UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF

REGISTERED MANAGEMENT INVESTMENT COMPANIES

Investment Company Act file number: 811-06017

Aberdeen Global Select Opportunities Fund Inc.

(Exact name of registrant as specified in charter)

1735 Market Street, 32nd Floor

Philadelphia, PA 19103

(Address of principal executive offices) (Zip code)

Ms. Andrea Melia

c/o Aberdeen Asset Management Inc.

1735 Market Street, 32nd Floor

Philadelphia, PA 19103

(Name and address of agent for service)

Registrant’s telephone number, including area code: (800) 387-6977

Date of fiscal year end: October 31

Date of reporting period: October 31, 2014

Item 1. Reports to Shareholders.

Aberdeen Investment Funds

Aberdeen Global Select Opportunities Fund Inc.

Annual Report

October 31, 2014

Aberdeen Global Select Opportunities Fund Inc.

Aberdeen Select International Equity Fund

Aberdeen Select International Equity Fund II

Aberdeen Total Return Bond Fund

Aberdeen Global High Income Fund

Table of Contents

Investors should carefully consider a fund’s investment objectives, risks, fees, and expenses before investing any money. To obtain this and other fund information, please call 1-800-387-6977 to request a prospectus, or download a prospectus at www.aberdeen-asset.us. Please read it carefully before investing any money.

Investing in mutual funds involves risk, including possible loss of principal.

Aberdeen Select International Equity Fund, Aberdeen Select International Equity Fund II, Aberdeen Total Return Bond Fund, and Aberdeen Global High Income Fund, (collectively the “Aberdeen Investment Funds”) and Aberdeen Global Select Opportunities Fund Inc. (with the Aberdeen Investment Funds the “Funds”) are distributed by Aberdeen Fund Distributors, LLC, Member FINRA, 1735 Market Street, 32nd Floor, Philadelphia, PA 19103.

Aberdeen Asset Management Inc. (AAMI) has been registered as an investment adviser under the Investment Advisers Act of 1940 since August 23,1995.

Statement Regarding Availability of Quarterly Portfolio Schedule.

The complete schedule of portfolio holdings for Aberdeen Investment Funds and Aberdeen Global Select Opportunities Fund Inc. is included in the Funds’ semi-annual and annual reports to shareholders. Aberdeen Investment Funds and Aberdeen Global Select Opportunities Fund Inc. file complete schedules of portfolio holdings for each Fund with the Securities and Exchange Commission (the “SEC”) for the first and third quarters of each fiscal year on Form N-Q. The Funds’ Forms N-Q are available on the SEC’s website at http://www.sec.gov. The Funds’ Forms N-Q may be reviewed and copied at the SEC’s Public Reference Room in Washington, DC, and information on the operation of the Public Reference Room may be obtained by calling 800-SEC-0330. The Funds make their most recent Forms N-Q available to shareholders on www.aberdeen-asset.us or upon request without charge.

Statement Regarding Availability of Proxy Voting Record.

Information regarding the policies and procedures that the Funds use to determine how to vote proxies relating to portfolio securities is available without charge, upon request, by calling 1-800-387-6977. The information is also included in the Funds’ Statement of Additional Information, which is available on the Funds’ website at www.aberdeen-asset.us and on the SEC’s website at www.sec.gov.

Information relating to how each Fund voted proxies relating to portfolio securities held during the most recent twelve months ended June 30 is available by August 30 of the relevant year: (i) upon request and without charge by calling 1-800-387-6977; and (ii) on the SEC’s website at www.sec.gov.

Letter to Shareholders

October 31, 2014

Dear Valued Shareholder,

Welcome to the Aberdeen Investment Funds and Aberdeen Global Select Opportunities Fund Inc. Annual Report covering the activities for the 12-month period ended October 31, 2014.

Market overview

Global equity markets continued to be dominated by concerns over global economic growth levels during the reporting period, lagging their U.S. counterparts. Strong U.S. equity market performance buoyed global markets as deflationary pressures continued to cause headwinds in Europe. Meanwhile, emerging markets finished the period with weak returns as a strong sell-off in September overshadowed gains from earlier in the year. The fixed income universe was volatile over the period, as investment-grade core and total return bond markets delivered modest returns against the backdrop of struggling global equity markets and falling commodity prices. Meanwhile, the global high yield bond market came under significant pressure during the period after yields and spreads made new lows in late June.

Markets continue to brace for more headwinds as we enter 2015 given the environment of slow global growth, a potential U.S. interest rate hike on the horizon and falling oil prices. In the U.S., voters elected eight new Republican senators as the GOP will take control of both houses of Congress in January 2015. The implications of this shift remain unclear, but dramatic legislative moves are likely to be made regarding healthcare and government spending. In emerging markets, the election of pro-business candidate Narendra Modi as the new Prime Minister of India has buoyed the outlook for the world’s 10th largest economy. In Europe, tensions between Russia and the West continue to hinder Russian markets.

Anne Richards, Aberdeen Asset Management (Aberdeen) Global Chief Investment Officer, provides you with a detailed insight on the investment marketplace in the Global Market Review and Outlook on the following page.

Aberdeen developments

As of April 1, 2014, Aberdeen Asset Management PLC completed the acquisition of Scottish Widows Investment Partnership (SWIP) from Lloyds Banking Group in the UK. During the period, the integration of SWIP into the wider Aberdeen group continued to progress. The acquisition combines Aberdeen and SWIP’s strengths across fixed income, real estate, active and quantitative equities, investment solutions and alternatives. The acquisition of SWIP will not have a direct impact on any funds in the Aberdeen Fund family but will significantly add to Aberdeen’s global investment capabilities.

During the period, Aberdeen reached an agreement with the European Tour and the Scottish Government to extend our sponsorship of the Aberdeen Asset Management Scottish Open through 2020.

Aberdeen received several industry awards during the period, including 12 Mutual Fund Education Association (MFEA) STAR Awards for financial communications in both digital and direct marketing categories.

Thank you for choosing Aberdeen Investment Funds and Aberdeen Global Select Opportunities Fund, Inc. We value your investment with us.

Kind Regards,

Yours sincerely,

/s/ Bev Hendry

Bev Hendry

President

Aberdeen Investment Funds

Aberdeen Global Select Opportunities Fund Inc.

2014 Annual Report

1

Market Review

In our opinion, the performances of the major global equity markets for the 12-month period ended October 31, 2014, might be best described as “all over the map”—literally. There was marked divergence in stock returns among geographical regions. On the surface, it appeared that global equities generally posted respectable gains, with the MSCI World Index, the developed-market benchmark, rising 9.3% (in U.S. dollars) over the period. However, the strength in the markets was concentrated on the western side of the Atlantic Ocean, with the U.S. broader-market S&P 500 Index climbing 17.3%. In contrast, the MSCI World ex US Index was up just 0.2% during the period, dragged down mainly by investors’ concerns about economic growth in Europe and the continued rise in the U.S. dollar against most major global currencies. Both the euro and the Japanese yen declined sharply against the U.S. dollar over the period, with the latter currency experiencing particular weakness. The upturn in the U.S. market was the primary contributor to the outperformance of developed markets versus their emerging counterparts, as measured by the MSCI Emerging Markets Index, which returned 1.0% for the reporting period. The sharp decline in oil prices over the annual period had a mixed effect on the global markets: Importing nations were notable beneficiaries, whereas exporters such as Russia came under pressure as lower oil prices may aggravate revenue shortfalls caused by a raft of Western sanctions.

Unlike many other regions, the U.S. equity market benefited from a generally improving economy over the reporting period. Healthy gross domestic product (GDP) growth in the fourth quarter of 2013 and the second and third quarters of 2014 offset a decline in the first quarter of the year, most likely attributable to bad weather-induced weakness in consumer spending. Additionally, the unemployment rate fell substantially during the period, although the labor participation rate declined to its lowest level in 36 years. Investors remained focused on U.S. monetary policy for much of the period. Former Federal Reserve (Fed) vice chair Janet Yellen succeeded Ben Bernanke as head of the Fed in February 2014. The Fed began to reduce its $85 billion-per-month asset purchase program in $10 billion increments in January 2014, and ended its tapering in late October.

United Kingdom (UK) stocks saw marginal gains while European equities ended the period modestly lower. Economic recovery in the Eurozone1 remains fragile and much slower-paced than in the U.S. and UK. The European labor market has continued to improve, albeit unevenly, as has household confidence; however, inflation expectations are dangerously low for the region. Late in the reporting period, the European Central Bank (ECB) announced that, if required, it would use “unconventional policy instruments” in support of the Eurozone economy. However, there are doubts over the scale and potential effectiveness of such measures. In Japan, the yen’s weakness lifted equity markets overall, but gains were pared because of doubts over the efficacy of Prime Minister Shinzo Abe’s “third arrow” stimulus measures, as well as the impact of the consumption tax hike that was implemented in April 2014.

Within the global emerging equity markets, strong performance in India and, to a lesser extent, China, was counterbalanced by notable weakness in Latin America and Russia. Indian stocks rallied after the business-friendly Bharatiya Janata Party (BJP), headed by Narendra Modi, swept into power as that country’s first single-party majority in 25 years. The Chinese market was bolstered by signs of an upturn in economic growth. Additionally, investors appeared to take a favorable view of a proposed pilot program for mutual market connectivity between Hong Kong and Shanghai, as it was seen as a significant step towards cross-border capital market integration. The program commenced operations shortly after the end of the reporting period in mid-November. In Latin America, Brazilian equities were hampered as investor sentiment soured in reaction to the nation’s bitterly-contested presidential election. Brazil’s incumbent president, Dilma Rousseff, whose policies generally are perceived as unfriendly to business, edged out her opponent, Aecio Neves, to secure a second term. Ongoing geopolitical tensions surrounding Russia’s expanded military presence in Ukraine had a negative impact on the Russian market for the period.

The global bond markets experienced periods of volatility over the reporting period, which increased more significantly in August and October. Concerns over faltering global economic growth, combined with heightened fears of potential deflation in Europe, drove much of the uncertainty. Nonetheless, the global fixed income markets collectively finished in positive territory for the period. Investment-grade bonds outperformed high yield securities, with the Bank of America Merrill Lynch Global Broad Market Corporate Index advancing 6.4% versus the 5.9% return of the Bank of America Merrill Lynch Global High Yield Constrained Index. Emerging markets debt, as measured by the J.P. Morgan EMBI Global Diversified Index, was the strongest-performing segment within the global fixed income universe, climbing 8.6% for the period, as investors focused on the yield differential between emerging and developed markets, rather than the geopolitical tensions between Russia and Ukraine.

Outlook

In our opinion, the global economic and monetary environment remains supportive of equities relative to fixed income and cash. We believe that the end to U.S. quantitative easing in late October, higher interest rates in 2015, and improvement in the U.S. economy could lead to continued strengthening of the U.S. dollar. Our overall view on interest rates is that they will remain low for an extended period. Confidence in the global recovery has improved somewhat, given the pick-up in U.S. economic activity. However, we feel that the picture is less rosy elsewhere in the developed world. The Eurozone continues to suffer from high debt and unemployment. We remain cautious about Japan, as the recovery in household consumption has been slower than expected. However, these conditions have led to unprecedented monetary stimulus in both regions, which we think may potentially create investment opportunities. We believe that prospects for emerging economies also remain mixed, with recent market developments highlighting sensitivities to U.S. monetary policy. At the corporate level, we observe efforts to boost margins through cost-cuts and reorganization, although this has yet to translate into a broader trend of improving profitability.

Anne Richards

Chief Investment Officer

Aberdeen Asset Management

| * | | The Eurozone comprises 18 European Union member states that have adopted the euro as their common currency. |

Indexes are unmanaged and have been provided for comparison purposes only. No fees or expenses are reflected. You cannot invest directly in an index.

Annual Report 2014

2

Aberdeen Global Select Opportunities Fund Inc. (Unaudited)

The Aberdeen Global Select Opportunities Fund Inc. (Class A shares at net asset value net of fees) returned 3.98% for the 12-month period ended October 31, 2014, versus the 8.32% return of its benchmark, the MSCI All Country World Index (MSCI ACWI), during the same period. For broader comparison, the average return of the Fund’s Lipper peer category of Global Large-Cap Core Funds (consisting of 24 funds) was 7.39% for the period.

Global equities, as measured by the MSCI ACWI, rallied during the review period, attributable largely to improved economic data in the U.S., as well as loose monetary policy in the developed world. The U.S. Federal Reserve’s (Fed) commitment to keep interest rates low for a longer period, as well as the European Central Bank’s unexpected rate cuts and fresh stimulus measures, reassured investors. In Japan, the yen’s weakness lifted equity markets, but gains were pared owing to doubts over the efficacy of Prime Minister Shinzo Abe’s “third arrow”1 stimulus measures, as well as the impact of the consumption tax hike that was implemented in April. The prospect of rising U.S. interest rates alarmed investors, while worsening geopolitical tensions and generally weak manufacturing and services data in Europe and China also dented market sentiment.

Towards the end of the period, monetary policy was the key theme. Although the Fed officially ended its bond-buying program, the Bank of Japan’s increased stimulus, as well as positive corporate earnings, boosted confidence in the global economy. However, oil prices tumbled to multi-year lows,2 as Saudi Arabia’s move to cut prices for exports exacerbated worries over global demand and rising supplies. The fall in oil prices had a mixed effect on markets. Importing nations were notable beneficiaries, whereas exporters such as Russia came under pressure as the lower oil price may aggravate revenue shortfalls caused by a raft of Western sanctions.

The top detractors from Fund performance for the reporting period included lender Standard Chartered, miner Vale, and Italian exchange-listed pipe-maker Tenaris. Standard Chartered’s stock price weakened after the third profit warning in a year as the company delivered its results for the first nine months of its 2014 fiscal year. Management cited high impairment charges as some corporate and institutional clients were hurt by weakening commodity markets. Investor sentiment was also dampened by speculation that U.S. regulators could reinvestigate its alleged sanction violations. Some of its problems are cyclical and may be resolved in the medium term, in our opinion. More structural difficulties may potentially require management to reprioritize investments, divest non-core businesses and streamline riskier portfolios. While we believe that it is a solid franchise, we would not be surprised by a management change. Shares of Vale moved lower as fears of a slowdown in China’s economy weighed on iron ore prices, while Tenaris’s stock price declined on concerns that soft oil prices may weigh on demand for its products.

The main contributors to the Fund’s relative return for the period were U.S. retail drugstore chain operator and pharmacy benefit manager CVS Health, Taiwan Semiconductor Manufacturing Co. (TSMC), and freight railroad operator Canadian National Railway. Shares of CVS Health rallied after the company boosted its dividend and approved a significant share buyback. It also reported better-than-expected earnings over the period. TSMC’s stock price gained ground after the company reported record-high sales over multiple quarters, on robust demand for its products. Finally, Canadian National Railway benefited from better-than-expected profits due to greater market share and increased shipments.

In Fund activity, we initiated a position in U.S. payment-processing services company Visa and UK aircraft engine manufacturer Rolls Royce. In our view, Visa has a high-return business with an established market position and attractive growth drivers. We feel that Rolls Royce has an attractive high recurring revenue model, high barriers to entry and positive structural growth potential.

Conversely, we exited the position in U.S. healthcare company Quest Diagnostics, in view of its increasingly challenging environment and lower growth visibility. We also sold the Fund’s shares in Australia’s QBE Insurance as we feel that there are more attractive investment opportunities elsewhere.

The divergence between major global central banks’ monetary policies has become more pronounced, which we believe may create a more complex and challenging market environment ahead. How that translates into global capital flows is uncertain. Meanwhile, the global economic environment appears mixed; while the U.S. economic engine continues to power on, the Eurozone3 and Japan’s economic health remained anemic. However, the sharp drop in oil prices since June may potentially provide some relief to large net importers such as the Eurozone and Japan. Similarly, the appreciation in the U.S. dollar may increase the trade competitiveness of these economies.

For us at Aberdeen, investing in companies that we view as fundamentally sound and well managed is an imperative that we believe should help negate the vagaries of market sentiment. Recent earnings from our holdings have been largely steady or met expectations despite the muted economic backdrop. Renewed efforts to boost profits through cost cuts and improving margins are further along, even though it may be some time before a broader rebound is evident. Many of these companies are market leaders and have weathered periods of crises; we think it should be no different this time. If we feel that valuations are attractive, we will look to add to favored holdings when opportunities arise.

| 1 | | The “third arrow” is the last of Japanese Prime Minister Shinzo Abe’s economic programs, comprising structural reforms in an effort to boost Japan’s competitiveness. |

| 2 | | Source: Bloomberg, October 2014. |

| 3 | | The Eurozone comprises 18 European Union member states that have adopted the euro as their common currency. |

2014 Annual Report

3

Aberdeen Global Select Opportunities Fund Inc. (Unaudited) (concluded)

Portfolio Management:

Aberdeen Global Equity Team

PAST PERFORMANCE DOES NOT GUARANTEE FUTURE RESULTS.

The performance quoted represents past performance, which does not guarantee future results. Class A Shares have up to a 0.25% 12b-1 fee. The investment return and principal value of an investment will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost. Current performance of the Fund may be lower or higher than the performance quoted. Performance data current to the most recent month-end may be obtained by calling 800-387-6977 or visiting www.aberdeen-asset.us.

Investing in mutual funds involves risk, including the possible loss of principal. There is no assurance that the investment objective of any fund will be achieved. Indexes are unmanaged and have been provided for comparison purposes only. No fees or expenses are reflected. You cannot invest directly in an index.

Lipper is a leading global provider of mutual fund information and analysis to fund companies, financial intermediaries and media organizations.

Risk Considerations

Foreign securities are more volatile, harder to price and less liquid than U.S. securities. They are subject to different accounting and regulatory standards, and political and economic risks. These risks are enhanced in emerging markets countries.

Equity stocks of small and mid-cap companies carry greater risk and more volatility than equity stocks of larger, more established companies.

Please read the prospectus for more detailed information regarding these and other risks.

Annual Report 2014

4

Aberdeen Global Select Opportunities Fund Inc. (Unaudited)

| | | | | | | | | | | | | | |

Average Annual Total Return (For periods ended October 31, 2014) | | 1 Yr. | | 5 Yr. | | | 10 Yr. | | | Inception | |

Class A1 | | 3.98% | | | 5.76% | | | | 4.88% | | | | 5.22% | |

Institutional Class2,3 | | 4.19% | | | 6.00% | | | | n/a | | | | 3.90% | |

| 1 | | Class commenced operations on July 01, 2004. |

| 2 | | Class commenced operations on March 14, 2005. |

2014 Annual Report

5

Aberdeen Global Select Opportunities Fund Inc. (Unaudited)

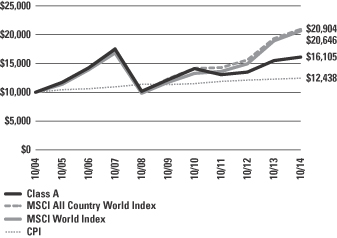

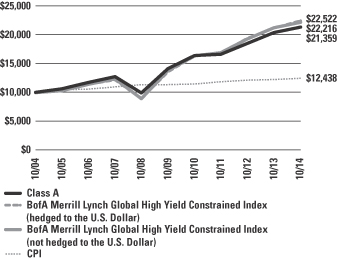

Performance of a $10,000 Investment (as of October 31, 2014)

Comparative performance of $10,000 invested in Class A shares of the Aberdeen Global Select Opportunities Fund Inc., Morgan Stanley Capital International (MSCI) All Country World Index, the MSCI World Index and the Consumer Price Index (CPI) over a 10-year period ended October 31, 2014. Unlike the Fund’s returns, the returns for these unmanaged indexes do not reflect any fees or expenses. Investors cannot invest directly in market indexes.

The MSCI All Country World Index is a free float-adjusted market capitalization-weighted index that is designed to measure the equity market performance of 46 country indexes comprising 23 developed and 23 emerging market country indexes. The developed market country indexes included are: Australia, Austria, Belgium, Canada, Denmark, Finland, France, Germany, Hong Kong, Ireland, Israel, Italy, Japan, Netherlands, New Zealand, Norway, Portugal, Singapore, Spain, Sweden, Switzerland, the United Kingdom and the United States. The emerging market country indexes included are: Brazil, Chile, China, Colombia, Czech Republic, Egypt, Greece, Hungary, India, Indonesia, Korea, Malaysia, Mexico, Peru, Philippines, Poland, Qatar, Russia, South Africa, Taiwan, Thailand, Turkey and United Arab Emirates.

The MSCI World Index is a free float-adjusted market capitalization-weighted index that is designed to measure the equity market performance of developed markets. The MSCI World Index consists of the following 23 developed market country indexes: Australia, Austria, Belgium, Canada, Denmark, Finland, France, Germany, Hong Kong, Ireland, Israel, Italy, Japan, Netherlands, New Zealand, Norway, Portugal, Singapore, Spain, Sweden, Switzerland, the United Kingdom, and the United States.

The CPI represents changes in prices of all goods and services purchased for consumption by urban households.

Investment return and principal value will fluctuate, and when redeemed, shares may be worth more or less than original cost. Past performance is no guarantee of future results. The Average Annual Total Return table and performance graph do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the redemption of Fund shares. Investing in mutual funds involves market risk, including loss of principal. Performance returns assume the reinvestment of all distributions. Performance returns reflect fee waivers and reimbursements in effect without which returns would have been lower.

Portfolio Summary (as a percentage of net assets)

October 31, 2014 (Unaudited)

| | | | |

| Asset Allocation | | | |

Common Stocks | | | 90.9% | |

Preferred Stocks | | | 8.1% | |

Repurchase Agreement | | | 1.5% | |

Liabilities in excess of other assets | | | (0.5)% | |

| | | | 100.0% | |

The following table summarizes the composition of the Fund’s portfolio, in Standard & Poor’s Global Industry Classification Standard (GICS) sectors, expressed as a percentage of net assets. The GICS structure consists of 10 sectors, 24 industry groups, 67 industries and 156 sub-industries. As of October 31, 2014, the Fund did not have more than 25% of its assets invested in any single industry group.

| | | | |

| Top Sectors | | | |

Consumer Staples | | | 17.7% | |

Energy | | | 16.6% | |

Financials | | | 15.5% | |

Health Care | | | 12.3% | |

Information Technology | | | 11.2% | |

Industrials | | | 9.9% | |

Materials | | | 9.7% | |

Telecommunication Services | | | 2.6% | |

Consumer Discretionary | | | 2.0% | |

Utilities | | | 1.5% | |

Other | | | 1.0% | |

| | | | 100.0% | |

| | | | |

| Top Holdings* | | | |

Roche Holding AG | | | 4.2% | |

Taiwan Semiconductor Manufacturing Co. Ltd., ADR | | | 3.2% | |

CVS Health Corp. | | | 3.2% | |

Philip Morris International, Inc. | | | 3.1% | |

Johnson & Johnson | | | 3.1% | |

British American Tobacco PLC | | | 3.0% | |

Novartis AG | | | 3.0% | |

Tenaris SA, ADR | | | 2.9% | |

Royal Dutch Shell PLC, B Shares | | | 2.9% | |

Banco Bradesco SA, ADR, Preferred Shares | | | 2.8% | |

Other | | | 68.6% | |

| | | | 100.0% | |

| | | | |

| Top Countries | | | |

United States | | | 31.6% | |

United Kingdom | | | 15.3% | |

Switzerland | | | 11.9% | |

Japan | | | 6.7% | |

Brazil | | | 5.5% | |

Sweden | | | 5.2% | |

Italy | | | 4.7% | |

Canada | | | 4.2% | |

Taiwan | | | 3.2% | |

Republic of South Korea | | | 2.6% | |

Other | | | 9.1% | |

| | | | 100.0% | |

| * | | For the purpose of listing top holdings, repurchase agreements are included as part of Other. |

Annual Report 2014

6

Statement of Investments

October 31, 2014

Aberdeen Global Select Opportunities Fund Inc.

| | | | | | | | |

| | | Shares or

Principal

Amount | | | Value | |

COMMON STOCKS (90.9%) | | | | | | | | |

CANADA (4.2%) | | | | | | | | |

Industrials (2.1%) | | | | | | | | |

Canadian National Railway Co. | | | 2,100 | | | $ | 148,004 | |

Materials (2.1%) | | | | | | | | |

Potash Corp. of Saskatchewan, Inc. | | | 4,400 | | | | 150,134 | |

| | | | | | | | 298,138 | |

CHINA (1.5%) | | | | | | | | |

Energy (1.5%) | | | | | | | | |

PetroChina Co. Ltd., H Shares (a) | | | 82,000 | | | | 103,170 | |

FRANCE (1.0%) | | | | | | | | |

Industrials (1.0%) | | | | | | | | |

Schneider Electric SE (a) | | | 910 | | | | 72,025 | |

HONG KONG (2.6%) | | | | | | | | |

Financials (2.6%) | | | | | | | | |

AIA Group Ltd. (a) | | | 19,300 | | | | 107,683 | |

Swire Pacific Ltd., Class A (a) | | | 5,500 | | | | 72,216 | |

| | | | | | | | 179,899 | |

ITALY (4.7%) | | | | | | | | |

Energy (4.7%) | | | | | | | | |

Eni SpA (a) | | | 5,900 | | | | 125,629 | |

Tenaris SA, ADR | | | 5,200 | | | | 206,128 | |

| | | | | | | | 331,757 | |

JAPAN (6.7%) | | | | | | | | |

Consumer Staples (1.6%) | | | | | | | | |

Japan Tobacco, Inc. (a) | | | 3,200 | | | | 111,087 | |

Financials (1.1%) | | | | | | | | |

Daito Trust Construction Co. Ltd. (a) | | | 600 | | | | 75,919 | |

Industrials (1.5%) | | | | | | | | |

FANUC Corp. (a) | | | 610 | | | | 107,385 | |

Materials (2.5%) | | | | | | | | |

Shin-Etsu Chemical Co. Ltd. (a) | | | 2,780 | | | | 181,191 | |

| | | | | | | | 475,582 | |

MEXICO (2.1%) | | | | | | | | |

Consumer Staples (2.1%) | | | | | | | | |

Fomento Economico Mexicano SAB de CV, ADR | | | 1,500 | | | | 144,360 | |

SINGAPORE (0.9%) | | | | | | | | |

Financials (0.9%) | | | | | | | | |

City Developments Ltd. (a) | | | 9,000 | | | | 66,288 | |

SOUTH AFRICA (1.5%) | | | | | | | | |

Telecommunication Services (1.5%) | | | | | | | | |

MTN Group Ltd. (a) | | | 4,900 | | | $ | 108,298 | |

SWEDEN (5.2%) | | | | | | | | |

Financials (1.5%) | | | | | | | | |

Nordea Bank AB (a) | | | 8,300 | | | | 106,211 | |

Industrials (2.2%) | | | | | | | | |

Atlas Copco AB, A Shares (a) | | | 5,200 | | | | 149,918 | |

Information Technology (1.5%) | | | | | | | | |

Telefonaktiebolaget LM Ericsson, B Shares (a) | | | 9,100 | | | | 107,367 | |

| | | | | | | | 363,496 | |

SWITZERLAND (11.9%) | | | | | | | | |

Consumer Staples (2.1%) | | | | | | | | |

Nestle SA (a) | | | 1,990 | | | | 145,644 | |

Financials (2.6%) | | | | | | | | |

Zurich Insurance Group AG (a)(b) | | | 600 | | | | 181,530 | |

Health Care (7.2%) | | | | | | | | |

Novartis AG (a) | | | 2,300 | | | | 213,245 | |

Roche Holding AG (a) | | | 1,010 | | | | 298,217 | |

| | | | | | | | 511,462 | |

| | | | | | | | 838,636 | |

TAIWAN (3.2%) | | | | | | | | |

Information Technology (3.2%) | | | | | | | | |

Taiwan Semiconductor Manufacturing Co. Ltd., ADR | | | 10,400 | | | | 229,008 | |

UNITED KINGDOM (15.3%) | | | | | | | | |

Consumer Staples (3.0%) | | | | | | | | |

British American Tobacco PLC (a) | | | 3,800 | | | | 215,849 | |

Energy (2.9%) | | | | | | | | |

Royal Dutch Shell PLC, B Shares (a) | | | 5,470 | | | | 202,951 | |

Financials (4.0%) | | | | | | | | |

HSBC Holdings PLC (a) | | | 14,180 | | | | 145,170 | |

Standard Chartered PLC (a) | | | 9,291 | | | | 139,863 | |

| | | | | | | | 285,033 | |

Industrials (1.0%) | | | | | | | | |

Rolls-Royce Holdings PLC (a)(b) | | | 5,142 | | | | 69,478 | |

Materials (1.8%) | | | | | | | | |

BHP Billiton PLC (a) | | | 4,930 | | | | 127,655 | |

Telecommunication Services (1.1%) | | | | | | | | |

Vodafone Group PLC (a) | | | 22,600 | | | | 75,103 | |

Utilities (1.5%) | | | | | | | | |

Centrica PLC (a) | | | 21,500 | | | | 104,161 | |

| | | | | | | | 1,080,230 | |

UNITED STATES (30.1%) | | | | | | | | |

Consumer Discretionary (2.0%) | | | | | | | | |

Comcast Corp., Class A | | | 2,500 | | | | 138,375 | |

Consumer Staples (8.9%) | | | | | | | | |

CVS Health Corp. | | | 2,600 | | | | 223,106 | |

PepsiCo, Inc. | | | 1,900 | | | | 182,723 | |

Philip Morris International, Inc. | | | 2,500 | | | | 222,525 | |

| | | | | | | | 628,354 | |

See accompanying notes to financial statements.

2014 Annual Report

7

Statement of Investments (concluded)

October 31, 2014

Aberdeen Global Select Opportunities Fund Inc.

| | | | | | | | |

| | | Shares or

Principal

Amount | | | Value | |

Energy (6.6%) | | | | | | | | |

Chevron Corp. | | | 900 | | | $ | 107,955 | |

EOG Resources, Inc. | | | 1,900 | | | | 180,595 | |

Schlumberger Ltd. | | | 1,800 | | | | 177,588 | |

| | | | | | | | 466,138 | |

Health Care (5.1%) | | | | | | | | |

Baxter International, Inc. | | | 2,000 | | | | 140,280 | |

Johnson & Johnson | | | 2,040 | | | | 219,871 | |

| | | | | | | | 360,151 | |

Industrials (2.1%) | | | | | | | | |

United Technologies Corp. | | | 1,400 | | | | 149,800 | |

Information Technology (3.9%) | | | | | | | | |

Oracle Corp. | | | 4,500 | | | | 175,725 | |

Visa, Inc., Class A | | | 400 | | | | 96,572 | |

| | | | | | | | 272,297 | |

Materials (1.5%) | | | | | | | | |

Praxair, Inc. | | | 870 | | | | 109,611 | |

| | | | | | | | 2,124,726 | |

Total Common Stocks | | | | | | | 6,415,613 | |

PREFERRED STOCKS (8.1%) | | | | | | | | |

BRAZIL (5.5%) | | | | | | | | |

Energy (0.9%) | | | | | | | | |

Petroleo Brasileiro SA, ADR, Preferred Shares | | | 5,400 | | | | 66,042 | |

Financials (2.8%) | | | | | | | | |

Banco Bradesco SA, ADR, Preferred Shares | | | 13,279 | | | | 198,919 | |

Materials (1.8%) | | | | | | | | |

Vale SA, ADR, Preferred Shares | | | 14,400 | | | | 126,144 | |

| | | | | | | | 391,105 | |

REPUBLIC OF SOUTH KOREA (2.6%) | | | | | | | | |

Information Technology (2.6%) | | | | | | | | |

Samsung Electronics Co. Ltd., GDR, Preferred Shares (c) | | | 400 | | | | 182,880 | |

UNITED KINGDOM (0.0%) | | | | | | | | |

Industrials (0.0%) | | | | | | | | |

Rolls-Royce Holdings PLC, Preferred Shares (b) | | | 414,000 | | | | 662 | |

Total Preferred Stocks | | | | | | | 574,647 | |

REPURCHASE AGREEMENT (1.5%) | | | | | | | | |

UNITED STATES (1.5%) | | | | | | | | |

Repurchase Agreement, Fixed Income Clearing Corp., 0.00%, dated 10/31/2014, due 11/03/2014, repurchase price $103,593 collateralized by U.S. Treasury Note, maturing 04/30/2018; total market value of $107,938 | | $ | 103,593 | | | $ | 103,593 | |

Total Repurchase Agreement | | | | | | | 103,593 | |

Total Investments

(Cost $6,888,231) (d)—100.5% | | | | | | | 7,093,853 | |

| | |

Liabilities in excess of other assets—(0.5)% | | | | | | | (33,686 | ) |

Net Assets—100.0% | | | | | | $ | 7,060,167 | |

| (a) | | Fair Valued Security. Fair Values are determined pursuant to procedures approved by the Fund’s Board of Directors. See Note 2(a) of the accompanying Notes to Financial Statements. |

| (b) | | Non-income producing security. |

| (c) | | Denotes a security issued under Regulation S or Rule 144A. |

| (d) | | See notes to financial statements for tax unrealized appreciation/depreciation of securities. |

| ADR | | American Depositary Receipt |

| GDR | | Global Depositary Receipt |

See accompanying notes to financial statements.

Annual Report 2014

8

Aberdeen Select International Equity Fund (Unaudited)

The Aberdeen Select International Equity Fund (Class A shares at net asset value net of fees) returned -0.04% for the year ended October 31, 2014, versus 0.49% for its benchmark, the MSCI All Country World ex U.S. Index (MSCI ACWI ex-U.S.), during the same period. For broader comparison, the average return of the Fund’s Lipper peer category of International Large-Cap Growth Funds (consisting of 48 funds) was 1.20% for the period.

International equities, as measured by the MSCI ACWI ex-U.S., posted marginal gains during the review period, attributable largely to improved economic data in the U.S., as well as loose monetary policy in the developed world. The U.S. Federal Reserve’s (Fed) commitment to keep interest rates low for a longer period, as well as the European Central Bank’s unexpected rate cuts and fresh stimulus measures, reassured investors. In Japan, the yen’s weakness lifted equity markets, but gains were pared owing to doubts over the efficacy of Prime Minister Shinzo Abe’s “third arrow”1 stimulus measures, as well as the impact of the consumption tax hike that was implemented in April. The prospect of rising U.S. interest rates alarmed investors, while worsening geopolitical tensions and generally weak manufacturing and services data in Europe and China also dented market sentiment.

Towards the end of the period, monetary policy was the key theme. Although the Fed officially ended its bond-buying program, the Bank of Japan’s increased stimulus, as well as positive corporate earnings, boosted confidence in the global economy. However, oil prices tumbled to multi-year lows,2 as Saudi Arabia’s move to cut prices for exports exacerbated worries over global demand and rising supplies. The fall in oil prices had a mixed effect on markets. Importing nations were notable beneficiaries, whereas exporters such as Russia came under pressure as the lower oil price may aggravate revenue shortfalls caused by a raft of Western sanctions.

The top detractors from Fund performance for the period included lender Standard Chartered, miner Vale, and Australian insurer QBE Insurance. Standard Chartered’s stock price weakened after the third profit warning in a year as the company delivered its results for the first nine months of its 2014 fiscal year. Management cited high impairment charges as some corporate and institutional clients were hurt by weakening commodity markets. Investor sentiment was also dampened by speculation that U.S. regulators could reinvestigate its alleged sanction violations. Some of its problems are cyclical and may be resolved in the medium term, in our opinion. More structural difficulties may potentially require management to reprioritize investments, divest non-core businesses and streamline riskier portfolios. While we believe that it is a solid franchise, we would not be surprised by a management change. Shares of Vale moved lower as fears of a slowdown in China’s economy weighed on iron ore prices, while the stock price of QBE Insurance fell on the back of the company’s profit warning in its 2014 fiscal year. This followed a strategic review of its North American operations which resulted in additional loss provisions, restructuring charges and a goodwill write-down.

The main contributors to the Fund’s relative return for the period were Swiss drug-maker Novartis, Taiwan Semiconductor Manufacturing Co. (TSMC), and freight railroad operator Canadian National Railway. Novartis’s share price reacted positively to favorable drug trial data related to the treatment of heart failure, while its significant three-way transaction with GlaxoSmithKline earlier in the reporting period also supported investor sentiment. TSMC’s stock price gained ground after the company reported record-high sales over multiple quarters, on robust demand for its products. Finally, Canadian National Railway benefited from better-than-expected profits due to greater market share and increased shipments.

In Fund activity, we initiated a position in Singapore conglomerate Jardine Matheson, UK credit and marketing services company Experian, and UK aircraft engine manufacturer Rolls Royce. We believe that Jardine has an attractive collection of assets, and Experian is the largest international operator in a growing industry. Rolls Royce has an attractive high recurring revenue model, high barriers to entry and positive structural growth potential, in our opinion.

Conversely, we sold the holding in Verizon Communications, which the Fund had received from the return of cash and shares from Vodafone after it sold its stake in the Verizon Wireless joint venture. We also exited the remaining small position in QBE Insurance, as we feel that there are more attractive investment opportunities elsewhere. Additionally, we continued to sell illiquid stocks such as Bulgarian toolmaker Sparky Eltos Ad Lovech, which was in the original portfolio managed by Artio Global Investors prior to the company’s acquisition by Aberdeen Asset Management in 2013.

The divergence between major global central banks’ monetary policies has become more pronounced, which we believe may create a more complex and challenging market environment ahead. How that translates into global capital flows is uncertain. Meanwhile, the global economic environment appears mixed; while the U.S. economic engine continues to power on, the Eurozone3 and Japan’s economic health remained anemic. However, the sharp drop in oil prices since June may potentially provide some relief to large net importers such as the Eurozone and Japan. Similarly, the appreciation in the U.S. dollar may increase the trade competitiveness of these economies.

For us at Aberdeen, investing in companies that we view as fundamentally sound and well managed is an imperative that we believe should help negate the vagaries of market sentiment. Recent earnings from our holdings have been largely steady or met expectations despite the muted economic backdrop. Renewed efforts

| 1 | | The “third arrow” is the last of Japanese Prime Minister Shinzo Abe’s economic programs, comprising structural reforms in an effort to boost Japan’s competitiveness. |

| 2 | | Source: Bloomberg, October 2014. |

| 3 | | The Eurozone comprises 18 European Union member states that have adopted the euro as their common currency. |

2014 Annual Report

9

Aberdeen Select International Equity Fund (Unaudited) (concluded)

to boost profits through cost cuts and improving margins are further along, even though it may be some time before a broader rebound is evident. Many of these companies are market leaders and have weathered periods of crises; we think it should be no different this time. With valuations still attractive, in our view, we will be looking to add to favored holdings when opportunities arise.

Portfolio Management:

Aberdeen Global Equity Team

PAST PERFORMANCE DOES NOT GUARANTEE FUTURE RESULTS.

The performance quoted represents past performance, which does not guarantee future results. Class A shares have up to a 0.25% 12b-1 fee. The investment return and principal value of an investment will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost. Current performance of the Fund may be lower or higher than the performance quoted. Performance data current to the most recent month-end may be obtained by calling 800-387-6977 or visiting www.aberdeen-asset.us.

Investing in mutual funds involves risk, including the possible loss of principal. There is no assurance that the investment objective of any fund will be achieved. Indexes are unmanaged and have been provided for comparison purposes only. No fees or expenses are reflected. You cannot invest directly in an index.

Lipper is a leading global provider of mutual fund information and analysis to fund companies, financial intermediaries and media organizations.

Risk Considerations

Foreign securities are more volatile, harder to price and less liquid than U.S. securities. They are subject to different accounting and regulatory standards, and political and economic risks. These risks are enhanced in emerging markets countries.

Equity stocks of small and mid-cap companies carry greater risk and more volatility than equity stocks of larger, more established companies.

Please read the prospectus for more detailed information regarding these and other risks.

Annual Report 2014

10

Aberdeen Select International Equity Fund (Unaudited)

| | | | | | | | | | |

Average Annual Total Return (For periods ended October 31, 2014) | | 1 Yr. | | 5 Yr. | | | 10 Yr. | |

Class A | | (0.04%) | | | 2.58% | | | | 4.33% | |

Institutional Class1 | | 0.19% | | | 2.83% | | | | 4.58% | |

2014 Annual Report

11

Aberdeen Select International Equity Fund (Unaudited)

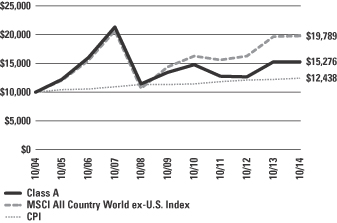

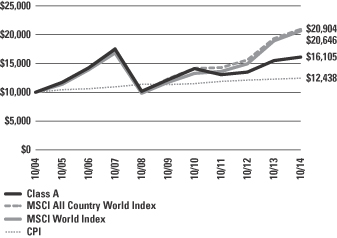

Performance of a $10,000 Investment (as of October 31, 2014)

Comparative performance of $10,000 invested in Class A shares of the Aberdeen Select International Equity Fund, Morgan Stanley Capital International All Country World ex-U.S. Index (MSCI ACWI ex-U.S.), and the Consumer Price Index (CPI) over a 10-year period ended October 31, 2014. Unlike the Fund’s returns, the returns for these unmanaged indexes do not reflect any fees or expenses. Investors cannot invest directly in market indexes.

The MSCI ACWI ex-U.S. is a free float-adjusted market capitalization index that is designed to measure the equity market performance of developed and emerging markets excluding the U.S.

The CPI represents changes in prices of all goods and services purchased for consumption by urban households.

Investment return and principal value will fluctuate, and when redeemed, shares may be worth more or less than original cost. Past performance is no guarantee of future results. The Average Annual Total Return table and performance graph do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the redemption of Fund shares. Investing in mutual funds involves market risk, including loss of principal. Performance returns assume the reinvestment of all distributions. Performance returns reflect fee waivers and reimbursements in effect without which returns would have been lower.

Portfolio Summary (as a percentage of net assets)

October 31, 2014 (Unaudited)

| | | | |

| Asset Allocation | | | |

Common Stocks | | | 89.1% | |

Preferred Stocks | | | 9.5% | |

Repurchase Agreement | | | 0.5% | |

Government Bonds | | | 0.2% | |

Other assets in excess of liabilities | | | 0.7% | |

| | | | 100.0% | |

The following table summarizes the composition of the Fund’s portfolio, in Standard & Poor’s Global Industry Classification Standard (GICS) sectors, expressed as a percentage of net assets. The GICS structure consists of 10 sectors, 24 industry groups, 67 industries and 156 sub-industries. As of October 31, 2014, the Fund did not have more than 25% of its assets invested in any single industry group.

| | | | |

| Top Sectors | | | |

Financials | | | 18.0% | |

Industrials | | | 15.3% | |

Consumer Staples | | | 14.9% | |

Energy | | | 12.4% | |

Materials | | | 11.3% | |

Health Care | | | 9.0% | |

Information Technology | | | 8.5% | |

Telecommunication Services | | | 6.5% | |

Utilities | | | 2.7% | |

Other | | | 1.4% | |

| | | | 100.0% | |

| | | | |

| Top Holdings* | | | |

Roche Holding AG | | | 4.7% | |

Novartis AG | | | 4.3% | |

Nestle SA | | | 3.8% | |

British American Tobacco PLC | | | 3.7% | |

Taiwan Semiconductor Manufacturing Co. Ltd. | | | 3.5% | |

Samsung Electronics Co. Ltd., Preferred Shares | | | 3.4% | |

Royal Dutch Shell PLC, B Shares | | | 3.3% | |

Japan Tobacco, Inc. | | | 2.9% | |

Tenaris SA, ADR | | | 2.8% | |

Banco Bradesco SA, ADR, Preferred Shares | | | 2.8% | |

Other | | | 64.8% | |

| | | | 100.0% | |

| | | | |

| Top Countries | | | |

United Kingdom | | | 22.3% | |

Switzerland | | | 16.4% | |

Japan | | | 8.7% | |

Brazil | | | 6.1% | |

Canada | | | 5.8% | |

Singapore | | | 5.5% | |

Sweden | | | 5.5% | |

Italy | | | 5.2% | |

France | | | 4.4% | |

Hong Kong | | | 3.7% | |

Other | | | 16.4% | |

| | | | 100.0% | |

| * | | For the purpose of listing top holdings, repurchase agreements are included as part of Other. |

Annual Report 2014

12

Statement of Investments

October 31, 2014

Aberdeen Select International Equity Fund

| | | | | | | | |

| | | Shares or

Principal

Amount | | | Value | |

COMMON STOCKS (89.1%) | | | | | | | | |

BULGARIA (0.4%) | | | | | | | | |

Financials (0.4%) | | | | | | | | |

LEV Insurance (a)(b)(c)(d) | | | 4,078,860 | | | $ | 1,780,958 | |

CANADA (5.8%) | | | | | | | | |

Industrials (2.2%) | | | | | | | | |

Canadian National Railway Co. | | | 150,400 | | | | 10,599,835 | |

Materials (2.4%) | | | | | | | | |

Potash Corp. of Saskatchewan, Inc. | | | 330,400 | | | | 11,273,660 | |

Telecommunication Services (1.2%) | | | | | | | | |

TELUS Corp. | | | 163,500 | | | | 5,857,258 | |

| | | | | | | | 27,730,753 | |

CHINA (1.6%) | | | | | | | | |

Energy (1.6%) | | | | | | | | |

PetroChina Co. Ltd., H Shares (d) | | | 6,129,200 | | | | 7,711,609 | |

FRANCE (4.4%) | | | | | | | | |

Consumer Staples (2.0%) | | | | | | | | |

Casino Guichard-Perrachon SA (d) | | | 92,100 | | | | 9,465,437 | |

Industrials (1.3%) | | | | | | | | |

Schneider Electric SE (d) | | | 80,200 | | | | 6,347,658 | |

Utilities (1.1%) | | | | | | | | |

GDF Suez (d) | | | 209,100 | | | | 5,074,936 | |

| | | | | | | | 20,888,031 | |

GERMANY (1.6%) | | | | | | | | |

Materials (1.6%) | | | | | | | | |

Linde AG (d) | | | 42,600 | | | | 7,855,639 | |

HONG KONG (3.7%) | | | | | | | | |

Financials (3.7%) | | | | | | | | |

AIA Group Ltd. (d) | | | 2,020,000 | | | | 11,270,482 | |

Swire Pacific Ltd., Class A (d) | | | 490,900 | | | | 6,445,567 | |

| | | | | | | | 17,716,049 | |

ITALY (5.2%) | | | | | | | | |

Energy (5.2%) | | | | | | | | |

Eni SpA (d) | | | 528,456 | | | | 11,252,460 | |

Tenaris SA, ADR | | | 340,200 | | | | 13,485,528 | |

| | | | | | | | 24,737,988 | |

JAPAN (8.7%) | | | | | | | | |

Consumer Staples (2.9%) | | | | | | | | |

Japan Tobacco, Inc. (d) | | | 397,700 | | | | 13,806,072 | |

Financials (1.2%) | | | | | | | | |

Daito Trust Construction Co. Ltd. (d) | | | 44,600 | | | | 5,643,331 | |

Industrials (2.0%) | | | | | | | | |

FANUC Corp. (d) | | | 54,800 | | | | 9,646,998 | |

Materials (2.6%) | | | | | | | | |

Shin-Etsu Chemical Co. Ltd. (d) | | | 196,900 | | | | 12,833,307 | |

| | | | | | | | 41,929,708 | |

LATVIA (0.0%) | | | | | | | | |

Financials (0.0%) | | | | | | | | |

AS Parex Banka (b)(c)(d) | | | 1,424,182 | | | | 2 | |

MEXICO (2.5%) | | | | | | | | |

Consumer Staples (2.5%) | | | | | | | | |

Fomento Economico Mexicano SAB de CV, ADR | | | 126,700 | | | | 12,193,608 | |

SERBIA (0.0%) | | | | | | | | |

Industrials (0.0%) | | | | | | | | |

Toza Markovic ad Kikinda (a)(b)(c)(d) | | | 78,160 | | | | 0 | |

SINGAPORE (5.5%) | | | | | | | | |

Financials (1.5%) | | | | | | | | |

City Developments Ltd. (d) | | | 992,000 | | | | 7,306,373 | |

Industrials (1.8%) | | | | | | | | |

Jardine Matheson Holdings Ltd. (d) | | | 143,600 | | | | 8,651,727 | |

Telecommunication Services (2.2%) | | | | | | | | |

Singapore Telecommunications Ltd. (d) | | | 3,533,600 | | | | 10,395,928 | |

| | | | | | | | 26,354,028 | |

SOUTH AFRICA (2.0%) | | | | | | | | |

Telecommunication Services (2.0%) | | | | | | | | |

MTN Group Ltd. (d) | | | 428,900 | | | | 9,479,406 | |

SWEDEN (5.5%) | | | | | | | | |

Financials (1.6%) | | | | | | | | |

Nordea Bank AB (d) | | | 589,900 | | | | 7,548,621 | |

Industrials (2.3%) | | | | | | | | |

Atlas Copco AB, A Shares (d) | | | 392,262 | | | | 11,309,078 | |

Information Technology (1.6%) | | | | | | | | |

Telefonaktiebolaget LM Ericsson, B Shares (d) | | | 633,900 | | | | 7,479,125 | |

| | | | | | | | 26,336,824 | |

SWITZERLAND (16.4%) | | | | | | | | |

Consumer Staples (3.8%) | | | | | | | | |

Nestle SA (d) | | | 245,100 | | | | 17,938,357 | |

Financials (2.5%) | | | | | | | | |

Zurich Insurance Group AG (c)(d) | | | 39,900 | | | | 12,071,775 | |

Health Care (9.0%) | | | | | | | | |

Novartis AG (d) | | | 221,100 | | | | 20,499,309 | |

Roche Holding AG (d) | | | 77,300 | | | | 22,823,935 | |

| | | | | | | | 43,323,244 | |

Industrials (1.1%) | | | | | | | | |

Schindler Holding AG (d) | | | 38,000 | | | | 5,315,399 | |

| | | | | | | | 78,648,775 | |

TAIWAN (3.5%) | | | | | | | | |

Information Technology (3.5%) | | | | | | | | |

Taiwan Semiconductor Manufacturing Co. Ltd. (d) | | | 3,937,000 | | | | 16,993,786 | |

See accompanying notes to financial statements.

2014 Annual Report

13

Statement of Investments (concluded)

October 31, 2014

Aberdeen Select International Equity Fund

| | | | | | | | |

| | | Shares or

Principal

Amount | | | Value | |

UNITED KINGDOM (22.3%) | | | | | | | | |

Consumer Staples (3.7%) | | | | | | | | |

British American Tobacco PLC (d) | | | 312,000 | | | $ | 17,722,357 | |

Energy (4.7%) | | | | | | | | |

John Wood Group PLC (d) | | | 638,100 | | | | 6,775,749 | |

Royal Dutch Shell PLC, B Shares (d) | | | 427,100 | | | | 15,846,463 | |

| | | | | | | | 22,622,212 | |

Financials (4.3%) | | | | | | | | |

HSBC Holdings PLC (d) | | | 1,026,900 | | | | 10,513,067 | |

Standard Chartered PLC (d) | | | 682,551 | | | | 10,274,809 | |

| | | | | | | | 20,787,876 | |

Industrials (4.6%) | | | | | | | | |

Experian PLC (d) | | | 491,900 | | | | 7,393,465 | |

Rolls-Royce Holdings PLC (c)(d) | | | 388,003 | | | | 5,242,644 | |

Weir Group PLC (The) (d) | | | 253,600 | | | | 9,275,501 | |

| | | | | | | | 21,911,610 | |

Materials (2.3%) | | | | | | | | |

BHP Billiton PLC (d) | | | 433,800 | | | | 11,232,608 | |

Telecommunication Services (1.1%) | | | | | | | | |

Vodafone Group PLC (d) | | | 1,589,798 | | | | 5,283,125 | |

Utilities (1.6%) | | | | | | | | |

Centrica PLC (d) | | | 1,560,000 | | | | 7,557,734 | |

| | | | | | | | 107,117,522 | |

VENEZUELA (0.0%) | | | | | | | | |

Financials (0.0%) | | | | | | | | |

Banco Provincial SA-Banco Universal (b) | | | 18,422 | | | | 166,522 | |

Banco Venezolano de Credito SA (b)(c)(d) | | | 156 | | | | 0 | |

| | | | | | | | 166,522 | |

Industrials (0.0%) | | | | | | | | |

Cemex Venezuela SACA-I (b)(c)(d) | | | 15,843,815 | | | | 0 | |

Materials (0.0%) | | | | | | | | |

Siderurgica Venezolana Sivensa SACA, ADR (b)(c)(d) | | | 2,847,910 | | | | 3 | |

| | | | | | | | 166,525 | |

Total Common Stocks | | | | | | | 427,641,211 | |

EXCHANGE TRADED FUNDS (0.0%) | | | | | | | | |

RUSSIA (0.0%) | | | | | | | | |

Renaissance Pre-IPO Fund (b)(c)(d) | | $ | 92,634 | | | | 0 | |

Total Exchange Traded Funds | | | | | | | 0 | |

GOVERNMENT BONDS (0.2%) | | | | |

VENEZUELA (0.2%) | | | | |

Bonos de la Deuda Publica Nacional (VEF), 17.25%, 12/31/2015 (b)(d) | | | 10,000,000 | | | | 106,212 | |

Bonos de la Deuda Publica Nacional (VEF), 16.00%, 08/23/2018 (b)(d) | | | 49,500,000 | | | | 606,539 | |

Bonos de la Deuda Publica Nacional (VEF), 18.00%, 04/12/2018 (b)(d) | | | 20,000,000 | | | | 256,114 | |

| | | | | | | | 968,865 | |

Total Government Bonds | | | | | | | 968,865 | |

PREFERRED STOCKS (9.5%) | | | | |

BRAZIL (6.1%) | | | | |

Energy (0.9%) | | | | |

Petroleo Brasileiro SA, ADR, Preferred Shares | | | 372,100 | | | | 4,550,783 | |

Financials (2.8%) | | | | | | | | |

Banco Bradesco SA, ADR, Preferred Shares | | | 890,400 | | | | 13,338,192 | |

Materials (2.4%) | | | | | | | | |

Vale SA, ADR, Preferred Shares | | | 1,296,000 | | | | 11,352,960 | |

| | | | | | | | 29,241,935 | |

REPUBLIC OF SOUTH KOREA (3.4%) | | | | | | | | |

Information Technology (3.4%) | | | | | | | | |

Samsung Electronics Co. Ltd., Preferred Shares (d) | | | 17,200 | | | | 16,248,677 | |

UNITED KINGDOM (0.0%) | | | | | | | | |

Industrials (0.0%) | | | | | | | | |

Rolls-Royce Holdings PLC, Preferred Shares (c) | | | 28,791,000 | | | | 46,061 | |

Total Preferred Stocks | | | | | | | 45,536,673 | |

REPURCHASE AGREEMENT (0.5%) | | | | |

UNITED STATES (0.5%) | | | | |

Repurchase Agreement, Fixed Income Clearing Corp., 0.00%, dated 10/31/2014, due 11/03/2014, repurchase price $2,201,050 collateralized by U.S. Treasury Note, maturing 06/30/2018; total market value of $2,246,888 | | | 2,201,050 | | | | 2,201,050 | |

Total Repurchase Agreement | | | | | | | 2,201,050 | |

Total Investments

(Cost $546,972,377) (e)—99.3% | | | | | | | 476,347,799 | |

| | |

Other assets in excess of liabilities—0.7% | | | | | | | 3,576,658 | |

Net Assets—100.0% | | | | | | $ | 479,924,457 | |

| (a) | | Investment in affiliate. |

| (b) | | The Fund’s adviser has deemed this security to be illiquid based upon procedures approved by the Board of Trustees. Illiquid securities held by the Fund represent 0.6% of net assets as of October 31, 2014. |

| (c) | | Non-income producing security. |

| (d) | | Fair Valued Security. Fair Values are determined pursuant to procedures approved by the Fund’s Board of Trustees. See Note 2(a) of the accompanying Notes to Financial Statements. |

| (e) | | See notes to financial statements for tax unrealized appreciation/depreciation of securities. |

| ADR | | American Depositary Receipt |

| VEF | | Venezuela Bolivar Fuerte |

See accompanying notes to financial statements.

Annual Report 2014

14

Aberdeen Select International Equity Fund II (Unaudited)

The Aberdeen Select International Equity Fund II (Class A shares at net asset value net of fees) returned 0.46% for the year ended October 31, 2014, versus 0.49% for its benchmark, the MSCI All Country World ex-U.S. Index (MSCI ACWI ex-U.S.), during the same period. For broader comparison, the average return of the Fund’s Lipper peer category of International Large-cap Growth Funds (consisting of 48 funds) was 1.20% for the period.

International equities, as measured by the MSCI ACWI ex-U.S., posted marginal gains during the review period, attributable largely to improved economic data in the U.S., as well as loose monetary policy in the developed world. The U.S. Federal Reserve’s (Fed) commitment to keep interest rates low for a longer period, as well as the European Central Bank’s unexpected rate cuts and fresh stimulus measures, reassured investors. In Japan, the yen’s weakness lifted equity markets, but gains were pared owing to doubts over the efficacy of Prime Minister Shinzo Abe’s “third arrow”1 stimulus measures, as well as the impact of the consumption tax hike that was implemented in April. The prospect of rising U.S. interest rates alarmed investors, while worsening geopolitical tensions and generally weak manufacturing and services data in Europe and China also dented market sentiment.

Towards the end of the period, monetary policy was the key theme. Although the Fed officially ended its bond-buying program, the Bank of Japan’s increased stimulus, as well as positive corporate earnings, boosted confidence in the global economy. However, oil prices tumbled to multi-year lows,2 as Saudi Arabia’s move to cut prices for exports exacerbated worries over global demand and rising supplies. The fall in oil prices had a mixed effect on markets. Importing nations were notable beneficiaries, whereas exporters such as Russia came under pressure as the lower oil price may aggravate revenue shortfalls caused by a raft of Western sanctions.

The top detractors from Fund performance for the period included lender Standard Chartered, miner Vale, and Australian insurer QBE Insurance. Standard Chartered’s stock price weakened after the third profit warning in a year as the company delivered its results for the first nine months of its 2014 fiscal year. Management cited high impairment charges as some corporate and institutional clients were hurt by weakening commodity markets. Investor sentiment was also dampened by speculation that U.S. regulators could reinvestigate its alleged sanction violations. Some of its problems are cyclical and may be resolved in the medium term, in our opinion. More structural difficulties may potentially require management to reprioritize investments, divest non-core businesses and streamline riskier portfolios. While we believe that it is a solid franchise, we would not be surprised by a management change. Shares of Vale moved lower as fears of a slowdown in China’s economy weighed on iron ore prices, while the stock price of QBE Insurance fell on the back of the company’s profit warning in its 2013 fiscal year. This followed a strategic review of its North American operations which resulted in additional loss provisions, restructuring charges and a goodwill write-down.

The main contributors to the Fund’s relative return for the period were Swiss drug-maker Novartis, Taiwan Semiconductor Manufacturing Co. (TSMC), and freight railroad operator Canadian National Railway. Novartis’s share price reacted positively to favorable drug trial data related to the treatment of heart failure, while its significant three-way transaction with GlaxoSmithKline earlier in the reporting period also supported investor sentiment. TSMC’s stock price gained ground after the company reported record-high sales over multiple quarters, on robust demand for its products. Finally, Canadian National Railway benefited from better-than-expected profits due to greater market share and increased shipments.

In Fund activity, we initiated a position in Singapore conglomerate Jardine Matheson, UK credit and marketing services company Experian, and UK aircraft engine manufacturer Rolls Royce. We believe that Jardine has an attractive collection of assets, and Experian is the largest international operator in a growing industry. Rolls Royce has an attractive high recurring revenue model, high barriers to entry and positive structural growth potential, in our opinion.

Conversely, we exited the remaining small position in QBE Insurance, as we feel that there are more attractive investment opportunities elsewhere.

The divergence between major global central banks’ monetary policies has become more pronounced, which we believe may create a more complex and challenging market environment ahead. How that translates into global capital flows is uncertain. Meanwhile, the global economic environment appears mixed; while the U.S. economic engine continues to power on, the Eurozone3 and Japan’s economic health remained anemic. However, the sharp drop in oil prices since June may potentially provide some relief to large net importers such as the Eurozone and Japan. Similarly, the appreciation in the U.S. dollar may increase the trade competitiveness of these economies.

For us at Aberdeen, investing in companies that we view as fundamentally sound and well managed is an imperative that we believe should help negate the vagaries of market sentiment. Recent earnings from our holdings have been largely steady or met expectations despite the muted economic backdrop. Renewed efforts to boost profits through cost cuts and improving margins are further along, even though it may be some time before a broader rebound is evident. Many of these companies are market leaders and have weathered periods of crises; we think it should be no different this time. If we feel that valuations are attractive, we will look to add to favored holdings when opportunities arise.

| 1 | | The “third arrow” is the last of Japanese Prime Minister Shinzo Abe’s economic programs, comprising structural reforms in an effort to boost Japan’s competitiveness. |

| 2 | | Source: Bloomberg, October 2014. |

| 3 | | The Eurozone comprises 18 European Union member states that have adopted the euro as their common currency. |

2014 Annual Report

15

Aberdeen Select International Equity Fund II (Unaudited) (concluded)

Portfolio Management:

Aberdeen Global Equity Team

PAST PERFORMANCE DOES NOT GUARANTEE FUTURE RESULTS.

The performance quoted represents past performance, which does not guarantee future results. Class A Shares have up to a 0.25% 12b-1 fee. The investment return and principal value of an investment will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost. Current performance of the Fund may be lower or higher than the performance quoted. Performance data current to the most recent month-end may be obtained by calling 800-387-6977 or visiting www.aberdeen-asset.us.

Investing in mutual funds involves risk, including the possible loss of principal. There is no assurance that the investment objective of any fund will be achieved. Indexes are unmanaged and have been provided for comparison purposes only. No fees or expenses are reflected. You cannot invest directly in an index.

Lipper is a leading global provider of mutual fund information and analysis to fund companies, financial intermediaries and media organizations.

Risk Considerations

Foreign securities are more volatile, harder to price and less liquid than U.S. securities. They are subject to different accounting and regulatory standards, and political and economic risks. These risks are enhanced in emerging markets countries.

Equity stocks of mid-cap companies carry greater risk and more volatility than equity stocks of larger, more established companies.

Please read the prospectus for more detailed information regarding these and other risks.

Annual Report 2014

16

Aberdeen Select International Equity Fund II (Unaudited)

| | | | | | | | | | |

Average Annual Total Return

(For periods ended October 31, 2014) | | 1 Yr. | | 5 Yr. | | | Inception1 | |

Class A | | 0.46% | | | 3.13% | | | | 3.94% | |

Institutional Class2 | | 0.64% | | | 3.39% | | | | 4.22% | |

| 1 | | Fund commenced operations on May 04, 2005. |

2014 Annual Report

17

Aberdeen Select International Equity Fund II (Unaudited)

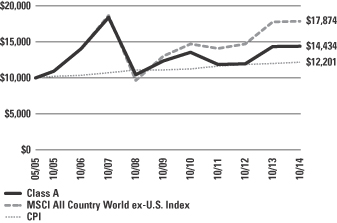

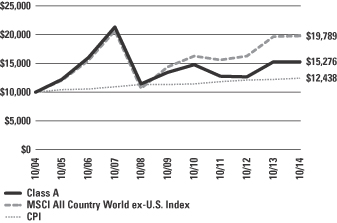

Performance of a $10,000 Investment (as of October 31, 2014)

Comparative performance of $10,000 invested in Class A shares of the Aberdeen Select International Equity Fund II, Morgan Stanley Capital International All Country World ex-U.S. Index (MSCI ACWI ex-U.S.), and the Consumer Price Index (CPI) since inception. Unlike the Fund’s returns, the returns for these unmanaged indexes do not reflect any fees or expenses. Investors cannot invest directly in market indexes.

The MSCI ACWI ex-U.S. is a free float-adjusted market capitalization index that is designed to measure the equity market performance of developed and emerging markets excluding the U.S.

The CPI represents changes in prices of all goods and services purchased for consumption by urban households.

Investment return and principal value will fluctuate, and when redeemed, shares may be worth more or less than original cost. Past performance is no guarantee of future results. The Average Annual Total Return table and performance graph do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the redemption of Fund shares. Investing in mutual funds involves market risk, including loss of principal. Performance returns assume the reinvestment of all distributions. Performance returns reflect fee waivers and reimbursements in effect without which returns would have been lower.

Portfolio Summary (as a percentage of net assets)

October 31, 2014 (Unaudited)

| | | | |

| Asset Allocation | |

Common Stocks | | | 87.2% | |

Preferred Stocks | | | 10.4% | |

Repurchase Agreement | | | 1.7% | |

Other assets in excess of liabilities | | | 0.7% | |

| | | | 100.0% | |

The following table summarizes the composition of the Fund’s portfolio, in Standard & Poor’s Global Industry Classification Standard (GICS) sectors, expressed as a percentage of net assets. The GICS structure consists of 10 sectors, 24 industry groups, 67 industries and 156 sub-industries. As of October 31, 2014, the Fund did not have more than 25% of its assets invested in any single industry group.

| | | | |

| Top Sectors | | | |

Financials | | | 17.5% | |

Consumer Staples | | | 15.0% | |

Industrials | | | 14.9% | |

Energy | | | 12.2% | |

Materials | | | 11.1% | |

Information Technology | | | 9.5% | |

Health Care | | | 8.9% | |

Telecommunication Services | | | 6.0% | |

Utilities | | | 2.5% | |

Other | | | 2.4% | |

| | | | 100.0% | |

| | | | |

| Top Holdings* | | | |

Roche Holding AG | | | 4.8% | |

Novartis AG | | | 4.1% | |

Taiwan Semiconductor Manufacturing Co. Ltd. | | | 4.0% | |

Samsung Electronics Co. Ltd., Preferred Shares | | | 4.0% | |

British American Tobacco PLC | | | 3.7% | |

Nestle SA | | | 3.7% | |

Royal Dutch Shell PLC, B Shares | | | 3.3% | |

Banco Bradesco SA, ADR, Preferred Shares | | | 3.0% | |

Japan Tobacco, Inc. | | | 2.8% | |

Fomento Economico Mexicano SAB de CV, ADR | | | 2.8% | |

Other | | | 63.8% | |

| | | | 100.0% | |

| | | | |

| Top Countries | | | |

United Kingdom | | | 22.0% | |

Switzerland | | | 16.4% | |

Japan | | | 8.7% | |

Brazil | | | 6.4% | |

Canada | | | 5.3% | |

Sweden | | | 5.2% | |

Italy | | | 5.0% | |

Hong Kong | | | 5.0% | |

France | | | 4.4% | |

Taiwan | | | 4.0% | |

Other | | | 17.6% | |

| | | | 100.0% | |

| * | | For the purpose of listing top holdings, repurchase agreements are included as part of Other. |

Annual Report 2014

18

Statement of Investments

October 31, 2014

Aberdeen Select International Equity Fund II

| | | | | | | | |

| | | Shares or

Principal

Amount | | | Value | |

COMMON STOCKS (87.2%) | | | | | | | | |

CANADA (5.3%) | | | | | | | | |

Industrials (2.1%) | | | | | | | | |

Canadian National Railway Co. | | | 68,000 | | | $ | 4,792,479 | |

Materials (2.1%) | | | | | | | | |

Potash Corp. of Saskatchewan, Inc. | | | 139,500 | | | | 4,759,914 | |

Telecommunication Services (1.1%) | | | | | | | | |

TELUS Corp. | | | 70,700 | | | | 2,532,771 | |

| | | | | | | | 12,085,164 | |

CHINA (1.6%) | | | | | | | | |

Energy (1.6%) | | | | | | | | |

PetroChina Co. Ltd., H Shares (a) | | | 2,882,000 | | | | 3,626,062 | |

FRANCE (4.4%) | | | | | | | | |

Consumer Staples (2.0%) | | | | | | | | |

Casino Guichard-Perrachon SA (a) | | | 44,000 | | | | 4,522,033 | |

Industrials (1.4%) | | | | | | | | |

Schneider Electric SE (a) | | | 39,500 | | | | 3,126,340 | |

Utilities (1.0%) | | | | | | | | |

GDF Suez (a) | | | 99,400 | | | | 2,412,476 | |

| | | | | | | | 10,060,849 | |

GERMANY (1.5%) | | | | | | | | |

Materials (1.5%) | | | | | | | | |

Linde AG (a) | | | 18,900 | | | | 3,485,248 | |

HONG KONG (5.0%) | | | | | | | | |

Financials (3.4%) | | | | | | | | |

AIA Group Ltd. (a) | | | 936,000 | | | | 5,222,362 | |

Swire Pacific Ltd., Class A (a) | | | 188,000 | | | | 2,468,459 | |

| | | | | | | | 7,690,821 | |

Industrials (1.6%) | | | | | | | | |

Jardine Matheson Holdings Ltd. (a) | | | 61,200 | | | | 3,687,226 | |

| | | | | | | | 11,378,047 | |

ITALY (5.0%) | | | | | | | | |

Energy (5.0%) | | | | | | | | |

Eni SpA (a) | | | 247,222 | | | | 5,264,120 | |

Tenaris SA, ADR | | | 159,400 | | | | 6,318,616 | |

| | | | | | | | 11,582,736 | |

JAPAN (8.7%) | | | | | | | | |

Consumer Staples (2.8%) | | | | | | | | |

Japan Tobacco, Inc. (a) | | | 186,100 | | | | 6,460,422 | |

Financials (1.1%) | | | | | | | | |

Daito Trust Construction Co. Ltd. (a) | | | 20,500 | | | | 2,593,908 | |

Industrials (2.1%) | | | | | | | | |

FANUC Corp. (a) | | | 26,800 | | | | 4,717,875 | |

Materials (2.7%) | | | | | | | | |

Shin-Etsu Chemical Co. Ltd. (a) | | | 94,200 | | | | 6,139,652 | |

| | | | | | | | 19,911,857 | |

MEXICO (2.8%) | | | | | | | | |

Consumer Staples (2.8%) | | | | | | | | |

Fomento Economico Mexicano SAB de CV, ADR | | | 65,700 | | | | 6,322,968 | |

SINGAPORE (3.6%) | | | | | | | | |

Financials (1.5%) | | | | | | | | |

City Developments Ltd. (a) | | | 482,000 | | | | 3,550,072 | |

Telecommunication Services (2.1%) | | | | | | | | |

Singapore Telecommunications Ltd. (a) | | | 1,624,000 | | | | 4,777,844 | |

| | | | | | | | 8,327,916 | |

SOUTH AFRICA (1.7%) | | | | | | | | |

Telecommunication Services (1.7%) | | | | | | | | |

MTN Group Ltd. (a) | | | 172,100 | | | | 3,803,697 | |

SWEDEN (5.2%) | | | | | | | | |

Financials (1.6%) | | | | | | | | |

Nordea Bank AB (a) | | | 286,600 | | | | 3,667,460 | |

Industrials (2.1%) | | | | | | | | |

Atlas Copco AB, A Shares (a) | | | 168,600 | | | | 4,860,809 | |

Information Technology (1.5%) | | | | | | | | |

Telefonaktiebolaget LM Ericsson, B Shares (a) | | | 285,700 | | | | 3,370,857 | |

| | | | | | | | 11,899,126 | |

SWITZERLAND (16.4%) | | | | | | | | |

Consumer Staples (3.7%) | | | | | | | | |

Nestle SA (a) | | | 115,200 | | | | 8,431,247 | |

Financials (2.7%) | | | | | | | | |

Zurich Insurance Group AG (a)(b) | | | 20,300 | | | | 6,141,780 | |

Health Care (8.9%) | | | | | | | | |

Novartis AG (a) | | | 102,600 | | | | 9,512,570 | |

Roche Holding AG (a) | | | 37,000 | | | | 10,924,781 | |

| | | | | | | | 20,437,351 | |

Industrials (1.1%) | | | | | | | | |

Schindler Holding AG (a) | | | 18,200 | | | | 2,545,796 | |

| | | | | | | | 37,556,174 | |

TAIWAN (4.0%) | | | | | | | | |

Information Technology (4.0%) | | | | | | | | |

Taiwan Semiconductor Manufacturing Co. Ltd. (a) | | | 2,147,000 | | | | 9,267,376 | |

UNITED KINGDOM (22.0%) | | | | | | | | |

Consumer Staples (3.7%) | | | | | | | | |

British American Tobacco PLC (a) | | | 150,000 | | | | 8,520,364 | |

Energy (4.6%) | | | | | | | | |

John Wood Group PLC (a) | | | 294,800 | | | | 3,130,372 | |

Royal Dutch Shell PLC, B Shares (a) | | | 201,800 | | | | 7,487,278 | |

| | | | | | | | 10,617,650 | |

Financials (4.2%) | | | | | | | | |

HSBC Holdings PLC (a) | | | 476,800 | | | | 4,881,323 | |

Standard Chartered PLC (a) | | | 312,803 | | | | 4,708,792 | |

| | | | | | | | 9,590,115 | |

See accompanying notes to financial statements.

2014 Annual Report

19

Statement of Investments (concluded)

October 31, 2014

Aberdeen Select International Equity Fund II

| | | | | | | | |

| | | Shares or

Principal

Amount | | | Value | |

Industrials (4.5%) | | | | | | | | |

Experian PLC (a) | | | 229,200 | | | $ | 3,444,973 | |

Rolls-Royce Holdings PLC (a)(b) | | | 183,031 | | | | 2,473,090 | |

Weir Group PLC (The) (a) | | | 119,300 | | | | 4,363,436 | |

| | | | | | | | 10,281,499 | |

Materials (2.4%) | | | | | | | | |

BHP Billiton PLC (a) | | | 213,200 | | | | 5,520,498 | |

Telecommunication Services (1.1%) | | | | | | | | |

Vodafone Group PLC (a) | | | 730,300 | | | | 2,426,891 | |

Utilities (1.5%) | | | | | | | | |

Centrica PLC (a) | | | 729,800 | | | | 3,535,663 | |

| | | | | | | | 50,492,680 | |

Total Common Stocks | | | | | | | 199,799,900 | |

PREFERRED STOCKS (10.4%) | | | | | | | | |

BRAZIL (6.4%) | | | | | | | | |

Energy (1.0%) | | | | | | | | |

Petroleo Brasileiro SA, ADR, Preferred Shares | | | 178,500 | | | | 2,183,055 | |

Financials (3.0%) | | | | | | | | |

Banco Bradesco SA, ADR, Preferred Shares | | | 460,223 | | | | 6,894,141 | |

Materials (2.4%) | | | | | | | | |

Vale SA, ADR, Preferred Shares | | | 619,800 | | | | 5,429,448 | |

| | | | | | | | 14,506,644 | |

REPUBLIC OF SOUTH KOREA (4.0%) | | | | | | | | |

Information Technology (4.0%) | | | | | | | | |

Samsung Electronics Co. Ltd., Preferred Shares (a) | | | 9,700 | | | | 9,163,498 | |

UNITED KINGDOM (0.0%) | | | | | | | | |

Industrials (0.0%) | | | | | | | | |

Rolls-Royce Holdings PLC, Preferred Shares | | | 13,527,000 | | | | 21,641 | |

Total Preferred Stocks | | | | 23,691,783 | |

REPURCHASE AGREEMENT (1.7%) | | | | | | | | |

UNITED STATES (1.7%) | | | | | | | | |

Repurchase Agreement, Fixed Income Clearing Corp., 0.00%, dated 10/31/2014, due 11/03/2014, repurchase price $3,938,150, collateralized by U.S. Treasury Note, maturing 04/30/2018; total market value of $4,018,219 | | $ | 3,938,150 | | | $ | 3,938,150 | |

Total Repurchase Agreement | | | | 3,938,150 | |

Total Investments

(Cost $229,072,957) (c)—99.3% | | | | 227,429,833 | |

| |

Other assets in excess of liabilities—0.7% | | | | 1,621,962 | |

Net Assets—100.0% | | | $ | 229,051,795 | |

| (a) | | Fair Valued Security. Fair Values are determined pursuant to procedures approved by the Fund’s Board of Trustees. See Note 2(a) of the accompanying Notes to Financial Statements. |

| (b) | | Non-income producing security. |

| (c) | | See notes to financial statements for tax unrealized appreciation/depreciation of securities. |

| ADR | | American Depositary Receipt |

See accompanying notes to financial statements.

Annual Report 2014

20

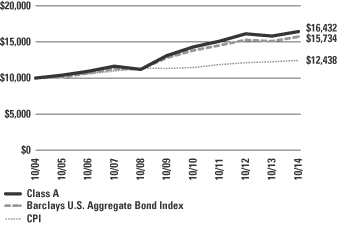

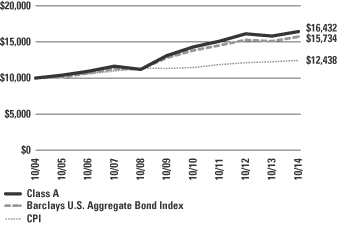

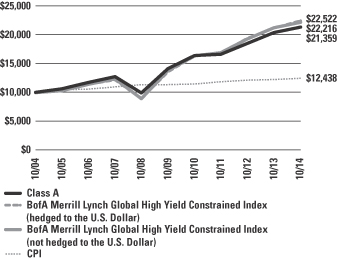

Aberdeen Total Return Bond Fund (Unaudited)

The Aberdeen Total Return Bond Fund (Class A shares at net asset value net of fees) returned 3.96% for the 12-month period ended October 31, 2014, versus the 4.14% return of its benchmark, the Barclays Capital U.S. Aggregate Bond Index, for the same period. For broader comparison, the average return of the Fund’s Lipper peer category of Core Bond Funds (consisting of 521 funds) was 4.12% for the period.