UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED

MANAGEMENT INVESTMENT COMPANIES

| Investment Company Act file number | 811-06114 | |

| (Exact name of registrant as specified in charter) | |

| Citi Fund Services Ohio, Inc., 4400 Easton Commons, Suite 200, Columbus, OH 43219 | |

| (Address of principal executive offices) (Zip code) | |

| Citi Fund Services Ohio, Inc., 4400 Easton Commons, Suite 200, Columbus, OH 43219 | |

| (Name and address of agent for service) | |

Registrant’s telephone number, including area code: 1-800-762-7085

Date of fiscal year end: 8/31

Date of reporting period: 8/31/18

Item 1. Reports to Stockholders.

Annual Report

August 31, 2018

U.S. Treasury Fund

Government Securities Money Market Fund

Limited Duration Fund

Moderate Duration Fund

Bond Fund

Strategic Enhanced Yield Fund

Ultra Short Tax-Free Income Fund

Active Core Fund

Mid Cap Core Equity Fund

Opportunistic Fund

World Energy Fund

This page intentionally left blank.

Table of Contents

A description of the policies and procedures that the Fund uses to determine how to vote proxies relating to the portfolio securities and information during the most recent 12-month period ended June 30 is available without charge, upon request, by calling 1-800-762-7085 or on the Securities and Exchange Commission’s website at http://www.sec.gov.

A complete schedule of each Fund’s portfolio holdings for the first and third fiscal quarter of each fiscal year is filed with the Securities and Exchange Commission on Form N-Q and is available on the Securities and Exchange Commission’s website at http://www.sec.gov. In addition, the schedules may be reviewed and copied at the Securities and Exchange Commission’s Public Reference Room in Washington D.C. Information on the operation of the Public Reference Room may be obtained by calling 1-800-SEC-0330.

This report is authorized for distribution to prospective investors only when preceded or accompanied by a prospectus or summary prospectus. An investor should consider the Fund’s investment objectives, risks, and charges and expenses carefully before investing or sending money. This and other important information about the investment company can be found in the Fund’s prospectus or summary prospectus. To obtain a prospectus or summary prospectus, please call 1-800-762-7085. Please read the prospectus carefully before investing.

Cavanal Hill Distributors, Inc., member FINRA, serves as the distributor for the Cavanal Hill Funds.

Shares of the Funds are not deposits or obligations of, or guaranteed or endorsed by, BOKF, any of its affiliates or the Distributor. Shares are NOT FDIC INSURED, nor are they insured by any other government agency. An investment in the Funds involves investment risk, including possible loss of principal.

This document may contain “forward-looking statements” within the meaning of the Private Securities Litigation Reform Act of 1995, Section 27A of the Securities Act and Section 21E of the Securities Exchange Act. Forward-looking statements give our current expectations of forecasts of future events. They include statements regarding our anticipated future operating and financial performance. Although we believe the expectations and statements reflected in these and other forward-looking statements are reasonable, we can give no assurance they will prove to have been correct. They can be affected by inaccurate assumptions, by inaccurate information from third parties, or by known or unknown risks and uncertainties.

Cavanal Hill Money Market Funds (Unaudited)

Investment Risks

You could lose money by investing in the Funds. Although the Funds seeks to preserve the value of your investment at $1.00 per share, it cannot guarantee it will do so. The Funds may impose a fee upon sale of your shares or may temporarily suspend your ability to sell shares if the Funds’ liquidity falls below required minimums because of market conditions or other factors. An investment in the Funds is not insured or guaranteed by the Federal Deposit Insurance Corporation or any other government agency. The Funds’ sponsor has no legal obligation to provide financial support to the Funds, and you should not expect that the sponsor will provide financial support to the Funds at any time.

Market Conditions

Strong economic growth in the second quarter of 2018 brought trailing 12-month gross domestic product1 growth up to 2.9%, the strongest level since the second quarter of 2015. Year-over-year core Personal Consumption Expenditure Price Index1, the Federal Reserve Board’s (the Fed) preferred inflation gauge, also rose to 2.0% in the second quarter, its highest post-crisis reading and matching the Fed’s inflation mandate. This relatively strong economic growth combined with the increase in inflation caused yields to rise across the board.

The strong growth and inflation figures gave the Fed the green light to continue its rate hike cycle. Accordingly, the Federal Open Market Committee raised the fed funds rate three times in the 12-month period, by 25 basis (0.25%) points each time, bringing the rate to 1.75% - 2.00% by period-end. The Fed’s hiking cycle led to a strong flattening trend in the yield curve.

The Cavanal Hill U.S. Treasury Fund and the Cavanal Hill Government Securities Money Market Fund

The primary theme informing our money market strategy was that we remain in a rising interest rate environment thanks largely to the benign economic backdrop.

Accordingly, we kept maturities in our money market funds relatively short so as to quickly take advantage of interest rate increases as they occurred. In addition, the London Interbank Offered Rate (LIBOR)1 and Treasury bill floating rate securities helped us capture higher rates as they occurred. We extended maturities slightly in a few select Treasury bonds and bills to potentially capture higher yields and to act as a bit of a hedge in case rate increases slowed down.*

One of the greatest challenges facing our market was the fact that Treasury bill and agency discount note rates were very close at times. In fact, Treasury bill yields tended to outperform discount note yields for portions of the year.

The LIBOR benchmark remains a standard benchmark for many floating rate instruments, but it is being phased out over the next few years. Ultimately, it will be replaced by the new Secured Overnight Financing Rate1.

Outlook

Maintaining high-credit-quality and liquidity remain the primary objectives of our money market funds. Investors will likely continue to focus on the Fed and its ongoing efforts to normalize short-term interest rates. We continue to expect additional increases in rates into 2019. Against this backdrop, we will continue to position our portfolios to reflect our view of the upcoming yield environment. We believe our current maturity positioning provides us the flexibility to act quickly when additional rate hikes become imminent, adjusting each Fund’s weighted average maturity as necessary.*

| 1 | Gross Domestic Product (GDP) measures the market value of the goods and services produced by labor and property within the respective country/ economic region. Personal Consumption Expenditure Price Index (PCE) measures the prices paid by consumers for goods and services without the volatility caused by movements in food and energy prices to reveal underlying inflation trends. London Interbank Offered Rate (LIBOR) is a daily reference rate based on the interest rates at which banks borrow unsecured funds from other banks in the London wholesale money market. Secured Overnight Financing Rate is a measure of the cost of borrowing cash overnight collateralized by Treasury securities, the benchmark is fully transaction-based, founded on a robust underlying market–actual transaction level data is provided by Bank of New York Mellon (BNYM) and an affiliate of the Depository Trust & Clearing Corporation, DTCC Solutions LLC. |

| * | The composition of the Fund’s portfolio is subject to change. |

The performance data quoted represents past performance and does not guarantee future results. The investment return and principal value of an investment will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost. Current performance may be lower or higher than the performance quoted. For performance data current to the most recent month end, please call 1-800-762-7085 or visit www.cavanalhillfunds.com.

The Cavanal Hill Limited Duration Fund (Unaudited)

Fund Goal

We pursue a strategy of broad diversification in order to benefit from investments in both corporate and government fixed-income securities as well as mortgage-backed securities (MBS) and asset-backed securities (ABS), with the Fund maintaining a dollar-weighted average duration of no longer than 3.5 years.

For the 12-month period ended August 31, 2018, the Limited Duration Fund A Shares (at NAV) returned 0.13%; Investor Shares returned 0.07%, while the Institutional Shares returned 0.37%. The Fund’s benchmark, the ICE BofA Merrill Lynch 1-5 Year U.S. Corporate/Government Index posted a total return of -0.38%.

The Fund maintained a high-quality portfolio during the year. Exposure to relatively short duration and higher-credit-quality securities benefited performance relative to the Fund’s benchmark during the 12-month period.*

Market Conditions

Strong growth in the second quarter of 2018 brought trailing 12-month gross domestic product1 growth up to 2.9%, the strongest level since the second quarter of 2015. Year-over-year core Personal Consumption Expenditure Index1, the Federal Reserve Board’s (the Fed) preferred inflation gauge, also rose to 2.0% in the second quarter, its highest post-crisis reading and matching the Fed’s inflation mandate. This relatively strong economic growth combined with the increase in inflation caused yields to rise across the board.

The strong growth and inflation figures gave the Fed the green light to continue its rate hike cycle. Accordingly, the Federal Open Market Committee raised the fed funds rate three times in the 12-month period, by 25 basis points (0.25%) each time, bringing the rate to 1.75% - 2.00% by period-end.

The Fed’s hiking cycle led to a strong flattening trend in the yield curve. For the 12-month period ended August 31, 2018, the 2-year Treasury yield rose 128 basis points (1.28%), the 5-year Treasury yield rose 100 basis points (1.00%), 10-year Treasury yields advanced 69 basis points (0.69%), and the 30-year Treasury yield increased 24 basis points (0.24%). The 2-year to 10-year yield spread declined 59 basis points (0.59%) over the year while the 5-year to 30-year spread fell 75 basis points (0.75%) for the period. Both levels are near the lowest yield spreads seen since 2007.

The U.S. dollar was volatile during the year, but its strength in 2018 year to date began to expose cracks in many emerging markets. The Fed’s continued hawkish stance versus other major central banks and the relatively strong performance of the U.S. economy make it difficult to imagine any significant weakness in the U.S. dollar, which opens the door to continued emerging markets weakness.

Strong economic growth, rising inflation, and an aggressive central bank led to weak fixed income returns for the period. The Bloomberg Barclays U.S. Aggregate Bond Index1 returned -1.05% for the 12-month period ended August 31, 2018, the Bloomberg Barclay Intermediate Aggregate Index1 fell 84 basis points (0.84%) for the period, and the ICE BofA Merrill Lynch 1-5 Year U.S. Corporate/ Government Index was down 38 basis points (0.38%).

Fund Strategy

We continued to focus on higher-quality, relatively liquid securities, including Treasury and other government-related securities and agency mortgage-backed securities.*

We maintained modestly short duration versus our benchmark along with a higher-quality bias as we continued to underweight Baa-rated securities. We also remained significantly underweighted in the corporate sector. Maintaining shorter duration and higher quality and being underweight to corporate securities all added to relative performance over the past year as rates rose and corporate bonds underperformed all other sectors except for Treasuries.*

The Fund’s A Shares (at NAV) outperformed its index by 51 basis points (0.51%) for the period. The strong performance was driven largely by the Fund’s shorter duration position and its underweight to the corporate sector. The Fund’s large allocation to the securitized sector (agency and non-agency ABS/ MBS) in the portfolio was beneficial as that sector outperformed the index significantly for the period.*

The largest detractor from absolute performance was the Fund’s allocation to corporate bonds and Treasuries, as both sectors performed poorly during the year. But because we were significantly underweight corporate bonds and modestly underweight duration, we were not hurt by these allocations as much as the indexes.*

As of August 31, 2018, 23.5% of the Fund was invested in U.S. Treasury securities, 43.1% in mortgage securities, 15.8% in corporates, and 11.1% in asset-backed securities. The Fund’s average duration was 2.51 years.*

Outlook

We believe that the shape of the yield curve provides important economic information. The flattening trend has been in place for a year and is classic late-cycle behavior. Late in the economic cycle, it is appropriate to maintain a high-quality bias and sufficient liquidity to take advantage of potential opportunities in lower-rated credit securities.

The Fed has shown little concern with the yield curve and its intention to raise rates twice more this year must be taken at face value. We believe yields in the U.S. are very attractive compared with other developed economies. With the Fed intimating two more hikes this year, in our opinion, the U.S. dollar should be well supported. We believe the strong U.S. dollar combined with weakness in commodities this year should reduce inflationary pressures and provide a strong tailwind to U.S. fixed income assets overall.

Because we believe that we are late in this economic cycle, we plan to maintain a higher-quality bias along with significant liquidity. Yield spreads on corporate bonds have widened, reflecting heightened concerns about credit risk, and we have reduced the size of our underweight, adding names that fit within our higher-quality bias while allowing us to pick up some extra yield. With the market fully pricing in a September 2018 rate hike plus a better than 50/50 chance of a December 2018 hike, we believe market expectations for Fed policy are appropriate. Accordingly, we have reduced our underweight in the two- to five-year maturity bucket.*

| 1 | Gross Domestic Product (GDP) measures the market value of the goods and services produced by labor and property within the respective country/ economic region. Personal Consumption Expenditure Price Index (PCE) measures the prices paid by consumers for goods and services without the volatility caused by movements in food and energy prices to reveal underlying inflation trends. The Bloomberg Barclays U.S. Aggregate Bond Index is a broad-based benchmark that measures the investment grade, U.S. dollar-denominated, fixed-rate taxable bond market, including Treasuries, government-related and corporate securities. MBS (agency fixed-rate and hybrid ARM passthroughs), ABS, and CMBS. The Bloomberg Barclays U.S. Intermediate Aggregate Bond Index represents securities in the intermediate maturity range from one year up to (but not including) 10 years. The securities in the index are SEC registered, taxable, and dollar denominated. The index covers the U.S. investment-grade fixed bond market, with index components for government and corporate securities, mortgage pass-through securities, and asset-backed securities. These major sectors are subdivided into more specific indexes that are calculated and reported on a regular basis. These indexes are unmanaged and do not reflect the fees and expenses associated with a mutual fund. An investor cannot invest directly in an index. |

| * | The composition of the Fund’s portfolio is subject to change. |

The performance data quoted represents past performance and does not guarantee future results. The investment return and principal value of an investment will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost. Current performance may be lower or higher than the performance quoted. For performance data current to the most recent month end, please call 1-800-762-7085 or visit www.cavanalhillfunds.com.

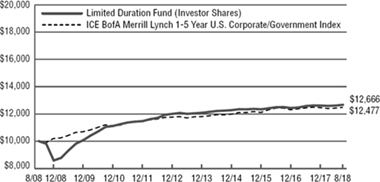

The Cavanal Hill Limited Duration Fund (Unaudited)

Index Description

The performance of the Limited Duration Fund is measured against the ICE BofA Merrill Lynch 1-5 Year U.S. Corporate/Government Index, an unmanaged index that is comprised of investment-grade government and corporate debt securities with maturities between one- and five-years. The index does not reflect the deduction of the expenses associated with a mutual fund, such as investment management and fund accounting fees. The Fund’s performance reflects the deduction of fees for these services, but does not reflect the deduction of taxes that a shareholder would pay on fund distributions or the redemption of fund shares. Investors cannot invest directly in an index.

Investment Risks

Fixed income securities are subject to interest rate risks. The principal value of a bond falls when interest rates rise and rise when interest rates fall. During periods of rising interest rates, the value of a bond investment is at greater risk than during periods of stable or falling rates. Short-term investment-grade bonds offer less risk and generally a lower rate of return than longer-term higher yielding bonds. Bond funds will tend to experience smaller fluctuations in value than stock funds. However, investors in any bond fund should anticipate fluctuations in price, especially for longer-term issues and in environments of changing interest rates.

For a complete description of these and other risks associated with investing in a mutual fund, please refer to the Fund’s prospectus.

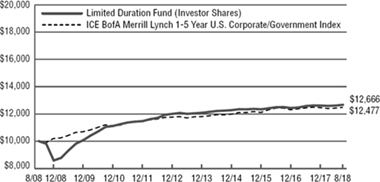

Value of a $10,000 Investment

The growth of $10,000 investment chart represents a hypothetical investment in the indicated share class versus a similar investment in the Fund’s benchmark, and represents the reinvestment of distributions and capital gains.

| Average Annual Total Return | | | |

| For the periods ended 8/31/18 | 1 Year | 5 Year | 10 Year |

| A Shares (at NAV)1 | 0.13% | 1.14% | 2.42% |

| A Shares (with 2.00% maximum load)1 | -1.91% | 0.74% | 2.21% |

| Investor Shares | 0.07% | 1.10% | 2.39% |

| Institutional Shares | 0.37% | 1.37% | 2.66% |

| ICE BofA Merrill Lynch 1-5 Year U.S. Corporate/Government Index | -0.38% | 1.27% | 2.24% |

| Lipper Short Investment Grade Debt Funds Average2 | 0.62% | 1.23% | 2.14% |

| | | | |

| Expense Ratio | | | |

| | | | Gross |

| A Shares | | | 0.78% |

| Investor Shares | | | 0.93% |

| Institutional Shares | | | 0.68% |

The performance data quoted represents past performance and does not guarantee future results. The investment return and principal value of an investment will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost. Current performance may be lower or higher than the performance quoted. For performance data current to the most recent month end, please call 1-800-762-7085 or visit www.cavanalhillfunds.com.

Investment performance for the Fund’s classes reflects fee waivers that have been in effect during the applicable periods. Without such waivers, the performance would have been lower. Contractual fee waivers are in effect through December 31, 2018.

The above expense ratios are from the Funds’ prospectus dated December 26, 2017. Additional information pertaining to the Funds’ expense ratios for the year ended August 31, 2018 can be found in the Financial Highlights.

| 1 | Class A Shares are subject to a 1.00% Maximum Deferred Sales Charge on shares purchased without an initial sales charge and redeemed within 12 months of purchase. Performance data does not reflect the Maximum Deferred Sales Charge. If reflected, performance quoted would be lower. This performance reflects the Fund’s no-Load Investor class (“Investor Shares”) for periods prior May 2, 2011 for the A Shares. The A Shares began presenting performance linked to the Investor Class in September of 2011. Unlike Institutional Shares, Investor Shares and A Shares bear a 12b-1 fee of 0.25%. Investor Shares and Institutional Shares are subject to a Shareholder Servicing Fee of 0.25%, whereas the Shareholder Servicing Fee for A Shares is 0.10%. As indicated in the table, A Shares are also subject to a sales charge (Load). Each of these differences is reflected in the performance information. Accordingly, had the A Shares of the Fund been offered for periods before May 2, 2011, the performance information would have been different as a result of differing annual operating expenses. |

| 2 | The Lipper Mutual Funds Average is an equally weighted average of the mutual funds within their respective Lipper classification, adjusted for reinvestment of capital gains distributions and income dividends. |

The Cavanal Hill Moderate Duration Fund (Unaudited)

Fund Goal

We pursue a strategy of broad diversification in order to benefit from investments in both corporate and government fixed-income securities as well as mortgage-backed securities (MBS) and asset-backed securities (ABS), with the Fund maintaining a dollar-weighted average duration of no longer than 5 years.

For the 12-month period ended August 31, 2018, the Moderate Duration Fund A Shares (at NAV) returned -0.03%; Investor Shares returned -0.07%, while the Institutional Shares returned 0.22%. The Fund’s benchmark, the Bloomberg Barclays U.S. Intermediate Aggregate Bond Index, showed total return of -0.84%.

The Fund maintained a high-quality portfolio during the year. Exposure to relatively short duration and higher-quality securities benefited performance relative to the Fund’s benchmark during the period.*

Market Conditions

Strong growth in the second quarter of 2018 brought trailing 12-month gross domestic product1 growth up to 2.9%, the strongest level since the second quarter of 2015. Year-over-year core Personal Consumption Expenditure Index1, the Federal Reserve Board’s (the Fed) preferred inflation gauge, also rose to 2.0% in the second quarter, its highest post-crisis reading and matching the Fed’s inflation mandate. This relatively strong economic growth combined with the increase in inflation caused yields to rise across the board.

The strong growth and inflation figures gave the Fed the green light to continue its rate hike cycle. Accordingly, the Federal Open Market Committee raised the fed funds rate three times in the period, by 25 basis points (0.25%) each time, bringing the rate to 1.75% - 2.00% by the 12-month period-end.

The Fed’s hiking cycle led to a strong flattening trend in the yield curve. For the 12-month period ended August 31, 2018, the 2-year Treasury yield rose 128 basis points (1.28%), the 5-year Treasury yield rose 100 basis points (1.00%), 10-year Treasury yields advanced 69 basis points (0.69%), and the 30-year Treasury yield increased 24 basis points (0.24%). The 2-year to 10-year yield spread declined 59 basis points (0.59%) over the year while the 5-year to 30-year spread fell 75 basis points (0.75%) for the period. Both levels are near the lowest yield spreads seen since 2007.

The U.S. dollar was volatile during the year, but its strength in 2018 year to date began to expose cracks in many emerging markets. The Fed’s continued hawkish stance versus other major central banks and the relatively strong performance of the U.S. economy make it difficult to imagine any significant weakness in the U.S. dollar, which opens the door to continued emerging markets weakness.

Strong economic growth, rising inflation, and an aggressive central bank led to weak fixed income returns for the period. The Bloomberg Barclays U.S. Aggregate Bond Index1 returned -1.05% for the 12-month period ended August 31, 2018, the Intermediate Aggregate Index fell 84 basis points (0.84%) for the period, and the ICE BofA Merrill Lynch 1-5 Year Government/Corporate Index1 was down 38 basis points (0.38%).

Fund Strategy

We continued to focus on higher-quality, relatively liquid securities, including Treasury and other government-related securities and agency mortgage-backed securities. We maintained modestly short duration versus our benchmark along with a higher-quality bias as we continued to underweight Baa-rated securities. We also remained significantly underweighted in the corporate sector. Maintaining shorter duration and higher quality and being underweight to corporate securities all added to relative performance over the past year as rates rose and corporate bonds underperformed all other sectors except for Treasuries.*

The Fund’s A Shares (at NAV) outperformed its index by 81 basis points (0.81%) for the period. The strong performance was driven largely by the Fund’s shorter duration position and its underweight to the corporate sector. Our allocation to taxable municipals as a corporate bond proxy in the Fund continued to work well as this sector did not see the spread widening that occurred in corporates during the period.*

The largest detractor from absolute performance was the Fund’s allocation to corporate bonds and Treasuries, as both sectors performed poorly during the year. But because we were significantly underweight corporate bonds and modestly underweight duration, we were not hurt by these allocations as much as the indexes were.*

As of August 31, 2018, 24.8% of the Fund was invested in U.S. Treasury securities, 28.5% in mortgage securities, 8% in agency securities, 20.5% in corporates, 10.2% in taxable municipal bonds, and 4.2% in asset-backed securities. The Fund’s average duration was 3.37 years.*

Outlook

We believe that the shape of the yield curve provides important economic information. The flattening trend has been in place for a year and is classic late-cycle behavior. Late in the economic cycle, it is appropriate to maintain a high-quality bias and sufficient liquidity to take advantage of potential opportunities in lower-rated credit securities.

The Fed has shown little concern with the yield curve and its intention to raise rates twice more this year must be taken at face value. We believe yields in the U.S. are very attractive compared with other developed economies. With the Fed intimating two more hikes this year, the U.S. dollar should be well supported. We believe the strong U.S. dollar combined with weakness in commodities this year should reduce inflationary pressures and provide a strong tailwind to U.S. fixed income assets overall.

Because we believe that we are late in this economic cycle, we plan to maintain a higher-quality bias along with significant liquidity. Yield spreads on corporate bonds have widened, reflecting heightened concerns about credit risk, and we have reduced the size of our underweight, adding names that fit within our higher-quality bias while allowing us to pick up some extra yield. With the market fully pricing in a September 2018 rate hike plus a better than 50/50 chance of a December 2018 hike, we believe market expectations for Fed policy are appropriate. Accordingly, we have reduced our underweight in the two- to five-year maturity bucket.*

| 1 | Gross Domestic Product (GDP) measures the market value of the goods and services produced by labor and property within the respective country/ economic region. Personal Consumption Expenditure Price Index (PCE) measures the prices paid by consumers for goods and services without the volatility caused by movements in food and energy prices to reveal underlying inflation trends. The Bloomberg Barclays U.S. Aggregate Bond Index is a broad-based benchmark that measures the investment grade, U.S. dollar-denominated, fixed-rate taxable bond market, including Treasuries, government-related and corporate securities. MBS (agency fixed-rate and hybrid ARM passthroughs), ABS, and CMBS. The BofA Merrill Lynch 1-5 Year U.S. Corporate/ Government Bond Index measures the performance of investment-grade government and corporate debt securities with maturities between one- and five-years. These indexes are unmanaged and do not reflect the fees and expenses associated with a mutual fund. An investor cannot invest directly in an index. |

| * | The composition of the Fund’s portfolio is subject to change. |

The performance data quoted represents past performance and does not guarantee future results. The investment return and principal value of an investment will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost. Current performance may be lower or higher than the performance quoted. For performance data current to the most recent month end, please call 1-800-762-7085 or visit www.cavanalhillfunds.com.

The Cavanal Hill Moderate Duration Fund (Unaudited)

Index Description

The performance of the Moderate Duration Fund is measured against the Bloomberg Barclays U.S. Intermediate Aggregate Bond Index, an unmanaged index that is representative of investment-grade debt issues with maturities from one year up to (but not including) 10 years. The index does not reflect the deduction of the expenses associated with a mutual fund, such as investment management and fund accounting fees. The Fund’s performance reflects the deduction of fees for these services, but does not reflect the deduction of taxes that a shareholder would pay on fund distributions or the redemption of fund shares. Investors cannot invest directly in an index.

Investment Risks

Fixed income securities are subject to interest rate risks. The principal value of a bond falls when interest rates rise and rise when interest rates fall. During periods of rising interest rates, the value of a bond investment is at greater risk than during periods of stable or falling rates. Intermediate-term investment-grade bonds offer less risk and generally a lower rate of return than longer-term higher yielding bonds. Bond funds will tend to experience smaller fluctuations in value than stock funds. However, investors in any bond fund should anticipate fluctuations in price, especially for longer-term issues and in environments of changing interest rates.

For a complete description of these and other risks associated with investing in a mutual fund, please refer to the Fund’s prospectus.

Value of a $10,000 Investment

The growth of $10,000 investment chart represents a hypothetical investment in the indicated share class versus a similar investment in the Fund’s benchmark, and represents the reinvestment of distributions and capital gains.

| Average Annual Total Return | | | |

| For the periods ended 8/31/18 | 1 Year | 5 Year | 10 Year |

| A Shares (at NAV)1 | -0.03% | 1.67% | 3.83% |

| A Shares (with 2.00% maximum load)1 | -2.00% | 1.25% | 3.62% |

| Investor Shares | -0.07% | 1.63% | 3.80% |

| Institutional Shares | 0.22% | 1.90% | 4.07% |

| Bloomberg Barclays U.S. Intermediate Aggregate Bond Index | -0.84% | 2.00% | 3.26% |

| Lipper Short-Intermediate Investment Grade Debt Funds Average2 | -0.23% | 1.41% | 2.90% |

| | | | |

| Expense Ratio | | | |

| | | | Gross |

| A Shares | | | 0.95% |

| Investor Shares | | | 1.10% |

| Institutional Shares | | | 0.85% |

The performance data quoted represents past performance and does not guarantee future results. The investment return and principal value of an investment will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost. Current performance may be lower or higher than the performance quoted. For performance data current to the most recent month end, please call 1-800-762-7085 or visit www.cavanalhillfunds.com.

Investment performance for the Fund’s classes reflects fee waivers that have been in effect during the applicable periods. Without such waivers, the performance would have been lower. Contractual fee waivers are in effect through December 31, 2018.

The above expense ratios are from the Funds’ prospectus dated December 26, 2017. Additional information pertaining to the Funds’ expense ratios for the year ended August 31, 2018 can be found in the Financial Highlights.

| 1 | Class A Shares are subject to a 1.00% Maximum Deferred Sales Charge on shares purchased without an initial sales charge and redeemed within 12 months of purchase. Performance data does not reflect the Maximum Deferred Sales Charge. If reflected, performance quoted would be lower. This performance reflects the Fund’s no-Load Investor class (“Investor Shares”) for periods prior May 2, 2011 for the A Shares. The A Shares began presenting performance linked to the Investor Class in September of 2011. Unlike Institutional Shares, Investor Shares and A Shares bear a 12b-1 fee of 0.25%. Investor Shares and Institutional Shares are subject to a Shareholder Servicing Fee of 0.25%, whereas the Shareholder Servicing Fee for A Shares is 0.10%. As indicated in the table, A Shares are also subject to a sales charge (Load). Each of these differences is reflected in the performance information. Accordingly, had the A Shares of the Fund been offered for periods before May 2, 2011, the performance information would have been different as a result of differing annual operating expenses. |

| 2 | The Lipper Mutual Funds Average is an equally weighted average of the mutual funds within their respective Lipper classification, adjusted for reinvestment of capital gains distributions and income dividends. |

The Cavanal Hill Bond Fund (Unaudited)

Fund Goal

We pursue a strategy of broad diversification in order to benefit from investments in both corporate and government fixed-income securities as well as mortgage-backed securities (MBS) and asset-backed securities (ABS), with the fund maintaining a dollar-weighted average maturity of three years or more, and generally no longer than 10 years.

For the 12-month period ended August 31, 2018, the Bond Fund A Shares (at NAV) returned -1.32%; the Investor Shares returned -1.33%; and the Institutional Shares returned -0.97%. The Fund’s benchmark, the Bloomberg Barclays U.S. Aggregate Bond Index, showed a total return of -1.05%.

The Fund’s A Shares (at NAV) underperformed its index by 27 basis points (0.27%) for the period. The largest detractor from absolute performance was the Fund’s allocation to corporate bonds and Treasuries, as both sectors performed poorly during the year.*

Market Conditions

Strong growth in the second quarter of 2018 brought trailing 12-month gross domestic product1 growth up to 2.9%, the strongest level since the second quarter of 2015. Year-over-year core Personal Consumption Expenditure Index1, the Federal Reserve Board’s (the Fed) preferred inflation gauge, also rose to 2.0% in the second quarter, its highest post-crisis reading and matching the Fed’s inflation mandate. This relatively strong economic growth combined with the increase in inflation caused yields to rise across the board.

The strong growth and inflation figures gave the Fed the green light to continue its rate hike cycle. Accordingly, the Federal Open Market Committee raised the fed funds rate three times in the period, by 25 basis points (0.25%) each time, bringing the rate to 1.75% - 2.00% by the 12-month period-end.

The Fed’s hiking cycle led to a strong flattening trend in the yield curve. For the 12-month period ended August 31, 2018, the 2-year Treasury yield rose 128 basis points (1.28%), the 5-year Treasury yield rose 100 basis points (1.00%), 10-year Treasury yields advanced 69 basis points (0.69%), and the 30-year Treasury yield increased 24 basis points (0.24%). The 2-year to 10-year yield spread declined 59 basis points (0.59%) over the year while the 5-year to 30-year spread fell 75 basis points (0.75%) for the period. Both levels are near the lowest yield spreads seen since 2007.

The U.S. dollar was volatile during the year, but its strength in 2018 year to date began to expose cracks in many emerging markets. The Fed’s continued hawkish stance versus other major central banks and the relatively strong performance of the U.S. economy make it difficult to imagine any significant weakness in the U.S. dollar, which opens the door to continued emerging markets weakness.

Strong economic growth, rising inflation, and an aggressive central bank led to weak fixed income returns for the period. The Bloomberg Barclays U.S. Aggregate Bond Index returned -1.05% for the 12-month period ended August 31, 2018, the Intermediate Aggregate Index1 fell 84 basis points (0.84%) for the period, and the ICE BofA Merrill Lynch 1-5 Year Government/Corporate Index1 was down 38 basis points (0.38%).

Fund Strategy

We continued to focus on higher-quality, relatively liquid securities, including Treasury and other government-related securities and agency mortgage-backed securities.*

We maintained modestly short duration versus our benchmark along with a higher-quality bias as we continued to underweight Baa-rated securities. We also remained significantly underweighted in the corporate sector. Maintaining shorter duration and higher quality and being underweight to corporate securities all added to relative performance over the past year as rates rose and corporate bonds underperformed all other sectors except for Treasuries.*

Our allocation to taxable municipals as a corporate bond proxy in the Fund continued to work well as this sector did not see the spread widening that occurred in corporates during the period.*

The largest detractor from absolute performance was the Fund’s allocation to corporate bonds and Treasuries, as both sectors performed poorly during the year. But because we were significantly underweight corporate bonds and modestly underweight duration, we were not hurt by these allocations as much as the indexes.*

As of August 31, 2018, 31.8% of the Fund was invested in U.S. Treasury securities, 26.4% in mortgage securities, 9.4% in agency securities, 15.1% in corporates, 12.7% in municipal bonds, and 1.6% in asset-backed securities. The Fund’s average maturity was 6.36 years.*

Outlook

We believe that the shape of the yield curve provides important economic information. The flattening trend has been in place for a year and is classic late-cycle behavior. Late in the economic cycle, it is appropriate to maintain a high-quality bias and sufficient liquidity to take advantage of potential opportunities in lower-rated credit securities.

The Fed has shown little concern with the yield curve and its intention to raise rates twice more this year must be taken at face value. We believe yields in the U.S. are very attractive compared with other developed economies. With the Fed intimating two more hikes this year, the U.S. dollar should be well supported. We believe the strong U.S. dollar combined with weakness in commodities this year should reduce inflationary pressures and provide a strong tailwind to U.S. fixed income assets overall.

Because we believe that we are late in this economic cycle, we plan to maintain a higher-quality bias along with significant liquidity. Yield spreads on corporate bonds have widened, reflecting heightened concerns about credit risk, and we have reduced the size of our underweight, adding names that fit within our higher-quality bias while allowing us to pick up some extra yield. With the market fully pricing in a September 2018 rate hike plus a better than 50/50 chance of a December 2018 hike, we believe market expectations for Fed policy are appropriate. Accordingly, we have reduced our underweight in the two- to five-year maturity bucket.*

| 1 | Gross Domestic Product (GDP) measures the market value of the goods and services produced by labor and property within the respective country/ economic region. Personal Consumption Expenditure Price Index (PCE) measures the prices paid by consumers for goods and services without the volatility caused by movements in food and energy prices to reveal underlying inflation trends. The Bloomberg Barclays U.S. Intermediate Aggregate Bond Index that is representative of investment-grade debt issues with maturities from one year up to (but not including) 10 years. The BofA Merrill Lynch 1-5 Year U.S. Corporate/ Government Bond Index measures the performance of investment-grade government and corporate debt securities with maturities between one- and five-years. These indexes are unmanaged and do not reflect the fees and expenses associated with a mutual fund. An investor cannot invest directly in an index. |

| * | The composition of the Fund’s portfolio is subject to change. |

The performance data quoted represents past performance and does not guarantee future results. The investment return and principal value of an investment will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost. Current performance may be lower or higher than the performance quoted. For performance data current to the most recent month end, please call 1-800-762-7085 or visit www.cavanalhillfunds.com.

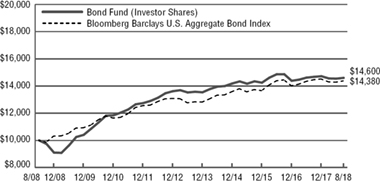

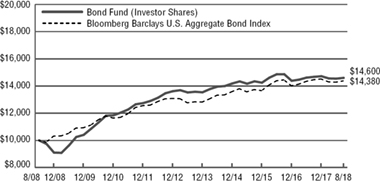

The Cavanal Hill Bond Fund (Unaudited)

Index Description

The performance of the Bond Fund is measured against the Bloomberg Barclays U.S. Aggregate Bond Index, an unmanaged index that is a market value-weighted performance benchmark for investment-grade fixed-rate debt issues, including government, corporate, asset-backed and mortgage-backed securities, with maturities of at least one year. The index does not reflect the deduction of the expenses associated with a mutual fund, such as investment management and fund accounting fees. The Fund’s performance reflects the deduction of fees for these value-added services, but does not reflect the deduction of taxes that a shareholder would pay on fund distributions or the redemption of fund shares. Investors cannot invest directly in an index.

Investment Risks

Fixed income securities are subject to interest rate risks. The principal value of a bond falls when interest rates rise and rise when interest rates fall. During periods of rising interest rates, the value of a bond investment is at greater risk than during periods of stable or falling rates. Bond funds will tend to experience smaller fluctuations in value than stock funds. However, investors in any bond fund should anticipate fluctuations in price, especially for longer-term issues and in environments of changing interest rates.

For a complete description of these and other risks associated with investing in a mutual fund, please refer to the Fund’s prospectus.

Value of a $10,000 Investment

The growth of $10,000 investment chart represents a hypothetical investment in the indicated share class versus a similar investment in the Fund’s benchmark, and represents the reinvestment of distributions and capital gains.

| Average Annual Total Return | | | |

| For the periods ended 8/31/18 | 1 Year | 5 Year | 10 Year |

| A Shares (at NAV)1 | -1.32% | 1.62% | 3.86% |

| A Shares (with 2.00% maximum load)1 | -3.24% | 1.21% | 3.65% |

| Investor Shares | -1.33% | 1.65% | 3.86% |

| Institutional Shares | -0.97% | 1.88% | 4.10% |

| Bloomberg Barclays U.S. Aggregate Bond Index | -1.05% | 2.49% | 3.70% |

| Lipper Core Bond Funds Average2 | -1.09% | 2.34% | 3.77% |

| | | | |

| Expense Ratio | | | |

| | | | Gross |

| A Shares | | | 0.79% |

| Investor Shares | | | 0.94% |

| Institutional Shares | | | 0.69% |

The performance data quoted represents past performance and does not guarantee future results. The investment return and principal value of an investment will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost. Current performance may be lower or higher than the performance quoted. For performance data current to the most recent month end, please call 1-800-762-7085 or visit www.cavanalhillfunds.com.

Investment performance for the Fund’s classes reflects fee waivers that have been in effect during the applicable periods. Without such waivers, the performance would have been lower. Contractual fee waivers are in effect through December 31, 2018.

The above expense ratios are from the Funds’ prospectus dated December 26, 2017. Additional information pertaining to the Funds’ expense ratios for the year ended August 31, 2018 can be found in the Financial Highlights.

| 1 | Class A Shares are subject to a 1.00% Maximum Deferred Sales Charge on shares purchased without an initial sales charge and redeemed within 12 months of purchase. Performance data does not reflect the Maximum Deferred Sales Charge. If reflected, performance quoted would be lower. This performance reflects the Fund’s no-Load Investor class (“Investor Shares”) for periods prior to May 2, 2011 for the A Shares. The A Shares began presenting performance linked to the Investor Class in September of 2011. Unlike Institutional Shares, Investor Shares and A Shares bear a 12b-1 fee of 0.25%. Investor Shares and Institutional Shares are subject to a Shareholder Servicing Fee of 0.25%, whereas the Shareholder Servicing Fee for A Shares is 0.10%. As indicated in the table, A Shares are also subject to a sales charge (Load). Each of these differences is reflected in the performance information. Accordingly, had the A Shares of the Fund been offered for periods before May 2, 2011, the performance information would have been different as a result of differing annual operating expenses. |

| 2 | The Lipper Mutual Funds Average is an equally weighted average of the mutual funds within their respective Lipper classification, adjusted for reinvestment of capital gains distributions and income dividends. |

The Cavanal Hill Strategic Enhanced Yield Fund (Unaudited)

Fund Goal

Our Strategic Enhanced Yield Fund is designed to be an opportunistic, multi-sector fixed income investment. The investment team attempts to shift allocations into areas that we believe provide the best risk/reward profiles. The Fund typically has a meaningful allocation to mortgage-backed securities and other securitized products, and the Fund has the freedom to invest in a broad range of credit ratings and durations.

From the inception date of December 26, 2017 to the period ended August 31, 2018, the Strategic Enhanced Yield Fund A Shares (at NAV) returned 1.60%; the Investor Shares returned 2.05%; and the Institutional Shares returned 1.87%. The Fund’s benchmark, the Bloomberg Barclays U.S. Aggregate Bond Index Index, showed a total return of -0.59%.

The Fund maintained a barbelled allocation during the year with a bias toward longer duration. This approach generally benefited performance as rates rose significantly in the middle of the curve during the period.*

Market Conditions

Strong growth in the second quarter of 2018 brought trailing 12-month gross domestic product1 growth up to 2.9%, the strongest level since the second quarter of 2015. Year-over-year core Personal Consumption Expenditure Index1, the Federal Reserve Board’s (the Fed) preferred inflation gauge, also rose to 2.0% in the second quarter, its highest post-crisis reading and matching the Fed’s inflation mandate. This relatively strong economic growth combined with the increase in inflation caused yields to rise across the board.

The strong growth and inflation figures gave the Fed the green light to continue its rate hike cycle. Accordingly, the Federal Open Market Committee raised the fed funds rate three times in the 12-month period, by 25 basis points (0.25%) each time, bringing the rate to 1.75% - 2.00% by the August 31, 2018 period-end.

The Fed’s hiking cycle led to a strong flattening trend in the yield curve. For the 12-month period ended August 31, 2018, the 2-year Treasury yield rose 128 basis points (1.28 %), the 5-year Treasury yield rose 100 basis points (1.00%), 10-year Treasury yields advanced 69 basis points (0.69%), and the 30-year Treasury yield increased 24 basis points (0.24%). The 2-year to 10-year yield spread declined 59 basis points (0.59%) over the year while the 5-year to 30-year spread fell 75 basis points (0.75%) for the period. Both levels are near the lowest yield spreads seen since 2007.

The U.S. dollar was volatile during the year, but its strength in 2018 year to date began to expose cracks in many emerging markets. The Fed’s continued hawkish stance versus other major central banks and the relatively strong performance of the U.S. economy make it difficult to imagine any significant weakness in the U.S. dollar, which opens the door to continued emerging markets weakness.

Strong economic growth, rising inflation, and an aggressive central bank led to weak fixed income returns for the period. The Bloomberg Barclays U.S. Aggregate Bond Index returned -1.05% for the 12-month period ended August 31, 2018, the Intermediate Aggregate Index1 fell 84 basis points (0.84%) for the period, and the ICE BofA Merrill Lynch 1-5 Year Government/Corporate Index1 was down 38 basis points (0.38%).

Fund Strategy

We had a bias toward longer duration during the period, and although rates moved higher, the long bias didn’t particularly hurt. Much of the longer duration came from the Fund’s allocation to the 30-year Treasury, and 30-year rates only rose 28 basis points (0.28%) this year. We maintained the barbelled allocation, which benefited the Fund as rates rose most significantly in the belly of the curve.*

The Fund continued to have a meaningful exposure to non-agency mortgage-backed (MBS) and asset-backed securities (ABS). This segment performed well this year, proving to be relatively immune to the increase in Treasury rates. We maintained a high-quality bias overall. Although we do own high-yield bonds, within that category we stayed at the high end of the spectrum.*

The Fund’s A Shares (at NAV) outperformed its index by 219 basis points (2.19%) since the Fund’s inception date of December 26, 2017 through period end. The relatively strong performance was driven by the portfolio’s large underweight to the corporate sector and by our large overweight to non-agency MBS and ABS.*

The largest detractor from absolute performance was our allocation to Treasuries. However, our underweight versus the index added to our benchmark-relative performance.*

As of August 31, 2018, 30.8% of the Fund was invested in U.S. Treasury securities, 39.8% in mortgage securities, 6.0% in corporates, and 15.8% in asset-backed securities. The Fund’s average maturity was 7.99 years.*

Outlook

We believe that the shape of the yield curve provides important economic information. The flattening trend has been in place for a year and is classic late-cycle behavior. Late in the economic cycle, it is appropriate to maintain a high-quality bias and sufficient liquidity to take advantage of potential opportunities in lower-rated credit securities.

The Fed has shown little concern with the yield curve and its could raise rates twice more this year. We believe yields in the U.S. are very attractive compared with other developed economies. With the Fed intimating two more hikes this year, the U.S. dollar should be well supported. We believe the strong U.S. dollar combined with weakness in commodities this year should reduce inflationary pressures and provide a strong tailwind to U.S. fixed income assets overall.

Because we believe that we are late in this economic cycle, we plan to maintain a higher-quality bias along with significant liquidity. Yield spreads on portions of the corporate market have widened, reflecting heightened concerns about credit risk, and we have reduced the size of our underweight, adding names that fit within our higher-quality bias while allowing us to pick up some extra yield. With the market pricing in a September 2018 rate hike plus a better than 50/50 chance of a December 2018 hike, we believe market expectations for Fed policy are appropriate. Accordingly, we have reduced our underweight in the two- to five-year maturity bucket.*

| 1 | Gross Domestic Product (GDP) measures the market value of the goods and services produced by labor and property within the respective country/ economic region. Personal Consumption Expenditure Price Index (PCE) measures the prices paid by consumers for goods and services without the volatility caused by movements in food and energy prices to reveal underlying inflation trends. The Bloomberg Barclays U.S. Intermediate Aggregate Bond Index that is representative of investment-grade debt issues with maturities from one year up to (but not including) 10 years. The BofA Merrill Lynch 1-5 Year U.S. Corporate/ Government Bond Index measures the performance of investment-grade government and corporate debt securities with maturities between one- and five-years. These indexes are unmanaged and do not reflect the fees and expenses associated with a mutual fund. An investor cannot invest directly in an index. |

| * | The composition of the Fund’s portfolio is subject to change. |

The performance data quoted represents past performance and does not guarantee future results. The investment return and principal value of an investment will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost. Current performance may be lower or higher than the performance quoted. For performance data current to the most recent month end, please call 1-800-762-7085 or visit www.cavanalhillfunds.com.

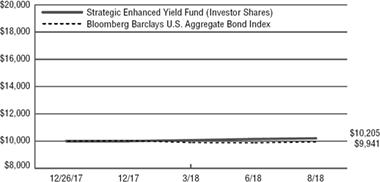

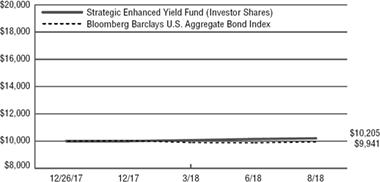

The Cavanal Hill Strategic Enhanced Yield Fund (Unaudited)

Index Description

The performance of the Strategic Enhanced Yield Fund is measured against the Bloomberg Barclays U.S. Aggregate Bond Index, an unmanaged index that is a market value-weighted performance benchmark for investment-grade fixed-rate debt issues, including government, corporate, asset-backed and mortgage-backed securities, with maturities of at least one year. The index does not reflect the deduction of the expenses associated with a mutual fund, such as investment management and fund accounting fees. The Fund’s performance reflects the deduction of fees for these value-added services, but does not reflect the deduction of taxes that a shareholder would pay on fund distributions or the redemption of fund shares. Investors cannot invest directly in an index.

Investment Risks

Fixed income securities are subject to interest rate risks. The principal value of a bond falls when interest rates rise and rise when interest rates fall. During periods of rising interest rates, the value of a bond investment is at greater risk than during periods of stable or falling rates. Short-term investment-grade bonds offer less risk and generally a lower rate of return than longer-term higher yielding bonds. Bond funds will tend to experience smaller fluctuations in value than stock funds. However, investors in any bond fund should anticipate fluctuations in price, especially for longer-term issues and in environments of changing interest rates. High-yield bonds have a higher risk of default or other adverse credit events, but have the potential to pay higher earnings over investment-grade bonds. The higher risk of default, or the inability of the creditor to repay its debt, is the primary reason for the higher interest rates on high-yield bonds.

For a complete description of these and other risks associated with investing in a mutual fund, please refer to the Fund’s prospectus.

Value of a $10,000 Investment

The growth of $10,000 investment chart represents a hypothetical investment in the indicated share class versus a similar investment in the Fund’s benchmark, and represents the reinvestment of distributions and capital gains.

| Aggregate Total Return | | | |

| | | | Since |

| | | | Inception |

| For the periods ended 8/31/18 | 3 Month | YTD | (12/26/17) |

| A Shares (at NAV)1 | 0.76% | 1.59% | 1.60% |

| A Shares (with 2.00% maximum load)1 | -1.22% | -0.40% | -0.39% |

| Investor Shares | 0.76% | 2.05% | 2.05% |

| Institutional Shares | 0.93% | 1.76% | 1.87% |

| Bloomberg Barclays U.S. Aggregate Bond Index | 0.54% | -0.96% | -0.59%. |

| Lipper Multi-Sector Income Funds Average2 | 0.67% | -0.26% | -0.26% |

| | | | |

| Expense Ratio | | | |

| | | | Gross |

| A Shares | | | 2.14% |

| Investor Shares | | | 2.29% |

| Institutional Shares | | | 2.04% |

The performance data quoted represents past performance and does not guarantee future results. The investment return and principal value of an investment will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost. Current performance may be lower or higher than the performance quoted. For performance data current to the most recent month end, please call 1-800-762-7085 or visit www.cavanalhillfunds.com.

Investment performance for the Fund’s classes reflects fee waivers that have been in effect during the applicable periods. Without such waivers, the performance would have been lower. Contractual fee waivers are in effect through December 31, 2018.

The above expense ratios are from the Funds’ prospectus dated December 26, 2017. Additional information pertaining to the Funds’ expense ratios for the year ended August 31, 2018 can be found in the Financial Highlights.

| 1 | Class A Shares are subject to a 1.00% Maximum Deferred Sales Charge on shares purchased without an initial sales charge and redeemed within 12 months of purchase. Performance data does not reflect the Maximum Deferred Sales Charge. If reflected, performance quoted would be lower. |

| 2 | The Lipper Mutual Funds Average is an equally weighted average of the mutual funds within their respective Lipper classification, adjusted for reinvestment of capital gains distributions and income dividends. Since inception value calculated from December 31, 2017. |

The Cavanal Hill Ultra Short Tax-Free Fund (Unaudited)

Fund Goal

The goal of our Ultra Short Tax-Free Income Fund is to generate current income that is exempt from federal income taxes by investing primarily in a diversified portfolio of municipal securities. To pursue its objective, this strategy invests in securities exempt from federal taxes and consists of a mix of Variable Rate Demand Notes (VRDN), which provide daily or weekly liquidity, as well as fixed rate paper; the Fund will have a weighted average maturity of one year or less.

From the inception date of December 26, 2017 to the period ended August 31, 2018, the Ultra Short Tax- Free Fund A Shares (at NAV) returned 0.10%; the Investor Shares returned 0.14%; and the Institutional Shares returned 0.65%. The Fund’s benchmark, the Bloomberg Barclays 1-Year Municipal Bond Index, showed a total return of 1.10%.

The Fund’s slight underperformance relative to the benchmark was due to our shorter duration strategy and to unexpectedly low VRDN rates in February and July.*

Market Conditions

Domestic economic activity has been solid since the inception of the Fund at the end of 2017. Gross domestic product1 grew at an annual pace of 2.2% in the first quarter of 2018 and rose to 4.2% in the second quarter, the highest level since the third quarter of 2014. The employment picture continued its impressive run, as nonfarm payrolls had averaged growth of over 200,000 in 2018 while the unemployment rate fell to 3.8% in May, its lowest level since April 2000. While inflation remained relatively benign, U.S. economic strength enabled the Federal Reserve Board (the Fed) to continue to raise rates at both the March and June Federal Open Market Committee meetings (FOMC). While market participants anticipate a third hike in September, a move in December is less certain.

The short end of the muni market was affected most directly by the Fed’s moves. The best indicator of this is the SIFMA Index1, which is an average of yields on 7-day variable rate demand notes. SIFMA hovered around 1% in February, but closed March at 1.58% and rose to 1.81% in April, the highest level since October 2008, before closing June at 1.51%. After strong demand caused VRDN rates to drop back down below 1% in July, they began to climb again and SIFMA closed the fiscal year at 1.56%.

The best opportunity in the short end of the municipal bond market came in late April/early May as yields hit their high-water mark for the year. This was primarily due to the cyclical supply/ demand imbalance, as many taxpayers use their tax-free money market funds to pay their taxes. The funds liquidate their VRDNs to raise cash to meet the redemptions and the remarketing agents raise rates to entice crossover buyers to help reduce their inventories. As a result, the SIFMA index rose to 1.81% in April and yields on 1-year fixed rate paper hovered around 1.75% for a few weeks in April and May.

Yields in the short end of the muni market fell in July because of an influx of cash via maturities, coupon payments, and calls. The demand far outweighed supply as the cash was deployed. As a result, the SIFMA index hit its lowest level of the year in July at 0.94% and yields on the 1-year fixed rate paper dropped to around 1.40% during the month.

Fund Strategy

The Fund has maintained a mix of VRDNs and fixed-rate paper since its inception. The target maturity range for the fixed-rate pieces was three- to six-months, which proved effective early in the period but held back performance in the summer months as rates fell. Overall, the Fund slightly underperformed the benchmark for the period due to its shorter duration and unexpectedly low VRDN rates during February and July.*

The Fund’s securities holdings rated AAA, AA, and A made up 7.7%, 61.2%, and 11.2% of the portfolio, respectively, as of August 31, 2018. BBB securities made up 1.1% of the portfolio. MIG1 securities made up 4.1% of the portfolio. SP-1+ securities made up 3.3% of the portfolio. Non-rated securities comprised 11.4% of the portfolio.*,**

Outlook

The Fed has reiterated its stance to continue to raise rates and market participants are anticipating a hike at the September FOMC meeting. An additional move in December is still uncertain, but the Fed’s “dot plots” indicate the tightening cycle will be maintained into 2019. The short end of the muni market should move higher in conjunction with U.S. Treasury yields.

The Fund will continue to look for opportunities in the fixed rate market and extend the average maturity when they arise. In addition, a core holding of VRDNs will capture Fed rate hikes.*

| 1 | Gross Domestic Product (GDP) measures the market value of the goods and services produced by labor and property within the respective country/ economic region. Securities Industry and Financial Markets Association (SIFMA) Municipal Swap Index, produced by Municipal Market Data (MMD), is a 7-day high-grade market index comprised of tax-exempt variable rated demand obligations (VRDO’s) from MMD’s extensive database. SIFMA is a leading securities industry trade group representing securities firms, banks, and asset management companies in the U.S. and Hong Kong. |

| * | The composition of the Fund’s portfolio is subject to change. |

| ** | The credit-quality ratings are derived from the underlying securities of the portfolio, and are rated by Moody’s. If a rating from Moody’s is unavailable, S&P’s rating is used. If neither Moody’s nor S&P ratings are available, Fitch’s rating is used. |

The performance data quoted represents past performance and does not guarantee future results. The investment return and principal value of an investment will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost. Current performance may be lower or higher than the performance quoted. For performance data current to the most recent month end, please call 1-800-762-7085 or visit www.cavanalhillfunds.com.

The Cavanal Hill Ultra Short Tax-Free Fund (Unaudited)

Index Description

The performance of the Ultra Short Tax-Free Fund is measured against the Bloomberg Barclays 1-Year Municipal Bond Index, an unmanaged index that includes bonds with a minimum credit rating of BAA3, are issued as part of a deal of at least $50 million, have an amount outstanding of at least $5 million, and have maturities of 1 to 2 years. The index does not reflect the deduction of the expenses associated with a mutual fund, such as investment management and fund accounting fees. The Fund’s performance reflects the deduction of fees for these value-added services, but does not reflect the deduction of taxes that a shareholder would pay on fund distributions or the redemption of fund shares. Investors cannot invest directly in an index.

Investment Risks

Fixed income securities are subject to interest rate risks. The principal value of a bond falls when interest rates rise and rise when interest rates fall. During periods of rising interest rates, the value of a bond investment is at greater risk than during periods of stable or falling rates. Short-term investment-grade bonds offer less risk and generally a lower rate of return than longer-term higher yielding bonds. Bond funds will tend to experience smaller fluctuations in value than stock funds. However, investors in any bond fund should anticipate fluctuations in price, especially for longer-term issues and in environments of changing interest rates. The Fund’s income may be subject to certain state and local taxes and, depending on one’s tax status, to the federal alternative minimum tax.

For a complete description of these and other risks associated with investing in a mutual fund, please refer to the Fund’s prospectus.

Value of a $10,000 Investment

The growth of $10,000 investment chart represents a hypothetical investment in the indicated share class versus a similar investment in the Fund’s benchmark, and represents the reinvestment of distributions and capital gains.

| Aggregate Total Return | | | |

| | | | Since |

| | | | Inception |

| For the periods ended 8/31/18 | 3 Month | YTD | (12/26/17) |

| A Shares (at NAV)1 | 0.10% | 0.10% | 0.10% |

| A Shares (with 1.00% maximum load)1 | -0.89% | -0.89% | -0.89% |

| Investor Shares | 0.09% | 0.14% | 0.14% |

| Institutional Shares | 0.25% | 0.62% | 0.65% |

| Bloomberg Barclays 1-Year Municipal Bond Index | 0.52% | 1.14% | 1.10% |

| Lipper Short Municipal Debt Funds Average2 | 0.47% | 0.79% | 0.79% |

| | | | |

| Expense Ratio | | | |

| | | | Gross |

| A Shares | | | 1.79% |

| Investor Shares | | | 1.94% |

| Institutional Shares | | | 1.69% |

The performance data quoted represents past performance and does not guarantee future results. The investment return and principal value of an investment will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost. Current performance may be lower or higher than the performance quoted. For performance data current to the most recent month end, please call 1-800-762-7085 or visit www.cavanalhillfunds.com.

Investment performance for the Fund’s classes reflects fee waivers that have been in effect during the applicable periods. Without such waivers, the performance would have been lower. Contractual fee waivers are in effect through December 31, 2018.

The above expense ratios are from the Funds’ prospectus dated December 26, 2017. Additional information pertaining to the Funds’ expense ratios for the year ended August 31, 2018 can be found in the Financial Highlights.

| 1 | Class A Shares are subject to a 1.00% Maximum Deferred Sales Charge on shares purchased without an initial sales charge and redeemed within 12 months of purchase. Performance data does not reflect the Maximum Deferred Sales Charge. If reflected, performance quoted would be lower. |

| 2 | The Lipper Mutual Funds Average is an equally weighted average of the mutual funds within their respective Lipper classification, adjusted for reinvestment of capital gains distributions and income dividends. Since inception value calculated from December 31, 2017. |

The Cavanal Hill Active Core Fund (Unaudited)

Fund Goal

We seek to construct a balanced portfolio of equities and bonds that is broadly diversified to attempt to control risk. Our diversification strategy is multi-dimensional across stock and bond asset classes, growth and value styles, and small capitalization and large capitalization stocks.

For the 12-month period ended August 31, 2018, the Active Core Fund A Shares (at NAV) posted a total return of 8.41%; the C Shares returned 7.70%; the Investor Shares returned 8.46%, and the Institutional Shares returned 8.70%. The Fund’s benchmarks, the Russell 1000® Index and the Bloomberg Barclays U.S. Aggregate Bond Index, returned 19.82% and -1.05%, respectively.

Market Conditions

Economic growth picked up in late 2017 and ran at a faster pace well into 2018. U.S. federal tax reform helped increase company spending and put upward pressure on wages and hiring. The Federal Reserve Board (the Fed) grew more comfortable raising interest rates over the past year, which supported a stronger dollar. Both factors led to increased market volatility and were compounded by trade and tariff disputes. Oil prices rose, boosting the energy sector while the technology and consumer discretionary sectors led the market over the past year.

Concerns over trade and tariff issues weighed on markets in a variety of ways. Technology companies were worried about the availability and cost of imports and exports from China. Tariffs on certain U.S. crops had an adverse impact on food companies. Additionally, disputes with Mexico, Canada, and China weighed on U.S. automotive companies and their suppliers.

After lagging for years, small-cap stocks bounced back over the past year and led mid- and large-cap stocks. The other source of strong performance was among mega-cap growth stocks, particularly technology and consumer discretionary giants like Netflix and Amazon. Elsewhere, returns were more muted. The energy sector provided another opportunity as oil prices increased. Small-cap energy companies did especially well.

Fund Strategy

We maintained a diversified portfolio, continuing to emphasize equities, which made up approximately 50.4% of the Fund’s portfolio at the end of the 12-month period, compared with 47.6% at the end of August 2017. Fixed-income securities represented approximately 40.6% of the portfolio, compared with 40.9% at the end of August 2017. The rest of the Fund was in cash and mutual funds.*

Within the equity portfolio, we continued to invest in a variety of domestic U.S. and international stocks, including developed and emerging market stocks, all of which posted strong performance overall for the period. Within the U.S. market, small-cap stocks outperformed mid-cap and large-cap stocks, and growth stocks continued to significantly outperform value stocks. The Russell 3000® Growth Index1 rose 27.50% versus the 13.04% gain for the Russell 3000® Value Index1.*

We maintained broad style exposure, investing in large- and mid-cap stocks within the core value and growth styles. We also held a modest allocation to non-U.S. stocks.*

Within fixed income, we continued to focus on higher-quality, relatively liquid securities, including Treasury and other government-related securities and agency mortgage-backed securities. We maintained modestly short duration versus our benchmark along with a higher-quality bias as we continued to underweight Baa-rated securities. We also remained significantly underweighted in the corporate sector. Maintaining shorter duration and higher quality and being underweight to corporate securities all added to relative performance over the past year as rates rose and corporate bonds underperformed all other sectors except for Treasuries.*

The largest detractor from absolute performance within fixed income was our allocation to corporate bonds and Treasuries, as both sectors performed poorly. But because we were significantly underweight corporate bonds and modestly underweight duration, we were not hurt by these allocations as much as the indexes.*

Outlook

The macroeconomic backdrop is still strong and the job market has tightened. We believe that left to its own devices, the U.S. economy should continue to run smoothly over the next six months. There are some potential risks that the Fed may raise rates too quickly but a greater challenge relates to disagreements over trade and tariffs. Companies are already mentioning negative impacts in their forward guidance. If this problem isn’t resolved or, worse, if it continues to grow, then the resulting uncertainty could put downward pressure on markets, making it harder for companies to make long-term plans.

Despite this accommodative environment, we are wary of the impact that the ongoing trade disputes may have on U.S. markets. For now, we are trying to find the right balance of cyclical themes that would benefit from a continued expansion combined with high quality, profitable companies that could hedge against market stress. We expect that higher volatility will continue over the medium term, and we are trying to position the portfolio to take advantage of shifting dynamics.

The flattening yield curve has been in place for a year and is classic late-economic cycle behavior. We believe this calls for a high-quality bias within fixed income assets and plenty of liquidity. The Fed has intimated to raise rates twice more this year, keeping U.S. yields highly attractive relative to other developed economies and providing strong support for the U.S. dollar. We believe the strong U.S. dollar and weakness in commodities should reduce inflationary pressures and provide a strong tailwind to U.S. fixed income assets. With the market fully pricing in a September 2018 rate hike plus a better than 50/50 chance of a December 2018 hike, we have reduced our underweight in the two- to five-year maturity bucket.*

| 1 | Russell 3000® Growth Index is a market capitalization weighted index based on the Russell 3000 Index. Russell 3000® Growth Index includes companies that display signs of above average growth, exhibit higher price-to-book, and forecasted earnings. The Russell 3000® Value Index is a market-capitalization weighted equity index maintained by the Russell Investment Group and based on the Russell 3000® Index, included in the index are stocks from the Russell 3000 Index with lower price-to-book ratios and lower expected growth rates. These indexes are unmanaged and do not reflect the fees and expenses associated with a mutual fund. An investor cannot invest directly in an index. |

| * | The composition of the Fund’s portfolio is subject to change. |

The performance data quoted represents past performance and does not guarantee future results. The investment return and principal value of an investment will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost. Current performance may be lower or higher than the performance quoted. For performance data current to the most recent month end, please call 1-800-762-7085 or visit www.cavanalhillfunds.com.

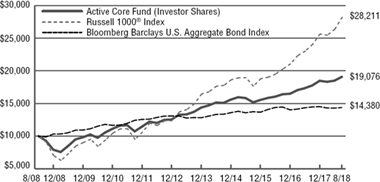

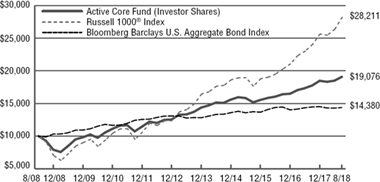

The Cavanal Hill Active Core Fund (Unaudited)

Index Description

The performance of the Active Core Fund is measured against the Russell 1000® Index and the Bloomberg Barclays U.S. Aggregate Bond Index. The Russell 1000® Index, which measures the performance of the large-cap segment of the U.S. equity universe, is a subset of the Russell 3000® Index and includes approximately 1,000 of the largest securities based on a combination of their market cap and current index membership. The Russell 1000® Index represents approximately 92% of the Russell 3000® Index. The Bloomberg Barclays U.S. Aggregate Bond Index is a market value-weighted performance benchmark for investment-grade fixed-rate debt issues, including government, corporate, asset-backed and mortgage-backed securities, with maturities of at least one year. These indexes are unmanaged and do not reflect the deduction of expenses associated with a mutual fund, such as investment management and fund accounting fees. The Fund’s performance reflects the deduction of fees for these services, but does not reflect the deduction of taxes that a shareholder would pay on fund distributions or the redemption of fund shares. Investors cannot invest directly in an index.

Investment Risks

Equity securities (stocks) are more volatile and carry more risk than other forms of investments, including investments in high-grade fixed income securities. Fixed income securities are subject to interest rate risks. The principal value of a bond falls when interest rates rise and rise when interest rates fall. During periods of rising interest rates, the value of a bond investment is at greater risk than during periods of stable or falling rates. The Fund invests in foreign and emerging market securities, which involves certain risks such as currency volatility, political and social instability, and reduced market liquidity. Mid- and small-cap companies may be more vulnerable to adverse business or economic developments. Because an ETF charges its own fees and expenses, Fund shareholders will indirectly bear these costs. The use of leverage in an ETF can magnify any price movements, resulting in high volatility. An inverse ETF seeks to provide returns that are the opposite of the underlying referenced financial asset, index, or commodity’s returns. Exposure to commodities may subject the Fund to greater volatility than investments in traditional securities.

For a complete description of these and other risks associated with investing in a mutual fund, please refer to the Fund’s prospectus.

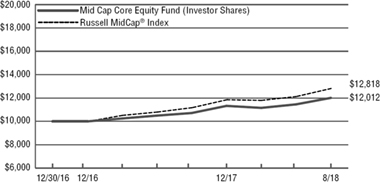

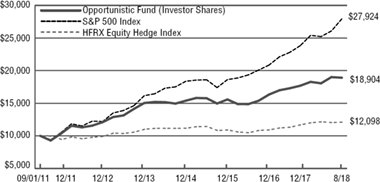

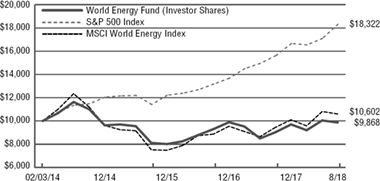

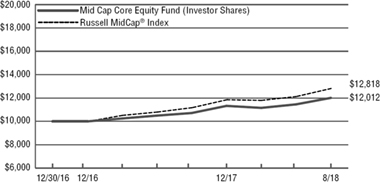

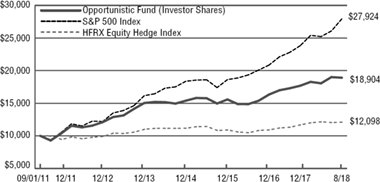

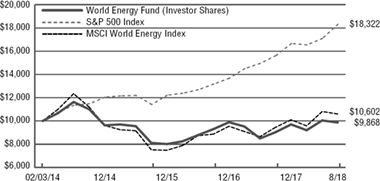

Value of a $10,000 Investment