UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED

MANAGEMENT INVESTMENT COMPANIES

Investment Company Act file number | 811-06017 |

|

Julius Baer Global Equity Fund Inc. |

(Exact name of registrant as specified in charter) |

|

330 Madison Avenue, New York, NY | | 10017 |

(Address of principal executive offices) | | (Zip code) |

|

Tony Williams |

330 Madison Avenue, New York, NY 10017 |

(Name and address of agent for service) |

|

Registrant’s telephone number, including area code: | 212-297-3600 | |

|

Date of fiscal year end: | 10/31 | |

|

Date of reporting period: | 11/01/04 – 10/31/05 | |

| | | | | | | | |

Item 1. Reports to Stockholders.

Dear Fellow Shareholder:

I am pleased to present the Annual Report for the Julius Baer Funds (the "Funds") for the fiscal year ended October 31, 2005 (the "Reporting Period"). In the wake of a bitter battle with Mother Nature that included a crippling tsunami in Southeast Asia as well as Hurricanes Katrina, Rita, and Wilma, which collectively changed the face of the U.S. Gulf Coast, energy prices soared to record levels during the Reporting Period. Consumers were faced with $3+ per gallon gasoline prices and many feared that this coupled with a forecast drop in the housing markets would lead to a significant drag on worldwide equity prices. Although periods of volatility arose from such events and the victims of such catastrophes are still reeling from their lingering effects, global markets have enjoyed positive returns. The Dow Jones Industrial Average and the S&P 500 posted moderate gains; whereas major European indices (such as the FTSE Index, CAC 40, and DA X) and Japan's Nikkei index garnered double digit increases. The Funds also achieved stellar performance, which is further outlined in each portfolio manager's commentary.

Not only was performance good, but the Funds also experienced sizeable growth in net assets during the Reporting Period. The net assets of our flagship product, the Julius Baer International Equity Fund ("IEF"), grew by 101.3%, crossing the $15 billion level and Management's overall assets under management rose by 84.7%, topping $31 billion. While we were pleased that IEF attracted so much interest, continued large inflows could have eventually impaired the portfolio managers' ability to maintain performance integrity and abide by its stated investment objectives. As a result of such rapid growth, Management, as well as the Board of Directors (the "Board") believed the responsible action was to close this specific fund to new investors while making the same basic investment strategy and the talents of the same management team available to investors through the launch of the Julius Baer International Equity Fund II ("IE2").

On May 4, 2005, we launched IE2. The product was structured to maintain a similar strategy as IEF, but limited its investment to shares of mid to large capitalization companies. The Fund offers both Class A and Class I shares and is available directly through its transfer agent (US Bancorp LLC) and through a broad array of distribution channels, such as Schwab, Fidelity, and TD Waterhouse.

Bearing in mind the Funds' growth as well as a desire to remain competitive in the marketplace, the Board and Management reassessed each Fund's current expense structure. As a result of such analysis, we introduced breakpoints to the IEF advisory fee schedule, which effectively reduced advisory fees from a flat 90 basis points to

Julius Baer Funds 2005 Annual Report

1

an annual rate of 0.90% for the first $7.5 billion dollars of average daily net assets, 0.88% for the next $2.5 billion dollars of average daily net assets and 0.85% for average daily net assets over $10.0 billion dollars, which translated into a full 2 basis point savings for shareholders during the Reporting Period. In addition, we opted to lower the advisory fee of the Julius Baer Total Return Bond Fund from 65 basis points to 45 basis points and capped the total net expense ratio at 69 basis points on Class A shares and 44 basis points on Class I, respectively. Finally, we decided to further lower the expense cap on the Julius Baer Global Equity Fund ("GEF") to 140 basis points on Class A shares and 115 basis points on Class I shares.

During the Reporting Period, we also initiated a 10:1 reverse stock split on GEF. Prior to engaging in such a split, the low absolute price of the Fund created a situation in which small movements in share price may not have completely captured the underlying Fund performance. While these differences would be expected to "average out" over time, near term variations could have adversely effected existing shareholders/new investors and could cause slight tracking issues with respect to competitors. We believe that this coupled with a general investor belief that low priced funds are inferior investments warranted the action taken.

To make all of the Funds more attractive to registered investment advisors as well as broker wrap platforms, we have also decided to lower the investment minimum on the Class I shares from $2 million to $1 million. The primary difference between the two share classes is that the Class A shares have a 12b-1 and Shareholder Servicing Fee of 25 basis points while this does not exist on the Class I shares. If current shareholders believe they qualify to transfer their assets to the Class I shares given these lower minimum investment thresholds, they should contact the Funds' transfer agent at 1-800-387-6977 or their intermediary. For more information on the Funds, please visit their website at www.us-funds.juliusbaer.com.

In closing, on behalf of Management, I would like to extend our appreciation to all shareholders for their continued support of the Funds. We look forward to continuing to provide clients with the best professional management in the forthcoming year.

Sincerely,

Tony Williams

President

Julius Baer Funds 2005 Annual Report

2

The Dow Jones Industrial Average is a price-weighted average of 30 blue-chip stocks that are generally the leaders in their industry. The FTSE 100 Index is a capitalization-weighted index of the 100 most highly capitalized companies traded on the London Stock Exchange. The CAC 40 Index is a narrow based, modified capitalization-weighted index of 40 companies listed on the Paris Bourse. The German Stock Index (DAX) is a total return index of 30 selected German blue chip stocks traded on the Frankfurt Stock Exchange. The Nikkei-225 Stock Average is a price-weighted average of 225 top-rated Japanese companies listed in the First Section of the Tokyo Stock Exchange. It is not possible to invest directly in an index or average.

This material is provided for informational purposes only and does not in any sense constitute a solicitation or offer of the purchase or sale of securities unless preceded or accompanied by a prospectus.

Mutual funding investing involves risk; principle loss is possible.

Distributor: Quasar Distributors, LLC (12/05)

Julius Baer Funds 2005 Annual Report

3

MANAGEMENT'S COMMENTARY

JULIUS BAER GLOBAL EQUITY FUND INC.

Annual Report

Period Ending October 31, 2005.

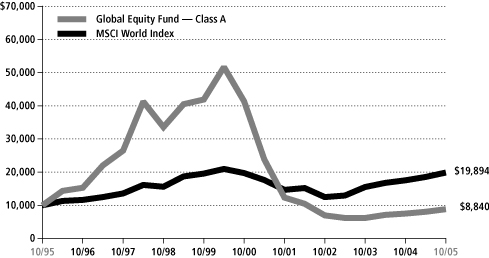

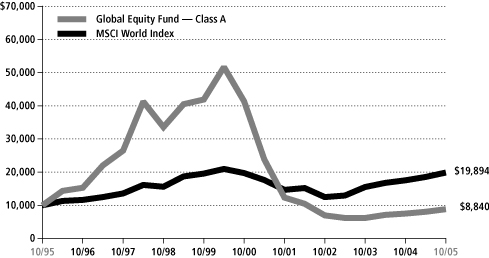

The Julius Baer Global Equity Fund Inc. ("Global Equity Fund") enjoyed its first full fiscal year in the current form. The Global Equity Fund, which had previously been known as the closed-end European Warrant Fund, became an open-ended fund on July 1, 2004 and changed its name to reflect the change in strategy and management team. This is the second annual report since the change and the first that covers a full 12-month period.

The Global Equity Fund Class A shares returned 17.00% over the Reporting Period (10/31/04 - 10/31/05), which compares favorably to its benchmark, the MSCI World Index (net dividends), which returned 13.27%.

Our ability to outperform the benchmark during this Reporting Period was due to a number of factors, including our decision to invest significantly in the emerging markets of Central and Eastern Europe while underweighting holdings based in North America. In addition, our overweight exposure to energy stocks for much of the period and underweighting companies exposed to the US consumer also provided benefit. Specifically, our best performance came from our decisions to invest in Turkey, Russia, Romania, Hungary and Poland; to underweight the United States; and to overweight Continental Europe. Individual names that contributed most to these results included OTP Bank (Hungary), Sberbank (Russia), Lukoil ADR (Russia), Prudential Financial (United States), Bank Pekao (Poland) and Macquarie Infrastructure Company Trust (United States).

Over the past year, we were concerned about the global economy and the imbalances in the Anglo-Saxon countries, especially the United States. This presented us with a tough balancing act as the global markets generally performed better than we expected and our cash holdings were a drag on performance. Consumers in the Anglo region were buffered by extraordinarily strong housing markets, which they were then able to translate into increased purchasing power, spending at levels well above what income growth alone would have allowed and driving economic growth forward. The US consumer's ability to continue to spend is now challenged by a central bank that was busily raising interest rates for much of the period. In the US, the Fed Funds rate was raised eight times from 1.75% to 3.75%, during the fiscal year and longer-term interest rates moved higher by roughly 50 basis points (the ten-year government note rose from 4.03% to 4.55%). Earlier, ce ntral bankers in the UK and Australia moved to raise interest rates keeping yield curves in these countries flat over the entire period. In addition, higher energy prices would also logically seem to take away from other discretionary spending.

Julius Baer Funds 2005 Annual Report

4

The US consumer defied all expectations and continued with unbridled spending. While disposable incomes only rose by 5.2%, personal consumption rose almost twice as much to 11% over the 12 months ending October 31 2005. Lower taxes and reduced savings rates helped, but the biggest boost was provided by that ATM machine otherwise known as the home. By virtue of rising prices and the ease of refinancing one's mortgage, the consumer was able to turn the growing equity in his home into cash. Going forward, we feel that the tailwinds described above will disappear as the new year progresses. Certainly with deficits catching the attention of lawmakers, tax cuts are off the table despite this being an election year. Second, with a savings rate already at zero, we should not count on any more stimulus from this source and may even see a reversal should the consumer opt to save more if interest rates move higher. More importantly, consumers who took out adjustable rate mortgages in 2004 will face higher rates when their reset period arrives. In 2004, approximately 37% of all borrowers opted for the adjustable rate mortgage. This percentage was even higher among lower end borrowers as 88% of all such mortgages were of the adjustable variety. Most importantly, 65% of total sub-prime mortgages had a two year reset, meaning they will come due during 2006 at interest rates at least 150 basis points higher. Such an increase amounts to approximately $90/month for each $100,000 borrowed. This will certainly detract from discretionary consumer spending that otherwise would have gone to MP3 players, flat-screen televisions and the like.

Contrary to the risks building in the United States, we remain excited about the prospects for the emerging markets of Central and Eastern Europe. As we noted in last year's annual report, "Central Europe possesses risks similar to those of a developed market, but with the potential for rewards and growth of an emerging one." We were not disappointed and while the strong gains over the past few years have left these markets pricier than in the past, strong economic growth has delivered great profit performance. Unlike previous emerging market booms that went bust, this one appears to be better balanced and less susceptible to outside influences. In May 2004, ten predominantly Eastern European countries joined the European Union. By reforming their legal, political and economic systems, these countries have become a favored destination for global investment capital, increasing standards of living across the region and spawning the beginning o f a consumer market. Likewise, they are not dependent on external growth as was the emerging market model in the past. Other countries that have not yet joined the union, such as Turkey, have also attracted our interest as they have implemented tough reforms to bring down deficits and inflation rates to ultimately join the EU. While Turkey's entry into the EU may not be for another ten years, we believe the process is more important than the final destination. Underpenetration of the consumer sectors of these countries has allowed banks to grow assets well in excess of already robust

Julius Baer Funds 2005 Annual Report

5

GDP growth rates. While some bumps are possible, if not probable, we believe the long-term attractiveness of the region remains.

Although somewhat more risky, Russia may ultimately be even more profitable. The immaturity of the Russian markets along with a government that hasn't always been investor friendly has created interesting valuation opportunities in this country. In particular, the energy sector looks attractive when compared to western country competitors with the ability to buy reserves in the public market at about one third the cost. Like Central Europe, an underpenetrated Russian consumer sector allows for significant growth opportunities.

One can't properly review the state of the world today without commenting on the two giants of the emerging world, China and India. Economic growth continues apace in both countries and in a complementary fashion. India has done a better job growing its service-oriented industries (benefiting from its educational levels and the widespread use of English), while China has become the world's "factory". The emergence of these two giants has already impacted the world as their increased demand for commodities to stoke their growth engines has led to higher prices for almost everything tangible. Previous underinvestment in global commodity production capacity has prevented supply from keeping pace and prices have subsequently moved higher. While direct investment in these countries might seem a simple decision given the rapid growth rates, this is not the case. In China, the quality of the listed companies, their transparency and their valuation has left us to largely skirt the market. India, on the other hand, may ultimately be the more interesting destination, and we continue to evaluate opportunities as they arise. Due to a potential whimsical judiciary and governmental red-tape, India has lagged other emerging countries in attracting investment capital and thus been less successful in developing its manufacturing base. The country has attracted only $3.4 billion of foreign investment in the 12 months ending June 30, 2005, compared with almost $55.3 billion for China and over $30 billion for Brazil. India has, however, succeeded in developing a strong domestic economy where consumption as a share of GDP has reached 64% compared with 58% in Europe, 55% in Japan and just 42% in China (of course, the US remains the undisputed champ of spending with the consumer at over 70% of GDP).

In Continental Europe, three major themes guided our investments over much of the Reporting Period. First, the opportunity for consolidation across the Italian banking sector prompted our investment in many of the country's banks. The investment was not without drama as Italy's head central banker, Antonio Fazio, became ensnared in controversy as he was caught interfering in the acquisition process of Banca Antonveneta by ABN Amro. The historic inefficiencies of the Italian banks leave further room for more internal or external consolidation. Second, our

Julius Baer Funds 2005 Annual Report

6

distaste for the heavily indebted Anglo-Saxon consumer led us to the more frugal consumers of Scandinavia. Whereas debt/income ratios in the US and the UK are closing in on 25%, ratios in the Nordic countries are closer to 5%, leaving the banks more opportunity for growth and less susceptible to bad credits in a slowing economy. Finally, we continued to invest in infrastructure-related companies around the world. In Europe, we purchased airport and seaport operators who should benefit from the physical movement of people and goods as the global economies grew. We also invested in cement companies that benefit from industry consolidation and the many public infrastructure projects taking place in Europe and the United States.

Japan has made significant strides in stoking its domestic economy and has benefited from its close proximity to China's booming economy. Recent elections reinforced Prime Minister Koizumi's reform agenda, which should help keep momentum moving forward. Japanese banks have (finally) taken the needed steps to clean their balance sheets and resume lending. Robust corporate profits and strengthened balance sheets have fed through into increased hiring (the year on year growth in total employment is the strongest since the 1996-1997 upswing). The key to Japan's story going forward will be maintenance and development of domestic growth drivers. Reform of the postal system may potentially stimulate increased capital markets activity as currently misallocated deposits are put to more productive use in the private sector. Still, we must remember that Japan has previously seen at least three false starts and talk of higher taxes could also cause this recovery to stumble prematurely.

In the period ahead, we plan to invest around the following key global themes:

• the increasing wealth of the Eastern and Central European countries,

• whether Japan can continue and accelerate its domestic demand,

• whether the US consumer finally throws in the towel and, of course,

• the direction of economic growth in China and its impact on commodity prices.

We lean favorably to the first theme and will proceed cautiously on the last three.

| |  | |

|

Brett Gallagher

Global Equity Fund Inc.

Portfolio Manager | | Rudolph-Riad Younes, CFA

Global Equity Fund Inc.

Portfolio Manager | |

|

Julius Baer Funds 2005 Annual Report

7

Performance quoted represents past performance which does not guarantee future results. Investment performance reflects fee waivers that may or may not be currently in effect. In the absence of such waivers, total return would be reduced.

Investing internationally involves additional risks, such as currency fluctuations, social and economic instability, differing securities regulations and accounting standards, limited public information, possible changes in taxation, and periods of illiquidity.

The views expressed are subject to change based on market and other conditions. Furthermore, the opinions expressed do not constitute investment advice or recommendation by the individuals, Julius Baer Investment Management LLC ("JBIM"), the Funds, or any affiliated company.

The MSCI World Index is a market capitalization weighted index composed of companies representative of the market structure of developed and emerging market countries in the Americas, Europe/Middle East, and Asia/Pacific Regions. It is not possible to invest directly in an index.

Please see the Portfolio of Investments in this report for complete fund holdings. Fund holdings and/or sector weightings are subject to change at any time and are not recommendations to buy or sell any security mentioned.

Julius Baer Funds 2005 Annual Report

8

MANAGEMENT'S COMMENTARY

JULIUS BAER INTERNATIONAL EQUITY FUND

JULIUS BAER INTERNATIONAL EQUITY FUND II

Annual Report

Period Ending October 31, 2005

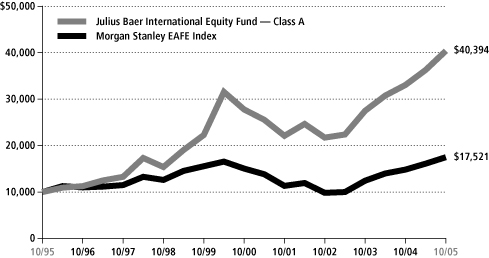

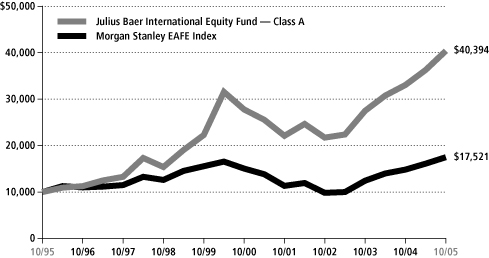

DIAGNOSIS:

Both the Julius Baer International Equity Fund ("IEF") and the Julius Baer International Equity Fund II ("IE II") outperformed their benchmark, the MSCI EAFE Index ("the Index"), for the period under review. For the twelve months ending October 31, 2005, IEF Class A shares returned 22.19% versus 18.09% for the Index. For the period from inception on May 4, 2005 to October 31, 2005, IE II Class A shares rose 9.30% compared to an Index return of 7.23% for the same timeframe. While IE II only invests in companies with a market capitalization greater than US$2.5 billion at the time of purchase (and IEF invests in securities of all market capitalizations), whenever feasible, the geographic and sector exposure for the two funds are similar.

Maintaining our strong performance proved to be a difficult balancing act of remaining defensively positioned yet still participating in the market's strong rally. We remain concerned about structural imbalances in the US economy and believe that the country's recent economic rebound was overly reliant on house-price inflation, which was the result of excessive monetary and fiscal stimuli.

Our strong performance was the result of a number of factors, primary among them was our exposure to emerging markets, specifically Russia and Turkey. In Russia, we focused on oil and gas companies that are rich in reserves and trade at a fraction of the valuation of their major Western counterparts. In Turkey, we emphasized the banking sector and conglomerates both of which we feel are well positioned to benefit from Turkey's quest to join the European Union.

In Japan, our focus on the banking sector and some of the country's dominant exporters proved beneficial. We believe that the banking sector stands to benefit the most from an end to deflation and continued structural reforms. Japanese auto manufacturers remain our favorite among the nation's exporters given their increasing global market share (including the US, Europe and China) based on popular, high quality car models at attractive prices. Their focus on fuel-efficient cars during this rising oil price environment puts them in a strategically well-placed position.

In Continental Europe, oil, construction, and airport holdings were strong contributors to performance. The valuation of these oil companies reflected a price of

Julius Baer Funds 2005 Annual Report

9

US$30-40 per barrel, which is way below prevailing and, we believe, normalized market prices. Airports and seaports are under-appreciated, unique assets that are natural monopolies able to leverage increases in travel and global trade. Those construction companies we invested in got rewarded for diversifying their business into higher margin and lower volatility public infrastructure projects.

Exposure to the Australian and Canadian mining and energy industries was also a positive factor in our performance. These basic resource companies are benefiting from overall global monetary policies and increased demand from China and India. We reduced our exposure towards the end of the fiscal-year over concerns of a cyclical downturn in commodity prices within a structural bull market.

The strength of the US dollar against most major currencies caught many market participants by surprise. The dollar benefited from rising US interest rates and covering of many short positions. Industry specific issues have prevented defensive sectors such as food, pharmaceuticals, and telecommunication carriers from offering a safe haven during times of market turbulence. The food sector is suffering from a combination of higher prices caused by commodities, and pricing pressure caused by private labels and discounters. Pharmaceutical companies continue to suffer from a weak pipeline of new products, assault from generic drug brands, and threats of pricing pressure from lawmakers. Telecommunications carriers are facing a tougher regulatory environment, aggressive new entrants, and price deflation caused by technological innovation.

Finally, this year was a very active year for mergers and acquisitions as cash rich corporations, private equity firms and hedge funds went on a spending binge. Twenty-two companies in IEF and ten in IE II were the targets of such activity.

PROGNOSIS

Looking ahead to next year, many challenges remain. The debate is no longer whether structural imbalances exist, but whether the adjustment will be painless. Some expect the US corporate sector, along with the stagnant Japanese and European economies, will take the baton from the US consumer while others expect a significant slowdown once the US consumer tires and asset prices deflate.

Adding complexity to the situation, early next year Ben Bernanke will replace Alan Greenspan as the Chairman of the US Federal Reserve ("the Fed")—arguably the world's most important financial position. How the new Chairman acts and reacts will significantly impact the ultimate trajectory of the global economy.

Julius Baer Funds 2005 Annual Report

10

BIG PICTURE

Our investment process is driven by both the big picture as well as the close-up details. Looking at the big picture, we continue to believe that the adjustment to such imbalances will not be smooth. The question also remains as to when such an adjustment will take place. Long-bond yield rates have barely budged, despite the fact that short-term rates have moved from 1.75% to 3.75%, between July 2004 to November 2005. Housing prices continue to rise and the current account deficit has fallen deeper in the red. The economy has not been stress-tested since the imbalances keep getting larger despite the increase in the short rates—and long rates may not rise at all.

We shall attempt to address three issues: the adjustment of the imbalances, the current pace of globalization, and the US dollar.

The Coming Adjustment: Where is the Baton?

As the US Fed tightens and the consumer grows tired, financial markets appear preoccupied with the question: will the consumer drop the baton or, will it be smoothly handed-off to the corporate sector? Thus far, the suspense continues. The consumer is running with the same energy and showing no sign of fatigue, while the corporate sector remains largely idle. What will happen to the baton?

The economy is driven by business and consumer dynamics. Businesses create jobs and pay wages to consumers who in turn consume their wages paying them back to the corporations who in turn re-invest the proceeds in more investments and job creation. Hence, a virtual circle is created. Whenever this circle is broken, macroeconomic policies intercede. In the US, these policies tend to be biased towards "trickle-down" economics—i.e., focus on the business sector. If the business sector is in good shape then the economy is in good shape, because a healthy business sector leads to a healthy job market, which leads to healthy demand and a healthy economy.

By late 2000, the balance sheet of corporate America was a total mess. Companies believed in their inflated market capitalization and over-borrowed, over-hired, over-expanded, over-paid for acquisitions, and over-cooked their books. The financial health of the consumer was also deteriorating due to job losses and balance sheet shrinkage caused by the meltdown of the equity market. To spare the US economy a severe recession, the monetary and fiscal authorities showered the corporate sector with tax breaks and lower borrowing costs, and put money in consumer's pockets through tax rebates and house price inflation. As a result of these policies, the current balance sheet of corporate America is in very solid shape.

Julius Baer Funds 2005 Annual Report

11

However, given that consumers are the ones who replenished the corporate coffers, they are now buried even further in debt. The consumers and the policy makers are still waiting for reciprocity from corporate America: to start expanding, investing, hiring, and raising wages.

So far, the business sector has invested little in the domestic economy. Managers remain cautious in the aftermath of the bubble. They continue to off-shore and outsource, suffer from excess capacity or do not believe in the sustainability of the recovery.

As a result, most of the action has been "trapped-up" instead of "trickle-down". Companies are using excess cash for share buy-backs or dividend hikes. While such actions tend to increase the wealth of shareholders, they do little to improve the prospects of the job market or the economy. More worrisome of late, private equity investors are undoing the macro-economic policies of the past five years. They are raiding cash-rich companies, taking out the excess cash, and re-leveraging them to the hilt. Again, excess cash is ending up in the pockets of wealthy investors instead of corporate investment that expands employment.

We believe the performance of the corporate sector in this relay will be disappointing. They will remain stingy in their contribution to the domestic economy for two main reasons: businesses continue to expand overseas to meet domestic demand and financial activities by CFOs and private equity firms siphoning liquidity away from the coffer of corporations into the pockets of wealthy investors. There is a possibility that the baton may have to be picked by the authorities again.

US policy makers will soon have to realize that "trickle-down" is an ineffective and misplaced policy. The business sector is no longer "domestic"; it is global while the consumers remain domestic. Hence the policies should focus on the consumer and not on the business sector. "Trickle up" policies would be much more effective in managing the domestic economy in this globalized world.

Globalization: It is the Anglo-Saxons Model—For Now

In the late 80's, short-sighted corporate America was the laughing stock of the business world. As the saying went, Japanese managers think in decades; Europeans think in years; while their American counterparts think in quarters. Today, we are at the other extreme and anything that is not done the Anglo-Saxon way is scorned both at the macro- and micro-economic levels. The economic prosperity and low unemployment that Anglo-Saxon countries have enjoyed over the past 15 years has been the envy of the rest of the developed world. Japan has been in deflation for years and Continental Europe has been stuck with low economic growth and double digit unemployment. In Japan's case, one might argue that some of its stagnation is

Julius Baer Funds 2005 Annual Report

12

a legacy of the bubble era and that it is currently benefiting from China's expansion. But it is also true that the globalization process has brought about the rise of Asian tigers such as Korea and Taiwan, which has had severe deflationary effects on many Japanese industries.

Citizens are protesting by voting against the establishment: the old guard in the Japanese ruling party LDP was voted out of office, the Social Democrats lost power in Germany, and the popularity of President Chirac in France and Prime Minister Berlusconi in Italy is at a low point. In turn, politicians are quarreling with their "independent" central bankers: Japan's Prime Minister Koizumi has threatened and ordered the Bank of Japan not to end its quantitative easing policies and European finance ministers have been very vocal and confrontational about their displeasure with European Central Bank (ECB) monetary policy. Governments under pressure from voters are now desperately seeking growth. Accommodative monetary and expansive fiscal policies are the easy remedies normally used to counter the deflationary effects of globalization but thus far, they have met with little success. While globalization is causing low inflation in tradable good s, and wage stagnation both in the manufacturing sector and a small part of the service sector where wage labor can be arbitraged, the remedies (the easy monetary policies) are mainly causing inflation in asset prices such as real-estate and bonds.

Why are the Anglo-Saxons prospering from global trade while the rest of the developed world, especially Continental Europe, is suffering from it? Should the rest of the developed world emulate the Anglo-Saxon model? If not, how do they get out of their miserable trap?

Common wisdom attributes the success of the US and its Anglo-Saxon brethren to their high productivity, the flexibility of their labor laws, their strong embrace of free market principles, and positive demographic trends. However, it is difficult to ignore that strong economic performance has been accompanied by a plethora of severe structural imbalances: the vast current account and fiscal deficits, the exceptionally low saving rates, the record high household debt as a percentage of income, and the overheated housing market.

Two factors may better explain the Anglo-Saxons' recent fortunes. First, their economies are less dependent on manufacturing and second, the development of their financial markets has enabled the consumers to easily extract equity from sky-rocketing home prices thereby compensating for stagnant wages. Meanwhile, Continental Europe is more dependent on manufacturing, and has experienced modest home price appreciation with limited means for extracting equity. Therefore, the Anglo-Saxons' recent fortunes may be transient in nature and merely

Julius Baer Funds 2005 Annual Report

13

reflect their ability to postpone a painful adjustment while Continental Europe, lacking this flexibility, is in the midst of such adjustments.

Beyond liberalizing its labor laws, Europe can do little but await the ultimate conclusion of this vendor-financing scheme. The current pace and nature of this globalization is hazardous to long-term U.S. vitality. Trade is a win-win game as long as it is a balanced one. Warren Buffett has publicly warned against the current trade imbalance and provided a possible solution, but his advice and warnings fell on deaf ears. Unless the United States wakes up, foreign central bank financing of our trade deficit may end up being the United States's Trojan horse: seemingly useful on the surface but deadly in the long run.

Workers are also voters. They may have lost their bargaining power with management but not with government. So far, the ability of consumers to transform houses into ATMs has softened the impact of stagnant wages and delayed a grass-root revolt in the US. However, malcontent was apparent in our recent November elections where the Democratic Party had big wins. It remains to be seen whether 2006 elections prove even more unsettling for incumbent politicians.

Finally, American corporations' rush to embrace outsourcing may resurrect the old label of shortsightedness. To save a few pennies today, they may have incubated future competitors who will cost them dollars tomorrow.

The US Dollar: What Next?

Despite the well publicized imbalances of the US economy, especially the current account deficit, the US dollar had a surprisingly strong year against most major currencies. What's happening here? Don't current account deficits on the scale of 6% of Gross Domestic Product ("GDP") matter? And what should we expect next year?

In hindsight, there are plausible explanations for the US dollar's strength. First, it rallied because by late 2004 it became a crowded trade—technically, it was oversold. Second, the dollar does not appear overvalued against major currencies based on purchasing power parity. Third, the US Federal Reserve is the only central bank that has been raising rates aggressively. Rates in the US are expected to hover between 4.5% and 5% from next year until the end of the decade. Japanese, Eurozone and Swiss rates are expected to stay below US rates for the foreseeable future. You may have to wait years before earning 1% on the yen, 2% on the Swiss franc, or 3% on the Euro. Only the British pound is forecast to provide interest rates commensurate

Julius Baer Funds 2005 Annual Report

14

to the US dollar. Finally, the yen and, to a lesser extent the Euro, have become the hedge funds' "borrow currency" of choice.

Short term interest rates

futures (90 days) | | December 2005 | | Long-dated future | |

| US dollar | | | 4.49 | % | | 4.97% (June '09) | |

|

| Euro | | | 2.52 | % | | 3.095% (Sept. '07) | |

|

| British pound | | | 4.61 | % | | 4.69% (June '09) | |

|

| Japanese yen | | | 0.09 | % | | 1.54% (Sept. '10) | |

|

| Swiss franc | | | 1.08 | % | | 2.14% (Sept. '07) | |

|

Source: Bloomberg

Though highest of the group, even US dollar rates are hardly enticing when for the last three years nominal GDP grew at a pace of 6% to 7%. Central bankers fooled many financial market participants into accepting core inflation as the reference point. They argue that interest rates somewhat above core inflation should be considered adequate if not generous. Over the past 12 months inflation has averaged about 3.4%—so one should be grateful for earning 4%.

For the past five years Consumer Price Inflation (CPI) has averaged 2.55% while Core CPI (which is ex-food and energy) was about 2.09%. It is hard to imagine that inflation was this low during a period where real estate prices more than doubled in many parts of the world and many commodities prices performed similarly. Many (ourselves included) suspect that conventional inflation measures understate the true cost of living.

Ricardo Reis, an economist at Princeton University, attempted to address that very issue in a recent paper (The Economist, October 15, 2005, page 76). He argued that CPI measures only the prices of goods and services consumed today; it does not include the prices of what we will consume tomorrow. If share or housing prices rise sharply, future consumption becomes more costly, as well as the cost of living. So, he designed a new inflation index—dynamic price index (DPI)—that included asset prices such as equities and real estate. For the four years ending in 2004, the annual rate of inflation according to DPI was 7.4%, compared with an average increase of only 2.3% in the CPI. No wonder there is a rush to buy real assets all over the world.

Investors are finally realizing that all major central banks, irrespective of their charter, are being forced 'de facto' either by politicians or by globalization to follow monetary policies that give more weight to growth than price stability. This is

Julius Baer Funds 2005 Annual Report

15

evidenced by the public quarrels between the Bank of Japan and the European Central Bank on the one hand and the politicians on the other.

The real issue is not the debate on the merit of holding yen versus US dollars or Euros; it is about holding any of these sanctioned currencies versus real assets, which were again major winners this year. It is apparent that holding paper currency today is akin to a hemorrhage of one's purchasing power. That's why people are grabbing real assets: real estate, commodities, and precious metals. Also, it is no surprise that gold has risen and many expect substantial gains are still to come while the Fed is raising interest rates.

The dilemma with real assets is that some of them have become expensive places to hide from the malfeasance of central bankers. The trick is to find those real assets whose values remain supported by fundamentals. For example, an investor should look for real estate opportunities in remote areas where prices have barely budged rather than overpaying for something similar in crowded metropolitan areas.

CLOSE-UP

Our analysis continues to guide us towards emerging Europe, including Russia and Turkey. In the short-term, there is a possibility of a correction in these markets, which we view as a buying opportunity. While we are not big believers in the current Japanese market rally, we are not yet fighting it. We have also returned to neutral positions in commodities until more clarity on the macroeconomics front is received. Lastly, we have identified positive dynamics in several sectors that may create attractive investment opportunities.

Emerging Markets

Our view on emerging markets is divided into two camps: one whose fortune is tied to global trade and the other whose is tied to the expansion of the European Union. The first relies on the current imbalance in global trade while the second relies on the goodwill of European politics.

Most markets in Asia and Latin America are benefiting from the boom in Anglo-Saxon consumption along with Chinese capital spending and infrastructure projects. Asia is gaining through exports and Latin America through the rise in commodity prices. The fortune of both is joined at the hip. There is no denying that the fundamentals have improved in both regions as evidenced by the record current account surpluses. However, we are not convinced that their fundamentals will remain positive once global imbalances start to adjust.

Central and Eastern Europe, in particular Turkey and Russia, are big beneficiaries of the drive to reunite Europe. This process is rooted in a sound political foundation,

Julius Baer Funds 2005 Annual Report

16

unlike the current imbalance in global trade. This year, both Turkey and Russia enjoyed outsized returns, but we believe the two countries will decouple once the pace of globalization slows or adjustment of the imbalances begins.

The biggest risk in Central and Eastern Europe is the complacency of the governments towards reform. The time table to join the European Monetary Union (EMU) is being continually pushed further into the future. In some countries, like Hungary, budget deficits are worsening as a result of populist policies aimed at appeasing voters. However, we believe that sooner rather than later, either market forces or fear of forfeiting their chance to join the EMU will force the violating countries into sound policies.

Japan

Japan's economic prospects have improved. Prime Minister Koizumi won decisively in the recent elections and earned a mandate to continue structural reform. Privatizing the postal office is likely to be at the top of the agenda. China, Japan's neighbor and its second most important trading partner, grew at a 9-10% pace. Corporate profits are strong, the result of restructuring, an improving domestic economy, a weaker yen, and strong global growth—especially in China and the US.

But are these improvements already discounted? As of late, the Japanese stock market has been on a tear: "Turnover reaches five times bubble average; concerns grow that new one is forming... Behind the records is active stock trading by foreigners and individual investors encouraged by the economic recovery and brighter corporate earnings... The high turnover is driven in large part by churning on the part of individuals trading online." (The Nikkei Weekly, November 14, 2005, Page 1)

Domestic retail investors have been active in low priced stocks—i.e. penny stocks. Foreign investors were active in the reflation trade, indiscriminately purchasing mainly domestic sector stocks perceived to be leveraged to the end of deflation in sectors such as real estate, insurance, banking, and retail. Foreign private equity funds have been aggressively bidding up real estate prices in Tokyo and now few prime properties there yield more than 3%.

On many valuation metrics Japan is looking very expensive compared to Europe. Japan's Topix Index trades on 23x earnings and yield 0.93% while European averages trade around 13x earnings and yield about 3%. The market is partially correct to ignore current financial multiples on the premise that earnings are depressed after more than ten years of deflation, but does Japan deserve a 100% premium to Europe?

Julius Baer Funds 2005 Annual Report

17

One way to measure operational leverage is to value companies based on assets and operational metrics instead of earnings related ones. Aside from banks, whose market capitalization to deposit ratio is still at a large discount to their European counterparts, we have failed to find fundamental justification to chase this rally in the other domestic sectors.

In our opinion, Japan's real leverage is not from reflation but from its unique exposure to its neighbor, China—and that can be huge. The potential benefit from this relationship could surpass the combined benefits that Mexico and the US enjoy from their trade relationship. Japan is doing the near-shoring that America did but at the same time they are, like the Mexicans, exposed to a super-jumbo economy next door. Whereas the US population is about three times that of Mexico, the Chinese population is about ten times that of Japan. As previously mentioned, Japan is a country with the worst demographics but the most improving geographics. Instead of chasing a reflation trade, we continue to focus on companies that are highly leveraged to the emergence of China as a major economy. We are also looking at companies that are transplanting the China-Japan model to India. In the long run, India may prove to be a more stable partner given the l ack of political sensitivity that exists with the Chinese. India is already a democracy and has a much younger demographic than China.

Sectors and Themes

We continue to attempt to find attractive industries that are consolidating, not reliant on global imbalances, with high entry barriers, and set to experience above average growth.

The global cement industry has been slowly consolidating into an oligopoly where the top eleven cement companies now own about 56% of global capacity today compared with less than 17% in 1988. The consolidation has led to more pricing discipline and additional capacity. The high transportation cost of the product, especially by land, provides an added protection from cheap imports—less than 5% of global cement is exported. The entry barriers are also very high with tough permission and environmental demands and intense capital expenditure. Cement also possesses some defensive characteristics since it benefits from large government spending when the economy slows. The industry is, for the first time, focused on cost cutting and efficiency programs. We feel the sector's valuations remain attractive; cement still trades in line with its long-term average while a re-rating is well deserved. Some of our holdings in the period include Lafarge , Holcim, and Cemex.

We anticipate the luxury goods industry will enjoy strong growth over the next decade. Currently, the industry is benefiting from several big drivers. First, as consumers are dividing their purchases between a "trade-up" to a luxury good or a

Julius Baer Funds 2005 Annual Report

18

"trade-down" to a discounter, the market share of luxury goods manufacturers is increasing. Second, the expected increase in purchasing power of consumers from emerging economies could be a boon for the industry. The Chinese consumer could account for as much as 29% of all luxury purchases by 2015 (Japanese make right now around 40% of all purchases). The Indian consumer demographic is also very attractive with 44% of population below 19 years of age, and lastly, the Russian consumer whose appetite is second to none. In addition, the increase in global travel should accelerate luxury good purchases through duty free shops. Two luxury goods companies we held during the reporting period were LVMH and Swatch, and we like their prospects based on their strong position in emerging markets.

Consolidation has brought the global spirits industry down to four players: Diageo, Pernod Ricard, Fortune Brands and Bacardi. The industry's barriers to entry are extremely high due to brand loyalty, expensive distribution networks, and high marketing spend. Additional features that make this an attractive segment include the world's aging demographics and the growth in wealth in emerging markets. As consumers get older, they drink more spirits and less beer, and as consumers in emerging economies grow in wealth they will increase their consumption of top spirits brands as a show of status. Our holdings over the fiscal year include the top two players in terms of sales, Pernod Ricard and Diageo.

The construction sector is benefiting from the budgetary problems that face national and local governments. Given the public sector's funding problems and inefficient operations, public authorities are now engaging private companies. The construction sector diversified its cash flows out of a business that traditionally had low margins and negative working capital requirements, into one that includes concessions like toll roads, airport services, and waste collection. Certain firms entered into build-operate-transfer (BOT) agreements for projects like hospitals, schools and prisons, which are projects that have double the margins of regular construction business. Construction deserved a strong re-rating as its business mix migrated towards higher margin and lower volatility projects. Companies that profited from these changes include Ferrovial, Vinci, and Skanska. Our exposure to the sector was reduced during the period due to strong perform ance and the rising risk from higher interest rates.

The European electric utility sector has also been experiencing a favorable pricing environment. We correctly anticipated that electricity prices would rise significantly in response to the increase in input (oil, gas, and coal) and emission costs. Given that the market equilibrium price is set by the producers who have the highest variable cost (coal and gas), we favored utilities that had high exposure to nuclear and hydro power. Strong performers in this category during the reporting period were

Julius Baer Funds 2005 Annual Report

19

Fortum, RWE, Suez and Eon and a smaller company, BKW. Later in the period, our exposure was reduced as the undervaluation has substantially narrowed.

Privately-owned hospitals in Europe are experiencing both growth and consolidation: governments are struggling to cope with the burden of healthcare costs while privately-owned hospitals are providing the best and most efficient hospital care. As a result, public hospitals are being privatized and long-term contracts for hospital care are being awarded to the private entities.

Private hospitals are also expected to benefit from an increase in medical procedures due to an aging population as well as from market share gains coming at the expense of poorly run public hospitals. There are ample opportunities for acquiring public hospitals and smaller private clinics as the market is still very fragmented. Profitability can be improved as leading hospitals gain economies of scale through consolidation and by reducing the length of hospital stays for the same procedure (most reimbursements are based on procedures rather than hospital days). Two such companies held in IEF during the reporting period were Generale De Sante, the largest private hospital in France and Capio, the largest private hospital in Europe. (Since both stocks have a capitalization of under US$2.5 billion, they were not in IE II.)

The Italian banking industry is one of the most fragmented in Europe but is expected to experience a wave of consolidations over the next two to three years. In the past, unfriendly shareholder rules and a hostile central banker made mergers and acquisitions difficult for both domestic and foreign banks. This has begun to change rather dramatically since the beginning of the year when two foreign banks, BBVA and ABN Amro, tested the resolve of the Bank of Italy with one of them succeeding in acquiring a local bank.

In addition to the prospects of consolidation, Italian banks have many attractive attributes. Italy is one of the most immature credit markets in Europe and penetration remains very low. Italians have been slow to increase borrowing given their cultural distaste for credit due to historically high interest rates, but that is changing and the potential for growth is high as Italy converges to European averages.

Italian banks still have ample opportunity for efficiency gains as their cost is one of the highest in Europe. The potential from restructuring is equally high based on cleaning the loan portfolios and liquidating non-core holdings. In summary, the leverage to higher profits is significant and originates from cost cutting, faster credit growth, lower structural provisions and, at some point, stronger economic growth. In spite of better long-term growth prospects and M&A speculation, the Italian banks trade in line to a discount to the European averages. During the period, our holdings in the area include Banca Intesa, Capitalia, and Banca Popolare di Milano, all of which are undergoing restructuring and are potential takeover targets.

Julius Baer Funds 2005 Annual Report

20

German real estate has been stagnant for more than a decade as a result of the huge overbuilds during the early '90's and unfriendly legislation that heavily favored tenants over landlords. However, the sector seems to be turning the corner driven by several strong fundamentals: household formation is growing as the number of persons per household declines. Home ownership in Germany (43%) is the lowest in Europe while in Spain, the UK, and France it is 82%, 69%, and 53%, respectively. The supply side is vastly improving as completions are at half the peak level of 1994 and vacancy rates are coming down. Despite the oversupply, rent grew by 2.4% annually over the past ten years. Finally, the anticipation of REIT legislation in 2006/2007 should attract additional private equity investors who would most likely cause upward pressure on market prices. We mainly gained exposure to the sector through real estate companies and banks.

Along with our attempts on getting the big picture right and identifying positive sector developments, we continue to focus on unearthing individual investment opportunities around the globe.

Rudolph-Riad Younes, CFA

International Equity Fund and International Equity Fund II Portfolio Manager

Performance quoted represents past performance, which does not guarantee future results. Investment performance reflects fee waivers that may or may not be currently in effect. In the absence of such waivers, total return would be reduced.

Investing internationally involves additional risks, such as currency fluctuations, social and economic instability, differing securities regulations and accounting standards, limited public information, possible changes in taxation, and periods of illiquidity.

The views expressed are subject to change based on market and other conditions. Furthermore, the opinions expressed do not constitute investment advice or recommendation by the individuals, JBIM, the funds, or any affiliated company.

The MSCI EAFE Index is an unmanaged list of equity securities from Europe, Australasia, and the Far East with all values expressed in U.S. dollars. It is not possible to invest directly in an index or average.

Please see the Portfolio of Investments in this report for complete fund holdings. Fund holdings and/or sector weightings are subject to change at any time and are not recommendations to buy or sell any security mentioned.

The Price to Earnings (P/E) Ratio reflects the multiple of earnings at which a stock sells.

Julius Baer Funds 2005 Annual Report

21

MANAGEMENT'S COMMENTARY

JULIUS BAER TOTAL RETURN BOND FUND

Annual Report

Period Ended October 31, 2005

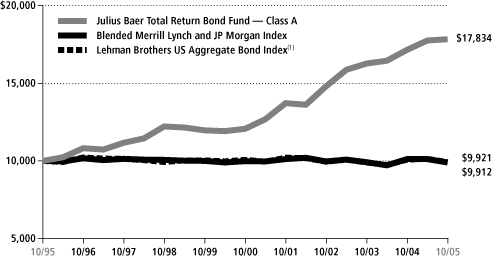

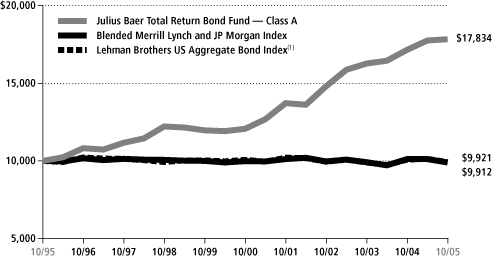

The Julius Baer Total Return Bond Fund (the "Fund"), Class A shares returned 3.93% for the fiscal year ending October 31, 2005. Over the same time period the benchmark, Lehman Brothers Aggregate Bond Index, had a return of 1.13%.

One of the major contributors to the Fund's outperformance over the last year was our positioning within the US yield curve. We expected the Federal Reserve to continue to raise the Federal Funds rate at least into the second half of 2005. We, therefore, were confident that rates would go up in the short end of the US yield curve. We were less sure about the direction of rates in the long end of the curve. Usually, when the Fed starts a tightening program, it is due to an increase in inflation or at least that inflationary expectations are moving higher. This results in higher interest rates all along the yield curve.

In our opinion, when the Fed started this tightening program, it was more driven by the desire to eliminate the 'insurance' of a historically low rate. This all-time low was in effect to ward off the threat of deflation that was a feared result of the bursting of the equity bubble in the beginning of the decade. When the members of the Federal Open Market Committee made the decision to begin to raise rates in June 2004, they made it clear that they were looking to reach a 'neutral' rate and not to prevent a pick-up in inflation.

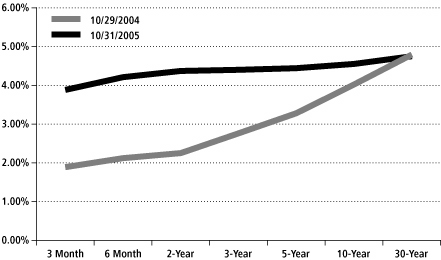

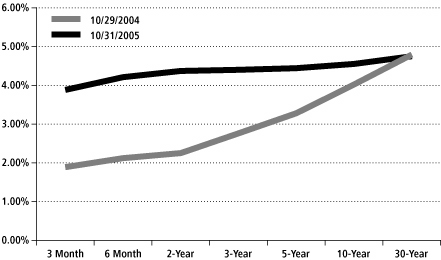

Bonds in the long end of the yield curve did not increase in yield simply because there was scant sign of inflationary pressure, and the Fed was tightening, meaning there was little chance of inflation getting ahead of the Fed. An environment with benign inflation and a central bank that is tightening is usually very good for longer-term bonds. Remember, the Federal Reserve can strongly influence rates in the short end of the yield curve. The longer end of the curve, on the other hand, is more influenced by inflation and inflationary expectations. Our yield curve strategy in October 2004 was to be positioned for a flattening. We had this position well into the second half of 2005 and it paid off. The following graph shows the

Julius Baer Funds 2005 Annual Report

22

change in the shape of the curve from the beginning to the end of the funds fiscal year.

U.S. Yield Curve

Source: Bloomberg

Another position that significantly added to the Fund's higher return versus the index was our positioning in Mexican bonos and the peso. In January 2005, Mexican bonos had a yield of 9.8%. At the same time, the Mexican peso was close to its all-time low versus the US dollar, trading as low as 11.38 and the US dollar was near the end of its two year depreciation versus the major world currencies. This meant that the Mexican peso had a large decreased in value versus many currencies, including a 61% drop value versus the Canadian dollar between early 2002 and December 31 of 2004. The central bank of Mexico, Banco De Mexico, meanwhile was quietly going about bringing inflation down and hence raising its own credibility. We believed that this was a very attractive combination for a fixed income investment. This, combined with the fact that Mexico has significant oil reserves, led us to our decision to take a large position in longer-term bonos and a corresponding weight in the currency. From January 1 to October 31, 2005, bonos have rallied 110 basis points while the peso rose over 3.3% versus the US dollar. A similar maturity US treasury actually lost almost 40 basis points over the same time period.

Over the full fiscal year, our currency stance had mix results. In the last two months of 2004 the Euro rallied from 1.2752 to 1.3554, an increase of 6.3%. During the same time period the Japanese yen rallied 3.6%. We feel the Fund was well positioned for this move, with our currency position very close to the maximum allowed by our guidelines.

Julius Baer Funds 2005 Annual Report

23

January to October 2005 was a much harder environment for non-dollar assets, as the US dollar rallied for most of the year. The Euro was down 11.5% versus the dollar, closing at 1.1992 on October 31, 2005. The Japanese yen lost 13.4% over the same time period. We substantially reduced our non-dollar position in the beginning of January. This allowed us to avoid much of the poor performance that would have resulted had we left our currency positioning static.

Outlook

The US fixed income market has two countervailing expectations. The first forecasts a pickup in inflation and higher interest rates. The second anticipates a drop in demand from the consumer and an inverted yield curve.

Those who believe in the first opinion, which appears to include the Fed, are fearful that inflation is on the rise and, probably more importantly, that there may be an increase in inflationary expectations. The Fed has expressed their reluctance to allow an increase in inflation expectations given the assumption that a wage/price spiral could develop. In addition, concerns over government-induced inflation from the hurricane rebuilding efforts along the Gulf Coast could contribute to inflation during 2006. Against this backdrop, high energy prices should flow through into both the current headline CPI and the more widely watched core CPI in the near future.

The second opinion is based on concerns that the housing market will correct or slow-down and that high heating costs may diminish consumer spending starting in early 2006. Both of these issues imply a shift in consumer spending behavior. In addition, a legislated increase from 2% to 4% in the minimum payments on credit cards balances may cause some consumers to rethink the use of credit as a spending vehicle or at least impair near-term purchases. The conclusion drawn from these factors is a growth slowdown, a limiting effect on inflation and, therefore, a desire by investors to extend duration.

We expect some combination of higher prices limited by slowing growth to emerge over the next several quarters but predict a "muddle through" economy rather than one with volatile characteristics. In the near-term, fixed income markets should continue to be dominated by tighter Fed policy. On February 1, 2006, Ben Bernanke will replace Alan Greenspan as the new Federal Reserve Chairman. Past changes in Fed chairmen have increased market volatility. The economic scenario and global imbalances Greenspan will leave behind suggest that concern is warranted.

From our perspective, the major item of concern is the housing market. Greenspan went so far as to co-author (only the second time in his role as Chairman) a long and technical piece on the subject. We believe the Fed is concerned that the housing market presents a substantial risk to the economy as many consumers have

Julius Baer Funds 2005 Annual Report

24

"cashed out" the equity in their homes to fund a lifestyle they could otherwise not afford. Also, savings rates have dropped dramatically, eroding many consumers' downside cushion. The Fed's concern is that a substantial number of consumers have no more equity in their house than they did five years ago, even though prices are dramatically higher and, at the same time, have very little traditional savings. ING Group recently released a study estimating that GDP would be reduced by 1.5% if housing price growth is flat for one year.

In a perfect world, we believe the Fed would prefer to have ten year Treasury rates rise just enough to slow housing price growth to a low, but positive, rate for several years allowing other portions of the economy to rebalance to the housing market gains. Therefore, we believe that the Fed would like to see long-term rates higher now but their ability to influence the long end of the yield curve is tenuous at best. Hence, Greenspan's conundrum. In short, we expect the Fed will continue to raise the Fed Funds rate to the point where long rates slow the growth rate of house prices.

In this environment, it can be difficult to manage fixed income assets. As the Fed tightens, we expect long rates to move higher. Yet, a rising interest rate environment is tough on fixed income performance. The classic response in a domestic fixed income account is to lower the portfolio's duration, hence, potentially reducing interest rate risk.

We are able to employ a different strategy. Instead of trying to bet if and when an increase or decrease in longer-term rates in the US will occur, we are inclined to use our global knowledge to position the Total Return Bond Fund in "friendlier" interest rate environments. An example is Europe, where we are invested in longer-term bonds, thereby capturing a substantial amount of duration versus a central bank handcuffed with a soft economy. Over the last year, we held a substantial position in European government debt having expected that this region's economy would struggle, which it has. We continue to hold this position based on our forecast that the European Central Bank (ECB) is unlikely to tighten more than one or two times because the regions economy is struggling to grow. Another positive aspect of this particular investment is the "positive carry" that is generated by hedging the Euro back to the US dollar. Due to the steeper yield curve in Europe versus the US, holding long European debt while hedging out the currency risk can result in a higher implied interest rate on the total investment than would be generated by buying a similar US Treasury bond. This allows us to invest in a bond with what we feel is substantially less risk of price erosion due to an increase in interest rates and have virtually no currency risk with a higher total yield than a comparable US Treasury.

Julius Baer Funds 2005 Annual Report

25

Another foreign market where we are currently positioned is the United Kingdom gilt market. Their ten year bonds currently yield approximately the same as ten year Treasuries, yet the UK central bank has already successfully slowed the country's growth rate. Therefore, we believe that their rates are less likely to rise than US interest rates. Finally, we have positions in Mexico and Iceland. Bonds in these countries offer higher yields (8.50% and 7.60%, respectively) making them attractive markets with the potential to make a meaningful contribution to performance while diversifying US interest rate risks.

We believe our defensive strategy should produce higher returns relative to the benchmark. While absolute returns are likely to be meager in the near-term, the expected adjustment in the fixed income market should provide a more favorable backdrop for investment returns in 2006.

Donald Quigley

Total Return Bond Fund Portfolio Manager

Performance quoted represents past performance which does not guarantee future results. Investment performance reflects fee waivers that may or may not be currently in effect. In the absence of such waivers, total return would be reduced.

Investments in debt securities typically decrease in value when interest rates rise. This risk is usually greater for longer term debt securities. Investing internationally involves additional risks, such as currency fluctuations, social and economic instability, differing securities regulations and accounting standards, limited public information, possible changes in taxation, and periods of illiquidity.

The views expressed are subject to change based on market and other conditions. Furthermore, the opinions expressed do not constitute investment advice or recommendation by the individuals, JBIM, the funds, or any affiliated company.

The Lehman Brothers US Aggregate Bond Index is a benchmark index composed of US securities in Treasury, Government-Related, Corporate, and Securitized sectors. It includes securities that are of investment-grade quality or better, have at least one year to maturity, and have an outstanding par value of at least $250 million. It is not possible to invest directly in an index or average.

Please see the Portfolio of Investments in this report for complete fund holdings. Fund holdings and/or sector weightings are subject to change at any time and are not recommendations to buy or sell any security mentioned.

Julius Baer Funds 2005 Annual Report

26

MANAGEMENT'S COMMENTARY

JULIUS BAER GLOBAL HIGH YIELD BOND FUND

Annual Report

Period Ended October 31, 2005

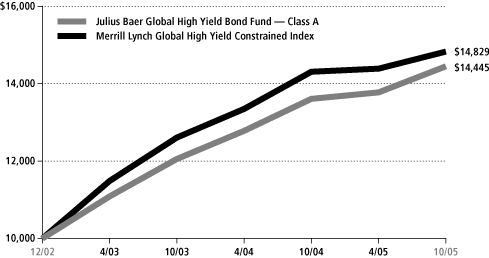

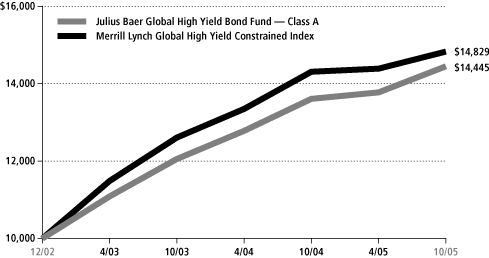

The Julius Baer Global High Yield Bond Fund (the "High Yield Fund"), Class A shares enjoyed a good fiscal year in the twelve months ending October 31, 2005, returning of 6.15%, net of all fees and expenses. This performance outpaced our benchmark, the Merrill Lynch Constrained Global High Yield Index by 2.53%.

The overall macro-economic environment continued to be support of high yield bonds during the review period. Global economies expanded, inflation remained muted, and corporate profits grew. However, imbalances in the global economy also grew, namely the US current account and budget deficits, structural rigidities in the European economy, highly export-oriented trade surpluses in some emerging market economies, and rising commodity prices, particularly energy. All of these imbalances are interconnected making it hard to see how they will be resolved without policy coordination on the part of governments throughout the world. In the US, there is a need to dampen excessive consumer spending and real estate speculation. Europe needs to address pension and employment reform. Some of the larger emerging economies need to introduce more flexible currency regimes and stimulate domestic consumption.

The most substantive movement during the review period was the steady rise of the US Federal Funds rate—steady rise a necessary evil given the circumstances. However, future hikes will likely be detrimental if there is not further progress on other economic problems both in the US and abroad.

As we manage the High Yield Fund, we keep a macro economic eye on two potential outcomes to this dilemma. The first and more pessimistic outcome is that US Fed Funds rate increases will continue without equivalent progress on other policy fronts. In this case, investment caution is warranted. Bonds, including high yield, should provide a better haven than equities, but within the bond asset class, high grade securities should outperform lower grade issues. If markets perceive policy responses as being asymmetric, risk aversion will likely take hold and high yield spreads (the difference in yield between high yield securities and government bonds) will presumably widen. The second potential outcome is that policy progress will in fact be balanced enough to engineer a "global soft landing". In this case, broad measures of economic progress will be positive, but there will, inevitably, be winners and losers.

Julius Baer Funds 2005 Annual Report

27

We remain optimistic and have managed the High Yield Fund with an emphasis on attempting to identify the potential winners and losers of economic rebalancing on a global scale. In doing so, we are also attentive to the risks of the first, more pessimistic, prognosis. One such potential winner we identified is the energy sector and therefore have maintained an overweight position for much of the fiscal year. On the flip-side, auto bonds are an area we are less enthusiastic about and hold a very low weighting in the industry. Those auto bonds we chose to invest in were primarily European-based companies denominated in their local currency because we believe they will endure the market turmoil better than their US-based counterparts. We also invested in the local currency bonds of a number of emerging economics, on the belief that they will benefit from global growth far more than corporations or whole industries rooted in the developed world.

At the same time, recognizing the possibility of the more pessimistic outcome to our current situation, we have steadily reduced our holdings of riskier developed economy corporates, including those rated below B-/B3 by S&P/Moody's, as we believe they have the potential to be more vulnerable in the event of a hard landing. For much of the year, we also carried an overweight position in healthcare bonds, given our feelings that they will perform relatively well regardless of the market or economic environment.

This dual approach has helped us navigate a somewhat turbulent fiscal year. While we were not perfect and made occasional mistakes in specific issues, we have moved quickly to assess each situation and cut our exposure at the point we felt our initial investment premise was no longer supportable.

As we enter a new fiscal year we remain optimists, but also retain our cautious approach. As optimists, we believe there will be many attractive opportunities to invest in areas of the world, in industries, and in companies that could be thriving in what is becoming a more global, more interconnected, and, hopefully, more balanced world. There will also be areas to avoid, and we will be careful to do so. And, along the way, there will always be uncertainty and volatility, for there is no free lunch in investing, but we will seek to dampen these bumps by respecting the more pessimistic possibilities and carefully considering any investments that do not live up to expectations.

Greg Hopper

Global High Yield Bond Portfolio Manager

Julius Baer Funds 2005 Annual Report

28

Performance quoted represents past performance, which does not guarantee future results. Investment performance reflects fee waivers that may or may not be currently in effect. In the absence of such waivers, total return would be reduced.

The securities in which the Fund will invest may be considered more speculative in nature and are sometimes known as "junk bonds." These securities tend to offer higher yields than higher rated securities fixed income securities can present a greater risk of loss of income and principal than higher rated securities. Investing internationally involves additional risks, such as currency fluctuations, social and economic instability, differing securities regulations and accounting standards, limited public information, possible changes in taxation, and periods of illiquidity.

The views expressed are subject to change based on market and other conditions. Furthermore, the opinions expressed do not constitute investment advice or recommendation by the individuals, JBIM, the funds, or any affiliated company.

The Merrill Lynch Global High Yield Constrained Index tracks the performance of below investment grade bonds of corporate issuers domiciled in countries having an investment grade foreign currency long term debt rating (based on a composite of Moody's and S&P). The index is weighted by outstanding issuance, but constrained such that the percentage that any one issuer may not represent more than 3% of the index. It is not possible to invest in an index.

Please see the Portfolio of Investments in this report for complete fund holdings. Fund holdings and/or sector weightings are subject to change at any time and are not recommendations to buy or sell any security mentioned.

Julius Baer Funds 2005 Annual Report

29

SHAREHOLDER EXPENSES (Unaudited)

As a shareholder of the Julius Baer Global Equity Fund Inc., Julius Baer International Equity Fund, Julius Baer International Equity Fund II, Julius Baer Total Return Bond Fund, or Julius Baer Global High Yield Bond Fund, you incur ongoing expenses, such as management fees, shareholder service fees, distribution fees and other fund expenses. The following table is intended to help you understand your ongoing expenses (in dollars and cents) of investing in Julius Baer Global Equity Fund Inc., Julius Baer International Equity Fund, Julius Baer International Equity Fund II, Julius Baer Total Return Bond Fund, or Julius Baer Global High Yield Bond Fund and to compare these expenses with the ongoing expenses of investing in other funds.

The table is based on an investment of $1,000 invested at the beginning of the period and held for the entire period from May 1, 2005 to October 31, 2005.

Actual Expenses

The first line in the table below provides information about the actual account values and actual expenses. You may use the information in this line, together with the amount you invested, to estimate the expenses that you paid over the period. Simply divide your account value by $1,000 (for example, an $8,600 account value divided by $1,000 = 8.6), then multiply the result by the number in the first line for the Fund under the heading entitled "Expenses Paid During Period" to estimate the expenses you paid on your account during this period.

Hypothetical Example for Comparison Purposes

The second line in the table below provides information about the hypothetical account values and hypothetical expenses based on the Fund's actual expense ratio and an assumed rate of return of 5% per year before expenses, which is not the Fund's actual return. The hypothetical account value and expenses may not be used to estimate the actual ending account balance or expenses you paid for the period. You may use this information to compare the ongoing costs of investing in your Fund and other funds. To do so, compare this 5% hypothetical example with the 5% hypothetical examples that appear in the shareholder reports of the other funds.

Global Equity Fund Class A

| | | Beginning Account

Value 5/1/05 | | Ending Account

Value 10/31/05 | | Annualized

Expense Ratio | | Expense Paid

during Period | |

| Actual | | $ | 1,000.00 | | | $ | 1,099.70 | | | | 1.41 | % | | $ | 7.46 | | |

| Hypothetical | | $ | 1,000.00 | | | $ | 1,018.10 | | | | 1.41 | % | | $ | 7.17 | | |

Julius Baer Funds 2005 Annual Report

30

Global Equity Fund Class I

| | | Beginning Account

Value 5/1/05 | | Ending Account

Value 10/31/05 | | Annualized

Expense Ratio | | Expense Paid

during Period | |

| Actual | | $ | 1,000.00 | | | $ | 1,100.60 | | | | 1.15 | % | | $ | 6.09 | | |

| Hypothetical | | $ | 1,000.00 | | | $ | 1,019.40 | | | | 1.15 | % | | $ | 5.85 | | |

International Equity Fund Class A

| | | Beginning Account

Value 5/1/05 | | Ending Account

Value 10/31/05 | | Annualized

Expense Ratio | | Expense Paid

during Period | |

| Actual | | $ | 1,000.00 | | | $ | 1,113.30 | | | | 1.30 | % | | $ | 6.92 | | |

| Hypothetical | | $ | 1,000.00 | | | $ | 1,018.70 | | | | 1.30 | % | | $ | 6.61 | | |

International Equity Fund Class I

| | | Beginning Account

Value 5/1/05 | | Ending Account

Value 10/31/05 | | Annualized

Expense Ratio | | Expense Paid

during Period | |

| Actual | | $ | 1,000.00 | | | $ | 1,115.50 | | | | 1.04 | % | | $ | 5.55 | | |

| Hypothetical | | $ | 1,000.00 | | | $ | 1,020.00 | | | | 1.04 | % | | $ | 5.30 | | |