September 30, 2006

To His Honour

The Honourable Herménégilde Chiasson

Lieutenant-Governor of New Brunswick

Sir:

New Brunswick Power Holding Corporation begs leave to submit, in accordance with the Electricity Act, Part II, Division A, 10(1), the report for the scal year ended March 31, 2006.

I am, Your Honour,

Yours very truly,

Derek H. Burney

Chair

| | | |

|

Financial Performance (in millions) | 2005/06 | 2004/05 | 2003/04 |

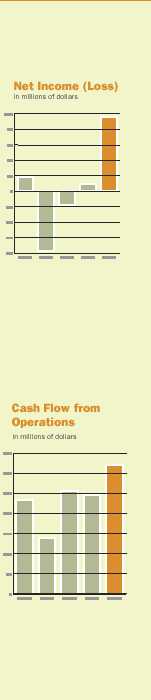

Net income (loss) | $96 | $9 | ($18) |

Cash flow from operations | $319 | $245 | $256 |

Free cash inflow (outflow) | $54 | ($161) | ($376) |

Reduction (increase) in net debt | $26 | $204 | ($321) |

| | | |

|

Financial Ratios and Percentages | 2005/06 | 2004/05 | 2003/04 |

Operating margin | 21% | 14% | 14% |

Operating cash flow/capital expenditures | 1.53x | 0.72x | 0.52x |

Operating cash flow/total debt | 0.10x | 0.08x | 0.08x |

Per cent of debt in capital structure | 93% | 96% | 106% |

Interest coverage ratio | 1.74x | 0.97x | 0.88x |

Table of Contents

| Message from the Chair | 2 |

| Message from the President and CEO | 3 |

| NB Power Group. | 4 |

| - Business Development. | 5 |

| - Corporate Commitment | 8 |

| Corporate Pro les. | 10 |

| - NB Power Generation Corporation. | 10 |

| - NB Power Nuclear Corporation | 12 |

| - NB Power Transmission Corporation | 14 |

| - NB Power Distribution and Customer Service Corporation | 16 |

| Financial Review 2005/06. | 18 |

| - Management’s Discussion and Analysis. | 20 |

| - Management’s and Auditors’ Reports | 32 |

| - Combined Financial Statements | 33 |

| - Notes to the Combined Financial Statements | 37 |

| - Statistical Overview. | 54 |

| System Map | 58 |

| Governance. | 59 |

| - TSX Corporate Governance Guidelines. | 60 |

| Board of Directors. | 62 |

| Senior Management | 63 |

| Glossary | 64 |

Message from the Chair

| The NB Power Group’s Board structure and priorities remained constant in 2005/06 – a continuing focus on major initiatives, corporate governance and management practices.

The Board examined in particular the impact of two major initiatives in the generation and transmission businesses and recommended they proceed. The refurbishment of the Point Lepreau Generating Station will extend the Station’s life, providing energy to New Brunswickers to 2034. The construction of the second International Power Line will provide increased transmission system reliability, efficiency and market development opportunities.

The Board also established ends policies to chart the direction for the NB Power Group, notably in the areas of reliability, rates, financial performance, safety and the environment.

Following the decision to refurbish Point Lepreau Generating Station, the Nuclear Oversight Committee of the Board was charged with monitoring the refurbishment project. The Committee established a project management reporting and control structure. It engaged an engineering firm to provide independent oversight and assessment of project management and risk management. The Nuclear Oversight Committee also established enhanced audit oversight, project reporting and controls for the Board, the Executive and the project management from NB Power Nuclear Corporation and Atomic Energy of Canada Limited.

In July 2006, the Board expanded the Audit Committee’s mandate to ensure oversight of the key corporate risks and risk processes across the Group.

Our commitment remains to provide clear direction and strong corporate governance to the NB Power Group. Together with management, we are determined to ensure that the Group continues to provide New Brunswickers with safe, reliable and reasonably-priced electricity.

Derek H. Burney Chairman |

| 2 NB POWER GROUP 2005 | 2006 ANNUAL REPORT | |

| Message from the President and CEO |

|

The year 2005/06 marked the first year of operations following significant cost and staff reductions, and the Group turned its attention to implementing process efficiencies to address the reductions in staffing levels.

The Group also continued its business development programs with the refurbishment of the Point Lepreau Generating Station, the construction of the International Power Line and renewable energy, to name a few.

The NB Power Group recorded a net income of $96 million in 2005/06 compared with a net income of $9 million in 2004/05. There were four major factors that contributed to the year-over-year improvement: significantly above-average hydro; the impact of hurricane Katrina on natural gas prices, which caused high New England export prices for our excess power; lower in-province winter demand, leaving excess capacity for export; and finally, the Group’s Business Excellence program.

In response to the relentless rise in fossil fuel prices, the Group implemented an overall three per cent rate increase effective July 2005. At the same time, NB Power Distribution and Customer Service Corporation (Disco) submitted a rate application to the New Brunswick Board of Commissioners of Public Utilities (PUB). Throughout the hearing, the first in 13 years, Disco answered thousands of questions and presented the PUB with dozens of volumes of documents, which were also published on the website. In the end, the PUB accepted Disco’s costs and as such, the PUB acknowledged that Disco was effectively controlling costs and running its business well. After reviewing the PUB’s decision, the Province announced an overall 6.9 per cent rate increase effective July 2006.

Looking forward, the Group will continue its focus on preparing for the refurbishment of the Point Lepreau Generating Station and constructing the second International Power Line. It will also prepare the other plants’ equipment for the extended outage during refurbishment. In addition, the Group will explore lower-cost alternative fuels in response to rising oil prices and the opportunity afforded by Coleson Cove Generating Station’s ability to burn alternative liquid fuels.

The NB Power Group story continues to be one of companies striving to achieve a level of business excellence that will rank the NB Power Group among the best-run utilities and will contribute to a more vibrant New Brunswick.

David D. Hay

President & Chief Executive Offi cer

|  |

| | 2005 | 2006 ANNUAL REPORT NB POWER GROUP 3 |

| NB Power Group | |

| The NB Power Group provides reliable, safe and reasonably-priced electricity with respect for the environment, while providing a commercial return to the Shareholder. The electricity is generated at 15 facilities and delivered via power lines, substations and terminals to more than 360,000 direct and indirect customers within New Brunswick and surrounding areas.

The NB Power Group consists of a holding company and four operating companies · New Brunswick Power Holding Corporation (Holdco), which provides strategic direction, governance and support to the subsidiaries for communications, finance, human resources, legal and governance. It also provides shared services on a cost-recovery basis · New Brunswick Power Generation Corporation (Genco), which is responsible for the operation and maintenance of the oil, hydro, coal, Orimulsion® and diesel-powered generating stations · New Brunswick Power Nuclear Corporation (Nuclearco), which is responsible for the operation of Point Lepreau Generating Station · New Brunswick Power Transmission Corporation (Transco), which is responsible for operating and maintaining the transmission system · New Brunswick Power Distribution and Customer Service Corporation (Disco), which is responsible for operating and maintaining the distribution system. Disco is designated as the standard service supplier for the Province of New Brunswick and is obligated to provide standard services to residential, commercial, wholesale and industrial customers located throughout the province

Genco wholly owns two subsidiaries · New Brunswick Power Coleson Cove Corporation (Colesonco), which owns and operates Coleson Cove Generating Station with a generating capacity of 978 MW included in Genco's total capacity · NB Coal Limited (NB Coal), which mines local coal to supply Grand Lake Generating Station

In 2005/06, the Group focused on operating in a new electricity environment, implementing process efficiencies to address reductions in staffing levels and continuing its business development programs. The project summaries that follow provide a glimpse into the business development story. |

| 4 NB POWER GROUP 2005 | 2006 ANNUAL REPORT | |

|

|

Business Development

Point Lepreau Generating Station Refurbishment On July 29, 2005, the Province of New Brunswick announced its decision to support the Board’s recommendation to refurbish the Point Lepreau Generating Station in partnership with Atomic Energy of Canada Limited (AECL), the original plant designer. The refurbishment project will extend the Station’s life to 2034, providing the NB Power Group with electricity from a fuel source that is not linked to volatility in fuel pricing. The refurbished station will also continue to provide an environmental benefit by generating electricity that avoids significant carbon dioxide, sulphur dioxide and nitrogen oxide emissions.

Planning started in 2000 with a definition of the appropriate scope and schedule for refurbishment. The project will culminate in an 18-month planned outage that will begin April 2008 and be completed by September 2009.

The $1 billion project will replace all 380 fuel channels and calandria tube assemblies and feeders. Other equipment replacements, inspections and upgrades will also be undertaken to allow the Station to operate for its extended life.

The impact of the refurbishment project will extend beyond Nuclearco to the NB Power Group, which must ensure adequate capacity and energy will be available during the outage.

Genco is being challenged to ready its generation system to run at high availability levels from October 2007 to April 2010, covering the period of the outage for refurbishment and the winter months that precede and follow it.

Transco is readying the transmission system to increase import energy in time for the Station being out of service. Transco is also performing proactive maintenance to ensure system reliability.

Genco and Disco are working together to develop a comprehensive strategy to replace capacity and energy while the Station undergoes refurbishment. The strategy will consider Genco assets, market conditions and availability of third-party supply, the associated transmission requirements and rate issues.

Nuclearco is focused on successful execution of the refurbishment project on time and on budget to ensure New Brunswick retains efficient, effective and diversified sources of power for years to come. |  |

| | 2005 | 2006 ANNUAL REPORT NB POWER GROUP 5 |

| NB Power Group | |

| International Power Line Transco and Bangor Hydro are constructing a 345 kV transmission line from Point Lepreau to Orrington, Maine (south of Bangor). For the past five years, the two have been working together to plan and obtain approvals for the construction of the International Power Line.

The completion of the International Power Line will allow for maintenance on the current 345 kV interconnection with New England to be completed without putting the Maritimes at risk of blackouts. The 35-year-old line has been very reliable, yet has left the Maritimes electrically isolated and vulnerable to blackouts.

The International Power Line will increase New Brunswick’s export capacity from 700 MW to 1,000 MW and increase its import capacity from a conditional 100 MW to 400 MW. The increased import capability will provide market participants with more options for capacity and energy and the New Brunswick System Operator (System Operator) with more options for ancillary services.

The line will also improve system efficiency by reducing losses for delivery of energy to New Brunswick customers and will allow generators to put more energy into the system for delivery to the New England market.

The International Power Line is scheduled to be in-service by December 2007. By January 2006, all permits had been obtained for construction on the Canadian and the U.S. sides. Transco will construct the line using its own resources supplemented with third-party resources.

Throughout the project, Transco will work closely with community members on the community liaison committee. As construction activities increase, the liaison committee will meet monthly to discuss community matters and stay updated on the project schedule, regulatory process, environmental impact and mitigation plans.

There is regional support for the International Power Line through long-term transmission commitments with Genco, Nova Scotia Power Inc. and Maritime Electric Company, Limited. Transco also sees potential for additional revenue from wind generation development and other third-party use of the transmission system.

Through the International Power Line, Transco and Bangor Hydro are building a system with improved reliability, efficiency and market opportunities for the Maritime transmission grid. |

| 6 NB POWER GROUP 2005 | 2006 ANNUAL REPORT | |

|

|

Renewable Energy New Brunswick enjoys generation produced from a diverse fuel supply. With the provincial government’s Renewable Portfolio Standard and new developments in the environmental arena, New Brunswickers will have access to even more fuel sources.

In 2003, NB Power set a long-term objective to acquire 100 MW from renewable energy projects by 2010. In June 2004, NB Power entered into a power purchase agreement with Eastern Wind Power, a subsidiary of Western Wind Inc.

Over the past year, Disco has increased its activity in the renewable energy portfolio by seeking additional wind energy. On June 29, 2005, NB Power announced it was increasing its commitment to acquire energy from renewable sources by seeking up to 400 MW of additional wind energy by 2016. Disco issued a request for expressions of interest for the development of wind generation that could be sited in the five highest wind areas in New Brunswick: Bay of Fundy, Tantramar, Miramichi Bay, Acadie/Chaleur and inland New Brunswick.

Disco received proposals revealing that opportunities exist in all five wind areas. The NB Power Group would like to take advantage of geographical dispersion of the wind sites to balance wind-based generation around the province. This will increase the overall efficiency of wind generation.

The development of wind energy projects will increase renewable energy in the province, resulting in benefits to the environment and local economic development, increased diversity of power supply and a greater reliance on domestic resources for electricity generated and sold in New Brunswick.

In addition, the NB Power Group is open to generation from other renewable sources, such as biomass, landfill gas, small hydro and solar. The Group participated in the tidal power study announced in summer 2005.

New Brunswick is entering a new era of energy production. It is an exciting time for the NB Power Group. Independent power producers are coming forward with proposals to generate and sell energy from renewable resources. And with it, opportunities open up as companies and individuals look for ways to develop and use these new technologies. |  |

| | 2005 | 2006 ANNUAL REPORT NB POWER GROUP 7 |

| NB Power Group | |

Corporate Commitment

In addition to focusing on business development, the NB Group maintained its focus on safety, social responsibility and the environment.

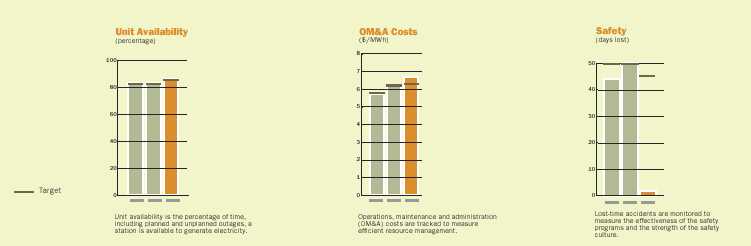

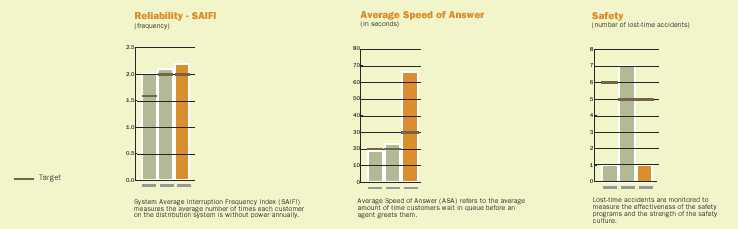

Safety Safety focus remains a key cultural element in the NB Power Group’s operations. The NB Power Group reports safety results nationally through its membership in the Canadian Electricity Association (CEA). In comparison with 2004, the Group’s performance improved by 18 per cent in the Disabling Accident Frequency and 22 per cent in the Severity Rates. This marks the first year in the past four that the Group’s statistics have improved. In addition, the Group’s performance is better than the CEA composite in all measured categories.

In recognition of the Group’s mature safety culture, the NB Power Group’s Workers’ Compensation Rates were reduced once again, which translates to projected savings in premiums shared by the Group. The Group also renewed its attention to safety through a refocused public safety campaign launched in March 2006 to advise the public that “What you don’t know about electricity can hurt you.”

Social Responsibility The NB Power Group operates in towns and cities across New Brunswick. The Group has established and participates in a number of community liaison committees and information forums regarding Point Lepreau Generating Station, the International Power Line construction, Coleson Cove Generating Station operations and hydro system operations.

Employees from across the NB Power Group are also active community members. They planted trees to celebrate Arbour Day and donated time to local community events. Employees also made donations, fundraised and volunteered for charitable organizations and events like the Canadian Breast Cancer Foundation’s CIBC Run for the Cure, the United Way Campaign, the Harbour Lights Campaign, the Rick Hansen Wheels in Motion and the Dalhousie Medical Research Foundation. The NB Power Group was also recognized by the National Defence Canadian Forces Liaison Council (CFLC) as Most Supportive Employer for the Province of New Brunswick. | Environment The NB Power Group is a member of the CEA and participates in the Environmental Commitment and Responsibility (ECR) program. The four environmental performance principles that electric utilities integrate into their daily business activities through their participation in the ECR program are • be more efficient in the use of resources • reduce the adverse environmental impact of the business • be accountable to constituents • ensure that employees understand the environmental implications of their actions and have the knowledge and skills to make the right decisions

Through this industry-wide initiative, electric utilities report on specific measures and indicators to benchmark performance. The NB Power Group submitted data to the ECR Program for the year 2004. Findings are used to assess where the Group is relative to other Canadian organizations wherever there is a like-to-like basis for comparison.

Throughout 2005/06, the NB Power Group continued to demonstrate the importance placed on conscientious environmental stewardship by its companies. • Coleson Cove Generating Station has emissions going through the flue gas desulphurization unit since July 2005 • The Group took an important step toward green energy development through requests for expressions of interest to add more wind power generation • The Group welcomed the Provincial Government decision to refurbish Point Lepreau Generating Station in July 2005, a project that will contribute to greenhouse gas emission reductions in the future and help to sustain the domestic supply of electricity for consumers • Genco received approvals to operate for air, water and sewage systems as well as eight petroleum storage site licenses • Transco received environmental regulatory approvals for construction of the International Power Line and maintenance on submarine cables • Disco established a net metering policy designed to encourage private, small-scale development of renewable or alternate generating assets • Disco also launched a pilot re-lamping program to refit street lights with the Lumalux Plus®Eco® energy-efficient high pressure sodium (HPS) lights |

| 8 NB POWER GROUP 2005 | 2006 ANNUAL REPORT | |

|

|

Spotlight on Genco’s Environmental Performance In addition to its supply and financial responsibilities, the NB Power Group is mindful of the footprint it leaves on the planet. Employees throughout the Group remain committed to working in an environmentally responsible manner. In Genco, this has meant investments in advanced technology that is proven, efficient and clean.

Three large fossil plants are all fitted with advanced pollution control equipment. In 1993, as part of construction of the Belledune coal-fired facility, Genco built the first flue gas desulphurization scrubber in Canada. It continued to lead Canada when it installed the third flue gas desulphurization scrubber at Dalhousie Generating Station in 1994 and the sixth at Coleson Cove Generating Station in 2004.

In 2005, the refurbishment of Coleson Cove Generating Station was successfully implemented with the output of all units going through the scrubber. The implementation required verification and fine-tuning of all equipment to ensure the specifications of the intended design performance were, indeed, being achieved. The findings were • SO2 emission rates were reduced by 77 per cent as a result of flue gas desulphurization equipment being installed • NOx emission rates were reduced by 70 per cent through modifications to the boiler • Particulate release rates reduced by 75 per cent with the addition of the wet electrostatic precipitator

The flue gas desulphurization scrubbers benefit Genco in a number of ways • sulphur dioxide emissions from the three plants were decreased from 92,700 tonnes annually in 1993 to 29,340 tonnes in 2006 • 100 per cent of the gypsum byproduct from the three plants is resold for wallboard production • Genco is able to explore the opportunity to burn alternative fuels. Research and development efforts are underway and Genco expects to make a decision on a fuel alternative in 2006/07

In the fall of 2005, Genco entered into a 15-year agreement with an outside party to build and operate a fly ash upgrading facility in Belledune. By separating unburned carbon from the fly ash and reintroducing it as fuel to the boiler, approximately 120,000 tonnes of pure fly ash will be diverted annually from landfill and sold as a value-added substitute for cement.

The Group also benefits from Genco’s diverse fuel supply. In addition to the coal, oil, Orimulsion® and diesel-powered stations, Genco also operates six hydro dams on the St. John, Tobique, and St. Croix Rivers. It takes advantage of this renewable energy resource throughout the year to provide lower-cost energy to New Brunswickers.

With new developments in the environmental arena, the Group will continue to address the challenges between maintaining the environment while sustaining profitability through access to even more diverse fuel sources. |  |

| | 2005 | 2006 ANNUAL REPORT NB POWER GROUP 9 |

| Corporate Profiles | |

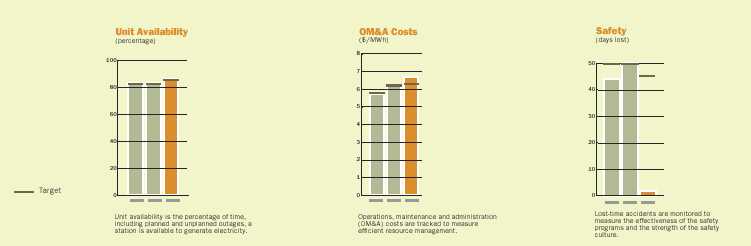

NB Power Generation Corporation (Genco)

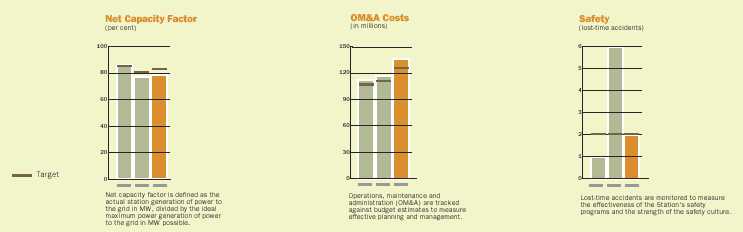

Genco operates and maintains one of North America’s most diverse generating systems consisting of 14 hydro, coal, oil, Orimulsion® and diesel-powered stations. The network of conventional generating stations has an installed net capacity of 3,313 MW comprised of 1,903 MW thermal capacity, 884 MW hydro capacity and 526 MW combustion turbine capacity.

Results Genco’s net income for the fiscal year was $51 m compared to last year’s net income of $28 million, an improvement of $23 million. The improvement is due mainly to higher out-of-province gross margin that was driven by higher export prices and increased hydro flows and an improved in-province gross margin that was driven by a reduced cost of supply due to lower loads and increased hydro flows, partially offset by the sharing of export gross margin benefits with Disco.

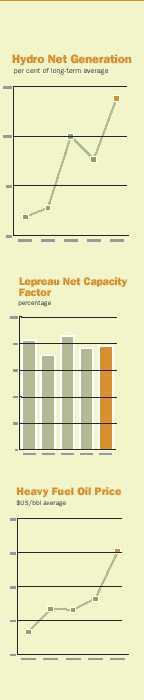

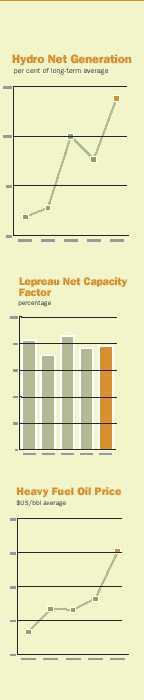

In 2005/06, Genco experienced an all-time record hydro flow with hydro production 43 per cent above the long-term average. The increased hydro generation resulted in reduced fuel costs and a significantly higher volume of export sales.

The year marked the first year of operations following the Business Excellence program’s significant cost and staff reductions. In 2005/06, under the leadership of vice president Darrell Bishop, Genco continued to seek further cost reductions by searching for a lower-cost alternative fuel for Coleson Cove Generating Station and improving station availability and plant maintenance processes. | Genco’s oil-fired Coleson Cove Generating Station supplies a significant amount of energy for in-province use and export sales. In response to rising oil prices and the opportunity afforded by Coleson Cove Generating Station’s ability to burn alternative liquid fuels, Genco began exploring lower-cost alternative fuels. Research and development efforts are underway and Genco expects to make a decision on a fuel alternative in 2006/07.

Achievements Genco achieved a thermal station availability of 82.5 per cent compared to a planned availability of 85.5 per cent. Results for the year were affected by the extension of planned outages, forced outages and the reduced capacity of Grand Lake Generating Station.

In January 2006, Genco began implementing a new work order and work management system. The new system will be used to manage the work order cycle, preventive maintenance and outage planning, scheduling and reporting. When the new system is fully implemented it will allow Genco to improve plant maintenance and increase plant reliability. Genco expects to begin realizing the benefits of the more robust work management and reporting system within a year of implementation.

The energy marketing group continued to develop good relationships with counterparties and was able to access new markets. Genco also developed plans to optimize export markets through the establishment of a 24-hour marketing desk and the exploration of opportunities to obtain a US marketing license while continuing to look at developing new markets and products. |

| 10 NB POWER GROUP 2005 | 2006 ANNUAL REPORT | |

General Business

General Business

Genco produced electricity with respect for the environment. In addition to closely monitoring station air emissions, Genco minimized landfill requirements for the by-products of generation. Genco entered into a partnership with a Belledune fly ash processing plant, which processes fly ash for sale as a portland cement substitute. In its first year of operations, the process reduced the dependency on landfill in Belledune by 56 per cent.

In the fall of 2005, Genco upgraded the precipitator on Coleson Cove Generating Station Unit #3 to allow the unit to produce marketable gypsum and thereby reduce landfill. A similar upgrade is planned for Unit #2 in 2006/07.

Throughout its operations, Genco maintained a safety focus. This year, there were two days lost due to accidents. The strong safety record is due to a safety program based on partnership and active participation of management, the union, employees and the Joint Health and Safety Committees. The program has been and will continue to be the foundation for efforts to preserve the health and well-being of Genco employees, its contractors and the general public.

Genco continues to enjoy a positive working relationship with the International Brotherhood of Electrical Workers (IBEW). The current collective agreement expires December 31, 2006.

Future Plans

Looking forward, Genco will continue strong operational performance and high station availability by strengthening outage and maintenance planning and through the implementation of the new work order and work management system. It will also continue to explore lower-cost alternative fuels for Coleson Cove Generating Station.

A major focus will be the development of a plan to secure replacement energy and capacity during the refurbishment outage at Point Lepreau Generating Station. Genco will also undertake inspections and maintenance outages at each of the major thermal stations in the next two years to ensure they operate at high capacity factors throughout the 18-month refurbishment outage.

| |

Genco | |

Number of positions | 485 |

Facilities owned | 14 |

Net load capacity | 3,313 MW |

Supply | approximately 75 per cent of in-province load |

Customers | Disco, export markets |

Net book value of fixed assets (in millions) | $1,943 |

| | 2005 | 2006 ANNUAL REPORT NB POWER GROUP 11 |

| Corporate Profiles | |

NB Power Nuclear Corporation (Nuclearco)

Nuclearco operates and maintains a CANDU 6 – 635 MW reactor at the Point Lepreau Generating Station. The Station provides approximately 25 per cent of New Brunswick’s electrical energy requirements.

Results Nuclearco’s net income for the fiscal year was $5 million compared to a net loss of $10 million in 2004/05, an improvement of $15 million. The increase is mainly due to a service life adjustment that reduced amortization, offset by an increase in special payment in lieu of taxes due to increased earnings.

Plant reliability, driven by aging equipment issues, continues to be an ongoing business risk facing Nuclearco. The spring 2005 planned maintenance outage was extended from 25 days to 44 days due to feeder tubes. As a result, the Station achieved a 78.4 per cent capacity factor compared to a target of 83.0 per cent.

The loss in production from the outage extension was partially offset by the fact that the plant operated reliably throughout the remainder of the year. Following a three-day unplanned outage in August, the plant operated for 264 continuous days until the planned outage in spring 2006. This was the longest continuous run since 1999. | Achievements On July 29, 2005, the Province of New Brunswick announced its decision to support the Board’s recommendation to refurbish the Station in partnership with Atomic Energy of Canada Limited (AECL), the original plant designer. To manage the potential impact on the Group and the Province, the NB Power Group has established a governance structure that includes oversight by the Board, the Executive and three external bodies. At the same time, Gaëtan Thomas was appointed as the new vice president of NB Power Nuclear Corporation.

Nuclearco began more detailed engineering project work in August 2005, including the development of a resource plan that supports the project, Station operations and preparation for the refurbishment outage.

It also began expansion of the Solid Radioactive Waste Management Facility, required to handle the waste resulting from retubing the reactor and the fuel from the extended operating life.

In August 2005, the Canadian Nuclear Safety Commission granted Nuclearco a six-month licence extension. Nuclearco then submitted an application for a five-year licence renewal, which was presented over a two-day hearing in February and May 2006. On June 30, 2006, the CNSC announced it had renewed the Point Lepreau Generating Station’s Nuclear Power Reactor Operating Licence to June 30, 2011. Nuclearco will seek the approval of CNSC before reloading fuel in the reactor and proceeding with the restart following the planned refurbishment outage, scheduled to be completed by September 2009. |

| 12 NB POWER GROUP 2005 | 2006 ANNUAL REPORT | |

Nuclearco solicited the World Association of Nuclear Operators’ (WANO’s) assistance with various aspects of the Station operations by hosting WANO assist visits in August, September and October. These visits provided recommendations on improvements, for which management has developed plans to address.

Nuclearco solicited the World Association of Nuclear Operators’ (WANO’s) assistance with various aspects of the Station operations by hosting WANO assist visits in August, September and October. These visits provided recommendations on improvements, for which management has developed plans to address.

WANO also conducted a mid-cycle review in March 2006 and noted evidence of progress on the areas for improvement identified in the 2004 Peer Review. WANO acknowledged the willingness and the desire of staff at all levels to make further improvements. Management has established plans to address any outstanding issues.

In December 2005, Nuclearco established a new joint Human Performance Working Team, comprised of management and union employees. The team began developing plans to help identify and resolve human performance issues at all organizational levels in a cooperative and constructive way.

General Business

Nuclearco continued to generate electricity with respect for the environment, allowing the Group to avoid significant carbon dioxide, sulphur dioxide and nitrogen oxide emissions.

Industrial safety results in 2004/05 identified a need for increased safety training and awareness. In 2005/06, Nuclearco renewed its focus on safety and improved its safety performance. It stayed within its industrial safety target with two lost-time accidents over the year.

Nuclearco continues to enjoy a positive relationship with the IBEW and has a labour agreement in place to December 2010.

Future Plans

Looking forward, Nuclearco’s major focus will be the execution of the refurbishment project activities on time and on budget. It will also ensure safe and reliable operations while working towards achieving world-class performance.

| |

Nuclearco | |

Number of positions | 676 |

Facility | CANDU-6 nuclear reactor |

Net load capacity | 635 MW |

Supply | approximately 25 per cent of in-province load |

Customers | Disco (95%), Maritime Electric Company, Limited (5%) |

Net book value of fixed assets (in millions) | $452 |

| | 2005 | 2006 ANNUAL REPORT NB POWER GROUP 13 |

| Corporate Profiles | |

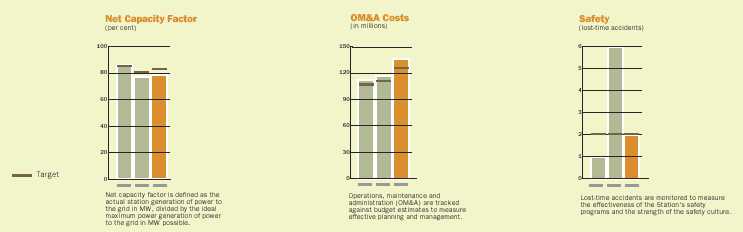

NB Power Transmission Corporation (Transco)

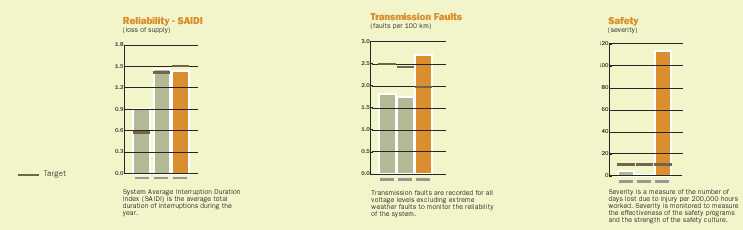

Transco operates and maintains 46 terminals and switchyards that are interconnected by over 6,700 km of transmission lines ranging in voltage from 69 kV to 345 kV. The system is interconnected with electrical systems in North America, including Quebec, Maine, Nova Scotia and Prince Edward Island.

Results Transco’s net income for the fiscal year was $15 million compared to net income in 2004/05 of $9 million, an improvement of $6 million. The increase is mainly due to lower operations, maintenance and administration costs from the impact of the Business Excellence program in 2004/05 year and decreased finance charges.

In 2005/06, Transco achieved a strong rate of return due to abnormally high hydro flows that led to increased point-to-point transmission tariff revenue. Transco also generated additional revenue through work carried out for third parties, primarily line relocations due to road shifts.

Transco and the New Brunswick System Operator (System Operator) participated in a hearing before the New Brunswick Board of Commissioners of Public Utilities (PUB) to realign costs between Transco and the System Operator. The decision modified rates in order to transfer $2 million in costs, compensated by equivalent transfer of work, from Transco to the System Operator. | The year marked the first year of operations following the Business Excellence program’s significant cost and staff reductions. In 2005/06, under the leadership of vice president Wayne Snowdon, Transco focused its efforts on achieving the regulatory rate of return approved by the PUB, preparing for the construction of the International Power Line, and transmission system maintenance, reliability, safety.

Achievements Transco is constructing the International Power Line in partnership with Bangor Hydro. The 345 kV transmission line will run from the Point Lepreau switchyard to the Orrington, Maine (south of Bangor) switching station. The line provides a second major interconnection between New Brunswick and New England. It also increases reliability and efficiency and allows for further market development.

The line is scheduled to be in-service by December 2007. Work continued throughout the year in preparation for construction. In June 2005, the specific route for the Canadian side of the International Power Line was approved. Transco prepared field documents in compliance with the National Energy Board Certificate of Public Convenience and Necessity and received approvals in December 2005. In January 2006, final permits were received on the U.S. side and Transco began construction with the first clearing activities.

Transco continued to provide a reliable transmission system. The overall reliability performance was within the 10-year cumulative average. However, Transco exceeded the target for the total number of faults per 100 km of line, due to an above-average amount of lightning. |

| 14 NB POWER GROUP 2005 | 2006 ANNUAL REPORT | |

To ensure the reliability of the system, Transco continued to upgrade the transmission system through its ongoing replacement programs for breakers, insulators and line life extensions. Transco also upgraded the terminal yard in Edmundston, lightning arrestors and purchased a spare transformer for Point Lepreau.

Transco implemented the first phase of the Workforce Management System to set the foundation for process definition and improvement, allowing for efficiency and productivity improvements. The implementation consolidated paper and online systems into one. Transco will review its processes and implement process and technology improvements to achieve greater efficiencies. The efficiencies will allow Transco to absorb the loss of employees in the staff reductions.

General Business

Transco provided electricity with respect for the environment and maintained an Environmental Management System that is ISO-14001 compliant. In addition, all work done during the construction of the International Power Line is in compliance with the environmental requirements.

It has been a very challenging time for Transco in the area of safety. Following a serious accident in April 2005, Transco has been further developing the safety culture and instilling safety in all of its work. It has developed with each employee a commitment to personal safety and safety leadership. In addition, it has conducted a management field safety visit program.

Transco continues to enjoy a positive relationship with the IBEW and has a labour agreement in place to December 2007.

Future Plans

The major area of focus for Transco will continue to be the construction of the International Power Line and maintaining the transmission system to provide a reliable system throughout the Point Lepreau Generating Station refurbishment outage. In the future, Transco will focus on further process efficiencies and productivity gains through the next two phases of Workforce Management.

| |

Transco | |

Number of positions | 279 |

Number of km of transmission lines | 6,703 |

Export capacity | 2,377 MW |

Import capacity | 1,680 MW |

Net book value of fixed assets (in millions) | $338 |

| | 2005 | 2006 ANNUAL REPORT NB POWER GROUP 15 |

| Corporate Profiles | |

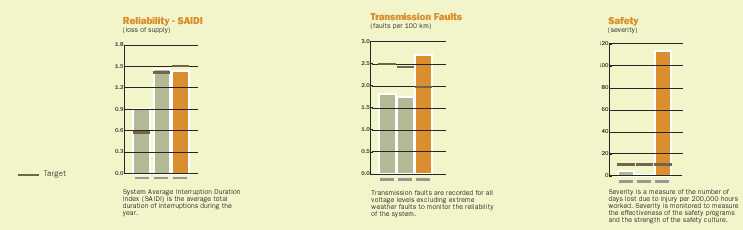

New Brunswick Power Distribution and Customer Service Corporation (Disco)

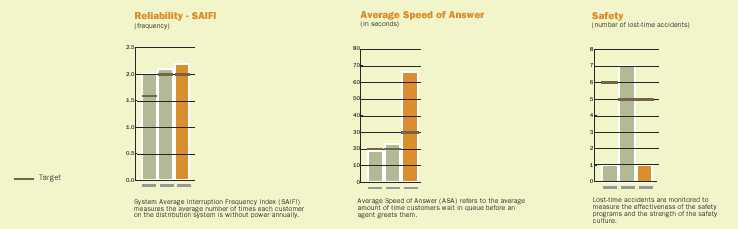

Disco is the standard service supplier, responsible for securing adequate capacity and energy supplies to meet customer demand in New Brunswick. Disco delivers safe, reliable and reasonably-priced energy to its customers by way of its 20,000 km of distribution lines and substations. It also provides valuable customer services through its regional offices, customer contact centres, account managers and energy advisors.

Results Disco’s net income for the fiscal year was $25 million compared to a net income of $7 million in 2004/05, an improvement of $18 million. This is primarily attributed to a higher in-province gross margin due to higher hydro flows reducing in-province costs, lower energy required to service in-province load, and higher in-province revenue due to a six per cent rate increase. Greater-than-anticipated export benefits also reduced in-province costs significantly. The net income was also impacted by lower operations, maintenance and administration costs resulting from the Business Excellence program in 2004/05 and higher payments in lieu of income taxes.

In 2005/06, the System Average Interruption Frequency Index (SAIFI), used to measure the frequency of interruptions, increased slightly over previous years. This was due to severe wind storms and outages in New Brunswick caused by the worst hurricane season in the U.S. in years. | The year marked the first year of operations following the Business Excellence program’s significant cost and staff reductions. In July 2005, Rock Marois was appointed as Disco’s new vice president. Throughout 2005/06, Disco focused on preparing and delivering its application for a rate increase, implementing process efficiencies to reduce costs and maintaining system reliability.

Achievements For the first time since 1993, Disco appeared before the PUB to present its application for an average 11.4 per cent rate increase. Disco requested the rate increase to address its forecasted revenue shortfall of $123 million for 2006/07, driven largely by the dramatic rise in fuel prices.

Over the course of the rate application, Disco answered approximately 2,000 information requests and participated in 56 days of hearings that generated over 6,000 pages of transcripts. In the end, the PUB accepted Disco’s costs and as such, the PUB acknowledged that Disco was effectively controlling costs and running its business well. After reviewing the PUB’s decision, the Province announced an overall 6.9 per cent rate increase effective July 2006.

The Business Excellence program’s staff reductions posed challenges for many Disco employees who needed to adapt to new roles, responsibilities and significant business process changes. In April 2005, Disco began exploring opportunities to strengthen its organizational structure. It established centres of excellence to centralize provincial work in one work location. In addition, further information systems implementations and enhancements have allowed Disco to continue to meet its existing workload with a reduced number of employees. |

| 16 NB POWER GROUP 2005 | 2006 ANNUAL REPORT | |

As part of the cost reductions, Disco undertook a meter estimating pilot project. Due to exceptionally warm weather, Disco had a number of difficulties with the estimating formula during the winter months of the trial. Based on the results of the pilot, Disco suspended its meter estimating.

On January 20, 2006, the first phase of the Workforce Management System was implemented across the province on time and on budget. The project was undertaken to improve operational productivity and access to key operational information, leverage Disco’s investment in existing technologies and reduce Disco’s operational costs. It also provided the platform for future phases that will allow Disco to further streamline its work processes to become more efficient in responding to customer inquiries.

General Business

Throughout the year, Disco delivered electricity with respect for the environment. It operated consistently with ISO 14001 and the Environmental Management System.

With the provincial government’s Renewable Portfolio Standard and new developments in the environmental arena, activity in the renewable energy portfolio increased. In July 2005, Disco implemented a net metering policy. The policy allows generating facilities outside the NB Power Group to generate energy from renewable resources and connect to the distribution system. In October 2005, Disco issued a request for expressions of interest for the development of wind generation.

Throughout its operations, Disco maintained a strong safety record with only one lost time accident and a renewed attention to public safety through a refocused campaign launched in March 2006. It also improved leaders’ training and focused on a safety mindset.

Disco continues to enjoy a positive relationship with the IBEW and has a labour agreement in place to December 2007.

Future Plans

Disco will continue to seek additional cost containments through process and technology changes and culture shifts. It will also examine opportunities to continue to meet customer expectations while managing costs.

| |

Disco | |

Number of positions | 647 |

Number of direct customers | 328,771 |

Number of indirect customers (wholesale) | 41,889 |

Number of calls per year (inbound and outbound) | 856,000 |

Number of poles | 366,000 |

Number km of primary wires | 20,045 |

Net book value of fixed assets (in millions) | $539 |

| | 2005 | 2006 ANNUAL REPORT NB POWER GROUP 17 |

| 18 NB POWER GROUP 2005 | 2006 ANNUAL REPORT | |

| Financial Review | |

| Management’s Discussion and Analysis. | 20 |

| Management’s and Auditors’ Reports | 32 |

| Combined Financial Statement | 33 |

| Notes to the Combined Financial Statements | 37 |

| Statistical Overview. | 54 |

| | 2005 | 2006 ANNUAL REPORT NB POWER GROUP 19 |

FOR THE YEAR ENDED MARCH 31, 2006 |

| Management's Discussion and Analysis |

Management’s Discussion and Analysis reviews financial results from operations for the fiscal year ended March 31, 2006 relative to the previous year. This section should be read in conjunction with the Combined Financial Statements and accompanying notes. The Combined Financial Statements include the accounts of New Brunswick Power Holding Corporation (Holdco) and those of its subsidiaries • New Brunswick Power Generation Corporation (Genco)* • New Brunswick Power Nuclear Corporation (Nuclearco) • New Brunswick Power Transmission Corporation (Transco) • New Brunswick Power Distribution & Customer Service Corporation (Disco) * including the New Brunswick Power Coleson Cove Corporation (Colesonco), formed as a subsidiary of Genco upon restructuring, and NB Coal Limited (NB Coal)

This is collectively referred to as either the NB Power Group or the Corporation.

Financial Viability

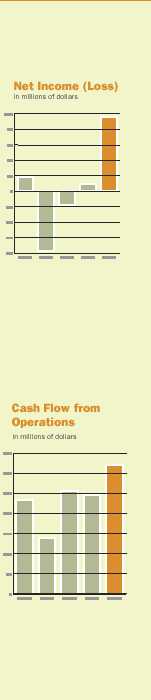

The NB Power Group recorded a net income of $96 million in 2005/06 compared with a net income of $9 million in 2004/05.

There were four major factors that contributed to the year-over-year improvement: significantly above-average hydro; the impact of hurricane Katrina on natural gas prices, which caused high New England export prices for excess power; lower in-province winter demand, leaving excess capacity for export; and finally, the company’s Business Excellence program.

The increase in hydro flows at 43 per cent above the long-term average resulted in a decrease of $50 million in energy costs, and an increase in out-of-province revenue of $74 million due to higher average prices for export energy. New Brunswick also experienced warmer-than-normal winter weather and required less energy to heat homes. The Group was able to sell its excess energy in the export markets at a time when the market was offering higher-than-average prices to purchase energy.

Total revenue was $1,585 million in 2005/06, which is an increase of $182 million or 13 per cent from 2004/05. Out-of-province revenue increased by $128 million or 51 per cent from 2004/05. | The Group’s Business Excellence program involved cost reductions, a ten percent reduction in staff, an improved business planning and budgeting process and the use of a balanced scorecard methodology to increase efficiency and reduce costs. Together, the staff reductions and cost reduction initiatives led to $40 million in annual cost reductions for 2005/06 and future years.

Rate Strategy A significant portion of the Group’s generating capacity is fuelled by oil, coal and natural gas. Due to the relentless rise in fossil fuel prices over the last couple of years, the NB Power Group submitted a rate application to the New Brunswick Board of Commissioners of Public Utilities (PUB).

Disco had requested an overall increase in firm rates of 11.4 per cent, effective April 1, 2006. Disco requested the increase to recover the budgeted 2006/07 revenue shortfall of $123 million driven mainly by rising fuel costs.

On June 19, 2006, the PUB approved an overall rate increase of 9.6 per cent, effective August 1, 2006. On June 30, 2006, the Province of New Brunswick modified the PUB decision pursuant to section 105(1) of the Electricity Act. The overall increase in firm rates approved by the Lieutenant-Governor in Council is 6.9 per cent. Pursuant to section 105(2), the Lieutenant-Governor in Council ruled that the rates would become effective July 1, 2006. This will result in a projected revenue shortfall for 2006/07 of $68 million. Business Development

The NB Power Group continues its Business Excellence program to reduce operating costs and transform into a business-focused organization through an improved business planning and budgeting process and the use of a balanced scorecard methodology to increase efficiency. In addition to its focus on Business Excellence, the Group is also continuing its long-term business development projects.

Point Lepreau Generating Station Refurbishment On July 29, 2005, the Province of New Brunswick announced its decision to support the Board’s recommendation to refurbish the Station in partnership with Atomic Energy of Canada Limited (AECL), the original plant designer. The refurbishment project will extend the Station’s life to 2034, providing the NB Power Group with electricity from a fuel source that is not linked to volatility in fuel pricing. The refurbished station will also continue to provide an environmental benefit by generating electricity that avoids significant carbon dioxide, sulphur dioxide and nitrogen oxide emissions. |

| 20 NB POWER GROUP 2005 | 2006 ANNUAL REPORT | |

|

|

Planning started in 2000 with a definition of the appropriate scope and schedule for refurbishment. With approval in 2005, the project is now well-underway. It will culminate in an 18-month planned outage that will begin April 2008 and be completed by September 2009.

Plant reliability, driven by aging equipment issues, continues to be an ongoing business risk facing Nuclearco. The $1 billion project will replace all 380 fuel channels and calandria tube assemblies and feeders. Other equipment replacements, inspections and upgrades will also be undertaken to allow the Station to operate for its extended life.

Preparing for Point Lepreau Generating Station Refurbishment Genco is being challenged to ready its generation system to run at high availability levels from October 2007 to April 2010, covering the period of the outage for refurbishment and the winter months that precede and follow it.

Transco is readying the transmission system to increase import energy in time for the Station being out of service. Transco is also performing proactive maintenance to ensure system reliability.

Genco and Disco are working together to develop a comprehensive strategy to replace capacity and energy while the Station undergoes refurbishment. The strategy will consider Genco assets, market conditions and availability of third-party supply, the associated transmission requirements and rate issues.

International Power Line In 2001, Transco partnered with Bangor Hydro to construct the International Power Line, a 345 kV transmission line from the Point Lepreau switchyard to the Orrington, Maine (south of Bangor) switching station. The $60 million project will provide a second major interconnection between New Brunswick and New England. It also increases reliability and efficiency and allows for further market development.

The line is scheduled to be in-service by December 2007. Work continued throughout the year in preparation for construction. In June 2005, the specific route for the Canadian side of the International Power Line was approved. Transco prepared field documents in compliance with the National Energy Board Certificate of Public Convenience and Necessity and received approvals in December 2005. By January 2006, all permits had been obtained for construction on the Canadian and U.S. sides.

Alternative Fuels Genco’s oil-fired Coleson Cove Generating Station supplies a significant amount of energy for in-province use and export sales. In response to rising oil prices and the opportunity afforded by Coleson Cove Generating Station’s ability to burn alternative liquid fuels, Genco began exploring lower-cost alternative fuels. Research and development efforts are underway and Genco expects to make a decision on a fuel alternative in 2006/07. |  |

| | 2005 | 2006 ANNUAL REPORT NB POWER GROUP 21 |

FOR THE YEAR ENDED MARCH 31, 2006 |

| Management's Discussion and Analysis |

Financial and Operating Statistics

| | | | |

Financial and Operating Performance Factors |

| | 2005/06 | 2004/05 | 2003/04 |

Hydro net generation as percentage of long-term average | 143% | 106% | 120% |

Point Lepreau Generating Station net capacity factor | 78.4% | 76.7% | 85.6% |

Average heavy fuel oil price ($US/bbl Platt’s NY 3%) | $40.42 | $26.50 | $23.23 |

Average natural gas price ($US/mmBTU) | $9.35 | $6.12 | $5.44 |

Average ICR* coal marker price ($US/ton) | $53.82 | $65.32 | $46.91 |

Average New England on-peak prices ($US/MWh)** | $84.27 | $59.85 | $48.58 |

Canadian dollar at March 31st ($US equivalent) | $0.857 | $0.828 | $0.763 |

* International Coal Report ** net of congestion and marginal losses

The following factors have a significant impact on financial performance because they affect the cost of generation or price competitiveness in export markets

• Hydro Generation – As the NB Power Group’s lowest-cost fuel to generate electricity, hydro typically accounts for approximately 15 per cent of total production. When flows are below anticipated levels, other more expensive fuels are used to account for the shortfall, thereby increasing generation costs. Conversely, when flows are higher than anticipated levels this reduces the use of expensive fuels and thereby decreases generation costs.

• Nuclear Generation – Supplying 25-30 per cent of New Brunswick’s energy requirements, and up to 25 per cent of total production, consistent performance from the Point Lepreau Generating Station is essential to positive financial performance. Planned maintenance outages have been scheduled annually with increased emphasis on feeder inspections. Nuclear performance continues to be an ongoing business risk facing the Corporation.

• Oil Prices – Heavy fuel oil represents approximately 35 per cent of fuel and purchased power costs and it is also used as the replacement fuel when low-cost nuclear and hydro generation is unavailable. To minimize short- to medium-term heavy fuel oil price exposure, the Corporation hedges its forecasted in-province and firm export requirements 18 months forward.

• Natural Gas Prices – The Group has two purchased power contracts tied to natural gas prices and price fluctuations will affect the cost to supply in-province load. The Corporation hedges a significant percentage of this exposure. These contracts represent 25 to 30 per cent of the total fuel and purchased power costs.

• Coal Prices – Coal represents 15 per cent of total fuel and purchased power costs and is purchased through tendered contracts of one to two years.

• Exchange Rates – The NB Power Group is exposed to foreign exchange risk through fuel and purchased power priced in US dollars that exceeds revenue received in US dollars. The Corporation hedges a significant portion of the net known and forecasted US dollar requirements. |

| 22 NB POWER GROUP 2005 | 2006 ANNUAL REPORT | |

Management’s Discussion and Analysis Overview

Management’s Discussion and Analysis Overview

| | | |

Financial Performance (in millions) | 2005/06 | 2004/05 | 2003/04 |

Net income (loss) | $96 | $9 | ($18) |

Cash flow from operations | $319 | $245 | $256 |

Free cash inflow (outflow) | $54 | ($161) | ($376) |

Reduction (increase) in net debt | $26 | $204 | ($321) |

| | | |

Financial Ratios and Percentages | 2005/06 | 2004/05 | 2003/04 |

Operating margin | 21% | 14% | 14% |

Operating cash flow/capital expenditures | 1.53x | 0.72x | 0.52x |

Operating cash flow/total debt | 0.10x | 0.08x | 0.08x |

Per cent of debt in capital structure | 93% | 96% | 106% |

Interest coverage ratio | 1.74x | 0.97x | 0.88x |

The NB Power Group recorded a net income of $96 million in 2005/06 compared with a net income of $9 million in 2004/05.

The most significant factor contributing to the change in year-over-year net income was an increase in gross margin of $116 million. Major contributors to the increase were hydro flows at 43 per cent above the long-term average that resulted in a decrease of $50 million in energy costs, and an increase in out-of-province revenue of $74 million due to higher average prices for export energy.

Other positive factors contributing to the year-over-year change in net income were

•

higher in-province revenue due to the rate increases implemented, offset by lower sales due to warmer weather and lower interruptible prices and volumes

•

decreased operations, maintenance and administration costs mainly due to reduced labour costs associated with a staff reduction program in the previous year

Other factors that offset the impact of these positive developments were

•

higher overall fuel and purchased power prices

•

higher special payments in lieu of income taxes arising from higher earnings

| | 2005 | 2006 ANNUAL REPORT NB POWER GROUP 23 |

FOR THE YEAR ENDED MARCH 31, 2006 |

| Management's Discussion and Analysis |

Management’s Discussion and Analysis Overview (continued)

Cash flow from operations in 2005/06 increased by $74 million to $319 million. This resulted primarily from the increase in net income.

The NB Power Group’s debt decreased by $26 million in 2005/06 as a result of the positive cash flow from operations offset largely by borrowing required for the Point Lepreau Refurbishment Project.

Operating Results 2005/06

| | | |

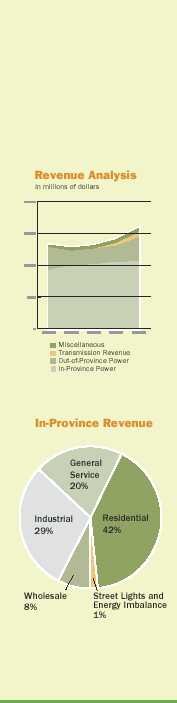

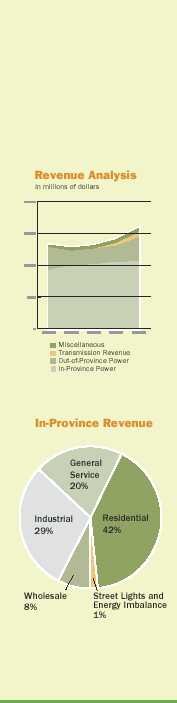

Revenue Overview (in millions) | 2005/06 | 2004/05 | 2003/04 |

Sales of power | | | |

In-province | $1,056 | $1,049 | $1,009 |

Out-of-province | 379 | 251 | 246 |

Miscellaneous | 73 | 62 | 56 |

Transmission | 77 | 41 | - |

Total revenues | $1,585 | $1,403 | $1,311 |

Per cent increase year-over-year | 13% | 7% | 3% |

Total revenues was $1,585 million in 2005/06, which is an increase of $182 million or 13 per cent from 2004/05.

| | | |

In-Province Revenue (in millions) | 2005/06 | 2004/05 | 2003/04 |

Residential | $436 | $427 | $409 |

Industrial | 310 | 319 | 306 |

General service | 213 | 203 | 196 |

Wholesale | 82 | 81 | 80 |

Street lights and energy imbalance | 15 | 19 | 18 |

Total | $1,056 | $1,049 | $1,009 |

GWh | 13,886 | 14,606 | 14,648 |

| 24 NB POWER GROUP 2005 | 2006 ANNUAL REPORT | |

In-province revenue was $1,056 million in 2005/06, representing an increase of $7 million or 0.7 per cent from 2004/05. The main contributors to the year-over-year variance were

In-province revenue was $1,056 million in 2005/06, representing an increase of $7 million or 0.7 per cent from 2004/05. The main contributors to the year-over-year variance were

•

a three per cent average rate increase implemented March 31, 2005, and another three per cent rate increase in July 2005, which increased revenue by $59 million

offset by

•

lower sales volume due to warmer than normal weather, which decreased revenue by

$27 million

•

lower sales volume due to strikes and shutdowns in the pulp and paper industry, which decreased revenue by $8 million

•

lower interruptible sales which decreased revenue by $12 million

•

a net energy imbalance charge paid by Genco and Nuclearco to the New Brunswick System Operator (System Operator) decreased revenue by $5 million (this is offset by a net redistribution credit paid to Disco from the System Operator in fuel and purchased power costs, resulting in an overall net reduction to net income of $1 million)

| | | |

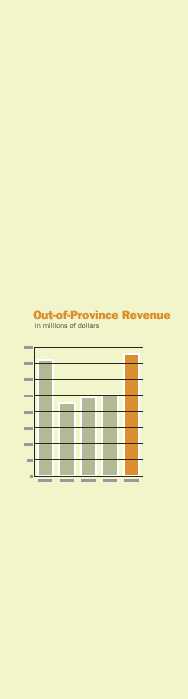

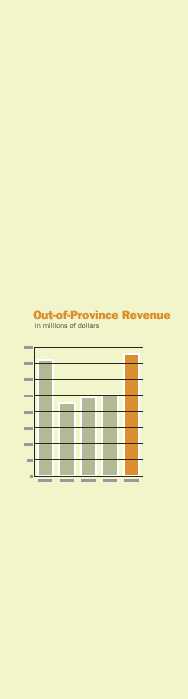

Out-of-Province Revenue (in millions) | 2005/06 | 2004/05 | 2003/04 |

Revenue | $379 | $251 | $246 |

GWh | 4,682 | 3,813 | 3,922 |

In 2005/06, out-of-province revenue increased by $128 million or 51 per cent from 2004/05. The main contributors to the year-over-year variance were

•

an increase of $54 million resulting from more energy available for sale due to lower

in-province demand and higher hydro performance

•

an increase of $74 million due to higher average prices for export energy

Miscellaneous Revenue

Miscellaneous revenue consists primarily of water heater rentals, pole attachment fees, the sale of steam and generation by-products and fees for secondment services provided to the System Operator (commenced after October 1, 2004). Miscellaneous revenue increased by $11 million or 18 per cent from 2004/05 to $73 million in 2005/06, primarily due to increased third-party billings, steam sales and water heater rentals.

Transmission Revenue and Expense

The transmission revenue represents recoveries from the System Operator for the transmission revenue requirement. The transmission expense includes charges for connection fees, point-to-point tariff, and scheduling services.

Transmission revenue was $77 million, an increase of $36 million compared to the previous year. The transmission expense was $86 million, an increase of $40 million compared to the previous year. These increases are mainly due to the previous year’s figures only accounting for the six-month period commencing on October 1, 2004.

| | 2005 | 2006 ANNUAL REPORT NB POWER GROUP 25 |

FOR THE YEAR ENDED MARCH 31, 2006 |

| Management's Discussion and Analysis |

Expenses

| | | | | | |

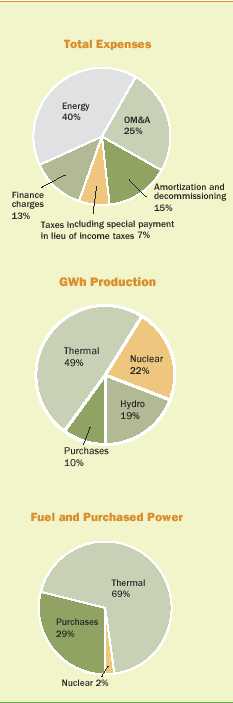

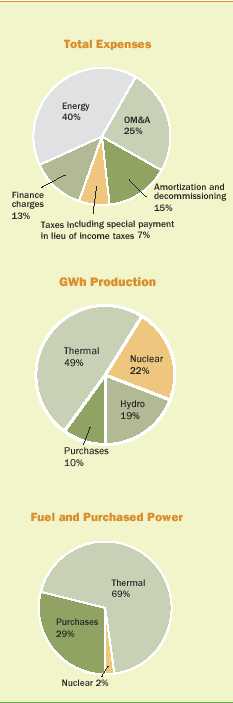

Expenses Overview (in millions) | 2005/06 | 2004/05 | 2003/04 |

| $ | % | $ | % | $ | % |

Fuel and purchased power | $512 | 34% | $497 | 36% | $467 | 36% |

OM&A | 373 | 25 | 384 | 28 | 355 | 27 |

Amortization and decommissioning | 217 | 15 | 219 | 15 | 213 | 16 |

Transmission | 86 | 6 | 46 | 3 | - | - |

Taxes | 47 | 3 | 41 | 3 | 33 | 2 |

Write-off of fuel handling system costs | - | - | - | - | 44 | 3 |

Finance charges | 199 | 13 | 202 | 15 | 217 | 16 |

Special payments | 55 | 4 | 5 | - | - | - |

Total | $1,489 | 100% | $1,394 | 100% | $1,329 | 100% |

Percentage increase (decrease) year-over-year | | 7% | | 5% | | (2%) |

Total expenses increased 7 per cent to $1,489 million in 2005/06. This $95 million increase resulted from the following factors • $15 million increase in fuel and purchased power costs due to overall higher fuel and purchased power prices offset by above-average hydro and increased nuclear generation • $40 million increase in transmission expenses paid to the System Operator • $56 million increase in special payments in lieu of income and capital taxes paid to New Brunswick Electric Finance Corporation (Electric Finance) and property taxes offset by • $11 million decrease in operations, maintenance and administration costs primarily due to reduced labour, pension and early retirement costs resulting from previous year’s staff reduction program • $3 million decrease in finance charges arising from the restructuring of NB Power in 2004/05 • $2 million decrease in amortization and decommissioning |

| | | | | | |

Fuel and Purchased Power (in millions) | 2005/06 | 2004/05 | 2003/04 |

| $ | % | $ | % | $ | % |

Hydro | $0 | 0% | $0 | 0% | $0 | 0% |

Nuclear | 11 | 2 | 9 | 2 | 10 | 2 |

Thermal | 351 | 69 | 366 | 74 | 364 | 78 |

Purchases | 150 | 29 | 122 | 24 | 93 | 20 |

Total | $512 | 100% | $497 | 100% | $467 | 100% |

| 26 NB POWER GROUP 2005 | 2006 ANNUAL REPORT | |

The cost of fuel and purchased power was $512 million in 2005/06, an increase of $15 million or 3.0 per cent from 2004/05. Heavy fuel oil represented 35 per cent of this spending while purchased power from utilities in Nova Scotia, Maine, Quebec and New Brunswick accounted for 29 per cent. The year-over-year increase in fuel and purchased power costs was attributable to the following factors

The cost of fuel and purchased power was $512 million in 2005/06, an increase of $15 million or 3.0 per cent from 2004/05. Heavy fuel oil represented 35 per cent of this spending while purchased power from utilities in Nova Scotia, Maine, Quebec and New Brunswick accounted for 29 per cent. The year-over-year increase in fuel and purchased power costs was attributable to the following factors

•

overall fuel and purchased power prices were higher on average, increasing costs by

$68 million

•

overall higher load increased costs by $2 million

offset by

•

increased hydro flows at 143 per cent of the long-term average in 2005/06 compared to 106 per cent in 2004/05, resulting in decreased energy costs of $50 million

•

Point Lepreau’s net capacity factor of 78.4 per cent during 2005/06 compared to 76.7 per cent in 2004/05 decreased generation costs by $5 million

| | | | |

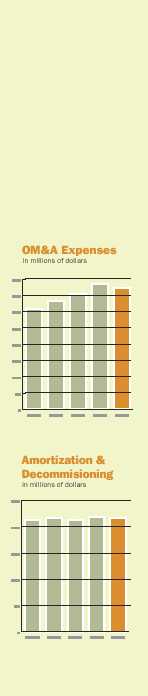

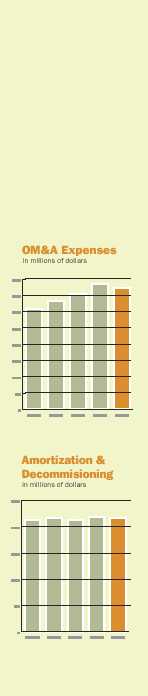

Operations, Maintenance & Administration (in millions) | 2005/06 | 2004/05 | 2003/04 |

OM&A expenses | | $373 | $384 | $355 |

Operations, maintenance and administration costs were $373 million in 2005/06, a decrease of $11 million or three per cent from 2004/05. This was mainly due to the following factors

•

labour, early retirement, and pension costs were $31 million lower due to the previous year’s staff adjustment program that reduced the Corporation’s workforce by 10 per cent

offset by

•

increased costs of $20 million resulting from regulatory hearing costs, plant outage and maintenance costs, increased allowance for doubtful accounts and inventory obsolescence

| | | |

Amortization and Decommissioning (in millions) | 2005/06 | 2004/05 | 2003/04 |

Amortization and decommissioning | $217 | $219 | $213 |

Amortization and decommissioning costs were $217 million in 2005/06, a decrease of $2 million or one per cent from 2004/05. This was primarily due to

•

nuclear service life adjustment reducing amortization costs by $19 million

offset by

•

an increase in thermal amortization expense of $17 million mainly due to the Coleson Cove Generating Station refurbishment project being completed and these assets being in service for all of 2005/06

| | 2005 | 2006 ANNUAL REPORT NB POWER GROUP 27 |

FOR THE YEAR ENDED MARCH 31, 2006 |

| Management's Discussion and Analysis |

| | | | |

Taxes (in millions) | 2005/06 | 2004/05 | 2003/04 |

Taxes | | $47 | $41 | $33 |

Taxes other than special payments in lieu of income taxes were $47 million in 2005/06, an increase of $6 million or 15 per cent from 2004/05. This was mainly due to required payments to Electric Finance for special payments in lieu of provincial capital taxes.

| | | |

Write-off of Fuel Handling System Costs (in millions) | 2005/06 | 2004/05 | 2003/04 |

Write-off of Fuel Handling System costs | $- | $- | $44 |

This one-time write-off in March 2004 was related to expenditures for the development and construction of an off-loading facility capable of handling the delivery of Orimulsion® fuel for the Coleson Cove Generation Station.

| | | | |

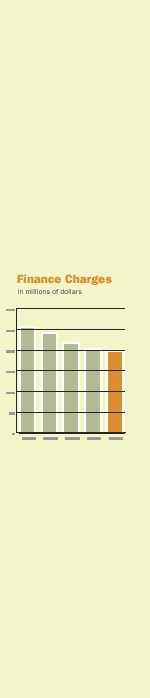

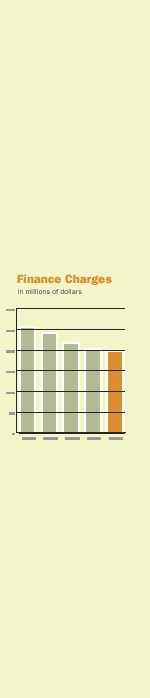

Finance Charges (in millions) | 2005/06 | 2004/05 | 2003/04 |

Finance charges | | $199 | $202 | $217 |

Finance charges were $199 million in 2005/06, a decrease of $3 million or one per cent from 2004/05. This was mainly due to the reduction in debt resulting from the reorganization of the Corporation in 2004/05, offset by an increase in interest costs related to the completion of the Coleson Cove Generating Station refurbishment project and the associated finance charges being charged to income.

| | | | |

Special Payments in Lieu of Income Taxes (in millions) | 2005/06 | 2004/05 | 2003/04 |

Special payments in lieu of income taxes | | $55 | $5 | $- |

Effective October 1, 2004, the NB Power Group was required to make special payments in lieu of income taxes to Electric Finance. These payments consist of an income tax component based on accounting net income and a federal capital tax component.

Special payments in lieu of income taxes were $55 million in 2005/06, an increase of $50 million from 2004/05. This increase was due to an increase in earnings in 2005/06 and the full year’s earnings being subject to these special payments.

| 28 NB POWER GROUP 2005 | 2006 ANNUAL REPORT | |

Liquidity and Capital Resources

Liquidity and Capital Resources

| | | |

Capital Expenditures (in millions) | 2005/06 | 2004/05 | 2003/04 |

Major project capital expenditures | $102 | $220 | $412 |

Regular project capital expenditures | 107 | 115 | 85 |

Total capital expenditures | $209 | $335 | $497 |

Capital expenditures, net of proceeds on disposal and customer contributions, were $209 million in 2005/06. This decrease of $126 million or 38 per cent from 2004/05 resulted from the following factors

•

$207 million decrease in spending on the Coleson Cove Generating Station refurbishment project as the project was completed in December 2004

•

$8 million decrease in regular capital expenditures

offset by

•

$89 million increase in Point Lepreau Generating Station refurbishment project spending

| | | | |

Cash Flow from Operations (in millions) | 2005/06 | 2004/05 | 2003/04 |

Cash flow from operations | | $319 | $245 | $256 |

Cash flow from operations in 2005/06 increased by $74 million to $319 million. This resulted primarily from the increase in net income.

| | | |

Free Cash Inflow (Outflow) (in millions) | 2005/06 | 2004/05 | 2003/04 |

Cash flow from operations | $319 | $245 | $256 |

Capital expenditures | (209) | (335) | (497) |

Other investments | - | (6) | - |

Decrease (increase) in working capital | (11) | (51) | 29 |

Nuclear decommissioning and used fuel management funds – installments and earnings | (40) | (13) | (156) |

Other | (5) | (1) | (8) |

Free cash inflow (outflow) | $54 | $(161) | $(376) |

Free cash inflow was $54 million in 2005/06, an increase of $215 million over 2004/05. The primary reasons for the increase were

•

reduced capital spending

•

increased cash flow from operations due to increased net income

| | 2005 | 2006 ANNUAL REPORT NB POWER GROUP 29 |

FOR THE YEAR ENDED MARCH 31, 2006 |

| Management's Discussion and Analysis |

| | | |

Reduction (Increase) in Net Debt (in millions) | 2005/06 | 2004/05 | 2003/04 |

Free cash inflow (outflow) | $54 | $(161) | $(376) |

Foreign exchange adjustment and deferred debt costs | - | (3) | - |

Net reduction in debt due to restructuring | - | 365 | - |

Dividends paid | (11) | - | - |

Change in cash | (17) | 3 | 55 |

Reduction (increase) in net debt | $26 | $204 | $(321) |

Net debt decreased by $26 million in 2005/06. This was mainly due to the following factors • increased free cash flow offset by • payment of dividends • increased ending cash balance |

| | | |

Total Net Debt (in millions) | 2005/06 | 2004/05 | 2003/04 |

Long-term debt | $2,887 | $2,816 | $2,883* |

Short-term indebtedness | 243 | 340 | 477 |

Total net debt | $3,130 | $3,156 | $3,360 |

Debt/capital | 93% | 96% | 106% |

Cash flow from operations/total debt | 0.10x | 0.08x | 0.08x |

* Long-term debt is net of sinking fund investments

The Group’s debt levels will increase in future years with refurbishment of Point Lepreau Generating Station and construction of the second International Power Line. The level of short-term borrowings fluctuates depending on the timing of debt maturities and capital investment requirements. Since restructuring on October 1, 2004 the Corporation issues long- and short-term notes to Electric Finance. Under the authority of the Electricity Act, Electric Finance issues debt in the name of the Province of New Brunswick.

| 30 NB POWER GROUP 2005 | 2006 ANNUAL REPORT | |

|

|

Significant Accounting Estimates

Amortization The NB Power Group has an amortization review process whereby the service life of major asset categories are reviewed every five years or more frequently as circumstances warrant. These reviews include physical inspection of the asset and review of maintenance and retirement history, technological obsolescence and industry practices. The current estimated useful lives of assets are in Note 4(a) of the Financial Statements.

The amortization expense for the year ended March 31, 2006 is $200 million (2005 – $201 million).

Plant decommissioning and used nuclear fuel management Effective April 1, 2002, the NB Power Group adopted the Canadian Institute of Chartered Accountants standard for asset retirement obligations requiring recognition of the net present value of these liabilities when incurred. The key assumptions on which the liabilities are based are disclosed in Note 18 of the Financial Statements and these assumptions are updated on a periodic basis.

The Government of Canada enacted the Nuclear Fuel Waste Act in 2002 creating the Nuclear Waste Management Organization (NWMO). The organization’s mandate is to recommend to the federal government the best approach for management of used nuclear fuel waste. The NWMO submitted its recommendations to the federal government in November 2005. The approach selected by the federal government could significantly change the liability currently recorded in the Financial Statements for used nuclear fuel management.

The thermal and nuclear decommissioning expense for the year ended March 31, 2006 is $17 million (2005 – $18 million).

Future employee benefits Employees of the NB Power Group belong to the Province of New Brunswick’s superannuation defined benefit pension plan (see Note 15 of the Financial Statements). The Corporation also has a retirement allowance program and at times has early retirement costs (see Note 19).

Unbilled revenue As the NB Power Group bills residential and general service customers on a cyclical basis, the revenue for energy supplied but not billed at the end of each fiscal period is estimated and recorded. This estimate is based on substation readings and average rates. The revenue accrued at March 31, 2006 was $36 million (2005– $36 million).

Overhead to capital As described in Note 4(a) of the Financial Statements, the Corporation adds an overhead to capital projects for indirect charges for administration and other expenses. The amount of overhead charged to capital in the year ended March 31, 2006 is $11 million (2005 – $11 million). |  |

| | 2005 | 2006 ANNUAL REPORT NB POWER GROUP 31 |

FOR THE YEAR ENDED MARCH 31, 2006 |

| Management's and Auditors' Reports |

Management Report

May 26, 2006

The NB Power Group’s financial statements have been prepared by management, who are responsible for the integrity, accuracy and fairness of the information. The accounting principles followed in the financial statements are generally accepted in Canada. The financial information presented throughout the annual report is consistent with the financial statements.

Systems of internal control and supporting procedures are maintained to provide assurance that transactions are authorized, assets are safeguarded and records properly maintained. These controls and procedures include • system security and various financial controls • quality standards in hiring and training of employees • a code of conduct • an organizational structure that provides a well-defined division of responsibilities • performance accountability • communication of policies and guidelines through the Corporation

Internal controls are reviewed and evaluated by audit programs which are subject to scrutiny by external auditors.

The ultimate responsibility for the financial statements rests with the Board of Directors. The Board is assisted in its responsibilities by the Audit Committee, which reviews the recommendations of internal and external auditors for improvements in internal control and the action of management to implement such recommendations. In carrying out its duties and responsibilities, the Audit Committee meets regularly with management and with external and internal auditors to review the scope and timing of their respective audits, to review their findings and to satisfy itself that its responsibility has been properly discharged. The Audit Committee reviews the financial statements and recommends them for approval by the Board of Directors.

The Corporation’s external auditors, Deloitte & Touche LLP, have conducted an independent examination of the financial statements in accordance with auditing standards generally accepted in Canada, performing such tests and other procedures as they consider necessary to express the opinion in their Auditors’ Report. The external auditors have full and unrestricted access to the Audit Committee to discuss their audit and related findings as to the integrity of the Corporation’s financial reporting and the adequacy of internal control systems.

David D. Hay Sharon MacFarlane President & CEO Vice President - Finance | Auditors’ Report

May 26, 2006

The Honourable Herménégilde Chiasson Lieutenant-Governor of New Brunswick Fredericton, New Brunswick

Sir:

We have audited the combined balance sheet of NB Power Holding Corporation (the “Corporation”) as at March 31, 2006 and the combined statements of operations, deficit and cash flows for the year then ended. These financial statements are the responsibility of the Corporation’s management. Our responsibility is to express an opinion on these financial statements based on our audit.