UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED

MANAGEMENT INVESTMENT COMPANIES

Investment Company Act file number: 811-06260

Quaker Investment Trust

(Exact name of registrant as specified in charter)

| | |

309 Technology Drive

Malvern, PA 19355 |

| (Address of principle executive offices) | | (Zip Code) |

Jeffry H. King, Sr.

Quaker Investment Trust

309 Technology Drive

Malvern, PA 19355

(Name and address of agent for service)

| | |

Registrant’s telephone number, including area code: | | (800) 220-8888 |

| |

Date of fiscal year end: | | June 30, 2012 |

| |

Date of reporting period: | | June 30, 2012 |

Form N-CSR is to be used by management investment companies to file reports with the Commission not later than 10 days after the transmission to stockholders of any report that is required to be transmitted to stockholders under Rule 30e-1 under the Investment Company Act of 1940 (17 CFR 270.30e-1). The Commission may use the information provided on Form N-CSR in its regulatory, disclosure review, inspection, and policymaking roles.

A registrant is required to disclose the information specified by Form N-CSR, and the Commission will make this information public. A registrant is not required to respond to the collection of information contained in Form N-CSR unless the Form displays a currently valid Office of Management and Budget (“OMB”) control number. Please direct comments concerning the accuracy of the information collection burden estimate and any suggestions for reducing the burden to Secretary, Securities and Exchange Commission, 450 Fifth Street, NW, Washington, DC 20549-0609. The OMB has reviewed this collection of information under the clearance requirements of 44 U.S.C. § 3507.

Item 1. Report to Shareholders.

ANNUAL REPORT

2012

QUAKER EVENT ARBITRAGE FUND

QUAKER GLOBAL TACTICAL ALLOCATION FUND

QUAKER MID-CAP VALUE FUND

QUAKER SMALL-CAP GROWTH TACTICAL ALLOCATION FUND

QUAKER SMALL-CAP VALUE FUND

QUAKER STRATEGIC GROWTH FUND

MUTUAL FUND INVESTING INVOLVES RISK. PRINCIPAL LOSS IS POSSIBLE.

Investing in the Quaker Funds may involve special risk including, but not limited to, investments in smaller companies, non-diversification, short sales, foreign securities, special situations, debt securities and value growth investing. Please refer to the prospectus for more complete information.

This report must be preceded or accompanied by a current prospectus.

The opinions expressed are those of the adviser and sub-advisers through the end of the period for this report, are subject to change, are not a guarantee, and should not be considered investment advice.

Fund holdings are subject to change and should not be considered a recommendation to buy or sell any security. Current and future holdings are subject to risk.

Chairman’s Letter to the Shareholders

June 30, 2012

Dear Fellow Shareholder,

The premise on which Quaker Funds, Inc. was founded was the desire to afford everyday investors access to the same tactical allocation used by professional money managers to augment traditional investing strategies within a holistic asset allocation mix. Our commitment to this principle is still as strong today as it was the day we opened our doors.

Our management team continually strives to provide our shareholders with innovative investment alternatives and advisers that constantly seek superior returns. Thank you for your trust and investment in the Quaker Funds.

Sincerely,

Jeffry King

Chairman & CEO

Quaker Investment Trust

Performance Update

Quaker Event Arbitrage Fund (QEAAX, QEACX, QEAIX)

OBJECTIVES AND PRINCIPAL STRATEGIES

The Quaker Event Arbitrage Fund (“Fund”) seeks to provide long-term growth of capital. The Fund generally invests in the securities of publicly traded companies involved in mergers, takeovers, tender offers, leveraged buyouts, spin-offs, liquidations or similar events.

PERFORMANCE REVIEW AND MARKET OUTLOOK

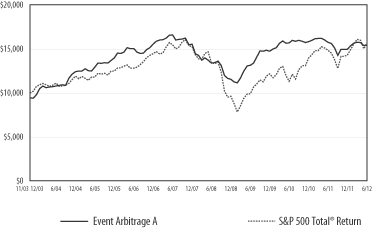

For the fiscal year ended June 30, 2012, the Fund returned -2.31%, whereas the total return of the S&P 500 Total Return Index (“S&P 500”) was 5.45%. While the equity market gyrated over the last year, the Fund’s daily volatility was roughly 59% lower than that of the S&P 500.

The past twelve months proved challenging for event-driven investing. This is evident, as the HFRI Event-Driven Total Index (“HFRI Index”) return was -3.92%. The HFRI Index is a good barometer for the asset class as it aggregates many hedge funds into one index that represents event-driven investing. Some causes for the negative returns that impacted the fund and the asset class in general could be traced to a pullback in corporate risk-taking, which had a negative impact on mergers and acquisition activity. The decrease in corporate risk-taking also negatively impacted activist/proxy fight investing as companies were not particularly interested in acquiring competing corporations.

Looking forward, the portfolio management team sees opportunities in merger arbitrage, mostly in event-driven mergers, which are bidding wars, hostile transactions, or other mergers that are deemed to have a higher level of uncertainty with significant upside potential. These opportunities have the potential to provide attractive rewards given the level of risk taken.

Also, the Fund’s distressed securities holdings, which lie mostly in distressed mortgage-backed securities, have delivered very strong cash flows relative to their low prices. The portfolio management team considers these risk/return profiles very appealing, and believe this profile will continue throughout the year. In contrast, few opportunities during the last year have presented themselves in distressed corporate bonds as corporate bankruptcies remain low.

Finally, we believe the outlook is very positive for proxy fight investing as activist investors are pushing underperforming companies to sell themselves. In addition, many potential acquirers have large amounts of cash available and continue to generate significant cash flows. Similarly, once companies are in play, competitive bidders can quickly enter the fray. All of this should bode well for the proxy fight sub-strategy.

I wish all investors a prosperous year and thank you for your continued support.

Sincerely,

Thomas Kirchner, Portfolio Manager

Quaker Funds, Inc.

|

| ADVISER: |

| Quaker Funds, Inc. |

| |

TOTAL NET ASSETS: AS OF JUNE 30, 2012 |

| $55,211,709 |

| | | | |

| Top Ten Holdings ** (% of net assets) | |

SurModics, Inc. | | | 2.40% | |

Progress Software Corp. | | | 2.32% | |

Lennar Corp. | | | 2.22% | |

Goodrich Corp. | | | 1.91% | |

Sycamore Networks, Inc. | | | 1.89% | |

Novell, Inc. | | | 1.77% | |

Seachange International, Inc. | | | 1.71% | |

Monster Worldwide, Inc. | | | 1.65% | |

Countrywide Home Equity Loan Trust | | | 1.64% | |

Tyco International Ltd. | | | 1.63% | |

% Fund Total | | | 19.14% | |

| ** | Excludes Short-Term Investments |

|

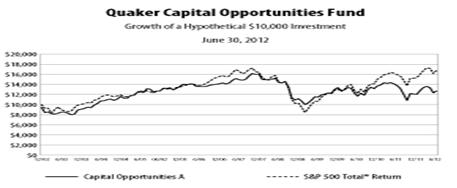

* The benchmark since inception returns are calculated for the period November 21, 2003 through June 30, 2012. |

Quaker Event Arbitrage Fund

Growth of a Hypothetical $10,000 Investment

June 30, 2012

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Average Annualized Total Return | |

| | | Expense

Ratio | | | Inception

Date | | | One Year | | | Five Year | | | Ten Year | | Commencement

of operations

through 6/30/2012 | |

| | | | | | | | | with

sales

charge | | | without

sales

charge | | | with

sales

charge | | | without

sales

charge | | | with

sales

charge | | without

sales

charge | | with

sales

charge | | | without

sales

charge | |

Class A | | | 1.99% | | | | 11/21/2003 | | | | -7.68% | | | | -2.31% | | | | -2.59% | | | | -1.48% | | | N/A | | N/A | | | 5.15% | | | | 5.84% | |

Class C | | | 2.74% | | | | 6/7/2010 | | | | -3.13% | | | | -3.13% | | | | N/A | | | | N/A | | | N/A | | N/A | | | -0.88% | | | | -0.88% | |

Institutional Class | | | 1.74% | | | | 6/7/2010 | | | | -2.14% | | | | -2.14% | | | | N/A | | | | N/A | | | N/A | | N/A | | | 0.04% | | | | 0.04% | |

S&P 500 Total Return Index* | | | | 5.45% | | | | 5.45% | | | | 0.22% | | | | 0.22% | | | N/A | | N/A | | | 5.36% | | | | 5.36% | |

Performance data quoted represents past performance and is no guarantee of future results. Investment return and principal value will fluctuate so that shares, when redeemed, may be worth more or less than their original cost. Current performance may be lower or higher than performance data quoted. Performance data current to the most recent month end is available at www.quakerfunds.com or by calling us toll free at 800-220-8888. Total return includes reinvestment of dividends and capital gains.

Class A shares of the Fund have a maximum sales charge of 5.50%.

The line graph and performance table do not reflect the deduction of taxes that a shareholder might pay on fund distributions or the redemption of fund shares. Total return calculations reflect expense reimbursements and fee waivers in the applicable periods. See financial highlights for periods where fees were waived or reimbursed.

The Fund’s portfolio holdings may differ significantly from the securities held in the index and, unlike a mutual fund, an unmanaged index assumes no transaction costs, taxes, management fees or other expenses. You cannot invest directly in an index.

The S&P 500 Total Return Index (“Index”) is a widely recognized, unmanaged index consisting of the approximately 500 largest companies in the United States as measured by market capitalization. The Index assumes reinvestment of all dividends and distributions.

Performance Update

Quaker Global Tactical Allocation Fund (QTRAX, QTRCX, QTRIX)

OBJECTIVES AND PRINCIPAL STRATEGIES

The Quaker Global Tactical Allocation Fund (“Fund”) seeks to provide long-term growth of capital. The Fund invests in common stocks of U.S. companies and American Depository Receipts (“ADRs”) of foreign companies without regard to market capitalization. Under normal circumstances, the Fund will invest at least 40% of its total assets in common stocks and ADRs of foreign companies.

PERFORMANCE REVIEW AND MARKET OUTLOOK

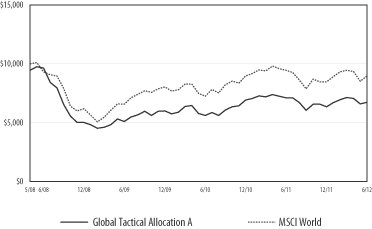

For the fiscal year ended June 30, 2012, the MSCI World Index (“MSCI World”) fell -4.98% while the Fund finished the fiscal year with a loss of -5.19%. For the first half of the 2012 calendar year, the MSCI World rose 5.91% while the Fund gained 6.11%.

During the fiscal year, the valuation of the majority of stock markets in emerging countries fell to decade lows. This largely reflected the economic slowdown in the emerging world and was also due to the onset of the recession in the Eurozone which is a large export market for those emerging economies. Another related factor was the negative flow of capital from countries like India and Brazil as hedge funds pulled back overseas investments and permanent capital flows in the form of direct investments slowed, the latter mainly due to domestic economic policies that were seen as hostile to such capital.

In the developed world, the slowdown in the Eurozone accelerated as policy makers implemented austerity programs in the southern countries of the zone as a condition of obtaining financial help from the northern euro countries and the European Central Bank. Unfortunately, conditions were not conducive for a quick resolution of the problems that the countries in the Eurozone faced: high debt levels on the sovereign and private level, high and stubborn unemployment rates in countries like Greece and Spain and limited hope of any fiscal stimulus due to the aforementioned high debt levels. Most forecasts now call for negative economic growth in euro countries like Italy, Spain, Portugal and Greece for the next two years.

Shifting to a longer term horizon, demographics continue to favor the emerging countries over the developed world due to the former’s younger populations. For example, in Israel, the Philippines and South Africa, the prime spending age group of 35 to 54 years does not peak until 2050. For India, Columbia, Mexico, Peru and Malaysia, the peak for this group does not occur until 2043 to 2045. The next group is Egypt, Brazil and Turkey which do not peak until the period 2030-2035. In contrast, Japan peaked in 1990, the U.S. in 2001, and Germany peaked in 2006. From an investment perspective, this fact should continue to benefit global companies that provide goods and services to populations in the emerging countries that have this “demographic dividend.”

Sectors posted mixed results for the year with the tech and consumer staples sectors (both overweights in the portfolio) advancing the most and energy, materials (both relative overweights) and financials (an underweight) trailing most other sectors and ending in negative territory. During the last twelve months, the portfolio was helped by stock picks in the consumer staples and financial sectors and hurt by stock picks in energy and materials.

Looking ahead, we believe the likelihood of a global recession has greatly increased from the spring of this calendar year when it seemed that the growth trajectory of the world economies was accelerating. In such a slow growth or “start and stop” environment (in that growth cycles seem to be truncated to very short periods), the Fund will continue to emphasize large multinational companies with good balance sheets and cash flows that cater to the expanding middle class in the emerging countries and companies that have secular growth ahead of them due to shifting technology trends. At the same time, the Fund will continue to seek to take advantage of its mandate of protecting capital by tactically raising cash and using its short-selling capabilities.

Respectfully,

Manu P. Daftary, Portfolio Manager

DG Capital Management

|

| SUB-ADVISER: |

| DG Capital Management, Inc. |

| |

TOTAL NET ASSETS: AS OF JUNE 30, 2012 |

| $9,763,433 |

| | | | |

| Top Ten Holdings ** (% of net assets) | |

Apple, Inc. | | | 4.03% | |

Mastercard, Inc. | | | 3.04% | |

Mead Johnson Nutrition Co. | | | 2.89% | |

Anheuser-Busch InBev NV | | | 2.72% | |

ACE Ltd. | | | 2.59% | |

Verisk Analytics, Inc. | | | 2.55% | |

Coca-Cola Co. | | | 2.54% | |

Capital One Financial Corp. | | | 2.52% | |

Monsanto Co. | | | 2.38% | |

Visa, Inc. | | | 2.28% | |

% Fund Total | | | 27.54% | |

| ** | Excludes Short-Term Investments |

| | | | | | |

| Country Allocation (% of net assets) |

| | | 95.31% | | | Common Stocks |

| | | 2.72% | | | Belgium |

| | | 3.59% | | | Bermuda |

| | | 1.77% | | | Canada |

| | | 2.22% | | | Denmark |

| | | 2.09% | | | France |

| | | 2.48% | | | Germany |

| | | 4.47% | | | Ireland |

| | | 1.98% | | | Mexico |

| | | 3.30% | | | Netherlands |

| | | 1.94% | | | Panama |

| | | 4.83% | | | Switzerland |

| | | 6.01% | | | United Kingdom |

| | | 57.91% | | | United States |

| | | 3.97% | | | Short-Term Investments |

| | | 99.28% | | | Total Market Value of Investments |

| | | 0.72% | | | Other Assets in Excess of Liabilities, Net |

| | | 100.00% | | | Total Net Assets |

|

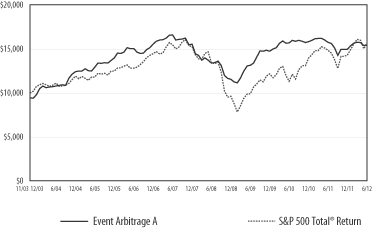

* The benchmark since inception returns are calculated since commencement of May 1, 2008 through June 30, 2012. |

Quaker Global Tactical Allocation Fund

Growth of a Hypothetical $10,000 Investment

June 30, 2012

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Average Annualized Total Return | |

| | | Expense

Ratio | | | Inception

Date | | | One Year | | | Five Year | | Ten Year | | Commencement

of operations

through 6/30/2012 | |

| | | | | | | | | with

sales

charge | | | without

sales

charge | | | with

sales

charge | | without

sales

charge | | with

sales

charge | | without

sales

charge | | with

sales

charge | | | without

sales

charge | |

Class A | | | 2.39% | | | | 5/1/2008 | | | | -10.41% | | | | -5.19% | | | N/A | | N/A | | N/A | | N/A | | | -9.07% | | | | -7.83% | |

Class C | | | 3.14% | | | | 5/1/2008 | | | | -5.99% | | | | -5.99% | | | N/A | | N/A | | N/A | | N/A | | | -8.52% | | | | -8.52% | |

Institutional Class | | | 2.14% | | | | 7/23/2008 | | | | -5.03% | | | | -5.03% | | | N/A | | N/A | | N/A | | N/A | | | -5.15% | | | | -5.15% | |

MSCI World Index* | | | | -4.98% | | | | -4.98% | | | N/A | | N/A | | N/A | | N/A | | | -2.60% | | | | -2.60% | |

Performance data quoted represents past performance and is no guarantee of future results. Investment return and principal value will fluctuate so that shares, when redeemed, may be worth more or less than their original cost. Current performance may be lower or higher than performance data quoted. Performance data current to the most recent month end is available at www.quakerfunds.com or by calling us toll free at 800-220-8888. Total return includes reinvestment of dividends and capital gains.

Class A shares of the Fund have a maximum sales charge of 5.50%.

The line graph and performance table do not reflect the deduction of taxes that a shareholder might pay on fund distributions or the redemption of fund shares. Total return calculations reflect expense reimbursements and fee waivers in the applicable periods. See financial highlights for periods where fees were waived or reimbursed.

The Fund’s portfolio holdings may differ significantly from the securities held in the index and, unlike a mutual fund, an unmanaged index assumes no transaction costs, taxes, management fees or other expenses. You cannot invest directly in an index.

The Morgan Stanley Capital International World Index (“MSCI World Index”) measures developed-market equity performance throughout the world. The MSCI World Index assumes reinvestment of all dividends and distributions.

Performance Update

Quaker Mid-Cap Value Fund (QMCVX, QMCCX, QMVIX)

OBJECTIVES AND PRINCIPAL STRATEGIES

The Quaker Mid-Cap Value Fund (“Fund”) seeks to provide long-term growth of capital. Current income is not a significant investment consideration and any such income realized will be considered incidental to the Fund’s investment objective. The Fund invests primarily in common stocks comparable to the companies included in the Russell Midcap Value Index (“Russell Index”).

PERFORMANCE REVIEW AND MARKET OUTLOOK

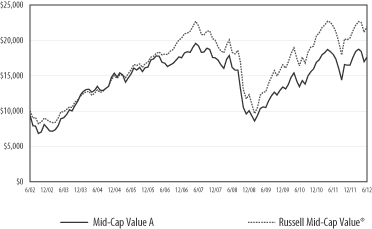

For the period from July 1, 2011 through June 30, 2012, the Fund generated a modest gain of 0.10% (gross of fees) and -1.87% (net of fees) versus a loss of -0.37% for the Russell Index. Despite both the Fund and the benchmark being essentially unchanged, there was significant variability in performance by sector. Energy and Industrials posted the largest declines in both the Fund and the Russell Index while utilities and consumer staples posted positive returns. The Fund’s relative performance was driven entirely by positive stock selection, particularly in materials and technology.

The financial crisis in Europe has likely put the Eurozone economy in recession, and the fear of this contagion spreading to the U.S. economy was clearly evidenced by the out performance of the defensive Utility and Consumer staples sectors over the last twelve months. Despite increasing levels of macroeconomic uncertainty, we believe we are still seeing attractive investment opportunities, as measured by the number of companies generating strong returns on capital invested at reasonable valuations. We believe these companies will create long-term value for shareholders.

Sincerely,

Frank Latuda, Jr. CFA

Chief Investment Officer & Portfolio Manager

Kennedy Capital Management, Inc.

|

| SUB-ADVISER: |

| Kennedy Capital Management, Inc. |

| |

TOTAL NET ASSETS: AS OF JUNE 30, 2012 |

| $8,415,236 |

| | | | |

| Top Ten Holdings ** (% of net assets) | |

Gildan Activewear, Inc. | | | 2.94% | |

Torchmark Corp. | | | 2.75% | |

Huntington Bancshares, Inc. | | | 2.61% | |

Hormel Foods Corp. | | | 2.56% | |

Ameriprise Financial, Inc. | | | 2.50% | |

Ultra Petroleum Corp. | | | 2.48% | |

AGCO Corp. | | | 2.45% | |

Zimmer Holdings, Inc. | | | 2.41% | |

Regal-Beloit Corp. | | | 2.34% | |

Harman International Industries, Inc. | | | 2.26% | |

% Fund Total | | | 25.30% | |

| ** | Excludes Short-Term Investments |

| | | | | | |

| Sectors (% of net assets) |

| | | 93.63% | | | Common Stocks |

| | | 6.14% | | | Basic Materials |

| | | 10.78% | | | Consumer Cyclical |

| | | 3.90% | | | Consumer Non-cyclical |

| | | 9.14% | | | Energy |

| | | 22.46% | | | Financial |

| | | 8.34% | | | Healthcare |

| | | 10.61% | | | Industrial |

| | | 9.11% | | | Technology |

| | | 13.15% | | | Utilities |

| | | 4.74% | | | Real Estate Investment Trusts |

| | | 4.06% | | | Short-Term Investments |

| | | 102.43% | | | Total Market Value of Investments |

| | | (2.43)% | | | Liabilities in Excess of Other Assets, Net |

| | | 100.00% | | | Total Net Assets |

|

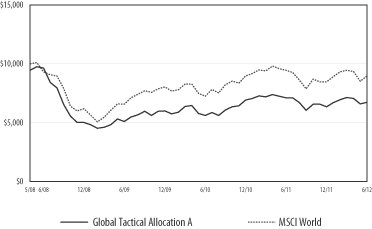

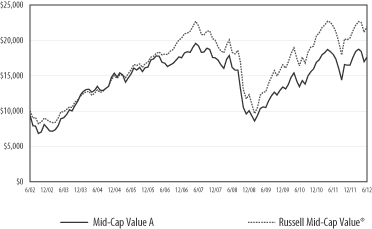

* The benchmark since inception returns are calculated since commencement of December 31,1997 through June 30, 2012. |

Quaker Mid-Cap Value Fund

Growth of a Hypothetical $10,000 Investment

June 30, 2012

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Average Annualized Total Return | |

| | | Expense

Ratio | | | Inception

Date | | | One Year | | | Five Year | | | Ten Year | | | Commencement

of operations

through 6/30/2012 | |

| | | | | | | | | with

sales

charge | | | without

sales

charge | | | with

sales

charge | | | without

sales

charge | | | with

sales

charge | | | without

sales

charge | | | with

sales

charge | | | without

sales

charge | |

Class A | | | 2.13% | | | | 12/31/1997 | | | | -7.27% | | | | -1.87% | | | | - 2.82% | | | | -1.71% | | | | 5.84% | | | | 6.44% | | | | 5.59% | | | | 6.01% | |

Class C | | | 2.88% | | | | 7/31/2000 | | | | -2.56% | | | | -2.56% | | | | - 2.43% | | | | -2.43% | | | | 5.65% | | | | 5.65% | | | | 6.26% | | | | 6.26% | |

Institutional Class | | | 1.88% | | | | 11/21/2000 | | | | -1.62% | | | | -1.62% | | | | - 1.46% | | | | -1.46% | | | | 6.72% | | | | 6.72% | | | | 7.54% | | | | 7.54% | |

Russell Mid-Cap Value Index* | | | | - 0.37% | | | | -0.37% | | | | -0.13% | | | | -0.13% | | | | 8.17% | | | | 8.17% | | | | 7.59% | | | | 7.59% | |

Performance data quoted represents past performance and is no guarantee of future results. Investment return and principal value will fluctuate so that shares, when redeemed, may be worth more or less than their original cost. Current performance may be lower or higher than performance data quoted. Performance data current to the most recent month end is available at www.quakerfunds.com or by calling us toll free at 800-220-8888. Total return includes reinvestment of dividends and capital gains.

Class A shares of the Fund have a maximum sales charge of 5.50%.

The line graph and performance table do not reflect the deduction of taxes that a shareholder might pay on fund distributions or the redemption of fund shares. Total return calculations reflect expense reimbursements and fee waivers in the applicable periods. See financial highlights for periods where fees were waived or reimbursed.

The Fund’s portfolio holdings may differ significantly from the securities held in the index and, unlike a mutual fund, an unmanaged index assumes no transaction costs, taxes, management fees or other expenses. You cannot invest directly in an index.

The Russell Midcap Value® Index is a widely recognized, unmanaged index of companies included in the Russell 1000 Index with current market capitalizations between $829 million and $12.2 billion. The Russell Midcap Value Index assumes reinvestment of all dividends.

Performance Update

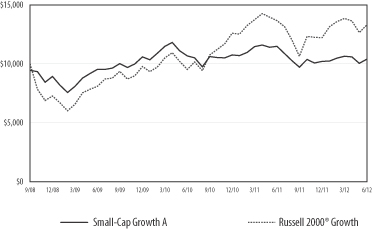

Quaker Small-Cap Growth Tactical Allocation Fund (QGASX, QGCSX, QGISX)

OBJECTIVES AND PRINCIPAL STRATEGIES

The Quaker Small-Cap Growth Tactical Allocation Fund (“Fund”) seeks to provide long-term growth of capital. The Fund invests at least 80% of its total assets in common stocks, American Depository Receipts (“ADRs”) and foreign securities traded on U.S. stock exchanges with market capitalizations within the range of companies included in the Russell 2000® Growth Index (“Russell 2000 Index”).

PERFORMANCE REVIEW AND MARKET OUTLOOK

The fiscal year ended June 30, 2012 witnessed the same volatility that has been present in the micro cap/small cap marketplace since 2008. In fact, the fiscal year began with a decline in the Russell 2000 Index that nearly matched its decline in the fourth quarter of 2008. The Russell 2000 Index declined -28.10% from its peak in early July 2011 to its trough in October 2011; the Fund fell significantly less: -17.87%. This is consistent with the Fund’s effort to manage risk, significant drawdowns, and volatility.

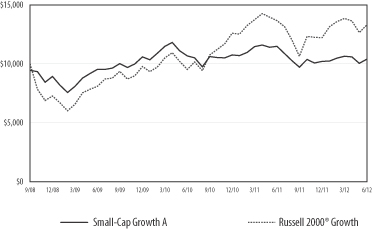

During the fiscal year ended June 30, 2012, the Fund’s performance decreased -9.51% while the Russell 2000 Index decreased -2.71%.

The purpose of the Fund is to allow investors to participate in a perceived risky marketplace of micro cap and small cap growth stocks, while seeking to avoid the volatility (and significant losses) associated with them. Since inception, the Fund has had an absolute return strategy that involves a very disciplined buying strategy that defaults to cash when appropriate investments are not available. Additionally, to modulate the volatility and to avoid downside risk, the Fund will sell the Russell 2000 Index short against its equity holdings.

The general underperformance of the Fund can be described by two factors, namely the size of the market capitalization of companies in the Russell 2000 Index versus the Fund and the performance difference among the companies as measured by their respective market capitalization.

As was true in the calendar year for the Russell 2000 Index, this past fiscal year saw all positive gains in the Russell 2000 Index derive from the largest quintile (or 20%) of the companies in the Russell 2000 Index. Generally speaking, these are companies whose market capitalization exceeded $1.3 billion. Furthermore, companies of that size comprised nearly one-half of the market cap weight of the Russell 2000 Index. So, the largest weights had the only positive result, which amounted to nearly half of the Russell 2000 Index. By contrast, the smallest quintile (or smallest 20%) of stocks in the Russell 2000 Index declined by 51.13%. Fortunately for owners of the Russell 2000 Index, these comprised less than 4% of the weight of the Index. The Fund’s largest quintile of companies also had positive results but only represented 17.81% of its portfolio weighting. Alternatively, the Fund had roughly five times the amount of companies in the smallest quintile. Although these significantly outperformed the Russell 2000 Index stocks of the same cap size, they still declined, on average, by approximately 34.42%. The strategy of the Fund has historically been to always hold smaller companies because they provide the best long term returns. So, it is a combination of much higher market capitalization companies and the generally better performance of these larger companies that lead to the outperformance of the Russell 2000 Index as compared to the Fund.

We believe that this performance differential is an indication of the dramatic degree of risk aversion that continues to exist through the market and the economy.

The Fund will continue to seek positive returns and to avoid significant losses no matter the market environment. It will maintain its disciplined buying, selling, and shorting strategy to avoid significant declines like we witnessed from July 2011 through October 2011. As a result, the Fund will strive to exhibit a ‘margin of safety’ when compared to all active small cap growth managers.

Stephen Shipman, Portfolio Manager

Century Management, Inc.

|

| SUB-ADVISER: |

| Century Management, Inc. |

| |

TOTAL NET ASSETS: AS OF JUNE 30, 2012 |

$6,304,898 |

| | | | |

| Top Ten Holdings ** (% of net assets) | |

Direxion Daily Small Cap Bear 3X | | | | |

Shares | | | 4.30% | |

Comstock Mining, Inc. | | | 4.14% | |

Titan Machinery, Inc. | | | 3.85% | |

Blucora, Inc. | | | 3.44% | |

Multimedia Games Holding Co., Inc. | | | 3.31% | |

BancorpSouth, Inc. | | | 3.04% | |

Hanmi Financial Corp. | | | 2.83% | |

Wilshire Bancorp, Inc. | | | 2.78% | |

Ellie Mae, Inc. | | | 2.77% | |

Arctic Cat, Inc. | | | 2.73% | |

% Fund Total | | | 33.19% | |

| ** | Excludes Short-Term Investments |

| | | | | | |

| Sectors (% of net assets) |

| | | 66.89% | | | Domestic Common Stocks |

| | | 7.74% | | | Basic Materials |

| | | 8.54% | | | Communications |

| | | 14.68% | | | Consumer Cyclical |

| | | 5.51% | | | Energy |

| | | 17.60% | | | Financial |

| | | 5.86% | | | Healthcare |

| | | 6.96% | | | Industrial |

| | | 14.34% | | | Foreign Common Stocks |

| | | 4.30% | | | Exchange-Traded Fund |

| | | 31.06% | | | Short-Term Investments |

| | | 116.59% | | | Total Market Value of Investments |

| | | (16.59)% | | | Liabilities in Excess of Other Assets, Net |

| | | 100.00% | | | Total Net Assets |

|

* The benchmark since inception

returns are calculated since commencement of September 30, 2008 through June 30, 2012. |

Quaker Small-Cap Growth Tactical Allocation Fund

Growth of a Hypothetical $10,000 Investment

June 30, 2012

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Average Annualized Total Return | |

| | | Expense

Ratio | | | Inception

Date | | | One Year | | | Five Year | | | Ten Year | | | Commencement

of operations

through 6/30/2012 | |

| | | | | | | | | with

sales

charge | | | without

sales

charge | | | with

sales

charge | | | without

sales

charge | | | with

sales

charge | | | without

sales

charge | | | with

sales

charge | | | without

sales

charge | |

Class A | | | 2.03% | | | | 9/30/2008 | | | | -14.49% | | | | -9.51% | | | | N/A | | | | N/A | | | | N/A | | | | N/A | | | | 1.03% | | | | 2.57% | |

Class C | | | 2.78% | | | | 9/30/2008 | | | | -10.23% | | | | -10.23% | | | | N/A | | | | N/A | | | | N/A | | | | N/A | | | | 1.80% | | | | 1.80% | |

Institutional Class | | | 1.78% | | | | 9/30/2008 | | | | -9.33% | | | | -9.33% | | | | N/A | | | | N/A | | | | N/A | | | | N/A | | | | 2.83% | | | | 2.83% | |

Russell 2000 Growth Index* | | | | -2.71% | | | | -2.71% | | | | N/A | | | | N/A | | | | N/A | | | | N/A | | | | 7.91% | | | | 7.91% | |

Performance data quoted represents past performance and is no guarantee of future results. Investment return and principal value will fluctuate so that shares, when redeemed, may be worth more or less than their original cost. Current performance may be lower or higher than performance data quoted. Performance data current to the most recent month end is available at www.quakerfunds.com or by calling us toll free at 800-220-8888. Total return includes reinvestment of dividends and capital gains.

Class A shares of the Fund have a maximum sales charge of 5.50%.

The line graph and performance table do not reflect the deduction of taxes that a shareholder might pay on fund distributions or the redemption of fund shares. Total return calculations reflect expense reimbursements and fee waivers in the applicable periods. See financial highlights for periods where fees were waived or reimbursed.

The Fund’s portfolio holdings may differ significantly from the securities held in the index and, unlike a mutual fund, an unmanaged index assumes no transaction costs, taxes, management fees or other expenses. You cannot invest directly in an index.

The Russell 2000® Growth Index is an unmanaged index that measures the performance of the small-cap growth segment of the U.S. equity universe. It includes the Russell 2000 companies with higher price-to-value ratios and higher forecasted growth values. The Index assumes reinvestment of all dividends and distributions.

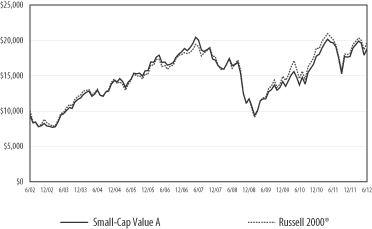

Performance Update

Quaker Small-Cap Value Fund (QUSVX, QSVCX, QSVIX)

OBJECTIVES AND PRINCIPAL STRATEGIES

The Quaker Small-Cap Value Fund (the “Fund”) seeks to provide long-term growth of capital. Current income is not a significant investment consideration, and any such income realized will be considered incidental to the Fund’s investment objective. The Fund invests primarily in common stocks of U.S. companies with market capitalizations similar to the market capitalizations of companies included in the Russell 2000® Index and Russell 2500® Index. The Fund invests in companies considered by the Fund’s sub-adviser to have consistent earnings and above-average core assets, selling at relatively low market valuations, with attractive growth and momentum characteristics.

PERFORMANCE REVIEW AND MARKET OUTLOOK

For the fiscal year ended June 30, 2012, the Fund’s performance was -4.11%, while the Fund’s benchmark, the Russell 2000® Index (a broad-based cross-section of the entire U.S. small-cap market) decreased by -2.08%. Working from the bottom up, we evaluate companies relative to their industry peers using three broad categories of attractiveness: value, management, and momentum. Value to us means fairly traditional ratios of price to fundamental value; management measures seek evidence that company management has produced and will continue to produce earnings power; and gauges of momentum help us determine when stocks might be expected to begin their ascent toward full valuation.

Our shortfall over the fiscal year was attributable to poor performance from our stock selection within the strategy’s three largest sectors: financial, technology, and healthcare. In financials, we can further zero-in on our holdings in the insurance and real estate industries as the culprits — they were heavily tilted toward positive momentum, a measure that was rewarded at the broad portfolio level but not in these two particular financial industries. Within the technology sector, our struggles in the semiconductor industry were mainly attributable to our deeper-than-benchmark value orientation. Although rewarding in its contribution to the bottom line over most of the last twelve months in healthcare stocks, that same value-orientation reversed for the quarter ended June 30, 2012.

We remain firm in our conviction that superior results can be achieved through a consistent, systematic approach that focuses on low-priced companies with proven management and earnings power.

The Portfolio Management Team

Aronson Johnson Ortiz

|

| SUB-ADVISER: |

| Aronson Johnson Ortiz, LP. |

| |

TOTAL NET ASSETS: AS OF JUNE 30, 2012 |

| $30,238,464 |

| | | | |

| Top Ten Holdings ** (% of net assets) | |

Community Health Systems, Inc. | | | 1.48% | |

Unisys Corp. | | | 1.39% | |

Tesoro Corp. | | | 1.35% | |

Montpelier Re Holdings Ltd. | | | 1.35% | |

CACI International, Inc. | | | 1.29% | |

Schweitzer-Mauduit International, Inc. | | | 1.28% | |

Huntington Bancshares, Inc. | | | 1.27% | |

AGCO Corp. | | | 1.27% | |

Interpublic Group of Cos, Inc. | | | 1.25% | |

Arctic Cat, Inc. | | | 1.22% | |

% Fund Total | | | 13.15% | |

| ** | Excludes Short-Term Investments |

| | | | | | |

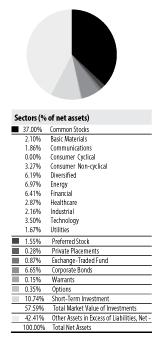

| Sectors (% of net assets) |

| | | 94.62% | | | Common Stocks |

| | | 6.65% | | | Basic Materials |

| | | 7.52% | | | Communications |

| | | 15.42% | | | Consumer Cyclical |

| | | 9.46% | | | Consumer Non-cyclical |

| | | 6.23% | | | Energy |

| | | 15.32% | | | Financial |

| | | 12.59% | | | Healthcare |

| | | 9.04% | | | Industrial |

| | | 8.61% | | | Technology |

| | | 3.78% | | | Utilities |

| | | 5.13% | | | Real Estate Investment Trusts |

| | | 6.58% | | | Short-Term Investments |

| | | 106.33% | | | Total Market Value of Investments |

| | | (6.33)% | | | Liabilities in Excess of Other Assets, Net |

| | | 100.00% | | | Total Net Assets |

|

* The benchmark since inception

returns are calculated since commencement of

November 25, 1996 through June 30, 2012. |

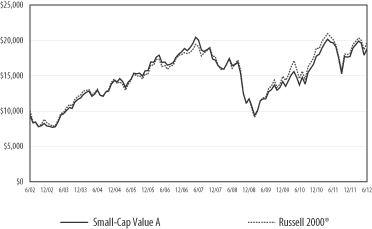

Quaker Small-Cap Value Fund

Growth of a Hypothetical $10,000 Investment

June 30, 2012

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Average Annualized Total Return | |

| | | Expense

Ratio | | | Inception

Date | | | One Year | | | Five Year | | | Ten Year | | | Commencement

of operations

through 6/30/2012 | |

| | | | | | | | | with

sales

charge | | | without

sales

charge | | | with

sales

charge | | | without

sales

charge | | | with

sales

charge | | | without

sales

charge | | | with

sales

charge | | | without

sales

charge | |

Class A | | | 1.98% | | | | 11/25/1996 | | | | -9.39% | | | | -4.11% | | | | - 2.36% | | | | -1.25% | | | | 6.52% | | | | 7.13% | | | | 8.73% | | | | 9.12% | |

Class C | | | 2.73% | | | | 7/28/2000 | | | | -4.80% | | | | -4.80% | | | | - 2.00% | | | | -2.00% | | | | 6.34% | | | | 6.34% | | | | 7.46% | | | | 7.46% | |

Institutional Class | | | 1.73% | | | | 9/12/2000 | | | | -3.79% | | | | -3.79% | | | | - 1.00% | | | | -1.00% | | | | 7.39% | | | | 7.39% | | | | 7.59% | | | | 7.59% | |

Russell 2000 Index* | | | | -2.08% | | | | -2.08% | | | | 0.54% | | | | 0.54% | | | | 7.00% | | | | 7.00% | | | | 6.77% | | | | 6.77% | |

Performance data quoted represents past performance and is no guarantee of future results. Investment return and principal value will fluctuate so that shares, when redeemed, may be worth more or less than their original cost. Current performance may be lower or higher than performance data quoted. Performance data current to the most recent month end is available at www.quakerfunds.com or by calling us toll free at 800-220-8888. Total return includes reinvestment of dividends and capital gains.

Class A shares of the Fund have a maximum sales charge of 5.50%.

The line graph and performance table do not reflect the deduction of taxes that a shareholder might pay on fund distributions or the redemption of fund shares. Total return calculations reflect expense reimbursements and fee waivers in the applicable periods. See financial highlights for periods where fees were waived or reimbursed.

The Fund’s portfolio holdings may differ significantly from the securities held in the index and, unlike a mutual fund, an unmanaged index assumes no transaction costs, taxes, management fees or other expenses. You cannot invest directly in an index.

The Russell 2000® Index is a widely recognized, unmanaged index comprised of the smallest 2000 companies represented in the Russell 3000® Index. The Russell 2000 Index currently represents approximately 8% of the market capitalization of the Russell 3000® Index.

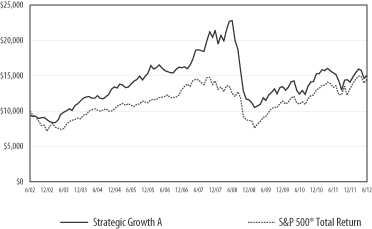

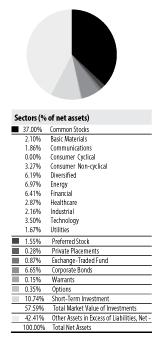

Performance Update

Quaker Strategic Growth Fund (QUAGX, QAGCX, QAGIX)

OBJECTIVES AND PRINCIPAL STRATEGIES

The Quaker Strategic Growth Fund (the “Fund”) seeks to provide long-term growth of capital. Current income is not a significant investment consideration. The Fund invests primarily in equity securities of domestic U.S. companies which the Fund’s sub-adviser believes show a high probability for superior growth.

PERFORMANCE REVIEW AND MARKET OUTLOOK

For the fiscal year ended June 30, 2012, the S&P 500 Total Return Index (the “S&P 500”) (a broad based market proxy) gained 5.45% while the Class A shares of the Fund finished the fiscal year with a total return of -2.42%. For the first half of calendar year 2012, the S&P 500 gained 9.49% while the Fund rose 6.68%.

Over the course of the last twelve months, macroeconomic and political machinations continued to dominate market movements as high correlations and volatility largely marginalized the influence of stock specific fundamentals. From a fundamental standpoint, valuations continued to be attractively low and did not seem to reflect the value and earnings growth that corporations have generated. This may have been due to investor skepticism over the sustainability of that earnings growth in light of the major risks facing the world economy including an EU recession and mediocre growth and rising taxes in the U.S. Taking a closer look at some of these influences, however brightens the picture somewhat. While 20.9% of domestic exports go to the EU, exports only make up 13.9% of the overall domestic economy — thus EU exports are only 2.8% of GDP and those exports will likely not go to zero. Also, the housing market, which typically averages about 5% of GDP (though it reached 7% in 2006), has now fallen to 2.5% of GDP. Thus continued weakness (which is expected through 2014) will have a smaller effect on domestic growth than in the past. The bright spot in domestic markets occurred in the first quarter of 2012, which saw a fall-off in volatility and sustained upward move in equity prices. In the current environment, no news is good news! However troubles in Europe shattered the placid façade pushing markets sharply lower in the most recent quarter. Many international markets continue to be attractive in spite of the high volatility and double digit losses that occurred in many of these markets in 2011. In the long run, demographics continue to favor the emerging markets over the developed markets due to their younger populations.

Sectors posted mixed results for the year with the telecom and utilities sectors (both underweights in the portfolio) advancing the most and energy, materials (both relative overweights) and financials (an underweight) trailing most other sectors. During the last twelve months the portfolio was helped by stock picks in the consumer staples and financial sectors and hurt by stock picks in energy healthcare and consumer discretionaries, as well as cash drag.

Although fundamentals still mattered to a degree, sector performance was largely driven by political events and macroeconomic factors. Case in point, in the first quarter of this year, signs of economic stability and political responsibility pushed cyclical sectors higher, while a breakdown in these factors punished the same sectors in the second quarter. Top-down perceptions (mainly political and international) largely drove market performance generating a difficult environment for any strategy to consistently navigate. Although monetary policy continues to be very accommodative, the market is expecting black swan events and will only appreciate in the absence of them; but it will also harshly punish equity prices when they occur.

Looking ahead, we believe the world economy will continue to be weak, even as corporate profitability continues to be strong. Thus, we believe corporate efficiency, rather than economic cyclically, will drive earnings results, which may enhance their sustainability and eventually provide an environment for multiple expansion. In order to capitalize on this we will continue to emphasize high quality companies with high levels of available cash, strong free cash flows and reasonable valuations. Currently, our favored areas to overweight include large multinational consumer staples and discretionary companies catering to the expanding middle class in emerging market countries, large-cap technology companies providing efficiency (and profit) enhancing IT products to their clients.

Respectfully,

Manu P. Daftary, Portfolio Manager

DG Capital Management

|

| SUB-ADVISER: |

| DG Capital Management, Inc. |

| |

TOTAL NET ASSETS: AS OF JUNE 30, 2012 |

| $179,167,411 |

| | | | |

| Top Ten Holdings ** (% of net assets) | |

Apple, Inc. | | | 4.01% | |

Mastercard, Inc. | | | 3.00% | |

Mead Johnson Nutrition Co. | | | 2.86% | |

Anheuser-Busch InBev NV | | | 2.70% | |

Verisk Analytics, Inc. | | | 2.53% | |

Coca-Cola Co. | | | 2.52% | |

ACE Ltd. | | | 2.52% | |

Capital One Financial Corp. | | | 2.46% | |

Monsanto Co. | | | 2.36% | |

Visa, Inc. | | | 2.27% | |

% Fund Total | | | 27.23% | |

| ** | Excludes Short-Term Investments |

| | | | | | |

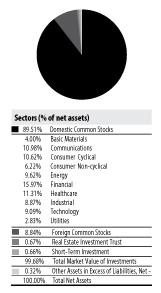

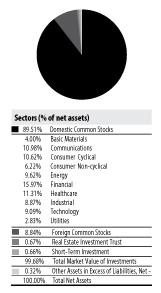

| Sectors (% of net assets) |

| | | 69.88% | | | Domestic Common Stocks |

| | | 3.34% | | | Basic Materials |

| | | 7.65% | | | Communications |

| | | 10.57% | | | Consumer Cyclical |

| | | 15.97% | | | Consumer Non-cyclical |

| | | 3.60% | | | Energy |

| | | 6.05% | | | Financial |

| | | 9.86% | | | Healthcare |

| | | 4.02% | | | Industrial |

| | | 8.82% | | | Technology |

| | | 20.29% | | | Foreign Common Stocks |

| | | 6.42% | | | Short-Term Investments |

| | | 96.59% | | | Total Market Value of Investments |

| | | 3.41% | | | Other Assets in Excess of Liabilities, Net |

| | | 100.00% | | | Total Net Assets |

|

* The benchmark since inception returns are calculated since commencement of November 25, 1996 through June 30, 2012 |

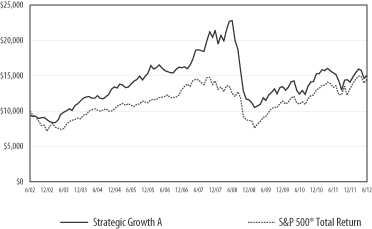

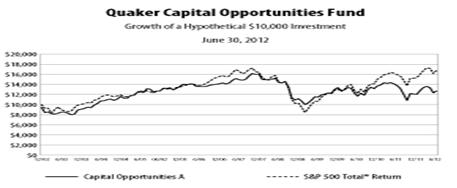

Quaker Strategic Growth Fund

Growth of a Hypothetical $10,000 Investment

June 30, 2012

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Average Annualized Total Return | |

| | | Expense

Ratio | | | Inception

Date | | | One Year | | | Five Year | | | Ten Year | | | Commencement

of operations

through 6/30/2012 | |

| | | | | | | | | with

sales

charge | | | without

sales

charge | | | with

sales

charge | | | without

sales

charge | | | with

sales

charge | | | without

sales

charge | | | with

sales

charge | | | without

sales

charge | |

Class A | | | 2.21% | | | | 11/25/1996 | | | | -7.79% | | | | -2.42% | | | | -5.30% | | | | -4.23% | | | | 4.16% | | | | 4.75% | | | | 10.19% | | | | 10.59% | |

Class C | | | 2.96% | | | | 7/11/2000 | | | | -3.15% | | | | -3.15% | | | | -4.94% | | | | -4.94% | | | | 3.98% | | | | 3.98% | | | | 1.38% | | | | 1.38% | |

Institutional Class | | | 1.96% | | | | 7/20/2000 | | | | -2.17% | | | | -2.17% | | | | -3.95% | | | | -3.95% | | | | 5.01% | | | | 5.01% | | | | 2.27% | | | | 2.27% | |

S&P 500® Total Return Index* | | | | 5.45% | | | | 5.45% | | | | 0.22% | | | | 0.22% | | | | 5.33% | | | | 5.33% | | | | 5.71% | | | | 5.71% | |

Performance data quoted represents past performance and is no guarantee of future results. Investment return and principal value will fluctuate so that shares, when redeemed, may be worth more or less than their original cost. Current performance may be lower or higher than performance data quoted. Performance data current to the most recent month end is available at www.quakerfunds.com or by calling us toll free at 800-220-8888. Total return includes reinvestment of dividends and capital gains.

Class A shares of the Fund have a maximum sales charge of 5.50%.

The line graph and performance table do not reflect the deduction of taxes that a shareholder might pay on fund distributions or the redemption of fund shares. Total return calculations reflect expense reimbursements and fee waivers in the applicable periods. See financial highlights for periods where fees were waived or reimbursed.

The Fund’s portfolio holdings may differ significantly from the securities held in the index and, unlike a mutual fund, an unmanaged index assumes no transaction costs, taxes, management fees or other expenses. You cannot invest directly in an index.

The S&P 500 Total Return Index (“Index”) is a widely recognized, unmanaged index consisting of the approximately 500 largest companies in the United States as measured by market capitalization. The index assumes reinvestment of all dividends and distributions.

Expense Information

As a shareholder of the Fund, you incur two types of costs: (1) transaction costs, including applicable sales charges and redemption fees; and (2) ongoing costs, including management fees, distribution (12b-1) fees and other Fund expenses. This example is intended to help you understand your ongoing costs (in dollars) of investing in the Fund and to compare these costs with the ongoing costs of investing in other funds. The example is based on an investment of $1,000 invested at the beginning of the (six-month) period and held for the entire period January 1, 2012 through June 30, 2012.

ACTUAL EXPENSES

The first section of each table below provides information about actual account values and actual expenses for each of the Funds. You may use this information, together with the amount you invested, to estimate the expenses that you paid over the period. Simply divide your account value by $1,000 (for example, an $8,600 account value divided by $1,000 = 8.6), then multiply the result by the number in the applicable line under the heading entitled “Expenses Paid During the Period” to estimate the expenses you paid on your account during this period.

HYPOTHETICAL EXAMPLE FOR COMPARISON PURPOSES

The second section of each table below provides information about hypothetical account values and hypothetical expenses based on the Fund’s actual expense ratio and an assumed rate of return of 5% per year before expenses, which is not the Fund’s actual return. The hypothetical account values and expenses may not be used to estimate the actual ending account balance or expenses you paid for the period. You may use this information to compare the ongoing costs of investing in the Fund to other funds. To do so, compare this 5% hypothetical example with the 5% hypothetical examples that appear in the shareholder reports of the other funds. Please note that the expenses shown in the table are meant to highlight your ongoing costs only and do not reflect any transactional costs, such as sales charges (loads), redemption fees or exchange fees. Therefore, the second section of the table is useful in comparing ongoing costs only, and will not help you determine the relative total costs of owning different funds. In addition, if these transactional costs were included, your costs would have been higher.

| | | | | | | | | | | | | | | | | | | | |

| | | | | | Beginning Account

Value 01/01/12 | | | Annualized Expense

Ratio For the Period | | | Ending Account

Value 6/30/2012 | | | Expenses Paid

During Period* | |

| Event Arbitrage | |

| Actual return based on actual return of: | |

Class A | | | 2.93 | % | | $ | 1,000.00 | | | | 1.99 | % | | $ | 1,029.30 | | | $ | 10.04 | |

Class C | | | 2.43 | % | | | 1,000.00 | | | | 2.74 | % | | | 1,024.30 | | | | 13.79 | |

Institutional Class | | | 2.92 | % | | | 1,000.00 | | | | 1.74 | % | | | 1,029.20 | | | | 8.78 | |

| Hypothetical return based on assumed 5% return: | |

Class A | | | | | | | 1,000.00 | | | | 1.99 | % | | | 1,014.97 | | | | 9.97 | |

Class C | | | | | | | 1,000.00 | | | | 2.74 | % | | | 1,011.24 | | | | 13.70 | |

Institutional Class | | | | | | | 1,000.00 | | | | 1.74 | % | | | 1,016.21 | | | | 8.72 | |

| Global Tactical Allocation | |

| Actual return based on actual return of: | |

Class A | | | 6.11 | % | | | 1,000.00 | | | | 2.89 | % | | | 1,061.10 | | | | 14.81 | |

Class C | | | 5.67 | % | | | 1,000.00 | | | | 3.64 | % | | | 1,056.70 | | | | 18.61 | |

Institutional Class | | | 6.14 | % | | | 1,000.00 | | | | 2.63 | % | | | 1,061.40 | | | | 13.48 | |

| Hypothetical return based on assumed 5% return: | |

Class A | | | | | | | 1,000.00 | | | | 2.89 | % | | | 1,010.49 | | | | 14.45 | |

Class C | | | | | | | 1,000.00 | | | | 3.64 | % | | | 1,006.76 | | | | 18.16 | |

Institutional Class | | | | | | | 1,000.00 | | | | 2.63 | % | | | 1,011.79 | | | | 13.16 | |

| Mid-Cap Value | |

| Actual return based on actual return of: | |

Class A | | | 6.93 | % | | | 1,000.00 | | | | 2.18 | % | | | 1,069.30 | | | | 11.22 | |

Class C | | | 6.57 | % | | | 1,000.00 | | | | 2.93 | % | | | 1,065.70 | | | | 15.05 | |

Institutional Class | | | 7.12 | % | | | 1,000.00 | | | | 1.93 | % | | | 1,071.20 | | | | 9.94 | |

| Hypothetical return based on assumed 5% return: | |

Class A | | | | | | | 1,000.00 | | | | 2.18 | % | | | 1,014.02 | | | | 10.92 | |

Class C | | | | | | | 1,000.00 | | | | 2.93 | % | | | 1,010.29 | | | | 14.64 | |

Institutional Class | | | | | | | 1,000.00 | | | | 1.93 | % | | | 1,015.27 | | | | 9.67 | |

| Small-Cap Growth Tactical Allocation | |

| Actual return based on actual return of: | |

Class A | | | 1.83 | % | | | 1,000.00 | | | | 2.14 | % | | | 1,018.30 | | | | 10.74 | |

Class C | | | 1.53 | % | | | 1,000.00 | | | | 2.86 | % | | | 1,015.30 | | | | 14.33 | |

Institutional Class | | | 1.93 | % | | | 1,000.00 | | | | 1.89 | % | | | 1,019.30 | | | | 9.49 | |

| Hypothetical return based on assumed 5% return: | |

Class A | | | | | | | 1,000.00 | | | | 2.14 | % | | | 1,014.22 | | | | 10.72 | |

Class C | | | | | | | 1,000.00 | | | | 2.86 | % | | | 1,010.64 | | | | 14.30 | |

Institutional Class | | | | | | | 1,000.00 | | | | 1.89 | % | | | 1,015.47 | | | | 9.47 | |

| | | | | | | | | | | | | | | | | | | | |

| | | | | | Beginning Account

Value 01/01/12 | | | Annualized Expense

Ratio For the Period | | | Ending Account

Value 6/30/2012 | | | Expenses Paid

During Period* | |

| Small-Cap Value | |

| Actual return based on actual return of: | |

Class A | | | 6.02 | % | | $ | 1,000.00 | | | | 1.81 | % | | $ | 1,060.20 | | | $ | 9.27 | |

Class C | | | 5.64 | % | | | 1,000.00 | | | | 2.56 | % | | | 1,056.40 | | | | 13.09 | |

Institutional Class | | | 6.18 | % | | | 1,000.00 | | | | 1.59 | % | | | 1,061.80 | | | | 8.15 | |

| Hypothetical return based on assumed 5% return: | |

Class A | | | | | | | 1,000.00 | | | | 1.81 | % | | | 1,015.86 | | | | 9.07 | |

Class C | | | | | | | 1,000.00 | | | | 2.56 | % | | | 1,012.13 | | | | 12.81 | |

Institutional Class | | | | | | | 1,000.00 | | | | 1.59 | % | | | 1,016.96 | | | | 7.97 | |

| Strategic Growth | |

| Actual return based on actual return of: | |

Class A | | | 6.68 | % | | | 1,000.00 | | | | 2.11 | % | | | 1,066.80 | | | | 10.84 | |

Class C | | | 6.32 | % | | | 1,000.00 | | | | 2.86 | % | | | 1,063.20 | | | | 14.67 | |

Institutional Class | | | 6.79 | % | | | 1,000.00 | | | | 1.88 | % | | | 1,067.90 | | | | 9.67 | |

| Hypothetical return based on assumed 5% return: | |

Class A | | | | | | | 1,000.00 | | | | 2.11 | % | | | 1,014.37 | | | | 10.57 | |

Class C | | | | | | | 1,000.00 | | | | 2.86 | % | | | 1,010.64 | | | | 14.30 | |

Institutional Class | | | | | | | 1,000.00 | | | | 1.88 | % | | | 1,015.51 | | | | 9.42 | |

| * | Expenses are equal to the Funds’ annualized six-month expense ratios (excluding reimbursements) multiplied by the average account value over the period muliplied by the number of days in the most recent fiscal half year (182) divided by 366 to reflect the one-half year period. |

Schedule of Investments

Quaker Event Arbitrage Fund

June 30, 2012

| | | | | | | | |

| | | Number of Shares | | | Fair

Value | |

| Domestic Common Stocks — 54.98% | |

| Basic Materials — 0.04% | | | | | |

| Forest Products & Paper — 0.04% | | | | | |

Wausau Paper Corp. | | | 2,500 | | | $ | 24,325 | |

Total Basic Materials (Cost: $24,138) | | | | 24,325 | |

| Communications — 12.21% | | | | | | | | |

| Internet — 3.78% | | | | | | | | |

30DC, Inc.(a)(b) | | | 50,000 | | | | 3,485 | |

AboveNet, Inc.(b) | | | 6,000 | | | | 504,000 | |

ModusLink Global Solutions, Inc.(b)(g) | | | 300,262 | | | | 897,783 | |

Selectica, Inc.(b) | | | 23,600 | | | | 92,512 | |

Unwired Planet, Inc.(b)(g) | | | 256,625 | | | | 590,238 | |

| | | | | | | | 2,088,018 | |

| Media — 1.21% | | | | | | | | |

Liberty Media Corp. Class A(b)(g) | | | 7,600 | | | | 668,116 | |

| Telecommunications — 7.22% | | | | | | | | |

Anaren, Inc.(b) | | | 25,000 | | | | 490,000 | |

Comverse Technology, Inc.(b)(g) | | | 100,000 | | | | 582,000 | |

Extreme Networks(b)(g) | | | 235,290 | | | | 809,397 | |

InterDigital, Inc. | | | 30,000 | | | | 885,300 | |

Sycamore Networks, Inc.(b) | | | 72,000 | | | | 1,045,440 | |

Telephone & Data Systems, Inc. | | | 8,131 | | | | 173,109 | |

| | | | | | | | 3,985,246 | |

Total Communications (Cost: $7,366,323) | | | | | | | 6,741,380 | |

| Consumer Cyclical — 9.68% | | | | | | | | |

| Entertainment — 0.64% | | | | | | | | |

EDCI Holdings, Inc.(b) | | | 74,000 | | | | 351,500 | |

| Home Builders — 2.22% | | | | | | | | |

Lennar Corp. Class B(g) | | | 51,000 | | | | 1,225,530 | |

| Leisure Time — 1.30% | | | | | | | | |

Ambassadors Group, Inc. | | | 131,900 | | | | 717,536 | |

| Lodging — 0.00% | | | | | | | | |

Trump Entertainment Resorts, Inc.(a)(b)(c) | | | 8,949 | | | | 0 | |

Trump Entertainment Resorts, Inc.(a)(b)(c) | | | 135 | | | | 409 | |

| | | | | | | | 409 | |

| Retail — 3.98% | | | | | | | | |

Abercrombie & Fitch Co. Class A | | | 14,300 | | | | 488,202 | |

Regis Corp. | | | 26,000 | | | | 466,960 | |

Syms Corp.(b) | | | 61,450 | | | | 406,185 | |

The Pantry, Inc.(b) | | | 57,000 | | | | 837,900 | |

| | | | | | | | 2,199,247 | |

| Toys/Games/Hobbies — 1.54% | | | | | | | | |

Jakks Pacific, Inc. | | | 53,000 | | | | 848,530 | |

Total Consumer Cyclical (Cost: $4,680,666) | | | | | | | 5,342,752 | |

| Consumer Non-cyclical — 5.68% | | | | | | | | |

| Commercial Services — 3.03% | | | | | | | | |

Corrections Corp. | | | 26,000 | | | | 765,700 | |

Monster Worldwide, Inc.(b) | | | 107,000 | | | | 909,500 | |

| | | | | | | | 1,675,200 | |

| Cosmetics & Personal Care — 1.06% | | | | | | | | |

CCA Industries, Inc. | | | 149,792 | | | | 584,189 | |

| | | | | | | | |

| | | Number of Shares | | | Fair

Value | |

| Domestic Common Stocks (Continued) | |

| Consumer Non-cyclical (Continued) | | | | | | | | |

| Food — 1.59% | | | | | | | | |

Dole Food Co., Inc.(b) | | | 100,000 | | | $ | 878,000 | |

Total Consumer Non-cyclical (Cost: $3,376,594) | | | | | | | 3,137,389 | |

| Diversified — 0.00% | | | | | | | | |

| Holding Companies-Diversified — 0.00% | | | | | | | | |

Stoneleigh Partners Acquisition Corp.(a)(b)(c) | | | 400 | | | | 0 | |

Total Diversified (Cost: $0) | | | | | | | 0 | |

| Energy — 0.49% | | | | | | | | |

| Oil & Gas — 0.49% | | | | | | | | |

Marathon Petroleum Corp. | | | 6,000 | | | | 269,520 | |

Total Energy (Cost: $250,890) | | | | | | | 269,520 | |

| Financial — 6.79% | | | | | | | | |

| Banks — 2.73% | | | | | | | | |

Alliance Bancorp, Inc. | | | 53,286 | | | | 658,082 | |

Franklin Financial Corp.(b) | | | 7,600 | | | | 125,020 | |

Standard Financial Corp. | | | 45,000 | | | | 724,500 | |

| | | | | | | | 1,507,602 | |

| Savings & Loans — 4.06% | | | | | | | | |

Colonial Financial Services, Inc.(b) | | | 46,700 | | | | 607,567 | |

FedFirst Financial Corp. | | | 25,000 | | | | 357,250 | |

Home Federal Bancorp, Inc. | | | 23,000 | | | | 333,615 | |

SI Financial Group, Inc. | | | 20,000 | | | | 230,000 | |

SP Bancorp, Inc.(b) | | | 33,500 | | | | 427,460 | |

Wolverine Bancorp, Inc.(b) | | | 17,300 | | | | 285,450 | |

| | | | | | | | 2,241,342 | |

Total Financial (Cost: $3,459,486) | | | | | | | 3,748,944 | |

| Healthcare — 6.06% | | | | | | | | |

| Biotechnology — 1.76% | | | | | | | | |

Cadus Corp.(b) | | | 194,229 | | | | 266,094 | |

Maxygen, Inc.(b) | | | 118,000 | | | | 703,280 | |

| | | | | | | | 969,374 | |

| Healthcare-Products — 2.40% | | | | | | | | |

SurModics, Inc.(b)(g) | | | 76,743 | | | | 1,327,654 | |

| Healthcare-Services — 1.21% | | | | | | | | |

InSight Health Services Holdings Corp.(b) | | | 10,221 | | | | 668,265 | |

| Pharmaceuticals — 0.69% | | | | | | | | |

INYX, Inc.(a)(b) | | | 167,850 | | | | 252 | |

Nabi Biopharmaceuticals(b) | | | 239,805 | | | | 378,892 | |

| | | | | | | | 379,144 | |

Total Healthcare (Cost: $3,194,691) | | | | | | | 3,344,437 | |

| Industrial — 2.39% | | | | | | | | |

| Aerospace & Defense — 2.17% | | | | | | | | |

API Technologies Corp.(b) | | | 40,000 | | | | 147,200 | |

Goodrich Corp. | | | 8,300 | | | | 1,053,270 | |

| | | | | | | | 1,200,470 | |

| Building Materials — 0.20% | | | | | | | | |

U.S. Concrete, Inc.(b) | | | 21,880 | | | | 108,197 | |

| | | | | | | | |

| | | Number of Shares | | | Fair

Value | |

| Domestic Common Stocks (Continued) | |

| Industrial (Continued) | | | | | | | | |

| Environmental Control — 0.02% | | | | | | | | |

Strategic Enviromental & Energy Resources, Inc.(a)(b) | | | 43,000 | | | $ | 12,977 | |

Total Industrial (Cost: $1,425,086) | | | | | | | 1,321,644 | |

| Technology — 11.64% | | | | | | | | |

| Computers — 0.01% | | | | | | | | |

Computer Horizons Corp.(b) | | | 65,000 | | | | 3,412 | |

| Semiconductors — 2.83% | | | | | | | | |

DSP Group, Inc.(b)(g) | | | 136,522 | | | | 865,549 | |

Integrated Device Technology, Inc.(b) | | | 124,000 | | | | 696,880 | |

| | | | | | | | 1,562,429 | |

| Software — 8.80% | | | | | | | | |

BMC Software, Inc.(b) | | | 20,000 | | | | 853,600 | |

Contra Softbrands, Inc.(a)(b)(c) | | | 5,000 | | | | 0 | |

Network-1 Security Solutions, Inc.(b) | | | 235,000 | | | | 303,150 | |

Novell, Inc. (a)(b) | | | 160,000 | | | | 976,000 | |

Official Payments Holdings, Inc. Class B(b) | | | 127,876 | | | | 498,717 | |

Progress Software Corp.(b) | | | 61,500 | | | | 1,283,505 | |

Seachange International, Inc.(b)(g) | | | 115,005 | | | | 946,491 | |

| | | | | | | | 4,861,463 | |

Total Technology (Cost: $6,728,853) | | | | | | | 6,427,304 | |

Total Domestic Common Stocks

(Cost $30,506,727) | | | | | | | 30,357,695 | |

| | | | | | | | |

| Foreign Common Stocks — 5.85% | | | | | | | | |

| Australia — 0.97% | | | | | | | | |

| Machinery-Construction & Mining — 0.97% | | | | | | | | |

Ludowici Ltd.(a) | | | 50,000 | | | | 534,319 | |

Total Australia (Cost: $525,049) | | | | 534,319 | |

| Canada — 0.40% | | | | | | | | |

| Mining — 0.02% | | | | | | | | |

Sacre-Coeur Minerals Ltd.(a)(b) | | | 109,000 | | | | 9,636 | |

Sacre-Coeur Minerals Ltd.(b) | | | 444 | | | | 39 | |

| | | | | 9,675 | |

| Oil & Gas — 0.38% | | | | | | | | |

PetroMagdalena Energy Corp.(b) | | | 9,200 | | | | 14,278 | |

Progress Energy Resources Corp.(b)(g) | | | 10,000 | | | | 197,142 | |

| | | | | 211,420 | |

Total Canada (Cost: $273,455) | | | | 221,095 | |

| Germany — 0.81% | | | | | | | | |

| Healthcare-Services — 0.80% | | | | | | | | |

Rhoen Klinikum AG | | | 20,000 | | | | 442,942 | |

| Holding Companies-Diversified — 0.01% | | | | | | | | |

KHD Humboldt Wedag International AG(b) | | | 1,014 | | | | 6,314 | |

Total Germany (Cost: $569,958) | | | | 449,256 | |

| Ireland — 1.30% | | | | | | | | |

| Pharmaceuticals — 1.30% | | | | | | | | |

Warner Chilcott PLC Class A(b) | | | 40,000 | | | | 716,800 | |

Total Ireland (Cost: $740,600) | | | | 716,800 | |

| | | | | | | | |

| | | Number of Shares | | | Fair

Value | |

| Foreign Common Stocks (Continued) | | | | | | | | |

| Spain — 0.23% | | | | | | | | |

| Media — 0.23% | | | | | | | | |

Promotora de Informaciones S.A. Class B ADR | | | 45,000 | | | $ | 129,150 | |

Total Spain (Cost: $425,693) | | | | 129,150 | |

| Switzerland — 2.14% | | | | | | | | |

| Banks — 0.51% | | | | | | | | |

Bank Sarasin & Cie AG(b) | | | 10,000 | | | | 281,334 | |

| Electronics — 1.63% | | | | | | | | |

Tyco International Ltd. | | | 17,000 | | | | 898,450 | |

Total Switzerland (Cost: $1,208,535) | | | | | | | 1,179,784 | |

Total Foreign Common Stocks

(Cost $3,743,290) | | | | | | | 3,230,404 | |

| | | | | | | | |

| Preferred Stocks — 1.13% | | | | | | | | |

| United States — 1.13% | | | | | | | | |

Ally Financial, Inc. 144A , 7.00% | | | 700 | | | | 623,635 | |

GeoMet, Inc. , 8.00%(b) | | | 3 | | | | 12 | |

| | | | | | | | 623,647 | |

Total United States (Cost $649,531) | | | | | | | 623,647 | |

Total Preferred Stocks

(Cost $649,531) | | | | | | | 623,647 | |

| | |

| | | Par

Value | | | | |

| Corporate Bonds — 1.47% | | | | | | | | |

| Basic Materials — 0.04% | | | | | | | | |

| Forest Products & Paper — 0.04% | | | | | | | | |

Catalyst Paper Corp. 7.38%, 03/01/2014(d) | | $ | 750,000 | | | | 13,125 | |

NewPage Corp. 10.00%, 05/01/2012(d) | | | 300,000 | | | | 12,000 | |

| | | | | | | | 25,125 | |

Total Basic Materials (Cost: $821,113) | | | | | | | 25,125 | |

| Financial — 1.24% | | | | | | | | |

| Diversified Financial Services — 1.24% | | | | | | | | |

Credit Suisse Securities USA LLC 11.00%, 09/05/2013 | | | 20,000 | | | | 19,906 | |

Credit Suisse Securities USA LLC 11.10%, 01/23/2013 | | | 500,000 | | | | 501,900 | |

Lehman Brothers Holdings, Inc. 0.00%, 07/08/2014(d) | | | 110,000 | | | | 24,750 | |

Lehman Brothers Holdings, Inc. 0.00%, 02/17/2015(d) | | | 130,000 | | | | 28,275 | |

Lehman Brothers Holdings, Inc. 0.00%, 01/28/2020(d) | | | 100,000 | | | | 21,750 | |

Lehman Brothers Holdings, Inc. 0.00%, 09/23/2020(a)(d) | | | 100,000 | | | | 21,880 | |

Lehman Brothers Holdings, Inc. 0.00%, 02/14/2023(d) | | | 200,000 | | | | 43,500 | |

Lehman Brothers Holdings, Inc. 5.50%, 02/27/2020(d) | | | 100,000 | | | | 21,750 | |

| | | | | | | | 683,711 | |

| Venture Capital — 0.00% | | | | | | | | |

Infinity Capital Group 7.00%, 12/31/2049(a)(c) | | | 25,000 | | | | 0 | |

Total Financial (Cost: $709,643) | | | | | | | 683,711 | |

| Industrial — 0.19% | | | | | | | | |

| Building Materials — 0.19% | | | | | | | | |

U.S. Concrete, Inc. 9.50%, 08/31/2015 | | | 100,000 | | | | 105,375 | |

Total Industrial (Cost: $100,000) | | | | | | | 105,375 | |

| Utilities — 0.0% | | | | | | | | |

| Electric — 0.0% | | | | | | | | |

Mirant Corp. 0.03%, 06/15/2021(a)(c) | | | 20,000 | | | | 0 | |

Total Utilities (Cost: $0) | | | | 0 | |

Total Corporate Bonds

(Cost $1,630,756) | | | | | | | 814,211 | |

Schedule of Investments

Quaker Event Arbitrage Fund

June 30, 2012

| | | | | | | | |

| | |

| | | Number

of Shares | | | Fair

Value | |

| Warrant — 0.00% | | | | | | | | |

Sacre-Coeur Minerals Ltd. Expiration:(a)(b)(c)

March, 2013 | | | 54,500 | | | $ | 0 | |

Total Warrant

(Cost $0) | | | | | | | 0 | |

| | |

| | | Par Value | | | | |

| Asset Backed Securities — 11.20% | | | | | | | | |

| United States — 11.20% | | | | | | | | |

AFC Home Equity Loan Trust

Class 1A Series 2000- 2 0.64%, 06/25/2030(e) | | | 17,622 | | | | 10,766 | |

Citigroup Mortgage Loan Trust, Inc.

Class A Series 2007-SHL1 0.65%, 11/25/2046(e) | | | 598,685 | | | | 289,739 | |

Countrywide Alternative Loan Trust

Class 2A2A Series 2006-OC5 0.42%, 06/25/2036(e) | | | 127,601 | | | | 70,895 | |

Countrywide Alternative Loan Trust

Class A3 Series 2007-OA7 0.55%, 05/25/2047(e) | | | 410,730 | | | | 33,738 | |

Countrywide Asset-Backed Certificates

Class A2 Series 2006-IM1 0.49%, 04/25/2036(e) | | | 985,443 | | | | 471,975 | |

Countrywide Asset-Backed Certificates

Class M1 Series 2006-23 0.50%, 05/25/2037(e) | | | 1,800,000 | | | | 112,669 | |

Countrywide Asset-Backed Certificates

Class M1 Series 2006-BC4 0.54%, 11/25/2036(e) | | | 3,000,000 | | | | 135,699 | |

Countrywide Asset-Backed Certificates

Class 2M2 Series 2007-11 0.57%, 06/25/2047(e) | | | 2,200,000 | | | | 39,488 | |

Countrywide Asset-Backed Certificates

Class A3 Series 2006-S8 5.56%, 04/25/2036(e) | | | 155,960 | | | | 110,836 | |

Countrywide Home Equity Loan Trust

Class 2A Series 2006-E 0.38%, 07/15/2036(e) | | | 445,402 | | | | 277,967 | |

Countrywide Home Equity Loan Trust

Class 2A Series 2006-G 0.39%, 10/15/2036(e) | | | 196,544 | | | | 121,756 | |

Countrywide Home Equity Loan Trust

Class A Series 2007-E 0.39%, 06/15/2037(e) | | | 761,219 | | | | 475,539 | |

Countrywide Home Equity Loan Trust

Class 2A Series 2005-A 0.48%, 04/15/2035(e) | | | 51,786 | | | | 33,010 | |

Credit-Based Asset Servicing & Securitization LLC

Class AF4 Series 2007-CB1 5.27%, 01/25/2037 | | | 961,804 | | | | 358,533 | |

GSAMP Trust

Class A1B Series 2007-H1 0.45%, 01/25/2047(e) | | | 500,000 | | | | 271,360 | |

HSI Asset Securitization Corp. Trust

Class 2A5 Series 2006-OPT4 0%, 03/25/2036 | | | 500,000 | | | | 390,886 | |

Morgan Stanley ABS Capital I

Class A2C Series 2006-HE6 0.40%, 09/25/2036(e) | | | 1,800,000 | | | | 553,887 | |

Novastar Home Equity Loan

Class A2B Series 2006- 6 0.35%, 01/25/2037(e) | | | 672,578 | | | | 341,560 | |

Option One Mortgage Loan Trust

Class 2A2 Series 2006-3 0.35%, 02/25/2037(e) | | | 822,827 | | | | 431,333 | |

Provident Bank Home Equity Loan Trust

Class A2 Series 2000-2 0.79%, 08/25/2031(e) | | | 507,824 | | | | 244,808 | |

Provident Bank Home Equity Loan Trust

Class A1 Series 2000-2 0.79%, 08/25/2031(e) | | | 148,236 | | | | 83,884 | |

Residential Funding Mortgage Securities II Home Loan Trust

Class AII Series 2007-HSA3 0.39%, 06/25/2037(e) | | | 875,334 | | | | 576,973 | |

Structured Asset Investment Loan Trust

Class M1 Series 2003-BC9 1.30%, 08/25/2033(e) | | | 892,128 | | | | 745,852 | |

| | | | | | | | 6,183,153 | |

Total United States (Cost $6,969,660) | | | | | | | 6,183,153 | |

Total Asset Backed Securities

(Cost $6,969,660) | | | | | | | 6,183,153 | |

| | | | | | | | |

| | |

| | | Number

of Shares | | | Fair

Value | |

| Rights — 0.10% | | | | | | | | |

| France — 0.10% | | | | | | | | |

Sanofi(b) | | | 37,500 | | | $ | 52,875 | |

Total France (Cost $54,095) | | | | | | | 52,875 | |

| United States — 0.00% | | | | | | | | |

Lev Pharmaceuticals, Inc. ESCROW(a)(b)(c) | | | 15,000 | | | | 0 | |

Petrocorp, Inc. ESCROW(a)(b)(c) | | | 200 | | | | 0 | |

| | | | | | | | 0 | |

Total United States (Cost $0) | | | | | | | 0 | |

Total Rights

(Cost $54,095) | | | | | | | 52,875 | |

| | |

| | | Number

of Contracts | | | | |

| Options — 0.11% | | | | | | | | |

Collective Brands, Inc. Expiration: December, 2012

Exercise Price: $19.00 | | | 75 | | | | 750 | |

Lennar Corp. Expiration: August, 2012

Exercise Price: $29.00 | | | 510 | | | | 61,200 | |

| | | | | | | | 61,950 | |

Total United States (Cost $237,881) | | | | | | | 61,950 | |

Total Options

(Cost $237,881) | | | | | | | 61,950 | |

| | |

| | | Number

of Shares | | | | |

| Short-Term Investment — 12.13% | | | | | | | | |

| Time Deposit — 12.13% | | | | | | | | |

Citibank 0.03%, 07/02/2012(f) | | | 6,694,675 | | | | 6,694,675 | |

Total Short-Term Investment

(Cost $6,694,675) | | | | | | | 6,694,675 | |

Total Investments

(Cost $50,486,615) — 86.97% | | | | | | | 48,018,610 | |

Other Assets in Excess of Liabilities, Net — 13.03% | | | | | | | 7,193,099 | |

Total Net Assets — 100.00% | | | | | | $ | 55,211,709 | |

| Schedule of Securities Sold Short | | | | | | |

| Common Stocks — 0.99% | | | | | | | | |

| Collective Brands, Inc.(b) | | | 12,000 | | | | 257,040 | |

InterDigital, Inc. | | | 200 | | | | 5,902 | |

Sirius XM Radio, Inc.(b) | | | 152,000 | | | | 281,200 | |

Total Common Stocks | | | | | | | 544,142 | |

Total Securities Sold Short (Proceeds: $593,645) | | | | | | | 544,142 | |

| | |

| | | Number

of Contracts | | | | |

| Call Options Written — 3.11% | | | | | | | | |

Abercrombie & Fitch Co. Expiration: July, 2012

Exercise Price: $33.00 | | | 143 | | | | 29,744 | |

Ambassadors Group, Inc. Expiration: July, 2012

Exercise Price: $5.00 | | | 1,319 | | | | 56,057 | |

| | | | | | | | |

| | | Number

of Contracts | | | Fair

Value | |

| Call Options Written (Continued) | | | | | | | | |

Anaren, inc. Expiration: July, 2012

Exercise Price: $20.00 | | | 150 | | | $ | 6,375 | |

Ancestry.Com, Inc. Expiration: July, 2012

Exercise Price: $22.50 | | | 300 | | | | 3,000 | |

BMC Software, Inc. Expiration: July, 2012

Exercise Price: $38.00 | | | 200 | | | | 89,000 | |

Corrections Corp. Expiration: July, 2012

Exercise Price: $25.00 | | | 100 | | | | 45,000 | |

Dole Food Co., Inc. Expiration: July, 2012

Exercise Price: $7.50 | | | 1,000 | | | | 130,000 | |

DSP Group, Inc. Expiration: July, 2012

Exercise Price: $5.00 | | | 1,000 | | | | 5,000 | |

InterDigital, Inc. Expiration: July, 2012

Exercise Price: $22.50 | | | 298 | | | | 207,110 | |

Iron Mountain, Inc. Expiration: July, 2012

Exercise Price: $30.00 | | | 250 | | | | 3,750 | |

Jakks Pacific, Inc. Expiration: July, 2012

Exercise Price: $15.00 | | | 230 | | | | 25,300 | |

Lennar Corp. Expiration: August, 2012

Exercise Price: $29.00 | | | 510 | | | | 153,000 | |

Monster Worldwide, Inc. Expiration: July, 2012

Exercise Price: $7.00 | | | 1,070 | | | | 139,100 | |

| | | | | | | | |

| | | Number

of Contracts | | | Fair

Value | |

| Call Options Written (Continued) | | | | | | | | |

Progress Software Corp. Expiration: July, 2012

Exercise Price: $17.50 | | | 220 | | | $ | 74,800 | |

Regis Corp. Expiration: July, 2012

Exercise Price: $17.50 | | | 230 | | | | 16,100 | |

Seachange International, Inc. Expiration: July, 2012

Exercise Price: $7.50 | | | 500 | | | | 32,500 | |

SurModics, Inc. Expiration: July, 2012

Exercise Price: $12.50 | | | 400 | | | | 190,000 | |

SurModics, Inc. Expiration: July, 2012

Exercise Price: $15.00 | | | 180 | | | | 40,950 | |

Sycamore Networks, Inc. Expiration: July, 2012

Exercise Price: $12.50 | | | 320 | | | | 64,800 | |

The Pantry, Inc. Expiration: July, 2012

Exercise Price: $12.50 | | | 570 | | | | 123,975 | |

Tyco International Ltd. Expiration: July, 2012

Exercise Price: $44.00 | | | 170 | | | | 149,175 | |

Warner Chilcott PLC Expiration: July, 2012

Exercise Price: $15.00 | | | 400 | | | | 131,000 | |

Total Options Written

(Premiums Received $1,274,680) | | | | | | $ | 1,715,736 | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Forward Currency Contracts | |

| Buy | | Counterparty | | | Principal

Covered

by contract | | | Settlement

month | | | Sell | | | Contract

Amount | | | Unrealized

Appreciation | | | Unrealized

Depreciation | | | Net

Unrealized

Appreciation/

(Depreciation) | |

| AUD | | | Brown Brothers Harriman & Co. | | | | 562,250 | | | | Jul-12 | | | | USD | | | | 555,278 | | | | 19,798 | | | | — | | | | 19,798 | |

| EUR | | | Brown Brothers Harriman & Co. | | | | 372,675 | | | | Jul-12 | | | | USD | | | | 465,934 | | | | 5,730 | | | | — | | | | 5,730 | |

| USD | | | Brown Brothers Harriman & Co. | | | | 542,131 | | | | Jul-12 | | | | EUR | | | | 430,000 | | | | — | | | | (2,117 | ) | | | (2,117 | ) |

| | | | | | | | | | | | | | | | | | | | | | | $ | 25,528 | | | $ | (2,117 | ) | | $ | 23,411 | |

Currency Abbreviations

| ADR | American Depositary Receipt |

| (a) | Indicates an illiquid security. Total market value for illiquid securities is $1,558,959, representing 2.82% of net assets. |

| (b) | Non-income producing security. |

| (c) | Indicates a fair valued security. Total market value for fair valued securities is $1,644,674 representing 2.98% of net assets. |

| (e) | The coupon rate shown on floating or adjustable rate securities represents the rate at period end. |

| (f) | The rate shown is the annualized seven-day yield at period end. |

| (g) | Held as collateral for short sales. |

The accompanying notes are an integral part of the financial statements.

Schedule of Investments

Quaker Global Tactical Allocation Fund

June 30, 2012

| | | | | | | | |

| | | Number

of Shares | | | Fair

Value | |

| Common Stocks — 95.31% | | | | | | | | |

| Belgium — 2.72% | | | | | | | | |