UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED

MANAGEMENT INVESTMENT COMPANIES

Investment Company Act file number | 811-6094 |

|

THE LATIN AMERICA EQUITY FUND, INC. |

(Exact name of registrant as specified in charter) |

|

Eleven Madison Avenue, New York, New York | | 10010 |

(Address of principal executive offices) | | (Zip code) |

|

J. Kevin Gao, Esq.

The Latin America Equity Fund, Inc.

Eleven Madison Avenue

New York, New York 10010 |

(Name and address of agent for service) |

|

Registrant’s telephone number, including area code: | (212) 325-2000 | |

|

Date of fiscal year end: | December 31st | |

|

Date of reporting period: | January 1, 2007 to December 31, 2007 | |

| | | | | | | | | |

Item 1. Reports to Stockholders.

THE LATIN AMERICA

EQUITY FUND, INC.

ANNUAL REPORT

DECEMBER 31, 2007

LAQ-AR-1207

LETTER TO SHAREHOLDERS (UNAUDITED)

February 7, 2008

Dear Shareholder:

For the year ended December 31, 2007, The Latin America Equity Fund, Inc. (the "Fund") had an increase in its net asset value (NAV) of 50.46%, assuming reinvestment of dividends and distributions, net of all fees, expenses and taxes. By comparison, the Morgan Stanley Capital International Latin America Index ("MSCI Latin America Index")* had an increase of 50.4% (total return index, net of foreign taxation) for the period.

Based on market price, the Fund's shares reported a total return of 42.45% during the year. These returns are calculated to include the payment of two dividends during the calendar year. The first for US$2.62 per share was paid on September 14, 2007. The second for US$9.93 per share was paid on January 18, 2008. Taken together, these two dividends are 131% higher than the dividends paid in calendar 2006 and represent a dividend yield of 25.1% based on the average market share price of $50.00 during 2007.

Latin America: Leading an Outperforming Asset Class

The year ended December 31, 2007, marks the fifth consecutive year of strong increases in the prices of Latin American equities. Since December 31, 2002, the Fund's NAV has compounded at an impressive rate of 48% per annum. The backdrop was a positive one. Emerging markets in general performed very well, aided by firm global growth as demand from the rest of the world compensated for slower economic activity in the United States. Additionally emerging markets performance was helped by strong commodity prices, low levels of risk aversion and supportive liquidity conditions. The annualized total return of the MSCI Emerging Markets Index was 39.23%, eclipsing developed equity market returns.

Latin America outperformed the broader emerging markets group with the MSCI Latin America Index (the Fund's benchmark) returning 50.4% during 2007.

A Quiet Year on the Political Front

Last year we noted the fact that 2006 was a year of significant political activity in Latin America with ten presidential elections during the year. This year was interesting for exactly the opposite reason: at the risk of tempting fate, seldom have politics seemed less relevant to financial markets than they do now. To be sure, Mr. Chávez keeps everyone on their toes; however, we think it was significant that his plans to alter the Constitution to permit indefinite reelection met with strong opposition and delivered him his first (acknowledged) electoral defeat during his time in office. As we have noted in the past, Venezuela is irrelevant in market terms since it now forms no part of the MSCI Latin America Index.

In Mexico, we think it fair to say that Mr. Calderón has proven himself a much more skillful political operator than his predecessor. He has been successful in breaking the political deadlock which had kept any kind of reform off the agenda in Mexico. He has introduced several bold pieces of legislation in conjunction with support from opposition parties. Not all of these reforms have been good for the incumbent oligopolies which make up an important part of trading activity on the Mexican stock exchange, but the way in which change has been implemented seems sensible to us.

1

LETTER TO SHAREHOLDERS (UNAUDITED) (CONTINUED)

In Brazil, where we have held an overweight position for many years, Mr. Luis Inacio "Lula" da Silva seems content to sit back and enjoy the benefits of an economy which continues to gather steam with, in our opinion, very sound macroeconomic fundamentals. 2008 may well be the year in which the rating agencies once again classify Brazil as investment grade.

The only country to experience a change of government was Argentina but even then change may be too strong a word: Nestor Kirchner handed the keys of the Casa Rosada over to his wife Cristina toward the end of the year, but all the signs are that it will be business as usual in Argentina. While commodity prices remain at current levels, the economy seems to be stable; however, we continue to believe that the government's approach to inflation remains a significant source of risk to macroeconomic stability in the future.

Strong Macroeconomic Fundamentals

From an economic perspective, there have been few significant changes over the course of the last year. It is perhaps worth noting, though, that many currencies in the region, particularly the Brazilian Real, have continued to strengthen on the back of high commodity prices and, as a consequence, strong trade surpluses. As a result, imports have also grown rapidly, leading to the prospect of deterioration in the balance of trade. A large part of the (U.S. dollar) returns over the last five years have come from currency appreciation against the dollar. We doubt that in the coming months and years there will be further currency appreciation on this scale. Having said that, we see no currencies which are conspicuously overvalued either.

Another point worth noting, in the light of current market conditions, is that the credit market problems in the United States have little direct relevance for Latin American financial institutions. The problem in Latin America is, if anything, the opposite—a legacy of high interest rates and financial instability which has meant that the market for financial services is too underpenetrated. Mortgage credit is very low by comparison to developed markets and the trend towards the securitization of those credits is in its infancy in the region. The way the subprime crisis may or may not be transmitted to Latin American equities is an indirect one through appetite for risk as investors retrench into "safer" assets. However, what has been interesting about how markets have reacted to the subprime crisis so far is that fund flows seem to suggest there has been little if any change in investor's perception of the riskiness of emerging markets assets as a result of financial instability in U.S. markets. Again, we hope that we are not tempting fate with such as statement!

It should also be noted that after a period of falling inflation in the region, inflation is once again on the rise in some countries, notably Argentina, Chile and Mexico. These inflationary trends have been driven by increases in the prices of foods (in most cases due to specific supply side conditions), but also as a function of the competition for land that has been created by the trend toward growing crops for biofuels. As a result, several Central Banks in the region are either in tightening mode (Mexico, Chile) or are no longer cutting (Brazil).

Brazil Led Latin Equity Markets in 2007

Turning to the equity markets, Brazil was again the standout in 2007, reaching all-time highs on the back of a supportive backdrop for commodity prices, as well as stronger domestic demand, encouraged by lower interest rates, higher real wages and employment growth. The political scene, as noted earlier, was very quiet.

2

LETTER TO SHAREHOLDERS (UNAUDITED) (CONTINUED)

It is also important to note that the breadth of the market was unusually narrow. Two stocks, diversified mining company Companhia Vale do Rio Doce (11.15% of the Fund's net assets as of December 31, 2007) and integrated oil company Petróleo Brasileiro (20.45% of the Fund's net assets as of December 31, 2007), which also happen to be the two largest weights in the MSCI indices, accounted for the lion's share of excess returns. Companhia Vale do Rio Doce's ADR on the preferred class of shares (NYSE Ticker: RIO/P) rose by 113.2%. Petróleo Brasileiro's ADR (NYSE ticker: PBR/A) rose by 107.5%. This compares with the index return of 50.4%. If one were to exclude Petróleo Brasileiro and Companhia Vale do Rio Doce from the MSCI Latin America Index, the index would have risen by 24.1% instead of 50.4%. Looking at it another way, 73% of the stocks in the MSCI Latin America Index did NOT return more than the benchmark.

On average, therefore, equity prices of Brazilian stocks were not nearly as high as the index return would suggest. Clearly, with oil prices at record levels, Petróleo Brasileiro's increase was significantly about oil prices, coupled with the discovery of a very large oil and natural gas field off the coast of Rio de Janeiro, while Companhia Vale do Rio Doce's strong performance was influenced by continuing strong demand for steel and iron ore from China, as well as the prospect of further rises in the price of iron ore in the near future.

The second most significant component of the MSCI Latin America Index, Mexico, closed the year up 9.3%, significantly behind Brazil, on the back of fears of economic contamination from its proximity to the United States. The only market to outperform Brazil was Peru, which rose 86%. Argentina fell by 5.4%. MSCI Chile returned 20%, buoyed by strong commodity prices—particularly copper and wood pulp—and strong growth in the retail sector originating from strong domestic demand as well as rapid expansion in other Latin American markets, notably Peru and Colombia.

MSCI Colombia returned only 12.6%, after reintroducing capital controls in 2007, thereby reducing the attractiveness of this promising market for foreign investors.

Performance: Distorted by a narrow market

For the year ended December 31, 2007, the Fund returned 50.46% based on net asset value, as compared to 50.4% for the MSCI Latin America Index. Among the positions which contributed positively to performance in 2007, the following stand out: PDG Realty SA (a real estate developer in Brazil) (1.01% of the Fund's net assets as of December 31, 2007), GVT Holding SA (an alternative telecommunications company in Brazil) (0.79% of the Fund's net assets as of December 31, 2007); Telenorte Leste Participações S.A. (a telecommunications company in Brazil) (2.87% of the Fund's net assets as of December 31, 2007); Empresas ICA S.A.B. de C.V (a construction company in Mexico) (1.71% of the Fund's net assets as of December 31, 2007) and Terna Participações S.A. (an electricity transportation company in Brazil) (1.28% of the Fund's net assets as of December 31, 2007).

Although Petróleo Brasileiro and Companhia Vale do Rio Doce remain the largest and the second largest positions in the Fund, together accounting for 31.6% of the Fund's net assets, the weighting of both of these stocks in the MSCI indices climbed significantly over the course of the year and with it, the relative underweight of the Fund also increased. These two underweights detracted significantly from performance. Other detractors from performance included our underweight positions in: CSN (a producer of steel and iron ore in Brazil) (0% of the Fund's net assets as of December 31, 2007); Banco Bradesco S.A. (a bank in Brazil) (2.68% of the Fund's net assets as of December 31, 2007); Southern Copper (a copper mining company in Peru) (0% of the Fund's net assets as of December 31, 2007); Gerdau S.A. (a steel company in Brazil

3

LETTER TO SHAREHOLDERS (UNAUDITED) (CONTINUED)

and the U.S.A.) (0.63% of the Fund's net assets as of December 31, 2007) and our overweight position in off index Mercantil Servicios Financieros, C.A. (a bank in Venezuela) (0.67% of the Fund's net assets as of December 31, 2007).

Strategic Review and Outlook: Fundamentals remain sound

As can be seen from these names, our largest sector underweight continues to be in the materials sector, particularly the steel sector.

From a country weighting perspective, toward the end of the year we reduced our longstanding overweight in Brazil and are now effectively neutral. First, valuations are no longer so compelling; second, the Brazilian market, due to the importance of companies which sell commodities, is particularly exposed to a slowdown in global growth. We are now slightly overweight in Mexico which has lagged Brazil significantly and now looks attractive to us. Although the Mexican economy is sensitive to economic activity in the U.S., the majority of the companies listed on the stock market are more oriented to the domestic economy than to export markets.

We continue to emphasize stocks which give exposure to infrastructure spending, credit growth and domestic consumption.

The underweights in Companhia Vale do Rio Doce and Petróleo Brasileiro, as well as other underweights in companies with larger stock market capitalizations, have funded overweight positions in a number of smaller and medium sized companies which we believe have better growth prospects and better valuation profiles. The liquidity conditions we experienced during much of the year did not favor small and mid cap companies; however, we continue to believe that the fundamental outlook for the companies in our portfolio is strong and we are sticking with our positions in spite of this underperformance. In the volatile market conditions we have experienced at the start of 2008, we feel that these positions should preserve their market value more successfully than some of the more liquid names in the market place.

Even though 2007 was the fifth consecutive year of strong returns from Latin American equities, (therefore representing a relatively old bull market by emerging markets standards), we continue to be bullish on the outlook for Latin American equities. This bullishness is predicated on the assumption that, as a whole, the region is able to maintain continuity of macroeconomic policy in the years ahead. If past performance were a guide to future performance, investors would have ample reason to be nervous at this stage of the cycle. However we are firm believers that the benefits of economic stability over a protracted period of time can be profound and long lasting.

The best advertisement for this belief is to look at the progress Chile has made over the last two decades by virtue of pursuing the same coherent macroeconomic policies over time. Even Chile, however, still has much to do to improve standards of living and standards of education for its citizens as the wealth that has been generated over the years permeates throughout the economy. Those challenges represent ongoing opportunities for investors.

A popular misconception about Latin America is that the region depends mainly on the export of natural resources to the rest of the world. This is an oversimplification. We believe many of the best investment opportunities are ones that involve bringing first world products and services to consumers who have never had the opportunity to enjoy those products and services. If economic stability can be maintained, the potential for growth of domestic consumption is enormous.

4

LETTER TO SHAREHOLDERS (UNAUDITED) (CONTINUED)

We also see significant potential in infrastructure investments. This includes electricity generation and transmission, roads, ports, railways, airports and airlines. Faced with the need to improve antiquated infrastructure in their countries, but constrained on the fiscal side, many governments in the region are turning to the private sector to lead investment. Again, anyone who has traveled the excellent new highways that have been built in Chile in recent years with private capital will know that this development model can work.

Capital market conditions were again very supportive throughout 2007, with greater liquidity and fund flows encouraging much new issue activity. This has given investors a much broader range of investment options, often in sectors of the economy to which it had previously been impossible to gain exposure. In contrast, 2008 is so far proving to be much harder and we think it likely that capital markets activity will be depressed. However, there is still significant liquidity in the world at this time and we anticipate that the current correction should not be long lived and should provide an excellent opportunity to pick good investments for the future at attractive prices.

Other than ever-present political risks, the main risks still seem to us to be external ones, in particular the risk of external shocks from slowing global demand and/or lower commodities prices. At the other end of the risk spectrum, Latin America's success at restructuring corporate and government balance sheets and the region's diminished dependency on foreign capital means that Latin America is much less sensitive to capital flows from outside the region than it has been in the past.

The main internal economic risk seems to us to be the risk of inflation once again returning to haunt a region which has historically not been very good at dealing with inflation.

We do not expect to see significant further market re-rating and believe that share prices will have to be driven by corporate earnings going forward. We also believe that there is less potential for local currency re-rating against the U.S. dollar. This means that investors should not, in our opinion, expect to see the same rate of returns that we have experienced over the last five years.

Nevertheless we reiterate that we believe overall macro economic fundamentals remain healthy and we are optimistic that 2008 should be another positive year for Latin American equities.

Respectfully,

| |  | |

|

Matthew J.K. Hickman

Chief Investment Officer ** | | Lawrence D. Haber

Chief Executive Officer and President *** | |

|

International investing entails special risk considerations, including currency fluctuations, lower liquidity, economic and political risks, and differences in accounting methods; these risks are generally heightened for emerging-market investments.

5

LETTER TO SHAREHOLDERS (UNAUDITED) (CONTINUED)

In addition to historical information, this report contains forward-looking statements, which may concern, among other things, domestic and foreign market, industry and economic trends and developments and government regulation and their potential impact on the Fund's investments. These statements are subject to risks and uncertainties and actual trends, developments and regulations in the future and their impact on the Fund could be materially different from those projected, anticipated or implied. The Fund has no obligation to update or revise forward-looking statements.

* The Morgan Stanley Capital International Daily TR Net Emerging Markets Latin America Index is a total return free float-adjusted market capitalization index that is designed to measure equity-market performance in Latin America, including an assumption for the reinvestment of dividends, net of all foreign taxes payable. It is the exclusive property of Morgan Stanley Capital International Inc. Investors cannot invest directly in an index.

** Matthew J.K. Hickman, Director, is a portfolio manager specializing in Latin American equities. He has specialized in Latin American financial markets since 1987. He joined Credit Suisse in 2003 from Compass Group Investment Advisors, where he was general manager of the private wealth management division, based in Santiago, Chile. For much of his career he worked as a sell-side equity analyst at various investment banks, focusing on Latin American telecommunications companies and several Latin American country markets; prior to this, he worked at Rothschild Asset Management where he was a member of the management team for the Five Arrows Chile Fund. Mr. Hickman holds a BA in modern languages from Cambridge University and a diploma in corporate finance from London Business School. He is fluent in Spanish, Portuguese and French. He is also the Chief Investment Officer of The Chile Fund, Inc.

*** Mr. Haber is a Managing Director and Chief Operating Officer of the Asset Management Division of Credit Suisse and a member of the Asset Management Division's Management Committee. Mr. Haber has been associated with Credit Suisse since 2003. Previously, he was Chief Financial Officer of Merrill Lynch Investment Managers from 1997 to 2003.

6

THE LATIN AMERICA EQUITY FUND, INC.

PORTFOLIO SUMMARY

DECEMBER 31, 2007 (UNAUDITED)

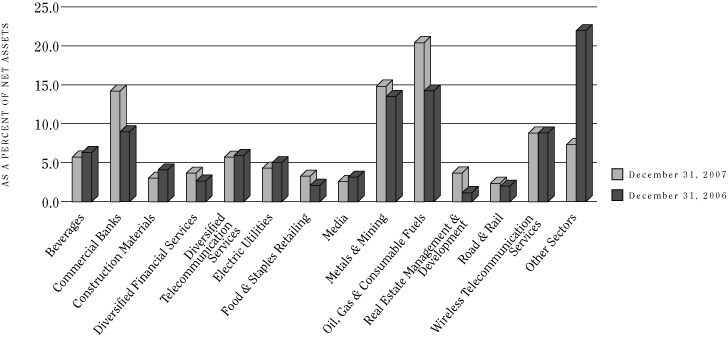

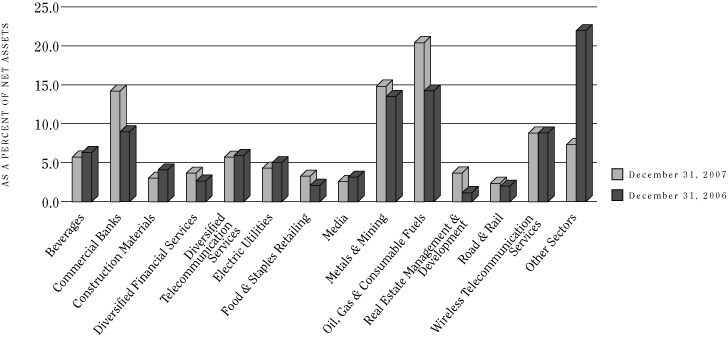

SECTOR ALLOCATION

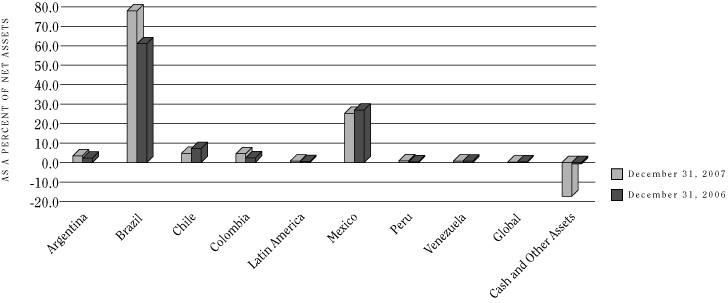

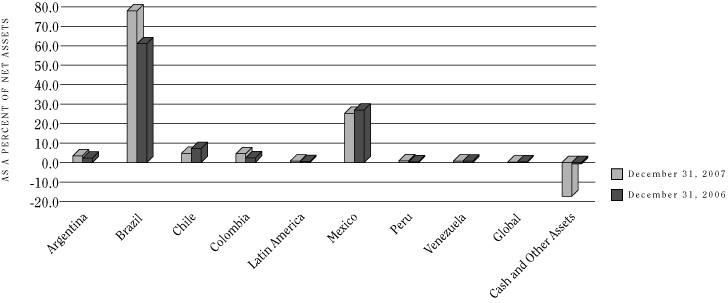

GEOGRAPHIC ASSET BREAKDOWN

7

THE LATIN AMERICA EQUITY FUND, INC.

PORTFOLIO SUMMARY

DECEMBER 31, 2007 (UNAUDITED) (CONTINUED)

TOP 10 HOLDINGS, BY ISSUER

| | | Holding | | Sector | | Country | | Percent of

Net Assets | |

| | 1. | | | Petróleo Brasileiro S.A. | | Oil, Gas & Consumable Fuels | | Brazil | | | 20.5 | | |

| | 2. | | | Companhia Vale do Rio Doce | | Metals & Mining | | Brazil | | | 11.2 | | |

| | 3. | | | América Móvil, SAB de C.V. | | Wireless Telecommunication Services | | Mexico | | | 8.4 | | |

| | 4. | | | Cemex SAB de C.V. | | Construction Materials | | Mexico | | | 3.0 | | |

| | 5. | | | Tele Norte Leste Participações S.A. | | Diversified Telecommunication Services | | Brazil | | | 2.9 | | |

| | 6. | | | Banco Bradesco S.A. | | Commercial Banks | | Brazil | | | 2.7 | | |

| | 7. | | | Fomento Economico Mexicano, S.A. de C.V. | | Beverages | | Mexico | | | 2.3 | | |

| | 8. | | | Companhia de Bebidas das Americas | | Beverages | | Brazil | | | 2.0 | | |

| | 9. | | | União de Bancos Brasileiros S.A. | | Commercial Banks | | Brazil | | | 2.0 | | |

| | 10. | | | Banco Itaú Holding Financeira S.A. | | Commercial Banks | | Brazil | | | 2.0 | | |

8

THE LATIN AMERICA EQUITY FUND, INC.

AVERAGE ANNUAL RETURNS

DECEMBER 31, 2007 (UNAUDITED)

| | | 1 Year | | 3 Years | | 5 Years | | 10 Years | |

| Net Asset Value (NAV) | | | 50.46 | % | | | 49.00 | % | | | 48.40 | % | | | 17.09 | % | |

| Market Value | | | 42.45 | % | | | 49.13 | % | | | 50.21 | % | | | 18.41 | % | |

From time to time, Credit Suisse may waive fees and/or reimburse expenses, without which performance would be lower. Waivers and/or reimbursements are subject to change and may be discontinued at any time. Returns represent past performance. Total investment return at net asset value is based on changes in the net asset value of fund shares and assumes reinvestment of dividends and distributions, if any. Total investment return at market value is based on changes in the market price at which the fund's shares traded on the stock exchange during the period and assumes reinvestment of dividends and distributions, if any, at actual prices pursuant to the fund's dividend reinvestment program. Because the fund's shares trade in the stock market based on investor demand, the fund may trade at a price higher or lower than its NAV. Therefore, returns are calculated based on share price and NAV. Past performance is no guarantee of future results. The current performance of the fund may be lower or higher than the figures shown. The fund's yield, return and market price and NAV will fluctuate. Performance information current to the most recent month-end is available by calling 800-293-1232.

9

THE LATIN AMERICA EQUITY FUND, INC.

SCHEDULE OF INVESTMENTS

DECEMBER 31, 2007

| Description | | No. of

Shares | | Value | |

| EQUITY OR EQUITY-LINKED SECURITIES-117.36% | |

| ARGENTINA-3.03% | |

| CAPITAL MARKETS-0.81% | |

| Pampa Holding SA, GDR†† | | | 141,098 | | | $ | 2,723,756 | | |

| COMMERCIAL BANKS-0.36% | |

| Banco Patagonia SA, BDR† | | | 56,000 | | | | 1,220,674 | | |

| ENERGY EQUIPMENT & SERVICES-1.45% | |

| Tenaris S.A., ADR | | | 108,600 | | | | 4,857,678 | | |

| THRIFTS & MORTGAGE FINANCE-0.41% | |

| Banco Hipotecario S.A., ADR† | | | 192,700 | | | | 1,376,437 | | |

TOTAL ARGENTINA

(Cost $8,166,714) | | | 10,178,545 | | |

| BRAZIL-77.92% | |

| AIR FREIGHT & LOGISTICS-0.41% | |

Log-in Logistica

Intermodal SA† | | | 175,463 | | | | 1,359,345 | | |

| AIRLINES-1.15% | |

| Tam S.A., PN | | | 160,800 | | | | 3,852,876 | | |

| BEVERAGES-2.03% | |

Companhia de Bebidas das

Americas, ADR | | | 22,600 | | | | 1,536,800 | | |

Companhia de Bebidas das

Americas, ADR, PN | | | 74,500 | | | | 5,291,735 | | |

| | | | 6,828,535 | | |

| BUILDING PRODUCTS-0.68% | |

Companhia Providencia

Industria e Comercio† | | | 402,000 | | | | 2,281,011 | | |

| CAPITAL MARKETS-0.27% | |

| Clean Energy Brazil PLC† | | | 477,912 | | | | 865,712 | | |

Clean Energy Brazil PLC,

warrants† | | | 126,750 | | | | 32,800 | | |

| | | | 898,512 | | |

| Description | | No. of

Shares | | Value | |

| COMMERCIAL BANKS-10.14% | |

| Banco Bradesco S.A., PN | | | 281,100 | | | $ | 8,993,621 | | |

Banco Industrial e Comercial

SA, PN† | | | 370,000 | | | | 2,259,494 | | |

Banco Itaú Holding Financeira

S.A., PN | | | 259,200 | | | | 6,625,618 | | |

| Banco Panamericano SA† | | | 691,000 | | | | 3,455,000 | | |

| Investimentos Itaú S.A., PN | | | 921,197 | | | | 6,080,935 | | |

União de Bancos Brasileiros

S.A., GDR | | | 47,500 | | | | 6,632,900 | | |

| | | | 34,047,568 | | |

| COMPUTERS & PERIPHERALS-1.10% | |

Bematech Industria e

Comercio de Equipamentos

Eletronicos SA† | | | 222,900 | | | | 1,164,590 | | |

| Positivo Informatica SA | | | 103,600 | | | | 2,531,216 | | |

| | | | 3,695,806 | | |

| CONTAINERS & PACKAGING-0.29% | |

| Klabin S.A., PN | | | 264,209 | | | | 981,136 | | |

| DIVERSIFIED FINANCIAL SERVICES-1.95% | |

Bolsa de Mercadorias e Futuros

(BM&F) SA† | | | 121,000 | | | | 1,699,438 | | |

| Bradespar S.A., PN | | | 180,800 | | | | 4,834,876 | | |

| | | | 6,534,314 | | |

| DIVERSIFIED TELECOMMUNICATION SERVICES-5.72% | |

Brasil Telecom

Participações S.A. | | | 87,605 | | | | 2,288,558 | | |

Brasil Telecom Participações

S.A., ADR | | | 14,100 | | | | 1,051,578 | | |

| GVT Holding SA† | | | 131,500 | | | | 2,641,081 | | |

Telecomunicações de São

Paulo S.A., PN | | | 72,900 | | | | 1,851,169 | | |

Telemar Norte Leste

S.A., PNA | | | 45,545 | | | | 1,752,715 | | |

Tele Norte Leste Participações

S.A., ON | | | 292,636 | | | | 9,625,752 | | |

| | | | 19,210,853 | | |

See accompanying notes to financial statements.

10

THE LATIN AMERICA EQUITY FUND, INC.

SCHEDULE OF INVESTMENTS

DECEMBER 31, 2007 (CONTINUED)

| Description | | No. of

Shares | | Value | |

| ELECTRIC UTILITIES-3.95% | |

Centrais Elétricas Brasileiras

S.A., PNB | | | 220,200 | | | $ | 2,839,095 | | |

Companhia Energética de Minas

Gerais, ADR | | | 159,600 | | | | 2,946,216 | | |

| EDP - Energias do Brasil S.A. | | | 112,700 | | | | 1,829,792 | | |

Eletropaulo Metropolitana

S.A., PNB | | | 16,510,000 | | | | 1,349,553 | | |

| Terna Participações S.A. | | | 246,918 | | | | 4,300,257 | | |

| | | | 13,264,913 | | |

| FOOD PRODUCTS-1.81% | |

Cosan S.A. Industria e

Comercio | | | 107,100 | | | | 1,251,506 | | |

Cosan S.A. Industria e

Comercio, rights

(expiring 1/7/08)† | | | 46,663 | | | | 2,359 | | |

Marfrig Frigorificos e Comercio

de Alimentos SA† | | | 93,000 | | | | 796,770 | | |

| Perdigao S.A. | | | 111,700 | | | | 2,777,439 | | |

| Sao Martinho SA | | | 109,000 | | | | 1,236,966 | | |

| | | | 6,065,040 | | |

| HEALTH CARE PROVIDERS & SERVICES-0.78% | |

| Diagnosticos da America S.A. | | | 127,000 | | | | 2,632,753 | | |

| HOUSEHOLD DURABLES-0.45% | |

Springs Global

Participacoes SA† | | | 121,000 | | | | 1,495,506 | | |

INDEPENDENT POWER PRODUCERS &

ENERGY TRADERS-0.56% | |

| Tractebel Energia S.A. | | | 158,191 | | | | 1,892,960 | | |

| INSURANCE-1.00% | |

| Sul America SA† | | | 197,000 | | | | 3,346,786 | | |

| INTERNET & CATALOG RETAIL-0.88% | |

| B2W Compania Global do Varejo | | | 74,400 | | | | 2,967,640 | | |

| IT SERVICES-0.35% | |

| Redecard SA | | | 73,000 | | | | 1,181,124 | | |

| Description | | No. of

Shares | | Value | |

| MACHINERY-1.07% | |

| Metalfrio Solutions SA† | | | 124,620 | | | $ | 1,819,592 | | |

| Weg S.A. | | | 124,200 | | | | 1,758,337 | | |

| | | | 3,577,929 | | |

| MEDIA-0.69% | |

Net Servicos de Comunicacao

SA, PN† | | | 191,399 | | | | 2,333,347 | | |

| METALS & MINING-13.18% | |

Companhia Vale do Rio Doce,

ADR, PNA | | | 1,337,800 | | | | 37,431,644 | | |

| Gerdau S.A., PN | | | 72,000 | | | | 2,101,753 | | |

Usinas Siderúrgicas de

Minas Gerais S.A. | | | 34,500 | | | | 1,608,708 | | |

Usinas Siderúrgicas de

Minas Gerais S.A., PNA | | | 67,950 | | | | 3,111,194 | | |

| | | | 44,253,299 | | |

| MULTILINE RETAIL-0.56% | |

| Lojas Americanas S.A., PN | | | 215,624 | | | | 1,883,682 | | |

| OIL, GAS & CONSUMABLE FUELS-20.45% | |

| Petróleo Brasileiro S.A., ADR | | | 713,500 | | | | 68,652,970 | | |

| PAPER & FOREST PRODUCTS-0.64% | |

| Aracruz Celulose S.A., ADR | | | 29,000 | | | | 2,156,150 | | |

| PERSONAL PRODUCTS-0.41% | |

| Natura Cosmeticos S.A. | | | 145,520 | | | | 1,389,798 | | |

| REAL ESTATE MANAGEMENT & DEVELOPMENT-3.69% | |

Cyrela Commercial Properties

SA Empreendimentos e

Particpações† | | | 32,440 | | | | 218,879 | | |

| General Shopping Brasil SA† | | | 317,000 | | | | 3,079,174 | | |

| Klabin Segall S.A. | | | 138,031 | | | | 1,042,212 | | |

MRV Engenharia e

Participacoes† | | | 56,000 | | | | 1,197,079 | | |

Multiplan Empreendimentos

Imobiliarios SA† | | | 188,000 | | | | 2,238,045 | | |

PDG Realty SA

Empreendimentos e

Particpações | | | 241,530 | | | | 3,392,275 | | |

See accompanying notes to financial statements.

11

THE LATIN AMERICA EQUITY FUND, INC.

SCHEDULE OF INVESTMENTS

DECEMBER 31, 2007 (CONTINUED)

| Description | | No. of

Shares | | Value | |

REAL ESTATE MANAGEMENT &

DEVELOPMENT (CONTINUED) | |

| Trisul S.A.† | | | 200,000 | | | $ | 1,213,483 | | |

| | | | 12,381,147 | | |

| ROAD & RAIL-2.35% | |

| All America Latina Logistica | | | 237,400 | | | | 3,072,863 | | |

| Localiza Rent a Car SA | | | 229,100 | | | | 2,431,292 | | |

| Tegma Gestao Logistica SA | | | 188,480 | | | | 2,382,472 | | |

| | | | 7,886,627 | | |

| TEXTILES, APPAREL & LUXURY GOODS-0.33% | |

Companhia de Tecidos Norte de

Minas S.A., PN | | | 192,000 | | | | 1,111,011 | | |

| TRANSPORTATION INFRASTRUCTURE-1.03% | |

Obrascon Huarte Lain

Brasil S.A. | | | 161,000 | | | | 2,034,208 | | |

| Wilson Sons Ltd., BDR† | | | 95,900 | | | | 1,398,093 | | |

| | | | 3,432,301 | | |

TOTAL BRAZIL

(Cost $118,880,604) | | | 261,594,939 | | |

| CHILE-4.60% | |

| BEVERAGES-0.89% | |

Compañia Cervecerías

Unidas S.A. | | | 175,010 | | | | 1,224,842 | | |

Embotelladora Andina

S.A., PNA | | | 235,561 | | | | 629,172 | | |

| Viña Concha y Toro S.A. | | | 540,000 | | | | 1,138,235 | | |

| | | | 2,992,249 | | |

| COMMERCIAL BANKS-0.45% | |

| Banco Santander Chile S.A | | | 30,613,969 | | | | 1,506,260 | | |

| ELECTRIC UTILITIES-0.36% | |

| Enersis S.A. | | | 3,780,000 | | | | 1,218,375 | | |

| FOOD & STAPLES RETAILING-0.34% | |

| Cencosud S.A. | | | 280,000 | | | | 1,126,860 | | |

| Description | | No. of

Shares | | Value | |

| INDEPENDENT POWER PRODUCERS & ENERGY TRADERS-0.76% | |

Empresa Nacional de

Electricidad S.A. | | | 1,249,910 | | | $ | 1,581,370 | | |

| Gener S.A. | | | 2,334,905 | | | | 984,369 | | |

| | | | 2,565,739 | | |

| INDUSTRIAL CONGLOMERATES-0.52% | |

| Empresas Copec S.A. | | | 98,000 | | | | 1,751,581 | | |

| MULTILINE RETAIL-0.16% | |

| S.A.C.I. Falabella, S.A. | | | 110,350 | | | | 536,293 | | |

| PAPER & FOREST PRODUCTS-0.51% | |

| Empresas CMPC S.A. | | | 45,000 | | | | 1,698,966 | | |

| WATER UTILITIES-0.61% | |

Inversiones Aguas

Metropolitanas S.A., ADR†† | | | 85,204 | | | | 2,053,314 | | |

TOTAL CHILE

(Cost $8,661,940) | | | 15,449,637 | | |

| COLOMBIA-4.39% | |

| COMMERCIAL BANKS-1.64% | |

| Bancolombia S.A., ADR | | | 117,603 | | | | 4,000,854 | | |

Corporacion Financiera

Colombiana | | | 169,417 | | | | 1,504,996 | | |

| | | | 5,505,850 | | |

| DIVERSIFIED FINANCIAL SERVICES-1.39% | |

Suramericana de

Inversiones S.A. | | | 470,274 | | | | 4,653,201 | | |

| FOOD & STAPLES RETAILING-1.02% | |

Almacenes Exito S.A.,

GDR† †† | | | 402,000 | | | | 3,419,999 | | |

| METALS & MINING-0.34% | |

| Acerias Paz del Rio S.A.† | | | 32,217,991 | | | | 1,165,901 | | |

TOTAL COLOMBIA

(Cost $11,013,637) | | | 14,744,951 | | |

See accompanying notes to financial statements.

12

THE LATIN AMERICA EQUITY FUND, INC.

SCHEDULE OF INVESTMENTS

DECEMBER 31, 2007 (CONTINUED)

| Description | | No. of

Shares | | Value | |

| LATIN AMERICA-0.61% | |

| VENTURE CAPITAL-0.19% | |

J.P. Morgan Latin America

Capital Partners, L.P.†‡# | | | 2,374,752 | | | $ | 650,160 | | |

| WIRELESS TELECOMMUNICATION SERVICES-0.42% | |

| NII Holdings Inc.† | | | 29,100 | | | | 1,406,112 | | |

TOTAL LATIN AMERICA

(Cost $2,475,705) | | | 2,056,272 | | |

| MEXICO-25.16% | |

| BEVERAGES-2.82% | |

Fomento Economico Mexicano,

S.A. de C.V., ADR | | | 197,736 | | | | 7,547,583 | | |

Grupo Modelo, S.A. de

C.V., Series C | | | 402,200 | | | | 1,915,870 | | |

| | | | 9,463,453 | | |

| COMMERCIAL BANKS-0.55% | |

Grupo Financiero Banorte

S.A.B. de C.V. | | | 446,600 | | | | 1,845,438 | | |

| CONSTRUCTION & ENGINEERING-1.71% | |

| Empresas ICA S.A.B. de C.V.† | | | 150,000 | | | | 989,390 | | |

Empresas ICA S.A.B. de

C.V., ADR† | | | 180,055 | | | | 4,753,452 | | |

| | | | 5,742,842 | | |

| CONSTRUCTION MATERIALS-3.02% | |

| Cemex SAB de C.V., ADR† | | | 392,306 | | | | 10,141,110 | | |

| FOOD & STAPLES RETAILING-1.91% | |

Controladora Comercial Mexicana

S.A. de C.V. | | | 758,700 | | | | 1,911,643 | | |

Wal-Mart de México, S.A. de

C.V., Series V | | | 974,630 | | | | 3,397,806 | | |

Wal-Mart de México, S.A. de

C.V., Series V, ADR | | | 31,190 | | | | 1,087,361 | | |

| | | | 6,396,810 | | |

| Description | | No. of

Shares | | Value | |

| HOTELS, RESTAURANTS & LEISURE-0.38% | |

| Alsea, S.A. de C.V. | | | 920,400 | | | $ | 1,290,245 | | |

| HOUSEHOLD DURABLES-1.85% | |

| Consorcio ARA, S.A. de C.V. | | | 922,800 | | | | 1,031,505 | | |

Corporación GEO, S.A. de

C.V., Series B† | | | 582,000 | | | | 1,674,390 | | |

Urbi, Desarrollos Urbanos,

S.A. de C.V.† | | | 1,009,257 | | | | 3,486,159 | | |

| | | | 6,192,054 | | |

| MEDIA-1.90% | |

| Grupo Televisa S.A., ADR | | | 145,000 | | | | 3,446,650 | | |

| Grupo Televisa S.A., CPO | | | 139,500 | | | | 665,783 | | |

Megacable Holdings

SAB de CV† | | | 663,000 | | | | 2,251,247 | | |

| | | | 6,363,680 | | |

| METALS & MINING-1.31% | |

Grupo Mexico SA de

C.V., Class B | | | 698,325 | | | | 4,389,205 | | |

| TRANSPORTATION INFRASTRUCTURE-1.31% | |

Grupo Aeroportuario del Centro

Norte, S.A.B. de C.V., ADR | | | 77,545 | | | | 1,947,930 | | |

Grupo Aeroportuario del

Pacifico S.A. de C.V., ADR | | | 55,200 | | | | 2,463,576 | | |

| | | | 4,411,506 | | |

| WIRELESS TELECOMMUNICATION SERVICES-8.40% | |

América Móvil SAB de

C.V., Series L | | | 6,220,823 | | | | 19,093,993 | | |

América Móvil SAB de

C.V., Series L, ADR | | | 148,500 | | | | 9,116,415 | | |

| | | | 28,210,408 | | |

TOTAL MEXICO

(Cost $52,388,616) | | | 84,446,751 | | |

| PERU-0.73% | |

| COMMERCIAL BANKS-0.40% | |

| Credicorp Limited | | | 17,500 | | | | 1,335,250 | | |

See accompanying notes to financial statements.

13

THE LATIN AMERICA EQUITY FUND, INC.

SCHEDULE OF INVESTMENTS

DECEMBER 31, 2007 (CONTINUED)

| Description | | No. of

Shares | | Value | |

| DIVERSIFIED FINANCIAL SERVICES-0.33% | |

Intergroup Financial Services

Corporation† †† | | | 63,000 | | | $ | 1,102,500 | | |

TOTAL PERU

(Cost $1,610,991) | | | 2,437,750 | | |

| VENEZUELA-0.67% | |

| COMMERCIAL BANKS-0.67% | |

Mercantil Servicios Financieros,

C.A., ADR

(Cost $1,240,868) | | | 36,358 | | | | 2,235,013 | | |

| GLOBAL-0.25% | |

| VENTURE CAPITAL-0.25% | |

Emerging Markets

Ventures I L.P.†‡#

(Cost $1,022,819) | | | 2,237,292 | | | | 834,689 | | |

TOTAL EQUITY OR EQUITY-LINKED

SECURITIES (Cost $205,461,894) | | | 393,978,547 | | |

| SHORT-TERM INVESTMENTS-1.34% | |

| GRAND CAYMAN-1.34% | |

Bank of America, overnight

deposit, 4.56%, 1/2/08

(Cost $4,492,000) | | | | | | | 4,492,000 | | |

TOTAL INVESTMENTS-118.70%

(Cost $209,953,894) | | | 398,470,547 | | |

LIABILITIES IN EXCESS OF CASH AND

OTHER ASSETS-(18.70)% | | | (62,771,602 | ) | |

| NET ASSETS-100.00% | | | | | | $ | 335,698,945 | | |

† Non-income producing security.

†† SEC Rule 144A security. Such securities are traded only among "qualified institutional buyers."

‡ Restricted security, not readily marketable; security is valued at fair value as determined in good faith by, or under the direction of, the Board of Directors under procedures established by the Board of Directors. (See Notes B and H).

# As of December 31, 2007, the aggregate amount of open commitments for the Fund is $941,942. (See Note H).

ADR American Depositary Receipts.

BDR Brazilian Depositary Receipts.

CPO Ordinary Participation Certificates.

GDR Global Depositary Receipts.

ON Ordinary Shares.

PN Preferred Shares.

PNA Preferred Shares, Class A.

PNB Preferred Shares, Class B.

See accompanying notes to financial statements.

14

THE LATIN AMERICA EQUITY FUND, INC.

STATEMENT OF ASSETS AND LIABILITIES

DECEMBER 31, 2007

| ASSETS | |

| Investments, at value (Cost $209,953,894) (Notes B,E,G) | | $ | 398,470,547 | | |

| Cash (including $51,252 of foreign currencies with a cost of $51,368) | | | 51,691 | | |

| Dividends receivable | | | 1,291,760 | | |

| Prepaid expenses | | | 1,619 | | |

| Total Assets | | | 399,815,617 | | |

| LIABILITIES | |

| Payables: | |

| Dividends and distributions (Note B) | | | 62,916,653 | | |

| Investment advisory fees (Note C) | | | 778,916 | | |

| Administration fees (Note C) | | | 70,245 | | |

| Directors' fees | | | 6,544 | | |

| Chilean repatriation taxes (Note B) | | | 39,442 | | |

| Other accrued expenses | | | 304,872 | | |

| Total Liabilities | | | 64,116,672 | | |

| NET ASSETS (applicable to 6,310,947 shares of common stock outstanding) (Note D) | | $ | 335,698,945 | | |

| NET ASSETS CONSIST OF | |

Capital stock, $0.001 par value; 6,310,947 shares issued and outstanding

(100,000,000 shares authorized) | | $ | 6,311 | | |

| Paid-in capital | | | 140,021,720 | | |

| Undistributed net investment income | | | 96,380 | | |

| Accumulated net realized gain on investments and foreign currency related transactions | | | 7,047,153 | | |

Net unrealized appreciation in value of investments and translation of other

assets and liabilities denominated in foreign currencies | | | 188,527,381 | | |

| Net assets applicable to shares outstanding | | $ | 335,698,945 | | |

| NET ASSET VALUE PER SHARE ($335,698,945 ÷ 6,310,947) | | $ | 53.19 | | |

| MARKET PRICE PER SHARE | | $ | 47.31 | | |

See accompanying notes to financial statements.

15

THE LATIN AMERICA EQUITY FUND, INC.

STATEMENT OF OPERATIONS

FOR THE YEAR ENDED DECEMBER 31, 2007

| INVESTMENT INCOME | |

| Income (Note B): | |

| Dividends | | $ | 9,069,800 | | |

| Interest | | | 175,890 | | |

| Less: Net investment loss allocated from partnerships | | | (70,128 | ) | |

| Less: Foreign taxes withheld | | | (623,023 | ) | |

| Total Investment Income | | | 8,552,539 | | |

| Expenses: | |

| Investment advisory fees (Note C) | | | 2,779,497 | | |

| Custodian fees | | | 465,159 | | |

| Administration fees (Note C) | | | 286,599 | | |

| Accounting fees | | | 91,938 | | |

| Audit and tax fees | | | 87,131 | | |

| Directors' fees | | | 81,002 | | |

| Legal fees | | | 54,998 | | |

| Printing (Note C) | | | 39,199 | | |

| Shareholder servicing fees | | | 19,199 | | |

| Insurance | | | 9,079 | | |

| Stock exchange listing fees | | | 1,330 | | |

| Miscellaneous | | | 17,179 | | |

| Brazilian taxes (Note B) | | | 81,574 | | |

| Chilean repatriation taxes (Note B) | | | 35,675 | | |

| Total Expenses | | | 4,049,559 | | |

| Less: Fee waivers (Note C) | | | (7,997 | ) | |

| Net Expenses | | | 4,041,562 | | |

| Net Investment Income | | | 4,510,977 | | |

NET REALIZED AND UNREALIZED GAIN ON INVESTMENTS AND

FOREIGN CURRENCY RELATED TRANSACTIONS | |

| Net realized gain from: | |

| Investments | | | 65,611,392 | | |

| Foreign currency related transactions | | | 6,085 | | |

Net change in unrealized appreciation in value of investments and translation

of other assets and liabilities denominated in foreign currencies | | | 53,144,688 | | |

| Net realized and unrealized gain on investments and foreign currency related transactions | | | 118,762,165 | | |

| NET INCREASE IN NET ASSETS RESULTING FROM OPERATIONS | | $ | 123,273,142 | | |

See accompanying notes to financial statements.

16

THE LATIN AMERICA EQUITY FUND, INC.

STATEMENT OF CHANGES IN NET ASSETS

| | | For the Years Ended

December 31, | |

| | | 2007 | | 2006 | |

| INCREASE IN NET ASSETS | |

| Operations: | |

| Net investment income | | $ | 4,510,977 | | | $ | 3,977,407 | | |

| Net realized gain on investments and foreign currency related transactions | | | 65,617,477 | | | | 41,282,098 | | |

Net change in unrealized appreciation/depreciation in value of

investments and translation of other assets and liabilities denominated

in foreign currencies | | | 53,144,688 | | | | 58,504,337 | | |

| Net increase in net assets resulting from operations | | | 123,273,142 | | | | 103,763,842 | | |

| Dividends and distributions to shareholders: | |

| Net investment income | | | (4,816,468 | ) | | | (3,540,454 | ) | |

| Net realized gain on investments | | | (74,458,333 | ) | | | (30,789,309 | ) | |

| Total dividends and distributions to shareholders | | | (79,274,801 | ) | | | (34,329,763 | ) | |

| Capital share transactions (Note I): | |

| Cost of 11,293 shares purchased under the share repurchase program | | | (585,158 | ) | | | — | | |

| Total increase in net assets | | | 43,413,183 | | | | 69,434,079 | | |

| NET ASSETS | |

| Beginning of year | | | 292,285,762 | | | | 222,851,683 | | |

| End of year* | | $ | 335,698,945 | | | $ | 292,285,762 | | |

* Includes undistibuted net investment income of $96,380 and $395,786, respectively.

See accompanying notes to financial statements.

17

THE LATIN AMERICA EQUITY FUND, INC.

Financial Highlights§

Contained below is per share operating performance data for a share of common stock outstanding, total investment return, ratios to average net assets and other supplemental data for each year indicated. This information has been derived from information provided in the financial statements and market price data for the Fund's shares.

| | | For the Years Ended December 31, | |

| | | 2007 | | 2006 | | 2005 | | 2004 | | 2003 | | 2002 | | 2001 | | 2000 | |

| PER SHARE OPERATING PERFORMANCE | |

| Net asset value, beginning of year | | $ | 46.23 | | | $ | 35.25 | | | $ | 24.39 | | | $ | 17.74 | | | $ | 11.55 | | | $ | 15.06 | | | $ | 16.60 | | | $ | 18.57 | | |

| Net investment income/(loss) | | | 0.71 | † | | | 0.63 | | | | 0.61 | | | | 0.45 | † | | | 0.34 | † | | | 0.01 | ** | | | 0.41 | * | | | (0.11 | )† | |

Net realized and unrealized gain/(loss) on investments

and foreign currency related transactions | | | 18.79 | | | | 15.78 | | | | 11.03 | | | | 6.66 | | | | 5.99 | | | | (3.41 | ) | | | (1.50 | ) | | | (2.44 | ) | |

| Net increase/(decrease) in net assets resulting from operations | | | 19.50 | | | | 16.41 | | | | 11.64 | | | | 7.11 | | | | 6.33 | | | | (3.40 | ) | | | (1.09 | ) | | | (2.55 | ) | |

| Dividends and distributions to shareholders: | |

| Net investment income | | | (0.76 | ) | | | (0.56 | ) | | | (0.50 | ) | | | (0.46 | ) | | | (0.14 | ) | | | (0.21 | ) | | | (0.57 | ) | | | (0.08 | ) | |

Net realized gain on investments and

foreign currency related transactions | | | (11.79 | ) | | | (4.87 | ) | | | (0.28 | ) | | | — | | | | — | | | | — | | | | — | | | | — | | |

| Total dividends and distributions to shareholders | | | (12.55 | ) | | | (5.43 | ) | | | (0.78 | ) | | | (0.46 | ) | | | (0.14 | ) | | | (0.21 | ) | | | (0.57 | ) | | | (0.08 | ) | |

| Anti-dilutive impact due to capital shares tendered or repurchased | | | 0.01 | | | | — | | | | — | | | | — | | | | — | | | | 0.10 | # | | | 0.12 | # | | | 0.66 | | |

| Net asset value, end of year | | $ | 53.19 | | | $ | 46.23 | | | $ | 35.25 | | | $ | 24.39 | | | $ | 17.74 | | | $ | 11.55 | | | $ | 15.06 | | | $ | 16.60 | | |

| Market value, end of year | | $ | 47.31 | | | $ | 43.43 | | | $ | 30.46 | | | $ | 21.64 | | | $ | 15.26 | | | $ | 9.67 | | | $ | 12.15 | | | $ | 12.875 | | |

| Total investment return (a) | | | 42.45 | % | | | 61.62 | % | | | 44.06 | % | | | 45.04 | % | | | 59.15 | % | | | (18.83 | )% | | | (1.07 | )% | | | (5.87 | )% | |

| RATIOS/SUPPLEMENTAL DATA | |

| Net assets, end of year (000 omitted) | | $ | 335,699 | | | $ | 292,286 | | | $ | 222,852 | | | $ | 154,214 | | | $ | 112,178 | | | $ | 73,045 | | | $ | 112,009 | | | $ | 145,281 | | |

| Ratio of expenses to average net assets (b) | | | 1.14 | % | | | 1.44 | % | | | 1.33 | % | | | 1.41 | % | | | 1.37 | % | | | 3.06 | % | | | 1.51 | % | | | 2.13 | % | |

| Ratio of expenses to average net assets, excluding fee waivers | | | 1.14 | % | | | 1.45 | % | | | 1.33 | % | | | 1.41 | % | | | 1.37 | % | | | 3.06 | % | | | 1.51 | % | | | 2.19 | % | |

| Ratio of expenses to average net assets, excluding taxes | | | 1.11 | % | | | 1.19 | % | | | 1.26 | % | | | 1.40 | % | | | 1.49 | % | | | 1.52 | % | | | 1.40 | % | | | 2.03 | % | |

| Ratio of net investment income/(loss) to average net assets | | | 1.28 | % | | | 1.49 | % | | | 2.13 | % | | | 2.36 | % | | | 2.49 | %(c) | | | 0.21 | % | | | 2.52 | % | | | (0.55 | )% | |

| Portfolio turnover rate | | | 26.33 | % | | | 46.05 | % | | | 75.60 | % | | | 69.80 | % | | | 62.62 | % | | | 75.28 | % | | | 101.73 | % | | | 125.83 | % | |

§ Per share amounts prior to November 10, 2000 have been restated to reflect a conversion factor of 0.9175 for shares issued in connection with the merger of The Latin America Investment Fund, Inc. and The Latin America Equity Fund, Inc.

* Based on actual shares outstanding on November 21, 2001 (prior to the 2001 tender offer) and December 31, 2001.

** Based on actual shares outstanding on November 6, 2002 (prior to the 2002 tender offer) and December 31, 2002.

† Based on average shares outstanding.

‡ Includes a $0.01 per share decrease to the Fund's net asset value per share resulting from the dilutive impact of shares issued pursuant to the Fund's automatic dividend reinvestment program.

# Impact of the Fund's self-tender program.

(a) Total investment return at market value is based on the changes in market price of a share during the year and assumes reinvestment of dividends and distributions, if any, at actual prices pursuant to the Fund's dividend reinvestment program.

(b) Ratios reflect actual expenses incurred by the Fund. Amounts are net of fee waivers and inclusive of taxes.

(c) Ratio includes the effect of a reversal of Chilean repatriation tax accrual; excluding the reversal, the ratio would have been 2.36%.

See accompanying notes to financial statements.

18

THE LATIN AMERICA EQUITY FUND, INC.

Financial Highlights

| | |

| | | 1999 | | 1998 | |

| PER SHARE OPERATING PERFORMANCE | |

| Net asset value, beginning of year | | $ | 10.96 | | | $ | 18.77 | | |

| Net investment income/(loss) | | | 0.07 | † | | | 0.16 | | |

Net realized and unrealized gain/(loss) on investments

and foreign currency related transactions | | | 7.07 | | | | (7.85 | )‡ | |

| Net increase/(decrease) in net assets resulting from operations | | | 7.14 | | | | (7.69 | ) | |

| Dividends and distributions to shareholders: | |

| Net investment income | | | — | | | | (0.12 | ) | |

Net realized gain on investments and

foreign currency related transactions | | | — | | | | — | | |

| Total dividends and distributions to shareholders | | | — | | | | (0.12 | ) | |

| Anti-dilutive impact due to capital shares tendered or repurchased | | | 0.47 | | | | — | | |

| Net asset value, end of year | | $ | 18.57 | | | $ | 10.96 | | |

| Market value, end of year | | $ | 13.76 | | | $ | 7.834 | | |

| Total investment return (a) | | | 75.65 | % | | | (46.63 | )% | |

| RATIOS/SUPPLEMENTAL DATA | |

| Net assets, end of year (000 omitted) | | $ | 123,262 | | | $ | 86,676 | | |

| Ratio of expenses to average net assets (b) | | | 2.14 | % | | | 2.41 | % | |

| Ratio of expenses to average net assets, excluding fee waivers | | | 2.22 | % | | | 2.60 | % | |

| Ratio of expenses to average net assets, excluding taxes | | | 2.05 | % | | | 1.77 | % | |

| Ratio of net investment income/(loss) to average net assets | | | 0.46 | % | | | 1.12 | % | |

| Portfolio turnover rate | | | 161.71 | % | | | 142.35 | % | |

19

THE LATIN AMERICA EQUITY FUND, INC.

NOTES TO FINANCIAL STATEMENTS

December 31, 2007

NOTE A. ORGANIZATION

The Latin America Equity Fund, Inc. (the "Fund") is registered under the Investment Company Act of 1940, as amended, as a closed-end, non-diversified management investment company.

NOTE B. SIGNIFICANT ACCOUNTING POLICIES

Use of Estimates: The preparation of financial statements in conformity with accounting principles generally accepted in the United States of America ("GAAP") requires management to make estimates and assumptions that affect the reported amounts of assets and liabilities and disclosure of contingent assets and liabilities at the date of the financial statements and the reported amounts of revenues and expenses during the reporting period. Actual results could differ from those estimates.

Security Valuation: The net asset value of the Fund is determined daily as of the close of regular trading on the New York Stock Exchange, Inc. (the "Exchange") on each day the Exchange is open for business. The Fund's equity investments are valued at market value, which is generally determined using the closing price on the exchange or market on which the security is primarily traded at the time of valuation (the "Valuation Time"). If no sales are reported, equity investments are generally valued at the most recent bid quotation as of the Valuation Time or at the lowest ask quotation in the case of a short sale of securities. Debt securities with a remaining maturity greater than 60 days are valued in accordance with the price supplied by a pricing service, which may use a matrix, formula or other objective method that takes into consideration market indic es, yield curves and other specific adjustments. Debt obligations that will mature in 60 days or less are valued on the basis of amortized cost, which approximates market value, unless it is determined that this method would not represent fair value. Investments in mutual funds are valued at the mutual fund's closing net asset value per share on the day of valuation.

Securities and other assets for which market quotations are not readily available, or whose values have been materially affected by events occurring before the Fund's Valuation Time, but after the close of the securities' primary market, are valued at fair value as determined in good faith by, or under the direction of, the Board of Directors under procedures established by the Board of Directors. The Fund may utilize a service provided by an independent third party which has been approved by the Board of Directors to fair value certain securities. When fair-value pricing is employed, the prices of securities used by a fund to calculate its net asset value may differ from quoted or published prices for the same securities. At December 31, 2007, the Fund held 0.44% of its net assets in securities valued at fair value as determined in good faith under procedures established by the Board of Directors with an aggregate cost of $1,900,349 and fai r value of $1,484,849. The Fund's estimate of fair value assumes a willing buyer and a willing seller neither acting under the compulsion to buy or sell. Although these securities may be resold in privately negotiated transactions, the prices realized on such sales could differ from the prices originally paid by the Fund or the current carrying values, and the difference could be material.

Short-Term Investment: The Fund sweeps available cash into a short-term time deposit available through Brown Brothers Harriman & Co., the Fund's custodian. The short-term time deposit is a variable rate account classified as a short-term investment.

Investment Transactions and Investment Income: Investment transactions are accounted for on a trade date basis. The cost of investments sold is determined by use of the specific identification method for both financial reporting and U.S. income tax purposes.

20

THE LATIN AMERICA EQUITY FUND, INC.

NOTES TO FINANCIAL STATEMENTS (CONTINUED)

December 31, 2007

Interest income is accrued as earned; dividend income is recorded on the ex-dividend date.

Taxes: No provision is made for U.S. income or excise taxes as it is the Fund's intention to continue to qualify as a regulated investment company and to make the requisite distributions to its shareholders sufficient to relieve it from all or substantially all U.S. income and excise taxes.

Income received by the Fund from sources within Latin America may be subject to withholding and other taxes imposed by such countries. Also, certain Latin American countries impose taxes on funds remitted or repatriated from such countries.

Brazil imposes a Contibução Provisoria sobre Movimentaçãoes Financieras ("CMPF") tax that applies to foreign exchange transactions related to dividends carried out by financial institutions. The tax rate is 0.38%. For the year ended December 31, 2007, the Fund incurred $81,574 of such expense.

For Chilean securities the Fund accrues foreign taxes on realized gains and repatriation taxes in an amount equal to what the Fund would owe if the securities were sold and the proceeds repatriated on the valuation date as a liability and reduction of realized/unrealized gains. Taxes on foreign income are recorded when the related income is recorded. For the year ended December 31, 2007, the Fund accrued $35,675.

Foreign Currency Translations: The books and records of the Fund are maintained in U.S. dollars. Foreign currency amounts are translated into U.S. dollars on the following basis:

(I) market value of investment securities, assets and liabilities at the valuation date rate of exchange; and

(II) purchases and sales of investment securities, income and expenses at the relevant rates of exchange prevailing on the respective dates of such transactions.

The Fund does not isolate that portion of gains and losses on investments in equity securities which is due to changes in the foreign exchange rates from that which is due to changes in market prices of equity securities. Accordingly, realized and unrealized foreign currency gains and losses with respect to such securities are included in the reported net realized and unrealized gains and losses on investment transactions balances.

The Fund reports certain foreign currency related transactions and foreign taxes withheld on security transactions as components of realized gains for financial reporting purposes, whereas such foreign currency related transactions are treated as ordinary income for U.S. federal income tax purposes.

Net unrealized currency gains or losses from valuing foreign currency denominated assets and liabilities at period end exchange rates are reflected as a component of net unrealized appreciation/depreciation in value of investments, and translation of other assets and liabilities denominated in foreign currencies.

Net realized foreign exchange gains or losses represent foreign exchange gains and losses from transactions in foreign currencies and forward foreign currency contracts, exchange gains or losses realized between the trade date and settlement date on security transactions, and the difference between the amounts of interest and dividends recorded on the Fund's books and the U.S. dollar equivalent of the amounts actually received.

Distributions of Income and Gains: The Fund distributes at least annually to shareholders substantially all of its net investment income and net realized short-term capital gains, if any. The Fund determines annually whether to distribute any net realized

21

THE LATIN AMERICA EQUITY FUND, INC.

NOTES TO FINANCIAL STATEMENTS (CONTINUED)

December 31, 2007

long-term capital gains in excess of net realized short-term capital losses, including capital loss carryovers, if any. An additional distribution may be made to the extent necessary to avoid the payment of a 4% U.S. federal excise tax. Dividends and distributions to shareholders are recorded by the Fund on the ex-dividend date.

The character of distributions made during the year from net investment income or net realized gains may differ from their ultimate characterization for U.S. income tax purposes due to U.S. generally accepted accounting principles/tax differences in the character of income and expense recognition.

Partnership Accounting Policy: The Fund records its pro-rata share of the income/(loss) and capital gains/(losses) allocated from the underlying partnerships and adjusts the cost of the underlying partnerships accordingly. These amounts are included in the Fund's Statement of Operations.

Other: The Fund invests in securities of foreign countries and governments which involve certain risks in addition to those inherent in domestic investments. Such risks generally include, among others, currency risk (fluctuations in currency exchange risk), information risk (key information may be inaccurate or unavailable) and political risk (expropriation, nationalization or the imposition of capital or currency controls or punitive taxes). Other risks in investing in foreign securities include liquidity and valuation risks.

Some countries require governmental approval for the repatriation of investment income, capital or the proceeds of sales of securities by foreign investors. In addition, if there is a deterioration in a country's balance of payments or for other reasons, a country may impose temporary restrictions on foreign capital remittances abroad. Amounts repatriated prior to the end of specified periods may be subject to taxes as imposed by a foreign country.

The Latin American securities markets are substantially smaller, less liquid and more volatile than the major securities markets in the United States. A high proportion of the securities of many companies in Latin American countries may be held by a limited number of persons, which may limit the number of securities available for the investment by the Fund. The limited liquidity of Latin American country securities markets may also affect the Fund's ability to acquire or dispose of securities at the price and time it wishes to do so.

The Fund, subject to local investment limitations, may invest up to 10% of its assets (at the time of commitment) in illiquid equity securities, including securities of private equity funds (whether in corporate or partnership form) that invest primarily in emerging markets. When investing through another investment fund, the Fund will bear its proportionate share of the expenses incurred by the fund, including management fees. Such securities are expected to be illiquid which may involve a high degree of business and financial risk and may result in substantial losses. Because of the current absence of any liquid trading market for these investments, the Fund may take longer to liquidate these positions than would be the case for publicly traded securities. Although these securities may be resold in privately negotiated transactions, the prices realized on such sales could be substantially less than those originally paid by the Fund or the current carrying values and these differences could be material. Further, companies whose securities are not publicly traded may not be subject to the disclosure and other investor protection requirements applicable to companies whose securities are publicly traded.

NOTE C. AGREEMENTS

Credit Suisse Asset Management, LLC ("Credit Suisse") serves as the Fund's investment adviser with respect to all investments. Credit Suisse receives as compensation for its advisory services from the Fund, an annual fee,

22

THE LATIN AMERICA EQUITY FUND, INC.

NOTES TO FINANCIAL STATEMENTS (CONTINUED)

December 31, 2007

calculated weekly and paid quarterly, equal to 1.00% of the first $100 million of the Fund's average weekly market value or net assets (whichever is lower), 0.90% of the next $50 million and 0.80% of amounts over $150 million. For the year ended December 31, 2007, Credit Suisse earned $2,779,497 for advisory services, of which Credit Suisse waived $7,997. Credit Suisse also provides certain administrative services to the Fund and is reimbursed by the Fund for costs incurred on behalf of the Fund (up to $20,000 per annum). For the year ended December 31, 2007, Credit Suisse was reimbursed $18,321 for administrative services rendered to the Fund.

CELFIN CAPITAL Servicios Financieros S.A. ("Celfin") serves as the Fund's sub-adviser with respect to Chilean investments. As compensation for its services, Celfin is paid a fee, out of the advisory fees payable to Credit Suisse, calculated weekly and paid quarterly at an annual rate of 0.10% of the Fund's average weekly market value or net assets (whichever is lower). For the year ended December 31, 2007, these sub-advisory fees amounted to $316,187.

For the year ended December 31, 2007, Celfin earned approximately $9,000 in brokerage commissions from portfolio transactions executed on behalf of the Fund.

Bear Stearns Funds Management Inc. ("BSFM") serves as the Fund's U.S. administrator. The Fund pays BSFM a monthly fee that is calculated weekly based on the Fund's average weekly net assets. For the year ended December 31, 2007, BSFM earned $181,277 for administrative services.

Celfin Capital S.A. Administradora de Fondos de Capital Extranjero ("AFCE") serves as the Fund's Chilean administrator. For its services, AFCE is paid an annual fee by the Fund equal to the greater of 2,000 Unidad de Fomentos ("U.F.s") (approximately $79,000 at December 31, 2007) or 0.10% of the Fund's average weekly market value or net assets invested in Chile (whichever is lower) and an annual reimbursement of out-of-pocket expenses not to exceed 500 U.F.s. In addition, an accounting fee is also paid to AFCE. For the year ended December 31, 2007, the administration fees and accounting fees amounted to $87,001 and $6,800 respectively.

Merrill Corporation ("Merrill"), an affiliate of Credit Suisse, has been engaged by the Fund to provide certain financial printing services. For the year ended December 31, 2007, Merrill was paid $26,697 for its services to the Fund.

The Independent Directors receive fifty percent (50%) of their annual retainer in the form of shares purchased by the Fund's transfer agent in the open market. Beginning in 2008, the Independent Directors can elect to receive up to 100% of their annual retainer in shares of the Fund. Directors as a group own less than 1% of the Fund's outstanding shares.

NOTE D. CAPITAL STOCK

The authorized capital stock of the Fund is 100,000,000 shares of common stock, $0.001 par value. Of the 6,310,947 shares outstanding at December 31, 2007, Credit Suisse owned 13,746 shares.

NOTE E. INVESTMENT IN SECURITIES

For the year ended December 31, 2007, purchases and sales of securities, other than short-term investments, were $92,466,115 and $111,356,063, respectively.

NOTE F. CREDIT FACILITY

The Fund, together with other funds/portfolios advised by Credit Suisse (collectively, the "Participating Funds"), participates in a $50 million committed, unsecured, line of credit facility ("Credit Facility") with Deutsche Bank, A.G. as administrative agent and syndication agent and State Street Bank and Trust Company as operations agent for temporary or

23

THE LATIN AMERICA EQUITY FUND, INC.

NOTES TO FINANCIAL STATEMENTS (CONTINUED)

December 31, 2007

emergency purposes. Under the terms of the Credit Facility, the Participating Funds pay an aggregate commitment fee at a rate of 0.10% per annum on the average unused amount of the Credit Facility, which is allocated among the Participating Funds in such manner as is determined by the governing Boards of the Participating Funds. In addition, the Participating Funds pay interest on borrowings at the Federal Funds rate plus 0.50%. During the year ended December 31, 2007, the Fund had no borrowings under the Credit Facility.

NOTE G. FEDERAL INCOME TAXES

Income and capital gain distributions are determined in accordance with federal income tax regulations, which may differ from GAAP.

The tax character of dividends paid during the years ended December 31 for the Fund were as follows:

| Ordinary Income | | Long-Term Capital Gains | |

| 2007 | | 2006 | | 2007 | | 2006 | |

| $ | 13,513,266 | | | $ | 11,000,697 | | | $ | 65,761,535 | | | $ | 23,329,066 | | |

The tax basis of components of distributable earnings differ from the amounts reflected in the Statement of Assets and Liabilities by temporary book/tax differences. These differences are primarily due to losses deferred on wash sales.

At December 31, 2007, the components of distributable earnings on a tax basis for the Fund were as follows:

| Undistributed ordinary income | | $ | 822,994 | | |

| Accumulated net realized gain | | | 6,392,093 | | |

| Unrealized appreciation | | | 188,455,827 | | |

| Total distributable earnings | | $ | 195,670,914 | | |

At December 31, 2007, the identified cost for federal income tax purposes, as well as the gross unrealized appreciation from investments for those securities having an excess of value over cost, gross unrealized depreciation from investments for those securities having an excess of cost over value and the net unrealized appreciation from investments were $210,025,448, $193,251,090, $(4,805,991) and $188,445,099, respectively.

At December 31, 2007, the Fund reclassified $6,085 from accumulated net realized gain on investments and foreign currency related transactions to undistributed net investment income. Net assets were not affected by this reclassification.

24

THE LATIN AMERICA EQUITY FUND, INC.

NOTES TO FINANCIAL STATEMENTS (CONTINUED)

December 31, 2007

NOTE H. RESTRICTED SECURITIES

Certain of the Fund's investments are restricted as to resale and are valued at fair value as determined in good faith by, or under the direction of, the Board of Directors under procedures established by the Board of Directors in the absence of readily ascertainable market values.

| Security | | Number

of

Shares | | Acquisition

Date(s) | | Cost | | Fair

Value At

12/31/07 | | Value Per

Share | | Percent

of Net

Assets | | Distributions

Received | | Open

Commitments | |

Emerging Markets

Ventures I L.P. | | | 2,237,292 | | | 01/22/98 – 01/10/06 | | $ | 1,022,819 | | | $ | 834,689 | | | | 0.37 | | | | 0.25 | | | $ | 1,969,180 | | | $ | 262,708 | | |

J.P. Morgan Latin America

Capital Partners, L.P. | | | 2,362,664 | | | 04/10/00 – 12/21/06 | | | 865,442 | | | | 646,850 | | | | 0.27 | | | | 0.19 | | | | | | | | | | |

| | | | 12,088 | | | 12/27/07 | | | 12,088 | | | | 3,310 | | | | 0.27 | | | | 0.00 | | | | | | | | | | |

| | | | 2,374,752 | | | | | | 877,530 | | | | 650,160 | | | | | | | | 0.19 | | | | 2,144,368 | | | | 679,234 | | |

| Total | | | | | | | | $ | 1,900,349 | | | $ | 1,484,849 | | | | | | | | 0.44 | | | $ | 4,113,548 | | | $ | 941,942 | | |

The Fund may incur certain costs in connection with the disposition of the above securities.

NOTE I. SHARE REPURCHASE PROGRAM

Share Repurchase Program: The Board of Directors of the Fund, at a meeting held on November 15, 2007, authorized management to make open market purchases from time to time in an amount up to 10% of the Fund's outstanding shares whenever the Fund's shares are trading at a discount to net asset value of 12% or more. Open market purchases may also be made within the discretion of management if the discount is less than 12%. The Board has instructed management to report repurchase activity to it regularly, and to post the number of shares repurchased on the Fund's website on a monthly basis. For the fiscal year ended December 31, 2007, the Fund repurchased 11,293 of its shares for a total cost of $585,158 at a weighted discount of 12.20% from its net asset value.

NOTE J. CONTINGENCIES

In the normal course of business, the Fund may provide general indemnifications pursuant to certain contracts and organizational documents. The Fund's maximum exposure under these arrangements is dependent on future claims that may be made against the Fund and, therefore, cannot be estimated: however, based on experience, the risk of loss from such claims is considered remote.

NOTE K. RECENT ACCOUNTING PRONOUNCEMENTS

During June 2006, the Financial Accounting Standards Board ("FASB") issued FASB Interpretation 48 ("FIN 48" or the "Interpretation"), Accounting for Uncertainty in Income Taxes—an interpretation of FASB statement 109. FIN 48 supplements FASB Statement 109, Accounting for Income Taxes, by defining the confidence level that a tax position must meet in order to be recognized in the financial statements. FIN 48 prescribes a comprehensive model for how a fund should recognize, measure, present, and disclose in its financial statements uncertain tax positions that the fund has taken or expects to take on a tax return. FIN 48 requires that the tax effects of a position be recognized only if it is "more likely than not" to be sustained based solely on its technical merits. Management must be able to conclude that the tax law, regulations, case law, and other objective information regarding the technical merits sufficiently

25

THE LATIN AMERICA EQUITY FUND, INC.

NOTES TO FINANCIAL STATEMENTS (CONTINUED)

December 31, 2007

support the position's sustainability with a likelihood of more than 50 percent. During the period ended December 31, 2007, management has adopted FIN 48. There was no material impact to the financial statements or disclosures thereto as a result of the adoption of this pronouncement.

On September 20, 2006, the FASB released Statement of Financial Accounting Standards No. 157 "Fair Value Measurements" ("FAS 157"). FAS 157 establishes an authoritative definition of fair value, sets out a framework for measuring fair value, and requires additional disclosures about fair-value measurements. The application of FAS 157 is required for fiscal years, beginning after November 15, 2007 and interim periods within those fiscal years. As of December 31, 2007, management does not believe the adoption of FAS 157 will impact the amounts reported in the financial statements, however, additional disclosures will be required in subsequent reports.

26

REPORT OF INDEPENDENT REGISTERED PUBLIC ACCOUNTING FIRM

To the Board of Directors and Shareholders

of The Latin America Equity Fund, Inc.:

In our opinion, the accompanying statement of assets and liabilities, including the schedule of investments, and the related statements of operations, of changes in net assets and the financial highlights present fairly, in all material respects, the financial position of The Latin America Equity Fund, Inc. (the "Fund") at December 31, 2007, the results of its operations for the year then ended, the changes in its net assets for each of the two years in the period then ended, and the financial highlights for each of the ten years in the period then ended, in conformity with accounting principles generally accepted in the United States of America. These financial statements and financial highlights (hereafter referred to as "financial statements") are the responsibility of the Fund's management; our responsibility is to express an opinion on these financial statements based on our audits. We conducted our audits of these financial statements in accordance with the standards of the Public Company Accounting Oversight Board (United States). These standards require that we plan and perform the audit to obtain reasonable assurance about whether the financial statements are free of material misstatement. An audit includes examining, on a test basis, evidence supporting the amounts and disclosures in the financial statements, assessing the accounting principles used and significant estimates made by management, and evaluating the overall financial statement presentation. We believe that our audits, which included confirmation of securities at December 31, 2007 by correspondence with the custodian, brokers and issuers, provide a reasonable basis for our opinion.

PricewaterhouseCoopers LLP

Baltimore, Maryland

February 25, 2008

27

RESULTS OF ANNUAL MEETING OF SHAREHOLDERS (UNAUDITED)

On April 26, 2007, the Annual Meeting of Shareholders of the Fund (the "Meeting") was held and the following matter was voted upon:

(1) To re-elect two directors (Mr. Haber and Mr. Torino) to the Board of Directors of the Fund:

| Name of Director | | For | | Withheld | |

| Lawrence D. Haber (Class I) | | | 3,384,265 | | | | 1,642,232 | | |

| Martin M. Torino (Class I) | | | 3,394,001 | | | | 1,632,496 | | |

In addition to the directors elected at the Meeting, James J. Cattano, Lawrence J. Fox, Steven N. Rappaport and Enrique R. Arzac continue to serve as directors of the Fund.

TAX INFORMATION (UNAUDITED)

The Fund is required by Subchapter M of the Internal Revenue Code of 1986, as amended, to advise its shareholders within 60 days of the Fund's year end (December 31, 2007) as to the U.S. federal tax status of dividends and distributions received by the Fund's shareholders in respect of such year. Of the $12.55 per share distributions paid in respect of such year, $0.76 per share was derived from net investment income, $1.38 per share was derived from net realized short-term capital gains and $10.41 per share was derived from net realized long-term capital gains. The Fund has met the requirements to pass through 57.91% of net investment income, and net realized short-term capital gains, as qualified dividends as noted on Box 1B on Form 1099-DIV. 57.91% of the short-term capital gains paid qualify to be designated as short-term capital gains dividends. Please note that to utilize the lower tax rate for qualifying dividend income, shareholders generally must have held their shares in the Fund for at least 61 days during the 121 day period beginning 60 days before the ex-dividend date.

The Fund has made an election under Section 853 to pass through foreign taxes paid by the Fund to its shareholders. The amount of foreign taxes that were passed through to shareholders for the year ended December 31, 2007, was $567,206 equal to $0.09 per share from Brazil. 57.9% of foreign source income is from qualifying dividend income. This information is given to meet certain requirements of the Internal Revenue Code of 1986, as amended. Shareholders should refer to their Form 1099-DIV to determine the amount includable on their respective tax returns for 2007.

Notification for calendar year 2007 was mailed in January 2008. The notification along with Form 1099-DIV reflects the amount to be used by calendar year taxpayers on their U.S. federal income tax returns.

Foreign shareholders will generally be subject to U.S. withholding tax on the amount of the actual ordinary dividends paid by the Fund. They will generally not be entitled to foreign tax credit or deduction for the withholding taxes paid by the Fund.