UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, DC 20549

FORM N-CSRS

CERTIFIED SHAREHOLDER REPORT OF REGISTERED MANAGEMENT INVESTMENT

COMPANIES

Investment Company Act file number 811-05878

Franklin Value Investors Trust___

(Exact name of registrant as specified in charter)

__One Franklin Parkway, San Mateo, CA 94403-1906_

(Address of principal executive offices) (Zip code)

Craig S. Tyle, One Franklin Parkway, San Mateo, CA 94403-1906_

(Name and address of agent for service)

Registrant's telephone number, including area Code: (650) 312-2000

Date of fiscal year end: 10/31

Date of reporting period: 4/30/16

Item 1. Reports to Stockholders.

.

| |

| Contents | |

| |

| Semiannual Report | |

| Economic and Market Overview | 3 |

| Franklin Balance Sheet Investment Fund | 4 |

| Franklin Large Cap Value Fund | 12 |

| Franklin MicroCap Value Fund | 20 |

| Franklin MidCap Value Fund | 26 |

| Franklin Small Cap Value Fund | 34 |

| Financial Highlights and Statements of Investments | 42 |

| Financial Statements | 82 |

| Notes to Financial Statements | 91 |

| Shareholder Information | 109 |

Visit franklintempleton.com for fund updates, to access your account, or to find helpful financial planning tools.

franklintempleton.com

Semiannual Report

Economic and Market Overview

The U.S. economy moderated in 2015’s fourth quarter and slowed further in 2016’s first quarter as exports, business investment and federal government spending declined. The manufacturing sector expanded in March and April after contracting for five consecutive months, while the services sector expanded throughout the six-month period under review. Growth in services contributed to new jobs and helped the unemployment rate to be largely stable at 5.0% throughout the review period.1 Home sales and prices rose amid relatively low mortgage rates. Monthly retail sales grew during most of the review period and rose to the highest level in April in more than a year, driven mainly by automobile sales. Inflation, as measured by the Consumer Price Index, remained relatively subdued due to low energy prices.

After maintaining a near-zero interest rate for seven years to support the U.S. economy’s recovery, the U.S. Federal Reserve (Fed) raised its target range for the federal funds rate to 0.25%–0.50% at its December meeting. At the time of the increase, policymakers cited the labor market’s considerable improvement and were reasonably confident that inflation would move back to the Fed’s 2.00% medium-term objective. The Fed maintained the rate through period-end, indicating it would monitor domestic and global developments and their implications on the labor markets as it tracks actual and expected progression toward its employment and inflation goals.

U.S. stock markets experienced sell-offs during the period under review, resulting from investor concerns about the timing of the Fed’s interest rate increases, global economic growth, China’s slowing economy and tumbling stock market, geopolitical tensions in certain regions and a plunge in crude oil prices. Investors generally remained confident, however as the Fed remained cautious about further interest rate increases, the eurozone economy improved, the European Central Bank expanded its quantitative easing measures and cut its benchmark interest rate to zero, the People’s Bank of China introduced further easing measures, and the Bank of Japan adopted a negative interest rate policy. The rally in crude oil prices toward period-end also boosted investor sentiment. Despite periods of volatility, the broad U.S. stock market ended the six-month period relatively flat, as measured by the Standard & Poor’s® 500 Index.

The foregoing information reflects our analysis and opinions as of April 30, 2016. The information is not a complete analysis of every aspect of any market, country, industry, security or fund. Statements of fact are from sources considered reliable.

1. Source: Bureau of Labor Statistics.

franklintempleton.com

Semiannual Report 3

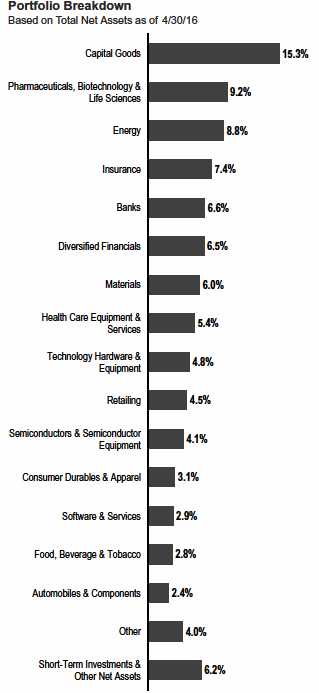

Franklin Balance Sheet Investment Fund

This semiannual report for Franklin Balance Sheet Investment Fund covers the period ended April 30, 2016.

Your Fund’s Goal and Main Investments

The Fund seeks high total return, of which capital appreciation and income are components, by investing most of its assets in equity securities of companies of any size that we believe are undervalued in the marketplace at the time of purchase but have the potential for capital appreciation.

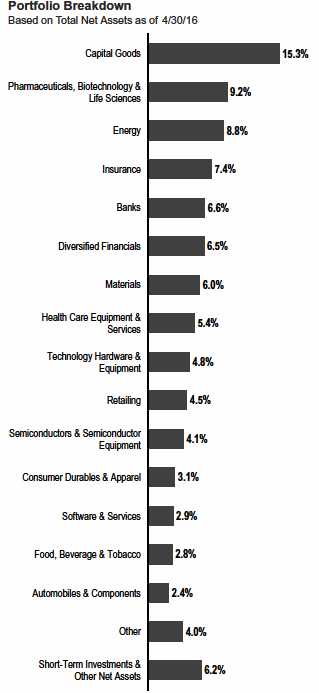

Performance Overview

The Fund’s Class A shares delivered a +1.11% cumulative total return for the six months under review. In comparison, the Russell 3000® Value Index, which measures performance of those Russell 3000® Index companies with lower price-to-book ratios and lower forecasted growth values, generated a +1.87% total return for the same period.1 You can find the Fund’s long-term performance data in the Performance Summary beginning on page 7.

Performance data represent past performance, which does not guarantee future results. Investment return and principal value will fluctuate, and you may have a gain or loss when you sell your shares. Current performance may differ from figures shown. For most recent month-end performance, go to franklintempleton.com or call (800) 342-5236.

Investment Strategy

Our strategy uses low price-to-book value as its primary reference valuation measure. Book value per share is a company’s net worth or shareholders’ equity on an accounting or “book” basis, divided by shares outstanding. The equity securities bought by the Fund will typically be purchased at a low price relative to book value. This strategy is not aimed at short-term trading gains, and we do not adhere to the composition of the benchmark. Rather, we try to identify individual companies that meet our investment criteria, with a 3-5 year investment horizon.

Manager’s Discussion

During the six months under review, holdings that contributed to Fund performance included Fabrinet, ORBCOMM and Century Aluminum. Fabrinet manufactures optical components and benefited during the period from growing data traffic demand, which fueled global telecommunications and data center networks’ need for optical components upgrades. We believe the company should continue to benefit from these

1. Source: Morningstar.

The index is unmanaged and includes reinvestment of any income or distributions. They do not reflect any fees, expenses or sales charges. One cannot invest directly in an

index, and an index is not representative of the Fund’s portfolio.

See www.franklintempletondatasources.com for additional data provider information.

The dollar value, number of shares or principal amount, and names of all portfolio holdings are listed in the Fund’s Statement of Investments (SOI).

The SOI begins on page 47.

4 Semiannual Report

franklintempleton.com

FRANKLIN BALANCE SHEET INVESTMENT FUND

trends for several years, which could expand profit margins and further enhance an already robust balance sheet. Shares of ORBCOMM, a wireless messaging services provider, improved partly due to the successful launch of its next generation satellites. The company also completed its decade-long capital expenditures program and subsequently stands to be free cash flow positive for the first time since 2006. Century Aluminum, an aluminum metal producer, improved its position as aluminum prices generally increased throughout the period. The company also implemented cost saving efficiencies and we believe these events should bode well for increased earnings and cash flows in the near term.

Detractors from Fund performance included National Western Life Group, Intrepid Potash and Citigroup. National Western Life Group, a life insurance provider, experienced lower earnings during the period as market volatility led to higher benefit costs in the company’s fixed-indexed annuities. The company also expected some temporary difficulties with its sales due to new U.S. Department of Labor regulations. The U.S. Federal Reserve’s decision to generally slow increasing rates also generally negatively impacted the life insurance industry. Intrepid Potash, a potash miner, continues to be plagued by its status as a high cost producer of potash. The domestic potash market is currently stressed by several issues including global over-supply of potash; a strong US dollar which encourages lower priced imports into the US; and weak demand from agricultural customers due to declining farm incomes. Intrepid is aggressively taking steps to mitigate losses from high cost production. Citigroup has made significant strides in recent years by fortifying its capital base and streamlining its operations, but as with most banking institutions, higher interest rates will be necessary for return on capital to move meaningfully higher. As the global economy continued to slow during the period, investor concerns surrounding a potential degrading credit quality reduced expectations for interest rates increases in 2016.

During the reporting period, several large new purchases included JP Morgan Chase, an investment banking services provider; Terex Corp, a machinery manufacturer; Marathon Oil, a liquid hydrocarbons and natural gas producer; Helmerich & Payne, an oil and gas drilling company; and Astec Industries, a construction equipment manufacturer; among several others. We also added to existing positions including Regal Beloit, an electric and mechanical products manufacturer; Chevron, an oil and gas company; and Devon Energy, an independent oil and gas exploration and production company. In contrast, the Fund’s largest liquidations included Apache Corp, Rofin-Sinar Technologies and Allegheny Technologies. We also reduced several holdings including KeyCorp, E-L Financial and Fresh Del Monte Produce. Additionally, StanCorp Financial’s acquisition by Meiji Yasuda Life Insurance was completed.

Thank you for your continued participation in Franklin Balance Sheet Investment Fund. We look forward to continuing to serve your investment needs.

| | |

| Top 10 Holdings | | |

| 4/30/16 | | |

| Company | % of Total | |

| Sector/Industry | Net Assets | |

| Corning Inc. | 3.7 | % |

| Technology Hardware & Equipment | | |

| First Solar Inc. | 3.0 | % |

| Semiconductors & Semiconductor Equipment | | |

| Photronics Inc. | 2.5 | % |

| Semiconductors & Semiconductor Equipment | | |

| Devon Energy Corp. | 2.5 | % |

| Energy | | |

| Fabrinet (Thailand) | 2.2 | % |

| Technology Hardware & Equipment | | |

| MKS Instruments Inc. | 2.1 | % |

| Semiconductors & Semiconductor Equipment | | |

| Encore Wire Corp. | 2.1 | % |

| Capital Goods | | |

| Citizens Financial Group Inc. | 2.0 | % |

| Banks | | |

| The Travelers Cos. Inc. | 1.9 | % |

| Property & Casualty Insurance | | |

| Bio-Rad Laboratories Inc. | 1.9 | % |

| Pharmaceuticals, Biotechnology & Life Sciences | | |

Bruce C. Baughman, CPA

Donald G. Taylor, CPA

Portfolio Management Team

franklintempleton.com

Semiannual Report 5

FRANKLIN BALANCE SHEET INVESTMENT FUND

The foregoing information reflects our analysis, opinions and portfolio holdings as of April 30, 2016, the end of the reporting period. The way we implement our main investment strategies and the resulting portfolio holdings may change depending on factors such as market and economic conditions. These opinions may not be relied upon as investment advice or an offer for a particular security. The information is not a complete analysis of every aspect of any market, country, industry, security or the Fund. Statements of fact are from sources considered reliable, but the investment manager makes no representation or warranty as to their completeness or accuracy. Although historical performance is no guarantee of future results, these insights may help you understand our investment management philosophy.

6 Semiannual Report

franklintempleton.com

FRANKLIN BALANCE SHEET INVESTMENT FUND

Performance Summary as of April 30, 2016

Your dividend income will vary depending on dividends or interest paid by securities in the Fund’s portfolio, adjusted for operating expenses of each class. Capital gain distributions are net profits realized from the sale of portfolio securities. The performance table does not reflect any taxes that a shareholder would pay on Fund dividends, capital gain distributions, if any, or any realized gains on the sale of Fund shares. Total return reflects reinvestment of the Fund’s dividends and capital gain distributions, if any, and any unrealized gains or losses.

| | | | | | |

| Net Asset Value | | | | | | |

| Share Class (Symbol) | | 4/30/16 | | 10/31/15 | | Change |

| A (FRBSX) | $ | 34.27 | $ | 40.06 | -$ | 5.79 |

| C (FCBSX) | $ | 33.05 | $ | 38.70 | -$ | 5.65 |

| R (FBSRX) | $ | 34.33 | $ | 40.06 | -$ | 5.73 |

| R6 (FBSIX) | $ | 35.19 | $ | 41.10 | -$ | 5.91 |

| Advisor (FBSAX) | $ | 35.24 | $ | 41.08 | -$ | 5.84 |

| |

| |

| Distributions1 (11/1/15–4/30/16) | | | | | | |

| | | Dividend | | Long-Term | | |

| Share Class | | Income | | Capital Gain | | Total |

| A | $ | 0.2796 | $ | 5.7721 | $ | 6.0517 |

| C | | — | $ | 5.7721 | $ | 5.7721 |

| R | $ | 0.1698 | $ | 5.7721 | $ | 5.9419 |

| R6 | $ | 0.4800 | $ | 5.7721 | $ | 6.2521 |

| Advisor | $ | 0.3673 | $ | 5.7721 | $ | 6.1394 |

See page 9 for Performance Summary footnotes.

franklintempleton.com

Semiannual Report 7

FRANKLIN BALANCE SHEET INVESTMENT FUND

PERFORMANCE SUMMARY

Performance as of 4/30/162

Cumulative total return excludes sales charges. Average annual total returns and value of $10,000 investment include maximum sales charges. Class A: 5.75% maximum initial sales charge; Class C: 1% contingent deferred sales charge in first year only;

Class R/R6/Advisor Class: no sales charges.

| | | | | | | | | | | | |

| | | | | | | Value of | Average Annual | | Total Annual Operating Expenses7 | |

| | Cumulative | | Average Annual | | $ | 10,000 | Total Return | | | | | |

| Share Class | Total Return3 | | Total Return4 | | | Investment5 | (3/31/16 | )6 | (with waiver) | | (without waiver) | |

| A | | | | | | | | | 0.95 | % | 0.96 | % |

| 6-Month | +1.11 | % | -4.69 | % | $ | 9,531 | | | | | | |

| 1-Year | -5.32 | % | -10.76 | % | $ | 8,924 | -10.42 | % | | | | |

| 5-Year | +29.92 | % | +4.14 | % | $ | 12,246 | +3.96 | % | | | | |

| 10-Year | +34.26 | % | +2.38 | % | $ | 12,654 | +2.35 | % | | | | |

| C | | | | | | | | | 1.70 | % | 1.71 | % |

| 6-Month | +0.72 | % | -0.13 | % | $ | 9,987 | | | | | | |

| 1-Year | -6.03 | % | -6.82 | % | $ | 9,318 | -6.47 | % | | | | |

| 5-Year | +25.17 | % | +4.59 | % | $ | 12,517 | +4.41 | % | | | | |

| 10-Year | +24.43 | % | +2.21 | % | $ | 12,443 | +2.18 | % | | | | |

| R | | | | | | | | | 1.20 | % | 1.21 | % |

| 6-Month | +0.96 | % | +0.96 | % | $ | 10,096 | | | | | | |

| 1-Year | -5.57 | % | -5.57 | % | $ | 9,443 | -5.20 | % | | | | |

| 5-Year | +28.32 | % | +5.11 | % | $ | 12,832 | +4.93 | % | | | | |

| 10-Year | +31.35 | % | +2.76 | % | $ | 13,135 | +2.73 | % | | | | |

| R6 | | | | | | | | | 0.51 | % | 0.52 | % |

| 6-Month | +1.35 | % | +1.35 | % | $ | 10,135 | | | | | | |

| 1-Year | -4.90 | % | -4.90 | % | $ | 9,510 | -4.54 | % | | | | |

| Since Inception (5/1/13) | +16.18 | % | +5.13 | % | $ | 11,618 | +4.70 | % | | | | |

| Advisor | | | | | | | | | 0.70 | % | 0.71 | % |

| 6-Month | +1.22 | % | +1.22 | % | $ | 10,122 | | | | | | |

| 1-Year | -5.11 | % | -5.11 | % | $ | 9,489 | -4.74 | % | | | | |

| 5-Year | +31.51 | % | +5.63 | % | $ | 13,151 | +5.45 | % | | | | |

| 10-Year | +39.53 | % | +3.39 | % | $ | 13,953 | +3.35 | % | | | | |

Performance data represent past performance, which does not guarantee future results. Investment return and principal value will fluctuate, and you may have a gain or loss when you sell your shares. Current performance may differ from figures shown. For most recent month-end performance, go to franklintempleton.com or call (800) 342-5236.

See page 9 for Performance Summary footnotes.

8 Semiannual Report

franklintempleton.com

FRANKLIN BALANCE SHEET INVESTMENT FUND

PERFORMANCE SUMMARY

All investments involve risks, including possible loss of principal. Value securities may not increase in price as anticipated or may decline further in value. While smaller and midsize companies may offer substantial opportunities for capital growth, they also involve heightened risks and should be considered speculative. Historically, smaller and midsize company securities have been more volatile in price than larger company securities, especially over the short term. The Fund may invest up to 25% of its total assets in foreign securities, which may involve special risks, including currency fluctuations and economic and political uncertainty. The Fund is actively managed but there is no guarantee that the manager’s investment decisions will produce the desired results. The Fund’s prospectus also includes a description of the main investment risks.

| |

| Class C: | These shares have higher annual fees and expenses than Class A shares. |

| Class R: | Shares are available to certain eligible investors as described in the prospectus. These shares have higher annual fees and expenses than Class A shares. |

| Class R6: | Shares are available to certain eligible investors as described in the prospectus. |

| Advisor Class: | Shares are available to certain eligible investors as described in the prospectus. |

1. The distribution amount is the sum of the dividend payments to shareholders for the period shown and includes only estimated tax-basis net investment income and capital

gain.

2. The Fund has a fee waiver associated with any investment in a Franklin Templeton money fund, contractually guaranteed through at least its current fiscal year-end. Fund

investment results reflect the fee waiver; without this reduction, the results would have been lower.

3. Cumulative total return represents the change in value of an investment over the periods indicated.

4. Average annual total return represents the average annual change in value of an investment over the periods indicated. Return for less than one year, ifany,hasnotbeen

annualized.

5. These figures represent the value of a hypothetical $10,000 investment in the Fund over the periods indicated.

6. In accordance with SEC rules, we provide standardized average annual total return information through the latest calendar quarter.

7. Figures are as stated in the Fund’s current prospectus and may differ from the expense ratios disclosed in the Financial Highlights in this report. In periods of market volatility,

assets may decline significantly, causing total annual Fund operating expenses to become higher than the figures shown.

franklintempleton.com

Semiannual Report 9

FRANKLIN BALANCE SHEET INVESTMENT FUND

Your Fund’s Expenses

As a Fund shareholder, you can incur two types of costs:

- Transaction costs, including sales charges (loads) on Fund purchases; and

- Ongoing Fund costs, including management fees, distribution and service (12b-1) fees, and other Fund expenses. All mutual funds have ongoing costs, sometimes referred to as operating expenses.

The following table shows ongoing costs of investing in the Fund and can help you understand these costs and compare them with those of other mutual funds. The table assumes a $1,000 investment held for the six months indicated.

Actual Fund Expenses

The first line (Actual) for each share class listed in the table provides actual account values and expenses. The “Ending Account Value” is derived from the Fund’s actual return, which includes the effect of Fund expenses.

You can estimate the expenses you paid during the period by following these steps. Of course, your account value and expenses will differ from those in this illustration:

| 1. | Divide your account value by $1,000. |

| | If an account had an $8,600 value, then $8,600 ÷ $1,000 = 8.6. |

| 2. | Multiply the result by the number under the heading “Expenses Paid During Period.” |

| | If Expenses Paid During Period were $7.50, then 8.6 x $7.50 = $64.50. |

In this illustration, the estimated expenses paid this period are $64.50.

Hypothetical Example for Comparison with Other Funds

Information in the second line (Hypothetical) for each class in the table can help you compare ongoing costs of investing in the Fund with those of other mutual funds. This information may not be used to estimate the actual ending account balance or expenses you paid during the period. The hypothetical “Ending Account Value” is based on the actual expense ratio for each class and an assumed 5% annual rate of return before expenses, which does not represent the Fund’s actual return. The figure under the heading “Expenses Paid During Period” shows the hypothetical expenses your account would have incurred under this scenario. You can compare this figure with the 5% hypothetical examples that appear in shareholder reports of other funds.

Please note that expenses shown in the table are meant to highlight ongoing costs and do not reflect any transaction costs, such as sales charges. Therefore, the second line for each class is useful in comparing ongoing costs only, and will not help you compare total costs of owning different funds. In addition, if transaction costs were included, your total costs would have been higher. Please refer to the Fund prospectus for additional information on operating expenses.

10 Semiannual Report

franklintempleton.com

| | | | | | |

| | | | | FRANKLIN BALANCE SHEET INVESTMENT FUND |

| | | | | | | YOUR FUND’S EXPENSES |

| |

| |

| |

| | | Beginning Account | | Ending Account | | Expenses Paid During |

| Share Class | | Value 11/1/15 | | Value 4/30/16 | | Period* 11/1/15–4/30/16 |

| A | | | | | | |

| Actual | $ | 1,000 | $ | 1,011.10 | $ | 4.70 |

| Hypothetical (5% return before expenses) | $ | 1,000 | $ | 1,020.19 | $ | 4.72 |

| C | | | | | | |

| Actual | $ | 1,000 | $ | 1,007.20 | $ | 8.43 |

| Hypothetical (5% return before expenses) | $ | 1,000 | $ | 1,016.46 | $ | 8.47 |

| R | | | | | | |

| Actual | $ | 1,000 | $ | 1,009.60 | $ | 5.95 |

| Hypothetical (5% return before expenses) | $ | 1,000 | $ | 1,018.95 | $ | 5.97 |

| R6 | | | | | | |

| Actual | $ | 1,000 | $ | 1,013.50 | $ | 2.55 |

| Hypothetical (5% return before expenses) | $ | 1,000 | $ | 1,022.33 | $ | 2.56 |

| Advisor | | | | | | |

| Actual | $ | 1,000 | $ | 1,012.20 | $ | 3.45 |

| Hypothetical (5% return before expenses) | $ | 1,000 | $ | 1,021.43 | $ | 3.47 |

*Expenses are calculated using the most recent six-month expense ratio, net of expense waivers, annualized for each class (A: 0.94%;

C: 1.69%; R: 1.19%; R6: 0.51%; and Advisor: 0.69%), multiplied by the average account value over the period, multiplied by 182/366 to reflect

the one-half year period.

franklintempleton.com

Semiannual Report 11

Franklin Large Cap Value Fund

This semiannual report for Franklin Large Cap Value Fund covers the period ended April 30, 2016. As previously communicated, shareholders approved the reorganization of Franklin Large Cap Value Fund into Franklin Rising Dividends Fund. The transaction was completed on May 20, 2016, and shares of Franklin Large Cap Value Fund share classes A, C, R and Advisor were exchanged for shares in Franklin Rising Dividends Fund share classes A, C, R and Advisor, respectively.

Your Fund’s Goal and Main Investments

The Fund seeks long-term capital appreciation by investing at least 80% of its net assets in large capitalization companies that we believe are undervalued. We define large capitalization companies as those with market capitalizations that are similar in size at the time of purchase to those in the Russell 1000® Index.1

Performance Overview

The Fund’s Class A shares had a -3.86% cumulative total return for the six months under review. In comparison, the Russell 1000® Value Index, which measures performance of those Russell 1000® Index companies with lower price-to-book ratios and lower forecasted growth values, generated a +1.93% total return.2 You can find the Fund’s long-term performance data in the Performance Summary beginning on page 15.

Performance data represent past performance, which does not guarantee future results. Investment return and principal value will fluctuate, and you may have a gain or loss when you sell your shares. Current performance may differ from figures shown. For most recent month-end performance, go to franklintempleton.com or call (800) 342-5236.

Investment Strategy

We seek to invest in securities of large capitalization companies that we believe are selling below their underlying worth and hold them until they reach what we consider their fair market value. Our aim is to construct a diversified portfolio of fundamentally sound companies purchased at attractive prices, often when they are out of favor with other investors for reasons we believe are temporary. Portfolio securities are selected without regard to benchmark comparisons and are based on fundamental, bottom-up research focusing on several criteria, such as low price relative to earnings, cash flow or book value. We also consider stocks with recent sharp price declines that we believe still have significant growth potential or that possess valuable intangibles not reflected in the stock price.

Manager’s Discussion

During the six months under review, holdings that contributed to Fund performance included Albemarle, Eaton and Chevron. Shares of Albemarle, a specialty and fine chemicals producer, rebounded strongly over the period as general economic concerns waned and the company reported better-than-expected earnings. The company’s 2016 outlook was more cautious than anticipated, but ongoing strength in key businesses and expectations for a significant increase in free cash flow generation benefited the company. Additionally, Albemarle struck an agreement with the Chilean government that extended the duration of its lithium production. Eaton, a manufacturer of engineered products for the industrial, vehicle, construction and aerospace markets, benefited from better-than-expected earnings due to improved cost controls, along with signs of an improving operating environment. The company remains one of the cheapest among large cap industrials. Chevron, an oil and gas company, experienced a share price increase partly due to improving oil prices, capital spending cuts and an improved outlook regarding oil production in the near term.

Detractors from Fund performance included Perrigo, Western Digital and HollyFrontier. Shares of Perrigo, a manufacturer of over-the-counter pharmaceuticals, declined after a weak earnings report led by underperformance in its recently acquired subsidiary Omega. During the period, Omega announced a series of restructuring and leadership changes, but a failed hostile takeover by Mylan delayed implementation of these beneficial changes. We continue to believe Perrigo’s capabilities position it uniquely within the generics and over-the-counter categories. Western Digital, a data storage solutions provider, experienced a weaker-than-expected demand for hard disk drives due to a weak personal computer environment. Investor concerns surrounding the merits of its

1. The Russell 1000 Index is market capitalization weighted and measures performance of the largest companies in the Russell 3000 Index, which represents the majority of the

U.S. market’s total market capitalization.

2. Source: Morningstar.

The index is unmanaged and includes reinvestment of any income or distributions. They do not reflect any fees, expenses or sales charges. One cannot invest directly in an

index, and an index is not representative of the Fund’s portfolio.

See www.franklintempletondatasources.com for additional data provider information.

The dollar value, number of shares or principal amount, and names of all portfolio holdings are listed in the Fund’s Statement of Investments (SOI).

The SOI begins on page 54.

12 Semiannual Report

franklintempleton.com

FRANKLIN LARGE CAP VALUE FUND

SanDisk acquisition also hurt the company. Shares of petroleum refiner and marketer HollyFrontier declined as profit margins were negatively affected by the narrowing spread between U.S. crude oil prices and international benchmarks. We exited the position during the period.

During the reporting period, we initiated one new position in the aforementioned Perrigo, and we added to some positions

including QUALCOMM, a telecommunications products and services provider; Microsoft, a software provider and KKR & Company, an investment and private equity asset manager. In contrast, we liquidated several positions held by the Fund including Xerox, Comerica, SanDisk, Regions Financial and Bank of America, among others. We reduced holdings in some positions including First Solar, MetLife and Prudential.

Thank you for your participation in Franklin Large Cap Value Fund. It has been a pleasure serving your investment needs.

| | |

| Top 10 Holdings | | |

| 4/30/16 | | |

| Company | % of Total | |

| Sector/Industry | Net Assets | |

| Microsoft Corp. | 2.9 | % |

| Software & Services | | |

| Perrigo Co. PLC | 2.7 | % |

| Pharmaceuticals, Biotechnology & Life Sciences | | |

| Johnson Controls Inc. | 2.4 | % |

| Automobiles & Components | | |

| Aflac Inc. | 2.2 | % |

| Insurance | | |

| QUALCOMM Inc. | 2.2 | % |

| Semiconductors & Semiconductor Equipment | | |

| Becton, Dickinson and Co. | 2.2 | % |

| Health Care Equipment & Services | | |

| NIKE Inc. | 2.2 | % |

| Consumer Durables & Apparel | | |

| The Allstate Corp. | 2.1 | % |

| Insurance | | |

| General Dynamics Corp. | 2.1 | % |

| Capital Goods | | |

| Corning Inc. | 2.1 | % |

| Technology Hardware & Equipment | | |

William J. Lippman

Lead Portfolio Manager

Jakov Stipanov, CFA

Donald G. Taylor, CPA

Bruce C. Baughman, CPA

Portfolio Management Team

CFA® is a trademark owned by CFA Institute.

franklintempleton.com

Semiannual Report 13

FRANKLIN LARGE CAP VALUE FUND

The foregoing information reflects our analysis, opinions and portfolio holdings as of April 30, 2016, the end of the reporting period. The way we implement our main investment strategies and the resulting portfolio holdings may change depending on factors such as market and economic conditions. These opinions may not be relied upon as investment advice or an offer for a particular security. The information is not a complete analysis of every aspect of any market, country, industry, security or the Fund. Statements of fact are from sources considered reliable, but the investment manager makes no representation or warranty as to their completeness or accuracy. Although historical performance is no guarantee of future results, these insights may help you understand our investment management philosophy.

14 Semiannual Report

franklintempleton.com

FRANKLIN LARGE CAP VALUE FUND

Performance Summary as of April 30, 2016

Your dividend income will vary depending on dividends or interest paid by securities in the Fund’s portfolio, adjusted for operating expenses of each class. Capital gain distributions are net profits realized from the sale of portfolio securities. The performance table does not reflect any taxes that a shareholder would pay on Fund dividends, capital gain distributions, if any, or any realized gains on the sale of Fund shares. Total return reflects reinvestment of the Fund’s dividends and capital gain distributions, if any, and any unrealized gains or losses.

| | | | | | | | |

| Net Asset Value | | | | | | | | |

| Share Class (Symbol) | | 4/30/16 | | 10/31/15 | | Change | | |

| A (FLVAX) | $ | 15.61 | $ | 17.86 | -$ | 2.25 | | |

| C (FLCVX) | $ | 15.45 | $ | 17.61 | -$ | 2.16 | | |

| R (FLCRX) | $ | 15.50 | $ | 17.71 | -$ | 2.21 | | |

| Advisor (N/A) | $ | 15.53 | $ | 17.81 | -$ | 2.28 | | |

| |

| |

| Distributions1 (11/1/15–4/30/16) | | | | | | | | |

| | | Dividend | | Short-Term | | Long-Term | | |

| Share Class | | Income | | Capital Gain | | Capital Gain | | Total |

| A | $ | 0.1595 | $ | 0.0214 | $ | 1.3867 | $ | 1.5676 |

| C | $ | 0.0255 | $ | 0.0214 | $ | 1.3867 | $ | 1.4336 |

| R | $ | 0.1167 | $ | 0.0214 | $ | 1.3867 | $ | 1.5248 |

| Advisor | $ | 0.2125 | $ | 0.0214 | $ | 1.3867 | $ | 1.6206 |

See page 17 for Performance Summary footnotes.

franklintempleton.com

Semiannual Report 15

FRANKLIN LARGE CAP VALUE FUND

PERFORMANCE SUMMARY

Performance as of 4/30/162

Cumulative total return excludes sales charges. Average annual total returns and value of $10,000 investment include maximum sales charges. Class A: 5.75% maximum initial sales charge; Class C: 1% contingent deferred sales charge in first year only;

Class R/Advisor Class: no sales charges.

| | | | | | | | | | |

| | Cumulative | | Average Annual | | | Value of | Average Annual | | Total Annual | |

| Share Class | Total Return3 | | Total Return4 | | $ | 10,000 Investment5 | Total Return (3/31/16)6 | | Operating Expenses7 | |

| A | | | | | | | | | 1.28 | % |

| 6-Month | -3.86 | % | -9.39 | % | $ | 9,061 | | | | |

| 1-Year | -9.20 | % | -14.40 | % | $ | 8,560 | -14.25 | % | | |

| 5-Year | +31.93 | % | +4.46 | % | $ | 12,435 | +4.82 | % | | |

| 10-Year | +38.05 | % | +2.67 | % | $ | 13,009 | +2.88 | % | | |

| C | | | | | | | | | 2.03 | % |

| 6-Month | -4.19 | % | -5.07 | % | $ | 9,493 | | | | |

| 1-Year | -9.87 | % | -10.69 | % | $ | 8,931 | -10.51 | % | | |

| 5-Year | +27.36 | % | +4.96 | % | $ | 12,736 | +5.34 | % | | |

| 10-Year | +28.78 | % | +2.56 | % | $ | 12,878 | +2.78 | % | | |

| R | | | | | | | | | 1.53 | % |

| 6-Month | -3.91 | % | -3.91 | % | $ | 9,609 | | | | |

| 1-Year | -9.39 | % | -9.39 | % | $ | 9,061 | -9.27 | % | | |

| 5-Year | +30.56 | % | +5.48 | % | $ | 13,056 | +5.84 | % | | |

| 10-Year | +35.26 | % | +3.07 | % | $ | 13,526 | +3.28 | % | | |

| Advisor | | | | | | | | | 1.03 | % |

| 6-Month | -3.74 | % | -3.74 | % | $ | 9,626 | | | | |

| 1-Year | -8.95 | % | -8.95 | % | $ | 9,105 | -8.83 | % | | |

| 5-Year | +33.85 | % | +6.00 | % | $ | 13,385 | +6.38 | % | | |

| 10-Year | +42.20 | % | +3.58 | % | $ | 14,220 | +3.80 | % | | |

Performance data represent past performance, which does not guarantee future results. Investment return and principal value will fluctuate, and you may have a gain or loss when you sell your shares. Current performance may differ from figures shown. For most recent month-end performance, go to franklintempleton.com or call (800) 342-5236.

See page 17 for Performance Summary footnotes.

16 Semiannual Report

franklintempleton.com

FRANKLIN LARGE CAP VALUE FUND

PERFORMANCE SUMMARY

All investments involve risks, including possible loss of principal. Stock prices fluctuate, sometimes rapidly and dramatically, due to factors affecting individual companies, particular industries or sectors, or general market conditions. These price movements may result from factors affecting individual companies, industries or the securities market as a whole. The Fund may invest up to 25% of its total assets in foreign securities, which may involve special risks, including currency fluctuations and economic and political uncertainty. The Fund is actively managed but there is no guarantee that the manager’s investment decisions will produce the desired results. The Fund’s prospectus also includes a description of the main investment risks.

| |

| Class C: | These shares have higher annual fees and expenses than Class A shares. |

| Class R: | Shares are available to certain eligible investors as described in the prospectus. These shares have higher annual fees and expenses than Class A shares. |

| Advisor Class: | Shares are available to certain eligible investors as described in the prospectus. |

1. The distribution amount is the sum of the dividend payments to shareholders for the period shown and includes only estimated tax-basis net investment income and capital

gain.

2. The Fund has a fee waiver associated with any investment in a Franklin Templeton money fund, contractually guaranteed through at least its current fiscal year-end. Fund

investment results reflect the fee waiver, to the extent applicable; without this reduction, the results would have been lower.

3. Cumulative total return represents the change in value of an investment over the periods indicated.

4. Average annual total return represents the average annual change in value of an investment over the periods indicated. Return for less than one year, ifany,hasnotbeen

annualized.

5. These figures represent the value of a hypothetical $10,000 investment in the Fund over the periods indicated.

6. In accordance with SEC rules, we provide standardized average annual total return information through the latest calendar quarter.

7. Figures are as stated in the Fund’s current prospectus and may differ from the expense ratios disclosed in the Financial Highlights in this report. In periods of market volatility,

assets may decline significantly, causing total annual Fund operating expenses to become higher than the figures shown.

franklintempleton.com

Semiannual Report 17

FRANKLIN LARGE CAP VALUE FUND

Your Fund’s Expenses

As a Fund shareholder, you can incur two types of costs:

- Transaction costs, including sales charges (loads) on Fund purchases; and

- Ongoing Fund costs, including management fees, distribution and service (12b-1) fees, and other Fund expenses. All mutual funds have ongoing costs, sometimes referred to as operating expenses.

The following table shows ongoing costs of investing in the Fund and can help you understand these costs and compare them with those of other mutual funds. The table assumes a $1,000 investment held for the six months indicated.

Actual Fund Expenses

The first line (Actual) for each share class listed in the table provides actual account values and expenses. The “Ending Account Value” is derived from the Fund’s actual return, which includes the effect of Fund expenses.

You can estimate the expenses you paid during the period by following these steps. Of course, your account value and expenses will differ from those in this illustration:

| 1. | Divide your account value by $1,000. |

| | If an account had an $8,600 value, then $8,600 ÷ $1,000 = 8.6. |

| 2. | Multiply the result by the number under the heading “Expenses Paid During Period.” |

| | If Expenses Paid During Period were $7.50, then 8.6 x $7.50 = $64.50. |

In this illustration, the estimated expenses paid this period are $64.50.

Hypothetical Example for Comparison with Other Funds

Information in the second line (Hypothetical) for each class in the table can help you compare ongoing costs of investing in the Fund with those of other mutual funds. This information may not be used to estimate the actual ending account balance or expenses you paid during the period. The hypothetical “Ending Account Value” is based on the actual expense ratio for each class and an assumed 5% annual rate of return before expenses, which does not represent the Fund’s actual return. The figure under the heading “Expenses Paid During Period” shows the hypothetical expenses your account would have incurred under this scenario. You can compare this figure with the 5% hypothetical examples that appear in shareholder reports of other funds.

Please note that expenses shown in the table are meant to highlight ongoing costs and do not reflect any transaction costs, such as sales charges. Therefore, the second line for each class is useful in comparing ongoing costs only, and will not help you compare total costs of owning different funds. In addition, if transaction costs were included, your total costs would have been higher. Please refer to the Fund prospectus for additional information on operating expenses.

18 Semiannual Report

franklintempleton.com

| | | | | | |

| | | | | | | FRANKLIN LARGE CAP VALUE FUND |

| | | | | | | YOUR FUND’S EXPENSES |

| |

| |

| |

| | | Beginning Account | | Ending Account | | Expenses Paid During |

| Share Class | | Value 11/1/15 | | Value 4/30/16 | | Period* 11/1/15–4/30/16 |

| A | | | | | | |

| Actual | $ | 1,000 | $ | 961.40 | $ | 6.39 |

| Hypothetical (5% return before expenses) | $ | 1,000 | $ | 1,018.35 | $ | 6.57 |

| C | | | | | | |

| Actual | $ | 1,000 | $ | 958.10 | $ | 9.93 |

| Hypothetical (5% return before expenses) | $ | 1,000 | $ | 1,014.72 | $ | 10.22 |

| R | | | | | | |

| Actual | $ | 1,000 | $ | 960.90 | $ | 7.61 |

| Hypothetical (5% return before expenses) | $ | 1,000 | $ | 1,017.11 | $ | 7.82 |

| Advisor | | | | | | |

| Actual | $ | 1,000 | $ | 962.60 | $ | 5.17 |

| Hypothetical (5% return before expenses) | $ | 1,000 | $ | 1,019.59 | $ | 5.32 |

*Expenses are calculated using the most recent six-month expense ratio, net of expense waivers, annualized for each class (A: 1.31%;

C: 2.04%; R: 1.56%; and Advisor: 1.06%), multiplied by the average account value over the period, multiplied by 182/366 to reflect the

one-half year period.

franklintempleton.com

Semiannual Report 19

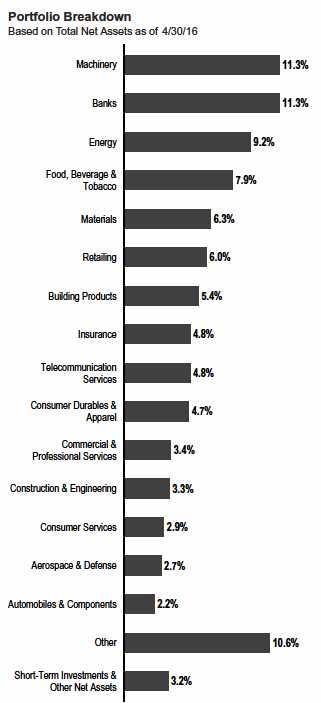

Franklin Microcap Value Fund

We are pleased to bring you Franklin MicroCap Value Fund’s semiannual report for the period ended April 30, 2016. The Fund closed to new investors (with the exception of certain retirement accounts) in January 2004 and has remained closed except for two days in mid-February 2013, when the Fund was opened on a limited basis. Existing shareholders may add to or reduce their investments in the Fund; however, once an account is reduced to zero, it may not be reopened unless the Fund reopens.

Your Fund’s Goal and Main Investments

The Fund seeks high total return, of which capital appreciation and income are components, by investing at least 80% of its net assets in securities of companies with market capitalizations under $500 million at the time of purchase that we believe are undervalued in the marketplace.1

Performance Overview

The Fund’s Class A shares delivered a +5.80% cumulative total return for the six months under review. In comparison, the Russell 2000® Value Index, which measures performance of those Russell 2000® Index companies with lower price-to-book ratios and lower forecasted growth values, had a +1.18% total return.2 You can find the Fund’s long-term performance data in the Performance Summary beginning on page 23.

Performance data represent past performance, which does not guarantee future results. Investment return and principal value will fluctuate, and you may have a gain or loss when you sell your shares. Current performance may differ from figures shown. For most recent month-end performance, go to franklintempleton.com or call (800) 342-5236.

Investment Strategy

Our strategy is to buy shares of financially sound, well-established companies at a low price-to-book value, where we have reasonable confidence that book value will increase over several years. We limit purchases to companies with market capitalizations of less than $500 million, which we define as “microcap.”1 Book value per share is a company’s net worth or shareholders’ equity on an accounting or “book” basis, divided by shares outstanding. This strategy is not aimed at short-term trading gains, nor do we consider the composition of any index. Rather, we try to identify individual companies that meet our investment criteria, and we assume at purchase that we will hold the positions for several years.

Manager’s Discussion

During the six months under review, holdings that contributed to Fund performance included Olympic Steel, Hardinge and Delta Apparel. Olympic Steel, which processes and distributes flat-rolled and tubular steel, is highly sensitive to import pricing, dollar strength and domestic end markets. Recent trade actions to counter the effects of low priced imports stand to improve Olympic Steel’s cash margins. Hardinge manufactures metal cutting and grinding machines in the U.S., Europe and China. Despite currency headwinds, profit margins and cash flow increased in the fourth quarter of 2015. In August 2015, Hardinge announced a strategic review, which it expects to complete in mid-2016 and could lead to the sale of the company. Delta Apparel manufactures leisure and athletic wear, both branded and private label, primarily t-shirts and fleece garments. Delta stabilized market share losses at the Soffe brand, and its Salt Life brand appears to be a growth engine. Management highlighted their outlook for continued higher earnings and cash flows in their February earnings call.

Detractors from Fund performance included Ardmore Shipping, Ducommun and Global Power Equipment Group. Shares of Ardmore Shipping, a product and chemical tanker fleet operator, declined as a combination of routine refinery maintenance and an unscheduled outage at ExxonMobil’s Beaumont, Texas, complex hurt results. Ducommun makes structural and electronic parts and assemblies primarily for aerospace and defense applications. The company’s program to deleverage following the 2011 LaBarge Technologies acquisition faltered in mid-2015, when cost overruns on contracts and other stumbles led to impairments and management changes. Global Power Equipment Group makes equipment and offers engineering services for the power generation industry. In May, 2015 the company delayed filing quarterly results and indicated it would restate prior results because of accounting errors. In August, Global Power disclosed the loss of a long-term contract with a large customer.

1. Effective 12/10/12, the maximum market capitalization for each investment that the Fund can invest in increased from $400 million at time of purchase to $500 million.

2. Source: Morningstar.

The index is unmanaged and includes reinvestment of any income or distributions. They do not reflect any fees, expenses or sales charges. One cannot invest directly in an

index, and an index is not representative of the Fund’s portfolio.

See www.franklintempletondatasources.com for additional data provider information.

The dollar value, number of shares or principal amount, and names of all portfolio holdings are listed in the Fund’s Statement of Investments (SOI).

The SOI begins on page 60.

20 Semiannual Report

franklintempleton.com

FRANKLIN MICROCAP VALUE FUND

By the end of April, 2016 the company still had not reported results for any period since 2014 and has not produced restated results for any period.

During the reporting period, we initiated several positions including Armstrong Flooring, a flooring products provider; ORBCOMM, a wireless messaging services provider; Schnitzer Steel Industries, a metals recycling operator; Global Ship Lease, a containership chartering company and Americas Car Mart, an automotive retailer. We also added to some positions including Northwest Pipe, a water pipe fabricator; Orion Marine Group, a marine construction services provider and Gulf Island Fabrication, a specialized steel structure manufacturer. We exited positions in Lydall, Midsouth BanCorp, Kelly Services, Leapfrog Enterprises and Dixie Group. The Fund reduced its holdings in several positions in response to price appreciation including Omega Protein, Gibraltar Industries and John B. SanFilippo & Son.

Thank you for your continued participation in Franklin MicroCap Value Fund. We look forward to continuing to serve your investment needs.

| | |

| Top 10 Holdings | | |

| 4/30/16 | | |

| Company | % of Total | |

| Sector/Industry | Net Assets | |

| Seneca Foods Corp. | 4.9 | % |

| Food, Beverage & Tobacco | | |

| Delta Apparel Inc. | 3.5 | % |

| Consumer Durables & Apparel | | |

| Hurco Cos. Inc. | 3.4 | % |

| Machinery | | |

| Hardinge Inc. | 3.3 | % |

| Machinery | | |

| Healthcare Services Group Inc. | 3.0 | % |

| Commercial & Professional Services | | |

| PHI Inc. | 2.8 | % |

| Energy | | |

| Bar Harbor Bankshares | 2.3 | % |

| Banks | | |

| Baldwin & Lyons Inc. | 2.3 | % |

| Insurance | | |

| Olympic Steel Inc. | 2.3 | % |

| Materials | | |

| Miller Industries Inc. | 2.2 | % |

| Machinery | | |

Bruce C. Baughman, CPA

Lead Portfolio Manager

Donald G. Taylor, CPA

Portfolio Management Team

franklintempleton.com

Semiannual Report 21

FRANKLIN MICROCAP VALUE FUND

The foregoing information reflects our analysis, opinions and portfolio holdings as of April 30, 2016, the end of the reporting period. The way we implement our main investment strategies and the resulting portfolio holdings may change depending on factors such as market and economic conditions. These opinions may not be relied upon as investment advice or an offer for a particular security. The information is not a complete analysis of every aspect of any market, country, industry, security or the Fund. Statements of fact are from sources considered reliable, but the investment manager makes no representation or warranty as to their completeness or accuracy. Although historical performance is no guarantee of future results, these insights may help you understand our investment management philosophy.

22 Semiannual Report

franklintempleton.com

FRANKLIN MICROCAP VALUE FUND

Performance Summary as of April 30, 2016

Your dividend income will vary depending on dividends or interest paid by securities in the Fund’s portfolio, adjusted for operating expenses of each class. Capital gain distributions are net profits realized from the sale of portfolio securities. The performance table does not reflect any taxes that a shareholder would pay on Fund dividends, capital gain distributions, if any, or any realized gains on the sale of Fund shares. Total return reflects reinvestment of the Fund’s dividends and capital gain distributions, if any, and any unrealized gains or losses.

| | | | | | |

| Net Asset Value | | | | | | |

| Share Class (Symbol) | | 4/30/16 | | 10/31/15 | | Change |

| A (FRMCX) | $ | 30.62 | $ | 32.90 | -$ | 2.28 |

| R6 (FMCVX) | $ | 30.88 | $ | 33.09 | -$ | 2.21 |

| Advisor (FVRMX) | $ | 30.76 | $ | 33.00 | -$ | 2.24 |

| |

| |

| Distributions1 (11/1/15–4/30/16) | | | | | | |

| | | Long-Term | | | | |

| Share Class | | Capital Gain | | | | |

| A | $ | 3.8954 | | | | |

| R6 | $ | 3.8954 | | | | |

| Advisor | $ | 3.8954 | | | | |

See page 24 for Performance Summary footnotes.

franklintempleton.com

Semiannual Report 23

FRANKLIN MICROCAP VALUE FUND

PERFORMANCE SUMMARY

Performance as of 4/30/162

Cumulative total return excludes sales charges. Average annual total returns and value of $10,000 investment include maximum sales charges. Class A: 5.75% maximum initial sales charge;Class R6/Advisor Class: no sales charges.

| | | | | | | | | | | | |

| | | | | | | Value of | Average Annual | | Total Annual Operating Expenses7 | |

| | Cumulative | | Average Annual | | $ | 10,000 | Total Return | | | | | |

| Share Class | Total Return3 | | Total Return4 | | | Investment5 | (3/31/16 | )6 | (with waiver) | | (without waiver) | |

| A | | | | | | | | | 1.20 | % | 1.21 | % |

| 6-Month | +5.80 | % | -0.29 | % | $ | 9,971 | | | | | | |

| 1-Year | -0.75 | % | -6.45 | % | $ | 9,355 | -9.48 | % | | | | |

| 5-Year | +43.61 | % | +6.24 | % | $ | 13,535 | +5.38 | % | | | | |

| 10-Year | +75.11 | % | +5.14 | % | $ | 16,502 | +4.75 | % | | | | |

| R6 | | | | | | | | | 0.81 | % | 0.82 | % |

| 6-Month | +6.00 | % | +6.00 | % | $ | 10,600 | | | | | | |

| 1-Year | -0.36 | % | -0.36 | % | $ | 9,964 | -3.57 | % | | | | |

| Since Inception (5/1/13) | +20.36 | % | +6.38 | % | $ | 12,036 | +5.40 | % | | | | |

| Advisor | | | | | | | | | 0.96 | % | 0.97 | % |

| 6-Month | +5.91 | % | +5.91 | % | $ | 10,591 | | | | | | |

| 1-Year | -0.51 | % | -0.51 | % | $ | 9,949 | -3.72 | % | | | | |

| 5-Year | +45.34 | % | +7.76 | % | $ | 14,534 | +6.89 | % | | | | |

| 10-Year | +79.29 | % | +6.01 | % | $ | 17,929 | +5.62 | % | | | | |

Performance data represent past performance, which does not guarantee future results. Investment return and principal value will fluctuate, and you may have a gain or loss when you sell your shares. Current performance may differ from figures shown. For most recent month-end performance, go to franklintempleton.com or call (800) 342-5236.

All investments involve risks, including possible loss of principal. The Fund’s ability to invest in smaller company securities that may have limited liquidity involves additional risks, such as relatively small revenues, limited product lines and small market share. Historically, these stocks have exhibited greater price volatility than larger company stocks, especially over the short term. In addition, the Fund may invest up to 25% of its total assets in foreign securities, which involve special risks, including currency fluctuations and economic and political uncertainty. The Fund is actively managed but there is no guarantee that the manager’s investment decisions will produce the desired results. The Fund’s prospectus also includes a description of the main investment risks.

| |

| Class R6: | Shares are available to certain eligible investors as described in the prospectus. |

| Advisor Class: | Shares are available to certain eligible investors as described in the prospectus. |

1. The distribution amount is the sum of the dividend payments to shareholders for the period shown and includes only estimated tax-basis capital gain.

2. The Fund has a fee waiver associated with any investment in a Franklin Templeton money fund, contractually guaranteed through at least its current fiscal year-end. Fund

investment results reflect the fee waiver, to the extent applicable; without this reduction, the results would have been lower.

3. Cumulative total return represents the change in value of an investment over the periods indicated.

4. Average annual total return represents the average annual change in value of an investment over the periods indicated. Return for less than one year, ifany,hasnotbeen

annualized.

5. These figures represent the value of a hypothetical $10,000 investment in the Fund over the periods indicated.

6. In accordance with SEC rules, we provide standardized average annual total return information through the latest calendar quarter.

7. Figures are as stated in the Fund’s current prospectus and may differ from the expense ratios disclosed in the Financial Highlights in this report. In periods of market volatility,

assets may decline significantly, causing total annual Fund operating expenses to become higher than the figures shown.

24 Semiannual Report

franklintempleton.com

FRANKLIN MICROCAP VALUE FUND

Your Fund’s Expenses

As a Fund shareholder, you can incur two types of costs:

- Transaction costs, including sales charges (loads) on Fund purchases; and

- Ongoing Fund costs, including management fees, distribution and service (12b-1) fees, and other Fund expenses. All mutual funds have ongoing costs, sometimes referred to as operating expenses.

The following table shows ongoing costs of investing in the Fund and can help you understand these costs and compare them with those of other mutual funds. The table assumes a $1,000 investment held for the six months indicated.

Actual Fund Expenses

The first line (Actual) for each share class listed in the table provides actual account values and expenses. The “Ending Account Value” is derived from the Fund’s actual return, which includes the effect of Fund expenses.

You can estimate the expenses you paid during the period by following these steps. Of course, your account value and expenses will differ from those in this illustration:

| 1. | Divide your account value by $1,000. |

| | If an account had an $8,600 value, then $8,600 ÷ $1,000 = 8.6. |

| 2. | Multiply the result by the number under the heading “Expenses Paid During Period.” |

| | If Expenses Paid During Period were $7.50, then 8.6 x $7.50 = $64.50. |

In this illustration, the estimated expenses paid this period are $64.50.

Hypothetical Example for Comparison with Other Funds

Information in the second line (Hypothetical) for each class in the table can help you compare ongoing costs of investing in the Fund with those of other mutual funds. This information may not be used to estimate the actual ending account balance or expenses you paid during the period. The hypothetical “Ending Account Value” is based on the actual expense ratio for each class and an assumed 5% annual rate of return before expenses, which does not represent the Fund’s actual return. The figure under the heading “Expenses Paid During Period” shows the hypothetical expenses your account would have incurred under this scenario. You can compare this figure with the 5% hypothetical examples that appear in shareholder reports of other funds.

Please note that expenses shown in the table are meant to highlight ongoing costs and do not reflect any transaction costs, such as sales charges. Therefore, the second line for each class is useful in comparing ongoing costs only, and will not help you compare total costs of owning different funds. In addition, if transaction costs were included, your total costs would have been higher. Please refer to the Fund prospectus for additional information on operating expenses.

| | | | | | |

| | | Beginning Account | | Ending Account | | Expenses Paid During |

| Share Class | | Value 11/1/15 | | Value 4/30/16 | | Period* 11/1/15–4/30/16 |

| A | | | | | | |

| Actual | $ | 1,000 | $ | 1,058.00 | $ | 6.14 |

| Hypothetical (5% return before expenses) | $ | 1,000 | $ | 1,018.90 | $ | 6.02 |

| R6 | | | | | | |

| Actual | $ | 1,000 | $ | 1,060.00 | $ | 4.15 |

| Hypothetical (5% return before expenses) | $ | 1,000 | $ | 1,020.84 | $ | 4.07 |

| Advisor | | | | | | |

| Actual | $ | 1,000 | $ | 1,059.10 | $ | 4.91 |

| Hypothetical (5% return before expenses) | $ | 1,000 | $ | 1,020.09 | $ | 4.82 |

*Expenses are calculated using the most recent six-month expense ratio, net of expense waivers, annualized for each class (A: 1.20%;

R6: 0.81%; and Advisor: 0.96%), multiplied by the average account value over the period, multiplied by 182/366 to reflect the one-half year

period.

franklintempleton.com

Semiannual Report 25

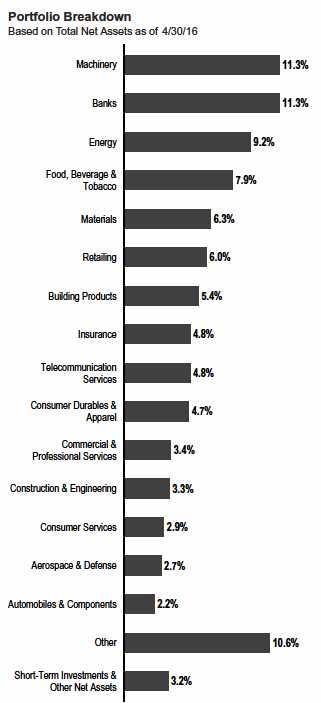

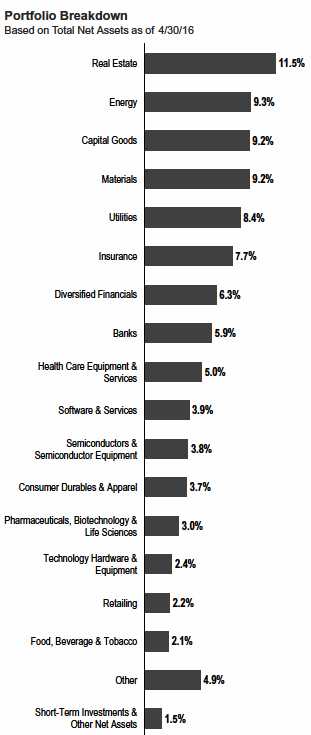

Franklin Midcap Value Fund

This semiannual report for Franklin MidCap Value Fund covers the period ended April 30, 2016.

Your Fund’s Goal and Main Investments

The Fund seeks long-term total return by investing at least 80% of net assets in securities of mid-capitalization companies that we believe are undervalued. We define mid-capitalization companies as those with market capitalizations that are similar in size at the time of purchase to those in the Russell Midcap® Index.1

Performance Overview

The Fund’s Class A shares delivered a +1.01% cumulative total return for the six months under review. In comparison, the Russell Midcap® Value Index, which measures performance of those Russell Midcap® Index companies with lower price-to-book ratios and lower forecasted growth values, generated a +3.16% total return.2 You can find the Fund’s long-term performance data in the Performance Summary beginning on page 29.

Performance data represent past performance, which does not guarantee future results. Investment return and principal value will fluctuate, and you may have a gain or loss when you sell your shares. Current performance may differ from figures shown. For most recent month-end performance, go to franklintempleton.com or call (800) 342-5236.

Investment Strategy

Our goal is to invest in mid-capitalization companies that we determine are currently undervalued and have the potential for capital appreciation. The Fund purchases stocks that are out of favor in the market for reasons we believe will prove to be temporary in nature. In addition, the Fund may invest in companies with valuable intangibles we believe are not reflected in the stock price. This strategy is not aimed at short-term trading gains, nor do we consider the composition of any index. Rather, we try to identify attractively priced, financially sound companies that meet our investment criteria, and we assume at purchase that we will hold the position for several years.

1. The Russell Midcap Index is market capitalization weighted and measures performance of the smallest companies in the Russell 1000 Index, which represent a modest

amount of the Russell 1000 Index’s total market capitalization.

2. Source: Morningstar.

The index is unmanaged and includes reinvestment of any income or distributions. They do not reflect any fees, expenses or sales charges. One cannot invest directly in an

index, and an index is not representative of the Fund’s portfolio.

See www.franklintempletondatasources.com for additional data provider information.

The dollar value, number of shares or principal amount, and names of all portfolio holdings are listed in the Fund’s Statement of Investments (SOI).

The SOI begins on page 68.

26 Semiannual Report

franklintempleton.com

FRANKLIN MIDCAP VALUE FUND

Manager’s Discussion

During the six months under review, holdings that aided Fund performance included Tyson Foods, Albemarle and Autodesk. Tyson Foods, a producer of chicken, beef, pork and prepared food products, benefited from a strong quarterly earnings report, which further supported its planned and ongoing transformation in to a branded packaged food company. The company’s strategic acquisition of Hillshire Brands also continued to boost margins, while decreasing volatility related to the commodity meat processor cycle. Shares of Albemarle, a specialty and fine chemicals producer, rebounded strongly over the period as general economic concerns waned and the company reported better-than-expected earnings. The company’s 2016 outlook was more cautious than anticipated, but ongoing strength in key businesses and expectations for a significant increase in free cash flow generation benefited the company. Additionally, Albemarle struck an agreement with the Chilean government that extended the duration of its lithium production. Autodesk, a key contributor and software developer in the computer aided design market, reported stronger-than-expected subscriber growth despite an ongoing transition from a license-based to subscription-based business model. We anticipate the company’s free cash flow growth profile to be robust following the completion of the transition.

Detractors from Fund performance included Western Digital, Perrigo and HollyFrontier. Western Digital, a data storage solutions provider, experienced a weaker-than-expected demand for hard disk drives due to a weak personal computer environment. Investor concerns surrounding the merits of its SanDisk acquisition also hurt the company. Shares of Perrigo, a manufacturer of over-the-counter pharmaceuticals, declined after a weak earnings report led by underperformance in its recently acquired subsidiary Omega. During the period, Omega announced a series of restructuring and leadership changes, but a failed hostile takeover by Mylan delayed implementation of these beneficial changes. We continue to believe Perrigo’s capabilities position it uniquely within the generics and over-the-counter categories. Shares of petroleum refiner and marketer HollyFrontier declined as profit margins were negatively affected by the narrowing spread between U.S. crude oil prices and international benchmarks.

During the reporting period, the Fund initiated positions in Synchrony Financial, a financial services provider; JetBlue Airways, a commercial airline and XL Group, an insurance provider; Martin Marietta Materials, a supplier of construction and heavy building materials and Pinnacle Foods, a packaged foods company, among others. We also added to several positions with the largest purchases including Western Digital, a data storage solutions provider; Premier, a health care services and performance provider and WestRock, a paper and packaging solutions provisioner. The Fund exited positions including ITC Holdings, SanDisk, Pulte Group, Cadence Designs and KLA-Tencor, among others. We also reduced holdings in many positions including Progressive, Host Hotels & Resorts and Equity Lifestyle Properties.

Thank you for your continued participation in Franklin MidCap Value Fund. We look forward to continuing to serve your investment needs.

| | |

| Top 10 Holdings | | |

| 4/30/16 | | |

| Company | % of Total | |

| Sector/Industry | Net Assets | |

| Northern Trust Corp. | 1.6 | % |

| Diversified Financials | | |

| Synchrony Financial | 1.5 | % |

| Diversified Financials | | |

| Regions Financial Corp. | 1.5 | % |

| Banks | | |

| KeyCorp | 1.4 | % |

| Banks | | |

| Boston Properties Inc. | 1.4 | % |

| Real Estate | | |

| Raymond James Financial Inc. | 1.4 | % |

| Diversified Financials | | |

| Concho Resources Inc. | 1.4 | % |

| Energy | | |

| WestRock Co. | 1.3 | % |

| Materials | | |

| Western Digital Corp. | 1.3 | % |

| Technology Hardware & Equipment | | |

| Sempra Energy | 1.2 | % |

| Utilities | | |

Jakov Stipanov, CFA

Donald G. Taylor, CPA

Portfolio Management Team

franklintempleton.com

Semiannual Report 27

FRANKLIN MIDCAP VALUE FUND

The foregoing information reflects our analysis, opinions and portfolio holdings as of April 30, 2016, the end of the reporting period. The way we implement our main investment strategies and the resulting portfolio holdings may change depending on factors such as market and economic conditions. These opinions may not be relied upon as investment advice or an offer for a particular security. The information is not a complete analysis of every aspect of any market, country, industry, security or the Fund. Statements of fact are from sources considered reliable, but the investment manager makes no representation or warranty as to their completeness or accuracy. Although historical performance is no guarantee of future results, these insights may help you understand our investment management philosophy.

28 Semiannual Report

franklintempleton.com

FRANKLIN MIDCAP VALUE FUND

Performance Summary as of April 30, 2016

Your dividend income will vary depending on dividends or interest paid by securities in the Fund’s portfolio, adjusted for operating expenses of each class. Capital gain distributions are net profits realized from the sale of portfolio securities. The performance table does not reflect any taxes that a shareholder would pay on Fund dividends, capital gain distributions, if any, or any realized gains on the sale of Fund shares. Total return reflects reinvestment of the Fund’s dividends and capital gain distributions, if any, and any unrealized gains or losses.

| | | | | | | | |

| Net Asset Value | | | | | | | | |

| Share Class (Symbol) | | 4/30/16 | | 10/31/15 | | Change | | |

| A (FMVAX) | $ | 14.03 | $ | 15.22 | -$ | 1.19 | | |

| C (FMVCX) | $ | 13.80 | $ | 14.97 | -$ | 1.17 | | |

| R (N/A) | $ | 14.05 | $ | 15.19 | -$ | 1.14 | | |

| Advisor (N/A) | $ | 14.09 | $ | 15.31 | -$ | 1.22 | | |

| |

| |

| Distributions1 (11/1/15–4/30/16) | | | | | | | | |

| | | Dividend | | Short-Term | | Long-Term | | |

| Share Class | | Income | | Capital Gain | | Capital Gain | | Total |

| A | $ | 0.0678 | $ | 0.0351 | $ | 1.1821 | $ | 1.2850 |

| C | | — | $ | 0.0351 | $ | 1.1821 | $ | 1.2172 |

| R | $ | 0.0103 | $ | 0.0351 | $ | 1.1821 | $ | 1.2275 |

| Advisor | $ | 0.1136 | $ | 0.0351 | $ | 1.1821 | $ | 1.3308 |

See page 31 for Performance Summary footnotes.

franklintempleton.com

Semiannual Report 29

FRANKLIN MIDCAP VALUE FUND

PERFORMANCE SUMMARY

Performance as of 4/30/162

Cumulative total return excludes sales charges. Average annual total returns and value of $10,000 investment include maximum sales charges. Class A: 5.75% maximum initial sales charge; Class C: 1% contingent deferred sales charge in first year only;

Class R/Advisor Class: no sales charges.

| | | | | | | | | | | | |

| | | | | | | Value of | Average Annual | | Total Annual Operating Expenses7 | |

| | Cumulative | | Average Annual | | $ | 10,000 | Total Return | | | | | |

| Share Class | Total Return3 | | Total Return4 | | | Investment5 | (3/31/16 | )6 | (with waiver) | | (without waiver) | |

| A | | | | | | | | | 1.30 | % | 1.56 | % |

| 6-Month | +1.01 | % | -4.80 | % | $ | 9,520 | | | | | | |

| 1-Year | -4.27 | % | -9.77 | % | $ | 9,023 | -11.13 | % | | | | |

| 5-Year | +35.25 | % | +4.97 | % | $ | 12,747 | +5.35 | % | | | | |

| 10-Year | +57.61 | % | +4.04 | % | $ | 14,858 | +4.00 | % | | | | |

| C | | | | | | | | | 2.05 | % | 2.31 | % |

| 6-Month | +0.67 | % | -0.25 | % | $ | 9,975 | | | | | | |

| 1-Year | -4.86 | % | -5.73 | % | $ | 9,427 | -7.20 | % | | | | |

| 5-Year | +30.70 | % | +5.50 | % | $ | 13,070 | +5.84 | % | | | | |

| 10-Year | +47.27 | % | +3.95 | % | $ | 14,727 | +3.91 | % | | | | |

| R | | | | | | | | | 1.55 | % | 1.81 | % |

| 6-Month | +0.95 | % | +0.95 | % | $ | 10,095 | | | | | | |

| 1-Year | -4.40 | % | -4.40 | % | $ | 9,560 | -5.81 | % | | | | |

| 5-Year | +34.00 | % | +6.03 | % | $ | 13,400 | +6.39 | % | | | | |

| 10-Year | +54.80 | % | +4.47 | % | $ | 15,480 | +4.43 | % | | | | |

| Advisor | | | | | | | | | 1.05 | % | 1.31 | % |

| 6-Month | +1.13 | % | +1.13 | % | $ | 10,113 | | | | | | |

| 1-Year | -4.01 | % | -4.01 | % | $ | 9,599 | -5.42 | % | | | | |

| 5-Year | +37.25 | % | +6.54 | % | $ | 13,725 | +6.93 | % | | | | |

| 10-Year | +62.64 | % | +4.98 | % | $ | 16,264 | +4.95 | % | | | | |

Performance data represent past performance, which does not guarantee future results. Investment return and principal value will fluctuate, and you may have a gain or loss when you sell your shares. Current performance may differ from figures shown. For most recent month-end performance, go to franklintempleton.com or call (800) 342-5236.

See page 31 for Performance Summary footnotes.

30 Semiannual Report

franklintempleton.com

FRANKLIN MIDCAP VALUE FUND

PERFORMANCE SUMMARY

All investments involve risks, including possible loss of principal. Stock prices fluctuate, sometimes rapidly and dramatically, due to factors affecting individual companies, particular industries or sectors, or general market conditions. Historically, midsize company securities have been more volatile in price than larger company securities, especially over the short term. Midsize companies may be more susceptible to particular economic events or competitive factors than are larger, more broadly diversified companies. In addition, the Fund may invest up to 25% of its total assets in foreign securities, which involve special risks, including currency fluctuations and economic and political uncertainty. The Fund is actively managed but there is no guarantee that the manager’s investment decisions will produce the desired results. The Fund’s prospectus also includes a description of the main investment risks.

| |

| Class C: | These shares have higher annual fees and expenses than Class A shares. |

| Class R: | Shares are available to certain eligible investors as described in the prospectus. These shares have higher annual fees and expenses than Class A shares. |

| Advisor Class: | Shares are available to certain eligible investors as described in the prospectus. |

1. The distribution amount is the sum of the dividend payments to shareholders for the period shown and includes only estimated tax-basis net investment income and capital

gain.

2. The Fund has an expense reduction contractually guaranteed through at least 2/28/17 and a fee waiver associated with any investment in a Franklin Templeton money fund,

contractually guaranteed through at least its current fiscal year-end. Fund investment results reflect the expense reduction and fee waiver, to the extent applicable; without

these reductions, the results would have been lower.

3. Cumulative total return represents the change in value of an investment over the periods indicated.

4. Average annual total return represents the average annual change in value of an investment over the periods indicated. Return for less than one year, ifany,hasnotbeen

annualized.

5. These figures represent the value of a hypothetical $10,000 investment in the Fund over the periods indicated.

6. In accordance with SEC rules, we provide standardized average annual total return information through the latest calendar quarter.

7. Figures are as stated in the Fund’s current prospectus and may differ from the expense ratios disclosed in the Financial Highlights in this report. In periods of market volatility,

assets may decline significantly, causing total annual Fund operating expenses to become higher than the figures shown.

franklintempleton.com

Semiannual Report 31

FRANKLIN MIDCAP VALUE FUND

Your Fund’s Expenses

As a Fund shareholder, you can incur two types of costs:

- Transaction costs, including sales charges (loads) on Fund purchases; and

- Ongoing Fund costs, including management fees, distribution and service (12b-1) fees, and other Fund expenses. All mutual funds have ongoing costs, sometimes referred to as operating expenses.

The following table shows ongoing costs of investing in the Fund and can help you understand these costs and compare them with those of other mutual funds. The table assumes a $1,000 investment held for the six months indicated.

Actual Fund Expenses

The first line (Actual) for each share class listed in the table provides actual account values and expenses. The “Ending Account Value” is derived from the Fund’s actual return, which includes the effect of Fund expenses.

You can estimate the expenses you paid during the period by following these steps. Of course, your account value and expenses will differ from those in this illustration:

| 1. | Divide your account value by $1,000. |

| | If an account had an $8,600 value, then $8,600 ÷ $1,000 = 8.6. |

| 2. | Multiply the result by the number under the heading “Expenses Paid During Period.” |

| | If Expenses Paid During Period were $7.50, then 8.6 x $7.50 = $64.50. |

In this illustration, the estimated expenses paid this period are $64.50.

Hypothetical Example for Comparison with Other Funds

Information in the second line (Hypothetical) for each class in the table can help you compare ongoing costs of investing in the Fund with those of other mutual funds. This information may not be used to estimate the actual ending account balance or expenses you paid during the period. The hypothetical “Ending Account Value” is based on the actual expense ratio for each class and an assumed 5% annual rate of return before expenses, which does not represent the Fund’s actual return. The figure under the heading “Expenses Paid During Period” shows the hypothetical expenses your account would have incurred under this scenario. You can compare this figure with the 5% hypothetical examples that appear in shareholder reports of other funds.

Please note that expenses shown in the table are meant to highlight ongoing costs and do not reflect any transaction costs, such as sales charges. Therefore, the second line for each class is useful in comparing ongoing costs only, and will not help you compare total costs of owning different funds. In addition, if transaction costs were included, your total costs would have been higher. Please refer to the Fund prospectus for additional information on operating expenses.

32 Semiannual Report

franklintempleton.com

| | | | | | |

| | | | | | | FRANKLIN MIDCAP VALUE FUND |

| | | | | | | YOUR FUND’S EXPENSES |

| |

| |

| |

| | | Beginning Account | | Ending Account | | Expenses Paid During |

| Share Class | | Value 11/1/15 | | Value 4/30/16 | | Period* 11/1/15–4/30/16 |

| A | | | | | | |

| Actual | $ | 1,000 | $ | 1,010.10 | $ | 6.50 |

| Hypothetical (5% return before expenses) | $ | 1,000 | $ | 1,018.40 | $ | 6.52 |

| C | | | | | | |

| Actual | $ | 1,000 | $ | 1,006.70 | $ | 10.18 |

| Hypothetical (5% return before expenses) | $ | 1,000 | $ | 1,014.72 | $ | 10.22 |

| R | | | | | | |

| Actual | $ | 1,000 | $ | 1,009.50 | $ | 7.74 |

| Hypothetical (5% return before expenses) | $ | 1,000 | $ | 1,017.16 | $ | 7.77 |

| Advisor | | | | | | |

| Actual | $ | 1,000 | $ | 1,011.30 | $ | 5.25 |