UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED

MANAGEMENT INVESTMENT COMPANIES

Investment Company Act file number | 811-06017 |

|

Julius Baer Global Equity Fund Inc. |

(Exact name of registrant as specified in charter) |

|

330 Madison Avenue, New York, NY | | 10017 |

(Address of principal executive offices) | | (Zip code) |

|

Tony Williams

330 Madison Avenue, New York, NY 10017 |

(Name and address of agent for service) |

|

Registrant’s telephone number, including area code: | 212-297-3600 | |

|

Date of fiscal year end: | 10/31 | |

|

Date of reporting period: | 10/31/07 | |

| | | | | | | | |

Item 1. Reports to Stockholders.

The annual report is attached.

Annual Report

Julius Baer Funds

Julius Baer Global Equity Fund Inc.

Julius Baer International Equity Fund

Julius Baer International Equity Fund II

Julius Baer Total Return Bond Fund

Julius Baer Global High Income Fund

Julius Baer U.S. Microcap Fund

Julius Baer U.S. Smallcap Fund

Julius Baer U.S. Midcap Fund

Julius Baer U.S. Multicap Fund

October 31, 2007

SHAREHOLDERS LETTER October 31, 2007

December 7, 2007

Dear Shareholder

I am pleased to present the Annual Report for the Julius Baer Funds (the "Funds") for the fiscal year ending October 31, 2007 (the "Reporting Period").

While the Reporting Period ended with many major world indices advancing significantly, financial markets faced several major hurdles. The most notable was the subprime mortgage crisis. For the last several years, economists warned that the "housing bubble" was due to burst. Despite these admonishments, homeowners qualified for loans which they ordinarily would not have been granted and in turn, refinanced their properties to fuel further consumer spending. When housing prices began to tumble, many homeowners could not meet the necessary payments. The sharp rise in foreclosures led to a chain reaction of corporate write-offs and bankruptcies. Not surprisingly, the major lending institutions' stock prices were severely punished. As investors attempted to reassess their risk exposure, the fixed income, equity and derivative markets became increasingly volatile.

Fortunately, the Funds did not have any material exposure to subprime investments and weathered the market meltdown. During the Reporting Period, most of our Funds had solid performance results (see each fund's commentary) and all experienced positive cash flows. Investors continued to be attracted to our International Equity Strategy, with strong growth in the Julius Baer International Equity Fund II ("International Equity Fund II") over the Reporting Period. Additionally, our fixed income products gained more traction. The Julius Baer Global High Income Fund ("Global High Income Fund") will soon reach its 5-year track record. For the twelve month period ending October 31, 2007, the Global High Income Fund Class A shares again received a 5-star overall rating from Morningstar out of 454 US domiciled high yield bond funds. The Julius Baer International Equity Fund Class A shares ("International Equity Fund") and Julius Baer Total Return Bond Fund Class A shares ("Total Return Bond Fund") were also rated with a 5-star overall from Morningstar for the same period, out of 571 funds in the foreign large blend funds and 972 funds in the intermediate-term bond funds, respectively. The Morningstar Overall RatingTM for a fund is derived from a weighted average of the performance figures associated with its three-, five- and ten-year (if applicable) Morningstar Ratings metrics, which are based on risk-adjusted performance. Such visibility combined with solid performance helped each fund increase assets significantly over the Reporting Period.

The Funds continue to expand their distribution capacities. In the past, they were available through packaged product platforms such as broker-dealer wrap fee

Julius Baer Funds 2007 Annual Report

1

programs and research models, primarily limiting them to the fee-based financial advisors that use these products. Effective November 1, 2007, we launched a Consultant share class for our global, US equity, and fixed income funds with a higher 12b-1 fee to provide a mechanism for commission-based advisors to create their own asset allocation program for more sophisticated clients. To accommodate some of the small to midsize retirement plans, we also launched an R-share class for the Julius Baer Global Equity Fund Inc. ("Global Equity Fund") and Total Return Bond Fund. The higher 12b-1 fee on this share class is used by plan sponsors to cover administration costs. With the passage of the Pension Protection Act of 2006, there is a significant opportunity to garner assets in the growing defined contribution marketplace. Corporations continue to freeze and close their defined benefit plans, offering employees a 401(k) plan. The provision also al lows employers to automatically enroll their employees and thus dramatically boost plan participation.

Our fund managers reacted to the changing investment landscape by positioning our Funds to be able to invest in both new products and new markets. For example, the Global High Income Fund began investing in bank loans late last year. Over the last several years, the bank loan market has evolved considerably. Bank loans are the most senior element of a firm's capital structure typically secured by the assets of the issuing firm. The use of loans was primarily a defensive tactic that seeks to protect the fund from bankruptcies in a down market; however, the loan market also gives us the ability to gain credit exposure to companies that do not have high yield bonds outstanding. As of the end of the Reporting Period, these instruments represented 19.1% of the Global High Income Fund's net assets.

As I stated in my letter last year, the International Equity Fund, International Equity Fund II and Global Equity Fund increased their potential exposure to emerging markets to 35%. Consequently, we changed each Fund's benchmark to make it more representative of the underlying holdings. The International Equity Fund and the International Equity Fund II now benchmark to MSCI (Morgan Stanley Capital International) ACWI (All Country World Index) ex-US and the Global Equity Fund benchmarks to MSCI ACWI.

In conclusion, I'd like to express our appreciation to you as shareholders for your continued support during these changing times and to wish you and your family a happy and healthy holiday season.

Sincerely,

Tony Williams

President

Julius Baer Funds 2007 Annual Report

2

This material is provided for informational purposes only and does not in any sense constitute a solicitation or offer of the purchase or sale of securities unless preceded or accompanied by a prospectus.

The Julius Baer International Equity Fund Class A shares received 5 stars among 571 foreign large blend funds for the three-year period, 5 stars among 470 funds for the five-year period, 5 stars among 225 funds for the ten-year period and 5 stars among 571 funds for the overall period.

The Julius Baer Total Return Bond Fund Class A shares received 5 stars among 972 intermediate-term bond funds for the three-year period, 5 stars among 828 funds for the five-year period, 4 stars among 409 funds for the ten-year period, and 5 stars among 972 funds for the overall period.

The Julius Baer Global High Income Fund Class A shares received 5 stars among 454 U.S.-domiciled high yield bond funds for the three-year period and 5 stars among 454 U.S.-domiciled high yield bond funds for the overall period.

For each fund with at least a three-year history, Morningstar calculates a Morningstar RatingTM (based on a Morningstar Risk-Adjusted Return measure that accounts for variation in a fund's monthly performance, including the effects of sales charges, loads, and redemption fees), placing more emphasis on downward variations and rewarding consistent performance. The top 10% of funds in each category receive 5 stars, the next 22.5% receive 4 stars, the next 35% receive 3 stars, the next 22.5% receive 2 stars, and the bottom 10% receive 1 star. (Each share class is counted as a fraction of one fund within this scale and rated separately, which may cause slight variations in the distribution percentages.)

© 2007 Morningstar, Inc. All Rights Reserved. The information contained herein: (1) is proprietary to Morningstar; (2) may not be copied or distributed; and (3) is not warranted to be accurate, complete or timely. Neither Morningstar nor its content providers are responsible for any damages or losses arising from any use of this information. Past performance is no guarantee of future results.

Mutual funding investing involves risk; principle loss is possible.

Distributor: Quasar Distributors, LLC (12/07)

Julius Baer Funds 2007 Annual Report

3

MANAGEMENT'S COMMENTARY

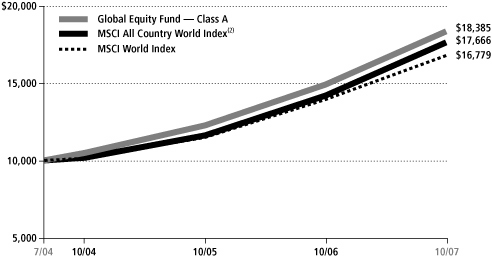

JULIUS BAER GLOBAL EQUITY FUND INC.

2007 Annual Report

On many levels, the fiscal year 2007 was one of extremes. Commodities, led by oil, gold and grain saw some of their largest gains in years, supported by China's continued demand (and no foreseeable cessation) for raw materials. The euro surged against the US dollar and investors flocked to US Treasury issues amid subprime concerns.

Extremes were also apparent across global equities with emerging markets far outpacing returns for developed markets. Asia, led by China, outperformed all other regions and in Latin America, Brazil was notably strong given its commodity orientation. Finally, of the larger developed markets, Japan and the United States underperformed.

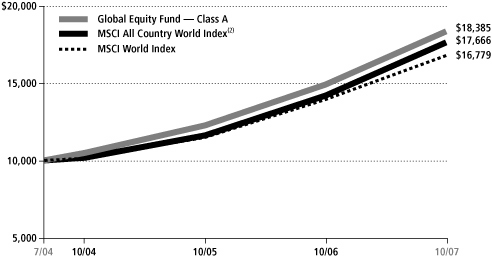

During this twelve month period ending October 31, 2007, the Julius Baer Global Equity Fund Inc. Class A Shares returned 23.02%, versus 24.19% for the MSCI All Country World Index. Effective March 1, 2007, the MSCI All Country World Index replaced the MSCI World Index as the Fund's benchmark. This change coincided with our ability to invest up to 35% of the portfolio in emerging markets.

From a geographic perspective, the Fund benefited from an underweight position to Japanese and US equities. Within Japan, lack of reforms, poor corporate governance and extended valuations leave little incentive to increase exposure. With regard to our stance in the US, we prefer opportunities within Continental Europe and those emerging markets we believe offer more compelling growth potential.

Our underweight to Asia, specifically South Korea, China and Hong Kong detracted from results as did our underweight to commodity-oriented countries such as Canada and Brazil. For some time, we have referred to the global imbalances, including current account and fiscal deficits, which exist today. Overconsumption within Anglo-Saxon countries, mainly the US, was one of the major imbalance concerns and subprime worries provided the global economy's first real stress-test. As these Anglo-Saxon imbalances began to unfold, Asian markets were the primary beneficiaries.

Our positioning in Central and Eastern Europe, including Russia, benefited returns. Economic growth within the region has been driven more by domestic demand than US consumption growth, providing diversification benefits. Our overweight to India also had a positive impact. While economic growth there was equally impressive as China, India offers an industry mix more focused on services than manufacturing, which we believe leaves the country less susceptible to a global slowdown.

Julius Baer Funds 2007 Annual Report

4

Financial services had a positive effect on performance. Several positions held in emerging market banks were particularly strong, including PKO Bank Polski and Bank Polska Kasa Opieki (Poland), Komercni Banka (Czech Republic), State Bank of India warrants and OTP Bank (Hungary). Our decision to underweight major banks in the United States, the United Kingdom and to a lesser degree Japan proved beneficial given fears of the impact of the subprime debacle. This positioning more than made up for poor performance from E*Trade Financial Group (United States) which was caught up in write-downs related to its mortgage-backed securities. Our defensive allocation to cash equivalents during a strong equity environment detracted. Within the energy sector, our underweight in China had a negative effect as did stock selection in Russia and Romania.

Stock selection was positive in the US healthcare sector. We have been particularly interested in companies benefiting from demographic shifts or capitalizing on baby boomers entering retirement age who want to maintain their active lifestyle. Companies involved in orthopedics is one way to tap into this trend; demand for knee and hip replacements, spinal surgeries and other procedures has been growing. ArthroCare Corp., whose medical devices are used to perform closed joint and cosmetic surgeries, was a positive contributor to results. Additionally, Medco Health Solutions Inc., the country's largest prescription benefits manager, was also a strong performer. These positions offset the underperformance of C.R. Bard Inc., the maker of hernia mesh and heart stents.

Weak performance from NII Holdings Inc. (United States), a vendor of mobile-phone service throughout Latin America, led returns from the telecommunications sector to detract. On a positive note, stock selection as well as our overweight to industrials supported performance. Shares of Stericycle Inc. (United States) which provides regulated medical waste management services had solid results. Additionally as part of our interest in transportation infrastructure, Beijing Capital International Airport Co. Ltd. (China) performed well. Finally, our overweight to and stock selection within consumer discretionary stocks detracted. Specifically, shares of Cheesecake Factory and Nordstrom (United States) as well as Melco PBL Entertainment (Macau) Ltd. ADR exhibited negative performance.

Looking ahead, we continue to find compelling opportunities across emerging markets. Specifically, Central and Eastern Europe including Russia remain an important component of the strategy. In addition, we established positions in South Korea and Taiwan which have become more like developed markets, although they are classified as emerging by MSCI.

Strong demand drove commodity-oriented markets such as Brazil, South Africa, Canada and Australia and during the period we increased our exposure. The UK is also underrepresented, especially given our avoidance to the UK banking sector. We still find transportation infrastructure companies, such as airports, compelling

Julius Baer Funds 2007 Annual Report

5

businesses with attractive franchises (restaurants, duty free shops, etc.) amid an increase in global travel and trade. Construction and cement companies are also well positioned given the increase in infrastructure projects. Luxury goods and spirits companies are expected to continue benefiting from emerging market consumer demand.

As we move into the next fiscal year, we remain focused on uncovering opportunities worldwide and managing the unique risks presented by the global equity markets on behalf of our valued shareholders.

Richard Pell

Chief Investment Officer

Past performance does not guarantee future results.

Investing internationally involves additional risks, such as currency fluctuations, social and economic instability, differing securities regulations and accounting standards, limited public information, possible changes in taxation, and periods of illiquidity.

The views expressed solely reflect those of Julius Baer Investment Management LLC ("JBIM") and the managers of the fund, and do not necessarily reflect the views of any affiliated companies. The material contains forward-looking statements regarding the intent, beliefs, or current expectations. Readers are cautioned that such forward-looking statements are not a guarantee of future performance, involve risks and uncertainties, and actual results may differ materially from those statements as a result of various factors. The views expressed are subject to change based on market and other conditions. Furthermore, the opinions expressed do not constitute investment advice or recommendation by the managers, JBIM, the fund, or any affiliated company.

The Morgan Stanley Capital International (MSCI) All Country World Index (ACWI) is a free float adjusted market capitalization index that is designed to measure equity market performance in the global developed and emerging markets.

The MSCI World Index is a market capitalization weighted index composed of companies representative of the market structure of developed market countries in the Americas, Europe/Middle East, and Asia/Pacific Regions.

It is not possible to invest directly in an index.

Please see the Schedule of Investments in this report for complete fund holdings. Fund holdings and/or sector weightings are subject to change at any time and are not recommendations to buy or sell any security mentioned.

Julius Baer Funds 2007 Annual Report

6

MANAGEMENT'S COMMENTARY

JULIUS BAER INTERNATIONAL EQUITY FUND

JULIUS BAER INTERNATIONAL EQUITY FUND II

2007 Annual Report

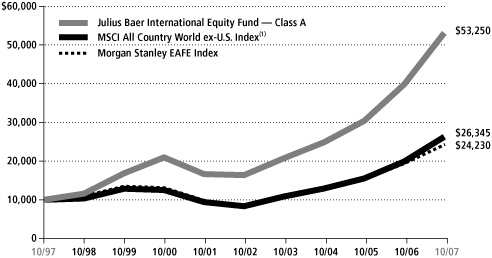

In the middle of this fiscal year, we made a decision to change our benchmark from MSCI (Morgan Stanley Capital International) EAFE (Europe, Australasia, Far East) Index to MSCI ACWI (All Country World Index) (ex-US). Although the difference in the ten-year performance between the two indices is less than 1%, we felt the difference in geographical composition would start to become relevant and the performance would start to diverge in a pronounced manner. The rationale for our move is that MSCI ACWI (ex-US) has substantial exposure to emerging markets (about 18%) and Canada (about 6%) while MSCI EAFE has no exposure to these markets. We believe that these geographic areas can greatly benefit from current US trade policies and the trend in globalization.

Since our benchmark transitioned mid-year, for this report, we will compare our performance to both indices.

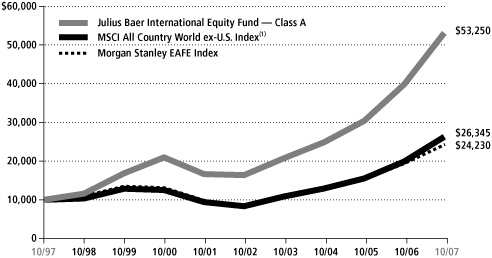

The Julius Baer International Equity Fund (Class A Shares) and Julius Baer International Equity Fund II (Class A Shares) had another strong year, up 33.33% and 30.89% respectively for the one year period ending October 31, 2007. During the same period MSCI EAFE gained 24.91%, MSCI ACWI (ex-US) rose 32.43%.

The current subprime debacle seems another pyrrhic victory for sanity in this age of decadence. It is pyrrhic because, like the tech bubble, it lasted longer than a skeptic could remain sane or solvent; decadence because greed apparently continues to blind many of the essential economic agents in our society.

For several years, we have warned about global imbalances driven mainly by excessive US consumption and Asian over-investment. The Anglo Saxons' voracious appetite to consume and their addiction to spend and borrow against asset prices has disproportionately benefited Asia through increased trade and other countries and regions such as Canada, Australia, Brazil, Russia, Africa, and the Middle East from the resulting increase in commodity prices. China has been winning on two fronts: record trade surplus and strong foreign direct investment. These two engines have caused investment in China to grow at an alarming rate (almost 50% of GDP), planting the seeds for a potential investment bubble whose dimension can only be scaled once the global economy slows down or the Anglo Saxons wake up from their malaise and start mending their errant ways of borrow and spend.

Julius Baer Funds 2007 Annual Report

7

While the first shoe of the global imbalance was being dropped, the second one was feverishly bid up by the decoupling and reflation crowd. On one hand we were rewarded for being underweight domestic Anglo Saxon sectors such as UK retailers and banks. On the other hand, we were punished for being underweight the beneficiaries of that boom: Canadian and Australian currencies dramatically shot up in a very short period; many Asian markets, including Hong Kong, rallied more than 40% between mid-August and the end of October. During that time, the rallying cry was that China's growth would not be impeded by the US slowdown. In addition, the Hong Kong market was overwrought on the prospect of a newly suggested law that may allow Chinese mainlanders to invest in Hong Kong.

In response, a precautionary move, we selectively increased our exposure to Canada, Australia, Hong Kong, South Korea, and Taiwan. This move did not mean we were advocating that Asian economies could decouple. However, in the short-term, given the huge foreign reserves these countries possess and China's continued spending for the summer 2008 Olympics, we acknowledge the region's capability to engineer a delayed coupling, one that could last long enough to make 2007 and even 2008 pyrrhic years for disbelievers.

In Europe, the decoupling theme also dominated. Sectors and companies with high exposure to Asia were strong and resilient. Those with US or even domestic exposure fared poorly. Given our aversion to global trade we did not benefit from that rally.

It was disheartening to witness many European financial companies prove once again that they are the dumping ground for America's toxic waste. While the insurers were caught during the tech bubble (holding debt from the likes of Enron and WorldCom), this time around it was the banks that seemed to rapaciously amass large sums of subprime collateralized debt obligations (CDOs), both on- and off-balance sheet. French and German banks—that we favored for their domestic exposure—negated that advantage by making investments that were not core to their activities. By doing so, they exposed us to an area we sought to avoid, depriving us of what we believed to be a safe-haven status.

In the aftermath of the subprime crisis, Asia became the darling of the hot money looking for a new home. The region's attractiveness seemed to be the positive short-term visibility it provides: record trade surpluses and the potential decoupling from a US slowdown driven by high spending on infrastructure and uninterrupted demand from China. There are also those who expect the recent interest rate cuts in the US to ignite asset reflation in the region. Finally, additional currency gains are possible as pressure for currency revaluation mounts from the US and Europe.

Three major factors contributed to Western Europe's poor performance during the crisis. First, a strong euro hindered the competitiveness and the margins of the export sector. With Asian central banks staunchly defending their currencies from

Julius Baer Funds 2007 Annual Report

8

significant appreciation, the only voting booth open for those who dislike the US dollar is the "euro booth". Second, as mentioned above, many European financial companies were caught in the US subprime mess. Finally, many investors sold European positions to fund their increasing exposure to Asia.

Latin America, Africa, and the Middle East continued to prosper as prices of commodities and oil stayed on an upward trajectory. In addition, trade surpluses, record foreign reserves, and hot money flows put upward pressure on many currencies in these regions.

For similar reasons, the Australian and Canadian dollars staged a rally against the US dollar. Surprisingly, they appreciated approximately 20% against the US dollar this fiscal year. What was also unusual was the drubbing that the US dollar received against third world currencies.

Our underweight in Japan was a positive contributor to performance. During the year, the country's domestic sectors such as banks and consumer related stocks underperformed the exporters, particularly those with significant exposure to Asia and China.

In most global markets, post the subprime crisis, the rally was narrowly focused on Asian decoupling and commodities, while the sell-off centered on the financial sector and the US dollar versus most currencies.

Again this year, actions by corporations, private equity funds, and sovereign wealth funds continued to drive prices of many stocks and sectors: ports, airports and stock exchanges continued to experience interest and bidding from a wide spectrum of investors due to the monopolistic nature of these businesses. Euronext was acquired by the New York Stock Exchange (NYSE) and OMX, the Swedish stock exchange, is scheduled to be taken over by a consortium led by NASDAQ and Bourse Dubai. The consolidation in the Italian banking sector continued as UniCredito Italiano acquired Capitalia and Banca Intesa Sanpaolo bid for Banca Carifirenze. With the recent approach of BHP Billiton to acquire Rio Tinto, the consolidation in the mining sector began to worry the Chinese government. Such a consolidation could mean pricing power for the mines and higher prices for the commodity hungry Chinese economy.

At the company level, we continue to focus on companies that we believe are: exhibiting strong leadership in a growing sector such as FLSmidth, a Danish company that is a global leader in cement plants and a consolidator in the mineral equipment space; undertaking a genuine restructuring such as Siemens in Germany; following a credible growth and expansion strategy such as OTP Bank (Hungary); or a conservative and consistent management sticking to their competence and competitive advantage such as Banca Credem in Italy.

Julius Baer Funds 2007 Annual Report

9

We continue to favor industries that are monopolistic or oligopolistic in nature such as airports, seaports and stock exchanges. We also prefer industries leveraged to infrastructure spending such as mining and cement and are attracted to the positive dynamic in the agriculture industry with exposure to producers of agriculture chemicals such Potash Corp. of Saskatchewan in Canada. In addition, we like the Indian banking sector due to its low relative valuations and high growth opportunities. Russia is expected to be our favorite country next year as it has lagged many emerging markets despite the cheap valuation and the $90 per barrel oil environment.

At the regional level, we feel strongly about Central and Eastern Europe based on our belief that it offers the best risk and reward tradeoff. We believe that if there is a genuine decoupling investment immune to the expected global imbalance adjustment, it is Central and Eastern Europe, whose fortune is mainly driven by its integration into the European Union. However, the region is currently confronted by its own imbalances. Strong, appreciating currencies accompanied by new money flow ignited consumption for imported goods, spiked inflation and eroded competitiveness. In particular, Romania and the three Baltic states need to rein in inflation and trade imbalances. An adjustment is needed and welcome. Although the current imbalances prevented the region from being what we consider a safe-haven this time, we expect it to be resilient when the second shoe of the global imbalance drops, especially if today's local excesses are largely addres sed.

Looking at the big picture, we believe that the process of correcting the imbalances has begun. As a result, we believe that both the Anglo Saxons and the Asian economies will share the pain of adjustment. Hence, unlike consensus thinking, we remain cautious on China and Asia. The most crucial issue is to understand how this global imbalance will end. We coined this period of imbalance the "Age of Decadence", and now make an attempt to share our thoughts and beliefs about its origin, its unfolding, and its implication on investment.

The Age of Decadence

Alan Greenspan, former chairman of the US Federal Reserve Bank (the "Fed"), predicted in a recently authored book that we are about to enter a new world: "The Age of Turbulence". That might very well be true. To survive and succeed in such a world it helps to understand the world we are about to exit. Upon reflection it doesn't take long to realize that we were living for more than two decades in the Age of Decadence. This decadence was so prevalent that everyone from the government down to the regular citizen was an accomplice.

During this period we saw America continually make the wrong decisions, lose its industrial might, damage its national balance sheet, and erode the reserve status of its

Julius Baer Funds 2007 Annual Report

10

currency. We also created structural imbalances and excesses in our economy that led to one bubble then another—the least painful way to contain one bubble is to create another; hence postponing the day of reckoning. In this period, we made useless financiers fly-by-night billionaires, destroyed most American's living standards by depressing their wages and sinking the dollar against most currencies known to man—with few exceptions such as the Zimbabwe dollar. How did we do it?

Decadence started at the top, with the government, and has gone on for more than two decades. The government has, since the early 1980s, rigged the inflation index to artificially depress the cost of living. It has used the flawed method of cash accounting instead of accrual accounting in order to "hide" the albatross of unfunded liabilities and entitlements such as Social Security; spent irresponsibly and accumulated record budget deficits; espoused trade policies responsible for the record deficits; and, damaged to the long-term prospects of the economy—all in an effort to appease the corporate lobby.

The Fed has shirked many of its responsibilities: by allowing asset bubbles to form unfettered; by maintaining ultra-lax monetary policies; by neglecting its regulatory oversight authority; and, by succumbing easily to the faintest political pressure.

The rampant decadence at the top trickled, as expected, all the way to the bottom resulting in two major bubbles while laying the foundation for future ones.

The tech bubble of the 1990's was the first major one. What enabled that bubble to form and fester was the contribution from the referees, the intermediaries and the players to the fertile background laid in by the government. The Financial Accounting Standards Board (FASB), under pressure from the US Congress, allowed firms to omit the cost of stock options in their earnings, thereby encouraging manipulation of earnings. Its abuse was a major enabler for the first bubble. Research analysts invented heretic valuation metrics to justify buying those stocks at any price and later some were accused of fraud. Accounting firms let conflicts of interest cloud their judgment, provided suspect audits and in some cases aided the fraud. Corporations were accused of malfeasance, aggressive accounting, abuse of tax loopholes and fraud. Financial entities were found guilty of market timing and predatory pricing. Even the regular citizen was guilty as his internet day-trading fad, leverage, and momentum investing took the mania to extreme.

The second bubble in real estate (especially in the subprime segment) started as soon as the tech bubble began to deflate. Again it was aided by top to bottom decadence, but through different agents. One agent included the Fed, which pursued an ultra-easy monetary policy. Rating agencies are also being accused of conflicts of interest and rendering suspect opinion on many of the structured products created. Appraisers are being sued by state attorneys for inflating home values. Loan originators

Julius Baer Funds 2007 Annual Report

11

are being accused of setting weak standards and for pressuring appraisers. Financial innovation was found to be nothing but a mix of concoction, hallucination, and heresy. Banks shocked the market with their lack of risk management, especially in the way the CDO exposure sneaked off balance sheet. Unregulated funds through their opacity and leverage also added to the confusion and the damage. Finally, the individual was a main agent by willingly filling these "liar loans".

Unfortunately, there is no Mother Theresa among us. We were decadent from top to bottom.

The Cardinal Sin: Believing in Santa Claus

If there were one cardinal sin to point to as the main enabler of the Age of Decadence, it would be the overhauling of the inflation index. The high inflation environment from the late 1970s to early 1980s created a vicious cycle for the Federal government because entitlement benefits were indexed to the inflation rate. High inflation led to higher entitlement costs and bigger government deficits.

One way to lower the entitlements was to bring inflation rates down, translating into lower cost of living adjustments (COLA). Instead of inflicting the pain to bring down the inflation rate, the government chose to alter the way it measured inflation, bringing the index artificially down. It replaced house prices with owners' equivalent rent (OER), introduced the concept of product substitution; and reduced prices of goods for quality improvements. Under these rules, the new inflation index was consistently below the old one. For example, under the old method, inflation during the past ten years would have ranged between 8% and 10% while under the new method it ranged between 2% and 4%.

While the artificially low inflation reading aided our fiscal situation, it inflicted fatal blows to our economic policies. With the new index understating inflation by approximately 4%-6% during the past decade, the Fed set interest rates too low and helped create the mirage of high real growth and low inflation which led credence to the theories of "the productivity miracle" and "paradigm shift".

However, history has taught us that the only miracle that comes from easy monetary policies is a bubble in asset prices. Had the inflation methodology been kept intact, inflation readings would have been 4%-6% higher and interest rates would have been correspondingly higher. In such an environment, we would have grown slower during the boom but we would have avoided the bubbles and the ensuing bust. Like the tortoise, we would have beaten the hare through the full economic (boom/bust) cycle.

Julius Baer Funds 2007 Annual Report

12

Directly targeting asset prices has always been political suicide for the Fed. The old inflation index—since it included asset prices—would have allowed the Fed to fight asset bubbles while only targeting inflation.

In short, the government (the parents) invented Santa Claus in order to cheer up pensioners and laborers (the children) who were worried about their parent's ability to pay for their entitlements (gifts). The whole family was happy with Santa Claus. The children were happy with the yearly gifts and parents were satisfied that their children were buying the fairly tale and able to rein in spending. But as in real life, it is a blessing only when children believe in Santa Claus and a tragedy when parents do!

The Fed now conducts its policies based on the new method, ignoring many obvious signs: the 8%-10% reading from the old method, the tech bubble, record trade deficits, record budget deficits, free falling US dollars, skyrocketing commodities, subprime bubble, housing bubble, etc... What a tragedy indeed!

"Turbulence" Ahead But Is It with More Decadence or Do We Experience Renaissance?

The case for renaissance would be based on the assumptions of the government adopting accrual accounting, balance the budget, releasing honest inflation figures, espousing sound trade policies, and curtailing lobbies' influence. It also entails having an independent and proactive Fed that fights inflation and asset bubbles, punishes risky behavior, and resists political pressure.

The probability, therefore, of renaissance is almost zero.

Hence, we anticipate more decadence emboldened by the following rationales:

1. We can't turn back the clock on innovation and globalization. The status quo seems to equate excessive leverage with innovation, trade deficits with globalization, and trade balance with protectionism.

2. We are better off being third in a fast growing world than being first in a slow growing one. Wealth is relative not an absolute. If I have one million dollars but everyone else has one billion then I must be a poor man. In our "fast growing world" the only ones who are better off are Wall Street and multinationals who are "the opium pushers" into the US economy.

3. Our policies are eradicating poverty around the world. This is akin to a surgeon boasting to a dead patient's parents that the surgery was extremely successful, because the donated organs will save many lives.

Julius Baer Funds 2007 Annual Report

13

4. Blame it on foreign exchange. The proponents of the status quo should continue to divert attention towards foreign exchange (FX) levels as the main culprit to our imbalance. It is the perfect decoy. By the time we figure out that the FX rate is no panacea to our ills, it might be too late to reverse course.

Hence, one should expect more turbulence and bubbles in the new age. We expect the ultimate winners to be real assets, commodities, emerging markets, and equities in general, and the big losers to be fiat currencies: money and bonds.

Rudolph-Riad Younes, CFA

International Equity Fund and International Equity Fund II Portfolio Manager

Past performance does not guarantee future results.

Investing internationally involves additional risks, such as currency fluctuations, social and economic instability, differing securities regulations and accounting standards, limited public information, possible changes in taxation, and periods of illiquidity.

The views expressed solely reflect those of Julius Baer Investment Management LLC ("JBIM") and the managers of the fund, and do not necessarily reflect the views of any affiliated companies. The material contains forward-looking statements regarding the intent, beliefs, or current expectations. Readers are cautioned that such forward-looking statements are not a guarantee of future performance, involve risks and uncertainties, and actual results may differ materially from those statements as a result of various factors. The views expressed are subject to change based on market and other conditions. Furthermore, the opinions expressed do not constitute investment advice or recommendation by the managers, JBIM, the fund, or any affiliated company.

The MSCI ACWI (ex-US) is a free float-adjusted market capitalization index that is designed to measure equity market performance in the global developed and emerging markets excluding the US.

The MSCI EAFE Index is an unmanaged list of equity securities from Europe, Australasia, and the Far East with all values expressed in U.S. dollars.

It is not possible to invest directly in an index or average.

Please see the Schedule of Investments in this report for complete fund holdings. Fund holdings and/or sector weightings are subject to change at any time and are not recommendations to buy or sell any security mentioned.

Julius Baer Funds 2007 Annual Report

14

MANAGEMENT'S COMMENTARY

JULIUS BAER TOTAL RETURN BOND FUND

2007 Annual Report

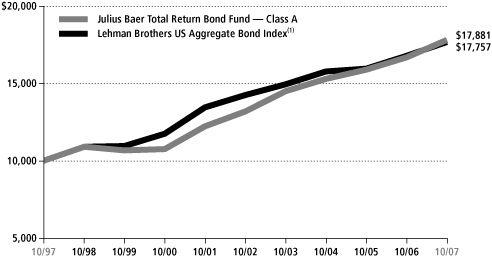

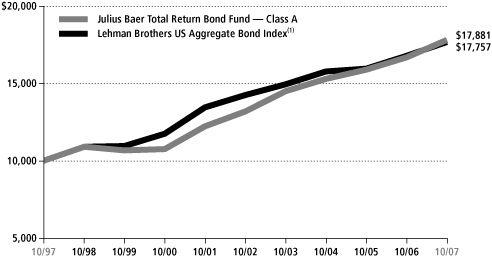

The Julius Baer Total Return Bond Fund Class A Shares (the "Fund") returned 6.75% for the 12 months ending October 31, 2007, outperforming its benchmark, the Lehman Brothers Aggregate Bond Index, which returned 5.38%.

A major source of the Fund's outperformance was our currency positioning. Our belief for most of the period was that the US dollar was in a long-term bear market. In the first few weeks of January 2007, the US dollar experienced a strong rally and it took until the end of March for the Fund's performance to overtake the index. All but one month since that time saw currency positioning contribute to outperformance. August was the exception, when the subprime mortgage driven credit crunch hit financial markets hard. Though we reduced risk before the liquidity crises emerged, it was not enough. Currencies that worked well over the twelve months included the Australian dollar, the euro and the Brazilian real while the Mexican peso was the largest detractor (especially in January).

For much of the fiscal year, the Fund was positioned to spend its duration budget in the US and away from most international markets. Our belief was that many international economies were in better condition than the US. While that is usually a good reason to like a country's currency, it's also likely to result in rates moving higher, which is bad for bondholders.

Of the few international bonds the Fund held during the period, a position in Mexican Bonos was the best performer. In the second calendar quarter of 2007, as rates around the world were rising, Mexican Bonos yields were moving down. One driver of this reduction in yield was a surge in investor optimism due to political cooperation after a contentious election and poor governmental relations between parties during the previous administration. Another contributing factor was a drop in inflation and inflationary expectations. The gain that resulted from this drop in yield was more than enough to offset the currency loss and led to Mexico's overall positive contribution. The Fund's position in a Romanian treasury bill also contributed to performance.

Within the US market, our interest rate positioning detracted from performance, particularly in July and August. When financial markets started to struggle with the liquidity crises, the Fund was positioned for interest rates to continue to increase. However, as yields dropped and markets began to freeze up, our repositioning did not occur fast enough.

Julius Baer Funds 2007 Annual Report

15

Within the spread sectors, our strategy to underweight US corporate bonds contributed most to outperformance. This positioning was based on the belief that corporate spreads were too tight and given the active leveraged buyout (LBO) market, we could achieve better risk-adjusted returns in other sectors. That stance paid off after the credit crunch unfolded in August and corporate bonds significantly underperformed. We used this spread widening to increase our positioning in the sector and anticipate we will continue to do so in an opportunistic manner.

Outlook

Looking forward, we anticipate the US dollar (USD) will remain in a long-term bear market. Our rationale includes the nation's huge current account deficit, considerable foreign participation in US financial markets, and a dampening in the economic growth advantage that the US enjoyed over the last two decades. It may take several years for such headwinds to USD performance to be resolved. Nonetheless, it is also possible for the USD to undergo a bear market rally that could last two or three quarters. Ultimately, we believe that the USD needs to fall more for the imbalances in the US economy to correct.

One currency that we like is the euro. Even though it is sitting close to its all-time high versus the USD, its importance as a credible replacement to the USD—as the reserve currency of the world—should encourage bidding by market participants as long as the economy of the eurozone keeps growing.

We also favor emerging market currencies because: a majority of them now float freely; fiscal and monetary policies in most emerging market countries are now more credible; and economic growth is likely to be markedly higher than in the developed world. However, we will continue to monitor changes in the political environment and market sentiment for emerging economies, as these countries and their currencies can pose more challenging risks than developed nations.

At the same time, we do not consider international sovereign bonds to be compelling investments. With most of the global economy growing at a decent pace, we think that foreign interest rates are more likely to increase than those in the US or that rates in the US will fall more than those abroad. Hence, our exposure to foreign government bonds is mild.

We do not have a strong opinion on the direction of US interest rates over the near-term. A reasonable case can be made for rates moving higher as well as lower. Given that level of uncertainty, we do not believe it is constructive to have a large duration position versus the benchmark. The yield curve is another matter. We believe that over the next several months the curve will steepen. With the Fed likely to ease interest rates a few more times over the next year, we think that short-term rates

Julius Baer Funds 2007 Annual Report

16

will trend lower. At the long end of the yield curve, inflation and inflationary expectations exert greater influence. With global growth likely to remain strong, we expect some inflationary pressure in the US over the next year, mostly due to higher commodity prices leading to higher prices throughout the economy. Therefore, it is more probable for interest rates at the short end of the yield curve to go down more or up less than rates at the long end of the curve.

In the domestic spread sectors, after being underweight corporate bonds for almost the entire fiscal year, we built-up our position after the increase in yield spreads that took place during the August and September credit crunch. At this time, we believe there is still value in corporate bonds. However, we continue to be cautious amid investor concern that many financial institutions have not fully disclosed their participation in the various beleaguered housing-related markets. One encouraging facet in the leveraged loan market is the lack of liquidity, because it is less likely that a corporate bond's value will implode due to a leveraged buyout.

Of the structured products in fixed income markets, we favor mortgage-backed securities (MBS) that have either a high coupon or a low one. A MBS with a high coupon—a premium bond—trades at a higher price than a current coupon bond. The price for a high coupon MBS will not rise as much as it would if it were a corporate or treasury bond, given that the prospect of the homeowner prepaying early by refinancing is high. Yet in the current housing market, we do not think premium bonds will experience prepayments at the same level that might have transpired a few years ago. Consequently, we expect these higher coupon bonds to pay higher yields than what the market presumes. At the same time, we also favor lower coupon bonds, as they should perform well if interest rates drop over the next few quarters.

Within the commercial mortgage-backed securities (CMBS) market, we continue to prefer the super senior structures. Despite a widening in spreads over the last few months, we believe that investors are still not correctly pricing these bonds versus the poorly structured bonds that are also available in the market. As such, we expect to continue choosing these securities until the market addresses the pricing discrepancy.

Donald Quigley

Total Return Bond Fund Portfolio Manager

Past performance does not guarantee future results.

Investments in debt securities typically decrease in value when interest rates rise. This risk is usually greater for longer term debt securities. Investing

Julius Baer Funds 2007 Annual Report

17

internationally involves additional risks, such as currency fluctuations, social and economic instability, differing securities regulations and accounting standards, limited public information, possible changes in taxation, and periods of illiquidity.

Investments in Asset Backed and Mortgage Backed Securities include additional risks that investors should be aware of such as credit risk, prepayment risk, possible illiquidity and default, as well as increased susceptibility to adverse economic developments.

The views expressed solely reflect those of Julius Baer Investment Management LLC ("JBIM") and the managers of the fund, and do not necessarily reflect the views of any affiliated companies. The material contains forward-looking statements regarding the intent, beliefs, or current expectations. Readers are cautioned that such forward-looking statements are not a guarantee of future performance, involve risks and uncertainties, and actual results may differ materially from those statements as a result of various factors. The views expressed are subject to change based on market and other conditions. Furthermore, the opinions expressed do not constitute investment advice or recommendation by the managers, JBIM, the fund, or any affiliated company.

The Lehman Brothers US Aggregate Bond Index is a benchmark index composed of US securities in Treasury, Government-Related, Corporate, and Securitized sectors. It includes securities that are of investment-grade quality or better, have at least one year to maturity, and have an outstanding par value of at least $250 million. It is not possible to invest directly in an index or average.

A basis point is a unit of measure equal to 1/100th of 1%.

Please see the Schedule of Investments in this report for complete fund holdings. Fund holdings and/or sector weightings are subject to change at any time and are not recommendations to buy or sell any security mentioned.

Julius Baer Funds 2007 Annual Report

18

MANAGEMENT'S COMMENTARY

JULIUS BAER GLOBAL HIGH INCOME FUND

2007 Annual Report

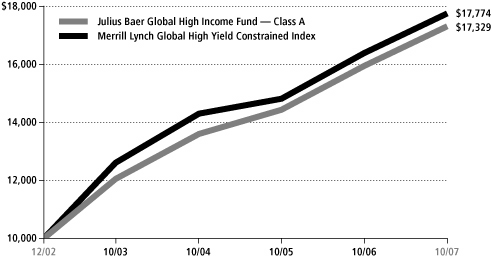

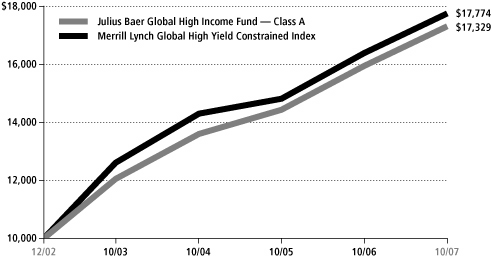

For the twelve months ending October 31, 2007, the Julius Baer Global High Income Fund (Class A Shares) rose 8.58%, beating its benchmark, the Merrill Lynch Global High Yield Constrained Index (in US dollars [USD]) which returned 8.33%.

These returns masked two divergent periods within the fiscal year. During the first eight months (through June 2007), global markets experienced robust performance, capping five years of generally improving prices. This was driven by a healthy global economy centered on GDP (Gross Domestic Product) growth in some of the largest emerging markets, strength in US consumer demand, rising corporate earnings, and ample liquidity. In addition, yield spreads over comparable treasuries for our benchmark declined from 3.17% to 2.87% in a generally benign interest rate environment, leading to total returns in USD terms of 6.36%.

However, beginning in the early summer, the persistent declines in US residential real estate prices and sales activity began manifesting itself in rising delinquency rates among subprime mortgage borrowers. Falling housing prices and rising subprime mortgage delinquencies caused several concerns among investors. First, there were (and still are) fears that weakness in this sector would spread to the rest of the US economy via its impact on the consumers' ability to continue spending. Second, there were concerns that the subprime mortgage market excesses would repeat in related markets, including high yield corporate securities which comprise the bulk of the Fund's investments. Finally, beginning in late summer and early fall, the rapidly accelerating decline in the value of subprime debt and related collateralized debt obligations (CDOs) forced many financial institutions to announce substantial write-downs. Banks became less willing to len d to each other in the money markets out of concern over what the actual subprime debt exposure of their counterparties might be as well as a desire to guard their own liquidity.

Beginning in August, the major developed country central banks repeatedly injected reserves into the financial system, including the US Federal Reserve which also cut their benchmark interest rate by fifty basis points on September 18. These actions on the part of policy makers helped stabilize the markets in late September and October, but, by the end of October there was still a great deal of uncertainty and volatility persisted.

During the final four months of the fiscal year, this economic and market backdrop was exacerbated within the high yield bond market by an historically unprecedented surge in the new issuance pipeline. In the highly confident period leading

Julius Baer Funds 2007 Annual Report

19

up to the summer, many investment banks made large, multi-billion dollar commitments to finance increasingly bigger transactions, most of which were leveraged buy-outs of public and private companies by private equity firms. In our opinion, this over-extension on the part of underwriters is one of the few attributes the subprime and high yield markets share. However, in terms of market structure, diversification, research and pricing practices, we believe the two have far more differences than similarities.

During these final four more challenging months, the US treasury yield curve declined substantially in yield, from 4.92% to 4.17% on the a five year bond, as investors sought the comparative safety of government bonds. In the opposite reaction, yields on high yield bonds expanded from 7.81% to 8.49%. Thus, the spread of high yield bonds to the benchmark treasury widened from the end of June's 2.89% to 4.32% at the end of October. The price depreciation implied by these moves was partially offset by coupon income such that the index total return for these final four months was still a positive, though meager, 1.84%.

Most credit markets followed similar patterns during the twelve month period, exhibiting tightening yield margins over riskless benchmarks and good total returns until June then widening for the final four months and showing considerably lower, though still positive, total returns. Leveraged loan markets moved along with the high yield bond market but turned in better returns for the latter four months of the period. Leveraged loans share some similarities to high yield bonds but differ in several respects, most importantly, they generally carry a more senior claim on assets.

Many non-US markets, whether dollar denominated or not, exhibited less volatility than the US market and turned in significantly better total returns. Emerging market sovereign bonds issued in hard currencies were especially strong, reflecting the issuers improved credit quality since the markets last went through a serious downturn. The local currency markets of emerging countries also performed considerably better than US high yield, both on a local currency and USD basis. The European high yield market, though less volatile, turned in lower returns in local currency terms, as benchmark European government interest rates were rising for much of the period, causing an underlying price erosion. For unhedged dollar investors, however, European high yield still outperformed its US counterpart as the effect of appreciating European currencies against the US dollar offset interest rate and credit related local price declines.

The Fund's performance was aided by several factors, all of which we believe are grounded in our more diversified, global approach to this asset class. First, beginning early in the period, we migrated the portfolio from close to 0% loans to 14% at the end of June. These securities were more defensive in nature and aided

Julius Baer Funds 2007 Annual Report

20

performance during the more difficult final four months. We executed this change out of relative value considerations, not because we necessarily predicted the turbulence of the June through October period. Second, our continued positioning in local emerging market sovereign debt, which performed better than US high yield debt, helped relative returns, even though our holdings in these markets never exceeded 9% of the portfolio. Finally, and again for relative value reasons, we gradually improved the credit quality of the portfolio between late 2006 and the summer of 2007. We accomplished this by selling out of some bonds whose issuers were particularly highly leveraged or vulnerable from an industry standpoint.

These positive contributions were somewhat offset by other factors. First, partly because of our loan position, the portfolio carried a significantly lower duration for much of the period. As investors sought the safety of government bonds beginning in July and interest rates declined precipitously, this lower duration hurt relative performance. Secondly, although issue selection was positive, there were some specific issues that detracted.

As the Fund enters its sixth fiscal year, high yield securities are generally at the highest yield and exhibit the highest premium over treasuries since late 2003. There are many uncertainties in the global economy and financial markets. However, we believe that current levels on high yield securities discount all but the direst scenarios. For the first time in many years the "premium" is back into the risk premia and investors are being paid to take risks, provided they take a longer-term view, greater than the next month or the next few quarters. There is no guarantee that these yields will ultimately prove high enough to compensate for what the future may bring, but we believe our more diversified approach, combined with our investment discipline, should continue to help us navigate these markets successfully.

Greg Hopper

Global High Income Fund Portfolio Manager

Past performance does not guarantee future results.

The securities in which the Fund will invest may be considered more speculative in nature and are sometimes known as "junk bonds." These securities tend to offer higher yields than higher rated securities fixed income securities can present a greater risk of loss of income and principal than higher rated securities. Investing internationally involves additional risks, such as currency fluctuations, social and economic instability, differing securities

Julius Baer Funds 2007 Annual Report

21

regulations and accounting standards, limited public information, possible changes in taxation, and periods of illiquidity.

Investments in Asset Backed Securities include additional risks that investors should be aware of such as credit risk, prepayment risk, possible illiquidity and default, as well as increased susceptibility to adverse economic developments.

The views expressed solely reflect those of Julius Baer Investment Management LLC ("JBIM") and the managers of the fund, and do not necessarily reflect the views of any affiliated companies. The material contains forward-looking statements regarding the intent, beliefs, or current expectations. Readers are cautioned that such forward-looking statements are not a guarantee of future performance, involve risks and uncertainties, and actual results may differ materially from those statements as a result of various factors. The views expressed are subject to change based on market and other conditions. Furthermore, the opinions expressed do not constitute investment advice or recommendation by the managers, JBIM, the fund, or any affiliated company.

The Merrill Lynch Global High Yield Constrained Index tracks the performance of below investment grade bonds of corporate issuers domiciled in countries having an investment grade foreign currency long term debt rating (based on a composite of Moody's and S&P). The index is weighted by outstanding issuance, but constrained such that the percentage that any one issuer may not represent more than 3% of the index. It is not possible to invest in an index.

A basis point is a unit of measure equal to 1/100th of 1%.

Please see the Schedule of Investments in this report for complete fund holdings. Fund holdings and/or sector weightings are subject to change at any time and are not recommendations to buy or sell any security mentioned.

Julius Baer Funds 2007 Annual Report

22

MANAGEMENT'S COMMENTARY

JULIUS BAER U.S. MICROCAP FUND

JULIUS BAER U.S. SMALLCAP FUND

JULIUS BAER U.S. MIDCAP FUND

JULIUS BAER U.S. MULTICAP FUND

2007 Annual Report

Equity Market Commentary

The twelve months ended October 31, 2007 was characterized by the return of share price volatility. It's difficult to recall a period with so many twists and turns led by repeating bouts of optimism and pessimism. Investors had many challenges to overcome throughout the year including the ongoing military effort in and around Iraq; a significant deterioration in the U.S. housing market in terms of oversupply and reduced purchases; the falling U.S. dollar; subprime credit concerns that paralyzed credit markets resulting in a sharp slowdown in merger and acquisition activity as well as surprisingly large financial sector write-downs; and, lower consumer spending growth rates toward the end of the year.

Despite these challenges, the U.S equity market saw a favorable environment in terms of capital formation underscored by a vibrant initial public offering market, decent job growth and manageable inflation levels. Performance leaders were dominated by the energy and materials sectors, which benefited from positive global demand. These two sectors led across the market capitalization spectrum, topping the Russell 2000 Index as well as the S&P 500 Index.

The past fiscal year saw small cap stocks cede leadership to their large counterparts for the first time since 2000 with the S&P 500 posting a gain of 14.56%, outpacing the Russell 2000's return of 9.29%. Earnings growth rates fell across the board during the period, but the rate of decline was greater for smaller companies. Sectors that lagged were financial services, the only sector that posted an absolute decline during the year, and consumer discretionary.

Portfolio Strategy and Investment Focus Areas

We manage concentrated portfolios and diversify our investment positions across multiple sectors. We believe our value added is from thoroughly researching and selecting stocks that seek to outperform the broader market. Our goal is to identify emerging growth companies and turn-around situations early on. Our dedicated analyst team has unique sector responsibilities which allow them to become experts of their respective sector's industries and individual companies.

Julius Baer Funds 2007 Annual Report

23

In terms of strategy, we are not interested in constructing portfolios that satisfy a certain style box category, i.e. smallcap growth—our goal is for each fund to outperform the U.S. market and all the various style boxes over a complete market cycle. We believe style investing limits a portfolio team to a narrower investment universe and prohibits any significant participation in anticipatory shifts in the markets' proclivity for certain types of risks or exposure. Our sector weights incorporate macroeconomic as well as fundamental, company-specific analysis. While we normally have fairly even representation across all sectors, from time-to-time we consciously overweight or underweight sectors. Nevertheless, sector allocation is generally a smaller, secondary factor with regard to our r elative returns—stock selection is the most important.

As the year progressed, we increased exposure to the technology sector, reflecting a favorable corporate spending environment and solid purchasing power based on many companies' record cash levels as a percentage of assets. As credit markets came under pressure during the summer, we reduced our weighting in the financial services sector and added to our industrials exposure. We felt it was difficult to assess the potential risks and exposure by many financial companies and the market would re-price the risk to reflect this uncertainty in the form of lower price-to-earnings and price-to-book multiple valuations. A second and more obvious indicator was falling loan demand due to a weakening housing market—diminished demand for mortgages was due to buyers not stepping up to purchase because home prices were declining. In summary, most banks were writing fewer loans, while at the same time, a small but increasing number of loans on their bo oks were becoming delinquent—both factors adversely impacting earnings prospects. As we ended the fiscal year, we had overweight positions in the consumer discretionary sector and small underweight positions in the energy and materials sectors. We also were overweight the healthcare sector based on the fact that we like the long-term demographic theme of aging and the demand it will create for healthcare and financial services such as aesthetics and asset management. Late in the period, we began to selectively add to our financial services exposure.

Julius Baer U.S. Microcap Fund

For the period of November 1, 2006 through October 31, 2007 the Julius Baer U.S. Microcap Fund (Class A Shares) returned 12.43%, ahead of its benchmark, the Russell 2000 Index, return of 9.29% as well as the Russell Microcap Index gain of 5.05%.

Outperformance versus the Russell 2000 and Russell Microcap Indexes was driven by our stock selection. In particular, consumer staples and healthcare holdings did well, more than offsetting unfavorable relative stock results in the technology and financial services sectors. Our best contributors to returns included Green

Julius Baer Funds 2007 Annual Report

24

Mountain Coffee Roasters, Abaxis Inc. and Measurement Specialties, Inc.; the largest detractors included Jones Soda Co., Evercore Partners, Inc. and Seacoast Banking Corp. of Florida. Our sector positioning had a modest negative impact. The Fund finished the fiscal year overweight in the consumer discretionary and healthcare sectors and underweight in the financial services and industrials sectors.

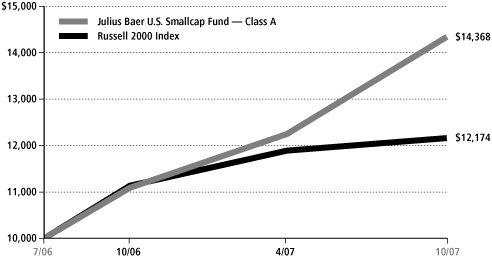

Julius Baer U.S. Smallcap Fund

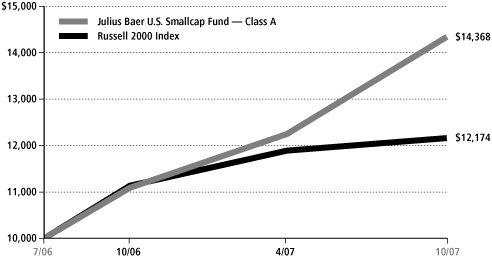

For the fiscal year ended October 31, 2007, the Julius Baer U.S. Smallcap Fund (Class A Shares) returned 29.44%, surpassing the Russell 2000 Index return of 9.29%.

The Fund's relative outperformance can be attributed to strong results within the consumer discretionary and technology sectors, which more than offset weak performance within the materials and financial services sectors. Our best contributors to returns included Chipotle Mexican Grill, Inc., Morningstar, Inc. and Ventana Medical Systems Inc.; the largest detractors included Palomar Medical Technologies Inc., Privatebancorp Inc. and Evercore Partners Inc. Our sector positioning had a modest negative impact. The Fund ended the period under review overweight in the technology, consumer discretionary and consumer staples sectors and underweight in the industrials and financial services sectors.

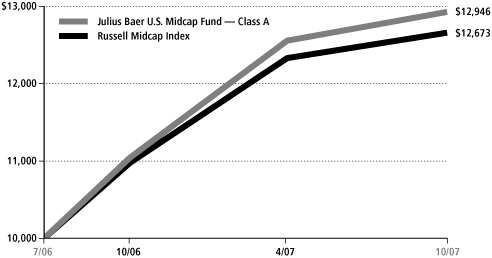

Julius Baer U.S. Midcap Fund

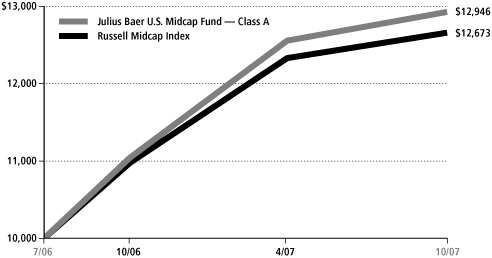

The Julius Baer U.S. Midcap Fund (Class A Shares) returned 17.16%, above the Russell Midcap Index return of 15.37%, for the twelve months ending October 31, 2007.

Outperformance versus the Russell Midcap benchmark was driven by stock selection, particularly our technology, consumer discretionary and healthcare holdings. This more than offset unfavorable results in the materials, energy and financial services sectors. Our largest contributors included VMware Inc., Express Scripts, Inc. and Wynn Resorts Ltd. while the largest detractors included E*TRADE Financial Corp., Qlogic Inc. and Melco PBL Entertainment Ltd. Our sector positioning had a relatively large negative effect, mainly due to low representation of materials, energy and utilities holdings in the portfolio. At the end of the fiscal year, the Fund was overweight the technology and healthcare sectors and underweight the financial services and utilities sectors.

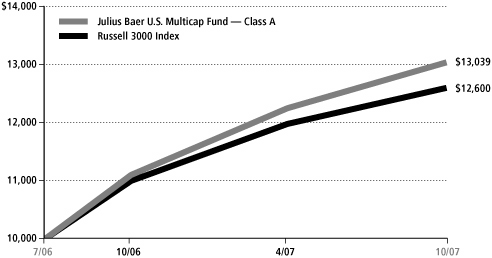

Julius Baer U.S. Multicap Fund

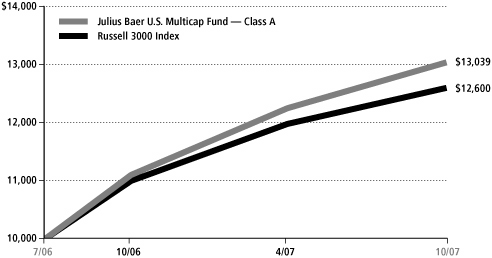

For the period of November 1, 2007 to October 31, 2007 the Julius Baer U.S. Multicap Fund (Class A Shares) returned 17.47%, ahead of the Russell 3000 Index's return of 14.59%.

Julius Baer Funds 2007 Annual Report

25

Relative outperformance versus the Russell 3000 benchmark was driven by stock selection, an overweight technology sector position and an underweight financial services sector position. In particular, our technology and healthcare sector holdings did well, more than offsetting unfavorable stock performance in the materials and consumer discretionary sectors. Our best contributors to returns included Apple Inc., VMware Inc. and ArthroCare Inc. while the largest detractors included E*TRADE Financial Corp., Qlogic, Inc. and Akamai Technologies Inc. Overall sector positioning had a positive impact to annual performance and the Fund finished the fiscal year overweight the technology and healthcare sectors and underweight the energy and consumer staples sectors.

Outlook

Shortly after the end of the fiscal year, fears of a potential U.S. recession intensified. Questions about how the continued soft housing market and hard-to-quantify exposure financial institutions had to subprime loans via lending or investments and SIVs (structured investment vehicles) may spill over and impact "Main Street" were a concern. The falling value of U.S. dollar versus other major world currencies was also on people's mind because it erodes purchasing power. However, the tradeoff is that U.S. exports are competitively priced in the market place, satisfying strong demand from Europe, China and India. While much was written about investment opportunities in China, I offer one simple thought: it is estimated that the number of middle class Chinese will soon be six-to-eight times larger than the U.S. While a Western influence on their economy is readily apparent by the success of some largecap, multinational companies that invested early there, the long-term opportunity is probably much greater.

From a short-term perspective, we believe that U.S. economic growth will slow in the coming year due to the leverage effect that consumer spending has on U.S. gross domestic product. Since the end of World War II, consumer spending remained fairly steady, between 60% and 65% of gross domestic product (GDP). The combination of low interest rates and easy credit likely caused consumer spending to peak at over 70% of GDP in the last few years. However, housing price declines slowed the rate of housing turnover and associated spending. In addition, rising default rates and greater credit losses should result in higher lending standards, ultimately reducing the pool of potential borrowers and the aggregate demand for mortgages. One of our major concerns is the health of the job market. Any protracted economic slowdown may slow job creation and increase the unemployment rate, both of which could negatively impact consumer confidence and hurt consu mer spending. If consumer spending slows for several quarters, investment or capital spending by businesses will likely decline in the future, resulting in a one-two punch to domestic economic

Julius Baer Funds 2007 Annual Report

26

growth. While we feel the strong housing and related industries helped our economy in terms of incremental growth during the early part of this decade, we believe the pendulum is swinging back and they will be a drag on our economy until 2009.

For 2008, a potentially slower economy and uncertainty regarding the outcome of the presidential election should create an interesting investment backdrop. Presidential elections generally create questions around the potential for change to tax and healthcare policies, so our goal is to be prepared to capitalize on any opportunities that surface. Our mantra is to be early in uncovering and investing in companies that we believe will improve their operating results and/or grow their sales and earnings in good or bad economic times. While a slowing economy will almost certainly reduce investor confidence, we do our best to capitalize where and when we see opportunities. Over the years, we learned that investors overreact with both optimism and pessimism, especially around inflection and/or turning points that have some substantive impact to the economy. A relevant, current example may be housing, financial services and consumer discretionary s tocks. All three benefited greatly during the favorable upswing in the housing market in the early part of this decade but struggled this year. We feel the pessimism may be close to a climax, so we are investigating these and other opportunities as we write this.

We take some solace in knowing that historically, the economy grows approximately 85% of the time and is in recession the remaining 15%. There have been twelve recessions since the Great Depression, with an average duration of 10.4 months. The average expansion period since World War II, including the current one, has lasted 58.3 months. As we construct our portfolios, we strongly believe that the most successful businesses are ones that create products and services that change the habits of consumers and business spenders, irrespective of the economy. Many of these companies will be smaller in size with the ability to prosper and outperform irrespective of the headwinds that develop in every economic cycle.

It is our duty to shareholders to capitalize on the opportunities that will undoubtedly present themselves as we reconcile the U.S. and global economic crosscurrents and we consider it a privilege to act as your Fund manager.

Samuel Dedio

U.S. Microcap Fund, U.S. Smallcap Fund, U.S. Midcap Fund and U.S. Multicap Fund Portfolio Manager

Julius Baer Funds 2007 Annual Report

27

Past performance does not guarantee future results.

Please refer to the prospectus for more complete information on the special risks associated with investing in the Julius Baer U.S. Equity Funds, including, but not limited to: stock market risk, smaller companies risk, liquidity risk, foreign investment risk, derivatives risk.

The views expressed solely reflect those of Julius Baer Investment Management LLC ("JBIM") and the managers of the fund, and do not necessarily reflect the views of any affiliated companies. The material contains forward-looking statements regarding the intent, beliefs, or current expectations. Readers are cautioned that such forward-looking statements are not a guarantee of future performance, involve risks and uncertainties, and actual results may differ materially from those statements as a result of various factors. The views expressed are subject to change based on market and other conditions. Furthermore, the opinions expressed do not constitute investment advice or recommendation by the managers, JBIM, the fund, or any affiliated company.

Please see the Schedule of Investments in this report for complete fund holdings. Fund holdings and/or sector weightings are subject to change at any time and are not recommendations to buy or sell any security mentioned.

The Russell 3000 Index measures the performance of the 3,000 largest U.S. companies based on total market capitalization, which represents approximately 98% of the investable U.S. equity market, with all values expressed in U.S. dollars.

The Russell Midcap Index measures the performance of the 800 smallest companies in the Russell 1000 Index, which represent approximately 25% of the total market capitalization of the Russell 1000 Index, with all values expressed in U.S. dollars.

The Russell 2000 Index measures the performance of the 2,000 smallest companies in the Russell 3000 Index, which represents approximately 8% of the total market capitalization of the Russell 3000 Index, with all values expressed in U.S. dollars.

The Russell Microcap Index measures the performance of the smallest 1,000 securities in the small-cap Russell 2000 Index along with the next smallest 1,000 companies, based on a ranking of all U.S. equities by market capitalization.

It is not possible to invest directly in an index.

Julius Baer Funds 2007 Annual Report

28

SHAREHOLDER EXPENSES

As a stockholder of the Julius Baer Global Equity Fund or a shareholder of Julius Baer Investment Funds, you incur ongoing expenses, such as management fees, shareholder service fees, distribution fees and other fund expenses. The following table is intended to help you understand your ongoing expenses (in dollars and cents) of investing in the Funds and to compare these expenses with the ongoing expenses of investing in other funds.

The table is based on an investment of $1,000 invested at the beginning of the period and held for the entire period from May 1, 2007 to October 31, 2007.

Actual Expenses

The first line in the table below provides information about the actual account values and actual expenses. You may use the information in this line, together with the amount you invested, to estimate the expenses that you paid over the period. Simply divide your account value by $1,000 (for example, an $8,600 account value divided by $1,000 = 8.6), then multiply the result by the number in the first line for the Fund under the heading entitled "Expenses Paid During Period" to estimate the expenses you paid on your account during this period.

Hypothetical Example for Comparison Purposes

The second line in the table below provides information about the hypothetical account values and hypothetical expenses based on the Fund's actual expense ratio and an assumed rate of return of 5% per year before expenses, which is not the Fund's actual return. The hypothetical account value and expenses may not be used to estimate the actual ending account balance or expenses you paid for the period. You may use this information to compare the ongoing costs of investing in your Fund and other funds. To do so, compare this 5% hypothetical example with the 5% hypothetical examples that appear in the shareholder reports of the other funds.

Global Equity Fund Class A

| | | Beginning Account

Value 05/01/07 | | Ending Account

Value 10/31/07 | | Annualized

Expense Ratio | | Expense Paid

During Period | |

| Actual | | $ | 1,000.00 | | | $ | 1,088.70 | | | | 1.42 | % | | $ | 7.48 | | |

| Hypothetical | | | 1,000.00 | | | | 1,018.00 | | | | 1.42 | | | | 7.22 | | |

Global Equity Fund Class I

| | | Beginning Account

Value 05/01/07 | | Ending Account

Value 10/31/07 | | Annualized

Expense Ratio | | Expense Paid

During Period | |

| Actual | | $ | 1,000.00 | | | $ | 1,090.00 | | | | 1.17 | % | | $ | 6.16 | | |

| Hypothetical | | | 1,000.00 | | | | 1,019.30 | | | | 1.17 | | | | 5.95 | | |

Julius Baer Funds 2007 Annual Report

29

International Equity Fund Class A

| | | Beginning Account

Value 05/01/07 | | Ending Account

Value 10/31/07 | | Annualized

Expense Ratio | | Expense Paid

During Period | |

| Actual | | $ | 1,000.00 | | | $ | 1,116.00 | | | | 1.24 | % | | $ | 6.61 | | |

| Hypothetical | | | 1,000.00 | | | | 1,019.00 | | | | 1.24 | | | | 6.31 | | |

International Equity Fund Class I

| | | Beginning Account