UNITED STATES SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

Form 10-Q

| þ | QUARTERLY REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the Quarterly Period Ended September 30, 2016

OR

| ¨ | TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

Commission File Number 1-10351

Potash Corporation of Saskatchewan Inc.

(Exact name of registrant as specified in its charter)

| | |

| Canada | | N/A |

(State or other jurisdiction of incorporation or organization) | | (I.R.S. Employer Identification No.) |

| |

122 — 1st Avenue South Saskatoon, Saskatchewan, Canada (Address of principal executive offices) | | S7K 7G3 (Zip Code) |

306-933-8500

(Registrant’s telephone number, including area code)

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Sections 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days.

Yes þ No ¨

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Web site, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files).

Yes ¨ No ¨

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See the definitions of “large accelerated filer,” “accelerated filer” and “smaller reporting company” in Rule 12b-2 of the Exchange Act. (Check one):

| | | | | | |

| Large accelerated filer þ | | Accelerated filer ¨ | | Non-accelerated filer ¨ | | Smaller reporting company ¨ |

| | | | (Do not check if a smaller reporting company) | | |

Indicate by check mark whether the registrant is a shell company (as defined in Exchange Act Rule 12b-2).

Yes ¨ No þ

As at September 30, 2016, Potash Corporation of Saskatchewan Inc. had 839,643,474 Common Shares outstanding.

Part I. Financial Information

Item 1. Financial Statements

Condensed Consolidated Statements of Income

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Unaudited | | | | | In millions of US dollars except as otherwise noted | |

| | | | | | Three Months Ended September 30 | | | | | | Nine Months Ended September 30 | |

| | | | | | 2016 | | | | | | 2015 | | | | | | 2016 | | | | | | 2015 | |

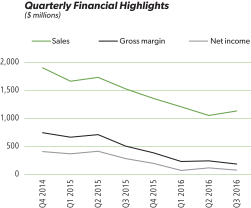

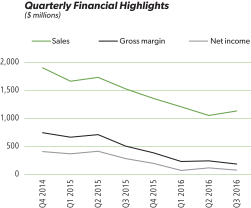

Sales(Note 2) | | | | | | $ | 1,136 | | | | | | | $ | 1,529 | | | | | | | $ | 3,398 | | | | | | | $ | 4,925 | |

Freight, transportation and distribution | | | | | | | (154 | ) | | | | | | | (128 | ) | | | | | | | (405 | ) | | | | | | | (380 | ) |

Cost of goods sold | | | | | | | (792 | ) | | | | | | | (896 | ) | | | | | | | (2,326 | ) | | | | | | | (2,662 | ) |

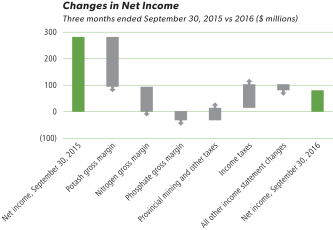

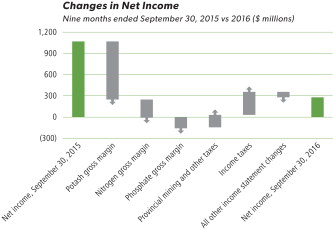

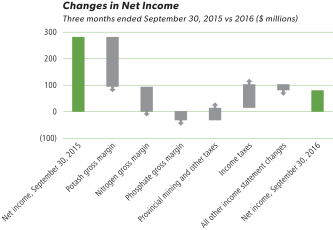

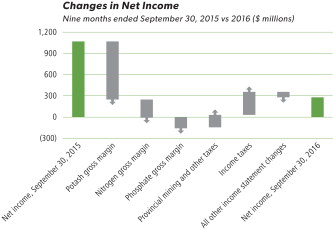

Gross Margin | | | | | | | 190 | | | | | | | | 505 | | | | | | | | 667 | | | | | | | | 1,883 | |

Selling and administrative expenses | | | | | | | (59 | ) | | | | | | | (52 | ) | | | | | | | (167 | ) | | | | | | | (172 | ) |

Provincial mining and other taxes | | | | | | | (31 | ) | | | | | | | (79 | ) | | | | | | | (88 | ) | | | | | | | (264 | ) |

Share of earnings of equity-accounted investees | | | | | | | 25 | | | | | | | | 32 | | | | | | | | 74 | | | | | | | | 103 | |

Dividend income | | | | | | | 8 | | | | | | | | 7 | | | | | | | | 24 | | | | | | | | 38 | |

Impairment of available-for-sale investment (Note 3) | | | | | | | — | | | | | | | | — | | | | | | | | (10 | ) | | | | | | | — | |

Other income (expenses) (Note 4) | | | | | | | 5 | | | | | | | | 8 | | | | | | | | (4 | ) | | | | | | | 11 | |

Operating Income | | | | | | | 138 | | | | | | | | 421 | | | | | | | | 496 | | | | | | | | 1,599 | |

Finance costs | | | | | | | (55 | ) | | | | | | | (49 | ) | | | | | | | (161 | ) | | | | | | | (148 | ) |

Income Before Income Taxes | | | | | | | 83 | | | | | | | | 372 | | | | | | | | 335 | | | | | | | | 1,451 | |

Income taxes (Note 5) | | | | | | | (2 | ) | | | | | | | (90 | ) | | | | | | | (58 | ) | | | | | | | (382 | ) |

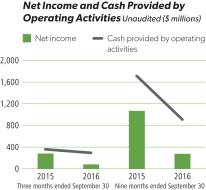

Net Income | | | | | | $ | 81 | | | | | | | $ | 282 | | | | | | | $ | 277 | | | | | | | $ | 1,069 | |

Net Income per Share | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

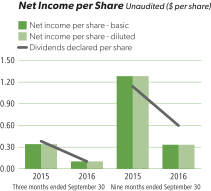

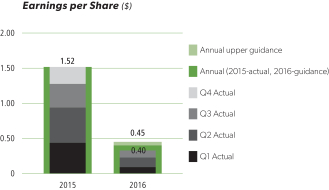

Basic | | | | | | $ | 0.10 | | | | | | | $ | 0.34 | | | | | | | $ | 0.33 | | | | | | | $ | 1.28 | |

Diluted | | | | | | $ | 0.10 | | | | | | | $ | 0.34 | | | | | | | $ | 0.33 | | | | | | | $ | 1.28 | |

Weighted Average Shares Outstanding | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Basic | | | | | | | 839,570,000 | | | | | | | | 834,850,000 | | | | | | | | 838,661,000 | | | | | | | | 833,573,000 | |

Diluted | | | | | | | 840,045,000 | | | | | | | | 837,454,000 | | | | | | | | 839,376,000 | | | | | | | | 837,377,000 | |

(See Notes to the Condensed Consolidated Financial Statements)

| | |

| 1 | | PotashCorp 2016 Third Quarter Quarterly Report on Form 10-Q |

Condensed Consolidated Statements of Comprehensive Income (Loss)

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Unaudited | | | | | | | | | | | | | | | | In millions of US dollars | |

| | | | | | Three Months Ended September 30 | | | | | Nine Months Ended September 30 | |

| (Net of related income taxes) | | | | | 2016 | | | | | | 2015 | | | | | 2016 | | | | | | 2015 | |

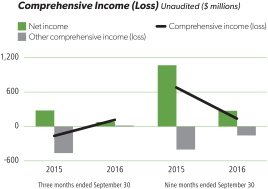

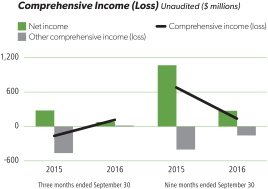

Net Income | | | | | | $ | 81 | | | | | | | $ | 282 | | | | | $ | 277 | | | | | | | $ | 1,069 | |

Other comprehensive income (loss) | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Items that will not be reclassified to net income: | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Net actuarial loss on defined benefit plans(1) | | | | | | | — | | | | | | | | — | | | | | | (103 | ) | | | | | | | — | |

Items that have been or may be subsequently reclassified to net income: | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Available-for-sale investments (2) | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Net fair value gain (loss) during the period | | | | | | | 15 | | | | | | | | (450 | ) | | | | | (88 | ) | | | | | | | (391 | ) |

Cash flow hedges | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Net fair value loss during the period(3) | | | | | | | (5 | ) | | | | | | | (21 | ) | | | | | (2 | ) | | | | | | | (42 | ) |

Reclassification to income of net loss(4) | | | | | | | 11 | | | | | | | | 13 | | | | | | 39 | | | | | | | | 39 | |

Other | | | | | | | — | | | | | | | | (3 | ) | | | | | 2 | | | | | | | | (7 | ) |

Other Comprehensive Income (Loss) | | | | | | | 21 | | | | | | | | (461 | ) | | | | | (152 | ) | | | | | | | (401 | ) |

Comprehensive Income (Loss) | | | | | | $ | 102 | | | | | | | $ | (179 | ) | | | | $ | 125 | | | | | | | $ | 668 | |

| (1) | Net of income taxes of $NIL (2015 — $NIL) for the three months ended September 30, 2016 and $60 (2015 — $NIL) for the nine months ended September 30, 2016. |

| (2) | Available-for-sale investments are comprised of shares in Israel Chemicals Ltd., Sinofert Holdings Limited and other. |

| (3) | Cash flow hedges are comprised of natural gas derivative instruments and treasury lock derivatives and were net of income taxes of $2 (2015 — $11) for the three months ended September 30, 2016 and $NIL (2015 — $23) for the nine months ended September 30, 2016. |

| (4) | Net of income taxes of $(6) (2015 — $(7)) for the three months ended September 30, 2016 and $(22) (2015 — $(21)) for the nine months ended September 30, 2016. |

(See Notes to the Condensed Consolidated Financial Statements)

| | |

| PotashCorp 2016 Third Quarter Quarterly Report on Form 10-Q | | 2 |

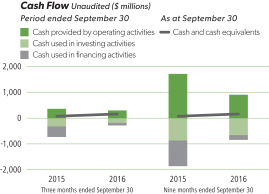

Condensed Consolidated Statements of Cash Flow

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Unaudited | | | | | | | | | | In millions of US dollars | |

| | | | | | Three Months Ended September 30 | | | | | Nine Months Ended September 30 | |

| | | | | | 2016 | | | | | | 2015 | | | | | 2016 | | | | | | 2015 | |

Operating Activities | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Net income | | | | | | $ | 81 | | | | | | | $ | 282 | | | | | $ | 277 | | | | | | | $ | 1,069 | |

Adjustments to reconcile net income to cash provided by

operating activities (Note 6) | | | | | | | 166 | | | | | | | | 223 | | | | | | 631 | | | | | | | | 652 | |

Changes in non-cash operating working capital (Note 6) | | | | | | | 48 | | | | | | | | (147 | ) | | | | | (1 | ) | | | | | | | (6 | ) |

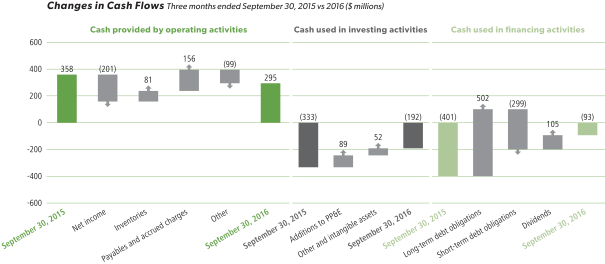

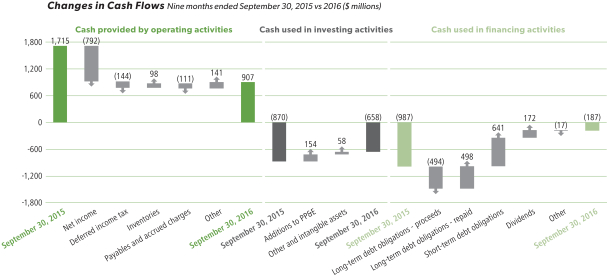

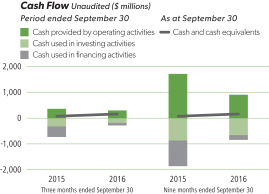

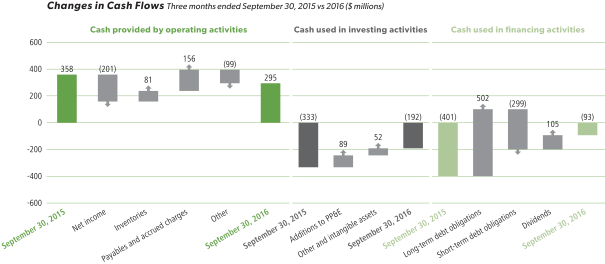

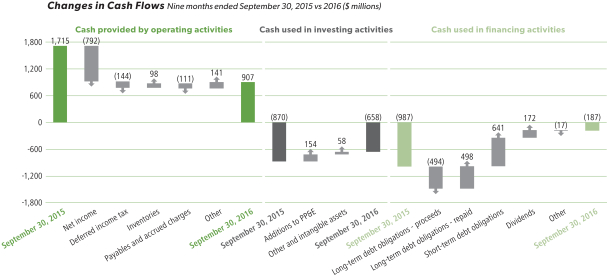

Cash provided by operating activities | | | | | | | 295 | | | | | | | | 358 | | | | | | 907 | | | | | | | | 1,715 | |

Investing Activities | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

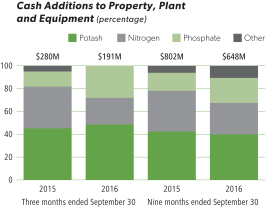

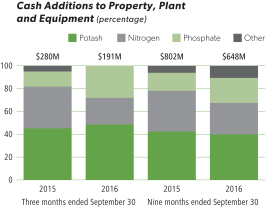

Additions to property, plant and equipment | | | | | | | (191 | ) | | | | | | | (280 | ) | | | | | (648 | ) | | | | | | | (802 | ) |

Other assets and intangible assets | | | | | | | (1 | ) | | | | | | | (53 | ) | | | | | (10 | ) | | | | | | | (68 | ) |

Cash used in investing activities | | | | | | | (192 | ) | | | | | | | (333 | ) | | | | | (658 | ) | | | | | | | (870 | ) |

Financing Activities | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Proceeds from long-term debt obligations | | | | | | | — | | | | | | | | — | | | | | | — | | | | | | | | 494 | |

Repayment of, and finance costs on, long-term debt obligations | | | | | | | — | | | | | | | | (502 | ) | | | | | (4 | ) | | | | | | | (502 | ) |

Proceeds from (repayment of) short-term debt obligations | | | | | | | 115 | | | | | | | | 414 | | | | | | 519 | | | | | | | | (122 | ) |

Dividends | | | | | | | (208 | ) | | | | | | | (313 | ) | | | | | (727 | ) | | | | | | | (899 | ) |

Issuance of common shares | | | | | | | — | | | | | | | | — | | | | | | 25 | | | | | | | | 42 | |

Cash used in financing activities | | | | | | | (93 | ) | | | | | | | (401 | ) | | | | | (187 | ) | | | | | | | (987 | ) |

Increase (Decrease) in Cash and Cash Equivalents | | | | | | | 10 | | | | | | | | (376 | ) | | | | | 62 | | | | | | | | (142 | ) |

Cash and Cash Equivalents, Beginning of Period | | | | | | | 143 | | | | | | | | 449 | | | | | | 91 | | | | | | | | 215 | |

Cash and Cash Equivalents, End of Period | | | | | | $ | 153 | | | | | | | $ | 73 | | | | | $ | 153 | | | | | | | $ | 73 | |

Cash and cash equivalents comprised of: | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Cash | | | | | | $ | 48 | | | | | | | $ | 39 | | | | | $ | 48 | | | | | | | $ | 39 | |

Short-term investments | | | | | | | 105 | | | | | | | | 34 | | | | | | 105 | | | | | | | | 34 | |

| | | | | | | $ | 153 | | | | | | | $ | 73 | | | | | $ | 153 | | | | | | | $ | 73 | |

(See Notes to the Condensed Consolidated Financial Statements)

| | |

| 3 | | PotashCorp 2016 Third Quarter Quarterly Report on Form 10-Q |

Condensed Consolidated Statements of Changes in Equity

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Unaudited | | | | In millions of US dollars | |

| | | | | | | | | | | Accumulated Other Comprehensive (Loss) Income | | | | | | | |

| | | | | Share

Capital | | | Contributed

Surplus | | | Net

unrealized

gain (loss) on

available-for-

sale

investments | | | Net (loss)

gain on

derivatives

designated as

cash flow

hedges | | | Net

actuarial

loss on

defined

benefit

plans | | | Other | | | Total

Accumulated

Other

Comprehensive

(Loss) Income | | | Retained

Earnings | | | Total

Equity (1) | |

Balance — December 31, 2015 | | | | $ | 1,747 | | | $ | 230 | | | $ | 77 | | | $ | (117 | ) | | $ | — | (2) | | $ | (10 | ) | | $ | (50 | ) | | $ | 6,455 | | | $ | 8,382 | |

Net income | | | | | — | | | | — | | | | — | | | | — | | | | — | | | | — | | | | — | | | | 277 | | | | 277 | |

Other comprehensive (loss) income | | | | | — | | | | — | | | | (88 | ) | | | 37 | | | | (103 | ) | | | 2 | | | | (152 | ) | | | — | | | | (152 | ) |

Dividends declared | | | | | — | | | | — | | | | — | | | | — | | | | — | | | | — | | | | — | | | | (506 | ) | | | (506 | ) |

Effect of share-based

compensation including issuance of common shares | | | | | 35 | | | | (1 | ) | | | — | | | | — | | | | — | | | | — | | | | — | | | | — | | | | 34 | |

Shares issued for dividend reinvestment plan | | | | | 13 | | | | — | | | | — | | | | — | | | | — | | | | — | | | | — | | | | — | | | | 13 | |

Transfer of net actuarial loss on defined benefit plans | | | | | — | | | | — | | | | — | | | | — | | | | 103 | | | | — | | | | 103 | | | | (103 | ) | | | — | |

Balance — September 30, 2016 | | | | $ | 1,795 | | | $ | 229 | | | $ | (11 | ) | | $ | (80 | ) | | $ | — | (2) | | $ | (8 | ) | | $ | (99 | ) | | $ | 6,123 | | | $ | 8,048 | |

Balance — December 31, 2014 | | | | $ | 1,632 | | | $ | 234 | | | $ | 623 | | | $ | (119 | ) | | $ | — | (2) | | $ | (1 | ) | | $ | 503 | | | $ | 6,423 | | | $ | 8,792 | |

Net income | | | | | — | | | | — | | | | — | | | | — | | | | — | | | | — | | | | — | | | | 1,069 | | | | 1,069 | |

Other comprehensive loss | | | | | — | | | | — | | | | (391 | ) | | | (3 | ) | | | — | | | | (7 | ) | | | (401 | ) | | | — | | | | (401 | ) |

Dividends declared | | | | | — | | | | — | | | | — | | | | — | | | | — | | | | — | | | | — | | | | (957 | ) | | | (957 | ) |

Effect of share-based

compensation including issuance of common shares | | | | | 56 | | | | (2 | ) | | | — | | | | — | | | | — | | | | — | | | | — | | | | — | | | | 54 | |

Shares issued for dividend reinvestment plan | | | | | 32 | | | | — | | | | — | | | | — | | | | — | | | | — | | | | — | | | | — | | | | 32 | |

Balance — September 30, 2015 | | | | $ | 1,720 | | | $ | 232 | | | $ | 232 | | | $ | (122 | ) | | $ | — | (2) | | $ | (8 | ) | | $ | 102 | | | $ | 6,535 | | | $ | 8,589 | |

| (1) | All equity transactions were attributable to common shareholders. |

| (2) | Any amounts incurred during a period are closed out to retained earnings at each period-end. Therefore, no balance exists at the beginning or end of period. |

(See Notes to the Condensed Consolidated Financial Statements)

| | |

| PotashCorp 2016 Third Quarter Quarterly Report on Form 10-Q | | 4 |

Condensed Consolidated Statements of Financial Position

| | | | | | | | | | | | | | |

| Unaudited | | | | In millions of US dollars except as otherwise noted | |

| | | | |

| As at | | | | September 30,

2016 | | | | | | December 31,

2015 | |

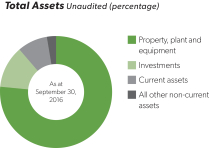

Assets | | | | | | | | | | | | | | |

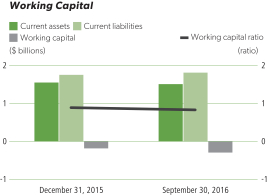

Current assets | | | | | | | | | | | | | | |

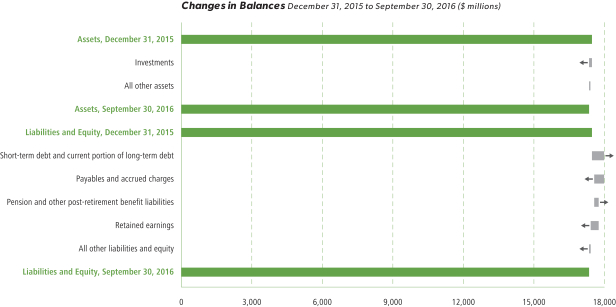

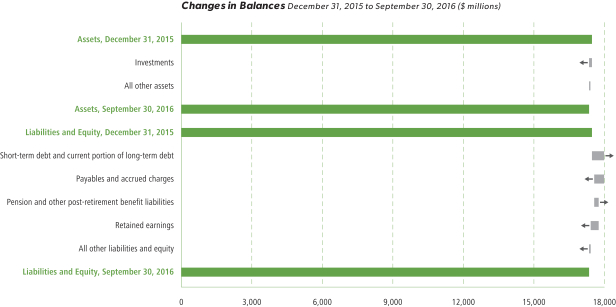

Cash and cash equivalents | | | | $ | 153 | | | | | | | $ | 91 | |

Receivables | | | | | 575 | | | | | | | | 640 | |

Inventories (Note 7) | | | | | 720 | | | | | | | | 749 | |

Prepaid expenses and other current assets | | | | | 62 | | | | | | | | 73 | |

| | | | | 1,510 | | | | | | | | 1,553 | |

Non-current assets | | | | | | | | | | | | | | |

Property, plant and equipment | | | | | 13,279 | | | | | | | | 13,212 | |

Investments in equity-accounted investees | | | | | 1,223 | | | | | | | | 1,243 | |

Available-for-sale investments (Note 3) | | | | | 886 | | | | | | | | 984 | |

Other assets | | | | | 271 | | | | | | | | 285 | |

Intangible assets | | | | | 182 | | | | | | | | 192 | |

Total Assets | | | | $ | 17,351 | | | | | | | $ | 17,469 | |

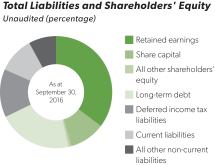

Liabilities | | | | | | | | | | | | | | |

Current liabilities | | | | | | | | | | | | | | |

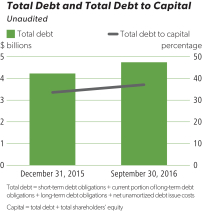

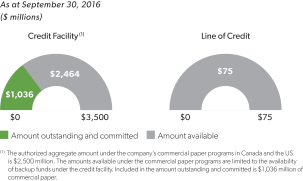

Short-term debt and current portion of long-term debt | | | | $ | 1,036 | | | | | | | $ | 517 | |

Payables and accrued charges | | | | | 717 | | | | | | | | 1,146 | |

Current portion of derivative instrument liabilities | | | | | 58 | | | | | | | | 84 | |

| | | | | 1,811 | | | | | | | | 1,747 | |

Non-current liabilities | | | | | | | | | | | | | | |

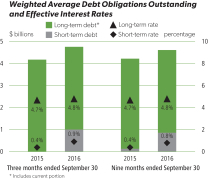

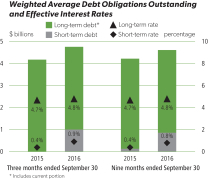

Long-term debt | | | | | 3,714 | | | | | | | | 3,710 | |

Derivative instrument liabilities | | | | | 70 | | | | | | | | 109 | |

Deferred income tax liabilities | | | | | 2,407 | | | | | | | | 2,438 | |

Pension and other post-retirement benefit liabilities (Note 8) | | | | | 621 | | | | | | | | 431 | |

Asset retirement obligations and accrued environmental costs | | | | | 610 | | | | | | | | 574 | |

Other non-current liabilities and deferred credits | | | | | 70 | | | | | | | | 78 | |

Total Liabilities | | | | | 9,303 | | | | | | | | 9,087 | |

Shareholders’ Equity | | | | | | | | | | | | | | |

Share capital (Note 9) | | | | | 1,795 | | | | | | | | 1,747 | |

Contributed surplus | | | | | 229 | | | | | | | | 230 | |

Accumulated other comprehensive loss | | | | | (99 | ) | | | | | | | (50 | ) |

Retained earnings | | | | | 6,123 | | | | | | | | 6,455 | |

Total Shareholders’ Equity | | | | | 8,048 | | | | | | | | 8,382 | |

Total Liabilities and Shareholders’ Equity | | | | $ | 17,351 | | | | | | | $ | 17,469 | |

(See Notes to the Condensed Consolidated Financial Statements)

| | |

| 5 | | PotashCorp 2016 Third Quarter Quarterly Report on Form 10-Q |

Notes to the Condensed Consolidated Financial Statements

For the Three and Nine Months Ended September 30, 2016

Unaudited | In millions of US dollars except as otherwise noted |

1. Significant Accounting Policies

Basis of Presentation

With its subsidiaries, Potash Corporation of Saskatchewan Inc. (“PCS”) — together known as “PotashCorp” or “the company” except to the extent the context otherwise requires — forms an integrated fertilizer and related industrial and feed products company. These unaudited interim condensed consolidated financial statements (“interim financial statements”) are based on International Financial Reporting Standards as issued by the International Accounting Standards Board (“IFRS”), and have been prepared in accordance with International Accounting Standard (“IAS”) 34, “Interim Financial Reporting.” The accounting policies and methods of computation used in preparing these interim financial statements are consistent with those used in the preparation of the company’s 2015 annual consolidated financial statements.

These interim financial statements include the accounts of PCS and its subsidiaries; however, they do not include all disclosures normally provided in annual consolidated financial statements and should be read in conjunction with the company’s 2015 annual consolidated financial statements. In management’s opinion, the interim financial statements include all adjustments necessary to fairly present such information. Interim results are not necessarily indicative of the results expected for any other interim period or the fiscal year.

These interim financial statements were authorized by the audit committee of the Board of Directors for issue on November 1, 2016.

Standards, Amendments and Interpretations Effective and Applied

The International Accounting Standards Board (“IASB”) and International Financial Reporting Interpretations Committee (“IFRIC”) have issued the following standards and amendments or interpretations to existing standards that were effective and applied by the company.

| | | | | | | | |

| Standard | | | | Description | | | | Impact |

| Amendments to IAS 1, Presentation of Financial Statements | | | | Issued to improve the effectiveness of presentation and disclosure in financial reports, with the objective of reducing immaterial note disclosures. | | | | Adopted prospectively effective January 1, 2016 with no change to the company’s interim financial statements. Immaterial disclosures are expected to be removed from the company’s annual consolidated financial statements. |

| Amendments to IAS 16, Property, Plant and Equipment and IAS 38, Intangible Assets | | | | Issued to clarify acceptable methods of depreciation and amortization. | | | | Adopted prospectively effective January 1, 2016 with no change to the company’s interim financial statements. |

| Amendments to IFRS 11, Joint Arrangements | | | | Issued to provide additional guidance on accounting for the acquisition of an interest in a joint operation. | | | | Adopted prospectively effective January 1, 2016 with no change to the company’s interim financial statements. |

Standards, Amendments and Interpretations Not Yet Effective and Not Applied

The IASB and IFRIC have issued the following standards and amendments or interpretations to existing standards that were not yet effective and not applied as at September 30, 2016. The company does not anticipate early adoption of these standards at this time.

| | | | | | | | | | | | |

| Standard | | | | Description | | | | Expected Impact | | | | Effective Date(1) |

| Amendments to IAS 7, Statement of Cash Flows | | | | Issued to require a reconciliation of the opening and closing liabilities that form part of an entity’s financing activities, including both changes arising from cash flows and non-cash changes. | | | | The company is reviewing the standard to determine the potential impact. | | | | January 1, 2017, applied prospectively. |

| | |

| PotashCorp 2016 Third Quarter Quarterly Report on Form 10-Q | | 6 |

| | | | | | | | | | | | |

| Standard | | | | Description | | | | Expected Impact | | | | Effective Date(1) |

| Amendments to IAS 12, Income Taxes | | | | Issued to clarify the requirements on recognition of deferred tax assets for unrealized losses on debt instruments measured at fair value. | | | | The company is reviewing the standard to determine the potential impact, if any; however, no significant impact is anticipated. | | | | January 1, 2017, applied retrospectively with certain practical expedients available. |

| IFRS 15, Revenue From Contracts With Customers | | | | Issued to provide guidance on the recognition of revenue from contracts with customers, including multiple-element arrangements and transactions not previously addressed comprehensively, and to enhance disclosures about revenue. | | | | The company is reviewing the standard to determine the potential impact, if any. | | | | January 1, 2018, applied retrospectively with certain practical expedients available. |

| IFRS 9, Financial Instruments | | | | Issued to replace IAS 39, providing guidance on the classification, measurement and disclosure of financial instruments and introducing a new hedge accounting model. | | | | The company is reviewing the standard to determine the potential impact, if any. | | | | January 1, 2018, applied retrospectively with certain exceptions. |

| Amendments to IFRS 2, Share-Based Payment | | | | Issued to provide clarification on the classification and measurement of share-based transactions. Specifically, accounting for cash-settled share-based transactions, share-based payment transactions with a net settlement feature and modifications of share-based payment transactions that change classification from cash-settled to equity settled. | | | | The company is reviewing the standard to determine the potential impact, if any. | | | | January 1, 2018, with the option of retrospective or prospective application. |

| IFRS 16, Leases | | | | Issued to supersede IAS 17, IFRIC 4, SIC-15 and SIC-27, providing the principles for the recognition, measurement, presentation and disclosure of leases. Lessees will be required to recognize assets and liabilities for the rights and obligations created by leases. Lessors will continue to classify leases using a similar approach to that of the superseded standards but with enhanced disclosure to improve information about a lessor’s risk exposure, particularly to residual value risk. | | | | The company is reviewing the standard to determine the potential impact. | | | | January 1, 2019, applied retrospectively with certain practical expedients available. |

| (1) | Effective date for annual periods beginning on or after the stated date. |

| | |

| 7 | | PotashCorp 2016 Third Quarter Quarterly Report on Form 10-Q |

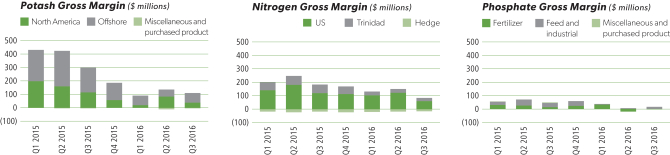

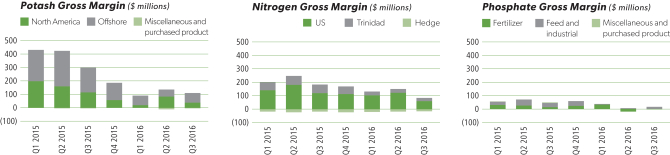

2. Segment Information

The company has three reportable operating segments: potash, nitrogen and phosphate. These segments are differentiated by the chemical nutrient contained in the products that each produces. The accounting policies of the segments are the same as those described in Note 1 and are measured in a manner consistent with that of the financial statements. Inter-segment sales are made under terms that approximate market value. The company’s operating segments have been determined based on reports reviewed by the Chief Executive Officer, assessed to be the company’s chief operating decision-maker, that are used to make strategic decisions.

| | | | | | | | | | | | | | | | | | | | | | |

| | | | | Three Months Ended September 30, 2016 | |

| | | | | Potash | | | Nitrogen | | | Phosphate | | | All Others | | | Consolidated | |

Sales — third party | | | | $ | 453 | | | $ | 333 | | | $ | 350 | | | $ | — | | | $ | 1,136 | |

Freight, transportation and distribution — third party | | | | | (73 | ) | | | (28 | ) | | | (53 | ) | | | — | | | | (154 | ) |

Net sales — third party | | | | | 380 | | | | 305 | | | | 297 | | | | — | | | | | |

Cost of goods sold — third party | | | | | (274 | ) | | | (243 | ) | | | (275 | ) | | | — | | | | (792 | ) |

Margin (cost) on inter-segment sales(1) | | | | | — | | | | 7 | | | | (7 | ) | | | — | | | | — | |

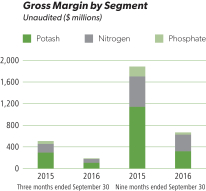

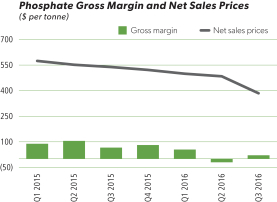

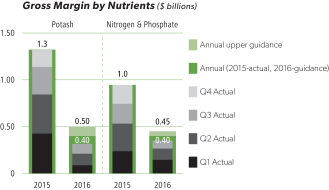

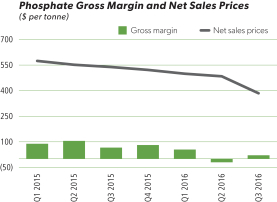

Gross margin | | | | | 106 | | | | 69 | | | | 15 | | | | — | | | | 190 | |

Depreciation and amortization | | | | | (59 | ) | | | (53 | ) | | | (53 | ) | | | (18 | ) | | | (183 | ) |

Assets | | | | | 9,752 | | | | 2,496 | | | | 2,350 | | | | 2,753 | | | | 17,351 | |

Cash outflows for additions to property, plant and equipment | | | | | 94 | | | | 44 | | | | 54 | | | | (1 | ) | | | 191 | |

| (1) | Inter-segment net sales were $14. |

| | | | | | | | | | | | | | | | | | | | | | |

| | | | | Three Months Ended September 30, 2015 | |

| | | | | Potash | | | Nitrogen | | | Phosphate | | | All Others | | | Consolidated | |

Sales — third party | | | | $ | 603 | | | $ | 460 | | | $ | 466 | | | $ | — | | | $ | 1,529 | |

Freight, transportation and distribution — third party | | | | | (55 | ) | | | (23 | ) | | | (50 | ) | | | — | | | | (128 | ) |

Net sales — third party | | | | | 548 | | | | 437 | | | | 416 | | | | — | | | | | |

Cost of goods sold — third party | | | | | (254 | ) | | | (292 | ) | | | (350 | ) | | | — | | | | (896 | ) |

Margin (cost) on inter-segment sales(1) | | | | | — | | | | 16 | | | | (16 | ) | | | — | | | | — | |

Gross margin | | | | | 294 | | | | 161 | | | | 50 | | | | — | | | | 505 | |

Depreciation and amortization | | | | | (52 | ) | | | (48 | ) | | | (56 | ) | | | (16 | ) | | | (172 | ) |

Assets | | | | | 9,678 | | | | 2,560 | | | | 2,369 | | | | 2,858 | | | | 17,465 | |

Cash outflows for additions to property, plant and equipment | | | | | 127 | | | | 102 | | | | 37 | | | | 14 | | | | 280 | |

| (1) | Inter-segment net sales were $25. |

| | | | | | | | | | | | | | | | | | | | | | |

| | | | | Nine Months Ended September 30, 2016 | |

| | | | | Potash | | | Nitrogen | | | Phosphate | | | All Others | | | Consolidated | |

Sales — third party | | | | $ | 1,227 | | | $ | 1,144 | | | $ | 1,027 | | | $ | — | | | $ | 3,398 | |

Freight, transportation and distribution — third party | | | | | (196 | ) | | | (88 | ) | | | (121 | ) | | | — | | | | (405 | ) |

Net sales — third party | | | | | 1,031 | | | | 1,056 | | | | 906 | | | | — | | | | | |

Cost of goods sold — third party | | | | | (714 | ) | | | (777 | ) | | | (835 | ) | | | — | | | | (2,326 | ) |

Margin (cost) on inter-segment sales(1) | | | | | — | | | | 27 | | | | (27 | ) | | | — | | | | — | |

Gross margin | | | | | 317 | | | | 306 | | | | 44 | | | | — | | | | 667 | |

Depreciation and amortization | | | | | (159 | ) | | | (159 | ) | | | (165 | ) | | | (35 | ) | | | (518 | ) |

Share of Canpotex’s(2) Prince Rupert project exit costs | | | | | (33 | ) | | | — | | | | — | | | | — | | | | (33 | ) |

Termination benefit costs | | | | | (32 | ) | | | — | | | | — | | | | — | | | | (32 | ) |

Impairment of property, plant and equipment | | | | | — | | | | — | | | | (27 | ) | | | — | | | | (27 | ) |

Assets | | | | | 9,752 | | | | 2,496 | | | | 2,350 | | | | 2,753 | | | | 17,351 | |

Cash outflows for additions to property, plant and equipment | | | | | 259 | | | | 178 | | | | 142 | | | | 69 | | | | 648 | |

| (1) | Inter-segment net sales were $48. |

| (2) | Canpotex Limited (“Canpotex”). |

| | |

| PotashCorp 2016 Third Quarter Quarterly Report on Form 10-Q | | 8 |

| | | | | | | | | | | | | | | | | | | | | | |

| | | | | Nine Months Ended September 30, 2015 | |

| | | | | Potash | | | Nitrogen | | | Phosphate | | | All Others | | | Consolidated | |

Sales — third party | | | | $ | 2,089 | | | $ | 1,501 | | | $ | 1,335 | | | $ | — | | | $ | 4,925 | |

Freight, transportation and distribution — third party | | | | | (178 | ) | | | (73 | ) | | | (129 | ) | | | — | | | | (380 | ) |

Net sales — third party | | | | | 1,911 | | | | 1,428 | | | | 1,206 | | | | — | | | | | |

Cost of goods sold — third party | | | | | (772 | ) | �� | | (905 | ) | | | (985 | ) | | | — | | | | (2,662 | ) |

Margin (cost) on inter-segment sales (1) | | | | | — | | | | 41 | | | | (41 | ) | | | — | | | | — | |

Gross margin | | | | | 1,139 | | | | 564 | | | | 180 | | | | — | | | | 1,883 | |

Depreciation and amortization | | | | | (170 | ) | | | (141 | ) | | | (181 | ) | | | (25 | ) | | | (517 | ) |

Assets | | | | | 9,678 | | | | 2,560 | | | | 2,369 | | | | 2,858 | | | | 17,465 | |

Cash outflows for additions to property, plant and equipment | | | | | 341 | | | | 285 | | | | 127 | | | | 49 | | | | 802 | |

| (1) | Inter-segment net sales were $62. |

3. Available-for-Sale Investments

The company assesses at the end of each reporting period whether there is objective evidence of impairment. A significant or prolonged decline in the fair value of the investment below its cost would be evidence that the asset is impaired. If objective evidence of impairment exists, the impaired amount (i.e. the unrealized loss) is recognized in net income; any subsequent reversals would be recognized in other comprehensive income (loss) (“OCI”) and would not flow back into net income. Any subsequent decline in fair value below the carrying amount at the impairment date would represent a further impairment to be recognized in net income.

At September 30, 2016, the company assessed whether there was objective evidence that its investment in Israel Chemicals Ltd. (“ICL”) was impaired. The fair value of the investment, recorded in the condensed consolidated statements of financial position, was $684 compared to the cost of $704. Factors considered in assessing impairment included the length of time and extent to which fair value had been below cost, and current financial and market conditions specific to ICL. The company concluded that objective evidence of impairment did not exist as at September 30, 2016 and, as a result, the unrealized holding loss of $20 was included in accumulated OCI. Impairment will be assessed again in future reporting periods if the fair value is below cost. The fair value was determined through the market value of ICL shares on the Tel Aviv Stock Exchange.

During 2012, the company concluded its investment in Sinofert Holdings Limited (“Sinofert”) was impaired due to the significance by which fair value was below cost. During 2014, the company concluded its investment in Sinofert was further impaired due to the fair value declining below the carrying amount of $238 at the previous impairment date. As a result, impairment losses of $341 and $38 were recognized in net income during 2012 and 2014, respectively. At June 30, 2016, the company concluded its investment in Sinofert was further impaired due to the fair value declining below the carrying amount of $200 at the previous impairment date. As a result, an impairment loss of $10 was recognized in net income during the nine months ended September 30, 2016. The fair value was determined through the market value of Sinofert shares on the Hong Kong Stock Exchange.

Changes in fair value, and related accounting, for the company’s investment in Sinofert since December 31, 2014 were as follows:

| | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | Impact of Unrealized Loss on: | |

| | | | | Fair Value | | | | | Unrealized Loss | | | | | OCI and

AOCI (1) | | | Net Income and Retained Earnings | |

Balance — December 31, 2014 | | | | $ | 252 | | | | | $ | (327 | ) | | | | $ | 52 | | | $ | (379 | ) |

Increase in fair value | | | | | 14 | | | | | | 14 | | | | | | 14 | | | | — | |

Balance — December 31, 2015 | | | | $ | 266 | | | | | $ | (313 | ) | | | | $ | 66 | | | $ | (379 | ) |

Decrease in fair value | | | | | (51 | ) | | | | | (51 | ) | | | | | (51 | ) | | | — | |

Balance — March 31, 2016 | | | | $ | 215 | | | | | $ | (364 | ) | | | | $ | 15 | | | $ | (379 | ) |

Decrease in fair value and recognition of impairment | | | | | (25 | ) | | | | | (25 | ) | | | | | (15 | ) | | | (10 | ) |

Balance — June 30, 2016 | | | | $ | 190 | | | | | $ | (389 | ) | | | | $ | — | | | $ | (389 | ) |

Increase in fair value | | | | | 8 | | | | | | 8 | | | | | | 8 | | | | — | |

Balance — September 30, 2016 | | | | $ | 198 | | | | | $ | (381 | ) | | | | $ | 8 | | | $ | (389 | ) |

| (1) | Accumulated other comprehensive income (“AOCI”). |

| | |

| 9 | | PotashCorp 2016 Third Quarter Quarterly Report on Form 10-Q |

4. Other Income (Expenses)

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | Three Months Ended September 30 | | | | | | Nine Months Ended September 30 | |

| | | | | | 2016 | | | | | | 2015 | | | | | | 2016 | | | | | | 2015 | |

Foreign exchange gain (loss) | | | | | | $ | 5 | | | | | | | $ | 24 | | | | | | | $ | (14 | ) | | | | | | $ | 36 | |

Other (expenses) income | | | | | | | — | | | | | | | | (16 | ) | | | | | | | 10 | | | | | | | | (25 | ) |

| | | | | | | $ | 5 | | | | | | | $ | 8 | | | | | | | $ | (4 | ) | | | | | | $ | 11 | |

5. Income Taxes

A separate estimated average annual effective tax rate was determined for each taxing jurisdiction and applied individually to the interim period pre-tax income of each jurisdiction.

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | Three Months Ended September 30 | | | | | | Nine Months Ended September 30 | |

| | | | | | 2016 | | | | | | 2015 | | | | | | 2016 | | | | | | 2015 | |

Income tax expense | | | | | | $ | 2 | | | | | | | $ | 90 | | | | | | | $ | 58 | | | | | | | $ | 382 | |

Actual effective tax rate on ordinary earnings | | | | | | | 16% | | | | | | | | 27% | | | | | | | | 20% | | | | | | | | 27% | |

Actual effective tax rate including discrete items | | | | | | | 2% | | | | | | | | 24% | | | | | | | | 17% | | | | | | | | 26% | |

Discrete tax adjustments that impacted the tax rate | | | | | | $ | (11 | ) | | | | | | $ | (11 | ) | | | | | | $ | (11 | ) | | | | | | $ | (5 | ) |

Significant items to note include the following:

| • | | The actual effective tax rate on ordinary earnings for the three and nine months ended September 30, 2016 decreased compared to the same periods last year due to significantly lower earnings in higher tax jurisdictions. |

| • | | In second-quarter 2016, a $10 discrete non-tax deductible impairment of the company’s available-for-sale investment in Sinofert was recorded. This increased the actual effective tax rate including discrete items for the nine months ended September 30, 2016 by one percentage point. |

| • | | In third-quarter 2015, a current tax recovery of $17 was recorded upon the conclusion of a tax authority audit. |

Income tax balances within the condensed consolidated statements of financial position were comprised of the following:

| | | | | | | | | | | | | | | | | | | | |

| Income Tax Assets (Liabilities) | | | | Statements of Financial Position Location | | | | | September 30,

2016 | | | | | | December 31,

2015 | |

Current income tax assets | | | | | | | | | | | | | | | | | | | | |

Current | | | | Receivables | | | | | | $ | 36 | | | | | | | $ | 60 | |

Non-current | | | | Other assets | | | | | | | 72 | | | | | | | | 66 | |

Deferred income tax assets | | | | Other assets | | | | | | | 13 | | | | | | | | 10 | |

Total income tax assets | | | | | | | | | | $ | 121 | | | | | | | $ | 136 | |

Current income tax liabilities | | | | | | | | | | | | | | | | | | | | |

Current | | | | Payables and accrued charges | | | | | | $ | (3 | ) | | | | | | $ | (14 | ) |

Non-current | | | | Other non-current liabilities and deferred credits | | | | | | | (66 | ) | | | | | | | (74 | ) |

Deferred income tax liabilities | | | | Deferred income tax liabilities | | | | | | | (2,407 | ) | | | | | | | (2,438 | ) |

Total income tax liabilities | | | | | | | | | | $ | (2,476 | ) | | | | | | $ | (2,526 | ) |

| | |

| PotashCorp 2016 Third Quarter Quarterly Report on Form 10-Q | | 10 |

6. Consolidated Statements of Cash Flow

| | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | Three Months Ended September 30 | | | | | Nine Months Ended September 30 | |

| | | | | 2016 | | | | | | 2015 | | | | | 2016 | | | | | | 2015 | |

Reconciliation of cash provided by operating activities | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Net income | | | | $ | 81 | | | | | | | $ | 282 | | | | | $ | 277 | | | | | | | $ | 1,069 | |

Adjustments to reconcile net income to cash provided by operating activities | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Depreciation and amortization | | | | | 183 | | | | | | | | 172 | | | | | | 518 | | | | | | | | 517 | |

Impairment of property, plant and equipment | | | | | — | | | | | | | | — | | | | | | 27 | | | | | | | | — | |

Net (undistributed) distributed earnings of equity-accounted investees | | | | | (23 | ) | | | | | | | (31 | ) | | | | | 21 | | | | | | | | (47 | ) |

Impairment of available-for-sale investment (Note 3) | | | | | — | | | | | | | | — | | | | | | 10 | | | | | | | | — | |

Share-based compensation | | | | | 3 | | | | | | | | 1 | | | | | | 8 | | | | | | | | 20 | |

Provision for deferred income tax | | | | | 6 | | | | | | | | 77 | | | | | | 5 | | | | | | | | 149 | |

Pension and other post-retirement benefits | | | | | 8 | | | | | | | | 11 | | | | | | 36 | | | | | | | | 27 | |

Asset retirement obligations and accrued environmental costs | | | | | (12 | ) | | | | | | | 5 | | | | | | 13 | | | | | | | | (19 | ) |

Other long-term liabilities and miscellaneous | | | | | 1 | | | | | | | | (12 | ) | | | | | (7 | ) | | | | | | | 5 | |

Subtotal of adjustments | | | | | 166 | | | | | | | | 223 | | | | | | 631 | | | | | | | | 652 | |

Changes in non-cash operating working capital | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Receivables | | | | | (66 | ) | | | | | | | 1 | | | | | | 79 | | | | | | | | 86 | |

Inventories | | | | | 63 | | | | | | | | (18 | ) | | | | | 20 | | | | | | | | (78 | ) |

Prepaid expenses and other current assets | | | | | 6 | | | | | | | | (19 | ) | | | | | 9 | | | | | | | | (16 | ) |

Payables and accrued charges | | | | | 45 | | | | | | | | (111 | ) | | | | | (109 | ) | | | | | | | 2 | |

Subtotal of changes in non-cash operating working capital | | | | | 48 | | | | | | | | (147 | ) | | | | | (1 | ) | | | | | | | (6 | ) |

Cash provided by operating activities | | | | $ | 295 | | | | | | | $ | 358 | | | | | $ | 907 | | | | | | | $ | 1,715 | |

Supplemental cash flow disclosure | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Interest paid | | | | $ | 31 | | | | | | | $ | 37 | | | | | $ | 124 | | | | | | | $ | 130 | |

Income taxes (recovered) paid | | | | $ | (3 | ) | | | | | | $ | 85 | | | | | $ | 43 | | | | | | | $ | 150 | |

7. Inventories

| | | | | | | | | | | | | | |

| | | | | September 30, 2016 | | | | | | December 31, 2015 | |

Finished products | | | | $ | 229 | | | | | | | $ | 302 | |

Intermediate products | | | | | 163 | | | | | | | | 125 | |

Raw materials | | | | | 81 | | | | | | | | 94 | |

Materials and supplies | | | | | 247 | | | | | | | | 228 | |

| | | | | $ | 720 | | | | | | | $ | 749 | |

The following items affected cost of goods sold:

| | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | Three Months Ended September 30 | | | | | Nine Months Ended September 30 | |

| | | | | 2016 | | | | | | 2015 | | | | | 2016 | | | | | | 2015 | |

Expensed inventories before the following items | | | | $ | 739 | | | | | | | $ | 802 | | | | | $ | 2,038 | | | | | | | $ | 2,505 | |

Reserves, reversals and writedowns of inventories | | | | | 2 | | | | | | | | 4 | | | | | | 21 | | | | | | | | 5 | |

| | | | | $ | 741 | | | | | | | $ | 806 | | | | | $ | 2,059 | | | | | | | $ | 2,510 | |

The carrying amount of inventory recorded at net realizable value was $55 as at September 30, 2016 (December 31, 2015 — $32), with the remaining inventory recorded at cost.

| | |

| 11 | | PotashCorp 2016 Third Quarter Quarterly Report on Form 10-Q |

8. Pension and Other Post-Retirement Benefits

A remeasurement of the defined benefit plan assets and liabilities was performed at June 30, 2016. Due to a change in the discount rate and actual return on plan assets, the company’s defined benefit pension and other post-retirement benefit obligations increased by $184, plan assets increased by $21 and deferred income taxes decreased by $60. As a result, the company recorded net actuarial losses on defined benefit plan obligations of $103 in OCI, which was recognized immediately in retained earnings at June 30, 2016. There was no such remeasurement during the three months ended September 30, 2016.

The net impact on assets and liabilities within the condensed consolidated statements of financial position at June 30, 2016 was as follows:

| | | | | | |

| | | | | (Decrease) Increase | |

Non-current assets | | | | | | |

Other assets | | | | $ | (9 | ) |

Non-current liabilities | | | | | | |

Deferred income tax liabilities | | | | | (60 | ) |

Pension and other post-retirement benefit liabilities | | | | | 154 | |

The discount rate used to determine the benefit obligation for the company’s significant plans at June 30, 2016 was 3.65 percent (December 31, 2015 — 4.35 percent).

9. Share Capital

Authorized

The company is authorized to issue an unlimited number of common shares without par value and an unlimited number of first preferred shares. The common shares are not redeemable or convertible. The first preferred shares may be issued in one or more series with rights and conditions to be determined by the Board of Directors. No first preferred shares have been issued.

Issued

| | | | | | | | | | |

| | | | | Number of Common Shares | | | Consideration | |

Balance — December 31, 2015 | | | | | 836,540,151 | | | $ | 1,747 | |

Issued under option plans | | | | | 2,294,950 | | | | 35 | |

Issued for dividend reinvestment plan | | | | | 808,373 | | | | 13 | |

Balance — September 30, 2016 | | | | | 839,643,474 | | | $ | 1,795 | |

Dividends Declared

The company declared dividends per share of $0.10 (2015 — $0.38) during the three months ended September 30, 2016 and $0.60 (2015 — $1.14) during the nine months ended September 30, 2016.

In connection with the Proposed Transaction, as described in Note 15, under the terms of the Arrangement Agreement the company is permitted to pay quarterly dividends up to but not in excess of existing rates.

| | |

| PotashCorp 2016 Third Quarter Quarterly Report on Form 10-Q | | 12 |

10. Share-Based Compensation

During the nine months ended September 30, 2016, the company issued stock options and performance share units (“PSUs”) to eligible employees under the 2016 Long-Term Incentive Plan (“LTIP”). Information on stock options and PSUs is summarized below:

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | 2016 LTIP | | | | | Expense for all Share-Based Compensation Plans | |

| | | | | Units

Granted | | | | | Units Outstanding as at September 30, 2016 | | | | | Three Months Ended September 30 | | | | | Nine Months Ended September 30 | |

| | | | | | | | | | 2016 | | | | | 2015 | | | | | 2016 | | | | | 2015 | |

Stock options | | | | | 3,099,913 | | | | | | 3,071,064 | | | | | $ | 2 | | | | | $ | 4 | | | | | $ | 8 | | | | | $ | 20 | |

Share-settled PSUs | | | | | 612,192 | | | | | | 612,192 | | | | | | 1 | | | | | | — | | | | | | 3 | | | | | | — | |

Cash-settled PSUs | | | | | 1,004,548 | | | | | | 1,004,548 | | | | | | 3 | | | | | | — | | | | | | 7 | | | | | | — | |

| | | | | | | | | | | | | | | | | $ | 6 | | | | | $ | 4 | | | | | $ | 18 | | | | | $ | 20 | |

Grant date fair value per unit for stock options and share-settled PSUs is $2.04 and $17.19, respectively.

Stock Options

Under the LTIP, stock options generally vest and become exercisable on the third anniversary of the grant date, subject to continuous employment or retirement, and have a maximum term of 10 years. The weighted average fair value of stock options granted was estimated as of the date of grant using the Black-Scholes-Merton option-pricing model with the following weighted average assumptions:

| | | | |

Exercise price per option | | $ | 16.20 | |

Expected annual dividend per share | | $ | 1.00 | |

Expected volatility | | | 30% | |

Risk-free interest rate | | | 1.06% | |

Expected life of options | | | 5.7 years | |

Performance Share Units

Currently, PSUs granted under the LTIP are comprised of three tranches, with each tranche vesting based on the achievement of performance metrics over separate performance periods ranging from one to three years, and will be settled in shares for grantees who are subject to the company’s share ownership guidelines and in cash for all other grantees. PSUs will vest based on performance metrics comprising the relative ranking of the company’s total shareholder return compared with a specified peer group and the company’s cash flow return on investment compared with its weighted average cost of capital. Compensation cost is measured based on the grant date fair value of the units, adjusted for the company’s best estimate of the outcome of non-market vesting conditions at the end of each period, for share-settled PSUs, and on period-end fair value of the awards for cash-settled PSUs. The company uses a Monte Carlo simulation model to estimate the outcome of relative total shareholder return.

11. Financial Instruments

Fair Value

Estimated fair values for financial instruments are designed to approximate amounts for which the instruments could be exchanged in a current arm’s-length transaction between knowledgeable willing parties. The valuation policies and procedures for financial reporting purposes are determined by the company’s finance department.

| | |

| 13 | | PotashCorp 2016 Third Quarter Quarterly Report on Form 10-Q |

Financial instruments included in the unaudited interim condensed consolidated statements of financial position are measured either at fair value or amortized cost. The tables below explain the valuation methods used to determine the fair value of each financial instrument and its associated level in the fair value hierarchy.

| | | | |

| Financial Instruments Measured at Fair Value | | | | Fair Value Method |

| Cash and cash equivalents | | | | Assumed to approximate carrying value due to their short-term nature. |

| Available-for-sale investments | | | | Based on the closing bid price of the common shares (Level 1) on the primary exchanges in which the relevant shares are traded as at the statements of financial position dates. |

| Foreign currency derivatives not traded in an active market | | | | Determined using quoted forward exchange rates (Level 2) as at the statements of financial position dates. |

| Natural gas swaps not traded in an active market | | | | Based on a discounted cash flow model. The inputs used in the model included contractual cash flows based on prices for natural gas futures contracts, fixed prices and notional volumes specified by the swap contracts, the time value of money, liquidity risk, the company’s own credit risk (related to instruments in a liability position) and counterparty credit risk (related to instruments in an asset position). Futures contract prices used as inputs in the model were supported by prices quoted in an active market and therefore categorized in Level 2. Prior to December 31, 2015, certain contract prices used as inputs in the model were not based on observable market data and therefore categorized in Level 3. |

| Natural gas futures | | | | Based on closing prices provided by the exchange (NYMEX) (Level 1) as at the statements of financial position dates. |

| | |

| Financial Instruments Measured at Amortized Cost | | | | Fair Value Method |

| Receivables, short-term debt and payables and accrued charges | | | | Assumed to approximate carrying value due to their short-term nature. |

| Long-term debt senior notes | | | | Quoted market prices (Level 1 or 2 depending on the market liquidity of the debt). |

| Other long-term debt instruments | | | | Assumed to approximate carrying value. |

Presented below is a comparison of the fair value of the company’s senior notes to their carrying values.

| | | | | | | | | | | | | | | | | | | | | | |

| | | | | September 30, 2016 | | | | | | December 31, 2015 | |

| | | | | Carrying Amount of Liability(1) | | | Fair Value of Liability | | | | | | Carrying Amount of Liability(1) | | | Fair Value of Liability | |

Long-term debt senior notes | | | | $ | 3,705 | | | $ | 4,106 | | | | | | | $ | 3,702 | | | $ | 3,912 | |

| (1) | Includes net unamortized debt issue costs. |

| | |

| PotashCorp 2016 Third Quarter Quarterly Report on Form 10-Q | | 14 |

The following table presents the company’s fair value hierarchy for financial assets and financial liabilities carried at fair value on a recurring basis.

| | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | Fair Value Measurements at Reporting Dates Using: | |

| | | | | | Carrying Amount of Asset (Liability) | | | | | | Quoted Prices in Active Markets for Identical Assets (Level 1)(1) | | | Significant Other Observable Inputs (Level 2)(1,2) | | | Significant Unobservable Inputs (Level 3)(2) | |

September 30, 2016 | | | | | | | | | | | | | | | | | | | | | | | | |

Derivative instrument assets | | | | | | | | | | | | | | | | | | | | | | | | |

Natural gas derivatives | | | | | | $ | 6 | | | | | | | $ | — | | | $ | 6 | | | $ | — | |

Available-for-sale investments(3) | | | | | | | 886 | | | | | | | | 886 | | | | — | | | | — | |

Derivative instrument liabilities | | | | | | | | | | | | | | | | | | | | | | | | |

Natural gas derivatives | | | | | | | (128 | ) | | | | | | | — | | | | (128 | ) | | | — | |

December 31, 2015 | | | | | | | | | | | | | | | | | | | | | | | | |

Derivative instrument assets | | | | | | | | | | | | | | | | | | | | | | | | |

Natural gas derivatives | | | | | | $ | 9 | | | | | | | $ | — | | | $ | 9 | | | $ | — | |

Available-for-sale investments(3) | | | | | | | 984 | | | | | | | | 984 | | | | — | | | | — | |

Derivative instrument liabilities | | | | | | | | | | | | | | | | | | | | | | | | |

Natural gas derivatives | | | | | | | (190 | ) | | | | | | | — | | | | (190 | ) | | | — | |

Foreign currency derivatives | | | | | | | (3 | ) | | | | | | | — | | | | (3 | ) | | | — | |

| (1) | During the nine months ended September 30, 2016 and twelve months ended December 31, 2015, there were no transfers between Level 1 and Level 2. |

| (2) | During the nine months ended September 30, 2016, there were no transfers into or out of Level 3. During the twelve months ended December 31, 2015, there were no transfers into Level 3 and $120 of losses was transferred out of Level 3 into Level 2 as the company’s valuation technique used a significant portion of observable inputs. The company’s policy is to recognize transfers at the end of the reporting period. |

| (3) | Available-for-sale investments are comprised of shares in ICL, Sinofert and other. |

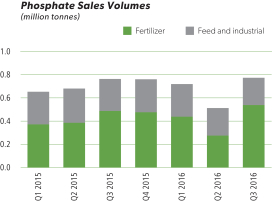

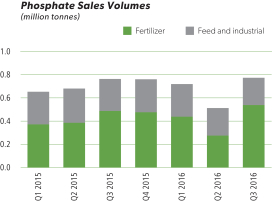

12. Seasonality

The company’s sales of fertilizer can be seasonal. Typically, fertilizer sales are highest in the second quarter of the year, due to the Northern Hemisphere’s spring planting season. However, planting conditions and the timing of customer purchases will vary each year, and fertilizer sales can be expected to shift from one quarter to another. Feed and industrial sales are more evenly distributed throughout the year.

13. Contingencies and Other Matters

Canpotex

PCS is a shareholder in Canpotex, a potash export, sales and marketing company owned in equal shares by PCS and two other Canadian potash producers, which markets Canadian potash offshore. Should any operating losses or other liabilities be incurred by Canpotex, the shareholders have contractually agreed to reimburse it for such losses or liabilities in proportion to each shareholder’s productive capacity. Through September 30, 2016, there were no such operating losses or other liabilities.

Mining Risk

The risk of underground water inflows, as with most other underground risks, is currently not insured.

Legal and Other Matters

The company is engaged in ongoing site assessment and/or remediation activities at a number of facilities and sites, and anticipated costs associated with these matters are added to accrued environmental costs in the manner previously described in Note 22 to the company’s 2015 annual consolidated financial statements. This includes matters related to investigation of potential brine migration at certain of the potash sites. The following environmental site assessment and/or remediation matters have uncertainties that may not be fully reflected in the amounts accrued for those matters:

Nitrogen and phosphate

| • | | The US Environmental Protection Agency (“USEPA”) has identified PCS Nitrogen, Inc. (“PCS Nitrogen”) as a potentially responsible party at the Planters Property or Columbia Nitrogen site in Charleston, South Carolina. PCS Nitrogen is subject to a final judgment by the US District Court for the District of South Carolina allocating 30 percent of the liability for response costs at the site to PCS Nitrogen, as well as a proportional share of any costs that cannot be recovered from another responsible party. In December 2013, the USEPA issued an order to PCS Nitrogen and four other respondents requiring them jointly and severally to conduct certain cleanup work at the site and reimburse the USEPA’s costs for overseeing that work. PCS Nitrogen is currently performing the work required by the |

| | |

| 15 | | PotashCorp 2016 Third Quarter Quarterly Report on Form 10-Q |

| | | USEPA order. The USEPA also has requested reimbursement of approximately $5 of previously incurred response costs. The ultimate amount of liability for PCS Nitrogen depends upon, among other factors, the final outcome of litigation to impose liability on additional parties, the amount needed for remedial activities, the ability of other parties to pay and the availability of insurance. |

| • | | PCS Phosphate Company, Inc. (“PCS Phosphate”) has agreed to participate, on a non-joint and several basis, with parties to an Administrative Settlement Agreement with the USEPA (“Settling Parties”) in a removal action and the payment of certain other costs associated with PCB soil contamination at the Ward Transformer Superfund Site in Raleigh, North Carolina (“Site”), including reimbursement of past USEPA costs. The removal activities commenced in August 2007. In September 2013, PCS Phosphate and other parties entered into an Administrative Order on Consent with the USEPA, pursuant to which a supplemental remedial investigation and focused feasibility study will be performed on the portion of the Site that was subject to the removal action. The response actions are nearly complete. The completed and anticipated remaining work on the Site is estimated to cost a total of $80. PCS Phosphate is a party to ongoing Comprehensive Environmental Response, Compensation and Liability Act (“CERCLA”) contribution and cost-recovery litigation for the recovery of costs of the removal activities. In addition to activities focused on the soil at the Site, PCS Phosphate signed a consent decree with USEPA and a number of entities in September 2016 requiring remediation downstream of the area subject to the removal action (“Operable Unit 1”). PCS Phosphate currently expects that it will not incur any remediation costs for Operable Unit 1 pursuant to the consent decree. Court entry of the Operable Unit 1 consent decree will effectively end the cost recovery/contribution litigation because participants were required to settle with PCS Phosphate as a prerequisite and the consent decree requires participants to release all claims concerning the Site. |

| • | | In 1996, PCS Nitrogen Fertilizer, L.P. (“PCS Nitrogen Fertilizer”), then known as Arcadian Fertilizer, L.P., entered into a Consent Order (the “Order”) with the Georgia Environmental Protection Division (“GEPD”) in conjunction with PCS Nitrogen Fertilizer’s acquisition of real property in Augusta, Georgia. Under the Order, PCS Nitrogen Fertilizer is required to perform certain activities to investigate and, if necessary, implement corrective measures for substances in soil and groundwater. The investigation has proceeded and the results have been presented to GEPD. Two interim corrective measures for substances in groundwater have been proposed by PCS Nitrogen Fertilizer and approved by GEPD. PCS Nitrogen Fertilizer is implementing the approved interim corrective measures, which may be modified by PCS Nitrogen Fertilizer |

| | | from time to time, but it is unable to estimate with reasonable certainty the total cost of its correction action obligations under the Order at this time. |

Based on current information and except for the uncertainties described in the preceding paragraphs, the company does not believe that its future obligations with respect to these facilities and sites are reasonably likely to have a material adverse effect on its consolidated financial position or results of operations.

Other legal matters with significant uncertainties include the following:

Nitrogen and phosphate

| • | | The USEPA has an ongoing initiative to evaluate implementation within the phosphate industry of a particular exemption for mineral processing wastes under the hazardous waste program. In connection with this industry-wide initiative, the USEPA conducted inspections at numerous phosphate operations and notified the company of alleged violations of the US Resource Conservation and Recovery Act (“RCRA”) at its plants in Aurora, North Carolina; Geismar, Louisiana; and White Springs, Florida. The company has entered into RCRA 3013 Administrative Orders on Consent and has performed certain site assessment activities at all of these plants. At this time, the company does not know the scope of action, if any, that may be required. As to the alleged RCRA violations, the company continues to participate in settlement discussions with the USEPA but is uncertain if any resolution will be possible without litigation, or, if litigation occurs, what the outcome would be. The company routinely monitors public information about the impacts of the initiative on other industry members, and it regularly considers this information in establishing the appropriate asset retirement obligations and accruals. |

| • | | In August 2015, the USEPA finalized hazardous air pollutant emission standards for phosphoric acid manufacturing and phosphate fertilizer production (“Final Rule”). The Final Rule includes certain new requirements for monitoring and emissions that are infeasible for the company to satisfy in a timely manner. As a result, in October 2015, the company filed a petition for reconsideration of certain aspects of the Final Rule with the USEPA and a petition for review of the Final Rule with the US Court of Appeals for the District of Columbia Circuit. The USEPA granted the petition for reconsideration and the petition for review is being held in abeyance pending the outcome of the USEPA proceeding, for which there is not a definite time frame for resolution. The company is participating in discussions with the USEPA to resolve the petition but whether future revisions to the Final Rule will be made is uncertain. Required emissions testing at our Aurora facility in 2016 indicated some alleged exceedances of the mercury emission limits that were established by the Final Rule. The facility has communicated |

| | |

| PotashCorp 2016 Third Quarter Quarterly Report on Form 10-Q | | 16 |

| | with the relevant agencies about this issue and is in the process of developing a compliance strategy, the costs of which cannot be estimated with any certainty at this time. In September 2016, the company filed an amended petition for reconsideration of the mercury emission limit in the Final Rule with the USEPA. However, whether the USEPA will grant any relief is uncertain. In the interim, the North Carolina Department of Environmental Quality (“NCDEQ”) has issued a Notice of Violation associated with the facility’s alleged exceedances of the new mercury limits, and the company is working with the NCDEQ to address these alleged violations via a negotiated settlement. |

General

| • | | The countries where we operate are parties to the Paris Agreement adopted in December 2015 pursuant to the United Nations Framework Convention on Climate Change. Each country that is a party to the Paris Agreement submitted an Intended Nationally Determined Contribution (“INDC”) toward the control of greenhouse gas emissions. The impacts of these INDCs on the company’s operations cannot be determined with any certainty at this time. Prior to the adoption of the Paris Agreement, the USEPA adopted several rules to control such emissions using authority under existing environmental laws. None of these regulations has resulted in material limitations on greenhouse gas emissions at the company’s facilities. In October 2016, the Canadian government announced a national plan to put a price on carbon emissions beginning in 2018 of $10 per tonne and increasing by $10 per tonne each year through 2022 to be implemented either through a carbon tax or a cap and trade program at the election of each province. The province of Saskatchewan previously announced plans to impose a type of carbon levy on emissions over 2006 levels with an associated technology fund, but the status of those plans is uncertain. The company is monitoring these developments and their future effect on its operations cannot be determined with certainty at this time. |

In addition, various other claims and lawsuits are pending against the company in the ordinary course of business. While it is not possible to determine the ultimate outcome of such actions at this time, and inherent uncertainties exist in predicting such outcomes, it is the company’s belief that the ultimate resolution of such actions is not reasonably likely to have a material adverse effect on its consolidated financial statements.

The breadth of the company’s operations and the global complexity of tax regulations require assessments of uncertainties

and judgments in estimating the taxes it will ultimately pay. The final taxes paid are dependent upon many factors, including negotiations with taxing authorities in various jurisdictions, outcomes of tax litigation and resolution of disputes arising from federal, provincial, state and local tax audits. The resolution of these uncertainties and the associated final taxes may result in adjustments to the company’s tax assets and tax liabilities.

The company owns facilities that have been either permanently or indefinitely shut down. It expects to incur nominal annual expenditures for site security and other maintenance costs at certain of these facilities. Should the facilities be dismantled, certain other shutdown-related costs may be incurred. Such costs are not expected to have a material adverse effect on the company’s consolidated financial statements and would be recognized and recorded in the period in which they are incurred.

14. Related Party Transactions

The company sells potash from its Saskatchewan mines for use outside Canada and the US exclusively to Canpotex. Sales are at prevailing market prices and are settled on normal trade terms. Sales to Canpotex for the three months ended September 30, 2016 were $221 (2015 — $316) and the nine months ended September 30, 2016 were $559 (2015 — $1,084). At September 30, 2016, $107 (December 31, 2015 — $148) was owing from Canpotex.

15. Proposed Transaction with Agrium

On September 11, 2016, the company entered into an Arrangement Agreement with Agrium Inc. (“Agrium”) pursuant to which the company and Agrium have agreed to combine their businesses (the “Proposed Transaction”) in a merger of equals transaction to be implemented by way of a plan of arrangement under the Canada Business Corporations Act. The Proposed Transaction is currently anticipated to be completed in mid-2017 and is subject to customary closing conditions, including shareholder, court and other regulatory approvals.

Upon the closing of the Proposed Transaction, the company and Agrium will become indirect, wholly owned subsidiaries of a new parent company. PotashCorp shareholders will own approximately 52 percent of the new parent, and Agrium shareholders will own approximately 48 percent.

During the three and nine months ended September 30, 2016, the company incurred $8 of costs in connection with the Proposed Transaction. These costs primarily included financial advisory, legal and consulting fees.

| | |

| 17 | | PotashCorp 2016 Third Quarter Quarterly Report on Form 10-Q |

Item 2. Management’s Discussion and Analysis of Financial Condition and Results of Operations (in US dollars)

The following discussion and analysis is the responsibility of management and is as at November 1, 2016. The Board of Directors (Board) carries out its responsibility for review of this disclosure principally through its audit committee, comprised exclusively of independent directors. The audit committee reviews and, prior to its publication, approves this disclosure, pursuant to the authority delegated to it by the Board. The term “PCS” refers to Potash Corporation of Saskatchewan Inc. and the terms “we,” “us,” “our,” “PotashCorp” and “the company” refer to PCS and, as applicable, PCS and its direct and indirect subsidiaries as a group. Additional information relating to PotashCorp (which, except as otherwise noted, is not incorporated by reference herein), including our Annual Report on Form 10-K for the year ended December 31, 2015 (2015 Form 10-K), can be found on SEDAR at www.sedar.com and on EDGAR at www.sec.gov. The company is a foreign private issuer under the rules and regulations of the US Securities and Exchange Commission (the SEC); however, it currently files voluntarily on the SEC’s domestic forms.

PotashCorp and Our Business Environment

PotashCorp is an integrated producer of fertilizer, industrial and animal feed products. We are the world’s largest fertilizer company by capacity, producing the three primary crop nutrients: potash (K), nitrogen (N) and phosphate (P). Our Canadian potash operations – the primary focus and namesake of our company – represent one-fifth of global capacity. To enhance our global footprint, we also have investments in four potash-related businesses in South America, the Middle East and Asia. We complement our potash assets with focused positions in nitrogen and phosphate.

A detailed description of our markets and customers can be found on pages 51 and 52 (potash), 61 and 62 (nitrogen) and 69 and 70 (phosphate) in our 2015 Annual Integrated Report (2015 AIR).

How We Approach Governance

We believe strong governance creates the environment for a successful company, and effective governance begins at the top. Our Board provides guidance and oversight, while management defines and executes strategy and simultaneously manages risk.

Success at the Board and management level at PotashCorp involves setting the right program priorities, having the appropriate team members in place, evaluating ourselves, continuing our education and communicating with our stakeholders. Grounded by our objective of creating superior shareholder value, our Board and management team consider the interdependence between strategy and risk to inform how to best position the company to achieve sustainable growth.

There have been no significant changes to how we approach governance from that described in our 2015 AIR (see pages 14 to 19).

How We Approach Strategy

Our Value Model, outlined on page 9 in our 2015 AIR, informs the strategies we put in place to affect value creation over time.

We believe strong financial health and performance are the cornerstones of PotashCorp. They reward our shareholders while allowing us to fulfill our broader social and environmental responsibilities. Our long-term objective is to create superior shareholder value by: growing earnings and cash flow while minimizing volatility; protecting and enhancing a premium valuation multiple; and maintaining the trust and support of our stakeholders.

Our strategy is to prioritize earnings growth and investment opportunities in potash, while complementing our business with other best-in-class assets. Our strategic priorities, depicted below and described in further detail, along with key target metrics, on pages 23 to 25 in our 2015 AIR did not change during the third quarter of 2016.

Proposed Transaction

During the third quarter of 2016, the company entered into an arrangement agreement (the Arrangement Agreement) with Agrium Inc. (Agrium) pursuant to which the company and Agrium have agreed to combine their businesses (the Proposed Transaction) in a merger of equals transaction to be implemented by way of a plan of arrangement under the Canada Business Corporations Act (the CBCA). Upon the closing of the Proposed Transaction, the company and Agrium will become indirect, wholly owned subsidiaries of a new parent company (New Parent). PotashCorp shareholders will own approximately 52 percent of New Parent, and Agrium shareholders will own approximately 48 percent. The Proposed Transaction is currently anticipated to be completed in mid-2017 and is subject to customary closing conditions, including shareholder, court and other regulatory approvals.

| | |

| PotashCorp 2016 Third Quarter Quarterly Report on Form 10-Q | | 18 |

We believe that the creation of the combined company pursuant to the Proposed Transaction is aligned with our long-term objective to create superior shareholder value through 1) the creation of a world-class integrated global supplier of crop inputs; 2) the creation of apre-eminent low-cost producer of potash and high-quality nitrogen and phosphate; 3) a leading retail-distribution platform combined with two world-class nutrient production platforms; 4) significant value creation from synergies of up to approximately $500 million; 5) compelling growth opportunities; 6) enhanced financial flexibility through a strong pro forma balance sheet and substantial cash flow to support growth initiatives and shareholder returns, including a robust dividend

payout to return excess capital to shareholders, and a strong investment grade rating profile; and 7) best-in-class leadership and governance.

For a discussion of various risks relating to the Proposed Transaction, see the section “How We Approach Risk” below and Item 1A “Risk Factors” included in Part II of this Quarterly Report on Form 10-Q. In addition, please refer to our Current Reports on Form 8-K, and the documents filed therewith, filed with the SEC on September 12, 2016 and on October 6, 2016 and the various filings with Canadian provincial securities commissions including the joint information circular of PCS and Agrium dated October 3, 2016.

How We Approach Risk

In our 2015 AIR, we provide an overview of our approach to risk (page 27), explain how we use a risk management-ranking methodology to assess the key risks specific to our company (page 28) and provide a description of, management approach to and any significant developments for each key risk (pages 29 to 33). For a discussion on the risks applicable to PotashCorp, including risks related to the Proposed Transaction, see item 1A “Risk Factors” included in Part II of this Quarterly Report on Form 10-Q.

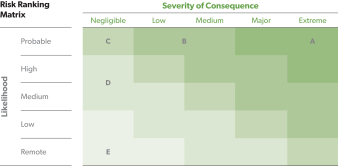

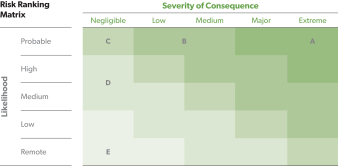

Our risk-ranking matrix, in terms of residual severity of consequence and likelihood, is displayed below.

Key risks with rankings unchanged from our 2015 AIR were as follows:

| (1) | Brighter sections indicate the strategic priority (described on page 18 of this Form 10-Q) impacted by the risk. Faded sections mean the strategic priority is not significantly affected by the risk. |

| | |

| 19 | | PotashCorp 2016 Third Quarter Quarterly Report on Form 10-Q |

Risks that have become key risks and key risks with rankings that have changed since our 2015 AIR were as follows:

| | | | | | | | | | | | |

| Risk | | | | Risk Ranking | | | | Associated

Strategies (1) | | | | Developments |

| Stakeholders’ support for our business plans | | | | C | | | |  | | | | The overall risk ranking remained a C. With anticipated benefits associated with the Proposed Transaction being subject to economic conditions at closing and requisite approvals yet to be obtained, we now include this as a key risk. |

| Operating capability | | | | D | | | |  | | | | The overall risk ranking has decreased from C to D. We have reduced the likelihood of this risk given the expected completion of our Rocanville capacity expansion later this year. |

| (1) | Brighter sections indicate the strategic priority (described on page 18 of this Form 10-Q) impacted by the risk. Faded sections mean the strategic priority is not significantly affected by the risk. |

Key Performance Drivers — Performance Compared to Targets

Through our integrated value model, we set, evaluate and refine our targets to drive improvements that benefit all those impacted by our business. We demonstrate our accountability by tracking and reporting our performance against targets related to each strategic priority set out on pages 40 to 47 in our 2015 AIR. A summary of our progress against selected strategic priorities and representative annual targets is set out below.

| | | | | | | | |

| Strategic Priority | | | | Representative 2016 Annual Target | | | | Performance to September 30, 2016 |

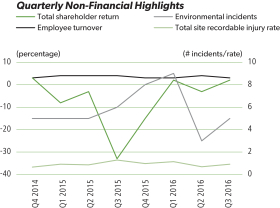

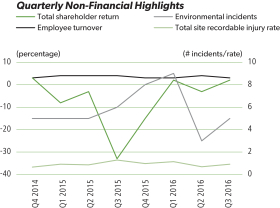

| Portfolio & Return Optimization | | | | Exceed total shareholder return (TSR) performance for our sector and the DAXglobal Agribusiness Index. | | | | PotashCorp’s TSR was 1 percent in the first nine months of 2016 compared to our sector’s weighted average return (based on market capitalization(1)) of -9 percent and the DAXglobal Agribusiness Index weighted average return (based on market capitalization) of 8 percent. |

| Operational Excellence | | | | Achieve 96 percent ammonia reliability rate (2) for all US nitrogen plants and 88 percent in Trinidad. | | | | Our ammonia reliability rate was 98 percent in the US and 94 percent in Trinidad for the first nine months of 2016. |

| People Development | | | | Maintain an annual employee turnover rate of 5 percent or less (excluding retirements and workforce changes related to suspension of Picadilly potash operations). | | | | Employee turnover rate (excluding retirements and workforce changes related to Picadilly) on an annualized basis for the first nine months of 2016 was 3 percent. |

| Safety & Health Excellence | | | | Achieve zero life-altering injuries at our sites. | | | | There were no life-altering injuries at our sites during the first nine months of 2016. |

| | | | | Reduce total site recordable injury rate to 0.85 (or lower) and total lost-time injury rate to 0.09 (or lower). | | | | During the first nine months of 2016, total site recordable injury rate was 0.92 and total lost-time injury rate was 0.08. |

| Environmental Excellence | | | | By 2018, reduce total reportable incidents (releases, permit excursions and spills) by 40 percent from 2014 levels. | | | | Annualized total reportable incidents were down 6 percent during the first nine months of 2016 compared to 2014 annual levels. Compared to the first nine months of 2015, total reportable incidents were up 6 percent. |

| (1) | TSRs are based on the currencies of the primary exchanges in which the relevant shares are traded. |

| (2) | Page 41 of our 2015 AIR initially described US and Trinidad operating rate percentages as our target. The company has clarified that the target refers to ammonia reliability rate, the company’s focus in the nitrogen segment. Operating rate is defined as actual production divided by capacity. Reliability rate is defined as actual production divided by capacity less non-reliability related downtime. |