Semi-Annual Report 2020

THE QUAKER INVESTMENT TRUST

December 31, 2020

CCM Core Impact Equity Fund

(Formerly Quaker Impact Growth Fund)

CCM Small/Mid-Cap Impact Value Fund

(Formerly Quaker Small/Mid-Cap Impact Value Fund)

Mutual fund investing involves risk. Principal loss is possible. Equity securities are subject to price fluctuation. Small- and mid-cap stocks involve greater risks and volatility than large-cap stocks. The Funds invest in companies that appear to be “undervalued” in the marketplace. The Funds’ exposure to (MLPs) may subject the Funds to greater volatility than investments in traditional securities.

This report must be preceded or accompanied by a current prospectus.

The opinions expressed are those of the adviser through the end of the period for this report, are subject to change, are not a guarantee, and should not be considered investment advice.

Fund holdings are subject to change and should not be considered a recommendation to buy or sell any security. Current and future holdings are subject to risk.

Table of Contents

| Performance Update: | |

| CCM Core Impact Equity Fund | 2 |

| CCM Small/Mid-Cap Impact Value Fund | 4 |

| Expense Information | 6 |

| Schedules of Investments | 7 |

| Statements of Assets and Liabilities | 11 |

| Statements of Operations | 12 |

| Statements of Changes in Net Assets | 13 |

| Financial Highlights | 15 |

| Notes to the Financial Statements | 19 |

| Statement Regarding Basis for Approval of Investment Advisory Contract | 25 |

| Statement Regarding Liquidity Risk Management Program | 26 |

| General Information | 27 |

Performance Update (unaudited)

CCM Core Impact Equity Fund(QUAGX, QAGIX)

(Formerly Quaker Impact Growth Fund)

OBJECTIVES AND PRINCIPAL STRATEGIES

The Fund, seeks to provide long-term growth of capital. The Fund’s principal holdings are large companies that demonstrate long term ability to compound earnings at higher rates than the broader market, regardless of industry. The Fund is managed independent of any index sector weightings. The Fund investments will be centered on US-domestic based companies although the Fund has the ability to invest internationally as well. The Fund will under normal market conditions, employ a tactical allocation philosophy.

| Average Annualized Total Return |

| | | | | | Inception |

| | | | | | through |

| | Expense Ratio* | Inception Date | One Year | Three Years | 12/31/20+ |

| Advisor Class | 2.09% | 1/1/18 | 18.71% | 13.62% | 13.62% |

| Institutional Class | 1.84% | 1/1/18 | 19.02% | 13.91% | 13.91% |

S&P 500® Total Return Index** | | | 18.40% | 14.18% | 14.18% |

| * | As stated in the Prospectus dated October 28, 2020. |

| ** | The benchmark since inception returns are calculated since inception of January 1, 2018 through December 31, 2020. |

+ | The Fund amended and restated its Registration Statement to change the performance reporting history. The inception date for the Fund’s performance history is now January 1, 2018, the date Community Capital Management, Inc. became the new investment adviser to the Fund. |

Performance data quoted represents past performance and is no guarantee of future results. Investment return and principal value will fluctuate so that shares, when redeemed, may be worth more or less than their original cost. Current performance may be lower or higher than performance data quoted. Performance data current to the most recent month end is available at www.ccminvests.com or by calling us toll free at 800-220-8888. Total return includes reinvestment of dividends and capital gains.

The performance table does not reflect the deduction of taxes that a shareholder might pay on fund distributions or the redemption of fund shares. Total return calculations reflect expense reimbursements and fee waivers in the applicable periods. See financial highlights for periods where fees were waived or reimbursed.

The Fund’s portfolio holdings may differ significantly from the securities held in the index and, unlike a mutual fund, an unmanaged index assumes no transaction costs, taxes, management fees or other expenses. You cannot invest directly in an index.

The S&P 500® Total Return Index (“S&P 500® Index”) is a widely recognized, unmanaged index consisting of the approximately 500 largest companies in the United States as measured by market capitalization. The S&P 500® Index assumes reinvestment of all dividends and distributions.

Performance Update (unaudited) (continued)

CCM Core Impact Equity Fund

(QUAGX, QAGIX)

(Formerly Quaker Impact Growth Fund)

TOTAL NET ASSETS:

AS OF DECEMBER 31, 2020

$65,471,388

| Top 10 Holdings* (% of net assets) | | |

| Microsoft Corp. | 6.1% | |

| Amazon.com Inc. | 6.0% | |

| Apple Inc. | 5.1% | |

| Facebook Inc. Cl A | 4.6% | |

| Discover Financial Services | 3.1% | |

| Dell Technologies Inc. | 3.0% | |

| Alphabet Inc. Cl A | 3.0% | |

| Alphabet Inc. Cl C | 2.9% | |

| Berkshire Hathaway Inc. Cl B | 2.8% | |

| BlackRock Inc. | 2.8% | |

| % Fund Total | 39.4% | |

| * Includes Long-Term Investments only. | | |

| Sectors (% of net assets) |

Performance Update (unaudited)

CCM Small/Mid-Cap Impact Value Fund

(QUSVX, QSVIX)

(Formerly Quaker Small/Mid-Cap Impact Value Fund)

OBJECTIVES AND PRINCIPAL STRATEGIES

The Fund, seeks to provide long-term growth of capital. Under normal circumstances, the Fund will invest at least 80% of its assets, plus the amount of any borrowings for investment purposes, in the securities of small- and mid-cap U.S. companies. The Fund generally considers small- and mid-cap companies to be those companies represented by the Russell 2500® Index.

| Average Annualized Total Return |

| | | | | | | Inception |

| | Gross | Net | | | | through |

| | Expense Ratio* | Expense Ratio* | Inception Date | One Year | Three Years | 12/31/20+ |

| Advisor Class | 2.66% | 1.83% | 1/1/18 | -20.05% | -2.37% | -2.37% |

| Institutional Class | 2.41% | 1.58% | 1/1/18 | -19.85% | -2.12% | -2.12% |

Russell 2500® Value Index** | | | | 4.88% | 4.34% | 4.34% |

Russell 2500® Index** | | | | 19.99% | 11.33% | 11.33% |

| * | As stated in the Prospectus dated October 28, 2020. The Adviser has contractually agreed to waive all or a portion of its investment advisory fees and/or pay/reimburse expenses (excluding any Rule 12b-1 fees, taxes, interest, acquired fund fees and expenses, short sale dividend and interest expenses, brokerage fees, certain insurance costs, and non-routine expenses or costs, including, but not limited to, those relating to reorganizations, litigation, conducting shareholder meetings, liquidations and other extraordinary expenses) in order to prevent total annual fund operating expenses from exceeding 1.30% of the Fund’s average daily net assets through October 28, 2021. Pursuant to its expense limitation agreement with the Fund, the Adviser is entitled to recoup any fees that it waived and/or Fund expenses that it paid for a period of three years following such fee waivers and expense payments, to the extent that such recoupment by the Adviser will not cause the Fund to exceed any applicable expense limitation that was in place for the Fund when the fees were waived or expenses were paid. These waivers and reimbursements may be terminated at any time with respect to the Fund by its Board of Trustees upon sixty (60) days’ written notice to the Adviser without payment of any penalty and shall automatically terminate upon the termination of the Fund's advisory contract with the Adviser. |

| ** | The benchmarks since inception returns are calculated since inception of January 1, 2018 through December 31, 2020. |

+ | The Fund amended and restated its Registration Statement to change the performance reporting history. The inception date for the Fund’s performance history is now January 1, 2018, the date Community Capital Management, Inc. became the new investment adviser to the Fund. |

Performance data quoted represents past performance and is no guarantee of future results. Investment return and principal value will fluctuate so that shares, when redeemed, may be worth more or less than their original cost. Current performance may be lower or higher than performance data quoted. Performance data current to the most recent month end is available at www.ccminvests.com or by calling us toll free at 800-220-8888. Total return includes reinvestment of dividends and capital gains.

The performance table does not reflect the deduction of taxes that a shareholder might pay on fund distributions or the redemption of fund shares. Total return calculations reflect expense reimbursements and fee waivers in the applicable periods.

The Fund’s portfolio holdings may differ significantly from the securities held in the index and, unlike a mutual fund, an unmanaged index assumes no transaction costs, taxes, management fees or other expenses. You cannot invest directly in an index.

The Russell 2500® Index is a widely recognized, unmanaged index comprised of the smallest 2500 companies represented in the Russell 3000® Index.

Performance Update (unaudited) (continued)

CCM Small/Mid-Cap Impact Value Fund

(QUSVX, QSVIX)

(Formerly Quaker Small/Mid-Cap Impact Value Fund)

TOTAL NET ASSETS:

AS OF DECEMBER 31, 2020

$19,144,264

| Top 10 Holdings* (% of net assets) | | |

| Independence Realty Trust Inc. | 6.3% | |

| Enviva Partners LP | 5.9% | |

| Skyline Champion Corp. | 5.2% | |

| Raymond James Financial Inc. | 4.8% | |

| AGNC Investment Corp., | | |

| 6.125%, Perpetual Preferred | 4.7% | |

| Crestwood Equity Partners LP | 4.4% | |

| Crestwood Equity Partners LP, | | |

| 9.250%, Pepetual Preferred | 3.9% | |

| Liberty Media Corp-Liberty SiriusXM Cl A | 3.8% | |

| Starwood Property Trust Inc. | 3.8% | |

| Two Harbors Investment Corp., | | |

| 7.250%, Perpetual Preferred | 3.8% | |

| % Fund Total | 46.6% | |

| * Includes Long-Term Investments only. | | |

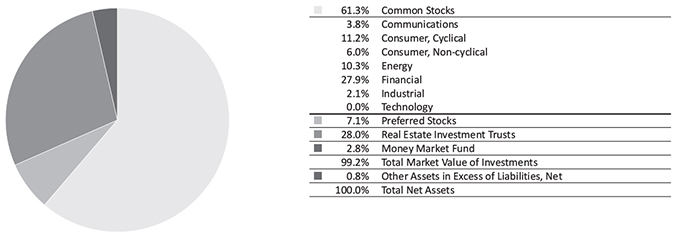

| Sectors (% of net assets) |

Expense Information (unaudited)

As a shareholder of the Funds, you incur two types of costs: (1) transaction costs, including applicable sales charges and redemption fees; and (2) ongoing costs, including management fees, distribution (12b-1) fees and other Fund expenses. This example is intended to help you understand your ongoing costs (in dollars) of investing in the Funds and to compare these costs with the ongoing costs of investing in other funds. The example is based on an investment of $1,000 invested at the beginning of the (six-month) period and held for the entire period July 1, 2020 through December 31, 2020.

ACTUAL EXPENSES

The first section of each table below provides information about actual account values and actual expenses for each of the Funds. You may use this information, together with the amount you invested, to estimate the expenses that you paid over the period. Simply divide your account value by $1,000 (for example, an $8,600 account value divided by $1,000 = 8.6), then multiply the result by the number in the applicable line under the heading entitled “Expenses Paid During the Period” to estimate the expenses you paid on your account during this period.

HYPOTHETICAL EXAMPLE FOR COMPARISON PURPOSES

The second section of each table below provides information about hypothetical account values and hypothetical expenses based on the Fund’s actual expense ratio and an assumed rate of return of 5% per year before expenses, which is not the Fund’s actual return. The hypothetical account values and expenses may not be used to estimate the actual ending account balance or expenses you paid for the period. You may use this information to compare the ongoing costs of investing in the Fund to other funds. To do so, compare this 5% hypothetical example with the 5% hypothetical examples that appear in the shareholder reports of the other funds. Please note that the expenses shown in the table are meant to highlight your ongoing costs only and do not reflect any transactional costs, such as sales charges (loads), redemption fees or exchange fees. Therefore, the second section of the table is useful in comparing ongoing costs only, and will not help you determine the relative total costs of owning different funds. In addition, if these transactional costs were included, your costs would have been higher.

| | | Beginning | Annualized | Ending | |

| | | Account Value | Expense Ratio | Account Value | Expenses Paid |

| | | (7/1/2020) | for the Period | (12/31/2020) | During Period* |

| CCM Core Impact Equity Fund (Formerly Quaker Impact Growth Fund) | | |

| Example based on actual return of: | | | | | |

| Advisor Class | 25.03% | $1,000.00

| 2.05% | $1,250.30

| $11.63

|

| Institutional Class | 25.16% | 1,000.00 | 1.80% | 1,251.60 | 10.22 |

| Hypothetical example based on assumed 5% return: | | | | | |

| Advisor Class | | 1,000.00 | 2.05% | 1,014.87 | 10.41 |

| Institutional Class | | 1,000.00 | 1.80% | 1,016.13 | 9.15 |

| CCM Small/Mid-Cap Impact Value Fund (Formerly Quaker Small/Mid-Cap Impact Value Fund) | |

| Example based on actual return of: | | | | | |

| Advisor Class | 24.55% | 1,000.00 | 1.55% | 1,245.50 | 8.77 |

| Institutional Class | 24.69% | 1,000.00 | 1.30% | 1,246.90 | 7.36 |

| Hypothetical example based on assumed 5% return: | | | | | |

| Advisor Class | | 1,000.00 | 1.55% | 1,017.39 | 7.88 |

| Institutional Class | | 1,000.00 | 1.30% | 1,018.65 | 6.61 |

| * | Expenses are equal to the Funds’ annualized six-month expense ratios multiplied by the average account value over the period multiplied by the number of days in the most recent fiscal half year (184) divided by 365 to reflect the one-half year period. |

Schedule of Investments

CCM Core Impact Equity Fund

(Formerly Quaker Impact Growth Fund)

December 31, 2020 (Unaudited)

| | | Number | | | Fair | |

| | | of Shares | | | Value | |

| Long-Term Investments — 96.9% | | | | | | |

| Common Stocks — 92.5% | | | | | | |

| Communications — 19.8% | | | | | | |

| E-Commerce/Products — 6.0% | | | | | | |

| Amazon.com Inc. (a) | | | 1,200 | | | $ | 3,908,316 | |

| Internet Content-Entertainment — 4.6% | | | | | | | | |

| Facebook Inc. Cl A (a) | | | 11,000 | | | | 3,004,760 | |

| Internet Content-Info/News — 2.0% | | | | | | | | |

Tencent Holdings Ltd. - ADR f | | | 18,000 | | | | 1,294,020 | |

| Radio — 1.3% | | | | | | | | |

| Liberty Media Corp.- | | | | | | | | |

| Liberty SiriusXM Cl A (a) | | | 20,000 | | | | 863,800 | |

| Web Portals/Internet Service Providers — 5.9% | | | | | | | | |

| Alphabet Inc. Cl A (a) | | | 1,102 | | | | 1,931,409 | |

| Alphabet Inc. Cl C (a) | | | 1,100 | | | | 1,927,068 | |

| | | | | | | | 3,858,477 | |

| Total Communications | | | | | | | | |

| (Cost $8,084,617) | | | | | | | 12,929,373 | |

| Consumer, Cyclical — 6.2% | | | | | | | | |

| Athletic Footwear — 0.6% | | | | | | | | |

adidas AG -SP-ADR (a) f | | | 2,000 | | | | 365,980 | |

| Distribution/Wholesale — 1.4% | | | | | | | | |

| IAA Inc. (a) | | | 6,000 | | | | 389,880 | |

| LKQ Corp. (a) | | | 15,000 | | | | 528,600 | |

| | | | | | | | 918,480 | |

| Retail-Automobile — 2.2% | | | | | | | | |

| Asbury Automotive Group Inc. (a) | | | 6,000 | | | | 874,440 | |

| Lithia Motors Inc. | | | 2,000 | | | | 585,340 | |

| | | | | | | | 1,459,780 | |

| Retail-Building Products — 0.6% | | | | | | | | |

| The Home Depot Inc. | | | 1,435 | | | | 381,165 | |

| Retail-Restaurants — 1.4% | | | | | | | | |

| Starbucks Corp. | | | 8,844 | | | | 946,131 | |

| Total Consumer, Cyclical | | | | | | | | |

| (Cost $3,009,562) | | | | | | | 4,071,536 | |

| Consumer, Non-cyclical — 20.6% | | | | | | | | |

| Brewery — 1.0% | | | | | | | | |

| Constellation Brands Inc. | | | 3,000 | | | | 657,150 | |

| Commercial Services — 1.4% | | | | | | | | |

| Quanta Services Inc. | | | 12,500 | | | | 900,250 | |

| Commercial Services-Finance — 2.8% | | | | | | | | |

| FleetCor Technologies Inc. (a) | | | 2,500 | | | | 682,075 | |

| PayPal Holdings Inc. (a) | | | 4,998 | | | | 1,170,532 | |

| | | | | | | | 1,852,607 | |

| Diagnostic Equipment — 1.5% | | | | | | | | |

| Thermo Fisher Scientific Inc. | | | 2,181 | | | | 1,015,866 | |

| Drug Delivery Systems — 0.5% | | | | | | | | |

| Becton Dickinson and Co. | | | 1,437 | | | | 359,566 | |

| Medical Instruments — 2.4% | | | | | | | | |

| Boston Scientific Corp. (a) | | | 14,000 | | | | 503,300 | |

| Edwards Lifesciences Corp. (a) | | | 3,810 | | | | 347,586 | |

| Intuitive Surgical Inc. (a) | | | 854 | | | | 698,658 | |

| | | | | | | | 1,549,544 | |

| Medical Products — 1.8% | | | | | | | | |

| The Cooper Cos. Inc. | | | 1,479 | | | | 537,350 | |

LivaNova PLC (a) f | | | 3,000 | | | | 198,630 | |

| Stryker Corp. | | | 1,956 | | | | 479,298 | |

| | | | | | | | 1,215,278 | |

| Medical-Biomedical/Genetics — 0.9% | | | | | | | | |

| Amgen Inc. | | | 2,600 | | | | 597,792 | |

| Medical-Drugs — 3.3% | | | | | | | | |

| Bristol-Myers Squibb Co. | | | 19,000 | | | | 1,178,570 | |

| Merck & Co Inc. | | | 12,000 | | | | 981,600 | |

| | | | | | | | 2,160,170 | |

| Medical-Health Maintenance Organization — 1.9% | | | | | | | | |

| Anthem Inc. | | | 3,800 | | | | 1,220,142 | |

| Medical-Wholesale Drug Distributors — 1.4% | | | | | | | | |

| AmerisourceBergen Corp. | | | 6,000 | | | | 586,560 | |

| McKesson Corp. | | | 1,800 | | | | 313,056 | |

| | | | | | | | 899,616 | |

| Pharmacy Services — 1.5% | | | | | | | | |

| Cigna Corp. | | | 4,600 | | | | 957,628 | |

| Rental Auto/Equipment — 0.2% | | | | | | | | |

| The Aaron’s Co. Inc (a) | | | 6,800 | | | | 128,928 | |

| Total Consumer, Non-cyclical | | | | | | | | |

| (Cost $10,337,389) | | | | | | | 13,514,537 | |

| Energy — 2.4% | | | | | | | | |

| Energy-Alternate Sources — 1.2% | | | | | | | | |

| Enviva Partners LP | | | 18,000 | | | | 817,560 | |

| Pipelines — 1.2% | | | | | | | | |

| Crestwood Equity Partners LP | | | 41,100 | | | | 780,078 | |

| Total Energy | | | | | | | | |

| (Cost $1,595,438) | | | | | | | 1,597,638 | |

| Financial — 21.9% | | | | | | | | |

| Commercial Banks — 1.5% | | | | | | | | |

| Financial Institutions Inc. | | | 22,734 | | | | 511,515 | |

| Signature Bank | | | 3,500 | | | | 473,515 | |

| | | | | | | | 985,030 | |

| Diversified Banking Institutions — 1.7% | | | | | | | | |

| JPMorgan Chase & Co. | | | 9,000 | | | | 1,143,630 | |

| Finance-Credit Card — 5.7% | | | | | | | | |

| Discover Financial Services | | | 22,500 | | | | 2,036,925 | |

| Visa Inc. Cl A | | | 7,600 | | | | 1,662,348 | |

| | | | | | | | 3,699,273 | |

| Finance-Leasing Company — 1.3% | | | | | | | | |

| PROG Holdings Inc. | | | 16,000 | | | | 861,920 | |

The accompanying notes are an integral part of the financial statements.

Schedule of Investments (continued)

CCM Core Impact Equity Fund

(Formerly Quaker Impact Growth Fund)

December 31, 2020 (Unaudited)

| | | Number | | | Fair | |

| | | of Shares | | | Value | |

| Common Stocks — 92.5% (Continued) | | | | | | |

| Insurance Brokers — 1.0% | | | | | | |

Willis Towers Watson PLC f | | | 3,000 | | | $ | 632,040 | |

| Investment Management/Advisory Services — 5.3% | | | | | | | | |

| Ameriprise Financial Inc. | | | 4,750 | | | | 923,067 | |

| BlackRock Inc. | | | 2,500 | | | | 1,803,850 | |

| Raymond James Financial Inc. | | | 7,885 | | | | 754,358 | |

| | | | | | | | 3,481,275 | |

| Multi-line Insurance — 1.1% | | | | | | | | |

Chubb Ltd. f | | | 4,500 | | | | 692,640 | |

| Property/Casualty Insurance — 4.3% | | | | | | | | |

| Berkshire Hathaway Inc. Cl B (a) | | | 8,000 | | | | 1,854,960 | |

| Fidelity National Financial Inc. | | | 25,000 | | | | 977,250 | |

| | | | | | | | 2,832,210 | |

| Total Financial | | | | | | | | |

| (Cost $11,125,958) | | | | | | | 14,328,018 | |

| Industrial — 1.1% | | | | | | | | |

| Instruments-Scientific — 1.1% | | | | | | | | |

| PerkinElmer Inc. | | | 5,115 | | | | 734,003 | |

| Total Industrial | | | | | | | | |

| (Cost $398,034) | | | | | | | 734,003 | |

| Technology — 17.4% | | | | | | | | |

| Applications Software — 6.7% | | | | | | | | |

| Microsoft Corp. | | | 18,000 | | | | 4,003,560 | |

| salesforce.com Inc. (a) | | | 1,600 | | | | 356,048 | |

| | | | | | | | 4,359,608 | |

| Computers — 8.1% | | | | | | | | |

| Apple Inc. | | | 25,000 | | | | 3,317,250 | |

| Dell Technologies Inc. (a) | | | 27,000 | | | | 1,978,830 | |

| | | | | | | | 5,296,080 | |

| Data Processing/Management — 0.0% | | | | | | | | |

| ImageWare Systems Inc. (a) | | | 125,000 | | | | 9,813 | |

| Electronic Components-Semiconducters — 1.0% | | | | | | | | |

| NVIDIA Corp. | | | 1,250 | | | | 652,750 | |

| Electronic Forms — 1.6% | | | | | | | | |

| Adobe Inc. (a) | | | 2,087 | | | | 1,043,750 | |

| Total Technology | | | | | | | | |

| (Cost $5,546,522) | | | | | | | 11,362,001 | |

| Utilities — 3.1% | | | | | | | | |

| Electric-Generation — 1.4% | | | | | | | | |

Brookfield Renewable Corp. f | | | 3,854 | | | | 224,544 | |

Brookfield Renewable Partners LP f | | | 15,414 | | | | 665,114 | |

| | | | | | | | 889,658 | |

| Electric-Integrated — 1.7% | | | | | | | | |

| NextEra Energy Inc. | | | 14,800 | | | | 1,141,820 | |

| Total Utilities | | | | | | | | |

| (Cost $1,176,560) | | | | | | | 2,031,478 | |

| Total Common Stocks | | | | | | | | |

| (Cost $41,274,080) | | | | | | | 60,568,584 | |

| Real Estate Investment Trusts — 4.4% | | | | | | | | |

| Apartments — 2.1% | | | | | | | | |

| Independence Realty Trust Inc. | | | 100,000 | | | | 1,343,000 | |

| Diversified — 2.1% | | | | | | | | |

| American Tower Corp. | | | 1,400 | | | | 314,244 | |

| Equinix Inc. | | | 990 | | | | 707,038 | |

| WP Carey Inc. | | | 5,000 | | | | 352,900 | |

| | | | | | | | 1,374,182 | |

| Mortgage — 0.2% | | | | | | | | |

| Starwood Property Trust Inc. | | | 7,519 | | | | 145,117 | |

| Total Real Estate Investment Trusts | | | | | | | | |

| (Cost $2,201,176) | | | | | | | 2,862,299 | |

| Escrow Shares — 0.0% | | | | | | | | |

| Consumer, Cyclical — 0.0% | | | | | | | | |

| Airlines — 0.0% | | | | | | | | |

| AMR Corp. Escrow (a)*^ | | | 218,835 | | | | 19,695 | |

| Total Escrow Shares | | | | | | | | |

| (Cost $24,535) | | | | | | | 19,695 | |

| | | Par | | | | | |

| | | Value | | | | | |

| Escrow Notes — 0.0% | | | | | | | | |

| Consumer, Cyclical — 0.0% | | | | | | | | |

| Retail — 0.0% | | | | | | | | |

| CB Trailer Bridge Inc. | | | | | | | | |

| (Toys R Us) (a)+*^ | | $ | 66,000 | | | | 0 | |

| Total Escrow Notes | | | | | | | | |

| (Cost $65,792) | | | | | | | 0 | |

| Total Long-Term Investments | | | | | | | | |

| (Cost $43,565,583) | | | | | | | 63,450,578 | |

| | | Number | | | | | |

| | | of Shares | | | | | |

| Short-Term Investments — 3.1% | | | | | | | | |

| Money Market Fund — 3.1% | | | | | | | | |

| First American Government | | | | | | | | |

| Obligations Fund, Cl X 0.040% (b) | | | 2,043,948 | | | | 2,043,948 | |

| Total Short-Term Investments | | | | | | | | |

| (Cost $2,043,948) | | | | | | | 2,043,948 | |

| Total Investments | | | | | | | | |

| (Cost $45,609,531) — 100.0% | | | | | | | 65,494,526 | |

| Liabilities in Excess | | | | | | | | |

| of Other Assets, Net 0.0% | | | | | | | (23,138 | ) |

| Total Net Assets — 100.0% | | | | | | $ | 65,471,388 | |

ADR - Unsponsored American Depositary Receipt

SP-ADR - Sponsored American Depositary Receipt

| (a) | Non-income producing security. |

| (b) | The rate quoted is the annualized 7 day yield as of December 31, 2020. |

| f | Foreign issued security. |

| + | Default Security. |

| * | Indicates an illiquid security. Total market value for illiquid securities is $19,695 representing 0.0% of net assets. |

| ^ | Indicates a fair valued security. Total market value for fair valued securities is $19,695, representing 0.0% of net assets and level 3 securities. |

The accompanying notes are an integral part of the financial statements.

Schedule of Investments

CCM Small/Mid-Cap Impact Value Fund

(Formerly Quaker Small/Mid-Cap Impact Value Fund)

December 31, 2020 (Unaudited)

| | | Number | | | Fair | |

| | | of Shares | | | Value | |

| Long-Term Investments — 96.4% | | | | | | |

| Common Stocks — 61.3% | | | | | | |

| Communications — 3.8% | | | | | | |

| Radio — 3.8% | | | | | | |

| Liberty Media Corp.-Liberty SiriusXM Cl A (a) | | | 17,000 | | | $ | 734,230 | |

| Total Communications | | | | | | | | |

| (Cost $612,361) | | | | | | | 734,230 | |

| Consumer, Cyclical — 11.2% | | | | | | | | |

| Building-Mobil Home/Manufactured Housing — 5.2% | | | | | | | | |

| Skyline Champion Corp. (a) | | | 32,000 | | | | 990,080 | |

| Distribution/Wholesale — 2.1% | | | | | | | | |

| IAA Inc. (a) | | | 2,000 | | | | 129,960 | |

| LKQ Corp. (a) | | | 7,500 | | | | 264,300 | |

| | | | | | | | 394,260 | |

| Retail-Automobile — 3.9% | | | | | | | | |

| Asbury Automotive Group Inc. (a) | | | 3,000 | | | | 437,220 | |

| Group 1 Automotive Inc. | | | 2,440 | | | | 319,982 | |

| | | | | | | | 757,202 | |

| Total Consumer, Cyclical | | | | | | | | |

| (Cost $1,554,028) | | | | | | | 2,141,542 | |

| Consumer, Non-cyclical — 6.0% | | | | | | | | |

| Commercial Services — 1.3% | | | | | | | | |

| Quanta Services Inc. | | | 3,500 | | | | 252,070 | |

| Medical Products — 1.6% | | | | | | | | |

LivaNova PLC (a) f | | | 4,500 | | | | 297,945 | |

| Medical-Health Maintenance Organization — 2.5% | | | | | | | | |

| Centene Corp. (a) | | | 8,000 | | | | 480,240 | |

| Medical-Hospitals — 0.0% | | | | | | | | |

Nobilis Health Corp. (a) f | | | 38,393 | | | | 46 | |

| Rental Auto/Equipment — 0.6% | | | | | | | | |

| The Aaron’s Co. Inc. (a) | | | 6,000 | | | | 113,760 | |

| Total Consumer, Non-cyclical | | | | | | | | |

| (Cost $1,126,311) | | | | | | | 1,144,061 | |

| Energy — 10.3% | | | | | | | | |

| Energy-Alternate Sources — 5.9% | | | | | | | | |

| Enviva Partners LP | | | 25,000 | | | | 1,135,500 | |

| Pipelines — 4.4% | | | | | | | | |

| Crestwood Equity Partners LP | | | 44,000 | | | | 835,120 | |

| Total Energy | | | | | | | | |

| (Cost $1,862,441) | | | | | | | 1,970,620 | |

| Financial — 27.9% | | | | | | | | |

| Commercial Banks — 4.3% | | | | | | | | |

| Financial Institutions Inc. | | | 13,547 | | | | 304,807 | |

| Synovus Financial Corp. | | | 16,000 | | | | 517,920 | |

| | | | | | | | 822,727 | |

| Finance-Credit Card — 1.7% | | | | | | | | |

| Discover Financial Services | | | 3,600 | | | | 325,908 | |

| Finance-Leasing Company — 2.8% | | | | | | | | |

| PROG Holdings Inc. | | | 10,000 | | | | 538,700 | |

| Investment Management/Advisory Services — 8.4% | | | | | | | | |

| Ameriprise Financial Inc. | | | 3,500 | | | | 680,155 | |

| Raymond James Financial Inc. | | | 9,700 | | | | 927,999 | |

| | | | | | | | 1,608,154 | |

| Property/Casualty Insurance — 7.0% | | | | | | | | |

| Ambac Financial Group Inc. (a) | | | 16,000 | | | | 246,080 | |

| Fidelity National Financial Inc. | | | 17,500 | | | | 684,075 | |

| Tiptree Inc. | | | 80,000 | | | | 401,600 | |

| | | | | | | | 1,331,755 | |

| Real Estate Operations/Development — 1.5% | | | | | | | | |

Invesque Inc. f | | | 158,000 | | | | 289,140 | |

| Savings & Loans/Thrifts — 2.2% | | | | | | | | |

| TFS Financial Corp. | | | 24,000 | | | | 423,120 | |

| Total Financial | | | | | | | | |

| (Cost $5,681,820) | | | | | | | 5,339,504 | |

| Industrial — 2.1% | | | | | | | | |

| Machinery-General Industrial — 2.1% | | | | | | | | |

| Wabtec Corp. | | | 5,500 | | | | 402,600 | |

| Total Industrial | | | | | | | | |

| (Cost $400,514) | | | | | | | 402,600 | |

| Technology — 0.0% | | | | | | | | |

| Data Processing/Management — 0.0% | | | | | | | | |

| ImageWare Systems Inc. (a) | | | 30,000 | | | | 2,355 | |

| Total Technology | | | | | | | | |

| (Cost $33,000) | | | | | | | 2,355 | |

| Total Common Stocks | | | | | | | | |

| (Cost $11,270,475) | | | | | | | 11,734,912 | |

| Preferred Stocks — 7.1% | | | | | | | | |

| Energy — 3.9% | | | | | | | | |

| Pipelines — 3.9% | | | | | | | | |

| Crestwood Equity Partners LP, | | | | | | | | |

| 9.250%, Perpetual | | | 99,909 | | | | 746,320 | |

| Total Energy | | | | | | | | |

| (Cost $712,016) | | | | | | | 746,320 | |

| Financial — 3.2% | | | | | | | | |

| Mortgage & Related Services — 3.2% | | | | | | | | |

| Federal National Mortgage Association, | | | | | | | | |

| 8.250%, Perpetual (a) | | | 25,000 | | | | 192,000 | |

| Federal National Mortgage Association, | | | | | | | | |

| 8.250%, Perpetual (a) ▲ | | | 50,000 | | | | 429,000 | |

| Total Financial | | | | | | | | |

| (Cost $684,614) | | | | | | | 621,000 | |

| Total Preferred Stocks | | | | | | | | |

| (Cost $1,396,630) | | | | | | | 1,367,320 | |

| Real Estate Investment Trusts — 28.0% | | | | | | | | |

| Apartments — 9.0% | | | | | | | | |

| Independence Realty Trust Inc. | | | 90,000 | | | | 1,208,700 | |

| Mid-America Apartment Communities Inc. | | | 4,000 | | | | 506,760 | |

| | | | | | | | 1,715,460 | |

The accompanying notes are an integral part of the financial statements.

Schedule of Investments (continued)

CCM Small/Mid-Cap Impact Value Fund

(Formerly Quaker Small/Mid-Cap Impact Value Fund)

December 31, 2020 (Unaudited)

| | | Number | | | Fair | |

| | | of Shares | | | Value | |

| Real Estate Investment Trusts — 28.0% (Continued) | | | | | | |

| Diversified — 3.0% | | | | | | |

| WP Carey Inc. | | | 8,250 | | | $ | 582,285 | |

| Mortgage — 13.9% | | | | | | | | |

| AG Mortgage Investment Trust Inc., | | | | | | | | |

| 8.000%, Perpetual Preferred ▲ | | | 7,000 | | | | 136,080 | |

| AGNC Investment Corp., 6.125%, | | | | | | | | |

| Perpetual Preferred ▲ | | | 38,000 | | | | 907,820 | |

| Annaly Capital Management Inc. | | | 20,000 | | | | 169,000 | |

| Starwood Property Trust Inc. | | | 38,000 | | | | 733,400 | |

| Two Harbors Investment Corp., | | | | | | | | |

| 7.250%, Perpetual Preferred ▲ | | | 31,500 | | | | 719,775 | |

| | | | | | | | 2,666,075 | |

| Office Property — 2.1% | | | | | | | | |

| Alexandria Real Estate Equities Inc. | | | 2,250 | | | | 400,995 | |

| Total Real Estate Investment Trusts | | | | | | | | |

| (Cost $4,474,025) | | | | | | | 5,364,815 | |

| Total Long-Term Investments | | | | | | | | |

| (Cost $17,141,130) | | | | | | | 18,467,047 | |

| Short-Term Investments — 2.8% | | | | | | | | |

| Money Market Fund — 2.8% | | | | | | | | |

| First American Government | | | | | | | | |

| Obligations Fund, Cl X 0.040% (b) | | | 530,043 | | | | 530,043 | |

| Total Short-Term Investments | | | | | | | | |

| (Cost $530,043) | | | | | | | 530,043 | |

| Total Investments | | | | | | | | |

| (Cost $17,671,173) — 99.2% | | | | | | | 18,997,090 | |

| Other Assets in Excess | | | | | | | | |

| of Liabilities, Net 0.8% | | | | | | | 147,174 | |

| Total Net Assets — 100.0% | | | | | | $ | 19,144,264 | |

| (a) | Non-income producing security. |

| (b) | The rate quoted is the annualized 7 day yield as of December 31, 2020. |

| f | Foreign issued security. |

| ▲ | The coupon rate shown on floating or adjustable rate securities represents the rate at period end. |

The accompanying notes are an integral part of the financial statements.

Statements of Assets and Liabilities

December 31, 2020 (Unaudited)

| | | | | | CCM Small/Mid-Cap | |

| | | CCM Core Impact | | | Impact Value Fund | |

| | | Equity Fund | | | (Formerly Quaker | |

| | | (Formerly Quaker | | | Small/Mid-Cap | |

| | | Impact Growth Fund) | | | Impact Value Fund) | |

| ASSETS: | | | | | | |

| Investments, at value | | $ | 65,494,526 | | | $ | 18,997,090 | |

| Cash | | | 4,891 | | | | 325 | |

| Due from advisor (Note 3) | | | — | | | | 1,021 | |

| Receivables: | | | | | | | | |

| Dividends and interest | | | 55,153 | | | | 69,862 | |

| Investment securities sold | | | — | | | | 66,991 | |

| Capital shares sold | | | 8,917 | | | | 27 | |

| Prepaid expenses and other assets | | | 61,891 | | | | 36,735 | |

| Total assets | | | 65,625,378 | | | | 19,172,051 | |

| | | | | | | | | |

| LIABILITIES: | | | | | | | | |

| Payables: | | | | | | | | |

| Due to advisor (Note 3) | | | 41,172 | | | | — | |

| Capital shares redeemed | | | 34,498 | | | | — | |

| Distribution fees | | | 11,555 | | | | 1,322 | |

| Transfer agent fees | | | 27,242 | | | | 9,763 | |

| Trustee fees | | | 18,576 | | | | 6,835 | |

| Fund administration and accounting fees | | | 16,015 | | | | 5,770 | |

| Accrued expenses | | | 4,932 | | | | 4,097 | |

| Total liabilities | | | 153,990 | | | | 27,787 | |

| Net assets | | $ | 65,471,388 | | | $ | 19,144,264 | |

| | | | | | | | | |

| NET ASSETS CONSIST OF: | | | | | | | | |

| Paid-in capital | | $ | 40,087,218 | | | $ | 23,955,466 | |

| Total distributable earnings (losses) | | | 25,384,170 | | | | (4,811,202 | ) |

| Total net assets | | $ | 65,471,388 | | | $ | 19,144,264 | |

| Total investments, at cost | | $ | 45,609,531 | | | $ | 17,671,173 | |

| Advisor Class shares: | | | | | | | | |

| Net assets | | $ | 55,145,257 | | | $ | 6,212,158 | |

Shares of beneficial interest outstanding(1) | | | 1,257,736 | | | | 439,751 | |

| Net asset value per share and redemption price per share | | $ | 43.85 | | | $ | 14.13 | |

| Institutional Class Shares: | | | | | | | | |

| Net assets | | $ | 10,326,131 | | | $ | 12,932,106 | |

Shares of beneficial interest outstanding(1) | | | 223,048 | | | | 830,233 | |

| Net asset value per share and redemption price per share | | $ | 46.30 | | | $ | 15.58 | |

(1) | Unlimited number of shares of beneficial interest with no par value authorized. |

The accompanying notes are an integral part of the financial statements.

Statements of Operations

For the Six-Month Period Ended December 31, 2020 (Unaudited)

| | | | | | CCM Small/Mid-Cap | |

| | | CCM Core Impact | | | Impact Value Fund | |

| | | Equity Fund | | | (Formerly Quaker | |

| | | (Formerly Quaker | | | Small/Mid-Cap | |

| | | Impact Growth Fund) | | | Impact Value Fund) | |

| INVESTMENT INCOME (LOSS) | | | | | | |

| Income: | | | | | | |

| Dividends (net of foreign withholding taxes) | | $ | 291,562 | | | $ | 225,843 | |

| Interest | | | 784 | | | | 209 | |

| Total income | | | 292,346 | | | | 226,052 | |

| Expenses: | | | | | | | | |

| Investment advisory fees (Note 3) | | | 232,597 | | | | 85,073 | |

| Transfer agent fees | | | 68,794 | | | | 23,215 | |

| Distribution fee - Advisor Class | | | 65,464 | | | | 7,430 | |

| Funds administration and accounting fees | | | 47,856 | | | | 16,089 | |

| Insurance | | | 42,848 | | | | 16,450 | |

| Trustee fees | | | 38,641 | | | | 11,770 | |

| Shareholder servicing fees | | | 29,889 | | | | 8,152 | |

| Chief Compliance Officer fees | | | 24,433 | | | | 11,966 | |

| Legal fees | | | 24,425 | | | | 7,514 | |

| Registration and filing expenses | | | 19,646 | | | | 19,397 | |

| Printing expenses | | | 13,264 | | | | 10,656 | |

| Audit fees | | | 11,513 | | | | 3,611 | |

| Custody fees | | | 2,139 | | | | 2,350 | |

| Other operating expenses | | | 1,391 | | | | 3,302 | |

| Total expenses | | | 622,900 | | | | 226,975 | |

| Investment advisory fees reimbursed (Note 3) | | | — | | | | (96,663 | ) |

| Net expenses | | | 622,900 | | | | 130,312 | |

| Net investment income (loss) | | | (330,554 | ) | | | 95,740 | |

| | | | | | | | | |

| REALIZED AND UNREALIZED GAIN (LOSS) ON INVESTMENTS | | | | | | | | |

| Net realized gain (loss) on investments: | | | | | | | | |

| Securities | | | 6,206,453 | | | | 680,617 | |

| Foreign currency transactions | | | — | | | | — | |

| Net realized gain (loss) on investments | | | 6,206,453 | | | | 680,617 | |

| Net change in unrealized appreciation (depreciation) of investments: | | | | | | | | |

| Securities | | | 7,722,496 | | | | 3,363,558 | |

| Net realized and unrealized gain (loss) on investments | | | 13,928,949 | | | | 4,044,175 | |

| Net increase in net assets resulting from operations | | $ | 13,598,395 | | | $ | 4,139,915 | |

| (Foreign withholding taxes on dividends/tax reclaims/interest) | | $ | (2,490 | ) | | $ | — | |

The accompanying notes are an integral part of the financial statements.

Statements of Changes in Net Assets

CCM Core Impact Equity Fund

(Formerly Quaker Impact Growth Fund)

| | | (unaudited) | | | | |

| | | For the | | | For the | |

| | | Six-Month Period Ended | | | Year Ended | |

| | | December 31, 2020 | | | June 30, 2020 | |

| INCREASE (DECREASE) IN NET ASSETS | | | | | | |

| Operations: | | | | | | |

| Net investment income (loss) | | $ | (330,554 | ) | | $ | (551,275 | ) |

| Net realized gain (loss) on investment transactions: | | | | | | | | |

| Securities | | | 6,206,453 | | | | 1,013,407 | |

| Foreign currency transactions | | | — | | | | 139 | |

| Net change in unrealized appreciation | | | | | | | | |

| (depreciation) of investment transactions: | | | | | | | | |

| Securities | | | 7,722,496 | | | | 2,442,904 | |

| Net increase (decrease) in net assets resulting from operations | | | 13,598,395 | | | | 2,905,175 | |

| Distributions to shareholders from: | | | | | | | | |

| Advisor Class | | | (366,465 | ) | | | (959,644 | ) |

| Institutional Class | | | (65,100 | ) | | | (159,052 | ) |

| Total distributions | | | (431,565 | ) | | | (1,118,696 | ) |

| Capital share transactions: | | | | | | | | |

| Increase (decrease) in net assets from fund share transactions (Note 8) | | | (4,032,426 | ) | | | (7,487,483 | ) |

| Total increase (decrease) in net assets | | | 9,134,404 | | | | (5,701,004 | ) |

| | | | | | | | | |

| NET ASSETS | | | | | | | | |

| Beginning of Period | | | 56,336,984 | | | | 62,037,988 | |

| End of Period | | $ | 65,471,388 | | | $ | 56,336,984 | |

The accompanying notes are an integral part of the financial statements.

Statements of Changes in Net Assets

CCM Small/Mid-Cap Impact Value Fund

(Formerly Quaker Small/Mid-Cap Impact Value Fund)

| | | (unaudited) | | | | |

| | | For the | | | For the | |

| | | Six-Month Period Ended | | | Year Ended | |

| | | December 31, 2020 | | | June 30, 2020 | |

| INCREASE (DECREASE) IN NET ASSETS | | | | | | |

| Operations: | | | | | | |

| Net investment income (loss) | | $ | 95,740 | | | $ | 160,234 | |

| Net realized gain (loss) on investment transactions: | | | | | | | | |

| Securities | | | 680,617 | | | | (6,032,512 | ) |

| Foreign currency transactions | | | — | | | | — | |

| Net change in unrealized appreciation | | | | | | | | |

| (depreciation) of investment transactions: | | | | | | | | |

| Securities | | | 3,363,558 | | | | (2,793,218 | ) |

| Net increase (decrease) in net assets resulting from operations | | | 4,139,915 | | | | (8,665,496 | ) |

| Distributions to shareholders from: | | | | | | | | |

| Advisor Class | | | (79,469 | ) | | | (675,516 | ) |

| Institutional Class | | | (184,600 | ) | | | (1,222,174 | ) |

| Total distributions | | | (264,069 | ) | | | (1,897,690 | ) |

| Capital share transactions: | | | | | | | | |

| Increase (decrease) in net assets from fund share transactions (Note 8) | | | (3,320,211 | ) | | | 9,165,439 | |

| Total increase (decrease) in net assets | | | 555,635 | | | | (1,397,747 | ) |

| | | | | | | | | |

| NET ASSETS | | | | | | | | |

| Beginning of Period | | | 18,588,629 | | | | 19,986,376 | |

| End of Period | | $ | 19,144,264 | | | $ | 18,588,629 | |

The accompanying notes are an integral part of the financial statements.

Financial Highlights

CCM Core Impact Equity Fund

(Formerly Quaker Impact Growth Fund)

(For a Share Outstanding Throughout each Period)

| | | Advisor Class | |

| | | (unaudited) | | | | | | | | | | | | | | | | |

| | | For the | | | | | | | | | | | | | | | | |

| | | Six-Month | | | | | | | | | | | | | | | | |

| | | Period from | | | | | | | | | | | | | | | | |

| | | July 1, 2020 to | | | Years Ended June 30, | |

| | | December 31, | | | |

| | | 2020 | | | 2020 | | | 2019 | | | 2018 | | | 2017 | | | 2016 | |

| Net asset value, beginning of period | | $ | 35.31 | | | $ | 34.22 | | | $ | 31.87 | | | $ | 27.86 | | | $ | 23.80 | | | $ | 26.55 | |

| Income from investment operations: | | | | | | | | | | | | | | | | | | | | | | | | |

Net investment income (loss)(1) | | | (0.22 | ) | | | (0.34 | ) | | | (0.30 | ) | | | (0.24 | ) | | | (0.07 | ) | | | (0.32 | ) |

Net realized and unrealized gain (loss) on investments | | | 9.05 | | | | 2.10 | | | | 2.65 | | | | 4.25 | | | | 4.13 | | | | (2.43 | ) |

| Total from investment operations | | | 8.83 | | | | 1.76 | | | | 2.35 | | | | 4.01 | | | | 4.06 | | | | (2.75 | ) |

| Distributions to shareholders from: | | | | | | | | | | | | | | | | | | | | | | | | |

| Net investment income | | | — | | | | — | | | | — | | | | — | | | | — | | | | — | |

| Net realized capital gain | | | (0.29 | ) | | | (0.67 | ) | | | — | | | | — | | | | — | | | | — | |

| Total distributions | | | (0.29 | ) | | | (0.67 | ) | | | — | | | | — | | | | — | | | | — | |

| Net asset value, end of period | | $ | 43.85 | | | $ | 35.31 | | | $ | 34.22 | | | $ | 31.87 | | | $ | 27.86 | | | $ | 23.80 | |

Total Return(2) | | | 25.03 | %* | | | 5.05 | % | | | 7.37 | % | | | 14.39 | % | | | 17.01 | % | | | (10.36 | )% |

| Ratios/supplemental data: | | | | | | | | | | | | | | | | | | | | | | | | |

| Net assets, end of period (000’ omitted) | | $ | 55,145 | | | $ | 47,731 | | | $ | 53,292 | | | $ | 44,964 | | | $ | 49,859 | | | $ | 57,159 | |

| Ratio of expenses to average net assets: | | | | | | | | | | | | | | | | | | | | | |

| Before expense reimbursements or recoveries | | | 2.05 | %** | | | 2.09 | % | | | 2.48 | % | | | 2.30 | % | | | 2.34 | %(3)(4) | | | 2.30 | %(3)(4) |

| After expense reimbursements or recoveries | | | 2.05 | %** | | | 2.09 | % | | | 2.48 | % | | | 2.30 | % | | | 2.22 | %(3)(5) | | | 2.24 | %(3)(5) |

| Ratio of net investment income (loss) to average net assets: | | | | | | | | | | | | | | | | | | | | |

| Before expense reimbursements or recoveries | | | (1.10 | )%** | | | (0.97 | )% | | | (0.99 | )% | | | (0.78 | )% | | | (0.40 | )%(3) | | (1.34 | )%(3)^ |

| After expense reimbursements or recoveries | | | (1.10 | )%** | | | (0.97 | )% | | | (0.99 | )% | | | (0.78 | )% | | | (0.28 | )%(3) | | (1.28 | )%(3)^ |

| Portfolio turnover rate | | | 30 | %* | | | 69 | % | | | 24 | % | | | 119 | % | | | 185 | % | | | 211 | % |

| (1) | The average shares outstanding method has been applied for per share information. |

| (2) | Total investment return is based on the change in net asset value of a share during the period, assumes reinvestment of dividends and distributions at net asset value and does not reflect the impact of a sales charge. As of September 30, 2018 the Fund no longer charges a sales charge. |

| (3) | Expense waived or reimbursed reflect reductions to total expenses, as discussed in the notes to the financial statements. These reimbursed amounts would increase the net investment loss ratio or decrease the net investment income ratio and recovered amounts would decrease the net investment loss ratio or increase the net investment income ratio, as applicable, had such reductions or increases not occurred. |

| (4) | Expenses before reductions (excluding dividend and interest expense for securities sold short) were 2.29% for the year ended June 30, 2016. |

| (5) | Expenses net of all reductions (excluding dividend and interest expense for securities sold short) were 2.23% for the year ended June 30, 2016. |

| * | Not annualized. |

| ** | Annualized. |

| ^ | The net investment income (loss) ratios include dividends on short positions. |

The accompanying notes are an integral part of the financial statements.

Financial Highlights

CCM Core Impact Equity Fund

(Formerly Quaker Impact Growth Fund)

(For a Share Outstanding Throughout each Period)

| | | Institutional Class | |

| | | (unaudited) | | | | | | | | | | | | | | | | |

| | | For the | | | | | | | | | | | | | | | | |

| | | Six-Month | | | | | | | | | | | | | | | | |

| | | Period from | | | | | | | | | | | | | | | | |

| | | July 1, 2020 to | | | Years Ended June 30, | |

| | | December 31, | | | |

| | | 2020 | | | 2020 | | | 2019 | | | 2018 | | | 2017 | | | 2016 | |

| Net asset value, beginning of period | | $ | 37.23 | | | $ | 35.96 | | | $ | 33.40 | | | $ | 29.12 | | | $ | 24.82 | | | $ | 27.62 | |

| Income from investment operations: | | | | | | | | | | | | | | | | | | | | | | | | |

Net investment income (loss)(1) | | | (0.18 | ) | | | (0.26 | ) | | | (0.25 | ) | | | (0.17 | ) | | | (0.01 | ) | | | (0.27 | ) |

Net realized and unrealized gain (loss) on investments | | | 9.54 | | | | 2.20 | | | | 2.81 | | | | 4.45 | | | | 4.31 | | | | (2.53 | ) |

| Total from investment operations | | | 9.36 | | | | 1.94 | | | | 2.56 | | | | 4.28 | | | | 4.30 | | | | (2.80 | ) |

| Distributions to shareholders from: | | | | | | | | | | | | | | | | | | | | | | | | |

| Net investment income | | | — | | | | — | | | | — | | | | — | | | | — | | | | — | |

| Net realized capital gain | | | (0.29 | ) | | | (0.67 | ) | | | — | | | | — | | | | — | | | | — | |

| Total distributions | | | (0.29 | ) | | | (0.67 | ) | | | — | | | | — | | | | — | | | | — | |

| Net asset value, end of period | | $ | 46.30 | | | $ | 37.23 | | | $ | 35.96 | | | $ | 33.40 | | | $ | 29.12 | | | $ | 24.82 | |

Total Return(2) | | | 25.16 | %* | | | 5.31 | % | | | 7.66 | % | | | 14.70 | % | | | 17.32 | % | | | (10.14 | )% |

| Ratios/supplemental data: | | | | | | | | | | | | | | | | | | | | | | | | |

| Net assets, end of period (000’ omitted) | | $ | 10,326 | | | $ | 8,606 | | | $ | 8,746 | | | $ | 9,039 | | | $ | 9,005 | | | $ | 13,457 | |

| Ratio of expenses to average net assets: | | | | | | | | | | | | | | | | | | | | | | | | |

| Before expense reimbursements or recoveries | | | 1.80 | %** | | | 1.84 | % | | | 2.23 | % | | | 2.05 | % | | | 2.09 | %(3)(4) | | | 2.05 | %(3)(4) |

| After expense reimbursements or recoveries | | | 1.80 | %** | | | 1.84 | % | | | 2.23 | % | | | 2.05 | % | | | 1.97 | %(3)(5) | | | 1.99 | %(3)(5) |

| Ratio of net investment income (loss) to average net assets: | | | | | | | | | | | | | | | | | | | | |

| Before expense reimbursements or recoveries | | | (0.85 | )%** | | | (0.72 | )% | | | (0.74 | )% | | | (0.53 | )% | | | (0.15 | )%(3) | | (1.09 | )%(3)^ |

| After expense reimbursements or recoveries | | | (0.85 | )%** | | | (0.72 | )% | | | (0.74 | )% | | | (0.53 | )% | | | (0.03 | )%(3) | | (1.03 | )%(3)^ |

| Portfolio turnover rate | | | 30 | %* | | | 69 | % | | | 24 | % | | | 119 | % | | | 185 | % | | | 211 | % |

| (1) | The average shares outstanding method has been applied for per share information. |

| (2) | Total investment return is based on the change in net asset value of a share during the period, assumes reinvestment of dividends and distributions at net asset value. |

| (3) | Expense waived or reimbursed reflect reductions to total expenses, as discussed in the notes to the financial statements. These reimbursed amounts would increase the net investment loss ratio or decrease the net investment income ratio and recovered amounts would decrease the net investment loss ratio or increase the net investment income ratio, as applicable, had such reductions or increases not occurred. |

| (4) | Expenses before reductions (excluding dividend and interest expense for securities sold short) were 2.04% for the year ended June 30, 2016. |

| (5) | Expenses net of all reductions (excluding dividend and interest expense for securities sold short) were 1.98% for the year ended June 30, 2016. |

| * | Not annualized. |

| ** | Annualized. |

| ^ | The net investment income (loss) ratios include dividends on short positions. |

The accompanying notes are an integral part of the financial statements.

Financial Highlights

CCM Small/Mid-Cap Impact Value Fund

(Formerly Quaker Small/Mid-Cap Impact Value Fund)

(For a Share Outstanding Throughout the Period)

| | | Advisor Class | |

| | | (unaudited) | | | | | | | | | | | | | | | | |

| | | For the | | | | | | | | | | | | | | | | |

| | | Six-Month | | | | | | | | | | | | | | | | |

| | | Period from | | | | | | | | | | | | | | | | |

| | | July 1, 2020 to | | | Years Ended June 30, | |

| | | December 31, | | | |

| | | 2020 | | | 2020 | | | 2019 | | | 2018 | | | 2017 | | | 2016 | |

| Net asset value, beginning of period | | $ | 11.49 | | | $ | 17.65 | | | $ | 23.23 | | | $ | 24.13 | | | $ | 20.09 | | | $ | 24.15 | |

| Income from investment operations: | | | | | | | | | | | | | | | | | | | | | | | | |

Net investment income (loss)(1) | | | 0.05 | | | | 0.09 | | | | 0.08 | | | | (0.23 | ) | | | (0.20 | ) | | | (0.08 | ) |

Net realized and unrealized gain (loss) on investments | | | 2.77 | | | | (4.91 | ) | | | 0.12 | | | | 3.03 | | | | 4.24 | | | | (2.26 | ) |

| Total from investment operations | | | 2.82 | | | | (4.82 | ) | | | 0.20 | | | | 2.80 | | | | 4.04 | | | | (2.34 | ) |

| Distributions to shareholders from: | | | | | | | | | | | | | | | | | | | | | | | | |

| Net investment income | | | (0.18 | ) | | | (0.34 | ) | | | — | | | | — | | | | — | | | | — | |

| Net realized capital gain | | | — | | | | (1.00 | ) | | | (5.78 | ) | | | (3.70 | ) | | | — | | | | (1.72 | ) |

| Total distributions | | | (0.18 | ) | | | (1.34 | ) | | | (5.78 | ) | | | (3.70 | ) | | | — | | | | (1.72 | ) |

| Net asset value, end of period | | $ | 14.13 | | | $ | 11.49 | | | $ | 17.65 | | | $ | 23.23 | | | $ | 24.13 | | | $ | 20.09 | |

Total Return(2) | | | 24.55 | %* | | | (30.04 | )% | | | 3.17 | % | | | 12.07 | % | | | 20.11 | % | | | (9.93 | )% |

| Ratios/supplemental data: | | | | | | | | | | | | | | | | | | | | | | | | |

| Net assets, end of period (000’ omitted) | | $ | 6,212 | | | $ | 5,890 | | | $ | 9,176 | | | $ | 4,737 | | | $ | 6,434 | | | $ | 6,431 | |

| Ratio of expenses to average net assets: | | | | | | | | | | | | | | | | | | | | | | | | |

| Before expense reimbursements | | | 2.57 | %(3)** | | | 2.38 | %(3) | | | 2.84 | %(3) | | | 2.44 | % | | | 2.21 | % | | | 1.93 | % |

| After expense reimbursements | | | 1.55 | %(3)** | | | 1.55 | %(3) | | | 2.65 | %(3) | | | 2.44 | % | | | 2.21 | % | | | 1.93 | % |

| Ratio of net investment income (loss) to average net assets: | | | | | | | | | | | | | | | | | | | | |

| Before expense reimbursements | | | (0.18 | )%(3)** | | | (0.28 | )%(3) | | | 0.28 | %(3) | | | (0.99 | )% | | | (0.89 | )% | | | (0.37 | )% |

| After expense reimbursements | | | 0.84 | %(3)** | | | 0.55 | %(3) | | | 0.47 | %(3) | | | (0.99 | )% | | | (0.89 | )% | | | (0.37 | )% |

| Portfolio turnover rate | | | 25 | %* | | | 117 | % | | | 111 | % | | | 122 | % | | | 146 | % | | | 119 | % |

| (1) | The average shares outstanding method has been applied for per share information. |

| (2) | Total investment return is based on the change in net asset value of a share during the period, assumes reinvestment of dividends and distributions at net asset value and does not reflect the impact of a sales charge. As of September 30, 2018 the Fund no longer charges a sales charge. |

| (3) | Expense waived or reimbursed reflect reductions to total expenses, as discussed in the notes to the financial statements. These reimbursed amounts would increase the net investment loss ratio or decrease the net investment income ratio, as applicable, had such reductions not occurred. |

| * | Not annualized. |

| ** | Annualized. |

The accompanying notes are an integral part of the financial statements.

Financial Highlights

CCM Small/Mid-Cap Impact Value Fund

(Formerly Quaker Small/Mid-Cap Impact Value Fund)

(For a Share Outstanding Throughout the Period)

| | | Institutional Class | |

| | | (unaudited) | | | | | | | | | | | | | | | | |

| | | For the | | | | | | | | | | | | | | | | |

| | | Six-Month | | | | | | | | | | | | | | | | |

| | | Period from | | | | | | | | | | | | | | | | |

| | | July 1, 2020 to | | | Years Ended June 30, | |

| | | December 31, | | | |

| | | 2020 | | | 2020 | | | 2019 | | | 2018 | | | 2017 | | | 2016 | |

| Net asset value, beginning of period | | $ | 12.67 | | | $ | 19.36 | | | $ | 24.83 | | | $ | 25.49 | | | $ | 21.17 | | | $ | 25.29 | |

| Income from investment operations: | | | | | | | | | | | | | | | | | | | | | | | | |

Net investment income (loss)(1) | | | 0.08 | | | | 0.13 | | | | 0.15 | | | | (0.19 | ) | | | (0.15 | ) | | | (0.03 | ) |

Net realized and unrealized gain (loss) on investments | | | 3.05 | | | | (5.41 | ) | | | 0.16 | | | | 3.23 | | | | 4.47 | | | | (2.37 | ) |

| Total from investment operations | | | 3.13 | | | | (5.28 | ) | | | 0.31 | | | | 3.04 | | | | 4.32 | | | | (2.40 | ) |

| Distributions to shareholders from: | | | | | | | | | | | | | | | | | | | | | | | | |

| Net investment income | | | (0.22 | ) | | | (0.41 | ) | | | — | | | | — | | | | — | | | | — | |

| Net realized capital gain | | | — | | | | (1.00 | ) | | | (5.78 | ) | | | (3.70 | ) | | | — | | | | (1.72 | ) |

| Total distributions | | | (0.22 | ) | | | (1.41 | ) | | | (5.78 | ) | | | (3.70 | ) | | | — | | | | (1.72 | ) |

| Net asset value, end of period | | $ | 15.58 | | | $ | 12.67 | | | $ | 19.36 | | | $ | 24.83 | | | $ | 25.49 | | | $ | 21.17 | |

Total Return(2) | | | 24.69 | %* | | | (29.89 | )% | | | 3.47 | % | | | 12.39 | % | | | 20.41 | % | | | (9.71 | )% |

| Ratios/supplemental data: | | | | | | | | | | | | | | | | | | | | | | | | |

| Net assets, end of period (000’ omitted) | | $ | 12,932 | | | $ | 12,699 | | | $ | 10,811 | | | $ | 9,747 | | | $ | 20,952 | | | $ | 24,642 | |

| Ratio of expenses to average net assets: | | | | | | | | | | | | | | | | | | | | | | | | |

| Before expense reimbursements | | | 2.32 | %(3)** | | | 2.13 | %(3) | | | 2.58 | %(3) | | | 2.19 | % | | | 1.96 | % | | | 1.68 | % |

| After expense reimbursements | | | 1.30 | %(3)** | | | 1.30 | %(3) | | | 2.39 | %(3) | | | 2.19 | % | | | 1.96 | % | | | 1.68 | % |

| Ratio of net investment income (loss) to average net assets: | | | | | | | | | | | | | | | | | | | | |

| Before expense reimbursements | | | 0.07 | %(3)** | | | (0.03 | )%(3) | | | 0.53 | %(3) | | | (0.74 | )% | | | (0.64 | )% | | | (0.12 | )% |

| After expense reimbursements | | | 1.09 | %(3)** | | | 0.80 | %(3) | | | 0.72 | %(3) | | | (0.74 | )% | | | (0.64 | )% | | | (0.12 | )% |

| Portfolio turnover rate | | | 25 | %* | | | 117 | % | | | 111 | % | | | 122 | % | | | 146 | % | | | 119 | % |

| (1) | The average shares outstanding method has been applied for per share information. |

| (2) | Total investment return is based on the change in net asset value of a share during the period, assumes reinvestment of dividends and distributions at net asset value. |

| (3) | Expense waived or reimbursed reflect reductions to total expenses, as discussed in the notes to the financial statements. These reimbursed amounts would increase the net investment loss ratio or decrease the net investment income ratio, as applicable, had such reductions not occurred. |

| * | Not annualized. |

| ** | Annualized. |

The accompanying notes are an integral part of the financial statements.

Notes to the Financial Statements (unaudited)

Note 1 — Organization

The Quaker Investment Trust (“Trust”), a diversified, open-end management investment company, was originally organized as a Massachusetts business trust on October 24, 1990, and was reorganized as a Delaware statutory trust on September 30, 2018. The Trust is registered under the Investment Company Act of 1940, as amended (“1940 Act”). The Trust’s Declaration of Trust permits the Trustees to issue an unlimited number of shares of beneficial interest for each of its series. Currently, the Trust offers two series: CCM Core Impact Equity Fund (“Core Impact Equity”) (Formerly Quaker Impact Growth Fund) and CCM Small/Mid-Cap Impact Value Fund (“Small/Mid-Cap Impact Value”)(Formerly Quaker Small/Mid-Cap Impact Value Fund) (each a “Fund” and collectively, “Funds”). Both Funds are diversified. The investment objectives of each Fund are set forth below. Community Capital Management, Inc. (“CCM”) has managed the Funds since January 1, 2018.

Core Impact Equity and Small/Mid-Cap Impact Value commenced operations on November 25, 1996. The investment objective of these Funds is to seek long-term growth of capital. The investment objective of these Funds is non-fundamental in that this objective may be changed by the Board of Trustees (“Board” or “Trustees”) without shareholder approval. Each Fund is an investment company and accordingly follows the investment company accounting and reporting guidance of the Financial Accounting Standards Board (“FASB”) Accounting Standards Codification Topic 946 “Financial Services – Investment Companies.”

The Funds offer two classes of shares: Advisor Class and Institutional Class. The Advisor Class shares are charged a distribution and service fee; and Institutional Class shares bear no distribution fee but have higher minimum investment thresholds. CCM has the ability to waive the minimum investment for Institutional Class shares at its discretion.

On February 1, 2019 the Trust amended and restated its Registration Statement to change each of the Funds’ performance reporting history. The inception date for each of the Fund’s performance reporting history is now January 1, 2018, the date CCM became the Adviser to the Funds.

Note 2 — Summary of Significant Accounting Policies and Other Information

The following is a summary of significant accounting policies consistently followed by the Funds in the preparation of their financial statements. The policies are in conformity with accounting principles generally accepted in the United States of America (“GAAP”).

A. Security Valuation. The Funds’ investments in securities are carried at market value. Securities listed on an exchange or quoted on a national market system are generally valued at the last quoted sales price at the time of valuation. Other securities traded in the over-the-counter market and listed securities for which no sale was reported on that date are valued at the most recent bid price. Each security reported on the NASDAQ National Market System is valued at the NASDAQ Official Closing Price.

Debt and other fixed-income securities are valued at the last quoted bid price and/or by using a combination of daily quotes and matrix evaluations provided by an independent pricing service (which reflect such factors as security prices, yields, maturities, ratings, and dealer and exchange quotations), the use of which has been approved by the Board.

The Funds may enter into forward foreign currency contracts to lock in the U.S. dollar cost of purchase and sale transactions or to defend the portfolio against currency fluctuations. A forward foreign currency contract is a commitment to purchase or sell a foreign currency at a future date at a negotiated rate. These contracts are valued daily, and the Fund’s net equity therein, representing unrealized gain or loss on the contracts as measured by the difference between the forward foreign exchange rates at the dates of entry into the contracts and the forward rates at the end of the reporting period, if any, is included in the Statements of Assets and Liabilities.

Realized and unrealized gains and losses, if any, are included in the Statements of Operations. Risks may arise upon entering into these contracts from the potential inability of counterparties to meet the terms of the contract and from unanticipated movements in the value of foreign currencies relative to the U.S. dollar.

For financial reporting purposes, investment transactions are recorded on the trade date; however, for purposes of executing shareholder transactions, the Funds record changes in holdings of portfolio securities no later than the first business day after the trade date in accordance with Rule 2a-4 of the 1940 Act. Accordingly, certain differences between net asset value for financial reporting and for executing shareholder transactions may arise.

The Funds have adopted fair valuation procedures to value securities at fair market value in certain circumstances, and the Trust has established an Investment Trading and Valuation Committee responsible for determining when fair valuing a security is necessary and appropriate. The Funds will value securities at fair market value when market quotations are not readily available or when securities cannot be accurately valued within established pricing procedures. The Investment Trading and Valuation Committee may also fair value foreign securities whose prices may have been affected by events occurring after the close of trading in their respective markets but prior to the time the Fund holding the foreign securities calculates its net asset value. The Funds’ fair valuation procedures are designed to help ensure that prices at which Fund shares are purchased and redeemed are fair and do not result in dilution of shareholder interest or other harm to shareholders.

The Fund is required to disclose information regarding the fair value measurements of the Fund’s assets and liabilities. Fair value is defined as the price that the Fund may receive upon selling an investment in an orderly transaction to an independent buyer in the principal or most advantageous market for the investment. The disclosure requirements utilize a three-tier hierarchy to maximize the use of observable market data, minimize the use of unobservable inputs and establish classification of fair value measurements for disclosure purposes. A financial instrument’s level within the fair value hierarchy is based on the lowest level that is significant to the fair value measurement. Inputs refer broadly to the assumptions that market participants would use in pricing the asset or liability, including assumptions about risk, for example, the risk inherent in a particular valuation technique used to measure fair value including the pricing model used and/or the risk inherent in the inputs to the valuation technique. Inputs may be observable or unobservable.

Observable inputs are inputs that reflect the assumptions market participants would use in pricing the asset or liability, which are based on market data obtained from sources independent of the reporting entity. Unobservable inputs are inputs that reflect the reporting entity’s own assumptions about the assumptions market participants would use in pricing the asset or liability developed based on the best information available in the circumstances.

The significant unobservable inputs used in the fair value measurement of the reporting entity’s equity holdings are, the projected final distribution applied for lack of marketability. Significant increases (decreases) in any of those inputs in isolation could result in a significantly lower (higher) fair value measurement.

Various inputs may be used to determine the value of each Fund’s investments. These inputs are summarized in three broad levels for financial statement purposes. The inputs or methodologies used to value securities are not necessarily an indication of the risk associated with investing in those securities.

| Level 1 — | Quoted prices in active markets for identical securities. |

Notes to the Financial Statements (unaudited) (continued)

| Level 2 — | Prices determined using significant other observable inputs (including quoted prices for similar securities, interest rates, prepayment speeds, credit risk, etc.) municipal securities, long-term U.S. Government obligations and corporate debt securities are valued in accordance with the evaluated price supplied by the pricing service and generally categorized as Level 2 in the hierarchy. Other securities that are categorized as Level 2 in the hierarchy may include, but are not limited to, OTC options and international equity securities valued by an independent third party in order to adjust for stale pricing and foreign market holidays. |

| | |

| Level 3 — | Prices determined using significant unobservable inputs (including the Fund’s own assumptions). For restricted equity securities where observable inputs are limited, assumptions about market activity and risk are used in determining fair value. These are categorized as Level 3 in the hierarchy. |

For international equity securities traded on a foreign exchange or market which closes prior to a Fund’s Valuation Time, in order to adjust for events which occur between the close of the foreign exchange they are traded on and the close of the New York Stock Exchange, a fair valuation model is used, and these securities are categorized as Level 2.

A Fund may hold securities, some of which are classified as Level 3 investments (as defined below). Level 3 investments have significant unobservable inputs, as they trade infrequently. In determining the fair value of these investments, management uses the market approach which includes as the primary input the capital balance reported; however, adjustments to the reported capital balance may be made based on various factors, including, but not limited to, the attributes of the interest held, including the rights and obligations, and any restrictions or illiquidity of such interests, and the fair value of these securities.

The value of a foreign security is generally determined as of the close of trading on the foreign stock exchange on which the security is primarily traded, or as of the close of trading on the New York Stock Exchange (“NYSE”), if earlier. The value is then converted into its U.S. dollar equivalent at the foreign exchange rate in effect at the close of the NYSE (generally 4:00 p.m. Eastern time) on the day that the value of the foreign security is determined. If no sale is reported at that time, the foreign security will be valued within the range of the most recent quoted bid and ask prices. If market quotations are not readily available for a foreign security or an event has occurred that caused a quotation to be unavailable or unreliable, the Investment Trading and Valuation Committee will fair value foreign securities using the procedures described below.

The Trust has adopted fair valuation procedures to value securities at fair market value when independent prices are unavailable or unreliable, and the Trust has established an Investment Trading and Valuation Committee that is responsible for determining when fair valuing a security is necessary and appropriate. Securities and assets for which market quotations are not readily available may be valued based upon valuation methods that include: (i) multiple of earnings; (ii) yield to maturity with respect to debt issues; (iii) discounts from market prices of similar freely traded securities; or (iv) a combination of these or other methods. Securities may also be priced using fair value pricing methods when their closing prices do not reflect their market values at the time the Fund calculates its net asset value (“NAV”) because an event had occurred since the closing prices were established on the domestic or foreign exchange or market but before the Fund’s NAV calculation.

The following is a summary of the fair valuations according to the inputs used as of December 31, 2020 in valuing the Fund’s assets and liabilities:

| CORE IMPACT EQUITY FUND | | | | | | | | | | | | |

| | | | | | | | | | | | | |

| Description | | Level 1 | | | Level 2 | | | Level 3 | | | Total | |

| Common Stocks | | $ | 60,568,584 | | | $ | — | | | $ | — | | | $ | 60,568,584 | |

| Real Estate | | | | | | | | | | | | | | | | |

| Investment Trusts | | | 2,862,299 | | | | — | | | | — | | | | 2,862,299 | |

Escrow Shares(1) | | | — | | | | — | | | | 19,695 | | | | 19,695 | |

Escrow Notes(1) | | | — | | | | — | | | | 0 | | | | 0 | |

| Money Market Fund | | | 2,043,948 | | | | — | | | | — | | | | 2,043,948 | |

| Total Investments | | | | | | | | | | | | | | | | |

| in Securities | | $ | 65,474,831 | | | $ | — | | | $ | 19,695 | | | $ | 65,494,526 | |

| | | | | | | | | | | | | | | | | |

| SMALL/MID-CAP IMPACT VALUE FUND | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | |

| Description | | Level 1 | | | Level 2 | | | Level 3 | | | Total | |

| Common Stocks | | $ | 11,734,912 | | | $ | — | | | $ | — | | | $ | 11,734,912 | |

| Preferred Stocks | | | 1,367,320 | | | | — | | | | — | | | | 1,367,320 | |

| Real Estate | | | | | | | | | | | | | | | | |

| Investment Trusts | | | 5,364,815 | | | | — | | | | — | | | | 5,364,815 | |

| Money Market Fund | | | 530,043 | | | | — | | | | — | | | | 530,043 | |

| Total Investments | | | | | | | | | | | | | | | | |

| in Securities | | $ | 18,997,090 | | | $ | — | | | $ | — | | | $ | 18,997,090 | |

| (1) | See the Core Impact Equity Fund’s Schedule of Investments for industry classifications of the two securities noted as Level 3. |

Level 3 Reconciliation

The following is a reconciliation of each Fund’s Level 3 investments for which significant unobservable inputs were used in determining value:

CORE IMPACT EQUITY FUND

| | | | | | | | | | Net unrealized | | | Amortized | | | | | |

| | Balance as of | | | | | | Realized | | appreciation | | | discounts/ | | Transfers in | | Balance as of | |

| | June 30, 2020 | | Purchases | | Sales | | gain (loss) | | (depreciation) | | | premiums | | to Level 3 | December 31, 2020 |

| Escrow Shares | $ | 28,449 | | $ | — | | $ | — | | $ | — | | $ | (8,754 | ) | | $ | — | | $ | — | | $ | 19,695 | |

| Escrow Notes | $ | 0 | | $ | — | | $ | — | | $ | — | | $ | — | | | $ | — | | $ | — | | $ | 0 | |

| Total | $ | 28,449 | | $ | — | | $ | — | | $ | — | | $ | (8,754 | ) | | $ | — | | $ | — | | $ | 19,695 | |

| Net change in unrealized appreciation (depreciation) for Level 3 investments still held as of December 31, 2020 | | $ | (8,754 | ) |

The following presents information about significant unobservable inputs related to Level 3 investments at December 31, 2020:

CORE IMPACT EQUITY FUND

| | | Fair Value at | | Valuation | Unobservable | Input |

| | | December 31, 2020 | | Technique | Input | Values |

| Escrow Shares | | | | | | |

| Airlines | | $ | 19,695 | | Market approach | Estimated obligations to other parties | 60mm* |

| Escrow Notes | | | | | | | |

| Retail | | $ | 0 | | Profitability expected return method | Uncertainty of any additional future payout | $0.00** |

| * | | An increase in the unobservable input would decrease the valuation and a decrease in the unobservable input would increase the valuation. |

| ** | | An increase in the unobservable input would increase the valuation and a decrease in the unobservable input would decrease the valuation. |

Notes to the Financial Statements (unaudited) (continued)

B. Federal Income Taxes. It is the Funds’ policy to comply with the requirements of Subchapter M of the Internal Revenue Code and to distribute substantially all of their taxable income to shareholders. Therefore, no federal income tax provision is required.

In accordance with FASB Interpretation ASC 740, (“ASC 740”), each Fund recognizes a tax benefit from an uncertain position only if it is more likely than not that the position is sustainable, based solely on its technical merits and consideration of the relevant taxing authority’s widely understood administrative practices and precedents. If this threshold is met, a Fund measures the tax benefit as the largest amount of benefit that is greater than fifty percent likely of being realized upon ultimate settlement. The Funds identify their major tax jurisdictions as U.S. Federal, the Commonwealth of Massachusetts and the State of Delaware. Management has reviewed the tax positions for each of the three open tax years as of June 30, 2020 and has determined that the implementation of ASC 740 does not have a material impact on the Funds’ financial statements. Each Fund’s federal tax returns for the prior three fiscal years remains subject to examination by the Internal Revenue Service.

Net investment income or loss and net realized gains or losses may differ for financial statement and income tax purposes primarily due to investments that have a different basis for financial statement and income tax purposes. The character of distributions made during the year from net investment income or net realized gains may differ from their ultimate characterization for federal income tax purposes. Also, due to the timing of dividend distributions, the fiscal year in which amounts are distributed may differ from the year that the income or realized gains were recorded by each Fund. Permanent differences in the recognition of earnings are reclassified to additional paid-in capital. Distributions in excess of tax-basis earnings are recorded as a return of capital.

C. Security Transactions and Investment Income. Security transactions are recorded on the trade date. Realized gains and losses are determined using the specific identification cost method. Interest income on debt securities is recorded daily on the accrual basis. Discounts and premiums on debt securities are amortized over their respective lives. Dividend income is recorded on the ex-dividend date, or as soon as information is available to the Fund.

D. Short Sales of Investments. The Funds may make short sales of investments, which are transactions in which a Fund sells a security it does not own in anticipation of a decline in the fair value of that security. To complete such a transaction, the Fund must borrow the security to make delivery to the buyer. The Fund is then obligated to replace the security borrowed by purchasing it at the market price at the time of replacement. The broker retains the proceeds of short sales to the extent necessary to meet margin requirements until the short position is closed out.

If a security pays a dividend while the Fund holds it short, the Fund will need to pay the dividend to the original owner of the security. Since the Fund borrowed the shares and sold them to a third party, the third party will receive the dividend from the security and the Fund will pay the original owner the dividend directly. The Fund is not entitled to the dividend because it does not own the shares. A gain, limited to the price at which the Fund sold the security short, or a loss, unlimited in size, will be recognized upon the termination of a short sale. The Funds did not have any short sales during the six-month period ended December 31, 2020.

E. Written Options Contracts. The Funds may write options to manage exposure to certain changes in the market. When a Fund writes an option, an amount equal to the premium received by the Fund is recorded as a liability, which is marked-to-market daily to reflect the current market value of the option written. If the option expires, the Fund realizes a gain from investments equal to the amount of the premium received. When a written call option is exercised, the difference between the premium and the amount for effecting a purchase transaction, including brokerage commission, is also treated as a realized gain or loss. When a written put option is exercised, the amount of the premium received reduces the cost of the security purchased by the Fund.

A risk in writing a covered call option is that the Fund may forego the opportunity of profit if the market price of the underlying security increases and the option is exercised. The risk in writing a put option is that the Fund may incur a loss if the market price of the underlying security decreases and the option is exercised.