UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT

OF

REGISTERED MANAGEMENT INVESTMENT COMPANIES

Investment Company Act file number: 811-6083

Name of Registrant: Vanguard Ohio Tax-Free Funds

Address of Registrant:

P.O. Box 2600

Valley Forge, PA 19482

Name and address of agent for service:

Heidi Stam, Esquire

P.O. Box 876

Valley Forge, PA 19482

Registrant’s telephone number, including area code: (610) 669-1000

Date of fiscal year end: November 30

Date of reporting period: December 1, 2010 – November 30, 2011

Item 1: Reports to Shareholders

Annual Report | November 30, 2011

Vanguard Ohio Tax-Exempt Funds

Vanguard Ohio Tax-Exempt Money Market Fund

Vanguard Ohio Long-Term Tax-Exempt Fund

> The municipal bond market slid lower in a tumultuous first quarter of the fiscal year before snapping back vigorously in the ensuing nine months.

> For the year ended November 30, 2011, Vanguard Ohio Tax-Exempt Money Market Fund returned 0.09%, as the Federal Reserve extended its low-interest-rate policy for short-term assets until at least 2013.

> Shares of Vanguard Ohio Long-Term Tax-Exempt Fund returned 5.81%, lagging the return of the fund’s benchmark index but ahead of the average return of its peers.

| |

| Contents | |

| Your Fund’s Total Returns. | 1 |

| Chairman’s Letter. | 2 |

| Advisor’s Report. | 8 |

| Ohio Tax-Exempt Money Market Fund. | 12 |

| Ohio Long-Term Tax-Exempt Fund. | 25 |

| About Your Fund’s Expenses. | 44 |

| Glossary. | 46 |

Please note: The opinions expressed in this report are just that—informed opinions. They should not be considered promises or advice.

Also, please keep in mind that the information and opinions cover the period through the date on the front of this report. Of course, the risks of investing in your fund are spelled out in the prospectus.

See the Glossary for definitions of investment terms used in this report.

About the cover: Vanguard was named for the HMS Vanguard, flagship of British Admiral Horatio Nelson. A ship—whose performance and safety depend on the work of all hands—has served as a fitting metaphor for the Vanguard crew as we strive to help clients reach their financial goals.

Your Fund’s Total Returns

| | | | | |

| Fiscal Year Ended November 30, 2011 | | | | | |

| | | Taxable- | | | |

| | SEC | Equivalent | Income | Capital | Total |

| | Yields | Yields | Returns | Returns | Returns |

| Vanguard Ohio Tax-Exempt Money Market Fund | 0.03% | 0.05% | 0.09% | 0.00% | 0.09% |

| Ohio Tax-Exempt Money Market Funds Average | | | | | 0.00 |

| Ohio Tax-Exempt Money Market Funds Average: Derived from data provided by Lipper Inc. |

| |

| Vanguard Ohio Long-Term Tax-Exempt Fund | 3.11% | 5.09% | 4.20% | 1.61% | 5.81% |

| Barclays Capital 10 Year Municipal Bond Index | | | | | 7.68 |

| Ohio Municipal Debt Funds Average | | | | | 4.63 |

| Ohio Municipal Debt Funds Average: Derived from data provided by Lipper Inc. |

7-day SEC yield for the Ohio Tax-Exempt Money Market Fund; 30-day SEC yield for the Ohio Long-Term Tax-Exempt Fund.

The calculation of taxable-equivalent yield assumes a typical itemized tax return and is based on the maximum federal tax rate of 35% and the maximum income tax rate for the state. Local taxes were not considered. Please see the prospectus for a detailed explanation of the calculation.

Your Fund’s Performance at a Glance

November 30, 2010 , Through November 30, 2011

| | | | |

| | | | Distributions Per Share |

| | Starting | Ending | Income | Capital |

| | Share Price | Share Price | Dividends | Gains |

| Vanguard Ohio Tax-Exempt Money Market | | | | |

| Fund | $1.00 | $1.00 | $0.001 | $0.000 |

| Vanguard Ohio Long-Term Tax-Exempt Fund | $11.92 | $12.09 | $0.478 | $0.021 |

1

Chairman’s Letter

Dear Shareholder,

Your fund’s fiscal year, which ended November 30, 2011, began inauspiciously. The turbulence in the municipal bond market that characterized the closing months of the 2010 fiscal year spilled over into the first quarter of this reporting period. By spring, however, the market had regained its footing, and it bounced back strongly for the remainder of the year.

For the 12 months, Vanguard Ohio Long-Term Tax-Exempt Fund returned 5.81%. Even in the difficult first quarter, the fund’s income helped cushion the effects of declining bond prices. For the period as a whole, the fund’s income return accounted for more than two-thirds of its total return.

As I noted in my semiannual report to you six months ago, a confluence of negative events affected the municipal bond market at the start of the year. Especially prominent were concerns that state and local governments’ fiscal straits might lead to large-scale defaults. Thankfully, that hasn’t happened—and in our view isn’t likely to happen—although these groups may continue to struggle for some time despite cautiously hopeful signs. It’s important to keep in mind that the recoveries of state and local governments typically lag after a recession ends, and this one follows the worst national slump since the Great Depression. One measure of the fiscal challenges faced in Ohio and elsewhere

2

is the substantially reduced issuance of bonds during the fiscal period as some projects are reconsidered.

In response to the market strains earlier in the year that sent municipal bond prices lower, the Long-Term Tax-Exempt Fund’s yield rose (because bond prices and yields move in opposite directions). As muni prices rallied, yields reversed course, ending the year slightly lower than where they started. By November 30, the SEC yield for the Long-Term Tax-Exempt Fund stood at 3.11%, compared with 3.42% a year earlier.

In contrast to the bond markets, money market fund yields were stable—or perhaps frozen is a better word. The Tax-Exempt Money Market Fund returned 0.09%, compared with the 0.00% average return of its peers. Money market funds, tax-exempt and taxable alike, continue to be affected by the Federal Reserve’s decision to keep its target for short-term interest rates near zero. In August, the Fed said it planned to maintain that level until at least mid-2013.

Note: The funds are permitted to invest in securities whose income is subject to the alternative minimum tax (AMT). As of November 30, the Long-Term Fund owned no securities that would generate income distributions subject to the AMT, but the Money Market Fund did.

| | | |

| Market Barometer | | | |

| | | Average Annual Total Returns |

| | | Periods Ended November 30, 2011 |

| | One | Three | Five |

| | Year | Years | Years |

| Bonds | | | |

| Barclays Capital U.S. Aggregate Bond Index (Broad | | | |

| taxable market) | 5.52% | 7.69% | 6.14% |

| Barclays Capital Municipal Bond Index (Broad tax-exempt | | | |

| market) | 6.53 | 8.41 | 4.75 |

| Citigroup Three-Month U.S. Treasury Bill Index | 0.09 | 0.12 | 1.44 |

| |

| Stocks | | | |

| Russell 1000 Index (Large-caps) | 7.38% | 15.10% | 0.07% |

| Russell 2000 Index (Small-caps) | 2.75 | 17.56 | 0.09 |

| Dow Jones U.S. Total Stock Market Index | 6.57 | 15.67 | 0.36 |

| MSCI All Country World Index ex USA (International) | -5.90 | 13.19 | -2.11 |

| |

| CPI | | | |

| Consumer Price Index | 3.39% | 2.12% | 2.34% |

3

Despite modest yields, bonds produced strong returns

Both municipal and taxable bonds performed strongly during the fiscal year as stock market volatility helped generate enthusiasm for the relative stability of fixed income securities. Municipal bonds returned 6.53% and the broad taxable investment-grade bond market returned 5.52%, as anxious investors bid up bond prices and drove already low yields lower still. At the start of the year, the yield of the 10-year U.S. Treasury note, a benchmark for longer-term interest rates, stood at 2.80%. At the end, the note yielded just 2.07%. As yields decline, of course, so do the prospective returns available from these interest-bearing investments.

Even as the Fed maintained its near-0% target for the shortest-term interest rates, the central bank instituted a bond-buying policy aimed at reducing long-term yields.

A tumultuous path to unremarkable returns

The broad U.S. stock market produced a single-digit gain for the 12 months ended November 30. International stocks recorded a single-digit loss. On the way to these unremarkable returns, however, global stock markets traversed dramatic highs and lows.

Stock prices surged through the first half of the period as the U.S. economy seemed to be grinding into gear. But investor optimism

Expense Ratios

Your Fund Compared With Its Peer Group

| | |

| | | Peer Group |

| | Fund | Average |

| Ohio Tax-Exempt Money Market Fund | 0.17% | 0.50% |

| Ohio Long-Term Tax-Exempt Fund | 0.17 | 1.10 |

The fund expense ratios shown are from the prospectus dated March 29, 2011, and represent estimated costs for the current fiscal year. For the fiscal year ended November 30, 2011, the funds’ expense ratios were: for the Ohio Tax-Exempt Money Market Fund, 0.17%; and for the Ohio Long-Term Tax-Exempt Fund, 0.17%. Peer-group expense ratios are derived from data provided by Lipper Inc. and capture information through year-end 2010.

Peer groups: For the Ohio Tax-Exempt Money Market Fund, Ohio Tax-Exempt Money Market Funds; for the Ohio Long-Term Tax-Exempt Fund, Ohio Municipal Debt Funds.

4

faded in the second half, as Europe’s sovereign-debt crisis took center stage and political gridlock led to high-stakes brinksmanship over a bill to raise the U.S. debt ceiling. The drama prompted Standard & Poor’s to downgrade the U.S. credit rating, a shock that reverberated through global financial markets. (Vanguard’s confidence in the full faith and credit of the U.S. Treasury remains unshaken.) Although U.S. stocks tumbled through the summer, Treasury prices increased as fear of a disorderly European fiscal resolution spurred a flight to quality among investors. U.S. stocks then rebounded in the period’s final months. International stock markets traced similar trajectories before finishing the year with a negative return.

After a difficult start, municipal bonds rallied

Ohio and most other states continued their budget struggles in the aftermath of the Great Recession. Governments throughout the country have been closely reexamining their cost structures, a process aimed at closing immediate budget gaps that may also help address some difficult longer- term issues.

On the income side of the equation, states’ tax revenue continued to recover for the seventh straight calendar quarter as of

Total Returns

Ten Years Ended November 30, 2011

| |

| | Average |

| | Annual Return |

| Ohio Tax-Exempt Money Market Fund | 1.57% |

| Ohio Tax-Exempt Money Market Funds Average | 1.22 |

| Ohio Tax-Exempt Money Market Funds Average: Derived from data provided by Lipper Inc. |

| Ohio Long-Term Tax-Exempt Fund | 4.87% |

| Barclays Capital 10 Year Municipal Bond Index | 5.52 |

| Ohio Municipal Debt Funds Average | 3.78 |

| Ohio Municipal Debt Funds Average: Derived from data provided by Lipper Inc. |

The figures shown represent past performance, which is not a guarantee of future results. (Current performance may be lower or higher than the performance data cited. For performance data current to the most recent month-end, visit our website at vanguard.com/performance.) Note, too, that both investment returns and principal value can fluctuate widely, so an investor’s shares, when sold, could be worth more or less than their original cost.

5

September, but at a more moderate pace, according to a preliminary report from The Nelson A. Rockefeller Institute of Government. Ohio reported an above-average gain in revenues for the third calendar quarter (an almost-10% year-over-year increase versus the national average of 7.3%).

At the start of the fiscal period, many investors viewed the fiscal challenges of state and local governments with deep pessimism, which contributed to an unusually deep plunge in municipal bond prices. Other factors included a rallying stock market, signs of a strengthening economy, rising interest rates, and the expiration of a popular subsidized taxable municipal bond program. Municipal market gloom persisted until the spring, when a strong rally began that lasted for the remainder of the Ohio Long-Term TaxExempt Fund’s fiscal year.

The market upswing countered the year’s discouraging start. The fund’s solid 5.81% return for the 12 months ended November 30 outpaced the 4.63% average return of competing Ohio funds, a consequence of its smaller loss in the opening months of the year.

The fund’s advisor, Vanguard Fixed Income Group, invests in higher-quality municipal bonds. This focus is a key reason for the fund’s better relative performance, because investors tend to prefer these kinds of investments in rough times.

As the year continued and investors regained their appetite for risk, the higher quality of the fund’s assets compared with those of its peers held back returns somewhat. And as longer-term yields declined, peer funds also got a boost from their typically longer average durations (the longer a fund’s duration, the more sensitive the fund is to interest rate changes). At root were the Federal Reserve’s actions at both ends of the yield spectrum. The Fed’s policy of keeping short-term interest rates low has driven many investors to intermediate-term bonds, thus raising prices and reducing yields, while its new bond-buying policy has pushed longer-term yields lower.

The advisor concentrated where possible on essential-service bonds, which typically generate relatively stable revenue streams from, for example, water, sewer, and electricity-generating facilities. The advisor also invested selectively in sectors such as health care.

6

The Advisor’s Report that follows this letter provides additional details about the Fixed Income Group’s management of the funds during the year.

Skillful management helps produce solid returns over the long term

A key measure of a fund’s performance is its experience over the long term. That is why it’s gratifying to review the history of the Ohio tax-exempt bond and money market funds. For the ten years ended November 30, 2011, the funds exceeded their peer-group average returns, and the Long-Term Fund modestly trailed a broad nationwide index that serves as a reasonable if imperfect benchmark for an Ohio fund.

The funds have benefited from their high-quality orientation and low costs. Especially important has been the skill of the Fixed Income Group—not only the portfolio managers and traders, but also its team of seasoned credit analysts, who provide stringent and objective evaluations of the fiscal strength of bond issuers.

The more markets change, the more they stay the same

Uncertainty—sometimes at elevated levels—is an integral part of the investment landscape. This latest fiscal year serves as a case in point: Concerns about the fiscal health of municipal bond issuers early in the period were overridden by a strong rally in municipal bonds even as the challenges for state and local governments continued unabated.

Whatever the market environment, we believe that an effective long-term investment approach is to select a mix of assets that is balanced between, and diversified among, stocks, bonds, and cash investments. By sticking with such a plan through the markets’ cycles of optimism and fear, you enhance your chances of investment success.

Thank you for entrusting your assets to Vanguard.

Sincerely,

F. William McNabb III

Chairman and Chief Executive Officer

December 15, 2011

7

Advisor’s Report

For the fiscal year ended November 30, 2011, Vanguard Ohio Tax-Exempt Money Market Fund returned 0.09%, as the Federal Reserve maintained—and said it would extend until mid-2013—its policy of keeping short-term interest rates near zero. Vanguard Ohio Long-Term Tax-Exempt Fund returned 5.81%, trailing the return of its national benchmark index but ahead of the average return of Ohio peer-group funds.

The investment environment

The opening months of the funds’ fiscal year coincided with the high point of unease in the municipal bond market. Investor concern had started to rise in October 2010, but the December–January period (your fund’s fiscal year starts on December 1) was characterized by a brief and historically heavy spate of withdrawals from muni funds and a slump in bond prices.

The price decline has been attributed to an almost perfect storm of economic and market factors that we described in detail in our last report to you six months ago. One of these factors, was some investors’ fear of a systemic decline in the creditworthiness of municipal bonds as state and local government tax revenues plunged in the wake of the Great Recession. After that disruptive start, more “normal” dynamics set in and municipal bonds returned a solid 6.53% for the fiscal year, ahead of the 5.52% return of taxable bonds, as measured by the Barclays

Yields of Tax-Exempt Municipal Bonds

(AAA-Rated General-Obligation Issues)

| | |

| | November 30, | November 30, |

| Maturity | 2010 | 2011 |

| 2 years | 0.60% | 0.42% |

| 5 years | 1.36 | 1.12 |

| 10 years | 2.79 | 2.22 |

| 30 years | 4.28 | 3.84 |

| Source: Vanguard. |

8

Capital Municipal Bond Index and Barclays Capital U.S. Aggregate Bond Index, respectively.

As we expected, the fear of widespread failure by bond issuers to make good on their payment promises never materialized. That said, they do face a challenging road ahead. Tax revenues have continued to rise for almost two years, but not enough to make budget-balancing easy. The effect of a national recession on these revenues lingers well after its official trough; the deeper the slump, the longer the recovery—and, as you know, the most recent downturn was the deepest in decades.

State and local governments continued to react to the forced austerity programs that the Great Recession precipitated, issuing fewer bonds than investors had expected earlier in the year and being more selective in the process. Overall municipal bond issuance during fiscal 2011 was about 7% lower than a year earlier, although it began to pick up later in the year. The volume figures exclude the effect of subsidized bonds issued under the Build America Bonds (BABs) program, part of the federal government’s economic-crisis stimulus package. These taxable bonds diverted some potential volume from the market for tax-exempt bonds before the program’s expiration at year-end 2010.

Roughly in line with the national average, the volume of bonds (excluding BABs) issued by Ohio and its municipal entities during the fund’s fiscal year decreased by almost 6% from the previous year, to just over $8 billion. The figure smooths over unusually low issuance in the fund’s second quarter (a 61% year-over-year drop) as well as higher issuance in the three other quarters. With BABs included, however, the total amount of issuance during the fund’s fiscal year was down almost 25%, attesting to the fiscal restraint being exercised by Ohio state and local governments.

At the same time, tax-exempt munis offered attractive yields compared with those of Treasury bonds. Muni bonds’ yields historically have been lower, a relationship that takes into account the federal tax-free nature of their income. During the latter part of the fiscal year, muni yields approached and then surpassed Treasury yields as investors sought “safe” assets in reaction to concerns about, among other things, Europe’s sovereign-debt problems. The flight to safety also fueled demand for higher-quality munis, even as state and local governments continued to struggle with their finances.

9

Given the unusual steepness of the yield curve during the year—that is, the difference in yields between the shortest-and longest-maturity bonds, as shown in the table on page 8—issuers sought to lower borrowing costs by favoring shorter maturities. They found a match with individual investors who were fleeing from the almost-nonexistent yields offered by money market mutual funds to short-and medium-term bonds, a dynamic that pushed intermediate-term yields lower as demand and prices rose (bond prices and yields move inversely to each other). In choosing our investments during the year, we took advantage of the steepness in the yield curve to boost returns.

The low money market fund yields, of course, were a consequence of the Federal Reserve’s policy, in place since December 2008, of keeping the shortest-term interest rates near zero. In August, the Fed said it would continue to do so until at least mid-2013, and one month later it said it would also strive to lower longer-term interest rates. Under this new policy, informally known as Operation Twist, the Fed has begun purchasing Treasury bonds with remaining maturities of 6 to 30 years. The purchases have had the effect of lowering yields and raising prices of longer-term bonds.

Management of the funds

Bond fund returns during the fiscal year were helped substantially by our decision to redeploy certain assets from the shorter- to the longer-maturity regions of the yield curve.

We also sought to add value through careful and diversified selection of revenue-based bonds rather than focusing on state and local general-obligation bonds. Some of the spreads between those bonds were among the highest we have seen. Among the sectors in which we benefited were essential services and A-rated hospital bonds.

We have been cautious in setting the Ohio bond fund’s duration, given the uncertainties hovering over both the U.S. and European economies as well as future U.S. tax policy. We have set the fund’s average weighted duration, which is a gauge of the sensitivity of its portfolio to changes in interest rates, at a neutral level compared with its benchmark index.

In managing the money market fund, we haven’t changed our strategy, even though we continue to operate in an investment environment shaped by the Federal Reserve’s anchoring of its target interest rate in the neighborhood of zero.

10

We remain focused on maintaining a diversified portfolio of high-quality short-term debt.

Going forward, credit concerns will continue to weigh on the municipal market—understandably, given the financial stresses that state and local governments will face for some time. Even so, our approach to muni bond investing hasn’t changed: As always, our dedicated and seasoned credit analysts, working together with traders and portfolio managers, will closely review the fiscal health of our borrowers as we choose issues to add to our portfolios and monitor those we have already purchased.

Pamela Wisehaupt Tynan, Principal, Head of Municipal Money Market Funds

Justin A. Schwartz, CFA, Portfolio Manager

Marlin G. Brown, Portfolio Manager

Christopher W. Alwine, CFA, Principal, Head of Municipal Bond Funds

Vanguard Fixed Income Group

December 20, 2011

11

Ohio Tax-Exempt Money Market Fund

Fund Profile

As of November 30, 2011

| |

| Financial Attributes | |

| Ticker Symbol | VOHXX |

| Expense Ratio1 | 0.17% |

| 7-Day SEC Yield | 0.03% |

| Average Weighted | |

| Maturity | 38 days |

| Distribution by Credit Quality (% of portfolio) | |

| First Tier | 100.0% |

| For information about these ratings, see the Glossary entry for Credit Quality. |

| |

1 The expense ratio shown is from the prospectus dated March 29, 2011, and represents estimated costs for the current fiscal year. For the fiscal year ended November 30, 2011, the expense ratio was 0.17%.

12

Ohio Tax-Exempt Money Market Fund

Performance Summary

Investment returns will fluctuate. All of the returns in this report represent past performance, which is not a guarantee of future results that may be achieved by the fund. (Current performance may be lower or higher than the performance data cited. For performance data current to the most recent month-end, visit our website at vanguard.com/performance.) The returns shown do not reflect taxes that a shareholder would pay on fund distributions. An investment in a money market fund is not insured or guaranteed by the Federal Deposit Insurance Corporation or any other government agency. Although the fund seeks to preserve the value of your investment at $1 per share, it is possible to lose money by investing in the fund. The fund’s 7-day SEC yield reflects its current earnings more closely than do the average annual returns.

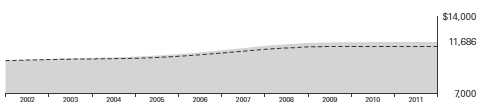

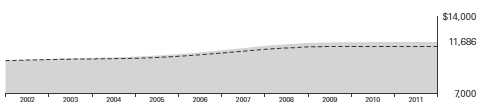

Cumulative Performance: November 30, 2001, Through November 30, 2011

Initial Investment of $10,000

| | | | |

| | Average Annual Total Returns | |

| | Periods Ended November 30, 2011 | |

| | | | | Final Value |

| | One | Five | Ten | of a $10,000 |

| | Year | Years | Years | Investment |

| Ohio Tax-Exempt Money Market Fund | 0.09% | 1.36% | 1.57% | $11,686 |

| Ohio Tax-Exempt Money Market Funds | | | | |

| Average | 0.00 | 1.10 | 1.22 | 11,288 |

Ohio Tax-Exempt Money Market Funds Average: Derived from data provided by Lipper Inc.

See Financial Highlights for dividend information.

13

Ohio Tax-Exempt Money Market Fund

| | |

| Fiscal-Year Total Returns (%): November 30, 2001, Through November 30, 2011 | |

| | | Ohio Tax-Exempt |

| | | Money Market |

| | | Funds Average |

| Fiscal Year | Total Returns | Total Returns |

| 2002 | 1.41% | 1.00% |

| 2003 | 0.95 | 0.55 |

| 2004 | 1.06 | 0.59 |

| 2005 | 2.21 | 1.73 |

| 2006 | 3.30 | 2.84 |

| 2007 | 3.63 | 3.14 |

| 2008 | 2.40 | 2.05 |

| 2009 | 0.56 | 0.31 |

| 2010 | 0.15 | 0.03 |

| 2011 | 0.09 | 0.00 |

| 7-day SEC yield (11/30/2011): 0.03% |

| Ohio Tax-Exempt Money Market Funds Average: Derived from data provided by Lipper Inc. |

Average Annual Total Returns: Periods Ended September 30, 2011

This table presents returns through the latest calendar quarter—rather than through the end of the fiscal period.

Securities and Exchange Commission rules require that we provide this information.

| | | | |

| | Inception | One | Five | Ten |

| | Date | Year | Years | Years |

| Ohio Tax-Exempt Money Market | | | | |

| Fund | 6/18/1990 | 0.11% | 1.47% | 1.60% |

14

Ohio Tax-Exempt Money Market Fund

Financial Statements

Statement of Net Assets

As of November 30, 2011

The fund reports a complete list of its holdings in various monthly and quarterly regulatory filings. The fund publishes its holdings on a monthly basis at vanguard.com and files them with the Securities and Exchange Commission on Form N-MFP. The fund’s Form N-MFP filings become public 60 days after the relevant month-end, and may be viewed at sec.gov or via a link on the “Portfolio Holdings” page on vanguard.com. For the second and fourth fiscal quarters, the lists appear in the fund’s semiannual and annual reports to shareholders. For the first and third fiscal quarters, the fund files the lists with the SEC on Form N-Q. Shareholders can look up the fund’s Forms N-Q on the SEC’s website at sec.gov. Forms N-Q may also be reviewed and copied at the SEC’s Public Reference Room (see the back cover of this report for further information).

| | | | |

| | | | Face | Market |

| | | Maturity | Amount | Value |

| | Coupon | Date | ($000) | ($000) |

| Tax-Exempt Municipal Bonds (100.7%) | | | | |

| Ohio (98.1%) | | | | |

| Akron OH BAN | 1.125% | 12/8/11 | 3,000 | 3,000 |

| Akron OH Bath & Copley Joint Township | | | | |

| Hospital District Revenue (Akron General | | | | |

| Health System) VRDO | 0.110% | 12/7/11 LOC | 2,600 | 2,600 |

| Allen County OH Hospital Facilities Revenue | | | | |

| (Catholic Healthcare Partners) VRDO | 0.060% | 12/1/11 LOC | 600 | 600 |

| 1 American Municipal Power Ohio Inc. Revenue | | | | |

| (Prairie State Energy Campus Project) | | | | |

| TOB VRDO | 0.260% | 12/7/11 (12) | 9,315 | 9,315 |

| Avon OH BAN | 1.000% | 7/3/12 | 5,500 | 5,519 |

| Avon OH BAN | 1.000% | 7/19/12 | 3,280 | 3,292 |

| Avon OH Local School District BAN | 1.125% | 12/14/11 | 1,255 | 1,255 |

| 2 Avon OH Local School District BAN | 1.000% | 12/13/12 | 1,675 | 1,683 |

| Butler County OH BAN | 0.500% | 8/2/12 | 5,000 | 5,000 |

| Central OH Solid Waste Authority BAN | 1.000% | 6/13/12 | 2,500 | 2,505 |

| 1 Cincinnati OH City School District GO TOB VRDO | 0.140% | 12/7/11 | 12,315 | 12,315 |

| 1 Cincinnati OH City School District GO TOB VRDO | 0.150% | 12/7/11 | 5,000 | 5,000 |

| Cleveland OH Airport System Revenue VRDO | 0.130% | 12/7/11 LOC | 6,170 | 6,170 |

| Cleveland OH Water BAN | 1.000% | 7/26/12 | 4,000 | 4,013 |

| 1 Cleveland OH Water Works Revenue TOB VRDO | 0.140% | 12/7/11 | 8,150 | 8,150 |

| 1 Cleveland OH Water Works Revenue TOB VRDO | 0.200% | 12/7/11 | 8,320 | 8,320 |

| Cleveland-Cuyahoga County OH Port | | | | |

| Authority Revenue (Carnegie/89th Garage | | | | |

| & Service Center LLC Project) VRDO | 0.150% | 12/7/11 LOC | 3,000 | 3,000 |

| Cleveland-Cuyahoga County OH Port | | | | |

| Authority Revenue (Cleveland Museum | | | | |

| of Art Project) VRDO | 0.130% | 12/7/11 | 15,115 | 15,115 |

| Cleveland-Cuyahoga County OH Port | | | | |

| Authority Revenue (Cleveland Museum | | | | |

| of Art Project) VRDO | 0.130% | 12/7/11 | 9,410 | 9,410 |

| Cleveland-Cuyahoga County OH Port | | | | |

| Authority Revenue (Euclid Avenue | | | | |

| Housing Corp. Project) VRDO | 0.130% | 12/7/11 LOC | 2,750 | 2,750 |

| Columbus OH City School District BAN | 2.000% | 12/1/11 | 3,000 | 3,000 |

| Columbus OH City School District BAN | 1.000% | 11/30/12 | 1,325 | 1,333 |

15

| | | | |

| Ohio Tax-Exempt Money Market Fund | | | | |

| |

| |

| |

| | | | Face | Market |

| | | Maturity | Amount | Value |

| | Coupon | Date | ($000) | ($000) |

| 1 Columbus OH GO TOB VRDO | 0.140% | 12/7/11 | 4,360 | 4,360 |

| Columbus OH GO VRDO | 0.100% | 12/7/11 | 13,195 | 13,195 |

| Columbus OH Regional Airport Authority | | | | |

| Airport Revenue (Oasbo Expanded | | | | |

| Asset Program) VRDO | 0.140% | 12/7/11 LOC | 12,905 | 12,905 |

| Columbus OH Regional Airport Authority | | | | |

| Airport Revenue (Oasbo Expanded | | | | |

| Asset Program) VRDO | 0.140% | 12/7/11 LOC | 5,440 | 5,440 |

| Columbus OH Regional Airport Authority | | | | |

| Airport Revenue (Oasbo Expanded | | | | |

| Asset Program) VRDO | 0.140% | 12/7/11 LOC | 3,100 | 3,100 |

| 1 Columbus OH Sewer Revenue TOB VRDO | 0.130% | 12/7/11 | 4,965 | 4,965 |

| Columbus OH Sewer Revenue VRDO | 0.100% | 12/7/11 | 8,965 | 8,965 |

| 2 Columbus Ohio TAN | 2.000% | 11/29/12 | 5,000 | 5,087 |

| Cuyahoga County OH Economic Development | | | | |

| Revenue (Cleveland Hearing & Speech) VRDO | 0.140% | 12/7/11 LOC | 600 | 600 |

| Cuyahoga County OH GO | 5.000% | 12/1/11 | 2,875 | 2,875 |

| Cuyahoga County OH Housing Revenue VRDO | 0.110% | 12/7/11 LOC | 6,935 | 6,935 |

| Cuyahoga Falls OH BAN | 1.250% | 12/8/11 | 2,880 | 2,880 |

| 2 Cuyahoga Falls OH BAN | 1.000% | 12/6/12 | 2,000 | 2,009 |

| Deerfield Township OH BAN | 1.250% | 11/1/12 | 2,000 | 2,009 |

| Franklin County OH Hospital Facilities Revenue | | | | |

| (Doctors OhioHealth Corp.) VRDO | 0.130% | 12/7/11 LOC | 15,110 | 15,110 |

| 1 Franklin County OH Hospital Facilities Revenue | | | | |

| (OhioHealth Corp.) TOB VRDO | 0.160% | 12/7/11 | 8,740 | 8,740 |

| Franklin County OH Hospital Revenue | | | | |

| (Holy Cross Health System) VRDO | 0.100% | 12/7/11 | 7,400 | 7,400 |

| Franklin County OH Hospital Revenue | | | | |

| (Nationwide Children’s Hospital Project) VRDO | 0.110% | 12/7/11 | 6,900 | 6,900 |

| Green OH BAN | 1.000% | 6/29/12 | 5,000 | 5,013 |

| Hamilton County OH Health Care | | | | |

| Facilities Revenue (The Children’s | | | | |

| Home of Cincinnati) VRDO | 0.140% | 12/7/11 LOC | 3,360 | 3,360 |

| Hamilton County OH Healthcare Revenue | | | | |

| (Life Enriching Communities) VRDO | 0.130% | 12/7/11 LOC | 2,650 | 2,650 |

| Hamilton County OH Sewer System Revenue | 5.250% | 12/1/11 (Prere.) | 1,355 | 1,355 |

| Hamilton County OH Sewer System Revenue | 5.250% | 12/1/11 (Prere.) | 1,000 | 1,000 |

| Hamilton OH BAN | 1.250% | 10/4/12 | 2,400 | 2,413 |

| Kent OH BAN | 1.000% | 10/10/12 | 1,725 | 1,731 |

| Lake County OH BAN | 1.500% | 6/28/12 | 2,000 | 2,007 |

| 1 Lakewood OH City School District GO TOB VRDO | 0.160% | 12/7/11 (4) | 3,825 | 3,825 |

| Lancaster Port Authority Ohio Gas Revenue VRDO | 0.130% | 12/7/11 | 28,825 | 28,825 |

| Lorain County OH BAN | 1.500% | 3/16/12 | 3,800 | 3,808 |

| 1 Lorain County OH Hospital Facilities Revenue | | | | |

| (Catholic Healthcare Partners) TOB VRDO | 0.160% | 12/7/11 (4) | 10,200 | 10,200 |

| 1 Lorain County OH Hospital Facilities Revenue | | | | |

| (Catholic Healthcare Partners) TOB VRDO | 0.200% | 12/7/11 (4) | 3,000 | 3,000 |

| 1 Lorain County OH Hospital Facilities Revenue | | | | |

| (Catholic Healthcare Partners) TOB VRDO | 0.200% | 12/7/11 (4) | 10,000 | 10,000 |

| Lorain County OH Port Authority | | | | |

| Educational Facilities Revenue | | | | |

| (St. Ignatius High School Project) VRDO | 0.140% | 12/7/11 LOC | 1,750 | 1,750 |

| Lucas County OH BAN | 1.000% | 7/19/12 | 2,500 | 2,507 |

| Mason OH City School District BAN | 2.000% | 2/1/12 | 2,600 | 2,607 |

| Miamisburg OH City School District BAN | 1.500% | 7/19/12 | 3,000 | 3,018 |

16

| | | | |

| Ohio Tax-Exempt Money Market Fund | | | | |

| |

| |

| |

| | | | Face | Market |

| | | Maturity | Amount | Value |

| | Coupon | Date | ($000) | ($000) |

| 1 Montgomery County OH Revenue | | | | |

| (Catholic Health Initiatives) TOB VRDO | 0.160% | 12/7/11 | 3,300 | 3,300 |

| 1 Montgomery County OH Revenue | | | | |

| (Catholic Health Initiatives) TOB VRDO | 0.160% | 12/7/11 | 6,970 | 6,970 |

| 1 Montgomery County OH Revenue | | | | |

| (Catholic Health Initiatives) TOB VRDO | 0.160% | 12/7/11 | 3,990 | 3,990 |

| 1 Montgomery County OH Revenue | | | | |

| (Catholic Health Initiatives) TOB VRDO | 0.170% | 12/7/11 | 2,400 | 2,400 |

| 1 Montgomery County OH Revenue | | | | |

| (Catholic Health Initiatives) TOB VRDO | 0.180% | 12/7/11 | 2,735 | 2,735 |

| Montgomery County OH Revenue | | | | |

| (Catholic Health Initiatives) VRDO | 0.100% | 12/7/11 | 11,300 | 11,300 |

| 1 Montgomery County OH Revenue | | | | |

| (Miami Valley Hospital) TOB VRDO | 0.140% | 12/7/11 | 7,500 | 7,500 |

| 1 Ohio Air Quality Development Authority Revenue | | | | |

| (Dayton Power & Light Co. Project) TOB VRDO | 0.200% | 12/7/11 (13) | 13,320 | 13,320 |

| Ohio Air Quality Development Authority Revenue | | | | |

| (Dayton Power & Light Co. Project) VRDO | 0.100% | 12/7/11 LOC | 6,500 | 6,500 |

| Ohio Air Quality Development Authority Revenue | | | | |

| (Ohio Valley Electric Corp. Project) VRDO | 0.070% | 12/7/11 LOC | 5,000 | 5,000 |

| Ohio Air Quality Development Authority Revenue | | | | |

| (Ohio Valley Electric Corp. Project) VRDO | 0.100% | 12/7/11 LOC | 13,650 | 13,650 |

| Ohio Common Schools GO VRDO | 0.080% | 12/7/11 | 5,120 | 5,120 |

| Ohio Development Assistance & | | | | |

| Revitalization Project BAN | 0.350% | 6/1/12 | 10,000 | 10,000 |

| Ohio GO | 5.000% | 6/15/12 (ETM) | 3,000 | 3,077 |

| Ohio GO VRDO | 0.070% | 12/7/11 | 4,600 | 4,600 |

| Ohio Higher Education Capital Facilities Revenue | 5.000% | 8/1/12 | 4,000 | 4,126 |

| 1 Ohio Higher Education GO TOB VRDO | 0.130% | 12/7/11 | 11,320 | 11,320 |

| Ohio Higher Educational Facility Commission | | | | |

| Revenue (Case Western Reserve | | | | |

| University Project) CP | 0.180% | 2/6/12 | 5,000 | 5,000 |

| Ohio Higher Educational Facility Commission | | | | |

| Revenue (Case Western Reserve | | | | |

| University Project) VRDO | 0.110% | 12/1/11 LOC | 6,500 | 6,500 |

| 1 Ohio Higher Educational Facility Commission | | | | |

| Revenue (Cleveland Clinic Health System | | | | |

| Obligated Group) TOB VRDO | 0.140% | 12/7/11 | 2,200 | 2,200 |

| Ohio Higher Educational Facility Commission | | | | |

| Revenue (Cleveland Clinic Health System | | | | |

| Obligated Group) VRDO | 0.070% | 12/1/11 | 1,030 | 1,030 |

| Ohio Higher Educational Facility Commission | | | | |

| Revenue (Marietta College Project) VRDO | 0.140% | 12/7/11 LOC | 2,985 | 2,985 |

| Ohio Higher Educational Facility Commission | | | | |

| Revenue (Oberlin College Project) VRDO | 0.100% | 12/7/11 | 800 | 800 |

| 1 Ohio Higher Educational Facility Commission | | | | |

| Revenue (University of Dayton Project) | | | | |

| TOB VRDO | 0.130% | 12/7/11 LOC | 6,240 | 6,240 |

| 1 Ohio Hospital Revenue (Cleveland Clinic Health | | | | |

| System Obligated Group) TOB VRDO | 0.110% | 12/1/11 | 2,425 | 2,425 |

| 1 Ohio Hospital Revenue (Cleveland Clinic Health | | | | |

| System Obligated Group) TOB VRDO | 0.110% | 12/1/11 | 11,835 | 11,835 |

| 1 Ohio Hospital Revenue (Cleveland Clinic Health | | | | |

| System Obligated Group) TOB VRDO | 0.140% | 12/7/11 | 6,745 | 6,745 |

| 1 Ohio Hospital Revenue (Cleveland Clinic Health | | | | |

| System Obligated Group) TOB VRDO | 0.140% | 12/7/11 | 2,895 | 2,895 |

17

| | | | |

| Ohio Tax-Exempt Money Market Fund | | | | |

| |

| |

| |

| | | | Face | Market |

| | | Maturity | Amount | Value |

| | Coupon | Date | ($000) | ($000) |

| 1 Ohio Hospital Revenue (University Hospitals | | | | |

| Health System Inc.) TOB VRDO | 0.240% | 12/7/11 (13) | 5,000 | 5,000 |

| 1 Ohio Housing Finance Agency Residential | | | | |

| Mortgage Revenue TOB VRDO | 0.190% | 12/7/11 | 1,765 | 1,765 |

| Ohio Housing Finance Agency Residential | | | | |

| Mortgage Revenue VRDO | 0.110% | 12/7/11 | 9,040 | 9,040 |

| Ohio Housing Finance Agency Residential | | | | |

| Mortgage Revenue VRDO | 0.120% | 12/7/11 | 13,000 | 13,000 |

| Ohio Housing Finance Agency Residential | | | | |

| Mortgage Revenue VRDO | 0.120% | 12/7/11 | 3,500 | 3,500 |

| Ohio Housing Finance Agency Residential | | | | |

| Mortgage Revenue VRDO | 0.120% | 12/7/11 | 7,500 | 7,500 |

| Ohio Housing Finance Agency Residential | | | | |

| Mortgage Revenue VRDO | 0.130% | 12/7/11 | 5,000 | 5,000 |

| Ohio Housing Finance Agency Residential | | | | |

| Mortgage Revenue VRDO | 0.130% | 12/7/11 | 11,530 | 11,530 |

| Ohio Housing Finance Agency Residential | | | | |

| Mortgage Revenue VRDO | 0.130% | 12/7/11 | 13,000 | 13,000 |

| Ohio Mental Health Capital Facilities Revenue | 5.000% | 8/1/12 | 2,570 | 2,648 |

| Ohio State University General Receipts | | | | |

| Revenue CP | 0.180% | 12/7/11 | 8,200 | 8,200 |

| Ohio State University General Receipts | | | | |

| Revenue CP | 0.130% | 12/8/11 | 11,045 | 11,045 |

| Ohio State University General Receipts | | | | |

| Revenue CP | 0.150% | 2/6/12 | 6,000 | 6,000 |

| Ohio State University General Receipts | | | | |

| Revenue VRDO | 0.070% | 12/7/11 | 7,000 | 7,000 |

| Ohio State University General Receipts | | | | |

| Revenue VRDO | 0.100% | 12/7/11 | 800 | 800 |

| 1 Ohio Turnpike Commission Turnpike | | | | |

| Revenue TOB VRDO | 0.140% | 12/7/11 | 15,565 | 15,565 |

| Ohio Water Development Authority Pollution | | | | |

| Control Revenue (FirstEnergy Nuclear | | | | |

| Generation Corp. Project) VRDO | 0.120% | 12/1/11 LOC | 18,950 | 18,950 |

| Ohio Water Development Authority Water | | | | |

| Pollution Control Loan Fund Revenue | 5.250% | 6/1/12 (Prere.) | 5,535 | 5,674 |

| 1 Olentangy OH School District GO TOB VRDO | 0.130% | 12/7/11 LOC | 4,850 | 4,850 |

| Pickerington OH Local School District | | | | |

| (School Facilities Construction | | | | |

| & Improvement) GO | 5.000% | 12/1/11 (Prere.) | 7,000 | 7,000 |

| South Euclid OH BAN | 1.250% | 9/26/12 | 2,500 | 2,516 |

| Strongsville OH BAN | 1.250% | 10/25/12 | 2,530 | 2,550 |

| Toledo-Lucas County OH Port Authority | | | | |

| Airport Development Revenue | | | | |

| (FlightSafety International Inc.) VRDO | 0.150% | 12/7/11 | 10,650 | 10,650 |

| University of Cincinnati Ohio | | | | |

| General Receipts BAN | 2.000% | 12/16/11 | 6,900 | 6,904 |

| University of Cincinnati Ohio | | | | |

| General Receipts BAN | 2.000% | 5/11/12 | 4,000 | 4,027 |

| Upper Arlington OH City School District TAN | 1.000% | 6/21/12 | 722 | 723 |

| Warren OH Health Care Facilities Improvement | | | | |

| Revenue (Otterbein Homes Project) VRDO | 0.130% | 12/7/11 LOC | 5,240 | 5,240 |

| Warren OH Health Care Facilities Improvement | | | | |

| Revenue (Otterbein Homes Project) VRDO | 0.130% | 12/7/11 LOC | 3,430 | 3,430 |

| | | | | 672,559 |

18

| | | | | |

| Ohio Tax-Exempt Money Market Fund | | | | |

| |

| |

| | | | | Face | Market |

| | | | Maturity | Amount | Value |

| | | Coupon | Date | ($000) | ($000) |

| Puerto Rico (2.6%) | | | | |

| 1 | Puerto Rico GO TOB VRDO | 0.110% | 12/1/11 LOC | 6,750 | 6,750 |

| | Puerto Rico Public Finance Corp. Revenue | 5.500% | 2/1/12 (Prere.) | 5,000 | 5,042 |

| | Puerto Rico Public Finance Corp. Revenue | 5.500% | 2/1/12 (Prere.) | 1,000 | 1,008 |

| 1 | Puerto Rico Sales Tax Financing Corp. | | | | |

| | Revenue TOB VRDO | 0.190% | 12/7/11 | 5,250 | 5,250 |

| | | | | | 18,050 |

| Total Tax-Exempt Municipal Bonds (Cost $690,609) | | | | 690,609 |

| Other Assets and Liabilities (-0.7%) | | | | |

| Other Assets | | | | 31,731 |

| Liabilities | | | | (36,358) |

| | | | | | (4,627) |

| Net Assets (100%) | | | | |

| Applicable to 685,819,535 outstanding $.001 par value shares of | | | |

| beneficial interest (unlimited authorization) | | | | 685,982 |

| Net Asset Value Per Share | | | | $1.00 |

| |

| Statement of Assets and Liabilities | | | | |

| Assets | | | | |

| Investments in Securities, at Value | | | | 690,609 |

| Receivables for Investment Securities Sold | | | | 28,360 |

| Other Assets | | | | 3,371 |

| Total Assets | | | | 722,340 |

| Liabilities | | | | |

| Payables for Investment Securities Purchased | | | | 33,379 |

| Other Liabilities | | | | 2,979 |

| Total Liabilities | | | | 36,358 |

| Net Assets | | | | 685,982 |

| |

| |

| At November 30, 2011, net assets consisted of: | | | | |

| | | | | | Amount |

| | | | | | ($000) |

| Paid-in Capital | | | | 685,979 |

| Undistributed Net Investment Income | | | | — |

| Accumulated Net Realized Gains | | | | 3 |

| Net Assets | | | | 685,982 |

See Note A in Notes to Financial Statements.

1 Security exempt from registration under Rule 144A of the Securities Act of 1933. Such securities may be sold in transactions exempt from registration, normally to qualified institutional buyers. At November 30, 2011, the aggregate value of these securities was $211,245,000, representing 30.8% of net assets.

2 Security purchased on a when-issued or delayed-delivery basis for which the fund has not taken delivery as of November 30, 2011.

A key to abbreviations and other references follows the Statement of Net Assets.

See accompanying Notes, which are an integral part of the Financial Statements.

19

Ohio Tax-Exempt Money Market Fund

Key to Abbreviations

ARS—Auction Rate Security.

BAN—Bond Anticipation Note.

COP—Certificate of Participation.

CP—Commercial Paper.

FR—Floating Rate.

GAN—Grant Anticipation Note.

GO—General Obligation Bond.

PUT—Put Option Obligation.

RAN—Revenue Anticipation Note.

TAN—Tax Anticipation Note.

TOB—Tender Option Bond.

TRAN—Tax Revenue Anticipation Note.

VRDO—Variable Rate Demand Obligation.

VRDP—Variable Rate Demand Preferred.

(ETM)—Escrowed to Maturity.

(Prere.)—Prerefunded.

Scheduled principal and interest payments are guaranteed by:

(1) MBIA (Municipal Bond Investors Assurance).

(2) AMBAC (Ambac Assurance Corporation).

(3) FGIC (Financial Guaranty Insurance Company).

(4) AGM (Assured Guaranty Municipal Corporation).

(5) BIGI (Bond Investors Guaranty Insurance).

(6) Connie Lee Inc.

(7) FHA (Federal Housing Authority).

(8) CapMAC (Capital Markets Assurance Corporation).

(9) American Capital Access Financial Guaranty Corporation.

(10) XL Capital Assurance Inc.

(11) CIFG (CDC IXIS Financial Guaranty).

(12) Assured Guaranty Corporation.

(13) Berkshire Hathaway Assurance Corporation.

(14) National Public Finance Guarantee Corporation.

The insurance does not guarantee the market value of the municipal bonds.

LOC—Scheduled principal and interest payments are guaranteed by bank letter of credit.

20

Ohio Tax-Exempt Money Market Fund

Statement of Operations

| |

| | Year Ended |

| | November 30, 2011 |

| | ($000) |

| Investment Income | |

| Income | |

| Interest | 1,878 |

| Total Income | 1,878 |

| Expenses | |

| The Vanguard Group—Note B | |

| Investment Advisory Services | 219 |

| Management and Administrative | 743 |

| Marketing and Distribution | 226 |

| Custodian Fees | 15 |

| Auditing Fees | 23 |

| Shareholders’ Reports | 7 |

| Trustees’ Fees and Expenses | 1 |

| Total Expenses | 1,234 |

| Net Investment Income | 644 |

| Realized Net Gain (Loss) on Investment Securities Sold | 9 |

| Net Increase (Decrease) in Net Assets Resulting from Operations | 653 |

See accompanying Notes, which are an integral part of the Financial Statements.

21

Ohio Tax-Exempt Money Market Fund

Statement of Changes in Net Assets

| | |

| | Year Ended November 30, |

| | 2011 | 2010 |

| | ($000) | ($000) |

| Increase (Decrease) in Net Assets | | |

| Operations | | |

| Net Investment Income | 644 | 1,279 |

| Realized Net Gain (Loss) | 9 | 2 |

| Net Increase (Decrease) in Net Assets Resulting from Operations | 653 | 1,281 |

| Distributions | | |

| Net Investment Income | (644) | (1,279) |

| Realized Capital Gain | — | — |

| Total Distributions | (644) | (1,279) |

| Capital Share Transactions (at $1.00) | | |

| Issued | 441,731 | 433,261 |

| Issued in Lieu of Cash Distributions | 603 | 1,198 |

| Redeemed | (542,680) | (595,306) |

| Net Increase (Decrease) from Capital Share Transactions | (100,346) | (160,847) |

| Total Increase (Decrease) | (100,337) | (160,845) |

| Net Assets | | |

| Beginning of Period | 786,319 | 947,164 |

| End of Period | 685,982 | 786,319 |

See accompanying Notes, which are an integral part of the Financial Statements.

22

Ohio Tax-Exempt Money Market Fund

Financial Highlights

| | | | | |

| For a Share Outstanding | | | Year Ended November 30, |

| Throughout Each Period | 2011 | 2010 | 2009 | 2008 | 2007 |

| Net Asset Value, Beginning of Period | $1.00 | $1.00 | $1.00 | $1.00 | $1.00 |

| Investment Operations | | | | | |

| Net Investment Income | .001 | .002 | .006 | .024 | .036 |

| Net Realized and Unrealized Gain (Loss) | | | | | |

| on Investments | — | — | — | — | — |

| Total from Investment Operations | .001 | .002 | .006 | .024 | .036 |

| Distributions | | | | | |

| Dividends from Net Investment Income | (.001) | (.002) | (.006) | (.024) | (.036) |

| Distributions from Realized Capital Gains | — | — | — | — | — |

| Total Distributions | (.001) | (.002) | (.006) | (.024) | (.036) |

| Net Asset Value, End of Period | $1.00 | $1.00 | $1.00 | $1.00 | $1.00 |

| |

| Total Return1 | 0.09% | 0.15% | 0.56% | 2.40% | 3.63% |

| |

| Ratios/Supplemental Data | | | | | |

| Net Assets, End of Period (Millions) | $686 | $786 | $947 | $1,096 | $1,168 |

| Ratio of Total Expenses to | | | | | |

| Average Net Assets | 0.17% | 0.17% | 0.17%2 | 0.11%2 | 0.10% |

| Ratio of Net Investment Income to | | | | | |

| Average Net Assets | 0.09% | 0.15% | 0.57% | 2.38% | 3.57% |

1 Total returns do not include account service fees that may have applied in the periods shown. Fund prospectuses provide information about any applicable account service fees.

2 Includes fees to participate in the Treasury Temporary Guarantee Program for Money Market Funds of 0.04% for 2009 and 0.01% for 2008.

See accompanying Notes, which are an integral part of the Financial Statements.

23

Ohio Tax-Exempt Money Market Fund

Notes to Financial Statements

Vanguard Ohio Tax-Exempt Money Market Fund is registered under the Investment Company Act of 1940 as an open-end investment company, or mutual fund. The fund invests in debt instruments of municipal issuers whose ability to meet their obligations may be affected by economic and political developments in the state.

A. The following significant accounting policies conform to generally accepted accounting principles for U.S. mutual funds. The fund consistently follows such policies in preparing its financial statements.

1. Security Valuation: Securities are valued at amortized cost, which approximates market value.

2. Federal Income Taxes: The fund intends to continue to qualify as a regulated investment company and distribute all of its income. Management has analyzed the fund’s tax positions taken for all open federal income tax years (November 30, 2008–2011), and has concluded that no provision for federal income tax is required in the fund’s financial statements.

3. Distributions: Distributions from net investment income are declared daily and paid on the first business day of the following month.

4. Other: Interest income is accrued daily. Premiums and discounts on debt securities purchased are amortized and accreted, respectively, to interest income over the lives of the respective securities. Security transactions are accounted for on the date securities are bought or sold. Costs used to determine realized gains (losses) on the sale of investment securities are those of the specific securities sold.

B. The Vanguard Group furnishes at cost investment advisory, corporate management, administrative, marketing, and distribution services. The costs of such services are allocated to the fund under methods approved by the board of trustees. The fund has committed to provide up to 0.40% of its net assets in capital contributions to Vanguard. At November 30, 2011, the fund had contributed capital of $113,000 to Vanguard (included in Other Assets), representing 0.02% of the fund’s net assets and 0.05% of Vanguard’s capitalization. The fund’s trustees and officers are also directors and officers of Vanguard. Vanguard and the board of trustees have agreed to temporarily limit certain net operating expenses in excess of the fund’s daily yield so as to maintain a zero or positive yield for the fund. Vanguard and the board of trustees may terminate the temporary expense limitation at any time.

C. Various inputs may be used to determine the value of the fund’s investments. These inputs are summarized in three broad levels for financial statement purposes. The inputs or methodologies used to value securities are not necessarily an indication of the risk associated with investing in those securities.

Level 1—Quoted prices in active markets for identical securities.

Level 2—Other significant observable inputs (including quoted prices for similar securities, interest rates, prepayment speeds, credit risk, etc.).

Level 3—Significant unobservable inputs (including the fund’s own assumptions used to determine the fair value of investments).

At November 30, 2011, 100% of the market value of the fund’s investments were valued using amortized cost, in accordance with rules under the Investment Company Act of 1940. Amortized cost approximates the current fair value of a security, but since the value is not obtained from a quoted price in an active market, securities valued at amortized cost are considered to be valued using Level 2 inputs.

D. In preparing the financial statements as of November 30, 2011, management considered the impact of subsequent events for potential recognition or disclosure in these financial statements.

24

Ohio Long-Term Tax-Exempt Fund

Fund Profile

As of November 30, 2011

| | | |

| Financial Attributes | | | |

| | | Barclays | Barclays |

| | | 10 Year | Municipal |

| | | Municipal | Bond |

| | Fund | Index | Index |

| Number of Bonds | 248 | 8,836 | 45,906 |

| Yield to Maturity | | | |

| (before expenses) | 3.3% | 2.8% | 3.1% |

| Average Coupon | 4.8% | 4.8% | 4.9% |

| Average Duration | 6.8 years | 6.6 years | 8.2 years |

| Average Effective | | | |

| Maturity | 7.5 years | 10.0 years | 13.5 years |

| Ticker Symbol | VOHIX | — | — |

| Expense Ratio1 | 0.17% | — | — |

| 30-Day SEC Yield | 3.11% | — | — |

| Short-Term | | | |

| Reserves | 7.6% | — | — |

| | |

| Volatility Measures | | |

| | Barclays | Barclays |

| | 10 Year | Municipal |

| | Municipal | Bond |

| | Index | Index |

| R-Squared | 0.84 | 0.98 |

| Beta | 0.81 | 1.01 |

| These measures show the degree and timing of the fund’s fluctuations compared with the indexes over 36 months. |

|

| |

| Distribution by Maturity (% of portfolio) | |

| Under 1 Year | | 9.1% |

| 1 - 3 Years | | 13.0 |

| 3 - 5 Years | | 12.9 |

| 5 - 10 Years | | 52.1 |

| 10 - 20 Years | | 6.6 |

| 20 - 30 Years | | 2.1 |

| Over 30 Years | | 4.2 |

| |

| Distribution by Credit Quality (% of portfolio) |

| AAA | | 9.7% |

| AA | | 59.1 |

| A | | 20.4 |

| BBB | | 7.4 |

| BB | | 0.9 |

| Not Rated | | 2.5 |

| For information about these ratings, see the Glossary entry for Credit Quality. |

| | |

Investment Focus

1 The expense ratio shown is from the prospectus dated March 29, 2011, and represents estimated costs for the current fiscal year. For the fiscal year ended November 30, 2011, the expense ratio was 0.17%.

25

Ohio Long-Term Tax-Exempt Fund

Performance Summary

All of the returns in this report represent past performance, which is not a guarantee of future results that may be achieved by the fund. (Current performance may be lower or higher than the performance data cited. For performance data current to the most recent month-end, visit our website at vanguard.com/performance.) Note, too, that both investment returns and principal value can fluctuate widely, so an investor’s shares, when sold, could be worth more or less than their original cost. The returns shown do not reflect taxes that a shareholder would pay on fund distributions or on the sale of fund shares.

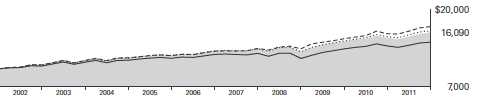

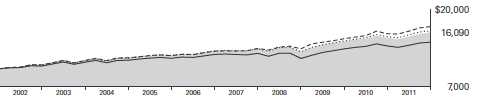

Cumulative Performance: November 30, 2001, Through November 30, 2011

Initial Investment of $10,000

| | | | |

| | Average Annual Total Returns | |

| | Periods Ended November 30, 2011 | |

| | | | | Final Value |

| | One | Five | Ten | of a $10,000 |

| | Year | Years | Years | Investment |

| Ohio Long-Term Tax-Exempt Fund | 5.81% | 4.37% | 4.87% | $16,090 |

| Barclays Capital Municipal Bond Index | 6.53 | 4.75 | 5.08 | 16,411 |

| Barclays Capital 10 Year Municipal | | | | |

| Bond Index | 7.68 | 5.70 | 5.52 | 17,113 |

| Ohio Municipal Debt Funds Average | 4.63 | 3.13 | 3.78 | 14,487 |

Ohio Municipal Debt Funds Average: Derived from data provided by Lipper Inc.

See Financial Highlights for dividend and capital gains information.

26

Ohio Long-Term Tax-Exempt Fund

| | | | |

| Fiscal-Year Total Returns (%): November 30, 2001, Through November 30, 2011 | |

| | | | | Barclays |

| | | | | 10 Year |

| | | | | Municipal |

| | | | | Index |

| Fiscal Year | Income Returns | Capital Returns | Total Returns | Total Returns |

| 2002 | 4.86% | 1.82% | 6.68% | 6.67% |

| 2003 | 4.62 | 2.82 | 7.44 | 6.88 |

| 2004 | 4.47 | -0.96 | 3.51 | 4.03 |

| 2005 | 4.36 | -1.16 | 3.20 | 3.01 |

| 2006 | 4.53 | 1.60 | 6.13 | 6.17 |

| 2007 | 4.32 | -1.61 | 2.71 | 3.51 |

| 2008 | 4.13 | -7.74 | -3.61 | -0.42 |

| 2009 | 4.76 | 8.85 | 13.61 | 12.67 |

| 2010 | 4.14 | -0.08 | 4.06 | 5.51 |

| 2011 | 4.20 | 1.61 | 5.81 | 7.68 |

Average Annual Total Returns: Periods Ended September 30, 2011

This table presents returns through the latest calendar quarter—rather than through the end of the fiscal period.

Securities and Exchange Commission rules require that we provide this information.

| | | | | | |

| | | | | | | Ten Years |

| | Inception Date | One Year | Five Years | Income | Capital | Total |

| Ohio Long-Term | | | | | | |

| Tax-Exempt Fund | 6/18/1990 | 3.25% | 4.64% | 4.45% | 0.43% | 4.88% |

27

Ohio Long-Term Tax-Exempt Fund

Financial Statements

Statement of Net Assets

As of November 30, 2011

The fund reports a complete list of its holdings in regulatory filings four times in each fiscal year, at the quarter-ends. For the second and fourth fiscal quarters, the lists appear in the fund’s semiannual and annual reports to shareholders. For the first and third fiscal quarters, the fund files the lists with the Securities and Exchange Commission on Form N-Q. Shareholders can look up the fund’s Forms N-Q on the SEC’s website at sec.gov. Forms N-Q may also be reviewed and copied at the SEC’s Public Reference Room (see the back cover of this report for further information).

| | | | |

| | | | Face | Market |

| | | Maturity | Amount | Value |

| | Coupon | Date | ($000) | ($000) |

| Tax-Exempt Municipal Bonds (101.4%) | | | | |

| Ohio (99.2%) | | | | |

| Akron OH GO | 5.500% | 12/1/11 (Prere.) | 1,315 | 1,315 |

| Akron OH Income Tax Revenue | | | | |

| (Community Learning Centers) | 5.000% | 12/1/27 (14) | 6,300 | 6,451 |

| Allen County OH Hospital Facilities Revenue | | | | |

| (Catholic Healthcare Partners) | 5.250% | 9/1/27 | 4,000 | 4,156 |

| Allen County OH Hospital Facilities Revenue | | | | |

| (Catholic Healthcare Partners) | 5.000% | 6/1/38 | 9,625 | 9,625 |

| Allen County OH Hospital Facilities Revenue | | | | |

| (Catholic Healthcare Partners) VRDO | 0.090% | 12/1/11 LOC | 6,030 | 6,030 |

| Allen County OH Hospital Facilities Revenue | | | | |

| (Catholic Healthcare Partners) VRDO | 0.140% | 12/1/11 LOC | 3,200 | 3,200 |

| American Municipal Power Ohio Inc. Revenue | | | | |

| (Electricity Purchase) | 5.000% | 2/1/13 | 3,000 | 3,127 |

| American Municipal Power Ohio Inc. Revenue | | | | |

| (Hydroelectric Projects) | 5.000% | 2/15/23 | 4,000 | 4,368 |

| American Municipal Power Ohio Inc. Revenue | | | | |

| (Hydroelectric Projects) | 5.000% | 2/15/24 | 1,215 | 1,310 |

| American Municipal Power Ohio Inc. Revenue | | | | |

| (Prairie State Energy Campus Project) | 5.000% | 2/15/38 | 17,375 | 17,811 |

| American Municipal Power Ohio Inc. Revenue | | | | |

| (Prairie State Energy Campus Project) | 5.750% | 2/15/39 (12) | 4,500 | 4,871 |

| Amherst OH Exempt Village School District GO | 5.750% | 12/1/11 (Prere.) | 1,300 | 1,300 |

| Amherst OH Exempt Village School District GO | 5.750% | 12/1/11 (Prere.) | 1,300 | 1,300 |

| Bowling Green State University Ohio | | | | |

| Student Housing Revenue | | | | |

| (CFP I LLC - State University Project) | 5.750% | 6/1/31 | 2,000 | 1,954 |

| Bowling Green State University Ohio | | | | |

| Student Housing Revenue | | | | |

| (CFP I LLC - State University Project) | 6.000% | 6/1/45 | 2,000 | 1,947 |

| Buckeye Tobacco Settlement Financing | | | | |

| Authority Ohio Revenue | 6.000% | 6/1/42 | 2,750 | 1,960 |

| Buckeye Tobacco Settlement Financing | | | | |

| Authority Ohio Revenue | 5.875% | 6/1/47 | 5,760 | 4,022 |

| Buckeye Tobacco Settlement Financing | | | | |

| Authority Ohio Revenue | 6.500% | 6/1/47 | 2,500 | 1,918 |

| Butler County OH GO | 5.250% | 12/1/12 (Prere.) | 1,655 | 1,753 |

| Butler County OH GO | 5.250% | 12/1/12 (Prere.) | 1,570 | 1,663 |

28

| | | | |

| Ohio Long-Term Tax-Exempt Fund | | | | |

| |

| |

| |

| | | | Face | Market |

| | | Maturity | Amount | Value |

| | Coupon | Date | ($000) | ($000) |

| Butler County OH Hospital Facilities Revenue | | | | |

| (Cincinnati Children’s Hospital | | | | |

| Medical Center Project) | 5.000% | 5/15/31 (14) | 5,000 | 4,664 |

| Butler County OH Hospital Facilities Revenue | | | | |

| (Kettering Health Network) | 6.375% | 4/1/36 | 1,250 | 1,348 |

| Butler County OH Hospital Facilities Revenue | | | | |

| (UC Health) | 5.250% | 11/1/29 | 2,500 | 2,449 |

| Butler County OH Hospital Facilities Revenue | | | | |

| (UC Health) | 5.500% | 11/1/40 | 2,500 | 2,426 |

| Butler County OH Waterworks Revenue | 5.250% | 12/1/21 (2) | 4,000 | 4,461 |

| Canal Winchester OH Local School District GO | 5.500% | 12/1/11 (Prere.) | 1,080 | 1,080 |

| Canal Winchester OH Local School District GO | 5.500% | 12/1/11 (Prere.) | 950 | 950 |

| Canal Winchester OH Local School District GO | 5.500% | 12/1/11 (Prere.) | 805 | 805 |

| Canal Winchester OH Local School District GO | 5.000% | 6/1/15 (Prere.) | 3,420 | 3,904 |

| Canal Winchester OH Local School District GO | 5.000% | 6/1/15 (Prere.) | 3,030 | 3,459 |

| Cincinnati OH City School District COP | 5.000% | 12/15/23 (4) | 1,620 | 1,767 |

| Cincinnati OH City School District COP | 5.000% | 12/15/32 (4) | 2,000 | 2,079 |

| Cincinnati OH City School District GO | 5.250% | 6/1/27 | 5,550 | 6,143 |

| Cincinnati OH City School District GO | 5.250% | 12/1/28 (14) | 4,000 | 4,661 |

| Cincinnati OH City School District GO | 5.250% | 12/1/30 (14) | 3,705 | 4,227 |

| Cincinnati OH City School District GO | 5.250% | 12/1/31 (14) | 3,000 | 3,397 |

| Cincinnati OH Economic Development Revenue | | | | |

| (Baldwin 300 Project) | 4.875% | 11/1/38 | 7,870 | 7,974 |

| Cincinnati OH GO | 5.000% | 12/1/24 | 1,090 | 1,236 |

| Cincinnati OH GO | 5.000% | 12/1/26 | 2,605 | 2,899 |

| Cincinnati OH Water System Revenue | 5.000% | 12/1/31 | 1,585 | 1,731 |

| Cincinnati OH Water System Revenue | 5.000% | 12/1/36 | 3,025 | 3,244 |

| Cleveland OH GO | 5.000% | 10/1/21 (2) | 2,920 | 3,221 |

| Cleveland OH GO | 5.500% | 10/1/22 (2) | 3,870 | 4,579 |

| Cleveland OH Income Tax Revenue | 5.000% | 10/1/29 (12) | 7,180 | 7,562 |

| Cleveland OH Public Power System Revenue | 5.000% | 11/15/28 (14) | 1,250 | 1,313 |

| Cleveland OH Public Power System Revenue | 0.000% | 11/15/33 (14) | 6,895 | 2,154 |

| Cleveland OH State University Revenue | 5.250% | 6/1/19 (14) | 2,825 | 3,028 |

| Cleveland OH State University Revenue | 5.000% | 6/1/30 (14) | 3,000 | 3,118 |

| Cleveland OH Water Works Revenue | 5.500% | 1/1/21 (14) | 9,635 | 11,657 |

| Cleveland-Cuyahoga County OH Port Authority | | | | |

| Revenue (Carnegie/89th Garage & Service | | | | |

| Center LLC Project) VRDO | 0.150% | 12/7/11 LOC | 1,375 | 1,375 |

| Cleveland-Cuyahoga County OH Port Authority | | | | |

| Revenue (Cleveland Museum of Art Project) | 5.000% | 10/1/18 | 6,000 | 7,052 |

| Cleveland-Cuyahoga County OH Port Authority | | | | |

| Revenue (Cleveland Museum of Art Project) | 5.000% | 10/1/19 | 6,000 | 7,069 |

| Columbus OH City School District GO | 4.500% | 12/1/29 | 3,000 | 3,085 |

| Columbus OH City School District School | | | | |

| Facilities Construction & Improvement GO | 5.000% | 12/1/22 | 1,545 | 1,772 |

| Columbus OH GO | 5.000% | 7/1/16 | 2,500 | 2,923 |

| Columbus OH GO | 5.000% | 9/1/16 | 4,225 | 4,958 |

| Columbus OH GO | 5.000% | 6/1/19 | 8,000 | 9,761 |

| Columbus OH GO | 5.000% | 7/1/27 | 2,000 | 2,277 |

| Columbus OH GO VRDO | 0.100% | 12/7/11 | 560 | 560 |

| Columbus OH Sewer Revenue | 5.000% | 6/1/28 | 4,005 | 4,323 |

| Cuyahoga County OH Economic Development | | | | |

| Revenue (Med Mart/Convention Center Project) | 5.000% | 12/1/19 | 7,000 | 8,293 |

| Cuyahoga County OH Economic Development | | | | |

| Revenue (Med Mart/Convention Center Project) | 5.000% | 12/1/24 | 4,000 | 4,452 |

29

| | | | |

| Ohio Long-Term Tax-Exempt Fund | | | | |

| |

| |

| |

| | | | Face | Market |

| | | Maturity | Amount | Value |

| | Coupon | Date | ($000) | ($000) |

| Cuyahoga County OH Revenue (Cleveland Clinic | | | | |

| Health System Obligated Group) | 6.000% | 7/1/13 (Prere.) | 5,100 | 5,546 |

| Cuyahoga County OH Revenue (Cleveland Clinic | | | | |

| Health System Obligated Group) | 6.000% | 1/1/32 | 4,900 | 5,136 |

| Cuyahoga County OH Revenue (Cleveland Clinic | | | | |

| Health System Obligated Group) VRDO | 0.090% | 12/1/11 | 7,805 | 7,805 |

| Erie County OH Hospital Facilities Revenue | | | | |

| (Firelands Regional Medical Center) | 5.250% | 8/15/46 | 9,080 | 8,052 |

| Fairborn OH City School District | | | | |

| School Improvement GO | 5.500% | 12/1/16 (14) | 1,840 | 1,840 |

| Fairborn OH City School District | | | | |

| School Improvement GO | 5.375% | 12/1/20 (14) | 1,200 | 1,200 |

| Fairfield County OH Hospital Facilities Revenue | | | | |

| (Lancaster-Fairfield Community Hospital) | 5.375% | 6/15/15 (14) | 3,000 | 3,154 |

| Franklin County OH GO | 5.000% | 12/1/31 | 6,885 | 7,367 |

| Franklin County OH Health Care Facilities | | | | |

| Improvement Revenue (Ohio Presbyterian | | | | |

| Retirement Services Project) | 5.625% | 7/1/26 | 2,750 | 2,771 |

| Franklin County OH Hospital Facilities Revenue | | | | |

| (OhioHealth Corp.) | 5.000% | 11/15/36 | 3,640 | 3,677 |

| Franklin County OH Hospital Facilities Revenue | | | | |

| (US Health Corp. of Columbus) VRDO | 0.110% | 12/7/11 LOC | 560 | 560 |

| Franklin County OH Hospital Improvement | | | | |

| Revenue (Nationwide Children’s Hospital Project) | 4.750% | 11/1/28 | 1,500 | 1,532 |

| Franklin County OH Hospital Improvement | | | | |

| Revenue (Nationwide Children’s Hospital Project) | 5.000% | 11/1/34 | 1,500 | 1,521 |

| Franklin County OH Hospital Revenue | | | | |

| (Nationwide Children’s Hospital Project) VRDO | 0.110% | 12/7/11 | 2,200 | 2,200 |

| Franklin County OH Hospital Revenue | | | | |

| (Nationwide Children’s Hospital Project) VRDO | 0.120% | 12/7/11 | 7,600 | 7,600 |

| Franklin County OH Hospital Revenue | | | | |

| (Nationwide Children’s Hospital Project) VRDO | 0.120% | 12/7/11 | 1,400 | 1,400 |

| Franklin County OH Revenue | | | | |

| (Trinity Health Credit Group) | 5.000% | 6/1/19 | 4,035 | 4,329 |

| Franklin County OH Revenue | | | | |

| (Trinity Health Credit Group) | 5.000% | 6/1/21 | 4,465 | 4,728 |

| Gallia County OH Hospital Facilities Revenue | | | | |

| (Holzer Medical Center Project) | 5.125% | 10/1/13 (2) | 1,365 | 1,368 |

| Gallia County OH Local School District GO | 5.000% | 12/1/30 (4) | 5,000 | 5,144 |

| Gallia County OH Local School District GO | 5.000% | 12/1/33 (4) | 3,500 | 3,568 |

| Gallipolis OH City School District | | | | |

| (School Facilities Construction | | | | |

| & Improvement) GO | 5.000% | 12/1/30 (14) | 4,040 | 4,176 |

| Garfield Heights OH City School District | | | | |

| School Improvement GO | 5.500% | 12/15/11 (Prere.) | 1,640 | 1,644 |

| Greene County OH Hospital Facilities Revenue | | | | |

| (Kettering Health Network | | | | |

| Obligated Group Project) | 5.375% | 4/1/34 | 2,500 | 2,541 |

| Greene County OH Hospital Facilities Revenue | | | | |

| (Kettering Health Network | | | | |

| Obligated Group Project) | 5.500% | 4/1/39 | 2,500 | 2,542 |

| Greene County OH Sewer System Revenue | 5.000% | 12/1/23 (4) | 4,695 | 5,015 |

| Hamilton County OH Convention Center | | | | |

| Facilities Authority Revenue | 5.250% | 12/1/20 (14) | 1,185 | 1,285 |

30

| | | | |

| Ohio Long-Term Tax-Exempt Fund | | | | |

| |

| |

| |

| | | | Face | Market |

| | | Maturity | Amount | Value |

| | Coupon | Date | ($000) | ($000) |

| Hamilton County OH Convention Center | | | | |

| Facilities Authority Revenue | 5.250% | 12/1/21 (14) | 1,245 | 1,348 |

| Hamilton County OH Convention Center | | | | |

| Facilities Authority Revenue | 5.250% | 12/1/23 (14) | 1,380 | 1,498 |

| Hamilton County OH Convention Center | | | | |

| Facilities Authority Revenue | 5.250% | 12/1/24 (14) | 185 | 201 |

| Hamilton County OH Economic Development | | | | |

| Revenue (King Highland Community Urban | | | | |

| Redevelopment Corp. - University of Cincinnati | | | | |

| Lessee Project) | 5.250% | 6/1/28 (14) | 7,290 | 7,520 |

| Hamilton County OH Hospital Facilities Revenue | | | | |

| (Cincinnati Children’s Hospital) | 5.500% | 5/15/19 (14) | 2,865 | 2,956 |

| Hamilton County OH Hospital Facilities Revenue | | | | |

| (Cincinnati Children’s Hospital) | 5.500% | 5/15/20 (14) | 3,020 | 3,105 |

| Hamilton County OH Sales Tax Revenue | 5.000% | 12/1/26 (2) | 5,000 | 5,225 |

| Hamilton County OH Sales Tax Revenue | 5.000% | 12/1/32 | 5,000 | 5,119 |

| Hamilton County OH Sales Tax Revenue | 5.000% | 12/1/32 (4) | 9,700 | 9,985 |

| Hamilton County OH Sewer System Revenue | 5.000% | 12/1/31 (14) | 5,300 | 5,541 |

| Hamilton OH City School District GO | 5.000% | 12/1/28 (4) | 5,000 | 5,217 |

| Hamilton OH City School District GO | 5.000% | 12/1/34 (4) | 2,250 | 2,304 |

| Highland OH Local School District | | | | |

| School Improvement GO | 5.750% | 12/1/11 (Prere.) | 1,510 | 1,510 |

| Hilliard OH School District GO | 5.250% | 12/1/16 (14) | 2,000 | 2,028 |

| Hilliard OH School District GO | 5.000% | 12/1/27 (14) | 2,895 | 3,135 |

| Huron County OH Hospital Facilities | | | | |

| Improvement Revenue | | | | |

| (Fisher-Titus Medical Center) | 5.250% | 12/1/37 | 3,000 | 2,987 |

| Kent State University OH Revenue VRDO | 0.140% | 12/7/11 LOC | 2,300 | 2,300 |

| Logan Hocking OH Local School District GO | 5.500% | 12/1/11 (Prere.) | 1,675 | 1,675 |

| Lorain County OH Community College | | | | |

| District General Revenue | 5.000% | 12/1/41 | 4,520 | 4,654 |

| Lorain County OH GO | 5.500% | 12/1/12 (Prere.) | 1,500 | 1,578 |

| Lorain County OH Hospital Facilities Revenue | | | | |

| (Catholic Healthcare Partners) | 5.000% | 4/1/15 (4) | 5,200 | 5,710 |

| Lorain County OH Hospital Facilities Revenue | | | | |

| (Catholic Healthcare Partners) | 5.400% | 10/1/21 | 4,000 | 4,051 |

| Lorain County OH Hospital Facilities Revenue | | | | |

| (Catholic Healthcare Partners) | 5.000% | 4/1/33 (4) | 4,000 | 4,044 |

| 1 Lorain County OH Hospital Facilities Revenue | | | | |

| (Catholic Healthcare Partners) TOB VRDO | 0.200% | 12/7/11 (4) | 4,995 | 4,995 |

| Lucas County OH GO | 5.000% | 10/1/40 | 1,500 | 1,543 |

| Lucas County OH Hospital Revenue | 5.000% | 11/15/38 | 5,000 | 5,000 |

| 2 Lucas County OH Hospital Revenue | | | | |

| (ProMedica Healthcare Obligated Group) | 5.250% | 11/15/27 | 2,000 | 2,123 |

| 2 Lucas County OH Hospital Revenue | | | | |

| (ProMedica Healthcare Obligated Group) | 5.250% | 11/15/28 | 4,000 | 4,212 |

| Lucas County OH Hospital Revenue | | | | |

| (ProMedica Healthcare Obligated Group) | 6.500% | 11/15/37 | 2,000 | 2,279 |

| Lucas County OH Hospital Revenue | | | | |

| (ProMedica Healthcare Obligated Group) | 6.000% | 11/15/41 | 2,000 | 2,188 |

| Mad River OH Local School District GO | 5.750% | 12/1/12 (Prere.) | 1,195 | 1,260 |

| Marysville OH Exempt Village School District COP | 5.250% | 6/1/15 (Prere.) | 2,095 | 2,412 |

| Marysville OH Exempt Village School District COP | 5.250% | 6/1/15 (Prere.) | 2,035 | 2,343 |

| Marysville OH Exempt Village School District COP | 5.250% | 6/1/15 (Prere.) | 2,140 | 2,464 |

31

| | | | |

| Ohio Long-Term Tax-Exempt Fund | | | | |

| |

| |

| |

| | | | Face | Market |

| | | Maturity | Amount | Value |

| | Coupon | Date | ($000) | ($000) |

| Marysville OH Wastewater Treatment | | | | |

| System Revenue | 5.000% | 12/1/31 (10) | 2,720 | 2,769 |

| Mason OH City School District School | | | | |

| Improvement GO | 5.000% | 12/1/35 | 1,000 | 1,045 |

| Medina OH School District COP | 5.250% | 12/1/37 (12) | 7,210 | 7,500 |

| Miami University of Ohio General | | | | |

| Receipts Revenue | 5.250% | 12/1/13 (Prere.) | 2,000 | 2,189 |

| 2 Miami University of Ohio General | | | | |

| Receipts Revenue | 5.000% | 9/1/31 | 2,000 | 2,115 |

| 2 Miami University of Ohio General | | | | |

| Receipts Revenue | 5.000% | 9/1/36 | 2,000 | 2,075 |

| Middletown OH City School District GO | 5.000% | 12/1/23 (4) | 5,345 | 5,792 |

| Milford OH Exempt Village School District | | | | |

| School Improvement GO | 6.000% | 12/1/11 (Prere.) | 1,425 | 1,425 |

| Milford OH Exempt Village School District | | | | |

| School Improvement GO | 6.000% | 12/1/11 (Prere.) | 1,600 | 1,600 |

| Montgomery County OH Revenue | | | | |

| (Catholic Health Initiatives) | 5.000% | 5/1/30 | 7,630 | 7,715 |

| Montgomery County OH Revenue | | | | |

| (Catholic Health Initiatives) | 5.000% | 5/1/39 | 5,000 | 5,034 |

| Montgomery County OH Revenue | | | | |

| (Catholic Health Initiatives) | 5.000% | 10/1/41 (4) | 5,000 | 5,016 |

| New Albany Plain OH Local School District GO | 5.500% | 6/1/12 (Prere.) | 500 | 513 |

| New Albany Plain OH Local School District GO | 5.500% | 12/1/17 (3) | 675 | 689 |

| Ohio Air Quality Development Authority | | | | |

| Pollution Control Revenue (FirstEnergy | | | | |

| Generation Corp. Project) | 5.625% | 6/1/18 | 7,000 | 7,849 |

| Ohio Air Quality Development Authority | | | | |

| Pollution Control Revenue (FirstEnergy | | | | |

| Generation Corp. Project) PUT | 5.875% | 6/1/16 | 6,000 | 6,713 |

| Ohio Air Quality Development Authority Revenue | | | | |

| (Columbus Southern Power Co. Project) | 5.800% | 12/1/38 | 2,000 | 2,123 |

| Ohio Air Quality Development Authority Revenue | | | | |

| (Columbus Southern Power Co. Project) PUT | 3.875% | 6/1/14 | 3,000 | 3,106 |

| Ohio Air Quality Development Authority Revenue | | | | |

| (FirstEnergy Generation Corp. Project) | 5.700% | 8/1/20 | 6,000 | 6,584 |

| 1 Ohio Air Quality Development Authority Revenue | | | | |

| (FirstEnergy Generation Corp. Project) | | | | |

| TOB VRDO | 0.160% | 12/7/11 | 4,995 | 4,995 |

| Ohio Air Quality Development Authority Revenue | | | | |

| (Ohio Power Co. Project) PUT | 3.250% | 6/2/14 | 7,000 | 7,142 |

| Ohio Building Authority Revenue | | | | |

| (Administration Building Fund) | 5.000% | 10/1/23 | 2,000 | 2,229 |

| Ohio Building Authority Revenue | | | | |

| (Highway Safety Building) | 5.000% | 10/1/17 | 1,040 | 1,218 |

| Ohio Building Authority Revenue | | | | |

| (Highway Safety Building) | 5.000% | 10/1/20 | 1,265 | 1,494 |

| Ohio Common Schools GO | 5.000% | 6/15/24 | 8,000 | 8,633 |

| Ohio Common Schools GO VRDO | 0.100% | 12/7/11 | 8,100 | 8,100 |

| Ohio Conservation Projects GO | 5.000% | 9/1/19 | 3,880 | 4,682 |

| Ohio GO | 5.000% | 9/15/14 | 10,000 | 11,154 |

| Ohio GO | 5.500% | 11/1/14 | 4,185 | 4,744 |

| Ohio GO | 5.000% | 9/15/15 | 3,695 | 4,233 |

| Ohio GO | 5.000% | 9/15/17 | 3,435 | 4,083 |

| Ohio GO | 5.000% | 9/15/19 | 5,000 | 6,043 |

32

| | | | |

| Ohio Long-Term Tax-Exempt Fund | | | | |

| |

| |

| |

| | | | Face | Market |

| | | Maturity | Amount | Value |

| | Coupon | Date | ($000) | ($000) |

| Ohio GO | 5.500% | 9/15/19 | 4,150 | 5,158 |

| Ohio GO | 5.000% | 8/1/20 | 2,870 | 3,467 |

| Ohio GO | 5.000% | 8/1/24 | 2,000 | 2,401 |

| Ohio GO VRDO | 0.070% | 12/7/11 | 1,485 | 1,485 |

| Ohio GO VRDO | 0.070% | 12/7/11 | 4,200 | 4,200 |

| Ohio Higher Educational Facility Commission | | | | |

| Revenue (Case Western Reserve | | | | |

| University Project) | 5.250% | 12/1/26 (14) | 3,520 | 4,211 |