UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED

MANAGEMENT INVESTMENT COMPANIES

Investment Company Act file number 811-06114

Cavanal Hill Funds

(Exact name of registrant as specified in charter)

Citi Fund Services Ohio, Inc., 4400 Easton Commons, Suite 200, Columbus, OH 43219

(Address of principal executive offices) (Zip code)

Cite Fund Services Ohio, Inc., 4400 Easton Commons, Suite 200, Columbus, OH 43219

(Name and address of agent for service)

Registrant’s telephone number, including area code: 1-800-762-7085

Date of fiscal year end: 8/31

Date of reporting period: 8/31/20

Item 1. Reports to Stockholders.

Annual Report

August 31, 2020

U.S. Treasury Fund

Government Securities Money Market Fund

Limited Duration Fund

Moderate Duration Fund

Bond Fund

Strategic Enhanced Yield Fund

Ultra Short Tax-Free Income Fund

Active Core Fund

Mid Cap Core Equity Fund

Opportunistic Fund

World Energy Fund

Beginning on January 1, 2021, as permitted by regulations adopted by the Securities and Exchange Commission, paper copies of the Fund’s annual and semi-annual shareholder reports will no longer be sent by mail, unless you specifically request paper copies of the reports. Instead, the reports will be made available on the Fund’s website (www.cavanalhillfunds.com), and you will be notified by mail each time a report is posted and provided with a website link to access the report.

If you already elected to receive shareholder reports electronically, you will not be affected by this change and you need not take any action. You may elect to receive shareholder reports and other communications from the Fund electronically anytime by contacting your financial intermediary (such as a broker-dealer or bank) or, if you are a direct investor, by calling (800) 762-7085.

Beginning on January 1, 2019, you may elect to receive all future reports in paper free of charge. If you invest through a financial intermediary, you can contact your financial intermediary to request that you continue to receive paper copies of your shareholder reports. If you invest directly with the Fund you can call (800) 762-7085 to let the Fund know you wish to continue receiving paper copies of your shareholder reports. Your election to receive reports in paper will apply to all funds held in your account if you invest through your financial intermediary or all funds held with the fund complex if you invest directly with the Fund.

Table of Contents

Management Discussion of Fund Performance

3

Statements of Assets and Liabilities

22

26

Statements of Changes in Net Assets

30

Schedules of Portfolio Investments

36

71

82

Report of Independent Registered Public Accounting Firm

104

106

A description of the policies and procedures that the Fund uses to determine how to vote proxies relating to the portfolio securities and information during the most recent 12-month period ended June 30 is available without charge, upon request, by calling 1-800-762-7085 or on the Securities and Exchange Commission’s website at http://www.sec.gov.

A complete schedule of each Fund’s portfolio holdings for the first and third fiscal quarter of each fiscal year is filed with the Securities and Exchange Commission on Form N-PORT and is available on the Securities and Exchange Commission’s website at http://www.sec.gov. In addition, the schedules may be reviewed and copied at the Securities and Exchange Commission’s Public Reference Room in Washington D.C. Information on the operation of the Public Reference Room may be obtained by calling 1-800-SEC-0330.

This report is authorized for distribution to prospective investors only when preceded or accompanied by a prospectus or summary prospectus. An investor should consider the Fund’s investment objectives, risks, and charges and expenses carefully before investing or sending money. This and other important information about the investment company can be found in the Fund’s prospectus or summary prospectus. To obtain a prospectus or summary prospectus, please call 1-800-762-7085. Please read the prospectus carefully before investing.

Cavanal Hill Distributors, Inc., member FINRA, serves as the distributor for the Cavanal Hill Funds.

Shares of the Funds are not deposits or obligations of, or guaranteed or endorsed by, BOKF, NA, any of its affiliates or the Distributor. Shares are NOT FDIC INSURED, nor are they insured by any other government agency. An investment in the Funds involves investment risk, including possible loss of principal.

This document may contain “forward-looking statements” within the meaning of the Private Securities Litigation Reform Act of 1995, Section 27A of the Securities Act and Section 21E of the Securities Exchange Act. Forward-looking statements give our current expectations of forecasts of future events. They include statements regarding our anticipated future operating and financial performance. Although we believe the expectations and statements reflected in these and other forward-looking statements are reasonable, we can give no assurance they will prove to have been correct. They can be affected by inaccurate assumptions, by inaccurate information from third parties, or by known or unknown risks and uncertainties.

– 1 –

Glossary of Terms

Bloomberg Barclays 1-Year Municipal Bond Index includes bonds with a minimum credit rating of BAA3, are issued as part of a deal of at least $50 million, have an amount outstanding of at least $5 million, and have maturities of 1 to 2 years.

Bloomberg Barclays Asset-Backed Securities (ABS) Index includes pass-through, bullet, and controlled amortization structures. The ABS Index includes only the senior class of each ABS issue and the ERISA-eligible B and C tranche.

Bloomberg Barclays U.S. Aggregate Bond Index measures the investment-grade, USD-denominated, fixed-rate taxable bond market, including Treasuries, government-related and corporate securities, MBS (agency fixed-rate and hybrid ARM pass-through), ABS, and CMBS.

Bloomberg Barclays U.S. CMBS Investment Grade Index measures the market of U.S. Agency and US Non-Agency conduit and fusion CMBS deals with a minimum current deal size of $300m. The index is divided into two subcomponents: the U.S. Aggregate-eligible component, which contains bonds that are ERISA eligible under the underwriter’s exemption, and the non-US Aggregate-eligible component, which consists of bonds that are not ERISA eligible.

Bloomberg Barclays U.S. Corporate High Yield Bond Index measures the USD-denominated, high-yield, fixed-rate corporate bond market. Securities are classified as high yield if the middle rating of Moody’s, Fitch and S&P is Ba1/BB+/ BB+ or below. Bonds from issuers with an emerging markets (EM) country of risk, based on Barclays EM country definition, are excluded.

Bloomberg Barclays U.S. Corporate Investment-Grade Index covers all publicly issued U.S. corporate, non-corporate and specified foreign debentures and secured notes that meet the specified maturity, liquidity, and quality requirements, to qualify, bonds must be SEC-registered.

Bloomberg Barclays U.S. Intermediate Aggregate Bond Index is representative of investment-grade debt issues with maturities from one year up to (but not including) 10 years.

Bloomberg Barclays U.S. Mortgage-Backed Securities tracks agency mortgage pass-through securities (no longer incorporates hybrid ARM) guaranteed by Ginnie Mae (GNMA), Mae (FNMA), and Freddie Mac (FHLMC). The index is constructed by grouping individual TBA-deliverable MBS pools into aggregates or generics based on program, coupon and vintage.

Bloomberg Barclays U.S. Treasury 20+ Year Index measures U.S. dollar-denominated, fixed-rate, nominal debt issued by the US Treasury with 20+ years to maturity. Treasury bills are excluded by the maturity constraint, but are part of a separate Short Treasury Index.

Bloomberg Barclays U.S. Treasury Index is an index of the public obligations of the U.S. Treasury with a remaining maturity of one year or more are non-convertible and are denominated in U.S. dollars. Securities must be rated investment-grade (Baa3/BBB- or higher) by at least two of the following ratings agencies: Moody’s, S&P, and Fitch. If only two of the three agencies rate the security, the lower rating is used to determine index eligibility. If only one of the three agencies rates a security, the rating must be investment grade.

Gross Domestic Product (GDP) measures the market value of the goods and services produced by labor and property within the respective country/economic region.

Hedge Fund Research, Inc. (HFR) utilizes a UCITSIII compliant methodology to construct the HFRX Hedge Fund Indices. The methodology is based on defined and predetermined rules and objective criteria to select and rebalance components to maximize representation of the Hedge Fund Universe. HFRX Indices utilize state-of-the-art quantitative techniques and analysis; multi-level screening, cluster analysis, Monte-Carlo simulations, and optimization techniques ensure that each Index is a pure representation of its corresponding investment focus.

ICE BofA Merrill Lynch 1-5 Year U.S. Corporate/Government Index is comprised of investment-grade government and corporate debt securities with maturities between one- and five-years.

MSCI World Energy Index captures the large- and mid-cap segments across 23 developed markets and includes securities classified in the energy sector per Global Industry Classification Standard.

Russell 1000® Energy Index is designed to represent the performance of companies within specific sectors of the Russell 1000® Index. Methodology equally weights securities within each sector, mitigating security specific risk and offering balanced exposure to particular sectors.

Russell 2000® Energy Index is designed to represent the performance of companies within specific sectors of the Russell 2000® Index. Methodology equally weights securities within each sector, mitigating security specific risk and offering balanced exposure to particular sectors.

Russell 3000® Energy Index is designed to represent the performance of companies within specific sectors of the Russell 3000® Index. Methodology equally weights securities within each sector, mitigating security specific risk and offering balanced exposure to particular sectors.

Russell 3000® Growth Index is a market capitalization weighted index based on the Russell 3000® Index. The Russell 3000® Growth Index includes companies that display signs of above average growth, exhibit higher price-to-book, and forecasted earnings.

Russell 3000® Value Index is a market capitalization weighted equity index maintained by the Russell Investment Group and based on the Russell 3000® Index, included in the index are stocks from the Russell 3000 with lower price-to-book ratios and lower expected growth rates.

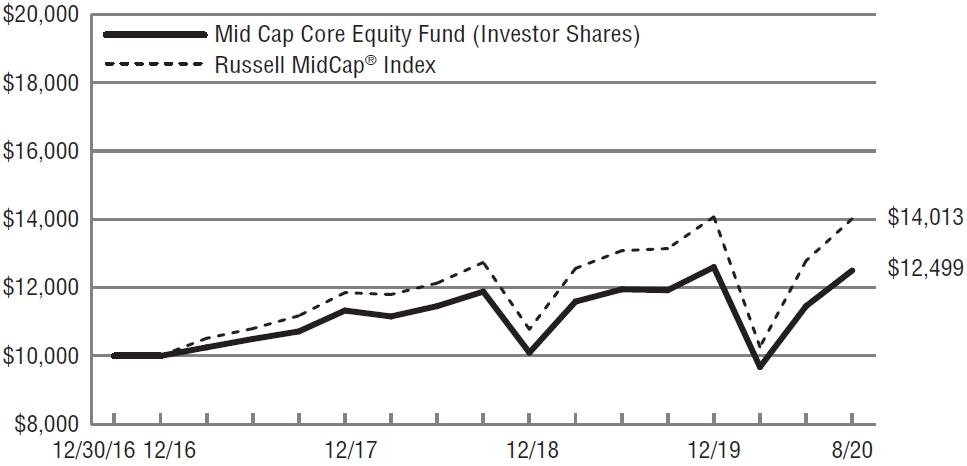

Russell Midcap® Index tracks the performance of the mid-cap segment of the U.S. equity universe. The Russell Midcap® Index is a subset of the Russell 1000® Index. It includes approximately 800 of the smallest securities based on a combination of their market cap and current index membership. The Russell Midcap® Index represents approximately 27% of the total market capitalization of the Russell 1000 companies.

Secured Overnight Financing Rate (SOFR) is a measure of the cost of borrowing cash overnight collateralized by Treasury securities, the benchmark is fully transaction based, founded on a robust underlying market–actual transaction level data is provided by Bank of New York Mellon and an affiliate of the Depository Trust & Clearing Corporation, DTCC Solutions LLC.

Securities Industry and Financial Markets Association (SIFMA) Municipal Swap Index is produced by Municipal Market Data (MMD), which is a 7-day high-grade market index comprised of tax-exempt variable rate demand obligations (VRDO’s) from MMD’s extensive database. SIFMA is a leading securities industry trade group representing securities firms, banks, and asset management companies in the U.S. and Hong Kong.

Standard & Poor 500 Index (S&P 500 Index) is regarded as a gauge of the U.S. equities market; this index includes 500 leading companies in leading industries of the U.S. economy. Although the S&P 500 focuses on the large-cap segment of the market, with approximately 75% coverage of U.S. equities, it is also an ideal proxy for the total market.

The above indices are unmanaged and do not reflect the deduction of the expenses associated with a mutual fund, such as investment management and fund accounting fees. The Fund’s performance reflects the deduction of fees for these services, but does not reflect the deduction of taxes that a shareholder would pay on fund distributions or the redemption of fund shares. Investors cannot invest directly in an index.

Gross Domestic Product (GDP) measures the market value of the goods and services produced by labor and property within the respective country/economic region.

Yield to Worst (YTW) is lowest potential bond yield received without the issuer defaulting, it assumes the worst-case scenario, or earliest redemption possible under terms of the bond.

Organization of Petroleum Exporting Countries (OPEC) is a permanent intergovernmental organization of 14 oil-exporting developing nations that coordinates and unifies the petroleum policies of its Member Countries.

– 2 –

Money Market Funds (Unaudited)

Investment Concerns

You could lose money by investing in the funds. Although each Fund seeks to preserve the value of your investment at $1.00 per share, it cannot guarantee it will do so. An investment in the funds is not insured or guaranteed by the Federal Deposit Insurance Corporation or any other government agency. The sponsor has no legal obligation to provide financial support to the funds, and you should not expect that the sponsor will provide financial support to the funds at any time.

Market Conditions

The fiscal year proved to be a lot more volatile than originally envisioned. The period started last September with a federal funds target rate range of 2.25%-2.50% and ended with 0.25%. The Federal Open Market Committee (FOMC) had already started to cut rates slightly beginning in July 2019 in response to economic weakness and it brought them to near zero in March 2020 because of the economic devastation being wrought by the coronavirus pandemic.

By far, the biggest macroeconomic event of the year was the coronavirus pandemic, which is still affecting the world’s economies and markets. Prime money market funds saw outflows of 18% ($138 billion) in March as financial markets fell sharply, while Government money market funds (including Treasury funds) rose a stunning 29.6% to $3.563 trillion. Drawing on the experiences of the 2008 financial crisis, central bankers and fiscal authorities rolled out a plethora of programs, including a number of Federal Reserve initiatives and Congress’s quick passage of the Coronavirus Aid, Relief, and Economic Security (CARES) Act. These provided the markets with a much-appreciated jolt of adrenaline and confidence.

The major opportunity was buying longer-term securities at higher interest rates, which became more valuable as rates dropped.

The main challenge facing money market investors for most of the year was buffering the effect of ever-lower short-term interest rates. As 2020 progressed, net money market fund yields dropped sharply, reflecting the drastically lower rate environment. By mid-summer, 61% of money market funds were yielding 0.0% to .01%, according to Money Fund Intelligence.

The U.S. Treasury Fund and the Government Securities Money Market Fund

The Funds extended out the interest rate curve at opportune moments during the year. This locked in higher longer-term yields and served to buffer the declines in interest rates.*

Longer-term securities with higher yields provided the most value for the money market funds. These buffered the fall in short-term interest rates and kept fund yields higher for a while longer. In addition, floating-rate notes tended to yield a bit more than overnight repurchase agreements, so we kept fairly substantial positions in these instruments. Some of them were based on the Secured Overnight Financing Rate1 and some were based on the three-month Treasury Bill.*

Repurchase agreements are essential for daily liquidity purposes. However, they immediately reflect downward FOMC interest rate moves.

Outlook

We believe that rates will stay low for an extended period. This is the greatest challenge facing the money markets, one that rivals that of the 2008-2016 period. Unlike that period, one challenge we do not anticipate facing is a new round of money market reforms, particularly as Government and Treasury Funds successfully navigated the market turmoil in March.

Safety, liquidity, and yield remain of primary importance to us as we manage the Money Market Funds during an unprecedented period. We remain ready to: a) purchase longer-term securities when they offer attractive value; b) continue to have substantial positions in floating-rate notes, which typically pay a bit more than repos; and c) keep judicious portions of each fund in daily liquid assets to meet future redemptions.*

| 1 | For additional information, please refer to the Glossary of Terms. |

| * | The composition of the Funds’ portfolio is subject to change. |

The performance data quoted represents past performance and does not guarantee future results. The investment return and principal value of an investment will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost. Current performance may be lower or higher than the performance quoted. For performance data current to the most recent month end, please call 1-800-762-7085 or visit www.cavanalhillfunds.com.

– 3 –

Limited Duration Fund (Unaudited)

Fund Goal

We pursue a strategy of broad diversification in order to benefit from investments in both corporate and government fixed-income securities as well as mortgage-backed securities (MBS) and asset-backed securities (ABS), with the Fund maintaining a dollar-weighted average duration of no longer than 3.5 years.

For the 12-month period ended August 31, 2020, the Limited Duration Fund A Shares (at NAV) returned 3.73%; Investor Shares returned 3.62%, while the Institutional Shares returned 3.87%. The Fund’s benchmark, the ICE BofA Merrill Lynch 1-5 Year U.S. Corporate/Government Index1 posted a total return of 4.66%.

Market Conditions

It has been a strange 12 months, in the financial markets and everywhere else. Behind the backdrop of an historic decline in economic activity, aggressive fiscal and monetary policy measures were the primary drivers of fixed-income market returns.

After strength in risk markets during the fourth quarter of 2019, concerns over the coronavirus pandemic’s potential impact were priced in rapidly in early March 2020. The Federal Reserve Board (the Fed) responded by reducing the federal funds rate by 150 basis points (1.50%) to its current range of 0–0.25% during March. Despite this support, cracks appeared in all areas of the credit markets, and credit spreads rapidly widened.

The Fed once again supported the bond market via large purchases of Treasuries and agency MBS. It also opened new Special Purpose Vehicles (SPV) to support the corporate and municipal markets. The U.S. Treasury pledged to absorb potential losses. This unprecedented action had the desired effect of supporting corporate bond prices. Despite the volatility, corporate bonds fared very well. Fixed-income returns, in general, were strong.

Another critical action was the large fiscal stimulus provided by the U.S. Congress through the Coronavirus Aid, Relief, and Economic Security (CARES) Act. The historic $2.2+ trillion stimulus measure provided direct payments to consumers, along with expanded unemployment benefits and aid to business and state/local governments.

Despite these massive stimulus measures, U.S. gross domestic product (GDP)1 in the second quarter of 2020 fell an annualized 31.7%, on the heels of a -5.0% first-quarter reading. Third-quarter GDP is expected to rebound sharply, with annualized growth estimates above 20%.

Strong returns for the period were available in most fixed-income sectors. Given the large drop in interest rates, long-duration fixed-income assets had significant price appreciation.

Investment-grade corporate credit was also a winner, thanks to the actions of the Fed and U.S. Treasury. Corporate bonds lost a lot of value in March 2020, but recouped those losses and added gains in the second quarter.

The Bloomberg Barclays U.S. Aggregate Bond Index1 returned 6.47% over the 12-month period. The Treasury1 portion of the index fared well, returning 6.98%. Longer-dated Treasuries posted very strong returns, with the 20-plus-year1 portion of the Treasury index up 13.19%.

The index’s corporate1 portion did well, despite significant volatility, returning 7.50%. High-yield corporate credit did not perform as well, with the Bloomberg Barclays U.S. Corporate High Yield Index1 returning just 4.71%. However, Ba-rated bonds1 (the index’s highest rating) were up 8.66%, as investors shunned lower-rated bonds.

All subsectors other than Treasuries and corporate bonds underperformed the overall Aggregate index. The commercial mortgage-backed securities1 (CMBS) portion returned 5.55%. CMBS also suffered large drawdowns in March 2020 and some bonds remained depressed at period-end given the uncertainty in the commercial real estate market.

The index’s asset-backed securities1 portion returned 4.26%, hurt by its short duration. The MBS1 market, also with a relatively short duration, underperformed the index, returning 4.54%.

Fund Strategy

We remained modestly long in the Fund with the largest underweight to corporates during the period. We reduced our exposure to non-agency MBS and reduced our Treasury positions. The Fund added significantly to the callable agency and agency MBS sectors.*

The Fund’s A Shares (at NAV) underperformed its benchmark by 93 basis points (0.93%), driven by the challenges posed by the volatility that occurred in March. The Fund has an underweight to government securities relative to the index and government bonds outperformed significantly during March. While the Fund maintained a high-quality bias, nearly every credit sector underperformed significantly during the month, regardless of quality.*

The Fund’s long duration position was additive, but the large underweight to the corporate sector dragged on performance.*

Outlook

With the Fed likely to leave the target federal funds rate at 0% for a long time, we think it makes sense to move out on the curve in shorter duration strategies.

The Fed’s rescue of the corporate bond market brought credit spreads back into tight levels. This and the decline in Treasury rates pushed investment-grade corporate yields to all-time lows. Despite the low yields, with the Fed directly supporting the investment-grade corporate market, we see little near-term risk in this sector and would look to add any high quality names that offer incremental yield.

With the low level of yields available across all sectors, we plan to maintain a high-quality bias. With the incremental yield pickup from moving down in quality being so low, we see little opportunity cost in holding safer assets. Investment-grade corporates, callable agencies, taxable municipals, and agency MBS all fit the bill.*

There has been a sharp spike in delinquencies in both the commercial and residential mortgage markets, so we see the potential for distressed assets to appear in those sectors. Until we see significant price declines, or until the economic backdrop for these sectors improves, we will remain cautious in the non-government guaranteed portions of these markets.*

| 1 | For additional information, please refer to the Glossary of Terms. |

| * | The composition of the Fund’s portfolio is subject to change. |

The performance data quoted represents past performance and does not guarantee future results. The investment return and principal value of an investment will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost. Current performance may be lower or higher than the performance quoted. For performance data current to the most recent month end, please call 1-800-762-7085 or visit www.cavanalhillfunds.com.

– 4 –

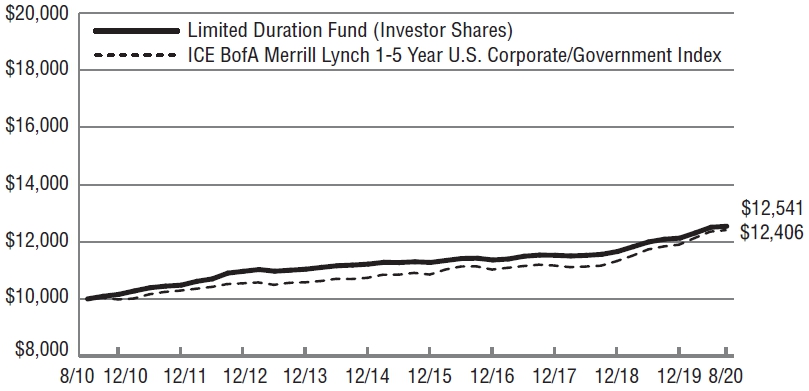

Limited Duration Fund (Unaudited)

Index Description

The performance of the Limited Duration Fund is measured against the ICE BofA Merrill Lynch 1-5 Year U.S. Corporate/Government Index, an unmanaged index that is comprised of investment-grade government and corporate debt securities with maturities between one- and five-years. The index does not reflect the deduction of the expenses associated with a mutual fund, such as investment management and fund accounting fees. The Fund’s performance reflects the deduction of fees for these services, but does not reflect the deduction of taxes that a shareholder would pay on fund distributions or the redemption of fund shares. Investors cannot invest directly in an index.

Investment Risks

Fixed income securities are subject to interest rate risks. The principal value of a bond falls when interest rates rise and rise when interest rates fall. During periods of rising interest rates, the value of a bond investment is at greater risk than during periods of stable or falling rates. Short-term investment-grade bonds offer less risk and generally a lower rate of return than longer-term higher-yielding bonds. Bond funds will tend to experience smaller fluctuations in value than stock funds. However, investors in any bond fund should anticipate fluctuations in price, especially for longer-term issues and in environments of changing interest rates.

For a complete description of these and other risks associated with investing in a mutual fund, please refer to the Funds’ prospectus.

Value of a $10,000 Investment

The growth of $10,000 investment chart represents a hypothetical investment in the indicated share class versus a similar investment in the Fund’s benchmark, and represents the reinvestment of distributions and capital gains.

Average Annual Total Return

| For the periods ended 8/31/20 | 1 Year | 5 Year | 10 Year |

| A Shares (at NAV)1 | 3.73% | 2.20% | 2.33% |

| A Shares (with 2.00% maximum load)1 | 1.61% | 1.78% | 2.12% |

| Investor Shares | 3.62% | 2.15% | 2.29% |

| Institutional Shares | 3.87% | 2.46% | 2.57% |

| ICE BofA Merrill Lynch 1-5 Year U.S. Corporate/Government Index | 4.66% | 2.70% | 2.18% |

| Lipper Short Investment Grade Debt Funds Average2 | 3.03% | 2.28% | 1.91% |

| Expense Ratio | |||

| Gross | |||

| A Shares | 0.84% | ||

| Investor Shares | 0.99% | ||

| Institutional Shares | 0.74% |

The performance data quoted represents past performance and does not guarantee future results. The investment return and principal value of an investment will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost. Current performance may be lower or higher than the performance quoted. For performance data current to the most recent month end, please call 1-800-762-7085 or visit www.cavanalhillfunds.com.

Investment performance for the Fund’s classes reflects fee waivers that have been in effect during the applicable periods. Without such waivers, the performance would have been lower. Contractual fee waivers are in effect through December 31, 2020.

The above expense ratios are from the Funds’ prospectus dated December 26, 2019. Additional information pertaining to the Funds’ expense ratios for the year ended August 31, 2020 can be found in the Financial Highlights.

| 1 | Class A Shares are subject to a 1.00% Maximum Deferred Sales Charge on shares purchased without an initial sales charge and redeemed within 12 months of purchase. Performance data does not reflect the Maximum Deferred Sales Charge. If reflected, one year performance quoted would be lower. This performance reflects the Fund’s no-Load Investor class (“Investor Shares”) for periods prior to May 2, 2011 for the A Shares. The A Shares began presenting performance linked to the Investor Class in September of 2011. Unlike Institutional Shares, Investor Shares and A Shares bear a 12b-1 fee of 0.25%. Investor Shares and Institutional Shares are subject to a Shareholder Servicing Fee of 0.25%, whereas the Shareholder Servicing Fee for A Shares is 0.10%. As indicated in the table, A Shares are also subject to a sales charge (Load). Each of these differences is reflected in the performance information. Accordingly, had the A Shares of the Fund been offered for periods before May 2, 2011, the performance information would have been different as a result of differing annual operating expenses. |

| 2 | The Lipper Mutual Funds Average is an equally weighted average of the mutual funds within their respective Lipper classification, adjusted for reinvestment of capital gains distributions and income dividends. |

– 5 –

Moderate Duration Fund (Unaudited)

Fund Goal

We pursue a strategy of broad diversification in order to benefit from investments in both corporate and government fixed-income securities as well as mortgage-backed securities (MBS) and asset-backed securities (ABS), with the Fund maintaining a dollar-weighted average duration of no longer than 5 years.

For the 12-month period ended August 31, 2020, the Moderate Duration Fund A Shares (at NAV) returned 3.40%; Investor Shares returned 3.40%, while the Institutional Shares returned 3.66%. The Fund’s benchmark, the Bloomberg Barclays U.S. Intermediate Aggregate Bond Index1, showed total return of 5.45%.

Market Conditions

It has been a strange 12 months, in the financial markets and everywhere else. Behind the backdrop of an historic decline in economic activity, aggressive fiscal and monetary policy measures were the primary drivers of fixed-income market returns.

After strength in risk markets during the fourth quarter of 2019, concerns over the coronavirus pandemic’s potential impact were priced in rapidly in early March 2020. The Federal Reserve Board (the Fed) responded by reducing the federal funds rate by 150 basis points (1.50%) to its current range of 0 – 0.25% during March. Despite this support, cracks appeared in all areas of the credit markets, and credit spreads rapidly widened.

The Fed once again supported the bond market via large purchases of Treasuries and agency MBS. It also opened new Special Purpose Vehicles (SPV) to support the corporate and municipal markets. The U.S. Treasury pledged to absorb potential losses. This unprecedented action had the desired effect of supporting corporate bond prices. Despite the volatility, corporate bonds fared very well following the announcement of these SPVs. Fixed-income returns, in general, were strong.

Another critical action was the large fiscal stimulus provided by the U.S. Congress through the Coronavirus Aid, Relief, and Economic Security (CARES) Act. The historic $2.2+ trillion stimulus measure provided direct payments to consumers, along with expanded unemployment benefits and aid to business and state/local governments.

Despite these massive stimulus measures, U.S. gross domestic product (GDP)1 in the second quarter of 2020 fell an annualized 31.7%, on the heels of a -5.0% first-quarter reading. Third-quarter GDP is expected to rebound sharply, with annualized growth estimates above 20%.

Strong returns for the period were available in most fixed-income sectors. Given the large drop in interest rates, long-duration fixed-income assets had significant price appreciation.

Investment-grade corporate credit was also a winner, thanks to the actions of the Fed and U.S. Treasury. Corporate bonds lost a lot of value in March 2020, but recouped those losses and added gains in the second quarter.

The Bloomberg Barclays U.S. Aggregate Bond Index1 returned 6.47% over the 12-month period. The Treasury1 portion of the index fared well, returning 6.98%. Longer-dated Treasuries posted very strong returns, with the 20-plus-year1 portion of the Treasury index up 13.19%.

The index’s corporate1 portion did well, despite significant volatility, returning 7.50%. High-yield corporate credit did not perform as well, with the Bloomberg Barclays U.S. Corporate High Yield Index1 returning just 4.71%. However, Ba-rated bonds1 (the index’s highest rating) were up 8.66%, as investors shunned lower-rated bonds.

All subsectors other than Treasuries and corporate bonds trailed the overall index. The commercial mortgage-backed securities1 (CMBS) portion returned 5.55%. CMBS also suffered large drawdowns in March 2020 and some bonds remained depressed at period-end given the market uncertainty.

The index’s asset-backed securities1 portion returned 4.26%, hurt by its short duration. The MBS1 market, also with a relatively short duration, underperformed the index, returning 4.54%.

Fund Strategy

The Fund remained modestly short versus the benchmark. The Fund added significant exposure to the corporate and taxable municipal sectors. The Fund significantly reduced the exposure to non-agency MBS and reduced the Fund’s Treasury position.*

The Fund’s A Shares (at NAV) underperformed its index by 205 basis points (2.05%). The underperformance was driven by the challenges posed by the volatility that occurred in March 2020. The Fund had underweights to government securities relative to the index and government bonds outperformed significantly during March. While the Fund maintained a high-quality bias, nearly every credit sector underperformed significantly during the month, regardless of quality.*

The short duration position was a headwind, partly offset by the positive effect of the Fund’s overweight to corporate bonds.*

Outlook

With the Fed likely to leave the target federal funds rate at 0% for a long time, we think it makes sense to move out on the curve in shorter duration strategies.

The Fed’s rescue of the corporate bond market brought credit spreads back into fairly tight levels. This and the decline in Treasury rates pushed investment-grade corporate yields to all-time lows. Despite the low yields, with the Fed directly supporting the investment grade corporate market, we see little near-term risk in this sector and would look to add any high quality names that offer incremental yield.

With the low level of yields available across all sectors, we plan to maintain a high-quality bias. With the incremental yield pickup from moving down in quality being so low, we see little opportunity cost in holding safer assets. Investment-grade corporates, callable agencies, taxable municipals, and agency MBS all fit the bill.*

There has been a sharp spike in delinquencies in both the commercial and residential mortgage markets, so we see the potential for more distressed assets in those sectors. Until we see significant price declines, or until the economic backdrop improves, we will remain cautious in the non-government guaranteed portions of these markets.*

| 1 | For additional information, please refer to the Glossary of Terms. |

| * | The composition of the Fund’s portfolio is subject to change. |

The performance data quoted represents past performance and does not guarantee future results. The investment return and principal value of an investment will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost. Current performance may be lower or higher than the performance quoted. For performance data current to the most recent month end, please call 1-800-762-7085 or visit www.cavanalhillfunds.com.

– 6 –

Moderate Duration Fund (Unaudited)

Index Description

The performance of the Moderate Duration Fund is measured against the Bloomberg Barclays U.S. Intermediate Aggregate Bond Index, an unmanaged index that is representative of investment-grade debt issues with maturities from one year up to (but not including) 10 years. The index does not reflect the deduction of the expenses associated with a mutual fund, such as investment management and fund accounting fees. The Fund’s performance reflects the deduction of fees for these services, but does not reflect the deduction of taxes that a shareholder would pay on fund distributions or the redemption of fund shares. Investors cannot invest directly in an index.

Investment Risks

Fixed income securities are subject to interest rate risks. The principal value of a bond falls when interest rates rise and rise when interest rates fall. During periods of rising interest rates, the value of a bond investment is at greater risk than during periods of stable or falling rates. Intermediate-term investment-grade bonds offer less risk and generally a lower rate of return than longer-term higher-yielding bonds. Bond funds will tend to experience smaller fluctuations in value than stock funds. However, investors in any bond fund should anticipate fluctuations in price, especially for longer-term issues and in environments of changing interest rates.

For a complete description of these and other risks associated with investing in a mutual fund, please refer to the Fund’s prospectus.

Value of a $10,000 Investment

The growth of $10,000 investment chart represents a hypothetical investment in the indicated share class versus a similar investment in the Fund’s benchmark, and represents the reinvestment of distributions and capital gains.

Average Annual Total Return

| For the periods ended 8/31/20 | 1 Year | 5 Year | 10 Year |

| A Shares (at NAV)1 | 3.40% | 2.37% | 3.56% |

| A Shares (with 2.00% maximum load)1 | 1.31% | 1.97% | 3.35% |

| Investor Shares | 3.40% | 2.33% | 3.52% |

| Institutional Shares | 3.66% | 2.61% | 3.80% |

| Bloomberg Barclays U.S. Intermediate Aggregate Bond Index | 5.45% | 3.41% | 3.00% |

| Lipper Short-Intermediate Investment Grade Debt Funds Average2 | 4.62% | 2.70% | 2.44% |

| Expense Ratio | |||

| Gross | |||

| A Shares | 1.11% | ||

| Investor Shares | 1.26% | ||

| Institutional Shares | 1.01% |

The performance data quoted represents past performance and does not guarantee future results. The investment return and principal value of an investment will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost. Current performance may be lower or higher than the performance quoted. For performance data current to the most recent month end, please call 1-800-762-7085 or visit www.cavanalhillfunds.com.

Investment performance for the Fund’s classes reflects fee waivers that have been in effect during the applicable periods. Without such waivers, the performance would have been lower. Contractual fee waivers are in effect through December 31, 2020.

The above expense ratios are from the Funds’ prospectus dated December 26, 2019. Additional information pertaining to the Funds’ expense ratios for the year ended August 31, 2020 can be found in the Financial Highlights.

| 1 | Class A Shares are subject to a 1.00% Maximum Deferred Sales Charge on shares purchased without an initial sales charge and redeemed within 12 months of purchase. Performance data does not reflect the Maximum Deferred Sales Charge. If reflected, one year performance quoted would be lower. This performance reflects the Fund’s no-Load Investor class (“Investor Shares”) for periods prior May 2, 2011 for the A Shares. The A Shares began presenting performance linked to the Investor Class in September of 2011. Unlike Institutional Shares, Investor Shares and A Shares bear a 12b-1 fee of 0.25%. Investor Shares and Institutional Shares are subject to a Shareholder Servicing Fee of 0.25%, whereas the Shareholder Servicing Fee for A Shares is 0.10%. As indicated in the table, A Shares are also subject to a sales charge (Load). Each of these differences is reflected in the performance information. Accordingly, had the A Shares of the Fund been offered for periods before May 2, 2011, the performance information would have been different as a result of differing annual operating expenses. |

| 2 | The Lipper Mutual Funds Average is an equally weighted average of the mutual funds within their respective Lipper classification, adjusted for reinvestment of capital gains distributions and income dividends. |

– 7 –

Bond Fund (Unaudited)

Fund Goal

We pursue a strategy of broad diversification in order to benefit from investments in both corporate and government fixed-income securities as well as mortgage-backed securities (MBS) and asset-backed securities (ABS), with the Fund maintaining a dollar-weighted average maturity of three years or more, and generally no longer than 10 years.

For the 12-month period ended August 31, 2020, the Bond Fund A Shares (at NAV) returned 5.07%; the Investor Shares returned 5.07%; and the Institutional Shares returned 5.34%. The Fund’s benchmark, the Bloomberg Barclays U.S. Aggregate Bond Index1, showed a total return of 6.47%.

Market Conditions

It has been a strange 12 months, in the financial markets and everywhere else. Behind the backdrop of an historic decline in economic activity, aggressive fiscal and monetary policy measures were the primary drivers of fixed-income market returns.

After strength in risk markets during the fourth quarter of 2019, concerns over the coronavirus pandemic’s potential impact were priced in rapidly in early March 2020. The Federal Reserve Board (the Fed) responded by reducing the federal funds rate by 150 basis points (1.50%) to its current range of 0 – 0.25% during March. Despite this support, cracks appeared in all areas of the credit markets, and credit spreads rapidly widened.

The Fed once again supported the bond market via large purchases of Treasuries and agency MBS. It also opened new Special Purpose Vehicles (SPV) to support the corporate and municipal markets. The U.S. Treasury pledged to absorb potential losses. This unprecedented action had the desired effect of supporting corporate bond prices. Despite the volatility, corporate bonds fared very well following the announcement of these SPVs. Fixed-income returns, in general, were strong.

Another critical action was the large fiscal stimulus provided by the U.S. Congress through the Coronavirus Aid, Relief, and Economic Security (CARES) Act. The historic $2.2+ trillion stimulus measure provided direct payments to consumers, along with expanded unemployment benefits and aid to business and state/local governments.

Despite these massive stimulus measures, U.S. gross domestic product (GDP)1 in the second quarter of 2020 fell an annualized 31.7%, on the heels of a -5.0% first-quarter reading. Third-quarter GDP is expected to rebound sharply, with annualized growth estimates above 20%.

Strong returns for the period were available in most fixed-income sectors. Given the large drop in interest rates, long-duration fixed-income assets had significant price appreciation.

Investment-grade corporate credit was also a winner, thanks to the actions of the Fed and U.S. Treasury. Corporate bonds lost a lot of value in March 2020, but recouped those losses and added gains in the second quarter.

Treasuries posted very strong returns, with the 20-plus-year1 portion of the Treasury index up 13.19%.

The index’s corporate1 portion did well, despite significant volatility, returning 7.50%. High-yield corporate credit did not perform as well, with the Bloomberg Barclays U.S. Corporate High Yield Index1 returning just 4.71%. However, Ba-rated bonds1 (the index’s highest rating) were up 8.66%, as investors shunned lower-rated bonds.

All subsectors other than Treasuries and corporate bonds underperformed the overall Aggregate index. The commercial mortgage-backed securities1 (CMBS) portion returned 5.55%. CMBS also suffered large drawdowns in March 2020 and some bonds remained depressed at period-end given the uncertainty in the commercial real estate market.

The index’s asset-backed securities1 portion returned 4.26%, hurt by its short duration. The MBS1 market, also with a relatively short duration, underperformed the index, returning 4.54%.

Fund Strategy

The Fund remained modestly short duration versus its benchmark. We added significant exposure to both the corporate sector and taxable municipal sector. We significantly reduced our exposure to non-agency MBS in the Fund, and reduced our Treasury position as well.*

The Fund underperformed its index by 140 basis points (1.40%) for the period. The underperformance was driven by the challenges posed by the volatility that occurred in March 2020. The Fund has underweights to government securities relative to the index and government bonds outperformed significantly during March. While the Fund maintained a high-quality bias, nearly every credit sector underperformed significantly during the month, regardless of quality.*

The short duration position was a headwind, partly offset by the positive effect of the Fund’s overweight to the corporate sector.*

Outlook

With the Fed likely to leave the target federal funds rate at 0% for a long time, we think it makes sense to move out on the curve in shorter duration strategies.

The Fed’s rescue of the corporate bond market brought credit spreads back into fairly tight levels. This and the decline in Treasury rates pushed investment-grade corporate yields to all-time lows. Despite the low yields, with the Fed directly supporting the investment grade corporate market, we see little near-term risk in this sector and would look to add any high quality names that offer incremental yield.*

With the low level of yields available across all sectors, we plan to maintain a high-quality bias. With the incremental yield pickup from moving down in quality being so low, we see little opportunity cost in holding safer assets. Investment-grade corporates, callable agencies, taxable municipals, and agency MBS all fit the bill.*

There has been a sharp spike in delinquencies in both the commercial and residential mortgage markets, so we see the potential for distressed assets to appear in those sectors. Until we see significant price declines, or until the economic backdrop for these sectors improves, we will remain cautious in the non-government guaranteed portions of these markets.*

| 1 | For additional information, please refer to the Glossary of Terms. |

| * | The composition of the Fund’s portfolio is subject to change. |

The performance data quoted represents past performance and does not guarantee future results. The investment return and principal value of an investment will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost. Current performance may be lower or higher than the performance quoted. For performance data current to the most recent month end, please call 1-800-762-7085 or visit www.cavanalhillfunds.com.

– 8 –

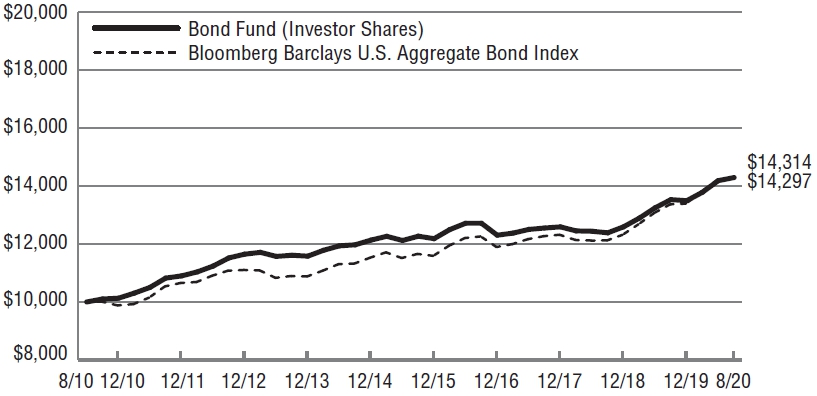

Bond Fund (Unaudited)

Index Description

The performance of the Bond Fund is measured against the Bloomberg Barclays U.S. Aggregate Bond Index, an unmanaged index that is a market value-weighted performance benchmark for investment-grade fixed-rate debt issues, including government, corporate, asset-backed and mortgage-backed securities, with maturities of at least one year. The index does not reflect the deduction of the expenses associated with a mutual fund, such as investment management and fund accounting fees. The Fund’s performance reflects the deduction of fees for these value-added services, but does not reflect the deduction of taxes that a shareholder would pay on fund distributions or the redemption of fund shares. Investors cannot invest directly in an index.

Investment Risks

Fixed income securities are subject to interest rate risks. The principal value of a bond falls when interest rates rise and rise when interest rates fall. During periods of rising interest rates, the value of a bond investment is at greater risk than during periods of stable or falling rates. Bond funds will tend to experience smaller fluctuations in value than stock funds. However, investors in any bond fund should anticipate fluctuations in price, especially for longer-term issues and in environments of changing interest rates.

For a complete description of these and other risks associated with investing in a mutual fund, please refer to the Fund’s prospectus.

Value of a $10,000 Investment

The growth of $10,000 investment chart represents a hypothetical investment in the indicated share class versus a similar investment in the Fund’s benchmark, and represents the reinvestment of distributions and capital gains.

Average Annual Total Return

| For the periods ended 8/31/20 | 1 Year | 5 Year | 10 Year |

| A Shares (at NAV)1 | 5.07% | 3.21% | 3.66% |

| A Shares (with 2.00% maximum load)1 | 2.97% | 2.81% | 3.46% |

| Investor Shares | 5.07% | 3.22% | 3.64% |

| Institutional Shares | 5.34% | 3.45% | 3.89% |

| Bloomberg Barclays U.S. Aggregate Bond Index | 6.47% | 4.33% | 3.65% |

| Lipper Core Bond Funds Average2 | 6.42% | 4.23% | 3.69% |

| Expense Ratio | |||

| Gross | |||

| A Shares | 0.84% | ||

| Investor Shares | 0.99% | ||

| Institutional Shares | 0.74% |

The performance data quoted represents past performance and does not guarantee future results. The investment return and principal value of an investment will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost. Current performance may be lower or higher than the performance quoted. For performance data current to the most recent month end, please call 1-800-762-7085 or visit www.cavanalhillfunds.com.

Investment performance for the Fund’s classes reflects fee waivers that have been in effect during the applicable periods. Without such waivers, the performance would have been lower. Contractual fee waivers are in effect through December 31, 2020.

The above expense ratios are from the Funds’ prospectus dated December 26, 2019. Additional information pertaining to the Funds’ expense ratios for the year ended August 31, 2020 can be found in the Financial Highlights.

| 1 | Class A Shares are subject to a 1.00% Maximum Deferred Sales Charge on shares purchased without an initial sales charge and redeemed within 12 months of purchase. Performance data does not reflect the Maximum Deferred Sales Charge. If reflected, one year performance quoted would be lower. This performance reflects the Fund’s no-Load Investor class (“Investor Shares”) for periods prior to May 2, 2011 for the A Shares. The A Shares began presenting performance linked to the Investor Class in September of 2011. Unlike Institutional Shares, Investor Shares and A Shares bear a 12b-1 fee of 0.25%. Investor Shares and Institutional Shares are subject to a Shareholder Servicing Fee of 0.25%, whereas the Shareholder Servicing Fee for A Shares is 0.10%. As indicated in the table, A Shares are also subject to a sales charge (Load). Each of these differences is reflected in the performance information. Accordingly, had the A Shares of the Fund been offered for periods before May 2, 2011, the performance information would have been different as a result of differing annual operating expenses. |

| 2 | The Lipper Mutual Funds Average is an equally weighted average of the mutual funds within their respective Lipper classification, adjusted for reinvestment of capital gains distributions and income dividends. |

– 9 –

Strategic Enhanced Yield Fund (Unaudited)

Fund Goal

The Fund is designed to be an opportunistic, multi-sector fixed income investment. The investment team attempts to shift allocations into areas that we believe provide the best risk/reward profiles. The Fund typically has a meaningful allocation to mortgage-backed securities and other securitized products, and the Fund has the freedom to invest in a broad range of credit ratings and durations.

For the 12-month period ended August 31, 2020, the Strategic Enhanced Yield Fund A Shares (at NAV) returned 4.41% the Investor Shares returned 4.47% and the Institutional Shares returned 4.66% The Fund’s benchmark, the Bloomberg Barclays U.S. Aggregate Bond Index1, showed a total return of 6.47%.

Market Conditions

It was a very strange 12 months, in the financial markets and everywhere else. Behind the backdrop of an historic decline in economic activity, aggressive fiscal and monetary policy measures were the primary drivers of fixed-income returns.

After strength in risk markets during the fourth quarter of 2019, concerns over the coronavirus pandemic’s potential impact were priced in rapidly in early March 2020. The The Federal Reserve Board (the Fed) responded by reducing the federal funds rate by 150 basis points (1.50%) to its current range of 0 – 0.25% during March. Despite this support, cracks appeared in all areas of the credit markets, and credit spreads rapidly widened.

The Fed once again supported the bond market via large purchases of Treasuries and agency MBS. It also opened new Special Purpose Vehicles (SPV) to support the corporate and municipal markets. The U.S. Treasury pledged to absorb potential losses. This unprecedented action had the desired effect of supporting corporate bond prices. Despite the volatility, corporate bonds fared well over the past 12 months. Fixed-income returns, in general, were strong.

Another critical action was the large fiscal stimulus provided by the U.S. Congress through the Coronavirus Aid, Relief, and Economic Security (CARES) Act. The historic $2.2+ trillion stimulus measure provided direct payments to consumers, along with expanded unemployment benefits and aid to business and state/local governments.

Despite these massive stimulus measures, U.S. gross domestic product (GDP)1 in the second quarter of 2020 fell an annualized 31.7%, on the heels of a -5.0% first-quarter reading. Third-quarter GDP is expected to rebound sharply, with annualized growth estimates above 20%.

Given the large drop in interest rates, long-duration fixed-income assets had significant price appreciation.

Investment-grade corporate credit was also a winner, thanks to the actions of the Fed and U.S. Treasury. Corporate bonds lost a lot of value in March 2020, but recouped those losses and added gains in the second quarter.

The Bloomberg Barclays U.S. Aggregate Bond Index1 returned 6.47% over the 12-month period. The Treasury1 portion of the index fared well, returning 6.98%. Longer-dated Treasuries posted very strong returns, with the 20-plus-year1 portion of the Treasury index up 13.19%.

The index’s corporate1 portion did well, despite significant volatility, returning 7.50%. High-yield corporate credit did not perform as well, with the Bloomberg Barclays U.S. Corporate High Yield Index1 returning just 4.71%. However, Ba-rated bonds1 (the index’s highest rating) were up 8.66%, as investors shunned lower-rated bonds.

All subsectors other than Treasuries and corporate bonds underperformed the overall Aggregate index. The commercial mortgage-backed securities1 (CMBS) portion returned 5.55%. CMBS also suffered large drawdowns in March 2020 and some bonds remained depressed at period-end given the uncertainty in the commercial real estate market.

The index’s asset-backed securities1 portion returned 4.26%, hurt by its short duration. The MBS1 market, also with a relatively short duration, underperformed the index, returning 4.54%.

Fund Strategy

The Fund’s duration was in line with to slightly longer than that of the benchmark index. It remained heavily underweighted to the corporate sector. The Fund began the period with a large position in the non-agency residential mortgage-backed securities sector, but reduced that dramatically early in the second quarter of 2020. The Fund added a large position in callable agencies over the past six months.*

The Fund underperformed its index by 206 basis points (2.06%) this year because of its large underweight to the corporate sector. The modest long duration position was a tailwind as rates fell, but it was not enough to make up for the corporate underweight.*

Because all sectors besides Treasuries and corporate bonds underperformed the index, any allocation outside of those two sectors made it difficult to keep up with the index, which has large weightings to both sectors.

Outlook

With the Fed likely to leave the target federal funds rate at 0% for a long time, we like having a longer duration bias. A move back down in yields on the long end of the curve would provide some decent capital appreciation.

The Fed’s rescue of the corporate bond market brought credit spreads back into fairly tight levels. This compression of spreads combined with the decline in Treasury rates pushed investment-grade corporate yields to all-time lows (the yield to worst1 on the corporate portion of the benchmark was 1.95% on August 31, 2020).

High-yield corporates still offer some yield potential. However, given the high level of uncertainty about future economic growth, it’s difficult to get too bullish on the sector.

Given the lack of market opportunities, we will maintain our high quality bias. We are positioned long in Treasuries, callable agencies, and MBS with plenty of credit enhancement. Absent any significant market distress, we are unlikely to deviate much from this allocation.*

| 1 | For additional information, please refer to the Glossary of Terms. |

| * | The composition of the Fund’s portfolio is subject to change. |

The performance data quoted represents past performance and does not guarantee future results. The investment return and principal value of an investment will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost. Current performance may be lower or higher than the performance quoted. For performance data current to the most recent month end, please call 1-800-762-7085 or visit www.cavanalhillfunds.com.

– 10 –

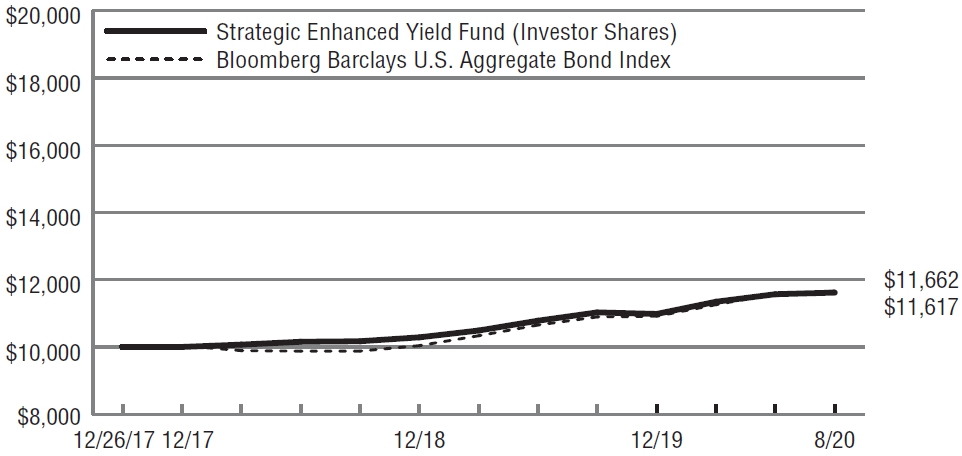

Strategic Enhanced Yield Fund (Unaudited)

Index Description

The performance of the Strategic Enhanced Yield Fund is measured against the Bloomberg Barclays U.S. Aggregate Bond Index, an unmanaged index that is a market value-weighted performance benchmark for investment-grade fixed-rate debt issues, including government, corporate, asset-backed and mortgage-backed securities, with maturities of at least one year. The index does not reflect the deduction of the expenses associated with a mutual fund, such as investment management and fund accounting fees. The Fund’s performance reflects the deduction of fees for these value-added services, but does not reflect the deduction of taxes that a shareholder would pay on fund distributions or the redemption of fund shares. Investors cannot invest directly in an index.

Investment Risks

Fixed income securities are subject to interest rate risks. The principal value of a bond falls when interest rates rise and rise when interest rates fall. During periods of rising interest rates, the value of a bond investment is at greater risk than during periods of stable or falling rates. Short-term investment-grade bonds offer less risk and generally a lower rate of return than longer-term higher-yielding bonds. Bond funds will tend to experience smaller fluctuations in value than stock funds. However, investors in any bond fund should anticipate fluctuations in price, especially for longer-term issues and in environments of changing interest rates. High-yield bonds have a higher risk of default or other adverse credit events, but have the potential to pay higher earnings over investment-grade bonds. The higher risk of default, or the inability of the creditor to repay its debt, is the primary reason for the higher interest rates on high-yield bonds.

For a complete description of these and other risks associated with investing in a mutual fund, please refer to the Fund’s prospectus.

Value of a $10,000 Investment

The growth of $10,000 investment chart represents a hypothetical investment in the indicated share class versus a similar investment in the Fund’s benchmark, and represents the reinvestment of distributions and capital gains.

Average Annual Total Return

| Since | ||

| Inception | ||

| For the periods ended 8/31/20 | 1 Year | (12/26/17) |

| A Shares (at NAV)1 | 4.41% | 5.59% |

| A Shares (with 2.00% maximum load)1 | 2.27% | 4.81% |

| Investor Shares | 4.47% | 5.75% |

| Institutional Shares | 4.66% | 5.85% |

| Bloomberg Barclays U.S. Aggregate Bond Index | 6.47% | 5.90% |

| Lipper Multi-Sector Income Funds Average2 | 3.23% | 3.65% |

| Expense Ratio | ||

| Gross | ||

| A Shares | 4.03% | |

| Investor Shares | 3.17% | |

| Institutional Shares | 3.24% |

The performance data quoted represents past performance and does not guarantee future results. The investment return and principal value of an investment will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost. Current performance may be lower or higher than the performance quoted. For performance data current to the most recent month end, please call 1-800-762-7085 or visit www.cavanalhillfunds.com.

Investment performance for the Fund’s classes reflects fee waivers that have been in effect during the applicable periods. Without such waivers, the performance would have been lower. Contractual fee waivers are in effect through December 31, 2020.

The above expense ratios are from the Funds’ prospectus dated December 26, 2019. Additional information pertaining to the Funds’ expense ratios for the year ended August 31, 2020 can be found in the Financial Highlights.

| 1 | Class A Shares are subject to a 1.00% Maximum Deferred Sales Charge on shares purchased without an initial sales charge and redeemed within 12 months of purchase. Performance data does not reflect the Maximum Deferred Sales Charge. If reflected, one year performance quoted would be lower. |

| 2 | The Lipper Mutual Funds Average is an equally weighted average of the mutual funds within their respective Lipper classification, adjusted for reinvestment of capital gains distributions and income dividends. Since inception value calculated from December 31, 2017. |

– 11 –

Ultra Short Tax-Free Fund (Unaudited)

Fund Goal

The goal of the Fund is to generate current income that is exempt from federal income taxes by investing primarily in a diversified portfolio of municipal securities. To pursue its objective, this Fund invests in securities exempt from federal taxes and consists of a mix of Variable Rate Demand Notes (VRDN), which provide daily or weekly liquidity, as well as fixed rate paper; the Fund will have a weighted average maturity of one year or less.

For the 12-month period ended August 31, 2020, the Ultra Short Tax-Free Fund A Shares (at NAV) returned 0.64%; the Investor Shares returned 0.64% and the Institutional Shares returned 0.89%. The Fund’s benchmark, the Bloomberg Barclays 1-Year Municipal Bond Index1, showed a total return of 1.95%.

Market Conditions

It was the tale of two halves for the fiscal period. The first half featured steady growth, low unemployment, benign inflation, and a resilient consumer. The second half was marked by the spread of the coronavirus pandemic, which nearly brought the global economy to a complete halt in the spring. Evidence of the shutdown can be seen in the U.S. unemployment rate rising from 3.5% at the end of February to 14.7% in April, before ending the period at 8.4%. The gross domestic product (GDP)1 reading was even more dramatic as 2019 ended at 2.4% growth for the fourth quarter, followed by a 5.0% contraction in the first quarter of 2020 and a historic 31.7% contraction in the second quarter. While the situation improved in the summer months, it’s evident that things won’t get back to normal until a long-awaited vaccine is available.

Like all financial markets, the short end of the municipal market was relatively calm in the first half of the period, but was marked by extreme volatility in the spring. Historic outflows from muni bond funds led to massive selling and resulted in sharp spikes in yields.

The SIFMA index1, which is an average of yields on variable rate demand notes (VRDNs), rose from 1.28% to 5.20% in one week in March. The fixed-rate market saw a similar move upward as yields in the 1-year maturity range moved about 150 basis points (1.50%) higher in just a few trading days. The volatility was short-lived, however, and yields on both VRDNs and fixed-rate maturities fell to multi-year lows by the end of the period.

The key opportunity came in March during the aforementioned spike in yields. Investors were able to lock in fixed-rate muni bonds at rates not seen since the financial crisis. Yields on VRDNs also rose to their highest level since September 2008.

The main challenges came as rates quickly declined after the spike in the spring, ultimately returning to levels not seen since 2016 by the end of the period.

Fund Strategy

The Fund took advantage of the buying opportunity in the spring by locking in fixed-rate bonds at extremely attractive levels. That resulted in very strong performance for a few months, but the situation changed as those bonds matured in a declining-rate environment, leading the Fund to underperform overall for the entire period.*

Outlook

The Fed has reiterated its intention to keep the overnight lending rate near zero in the foreseeable future, so we believe that the short end of the muni market will likely follow that lead. The challenge for investors in the market will be in finding yield in a low-rate environment without taking on unnecessary credit risk, as state and local municipalities could face potential revenue declines due to the economic downturn.

In anticipation of continued low rates on VRDNs, the Fund will look to extend duration by taking advantage of buying opportunities in the fixed-rate market. As always, market participants will be paying close attention to the supply/demand dynamic.

While it’s likely that issuers will take advantage of the low rate environment, yields on munis could rise relative to taxable alternatives if demand wanes due to muni fund outflows.*

The 2020 election could also affect the muni market: A Biden victory would likely result in higher taxes at some point, which would make munis more attractive. A Trump victory would likely maintain the muni market’s status quo.

One final potential market mover could come from the credit perspective as it remains to be seen how long and deep the pandemic’s impact on state and local government revenues will be felt.*

| 1 | For additional information, please refer to the Glossary of Terms. |

| * | The composition of the Fund’s portfolio is subject to change. |

The performance data quoted represents past performance and does not guarantee future results. The investment return and principal value of an investment will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost. Current performance may be lower or higher than the performance quoted. For performance data current to the most recent month end, please call 1-800-762-7085 or visit www.cavanalhillfunds.com.

– 12 –

Ultra Short Tax-Free Fund (Unaudited)

Index Description

The performance of the Ultra Short Tax-Free Fund is measured against the Bloomberg Barclays 1-Year Municipal Bond Index, an unmanaged index that includes bonds with a minimum credit rating of BAA3, are issued as part of a deal of at least $50 million, have an amount outstanding of at least $5 million, and have maturities of 1 to 2 years. The index does not reflect the deduction of the expenses associated with a mutual fund, such as investment management and fund accounting fees. The Fund’s performance reflects the deduction of fees for these value-added services, but does not reflect the deduction of taxes that a shareholder would pay on fund distributions or the redemption of fund shares. Investors cannot invest directly in an index.

Investment Risks

Fixed income securities are subject to interest rate risks. The principal value of a bond falls when interest rates rise and rise when interest rates fall. During periods of rising interest rates, the value of a bond investment is at greater risk than during periods of stable or falling rates. Short-term investment-grade bonds offer less risk and generally a lower rate of return than longer-term higher yielding bonds. Bond funds will tend to experience smaller fluctuations in value than stock funds. However, investors in any bond fund should anticipate fluctuations in price, especially for longer-term issues and in environments of changing interest rates. The Fund’s income may be subject to certain state and local taxes and, depending on one’s tax status, to the federal alternative minimum tax.

For a complete description of these and other risks associated with investing in a mutual fund, please refer to the Fund’s prospectus.

Value of a $10,000 Investment

The growth of $10,000 investment chart represents a hypothetical investment in the indicated share class versus a similar investment in the Fund’s benchmark, and represents the reinvestment of distributions and capital gains.

Average Annual Total Return

| Since | ||

| Inception | ||

| For the periods ended 8/31/20 | 1 Year | (12/26/17) |

| A Shares (at NAV)1 | 0.64% | 0.41% |

| A Shares (with 1.00% maximum load)1 | -0.35% | 0.04% |

| Investor Shares | 0.64% | 0.80% |

| Institutional Shares | 0.89% | 1.14% |

| Bloomberg Barclays 1-Year Municipal Bond Index | 1.95% | 2.13% |

| Lipper Short Municipal Debt Funds Average2 | 1.56% | 1.99% |

| Expense Ratio | ||

| Gross | ||

| A Shares | 1.44% | |

| Investor Shares | 1.59% | |

| Institutional Shares | 1.34% |

The performance data quoted represents past performance and does not guarantee future results. The investment return and principal value of an investment will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost. Current performance may be lower or higher than the performance quoted. For performance data current to the most recent month end, please call 1-800-762-7085 or visit www.cavanalhillfunds.com.

Investment performance for the Fund’s classes reflects fee waivers that have been in effect during the applicable periods. Without such waivers, the performance would have been lower. Contractual fee waivers are in effect through December 31, 2020.

The above expense ratios are from the Funds’ prospectus dated December 26, 2019. Additional information pertaining to the Funds’ expense ratios for the year ended August 31, 2020 can be found in the Financial Highlights.

| 1 | Class A Shares are subject to a 1.00% Maximum Deferred Sales Charge on shares purchased without an initial sales charge and redeemed within 12 months of purchase. Performance data does not reflect the Maximum Deferred Sales Charge. If reflected, one year performance quoted would be lower. |

| 2 | The Lipper Mutual Funds Average is an equally weighted average of the mutual funds within their respective Lipper classification, adjusted for reinvestment of capital gains distributions and income dividends. Since inception value calculated from December 31, 2017. |

– 13 –

Active Core Fund (Unaudited)

Fund Goal

We seek to construct a balanced portfolio of equities and bonds that is broadly diversified to attempt to control risk. Our diversification strategy is multi-dimensional across stock and bond asset classes, growth and value styles, and small capitalization and large capitalization stocks.

For the 12-month period ended August 31, 2020, the Active Core Fund A Shares (at NAV) posted a total return of 11.26%; the C Shares returned 10.42%; the Investor Shares returned 11.29%, and the Institutional Shares returned 11.54%. The Fund’s benchmarks, the Russell 1000® Index1 and the Bloomberg Barclays U.S. Aggregate Bond Index1, returned 22.50% and 6.47%, respectively.

Market Conditions

U.S. gross domestic product (GDP)1 growth was above 2% in the latter half of 2019. However, the arrival of the coronavirus and government efforts to slow the virus’s spread had a dramatic impact in 2020. GDP growth turned negative at -5.0% in the first quarter but the real slowdown occurred in the second quarter at an annualized -31.7%.

When the pandemic’s impact was felt in early March, the government response was massive and swift, with substantial assistance from the Federal Reserve Board (the Fed) and Congress. Equity markets quickly reversed course as investors recognized the government’s firm commitment to keeping the economy afloat. As well, as the months progressed, optimism around easing lock-down measures and the potential for improved treatments and vaccines helped to move markets even higher. By August, many equity indices had fully recovered and reached new highs.

Over the past 12 months, U.S. equity markets fared better than developed and emerging market equities. The U.S. technology sector helped growth stocks to significantly outperform value. The initial phase of the virus shutdown caused investors to prefer large- and mega-cap stocks with greater balance sheet stability. Against the backdrop of an almost unwavering interest in mega-cap technology stocks, the defining shift over the past year was the extreme preference for lower-risk, more defensive stocks in the coronavirus-driven market downturn and then the sudden shift to buying more volatile, cyclical ones in the ensuing stimulus-inspired market run-up.

A persistent exposure to technology was a major driver of performance. Apart from that, it was beneficial to be positioned in high quality, defensive stocks pre-pandemic and then in beaten-down, higher-risk cyclical stocks as the market rebounded. Value stocks and small caps lagged as energy faced structural headwinds and a secular threat to demand and oil prices, from reduced economic activity. Lower interest rates and the potential for increased defaults from business failures weighed on the financial sector. The market’s extreme volatility also presented a challenge, particularly for lower turnover strategies.

Most fixed-income sectors had strong returns for the period. Given the large drop in interest rates, long-duration fixed-income assets had significant price appreciation.

Investment-grade corporate credit was also a winner, thanks to the actions of the Fed and U.S. Treasury. Corporate bonds lost a lot of value in March 2020, but recouped those losses and added gains in the second quarter.

Fund Strategy

We maintained a diversified portfolio, with approximately 52.8% of the Fund’s portfolio in equities at the end of the 12-month period, compared with 45.9% at the end of August 2019. Fixed-income securities represented approximately 38.2% of the portfolio, compared with 44.2% at the end of August 2019. The rest of the Fund was in cash and mutual funds.*

Within the equity portfolio, we continued to invest in a variety of domestic U.S. and international stocks, including developed and emerging market stocks, which generally posted strong performance for the period. Within the U.S. market, large-cap stocks outperformed mid-cap and small-cap stocks, and growth stocks continued to outperform value stocks. The Russell 3000® Growth Index rose 42.59% versus the Russell 3000® Value Index’s return of 0.39%. We maintained broad style exposure, investing in large- and mid-cap stocks within the core value and growth styles. We also held a modest allocation to non-U.S. stocks.*

Within fixed income, we maintained a higher quality bias versus the benchmark with modestly short duration. We added exposure to the corporate and taxable municipal sectors while reducing our exposure to non-agency mortgage-backed securities1 and reduced the Fund’s Treasury position. While the Fund maintained a high-quality bias, nearly every credit sector underperformed significantly during the volatile month of March, regardless of quality. The short duration position was a headwind, partly offset by the positive effect of the Fund’s overweight to corporate bonds.*

Outlook

The U.S. and global economies have started to recover from the coronavirus shutdown but there is a long way to go. While a vaccine could receive FDA approval before year-end, there remains uncertainty over public acceptance and the speed of distribution. Businesses will also be challenged to adapt to the new environment. However, as they modify their operations, we expect businesses will face significant opportunities. The greatest source of near-term uncertainty is the U.S. elections in November. While it appears that the market is well supported and that the economy has room to grow, we expect to see more volatility in the coming months.

With the Fed likely to leave the target federal funds rate at 0% for a long time, we think it makes sense to move out on the curve in shorter duration fixed income strategies. Despite the unusually low yields, with the Fed directly supporting the investment-grade corporate market, we see little near-term risk in this sector and would look to add any high quality names that offer incremental yield. And with low yields across all sectors, we plan to maintain a high-quality bias, seeing little reason not to hold safer assets, such as investment-grade corporates, callable agencies, taxable municipals, and agency MBS.*

| 1 | For additional information, please refer to the Glossary of Terms. |

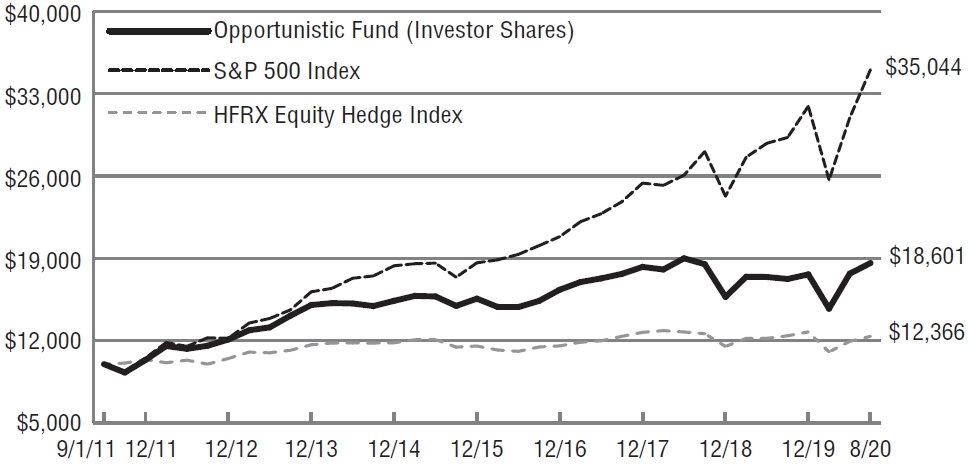

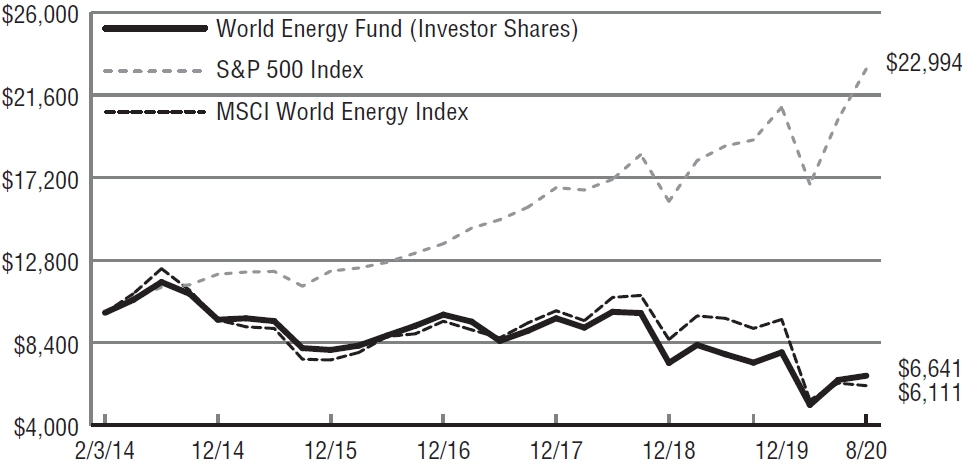

| * | The composition of the Fund’s portfolio is subject to change. |