UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORMN-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED

MANAGEMENT INVESTMENT COMPANIES

Investment Company Act file number:811-06161

Allianz Funds

(Exact name of registrant as specified in charter)

1633 Broadway, New York, NY 10019

(Address of principal executive offices) (Zip code)

Scott Whisten

1633 Broadway, New York, NY 10019

(Name and address of agent for service)

Registrant’s telephone number, including area code:212-739-3367

Date of fiscal year end: June 30

Date of reporting period: December 31, 2018

ITEM 1. REPORT TO SHAREHOLDERS

Allianz Funds

SHARE CLASSES A, C, R, P, INSTITUTIONAL, R6, ADMINISTRATIVE

Semiannual Report

December 31, 2018

AllianzGI Emerging Markets Opportunities Fund

AllianzGI Focused Growth Fund

AllianzGI Global Natural Resources Fund

AllianzGI Global Small-Cap Fund

AllianzGI Health Sciences Fund

AllianzGI Income & Growth Fund

AllianzGI Mid-Cap Fund

AllianzGI NFJ Dividend Value Fund

AllianzGI NFJ International Value Fund

AllianzGI NFJ Large-Cap Value Fund

AllianzGI NFJ Mid-Cap Value Fund

AllianzGI NFJ Small-Cap Value Fund

AllianzGI Small-Cap Fund

AllianzGI Technology Fund

This material is authorized for use only when preceded or accompanied by the current Allianz Funds prospectus. Investors should consider the investment objectives, risks, charges and expenses of each Fund carefully before investing. This and other information is contained in the Funds’ prospectus or summary prospectus. Please read the prospectus carefully before you invest or send money.

Beginning on January 1, 2021, as permitted by regulations adopted by the U.S. Securities and Exchange Commission, paper copies of shareholder reports will no longer be sent by mail, unless you specifically request paper copies of the reports. Instead, the reports will be made available on the Funds’ website (us.allianzgi.com), and you will be notified by mail each time a report is posted and provided with a website link to access the report.

If you already elected to receive shareholder reports electronically, you will not be affected by this change and you need not take any action. You may elect to receive shareholder reports and other communications from a Fund electronically anytime by contacting your financial intermediary (such as a broker-dealer or bank) or, if you are a direct investor, by enrolling at us.allianzgi.com/edelivery.

If you prefer to receive paper copies of your shareholder reports after January 1, 2021, direct investors may inform a Fund at any time. If you invest through a financial intermediary, you should contact your financial intermediary directly. Paper copies are provided free of charge and your election to receive reports in paper will apply to all funds held with the fund complex if you invest directly with a Fund or all funds held in your account if you invest through your financial intermediary.

Receive this report electronically and eliminate paper mailings.

To enroll, go to us.allianzgi.com/edelivery.

Table of Contents

A Word About Risk: A fund may be subject to various risks as described in its prospectus. Some of those risks may include, but are not limited to, the following: fixed-income risk, liquidity risk, derivatives risk, smaller company risk, non-US investment risk, focused investment risk and specific sector investment risks. Below investment grade securities involve a greater risk to principal than investment grade securities. Bond prices will normally decline as interest rates rise. The impact may be greater with longer-duration bonds. The market for certain securities may become illiquid, which could prevent a fund from purchasing or selling these securities at an advantageous time or price and possibly delay redemptions of fund shares. Use of derivative instruments may involve certain costs and risks such as liquidity risk, interest rate risk, market risk, credit and counterparty risk, management risk and the risk that a fund is unable to close out a position when it is most advantageous to do so. Portfolios investing in derivatives could lose more than the principal amount invested in those instruments. Investing in foreign securities may entail risk due to foreign economic and political developments; this risk may be enhanced when investing in emerging markets. Smaller companies may be more volatile than larger companies and may entail more risk. Concentrating investments in individual sectors may add additional risk and additional volatility compared to a diversified equity portfolio. The principal values of the funds are not guaranteed at any time. Please refer to the applicable fund’s current prospectus for complete details.

Letter from the President

Thomas J. Fuccillo

President & CEO

Dear Shareholder,

The economic expansion continued at a solid pace during the six-month fiscal reporting period ended December 31, 2018. In contrast, economic growth overseas moderated. Due to a sharp decline in the fourth quarter of 2018, both US and international equities generated weak results. The overall US bond market posted a modest gain during the reporting period.

The Six-Month Fiscal Period in Review

For the six-month period ended December 31, 2018, US stocks returned -6.85%, as measured by the S&P 500 Index. Two measures of stock performance in developed international and global markets produced weak results, in dollar-denominated terms, with the MSCI EAFE (Europe, Australasia and Far East) Index returning -11.35% and the MSCI World Index returning-9.10%. Elsewhere, the MSCI Emerging Markets Index returned -8.49% in dollar-denominated terms. With respect to bonds, the Bloomberg Barclays US Credit Index returned 0.90% and the Bloomberg Barclays Global High Yield Index returned -1.57%. The Bloomberg Barclays US Government Bond Index returned -1.41%, while the broader bond market, as measured by the Bloomberg Barclays US Aggregate Bond Index, returned 1.65%.

Turning to the US economy, gross domestic product (“GDP”), the value of goods and services produced in the country, the broadest measure of economic activity and the principal indicator of economic performance, expanded at a 4.2% annualized pace during the second quarter of 2018 — the best reading since the third quarter of 2014. GDP grew at an annual pace of 3.4% during the third quarter of 2018. The Commerce Department’s initial GDP growth estimate for the fourth quarter of 2018 was delayed due to the partial government shutdown.

After raising interest rates twice during the first half of 2018, the US Federal Reserve (the “Fed”) again raised rates at its meetings in September and December 2018. The last hike pushed the federal funds rate to a range between 2.25% and 2.50%. The Fed currently anticipates making two additional rate hikes in 2019, but this may change based on incoming economic data.

Economic growth outside the US decelerated during the reporting period. Unlike the Fed, the European Central Bank (“ECB”) and the Bank of Japan largely maintained their accommodative monetary policies. While the ECB concluded its bond buying program at the end of the 2018, it stated that it does not anticipate raising interest rates “at least through the summer of 2019.” Elsewhere, in August 2018, the Bank of England raised rates from 0.50% to 0.75%, but then remained on hold through the remainder of the year.

| | | | | | |

| 2 | | December 31, 2018 | | | Semiannual Report | | |

Outlook

In our view, higher interest rates in the US — and less quantitative easing from the Fed and ECB — will likely reduce liquidity and create higher market volatility for investors in 2019. Because navigating the markets successfully may take greater skill, we believe investors should consider actively selecting where to invest, rather than passively accept market returns – understanding there is no guarantee that any type of strategy will outperform its relevant benchmark or the broader market.

The global economy — which has been doing fairly well — is likely to become even less synchronized and more fragmented. This would continue a trend that began in earnest in 2018, as market returns turned negative. We believe that trade tensions and political uncertainty may be primary drags on performance, while high oil prices and tight labor markets in the US, UK, Germany and Japan could heighten fears of rising rates and inflation.

In recent years, investors have been able to follow the herd as markets have risen, but we feel that continuing that approach now could destroy value rather than create it. As we enter into a period of lower cross-asset correlations, higher volatility and lower returns — particularly for equities — active asset allocation and active security selection is likely to become increasingly important, in our opinion.

On behalf of Allianz Global Investors U.S. LLC, the Funds’ investment adviser, thank you for investing with us. We encourage you to consult with your financial advisor and to visit our website, us.allianzgi.com, for additional information. We remain dedicated to serving your investment needs.

Sincerely,

Thomas J. Fuccillo

President & CEO

Past performance is no guarantee of future results. Unless otherwise noted, index returns reflect the reinvestment of income dividends and capital gains, if any, but do not reflect fees, brokerage commissions or other expenses of investing. It is not possible to invest directly in an index.

Receive this report electronically and eliminate paper mailings.

To enroll, go to us.allianzgi.com/edelivery.

| | | | | | |

| | Semiannual Report | | | December 31, 2018 | | | 3 |

Unaudited

AllianzGI Emerging Markets Opportunities Fund

For the period of July 1, 2018 through December 31, 2018, as provided by Lu Yu, CFA, CIPM, Portfolio Manager.

Fund Insights

For the six-month period ended December 31, 2018, Class A shares at net asset value (“NAV”) of the AllianzGI Emerging Markets Opportunities Fund (the “Fund”) returned -11.58%, underperforming the MSCI Emerging Markets Index (the “benchmark”) which returned -8.49%.

Market Overview

Emerging market equities were negatively impacted by apprehension over a global trade war between the US and China, mounting geopolitical tensions in Russia and concerns of rising inflation expectations, which could lead the US Federal Reserve to accelerate rate hikes. Emerging market currencies broadly declined as a result of a moderation in asset class sentiment and earnings estimates were subsequently lowered. These headwinds were present during the majority of the reporting period, with July and November the only positive performance months to counteract this trend.

Country results were mostly lower with 16 of 24 benchmark countries posting declines. Performance was led to the upside by Qatar, which posted strong gains due in part to demand for oil and gas. Brazil outperformed as investors reacted positively to the election of the country’s new president, which led to an advance in the Brazilian real. Meanwhile, Greece was cut nearly in one-third as investors weighed the risk-reward tradeoff following the country’s exit from its bailout program. Pakistan, Colombia and Turkey were also down significantly due to macroeconomic headwinds in each country.

Sector results were mostly lower with nine out of 11 sectors in the benchmark posting declines. Energy was the top performer thanks to robust oil and gas demand globally, followed by a modest gain in financials. Meanwhile, health care, consumer discretionary and information technology sectors each posted double-digit losses for the period due to a moderation in local consumer-related demand.

Portfolio Review

The Fund seeks to deliver outperformance over time by investing in emerging-market companies that are benefiting from change not yet fully reflected in the market. The investment team believes that investor behavioral biases contribute to market inefficiencies, which can be exploited through a transparent and repeatable investment process.

During the six-month period, the Fund trailed the benchmark due to stock selection. From a sector standpoint, a relative underweight allocation to health care contributed to results as did bottom-up selections in information technology and communication services sectors. Meanwhile, stock picking in materials was the primary source of underperformance. Financials and consumer discretionary sectors detracted more modestly. From a country standpoint, a relative overweight allocation and stock picking within Russia aided returns as did stock selection in China and overweight allocation to India. Conversely, negative stock selection in South Korea offset results as did an underweight allocation and more conservative stock picking in Brazil.

Outlook

Our belief is that emerging market equities may be bottoming as headwinds over tariffs, deleveraging in China and currency weakness are likely subsiding. There appears to be willingness on both the US and China to come to a trade truce, and timing is particularly important post US midterm elections where President Trump has the potential to relax his protectionist stance. While recent deleveraging in China has resulted in slowing near-term growth, longer-term we believe this will be beneficial for the asset class as the quality of future growth should be more sustainable. The US dollar has been very strong relative to emerging market currencies in 2018 due in part to tax cuts and repatriation of foreign capital back to the US, which in our view, the emerging market currencies are rebounding. Valuations remain low and significant when compared to recent history. We believe earnings growth will follow projections and remain at a healthy high single-digit level for the calendar year.

| | | | | | |

| 4 | | December 31, 2018 | | | Semiannual Report | | |

Unaudited

AllianzGI Emerging Markets Opportunities Fund (cont’d)

Average Annual Total Return for the period ended December 31, 2018

| | | | | | | | | | | | | | | | | | | | | | |

| | | | | | |

| | | | | 6 Month* | | | 1 Year | | | 5 Year | | | 10 Year | | | Since Inception† | |

| | | AllianzGI Emerging Markets Opportunities Fund Class A | | | –11.58% | | | | –16.91% | | | | 0.87% | | | | 7.38% | | | | 8.11% | |

| | AllianzGI Emerging Markets Opportunities Fund Class A (adjusted) | | | –16.45% | | | | –21.48% | | | | –0.27% | | | | 6.78% | | | | 7.70% | |

| | | AllianzGI Emerging Markets Opportunities Fund Class C | | | –11.92% | | | | –17.53% | | | | 0.12% | | | | 6.58% | | | | 7.30% | |

| | AllianzGI Emerging Markets Opportunities Fund Class C (adjusted) | | | –12.80% | | | | –18.36% | | | | 0.12% | | | | 6.58% | | | | 7.30% | |

| | AllianzGI Emerging Markets Opportunities Fund Class P | | | –11.48% | | | | –16.71% | | | | 1.12% | | | | 7.65% | | | | 8.41% | |

| | AllianzGI Emerging Markets Opportunities Fund Institutional Class | | | –11.42% | | | | –16.62% | | | | 1.22% | | | | 7.78% | | | | 8.53% | |

| | AllianzGI Emerging Markets Opportunities Fund Class R6 | | | –11.42% | | | | –16.58% | | | | 1.27% | | | | 7.84% | | | | 8.58% | |

| | MSCI Emerging Markets Index | | | –8.49% | | | | –14.58% | | | | 1.65% | | | | 8.02% | | | | 8.20% | |

| | | Lipper Emerging Markets Funds Average | | | –9.92% | | | | –16.27% | | | | 0.37% | | | | 7.53% | | | | 7.57% | |

* Cumulative return

† The Fund began operations on 5/27/04. Benchmark comparisons began on the fund inception date. Lipper comparisons began on 5/31/04.

Performance quoted represents past performance and is no guarantee of future results. Current performance may be lower or higher than performance shown. For performance current to the most recent month-end, visit our website at us.allianzgi.com. Investment return and the principal value will fluctuate. Shares may be worth more or less than original cost when redeemed.The adjusted returns take into account the maximum sales charge of 5.50% on Class A shares and 1% contingent deferred sales charge (CDSC) on Class C shares, which may apply to shares redeemed during the first year of ownership. Returns do not reflect deduction of taxes that a shareholder would pay on fund distributions or redemption of fund shares. Please see pages 60-62 for more information. The Fund’s gross expense ratios are 1.61% for Class A shares, 2.36% for Class C shares, 1.36% for Class P shares, 1.26% for Institutional Class and 1.21% for Class R6 shares. These ratios do not include an expense reduction, contractually agreed through at least October 31, 2019. The Fund’s expense ratios net of these reductions and waivers are 1.26% for Class A shares, 2.01% for Class C shares, 1.01% for Class P shares, 0.91% for Institutional Class shares and 0.86% for Class R6 shares. Expense ratio information is as of the Fund’s current prospectus dated August 30, 2018, as supplemented to date.

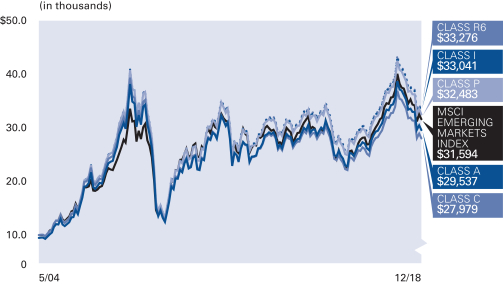

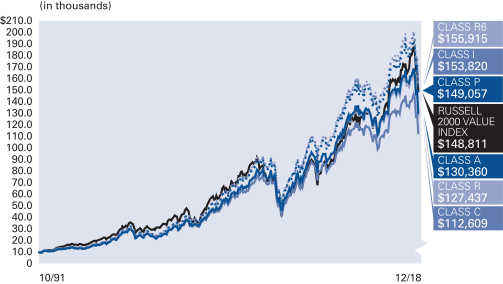

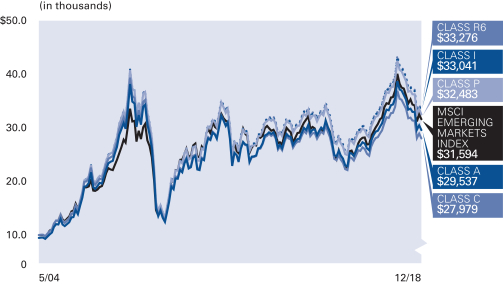

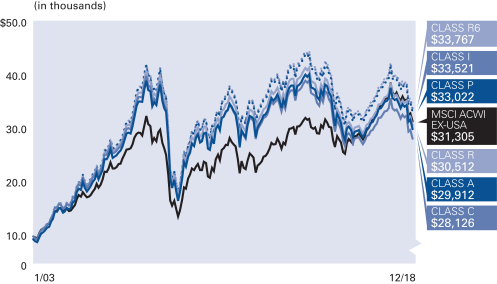

Cumulative Returns Through December 31, 2018

The Fund began operations on 5/27/04. Benchmark comparisons began on the fund inception date.

Country Allocation (as of December 31, 2018)

| | | | |

| |

| China | | | 29.9% | |

| |

| India | | | 13.0% | |

| |

| Korea (Republic of) | | | 12.4% | |

| |

| Taiwan | | | 8.9% | |

| |

| Russian Federation | | | 7.1% | |

| |

| Brazil | | | 6.1% | |

| |

| Peru | | | 3.8% | |

| |

| Hong Kong | | | 3.4% | |

| |

| Other | | | 13.0% | |

| |

| Cash & Equivalents — Net | | | 2.4% | |

| | | | | | |

| | Semiannual Report | | | December 31, 2018 | | 5 |

Unaudited

AllianzGI Emerging Markets Opportunities Fund (cont’d)

| | | | | | | | | | |

| |

| Shareholder Expense Example | | Actual Performance |

| | | Class A | | Class C | | Class P | | Institutional

Class | | Class R6 |

| | | | | |

| Beginning Account Value (7/1/18) | | $1,000.00 | | $1,000.00 | | $1,000.00 | | $1,000.00 | | $1,000.00 |

| | | | | |

| Ending Account Value (12/31/18) | | $884.20 | | $880.80 | | $885.20 | | $885.80 | | $885.80 |

| | | | | |

| Expenses Paid During Period | | $5.98 | | $9.53 | | $4.80 | | $4.33 | | $4.09 |

| | | | | | | | | | | |

| |

| | | Hypothetical Performance |

| | | (5% return before expenses) |

| | | Class A | | Class C | | Class P | | Institutional

Class | | Class R6 |

| | | | | |

| Beginning Account Value (7/1/18) | | $1,000.00 | | $1,000.00 | | $1,000.00 | | $1,000.00 | | $1,000.00 |

| | | | | |

| Ending Account Value (12/31/18) | | $1,018.85 | | $1,015.07 | | $1,020.11 | | $1,020.62 | | $1,020.87 |

| | | | | |

| Expenses Paid During Period | | $6.41 | | $10.21 | | $5.14 | | $4.63 | | $4.38 |

For each class of the Fund, expenses (net of fee waivers) are equal to the annualized expense ratio for the class (1.26% for Class A, 2.01% for Class C, 1.01% for Class P, 0.91% for Institutional Class and 0.86% for R6 Class), multiplied by the average account value over the period, multiplied by 184/365.

| | | | | | |

| 6 | | December 31, 2018 | | | Semiannual Report | | |

(THIS PAGE INTENTIONALLY LEFT BLANK)

| | | | | | |

| | Semiannual Report | | | December 31, 2018 | | 7 |

Unaudited

AllianzGI Focused Growth Fund

For the period of July 1, 2018 through December 31, 2018, as provided by Karen Hiatt, CFA, Lead Portfolio Manager.

Fund Insights

For the six-month period ended December 31, 2018, Class A shares at net asset value (“NAV”) of the AllianzGI Focused Growth Fund (the “Fund”) returned -12.29%, underperforming the Russell 1000 Growth Index (the “benchmark”), which returned -8.17%.

Market Overview

US equities ratcheted steadily higher over the third quarter, with major indices touching a series of fresh peaks bolstered by corporate earnings growth and positive economic data. However, the bull market ended abruptly in the final quarter of 2018 when US stocks plummeted, recording their weakest fourth-quarter returns since 2008. The S&P 500 index touched its lowest level since September 2017, while both the tech-heavy NASDAQ index and the small-cap Russell 2000 index entered official bear markets. A sudden rise in bond yields provided the catalyst for the initial downward movement in October. The sell-off intensified as worries over impact of higher tariffs and the outlook for global growth added to concerns. Politics also unsettled investors, with a US government shutdown and continued uncertainty over Brexit.

Portfolio Review

The Fund’s higher growth tilt relative to its benchmark hurt relative performance as investors rushed to defensive sectors amid the market sell-off.

Within the technology sector, our overweight position in semiconductor holdings NVIDIA Corp. and Applied Materials, Inc. underperformed as investors grew concerned about future growth amid rising inventories and trade issues with China. Our position in financial services company SVB Financial Group also underperformed, mostly due to its lending exposure to technology companies amid the deep sell-off. Other detractors included overweight positions in Floor & Décor Holdings, Inc. and United Rentals, Inc.

On the positive side, stock selection in the health care sector contributed to relative returns. Anthem, Inc. and UnitedHealth Group, Inc. were the largest contributors within the sector as they have delivered positive business results mostly due to the ongoing company initiatives in value based health care and cost savings. Within consumer discretionary, Burlington Stores, Inc. has consistently delivered strong results in off price retail. Other contributors included an overweight position in Agilent Technologies, Inc. and not owning Netflix, Inc.

We believe the portfolio holdings have attractive long-term growth prospects, and we remain comfortable with our overall positioning, despite short-term periods of volatility.

From a sector allocation perspective, an overweight position in health care and an underweight position in communication services helped relative performance. Conversely, an overweight position in technology and an underweight position in consumer staples hurt relative performance.

Outlook

We are assuming ongoing volatility in equity markets in the new year, which we believe should drive increasing dispersion of individual stock performance. In our opinion, the fallout from a prolonged partial government shutdown, ongoing trade disputes and geopolitical issues with China, rising interest rates in the US, ongoing political disputes in the US, and weakening data from emerging markets and Europe will likely weigh on global growth and increase stock volatility in 2019. Given the strong corporate earnings and employment trends in the US, we do not believe a US recession is imminent; however, we do believe it is prudent to be more selective in picking stocks.

Despite the sharp sell-off in the fourth quarter, many high quality companies continue to deliver strong operational execution. With more reasonable valuations and less euphoria in the market, we believe high quality companies should exceed expectations and deliver attractive stock returns in 2019.

Over the long term, we believe that the market will ultimately reward companies that deliver consistent growth and increase shareholder value over time. Our focus continues to be on applying rigorous fundamental research to identify companies with strong or under-appreciated growth prospects and attractive risk-reward characteristics.

| | | | | | |

| 8 | | December 31, 2018 | | | Semiannual Report | | |

Unaudited

AllianzGI Focused Growth Fund (cont’d)

Average Annual Total Return for the period ended December 31, 2018

| | | | | | | | | | | | | | | | | | | | | | |

| | | | | | |

| | | | | 6 Month* | | | 1 Year | | | 5 Year | | | 10 Year | | | Since Inception† | |

| | | AllianzGI Focused Growth Fund Class A | | | –12.29% | | | | –5.69% | | | | 8.62% | | | | 13.96% | | | | 10.84% | |

| | AllianzGI Focused Growth Fund Class A (adjusted) | | | –17.11% | | | | –10.87% | | | | 7.39% | | | | 13.31% | | | | 10.66% | |

| | | AllianzGI Focused Growth Fund Class C | | | –12.62% | | | | –6.40% | | | | 7.80% | | | | 13.10% | | | | 10.01% | |

| | AllianzGI Focused Growth Fund Class C (adjusted) | | | –13.34% | | | | –7.17% | | | | 7.80% | | | | 13.10% | | | | 10.01% | |

| | AllianzGI Focused Growth Fund Class R | | | –12.41% | | | | –5.93% | | | | 8.34% | | | | 13.67% | | | | 10.50% | |

| | AllianzGI Focused Growth Fund Class P | | | –12.19% | | | | –5.44% | | | | 8.89% | | | | 14.24% | | | | 11.15% | |

| | AllianzGI Focused Growth Fund Institutional Class | | | –12.14% | | | | –5.36% | | | | 8.99% | | | | 14.35% | | | | 11.26% | |

| | AllianzGI Focused Growth Fund Class R6 | | | –12.13% | | | | –5.32% | | | | 9.04% | | | | 14.40% | | | | 11.31% | |

| | | AllianzGI Focused Growth Fund Administrative Class | | | –12.25% | | | | –5.62% | | | | 8.72% | | | | 14.07% | | | | 10.97% | |

| | Russell 1000 Growth Index | | | –8.17% | | | | –1.51% | | | | 10.40% | | | | 15.29% | | | | 10.68% | |

| | | Lipper Large-Cap Growth Funds Average | | | –9.03% | | | | –0.80% | | | | 8.92% | | | | 14.13% | | | | 8.25% | |

* Cumulative return

† The Fund began operations on 2/24/84. Benchmark and Lipper performance comparisons began on 2/29/84.

Performance quoted represents past performance and is no guarantee of future results. Current performance may be lower or higher than performance shown. For performance current to the most recent month-end, visit our website at us.allianzgi.com. Investment return and the principal value will fluctuate. Shares may be worth more or less than original cost when redeemed.The adjusted returns take into account the maximum sales charge of 5.50% on Class A shares and 1% contingent deferred sales charge (CDSC) on Class C shares, which may apply to shares redeemed during the first year of ownership. Returns do not reflect deduction of taxes that a shareholder would pay on fund distributions or redemption of fund shares. Please see pages 60-62 for more information. The Fund’s gross expense ratios are 1.11% for Class A shares, 1.86% for Class C shares, 1.36% for Class R shares, 0.86% for Class P shares, 0.76% for Institutional Class, 0.71% for Class R6 shares, and 1.01% for Administrative Class shares. These ratios do not include an expense reduction, contractually agreed through at least October 31, 2019. The Fund’s expense ratios net of this reduction are 0.99% for Class A shares, 1.76% for Class C shares, 1.26% for Class R shares, 0.76% for Class P shares, 0.66% for Institutional Class shares, 0.61% for Class R6 shares, and 0.91% for Administrative Class shares. Expense ratio information is as of the Fund’s current prospectus dated August 30, 2018, as supplemented to date.

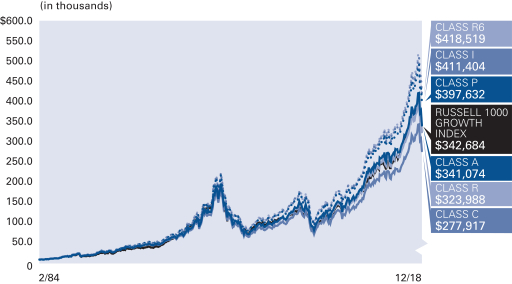

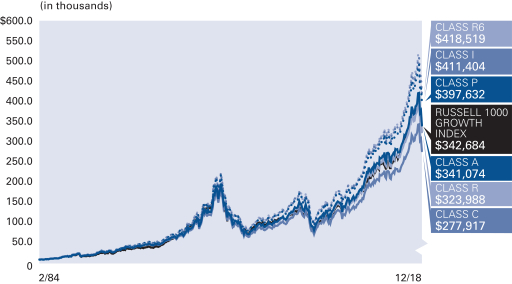

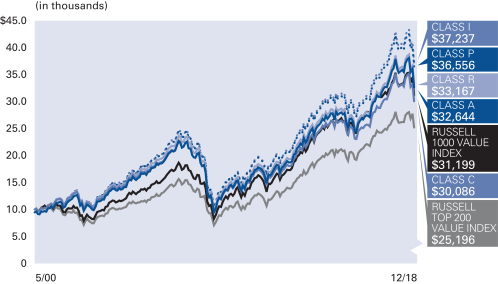

Cumulative Returns Through December 31, 2018

The Fund began operations on 2/24/84. Benchmark performance comparisons began on 2/29/84.

Industry/Sectors (as of December 31, 2018)

| | | | |

| |

| IT Services | | | 13.5% | |

| |

| Software | | | 13.5% | |

| |

| Healthcare Providers & Services | | | 11.7% | |

| |

| Specialty Retail | | | 7.6% | |

| |

| Internet & Direct Marketing Retail | | | 7.2% | |

| |

| Interactive Media & Services | | | 7.0% | |

| |

| Technology Hardware, Storage & Peripherals | | | 5.2% | |

| |

| Road & Rail | | | 3.6% | |

| |

| Other | | | 30.3% | |

| |

| Cash & Equivalents — Net | | | 0.4% | |

| | | | | | |

| | Semiannual Report | | | December 31, 2018 | | 9 |

Unaudited

AllianzGI Focused Growth Fund (cont’d)

| | | | | | | | | | | | | | |

| |

| Shareholder Expense Example | | Actual Performance |

| | | Class A | | Class C | | Class R | | Class P | | Institutional

Class | | Class R6 | | Administrative

Class |

| | | | | | | |

| Beginning Account Value (7/1/18) | | $1,000.00 | | $1,000.00 | | $1,000.00 | | $1,000.00 | | $1,000.00 | | $1,000.00 | | $1,000.00 |

| | | | | | | |

| Ending Account Value (12/31/18) | | $877.10 | | $873.80 | | $875.90 | | $878.10 | | $878.60 | | $878.70 | | $877.50 |

| | | | | | | |

| Expenses Paid During Period | | $4.68 | | $8.31 | | $5.96 | | $3.60 | | $3.13 | | $2.89 | | $4.31 |

| | | | | | | | | | | | | | | |

| |

| | | Hypothetical Performance |

| | | (5% return before expenses) |

| | | Class A | | Class C | | Class R | | Class P | | Institutional

Class | | Class R6 | | Administrative

Class |

| | | | | | | |

| Beginning Account Value (7/1/18) | | $1,000.00 | | $1,000.00 | | $1,000.00 | | $1,000.00 | | $1,000.00 | | $1,000.00 | | $1,000.00 |

| | | | | | | |

| Ending Account Value (12/31/18) | | $1,020.21 | | $1,016.33 | | $1,018.85 | | $1,021.37 | | $1,021.88 | | $1,022.13 | | $1,020.62 |

| | | | | | | |

| Expenses Paid During Period | | $5.04 | | $8.94 | | $6.41 | | $3.87 | | $3.36 | | $3.11 | | $4.63 |

For each class of the Fund, expenses (net of fee waivers) are equal to the annualized expense ratio for the class (0.99% for Class A, 1.76% for Class C, 1.26% for Class R, 0.76% for Class P, 0.66% for Institutional Class, 0.61% for Class R6 and 0.91% for Administrative Class), multiplied by the average account value over the period, multiplied by 184/365.

| | | | | | |

| 10 | | December 31, 2018 | | | Semiannual Report | | |

(THIS PAGE INTENTIONALLY LEFT BLANK)

| | | | | | |

| | Semiannual Report | | | December 31, 2018 | | 11 |

Unaudited

AllianzGI Global Natural Resources Fund

For the reporting period of July 1, 2018, through December 31, 2018, as provided by Paul Strand, CFA, Portfolio Manager.

Fund Insights

For the six-month period ended December 31, 2018, Class A shares at net asset value (“NAV”) of the AllianzGI Global Natural Resources Fund (the “Fund”) returned -19.85%, underperforming the 60% MSCI World Energy Index/40% MSCI World Materials (the “benchmark”), which returned -18.40%.

Market overview

Crude oil markets fell sharply in the fourth quarter of 2018, falling over 40% to a Brent crude level of $50 a barrel, after hitting a year’s high of $85 in September. The significant drop in crude was a result of many factors including pressure from the Trump Administration on Saudi Arabia to maintain production, Iranian supplies higher than expected despite the sanctions, strong production from US shale producers and worries of a possible global economic slowdown impacting global demand. Largely due to the fourth quarter drop in energy prices, the MSCI World Energy Index was one of the worst performing MSCI World sector indexes in the second half of 2018, down 21%. Meanwhile, similar worries of a global economic contraction, particularly in China, and the ongoing trade tensions, helped push the MSCI World Materials Index down in the fourth quarter as well. The MSCI World Materials Index fell 14% for the six-months period, largely impacted by the fourth quarter sell-off.

Portfolio review

The Fund’s underperformance was driven by stock selection effects primarily in the oil and gas exploration and production industry. The Fund’s use of option call writing had a negligible impact on performance for the six month period.

A variety of industries were represented in the largest contributors to relative performance. The Van Eck Vectors Gold Miners ETF was a large contributor to relative performance. Gold stocks generally outperform the broader market during periods of uncertainty like the market sell-off in the fourth quarter. The Fund’s position in specialty chemical companies, Air Products & Chemicals, Inc. and Ecolab, Inc., as well as the mining giant, BHP Group Ltd., added to performance as well. All three positions generated modest positive total returns for the Fund versus the benchmark’s larger decline. Finally, the US rail company, Union Pacific Corp., also contributed to performance.

The largest performance detractors were energy-related positions, including some positions in oil and gas exploration and production and a refiner. In general, oil and gas exploration and production stocks, which are in an industry that has a relatively higher beta than most other energy-related industries, tend to underperform in the energy sector when oil prices drop quickly and significantly like we saw in the fourth quarter. The refiner, Valero Energy Corp., negatively impacted performance as refining margins for the US refiners also contracted in the second-half of 2018.

Outlook

It was a difficult 2018 for natural resource-related funds, in general, largely due to the significant sell-off in the underlying commodities in the fourth quarter. During the latter part of the third quarter and throughout the fourth quarter, the Fund lowered its overall portfolio beta and layered in more energy exposure with yield support, such as the integrated oils. While this action helped to contain losses, particularly relative to some of the Fund’s peers which suffered larger drawdowns, the fourth quarter pressure on the natural resource sectors led to a significant absolute decline for the Fund in the fourth quarter.

As we enter 2019, we hope the worst is over for the more cyclical sectors of the economy. Valuations for some energy and materials stocks have reached levels that have not been seen since the recession in 2007-08. Given these depressed valuations and the prospect for the stabilization of energy prices after major declines, we anticipate layering more beta in the portfolio through these stocks at the beginning of the year. The Fund’s current focus is adding exposure in relatively higher quality energy names, particularly oil and gas exploration and production companies. The Fund is currently overweight in energy and underweight materials and remains globally diversified.

We continue to favor our diversified, thematic and opportunistic approach to investing in natural resource-related companies, and maintain our belief that over the long-term the performance of the equities may outperform the underlying commodities. Risks to the Fund include a relapse in the global economy, disruption to world bond markets and a sustained drop in commodity prices.

| | | | | | |

| 12 | | December 31, 2018 | | | Semiannual Report | | |

Unaudited

AllianzGI Global Natural Resources Fund (cont’d)

Average Annual Total Return for the period ended December 31, 2018

| | | | | | | | | | | | | | | | | | | | | | |

| | | | | | |

| | | | | 6 Month* | | | 1 Year | | | 5 Year | | | 10 Year | | | Since Inception† | |

| | | AllianzGI Global Natural Resources Fund Class A | | | –19.85% | | | | –19.34% | | | | –7.11% | | | | 2.72% | | | | 4.08% | |

| | AllianzGI Global Natural Resources Fund Class A (adjusted) | | | –24.26% | | | | –23.78% | | | | –8.16% | | | | 2.14% | | | | 3.67% | |

| | | AllianzGI Global Natural Resources Fund Class C | | | –20.21% | | | | –19.99% | | | | –7.81% | | | | 1.94% | | | | 3.30% | |

| | AllianzGI Global Natural Resources Fund Class C (adjusted) | | | –21.00% | | | | –20.78% | | | | –7.81% | | | | 1.94% | | | | 3.30% | |

| | AllianzGI Global Natural Resources Fund Class P | | | –19.73% | | | | –19.14% | | | | –6.88% | | | | 2.98% | | | | 4.35% | |

| | AllianzGI Global Natural Resources Fund Institutional Class | | | –19.73% | | | | –19.04% | | | | –6.78% | | | | 3.08% | | | | 4.45% | |

| | 60% MSCI World Energy/40% MSCI World Materials Benchmark | | | –18.40% | | | | –16.12% | | | | –2.57% | | | | 4.43% | | | | 5.19% | |

| | MSCI World Index | | | –9.10% | | | | –8.71% | | | | 4.56% | | | | 9.67% | | | | 6.13% | |

| | | Lipper Global Natural Resources Funds Average | | | –20.29% | | | | –20.21% | | | | –6.64% | | | | 1.20% | | | | 2.83% | |

* Cumulative return

† The Fund began operations on 6/30/04. Benchmark and Lipper comparisons began on the fund inception date.

Performance quoted represents past performance and is no guarantee of future results. Current performance may be lower or higher than performance shown. For performance current to the most recent month-end, visit our website at us.allianzgi.com. Investment return and the principal value will fluctuate. Shares may be worth more or less than original cost when redeemed.The adjusted returns take into account the maximum sales charge of 5.50% on Class A shares and 1% contingent deferred sales charge (CDSC) on Class C shares, which may apply to shares redeemed during the first year of ownership. Returns do not reflect deduction of taxes that a shareholder would pay on fund distributions or redemption of fund shares. Please see pages 60-62 for more information. The Fund’s expense ratios are 1.45% for Class A shares, 2.20% for Class C shares, 1.20% for Class P shares and 1.10% for Institutional Class shares. Expense ratio information is as of the Fund’s current prospectus dated August 30, 2018, as supplemented to date.

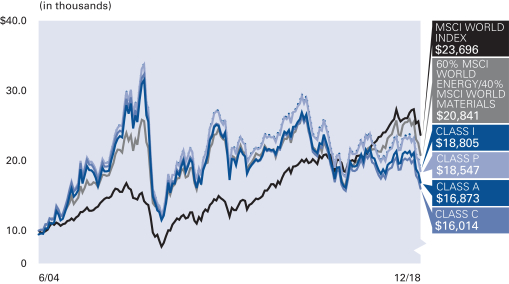

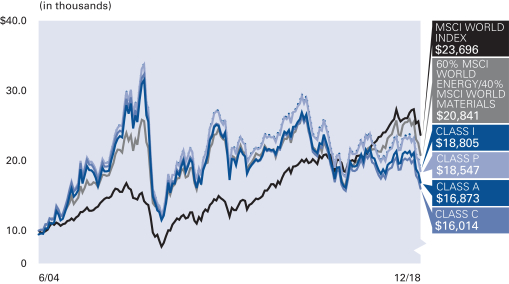

Cumulative Returns Through December 31, 2018

The Fund began operations on 6/30/04. Benchmark comparisons began on the fund inception date.

Country Allocation (as of December 31, 2018)

| | | | |

| |

| United States | | | 61.1% | |

| |

| United Kingdom | | | 15.7% | |

| |

| Canada | | | 6.4% | |

| |

| France | | | 6.3% | |

| |

| Australia | | | 6.1% | |

| |

| Germany | | | 1.1% | |

| |

| Denmark | | | 0.9% | |

| |

| Japan | | | 0.8% | |

| |

| Other | | | 1.7% | |

| |

| Cash & Equivalents — Net | | | –0.1% | |

| | | | | | |

| | Semiannual Report | | | December 31, 2018 | | 13 |

Unaudited

AllianzGI Global Natural Resources Fund (cont’d)

| | | | | | | | |

| |

| Shareholder Expense Example | | Actual Performance |

| | | Class A | | Class C | | Class P | | Institutional

Class |

| | | | |

| Beginning Account Value (7/1/18) | | $1,000.00 | | $1,000.00 | | $1,000.00 | | $1,000.00 |

| | | | |

| Ending Account Value (12/31/18) | | $801.50 | | $797.90 | | $802.70 | | $802.70 |

| | | | |

| Expenses Paid During Period | | $6.49 | | $9.88 | | $5.36 | | $4.91 |

| | | | | | | | | |

| |

| | | Hypothetical Performance |

| | | (5% return before expenses) |

| | | Class A | | Class C | | Class P | | Institutional

Class |

| | | | |

| Beginning Account Value (7/1/18) | | $1,000.00 | | $1,000.00 | | $1,000.00 | | $1,000.00 |

| | | | |

| Ending Account Value (12/31/18) | | $1,018.00 | | $1,014.22 | | $1,019.26 | | $1,019.76 |

| | | | |

| Expenses Paid During Period | | $7.27 | | $11.07 | | $6.01 | | $5.50 |

For each class of the Fund, expenses are equal to the annualized expense ratio for the class (1.43% for Class A, 2.18% for Class C, 1.18% for Class P and 1.08% for Institutional Class), multiplied by the average account value over the period, multiplied by 184/365.

| | | | | | |

| 14 | | December 31, 2018 | | | Semiannual Report | | |

(THIS PAGE INTENTIONALLY LEFT BLANK)

| | | | | | |

| | Semiannual Report | | | December 31, 2018 | | 15 |

Unaudited

AllianzGI Global Small-Cap Fund

For the period of July 1, 2018 through December 31, 2018, as provided by Andrew Neville, Lead Portfolio Manager.

Fund Insights

For the six-month period ended December 31, 2018, the Class A shares at net asset value (“NAV”) of the AllianzGI Global Small-Cap Fund (the “Fund”) returned -18.90%, underperforming the MSCI World Small-Cap Index (the “benchmark”), which returned -16.12%.

Market Overview

Global equities fell sharply over the second half of 2018, with many markets entering bear territory (defined as a drop of at least 20% from a recent peak) in the fourth quarter. In general, markets continued to ratchet higher during the third quarter, but a sudden rise in bond yields at the start of October sent stocks into reverse. The sell-off intensified as worries over earnings added to concerns over the impact of higher tariffs and the outlook for global growth. Politics also unsettled investors, with a US government shutdown, continued uncertainty over Brexit, Italy’s controversial budget and political unrest in France, all adding to the downward pressure on prices.

Global small-caps closed the second half of 2018 with losses and overall lagging their large-cap counterparts.

Portfolio review

The Fund underperformed its benchmark during the six-month period ended December 31, 2018 (net of fees, in USD). In absolute terms, all four small-cap markets showed losses. European small-caps registered the strongest losses followed by small-caps from the US, Japan and finally Asia ex Japan. In relative terms, whilst the US sleeve portfolio was able to perform almost in line with the local market, the Japanese, the European and the Asia ex-Japan sleeve portfolios lagged their respective regional indices.

Both stock selection and sector allocation had a negative effect on performance. The overweight in materials stocks as well as the underweight in real estate and utilities weighed on the fund’s relative performance. Nevertheless, our overweight exposure to the consumer staples sector and our underweight in consumer discretionary were favourable. Stock selection in the industrials , information technology and real estate sectors had a particularly negative impact on performance. Stock selection in the communication services, consumer staples and energy sectors worked well, however. Detractors to performance came in the form of Japanese, American and Swiss stocks. Nevertheless, stock selection in France and the Netherlands contributed positively.

On single stock basis, the positions in The Simply Good Foods Co., Service Corp International and NRG Energy, Inc. (all US) were the most positive contributors. On the other hand, the positions in ASOS Plc (UK), ams AG (Switzerland) and USA Technologies, Inc. (US) were the most significant detractors.

Outlook

We believe that geopolitical risks will remain a burden for global equities. In Europe, the Brexit date is relentlessly approaching, and the fiscal policy conflict between Italy and the European Commission is still not resolved. In addition, the trade conflict between the US and China is going into the next round, and growth rates are diverging more and more. While the US economy is still quite healthy and acting as a global growth engine, we believe the first signs of weakness are emerging in other regions. Nevertheless, the global economy as a whole does not seem to be at the brink of a recession. The major central banks look set to stick to their monetary normalisation course (peak liquidity), even though the recent oil price decline has had a dampening effect on long-term inflation expectations. Overall, we believe that volatility will rise and different sectors and countries will move in different directions.

| | | | | | |

| 16 | | December 31, 2018 | | | Semiannual Report | | |

Unaudited

AllianzGI Global Small-Cap Fund (cont’d)

Average Annual Total Return for the period ended December 31, 2018

| | | | | | | | | | | | | | | | | | | | | | |

| | | | | | |

| | | | | 6 Month* | | | 1 Year | | | 5 Year | | | 10 Year | | | Since Inception† | |

| | | AllianzGI Global Small-Cap Fund Class A | | | –18.90% | | | | –16.75% | | | | 1.46% | | | | 12.36% | | | | 9.15% | |

| | AllianzGI Global Small-Cap Fund Class A (adjusted) | | | –23.36% | | | | –21.33% | | | | 0.32% | | | | 11.73% | | | | 8.87% | |

| | | AllianzGI Global Small-Cap Fund Class C | | | –19.21% | | | | –17.38% | | | | 0.71% | | | | 11.52% | | | | 8.35% | |

| | AllianzGI Global Small-Cap Fund Class C (adjusted) | | | –19.84% | | | | –18.02% | | | | 0.71% | | | | 11.52% | | | | 8.35% | |

| | AllianzGI Global Small-Cap Fund Class P | | | –18.80% | | | | –16.55% | | | | 1.72% | | | | 12.66% | | | | 9.46% | |

| | AllianzGI Global Small-Cap Fund Institutional Class | | | –18.75% | | | | –16.46% | | | | 1.83% | | | | 12.76% | | | | 9.57% | |

| | MSCI World Small-Cap Index | | | –16.12% | | | | –13.86% | | | | 3.88% | | | | 12.02% | | | | 7.39% | |

| | | Lipper Global Small-/Mid-Cap Funds Average | | | –15.20% | | | | –13.39% | | | | 2.90% | | | | 11.61% | | | | 7.94% | |

* Cumulative return

† The Fund began operations on 12/31/96. Benchmark and Lipper comparisons began on the fund inception date.

Performance quoted represents past performance and is no guarantee of future results. Current performance may be lower or higher than performance shown. For performance current to the most recent month-end, visit our website at us.allianzgi.com. Investment return and the principal value will fluctuate. Shares may be worth more or less than original cost when redeemed.The adjusted returns take into account the maximum sales charge of 5.50% on Class A shares and 1% contingent deferred sales charge (CDSC) on Class C shares, which may apply to shares redeemed during the first year of ownership. Returns do not reflect deduction of taxes that a shareholder would pay on fund distributions or redemption of fund shares. Please see pages 60-62 for more information. The Fund’s expense ratios are 1.62% for Class A shares, 2.37% for Class C shares, 1.37% for Class P shares and 1.27% for Institutional Class shares. Expense ratio information is as of the Fund’s current prospectus dated August 30, 2018, as supplemented to date.

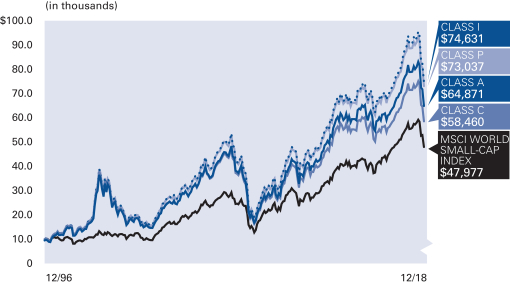

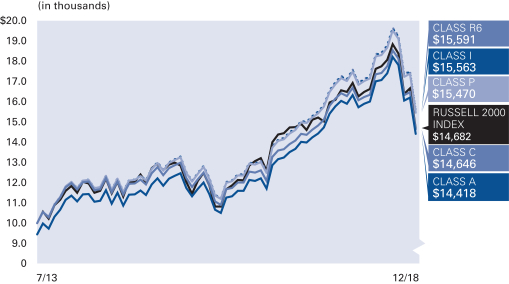

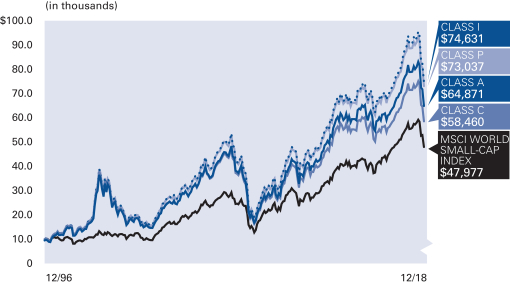

Cumulative Returns Through December 31, 2018

The Fund began operations on 12/31/96. Benchmark comparisons began on the fund inception date.

Country Allocation (as of December 31, 2018)

| | | | |

| |

| United States | | | 58.5% | |

| |

| Japan | | | 13.1% | |

| |

| United Kingdom | | | 4.8% | |

| |

| Germany | | | 4.1% | |

| |

| France | | | 2.4% | |

| |

| Denmark | | | 2.4% | |

| |

| Switzerland | | | 2.3% | |

| |

| Austria | | | 2.2% | |

| |

| Other | | | 8.9% | |

| |

| Cash & Equivalents — Net | | | 1.3% | |

| | | | | | |

| | Semiannual Report | | | December 31, 2018 | | 17 |

Unaudited

AllianzGI Global Small-Cap Fund (cont’d)

| | | | | | | | |

| |

| Shareholder Expense Example | | Actual Performance |

| | | Class A | | Class C | | Class P | | Institutional

Class |

| | | | |

| Beginning Account Value (7/1/18) | | $1,000.00 | | $1,000.00 | | $1,000.00 | | $1,000.00 |

| | | | |

| Ending Account Value (12/31/18) | | $811.00 | | $807.90 | | $812.00 | | $812.50 |

| | | | |

| Expenses Paid During Period | | $7.39 | | $10.80 | | $6.26 | | $5.80 |

| | | | | | | | | |

| |

| | | Hypothetical Performance |

| | | (5% return before expenses) |

| | | Class A | | Class C | | Class P | | Institutional

Class |

| | | | |

| Beginning Account Value (7/1/18) | | $1,000.00 | | $1,000.00 | | $1,000.00 | | $1,000.00 |

| | | | |

| Ending Account Value (12/31/18) | | $1,017.04 | | $1,013.26 | | $1,018.30 | | $1,018.80 |

| | | | |

| Expenses Paid During Period | | $8.24 | | $12.03 | | $6.97 | | $6.46 |

For each class of the Fund, expenses are equal to the annualized expense ratio for the class (1.62% for Class A, 2.37% for Class C, 1.37% for Class P and 1.27% for Institutional Class), multiplied by the average account value over the period, multiplied by 184/365.

| | | | | | |

| 18 | | December 31, 2018 | | | Semiannual Report | | |

(THIS PAGE INTENTIONALLY LEFT BLANK)

| | | | | | |

| | Semiannual Report | | | December 31, 2018 | | 19 |

Unaudited

AllianzGI Health Sciences Fund

For the period of July 1, 2018 through December 31, 2018, as provided by Peter Pirsch, CFA, Lead Portfolio Manager.

Fund Insights

For the six-month period ended December 31, 2018, the Class A shares at net asset value (“NAV”) of the AllianzGI Health Sciences Fund (the “Fund”) returned -0.08%, underperforming the MSCI World Healthcare Index (the “benchmark”), which returned 0.98%.

Market overview

For the six-month period, global health care stocks significantly outperformed the broader averages. The benchmark rose 0.98% versus the S&P 500 Index and the MSCI World Index declines of -6.9% and -9.1%, respectively. Given the overall market’s fourth quarter declines, the more defensive sectors of the market outperformed less defensive sectors, such as health care, consumer staples, utilities and telecommunications. Conversly, the more cyclical sectors such as energy, materials and industrials were among the worst performing sectors for the second half of 2018.

It was a difficult fourth quarter for global equity markets. A big concern is whether the global equity sell-off is signaling a significant economic contraction. The combination of several factors including the US Federal Reserve’s desire to normalize higher interest rates, the unwinding of the US Federal Reserve’s quantitative easing programs, trade tensions and the outcome of the US midterm elections have elevated market volatility. Despite the uncertain current market environment and the sell-off in the fourth quarter, the global health care sector enjoyed a very solid full year of relative returns in 2018 and was one of the few sectors to post a positive return for the calendar year. The focus of the Trump administration continues to be on containing drug pricing and health care costs in general, although other non-health care related matters are currently more center stage.

Portfolio review

Overall, the Fund’s underperformance was primarily driven by adverse stock selection in biotechnology. The managed care company, Anthem Inc., was one the biggest contributors to performance for the six-month period. The stock benefitted from solid quarterly earnings reports throughout the year and a strong year in general for stock returns for the large cap managed care industry. Another larger contributor to performance was a small-cap biotechnology holding, Addus Homecare Corp., which provides a broad range of social and medical services to the home. The zero weights throughout the six month period in Bayer AG and Fresenius Medical Care AG & Co. KGaA, and the underweight position in GlaxoSmithKline Plc also benefitted performance.

The largest individual detractors to performance were centered on the positioning in several biopharma stocks. The underweight positions in Eli Lilly Co., Pfizer, Inc. and Roche Holdings AG hurt performance as the stocks of large-cap pharmaceutical companies generally outperformed the Fund’s benchmark during the fourth quarter sell-off due to their defensive characteristics. Other detractors included Allergan Plc and Heron Therapeutics, Inc. Allergan’s estimates were reduced several times throughout the year.

Outlook

2018 was a solid year for relative returns for the global health care sector. As we enter 2019, we are both committed and focused on what we believe are the significant secular, long-term growth drivers for health care, drug and cost innovation. Areas of focus and where the Fund is currently overweight include emerging biopharma therapies, unique medical device technology, drug retail and managed care. The Fund remains underweight in the larger pharmaceutical companies whose pipelines lack the comparative innovation of biotechnology and whose pricing power has eroded as more and more legacy products are subjected to generic competition. We believe that pricing power is particularly critical given the recent pick- up in rhetoric about drug price controls. The overall current beta in the Fund’s portfolio is relatively more conservative now given the recent market volatility.

| | | | | | |

| 20 | | December 31, 2018 | | | Semiannual Report | | |

Unaudited

AllianzGI Health Sciences Fund (cont’d)

Average Annual Total Return for the period ended December 31, 2018

| | | | | | | | | | | | | | | | | | | | | | |

| | | | | | |

| | | | | 6 Month* | | | 1 Year | | | 5 Year | | | 10 Year | | | Since Inception† | |

| | | AllianzGI Health Sciences Fund Class A | | | –0.08% | | | | 4.67% | | | | 9.57% | | | | 14.28% | | | | 11.28% | |

| | AllianzGI Health Sciences Fund Class A (adjusted) | | | –5.58% | | | | –1.09% | | | | 8.34% | | | | 13.63% | | | | 10.99% | |

| | | AllianzGI Health Sciences Fund Class C | | | –0.44% | | | | 3.89% | | | | 8.75% | | | | 13.42% | | | | 10.45% | |

| | AllianzGI Health Sciences Fund Class C (adjusted) | | | –1.26% | | | | 3.02% | | | | 8.75% | | | | 13.42% | | | | 10.45% | |

| | AllianzGI Health Sciences Fund Institutional Class | | | 0.09% | | | | 5.02% | | | | 9.95% | | | | 14.67% | | | | 11.69% | |

| | MSCI World Health Care Index | | | 0.98% | | | | 2.51% | | | | 7.58% | | | | 11.89% | | | | 8.30% | |

| | | Lipper Health/Biotech Funds Average | | | –8.17% | | | | –0.84% | | | | 9.14% | | | | 15.46% | | | | 11.26% | |

* Cumulative return

† The Fund began operations on 12/31/96. Benchmark and Lipper comparisons began on the fund inception date.

Performance quoted represents past performance and is no guarantee of future results. Current performance may be lower or higher than performance shown. For performance current to the most recent month-end, visit our website at us.allianzgi.com. Investment return and the principal value will fluctuate. Shares may be worth more or less than original cost when redeemed.The adjusted returns take into account the maximum sales charge of 5.50% on Class A shares and 1% contingent deferred sales charge (CDSC) on Class C shares, which may apply to shares redeemed during the first year of ownership. Returns do not reflect deduction of taxes that a shareholder would pay on fund distributions or redemption of fund shares. Please see pages 60-62 for more information. The Fund’s expense ratios are 1.47% for Class A shares, 2.22% for Class C shares and 1.12% for Institutional Class shares. Expense ratio information is as of the Fund’s current prospectus dated August 30, 2018, as supplemented to date.

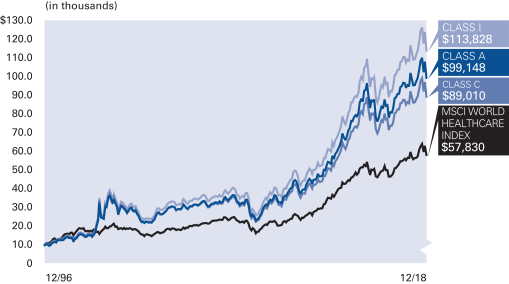

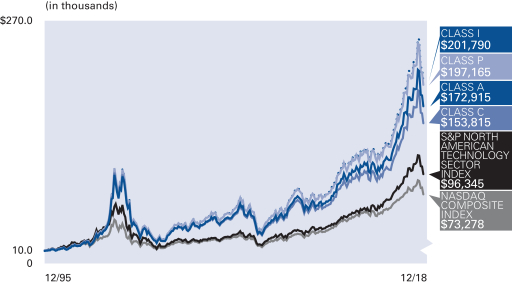

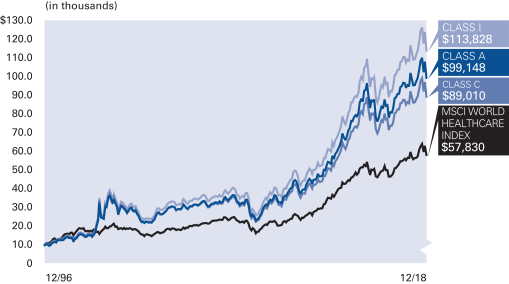

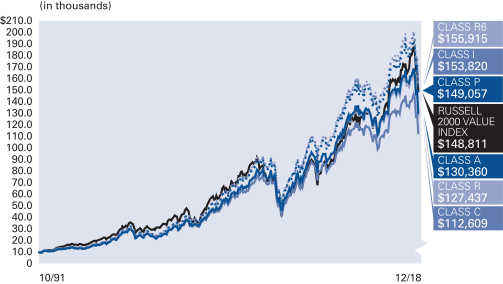

Cumulative Returns Through December 31, 2018

The Fund began operations on 12/31/96. Benchmark comparisons began on the fund inception date.

Industry/Sectors (as of December 31, 2018)

| | | | |

| |

| Pharmaceuticals | | | 37.2% | |

| |

| HealthCare Providers & Services | | | 20.7% | |

| |

| HealthCare Equipment & Supplies | | | 18.3% | |

| |

| Biotechnology | | | 15.4% | |

| |

| Life Sciences Tools & Services | | | 6.6% | |

| |

| Cash & Equivalents — Net | | | 1.8% | |

| | | | | | |

| | Semiannual Report | | | December 31, 2018 | | 21 |

Unaudited

AllianzGI Health Sciences Fund (cont’d)

| | | | | | | | | | |

| |

| Shareholder Expense Example | | Actual Performance |

| | | | | | | Class A | | Class C | | Institutional

Class |

| | | | | |

| Beginning Account Value (7/1/18) | | | | | | $1,000.00 | | $1,000.00 | | $1,000.00 |

| | | | | |

| Ending Account Value (12/31/18) | | | | | | $999.20 | | $995.60 | | $1,000.90 |

| | | | | |

| Expenses Paid During Period | | | | | | $7.36 | | $11.12 | | $5.60 |

| | | | | | | | | | | |

| |

| | | Hypothetical Performance |

| | | (5% return before expenses) |

| | | | | | | Class A | | Class C | | Institutional

Class |

| | | | | |

| Beginning Account Value (7/1/18) | | | | | | $1,000.00 | | $1,000.00 | | $1,000.00 |

| | | | | |

| Ending Account Value (12/31/18) | | | | | | $1,017.85 | | $1,014.06 | | $1,019.61 |

| | | | | |

| Expenses Paid During Period | | | | | | $7.43 | | $11.22 | | $5.65 |

For each class of the Fund, expenses are equal to the annualized expense ratio for the class (1.46% for Class A, 2.21% for Class C and 1.11% for Institutional Class), multiplied by the average account value over the period, multiplied by 184/365.

| | | | | | |

| 22 | | December 31, 2018 | | | Semiannual Report | | |

(THIS PAGE INTENTIONALLY LEFT BLANK)

| | | | | | |

| | Semiannual Report | | | December 31, 2018 | | 23 |

Unaudited

AllianzGI Income & Growth Fund

For the period of July 1, 2018, through December 31, 2018, as provided by Doug Forsyth, CFA, Portfolio Manager.

Fund Insights

For the six-month period ended December 31, 2018, Class A shares at net asset value (“NAV”) of the AllianzGI Income & Growth Fund (the “Fund”) returned -6.83%. During the same period, the S&P 500 Index declined -6.85% and the overall U.S. bond market, as measured by the Bloomberg Barclays U.S. Aggregate Bond Index, rose 1.65%. The convertible universe returned -5.75%, as measured by the ICE BofA Merrill Lynch All US Convertibles Index; and high yield bonds, as measured by the ICE BofA Merrill Lynch US High Yield Master II Index, declined -2.34%. Lastly, the Russell 1000 Growth Index fell-8.17%.

Market Overview

Risk assets were set to deliver strong annual returns exiting the third quarter of 2018 based on fundamental strength and economic momentum. However, US stocks, convertibles and high yield bonds faded in the fourth quarter as investors lost confidence in the staying power of earnings and the stability of the economy, fearing that trade wars and the US Federal Reserve’s path would lessen their durability. Overseas growth concerns and headlines—sources of persistent angst throughout 2018—in combination with crude oil weakness and US political uncertainty, also eroded sentiment. That being said, there was no change in overall fundamentals to substantiate the sharp selloff.

US stocks turned in their worst fourth quarter and annual performances since 2008. Convertibles and high-yield bonds experienced selling pressure alongside equities. Although the two asset classes finished lower, both continued to perform as expected, holding up much better than stocks.

Corporate fundamentals continued to improve with most US companies reporting better-than-expected financial results. Earnings growth for the S&P 500 Index rose more than 25% on a year-over-year basis, according to FactSet Research. Additionally, high-yield credit fundamentals strengthened, continuing a multi-year trend.

The strength of the US economy was supportive of the markets and contrasted overseas slowing. US reports revealed robust growth with third-quarter GDP increasing 3.4%. Unemployment stayed low, industrial production increased and consumer spending was strong. Not all data were positive, however. Auto, housing and semiconductor reports confirmed further easing in these industries.

With the US economy growing above trend the US Federal Reserve continued to reduce its balance sheet and, as expected, raised rates. The federal funds rate reached a range of 2.25 to 2.50%. Fearing a policy mistake, risk assets were sold following the Fed’s December communication.

Lastly, crude oil settled near $45 per barrel after falling 55% from its October peak to its December trough amid oversupply and slowing demand concerns and US dollar strength.

Portfolio Review

The Fund provided consistent income—the primary goal of the Fund—over the six-month period. Convertible and high-yield bond holdings experienced selling pressure alongside equity positions, but held up better, dampening downside volatility and benefiting the Fund’s overall performance.

In the equity sleeve, consumer discretionary, information technology and consumer staples helped relative performance. Conversely, the energy, health care and materials sectors hindered relative performance.

In the convertible sleeve, sectors that contributed positively to relative performance were technology, materials and media. On the other hand, energy, financials and telecommunications pressured relative performance.

In the high yield sleeve, industries that aided relative performance were basic industry & real estate, printing & publishing and media content. In contrast, financials services, chemicals and theaters & entertainment hampered relative performance.

The Fund took advantage of the new opportunities provided by the elevated volatility environment over the latter half of the reporting period and was able to retain many of the option premiums within these months. The period ended with the percent of equity holdings with a covered call structure near the upper end of the last twelve month range of 25-50%.

Outlook

Volatility remained elevated throughout the fourth quarter of 2018. However, the US economy and corporate earnings are expected to deliver continued growth in 2019. Corporations are expected to continue to invest for growth and create shareholder value. While some cyclical areas have exhibited weakness, we believe the overall credit and fundamental profiles of risk assets remain healthy and are not signaling an economic downturn. In our opinion, these factors should be market supportive going forward.

| | | | | | |

| 24 | | December 31, 2018 | | | Semiannual Report | | |

Unaudited

AllianzGI Income & Growth Fund (cont’d)

Average Annual Total Return for the period ended December 31, 2018

| | | | | | | | | | | | | | | | | | | | | | |

| | | | | | |

| | | | | 6 Month* | | | 1 Year | | | 5 Year | | | 10 Year | | | Since Inception† | |

| | | AllianzGI Income & Growth Fund Class A | | | –6.83% | | | | –4.18% | | | | 4.04% | | | | 10.74% | | | | 6.04% | |

| | AllianzGI Income & Growth Fund Class A (adjusted) | | | –11.96% | | | | –9.45% | | | | 2.87% | | | | 10.11% | | | | 5.54% | |

| | | AllianzGI Income & Growth Fund Class C | | | –7.16% | | | | –4.89% | | | | 3.27% | | | | 9.92% | | | | 5.25% | |

| | AllianzGI Income & Growth Fund Class C (adjusted) | | | –8.05% | | | | –5.77% | | | | 3.27% | | | | 9.92% | | | | 5.25% | |

| | AllianzGI Income & Growth Fund Class R | | | –6.95% | | | | –4.42% | | | | 3.77% | | | | 10.47% | | | | 5.79% | |

| | AllianzGI Income & Growth Fund Class P | | | –6.74% | | | | –3.95% | | | | 4.30% | | | | 11.02% | | | | 6.32% | |

| | AllianzGI Income & Growth Fund Institutional Class | | | –6.72% | | | | –3.82% | | | | 4.40% | | | | 11.13% | | | | 6.42% | |

| | Bloomberg Barclays U.S. Aggregate Bond Index | | | 1.65% | | | | 0.01% | | | | 2.52% | | | | 3.48% | | | | 3.83% | |

| | S&P 500 Index | | | –6.85% | | | | –4.38% | | | | 8.49% | | | | 13.12% | | | | 7.25% | |

| | | Lipper Flexible Portfolio Funds Average | | | –6.54% | | | | –7.23% | | | | 2.02% | | | | 7.38% | | | | 3.93% | |

* Cumulative return

† The Fund began operations on 2/28/07. Benchmark and Lipper comparisons began on the fund inception date.

Performance quoted represents past performance and is no guarantee of future results. Current performance may be lower or higher than performance shown. For performance current to the most recent month-end, visit our website at us.allianzgi.com. Investment return and the principal value will fluctuate. Shares may be worth more or less than original cost when redeemed.The adjusted returns take into account the maximum sales charge of 5.50% on Class A shares and 1% contingent deferred sales charge (CDSC) on Class C shares, which may apply to shares redeemed during the first year of ownership. Returns do not reflect deduction of taxes that a shareholder would pay on fund distributions or redemption of fund shares. Please see pages 60-62 for more information. The Fund’s gross expense ratios are 1.28% for Class A shares, 2.03% for Class C shares, 1.53% for Class R shares, 1.03% for Class P shares and 0.93% for Institutional Class shares. These ratios do not include an expense reduction, contractually agreed through at least October 31, 2019. The Fund’s expense ratios net of this reduction are 1.27% for Class A shares, 2.02% for Class C shares, 1.52% for Class R shares, 1.02% for Class P shares and 0.92% for Institutional Class shares. Expense ratio information is as of the Fund’s current prospectus dated August 30, 2018, as supplemented to date.

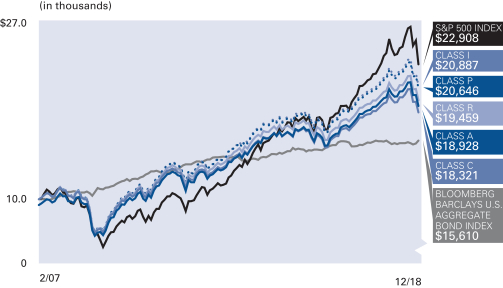

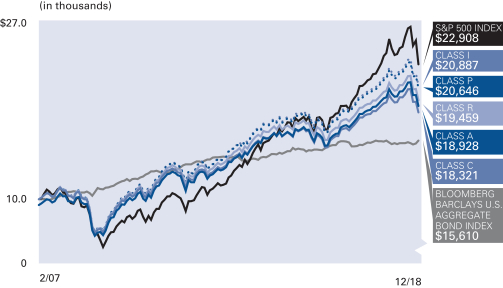

Cumulative Returns Through December 31, 2018

The Fund began operations on 2/28/07. Benchmark comparisons began on the fund inception date.

Industry/Sectors (as of December 31, 2018)

| | | | |

| |

| Software | | | 8.1% | |

| |

| Oil, Gas & Consumable Fuels | | | 5.1% | |

| |

| Internet | | | 5.1% | |

| |

| Media | | | 4.7% | |

| |

| Semiconductors | | | 4.2% | |

| |

| Telecommunications | | | 4.1% | |

| |

| Biotechnology | | | 4.0% | |

| |

| Pharmaceuticals | | | 3.9% | |

| |

| Other | | | 57.6% | |

| |

| Cash & Equivalents — Net | | | 3.2% | |

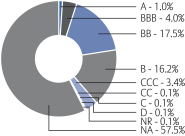

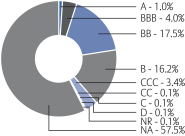

S&P Ratings* (as of December 31, 2018)

| * | As a percentage of fixed-income investments. Bond ratings refer to the underlying holdings of the Fund and are categorized from highest to lowest credit quality using ratings provided by S&P Global Ratings (“S&P”). S&P’s ratings have been selected for several reasons, including the portfolio managers’ usage of S&P ratings methodology among other credit quality information in managing the Fund, access to background information and other materials provided by S&P, as well as the Fund’s consideration of industry practice. The Fund also displays S&P credit ratings information in materials provided in client presentations. See “Important Information” for more detail on the selection of S&P for the Fund’s ratings presentation. Securities not rated by S&P and bonds that do not currently have a rating available are designated in the chart as “NR” and “NA”, respectively. |

| | | | | | |

| | Semiannual Report | | | December 31, 2018 | | 25 |

Unaudited

AllianzGI Income & Growth Fund (cont’d)

| | | | | | | | | | |

| |

| Shareholder Expense Example | | Actual Performance |

| | | Class A | | Class C | | Class R | | Class P | | Institutional

Class |

| | | | | |

| Beginning Account Value (7/1/18) | | $1,000.00 | | $1,000.00 | | $1,000.00 | | $1,000.00 | | $1,000.00 |

| | | | | |

| Ending Account Value (12/31/18) | | $931.70 | | $928.40 | | $930.50 | | $932.60 | | $932.80 |

| | | | | |

| Expenses Paid During Period | | $6.23 | | $9.87 | | $7.44 | | $5.02 | | $4.53 |

| | | | | | | | | | | |

| |

| | | Hypothetical Performance |

| | | (5% return before expenses) |

| | | Class A | | Class C | | Class R | | Class P | | Institutional

Class |

| | | | | |

| Beginning Account Value (7/1/18) | | $1,000.00 | | $1,000.00 | | $1,000.00 | | $1,000.00 | | $1,000.00 |

| | | | | |

| Ending Account Value (12/31/18) | | $1,018.75 | | $1,014.97 | | $1,017.49 | | $1,020.01 | | $1,020.52 |

| | | | | |

| Expenses Paid During Period | | $6.51 | | $10.31 | | $7.78 | | $5.24 | | $4.74 |

For each class of the Fund, expenses (net of fee waivers) are equal to the annualized expense ratio for the class (1.28% for Class A, 2.03% for Class C, 1.53% for Class R, 1.03% for Class P and 0.93% for Institutional Class), multiplied by the average account value over the period, multiplied by 184/365.

| | | | | | |

| 26 | | December 31, 2018 | | | Semiannual Report | | |

(THIS PAGE INTENTIONALLY LEFT BLANK)

| | | | | | |

| | Semiannual Report | | | December 31, 2018 | | 27 |

Unaudited

AllianzGI Mid-Cap Fund

For the period July 1, 2018 through December 31, 2018, as provided by Steven Klopukh, CFA, Lead Portfolio Manager.

Fund Insights

For the six-month period ended December 31, 2018, Class A shares at net asset value (“NAV”) of the AllianzGI Mid-Cap Fund (the “Fund”) returned-13.79%, underperforming the Russell Midcap Growth Index (the “benchmark”), which returned -9.63%.

Market Overview

Broader US equity markets posted losses over the six-month period. In early October, the combination of the potential for a decelerating economic environment and investors’ hawkish interpretation of US Federal Reserve Chairman Jerome Powell’s commentary on monetary policy provided the catalyst for the sharp selloff. Despite volatility in the equity markets, economic fundamentals were positive. Third quarter GDP grew at 3.4% and corporate earnings growth remained robust. Against this backdrop, the Russell Midcap Index returned -11.1%, underperforming the Russell 1000 Index’s return of -7.4%.

Portfolio Review

Security selection was the main driver of the underperformance while sector allocation had a negligible effect. Stock picking in industrials was the primary detractor, followed by the information technology and consumer discretionary sectors. Positive security selection was partly offsetting from the health care, materials and real estate sectors.

The top active contributor over the period was DexCom, Inc., which is a medical device company that specializes in continuous glucose monitoring (CGM) systems with smart device connectivity. The stock benefited from quarterly earnings results and guidance that exceeded investor expectations. With low penetration in a large addressable market and strong product offerings, including the upcoming Dexcom G6 that does not require finger prick calibration, DexCom’s growth trajectory remains robust.

A top detractor over the period, XPO Logistics, Inc. is a leading global freight, transportation and logistics company with a focus on e-commerce. The stock fell during the period after the company posted lowered earnings guidance and a hedge fund released a short-sell report on XPO. Overall, we believe the report is based on exaggerated claims and we maintain a constructive long-term outlook for the company. However, given the recent volatility, we continue to monitor the situation closely.

As of December 31, 2018, the largest sector overweight was in information technology, followed by health care and consumer discretionary. Financials was the largest underweight position in the Fund, followed by the real estate and utilities sectors.

Outlook

We maintain a constructive outlook for the US economy, which we believe should continue its pace of moderate growth. Overall recession risk appears benign as key manufacturing and service surveys flash expansionary numbers; employment metrics remain positive; and leading indicators signal favorable conditions. However when compared to 2018, we believe economic growth should decelerate, as the temporary boost from tax reform and inventory build ahead of tariffs rolls off in 2019.

With regard to Jerome Powell’s communications misstep that contributed to the equity market selloff, the US Federal Reserve Chairman has since clarified that monetary policy remains data dependent and will be flexible according to changing conditions. In our opinion, this clarification should help stabilize investor appetite for risk assets into the New Year. As for decelerating economic conditions, we suspect that the recent sharp selloff in equity markets has more than discounted the prospects of slower growth. Indeed, the Russell Midcap Index’s price to earnings ratio experienced significant multiple contraction. From our research, we believe this was a negative two standard deviation event and current levels are comparable to the tail end of previous distressed environments. Overall, we think the risk return outlook of the asset class appears attractive.

As always, we continue to focus on stock selection, seeking to invest in high quality mid-cap companies with attractive growth prospects that are attractively valued. The Fund emphasizes free cash flow yield and responsible capital allocation.

| | | | | | |

| 28 | | December 31, 2018 | | | Semiannual Report | | |

Unaudited

AllianzGI Mid-Cap Fund (cont’d)

Average Annual Total Return for the period ended December 31, 2018

| | | | | | | | | | | | | | | | | | | | | | |

| | | | | | |

| | | | | 6 Month* | | | 1 Year | | | 5 Year | | | 10 Year | | | Since Inception† | |

| | | AllianzGI Mid-Cap Fund Class A | | | –13.79% | | | | –11.28% | | | | 5.42% | | | | 12.85% | | | | 12.25% | |

| | AllianzGI Mid-Cap Fund Class A (adjusted) | | | –18.54% | | | | –16.16% | | | | 4.24% | | | | 12.21% | | | | 12.09% | |

| | | AllianzGI Mid-Cap Fund Class C | | | –14.40% | | | | –11.95% | | | | 4.60% | | | | 12.00% | | | | 11.47% | |

| | AllianzGI Mid-Cap Fund Class C (adjusted) | | | –15.10% | | | | –12.67% | | | | 4.60% | | | | 12.00% | | | | 11.47% | |

| | AllianzGI Mid-Cap Fund Class R | | | –14.00% | | | | –11.45% | | | | 5.12% | | | | 12.56% | | | | 12.06% | |

| | AllianzGI Mid-Cap Fund Class P | | | –13.71% | | | | –10.88% | | | | 5.71% | | | | 13.19% | | | | 12.70% | |

| | AllianzGI Mid-Cap Fund Institutional Class | | | –13.65% | | | | –10.83% | | | | 5.79% | | | | 13.27% | | | | 12.81% | |

| | | AllianzGI Mid-Cap Fund Administrative Class | | | –13.98% | | | | –11.17% | | | | 5.47% | | | | 12.99% | | | | 12.51% | |

| | Russell Midcap Growth Index | | | –9.63% | | | | –4.75% | | | | 7.42% | | | | 15.12% | | | | 11.91% | |

| | | Lipper Mid-Cap Growth Funds Average | | | –12.00% | | | | –5.37% | | | | 6.05% | | | | 13.33% | | | | 9.63% | |

| | | Lipper Multi-Cap Growth Funds Average | | | –10.07% | | | | –2.95% | | | | 7.24% | | | | 13.65% | | | | —% | |

* Cumulative return

† The Fund began operations on 11/6/79. Benchmark and primary Lipper performance comparisons began on 10/31/79; secondary Lipper performance is available for trailing 10 years.

Performance quoted represents past performance and is no guarantee of future results. Current performance may be lower or higher than performance shown. For performance current to the most recent month-end, visit our website at us.allianzgi.com. Investment return and the principal value will fluctuate. Shares may be worth more or less than original cost when redeemed.The adjusted returns take into account the maximum sales charge of 5.50% on Class A shares and 1% contingent deferred sales charge (CDSC) on Class C shares, which may apply to shares redeemed during the first year of ownership. Returns do not reflect deduction of taxes that a shareholder would pay on fund distributions or redemption of fund shares. Please see pages 60-62 for more information. The Fund’s expense ratios are 1.13% for Class A shares, 1.88% for Class C shares, 1.38% for Class R shares, 0.88% for Class P shares, 0.78% for Institutional Class shares and 1.03% for Administrative Class shares. Expense ratio information is as of the Fund’s current prospectus dated August 30, 2018, as supplemented to date.

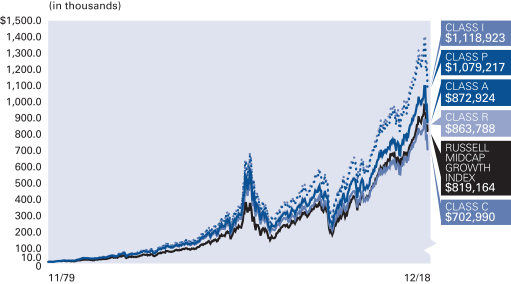

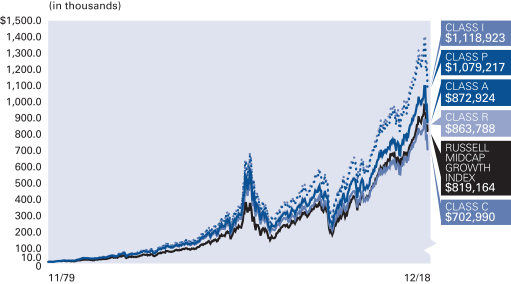

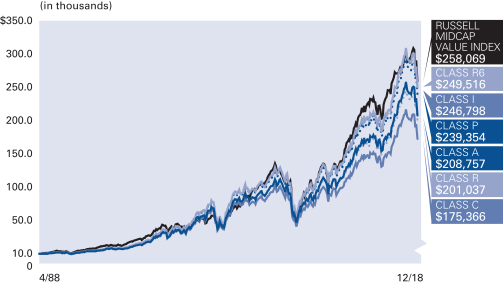

Cumulative Returns Through December 31, 2018

The Fund began operations on 11/6/79. Benchmark performance comparisons began on 10/31/79.

Industry/Sectors (as of December 31, 2018)

| | | | |

| |

| Health Care Equipment & Supplies | | | 13.1% | |

| |

| Software | | | 9.6% | |

| |

| IT Services | | | 8.9% | |

| |

| Semiconductors & Semiconductor Equipment | | | 6.6% | |

| |

| Entertainment | | | 5.4% | |

| |

| Specialty Retail | | | 4.5% | |

| |

| Hotels, Restaurants & Leisure | | | 4.3% | |

| |

| Textiles, Apparel & Luxury Goods | | | 4.1% | |

| |

| Other | | | 44.2% | |

| |

| Cash & Equivalents — Net | | | –0.7% | |

| | | | | | |

| | Semiannual Report | | | December 31, 2018 | | 29 |

Unaudited

AllianzGI Mid-Cap Fund (cont’d)

| | | | | | | | | | | | |

| |

| Shareholder Expense Example | | Actual Performance |

| | | Class A | | Class C | | Class R | | Class P | | Institutional

Class | | Administrative

Class |

| | | | | | |

| Beginning Account Value (7/1/18) | | $1,000.00 | | $1,000.00 | | $1,000.00 | | $1,000.00 | | $1,000.00 | | $1,000.00 |

| | | | | | |

| Ending Account Value (12/31/18) | | $862.10 | | $856.00 | | $860.00 | | $862.90 | | $863.50 | | $860.20 |

| | | | | | |

| Expenses Paid During Period | | $5.35 | | $8.84 | | $6.52 | | $4.18 | | $3.71 | | $4.88 |

| | | | | | | | | | | | | |

| |

| | | Hypothetical Performance |

| | | (5% return before expenses) |

| | | Class A | | Class C | | Class R | | Class P | | Institutional

Class | | Administrative

Class |

| | | | | | |

| Beginning Account Value (7/1/18) | | $1,000.00 | | $1,000.00 | | $1,000.00 | | $1,000.00 | | $1,000.00 | | $1,000.00 |

| | | | | | |

| Ending Account Value (12/31/18) | | $1,019.46 | | $1,015.68 | | $1,018.20 | | $1,020.72 | | $1,021.22 | | $1,019.96 |

| | | | | | |

| Expenses Paid During Period | | $5.80 | | $9.60 | | $7.07 | | $4.53 | | $4.02 | | $5.30 |

For each class of the Fund, expenses are equal to the annualized expense ratio for the class (1.14% for Class A, 1.89% for Class C, 1.39% for Class R, 0.89% for Class P, 0.79% for Institutional Class and 1.04% for Administrative Class), multiplied by the average account value over the period, multiplied by 184/365.

| | | | | | |

| 30 | | December 31, 2018 | | | Semiannual Report | | |

(THIS PAGE INTENTIONALLY LEFT BLANK)

| | | | | | |

| | Semiannual Report | | | December 31, 2018 | | 31 |

Unaudited

AllianzGI NFJ Dividend Value Fund

For the period July 1, 2018 through December 31, 2018, as provided by the Value Equity, US team.

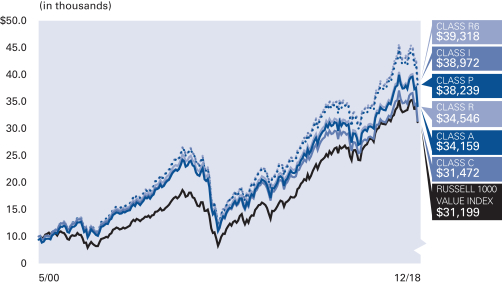

Fund Insights

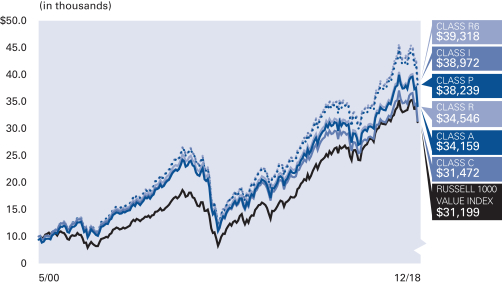

For the six-month period ended December 31, 2018, Class A shares at net asset value (“NAV”) of the AllianzGI NFJ Dividend Value Fund (the “Fund”) returned -8.62%, underperforming the Russell 1000 Value Index (the “benchmark”), which returned -6.69%.

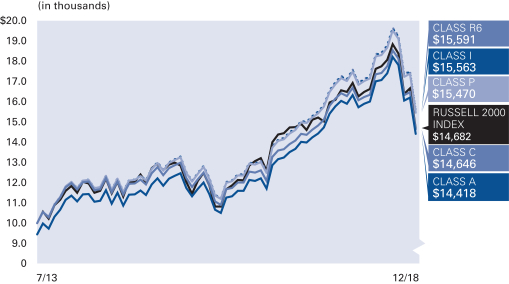

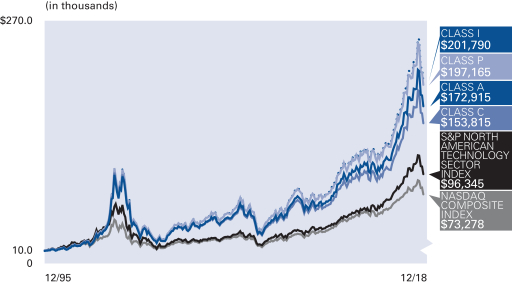

Market Overview