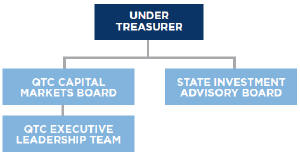

19 Contingent liabilities The following contingent liabilities existed at balance date: ∎ QTC has provided guarantees to the value of $2.5 billion (2020: $2.5 billion) to support the commercial activities of various Queensland public sector entities. In each case, a counter indemnity has been obtained by QTC from the appropriate public sector entity. 20 Related party transactions QTC’s related parties are those entities that it controls, is controlled by, under common control or can exert significant influence over. This includes controlled entities of the State of Queensland, being Queensland Treasury, government departments, statutory bodies (excluding universities) and Government owned corporations, and also includes QTC’s key management personnel and their related parties. Along with universities, local governments are not considered as related parties of QTC. (a) Ultimate controlling entity The immediate controlling entity is the Under Treasurer of Queensland as the Corporation Sole of QTC and the ultimate controlling entity is the State of Queensland. No remuneration is payable by QTC to the Under Treasurer in relation to this role. (b) Key management personnel Disclosures relating to key management personnel are set out in note 21. (c) Investments in companies Details of investments in associates and other companies are set out in note 23. (d) Transactions with related parties Transactions undertaken with related parties during the year include: ∎ loans $93.8 billion (2020: $87.6 billion) and interest received $2.7 billion (2020: $4.0 billion) ∎ investment of cash surpluses $1.9 billion (2020: $1.8 billion) and interest paid $14.3 million (2020: $17.1 million) ∎ fees received $71.9 million (2020: $63.4 million) ∎ dividends paid to Queensland Treasury $50 million (2020: $50 million) ∎ $206 million in Aurizon shares were transferred from QTH to the QFF via Queensland Treasury ∎ The State transferred Queensland Titles Registry Pty Ltd to SIO segment of QTC. At the time of transfer Queensland Titles Registry was valued at $8.0 billion, and ∎ QTC issued an FRN to Queensland Treasury to match the fair value of the assets in the DRF. At 30 June 2021, the FRN was valued at $7.7 billion. QTC may from time to time indirectly hold a small amount of investments in QTC Bonds via its investments in unit trusts managed by QIC. QTC does not have direct legal ownership of these assets and therefore, no adjustment has been made in the financial statements. QTC through SIO has paid $157.5 million in management fees to QIC (2020: $177.9 million) and $0.5 million (2020: $0.5 million) to Queensland Treasury for board secretariat services to SIAB. The nature and amount of any individually significant transactions with principal related parties are disclosed below. ∎ QTC sometimes acts as an agent to government entities in the procurement of advice from consultants. In these situations, QTC does not bear any significant risks or benefits associated with the advice and is reimbursed for the costs of the consultant by the government entity. The funds received as reimbursement offset consultant costs in the financial statements providing a nil net effect. The amount of costs reimbursed to QTC during the financial year totalled $6.0 million (2020: $4.2 million). ∎ QTC has a shareholding in QTH and its associated entities (QTH group). The QTH group hold deposits of $114.1 million (2020: $94.5 million) and loans of $102.9 million (2020: $104.4 million) with QTC that are provided on an arm’s length basis and are subject to QTC’s normal terms and conditions. QTC also provides company secretariat services to the QTH group on a cost recovery basis and received fees of $0.3 million (2020: $0.4 million) for the provision of these services. (e) Agency arrangements QTC undertakes the following agency arrangements on behalf of its clients. ∎ QTC provides services on behalf of Queensland Treasury under a GOC Cash Management Facility. QTC is not exposed to the risks and benefits of this facility and therefore does not recognise these deposits on its balance sheet. QTC charges a fee for this service. The balance of deposits under this facility at year end was $1.1 billion (2020: $1.5 billion). ∎ QTC may enter into derivative transactions from time to time on behalf of its clients. These arrangements have back to back contracts between QTC and the client and QTC and the market. In this way QTC is not exposed to the risks and benefits of these contracts and does not recognise these on-balance sheet. The notional value of these derivative arrangements at year end was $36.7 million (2020: $25.3 million). |