UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT

OF

REGISTERED MANAGEMENT INVESTMENT COMPANIES

Investment Company Act file number: 811-5972

Name of Registrant: Vanguard International Equity Index Funds

Address of Registrant: | P.O. Box 2600 |

| Valley Forge, PA 19482 |

| |

Name and address of agent for service: | Heidi Stam, Esquire |

| P.O. Box 876 |

| Valley Forge, PA 19482 |

| |

Registrant’s telephone number, including area code: (610) 669-1000

Date of fiscal year end: October 31

Date of reporting period: November 1, 2008 – April 30, 2009

Item 1: Reports to Shareholders |

> | A broad-based rally in March and April helped many international markets recover most, if not all, of the ground lost earlier in the fiscal half-year. |

> | For the six months ended April 30, returns for the conventional share classes of the Vanguard International Stock Index Funds ranged from a low of about –6% for the European Stock Index Fund to a high of about 16% for the Emerging Markets Stock Index Fund. |

> | Sector performance varied widely across the developed and emerging markets, with materials and industrial companies generally demonstrating strength. |

Contents | |

| |

Your Fund’s Total Returns | 1 |

President’s Letter | 4 |

European Stock Index Fund | 12 |

Pacific Stock Index Fund | 36 |

Emerging Markets Stock Index Fund | 59 |

Developed Markets Index Fund | 87 |

Institutional Developed Markets Index Fund | 95 |

About Your Fund’s Expenses | 103 |

Trustees Approve Advisory Arrangements | 106 |

Glossary | 108 |

European Stock Index Fund

Pacific Stock Index Fund

Emerging Markets Stock Index Fund

Developed Markets Index Fund

Institutional Developed Markets Index Fund

Please note: The opinions expressed in this report are just that—informed opinions. They should not be considered promises or advice. Also, please keep in mind that the information and opinions cover the period through the date on the front of this report. Of course, the risks of investing in your fund are spelled out in the prospectus.

Your Fund’s Total Returns

Six Months Ended April 30, 2009 | | |

| Ticker | Total |

| Symbol | Returns |

Vanguard European Stock Index Fund | | |

Investor Shares | VEURX | –5.84% |

Admiral™ Shares1 | VEUSX | –5.82 |

Signal® Shares2 | VESSX | –5.81 |

Institutional Shares3 | VESIX | –5.80 |

ETF Shares4 | VGK | |

Market Price | | –6.88 |

Net Asset Value | | –5.84 |

MSCI Europe Index | | –4.56 |

Average European Region Fund5 | | –3.56 |

| | |

Vanguard Pacific Stock Index Fund | | |

Investor Shares | VPACX | –0.75% |

Admiral Shares1 | VPADX | –0.76 |

Signal Shares2 | VPASX | –0.77 |

Institutional Shares3 | VPKIX | –0.77 |

ETF Shares4 | VPL | |

Market Price | | –1.20 |

Net Asset Value | | –0.77 |

MSCI Pacific Index | | 1.29 |

Average Japan/Pacific Region Fund5 | | –0.53 |

1 A lower-cost class of shares available to many longtime shareholders and to those with significant investments in the fund.

2 Signal Shares also carry lower costs and are available to certain institutional shareholders who meet specific administrative, service, and account-size criteria.

3 This class of shares carries low expenses and is available for a minimum initial investment of $5 million.

4 Vanguard ETF™ Shares are traded on the NYSE Arca exchange and are available only through brokers. The table shows the ETF returns based on both the NYSE Arca market price and the net asset value for a share. U.S. Pat. No. 6,879,964 B2; 7,337,138.

5 Derived from data provided by Lipper Inc.

1

Your Fund’s Total Returns

Six Months Ended April 30, 2009 | | |

| Ticker | Total |

| Symbol | Returns |

Vanguard Emerging Markets Stock Index Fund | | |

Investor Shares | VEIEX | 15.87% |

Admiral Shares1 | VEMAX | 16.00 |

Signal Shares2 | VERSX | 15.98 |

Institutional Shares3 | VEMIX | 16.05 |

ETF Shares4 | VWO | |

Market Price | | 16.96 |

Net Asset Value | | 15.97 |

MSCI Emerging Markets Index | | 17.38 |

Average Emerging Markets Fund5 | | 11.37 |

| | |

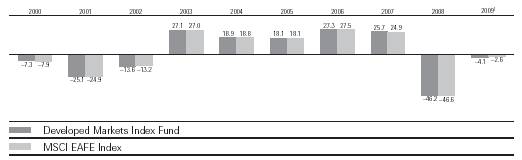

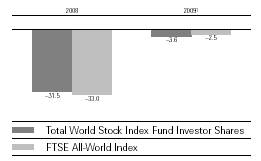

Vanguard Developed Markets Index Fund | VDMIX | –4.12% |

MSCI EAFE Index | | –2.64 |

Average International Fund5 | | –2.20 |

| | |

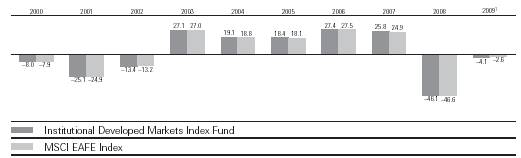

Vanguard Institutional Developed Markets Index Fund | VIDMX | –4.07% |

MSCI EAFE Index | | –2.64 |

Average International Fund5 | | –2.20 |

1 A lower-cost class of shares available to many longtime shareholders and to those with significant investments in the fund.

2 Signal Shares also carry lower costs and are available to certain institutional shareholders who meet specific administrative, service, and account-size criteria.

3 This class of shares carries low expenses and is available for a minimum initial investment of $5 million.

4 Vanguard ETF™ Shares are traded on the NYSE Arca exchange and are available only through brokers. The table shows the ETF returns based on both the NYSE Arca market price and the net asset value for a share. U.S. Pat. No. 6,879,964 B2; 7,337,138.

5 Derived from data provided by Lipper Inc.

2

Your Fund’s Performance at a Glance

October 31, 2008–April 30, 2009 | | | | |

| | | Distributions Per Share |

| Starting | Ending | Income | Capital |

| Share Price | Share Price | Dividends | Gains |

European Stock Index Fund | | | | |

Investor Shares | $21.99 | $19.22 | $1.497 | $0.000 |

Admiral Shares | 51.71 | 45.11 | 3.616 | 0.000 |

Signal Shares | 20.01 | 17.46 | 1.397 | 0.000 |

Institutional Shares | 22.04 | 19.22 | 1.553 | 0.000 |

ETF Shares | 41.37 | 36.08 | 2.901 | 0.000 |

Pacific Stock Index Fund | | | | |

Investor Shares | $7.94 | $7.74 | $0.140 | $0.000 |

Admiral Shares | 52.04 | 50.63 | 1.007 | 0.000 |

Signal Shares | 18.08 | 17.59 | 0.349 | 0.000 |

Institutional Shares | 7.96 | 7.74 | 0.158 | 0.000 |

ETF Shares | 42.10 | 40.95 | 0.823 | 0.000 |

Emerging Markets Stock Index Fund | | | | |

Investor Shares | $15.66 | $17.30 | $0.700 | $0.000 |

Admiral Shares | 20.63 | 22.76 | 0.969 | 0.000 |

Signal Shares | 19.85 | 21.89 | 0.938 | 0.000 |

Institutional Shares | 15.71 | 17.32 | 0.754 | 0.000 |

ETF Shares | 24.83 | 27.38 | 1.178 | 0.000 |

Developed Markets Index Fund | $ 7.79 | $ 7.09 | $0.398 | $0.000 |

Institutional Developed Markets Index Fund | $ 7.74 | $ 7.03 | $0.414 | $0.000 |

3

President’s Letter

Dear Shareholder,

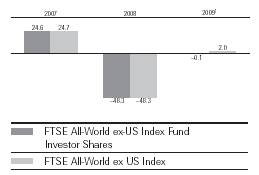

A springtime rally helped international markets to recoup most, if not all, of the losses sustained earlier in the fiscal half-year and to reclaim the lead over U.S. equities. Still, global markets remained well below their late-2007 highs.

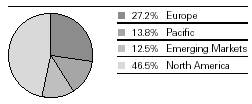

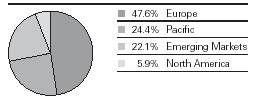

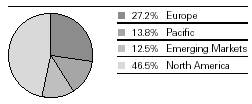

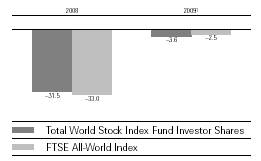

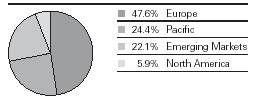

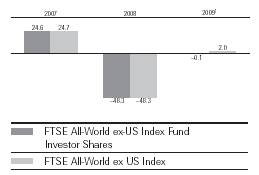

Emerging markets led the way, with a return of about 16% for the conventional (non-ETF) share classes of Vanguard Emerging Markets Stock Index Fund. Developed markets in Europe and the Pacific region lagged, with returns of about –6% for the conventional shares of Vanguard European Stock Index Fund and about –1% for Vanguard Pacific Stock Index Fund. Returns for the Developed Markets Index Fund and its institutional counterpart, which hold market-based weightings in the European and Pacific markets, reflected the proportional returns of those markets.

Because of temporary price differences arising from fair-value pricing policies (see page 6 for an explanation), the funds did not track their respective target indexes as closely as they typically do. Compared with the average return of their international fund peers, the Emerging Markets Stock Index Fund had a strong lead, while the other funds fell a bit behind.

Until now, both Vanguard Developed Markets Index Fund and Vanguard Institutional Developed Markets Index Fund have been structured as funds-of-funds, investing in Vanguard European Stock Index Fund and Vanguard Pacific Stock Index Fund. However, beginning in

4

June, as previously announced, both developed markets funds may begin to invest a portion of their portfolios directly in individual stocks—a transition that has been successfully accomplished for Vanguard Total International Stock Index Fund, which was formerly included in this report.

The ability to invest up to 100% of each fund’s assets directly in stocks gives Vanguard greater flexibility in managing the portfolios, without altering the funds’ objectives and risks. The developed markets funds will continue to seek to track the performance of the MSCI EAFE Index. Investing directly in stocks also has the potential to enhance the funds’ tax efficiency, and may allow investors to gain U.S. tax benefits from the pass-through of withholding taxes paid by the fund to foreign governments.

Volatile six months ends amid signs of hope

After a bumpy start, overseas markets rallied in March and April. The broad international market finished the half-year almost unchanged, with a positive return of about 1%. Despite gloomy international economic forecasts, investors began to believe that perhaps the worst of the bad news regarding the global financial crisis and economic slowdown was over. Investors were encouraged by foreign governments’ stimulus programs and by early signs of stabilization in the United

Market Barometer | | | |

| | | Total Returns |

| | Periods Ended April 30, 2009 |

| Six Months | One Year | Five Years1 |

Stocks | | | |

MSCI All Country World Index ex USA (International) | 1.31% | –42.32% | 3.02% |

Russell 1000 Index (Large-caps) | –7.39 | –35.30 | –2.32 |

Russell 2000 Index (Small-caps) | –8.40 | –30.74 | –1.45 |

Dow Jones U.S. Total Stock Market Index | –6.97 | –34.37 | –1.86 |

| | | |

Bonds | | | |

Barclays Capital U.S. Aggregate Bond Index | | | |

(Broad taxable market) | 7.74% | 3.84% | 4.78% |

Barclays Capital Municipal Bond Index | 8.20 | 3.11 | 4.11 |

Citigroup 3-Month Treasury Bill Index | 0.19 | 1.01 | 3.05 |

| | | |

CPI | | | |

Consumer Price Index | –1.54% | –0.74% | 2.55% |

1 Annualized.

5

A note on fair-value pricing |

An index fund’s return sometimes may appear to diverge from the return of its benchmark index a bit more than would be expected. This may be the result of a fair-value pricing adjustment. |

|

These adjustments address pricing discrepancies that may arise because of time-zone differences among global stock markets. Foreign stocks may trade on exchanges that close many hours before a fund’s closing share price is calculated in the United States, generally at 4 p.m., Eastern time. In the hours between the foreign close and the U.S. close, the value of these foreign securities may change—because of company- specific announcements or market-wide developments, for example. Such price changes are not immediately reflected in international index values. |

|

Fair-value pricing takes such changes into account in calculating the fund’s daily net asset value, thus ensuring that the NAV doesn’t include “stale” prices. The result can be a temporary divergence between the return of the fund and that of its benchmark index—a difference that usually corrects itself when the foreign markets reopen. |

States. Also, the U.S. dollar weakened compared with the euro, giving a modest boost to European stock returns for U.S. investors. The dollar appreciated, however, compared with the British pound and, to a lesser extent, the Japanese yen.

Although final six-month results for U.S. markets were less impressive, they also showed significant improvement from the beginning of the period. Things began to turn around in March, as investors gained confidence and started taking on more risk. In April, the U.S. stock market recorded its biggest monthly gain since 1991. The broad U.S. stock market returned about –7% for the six months.

Despite some encouraging signs, continued job losses and persistent uncertainty about the health of the financial sector, both in the United States and overseas, suggested that the road ahead could be bumpy.

Investor confidence boosted weakest bonds

The period was an erratic time for the fixed income market as well. After Lehman Brothers collapsed in September, investors steered clear of corporate bonds and instead sought safety in U.S. Treasury bonds—considered the safest, most liquid securities. The difference between the yields of Treasuries and those of corporate bonds surged to levels not seen since the 1930s.

6

Expense Ratios | | |

Your Fund Compared With Its Peer Group | | |

| Fund | Peer-Group |

| Expense | Expense |

| Ratio1 | Ratio |

European Stock Index Fund | | |

Investor Shares | 0.29% | 1.34% |

Admiral Shares | 0.18 | 1.34 |

Signal Shares | 0.18 | 1.34 |

Institutional Shares | 0.13 | 1.34 |

ETF Shares | 0.18 | 1.34 |

Pacific Stock Index Fund | | |

Investor Shares | 0.29% | 1.57% |

Admiral Shares | 0.18 | 1.57 |

Signal Shares | 0.18 | 1.57 |

Institutional Shares | 0.13 | 1.57 |

ETF Shares | 0.18 | 1.57 |

Emerging Markets Stock Index Fund | | |

Investor Shares | 0.39% | 1.73% |

Admiral Shares | 0.27 | 1.73 |

Signal Shares | 0.27 | 1.73 |

Institutional Shares | 0.20 | 1.73 |

ETF Shares | 0.27 | 1.73 |

Developed Markets Index Fund | 0.29% | 1.44% |

Institutional Developed Markets Index Fund | 0.13% | 1.44% |

1 The fund expense ratios shown are from the prospectus dated February 27, 2009, for the European, Pacific, and Emerging Markets Stock Index Funds and June 8, 2009, for the Developed Markets and Institutional Developed Markets Index Funds, and represent estimated costs for the current fiscal year based on each fund’s current net assets. For the six months ended April 30, 2009, the European Stock Index Fund’s annualized expense ratios were 0.29% for Investor Shares, 0.17% for Admiral Shares, 0.18% for Signal Shares, 0.13% for Institutional Shares, and 0.17% for ETF Shares. The Pacific Stock Index Fund’s annualized expense ratios were 0.29% for Investor Shares, 0.18% for Admiral Shares, 0.18% for Signal Shares, 0.13% for Institutional Shares, and 0.18% for ETF Shares. The Emerging Markets Stock Index Fund’s annualized expense ratios were 0.38% for Investor Shares, 0.26% for Admiral Shares, 0.26% for Signal Shares, 0.20% for Institutional Shares, and 0.27% for ETF Shares. For the six months ended April 30, 2009, the annualized expense ratios for the Developed Markets and Institutional Developed Markets Index Funds were 0.29% and 0.13%, respectively, and represent a weighted average of the annualized expense ratios and any transaction fees charged by the underlying mutual funds in which the funds invested during the six-month period. The peer-group expense ratios are derived from data provided by Lipper Inc. and capture information through year-end 2008.

7

Later in the period, optimism from the stock market provided a boost to corporate bonds. High-yield—or “junk”—bonds posted record gains for the month of April. For the six months, both the Barclays Capital U.S. Aggregate Bond Index and the broad municipal bond market returned about 8%.

In December, the Federal Reserve Board responded to the credit crisis by lowering its target for short-term interest rates to a range of 0% to 0.25%, an all-time low. After a meeting in late April, policymakers announced that lower rates had led to modest improvements in the credit market but that, overall, conditions remained weak.

Emerging markets staged a strong comeback

After suffering some of the steepest declines during the prior fiscal year, emerging markets were the star performers in the first half of the new fiscal year—once again reminding investors of their significant volatility. Developing countries benefited from investors’ renewed appetite for risk. An agreement by developed nations to quadruple the resources of the International Monetary Fund, raising them to $1 trillion, also bolstered confidence in developing economies, which may have access to IMF funds to shore up their economies.

The Emerging Markets Stock Index Fund’s Investor Shares returned 15.87% for the six months. China, one of the largest developing-country holdings in the index and the fund, was a standout. Investors became more confident that the Chinese government’s massive stimulus program would help the world’s third-largest economy turn around, which would bode well for global recovery. Other sizable country holdings—including Brazil, South Africa, South Korea, and Taiwan—had returns that ranged from about 20% to about 25%.

The rising tide of investor sentiment for emerging markets lifted all ten industry sectors in the emerging markets index into positive territory. The materials and industrial sectors each returned about 25% on hopes that the economic downturn was bottoming out.

European and Pacific developed markets struggled

In contrast to the double-digit six-month gains posted by many emerging-market countries, developed markets struggled. The Investor Shares for the European Stock Index Fund returned –5.84%. Despite the spring rally, many European markets were unable to recoup early-period losses resulting from banks’ troubled assets and the deepening recession. The United Kingdom, France, and Germany—the region’s largest markets, together representing about three-fifths of the index, on average—sustained single-digit declines. Other countries, including Sweden and Spain, for example, gained ground.

8

The materials and industrial sectors in Europe notched gains, though not as robust as those in emerging markets. Most other sectors posted losses for the six months. Financials, the largest sector, was one of the weaker performers, as financial-center banks continued to deal with the global credit crisis. Utilities and health care also lagged.

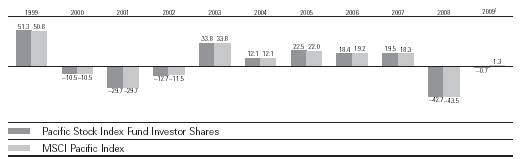

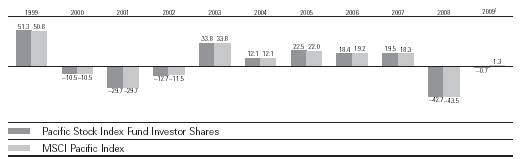

The Investor Shares for the Pacific Stock Index Fund returned –0.75% for the six months. In Japan, which represented about three-quarters of the value of the index, a plunge in exports dealt another blow to the embattled economy. Still, Japanese stock prices proved remarkably resilient, sliding only modestly. Stocks in Australia, Hong Kong, and Singapore were able to post gains.

Half of the ten sectors in the Pacific region posted gains, including double-digit advances by materials and the small energy sector. As in Europe, the utilities and health care sectors were among the weakest performers.

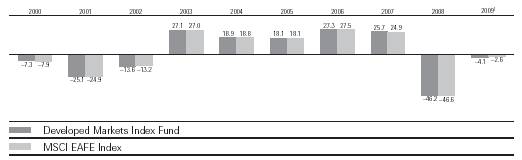

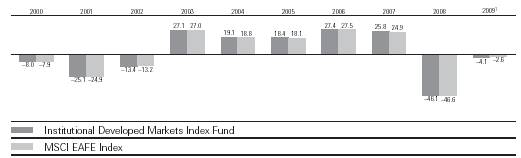

The Developed Markets Index Fund returned –4.12% and the Institutional Developed Markets Index Fund returned –4.07%, reflecting their proportional investment in the European and Pacific Stock Index Funds.

Whether converging or decoupling, foreign stocks still have a role

After delivering superior returns for several years, international stocks were hit even harder than U.S. stocks by the most severe financial shock since the Great Depression. This led many investors to reconsider the merits of international investing and to retrench into U.S. assets. And it fueled the debate between those who believe world markets are “converging” (becoming more similar in performance through the stronger linkages of trade, finance, and banking) and those who believe markets are “decoupling.”

Indeed, research shows that when there is a bear market in U.S. stocks, other markets also tend to experience bear markets. Put differently, correlations among international equity markets tend to rise noticeably during global financial crises. However, the diversification benefits of international investing usually become more apparent once financial crises subside. That’s when the economic and financial performance of various countries can be expected to differ, reflecting the heterogeneous nature of national economies, capital-flow sensitivities, commodity-price exposures, and monetary and fiscal policies.

Because markets don’t move in lockstep, we believe it is appropriate to consider international stocks within a portfolio that is balanced and diversified across asset

9

classes, consistent with your investment goals and risk tolerance. As it does in the United States, indexing offers a low-cost strategy to capture international equity-market returns, whether markets are rising or falling. Vanguard International Stock Index Funds offer a simple, convenient way to help you gain exposure to the potential long-term opportunities of investing abroad.

Thank you for entrusting your assets to Vanguard.

Sincerely,

F. William McNabb III

President and Chief Executive Officer

May 14, 2009

10

Vanguard European ETF | | | | |

Premium/Discount: March 4, 20051–April 30, 2009 | | | |

| | | | |

| Market Price Above or | Market Price Below |

| Equal to Net Asset Value | | Net Asset Value |

| Number | Percentage | Number | Percentage |

Basis Point Differential2 | of Days | of Total Days | of Days | of Total Days |

0–24.9 | 280 | 26.72% | 101 | 9.63% |

25–49.9 | 290 | 27.67 | 29 | 2.77 |

50–74.9 | 172 | 16.41 | 15 | 1.43 |

75–100.0 | 92 | 8.78 | 3 | 0.29 |

>100.0 | 62 | 5.92 | 4 | 0.38 |

Total | 896 | 85.50% | 152 | 14.50% |

Vanguard Pacific ETF | | | | |

Premium/Discount: March 4, 20051–April 30, 2009 | | | |

| | | | |

| Market Price Above or | Market Price Below |

| Equal to Net Asset Value | | Net Asset Value |

| Number | Percentage | Number | Percentage |

Basis Point Differential2 | of Days | of Total Days | of Days | of Total Days |

0–24.9 | 281 | 26.82% | 143 | 13.65% |

25–49.9 | 236 | 22.52 | 50 | 4.77 |

50–74.9 | 146 | 13.93 | 19 | 1.81 |

75–100.0 | 80 | 7.63 | 11 | 1.05 |

>100.0 | 69 | 6.58 | 13 | 1.24 |

Total | 812 | 77.48% | 236 | 22.52% |

Vanguard Emerging Markets ETF | | | | |

Premium/Discount: March 4, 20051–April 30, 2009 | | | |

| | | | |

| Market Price Above or | Market Price Below |

| Equal to Net Asset Value | | Net Asset Value |

| Number | Percentage | Number | Percentage |

Basis Point Differential2 | of Days | of Total Days | of Days | of Total Days |

0–24.9 | 180 | 17.18% | 104 | 9.92% |

25–49.9 | 211 | 20.13 | 58 | 5.53 |

50–74.9 | 182 | 17.37 | 31 | 2.96 |

75–100.0 | 113 | 10.78 | 25 | 2.39 |

>100.0 | 106 | 10.11 | 38 | 3.63 |

Total | 792 | 75.57% | 256 | 24.43% |

1 Inception.

2 One basis point equals 1/100 of a percentage point.

11

European Stock Index Fund

Fund Profile

As of April 30, 2009

Portfolio Characteristics | | |

| | Target | Broad |

| Fund | Index1 | Index2 |

Number of Stocks | 510 | 488 | 1,813 |

Turnover Rate3 | 19% | — | — |

Expense Ratio4 | | — | — |

Investor Shares | 0.29% | | |

Admiral Shares | 0.18% | | |

Signal Shares | 0.18% | | |

Institutional Shares | 0.13% | | |

ETF Shares | 0.18% | | |

Short-Term Reserves5 | –0.1% | — | — |

Sector Diversification (% of equity exposure) |

| | Target | Broad |

| Fund | Index1 | Index2 |

Consumer Discretionary | 8.2% | 8.2% | 9.1% |

Consumer Staples | 11.6 | 11.6 | 8.3 |

Energy | 12.0 | 12.1 | 11.5 |

Financials | 22.3 | 22.2 | 24.0 |

Health Care | 10.5 | 10.5 | 6.8 |

Industrials | 9.9 | 9.9 | 10.4 |

Information Technology | 3.3 | 3.3 | 6.7 |

Materials | 7.9 | 8.0 | 10.5 |

Telecommunication | | | |

Services | 7.4 | 7.3 | 7.0 |

Utilities | 6.9 | 6.9 | 5.7 |

Volatility Measures6 | |

| Fund Versus | Fund Versus |

| Target Index1 | Broad Index2 |

R-Squared | 0.98 | 0.95 |

Beta | 1.01 | 0.99 |

Ten Largest Holdings7 (% of total net assets) |

| | |

Royal Dutch Shell PLC | integrated oil | |

| and gas | 2.9% |

BP PLC | integrated oil | |

| and gas | 2.7 |

Nestle SA (Registered) | packaged foods | |

| and meats | 2.5 |

HSBC Holdings PLC | diversified banks | 2.5 |

Total SA | integrated oil | |

| and gas | 2.2 |

Vodafone Group PLC | wireless | |

| telecommunication | |

| services | 2.0 |

Novartis AG (Registered) | pharmaceuticals | 1.8 |

Roche Holdings AG | pharmaceuticals | 1.8 |

Telefonica SA | integrated | |

| telecommunication | |

| services | 1.6 |

GlaxoSmithKline PLC | pharmaceuticals | 1.6 |

Top Ten | | 21.6% |

1 MSCI Europe Index.

2 MSCI All Country World Index ex USA.

3 Annualized.

4 The expense ratios shown are from the prospectus dated February 27, 2009, and represent estimated costs for the current fiscal year based on the fund’s current net assets. For the six months ended April 30, 2009, the annualized expense ratios were 0.29% for Investor Shares, 0.17% for Admiral Shares, 0.18% for Signal Shares, 0.13% for Institutional Shares, and 0.17% for ETF Shares.

5 The fund invested a portion of its cash reserves in equity markets through the use of index futures contracts. After the effect of the futures investments, the fund’s temporary cash position was negative.

6 For an explanation of R-squared, beta, and other terms used here, see the Glossary.

7 The holdings listed exclude any temporary cash investments and equity index futures.

12

European Stock Index Fund

Market Diversification (% of equity exposure) |

| | Target |

| Fund | Index1 |

United Kingdom | 31.5% | 31.5% |

France | 16.3 | 16.3 |

Germany | 12.8 | 12.7 |

Switzerland | 11.8 | 11.8 |

Spain | 6.6 | 6.6 |

Italy | 5.5 | 5.5 |

Sweden | 3.7 | 3.7 |

Netherlands | 3.5 | 3.5 |

Finland | 2.1 | 2.1 |

Belgium | 1.4 | 1.4 |

Denmark | 1.4 | 1.4 |

Norway | 1.1 | 1.1 |

Other European Countries | 2.3 | 2.4 |

1 MSCI Europe Index.

13

European Stock Index Fund

Performance Summary

All of the returns in this report represent past performance, which is not a guarantee of future results that may be achieved by the fund. (Current performance may be lower or higher than the performance data cited. For performance data current to the most recent month-end, visit our website at www.vanguard.com/performance.) Note, too, that both investment returns and principal value can fluctuate widely, so an investor’s shares, when sold, could be worth more or less than their original cost. The returns shown do not reflect taxes that a shareholder would pay on fund distributions or on the sale of fund shares.

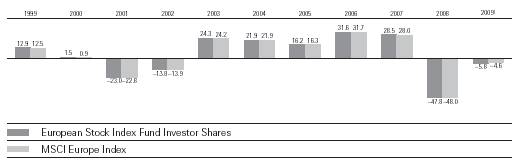

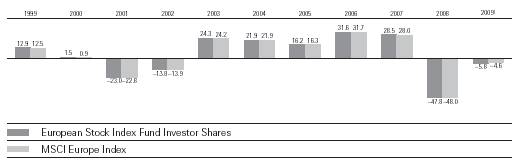

Fiscal-Year Total Returns (%): October 31, 1998–April 30, 2009

Average Annual Total Returns: Periods Ended March 31, 2009

This table presents average annual total returns through the latest calendar quarter—rather than through the end of the fiscal period. Securities and Exchange Commission rules require that we provide this information.

| Inception Date | One Year | Five Years | Ten Years |

European Stock Index Fund | | | | |

Investor Shares2 | 6/18/1990 | –49.72% | –1.77% | –0.88% |

Admiral Shares2 | 8/13/2001 | –49.66 | –1.67 | 0.353 |

Signal Shares2 | 10/6/2006 | –49.65 | –19.733 | — |

Institutional Shares2 | 5/15/2000 | –49.65 | –1.64 | –2.193 |

ETF Shares | 3/4/2005 | | | |

Market Price | | –49.94 | –7.313 | — |

Net Asset Value | | –49.65 | –7.293 | — |

1 Six months ended April 30, 2009.

2 Total returns do not reflect the 0.5% transaction fee on purchases through March 31, 2000; the 2% fee assessed on redemptions of shares purchased on or after June 27, 2003, and held for less than two months; or, for the Investor Shares, the account service fee that may be applicable to certain accounts with balances below $10,000.

3 Returns since inception.

Note: See Financial Highlights tables for dividend and capital gains information.

14

European Stock Index Fund

Financial Statements (unaudited)

Statement of Net Assets

As of April 30, 2009

The fund provides a complete list of its holdings four times in each fiscal year, at the quarter-ends. For the second and fourth fiscal quarters, the lists appear in the fund’s semiannual and annual reports to shareholders. For the first and third fiscal quarters, the fund files the lists with the Securities and Exchange Commission on Form N-Q. Shareholders can look up the fund’s Forms N-Q on the SEC’s website at www.sec.gov. Forms N-Q may also be reviewed and copied at the SEC’s Public Reference Room (see the back cover of this report for further information).

| | | Market |

| | | Value• |

| | Shares | ($000) |

Common Stocks (99.3%)1 | | |

Austria (0.5%) | | |

| OMV AG | 411,456 | 12,747 |

| Telekom Austria AG | 861,508 | 11,332 |

| Erste Bank der | | |

| Oesterreichischen | | |

| Sparkassen AG | 473,896 | 9,888 |

| Oesterreichische | | |

| Elektrizitaetswirtschafts | | |

| AG Class A | 193,025 | 7,926 |

| Voestalpine AG | 287,431 | 5,499 |

^ | Raiffeisen International | | |

| Bank-Holding AG | 135,324 | 4,665 |

* | Vienna Insurance Group | 92,691 | 3,614 |

| Strabag SE | 129,312 | 2,991 |

| Wienerberger AG | 208,463 | 2,453 |

| | | 61,115 |

Belgium (1.4%) | | |

| Anheuser-Busch InBev NV | 1,796,611 | 54,998 |

| Delhaize Group | 249,154 | 16,804 |

| Groupe Bruxelles | | |

| Lambert SA | 200,676 | 14,467 |

^ | Fortis | 5,562,341 | 13,673 |

| Solvay SA | 148,592 | 12,737 |

| Belgacom SA | 419,673 | 12,199 |

| Colruyt NV | 41,200 | 9,365 |

^ | KBC Bank & | | |

| Verzekerings Holding | 398,082 | 8,750 |

* | UCB SA | 252,983 | 6,886 |

^ | Dexia | 1,329,903 | 6,450 |

| Umicore | 312,143 | 6,118 |

| Compagnie Nationale | | |

| a Portefeuille | 98,947 | 4,769 |

| Mobistar SA | 77,307 | 4,626 |

| | | 171,842 |

Denmark (1.4%) | | |

| Novo Nordisk A/S B Shares | 1,116,351 | 53,117 |

* | Vestas Wind Systems A/S | 462,010 | 29,990 |

^ | AP Moller-Maersk A/S | | |

| B Shares | 2,741 | 15,922 |

| | | Market |

| | | Value• |

| | Shares | ($000) |

* | Danske Bank A/S | 1,132,473 | 12,421 |

| Carlsberg A/S B Shares | 178,129 | 8,564 |

^ | AP Moller-Maersk A/S | | |

| A Shares | 1,372 | 7,838 |

| Novozymes A/S | 114,164 | 7,697 |

^ | DSV A/S | 479,036 | 5,410 |

* | Topdanmark A/S | 39,228 | 4,637 |

^,* | FLS Industries A/S B Shares | 133,265 | 4,262 |

| Coloplast A/S B Shares | 58,526 | 3,995 |

| Danisco A/S | 118,663 | 3,886 |

| Trygvesta A/S | 67,895 | 3,716 |

* | Jyske Bank A/S | 121,775 | 3,120 |

^,* | William Demant A/S | 59,227 | 2,801 |

| | | 167,376 |

Finland (2.1%) | | |

^ | Nokia Oyj | 9,481,245 | 134,666 |

^ | Fortum Oyj | 1,108,459 | 22,358 |

^ | Sampo Oyj A Shares | 1,050,005 | 19,587 |

| UPM-Kymmene Oyj | 1,295,561 | 11,594 |

| Kone Oyj | 383,883 | 10,486 |

* | Stora Enso Oyj R Shares | 1,429,234 | 8,158 |

^ | Wartsila Oyj B Shares | 207,863 | 6,853 |

| Metso Oyj | 322,760 | 4,942 |

| Elisa Oyj Class A | 346,232 | 4,584 |

| Outokumpu Oyj A Shares | 296,059 | 4,411 |

^ | Kesko Oyj | 164,889 | 4,288 |

^ | Nokian Renkaat Oyj | 264,994 | 4,185 |

^ | Neste Oil Oyj | 316,909 | 4,099 |

| Rautaruuki Oyj | 205,175 | 3,818 |

| Orion Oyj | 225,284 | 3,263 |

^ | Sanoma Oyj | 203,505 | 2,681 |

^ | Pohjola Bank PLC | 280,265 | 2,074 |

^,* | Pohjola Bank PLC | | |

| Assimilation Line | | |

| Exp. 5/5/09 | 160,148 | 1,208 |

| | | 253,255 |

France (16.2%) | | |

| Total SA | 5,321,540 | 266,268 |

^ | Sanofi-Aventis | 2,624,088 | 151,967 |

| BNP Paribas SA | 2,046,919 | 107,758 |

15

European Stock Index Fund

| | | Market |

| | | Value• |

| | Shares | ($000) |

| France Telecom SA | 4,564,932 | 101,342 |

^ | Gaz de France | 2,733,792 | 98,182 |

^ | Vivendi SA | 2,917,946 | 78,461 |

^ | Axa | 3,862,092 | 64,890 |

^ | Carrefour SA | 1,582,503 | 64,166 |

| Societe Generale Class A | 1,158,871 | 59,228 |

^ | Groupe Danone | 1,089,401 | 51,819 |

^ | ArcelorMittal | | |

| (Amsterdam Shares) | 2,190,447 | 51,310 |

^ | Air Liquide SA | 618,183 | 50,301 |

| Vinci SA | 1,051,698 | 47,117 |

^ | LVMH Louis Vuitton | | |

| Moet Hennessy | 611,059 | 46,134 |

^ | L'Oreal SA | 601,672 | 43,043 |

^ | Schneider Electric SA | 555,809 | 42,296 |

| Alstom | 532,615 | 33,202 |

| Cie. de St. Gobain SA | 917,576 | 32,918 |

| Credit Agricole SA | 2,221,390 | 32,480 |

| Unibail Co. | 204,465 | 30,491 |

^ | Pernod Ricard SA | 484,271 | 28,637 |

^ | Veolia Environnement | 945,055 | 25,888 |

^ | Bouygues SA | 596,565 | 25,449 |

| Electricite de France | 498,269 | 23,080 |

^ | Essilor International SA | 500,699 | 21,572 |

^ | Accor SA | 474,588 | 20,081 |

^ | Compagnie Generale des | | |

| Etablissements | | |

| Michelin SA | 362,013 | 18,531 |

^ | Lafarge SA | 316,602 | 17,865 |

^ | Hermes International | 132,731 | 17,603 |

| Renault SA | 461,765 | 14,806 |

* | Alcatel-Lucent | 5,775,476 | 14,604 |

^ | Pinault- | | |

| Printemps-Redoute SA | 188,187 | 14,418 |

| Vallourec SA | 131,725 | 14,398 |

^,* | Cap Gemini SA | 344,604 | 12,881 |

| SES Global Fiduciary | | |

| Depositary Receipts | 703,717 | 12,703 |

^ | European Aeronautic | | |

| Defence and Space Co. | 807,985 | 11,662 |

| Sodexho Alliance SA | 235,816 | 11,328 |

| STMicroelectronics NV | 1,705,822 | 11,242 |

^ | Technip SA | 259,649 | 11,155 |

* | Suez Environnement SA | 673,215 | 10,262 |

^ | Publicis Groupe SA | 314,979 | 9,627 |

^ | Lagardere S.C.A. | 295,146 | 9,266 |

^ | SCOR SA | 437,696 | 9,186 |

| Thales SA | 220,702 | 9,156 |

^ | Christian Dior SA | 135,826 | 9,101 |

| PSA Peugeot Citroen | 381,756 | 8,816 |

* | Lafarge SA Assimilation | | |

| Line Exp. 7/1/09 | 144,684 | 7,753 |

^ | CNP Assurances | 93,301 | 7,356 |

| Casino | | |

| Guichard-Perrachon SA | 109,104 | 6,806 |

^ | Dassault Systemes SA | 164,473 | 6,751 |

| | | Market |

| | | Value• |

| | Shares | ($000) |

| Neopost SA | 78,223 | 6,624 |

| Natixis | 2,514,263 | 5,693 |

| Safran SA | 467,370 | 5,578 |

* | Compagnie Generale de | | |

| Geophysique SA | 373,872 | 5,401 |

| Atos Origin SA | 174,894 | 5,392 |

| Eutelsat Communications | 220,792 | 4,781 |

^ | Eiffage SA | 90,520 | 4,670 |

| Legrand SA | 231,412 | 4,645 |

^ | Klepierre | 208,668 | 4,639 |

^,* | Iliad SA | 41,069 | 4,314 |

| Aeroports de Paris (ADP) | 74,770 | 4,305 |

^ | ICADE | 49,624 | 3,839 |

| Valeo SA | 185,729 | 3,827 |

| Air France | 339,405 | 3,768 |

| Bureau Veritas SA | 91,920 | 3,741 |

^ | Societe des Autoroutes | | |

| Paris-Rhin-Rhone | 56,788 | 3,657 |

| Societe BIC SA | 66,522 | 3,571 |

^ | PagesJaunes SA | 319,978 | 3,476 |

^ | Zodiac SA | 104,424 | 3,050 |

^ | Imerys SA | 71,197 | 2,946 |

^ | M6 Metropole Television | 156,169 | 2,919 |

| Eramet SLN | 12,935 | 2,778 |

^ | Societe Television Francaise | 1,289,139 | 2,708 |

^ | Wendel Investissement | 69,984 | 2,567 |

* | Biomerieux SA | 33,897 | 2,539 |

| Eurazeo | 61,848 | 2,527 |

| Ipsen Promesses | 61,011 | 2,498 |

^ | JCDecaux SA | 167,279 | 2,379 |

^ | Gecina SA | 39,627 | 2,169 |

| | | 1,986,357 |

Germany (12.7%) | | |

^ | E.On AG | 4,741,802 | 160,353 |

| Siemens AG | 2,166,403 | 145,658 |

^ | Allianz AG | 1,130,105 | 104,278 |

^ | Bayer AG | 1,906,604 | 94,772 |

^ | BASF AG | 2,302,687 | 86,898 |

| Deutsche Telekom AG | 7,071,378 | 85,515 |

| SAP AG | 2,140,314 | 82,287 |

| RWE AG | 1,109,761 | 80,001 |

^ | Deutsche Bank AG | 1,352,774 | 72,140 |

| Daimler AG (Registered) | 2,001,406 | 71,751 |

^ | Muenchener | | |

| Rueckversicherungs- | | |

| Gesellschaft AG | | |

| (Registered) | 514,862 | 71,139 |

^ | Volkswagen AG | 220,695 | 69,823 |

| Deutsche Boerse AG | 485,412 | 35,860 |

| Bayerische Motoren | | |

| Werke AG | 825,902 | 28,617 |

| Linde AG | 336,228 | 26,813 |

| Deutsche Post AG | 2,114,857 | 24,401 |

^ | K&S AG | 370,972 | 22,317 |

| ThyssenKrupp AG | 894,397 | 19,134 |

^ | Adidas AG | 495,205 | 18,710 |

16

European Stock Index Fund

| | | Market |

| | | Value• |

| | Shares | ($000) |

^ | Fresenius Medical Care AG | 474,314 | 18,406 |

^ | Volkswagen AG Pfd. | 263,213 | 16,713 |

| Man AG | 263,785 | 16,350 |

| Porsche AG | 217,645 | 15,678 |

| Merck KGaA | 160,329 | 14,376 |

^ | Metro AG | 283,170 | 12,045 |

^ | Henkel AG & Co. KGaA | 442,385 | 11,998 |

^ | Commerzbank AG | 1,762,582 | 11,984 |

^ | Fresenius AG Pfd. | 201,505 | 10,393 |

^ | Beiersdorf AG | 221,149 | 9,112 |

| DaimlerChrysler AG | 248,172 | 8,860 |

^ | Henkel KGaA | 325,049 | 8,036 |

^,* | Qiagen NV | 465,908 | 7,709 |

| Deutsche Lufthansa AG | 567,626 | 7,241 |

| Salzgitter AG | 98,086 | 6,977 |

^ | RWE AG Pfd. | 97,422 | 6,050 |

^ | Solarworld AG | 209,679 | 5,976 |

^ | TUI AG | 529,285 | 5,819 |

| Hochtief AG | 103,653 | 5,076 |

| GEA Group AG | 368,394 | 4,845 |

| Hannover | | |

| Rueckversicherung AG | 147,613 | 4,783 |

^ | Deutsche Postbank AG | 220,619 | 4,714 |

^ | Celesio AG | 210,035 | 4,658 |

^ | Wacker Chemie AG | 39,724 | 4,112 |

^ | Fraport AG | 92,682 | 3,736 |

* | Puma AG | 16,181 | 3,468 |

^,* | Q-Cells AG | 156,351 | 3,338 |

* | United Internet AG | 317,276 | 3,329 |

| Suedzucker AG | 166,034 | 3,214 |

^ | Fresenius AS | 70,559 | 2,917 |

| Bayerische Motoren | | |

| Werke (BMW) | 125,787 | 2,644 |

^ | HeidelbergCement AG | 62,396 | 2,631 |

| Hamburger Hafen und | | |

| Logistik AG | 61,593 | 2,220 |

| | | 1,549,875 |

Greece (0.8%) | | |

| National Bank of Greece SA | 1,031,658 | 21,454 |

| Greek Organization of | | |

| Football Prognostics | 560,130 | 17,280 |

* | Alpha Credit Bank SA | 943,443 | 9,190 |

| Hellenic | | |

| Telecommunications | | |

| Organization SA | 475,203 | 7,235 |

| Bank of Piraeus | 778,275 | 7,136 |

| Coca-Cola Hellenic | | |

| Bottling Co. SA | 408,727 | 6,536 |

| Marfin Financial Group SA | 1,485,997 | 6,372 |

| EFG Eurobank Ergasias | 786,940 | 6,178 |

| Public Power Corp. | 259,536 | 5,003 |

| National Bank | | |

| of Greece SA ADR | 1,051,515 | 4,259 |

| Titan Cement Co. SA | 143,472 | 3,658 |

| Hellenic Petroleum SA | 303,921 | 2,945 |

| | | Market |

| | | Value• |

| | Shares | ($000) |

| Hellenic | | |

| Telecommunications | | |

| Organization SA ADR | 394,508 | 2,931 |

| | | 100,177 |

Ireland (0.5%) | | |

| CRH PLC | 1,670,522 | 43,365 |

| Kerry Group PLC A Shares | 351,069 | 7,218 |

* | Elan Corp. PLC | 1,167,947 | 6,950 |

* | Ryanair Holdings PLC ADR | 133,845 | 3,661 |

* | Ryanair Holdings PLC | 215,111 | 929 |

^ | Anglo Irish Bank Corp. PLC | 2,503,596 | 719 |

* | CRH PLC | 14,534 | 375 |

| | | 63,217 |

Italy (5.4%) | | |

| Eni SpA | 6,494,228 | 139,361 |

| UniCredit SpA | 30,406,404 | 74,039 |

| Intesa Sanpaolo SpA | 19,212,328 | 61,208 |

| Enel SpA | 10,800,941 | 58,546 |

| Assicurazioni | | |

| Generali SpA | 2,638,079 | 53,674 |

| Telecom Italia SpA | 25,033,174 | 31,654 |

| Unione Di Banche | | |

| Italiane ScpA | 1,506,851 | 20,777 |

^,* | Fiat SpA | 1,771,607 | 17,320 |

^,* | Tenaris S.A. | 1,176,727 | 14,801 |

| Finmeccanica SpA | 1,004,531 | 14,151 |

| Saipem SpA | 660,777 | 14,124 |

| Mediobanca Banca di | | |

| Credito Finanziaria SpA | 1,223,883 | 14,121 |

| Telecom Italia SpA RNC | 14,933,487 | 13,341 |

| Atlantia SpA | 643,643 | 11,355 |

| Mediaset SpA | 1,918,185 | 10,776 |

| Banco Popolare SpA | 1,599,579 | 10,509 |

| Banca Monte dei Paschi | | |

| di Siena SpA | 6,179,417 | 9,888 |

| Terna SpA | 3,000,749 | 9,636 |

| Parmalat SpA | 4,141,375 | 8,225 |

| Snam Rete Gas SpA | 1,957,707 | 7,753 |

| Alleanza Assicurazioni SpA | 1,059,124 | 7,097 |

| Banca Carige SpA | 1,822,317 | 6,675 |

^ | Luxottica Group SpA | 340,995 | 6,258 |

| Banca Popolare di | | |

| Milano SpA | 992,345 | 5,769 |

| A2A SpA | 3,157,918 | 5,191 |

| Intesa Sanpaolo SpA | | |

| Non Convertible Risp. | 2,229,356 | 4,951 |

| Prysmian SpA | 273,647 | 3,327 |

* | Lottomatica SpA | 154,023 | 3,166 |

| ACEA SpA | 240,092 | 2,978 |

| Fondiari-Sai SpA | 171,525 | 2,852 |

| Saras SpA Raffinerie Sarde | 849,022 | 2,486 |

| Pirelli & C. Accomandita | | |

| per Azioni SpA | 6,350,972 | 2,471 |

^ | Mediolanum SpA | 526,398 | 2,406 |

* | Exor SpA | 176,728 | 2,261 |

^ | Italcementi SpA | 172,707 | 2,079 |

17

European Stock Index Fund

| | | Market |

| | | Value• |

| | Shares | ($000) |

| Unipol Gruppo Finanziario | | |

| SpA | 1,666,086 | 2,071 |

^ | Autogrill SpA | 258,081 | 1,961 |

^ | Bulgari SpA | 381,146 | 1,941 |

| Unipol Gruppo Finanziario | | |

| SpA Pfd. | 2,309,598 | 1,919 |

| Italcementi SpA Risp. | 256,311 | 1,625 |

* | Snam Rete Gas SpA | | |

| Rights Exp. 5/15/09 | 1,957,707 | 1,502 |

| | | 666,245 |

Netherlands (3.5%) | | |

| Unilever NV | 4,063,418 | 80,405 |

| Koninklijke KPN NV | 4,352,960 | 52,333 |

| ING Groep NV | 4,885,158 | 44,529 |

| Koninklijke (Royal) Philips | | |

| Electronics NV | 2,425,745 | 43,768 |

| Koninklijke Ahold NV | 2,973,090 | 32,574 |

| Akzo Nobel NV | 592,617 | 24,783 |

| ASML Holding NV | 1,045,446 | 21,938 |

| Heineken NV | 608,279 | 18,076 |

| Aegon NV | 3,553,815 | 17,874 |

| Reed Elsevier NV | 1,561,224 | 17,153 |

| TNT NV | 922,745 | 17,006 |

| Wolters Kluwer NV | 679,984 | 11,189 |

| Koninklijke DSM NV | 337,026 | 10,452 |

| Heineken Holding NV | 273,975 | 6,469 |

| Randstad Holding NV | 256,537 | 5,886 |

| SBM Offshore NV | 357,204 | 5,757 |

| Fugro NV | 146,822 | 5,256 |

| Corio NV | 110,210 | 4,891 |

| Koninklijke Boskalis | | |

| Westminster NV | 139,414 | 3,251 |

| SNS REAAL | 339,243 | 1,910 |

| ASML Holding NV | | |

| (New York Shares) | 26,013 | 550 |

| Aegon NV (New York) ARS | 2,625 | 12 |

| | | 426,062 |

Norway (1.1%) | | |

| StatoilHydro ASA | 3,201,717 | 59,672 |

^ | Orkla ASA | 2,040,173 | 14,606 |

| Telenor ASA | 2,082,239 | 12,950 |

^ | Yara International ASA | 474,243 | 12,710 |

| DnB NOR ASA | 1,829,056 | 11,385 |

| Norsk Hydro ASA | 1,717,394 | 7,572 |

^ | Seadrill Ltd. | 699,593 | 7,467 |

^,* | Renewable | | |

| Energy Corp. AS | 369,000 | 3,333 |

^ | Frontline Ltd. | 129,900 | 2,569 |

^ | Aker Solutions ASA | 412,056 | 2,491 |

| | | 134,755 |

Portugal (0.5%) | | |

| Electricidade de | | |

| Portugal SA | 4,574,425 | 16,637 |

| Portugal Telecom SGPS SA | 1,530,579 | 11,671 |

^ | Banco Espirito Santo SA | 1,294,251 | 6,335 |

| | | Market |

| | | Value• |

| | Shares | ($000) |

| Galp Energia, SGPS, SA | | |

| B Shares | 473,892 | 6,284 |

^ | Banco Comercial | | |

| Portugues SA | 5,878,261 | 5,486 |

| Brisa-Auto Estradas de | | |

| Portugal SA | 754,906 | 5,145 |

^,* | EDP Renovaveis SA | 546,345 | 4,455 |

^ | Cimpor-Cimento de | | |

| Portugal SA | 676,715 | 4,037 |

| Jeronimo Martins, | | |

| SGPS, SA | 530,675 | 2,993 |

^ | Zon Multimedia Servicos | | |

| de Telecomunicacoes e | | |

| Multimedia SGPS SA | 438,885 | 2,399 |

| | | 65,442 |

Spain (6.6%) | | |

| Telefonica SA | 10,364,007 | 196,358 |

| Banco Santander SA | 19,927,648 | 191,683 |

| Banco Bilbao Vizcaya | | |

| Argentaria SA | 8,881,624 | 96,256 |

| Iberdrola SA | 8,734,591 | 68,783 |

| Repsol YPF SA | 1,827,221 | 34,731 |

^ | Industria de Diseno | | |

| Textil SA | 544,200 | 23,204 |

^ | ACS, Actividades de | | |

| Contruccion y | | |

| Servisios, SA | 458,301 | 22,922 |

^ | Banco Popular Espanol SA | 1,970,798 | 16,243 |

^ | Banco de Sabadell SA | 2,280,729 | 13,161 |

^ | Abertis | | |

| Infraestructuras SA | 670,212 | 11,996 |

| Red Electrica de | | |

| Espana SA | 270,805 | 11,334 |

| Gas Natural SDG SA | 559,408 | 8,870 |

| Gamesa Corporacion | | |

| Tecnologica SA | 456,373 | 8,614 |

* | Iberdrola Renovables | 2,118,811 | 8,604 |

| Criteria Caixacorp SA | 2,095,197 | 7,870 |

^ | Bankinter SA | 661,273 | 7,817 |

| Enagas SA | 444,468 | 7,727 |

| Acciona SA | 70,361 | 7,194 |

^ | Zardoya Otis SA | 318,407 | 6,526 |

| Grifols SA | 318,858 | 5,595 |

^ | Acerinox SA | 351,508 | 5,354 |

| Mapfre SA | 1,807,328 | 5,152 |

^ | Indra Sistemas, SA | 245,059 | 4,847 |

^ | Banco de Valencia SA | 511,334 | 4,676 |

^ | Grupo Ferrovial SA | 158,259 | 4,589 |

| Banco Santander SA ADR | 455,572 | 4,169 |

^ | Fomento de Construc y | | |

| Contra SA | 112,176 | 4,009 |

| Telefonica SA ADR | 66,228 | 3,728 |

^,* | Cintra Concesiones de | | |

| Infraestructuras de | | |

| Transport SA | 566,026 | 3,093 |

^ | Gestevision Telecinco SA | 271,527 | 2,560 |

18

European Stock Index Fund

| | | Market |

| | | Value• |

| | Shares | ($000) |

| Iberia (Linea Aerea Espana) | 1,170,966 | 2,186 |

^ | Sacyr Vallehermoso SA | 195,552 | 2,010 |

* | Banco de Valencia SA | | |

| Rights Exp. 5/11/09 | 511,334 | 88 |

| | | 801,949 |

Sweden (3.7%) | | |

^ | Telefonaktiebolaget LM | | |

| Ericsson AB Class B | 7,394,412 | 62,807 |

^ | Nordea Bank AB | 8,042,394 | 59,822 |

^ | Hennes & Mauritz AB | | |

| B Shares | 1,275,260 | 56,774 |

| TeliaSonera AB | 5,600,519 | 26,277 |

^ | Svenska | | |

| Handelsbanken AB | | |

| A Shares | 1,141,359 | 19,883 |

^ | Volvo AB B Shares | 2,714,222 | 17,698 |

^ | Sandvik AB | 2,508,036 | 16,472 |

^ | Investor AB B Shares | 1,132,705 | 16,365 |

^ | Atlas Copco AB A Shares | 1,672,834 | 15,551 |

^,* | Skandinaviska Enskilda | | |

| Banken AB A Shares | 3,923,599 | 15,232 |

| Svenska Cellulosa AB | | |

| B Shares | 1,398,258 | 13,482 |

^ | SKF AB B Shares | 966,566 | 10,599 |

^ | Skanska AB B Shares | 941,554 | 10,156 |

^ | Assa Abloy AB | 779,806 | 9,181 |

^ | Swedish Match AB | 629,923 | 8,989 |

| Millicom International | | |

| Cellular SA | 175,860 | 8,652 |

^ | Scania AB B Shares | 797,055 | 8,451 |

^ | Alfa Laval AB | 913,668 | 8,093 |

^ | Atlas Copco AB B Shares | 962,107 | 7,964 |

^ | Volvo AB A Shares | 1,104,216 | 7,232 |

^ | Tele2 AB B Shares | 764,182 | 7,203 |

^,* | Electrolux AB Series B | 638,991 | 7,200 |

^,* | Securitas AB B Shares | 778,869 | 6,454 |

^ | Getinge AB B Shares | 501,460 | 5,825 |

^ | Husqvarna AB B Shares | 1,027,416 | 5,051 |

^ | Swedbank AB A Shares | 891,172 | 5,018 |

^ | SSAB Svenskt Stal AB | | |

| Series A | 454,834 | 4,333 |

^,* | Lundin Petroleum AB | 556,243 | 3,617 |

^ | Modern Times Group AB | | |

| B Shares | 124,296 | 3,363 |

| Holmen AB | 131,687 | 2,904 |

| SSAB Svenskt Stal AB | | |

| Series B | 210,099 | 1,884 |

| | | 452,532 |

Switzerland (11.7%) | | |

| Nestle SA (Registered) | 9,553,698 | 311,419 |

| Novartis AG (Registered) | 5,934,919 | 224,627 |

| Roche Holdings AG | 1,752,499 | 220,997 |

| Credit Suisse Group | | |

| (Registered) | 2,664,830 | 104,132 |

* | UBS AG | 7,239,252 | 99,442 |

| ABB Ltd. | 5,488,299 | 77,694 |

| | | Market |

| | | Value• |

| | Shares | ($000) |

| Zurich Financial | | |

| Services AG | 354,495 | 65,876 |

| Syngenta AG | 241,748 | 51,611 |

| Holcim Ltd. (Registered) | 491,422 | 24,926 |

* | Compagnie Financiere | | |

| Richemont SA | 1,296,929 | 23,217 |

| Swiss Re (Registered) | 834,924 | 19,819 |

| Julius Baer Holding, Ltd. | 526,412 | 17,269 |

| Swisscom AG | 59,811 | 15,596 |

| Synthes, Inc. | 148,413 | 15,016 |

| SGS Societe Generale de | | |

| Surveillance Holding SA | | |

| (Registered) | 11,733 | 13,158 |

| Adecco SA (Registered) | 305,983 | 12,043 |

* | Actelion Ltd. | 245,467 | 11,183 |

| Geberit AG | 102,044 | 10,875 |

| Lonza AG (Registered) | 118,478 | 10,869 |

| Swatch Group AG (Bearer) | 77,017 | 10,716 |

| Givaudan SA | 16,858 | 10,673 |

| Kuehne & Nagel | | |

| International AG | 134,569 | 10,114 |

| Baloise Holdings AG | 125,091 | 9,183 |

| Sonova Holding AG | 115,523 | 7,506 |

| Swiss Life Holding | 87,218 | 6,748 |

| Schindler Holding AG | | |

| (Bearer Participation | | |

| Certificates) | 127,311 | 6,674 |

| Nobel Biocare Holding AG | 296,720 | 6,049 |

* | Logitech International SA | 433,359 | 5,791 |

| Lindt & Spruengli | | |

| AG Regular | 277 | 5,300 |

| Pargesa Holding SA | 67,230 | 4,253 |

| Sulzer AG (Registered) | 69,129 | 3,757 |

| Straumann Holding AG | 19,658 | 3,595 |

| Swatch Group AG | | |

| (Registered) | 125,060 | 3,587 |

| Lindt & Spruengli AG | 2,030 | 3,249 |

* | Aryzta AG | | |

| (Switzerland Shares) | 104,408 | 3,024 |

| BKW FMB Energie AG | 40,124 | 2,790 |

* | Aryzta AG (Ireland Shares) | 93,482 | 2,724 |

| EFG International | 129,237 | 1,564 |

* | UBS AG | | |

| (New York Shares) | 75,873 | 1,035 |

| | | 1,438,101 |

United Kingdom (31.2%) | | |

| BP PLC | 44,098,842 | 311,632 |

| HSBC Holdings PLC | 42,776,447 | 304,203 |

| Vodafone Group PLC | 123,077,555 | 226,213 |

| GlaxoSmithKline PLC | 12,964,711 | 199,699 |

| Royal Dutch Shell PLC | | |

| Class B | 6,724,527 | 152,180 |

| Royal Dutch Shell PLC | | |

| Class A | | |

| (Amsterdam Shares) | 6,436,888 | 147,628 |

| BG Group PLC | 8,370,528 | 133,660 |

19

European Stock Index Fund

| | | Market |

| | | Value• |

| | Shares | ($000) |

| AstraZeneca Group PLC | 3,609,691 | 126,395 |

| BHP Billiton PLC | 5,505,244 | 114,261 |

| British American | | |

| Tobacco PLC | 4,731,230 | 114,102 |

| Rio Tinto PLC | 2,489,931 | 101,169 |

| Tesco PLC | 19,610,251 | 97,165 |

| Barclays PLC | 20,879,564 | 84,773 |

| Diageo PLC | 6,240,446 | 74,447 |

| Standard Chartered PLC | 4,717,699 | 72,980 |

| Anglo American PLC | 3,283,892 | 70,664 |

| Unilever PLC | 3,201,510 | 62,339 |

| Reckitt Benckiser | | |

| Group PLC | 1,501,914 | 58,958 |

| Imperial Tobacco | | |

| Group PLC | 2,534,913 | 57,837 |

| Royal Dutch Shell PLC | | |

| Class A | 2,407,552 | 55,428 |

| National Grid Transco PLC | 6,057,158 | 50,326 |

| BAE Systems PLC | 8,796,564 | 46,272 |

| Centrica PLC | 12,724,654 | 42,543 |

| Xstrata PLC | 4,759,311 | 41,959 |

| Lloyds Banking | | |

| Group PLC | 24,496,380 | 39,733 |

| SABMiller PLC | 2,259,726 | 37,891 |

| Scottish & Southern | | |

| Energy PLC | 2,288,574 | 37,296 |

| Prudential PLC | 6,239,943 | 35,865 |

| Aviva PLC | 6,608,211 | 30,425 |

| BT Group PLC | 19,346,196 | 26,661 |

| Royal Bank of Scotland | | |

| Group PLC | 42,056,610 | 25,667 |

| Cadbury PLC | 3,391,820 | 25,362 |

| Tullow Oil PLC | 1,984,217 | 23,424 |

| Rolls-Royce Group PLC | 4,571,333 | 22,662 |

| Compass Group PLC | 4,614,569 | 21,942 |

| Morrison | | |

| Supermarkets PLC | 5,884,723 | 21,316 |

| Pearson PLC | 2,012,565 | 20,767 |

| Reed Elsevier PLC | 2,741,072 | 20,317 |

| British Sky Broadcasting | | |

| Group PLC | 2,832,011 | 20,161 |

| Marks & Spencer | | |

| Group PLC | 3,941,819 | 19,529 |

| BP PLC ADR | 436,130 | 18,518 |

| Shire Ltd. | 1,390,848 | 17,391 |

* | WPP PLC | 2,488,538 | 17,026 |

| Experian Group Ltd. | 2,557,492 | 16,840 |

| Kingfisher PLC | 5,891,044 | 16,037 |

| Royal & Sun Alliance | | |

| Insurance Group PLC | 8,305,772 | 15,979 |

| Man Group PLC | 4,220,195 | 15,599 |

| Capita Group PLC | 1,545,866 | 15,586 |

| Smith & Nephew PLC | 2,208,342 | 15,537 |

^ | Land Securities Group PLC | 1,845,181 | 15,217 |

| Standard Life PLC | 5,449,920 | 15,153 |

| Vodafone Group PLC ADR | 780,960 | 14,331 |

| | | Market |

| | | Value• |

| | Shares | ($000) |

| International Power PLC | 3,790,716 | 13,853 |

| Cable and Wireless PLC | 6,287,066 | 13,846 |

^ | British Land Co., PLC | 2,111,801 | 13,325 |

| United Utilities Group PLC | 1,690,828 | 12,645 |

^,* | Wolseley PLC | 703,182 | 12,611 |

| J. Sainsbury PLC | 2,600,303 | 12,601 |

| Old Mutual PLC | 12,525,008 | 12,479 |

| Legal & General | | |

| Group PLC | 14,667,260 | 12,461 |

| Next PLC | 492,844 | 11,788 |

^ | Thomson Reuters PLC | 446,813 | 11,493 |

| Carnival PLC | 406,048 | 11,158 |

* | Autonomy Corp.PLC | 531,292 | 11,146 |

* | Cairn Energy PLC | 341,160 | 10,696 |

| Smiths Group PLC | 975,349 | 10,481 |

| Johnson Matthey PLC | 537,112 | 9,485 |

| Associated British | | |

| Foods PLC | 881,912 | 9,310 |

| Severn Trent PLC | 589,625 | 9,072 |

| The Sage Group PLC | 3,234,325 | 8,808 |

| Group 4 Securicor PLC | 3,159,743 | 8,762 |

| Antofagasta PLC | 972,083 | 8,343 |

^ | Hammerson PLC | 1,743,462 | 8,078 |

| Home Retail Group | 2,186,286 | 8,045 |

| Amec PLC | 829,225 | 7,548 |

| Rexam PLC | 1,590,491 | 7,367 |

| Cobham PLC | 2,835,957 | 7,347 |

| ICAP PLC | 1,295,951 | 7,084 |

| Eurasian Natural | | |

| Resources Corp. | 807,331 | 7,030 |

| Serco Group PLC | 1,214,190 | 6,551 |

| Bunzl PLC | 804,914 | 6,490 |

| Burberry Group PLC | 1,086,726 | 6,469 |

| Drax Group PLC | 852,805 | 6,467 |

| Lonmin PLC | 296,226 | 6,220 |

| Admiral Group PLC | 460,726 | 6,161 |

| InterContinental Hotels | | |

| Group PLC | 645,646 | 6,134 |

| Whitbread PLC | 438,439 | 6,065 |

| FirstGroup PLC | 1,215,042 | 5,944 |

| Balfour Beatty PLC | 1,203,345 | 5,942 |

* | Invensys PLC | 2,019,395 | 5,897 |

| Tomkins PLC | 2,219,877 | 5,667 |

| Vedanta Resources PLC | 357,724 | 5,596 |

| Friends Provident PLC | 5,796,355 | 5,454 |

| Ladbrokes PLC | 1,513,441 | 5,228 |

| TUI Travel PLC | 1,390,038 | 5,181 |

| Segro PLC | 14,269,437 | 5,004 |

^ | 3i Group PLC | 1,050,956 | 4,943 |

| Investec PLC | 1,001,951 | 4,799 |

| Tate & Lyle PLC | 1,140,659 | 4,623 |

| Hays PLC | 3,462,682 | 4,597 |

| Meggitt PLC | 1,676,902 | 4,444 |

| Kazakhmys PLC | 534,704 | 4,154 |

| Thomas Cook Group PLC | 1,075,137 | 4,150 |

| IMI PLC | 791,281 | 4,149 |

20

European Stock Index Fund

| | | Market |

| | | Value• |

| | Shares | ($000) |

| LogicaCMG PLC | 3,666,137 | 4,136 |

^ | London Stock | | |

| Exchange PLC | 368,633 | 4,040 |

| United Business | | |

| Media Ltd. | 574,376 | 3,890 |

| ITV PLC | 8,180,322 | 3,841 |

^ | Liberty International PLC | 640,852 | 3,756 |

| Schroders PLC | 299,140 | 3,623 |

| Daily Mail and General | | |

| Trust PLC | 720,087 | 3,496 |

| British Airways PLC | 1,462,272 | 3,166 |

^,* | The Berkeley Group | | |

| Holdings PLC | 215,774 | 3,103 |

| Stagecoach Group PLC | 1,373,363 | 2,643 |

^ | Carphone Warehouse PLC | 1,029,492 | 2,255 |

| WPP PLC ADR | 59,481 | 2,030 |

* | Liberty International PLC | | |

| Rights Exp. 5/21/09 | 166,747 | 223 |

| | | 3,822,458 |

Total Common Stocks | | |

(Cost $19,880,677) | | 12,160,758 |

Temporary Cash Investments (17.5%)1 | |

Money Market Fund (17.3%) | | |

2,3 | Vanguard Market | | |

| Liquidity Fund, | | |

| 0.355% | 2,125,079,501 | 2,125,080 |

| | | |

| | Face | |

| | Amount | |

| | ($000) | |

U.S. Government and Agency Obligations (0.2%) |

4 | Federal Home Loan Bank, | | |

| 0.571%, 7/20/09 | 5,000 | 4,999 |

4 | Federal Home Loan Bank, | | |

| 0.411%, 9/28/09 | 5,000 | 4,994 |

4,5 | Federal Home Loan | | |

| Mortgage Corp., 0.592%, | | |

| 8/26/09 | 10,000 | 9,994 |

| | | 19,987 |

Total Temporary Cash Investments | |

(Cost $2,145,045) | | 2,145,067 |

Total Investments (116.8%) | | |

(Cost $22,025,722) | | 14,305,825 |

Other Assets and Liabilites (–16.8%) | |

Other Assets | | 80,324 |

Liabilities3 | | (2,134,501) |

| | | (2,054,177) |

Net Assets (100%) | | 12,251,648 |

At April 30, 2009, net assets consisted of: |

| Amount |

| ($000) |

Paid-in Capital | 21,430,430 |

Undistributed Net Investment Income | 149,771 |

Accumulated Net Realized Losses | (1,618,625) |

Unrealized Appreciation (Depreciation) | |

Investment Securities | (7,719,897) |

Futures Contracts | 11,527 |

Foreign Currencies and Forward | |

Currency Contracts | (1,558) |

Net Assets | 12,251,648 |

| |

Investor Shares—Net Assets | |

Applicable to 313,631,857 outstanding | |

$.001 par value shares of beneficial | |

interest (unlimited authorization) | 6,026,483 |

Net Asset Value Per Share— | |

Investor Shares | $19.22 |

| |

Admiral Shares—Net Assets | |

Applicable to 27,924,258 outstanding | |

$.001 par value shares of beneficial | |

interest (unlimited authorization) | 1,259,528 |

Net Asset Value Per Share— | |

Admiral Shares | $45.11 |

| |

Signal Shares—Net Assets | |

Applicable to 10,717,119 outstanding | |

$.001 par value shares of beneficial | |

interest (unlimited authorization) | 187,102 |

Net Asset Value Per Share— | |

Signal Shares | $17.46 |

21

European Stock Index Fund

| Amount |

| ($000) |

Institutional Shares—Net Assets | |

Applicable to 168,272,930 outstanding | |

$.001 par value shares of beneficial | |

interest (unlimited authorization) | 3,234,339 |

Net Asset Value Per Share— | |

Institutional Shares | $19.22 |

| |

ETF Shares—Net Assets | |

Applicable to 42,794,873 outstanding | |

$.001 par value shares of beneficial | |

interest (unlimited authorization) | 1,544,196 |

Net Asset Value Per Share— | |

ETF Shares | $36.08 |

• | See Note A in Notes to Financial Statements. |

^ | Part of security position is on loan to broker-dealers. The total value of securities on loan is $1,994,139,000. |

* | Non-income-producing security. |

1 The fund invests a portion of its cash reserves in equity markets through the use of index futures contracts. After giving effect to futures investments, the fund’s effective common stock and temporary cash investment positions represent 99.9% and 16.9%, respectively, of net assets.

2 Affiliated money market fund available only to Vanguard funds and certain trusts and accounts managed by Vanguard. Rate shown is the 7-day yield.

3 Includes $2,081,647,000 of collateral received for securities on loan.

4 The issuer operates under a congressional charter; its securities are not backed by the full faith and credit of the U.S. government.

5 Securities with a value of $9,495,000 have been segregated as initial margin for open futures contracts.

ADR—American Depositary Receipt.

ARS—Auction Rate Security.

See accompanying Notes, which are an integral part of the Financial Statements.

22

European Stock Index Fund

Statement of Operations

| Six Months Ended |

| April 30, 2009 |

| ($000) |

Investment Income | |

Income | |

Dividends1 | 266,937 |

Interest2 | 486 |

Security Lending | 7,523 |

Total Income | 274,946 |

Expenses | |

The Vanguard Group—Note B | |

Investment Advisory Services | 304 |

Management and Administrative—Investor Shares | 8,723 |

Management and Administrative—Admiral Shares | 741 |

Management and Administrative—Signal Shares | 102 |

Management and Administrative—Institutional Shares | 1,044 |

Management and Administrative—ETF Shares | 839 |

Marketing and Distribution—Investor Shares | 1,875 |

Marketing and Distribution—Admiral Shares | 214 |

Marketing and Distribution—Signal Shares | 38 |

Marketing and Distribution—Institutional Shares | 569 |

Marketing and Distribution—ETF Shares | 301 |

Custodian Fees | 1,038 |

Auditing Fees | 4 |

Shareholders’ Reports—Investor Shares | 49 |

Shareholders’ Reports—Admiral Shares | 4 |

Shareholders’ Reports—Signal Shares | 1 |

Shareholders’ Reports—Institutional Shares | — |

Shareholders’ Reports—ETF Shares | 10 |

Trustees’ Fees and Expenses | 12 |

Total Expenses | 15,868 |

Net Investment Income | 259,078 |

Realized Net Gain (Loss) | |

Investment Securities Sold | (1,642,287) |

Futures Contracts | (37,448) |

Foreign Currencies and Forward Currency Contracts | (8,445) |

Realized Net Gain (Loss) | (1,688,180) |

Change in Unrealized Appreciation (Depreciation) | |

Investment Securities | (227,632) |

Futures Contracts | 25,974 |

Foreign Currencies and Forward Currency Contracts | 10,746 |

Change in Unrealized Appreciation (Depreciation) | (190,912) |

Net Increase (Decrease) in Net Assets Resulting from Operations | (1,620,014) |

1 Dividends are net of foreign withholding taxes of $29,011,000.

2 Interest income from an affiliated company of the fund was $163,000.

See accompanying Notes, which are an integral part of the Financial Statements.

23

European Stock Index Fund

Statement of Changes in Net Assets

| Six Months Ended | Year Ended |

| April 30, | October 31, |

| 2009 | 2008 |

| ($000) | ($000) |

Increase (Decrease) in Net Assets | | |

Operations | | |

Net Investment Income | 259,078 | 1,208,160 |

Realized Net Gain (Loss) | (1,688,180) | 3,003,134 |

Change in Unrealized Appreciation (Depreciation) | (190,912) | (20,976,281) |

Net Increase (Decrease) in Net Assets Resulting from Operations | (1,620,014) | (16,764,987) |

Distributions | | |

Net Investment Income | | |

Investor Shares | (708,975) | (743,072) |

Admiral Shares | (100,154) | (87,518) |

Signal Shares | (14,655) | (14,971) |

Institutional Shares | (234,718) | (139,970) |

ETF Shares | (124,097) | (97,010) |

Realized Capital Gain | | |

Investor Shares | — | — |

Admiral Shares | — | — |

Signal Shares | — | — |

Institutional Shares | — | — |

ETF Shares | — | — |

Total Distributions | (1,182,599) | (1,082,541) |

Capital Share Transactions | | |

Investor Shares | (2,593,527) | (3,934,149) |

Admiral Shares | (15,269) | 12,041 |

Signal Shares | (7,629) | (29,856) |

Institutional Shares | 355,644 | 815,638 |

ETF Shares | 16,913 | 225,574 |

Net Increase (Decrease) from Capital Share Transactions | (2,243,868) | (2,910,752) |

Total Increase (Decrease) | (5,046,481) | (20,758,280) |

Net Assets | | |

Beginning of Period | 17,298,129 | 38,056,409 |

End of Period1 | 12,251,648 | 17,298,129 |

1 Net Assets—End of Period includes undistributed net investment income of $149,771,000 and $1,073,239,000.

See accompanying Notes, which are an integral part of the Financial Statements.

24

European Stock Index Fund

Financial Highlights

Investor Shares | | | | | | |

| Six Months | | | | | |

| Ended | | | | | |

For a Share Outstanding | April 30, | Year Ended October 31, |

Throughout Each Period | 2009 | 2008 | 2007 | 2006 | 2005 | 2004 |

Net Asset Value, Beginning of Period | $21.99 | $43.43 | $34.67 | $27.00 | $23.77 | $19.93 |

Investment Operations | | | | | | |

Net Investment Income | .378 | 1.3721 | 1.2981 | .920 | .670 | .540 |

Net Realized and Unrealized Gain (Loss) | | | | | | |

on Investments | (1.651) | (21.597) | 8.386 | 7.450 | 3.140 | 3.760 |

Total from Investment Operations | (1.273) | (20.225) | 9.684 | 8.370 | 3.810 | 4.300 |

Distributions | | | | | | |

Dividends from Net Investment Income | (1.497) | (1.215) | (.924) | (.700) | (.580) | (.460) |

Distributions from Realized Capital Gains | — | — | — | — | — | — |

Total Distributions | (1.497) | (1.215) | (.924) | (.700) | (.580) | (.460) |

Net Asset Value, End of Period | $19.22 | $21.99 | $43.43 | $34.67 | $27.00 | $23.77 |

| | | | | | |

Total Return2 | –5.84% | –47.80% | 28.49% | 31.63% | 16.21% | 21.89% |

| | | | | | |

Ratios/Supplemental Data | | | | | | |

Net Assets, End of Period (Millions) | $6,026 | $10,534 | $26,188 | $16,850 | $10,759 | $7,904 |

Ratio of Total Expenses to | | | | | | |

Average Net Assets | 0.29%3 | 0.22% | 0.22% | 0.27% | 0.27% | 0.27% |

Ratio of Net Investment Income to | | | | | | |

Average Net Assets | 3.68%3 | 3.82% | 3.35% | 3.35% | 2.84% | 2.67% |

Portfolio Turnover Rate4 | 19%3 | 15% | 9% | 6% | 5% | 5% |

1 Calculated based on average shares outstanding.

2 Total returns do not reflect the 2% fee assessed on redemptions of shares purchased on or after June 27, 2003, held for less than two months or the account service fee that may be applicable to certain accounts with balances below $10,000.

3 Annualized.

4 Excludes the value of portfolio securities received or delivered as a result of in-kind purchases or redemptions of the fund’s capital shares, including ETF Creation Units.

See accompanying Notes, which are an integral part of the Financial Statements.

25

European Stock Index Fund

Financial Highlights

Admiral Shares | | | | | | |

| Six Months | | | | | |

| Ended | | | | | |

For a Share Outstanding | April 30, | Year Ended October 31, |

Throughout Each Period | 2009 | 2008 | 2007 | 2006 | 2005 | 2004 |

Net Asset Value, Beginning of Period | $51.71 | $102.09 | $81.50 | $63.44 | $55.84 | $46.82 |

Investment Operations | | | | | | |

Net Investment Income | .921 | 3.1771 | 3.1401 | 2.230 | 1.611 | 1.308 |

Net Realized and Unrealized Gain (Loss) | | | | | | |

on Investments | (3.905) | (50.618) | 19.692 | 17.510 | 7.396 | 8.830 |

Total from Investment Operations | (2.984) | (47.441) | 22.832 | 19.740 | 9.007 | 10.138 |

Distributions | | | | | | |

Dividends from Net Investment Income | (3.616) | (2.939) | (2.242) | (1.680) | (1.407) | (1.118) |

Distributions from Realized Capital Gains | — | — | — | — | — | — |

Total Distributions | (3.616) | (2.939) | (2.242) | (1.680) | (1.407) | (1.118) |

Net Asset Value, End of Period | $45.11 | $51.71 | $102.09 | $81.50 | $63.44 | $55.84 |

| | | | | | |

Total Return2 | –5.82% | –47.74% | 28.59% | 31.77% | 16.32% | 21.98% |

| | | | | | |

Ratios/Supplemental Data | | | | | | |

Net Assets, End of Period (Millions) | $1,260 | $1,472 | $2,955 | $2,175 | $1,360 | $628 |

Ratio of Total Expenses to | | | | | | |

Average Net Assets | 0.17%3 | 0.12% | 0.12% | 0.17% | 0.18% | 0.18% |

Ratio of Net Investment Income to | | | | | | |

Average Net Assets | 3.80%3 | 3.92% | 3.45% | 3.45% | 2.93% | 2.76% |

Portfolio Turnover Rate4 | 19%3 | 15% | 9% | 6% | 5% | 5% |

1 Calculated based on average shares outstanding.

2 Total returns do not reflect the 2% fee assessed on redemptions of shares purchased on or after June 27, 2003, and held for less than two months.

3 Annualized.

4 Excludes the value of portfolio securities received or delivered as a result of in-kind purchases or redemptions of the fund’s capital shares, including ETF Creation Units.

See accompanying Notes, which are an integral part of the Financial Statements.

26

European Stock Index Fund

Financial Highlights

Signal Shares | | | | |

| Six Months | | | Oct. 6, |

| Ended | | Year Ended | 20061 to |

| April 30, | October 31, | Oct. 31, |

For a Share Outstanding Throughout Each Period | 2009 | 2008 | 2007 | 2006 |

Net Asset Value, Beginning of Period | $20.01 | $39.50 | $31.51 | $30.41 |

Investment Operations | | | | |

Net Investment Income | .355 | 1.2552 | 1.1512 | .0102 |

Net Realized and Unrealized Gain (Loss) on Investments | (1.508) | (19.616) | 7.681 | 1.090 |

Total from Investment Operations | (1.153) | (18.361) | 8.832 | 1.100 |

Distributions | | | | |

Dividends from Net Investment Income | (1.397) | (1.129) | (.842) | — |

Distributions from Realized Capital Gains | — | — | — | — |

Total Distributions | (1.397) | (1.129) | (.842) | — |

Net Asset Value, End of Period | $17.46 | $20.01 | $39.50 | $31.51 |

| | | | |

Total Return3 | –5.81% | –47.74% | 28.59% | 3.62% |

| | | | |

Ratios/Supplemental Data | | | | |

Net Assets, End of Period (Millions) | $187 | $223 | $502 | $12 |

Ratio of Total Expenses to Average Net Assets | 0.18%4 | 0.12% | 0.12% | 0.17%4 |

Ratio of Net Investment Income to Average Net Assets | 3.79%4 | 3.92% | 3.45% | 3.45%4 |

Portfolio Turnover Rate5 | 19%4 | 15% | 9% | 6% |

1 Inception.

2 Calculated based on average shares outstanding.

3 Total returns do not reflect the 2% fee assessed on redemptions of shares held for less than two months.

4 Annualized.

5 Excludes the value of portfolio securities received or delivered as a result of in-kind purchases or redemptions of the fund’s capital shares, including ETF Creation Units.

See accompanying Notes, which are an integral part of the Financial Statements.

27

European Stock Index Fund

Financial Highlights

Institutional Shares | | | | | | |

| Six Months | | | | | |

| Ended | | | | | |

For a Share Outstanding | April 30, | Year Ended October 31, |

Throughout Each Period | 2009 | 2008 | 2007 | 2006 | 2005 | 2004 |

Net Asset Value, Beginning of Period | $22.04 | $43.51 | $34.74 | $27.05 | $23.80 | $19.96 |

Investment Operations | | | | | | |

Net Investment Income | .398 | 1.3151 | 1.3501 | .978 | .721 | .570 |

Net Realized and Unrealized Gain (Loss) | | | | | | |

on Investments | (1.665) | (21.524) | 8.390 | 7.450 | 3.140 | 3.760 |

Total from Investment Operations | (1.267) | (20.209) | 9.740 | 8.428 | 3.861 | 4.330 |

Distributions | | | | | | |

Dividends from Net Investment Income | (1.553) | (1.261) | (.970) | (.738) | (.611) | (.490) |

Distributions from Realized Capital Gains | — | — | — | — | — | — |

Total Distributions | (1.553) | (1.261) | (.970) | (.738) | (.611) | (.490) |

Net Asset Value, End of Period | $19.22 | $22.04 | $43.51 | $34.74 | $27.05 | $23.80 |

| | | | | | |

Total Return2 | –5.80% | –47.72% | 28.63% | 31.83% | 16.42% | 22.03% |

| | | | | | |

Ratios/Supplemental Data | | | | | | |

Net Assets, End of Period (Millions) | $3,234 | $3,316 | $5,263 | $3,113 | $1,827 | $988 |

Ratio of Total Expenses to | | | | | | |

Average Net Assets | 0.13%3 | 0.09% | 0.09% | 0.12% | 0.12% | 0.12% |

Ratio of Net Investment Income to | | | | | | |

Average Net Assets | 3.84%3 | 3.95% | 3.48% | 3.50% | 2.99% | 2.77% |

Portfolio Turnover Rate4 | 19%3 | 15% | 9% | 6% | 5% | 5% |

1 Calculated based on average shares outstanding.

2 Total returns do not reflect the 2% fee on redemptions of shares purchased on or after June 27, 2003, and held for less than two months.

3 Annualized.

4 Excludes the value of portfolio securities received or delivered as a result of in-kind purchases or redemptions of the fund’s capital shares, including ETF Creation Units.

See accompanying Notes, which are an integral part of the Financial Statements.

28

European Stock Index Fund

Financial Highlights

ETF Shares | | | | | | |

| Six Months | | | | | March 4, |

| Ended | | | | | 20051 to |

For a Share Outstanding | April 30, | Year Ended October 31, | Oct. 31, |

Throughout Each Period | 2009 | 2008 | | 2007 | 2006 | 2005 |

Net Asset Value, Beginning of Period | $41.37 | $81.66 | | $65.21 | $50.80 | $50.96 |

Investment Operations | | | | | | |

Net Investment Income | .738 | 2.530 | 2 | 2.5762 | 1.800 | 1.040 |

Net Realized and Unrealized Gain (Loss) | | | | | | |

on Investments | (3.127) | (40.464) | 15.683 | 13.990 | (1.200) |

Total from Investment Operations | (2.389) | (37.934) | 18.259 | 15.790 | (.160) |

Distributions | | | | | | |

Dividends from Net Investment Income | (2.901) | (2.356) | (1.809) | (1.380) | — |

Distributions from Realized Capital Gains | — | — | — | — | — |

Total Distributions | (2.901) | (2.356) | (1.809) | (1.380) | — |

Net Asset Value, End of Period | $36.08 | $41.37 | | $81.66 | $65.21 | $50.80 |

| | | | | | |

Total Return | –5.84% | –47.73% | | 28.60% | 31.75% | –0.31% |

| | | | | | |

Ratios/Supplemental Data | | | | | | |

Net Assets, End of Period (Millions) | $1,544 | $1,754 | | $3,148 | $1,205 | $178 |

Ratio of Total Expenses to | | | | | | |

Average Net Assets | 0.17%3 | 0.11% | | 0.12% | 0.18% | 0.18%3 |

Ratio of Net Investment Income to | | | | | | |

Average Net Assets | 3.80%3 | 3.93% | | 3.45% | 3.44% | 2.93%3 |

Portfolio Turnover Rate4 | 19%3 | 15% | | 9% | 6% | 5% |

1 Inception.

2 Calculated based on average shares outstanding.

3 Annualized.

4 Excludes the value of portfolio securities received or delivered as a result of in-kind purchases or redemptions of the fund’s capital shares, including ETF Creation Units.

See accompanying Notes, which are an integral part of the Financial Statements.

29

European Stock Index Fund

Notes to Financial Statements

Vanguard European Stock Index Fund is registered under the Investment Company Act of 1940 as an open-end investment company, or mutual fund. The fund invests in securities of foreign issuers, which may subject it to investment risks not normally associated with investing in securities of U.S. corporations. The fund offers five classes of shares: Investor Shares, Admiral Shares, Signal Shares, Institutional Shares, and ETF Shares. Investor Shares are available to any investor who meets the fund’s minimum purchase requirements. Admiral Shares are designed for investors who meet certain administrative, service, tenure, and account-size criteria. Signal Shares are designed for institutional investors who meet certain administrative, service, and account-size criteria. Institutional Shares are designed for investors who meet certain administrative and service criteria and invest a minimum of $5 million. ETF Shares are listed for trading on the NYSE Arca, Inc.; they can be purchased and sold through a broker.

A. The following significant accounting policies conform to generally accepted accounting principles for U.S. mutual funds. The fund consistently follows such policies in preparing its financial statements.