Semiannual Report

Economic and Market Overview

Modest growth for the U.S. economy, as measured by gross domestic product, characterized the six-month period ended April 30, 2013. Increasing job creation helped the unemployment rate decline during the period, and consumer spending remained strong. In the housing sector, accelerating new and existing homes sales accompanied record-low mortgage rates, affordable housing prices, low new-home inventories and a six-year low in U.S. foreclosures. Orders for manufactured goods and manufacturers’ inventory reached record levels in March and the sector expanded for the fifth consecutive month through period-end.

Businesses and investors awaited the U.S. election that resulted in an unchanged balance of power in Washington, given the re-election of President Obama and respective control of the House and Senate by Republicans and Democrats. Uncertainty surrounding budget deadlines set for the end of 2012 largely abated when an agreement between Congress and the President resolved many issues, including preserving lower income tax rates for most U.S. households. Concerns remained about the effects of the expired payroll tax cut, far-reaching federal spending cuts, and future negotiations regarding the federal debt ceiling.

U.S. stocks generated healthy returns as the Standard & Poor’s® 500 Index and Dow Jones Industrial Average reached all-time highs near period-end.1 Rising corporate profits and generally favorable economic data bolstered investor confidence, but some caution surrounded the extent to which positive business and market results were dependent on the Federal Reserve Board’s accommodative monetary policy.

The foregoing information reflects our analysis and opinions as of April 30, 2013. The information is not a com-

plete analysis of every aspect of any market, country, industry, security or fund. Statements of fact are from

sources considered reliable.

1. STANDARD & POOR’S®, S&P® and S&P 500® are registered trademarks of Standard & Poor’s Financial Services LLC.

Semiannual Report | 3

Franklin All Cap Value Fund

Your Fund’s Goal and Main Investments: Franklin All Cap Value Fund seeks long-term total return by primarily investing in stocks of companies of any size that we believe are undervalued at the time of purchase and have the potential for capital appreciation.

This semiannual report for Franklin All Cap Value Fund covers the period ended April 30, 2013.

Performance Overview

Franklin All Cap Value Fund – Class A delivered a +15.00% cumulative total return for the six months under review. In comparison, the Russell 3000® Value Index, which measures performance of those Russell 3000® Index companies with lower price-to-book ratios and lower forecasted growth values, generated a +16.33% total return.1 You can find more of the Fund’s performance data in the Performance Summary beginning on page 7.

Investment Strategy

Our goal is to invest in stocks of companies of any size that we determine are currently undervalued and have the potential for capital appreciation. The Fund purchases securities that are out of favor in the market for reasons we believe will prove to be temporary in nature, or that appear to be inexpensive measured by factors such as price relative to earnings, book value or cash flow. In addition, the Fund may invest in companies with valuable intangibles we believe are not reflected in the stock price. This strategy is not aimed at short-term trading gains, nor do we consider the composition of any index. Rather, we try to identify attractively priced, financially sound companies that meet our investment criteria, and we assume at purchase that we will hold the positions for several years.

1. Source: © 2013 Morningstar. All Rights Reserved. The information contained herein: (1) is proprietary to Morningstar

and/or its content providers; (2) may not be copied or distributed; and (3) is not warranted to be accurate, complete or

timely. Neither Morningstar nor its content providers are responsible for any damages or losses arising from any use of

this information. Russell® is a trademark of the Frank Russell Company. The index is unmanaged and includes rein-

vested dividends. One cannot invest directly in an index, and an index is not representative of the Fund’s portfolio.

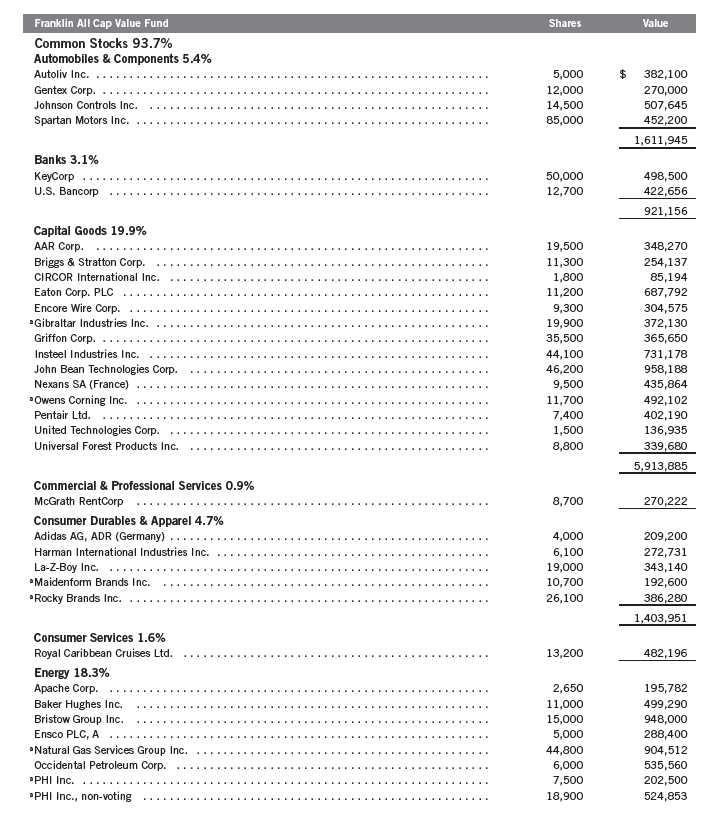

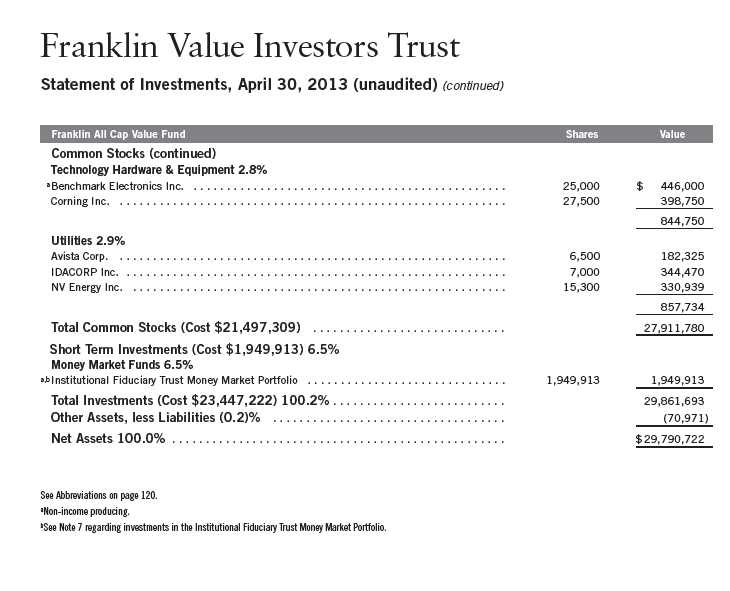

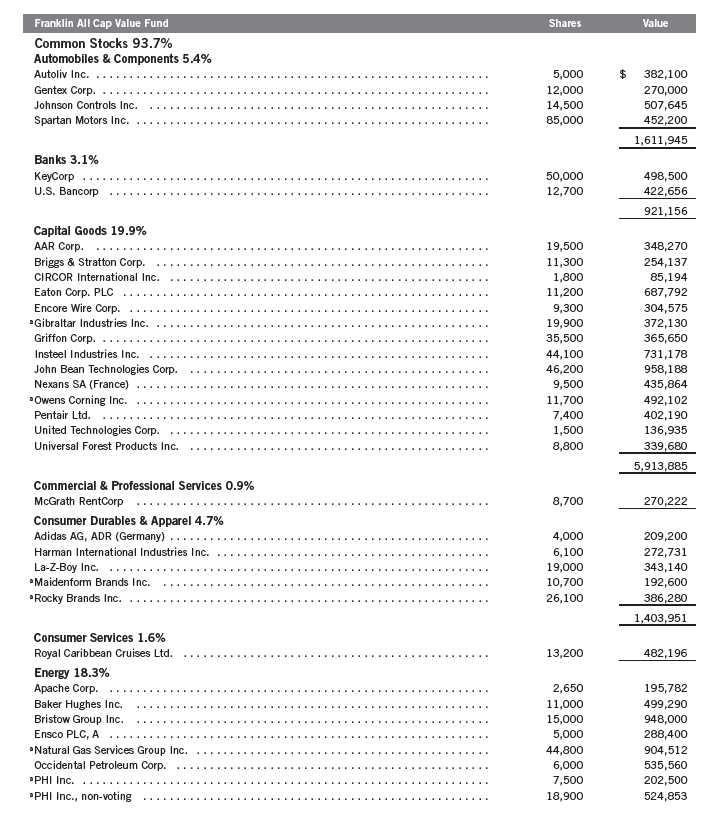

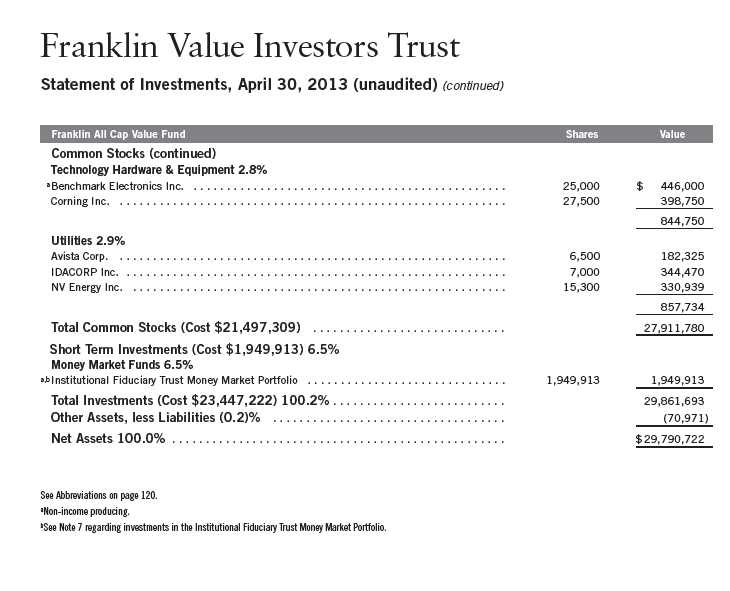

The dollar value, number of shares or principal amount, and names of all portfolio holdings are listed in the Fund’s

Statement of Investments (SOI). The SOI begins on page 55.

4 | Semiannual Report

Manager’s Discussion

During the six months under review, contributors to absolute performance encompassed several of the Fund’s largest holdings. These included food processing equipment manufacturer John Bean Technologies, steel wire reinforcing products manufacturer Insteel Industries, helicopter transportation provider for the offshore energy industry, Bristow Group, energy equipment manufacturer Natural Gas Services Group and health care products manufacturer Johnson & Johnson.2

In contrast, detractors included helicopter transportation services provider PHI and oil and gas exploration and production company Apache. Other individual detractors included global software and services provider Microsoft, steel manufacturer Nucor and cable television provider Time Warner Cable.

During the period, we initiated positions in eight new holdings, including diversified oil services company Baker Hughes, bank holding company Keycorp, auto safety systems company Autoliv, audio and infotainment manufacturer Harman International, outdoor power equipment manufacturer Briggs & Stratton, auto service and retail chain Pep Boys – Manny, Moe & Jack, color, flavor and fragrance manufacturer Sensient Technologies and Nucor, mentioned above.

We also added to several other existing positions including the aforementioned Insteel Industries, vehicle chassis manufacturer Spartan Motors, and intimate apparel manufacturer Maidenform Brands, among others.

We liquidated our positions in Microsoft, Xerox, Time Warner Cable, Rockwell Automation and Gardner Denver, the latter of which was subject to an all cash takeover offer from KKR. We also reduced several existing positions, including International Business Machines, Kaiser Aluminum and Becton, Dickinson.

2. The consumer discretionary sector comprises automobiles and components, consumer durables and apparel, media and retailing in the SOI.

Semiannual Report | 5

Thank you for your participation in Franklin All Cap Value Fund. We look

forward to serving your future investment needs.

The foregoing information reflects our analysis, opinions and portfolio holdings as of April 30, 2013, the end of the

reporting period. The way we implement our main investment strategies and the resulting portfolio holdings may

change depending on factors such as market and economic conditions. These opinions may not be relied upon as

investment advice or an offer for a particular security. The information is not a complete analysis of every aspect

of any market, country, industry, security or the Fund. Statements of fact are from sources considered reliable, but

the investment manager makes no representation or warranty as to their completeness or accuracy. Although his-

torical performance is no guarantee of future results, these insights may help you understand our investment

management philosophy.

6 | Semiannual Report

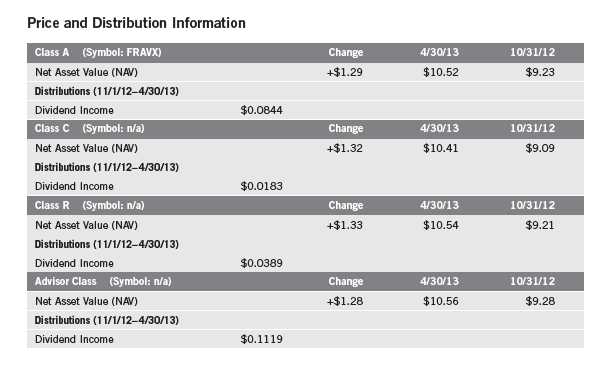

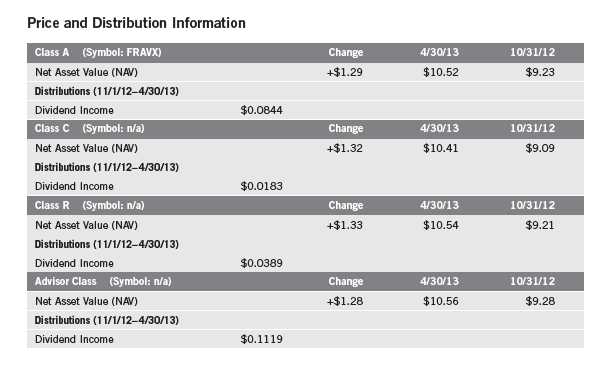

Performance Summary as of 4/30/13

Franklin All Cap Value Fund

Your dividend income will vary depending on dividends or interest paid by securities in the Fund’s

portfolio, adjusted for operating expenses of each class. Capital gain distributions are net profits

realized from the sale of portfolio securities. The performance table does not reflect any taxes that

a shareholder would pay on Fund dividends, capital gain distributions, if any, or any realized gains

on the sale of Fund shares. Total return reflects reinvestment of the Fund’s dividends and capital

gain distributions, if any, and any unrealized gains or losses.

Semiannual Report | 7

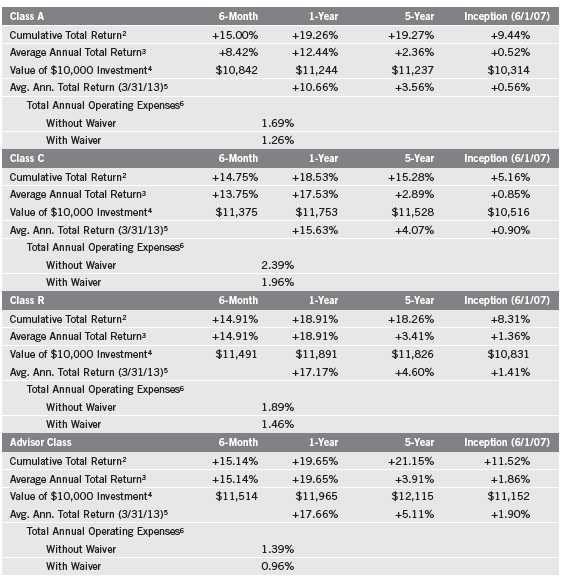

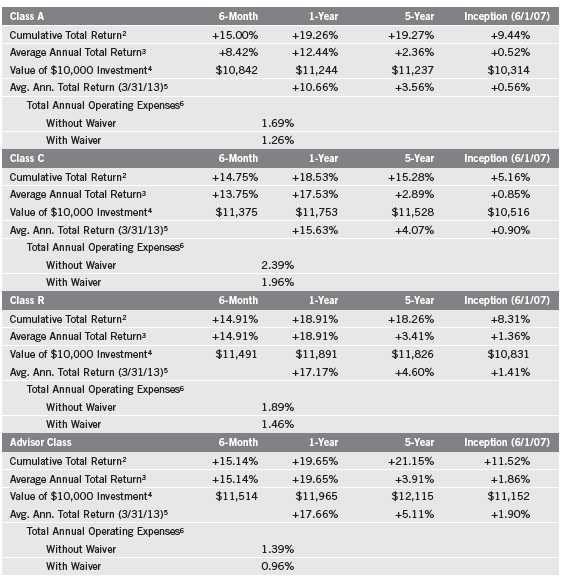

Performance Summary (continued)

Performance1

Cumulative total return excludes sales charges. Average annual total returns and value of $10,000 investment include

maximum sales charges. Class A: 5.75% maximum initial sales charge; Class C: 1% contingent deferred sales charge in

first year only; Class R/Advisor Class: no sales charges.

Performance data represent past performance, which does not guarantee future results. Investment return and principal

value will fluctuate, and you may have a gain or loss when you sell your shares. Current performance may differ from

figures shown. For most recent month-end performance, go to franklintempleton.com or call (800) 342-5236.

The investment manager and administrator have contractually agreed to waive or assume certain expenses so that common

expenses (excluding Rule 12b-1 fees and acquired fund fees and expenses) for each class of the Fund do not exceed

0.95% (other than certain nonroutine expenses) until 2/28/14.

8 | Semiannual Report

Performance Summary (continued)

Endnotes

All investments involve risks, including possible loss of principal. Value securities may not increase in price as anticipated or may decline fur-

ther in value. While smaller and midsize companies may offer substantial opportunities for capital growth, they also involve heightened risks and

should be considered speculative. Historically, smaller and midsize company securities have been more volatile in price than larger company

securities, especially over the short term. The Fund may invest up to 25% of its total assets in foreign securities, which may involve special

risks, including currency fluctuations and economic and political uncertainty. The Fund is actively managed but there is no guarantee that the

manager’s investment decisions will produce the desired results. The Fund’s prospectus also includes a description of the main investment risks.

Class C: These shares have higher annual fees and expenses than Class A shares.

Class R: Shares are available to certain eligible investors as described in the prospectus. These shares have higher annual fees and expenses

than Class A shares.

Advisor Class: Shares are available to certain eligible investors as described in the prospectus.

1. Fund investment results reflect the expense reduction, without which the results would have been lower.

2. Cumulative total return represents the change in value of an investment over the periods indicated.

3. Average annual total return represents the average annual change in value of an investment over the periods indicated. Six-month return has not

been annualized.

4. These figures represent the value of a hypothetical $10,000 investment in the Fund over the periods indicated.

5. In accordance with SEC rules, we provide standardized average annual total return information through the latest calendar quarter.

6. Figures are as stated in the Fund’s current prospectus. In periods of market volatility, assets may decline significantly, causing total annual Fund

operating expenses to become higher than the figures shown.

Semiannual Report | 9

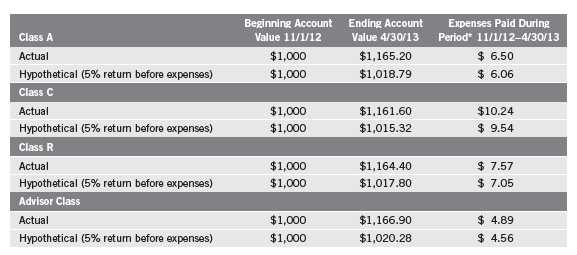

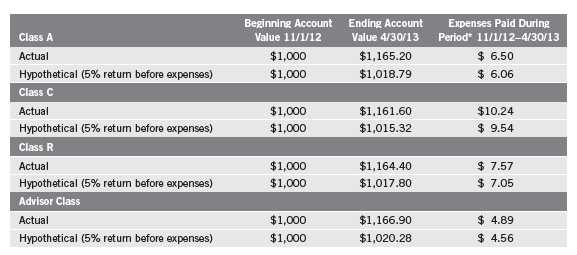

Your Fund’s Expenses

Franklin All Cap Value Fund

As a Fund shareholder, you can incur two types of costs:

- Transaction costs, including sales charges (loads) on Fund purchases; and

- Ongoing Fund costs, including management fees, distribution and service (12b-1) fees, and other Fund expenses. All mutual funds have ongoing costs, sometimes referred to as operating expenses.

The following table shows ongoing costs of investing in the Fund and can help you understand these costs and compare them with those of other mutual funds. The table assumes a $1,000 investment held for the six months indicated.

Actual Fund Expenses

The first line (Actual) for each share class listed in the table provides actual account values and expenses. The “Ending Account Value” is derived from the Fund’s actual return, which includes the effect of Fund expenses.

You can estimate the expenses you paid during the period by following these steps. Of course, your account value and expenses will differ from those in this illustration:

| 1. | Divide your account value by $1,000. |

| | If an account had an $8,600 value, then $8,600 ÷ $1,000 = 8.6. |

| 2. | Multiply the result by the number under the heading “Expenses Paid During Period.” |

| | If Expenses Paid During Period were $7.50, then 8.6 x $7.50 = $64.50. |

In this illustration, the estimated expenses paid this period are $64.50.

Hypothetical Example for Comparison with Other Funds

Information in the second line (Hypothetical) for each class in the table can help you compare ongoing costs of investing in the Fund with those of other mutual funds. This information may not be used to estimate the actual ending account balance or expenses you paid during the period. The hypothetical “Ending Account Value” is based on the actual expense ratio for each class and an assumed 5% annual rate of return before expenses, which does not represent the Fund’s actual return. The figure under the heading “Expenses Paid During Period” shows the hypothetical expenses your account would have incurred under this scenario. You can compare this figure with the 5% hypothetical examples that appear in shareholder reports of other funds.

10 | Semiannual Report

Your Fund’s Expenses (continued)

Please note that expenses shown in the table are meant to highlight ongoing costs and do not reflect

any transaction costs, such as sales charges. Therefore, the second line for each class is useful in

comparing ongoing costs only, and will not help you compare total costs of owning different

funds. In addition, if transaction costs were included, your total costs would have been higher.

Please refer to the Fund prospectus for additional information on operating expenses.

Semiannual Report | 11

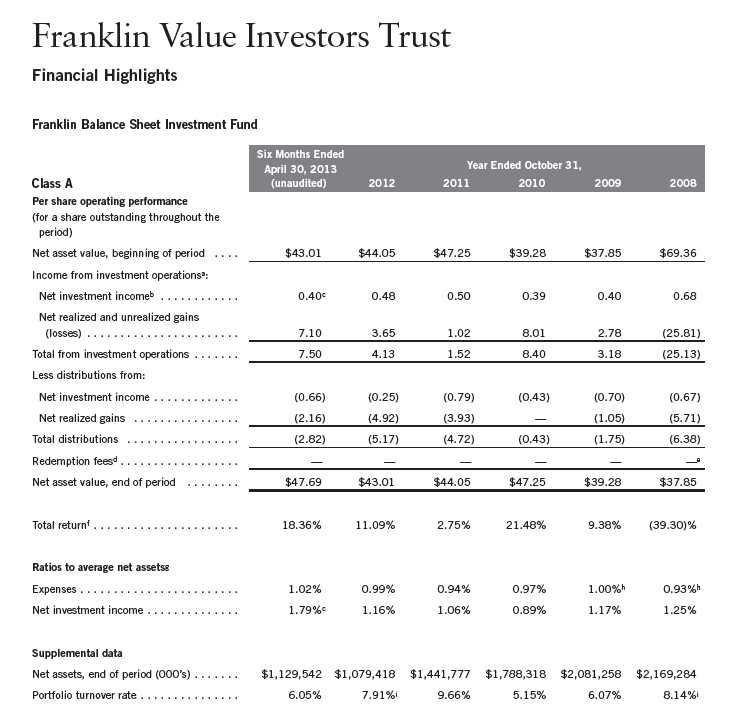

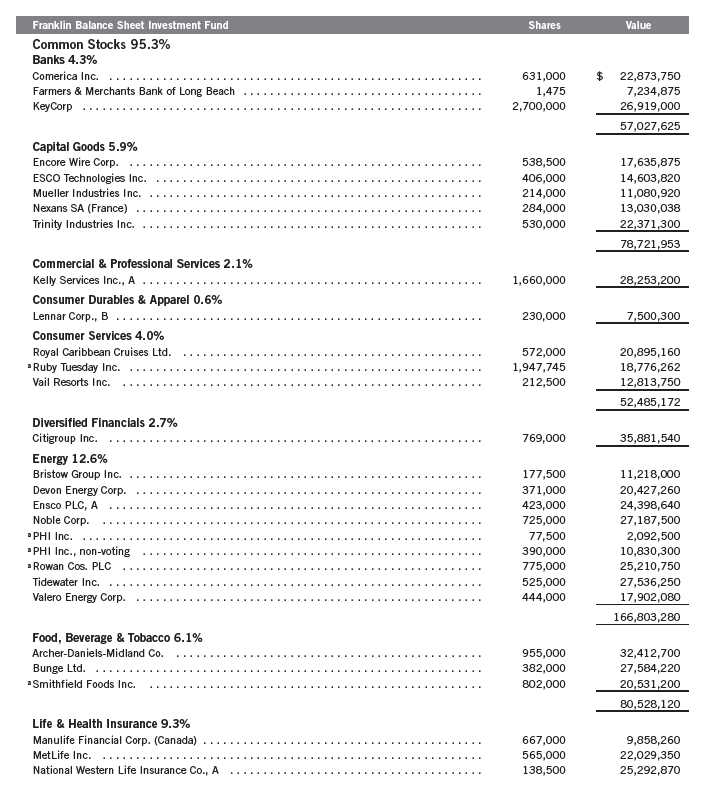

Franklin Balance Sheet Investment Fund

Your Fund’s Goal and Main Investments: Franklin Balance Sheet Investment Fund seeks high total return, of which capital appreciation and income are components, by investing most of its assets in equity securities of companies of any size that we believe are undervalued in the marketplace at the time of purchase but have the potential for capital appreciation.

We are pleased to bring you Franklin Balance Sheet Investment Fund’s semi-annual report for the period ended April 30, 2013.

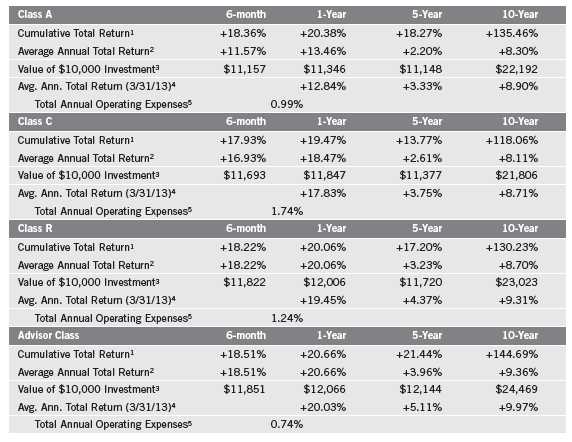

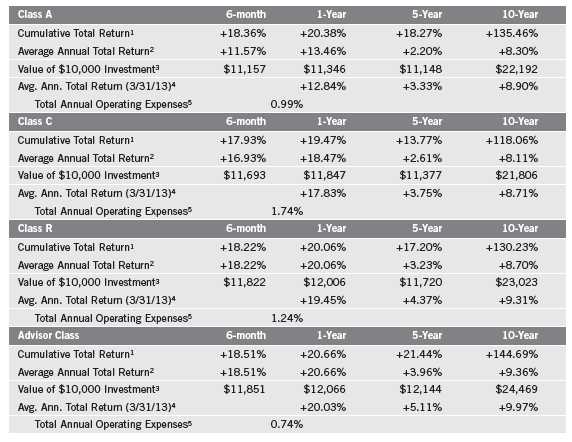

Performance Overview

Franklin Balance Sheet Investment Fund – Class A delivered a cumulative total return of +18.36% for the six months under review. In comparison, the Russell 3000® Value Index, which measures performance of those Russell 3000® Index companies with lower price-to-book ratios and lower forecasted growth values, generated a +16.33% total return.1 Although this report covers a six-month period, our investment strategy aims for long-term results. You can find the Fund’s long-term performance data in the Performance Summary beginning on page 15.

Investment Strategy

Our strategy is to buy shares of financially sound, well-established companies at a low price-to-book value when we have reasonable confidence that book value will increase over several years. Book value per share is a company’s net worth or shareholders’ equity on an accounting or “book” basis, divided by shares outstanding. We generally define “low price-to-book value” as the lower two deciles (20%) of our investable universe, which we derive from a proprietary database for screening purposes. This strategy is not aimed at short-term trading gains, nor do we consider the composition of any index. Rather, we try to identify individual companies that meet our investment criteria, and we assume at purchase that we will hold the positions for several years.

1. Source: © 2013 Morningstar. All Rights Reserved. The information contained herein: (1) is proprietary to Morningstar

and/or its content providers; (2) may not be copied or distributed; and (3) is not warranted to be accurate, complete or

timely. Neither Morningstar nor its content providers are responsible for any damages or losses arising from any use of

this information. The index is unmanaged and includes reinvested dividends. One cannot invest directly in an index, and

an index is not representative of the Fund’s portfolio.

The dollar value, number of shares or principal amount, and names of all portfolio holdings are listed in the Fund’s

Statement of Investments (SOI). The SOI begins on page 62.

12 | Semiannual Report

Manager’s Discussion

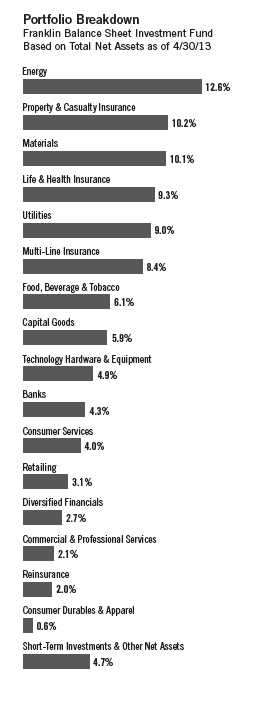

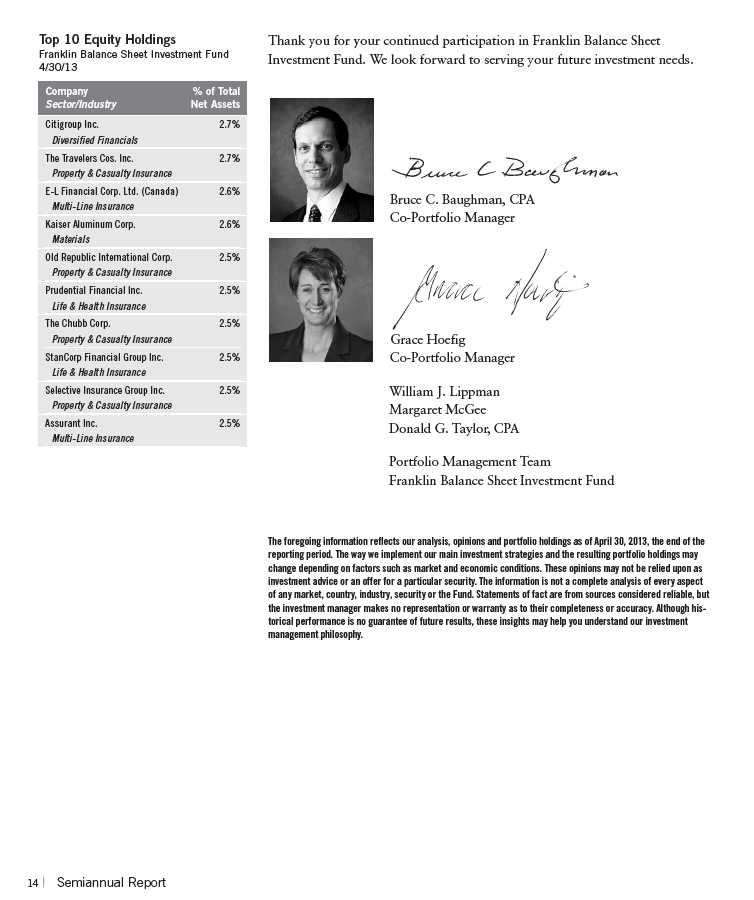

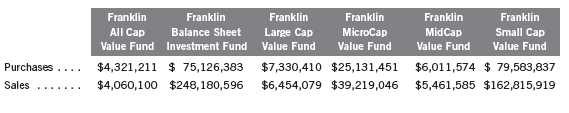

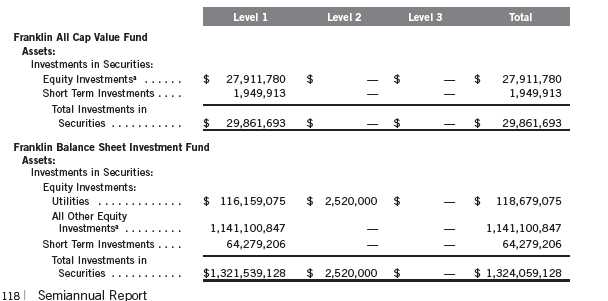

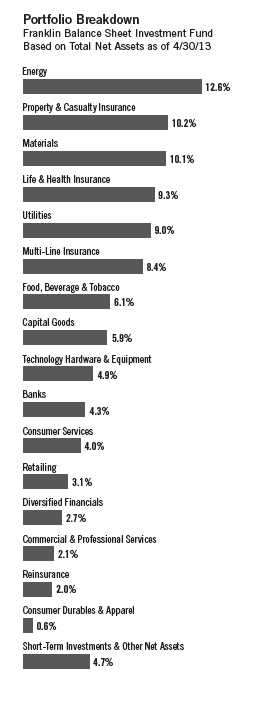

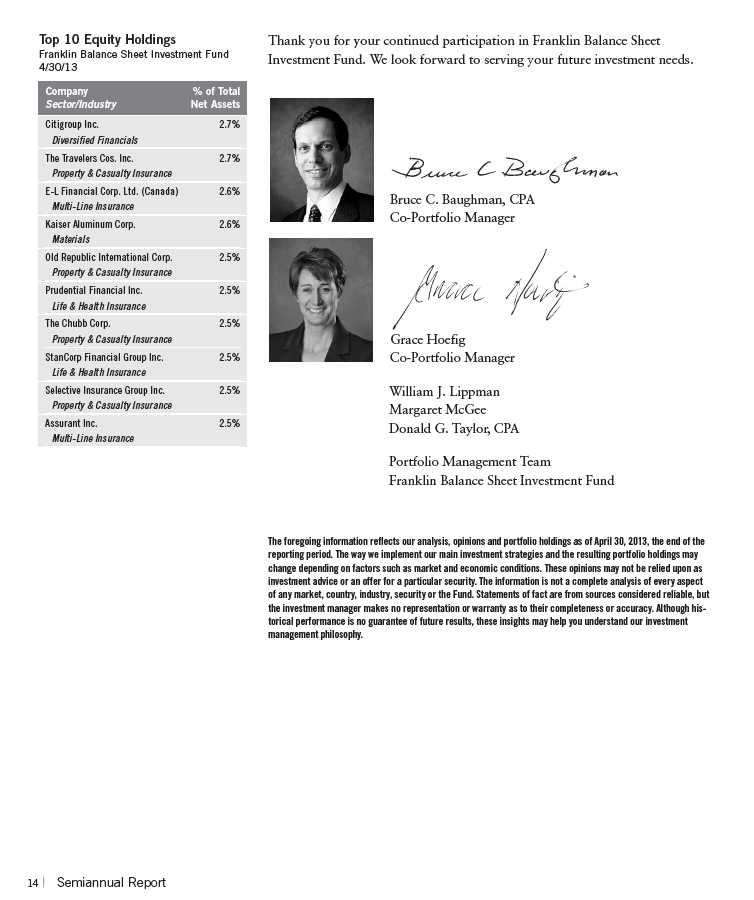

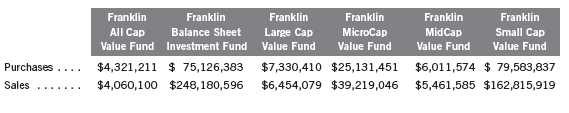

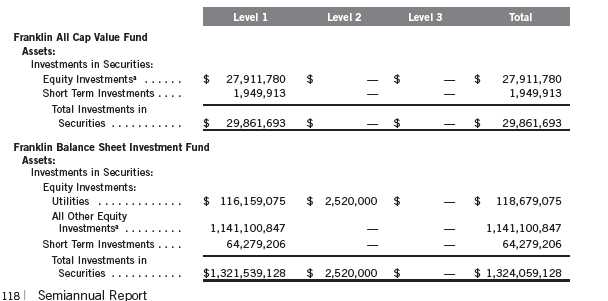

On April 30, 2013, the Fund’s total net assets were $1.32 billion, with short-term investments and other net assets making up 4.7%, compared with total net assets of $1.28 billion and short-term investments and other net assets of 2.4% on October 31, 2012. During the six-month period, we identified two new investment opportunities: oil and natural gas exploration and production company Devon Energy and restaurant chain operator Ruby Tuesday. We also added to existing positions in global agribusiness and food company Bunge, cruise ship operator Royal Caribbean Cruises and bank holding company Comerica, among others. Cash deployed into new or existing positions totaled $75 million.

Portfolio sales totaled $248 million. During the period, we liquidated the following holdings: Actavis (formerly Watson Pharmaceuticals), Teekay, CNH Global, Callaway Golf, Werner Enterprises, Texas Industries, and ConocoPhillips and its spin-off, Phillips 66. We also reduced numerous positions including Bristow Group, OfficeMax and Kaiser Aluminum.

During the six-month reporting period, contributors to absolute Fund performance included OfficeMax (office supplies retailer), as it was the subject of a takeover offer at a 20% premium to its then share price. A number of financials sector holdings such as insurers Old Republic International, StanCorp Financial Group, E-L Financial and Assurant also contributed.2 In contrast, detractors included energy sector holdings PHI, Devon Energy and ConocoPhillips. ESCO Technologies in the industrials sector and the aforementioned Actavis in the health care sector also hindered results.

2. The financials sector comprises banks, diversified financials, life and health insurance, multi-line insurance, property and casualty insurance, and reinsurance in the SOI.

Semiannual Report | 13

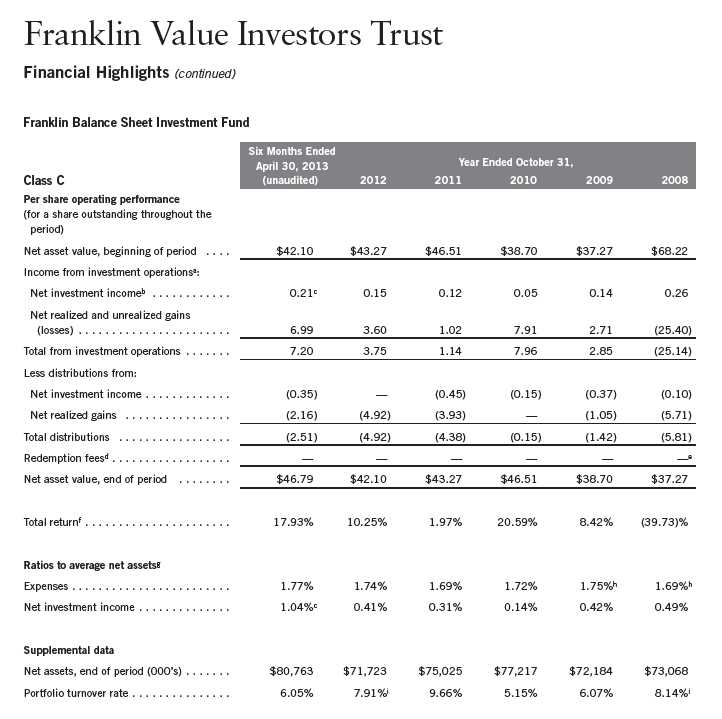

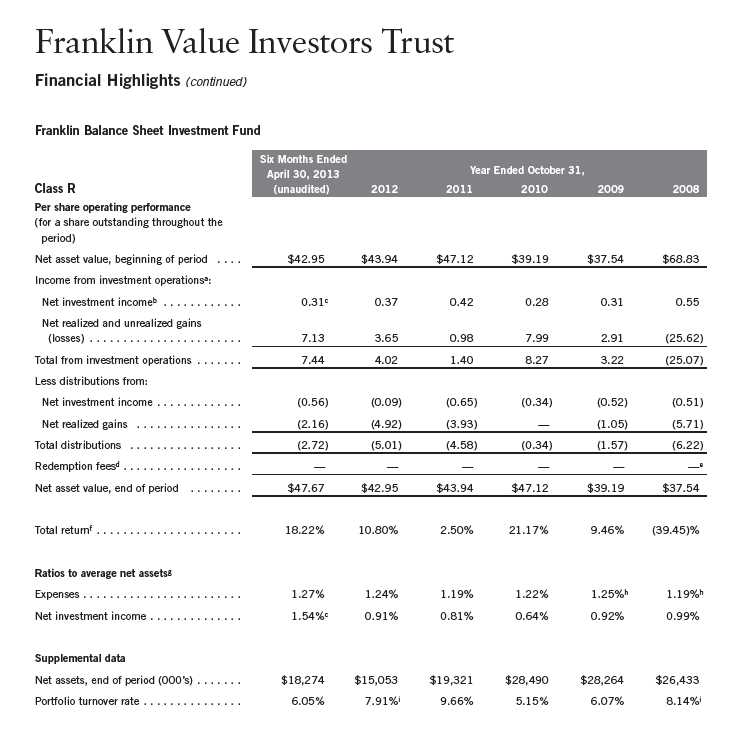

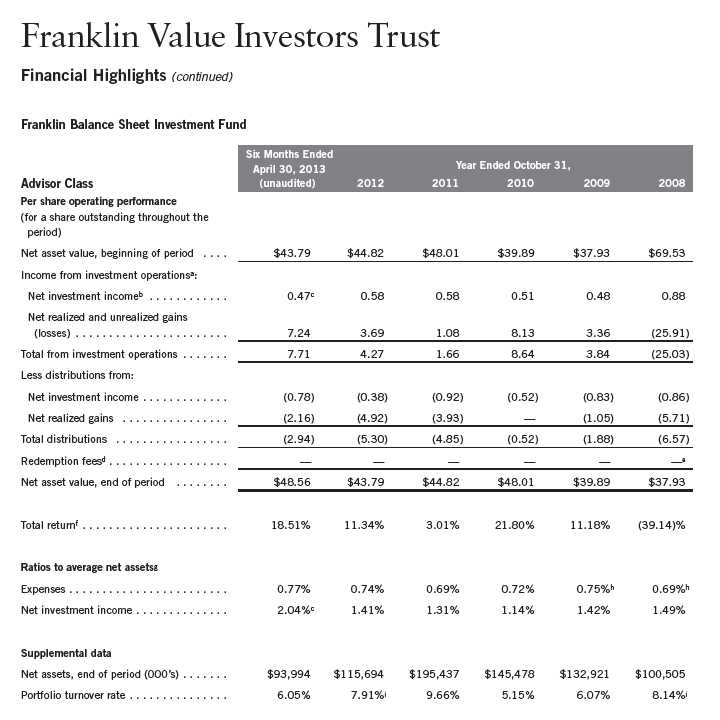

Performance Summary as of 4/30/13

Franklin Balance Sheet Investment Fund

Your dividend income will vary depending on dividends or interest paid by securities in the Fund’s

portfolio, adjusted for operating expenses of each class. Capital gain distributions are net profits

realized from the sale of portfolio securities. The performance table does not reflect any taxes that

a shareholder would pay on Fund dividends, capital gain distributions, if any, or any realized gains

on the sale of Fund shares. Total return reflects reinvestment of the Fund’s dividends and capital

gain distributions, if any, and any unrealized gains or losses.

Semiannual Report | 15

Performance Summary (continued)

Performance

Cumulative total return excludes sales charges. Average annual total returns and value of $10,000 investment include

maximum sales charges. Class A: 5.75% maximum initial sales charge; Class C: 1% contingent deferred sales charge in

first year only; Class R/Advisor Class: no sales charges.

Performance data represent past performance, which does not guarantee future results. Investment return and principal

value will fluctuate, and you may have a gain or loss when you sell your shares. Current performance may differ from

figures shown. For most recent month-end performance, go to franklintempleton.com or call (800) 342-5236.

16 | Semiannual Report

Performance Summary (continued)

Endnotes

All investments involve risks, including possible loss of principal. Value securities may not increase in price as anticipated or may decline further in value. While smaller and midsize companies may offer substantial opportunities for capital growth, they also involve heightened risks and should be considered speculative. Historically, smaller and midsize company securities have been more volatile in price than larger company securities, especially over the short term. The Fund may invest up to 25% of its total assets in foreign securities, which may involve special risks, including currency fluctuations and economic and political uncertainty. The Fund is actively managed but there is no guarantee that the manager’s investment decisions will produce the desired results. The Fund’s prospectus also includes a description of the main investment risks.

| |

Class C: | Prior to 1/1/04, these shares were offered with an initial sales charge; thus actual total returns would have differed. These shares have higher annual fees and expenses than Class A shares. |

| |

Class R: | Shares are available to certain eligible investors as described in the prospectus. These shares have higher annual fees and expenses than Class A shares. |

| |

Advisor Class: | Shares are available to certain eligible investors as described in the prospectus. |

1. Cumulative total return represents the change in value of an investment over the periods indicated.

2. Average annual total return represents the average annual change in value of an investment over the periods indicated. Six-month return has not been annualized.

3. These figures represent the value of a hypothetical $10,000 investment in the Fund over the periods indicated.

4. In accordance with SEC rules, we provide standardized average annual total return information through the latest calendar quarter.

5. Figures are as stated in the Fund’s current prospectus. In periods of market volatility, assets may decline significantly, causing total annual Fund operating expenses to become higher than the figures shown.

Semiannual Report | 17

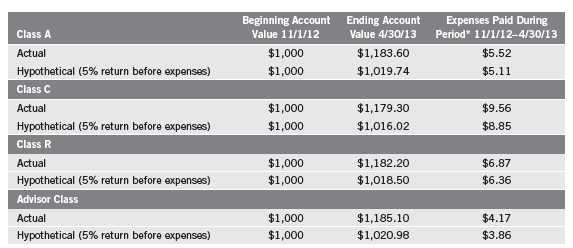

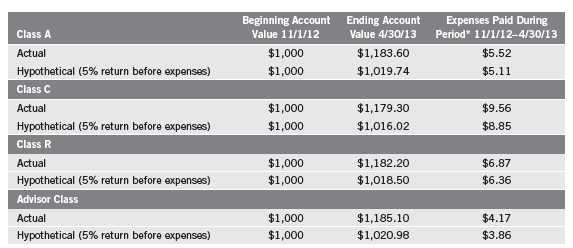

Your Fund’s Expenses

Franklin Balance Sheet Investment Fund

As a Fund shareholder, you can incur two types of costs:

- Transaction costs, including sales charges (loads) on Fund purchases; and

- Ongoing Fund costs, including management fees, distribution and service (12b-1) fees, and other Fund expenses. All mutual funds have ongoing costs, sometimes referred to as operating expenses.

The following table shows ongoing costs of investing in the Fund and can help you understand these costs and compare them with those of other mutual funds. The table assumes a $1,000 investment held for the six months indicated.

Actual Fund Expenses

The first line (Actual) for each share class listed in the table provides actual account values and expenses. The “Ending Account Value” is derived from the Fund’s actual return, which includes the effect of Fund expenses.

You can estimate the expenses you paid during the period by following these steps. Of course, your account value and expenses will differ from those in this illustration:

| 1. | Divide your account value by $1,000. |

| | If an account had an $8,600 value, then $8,600 ÷ $1,000 = 8.6. |

| 2. | Multiply the result by the number under the heading “Expenses Paid During Period.” |

| | If Expenses Paid During Period were $7.50, then 8.6 x $7.50 = $64.50. |

In this illustration, the estimated expenses paid this period are $64.50.

Hypothetical Example for Comparison with Other Funds

Information in the second line (Hypothetical) for each class in the table can help you compare ongoing costs of investing in the Fund with those of other mutual funds. This information may not be used to estimate the actual ending account balance or expenses you paid during the period. The hypothetical “Ending Account Value” is based on the actual expense ratio for each class and an assumed 5% annual rate of return before expenses, which does not represent the Fund’s actual return. The figure under the heading “Expenses Paid During Period” shows the hypothetical expenses your account would have incurred under this scenario. You can compare this figure with the 5% hypothetical examples that appear in shareholder reports of other funds.

18 | Semiannual Report

Your Fund’s Expenses (continued)

Please note that expenses shown in the table are meant to highlight ongoing costs and do not reflect

any transaction costs, such as sales charges. Therefore, the second line for each class is useful in

comparing ongoing costs only, and will not help you compare total costs of owning different

funds. In addition, if transaction costs were included, your total costs would have been higher.

Please refer to the Fund prospectus for additional information on operating expenses.

*Expenses are calculated using the most recent six-month expense ratio, annualized for each class (A: 1.02%; C: 1.77%; R: 1.27%; and

Advisor: 0.77%), multiplied by the average account value over the period, multiplied by 181/365 to reflect the one-half year period.

Semiannual Report | 19

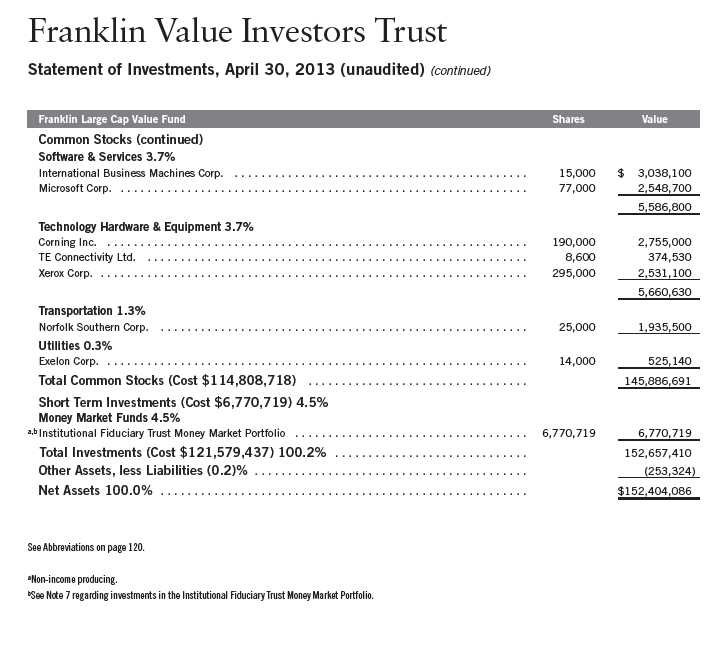

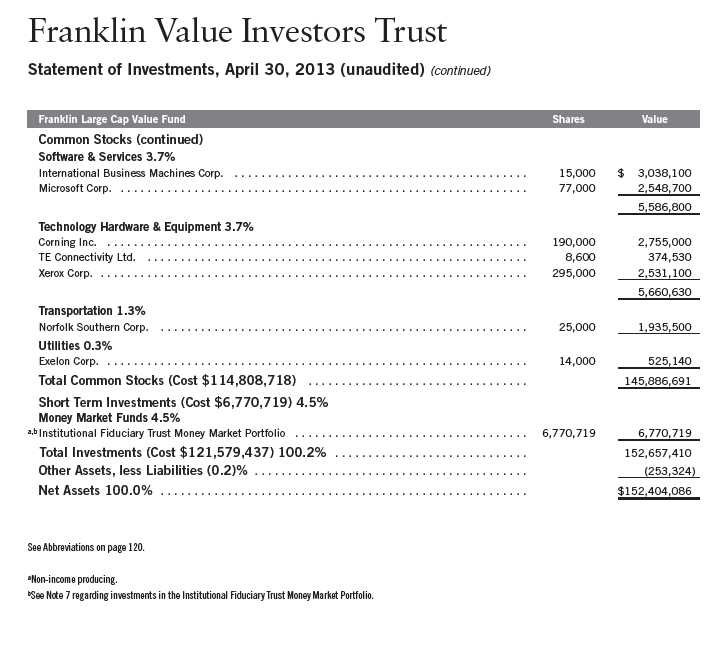

Franklin Large Cap Value Fund

Your Fund’s Goal and Main Investments: Franklin Large Cap Value Fund seeks long-term capital appreciation by investing at least 80% of its net assets in large capitalization companies that we believe are undervalued. We define large capitalization companies as those with market capitalizations that are similar in size at the time of purchase to those in the Russell 1000® Index.1

This semiannual report for Franklin Large Cap Value Fund covers the period ended April 30, 2013.

Performance Overview

Franklin Large Cap Value Fund – Class A delivered a +14.57% cumulative total return for the six months under review. In comparison, the Russell 1000® Value Index, which measures performance of those Russell 1000® Index companies with lower price-to-book ratios and lower forecasted growth values, generated a total return of +16.31%.2 Although this report covers a six-month period, our investment strategy aims for long-term results. You can find the Fund’s long-term performance data in the Performance Summary beginning on page 23.

Investment Strategy

We seek to invest in securities of large capitalization companies that we believe are selling below their underlying worth and hold them until they reach what we consider their fair market value. Our aim is to construct a diversified portfolio of fundamentally sound companies purchased at attractive prices, often when they are out of favor with other investors for reasons we believe are temporary. Portfolio securities are selected without regard to benchmark comparisons and are based on fundamental, bottom-up research focusing on several criteria, such as low price relative to earnings, cash flow or book value. We also consider stocks with recent sharp price declines that we believe still have significant growth potential or that possess valuable intangibles not reflected in the stock price.

1. The Russell 1000® Index is market capitalization weighted and measures performance of the largest companies in

the Russell 3000® Index, which represents the majority of the U.S. market’s total market capitalization.

2. Source: © 2013 Morningstar. All Rights Reserved. The information contained herein: (1) is proprietary to Morningstar

and/or its content providers; (2) may not be copied or distributed; and (3) is not warranted to be accurate, complete or

timely. Neither Morningstar nor its content providers are responsible for any damages or losses arising from any use of

this information. The index is unmanaged and includes reinvested dividends. One cannot invest directly in an index, and

an index is not representative of the Fund’s portfolio.

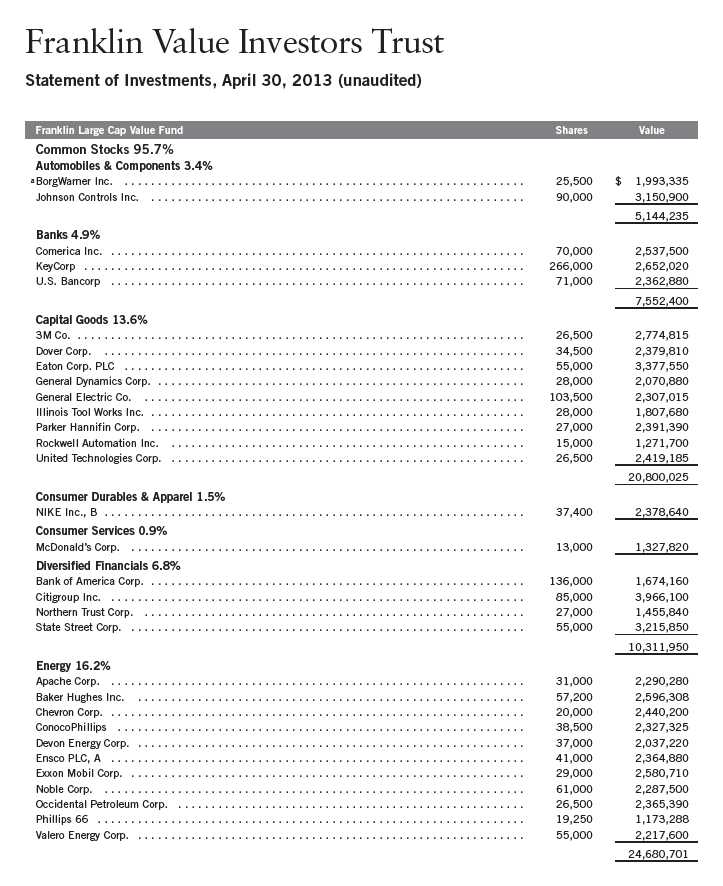

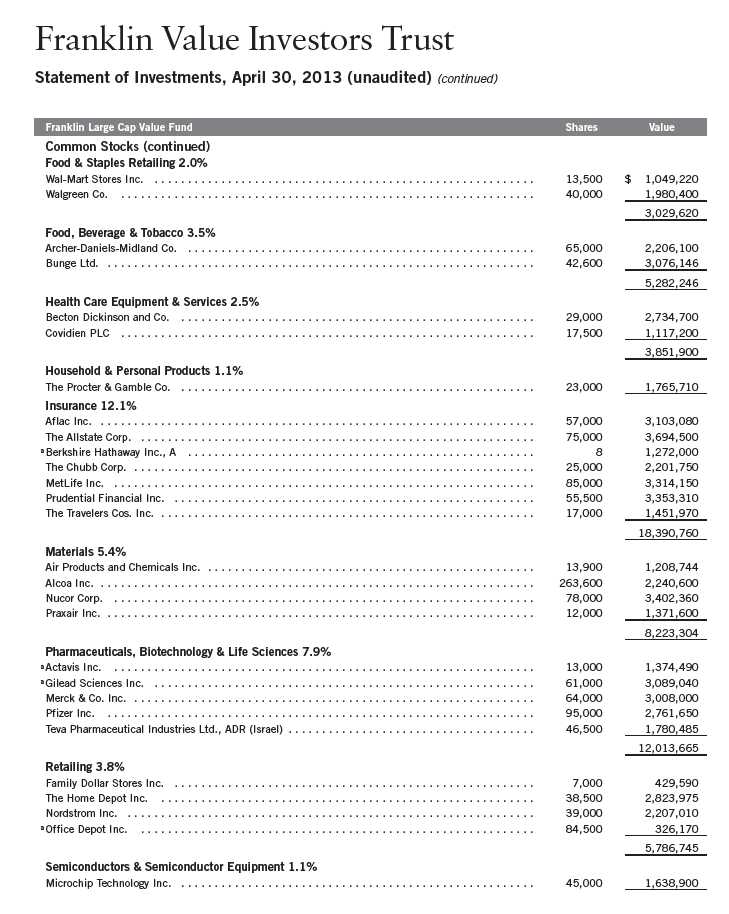

The dollar value, number of shares or principal amount, and names of all portfolio holdings are listed in the Fund’s

Statement of Investments (SOI). The SOI begins on page 69.

20 | Semiannual Report

Manager’s Discussion

During the six months under review, financials sector holdings contributed to absolute Fund performance, most notably institutional financial products and services provider State Street, financial conglomerate Citigroup, and property and casualty insurer Allstate.3 Consumer discretionary and health care sector holdings also contributed to results, especially auto components and building efficiency manufacturer Johnson Controls and biopharmaceutical firm Gilead Sciences.4 The Fund’s industrials sector holdings also aided performance.5

In contrast, detractors from performance included several energy sector holdings including oil and gas exploration and production companies Apache, Devon Energy and Exxon Mobil. Health care company Teva Pharmaceutical Industries and aluminum manufacturer Alcoa also hindered performance.

During the six-month period, the Fund initiated positions in the largest U.S. drug store operator Walgreen, electric utility Exelon and discount retailer Family Dollar Stores. We also increased our positions in the aforementioned Apache, agribusiness and food company Bunge, and petroleum refiner and marketer Valero Energy, among others.

We liquidated our positions in Johnson & Johnson and Abbott Laboratories. We also reduced our holdings in Xerox, State Street and Wal-Mart Stores, among others.

3. The financials sector comprises banks, diversified financials and insurance in the SOI.

4. The consumer discretionary sector comprises consumer durables and apparel, consumer services and retailing in

the SOI. The health care sector comprises health care equipment and services; and pharmaceuticals, biotechnology

and life sciences in the SOI.

5. The industrials sector comprises capital goods and transportation in the SOI.

Semiannual Report | 21

Thank you for your continued participation in Franklin Large Cap Value

Fund. We look forward to serving your future investment needs.

William J. Lippman

President and Lead Portfolio Manager

Bruce C. Baughman, CPA

Margaret McGee

Donald G. Taylor, CPA

Portfolio Management Team

Franklin Large Cap Value Fund

The foregoing information reflects our analysis, opinions and portfolio holdings as of April 30, 2013, the end of the

reporting period. The way we implement our main investment strategies and the resulting portfolio holdings may

change depending on factors such as market and economic conditions. These opinions may not be relied upon as

investment advice or an offer for a particular security. The information is not a complete analysis of every aspect of

any market, country, industry, security or the Fund. Statements of fact are from sources considered reliable, but the

investment manager makes no representation or warranty as to their completeness or accuracy. Although historical

performance is no guarantee of future results, these insights may help you understand our investment management

philosophy.

22 | Semiannual Report

Performance Summary as of 4/30/13

Franklin Large Cap Value Fund

Your dividend income will vary depending on dividends or interest paid by securities in the Fund’s

portfolio, adjusted for operating expenses of each class. Capital gain distributions are net profits

realized from the sale of portfolio securities. The performance table does not reflect any taxes that

a shareholder would pay on Fund dividends, capital gain distributions, if any, or any realized gains

on the sale of Fund shares. Total return reflects reinvestment of the Fund’s dividends and capital

gain distributions, if any, and any unrealized gains or losses.

Semiannual Report | 23

Performance Summary (continued)

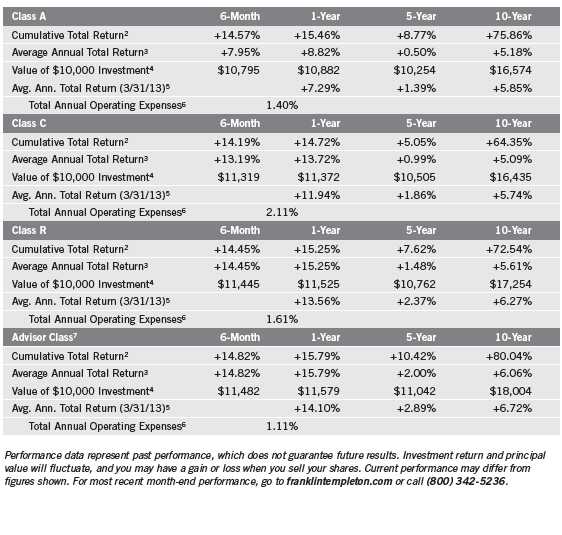

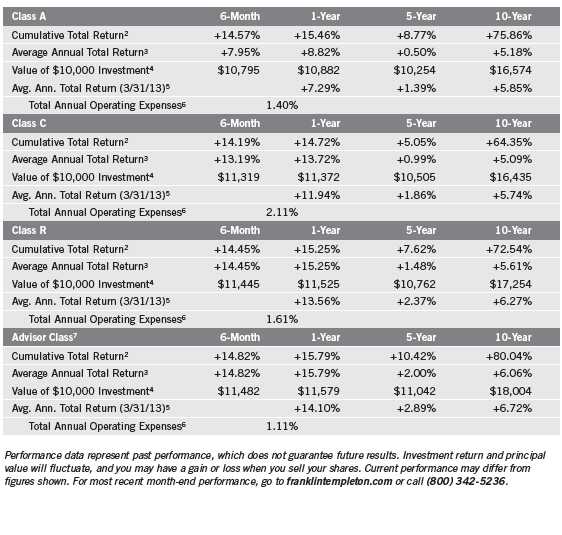

Performance1

Cumulative total return excludes sales charges. Average annual total returns and value of $10,000 investment include

maximum sales charges. Class A: 5.75% maximum initial sales charge; Class C: 1% contingent deferred sales charge in

first year only; Class R/Advisor Class: no sales charges.

24 | Semiannual Report

Performance Summary (continued)

Endnotes

All investments involve risks, including possible loss of principal. Stock prices fluctuate, sometimes rapidly and dramatically, due to factors

affecting individual companies, particular industries or sectors, or general market conditions. These price movements may result from factors

affecting individual companies, industries or the securities market as a whole. The Fund may invest up to 25% of its total assets in foreign

securities, which may involve special risks, including currency fluctuations and economic and political uncertainty. The Fund is actively man-

aged but there is no guarantee that the manager’s investment decisions will produce the desired results. The Fund’s prospectus also includes

a description of the main investment risks.

Class C: Prior to 1/1/04, these shares were offered with an initial sales charge; thus actual total returns would have differed. These shares

have higher annual fees and expenses than Class A shares.

Class R: Shares are available to certain eligible investors as described in the prospectus. These shares have higher annual fees and expenses

than Class A shares.

Advisor Class: Shares are available to certain eligible investors as described in the prospectus.

1. Fund investment results reflect past expense reductions, without which the results would have been lower.

2. Cumulative total return represents the change in value of an investment over the periods indicated.

3. Average annual total return represents the average annual change in value of an investment over the periods indicated. Six-month return has not

been annualized.

4. These figures represent the value of a hypothetical $10,000 investment in the Fund over the periods indicated.

5. In accordance with SEC rules, we provide standardized average annual total return information through the latest calendar quarter.

6. Figures are as stated in the Fund’s current prospectus. In periods of market volatility, assets may decline significantly, causing total annual Fund

operating expenses to become higher than the figures shown.

7. Effective 11/1/05, the Fund began offering Advisor Class shares, which do not have sales charges or a Rule 12b-1 plan. Performance quotations

for this class reflect the following methods of calculation: (a) For periods prior to 11/1/05, a restated figure is used based upon the Fund’s Class A

performance, excluding the effect of Class A’s maximum initial sales charge, but reflecting the effect of the Class A Rule 12b-1 fees; and (b) for peri-

ods after 11/1/05, actual Advisor Class performance is used reflecting all charges and fees applicable to that class. Since 11/1/05 (commencement

of sales), the cumulative and average annual total returns of Advisor Class shares were +31.51% and +3.72%.

Semiannual Report | 25

Your Fund’s Expenses

Franklin Large Cap Value Fund

As a Fund shareholder, you can incur two types of costs:

- Transaction costs, including sales charges (loads) on Fund purchases; and

- Ongoing Fund costs, including management fees, distribution and service (12b-1) fees, and other Fund expenses. All mutual funds have ongoing costs, sometimes referred to as operating expenses.

The following table shows ongoing costs of investing in the Fund and can help you understand these costs and compare them with those of other mutual funds. The table assumes a $1,000 investment held for the six months indicated.

Actual Fund Expenses

The first line (Actual) for each share class listed in the table provides actual account values and expenses. The “Ending Account Value” is derived from the Fund’s actual return, which includes the effect of Fund expenses.

You can estimate the expenses you paid during the period by following these steps. Of course, your account value and expenses will differ from those in this illustration:

| 1. | Divide your account value by $1,000. |

| | If an account had an $8,600 value, then $8,600 ÷ $1,000 = 8.6. |

| 2. | Multiply the result by the number under the heading “Expenses Paid During Period.” |

| | If Expenses Paid During Period were $7.50, then 8.6 x $7.50 = $64.50. |

In this illustration, the estimated expenses paid this period are $64.50.

Hypothetical Example for Comparison with Other Funds

Information in the second line (Hypothetical) for each class in the table can help you compare ongoing costs of investing in the Fund with those of other mutual funds. This information may not be used to estimate the actual ending account balance or expenses you paid during the period. The hypothetical “Ending Account Value” is based on the actual expense ratio for each class and an assumed 5% annual rate of return before expenses, which does not represent the Fund’s actual return. The figure under the heading “Expenses Paid During Period” shows the hypothetical expenses your account would have incurred under this scenario. You can compare this figure with the 5% hypothetical examples that appear in shareholder reports of other funds.

26 | Semiannual Report

Your Fund’s Expenses (continued)

Please note that expenses shown in the table are meant to highlight ongoing costs and do not reflect

any transaction costs, such as sales charges. Therefore, the second line for each class is useful in

comparing ongoing costs only, and will not help you compare total costs of owning different

funds. In addition, if transaction costs were included, your total costs would have been higher.

Please refer to the Fund prospectus for additional information on operating expenses.

*Expenses are calculated using the most recent six-month expense ratio, annualized for each class (A: 1.37%; C: 2.08%; R: 1.58%; and

Advisor: 1.08%), multiplied by the average account value over the period, multiplied by 181/365 to reflect the one-half year period.

Semiannual Report | 27

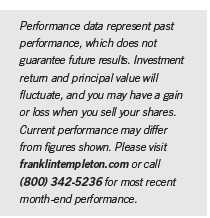

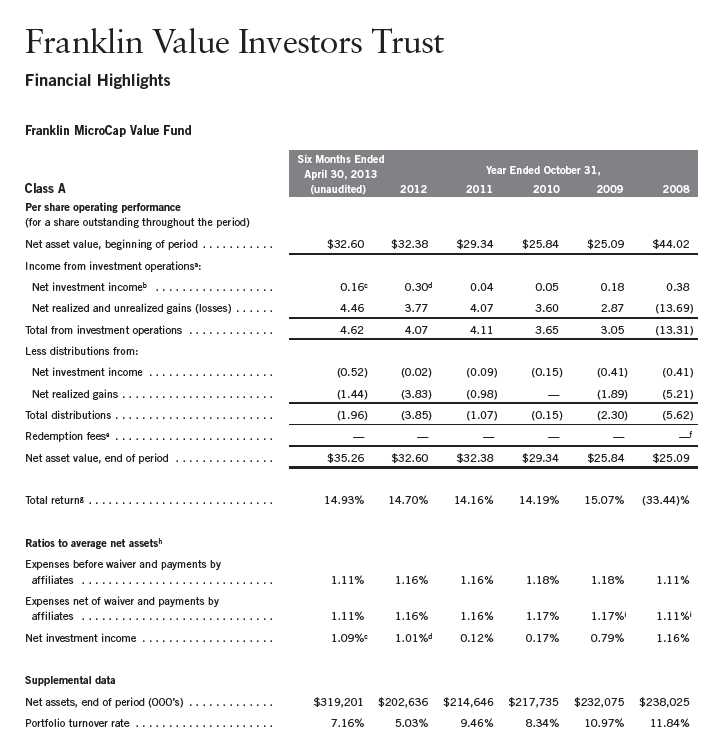

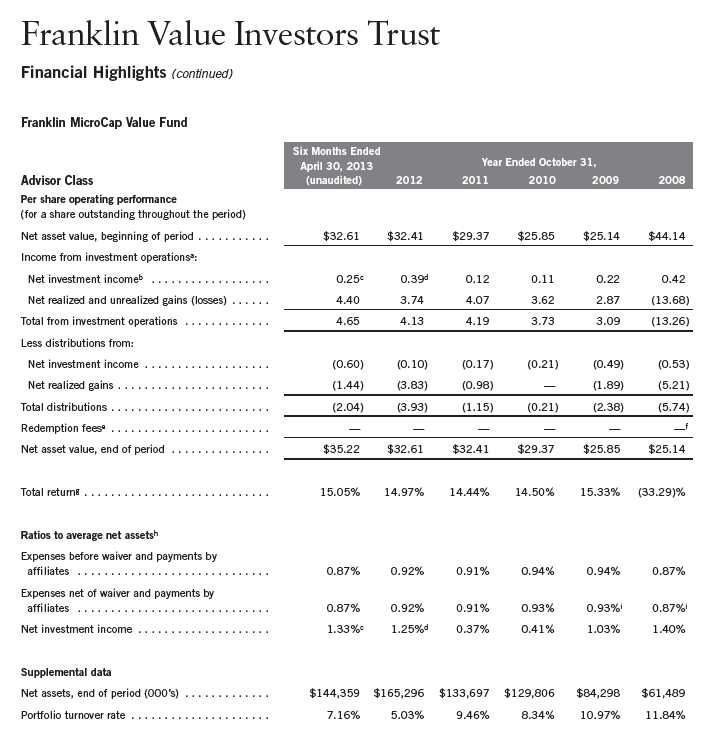

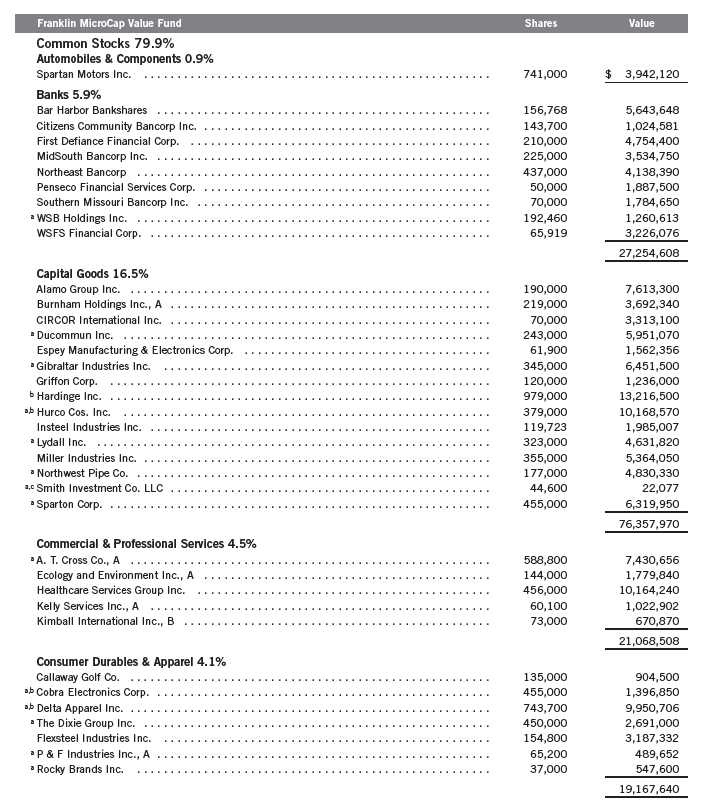

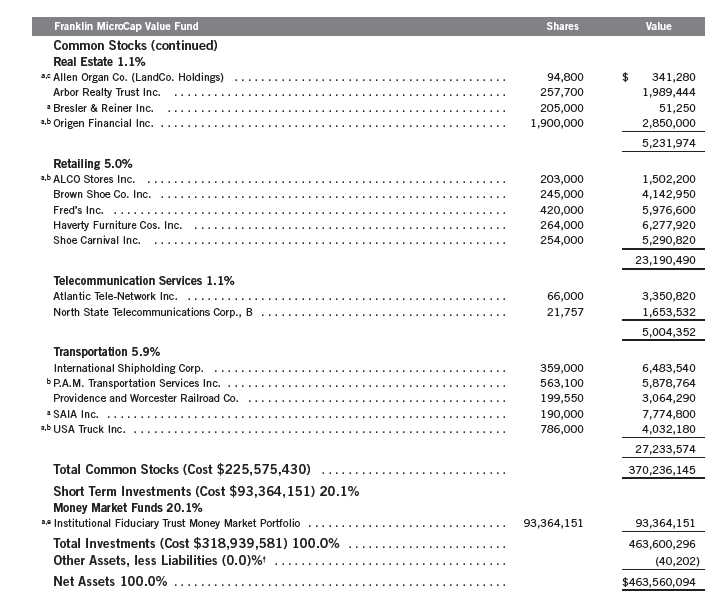

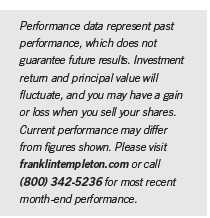

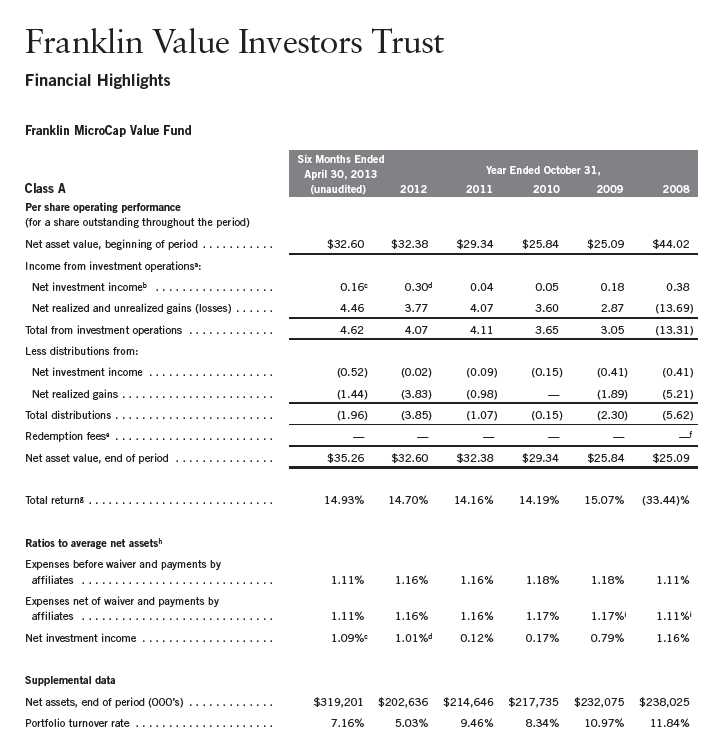

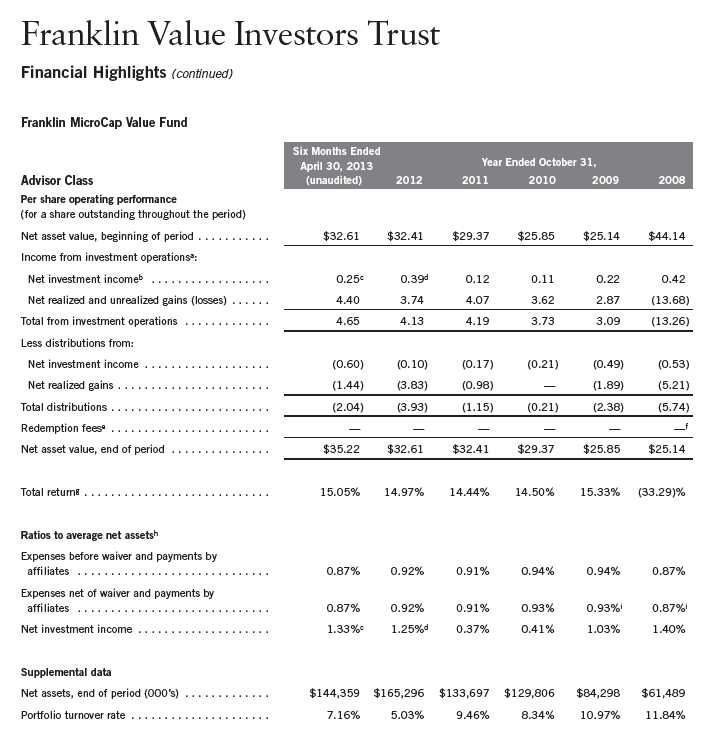

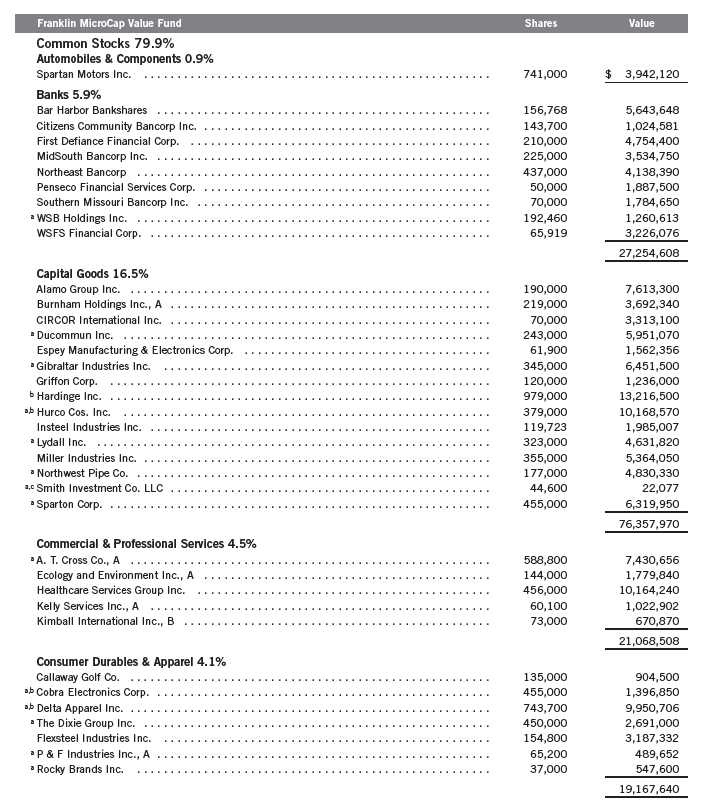

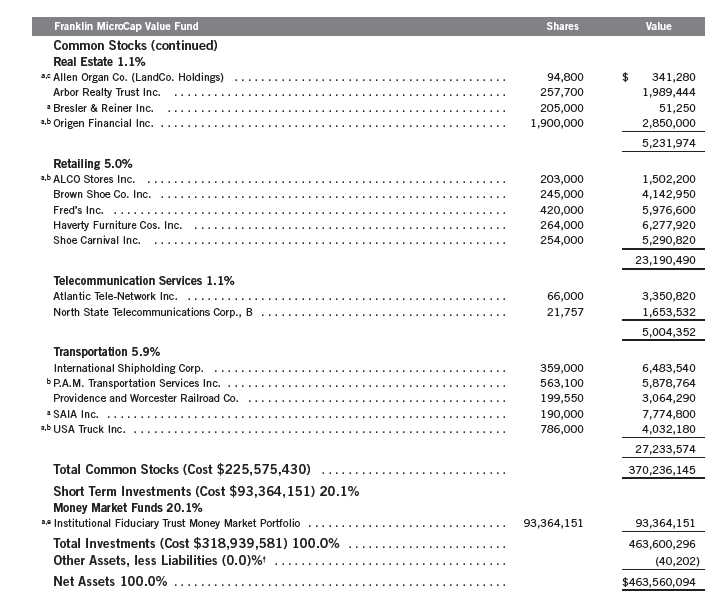

Franklin MicroCap Value Fund

Your Fund’s Goal and Main Investments: Franklin MicroCap Value Fund seeks high total return, of which capital appreciation and income are components, by investing at least 80% of its net assets in securities of companies with market capitalizations under $500 million at the time of purchase that we believe are undervalued in the marketplace.1

This semiannual report for Franklin MicroCap Value Fund covers the period ended April 30, 2013.

Performance Overview

Franklin MicroCap Value Fund – Class A delivered a +14.93% cumulative total return for the six months under review. In comparison, the Russell 2000® Value Index, which measures performance of those Russell 2000® Index companies with lower price-to-book ratios and lower forecasted growth values, generated a +16.58% total return.2 Although this report covers a six-month period, our investment strategy aims for long-term results. You can find the Fund’s long-term performance data in the Performance Summary beginning on page 31.

Investment Strategy

Our strategy is to buy shares of financially sound, well-established companies at a low price-to-book value, where we have reasonable confidence that book value will increase over several years. We limit purchases to companies with market capitalizations of less than $500 million, which we define as “microcap.”1 Book value per share is a company’s net worth or shareholders’ equity on an accounting or “book” basis, divided by shares outstanding. This strategy is not aimed at short-term trading gains, nor do we consider the composition of any index. Rather, we try to identify individual companies that meet our investment criteria, and we assume at purchase that we will hold the positions for several years.

1. Effective 12/10/12, the maximum market capitalization for each investment that the Fund can invest in increased from $400 million at time of purchase to $500 million.

2. Source: © 2013 Morningstar. All Rights Reserved. The information contained herein: (1) is proprietary to Morningstar and/or its content providers; (2) may not be copied or distributed; and (3) is not warranted to be accurate, complete or timely. Neither Morningstar nor its content providers are responsible for any damages or losses arising from any use of this information. The index is unmanaged and includes reinvested dividends. One cannot invest directly in an index, and an index is not representative of the Fund’s portfolio.

The dollar value, number of shares or principal amount, and names of all portfolio holdings are listed in the Fund’s Statement of Investments (SOI). The SOI begins on page 74.

28 | Semiannual Report

Manager’s Discussion

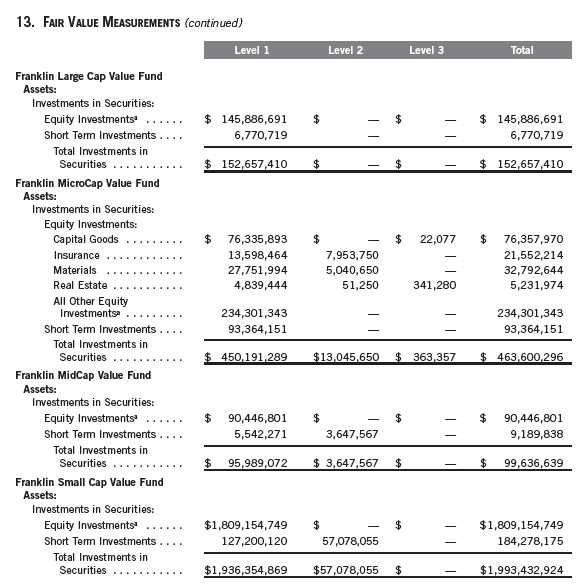

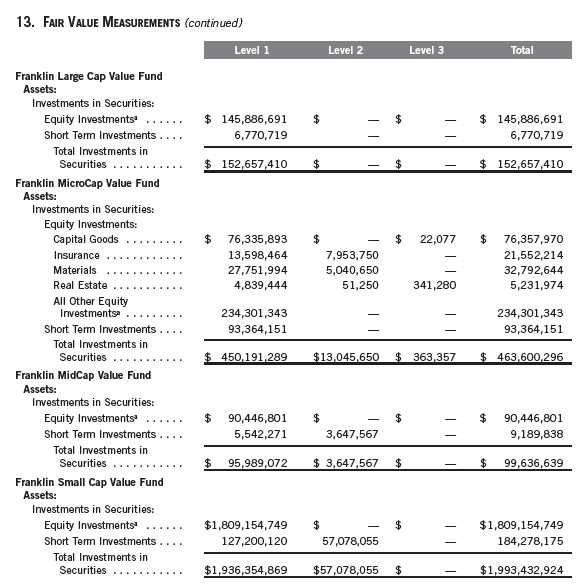

On April 30, 2013, the Fund’s total net assets were $463.5 million, with short-term investments and other net assets making up 20.1%, compared with total net assets of $367.9 million and short-term investments and other net assets of 9.3% on October 31, 2012. The Fund closed to new investors (with the exception of certain retirement accounts) in January 2004 and has remained closed except for two days in mid-February 2013. We opened the Fund on a limited basis so that we might increase the number of shareholders and broaden our investor base. The Fund’s being closed does not restrict existing shareholders from adding to or reducing their investments in the Fund, except that once an account is reduced to zero, it may not be reopened unless the Fund reopens.

We identified seven new investment opportunities during the period under review: restaurant chain operator Ruby Tuesday, oil and gas drilling equipment provider Tesco, gaming company Full House Resorts, oil and gas drilling contractor Parker Drilling, oil and gas exploration and production company Magellan Petroleum, offshore oil and gas construction contractor Cal Dive International, and specialty insurance and reinsurance holding company American Safety Insurance Holdings. We also added to existing positions in cement maker and contractor Monarch Cement, fish meal and oil products producer Omega Protein, and bank holding company Penseco Financial Services, among others. Cash deployed into new and existing positions totaled $25.1 million during the period.

Portfolio sales over the semiannual period totaled $39.2 million. We liquidated positions in Bassett Furniture Industries, Destination XL Group (formerly Casual Male Retail Group), LCNB, Unifi, Tandy Brands Accessories, Coast Distribution System and Presidential Life, which was acquired by Athene Holdings. We reduced positions in Haverty Furniture, Saia and American Pacific, among others.

During the six months under review, contributors to absolute Fund performance included American Pacific (specialty chemicals), Saia (less than truckload carrier), the aforementioned Omega Protein, Haverty Furniture (furniture retailer) and Hardinge (machine tools). In contrast, detractors included PHI (helicopter transportation services), Delta Apparel (T-shirt manufacturer), Cobra Electronics (mobile communication products manufacturer), Healthcare Services Group (nursing, home housekeeping and food service) and ALCO Stores (general merchandise retailer).

Semiannual Report | 29

Thank you for your continued participation in Franklin MicroCap Value Fund.

We look forward to serving your future investment needs.

Bruce C. Baughman, CPA

Lead Portfolio Manager

William J. Lippman

Margaret McGee

Donald G. Taylor, CPA

Portfolio Management Team

Franklin MicroCap Value Fund

The foregoing information reflects our analysis, opinions and portfolio holdings as of April 30, 2013, the end of the

reporting period. The way we implement our main investment strategies and the resulting portfolio holdings may

change depending on factors such as market and economic conditions. These opinions may not be relied upon as

investment advice or an offer for a particular security. The information is not a complete analysis of every aspect

of any market, country, industry, security or the Fund. Statements of fact are from sources considered reliable, but

the investment manager makes no representation or warranty as to their completeness or accuracy. Although his-

torical performance is no guarantee of future results, these insights may help you understand our investment

management philosophy.

30 | Semiannual Report

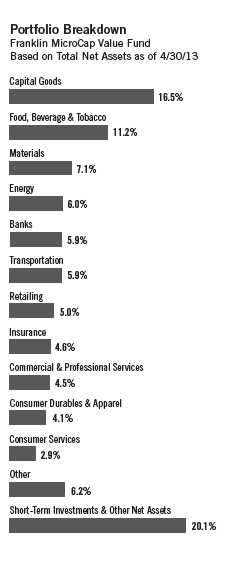

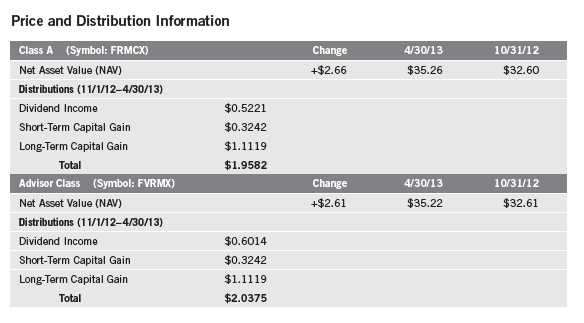

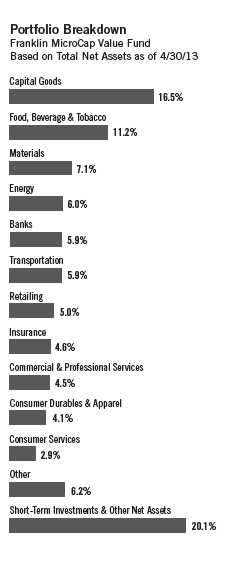

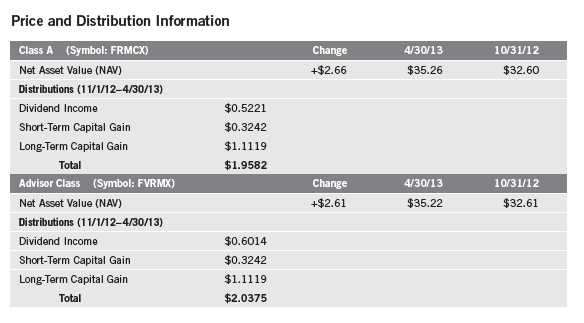

Performance Summary as of 4/30/13

Franklin MicroCap Value Fund

Your dividend income will vary depending on dividends or interest paid by securities in the Fund’s

portfolio, adjusted for operating expenses of each class. Capital gain distributions are net profits

realized from the sale of portfolio securities. The performance table does not reflect any taxes that

a shareholder would pay on Fund dividends, capital gain distributions, if any, or any realized gains

on the sale of Fund shares. Total return reflects reinvestment of the Fund’s dividends and capital

gain distributions, if any, and any unrealized gains or losses.

Performance data represent past performance, which does not guarantee future results. Investment return and principal

value will fluctuate, and you may have a gain or loss when you sell your shares. Current performance may differ from

figures shown. For most recent month-end performance, go to franklintempleton.com or call (800) 342-5236.

Semiannual Report | 31

Performance Summary (continued)

Endnotes

All investments involve risks, including possible loss of principal. The Fund’s ability to invest in smaller company securities that may have

limited liquidity involves additional risks, such as relatively small revenues, limited product lines and small market share. Historically, these

stocks have exhibited greater price volatility than larger company stocks, especially over the short term. In addition, the Fund may invest up

to 25% of its total assets in foreign securities, which involve special risks, including currency fluctuations and economic and political uncer-

tainty. The Fund is actively managed but there is no guarantee that the manager’s investment decisions will produce the desired results. The

Fund’s prospectus also includes a description of the main investment risks.

Advisor Class: Shares are available to certain eligible investors as described in the prospectus.

1. Cumulative total return represents the change in value of an investment over the periods indicated.

2. Average annual total return represents the average annual change in value of an investment over the periods indicated. Six-month return has not

been annualized.

3. These figures represent the value of a hypothetical $10,000 investment in the Fund over the periods indicated.

4. In accordance with SEC rules, we provide standardized average annual total return information through the latest calendar quarter.

5. Figures are as stated in the Fund’s current prospectus. In periods of market volatility, assets may decline significantly, causing total annual Fund

operating expenses to become higher than the figures shown.

6. Effective 11/1/05, the Fund began offering Advisor Class shares, which do not have sales charges or a Rule 12b-1 plan. Performance quotations

for this class reflect the following methods of calculation: (a) For periods prior to 11/1/05, a restated figure is used based upon the Fund’s Class A

performance, excluding the effect of Class A’s maximum initial sales charge, but reflecting the effect of the Class A Rule 12b-1 fees; and (b) for peri-

ods after 11/1/05, actual Advisor Class performance is used reflecting all charges and fees applicable to that class. Since 11/1/05 (commencement

of sales), the cumulative and average annual total returns of Advisor Class shares were +78.08% and +8.01%.

32 | Semiannual Report

Your Fund’s Expenses

Franklin MicroCap Value Fund

As a Fund shareholder, you can incur two types of costs:

- Transaction costs, including sales charges (loads) on Fund purchases; and

- Ongoing Fund costs, including management fees, distribution and service (12b-1) fees, and other Fund expenses. All mutual funds have ongoing costs, sometimes referred to as operating expenses.

The following table shows ongoing costs of investing in the Fund and can help you understand these costs and compare them with those of other mutual funds. The table assumes a $1,000 investment held for the six months indicated.

Actual Fund Expenses

The first line (Actual) for each share class listed in the table provides actual account values and expenses. The “Ending Account Value” is derived from the Fund’s actual return, which includes the effect of Fund expenses.

You can estimate the expenses you paid during the period by following these steps. Of course, your account value and expenses will differ from those in this illustration:

| 1. | Divide your account value by $1,000. |

| | If an account had an $8,600 value, then $8,600 ÷ $1,000 = 8.6. |

| 2. | Multiply the result by the number under the heading “Expenses Paid During Period.” |

| | If Expenses Paid During Period were $7.50, then 8.6 x $7.50 = $64.50. |

In this illustration, the estimated expenses paid this period are $64.50.

Hypothetical Example for Comparison with Other Funds

Information in the second line (Hypothetical) for each class in the table can help you compare ongoing costs of investing in the Fund with those of other mutual funds. This information may not be used to estimate the actual ending account balance or expenses you paid during the period. The hypothetical “Ending Account Value” is based on the actual expense ratio for each class and an assumed 5% annual rate of return before expenses, which does not represent the Fund’s actual return. The figure under the heading “Expenses Paid During Period” shows the hypothetical expenses your account would have incurred under this scenario. You can compare this figure with the 5% hypothetical examples that appear in shareholder reports of other funds.

Semiannual Report | 33

Your Fund’s Expenses (continued)

Please note that expenses shown in the table are meant to highlight ongoing costs and do not reflect

any transaction costs, such as sales charges. Therefore, the second line for each class is useful in

comparing ongoing costs only, and will not help you compare total costs of owning different

funds. In addition, if transaction costs were included, your total costs would have been higher.

Please refer to the Fund prospectus for additional information on operating expenses.

34 | Semiannual Report

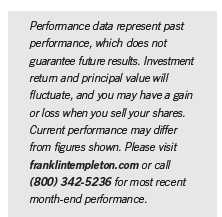

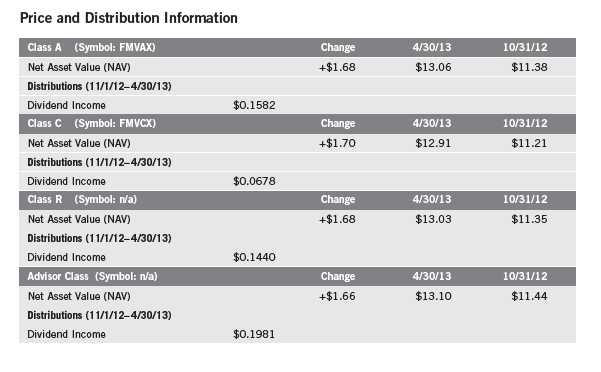

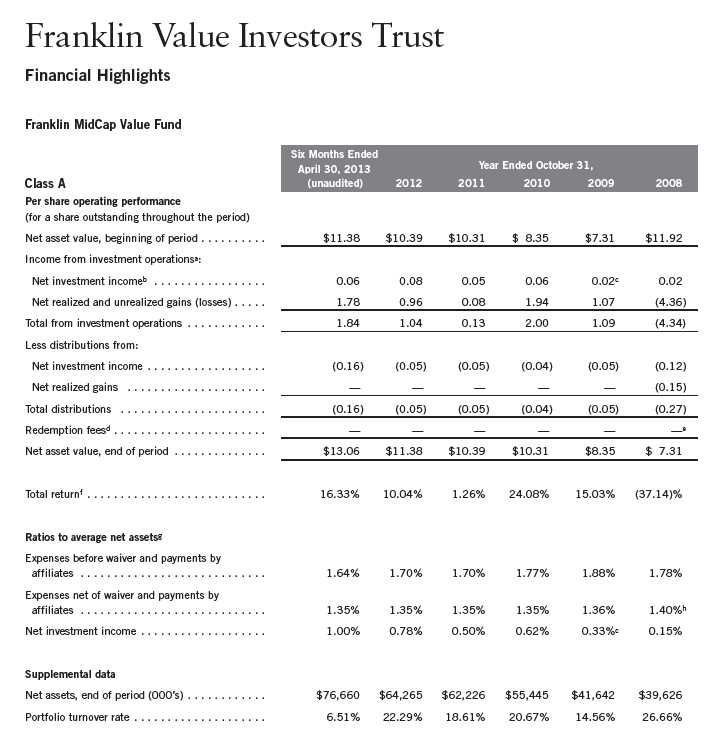

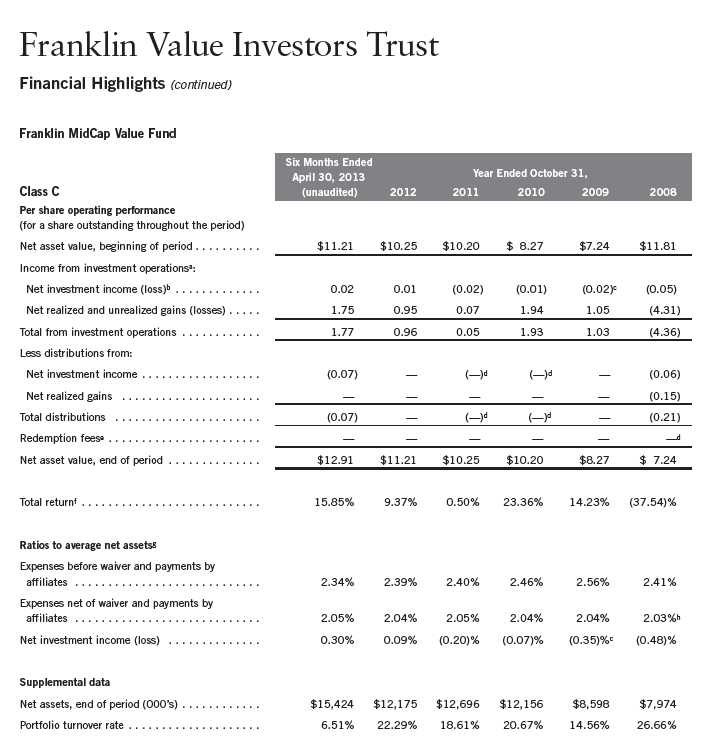

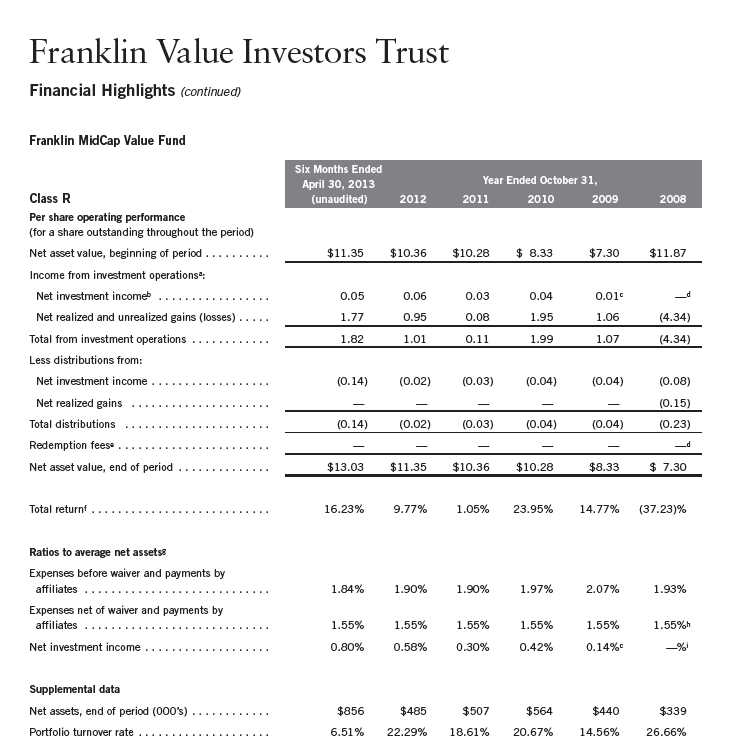

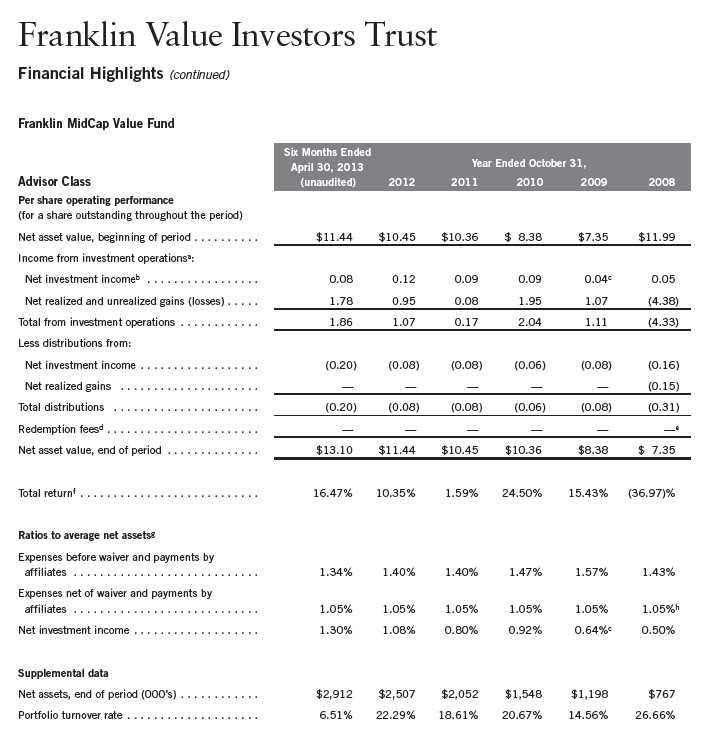

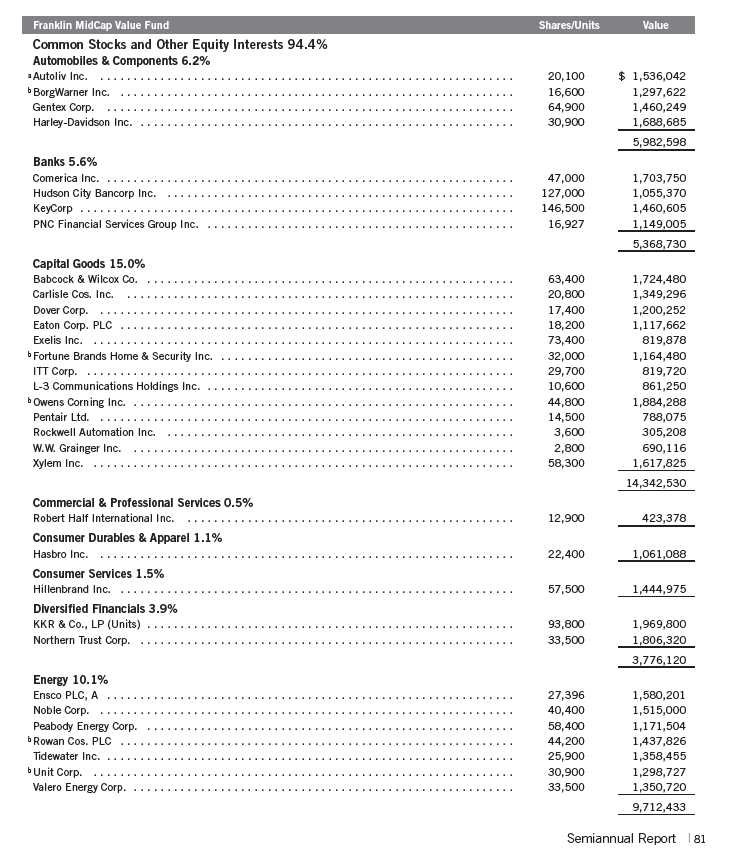

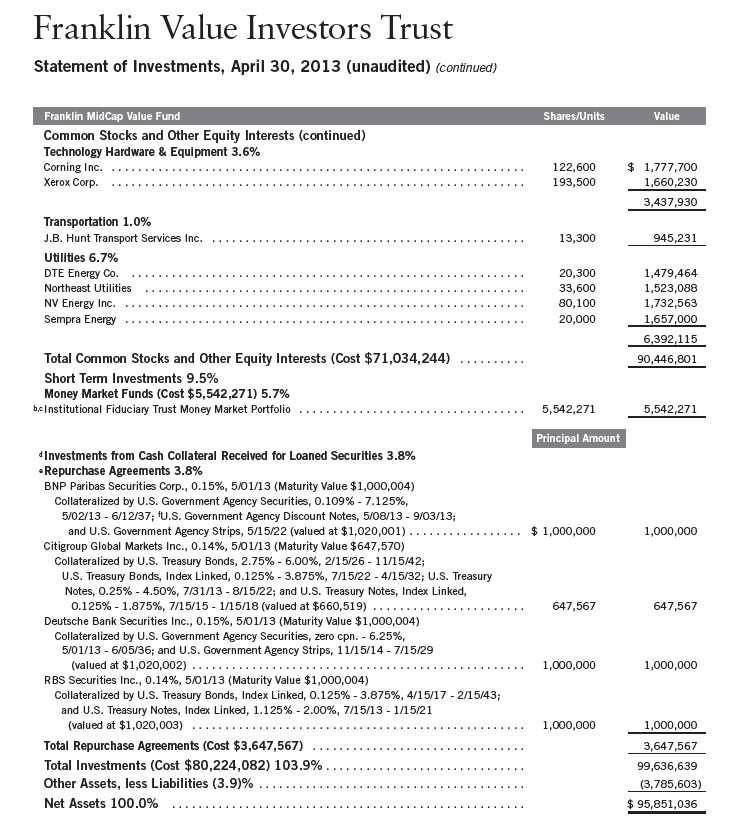

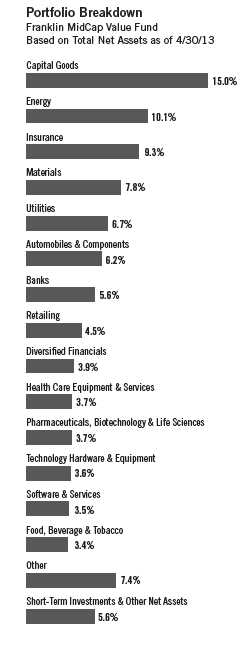

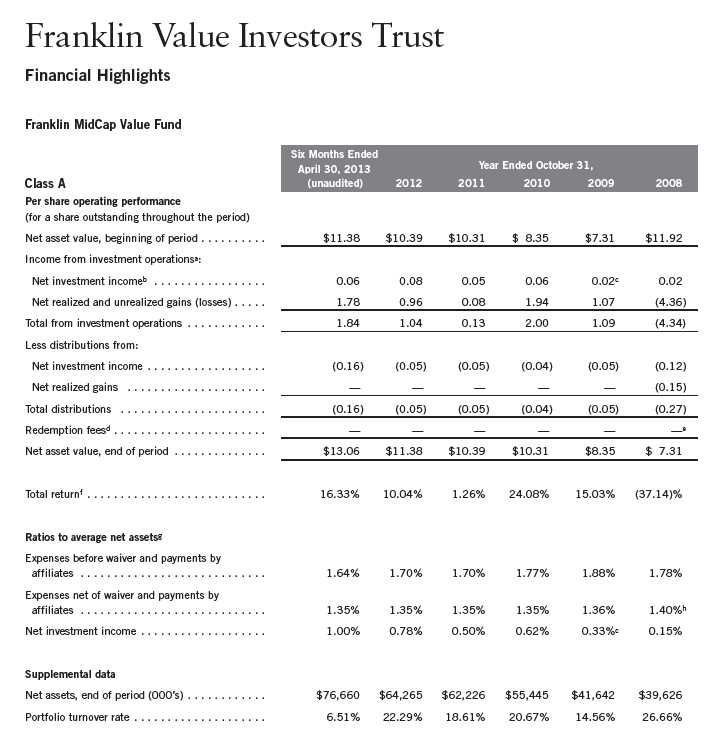

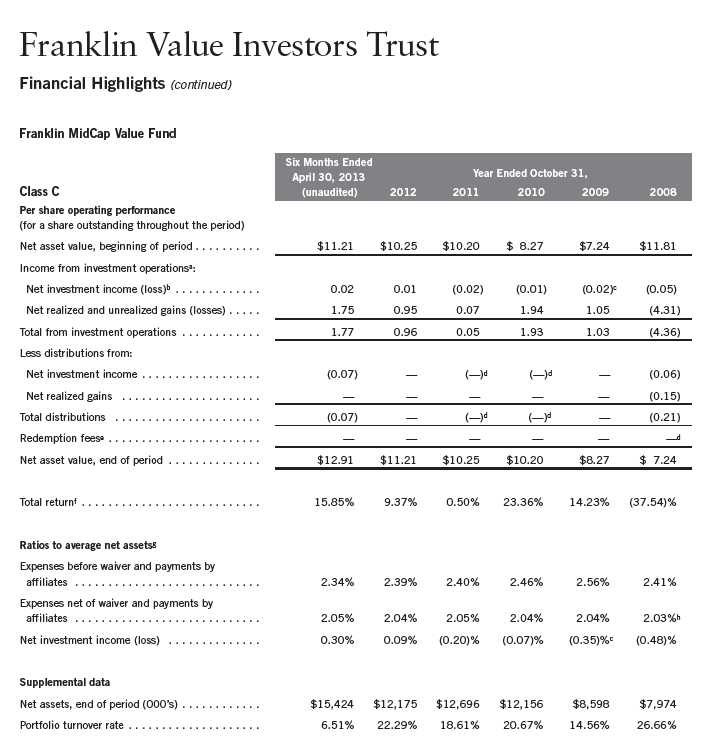

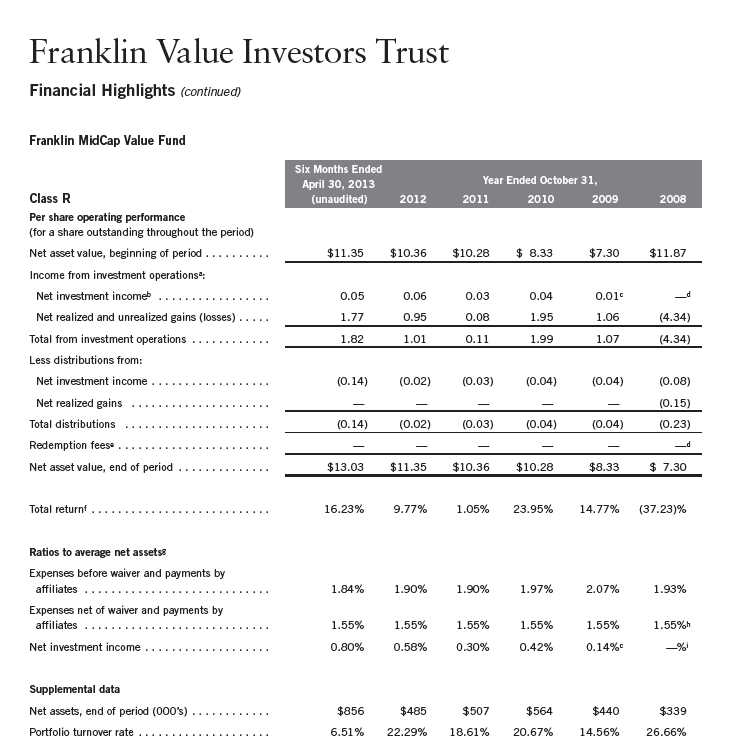

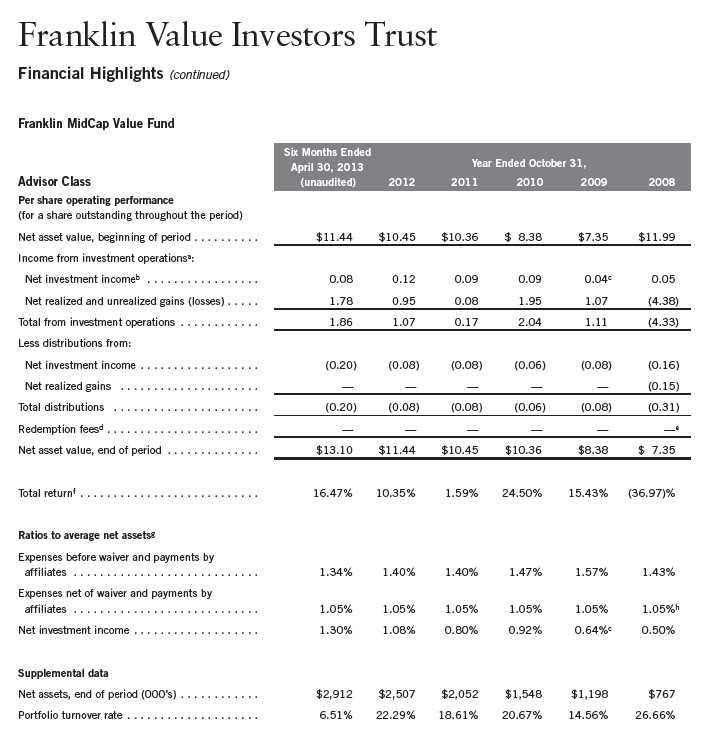

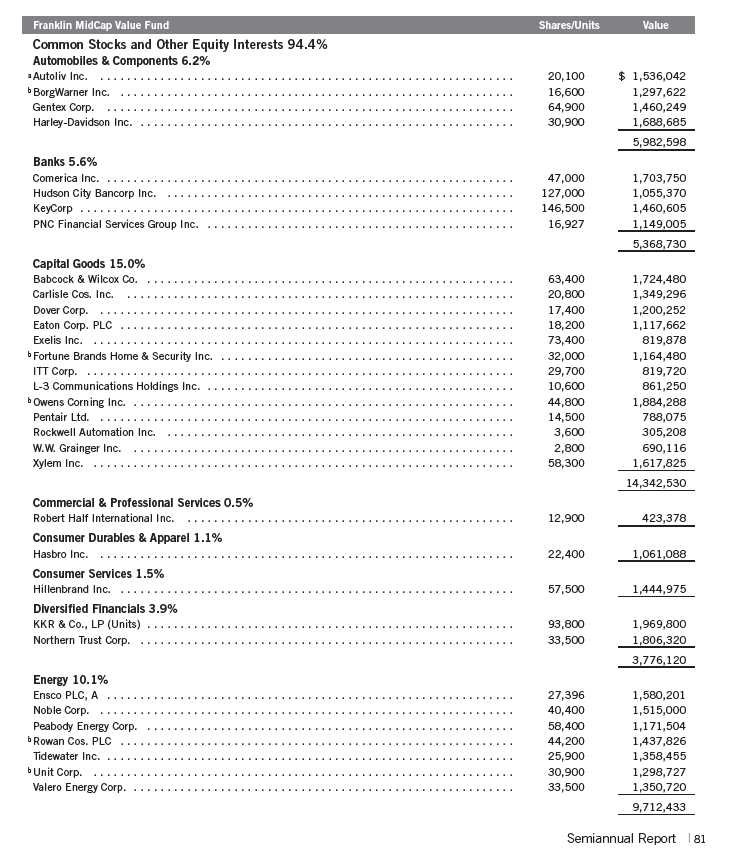

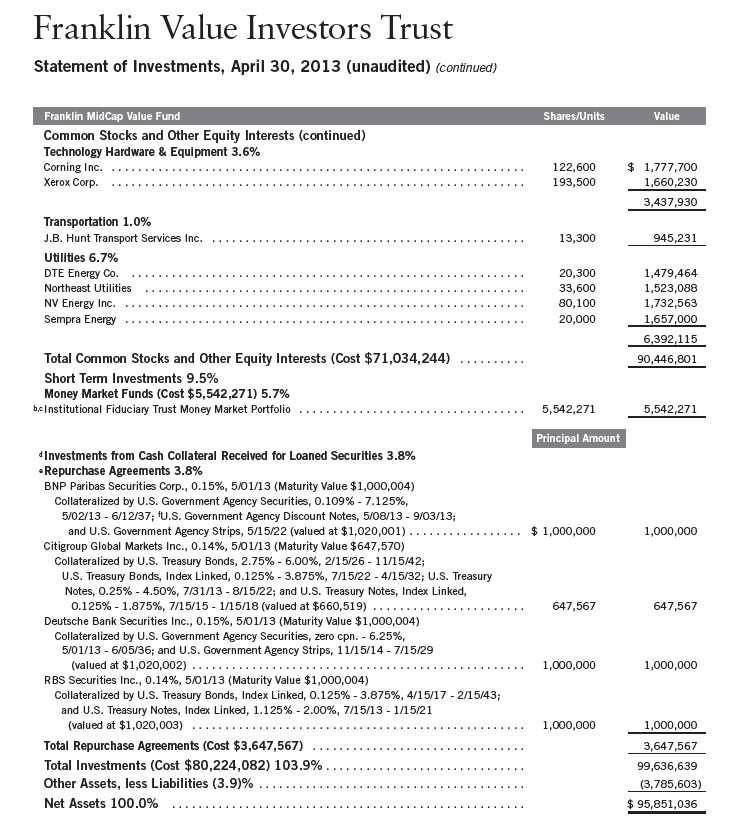

Franklin MidCap Value Fund

Your Fund’s Goal and Main Investments: Franklin MidCap Value Fund seeks long-term total return by investing at least 80% of net assets in securities of mid-capitalization companies that we believe are undervalued. We define mid-capitalization companies as those with market capitalizations that are similar in size at the time of purchase to those in the Russell Midcap® Index.1

This semiannual report for Franklin MidCap Value Fund covers the period ended April 30, 2013.

Performance Overview

Franklin MidCap Value Fund – Class A delivered a +16.33% cumulative total return for the six months under review. In comparison, the Russell Midcap® Value Index, which measures performance of those Russell Midcap® Index companies with lower price-to-book ratios and lower forecasted growth values, generated a +19.89% total return.2 Although this report covers a six-month period, our investment strategy aims for long-term results. You can find the Fund’s long-term performance data in the Performance Summary beginning on page 38.

Investment Strategy

Our goal is to invest in mid-capitalization companies that we determine are currently undervalued and have the potential for capital appreciation. The Fund purchases stocks that are out of favor in the market for reasons we believe will prove to be temporary in nature. In addition, the Fund may invest in companies with valuable intangibles we believe are not reflected in the stock price. This strategy is not aimed at short-term trading gains, nor do we consider the composition of any index. Rather, we try to identify attractively priced, financially sound companies that meet our investment criteria, and we assume at purchase that we will hold the positions for several years.

1. The Russell Midcap® Index is market capitalization weighted and measures performance of the smallest companies in the Russell 1000® Index, which represent a modest amount of the Russell 1000® Index’s total market capitalization.

2. Source: © 2013 Morningstar. All Rights Reserved. The information contained herein: (1) is proprietary to Morningstar and/or its content providers; (2) may not be copied or distributed; and (3) is not warranted to be accurate, complete or timely. Neither Morningstar nor its content providers are responsible for any damages or losses arising from any use of this information. The index is unmanaged and includes reinvested dividends. One cannot invest directly in an index, and an index is not representative of the Fund’s portfolio.

The dollar value, number of shares or principal amount, and names of all portfolio holdings are listed in the Fund’s Statement of Investments (SOI). The SOI begins on page 81.

Semiannual Report | 35

Manager’s Discussion

During the six months under review, contributors to absolute Fund performance included video game retailer GameStop, private equity investment group KKR & Co., defense and intelligence solutions provider SAIC and auto safety systems company Autoliv.

In contrast, detractors included coal producer Peabody Energy, cable television provider Time Warner Cable, discount retailer Family Dollar Stores and savings bank Hudson City Bancorp.

During the reporting period, the Fund initiated one new position in specialty glass and ceramics manufacturer Corning. Consistent with our value strategy, we added to existing positions in Nucor, Bunge and Peabody Energy, among others. We liquidated our positions in Old Republic International, Teekay, McCormick & Co. and Gardner Denver, which was subject to an all cash takeover offer from KKR. We also reduced our positions in JB Hunt Transport Services, Rockwell Automation and Hasbro, among others.

36 | Semiannual Report

Thank you for your continued participation in Franklin MidCap Value Fund.

We look forward to serving your future investment needs.

Bruce C. Baughman, CPA

William J. Lippman

Margaret McGee

Donald G. Taylor, CPA

Portfolio Management Team

Franklin MidCap Value Fund

CFA® is a trademark owned by CFA Institute.

The foregoing information reflects our analysis, opinions and portfolio holdings as of April 30, 2013, the end of the

reporting period. The way we implement our main investment strategies and the resulting portfolio holdings may

change depending on factors such as market and economic conditions. These opinions may not be relied upon as

investment advice or an offer for a particular security. The information is not a complete analysis of every aspect

of any market, country, industry, security or the Fund. Statements of fact are from sources considered reliable, but

the investment manager makes no representation or warranty as to their completeness or accuracy. Although his-

torical performance is no guarantee of future results, these insights may help you understand our investment

management philosophy.

Semiannual Report | 37

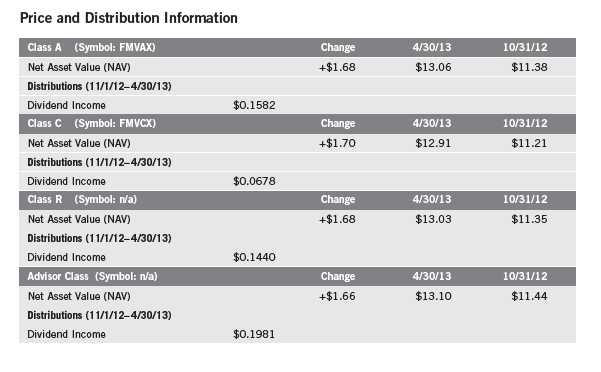

Performance Summary as of 4/30/13

Franklin MidCap Value Fund

Your dividend income will vary depending on dividends or interest paid by securities in the Fund’s

portfolio, adjusted for operating expenses of each class. Capital gain distributions are net profits

realized from the sale of portfolio securities. The performance table does not reflect any taxes that

a shareholder would pay on Fund dividends, capital gain distributions, if any, or any realized gains

on the sale of Fund shares. Total return reflects reinvestment of the Fund’s dividends and capital

gain distributions, if any, and any unrealized gains or losses.

38 | Semiannual Report

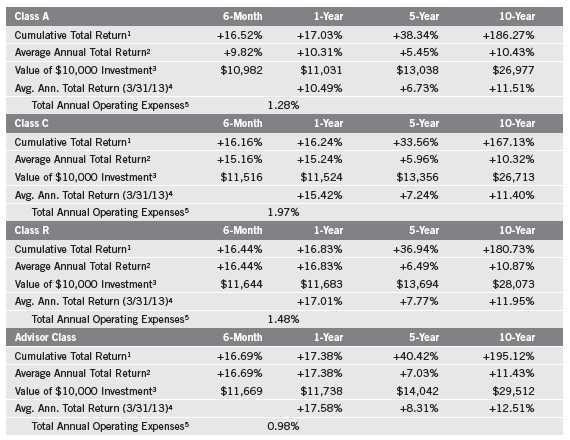

Performance Summary (continued)

Performance1

Cumulative total return excludes sales charges. Average annual total returns and value of $10,000 investment include

maximum sales charges. Class A: 5.75% maximum initial sales charge; Class C: 1% contingent deferred sales charge

in first year only; Class R/Advisor Class: no sales charges.

Performance data represent past performance, which does not guarantee future results. Investment return and principal

value will fluctuate, and you may have a gain or loss when you sell your shares. Current performance may differ from

figures shown. For most recent month-end performance, go to franklintempleton.com or call (800) 342-5236.

The investment manager and administrator have contractually agreed to waive or assume certain expenses so that common

expenses (excluding Rule 12b-1 fees and acquired fund fees and expenses) for each class of the Fund do not exceed

1.05% (other than certain nonroutine expenses) until 2/28/14.

Semiannual Report | 39

Performance Summary (continued)

Endnotes

All investments involve risks, including possible loss of principal. Stock prices fluctuate, sometimes rapidly and dramatically, due to factors affecting individual companies, particular industries or sectors, or general market conditions. Historically, midsize company securities have been more volatile in price than larger company securities, especially over the short term. Midsize companies may be more susceptible to particular economic events or competitive factors than are larger, more broadly diversified companies. In addition, the Fund may invest up to 25% of its total assets in foreign securities, which involve special risks, including currency fluctuations and economic and political uncertainty. The Fund is actively managed but there is no guarantee that the manager’s investment decisions will produce the desired results. The Fund’s prospectus also includes a description of the main investment risks.

| |

Class C: Class R: | These shares have higher annual fees and expenses than Class A shares. Shares are available to certain eligible investors as described in the prospectus. These shares have higher annual fees and expenses than Class A shares. |

Advisor Class: | Shares are available to certain eligible investors as described in the prospectus. |

1. Fund investment results reflect the expense reduction, without which the results would have been lower.

2. Cumulative total return represents the change in value of an investment over the periods indicated.

3. Average annual total return represents the average annual change in value of an investment over the periods indicated. Six-month return has not

been annualized.

4. These figures represent the value of a hypothetical $10,000 investment in the Fund over the periods indicated.

5. In accordance with SEC rules, we provide standardized average annual total return information through the latest calendar quarter.

6. Figures are as stated in the Fund’s current prospectus. In periods of market volatility, assets may decline significantly, causing total annual Fund

operating expenses to become higher than the figures shown.

40 | Semiannual Report

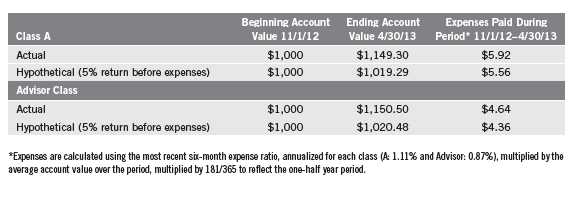

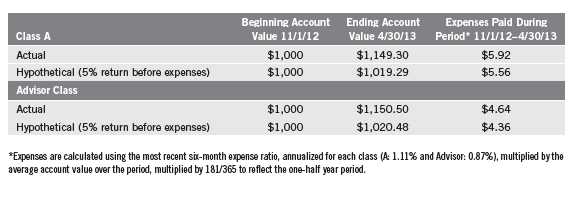

Your Fund’s Expenses

Franklin MidCap Value Fund

As a Fund shareholder, you can incur two types of costs:

- Transaction costs, including sales charges (loads) on Fund purchases; and

- Ongoing Fund costs, including management fees, distribution and service (12b-1) fees, and other Fund expenses. All mutual funds have ongoing costs, sometimes referred to as operating expenses.

The following table shows ongoing costs of investing in the Fund and can help you understand these costs and compare them with those of other mutual funds. The table assumes a $1,000 investment held for the six months indicated.

Actual Fund Expenses

The first line (Actual) for each share class listed in the table provides actual account values and expenses. The “Ending Account Value” is derived from the Fund’s actual return, which includes the effect of Fund expenses.

You can estimate the expenses you paid during the period by following these steps. Of course, your account value and expenses will differ from those in this illustration:

| 1. | Divide your account value by $1,000. |

| | If an account had an $8,600 value, then $8,600 ÷ $1,000 = 8.6. |

| 2. | Multiply the result by the number under the heading “Expenses Paid During Period.” |

| | If Expenses Paid During Period were $7.50, then 8.6 x $7.50 = $64.50. |

In this illustration, the estimated expenses paid this period are $64.50.

Hypothetical Example for Comparison with Other Funds

Information in the second line (Hypothetical) for each class in the table can help you compare ongoing costs of investing in the Fund with those of other mutual funds. This information may not be used to estimate the actual ending account balance or expenses you paid during the period. The hypothetical “Ending Account Value” is based on the actual expense ratio for each class and an assumed 5% annual rate of return before expenses, which does not represent the Fund’s actual return. The figure under the heading “Expenses Paid During Period” shows the hypothetical expenses your account would have incurred under this scenario. You can compare this figure with the 5% hypothetical examples that appear in shareholder reports of other funds.

Semiannual Report | 41

Your Fund’s Expenses (continued)

Please note that expenses shown in the table are meant to highlight ongoing costs and do not reflect

any transaction costs, such as sales charges. Therefore, the second line for each class is useful in

comparing ongoing costs only, and will not help you compare total costs of owning different

funds. In addition, if transaction costs were included, your total costs would have been higher.

Please refer to the Fund prospectus for additional information on operating expenses.

42 | Semiannual Report

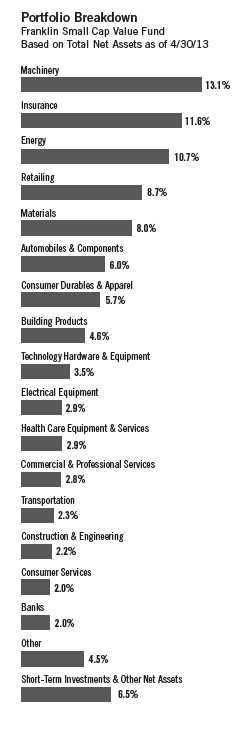

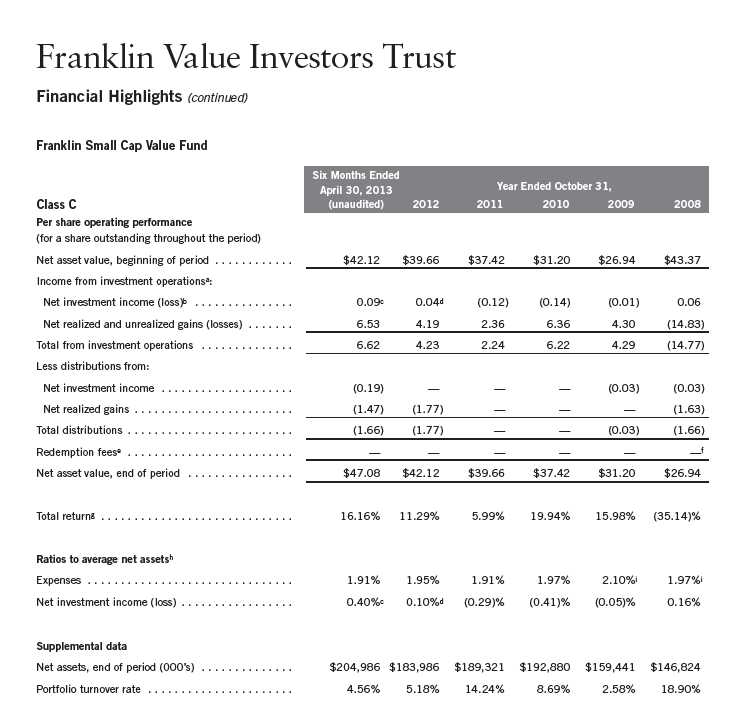

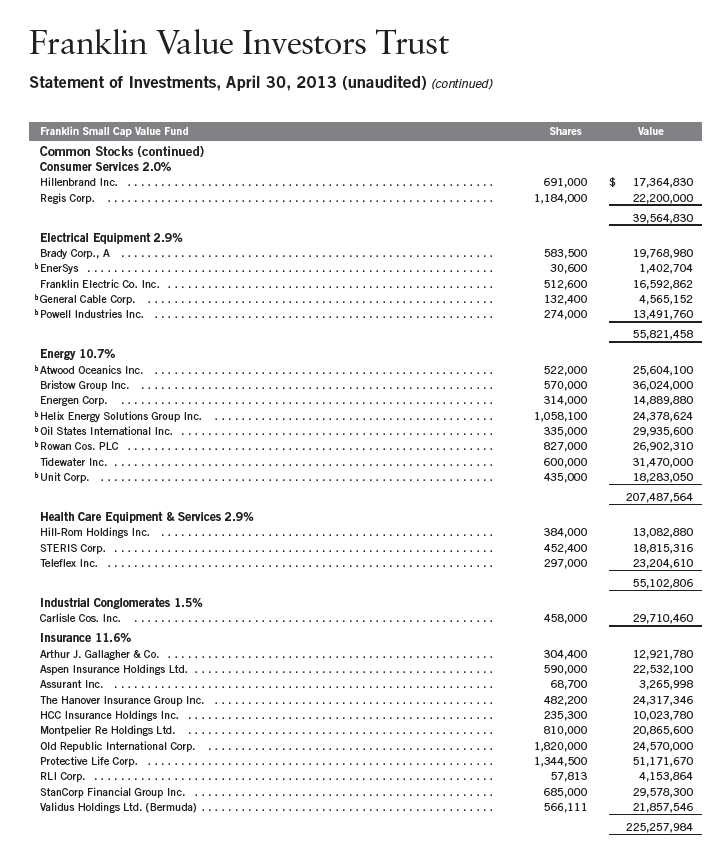

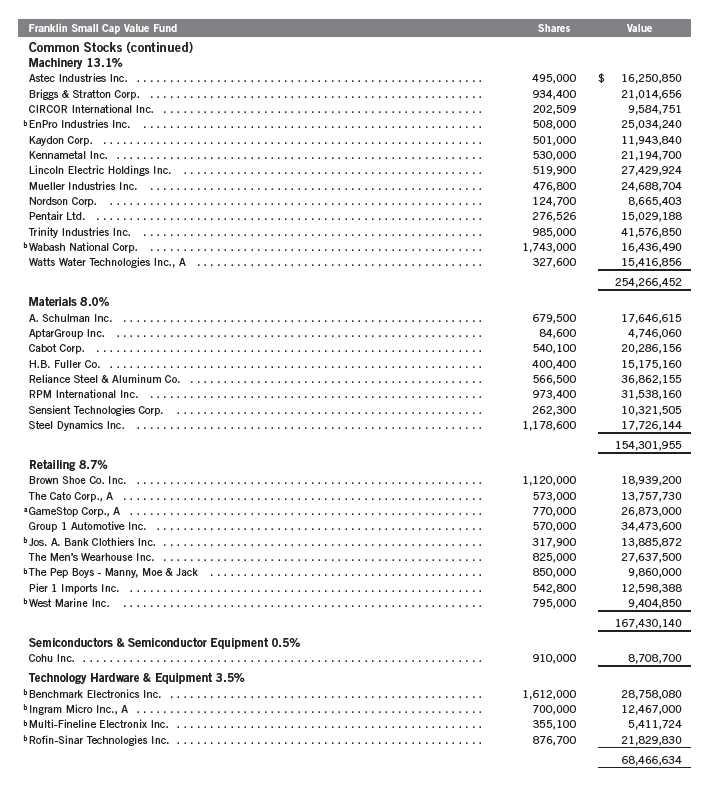

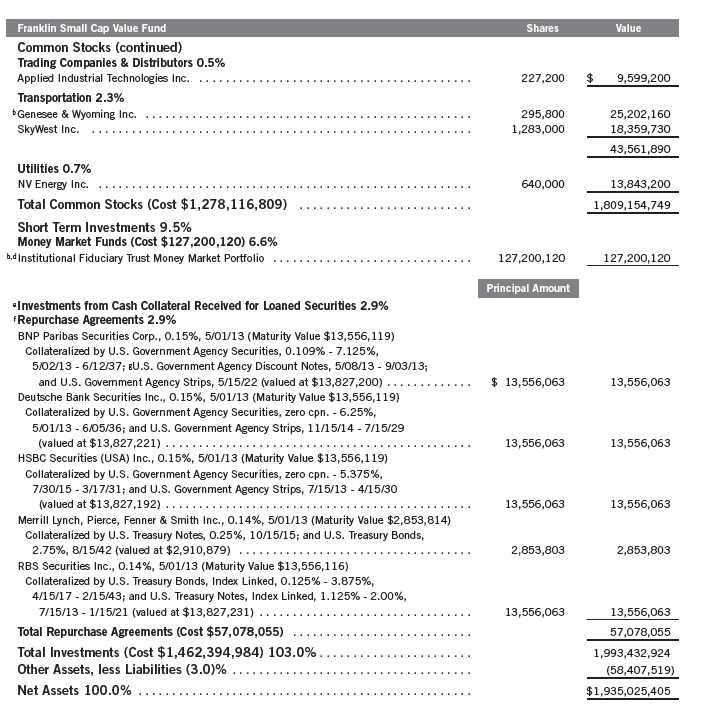

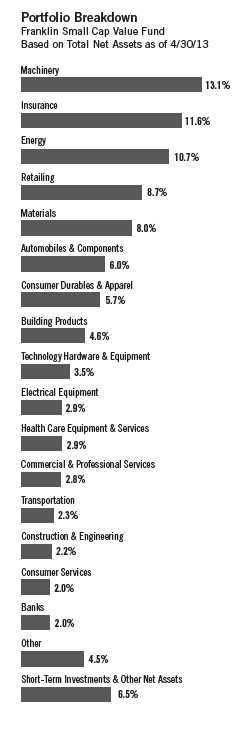

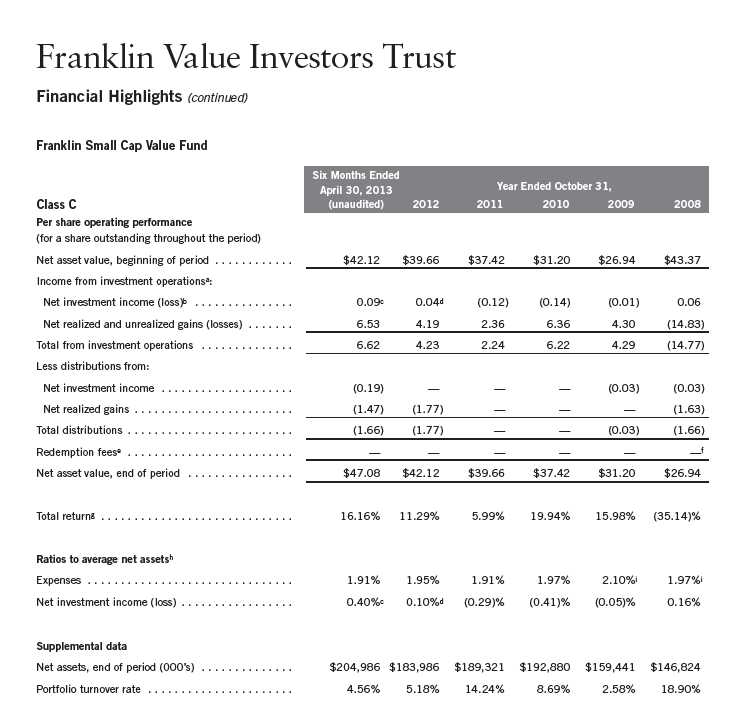

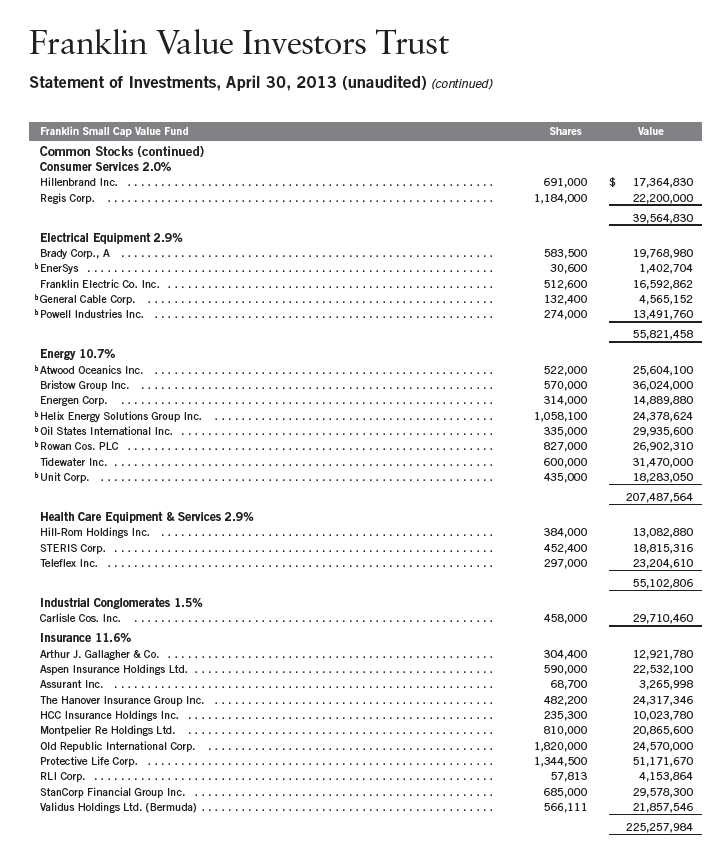

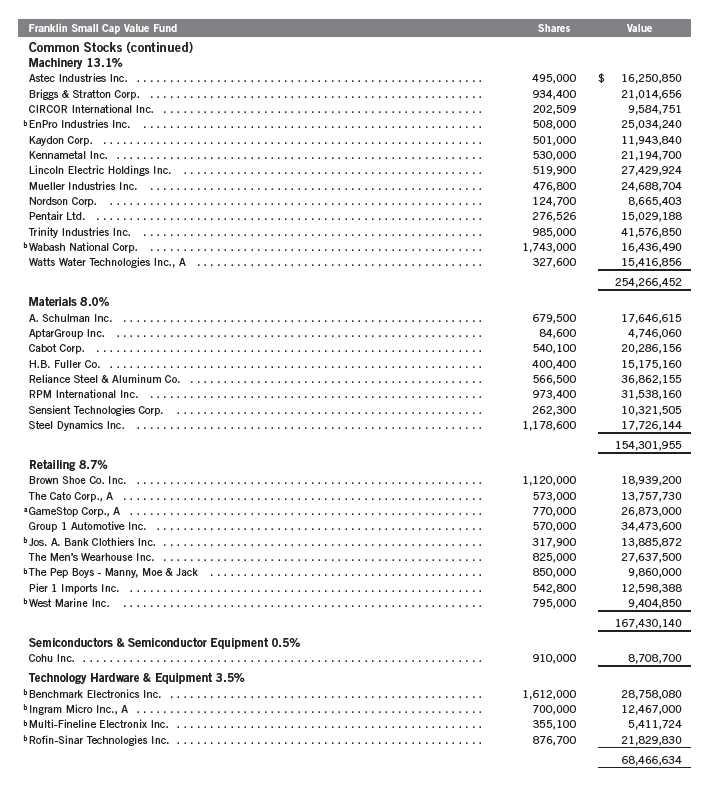

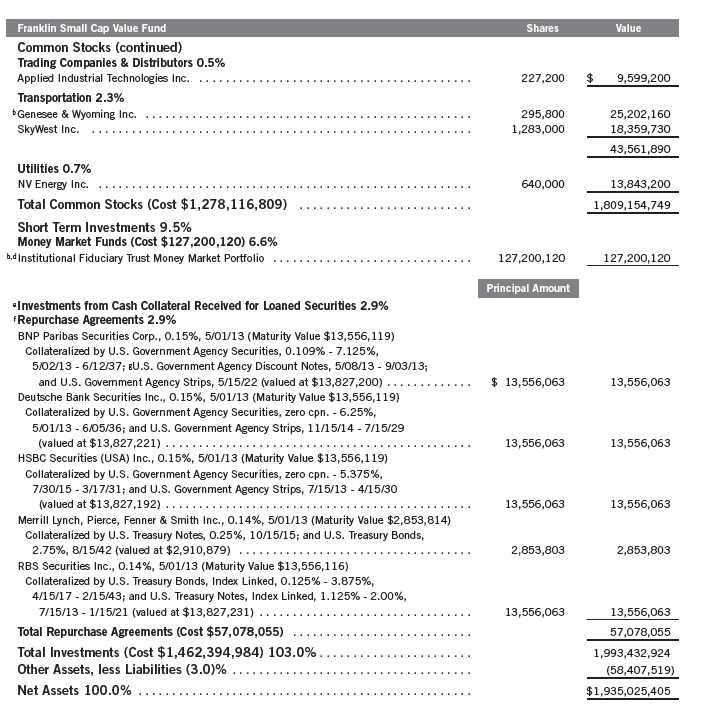

Franklin Small Cap Value Fund

Your Fund’s Goal and Main Investments: Franklin Small Cap Value Fund seeks long-term total return by investing at least 80% of net assets in securities of small-capitalization companies that we believe are undervalued. We define small-capitalization companies as those with market capitalizations less than $3.5 billion at the time of purchase.

This semiannual report for Franklin Small Cap Value Fund covers the period ended April 30, 2013.

Performance Overview

Franklin Small Cap Value Fund – Class A delivered a +16.52% cumulative total return for the six months under review. In comparison, the Russell 2500™ Value Index, which measures performance of those Russell 2500™ Index companies with lower price-to-book ratios and lower forecasted growth values, generated a total return of +18.83%.1 Although this report covers a six-month period, our investment strategy aims for long-term results. You can find the Fund’s long-term performance data in the Performance Summary beginning on page 46.

Investment Strategy

We seek to invest in small-capitalization companies that we believe are selling below their underlying worth and hold them until they reach what we consider their fair market value. We seek a diversified portfolio of fundamentally sound companies purchased at attractive prices, often when they are out of favor with other investors. Portfolio securities are selected without regard to benchmark comparisons and are based on fundamental, bottom-up research focusing on several criteria, such as low price relative to earnings, book value or cash flow. We also consider stocks with recent sharp price declines that we believe still have significant growth potential or that possess valuable intangibles not reflected in the stock price.

1. Source: © 2013 Morningstar. All Rights Reserved. The information contained herein: (1) is proprietary to Morningstar

and/or its content providers; (2) may not be copied or distributed; and (3) is not warranted to be accurate, complete or

timely. Neither Morningstar nor its content providers are responsible for any damages or losses arising from any use of

this information. The index is unmanaged and includes reinvested dividends. One cannot invest directly in an index, and

an index is not representative of the Fund’s portfolio.

The dollar value, number of shares or principal amount, and names of all portfolio holdings are listed in the Fund’s

Statement of Investments (SOI). The SOI begins on page 88.

Semiannual Report | 43

Manager’s Discussion

During the six months under review, contributors to absolute Fund performance included railcar manufacturer Trinity Industries, video game retailer GameStop, auto components supplier Autoliv, insurer Protective Life and helicopter transportation provider for the offshore energy industry, Bristow Group.

In contrast, detractors from performance included flexible circuit materials manufacturer Multi-Fineline Electronix, civil construction and transportation contractor Granite Construction, women’s fashion and accessories retailer Cato, brand marketing consultant Schawk and building products manufacturer Simpson Manufacturing.

During the reporting period, the Fund initiated new positions in audio and infotainment manufacturer Harman International Industries, men’s clothing designer and retailer Jos. A. Bank Clothiers, auto service and retail chain Pep Boys – Manny, Moe & Jack, and insurer Assurant. We also added to our positions in several holdings, including business-to-business rental provider McGrath RentCorp, insurer StanCorp Financial Group, and specialty chemicals and materials company Cabot, among others. We liquidated our positions in Graco, American Woodmark, Lancaster Colony and a few other holdings, and Gardner Denver, which was subject to an all cash takeover offer from KKR. We reduced our positions in several securities including Protective Life, Pier 1 Imports, Ingram Micro, Mueller Industries and Autoliv, among others.

44 | Semiannual Report

Thank you for your continued participation in Franklin Small Cap Value

Fund. We look forward to serving your future investment needs.

Bruce C. Baughman, CPA

Margaret McGee

Donald G. Taylor, CPA

Portfolio Management Team

Franklin Small Cap Value Fund

The foregoing information reflects our analysis, opinions and portfolio holdings as of April 30, 2013, the end of the

reporting period. The way we implement our main investment strategies and the resulting portfolio holdings may

change depending on factors such as market and economic conditions. These opinions may not be relied upon as

investment advice or an offer for a particular security. The information is not a complete analysis of every aspect of

any market, country, industry, security or the Fund. Statements of fact are from sources considered reliable, but the

investment manager makes no representation or warranty as to their completeness or accuracy. Although historical

performance is no guarantee of future results, these insights may help you understand our investment management

philosophy.

Semiannual Report | 45

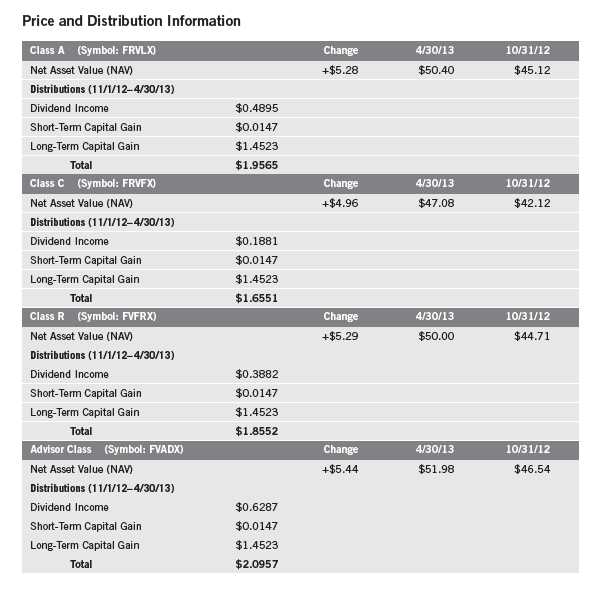

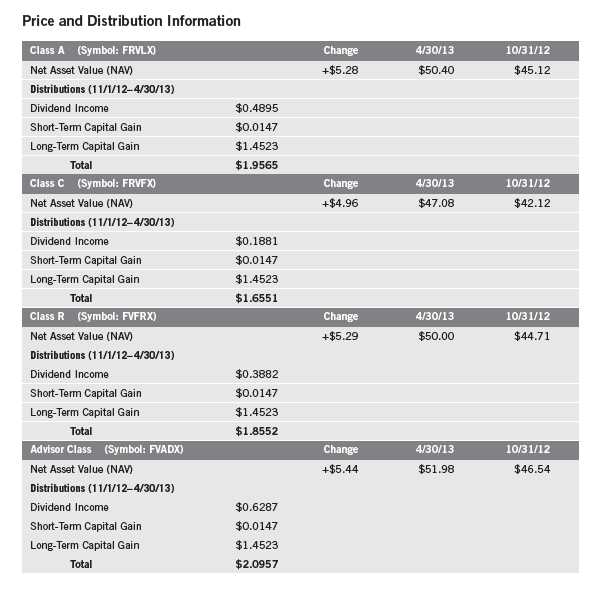

Performance Summary as of 4/30/13

Franklin Small Cap Value Fund

Your dividend income will vary depending on dividends or interest paid by securities in the Fund’s

portfolio, adjusted for operating expenses of each class. Capital gain distributions are net profits

realized from the sale of portfolio securities. The performance table does not reflect any taxes that

a shareholder would pay on Fund dividends, capital gain distributions, if any, or any realized gains

on the sale of Fund shares. Total return reflects reinvestment of the Fund’s dividends and capital

gain distributions, if any, and any unrealized gains or losses.

46 | Semiannual Report

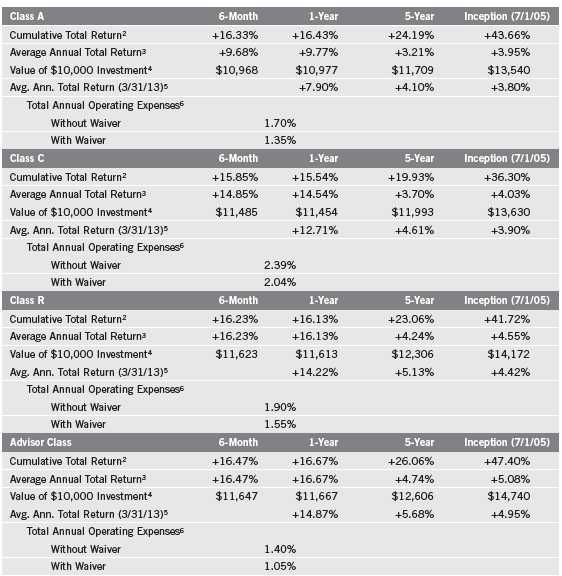

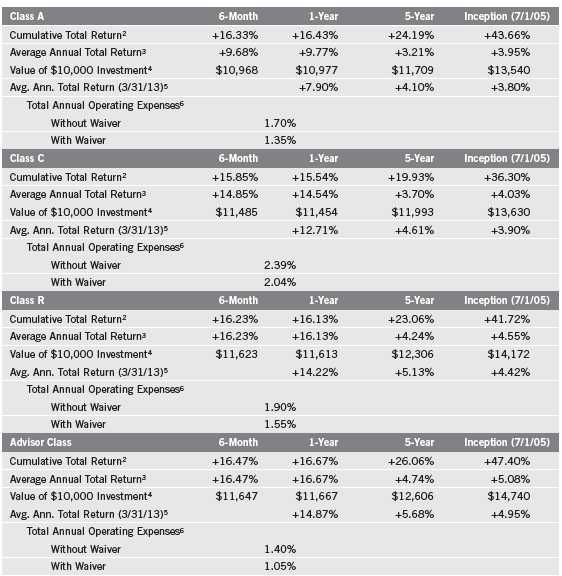

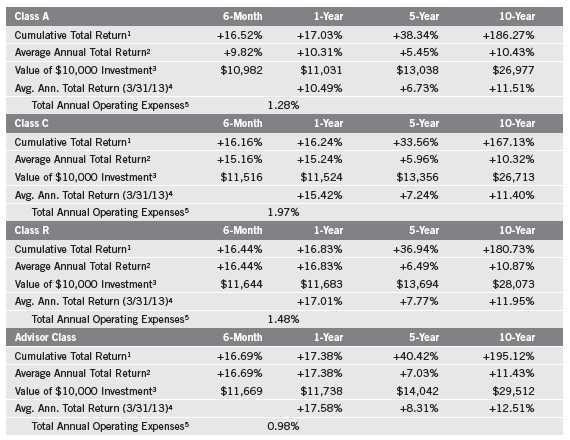

Performance Summary (continued)

Performance

Cumulative total return excludes sales charges. Average annual total returns and value of $10,000 investment include

maximum sales charges. Class A: 5.75% maximum initial sales charge; Class C: 1% contingent deferred sales charge in

first year only; Class R/Advisor Class: no sales charges.

Performance data represent past performance, which does not guarantee future results. Investment return and principal

value will fluctuate, and you may have a gain or loss when you sell your shares. Current performance may differ from

figures shown. For most recent month-end performance, go to franklintempleton.com or call (800) 342-5236.

Semiannual Report | 47

Performance Summary (continued)

Endnotes

All investments involve risks, including possible loss of principal. The Fund’s investments in smaller company stocks carry special risks as such stocks have historically exhibited greater price volatility than larger company stocks, particularly over the short term. Additionally, smaller companies often have relatively small revenues, limited product lines and small market share. In addition, the Fund may invest up to 25% of its total assets in foreign securities, which involve special risks, including currency fluctuations and economic and political uncertainty. The Fund is actively managed but there is no guarantee that the manager’s investment decisions will produce the desired results. The Fund’s prospectus also includes a description of the main investment risks.

| |

Class C: | Prior to 1/1/04, these shares were offered with an initial sales charge; thus actual total returns would have differed. These shares have higher annual fees and expenses than Class A shares. |

| |

Class R: | Shares are available to certain eligible investors as described in the prospectus. These shares have higher annual fees and expenses than Class A shares. |

| |

Advisor Class: | Shares are available to certain eligible investors as described in the prospectus. |

1. Cumulative total return represents the change in value of an investment over the periods indicated.

2. Average annual total return represents the average annual change in value of an investment over the periods indicated. Six-month return has not

been annualized.

3. These figures represent the value of a hypothetical $10,000 investment in the Fund over the periods indicated.

4. In accordance with SEC rules, we provide standardized average annual total return information through the latest calendar quarter.

5. Figures are as stated in the Fund’s current prospectus. In periods of market volatility, assets may decline significantly, causing total annual Fund

operating expenses to become higher than the figures shown.

48 | Semiannual Report

Your Fund’s Expenses

Franklin Small Cap Value Fund

As a Fund shareholder, you can incur two types of costs:

- Transaction costs, including sales charges (loads) on Fund purchases; and

- Ongoing Fund costs, including management fees, distribution and service (12b-1) fees, and other Fund expenses. All mutual funds have ongoing costs, sometimes referred to as operating expenses.

The following table shows ongoing costs of investing in the Fund and can help you understand these costs and compare them with those of other mutual funds. The table assumes a $1,000 investment held for the six months indicated.

Actual Fund Expenses

The first line (Actual) for each share class listed in the table provides actual account values and expenses. The “Ending Account Value” is derived from the Fund’s actual return, which includes the effect of Fund expenses.

You can estimate the expenses you paid during the period by following these steps. Of course, your account value and expenses will differ from those in this illustration:

| 1. | Divide your account value by $1,000. |

| | If an account had an $8,600 value, then $8,600 ÷ $1,000 = 8.6. |

| 2. | Multiply the result by the number under the heading “Expenses Paid During Period.” |

| | If Expenses Paid During Period were $7.50, then 8.6 x $7.50 = $64.50. |

In this illustration, the estimated expenses paid this period are $64.50.

Hypothetical Example for Comparison with Other Funds

Information in the second line (Hypothetical) for each class in the table can help you compare ongoing costs of investing in the Fund with those of other mutual funds. This information may not be used to estimate the actual ending account balance or expenses you paid during the period. The hypothetical “Ending Account Value” is based on the actual expense ratio for each class and an assumed 5% annual rate of return before expenses, which does not represent the Fund’s actual return. The figure under the heading “Expenses Paid During Period” shows the hypothetical expenses your account would have incurred under this scenario. You can compare this figure with the 5% hypothetical examples that appear in shareholder reports of other funds.

Semiannual Report | 49

Your Fund’s Expenses (continued)

Please note that expenses shown in the table are meant to highlight ongoing costs and do not reflect

any transaction costs, such as sales charges. Therefore, the second line for each class is useful in

comparing ongoing costs only, and will not help you compare total costs of owning different

funds. In addition, if transaction costs were included, your total costs would have been higher.

Please refer to the Fund prospectus for additional information on operating expenses.

*Expenses are calculated using the most recent six-month expense ratio, annualized for each class (A: 1.21%; C: 1.91%; R: 1.41%; and

Advisor: 0.91%), multiplied by the average account value over the period, multiplied by 181/365 to reflect the one-half year period.

50 | Semiannual Report

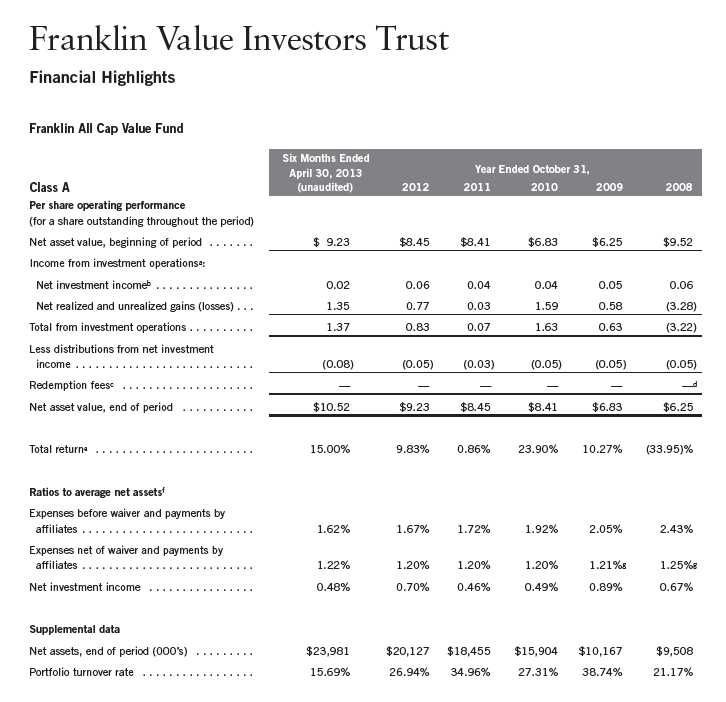

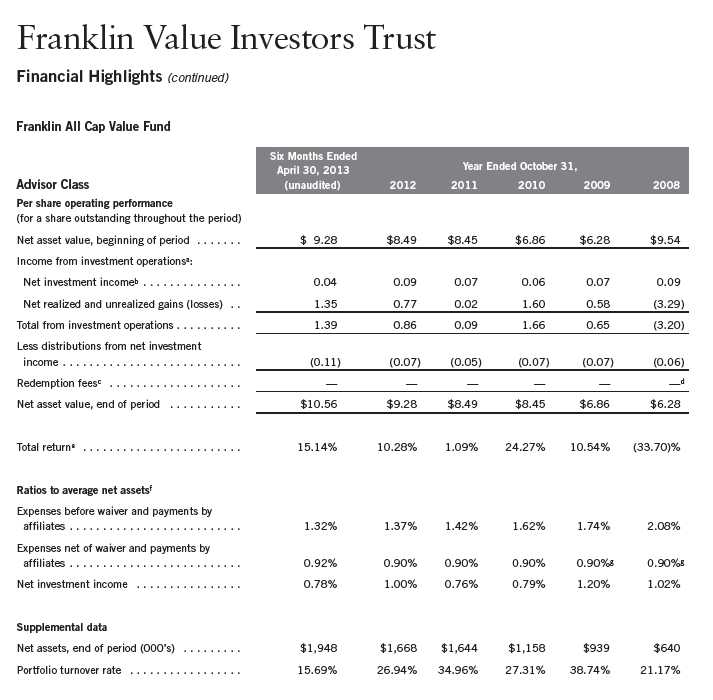

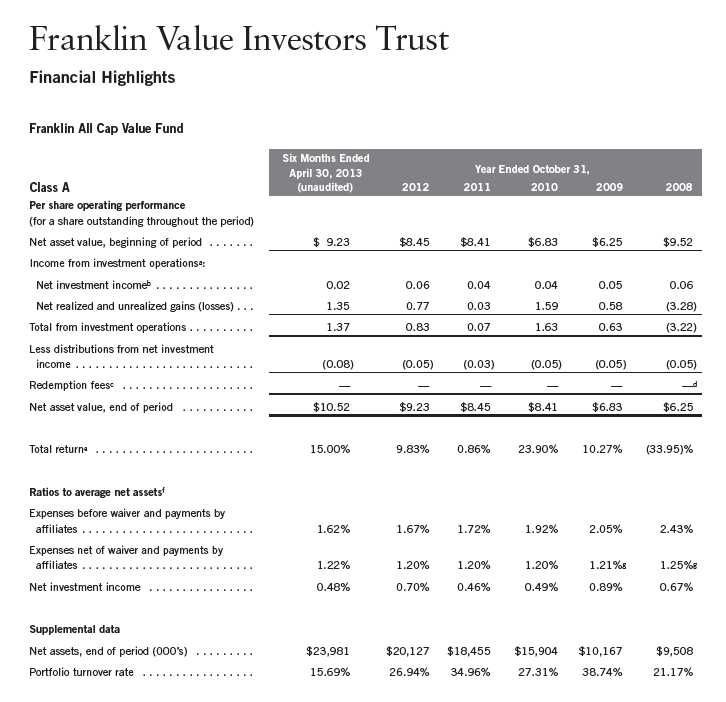

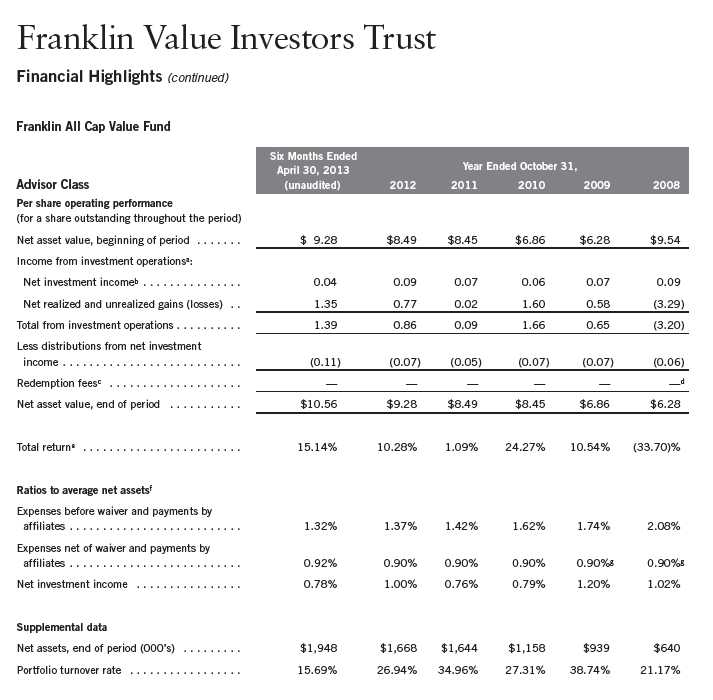

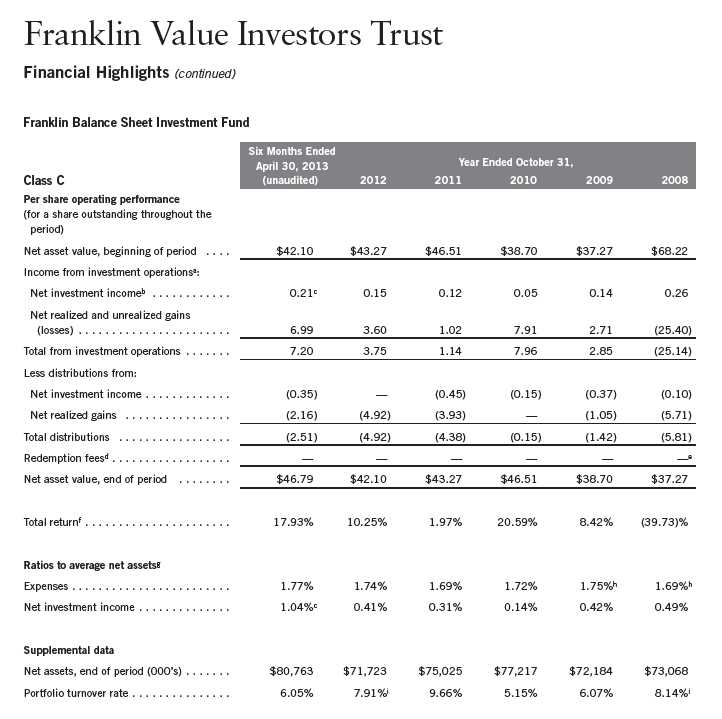

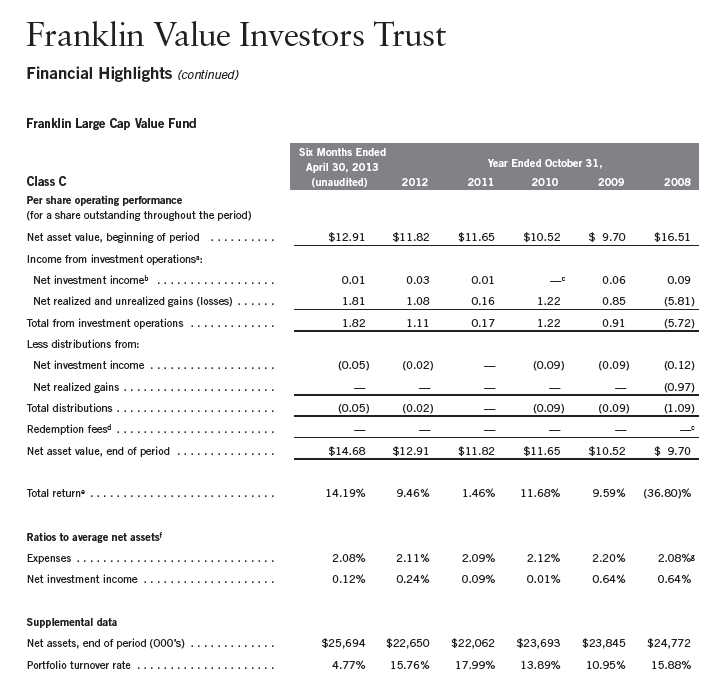

aThe amount shown for a share outstanding throughout the period may not correlate with the Statement of Operations for the period due to the timing of sales and repurchases of

the Fund shares in relation to income earned and/or fluctuating market value of the investments of the Fund.

bBased on average daily shares outstanding.

cEffective September 1, 2008, the redemption fee was eliminated.

dAmount rounds to less than $0.01 per share.

eTotal return does not reflect sales commissions or contingent deferred sales charges, if applicable, and is not annualized for periods less than one year.

fRatios are annualized for periods less than one year.

gBenefit of expense reduction rounds to less than 0.01%.

Semiannual Report | The accompanying notes are an integral part of these financial statements. | 51

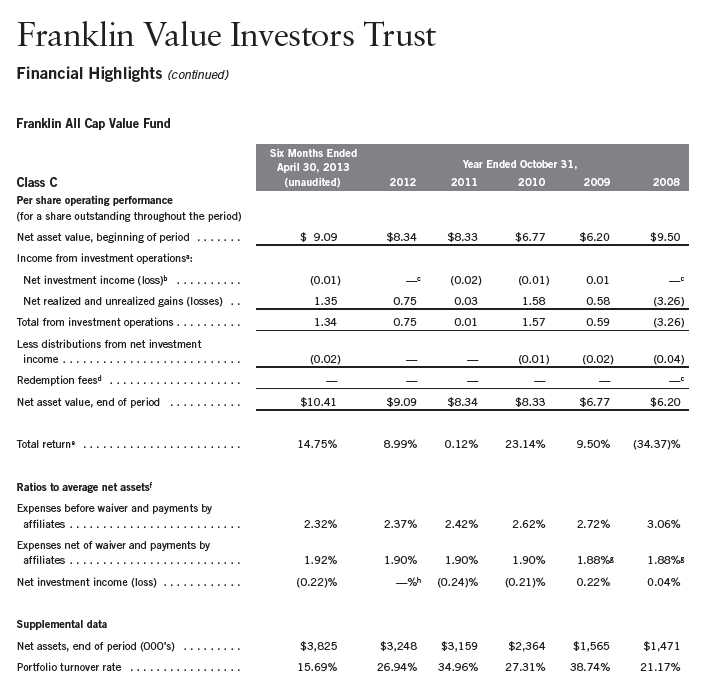

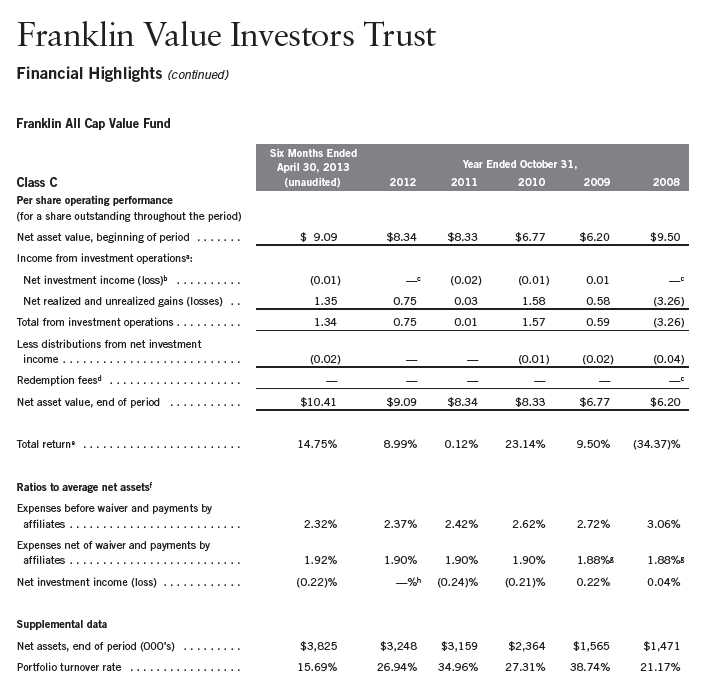

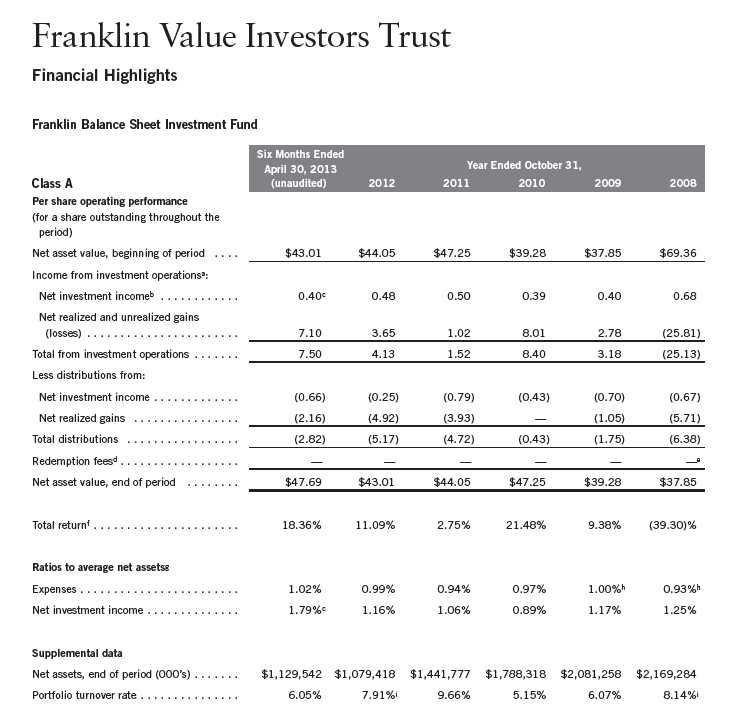

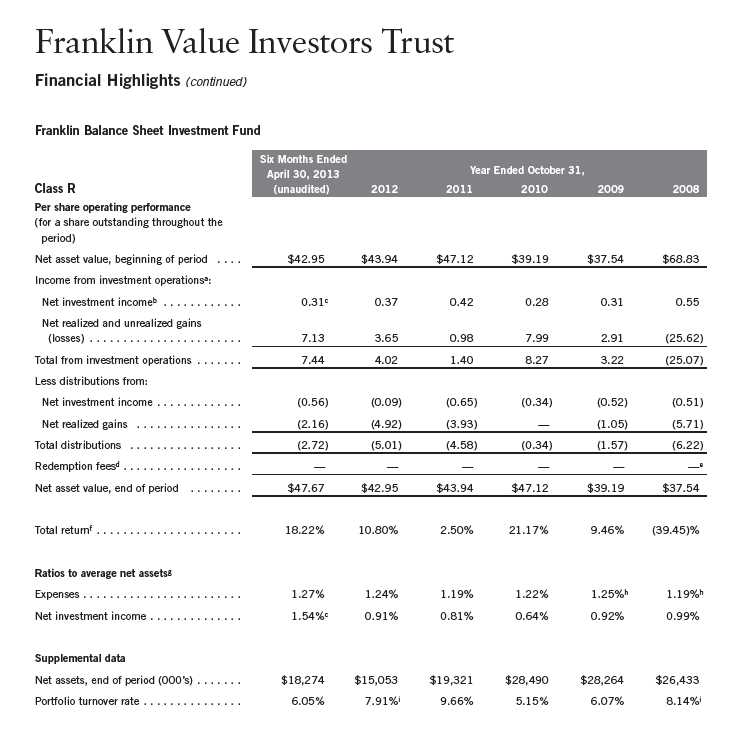

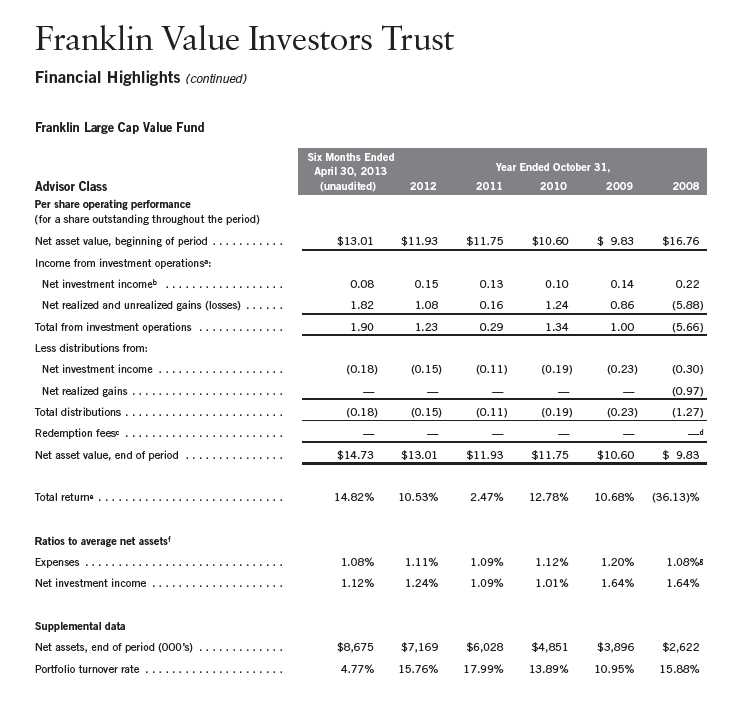

aThe amount shown for a share outstanding throughout the period may not correlate with the Statement of Operations for the period due to the timing of sales and repurchases of

the Fund shares in relation to income earned and/or fluctuating market value of the investments of the Fund.

bBased on average daily shares outstanding.

cAmount rounds to less than $0.01 per share.

dEffective September 1, 2008, the redemption fee was eliminated.

eTotal return does not reflect sales commissions or contingent deferred sales charges, if applicable, and is not annualized for periods less than one year.

fRatios are annualized for periods less than one year.

gBenefit of expense reduction rounds to less than 0.01%.

hRounds to less than 0.01%.

52 | The accompanying notes are an integral part of these financial statements. | Semiannual Report

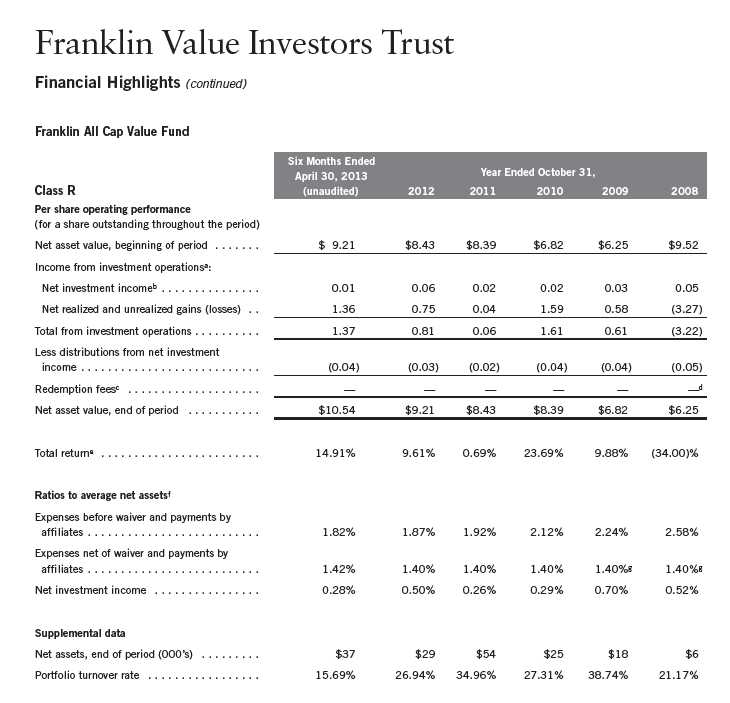

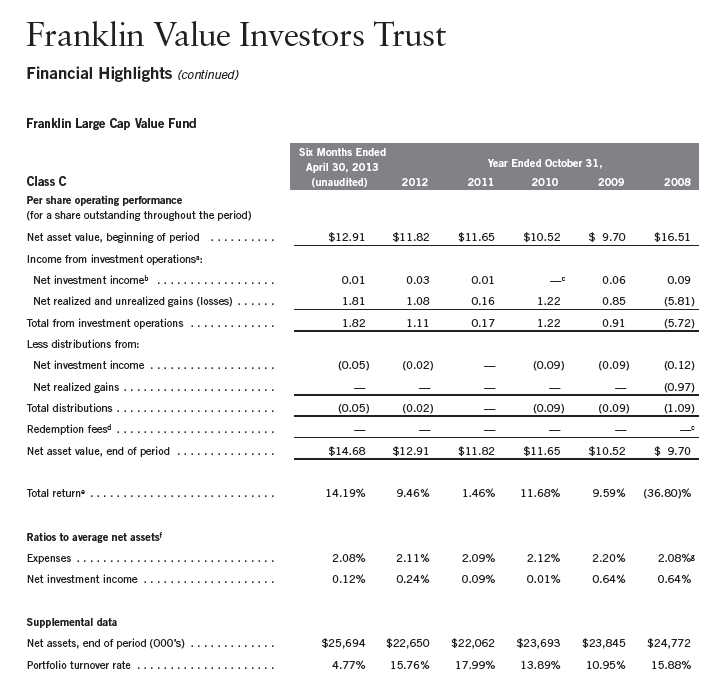

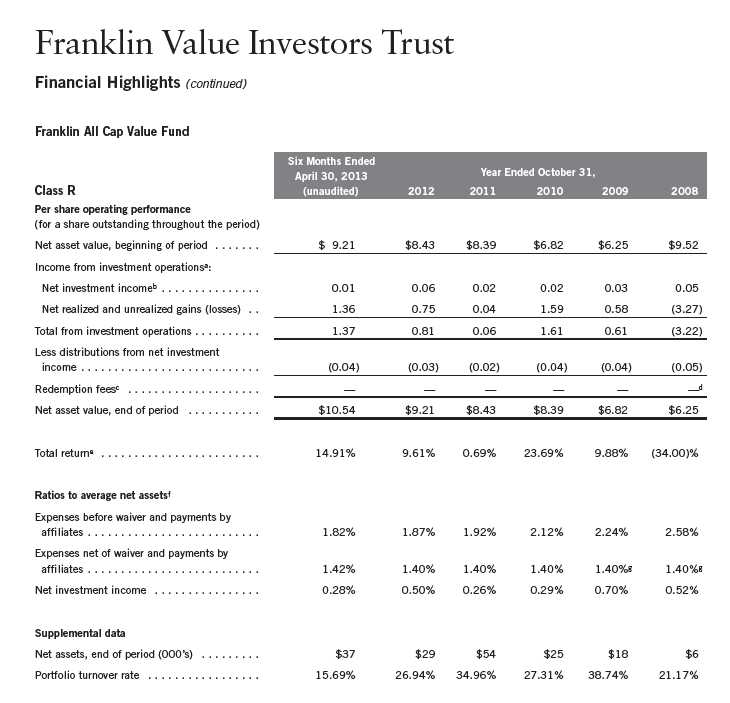

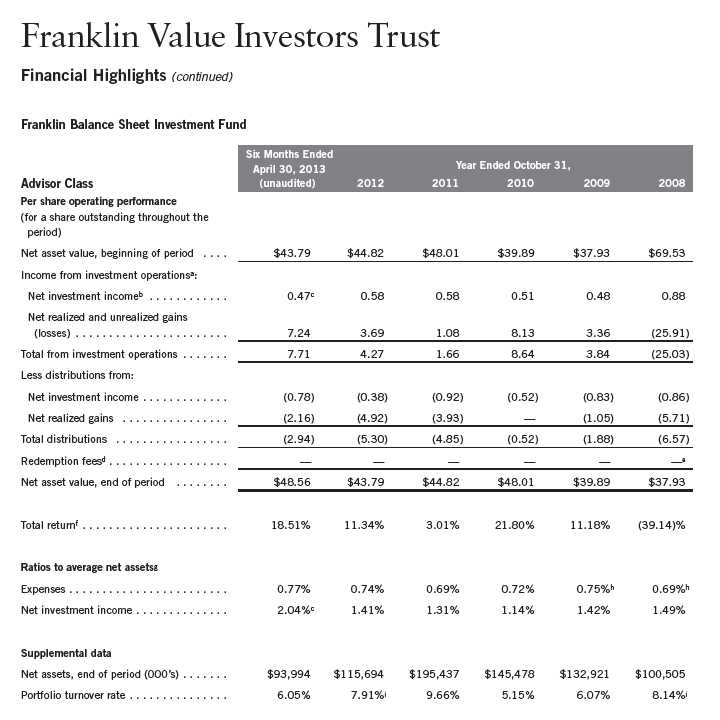

aThe amount shown for a share outstanding throughout the period may not correlate with the Statement of Operations for the period due to the timing of sales and repurchases of

the Fund shares in relation to income earned and/or fluctuating market value of the investments of the Fund.

bBased on average daily shares outstanding.

cEffective September 1, 2008, the redemption fee was eliminated.

dAmount rounds to less than $0.01 per share.

eTotal return does not reflect sales commissions or contingent deferred sales charges, if applicable, and is not annualized for periods less than one year.

fRatios are annualized for periods less than one year.

gBenefit of expense reduction rounds to less than 0.01%.

Semiannual Report | The accompanying notes are an integral part of these financial statements. | 53

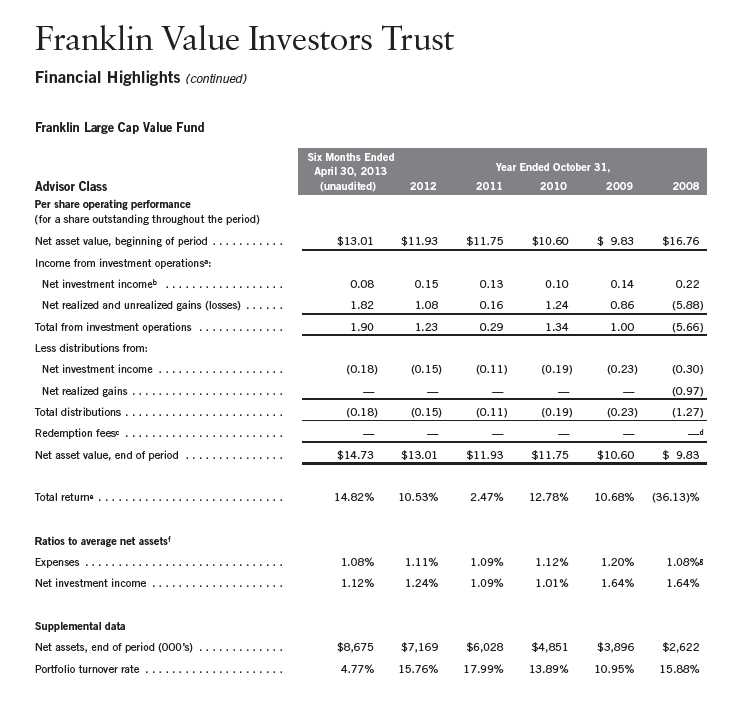

aThe amount shown for a share outstanding throughout the period may not correlate with the Statement of Operations for the period due to the timing of sales and repurchases of

the Fund shares in relation to income earned and/or fluctuating market value of the investments of the Fund.

bBased on average daily shares outstanding.

cEffective September 1, 2008, the redemption fee was eliminated.

dAmount rounds to less than $0.01 per share.

eTotal return is not annualized for periods less than one year.

fRatios are annualized for periods less than one year.

gBenefit of expense reduction rounds to less than 0.01%.

54 | The accompanying notes are an integral part of these financial statements. | Semiannual Report

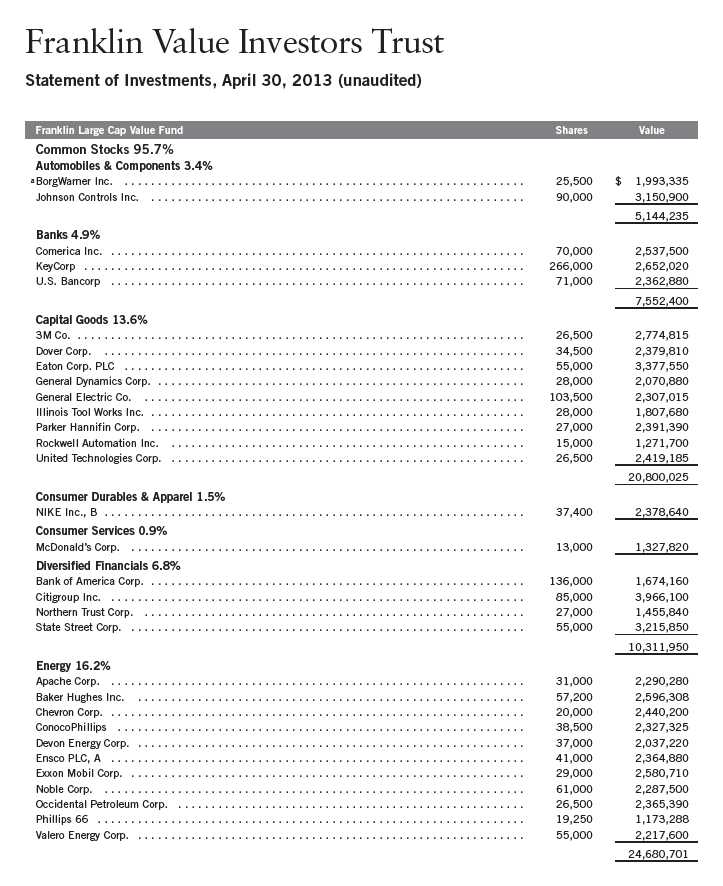

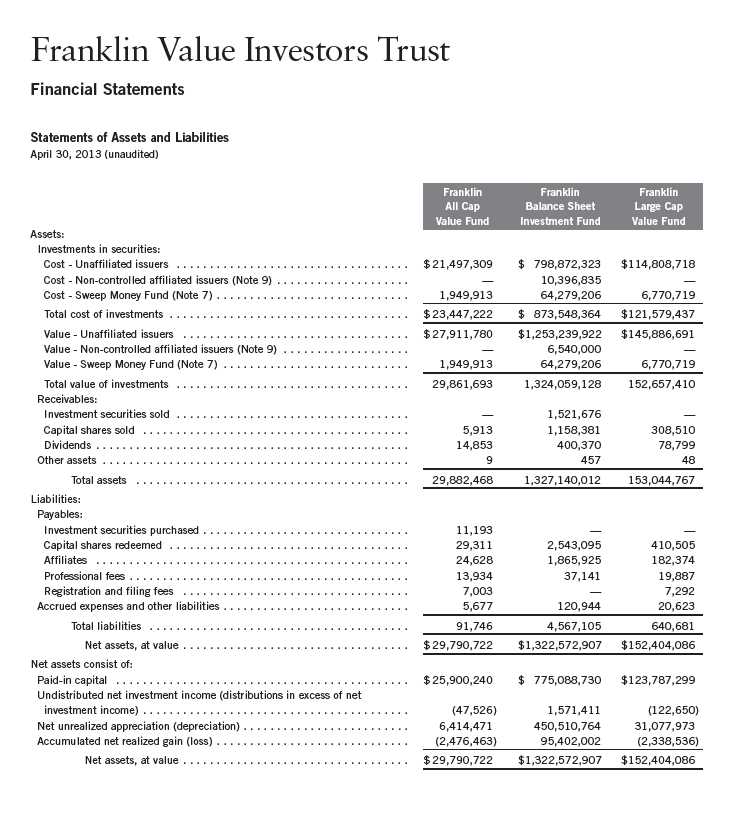

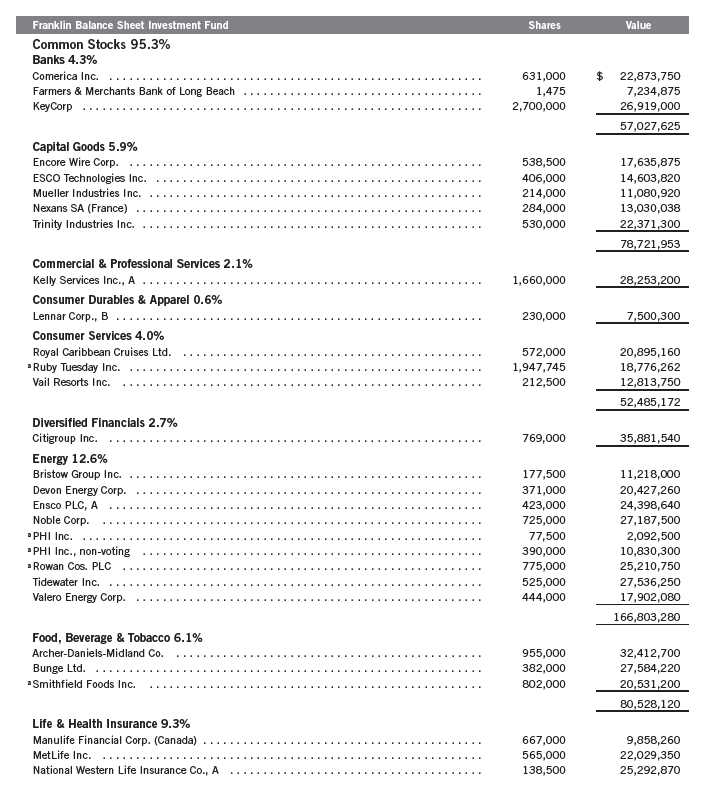

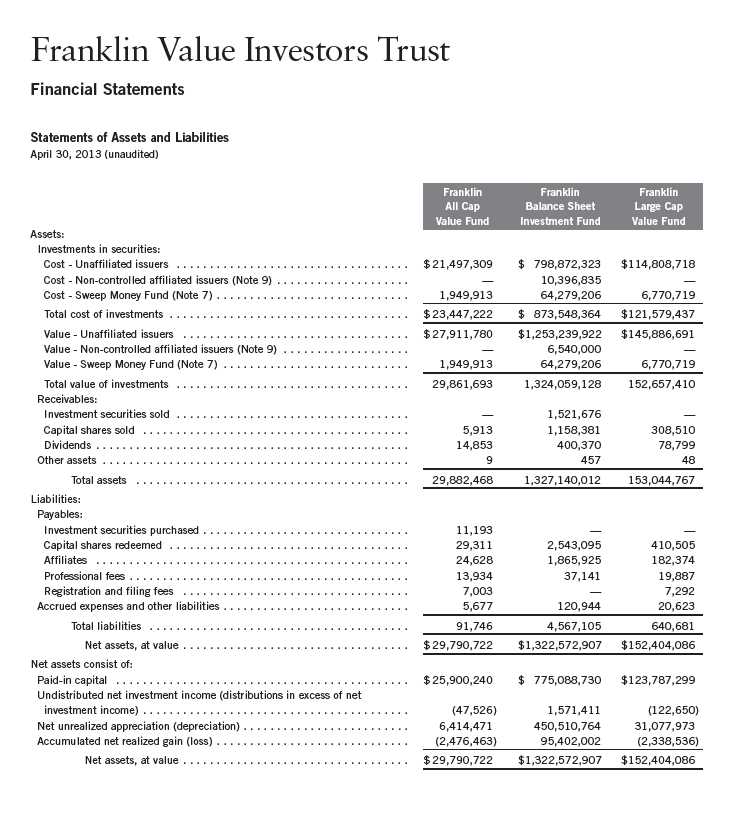

Franklin Value Investors Trust

Statement of Investments, April 30, 2013 (unaudited)

Semiannual Report | 55

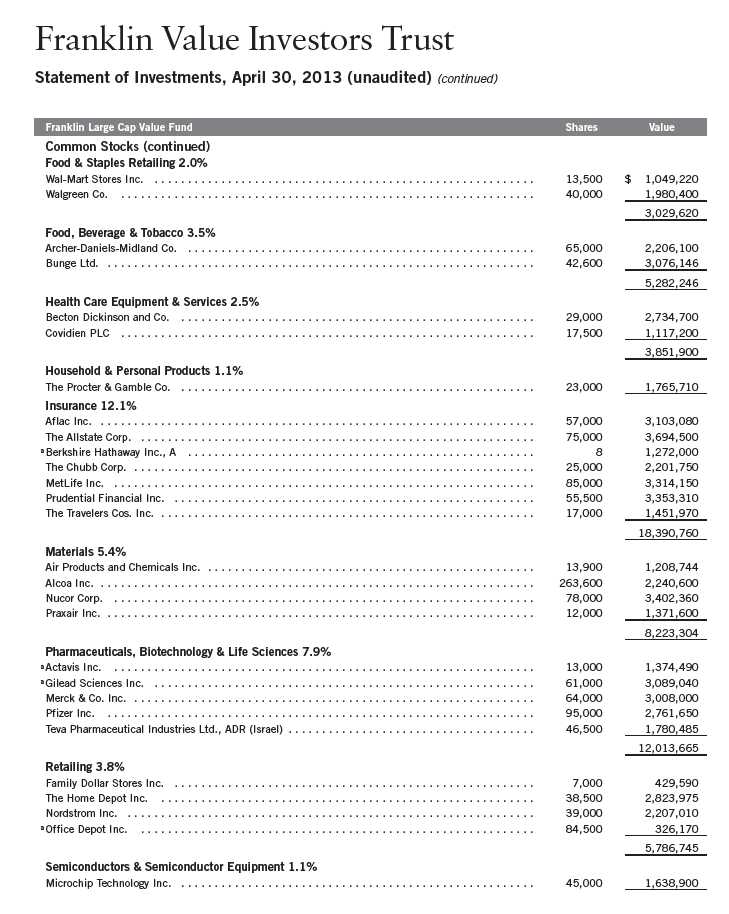

Franklin Value Investors Trust

Statement of Investments, April 30, 2013 (unaudited) (continued)

56 | Semiannual Report

Semiannual Report | The accompanying notes are an integral part of these financial statements. | 57