UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF

REGISTERED MANAGEMENT INVESTMENT COMPANIES

Investment Company Act file number: 811-06083

Name of Registrant: Vanguard Ohio Tax-Free Funds

Address of Registrant:

P.O. Box 2600

Valley Forge, PA 19482

Name and address of agent for service:

Heidi Stam, Esquire

P.O. Box 876

Valley Forge, PA 19482

Registrant’s telephone number, including area code: (610) 669-1000

Date of fiscal year end: November 30

Date of reporting period: December 1, 2014 – November 30, 2015

Item 1: Reports to Shareholders

Annual Report | November 30, 2015

Vanguard Ohio Tax-Exempt Funds

Vanguard Ohio Tax-Exempt Money Market Fund

Vanguard Ohio Long-Term Tax-Exempt Fund

Vanguard’s Principles for Investing Success

We want to give you the best chance of investment success. These principles, grounded in Vanguard’s research and experience, can put you on the right path.

Goals. Create clear, appropriate investment goals.

Balance. Develop a suitable asset allocation using broadly diversified funds. Cost. Minimize cost.

Discipline. Maintain perspective and long-term discipline.

A single theme unites these principles: Focus on the things you can control.

We believe there is no wiser course for any investor.

| |

| Contents | |

| Your Fund’s Total Returns. | 1 |

| Chairman’s Letter. | 2 |

| Advisor’s Report. | 8 |

| Ohio Tax-Exempt Money Market Fund. | 12 |

| Ohio Long-Term Tax-Exempt Fund. | 26 |

| About Your Fund’s Expenses. | 49 |

| Glossary. | 51 |

Please note: The opinions expressed in this report are just that—informed opinions. They should not be considered promises or advice. Also, please keep in mind that the information and opinions cover the period through the date on the front of this report. Of course, the risks of investing in your fund are spelled out in the prospectus.

See the Glossary for definitions of investment terms used in this report.

About the cover: Pictured is a sailing block on the Brilliant, a 1932 schooner docked in Mystic, Connecticut. A type of pulley, the sailing block helps coordinate the setting of the sails. At Vanguard, the intricate coordination of technology and people allows us to help millions of clients around the world reach their financial goals.

| | | | | |

| Your Fund’s Total Returns | | | | | |

| |

| |

| |

| |

| Fiscal Year Ended November 30, 2015 | | | | | |

| | | Taxable- | | | |

| | SEC | Equivalent | Income | Capital | Total |

| | Yield | Yield | Returns | Returns | Returns |

| Vanguard Ohio Tax-Exempt Money Market Fund | 0.01% | 0.02% | 0.01% | 0.00% | 0.01% |

| Other States Tax-Exempt Money Market Funds | | | | | |

| Average | | | | | 0.01 |

| Other States Tax-Exempt Money Market Funds Average: Derived from data provided by Lipper, a Thomson Reuters Company. | |

| |

| Vanguard Ohio Long-Term Tax-Exempt Fund | 2.35% | 4.39% | 3.46% | 0.44% | 3.90% |

| Barclays OH Municipal Bond Index | | | | | 3.55 |

| Ohio Municipal Debt Funds Average | | | | | 2.69 |

| Ohio Municipal Debt Funds Average: Derived from data provided by Lipper, a Thomson Reuters Company. | | |

7-day SEC yield for the Ohio Tax-Exempt Money Market Fund; 30-day SEC yield for the Ohio Long-Term Tax-Exempt Fund.

The calculation of taxable-equivalent yield assumes a typical itemized tax return and is based on the maximum federal tax rate of 43.4% and the maximum income tax rate for the state. Local taxes were not considered. Please see the prospectus for a detailed explanation of the calculation.

| | | | |

| Your Fund’s Performance at a Glance | | | | |

| November 30, 2014, Through November 30, 2015 | | | | |

| | | | Distributions Per Share |

| | Starting | Ending | | |

| | Share | Share | Income | Capital |

| | Price | Price | Dividends | Gains |

| Vanguard Ohio Tax-Exempt Money Market Fund | $1.00 | $1.00 | $0.000 | $0.000 |

| Vanguard Ohio Long-Term Tax-Exempt Fund | $12.63 | $12.62 | $0.427 | $0.065 |

1

Chairman’s Letter

Dear Shareholder,

The broad U.S. municipal bond market performed relatively well for the 12 months ended November 30, 2015, a less turbulent period for munis than some recent years have been. Its return of about 3% was more than 2 percentage points higher than that of its taxable counterpart.

Vanguard Ohio Long-Term Tax-Exempt Fund came in a step or two ahead of the national muni market with a return of 3.90% for the 12 months.

Interest income was the main driver of this fund’s return, although its capital return was also positive. Short-term muni yields moved higher amid expectations that the Federal Reserve would soon begin to normalize monetary policy. (In mid-December, after the close of the reporting period, the Fed raised its target for short-term rates to 0.25%–0.50%.)

Intermediate- and long-term muni yields, on the other hand, experienced some ups and downs, driven in part by supply and demand factors. They generally finished the fiscal year a little lower than where they had started. (Bond yields and prices move in opposite directions.)

The Long-Term Fund outpaced the 3.55% return of its benchmark and the 2.69% average return of its peer group.

The fund’s 30-day SEC yield finished the period at 2.35%, not far from its level of 2.33% a year earlier.

2

Vanguard Ohio Tax-Exempt Money Market Fund returned 0.01%, constrained by the Fed’s near-zero policy for short-term interest rates. That return matched the average for its peers. The fund’s 7-day SEC yield began and ended the fiscal year at 0.01%.

Please note that the funds are permitted to invest in securities whose income is subject to the alternative minimum tax (AMT). As of November 30, the Long-Term Fund owned no securities that would generate income distributions subject to the AMT, but the Money Market Fund did.

As I’ve discussed previously, we’re making some changes to Vanguard’s lineup of money market funds in response to regulatory changes adopted in 2014 by

the Securities and Exchange Commission. Most notably, we plan to designate the Ohio Tax-Exempt Money Market Fund as a retail fund, along with all of our national and state-specific tax-exempt money market funds. This change, which will take place ahead of the October 2016 compliance date, will enable individual investors to continue to access these very liquid, high-quality funds at a stable net asset value of $1 per share.

Bonds managed slight gains as investors waited for the Fed

Bond returns were muted for the 12 months as a whole. Prices rose and fell while investors digested the Fed’s latest statements about when it might begin to raise short-term interest rates. At times, both taxable and tax-exempt bonds

| | | |

| Market Barometer | | | |

| | | Average Annual Total Returns |

| | | Periods Ended November 30, 2015 |

| | One | Three | Five |

| | Year | Years | Years |

| Bonds | | | |

| Barclays U.S. Aggregate Bond Index (Broad taxable | | | |

| market) | 0.97% | 1.50% | 3.09% |

| Barclays Municipal Bond Index (Broad tax-exempt market) | 3.10 | 2.49 | 4.79 |

| Citigroup Three-Month U.S. Treasury Bill Index | 0.02 | 0.02 | 0.04 |

| |

| Stocks | | | |

| Russell 1000 Index (Large-caps) | 2.53% | 16.10% | 14.32% |

| Russell 2000 Index (Small-caps) | 3.51 | 14.92 | 12.02 |

| Russell 3000 Index (Broad U.S. market) | 2.58 | 16.00 | 14.13 |

| FTSE All-World ex US Index (International) | -6.43 | 3.85 | 3.41 |

| |

| CPI | | | |

| Consumer Price Index | 0.50% | 1.02% | 1.64% |

3

benefited from demand for a safe haven amid various concerns, such as Greece’s fiscal crisis.

The broad U.S. taxable bond market returned 0.97%. Interest income more than offset bond price declines. Although the yield of the 10-year Treasury note ended November at 2.22%, almost unchanged from 2.25% a year earlier, the yields of shorter-term bonds rose, especially in the second half of the period. For example, the 1-year Treasury yield climbed from 0.12% a year ago to 0.48%.

International bond markets (as measured by the Barclays Global Aggregate Index ex USD) returned about –8%, held back by the dollar’s strength against many foreign currencies. Without this currency effect, results were positive.

The Fed’s 0%–0.25% target for short-term rates, which remained unchanged over the fiscal year, continued to limit returns for money market funds and savings accounts.

The broad U.S. stock market produced modest returns

U.S. stocks traveled a bumpy route on their way to returns that approached 3% for the period. They dropped sharply in August and slid further in September amid fears about the ripple effects of China’s slowing growth before rebounding strongly in October.

| | |

| Expense Ratios | | |

| Your Fund Compared With Its Peer Group | | |

| |

| | | Peer Group |

| | Fund | Average |

| Ohio Tax-Exempt Money Market Fund | 0.16% | 0.14% |

| Ohio Long-Term Tax-Exempt Fund | 0.16 | 1.05 |

The fund expense ratios shown are from the prospectus dated March 26, 2015, and represent estimated costs for the current fiscal year. For the fiscal year ended November 30, 2015, the funds’ expense ratios were: for the Ohio Tax-Exempt Money Market Fund, 0.08%; and for the Ohio Long-Term Tax-Exempt Fund, 0.16%. The expense ratio for the Ohio Tax-Exempt Money Market Fund reflects a temporary reduction in operating expenses (described in Note B of the Notes to Financial Statements). Before the reduction, the expense ratio was 0.16%. Peer-group expense ratios are derived from data provided by Lipper, a Thomson Reuters Company, and capture information through year-end 2014.

Peer groups: For the Ohio Tax-Exempt Money Market Fund, Other States Tax-Exempt Money Market Funds; for the Ohio Long-Term Tax-Exempt Fund, Ohio Municipal Debt Funds. In most, if not all, cases, the expense ratios for funds in the peer groups are based on net operating expenses after reimbursement and/or fee waivers by fund sponsors. In contrast, the Vanguard money market funds' expense ratios in the table above do not reflect expense reductions.

4

International stocks returned about –6%, also held back by the dollar’s strength. Returns for emerging markets, which were especially affected by the concerns about China, trailed those of developed Pacific and European markets.

The funds’ positioning was key to their competitive performance

Nationwide demand for municipal bonds was solid, not only from individual investors looking for tax-exempt income but also from nontraditional buyers such as banks and insurance companies. Municipals also benefited from some of the safe-haven demand that helped Treasury bonds amid concerns about Greece and slower growth in China. Ohio’s finances continued to strengthen, adding to the allure of its muni bonds, and supply was more or less flat compared with the prior 12 months.

That demand was not felt evenly across the yield curve, however, as investors shied away from short-term bonds. Faced with the prospect of a Fed rate hike, they preferred the higher yields (and greater risk) of longer-dated and lower-rated bonds.

In that environment, the Long-Term Fund had an advantage over its benchmark index, which spans all maturities. Returns of Ohio munis maturing in less than five years returned roughly 1% for the benchmark, for example. Meanwhile,

| |

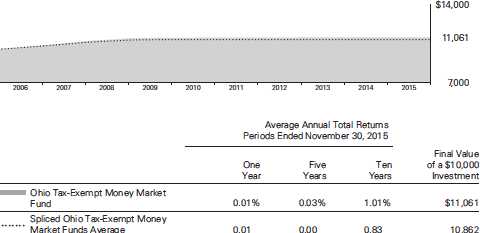

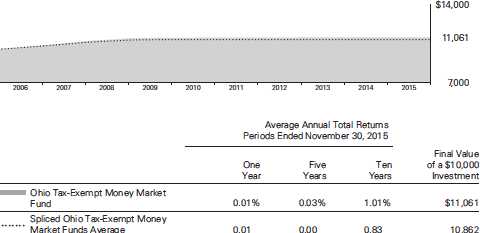

| Total Returns | |

| Ten Years Ended November 30, 2015 | |

| | Average |

| | Annual Return |

| Ohio Tax-Exempt Money Market Fund | 1.01% |

| Spliced Ohio Tax-Exempt Money Market Funds Average | 0.83 |

| For a benchmark description, see the Glossary. | |

| Spliced Ohio Tax-Exempt Money Market Funds Average: Derived from data provided by Lipper, a Thomson Reuters Company. | |

| |

| |

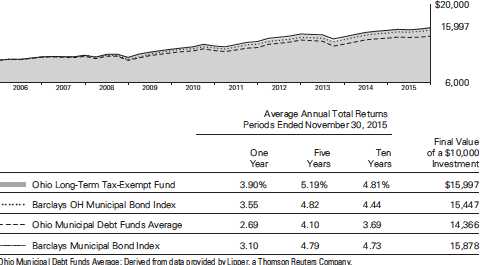

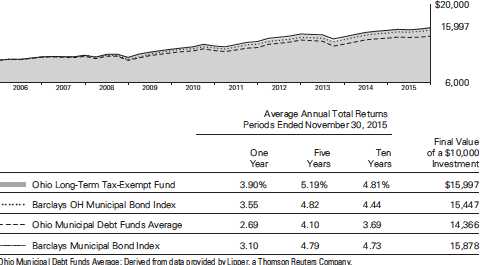

| Ohio Long-Term Tax-Exempt Fund | 4.81% |

| Barclays OH Municipal Bond Index | 4.44 |

| Ohio Municipal Debt Funds Average | 3.69 |

| Ohio Municipal Debt Funds Average: Derived from data provided by Lipper, a Thomson Reuters Company. | |

The figures shown represent past performance, which is not a guarantee of future results. (Current performance may be lower or higher than the performance data cited. For performance data current to the most recent month-end, visit our website at vanguard.com/performance.) Note, too, that both investment returns and principal value can fluctuate widely, so an investor’s shares, when sold, could be worth more or less than their original cost.

5

securities maturing in ten years or more, which made up the bulk of the Long-Term Fund’s holdings, returned more than 4%.

Results by credit quality varied less, but the tilt of the fund’s advisor, Vanguard Fixed Income Group, toward lower-quality investment-grade bonds played in its favor.

The advisor added value through an overweight to premium callable bonds, which typically trade at prices that compensate holders for the risk that the bonds might be redeemed before maturity. Switching out individual issues whose valuations had risen for more attractively priced securities helped as well.

For more information about the advisor’s approach and the funds’ positioning during the year, please see the Advisor’s Report that follows this letter.

Long-term results were supported by rigorous credit analysis

Although the most recent fiscal year was relatively calm for the broad municipal bond market, that hasn’t been the case over much of the past decade. A small number of widely publicized bankruptcies took place, including that of Detroit. And tax revenues shrank during the Great Recession and its aftermath, further straining already challenged borrowers.

Through it all, Vanguard Ohio Tax-Exempt Funds have benefited from the expertise and experience of our team of in-house

Credit research: A key part of Vanguard’s investment process

When our funds buy a municipal bond, fund shareholders are lending money to a school district, turnpike authority, hospital, university, or other tax-exempt borrower. We expect those loans to be repaid. That’s why credit research is a pillar of our investment process and why our credit analysts work closely with our portfolio managers and traders.

Our credit team conducts an objective, thorough, and independent analysis of each issuer’s overall creditworthiness. This quantitative and qualitative approach may include testing the sensitivity of projected cash flows, analyzing demographic and economic drivers, negotiating legal covenants, meeting with the issuer’s officials, and, of course, digging into financial statements.

Credit analysts look to identify opportunities or problems among any bonds we own or are considering. Their informed opinions help us understand and manage risk, sidestep troubled issuers, and uncover value.

Our senior municipal credit analysts average more than 23 years of industry experience and more than 10 years at Vanguard. This experience, along with stability in our team structure, helps ensure consistency in credit exposure and risk management across funds with similar objectives.

6

credit analysts. The group worked closely with the portfolio management team to identify and understand the risks and opportunities of the bonds we own or are considering for inclusion. (For more on the credit team, see the insight box on page 6.)

This rigorous approach and Vanguard’s low costs helped the Long-Term Fund produce a return of 4.81% over the past decade. This put it well ahead of the 3.69% average return of its peer group and the 4.44% return of its benchmark. The Money Market Fund also did better than its peer group, returning 1.01% compared with 0.83%.

A final note about a key member of our municipal bond fund management team: Pamela Wisehaupt Tynan, who joined Vanguard in 1982 and has been a longtime muni bond fund manager with us, has announced her retirement effective at the end of February 2016. We are grateful for her dedication in successfully managing a number of our funds for more than two decades. Pam also developed a deep and talented team of portfolio managers and traders to oversee Vanguard’s tax-exempt money market funds. I know that our short-term muni bond team is in good hands, as we’ve appointed Justin Schwartz to succeed Pam. Justin joined Vanguard in 2004 and has worked closely with Pam since 2005.

A dose of discipline is crucial when markets become volatile

The developments over the past few months remind us that nobody can control the direction of the markets or reliably predict where they’ll go in the short term. However, investors can control how they react to volatility.

During periods of market adversity, it’s more important than ever to keep sight of one of Vanguard’s key principles: Maintain perspective and long-term discipline. Whether you’re investing for yourself or on behalf of clients, your success is affected greatly by how you respond—or don’t respond—to turbulence. (You can read Vanguard’s Principles for Investing Success at vanguard.com/ research.)

As I’ve written in the past, the best course for long-term investors is generally to ignore daily market moves and not make decisions based on emotion. This is also a good time to evaluate your portfolio and make sure your asset allocation is aligned with your time horizon, goals, and risk tolerance.

The markets are unpredictable and often confounding. Keeping your long-term plans clearly in focus can help you weather these periodic storms.

As always, thank you for investing with Vanguard.

Sincerely,

F. William McNabb III

Chairman and Chief Executive Officer

January 7, 2016

7

Advisor’s Report

For the fiscal year ended November 30, 2015, Vanguard Ohio Long-Term Tax-Exempt Fund posted a return of 3.90%. It outpaced the 3.55% return of its benchmark, the Barclays Ohio Municipal Bond Index, and the average return of 2.69% for peer-group funds. Vanguard Ohio Tax-Exempt Money Market Fund returned 0.01%, matching the average return of its peers.

The investment environment

The fiscal year began soon after the Federal Reserve wrapped up its multiyear stimulative bond-buying program. Attention turned to when interest rates would rise, a question that preoccupied stock and bond investors globally throughout the period.

The Fed made clear that the timing of its first rate hike in almost a decade would depend on the overall health of the economy and on the picture for employment and inflation in particular. Those data points generally moved in the right direction.

Although gross domestic product growth almost ground to a halt in early 2015, in part because of a harsh winter and a West Coast port strike, it recovered in the second and third quarters. Job growth was generally strong. The national unemployment rate fell over the period from 5.8% to 5.0%—a level not seen since April 2008. And inflation, although under pressure from falling energy and import prices, was expected to move toward the Fed’s 2% target in the medium term.

| | |

| Yields of Tax-Exempt Municipal Securities | | |

| (AAA-Rated General-Obligation Issues) | | |

| | November 30, | November 30, |

| Maturity | 2014 | 2015 |

| 2 years | 0.38% | 0.72% |

| 5 years | 1.15 | 1.26 |

| 10 years | 2.08 | 2.02 |

| 30 years | 3.01 | 2.96 |

| Source: Vanguard. | | |

8

But growth outside the United States was spotty. The Greek debt crisis weighed on prospects for the euro zone for a good part of the fiscal year. And concerns about policymakers’ ability to engineer a soft landing for China’s economy rattled global markets in the summer.

International concerns may have contributed to the Fed’s decision to hold off raising rates during the funds’ fiscal year. (It did, however, raise the target rate in mid-December, just after the close of the period, from 0.00%–0.25% to 0.25%–0.50%.) Short-term U.S. Treasury rates nevertheless moved higher over the 12 months in anticipation, while longer-term Treasury rates dipped a little lower. The Ohio municipal yield curve also flattened.

Ohio’s economy expanded a little faster than that of the United States as a whole, according to a gauge of current economic conditions published monthly by the Federal Reserve Bank of Philadelphia. That can be attributed in part to strength in automobile manufacturing and health care, two key sectors of the Ohio economy.

The bank’s index for the Buckeye State climbed by a little more than 3% from November 2014 through October 2015. The increase in the index at the national level was a little less than 3%. (Each state’s index incorporates data on nonfarm payroll employment, the jobless rate, average hours worked in manufacturing, and inflation-adjusted wage and salary payments.)

Ohio’s financial position also continued to improve. The state has a structurally balanced budget, and tax revenues have been rising despite tax cuts. At the same time, spending remained contained. Municipal bond issuance went up at the national level compared with the prior 12 months but stayed more or less flat in Ohio.

On the demand side, investors looking for yield helped longer-dated and lower-rated bonds outperform.

Management of the funds

At Vanguard, we strive to add value through a diversified mix of strategies—primarily, duration and yield-curve positioning, credit-quality decisions, and security selection. We don’t try to hit home runs, preferring to consistently hit singles and doubles. Risk management is key to our investment processes, along with collaboration with Vanguard’s experienced team of credit analysts. The credit team performs an objective, thorough, and independent analysis of the overall creditworthiness of every issuer whose bonds we own or consider buying.

9

We made no significant shifts during the period in the Long-Term Fund’s portfolio strategy or positioning. In a relatively range-bound environment for bond yields and credit spreads, we believed that additional yield could boost outperformance. Accordingly, we started and ended with a tilt toward lower-quality and longer-dated bonds compared with the credit and maturity profiles of the benchmark.

This strategy, which served us well, was part of our defensive posture while awaiting the Fed’s first move. Longer-dated bond yields are influenced more by inflation expectations than short-term borrowing costs.

We added value by holding premium callable bonds. Because these bonds may be redeemed before maturity, exposing investors to reinvestment risk, they offer attractive yields and favorable total return potential in many interest rate scenarios. We were also highly selective among general obligation bonds, instead favoring revenue bonds that have more identifiable cash-flow streams to service their debt.

For the Money Market Fund, the low-interest-rate environment remained challenging but not unfamiliar. We sought opportunities to support returns through risk management, security selection, and relative value plays in credit sectors.

A look ahead

Although the U.S. economy’s growth rate slowed in the third calendar quarter, we believe it is on track to average about 2.5% or a bit higher in 2016. Inflation should continue to be tempered by oil prices, which seem to have settled into a range far below their summer 2014 peak.

The monetary tightening cycle the Fed has just initiated is likely to be very slow and gradual. Moreover, it may well end at a level below the historical average because of the moderate pace of U.S. economic growth, fragile growth abroad, and the modest outlook for inflation. These expectations are already largely built into bond prices.

On the money market front, the coming year should be an interesting one. In addition to the interest rate rise, a shifting of assets is expected before the October 2016 compliance date for the new Securities and Exchange Commission rules. As previously mentioned, we plan to designate all of our tax-exempt money market funds (including the Ohio fund) as retail funds—giving investors continued access to stable-value offerings.

Apart from Fed policy, interest rates are likely to remain range-bound. We expect their floor to be set, at least in part, by the strength of the U.S. economy. The cap will be determined by global conditions,

10

including the relative strength of the dollar, slower growth overseas, and central bank policies—which have driven down bond yields abroad.

As interest rates fell in recent years, we captured many opportunities for price appreciation. We don’t see much scope for credit spreads to tighten significantly, nor do we expect them to widen back out. Given the current macroeconomic environment and muni and taxable bond valuations, we expect that we will keep seeking to add value through duration and maturity positioning, credit-quality calls, and security selection.

Because market volatility may increase as interest rates move higher, we will maintain above-average levels of liquidity.

This will give us the necessary “dry powder” to take advantage of any dislocations in pricing.

As always, our experienced team of portfolio managers, traders, and credit analysts will continue to look for opportunities to add to the funds’ performance, whatever the markets may bring.

Christopher W. Alwine, CFA, Principal, Head of Municipal Bond Funds Pamela Wisehaupt Tynan, Principal, Head of Municipal Money Market Funds Marlin G. Brown, Portfolio Manager John M. Carbone, Principal, Portfolio Manager Vanguard Fixed Income Group December 18, 2015

11

Ohio Tax-Exempt Money Market Fund

| |

| Fund Profile | |

| As of November 30, 2015 | |

| |

| Financial Attributes | |

| Ticker Symbol | VOHXX |

| Expense Ratio1 | 0.16% |

| 7-Day SEC Yield | 0.01% |

| Average Weighted | |

| Maturity | 36 days |

| |

| Distribution by Credit Quality (% of portfolio) |

| First Tier | 100.0% |

A First Tier security is one that is eligible for money market funds and has been rated in the highest short-term rating category for debt obligations by nationally recognized statistical rating organizations. Credit-quality ratings are obtained from Moody's, Fitch, and S&P. For securities rated by all three agencies, where two of them are in agreement and assign the highest rating category, the highest rating applies. If a security is only rated by two agencies, and their ratings are in different categories, the lower of the ratings applies. An unrated security is First Tier if it represents quality comparable to that of a rated security, as determined in accordance with SEC Rule 2a-7. For more information about these ratings, see the Glossary entry for Credit Quality.

1 The expense ratio shown is from the prospectus dated March 26, 2015, and represents estimated costs for the current fiscal year. For the fiscal year ended November 30, 2015, the expense ratio was 0.08%, reflecting a temporary reduction in operating expenses (described in Note B of the Notes to Financial Statements). Before this reduction, the expense ratio was 0.16%.

12

Ohio Tax-Exempt Money Market Fund

Performance Summary

Investment returns will fluctuate. All of the returns in this report represent past performance, which is not a guarantee of future results that may be achieved by the fund. (Current performance may be lower or higher than the performance data cited. For performance data current to the most recent month-end, visit our website at vanguard.com/performance.) The returns shown do not reflect taxes that a shareholder would pay on fund distributions. An investment in a money market fund is not insured or guaranteed by the Federal Deposit Insurance Corporation or any other government agency. Although the fund seeks to preserve the value of your investment at $1 per share, it is possible to lose money by investing in the fund. The fund’s 7-day SEC yield reflects its current earnings more closely than do the average annual returns.

Cumulative Performance: November 30, 2005, Through November 30, 2015

Initial Investment of $10,000

For a benchmark description, see the Glossary.

Spliced Ohio Tax-Exempt Money Market Funds Average: Derived from data provided by Lipper, a Thomson Reuters Company.

See Financial Highlights for dividend information.

13

| | |

| Ohio Tax-Exempt Money Market Fund | | |

| |

| |

| |

| Fiscal-Year Total Returns (%): November 30, 2005, Through November 30, 2015 | |

| | | Spliced Ohio |

| | | Tax-Exempt |

| | | Money Mkt |

| | | Funds Avg. |

| Fiscal Year | Total Returns | Total Returns |

| 2006 | 3.30% | 2.84% |

| 2007 | 3.63 | 3.14 |

| 2008 | 2.40 | 2.05 |

| 2009 | 0.56 | 0.31 |

| 2010 | 0.15 | 0.03 |

| 2011 | 0.09 | 0.00 |

| 2012 | 0.05 | 0.00 |

| 2013 | 0.02 | 0.00 |

| 2014 | 0.01 | 0.00 |

| 2015 | 0.01 | 0.01 |

| 7-day SEC yield (11/30/2015): 0.01% | | |

| For a benchmark description, see the Glossary. | | |

| Spliced Ohio Tax-Exempt Money Market Funds Average: Derived from data provided by Lipper, a Thomson Reuters Company. | |

Average Annual Total Returns: Periods Ended September 30, 2015

This table presents returns through the latest calendar quarter—rather than through the end of the fiscal period.

Securities and Exchange Commission rules require that we provide this information.

| | | | |

| | Inception | One | Five | Ten |

| | Date | Year | Years | Years |

| Ohio Tax-Exempt Money Market | | | | |

| Fund | 6/18/1990 | 0.01% | 0.04% | 1.06% |

14

Ohio Tax-Exempt Money Market Fund

Financial Statements

Statement of Net Assets

As of November 30, 2015

The fund reports a complete list of its holdings in various monthly and quarterly regulatory filings. The fund publishes its holdings on a monthly basis at vanguard.com and files them with the Securities and Exchange Commission on Form N-MFP. The fund’s Form N-MFP filings become public 60 days after the relevant month-end, and may be viewed at sec.gov or via a link on the “Portfolio Holdings” page on vanguard.com. For the second and fourth fiscal quarters, the lists appear in the fund’s semiannual and annual reports to shareholders. For the first and third fiscal quarters, the fund files the lists with the SEC on Form N-Q. Shareholders can look up the fund’s Forms N-Q on the SEC’s website at sec.gov. Forms N-Q may also be reviewed and copied at the SEC’s Public Reference Room (see the back cover of this report for further information).

| | | | |

| | | | Face | Market |

| | | Maturity | Amount | Value• |

| | Coupon | Date | ($000) | ($000) |

| Tax-Exempt Municipal Bonds (100.8%) | | | | |

| Ohio (100.8%) | | | | |

| Akron OH GO | 5.000% | 12/1/15 (Prere.) | 2,000 | 2,000 |

| Akron OH Income Tax Revenue | 2.000% | 12/1/15 | 1,145 | 1,145 |

| Akron OH Income Tax Revenue BAN | 1.150% | 3/10/16 | 2,250 | 2,255 |

| Allen County OH Hospital Facilities Revenue | | | | |

| (Catholic Healthcare Partners) VRDO | 0.010% | 12/1/15 LOC | 7,730 | 7,730 |

| Athens County OH Port Authority Housing | | | | |

| Revenue VRDO | 0.010% | 12/7/15 LOC | 4,700 | 4,700 |

| Berea OH BAN | 1.000% | 3/17/16 | 1,180 | 1,182 |

| Butler County OH BAN | 0.520% | 7/28/16 | 2,343 | 2,343 |

| Butler County OH Capital Funding Revenue VRDO | 0.010% | 12/7/15 LOC | 1,555 | 1,555 |

| 1 Cincinnati OH City School District GO TOB VRDO | 0.010% | 12/7/15 | 12,090 | 12,090 |

| 1 Cincinnati OH City School District GO TOB VRDO | 0.020% | 12/7/15 | 5,000 | 5,000 |

| Cleveland OH Municipal School District GO | 2.000% | 12/1/15 | 5,500 | 5,500 |

| Cleveland-Cuyahoga County OH Port Authority | | | | |

| Revenue (Carnegie/89th Garage & Service | | | | |

| Center LLC Project) VRDO | 0.010% | 12/7/15 LOC | 3,965 | 3,965 |

| Cleveland-Cuyahoga County OH Port Authority | | | | |

| Revenue (Cleveland Museum of Art Project) | | | | |

| VRDO | 0.010% | 12/7/15 | 3,250 | 3,250 |

| Cleveland-Cuyahoga County OH Port Authority | | | | |

| Revenue (Cleveland Museum of Art Project) | | | | |

| VRDO | 0.010% | 12/7/15 | 3,100 | 3,100 |

| Cleveland-Cuyahoga County OH Port Authority | | | | |

| Revenue (Cleveland Museum of Art Project) | | | | |

| VRDO | 0.020% | 12/7/15 | 3,000 | 3,000 |

| Cleveland-Cuyahoga County OH Port Authority | | | | |

| Revenue (Cleveland Museum of Art Project) | | | | |

| VRDO | 0.020% | 12/7/15 | 8,990 | 8,990 |

| Columbus OH GO VRDO | 0.010% | 12/7/15 | 3,815 | 3,815 |

| Columbus OH Regional Airport Authority Airport | | | | |

| Revenue (Flight Safety International Inc. Project) | | | | |

| VRDO | 0.030% | 12/7/15 | 11,000 | 11,000 |

15

| | | | |

| Ohio Tax-Exempt Money Market Fund | | | | |

| |

| |

| |

| | | | Face | Market |

| | | Maturity | Amount | Value• |

| | Coupon | Date | ($000) | ($000) |

| Columbus OH Regional Airport Authority Airport | | | | |

| Revenue (Oasbo Expanded Asset Program) | | | | |

| VRDO | 0.010% | 12/7/15 LOC | 8,790 | 8,790 |

| Columbus OH Regional Airport Authority Airport | | | | |

| Revenue (Oasbo Expanded Asset Program) | | | | |

| VRDO | 0.010% | 12/7/15 LOC | 1,345 | 1,345 |

| Columbus OH Regional Airport Authority Airport | | | | |

| Revenue (Oasbo Expanded Asset Program) | | | | |

| VRDO | 0.010% | 12/7/15 LOC | 6,040 | 6,040 |

| Columbus OH Regional Airport Authority Revenue | | | | |

| (Pooled Financing Program) VRDO | 0.010% | 12/7/15 LOC | 4,170 | 4,170 |

| Columbus OH Sewer Revenue VRDO | 0.010% | 12/7/15 | 3,365 | 3,365 |

| Cuyahoga Falls OH BAN | 1.000% | 12/3/15 | 1,550 | 1,550 |

| Deerfield Township OH BAN | 1.000% | 10/27/16 | 4,565 | 4,585 |

| Delaware OH BAN | 1.000% | 4/18/16 | 3,000 | 3,008 |

| Dublin OH City School District GO BAN | 1.000% | 5/5/16 | 2,250 | 2,257 |

| Fairfield Township OH BAN | 1.000% | 6/3/16 | 1,350 | 1,354 |

| Forest Hills OH Local School District GO | 2.000% | 12/1/15 | 675 | 675 |

| Franklin County OH GO | 5.000% | 12/1/15 | 2,000 | 2,000 |

| Franklin County OH Hospital Facilities Revenue | | | | |

| (Doctors OhioHealth Corp.) VRDO | 0.020% | 12/7/15 LOC | 9,955 | 9,955 |

| 2 Franklin County OH Hospital Facilities Revenue | | | | |

| (OhioHealth Corp.) PUT | 0.050% | 6/1/16 | 5,750 | 5,750 |

| 1 Franklin County OH Hospital Facilities Revenue | | | | |

| (OhioHealth Corp.) TOB VRDO | 0.020% | 12/7/15 | 2,000 | 2,000 |

| Franklin County OH Hospital Facilities Revenue | | | | |

| (OhioHealth Corp.) VRDO | 0.010% | 12/7/15 | 1,600 | 1,600 |

| Franklin County OH Hospital Facilities Revenue | | | | |

| (OhioHealth Corp.) VRDO | 0.010% | 12/7/15 | 200 | 200 |

| Franklin County OH Hospital Revenue | | | | |

| (Holy Cross Health System) VRDO | 0.010% | 12/7/15 | 700 | 700 |

| Franklin County OH Hospital Revenue | | | | |

| (Nationwide Children’s Hospital Project) VRDO | 0.010% | 12/7/15 | 13,600 | 13,600 |

| Franklin County OH Hospital Revenue | | | | |

| (Nationwide Children’s Hospital Project) VRDO | 0.010% | 12/7/15 | 1,095 | 1,095 |

| Franklin County OH Hospital Revenue | | | | |

| (Nationwide Hospital) VRDO | 0.010% | 12/7/15 | 1,205 | 1,205 |

| Franklin County OH Revenue | | | | |

| (Trinity Health Credit Group) PUT | 0.070% | 12/1/15 | 14,490 | 14,490 |

| Gallia County OH Local School District GO | 5.000% | 6/1/16 (Prere.) | 3,000 | 3,072 |

| Greene County OH Sewer System Revenue | 5.000% | 12/1/15 (Prere.) | 1,000 | 1,000 |

| Greene County OH Sewer System Revenue | 5.000% | 12/1/15 (Prere.) | 4,695 | 4,695 |

| Hamilton County OH Economic Development | | | | |

| Revenue (University of Cincinnati Lessee | | | | |

| Project) | 5.000% | 6/1/16 (Prere.) | 4,000 | 4,091 |

| Hamilton County OH Economic Development | | | | |

| Revenue (University of Cincinnati Lessee | | | | |

| Project) | 5.250% | 6/1/16 (Prere.) | 3,290 | 3,369 |

| Hamilton County OH Healthcare Facilities | | | | |

| Revenue (The Children’s Home of Cincinnati) | | | | |

| VRDO | 0.020% | 12/7/15 LOC | 2,960 | 2,960 |

| 1 Hamilton County OH Hospital Facilities Revenue | | | | |

| (Cincinnati Children’s Hospital Medical Center) | | | | |

| TOB VRDO | 0.020% | 12/7/15 | 5,625 | 5,625 |

16

| | | | |

| Ohio Tax-Exempt Money Market Fund | | | | |

| |

| |

| |

| | | | Face | Market |

| | | Maturity | Amount | Value• |

| | Coupon | Date | ($000) | ($000) |

| Hamilton County OH Sewer System Revenue | 5.000% | 12/1/15 (Prere.) | 5,000 | 5,000 |

| 1 Hamilton County OH Sewer System Revenue | | | | |

| TOB VRDO | 0.020% | 12/7/15 | 8,500 | 8,500 |

| Hamilton OH Electric System Revenue | 0.430% | 9/27/16 | 4,700 | 4,700 |

| Hilliard OH GO | 1.000% | 4/22/16 | 1,275 | 1,279 |

| Hilliard OH School District GO | 5.000% | 12/1/15 (Prere.) | 2,895 | 2,895 |

| Huber Heights OH BAN | 1.000% | 6/2/16 | 3,500 | 3,511 |

| Independence OH BAN | 1.000% | 4/14/16 | 2,150 | 2,156 |

| Kenston OH Local School District GO | 1.000% | 9/15/16 | 2,500 | 2,513 |

| Kent OH BAN | 1.125% | 8/31/16 | 1,800 | 1,808 |

| Lakewood OH BAN | 1.000% | 4/7/16 | 3,685 | 3,695 |

| 1 Lakewood OH City School District GO TOB VRDO | 0.030% | 12/7/15 | 3,825 | 3,825 |

| 1 Lorain County OH Hospital Facilities Revenue | | | | |

| (Catholic Healthcare Partners) TOB VRDO | 0.150% | 12/7/15 | 12,785 | 12,785 |

| Lorain County OH Port Authority Educational | | | | |

| Facilities Revenue (St. Ignatius High School | | | | |

| Project) VRDO | 0.030% | 12/7/15 LOC | 915 | 915 |

| Lucas County OH BAN | 1.500% | 7/13/16 | 2,400 | 2,416 |

| Marysville OH BAN | 1.250% | 8/25/16 | 1,500 | 1,507 |

| Mason OH BAN | 1.250% | 6/23/16 | 2,000 | 2,009 |

| Mason OH City School District BAN | 1.250% | 1/26/16 | 3,000 | 3,005 |

| 1 Miami University of Ohio General Receipts | | | | |

| Revenue TOB VRDO | 0.020% | 12/7/15 | 3,365 | 3,365 |

| 1 Montgomery County OH Revenue | | | | |

| (Miami Valley Hospital) TOB VRDO | 0.020% | 12/7/15 | 4,000 | 4,000 |

| Montgomery County OH Revenue | | | | |

| (Miami Valley Hospital) VRDO | 0.010% | 12/1/15 | 600 | 600 |

| Montgomery County OH Revenue | | | | |

| (Miami Valley Hospital) VRDO | 0.010% | 12/1/15 | 5,800 | 5,800 |

| Montgomery County OH Revenue | | | | |

| (Miami Valley Hospital) VRDO | 0.010% | 12/1/15 | 6,865 | 6,865 |

| Montgomery County OH Revenue | | | | |

| (Miami Valley Hospital) VRDO | 0.010% | 12/1/15 | 2,600 | 2,600 |

| North Olmsted OH BAN | 0.300% | 2/3/16 | 1,335 | 1,335 |

| 1 Northeast OH Regional Sewer District Revenue | | | | |

| (Wastewater Revenue Improvement) TOB VRDO | 0.010% | 12/7/15 | 6,800 | 6,800 |

| 1 Nuveen Ohio Quality Income Municipal Fund | | | | |

| VRDP VRDO | 0.100% | 12/7/15 LOC | 21,000 | 21,000 |

| Ohio Air Quality Development Authority Pollution | | | | |

| Control Revenue (FirstEnergy Nuclear | | | | |

| Generation Corp. Project) VRDO | 0.010% | 12/1/15 LOC | 985 | 985 |

| 1 Ohio Air Quality Development Authority Revenue | | | | |

| (Dayton Power & Light Co. Project) TOB VRDO | 0.050% | 12/7/15 (13) | 13,320 | 13,320 |

| Ohio Air Quality Development Authority Revenue | | | | |

| (Ohio Valley Electric Corp. Project) VRDO | 0.010% | 12/7/15 LOC | 12,100 | 12,100 |

| Ohio Air Quality Development Authority Revenue | | | | |

| (Ohio Valley Electric Corp. Project) VRDO | 0.010% | 12/7/15 LOC | 1,500 | 1,500 |

| Ohio Air Quality Development Authority Revenue | | | | |

| (Ohio Valley Electric Corp. Project) VRDO | 0.010% | 12/7/15 LOC | 6,000 | 6,000 |

| Ohio Common Schools GO VRDO | 0.010% | 12/7/15 | 8,530 | 8,530 |

| Ohio Common Schools GO VRDO | 0.010% | 12/7/15 | 5,000 | 5,000 |

| Ohio Common Schools GO VRDO | 0.010% | 12/7/15 | 1,050 | 1,050 |

| Ohio GO | 5.000% | 2/1/16 | 1,100 | 1,109 |

| Ohio GO | 5.375% | 2/1/16 | 1,000 | 1,009 |

17

| | | | |

| Ohio Tax-Exempt Money Market Fund | | | | |

| |

| |

| |

| | | | Face | Market |

| | | Maturity | Amount | Value• |

| | Coupon | Date | ($000) | ($000) |

| Ohio GO VRDO | 0.010% | 12/7/15 | 9,100 | 9,100 |

| Ohio GO VRDO | 0.010% | 12/7/15 | 13,430 | 13,430 |

| Ohio GO VRDO | 0.010% | 12/7/15 | 985 | 985 |

| Ohio Higher Educational Facility Commission | | | | |

| Revenue (Case Western Reserve University | | | | |

| Project) CP | 0.060% | 12/17/15 | 7,000 | 7,000 |

| Ohio Higher Educational Facility Commission | | | | |

| Revenue (Cleveland Clinic Health System | | | | |

| Obligated Group) VRDO | 0.010% | 12/1/15 | 1,600 | 1,600 |

| Ohio Higher Educational Facility Commission | | | | |

| Revenue (Cleveland Clinic Health System | | | | |

| Obligated Group) VRDO | 0.010% | 12/1/15 | 11,300 | 11,300 |

| Ohio Higher Educational Facility Commission | | | | |

| Revenue (Cleveland Clinic Health System | | | | |

| Obligated Group) VRDO | 0.010% | 12/1/15 | 6,200 | 6,200 |

| 1 Ohio Higher Educational Facility Commission | | | | |

| Revenue (University Hospitals Health | | | | |

| System Inc.) TOB VRDO | 0.060% | 12/7/15 (13) | 5,000 | 5,000 |

| Ohio Housing Finance Agency Residential | | | | |

| Mortgage Revenue VRDO | 0.020% | 12/7/15 | 2,000 | 2,000 |

| Ohio Housing Finance Agency Residential | | | | |

| Mortgage Revenue VRDO | 0.020% | 12/7/15 | 7,210 | 7,210 |

| Ohio Housing Finance Agency Residential | | | | |

| Mortgage Revenue VRDO | 0.020% | 12/7/15 | 1,755 | 1,755 |

| Ohio Housing Finance Agency Residential | | | | |

| Mortgage Revenue VRDO | 0.030% | 12/7/15 | 6,005 | 6,005 |

| Ohio State University General Receipts | | | | |

| Revenue CP | 0.060% | 1/4/16 | 7,790 | 7,790 |

| Ohio State University General Receipts | | | | |

| Revenue CP | 0.070% | 1/6/16 | 8,200 | 8,200 |

| Ohio State University General Receipts | | | | |

| Revenue CP | 0.100% | 3/2/16 | 8,000 | 8,000 |

| Ohio Water Development Authority Drinking | | | | |

| Water Assistance Fund Revenue | 5.000% | 12/1/15 (Prere.) | 1,815 | 1,815 |

| Ohio Water Development Authority Drinking | | | | |

| Water Assistance Fund Revenue | 5.000% | 12/1/15 (Prere.) | 1,000 | 1,000 |

| Ohio Water Development Authority Drinking | | | | |

| Water Assistance Fund Revenue | 5.000% | 12/1/15 | 2,000 | 2,000 |

| Ohio Water Development Authority Drinking | | | | |

| Water Assistance Fund Revenue | 4.000% | 6/1/16 | 2,235 | 2,278 |

| Ohio Water Development Authority Pollution | | | | |

| Control Revenue (Water Quality) | 5.000% | 12/1/15 | 1,030 | 1,030 |

| Toledo-Lucas County OH Port Authority | | | | |

| Airport Development Revenue (Flight Safety | | | | |

| International Inc.) VRDO | 0.020% | 12/7/15 | 8,050 | 8,050 |

| Union County OH BAN | 1.000% | 3/30/16 | 2,950 | 2,957 |

| Union Township OH BAN | 1.500% | 9/8/16 | 2,000 | 2,015 |

| Wayne County OH BAN | 2.000% | 7/7/16 | 5,000 | 5,045 |

| | | | | 484,418 |

| Total Tax-Exempt Municipal Bonds (Cost $484,418) | | | | 484,418 |

18

| |

| Ohio Tax-Exempt Money Market Fund | |

| |

| |

| |

| |

| | Amount |

| | ($000) |

| Other Assets and Liabilities (-0.8%) | |

| Other Assets | |

| Investment in Vanguard | 42 |

| Receivables for Investment Securities Sold | 1,850 |

| Receivables for Accrued Income | 1,316 |

| Receivables for Capital Shares Issued | 1,110 |

| Other Assets | 1,026 |

| Total Other Assets | 5,344 |

| Liabilities | |

| Payables for Investment Securities Purchased | (7,245) |

| Payables for Capital Shares Redeemed | (674) |

| Payables to Vanguard | (1,394) |

| Total Liabilities | (9,313) |

| Net Assets (100%) | |

| Applicable to 480,295,052 outstanding $.001 par value shares of | |

| beneficial interest (unlimited authorization) | 480,449 |

| Net Asset Value Per Share | $1.00 |

| |

| |

| At November 30, 2015, net assets consisted of: | |

| | Amount |

| | ($000) |

| Paid-in Capital | 480,455 |

| Undistributed Net Investment Income | — |

| Accumulated Net Realized Losses | (6) |

| Net Assets | 480,449 |

- See Note A in Notes to Financial Statements.

- Security exempt from registration under Rule 144A of the Securities Act of 1933. Such securities may be sold in transactions exempt from registration, normally to qualified institutional buyers. At November 30, 2015, the aggregate value of these securities was $103,310,000, representing 21.5% of net assets.

- Adjustable-rate security.

A key to abbreviations and other references follows the Statement of Net Assets. See accompanying Notes, which are an integral part of the Financial Statements.

19

Ohio Tax-Exempt Money Market Fund

Key to Abbreviations

ARS—Auction Rate Security.

BAN—Bond Anticipation Note.

COP—Certificate of Participation.

CP—Commercial Paper.

FR—Floating Rate.

GAN—Grant Anticipation Note.

GO—General Obligation Bond.

PILOT—Payments in Lieu of Taxes.

PUT—Put Option Obligation.

RAN—Revenue Anticipation Note.

TAN—Tax Anticipation Note.

TOB—Tender Option Bond.

TRAN—Tax Revenue Anticipation Note.

VRDO—Variable Rate Demand Obligation.

VRDP—Variable Rate Demand Preferred.

(ETM)—Escrowed to Maturity.

(Prere.)—Prerefunded.

Scheduled principal and interest payments are guaranteed by:

(1) MBIA (Municipal Bond Investors Assurance).

(2) AMBAC (Ambac Assurance Corporation).

(3) FGIC (Financial Guaranty Insurance Company).

(4) AGM (Assured Guaranty Municipal Corporation).

(5) BIGI (Bond Investors Guaranty Insurance).

(6) Connie Lee Inc.

(7) FHA (Federal Housing Authority).

(8) CapMAC (Capital Markets Assurance Corporation).

(9) American Capital Access Financial Guaranty Corporation.

(10) XL Capital Assurance Inc.

(11) CIFG (CDC IXIS Financial Guaranty).

(12) AGC (Assured Guaranty Corporation).

(13) BHAC (Berkshire Hathaway Assurance Corporation).

(14) NPFG (National Public Finance Guarantee Corporation).

(15) BAM (Build America Mutual Assurance Company).

(16) MAC (Municipal Assurance Corporation).

(17) RAA (Radian Asset Assurance Inc).

The insurance does not guarantee the market value of the municipal bonds.

LOC—Scheduled principal and interest payments are guaranteed by bank letter of credit.

20

| |

| Ohio Tax-Exempt Money Market Fund | |

| |

| |

| Statement of Operations | |

| |

| | Year Ended |

| | November 30, 2015 |

| | ($000) |

| Investment Income | |

| Income | |

| Interest | 462 |

| Total Income | 462 |

| Expenses | |

| The Vanguard Group—Note B | |

| Investment Advisory Services | 110 |

| Management and Administrative | 578 |

| Marketing and Distribution | 129 |

| Custodian Fees | 7 |

| Auditing Fees | 29 |

| Shareholders’ Reports | 4 |

| Total Expenses | 857 |

| Expenses Reduction—Note B | (449) |

| Net Expenses | 408 |

| Net Investment Income | 54 |

| Realized Net Gain (Loss) on Investment Securities Sold | — |

| Net Increase (Decrease) in Net Assets Resulting from Operations | 54 |

See accompanying Notes, which are an integral part of the Financial Statements.

21

| | |

| Ohio Tax-Exempt Money Market Fund | | |

| |

| |

| Statement of Changes in Net Assets | | |

| |

| | Year Ended November 30, |

| | 2015 | 2014 |

| | ($000) | ($000) |

| Increase (Decrease) in Net Assets | | |

| Operations | | |

| Net Investment Income | 54 | 58 |

| Realized Net Gain (Loss) | — | — |

| Net Increase (Decrease) in Net Assets Resulting from Operations | 54 | 58 |

| Distributions | | |

| Net Investment Income | (54) | (58) |

| Realized Capital Gain | — | — |

| Total Distributions | (54) | (58) |

| Capital Share Transactions (at $1.00 per share) | | |

| Issued | 298,801 | 301,581 |

| Issued in Lieu of Cash Distributions | 50 | 55 |

| Redeemed | (375,246) | (346,905) |

| Net Increase (Decrease) from Capital Share Transactions | (76,395) | (45,269) |

| Total Increase (Decrease) | (76,395) | (45,269) |

| Net Assets | | |

| Beginning of Period | 556,844 | 602,113 |

| End of Period1 | 480,449 | 556,844 |

| 1 Net Assets—End of Period includes undistributed (overdistributed) net investment income of $0 and $0. | | |

See accompanying Notes, which are an integral part of the Financial Statements.

22

| | | | | |

| Ohio Tax-Exempt Money Market Fund | | | | | |

| |

| |

| Financial Highlights | | | | | |

| |

| |

| For a Share Outstanding | | | Year Ended November 30, |

| Throughout Each Period | 2015 | 2014 | 2013 | 2012 | 2011 |

| Net Asset Value, Beginning of Period | $1.00 | $1.00 | $1.00 | $1.00 | $1.00 |

| Investment Operations | | | | | |

| Net Investment Income | .0001 | .0001 | .0002 | .0005 | .001 |

| Net Realized and Unrealized Gain (Loss) | | | | | |

| on Investments | — | — | — | — | — |

| Total from Investment Operations | .0001 | .0001 | .0002 | .0005 | .001 |

| Distributions | | | | | |

| Dividends from Net Investment Income | (.0001) | (.0001) | (.0002) | (.0005) | (.001) |

| Distributions from Realized Capital Gains | — | — | — | — | — |

| Total Distributions | (.0001) | (.0001) | (.0002) | (.0005) | (.001) |

| Net Asset Value, End of Period | $1.00 | $1.00 | $1.00 | $1.00 | $1.00 |

| |

| Total Return1 | 0.01% | 0.01% | 0.02% | 0.05% | 0.09% |

| |

| Ratios/Supplemental Data | | | | | |

| Net Assets, End of Period (Millions) | $480 | $557 | $602 | $609 | $686 |

| Ratio of Expenses to Average Net Assets | 0.08%2 | 0.08%2 | 0.12%2 | 0.16%2 | 0.17% |

| Ratio of Net Investment Income to | | | | | |

| Average Net Assets | 0.01% | 0.01% | 0.02% | 0.05% | 0.09% |

1 Total returns do not include account service fees that may have applied in the periods shown. Fund prospectuses provide information about any applicable account service fees.

2 The ratio of expenses to average net assets before an expense reduction was 0.16% for 2015, 0.16% for 2014, 0.16% for 2013, and 0.16% for 2012. See Note B in Notes to Financial Statements.

See accompanying Notes, which are an integral part of the Financial Statements.

23

Ohio Tax-Exempt Money Market Fund

Notes to Financial Statements

Vanguard Ohio Tax-Exempt Money Market Fund is registered under the Investment Company Act of 1940 as an open-end investment company, or mutual fund. The fund invests in debt instruments of municipal issuers whose ability to meet their obligations may be affected by economic and political developments in the state.

A. The following significant accounting policies conform to generally accepted accounting principles for U.S. investment companies. The fund consistently follows such policies in preparing its financial statements.

1. Security Valuation: Securities are valued as of the close of trading on the New York Stock Exchange (generally 4 p.m., Eastern time) on the valuation date. Securities are valued at amortized cost, which approximates market value.

2. Federal Income Taxes: The fund intends to continue to qualify as a regulated investment company and distribute all of its income. Management has analyzed the fund’s tax positions taken for all open federal income tax years (November 30, 2012–2015), and has concluded that no provision for federal income tax is required in the fund’s financial statements.

3. Distributions: Distributions from net investment income are declared daily and paid on the first business day of the following month.

4. Credit Facility: The fund and certain other funds managed by The Vanguard Group (“Vanguard”) participate in a $3 billion committed credit facility provided by a syndicate of lenders pursuant to a credit agreement that may be renewed annually; each fund is individually liable for its borrowings, if any, under the credit facility. Borrowings may be utilized for temporary and emergency purposes, and are subject to the fund’s regulatory and contractual borrowing restrictions. The participating funds are charged administrative fees and an annual commitment fee of 0.06% of the undrawn amount of the facility; these fees are allocated to the funds based on a method approved by the fund’s board of trustees and included in Management and Administrative expenses on the fund’s Statement of Operations. Any borrowings under this facility bear interest at a rate equal to the higher of the federal funds rate or LIBOR reference rate plus an agreed-upon spread.

The fund had no borrowings outstanding at November 30, 2015, or at any time during the period then ended.

5. Other: Interest income is accrued daily. Premiums and discounts on debt securities purchased are amortized and accreted, respectively, to interest income over the lives of the respective securities. Security transactions are accounted for on the date securities are bought or sold. Costs used to determine realized gains (losses) on the sale of investment securities are those of the specific securities sold.

B. In accordance with the terms of a Funds’ Service Agreement (the “FSA”) between Vanguard and the fund, Vanguard furnishes to the fund investment advisory, corporate management, administrative, marketing, and distribution services at Vanguard’s cost of operations (as defined by the FSA). These costs of operations are allocated to the fund based on methods and guidelines approved by the board of trustees. Vanguard does not require reimbursement in the current period for certain costs of operations (such as deferred compensation/benefits and risk/insurance costs); the fund’s liability for these costs of operations is included in Payables to Vanguard on the Statement of Net Assets.

24

Ohio Tax-Exempt Money Market Fund

Upon the request of Vanguard, the fund may invest up to 0.40% of its net assets as capital in Vanguard. At November 30, 2015, the fund had contributed to Vanguard capital in the amount of $42,000, representing 0.01% of the fund’s net assets and 0.02% of Vanguard’s capitalization. The fund’s trustees and officers are also directors and employees, respectively, of Vanguard.

Vanguard and the board of trustees have agreed to temporarily limit certain net operating expenses in excess of the fund’s daily yield in order to maintain a zero or positive yield for the fund. Vanguard and the board of trustees may terminate the temporary expense limitation at any time. For the year ended November 30, 2015, Vanguard’s expenses were reduced by $449,000 (an effective annual rate of 0.08% of the fund’s average net assets); the fund is not obligated to repay this amount to Vanguard.

C. Various inputs may be used to determine the value of the fund’s investments. These inputs are summarized in three broad levels for financial statement purposes. The inputs or methodologies used to value securities are not necessarily an indication of the risk associated with investing in those securities.

Level 1—Quoted prices in active markets for identical securities.

Level 2—Other significant observable inputs (including quoted prices for similar securities, interest rates, prepayment speeds, credit risk, etc.).

Level 3—Significant unobservable inputs (including the fund’s own assumptions used to determine the fair value of investments).

At November 30, 2015, 100% of the market value of the fund’s investments was determined using amortized cost, in accordance with rules under the Investment Company Act of 1940. Amortized cost approximates the current fair value of a security, but since the value is not obtained from a quoted price in an active market, securities valued at amortized cost are considered to be valued using Level 2 inputs.

D. Management has determined that no material events or transactions occurred subsequent to November 30, 2015, that would require recognition or disclosure in these financial statements.

25

Ohio Long-Term Tax-Exempt Fund

| | | |

| Fund Profile | | |

| As of November 30, 2015 | | |

| |

| Financial Attributes | | |

| |

| | | Barclays | |

| | | OH | Barclays |

| | | Muni | Municipal |

| | | Bond | Bond |

| | Fund | Index | Index |

| Number of Bonds | 310 | 1,380 | 47,840 |

| Yield to Maturity | | | |

| (before expenses) | 2.5% | 2.2% | 2.2% |

| Average Coupon | 4.6% | 4.8% | 4.8% |

| Average Duration | 6.3 years | 6.8 years | 6.4 years |

| Average Stated | | | |

| Maturity | 16.1 years | 13.0 years | 13.1 years |

| Ticker Symbol | VOHIX | — | — |

| Expense Ratio1 | 0.16% | — | — |

| 30-Day SEC Yield | 2.35% | — | — |

| Short-Term | | | |

| Reserves | 4.5% | — | — |

| | |

| Volatility Measures | | |

| | Barclays OH | Barclays |

| | Muni Bond | Municipal |

| | Index | Bond Index |

| R-Squared | 0.99 | 0.99 |

| Beta | 1.21 | 1.23 |

These measures show the degree and timing of the fund’s fluctuations compared with the indexes over 36 months.

| |

| Distribution by Stated Maturity | |

| (% of portfolio) | |

| Under 1 Year | 4.9% |

| 1 - 3 Years | 4.5 |

| 3 - 5 Years | 2.7 |

| 5 - 10 Years | 9.1 |

| 10 - 20 Years | 39.4 |

| 20 - 30 Years | 37.1 |

| Over 30 Years | 2.3 |

Distribution by Credit Quality (% of portfolio)

| |

| AAA | 7.2% |

| AA | 56.1 |

| A | 30.7 |

| BBB | 5.2 |

| BB | 0.2 |

| Not Rated | 0.6 |

Credit-quality ratings are obtained from Moody's and S&P, and the higher rating for each issue is shown. "Not Rated" is used to classify securities for which a rating is not available. Not rated securities include a fund's investment in Vanguard Market Liquidity Fund or Vanguard Municipal Cash Management Fund, each of which invests in high-quality money market instruments and may serve as a cash management vehicle for the Vanguard funds, trusts, and accounts. For more information about these ratings, see the Glossary entry for Credit Quality.

Investment Focus

1 The expense ratio shown is from the prospectus dated March 26, 2015, and represents estimated costs for the current fiscal year. For the fiscal year ended November 30, 2015, the expense ratio was 0.16%.

26

Ohio Long-Term Tax-Exempt Fund

Performance Summary

All of the returns in this report represent past performance, which is not a guarantee of future results that may be achieved by the fund. (Current performance may be lower or higher than the performance data cited. For performance data current to the most recent month-end, visit our website at vanguard.com/performance.) Note, too, that both investment returns and principal value can fluctuate widely, so an investor’s shares, when sold, could be worth more or less than their original cost. The returns shown do not reflect taxes that a shareholder would pay on fund distributions or on the sale of fund shares.

Cumulative Performance: November 30, 2005, Through November 30, 2015

Initial Investment of $10,000

See Financial Highlights for dividend and capital gains information.

27

| | | | |

| Ohio Long-Term Tax-Exempt Fund | | | | |

| |

| |

| |

| Fiscal-Year Total Returns (%): November 30, 2005, Through November 30, 2015 | |

| | | | | Barclays OH |

| | | | | Muni Bond |

| | | | | Index |

| Fiscal Year | Income Returns | Capital Returns | Total Returns | Total Returns |

| 2006 | 4.53% | 1.60% | 6.13% | 5.73% |

| 2007 | 4.32 | -1.61 | 2.71 | 2.64 |

| 2008 | 4.13 | -7.74 | -3.61 | -6.73 |

| 2009 | 4.76 | 8.85 | 13.61 | 15.73 |

| 2010 | 4.14 | -0.08 | 4.06 | 4.20 |

| 2011 | 4.20 | 1.61 | 5.81 | 5.84 |

| 2012 | 3.88 | 7.20 | 11.08 | 9.28 |

| 2013 | 3.48 | -7.76 | -4.28 | -2.71 |

| 2014 | 3.89 | 6.30 | 10.19 | 8.60 |

| 2015 | 3.46 | 0.44 | 3.90 | 3.55 |

Average Annual Total Returns: Periods Ended September 30, 2015

This table presents returns through the latest calendar quarter—rather than through the end of the fiscal period.

Securities and Exchange Commission rules require that we provide this information.

| | | | | | |

| | | | | | | Ten Years |

| | Inception Date | One Year | Five Years | Income | Capital | Total |

| Ohio Long-Term | | | | | | |

| Tax-Exempt Fund | 6/18/1990 | 3.99% | 4.51% | 4.09% | 0.60% | 4.69% |

28

Ohio Long-Term Tax-Exempt Fund

Financial Statements

Statement of Net Assets

As of November 30, 2015

The fund reports a complete list of its holdings in regulatory filings four times in each fiscal year, at the quarter-ends. For the second and fourth fiscal quarters, the lists appear in the fund’s semiannual and annual reports to shareholders. For the first and third fiscal quarters, the fund files the lists with the Securities and Exchange Commission on Form N-Q. Shareholders can look up the fund’s Forms N-Q on the SEC’s website at sec.gov. Forms N-Q may also be reviewed and copied at the SEC’s Public Reference Room (see the back cover of this report for further information).

| | | | |

| | | | Face | Market |

| | | Maturity | Amount | Value• |

| | Coupon | Date | ($000) | ($000) |

| Tax-Exempt Municipal Bonds (98.6%) | | | | |

| Ohio (97.7%) | | | | |

| Akron OH Bath & Copley Joint Township Hospital | | | | |

| District Revenue (Children’s Hospital Medical | | | | |

| Center of Akron) | 5.000% | 11/15/24 | 920 | 1,057 |

| Akron OH Bath & Copley Joint Township Hospital | | | | |

| District Revenue (Children’s Hospital Medical | | | | |

| Center of Akron) | 5.000% | 11/15/38 | 5,000 | 5,420 |

| Akron OH Bath & Copley Joint Township Hospital | | | | |

| District Revenue (Children’s Hospital Medical | | | | |

| Center of Akron) | 5.000% | 11/15/42 | 2,780 | 2,997 |

| Akron OH Income Tax Revenue | | | | |

| (Community Learning Centers) | 5.000% | 12/1/28 | 4,000 | 4,613 |

| Akron OH Income Tax Revenue | | | | |

| (Community Learning Centers) | 5.000% | 12/1/33 | 1,500 | 1,698 |

| Allen County OH Hospital Facilities Revenue | | | | |

| (Catholic Healthcare Partners) | 5.250% | 9/1/27 | 4,015 | 4,607 |

| Allen County OH Hospital Facilities Revenue | | | | |

| (Catholic Healthcare Partners) | 5.000% | 5/1/33 | 6,270 | 6,975 |

| Allen County OH Hospital Facilities Revenue | | | | |

| (Catholic Healthcare Partners) | 5.000% | 6/1/38 | 8,000 | 8,779 |

| Allen County OH Hospital Facilities Revenue | | | | |

| (Catholic Healthcare Partners) | 5.000% | 5/1/42 | 12,645 | 13,810 |

| Allen County OH Hospital Facilities Revenue | | | | |

| (Catholic Healthcare Partners) | 5.000% | 11/1/43 | 1,000 | 1,107 |

| American Municipal Power Ohio Inc. Revenue | 5.250% | 2/15/18 (Prere.) | 1,065 | 1,166 |

| American Municipal Power Ohio Inc. Revenue | 5.250% | 2/15/18 (Prere.) | 1,880 | 2,059 |

| American Municipal Power Ohio Inc. Revenue | 5.250% | 2/15/18 (Prere.) | 940 | 1,029 |

| American Municipal Power Ohio Inc. Revenue | 5.250% | 2/15/22 | 70 | 76 |

| American Municipal Power Ohio Inc. Revenue | 5.250% | 2/15/23 | 120 | 131 |

| American Municipal Power Ohio Inc. Revenue | 5.000% | 2/15/24 | 2,000 | 2,269 |

| American Municipal Power Ohio Inc. Revenue | 5.250% | 2/15/27 | 60 | 65 |

| American Municipal Power Ohio Inc. Revenue | 5.000% | 2/15/39 | 7,000 | 7,775 |

| American Municipal Power Ohio Inc. Revenue | 5.000% | 2/15/42 | 5,880 | 6,517 |

| American Municipal Power Ohio Inc. Revenue | | | | |

| (Fremont Energy Center Project) | 5.000% | 2/15/24 | 3,500 | 4,090 |

| American Municipal Power Ohio Inc. Revenue | | | | |

| (Fremont Energy Center Project) | 5.000% | 2/15/31 | 3,000 | 3,392 |

| American Municipal Power Ohio Inc. Revenue | | | | |

| (Fremont Energy Center Project) | 5.000% | 2/15/37 | 8,000 | 8,919 |

29

| | | | |

| Ohio Long-Term Tax-Exempt Fund | | | | |

| |

| |

| |

| | | | Face | Market |

| | | Maturity | Amount | Value• |

| | Coupon | Date | ($000) | ($000) |

| American Municipal Power Ohio Inc. Revenue | | | | |

| (Fremont Energy Center Project) | 5.000% | 2/15/42 | 10,755 | 11,913 |

| American Municipal Power Ohio Inc. Revenue | | | | |

| (Hydroelectric Projects) | 5.000% | 2/15/23 | 4,000 | 4,547 |

| American Municipal Power Ohio Inc. Revenue | | | | |

| (Hydroelectric Projects) | 5.000% | 2/15/24 | 1,215 | 1,378 |

| American Municipal Power Ohio Inc. Revenue | | | | |

| (Prairie State Energy Campus Project) | 5.750% | 2/15/19 (Prere.) | 4,500 | 5,170 |

| American Municipal Power Ohio Inc. Revenue | | | | |

| (Prairie State Energy Campus Project) | 5.000% | 2/15/26 | 2,000 | 2,364 |

| American Municipal Power Ohio Inc. Revenue | | | | |

| (Prairie State Energy Campus Project) | 5.000% | 2/15/29 | 7,365 | 8,493 |

| American Municipal Power Ohio Inc. Revenue | | | | |

| (Prairie State Energy Campus Project) | 5.250% | 2/15/30 | 600 | 691 |

| American Municipal Power Ohio Inc. Revenue | | | | |

| (Prairie State Energy Campus Project) | 5.250% | 2/15/31 | 2,500 | 2,874 |

| Apollo Career Center Joint Vocational | | | | |

| School District Ohio GO | 5.250% | 12/1/31 | 1,015 | 1,155 |

| Apollo Career Center Joint Vocational | | | | |

| School District Ohio GO | 5.000% | 12/1/38 | 4,700 | 5,183 |

| Bowling Green State University Ohio Student | | | | |

| Housing Revenue (CFP I LLC - State University | | | | |

| Project) | 5.750% | 6/1/31 | 2,000 | 2,147 |

| Bowling Green State University Ohio Student | | | | |

| Housing Revenue (CFP I LLC - State University | | | | |

| Project) | 6.000% | 6/1/45 | 2,000 | 2,132 |

| Butler County OH Hospital Facilities Revenue | | | | |

| (Cincinnati Children’s Hospital Medical Center | | | | |

| Project) | 5.000% | 5/15/31 (14) | 4,000 | 4,054 |

| Butler County OH Hospital Facilities Revenue | | | | |

| (Kettering Health Network) | 6.375% | 4/1/36 | 1,350 | 1,566 |

| Butler County OH Hospital Facilities Revenue | | | | |

| (Kettering Health Network) | 5.625% | 4/1/41 | 2,000 | 2,235 |

| Butler County OH Hospital Facilities Revenue | | | | |

| (UC Health) | 5.500% | 11/1/22 | 2,000 | 2,319 |

| Butler County OH Hospital Facilities Revenue | | | | |

| (UC Health) | 5.250% | 11/1/29 | 4,000 | 4,614 |

| Butler County OH Hospital Facilities Revenue | | | | |

| (UC Health) | 5.500% | 11/1/40 | 4,160 | 4,767 |

| Butler County OH Hospital Facilities Revenue | | | | |

| (UC Health) | 5.750% | 11/1/40 | 1,305 | 1,513 |

| Central Ohio Solid Waste Authority GO | 5.000% | 12/1/19 (ETM) | 115 | 132 |

| Central Ohio Solid Waste Authority GO | 5.000% | 12/1/19 | 1,195 | 1,367 |

| Cincinnati OH City School District COP | 5.000% | 12/15/16 (Prere.) | 1,190 | 1,246 |

| Cincinnati OH City School District COP | 5.000% | 12/15/16 (Prere.) | 1,470 | 1,539 |

| Cincinnati OH City School District COP | 5.000% | 12/15/16 (Prere.) | 430 | 450 |

| Cincinnati OH City School District COP | 5.000% | 12/15/16 (Prere.) | 530 | 555 |

| Cincinnati OH City School District GO | 5.250% | 6/1/27 | 5,550 | 6,310 |

| Cincinnati OH City School District GO | 5.250% | 12/1/30 (14) | 4,385 | 5,607 |

| Cincinnati OH City School District GO | 5.250% | 12/1/31 (14) | 3,000 | 3,835 |

| Cincinnati OH GO | 5.000% | 12/1/18 | 1,000 | 1,113 |

| Cincinnati OH GO | 5.000% | 12/1/24 | 1,090 | 1,228 |

| Cincinnati OH GO | 5.000% | 12/1/26 | 2,605 | 2,920 |

| Cincinnati OH Water System Revenue | 5.000% | 12/1/31 | 1,000 | 1,173 |

| Cincinnati OH Water System Revenue | 5.000% | 12/1/31 | 1,585 | 1,859 |

| Cincinnati OH Water System Revenue | 5.000% | 12/1/32 | 1,000 | 1,174 |

30

| | | | |

| Ohio Long-Term Tax-Exempt Fund | | | | |

| |

| |

| |

| | | | Face | Market |

| | | Maturity | Amount | Value• |

| | Coupon | Date | ($000) | ($000) |

| Cincinnati OH Water System Revenue | 5.000% | 12/1/36 | 5,025 | 5,868 |

| Cincinnati OH Water System Revenue | 5.000% | 12/1/37 | 2,000 | 2,320 |

| Cleveland OH Airport System Revenue | 5.000% | 1/1/26 | 1,000 | 1,121 |

| Cleveland OH Airport System Revenue | 5.000% | 1/1/28 | 4,530 | 5,012 |

| Cleveland OH Airport System Revenue | 5.000% | 1/1/30 | 5,000 | 5,477 |

| Cleveland OH Airport System Revenue | 5.000% | 1/1/31 | 1,020 | 1,114 |

| Cleveland OH Airport System Revenue | 5.000% | 1/1/31 (4) | 7,000 | 7,240 |

| Cleveland OH Income Tax Revenue | 5.000% | 4/1/18 (Prere.) | 7,180 | 7,852 |

| Cleveland OH Income Tax Revenue | 5.000% | 10/1/37 | 10,000 | 11,327 |

| Cleveland OH Municipal School District GO | 5.000% | 12/1/25 | 1,845 | 2,169 |

| Cleveland OH Municipal School District GO | 5.000% | 12/1/46 | 3,000 | 3,329 |

| Cleveland OH Public Power System Revenue | 5.000% | 11/15/28 (14) | 1,250 | 1,351 |

| Cleveland OH Public Power System Revenue | 0.000% | 11/15/33 (14) | 6,895 | 3,410 |

| Cleveland OH Water Revenue | 5.000% | 1/1/27 | 2,000 | 2,325 |

| Cleveland OH Water Revenue | 4.000% | 1/1/35 | 2,000 | 2,080 |

| Cleveland OH Water Works Revenue | 5.500% | 1/1/21 (14) | 9,540 | 10,558 |

| Cleveland State University Ohio General Receipts | | | | |

| Revenue | 5.000% | 6/1/25 | 2,000 | 2,324 |

| Cleveland State University Ohio General Receipts | | | | |

| Revenue | 5.000% | 6/1/26 | 2,700 | 3,118 |

| Cleveland State University Ohio General Receipts | | | | |

| Revenue | 5.000% | 6/1/27 | 2,000 | 2,296 |

| Cleveland State University Ohio General Receipts | | | | |

| Revenue | 5.000% | 6/1/30 (14) | 3,000 | 3,155 |

| Cleveland State University Ohio General Receipts | | | | |

| Revenue | 5.000% | 6/1/37 | 2,815 | 3,125 |

| Cleveland-Cuyahoga County OH Port Authority | | | | |

| Revenue (Carnegie/89th Garage & Service | | | | |

| Center LLC Project) VRDO | 0.010% | 12/7/15 LOC | 2,775 | 2,775 |

| Cleveland-Cuyahoga County OH Port Authority | | | | |

| Revenue (Cleveland Museum of Art Project) | | | | |

| VRDO | 0.010% | 12/7/15 | 1,400 | 1,400 |

| Cleveland-Cuyahoga County OH Port Authority | | | | |

| Revenue (Euclid Avenue Development Corp. | | | | |

| Project) | 5.000% | 8/1/28 | 680 | 783 |

| Cleveland-Cuyahoga County OH Port Authority | | | | |

| Revenue (Euclid Avenue Development Corp. | | | | |

| Project) | 5.000% | 8/1/39 | 3,000 | 3,329 |

| Columbus OH City School District GO | 4.500% | 12/1/29 | 3,000 | 3,278 |

| Columbus OH City School District School Facilities | | | | |

| Construction & Improvement GO | 5.000% | 6/1/19 (Prere.) | 1,545 | 1,750 |

| Columbus OH GO | 5.000% | 2/15/22 | 1,900 | 2,283 |

| Columbus OH GO | 5.000% | 2/15/24 | 1,475 | 1,817 |

| Columbus OH GO | 5.000% | 7/1/24 | 1,000 | 1,200 |

| Columbus OH GO | 5.000% | 8/15/26 | 2,000 | 2,388 |

| Columbus OH GO | 5.000% | 7/1/27 | 2,000 | 2,343 |

| Columbus OH GO | 5.000% | 7/1/30 | 2,500 | 2,937 |

| Columbus OH GO | 5.000% | 7/1/31 | 1,185 | 1,386 |

| Columbus OH Metropolitan Library Special | | | | |

| Obligation Revenue | 5.000% | 12/1/24 | 1,320 | 1,516 |

| Columbus OH Metropolitan Library Special | | | | |

| Obligation Revenue | 5.000% | 12/1/25 | 1,000 | 1,148 |

| Columbus OH Metropolitan Library Special | | | | |

| Obligation Revenue | 4.000% | 12/1/37 | 2,000 | 2,058 |

| Columbus OH Sewer Revenue | 5.000% | 6/1/26 | 3,255 | 3,986 |

| Columbus OH Sewer Revenue | 5.000% | 6/1/31 | 1,000 | 1,185 |

31

| | | | |

| Ohio Long-Term Tax-Exempt Fund | | | | |

| |

| |

| |

| | | | Face | Market |

| | | Maturity | Amount | Value• |

| | Coupon | Date | ($000) | ($000) |

| Cuyahoga County OH (Convention Hotel Project) | | | | |

| COP | 5.000% | 12/1/36 | 2,000 | 2,235 |

| Cuyahoga County OH Economic Development | | | | |

| Revenue (Med Mart/Convention Center Project) | 5.000% | 12/1/24 | 4,000 | 4,541 |

| Cuyahoga County OH Sales Tax Revenue | 5.000% | 12/1/32 | 1,900 | 2,236 |

| Cuyahoga County OH Sales Tax Revenue | 5.000% | 12/1/34 | 2,775 | 3,239 |

| Cuyahoga County OH Sales Tax Revenue | 5.000% | 12/1/35 | 4,485 | 5,215 |

| Dublin OH Special Obligation Revenue | 5.000% | 12/1/42 | 3,485 | 3,989 |

| Dublin OH Special Obligation Revenue | 5.000% | 12/1/44 | 1,920 | 2,194 |

| Fairfield County OH Hospital Facilities Revenue | | | | |

| (Fairfield Medical Center) | 5.000% | 6/15/43 | 4,250 | 4,524 |

| Forest Hills OH Local School District GO | 5.000% | 12/1/46 | 4,430 | 4,995 |

| Franklin County OH GO | 5.000% | 12/1/26 | 3,000 | 3,734 |

| Franklin County OH GO | 5.000% | 12/1/31 | 3,000 | 3,622 |

| Franklin County OH Health Care Facilities | | | | |

| Improvement Revenue (Ohio Presbyterian | | | | |

| Retirement Services Project) | 5.625% | 7/1/26 | 2,800 | 3,022 |

| Franklin County OH Health Care Facilities | | | | |

| Improvement Revenue (OPRS Communities) | 6.125% | 7/1/40 | 4,110 | 4,504 |

| Franklin County OH Hospital Facilities Revenue | | | | |

| (OhioHealth Corp.) | 5.000% | 5/15/31 | 5,000 | 5,787 |

| Franklin County OH Hospital Facilities Revenue | | | | |

| (OhioHealth Corp.) | 5.000% | 5/15/34 | 2,610 | 2,977 |

| Franklin County OH Hospital Facilities Revenue | | | | |

| (OhioHealth Corp.) | 5.000% | 11/15/36 | 3,640 | 4,055 |

| Franklin County OH Hospital Facilities Revenue | | | | |

| (OhioHealth Corp.) | 5.000% | 5/15/45 | 2,000 | 2,233 |

| Franklin County OH Hospital Improvement | | | | |

| Revenue (Nationwide Children’s Hospital Project) | 4.750% | 11/1/28 | 1,500 | 1,625 |

| Franklin County OH Hospital Improvement | | | | |

| Revenue (Nationwide Children’s Hospital Project) | 5.000% | 11/1/34 | 1,500 | 1,654 |

| Franklin County OH Hospital Improvement | | | | |

| Revenue (Nationwide Children’s Hospital Project) | 5.000% | 11/1/42 | 7,000 | 7,569 |

| Franklin County OH Hospital Revenue (Nationwide | | | | |

| Children’s Hospital Project) VRDO | 0.010% | 12/7/15 | 475 | 475 |

| Greene County OH Hospital Facilities Revenue | | | | |

| (Kettering Health Network Obligated Group | | | | |

| Project) | 5.375% | 4/1/34 | 2,500 | 2,726 |

| Greene County OH Hospital Facilities Revenue | | | | |

| (Kettering Health Network Obligated Group | | | | |

| Project) | 5.500% | 4/1/39 | 2,500 | 2,728 |

| Hamilton County OH Healthcare Facilities | | | | |

| Revenue (Christ Hospital Project) | 5.250% | 6/1/32 | 3,150 | 3,528 |

| Hamilton County OH Healthcare Facilities | | | | |

| Revenue (Christ Hospital Project) | 5.000% | 6/1/42 | 5,000 | 5,407 |

| Hamilton County OH Healthcare Facilities | | | | |

| Revenue (Christ Hospital Project) | 5.500% | 6/1/42 | 3,000 | 3,345 |

| Hamilton County OH Healthcare Revenue | | | | |

| (Life Enriching Communities) | 5.000% | 1/1/32 | 1,750 | 1,854 |

| Hamilton County OH Healthcare Revenue | | | | |

| (Life Enriching Communities) | 5.000% | 1/1/42 | 2,000 | 2,081 |

| Hamilton County OH Healthcare Revenue | | | | |

| (Life Enriching Communities) | 5.000% | 1/1/46 | 2,000 | 2,075 |

| Hamilton County OH Hospital Facilities Revenue | | | | |

| (Cincinnati Children’s Hospital Medical Center) | 5.000% | 5/15/34 | 1,000 | 1,140 |

32

| | | | |

| Ohio Long-Term Tax-Exempt Fund | | | | |

| |

| |

| |

| | | | Face | Market |

| | | Maturity | Amount | Value• |

| | Coupon | Date | ($000) | ($000) |

| Hamilton County OH Hospital Facilities Revenue | | | | |

| (UC Health) | 5.000% | 2/1/30 | 1,360 | 1,521 |

| Hamilton County OH Hospital Facilities Revenue | | | | |

| (UC Health) | 5.000% | 2/1/44 | 2,500 | 2,718 |

| Hamilton County OH Sales Tax Revenue | 5.000% | 12/1/26 (2) | 5,000 | 5,209 |

| Hamilton County OH Sales Tax Revenue | 5.000% | 12/1/32 | 5,000 | 5,551 |

| Hamilton County OH Sales Tax Revenue | 5.000% | 12/1/32 (4) | 9,700 | 10,073 |

| Hamilton County OH Sewer System Revenue | 5.000% | 12/1/22 | 1,000 | 1,215 |

| Hamilton County OH Sewer System Revenue | 5.000% | 12/1/32 | 1,525 | 1,788 |

| Hamilton OH City School District GO | 5.000% | 12/1/34 | 1,500 | 1,733 |