UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED

MANAGEMENT INVESTMENT COMPANIES

Investment Company Act file number: 811-06113

The Caldwell & Orkin Funds, Inc.

(Exact name of registrant as specified in charter)

5185 Peachtree Parkway, Suite 370

Norcross, GA 30092-6541

(Address of principal executive offices) (Zip code)

Michael B. Orkin

5185 Peachtree Parkway, Suite 370

Norcross, GA 30092-6541

(Name and Address of Agent for Service)

678-533-7850

Registrant’s Telephone Number, including Area Code

Date of fiscal year end: April 30

Date of reporting period: May 1, 2015 – April 30, 2016

Form N-CSR is to be used by management investment companies to file reports with the Commission not later than 10 days after the transmission to stockholders of any report that is required to be transmitted to stockholders under Rule 30e-1 under the Investment Company Act of 1940 (17 CFR 270.30e-1). The Commission may use the information provided on Form N-CSR in its regulatory, disclosure review, inspection, and policymaking roles.

A registrant is required to disclose the information specified by Form N-CSR, and the Commission will make this information public. A registrant is not required to respond to the collection of information contained in Form N‑CSR unless the Form displays a currently valid Office of Management and Budget ("OMB") control number. Please direct comments concerning the accuracy of the information collection burden estimate and any suggestions for reducing the burden to Secretary, Securities and Exchange Commission, 450 Fifth Street, NW, Washington, DC 20549-0609. The OMB has reviewed this collection of information under the clearance requirements of 44 U.S.C. ss. 3507.

| Item 1. | Reports to Stockholders. |

| | Caldwell & Orkin |

| Table of Contents | Market Opportunity Fund |

| Shareholder Letter | 2 |

| Performance Summary | 7 |

| Statistical Risk Profile | 9 |

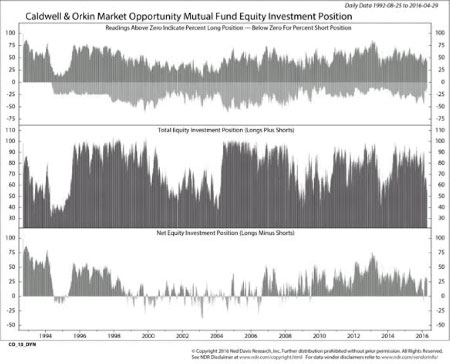

| Growth of $10,000 | Equity Investment Position Chart | 11 |

| Disclosure of Fund Expenses | 12 |

| Sector Diversification | 14 |

| Schedule of Investments | 16 |

| Statement of Assets & Liabilities | 23 |

| Statement of Operations | 24 |

| Statements of Changes in Net Assets | 25 |

| Financial Highlights | 26 |

| Notes to Financial Statements | 28 |

| Report of Independent Registered Public Accounting Firm | 38 |

| Additional Information | 39 |

| Caldwell & Orkin | |

| Market Opportunity Fund | Shareholder Letter |

April 30, 2016 (Unaudited)

Investment Adviser C&O Funds Advisor, Inc. 5185 Peachtree Parkway, Suite 370 Norcross, Georgia

30092-6541 (800) 237-7073 |  | Shareholder Accounts

c/o ALPS Fund Services, Inc. P.O. Box 46256 Denver, Colorado 80201 (800) 467-7903 |

Dear Fellow Shareholder:

The Caldwell & Orkin Market Opportunity Fund’s (the “Fund”) investment objective is to provide long-term capital growth with a short-term focus on capital preservation. In other words, we manage for risk as well as return. Our investment process includes both macro (top-down) analysis and stock selection (bottom-up). Our macro analysis informs our net equity exposure while our stock selection helps us determine what stocks will help us reach this exposure. The Fund is actively managed, with the goal of outperforming the market over a full-market cycle (inclusive of both a bull cycle and a bear cycle) with less risk.

Management Discussion and Analysis

During the fiscal year-ended April 30, 2016 the equity markets went on a roller coaster ride. From July 20th – August 25th the S&P Total Return Index fell -12%, recovered those losses by October, fell-14% from November 3rd – January 20th and recovered those losses again to end the fiscal year up 1%. During these significant setbacks the Fund was up 1% and flat, respectively.

The Fund’s gross long exposure at period end was 43.55%, and it fluctuated throughout the year from a low of 34.53% to a high of 62.39%. During this time period the longs underperformed the S&P 500, returning -4.01%. The Fund’s gross short exposure ended the period at -14.01%, fluctuating throughout the year from a low of -12.02% to a high of -45.49%. The shorts significantly outperformed the inverse of the S&P 500, returning 16.67%. The Fund’s net invested position (longs minus shorts) ended the period at 29.54% net-long, fluctuating from -7.33% net-short to 38.61% net-long. The Fund’s total invested position (longs plus absolute value of the shorts plus puts and calls) ended the period at 55.68%, fluctuating from 53.32% to 95.87%.

The Fund is actively managed. The asset allocation fluctuations throughout the fiscal year were the result our macro factor analysis. Specifically, as the markets sold off from July to August our net exposure fell from 30.23% net-long to 15.47% net-long primarily as a result of a reduction in our long exposure. Our net exposure then rose slightly to 25.52% net-long as the market rebounded through early November. During the November to January downturn our exposure fell significantly to 5.30% net-long, again as a result of a reduction in our long exposure. By period-end the Fund was 27.64% net-long as a result of a significant reduction in our short exposure.

As of April 30, 2016 the longs were broadly diversified and positioned to benefit from global stimulus actions occurring within the backdrop of a slow-growing economy. Retail was the largest long exposure at 5.47%. Within this group we were both long specialty and discount retailers. The Fund had a 4.04% exposure to diversified Industrial companies. The Fund’s third-largest long exposure (at 3.83%) was to Technology companies with an emphasis on Internet, media and e-Commerce.

| 2 | 1-800-467-7903 | www.CaldwellOrkin.com |

| Caldwell & Orkin | |

| Market Opportunity Fund | Shareholder Letter |

April 30, 2016 (Unaudited)

As mentioned, the allocation to the shorts was significantly reduced as the markets rallied from their beginning-of-the-year lows. As of April 30, consumer finance companies made up the Fund’s largest short industry exposure at -2.17%.

During the year, eight of our ten biggest winners were shorts while only two were longs. On the short side the winners include deep-water drilling companies Seadrill Ltd. (SDRL) and Transocean Ltd. (RIG), for-profit education companies Apollo Education Group, Inc. (APOL) and DeVry Education Group Inc. (DV), specialty retailer Conn’s, Inc. (CONN), real-estate e-commerce service provider Zillow Group, Inc. (ZG) and e-Commerce service provider Etsy, Inc. (ETSY) and investment management company Waddell & Reed Financial, Inc. (WDR). On the long side, an equity position and a call position in Internet media company Facebook Inc. (FB) were our top performers.

Three out of five of our biggest losers were shorts. Among these shorts were specialty beverage company Keurig Green Mountain Inc. (GMCR), real estate e-commerce service provider Zillow Group, Inc. (Z) (note: during the period Zillow spilt into two share classes represented by tickers Z and ticker ZG) and specialty apparel company Michael Kors Holdings Limited (KORS). Footwear designer Skechers U.S.A., Inc. (SKX) and pipeline transportation and energy storage company Kinder Morgan Inc. (KMI) were the two longs in the bottom five biggest losers.

Outlook

Entering this fiscal year, global economic liquidity has turned positive despite the Federal Reserve being in a rate-tightening cycle. The economy continues to grow at a slow pace while wage and consumer goods inflation are accelerating. Taken together, the outlook for economic liquidity could again turn less bullish. Like last year, we see the potential for a volatile equity market backdrop, in which we could continue to find attractive opportunities for the Fund’s long and short positions.

Markets move in cycles. Our goal in managing the Fund is to outperform over the course of a full market cycle, which includes both bull and bear market phases. Ned Davis Research, Inc. (“NDR”) has computed the bull and bear market cycles for the S&P 500 (“S&P”). Most of their definition focuses on a 20% market move in either direction. Over time, the Fund has underperformed during the bull phase of the full market cycle while outperforming in the bear phase. Meanwhile, the Fund’s drawdowns have been uncorrelated to and significantly less than the market’s drawdowns. The Fund’s total returns also have little correlation to market returns.

| Bull Market Phase |

| Start Date | MOF | S&P |

| 8/24/1992* | 212.19% | 230.03% |

| 8/31/1998 | 6.02% | 62.88% |

| 9/21/2001 | -5.75% | 22.00% |

| 10/9/2002 | 16.21% | 119.38% |

| 3/9/2009 | -2.47% | 111.33% |

| Bear Market Phase |

Start Date** | MOF | S&P |

| 7/17/1998 | 4.01% | -19.19% |

| 9/1/2000 | 14.71% | -35.71% |

| 3/19/2002 | 9.97% | -33.01% |

| 10/9/2007 | 2.20% | -55.26% |

| 4/29/2011 | 0.46% | -18.72% |

| Full Market Cycle |

End Date*** | MOF | S&P |

| 8/31/1998 | 224.71% | 166.69% |

| 9/21/2001 | 21.61% | 4.72% |

| 10/9/2002 | 3.65% | -18.27% |

| 3/9/2009 | 18.77% | -1.85% |

| 10/3/2011 | -2.02% | 71.76% |

| Annual Report | April 30, 2016 | 3 |

| Caldwell & Orkin | |

| Market Opportunity Fund | Shareholder Letter |

April 30, 2016 (Unaudited)

| * | The first bull market phase began 10/11/1990, but the table begins with 8/24/1992, which coincides with commencement of active management of the Caldwell & Orkin Market Opportunity Fund. |

| ** | The bear market start date is the bull market’s end date. |

| *** | A full market cycle runs from the bull market start date to the full market cycle end date. |

Sincerely,

Michael B. Orkin, CFA

Portfolio Manager and Chief Investment Officer

The performance data quoted represents past performance. Past performance is no guarantee of future results. The investment return and principal value of an investment in the Fund will fluctuate so that an investor's shares, when redeemed, may be worth more or less than their original cost. Current performance may be higher or lower than the performance data quoted. Please call 800-377-7073 or visit www.CaldwellOrkin.com for current month-end performance. To see the most current performance as of 4/30/2016, please see page 7 of this annual report.

| 4 | 1-800-467-7903 | www.CaldwellOrkin.com |

| Caldwell & Orkin | |

| Market Opportunity Fund | Shareholder Letter |

April 30, 2016 (Unaudited)

Disclosure

The Fund’s investment objective is to provide long-term capital growth with a short-term focus on capital preservation. Our philosophy in managing the Fund is to focus on risk as well as return. We use an investment philosophy based upon sophisticated exploitation of the low-risk anomaly. The low-risk anomaly stands in direct contradiction to the conventional beliefs of Efficient Market Hypothesis stating that high risk is equated with higher return. Caldwell and Orkin takes the opposite view – we believe that lower risk can result in higher return. The Fund may hold up to 60% of its net assets in short positions at any time and also invest in options. Short positions and put options are employed with the intent of making money when those stocks we judge to be mispriced fall. When we use short positions or put options, the Fund’s portfolio is considered to be “hedged,” so that it is not fully exposed to the price movements and volatility of the broader market. Our asset allocation determinations are primarily based on our perception of risk in the marketplace. In summary, our goal is to make money over a full market cycle, but with less stomach churn.

The Fund’s disciplined investment philosophy and active management style typically leads to higher-than-average portfolio turnover. High turnover may have an unfavorable impact on the amount of taxable distributions paid to shareholders. Higher turnover may also result in higher brokerage costs for the Fund. The Fund’s turnover rate will typically exceed 100% per year, and will not be a limiting factor when we deem change appropriate. Fund holdings, industry and asset allocations are subject to change without notice. The Fund may or may not have a position in any of the companies mentioned in this commentary as of the date of this report.

An investment in the Fund involves risk, including the loss of principal. Additionally, there are certain risks inherent in investing in the Fund, including market risk, short sale risk, interest rate risk, business risk, small company risk, market valuation risk, political risk, and portfolio turnover risk. For a complete discussion of these risks, you may request a copy of the Fund’s prospectus by calling 800-237-7073. The Fund uses aggressive investment strategies (including short positions and options) that have the potential for yielding high returns; however, these strategies may also result in losses. Stocks sold short have unlimited risk. Investment return and principal value will fluctuate so that shares, when redeemed, may be worth more or less than their original cost. Options are not suitable for all investors.

Investors should expect that the Fund’s performance may fluctuate independently of stock market indices, such as the S&P 500 Total Return Index.

Distributed by ALPS Distributors, Inc., Member FINRA/SIPC

1290 Broadway, Suite 1100, Denver, CO 80203

| Annual Report | April 30, 2016 | 5 |

| Caldwell & Orkin | |

| Market Opportunity Fund | Shareholder Letter |

April 30, 2016 (Unaudited)

Statistical Risk Definitions:

Correlation Coefficient (R): R is a statistical measure of correlation. In this report, R is a measurement of investment risk that indicates how closely performance is linked to the broad market – it quantifies the degree to which a fund’s performance correlates with the performance of a benchmark. R can vary between 1.000 (perfect positive correlation) and -1.000 (perfect negative correlation). 0.000 represents no correlation. An R of 1.000 means that all movements of a fund are fully explained by movements in its benchmark index. Conversely, a low R indicates that very few of the fund's movements are explained by movements in its benchmark index, and a negative R indicates a fund’s movements are inversely correlated with its benchmark index.

Coefficient of Determination (R-Square): R-Square, also represented as R2, is another measurement of investment risk that quantifies the degree to which a fund’s performance correlates with the performance of its benchmark index. R-Square is calculated by multiplying the Correlation Coefficient (R) by itself, and is therefore always positive. R-Square can vary between 0.000 (no correlation) and 1.000 (perfect correlation). The higher the value of R-Square, the greater the degree of correlation between the fund and its benchmark index. R-squared does not take into account the direction of the correlation (positive or negative), therefore R-Squared is not able to reflect inverse correlation between a fund and its benchmark index.

Beta: A measure of a fund’s sensitivity to market movements. Usually the higher betas represent riskier investments. When correlation is low, beta has minimal, if any, significance.

Standard deviation: A statistical measure of dispersion about an average, indicating the volatility of a fund’s total returns.

Sharpe Ratio: The Sharpe Ratio is calculated by subtracting the risk-free (T-bill) rate of return from a portfolio’s total return and then dividing this by its standard deviation. The resulting fraction can be thought of as return per unit of risk. The higher a portfolio’s Sharpe Ratio, the better the risk-adjusted performance.

Semi-variance: A measure of a fund’s downside (negative return) volatility relative to a benchmark. Lower numbers are associated with less risk.

Index Definition:

S&P 500 Total Return Index: The S&P 500 Total Return Index is a capitalization-weighted, unmanaged index of 500 large U.S. companies chosen for market size, liquidity and industry group representation and includes reinvested dividends. You cannot invest directly in an index.

| 6 | 1-800-467-7903 | www.CaldwellOrkin.com |

| Caldwell & Orkin | |

| Market Opportunity Fund | Performance Summary |

April 30, 2016 (Unaudited)

| Fiscal Year Ended April 30, | C&O Market Opportunity Fund(1) | S&P 500 Total Return Index(2) |

| 1993** | 21.09% | 9.18% |

| 1994 | 16.48% | 5.32% |

| 1995 | -2.28% | 17.47% |

| 1996 | 31.80% | 30.21% |

| 1997 | 23.24% | 25.13% |

| 1998 | 25.77% | 41.07% |

| 1999 | 19.43% | 21.82% |

| 2000 | -0.02% | 10.13% |

| 2001 | 11.43% | -12.97% |

| 2002 | 1.88% | -12.63% |

| 2003 | 1.12% | -13.31% |

| 2004 | -3.55% | 22.88% |

| Total Return Through April 30, 2016 | | |

| 6 months ended | -7.98% | 0.43% |

| 12 months ended | -0.56% | 1.21% |

Since 8/24/92(3) | 474.91% | 707.53% |

| Fiscal Year Ended April 30, | C&O Market Opportunity Fund(1) | S&P 500 Total Return Index(2) |

| 2005 | -0.17% | 6.34% |

| 2006 | -2.74% | 15.42% |

| 2007 | 15.31% | 15.24% |

| 2008 | 17.92% | -4.68% |

| 2009 | 4.73% | -35.31% |

| 2010 | -7.40% | 38.84% |

| 2011 | 0.41% | 17.22% |

| 2012 | 4.95% | 4.76% |

| 2013 | 11.72% | 16.89% |

| 2014 | -6.92% | 20.44% |

| 2015 | 10.73% | 12.98% |

| 2016 | -0.56% | 1.21% |

| Average Annual Returns Through April 30, 2016 | | |

| One Year | -0.56% | 1.21% |

| Three Years | 0.83% | 11.26% |

| Five Years | 3.74% | 11.02% |

| Ten Years | 4.75% | 6.91% |

| Fifteen Years | 2.90% | 5.48% |

| Twenty Years | 5.93% | 7.92% |

Since 8/24/92(3) | 7.67% | 9.24% |

| 1 | The performance data quoted represents past performance. Past performance is no guarantee of future results. The investment return and principal value of an investment in the Fund will fluctuate so that an investor's shares, when redeemed, may be worth more or less than their original cost. Current performance may be higher or lower than the performance data quoted. Please call 800-377-7073 or visit www.CaldwellOrkin.com for current month-end performance. The Fund's performance assumes the reinvestment of dividends and capital gains, if any. Fund holdings, industry and asset allocations are subject to change without notice. The Fund may or may not have a position in any of the companies mentioned in this report as of the date of this report. See additional important disclosures on pages 5 and 6. |

| 2 | Investors should expect that the Fund’s performance may fluctuate independently of stock market indices, such as the S&P 500 Total Return index. The S&P 500 Total Return index is a widely recognized unmanaged index of 500 common stock prices adjusted to reflect the reinvestment of dividends and distributions. You may not invest directly in an index. |

3 | Effective August 24, 1992, the Fund changed its investment objective to provide long-term capital growth with a short-term focus on capital preservation through investment selection and asset allocation. Prior to that time, the Fund was passively managed and indexed to the largest 100 over-the-counter (OTC) stocks. |

| Annual Report | April 30, 2016 | 7 |

| Caldwell & Orkin | |

| Market Opportunity Fund | Performance Summary |

April 30, 2016 (Unaudited)

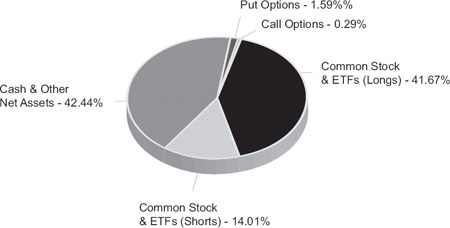

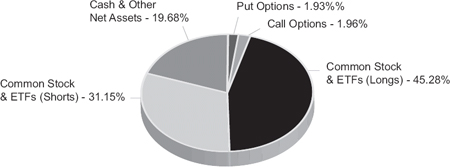

† | As a percentage of net assets plus the absolute value of securities sold short. |

| * | For the full fiscal year ended April 30, 1993. |

| ** | From August 24, 1992 through April 30, 1993 - the portion of the year using the active investment management style of C&O Funds Advisor, Inc., the manager of the Fund. |

Total annualized Fund operating expenses for the Fund’s fiscal year ended April 30, 2016 were 2.95%, or 1.37% before interest expenses and dividend expenses related to short sales. These figures exclude Acquired Fund Fees and Expenses of 0.02%. Additional information about the Fund’s fees and expenses is available in the Fund’s prospectus.

Net Asset Allocation

April 30, 2016†

Net Asset Allocation

October 31, 2015†

| 8 | 1-800-467-7903 | www.CaldwellOrkin.com |

Caldwell & Orkin | |

Market Opportunity Fund | Statistical Risk Profile |

April 30, 2016 (Unaudited)

| Ten Worst S&P 500 Total Return Days |

| Date | C&O MOF | S&P 500 | Variance | The Caldwell & Orkin Market Opportunity Fund outperformed the S&P 500 Total Return index on all ten of the ten worst days, and was positive on two of the ten days. |

| 10/15/2008 | -1.47% | -9.02% | 7.55% |

| 12/1/2008 | -1.58% | -8.92% | 7.34% |

| 9/29/2008 | -0.37% | -8.78% | 8.41% |

| 10/9/2008 | -2.12% | -7.61% | 5.49% |

| 10/27/1997 | -1.60% | -6.89% | 5.29% |

| 8/31/1998 | 0.42% | -6.79% | 7.21% |

| 11/20/2008 | 0.23% | -6.70% | 6.93% |

| 8/8/2011 | -0.63% | -6.66% | 6.03% |

| 11/19/2008 | -0.28% | -6.10% | 5.82% |

| 10/22/2008 | -1.11% | -6.09% | 4.98% |

| Ten Worst S&P 500 Total Return Weeks |

| Week Ending | C&O MOF | S&P 500 | Variance | The Caldwell & Orkin Market Opportunity Fund outperformed the S&P 500 Total Return index in all ten of the ten worst weeks, and was positive in seven of those weeks. |

| 10/10/2008 | -2.71% | -18.14% | 15.43% |

| 9/21/2001 | 1.62% | -11.57% | 13.19% |

| 4/14/2000 | 4.51% | -10.52% | 15.03% |

| 10/3/2008 | 1.82% | -9.33% | 11.15% |

| 11/21/2008 | 0.55% | -8.33% | 8.88% |

| 7/19/2002 | 0.64% | -7.96% | 8.60% |

| 8/5/2011 | -0.78% | -7.15% | 6.37% |

| 3/6/2009 | -0.88% | -6.96% | 6.08% |

| 7/12/2002 | 1.02% | -6.81% | 7.83% |

| 2/20/2009 | 0.19% | -6.80% | 6.99% |

| Ten Worst S&P 500 Total Return Months |

| Month | C&O MOF | S&P 500 | Variance | The Caldwell & Orkin Market Opportunity Fund outperformed the S&P 500 Total Return index in all ten of the ten worst months, and was positive in seven of those months. |

| 10/31/2008 | 2.86% | -16.74% | 19.60% |

| 8/31/1998 | 3.11% | -14.46% | 17.57% |

| 9/30/2002 | 2.10% | -10.86% | 12.96% |

| 2/28/2009 | 0.29% | -10.71% | 11.00% |

| 2/28/2001 | 4.78% | -9.13% | 13.91% |

| 9/30/2008 | -0.42% | -8.89% | 8.47% |

| 6/30/2008 | 4.84% | -8.43% | 13.27% |

| 1/31/2009 | -0.73% | -8.30% | 7.57% |

| 9/30/2001 | 3.28% | -8.06% | 11.34% |

| 5/31/2010 | -2.56% | -8.04% | 5.48% |

Short selling began May 2, 1994. Past performance is no guarantee of future results. See additional important disclosures on pages 5 and 6. Computations by Ned Davis Research, Inc.

| Annual Report | April 30, 2016 | 9 |

Caldwell & Orkin | |

Market Opportunity Fund | Statistical Risk Profile |

April 30, 2016 (Unaudited)

| Ten Worst Drawdowns |

| Caldwell & Orkin Market Opportunity Fund | | S&P 500 Total Return Index |

| Date Range | C&O MOF | S&P 500 | | Date Range | C&O MOF | S&P 500 |

| 01/17/2008 - 05/07/2010 | -15.68% | -11.68% | | 10/09/2007 - 03/09/2009 | 2.20% | -55.26% |

| 04/12/1999 - 11/23/1999 | -13.30% | 4.23% | | 03/24/2000 - 10/09/2002 | 28.03% | -47.41% |

| 10/09/2002 - 05/25/2006 | -12.82% | 74.17% | | 07/17/1998 - 08/31/1998 | 4.01% | -19.19% |

| 02/02/2016 - 03/07/2016 | -10.90% | 5.41% | | 04/29/2011 - 10/03/2011 | 0.46% | -18.72% |

| 05/17/2013 - 04/11/2014 | -10.22% | 10.82% | | 04/23/2010 - 07/02/2010 | -1.47% | -15.67% |

| 03/18/1994 - 05/22/1995 | -10.03% | 14.95% | | 11/27/2002 - 03/11/2003 | 2.18% | -14.28% |

| 05/26/2000 - 06/07/2000 | -8.14% | 6.81% | | 05/21/2015 – 02/11/2016 | 5.26% | -12.85% |

| 12/29/2000 - 01/19/2001 | -8.06% | 1.75% | | 07/16/1999 - 10/15/1999 | -0.47% | -11.78% |

| 04/04/2001 - 03/11/2002 | -8.03% | 7.22% | | 10/07/1997 - 10/27/1997 | 0.16% | -10.74% |

| 03/15/1993 - 04/26/1993 | -7.83% | -3.65% | | 09/23/1998 - 10/08/1998 | 2.03% | -9.94% |

| Statistical Risk Measurements |

| 8/24/1992 through 4/30/16 (daily data) |

| | C&O MOF | S&P 500 |

| Coefficient of Determination (R-Square) | 0.008 | 1.000 |

| Correlation Coefficient "R" | 0.088 | 1.000 |

| Beta | 0.040 | 1.000 |

| Standard Deviation | 0.522 | 1.159 |

| Sharpe Ratio | 0.60 | 0.43 |

| Semi-Variance | 0.13 | 0.66 |

| Performance During Market Downturns of 20% or More |

| | C&O MOF | S&P 500 |

| 01/06/2009 - 03/09/2009 | -3.43% | -27.19% |

| 10/09/2007 - 11/20/2008 | 4.27% | -50.73% |

| 01/04/2002 - 10/09/2002 | 7.20% | -32.95% |

| 03/24/2000 - 09/21/2001 | 23.52% | -35.65% |

Short selling began May 2, 1994. Past performance is no guarantee of future results. See additional important disclosures on pages 5 and 6. Computations by Ned Davis Research, Inc.

| 10 | 1-800-467-7903 | www.CaldwellOrkin.com |

Caldwell & Orkin | |

Market Opportunity Fund | Growth of $10,000 |

April 30, 2016 (Unaudited)

Caldwell & Orkin Market Opportunity Fund Versus S&P 500 Total Return Index

Since Commencement of Active Style of Investment Management Results of a Hypothetical $10,000 Investment August 24, 1992 through April 30, 2016.

Past performance does not predict future performance. The returns do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the redemption of Fund shares. See additional disclosure on pages 5 and 6.

| Annual Report | April 30, 2016 | 11 |

Caldwell & Orkin

Market Opportunity Fund | Disclosure of Fund Expenses |

April 30, 2016 (Unaudited)

We believe it is important for you to understand the impact of fees and expenses on your investment in the Fund. As a shareholder of the Fund, you incur two types of costs: (1) transaction costs related to the purchase and redemption of Fund shares, including redemption fees and brokerage commissions (if applicable); and (2) ongoing costs, including management fees, administrative expenses, portfolio transaction costs and other Fund expenses. A mutual fund’s ongoing costs are expressed as a percentage of its average net assets. This figure is known as the expense ratio. The following example is intended to help you understand your ongoing costs (in dollars and cents) of investing in the Fund and to compare these costs with the ongoing costs of investing in other mutual funds.

The below example is based on an investment of $1,000.00 invested at the beginning of the period and held for the entire period indicated, November 1, 2015 through April 30, 2016. The table below illustrates the Fund’s expenses in two ways:

Based on Actual Fund Returns

The first line of the table below provides information about actual account values and actual expenses. You may use the information in this line, together with the amount you invested, to estimate the expenses that you paid over the period. Simply divide your account value by $1,000 (for example, an $8,600 account value divided by $1,000 = 8.6), then multiply the result by the number in the first line under the heading entitled “Expenses Paid During Period” to estimate the expenses you paid on your account during this period.

Based on a Hypothetical 5% Return for Comparison Purposes

The second line of the table below provides information about hypothetical account values and hypothetical expenses based on the Fund’s actual expense ratio and an assumed rate of return of 5% per year before expenses, which is not the Fund’s actual return. The hypothetical account values and expenses may not be used to estimate the actual ending account balance or expenses you paid for the period. You may use this information to compare the ongoing costs of investing in the Fund and other funds. To do so, compare this 5% hypothetical example with the 5% hypothetical examples that appear in the shareholder reports of the other funds.

Please note that the expenses shown in the table are meant to highlight your ongoing costs only and do not reflect any transactional costs, such as redemption fees or brokerage commissions. Therefore, the second line of the table is useful in comparing ongoing costs only, and will not help you determine the relative total costs of owning different funds. In addition, if these transactional costs were included, your costs would have been higher.

| 12 | 1-800-467-7903 | www.CaldwellOrkin.com |

Caldwell & Orkin

Market Opportunity Fund | Disclosure of Fund Expenses |

April 30, 2016 (Unaudited)

| | Beginning Account Value 11/01/2015 | | Ending Account Value 04/30/2016 | | Expense Ratio1 | | Expenses Paid During Period2 |

Actual3 | $1,000.00 | | $920.20 | | 2.94% | | $14.04 |

Hypothetical (5% return before expenses)4 | $1,000.00 | | $1,010.24 | | 2.94% | | $14.69 |

| 1 | The annualized expense ratio reflects actual expenses from the Fund from November 1, 2015 through April 30, 2016, as a percentage of average net assets for that period. |

| 2 | Expenses are equal to the Caldwell & Orkin Market Opportunity Fund's annualized expense ratio of 2.93% multiplied by the average account value over the period, multiplied by the number of days in the most recent fiscal half year (182), divided by 366 (to reflect the half-year period.) |

| 3 | Excluding interest expense and dividend expense from short positions the expense ratio is 1.32%, your actual cost of investment in the Fund would be $6.30. |

| 4 | Excluding interest expense and dividend expense from short positions the expense ratio is 1.32%, your hypothetical cost of investment in the Fund would be $6.62. |

| Annual Report | April 30, 2016 | 13 |

| Caldwell & Orkin | |

| Market Opportunity Fund | Sector Diversification |

April 30, 2016 (Unaudited)

The following table presents the Caldwell & Orkin Market Opportunity Fund's April 30, 2016 portfolio holdings by sector based on total net assets, sorted by net exposure (net long to net short).

| | Long | Short | Total(1) | Net(2) |

| | | | | |

| Diversified Manufacturing Operations | 4.03% | | 4.03% | 4.03% |

| Aerospace/Defense | 3.41% | | 3.41% | 3.41% |

| Retail - Apparel/Shoe | 2.44% | | 2.44% | 2.44% |

| Beverages - Non - Alcoholic | 2.34% | | 2.34% | 2.34% |

| Retail - Discount | 2.15% | | 2.15% | 2.15% |

| Retail - Restaurants | 2.00% | | 2.00% | 2.00% |

| Reinsurance | 1.59% | | 1.59% | 1.59% |

| Food - Miscellaneous/Diversified | 1.53% | | 1.53% | 1.53% |

| Building Production - Wood | 1.24% | | 1.24% | 1.24% |

| Retail - Building Products | 1.23% | | 1.23% | 1.23% |

| Non-Hazardous Waste Disposal | 1.20% | | 1.20% | 1.20% |

| E - Commerce/Products | 1.04% | | 1.04% | 1.04% |

| Commercial Banks Non - U.S. | 1.04% | | 1.04% | 1.04% |

| Infrastructure Software | 0.99% | | 0.99% | 0.99% |

| Textile - Home Furnishings | 0.80% | | 0.80% | 0.80% |

| Toys | 0.77% | | 0.77% | 0.77% |

| Electric - Integrated | 0.76% | | 0.76% | 0.76% |

| Beverages - Wine/Spirits | 0.62% | | 0.62% | 0.62% |

| Internet Content - Entertainment | 0.55% | | 0.55% | 0.55% |

| Water | 0.54% | | 0.54% | 0.54% |

| Retail - Major Department Store | 0.51% | | 0.51% | 0.51% |

| Networking Products | 0.50% | | 0.50% | 0.50% |

| Commercial Services | 1.47% | -0.98% | 2.45% | 0.49% |

| Building & Construction Products - Miscellaneous | 0.49% | | 0.49% | 0.49% |

| Home Decoration Products | 0.42% | | 0.42% | 0.42% |

| Applications Software | 0.29% | | 0.29% | 0.29% |

| Building Production - Cement/Aggregate | 0.28% | | 0.28% | 0.28% |

| Web Portals/Internet Service Providers | 0.25% | | 0.25% | 0.25% |

| Computer Services | 0.20% | | 0.20% | 0.20% |

| Oil & Gas Companies - Exploration & Production | 0.01% | | 0.01% | 0.01% |

| Finance - Consumer Loans | 1.04% | -1.20% | 2.24% | -0.16% |

| Vitamins & Nutrition Products | | -0.26% | 0.26% | -0.26% |

| Instruments - Controls | | -0.31% | 0.31% | -0.31% |

| Web Hosting/Design | | -0.47% | 0.47% | -0.47% |

| Food - Retail | | -0.58% | 0.58% | -0.58% |

| Oil & Gas Drilling | 0.51% | -1.32% | 1.83% | -0.81% |

| Investment Management/Advisory Services | | -0.96% | 0.96% | -0.96% |

| 14 | 1-800-467-7903 | www.CaldwellOrkin.com |

Caldwell & Orkin

Market Opportunity Fund | Sector Diversification |

April 30, 2016 (Unaudited)

| | Long | Short | Total(1) | Net(2) |

| Machinery - Farm | | -1.00% | 1.00% | -1.00% |

| Rental Auto/Equipment | | -1.04% | 1.04% | -1.04% |

| Automobiles | | -1.23% | 1.23% | -1.23% |

| Home Furnishings | | -1.27% | 1.27% | -1.27% |

| E - Commerce/Services | | -1.52% | 1.52% | -1.52% |

| Schools | | -1.87% | 1.87% | -1.87% |

| Subtotal Common Stocks (long & short positions) | 36.24% | -14.01% | 50.25% | 22.23% |

| | | | | |

| Exchange-Traded Funds - Gold | 2.04% | | 2.04% | 2.04% |

| Exchange-Traded Funds - Country Fund - United States | 1.36% | | 1.36% | 1.36% |

| Exchange-Traded Funds - U.S. Treasury Inflation Protected Bond Fund | 1.01% | | 1.01% | 1.01% |

| Exchange-Traded Funds - Large Cap Value | 0.00%* | | 0.00%* | 0.00%* |

| Subtotal Exchange-Traded Funds (long & short positions) | 4.41% | | 4.41% | 4.41% |

| | | | | |

| Investment Companies | 1.02% | | 1.02% | 1.02% |

| Subtotal Master Limited Partnerships (long & short positions) | 1.02% | | 1.02% | 1.02% |

| | | | | |

| Subtotal Equities (long & short positions) | 41.67% | -14.01% | 55.68% | 27.66% |

| | | | | |

| Call Options | 0.29% | | 0.29% | |

| Put Options | 1.59% | | 1.59% | |

| Other Assets less Liabilities | 42.44% | | 42.44% | |

| Total Portfolio Holdings | 85.99% | -14.01% | 100% | |

| (1) | Total exposure is Long exposure plus the absolute value of the Short exposure. |

| (2) | Net exposure is Long exposure less Short exposure. |

| * | Less than 0.005% of net assets. |

| Annual Report | April 30, 2016 | 15 |

| Caldwell & Orkin | |

| Market Opportunity Fund | Schedule of Investments |

April 30, 2016

| | | Shares | | | Value (Note 1) | |

| LONG INVESTMENTS (43.55%) | | | | | | |

| COMMON STOCKS (36.24%) | | | | | | |

| Aerospace/Defense (3.41%) | | | | | | |

| Lockheed Martin Corp. | | | 9,400 | | | $ | 2,184,372 | |

| Northrop Grumman Corp. | | | 10,600 | | | | 2,186,356 | |

| Raytheon Co. | | | 21,700 | | | | 2,741,795 | |

| | | | | | | | 7,112,523 | |

| | | | | | | | | |

| Applications Software (0.29%) | | | | | | | | |

Adobe Systems, Inc.1 | | | 6,500 | | | | 612,430 | |

| | | | | | | | | |

| Beverages - Non - Alcoholic (2.34%) | | | | | | | | |

| The Coca-Cola Co. | | | 46,800 | | | | 2,096,640 | |

National Beverage Corp.1 | | | 14,300 | | | | 668,382 | |

| PepsiCo, Inc. | | | 20,400 | | | | 2,100,384 | |

| | | | | | | | 4,865,406 | |

| | | | | | | | | |

| Beverages - Wine/Spirits (0.62%) | | | | | | | | |

| Constellation Brands, Inc. - Class A | | | 8,300 | | | | 1,295,298 | |

| | | | | | | | | |

| Building & Construction Products - Miscellaneous (0.49%) | | | | | | | | |

| Fortune Brands Home & Security, Inc. | | | 18,500 | | | | 1,025,085 | |

| | | | | | | | | |

| Building Production - Cement/Aggregate (0.28%) | | | | | | | | |

| Vulcan Materials Co. | | | 5,400 | | | | 581,202 | |

| | | | | | | | | |

| Building Production - Wood (1.24%) | | | | | | | | |

| Masco Corp. | | | 84,000 | | | | 2,579,640 | |

| | | | | | | | | |

| Commercial Banks Non - U.S. (1.04%) | | | | | | | | |

| HDFC Bank, Ltd. - ADR | | | 34,400 | | | | 2,162,728 | |

| | | | | | | | | |

| Commercial Services (1.47%) | | | | | | | | |

| Aramark | | | 91,600 | | | | 3,069,516 | |

| | | | | | | | | |

| Computer Services (0.20%) | | | | | | | | |

| Accenture PLC - Class A | | | 3,600 | | | | 406,512 | |

| | | | | | | | | |

| Diversified Manufacturing Operations (4.03%) | | | | | | | | |

| General Electric Co. | | | 137,200 | | | | 4,218,900 | |

See accompanying notes to financial statements.

| 16 | 1-800-467-7903 | www.CaldwellOrkin.com |

| Caldwell & Orkin | |

| Market Opportunity Fund | Schedule of Investments |

April 30, 2016

| | | Shares | | | Value (Note 1) | |

| Diversified Manufacturing Operations (continued) | | | | | | |

| Honeywell International, Inc. | | | 36,600 | | | $ | 4,182,282 | |

| | | | | | | | 8,401,182 | |

| | | | | | | | | |

| E - Commerce/Products (1.04%) | | | | | | | | |

Amazon.com, Inc.1 | | | 3,300 | | | | 2,176,647 | |

| | | | | | | | | |

| Electric - Integrated (0.76%) | | | | | | | | |

| American Electric Power Co., Inc. | | | 8,200 | | | | 520,700 | |

| The Southern Co. | | | 21,100 | | | | 1,057,110 | |

| | | | | | | | 1,577,810 | |

| | | | | | | | | |

| Finance - Consumer Loans (1.04%) | | | | | | | | |

Synchrony Financial1 | | | 70,600 | | | | 2,158,242 | |

| | | | | | | | | |

| Food - Miscellaneous/Diversified (1.53%) | | | | | | | | |

| General Mills, Inc. | | | 13,800 | | | | 846,492 | |

| The Kraft Heinz Co. | | | 30,000 | | | | 2,342,100 | |

| | | | | | | | 3,188,592 | |

| | | | | | | | | |

| Home Decoration Products (0.42%) | | | | | | | | |

| Newell Brands, Inc. | | | 19,400 | | | | 883,476 | |

| | | | | | | | | |

| Infrastructure Software (0.99%) | | | | | | | | |

| Microsoft Corp. | | | 41,500 | | | | 2,069,605 | |

| | | | | | | | | |

| Internet Content - Entertainment (0.55%) | | | | | | | | |

Facebook, Inc. - Class A1 | | | 9,700 | | | | 1,140,526 | |

| | | | | | | | | |

| Networking Products (0.50%) | | | | | | | | |

Palo Alto Networks, Inc.1 | | | 6,900 | | | | 1,041,003 | |

| | | | | | | | | |

| Non-Hazardous Waste Disposal (1.20%) | | | | | | | | |

| Republic Services, Inc. | | | 34,800 | | | | 1,638,036 | |

| Waste Management, Inc. | | | 14,500 | | | | 852,455 | |

| | | | | | | | 2,490,491 | |

| | | | | | | | | |

| Oil & Gas Companies - Exploration & Production (0.01%) | | | | | | | | |

Concho Resources, Inc.1 | | | 100 | | | | 11,617 | |

| Pioneer Natural Resources Co. | | | 100 | | | | 16,610 | |

| | | | | | | | 28,227 | |

See accompanying notes to financial statements.

| Annual Report | April 30, 2016 | 17 |

Caldwell & Orkin

Market Opportunity Fund | Schedule of Investments |

April 30, 2016

| | | Shares | | | Value (Note 1) | |

| Oil & Gas Drilling (0.51%) | | | | | | |

Seadrill, Ltd.1 | | | 221,400 | | | $ | 1,058,292 | |

| | | | | | | | | |

| Reinsurance (1.59%) | | | | | | | | |

Berkshire Hathaway, Inc. - Class B1 | | | 22,700 | | | | 3,302,396 | |

| | | | | | | | | |

| Retail - Apparel/Shoe (2.44%) | | | | | | | | |

| Abercrombie & Fitch Co. - Class A | | | 15,500 | | | | 414,315 | |

| Coach, Inc. | | | 61,600 | | | | 2,480,632 | |

Kate Spade & Co.1 | | | 84,900 | | | | 2,184,477 | |

| | | | | | | | 5,079,424 | |

| | | | | | | | | |

| Retail - Building Products (1.23%) | | | | | | | | |

| The Home Depot, Inc. | | | 19,100 | | | | 2,557,299 | |

| | | | | | | | | |

| Retail - Discount (2.15%) | | | | | | | | |

| Costco Wholesale Corp. | | | 16,400 | | | | 2,429,332 | |

| Target Corp. | | | 25,700 | | | | 2,043,150 | |

| | | | | | | | 4,472,482 | |

| | | | | | | | | |

| Retail - Major Department Store (0.51%) | | | | | | | | |

| TJX Cos., Inc. | | | 13,900 | | | | 1,053,898 | |

| | | | | | | | | |

| Retail - Restaurants (2.00%) | | | | | | | | |

| McDonald's Corp. | | | 33,000 | | | | 4,174,170 | |

| | | | | | | | | |

| Textile - Home Furnishings (0.80%) | | | | | | | | |

Mohawk Industries, Inc.1 | | | 8,700 | | | | 1,675,881 | |

| | | | | | | | | |

| Toys (0.77%) | | | | | | | | |

| Hasbro, Inc. | | | 19,000 | | | | 1,608,160 | |

| | | | | | | | | |

| Water (0.54%) | | | | | | | | |

| American Water Works Co., Inc. | | | 15,400 | | | | 1,120,504 | |

| | | | | | | | | |

| Web Portals/Internet Service Providers (0.25%) | | | | | | | | |

Alphabet, Inc. - Class A1 | | | 750 | | | | 530,910 | |

| | | | | | | | | |

TOTAL COMMON STOCKS

(Cost $69,700,130) | | | | | | | 75,499,557 | |

See accompanying notes to financial statements.

| 18 | 1-800-467-7903 | www.CaldwellOrkin.com |

Caldwell & Orkin

Market Opportunity Fund | Schedule of Investments |

April 30, 2016

| | | Shares | | | Value (Note 1) | |

| EXCHANGE-TRADED FUNDS (4.41%) | | | | | | |

| Country Fund - United States (1.36%) | | | | | | |

Market Vectors® Gold Miners ETF | | | 109,400 | | | $ | 2,825,802 | |

| | | | | | | | | |

| Gold (2.04%) | | | | | | | | |

SPDR® Gold Shares1 | | | 34,400 | | | | 4,253,560 | |

| | | | | | | | | |

Large Cap Value (0.00%)* | | | | | | | | |

| Vanguard Value ETF | | | 100 | | | | 8,364 | |

| | | | | | | | | |

| U.S. Treasury Inflation Protected Bond Fund (1.01%) | | | | | | | | |

iShares® TIPS Bond ETF1 | | | 18,300 | | | | 2,102,304 | |

| | | | | | | | | |

TOTAL EXCHANGE-TRADED FUNDS

(Cost $7,837,882) | | | | | | | 9,190,030 | |

| MASTER LIMITED PARTNERSHIPS (1.02%) | | | | | | | | |

| Investment Companies (1.02%) | | | | | | | | |

| Oaktree Capital Group LLC | | | 44,000 | | | | 2,125,640 | |

| | | | | | | | | |

TOTAL MASTER LIMITED PARTNERSHIPS

(Cost $2,103,151) | | | | | | | 2,125,640 | |

| | Expiration Date | | Exercise Price | | | Number of Contracts | | | Value (Note 1) | |

| PURCHASED OPTIONS (1.88%) | | | | | | | | | | |

| PURCHASED CALL OPTIONS (0.29%) | | | | | | | | | | |

| Blackberry, Ltd. | January, 2017 | | $ | 10.00 | | | | 525 | | | | 9,975 | |

| Concho Resources, Inc. | June, 2016 | | | 120.00 | | | | 370 | | | | 155,400 | |

iShares® MSCI Brazil Capped ETF | September, 2016 | | | 27.00 | | | | 420 | | | | 170,100 | |

| Microsoft Corp. | July, 2016 | | | 55.00 | | | | 1,096 | | | | 27,400 | |

| Pioneer Natural Resources Co. | January, 2017 | | | 120.00 | | | | 19 | | | | 94,810 | |

| TerraForm Power, Inc. | September, 2016 | | | 10.00 | | | | 650 | | | | 133,250 | |

| Twitter, Inc. | June, 2016 | | | 20.00 | | | | 1,200 | | | | 9,600 | |

| | | | | | | | | | | | | | |

TOTAL PURCHASED CALL OPTIONS

(Cost $1,085,890) | | | | | | | | | | | | 600,535 | |

See accompanying notes to financial statements.

| Annual Report | April 30, 2016 | 19 |

Caldwell & Orkin

Market Opportunity Fund | Schedule of Investments |

April 30, 2016

| | Expiration Date | | Exercise Price | | | Number of Contracts | | | Value (Note 1) | |

| PURCHASED PUT OPTIONS (1.59%) | | | | | | | | | | |

| Alliance Data Systems Corp. | September, 2016 | | $ | 210.00 | | | | 295 | | | $ | 525,100 | |

| Avis Budget Group, Inc. | August, 2016 | | | 24.00 | | | | 259 | | | | 69,930 | |

| Bridgepoint Education, Inc. | August, 2016 | | | 10.00 | | | | 2,154 | | | | 333,870 | |

| Conn's, Inc. | July, 2016 | | | 18.00 | | | | 701 | | | | 336,480 | |

| Control4 Corp. | July, 2016 | | | 7.50 | | | | 1,417 | | | | 113,360 | |

| DeVry Education Group, Inc. | August, 2016 | | | 17.50 | | | | 457 | | | | 82,260 | |

| Fossil Group, Inc. | June, 2016 | | | 35.00 | | | | 130 | | | | 15,600 | |

| Harley-Davidson, Inc. | August, 2016 | | | 40.00 | | | | 2,159 | | | | 237,490 | |

| Harley-Davidson, Inc. | August, 2016 | | | 45.00 | | | | 1,296 | | | | 322,704 | |

| Qorvo, Inc. | May, 2016 | | | 40.00 | | | | 510 | | | | 61,200 | |

| Restoration Hardware Holdings, Inc. | August, 2016 | | | 40.00 | | | | 326 | | | | 110,840 | |

| Tesla Motors, Inc. | June, 2016 | | | 170.00 | | | | 144 | | | | 22,320 | |

| Tesla Motors, Inc. | September, 2016 | | | 225.00 | | | | 83 | | | | 176,375 | |

| Transocean, Ltd. | August, 2016 | | | 10.00 | | | | 2,736 | | | | 290,016 | |

| Whole Foods Market, Inc. | May, 2016 | | | 33.00 | | | | 570 | | | | 235,410 | |

| Zillow Group, Inc. - Class A | August, 2016 | | | 25.00 | | | | 999 | | | | 386,613 | |

| | | | | | | | | | | | | | |

TOTAL PURCHASED PUT OPTIONS

(Cost $4,729,287) | | | | | | | | | | | | 3,319,568 | |

| | | | | | | | | | | | | | |

TOTAL PURCHASED OPTIONS

(Cost $5,815,177) | | | | | | | | | | | | 3,920,103 | |

TOTAL LONG INVESTMENTS

(Cost $85,456,340) | | | | | | | | | | | | 90,735,330 | |

| | | 7-Day Yield | | | Shares | | | Value (Note 1) | |

| SHORT TERM INVESTMENTS (51.22%) | | | | | | | | | |

MONEY MARKET FUNDS2 | | | | | | | | | |

| JPMorgan 100% U.S. Treasury Securities Money Market Fund - Capital Shares | | 0.17% | | | 106,705,061 | | | | 106,705,061 | |

| | | | | | | | | | | |

TOTAL SHORT TERM INVESTMENTS

(Cost $106,705,061) | | | | | | | | | 106,705,061 | |

See accompanying notes to financial statements.

| 20 | 1-800-467-7903 | www.CaldwellOrkin.com |

Caldwell & Orkin

Market Opportunity Fund | Schedule of Investments |

April 30, 2016

TOTAL INVESTMENTS - (94.77%)

(Cost $192,161,401) | | $ | 197,440,391 | |

| | | | | |

| Assets in Excess of Other Liabilities (5.23%) | | | 10,887,784 | |

| | | | | |

| NET ASSETS (100.00%) | | $ | 208,328,175 | |

| SCHEDULE OF SECURITIES SOLD SHORT (-14.01%) | | Shares | | | Value (Note 1) | |

| COMMON STOCKS (-14.01%) | | | | | | |

Automobiles (-1.23%) | | | | | | |

| Harley-Davidson, Inc. | | | (53,500 | ) | | $ | (2,558,905 | ) |

| | | | | | | | | |

Commercial Services (-0.98%) | | | | | | | | |

| Alliance Data Systems Corp. | | | (10,000 | ) | | | (2,033,100 | ) |

| | | | | | | | | |

E - Commerce/Services (-1.52%) | | | | | | | | |

| Etsy, Inc. | | | (94,100 | ) | | | (826,198 | ) |

| Zillow Group, Inc. - Class A | | | (93,800 | ) | | | (2,346,876 | ) |

| | | | | | | | (3,173,074 | ) |

| | | | | | | | | |

Finance - Consumer Loans (-1.20%) | | | | | | | | |

| LendingClub Corp. | | | (315,300 | ) | | | (2,490,870 | ) |

| | | | | | | | | |

Food - Retail (-0.58%) | | | | | | | | |

| Whole Foods Market, Inc. | | | (41,300 | ) | | | (1,201,004 | ) |

| | | | | | | | | |

Home Furnishings (-1.27%) | | | | | | | | |

| Tempur Sealy International, Inc. | | | (43,800 | ) | | | (2,657,346 | ) |

| | | | | | | | | |

Instruments - Controls (-0.31%) | | | | | | | | |

| Control4 Corp. | | | (86,700 | ) | | | (642,447 | ) |

| | | | | | | | | |

Investment Management/Advisory Services (-0.96%) | | | | | | | | |

| WisdomTree Investments, Inc. | | | (183,500 | ) | | | (1,998,315 | ) |

| | | | | | | | | |

Machinery - Farm (-1.00%) | | | | | | | | |

| Deere & Co. | | | (24,800 | ) | | | (2,085,928 | ) |

| | | | | | | | | |

Oil & Gas Drilling (-1.32%) | | | | | | | | |

| Seadrill, Ltd. | | | (393,400 | ) | | | (1,880,452 | ) |

See accompanying notes to financial statements.

| Annual Report | April 30, 2016 | 21 |

Caldwell & Orkin

Market Opportunity Fund | Schedule of Investments |

April 30, 2016

| | | Shares | | | Value (Note 1) | |

| Oil & Gas Drilling (continued) | | | | | | |

| Transocean, Ltd. | | | (78,800 | ) | | $ | (873,104 | ) |

| | | | | | | | (2,753,556 | ) |

| | | | | | | | | |

Rental Auto/Equipment (-1.04%) | | | | | | | | |

| Avis Budget Group, Inc. | | | (86,000 | ) | | | (2,158,600 | ) |

| | | | | | | | | |

Schools (-1.87%) | | | | | | | | |

| American Public Education, Inc. | | | (21,500 | ) | | | (497,940 | ) |

| Bridgepoint Education, Inc. | | | (51,500 | ) | | | (491,310 | ) |

| Career Education Corp. | | | (100 | ) | | | (534 | ) |

| DeVry Education Group, Inc. | | | (130,000 | ) | | | (2,255,500 | ) |

| ITT Educational Services, Inc. | | | (307,700 | ) | | | (661,555 | ) |

| | | | | | | | (3,906,839 | ) |

| | | | | | | | | |

Vitamins & Nutrition Products (-0.26%) | | | | | | | | |

| USANA Health Sciences, Inc. | | | (4,600 | ) | | | (544,824 | ) |

| | | | | | | | | |

Web Hosting/Design (-0.47%) | | | | | | | | |

| Endurance International Group Holdings, Inc. | | | (91,200 | ) | | | (976,752 | ) |

| | | | | | | | | |

TOTAL COMMON STOCKS

(Proceeds $36,465,800) | | | | | | | (29,181,560 | ) |

| | | | | | | | | |

TOTAL SECURITIES SOLD SHORT

(Proceeds $36,465,800) | | | | | | $ | (29,181,560 | ) |

* | Less than 0.005% of net assets. |

1 | Non-Income Producing Security. |

2 | A portion of the Money Market Fund's assets are held as collateral for short sales activity. As of April 30, 2016, the amount held as collateral was $45,000,000. |

Common Abbreviations:

ADR - American Depositary Receipts.

ETF - Exchange-Traded Fund.

LLC - Limited Liability Company.

Ltd. - Limited.

MSCI - Morgan Stanley Capital International.

PLC - Public Limited Company.

SPDR - Standard and Poor's Depositary Receipt.

TIPS - Treasury Inflation Protected Securities.

See accompanying notes to financial statements.

| 22 | 1-800-467-7903 | www.CaldwellOrkin.com |

Caldwell & Orkin

Market Opportunity Fund | Statement of Assets & Liabilities |

April 30, 2016

| ASSETS | | | |

| Investments at value (cost $192,161,401) | | $ | 197,440,391 | |

| Deposits with brokers for securities sold short | | | 31,756,351 | |

| Receivables: | | | | |

| Investment securities sold | | | 9,654,346 | |

| Dividends and interest | | | 69,018 | |

| Capital shares sold | | | 468,474 | |

| Other assets | | | 35,468 | |

| Total Assets | | | 239,424,048 | |

| | | | | |

| LIABILITIES | | | | |

| Securities sold short, not yet purchased (proceeds $36,465,800) | | | 29,181,560 | |

| Payables: | | | | |

| Investment securities purchased | | | 1,522,518 | |

| Capital shares redeemed | | | 109,249 | |

| Dividends payable - short sales | | | 14,403 | |

| Investment advisory fee | | | 171,719 | |

| Accrued expenses and other liabilities | | | 96,424 | |

| Total Liabilities | | | 31,095,873 | |

| | | | | |

| Net Assets | | $ | 208,328,175 | |

| | | | | |

| COMPOSITION OF NET ASSETS | | | | |

| Paid-in capital applicable to 9,658,413 shares outstanding; par value $0.10 per share; 30,000,000 shares authorized | | $ | 206,874,875 | |

| Accumulated net investment loss | | | (1,183,361 | ) |

| Accumulated net realized loss on investments and securities sold short | | | (9,926,569 | ) |

| Net unrealized appreciation of investments and securities sold short | | | 12,563,230 | |

| Net Assets | | $ | 208,328,175 | |

| | | | | |

| NET ASSET VALUE AND OFFERING/REDEMPTION PRICE PER SHARE | | $ | 21.57 | |

See accompanying notes to financial statements.

| Annual Report | April 30, 2016 | 23 |

Caldwell & Orkin

Market Opportunity Fund | Statement of Operations |

For the Year Ended April 30, 2016

| INVESTMENT INCOME | | | |

| Dividends | | $ | 1,469,608 | |

| Interest | | | 45,223 | |

| Total Investment Income | | | 1,514,831 | |

| | | | | |

| EXPENSES | | | | |

| Investment advisory fees (Note 2) | | | 1,694,029 | |

| Interest expense | | | 1,434,170 | |

| Dividend expense on securities sold short | | | 1,248,253 | |

| Administration and accounting fees (Note 2) | | | 169,732 | |

| Transfer agent fees | | | 142,851 | |

| Directors' fees and expenses | | | 90,252 | |

| Professional fees | | | 80,643 | |

| Insurance expense | | | 46,014 | |

| Blue sky servicing fees | | | 32,001 | |

| Chief compliance officer expense | | | 30,910 | |

| Custodian fees | | | 21,929 | |

| Shareholder report printing | | | 20,384 | |

| Other expenses | | | 16,791 | |

| Total Expenses before waiver | | | 5,027,959 | |

| Less fees waived by Administrator (Note 2) | | | (30,000 | ) |

| Total net expenses | | | 4,997,959 | |

| Net Investment Loss | | | (3,483,128 | ) |

| | | | | |

| REALIZED AND UNREALIZED GAIN/(LOSS) ON INVESTMENTS | | | | |

| Net realized loss on investments | | | (3,284,825 | ) |

| Net realized gain on purchased options | | | 1,145,898 | |

| Net realized gain on securities sold short | | | 503,097 | |

| Change in unrealized appreciation on investments | | | 777,430 | |

| Change in unrealized depreciation on purchased options | | | (1,843,029 | ) |

| Change in unrealized depreciation on securities sold short | | | (564,040 | ) |

| NET REALIZED AND UNREALIZED LOSS ON INVESTMENTS AND SECURITIES SOLD SHORT | | | (3,265,469 | ) |

| NET DECREASE IN NET ASSETS RESULTING FROM OPERATIONS | | $ | (6,748,597 | ) |

See accompanying notes to financial statements.

| 24 | 1-800-467-7903 | www.CaldwellOrkin.com |

Caldwell & Orkin

Market Opportunity Fund | Statements of Changes in Net Assets |

| | | For the Year Ended April 30, 2016 | | | For the Year Ended April 30, 2015 | |

| INCREASE/(DECREASE) IN NET ASSETS FROM OPERATIONS: | | | | | | |

| Net investment loss | | $ | (3,483,128 | ) | | $ | (2,466,298 | ) |

| Net realized gain/(loss) on investments, purchased options and securities sold short | | | (1,635,830 | ) | | | 10,050,536 | |

| Change in net unrealized appreciation/(depreciation) of investments, purchased options and securities sold short | | | (1,629,639 | ) | | | 6,671,523 | |

| | | | (6,748,597 | ) | | | 14,255,761 | |

| | | | | | | | | |

| DECREASE IN NET ASSETS FROM DISTRIBUTIONS TO STOCKHOLDERS FROM: | | | | | | | | |

| Net realized gain on investments | | | (10,125,493 | ) | | | (970,482 | ) |

| Total Distributions | | | (10,125,493 | ) | | | (970,482 | ) |

| | | | | | | | | |

| INCREASE/(DECREASE) IN NET ASSETS FROM COMMON STOCK TRANSACTIONS: | | | | | | | | |

| Net proceeds from sale of shares | | | 126,098,676 | | | | 15,030,083 | |

| Reinvested distributions | | | 7,336,522 | | | | 854,216 | |

| Cost of shares redeemed | | | (37,226,116 | ) | | | (65,742,896 | ) |

| Redemption fee proceeds (Note 1) | | | 57,689 | | | | 36,897 | |

| Net increase/(decrease) in net assets resulting from capital share transactions | | | 96,266,771 | | | | (49,821,700 | ) |

| | | | | | | | | |

| INCREASE/(DECREASE) IN NET ASSETS | | | 79,392,681 | | | | (36,536,421 | ) |

| | | | | | | | | |

| NET ASSETS | | | | | | | | |

| Beginning of year | | | 128,935,494 | | | | 165,471,915 | |

| End of year (including accumulated net investment loss of $(1,183,361) and $0, respectively) | | $ | 208,328,175 | | | $ | 128,935,494 | |

See accompanying notes to financial statements.

| Annual Report | April 30, 2016 | 25 |

Caldwell & Orkin

Market Opportunity Fund | Financial Highlights |

For a capital share outstanding throughout each year.

| | | For the Year Ended April 30, 2016 | | | For the Year Ended April 30, 2015 | | | For the Year Ended April 30, 2014 | | | For the Year Ended April 30, 2013 | | | For the Year Ended April 30, 2012 | |

| PER SHARE DATA: | | | | | | | | | | | | | | | |

| Net asset value, beginning of year | | $ | 22.94 | | | $ | 20.88 | | | $ | 22.97 | | | $ | 20.56 | | | $ | 19.59 | |

| Income/(loss) from investment operations: | | | | | | | | | | | | | | | | | | | | |

| Net Investment loss | | | (0.36 | ) | | | (0.49 | ) | | | (0.29 | ) | | | (0.20 | ) | | | (0.28 | ) |

| Net realized and unrealized gain/(loss) on investments | | | 0.30 | | | | 2.71 | | | | (1.30 | ) | | | 2.60 | | | | 1.24 | |

| Total from Investment Operations | | | (0.06 | ) | | | 2.22 | | | | (1.59 | ) | | | 2.40 | | | | 0.96 | |

| | | | | | | | | | | | | | | | | | | | | |

| LESS DISTRIBUTIONS: | | | | | | | | | | | | | | | | | | | | |

| From net realized gain on investments | | | (1.32 | ) | | | (0.17 | ) | | | (0.51 | ) | | | – | | | | – | |

| Total Distributions | | | (1.32 | ) | | | (0.17 | ) | | | (0.51 | ) | | | – | | | | – | |

| Redemption fee proceeds | | | 0.01 | | | | 0.01 | | | | 0.01 | | | | 0.01 | | | | 0.01 | |

| Net asset value, end of year | | $ | 21.57 | | | $ | 22.94 | | | $ | 20.88 | | | $ | 22.97 | | | $ | 20.56 | |

| | | | | | | | | | | | | | | | | | | | | |

| Total Return | | | (0.56 | %) | | | 10.68 | % | | | (6.92 | %) | | | 11.72 | % | | | 4.95 | % |

See accompanying notes to financial statements.

| 26 | 1-800-467-7903 | www.CaldwellOrkin.com |

Caldwell & Orkin

Market Opportunity Fund | Financial Highlights |

For a capital share outstanding throughout each year.

| | | For the Year Ended April 30, 2016 | | | For the Year Ended April 30, 2015 | | | For the Year Ended April 30, 2014 | | | For the Year Ended April 30, 2013 | | | For the Year Ended April 30, 2012 | |

| Ratios and Supplemental Data: | | | | | | | | | | | | | | | |

| Net assets, end of year (000’s) | | $ | 208,328 | | | $ | 128,935 | | | $ | 165,472 | | | $ | 260,916 | | | $ | 251,907 | |

| Ratios to Average Net Assets: | | | | | | | | | | | | | | | | | | | | |

| Management fees | | | 1.00 | % | | | 1.00 | % | | | 1.00 | % | | | 1.00 | % | | | 0.99 | % |

| Administrative fees | | | 0.37 | % | | | 0.44 | % | | | 0.29 | % | | | 0.27 | % | | | 0.27 | % |

| Expenses before dividends on securities sold short and interest expense | | | 1.37 | % | | | 1.44 | % | | | 1.29 | % | | | 1.27 | % | | | 1.26 | % |

| Interest expense | | | 0.85 | % | | | 0.63 | % | | | 0.30 | % | | | 0.46 | % | | | 0.43 | % |

| Expenses from dividends on securities sold short | | | 0.73 | % | | | 0.57 | % | | | 0.14 | % | | | 0.26 | % | | | 0.43 | % |

Ratio of total expenses(1)(2) | | | 2.95 | % | | | 2.64 | % | | | 1.73 | % | | | 1.99 | % | | | 2.12 | % |

Ratio of net investment loss(1)(2) | | | (2.06 | %) | | | (1.80 | %) | | | (0.98 | %) | | | (0.87 | %) | | | (1.27 | %) |

| Portfolio turnover rate | | | 415 | % | | | 434 | % | | | 657 | % | | | 352 | % | | | 517 | % |

| (1) | The ratio of expenses to average net assets and net investment income/(loss) to average net assets do not reflect the expenses of other investment companies. |

| (2) | The ratio of total expenses to average net assets and ratio of net investment loss include fees waived by Fund’s Administrator in the amount of 0.02%, 0.02%, 0.01%, 0.01%, 0.01%, respectively, for the years ended April 30, 2016, 2015, 2014, 2013 and 2012, respectively. |

See accompanying notes to financial statements.

| Annual Report | April 30, 2016 | 27 |

Caldwell & Orkin

Market Opportunity Fund | Notes to Financial Statements |

April 30, 2016

The Caldwell & Orkin Market Opportunity Fund (the “Fund”) is the only active investment portfolio of The Caldwell & Orkin Funds, Inc. (“Caldwell & Orkin”), an open-end, diversified management investment company registered under the Investment Company Act of 1940, as amended (the “1940 Act”), and incorporated under the laws of the State of Maryland on August 15, 1989. Prior to June, 1992, Caldwell & Orkin’s name was The OTC Select-100 Fund, Inc. and consisted of only one portfolio, The OTC Select-100 Fund. The shareholders of The OTC Select-100 Fund subsequently approved changing the corporate name from The OTC Select-100 Fund, Inc. to The Caldwell & Orkin Funds, Inc. and to amend the investment objective and policies of The OTC Select-100 Fund. As a result of such amendment, The OTC Select-100 Fund was renamed and its assets and objectives were those of the Caldwell & Orkin Aggressive Growth Fund. In August, 1996, the Board of Directors of Caldwell & Orkin approved changing the name of the Caldwell & Orkin Aggressive Growth Fund to the Caldwell & Orkin Market Opportunity Fund. The Fund’s investment objective is to provide long-term capital growth with a short-term focus on capital preservation. C&O Funds Advisor, Inc. (the “Adviser”) uses a catalyst-driven, multi-dimensional, disciplined investment process focusing on active asset allocation, security selection and surveillance to achieve the Fund’s investment objective. The Adviser’s philosophy in managing the Fund is to focus on risk as well as return. The Adviser utilizes an investment philosophy based upon sophisticated exploitation of the low-risk anomaly. The low-risk anomaly stands in direct contradiction to the conventional beliefs of Efficient Market Hypothesis stating that high risk is equated with higher return. Caldwell and Orkin takes the opposite view – we believe that lower risk can result in higher return.

1. SUMMARY OF SIGNIFICANT ACCOUNTING POLICIES

Use of Estimates

The preparation of financial statements in conformity with accounting principles generally accepted in the United States of America (“GAAP”) requires management to make estimates and assumptions that affect the reported amounts of assets and liabilities and disclosure of contingent assets and liabilities at the date of the financial statements and the reported amounts of revenues and expenses during the reporting period. Actual results could differ from those estimates.

Securities Valuation

Securities are stated at the closing price on the date at which the net asset value (“NAV”) is being determined. If the date of determination is not a trading date, or the closing price is not otherwise available, the last bid price is used for a value instead. Debt securities, other than short-term investments, are valued at the price provided by an independent pricing service. Any assets or securities for which market quotations are not readily available are valued at fair value as determined in good faith by or under the direction of the Fund’s Board of Directors in accordance with the Fund’s Fair Value Pricing Policy.

| 28 | 1-800-467-7903 | www.CaldwellOrkin.com |

Caldwell & Orkin

Market Opportunity Fund | Notes to Financial Statements |

April 30, 2016

Fair Value Measurements

A three-tier hierarchy has been established to classify fair value measurements for disclosure purposes. Inputs refer broadly to the assumptions that market participants would use in pricing the asset or liability, including assumptions about risk. Inputs may be observable or unobservable. Observable inputs are inputs that reflect the assumptions market participants would use in pricing the asset or liability that are developed based on market data obtained from sources independent of the reporting entity. Unobservable inputs are inputs that reflect the reporting entity’s own assumptions about the assumptions market participants would use in pricing the asset or liability that are developed based on the best information available.

Various inputs are used in determining the value of the Fund’s investments as of the reporting period end. These inputs are categorized in the following hierarchy under applicable financial accounting standards:

| Level 1 – | Unadjusted quoted prices in active markets for identical, unrestricted assets or liabilities that the Fund has the ability to access at measurement date. |

| Level 2 – | Quoted prices which are not active quoted prices for similar assets or liabilities in active markets or inputs other than quoted process that are observable (either directly or indirectly) for substantially the full term of the asset of liability. |

| Level 3 – | Significant unobservable prices or inputs (including the Fund’s own assumptions in determining the fair value of investments) where there is little or no market for the asset or liability at the measurement date. |

The following is a summary of the inputs used as of April 30, 2016 in valuing the Fund’s investments carried at value:

| Investments in Securities at Value* | | Level 1 - Quoted Prices | | | Level 2 - Other Significant Observable Inputs | | | Level 3 - Significant Unobservable Inputs | | | Total | |

| Common Stocks | | $ | 75,499,557 | | | $ | – | | | $ | – | | | $ | 75,499,557 | |

| Exchange-Traded Funds | | | 9,190,030 | | | | – | | | | – | | | | 9,190,030 | |

| Master Limited Partnerships | | | 2,125,640 | | | | – | | | | – | | | | 2,125,640 | |

| Purchased Options | | | | | | | | | | | | | | | | |

| Call Options | | | 590,560 | | | | 9,975 | | | | – | | | | 600,535 | |

| Put Options | | | 2,262,368 | | | | 1,057,200 | | | | – | | | | 3,319,568 | |

| Short Term Investments | | | 106,705,061 | | | | – | | | | – | | | | 106,705,061 | |

| TOTAL | | $ | 196,373,216 | | | $ | 1,067,175 | | | $ | – | | | $ | 197,440,391 | |

| | | | | | | | | | | | | | | | | |

| Other Financial Instruments* | | | | | | | | | | | | | | | | |

| Liabilities | | | | | | | | | | | | | | | | |

| Securities Sold Short | | | | | | | | | | | | | | | | |

| Common Stocks | | $ | (29,181,560 | ) | | $ | – | | | $ | – | | | $ | (29,181,560 | ) |

| TOTAL | | $ | (29,181,560 | ) | | $ | – | | | $ | – | | | $ | (29,181,560 | ) |

| Annual Report | April 30, 2016 | 29 |

Caldwell & Orkin

Market Opportunity Fund | Notes to Financial Statements |

April 30, 2016

Transfers into and out of Levels 1 and 2 as of April 30, 2016 were as follows:

| | Level 1 | | | Level 2 |

| Caldwell & Orkin Market Opportunity Fund | Transfer In | Transfers (Out) | | | Transfer In | | Transfers (Out) |

| Purchased Options | | | $ | (9,975 | ) | | $ | 9,975 | | |

| Total | | | $ | (9,975 | ) | | $ | 9,975 | | |

All securities of the Fund were valued using either Level 1 or Level 2 inputs during the year ended April 30, 2016.

| * | For detailed industry descriptions, see the accompanying Schedule of Investments. |

Use of Derivatives

Derivative Instruments and Hedging Activities: The following discloses the Fund’s use of derivative instruments and hedging activities. The Fund’s investment objective not only permits the Fund to purchase investment securities, it also allows the Fund to enter into various types of derivative contracts, purchased and written options. In doing so, the Fund will employ strategies in differing combinations to permit it to increase, decrease, or change the level or types of exposure to market factors. Central to those strategies are features inherent to derivatives that make them more attractive for this purpose than equity or debt securities; they require little or no initial cash investment, they can focus exposure on only certain selected risk factors, and they may not require the ultimate receipt or delivery of the underlying security (or securities) to the contract holder. This may allow the Fund to pursue its objective more quickly and efficiently than if it were to make direct purchases or sales of securities capable of affecting a similar response to market factors.

Market Risk Factors: In pursuit of their investment objectives, certain Funds may seek to use derivatives to increase or decrease their exposure to the following market risk factors:

Equity Risk: Equity risk relates to the change in value of equity securities as they relate to increases or decreases in the general market.

Purchasing Put and Call Options: The Fund may invest in options on securities and indices, and use such securities either to hedge risk or enhance the long positions in the Fund’s portfolio.

By purchasing a put option, the purchaser obtains the right (but not the obligation) to sell the option’s underlying instrument at a fixed strike price. In return for this right, the purchaser pays the current market price for the option (known as the option premium). Options have various types of underlying instruments, including specific securities, indices of securities prices, and futures contracts. The purchaser may terminate its position in a put option by allowing it to expire or by exercising the option. If the option is allowed to expire, the purchaser will lose the entire premium. If the option is exercised, the purchaser completes the sale of the underlying instrument at the strike price. A purchaser may also terminate a put option position by closing it out in the secondary market at its current price, if a liquid secondary market exists. The buyer of a typical put option can expect to realize a gain if security prices fall. However, if the underlying instrument’s price does not fall enough to offset the cost of purchasing the option, a put buyer can expect to suffer a loss (limited to the amount of the premium, plus related transaction costs).

| 30 | 1-800-467-7903 | www.CaldwellOrkin.com |

Caldwell & Orkin

Market Opportunity Fund | Notes to Financial Statements |

April 30, 2016

The features of call options are essentially the same as those of put options, except that the purchaser of a call option obtains the right to purchase, rather than sell, the underlying instrument at the option’s strike price. A call buyer typically attempts to participate in potential price increases of the underlying instrument with risk limited to the cost of the option if security prices fall. At the same time, the buyer can expect to suffer a loss if security prices do not rise sufficiently to offset the cost of the option.

Writing Put and Call Options: The writer of a put or call option takes the opposite side of the transaction from the option’s purchaser. In return for receipt of the premium, the writer assumes the obligation to pay the strike price for the option’s underlying instrument if the other party to the option chooses to exercise it. The writer may seek to terminate a position in a put option before exercise by closing out the option in the secondary market at its current price. If the secondary market is not liquid for a put option, however, the writer must continue to be prepared to pay the strike price while the option is outstanding, regardless of price changes.

If security prices rise, a put writer would generally expect to profit, although its gain would be limited to the amount of the premium it received. If security prices remain the same over time, it is likely that the writer will also profit, because it should be able to close out the option at a lower price. If security prices fall, the put writer would expect to suffer a loss. This loss should be less than the loss from purchasing the underlying instrument directly, however, because the premium received for writing the option should mitigate the effects of the decline.

Writing a call option obligates the writer to sell or deliver the option’s underlying instrument, in return for the strike price, upon exercise of the option. The characteristics of writing call options are similar to those of writing put options, except that writing calls generally is a profitable strategy if the price of the underlying security remains the same or falls. Through receipt of the option premium, a call writer mitigates some of the effects of a price decline. At the same time, because a call writer must be prepared to deliver the underlying instrument in return for the strike price, even if its current value is greater, a call writer gives up some ability to participate in security price increases.

The Fund did not transact in any written options during the fiscal year ended April 30, 2016.

The following discloses the amounts related to the Fund’s use of derivative instruments and hedging activities.

The effect of derivative instruments on the Statement of Assets and Liabilities as of April 30, 2016:

| Asset Derivatives | | | | |

| Derivatives not Accounted for as Hedging Instruments | Statement of Assets and Liabilities Location | | Market Value | |

| Purchased Options (Equity Contracts) | Investments, at value | | $ | 3,920,103 | |

| Total | | | $ | 3,920,103 | |

| Annual Report | April 30, 2016 | 31 |

Caldwell & Orkin

Market Opportunity Fund | Notes to Financial Statements |

The effect of derivative instruments on the Statement of Operations for the fiscal year ended April 30, 2016:

Derivatives not Accounted for as Hedging Instruments | Location of Gain/(Loss) On Derivatives Recognized in Income | | Realized Gain/(Loss) on Derivatives Recognized in Income | | | Change in Unrealized Gain/(Loss) on Derivatives Recognized in Income | |

| Purchased Options (Equity Contracts) | Net realized gain on purchased options | | $ | 1,145,898 | | | | |

| | Change in unrealized depreciation on purchased options | | | | | | $ | (1,843,029 | ) |

| Total | | | $ | 1,145,898 | | | $ | (1,843,029 | ) |

The Fund’s average contracts for the purchased options is $18,378 for the fiscal year ended April 30, 2016.

Significant Ownership Concentration

At April 30, 2016, the Fund invested 51.22% total net assets in the JPMorgan 100% U.S. Treasury Securities Money Market Fund Capital Class (CJTXX). The financial statements of the Money Market Fund, including the portfolio of investments, are included in the JPMorgan 100% U.S. Treasury Securities Money Market Fund Capital Class Fund’s annual report and can be found at www.jpmorganfunds.com and should be read in conjunction with the Fund’s financial statements. The Fund uses the money market instrument as a vehicle for holding collateral related to securities sold short. As stated in the Fund’s prospectus, the Fund will typically invest between 0% and 50% of net assets in money market securities and fixed income securities. This portion of the Fund’s portfolio includes cash equivalents (i.e., money market funds or U.S. treasury notes) and bonds (i.e., corporate or government bonds), although generally cash equivalents are emphasized more than bonds. The corporate bonds purchased may have any maturity and be of any rating or quality, as long as Fund management believes it is consistent with the Fund’s investment objective.

The JPMorgan 100% U.S. Treasury Securities Money Market Fund’s objective is to provide the highest possible level of current income while still maintaining liquidity and providing maximum safety of principal. The JPMorgan 100% U.S. Treasury Securities Money Market Fund invests its assets exclusively in obligations of the U.S. Treasury including treasury bills, bonds and notes.

Fund management considers investments in securities sold short to be part of managed assets, thereby reducing the Fund’s available cash balance. If the absolute value of securities sold short was added to the Fund’s total long positions as of April 30, 2016, total investments would equal 57.56%, as a percentage of net assets. This would result in cash equivalents representing 42.44% of net assets, vs. the 37.21% that is disclosed on the Schedule of Investments. This better illustrates the Fund’s net cash exposure as of April 30, 2016.

| 32 | 1-800-467-7903 | www.CaldwellOrkin.com |

Caldwell & Orkin

Market Opportunity Fund | Notes to Financial Statements |

Share Valuation

The NAV per share of the Fund is calculated by dividing the sum of the value of the securities held by the Fund, plus cash or other assets, minus all liabilities (including estimated accrued expenses) by the total number of shares outstanding for the Fund, rounded to the nearest cent. The Fund’s shares will not be priced on the days on which the New York Stock Exchange is closed for trading. The offering and redemption price per share for the Fund is equal to the Fund’s NAV per share.

The Fund charges a 2.00% redemption fee on shares held less than 90 days. These fees are deducted from the redemption proceeds otherwise payable to the shareholder. The Fund will retain the fee charged as paid-in capital and such fees become part of the Fund’s daily NAV calculation. For the fiscal year ended April 30, 2016, the Fund recorded $57,689 in redemption fee proceeds.

Securities Transactions and Related Investment Income

Securities transactions are accounted for on trade date. Dividend income is recorded on the ex-dividend date. Realized gains and losses from investment transactions are determined using the specific identification method. Interest income which includes amortization of premium and accretion of discount, is accrued as earned.

Cash

The Fund maintains cash available for the settlement of securities transactions and capital shares reacquired. Available cash is invested daily in money market instruments.

Income Taxes

The Fund intends to continue to comply with the requirements of the Internal Revenue Code of 1986, as amended, applicable to regulated investment companies and to distribute all taxable income to their shareholders. Therefore, no federal income tax provision is required.

In order to avoid imposition of the excise tax applicable to regulated investment companies, the Fund intends to declare each year as dividends, in each calendar year, at least 98% of its net investment income (earned during the calendar year) and at least 98.2% of its net realized capital gains (earned during the twelve months ended October 31) plus undistributed amounts, if any, from prior years.