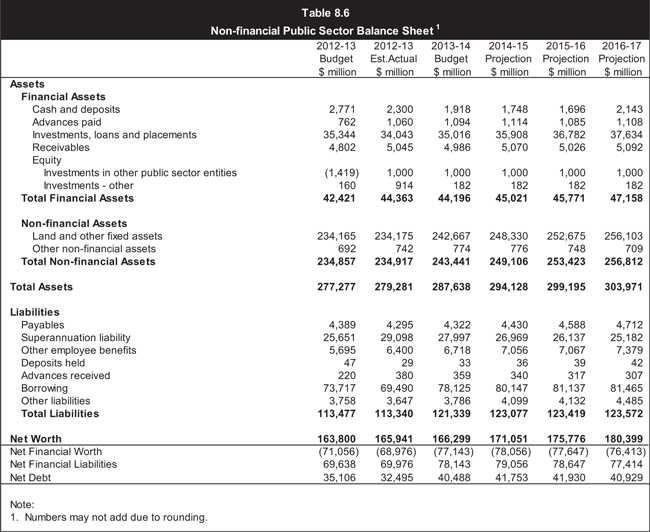

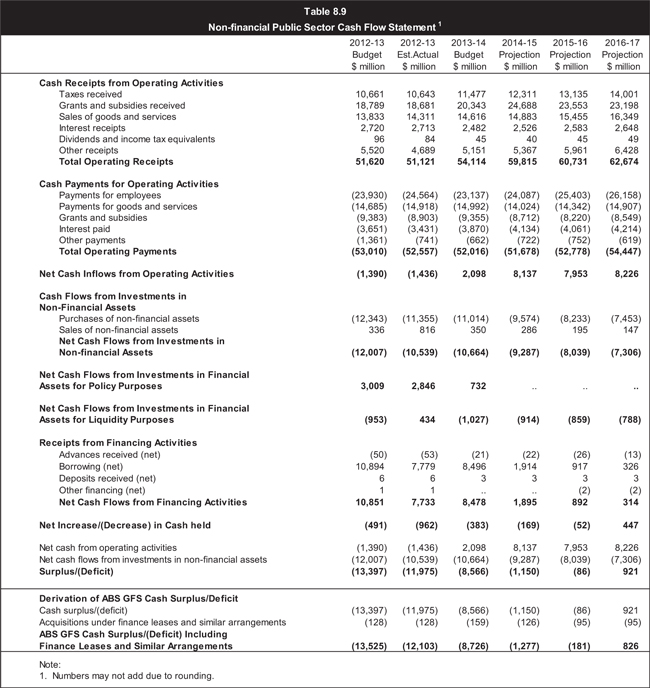

Non-financial Public sector

The Non-financial Public (NFP) sector is the combination of the General Government and Public Non-financial Corporations (PNFC) sectors, with transactions between these sectors being eliminated.

Net borrowings of $7.779 billion are expected in the NFP sector in 2012-13, a decrease of $3.089 billion compared with the 2012-13 MYFER estimate, primarily driven by the improvement in the fiscal balance in the General Government sector.

Gross borrowings of $69.49 billion are projected at 30 June 2013, comprising $38.864 billion in the General Government sector and $30.626 billion in the PNFC sector. Total NFP sector borrowings are expected to be $2.957 billion less than the MYFER estimate, largely reflecting the lower borrowing requirement in the General Government in 2012-13.

Capital purchases of $11.355 billion are expected in the NFP sector in 2012-13, $826 million lower than MYFER estimate.

| | | | |

| 12 | | Budget Strategy and Outlook 2013-14 | | |

2013-14 BUDGET AND OUTYEAR PROJECTIONS

Key financial aggregates

Table 1.7 provides aggregate actual outcome information for 2011-12, estimated actual outcome information for 2012-13, forecasts for 2013-14 and projections for the outyears.

Operating balance

2013-14 Budget

A net operating deficit of $3.76 billion is budgeted for 2013-14, compared with an estimated deficit of $783 million in the MYFER.

The deterioration in the forecast operating position since MYFER is largely driven by the incorporation of expenditure associated with ex-Tropical Cyclone Oswald and changes to the timing of Natural Disaster Relief and Recovery Arrangement revenue.

As shown in Table 1.5, there is a significant mismatch between the timing of natural disaster revenue from the Australian Government and the timing of the associated expenditure.

Grant funding from the Australian Government, excluding GST, is expected to be approximately $1.5 billion lower in 2013-14 than estimated at MYFER. The main contributors to this reduction are changes in the timing of funding for natural disasters and local government grant funding (paid via the State) being brought forward into 2012-13.

| | | | |

| | | Budget Strategy and Outlook 2013-14 | | 13 |

The other key drivers in the deterioration of the forecast 2013-14 net operating position since the 2012-13 MYFER are:

| | • | | a $452 million reduction in forecast royalty revenue, largely due to a weaker outlook for coal prices |

| | • | | a $210 million reduction in Queensland’s forecast share of GST revenue, as a result of the Australian Government revising down the size of the national GST pool and also revising down Queensland’s share of the national population |

| | • | | a $129 million underlying reduction in taxation revenue, primarily reflecting a slower recovery in property market activity and weakness in taxable land values. |

Forward estimates

Significant improvements in the net operating balance are projected over the forward estimates as a result of the fiscal repair measures announced in the 2012-13 Budget, which were estimated to improve the fiscal balance by an average of $2.4 billion per annum from 2013-14 onwards.

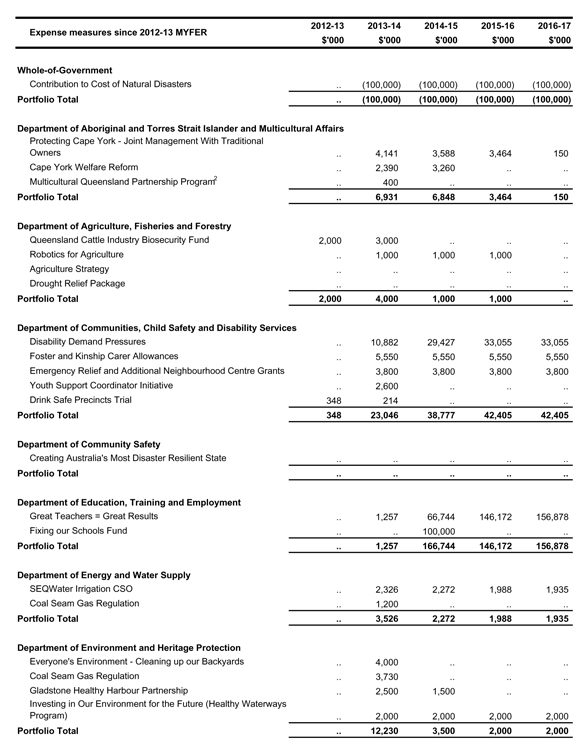

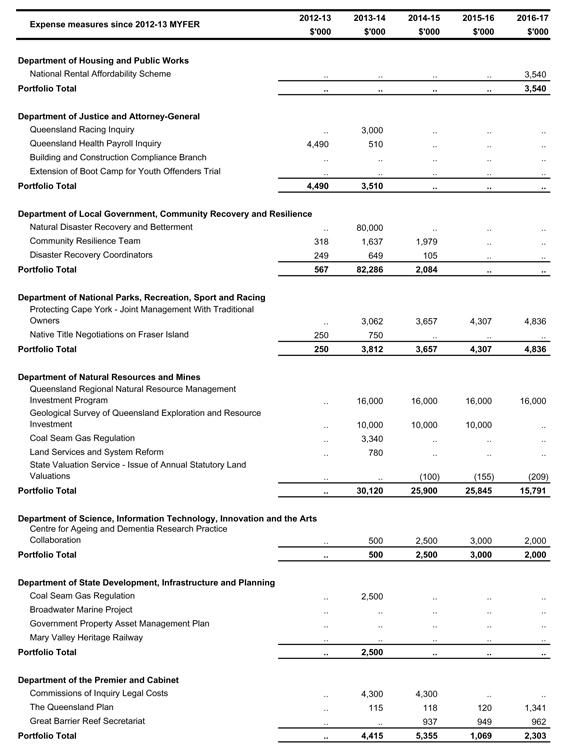

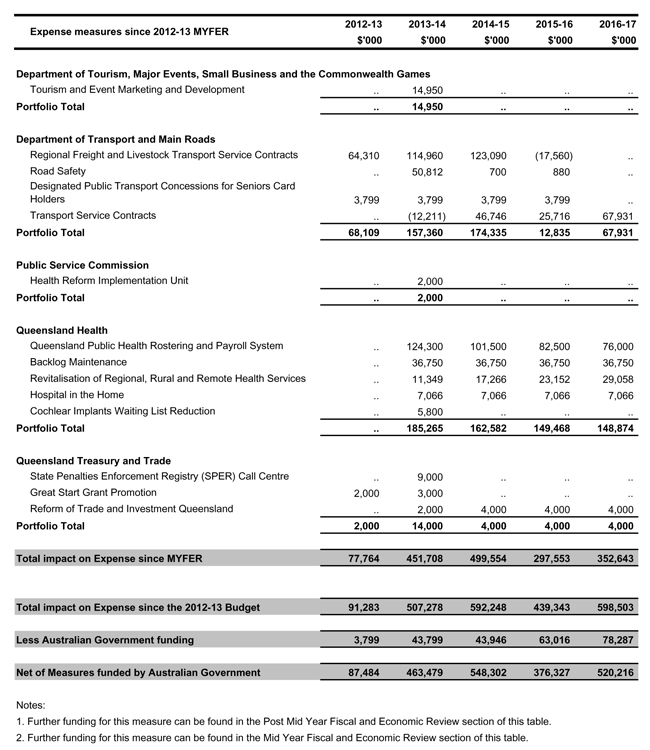

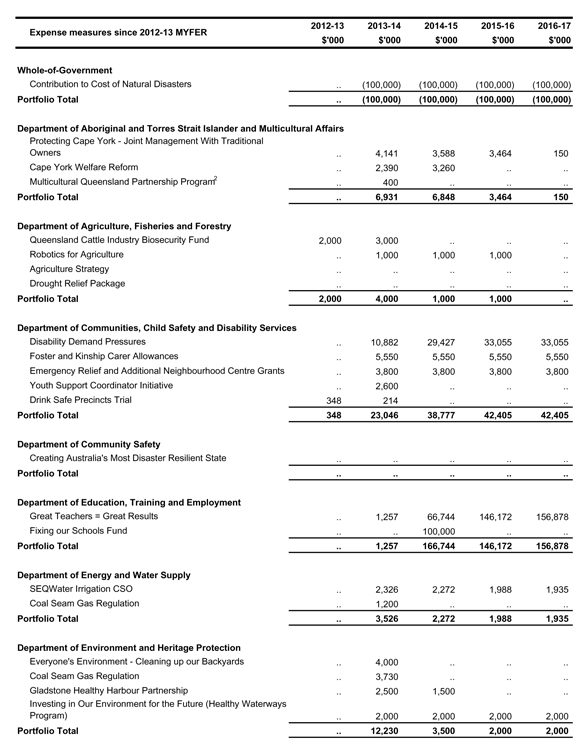

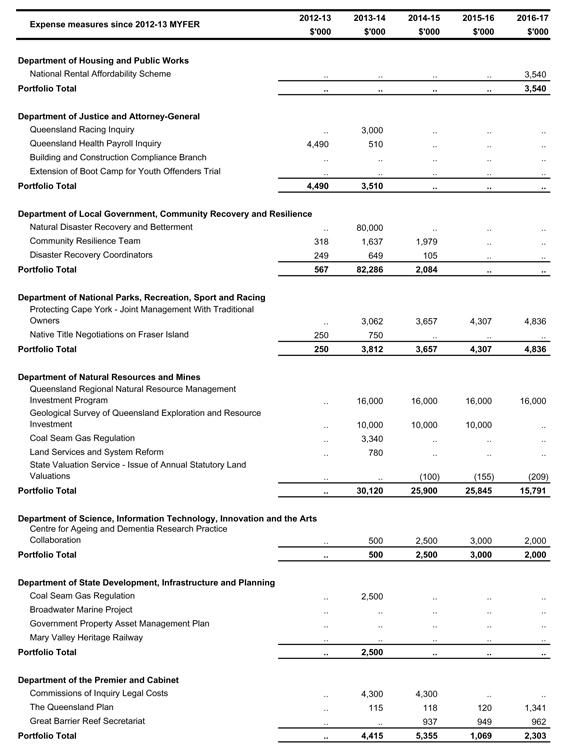

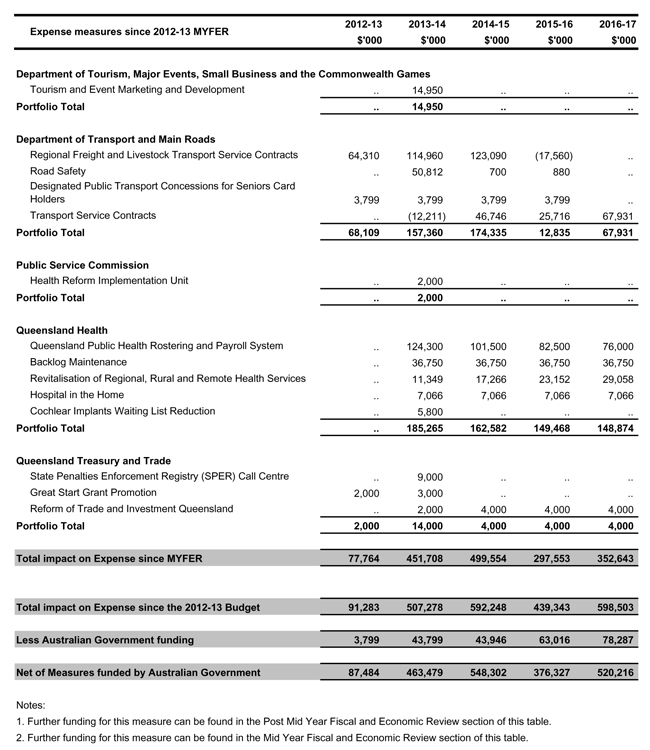

The 2013-14 Budget demonstrates the Government’s ongoing commitment to fiscal discipline. While the Government is implementing service delivery enhancements, such as Great Teachers = Great Results, the budget impact of spending measures since the 2012-13 Budget has been offset across the forward estimates by saving and revenue measures.

Total operating expenses are expected to grow by 4.1% in 2013-14, with the largest component of this growth relating to grants to local governments associated with disaster recovery. Abstracting from disaster related expenditure, operating expenses are expected to grow by 2.8%. Expenses are projected to continue to grow modestly from 2014-15 onwards.

| | | | |

| 14 | | Budget Strategy and Outlook 2013-14 | | |

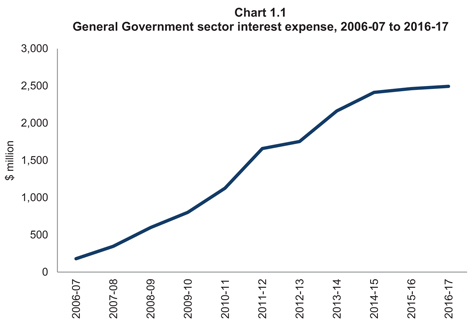

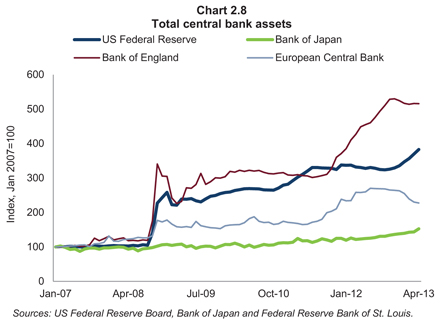

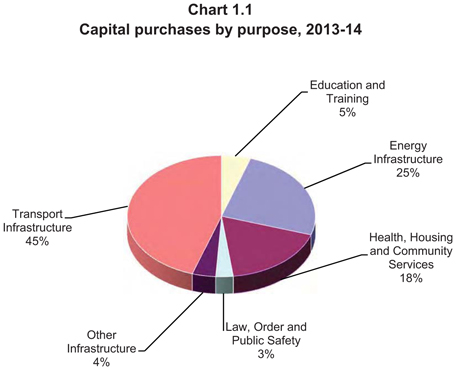

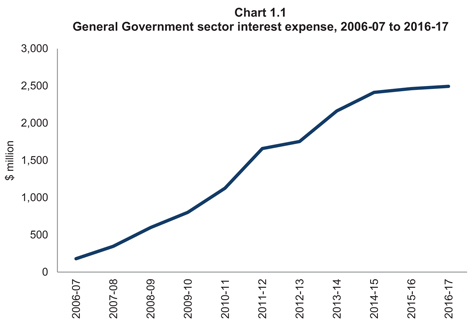

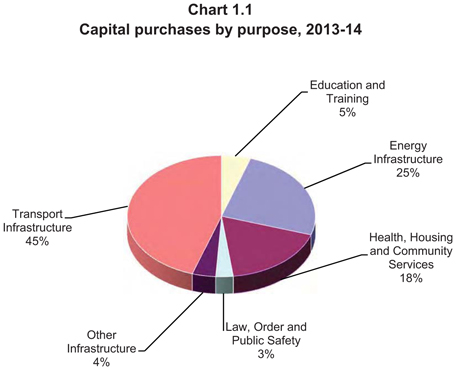

The Independent Commission of Audit’s Interim Report found that interest expense had been the fastest growing expense in the decade to 2010-11. Chart 1.1 shows that General Government sector interest expense continues to grow in 2013-14 and 2014-15 before stabilising, consistent with the profile for gross borrowings.

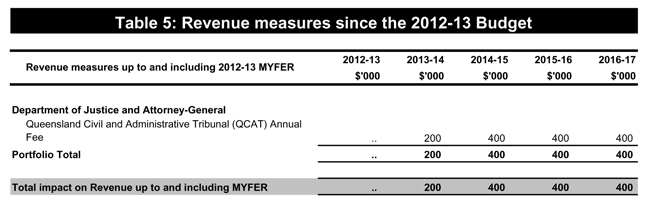

In terms of revenue, the most significant underlying changes since the MYFER relate to downward revisions in royalty, GST and tax forecasts. These reductions have been partly offset by the introduction of revenue measures in relation to payroll tax, insurance duty and the Emergency Management, Fire and Rescue Levy.

Further details on revenue and expense projections are contained in Chapters 3 and 4, respectively.

| | | | |

| | | Budget Strategy and Outlook 2013-14 | | 15 |

Fiscal balance

A fiscal deficit of $7.664 billion is budgeted for 2013-14. As with the operating balance, the estimated fiscal balance is significantly impacted by the expenditure associated with natural disasters, including ex-Tropical Cyclone Oswald, and the timing of Australian Government funding, particularly the mismatch between natural disaster revenue and expenditure. The estimated impact of natural disaster arrangements on the fiscal balance across the forward estimates is outlined in Table 1.5 earlier in this chapter.

The extent of this mismatch in 2013-14, now estimated at $4.161 billion, has increased substantially since MYFER, where it was estimated at $1.453 billion.

The fiscal deficit expected in 2013-14 represents a $3.017 billion deterioration from the 2012-13 MYFER estimate of $4.647 billion, largely reflecting the revisions to the operating position.

From 2014-15 onwards, there is a significant improvement in the fiscal balance each year as natural disaster expenses reduce and revenue grows faster than expenditure.

Cash Flows and Balance Sheet

General Government Sector

Cash surplus/(deficit)

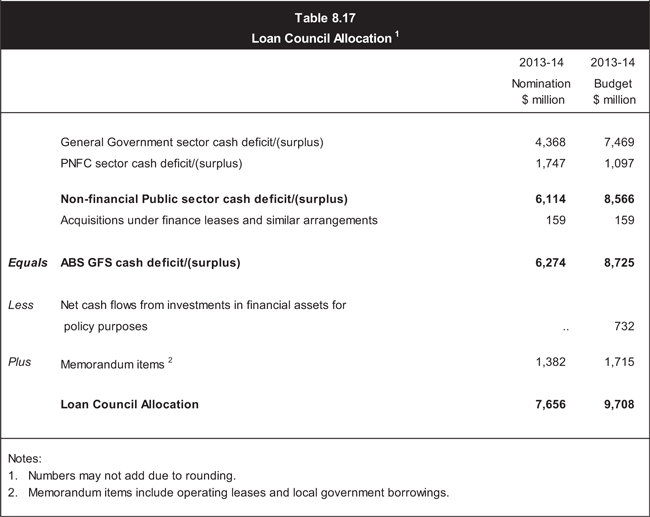

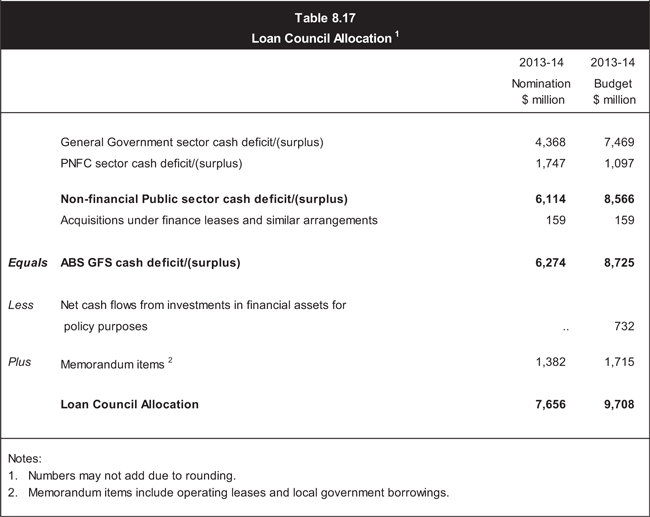

A cash deficit of $7.469 billion is expected for the General Government sector in 2013-14, reducing to $134 million in 2014-15, with cash surpluses in excess of $1 billion projected from 2015-16 onwards.

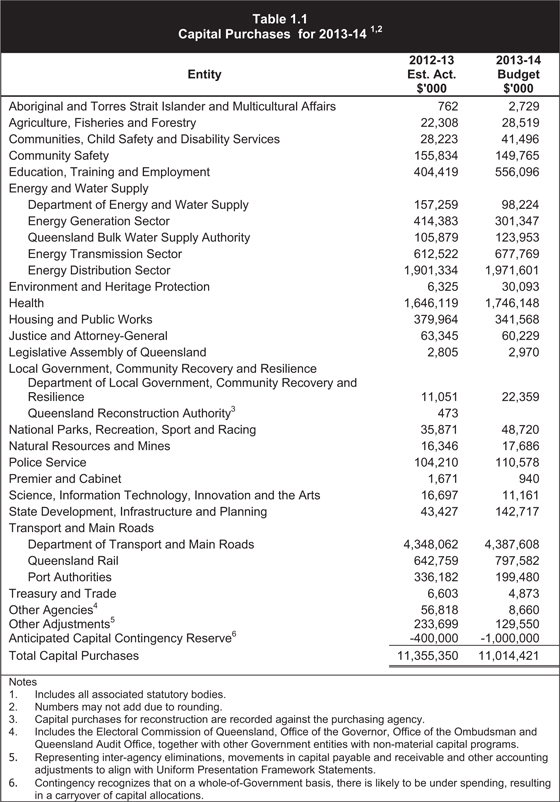

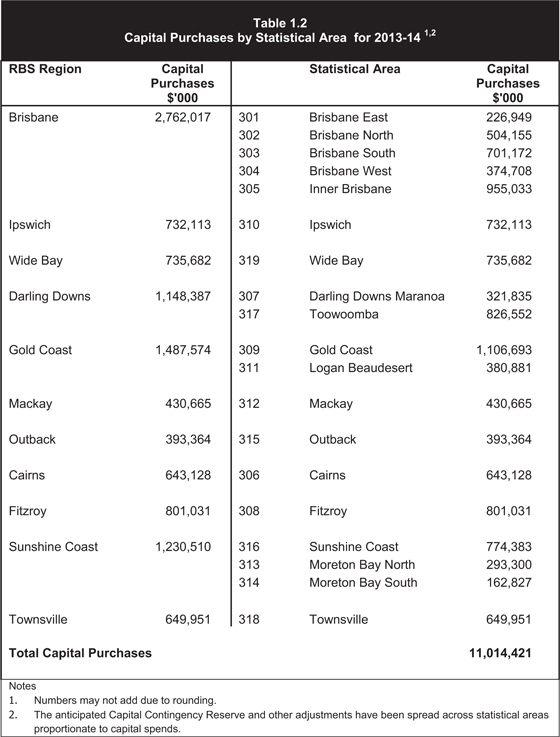

Capital purchases

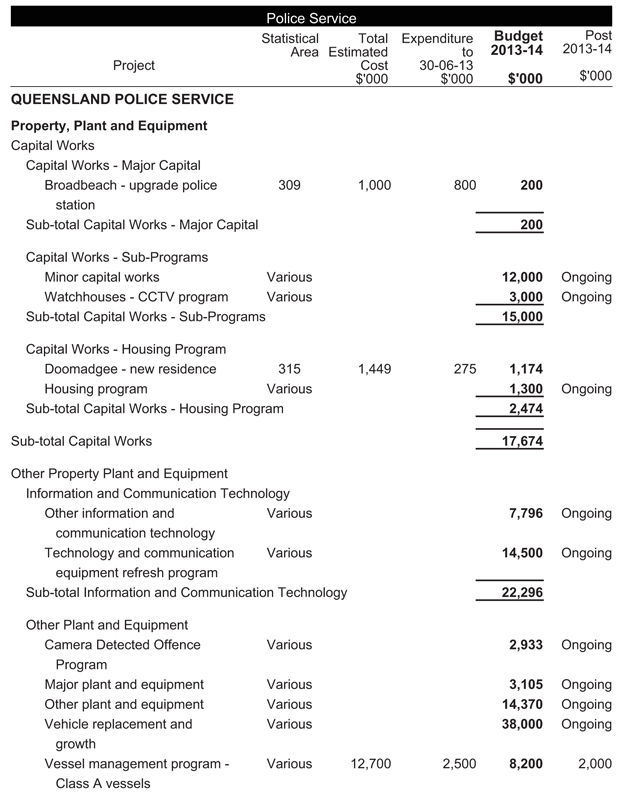

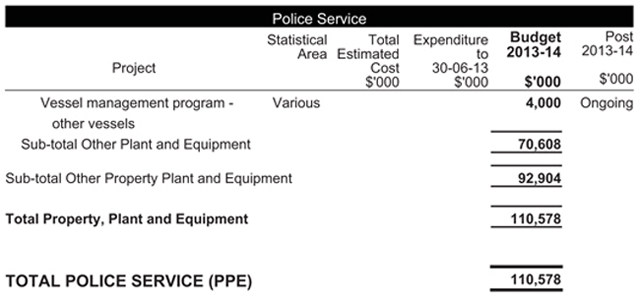

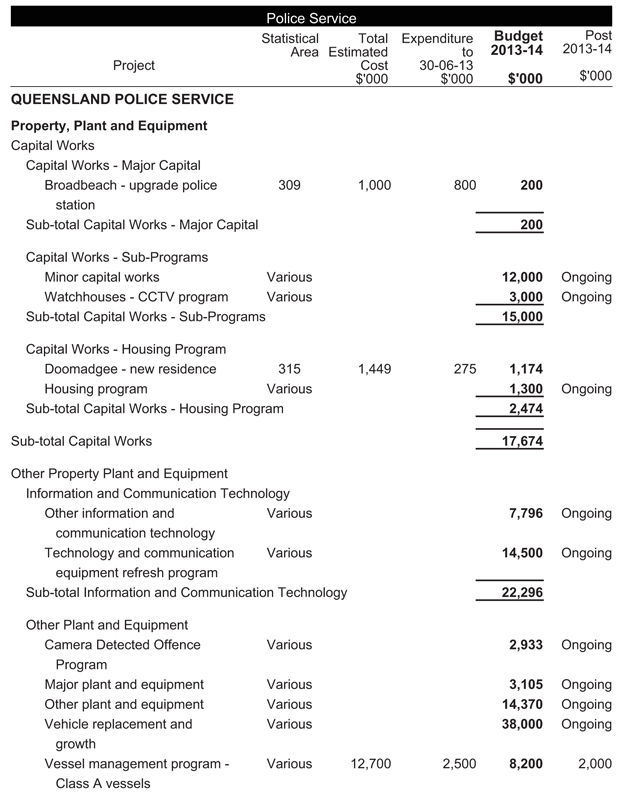

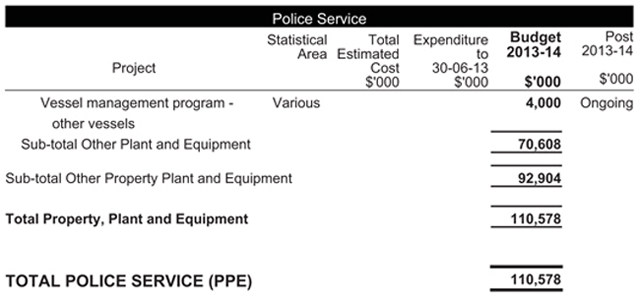

Total General Government capital purchases of $7.13 billion are budgeted for 2013-14, slightly lower than the $7.228 billion forecast in the 2012-13 MYFER. Budget Paper 3 – Capital Statement provides details of budgeted 2013-14 capital outlays, by portfolio.

Over the period 2013-14 to 2016-17, purchases of non-financial assets (capital purchases) in the General Government sector of $20.928 billion are planned.

Borrowings

Net borrowings of $7.966 billion are budgeted for 2013-14, with the $2.352 billion deterioration since 2012-13 MYFER driven by the same factors as the deterioration in the fiscal balance. Net borrowing requirements improve significantly across the forward estimates, leading to a stabilisation of debt.

The net borrowing requirement is larger than implied by the fiscal balance each year due to the reinvestment of earnings on financial assets, equity injections to PNFC entities and the non-cash nature of some items in the Operating Statement.

| | | | |

| 16 | | Budget Strategy and Outlook 2013-14 | | |

Gross borrowings of $47.196 billion are expected in the General Government sector at 30 June 2014, similar to the 2012-13 MYFER forecast of $47.103 billion, reflecting the lower borrowing requirement in 2012-13 being offset by the higher borrowing requirement in 2013-14.

Over the Budget and forward estimates period, total General Government net borrowings of $8.74 billion are planned. Gross borrowings are expected to peak at $48.49 billion at 30 June 2015, before declining slightly to $48.003 billion at 30 June 2017. This would represent the first reduction in General Government gross borrowings since 2005-06.

Non-financial Public Sector

Net borrowings in 2013-14 are estimated at $8.496 billion, compared to a 2012-13 MYFER forecast of $6.839 billion. This largely reflects the deterioration in the General Government sector’s fiscal balance, partially offset by a lower than expected borrowing requirement in the PNFC sector.

Total net borrowings across 2013-14 and the forward estimates are expected to be $11.653 billion. These borrowings represent less than a third of the planned $36.274 billion of purchases of non-financial assets in this period, which includes $15.346 billion in the PNFC sector.

Gross NFP sector borrowings of $78.125 billion are expected at 30 June 2014, $1 billion below the 2012-13 MYFER forecast of $79.135 billion, reflecting a lower borrowing requirement in the PNFC sector.

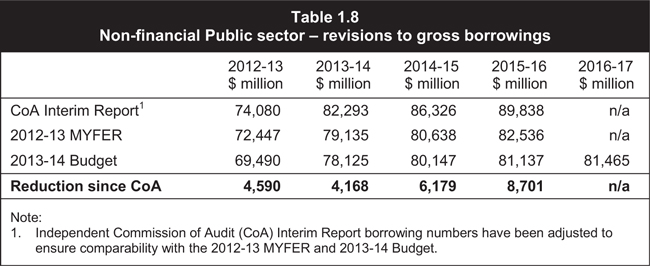

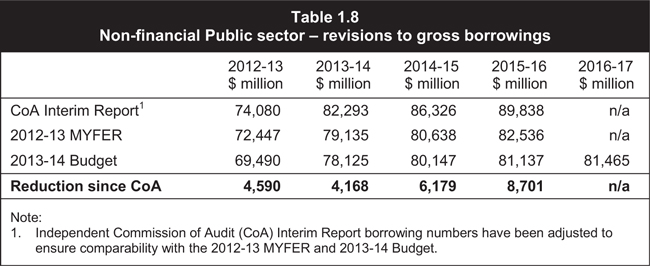

As outlined in Table 1.8, gross borrowings are expected to reach $80.147 billion at 30 June 2015, $6.179 billion lower than the comparable Independent Commission of Audit Interim Report estimate.

��

| | | | |

| | | Budget Strategy and Outlook 2013-14 | | 17 |

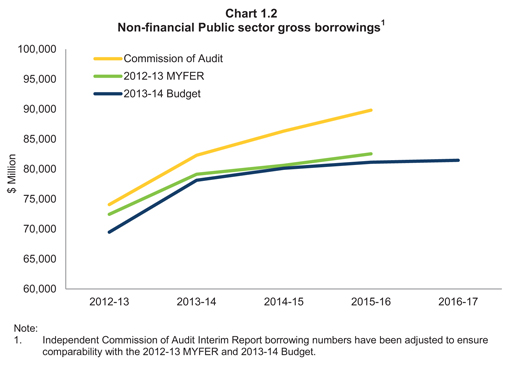

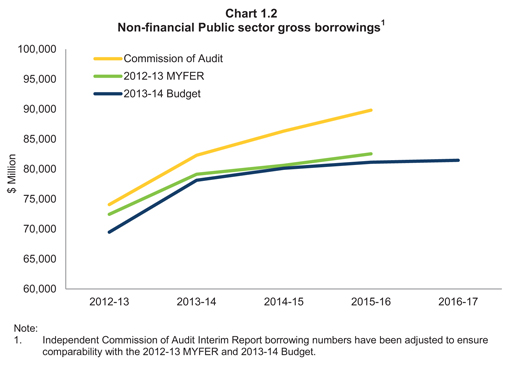

Chart 1.2 illustrates that NFP sector borrowings are lower in each year of the forward estimates compared to the 2012-13 MYFER. This is primarily driven by lower borrowings in the PNFC sector largely as a result of reforms in the water entities. In particular, Seqwater (resulting from the merger of several entities) has substantially improved its operating position across the forward estimates resulting in a significantly lower borrowing.

Further, Chart 1.2 shows that borrowings stabilise around $81 billion from 2015-16 onwards, an important first step in regaining a AAA credit rating.

| | | | |

| 18 | | Budget Strategy and Outlook 2013-14 | | |

FISCAL STRATEGY AS A GUIDING PRINCIPLE FOR POLICY

The Government undertook significant fiscal reform in the 2012-13 Budget. Without this reform the Government would not have been as well placed to meet the costs associated with the rebuilding task arising from the ex-Tropical Cyclone Oswald. However, the extent of the disaster repairs and continued weakness in global economic conditions has created further fiscal challenges for Government.

Savings on Track

The 2012-13 Budget included measures worth $7.766 billion over the period 2012-13 to 2015-16, comprising:

| | • | | expense measures of $5.277 billion |

| | • | | revenue measures of $0.812 billion |

| | • | | capital measures of $1.677 billion. |

These measures were largely achieved by Government exiting activities that are not the domain of the Queensland Government, by reducing waste and inefficiency in Government activities and by implementing specifically targeted revenue measures.

The Government implemented a number of expense measures in late 2011-12 (for example, $431.2 million from 2011-12 to 2014-15 from the abolition of redundant carbon schemes) or part way through 2012-13 (for example, $287.7 million from 2012-13 to 2015-16 from ceasing state employment programs which are appropriately the responsibility of the Australian Government). Once implemented, these measures resulted in ongoing annual savings.

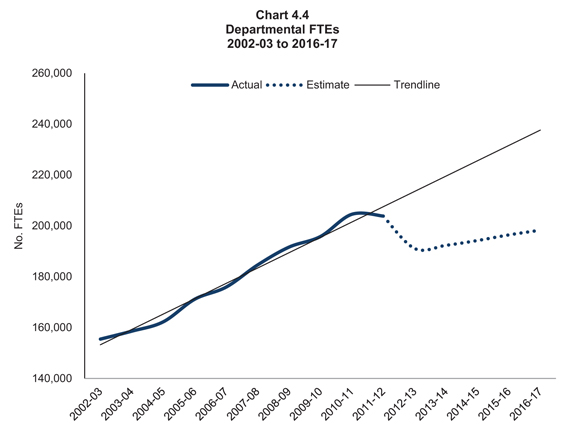

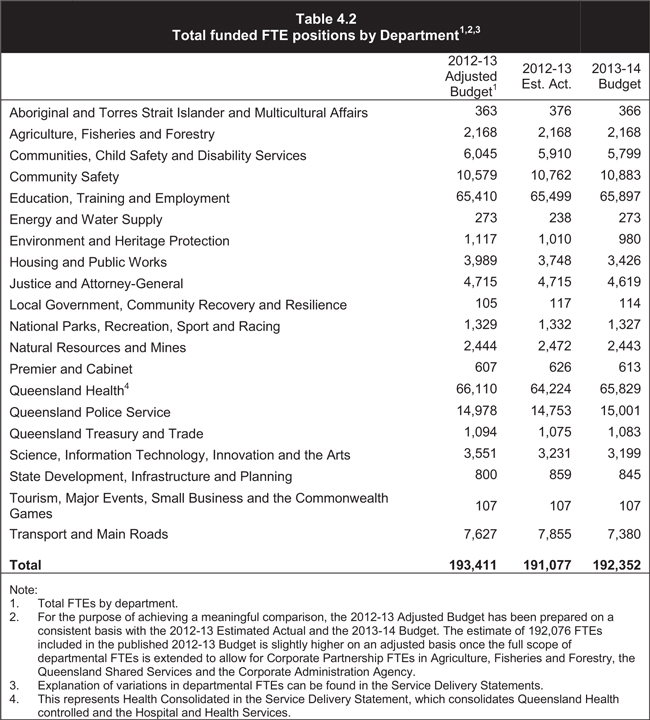

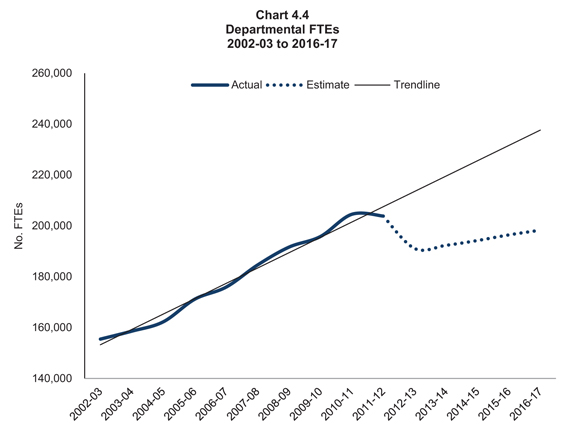

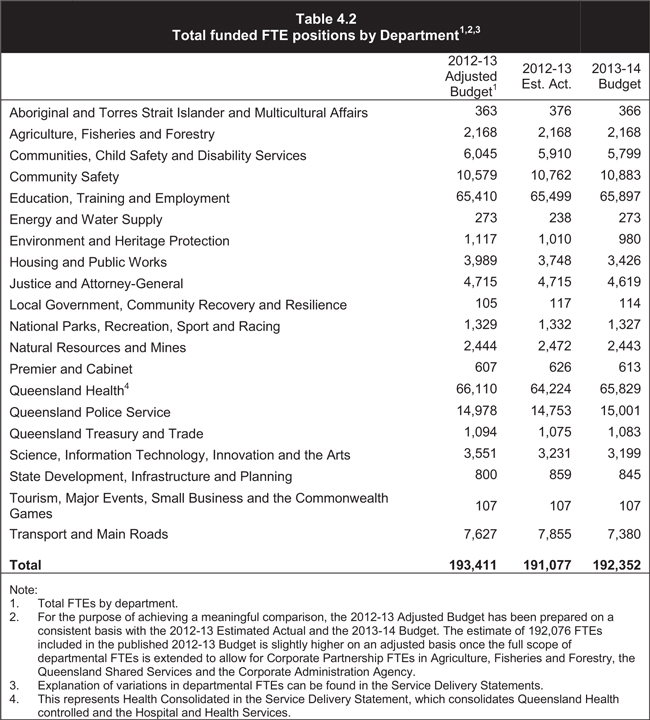

Another major component of the 2012-13 Budget fiscal measures was a 14,000 reduction in Full Time Equivalent (FTE) positions in 2012-13 including 10,600 redundancies. As outlined in Chapter 4, the Government is now estimating the reduction in FTEs in 2012-13 to be 12,800, including approximately 9,200 redundancies.

The Government has clearly demonstrated its ability to manage expenditure, with operating expenses in 2012-13 estimated to be $2 billion lower than budgeted. It is estimated that total operating expenses in 2012-13 will be only 1.1% above 2011-12 levels.

Ongoing monitoring of Government activity will ensure that forecast savings continue to be met across the forward estimates. As part of this monitoring process, the Government has decided that departments will achieve further savings of $100 million per annum from 2013-14. More detail on this measure can be found in Chapter 4 of this Budget Paper and in Budget Paper 4 – Budget Measures.

| | | | |

| | | Budget Strategy and Outlook 2013-14 | | 19 |

Improvements in Key Measures of Queensland’s Fiscal Position

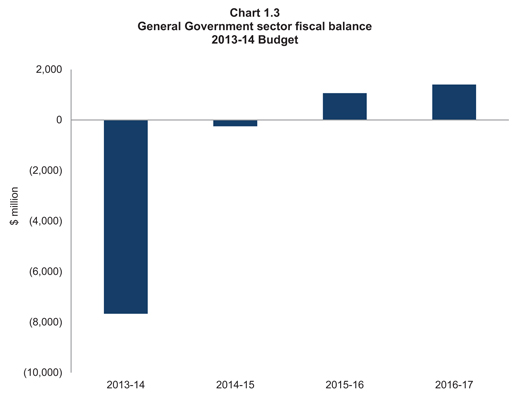

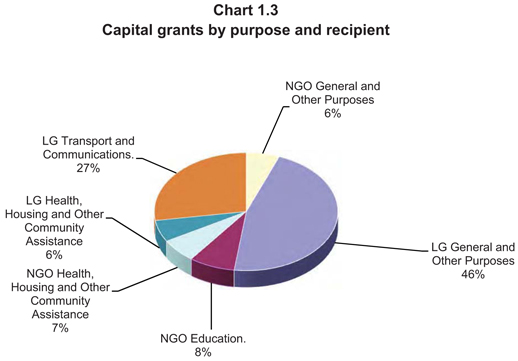

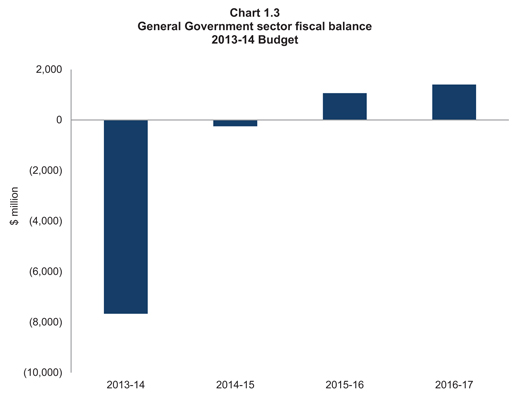

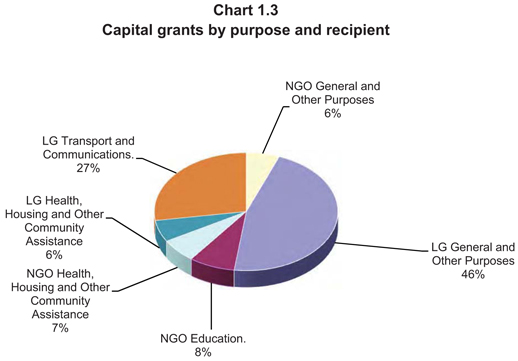

As a consequence of the fiscal repair decisions made in the 2012-13 and 2013-14 Budgets, there are significant improvements in the General Government sector fiscal balance (Chart 1.3).

Borrowings

As a result of the Government’s fiscal repair efforts, there has been a significant improvement in borrowing projections since the Independent Commission of Audit Interim Report. Borrowings are now projected to be approximately $6.2 billion less in 2014-15 and around $8.7 billion less in 2015-16 than outlined in the Independent Commission of Audit Interim Report (comparable figure).

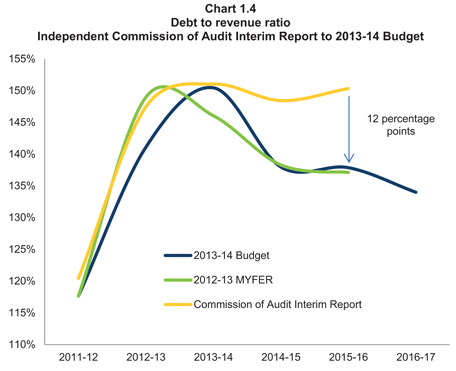

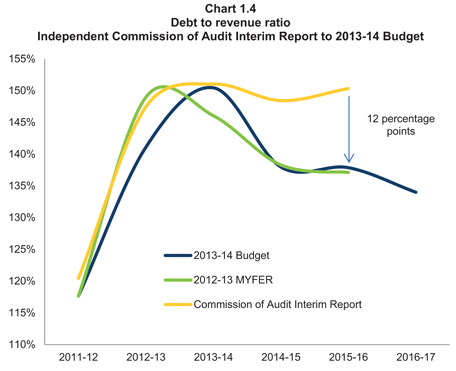

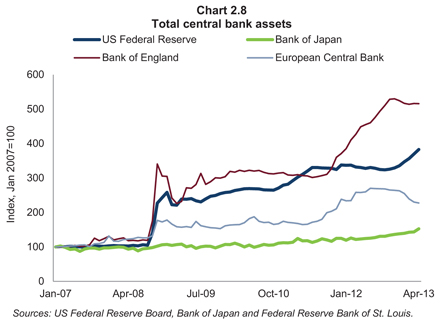

As can be seen in Chart 1.4, Queensland’s debt to revenue ratio has improved since the Independent Commission of Audit Interim Report and falls substantially over the forward estimates reflecting a stabilisation of debt, as a result of Government’s fiscal repair efforts, and growth in revenue.

| | | | |

| 20 | | Budget Strategy and Outlook 2013-14 | | |

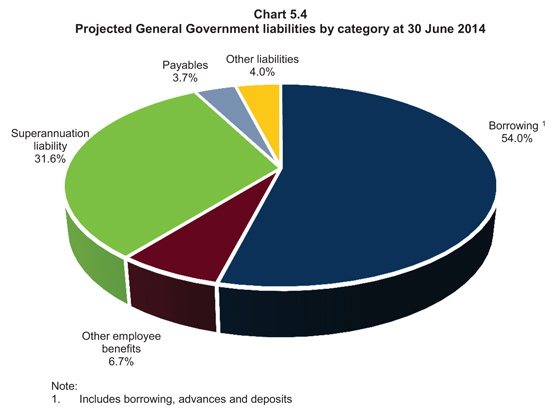

Queensland Governments have previously also placed a significant emphasis on the ratio of net financial liabilities to revenue, partly reflecting the prominence this measure previously had in Standard and Poor’s credit rating reports.

Superannuation liabilities, which are a key component of net financial liabilities, are required by Australian Accounting Standards to be valued with reference to Australian Government long term bond yields. As bond yields have fallen significantly in recent years, the accounting value of superannuation liabilities has increased substantially. Standard and Poor’s has noted that the rise in valuation of superannuation liabilities has not reflected a material shift in the economic position of the liabilities. In conjunction with concerns about the interstate comparability of valuation estimates across the Budget period, this has led Standard and Poor’s to consider that the net financial liabilities to revenue ratio is less informative than previously considered. Accordingly, it is now given less prominence in their rating analysis, with the key factors in the ‘debt burden’ assessment now being the NFP sector debt to revenue ratio and NFP sector interest to revenue ratio.

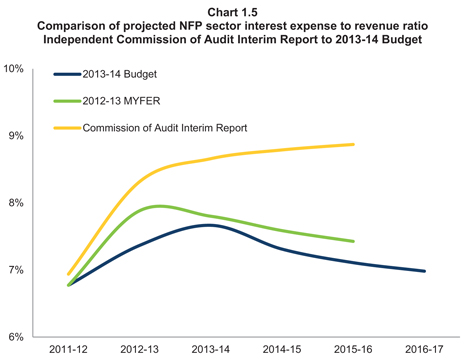

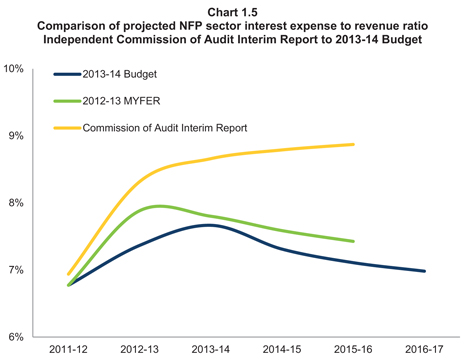

The reduction in borrowing requirements over the forward estimates, together with lower interest rates, have resulted in a substantially lower projected interest to revenue ratio over the forward estimates compared to the Independent Commission of Audit Interim Report (refer Chart 1.5).

| | | | |

| | | Budget Strategy and Outlook 2013-14 | | 21 |

The Budget projections of interest expenses (consistent with the implied yield curve) assume that bond yields will increase across the forward estimates period, which will impact on the cost of new borrowings and the refinancing of existing borrowings. However, given the potential for volatility in financial markets, there is a risk that bond yields, and therefore interest expense, will be higher than currently projected.

Fiscal Principles

Principle 1 – Stabilise then significantly reduce debt

A debt to revenue ratio allows a jurisdiction to determine how affordable its debt levels are and consequently is the key fiscal measure supporting a fiscal sustainability objective. For this reason, some form of debt to revenue ratio features in all major ratings agency methodologies and is usually a feature of any government’s fiscal principles.

| | | | |

| 22 | | Budget Strategy and Outlook 2013-14 | | |

Principle 2 – Achieve and maintain a General Government sector fiscal balance by 2014-15

The Independent Commission of Audit’s Interim Report emphasised that fiscal repair requires realigning recurrent and capital spending so that it can be funded from recurrent revenue. The achievement of an operating surplus in itself is not sufficient for Government to attain fiscal sustainability or maintain or improve its credit rating given the impact of capital investment on the debt position.

Borrowing should not be undertaken for the maintenance of the existing capital base. This means that Government needs a minimum of a balanced operating position (depreciation and maintenance are expensed) with any operating surplus used to fund new capital expansion. The size of that surplus should be determined by the appropriate size of the capital program and the sustainability of current debt levels.

While it is arguably appropriate to borrow for new essential infrastructure when debt levels are manageable, they are currently too high.

Accordingly, the fiscal balance has replaced the operating balance as the primary fiscal target of the Government.

In the 2013-14 Budget, the Government has implemented savings and revenue measures that offset expenditure decisions since MYFER, and is continuing to deliver the savings outlined in the 2012-13 Budget. Nevertheless, the scale of natural disasters and revenue write-downs has resulted in a modest fiscal deficit of $244 million (or 0.5% of General Government revenue) being projected for 2014-15. The Government will continue to pursue a fiscal balance in 2014-15 as a policy objective.

Principle 3 – Maintain a competitive tax environment for business

Queensland has a competitive tax environment for business. Queensland’s General Government taxation revenue as a percentage of gross state product has fallen over the past decade (in part reflecting the relative weakness in the property sector and the abolition of state taxes under the Intergovernmental Agreement on Federal Financial Relations). Queensland’s tax take, on a per capita basis, is also significantly less than the average of the other states.

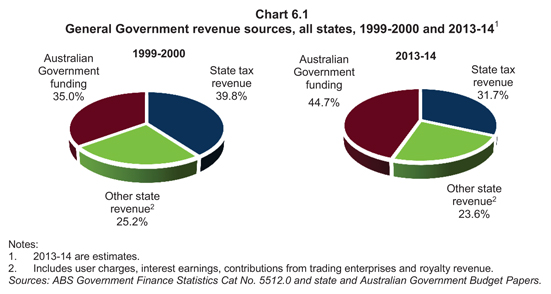

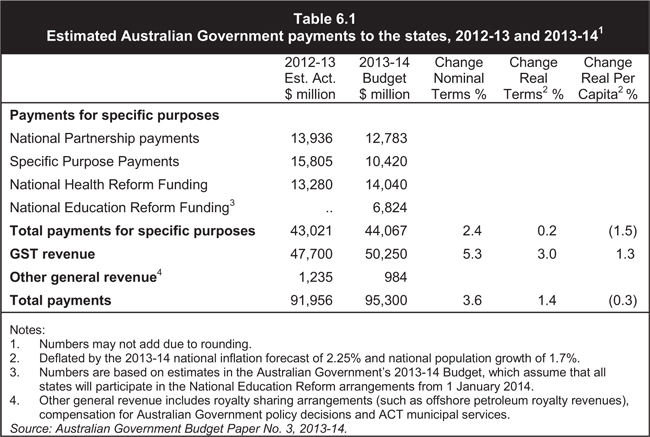

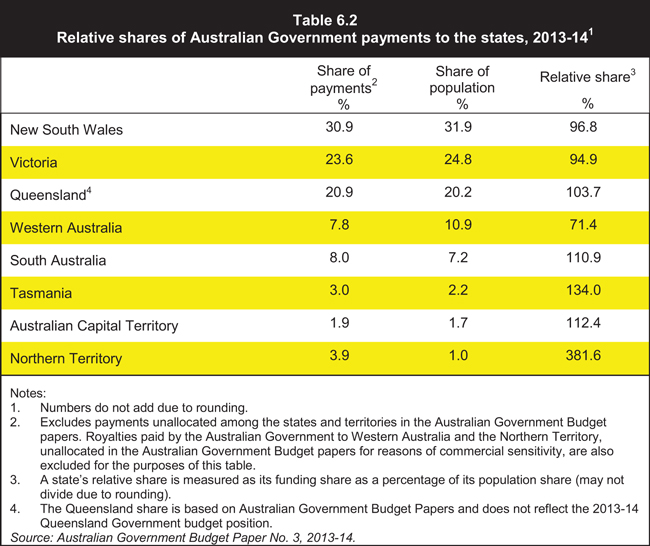

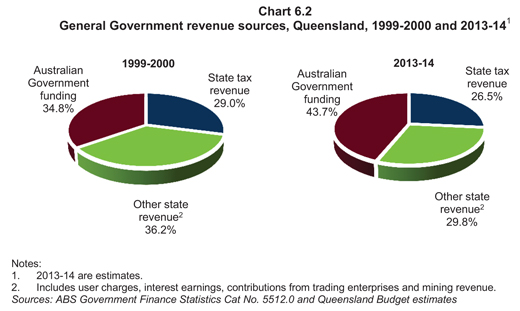

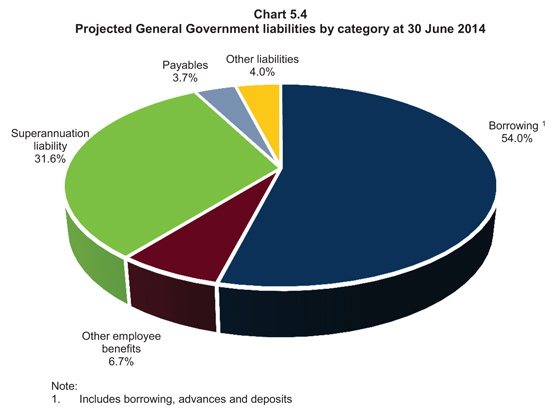

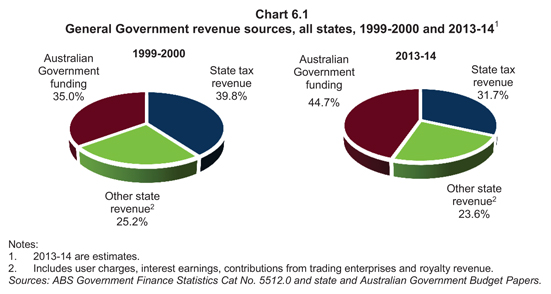

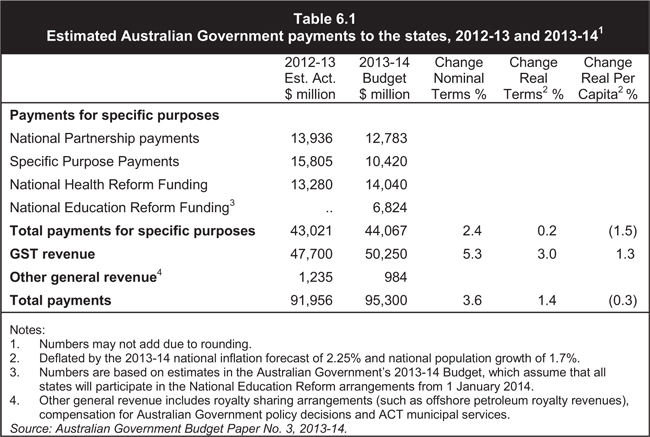

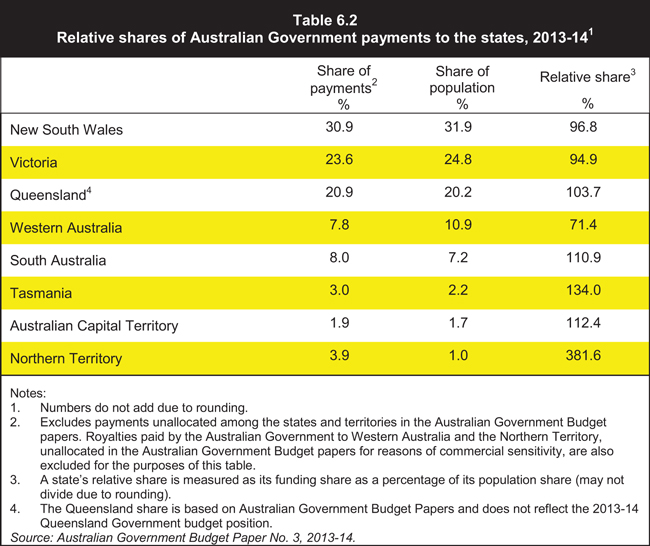

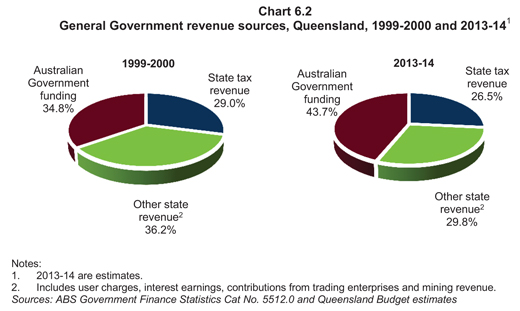

Principle 4 – Target full funding of long term liabilities such as superannuation in accordance with actuarial advice