UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF

REGISTERED MANAGEMENT INVESTMENT COMPANIES

| | |

| Investment Company Act file number: | | 811-06110 |

| |

| Name of Fund: | | Western Asset Funds, Inc. |

| | Address of Principal Executive Offices: |

| | 385 East Colorado Boulevard |

| | Pasadena, CA 91101 |

| |

| | |

| Name and address of agent for service: | | Richard M. Wachterman, Esq. |

| | Legg Mason Wood Walker, Incorporated |

| | 100 Light Street |

| | Baltimore, MD 21202. |

| |

| Registrant’s telephone number, including area code: | | (410) 539-0000 |

| |

| Date of fiscal year end: | | March 31, 2006 |

| |

| Date of reporting period: | | March 31, 2006 |

Item 1 – Report to Shareholders

Western Asset Funds, Inc.

Western Asset Limited Duration Bond Portfolio

Western Asset Intermediate Bond Portfolio

Western Asset Intermediate Plus Bond Portfolio

Western Asset Core Bond Portfolio

Western Asset Core Plus Bond Portfolio

Western Asset Inflation Indexed Plus Bond Portfolio

Western Asset High Yield Portfolio

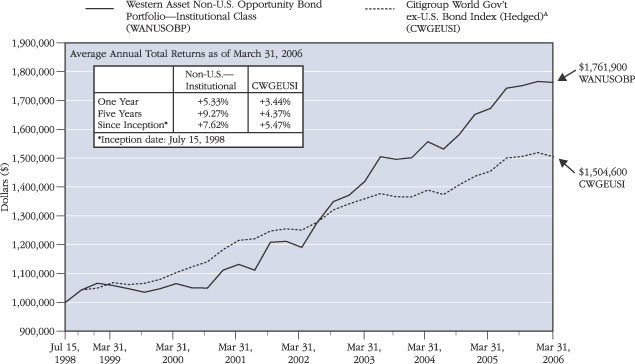

Western Asset Non-U.S. Opportunity Bond Portfolio

Annual Report to Shareholders

March 31, 2006

Annual Report to Shareholders

Management’s Discussion of Fund Performance

Western Asset Limited Duration Bond Portfolio

The average annual total returns for the Western Asset Limited Duration Bond Portfolio for the period from its inception to March 31, 2006, are presented below, along with the total returns of its benchmark:

| | | | | | |

| | | Average Annual Total Returns Periods Ended March 31, 2006

|

| | | First

Quarter 2006 | | One

Year | | Since

InceptionA |

Western Asset Limited Duration Bond Portfolio | | | | | | |

Institutional Class | | 0.84% | | 3.01% | | 2.15% |

Merrill Lynch 1-3 Year Treasury IndexB | | 0.38% | | 2.32% | | 1.25% |

The performance data quoted represents past performance and does not guarantee future results. The performance stated may have been due to extraordinary market conditions, which may not be duplicated in the future. Current performance may be lower or higher than the performance data quoted. To obtain the most recent month-end performance information please visit www.westernassetfunds.com. The investment return and principal value of the Fund will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than the original cost. Calculations assume reinvestment of dividends and capital gain distributions. Performance would have been lower if fees had not been waived in various periods.

Short-term interest rates rose significantly over the past 12 months, led by a 200 bpsC increase in the federal funds rate target. Long-term interest rates rose only moderately, resulting in a substantial flattening of the yield curve. Contrary to expectations that they would hike rates to only 4%, the Federal Reserve increased its target funds rate by 25 bps at every Federal Open Market Committee (“FOMC”) meeting, reaching 4.75% in March. Tighter-than-expected monetary policy pushed real yields up by more than nominal yields, reflecting reduced inflation expectations. The dollar also benefited from higher rates, rising some 7% against a basket of currencies. Mortgage-backed spreads began the period fairly tight, only to widen in the latter half of the period as concerns over extension risk mounted. Investment-grade credit spreads drifted wider, driven largely by fallout from the unexpected downgrade of Ford and GM debt. Thanks to a robust global economy, easy money, and strong gains in commodity prices, emerging market spreads tightened dramatically over the course of the period, leaving yields at record-low levels. High-yield spreads soared in the wake of the GM and Ford downgrades, but recovered dramatically to finish the period unchanged to somewhat tighter. Despite a substantial reduction of monetary policy accommodation during the period, gold rose over 35%, to $584 per ounce, returning to levels not seen since the inflation panic of 1980. Energy and industrial commodity prices also rose, registering substantial gains against all major currencies. Equity markets moved steadily higher over the course of the period.

The impact of market conditions on the Portfolio’s performance was negative for the 12-month period ended March 31, 2006, since short-term interest rates rose. With strategies producing generally positive results, the Portfolio’s total return of 3.01% (net of expenses) exceeded that of its benchmark, the Merrill Lynch 1-3 year Treasury Index, which recorded a total return of 2.32%. Duration management detracted from performance as yields, lead by the front-end, rose higher than we expected. The mortgage-backed sector contributed to performance as a higher carry and narrowing spreads late in the period generated excess returns beyond Treasuries. Exposure to BBB corporate securities was increased following the spread widening in the beginning of the period and this benefited the portfolio. A modest exposure to Treasury Inflation-Protected Securities was slightly negative as real yields rose faster than nominal yields.

Western Asset Management Company

| A | | The Fund’s Institutional Class inception date is October 1, 2003. Index returns are for periods beginning September 30, 2003. |

| B | | A subset of the Merrill Lynch Treasury Master Index, consisting of bonds with an outstanding par that is greater than or equal to $25 million and fixed rate coupons greater than 4.25%. The maturity range on these securities is from 1 to 3 years. The index does not incur fees and expenses and cannot be purchased directly by investors. |

1

Annual Report to Shareholders

Expense Example

Western Asset Limited Duration Bond Portfolio

As a shareholder of the Fund, you incur ongoing costs, including management fees and other Fund expenses. These examples are intended to help you understand your ongoing costs (in dollars) of investing in the Fund and to compare these costs with the ongoing costs of investing in other mutual funds. The example is based on an investment of $1,000 invested on October 1, 2005, and held through March 31, 2006.

Actual Expenses

The first line in the table below provides information about actual account values and actual expenses for the Fund. You may use the information in this line, together with the amount you invested, to estimate the expenses that you paid over the period. Simply divide your account value by $1,000 (for example, an $8,600 account divided by $1,000 = 8.6), then multiply the result by the number in the first line under the heading entitled “Expenses Paid During the Period” to estimate the expenses you paid on your account during this period.

Hypothetical Example for Comparison Purposes

The second line in the table below provides information about hypothetical account values and hypothetical expenses based on the Fund’s actual expense ratio and an assumed rate of return of 5% per year before expenses, which is not the Fund’s actual return. The hypothetical account values and expenses may not be used to estimate the actual ending account balance or expenses you paid for the period. You may use this information to compare the ongoing costs of investing in the Fund and other funds. To do so, compare this 5% hypothetical example with the 5% hypothetical examples that appear in the shareholder reports of other funds.

| | | | | | | | | |

| | | Beginning

Account Value

10/1/05 | | Ending

Account Value

3/31/06 | | Expenses PaidA

During the Period

10/1/05 to 3/31/06 |

Institutional Class: | | | | | | | | | |

Actual | | $ | 1,000.00 | | $ | 1,012.90 | | $ | 2.01 |

Hypothetical (5% return before expenses) | | | 1,000.00 | | | 1,022.94 | | | 2.02 |

| A | | These calculations are based on expenses incurred in the most recent fiscal half-year. The dollar amounts shown as “Expenses Paid” are equal to the annualized expense ratio of 0.40% multiplied by the average value over the period, multiplied by the number of days in the most recent fiscal half-year (182), and divided by 365. |

2

Annual Report to Shareholders

Performance Information

Western Asset Limited Duration Bond Portfolio

The graph compares the Fund’s total returns against that of an appropriate broad-based securities market index. The line illustrates the cumulative total return of an initial $1,000,000 investment for the periods indicated. The line for the Fund represents the total return after deducting all Fund investment management and other administrative expenses and the transaction costs of buying and selling securities. The line representing the securities market index does not include any transaction costs associated with buying and selling securities in the index or other investment management or administrative expenses.

Total return measures investment performance in terms of appreciation or depreciation in the Fund’s net asset value per share, plus dividends and any capital gain distributions. It assumes that dividends and distributions were reinvested at the time they were paid. Returns (and the graph and table found below) do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the redemption of Fund shares. Average annual returns tend to smooth out variations in a fund’s return, so that they differ from actual year-to-year results.

Bonds are subject to a variety of risks, including interest rate, credit and inflation risk.

Growth of a $1,000,000 Investment—Institutional Class

The performance data quoted represents past performance and does not guarantee future results. The performance stated may have been due to extraordinary market conditions, which may not be duplicated in the future. Current performance may be lower or higher than the performance data quoted. To obtain the most recent month-end performance information, please visit www.westernassetfunds.com. The investment return and principal value of the Fund will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than the original cost. Calculations assume reinvestment of dividends and capital gain distributions. Performance would have been lower if fees had not been waived in various periods.

| A | | Index returns are for periods beginning September 30, 2003. |

3

Annual Report to Shareholders

Performance Information—Continued

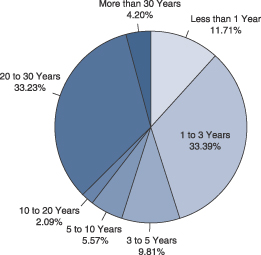

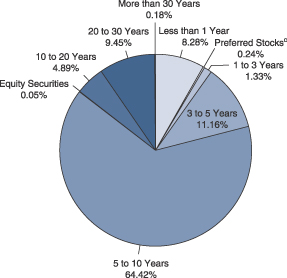

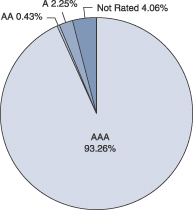

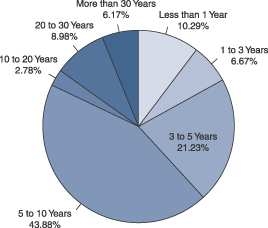

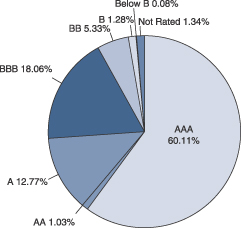

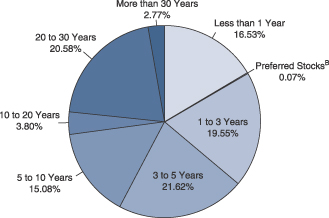

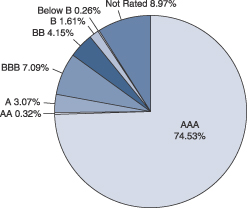

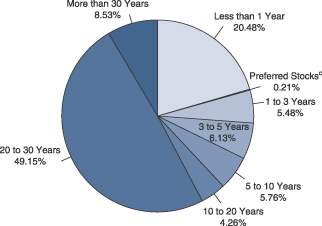

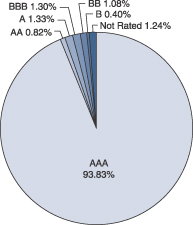

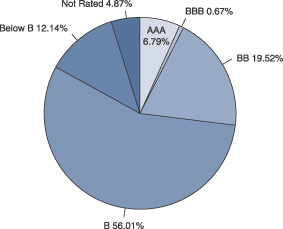

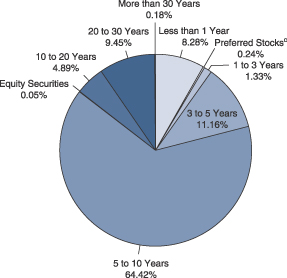

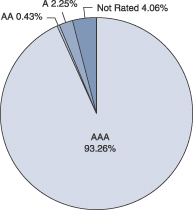

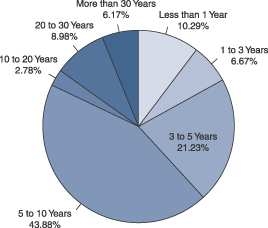

Portfolio Composition (as of March 31, 2006)

Standard & Poor’s Debt RatingsB

(as a percentage of the portfolio)

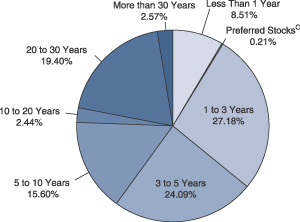

Maturity Schedule (as a percentage of the portfolio)

| B | | Source: Standard & Poor's. |

| | | The Fund is actively managed. As a result, the composition of the portfolio holdings and sectors are subject to change at any time. |

4

Annual Report to Shareholders

Portfolio of Investments

Western Asset Limited Duration Bond Portfolio

March 31, 2006

(Amounts in Thousands)

| | | | | | | | | | | | | |

| | | % OF

NET ASSETS | | RATE | | MATURITY

DATE | | PAR | | VALUE | |

| | | | | | | | | | | | | | |

Long-Term Securities | | 98.5% | | | | | | | | | | | |

| | | | | |

Corporate Bonds and Notes | | 25.4% | | | | | | | | | | | |

| | | | | |

Auto Parts and Equipment | | 0.1% | | | | | | | | | | | |

Johnson Controls, Inc. | | | | 4.830% | | 1/17/08 | | $ | 70 | | $ | 70 | A |

| | | | | | | | | | | |

|

|

|

| | | | | |

Banking and Finance | | 7.3% | | | | | | | | | | | |

Caterpillar Financial Services | | | | 3.450% | | 1/15/09 | | | 100 | | | 95 | |

Countrywide Financial Corporation | | | | 5.170% | | 3/24/09 | | | 280 | | | 280 | A |

Ford Motor Credit Company | | | | 5.795% | | 9/28/07 | | | 450 | | | 432 | A |

Ford Motor Credit Company | | | | 6.625% | | 6/16/08 | | | 1,510 | | | 1,429 | |

General Motors Acceptance Corporation | | | | 5.550% | | 7/16/07 | | | 100 | | | 97 | A |

General Motors Acceptance Corporation | | | | 6.090% | | 9/23/08 | | | 1,340 | | | 1,265 | A |

HSBC Finance Corporation | | | | 4.970% | | 5/10/10 | | | 310 | | | 311 | A |

Residential Capital Corporation | | | | 6.335% | | 6/29/07 | | | 600 | | | 604 | A |

Residential Capital Corporation | | | | 6.070% | | 11/21/08 | | | 300 | | | 304 | A |

SLM Corporation | | | | 4.763% | | 7/27/09 | | | 250 | | | 250 | A |

Wachovia Capital Trust III | | | | 5.800% | | 3/15/42 | | | 330 | | | 324 | B |

| | | | | | | | | | | |

|

|

|

| | | | | | | | | | | | | 5,391 | |

| | | | | | | | | | | |

|

|

|

Cable | | 0.6% | | | | | | | | | | | |

Comcast Cable Communications, Inc. | | | | 8.375% | | 5/1/07 | | | 230 | | | 237 | |

Comcast Cable Communications, Inc. | | | | 6.875% | | 6/15/09 | | | 200 | | | 207 | |

| | | | | | | | | | | |

|

|

|

| | | | | | | | | | | | | 444 | |

| | | | | | | | | | | |

|

|

|

Casino Resorts | | 0.4% | | | | | | | | | | | |

Caesars Entertainment, Inc. | | | | 7.500% | | 9/1/09 | | | 130 | | | 137 | |

Harrah’s Operating Company, Inc. | | | | 5.315% | | 2/8/08 | | | 120 | | | 120 | A,C |

Harrah’s Operating Company, Inc. | | | | 7.500% | | 1/15/09 | | | 40 | | | 42 | |

| | | | | | | | | | | |

|

|

|

| | | | | | | | | | | | | 299 | |

| | | | | | | | | | | |

|

|

|

Chemicals | | 0.3% | | | | | | | | | | | |

The Dow Chemical Company | | | | 5.970% | | 1/15/09 | | | 200 | | | 203 | |

| | | | | | | | | | | |

|

|

|

| | | | | |

Computer Services and Systems | | 0.4% | | | | | | | | | | | |

Electronic Data Systems Corporation | | | | 7.125% | | 10/15/09 | | | 290 | | | 305 | |

| | | | | | | | | | | |

|

|

|

| | | | | |

Diversified Financial Services | | 2.8% | | | | | | | | | | | |

Citigroup Inc. | | | | 5.000% | | 9/15/14 | | | 200 | | | 192 | |

Capital One Financial Corporation | | | | 4.738% | | 5/17/07 | | | 90 | | | 89 | |

CIT Group Incorporated | | | | 4.810% | | 1/30/09 | | | 300 | | | 300 | A |

General Electric Capital Corporation | | | | 5.010% | | 6/15/09 | | | 100 | | | 100 | A |

iStar Financial Inc. | | | | 5.220% | | 3/3/08 | | | 260 | | | 261 | A |

5

Annual Report to Shareholders

Portfolio of Investments—Continued

Western Asset Limited Duration Bond Portfolio—Continued

| | | | | | | | | | | | | |

| | | % OF

NET ASSETS | | RATE | | MATURITY

DATE | | PAR | | VALUE | |

| | | | | | | | | | | | | | |

Corporate Bonds and Notes—Continued | | | | | | | | | | | | | |

| | | | | |

Diversified Financial Services—Continued | | | | | | | | | | | | | |

iStar Financial Inc. | | | | 5.650% | | 9/15/11 | | $ | 640 | | $ | 631 | |

ZFS Finance (USA) Trust III | | | | 6.060% | | 12/15/65 | | | 500 | | | 503 | A,C |

| | | | | | | | | | | |

|

|

|

| | | | | | | | | | | | | 2,076 | |

| | | | | | | | | | | |

|

|

|

Electric | | 1.5% | | | | | | | | | | | |

Appalachian Power Company | | | | 3.600% | | 5/15/08 | | | 300 | | | 289 | |

Commonwealth Edison Company | | | | 3.700% | | 2/1/08 | | | 180 | | | 175 | |

Dominion Resources, Inc. | | | | 4.125% | | 2/15/08 | | | 100 | | | 97 | |

FirstEnergy Corp. | | | | 6.450% | | 11/15/11 | | | 430 | | | 445 | |

Niagara Mohawk Power Corporation | | | | 7.750% | | 10/1/08 | | | 100 | | | 105 | |

| | | | | | | | | | | |

|

|

|

| | | | | | | | | | | | | 1,111 | |

| | | | | | | | | | | |

|

|

|

Energy | | 1.3% | | | | | | | | | | | |

CenterPoint Energy, Inc. | | | | 5.875% | | 6/1/08 | | | 150 | | | 151 | |

Duke Energy Corporation | | | | 3.750% | | 3/5/08 | | | 200 | | | 194 | |

Pacific Gas and Electric Co. | | | | 3.600% | | 3/1/09 | | | 190 | | | 181 | |

Progress Energy, Inc. | | | | 5.850% | | 10/30/08 | | | 200 | | | 201 | |

Sempra Energy | | | | 5.240% | | 5/21/08 | | | 90 | | | 90 | A |

TXU Corp. | | | | 4.800% | | 11/15/09 | | | 180 | | | 173 | |

| | | | | | | | | | | |

|

|

|

| | | | | | | | | | | | | 990 | |

| | | | | | | | | | | |

|

|

|

Environmental Services | | 0.6% | | | | | | | | | | | |

Waste Management, Inc. | | | | 6.500% | | 11/15/08 | | | 100 | | | 103 | |

Waste Management, Inc. | | | | 7.375% | | 8/1/10 | | | 300 | | | 320 | |

| | | | | | | | | | | |

|

|

|

| | | | | | | | | | | | | 423 | |

| | | | | | | | | | | |

|

|

|

Food, Beverage and Tobacco | | 0.7% | | | | | | | | | | | |

Altria Group, Inc. | | | | 7.200% | | 2/1/07 | | | 110 | | | 111 | |

Altria Group, Inc. | | | | 7.650% | | 7/1/08 | | | 30 | | | 32 | |

Altria Group, Inc. | | | | 5.625% | | 11/4/08 | | | 360 | | | 361 | |

| | | | | | | | | | | |

|

|

|

| | | | | | | | | | | | | 504 | |

| | | | | | | | | | | |

|

|

|

Investment Banking/Brokerage | | 1.5% | | | | | | | | | | | |

Lehman Brothers Holdings Inc. | | | | 4.970% | | 11/10/09 | | | 100 | | | 100 | A |

Merrill Lynch & Co., Inc. | | | | 4.930% | | 2/5/10 | | | 300 | | | 301 | A |

Morgan Stanley | | | | 4.850% | | 1/18/11 | | | 250 | | | 251 | A |

The Bear Stearns Companies Inc. | | | | 4.898% | | 1/31/11 | | | 160 | | | 160 | A |

The Goldman Sachs Group, Inc. | | | | 5.265% | | 6/28/10 | | | 300 | | | 301 | A |

| | | | | | | | | | | |

|

|

|

| | | | | | | | | | | | | 1,113 | |

| | | | | | | | | | | |

|

|

|

Manufacturing (Diversified) | | 0.2% | | | | | | | | | | | |

Tyco International Group SA | | | | 4.436% | | 6/15/07 | | | 190 | | | 187 | C |

| | | | | | | | | | | |

|

|

|

6

Annual Report to Shareholders

| | | | | | | | | | | | | | |

| | | % OF

NET ASSETS | | RATE | | MATURITY

DATE | | PAR | | | VALUE | |

| | | | | | | | | | | | | | | |

Corporate Bonds and Notes—Continued | | | | | | | | | | | | | | |

| | | | | |

Media | | 1.4% | | | | | | | | | | | | |

Clear Channel Communications, Inc. | | | | 6.625% | | 6/15/08 | | $ | 60 | | | $ | 61 | |

Clear Channel Communications, Inc. | | | | 4.250% | | 5/15/09 | | | 340 | | | | 323 | |

Clear Channel Communications, Inc. | | | | 7.650% | | 9/15/10 | | | 20 | | | | 21 | |

Liberty Media Corporation | | | | 7.875% | | 7/15/09 | | | 300 | | | | 316 | |

Time Warner Inc. | | | | 6.150% | | 5/1/07 | | | 220 | | | | 222 | |

Viacom Inc. | | | | 5.625% | | 5/1/07 | | | 100 | | | | 100 | |

| | | | | | | | | | | | |

|

|

|

| | | | | | | | | | | | | | 1,043 | |

| | | | | | | | | | | | |

|

|

|

Oil and Gas | | 2.8% | | | | | | | | | | | | |

Amerada Hess Corporation | | | | 6.650% | | 8/15/11 | | | 420 | | | | 439 | |

Anadarko Petroleum Corporation | | | | 3.250% | | 5/1/08 | | | 230 | | | | 220 | |

Occidental Petroleum Corporation | | | | 7.375% | | 11/15/08 | | | 320 | | | | 336 | |

Ocean Energy Inc. | | | | 4.375% | | 10/1/07 | | | 100 | | | | 99 | |

Pemex Project Funding Master Trust | | | | 8.500% | | 2/15/08 | | | 50 | | | | 52 | |

Pemex Project Funding Master Trust | | | | 6.125% | | 8/15/08 | | | 490 | | | | 494 | |

Pemex Project Funding Master Trust | | | | 6.210% | | 6/15/10 | | | 140 | | | | 144 | A,C |

Texas Eastern Transmission Corporation | | | | 5.250% | | 7/15/07 | | | 100 | | | | 99 | |

XTO Energy, Inc. | | | | 5.650% | | 4/1/16 | | | 180 | | | | 178 | |

| | | | | | | | | | | | |

|

|

|

| | | | | | | | | | | | | | 2,061 | |

| | | | | | | | | | | | |

|

|

|

Paper and Forest Products | | 0.5% | | | | | | | | | | | | |

International Paper Company | | | | 3.800% | | 4/1/08 | | | 190 | | | | 184 | |

Weyerhaeuser Company | | | | 6.125% | | 3/15/07 | | | 123 | | | | 124 | |

Weyerhaeuser Company | | | | 5.950% | | 11/1/08 | | | 40 | | | | 40 | |

| | | | | | | | | | | | |

|

|

|

| | | | | | | | | | | | | | 348 | |

| | | | | | | | | | | | |

|

|

|

Pharmaceuticals | | 0.2% | | | | | | | | | | | | |

Bristol-Myers Squibb Company | | | | 4.000% | | 8/15/08 | | | 140 | | | | 136 | |

| | | | | | | | | | | | |

|

|

|

| | | | | |

Photo Equipment and Supplies | | N.M. | | | | | | | | | | | | |

Eastman Kodak Company | | | | 7.250% | | 11/15/13 | | | 10 | | | | 10 | |

| | | | | | | | | | | | |

|

|

|

| | | | | |

Special Purpose | | 2.0% | | | | | | | | | | | | |

BAE Systems Holdings Inc. | | | | 5.149% | | 8/15/08 | | | 100 | | | | 100 | A,C |

DaimlerChrysler North America Holding Corporation | | | | 5.210% | | 10/31/08 | | | 370 | | | | 371 | A |

DaimlerChrysler North America Holding Corporation | | | | 5.875% | | 3/15/11 | | | 100 | | | | 100 | |

ILFC E-Capital Trust I | | | | 5.900% | | 12/21/65 | | | 300 | | | | 291 | B,C |

International Lease Finance Corporation | | | | 5.000% | | 4/15/10 | | | 140 | | | | 137 | |

National Rural Utilities Cooperative Finance Corporation | | | | 3.875% | | 2/15/08 | | | 100 | | | | 98 | |

Sprint Capital Corporation | | | | 6.125% | | 11/15/08 | | | 410 | | | | 417 | |

| | | | | | | | | | | | |

|

|

|

| | | | | | | | | | | | | | 1,514 | |

| | | | | | | | | | | | |

|

|

|

7

Annual Report to Shareholders

Portfolio of Investments—Continued

Western Asset Limited Duration Bond Portfolio—Continued

| | | | | | | | | | | | | |

| | | % OF

NET ASSETS | | RATE | | MATURITY

DATE | | PAR | | VALUE | |

| | | | | | | | | | | | | | |

Corporate Bonds and Notes—Continued | | | | | | | | | | | | | |

| | | | | |

Telecommunications | | 0.3% | | | | | | | | | | | |

AT&T Inc. | | | | 4.125% | | 9/15/09 | | $ | 100 | | $ | 95 | |

AT&T Inc. | | | | 5.300% | | 11/15/10 | | | 100 | | | 99 | |

| | | | | | | | | | | |

|

|

|

| | | | | | | | | | | | | 194 | |

| | | | | | | | | | | |

|

|

|

Telecommunications (Cellular/Wireless) | | 0.4% | | | | | | | | | | | |

Motorola, Inc. | | | | 4.608% | | 11/16/07 | | | 100 | | | 99 | |

New Cingular Wireless Services Inc. | | | | 7.500% | | 5/1/07 | | | 200 | | | 204 | |

| | | | | | | | | | | |

|

|

|

| | | | | | | | | | | | | 303 | |

| | | | | | | | | | | |

|

|

|

Telecommunications Equipment | | 0.1% | | | | | | | | | | | |

New York Telephone Co. | | | | 6.000% | | 4/15/08 | | | 100 | | | 100 | |

| | | | | | | | | | | |

|

|

|

Total Corporate Bonds and Notes

(Identified Cost—$19,066) | | | | | | | | | | | | 18,825 | |

Asset-Backed Securities | | 8.2% | | | | | | | | | | | |

| | | | | |

Fixed Rate Securities | | 2.9% | | | | | | | | | | | |

AmeriCredit Automobile Receivables Trust

2003-BX A4A | | | | 2.720% | | 1/6/10 | | | 302 | | | 297 | |

MBNA Practice Solutions Owners Trust 2005-2 | | | | 4.100% | | 5/15/09 | | | 400 | | | 393 | C |

Onyx Acceptance Owner Trust 2002-D | | | | 3.100% | | 7/15/09 | | | 60 | | | 60 | |

Prestige Auto Receivables Trust 2005-1A | | | | 4.370% | | 6/15/12 | | | 200 | | | 196 | C |

Prestige Auto Receivables Trust 2006-1A | | | | 5.120% | | 2/15/10 | | | 592 | | | 590 | C |

UCFC Home Equity Loan 1998-D | | | | 6.905% | | 4/15/30 | | | 104 | | | 104 | |

UPFC Auto Receivables Trust 2004-A | | | | 3.270% | | 9/15/10 | | | 500 | | | 493 | |

| | | | | | | | | | | |

|

|

|

| | | | | | | | | | | | | 2,133 | |

| | | | | | | | | | | |

|

|

|

Indexed SecuritiesA | | 5.3% | | | | | | | | | | | |

AmeriCredit Automobile Loan Trust 2003-BX A4B | | | | 4.780% | | 1/6/10 | | | 23 | | | 23 | |

AQ Finance Nim Trust 2003-N13 | | | | 5.048% | | 12/25/08 | | | 21 | | | 21 | C,D |

Bayview Financial Acquisition Trust 2004-C | | | | 5.241% | | 5/28/44 | | | 210 | | | 211 | |

Bear Stearns Asset-Backed Securities, Inc. 2005-AQ2 | | | | 5.088% | | 9/25/35 | | | 500 | | | 500 | |

Chase Funding Mortgage Loan Asset-Backed Certificates 2002-4 | | | | 5.188% | | 10/25/32 | | | 27 | | | 27 | |

Citibank Credit Card Issuance Trust 2002-C3 | | | | 6.050% | | 12/15/09 | | | 160 | | | 162 | |

Countrywide Asset-Backed Certificates 2002-3 | | | | 5.188% | | 5/25/32 | | | 7 | | | 7 | |

Countrywide Home Equity Loan Trust 2002-C | | | | 4.989% | | 5/15/28 | | | 43 | | | 43 | |

Countrywide Home Equity Loan Trust 2004-J | | | | 5.039% | | 12/15/33 | | | 135 | | | 135 | |

Countrywide Home Equity Loan Trust 2004-O | | | | 5.029% | | 2/15/34 | | | 171 | | | 171 | |

CS First Boston Mortgage Securities Corporation

2004-HC1A | | | | 5.149% | | 12/15/21 | | | 564 | | | 564 | C |

EQCC Trust 2002-1 | | | | 5.118% | | 11/25/31 | | | 35 | | | 35 | |

8

Annual Report to Shareholders

| | | | | | | | | | | | | |

| | | % OF

NET ASSETS | | RATE | | MATURITY

DATE | | PAR | | VALUE | |

| | | | | | | | | | | | | | |

Asset-Backed Securities—Continued | | | | | | | | | | | | | |

| | | | | |

Indexed Securities—Continued | | | | | | | | | | | | | |

First Franklin Mortgage Loan Asset-Backed Certificate 2004-FF10 | | | | 5.218% | | 12/25/32 | | $ | 382 | | $ | 383 | |

First North American National Bank 2003-A | | | | 5.229% | | 5/16/11 | | | 220 | | | 220 | |

Fremont Home Loan Trust 2004-C | | | | 5.088% | | 1/25/32 | | | 134 | | | 134 | |

GSAA Home Equity Trust 2004-9 | | | | 5.198% | | 9/25/34 | | | 171 | | | 171 | |

Navistar Financial Corp Owner Trust 2003-B | | | | 4.949% | | 4/15/08 | | | 119 | | | 119 | |

Rental Car Finance Corp. 2004-1A | | | | 5.018% | | 6/25/09 | | | 500 | | | 501 | C |

Residential Asset Mortgage Products, Inc. 2002-RS6 | | | | 5.268% | | 11/25/32 | | | 47 | | | 47 | |

Superior Wholesale Inventory Financing Trust 2004-A10 | | | | 4.849% | | 9/15/11 | | | 500 | | | 500 | |

| | | | | | | | | | | |

|

|

|

| | | | | | | | | | | | | 3,974 | |

| | | | | | | | | | | |

|

|

|

Total Asset-Backed Securities

(Identified Cost—$6,136) | | | | | | | | | | | | 6,107 | |

Mortgage-Backed Securities | | 18.1% | | | | | | | | | | | |

| | | | | |

Fixed Rate Securities | | 0.9% | | | | | | | | | | | |

Asset Securitization Corporation 1996-D2 | | | | 6.920% | | 2/14/29 | | | 26 | | | 26 | |

Countrywide Alternative Loan Trust 2004-J1 | | | | 6.000% | | 2/25/34 | | | 55 | | | 55 | |

Prime Mortgage Trust 2005-2 | | | | 7.596% | | 10/25/32 | | | 234 | | | 239 | |

Residential Asset Mortgage Products, Inc. 2004-SL2 | | | | 8.500% | | 10/25/31 | | | 44 | | | 45 | |

Residential Asset Mortgage Products, Inc. 2005-SL1 | | | | 8.000% | | 5/25/32 | | | 273 | | | 285 | |

| | | | | | | | | | | |

|

|

|

| | | | | | | | | | | | | 650 | |

| | | | | | | | | | | |

|

|

|

Indexed SecuritiesA | | 14.2% | | | | | | | | | | | |

Banc of America Mortgage Securities 2003-D | | | | 4.569% | | 5/25/33 | | | 189 | | | 186 | |

Banc of America Mortgage Securities 2005-F | | | | 5.025% | | 7/25/35 | | | 736 | | | 723 | |

Bear Stearns Arm Trust 2004-10 | | | | 4.581% | | 1/25/35 | | | 115 | | | 114 | |

CBA Commercial Small Balance Commercial 2005-1A | | | | 5.138% | | 7/25/35 | | | 637 | | | 637 | C |

Citigroup Mortgage Loan Trust, Inc. 2005-5 | | | | 5.502% | | 8/25/35 | | | 450 | | | 447 | |

Countrywide Alternative Loan Trust 2005-38 | | | | 5.168% | | 9/25/35 | | | 693 | | | 697 | C |

Countrywide Asset-backed Certificates 2005-IM1 | | | | 5.098% | | 11/25/35 | | | 1,000 | | | 1,000 | |

Countrywide Home Loans 2005-R3 | | | | 5.218% | | 9/25/35 | | | 796 | | | 799C | |

Crusade Global Trust 2003-2 | | | | 5.120% | | 9/18/34 | | | 92 | | | 92 | D |

Granite Mortgages PLC 2003-1 | | | | 4.791% | | 1/20/20 | | | 177 | | | 177 | |

GSMPS Mortgage Loan Trust 2005-RP3 | | | | 5.168% | | 9/25/35 | | | 613 | | | 615 | |

J.P. Morgan Mortgage Trust 2003-A1 | | | | 4.364% | | 10/25/33 | | | 291 | | | 281 | |

Luminent Mortgage Trust 2006-2 | | | | 5.018% | | 2/25/46 | | | 896 | | | 896 | |

MASTR Adjustable Rate Mortgages Trust 2004-13 | | | | 3.787% | | 11/21/34 | | | 350 | | | 329 | |

Medallion Trust 2000-2G | | | | 5.130% | | 12/18/31 | | | 101 | | | 101 | D |

9

Annual Report to Shareholders

Portfolio of Investments—Continued

Western Asset Limited Duration Bond Portfolio—Continued

| | | | | | | | | | | | | |

| | | % OF

NET ASSETS | | RATE | | MATURITY

DATE | | PAR | | VALUE | |

| | | | | | | | | | | | | | |

Mortgage-Backed Securities—Continued | | | | | | | | | | | | | |

| | | | | |

Indexed Securities—Continued | | | | | | | | | | | | | |

Medallion Trust 2003-1G | | | | 5.120% | | 12/21/33 | | $ | 91 | | $ | 91 | D |

MLCC Mortgage Investors, Inc. 2003-H | | | | 5.844% | | 1/25/29 | | | 62 | | | 63 | |

Provident Funding Mortgage Loan Trust 2005-1 | | | | 4.176% | | 5/25/35 | | | 318 | | | 312 | |

Sequoia Mortgage Trust 2003-2 A2 | | | | 4.700% | | 6/20/33 | | | 83 | | | 82 | |

Structured Adjustable Rate Mortgage Loan Trust

2005-16XS | | | | 5.158% | | 8/25/35 | | | 601 | | | 602 | |

Structured Adjustable Rate Mortgage Loan Trust

2005-19XS | | | | 5.118% | | 10/25/35 | | | 644 | | | 647 | |

Torrens Trust 2000-1GA | | | | 5.009% | | 7/15/31 | | | 43 | | | 43 | C,D |

Wachovia Mortgage Loan Trust, LLC 2005-A | | | | 4.809% | | 8/20/35 | | | 407 | | | 403 | |

WaMu Mortgage Pass-Through Certificates, Series 2003-AR10 | | | | 4.065% | | 10/25/33 | | | 200 | | | 193 | |

WaMu Mortgage Pass-Through Certificates, Series 2005-AR15 | | | | 5.098% | | 11/25/45 | | | 970 | | | 973 | |

| | | | | | | | | | | |

|

|

|

| | | | | | | | | | | | | 10,503 | |

| | | | | | | | | | | |

|

|

|

Variable Rate SecuritiesE | | 3.0% | | | | | | | | | | | |

Banc of America Funding Corporation 2004-B | | | | 4.198% | | 12/20/34 | | | 202 | | | 201 | |

Banc of America Funding Corporation 2005-F | | | | 5.303% | | 9/20/35 | | | 313 | | | 312 | |

Countrywide Alternative Loan Trust 2004-33 1A1 | | | | 5.021% | | 12/25/34 | | | 118 | | | 118 | |

Countrywide Alternative Loan Trust 2004-33 2A1 | | | | 4.959% | | 12/25/34 | | | 57 | | | 57 | |

Countrywide Alternative Loan Trust 2005-14 | | | | 3.300% | | 5/25/35 | | | 178 | | | 173 | |

IndyMac Index Mortgage Loan Trust 2004-AR15 | | | | 5.061% | | 2/25/35 | | | 604 | | | 599 | |

Residential Funding Mortgage Securities I

2005-SA3 | | | | 4.944% | | 8/25/35 | | | 646 | | | 640 | |

Structured Asset Securities Corporation 2004-SC1 | | | | 9.524% | | 12/25/29 | | | 145 | | | 150 | C |

| | | | | | | | | | | |

|

|

|

| | | | | | | | | | | | | 2,250 | |

| | | | | | | | | | | |

|

|

|

Total Mortgage-Backed Securities

(Identified Cost—$13,496) | | | | | | | | | | | | 13,403 | |

U.S. Government and Agency Obligations | | 25.1% | | | | | | | | | | | |

| | | | | |

Fixed Rate Securities | | 21.7% | | | | | | | | | | | |

Federal Home Loan Bank | | | | 3.125% | | 9/15/06 | | | 950 | | | 942 | |

Federal Home Loan Bank | | | | 3.625% | | 11/14/08 | | | 375 | | | 362 | |

Freddie Mac | | | | 3.800% | | 12/27/06 | | | 1,820 | | | 1,802 | |

United States Treasury Notes | | | | 3.500% | | 5/31/07 | | | 2,160 | | | 2,127 | |

United States Treasury Notes | | | | 3.625% | | 6/30/07 | | | 1,730 | | | 1,704 | |

United States Treasury Notes | | | | 4.375% | | 1/31/08 | | | 9,220 | | | 9,143 | |

| | | | | | | | | | | |

|

|

|

| | | | | | | | | | | | | 16,080 | |

| | | | | | | | | | | |

|

|

|

10

Annual Report to Shareholders

| | | | | | | | | | | | | |

| | | % OF

NET ASSETS | | RATE | | MATURITY

DATE | | PAR | | VALUE | |

| | | | | | | | | | | | | |

U.S. Government and Agency Obligations—Continued | | | | | | | | | | | | | |

| | | | | |

Treasury Inflation-Protected SecuritiesF | | 3.4% | | | | | | | | | | | |

United States Treasury Inflation-Protected Security | | | | 3.000% | | 7/15/12 | | $ | 1,709 | | $ | 1,781 | |

United States Treasury Inflation-Protected Security | | | | 2.375% | | 1/15/25 | | | 736 | | | 740 | |

| | | | | | | | | | | | | |

| | | | | | | | | | | | 2,521 | |

| | | | | | | | | | | | | |

Total U.S. Government and Agency Obligations

(Identified Cost—$18,806) | | | | | | | | | | | | 18,601 | |

U.S. Government Agency Mortgage-Backed Securities | | 17.9% | | | | | | | | | | | |

| | | | | |

Fixed Rate Securities | | 7.6% | | | | | | | | | | | |

Fannie Mae | | | | 5.500% | | 12/1/36 | | | 2,100 | | | 2,050 | G |

Fannie Mae | | | | 6.000% | | 12/1/36 | | | 1,150 | | | 1,148 | G |

Freddie Mac | | | | 5.000% | | 12/1/36 | | | 100 | | | 95 | G |

Government National Mortgage Association | | | | 5.000% | | 8/15/33 | | | 93 | | | 90 | |

Government National Mortgage Association | | | | 5.500% | | 12/1/36 | | | 2,100 | | | 2,079 | G |

Government National Mortgage Association | | | | 5.000% | | 12/1/36 | | | 130 | | | 126 | G |

| | | | | | | | | | | | | |

| | | | | | | | | | | | 5,588 | |

| | | | | | | | | | | | | |

Variable Rate SecuritiesE | | 10.3% | | | | | | | | | | | |

Fannie Mae | | | | 4.214% | | 12/1/34 | | | 166 | | | 162 | |

Fannie Mae | | | | 4.258% | | 12/1/34 | | | 158 | | | 154 | |

Fannie Mae | | | | 4.332% | | 1/1/35 | | | 176 | | | 171 | |

Fannie Mae | | | | 4.872% | | 1/1/35 | | | 325 | | | 322 | |

Fannie Mae | | | | 4.813% | | 2/1/35 | | | 786 | | | 774 | |

Fannie Mae | | | | 4.545% | | 3/1/35 | | | 359 | | | 350 | |

Fannie Mae | | | | 5.129% | | 3/1/35 | | | 599 | | | 596 | |

Fannie Mae | | | | 4.727% | | 7/1/35 | | | 4,662 | | | 4,600 | |

Freddie Mac | | | | 4.352% | | 12/1/34 | | | 80 | | | 78 | |

Freddie Mac | | | | 4.079% | | 1/1/35 | | | 57 | | | 56 | |

Freddie Mac | | | | 4.105% | | 1/1/35 | | | 101 | | | 98 | |

Freddie Mac | | | | 4.513% | | 1/1/35 | | | 301 | | | 295 | |

| | | | | | | | | | | | | |

| | | | | | | | | | | | 7,656 | |

| | | | | | | | | | | | | |

Total U.S. Government Agency Mortgage-Backed Securities

(Identified Cost—$13,417) | | | | | | | | | | | | 13,244 | |

Yankee BondsD | | 3.8% | | | | | | | | | | | |

| | | | | |

Banking and Finance | | 0.5% | | | | | | | | | | | |

AIFUL CORPORATION | | | | 5.000% | | 8/10/10 | | | 230 | | | 222 | C |

MUFG Capital Finance 1 Limited | | | | 6.346% | | 7/29/49 | | | 140 | | | 138 | B |

| | | | | | | | | | | | | |

| | | | | | | | | | | | 360 | |

| | | | | | | | | | | | | |

11

Annual Report to Shareholders

Portfolio of Investments—Continued

Western Asset Limited Duration Bond Portfolio—Continued

| | | | | | | | | | | | | |

| | | % OF

NET ASSETS | | RATE | | MATURITY

DATE | | PAR | | VALUE | |

| | | | | | | | | | | | | | |

Yankee Bonds—Continued | | | | | | | | | | | | | |

| | | | | |

Foreign Governments | | 0.7% | | | | | | | | | | | |

Russian Federation | | | | 3.000% | | 5/14/08 | | $ | 330 | | $ | 313 | |

Russian Federation | | | | 8.250% | | 3/31/10 | | | 40 | | | 42 | |

Russian Federation | | | | 8.250% | | 3/31/10 | | | 170 | | | 180 | C |

| | | | | | | | | | | |

|

|

|

| | | | | | | | | | | | | 535 | |

| | | | | | | | | | | |

|

|

|

Manufacturing (Diversified) | | 0.9% | | | | | | | | | | | |

Tyco International Group SA | | | | 6.125% | | 11/1/08 | | | 670 | | | 679 | |

| | | | | | | | | | | |

|

|

|

| | | | | |

Special Purpose | | 0.4% | | | | | | | | | | | |

Diageo Capital Plc | | | | 3.375% | | 3/20/08 | | | 280 | | | 270 | |

| | | | | | | | | | | |

|

|

|

| | | | | |

Telecommunications | | 1.1% | | | | | | | | | | | |

British Telecommunications plc | | | | 8.375% | | 12/15/10 | | | 300 | | | 335 | |

Koninklijke (Royal) KPN NV | | | | 8.000% | | 10/1/10 | | | 220 | | | 236 | |

Telecom Italia Capital | | | | 4.000% | | 11/15/08 | | | 160 | | | 154 | |

Telecom Italia Capital | | | | 5.160% | | 2/1/11 | | | 100 | | | 101 | A |

| | | | | | | | | | | |

|

|

|

| | | | | | | | | | | | | 826 | |

| | | | | | | | | | | |

|

|

|

Telecommunications (Cellular/Wireless) | | 0.2% | | | | | | | | | | | |

Vodafone Group Plc | | | | 3.950% | | 1/30/08 | | | 170 | | | 166 | |

| | | | | | | | | | | |

|

|

|

Total Yankee Bonds (Identified Cost—$2,878) | | | | | | | | | | | | 2,836 | |

| | | | | | | | | | | |

|

|

|

Total Long-Term Securities (Identified Cost—$73,799) | | | | | | | | | | | | 73,016 | |

Short-Term Securities | | 8.5% | | | | | | | | | | | |

| | | | | |

U.S. Government and Agency Obligations | | 0.1% | | | | | | | | | | | |

Fannie Mae | | | | 0.000% | | 5/15/06 | | $ | 60 | | | 60 | H,I |

| | | | | | | | | | | |

|

|

|

| | | | | |

Repurchase Agreements | | 8.4% | | | | | | | | | | | |

Deutsche Bank AG

4.75%, dated 3/31/06, to be repurchased at $6,250 on 4/3/06 (Collateral: $6,360 Federal Home Loan Bank bonds, 5%, due 2/29/08, value $6,344) | | | | | | | | | 6,248 | | | 6,248 | |

| | | | | | | | | | | |

|

|

|

Total Short-Term Securities (Identified Cost—$6,308) | | | | | | | | | | | | 6,308 | |

Total Investments (Identified Cost—$80,107) | | 107.0% | | | | | | | | | | 79,324 | |

Other Assets Less Liabilities | | (7.0)% | | | | | | | | | | (5,181 | ) |

| | | | | | | | | | | |

|

|

|

| | | | | |

Net Assets | | 100.0% | | | | | | | | | $ | 74,143 | |

| | | | | | | | | | | |

|

|

|

12

Annual Report to Shareholders

| | | | | | | | |

| | | EXPIRATION | | ACTUAL

CONTRACTS | | APPRECIATION/

(DEPRECIATION) | |

Futures Contracts PurchasedJ | | | | | | | | |

U.S. Treasury Note Futures | | June 2006 | | 4 | | $ | (4 | ) |

| | | | | | |

|

|

|

Futures Contracts WrittenJ | | | | | | | | |

U.S. Treasury Note Futures | | June 2006 | | 41 | | $ | 27 | |

| | | | | | |

|

|

|

| | | | | | | | | |

| A | | Indexed Security – The rates of interest earned on these securities are tied to the London Interbank Offered Rate (“LIBOR”) or the one-year Treasury Bill rate. The coupon rates are the rates as of March 31, 2006. |

| B | | Stepped Coupon Security – A security with a predetermined schedule of interest or dividend rate changes, at which time it begins to accrue interest or pay dividends. |

| C | | Rule 144a Security – A security purchased pursuant to Rule 144a under the Securities Act of 1933 which may not be resold subject to that rule except to qualified institutional buyers. These securities, which the Fund’s investment adviser has determined to be liquid, represent 8.5% of net assets. |

| D | | Yankee Bond – A dollar denominated bond issued in the U.S. by foreign entities. |

| E | | The coupon rates shown on variable rate securities are the rates at March 31, 2006. These rates vary with the weighted average coupon of the underlying loans. |

| F | | Treasury Inflation-Protected Security – A security whose principal value is adjusted daily in accordance with changes to the Consumer Price Index for All Urban Consumers. Interest is calculated on the basis of the current adjusted principal value. |

| G | | When-issued Security – A security purchased on a delayed delivery basis. Final settlement amount and maturity date have not yet been announced. |

| H | | Zero Coupon Bond – A bond with no periodic interest payments which is sold at such a discount as to produce a current yield to maturity. |

| I | | All or a portion of this security is pledged as collateral to cover futures contracts. |

| J | | Futures are described in more detail in the notes to financial statements. |

See note to financial statements.

13

Annual Report to Shareholders

Statement of Assets and Liabilities

Western Asset Limited Duration Bond Portfolio

March 31, 2006

(Amounts in Thousands)

| | | | | | | |

Assets: | | | | | | | |

Investment securities at market value (Identified Cost—$73,799) | | | | | $ | 73,016 | |

Short-term securities at value (Identified Cost—$6,308) | | | | | | 6,308 | |

Cash | | | | | | 1 | |

Receivable for securities sold | | | | | | 1,252 | |

Interest receivable | | | | | | 502 | |

Other assets | | | | | | 7 | |

| | | | | |

|

|

|

Total assets | | | | | | 81,086 | |

| | |

Liabilities: | | | | | | | |

Payable for securities purchased | | $ | 6,875 | | | | |

Payable for fund shares repurchased | | | 5 | | | | |

Accrued management fee | | | 7 | | | | |

Futures variation margin payable | | | 2 | | | | |

Accrued expenses | | | 54 | | | | |

| | |

|

| | | | |

Total liabilities | | | | | | 6,943 | |

| | | | | |

|

|

|

| | |

Net Assets | | | | | $ | 74,143 | |

| | | | | |

|

|

|

| | |

Net assets consist of: | | | | | | | |

Accumulated paid-in-capital applicable to: | | | | | | | |

7,566 Institutional Class shares outstanding | | | | | $ | 75,419 | |

Undistributed net investment income | | | | | | 7 | |

Accumulated net realized loss on investments and futures | | | | | | (523 | ) |

Unrealized appreciation/(depreciation) of investments and futures | | | | | | (760 | ) |

| | | | | |

|

|

|

| | |

Net Assets | | | | | $ | 74,143 | |

| | | | | |

|

|

|

| | |

Net Asset Value Per Share: | | | | | | | |

Institutional Class | | | | |

| $9.80

|

|

| | | | | | | | |

See notes to financial statements.

14

Annual Report to Shareholders

Statement of Operations

Western Asset Limited Duration Bond Portfolio

For the Year Ended March 31, 2006

(Amounts in Thousands)

| | | | | | | | |

Investment Income: | | | | | | | | |

Interest | | $ | 2,873 | | | | | |

Dividends | | | 57 | | | | | |

| | |

|

|

| | | | |

Total income | | | | | | | 2,930 | |

| | | | | | | | | |

Expenses: | | | | | | | | |

Advisory fee | | | 238 | | | | | |

Audit and legal fees | | | 76 | | | | | |

Custodian fees | | | 54 | | | | | |

Directors’ fees and expenses | | | 11 | | | | | |

Registration fees | | | 29 | | | | | |

Reports to shareholders | | | 18 | | | | | |

Transfer agent and shareholder servicing expense | | | 13 | | | | | |

Other expenses | | | 22 | | | | | |

| | |

|

|

| | | | |

| | | | 461 | | | | | |

Less: Fees waived | | | (187 | ) | | | | |

Compensating balance creditsA | | | (2 | ) | | | | |

| | |

|

|

| | | | |

Total expenses, net of waivers and compensating balance credits | | | | | | | 272 | |

| | | | | | |

|

|

|

Net Investment Income | | | | | | | 2,658 | |

Net Realized and Unrealized Gain/(Loss) on Investments: | | | | | | | | |

Realized gain/(loss) on: | | | | | | | | |

Investments | | | (491 | ) | | | | |

Futures | | | 42 | | | | | |

| | |

|

|

| | | | |

| | | | | | | | (449 | ) |

Change in unrealized appreciation/(depreciation) of investments and futures | | | | | | | (458 | ) |

| | | | | | |

|

|

|

Net Realized and Unrealized Loss on Investments | | | | | | | (907 | ) |

| | | | | | | | | |

Change in Net Assets Resulting From Operations | | | | | | $ | 1,751 | |

| | | | | | | | | |

| A | | See note 1, compensating balance credits, in the notes to financial statements. |

See notes to financial statements.

15

Annual Report to Shareholders

Statement of Changes in Net Assets

Western Asset Limited Duration Bond Portfolio

(Amounts in Thousands)

| | | | | | | | |

| | | FOR THE

YEARS ENDED

| |

| | | 3/31/06 | | | 3/31/05 | |

Change in Net Assets: | | | | | | | | |

Net investment income | | $ | 2,658 | | | $ | 855 | |

| | |

Net realized gain/(loss) on investments and futures | | | (449 | ) | | | 66 | |

| | |

Change in unrealized appreciation/(depreciation) of investments and futures | | | (458 | ) | | | (552 | ) |

| | |

|

|

| |

|

|

|

Change in net assets resulting from operations | | | 1,751 | | | | 369 | |

| | |

Distributions to Shareholders from: | | | | | | | | |

Net investment income | | | (2,696 | ) | | | (882 | ) |

Net realized gain on investments | | | — | | | | (62 | ) |

| | |

Change in net assets from Fund share transactions | | | 37,662 | | | | 11,819 | |

| | |

|

|

| |

|

|

|

Change in net assets | | | 36,717 | | | | 11,244 | |

| | |

Net Assets: | | | | | | | | |

Beginning of year | | | 37,426 | | | | 26,182 | |

| | |

|

|

| |

|

|

|

| | |

End of year | | $ | 74,143 | | | $ | 37,426 | |

| | |

|

|

| |

|

|

|

| | |

Undistributed net investment income | | $ | 7 | | | $ | — | |

| | |

|

|

| |

|

|

|

| | | | | | | | | |

See notes to financial statements.

16

Annual Report to Shareholders

Financial Highlights

Western Asset Limited Duration Bond Portfolio

Contained below is per share operating performance data for a share of common stock outstanding throughout each period shown, total investment return, ratios to average net assets and other supplemental data. This information has been derived from information in the financial statements.

Institutional Class:

| | | | | | | | | | | | |

| | | FOR THE YEARS ENDED

MARCH 31,

| |

| | | 2006 | | | 2005 | | | 2004A | |

Net asset value, beginning of year | | $ | 9.89 | | | $ | 10.09 | | | $ | 10.00 | |

| | |

|

|

| |

|

|

| |

|

|

|

Investment operations: | | | | | | | | | | | | |

Net investment income | | | .38 | | | | .24 | | | | .08 | |

Net realized and unrealized gain/(loss) on investments and futures | | | (.09 | ) | | | (.17 | ) | | | .09 | |

| | |

|

|

| |

|

|

| |

|

|

|

Total from investment operations | | | .29 | | | | .07 | | | | .17 | |

| | |

|

|

| |

|

|

| |

|

|

|

Distributions paid from: | | | | | | | | | | | | |

Net investment income | | | (.38 | ) | | | (.25 | ) | | | (.08) | |

Net realized gain on investments | | | — | | | | (.02 | ) | | | — | |

| | |

|

|

| |

|

|

| |

|

|

|

Total distributions | | | (.38 | ) | | | (.27 | ) | | | (.08) | |

| | |

|

|

| |

|

|

| |

|

|

|

Net asset value, end of year | | $ | 9.80 | | | $ | 9.89 | | | $ | 10.09 | |

| | |

|

|

| |

|

|

| |

|

|

|

Total return | | | 3.01 | % | | | .69 | % | | | 1.69% | B |

| | | |

Ratios To Average Net Assets:C | | | | | | | | | | | | |

Total expenses | | | .68 | % | | | .73 | % | | | .68% | D |

Expenses net of waivers, if any | | | .40 | % | | | .40 | % | | | .40% | D |

Expenses net of all reductions | | | .40 | % | | | .40 | % | | | .40% | D |

Net investment income | | | 3.9 | % | | | 2.4 | % | | | 1.6% | D |

| | | |

Supplemental Data: | | | | | | | | | | | | |

Portfolio turnover rate | | | 244.7 | % | | | 231.5 | % | | | 125.5% | |

Net assets at end of year (in thousands) | | $ | 74,143 | | | $ | 37,426 | | | | $26,182 | |

| | | | | | | | | | | | | |

| A | | For the period October 1, 2003 (commencement of operations) to March 31, 2004. |

| C | | Total expenses reflects operating expenses prior to any voluntary expense waivers and/or compensating balance credits. Expenses net of waivers reflects total expenses before compensating balance credits but net of any voluntary expense waivers. Expenses net of all reductions reflects expenses less any compensating balance credits and/or voluntary expense waivers. |

See notes to financial statements.

17

Annual Report to Shareholders

Management’s Discussion of Fund Performance

Western Asset Intermediate Bond Portfolio

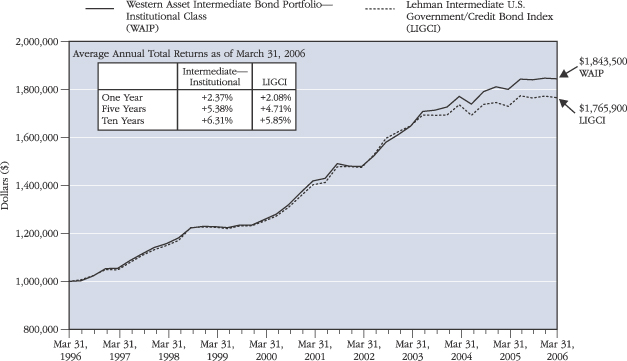

The average annual total returns for the Western Asset Intermediate Bond Portfolio for the period from its inception to March 31, 2006, are presented below, along with the total returns of its benchmark:

| | | | | | | | |

| | | | | Average Annual Total Returns Periods Ended March 31, 2006

|

| | | First

Quarter 2006 | | One

Year | | Five

Years | | Ten

Years |

Western Asset Intermediate Bond Portfolio | | | | | | | | |

Institutional Class | | -0.19% | | 2.37% | | 5.38% | | 6.31% |

Lehman Intermediate U.S. Government/Credit Bond IndexA | | -0.38% | | 2.08% | | 4.71% | | 5.85% |

The performance data quoted represents past performance and does not guarantee future results. The performance stated may have been due to extraordinary market conditions, which may not be duplicated in the future. Current performance may be lower or higher than the performance data quoted. To obtain the most recent month-end performance information please visit www.westernassetfunds.com. The investment return and principal value of the Fund will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than the original cost. Calculations assume reinvestment of dividends and capital gain distributions. Performance would have been lower if fees had not been waived in various periods.

Short-term interest rates rose significantly over the past 12 months, led by a 200 bpsB increase in the federal funds rate target. Long-term interest rates rose only moderately, resulting in a substantial flattening of the yield curve. Contrary to expectations that they would hike rates to only 4%, the Federal Reserve increased its target funds rate by 25 bps at every FOMC meeting, reaching 4.75% in March. Tighter-than-expected monetary policy pushed real yields up by more than nominal yields, reflecting reduced inflation expectations. The dollar also benefited from higher rates, rising some 7% against a basket of currencies. Mortgage-backed spreads began the period fairly tight, only to widen in the latter half of the period as concerns over extension risk mounted. Investment-grade credit spreads drifted wider, driven largely by fallout from the unexpected downgrade of Ford and GM debt. Thanks to a robust global economy, easy money, and strong gains in commodity prices, emerging market spreads tightened dramatically over the course of the period, leaving yields at record-low levels. High yield spreads soared in the wake of the GM and Ford downgrades, but recovered dramatically to finish the period unchanged to somewhat tighter. Despite a substantial reduction of monetary policy accommodation during the period, gold rose over 35%, to $584 per ounce, returning to levels not seen since the inflation panic of 1980. Energy and industrial commodity prices also rose, registering substantial gains against all major currencies. Equity markets moved steadily higher over the course of the period.

The impact of market conditions on the Portfolio’s performance was negative for the 12-month period ended March 31, 2006, since short- and intermediate-term interest rates rose. With strategies producing mixed but generally positive results, the Portfolio’s total return of 2.37% (net of expenses) exceeded that of its benchmark, the Lehman Intermediate U.S. Government/Credit Bond Index, which recorded a total return of 2.08%. A short duration position benefited the portfolio as rates rose. However, this was partially offset by a curve steepening bet. A moderate overweight to the corporate sector contributed to outperformance as spreads narrowed. Mortgages contributed to outperformance as spreads narrowed late in the period and a high carry resulted in excess returns over Treasuries.

Western Asset Management Company

| A | | A market value-weighted index that tracks the daily price, coupon and total return performance of fixed-rate, publicly placed, dollar-denominated obligations. Issuers include the U.S. Treasury, U.S. Government agencies, quasi-federal corporations and corporations whose debt is guaranteed by the U.S. Government and has at least $100 million par amount outstanding and at least one year to maturity. The index does not incur fees and expenses and cannot be purchased directly by investors. |

18

Annual Report to Shareholders

Expense Example

Western Asset Intermediate Bond Portfolio

As a shareholder of the Fund, you incur ongoing costs, including management fees, and other Fund expenses. These examples are intended to help you understand your ongoing costs (in dollars) of investing in the Fund and to compare these costs with the ongoing costs of investing in other mutual funds. The example is based on an investment of $1,000 invested on October 1, 2005, and held through March 31, 2006.

Actual Expenses

The first line in the table below provides information about actual account values and actual expenses for the Fund. You may use the information in this line, together with the amount you invested, to estimate the expenses that you paid over the period. Simply divide your account value by $1,000 (for example, an $8,600 account divided by $1,000 = 8.6), then multiply the result by the number in the first line under the heading entitled “Expenses Paid During the Period” to estimate the expenses you paid on your account during this period.

Hypothetical Example for Comparison Purposes

The second line in the table below provides information about hypothetical account values and hypothetical expenses based on the Fund’s actual expense ratio and an assumed rate of return of 5% per year before expenses, which is not the Fund’s actual return. The hypothetical account values and expenses may not be used to estimate the actual ending account balance or expenses you paid for the period. You may use this information to compare the ongoing costs of investing in the Fund and other funds. To do so, compare this 5% hypothetical example with the 5% hypothetical examples that appear in the shareholder reports of other funds.

| | | | | | | | | |

| | | Beginning

Account Value

10/1/05 | | Ending

Account Value

3/31/06 | | Expenses PaidA

During the Period

10/1/05 to 3/31/06 |

Institutional Class: | | | | | | | | | |

Actual | | $ | 1,000.00 | | $ | 1,001.80 | | $ | 2.25 |

Hypothetical (5% return before expenses) | | | 1,000.00 | | | 1,022.69 | | | 2.27 |

| A | | These calculations are based on expenses incurred in the most recent fiscal half-year. The dollar amounts shown as “Expenses Paid” are equal to the annualized expense ratio of 0.45% multiplied by the average value over the period, multiplied by the number of days in the most recent fiscal half-year (182), and divided by 365. |

19

Annual Report to Shareholders

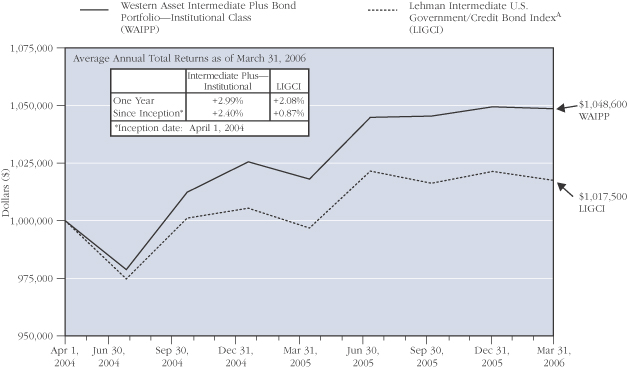

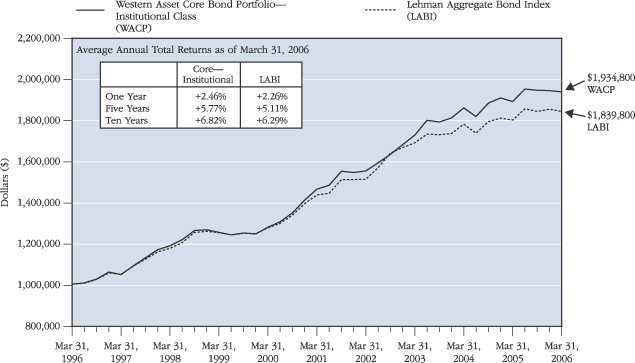

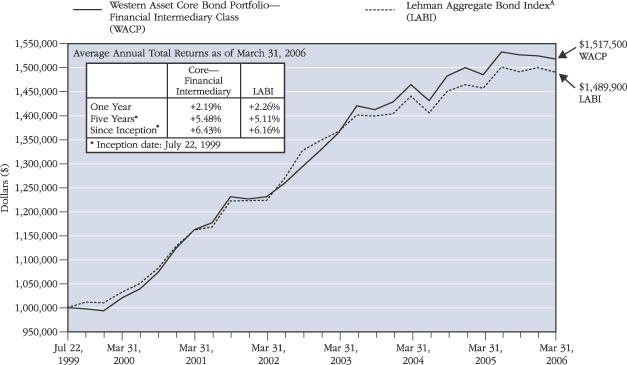

Performance Information

Western Asset Intermediate Bond Portfolio

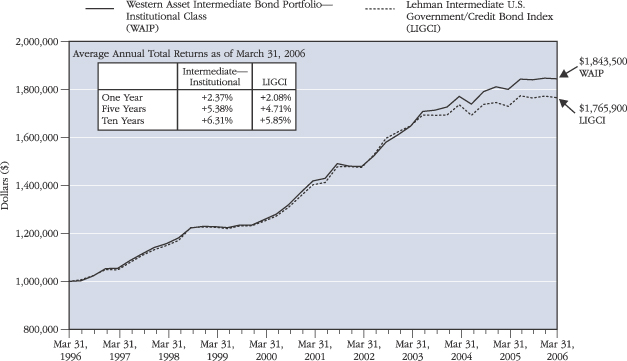

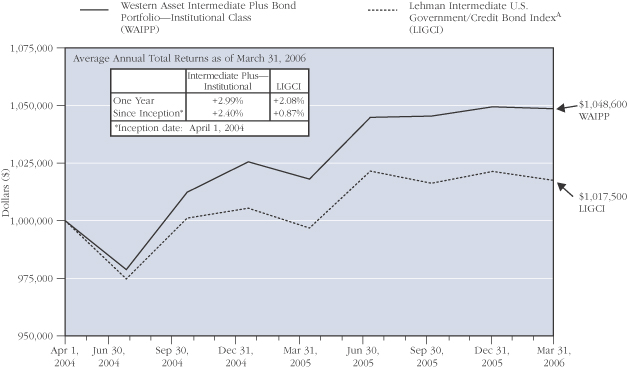

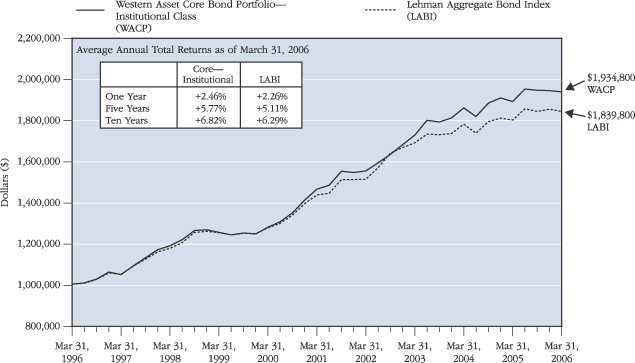

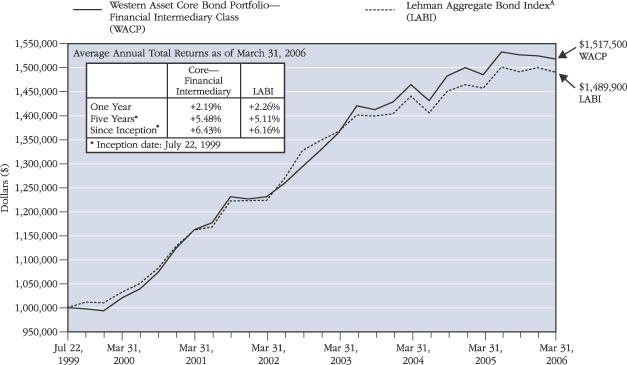

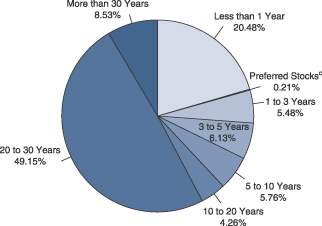

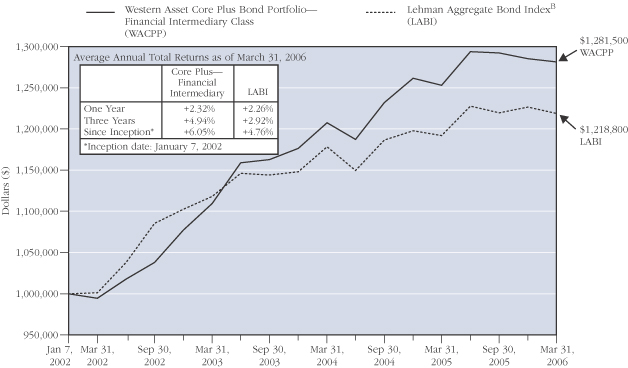

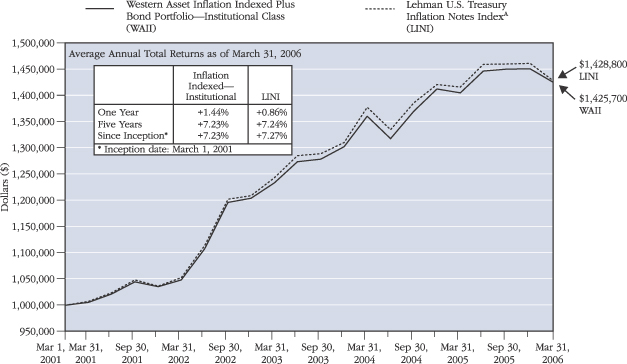

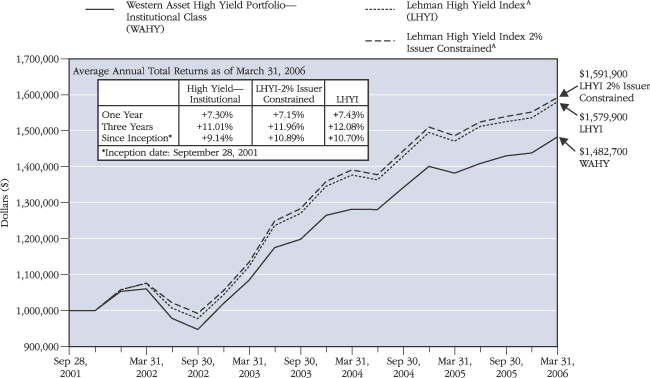

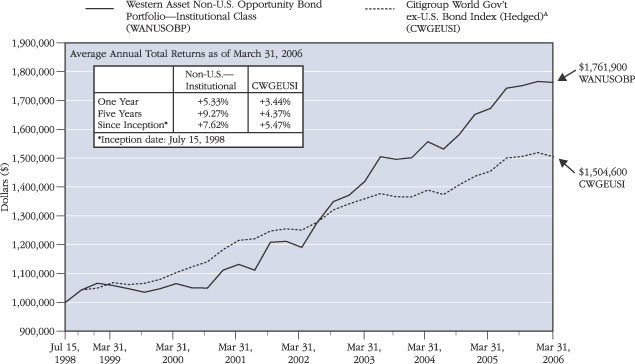

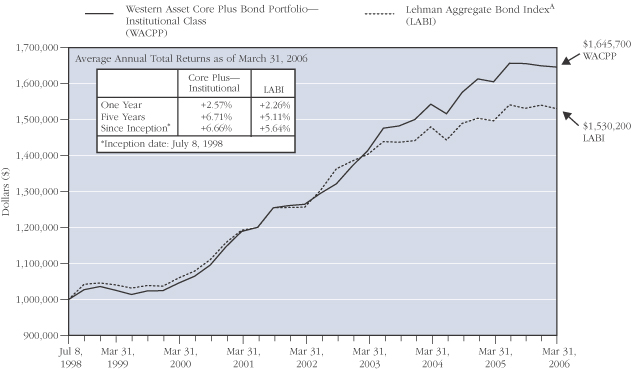

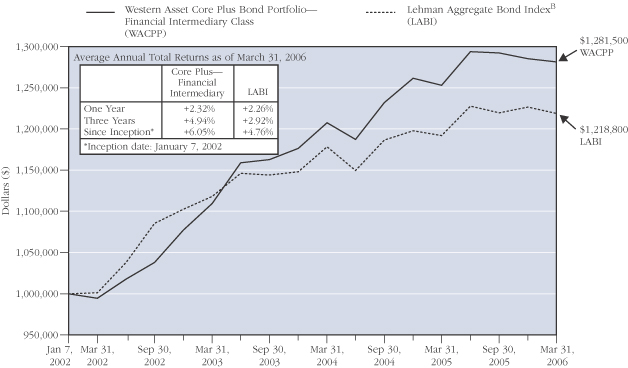

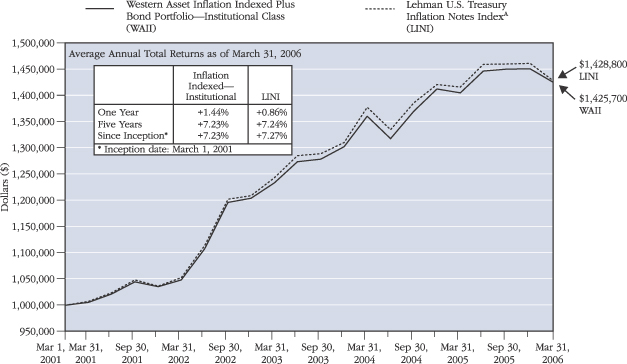

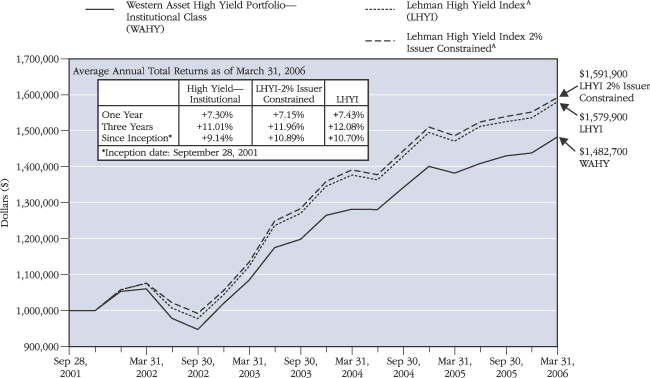

The graph compares the Fund’s total returns against that of an appropriate broad-based securities market index. The line illustrates the cumulative total return of an initial $1,000,000 investment for the periods indicated. The line for the Fund represents the total return after deducting all Fund investment management and other administrative expenses and the transaction costs of buying and selling securities. The line representing the securities market index does not include any transaction costs associated with buying and selling securities in the index or other investment management or administrative expenses.

Total return measures investment performance in terms of appreciation or depreciation in net asset value per share, plus dividends and any capital gain distributions. It assumes that dividends and distributions were reinvested at the time they were paid. Returns (and the graph and table found below) do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the redemption of Fund shares. Average annual returns tend to smooth out variations in a fund’s return, so that they differ from actual year-to-year results.

Bonds are subject to a variety of risks, including interest rate, credit, and inflation risk.

Growth of a $1,000,000 Investment—Institutional Class

The performance data quoted represents past performance and does not guarantee future results. The performance stated may have been due to extraordinary market conditions, which may not be duplicated in the future. Current performance may be lower or higher than the performance data quoted. To obtain the most recent month-end performance information, please visit www.westernassetfunds.com. The investment return and principal value of the Fund will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than the original cost. Calculations assume reinvestment of dividends and capital gain distributions. Performance would have been lower if fees had not been waived in various periods.

20

Annual Report to Shareholders

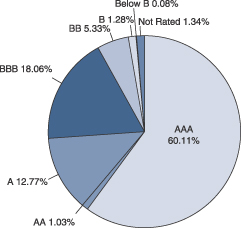

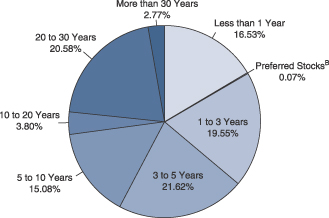

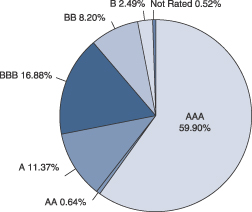

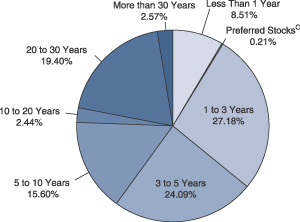

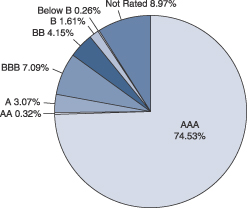

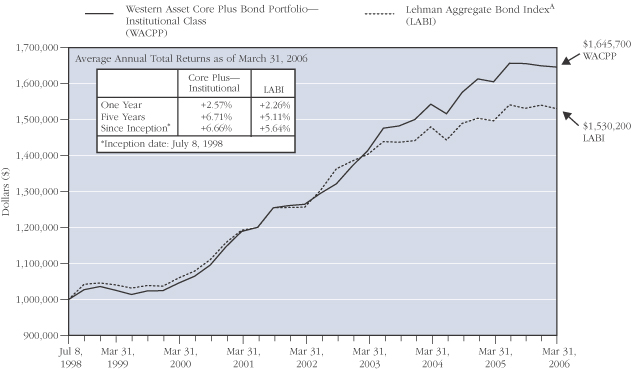

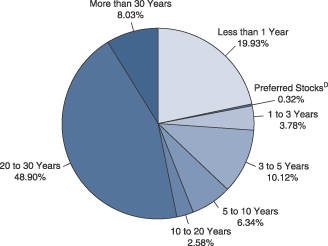

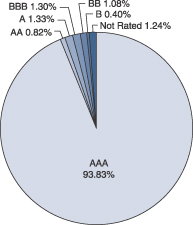

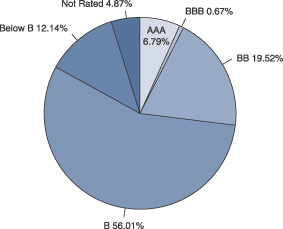

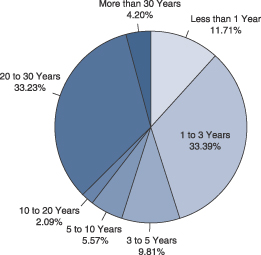

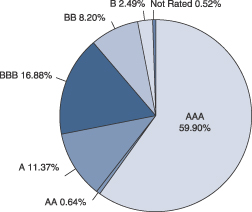

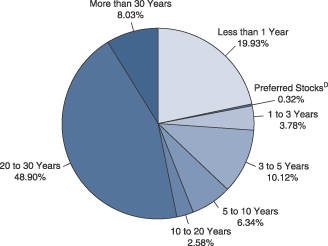

Portfolio Composition (as of March 31, 2006)

Standard & Poor’s Debt RatingsA

(as a percentage of the portfolio)

Maturity Schedule

(as a percentage of the portfolio)

| A | | Source: Standard & Poor's. |

| B | | Preferred Stocks do not have a defined maturity date. |

| | | The Fund is actively managed. As a result, the composition of the portfolio holdings and sectors are subject to change at any time. |

21

Annual Report to Shareholders

Portfolio of Investments

Western Asset Intermediate Bond Portfolio

March 31, 2006

(Amounts in Thousands)

| | | | | | | | | | | | | |

| | | % OF

NET ASSETS | | RATE | | MATURITY

DATE | | PAR | | VALUE | |

Long-Term Securities | | 95.3% | | | | | | | | | | | |

| | | | | |

Corporate Bonds and Notes | | 36.1% | | | | | | | | | | | |

| | | | | |

Aerospace/Defense | | 0.2% | | | | | | | | | | | |

United Technologies Corporation | | | | 6.350% | | 3/1/11 | | $ | 1,280 | | $ | 1,330 | |

| | | | | | | | | | | |

|

|

|

| | | | | |

Auto Parts and Equipment | | 0.1% | | | | | | | | | | | |

Johnson Controls, Inc. | | | | 4.830% | | 1/17/08 | | | 880 | | | 881 | A |

| | | | | | | | | | | |

|

|

|

| | | | | |

Automotive | | 0.6% | | | | | | | | | | | |

Ford Motor Company | | | | 7.450% | | 7/16/31 | | | 1,430 | | | 1,062 | B |

General Motors Corporation | | | | 8.375% | | 7/15/33 | | | 4,440 | | | 3,252 | B |

| | | | | | | | | | | |

|

|

|

| | | | | | | | | | | | | 4,314 | |

| | | | | | | | | | | |

|

|

|

Banking and Finance | | 7.2% | | | | | | | | | | | |

Caterpillar Financial Services Corporation | | | | 3.450% | | 1/15/09 | | | 1,700 | | | 1,620 | B |

Ford Motor Credit Company | | | | 5.795% | | 9/28/07 | | | 9,540 | | | 9,156 | A |

Ford Motor Credit Company | | | | 7.680% | | 11/2/07 | | | 310 | | | 306 | A |

Ford Motor Credit Company | | | | 6.625% | | 6/16/08 | | | 11,290 | | | 10,686 | |

General Motors Acceptance Corporation | | | | 6.125% | | 8/28/07 | | | 4,680 | | | 4,539 | |

General Motors Acceptance Corporation | | | | 6.090% | | 9/23/08 | | | 1,228 | | | 1,159 | A |

General Motors Acceptance Corporation | | | | 6.750% | | 12/1/14 | | | 1,920 | | | 1,729 | B |

General Motors Acceptance Corporation | | | | 5.052% | | 9/19/35 | | | 2,290 | | | 2,255 | A |

HSBC Finance Corporation | | | | 4.970% | | 5/10/10 | | | 1,570 | | | 1,573 | A |

Nissan Motor Acceptance Corporation | | | | 5.625% | | 3/14/11 | | | 2,710 | | | 2,700 | C |

Residential Capital Corporation | | | | 6.335% | | 6/29/07 | | | 5,480 | | | 5,521 | A,B |

Residential Capital Corporation | | | | 6.000% | | 2/22/11 | | | 3,500 | | | 3,472 | |

Wachovia Capital Trust III | | | | 5.800% | | 3/15/42 | | | 5,770 | | | 5,669D | |

Washington Mutual, Inc. | | | | 4.200% | | 1/15/10 | | | 2,990 | | | 2,856 | |

| | | | | | | | | | | |

|

|

|

| | | | | | | | | | | | | 53,241 | |

| | | | | | | | | | | |

|

|

|

Cable | | 0.7% | | | | | | | | | | | |

Comcast Cable Communications, Inc. | | | | 6.750% | | 1/30/11 | | | 5,310 | | | 5,520 | B |

| | | | | | | | | | | |

|

|

|

| | | | | |

Casino Resorts | | 0.5% | | | | | | | | | | | |

Caesars Entertainment, Inc. | | | | 7.500% | | 9/1/09 | | | 990 | | | 1,042 | |

Harrah’s Operating Company, Inc. | | | | 5.315% | | 2/8/08 | | | 530 | | | 531 | A,C |

Harrah’s Operating Company, Inc. | | | | 5.500% | | 7/1/10 | | | 400 | | | 396 | |

Harrah’s Operating Company, Inc. | | | | 5.625% | | 6/1/15 | | | 1,700 | | | 1,629 | |

| | | | | | | | | | | |

|

|

|

| | | | | | | | | | | | | 3,598 | |

| | | | | | | | | | | |

|

|

|

22

Annual Report to Shareholders

| | | | | | | | | | | | | |

| | | % OF

NET ASSETS | | RATE | | MATURITY

DATE | | PAR | | VALUE | |

Corporate Bonds and Notes—Continued | | | | | | | | | | | | | |

Chemicals | | 0.4% | | | | | | | | | | | |

Rohm and Haas Company | | | | 7.400% | | 7/15/09 | | $ | 342 | | $ | 361 | |

The Dow Chemical Company | | | | 5.750% | | 12/15/08 | | | 760 | | | 769 | |

The Dow Chemical Company | | | | 5.970% | | 1/15/09 | | | 880 | | | 894 | |

The Dow Chemical Company | | | | 6.000% | | 10/1/12 | | | 1,000 | | | 1,024 | |

| | | | | | | | | | | |

|

|

|

| | | | | | | | | | | | | 3,048 | |

| | | | | | | | | | | |

|

|

|

Computer Services and Systems | | 0.5% | | | | | | | | | | | |

Electronic Data Systems Corporation | | | | 7.125% | | 10/15/09 | | | 3,240 | | | 3,404 | |

| | | | | | | | | | | |

|

|

|

| | | | | |

Diversified Financial Services | | 1.2% | | | | | | | | | | | |

Capital One Bank | | | | 4.250% | | 12/1/08 | | | 2,030 | | | 1,975 | |

iStar Financial Inc. | | | | 5.220% | | 3/3/08 | | | 1,280 | | | 1,283 | A |

ZFS Finance (USA) Trust III | | | | 6.060% | | 12/15/65 | | | 5,400 | | | 5,433A,C | |

| | | | | | | | | | | |

|

|

|

| | | | | | | | | | | | | 8,691 | |

| | | | | | | | | | | |

|

|

|

Drug and Grocery Store Chains | | 0.2% | | | | | | | | | | | |

The Kroger Co. | | | | 6.200% | | 6/15/12 | | | 1,090 | | | 1,105 | |

| | | | | | | | | | | |

|

|

|

| | | | | |

Electric | | 1.6% | | | | | | | | | | | |

Appalachian Power Company | | | | 3.600% | | 5/15/08 | | | 3,350 | | | 3,228 | |

Commonwealth Edison Company | | | | 6.150% | | 3/15/12 | | | 325 | | | 331 | |

Dominion Resources, Inc. | | | | 4.750% | | 12/15/10 | | | 540 | | | 519 | |

Dominion Resources, Inc. | | | | 5.700% | | 9/17/12 | | | 1,970 | | | 1,952 | B |

FirstEnergy Corp. | | | | 6.450% | | 11/15/11 | | | 3,550 | | | 3,673 | |

Niagara Mohawk Power Corporation | | | | 7.750% | | 10/1/08 | | | 2,150 | | | 2,260 | |

| | | | | | | | | | | |

|

|

|

| | | | | | | | | | | | | 11,963 | |

| | | | | | | | | | | |

|

|

|

Energy | | 2.4% | | | | | | | | | | | |

Alabama Power Company | | | | 4.990% | | 8/25/09 | | | 1,400 | | | 1,404A | |

CenterPoint Energy Inc. | | | | 5.875% | | 6/1/08 | | | 1,635 | | | 1,643 | |

Duke Energy Corporation | | | | 6.250% | | 1/15/12 | | | 1,330 | | | 1,371 | |

Duke Energy Corporation | | | | 5.625% | | 11/30/12 | | | 900 | | | 901 | |

Exelon Corporation | | | | 6.750% | | 5/1/11 | | | 2,800 | | | 2,923 | |

MidAmerican Energy Holdings Company | | | | 5.875% | | 10/1/12 | | | 1,020 | | | 1,030 | |

Pacific Gas and Electric Company | | | | 3.600% | | 3/1/09 | | | 2,850 | | | 2,710 | |

Progress Energy, Inc. | | | | 5.850% | | 10/30/08 | | | 1,250 | | | 1,260B | |

Progress Energy, Inc. | | | | 7.100% | | 3/1/11 | | | 1,650 | | | 1,750 | |

TXU Corp. | | | | 4.800% | | 11/15/09 | | | 2,600 | | | 2,498 | |

| | | | | | | | | | | |

|

|

|

| | | | | | | | | | | | | 17,490 | |

| | | | | | | | | | | |

|

|

|

23

Annual Report to Shareholders

Portfolio of Investments—Continued

Western Asset Intermediate Bond Portfolio—Continued

| | | | | | | | | | | | |

| | | % OF

NET ASSETS | | RATE | | MATURITY

DATE | | PAR | | VALUE |

Corporate Bonds and Notes—Continued | | | | | | | | | | | | |

Environmental Services | | 0.8% | | | | | | | | | | |

Waste Management, Inc. | | | | 6.875% | | 5/15/09 | | $ | 2,820 | | $ | 2,932 |

Waste Management, Inc. | | | | 7.375% | | 8/1/10 | | | 2,630 | | | 2,806 |

| | | | | | | | | | | |

|

|

| | | | | | | | | | | | | 5,738 |

| | | | | | | | | | | |

|

|

Food, Beverage and Tobacco | | 1.6% | | | | | | | | | | |

Altria Group, Inc. | | | | 6.950% | | 6/1/06 | | | 1,390 | | | 1,393 |

Altria Group, Inc. | | | | 7.200% | | 2/1/07 | | | 4,130 | | | 4,172 |

Altria Group, Inc. | | | | 7.000% | | 11/4/13 | | | 210 | | | 226 |

General Mills, Inc. | | | | 5.125% | | 2/15/07 | | | 440 | | | 439 |

Kraft Foods Inc. | | | | 5.625% | | 11/1/11 | | | 780 | | | 781 |

Pepsi Bottling Holdings Inc. | | | | 5.625% | | 2/17/09 | | | 2,441 | | | 2,463C |

Sara Lee Corporation | | | | 2.750% | | 6/15/08 | | | 2,050 | | | 1,930 |

Sara Lee Corporation | | | | 6.250% | | 9/15/11 | | | 670 | | | 679 |

| | | | | | | | | | | |

|

|

| | | | | | | | | | | | | 12,083 |

| | | | | | | | | | | |

|

|

Gas and Pipeline Utilities | | 0.5% | | | | | | | | | | |

Kinder Morgan Energy Partners, L.P. | | | | 7.500% | | 11/1/10 | | | 1,630 | | | 1,750 |

The Williams Companies, Inc. | | | | 8.125% | | 3/15/12 | | | 1,900 | | | 2,040 |

| | | | | | | | | | | |

|

|

| | | | | | | | | | | | | 3,790 |

| | | | | | | | | | | |

|

|

Investment Banking/Brokerage | | 3.2% | | | | | | | | | | |

Goldman Sachs Group, L.P. | | | | 5.265% | | 6/28/10 | | | 6,780 | | | 6,808A |

J.P. Morgan & Co. Incorporated | | | | 6.805% | | 2/15/12 | | | 2,190 | | | 2,308A |

JPMorgan Chase & Co. | | | | 5.125% | | 9/15/14 | | | 1,770 | | | 1,701 |

JPMorgan Chase Capital XIII | | | | 5.910% | | 9/30/34 | | | 150 | | | 151A,B |

Lehman Brothers Holdings | | | | 5.550% | | 8/19/65 | | | 3,870 | | | 3,881A,C |

Merrill Lynch & Co. Inc. | | | | 4.930% | | 2/5/10 | | | 2,880 | | | 2,888A |

Morgan Stanley | | | | 4.850% | | 1/18/11 | | | 1,000 | | | 1,002A |

Morgan Stanley | | | | 5.050% | | 1/21/11 | | | 3,880 | | | 3,803 |

The Bear Stearns Companies Inc. | | | | 4.550% | | 6/23/10 | | | 1,380 | | | 1,333 |

| | | | | | | | | | | |

|

|

| | | | | | | | | | | | | 23,875 |

| | | | | | | | | | | |

|

|

Investment Management | | 0.3% | | | | | | | | | | |

Dryden Investor Trust | | | | 7.157% | | 7/23/08 | | | 1,839 | | | 1,871C |

| | | | | | | | | | | |

|

|

Manufacturing (Diversified) | | 0.4% | | | | | | | | | | |

Tyco International Group SA | | | | 4.436% | | 6/15/07 | | | 3,350 | | | 3,296C |

| | | | | | | | | | | |

|

|

Media | | 1.9% | | | | | | | | | | |

Clear Channel Communications, Inc. | | | | 6.000% | | 11/1/06 | | | 2,730 | | | 2,736 |

Clear Channel Communications, Inc. | | | | 4.250% | | 5/15/09 | | | 2,120 | | | 2,019 |

Liberty Media Corporation | | | | 7.875% | | 7/15/09 | | | 3,480 | | | 3,662B |

News America Incorporated | | | | 5.300% | | 12/15/14 | | | 2,300 | | | 2,213 |

24

Annual Report to Shareholders

| | | | | | | | | | | | | |

| | | % OF

NET ASSETS | | RATE | | MATURITY

DATE | | PAR | | VALUE | |

Corporate Bonds and Notes—Continued | | | | | | | | | | | | | |

| | | | | |

Media—Continued | | | | | | | | | | | | | |

Time Warner Inc. | | | | 6.875% | | 5/1/12 | | $ | 1,590 | | $ | 1,667 | |

Turner Broadcasting System, Inc. | | | | 8.375% | | 7/1/13 | | | 1,830 | | | 2,046 | |

| | | | | | | | | | | |

|

|

|

| | | | | | | | | | | | | 14,343 | |

| | | | | | | | | | | |

|

|

|

Medical Care Facilities | | 0.2% | | | | | | | | | | | |

HCA, Inc. | | | | 8.750% | | 9/1/10 | | | 1,705 | | | 1,849 | |

| | | | | | | | | | | |

|

|

|

Oil and Gas | | 3.5% | | | | | | | | | | | |

Amerada Hess Corporation | | | | 6.650% | | 8/15/11 | | | 5,218 | | | 5,458 | |

Pemex Project Funding Master Trust | | | | 8.500% | | 2/15/08 | | | 262 | | | 275B | |

Pemex Project Funding Master Trust | | | | 6.125% | | 8/15/08 | | | 660 | | | 665 | |

Pemex Project Funding Master Trust | | | | 6.210% | | 6/15/10 | | | 5,680 | | | 5,830A,C | |

Pemex Project Funding Master Trust | | | | 5.430% | | 12/3/12 | | | 779 | | | 777A,C | |

Pemex Project Funding Master Trust | | | | 7.375% | | 12/15/14 | | | 220 | | | 235B | |

Occidental Petroleum Corporation | | | | 7.375% | | 11/15/08 | | | 2,370 | | | 2,487 | |

Sonat Inc. | | | | 7.625% | | 7/15/11 | | | 4,880 | | | 5,026B | |

XTO Energy, Inc. | | | | 7.500% | | 4/15/12 | | | 1,060 | | | 1,157 | |

XTO Energy, Inc. | | | | 6.250% | | 4/15/13 | | | 2,030 | | | 2,100 | |

XTO Energy, Inc. | | | | 5.650% | | 4/1/16 | | | 1,990 | | | 1,966 | |

| | | | | | | | | | | |

|

|

|

| | | | | | | | | | | | | 25,976 | |

| | | | | | | | | | | |

|

|

|

Paper and Forest Products | | 0.8% | | | | | | | | | | | |

International Paper Company | | | | 3.800% | | 4/1/08 | | | 2,310 | | | 2,233 | |

International Paper Company | | | | 6.750% | | 9/1/11 | | | 1,000 | | | 1,039 | |

Willamette Industries, Inc. | | | | 7.125% | | 7/22/13 | | | 2,270 | | | 2,417 | |

| | | | | | | | | | | |

|

|

|

| | | | | | | | | | | | | 5,689 | |

| | | | | | | | | | | |

|

|

|

Photo Equipment and Supplies | | 0.3% | | | | | | | | | | | |

Eastman Kodak Company | | | | 7.250% | | 11/15/13 | | | 2,470 | | | 2,399 | |

| | | | | | | | | | | |

|

|

|

| | | | | |

Special Purpose | | 4.9% | | | | | | | | | | | |

BAE Systems Holdings Inc. | | | | 5.149% | | 8/15/08 | | | 1,740 | | | 1,742 | A,C |

DaimlerChrysler NA Holding Corporation | | | | 4.875% | | 6/15/10 | | | 1,800 | | | 1,735 | |

DaimlerChrysler NA Holding Corporation | | | | 6.500% | | 11/15/13 | | | 4,020 | | | 4,088 | |

DaimlerChrysler NA Holding Corporation | | | | 5.210% | | 10/31/08 | | | 2,840 | | | 2,851 | A |

Devon Financing Corporation ULC | | | | 6.875% | | 9/30/11 | | | 2,500 | | | 2,651 | |

ILFC E-Capital Trust I | | | | 5.900% | | 12/21/65 | | | 2,580 | | | 2,504 | C,D |

International Lease Finance Corporation | | | | 5.000% | | 4/15/10 | | | 5,260 | | | 5,159 | B |

National Rural Utilities Cooperative Finance Corporation | | | | 3.875% | | 2/15/08 | | | 1,160 | | | 1,131 | B |

National Rural Utilities Cooperative Finance Corporation | | | | 5.750% | | 12/1/08 | | | 690 | | | 694 | |

25

Annual Report to Shareholders

Portfolio of Investments—Continued

Western Asset Intermediate Bond Portfolio—Continued

| | | | | | | | | | | | | |

| | | % OF

NET ASSETS | | RATE | | MATURITY

DATE | | PAR | | VALUE | |

Corporate Bonds and Notes—Continued | | | | | | | | | | | | | |

| | | | | |

Special Purpose—Continued | | | | | | | | | | | | | |

Sprint Capital Corporation | | | | 6.125% | | 11/15/08 | | $ | 3,270 | | $ | 3,328 | |

Sprint Capital Corporation | | | | 8.375% | | 3/15/12 | | | 4,280 | | | 4,836 | |

Verizon Global Funding Corp. | | | | 7.250% | | 12/1/10 | | | 5,000 | | | 5,309 | |

| | | | | | | | | | | |

|

|

|

| | | | | | | | | | | | | 36,028 | |

| | | | | | | | | | | |

|

|

|

Telecommunications | | 0.7% | | | | | | | | | | | |

AT&T Inc. | | | | 4.125% | | 9/15/09 | | | 2,380 | | | 2,276 | |

AT&T Inc. | | | | 5.300% | | 11/15/10 | | | 3,080 | | | 3,039 | |

| | | | | | | | | | | |

|

|

|

| | | | | | | | | | | | | 5,315 | |

| | | | | | | | | | | |

|

|

|

Telecommunications (Cellular/Wireless) | | 0.7% | | | | | | | | | | | |

New Cingular Wireless Services Inc. | | | | 8.125% | | 5/1/12 | | | 4,634 | | | 5,203 | |

| | | | | | | | | | | |

|

|

|

| | | | | |

Transportation | | 0.7% | | | | | | | | | | | |

Continental Airlines, Inc. | | | | 6.545% | | 2/12/19 | | | 1,285 | | | 1,302 | |

Delta Air Lines, Inc. | | | | 5.869% | | 3/18/11 | | | 390 | | | 395 | |

Delta Air Lines, Inc. | | | | 6.718% | | 1/2/23 | | | 2,229 | | | 2,252 | |

U.S. Airways | | | | 6.850% | | 1/30/18 | | | 1,197 | | | 1,222 | |

| | | | | | | | | | | |

|

|

|

| | | | | | | | | | | | | 5,171 | |

| | | | | | | | | | | |

|

|

|

Total Corporate Bonds and Notes

(Identified Cost—$272,129) | | | | | | | | | | | | 267,211 | |

Asset-Backed Securities | | 1.6% | | | | | | | | | | | |

| | | | | |

Fixed Rate Securities | | 0.7% | | | | | | | | | | | |

ABFS Mortgage Loan Trust 2002-3 | | | | 4.263% | | 9/15/33 | | | 883 | | | 869 | |

Conseco Finance Securitizations Corp. 2000-4 | | | | 8.310% | | 5/1/32 | | | 800 | | | 660 | |

Green Tree Financial Corporation 1994-6 | | | | 8.900% | | 1/15/20 | | | 2,790 | | | 2,867 | |

Mego Mortgage Home Loan Trust 1996-2 | | | | 7.275% | | 9/25/16 | | | 20 | | | 20 | |

UCFC Home Equity Loan 1998-D | | | | 6.905% | | 4/15/30 | | | 584 | | | 584 | |

| | | | | | | | | | | |

|

|

|

| | | | | | | | | | | | | 5,000 | |

| | | | | | | | | | | |

|

|

|

Indexed SecuritiesA | | 0.8% | | | | | | | | | | | |

AFC Home Equity Loan Trust 2003-3 | | | | 5.011% | | 10/25/30 | | | 1,435 | | | 1,440 | C |

AMRESCO Residential Securities Mortgage Loan Trust 1998-2 | | | | 5.643% | | 6/25/28 | | | 305 | | | 305 | |

Countrywide Asset-Backed Certificates 2002-BC1 | | | | 5.148% | | 4/25/32 | | | 853 | | | 853 | |

IndyMac Home Equity Loan Asset-Backed Trust

2001-A | | | | 5.078% | | 3/25/31 | | | 740 | | | 740 | |

Morgan Stanley ABS Capital I 2003-NC8 A2 | | | | 5.178% | | 9/25/33 | | | 181 | | | 181 | |

MSDWCC HELOC Trust 2003-1 | | | | 5.088% | | 11/25/15 | | | 1,830 | | | 1,830 | |

Residential Asset Securities Corporation 2003-KS1 | | | | 5.188% | | 1/25/33 | | | 745 | | | 747 | |

| | | | | | | | | | | |

|

|

|

| | | | | | | | | | | | | 6,096 | |

| | | | | | | | | | | |

|

|

|

26

Annual Report to Shareholders

| | | | | | | | | | | | | |

| | | % OF

NET ASSETS | | RATE | | MATURITY

DATE | | PAR | | VALUE | |

Asset-Backed Securities—Continued | | | | | | | | | | | | | |

Stripped Securities | | 0.1% | | | | | | | | | | | |

ACA CDS 2002-1, Ltd. | | | | 2.742% | | 7/15/08 | | $ | 7,600 | | $ | 270 | E1 |

Oakwood Mortgage Investors Inc. 2001-C | | | | 6.000% | | 5/15/08 | | | 4,053 | | | 410 | E1 |

| | | | | | | | | | | |

|

|

|

| | | | | | | | | | | | | 680 | |

| | | | | | | | | | | |

|

|

|