UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF

REGISTERED MANAGEMENT INVESTMENT COMPANIES

Investment Company Act file number 811-05957

Nuveen Municipal Advantage Fund, Inc.

(Exact name of registrant as specified in charter)

Nuveen Investments

333 West Wacker Drive

Chicago, IL 60606

(Address of principal executive offices) (Zip code)

Kevin J. McCarthy

Nuveen Investments

333 West Wacker Drive

Chicago, IL 60606

(Name and address of agent for service)

Registrant’s telephone number, including area code: (312) 917-7700

Date of fiscal year end: October 31

Date of reporting period: October 31, 2014

Form N-CSR is to be used by management investment companies to file reports with the Commission not later than 10 days after the transmission to stockholders of any report that is required to be transmitted to stockholders under Rule 30e-1 under the Investment Company Act of 1940 (17 CFR 270.30e-1). The Commission may use the information provided on Form N-CSR in its regulatory, disclosure review, inspection, and policymaking roles.

A registrant is required to disclose the information specified by Form N-CSR, and the Commission will make this information public. A registrant is not required to respond to the collection of information contained in Form N-CSR unless the Form displays a currently valid Office of Management and Budget (“OMB”) control number. Please direct comments concerning the accuracy of the information collection burden estimate and any suggestions for reducing the burden to Secretary, Securities and Exchange Commission, 450 Fifth Street, NW, Washington, DC 20549-0609. The OMB has reviewed this collection of information under the clearance requirements of 44 U.S.C. ss. 3507.

ITEM 1. REPORTS TO STOCKHOLDERS.

NUVEEN INVESTMENTS ACQUIRED BY TIAA-CREF

On October 1, 2014, TIAA-CREF completed its previously announced acquisition of Nuveen Investments, Inc., the parent company of your fund’s investment adviser, Nuveen Fund Advisors, LLC (“NFAL”) and the Nuveen affiliates that act as sub-advisers to the majority of the Nuveen Funds. TIAA-CREF is a national financial services organization with approximately $840 billion in assets under management as of October 1, 2014 and is a leading provider of retirement services in the academic, research, medical and cultural fields. Nuveen expects to operate as a separate subsidiary within TIAA-CREF’s asset management business. Nuveen’s existing leadership and key investment teams have remained in place following the transaction.

NFAL and your fund’s sub-adviser(s) continue to manage your fund according to the same objectives and policies as before, and there have been no changes to your fund’s operations.

Table of Contents

| Chairman’s Letter to Shareholders | 4 |

| | |

| Portfolio Managers’ Comments | 5 |

| | |

| Fund Leverage | 10 |

| | |

| Common Share Information | 12 |

| | |

| Risk Considerations | 14 |

| | |

| Performance Overview and Holding Summaries | 15 |

| | |

| Shareholder Meeting Report | 27 |

| | |

| Report of Independent Registered Public Accounting Firm | 31 |

| | |

| Portfolios of Investments | 32 |

| | |

| Statement of Assets and Liabilities | 101 |

| | |

| Statement of Operations | 103 |

| | |

| Statement of Changes in Net Assets | 104 |

| | |

| Statement of Cash Flows | 106 |

| | |

| Financial Highlights | 108 |

| | |

| Notes to Financial Statements | 117 |

| | |

| Additional Fund Information | 131 |

| | |

| Glossary of Terms Used in this Report | 132 |

| | |

| Reinvest Automatically, Easily and Conveniently | 134 |

| | |

| Board Members & Officers | 135 |

Chairman’s Letter to Shareholders

Dear Shareholders,

Over the past year, global financial markets were generally strong as stocks of many countries rose due to strengthening economies and abundant central bank support. A low and stable interest rate environment allowed the bond market to generate modest but positive returns.

More recently, markets have been less certain as economic growth is strengthening in some parts of the world, but in other areas recovery has been slow or uneven at best. Despite increasing market volatility, geopolitical turmoil and concerns over rising rates, better-than-expected earnings results and economic data have supported U.S. stocks. Europe continues to face challenges as disappointing growth and inflation measures led the European Central Bank to further cut interest rates. Japan is suffering from the burden of the recent consumption tax as the government’s structural reforms continue to steadily progress. Flare-ups in hotspots, such as the ongoing Russia-Ukraine conflict and Middle East, have not yet been able to derail the markets, though that remains a possibility. With all the challenges facing the markets, accommodative monetary policy around the world has helped lessen the impact of these events.

It is in such changeable markets that professional investment management is most important. Investment teams who have experienced challenging markets in the past understand how their asset class can behave in rapidly changing times. Remaining committed to their investment disciplines during these times is a critical component to achieving long-term success. In fact, many strong investment track records are established during challenging periods because experienced investment teams understand that volatile markets place a premium on companies and investment ideas that can weather the short-term volatility. By maintaining appropriate time horizons, diversification and relying on practiced investment teams, we believe that investors can achieve their long-term investment objectives.

As always, I encourage you to communicate with your financial consultant if you have any questions about your investment in a Nuveen Fund. On behalf of the other members of the Nuveen Fund Board, we look forward to continuing to earn your trust in the months and years ahead.

William J. Schneider

Chairman of the Board

December 22, 2014

Portfolio Managers’ Comments

Nuveen Performance Plus Municipal Fund, Inc. (NPP)

Nuveen Municipal Advantage Fund, Inc. (NMA)

Nuveen Municipal Market Opportunity Fund, Inc. (NMO)

Nuveen Dividend Advantage Municipal Fund (NAD)

Nuveen Dividend Advantage Municipal Fund 2 (NXZ)

Nuveen Dividend Advantage Municipal Fund 3 (NZF)

These Funds feature portfolio management by Nuveen Asset Management, LLC, an affiliate of Nuveen Investments, Inc. Portfolio managers Thomas C. Spalding, CFA, and Paul L. Brennan, CFA, review U.S. economic and municipal market conditions, key investment strategies and the twelve-month performance of these six national Funds. Tom has managed NXZ since its inception in 2001 and NPP, NMA, NMO and NAD since 2003. Paul assumed portfolio management responsibility for NZF in 2006.

What factors affected the U.S. economy and the national municipal market during the twelve-month reporting period ended October 31, 2014?

During this reporting period, the U.S. economy continued to expand at a moderate pace. The Federal Reserve (Fed) maintained efforts to bolster growth and promote progress toward its mandates of maximum employment and price stability by holding the benchmark fed funds rate at the record low level of zero to 0.25% that it established in December 2008. At its October 2014 meeting, the Fed announced that it would end its bond-buying stimulus program as of November 1, 2014, after tapering its monthly asset purchases of mortgage-backed and longer-term Treasury securities from the original $85 billion per month to $15 billion per month over the course of seven consecutive meetings (December 2013 through September 2014). In making the announcement, the Fed cited substantial improvement in the outlook for the labor market since the inception of the current asset purchase program as well as sufficient underlying strength in the broader economy to support ongoing progress toward maximum employment in a context of price stability. The Fed also reiterated that it would continue to look at a wide range of factors, including labor market conditions, indicators of inflationary pressures and readings on financial developments, in determining future actions, saying that it would likely maintain the current target range for the fed funds rate for a considerable time after the end of the asset purchase program, especially if projected inflation continues to run below the Fed’s 2% longer-run goal. However, if economic data shows faster progress toward the Fed’s employment and inflation objectives than currently anticipated, the Fed indicated that the first increase in the fed funds rate since 2006 could occur sooner than expected.

| Certain statements in this report are forward-looking statements. Discussions of specific investments are for illustration only and are not intended as recommendations of individual investments. The forward-looking statements and other views expressed herein are those of the portfolio managers as of the date of this report. Actual future results or occurrences may differ significantly from those anticipated in any forward-looking statements, and the views expressed herein are subject to change at any time, due to numerous market and other factors. The Funds disclaim any obligation to update publicly or revise any forward-looking statements or views expressed herein. |

Ratings shown are the highest rating given by one of the following national rating agencies: Standard & Poor’s (S&P), Moody’s Investors Service, Inc. (Moody’s) or Fitch, Inc. (Fitch) Credit ratings are subject to change. AAA, AA, A and BBB are investment grade ratings; BB, B, CCC, CC, C and D are below investment grade ratings. Certain bonds backed by U.S. government or agency securities are regarded as having an implied rating equal to the rating of such securities. Holdings designated N/R are not rated by these national rating agencies.

Bond insurance guarantees only the payment of principal and interest on the bond when due, and not the value of the bonds themselves, which will fluctuate with the bond market and the financial success of the issuer and the insurer. Insurance relates specifically to the bonds in the portfolio and not to the share prices of a Fund. No representation is made as to the insurers’ ability to meet their commitments.

Portfolio Managers’ Comments (continued)

In the third quarter of 2014, the U.S. economy, as measured by the U.S. gross domestic product (GDP), grew at a 3.9% annual rate, compared with -2.1% in the first quarter of 2014 and 4.6% in the second quarter. Third-quarter growth was attributed in part to expanded business investment in equipment and a major increase in military spending. The Consumer Price Index (CPI) rose 1.7% year-over-year as of October 2014, while the core CPI (which excludes food and energy) increased 1.8% during the same period, below the Fed’s unofficial longer term inflation objective of 2.0%. As of October 2014, the national unemployment rate was 5.8%, the lowest level since July 2008, down from the 7.2% reported in October 2013, marking the ninth consecutive month in which the economy saw the addition of more than 200,000 new jobs. The housing market continued to post gains, although price growth has shown signs of deceleration in recent months. The average home price in the S&P/Case-Shiller Index of 20 major metropolitan areas rose 4.9% for the twelve months ended September 2014 (most recent data available at the time this report was prepared), putting home prices at fall 2004 levels, although they continued to be down 15%-17% from their mid-2006 peaks.

During the first two months of this reporting period, the financial markets remained unsettled in the aftermath of widespread uncertainty about the future of the Fed’s quantitative easing program. Also contributing to investor concern was Congress’s failure to reach an agreement on the Fiscal 2014 federal budget, which triggered sequestration, or automatic spending cuts and a 16-day federal government shutdown in October 2013. This sequence of events sparked increased volatility in the financial markets, with the Treasury market trading off, the municipal market following suit and spreads widening as investor concern grew, prompting selling by bondholders across the fixed income markets.

As we turned the page to calendar year 2014, the market environment stabilized, as the Fed’s policies continued to be accommodative and some degree of political consensus was reached. The Treasury market rallied and municipal bonds rebounded, with flows into municipal bond funds increasing, while supply continued to drop. This supply/demand dynamic served as a key driver of municipal market performance for the period. The resultant rally in municipal bonds generally produced positive total returns for the reporting period as a whole. Overall, municipal credit fundamentals continued to improve, as state governments made good progress in dealing with budget issues. Due to strong growth in personal income tax and sales tax collections, year-over-year totals for state tax revenues had increased for 16 consecutive quarters as of the second quarter of 2014, while on the expense side, many states made headway in cutting and controlling costs, with the majority implementing some type of pension reform. The current level of municipal issuance reflects the more conservative approach to state budgeting. For the twelve months ended October 31, 2014, municipal bond issuance nationwide totaled $319.7 billion, down 4.6% from the issuance for the twelve-month reporting period ended October 31, 2013.

What key strategies were used to manage these Funds during the twelve-month reporting period ended October 31, 2014?

During this reporting period, we saw the municipal market environment shift from the volatility of late 2013 to a rally driven by strong demand and tight supply and reinforced by an environment of improving fundamentals in 2014. For the reporting period as a whole, municipal bond prices generally rose, as interest rates declined and the yield curve flattened. We continued to take a bottom-up approach to identifying sectors that appeared undervalued as well as individual credits that had the potential to perform well over the long term and helped us keep the Funds fully invested.

During the first two months of this reporting period, we primarily focused on strategies that enabled us to take advantage of the higher coupons and attractive prices resulting from a pattern of outflows, predominately from high yield funds. This presented opportunities to add lower rated credits and bonds with longer maturities to the Funds in the secondary market. Among our purchases in NPP, NMA, NMO, NAD and NXZ were tobacco credits and zero coupon bonds, which provided long maturities, good call protection and additional income to support the Funds’ dividends.

Municipal supply nationally remained tight throughout this reporting period, although issuance improved during the second half of this twelve-month period compared with the first half. Much of this increase was attributable to refunding activity as bond issuers, prompted by low interest rates, sought to lower debt service costs by retiring older bonds from the proceeds of lower cost new bond issues. During the third quarter of 2014, for example, we saw current refunding activity increase by more than 64% nationwide

and estimates are that these refundings accounted for 35% of issuance during the first nine months of 2014. These refunding bonds do not represent an actual net increase in issuance because they mostly replaced outstanding issues that were called soon thereafter. As a result, it remained challenging to source attractive bonds that would enhance the Funds’ holdings. Much of our investment activity focus during this reporting period was on reinvesting the cash generated by current calls into credit sensitive sectors and longer maturity bonds that could help us offset the decline in rates and maintain investment performance potential. These Funds were well positioned coming into the reporting period, so we could be selective in looking for opportunities to purchase bonds that added value.

In general, NPP, NMA, NMO, NAD and NXZ continued to find value in sectors that represent some of our larger exposures, including transportation (e.g., tollroads, highways, bridges) and health care. Among our additions in the transportation sector were tollroad revenue bonds issued for Route 460 in Virginia and a new issue from the Foothill/Eastern Transportation Corridor Agency (F/ETCA) in California, which we purchased at attractive prices in December 2013. In one of the largest fixed rate municipal transactions of 2013, F/ETCA refinanced $2.3 billion in outstanding debt originally issued in 1999. Traffic and revenues on the tollroads in F/ETCA’s 36-mile network, which links major population centers in Southern California, have increased and the bonds have performed well for the Funds since purchase. In October 2014, we also participated in the tender offer and new issuance of tollroad bonds for the San Joaquin Hills Transportation Corridor Agency in Orange County, California, the largest tollroad network in the western U.S. The agency took advantage of the decline in interest rates to restructure its debt by making a tender offer for existing bonds at terms favorable to shareholders and then issuing new bonds at lower interest rates, thereby reducing debt service costs, improving cash flow and increasing financial flexibility. In our view, the agency’s debt restructuring resulted in an improved credit outlook for these bonds and we added some of the new San Joaquin credits to our portfolios.

NZF also found value in the transportation sector, especially in tollroad issues, where we saw increased activity after several years of low issuance and deferred maintenance. We added new offerings, including the Foothill/Eastern and San Joaquin issues mentioned above as well as bonds issued to finance the Downtown Crossing bridge across the Ohio River from Indiana to Louisville, Kentucky and credits issued for the Dulles Tollroad in Virginia and suburban Washington, D.C. We also purchased health care bonds, including those issued for Catholic Health Initiatives, a national nonprofit health system that operates hospitals and long-term care facilities in 17 states, for facilities in Colorado and Tennessee. In addition, we added to our holdings in higher education, water and sewer, and utilities.

Also during this reporting period, S&P upgraded its credit rating on National Public Finance Guarantee Corp. (NPFG), the insurance subsidiary of MBIA, to AA- from A, citing NPFG’s strong operating performance and competitive position in the financial guarantee market. As a result, the ratings on the Funds’ holdings of bonds backed by insurance from NPFG, and not already rated at least AA-due to higher underlying borrower ratings were similarly upgraded to AA- as of mid-March 2014. This action produced an increase in the percentage of our portfolios held in the AA credit quality category (and a corresponding decrease in the A category), improving the overall credit rating of the Funds. S&P also upgraded its rating on Assured Guaranty Municipal (AGM) as well as AGM’s municipal-only insurer Municipal Assurance Corp. to AA from AA-.

Cash for purchases was generated primarily by proceeds from called and matured bonds, which we worked to redeploy to keep the Funds fully invested and support their income streams. As previously mentioned, the decline in municipal yields and the flattening of the municipal yield curve relative to the Treasury curve helped to make refunding deals more attractive. The increase in this activity provided ample cash for purchases and drove much of our trading. In addition, NPP, NMA, NMO, NAD and NXZ continued to trim holdings of Puerto Rico paper.

As of October 31, 2014, all of these Funds continued to use inverse floating rate securities. We employ inverse floaters for a variety of reasons, including duration management, income enhancement and total return enhancement.

How did the Funds perform during the twelve-month reporting period ended October 31, 2014?

The tables in each Fund’s Performance Overview and Holding Summaries section of this report provide the Funds’ total returns for the one-year, five-year and ten-year periods ended October 31, 2014. Each Fund’s total returns at net asset value (NAV) are compared with the performance of a corresponding market index and Lipper classification average.

For the twelve months ended October 31, 2014, the total returns on common share NAV for all six of these Funds outperformed the return for the national S&P Municipal Bond Index. For the same period, all of these Funds underperformed the average return for the Lipper General & Insured Leveraged Municipal Debt Funds Classification Average.

Key management factors that influenced the Funds’ returns included duration and yield curve positioning, credit exposure and sector allocation. Keeping the Funds fully invested throughout the reporting period also was beneficial for performance. In addition, the use of regulatory leverage was an important positive factor affecting the Funds’ performance. Leverage is discussed in more detail later in the Fund Leverage section of this report.

Given the combination of declining interest rates and a flattening yield curve during this reporting period, municipal bonds with longer maturities generally outperformed those with shorter maturities. Overall, credits with maturities of 15 years or more, especially those at the longest end of the municipal yield curve, outperformed the general municipal market, while bonds at the shortest end of the curve produced the weakest results. Consistent with our long term strategy, these Funds tended to have longer durations than the municipal market in general, with overweightings in the longer parts of the yield curve that performed well and underweightings in the underperforming shorter end of the curve. This was especially true in NMO and NPP, where greater sensitivity to changes in interest rates benefited their performance. The positioning of NXZ, which had the shortest duration among these Funds, was slightly less advantageous and it received less benefit from duration. Overall, duration and yield curve positioning was the major driver of performance and differences in positioning accounted for much of the differences in performance.

During this reporting period, lower rated bonds, bonds rated A or lower, generally outperformed higher quality bonds, as the municipal market rally continued and investors became more willing to accept risk in their search for yield in the current low rate environment. While their longer average durations provided an advantage for lower rated bonds, these bonds also generally had stronger duration-adjusted results. Because these Funds typically tended to be overweighted in the lower quality categories relative to the market, credit exposure was positive for their performance.

Among the municipal market sectors, health care, industrial development revenue (IDR) and transportation (especially tollroads) bonds generally were the top performers, with water and sewer, education and housing credits also outperforming the general municipal market. The outperformance of the health care sector can be attributed in part to the recent scarcity of these bonds, with issuance in this sector declining 31% during the first nine months of 2014, while the performance of tollroad bonds was boosted by improved traffic and revenue from increased rates. Each of these Funds had strong exposures to the health care and transportation sectors, which benefited their performance. Bonds backed by prepaid gas contracts also performed well for NPP, NMA, NMO, NAD and NXZ. During this reporting period, lower rated tobacco credits backed by the 1998 master tobacco settlement agreement experienced some volatility, but finished the reporting period ahead of the national municipal market as a whole. The performance of these bonds was helped by their longer effective durations, lower credit quality and the broader demand for higher yields. In addition, several tobacco bond issues were strengthened following the favorable resolution of a dispute over payments by tobacco companies. All of these Funds were overweighted in tobacco bonds.

In contrast, pre-refunded bonds, which are often backed by U.S. Treasury securities, were among the poorest performing market segments. The underperformance of these bonds relative to the market can be attributed primarily to their shorter effective maturities and higher credit quality. As of October 31, 2014, all of these Funds had holdings of pre-refunded bonds. In addition, general obligation (GO) credits generally trailed the revenue sectors as well as the municipal market as a whole, although by a substantially smaller margin than the pre-refunded category. Some of the GOs’ underperformance can be attributed to their higher quality.

We continued to monitor two situations in the broader municipal market for any impact on the Funds’ holdings and performance: the ongoing economic problems of Puerto Rico and the City of Detroit’s bankruptcy case. In terms of Puerto Rico holdings, shareholders should note that all of the Funds in this report had limited exposure to Puerto Rico debt during this reporting period. These territorial bonds were originally added to our portfolios to keep assets fully invested and working for the Funds as well as to enhance diversity, duration and credit. The Puerto Rico credits offered higher yields, added diversification and triple exemption (i.e., exemption from most federal, state and local taxes). However, Puerto Rico’s continued economic weakening, escalating debt service obligations and long-standing inability to deliver a balanced budget led to multiple downgrades on its debt over the past two years. Following the latest rating reduction by Moody’s in July 2014, Puerto Rico general obligation debt was rated B2/BB+/BB (below investment grade) by Moody’s, S&P and Fitch, respectively, with negative outlooks. In late June 2014, Puerto Rico approved new legislation creating a judicial framework and formal process that would allow several of the commonwealth’s public corporations to restructure their public debt. As of October 2014, the Nuveen complex held $69.8 million in bonds backed by public corporations in Puerto Rico that could be restructured under this legislation, representing less than 0.1% of our municipal assets under management. In light of the evolving economic situation in Puerto Rico, Nuveen’s credit analysis of the commonwealth had previously considered the possibility of a default and restructuring of public corporations and we adjusted our portfolios to prepare for such an outcome, although no such default or restructuring has occurred to date. The Nuveen complex’s entire exposure to obligations of the government of Puerto Rico and other Puerto Rico issuers totaled 0.35% of assets under management as of October 31, 2014. As of October 31, 2014, these Funds’ limited exposure to Puerto Rico generally was invested in bonds that were insured (which we believe adds value), pre-refunded (and therefore backed by securities such as U.S. Treasuries) or unrelated to the government of Puerto Rico. Overall, the small size of our exposures meant that our Puerto Rico holdings had a negligible impact on performance.

The second situation that we continued to monitor was the City of Detroit’s filing for Chapter 9 in federal bankruptcy court in July 2013. Burdened by decades of population loss, changes in the auto manufacturing industry and significant tax base deterioration, Detroit had been under severe financial stress for an extended period prior to the filing. Before Detroit could exit bankruptcy, issues surrounding the city’s complex debt portfolio, numerous union contracts, significant legal questions and more than 100,000 creditors had to be resolved. By October 2014, all of the major creditors had reached agreement on the city’s plan to restructure its $18.5 billion of debt and emerge from bankruptcy and on November 7, 2014 (subsequent to the close of this reporting period). The U.S. Bankruptcy Court approved the city’s bankruptcy exit plan, thereby erasing approximately $7 billion in debt. The settlement plan also provided for $1.7 billion to be reinvested in the city for improved public safety, blight removal and upgraded basic services. All of these Funds had exposure to Detroit-related bonds, including Detroit water and sewer credits. In August 2014, Detroit announced a tender offer for the city’s water and sewer bonds, aimed at replacing some of the $5.2 billion of existing debt with lower cost bonds. (Not all of the Detroit water and sewer bonds were eligible for the tender offer.) Approximately $1.5 billion in existing water and sewer bonds were returned to the city by investors under the tender offer, which enabled Detroit to issue $1.8 billion in new water and sewer bonds, resulting in savings of $250 million over the life of the bonds. The city also raised about $150 million to finance sewer system improvements. As part of the deal, Detroit water and sewer bonds were permanently removed from the city’s bankruptcy case. Some of the Funds in this report participated in the tender offer for existing Detroit water and sewer bonds and purchased the new water and sewer bonds. In general, Detroit water and sewer credits rallied following these positive developments.

IMPACT OF THE FUNDS’ LEVERAGE STRATEGIES ON PERFORMANCE

One important factor impacting the returns of the Funds relative to their comparative benchmarks was the Funds’ use of leverage through their issuance of preferred shares and/or investments in inverse floating rate securities, which represent leveraged investments in underlying bonds. The Funds use leverage because our research has shown that, over time, leveraging provides opportunities for additional income, particularly in the recent market environment where short-term market rates are at or near historical lows, meaning that the short-term rates the Fund has been paying on its leveraging instruments have been much lower than the interest the Fund has been earning on its portfolio of long-term bonds that it has bought with the proceeds of that leverage. However, use of leverage also can expose the Fund to additional price volatility. When a Fund uses leverage, the Fund will experience a greater increase in its net asset value if the municipal bonds acquired through the use of leverage increase in value, but it will also experience a correspondingly larger decline in its net asset value if the bonds acquired through leverage decline in value, which will make the Fund’s net asset value more volatile, and its total return performance more variable over time. In addition, income in levered funds will typically decrease in comparison to unlevered funds when short-term interest rates increase and increase when short-term interest rates decrease. Leverage made a positive contribution to the performance of these Funds over this reporting period.

As of October 31, 2014, the Funds’ percentages of leverage are as shown in the accompanying table.

| | NPP | NMA | NMO | NAD | NXZ | NZF | |

| Effective Leverage* | 37.24% | 34.89% | 35.99% | 34.66% | 33.67% | 34.56% | |

| Regulatory Leverage* | 35.32% | 30.73% | 33.44% | 30.13% | 29.59% | 28.67% | |

| * | Effective Leverage is a Fund’s effective economic leverage, and includes both regulatory leverage and the leverage effects of certain derivative and other investments in a Fund’s portfolio that increase the Fund’s investment exposure. Currently, the leverage effects of Tender Option Bond (TOB) inverse floater holdings are included in effective leverage values, in addition to any regulatory leverage. Regulatory leverage consists of preferred shares issued or borrowings of a Fund. Both of these are part of a Fund’s capital structure. Regulatory leverage is subject to asset coverage limits set forth in the Investment Company Act of 1940. |

THE FUNDS’ REGULATORY LEVERAGE

As of October 31, 2014, the Funds have issued and outstanding Institutional MuniFund Term Preferred (iMTP) Shares, Variable Rate MuniFund Term Preferred (VMTP) Shares and/or Variable Rate Demand Preferred (VRDP) Shares as shown in the accompanying table.

| | | iMTP Shares | | VMTP Shares | | VRDP Shares | | | | |

| | | | Series | | Shares Issued at Liquidation Value | | | Series | | Shares Issued at Liquidation Value | | | Series | | Shares Issued at Liquidation Value | | | Total | |

| NPP | | | — | | | — | | | 2015 | | $ | 535,000,000 | | | — | | | — | | $ | 535,000,000 | |

| NMA | | | — | | | — | | | — | | | — | | | 1 | | $ | 268,800,000 | | $ | 268,800,000 | |

| NMO | | | — | | | — | | | — | | | — | | | 1 | | $ | 350,900,000 | | $ | 350,900,000 | |

| NAD | | | — | | | — | | | 2016 | | $ | 265,000,000 | | | — | | | — | | $ | 265,000,000 | |

| NXZ | | | — | | | — | | | — | | | — | | | 2 | | $ | 196,000,000 | | $ | 196,000,000 | |

| NZF | | | 2017 | | $ | 150,000,000 | | | 2017 | | $ | 81,000,000 | | | — | | | — | | $ | 231,000,000 | |

During the current reporting period, NAD refinanced all of its outstanding MuniFund Term Preferred (MTP) and VMTP shares with the issuance of new VMTP Shares, and NZF refinanced all of its outstanding MTP and VMTP shares with the issuance of new iMTP and VMTP Shares. During the current reporting period NMA and NZF also redeemed a portion of their VRDP Shares and VMTP Shares, respectively. Refer to Notes to Financial Statements, Note 1 – General Information and Significant Accounting Policies for further details on iMTP, MTP, VMTP and VRDP Shares and each Fund’s respective transactions.

COMMON SHARE DISTRIBUTION INFORMATION

The following information regarding the Funds’ distributions is current as of October 31, 2014. Each Fund’s distribution levels may vary over time based on each Fund’s investment activity and portfolio investments value changes.

During the current reporting period, each Fund’s monthly distributions to common shareholders were as shown in the accompanying table.

| | | Per Common Share Amounts |

| Ex-Dividend Date | | | NPP | | | NMA | | | NMO | | | NAD | | | NXZ | | | NZF | |

| November 2013 | | $ | 0.0770 | | $ | 0.0670 | | $ | 0.0645 | | $ | 0.0730 | | $ | 0.0670 | | $ | 0.0580 | |

| December | | | 0.0770 | | | 0.0670 | | | 0.0645 | | | 0.0730 | | | 0.0670 | | | 0.0580 | |

| January | | | 0.0770 | | | 0.0670 | | | 0.0670 | | | 0.0740 | | | 0.0695 | | | 0.0595 | |

| February | | | 0.0770 | | | 0.0670 | | | 0.0670 | | | 0.0740 | | | 0.0695 | | | 0.0595 | |

| March | | | 0.0770 | | | 0.0670 | | | 0.0670 | | | 0.0740 | | | 0.0695 | | | 0.0595 | |

| April | | | 0.0770 | | | 0.0670 | | | 0.0670 | | | 0.0740 | | | 0.0695 | | | 0.0595 | |

| May | | | 0.0770 | | | 0.0670 | | | 0.0670 | | | 0.0740 | | | 0.0695 | | | 0.0595 | |

| June | | | 0.0770 | | | 0.0670 | | | 0.0670 | | | 0.0740 | | | 0.0695 | | | 0.0595 | |

| July | | | 0.0770 | | | 0.0670 | | | 0.0670 | | | 0.0740 | | | 0.0715 | | | 0.0625 | |

| August | | | 0.0770 | | | 0.0670 | | | 0.0670 | | | 0.0740 | | | 0.0715 | | | 0.0625 | |

| September | | | 0.0770 | | | 0.0670 | | | 0.0670 | | | 0.0740 | | | 0.0715 | | | 0.0625 | |

| October 2014 | | | 0.0770 | | | 0.0670 | | | 0.0670 | | | 0.0740 | | | 0.0715 | | | 0.0625 | |

| | | | | | | | | | | | | | | | | | | | |

| Ordinary Income Distribution* | | $ | 0.0006 | | $ | 0.0009 | | $ | 0.0042 | | $ | 0.0183 | | $ | 0.0002 | | $ | 0.0002 | |

| | | | | | | | | | | | | | | | | | | | |

| Market Yield** | | | 6.32 | % | | 5.85 | % | | 5.91 | % | | 6.27 | % | | 6.08 | % | | 5.43 | % |

| Taxable-Equivalent Yield** | | | 8.78 | % | | 8.13 | % | | 8.21 | % | | 8.71 | % | | 8.44 | % | | 7.54 | % |

| * | Distribution paid in December 2013. |

| ** | Market Yield is based on the Fund’s current annualized monthly dividend divided by the Fund’s current market price as of the end of the reporting period. Taxable-Equivalent Yield represents the yield that must be earned on a fully taxable investment in order to equal the yield of the Fund on an after-tax basis. It is based on a federal income tax rate of 28.0%. When comparing a Fund to investments that generate qualified dividend income, the Taxable-Equivalent Yield is lower. |

Each Fund in this report seeks to pay regular monthly dividends out of its net investment income at a rate that reflects its past and projected net income performance. To permit each Fund to maintain a more stable monthly dividend, the Fund may pay dividends at a rate that may be more or less than the amount of net income actually earned by the Fund during the period. If a Fund has cumulatively earned more than it has paid in dividends, it will hold the excess in reserve as undistributed net investment income (UNII) as part of the Fund’s net asset value. Conversely, if a Fund has cumulatively paid in dividends more than it has earned, the excess will constitute a negative UNII that will likewise be reflected in the Fund’s net asset value. Each Fund will, over time, pay all its net investment income as dividends to shareholders.

As of October 31, 2014, all the Funds in this report had positive UNII balances for both tax and financial reporting purposes.

All monthly dividends paid by the Funds during the fiscal year ended October 31, 2014 were paid from net investment income. If a portion of a Fund’s monthly distributions was sourced from or comprised of elements other than net investment income, including capital gains and/or a return of capital, the Funds’ shareholders would have received a notice to that effect. The composition and per share amounts of each Fund’s monthly dividends for the reporting period are presented in the Statement of Changes in Net Assets and Financial Highlights, respectively (for reporting purposes) and in Note 6 — Income Tax Information within the accompany Notes to Financial Statements (for income tax purposes), later in this report.

COMMON SHARE REPURCHASES

During August 2014, the Funds’ Board of Directors/Trustees reauthorized an open-market share repurchase program, allowing each Fund to repurchase an aggregate of up to approximately 10% of its outstanding shares.

As of October 31, 2014, and since the inception of the Funds’ repurchase programs, the Funds have cumulatively repurchased and retired their common shares as shown in the accompanying table.

| | NPP | NMA | NMO | NAD | NXZ | NZF | |

| Common Shares Cumulatively Repurchased and Retired | 0 | 0 | 0 | 0 | 0 | 30,000 | |

| Common Shares Authorized for Repurchase | 6,005,000 | 4,370,000 | 4,585,000 | 3,930,000 | 2,950,000 | 4,040,000 | |

During the current reporting period, NZF repurchased and retired its common shares at a weighted average price per common share and a weighted average discount per common share as shown in the accompanying table.

| | | NZF | |

| Common Shares Repurchased and Retired | | 30,000 | |

| Weighted Average Price per Common Share Repurchased and Retired | $ | 13.72 | |

| Weighted Average Discount per Common Share Repurchased and Retired | | 14.14 | % |

TENDER OFFER

During the current fiscal period, the Board of Directors/Trustees of NMA and NZF each approved a tender offer to purchase up to 10% of each Fund’s outstanding common shares for cash at a price per common share equal to 98% of the Fund’s per common share NAV determined on the date the tender offer expires.

Each Fund’s tender offer commenced on August 18, 2014 and expired on September 19, 2014. Each Fund’s tender offer was oversubscribed, and therefore each Fund purchased 10% of its respective outstanding common shares allocating such purchases pro-rata based on the number of shares properly tendered. Refer to Notes to Financial Statements, Note 1 – General Information and Significant Accounting Policies for further details on each Fund’s tender offer.

OTHER COMMON SHARE INFORMATION

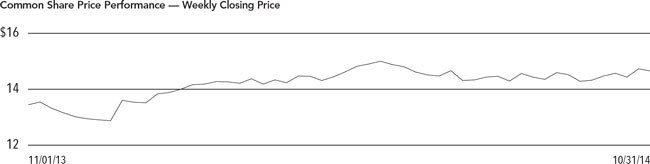

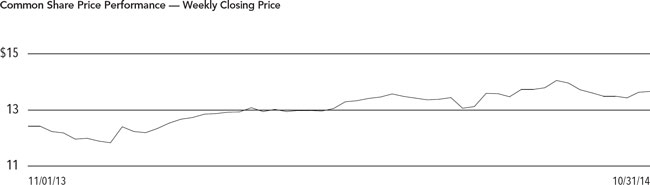

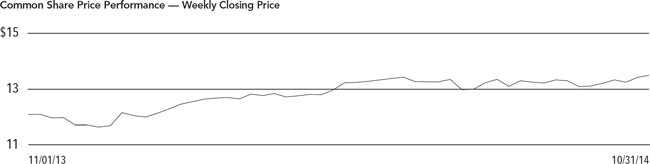

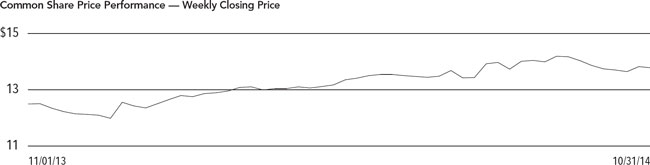

As of October 31, 2014, and during the current reporting period, the Funds’ common share prices were trading at a premium/(discount) to their common share NAVs as shown in the accompanying table.

| | | | NPP | | | NMA | | | NMO | | | NAD | | | NXZ | | | NZF | |

| NAV | | $ | 16.32 | | $ | 15.41 | | $ | 15.23 | | $ | 15.64 | | $ | 15.82 | | $ | 15.82 | |

| Share Price | | $ | 14.61 | | $ | 13.74 | | $ | 13.60 | | $ | 14.16 | | $ | 14.12 | | $ | 13.80 | |

| Premium/(Discount) to NAV | | | (10.48 | )% | | (10.84 | )% | | (10.70 | )% | | (9.46 | )% | | (10.75 | )% | | (12.77 | )% |

| 12-Month Average Premium/(Discount) to NAV | | | (8.37 | )% | | (10.57 | )% | | (10.80 | )% | | (9.46 | )% | | (10.28 | )% | | (11.68 | )% |

Fund shares are not guaranteed or endorsed by any bank or other insured depository institution, and are not federally insured by the Federal Deposit Insurance Corporation. Past performance is no guarantee of future results. Fund common shares are subject to a variety of risks, including:

Investment, Market and Price Risk. An investment in common shares is subject to investment risk, including the possible loss of the entire principal amount that you invest. Your investment in common shares represents an indirect investment in the municipal securities owned by the Funds, which generally trade in the over-the-counter markets. Shares of closed-end investment companies like these Funds frequently trade at a discount to their net asset value (NAV). Your common shares at any point in time may be worth less than your original investment, even after taking into account the reinvestment of Fund dividends and distributions.

Leverage Risk. Each Fund’s use of leverage creates the possibility of higher volatility for the Fund’s per share NAV, market price, distributions and returns. There is no assurance that a Fund’s leveraging strategy will be successful. Certain aspects of the recently adopted Volcker Rule may limit the availability of tender option bonds, which are used by the Funds for leveraging and duration management purposes. The effects of this new Rule, expected to take effect in mid-2015, may make it more difficult for a Fund to maintain current or desired levels of leverage and may cause the Fund to incur additional expenses to maintain its leverage.

Inverse Floater Risk. The Funds may invest in inverse floaters. Due to their leveraged nature, these investments can greatly increase a Fund’s exposure to interest rate risk and credit risk. In addition, investments in inverse floaters involve the risk that a Fund could lose more than its original principal investment.

Tax Risk. The tax treatment of Fund distributions may be affected by new IRS interpretations of the Internal Revenue Code and future changes in tax laws and regulations.

Issuer Credit Risk. This is the risk that a security in a Fund’s portfolio will fail to make dividend or interest payments when due.

Interest Rate Risk. Fixed-income securities such as bonds, preferred, convertible and other debt securities will decline in value if market interest rates rise.

Reinvestment Risk. If market interest rates decline, income earned from a Fund’s portfolio may be reinvested at rates below that of the original bond that generated the income.

Call Risk or Prepayment Risk. Issuers may exercise their option to prepay principal earlier than scheduled, forcing a Fund to reinvest in lower-yielding securities.

Derivatives Risk. The Funds may use derivative instruments which involve a high degree of financial risk, including the risk that the loss on a derivative may be greater than the principal amount investment.

Municipal Bond Market Liquidity Risk. Inventories of municipal bonds held by brokers and dealers have decreased in recent years, lessening their ability to make a market in these securities. This reduction in market making capacity has the potential to decrease a Fund’s ability to buy or sell bonds, and increase bond price volatility and trading costs, particularly during periods of economic or market stress. In addition, recent federal banking regulations may cause certain dealers to reduce their inventories of municipal bonds, which may further decrease a Fund’s ability to buy or sell bonds. As a result, the Fund may be forced to accept a lower price to sell a security, to sell other securities to raise cash, or to give up an investment opportunity, any of which could have a negative effect on performance. If the Fund needed to sell large blocks of bonds, those sales could further reduce the bonds’ prices and hurt performance.

| NPP | |

| | Nuveen Performance Plus Municipal Fund, Inc. |

| | Performance Overview and Holding Summaries as of October 31, 2014 |

Refer to the Glossary of Terms Used in this Report for further definition of the terms used within this section.

Average Annual Total Returns as of October 31, 2014

| | Average Annual |

| | 1-Year | 5-Year | 10-Year |

| NPP at Common Share NAV | 16.91% | 8.96% | 6.32% |

| NPP at Common Share Price | 14.24% | 8.47% | 6.13% |

| S&P Municipal Bond Index | 7.94% | 5.45% | 4.74% |

| Lipper General & Insured Leveraged Municipal Debt Funds Classification Average | 17.38% | 9.24% | 6.28% |

Past performance is not predictive of future results. Current performance may be higher or lower than the data shown. Returns do not reflect the deduction of taxes that shareholders may have to pay on Fund distributions or upon the sale of Fund shares. Returns at NAV are net of Fund expenses, and assume reinvestment of distributions. Comparative index and Lipper return information is provided for the Fund’s shares at NAV only. Indexes and Lipper averages are not available for direct investment.

| NPP | Performance Overview and Holding Summaries as of October 31, 2014 (continued) |

This data relates to the securities held in the Fund’s portfolio of investments as of the end of the reporting period. It should not be construed as a measure of performance for the Fund itself. Holdings are subject to change.

Ratings shown are the highest rating given by one of the following national rating agencies: Standard & Poor’s Group, Moody’s Investors Service, Inc. or Fitch, Inc. Credit ratings are subject to change. AAA, AA, A and BBB are investment grade ratings; BB, B, CCC, CC, C and D are below-investment grade ratings. Certain bonds backed by U.S. Government or agency securities are regarded as having an implied rating equal to the rating of such securities. Holdings designated N/R are not rated by these national rating agencies.

| Fund Allocation | |

| (% of net assets) | |

| Long-Term Municipal Bonds | 154.5% |

| Corporate Bonds | 0.0% |

| Floating Rate Obligations | (2.9)% |

| VMTP, at Liquidation Value Shares | (54.6)% |

| Other Assets Less Liabilities | 3.0% |

| Credit Quality | |

| (% of total investment exposure) | |

| AAA/U.S. Guaranteed | 14.8% |

| AA | 50.6% |

| A | 18.3% |

| BBB | 8.4% |

| BB or Lower | 6.5% |

| N/R (not rated) | 1.4% |

| Portfolio Composition | |

| (% of total investments) | |

| Transportation | 18.9% |

| Tax Obligation/Limited | 18.5% |

| Health Care | 16.9% |

| Tax Obligation/General | 14.8% |

| U.S. Guaranteed | 8.9% |

| Utilities | 7.7% |

| Consumer Staples | 6.1% |

| Other | 8.2% |

| States and Territories | |

| (% of total municipal bonds) | |

| Illinois | 17.0% |

| California | 13.0% |

| Texas | 9.4% |

| Colorado | 6.5% |

| Florida | 5.4% |

| Ohio | 4.1% |

| New York | 3.6% |

| Virginia | 3.3% |

| Pennsylvania | 2.8% |

| South Carolina | 2.7% |

| Nevada | 2.7% |

| New Jersey | 2.6% |

| Massachusetts | 2.6% |

| Indiana | 2.4% |

| Michigan | 2.3% |

| Other | 19.6% |

| NMA | |

| | Nuveen Municipal Advantage Fund, Inc. |

| | Performance Overview and Holding Summaries as of October 31, 2014 |

Refer to the Glossary of Terms Used in this Report for further definition of the terms used within this section.

Average Annual Total Returns as of October 31, 2014

| | Average Annual |

| | 1-Year | 5-Year | 10-Year |

| NMA at Common Share NAV | 15.93% | 8.83% | 6.08% |

| NMA at Common Share Price | 16.64% | 7.67% | 5.31% |

| S&P Municipal Bond Index | 7.94% | 5.45% | 4.74% |

| Lipper General & Insured Leveraged Municipal Debt Funds Classification Average | 17.38% | 9.24% | 6.28% |

Past performance is not predictive of future results. Current performance may be higher or lower than the data shown. Returns do not reflect the deduction of taxes that shareholders may have to pay on Fund distributions or upon the sale of Fund shares. Returns at NAV are net of Fund expenses, and assume reinvestment of distributions. Comparative index and Lipper return information is provided for the Fund’s shares at NAV only. Indexes and Lipper averages are not available for direct investment.

| NMA | Performance Overview and Holding Summaries as of October 31, 2014 (continued) |

This data relates to the securities held in the Fund’s portfolio of investments as of the end of the reporting period. It should not be construed as a measure of performance for the Fund itself. Holdings are subject to change.

Ratings shown are the highest rating given by one of the following national rating agencies: Standard & Poor’s Group, Moody’s Investors Service, Inc. or Fitch, Inc. Credit ratings are subject to change. AAA, AA, A and BBB are investment grade ratings; BB, B, CCC, CC, C and D are below-investment grade ratings. Certain bonds backed by U.S. Government or agency securities are regarded as having an implied rating equal to the rating of such securities. Holdings designated N/R are not rated by these national rating agencies.

| Fund Allocation | |

| (% of net assets) | |

| Long-Term Municipal Bonds | 144.8% |

| Corporate Bonds | 0.0% |

| Floating Rate Obligations | (5.1)% |

| VRDP Shares, at Liquidation Value | (44.4)% |

| Other Assets Less Liabilities | 4.7% |

| Credit Quality | |

| (% of total investment exposure) | |

| AAA/U.S. Guaranteed | 10.0% |

| AA | 53.8% |

| A | 17.0% |

| BBB | 10.3% |

| BB or Lower | 7.9% |

| N/R (not rated) | 1.0% |

| Portfolio Composition | |

| (% of total investments) | |

| Health Care | 22.0% |

| Transportation | 19.9% |

| Tax Obligation/General | 17.7% |

| Tax Obligation/Limited | 15.0% |

| Utilities | 6.6% |

| Consumer Staples | 5.7% |

| Other | 13.1% |

| States and Territories | |

| (% of total municipal bonds) | |

| California | 15.5% |

| Illinois | 10.2% |

| Texas | 9.6% |

| Colorado | 9.1% |

| New York | 5.9% |

| Ohio | 5.2% |

| Louisiana | 4.4% |

| Indiana | 3.8% |

| Nevada | 3.5% |

| Pennsylvania | 3.0% |

| Michigan | 3.0% |

| Florida | 2.9% |

| Arizona | 2.7% |

| Virginia | 2.2% |

| Other | 19.0% |

| NMO | |

| | Nuveen Municipal Market Opportunity Fund, Inc. |

| | Performance Overview and Holding Summaries as of October 31, 2014 |

Refer to the Glossary of Terms Used in this Report for further definition of the terms used within this section.

Average Annual Total Returns as of October 31, 2014

| | Average Annual |

| | 1-Year | 5-Year | 10-Year |

| NMO at Common Share NAV | 17.25% | 8.91% | 5.93% |

| NMO at Common Share Price | 18.70% | 7.17% | 5.78% |

| S&P Municipal Bond Index | 7.94% | 5.45% | 4.74% |

| Lipper General & Insured Leveraged Municipal Debt Funds Classification Average | 17.38% | 9.24% | 6.28% |

Past performance is not predictive of future results. Current performance may be higher or lower than the data shown. Returns do not reflect the deduction of taxes that shareholders may have to pay on Fund distributions or upon the sale of Fund shares. Returns at NAV are net of Fund expenses, and assume reinvestment of distributions. Comparative index and Lipper return information is provided for the Fund’s shares at NAV only. Indexes and Lipper averages are not available for direct investment.

| NMO | Performance Overview and Holding Summaries as of October 31, 2014 (continued) |

This data relates to the securities held in the Fund’s portfolio of investments as of the end of the reporting period. It should not be construed as a measure of performance for the Fund itself. Holdings are subject to change.

Ratings shown are the highest rating given by one of the following national rating agencies: Standard & Poor’s Group, Moody’s Investors Service, Inc. or Fitch, Inc. Credit ratings are subject to change. AAA, AA, A and BBB are investment grade ratings; BB, B, CCC, CC, C and D are below-investment grade ratings. Certain bonds backed by U.S. Government or agency securities are regarded as having an implied rating equal to the rating of such securities. Holdings designated N/R are not rated by these national rating agencies.

| Fund Allocation | |

| (% of net assets) | |

| Long-Term Municipal Bonds | 149.4% |

| Common Stocks | 0.4% |

| Corporate Bonds | 0.0% |

| Floating Rate Obligations | (3.2)% |

| VRDP Shares, at Liquidation Value | (50.2)% |

| Other Assets Less Liabilities | 3.6% |

| Credit Quality | |

| (% of total investment exposure) | |

| AAA/U.S. Guaranteed | 14.4% |

| AA | 49.7% |

| A | 19.9% |

| BBB | 7.3% |

| BB or Lower | 7.7% |

| N/R (not rated) | 0.7% |

| N/A (not applicable) | 0.3% |

| Portfolio Composition | |

| (% of total investments) | |

| Transportation | 21.1% |

| Health Care | 18.7% |

| Tax Obligation/General | 15.0% |

| Tax Obligation/Limited | 13.7% |

| U.S. Guaranteed | 9.0% |

| Consumer Staples | 6.1% |

| Utilities | 5.2% |

| Other | 11.2% |

| States and Territories | |

| (% of total municipal bonds) | |

| California | 16.3% |

| Illinois | 11.5% |

| Texas | 10.4% |

| Colorado | 5.7% |

| Ohio | 5.6% |

| New York | 4.4% |

| Florida | 4.4% |

| Pennsylvania | 4.2% |

| Nevada | 3.8% |

| Virginia | 3.5% |

| North Carolina | 2.8% |

| New Jersey | 2.7% |

| Michigan | 2.6% |

| Indiana | 2.4% |

| Other | 19.7% |

| NAD | |

| | Nuveen Dividend Advantage Municipal Fund |

| | Performance Overview and Holding Summaries as of October 31, 2014 |

Refer to the Glossary of Terms Used in this Report for further definition of the terms used within this section.

Average Annual Total Returns as of October 31, 2014

| | Average Annual |

| | 1-Year | 5-Year | 10-Year |

| NAD at Common Share NAV | 15.19% | 8.93% | 6.22% |

| NAD at Common Share Price | 17.10% | 8.74% | 5.70% |

| S&P Municipal Bond Index | 7.94% | 5.45% | 4.74% |

| Lipper General & Insured Leveraged Municipal Debt Funds Classification Average | 17.38% | 9.24% | 6.28% |

Past performance is not predictive of future results. Current performance may be higher or lower than the data shown. Returns do not reflect the deduction of taxes that shareholders may have to pay on Fund distributions or upon the sale of Fund shares. Returns at NAV are net of Fund expenses, and assume reinvestment of distributions. Comparative index and Lipper return information is provided for the Fund’s shares at NAV only. Indexes and Lipper averages are not available for direct investment.

| NAD | Performance Overview and Holding Summaries as of October 31, 2014 (continued) |

This data relates to the securities held in the Fund’s portfolio of investments as of the end of the reporting period. It should not be construed as a measure of performance for the Fund itself. Holdings are subject to change.

Ratings shown are the highest rating given by one of the following national rating agencies: Standard & Poor’s Group, Moody’s Investors Service, Inc. or Fitch, Inc. Credit ratings are subject to change. AAA, AA, A and BBB are investment grade ratings; BB, B, CCC, CC, C and D are below-investment grade ratings. Certain bonds backed by U.S. Government or agency securities are regarded as having an implied rating equal to the rating of such securities. Holdings designated N/R are not rated by these national rating agencies.

| Fund Allocation | |

| (% of net assets) | |

| Long-Term Municipal Bonds | 144.8% |

| Corporate Bonds | 0.0% |

| Investment Companies | 0.1% |

| Floating Rate Obligations | (5.9)% |

| VMTP Shares, at Liquidation Value | (43.1)% |

| Other Assets Less Liabilities | 4.1% |

| Credit Quality | |

| (% of total investment exposure) | |

| AAA/U.S. Guaranteed | 10.3% |

| AA | 54.9% |

| A | 18.8% |

| BBB | 8.4% |

| BB or Lower | 5.4% |

| N/R (not rated) | 2.1% |

| N/A (not applicable) | 0.1% |

| Portfolio Composition | |

| (% of total investments) | |

| Health Care | 20.3% |

| Transportation | 19.7% |

| Tax Obligation/Limited | 17.8% |

| Tax Obligation/General | 16.9% |

| Consumer Staples | 6.5% |

| U.S. Guaranteed | 6.2% |

| Other | 12.6% |

| States and Territories | |

| (% of total municipal bonds) | |

| Illinois | 16.0% |

| California | 10.8% |

| Colorado | 7.2% |

| Texas | 7.2% |

| Florida | 6.5% |

| New York | 6.3% |

| Washington | 5.4% |

| Wisconsin | 3.9% |

| Nevada | 3.8% |

| Ohio | 3.7% |

| New Jersey | 3.6% |

| Virginia | 2.4% |

| Arizona | 2.3% |

| Indiana | 2.2% |

| Other | 18.7% |

| NXZ | |

| | Nuveen Dividend Advantage Municipal Fund 2 |

| | Performance Overview and Holding Summaries as of October 31, 2014 |

Refer to the Glossary of Terms Used in this Report for further definition of the terms used within this section.

Average Annual Total Returns as of October 31, 2014

| | Average Annual |

| | 1-Year | 5-Year | 10-Year |

| NXZ at Common Share NAV | 14.72% | 8.47% | 6.58% |

| NXZ at Common Share Price | 15.56% | 6.79% | 5.70% |

| S&P Municipal Bond Index | 7.94% | 5.45% | 4.74% |

| Lipper General & Insured Leveraged Municipal Debt Funds Classification Average | 17.38% | 9.24% | 6.28% |

Past performance is not predictive of future results. Current performance may be higher or lower than the data shown. Returns do not reflect the deduction of taxes that shareholders may have to pay on Fund distributions or upon the sale of Fund shares. Returns at NAV are net of Fund expenses, and assume reinvestment of distributions. Comparative index and Lipper return information is provided for the Fund’s shares at NAV only. Indexes and Lipper averages are not available for direct investment.

| NXZ | Performance Overview and Holding Summaries as of October 31, 2014 (continued) |

This data relates to the securities held in the Fund’s portfolio of investments as of the end of the reporting period. It should not be construed as a measure of performance for the Fund itself. Holdings are subject to change.

Ratings shown are the highest rating given by one of the following national rating agencies: Standard & Poor’s Group, Moody’s Investors Service, Inc. or Fitch, Inc. Credit ratings are subject to change. AAA, AA, A and BBB are investment grade ratings; BB, B, CCC, CC, C and D are below-investment grade ratings. Certain bonds backed by U.S. Government or agency securities are regarded as having an implied rating equal to the rating of such securities. Holdings designated N/R are not rated by these national rating agencies.

| Fund Allocation | |

| (% of net assets) | |

| Long-Term Municipal Bonds | 139.8% |

| Corporate Bonds | 0.0% |

| Floating Rate Obligations | (4.2)% |

| VRDP Shares, at Liquidation Value | (42.0)% |

| Other Assets Less Liabilities | 6.4% |

| Credit Quality | |

| (% of total investment exposure) | |

| AAA/U.S. Guaranteed | 13.1% |

| AA | 50.8% |

| A | 17.0% |

| BBB | 8.4% |

| BB or Lower | 8.0% |

| N/R (not rated) | 2.7% |

| Portfolio Composition | |

| (% of total investments) | |

| Tax Obligation/Limited | 22.4% |

| Health Care | 18.5% |

| Transportation | 13.7% |

| Tax Obligation/General | 11.9% |

| U.S. Guaranteed | 9.5% |

| Consumer Staples | 6.5% |

| Utilities | 5.8% |

| Other | 11.7% |

| States and Territories | |

| (% of total municipal bonds) | |

| Texas | 18.1% |

| California | 16.8% |

| Illinois | 12.7% |

| Colorado | 6.6% |

| New York | 6.5% |

| Florida | 4.0% |

| Michigan | 3.5% |

| South Carolina | 2.5% |

| Pennsylvania | 2.4% |

| Indiana | 2.4% |

| Ohio | 2.3% |

| Georgia | 2.1% |

| Massachusetts | 1.7% |

| Other | 18.4% |

| NZF | |

| | Nuveen Dividend Advantage Municipal Fund 3 |

| | Performance Overview and Holding Summaries as of October 31, 2014 |

Refer to the Glossary of Terms Used in this Report for further definition of the terms used within this section.

Average Annual Total Returns as of October 31, 2014

| | Average Annual |

| | 1-Year | 5-Year | 10-Year |

| NZF at Common Share NAV | 15.90% | 8.57% | 6.47% |

| NZF at Common Share Price | 15.07% | 7.22% | 5.96% |

| S&P Municipal Bond Index | 7.94% | 5.45% | 4.74% |

| Lipper General & Insured Leveraged Municipal Debt Funds Classification Average | 17.38% | 9.24% | 6.28% |

Past performance is not predictive of future results. Current performance may be higher or lower than the data shown. Returns do not reflect the deduction of taxes that shareholders may have to pay on Fund distributions or upon the sale of Fund shares. Returns at NAV are net of Fund expenses, and assume reinvestment of distributions. Comparative index and Lipper return information is provided for the Fund’s shares at NAV only. Indexes and Lipper averages are not available for direct investment.

| NZF | Performance Overview and Holding Summaries as of October 31, 2014 (continued) |

This data relates to the securities held in the Fund’s portfolio of investments as of the end of the reporting period. It should not be construed as a measure of performance for the Fund itself. Holdings are subject to change.

Ratings shown are the highest rating given by one of the following national rating agencies: Standard & Poor’s Group, Moody’s Investors Service, Inc. or Fitch, Inc. Credit ratings are subject to change. AAA, AA, A and BBB are investment grade ratings; BB, B, CCC, CC, C and D are below-investment grade ratings. Certain bonds backed by U.S. Government or agency securities are regarded as having an implied rating equal to the rating of such securities. Holdings designated N/R are not rated by these national rating agencies.

| Fund Allocation | |

| (% of net assets) | |

| Long-Term Municipal Bonds | 143.8% |

| Corporate Bonds | 0.0% |

| Investment Companies | 0.6% |

| Floating Rate Obligations | (6.4)% |

| iMTP Shares, at Liquidation Value | (26.1)% |

| VMTP Shares, at Liquidation Value | (14.1)% |

| Other Assets Less Liabilities | 2.2% |

| Credit Quality | |

| (% of total investment exposure) | |

| AAA/U.S. Guaranteed | 17.6% |

| AA | 43.5% |

| A | 20.1% |

| BBB | 8.4% |

| BB or Lower | 4.0% |

| N/R (not rated) | 6.0% |

| N/A (not applicable) | 0.4% |

| Portfolio Composition | |

| (% of total investments) | |

| Tax Obligation/Limited | 20.5% |

| Health Care | 16.2% |

| Transportation | 14.9% |

| Tax Obligation/General | 11.8% |

| U.S. Guaranteed | 8.7% |

| Utilities | 8.3% |

| Water and Sewer | 6.8% |

| Other | 12.8% |

| States and Territories | |

| (% of total municipal bonds) | |

| Texas | 13.2% |

| Illinois | 11.6% |

| California | 9.3% |

| Indiana | 8.5% |

| New York | 5.0% |

| Michigan | 4.4% |

| Nevada | 4.2% |

| Massachusetts | 3.2% |

| South Carolina | 3.1% |

| Colorado | 3.1% |

| New Jersey | 3.0% |

| Georgia | 2.9% |

| Louisiana | 2.9% |

| Washington | 2.7% |

| Missouri | 2.2% |

| Ohio | 2.2% |

| Other | 18.5% |

| Shareholder Meeting Report |

The annual meeting of shareholders was held in the offices of Nuveen Investments on August 5, 2014 for NPP, NMA, NMO, NAD, NXZ and NZF; at this meeting the shareholders were asked to vote to approve a new investment management agreement, to approve a new sub-advisory agreement and to elect Board Members.

| | | NPP | | NMA | | NMO | |

| | | | Common and | | | | | | Common and | | | | | | Common and | | | | |

| | | | Preferred | | | | | | Preferred | | | | | | Preferred | | | | |

| | | | shares voting | | | | | | shares voting | | | | | | shares voting | | | | |

| | | | together | | | Preferred | | | together | | | Preferred | | | together | | | Preferred | |

| | | | as a class | | | Shares | | | as a class | | | Shares | | | as a class | | | Shares | |

| To approve a new investment management agreement | | | | | | | | | | | | | | | | | | | |

| For | | | 29,878,557 | | | — | | | 24,160,036 | | | — | | | 24,238,851 | | | — | |

| Against | | | 899,344 | | | — | | | 735,554 | | | — | | | 1,242,461 | | | — | |

| Abstain | | | 844,109 | | | — | | | 741,316 | | | — | | | 771,668 | | | — | |

| Broker Non-Votes | | | 6,551,436 | | | — | | | 4,756,899 | | | — | | | 5,682,975 | | | — | |

| Total | | | 38,173,446 | | | — | | | 30,393,805 | | | — | | | 31,935,955 | | | — | |

| To approve a new sub-advisory agreement | | | | | | | | | | | | | | | | | | | |

| For | | | 29,785,578 | | | — | | | 23,987,869 | | | — | | | 24,174,913 | | | — | |

| Against | | | 964,435 | | | — | | | 856,026 | | | — | | | 1,316,566 | | | — | |

| Abstain | | | 871,999 | | | — | | | 793,013 | | | — | | | 761,499 | | | — | |

| Broker Non-Votes | | | 6,551,434 | | | — | | | 4,756,897 | | | — | | | 5,682,977 | | | — | |

| Total | | | 38,173,446 | | | — | | | 30,393,805 | | | — | | | 31,935,955 | | | — | |

| Approval of the Board Members was reached as follows: | | | | | | | | | | | | | | | | | | | |

| William Adams IV | | | | | | | | | | | | | | | | | | | |

| For | | | 37,001,421 | | | — | | | 29,362,016 | | | — | | | 30,309,433 | | | — | |

| Withhold | | | 1,172,025 | | | — | | | 1,031,789 | | | — | | | 1,626,522 | | | — | |

| Total | | | 38,173,446 | | | — | | | 30,393,805 | | | — | | | 31,935,955 | | | — | |

| Robert P. Bremner | | | | | | | | | | | | | | | | | | | |

| For | | | 36,987,809 | | | — | | | 29,338,220 | | | — | | | 30,365,752 | | | — | |

| Withhold | | | 1,185,637 | | | — | | | 1,055,585 | | | — | | | 1,570,203 | | | — | |

| Total | | | 38,173,446 | | | — | | | 30,393,805 | | | — | | | 31,935,955 | | | — | |

| Jack B. Evans | | | | | | | | | | | | | | | | | | | |

| For | | | 36,972,395 | | | — | | | 29,385,392 | | | — | | | 30,384,294 | | | — | |

| Withhold | | | 1,201,051 | | | — | | | 1,008,413 | | | — | | | 1,551,661 | | | — | |

| Total | | | 38,173,446 | | | — | | | 30,393,805 | | | — | | | 31,935,955 | | | — | |

| William C. Hunter | | | | | | | | | | | | | | | | | | | |

| For | | | — | | | 5,350 | | | — | | | 153 | | | — | | | 2,859 | |

| Withhold | | | — | | | — | | | — | | | 974 | | | — | | | 550 | |

| Total | | | — | | | 5,350 | | | — | | | 1,127 | | | — | | | 3,409 | |

Shareholder Meeting Report (continued)

| | | NPP | | NMA | | NMO | |

| | | | Common and | | | | | | Common and | | | | | | Common and | | | | |

| | | | Preferred | | | | | | Preferred | | | | | | Preferred | | | | |

| | | | shares voting | | | | | | shares voting | | | | | | shares voting | | | | |

| | | | together | | | Preferred | | | together | | | Preferred | | | together | | | Preferred | |

| | | | as a class | | | Shares | | | as a class | | | Shares | | | as a class | | | Shares | |

| Approval of the Board Members was reached as follows: | | | | | | | | | | | | | | | | | | | |

| David J. Kundert | | | | | | | | | | | | | | | | | | | |

| For | | | 37,003,468 | | | — | | | 29,345,370 | | | — | | | 30,357,874 | | | — | |

| Withhold | | | 1,169,978 | | | — | | | 1,048,435 | | | — | | | 1,578,081 | | | — | |

| Total | | | 38,173,446 | | | — | | | 30,393,805 | | | — | | | 31,935,955 | | | — | |

| John K. Nelson | | | | | | | | | | | | | | | | | | | |

| For | | | 37,013,020 | | | — | | | 29,384,695 | | | — | | | 30,370,051 | | | — | |

| Withhold | | | 1,160,426 | | | — | | | 1,009,110 | | | — | | | 1,565,904 | | | — | |

| Total | | | 38,173,446 | | | — | | | 30,393,805 | | | — | | | 31,935,955 | | | — | |

| William J. Schneider | | | | | | | | | | | | | | | | | | | |

| For | | | — | | | 5,350 | | | — | | | 153 | | | — | | | 2,859 | |

| Withhold | | | — | | | — | | | — | | | 974 | | | — | | | 550 | |

| Total | | | — | | | 5,350 | | | — | | | 1,127 | | | — | | | 3,409 | |

| Thomas S. Schreier, Jr. | | | | | | | | | | | | | | | | | | | |

| For | | | 37,002,318 | | | — | | | 29,371,524 | | | — | | | 30,355,025 | | | — | |

| Withhold | | | 1,171,128 | | | — | | | 1,022,281 | | | — | | | 1,580,930 | | | — | |

| Total | | | 38,173,446 | | | — | | | 30,393,805 | | | — | | | 31,935,955 | | | — | |

| Judith M. Stockdale | | | | | | | | | | | | | | | | | | | |

| For | | | 36,974,480 | | | — | | | 29,313,818 | | | — | | | 30,371,729 | | | — | |

| Withhold | | | 1,198,966 | | | — | | | 1,079,987 | | | — | | | 1,564,226 | | | — | |

| Total | | | 38,173,446 | | | — | | | 30,393,805 | | | — | | | 31,935,955 | | | — | |

| Carole E. Stone | | | | | | | | | | | | | | | | | | | |

| For | | | 36,996,976 | | | — | | | 29,344,715 | | | — | | | 30,363,411 | | | — | |

| Withhold | | | 1,176,470 | | | — | | | 1,049,090 | | | — | | | 1,572,544 | | | — | |

| Total | | | 38,173,446 | | | — | | | 30,393,805 | | | — | | | 31,935,955 | | | — | |

| Virginia L. Stringer | | | | | | | | | | | | | | | | | | | |

| For | | | 37,000,050 | | | — | | | 29,348,291 | | | — | | | 30,343,226 | | | — | |

| Withhold | | | 1,173,396 | | | — | | | 1,045,514 | | | — | | | 1,592,729 | | | — | |

| Total | | | 38,173,446 | | | — | | | 30,393,805 | | | — | | | 31,935,955 | | | — | |

| Terence J. Toth | | | | | | | | | | | | | | | | | | | |

| For | | | 37,021,552 | | | — | | | 29,354,684 | | | — | | | 30,359,615 | | | — | |

| Withhold | | | 1,151,894 | | | — | | | 1,039,121 | | | — | | | 1,576,340 | | | — | |

| Total | | | 38,173,446 | | | — | | | 30,393,805 | | | — | | | 31,935,955 | | | — | |

| | | | NAD | | | NXZ | | | NZF | |

| | | | Common and | | | | | | Common and | | | | | | Common and | | | | |

| | | | Preferred | | | | | | Preferred | | | | | | Preferred | | | Preferred | |

| | | | shares voting | | | | | | shares voting | | | | | | shares voting | | | shares voting | |

| | | | together | | | Preferred | | | together | | | Preferred | | | together | | | together | |

| | | | as a class | | | Shares | | | as a class | | | Shares | | | as a class | | | as a class | |

| To approve a new investment management agreement | | | | | | | | | | | | | | | | | | | |

| For | | | 19,027,034 | | | — | | | 15,004,248 | | | — | | | 21,624,211 | | | — | |

| Against | | | 856,333 | | | — | | | 471,660 | | | — | | | 1,581,506 | | | — | |

| Abstain | | | 484,943 | | | — | | | 525,614 | | | — | | | 549,565 | | | — | |

| Broker Non-Votes | | | 5,656,883 | | | — | | | 3,656,559 | | | — | | | 4,676,258 | | | — | |

| Total | | | 26,025,193 | | | — | | | 19,658,081 | | | — | | | 28,431,540 | | | — | |

| To approve a new sub-advisory agreement | | | | | | | | | | | | | | | | | | | |

| For | | | 19,023,953 | | | — | | | 14,964,311 | | | — | | | 21,600,235 | | | — | |

| Against | | | 826,999 | | | — | | | 477,123 | | | — | | | 1,598,833 | | | — | |

| Abstain | | | 517,358 | | | — | | | 560,088 | | | — | | | 556,214 | | | — | |

| Broker Non-Votes | | | 5,656,883 | | | — | | | 3,656,559 | | | — | | | 4,676,258 | | | — | |

| Total | | | 26,025,193 | | | — | | | 19,658,081 | | | — | | | 28,431,540 | | | — | |

| Approval of the Board Members was reached as follows: | | | | | | | | | | | | | | | | | | | |

| William Adams IV | | | | | | | | | | | | | | | | | | | |

| For | | | 24,994,341 | | | — | | | 18,876,156 | | | — | | | 26,869,672 | | | — | |

| Withhold | | | 1,030,852 | | | — | | | 781,925 | | | — | | | 1,561,868 | | | — | |

| Total | | | 26,025,193 | | | — | | | 19,658,081 | | | — | | | 28,431,540 | | | — | |

| Robert P. Bremner | | | | | | | | | | | | | | | | | | | |

| For | | | — | | | — | | | — | | | — | | | — | | | — | |

| Withhold | | | — | | | — | | | — | | | — | | | — | | | — | |

| Total | | | — | | | — | | | — | | | — | | | — | | | — | |

| Jack B. Evans | | | | | | | | | | | | | | | | | | | |

| For | | | — | | | — | | | — | | | — | | | — | | | — | |

| Withhold | | | — | | | — | | | — | | | — | | | — | | | — | |

| Total | | | — | | | — | | | — | | | — | | | — | | | — | |

| William C. Hunter | | | | | | | | | | | | | | | | | | | |

| For | | | — | | | 2,650 | | | — | | | 586 | | | — | | | 20,910 | |

| Withhold | | | — | | | — | | | — | | | 1,274 | | | — | | | — | |

| Total | | | — | | | 2,650 | | | — | | | 1,860 | | | — | | | 20,910 | |

Shareholder Meeting Report (continued) |

| | | | NAD | | | NXZ | | | NZF | |

| | | | Common and | | | | | | Common and | | | | | | Common and | | | | |

| | | | Preferred | | | | | | Preferred | | | | | | Preferred | | | Preferred | |

| | | | shares voting | | | | | | shares voting | | | | | | shares voting | | | shares voting | |

| | | | together | | | Preferred | | | together | | | Preferred | | | together | | | together | |

| | | | as a class | | | Shares | | | as a class | | | Shares | | | as a class | | | as a class | |

| Approval of the Board Members was reached as follows: | | | | | | | | | | | | | | | | | | | |

| David J. Kundert | | | | | | | | | | | | | | | | | | | |

| For | | | 24,972,749 | | | — | | | 18,868,191 | | | — | | | 26,896,173 | | | — | |

| Withhold | | | 1,052,444 | | | — | | | 789,890 | | | — | | | 1,535,367 | | | — | |

| Total | | | 26,025,193 | | | — | | | 19,658,081 | | | — | | | 28,431,540 | | | — | |

| John K. Nelson | | | | | | | | | | | | | | | | | | | |

| For | | | 24,969,529 | | | — | | | 18,867,073 | | | — | | | 26,898,576 | | | — | |

| Withhold | | | 1,055,664 | | | — | | | 791,008 | | | — | | | 1,532,964 | | | — | |

| Total | | | 26,025,193 | | | — | | | 19,658,081 | | | — | | | 28,431,540 | | | — | |

| William J. Schneider | | | | | | | | | | | | | | | | | | | |

| For | | | — | | | 2,650 | | | — | | | 586 | | | — | | | 20,910 | |

| Withhold | | | — | | | — | | | — | | | 1,274 | | | — | | | — | |

| Total | | | — | | | 2,650 | | | — | | | 1,860 | | | — | | | 20,910 | |

| Thomas S. Schreier, Jr. | | | | | | | | | | | | | | | | | | | |

| For | | | — | | | — | | | — | | | — | | | — | | | — | |

| Withhold | | | — | | | — | | | — | | | — | | | — | | | — | |

| Total | | | — | | | — | | | — | | | — | | | — | | | — | |

| Judith M. Stockdale | | | | | | | | | | | | | | | | | | | |

| For | | | — | | | — | | | — | | | — | | | — | | | — | |

| Withhold | | | — | | | — | | | — | | | — | | | — | | | — | |

| Total | | | — | | | — | | | — | | | — | | | — | | | — | |

| Carole E. Stone | | | | | | | | | | | | | | | | | | | |

| For | | | — | | | — | | | — | | | — | | | — | | | — | |

| Withhold | | | — | | | — | | | — | | | — | | | — | | | — | |

| Total | | | — | | | — | | | — | | | — | | | — | | | — | |

| Virginia L. Stringer | | | | | | | | | | | | | | | | | | | |

| For | | | — | | | — | | | — | | | — | | | — | | | — | |

| Withhold | | | — | | | — | | | — | | | — | | | — | | | — | |

| Total | | | — | | | — | | | — | | | — | | | — | | | — | |

| Terence J. Toth | | | | | | | | | | | | | | | | | | | |

| For | | | 24,990,065 | | | — | | | 18,871,668 | | | — | | | 26,884,129 | | | — | |

| Withhold | | | 1,035,128 | | | — | | | 786,413 | | | — | | | 1,547,411 | | | — | |

| Total | | | 26,025,193 | | | — | | | 19,658,081 | | | — | | | 28,431,540 | | | — | |

| Report of Independent Registered Public Accounting Firm |

To the Board of Directors/Trustees and Shareholders of

Nuveen Performance Plus Municipal Fund, Inc.

Nuveen Municipal Advantage Fund, Inc.

Nuveen Municipal Market Opportunity Fund, Inc.

Nuveen Dividend Advantage Municipal Fund

Nuveen Dividend Advantage Municipal Fund 2

Nuveen Dividend Advantage Municipal Fund 3: