Notes to the Financial Statements

Capital Markets Operations

For the year ended 30 June 2018

| 12 | Financial risk management continued |

QTC lends to clients based on a duration profile specified in the client mandates. QTC then manages any mismatch between the duration profile of client loans and QTC’s funding within an Asset and Liability Management Portfolio. Duration is a direct measure of the interest rate sensitivity of a financial instrument or a portfolio of financial instruments and quantifies the change in value of a financial instrument or portfolio due to interest rate movements. All costs or benefits of managing any mismatch between client loans and QTC funding are passed on to QTC clients ensuring that QTC is effectively immunised from interest rate risk with respect to these portfolios.

QTC’s interest rate risk, which results from borrowing in advance and investing surplus funds in high credit quality, highly liquid assets, is managed with consideration given to duration risk, yield curve risk, basis risk and Value-at-Risk (VaR). To manage the risk of non-parallel yield curve movements, QTC manages portfolio cash flows in a series of time periods so that the net interest rate risk in each time period can be measured. QTC enters into interest rate swaps, forward rate agreements and futures contracts to assist in the management of interest rate risk.

In QTC’s Funding and Liquidity portfolios, interest rate swaps may be utilised to change the interest rate exposure of medium to long term fixed rate borrowings into that of a floating rate borrowing. Also, at times, floating to fixed swaps may be undertaken to generate a fixed rate term funding profile. QTC is exposed to basis risk when interest rate swaps are used in the Funding and Liquidity portfolios. Basis risk represents a mark-to-market exposure due to movements between the swap curve and QTC’s yield curve.

QTC uses a Board approved VaR framework to manage QTC’s exposure to market risk complemented by other measures such as defined stress tests and PVBP (change in the present value for a one basis point movement). The VaR measure estimates the potential mark-to-market loss over a given holding period at a 99 per cent confidence level. QTC uses the historical simulation approach to calculate VaR with a holding period of 10 business days.

VaR impact

The VaR at 30 June, along with the minimum, maximum and average exposure over the financial year was as follows:

| | | | | | | | |

| | | 2018 | | | 2017 | |

INTEREST RATE RISK VAR | | $M | | | $M | |

As at 30 June | | | 11 | | | | 16 | |

Average for the year | | | 14 | | | | 14 | |

Financial year - minimum | | | 11 | | | | 10 | |

Financial year - maximum | | | 24 | | | | 16 | |

The above VaR calculation does not include the potential mark-to-market impact of changes in credit spreads on the value of assets held in the QTC Cash Fund. At 30 June 2018, QTC had an exposure of approximately $0.90 million per basis point to changes in credit spreads of assets held in the QTC Cash Fund.

QTC also calculates Stressed VaR, which is a measure used to determine the optimal level of capital that QTC should maintain in order to manage its risks in accordance with its Capital Adequacy Policy. Optimal Capital is calculated and compared to QTC’s actual capital. The Stressed VaR is based on a historical period that covers the Global Financial Crisis.

| (b) | Liquidity and financing risks |

QTC has a robust internal framework whereby extensive liquidity scenario analysis and forecasting is undertaken to understand assumption sensitivities to ensure there is appropriate forward looking visibility of the State’s liquidity position.

QTC debt is a Level 1 (prudentially required) asset for Australian banks under Basel III reforms with a 0% capital risk weighting. In normal and difficult market circumstances, QTC debt is likely to be in high demand. The ability to issue debt is considered a potential source of liquidity.

QTC holds appropriate liquidity (allowing for suitable haircuts of liquid assets) to meet minimum liquidity requirements as estimated today and as forecast into the future. QTC measures the minimum liquidity requirement to comfortably meet the following scenarios simultaneously:

| • | | Standard & Poor’s Liquidity Ratio – maintaining a ratio greater than 80% of liquid assets over debt servicing requirements over next 12 months |

| • | | Liquidity forecast – maintaining a minimum of $4 billion forecast liquidity over any pending 12 month period |

| • | | Daily cash balances – maintaining a minimum of five working days’ net cash requirements in 11AM cash, RBA repo eligible securities and Negotiable Certificates of Deposits to fund the net cash flows from assets and liabilities on QTC’s balance sheet. |

In addition, QTC holds liquid assets to support public sector entity deposits and the State’s Long Term Assets. QTC considers these liquid assets as potential sources of liquidity in a liquidity crisis.

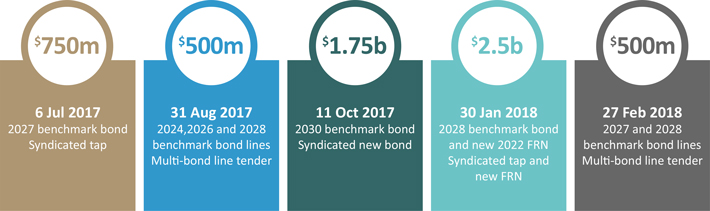

QTC maintains its AUD benchmark bond facility as its core medium to long-term funding facility and its domestic treasury note facility, euro-commercial paper facility and US commercial paper facility as its core short-term funding facilities. In addition, QTC has in place Euro and US medium-term note facilities to take advantage of funding opportunities in offshore markets. These facilities ensure that QTC is readily able to access the domestic and international financial markets.

With the exception of deposits and payables, the maturity analysis for liabilities has been calculated based on the contractual cash flows relating to the repayment of the principal (face value) and interest amounts over the contractual terms.

Deposits on account of the Cash Fund and Working Capital Facility (11AM Fund) are repayable at call while deposits held as security for stock lending and repurchase agreements are repayable when the security is lodged with QTC.

With the exception of cash and receivables, the maturity analysis for assets has been calculated based on the contractual cash flows relating to the repayment of the principal (face value) and interest amounts over the contractual terms.

In relation to client onlendings, certain loans are interest only with no fixed repayment date for the principal component (ie. loans are made based on the quality of the client’s business and its financial strength). For the purposes of completing the maturity analysis, the principal component of these loans has been included in the greater than five year time band with no interest payment assumed in this time band.

| | |

| ANNUAL REPORT 2017-18 | QUEENSLAND TREASURY CORPORATION | | 33 |