UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED

MANAGEMENT INVESTMENT COMPANIES

Investment Company Act file number (811-06260)

Quaker Investment Trust

(Exact name of registrant as specified in charter)

1180 W. Swedesford Road, Suite 150

Berwyn, PA 19312

(Address of principal executive offices) (Zip code)

Jeffry H. King, Sr.

Quaker Investment Trust

1180 W. Swedesford Road, Suite 150

Berwyn, PA 19312

(Name and address of agent for service)

(800) 220-8888

Registrant's telephone number, including area code

Date of fiscal year end: June 30, 2016

Date of reporting period: December 31, 2015

Item 1. Report to Stockholders.

Semi-Annual Report

December 31, 2015

Quaker Event Arbitrage Fund

Quaker Global Tactical Allocation Fund

Quaker Mid-Cap Value Fund

Quaker Small-Cap Value Fund

Quaker Strategic Growth Fund

| | | |

| | Mutual fund investing involves risk. Principal loss is possible. Investing in the Quaker Funds may involve special risk including, but not limited to, investments in smaller companies, short sales, foreign securities, special situations, debt securities and value growth investing. Please refer to the prospectus for more complete information. This report must be preceded or accompanied by a current prospectus. The opinions expressed are those of the adviser or sub-advisers through the end of the period for this report, are subject to change, are not a guarantee, and should not be considered investment advice. Fund holdings are subject to change and should not be considered a recommendation to buy or sell any security. Current and future holdings are subject to risk. | |

| | | |

Chairman’s Letter to the Shareholders (unaudited)

December 31, 2015

Dear Fellow Shareholder:

The premise upon which Quaker Funds, Inc. was founded was the desire to afford everyday investors access to the same tactical and allocation strategies used by professional money managers to augment traditional investing strategies within a holistic asset allocation mix. Our commitment to this principle is still as strong today as it was the day we opened our doors.

Our management team continually strives to provide our shareholders with innovative investment alternatives and advisers that constantly seek superior returns. Thank you for your trust and investment in the Quaker Funds.

Sincerely,

Jeffry H. King, Sr.

Chairman & CEO

Quaker Investment Trust

| | | | |

| | Table of Contents | | |

| | | Page | |

| | Chairman’s Letter to the Shareholders | 1 | |

| | Performance Update: | | |

| | Quaker Event Arbitrage Fund | 2 | |

| | Quaker Global Tactical Allocation Fund | 4 | |

| | Quaker Mid-Cap Value Fund | 6 | |

| | Quaker Small-Cap Value Fund | 8 | |

| | Quaker Strategic Growth Fund | 10 | |

| | Expense Information | 12 | |

| | Schedule of Investments | 14 | |

| | Statements of Assets and Liabilities | 32 | |

| | Statements of Operations | 34 | |

| | Statements of Changes in Net Assets | 36 | |

| | Financial Highlights | 38 | |

| | Notes to the Financial Statements | 53 | |

| | General Information | 73 | |

| | | | |

Performance Update (unaudited)

Quaker Event Arbitrage Fund (QEAAX, QEACX, QEAIX)

OBJECTIVES AND PRINCIPAL STRATEGIES

The Quaker Event Arbitrage Fund (“Fund”) seeks to provide long-term growth of capital. The Fund generally invests in the securities of publicly traded companies involved in mergers, takeovers, tender offers, leveraged buyouts, spin-offs, liquidations or similar events.

| Average Annualized Total Return |

| | | | | | | | | | Commencement |

| | | | | | | | | | of operations |

| | Expense | Inception | | | | | | | through |

| | Ratio* | Date | One Year | Five Year | Ten Year | 12/31/2015 |

| | | | with | without | with | without | with | without | with | without |

| | | | sales | sales | sales | sales | sales | sales | sales | sales |

| | | | charge | charge | charge | charge | charge | charge | charge | charge |

| Class A | 1.99% | 11/21/03 | -13.57% | -8.57% | -0.22% | 0.91% | 1.15% | 1.73% | 4.28% | 4.77% |

| Class C | 2.74% | 6/7/10 | -9.25% | -9.25% | 0.15% | 0.15% | N/A | N/A | 0.57% | 0.57% |

| Institutional Class | 1.74% | 6/7/10 | -8.30% | -8.30% | 1.16% | 1.16% | N/A | N/A | 1.55% | 1.55% |

S&P 500® Total Return Index** | | | 1.38% | 1.38% | 12.57% | 12.57% | 7.31% | 7.31% | 7.98% | 7.98% |

| * | As stated in the Prospectus dated October 28, 2015. Net Expense Ratio shown. Gross Expense Ratio: A:2.17%, C:2.92%, I:1.92%. The net expense ratio reflects a contractual commitment by the Fund’s investment adviser to waive fees and reimburse expenses through October 28, 2016. Absent the waiver and reimbursement, performance would have been less favorable. |

| ** | The benchmark since inception returns are calculated since commencement of November 21, 2003 through December 31, 2015. |

Performance data quoted represents past performance and is no guarantee of future results. Investment return and principal value will fluctuate so that shares, when redeemed, may be worth more or less than their original cost. Current performance may be lower or higher than performance data quoted. Performance data current to the most recent month end is available at www.quakerfunds.com or by calling us toll free at 800-220-8888. Total return includes reinvestment of dividends and capital gains.

Class A shares of the Fund have a maximum sales charge of 5.50%.

The performance table does not reflect the deduction of taxes that a shareholder might pay on fund distributions or the redemption of fund shares. Total return calculations reflect expense reimbursements and fee waivers in the applicable periods. See financial highlights for periods where fees were waived or reimbursed.

The Fund’s portfolio holdings may differ significantly from the securities held in the index and, unlike a mutual fund, an unmanaged index assumes no transaction costs, taxes, management fees or other expenses. You cannot invest directly in an index.

The S&P 500® Total Return Index (“S&P 500® Index”) is a widely recognized, unmanaged index consisting of the approximately 500 largest companies in the United States as measured by market capitalization. The S&P 500® Index assumes reinvestment of all dividends and distributions.

2015 SEMI-ANNUAL REPORT

Performance Update (unaudited) (continued)

Quaker Event Arbitrage Fund (QEAAX, QEACX, QEAIX)

ADVISER:

Quaker Funds, Inc.

TOTAL NET ASSETS:

AS OF DECEMBER 31, 2015

$59,195,285

| Top 10 Holdings* (% of net assets) |

| | |

| Pfizer Inc. | 3.8% |

| Mondelez International Inc. | 3.3% |

| AGL Resources Inc. | 3.2% |

| API Technologies Corp. | 2.8% |

| GFI Group Inc. | 2.7% |

| QUALCOMM Inc. | 2.6% |

| AbbVie Inc. | 2.6% |

| PepsiCo Inc. | 2.5% |

| Anheuser-Busch InBev NV - ADR | 2.4% |

| IEC Electronics Corp. | 2.4% |

| % Fund Total | 28.3% |

| * | Includes Long-Term Investments only. |

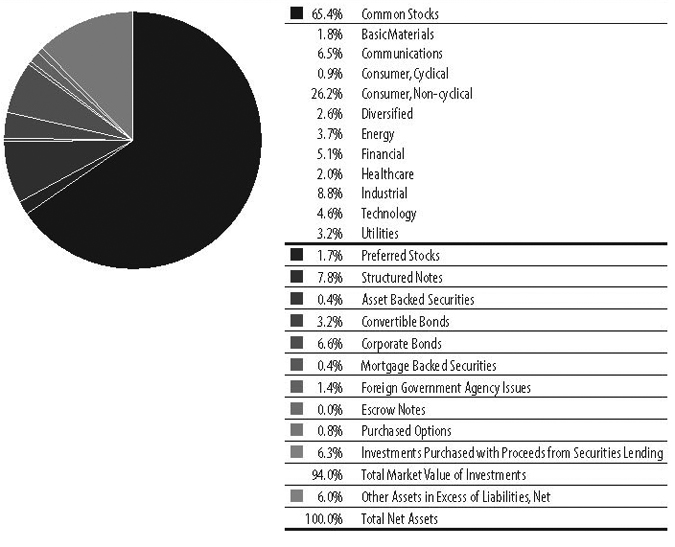

| Sectors (% of net assets) |

2015 SEMI-ANNUAL REPORT

Performance Update (unaudited)

Quaker Global Tactical Allocation Fund (QTRAX, QTRCX, QTRIX)

OBJECTIVES AND PRINCIPAL STRATEGIES

The Quaker Global Tactical Allocation Fund (“Fund”) seeks to provide long-term growth of capital. The Fund invests in common stocks of U.S. companies and American Depositary Receipts (“ADRs”) of foreign companies without regard to market capitalization. Under normal circumstances, the Fund will invest at least 40% of its total assets in common stocks and ADRs of foreign companies.

| Average Annualized Total Return |

| | | | | | | | | | Commencement |

| | | | | | | | | | of operations |

| | Expense | Inception | | | | | | | through |

| | Ratio* | Date | One Year | Five Year | Ten Year | 12/31/2015 |

| | | | with | without | with | without | with | without | with | without |

| | | | sales | sales | sales | sales | sales | sales | sales | sales |

| | | | charge | charge | charge | charge | charge | charge | charge | charge |

| Class A | 2.29% | 5/1/08 | -5.05% | 0.46% | 7.09% | 8.32% | N/A | N/A | 0.39% | 1.13% |

| Class C | 3.04% | 5/1/08 | -0.39% | -0.39% | 7.50% | 7.50% | N/A | N/A | 0.36% | 0.36% |

| Institutional Class | 2.04% | 7/23/08 | 0.72% | 0.72% | 8.58% | 8.58% | N/A | N/A | 3.09% | 3.09% |

| MSCI World® Index** | | | -0.87% | -0.87% | 7.59% | 7.59% | N/A | N/A | 3.39% | 3.39% |

| * | As stated in the Prospectus dated October 28, 2015. |

| ** | The benchmark since inception returns are calculated since commencement of May 1, 2008 through December 31, 2015. |

Performance data quoted represents past performance and is no guarantee of future results. Investment return and principal value will fluctuate so that shares, when redeemed, may be worth more or less than their original cost. Current performance may be lower or higher than performance data quoted. Performance data current to the most recent month end is available at www.quakerfunds.com or by calling us toll free at 800-220-8888. Total return includes reinvestment of dividends and capital gains.

Class A shares of the Fund have a maximum sales charge of 5.50%.

The performance table does not reflect the deduction of taxes that a shareholder might pay on fund distributions or the redemption of fund shares. Total return calculations reflect expense reimbursements and fee waivers in the applicable periods. See financial highlights for periods where fees were waived or reimbursed.

The Fund’s portfolio holdings may differ significantly from the securities held in the index and, unlike a mutual fund, an unmanaged index assumes no transaction costs, taxes, management fees or other expenses. You cannot invest directly in an index.

The Morgan Stanley Capital International World Index (“MSCI World® Index”) measures developed-market equity performance throughout the world. The MSCI World® Index assumes reinvestment of all dividends and distributions.

2015 SEMI-ANNUAL REPORT

Performance Update (unaudited) (continued)

Quaker Global Tactical Allocation Fund (QTRAX, QTRCX, QTRIX)

SUB-ADVISER:

DG Capital Management, Inc.

TOTAL NET ASSETS:

AS OF DECEMBER 31, 2015

$9,872,230

| Top 10 Holdings* (% of net assets) |

| Amazon.com Inc. | 4.5% |

| Alphabet Inc. CI A & C | 4.5% |

| Adobe Systems Inc. | 3.8% |

| Eli Lilly & Co. | 3.5% |

| Amgen Inc. | 3.3% |

| Gilead Sciences Inc. | 2.9% |

| Visa Inc. Cl A | 2.8% |

| Roche Holding AG | 2.8% |

| Bristol-Myers Squibb Co. | 2.6% |

| MasterCard Inc. Cl A | 2.6% |

| % Fund Total | 33.3% |

| * | Includes Long-Term Investments only. |

| Country Allocation (% of net assets) |

2015 SEMI-ANNUAL REPORT

Performance Update (unaudited)

Quaker Mid-Cap Value Fund (QMCVX, QMCCX, QMVIX)

OBJECTIVES AND PRINCIPAL STRATEGIES

The Quaker Mid-Cap Value Fund (the “Fund”) seeks to provide long-term growth of capital. Current income is not a significant investment consideration and any such income realized will be considered incidental to the Fund’s investment objective. The Fund invests primarily in common stocks comparable to the companies included in the Russell Midcap® Value Index.

| Average Annualized Total Return |

| | | | | | | | | | Commencement |

| | | | | | | | | | of operations |

| | Expense | Inception | | | | | | | through |

| | Ratio* | Date | One Year | Five Year | Ten Year | 12/31/2015 |

| | | | with | without | with | without | with | without | with | without |

| | | | sales | sales | sales | sales | sales | sales | sales | sales |

| | | | charge | charge | charge | charge | charge | charge | charge | charge |

| Class A | 1.98% | 12/31/97 | -15.60% | -10.70% | 6.73% | 7.95% | 3.74% | 4.33% | 6.48% | 6.82% |

| Class C | 2.73% | 7/31/00 | -11.38% | -11.38% | 7.13% | 7.13% | 3.56% | 3.56% | 6.96% | 6.96% |

| Institutional Class | 1.73% | 11/21/00 | -10.44% | -10.44% | 8.22% | 8.22% | 4.60% | 4.60% | 8.22% | 8.22% |

| Russell Mid-Cap® Value Index** | | | -4.78% | -4.78% | 11.25% | 11.25% | 7.61% | 7.61% | 8.89% | 8.89% |

| * | As stated in the Prospectus dated October 28, 2015. |

| ** | The benchmark since inception returns are calculated since commencement of December 31,1997 through December 31, 2015. |

Performance data quoted represents past performance and is no guarantee of future results. Investment return and principal value will fluctuate so that shares, when redeemed, may be worth more or less than their original cost. Current performance may be lower or higher than performance data quoted. Performance data current to the most recent month end is available at www.quakerfunds.com or by calling us toll free at 800-220-8888. Total return includes reinvestment of dividends and capital gains.

Class A shares of the Fund have a maximum sales charge of 5.50%.

The performance table does not reflect the deduction of taxes that a shareholder might pay on fund distributions or the redemption of fund shares. Total return calculations reflect expense reimbursements and fee waivers in the applicable periods. See financial highlights for periods where fees were waived or reimbursed.

The Fund’s portfolio holdings may differ significantly from the securities held in the index and, unlike a mutual fund, an unmanaged index assumes no transaction costs, taxes, management fees or other expenses. You cannot invest directly in an index.

The Russell Midcap® Value Index is a widely recognized, unmanaged index of companies included in the Russell 1000 Index with current market capitalizations between $2.4 billion to $28.7 billion. The Russell Midcap® Value index assumes reinvestment of all dividends.

2015 SEMI-ANNUAL REPORT

Performance Update (unaudited) (continued)

Quaker Mid-Cap Value Fund (QMCVX, QMCCX, QMVIX)

SUB-ADVISER:

Kennedy Capital Management, Inc.

TOTAL NET ASSETS:

AS OF DECEMBER 31, 2015

$7,202,191

| Top 10 Holdings* (% of net assets) |

| Brixmor Property Group Inc. | 3.0% |

| Mid-America Apartment Communities Inc. | 2.8% |

| Reinsurance Group of America Inc. Cl A | 2.6% |

| Teradyne Inc. | 2.3% |

| UGI Corp. | 2.3% |

| Woodward Inc. | 2.3% |

| Torchmark Corp. | 2.2% |

| Xcel Energy Inc. | 2.2% |

| Regions Financial Corp. | 2.2% |

| DTE Energy Co. | 2.2% |

| % Fund Total | 24.1% |

| * | Includes Long-Term Investments only. |

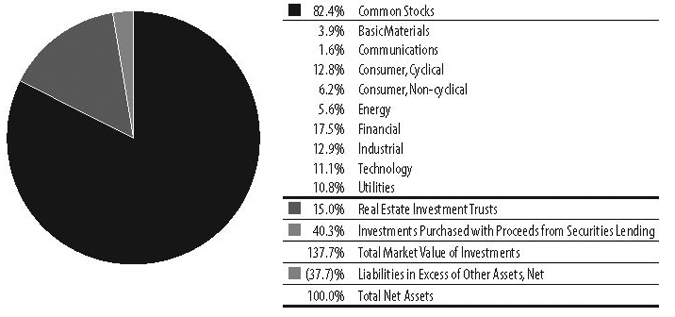

| Sectors (% of net assets) |

2015 SEMI-ANNUAL REPORT

Performance Update (unaudited)

Quaker Small-Cap Value Fund (QUSVX, QSVCX, QSVIX)

OBJECTIVES AND PRINCIPAL STRATEGIES

The Quaker Small-Cap Value Fund (“Fund”) seeks to provide long-term growth of capital. Current income is not a significant investment consideration, and any such income realized will be considered incidental to the Fund’s investment objective. The Fund invests primarily in common stocks of U.S. companies with market capitalizations similar to the market capitalizations of companies included in the Russell 2000® Index and Russell 2500® Index. The Fund invests in companies considered by the Fund’s sub-adviser to have consistent earnings and above-average core assets, selling at relatively low market valuations, with attractive growth and momentum characteristics.

| Average Annualized Total Return |

| | | | | | | | | | Commencement |

| | | | | | | | | | of operations |

| | Expense | Inception | | | | | | | through |

| | Ratio* | Date | One Year | Five Year | Ten Year | 12/31/2015 |

| | | | with | without | with | without | with | without | with | without |

| | | | sales | sales | sales | sales | sales | sales | sales | sales |

| | | | charge | charge | charge | charge | charge | charge | charge | charge |

| Class A | 1.79% | 11/25/96 | -8.90% | -3.60% | 8.27% | 9.50% | 5.32% | 5.92% | 9.32% | 9.64% |

| Class C | 2.54% | 7/28/00 | -4.34% | -4.34% | 8.68% | 8.68% | 5.12% | 5.12% | 8.29% | 8.29% |

| Institutional Class | 1.54% | 9/12/00 | -3.36% | -3.36% | 9.77% | 9.77% | 6.18% | 6.18% | 8.64% | 8.64% |

| Russell 2000® Index** | | | -4.41% | -4.41% | 9.19% | 9.19% | 6.80% | 6.80% | 7.73% | 7.73% |

| * | As stated in the Prospectus dated October 28, 2015. |

| ** | The benchmark since inception returns are calculated since commencement of November 25, 1996 through December 31, 2015. |

Performance data quoted represents past performance and is no guarantee of future results. Investment return and principal value will fluctuate so that shares, when redeemed, may be worth more or less than their original cost. Current performance may be lower or higher than performance data quoted. Performance data current to the most recent month end is available at www.quakerfunds.com or by calling us toll free at 800-220-8888. Total return includes reinvestment of dividends and capital gains.

Class A shares of the Fund have a maximum sales charge of 5.50%.

The performance table does not reflect the deduction of taxes that a shareholder might pay on fund distributions or the redemption of fund shares. Total return calculations reflect expense reimbursements and fee waivers in the applicable periods. See financial highlights for periods where fees were waived or reimbursed.

The Fund’s portfolio holdings may differ significantly from the securities held in the index and, unlike a mutual fund, an unmanaged index assumes no transaction costs, taxes, management fees or other expenses. You cannot invest directly in an index.

The Russell 2000® Index is a widely recognized, unmanaged index comprised of the smallest 2000 companies represented in the Russell 3000® Index. The Russell 2000® Index currently represents approximately 8% of the market capitalization of the Russell 3000® Index.

2015 SEMI-ANNUAL REPORT

Performance Update (unaudited) (continued)

Quaker Small-Cap Value Fund (QUSVX, QSVCX, QSVIX)

SUB-ADVISER:

Aronson Johnson Ortiz, LP

TOTAL NET ASSETS:

AS OF DECEMBER 31, 2015

$33,720,523

| Top 10 Holdings* (% of net assets) |

| Alaska Air Group Inc. | 1.5% |

| Emergent BioSolutions Inc. | 1.4% |

| Take-Two Interactive Software Inc. | 1.4% |

| United Therapeutics Corp. | 1.4% |

| Everest Re Group Ltd. | 1.4% |

| EMCOR Group Inc. | 1.4% |

| Ligand Pharmaceuticals Inc. | 1.4% |

| Wabash National Corp. | 1.4% |

| Kaiser Aluminum Corp. | 1.4% |

| Cooper Tire & Rubber Co. | 1.4% |

| % Fund Total | 14.1% |

| * | Includes Long-Term Investments only. |

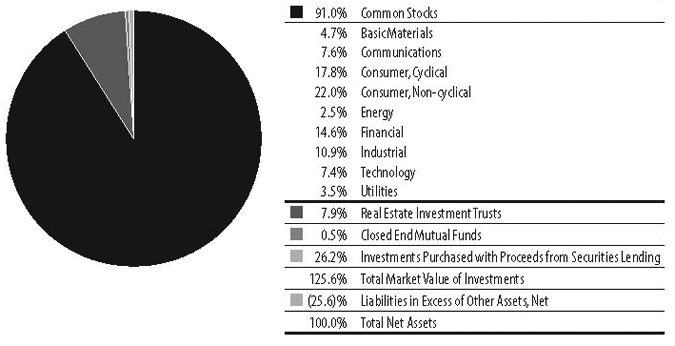

| Sectors (% of net assets) |

2015 SEMI-ANNUAL REPORT

Performance Update (unaudited)

Quaker Strategic Growth Fund (QUAGX, QAGCX, QAGIX)

OBJECTIVES AND PRINCIPAL STRATEGIES

The Quaker Strategic Growth Fund (“Fund”) seeks to provide long-term growth of capital. Current income is not a significant investment consideration. The Fund invests primarily in equity securities of domestic U.S. companies which the Fund’s sub-adviser believes show a high probability for superior growth.

| Average Annualized Total Return |

| | | | | | | | | | Commencement |

| | | | | | | | | | of operations |

| | Expense | Inception | | | | | | | through |

| | Ratio* | Date | One Year | Five Year | Ten Year | 12/31/2015 |

| | | | with | without | with | without | with | without | with | without |

| | | | sales | sales | sales | sales | sales | sales | sales | sales |

| | | | charge | charge | charge | charge | charge | charge | charge | charge |

| Class A | 2.24% | 11/25/96 | -4.82% | 0.71% | 8.19% | 9.41% | 3.95% | 4.54% | 10.92% | 11.25% |

| Class C | 2.99% | 7/11/00 | 0.00% | 0.00% | 8.60% | 8.60% | 3.76% | 3.76% | 3.97% | 3.97% |

| Institutional Class | 1.99% | 7/20/00 | 0.98% | 0.98% | 9.66% | 9.66% | 4.79% | 4.79% | 4.91% | 4.91% |

| S&P 500® Total Return Index** | | | 1.38% | 1.38% | 12.57% | 12.57% | 7.31% | 7.31% | 7.31% | 7.31% |

| * | As stated in the Prospectus dated October 28, 2015. |

| ** | The benchmark since inception returns are calculated since commencement of November 25, 1996 through December 31, 2015. |

Performance data quoted represents past performance and is no guarantee of future results. Investment return and principal value will fluctuate so that shares, when redeemed, may be worth more or less than their original cost. Current performance may be lower or higher than performance data quoted. Performance data current to the most recent month end is available at www.quakerfunds.com or by calling us toll free at 800-220-8888. Total return includes reinvestment of dividends and capital gains.

Class A shares of the Fund have a maximum sales charge of 5.50%.

The performance table does not reflect the deduction of taxes that a shareholder might pay on fund distributions or the redemption of fund shares. Total return calculations reflect expense reimbursements and fee waivers in the applicable periods. See financial highlights for periods where fees were waived or reimbursed.

The Fund’s portfolio holdings may differ significantly from the securities held in the index and, unlike a mutual fund, an unmanaged index assumes no transaction costs, taxes, management fees or other expenses. You cannot invest directly in an index.

The S&P 500® Total Return Index (“S&P 500® Index”) is a widely recognized, unmanaged index consisting of the approximately 500 largest companies in the United States as measured by market capitalization. The S&P 500® Index assumes reinvestment of all dividends and distributions.

2015 SEMI-ANNUAL REPORT

Performance Update (unaudited) (continued)

Quaker Strategic Growth Fund (QUAGX, QAGCX, QAGIX)

SUB-ADVISER:

DG Capital Management, Inc.

TOTAL NET ASSETS:

AS OF DECEMBER 31, 2015

$104,080,171

| Top 10 Holdings* (% of net assets) |

| Roche Holding AG | 6.0% |

| Alphabet Inc. Cl A&C | 4.6% |

| Amazon.com Inc. | 4.5% |

| Adobe Systems Inc. | 3.9% |

| Eli Lilly & Co. | 3.5% |

| Amgen Inc. | 3.3% |

| Mastercard Inc. Cl A | 3.3% |

| Visa Inc. Cl A | 3.2% |

| Gilead Sciences Inc. | 2.9% |

| NIKE Inc. | 2.9% |

| % Fund Total | 38.1% |

| * | Includes Long-Term Investments only. |

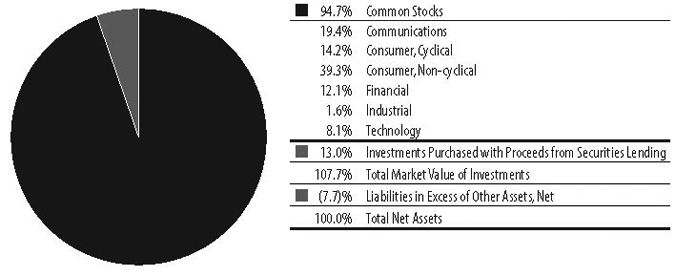

| Sectors (% of net assets) |

2015 SEMI-ANNUAL REPORT

Expense Information (unaudited)

As a shareholder of the Fund, you incur two types of costs: (1) transaction costs, including applicable sales charges and redemption fees; and (2) ongoing costs, including management fees, distribution (12b-1) fees and other Fund expenses. This example is intended to help you understand your ongoing costs (in dollars) of investing in the Fund and to compare these costs with the ongoing costs of investing in other funds. The example is based on an investment of $1,000 invested at the beginning of the (six-month) period and held for the entire period July 1, 2015 through December 31, 2015.

ACTUAL EXPENSES

The first section of each table below provides information about actual account values and actual expenses for each of the Funds. You may use this information, together with the amount you invested, to estimate the expenses that you paid over the period. Simply divide your account value by $1,000 (for example, an $8,600 account value divided by $1,000 = 8.6), then multiply the result by the number in the applicable line under the heading entitled “Expenses Paid During the Period” to estimate the expenses you paid on your account during this period.

HYPOTHETICAL EXAMPLE FOR COMPARISON PURPOSES

The second section of each table below provides information about hypothetical account values and hypothetical expenses based on the Fund’s actual expense ratio and an assumed rate of return of 5% per year before expenses, which is not the Fund’s actual return. The hypothetical account values and expenses may not be used to estimate the actual ending account balance or expenses you paid for the period. You may use this information to compare the ongoing costs of investing in the Fund to other funds. To do so, compare this 5% hypothetical example with the 5% hypothetical examples that appear in the shareholder reports of the other funds. Please note that the expenses shown in the table are meant to highlight your ongoing costs only and do not reflect any transactional costs, such as sales charges (loads), redemption fees or exchange fees. Therefore, the second section of the table is useful in comparing ongoing costs only, and will not help you determine the relative total costs of owning different funds. In addition, if these transactional costs were included, your costs would have been higher.

| | | Beginning | Annualized | Ending | |

| | | Account Value | Expense Ratio | Account Value | Expenses Paid |

| | | (7/1/2015) | for the Period | (12/31/2015) | During the Period* |

| Event Arbitrage |

| Example based on actual return of: |

| Class A | -11.44% | $1,000.00 | 1.99% | $ 885.60 | $ 9.43 |

| Class C | -11.69% | 1,000.00 | 2.74% | 883.10 | 12.97 |

| Institutional Class | -11.38% | 1,000.00 | 1.74% | 886.20 | 8.25 |

| Hypothetical example based on assumed 5% return: |

| Class A | | 1,000.00 | 1.99% | 1,015.13 | 10.08 |

| Class C | | 1,000.00 | 2.74% | 1,011.36 | 13.85 |

| Institutional Class | | 1,000.00 | 1.74% | 1,016.39 | 8.82 |

2015 SEMI-ANNUAL REPORT

Expense Information (unaudited) (continued)

| | | Beginning | Annualized | Ending | |

| | | Account Value | Expense Ratio | Account Value | Expenses Paid |

| | | (7/1/2015) | for the Period | (12/31/2015) | During the Period* |

| Global Tactical Allocation |

| Example based on actual return of: | | | | | |

| Class A | -5.30% | $1,000.00 | 2.25% | $ 947.00 | $11.01 |

| Class C | -5.77% | 1,000.00 | 3.00% | 942.30 | 14.65 |

| Institutional Class | -5.22% | 1,000.00 | 2.00% | 947.80 | 9.79 |

| Hypothetical example based on assumed 5% return: |

| Class A | | 1,000.00 | 2.25% | 1,013.83 | 11.39 |

| Class C | | 1,000.00 | 3.00% | 1,010.05 | 15.16 |

| Institutional Class | | 1,000.00 | 2.00% | 1,015.08 | 10.13 |

| | | | | | |

| Mid-Cap Value |

| Example based on actual return of: |

| Class A | -10.73% | 1,000.00 | 2.06% | 892.70 | 9.80 |

| Class C | -11.09% | 1,000.00 | 2.81% | 889.10 | 13.34 |

| Institutional Class | -10.61% | 1,000.00 | 1.81% | 893.90 | 8.62 |

| Hypothetical example based on assumed 5% return: |

| Class A | | 1,000.00 | 2.06% | 1,014.78 | 10.43 |

| Class C | | 1,000.00 | 2.81% | 1,011.01 | 14.20 |

| Institutional Class | | 1,000.00 | 1.81% | 1,016.04 | 9.17 |

| | | | | | |

| Small-Cap Value |

| Example based on actual return of: |

| Class A | -7.91% | 1,000.00 | 1.82% | 920.90 | 8.79 |

| Class C | -8.27% | 1,000.00 | 2.57% | 917.30 | 12.39 |

| Institutional Class | -7.79% | 1,000.00 | 1.57% | 922.10 | 7.59 |

| Hypothetical example based on assumed 5% return: |

| Class A | | 1,000.00 | 1.82% | 1,015.99 | 9.22 |

| Class C | | 1,000.00 | 2.57% | 1,012.22 | 13.00 |

| Institutional Class | | 1,000.00 | 1.57% | 1,017.24 | 7.96 |

| | | | | | |

| Strategic Growth |

| Example based on actual return of: |

| Class A | -3.31% | 1,000.00 | 2.24% | 966.90 | 11.07 |

| Class C | -3.65% | 1,000.00 | 2.99% | 963.50 | 14.76 |

| Institutional Class | -3.19% | 1,000.00 | 1.99% | 968.10 | 9.84 |

| Hypothetical example based on assumed 5% return: |

| Class A | | 1,000.00 | 2.24% | 1,013.88 | 11.34 |

| Class C | | 1,000.00 | 2.99% | 1,010.10 | 15.11 |

| Institutional Class | | 1,000.00 | 1.99% | 1,015.13 | 10.08 |

| * | Expenses are equal to the Funds’ annualized six-month expense ratios multiplied by the average account value over the period multiplied by the number of days in the most recent fiscal half year (184) divided by 366 to reflect the one-half year period. |

2015 SEMI-ANNUAL REPORT

Schedule of Investments

Quaker Event Arbitrage Fund

December 31, 2015 (unaudited)

| | | Number | | | Fair | |

| | | of Shares | | | Value | |

| Long-Term Investments — 86.9% | | | | | | |

| | | | | | | |

| Common Stocks — 65.4% | | | | | | |

| | | | | | | |

| Basic Materials — 1.8% | | | | | | |

| | | | | | | |

| Chemicals — 1.8% | | | | | | |

| MPM Holdings Inc. (a)^ | | | 34,576 | | | $ | 332,967 | |

| Platform Specialty | | | | | | | | |

| Products Corp. (a)(b) | | | 56,000 | | | | 718,480 | |

| | | | | | | | 1,051,447 | |

| Mining — 0.0% | | | | | | | | |

Sacre-Coeur Minerals Ltd. (a)f*#^ | | | 109,444 | | | | 0 | |

| Total Basic Materials | | | | | | | | |

| (Cost $1,887,488) | | | | | | | 1,051,447 | |

| | | | | | | | | |

| Communications — 6.5% | | | | | | | | |

| | | | | | | | | |

| Internet — 3.2% | | | | | | | | |

30DC Inc. (a) •● | | | 50,000 | | | | 2,650 | |

| FTD Cos. Inc. (a)(b) | | | 47,700 | | | | 1,248,309 | |

| Yahoo! Inc. (a) | | | 20,000 | | | | 665,200 | |

| | | | | | | | 1,916,159 | |

| Media — 1.4% | | | | | | | | |

| Tribune Media Co. Cl A (b)** | | | 24,600 | | | | 831,726 | |

| | | | | | | | | |

| Telecommunications — 1.9% | | | | | | | | |

| NII Holdings Inc. (a)(b) | | | 89,529 | | | | 452,121 | |

Vodafone Group PLC - ADR f | | | 21,000 | | | | 677,460 | |

| | | | | | | | 1,129,581 | |

| Total Communications | | | | | | | | |

| (Cost $5,455,306) | | | | | | | 3,877,466 | |

| | | | | | | | | |

| Consumer, Cyclical — 0.9% | | | | | | | | |

| | | | | | | | | |

| Distribution/Wholesale — 0.3% | | | | | | | | |

Medion AG f | | | 9,211 | | | | 172,825 | |

| | | | | | | | | |

| Lodging — 0.0% | | | | | | | | |

| Trump Entertainment | | | | | | | | |

| Resorts Inc. (a)*^ | | | 8,949 | | | | 0 | |

| Trump Entertainment | | | | | | | | |

| Resorts Inc. (a)*^ | | | 135 | | | | 0 | |

| | | | | | | | 0 | |

| Retail — 0.6% | | | | | | | | |

Punch Taverns PLC (a) f | | | 177,546 | | | | 335,027 | |

| Total Consumer, Cyclical | | | | | | | | |

| (Cost $542,094) | | | | | | | 507,852 | |

| | | | | | | | | |

| Consumer, Non-cyclical — 26.2% | | | | | | | | |

| | | | | | | | | |

| Beverages — 4.9% | | | | | | | | |

Anheuser-Busch InBev NV - ADR f | | | 11,500 | | | | 1,437,500 | |

| PepsiCo Inc. | | | 14,700 | | | | 1,468,824 | |

| | | | | | | | 2,906,324 | |

| Commercial Services — 5.5% | | | | | | | | |

| Hertz Global Holdings Inc. (a) | | | 68,500 | | | | 974,755 | |

| PayPal Holdings Inc. (a) | | | 37,700 | | | | 1,364,740 | |

| Sotheby’s (b) | | | 35,300 | | | | 909,328 | |

| | | | | | | | 3,248,823 | |

| Food — 3.3% | | | | | | | | |

| Mondelez International Inc. (b)** | | | 43,200 | | | | 1,937,088 | |

| | | | | | | | | |

| Healthcare-Products — 0.0% | | | | | | | | |

| Synovis Life Technologies Inc. (a)^ | | | 43,000 | | | | 15,931 | |

| | | | | | | | | |

| Healthcare-Services — 1.3% | | | | | | | | |

| Brookdale Senior Living Inc. (a) | | | 42,000 | | | | 775,320 | |

| | | | | | | | | |

| Pharmaceuticals — 11.2% | | | | | | | | |

| AbbVie Inc. ** | | | 25,500 | | | | 1,510,620 | |

Celesio AG f | | | 16,996 | | | | 462,778 | |

GlaxoSmithKline PLC - ADR f | | | 26,400 | | | | 1,065,240 | |

| INYX Inc. (a) | | | 167,850 | | | | 504 | |

| Pfizer Inc. ** | | | 70,600 | | | | 2,278,968 | |

| Zoetis Inc. | | | 28,000 | | | | 1,341,760 | |

| | | | | | | | 6,659,870 | |

| Total Consumer, Non-cyclical | | | | | | | | |

| (Cost $15,686,534) | | | | | | | 15,543,356 | |

| | | | | | | | | |

| Diversified — 2.6% | | | | | | | | |

| | | | | | | | | |

| Holding Companies-Diversified — 2.6% | | | | | | | | |

| Atlantic Alliance | | | | | | | | |

Partnership Corp. (a) f •● | | | 72,000 | | | | 731,160 | |

| GP Investments | | | | | | | | |

Acquisition Corp. (a) f | | | 81,750 | | | | 812,595 | |

| Stoneleigh Partners | | | | | | | | |

| Acquisition Corp. (a)*^ | | | 400 | | | | 0 | |

| | | | | | | | 1,543,755 | |

| Total Diversified | | | | | | | | |

| (Cost $1,546,744) | | | | | | | 1,543,755 | |

| | | | | | | | | |

| Energy — 3.7% | | | | | | | | |

| | | | | | | | | |

| Oil & Gas — 1.5% | | | | | | | | |

| Hess Corp. | | | 17,000 | | | | 824,160 | |

| OGX Austria Petroleo e | | | | | | | | |

Gas SA-SP-ADR (a) f• ● | | | 55,075 | | | | 35 | |

| Southwestern Energy Co. (a)(b) | | | 12,300 | | | | 87,453 | |

| | | | | | | | 911,648 | |

The accompanying notes are an integral part of the financial statements.

2015 SEMI-ANNUAL REPORT

Schedule of Investments (continued)

Quaker Event Arbitrage Fund

December 31, 2015 (unaudited)

| | | Number | | | Fair | |

| | | of Shares | | | Value | |

| | | | | | | |

| Common Stocks (Continued) | |

| | | | | | | |

| Oil & Gas Services — 1.6% | | | | | | |

| Halliburton Co. | | | 28,300 | | | $ | 963,332 | |

| | | | | | | | | |

| Pipelines — 0.6% | | | | | | | | |

| Energy Transfer Equity LP ** | | | 24,000 | | | | 329,760 | |

| Total Energy | | | | | | | | |

| (Cost $3,358,319) | | | | | | | 2,204,740 | |

| | | | | | | | | |

| Financial — 5.1% | | | | | | | | |

| | | | | | | | | |

| Diversified Financial Services — 2.7% | | | | | | | | |

| GFI Group Inc. (a)(b) | | | 257,083 | | | | 1,568,206 | |

| | | | | | | | | |

| Insurance — 0.7% | | | | | | | | |

| Ambac Financial Group Inc. (a)** | | | 28,500 | | | | 401,565 | |

| | | | | | | | | |

| Real Estate — 1.7% | | | | | | | | |

CA Immobilien Anlagen AG f | | | 55,000 | | | | 1,005,956 | |

| Safeway Casa Ley CVR (a)*^ | | | 47,000 | | | | 10,575 | |

| Safeway Property Development | | | | | | | | |

| Center LLC CVR (a)*^ | | | 47,000 | | | | 10,575 | |

| | | | | | | | 1,027,106 | |

| Total Financial | | | | | | | | |

| (Cost $3,283,133) | | | | | | | 2,996,877 | |

| | | | | | | | | |

| Healthcare — 2.0% | | | | | | | | |

| | | | | | | | | |

| Healthcare-Services — 2.0% | | | | | | | | |

| Diagnostic Services | | | | | | | | |

| Holdings Inc. (a)^ | | | 10,221 | | | | 1,163,958 | |

| Total Healthcare | | | | | | | | |

| (Cost $735,000) | | | | | | | 1,163,958 | |

| | | | | | | | | |

| Industrial — 8.8% | | | | | | | | |

| | | | | | | | | |

| Aerospace & Defense — 5.4% | | | | | | | | |

| API Technologies Corp. (a) | | | 1,220,229 | | | | 1,683,916 | |

| B/E Aerospace Inc. | | | 18,100 | | | | 766,897 | |

Rolls-Royce Holdings PLC (a)f | | | 85,000 | | | | 720,519 | |

| | | | | | | | 3,171,332 | |

| Electronics — 2.4% | | | | | | | | |

| IEC Electronics Corp. (a) | | | 439,042 | | | | 1,431,277 | |

| | | | | | | | | |

| Miscellaneous Manufacturing — 1.0% | | | | | | | | |

Pentair PLC (b)f | | | 12,000 | | | | 594,360 | |

| Total Industrial | | | | | | | | |

| (Cost $7,638,061) | | | | | | | 5,196,969 | |

| | | | | | | | | |

| Technology — 4.6% | | | | | | | | |

| | | | | | | | | |

| Computers — 0.0% | | | | | | | | |

| Computer Horizons Corp. (a)*^ | | | 65,000 | | | | 0 | |

| | | | | | | | | |

| Semiconductors — 2.6% | | | | | | | | |

| QUALCOMM Inc. | | | 30,500 | | | | 1,524,543 | |

| | | | | | | | | |

| Software — 2.0% | | | | | | | | |

| Contra Softbrands Inc. (a)*^ | | | 5,000 | | | | 0 | |

| Microsoft Corp. | | | 21,700 | | | | 1,203,916 | |

| | | | | | | | 1,203,916 | |

| Total Technology | | | | | | | | |

| (Cost $2,989,946) | | | | | | | 2,728,459 | |

| | | | | | | | | |

| Utilities — 3.2% | | | | | | | | |

| | | | | | | | | |

| Gas — 3.2% | | | | | | | | |

| AGL Resources Inc. | | | 30,000 | | | | 1,914,300 | |

| Total Utilities | | | | | | | | |

| (Cost $1,835,244) | | | | | | | 1,914,300 | |

| Total Common Stocks | | | | | | | | |

| (Cost $44,957,869) | | | | | | | 38,729,179 | |

| | | | | | | | | |

| Preferred Stocks — 1.7% | |

| | | | | | | | | |

| Energy — 0.1% | | | | | | | | |

| | | | | | | | | |

| Oil & Gas — 0.1% | | | | | | | | |

| GeoMet Inc., 12.50% - | | | | | | | | |

Convertible Series Ap● | | | 3 | | | | 5 | |

| Southwestern Energy Co., | | | | | | | | |

| 6.25% - Convertible Series B | | | 1,700 | | | | 31,535 | |

| | | | | | | | 31,540 | |

| Total Energy | | | | | | | | |

| (Cost $85,022) | | | | | | | 31,540 | |

| | | | | | | | | |

| Financial — 0.6% | | | | | | | | |

| | | | | | | | | |

| Insurance — 0.3% | | | | | | | | |

| MBIA Insurance Corp., 4.71% (a)*#^ | | | 10 | | | | 150,000 | |

| | | | | | | | | |

| Mortgage Agencies — 0.3% | | | | | | | | |

| Federal Home Loan Mortgage Corp., | | | | | | | | |

0.00%, Series G (a)p | | | 3,000 | | | | 12,600 | |

| Federal Home Loan Mortgage Corp., | | | | | | | | |

| 0.00%, Series M (a) | | | 9,500 | | | | 44,650 | |

| Federal Home Loan Mortgage Corp., | | | | | | | | |

0.00%, Series Q (a)p | | | 1,000 | | | | 4,010 | |

| Federal Home Loan Mortgage Corp., | | | | | | | | |

0.00%, Series S (a)p | | | 25,000 | | | | 102,750 | |

| Federal Home Loan Mortgage Corp., | | | | | | | | |

| 5.00%, Series F (a) | | | 4,500 | | | | 20,070 | |

| | | | | | | | 184,080 | |

| Total Financial | | | | | | | | |

| (Cost $1,051,290) | | | | | | | 334,080 | |

The accompanying notes are an integral part of the financial statements.

2015 SEMI-ANNUAL REPORT

Schedule of Investments (continued)

Quaker Event Arbitrage Fund

December 31, 2015 (unaudited)

| | | Number | | | Fair | |

| | | of Shares | | | Value | |

| | | | | | | |

| Preferred Stocks (Continued) | |

| | | | | | | |

| Healthcare — 1.0% | | | | | | |

| | | | | | | |

| Healthcare-Services — 1.0% | | | | | | |

| Diagnostic Services Holdings | | | | | | |

| Inc., 0.00% (a)*^ | | | 613 | | | $ | 613,000 | |

| Total Healthcare | | | | | | | | |

| (Cost $613,000) | | | | | | | 613,000 | |

| Total Preferred Stocks | | | | | | | | |

| (Cost $1,749,312) | | | | | | | 978,620 | |

| | | | | | | | | |

| Structured Notes — 7.8% | |

| | | | | | | | | |

| Bloomberg Gold Subindex | | | | | | | | |

| Stub Structured Note, | | | | | | | | |

Expiration: 01/29/2016 (a)● | | | 14,200 | | | | 1,164,968 | |

| Ryanair Holdings PLC | | | | | | | | |

| Structured Note, | | | | | | | | |

Expiration: 09/10/2016 (a)● | | | 31,440 | | | | 1,206,195 | |

| The Swatch Group AG | | | | | | | | |

| Structured Note, | | | | | | | | |

Expiration: 04/20/2016 f ● | | | 5,750 | | | | 1,250,493 | |

| Yahoo Japan Corp. Structured Note, | | | | | | | | |

Expiration: 05/31/2016 (a)● | | | 75,000 | | | | 1,010,550 | |

| | | | | | | | 4,632,206 | |

| Total Structured Notes | | | | | | | | |

| (Cost $5,408,786) | | | | | | | 4,632,206 | |

| | | | | | | | | |

| | | Par | | | | | |

| | | Value | | | | | |

| | | | | | | | | |

| Asset Backed Securities — 0.4% | |

| | | | | | | | | |

| AFC Home Equity Loan Trust | | | | | | | | |

| Class 1A, Series 2000-2, | | | | | | | | |

1.21%, 06/25/2030 p● | | $ | 9,140 | | | | 8,208 | |

| Citigroup Mortgage Loan Trust Inc. | | | | | | | | |

| Class M3, Series 2005-OPT1, | | | | | | | | |

0.93%, 02/25/2035 p● | | | 221,430 | | | | 179,002 | |

| Countrywide Home Equity Loan Trust | | | | | | | | |

| Class 2A, Series 2005-A, | | | | | | | | |

0.57%, 04/15/2035 p● | | | 22,905 | | | | 19,619 | |

| | | | | | | | 206,829 | |

| Total Asset Backed Securities | | | | | | | | |

| (Cost $220,839) | | | | | | | 206,829 | |

| | | | | | | | | |

| Convertible Bonds — 3.2% | |

| | | | | | | | | |

| Basic Materials — 0.0% | | | | | | | | |

| | | | | | | | | |

| Mining — 0.0% | | | | | | | | |

| Talvivaara Mining Co. PLC, | | | | | | | | |

4.00%, 12/16/2015 f +^ | | € | 12,900,000 | | | | 0 | |

| Total Basic Materials | | | | | | | | |

| (Cost $1,141,281) | | | | | | | 0 | |

| | | | | | | | | |

| Consumer, Cyclical — 0.2% | | | | | | | | |

| | | | | | | | | |

| Auto Parts & Equipment — 0.2% | | | | | | | | |

| Exide Technologies, | | | | | | | | |

7.00%, 04/30/2025● | | $ | 154,226 | | | | 104,874 | |

| Total Consumer, Cyclical | | | | | | | | |

| (Cost $147,516) | | | | | | | 104,874 | |

| | | | | | | | | |

| Financial — 3.0% | | | | | | | | |

| | | | | | | | | |

| Banks — 0.7% | | | | | | | | |

| BNP Paribas Fortis SA, | | | | | | | | |

1.867%, 12/29/2049 f p● | | € | 500,000 | | | | 393,949 | |

| | | | | | | | | |

| Real Estate — 2.3% | | | | | | | | |

| Conwert Immobilien Invest SE, | | | | | | | | |

5.25%, 02/01/2016 f ● | | | 1,000,000 | | | | 1,393,764 | |

| Total Financial | | | | | | | | |

| (Cost $1,694,344) | | | | | | | 1,787,713 | |

| Total Convertible Bonds | | | | | | | | |

| (Cost $2,983,141) | | | | | | | 1,892,587 | |

| | | | | | | | | |

| Corporate Bonds — 6.6% | |

| | | | | | | | | |

| Consumer, Cyclical — 0.6% | | | | | | | | |

| | | | | | | | | |

| Auto Parts & Equipment — 0.6% | | | | | | | | |

| Exide Technologies, | | | | | | | | |

| 8.625%, 02/01/2018 *^ | | $ | 1,000,000 | | | | 15,000 | |

| Exide Technologies, | | | | | | | | |

| 8.625%, 02/12/2018 *^ | | | 1,000,000 | | | | 0 | |

| Exide Technologies, | | | | | | | | |

11.00%, 04/30/2020 *● | | | 407,375 | | | | 334,048 | |

| | | | | | | | 349,048 | |

| Total Consumer, Cyclical | | | | | | | | |

| (Cost $974,519) | | | | | | | 349,048 | |

The accompanying notes are an integral part of the financial statements.

2015 SEMI-ANNUAL REPORT

Schedule of Investments (continued)

Quaker Event Arbitrage Fund

December 31, 2015 (unaudited)

| | | Par | | | Fair | |

| | | Value | | | Value | |

| Corporate Bonds (Continued) | |

| | | | | | | |

| Energy — 5.1% | | | | | | |

| | | | | | | |

| Oil & Gas — 5.1% | | | | | | |

| Gastar Exploration Inc., | | | | | | |

8.625%, 05/15/2018● | | $ | 1,000,000 | | | $ | 525,000 | |

| Halcon Resources Corp., | | | | | | | | |

12.00%, 02/15/2022 (b) #● | | | 390,000 | | | | 250,000 | |

| Ithaca Energy Inc., | | | | | | | | |

8.125%, 07/01/2019 f # | | | 1,000,000 | | | | 740,000 | |

| Kosmos Energy Ltd., | | | | | | | | |

7.875%, 08/01/2021 (b) f#● | | | 1,000,000 | | | | 805,000 | |

| Tullow Oil PLC, | | | | | | | | |

6.00%, 11/01/2020 f#● | | | 1,000,000 | | | | 695,000 | |

| | | | | | | | 3,015,000 | |

| Total Energy | | | | | | | | |

| (Cost $4,195,278) | | | | | | | 3,015,000 | |

| | | | | | | | | |

| Financial — 0.9% | | | | | | | | |

| | | | | | | | | |

| Diversified Financial Services — 0.6% | | | | | | | | |

| Hellas Telecommunications | | | | | | | | |

| Luxembourg II SCA, | | | | | | | | |

0.00%, 01/15/2015 f*+#^ | | | 5,000,000 | | | | 50,000 | |

| Lehman Brothers Holdings Inc., | | | | | | | | |

4.55%, 07/08/2014 +● | | | 110,000 | | | | 8,112 | |

| Lehman Brothers Holdings Inc., | | | | | | | | |

5.32%, 02/17/2015 +● | | | 130,000 | | | | 9,425 | |

| Lehman Brothers Holdings Inc., | | | | | | | | |

5.50%, 02/27/2020 +● | | | 100,000 | | | | 7,250 | |

| Lehman Brothers Holdings Inc., | | | | | | | | |

7.00%, 01/28/2020 p● | | | 100,000 | | | | 7,250 | |

| Lehman Brothers Holdings Inc., | | | | | | | | |

8.25%, 09/23/2020 p● | | | 100,000 | | | | 7,250 | |

| Lehman Brothers Holdings Inc., | | | | | | | | |

8.75%, 02/14/2023 p● | | | 200,000 | | | | 14,500 | |

| Twin Reefs Pass-Through Trust, | | | | | | | | |

0.01%, 12/29/2049 *#p^ | | | 1,000,000 | | | | 290,000 | |

| | | | | | | | 393,787 | |

| Insurance — 0.3% | | | | | | | | |

| Ambac Assurance Corp., | | | | | | | | |

| 5.10%, 06/07/2020 #^ | | | 221,329 | | | | 174,983 | |

| | | | | | | | | |

| Venture Capital — 0.0% | | | | | | | | |

| Infinity Capital Group, | | | | | | | | |

| 7.00%, 12/31/2049 *+^ | | | 25,000 | | | | 0 | |

| Total Financial | | | | | | | | |

| (Cost $821,207) | | | | | | | 568,770 | |

| Total Corporate Bonds | | | | | | | | |

| (Cost $5,991,004) | | | | | | | 3,932,818 | |

| | | | | | | | | |

| Mortgage Backed Securities — 0.4% | |

| | | | | | | | | |

| GSR Mortgage Loan Trust | | | | | | | | |

| Class B2, Series 2005-5F, | | | | | | | | |

5.75%, 06/25/2035● | | | 628,584 | | | | 261,732 | |

| | | | | | | | 261,732 | |

| Total Mortgage Backed Securities | | | | | | | | |

| (Cost $531,762) | | | | | | | 261,732 | |

| | | | | | | | | |

| Foreign Government Agency Issues — 1.4% | |

| | | | | | | | | |

| Ukraine Government, | | | | | | | | |

0.00%, 05/31/2040 f #● | | | 200,000 | | | | 79,000 | |

| Ukraine Government, | | | | | | | | |

7.75%, 09/01/2019 f #● | | | 830,000 | | | | 768,232 | |

| | | | | | | | 847,232 | |

| Total Foreign Government Agency Issues | | | | | | | | |

| (Cost $830,000) | | | | | | | 847,232 | |

| | | | | | | | | |

| Escrow Notes — 0.0% | |

| | | | | | | | | |

| Mirant Corp. (a)*^ | | | 20,000 | | | | 0 | |

| NewPage Corp. (a)*^ | | | 300,000 | | | | 0 | |

| Petrocorp Inc. (a)*^ | | | 200 | | | | 0 | |

| | | | | | | | 0 | |

| Total Escrow Notes | | | | | | | | |

| (Cost $198,770) | | | | | | | 0 | |

| Total Long-Term Investments | | | | | | | | |

| (Cost $62,871,483) | | | | | | | 51,481,203 | |

| | | | | | | | | |

| | | Number of | | | | | |

| | | Contracts | | | | | |

| | | (100 Shares | | | | | |

| | | Per Contract) | | | | | |

| Purchased Options — 0.8% | |

| | | | | | | | | |

| Call Options — 0.5% | | | | | | | | |

| QUALCOMM Inc., | | | | | | | | |

| Expiration: January, 2016 | | | | | | | | |

| Exercise Price: $67.50 | | | 800 | | | | 1,600 | |

| Southwestern Energy Co., | | | | | | | | |

| Expiration: January, 2016 | | | | | | | | |

| Exercise Price: $6.00 | | | 404 | | | | 49,288 | |

The accompanying notes are an integral part of the financial statements.

2015 SEMI-ANNUAL REPORT

Schedule of Investments (continued)

Quaker Event Arbitrage Fund

December 31, 2015 (unaudited)

| | | Number | | | | |

| | | of Contracts | | | | |

| | | (100 Shares | | | Fair | |

| | | Per Contract) | | | Value | |

| | | | | | | |

| Purchased Options (Continued) | |

| | | | | | | |

| Call Options (Continued) | | | | | | |

| Tenet Healthcare Corp., | | | | | | |

| Expiration: May, 2016 | | | | | | |

| Exercise Price: $35.00 | | | 400 | | | $ | 92,000 | |

| Tenet Healthcare Corp., | | | | | | | | |

| Expiration: May, 2016 | | | | | | | | |

Exercise Price: $45.00● | | | 600 | | | | 33,000 | |

| The Williams Cos. Inc., | | | | | | | | |

| Expiration: January, 2016 | | | | | | | | |

Exercise Price: $22.00● | | | 240 | | | | 86,400 | |

| Total Call Options | | | | | | | | |

| (Cost $411,479) | | | | | | | 262,288 | |

| | | | | | | | | |

| Put Options — 0.3% | | | | | | | | |

| AGL Resources Inc., | | | | | | | | |

| Expiration: January, 2016 | | | | | | | | |

| Exercise Price: $59.00^ | | | 300 | | | | 600 | |

| CurrencyShares Euro Trust, | | | | | | | | |

| Expiration: April, 2016 | | | | | | | | |

| Exercise Price: $110.00 | | | 432 | | | | 194,400 | |

| Total Put Options | | | | | | | | |

| (Cost $266,664) | | | | | | | 195,000 | |

| Total Purchased Options | | | | | | | | |

| (Cost $678,143) | | | | | | | 457,288 | |

| | | | | | | | | |

| | | Number | | | | | |

| | | of Shares | | | | | |

| Investments Purchased with Proceeds | |

| from Securities Lending — 6.3% | |

| | | | | | | | | |

| Money Market Funds — 6.3% | | | | | | | | |

| Mount Vernon Securities | | | | | | | | |

| Lending Trust Prime Portfolio, | | | | | | | | |

| 0.47% (c)(d) | | | 3,714,588 | | | | 3,714,588 | |

| Total Investments Purchased with | | | | | | | | |

| Proceeds from Securities Lending | | | | | | | | |

| (Cost $3,714,588) | | | | | | | 3,714,588 | |

| Total Investments | | | | | | | | |

| (Cost $67,264,214) — 94.0% | | | | | | | 55,653,079 | |

| Other Assets in Excess | | | | | | | | |

| of Liabilities, Net 6.0% | | | | | | | 3,542,206 | |

| Total Net Assets — 100.0% | | | | | | $ | 59,195,285 | |

| Schedule of Securities Sold Short (a) | | | | | | | | |

| | | | | | | | | |

| Common Stocks | |

| | | | | | | | | |

Alibaba Group Holding Ltd. - ADR f | | | 8,134 | | | | 661,050 | |

Yahoo Japan Corp. f | | | 16,500 | | | | 67,815 | |

| Total Common Stocks | | | | | | | 728,865 | |

| Total Securities Sold Short | | | | | | | | |

| (Proceeds $761,581) | | | | | | $ | 728,865 | |

| | | | | | | | | |

| | | Number | | | | | |

| | | of Contracts | | | | | |

| | | (100 Shares | | | | | |

| | | Per Contract) | | | | | |

| Written Options | |

| | | | | | | | | |

| Call Options | | | | | | | | |

| CurrencyShares Euro Trust, | | | | | | | | |

| Expiration: April, 2016 | | | | | | | | |

| Exercise Price: $110.00 | | | 432 | | | | 42,336 | |

| Microsoft Corp., | | | | | | | | |

| Expiration: January, 2016 | | | | | | | | |

| Exercise Price: $56.50 | | | 71 | | | | 2,911 | |

| Mondelez International Inc., | | | | | | | | |

| Expiration: January, 2016 | | | | | | | | |

| Exercise Price: $46.00 | | | 88 | | | | 3,784 | |

| PepsiCo Inc., | | | | | | | | |

| Expiration: January, 2016 | | | | | | | | |

| Exercise Price: $102.00 | | | 40 | | | | 1,640 | |

| Pfizer Inc., | | | | | | | | |

| Expiration: January, 2016 | | | | | | | | |

| Exercise Price: $33.00 | | | 92 | | | | 1,288 | |

| QUALCOMM Inc., | | | | | | | | |

| Expiration: January, 2016 | | | | | | | | |

| Exercise Price: $51.50 | | | 78 | | | | 3,354 | |

| Tenet Healthcare Corp., | | | | | | | | |

| Expiration: May, 2016 | | | | | | | | |

Exercise Price: $55.00● | | | 1,000 | | | | 25,000 | |

| Zoetis Inc., | | | | | | | | |

| Expiration: January, 2016 | | | | | | | | |

Exercise Price: $49.00● | | | 83 | | | | 4,358 | |

| Total Call Options | | | | | | | | |

| (Premiums Received $104,643) | | | | | | | 84,671 | |

The accompanying notes are an integral part of the financial statements.

2015 SEMI-ANNUAL REPORT

Schedule of Investments (continued)

Quaker Event Arbitrage Fund

December 31, 2015 (unaudited)

| | | Number | | | | |

| | | of Contracts | | | | |

| | | (100 Shares | | | Fair | |

| | | Per Contract) | | | Value | |

| Written Options (Continued) | |

| | | | | | | |

| Put Options | | | | | | |

| Southwestern Energy Co., | | | | | | |

| Expiration: January, 2016 | | | | | | |

| Exercise Price: $6.00 | | | 251 | | | $ | 3,765 | |

| VMware Inc., | | | | | | | | |

| Expiration: January, 2016 | | | | | | | | |

| Exercise Price: $60.00 | | | 165 | | | | 76,890 | |

| The Williams Cos. Inc., | | | | | | | | |

| Expiration: January, 2016 | | | | | | | | |

Exercise Price: $22.00• | | | 240 | | | | 15,840 | |

| Total Put Options | | | | | | | | |

| (Premiums Received $134,547) | | | | | | | 96,495 | |

| Total Written Options | | | | | | | | |

| (Premiums Received $239,190) | | | | | | $ | 181,166 | |

ADR - American Depositary Receipt

CVR - Contingent Value Rights

€ - Euro

| (a) | Non-income producing security. |

| (b) | All or a portion of the security is out on loan. The total market value of securities on loan was $3,475,334. The remaining contractual maturity of all of the securities lending transactions is overnight and continuous. |

| (c) | Rate shown is the annualized seven-day effective yield at period end. |

| (d) | Represents investments of collateral received from securities lending transactions. |

| f | Foreign issued security. |

| * | Indicates an illiquid security. Total market value for illiquid securities is $1,473,198, representing 2.5% of net assets. |

| ** | All or a portion of the shares have been committed as collateral for open securities sold short or written options. |

| + | Defaulted bonds. |

| # | Restricted security that may be sold to “qualified institutional buyers” pursuant to the conditions of Rule 144A under the Securities Act of 1933, as amended. |

p | The coupon rate shown on floating or adjustable rate securities represents the rate at period end. |

| ● | Level 2 securities. |

| ^ | Indicates a fair valued security. Total market value for fair valued securities is $2,827,589 representing 4.8% of net assets and Level 3 securities. |

The accompanying notes are an integral part of the financial statements.

2015 SEMI-ANNUAL REPORT

Schedule of Investments

Quaker Global Tactical Allocation Fund

December 31, 2015 (unaudited)

| | | Number | | | Fair | |

| | | of Shares | | | Value | |

| Long-Term Investments - 92.8% | | | | | | |

| | | | | | | |

| Common Stocks — 89.5% | |

| | | | | | | |

| Communications — 20.0% | | | | | | |

| | | | | | | |

| Internet — 18.3% | | | | | | |

| 58.com Inc. - ADR | | | | | | |

| (Cayman Islands) (a) | | | 1,140 | | | $ | 75,194 | |

| Alphabet Inc. Cl A (a) | | | 283 | | | | 220,177 | |

| Alphabet Inc. Cl C (a)(b) | | | 293 | | | | 222,352 | |

| Amazon.com Inc. (a) | | | 655 | | | | 442,708 | |

| Ctrip.com International Ltd. - ADR | | | | | | | | |

| (Cayman Islands) (a) | | | 4,625 | | | | 214,276 | |

| Expedia Inc. | | | 695 | | | | 86,389 | |

| Facebook Inc. Cl A (a) | | | 2,278 | | | | 238,415 | |

| LinkedIn Corp. Cl A (a) | | | 315 | | | | 70,900 | |

| Netflix Inc. (a)(b) | | | 1,507 | | | | 172,371 | |

| The Priceline Group Inc. (a) | | | 50 | | | | 63,748 | |

| | | | | | | | 1,806,530 | |

| Media — 1.1% | | | | | | | | |

| Liberty Global PLC - LiLAC Class C | | | | | | | | |

| (United Kingdom) (a) | | | 199 | | | | 8,557 | |

| Liberty Global PLC - Series C | | | | | | | | |

| (United Kingdom) (a) | | | 2,355 | | | | 96,013 | |

| | | | | | | | 104,570 | |

| Telecommunications — 0.6% | | | | | | | | |

| Palo Alto Networks Inc. (a)(b) | | | 360 | | | | 63,410 | |

| Sub-Total Communications — | | | | | | | | |

| Foreign (Cost $347,544) | | | | | | | 394,040 | |

| Sub-Total Communications — | | | | | | | | |

| United States (Cost $1,419,770) | | | | | | | 1,580,470 | |

| Total Communications (Cost $1,767,314) | | | | | | | 1,974,510 | |

| | | | | | | | | |

| Consumer, Cyclical — 12.4% | | | | | | | | |

| | | | | | | | | |

| Airlines — 2.9% | | | | | | | | |

| American Airlines Group Inc. | | | 3,302 | | | | 139,823 | |

| AMR Corp. Escrow (a)*^ | | | 7,600 | | | | 13,756 | |

| Delta Air Lines Inc. | | | 2,582 | | | | 130,882 | |

| | | | | | | | 284,461 | |

| Apparel — 2.7% | | | | | | | | |

| Adidas AG - ADR (Germany) | | | 340 | | | | 16,493 | |

| NIKE Inc. (b) | | | 4,042 | | | | 252,625 | |

| | | | | | | | 269,118 | |

| Auto Manufacturers — 1.7% | | | | | | | | |

| Bayerische Motoren | | | | | | | | |

| Werke AG - ADR (Germany) | | | 4,590 | | | | 160,030 | |

| Tata Motors Ltd. - ADR (India) (a) | | | 130 | | | | 3,845 | |

| | | | | | | | 163,875 | |

| Leisure Time — 0.8% | | | | | | | | |

| Norwegian Cruise Line | | | | | | | | |

| Holdings Ltd. (Bermuda) (a) | | | 1,260 | | | | 73,836 | |

| | | | | | | | | |

| Lodging — 0.7% | | | | | | | | |

| InterContinental Hotels Group | | | | | | | | |

| PLC - ADR (United Kingdom) | | | 1,764 | | | | 68,337 | |

| | | | | | | | | |

| Retail — 3.6% | | | | | | | | |

| McDonald’s Corp. | | | 750 | | | | 88,605 | |

| The TJX Cos. Inc. (b) | | | 1,870 | | | | 132,602 | |

| Ulta Salon Cosmetics & | | | | | | | | |

| Fragrance Inc. (a) | | | 750 | | | | 138,750 | |

| | | | | | | | 359,957 | |

| Sub-Total Consumer, Cyclical — | | | | | | | | |

| Foreign (Cost $315,176) | | | | | | | 322,541 | |

| Sub-Total Consumer, Cyclical — | | | | | | | | |

| United States (Cost $827,355) | | | | | | | 897,043 | |

| Total Consumer, Cyclical (Cost $1,142,531) | | | | | | | 1,219,584 | |

| | | | | | | | | |

| Consumer, Non-cyclical — 35.2% | | | | | | | | |

| | | | | | | | | |

| Beverages — 1.8% | | | | | | | | |

| Anheuser-Busch InBev NV - | | | | | | | | |

| ADR (Belgium) | | | 1,390 | | | | 173,750 | |

| | | | | | | | | |

| Biotechnology — 11.7% | | | | | | | | |

| Amgen Inc. | | | 2,001 | | | | 324,822 | |

| Biogen Inc. (a) | | | 575 | | | | 176,151 | |

| Celgene Corp. (a)(b) | | | 1,015 | | | | 121,556 | |

| Gilead Sciences Inc. | | | 2,805 | | | | 283,838 | |

| Incyte Corp. (a)(b) | | | 610 | | | | 66,155 | |

| Regeneron Pharmaceuticals Inc. (a)(b) | | | 201 | | | | 109,117 | |

| Vertex Pharmaceuticals Inc. (a) | | | 595 | | | | 74,869 | |

| | | | | | | | 1,156,508 | |

| Commercial Services — 2.0% | | | | | | | | |

| PayPal Holdings Inc. (a) | | | 2,395 | | | | 86,699 | |

| Sabre Corp. | | | 3,810 | | | | 106,566 | |

| | | | | | | | 193,265 | |

| Food — 1.4% | | | | | | | | |

| Mondelez International Inc. | | | 3,205 | | | | 143,712 | |

| | | | | | | | | |

| Healthcare-Products — 2.3% | | | | | | | | |

| Abbott Laboratories | | | 2,834 | | | | 127,275 | |

The accompanying notes are an integral part of the financial statements.

2015 SEMI-ANNUAL REPORT

Schedule of Investments (continued)

Quaker Global Tactical Allocation Fund

December 31, 2015 (unaudited)

| | | Number | | | Fair | |

| | | of Shares | | | Value | |

| | | | | | | |

| Common Stocks (Continued) | |

| | | | | | | |

| Healthcare-Products (Continued) | | | | | | |

| Intuitive Surgical Inc. (a) | | | 185 | | | $ | 101,040 | |

| | | | | | | | 228,315 | |

| Pharmaceuticals — 16.0% | | | | | | | | |

| AbbVie Inc. | | | 3,750 | | | | 222,150 | |

| Alkermes PLC (Ireland) (a) | | | 595 | | | | 47,231 | |

| Allergan PLC (Ireland) (a) | | | 605 | | | | 189,063 | |

| AstraZeneca PLC - SP-ADR | | | | | | | | |

| (United Kingdom) (b) | | | 2,605 | | | | 88,440 | |

| Bristol-Myers Squibb Co. | | | 3,720 | | | | 255,899 | |

| Eli Lilly & Co. | | | 4,086 | | | | 344,286 | |

| Novartis AG - ADR (Switzerland) | | | 1,295 | | | | 111,422 | |

| Roche Holding AG (Switzerland) | | | 7,885 | | | | 271,796 | |

| Shire PLC - ADR (Jersey) | | | 220 | | | | 45,100 | |

| | | | | | | | 1,575,387 | |

| Sub-Total Consumer, Non-cyclical — | | | | | | | | |

| Foreign (Cost $879,085) | | | | | | | 926,802 | |

| Sub-Total Consumer, Non-cyclical — | | | | | | | | |

| United States (Cost $2,519,435) | | | | | | | 2,544,135 | |

| Total Consumer, Non-cyclical (Cost $3,398,520) | | | | | | | 3,470,937 | |

| | | | | | | | | |

| Energy — 1.0% | | | | | | | | |

| | | | | | | | | |

| Oil & Gas — 1.0% | | | | | | | | |

| Concho Resources Inc. (a)(b) | | | 240 | | | | 22,286 | |

| Diamondback Energy Inc. (a) | | | 335 | | | | 22,412 | |

| Encana Corp. (Canada) | | | 3,155 | | | | 16,059 | |

| Memorial Resource | | | | | | | | |

| Development Corp. (a)(b) | | | 1,265 | | | | 20,430 | |

| Occidental Petroleum Corp. | | | 325 | | | | 21,973 | |

| | | | | | | | 103,160 | |

| Sub-Total Energy — Foreign | | | | | | | | |

| (Cost $23,302) | | | | | | | 16,059 | |

| Sub-Total Energy — United States | | | | | | | | |

| (Cost $98,041) | | | | | | | 87,101 | |

| Total Energy (Cost $121,343) | | | | | | | 103,160 | |

| | | | | | | | | |

| Financial — 11.0% | | | | | | | | |

| | | | | | | | | |

| Banks — 3.9% | | | | | | | | |

| The Goldman Sachs Group Inc. | | | 960 | | | | 173,021 | |

| HDFC Bank Ltd. - ADR (India) (b) | | | 2,277 | | | | 140,263 | |

| UBS Group AG (Switzerland) | | | 3,625 | | | | 70,216 | |

| | | | | | | | 383,500 | |

| Diversified Financial Services — 5.4% | | | | | | | | |

| MasterCard Inc. Cl A | | | 2,625 | | | | 255,570 | |

| Visa Inc. Cl A (b) | | | 3,618 | | | | 280,576 | |

| | | | | | | | 536,146 | |

| Insurance — 1.7% | | | | | | | | |

| Arch Capital Group Ltd. | | | | | | | | |

| (Bermuda) (a) | | | 1,105 | | | | 77,074 | |

| Prudential PLC - ADR | | | | | | | | |

| (United Kingdom) | | | 2,015 | | | | 90,836 | |

| | | | | | | | 167,910 | |

| Sub-Total Financial — Foreign | | | | | | | | |

| (Cost $337,231) | | | | | | | 378,389 | |

| Sub-Total Financial — United States | | | | | | | | |

| (Cost $633,966) | | | | | | | 709,167 | |

| Total Financial (Cost $971,197) | | | | | | | 1,087,556 | |

| | | | | | | | | |

| Industrial — 1.4% | | | | | | | | |

| | | | | | | | | |

| Electronics — 0.7% | | | | | | | | |

| Honeywell International Inc. | | | 655 | | | | 67,838 | |

| | | | | | | | | |

| Transportation — 0.7% | | | | | | | | |

| FedEx Corp. | | | 460 | | | | 68,535 | |

| Sub-Total Industrial — United States | | | | | | | | |

| (Cost $137,555) | | | | | | | 136,373 | |

| Total Industrial (Cost $137,555) | | | | | | | 136,373 | |

| | | | | | | | | |

| Technology — 8.5% | | | | | | | | |

| | | | | | | | | |

| Computers — 1.2% | | | | | | | | |

| Apple Inc. | | | 1,174 | | | | 123,575 | |

| | | | | | | | | |

| Software — 7.3% | | | | | | | | |

| Adobe Systems Inc. (a) | | | 3,990 | | | | 374,821 | |

| Intuit Inc. | | | 820 | | | | 79,130 | |

| Microsoft Corp. (b) | | | 1,730 | | | | 95,980 | |

| NetEase Inc. - ADR (Cayman Islands) | | | 385 | | | | 69,777 | |

| salesforce.com Inc. (a)(b) | | | 1,235 | | | | 96,824 | |

| | | | | | | | 716,532 | |

| Sub-Total Technology — Foreign | | | | | | | | |

| (Cost $61,399) | | | | | | | 69,777 | |

| Sub-Total Technology — United States | | | | | | | | |

| (Cost $726,738) | | | | | | | 770,330 | |

| Total Technology (Cost $788,137) | | | | | | | 840,107 | |

| Total Common Stocks | | | | | | | | |

| (Cost $8,326,597) | | | | | | | 8,832,227 | |

The accompanying notes are an integral part of the financial statements.

2015 SEMI-ANNUAL REPORT

Schedule of Investments (continued)

Quaker Global Tactical Allocation Fund

December 31, 2015 (unaudited)

| | | Number | | | Fair | |

| | | of Shares | | | Value | |

| | | | | | | |

| Exchange Traded Funds — 3.3% | |

| | | | | | | |

| Deutsche X-trackers MSCI | | | | | | |

| Japan Hedged Equity ETF | | | 4,060 | | | $ | 154,645 | |

| WisdomTree Europe | | | | | | | | |

| Hedged Equity Fund | | | 3,255 | | | | 175,152 | |

| Sub-Total Exchange Traded Funds — | | | | | | | | |

| United States (Cost $379,107) | | | | | | | 329,797 | |

| Total Exchange Traded Funds | | | | | | | | |

| Cost ($379,107) | | | | | | | 329,797 | |

| Total Long-Term Investments | | | | | | | | |

| Cost ($8,705,704) | | | | | | | 9,162,024 | |

| | | | | | | | | |

| Investments Purchased with Proceeds | | | | | | | | |

| from Securities Lending — 15.9% | | | | | | | | |

| | | | | | | | | |

| Money Market Funds — 15.9% | | | | | | | | |

| Mount Vernon Securities | | | | | | | | |

| Lending Trust Prime Portfolio, | | | | | | | | |

| 0.47% (c)(d) | | | 1,572,303 | | | | 1,572,303 | |

| Total Investments Purchased with | |

| Proceeds from Securities Lending | |

| (Cost $1,572,303) | | | | | | | 1,572,303 | |

| Total Investments | | | | | | | | |

| (Cost $10,278,007) — 108.7% | | | | | | | 10,734,327 | |

| Liabilities in Excess of | | | | | | | | |

| Other Assets, Net (8.7%) | | | | | | | (862,097 | ) |

| Total Net Assets — 100.0% | | | | | | $ | 9,872,230 | |

| Schedule of Securities Sold Short (a) | | | | | | | | |

| | | | | | | | | |

| Common Stocks | | | | | | | | |

| | | | | | | | | |

| Cabot Oil & Gas Corp. | | | 2,925 | | | | 51,743 | |

| Pioneer Natural Resources Co. | | | 190 | | | | 23,822 | |

| Total Common Stocks | | | | | | | 75,565 | |

| Total Securities Sold Short | | | | | | | | |

| (Proceeds $77,051) | | | | | | $ | 75,565 | |

ADR - American Depositary Receipt

| (a) | Non-income producing security. |

| (b) | All or a portion of the security is out on loan. The total market value of securities on loan was $1,529,417. The remaining contractual maturity of all of the securities lending transactions is overnight and continuous. |

| (c) | The rate shown is the annualized seven-day effective yield at period end. |

| (d) | Represents investments of collateral received from securities lending transactions. |

| * | Indicates an illiquid security. Total market value for illiquid securities is $13,756, representing 0.1% of net assets. |

| ^ | Indicates a fair valued security. Total market value for fair valued securities is $13,756, representing 0.1% of net assets and Level 3 securities. |

The accompanying notes are an integral part of the financial statements.

2015 SEMI-ANNUAL REPORT

Schedule of Investments

Quaker Mid-Cap Value Fund

December 31, 2015 (unaudited)

| | | Number | | | Fair | |

| | | of Shares | | | Value | |

| Long-Term Investments - 97.4% | | | | | | |

| | | | | | | |

| Common Stocks — 82.4% | |

| | | | | | | |

| Basic Materials — 3.9% | | | | | | |

| | | | | | | |

| Chemicals — 0.7% | | | | | | |

| Axiall Corp. | | | 3,411 | | | $ | 52,530 | |

| | | | | | | | | |

| Iron & Steel — 2.1% | | | | | | | | |

| Reliance Steel & Aluminum Co. | | | 2,580 | | | | 149,408 | |

| | | | | | | | | |

| Mining — 1.1% | | | | | | | | |

| Freeport-McMoRan Inc. (b) | | | 11,312 | | | | 76,582 | |

| Total Basic Materials | | | | | | | | |

| (Cost $413,400) | | | | | | | 278,520 | |

| | | | | | | | | |

| Communications — 1.6% | | | | | | | | |

| | | | | | | | | |

| Internet — 1.6% | | | | | | | | |

| F5 Networks Inc. (a) | | | 1,227 | | | | 118,970 | |

| Total Communications | | | | | | | | |

| (Cost $139,028) | | | | | | | 118,970 | |

| | | | | | | | | |

| Consumer, Cyclical — 12.8% | | | | | | | | |

| | | | | | | | | |

| Apparel — 3.4% | | | | | | | | |

Gildan Activewear Inc. Cl A (b)f | | | 3,818 | | | | 108,508 | |

| Ralph Lauren Corp. (b) | | | 1,202 | | | | 133,999 | |

| | | | | | | | 242,507 | |

| Distribution & Wholesale — 1.5% | | | | | | | | |

| LKQ Corp. (a) | | | 3,754 | | | | 111,231 | |

| | | | | | | | | |

| Home Furnishings — 3.6% | | | | | | | | |

| Harman International Industries Inc. | | | 1,512 | | | | 142,446 | |

| Whirlpool Corp. | | | 787 | | | | 115,587 | |

| | | | | | | | 258,033 | |

| Leisure Time — 1.3% | | | | | | | | |

| Polaris Industries Inc. | | | 1,060 | | | | 91,107 | |

| | | | | | | | | |

| Retail — 2.0% | | | | | | | | |

| Best Buy Co. Inc. | | | 4,838 | | | | 147,317 | |

| | | | | | | | | |

| Toys, Games & Hobbies — 1.0% | | | | | | | | |

| Hasbro Inc. (b) | | | 1,039 | | | | 69,987 | |

| Total Consumer, Cyclical | | | | | | | | |

| (Cost $941,286) | | | | | | | 920,182 | |

| | | | | | | | | |

| Consumer, Non-cyclical — 6.2% | | | | | | | | |

| | | | | | | | | |

| Food — 3.5% | | | | | | | | |

| Ingredion Inc. (b) | | | 1,266 | | | | 121,333 | |

| Tyson Foods Inc. (b) | | | 2,498 | | | | 133,218 | |

| | | | | | | | 254,551 | |

| Healthcare-Products — 1.5% | | | | | | | | |

| Zimmer Biomet Holdings Inc. (b) | | | 1,060 | | | | 108,745 | |

| | | | | | | | | |

| Healthcare-Services — 1.2% | | | | | | | | |

| Brookdale Senior Living Inc. (a) | | | 4,552 | | | | 84,030 | |

| Total Consumer, Non-cyclical | | | | | | | | |

| (Cost $439,901) | | | | | | | 447,326 | |

| | | | | | | | | |

| Energy — 5.6% | | | | | | | | |

| | | | | | | | | |

| Oil & Gas — 5.6% | | | | | | | | |

| Concho Resources Inc. (a)(b) | | | 1,382 | | | | 128,333 | |

| Diamond Offshore Drilling Inc. (b) | | | 2,791 | | | | 58,890 | |

| Helmerich & Payne Inc. (b) | | | 2,756 | | | | 147,584 | |

| Whiting Petroleum Corp. (a) | | | 7,259 | | | | 68,525 | |

| | | | | | | | 403,332 | |

| Total Energy | | | | | | | | |

| (Cost $516,925) | | | | | | | 403,332 | |

| | | | | | | | | |

| Financial — 17.5% | | | | | | | | |

| | | | | | | | | |

| Banks — 9.0% | | | | | | | | |

| Citizens Financial Group Inc. | | | 5,460 | | | | 142,997 | |

| Huntington Bancshares Inc. (b) | | | 10,608 | | | | 117,324 | |

| PacWest Bancorp (b) | | | 2,698 | | | | 116,284 | |

| Regions Financial Corp. | | | 16,284 | | | | 156,326 | |

| Zions Bancorporation (b) | | | 4,110 | | | | 112,203 | |

| | | | | | | | 645,134 | |

| Diversified Financial Services — 1.6% | | | | | | | | |

Invesco Ltd. f | | | 3,451 | | | | 115,539 | |

| | | | | | | | | |

| Insurance — 6.9% | | | | | | | | |

| Lincoln National Corp. | | | 3,081 | | | | 154,851 | |

| Reinsurance Group of America Inc. Cl A | | | 2,192 | | | | 187,526 | |

| Torchmark Corp. (b) | | | 2,770 | | | | 158,333 | |

| | | | | | | | 500,710 | |

| Total Financial | | | | | | | | |

| (Cost $1,008,836) | | | | | | | 1,261,383 | |

| | | | | | | | | |

| Industrial — 12.9% | | | | | | | | |

| | | | | | | | | |

| Aerospace & Defense — 1.0% | | | | | | | | |

| Teledyne Technologies Inc. (a) | | | 803 | | | | 71,226 | |

| | | | | | | | | |

| Electronics — 2.3% | | | | | | | | |

| Woodward Inc. (b) | | | 3,300 | | | | 163,878 | |

| | | | | | | | | |

| Engineering & Construction — 1.6% | | | | | | | | |

| Fluor Corp. (b) | | | 2,410 | | | | 113,800 | |

| | | | | | | | | |

| Hand & Machine Tools — 1.2% | | | | | | | | |

| Regal-Beloit Corp. | | | 1,484 | | | | 86,844 | |

| | | | | | | | | |

| Machinery-Diversified — 3.7% | | | | | | | | |

| AGCO Corp. (b) | | | 2,585 | | | | 117,333 | |

The accompanying notes are an integral part of the financial statements.

2015 SEMI-ANNUAL REPORT

Schedule of Investments (continued)

Quaker Mid-Cap Value Fund

December 31, 2015 (unaudited)

| | | Number | | | Fair | |

| | | of Shares | | | Value | |

| | | | | | | |

| Common Stocks (Continued) | |

| | | | | | | |

| Machinery-Diversified (Continued) | | | | | | |

| Roper Technologies Inc. (b) | | | 789 | | | $ | 149,744 | |

| | | | | | | | 267,077 | |

| Miscellaneous Manufacturing — 2.1% | | | | | | | | |

| Carlisle Cos. Inc. | | | 1,743 | | | | 154,587 | |

| | | | | | | | | |

| Transportation — 1.0% | | | | | | | | |

| Old Dominion Freight Line Inc. (a) | | | 1,235 | | | | 72,951 | |

| Total Industrial | | | | | | | | |

| (Cost $888,455) | | | | | | | 930,363 | |

| | | | | | | | | |

| Technology — 11.1% | | | | | | | | |

| | | | | | | | | |

| Computers — 5.4% | | | | | | | | |

| Cadence Design Systems Inc. (a) | | | 6,516 | | | | 135,598 | |

| MAXIMUS Inc. (b) | | | 2,622 | | | | 147,488 | |

| NetApp Inc. | | | 3,918 | | | | 103,945 | |

| | | | | | | | 387,031 | |

| Semiconductors — 5.7% | | | | | | | | |

| Micron Technology Inc. (a) | | | 6,451 | | | | 91,346 | |

| ON Semiconductor Corp. (a) | | | 15,760 | | | | 154,448 | |

| Teradyne Inc. | | | 7,991 | | | | 165,174 | |

| | | | | | | | 410,968 | |

| Total Technology | | | | | | | | |

| (Cost $815,586) | | | | | | | 797,999 | |

| | | | | | | | | |

| Utilities — 10.8% | | | | | | | | |

| | | | | | | | | |

| Electric — 5.4% | | | | | | | | |

| DTE Energy Co. | | | 1,946 | | | | 156,050 | |

| Pepco Holdings Inc. | | | 2,955 | | | | 76,860 | |

| Xcel Energy Inc. | | | 4,385 | | | | 157,465 | |

| | | | | | | | 390,375 | |

| Gas — 5.4% | | | | | | | | |

| CenterPoint Energy Inc. (b) | | | 5,929 | | | | 108,856 | |

| Questar Corp. | | | 5,811 | | | | 113,198 | |

| UGI Corp. | | | 4,875 | | | | 164,580 | |

| | | | | | | | 386,634 | |

| Total Utilities | | | | | | | | |

| (Cost $712,603) | | | | | | | 777,009 | |

| Total Common Stocks | | | | | | | | |

| (Cost $5,876,020) | | | | | | | 5,935,084 | |

| | | | | | | | | |

| Real Estate Investment Trusts — 15.0% | |

| | | | | | | | | |

| Alexandria Real Estate Equities Inc. (b) | | | 1,662 | | | | 150,178 | |

| Brixmor Property Group Inc. | | | 8,393 | | | | 216,707 | |

| Camden Property Trust (b) | | | 1,983 | | | | 152,215 | |

| Corporate Office Properties Trust | | | 6,802 | | | | 148,488 | |

| DDR Corp. | | | 7,337 | | | | 123,555 | |

| Duke Realty Corp. | | | 3,840 | | | | 80,717 | |

| Mid-America Apartment | | | | | | | | |

| Communities Inc. (b) | | | 2,255 | | | | 204,777 | |

| | | | | | | | 1,076,637 | |

| Total Real Estate Investment Trusts | | | | | | | | |

| (Cost $1,006,878) | | | | | | | 1,076,637 | |

| Total Long-Term Investments | | | | | | | | |

| (Cost $6,882,898) | | | | | | | 7,011,721 | |

| | | | | | | | | |

| Investments Purchased with Proceeds | |

| from Securities Lending — 40.3% | |

| | | | | | | | | |

| Money Market Funds — 40.3% | | | | | | | | |

| Mount Vernon Securities | | | | | | | | |

| Lending Trust Prime Portfolio, | | | | | | | | |

| 0.47% (c)(d) | | | 2,903,093 | | | | 2,903,093 | |

| Total Investments Purchased with | | | | | | | | |

| Proceeds from Securities Lending | | | | | | | | |

| (Cost $2,903,093) | | | | | | | 2,903,093 | |

| Total Investments | | | | | | | | |

| (Cost $9,785,991) — 137.7% | | | | | | | 9,914,814 | |

| Liabilities in Excess | | | | | | | | |

| of Other Assets, Net (37.7%) | | | | | | | (2,712,623 | ) |

| Total Net Assets — 100.0% | | | | | | $ | 7,202,191 | |

| (a) | Non-income producing security. |

| (b) | All or a portion of the security is out on loan. The total market value of securities on loan was $2,817,619. The remaining contractual maturity of all of the securities lending transactions is overnight and continuous. |

| (c) | The rate shown is the annualized seven-day effective yield at period end. |

| (d) | Represents investments of collateral received from securities lending transactions. |

| f | Foreign issued security. |

The accompanying notes are an integral part of the financial statements.

2015 SEMI-ANNUAL REPORT

Schedule of Investments

Quaker Small-Cap Value Fund

December 31, 2015 (unaudited)

| | | Number | | | Fair | |

| | | of Shares | | | Value | |

| Long-Term Investments — 99.4% | | | | | | |

| | | | | | | |

| Common Stocks — 91.0% | |

| | | | | | | |

| Basic Materials — 4.7% | | | | | | |

| | | | | | | |

| Chemicals — 1.5% | | | | | | |

| Chemtura Corp. (a)(b) | | | 3,772 | | | $ | 102,862 | |

| KMG Chemicals Inc. | | | 1,171 | | | | 26,956 | |

| Kraton Performance Polymers Inc. (a) | | | 20,740 | | | | 344,491 | |

| OMNOVA Solutions Inc. (a) | | | 5,850 | | | | 35,861 | |