UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED

MANAGEMENT INVESTMENT COMPANIES

Investment Company Act file number 811-06114

Cavanal Hill Funds

(Exact name of registrant as specified in charter)

| Citi Fund Services Ohio, Inc., 4400 Easton Commons, Suite 200, Columbus, OH 43219 | |

| (Address of principal executive offices) | (Zip code) |

Citi Fund Services Ohio, Inc., 4400 Easton Commons, Suite 200, Columbus, OH 43219

(Name and address of agent for service)

Registrant’s telephone number, including area code: 1-800-762-7085

Date of fiscal year end: 8/31

Date of reporting period: 8/31/23

Item 1. Reports to Stockholders.

Annual Report

August 31, 2023

U.S. Treasury Fund

Government Securities Money Market Fund

Limited Duration Fund

Moderate Duration Fund

Bond Fund

Strategic Enhanced Yield Fund

Ultra Short Tax-Free Income Fund

Opportunistic Fund

World Energy Fund

Hedged Income Fund

On January 1, 2021, as permitted by regulations adopted by the Securities and Exchange Commission, paper copies of the Fund’s annual and semi-annual shareholder reports will no longer be sent by mail, unless you specifically request paper copies of the reports from the Fund or from your financial intermediary, such as a broker-dealer or bank. Instead, the reports will be made available on the Fund’s website (www.cavanalhillfunds.com), and you will be notified by mail each time a report is posted and provided with a website link to access the report.

If you already elected to receive shareholder reports electronically, you will not be affected by this change and you need not take any action. You may elect to receive shareholder reports and other communications from the Fund electronically anytime by contacting your financial intermediary (such as a broker-dealer or bank) or, if you are a direct investor, by calling (800) 762-7085.

You may elect to receive all future reports in paper free of charge. If you invest through a financial intermediary, you can contact your financial intermediary to request that you continue to receive paper copies of your shareholder reports. If you invest directly with the Fund you can call (800) 762-7085 to let the Fund know you wish to continue receiving paper copies of your shareholder reports. Your election to receive reports in paper will apply to all funds held in your account if you invest through your financial intermediary or all funds held with the fund complex if you invest directly with the Fund.

Table of Contents

Management Discussion of Fund Performance

Statements of Assets and Liabilities

Statements of Changes in Net Assets

Schedules of Portfolio Investments

Notes to the Financial Statements

Report of Independent Registered Public Accounting Firm

A description of the policies and procedures that the Fund uses to determine how to vote proxies relating to the portfolio securities and information during the most recent 12-month period ended June 30th is available without charge, upon request, by calling 1-800-762-7085 or on the Securities and Exchange Commission’s website at http://www.sec.gov.

A complete schedule of each non-Money Market Fund’s portfolio holdings for the first and third fiscal quarter of each fiscal year is filed with the Securities and Exchange Commission on Form N-PORT. The Money Market Funds file completed Schedules of Portfolio Holdings with the Securities and Exchange Commission on Form N-NMFP. Schedules of Portfolio Holdings for the funds are available without charge on the Securities and Exchange Commission’s website at http://www.sec.gov. In addition, the schedules may be reviewed and copied at the Securities and Exchange Commission’s Public Reference Room in Washington D.C. Information on the operation of the Public Reference Room may be obtained by calling 1-800-SEC-0330.

This report is authorized for distribution to prospective investors only when preceded or accompanied by a prospectus or summary prospectus. An investor should consider the Fund’s investment objectives, risks, and charges and expenses carefully before investing or sending money. This and other important information about the investment company can be found in the Fund’s prospectus or summary prospectus. To obtain a prospectus or summary prospectus, please call 1-800-762-7085. Please read the prospectus carefully before investing.

Cavanal Hill Distributors, Inc., member FINRA, serves as the distributor for the Cavanal Hill Funds.

Shares of the Funds are not deposits or obligations of, or guaranteed or endorsed by, BOKF, NA, any of its affiliates or the Distributor. Shares are NOT FDIC INSURED, nor are they insured by any other government agency. An investment in the Funds involves investment risk, including possible loss of principal.

This document may contain “forward-looking statements” within the meaning of the Private Securities Litigation Reform Act of 1995, Section 27A of the Securities Act and Section 21E of the Securities Exchange Act. Forward-looking statements give our current expectations of forecasts of future events. They include statements regarding our anticipated future operating and financial performance. Although we believe the expectations and statements reflected in these and other forward-looking statements are reasonable, we can give no assurance they will prove to have been correct. They can be affected by inaccurate assumptions, by inaccurate information from third parties, or by known or unknown risks and uncertainties.

- 1 -

Glossary of Terms

Bloomberg 1-Year Municipal Bond Index includes bonds with a minimum credit rating of BAA3, are issued as part of a deal of at least $50 million, have an amount outstanding of at least $5 million, and have maturities of 1 to 2 years.

Bloomberg Asset-Backed Securities (ABS) Index includes pass-through, bullet, and controlled amortization structures. The ABS Index includes only the senior class of each ABS issue and the ERISA-eligible B and C tranche.

Bloomberg U.S. Aggregate Bond Index measures the investment-grade, USD-denominated, fixed-rate taxable bond market, including Treasuries, government-re-lated and corporate securities, MBS (agency fixed-rate and hybrid ARM pass-through), ABS, and CMBS.

Bloomberg U.S. CMBS Investment Grade Index measures the market of U.S. Agency and US Non-Agency conduit and fusion CMBS deals with a minimum current deal size of $300m. The index is divided into two subcomponents: the U.S. Aggregate-eligible component, which contains bonds that are ERISA eligible under the underwriter’s exemption, and the non-US Aggregate-eligible component, which consists of bonds that are not ERISA eligible.

Bloomberg U.S. Corporate High Yield Bond Index measures the USD-denominated, high-yield, fixed-rate corporate bond market. Securities are classified as high yield if the middle rating of Moody’s, Fitch and S&P is Ba1/BB+/ BB+ or below. Bonds from issuers with an emerging markets (EM) country of risk, based on Barclays EM country definition, are excluded.

Bloomberg U.S. Corporate Investment-Grade Index covers all publicly issued U.S. corporate, non-corporate and specified foreign debentures and secured notes that meet the specified maturity, liquidity, and quality requirements, to qualify, bonds must be SEC-registered.

Bloomberg U.S. Intermediate Aggregate Bond Index is representative of investment-grade debt issues with maturities from one year up to (but not including) 10 years.

Bloomberg U.S. Mortgage-Backed Securities tracks agency mortgage pass-through securities (no longer incorporates hybrid ARM) guaranteed by Ginnie Mae (GNMA), Mae (FNMA), and Freddie Mac (FHLMC). The index is constructed by grouping individual TBA-deliverable MBS pools into aggregates or generics based on program, coupon and vintage.

Bloomberg U.S. Treasury 20+ Year Index measures U.S. dollar-denominated, fixed-rate, nominal debt issued by the US Treasury with 20+ years to maturity. Treasury bills are excluded by the maturity constraint, but are part of a separate Short Treasury Index.

Bloomberg U.S. Treasury Index is an index of the public obligations of the U.S. Treasury with a remaining maturity of one year or more are non-convertible and are denominated in U.S. dollars. Securities must be rated investment-grade (Baa3/BBB- or higher) by at least two of the following ratings agencies: Moody’s, S&P, and Fitch. If only two of the three agencies rate the security, the lower rating is used to determine index eligibility. If only one of the three agencies rates a security, the rating must be investment grade.

CBOE S&P 500 BuyWrite Index is designed to show the hypothetical performance of a portfolio that engages in a buywrite strategy using S&P 500 index call options.

Hedge Fund Research, Inc. (HFR) utilizes a UCITSIII compliant methodology to construct the HFRX Hedge Fund Indices. The methodology is based on defined and predetermined rules and objective criteria to select and rebalance components to maximize representation of the Hedge Fund Universe. HFRX Indices utilize state-of-the-art quantitative techniques and analysis; multi-level screening, cluster analysis, Monte-Carlo simulations, and optimization techniques ensure that each Index is a pure representation of its corresponding investment focus.

ICE BofA Merrill Lynch 1-5 Year U.S. Corporate/Government Index is comprised of investment-grade government and corporate debt securities with maturities between one- and five-years.

MSCI World Energy Index captures the large- and mid-cap segments across 23 developed markets and includes securities classified in the energy sector per Global Industry Classification Standard.

Russell 1000® Index is designed to represent the performance of companies within specific sectors of the Russell 1000® Index. Methodology equally weights securities within each sector, mitigating security specific risk an offering balanced exposure to particular sectors.

Russell 2000® Index is designed to represent the performance of companies within specific sectors of the Russell 2000® Index. Methodology equally weights securities within each sector, mitigating security specific risk and offering balanced exposure to particular sectors.

Russell 3000® Index is designed to represent the performance of companies within specific sectors of the Russell 3000® Index. Methodology equally weights securities within each sector, mitigating security specific risk and offering balanced exposure to particular sectors.

Russell 3000® Growth Index is a market capitalization weighted index based on the Russell 3000® Index. The Russell 3000® Growth Index includes companies that display signs of above average growth, exhibit higher price-to-book, and forecasted earnings.

Russell 3000® Value Index is a market capitalization weighted equity index maintained by the Russell Investment Group and based on the Russell 3000® Index, included in the index are stocks from the Russell 3000 with lower price-to-book ratios and lower expected growth rates.

Russell Midcap® Index tracks the performance of the mid-cap segment of the U.S. equity universe. The Russell Midcap® Index is a subset of the Russell 1000® Index. It includes approximately 800 of the smallest securities based on a combination of their market cap and current index membership. The Russell Midcap® Index represents approximately 27% of the total market capitalization of the Russell 1000 companies.

Secured Overnight Financing Rate (SOFR) is a measure of the cost of borrowing cash overnight collateralized by Treasury securities, the benchmark is fully transaction based, founded on a robust underlying market–actual transaction level data is provided by Bank of New York Mellon and an affiliate of the Depository Trust & Clearing Corporation, DTCC Solutions LLC.

Securities Industry and Financial Markets Association (SIFMA) Municipal Swap Index is produced by Municipal Market Data (MMD), which is a 7-day high-grade market index comprised of tax-exempt variable rate demand obligations (VRDO’s) from MMD’s extensive database. SIFMA is a leading securities industry trade group representing securities firms, banks, and asset management companies in the U.S. and Hong Kong.

Standard & Poor 500 Index (S&P 500 Index) is regarded as a gauge of the U.S. equities market; this index includes 500 leading companies in leading industries of the U.S. economy. Although the S&P 500 focuses on the large-cap segment of the market, with approximately 75% coverage of U.S. equities, it is also an ideal proxy for the total market.

The above indices are unmanaged and do not reflect the deduction of the expenses associated with a mutual fund, such as investment management and fund accounting fees. The Fund’s performance reflects the deduction of fees for these services, but does not reflect the deduction of taxes that a shareholder would pay on fund distributions or the redemption of fund shares. Investors cannot invest directly in an index.

Gross Domestic Product (GDP) measures the market value of the goods and services produced by labor and property within the respective country/economic region. Yield to Worst (YTW) is lowest potential bond yield received without the issuer defaulting, it assumes the worst-case scenario, or earliest redemption possible under terms of the bond.

Organization of Petroleum Exporting Countries (OPEC) is a permanent intergovernmental organization of 14 oil-exporting developing nations that coordinates and unifies the petroleum policies of its Member Countries.

- 2 -

Money Market Funds (Unaudited)

Market Conditions

A material economic slowdown, although anticipated by a number of market participants, did not happen over the course of the Funds’ fiscal year ended August 31, 2023, and Federal Reserve actions to lower inflation took considerably more effort than many had thought.

The overall environment for the money market fund industry was quite benign. In fact, U.S. money market fund assets reached an all-time high of $6.007 trillion as of August 31, according to Money Fund Intelligence. For the 12 months ended August 31, the industry enjoyed growth of $965.4 billion, or 19.1%. This growth was driven by the high returns available in the money fund sector.

As of August 31, 2023, the average money market fund yield was 5.04%. The market environment rewarded very short maturity instruments as rates continued to climb upwards. The main challenge was to try to anticipate when the Fed’s monetary tightening campaign would end.

The U.S. Treasury Fund and the Government Securities Money Market Fund

The key investment opportunity during the year was to ride the wave of ever-higher short-term interest rates. To that end, we kept a very sizable proportion of funds in overnight repurchase agreements (repos), which quickly captured rate increases as they happened, and being priced at par, they did not fluctuate in value as rates rose.

Both money market funds have Treasury Bill positions maturing later in the year to capture yields that are better than overnight repos. Our Government Securities Money Market Fund also has U.S. Government Agency floating rate notes that, again, yield more than overnight repos.*

We began investing in overnight repos issued by the Federal Reserve Bank of New York in the U.S. Treasury Fund, as we have been doing for more than a year in the Government Securities Money Market Fund. This adds an appreciable advantage over the typical yield of other overnight repos.*

Outlook

The federal funds futures market indicates that the Fed is close to the end of its tightening campaign, and we agree. We feel that rates will stay elevated for some time to come. The challenge will be to maintain the optimal blend of maturities and securities types to be able to exploit the opportunities the markets present.

| * | The composition of the Funds’ portfolio is subject to change. |

The performance data quoted represents past performance and does not guarantee future results. The investment return and principal value of an investment will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost. Current performance may be lower or higher than the performance quoted. For performance data current to the most recent month end, please call 1-800-762-7085 or visit www.cavanalhillfunds.com.

- 3 -

Limited Duration Fund (Unaudited)

Fund Goal

We pursue a strategy of broad diversification in order to benefit from investments in both corporate and government fixed-income securities as well as mortgage-backed securities (MBS) and asset-backed securities (ABS), with the Fund maintaining a dollar-weighted average duration of no longer than 3.5 years.

For the year ended August 31, 2023, the Limited Duration Fund A Shares (at NAV) returned 1.13%; Investor Shares returned 1.33%, while the Institutional Shares returned 1.56%. The Fund’s benchmark, the ICE BofA Merrill Lynch 1-5 Year U.S. Corporate/Government Index1 posted a total return of 1.20%.

Market Conditions

Real economic growth has remained remarkably resilient over the past 12 months, surprising many forecasters who expected a significant decline in economic activity. In its mandate to achieve stable prices, the Federal Reserve maintained its hawkish stance throughout the period, embarking on the largest rate hike cycle in decades. While inflation remains well above the Fed’s stated 2% target, inflation is far from its peak and appears to be on a path towards the 2% level.

Tighter Fed policy has yet to affect employment, with the unemployment rate remaining well below 4% over the past 12 months. The strength in employment and wage gains provided a strong tailwind for consumer spending. Most notably, the housing and auto markets have remained strong in the face of significantly higher borrowing costs.

Despite the sharp increase in interest rates, risk markets performed admirably over the past year.

Within the domestic fixed income market, high yield was the star performer, posting mid- to high-single-digit returns. Looking at the U.S. high grade fixed income market, the two paths to outperformance were being short duration or having a lower quality bias. Long duration, high quality bonds were the laggards over the period, bearing the brunt of the increase in interest rates without much of a spread component to soften the blow.

The interest rate curve remains significantly inverted, as the market continues to price in interest rate cuts within the next two years. Given the low level of unemployment and inflation remaining above the Fed’s stated target, along with strength in the risk markets, interest rate cuts appear implausible. If these trends continue, the market should have to price out the interest rate cuts. In that environment, interest rates in the belly of the curve should rise, reducing the level of inversion. Given the potential for this outcome, we favor maintaining a short duration bias.

We also favor a high quality bias. Tight monetary policy has historically been effective at slowing down economic growth and inflation. The Fed has raised interest rates to levels not seen in 15 years. It makes sense to maintain a degree of caution as the ultimate impacts of the new interest rate regime may not yet be fully known. If the economy continues to strengthen, there would very likely be further spread narrowing in the riskier parts of the bond market. However, given the high absolute level of interest rates, the opportunity cost in eschewing riskier credits appears marginal.

Fund Strategy

We remain short of our benchmark on duration. Given the continued strength in the economy and risk markets, we expect monetary policy to remain tight for longer than the market currently expects. This would pressure interest rates in the belly of the curve higher and supports a shorter duration bias.*

We also continue to favor higher quality credits over lower quality. The spread tightening over the past 12 months has reduced the opportunity cost of holding higher quality relative to lower quality. We believe the yields available in some government sectors appear very attractive, certainly relative to much of the Baa-rated corporate market. If tight monetary policy does indeed begin to negatively affect economic growth, a high quality bias is appropriate.*

The same idea holds true in our preference for maintaining a high degree of liquidity. With the cash market now yielding over 5%, the hurdle rate for taking on liquidity risk is much higher than it has been in a very long time.*

Outlook

Expected returns across fixed income are as high as they have been in 15 years. Inflation is the most troubling economic outcome for fixed income investors and inflation has remained higher and stickier than most had predicted. However, the trend has certainly been lower and the rhetoric from the Fed has been consistent in that it is committed to bringing inflation back down to its 2% target. With that backdrop, fixed income appears extremely attractive compared with the low rate environment that had existed since the Great Financial Crisis.

| 1 | For additional information, please refer to the Glossary of Terms. |

| * | The composition of the Funds’ portfolio is subject to change. |

The performance data quoted represents past performance and does not guarantee future results. The investment return and principal value of an investment will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost. Current performance may be lower or higher than the performance quoted. For performance data current to the most recent month end, please call 1-800-762-7085 or visit www.cavanalhillfunds.com.

- 4 -

Limited Duration Fund (Unaudited)

Index Description

The performance of the Limited Duration Fund is measured against the ICE BofA Merrill Lynch 1-5 Year U.S. Corporate/Government Index, an unmanaged index that is comprised of investment-grade government and corporate debt securities with maturities between one- and five-years. The index does not reflect the deduction of the expenses associated with a mutual fund, such as investment management and fund accounting fees. The Fund’s performance reflects the deduction of fees for these services, but does not reflect the deduction of taxes that a shareholder would pay on fund distributions or the redemption of fund shares. Investors cannot invest directly in an index.

Investment Risks

Fixed income securities are subject to interest rate risks. The principal value of a bond falls when interest rates rise and rise when interest rates fall. During periods of rising interest rates, the value of a bond investment is at greater risk than during periods of stable or falling rates. Short-term investment-grade bonds offer less risk and generally a lower rate of return than longer-term higher-yielding bonds. Bond funds will tend to experience smaller fluctuations in value than stock funds. However, investors in any bond fund should anticipate fluctuations in price, especially for longer-term issues and in environments of changing interest rates.

For a complete description of these and other risks associated with investing in a mutual fund, please refer to the Funds’ prospectus.

Value of a $10,000 Investment

The growth of $10,000 investment chart represents a hypothetical investment in the indicated share class versus a similar investment in the Fund’s benchmark, and represents the reinvestment of distributions and capital gains.

| Average Annual Total Return | ||||||||||||

| For the periods ended 8/31/2023 | 1 Year | 5 years | 10 Year | |||||||||

| A Shares (at NAV)1 | 1.13% | 0.78% | 0.96% | |||||||||

| A Shares (with 2.00% maximum load)1 | (0.85)% | 0.37% | 0.76% | |||||||||

| Investor Shares | 1.33% | 0.80% | 0.95% | |||||||||

| Institutional Shares | 1.56% | 1.04% | 1.21% | |||||||||

| ICE BofA ML 1-5 Year US Corporate/Government Index | 1.20% | 1.21% | 1.24% | |||||||||

| Lipper Short Investment Grade Debt Funds Average2 | 2.54% | 1.38% | 1.32% | |||||||||

| Expense Ratios | ||||||||||||

| Gross | ||||||||||||

| A Shares | 0.93% | |||||||||||

| Investor Shares | 1.08% | |||||||||||

| Institutional Shares | 0.83% |

The performance data quoted represents past performance and does not guarantee future results. The investment return and principal value of an investment will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost. Current performance may be lower or higher than the performance quoted. For performance data current to the most recent month end, please call 1-800-762-7085 or visit www.cavanalhillfunds.com.

Investment performance for the Fund’s classes reflects fee waivers that have been in effect during the applicable periods. Without such waivers, the performance would have been lower. Contractual fee waivers are in effect through December 31, 2023.

The above expense ratios are from the Funds’ prospectus dated December 28, 2022. Additional information pertaining to the Funds’ expense ratios for the year ended August 31, 2023 can be found in the Financial Highlights.

| 1 | Class A Shares are subject to a 1.00% Maximum Deferred Sales Charge on shares purchased without an initial sales charge and redeemed within 12 months of purchase. Performance data does not reflect the Maximum Deferred Sales Charge. If reflected, one year performance quoted would be lower. This performance reflects the Fund’s no-Load Investor class (“Investor Shares”) for periods prior to May 2, 2011 for the A Shares. The A Shares began presenting performance linked to the Investor Class in September of 2011. Unlike Institutional Shares, Investor Shares and A Shares bear a 12b-1 fee of 0.25%. Investor Shares and Institutional Shares are subject to a Shareholder Servicing Fee of 0.25%, whereas the Shareholder Servicing Fee for A Shares is 0.10%. As indicated in the table, A Shares are also subject to a sales charge (Load). Each of these differences is reflected in the performance information. Accordingly, had the A Shares of the Fund been offered for periods before May 2, 2011, the performance information would have been different as a result of differing annual operating expenses. |

| 2 | The Lipper Mutual Funds Average is an equally weighted average of the mutual funds within their respective Lipper classification, adjusted for reinvestment of capital gains distributions and income dividends. |

- 5 -

Moderate Duration Fund (Unaudited)

Fund Goal

We pursue a strategy of broad diversification in order to benefit from investments in both corporate and government fixed-income securities as well as mortgage-backed securities (MBS) and asset-backed securities (ABS), with the Fund maintaining a dollar-weighted average duration of no longer than five years.

For the year ended August 31, 2023, the Moderate Duration Fund A Shares (at NAV) returned 0.59%; Investor Shares returned 0.59%, and the Institutional Shares returned 0.74%. The Fund’s benchmark, the Bloomberg U.S. Intermediate Aggregate Bond Index1, showed total return of -0.35%.

Market Conditions

Real economic growth has remained remarkably resilient over the past 12 months, surprising many forecasters who expected a significant decline in economic activity. In its mandate to achieve stable prices, the Federal Reserve maintained its hawkish stance throughout the period, embarking on the largest rate hike cycle in decades. While inflation remains well above the Fed’s stated 2% target, inflation is far from its peak and appears to be on a path towards the 2% level.

Tighter Fed policy has yet to affect employment, with the unemployment rate remaining well below 4% over the past 12 months. The strength in employment and wage gains provided a strong tailwind for consumer spending. Most notably, the housing and auto markets have remained strong in the face of significantly higher borrowing costs.

Despite the sharp increase in interest rates, risk markets performed admirably over the past year.

Within the domestic fixed income market, high yield was the star performer, posting mid- to high-single-digit returns. Looking at the U.S. high grade fixed income market, the two paths to outperformance were being short duration or having a lower quality bias. Long duration, high quality bonds were the laggards over the period, bearing the brunt of the increase in interest rates without much of a spread component to soften the blow.

The interest rate curve remains significantly inverted, as the market continues to price in interest rate cuts within the next two years. Given the low level of unemployment and inflation remaining above the Fed’s stated target, along with strength in the risk markets, interest rate cuts appear implausible. If these trends continue, the market should have to price out the interest rate cuts. In that environment, interest rates in the belly of the curve should rise, reducing the level of inversion. Given the potential for this outcome, we favor maintaining a short duration bias.

We also favor a high quality bias. Tight monetary policy has historically been effective at slowing down economic growth and inflation. The Fed has raised interest rates to levels not seen in 15 years. It makes sense to maintain a degree of caution as the ultimate impacts of the new interest rate regime may not yet be fully known. If the economy continues to strengthen, there would very likely be further spread narrowing in the riskier parts of the bond market. However, given the high absolute level of interest rates, the opportunity cost in eschewing riskier credits appears marginal.

Fund Strategy

We remain short of our benchmark on duration. Given the continued strength in the economy and risk markets, we expect monetary policy to remain tight for longer than the market currently expects. This would pressure interest rates in the belly of the curve higher and supports a shorter duration bias.*

We also continue to favor higher quality credits over lower quality. The spread tightening over the past 12 months has reduced the opportunity cost of holding higher quality relative to lower quality. We believe the yields available in some government sectors appear very attractive, certainly relative to much of the Baa-rated corporate market. If tight monetary policy does indeed begin to negatively affect economic growth, a high quality bias is appropriate.*

The same idea holds true in our preference for maintaining a high degree of liquidity. With the cash market now yielding over 5%, the hurdle rate for taking on liquidity risk is much higher than it has been in a very long time.*

Outlook

Expected returns across fixed income are as high as they have been in 15 years. Inflation is the most troubling economic outcome for fixed income investors and inflation has remained higher and stickier than most had predicted. However, the trend has certainly been lower and the rhetoric from the Fed has been consistent in that it is committed to bringing inflation back down to its 2% target. With that backdrop, fixed income appears extremely attractive compared with the low rate environment that had existed since the Great Financial Crisis.

| 1 | For additional information, please refer to the Glossary of Terms. |

| * | The composition of the Funds’ portfolio is subject to change. |

The performance data quoted represents past performance and does not guarantee future results. The investment return and principal value of an investment will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost. Current performance may be lower or higher than the performance quoted. For performance data current to the most recent month end, please call 1-800-762-7085 or visit www.cavanalhillfunds.com.

- 6 -

Moderate Duration Fund (Unaudited)

Index Description

The performance of the Moderate Duration Fund is measured against the Bloomberg U.S. Intermediate Aggregate Bond Index, an unmanaged index that is representative of investment-grade debt issues with maturities from one year up to (but not including) 10 years. The index does not reflect the deduction of the expenses associated with a mutual fund, such as investment management and fund accounting fees. The Fund’s performance reflects the deduction of fees for these services, but does not reflect the deduction of taxes that a shareholder would pay on fund distributions or the redemption of fund shares. Investors cannot invest directly in an index.

Investment Risks

Fixed income securities are subject to interest rate risks. The principal value of a bond falls when interest rates rise and rise when interest rates fall. During periods of rising interest rates, the value of a bond investment is at greater risk than during periods of stable or falling rates. Intermediate-term investment-grade bonds offer less risk and generally a lower rate of return than longer-term higher-yielding bonds. Bond funds will tend to experience smaller fluctuations in value than stock funds. However, investors in any bond fund should anticipate fluctuations in price, especially for longer-term issues and in environments of changing interest rates.

For a complete description of these and other risks associated with investing in a mutual fund, please refer to the Fund’s prospectus.

Value of a $10,000 Investment

The growth of $10,000 investment chart represents a hypothetical investment in the indicated share class versus a similar investment in the Fund’s benchmark, and represents the reinvestment of distributions and capital gains.

| Average Annual Total Return | ||||||||||||

| For the periods ended 8/31/2023 | 1 Year | 5 years | 10 Year | |||||||||

| A Shares (at NAV)1 | 0.59% | 0.32% | 0.99% | |||||||||

| A Shares (with 2.00% maximum load)1 | (1.44)% | (0.08)% | 0.79% | |||||||||

| Investor Shares | 0.59% | 0.30% | 0.96% | |||||||||

| Institutional Shares | 0.74% | 0.55% | 1.22% | |||||||||

| Bloomberg U.S. Intermediate Aggregate Bond Index | (0.35)% | 0.68% | 1.34% | |||||||||

| Lipper Short-Intermediate Investment Grade Debt Funds Average2 | 1.33% | 1.16% | 1.23% | |||||||||

| Expense Ratios | ||||||||||||

| Gross | ||||||||||||

| A Shares | 1.38% | |||||||||||

| Investor Shares | 1.53% | |||||||||||

| Institutional Shares | 1.28% |

The performance data quoted represents past performance and does not guarantee future results. The investment return and principal value of an investment will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost. Current performance may be lower or higher than the performance quoted. For performance data current to the most recent month end, please call 1-800-762-7085 or visit www.cavanalhillfunds.com.

Investment performance for the Fund’s classes reflects fee waivers that have been in effect during the applicable periods. Without such waivers, the performance would have been lower. Contractual fee waivers are in effect through December 31, 2023.

The above expense ratios are from the Funds’ prospectus dated December 28, 2022. Additional information pertaining to the Funds’ expense ratios for the year ended August 31, 2023 can be found in the Financial Highlights.

| 1 | Class A Shares are subject to a 1.00% Maximum Deferred Sales Charge on shares purchased without an initial sales charge and redeemed within 12 months of purchase. Performance data does not reflect the Maximum Deferred Sales Charge. If reflected, one year performance quoted would be lower. This performance reflects the Fund’s no-Load Investor class (“Investor Shares”) for periods prior to May 2, 2011 for the A Shares. The A Shares began presenting performance linked to the Investor Class in September of 2011. Unlike Institutional Shares, Investor Shares and A Shares bear a 12b-1 fee of 0.25%. Investor Shares and Institutional Shares are subject to a Shareholder Servicing Fee of 0.25%, whereas the Shareholder Servicing Fee for A Shares is 0.10%. As indicated in the table, A Shares are also subject to a sales charge (Load). Each of these differences is reflected in the performance information. Accordingly, had the A Shares of the Fund been offered for periods before May 2, 2011, the performance information would have been different as a result of differing annual operating expenses. |

| 2 | The Lipper Mutual Funds Average is an equally weighted average of the mutual funds within their respective Lipper classification, adjusted for reinvestment of capital gains distributions and income dividends. |

- 7 -

Bond Fund (Unaudited)

Fund Goal

We pursue a strategy of broad diversification in order to benefit from investments in both corporate and government fixed-income securities as well as mortgage-backed securities (MBS) and asset-backed securities (ABS), with the Fund maintaining a dollar-weighted average maturity of three years or more and generally no longer than 10 years.

For the year ended August 31, 2023, the Bond Fund A Shares (at NAV) returned -1.42%; the Investor Shares returned -1.42%; and the Institutional Shares returned -1.19%. The Fund’s benchmark, the Bloomberg U.S. Aggregate Bond Index1, showed a total return of -1.19%.

Market Conditions

Real economic growth has remained remarkably resilient over the past 12 months, surprising many forecasters who expected a significant decline in economic activity. In its mandate to achieve stable prices, the Federal Reserve maintained its hawkish stance throughout the period, embarking on the largest rate hike cycle in decades. While inflation remains well above the Fed’s stated 2% target, inflation is far from its peak and appears to be on a path towards the 2% level.

Tighter Fed policy has yet to affect employment, with the unemployment rate remaining well below 4% over the past 12 months. The strength in employment and wage gains provided a strong tailwind for consumer spending. Most notably, the housing and auto markets have remained strong in the face of significantly higher borrowing costs.

Despite the sharp increase in interest rates, risk markets performed admirably over the past year. Within the domestic fixed income market, high yield was the star performer, posting mid- to high-single-digit returns. Looking at the U.S. high grade fixed income market, the two paths to outperformance were being short duration or having a lower quality bias. Long duration, high quality bonds were the laggards over the period, bearing the brunt of the increase in interest rates without much of a spread component to soften the blow.

The interest rate curve remains significantly inverted, as the market continues to price in interest rate cuts within the next two years. Given the low level of unemployment and inflation remaining above the Fed’s stated target, along with strength in the risk markets, interest rate cuts appear implausible. If these trends continue, the market should have to price out the interest rate cuts. In that environment, interest rates in the belly of the curve should rise, reducing the level of inversion. Given the potential for this outcome, we favor maintaining a short duration bias.

We also favor a high quality bias. Tight monetary policy has historically been effective at slowing down economic growth and inflation. The Fed has raised interest rates to levels not seen in 15 years. It makes sense to maintain a degree of caution as the ultimate impacts of the new interest rate regime may not yet be fully known. If the economy continues to strengthen, there would very likely be further spread narrowing in the riskier parts of the bond market. However, given the high absolute level of interest rates, the opportunity cost in eschewing riskier credits appears marginal.

Fund Strategy

We remain short of our benchmark on duration. Given the continued strength in the economy and risk markets, we expect monetary policy to remain tight for longer than the market currently expects. This would pressure interest rates in the belly of the curve higher and supports a shorter duration bias.*

We also continue to favor higher quality credits over lower quality. The spread tightening over the past 12 months has reduced the opportunity cost of holding higher quality relative to lower quality. We believe the yields available in some government sectors appear very attractive, certainly relative to much of the Baa-rated corporate market. If tight monetary policy does indeed begin to negatively affect economic growth, a high quality bias is appropriate.*

The same idea holds true in our preference for maintaining a high degree of liquidity. With the cash market now yielding over 5%, the hurdle rate for taking on liquidity risk is much higher than it has been in a very long time.*

Outlook

Expected returns across fixed income are as high as they have been in 15 years. Inflation is the most troubling economic outcome for fixed income investors and inflation has remained higher and stickier than most had predicted. However, the trend has certainly been lower and the rhetoric from the Fed has been consistent in that it is committed to bringing inflation back down to its 2% target. With that backdrop, fixed income appears extremely attractive compared with the low rate environment that had existed since the Great Financial Crisis.

| 1 | For additional information, please refer to the Glossary of Terms. |

| * | The composition of the Funds’ portfolio is subject to change. |

The performance data quoted represents past performance and does not guarantee future results. The investment return and principal value of an investment will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost. Current performance may be lower or higher than the performance quoted. For performance data current to the most recent month end, please call 1-800-762-7085 or visit www.cavanalhillfunds.com.

- 8 -

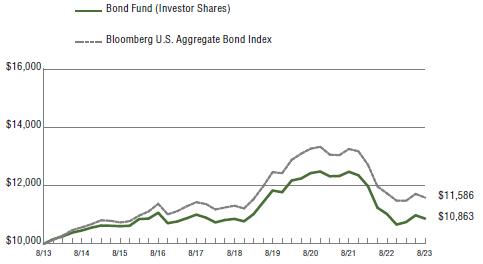

Bond Fund (Unaudited)

Index Description

The performance of the Bond Fund is measured against the Bloomberg U.S. Aggregate Bond Index, an unmanaged index that is a market value-weighted performance benchmark for investment-grade fixed-rate debt issues, including government, corporate, asset-backed and mortgage-backed securities, with maturities of at least one year. The index does not reflect the deduction of the expenses associated with a mutual fund, such as investment management and fund accounting fees. The Fund’s performance reflects the deduction of fees for these value-added services, but does not reflect the deduction of taxes that a shareholder would pay on fund distributions or the redemption of fund shares. Investors cannot invest directly in an index.

Investment Risks

Fixed income securities are subject to interest rate risks. The principal value of a bond falls when interest rates rise and rise when interest rates fall. During periods of rising interest rates, the value of a bond investment is at greater risk than during periods of stable or falling rates. Bond funds will tend to experience smaller fluctuations in value than stock funds. However, investors in any bond fund should anticipate fluctuations in price, especially for longer-term issues and in environments of changing interest rates.

For a complete description of these and other risks associated with investing in a mutual fund, please refer to the Fund’s prospectus.

Value of a $10,000 Investment

The growth of $10,000 investment chart represents a hypothetical investment in the indicated share class versus a similar investment in the Fund’s benchmark, and represents the reinvestment of distributions and capital gains.

| Average Annual Total Return | ||||||

| For the periods ended 8/31/2023 | 1 Year | 5 years | 10 Year | |||

| A Shares (at NAV)1 | (1.42)% | 0.05% | 0.83% | |||

| A Shares (with 2.00% maximum load)1 | (3.43)% | (0.36)% | 0.63% | |||

| Investor Shares | (1.42)% | 0.02% | 0.83% | |||

| Institutional Shares | (1.19)% | 0.27% | 1.07% | |||

| Bloomberg U.S. Aggregate Bond Index | (1.19)% | 0.49% | 1.48% | |||

| Lipper Core Bond Funds Average2 | (1.08)% | 0.51% | 1.45% | |||

| Expense Ratios | ||||||

| Gross | ||||||

| A Shares | 0.84% | |||||

| Investor Shares | 0.99% | |||||

| Institutional Shares | 0.74% |

The performance data quoted represents past performance and does not guarantee future results. The investment return and principal value of an investment will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost. Current performance may be lower or higher than the performance quoted. For performance data current to the most recent month end, please call 1-800-762-7085 or visit www.cavanalhillfunds.com.

Investment performance for the Fund’s classes reflects fee waivers that have been in effect during the applicable periods. Without such waivers, the performance would have been lower. Contractual fee waivers are in effect through December 31, 2023.

The above expense ratios are from the Funds’ prospectus dated December 28, 2022. Additional information pertaining to the Funds’ expense ratios for the year ended August 31, 2023 can be found in the Financial Highlights.

| 1 | Class A Shares are subject to a 1.00% Maximum Deferred Sales Charge on shares purchased without an initial sales charge and redeemed within 12 months of purchase. Performance data does not reflect the Maximum Deferred Sales Charge. If reflected, one year performance quoted would be lower. This performance reflects the Fund’s no-Load Investor class (“Investor Shares”) for periods prior to May 2, 2011 for the A Shares. The A Shares began presenting performance linked to the Investor Class in September of 2011. Unlike Institutional Shares, Investor Shares and A Shares bear a 12b-1 fee of 0.25%. Investor Shares and Institutional Shares are subject to a Shareholder Servicing Fee of 0.25%, whereas the Shareholder Servicing Fee for A Shares is 0.10%. As indicated in the table, A Shares are also subject to a sales charge (Load). Each of these differences is reflected in the performance information. Accordingly, had the A Shares of the Fund been offered for periods before May 2, 2011, the performance information would have been different as a result of differing annual operating expenses. |

| 2 | The Lipper Mutual Funds Average is an equally weighted average of the mutual funds within their respective Lipper classification, adjusted for reinvestment of capital gains distributions and income dividends. |

- 9 -

Strategic Enhanced Yield Fund (Unaudited)

Fund Goal

The Fund seeks to achieve its investment objective by investing in a diversified portfolio of fixed income instruments of varying maturities. In an effort to actively enhance total return and minimize risk, the Fund will engage in opportunistic trading among various sectors based on the perceived market anomalies and inefficiencies detected by the Fund’s portfolio managers.

For the year ended August 31, 2023, the Strategic Enhanced Yield Fund A shares (at NAV) returned -2.66%; Investor Shares returned -2.69%, and the Institutional shares returned -2.31%. The Fund’s benchmark, the Bloomberg U.S. Aggregate Bond Index1, posted a total return of -1.19%.

Market Conditions

The financial markets evolved significantly during the 12-month period ended August 31, 2023. After experiencing two consecutive quarters of slight decline in gross domestic product in the first half of 2022, the U.S. economy resumed growth, inflation was seen as persistent rather than transient, and the labor market remained resilient throughout the 12 months. The Federal Reserve remained on path to continue its aggressive rate hike schedule, only briefly pausing in June 2023. Government spending and an ongoing threat of shutdowns resulted in a quality downgrade of U.S. government debt to AA+. Some economic sectors, including banking and housing, suffered as a consequence of the interest rate hikes, while other sectors, mainly energyrelated and selected technology, had banner years.

Fixed income assets leveled last year’s poor returns due to a more subdued rate of inflation and smaller rate hikes. Credit spreads tightened during the period after a significant widening in March. Throughout most of 2023, the Treasury yield curve was inverted, which brought additional uncertainty and volatility to the Treasury marketplace.

Fund Strategy

For the first four months of the fiscal year, the Fund transitioned to a more diverse and aggressive strategy. In addition to the sectors associated with the Bloomberg U.S. Aggregate Bond Index, it included out-of-benchmark securities in high yield and emerging market debt.*

Our defensive position holds a portfolio duration targeted at 8% to 10% short of the benchmark index, with an underweight allocation to the Treasury sector. Our corporate sector holds a market overweight as we closely monitor credit spreads. The Fund has a neutral weighting in agency mortgage-backed securities and, as noted above, holds an allocation to the emerging market debt and high yield sectors.*

If the premium received from the portfolio’s riskier assets diminishes, we will reduce their allocation until spreads normalize to where we believe the portfolio can outperform in all its sectors. *

Outlook

Tighter monetary policy remains the dominant theme in fixed income markets. The federal funds futures market, which had underpriced the Fed’s resolve in past months, now reflects a more aggressive position, reaffirming hawkish statements by Chairman Powell and other Fed governors following the Jackson Hole conference.

High inflation appears to be persisting for longer than anticipated due to a combination of the resilient U.S. labor market and inflationary pressures from higher food prices and wages. The situation is further amplified by loose fiscal policy evidenced by recent Congressional legislation. The Federal Open Market Committee’s tighter monetary policy of higher rates and quantitative tightening continues to raise fears of a recession in 2023, but concerns also exist regarding financial instability. As spreads in the riskier sectors continue to tighten, we may further reduce positions in emerging market debt, as we remain focused on evaluating the risk-reward equation regarding individual security selection.

| 1 | For additional information, please refer to the Glossary of Terms. |

| * | The composition of the Funds’ portfolio is subject to change. |

The performance data quoted represents past performance and does not guarantee future results. The investment return and principal value of an investment will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost. Current performance may be lower or higher than the performance quoted. For performance data current to the most recent month end, please call 1-800-762-7085 or visit www.cavanalhillfunds.com.

- 10 -

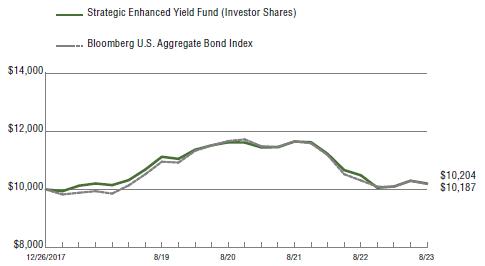

Strategic Enhanced Yield Fund (Unaudited)

Index Description

The performance of the Strategic Enhanced Yield Fund is measured against the Bloomberg U.S. Aggregate Bond Index, an unmanaged index that is a market value-weighted performance benchmark for investment-grade fixed-rate debt issues, including government, corporate, asset-backed and mortgage-backed securities, with maturities of at least one year. The index does not reflect the deduction of the expenses associated with a mutual fund, such as investment management and fund accounting fees. The Fund’s performance reflects the deduction of fees for these value-added services, but does not reflect the deduction of taxes that a shareholder would pay on fund distributions or the redemption of fund shares. Investors cannot invest directly in an index.

Investment Risks

Fixed income securities are subject to interest rate risks. The principal value of a bond falls when interest rates rise and rise when interest rates fall. During periods of rising interest rates, the value of a bond investment is at greater risk than during periods of stable or falling rates. Short-term investment-grade bonds offer less risk and generally a lower rate of return than longer-term higher-yielding bonds. Bond funds will tend to experience smaller fluctuations in value than stock funds. However, investors in any bond fund should anticipate fluctuations in price, especially for longer-term issues and in environments of changing interest rates. High-yield bonds have a higher risk of default or other adverse credit events, but have the potential to pay higher earnings over investment-grade bonds. The higher risk of default, or the inability of the creditor to repay its debt, is the primary reason for the higher interest rates on high-yield bonds.

For a complete description of these and other risks associated with investing in a mutual fund, please refer to the Fund’s prospectus.

Value of a $10,000 Investment

The growth of $10,000 investment chart represents a hypothetical investment in the indicated share class versus a similar investment in the Fund’s benchmark, and represents the reinvestment of distributions and capital gains.

| Average Annual Total Return | ||||||

| For the periods ended 8/31/2023 | 1 Year | 5 years | Since (12/26/2017) | |||

| A Shares (at NAV)1 | (2.66)% | 0.03% | 0.31% | |||

| A Shares (with 2.00% maximum load)1 | (4.66)% | (0.37)% | (0.04)% | |||

| Investor Shares | (2.69)% | 0.00 | 0.36% | |||

| Institutional Shares | (2.31)% | 0.26% | 0.56% | |||

| Bloomberg U.S. Aggregate Bond Index | (1.19)% | 0.49% | 0.33% | |||

| Lipper Multi-Sector Income Funds Average2 | 1.98% | 1.43% | 1.21% |

| Expense Ratios | ||||||

| Gross | ||||||

| A Shares | 1.85% | |||||

| Investor Shares | 2.09% | |||||

| Institutional Shares | 1.84% |

The performance data quoted represents past performance and does not guarantee future results. The investment return and principal value of an investment will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost. Current performance may be lower or higher than the performance quoted. For performance data current to the most recent month end, please call 1-800-762-7085 or visit www.cavanalhillfunds.com.

Investment performance for the Fund’s classes reflects fee waivers that have been in effect during the applicable periods. Without such waivers, the performance would have been lower. Contractual fee waivers are in effect through December 31, 2023.

The above expense ratios are from the Funds’ prospectus dated December 28, 2022. Additional information pertaining to the Funds’ expense ratios for the year ended August 31, 2023 can be found in the Financial Highlights.

| 1 | Class A Shares are subject to a 1.00% Maximum Deferred Sales Charge on shares purchased without an initial sales charge and redeemed within 12 months of purchase. Performance data does not reflect the Maximum Deferred Sales Charge. If reflected, one year performance quoted would be lower. |

| 2 | The Lipper Mutual Funds Average is an equally weighted average of the mutual funds within their respective Lipper classification, adjusted for reinvestment of capital gains distributions and income dividends. Since inception value calculated from December 31, 2017. |

- 11 -

Ultra Short Tax-Free Income Fund (Unaudited)

Fund Goal

We seek to generate current income that is exempt from federal income taxes by investing primarily in a diversified portfolio of municipal securities, with at least 65% of the Fund’s assets invested in securities that are rated within the three highest long-term or highest short-term rating categories at the time of purchase. The Fund normally maintains a dollarweighted average maturity of one day to one year.

For the year ended August 31, 2023, the Ultra Short Tax-Free Fund A Shares (at NAV) returned 2.37%; the Investor Shares returned 2.37% and the Institutional Shares returned 2.63%. The Fund’s benchmark, the Bloomberg 1-year Municipal Bond Index1, showed a total return of 1.83%.

Market Conditions

The Federal Reserve continued its aggressive fight to lower the inflation rate by raising the overnight lending rate at seven of the eight Federal Open Market Committee meetings during the period. The total increase of 300 basis points (3.0%) brought the federal funds level to the highest since 2007. The rate increases have certainly worked, as evidenced by the drop in the Consumer Price Index (CPI), which saw a year-over-year decline from 8.2% to 3.7%. Although the trend is a positive development for the Fed, the level is still above its target inflation rate of 2% and the Fed has left the possibility open for another rate hike before the tightening cycle is over.

While the overall trend for yields in the short end of the municipal market was higher for the period given the Fed’s aggressive moves, there was an unusual amount of volatility throughout the Fund’s fiscal year. The fixed rate portion of the market saw rates rise about 100 basis points (1.0%) over the course of the period, but there were several moves of 50 basis points in both directions within a short timeframe.

Yields on variable rate demand notes (VRDNs) experienced even more pronounced moves during the period, as nine different months featured moves of at least 100 basis points. Over the entire year, the SIFMA index, which is an average of yields on VRDNs, rose from 1.50% to 4.06% and reached its highest sustained levels since the early 2000s.

The regional bank crisis in early 2023 was a highprofile news event in the financial markets, but it had very little impact on the short end of the muni market. While it led to the liquidation of longer fixed rate bonds held in the bank’s portfolios, the secondary market easily absorbed the volume.

Fund Strategy

The Fund has looked for opportunities to lock in attractive yields in fixed rate bonds, while maintaining a core position of VRDNs, as that structure shores up the liquidity for the Fund while also taking advantage of the recent environment of rising weekly resets.*

Outlook

It appears that the Federal Reserve is nearing the end of its tightening cycle, but it has maintained its stance to keep the overnight rate at an elevated level until the inflation rate reaches its 2% target rate, so the short end of the muni market should continue to mirror those levels.

| 1 | For additional information, please refer to the Glossary of Terms. |

| * | The composition of the Funds’ portfolio is subject to change. |

The performance data quoted represents past performance and does not guarantee future results. The investment return and principal value of an investment will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost. Current performance may be lower or higher than the performance quoted. For performance data current to the most recent month end, please call 1-800-762-7085 or visit www.cavanalhillfunds.com.

- 12 -

Ultra Short Tax-Free Income Fund (Unaudited)

Index Description

The performance of the Ultra Short Tax-Free Fund is measured against the Bloomberg 1-Year Municipal Bond Index, an unmanaged index that includes bonds with a minimum credit rating of BAA3, are issued as part of a deal of at least $50 million, have an amount outstanding of at least $5 million, and have maturities of 1 to 2 years. The index does not reflect the deduction of the expenses associated with a mutual fund, such as investment management and fund accounting fees. The Fund’s performance reflects the deduction of fees for these value-added services, but does not reflect the deduction of taxes that a shareholder would pay on fund distributions or the redemption of fund shares. Investors cannot invest directly in an index.

Investment Risks

Fixed income securities are subject to interest rate risks. The principal value of a bond falls when interest rates rise and rise when interest rates fall. During periods of rising interest rates, the value of a bond investment is at greater risk than during periods of stable or falling rates. Short-term investment-grade bonds offer less risk and generally a lower rate of return than longer-term higher yielding bonds. Bond funds will tend to experience smaller fluctuations in value than stock funds. However, investors in any bond fund should anticipate fluctuations in price, especially for longer-term issues and in environments of changing interest rates. The Fund’s income may be subject to certain state and local taxes and, depending on one’s tax status, to the federal alternative minimum tax.

For a complete description of these and other risks associated with investing in a mutual fund, please refer to the Fund’s prospectus.

Value of a $10,000 Investment

The growth of $10,000 investment chart represents a hypothetical investment in the indicated share class versus a similar investment in the Fund’s benchmark, and represents the reinvestment of distributions and capital gains.

| Average Annual Total Return | ||||||

| For the periods ended 8/31/2023 | 1 Year | 5 years | Since (12/26/2017) | |||

| A Shares (at NAV)1 | 2.37% | 0.44% | 0.41% | |||

| A Shares (with 2.00% maximum load)1 | 1.35% | 0.24% | 0.23% | |||

| Investor Shares | 2.37% | 0.62% | 0.57% | |||

| Institutional Shares | 2.63% | 0.85% | 0.86% | |||

| Bloomberg 1-Year Municipal Bond Index | 1.83% | 1.08% | 1.15% | |||

| Lipper Short Municipal Debt Funds Average2 | 1.91% | 0.83% | 0.86% | |||

| Expense Ratios | ||||||

| Gross | ||||||

| A Shares | 1.16% | |||||

| Investor Shares | 1.28% | |||||

| Institutional Shares | 1.03% |

The performance data quoted represents past performance and does not guarantee future results. The investment return and principal value of an investment will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost. Current performance may be lower or higher than the performance quoted. For performance data current to the most recent month end, please call 1-800-762-7085 or visit www.cavanalhillfunds.com.

Investment performance for the Fund’s classes reflects fee waivers that have been in effect during the applicable periods. Without such waivers, the performance would have been lower. Contractual fee waivers are in effect through December 31, 2023.

The above expense ratios are from the Funds’ prospectus dated December 28, 2023. Additional information pertaining to the Funds’ expense ratios for the year ended 2023 can be found in the Financial Highlights.

| 1 | Class A Shares are subject to a 1.00% Maximum Deferred Sales Charge on shares purchased without an initial sales charge and redeemed within 12 months of purchase. Performance data does not reflect the Maximum Deferred Sales Charge. If reflected, one year performance quoted would be lower. |

| 2 | The Lipper Mutual Funds Average is an equally weighted average of the mutual funds within their respective Lipper classification, adjusted for reinvestment of capital gains distributions and income dividends. Since inception value calculated from December 31, 2017. |

- 13 -

Opportunistic Fund (Unaudited)

Fund Goal

We pursue positive investment returns by opportunistically investing in equities, real estate investment trusts (REITs), fixed income securities, preferred stocks, exchange traded funds (ETFs), which may include leveraged and inverse ETFs, options, commodities, and money market funds. The Fund's management team will consider all asset classes and may invest in domestic as well as international securities. The team pursues investment opportunities with the most attractive risk/return profiles.

For the year ended August 31, 2023, the Opportunistic Fund’s A Shares (at NAV) returned -0.48%; the C Shares returned -1.22%; the Investor Shares returned -0.53%, and the Institutional Shares returned -0.29%. The Fund’s benchmarks, the S&P 500 Index1 and the HFRX Equity Hedge Index1, posted total returns of 15.94% and 4.10%, for the same time period.

Market Conditions

The heavily anticipated recession didn’t show up during the fiscal year, as economic data remained resilient despite the Federal Reserve’s restrictive monetary policy, effectuated through aggressive interest rate hikes and quantitative tightening. As a result, investors weren’t ready to sell equities. However, without a clear direction on the economy, they flocked to the largest stocks, concentrated in technology and communication services, which they perceived to be defensive. To demonstrate the impact of the top-heavy market leadership, the cap-weighted S&P 500 Index outperformed the equal-weighted S&P 500 by more than 700 bps (7 percentage points) during the roughly 18 months from mid-March 2022 through August 2023.

After two quarters of a slight decline in the U.S. gross domestic product to start 2022, the U.S. economy resumed growth at an annual pace of close to 3% for the second half of 2022 and moderated to around 2% for the first half of 2023.

During the Fund’s fiscal year, the core consumer price index decelerated from 6.6% in September 2022 to 4.3% in August 2023. The fiscal year-end figure of 4.7% is still at levels much higher than the Fed’s target of 2%. More recently, inflation data were bolstered by a $10 increase in West Texas Intermediate oil prices in July and August 2023, rising to $80 per barrel.

We expect this to keep the Fed hawkish and, as a result, maintain upward pressure on interest rates, which could bode poorly for tech stocks, real estate, and utilities.

For the Fund’s fiscal year, ended August 31, 2023, the S&P 500 Index had a total return of almost 16%. Among the leading sectors were information technology (+33%) and communication services (+26%). The weakest-performing sectors were utilities (-12.7%) and real estate (-8%).

Large-cap and mega-cap stocks were both up more than 14%. In contrast, small caps were up only 3% over the same period. Growth easily outperformed value stocks as the Russell 1000 Growth Index outperformed the Russell 1000 Value Index by more than 1300 basis points (13 percentage points).

Fund Strategy

We believe attractive investment opportunities often arise where Wall Street research is lacking. We use bottom-up research to identify opportunities and we adjust the Fund’s level of exposure to risk assets accordingly, which can lead to fluctuations of the Fund’s net risk exposure over time.*

We may use ETFs to hedge the Fund’s long positions, and we may use options on indices or ETFs to hedge a portion of the portfolio. When opportunities are scarce, we also may raise cash to lower our net market exposure. We track and modulate the Fund’s stock market exposure based on our view of market conditions and investment opportunities.*

Given our increasing concerns about the economy, and our view of there being more attractive opportunities in other asset classes, the Fund’s equity exposure was meaningfully reduced for the final eight months of the fiscal year ended August 31, 2023.*

Outlook

The effects of monetary policy have a long and variable lag. The pace at which the Fed increased interest rates over the past 18 months is the fastest and most severe in several decades. As such, we are deeply concerned about the negative impact that could have on U.S. economic growth and the labor market. We retain a cautious view with regard to equity markets from here.

| 1 | For additional information, please refer to the Glossary of Terms. |

| * | The composition of the Funds’ portfolio is subject to change. |

The performance data quoted represents past performance and does not guarantee future results. The investment return and principal value of an investment will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost. Current performance may be lower or higher than the performance quoted. For performance data current to the most recent month end, please call 1-800-762-7085 or visit www.cavanalhillfunds.com.

- 14 -

Opportunistic Fund (Unaudited)

Index Description

The performance of the Opportunistic Fund is measured against the S&P 500 Index and the HFRX Equity Hedge Index. The S&P 500 is regarded as a gauge of the U.S. equities market, this index includes 500 leading companies in leading industries of the U.S. economy. Although the S&P 500 focuses on the large-cap segment of the market, with approximately 75% coverage of U.S. equities, it is also an ideal proxy for the total market. The Hedge Fund Research, Inc. (HFR) utilizes a UCITSIII compliant methodology to construct the HFRX Hedge Fund Indices. The methodology is based on defined and predetermined rules and objective criteria to select and rebalance components to maximize representation of the Hedge Fund Universe. HFRX Indices utilize state-of-the-art quantitative techniques and analysis; multi-level screening, cluster analysis, Monte-Carlo simulations and optimization techniques ensure that each Index is a pure representation of its corresponding investment focus. These indices are unmanaged and do not reflect the deduction of expenses associated with a mutual fund, such as investment management and fund accounting fees. The Fund’s performance reflects the deduction of fees for these services, but does not reflect the deduction of taxes that a shareholder would pay on fund distributions or the redemption of fund shares. Investors cannot invest directly in an index.

Investment Risks

Equity securities (stocks) are more volatile and carry more risk than other forms of investments, including investments in high-grade fixed income securities. Investments in the Fund are subject to the risks related to direct investment in real estate, such as real estate risk, regulatory risks, concentration risk, and diversification risk. Fixed income securities are subject to interest rate risks. The principal value of a bond falls when interest rates rise and rise when interest rates fall. During periods of rising interest rates, the value of a bond investment is at greater risk than during periods of stable or falling rates. International investing involves increased risk and volatility. Mid- and small-cap companies may be more vulnerable to adverse business or economic developments. The ETFs in which the Funds invest are subject to the risks applicable to the types of securities and investments used by the ETFs. Because an ETF charges its own fees and expenses, Fund shareholders will indirectly bear these costs. The use of leverage in an ETF can magnify any price movements, resulting in high volatility. An inverse ETF seeks to provide returns that are the opposite of the underlying referenced financial asset, index, or commodity’s returns. Exposure to commodities may subject the Fund to greater volatility than investments in traditional securities.

For a complete description of these and other risks associated with investing in a mutual fund, please refer to the Fund’s prospectus.

Value of a $10,000 Investment

The growth of $10,000 investment chart represents a hypothetical investment in the indicated share class versus a similar investment in the Fund’s benchmark, and represents the reinvestment of distributions and capital gains.

Average Annual Total Return

| For the periods ended 8/31/2023 | 1 Year | 5 years | 10 Year | ||||||

| A Shares (at NAV)1 | (0.48)% | (0.44)% | 3.24% | ||||||

| A Shares (with 2.00% maximum load)1 | (2.45)% | (0.85)% | 3.03% | ||||||

| C Shares1 | (1.22)% | (1.20)% | 2.56% | ||||||

| Investor Shares | (0.53)% | (0.44)% | 3.23% | ||||||

| Institutional Shares | (0.29)% | (0.20)% | 3.50% | ||||||

| S&P 500 Index | 15.94% | 11.12% | 12.81% | ||||||

| HFRX Equity Hedge Index | 3.62% | 3.28% | 3.15% | ||||||

| Lipper Absolute Return Funds Average2 | 4.63% | 2.23% | 2.45% | ||||||

| Expense Ratios | |||

| Gross | |||

| A Shares | 1.72% | ||

| C Shares | 2.62% | ||

| Investor Shares | 1.87% | ||

| Institutional Shares | 1.62% | ||

The performance data quoted represents past performance and does not guarantee future results. The investment return and principal value of an investment will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost. Current performance may be lower or higher than the performance quoted. For performance data current to the most recent month end, please call 1-800-762-7085 or visit www.cavanalhillfunds.com.

Investment performance for the Fund’s classes reflects fee waivers that have been in effect during the applicable periods. Without such waivers, the performance would have been lower. Contractual fee waivers are in effect through December 31, 2023.

The above expense ratios are from the Funds’ prospectus dated December 28, 2022. Additional information pertaining to the Funds’ expense ratios for the year ended August 31, 2023 can be found in the Financial Highlights.

| 1 | Class A Shares and C Shares are subject to a 1.00% Maximum Deferred Sales Charge on shares purchased without an initial sales charge and redeemed within 12 months of purchase. Performance data does not reflect the Maximum Deferred Sales Charge. If reflected, one year performance quoted would be lower. Class C Shares performance reflects the Fund’s no-Load Investor class (“Investor Shares”) for periods prior to December 31, 2014. Unlike Investor Shares, which bear a 12b-1 fee of 0.25%, C Shares bear a 12b-1 fee of 1.00%. This difference is reflected in the performance information. Accordingly, had the C Shares of the Fund been offered for periods prior to December 31, 2014, the performance information would have been different as a result of differing annual operating expenses. |

| 2 | The Lipper Mutual Funds Average is an equally weighted average of the mutual funds within their respective Lipper classification, adjusted for reinvestment of capital gains distributions and income dividends. |

- 15 -

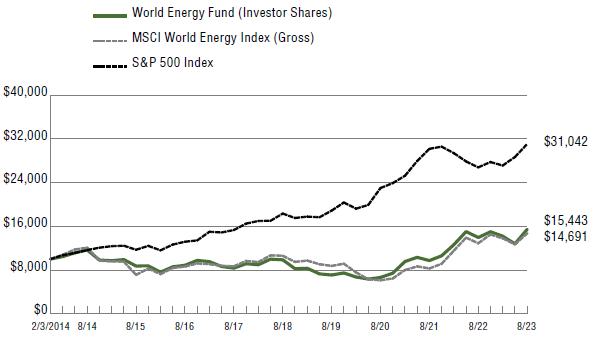

World Energy Fund (Unaudited)

Fund Goal

We seek to provide growth and income by primarily investing net assets in a wide range of energy-related financial instruments issued in the U.S. and markets around the world.

Fund Performance

For the year ended August 31, 2023, the World Energy Fund’s A Shares (at NAV) posted a total return of 10.77%; the C Shares returned 9.93%; the Investor Shares returned 10.72% and the Institutional Shares posted a total return of 11.02%.The Fund’s benchmarks, the S&P 500 Index1 and the MSCI World Energy Index1 returned 15.94% and 13.96%, respectively.

Oil Market Backdrop

Russia’s invasion of Ukraine coupled with the ending of global COVID restrictions created significant volatility in energy markets. Immediately following the February 2022 invasion, investors were concerned with the availability of Russian natural gas and oil exports. Russia is a top-three global oil producer, producing more than 11 million barrels of oil daily. In addition, prior to the invasion, Russia was the primary source of European natural gas.

As a result, in the first half of calendar 2022, oil prices were above $100 for months. However, during the first half of the Fund’s fiscal year, which began in September 2022, as Russian oil continued to reach the market, oil prices traded lower. Brent crude began the year at $96 and traded as low as $70 a barrel in March 2023. After bottoming in March, oil prices rose as China’s recovery led to increased oil demand, resulting in prices at $86 per barrel at fiscal year end.

Natural gas had even more volatility as shortages in Europe caused natural gas prices to spike, particularly for liquefied natural gas. However, global natural gas prices plummeted in response to Europe’s unusually warm winter.

Despite global economic expansion, energy prices ended the year lower in most markets. Brent opened the fiscal year at $96 per barrel and closed the period down about $10. U.S. natural gas prices fell from $9 per mcf in September 2022 to below $2.80/mcf by August 2023.

Fund Strategy

First, we lowered our exposure to alternative energy in favor of fossil fuel-related companies. Where we began the year with positions in wind, solar, and hydrogen, most of our alternative investments are now focused on nuclear power, with limited exposure to wind and solar.*

During the fiscal year, we decreased our substantial overweight to U.S. exploration and production (E&P) companies in favor of international major oil companies and offshore oilfield service stocks. We continue to believe the U.S. E&P companies are focused on returns rather than production growth. As a result, with global demand growing, we believe offshore oil is going to be increasingly necessary to meet global demand. While we reduced our exposure to international major oil companies during the fiscal year, we added materially to our allocation to offshore oil services.*

At year end, we are positioned with a focus on U.S. E&Ps that have substantial international opportunities as well as offshore drilling and service companies.*

Fossil fuel stocks performed well. We had the best returns from our oil field service investments as well as our offshore drilling stocks. We had strong returns from our international major oil companies and solid returns from our investments in refining.*

The Fund’s weakest performance came from our midstream/pipeline assets as rising interest rates dampened valuation for these cash-flow-focused firms. In addition, wind/solar/hydrogen assets performed poorly after those stocks began the year at elevated valuations. As noted above, we reduced our exposure to alternative energy, and replaced some of it with a focus on nuclear power assets, which performed well. Fixed income securities were also a drag on overall performance as rising rates dampened bond prices.*

Outlook