UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT

OF

REGISTERED MANAGEMENT INVESTMENT COMPANIES

Investment Company Act file number:

811-6083

Name of Registrant:

Vanguard Ohio Tax-Free Funds

Address of Registrant:

P.O. Box 2600

Valley Forge, PA 19482

Name and address of agent for service:

Heidi Stam, Esquire

P.O. Box 876

Valley Forge, PA 19482

Registrant’s telephone number, including area code: (610) 669-1000

Date of fiscal year end: November 30

Date of reporting period: December 1, 2008 – November 30, 2009

Item 1: Reports to Shareholders

|

|

| Vanguard Ohio Tax-Exempt Funds |

| Annual Report |

|

|

| November 30, 2009 |

|

|

|

|

| Vanguard Ohio Tax-Exempt Money Market Fund |

| Vanguard Ohio Long-Term Tax-Exempt Fund |

|

|

> Vanguard Ohio Tax-Exempt Money Market Fund returned 0.56% for the 12 months ended November 30, 2009, a record low that nevertheless exceeded the average return of its peer group.

> Vanguard Ohio Long-Term Tax-Exempt Fund returned 13.61%, a 14-year high that matched the average return of its peer group and outpaced its benchmark index.

> The long-term municipal bond market roared back from a loss in fiscal 2008 to a double-digit gain in fiscal 2009.

| |

| Contents | |

| Your Fund’s Total Returns | 1 |

| President’s Letter | 2 |

| Advisor’s Report | 9 |

| Results of Proxy Voting | 12 |

| Ohio Tax-Exempt Money Market Fund | 14 |

| Ohio Long-Term Tax-Exempt Fund | 28 |

| About Your Fund’s Expenses | 47 |

| Glossary | 49 |

Please note: The opinions expressed in this report are just that—informed opinions. They should not be considered promises or advice. Also, please keep in mind that the information and opinions cover the period through the date on the front of this report. Of course, the risks of investing in your fund are spelled out in the prospectus.

Cover photograph: Veronica Coia.

| | | | |

| Your Fund’s Total Returns | | | |

| |

| |

| |

| |

| Fiscal Year Ended November 30, 2009 | | | | |

| | | | Ticker | Total |

| | | | Symbol | Returns |

| Vanguard Ohio Tax-Exempt Money Market Fund | | | VOHXX | 0.56% |

| 7-Day SEC Yield: 0.19% | | | | |

| Taxable-Equivalent Yield: 0.31%1 | | | | |

| Ohio Tax-Exempt Money Market Funds Average2 | | | | 0.31 |

| |

| Vanguard Ohio Long-Term Tax-Exempt Fund | | | VOHIX | 13.61% |

| 30-Day SEC Yield: 3.47% | | | | |

| Taxable-Equivalent Yield: 5.69%1 | | | | |

| Barclays Capital 10 Year Municipal Bond Index | | | | 12.67 |

| Ohio Municipal Debt Funds Average2 | | | | 13.62 |

| |

| |

| Your Fund’s Performance at a Glance | | | | |

| November 30, 2008–November 30, 2009 | | | | |

| | | | Distributions Per Share |

| | Starting | Ending | Income | Capital |

| Share Price | Share Price | Dividends | Gains |

| Vanguard Ohio Tax-Exempt Fund | | | | |

| Money Market | $1.00 | $1.00 | $0.006 | $0.000 |

| Long-Term | 10.96 | 11.93 | 0.498 | 0.000 |

1 This calculation, which assumes a typical itemized tax return, is based on the maximum federal tax rate of 35% and the maximum state of Ohio income tax rate. Local taxes were not considered. Please see the prospectus for a detailed explanation of the calculation.

2 Derived from data provided by Lipper Inc.

1

President’s Letter

Dear Shareholder,

The Vanguard Ohio Tax-Exempt Funds performed well in fiscal-year 2009, a period that began with fears about the viability of the nation’s financial institutions and a related plunge in municipal bond prices. As the year progressed, government rescue programs began to take hold, accompanied by a rally in municipal bonds.

Simultaneously, Ohio and other states grappled with the disruption in revenues brought about by the worst economic slump since the Great Depression, including an unemployment rate that climbed above 10% in Ohio. Fears of defaults were in the air (generally unwarranted in our view).

The Ohio Long-Term Tax-Exempt Fund fully participated in the national muni bond market rally. The fund returned 13.61% for the 12 months, nearly a record high. Rising bond prices go hand-in-hand with declining yields: As of November 30, 2009, the long-term fund’s yield was 3.47%, down from 4.39% a year earlier.

Money market funds faced a different dynamic, including aggressive actions by the Federal Reserve that drove down short-term interest rates. The Ohio Tax-Exempt Money Market Fund returned 0.56% for the fiscal year, a record low. The fund’s ending yield was a barely perceptible 0.19%, down from 1.23% a year earlier.

2

On a taxable-equivalent basis, the yield of each fund was higher, as shown on page 1. Note: The funds are permitted to invest in securities whose income is subject to the alternative minimum tax. As of November 30, the Long-Term Fund owned no securities that would generate income distributions subject to the AMT. The Money Market Fund did own some of these securities.

For bonds, a period of panic was followed by robust returns

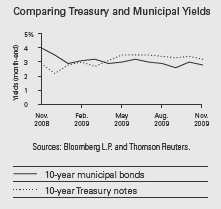

Volatility was a theme in the fixed income market over the 12 months ended November 30. At the peak of the credit crisis in late 2008, investors shunned just about any security not issued by the U.S. Treasury. This stampede to quality led to the widest gap between the very low yields of Treasuries and the much higher yields of corporate bonds since the Great Depression. The crisis also rattled the municipal bond market, propelling muni bond yields above those of Treasury bonds—a reversal of the typical relationship.

In early spring, “green shoots” began to emerge—signs that aggressive fiscal and monetary policies were getting the global economy back on its feet. Investors’ appetite for risk returned, and then some: Not only did they propel the stock market to an amazingly strong bounceback, but many sought out the riskiest bonds in the credit markets. For the 12 months, taxable and municipal bonds each notched double-digit results, returning about 12% and 14%, respectively.

| | | |

| Market Barometer | | | |

| | | Average Annual Total Returns |

| | | Periods Ended November 30, 2009 |

| | One Year | Three Years | Five Years |

| Bonds | | | |

| Barclays Capital U.S. Aggregate Bond Index | | | |

| (Broad taxable market) | 11.63% | 6.40% | 5.49% |

| Barclays Capital Municipal Bond Index | 14.17 | 4.17 | 4.50 |

| Citigroup 3-Month Treasury Bill Index | 0.20 | 2.36 | 2.91 |

| |

| Stocks | | | |

| Russell 1000 Index (Large-caps) | 27.38% | –5.71% | 1.02% |

| Russell 2000 Index (Small-caps) | 24.53 | –8.36 | –0.46 |

| Dow Jones U.S. Total Stock Market Index | 28.06 | –5.55 | 1.24 |

| MSCI All Country World Index ex USA (International) | 47.13 | –2.73 | 6.75 |

| |

| CPI | | | |

| Consumer Price Index | 1.84% | 2.40% | 2.52% |

3

Shorter-term savings vehicles, including money market funds, didn’t fare as well. They became casualties of the Fed’s dramatic cuts in short-term interest rates and other policies that pumped up the money supply, all intended to nurse the economy, markets, and banks back to health. In December 2008, the Fed reduced its target for the federal funds rate, a benchmark for the interest rates paid by money market instruments and other very short-term securities, to between 0% and 0.25%. The target has stayed there ever since. After its meeting in early November, the Fed said it expected to maintain the target at this level “for an extended period.”

Stock markets worldwide produced double-digit returns

U.S. stocks posted unusually large gains as the steep losses suffered during the first few months of the fiscal year were erased by the rally that began in March. The stock market’s rebound seemed to anticipate an improvement in the broader economy, which began to show signs of growth in the second half of the period.

The story was similar in many international markets: They collapsed in late 2008 and early 2009, then rebounded at a startling rate. The recovery was especially swift and powerful in emerging markets, many of which came out of the financial crisis in relatively better fiscal and economic shape than their developed-market counterparts.

| | |

| Expense Ratios1 | | |

| Your Fund Compared With Its Peer Group | | |

| | | Peer |

| Ohio Tax Exempt Fund | Fund | Group |

| Money Market | 0.17% | 0.62% |

| Long-Term | 0.17 | 1.12 |

1 The fund expense ratios shown are from the prospectus dated March 27, 2009, and represent estimated costs for the current fiscal year based on the funds’ net assets as of the prospectus date. For the fiscal year ended November 30, 2009, the expense ratios were 0.17% for the Ohio Tax-Exempt Money Market Fund and 0.17% for the Ohio Long-Term Tax-Exempt Fund. Peer-group expense ratios are derived from data provided by Lipper Inc. and capture information through year-end 2008. Peer groups are: for the Ohio Tax-Exempt Money Market Fund, Ohio Tax-Exempt Money Market Funds; and for the Ohio Long-Term Tax-Exempt Fund, Ohio Municipal Debt Funds.

4

Despite the strong performance seen since March, the longer-term returns of most stock market indexes bear witness to the trials suffered by many investors in the not-so-distant past. Over the past three years, for example, both U.S. and international stock indexes have declined. Five-year annualized returns for U.S. stocks as of November 30 were mostly positive, but far from impressive. Stock markets abroad fared better over this longer period, posting average annual returns of almost 7%.

Fear, the Fed, and a rally put a squeeze on yields

Fiscal 2009 was a period of falling yields for tax-exempt securities. However, the primary factors behind the slide in yields for short-term securities differed from those affecting longer-term tax-exempt bonds.

Because money market investments are extremely sensitive to changes in short-term interest rates, the Ohio Tax-Exempt Money Market Fund’s yield dwindled all year in response to the Fed’s rate-cutting policy. Further encouraging the downward trend was strong market demand for low-risk, liquid assets at the height of the financial panic.

By November 30, the money market fund’s yield was down to 0.19%, compared with 1.23% a year earlier. For the 12 months, the fund returned 0.56%, a record low. The good news—on a relative basis, to be sure—is that the fund’s return was almost double that of its competitive peers, a consequence primarily of the fund’s low expense ratio (a hallmark of Vanguard funds).

| | |

| Total Returns | | |

| Ten Years Ended November 30, 2009 | | |

| | Average Annual Return |

| | Vanguard | Peer-Group |

| Ohio Tax-Exempt Fund | Fund | Average1 |

| Money Market | 2.24% | 1.83% |

| Long-Term | 5.64 | 4.36 |

The figures shown represent past performance, which is not a guarantee of future results. Current performance may be lower or higher than the performance data cited. For performance data current to the most recent month-end, visit our website at www.vanguard.com/performance.) Note, too, that both investment returns and principal value can fluctuate widely, so an investor’s shares, when sold, could be worth more or less than their original cost.

1 Peer groups are: for the Ohio Tax-Exempt Money Market Fund, Ohio Tax-Exempt Money Market Funds; and for the Ohio Long-Term Tax-Exempt Fund, Ohio Municipal Debt Funds. Peer-group returns are derived from data provided by Lipper Inc.

5

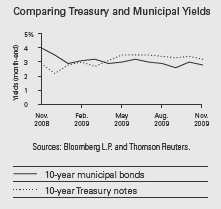

| A historical yield pattern has reasserted itself Atypical times can upend typical relationships. At the start of the fiscal year, municipal securities generally offered higher pre-tax yields than taxable Treasuries—an inversion of the historical relationship. A variety of investor fears about the financial outlook drove demand for Treasuri es up and their yields down, while market turmoil was doing the opposite for municipal bonds. Munis have usually yielded less than Treasuries, because their interest income is generally exempt from federal taxes. As the period progressed, Treasury yields rose and muni yields declined—returning to the more usual relationship in the spring. |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

In the longer-term portion of the tax-exempt market, yields declined and prices rose because of a rally that took hold early in the year and didn’t let up. The Ohio Long-Term Tax-Exempt Fund’s yield fell to 3.47% on November 30 from 4.39% a year earlier.

The seeds of the rally were planted early in the fiscal year by an offshoot of the credit-market crisis: the extreme pressure on certain institutional investors to raise capital in a hurry. The resulting forced sales of municipal bonds drove prices down to levels that would prove attractive to later investors. Yields on munis rose accordingly, even climbing above those of Treasuries (see the Investment insight chart on this page). As investors’ appetite for risk rekindled, the combination of low prices and high yields fueled strong demand.

Also helping to boost prices was a decline in supply. Issuance of tax-exempt bonds dropped as states and municipalities turned to the newly created Build America Bonds; such bonds were offered, for example, by issuers as varied as the Greater Cincinnati Water Works and the Edgewood and Talawanda school districts in western Ohio. The new bonds, whose interest payments are taxable, are one element of the federal economic stimulus package and were designed to subsidize states’ and local governments’ borrowing costs. (The stimulus program also included direct payments to states and local governments, another factor that reduced bond supply.)

6

In this environment, the Ohio Long-Term Tax-Exempt Fund returned 13.61%, its highest return since fiscal-year 1995. The fund’s return matched the average return of peer-group funds and outpaced the 12.67% return of its benchmark index.

Diligent analysis underlies our solid long-term results

Current economic signals seem to point to renewed growth for the nation as a whole, but it’s likely that the finances of states and municipalities will be slower to recover. The next couple of years will remain challenging for Ohio and other states.

For municipal bond investors, this means that close monitoring of the financial strength of issuers is of paramount importance. Fortunately, that is what Vanguard Fixed Income Group’s team of seasoned credit analysts routinely does.

The team brings an informed skeptic’s view to the task: Its analyses are independent of those published by rating agencies, and include not only issues being considered for purchase but those already owned by the funds. Our analysts believe that concerns about possible defaults by issuers of tax-exempt securities in Ohio, and in other states represented in Vanguard’s tax-exempt portfolios, are generally unwarranted.

As investment advisor to the Ohio Tax-Exempt Funds, the Fixed Income Group seeks to maintain low-cost portfolios of high-quality, liquid assets with a level of interest rate risk generally in line with that of their respective market segments. This strategy, together with the advisor’s diligent credit analysis, has served our shareholders well over the long term.

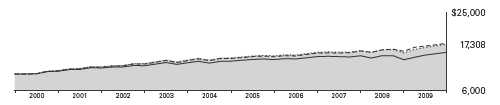

As you can see in the table on page 5, for the ten-year period ended November 30, 2009, both the Ohio Tax-Exempt Money Market Fund and the Ohio Long-Term Tax-Exempt Fund outpaced the average return of peer-group funds by a significant margin.

The higher the costs, the higher the hurdle

Costs are an important factor in any fund’s performance, but they’re critical in fixed income investing because bond returns fall within a narrower range than stock returns. This simple fact provides two interrelated advantages for the skilled bond-fund manager who has the advantage of low costs. He or she has a lower hurdle to overcome in seeking to produce competitive performance, because expenses are deducted directly from returns. And the manager needn’t pursue higher-risk strategies in an effort to overcome the drag from higher costs.

As you can see in the table on page 4, our funds’ costs are far below the norm for their peers. And while our commitment to keeping your costs low is unwavering, the money market fund's expense ratio nevertheless rose by about 6 basis points during the past year. The increase largely reflected the cost of participating in the U.S. Treasury's Temporary Guarantee Program. This program was established in late 2008, as turmoil in short-term debt markets raised concern about the stability

7

of money market mutual funds. Markets soon stabilized, and the Treasury allowed the program to expire in September 2009.

Investing in funds that have low costs and skilled management is just one step in the journey toward your investment goals. Investors should take into account not only that markets fluctuate, but also that different markets—stocks and bonds, for example—often fluctuate differently from each other. That is why we recommend that investors balance their portfolios among different asset classes, and diversify within those classes, based on each investor’s unique goals, time horizon, and tolerance for risk.

On another matter, I would like to inform you that on January 1, 2010, we will complete a leadership transition that began in March 2008. I will succeed Jack Brennan as chairman of Vanguard and each of the funds. Jack has agreed to serve as chairman emeritus and senior advisor.

Under Jack’s leadership, Vanguard has grown to become a preeminent firm in the mutual fund industry. Jack’s energy, his relentless pursuit of perfection, and his unwavering focus on always doing the right thing for our clients are evident in every facet of Vanguard policy today.

Thank you for entrusting your assets to Vanguard.

Sincerely,

F. William McNabb III

President and Chief Executive Officer

December 10, 2009

8

Advisor’s Report

For the fiscal year ended November 30, 2009, Vanguard Ohio Tax-Exempt Money Market Fund returned 0.56%, ahead of the average return of its peer group. The Ohio Long-Term Tax-Exempt Fund returned 13.61%—showing just how far and fast the bond market recovered from the dark days of 2008 and early 2009, when credit was essentially frozen. The long-term fund’s return was above that of its diversified Barclays Capital index benchmark and in line with the average return of competing funds.

The investment environment

In the past 12 months we have seen a significant rebound in the municipal bond market. The fiscal year began in December amid a seemingly desperate crisis: Major financial firms had imploded; the credit markets were frozen; hedge funds and closed-end funds were unloading high-quality assets, including municipal bonds, at fire-sale prices to meet collateral requirements; and investors were fleeing securities with any hint of risk for the perceived safety of U.S. Treasury securities.

By early 2009, federal government and Federal Reserve initiatives aimed at combating the financial crisis and the intertwined economic slump started gaining some traction. The banks and brokerage firms that underwrite municipal issues and facilitate liquidity began to operate normally once again, helping to stabilize the muni market. And munis’ depressed prices began to attract buyers, helping to fuel a rally that continued for the remainder of the year. Toward the end

| | |

| Yields of Municipal Securities | | |

| (AAA-Rated General-Obligation Issues) | | |

| | November 30, | November 30, |

| Maturity | 2008 | 2009 |

| 2 years | 2.13% | 0.61% |

| 5 years | 2.93 | 1.50 |

| 10 years | 4.02 | 2.78 |

| 30 years | 5.38 | 4.28 |

Source: Vanguard.

9

of the fiscal year, tax-free bond yields had fallen (and prices risen) to levels not seen for four decades.

Prices also got a boost from the shortage of traditional tax-exempt securities. After the yields demanded by muni investors became exceptionally high in early 2009, many municipal borrowers began shifting a significant portion of their issuance to a new and lower-cost type of municipal bond—the subsidized and taxable Build America Bond. These bonds were created as part of the federal government’s stimulus package (signed into law in February). They are intended to encourage investment in public infrastructure and to help state and local governments, as well as other municipal issuers, meet their financing needs.

Although Build America Bonds may not have become a household name yet, these bonds’ impact on the municipal bond market should not be underestimated. From April—when the first such bond was issued—through November 2009, more than $55 billion of taxable Build America Bonds were issued across the United States. In October alone, about one-third of all new municipal bond issues were taxable, and most of those were Build America Bonds. Because these bonds siphoned off some of the potential supply of new tax-exempt bonds, investors seeking traditional munis found their prices being bid up.

Still, tax-exempt bonds represented close to 80% of the almost $375 billion of muni issues sold nationwide in 2009 through November. And the total value of new municipal issues—including taxable bonds—appeared on track to exceed $400 billion in calendar year 2009, which would join 2005 and 2007 in the $400 billion-plus record book. In Ohio, during the fiscal year just ended, a total of $11.7 billion of municipal bonds was issued (including $1.9 billion of Build America Bonds), slightly above the total of $11.6 billion last year though behind the $17.8 billion of issuance in fiscal 2007.

As economic conditions improved during the year, investors sought out higher yields—by moving out of money market securities into longer-term bonds and by taking on more credit risk. Indeed, with state and local finances remaining shaky throughout the period, it was the market’s shift toward risk that led to a narrowing of the yield gap between lower-quality municipals and U.S. Treasuries. In this environment, lower-quality bonds performed best in both the taxable and municipal markets—generally creating headwinds for Vanguard funds because of our focus on quality.

Management of the funds

The economic slump and high unemploy- ment at the national level have translated into historic budget challenges for states and municipalities, leading them to resort to a variety of measures to help meet their fiscal needs. These have included cutting

10

spending, increasing taxes and fees, and tapping into reserves—in Ohio’s case, the state depleted almost its entire $1 billion rainy-day fund to help meet its fiscal-year 2009 budget gap. Federal stimulus payments also helped bridge budget gaps.

In anticipation of the market’s recovery, we increased the funds’ exposure to lower-quality securities, while maintaining our overall emphasis on securities with high credit quality. Indeed, compared with the funds’ peer groups, our allocations to lower-rated issues remain quite modest.

The funds’ interest rate positioning, as measured by their average weighted durations, had no meaningful impact on performance relative to benchmark indexes.

Outlook

We expect slow and stable economic growth to continue. Although the ultimate strength and pace of the recovery are open to question, the muni market has clearly priced out depression and priced in recovery. And, while we expect the Federal Reserve to keep interest rates low, we will be closely watching for any serious uptick in inflation. If inflation becomes a concern, we are prepared to act quickly. As the economic expansion proceeds, yield spreads between lower-risk and higher-risk bonds should continue to tighten, albeit at a more moderate pace.

At the state and local levels, we do not expect any immediate respite from financial stress. Indeed, Ohio is expected to be among the hardest-hit states in terms of declines in personal and corporate income tax revenues (according to state forecasts compiled by the National Conference of State Legislatures).

If the historical pattern holds, fiscal pressure on state and local governments will continue for the next few years. Changes in the financial picture of municipal bond issuers tend to lag the broader economic cycle by one to two years. As we usually do, we will continue to independently monitor developments in Ohio and nationally and closely analyze the finances of the muni issuers. We strive to make sure that any financial pressure or problems of issuers won’t become the problems of the shareholders in our funds.

Pamela Wisehaupt Tynan, Principal, Portfolio Manager

Marlin G. Brown, Portfolio Manager

Christopher W. Alwine, CFA

Principal and Head of Municipal Money Market and Municipal Bond Groups

Vanguard Fixed Income Group

December 18, 2009

11

Results of Proxy Voting

At a special meeting of shareholders on July 2, 2009, fund shareholders approved the following two proposals:

Proposal 1—Elect trustees for each fund.*

The individuals listed in the table below were elected as trustees for each fund. All trustees with the exception of Messrs. McNabb and Volanakis (both of whom already served as directors of The Vanguard Group, Inc.) served as trustees to the funds prior to the shareholder meeting.

| | | |

| | | | Percentage |

| Trustee | For | Withheld | For |

| John J. Brennan | 718,227,005 | 24,398,024 | 96.7% |

| Charles D. Ellis | 714,659,149 | 27,965,880 | 96.2% |

| Emerson U. Fullwood | 715,293,922 | 27,331,108 | 96.3% |

| Rajiv L. Gupta | 715,499,068 | 27,125,962 | 96.3% |

| Amy Gutmann | 714,735,559 | 27,889,471 | 96.2% |

| JoAnn Heffernan Heisen | 717,008,144 | 25,616,885 | 96.6% |

| F. William McNabb III | 717,929,406 | 24,695,624 | 96.7% |

| André F. Perold | 716,068,800 | 26,556,230 | 96.4% |

| Alfred M. Rankin, Jr. | 709,011,750 | 33,613,280 | 95.5% |

| Peter F. Volanakis | 717,569,923 | 25,055,107 | 96.6% |

| * Results are for all funds within the same trust. | | | |

Proposal 2—Update and standardize the funds’ fundamental policies regarding:

(a) Purchasing and selling real estate.

(b) Issuing senior securities.

(c) Borrowing money.

(d) Making loans.

(e) Purchasing and selling commodities.

(f) Concentrating investments in a particular industry or group of industries.

(g) Eliminating outdated fundamental investment policies not required by law.

The revised fundamental policies are clearly stated and simple, yet comprehensive, making oversight and compliance more efficient than under the former policies. The revised fundamental policies will allow the funds to respond more quickly to regulatory and market changes, while avoiding the costs and delays associated with successive shareholder meetings.

12

| | | | | |

| | | | | Broker | Percentage |

| Vanguard Fund | For | Abstain | Against | Non-Votes | For |

| Ohio Tax-Exempt Money Market Fund | | | | |

| 2a | 607,480,029 | 11,225,425 | 51,594,312 | 18,524,121 | 88.2% |

| 2b | 605,730,640 | 13,529,263 | 51,039,864 | 18,524,121 | 87.9% |

| 2c | 593,431,739 | 11,730,083 | 65,137,945 | 18,524,121 | 86.2% |

| 2d | 594,213,069 | 10,751,730 | 65,334,968 | 18,524,121 | 86.3% |

| 2e | 591,774,181 | 12,450,257 | 66,075,329 | 18,524,121 | 85.9% |

| 2f | 597,365,552 | 16,577,549 | 56,356,666 | 18,524,121 | 86.7% |

| 2g | 615,373,128 | 15,335,532 | 39,591,106 | 18,524,121 | 89.3% |

| |

| Ohio Long-Term Tax-Exempt Fund | | | | | |

| 2a | 46,518,980 | 747,651 | 2,082,208 | 4,452,303 | 86.5% |

| 2b | 46,672,560 | 960,550 | 1,715,730 | 4,452,302 | 86.8% |

| 2c | 45,811,526 | 928,881 | 2,608,435 | 4,452,300 | 85.1% |

| 2d | 45,911,920 | 942,805 | 2,494,115 | 4,452,302 | 85.3% |

| 2e | 45,810,266 | 935,941 | 2,602,634 | 4,452,301 | 85.1% |

| 2f | 46,362,233 | 775,036 | 2,211,572 | 4,452,301 | 86.2% |

| 2g | 46,997,206 | 698,567 | 1,653,068 | 4,452,301 | 87.4% |

13

Ohio Tax-Exempt Money Market Fund

Fund Profile

As of November 30, 2009

| |

| Financial Attributes | |

| Yield1 | 0.2% |

| Average Weighted Maturity | 36 days |

| Average Quality2 | MIG-1 |

| Expense Ratio3 | 0.17% |

| |

| Distribution by Credit Quality4 (% of portfolio) |

| MIG-1/A-1+/SP-1+/F-1+ | 88.8% |

| P-1/A-1/SP-1/F-1 | 9.2 |

| AAA/AA | 2.0 |

1 7-day SEC yield. See the Glossary.

2 Moody’s Investors Service.

3 The expense ratio shown is from the prospectus dated March 27, 2009, and represents estimated costs for the current fiscal year based on the fund’s net assets as of the prospectus date. For the fiscal year ended November 30, 2009, the expense ratio was 0.17%.

4 Ratings: Moody’s Investors Service, Standard & Poor’s, Fitch.

14

Ohio Tax-Exempt Money Market Fund

Performance Summary

Investment returns will fluctuate. All of the returns in this report represent past performance, which is not a guarantee of future results that may be achieved by the fund. (Current performance may be lower or higher than the performance data cited. For performance data current to the most recent month-end, visit our website at www.vanguard.com/performance.) The returns shown do not reflect taxes that a shareholder would pay on fund distributions. An investment in a money market fund is not insured or guaranteed by the Federal Deposit Insurance Corporation or any other government agency. Although the fund seeks to preserve the value of your investment at $1 per share, it is possible to lose money by investing in the fund. The fund’s 7 - -day SEC yield reflects its current earnings more closely than do the average annual returns.

Cumulative Performance: November 30, 1999–November 30, 2009

Initial Investment of $10,000

| | | | |

| | | Average Annual Total Returns | Final Value |

| | Periods Ended November 30, 2009 | of a $10,000 |

| | One Year | Five Years | Ten Years | Investment |

| Ohio Tax-Exempt Money Market Fund1 | 0.56% | 2.42% | 2.24% | $12,485 |

| Ohio Tax-Exempt Money Market | | | | |

| Funds Average2 | 0.31 | 2.01 | 1.83 | 11,993 |

1 Total returns do not include the account service fee that may be applicable to certain accounts with balances below $10,000.

2 Derived from data provided by Lipper Inc.

See Financial Highlights for dividend information.

15

| | |

| Ohio Tax-Exempt Money Market Fund | | |

| |

| |

| |

| |

| Fiscal-Year Total Returns (%): November 30, 1999–November 30, 2009 | | |

| | | Funds |

| | | Average1 |

| Fiscal | Total | Total |

| Year | Return | Return |

| 2000 | 4.0% | 3.6% |

| 2001 | 3.0 | 2.6 |

| 2002 | 1.4 | 1.0 |

| 2003 | 0.9 | 0.6 |

| 2004 | 1.1 | 0.6 |

| 2005 | 2.2 | 1.7 |

| 2006 | 3.3 | 2.8 |

| 2007 | 3.6 | 3.1 |

| 2008 | 2.4 | 2.0 |

| 2009 | 0.6 | 0.3 |

| 7-day SEC yield (11/30/2009): 0.19% | | |

Average Annual Total Returns: Periods Ended September 30, 2009

This table presents average annual total returns through the latest calendar quarter—rather than through the end of the fiscal period. Securities and Exchange Commission rules require that we provide this information.

| | | | |

| | Inception Date | One Year | Five Years | Ten Years |

| Ohio Tax-Exempt Money Market Fund2 | 6/18/1990 | 0.92% | 2.46% | 2.30% |

1 Average returns for Ohio Tax-Exempt Money Market Funds are derived from data provided by Lipper Inc.

2 Total returns do not include the account service fee that may be applicable to certain accounts with balances below $10,000.

16

Ohio Tax-Exempt Money Market Fund

Financial Statements

Statement of Net Assets

As of November 30, 2009

The fund reports a complete list of its holdings in regulatory filings four times in each fiscal year, at the quarter-ends. For the second and fourth fiscal quarters, the lists appear in the fund’s semiannual and annual reports to shareholders. For the first and third fiscal quarters, the fund files the lists with the Securities and Exchange Commission on Form N-Q. Shareholders can look up the fund’s Forms N-Q on the SEC’s website at www.sec.gov. Forms N-Q may also be reviewed and copied at the SEC’s Public Reference Room (see the back cover of this report for further information). In addition, the fund publishes its holdings on a monthly basis at www.vanguard.com.

| | | | |

| | | | Face | Market |

| | | Maturity | Amount | Value• |

| | Coupon | Date | ($000) | ($000) |

| Tax-Exempt Municipal Bonds (101.7%) | | | | |

| Ohio (100.2%) | | | | |

| Akron OH BAN | 1.375% | 6/24/10 | 3,000 | 3,005 |

| Allen County OH Hosp. Fac. Rev. | | | | |

| (Catholic Healthcare Partners) VRDO | 0.190% | 12/1/09 LOC | 4,250 | 4,250 |

| Allen County OH Hosp. Fac. Rev. | | | | |

| (Catholic Healthcare) VRDO | 0.270% | 12/7/09 LOC | 13,250 | 13,250 |

| 1 American Muni. Power Ohio Inc. TOB VRDO | 0.320% | 12/7/09 (12) | 10,000 | 10,000 |

| 1 American Muni. Power Ohio Inc. TOB VRDO | 0.320% | 12/7/09 (12) | 9,315 | 9,315 |

| Beachwood OH BAN | 2.250% | 12/3/09 | 1,000 | 1,000 |

| Bowling Green State Univ. Ohio | | | | |

| General Receipts Rev. | 5.750% | 6/1/10 (Prere.) | 2,250 | 2,331 |

| Butler County OH BAN | 1.250% | 8/5/10 | 7,500 | 7,528 |

| Cincinnati OH City School Dist. GO | 1.750% | 5/26/10 | 2,500 | 2,505 |

| 1 Cincinnati OH City School Dist. GO TOB VRDO | 0.270% | 12/7/09 (12) | 12,415 | 12,415 |

| Cleveland OH Airport System Rev. VRDO | 0.270% | 12/7/09 LOC | 3,100 | 3,100 |

| Cleveland OH COP VRDO | 0.240% | 12/7/09 LOC | 22,600 | 22,600 |

| 1 Cleveland OH Water Works Rev. TOB VRDO | 0.250% | 12/7/09 | 14,850 | 14,850 |

| Cleveland OH Water Works Rev. VRDO | 0.250% | 12/7/09 LOC | 25,000 | 25,000 |

| Cleveland-Cuyahoga County OH Port Auth. Rev. | | | | |

| (Euclid Avenue Housing Corp. Project) VRDO | 0.240% | 12/7/09 LOC | 2,750 | 2,750 |

| Cleveland-Cuyahoga County OH Port Auth. Rev. | | | | |

| (Museum of Art) VRDO | 0.210% | 12/7/09 | 10,000 | 10,000 |

| Cleveland-Cuyahoga County OH Port Auth. Rev. | | | | |

| (Museum of Art) VRDO | 0.230% | 12/7/09 | 7,300 | 7,300 |

| Cleveland-Cuyahoga County OH Port Auth. Rev. | | | | |

| (Museum of Art) VRDO | 0.230% | 12/7/09 | 16,700 | 16,700 |

| Columbus OH BAN | 2.500% | 12/16/09 | 5,000 | 5,003 |

| 2 Columbus OH City School Dist. BAN | 1.500% | 12/2/10 | 7,000 | 7,073 |

| 1 Columbus OH City School Dist. TOB VRDO | 0.250% | 12/7/09 LOC | 10,230 | 10,230 |

| 1 Columbus OH GO TOB VRDO | 0.300% | 12/7/09 | 4,360 | 4,360 |

| Columbus OH Regional Airport Auth. Airport | | | | |

| Refunding Rev. (Oasbo Expanded | | | | |

| Asset Program) VRDO | 0.250% | 12/7/09 LOC | 6,380 | 6,380 |

| Columbus OH Regional Airport Auth. Airport | | | | |

| Refunding Rev. (Oasbo Expanded Asset | | | | |

| Program) VRDO | 0.250% | 12/7/09 LOC | 33,435 | 33,435 |

17

| | | | |

| Ohio Tax-Exempt Money Market Fund | | | | |

| |

| |

| |

| | | | Face | Market |

| | | Maturity | Amount | Value• |

| | Coupon | Date | ($000) | ($000) |

| Columbus OH Regional Airport Auth. Airport | | | | |

| Refunding Rev. (Oasbo Expanded | | | | |

| Asset Program) VRDO | 0.250% | 12/7/09 LOC | 3,700 | 3,700 |

| 1 Columbus OH Regional Airport Auth. | | | | |

| Rev. TOB VRDO | 0.270% | 12/7/09 LOC | 3,540 | 3,540 |

| 1 Columbus OH Sewer Rev. TOB VRDO | 0.220% | 12/7/09 | 4,985 | 4,985 |

| Cuyahoga County OH BAN | 1.500% | 5/13/10 | 5,000 | 5,013 |

| Cuyahoga County OH Hosp. Rev. | | | | |

| (Cleveland Clinic Foundation) CP | 0.300% | 2/10/10 | 5,000 | 5,000 |

| Cuyahoga Falls OH BAN | 2.750% | 12/9/09 | 4,500 | 4,501 |

| Delaware County OH Port Auth. Econ. Dev. Rev. | | | | |

| (Columbus Zoological Park) VRDO | 0.260% | 12/7/09 LOC | 5,350 | 5,350 |

| Delaware County OH Sewer Dist. | 4.950% | 12/1/09 (Prere.) | 1,500 | 1,515 |

| Dublin OH City School Dist. BAN | 1.000% | 10/14/10 | 3,750 | 3,763 |

| Franklin County OH BAN | 1.500% | 4/21/10 | 12,600 | 12,648 |

| Franklin County OH Hosp. Rev. | | | | |

| (Nationwide Hosp.) VRDO | 0.210% | 12/7/09 | 3,800 | 3,800 |

| Franklin County OH Hosp. Rev. | | | | |

| (OhioHealth Corp.) VRDO | 0.210% | 12/7/09 LOC | 2,475 | 2,475 |

| Franklin County OH Hosp. Rev. | | | | |

| (OhioHealth Corp.) VRDO | 0.240% | 12/7/09 | 21,300 | 21,300 |

| Greater Cleveland OH Regional Transp. | | | | |

| Auth. Rev. RAN | 1.150% | 12/22/09 | 12,000 | 12,002 |

| Green City OH BAN | 1.750% | 7/9/10 | 8,400 | 8,455 |

| Greene County OH BAN | 1.375% | 6/22/10 | 4,350 | 4,358 |

| Hamilton County OH Health Care Fac. Rev. VRDO | 0.270% | 12/7/09 LOC | 3,450 | 3,450 |

| Kent State Univ. Ohio Univ. Rev. VRDO | 0.250% | 12/7/09 LOC | 9,350 | 9,350 |

| Lake County Ohio BAN | 2.000% | 4/8/10 | 1,000 | 1,002 |

| Lake County Ohio BAN | 1.500% | 7/8/10 | 2,500 | 2,512 |

| 1 Lakewood OH City School Dist. GO TOB VRDO | 0.320% | 12/7/09 (4) | 4,785 | 4,785 |

| Lancaster Port Auth. Ohio Gas Rev. VRDO | 0.250% | 12/7/09 | 19,605 | 19,605 |

| Lorain County OH GO BAN | 2.000% | 5/28/10 | 2,625 | 2,639 |

| Lorain County OH Hosp. Fac. Rev. | | | | |

| (EMH Regional Medical Center) VRDO | 0.250% | 12/7/09 LOC | 4,600 | 4,600 |

| 1 Lorain County OH Hosp. Rev. | | | | |

| (Catholic Healthcare Partners) TOB VRDO | 0.320% | 12/7/09 (4) | 10,500 | 10,500 |

| 1 Lorain County OH Hosp. Rev. | | | | |

| (Catholic Healthcare Partners) TOB VRDO | 0.320% | 12/7/09 (4) | 7,715 | 7,715 |

| 1 Lorain County OH Hosp. Rev. | | | | |

| (Catholic Healthcare Partners) TOB VRDO | 0.320% | 12/7/09 (4)(12) | 12,780 | 12,780 |

| Lorain County OH Port Auth. Educ. Fac. | | | | |

| (St. Ignatius High School) VRDO | 0.240% | 12/7/09 LOC | 2,050 | 2,050 |

| Lucas County OH BAN | 1.000% | 7/22/10 | 3,000 | 3,006 |

| Lucas County OH BAN | 2.000% | 9/16/10 | 4,505 | 4,552 |

| Mason OH BAN | 1.500% | 3/11/10 | 2,550 | 2,555 |

| Mason OH BAN | 0.750% | 7/28/10 | 4,650 | 4,650 |

| Mason OH City School Dist. BAN | 1.500% | 2/4/10 | 2,845 | 2,849 |

| 1 Montgomery County OH Rev. (Catholic Health | | | | |

| Initiatives) TOB VRDO | 0.260% | 12/7/09 | 5,425 | 5,425 |

| 1 Montgomery County OH Rev. | | | | |

| (Catholic Health Initiatives) TOB VRDO | 0.320% | 12/7/09 (4) | 6,970 | 6,970 |

| Montgomery County OH Rev. | | | | |

| (Catholic Health Initiatives) VRDO | 0.270% | 12/7/09 | 5,200 | 5,200 |

| 1 Montgomery County OH Rev. TOB VRDO | 0.320% | 12/7/09 (4) | 4,995 | 4,995 |

| Oberlin OH BAN | 1.500% | 5/5/10 | 4,000 | 4,012 |

| Ohio Air Quality Dev. Auth. PCR | | | | |

| (Ohio Valley Electric Corp.) VRDO | 0.220% | 12/7/09 LOC | 2,750 | 2,750 |

18

| | | | |

| Ohio Tax-Exempt Money Market Fund | | | | |

| |

| |

| |

| | | | Face | Market |

| | | Maturity | Amount | Value• |

| | Coupon | Date | ($000) | ($000) |

| Ohio Air Quality Dev. Auth. PCR | | | | |

| (Ohio Valley Electric Corp.) VRDO | 0.290% | 12/7/09 LOC | 4,000 | 4,000 |

| 1 Ohio Air Quality Dev. Rev. TOB VRDO | 0.230% | 12/7/09 | 4,995 | 4,995 |

| 1 Ohio Air Quality Dev. Rev. TOB VRDO | 0.300% | 12/7/09 (13) | 8,000 | 8,000 |

| Ohio Common Schools Capital Fac. Rev. | 5.000% | 6/15/10 (Prere.) | 5,000 | 5,124 |

| 1 Ohio Common Schools GO TOB VRDO | 0.250% | 12/7/09 (4) | 7,755 | 7,755 |

| Ohio Common Schools GO VRDO | 0.230% | 12/7/09 | 10,130 | 10,130 |

| Ohio GO | 5.000% | 5/1/10 | 2,460 | 2,507 |

| Ohio GO | 5.625% | 5/1/10 (Prere.) | 5,065 | 5,175 |

| Ohio GO | 2.000% | 11/1/10 | 3,000 | 3,043 |

| Ohio GO | 2.000% | 11/1/10 | 2,000 | 2,028 |

| 1 Ohio GO TOB VRDO | 0.220% | 12/7/09 | 3,380 | 3,380 |

| 1 Ohio GO TOB VRDO | 0.250% | 12/7/09 | 4,925 | 4,925 |

| Ohio GO VRDO | 0.260% | 12/7/09 | 20,000 | 20,000 |

| Ohio GO VRDO | 0.260% | 12/7/09 | 1,955 | 1,955 |

| Ohio Higher Educ. Fac. Comm. Rev. | | | | |

| (Case Western Reserve Univ.) CP | 0.400% | 12/7/09 | 5,000 | 5,000 |

| Ohio Higher Educ. Fac. Comm. Rev. | | | | |

| (Case Western Reserve Univ.) VRDO | 0.270% | 12/1/09 LOC | 12,165 | 12,165 |

| Ohio Higher Educ. Fac. Comm. Rev. | | | | |

| (Case Western Reserve Univ.) VRDO | 0.390% | 12/7/09 LOC | 11,400 | 11,400 |

| Ohio Higher Educ. Fac. Comm. Rev. | | | | |

| (Kenyon College) VRDO | 0.190% | 12/1/09 LOC | 6,100 | 6,100 |

| Ohio Higher Educ. Fac. Comm. Rev. | | | | |

| (Northern Univ.) VRDO | 0.200% | 12/7/09 LOC | 5,000 | 5,000 |

| Ohio Higher Educ. Fac. Comm. Rev. | | | | |

| (Univ. Hospitals Health System) VRDO | 0.270% | 12/7/09 LOC | 7,400 | 7,400 |

| 1 Ohio Higher Educ. Fac. Comm. Rev. TOB VRDO | 0.270% | 12/7/09 (13) | 5,000 | 5,000 |

| Ohio Highway Capital Improvements GO | 5.250% | 5/1/10 | 1,820 | 1,856 |

| Ohio Highway Capital Improvements GO | 5.625% | 5/1/10 | 4,900 | 5,005 |

| 1 Ohio Housing Finance Agency Mortgage | | | | |

| Rev. TOB VRDO | 0.210% | 12/7/09 | 4,000 | 4,000 |

| 1 Ohio Housing Finance Agency Mortgage | | | | |

| Rev. TOB VRDO | 0.330% | 12/7/09 | 4,870 | 4,870 |

| 1 Ohio Housing Finance Agency Mortgage | | | | |

| Rev. TOB VRDO | 0.420% | 12/7/09 | 4,455 | 4,455 |

| Ohio Housing Finance Agency | | | | |

| Mortgage Rev. VRDO | 0.280% | 12/7/09 | 5,000 | 5,000 |

| Ohio Housing Finance Agency | | | | |

| Mortgage Rev. VRDO | 0.300% | 12/7/09 | 22,430 | 22,430 |

| Ohio Housing Finance Agency | | | | |

| Mortgage Rev. VRDO | 0.300% | 12/7/09 | 8,580 | 8,580 |

| Ohio Housing Finance Agency | | | | |

| Mortgage Rev. VRDO | 0.300% | 12/7/09 | 9,040 | 9,040 |

| Ohio Housing Finance Agency | | | | |

| Mortgage Rev. VRDO | 0.300% | 12/7/09 | 8,000 | 8,000 |

| Ohio Housing Finance Agency | | | | |

| Mortgage Rev. VRDO | 0.320% | 12/7/09 | 11,530 | 11,530 |

| Ohio Infrastructure Improvement GO VRDO | 0.260% | 12/7/09 | 1,200 | 1,200 |

| Ohio PCR (Sohio Air British Petroleum Co.) VRDO | 0.190% | 12/1/09 | 2,800 | 2,800 |

| Ohio Solid Waste Rev. (BP Exploration & Oil Inc.) | | | | |

| VRDO | 0.240% | 12/1/09 | 10,225 | 10,225 |

| Ohio Solid Waste Rev. (BP Exploration & Oil Inc.) | | | | |

| VRDO | 0.240% | 12/1/09 | 12,505 | 12,505 |

| Ohio Solid Waste Rev. (BP Exploration & Oil Inc.) | | | | |

| VRDO | 0.240% | 12/1/09 | 7,625 | 7,625 |

19

| | | | |

| Ohio Tax-Exempt Money Market Fund | | | | |

| |

| |

| |

| | | | Face | Market |

| | | Maturity | Amount | Value• |

| | Coupon | Date | ($000) | ($000) |

| 1 Ohio State Higher Educ. Fac. TOB VRDO | 0.300% | 12/7/09 | 3,700 | 3,700 |

| 1 Ohio State Higher Educ. TOB VRDO | 0.250% | 12/7/09 LOC | 4,970 | 4,970 |

| 1 Ohio State Hosp Rev. (Cleveland Clinic Health | | | | |

| System Obligated Group) TOB VRDO | 0.230% | 12/7/09 | 9,000 | 9,000 |

| 1 Ohio State Hosp Rev. (Cleveland Clinic Health | | | | |

| System Obligated Group) TOB VRDO | 0.300% | 12/7/09 | 6,745 | 6,745 |

| 1 Ohio State Hosp Rev. (Cleveland Clinic Health | | | | |

| System Obligated Group) TOB VRDO | 0.300% | 12/7/09 | 6,495 | 6,495 |

| 1 Ohio State Hosp Rev. (Cleveland Clinic Health | | | | |

| System Obligated Group) TOB VRDO | 0.300% | 12/7/09 | 5,170 | 5,170 |

| Ohio State Univ. CP | 0.300% | 1/12/10 | 10,000 | 10,000 |

| Ohio State Univ. CP | 0.350% | 2/9/10 | 12,400 | 12,400 |

| Ohio State Univ. General Receipts Rev. VRDO | 0.230% | 12/7/09 | 3,100 | 3,100 |

| 1 Ohio State Water Dev. Auth. PCR TOB VRDO | 0.300% | 12/7/09 | 5,995 | 5,995 |

| 1 Ohio Turnpike Comm. Turnpike Rev. TOB VRDO | 0.230% | 12/7/09 | 15,745 | 15,745 |

| Ohio Water Dev. Auth. PCR | 2.000% | 12/1/09 | 8,960 | 8,960 |

| Ohio Water Dev. Auth. PCR (FirstEnergy) VRDO | 0.200% | 12/1/09 LOC | 3,400 | 3,400 |

| Ohio Water Dev. Auth. PCR (FirstEnergy) VRDO | 0.210% | 12/1/09 LOC | 700 | 700 |

| Ohio Water Dev. Auth. PCR (FirstEnergy) VRDO | 0.230% | 12/7/09 LOC | 8,000 | 8,000 |

| Ohio Water Dev. Auth. PCR (FirstEnergy) VRDO | 0.250% | 12/7/09 LOC | 15,000 | 15,000 |

| Ohio Water Dev. Auth. PCR (FirstEnergy) VRDO | 0.350% | 12/7/09 LOC | 10,000 | 10,000 |

| Ohio Water Dev. Auth. Rev. | 5.000% | 12/1/09 | 7,130 | 7,130 |

| Ohio Water Dev. Auth. Rev. (Pure Water) VRDO | 0.280% | 12/7/09 | 35,275 | 35,275 |

| Port of Greater Cincinnati Dev. Auth. | | | | |

| (Sycamore Township Kenwood) VRDO | 0.250% | 12/7/09 LOC | 5,315 | 5,315 |

| Portage County OH BAN | 1.500% | 9/30/10 | 4,000 | 4,023 |

| Salem OH Hosp. Rev. (Salem Community | | | | |

| Hosp. Project) VRDO | 0.250% | 12/7/09 LOC | 2,055 | 2,055 |

| 1 Toledo Lucas County OH Port Auth. | | | | |

| Airport Rev. (Flight Safety) VRDO | 0.340% | 12/7/09 | 5,500 | 5,500 |

| Toledo OH City Services Special | | | | |

| Assessment VRDO | 0.240% | 12/7/09 LOC | 6,200 | 6,200 |

| Univ. of Akron OH General Receipts Rev. | 5.500% | 1/1/10 (Prere.) | 2,545 | 2,581 |

| Univ. of Cincinnati OH General Receipts BAN | 1.500% | 5/12/10 | 10,000 | 10,012 |

| Univ. of Cincinnati OH General Receipts BAN | 2.000% | 7/21/10 | 2,500 | 2,513 |

| Upper Arlington OH City School Dist. TAN | 2.000% | 6/24/10 | 2,100 | 2,108 |

| Vandalia Butler OH City School Dist. | | | | |

| Montgomery County BAN | 1.500% | 3/1/10 | 3,750 | 3,757 |

| Warren OH Health Care Fac. | | | | |

| (Otterbein Homes Project) VRDO | 0.240% | 12/7/09 LOC | 11,210 | 11,210 |

| Westlake OH BAN | 1.250% | 1/28/10 | 3,100 | 3,101 |

| | | | | 949,100 |

| Puerto Rico (1.5%) | | | | |

| 1 Puerto Rico Sales Tax Financing Corp. | | | | |

| Rev. TOB VRDO | 0.200% | 12/7/09 | 6,000 | 6,000 |

| 1 Puerto Rico Sales Tax Financing Corp. | | | | |

| Rev. TOB VRDO | 0.390% | 12/7/09 | 7,875 | 7,875 |

| | | | | 13,875 |

| Total Tax-Exempt Municipal Bonds (Cost $962,975) | | | | 962,975 |

20

| |

| Ohio Tax-Exempt Money Market Fund | |

| |

| |

| | Market |

| | Value• |

| | ($000) |

| Other Assets and Liabilities (–1.7%) | |

| Other Assets | 8,096 |

| Liabilities | (23,907) |

| | (15,811) |

| Net Assets (100%) | |

| Applicable to 947,011,713 outstanding $.001 par value shares of | |

| beneficial interest (unlimited authorization) | 947,164 |

| Net Asset Value Per Share | $1.00 |

| |

| |

| At November 30, 2009, net assets consisted of: | |

| | Amount |

| | ($000) |

| Paid-in Capital | 947,164 |

| Undistributed Net Investment Income | — |

| Accumulated Net Realized Gains | — |

| Net Assets | 947,164 |

• See Note A in Notes to Financial Statements.

1 Security exempt from registration under Rule 144A of the Securities Act of 1933. Such securities may be sold in transactions exempt from registration, normally to qualified institutional buyers. At November 30, 2009, the aggregate value of these securities was 247,440,000, representing 26.1% of net assets.

2 Security purchased on a when-issued or delayed-delivery basis for which the fund has not taken delivery as of November 30, 2009.

A key to abbreviations and other references follows the Statement of Net Assets.

See accompanying Notes, which are an integral part of the Financial Statements.

21

Ohio Tax-Exempt Money Market Fund

Key to Abbreviations

ARS—Auction Rate Security.

BAN—Bond Anticipation Note.

COP—Certificate of Participation.

CP—Commercial Paper.

FR—Floating Rate.

GAN—Grant Anticipation Note.

GO—General Obligation Bond.

IDA—Industrial Development Authority Bond.

IDR—Industrial Development Revenue Bond.

PCR—Pollution Control Revenue Bond.

PUT—Put Option Obligation.

RAN—Revenue Anticipation Note.

TAN—Tax Anticipation Note.

TOB—Tender Option Bond.

TRAN—Tax Revenue Anticipation Note.

UFSD—Union Free School District.

USD—United School District.

VRDO—Variable Rate Demand Obligation.

(ETM)—Escrowed to Maturity.

(Prere.)—Prerefunded.

Scheduled principal and interest payments are guaranteed by:

(1) MBIA (Municipal Bond Insurance Association).

(2) AMBAC (Ambac Assurance Corporation).

(3) FGIC (Financial Guaranty Insurance Company).

(4) FSA (Financial Security Assurance).

(5) BIGI (Bond Investors Guaranty Insurance).

(6) Connie Lee Inc.

(7) FHA (Federal Housing Authority).

(8) CapMAC (Capital Markets Assurance Corporation).

(9) American Capital Access Financial Guaranty Corporation.

(10) XL Capital Assurance Inc.

(11) CIFG (CDC IXIS Financial Guaranty).

(12) Assured Guaranty Corp.

(13) Berkshire Hathaway Assurance Corp.

(14) National Public Finance Guarantee Corp.

The insurance does not guarantee the market value of the municipal bonds.

LOC—Scheduled principal and interest payments are guaranteed by bank letter of credit.

22

| |

| Ohio Tax-Exempt Money Market Fund | |

| |

| |

| Statement of Operations | |

| |

| | Year Ended |

| | November 30, 2009 |

| | ($000) |

| Investment Income | |

| Income | |

| Interest | 7,493 |

| Total Income | 7,493 |

| Expenses | |

| The Vanguard Group—Note B | |

| Investment Advisory Services | 147 |

| Management and Administrative | 818 |

| Marketing and Distribution | 338 |

| Money Market Guarantee Program | 358 |

| Custodian Fees | 11 |

| Auditing Fees | 19 |

| Shareholders’ Reports and Proxies | 19 |

| Trustees’ Fees and Expenses | 2 |

| Total Expenses | 1,712 |

| Net Investment Income | 5,781 |

| Realized Net Gain (Loss) on Investment Securities Sold | 142 |

| Net Increase (Decrease) in Net Assets Resulting from Operations | 5,923 |

See accompanying Notes, which are an integral part of the Financial Statements.

23

| | |

| Ohio Tax-Exempt Money Market Fund | | |

| |

| |

| Statement of Changes in Net Assets | | |

| |

| | Year Ended November 30, |

| | 2009 | 2008 |

| | ($000) | ($000) |

| Increase (Decrease) in Net Assets | | |

| Operations | | |

| Net Investment Income | 5,781 | 26,961 |

| Realized Net Gain (Loss) | 142 | (21) |

| Net Increase (Decrease) in Net Assets Resulting from Operations | 5,923 | 26,940 |

| Distributions | | |

| Net Investment Income | (5,781) | (26,961) |

| Realized Capital Gain | — | — |

| Total Distributions | (5,781) | (26,961) |

| Capital Share Transactions (at $1.00) | | |

| Issued | 573,204 | 974,567 |

| Issued in Lieu of Cash Distributions | 5,412 | 25,163 |

| Redeemed | (727,714) | (1,072,018) |

| Net Increase (Decrease) from Capital Share Transactions | (149,098) | (72,288) |

| Total Increase (Decrease) | (148,956) | (72,309) |

| Net Assets | | |

| Beginning of Period | 1,096,120 | 1,168,429 |

| End of Period | 947,164 | 1,096,120 |

See accompanying Notes, which are an integral part of the Financial Statements.

24

| | | | | |

| Ohio Tax-Exempt Money Market Fund | | | | | |

| |

| |

| Financial Highlights | | | | | |

| |

| |

| For a Share Outstanding | | | Year Ended November 30, |

| Throughout Each Period | 2009 | 2008 | 2007 | 2006 | 2005 |

| Net Asset Value, Beginning of Period | $1.00 | $1.00 | $1.00 | $1.00 | $1.00 |

| Investment Operations | | | | | |

| Net Investment Income | .006 | .024 | .036 | .033 | .022 |

| Net Realized and Unrealized Gain (Loss) | | | | | |

| on Investments | — | — | — | — | — |

| Total from Investment Operations | .006 | .024 | .036 | .033 | .022 |

| Distributions | | | | | |

| Dividends from Net Investment Income | (.006) | (.024) | (.036) | (.033) | (.022) |

| Distributions from Realized Capital Gains | — | — | — | — | — |

| Total Distributions | (.006) | (.024) | (.036) | (.033) | (.022) |

| Net Asset Value, End of Period | $1.00 | $1.00 | $1.00 | $1.00 | $1.00 |

| |

| Total Return1 | 0.56% | 2.40% | 3.63% | 3.30% | 2.21% |

| |

| Ratios/Supplemental Data | | | | | |

| Net Assets, End of Period (Millions) | $947 | $1,096 | $1,168 | $1,036 | $910 |

| Ratio of Total Expenses to | | | | | |

| Average Net Assets | 0.17%2 | 0.11%2 | 0.10% | 0.13% | 0.13% |

| Ratio of Net Investment Income to | | | | | |

| Average Net Assets | 0.57% | 2.38% | 3.57% | 3.26% | 2.19% |

1 Total returns do not include the account service fee that may be applicable to certain accounts with balances below $10,000.

2 Includes fees to participate in the Treasury Temporary Guarantee Program for Money Market Funds of 0.04% for 2009 and 0.01% for 2008.

See Note D in Notes to Financial Statements.

See accompanying Notes, which are an integral part of the Financial Statements.

25

Ohio Tax-Exempt Money Market Fund

Notes to Financial Statements

Vanguard Ohio Tax-Exempt Money Market Fund is registered under the Investment Company Act of 1940 as an open-end investment company, or mutual fund. The fund invests in debt instruments of municipal issuers whose ability to meet their obligations may be affected by economic and political developments in the state.

A. The following significant accounting policies conform to generally accepted accounting principles for U.S. mutual funds. The fund consistently follows such policies in preparing its financial statements.

1. Security Valuation: Securities are valued at amortized cost, which approximates market value.

2. Federal Income Taxes: The fund intends to continue to qualify as a regulated investment company and distribute all of its income. Management has analyzed the fund’s tax positions taken for all open federal income tax years (November 30, 2006–2009), and has concluded that no provision for federal income tax is required in the fund’s financial statements.

3. Distributions: Distributions from net investment income are declared daily and paid on the first business day of the following month.

4. Other: Interest income is accrued daily. Premiums and discounts on debt securities purchased are amortized and accreted, respectively, to interest income over the lives of the respective securities. Security transactions are accounted for on the date securities are bought or sold. Costs used to determine realized gains (losses) on the sale of investment securities are those of the specific securities sold.

B. The Vanguard Group furnishes at cost investment advisory, corporate management, administrative, marketing, and distribution services. The costs of such services are allocated to the fund under methods approved by the board of trustees. The fund has committed to provide up to 0.40% of its net assets in capital contributions to Vanguard. At November 30, 2009, the fund had contributed capital of $202,000 to Vanguard (included in Other Assets), representing 0.02% of the fund’s net assets and 0.08% of Vanguard’s capitalization. The fund’s trustees and officers are also directors and officers of Vanguard.

C. Various inputs may be used to determine the value of the fund’s investments. These inputs are summarized in three broad levels for financial statement purposes. The inputs or methodologies used to value securities are not necessarily an indication of the risk associated with investing in those securities.

Level 1 — Quoted prices in active markets for identical securities.

Level 2 — Other significant observable inputs (including quoted prices for similar securities, interest rates, prepayment speeds, credit risk, etc.).

Level 3 — Significant unobservable inputs (including the fund’s own assumptions used to determine the fair value of investments).

At November 30, 2009, 100% of the fund’s investments were valued using amortized cost, in accordance with rules under the Investment Company Act of 1940. Amortized cost approximates the current fair value of a security, but since the value is not obtained from a quoted price in an active market, securities valued at amortized cost are considered to be valued using Level 2 inputs.

26

Ohio Tax-Exempt Money Market Fund

D. On October 7, 2008, the board of trustees approved the fund’s participation in a temporary program introduced by the U.S. Treasury to guarantee the account values of shareholders in a money market fund in the event the fund’s net asset value fell below $0.995 and the fund’s trustees decided to liquidate the fund. The program covered the lesser of a shareholder’s account value on September 19, 2008, or on the date of liquidation. To participate, the fund was required to pay a fee of 0.01% of its net assets as of September 19, 2008, for coverage through December 18, 2008. In December 2008, the U.S. Treasury extended the program through April 30, 2009, and the fund’s trustees approved the fund’s continuing participation in the program at a cost of an additional 0.015% of its net assets as of September 19, 2008. In March 2009, t he U.S. Treasury extended the program through September 18, 2009, and the fund’s trustees approved the fund’s continuing participation in the program at a cost of an additional 0.015% of its net assets as of September 19, 2008.

E. In preparing the financial statements as of November 30, 2009, management considered the impact of subsequent events occurring through January 11, 2010, for potential recognition or disclosure in these financial statements.

27

Ohio Long-Term Tax-Exempt Fund

Fund Profile

As of November 30, 2009

| | | |

| Financial Attributes | | |

| | | Comparative | Broad |

| | Fund | Index1 | Index2 |

| Number of Issues | 269 | 8,323 | 46,048 |

| Yield3 | 3.5% | 3.6% | 3.6% |

| Yield to Maturity | 3.7%4 | 3.6% | 3.6% |

| Average Coupon | 4.9% | 5.0% | 5.0% |

| Average Effective | | | |

| Maturity | 9.0 years | 9.9 years | 13.5 years |

| Average Quality | AA– | AA | AA |

| Average Duration | 7.0 years | 7.2 years | 8.4 years |

| Expense Ratio5 | 0.17% | — | — |

| Short-Term Reserves | 4.3% | — | — |

| | |

| Volatility Measures6 | |

| | Fund Versus | Fund Versus |

| | Comparative Index1 | Broad Index2 |

| R-Squared | 0.90 | 0.99 |

| Beta | 0.92 | 0.97 |

| |

| Distribution by Maturity (% of portfolio) | |

| |

| Under 1 Year | 5.7% |

| 1– 5 Years | 30.1 |

| 5–10 Years | 40.8 |

| 10–20 Years | 10.2 |

| 20–30 Years | 8.0 |

| Over 30 Years | 5.2 |

| |

| Distribution by Credit Quality (% of portfolio) |

| |

| AAA | 16.7% |

| AA | 48.2 |

| A | 26.1 |

| BBB | 5.7 |

| Other | 3.3 |

Investment Focus

1 Barclays Capital 10 Year Municipal Bond Index.

2 Barclays Capital Municipal Bond Index.

3 30-day SEC yield for the fund; index yield assumes that all bonds are called or prepaid at the earliest possible dates. See the Glossary.

4 Before expenses.

5 The expense ratio shown is from the prospectus dated March 27, 2009, and represents estimated costs for the current fiscal year based on the fund’s net assets as of the prospectus date. For the fiscal year ended November 30, 2009, the expense ratio was 0.17%.

6 For an explanation of R-squared, beta, and other terms used here, see the Glossary.

28

Ohio Long-Term Tax-Exempt Fund

Performance Summary

All of the returns in this report represent past performance, which is not a guarantee of future results that may be achieved by the fund. (Current performance may be lower or higher than the performance data cited. For performance data current to the most recent month-end, visit our website at www.vanguard.com/performance.) Note, too, that both investment returns and principal value can fluctuate widely, so an investor’s shares, when sold, could be worth more or less than their original cost. The returns shown do not reflect taxes that a shareholder would pay on fund distributions or on the sale of fund shares.

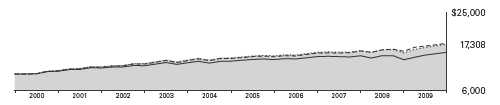

Cumulative Performance: November 30, 1999–November 30, 2009

Initial Investment of $10,000

| | | | |

| | | Average Annual Total Returns | Final Value |

| | Periods Ended November 30, 2009 | of a $10,000 |

| | One Year | Five Years | Ten Years | Investment |

| Ohio Long-Term Tax-Exempt Fund1 | 13.61% | 4.26% | 5.64% | $17,308 |

| Barclays Capital Municipal Bond Index | 14.17 | 4.50 | 5.64 | 17,302 |

| Barclays Capital 10 Year Municipal Bond Index | 12.67 | 4.90 | 5.79 | 17,549 |

| Ohio Municipal Debt Funds Average2 | 13.62 | 3.13 | 4.36 | 15,325 |

1 Total returns do not include the account service fee that may be applicable to certain accounts with balances below $10,000.

2 Derived from data provided by Lipper Inc.

See Financial Highlights for dividend and capital gains information.

| | | | |

| Ohio Long-Term Tax-Exempt Fund | | | | |

| |

| |

| |

| |

| Fiscal-Year Total Returns (%): November 30, 1999–November 30, 2009 | | |

| |

| | | | | Barclays1 |

| Fiscal | Capital | Income | Total | Total |

| Year | Return | Return | Return | Return |

| 2000 | 3.2% | 5.6% | 8.8% | 7.7% |

| 2001 | 3.7 | 5.2 | 8.9 | 8.2 |

| 2002 | 1.8 | 4.9 | 6.7 | 6.7 |

| 2003 | 2.8 | 4.6 | 7.4 | 6.9 |

| 2004 | –1.0 | 4.5 | 3.5 | 4.0 |

| 2005 | –1.2 | 4.4 | 3.2 | 3.0 |

| 2006 | 1.6 | 4.5 | 6.1 | 6.2 |

| 2007 | –1.6 | 4.3 | 2.7 | 3.5 |

| 2008 | –7.7 | 4.1 | –3.6 | –0.4 |

| 2009 | 8.9 | 4.7 | 13.6 | 12.7 |

Average Annual Total Returns: Periods Ended September 30, 2009

This table presents average annual total returns through the latest calendar quarter—rather than through the end

of the fiscal period. Securities and Exchange Commission rules require that we provide this information.

| | | | | | |

| | | | | | | Ten Years |

| | Inception Date | One Year | Five Years | Capital | Income | Total |

| Ohio Long-Term Tax-Exempt Fund2 | 6/18/1990 | 14.30% | 4.47% | 1.11% | 4.69% | 5.80% |

1 Barclays Capital 10 Year Municipal Bond Index.

2 Total returns do not include the account service fee that may be applicable to certain accounts with balances below $10,000.

30

Ohio Long-Term Tax-Exempt Fund

Financial Statements

Statement of Net Assets

As of November 30, 2009

The fund reports a complete list of its holdings in regulatory filings four times in each fiscal year, at the quarter-ends. For the second and fourth fiscal quarters, the lists appear in the fund’s semiannual and annual reports to shareholders. For the first and third fiscal quarters, the fund files the lists with the Securities and Exchange Commission on Form N-Q. Shareholders can look up the fund’s Forms N-Q on the SEC’s website at www.sec.gov. Forms N-Q may also be reviewed and copied at the SEC’s Public Reference Room (see the back cover of this report for further information).

| | | | | |

| | | | | Face | Market |

| | | Maturity | Amount | Value• |

| | Coupon | Date | ($000) | ($000) |

| Tax-Exempt Municipal Bonds (99.5%) | | | | | |

| Ohio (97.2%) | | | | | |

| Adams County OH School Dist. GO | 5.550% | 12/1/09 (14) | 1,000 | 1,000 |

| Akron OH GO | 5.500% | 12/1/18 (14) | 1,315 | 1,370 |

| Akron OH Income Tax Rev. | | | | | |

| (Community Learning Center) | 5.000% | 12/1/27 (14) | 6,300 | 6,493 |

| Allen County OH Hosp. Fac. Rev. | | | | | |

| (Catholic Healthcare Partners) VRDO | 0.190% | 12/1/09 LOC | 600 | 600 |

| 1 American Muni. Power Ohio Inc. | 5.000% | 2/15/23 | 4,000 | 4,155 |

| 1 American Muni. Power Ohio Inc. | 5.000% | 2/15/24 | 1,215 | 1,254 |

| American Muni. Power Ohio Inc. | 5.000% | 2/15/38 | 21,885 | 22,001 |

| American Muni. Power Ohio Inc. | 5.750% | 2/15/39 (12) | 4,500 | 4,719 |

| American Muni. Power Ohio Inc. (Omega JV) | 5.250% | 1/1/14 (2) | 2,625 | 2,716 |

| American Muni. Power Ohio Inc. (Omega JV) | 5.250% | 1/1/15 (2) | 2,865 | 2,953 |

| American Muni. Power Ohio Inc. (Omega JV) | 5.250% | 1/1/16 (2) | 1,015 | 1,042 |

| American Muni. Power Ohio Inc. | | | | | |

| Electricity Purchase Rev. | 5.000% | 2/1/13 | 3,000 | 3,186 |

| Amherst OH Exempt Village School Dist. GO | 5.750% | 12/1/11 (3)(Prere.) | 1,300 | 1,433 |

| Amherst OH Exempt Village School Dist. GO | 5.750% | 12/1/11 (3)(Prere.) | 1,300 | 1,433 |

| Bowling Green State Univ. Ohio | | | | | |

| General Receipts Rev. | 5.750% | 6/1/10 (3)(Prere.) | 1,190 | 1,235 |

| Buckeye OH Tobacco Settlement | | | | | |

| Financing Corp. Rev. | 5.125% | 6/1/24 | 10,035 | 8,500 |

| Buckeye OH Tobacco Settlement | | | | | |

| Financing Corp. Rev. | 5.875% | 6/1/30 | 2,825 | 2,369 |

| Buckeye OH Tobacco Settlement | | | | | |

| Financing Corp. Rev. | 5.750% | 6/1/34 | 4,000 | 3,202 |

| Buckeye OH Tobacco Settlement | | | | | |

| Financing Corp. Rev. | 6.000% | 6/1/42 | 2,750 | 2,066 |

| Buckeye OH Tobacco Settlement | | | | | |

| Financing Corp. Rev. | 5.875% | 6/1/47 | 5,760 | 4,084 |

| Buckeye OH Tobacco Settlement | | | | | |

| Financing Corp. Rev. | 6.500% | 6/1/47 | 4,750 | 3,703 |

| Butler County OH GO | 5.250% | 12/1/12 (Prere.) | 1,655 | 1,880 |

| Butler County OH GO | 5.250% | 12/1/12 (Prere.) | 1,570 | 1,783 |

| Butler County OH Hosp. Fac. Rev. | | | | | |

| (Cincinnati Children’s Hosp.) | 5.000% | 5/15/31 (14) | 5,000 | 4,412 |

| Butler County OH Sewer System Rev. | 5.375% | 12/1/09 (3)(Prere.) | 1,230 | 1,242 |

| Butler County OH Waterworks Rev. | 5.250% | 12/1/21 (2) | 4,000 | 4,295 |

| Canal Winchester OH Local School Dist. GO | 5.500% | 12/1/11 (3)(Prere.) | 1,080 | 1,182 |

| Canal Winchester OH Local School Dist. GO | 5.500% | 12/1/11 (3)(Prere.) | 950 | 1,040 |

31

| | | | |

| Ohio Long-Term Tax-Exempt Fund | | | | |

| | | | | |

| | | | | |

| | | | | |

| | | | Face | Market |

| | | Maturity | Amount | Value• |

| | Coupon | Date | ($000) | ($000) |

| Canal Winchester OH Local School Dist. GO | 5.500% | 12/1/11 (3)(Prere.) | 805 | 881 |

| Canal Winchester OH Local School Dist. GO | 5.000% | 6/1/15 (14)(Prere.) | 3,030 | 3,529 |

| Centerville OH City School Dist. GO | 5.000% | 12/1/30 (4) | 9,260 | 9,681 |

| Cincinnati OH City School Dist. Classroom Fac. | | | | |

| Construction & Improvement | 5.250% | 12/1/28 (14) | 4,000 | 4,496 |

| Cincinnati OH City School Dist. Classroom Fac. | | | | |

| Construction & Improvement | 5.250% | 12/1/30 (14) | 3,705 | 4,091 |

| Cincinnati OH City School Dist. Classroom Fac. | | | | |

| Construction & Improvement | 5.250% | 12/1/31 (14)(3) | 3,000 | 3,277 |

| 2 Cincinnati OH City School Dist. GO TOB VRDO | 0.720% | 12/7/09 (3)LOC | 2,800 | 2,800 |

| 2 Cincinnati OH City School Dist. GO TOB VRDO | 0.720% | 12/7/09 LOC | 2,280 | 2,280 |

| Cincinnati OH City School Dist. Improvement GO | 5.000% | 12/15/23 (4) | 1,620 | 1,737 |

| Cincinnati OH City School Dist. Improvement GO | 5.000% | 12/15/32 (4) | 1,000 | 1,022 |

| Cincinnati OH Econ. Dev. Rev. (Baldwin) | 4.875% | 11/1/38 | 7,870 | 7,444 |

| Cincinnati OH Water System Rev. | 5.500% | 6/1/11 (Prere.) | 1,380 | 1,483 |

| Cleveland OH GO | 5.375% | 9/1/10 (2) | 1,000 | 1,033 |

| Cleveland OH GO | 5.500% | 12/1/10 (3)(Prere.) | 1,135 | 1,205 |

| Cleveland OH GO | 5.500% | 12/1/10 (3)(Prere.) | 1,415 | 1,503 |

| Cleveland OH GO | 5.500% | 12/1/11 (14) | 1,340 | 1,413 |

| Cleveland OH GO | 5.375% | 9/1/12 (2) | 1,000 | 1,101 |

| Cleveland OH GO | 5.500% | 10/1/20 (2) | 7,350 | 8,433 |

| Cleveland OH GO | 5.000% | 10/1/21 (2) | 2,920 | 3,119 |

| Cleveland OH GO | 5.500% | 10/1/22 (2) | 3,870 | 4,415 |

| Cleveland OH Income Tax Rev. | 5.000% | 10/1/29 (12) | 7,180 | 7,483 |

| Cleveland OH Public Power System Rev. | 5.000% | 11/15/28 (14) | 1,250 | 1,286 |

| Cleveland OH Public Power System Rev. | 0.000% | 11/15/33 (14) | 6,895 | 1,945 |

| Cleveland OH State Univ. Rev. | 5.250% | 6/1/19 (14) | 2,825 | 3,046 |

| Cleveland OH State Univ. Rev. | 5.000% | 6/1/30 (14) | 5,000 | 5,145 |

| Cleveland OH Water Works Rev. | 5.500% | 1/1/21 (14) | 9,635 | 11,030 |

| Columbus OH City School Dist. | 4.500% | 12/1/29 | 3,000 | 3,012 |

| Columbus OH City School Dist. | 4.750% | 12/1/33 | 7,000 | 7,016 |

| 3 Columbus OH GO | 5.000% | 12/15/13 | 5,000 | 5,735 |

| Columbus OH GO VRDO | 0.200% | 12/7/09 | 900 | 900 |

| Columbus OH Sewer Rev. | 5.000% | 6/1/28 | 4,005 | 4,294 |

| Columbus OH Sewer Rev. | 4.250% | 6/1/30 | 8,700 | 8,568 |

| Columbus OH Sewer Rev. | 5.000% | 6/1/31 | 4,000 | 4,210 |

| Cuyahoga County OH (Capital Improvement) GO | 5.750% | 12/1/10 (Prere.) | 1,710 | 1,802 |

| Cuyahoga County OH (Capital Improvement) GO | 5.750% | 12/1/10 (Prere.) | 2,000 | 2,108 |

| Cuyahoga County OH (Capital Improvement) GO | 5.750% | 12/1/10 (Prere.) | 2,000 | 2,108 |

| Cuyahoga County OH (Capital Improvement) GO | 5.750% | 12/1/10 (Prere.) | 2,000 | 2,108 |

| Cuyahoga County OH Hosp. Rev. | | | | |

| (Cleveland Clinic Foundation) | 6.000% | 1/1/32 | 10,000 | 10,488 |

| Cuyahoga County OH Hosp. Rev. | | | | |

| (Cleveland Clinic Foundation) VRDO | 0.190% | 12/1/09 | 6,700 | 6,700 |

| Erie County OH Hosp. Fac. Rev. | | | | |

| (Firelands Regional Medical Center) | 5.500% | 8/15/22 | 1,750 | 1,692 |

| Erie County OH Hosp. Fac. Rev. | | | | |

| (Firelands Regional Medical Center) | 5.250% | 8/15/46 | 11,080 | 9,108 |

| Fairborn OH City School Dist. | | | | |

| School Improvement GO | 5.500% | 12/1/16 (14) | 1,840 | 2,003 |

| Fairborn OH City School Dist. | | | | |

| School Improvement GO | 5.375% | 12/1/20 (14) | 1,200 | 1,281 |

| Fairfield County OH Hosp. Rev. | | | | |

| (Lancaster-Fairfield Hosp.) | 5.375% | 6/15/15 (14) | 3,000 | 3,130 |

| Franklin County OH GO | 5.000% | 12/1/31 | 7,500 | 7,967 |

32

| | | | |

| Ohio Long-Term Tax-Exempt Fund | | | | |

| | | | | |

| | | | | |

| | | | | |

| | | | Face | Market |

| | | Maturity | Amount | Value• |

| | Coupon | Date | ($000) | ($000) |

| Franklin County OH Hosp. Rev. | | | | |

| (Nationwide Childrens) | 4.750% | 11/1/28 | 1,500 | 1,482 |

| Franklin County OH Hosp. Rev. | | | | |

| (Nationwide Hosp.) VRDO | 0.200% | 12/7/09 | 3,845 | 3,845 |

| Franklin County OH Hosp. Rev. | | | | |

| (Trinity Health Credit Group) | 5.000% | 6/1/19 | 4,035 | 4,220 |

| Franklin County OH Hosp. Rev. | | | | |

| (Trinity Health Credit Group) | 5.000% | 6/1/21 | 4,465 | 4,603 |

| Franklin County OH Hosp. Rev. | | | | |

| (U.S. Health Corp.) VRDO | 0.210% | 12/7/09 LOC | 2,275 | 2,275 |

| Gallia County OH Hosp. Rev. | | | | |

| (Holzer Medical Center) | 5.125% | 10/1/13 (2) | 2,000 | 2,002 |

| Gallia County OH Local School Dist. | 5.000% | 12/1/26 (4) | 2,075 | 2,184 |

| Gallia County OH Local School Dist. | 5.000% | 12/1/27 (4) | 2,180 | 2,285 |

| Gallia County OH Local School Dist. | 5.000% | 12/1/30 (4) | 5,000 | 5,151 |

| Gallia County OH Local School Dist. | 5.000% | 12/1/33 (4) | 3,500 | 3,558 |

| Gallipolis Ohio City School Dist. (School Fac.) | 5.000% | 12/1/30 (14) | 4,040 | 4,110 |

| Garfield Heights OH City School Dist. | | | | |

| School Improvement GO | 5.500% | 12/15/11 (14)(Prere.) | 1,640 | 1,802 |

| Greene County OH Facs. Rev. | | | | |

| (Kettering Health Network) | 5.375% | 4/1/34 | 2,500 | 2,413 |

| Greene County OH Facs. Rev. | | | | |

| (Kettering Health Network) | 5.500% | 4/1/39 | 2,500 | 2,429 |

| Greene County OH Sewer System Rev. | 5.000% | 12/1/22 (4) | 4,470 | 4,698 |

| Greene County OH Sewer System Rev. | 5.000% | 12/1/23 (4) | 4,695 | 4,916 |

| Greene County OH Sewer System Rev. | 5.000% | 12/1/24 (4) | 5,050 | 5,271 |

| Greene County OH Sewer System Rev. | 5.000% | 12/1/25 (4) | 5,000 | 5,197 |

| Hamilton County OH Convention Center Fac. | | | | |

| Auth. Rev. Second Lien | 5.250% | 12/1/20 (14) | 1,185 | 1,287 |

| Hamilton County OH Convention Center Fac. | | | | |

| Auth. Rev. Second Lien | 5.250% | 12/1/21 (14) | 1,245 | 1,339 |

| Hamilton County OH Convention Center Fac. | | | | |

| Auth. Rev. Second Lien | 5.250% | 12/1/23 (14) | 1,380 | 1,494 |

| Hamilton County OH Convention Center Fac. | | | | |

| Auth. Rev. Second Lien | 5.250% | 12/1/24 (14) | 185 | 199 |

| Hamilton County OH Econ. Dev. Rev. | | | | |

| (King Highland Community Urban) | 5.250% | 6/1/28 (14) | 7,290 | 7,591 |

| Hamilton County OH Hosp. Fac. Rev. | | | | |

| (Cincinnati Children’s Hosp.) | 5.500% | 5/15/19 (14) | 2,865 | 2,978 |

| Hamilton County OH Hosp. Fac. Rev. | | | | |

| (Cincinnati Children’s Hosp.) | 5.500% | 5/15/20 (14) | 3,020 | 3,132 |

| Hamilton County OH Sales Tax Rev. | 5.000% | 12/1/25 (2) | 5,000 | 5,155 |

| Hamilton County OH Sales Tax Rev. | 5.000% | 12/1/26 (2) | 5,000 | 5,131 |

| Hamilton County OH Sales Tax Rev. | 5.000% | 12/1/32 (4) | 10,000 | 10,207 |

| Hamilton County OH Sewer System Rev. | 5.450% | 12/1/09 (14) | 3,250 | 3,250 |

| Hamilton County OH Sewer System Rev. | 5.625% | 6/1/10 (14)(Prere.) | 965 | 1,000 |

| Hamilton County OH Sewer System Rev. | 5.625% | 6/1/10 (14)(Prere.) | 755 | 783 |

| Hamilton County OH Sewer System Rev. | 5.250% | 12/1/11 (14)(Prere.) | 1,355 | 1,477 |

| Hamilton County OH Sewer System Rev. | 5.250% | 12/1/11 (14)(Prere.) | 1,000 | 1,090 |

| Hamilton County OH Sewer System Rev. | 5.000% | 12/1/31 (14) | 5,300 | 5,448 |

| Hamilton OH City School Dist. GO | 5.000% | 12/1/26 (4) | 3,070 | 3,327 |

| Hamilton OH City School Dist. GO | 5.000% | 12/1/28 (4) | 5,000 | 5,362 |

| Hamilton OH City School Dist. GO | 5.000% | 12/1/34 (4) | 2,250 | 2,340 |

| Highland OH Local School Dist. | | | | |

| School Improvement GO | 5.750% | 12/1/11 (4)(Prere.) | 1,510 | 1,664 |

| Hilliard OH School Dist. GO | 0.000% | 12/1/12 (14) | 3,220 | 3,086 |

33

| | | | |

| Ohio Long-Term Tax-Exempt Fund | | | | |

| | | | | |

| | | | | |

| | | | | |

| | | | Face | Market |

| | | Maturity | Amount | Value• |

| | Coupon | Date | ($000) | ($000) |

| Hilliard OH School Dist. GO | 0.000% | 12/1/13 (14) | 3,220 | 2,986 |

| Hilliard OH School Dist. GO | 5.250% | 12/1/16 (14) | 2,000 | 2,191 |

| Hilliard OH School Dist. GO | 5.000% | 12/1/27 (14) | 2,895 | 3,032 |

| Huber Heights OH City School Dist. | 5.000% | 12/1/33 | 3,000 | 3,064 |

| Huber Heights OH City School Dist. | 5.000% | 12/1/36 | 4,000 | 4,085 |

| Huron County OH Hosp. Fac. Rev. | | | | |

| (Fisher-Titus Medical Center) | 5.250% | 12/1/37 | 4,825 | 4,491 |

| Indian Hill OH Exempt Village School Dist. | | | | |

| Hamilton County GO | 5.500% | 12/1/11 (Prere.) | 1,295 | 1,421 |

| Lake Ohio Local School Dist. Stark County OH GO | 5.750% | 12/1/10 (3)(Prere.) | 1,000 | 1,054 |

| Logan Hocking OH Local School Dist. GO | 5.500% | 12/1/11 (14)(Prere.) | 1,675 | 1,838 |

| Lorain County OH GO | 5.500% | 12/1/22 (14) | 1,500 | 1,618 |

| Lorain County OH Hosp. Fac. Rev. | | | | |

| (Catholic Healthcare Partners) | 5.000% | 4/1/15 (4) | 5,200 | 5,681 |

| Lorain County OH Hosp. Fac. Rev. | | | | |

| (Catholic Healthcare Partners) | 5.400% | 10/1/21 | 4,000 | 4,078 |

| Lorain County OH Hosp. Fac. Rev. | | | | |

| (Catholic Healthcare Partners) | 5.000% | 4/1/33 (4) | 5,000 | 4,885 |

| Lucas County OH Hosp. Rev. | 5.000% | 11/15/38 | 5,000 | 4,858 |

| Lucas County OH Hosp. Rev. | | | | |

| (ProMedica Health Care) | 5.750% | 11/15/14 (14)(ETM) | 5,360 | 5,382 |

| Lucas County OH Hosp. Rev. | | | | |

| (ProMedica Health Care) | 5.750% | 11/15/14 (14) | 640 | 641 |

| Lucas County OH Hosp. Rev. | | | | |

| (ProMedica Health Care) | 5.625% | 11/15/15 (2) | 2,500 | 2,529 |

| Lucas County OH Hosp. Rev. | | | | |

| (ProMedica Health Care) | 5.625% | 11/15/17 (2) | 2,075 | 2,098 |

| Mad River OH Local School Dist. GO | 5.750% | 12/1/12 (3)(Prere.) | 1,195 | 1,366 |

| Marysville OH Exempt Village School Dist. COP | 5.250% | 6/1/15 (14)(Prere.) | 2,140 | 2,534 |

| Marysville OH Exempt Village School Dist. COP | 5.250% | 6/1/15 (14)(Prere.) | 2,095 | 2,481 |

| Marysville OH Exempt Village School Dist. COP | 5.250% | 6/1/15 (14)(Prere.) | 2,035 | 2,410 |

| Marysville OH WasteWater Treatment System Rev. | 5.000% | 12/1/31 (10) | 2,720 | 2,709 |