UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED

MANAGEMENT INVESTMENT COMPANIES

Investment Company Act file number 811-06114

(Exact name of registrant as specified in charter)

Citi Fund Services Ohio, Inc., 4400 Easton Commons, Suite 200, Columbus, OH 43219

(Address of principal executive offices) (Zip code)

Citi Fund Services Ohio, Inc., 4400 Easton Commons, Suite 200, Columbus, OH 43219

(Name and address of agent for service)

Registrant’s telephone number, including area code: 1-800-762-7085

Date of fiscal year end: August 31

Date of reporting period: August 31, 2024

EXPLANATORY NOTE: The Registrant is filing this amendment to its Form N-CSR for the period ended August 31, 2024, originally filed with the Securities and Exchange Commission on November 6, 2024 (Accession Number 0001004726-24-000171), amended on November 13, 2024 (Accession Number 0001004726-24-000176). This filing amends the signature dates referenced on the Form N-CSR and within the exhibits referenced within Item 19(a)(3) and Item 19(b). This filing also replaces references of Bill King with Cathy Dunn, as Cathy Dunn became the Registrant’s Principal Executive Officer effective November 1, 2024. Except as set forth above, this amendment does not amend, update or change any other items or disclosures.

Item 1. Reports to Stockholders.

0000864508cav:BloombergMunicipal1YearIndex1723AdditionalIndexMember2020-08-31

Annual Shareholder Report

August 31, 2024

This Annual shareholder report contains important information about Bond Fund for the period of September 1, 2023 to August 31, 2024. You can find additional information about the Fund at https://www.cavanalhillfunds.com/literature/mutual-fund-literature/. You can also request this information by contacting us at 1-800-762-7085.

What were the Fund's costs for the last year?

(based on a $10,000 investment)

| Class name | Costs of a $10,000 investment | Costs paid as a percentage of a $10,000 investment |

|---|

| A Shares | $73 | 0.70% |

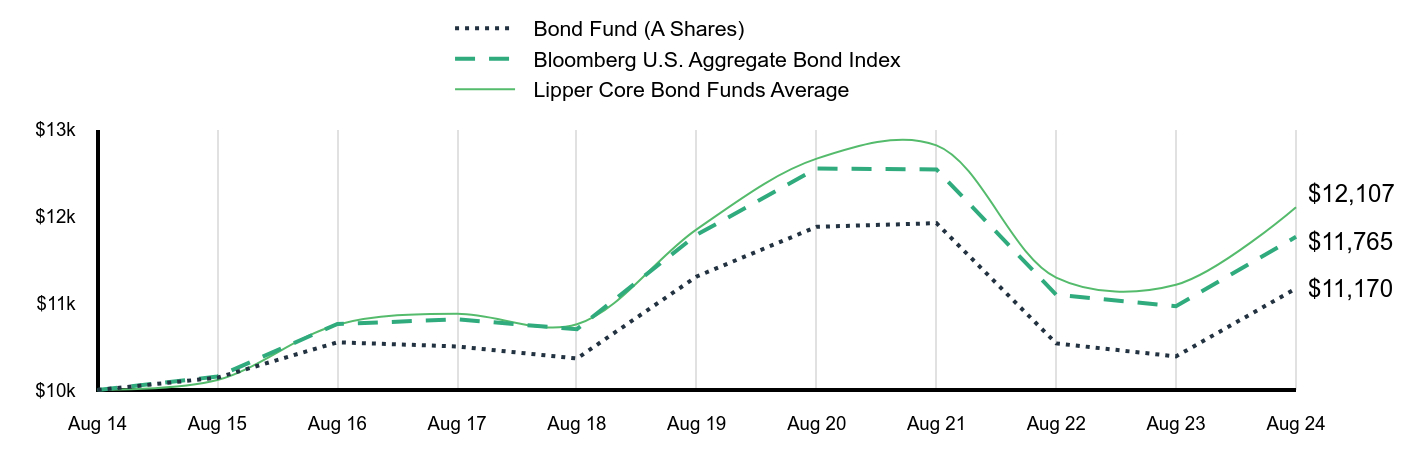

How did the Fund perform last year?

We extended duration to match the index as we expect rates to decline. This was largely beneficial. Efforts to increase credit quality were not as beneficial as credit spreads tightened over the past 12 months. However, with credit spreads approaching historical lows and the economy slowing, we expect higher-quality paper to outperform. The Bond Fund outperformed its benchmark (Bloomberg U.S. Aggregate Bond Index) for the year, benefiting from exposure to higher-yielding non-agency asset-backed securities and non-agency mortgage-backed securities, along with an increasing weight to agency MBS. An overweight to credit also contributed to performance as spreads tightened. A lack of exposure to lower-quality (BBB) corporates detracted, along with exposure to shorter-duration taxable municipals. We will look to increase duration during market pullbacks and to increase the portfolio’s liquidity. Should the economy continue to slow, less liquid securities, especially longer durations, are likely to underperform. With credit spreads nearing historic tight levels, we expect credit to underperform. If so, we will look to increase the Fund’s credit profile.

Value of a $10,000 Investment

| Bond Fund (A Shares) | Bloomberg U.S. Aggregate Bond Index | Lipper Core Bond Funds Average |

|---|

| Aug 14 | $10,000 | $10,000 | $10,000 |

| Aug 15 | $10,142 | $10,155 | $10,115 |

| Aug 16 | $10,550 | $10,761 | $10,753 |

| Aug 17 | $10,502 | $10,814 | $10,878 |

| Aug 18 | $10,363 | $10,701 | $10,758 |

| Aug 19 | $11,308 | $11,789 | $11,852 |

| Aug 20 | $11,881 | $12,553 | $12,666 |

| Aug 21 | $11,923 | $12,542 | $12,819 |

| Aug 22 | $10,537 | $11,098 | $11,296 |

| Aug 23 | $10,387 | $10,965 | $11,213 |

| Aug 24 | $11,170 | $11,765 | $12,107 |

Average Annual Total Returns

| 1 Year | 5 Year | 10 Year |

|---|

| A Shares | 7.53% | -0.25% | 1.11% |

| Bloomberg U.S. Aggregate Bond Index | 7.30% | -0.04% | 1.64% |

| Lipper Core Bond Funds Average | 7.97% | 0.43% | 1.93% |

| Net Assets | $123,466,101 |

| Number of Portfolio Holdings | 182 |

| Net Investment Advisory Fees | $240,009 |

| Portfolio Turnover Rate | 36% |

The performance data quoted represents past performance and does not guarantee future results. The investment return and principal value of an investment will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost.

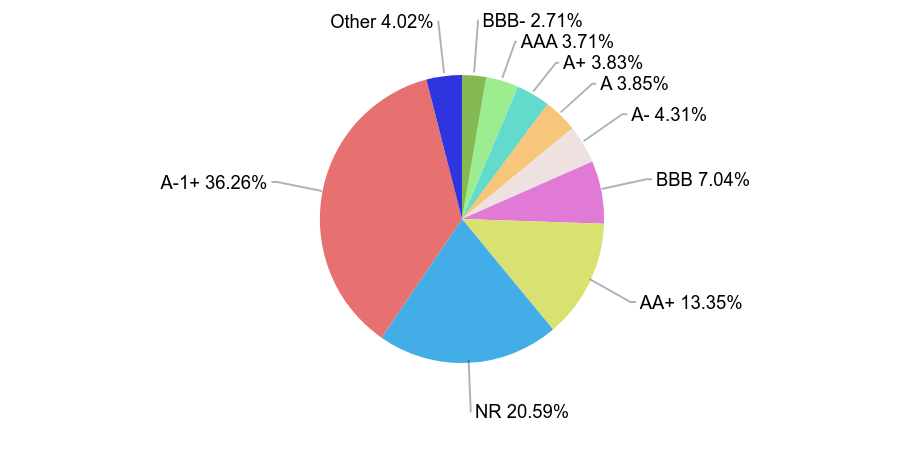

Graphical Presentation of Holdings

(as of 8/31/2024)

The tables below provide additional information about the Fund's investments.

| U.S. Treasury Bonds | 13.2% |

| U.S. Treasury Notes | 4.1% |

| U.S. Treasury Bonds | 2.6% |

| Sonic Capital LLC, Series 2020-1A, Class A2I | 1.8% |

| Broadcom, Inc. | 1.7% |

| Bank of America Corp. | 1.6% |

| Fannie Mae REMIC, Series 2023-16, Class VE | 1.5% |

| SBA Tower Trust | 1.4% |

| U.S. Treasury Notes | 1.4% |

| The University of Oklahoma Revenue | 1.3% |

| Value | Value |

|---|

| BBB- | 2.71% |

| AAA | 3.71% |

| A+ | 3.83% |

| A | 3.85% |

| A- | 4.31% |

| BBB | 7.04% |

| AA+ | 13.35% |

| NR | 20.59% |

| A-1+ | 36.26% |

| Other | 4.02% |

| Asset Backed Securities | 17.8% |

| Mortgage Backed Securities | 25.0% |

| Commercial Mortgage Backed Securities | 1.1% |

| Corporate Bonds | 19.1% |

| Taxable Municipal Bonds | 7.9% |

| U.S. Government Agency Securities | 6.6% |

| U.S. Treasury Obligations | 21.3% |

| Investment in Affiliates | 0.9% |

There were no material fund changes during the reporting period.

Changes In Or Disagreements With Accountants

There were no changes in or disagreements with accountants during the reporting period.

Annual Shareholder Report

August 31, 2024

Annual Shareholder Report

August 31, 2024

This Annual shareholder report contains important information about Bond Fund for the period of September 1, 2023 to August 31, 2024. You can find additional information about the Fund at https://www.cavanalhillfunds.com/literature/mutual-fund-literature/. You can also request this information by contacting us at 1-800-762-7085.

What were the Fund's costs for the last year?

(based on a $10,000 investment)

| Class name | Costs of a $10,000 investment | Costs paid as a percentage of a $10,000 investment |

|---|

| Institutional Shares | $47 | 0.45% |

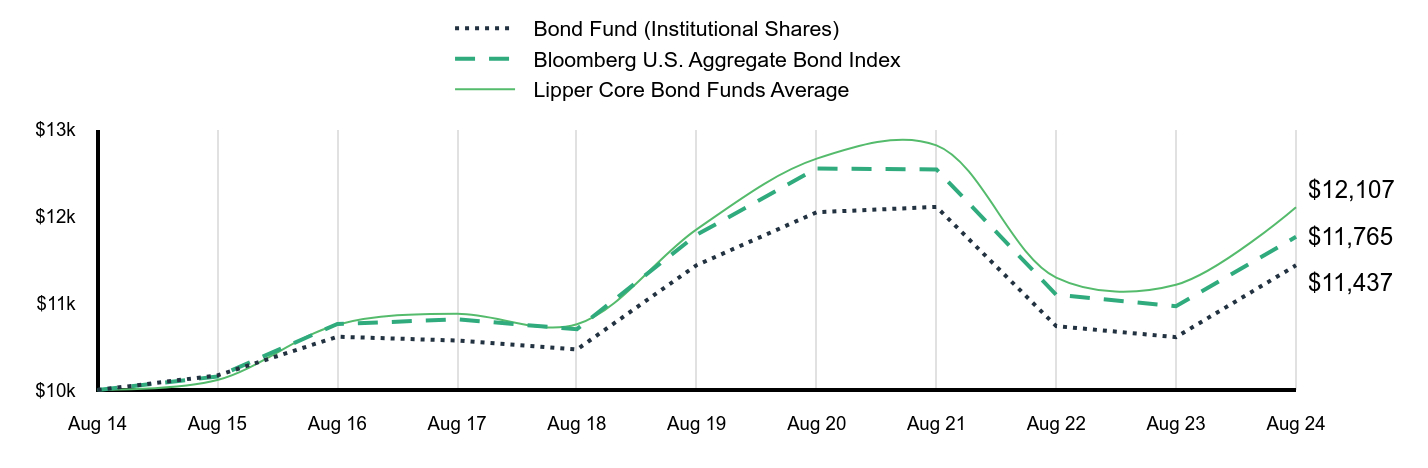

How did the Fund perform last year?

We extended duration to match the index as we expect rates to decline. This was largely beneficial. Efforts to increase credit quality were not as beneficial as credit spreads tightened over the past 12 months. However, with credit spreads approaching historical lows and the economy slowing, we expect higher-quality paper to outperform. The Bond Fund outperformed its benchmark (Bloomberg U.S. Aggregate Bond Index) for the year, benefiting from exposure to higher-yielding non-agency asset-backed securities and non-agency mortgage-backed securities, along with an increasing weight to agency MBS. An overweight to credit also contributed to performance as spreads tightened. A lack of exposure to lower-quality (BBB) corporates detracted, along with exposure to shorter-duration taxable municipals. We will look to increase duration during market pullbacks and to increase the portfolio’s liquidity. Should the economy continue to slow, less liquid securities, especially longer durations, are likely to underperform. With credit spreads nearing historic tight levels, we expect credit to underperform. If so, we will look to increase the Fund’s credit profile.

Value of a $10,000 Investment

| Bond Fund (Institutional Shares) | Bloomberg U.S. Aggregate Bond Index | Lipper Core Bond Funds Average |

|---|

| Aug 14 | $10,000 | $10,000 | $10,000 |

| Aug 15 | $10,168 | $10,155 | $10,115 |

| Aug 16 | $10,614 | $10,761 | $10,753 |

| Aug 17 | $10,570 | $10,814 | $10,878 |

| Aug 18 | $10,467 | $10,701 | $10,758 |

| Aug 19 | $11,439 | $11,789 | $11,852 |

| Aug 20 | $12,049 | $12,553 | $12,666 |

| Aug 21 | $12,110 | $12,542 | $12,819 |

| Aug 22 | $10,736 | $11,098 | $11,296 |

| Aug 23 | $10,609 | $10,965 | $11,213 |

| Aug 24 | $11,437 | $11,765 | $12,107 |

Average Annual Total Returns

| 1 Year | 5 Year | 10 Year |

|---|

| Institutional Shares | 7.81% | 0.00% | 1.35% |

| Bloomberg U.S. Aggregate Bond Index | 7.30% | -0.04% | 1.64% |

| Lipper Core Bond Funds Average | 7.97% | 0.43% | 1.93% |

| Net Assets | $123,466,101 |

| Number of Portfolio Holdings | 182 |

| Net Investment Advisory Fees | $240,009 |

| Portfolio Turnover Rate | 36% |

The performance data quoted represents past performance and does not guarantee future results. The investment return and principal value of an investment will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost.

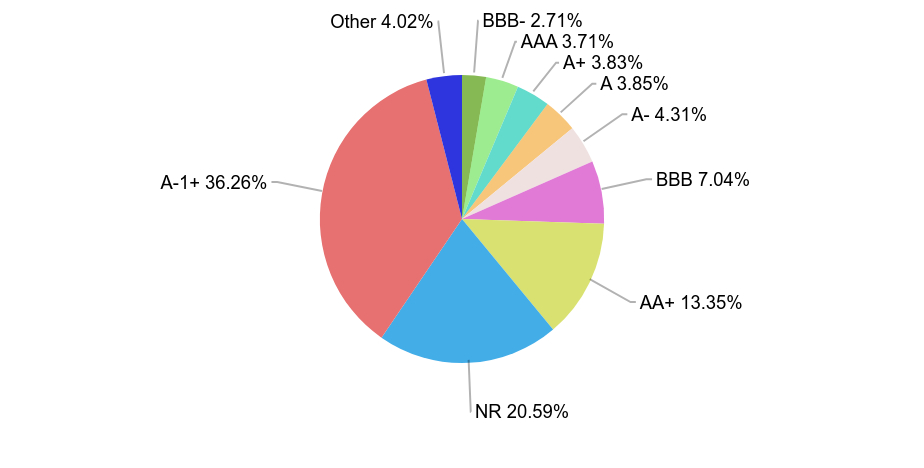

Graphical Presentation of Holdings

(as of 8/31/2024)

The tables below provide additional information about the Fund's investments.

| U.S. Treasury Bonds | 13.2% |

| U.S. Treasury Notes | 4.1% |

| U.S. Treasury Bonds | 2.6% |

| Sonic Capital LLC, Series 2020-1A, Class A2I | 1.8% |

| Broadcom, Inc. | 1.7% |

| Bank of America Corp. | 1.6% |

| Fannie Mae REMIC, Series 2023-16, Class VE | 1.5% |

| SBA Tower Trust | 1.4% |

| U.S. Treasury Notes | 1.4% |

| The University of Oklahoma Revenue | 1.3% |

| Value | Value |

|---|

| BBB- | 2.71% |

| AAA | 3.71% |

| A+ | 3.83% |

| A | 3.85% |

| A- | 4.31% |

| BBB | 7.04% |

| AA+ | 13.35% |

| NR | 20.59% |

| A-1+ | 36.26% |

| Other | 4.02% |

| Asset Backed Securities | 17.8% |

| Mortgage Backed Securities | 25.0% |

| Commercial Mortgage Backed Securities | 1.1% |

| Corporate Bonds | 19.1% |

| Taxable Municipal Bonds | 7.9% |

| U.S. Government Agency Securities | 6.6% |

| U.S. Treasury Obligations | 21.3% |

| Investment in Affiliates | 0.9% |

There were no material fund changes during the reporting period.

Changes In Or Disagreements With Accountants

There were no changes in or disagreements with accountants during the reporting period.

Annual Shareholder Report

August 31, 2024

Annual Shareholder Report

August 31, 2024

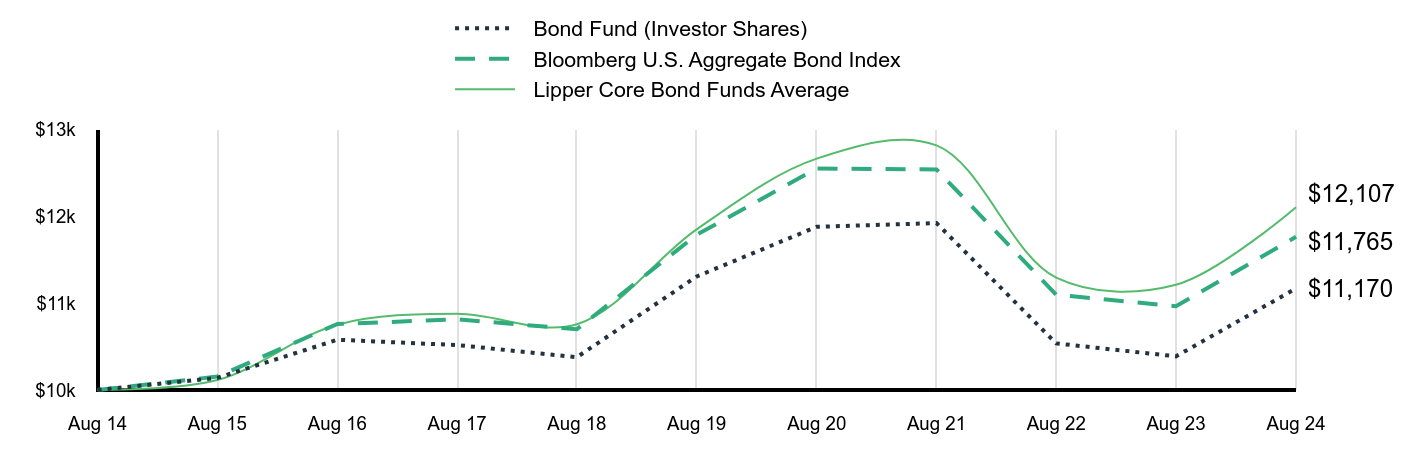

This Annual shareholder report contains important information about Bond Fund for the period of September 1, 2023 to August 31, 2024. You can find additional information about the Fund at https://www.cavanalhillfunds.com/literature/mutual-fund-literature/. You can also request this information by contacting us at 1-800-762-7085.

What were the Fund's costs for the last year?

(based on a $10,000 investment)

| Class name | Costs of a $10,000 investment | Costs paid as a percentage of a $10,000 investment |

|---|

| Investor Shares | $73 | 0.69% |

How did the Fund perform last year?

We extended duration to match the index as we expect rates to decline. This was largely beneficial. Efforts to increase credit quality were not as beneficial as credit spreads tightened over the past 12 months. However, with credit spreads approaching historical lows and the economy slowing, we expect higher-quality paper to outperform. The Bond Fund outperformed its benchmark (Bloomberg U.S. Aggregate Bond Index) for the year, benefiting from exposure to higher-yielding non-agency asset-backed securities and non-agency mortgage-backed securities, along with an increasing weight to agency MBS. An overweight to credit also contributed to performance as spreads tightened. A lack of exposure to lower-quality (BBB) corporates detracted, along with exposure to shorter-duration taxable municipals. We will look to increase duration during market pullbacks and to increase the portfolio’s liquidity. Should the economy continue to slow, less liquid securities, especially longer durations, are likely to underperform. With credit spreads nearing historic tight levels, we expect credit to underperform. If so, we will look to increase the Fund’s credit profile.

Value of a $10,000 Investment

| Bond Fund (Investor Shares) | Bloomberg U.S. Aggregate Bond Index | Lipper Core Bond Funds Average |

|---|

| Aug 14 | $10,000 | $10,000 | $10,000 |

| Aug 15 | $10,140 | $10,155 | $10,115 |

| Aug 16 | $10,579 | $10,761 | $10,753 |

| Aug 17 | $10,518 | $10,814 | $10,878 |

| Aug 18 | $10,378 | $10,701 | $10,758 |

| Aug 19 | $11,308 | $11,789 | $11,852 |

| Aug 20 | $11,881 | $12,553 | $12,666 |

| Aug 21 | $11,924 | $12,542 | $12,819 |

| Aug 22 | $10,537 | $11,098 | $11,296 |

| Aug 23 | $10,388 | $10,965 | $11,213 |

| Aug 24 | $11,170 | $11,765 | $12,107 |

Average Annual Total Returns

| 1 Year | 5 Year | 10 Year |

|---|

| Investor Shares | 7.53% | -0.25% | 1.11% |

| Bloomberg U.S. Aggregate Bond Index | 7.30% | -0.04% | 1.64% |

| Lipper Core Bond Funds Average | 7.97% | 0.43% | 1.93% |

| Net Assets | $123,466,101 |

| Number of Portfolio Holdings | 182 |

| Net Investment Advisory Fees | $240,009 |

| Portfolio Turnover Rate | 36% |

The performance data quoted represents past performance and does not guarantee future results. The investment return and principal value of an investment will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost.

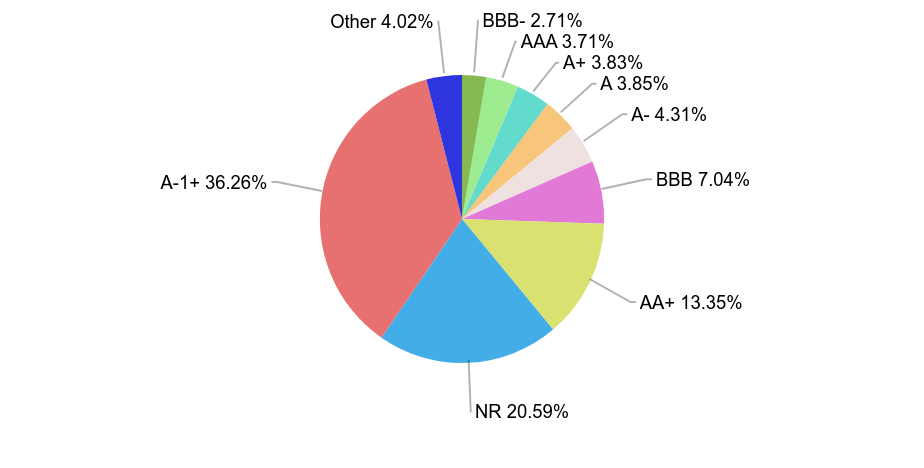

Graphical Presentation of Holdings

(as of 8/31/2024)

The tables below provide additional information about the Fund's investments.

| U.S. Treasury Bonds | 13.2% |

| U.S. Treasury Notes | 4.1% |

| U.S. Treasury Bonds | 2.6% |

| Sonic Capital LLC, Series 2020-1A, Class A2I | 1.8% |

| Broadcom, Inc. | 1.7% |

| Bank of America Corp. | 1.6% |

| Fannie Mae REMIC, Series 2023-16, Class VE | 1.5% |

| SBA Tower Trust | 1.4% |

| U.S. Treasury Notes | 1.4% |

| The University of Oklahoma Revenue | 1.3% |

| Value | Value |

|---|

| BBB- | 2.71% |

| AAA | 3.71% |

| A+ | 3.83% |

| A | 3.85% |

| A- | 4.31% |

| BBB | 7.04% |

| AA+ | 13.35% |

| NR | 20.59% |

| A-1+ | 36.26% |

| Other | 4.02% |

| Asset Backed Securities | 17.8% |

| Mortgage Backed Securities | 25.0% |

| Commercial Mortgage Backed Securities | 1.1% |

| Corporate Bonds | 19.1% |

| Taxable Municipal Bonds | 7.9% |

| U.S. Government Agency Securities | 6.6% |

| U.S. Treasury Obligations | 21.3% |

| Investment in Affiliates | 0.9% |

There were no material fund changes during the reporting period.

Changes In Or Disagreements With Accountants

There were no changes in or disagreements with accountants during the reporting period.

Annual Shareholder Report

August 31, 2024

Government Securities Money Market Fund

Annual Shareholder Report

August 31, 2024

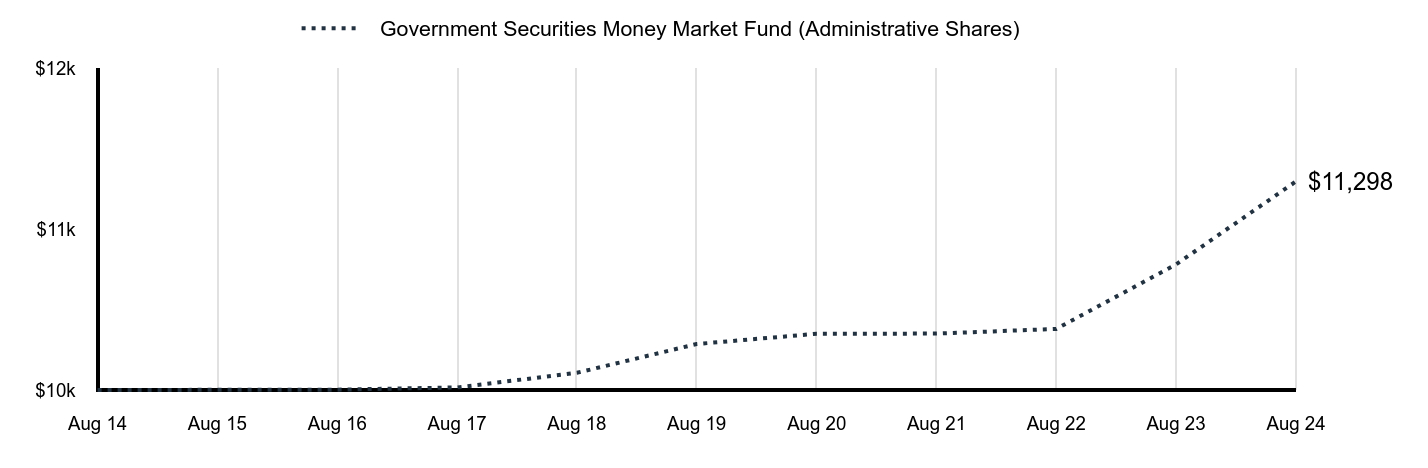

This Annual shareholder report contains important information about Government Securities Money Market Fund for the period of September 1, 2023 to August 31, 2024. You can find additional information about the Fund at https://www.cavanalhillfunds.com/literature/mutual-fund-literature/. You can also request this information by contacting us at 1-800-762-7085.

What were the Fund's costs for the last year?

(based on a $10,000 investment)

| Class name | Costs of a $10,000 investment | Costs paid as a percentage of a $10,000 investment |

|---|

| Administrative Shares | $71 | 0.69% |

How did the Fund perform last year?

After a clear signal from Fed Chair Jerome Powell that interest rate cuts were imminent, we extended the Funds’ duration to slow the pace of inevitable yield decline by focusing on fixed-rate Treasuries and Agencies. The weighted average maturity (WAM) of our Government Securities Fund is a few days longer than the average while our Treasury Fund’s WAM is a few days shorter. Longer durations will typically outperform the market in declining interest rate environments. Securities purchased as late as the middle of July will have the best and most enduring impact on Fund performance as positive Consumer Price Index data released then sparked a Treasury market rally. Subsequently, any securities purchased after this rally must be weighed against the Fed’s anticipated interest rate decision and the spread benefit that it is expected to create. Markets tend to have exaggerated expectations. We continue to add duration carefully to avoid overpaying for securities as those expectations revert to the mean.

Value of a $10,000 Investment

| Government Securities Money Market Fund (Administrative Shares) |

|---|

| Aug 14 | $10,000 |

| Aug 15 | $10,001 |

| Aug 16 | $10,002 |

| Aug 17 | $10,016 |

| Aug 18 | $10,107 |

| Aug 19 | $10,286 |

| Aug 20 | $10,350 |

| Aug 21 | $10,351 |

| Aug 22 | $10,380 |

| Aug 23 | $10,781 |

| Aug 24 | $11,298 |

Average Annual Total Returns

| 1 Year | 5 Year | 10 Year |

|---|

| Administrative Shares | 4.80% | 1.89% | 1.23% |

| Net Assets | $2,747,357,730 |

| Number of Portfolio Holdings | 34 |

| Net Investment Advisory Fees | $1,321,857 |

The performance data quoted represents past performance and does not guarantee future results. The investment return and principal value of an investment will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost.

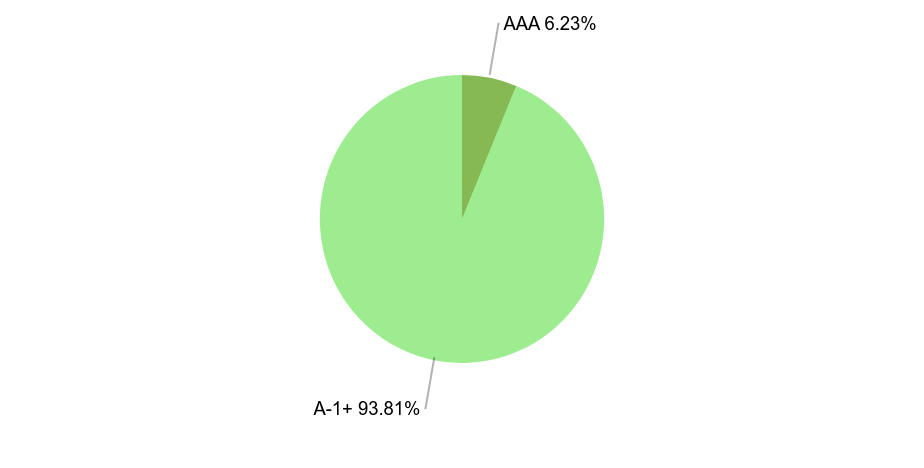

Graphical Presentation of Holdings

(as of 8/31/2024)

The tables below provide additional information about the Fund's investments.

| U.S. Treasury Bills | 7.3% |

| Federal Farm Credit Banks Funding Corp. | 3.6% |

| Federal Farm Credit Banks Funding Corp. | 3.6% |

| Federal Farm Credit Banks Funding Corp. | 3.6% |

| Federal Farm Credit Banks Funding Corp. | 3.6% |

| Federal Farm Credit Banks Funding Corp. | 2.7% |

| Federal Farm Credit Banks Funding Corp. | 1.9% |

| Federal Farm Credit Banks Funding Corp. | 1.8% |

| Federal Farm Credit Banks Funding Corp. | 1.8% |

| Federal Farm Credit Banks Funding Corp. | 1.8% |

| Value | Value |

|---|

| AAA | 6.23% |

| A-1+ | 93.81% |

| U.S. Government Agency Securities | 37.8% |

| U.S. Treasury Obligations | 12.7% |

| Repurchase Agreements | 43.3% |

| Investment Companies | 6.2% |

There were no material fund changes during the reporting period.

Changes In Or Disagreements With Accountants

There were no changes in or disagreements with accountants during the reporting period.

Government Securities Money Market Fund

Annual Shareholder Report

August 31, 2024

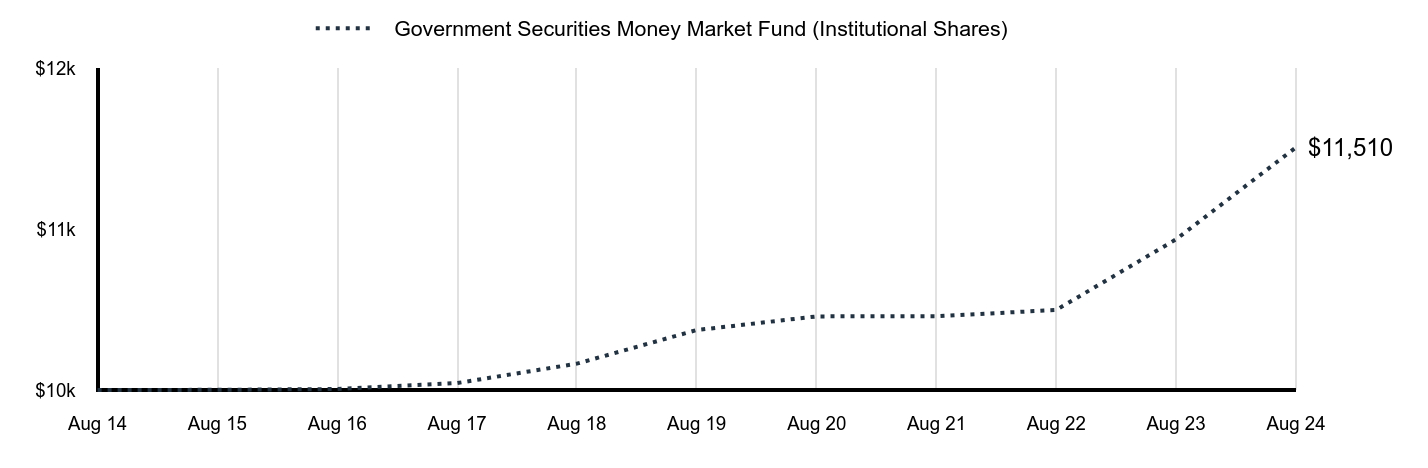

Government Securities Money Market Fund

Annual Shareholder Report

August 31, 2024

This Annual shareholder report contains important information about Government Securities Money Market Fund for the period of September 1, 2023 to August 31, 2024. You can find additional information about the Fund at https://www.cavanalhillfunds.com/literature/mutual-fund-literature/. You can also request this information by contacting us at 1-800-762-7085.

What were the Fund's costs for the last year?

(based on a $10,000 investment)

| Class name | Costs of a $10,000 investment | Costs paid as a percentage of a $10,000 investment |

|---|

| Institutional Shares | $28 | 0.27% |

How did the Fund perform last year?

After a clear signal from Fed Chair Jerome Powell that interest rate cuts were imminent, we extended the Funds’ duration to slow the pace of inevitable yield decline by focusing on fixed-rate Treasuries and Agencies. The weighted average maturity (WAM) of our Government Securities Fund is a few days longer than the average while our Treasury Fund’s WAM is a few days shorter. Longer durations will typically outperform the market in declining interest rate environments. Securities purchased as late as the middle of July will have the best and most enduring impact on Fund performance as positive Consumer Price Index data released then sparked a Treasury market rally. Subsequently, any securities purchased after this rally must be weighed against the Fed’s anticipated interest rate decision and the spread benefit that it is expected to create. Markets tend to have exaggerated expectations. We continue to add duration carefully to avoid overpaying for securities as those expectations revert to the mean.

Value of a $10,000 Investment

| Government Securities Money Market Fund (Institutional Shares) |

|---|

| Aug 14 | $10,000 |

| Aug 15 | $10,001 |

| Aug 16 | $10,006 |

| Aug 17 | $10,043 |

| Aug 18 | $10,164 |

| Aug 19 | $10,373 |

| Aug 20 | $10,458 |

| Aug 21 | $10,459 |

| Aug 22 | $10,498 |

| Aug 23 | $10,937 |

| Aug 24 | $11,510 |

Average Annual Total Returns

| 1 Year | 5 Year | 10 Year |

|---|

| Institutional Shares | 5.24% | 2.10% | 1.42% |

| Net Assets | $2,747,357,730 |

| Number of Portfolio Holdings | 34 |

| Net Investment Advisory Fees | $1,321,857 |

The performance data quoted represents past performance and does not guarantee future results. The investment return and principal value of an investment will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost.

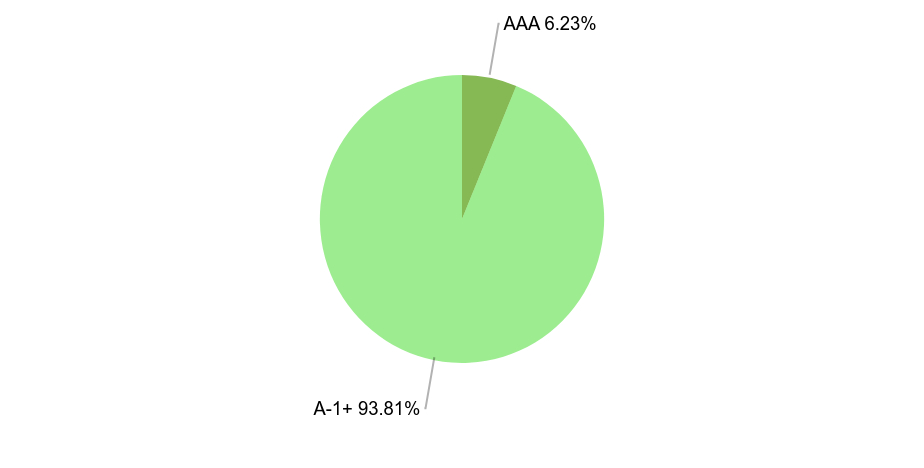

Graphical Presentation of Holdings

(as of 8/31/2024)

The tables below provide additional information about the Fund's investments.

| U.S. Treasury Bills | 7.3% |

| Federal Farm Credit Banks Funding Corp. | 3.6% |

| Federal Farm Credit Banks Funding Corp. | 3.6% |

| Federal Farm Credit Banks Funding Corp. | 3.6% |

| Federal Farm Credit Banks Funding Corp. | 3.6% |

| Federal Farm Credit Banks Funding Corp. | 2.7% |

| Federal Farm Credit Banks Funding Corp. | 1.9% |

| Federal Farm Credit Banks Funding Corp. | 1.8% |

| Federal Farm Credit Banks Funding Corp. | 1.8% |

| Federal Farm Credit Banks Funding Corp. | 1.8% |

| Value | Value |

|---|

| AAA | 6.23% |

| A-1+ | 93.81% |

| U.S. Government Agency Securities | 37.8% |

| U.S. Treasury Obligations | 12.7% |

| Repurchase Agreements | 43.3% |

| Investment Companies | 6.2% |

There were no material fund changes during the reporting period.

Changes In Or Disagreements With Accountants

There were no changes in or disagreements with accountants during the reporting period.

Government Securities Money Market Fund

Annual Shareholder Report

August 31, 2024

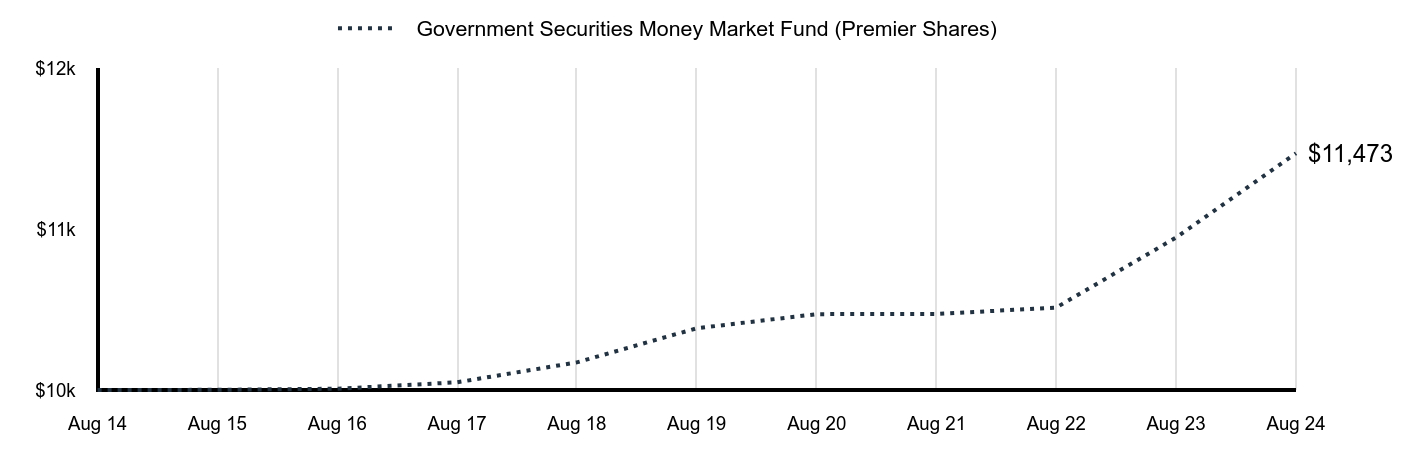

Government Securities Money Market Fund

Annual Shareholder Report

August 31, 2024

This Annual shareholder report contains important information about Government Securities Money Market Fund for the period of September 1, 2023 to August 31, 2024. You can find additional information about the Fund at https://www.cavanalhillfunds.com/literature/mutual-fund-literature/. You can also request this information by contacting us at 1-800-762-7085.

What were the Fund's costs for the last year?

(based on a $10,000 investment)

| Class name | Costs of a $10,000 investment | Costs paid as a percentage of a $10,000 investment |

|---|

| Premier Shares | $71 | 0.69% |

How did the Fund perform last year?

After a clear signal from Fed Chair Jerome Powell that interest rate cuts were imminent, we extended the Funds’ duration to slow the pace of inevitable yield decline by focusing on fixed-rate Treasuries and Agencies. The weighted average maturity (WAM) of our Government Securities Fund is a few days longer than the average while our Treasury Fund’s WAM is a few days shorter. Longer durations will typically outperform the market in declining interest rate environments. Securities purchased as late as the middle of July will have the best and most enduring impact on Fund performance as positive Consumer Price Index data released then sparked a Treasury market rally. Subsequently, any securities purchased after this rally must be weighed against the Fed’s anticipated interest rate decision and the spread benefit that it is expected to create. Markets tend to have exaggerated expectations. We continue to add duration carefully to avoid overpaying for securities as those expectations revert to the mean.

Value of a $10,000 Investment

| Government Securities Money Market Fund (Premier Shares) |

|---|

| Aug 14 | $10,000 |

| Aug 15 | $10,001 |

| Aug 16 | $10,008 |

| Aug 17 | $10,048 |

| Aug 18 | $10,172 |

| Aug 19 | $10,384 |

| Aug 20 | $10,472 |

| Aug 21 | $10,473 |

| Aug 22 | $10,513 |

| Aug 23 | $10,948 |

| Aug 24 | $11,473 |

Average Annual Total Returns

| 1 Year | 5 Year | 10 Year |

|---|

| Premier Shares | 4.79% | 2.01% | 1.38% |

| Net Assets | $2,747,357,730 |

| Number of Portfolio Holdings | 34 |

| Net Investment Advisory Fees | $1,321,857 |

The performance data quoted represents past performance and does not guarantee future results. The investment return and principal value of an investment will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost.

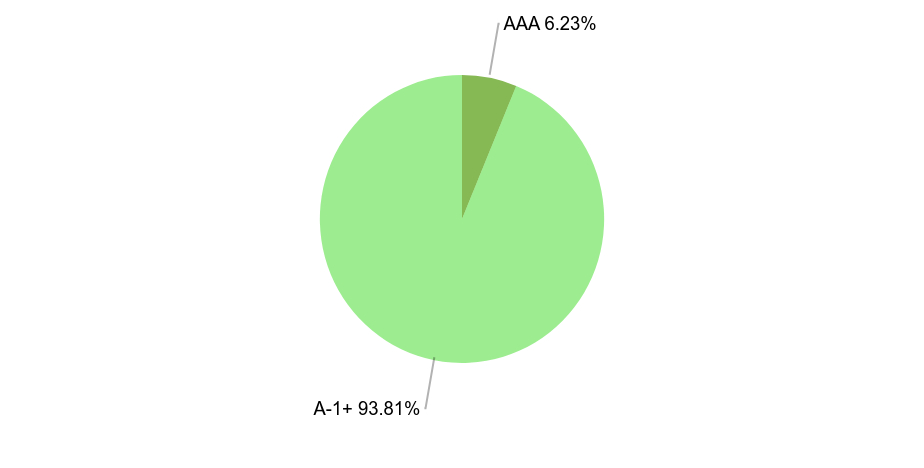

Graphical Presentation of Holdings

(as of 8/31/2024)

The tables below provide additional information about the Fund's investments.

| U.S. Treasury Bills | 7.3% |

| Federal Farm Credit Banks Funding Corp. | 3.6% |

| Federal Farm Credit Banks Funding Corp. | 3.6% |

| Federal Farm Credit Banks Funding Corp. | 3.6% |

| Federal Farm Credit Banks Funding Corp. | 3.6% |

| Federal Farm Credit Banks Funding Corp. | 2.7% |

| Federal Farm Credit Banks Funding Corp. | 1.9% |

| Federal Farm Credit Banks Funding Corp. | 1.8% |

| Federal Farm Credit Banks Funding Corp. | 1.8% |

| Federal Farm Credit Banks Funding Corp. | 1.8% |

| Value | Value |

|---|

| AAA | 6.23% |

| A-1+ | 93.81% |

| U.S. Government Agency Securities | 37.8% |

| U.S. Treasury Obligations | 12.7% |

| Repurchase Agreements | 43.3% |

| Investment Companies | 6.2% |

There were no material fund changes during the reporting period.

Changes In Or Disagreements With Accountants

There were no changes in or disagreements with accountants during the reporting period.

Government Securities Money Market Fund

Annual Shareholder Report

August 31, 2024

Government Securities Money Market Fund

Annual Shareholder Report

August 31, 2024

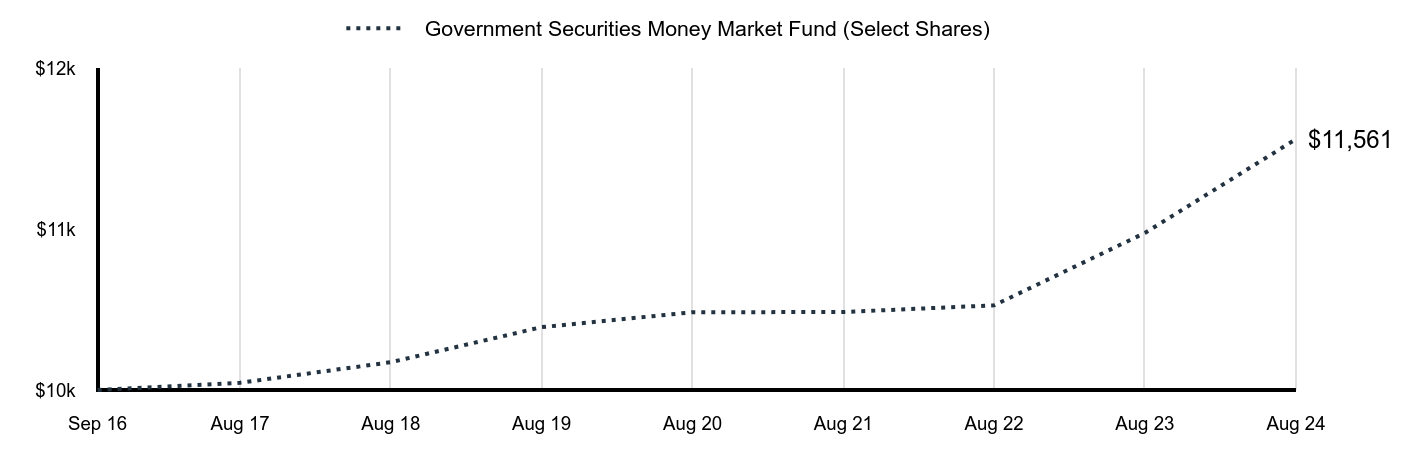

This Annual shareholder report contains important information about Government Securities Money Market Fund for the period of September 1, 2023 to August 31, 2024. You can find additional information about the Fund at https://www.cavanalhillfunds.com/literature/mutual-fund-literature/. You can also request this information by contacting us at 1-800-762-7085.

What were the Fund's costs for the last year?

(based on a $10,000 investment)

| Class name | Costs of a $10,000 investment | Costs paid as a percentage of a $10,000 investment |

|---|

| Select Shares | $20 | 0.19% |

How did the Fund perform last year?

After a clear signal from Fed Chair Jerome Powell that interest rate cuts were imminent, we extended the Funds’ duration to slow the pace of inevitable yield decline by focusing on fixed-rate Treasuries and Agencies. The weighted average maturity (WAM) of our Government Securities Fund is a few days longer than the average while our Treasury Fund’s WAM is a few days shorter. Longer durations will typically outperform the market in declining interest rate environments. Securities purchased as late as the middle of July will have the best and most enduring impact on Fund performance as positive Consumer Price Index data released then sparked a Treasury market rally. Subsequently, any securities purchased after this rally must be weighed against the Fed’s anticipated interest rate decision and the spread benefit that it is expected to create. Markets tend to have exaggerated expectations. We continue to add duration carefully to avoid overpaying for securities as those expectations revert to the mean.

Value of a $10,000 Investment

| Government Securities Money Market Fund (Select Shares) |

|---|

| Sep 16 | $10,000 |

| Aug 17 | $10,045 |

| Aug 18 | $10,173 |

| Aug 19 | $10,391 |

| Aug 20 | $10,484 |

| Aug 21 | $10,485 |

| Aug 22 | $10,527 |

| Aug 23 | $10,977 |

| Aug 24 | $11,561 |

Average Annual Total Returns

| 1 Year | 5 Year | Since Inception |

|---|

| Select Shares | 5.32% | 2.16% | 1.84% |

| Net Assets | $2,747,357,730 |

| Number of Portfolio Holdings | 34 |

| Net Investment Advisory Fees | $1,321,857 |

The performance data quoted represents past performance and does not guarantee future results. The investment return and principal value of an investment will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost.

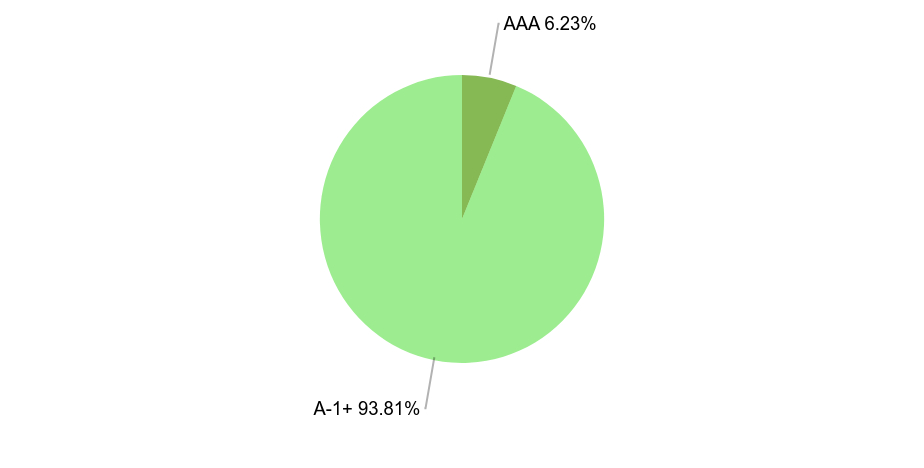

Graphical Presentation of Holdings

(as of 8/31/2024)

The tables below provide additional information about the Fund's investments.

| U.S. Treasury Bills | 7.3% |

| Federal Farm Credit Banks Funding Corp. | 3.6% |

| Federal Farm Credit Banks Funding Corp. | 3.6% |

| Federal Farm Credit Banks Funding Corp. | 3.6% |

| Federal Farm Credit Banks Funding Corp. | 3.6% |

| Federal Farm Credit Banks Funding Corp. | 2.7% |

| Federal Farm Credit Banks Funding Corp. | 1.9% |

| Federal Farm Credit Banks Funding Corp. | 1.8% |

| Federal Farm Credit Banks Funding Corp. | 1.8% |

| Federal Farm Credit Banks Funding Corp. | 1.8% |

| Value | Value |

|---|

| AAA | 6.23% |

| A-1+ | 93.81% |

| U.S. Government Agency Securities | 37.8% |

| U.S. Treasury Obligations | 12.7% |

| Repurchase Agreements | 43.3% |

| Investment Companies | 6.2% |

There were no material fund changes during the reporting period.

Changes In Or Disagreements With Accountants

There were no changes in or disagreements with accountants during the reporting period.

Government Securities Money Market Fund

Annual Shareholder Report

August 31, 2024

Annual Shareholder Report

August 31, 2024

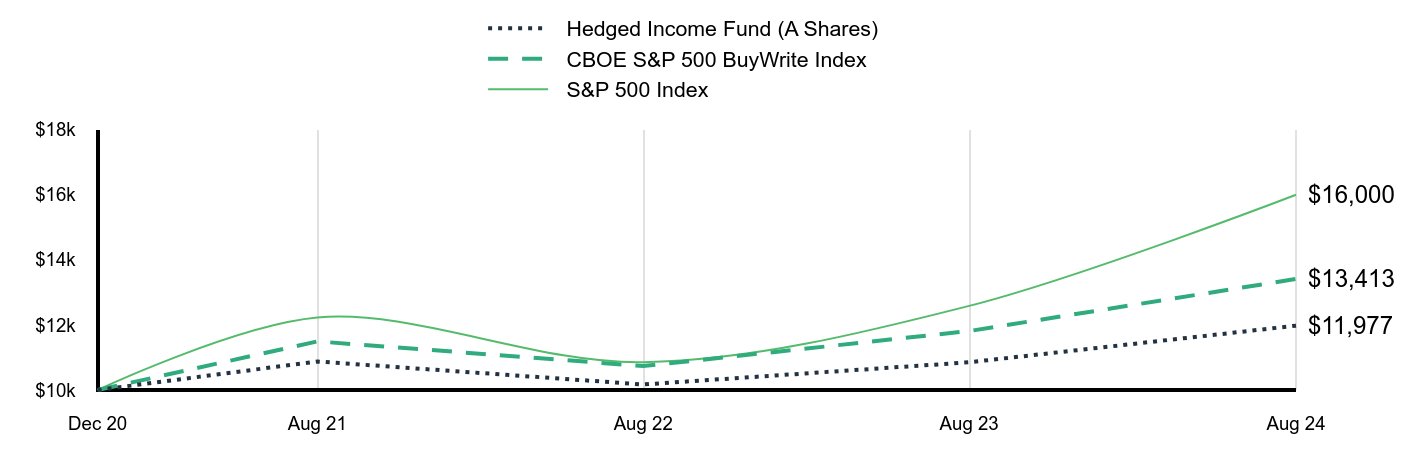

This Annual shareholder report contains important information about Hedged Income Fund for the period of September 1, 2023 to August 31, 2024. You can find additional information about the Fund at https://www.cavanalhillfunds.com/literature/mutual-fund-literature/. You can also request this information by contacting us at 1-800-762-7085.

What were the Fund's costs for the last year?

(based on a $10,000 investment)

| Class name | Costs of a $10,000 investment | Costs paid as a percentage of a $10,000 investment |

|---|

| A Shares | $142 | 1.35% |

How did the Fund perform last year?

Early in 2024, we increased the Fund’s active risk to growth stocks, sacrificing dividend yield to increase the Fund’s total return potential. We also reduced the notional value of the Fund’s put options to allow for more upside capture as the market rallied. Both tactics added to performance. The Fund underperformed its benchmark (CBOE S&P 500 BuyWrite Index). Most of that occurred in August 2024, when the Fund trailed its benchmark by 2.0% as a result of the Fund’s overweight to the energy sector and poor stockpicking in industrials. Key contributors to performance were stock picking in energy and health care while major detractors included overweights to energy and materials, an underweight to technology, and stock picking in the consumer discretionary and consumer staples sectors. Earlier this year, we removed some of the Fund’s defensive posturing in anticipation of a soft landing. Following this year’s rally, we see risk and reward as balanced based on weakening economic data. The Fund is positioned as such, with a moderate amount of notional put coverage and muted active risk with regard to investment style and cyclical stocks.

Value of a $10,000 Investment

| Hedged Income Fund (A Shares) | CBOE S&P 500 BuyWrite Index | S&P 500 Index |

|---|

| Dec 20 | $10,000 | $10,000 | $10,000 |

| Aug 21 | $10,877 | $11,494 | $12,227 |

| Aug 22 | $10,170 | $10,735 | $10,855 |

| Aug 23 | $10,852 | $11,812 | $12,585 |

| Aug 24 | $11,977 | $13,413 | $16,000 |

Average Annual Total Returns

| 1 Year | Since Inception |

|---|

| A Shares | 10.36% | 5.03% |

| CBOE S&P 500 BuyWrite Index | 13.55% | 8.32% |

| S&P 500 Index | 27.14% | 13.65% |

| Net Assets | $28,167,401 |

| Number of Portfolio Holdings | 67 |

| Net Investment Advisory Fees | $232,682 |

| Portfolio Turnover Rate | 44% |

The performance data quoted represents past performance and does not guarantee future results. The investment return and principal value of an investment will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost.

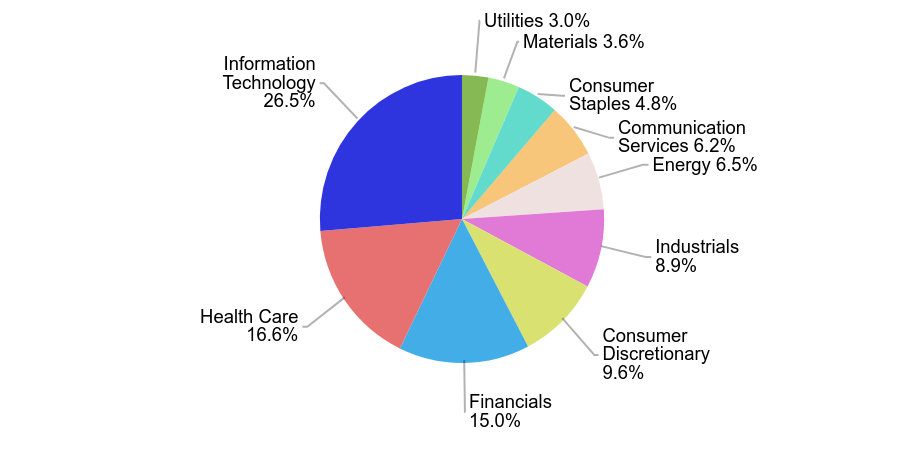

Graphical Presentation of Holdings

(as of 8/31/2024)

The tables below provide additional information about the Fund's investments.

| Apple, Inc. | 6.8% |

| Microsoft Corp. | 5.6% |

| JPMorgan Chase & Co. | 5.0% |

| Broadcom, Inc. | 4.6% |

| Emerson Electric Co. | 4.1% |

| Merck & Co., Inc. | 3.9% |

| Amazon.com, Inc. | 3.7% |

| Dow, Inc. | 3.6% |

| AstraZeneca PLC | 3.5% |

| Phillips 66 | 3.5% |

| Value | Value |

|---|

| Utilities | 3.0% |

| Materials | 3.6% |

| Consumer Staples | 4.8% |

| Communication Services | 6.2% |

| Energy | 6.5% |

| Industrials | 8.9% |

| Consumer Discretionary | 9.6% |

| Financials | 15.0% |

| Health Care | 16.6% |

| Information Technology | 26.5% |

| Common Stocks | 103.0% |

| Purchased Options | 0.7% |

| Investment in Affiliates | 1.2% |

There were no material fund changes during the reporting period.

Changes In Or Disagreements With Accountants

There were no changes in or disagreements with accountants during the reporting period.

Annual Shareholder Report

August 31, 2024

Annual Shareholder Report

August 31, 2024

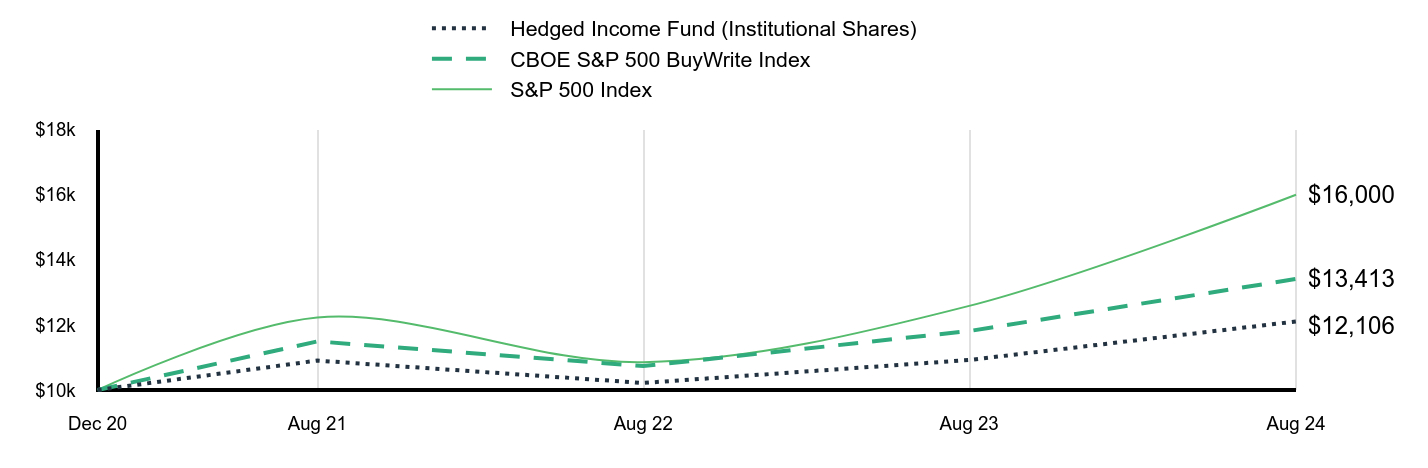

This Annual shareholder report contains important information about Hedged Income Fund for the period of September 1, 2023 to August 31, 2024. You can find additional information about the Fund at https://www.cavanalhillfunds.com/literature/mutual-fund-literature/. You can also request this information by contacting us at 1-800-762-7085.

What were the Fund's costs for the last year?

(based on a $10,000 investment)

| Class name | Costs of a $10,000 investment | Costs paid as a percentage of a $10,000 investment |

|---|

| Institutional Shares | $116 | 1.10% |

How did the Fund perform last year?

Early in 2024, we increased the Fund’s active risk to growth stocks, sacrificing dividend yield to increase the Fund’s total return potential. We also reduced the notional value of the Fund’s put options to allow for more upside capture as the market rallied. Both tactics added to performance. The Fund underperformed its benchmark (CBOE S&P 500 BuyWrite Index). Most of that occurred in August 2024, when the Fund trailed its benchmark by 2.0% as a result of the Fund’s overweight to the energy sector and poor stockpicking in industrials. Key contributors to performance were stock picking in energy and health care while major detractors included overweights to energy and materials, an underweight to technology, and stock picking in the consumer discretionary and consumer staples sectors. Earlier this year, we removed some of the Fund’s defensive posturing in anticipation of a soft landing. Following this year’s rally, we see risk and reward as balanced based on weakening economic data. The Fund is positioned as such, with a moderate amount of notional put coverage and muted active risk with regard to investment style and cyclical stocks.

Value of a $10,000 Investment

| Hedged Income Fund (Institutional Shares) | CBOE S&P 500 BuyWrite Index | S&P 500 Index |

|---|

| Dec 20 | $10,000 | $10,000 | $10,000 |

| Aug 21 | $10,904 | $11,494 | $12,227 |

| Aug 22 | $10,216 | $10,735 | $10,855 |

| Aug 23 | $10,923 | $11,812 | $12,585 |

| Aug 24 | $12,106 | $13,413 | $16,000 |

Average Annual Total Returns

| 1 Year | Since Inception |

|---|

| Institutional Shares | 10.83% | 5.34% |

| CBOE S&P 500 BuyWrite Index | 13.55% | 8.32% |

| S&P 500 Index | 27.14% | 13.65% |

| Net Assets | $28,167,401 |

| Number of Portfolio Holdings | 67 |

| Net Investment Advisory Fees | $232,682 |

| Portfolio Turnover Rate | 44% |

The performance data quoted represents past performance and does not guarantee future results. The investment return and principal value of an investment will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost.

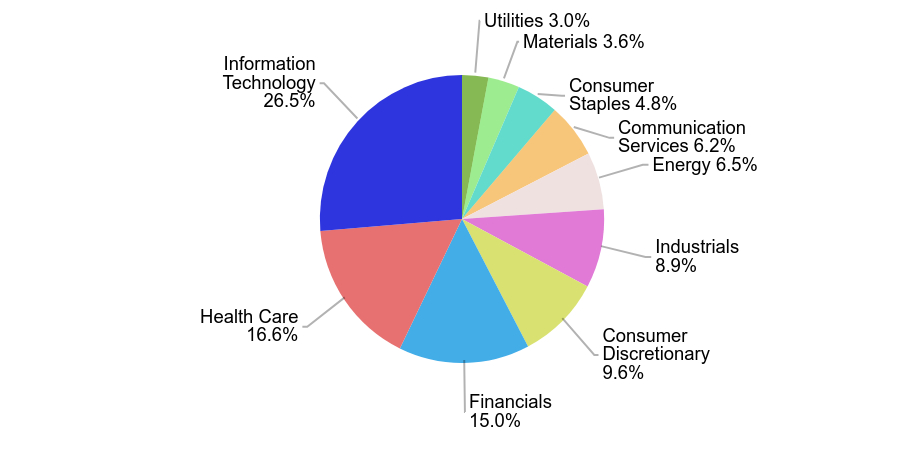

Graphical Presentation of Holdings

(as of 8/31/2024)

The tables below provide additional information about the Fund's investments.

| Apple, Inc. | 6.8% |

| Microsoft Corp. | 5.6% |

| JPMorgan Chase & Co. | 5.0% |

| Broadcom, Inc. | 4.6% |

| Emerson Electric Co. | 4.1% |

| Merck & Co., Inc. | 3.9% |

| Amazon.com, Inc. | 3.7% |

| Dow, Inc. | 3.6% |

| AstraZeneca PLC | 3.5% |

| Phillips 66 | 3.5% |

| Value | Value |

|---|

| Utilities | 3.0% |

| Materials | 3.6% |

| Consumer Staples | 4.8% |

| Communication Services | 6.2% |

| Energy | 6.5% |

| Industrials | 8.9% |

| Consumer Discretionary | 9.6% |

| Financials | 15.0% |

| Health Care | 16.6% |

| Information Technology | 26.5% |

| Common Stocks | 103.0% |

| Purchased Options | 0.7% |

| Investment in Affiliates | 1.2% |

There were no material fund changes during the reporting period.

Changes In Or Disagreements With Accountants

There were no changes in or disagreements with accountants during the reporting period.

Annual Shareholder Report

August 31, 2024

Annual Shareholder Report

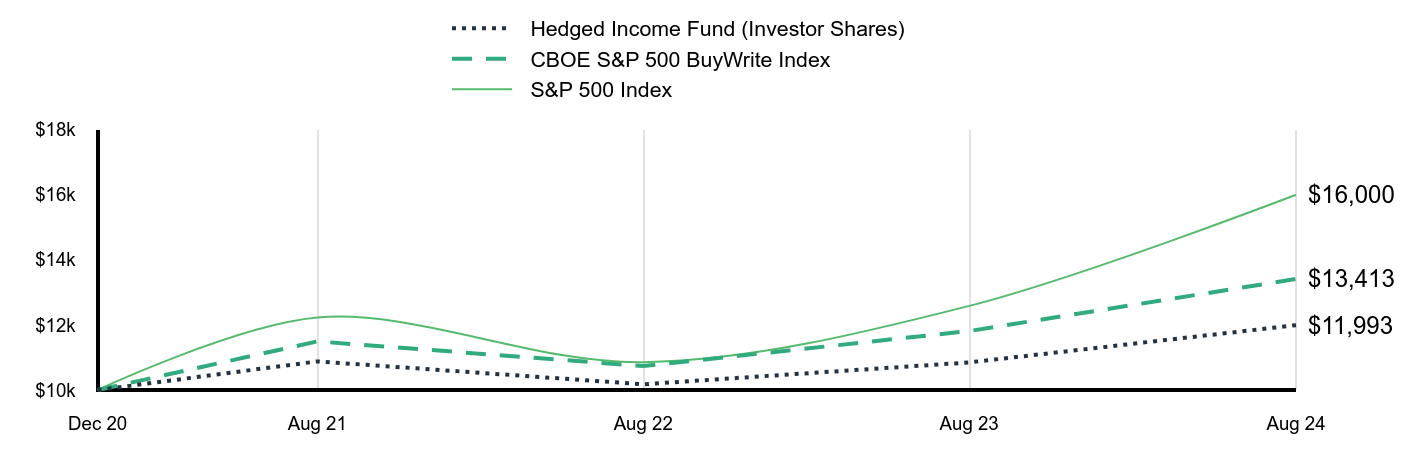

August 31, 2024

This Annual shareholder report contains important information about Hedged Income Fund for the period of September 1, 2023 to August 31, 2024. You can find additional information about the Fund at https://www.cavanalhillfunds.com/literature/mutual-fund-literature/. You can also request this information by contacting us at 1-800-762-7085.

What were the Fund's costs for the last year?

(based on a $10,000 investment)

| Class name | Costs of a $10,000 investment | Costs paid as a percentage of a $10,000 investment |

|---|

| Investor Shares | $142 | 1.35% |

How did the Fund perform last year?

Early in 2024, we increased the Fund’s active risk to growth stocks, sacrificing dividend yield to increase the Fund’s total return potential. We also reduced the notional value of the Fund’s put options to allow for more upside capture as the market rallied. Both tactics added to performance. The Fund underperformed its benchmark (CBOE S&P 500 BuyWrite Index). Most of that occurred in August 2024, when the Fund trailed its benchmark by 2.0% as a result of the Fund’s overweight to the energy sector and poor stockpicking in industrials. Key contributors to performance were stock picking in energy and health care while major detractors included overweights to energy and materials, an underweight to technology, and stock picking in the consumer discretionary and consumer staples sectors. Earlier this year, we removed some of the Fund’s defensive posturing in anticipation of a soft landing. Following this year’s rally, we see risk and reward as balanced based on weakening economic data. The Fund is positioned as such, with a moderate amount of notional put coverage and muted active risk with regard to investment style and cyclical stocks.

Value of a $10,000 Investment

| Hedged Income Fund (Investor Shares) | CBOE S&P 500 BuyWrite Index | S&P 500 Index |

|---|

| Dec 20 | $10,000 | $10,000 | $10,000 |

| Aug 21 | $10,879 | $11,494 | $12,227 |

| Aug 22 | $10,176 | $10,735 | $10,855 |

| Aug 23 | $10,848 | $11,812 | $12,585 |

| Aug 24 | $11,993 | $13,413 | $16,000 |

Average Annual Total Returns

| 1 Year | Since Inception |

|---|

| Investor Shares | 10.55% | 5.07% |

| CBOE S&P 500 BuyWrite Index | 13.55% | 8.32% |

| S&P 500 Index | 27.14% | 13.65% |

| Net Assets | $28,167,401 |

| Number of Portfolio Holdings | 67 |

| Net Investment Advisory Fees | $232,682 |

| Portfolio Turnover Rate | 44% |

The performance data quoted represents past performance and does not guarantee future results. The investment return and principal value of an investment will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost.

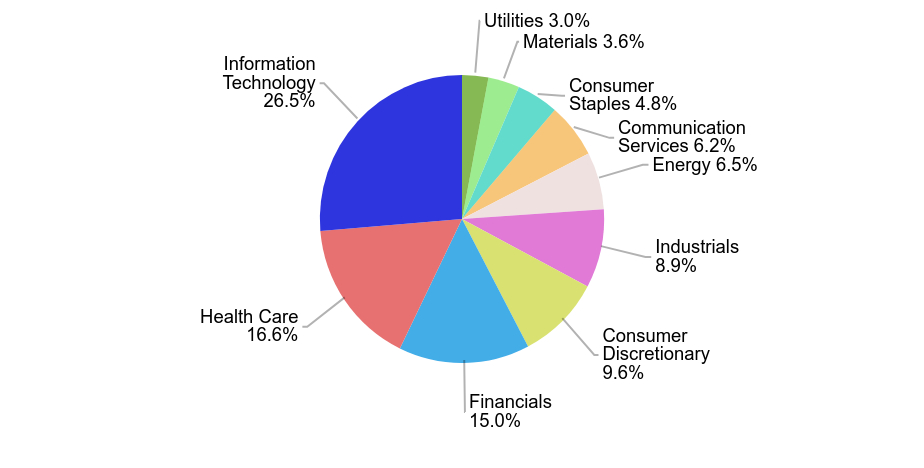

Graphical Presentation of Holdings

(as of 8/31/2024)

The tables below provide additional information about the Fund's investments.

| Apple, Inc. | 6.8% |

| Microsoft Corp. | 5.6% |

| JPMorgan Chase & Co. | 5.0% |

| Broadcom, Inc. | 4.6% |

| Emerson Electric Co. | 4.1% |

| Merck & Co., Inc. | 3.9% |

| Amazon.com, Inc. | 3.7% |

| Dow, Inc. | 3.6% |

| AstraZeneca PLC | 3.5% |

| Phillips 66 | 3.5% |

| Value | Value |

|---|

| Utilities | 3.0% |

| Materials | 3.6% |

| Consumer Staples | 4.8% |

| Communication Services | 6.2% |

| Energy | 6.5% |

| Industrials | 8.9% |

| Consumer Discretionary | 9.6% |

| Financials | 15.0% |

| Health Care | 16.6% |

| Information Technology | 26.5% |

| Common Stocks | 103.0% |

| Purchased Options | 0.7% |

| Investment in Affiliates | 1.2% |

There were no material fund changes during the reporting period.

Changes In Or Disagreements With Accountants

There were no changes in or disagreements with accountants during the reporting period.

Annual Shareholder Report

August 31, 2024

Annual Shareholder Report

August 31, 2024

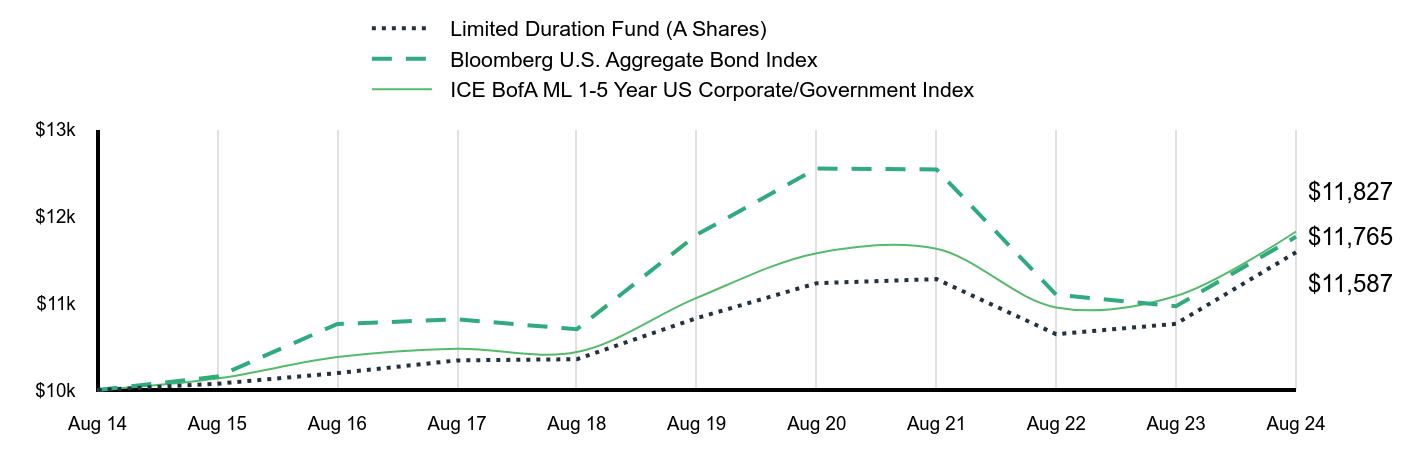

This Annual shareholder report contains important information about Limited Duration Fund for the period of September 1, 2023 to August 31, 2024. You can find additional information about the Fund at https://www.cavanalhillfunds.com/literature/mutual-fund-literature/. You can also request this information by contacting us at 1-800-762-7085.

What were the Fund's costs for the last year?

(based on a $10,000 investment)

| Class name | Costs of a $10,000 investment | Costs paid as a percentage of a $10,000 investment |

|---|

| A Shares | $109 | 1.05% |

How did the Fund perform last year?

We maintained a heavy overweight to credit, particularly non-agency asset-backed securities (ABS). The excess yield on the securities was coupled with broad spread tightening over the period, leading to strong returns. The Limited Duration Fund outperformed its benchmark (Bloomberg U.S. Aggregate Bond Index) for the year. Exposure to higher-yielding, non-agency ABS and non-agency mortgage-backed securities benefited the portfolio, as did a longer-than-benchmark duration as interest rates fell. Broad spread tightening and an overweight to credit also contributed to performance as some of the Fund’s corporate positions performed very well. The main detractor from Fund relative performance was an underweight to the corporate sector as corporate bonds were very strong for the period. We will look to increase duration during market pullbacks and to increase the portfolio’s liquidity. Should the economy continue to slow, less liquid securities, especially longer durations, are likely to underperform. With credit spreads nearing historic tight levels, we expect credit to underperform. If so, we will look to increase the Fund’s credit profile.

Value of a $10,000 Investment

| Limited Duration Fund (A Shares) | Bloomberg U.S. Aggregate Bond Index | ICE BofA ML 1-5 Year US Corporate/Government Index |

|---|

| Aug 14 | $10,000 | $10,000 | $10,000 |

| Aug 15 | $10,072 | $10,155 | $10,133 |

| Aug 16 | $10,195 | $10,761 | $10,379 |

| Aug 17 | $10,341 | $10,814 | $10,476 |

| Aug 18 | $10,355 | $10,701 | $10,437 |

| Aug 19 | $10,828 | $11,789 | $11,061 |

| Aug 20 | $11,231 | $12,553 | $11,577 |

| Aug 21 | $11,278 | $12,542 | $11,628 |

| Aug 22 | $10,643 | $11,098 | $10,952 |

| Aug 23 | $10,763 | $10,965 | $11,084 |

| Aug 24 | $11,587 | $11,765 | $11,827 |

Average Annual Total Returns

| 1 Year | 5 Year | 10 Year |

|---|

| A Shares | 7.66% | 1.37% | 1.48% |

| Bloomberg U.S. Aggregate Bond Index | 7.30% | -0.04% | 1.64% |

| ICE BofA ML 1-5 Year US Corporate/Government Index | 6.71% | 1.35% | 1.69% |

| Net Assets | $38,159,387 |

| Number of Portfolio Holdings | 267 |

| Net Investment Advisory Fees | $48,128 |

| Portfolio Turnover Rate | 18% |

The performance data quoted represents past performance and does not guarantee future results. The investment return and principal value of an investment will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost.

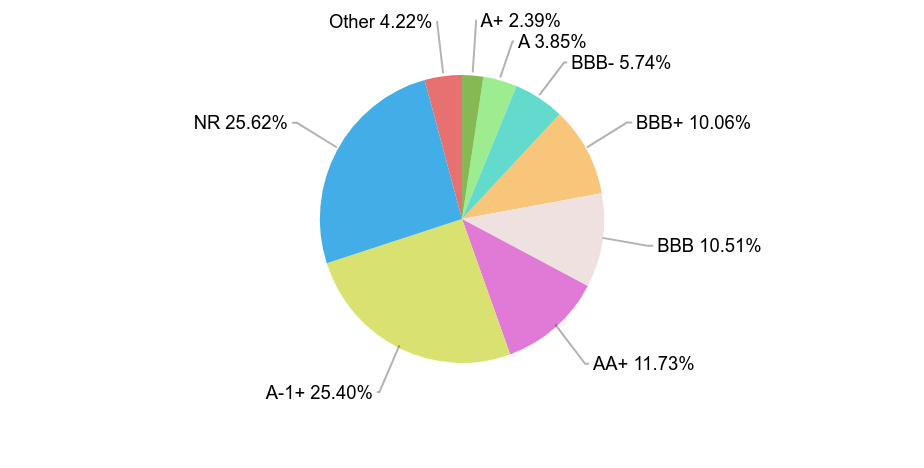

Graphical Presentation of Holdings

(as of 8/31/2024)

The tables below provide additional information about the Fund's investments.

| U.S. Treasury Notes | 3.0% |

| The Western Union Co. | 3.0% |

| The Goldman Sachs Group, Inc. | 2.9% |

| Southtrust Bank | 2.8% |

| Flexential Issuer, Series 2021-1A, Class A2 | 2.7% |

| U.S. Treasury Notes | 2.5% |

| Goodgreen Trust, Series 2020-1A, Class A | 2.5% |

| Federal Farm Credit Banks Funding Corp. | 2.3% |

| Truist Financial Corp., Series N | 2.1% |

| BAT Capital Corp. | 2.1% |

| Value | Value |

|---|

| A+ | 2.39% |

| A | 3.85% |

| BBB- | 5.74% |

| BBB+ | 10.06% |

| BBB | 10.51% |

| AA+ | 11.73% |

| A-1+ | 25.40% |

| NR | 25.62% |

| Other | 4.22% |

| Asset Backed Securities | 28.2% |

| Mortgage Backed Securities | 23.7% |

| Commercial Mortgage Backed Securities | 0.1% |

| Corporate Bonds | 21.0% |

| Taxable Municipal Bonds | 0.8% |

| U.S. Government Agency Securities | 10.5% |

| U.S. Treasury Obligations | 11.5% |

| Investment in Affiliates | 3.7% |

Effective August 5, 2024, the Adviser has contractually agreed to waive fees or reimburse expenses so that expenses do not exceed 0.50% of average daily net assets, plus class specific fees, through December 31, 2025. Prior to August 5, 2024, there was not an expense limitation for the Fund.

Changes In Or Disagreements With Accountants

There were no changes in or disagreements with accountants during the reporting period.

Annual Shareholder Report

August 31, 2024

Annual Shareholder Report

August 31, 2024

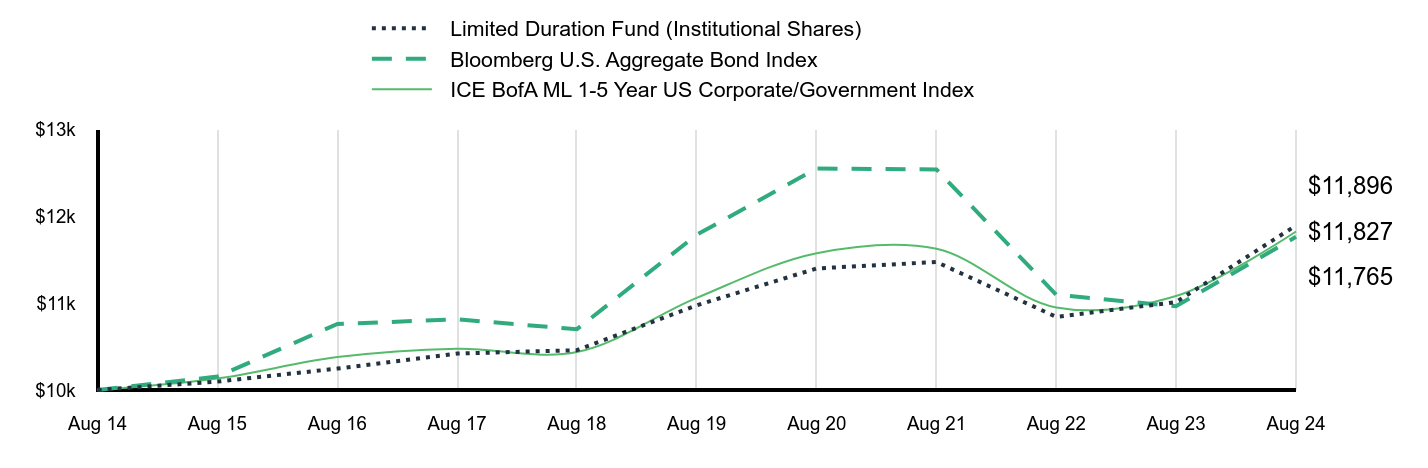

This Annual shareholder report contains important information about Limited Duration Fund for the period of September 1, 2023 to August 31, 2024. You can find additional information about the Fund at https://www.cavanalhillfunds.com/literature/mutual-fund-literature/. You can also request this information by contacting us at 1-800-762-7085.

What were the Fund's costs for the last year?

(based on a $10,000 investment)

| Class name | Costs of a $10,000 investment | Costs paid as a percentage of a $10,000 investment |

|---|

| Institutional Shares | $76 | 0.73% |

How did the Fund perform last year?

We maintained a heavy overweight to credit, particularly non-agency asset-backed securities (ABS). The excess yield on the securities was coupled with broad spread tightening over the period, leading to strong returns. The Limited Duration Fund outperformed its benchmark (Bloomberg U.S. Aggregate Bond Index) for the year. Exposure to higher-yielding, non-agency ABS and non-agency mortgage-backed securities benefited the portfolio, as did a longer-than-benchmark duration as interest rates fell. Broad spread tightening and an overweight to credit also contributed to performance as some of the Fund’s corporate positions performed very well. The main detractor from Fund relative performance was an underweight to the corporate sector as corporate bonds were very strong for the period. We will look to increase duration during market pullbacks and to increase the portfolio’s liquidity. Should the economy continue to slow, less liquid securities, especially longer durations, are likely to underperform. With credit spreads nearing historic tight levels, we expect credit to underperform. If so, we will look to increase the Fund’s credit profile.

Value of a $10,000 Investment

| Limited Duration Fund (Institutional Shares) | Bloomberg U.S. Aggregate Bond Index | ICE BofA ML 1-5 Year US Corporate/Government Index |

|---|

| Aug 14 | $10,000 | $10,000 | $10,000 |

| Aug 15 | $10,097 | $10,155 | $10,133 |

| Aug 16 | $10,247 | $10,761 | $10,379 |

| Aug 17 | $10,420 | $10,814 | $10,476 |

| Aug 18 | $10,459 | $10,701 | $10,437 |

| Aug 19 | $10,976 | $11,789 | $11,061 |

| Aug 20 | $11,401 | $12,553 | $11,577 |

| Aug 21 | $11,475 | $12,542 | $11,628 |

| Aug 22 | $10,843 | $11,098 | $10,952 |

| Aug 23 | $11,013 | $10,965 | $11,084 |

| Aug 24 | $11,896 | $11,765 | $11,827 |

Average Annual Total Returns

| 1 Year | 5 Year | 10 Year |

|---|

| Institutional Shares | 8.02% | 1.62% | 1.75% |

| Bloomberg U.S. Aggregate Bond Index | 7.30% | -0.04% | 1.64% |

| ICE BofA ML 1-5 Year US Corporate/Government Index | 6.71% | 1.35% | 1.69% |

| Net Assets | $38,159,387 |

| Number of Portfolio Holdings | 267 |

| Net Investment Advisory Fees | $48,128 |

| Portfolio Turnover Rate | 18% |

The performance data quoted represents past performance and does not guarantee future results. The investment return and principal value of an investment will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost.

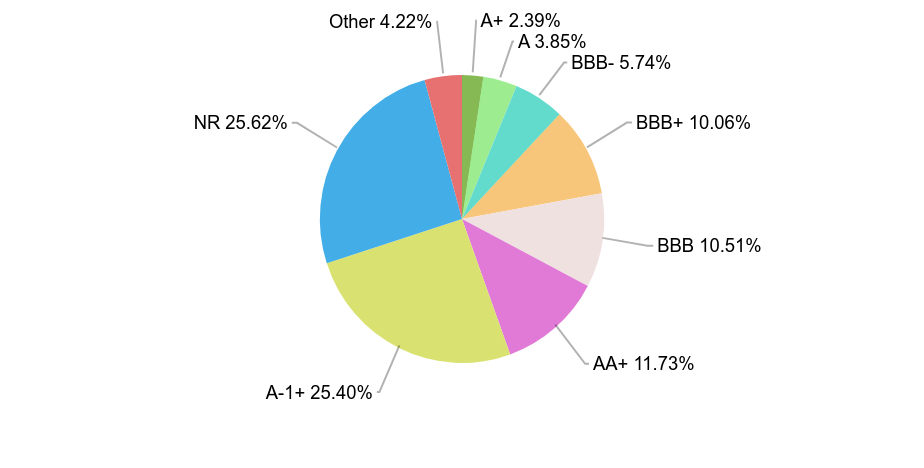

Graphical Presentation of Holdings

(as of 8/31/2024)

The tables below provide additional information about the Fund's investments.

| U.S. Treasury Notes | 3.0% |

| The Western Union Co. | 3.0% |

| The Goldman Sachs Group, Inc. | 2.9% |

| Southtrust Bank | 2.8% |

| Flexential Issuer, Series 2021-1A, Class A2 | 2.7% |

| U.S. Treasury Notes | 2.5% |

| Goodgreen Trust, Series 2020-1A, Class A | 2.5% |

| Federal Farm Credit Banks Funding Corp. | 2.3% |

| Truist Financial Corp., Series N | 2.1% |

| BAT Capital Corp. | 2.1% |

| Value | Value |

|---|

| A+ | 2.39% |

| A | 3.85% |

| BBB- | 5.74% |

| BBB+ | 10.06% |

| BBB | 10.51% |

| AA+ | 11.73% |

| A-1+ | 25.40% |

| NR | 25.62% |

| Other | 4.22% |

| Asset Backed Securities | 28.2% |

| Mortgage Backed Securities | 23.7% |

| Commercial Mortgage Backed Securities | 0.1% |

| Corporate Bonds | 21.0% |

| Taxable Municipal Bonds | 0.8% |

| U.S. Government Agency Securities | 10.5% |

| U.S. Treasury Obligations | 11.5% |

| Investment in Affiliates | 3.7% |

Effective August 5, 2024, the Adviser has contractually agreed to waive fees or reimburse expenses so that expenses do not exceed 0.50% of average daily net assets, plus class specific fees, through December 31, 2025. Prior to August 5, 2024, there was not an expense limitation for the Fund.

Changes In Or Disagreements With Accountants

There were no changes in or disagreements with accountants during the reporting period.

Annual Shareholder Report

August 31, 2024

Annual Shareholder Report

August 31, 2024

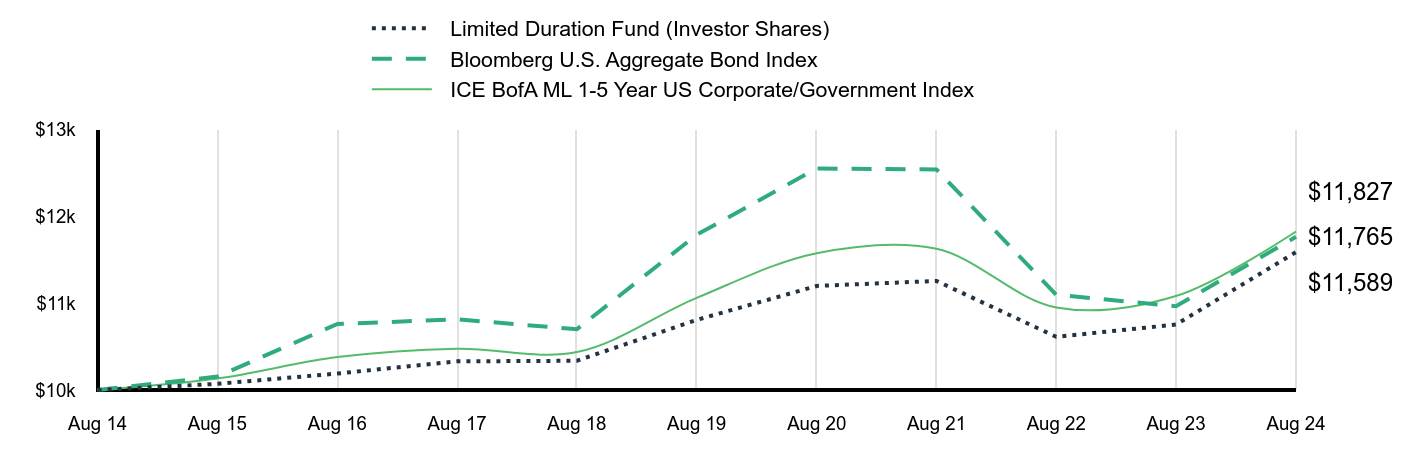

This Annual shareholder report contains important information about Limited Duration Fund for the period of September 1, 2023 to August 31, 2024. You can find additional information about the Fund at https://www.cavanalhillfunds.com/literature/mutual-fund-literature/. You can also request this information by contacting us at 1-800-762-7085.

What were the Fund's costs for the last year?

(based on a $10,000 investment)

| Class name | Costs of a $10,000 investment | Costs paid as a percentage of a $10,000 investment |

|---|

| Investor Shares | $100 | 0.96% |

How did the Fund perform last year?

We maintained a heavy overweight to credit, particularly non-agency asset-backed securities (ABS). The excess yield on the securities was coupled with broad spread tightening over the period, leading to strong returns. The Limited Duration Fund outperformed its benchmark (Bloomberg U.S. Aggregate Bond Index) for the year. Exposure to higher-yielding, non-agency ABS and non-agency mortgage-backed securities benefited the portfolio, as did a longer-than-benchmark duration as interest rates fell. Broad spread tightening and an overweight to credit also contributed to performance as some of the Fund’s corporate positions performed very well. The main detractor from Fund relative performance was an underweight to the corporate sector as corporate bonds were very strong for the period. We will look to increase duration during market pullbacks and to increase the portfolio’s liquidity. Should the economy continue to slow, less liquid securities, especially longer durations, are likely to underperform. With credit spreads nearing historic tight levels, we expect credit to underperform. If so, we will look to increase the Fund’s credit profile.

Value of a $10,000 Investment

| Limited Duration Fund (Investor Shares) | Bloomberg U.S. Aggregate Bond Index | ICE BofA ML 1-5 Year US Corporate/Government Index |

|---|

| Aug 14 | $10,000 | $10,000 | $10,000 |

| Aug 15 | $10,071 | $10,155 | $10,133 |

| Aug 16 | $10,190 | $10,761 | $10,379 |

| Aug 17 | $10,330 | $10,814 | $10,476 |

| Aug 18 | $10,337 | $10,701 | $10,437 |

| Aug 19 | $10,808 | $11,789 | $11,061 |

| Aug 20 | $11,199 | $12,553 | $11,577 |

| Aug 21 | $11,257 | $12,542 | $11,628 |

| Aug 22 | $10,613 | $11,098 | $10,952 |

| Aug 23 | $10,754 | $10,965 | $11,084 |

| Aug 24 | $11,589 | $11,765 | $11,827 |

Average Annual Total Returns

| 1 Year | 5 Year | 10 Year |

|---|

| Investor Shares | 7.76% | 1.40% | 1.49% |

| Bloomberg U.S. Aggregate Bond Index | 7.30% | -0.04% | 1.64% |

| ICE BofA ML 1-5 Year US Corporate/Government Index | 6.71% | 1.35% | 1.69% |

| Net Assets | $38,159,387 |

| Number of Portfolio Holdings | 267 |

| Net Investment Advisory Fees | $48,128 |

| Portfolio Turnover Rate | 18% |

The performance data quoted represents past performance and does not guarantee future results. The investment return and principal value of an investment will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost.

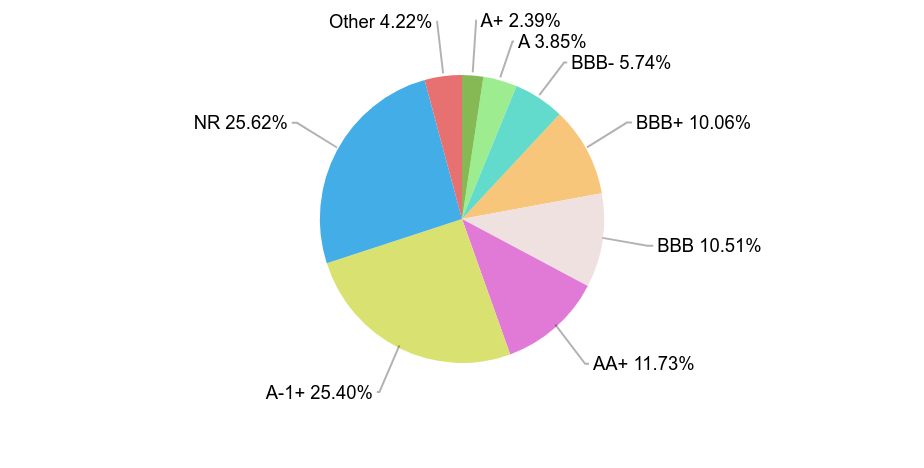

Graphical Presentation of Holdings

(as of 8/31/2024)

The tables below provide additional information about the Fund's investments.

| U.S. Treasury Notes | 3.0% |

| The Western Union Co. | 3.0% |

| The Goldman Sachs Group, Inc. | 2.9% |

| Southtrust Bank | 2.8% |

| Flexential Issuer, Series 2021-1A, Class A2 | 2.7% |

| U.S. Treasury Notes | 2.5% |

| Goodgreen Trust, Series 2020-1A, Class A | 2.5% |

| Federal Farm Credit Banks Funding Corp. | 2.3% |

| Truist Financial Corp., Series N | 2.1% |

| BAT Capital Corp. | 2.1% |

| Value | Value |

|---|

| A+ | 2.39% |

| A | 3.85% |

| BBB- | 5.74% |

| BBB+ | 10.06% |

| BBB | 10.51% |

| AA+ | 11.73% |

| A-1+ | 25.40% |

| NR | 25.62% |

| Other | 4.22% |

| Asset Backed Securities | 28.2% |

| Mortgage Backed Securities | 23.7% |

| Commercial Mortgage Backed Securities | 0.1% |

| Corporate Bonds | 21.0% |

| Taxable Municipal Bonds | 0.8% |

| U.S. Government Agency Securities | 10.5% |

| U.S. Treasury Obligations | 11.5% |

| Investment in Affiliates | 3.7% |

Effective August 5, 2024, the Adviser has contractually agreed to waive fees or reimburse expenses so that expenses do not exceed 0.50% of average daily net assets, plus class specific fees, through December 31, 2025. Prior to August 5, 2024, there was not an expense limitation for the Fund.

Changes In Or Disagreements With Accountants

There were no changes in or disagreements with accountants during the reporting period.

Annual Shareholder Report

August 31, 2024

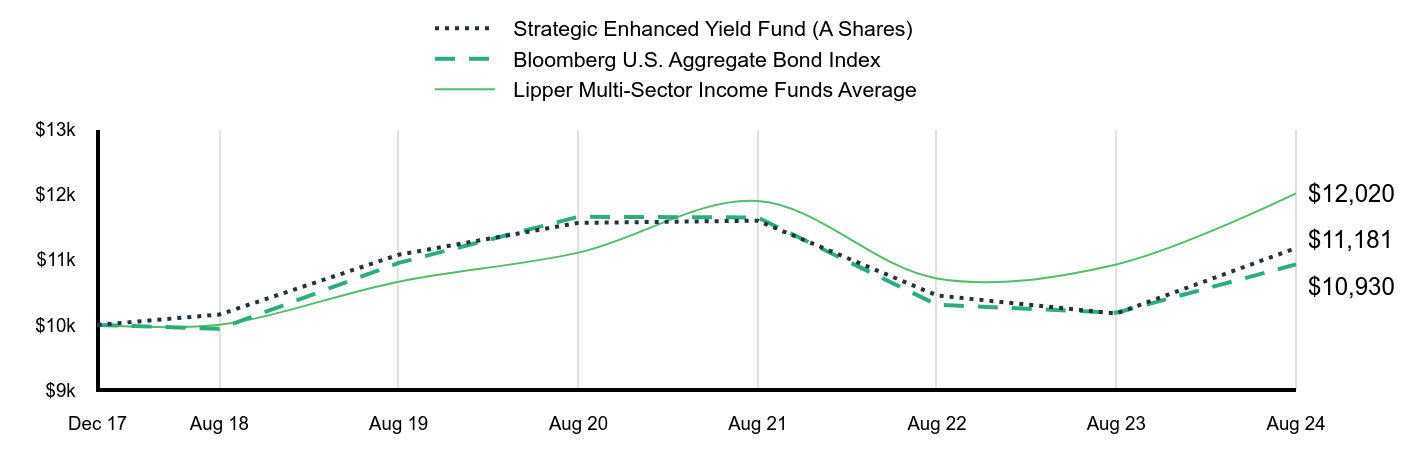

Strategic Enhanced Yield Fund

Annual Shareholder Report

August 31, 2024

This Annual shareholder report contains important information about Strategic Enhanced Yield Fund for the period of September 1, 2023 to August 31, 2024. You can find additional information about the Fund at https://www.cavanalhillfunds.com/literature/mutual-fund-literature/. You can also request this information by contacting us at 1-800-762-7085.

What were the Fund's costs for the last year?

(based on a $10,000 investment)

| Class name | Costs of a $10,000 investment | Costs paid as a percentage of a $10,000 investment |

|---|

| A Shares | $106 | 1.01% |

How did the Fund perform last year?

Starting from a defensive strategy, with a shorter duration than the benchmark and an overweight to emerging market debt (EMD) and high yield securities, we reduced the duration gap and added to the Treasury and Mortgage sectors. The Fund outperformed its benchmark (Bloomberg U.S. Aggregate Bond Index) for the year. The key contributors were emerging market debt and high yield securities. Government-related securities detracted from relative returns. The weakening U.S. labor market and downward trend on inflation continue to push our proprietary Trend Score toward a more neutral position, with a near-certain rate cut in September. We foresee an ongoing decline in the federal funds rate. We maintain our portfolio duration positioning closer to the index, assigning 3%-5% short as a target position. We continue to expect more positive returns for fixed income for the remainder of 2024. Regardless of who wins the 2024 presidential election, we expect the policies of both parties will increase the U.S. deficit. Therefore, we expect the yield curve to continue to normalize over the next three to six months.

Value of a $10,000 Investment

| Strategic Enhanced Yield Fund (A Shares) | Bloomberg U.S. Aggregate Bond Index | Lipper Multi-Sector Income Funds Average |

|---|

| Dec 17 | $10,000 | $10,000 | $10,000 |

| Aug 18 | $10,160 | $9,941 | $10,003 |

| Aug 19 | $11,079 | $10,953 | $10,665 |

| Aug 20 | $11,568 | $11,662 | $11,111 |

| Aug 21 | $11,602 | $11,652 | $11,903 |

| Aug 22 | $10,453 | $10,310 | $10,715 |

| Aug 23 | $10,175 | $10,187 | $10,930 |

| Aug 24 | $11,181 | $10,930 | $12,020 |

Average Annual Total Returns

| 1 Year | 5 Year | Since Inception |

|---|

| A Shares | 9.89% | 0.18% | 1.68% |

| Bloomberg U.S. Aggregate Bond Index | 7.30% | -0.04% | 1.34% |

| Lipper Multi-Sector Income Funds Average | 9.97% | 2.42% | 2.79% |

| Net Assets | $14,798,496 |

| Number of Portfolio Holdings | 90 |

| Net Investment Advisory Fees | $34,769 |

| Portfolio Turnover Rate | 55% |

The performance data quoted represents past performance and does not guarantee future results. The investment return and principal value of an investment will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost.

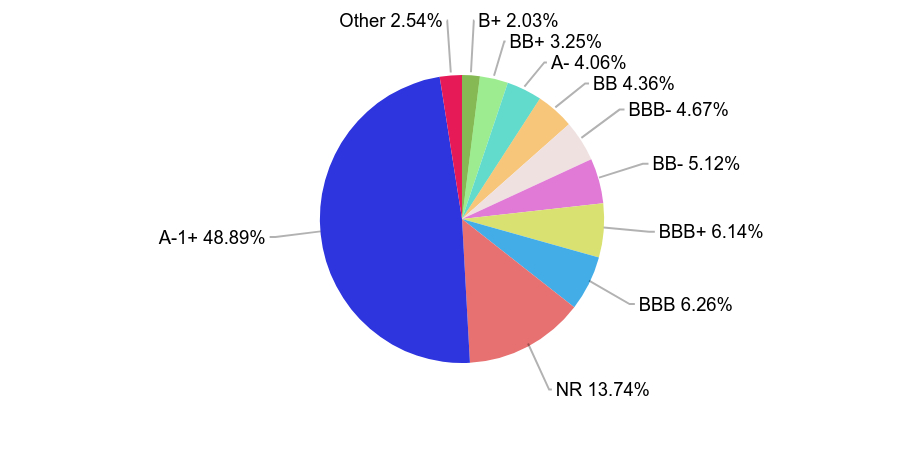

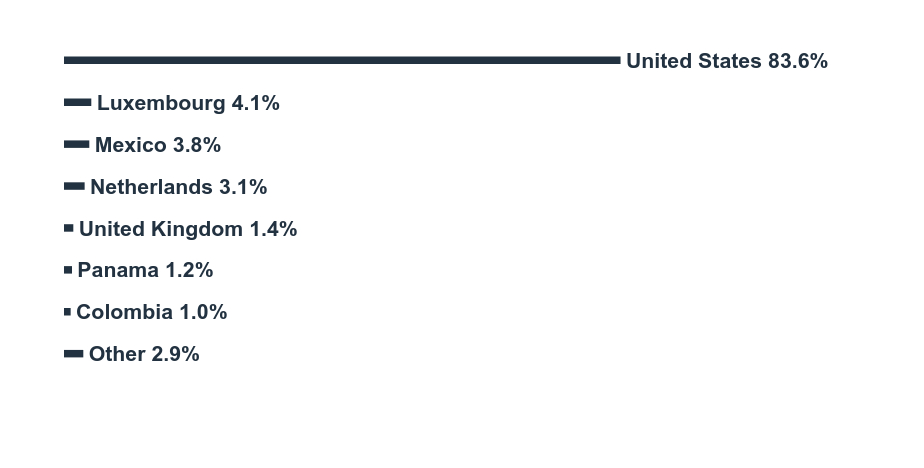

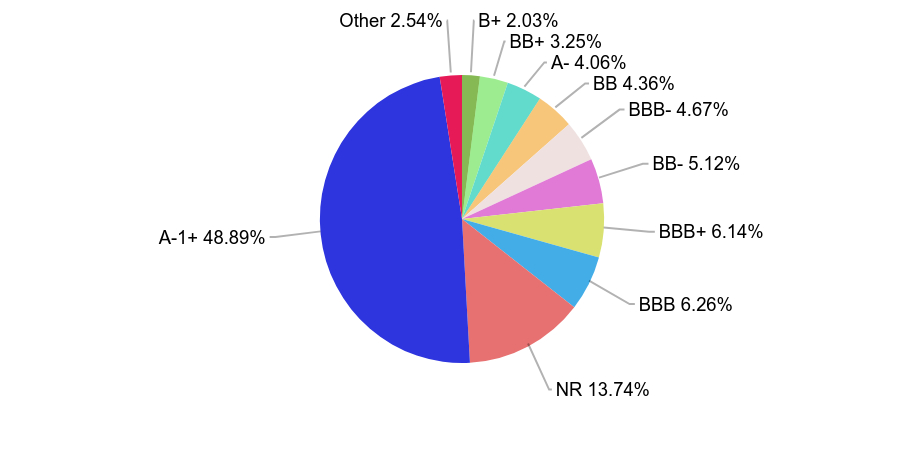

Graphical Presentation of Holdings

(as of 8/31/2024)

The tables below provide additional information about the Fund's investments.

| U.S. Treasury Notes | 7.8% |

| U.S. Treasury Notes | 2.4% |

| U.S. Treasury Bonds | 2.3% |

| U.S. Treasury Notes | 2.3% |

| U.S. Treasury Bonds | 2.3% |

| Brean Asset Backed Securities Trust, Series 2021-RM1, Class M1 | 1.9% |

| Fannie Mae | 1.8% |

| U.S. Treasury Bonds | 1.8% |

| Ford Motor Credit Co. LLC | 1.8% |

| Fannie Mae | 1.7% |

| Value | Value |

|---|

| B+ | 2.03% |

| BB+ | 3.25% |

| A- | 4.06% |

| BB | 4.36% |

| BBB- | 4.67% |

| BB- | 5.12% |

| BBB+ | 6.14% |

| BBB | 6.26% |

| NR | 13.74% |

| A-1+ | 48.89% |

| Other | 2.54% |

| Mortgage Backed Securities | 21.9% |

| Corporate Bonds | 44.2% |

| U.S. Treasury Obligations | 28.9% |

| Investment in Affiliates | 6.1% |

| Value | Value |

|---|

| Other | 2.9% |

| Colombia | 1.0% |

| Panama | 1.2% |

| United Kingdom | 1.4% |

| Netherlands | 3.1% |

| Mexico | 3.8% |

| Luxembourg | 4.1% |

| United States | 83.6% |

There were no material fund changes during the reporting period.

Changes In Or Disagreements With Accountants

There were no changes in or disagreements with accountants during the reporting period.

Strategic Enhanced Yield Fund

Annual Shareholder Report

August 31, 2024

Strategic Enhanced Yield Fund

Annual Shareholder Report

August 31, 2024

This Annual shareholder report contains important information about Strategic Enhanced Yield Fund for the period of September 1, 2023 to August 31, 2024. You can find additional information about the Fund at https://www.cavanalhillfunds.com/literature/mutual-fund-literature/. You can also request this information by contacting us at 1-800-762-7085.

What were the Fund's costs for the last year?

(based on a $10,000 investment)

| Class name | Costs of a $10,000 investment | Costs paid as a percentage of a $10,000 investment |

|---|

| Institutional Shares | $80 | 0.76% |

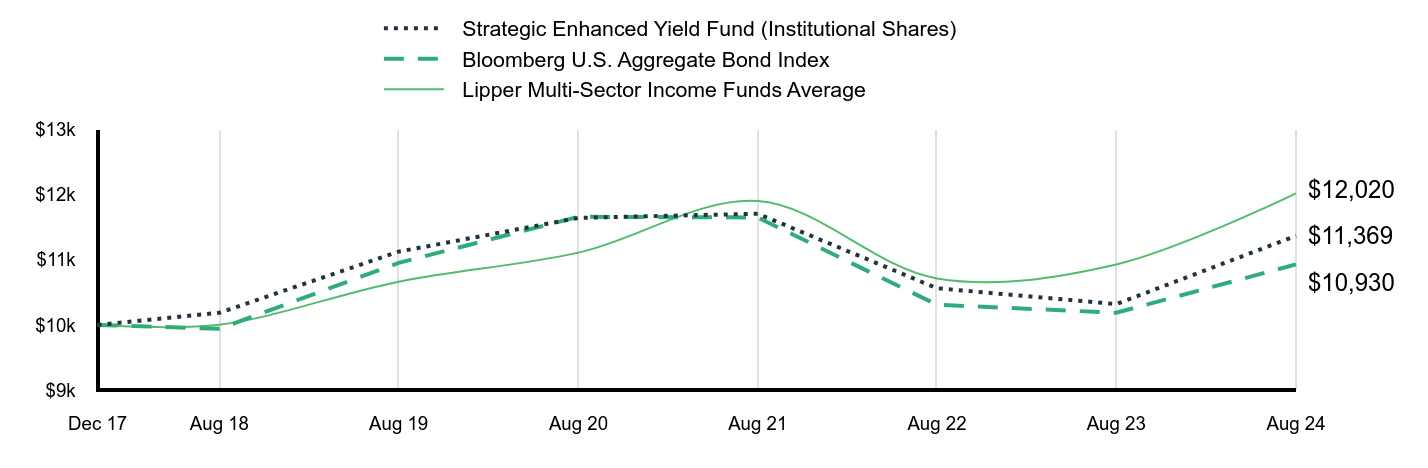

How did the Fund perform last year?

Starting from a defensive strategy, with a shorter duration than the benchmark and an overweight to emerging market debt (EMD) and high yield securities, we reduced the duration gap and added to the Treasury and Mortgage sectors. The Fund outperformed its benchmark (Bloomberg U.S. Aggregate Bond Index) for the year. The key contributors were emerging market debt and high yield securities. Government-related securities detracted from relative returns. The weakening U.S. labor market and downward trend on inflation continue to push our proprietary Trend Score toward a more neutral position, with a near-certain rate cut in September. We foresee an ongoing decline in the federal funds rate. We maintain our portfolio duration positioning closer to the index, assigning 3%-5% short as a target position. We continue to expect more positive returns for fixed income for the remainder of 2024. Regardless of who wins the 2024 presidential election, we expect the policies of both parties will increase the U.S. deficit. Therefore, we expect the yield curve to continue to normalize over the next three to six months.

Value of a $10,000 Investment

| Strategic Enhanced Yield Fund (Institutional Shares) | Bloomberg U.S. Aggregate Bond Index | Lipper Multi-Sector Income Funds Average |

|---|

| Dec 17 | $10,000 | $10,000 | $10,000 |

| Aug 18 | $10,187 | $9,941 | $10,003 |

| Aug 19 | $11,126 | $10,953 | $10,665 |

| Aug 20 | $11,645 | $11,662 | $11,111 |

| Aug 21 | $11,709 | $11,652 | $11,903 |

| Aug 22 | $10,564 | $10,310 | $10,715 |

| Aug 23 | $10,320 | $10,187 | $10,930 |

| Aug 24 | $11,369 | $10,930 | $12,020 |

Average Annual Total Returns

| 1 Year | 5 Year | Since Inception |

|---|

| Institutional Shares | 10.16% | 0.43% | 1.94% |

| Bloomberg U.S. Aggregate Bond Index | 7.30% | -0.04% | 1.34% |

| Lipper Multi-Sector Income Funds Average | 9.97% | 2.42% | 2.79% |

| Net Assets | $14,798,496 |

| Number of Portfolio Holdings | 90 |

| Net Investment Advisory Fees | $34,769 |

| Portfolio Turnover Rate | 55% |

The performance data quoted represents past performance and does not guarantee future results. The investment return and principal value of an investment will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost.

Graphical Presentation of Holdings

(as of 8/31/2024)

The tables below provide additional information about the Fund's investments.

| U.S. Treasury Notes | 7.8% |

| U.S. Treasury Notes | 2.4% |

| U.S. Treasury Bonds | 2.3% |

| U.S. Treasury Notes | 2.3% |

| U.S. Treasury Bonds | 2.3% |

| Brean Asset Backed Securities Trust, Series 2021-RM1, Class M1 | 1.9% |

| Fannie Mae | 1.8% |

| U.S. Treasury Bonds | 1.8% |

| Ford Motor Credit Co. LLC | 1.8% |

| Fannie Mae | 1.7% |

| Value | Value |

|---|

| B+ | 2.03% |

| BB+ | 3.25% |

| A- | 4.06% |

| BB | 4.36% |

| BBB- | 4.67% |

| BB- | 5.12% |

| BBB+ | 6.14% |

| BBB | 6.26% |

| NR | 13.74% |

| A-1+ | 48.89% |

| Other | 2.54% |

| Mortgage Backed Securities | 21.9% |

| Corporate Bonds | 44.2% |

| U.S. Treasury Obligations | 28.9% |

| Investment in Affiliates | 6.1% |

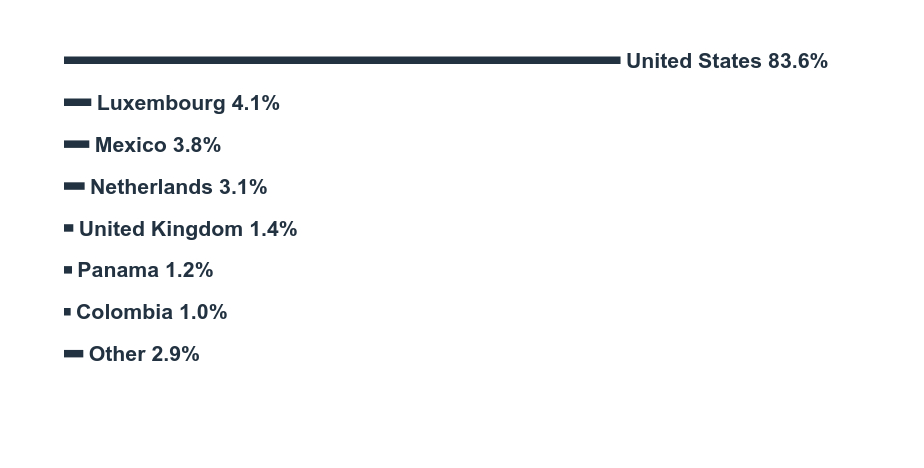

| Value | Value |

|---|

| Other | 2.9% |

| Colombia | 1.0% |

| Panama | 1.2% |

| United Kingdom | 1.4% |

| Netherlands | 3.1% |

| Mexico | 3.8% |

| Luxembourg | 4.1% |

| United States | 83.6% |

There were no material fund changes during the reporting period.

Changes In Or Disagreements With Accountants

There were no changes in or disagreements with accountants during the reporting period.

Strategic Enhanced Yield Fund

Annual Shareholder Report

August 31, 2024

Strategic Enhanced Yield Fund

Annual Shareholder Report

August 31, 2024

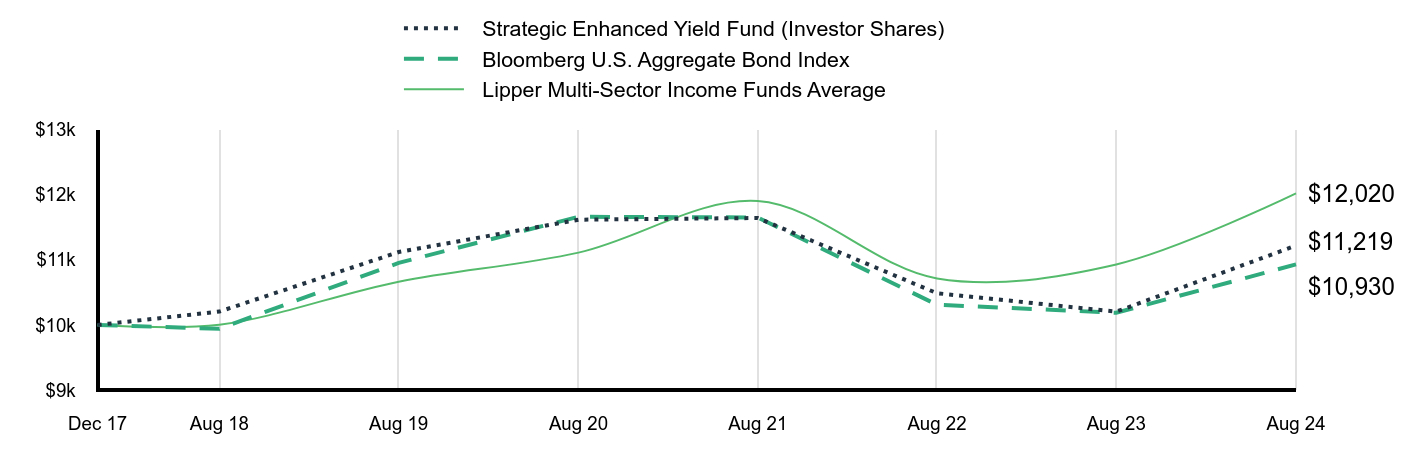

This Annual shareholder report contains important information about Strategic Enhanced Yield Fund for the period of September 1, 2023 to August 31, 2024. You can find additional information about the Fund at https://www.cavanalhillfunds.com/literature/mutual-fund-literature/. You can also request this information by contacting us at 1-800-762-7085.

What were the Fund's costs for the last year?

(based on a $10,000 investment)

| Class name | Costs of a $10,000 investment | Costs paid as a percentage of a $10,000 investment |

|---|

| Investor Shares | $106 | 1.01% |

How did the Fund perform last year?

Starting from a defensive strategy, with a shorter duration than the benchmark and an overweight to emerging market debt (EMD) and high yield securities, we reduced the duration gap and added to the Treasury and Mortgage sectors. The Fund outperformed its benchmark (Bloomberg U.S. Aggregate Bond Index) for the year. The key contributors were emerging market debt and high yield securities. Government-related securities detracted from relative returns. The weakening U.S. labor market and downward trend on inflation continue to push our proprietary Trend Score toward a more neutral position, with a near-certain rate cut in September. We foresee an ongoing decline in the federal funds rate. We maintain our portfolio duration positioning closer to the index, assigning 3%-5% short as a target position. We continue to expect more positive returns for fixed income for the remainder of 2024. Regardless of who wins the 2024 presidential election, we expect the policies of both parties will increase the U.S. deficit. Therefore, we expect the yield curve to continue to normalize over the next three to six months.

Value of a $10,000 Investment

| Strategic Enhanced Yield Fund (Investor Shares) | Bloomberg U.S. Aggregate Bond Index | Lipper Multi-Sector Income Funds Average |

|---|

| Dec 17 | $10,000 | $10,000 | $10,000 |

| Aug 18 | $10,205 | $9,941 | $10,003 |

| Aug 19 | $11,120 | $10,953 | $10,665 |

| Aug 20 | $11,617 | $11,662 | $11,111 |

| Aug 21 | $11,643 | $11,652 | $11,903 |

| Aug 22 | $10,487 | $10,310 | $10,715 |

| Aug 23 | $10,204 | $10,187 | $10,930 |

| Aug 24 | $11,219 | $10,930 | $12,020 |

Average Annual Total Returns

| 1 Year | 5 Year | Since Inception |

|---|

| Investor Shares | 9.94% | 0.18% | 1.74% |

| Bloomberg U.S. Aggregate Bond Index | 7.30% | -0.04% | 1.34% |

| Lipper Multi-Sector Income Funds Average | 9.97% | 2.42% | 2.79% |

| Net Assets | $14,798,496 |

| Number of Portfolio Holdings | 90 |

| Net Investment Advisory Fees | $34,769 |

| Portfolio Turnover Rate | 55% |

The performance data quoted represents past performance and does not guarantee future results. The investment return and principal value of an investment will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost.

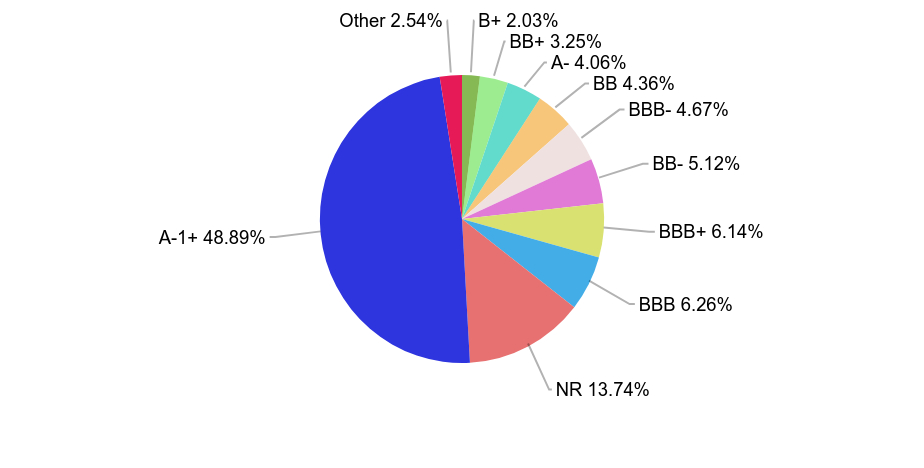

Graphical Presentation of Holdings

(as of 8/31/2024)

The tables below provide additional information about the Fund's investments.

| U.S. Treasury Notes | 7.8% |

| U.S. Treasury Notes | 2.4% |

| U.S. Treasury Bonds | 2.3% |

| U.S. Treasury Notes | 2.3% |

| U.S. Treasury Bonds | 2.3% |

| Brean Asset Backed Securities Trust, Series 2021-RM1, Class M1 | 1.9% |

| Fannie Mae | 1.8% |

| U.S. Treasury Bonds | 1.8% |

| Ford Motor Credit Co. LLC | 1.8% |

| Fannie Mae | 1.7% |

| Value | Value |

|---|

| B+ | 2.03% |

| BB+ | 3.25% |

| A- | 4.06% |

| BB | 4.36% |

| BBB- | 4.67% |

| BB- | 5.12% |

| BBB+ | 6.14% |

| BBB | 6.26% |

| NR | 13.74% |

| A-1+ | 48.89% |

| Other | 2.54% |

| Mortgage Backed Securities | 21.9% |

| Corporate Bonds | 44.2% |

| U.S. Treasury Obligations | 28.9% |

| Investment in Affiliates | 6.1% |

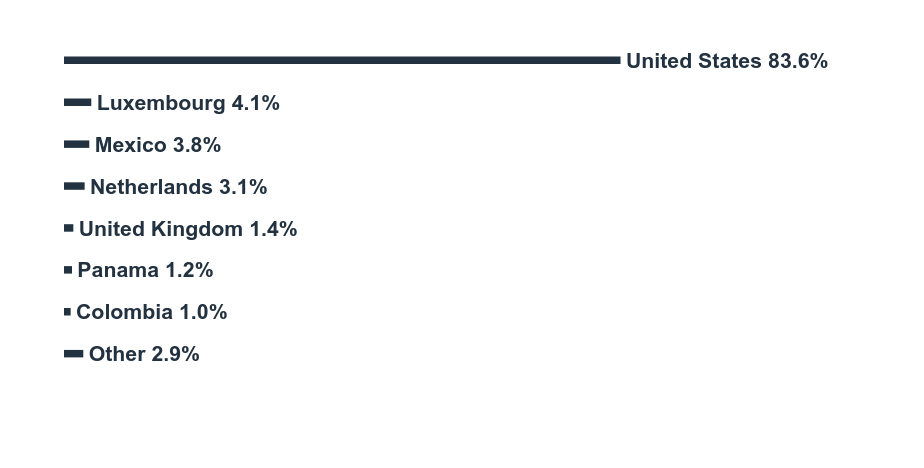

| Value | Value |

|---|

| Other | 2.9% |

| Colombia | 1.0% |

| Panama | 1.2% |

| United Kingdom | 1.4% |

| Netherlands | 3.1% |

| Mexico | 3.8% |

| Luxembourg | 4.1% |

| United States | 83.6% |

There were no material fund changes during the reporting period.

Changes In Or Disagreements With Accountants

There were no changes in or disagreements with accountants during the reporting period.

Strategic Enhanced Yield Fund

Annual Shareholder Report

August 31, 2024

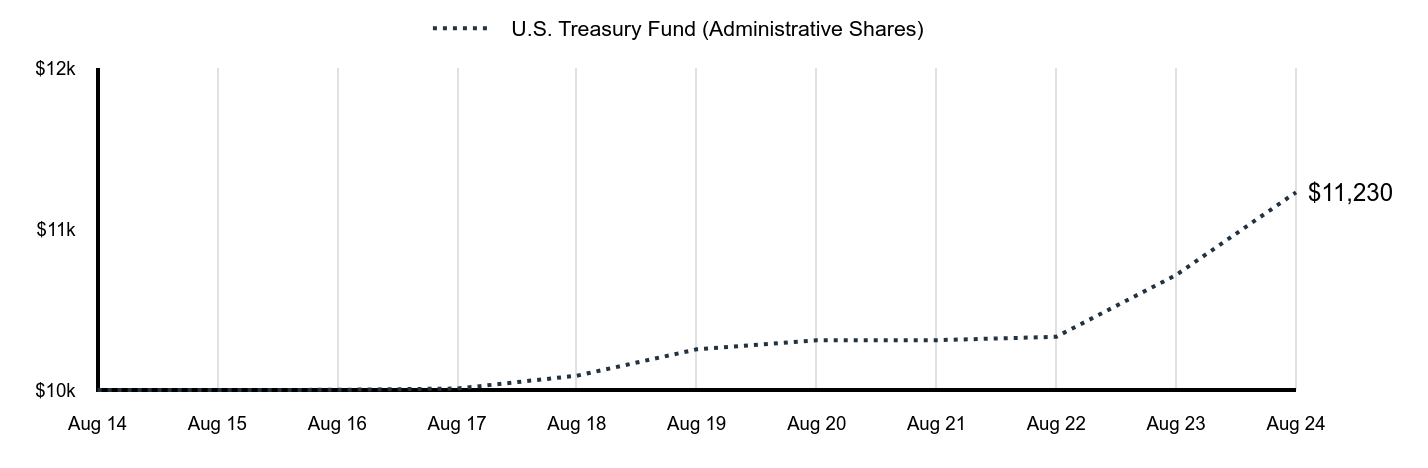

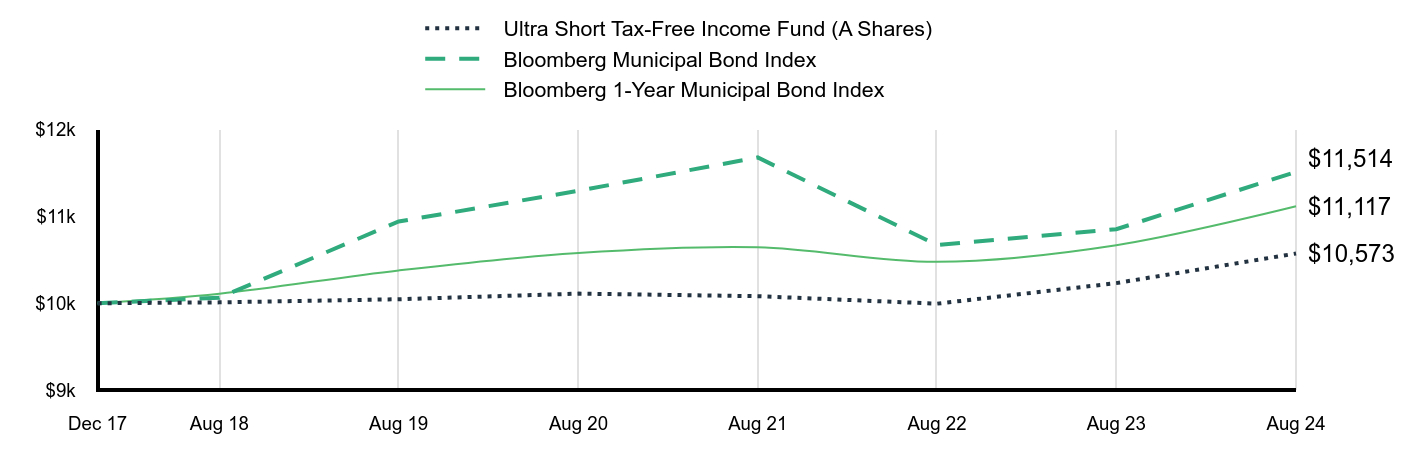

Annual Shareholder Report

August 31, 2024

This Annual shareholder report contains important information about U.S. Treasury Fund for the period of September 1, 2023 to August 31, 2024. You can find additional information about the Fund at https://www.cavanalhillfunds.com/literature/mutual-fund-literature/. You can also request this information by contacting us at 1-800-762-7085.

What were the Fund's costs for the last year?

(based on a $10,000 investment)

| Class name | Costs of a $10,000 investment | Costs paid as a percentage of a $10,000 investment |

|---|

| Administrative Shares | $68 | 0.66% |

How did the Fund perform last year?

After a clear signal from Fed Chair Jerome Powell that interest rate cuts were imminent, we extended the Funds’ duration to slow the pace of inevitable yield decline by focusing on fixed-rate Treasuries and Agencies. The weighted average maturity (WAM) of our Government Securities Fund is a few days longer than the average while our Treasury Fund’s WAM is a few days shorter. Longer durations will typically outperform the market in declining interest rate environments. Securities purchased as late as the middle of July will have the best and most enduring impact on Fund performance as positive Consumer Price Index data released then sparked a Treasury market rally. Subsequently, any securities purchased after this rally must be weighed against the Fed’s anticipated interest rate decision and the spread benefit that it is expected to create. Markets tend to have exaggerated expectations. We continue to add duration carefully to avoid overpaying for securities as those expectations revert to the mean.

Value of a $10,000 Investment

| U.S. Treasury Fund (Administrative Shares) |

|---|

| Aug 14 | $10,000 |

| Aug 15 | $10,000 |

| Aug 16 | $10,001 |

| Aug 17 | $10,009 |

| Aug 18 | $10,089 |

| Aug 19 | $10,253 |

| Aug 20 | $10,309 |

| Aug 21 | $10,310 |

| Aug 22 | $10,331 |

| Aug 23 | $10,715 |

| Aug 24 | $11,230 |

Average Annual Total Returns

| 1 Year | 5 Year | 10 Year |

|---|

| Administrative Shares | 4.81% | 1.84% | 1.17% |

| Net Assets | $1,760,417,769 |

| Number of Portfolio Holdings | 17 |

| Net Investment Advisory Fees | $895,445 |

The performance data quoted represents past performance and does not guarantee future results. The investment return and principal value of an investment will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost.

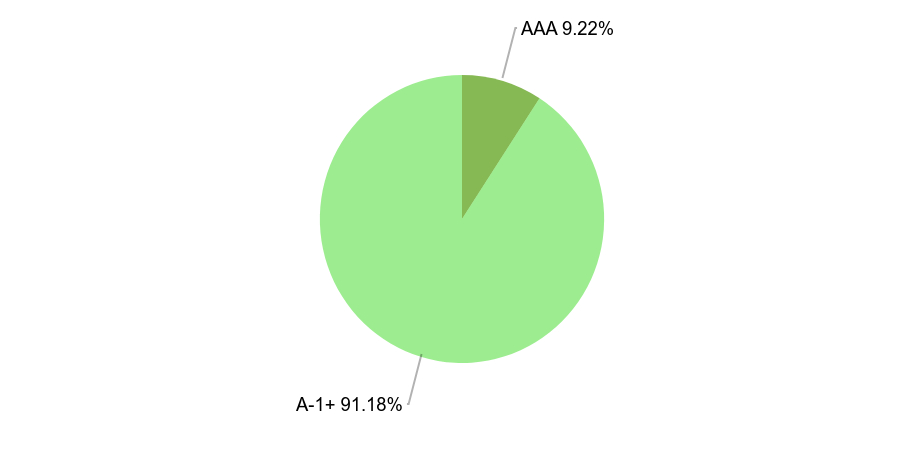

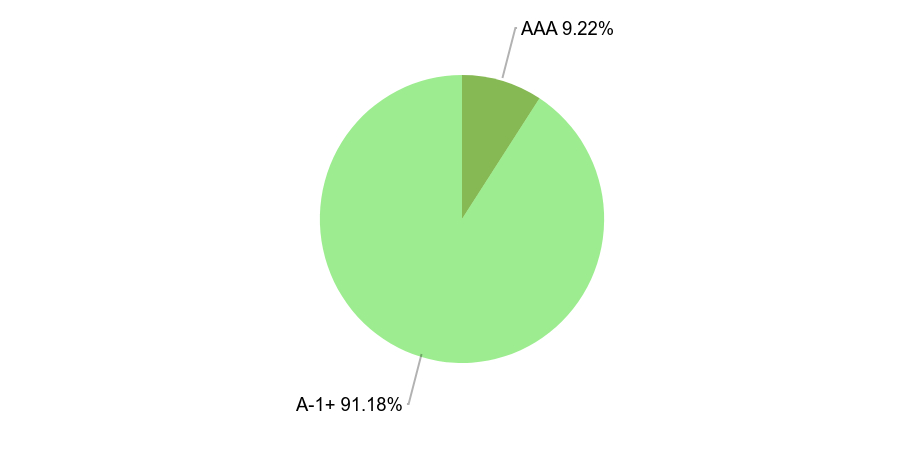

Graphical Presentation of Holdings

(as of 8/31/2024)

The tables below provide additional information about the Fund's investments.

| U.S. Treasury Bills | 8.5% |

| U.S. Treasury Bills | 2.9% |

| U.S. Treasury Bills | 2.8% |

| U.S. Treasury Bills | 2.8% |

| U.S. Treasury Bills | 2.8% |

| U.S. Treasury Bills | 2.7% |

| Value | Value |

|---|

| AAA | 9.22% |

| A-1+ | 91.18% |

| U.S. Treasury Obligations | 22.5% |

| Repurchase Agreements | 68.7% |

| Investment Companies | 9.2% |

There were no material fund changes during the reporting period.

Changes In Or Disagreements With Accountants

There were no changes in or disagreements with accountants during the reporting period.

Annual Shareholder Report

August 31, 2024

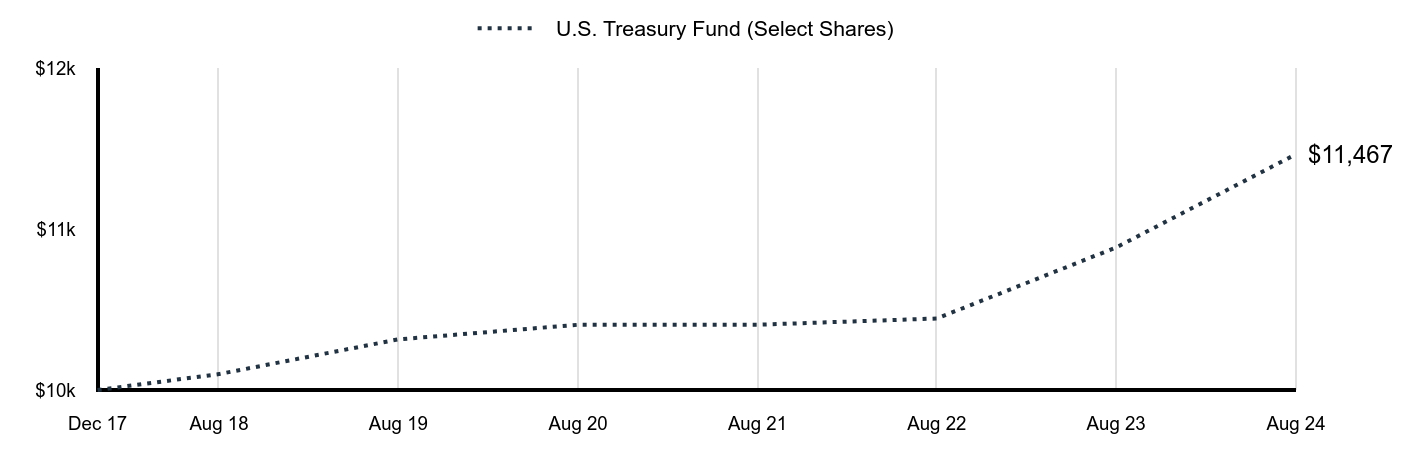

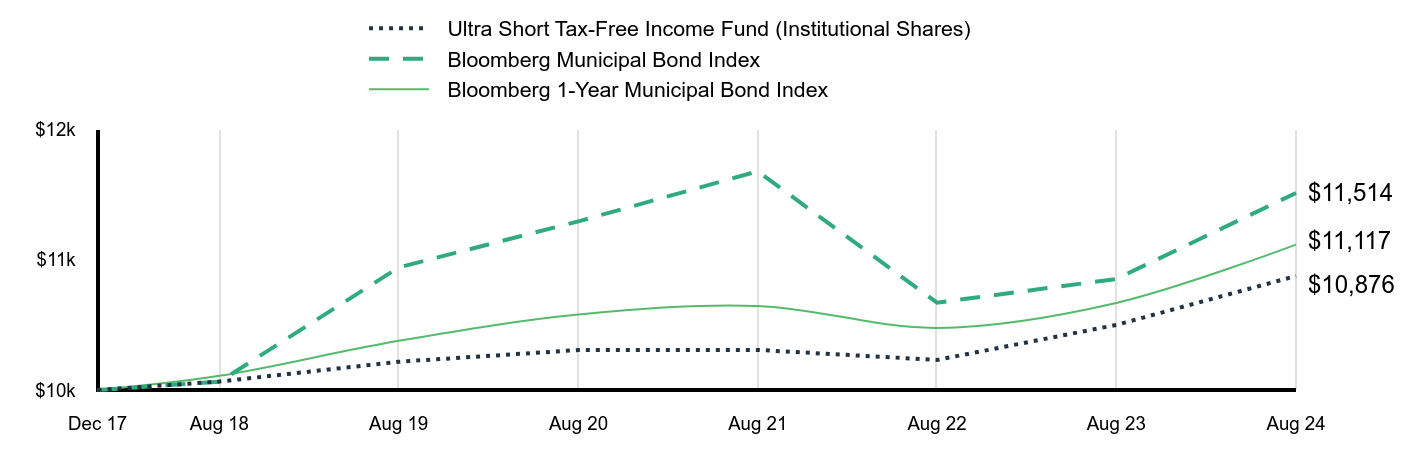

Annual Shareholder Report

August 31, 2024

This Annual shareholder report contains important information about U.S. Treasury Fund for the period of September 1, 2023 to August 31, 2024. You can find additional information about the Fund at https://www.cavanalhillfunds.com/literature/mutual-fund-literature/. You can also request this information by contacting us at 1-800-762-7085.

What were the Fund's costs for the last year?

(based on a $10,000 investment)

| Class name | Costs of a $10,000 investment | Costs paid as a percentage of a $10,000 investment |

|---|

| Institutional Shares | $25 | 0.24% |

How did the Fund perform last year?

After a clear signal from Fed Chair Jerome Powell that interest rate cuts were imminent, we extended the Funds’ duration to slow the pace of inevitable yield decline by focusing on fixed-rate Treasuries and Agencies. The weighted average maturity (WAM) of our Government Securities Fund is a few days longer than the average while our Treasury Fund’s WAM is a few days shorter. Longer durations will typically outperform the market in declining interest rate environments. Securities purchased as late as the middle of July will have the best and most enduring impact on Fund performance as positive Consumer Price Index data released then sparked a Treasury market rally. Subsequently, any securities purchased after this rally must be weighed against the Fed’s anticipated interest rate decision and the spread benefit that it is expected to create. Markets tend to have exaggerated expectations. We continue to add duration carefully to avoid overpaying for securities as those expectations revert to the mean.

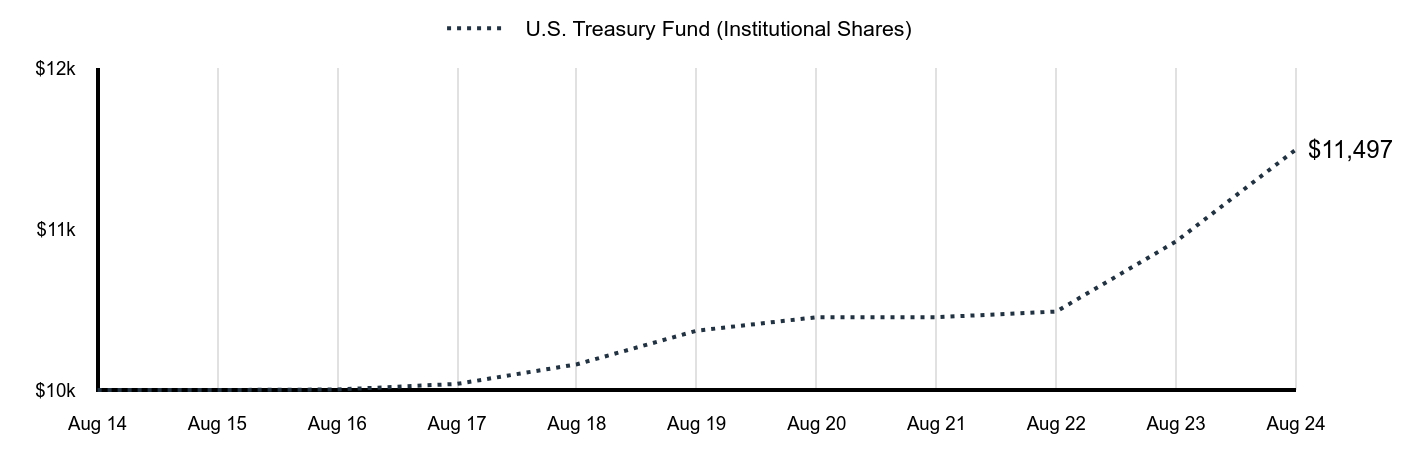

Value of a $10,000 Investment

| U.S. Treasury Fund (Institutional Shares) |

|---|

| Aug 14 | $10,000 |

| Aug 15 | $10,000 |

| Aug 16 | $10,003 |

| Aug 17 | $10,038 |

| Aug 18 | $10,160 |

| Aug 19 | $10,369 |

| Aug 20 | $10,453 |

| Aug 21 | $10,453 |

| Aug 22 | $10,488 |

| Aug 23 | $10,924 |

| Aug 24 | $11,497 |

Average Annual Total Returns

| 1 Year | 5 Year | 10 Year |

|---|

| Institutional Shares | 5.25% | 2.09% | 1.40% |

| Net Assets | $1,760,417,769 |

| Number of Portfolio Holdings | 17 |

| Net Investment Advisory Fees | $895,445 |

The performance data quoted represents past performance and does not guarantee future results. The investment return and principal value of an investment will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost.

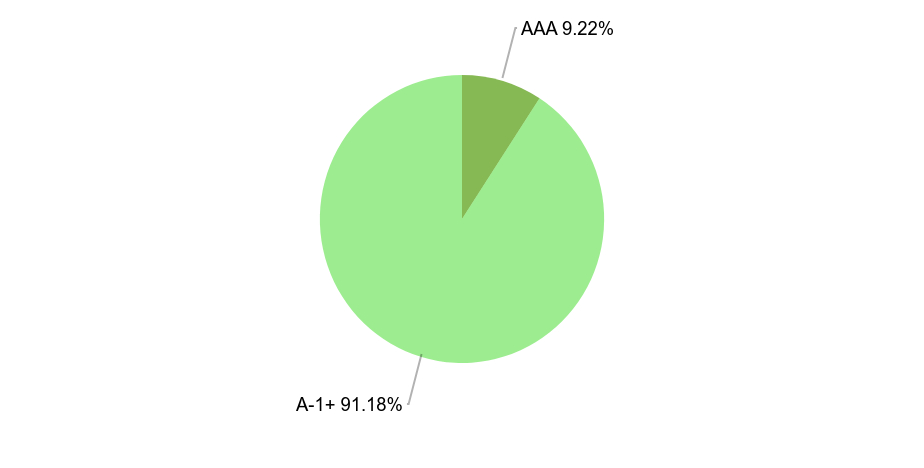

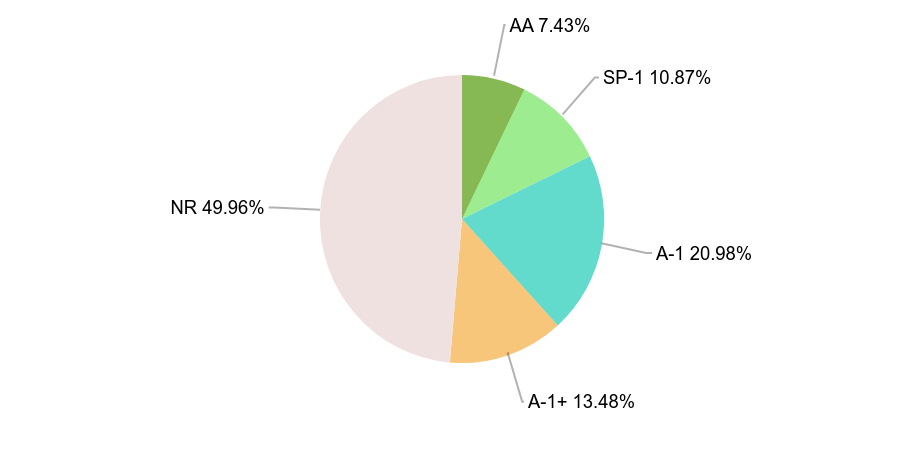

Graphical Presentation of Holdings

(as of 8/31/2024)

The tables below provide additional information about the Fund's investments.

| U.S. Treasury Bills | 8.5% |

| U.S. Treasury Bills | 2.9% |

| U.S. Treasury Bills | 2.8% |

| U.S. Treasury Bills | 2.8% |

| U.S. Treasury Bills | 2.8% |

| U.S. Treasury Bills | 2.7% |

| Value | Value |

|---|

| AAA | 9.22% |

| A-1+ | 91.18% |

| U.S. Treasury Obligations | 22.5% |

| Repurchase Agreements | 68.7% |

| Investment Companies | 9.2% |

There were no material fund changes during the reporting period.

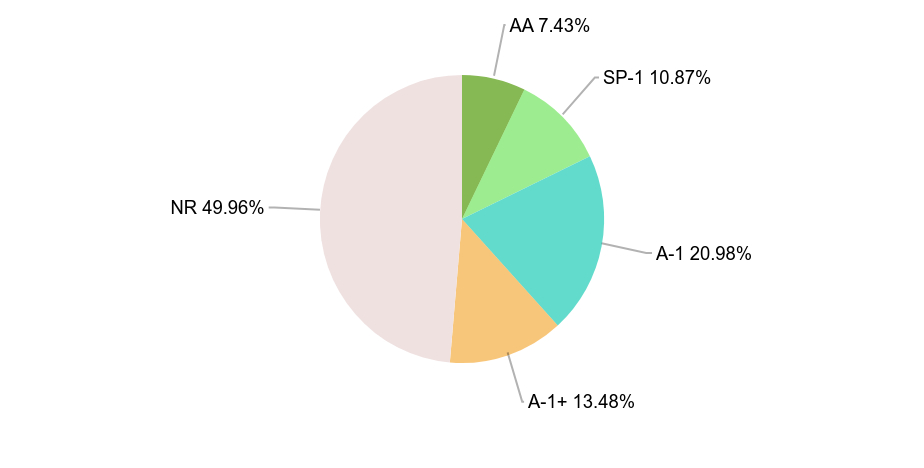

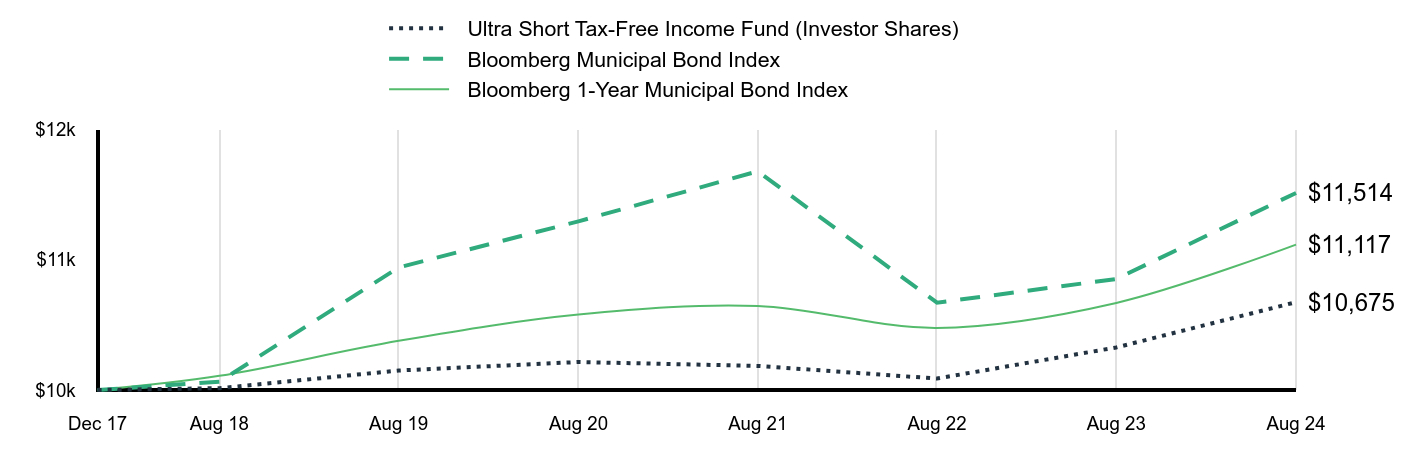

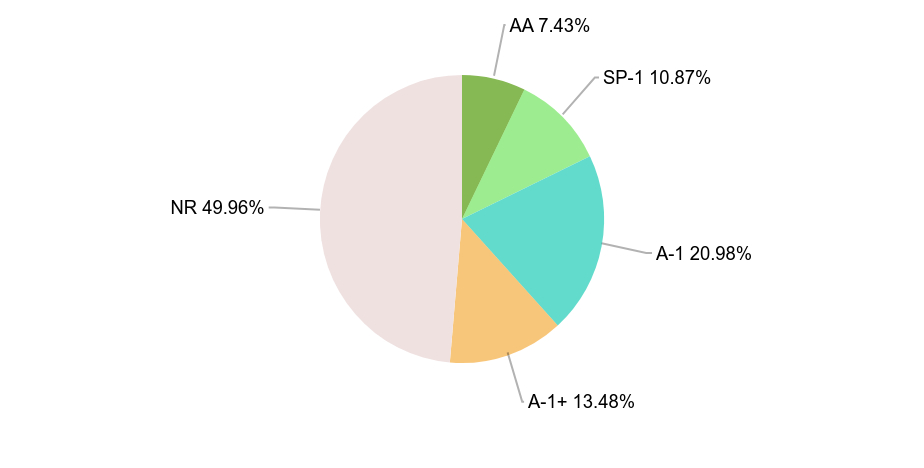

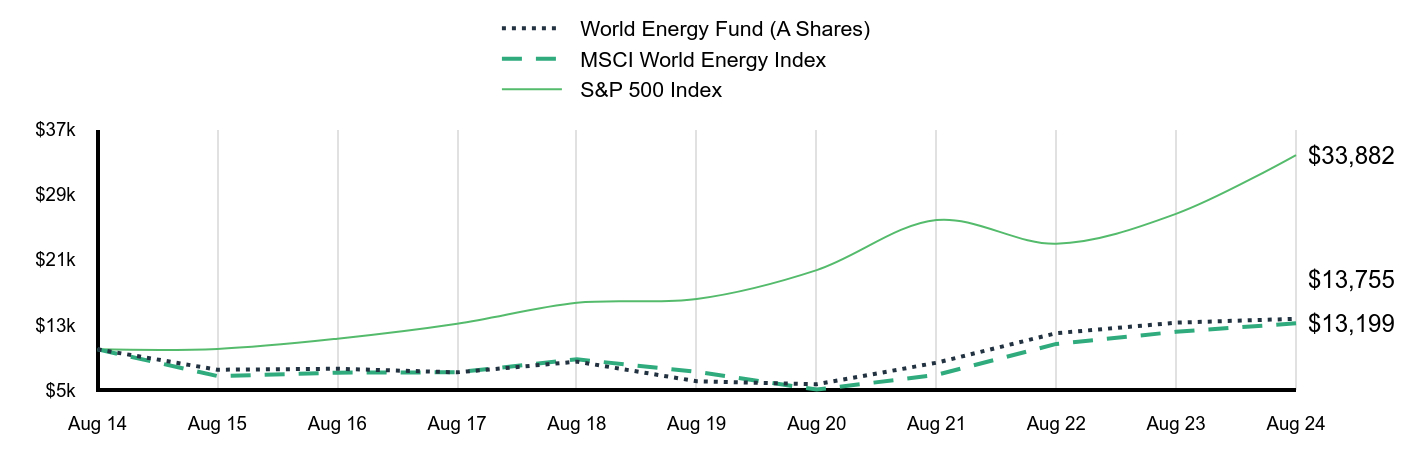

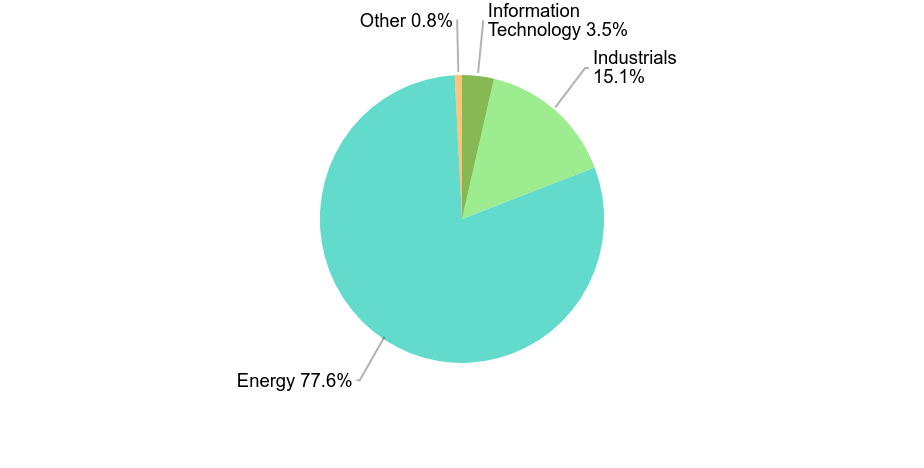

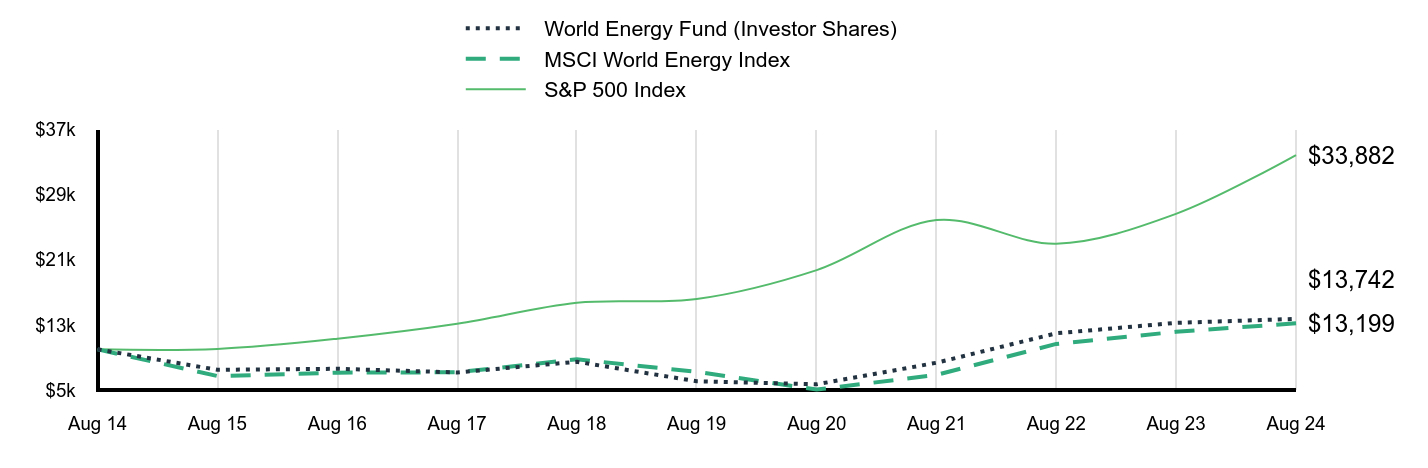

Changes In Or Disagreements With Accountants