UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED

MANAGEMENT INVESTMENT COMPANIES

Investment Company Act file number (811-06260)

Quaker Investment Trust

(Exact name of registrant as specified in charter)

309 Technology Drive

Malvern, PA 19355

(Address of principal executive offices) (Zip code)

Jeffry H. King, Sr.

Quaker Investment Trust

309 Technology Drive

Malvern, PA 19355

(Name and address of agent for service)

(800) 220-8888

Registrant’s telephone number, including area code

Date of fiscal year end: June 30, 2013

Date of reporting period: June 30, 2013

Item 1. Report to Stockholders.

Quaker Akros Absolute Return Fund

Quaker Event Arbitrage Fund

Quaker Global Tactical Allocation Fund

Quaker Mid-Cap Value Fund

Quaker Small-Cap Growth Tactical Allocation Fund

Quaker Small-Cap Value Fund

Quaker Strategic Growth Fund

Mutual fund investing involves risk. Principal loss is possible. Investing in the Quaker Funds may involve special risk including, but not limited to, investments in smaller companies, non-diversification, short sales, foreign securities, special situations, debt securities and value growth investing. Please refer to the prospectus for more complete information. This report must be preceded or accompanied by a current prospectus. The opinions expressed are those of the sub-adviser through the end of the period for this report, are subject to change, are not a guarantee, and should not be considered investment advice. Fund holdings are subject to change and should not be considered a recommendation to buy or sell any security. Current and future holdings are subject to risk. |

Chairman’s Letter to the Shareholders (Unaudited)

June 30, 2013

Dear Fellow Shareholder,

The premise on which Quaker Funds, Inc. was founded was the desire to afford everyday investors access to the same tactical allocation used by professional money managers to augment traditional investing strategies within a holistic asset allocation mix. Our commitment to this principle is still as strong today as it was the day we opened our doors.

Our management team continually strives to provide our shareholders with innovative investment alternatives and advisers that constantly seek superior returns. Thank you for your trust and investment in the Quaker Funds.

Sincerely,

Jeffry King

Chairman & CEO

Quaker Investment Trust

Performance Update (Unaudited)

Quaker Akros Absolute Return Fund (AARFX, QASDX, QASIX)

INVESTMENT OBJECTIVE AND PRINCIPAL INVESTMENT STRATEGIES

The Quaker Akros Absolute Return Fund (“Fund”) seeks to provide long-term capital appreciation and income, while seeking to protect principal during unfavorable market conditions.

PERFORMANCE REVIEW AND MARKET OUTLOOK

For the fiscal year ended June 30, 2013, the Fund was down -5.82% while the S&P 500 Total Return Index (S&P 500) gained 20.60%. For the six months ended June 30, 2013, the Fund was down -3.50% while the S&P 500 returned 13.82%

The performance of AARFX for the twelve months ending June 30th, 2013 was the most disappointing twelve month period we have had since starting the Fund almost eight years ago. Our bearish stance on the market was the biggest contributor to the Fund’s underperformance. In particular, betting against the American consumer and home builders in the face of falling interest rates hurt us the most. We still have strong convictions that these segments of the market will be very vulnerable in the face of higher interest rates which, we believe have finally arrived. We continue to hold short positions in these expensive segments of the market.

On the long side, the biggest detractors from performance were Knight Capital Group, Inc. (KCG), SuperValu, Inc. (SVU), Professional Diversity Network, Inc. (IPDN) and ATP Oil & Gas Corp. bonds. We have since sold our position in KCG and SVU but continue to hold IPDN as we believe there is huge upside potential considering their recent strategic partnership with LinkedIn. On the short side, the biggest detractors from performance were positions in Sherwin-Williams Co. (SHW) and Canadian Pacific Railway Ltd. (CP).

Stocks having the biggest positive impact on our fund were: Citigroup, Inc. (C), Nokia Corp. (NOK), Cooper Tire & Rubber Co. (CTB), Synergy Pharmaceuticals, Inc. (SGYP), Total, S.A. (TOT) and Kips Bay Medical, Inc. (KIPS). We have sold all those stocks with the exception of SGYP which we believe has significant long term upside potential as they are entering Phase III trials with a chronic constipation drug that could be a blockbuster drug if it gets approved. The Phase IIb results were so impressive that I believe there is a chance the company could be an acquisition target for larger cap pharmaceutical firms. Short positions that helped us included Chipotle Mexican Grill, Inc. (CMG) and Salesforce.com, Inc. (CRM).

Looking ahead, we may become more trading oriented, as we believe we could be nearing an inflection point this fall. With that said, we have tempered our bearishness to the point that we have limited our losses, and we anticipate making up for our past mistakes with solid performance going forward. We continue to respect the fact that the stock market can continue to move higher in the near term due to its tremendous momentum and push from the world’s central banks. We will be watching interest rates, credit growth, and economic indicators as key gauges in making our asset allocation decisions for the remainder of the year. If interest rates rise much higher, we believe that such higher rates will exacerbate an already leveraged financial system. If the economy begins to deteriorate from an already anemic condition, despite the massive monetary stimulus being thrown at it, we believe that the end of this four-year recovery could be around the corner. The proverbial, “pushing on a string” liquidity trap that has embraced Japan for the past twenty-four years could be upon us. If credit growth begins to slow due to higher interest rates or fickleness on the part of investors, we believe the storm will have arrived. In such an environment, we believe that being short highly leveraged companies, while being long solid, reasonably priced growth companies with clean balance sheets will be a good strategy in such an environment.

We remain slightly net short the market on a beta adjusted basis and expect to remain slightly short at these stock market levels. There are stocks that interest us at lower levels and we may add to long positions in select stocks on weakness. For the foreseeable future, we would expect to be market neutral, plus or minus 25% depending on the opportunity sets. Most of our long positions will be special situations or trading situations in companies that have gotten too cheap.

Brady T. Lipp, Portfolio Manager

Akros Capital, LLC

| | SUB-ADVISER: |

| | Akros Capital, LLC |

| | |

| | TOTAL NET ASSETS:

AS OF JUNE 30, 2013

$4,202,223 |

| | |

| Top 10 Holdings ** (% of net assets) |

| | |

| Apple, Inc. | 2.83% |

| FibroGen, Inc. | 2.68% |

| Marvell Technology Group Ltd. | 2.26% |

| Barrick Gold Corp. | 2.25% |

| Synergy Pharmaceuticals, Inc. | 2.06% |

| Professional Diversity Network | 1.78% |

| Nuance Communications, Inc. | 1.75% |

| Encana Corp. | 1.61% |

| Agnico Eagle Mines Ltd | 1.31% |

| Devon Energy Corp. | 1.23% |

| | |

| % Fund Total | 19.76% |

| ** | Excludes Short-Term Investments |

| Sectors (% of net assets) |

| | | |

| n | 19.02% | Domestic Common Stocks |

| | 0.71% | Basic Materials |

| | 0.18% | Communications |

| | 1.78% | Consumer Staple |

| | 0.00% | Consumer, Cyclical |

| | 1.27% | Consumer, Non-cyclical |

| | 0.53% | Diversified |

| | 2.54% | Energy |

| | 1.41% | Financial |

| | 6.02% | Health Care |

| | 4.58% | Technology |

| n | 12.01% | Foreign Common Stocks |

| n | 2.68% | Preferred Stocks |

| n | 0.45% | Domestic Private Placements |

| n | 0.00% | Rights |

| n | 1.11% | Warrants |

| n | 0.03% | Corporate Bonds |

| n | 0.01% | Purchased Options |

| n | 22.75% | Short-Term Investments |

| n | 6.71% | Investments Purchased with Proceeds from Securities Lending |

| | 64.77% | Total Market Value of Investments |

| | 35.23% | Other Assets in Excess of Liabilities, Net |

| | 100.00% | Total Net Assets |

2 | 2 0 1 3 A N N U A L R E P O R T

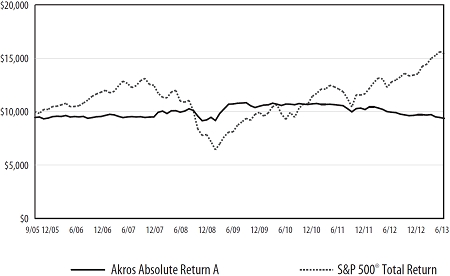

| | |

| * | The benchmark since inception

returns are calculated for the period

September 30, 2005 through

June 30, 2013. |

| | |

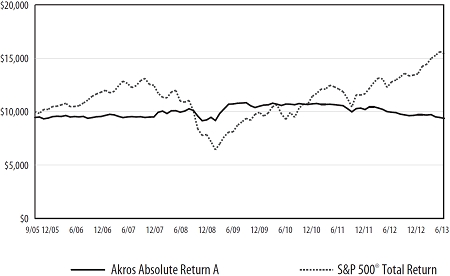

Quaker Akros Absolute Return Fund

Growth of a Hypothetical $10,000 Investment

June 30, 2013

| Average Annualized Total Return |

| | | Expense

Ratio | | Inception

Date | | One Year | | Five Year | | Ten Year | | Commencement

of operations

through 6/30/2013 |

| | | | | | | with

sales

charge | | without

sales

charge | | with

sales

charge | | without

sales

charge | | with

sales

charge | | without

sales

charge | | with

sales

charge | | without

sales

charge |

| Class A | | 1.99 | % | | 09/30/2005 | | -10.98 | % | | -5.82 | % | | -2.32 | % | | -1.21 | % | | N/A | | N/A | | -0.84 | % | | -0.11 | % |

| Class C | | 2.74 | % | | 10/04/2010 | | -6.64 | % | | -6.64 | % | | N/A | | | N/A | | | N/A | | N/A | | -5.67 | % | | -5.67 | % |

| Institutional Class | | 1.74 | % | | 10/04/2010 | | -5.56 | % | | -5.56 | % | | N/A | | | N/A | | | N/A | | N/A | | -4.65 | % | | -4.65 | % |

| S&P 500® Total Return Index* | | 20.60 | % | | 20.60 | % | | 7.01 | % | | 7.01 | % | | N/A | | N/A | | 5.74 | % | | 5.74 | % |

Performance data quoted represents past performance and is no guarantee of future results. Investment return and principal value will fluctuate so that shares, when redeemed, may be worth more or less than their original cost. Current performance may be lower or higher than performance data quoted. Performance data current to the most recent month end is available at www.quakerfunds.com or by calling us toll free at 800-220-8888. Total return includes reinvestment of dividends and capital gains.

Class A shares of the Fund have a maximum sales charge of 5.50%.

The line graph and performance table do not reflect the deduction of taxes that a shareholder might pay on fund distributions or the redemption of fund shares. Total return calculations reflect expense reimbursements and fee waivers in the applicable periods. See financial highlights for periods where fees were waived or reimbursed.

The Fund’s portfolio holdings may differ significantly from the securities held in the index and, unlike a mutual fund, an unmanaged index assumes no transaction costs, taxes, management fees or other expenses. You cannot invest directly in an index.

The S&P 500® Total Return Index (“Index”) is a widely recognized, unmanaged index consisting of the approximately 500 largest companies in the United States as measured by market capitalization. The index assumes reinvestment of all dividends and distributions.

2 0 1 3 A N N U A L R E P O R T | 3

Performance Update (Unaudited)

Quaker Event Arbitrage Fund (QEAAX, QEACX, QEAIX)

OBJECTIVES AND PRINCIPAL STRATEGIES

The Quaker Event Arbitrage Fund (“Fund”) seeks to provide long-term growth of capital. The Fund generally invest in the securities of publicly traded companies involved in mergers, takeovers, tender offers, leveraged buyouts, spin-offs, liquidations or similar events.

PERFORMANCE REVIEW AND MARKET OUTLOOK

Over the last year the Fund returned 8.70%, whereas the total return of the S&P 500 was 20.60%. While the equity market gyrated over the last year, the Fund’s daily volatility was roughly 61% lower than that of the S&P 500.

The past 12 months proved more favorable for event driven investing than prior years. This is evident, as the HFRI Event Driven (Total) Index return was 12.43%. The HFRI Event Driven (Total) Index is a good barometer for the asset class as it aggregates many hedge funds into one index that represents Event Driven investing. Nevertheless, monetary policy has been more advantageous to direct market exposure than to other investment strategies like event-driven investment.

Looking forward, the portfolio management team sees opportunities in proxy fights, where activist investors are pushing underperforming companies to sell themselves. These investments have multiple ways to generate returns for the funds: first, activist investors prepare companies for a sale by eliminating governance problems that hold the firms back; second, they divest non-core assets and allow management to focus on the core business; third, they help the companies implement operational changes; and finally, the sale of the company occurs with a control premium.

This year, the Fund has found more opportunities in distressed securities of corporate issues. While most of the distress in recent years was found to lie mostly in distressed mortgage-backed securities, opportunities in this space can now be found in corporate distress. The Fund exited most of its mortgage backed securities holdings during the year as the risk/reward profile became less attractive when prices recovered closer to pre-crisis levels.

Finally, merger arbitrage remains a small portion of the portfolio. With interest rates remaining near historic lows this strategy in general generates unattractive returns, in particular in light of the risks incurred. Nevertheless, opportunities appear from time to time and the investment team invests on such occasions.

I wish all investors a prosperous year and thank you for your continued support.

Sincerely,

Thomas Kirchner, Portfolio Manager

Quaker Funds, Inc.

| | ADVISER: |

| | Quaker Funds, Inc. |

| | |

| | TOTAL NET ASSETS:

AS OF JUNE 30, 2013

$66,114,800 |

| | |

| Top 10 Holdings ** (% of net assets) |

| | |

| Regis Corp. | 2.01% |

| Integrated Device Technology, Inc. | 1.75% |

| Whitewave Foods Co. Class A | 1.75% |

| Vodafone Group PLC | 1.74% |

| Seachange International, Inc. | 1.53% |

| API Technologies Corp. | 1.49% |

| Fairpoint Communications, Inc. | 1.43% |

| NetApp, Inc. | 1.41% |

| Nuance Communications, Inc. | 1.40% |

| Long Beach Mortgage Loan Trust | 1.37% |

| | |

| % Fund Total | 15.88% |

| ** | Excludes Short-Term Investments |

| Sectors (% of net assets) |

| | |

| n | 49.90% | Domestic Common Stocks |

| | 0.88% | Basic Materials |

| | 10.60% | Communications |

| | 7.99% | Consumer, Cyclical |

| | 8.11% | Consumer, Non-cyclical |

| | 0.00% | Diversified |

| | 2.01% | Energy |

| | 1.14% | Healthcare |

| | 4.31% | Industrial |

| | 14.51% | Technology |

| | 0.35% | Utilities |

| n | 5.90% | Foreign Common Stocks |

| n | 0.93% | Preferred Stocks |

| n | 1.54% | Real Estate Investment Trusts |

| n | 0.00% | Rights |

| n | 0.75% | Warrants |

| n | 4.54% | Asset Backed Securities |

| n | 1.00% | Convertible Bonds |

| n | 3.13% | Corporate Bonds |

| n | 2.84% | Mortgage Backed Securities |

| n | 1.45% | Municipal Bonds |

| n | 0.77% | Term Loan |

| n | 2.15% | Purchased Options |

| n | 12.89% | Short-Term Investments |

| n | 6.46% | Investments Purchased with Proceeds from Securities Lending |

| | 94.25% | Total Market Value of Investments |

| | 5.75% | Other Assets in Excess of Liabilities, Net |

| | 100.00% | Total Net Assets |

4 | 2 0 1 3 A N N U A L R E P O R T

| | |

| * | The benchmark since inception

returns are calculated for the period

November 21, 2003 through

June 30, 2013. |

| | |

Quaker Event Arbitrage Fund

Growth of a Hypothetical $10,000 Investment

June 30, 2013

| Average Annualized Total Return |

| | | Expense

Ratio | | Inception

Date | | One Year | | Five Year | | Ten Year | | Commencement

of operations

through 6/30/2013 |

| | | | | | | with

sales

charge | | without

sales

charge | | with

sales

charge | | without

sales

charge | | with

sales

charge | | without

sales

charge | | with

sales

charge | | without

sales

charge |

| Class A | | 1.99 | % | | 11/21/2003 | | 2.75 | % | | 8.70 | % | | 3.34 | % | | 4.51 | % | | N/A | | N/A | | 5.52 | % | | 6.14 | % |

| Class C | | 2.74 | % | | 6/7/2010 | | 7.91 | % | | 7.91 | % | | N/A | | | N/A | | | N/A | | N/A | | 1.91 | % | | 1.91 | % |

| Institutional Class | | 1.74 | % | | 6/7/2010 | | 9.04 | % | | 9.04 | % | | N/A | | | N/A | | | N/A | | N/A | | 2.89 | % | | 2.89 | % |

| S&P 500 Total Return Index* | | 20.60 | % | | 20.60 | % | | 7.01 | % | | 7.01 | % | | N/A | | N/A | | 6.85 | % | | 6.85 | % |

Performance data quoted represents past performance and is no guarantee of future results. Investment return and principal value will fluctuate so that shares, when redeemed, may be worth more or less than their original cost. Current performance may be lower or higher than performance data quoted. Performance data current to the most recent month end is available at www.quakerfunds.com or by calling us toll free at 800-220-8888. Total return includes reinvestment of dividends and capital gains.

Class A shares of the Fund have a maximum sales charge of 5.50%.

The line graph and performance table do not reflect the deduction of taxes that a shareholder might pay on fund distributions or the redemption of fund shares. Total return calculations reflect expense reimbursements and fee waivers in the applicable periods. See financial highlights for periods where fees were waived or reimbursed.

The Fund’s portfolio holdings may differ significantly from the securities held in the index and, unlike a mutual fund, an unmanaged index assumes no transaction costs, taxes, management fees or other expenses. You cannot invest directly in an index.

The S&P 500® Total Return Index (“Index”) is a widely recognized, unmanaged index consisting of the approximately 500 largest companies in the United States as measured by market capitalization. The Index assumes reinvestment of all dividends and distributions.

2 0 1 3 A N N U A L R E P O R T | 5

Performance Update (Unaudited)

Quaker Global Tactical Allocation Fund (QTRAX, QTRCX, QTRIX)

OBJECTIVES AND PRINCIPAL STRATEGIES

The Fund seeks to provide long-term growth of capital. The Fund invests in common stocks of U.S. companies and American Depository Receipts (“ADRs”) of foreign companies without regard to market capitalization. Under normal circumstances, the Fund will invest at least 40% of its total assets in common stocks and ADRs of foreign companies.

PERFORMANCE REVIEW AND MARKET OUTLOOK

For the fiscal year ended June 30, 2013, the MSCI World Index (“MSCI World”) (a global market proxy) gained 18.58% while the Quaker Global Tactical Allocation Fund finished the fiscal year with a gain of 16.57%. For the first half of the 2013 calendar year, the MSCI World rose 8.43% while the Quaker Global Tactical Allocation Fund gained 11.71%.

In spite of a host of headwinds, markets exhibited robust advances over the last year, with all global sectors gaining ground. One of the biggest surprises for domestic markets in the first half of 2013 was the lack of damage from the fiscal cliff tax increases (which reduced personal income without impacting consumer spending) and sequestration spending cuts (which took effect in early March) lopping off 2% from overall government expenditures. Another surprise from Washington was the bipartisan debt ceiling compromise that allowed it to avoid a repeat of the showdown that ultimately led to a downgrade in federal debt in 2011. Along with sustained consumer spending and reduced political uncertainty, the housing rebound has also begun to provide a lift to the economy. Since so many potential problems were already “on the calendar,” bad news was already priced into equity prices, helping the slate of positive news provide upward momentum for domestic markets.

As we look back over the last couple years, it is undeniable that the Fed and other central banks have been the primary driver of stock market performance as anticipation of central bank moves have left a clear mark on the trajectory of equity prices. While changing expectations and shifts in fundamentals still have an effect, in the U.S., the Fed’s flood of liquidity largely overshadowed the ability of fundamental earnings analysis to determine proper valuation creating a difficult environment for stock picking. While the Bank of Japan continues to stimulate, this trend seems to finally be reversing itself domestically. The reversal began when the Fed added clarity to its liquidity program by setting definitive unemployment and inflation targets for continued Fed intervention in hopes of lessening the risk-on/risk-off market movements that characterized Fed announcements cycles. The trend continued with the taper announcement which, after a short “taper tantrum” sell-off, continued to add clarity to Fed intentions and stability to domestic markets. Time will tell if the Bank of Japan or the European Central bank follow suit.

Domestically, in addition to the clarity provided by the Fed, there continues to be bullish signs. While many are skeptical of future earnings growth since profit margins are at historic highs, it is difficult to fathom that corporate profitability is peaking while the developed world’s economy is in such a depressed state. If growth picks up (and the corporate cash hoard is put to work) profits will continue to have the ability to surprise on the upside. The flip side of earnings skepticism is the continued modest valuation of the S&P500, which at a 15x forward P/E multiple stands below the historical average valuation band. If economic conditions improve, there is plenty of room for multiple expansion.

Foreign economies looked much more dire for most of the year. Early this year, the Cypriot crisis reinforced the perception that the European crisis is far from over, with continued recession affecting much of the continent. The European slowdown also affected export markets in many emerging economies, which also had many homegrown issues including: wage pressure and weak manufacturing growth in China, rising inflation in Brazil and weakening natural gas prices in Russia (not to mention the periodic pounding of war-drums on the Korean peninsula). That said the global outlook is improving with growth in China beginning to stabilize and European recession showing indications that it may be at an end.

All sectors gained ground for the year with consumer discretionaries, healthcare (both overweights) and financials advancing the most and materials, utilities (both relative underweights) and technology trailing most other sectors. During the last 12 months the portfolio was helped by stock picks in the healthcare (Celgene and Biogen) and technology (Apple and Visa) sectors and hurt by stock picks in consumer staples (Mead Johnson) and financials (Capital One and Royal Bank of Scotland), as well as cash drag.

Over the last year, we concentrated our stock picking efforts on seeking out companies that have a definitive competitive advantage and access to consumer growth patterns, both domestically, but also in emerging markets. Areas fitting this pattern (which we called the three M’s) continue to be themes in the portfolio.

Media: which has enormous potential growth internationally through several channels and provides margin protection due to intellectual property rights (IP). The landscape has rapidly changed in this arena as content has gone digital allowing streaming video and audio services. As they are rolled out into areas with existing broadband infrastructure, services are highly scalable with little additional fixed cost, boosting margins dramatically.

Molecular Biology: which encompasses both drug companies and biotech. These firms again have protections from competition through IP and have an expanding customer base as their inroads into emerging markets become more profitable as those countries grow richer and can afford more sophisticated treatments and (to a lessor extent) as Obamacare broadens the population with healthcare coverage domestically. A slew of M&A deals have also pushed up prices in this sector recently.

Mobile: as more content migrates onto mobile platforms and more cell phones and smart phones are sold into emerging markets, companies that can leverage, capitalize and monetize their mobile presence will outmaneuver their competition.

| | SUB-ADVISER: |

| | DG Capital Management, Inc. |

| | |

| | TOTAL NET ASSETS:

AS OF JUNE 30, 2013

$6,605,687 |

| | |

| Top 10 Holdings ** (% of net assets) |

| | |

| Biogen Idec, Inc. | 3.80% |

| Gilead Sciences, Inc. | 3.15% |

| Google, Inc. Class A | 2.64% |

| American International Group, Inc. | 2.59% |

| CBS Corp. | 2.57% |

| Mastercard, Inc. Class A | 2.57% |

| Citigroup, Inc. | 2.54% |

| Adidas AG - ADR | 2.48% |

| ACE Ltd. | 2.48% |

| Allied World Assurance Co. Holdings AG | 2.45% |

| | |

| % Fund Total | 27.27% |

| ** | Excludes Short-Term Investments |

| Country Allocation (% of net assets) |

| | |

| n | 99.01% | Common Stocks |

| | 1.51% | Belgium |

| | 2.42% | Bermuda |

| | 1.31% | Denmark |

| | 2.25% | France |

| | 6.62% | Germany |

| | 1.94% | Ireland |

| | 1.44% | Japan |

| | 1.63% | Mexico |

| | 3.74% | Netherlands |

| | 11.12% | Switzerland |

| | 4.95% | United Kingdom |

| | 60.08% | United States |

| n | 0.40% | Short-Term Investments |

| n | 23.55% | Investments Purchased with Proceeds from Securities Lending |

| | 122.96% | Total Market Value of Investments |

| | (22.96)% | Liabilities in Excess of Other Assets, Net |

| | 100.00% | Total Net Assets |

6 | 2 0 1 3 A N N U A L R E P O R T

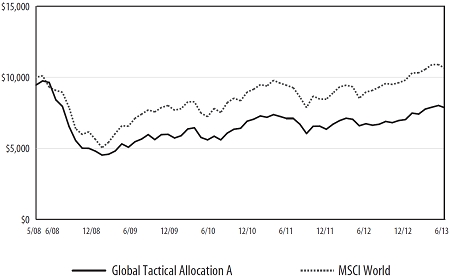

| | |

| * | The benchmark since inception

returns are calculated since

commencement of May 1, 2008

through June 30, 2013. |

| | |

More recently we have also increased our allocation to industrials which should benefit from the infrastructure build out needed to exploit fracking technology. Cheap energy costs in the U.S. along with slow growing labor costs and improving productivity have also begun to encourage the on shoring of some industrial production back in the U.S. (especially in light of fast growing wages in China, and rising transport costs) which will help further boost the sector.

We will continue to seek opportunities both domestically and worldwide that meet our investment criteria in an effort to provide a good risk adjusted return for our clients going forward, and at the same time the Fund will continue to take advantage of its mandate to protect capital by tactically raising cash and use its short-selling capabilities when we believe it is warranted. Thank you for your continued support.

Respectfully,

Manu P. Daftary, Portfolio Manager

DG Capital Management

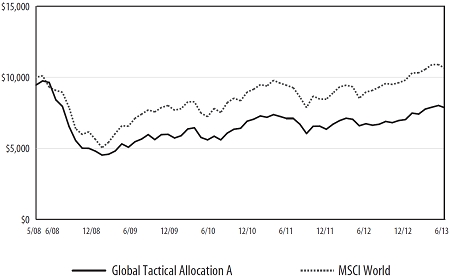

Quaker Global Tactical Allocation Fund

Growth of a Hypothetical $10,000 Investment

June 30, 2013

| Average Annualized Total Return |

| | | Expense

Ratio | | Inception

Date | | One Year | | Five Year | | Ten Year | | Commencement

of operations

through 6/30/2013 |

| | | | | | | | with

sales

charge | | without

sales

charge | | with

sales

charge | | without

sales

charge | | with

sales

charge | without

sales

charge | with

sales

charge | | without

sales

charge |

| Class A | | 2.68 | % | | 5/1/2008 | | 10.23 | % | | 16.57 | % | | -5.09 | % | | -4.02 | % | | N/A | | N/A | | -4.59 | % | | -3.54 | % |

| Class C | | 3.43 | % | | 5/1/2008 | | 15.65 | % | | 15.65 | % | | -4.73 | % | | -4.73 | % | | N/A | | N/A | | -4.28 | % | | -4.28 | % |

| Institutional Class | | 2.43 | % | | 7/23/2008 | | 16.87 | % | | 16.87 | % | | N/A | | | N/A | | | N/A | | N/A | | -1.05 | % | | -1.05 | % |

| MSCI World Index* | | 18.58 | % | | 18.58 | % | | 2.70 | % | | 2.70 | % | | N/A | | N/A | | 1.18 | % | | 1.18 | % |

Performance data quoted represents past performance and is no guarantee of future results. Investment return and principal value will fluctuate so that shares, when redeemed, may be worth more or less than their original cost. Current performance may be lower or higher than performance data quoted. Performance data current to the most recent month end is available at www.quakerfunds.com or by calling us toll free at 800-220-8888. Total return includes reinvestment of dividends and capital gains.

Class A shares of the Fund have a maximum sales charge of 5.50%.

The line graph and performance table do not reflect the deduction of taxes that a shareholder might pay on fund distributions or the redemption of fund shares. Total return calculations reflect expense reimbursements and fee waivers in the applicable periods. See financial highlights for periods where fees were waived or reimbursed.

The Fund’s portfolio holdings may differ significantly from the securities held in the index and, unlike a mutual fund, an unmanaged index assumes no transaction costs, taxes, management fees or other expenses. You cannot invest directly in an index.

The Morgan Stanley Capital International World Index (“MSCI World Index”) measures developed-market equity performance throughout the world. The MSCI World Index assumes reinvestment of all dividends and distributions.

2 0 1 3 A N N U A L R E P O R T | 7

Performance Update (Unaudited)

Quaker Mid-Cap Value Fund (QMCVX, QMCCX, QMVIX)

OBJECTIVES AND PRINCIPAL STRATEGIES

The Quaker Mid-Cap Value Fund (“Fund”) seeks to provide long-term growth of capital. Current income is not a significant investment consideration and any such income realized will be considered incidental to the Fund’s investment objective. The Fund invests primarily in common stocks comparable to the companies included in the Russell Midcap® Value Index.

PERFORMANCE REVIEW AND MARKET OUTLOOK

For the period from July 1, 2012 through June 30, 2013, the Fund generated a gain of 20.72% (before sales charges) and 14.05% (after sales charges) versus a gain of 27.65% for the Russell Midcap® Value Index. Every sector in the benchmark was up double-digits. The same was true for the Fund, except for the Information Technology and Telecommunication sectors (the fund has no exposure in telecommunication), the Information Technology sector only increased 6% due to poor performance from stocks that were either tied to the slowdown at bell weather Apple, Inc., or to the slower than expected recovery in semiconductor equipment capital spending. The Fund’s best relative performance came from the Materials sector, which increased 24% versus an increase of 14% in the benchmark. We believe our stocks did well and we avoided the worst performing industries and stocks in the sector.

In our opinion, a significant portion of the rally in equities over the past year can be attributed to the massive quantitative easing program implemented by the Federal Reserve. For the most part, the Federal Reserve’s liquidity injection had held rates on 10 year treasuries below 2 percent for the last 2 years, with rates reaching a low of 1.4% last July. With the interest rate shock to over 2.5% recently, the pace of outflows from bond funds accelerated towards the end of the second quarter, reaching $60 billion in June according to ICI. However, this still only represents less than 2% of the nearly $3.8 trillion total invested in bond funds, and additional asset reallocation could provide an increasing source of stimulus to equity markets.

Ultimately, we believe corporate performance will need to replace federal stimulus for equities to continue to perform well. Overall, returns remain high by historical standards, but growth opportunities continue to pose a challenge for management teams in the current slow growth environment. We believe our investment approach is well suited to such an environment, as we continue to focus our investments in companies with stable or improving returns on invested capital and a demonstrated ability to reinvest in the businesses.

Sincerely,

Frank Latuda, Jr. CFA

Chief Investment Officer & Portfolio Manager

Kennedy Capital Management, Inc.

| | SUB-ADVISER: |

| | Kennedy Capital Management, Inc. |

| | |

| | TOTAL NET ASSETS: |

| | AS OF JUNE 30, 2013 |

| | $8,904,312 |

| | |

| | |

| Top 10 Holdings ** (% of net assets) |

| | | |

| Torchmark Corp. | | 2.51% |

| Huntington Bancshares, Inc. | | 2.50% |

| Timken Co. | | 2.46% |

| Regions Financial Corp. | | 2.43% |

| Hospira, Inc. | | 2.30% |

| Harman International Industries, Inc. | | 2.23% |

| Keycorp | | 2.17% |

| Protective Life Corp. | | 2.12% |

| Dana Holding Corp. | | 2.10% |

| Reinsurance Group of America, Inc., Class A | | 2.10% |

| | | |

| % Fund Total | | 22.92% |

| ** | Excludes Short-Term Investments |

| Sectors (% of net assets) |

| ¢ | 83.59% | Domestic Common Stocks |

| | 4.56% | Basic Materials |

| | 10.69% | Consumer, Cyclical |

| | 9.76% | Consumer, Non-cyclical |

| | 8.95% | Energy |

| | 15.69% | Financial |

| | 17.27% | Industrial |

| | 8.80% | Technology |

| | 7.87% | Utilities |

| ¢ | 5.46% | Foreign Common Stocks |

| ¢ | 4.73% | Real Estate Investment Trusts |

| ¢ | 5.22% | Short-Term Investments |

| ¢ | 26.90% | Investments Purchased with Proceeds from Securities Lending |

| | 125.90% | Total Market Value of Investments |

| | (25.90)% | Liabilities in Excess of Other Assets, Net |

| | 100.00% | Total Net Assets |

8 | 2 0 1 3 A N N U A L R E P O R T

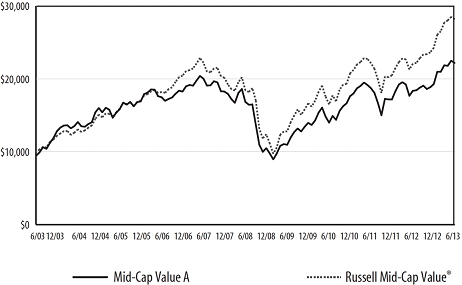

| | |

| * | The benchmark since inception returns are calculated since commencement of December 31, 1997 through June 30, 2013. |

| | |

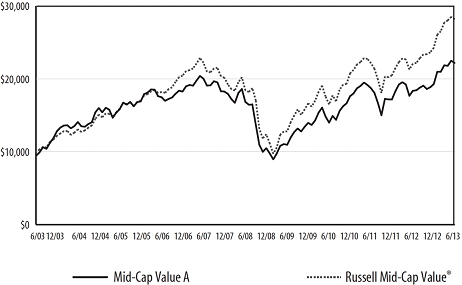

Quaker Mid-Cap Value Fund

Growth of a Hypothetical $10,000 Investment

June 30, 2013

| Average Annualized Total Return |

| | | | | | | | | | | | | | | | | | | | | | | | | | Commencement | |

| | | Expense | | Inception | | | | | | | | | | | of operations | |

| | | Ratio | | Date | | One Year | | Five Year | | Ten Year | | through 6/30/2013 | |

| | | | | | | | with | | without | | with | | without | | with | | without | | with | | without | |

| | | | | | | | sales | | sales | | sales | | sales | | sales | | sales | | sales | | sales | |

| | | | | | | | charge | | charge | | charge | | charge | | charge | | charge | | charge | | charge | |

| Class A | | | 2.21 | % | | 12/31/1997 | | | 14.05 | % | | | 20.72 | | | | 4.47 | % | | | 5.66 | % | | | 8.29 | % | | | 8.91 | % | | | 6.52 | % | | | 6.90 | % | |

| Class C | | | 2.96 | % | | 7/31/2000 | | | 19.84 | % | | | 19.84 | % | | | 4.89 | % | | | 4.89 | % | | | 8.11 | % | | | 8.11 | % | | | 7.26 | % | | | 7.26 | % | |

| Institutional Class | | | 1.96 | % | | 11/21/2000 | | | 20.99 | % | | | 20.99 | % | | | 5.93 | % | | | 5.93 | % | | | 9.19 | % | | | 9.19 | % | | | 8.55 | % | | | 8.55 | % | |

| Russell Mid-Cap Value Index* | | | 27.65 | % | | | 27.65 | % | | | 8.87 | % | | | 8.87 | % | | | 10.92 | % | | | 10.92 | % | | | 8.79 | % | | | 8.79 | % | |

Performance data quoted represents past performance and is no guarantee of future results. Investment return and principal value will fluctuate so that shares, when redeemed, may be worth more or less than their original cost. Current performance may be lower or higher than performance data quoted. Performance data current to the most recent month end is available at www.quakerfunds.com or by calling us toll free at 800-220-8888. Total return includes reinvestment of dividends and capital gains.

Class A shares of the Fund have a maximum sales charge of 5.50%.

The line graph and performance table do not reflect the deduction of taxes that a shareholder might pay on fund distributions or the redemption of fund shares. Total return calculations reflect expense reimbursements and fee waivers in the applicable periods. See financial highlights for periods where fees were waived or reimbursed.

The Fund’s portfolio holdings may differ significantly from the securities held in the index and, unlike a mutual fund, an unmanaged index assumes no transaction costs, taxes, management fees or other expenses. You cannot invest directly in an index.

The Russell Midcap Value® Index is a widely recognized, unmanaged index of companies included in the Russell 1000 Index with current market capitalizations between $829 million and $12.2 billion. The Russell Midcap Value Index assumes reinvestment of all dividends.

2 0 1 3 A N N U A L R E P O R T | 9

Performance Update (Unaudited)

Quaker Small-Cap Growth Tactical Allocation Fund (QGASX, QGCSX, QGISX)

PERFORMANCE REVIEW AND MARKET OUTLOOK

The Quaker Small-Cap Growth Tactical Allocation Fund (“The Fund”) increased 8.00% for the year ending June 30, 2013. The Russell 2000 Growth Index (“The Index”) increased 23.67% for the year. It is the benchmark against which the Fund is compared. As an absolute return strategy, the Fund will own stocks, hold cash, and sell short the Index against its equity positions. The objective of the strategy is to enable its shareholders to make money in all markets, owning small cap and microcap growth stocks only when we believe they measure a considerable margin of safety.

The equities of the Fund increased 15.77% for the fiscal year. The fund had a net equity invested position of 59.27% during the year. The average cash position was 15.35% and the average ‘short’ position was 25.38%. Importantly, the cash position and the ‘shorts’ are not derived from a macro- economic ‘top down’ view or from an assessment of the overall market’s valuation. The equities are held and owned regardless of the economic or market environment as long as they meet three strict criteria that comprise our assessment of the appropriate ‘margin of safety:’ These companies have to have a price/earnings ratio less than their anticipated growth rate of earnings; the companies must have a debt to market capitalization ratio of less than twenty five percent; and the companies must have a market price that exceeds their one-hundred and fifty day moving average price. If there are not enough equities that meet these criteria, the Fund defaults to own cash until other opportunities arise.

The decision to sell short the Index and to cover the shorts is mechanical and depends solely upon two measures of sentiment. The short position is activated when the number of advancing stocks over a ten day period exceeds the number of declining stocks by at least thirty percent. Oppositely, the position is ‘covered’ when the number of advancing stocks is at least thirty percent less than the declining stocks over the same ten day period. Generally, the strategy employs the short selling on a fairly short term basis and is effective to help preserve gains from the equities in the portfolio. It did so until the end of November of 2012 and the Fund was outperforming the Index. However, from the bottom of that market, the ten day moving average discipline triggered the short selling position but never really triggered an action to ‘cover’ those shorts. As a result, the portfolio of the Fund declined - 5.36% more than it would have if the shorts were not used. Like many other hedged strategies that seek absolute returns, the past few years’ performance of the Fund have been very disappointing, mostly because of the short position of the portfolio.

The most aggravating equity in the Fund this past year was Velti PLC. A new media advertising company, it provides advanced insights and analysis for companies wanting to advertise on the proliferating mobile devices. During the year they changed their strategy and reorganized a very successful, fast growing business. Unfortunately, their revamp was going to cost them some money, but, more importantly, time to recover their profitability. The company declined considerably in price and cost the portfolio -5.25%.

By any measure, the Fund had a disappointing year whose potential return was diminished by a large cash position, a large short position, and a large loss in a single company. It did achieve its objective by limiting downside risk to the extent that it barely dipped below par during the most difficult months of the early part of the fiscal year, especially in July and then, again, in November when the Index became untracked and declined over ten percent from its previous high. The Fund continues to maintain its hallmark profile of very low volatility of price when compared to the Index.

Stephen W. Shipman, CFA

Portfolio Manager

| | SUB-ADVISER: |

| | Century Management, Inc. |

| | |

| | TOTAL NET ASSETS: |

| | AS OF JUNE 30, 2013 |

| | $3,443,885 |

| | |

| | |

| Top 10 Holdings ** (% of net assets) |

| | | |

| WMS Industries, Inc. | | 5.48% |

| Arbitron, Inc. | | 5.13% |

| Direxion Daily Small Cap Bear 3X Shares | | 4.72% |

| ProShares UltraPro Short Russell 2000 | | 4.66% |

| Comstock Mining, Inc. | | 3.59% |

| Core-Mark Holding Co., Inc. | | 3.32% |

| Tangoe, Inc. | | 3.18% |

| Mitcham Industries, Inc. | | 2.92% |

| PowerSecure International, Inc. | | 2.84% |

| RF Micro Devices, Inc. | | 2.73% |

| | | |

| % Fund Total | | 38.57% |

| ** | Excludes Short-Term Investments |

| Sectors (% of net assets) |

| | | |

| ¢ | 66.34% | Domestic Common Stocks |

| | 4.91% | Basic Materials |

| | 6.11% | Communications |

| | 11.97% | Consumer, Cyclical |

| | 8.58% | Consumer, Non-cyclical |

| | 4.05% | Energy |

| | 3.29% | Financial |

| | 11.02% | Industrial |

| | 16.41% | Technology |

| ¢ | 14.27% | Foreign Common Stocks |

| ¢ | 9.38% | Exchange Traded Funds |

| ¢ | 12.35% | Short-Term Investments |

| ¢ | 24.32% | Investments Purchased with Proceeds from Securities Lending |

| | 126.66% | Total Market Value of Investments |

| | (26.66)% | Liabilities in Excess of Other Assets, Net |

| | 100.00% | Total Net Assets |

10 | 2 0 1 3 A N N U A L R E P O R T

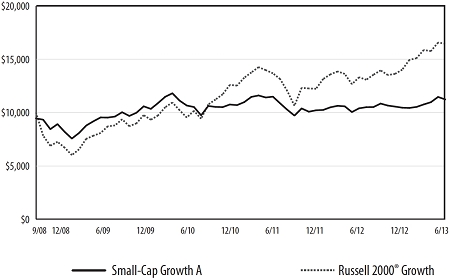

| | |

| * | The benchmark since inception returns are calculated since commencement of September 30, 2008 through June 30, 2013. |

| | |

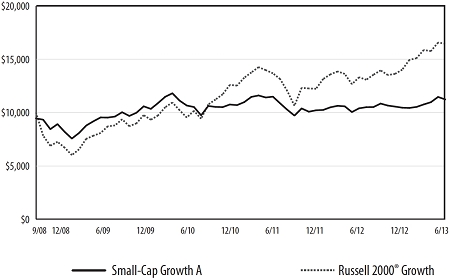

Quaker Small-Cap Growth Tactical Allocation Fund

Growth of a Hypothetical $10,000 Investment

June 30, 2013

| Average Annualized Total Return |

| | | | | | | | | | | | | | | | | | | Commencement | |

| | | Expense | | Inception | | | | | | | | | | | | | | of operations | |

| | | Ratio | | Date | | One Year | | Five Year | | Ten Year | | through 6/30/2013 | |

| | | | | | | with | | without | | with | | without | | with | | without | | with | | without | |

| | | | | | | sales | | sales | | sales | | sales | | sales | | sales | | sales | | sales | |

| | | | | | | charge | | charge | | charge | | charge | | charge | | charge | | charge | | charge | |

| Class A | | | 2.28 | % | | 9/30/2008 | | | 2.02 | % | | | 8.00 | % | | | N/A | | | | N/A | | | | N/A | | | | N/A | | | | 2.46 | % | | | 3.69 | % | |

| Class C | | | 3.03 | % | | 9/30/2008 | | | 7.08 | % | | | 7.08 | % | | | N/A | | | | N/A | | | | N/A | | | | N/A | | | | 2.89 | % | | | 2.89 | % | |

| Institutional Class | | | 2.03 | % | | 9/30/2008 | | | 8.24 | % | | | 8.24 | % | | | N/A | | | | N/A | | | | N/A | | | | N/A | | | | 3.95 | % | | | 3.95 | % | |

| Russell 2000 Growth Index* | | | 23.67 | % | | | 23.67 | % | | | N/A | | | | N/A | | | | N/A | | | | N/A | | | | 11.06 | % | | | 11.06 | % | |

Performance data quoted represents past performance and is no guarantee of future results. Investment return and principal value will fluctuate so that shares, when redeemed, may be worth more or less than their original cost. Current performance may be lower or higher than performance data quoted. Performance data current to the most recent month end is available at www.quakerfunds.com or by calling us toll free at 800-220-8888. Total return includes reinvestment of dividends and capital gains.

Class A shares of the Fund have a maximum sales charge of 5.50%.

The line graph and performance table do not reflect the deduction of taxes that a shareholder might pay on fund distributions or the redemption of fund shares. Total return calculations reflect expense reimbursements and fee waivers in the applicable periods. See financial highlights for periods where fees were waived or reimbursed.

The Fund’s portfolio holdings may differ significantly from the securities held in the index and, unlike a mutual fund, an unmanaged index assumes no transaction costs, taxes, management fees or other expenses. You cannot invest directly in an index.

The Russell 2000® Growth Index is an unmanaged index that measures the performance of the small-cap growth segment of the U.S. equity universe. It includes the Russell 2000 companies with higher price-to-value ratios and higher forecasted growth values. The Index assumes reinvestment of all dividends and distributions.

2 0 1 3 A N N U A L R E P O R T | 11

Performance Update (Unaudited)

Quaker Small-Cap Value Fund (QUSVX, QSVCX, QSVIX)

OBJECTIVES AND PRINCIPAL STRATEGIES

The Fund seeks to provide long-term growth of capital. Current income is not a significant investment consideration, and any such income realized will be considered incidental to the Fund’s investment objective. The Fund invests primarily in common stocks of U.S. companies with market capitalizations similar to the market capitalizations of companies included in the Russell 2000® Index and Russell 2500® Index. The Fund invests in companies considered by the Fund’s sub-adviser to have consistent earnings and above-average core assets, selling at relatively low market valuations, with attractive growth and momentum characteristics.

PERFORMANCE REVIEW AND MARKET OUTLOOK

For the fiscal year ended June 30, 2013, the Fund’s performance was 23.17%, while the Fund’s benchmark, the Russell 2000® Index (a broad-based cross-section of the entire U.S. small-cap market) returned 24.21%. Working from the bottom up, we evaluate companies relative to their industry peers using three broad categories of attractiveness: value, management, and momentum. Value to us means fairly traditional ratios of price to fundamental value; management measures seek evidence that company management has produced and will continue to produce earnings power; and gauges of momentum help us determine when stocks might be expected to begin their ascent toward full valuation.

Our shortfall over the fiscal year can be attributed to one of the three broad categories of attractiveness we use to pick stocks —management — and was almost entirely due to the emphasis we place on earnings quality. This was most evident in the consumer discretionary sector as stocks with strong management scores, such as Apollo Group (APOL) underperformed. The Fund’s market-cap distribution also held back performance: Aronson Johnson Ortiz overweights the small-cap names in its universe and implements a corresponding underweight to the most microcap names, contrary to market preference this period. On the other hand, both value and momentum were positive influences, particularly across the Fund’s holdings in the energy, healthcare, and industrial sectors where nearly all factors worked to our advantage. Examples include Tesoro (TSO) and Alliant Techsystems (ATK).

We remain firm in our conviction that superior results can be achieved through a consistent, systematic approach that focuses on low-priced companies with proven management and earnings power.

The Portfolio Management Team

Aronson Johnson Ortiz

| | SUB-ADVISER: |

| | Aronson Johnson Ortiz, LP. |

| | |

| | TOTAL NET ASSETS: |

| | AS OF JUNE 30, 2013 |

| | $32,745,259 |

| | |

| | |

| Top 10 Holdings ** (% of net assets) |

| | |

| GameStop Corp. | 1.33% |

| Huntington Bancshares, Inc. | 1.32% |

| CBOE Holdings, Inc. | 1.31% |

| Alliant Techsystems, Inc. | 1.31% |

| Exelis, Inc. | 1.26% |

| NV Energy, Inc. | 1.25% |

| Packaging Corp. of America | 1.24% |

| Myriad Genetics, Inc. | 1.23% |

| EMCOR Group, Inc. | 1.22% |

| Manhattan Associates, Inc. | 1.20% |

| | |

| % Fund Total | 12.67% |

| ** | Excludes Short-Term Investments |

| Sectors (% of net assets) |

| | | |

| ¢ | 84.48% | Domestic Common Stocks |

| | 3.07% | Basic Materials |

| | 6.47% | Communications |

| | 11.41% | Consumer, Cyclical |

| | 17.57% | Consumer, Non-cyclical |

| | 4.98% | Energy |

| | 14.86% | Financial |

| | 16.34% | Industrial |

| | 6.18% | Technology |

| | 3.60% | Utilities |

| ¢ | 10.65% | Foreign Common Stocks |

| ¢ | 4.23% | Real Estate Investment Trusts |

| ¢ | 2.22% | Short-Term Investments |

| ¢ | 18.42% | Investments Purchased with Proceeds from Securities Lending |

| | 120.00% | Total Market Value of Investments |

| | (20.00)% | Liabilities in Excess of Other Assets, Net |

| | 100.00% | Total Net Assets |

12 | 2 0 1 3 A N N U A L R E P O R T

| | |

| * | The benchmark since inception returns are calculated since commencement of November 25, 1996 through June 30, 2013. |

| | |

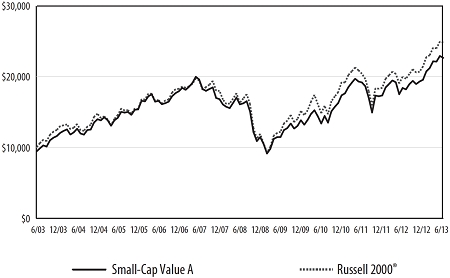

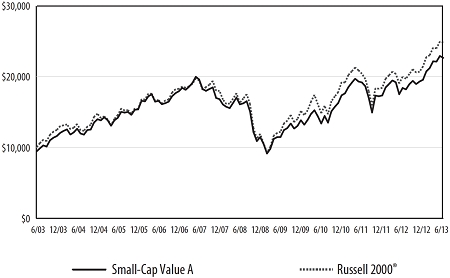

Quaker Small-Cap Value Fund

Growth of a Hypothetical $10,000 Investment

June 30, 2013

| Average Annualized Total Return |

| | | | | | | | | | | | | | | | | | | Commencement | |

| | | Expense | | Inception | | | | | | | | of operations | |

| | | Ratio | | Date | | One Year | | Five Year | | Ten Year | | through 6/30/2013 | |

| | | | | | | with | | without | | with | | without | | with | | without | | with | | without | |

| | | | | | | sales | | sales | | sales | | sales | | sales | | sales | | sales | | sales | |

| | | | | | | charge | | charge | | charge | | charge | | charge | | charge | | charge | | charge | |

| Class A | | 1.96% | | 11/25/1996 | | | 16.41 | % | | | 23.17 | % | | | 5.87 | % | | | 7.08 | % | | | 8.53 | % | | | 9.14 | % | | | 9.56 | % | | | 9.93 | % | |

| Class C | | 2.71% | | 7/28/2000 | | | 22.24 | % | | | 22.24 | % | | | 6.27 | % | | | 6.27 | % | | | 8.34 | % | | | 8.34 | % | | | 8.54 | % | | | 8.54 | % | |

| Institutional Class | | 1.71% | | | | 9/12/2000 | | | 23.44 | % | | | 23.44 | % | | | 7.34 | % | | | 7.34 | % | | | 9.41 | % | | | 9.41 | % | | | 8.76 | % | | | 8.76 | % | |

| Russell 2000® Index* | | | 24.21 | % | | | 24.21 | % | | | 8.77 | % | | | 8.77 | % | | | 9.53 | % | | | 9.53 | % | | | 7.75 | % | | | 7.75 | % | |

Performance data quoted represents past performance and is no guarantee of future results. Investment return and principal value will fluctuate so that shares, when redeemed, may be worth more or less than their original cost. Current performance may be lower or higher than performance data quoted. Performance data current to the most recent month end is available at www.quakerfunds.com or by calling us toll free at 800-220-8888. Total return includes reinvestment of dividends and capital gains.

Class A shares of the Fund have a maximum sales charge of 5.50%.

The line graph and performance table do not reflect the deduction of taxes that a shareholder might pay on fund distributions or the redemption of fund shares. Total return calculations reflect expense reimbursements and fee waivers in the applicable periods. See financial highlights for periods where fees were waived or reimbursed.

The Fund’s portfolio holdings may differ significantly from the securities held in the index and, unlike a mutual fund, an unmanaged index assumes no transaction costs, taxes, management fees or other expenses. You cannot invest directly in an index.

The Russell 2000® Index is a widely recognized, unmanaged index comprised of the smallest 2000 companies represented in the Russell 3000® Index. The Russell 2000 Index currently represents approximately 8% of the market capitalization of the Russell 3000® Index.

2 0 1 3 A N N U A L R E P O R T | 13

Performance Update (Unaudited)

Quaker Strategic Growth Fund (QUAGX, QAGCX, QAGIX)

OBJECTIVES AND PRINCIPAL STRATEGIES

The Fund seeks to provide long-term growth of capital. Current income is not a significant investment consideration. The Fund invests primarily in equity securities of domestic U.S. companies which the Fund’s sub-adviser believes show a high probability for superior growth.

PERFORMANCE REVIEW AND MARKET OUTLOOK

For the fiscal year ended June 30, 2013, the S&P 500 Total Return Index (the “S&P 500®”) (a broad based market proxy) gained 20.60% while the Class A shares of the Quaker Strategic Growth Fund finished the fiscal year with a total return of 19.71%. For the first half of calendar year 2013, the S&P 500® gained 13.82% while the Quaker Strategic Growth Fund rose 15.84%.

In spite of a host of headwinds, markets exhibited robust advances over the last year, with all domestic sectors gaining ground. One of the biggest surprises for the first half of 2013 was the lack of damage from the fiscal cliff tax increases, which reduced personal income without significantly impacting consumer spending. Sequestration spending cuts also took effect in early March lopping off 2% from overall government expenditures, which comprise upward of 20-25% of U.S. GDP (however much of this will be implemented over time). The real upside surprise from Washington was the bipartisan debt ceiling compromise that allowed it to avoid a repeat of the showdown that ultimately led to a downgrade in federal debt in 2011. Along with sustained consumer spending and reduced political uncertainty, the housing rebound has also begun to provide a lift to the economy. Increasing prices and a declining supply of houses has spurred new housing construction to such an extent that it has actually added to, rather than subtracted from, economic growth for the first time in six years.

All sectors gained ground for the year with consumer discretionaries, healthcare (both overweights) and financials advancing the most and tech, telecom and utilities (all relative underweights) trailing most other sectors. During the last 12 months the portfolio was helped by stock picks in the healthcare (Vertex and Celgene) and technology sectors and hurt by stock picks in consumer staples (Mead Johnson) and financials (Capital One), as well as cash drag.

Looking at the portfolio sector by sector, over the last year we concentrated our stock picking efforts on seeking out companies that have a definitive competitive advantage and a runway to consumer growth patterns, both domestically, but also in emerging markets. Areas fitting this pattern we called the three M’s, all of which continue to be themes in the portfolio.

Media: which has enormous potential growth internationally through several channels (including streaming video and audio – which is very scalable) and provides margin protection due to intellectual property rights (IP).

Molecular Biology: which encompasses both drug companies and biotech. These firms again have protections from competition through IP and have an expanding customer base as their inroads into emerging markets become more profitable as those countries grow richer and can afford more sophisticated treatments.

Mobile: as more content migrates onto mobile platforms and more cell phones and smart phones are sold into emerging markets, companies that can leverage, capitalize and monetize their mobile presence will outmaneuver their competition.

More recently we have also increased our allocation to industrials which should benefit from the infrastructure build out needed to exploit fracking technology. Cheap energy costs in the U.S. along with slow growing labor costs and improving productivity have also begun to encourage the on shoring of some industrial production back to the U.S. (especially in light of fast growing wages in China, and rising transport costs) which will help further boost the sector. We have largely avoided the utilities and telecom sectors whose bond-like characteristics and high dividend rates have driven up valuations as investors bid them up in a desperate search for yields. These same characteristics will likely work against them as interest rates begin to rise.

Going forward, earnings should play an increasingly positive role in equity markets. While profitability is high by historical standards, earnings peaks are generally associated with strong, vibrant economic activity. Given the recession in Europe, slowdown in China, emerging market doldrums and high unemployment in the U.S., it is difficult to fathom that economic activity, and the resultant earnings, have peaked.

We will continue to seek opportunities both domestically and worldwide that meet our investment criteria in an effort to provide a good risk adjusted return for our shareholders going forward, and at the same time the Fund will continue to take advantage of its mandate to protect capital by tactically raising cash and use its short-selling capabilities when we believe it is warranted. Thank you for your continued support.

Respectfully,

Manu P. Daftary, Portfolio Manager

DG Capital Management

| | SUB-ADVISER: |

| | DG Capital Management, Inc. |

| | |

| | TOTAL NET ASSETS: |

| | AS OF JUNE 30, 2013 |

| | $157,789,693 |

| | |

| | |

| Top 10 Holdings ** (% of net assets) |

| | | |

| Biogen Idec, Inc. | | 3.71% |

| Gilead Sciences, Inc. | | 3.09% |

| American International Group, Inc. | | 2.52% |

| CBS Corp. | | 2.51% |

| Mastercard, Inc. Class A | | 2.47% |

| Citigroup, Inc. | | 2.46% |

| ACE Ltd. | | 2.34% |

| Google, Inc. Class A | | 2.33% |

| Novartis AG - ADR | | 2.26% |

| AbbVie, Inc. | | 2.20% |

| % Fund Total | | 25.89% |

| ** | Excludes Short-Term Investments |

| Sectors (% of net assets) |

| | | |

| ¢ | 76.28% | Domestic Common Stocks |

| | 1.24% | Basic Materials |

| | 16.48% | Communications |

| | 11.26% | Consumer, Cyclical |

| | 25.94% | Consumer, Non-cyclical |

| | 3.94% | Energy |

| | 10.51% | Financial |

| | 3.07% | Industrial |

| | 3.84% | Technology |

| ¢ | 19.35% | Foreign Common Stocks |

| ¢ | 4.49% | Short-Term Investments |

| ¢ | 18.97% | Investments Purchased with Proceeds from Securities Lending |

| | 119.09% | Total Market Value of Investments |

| | (19.09)% | Liabilities in Excess of Other Assets, Net |

| | 100.00% | Total Net Assets |

14 | 2 0 1 3 A N N U A L R E P O R T

| | |

| * | The benchmark since inception returns are calculated since commencement of November 25, 1996 through June 30, 2013. |

| | |

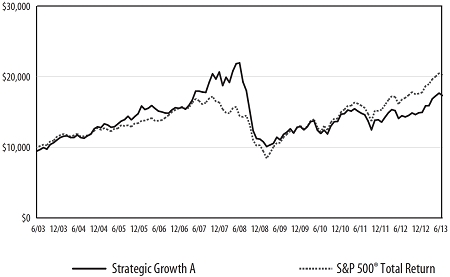

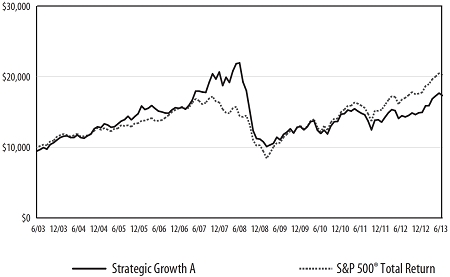

Quaker Strategic Growth Fund

Growth of a Hypothetical $10,000 Investment

June 30, 2013

| Average Annualized Total Return |

| | | | | | | | | | | | | | | | | | | Commencement | |

| | | Expense | | Inception | | | | | | | �� | of operations | |

| | | Ratio | | Date | | One Year | | Five Year | | Ten Year | | through 6/30/2013 | |

| | | | | | | with | | without | | with | | without | | with | | without | | with | | without | |

| | | | | | | sales | | sales | | sales | | sales | | sales | | sales | | sales | | sales | |

| | | | | | | charge | | charge | | charge | | charge | | charge | | charge | | charge | | charge | |

| Class A | | | 2.30 | % | | 11/25/1996 | | | 13.12 | % | | | 19.71 | % | | | -5.70 | % | | | -4.63 | % | | | 5.64 | % | | | 6.24 | % | | | 10.75 | % | | | 11.13 | % | |

| Class C | | | 3.05 | % | | 7/11/2000 | | | 18.80 | % | | | 18.80 | % | | | -5.34 | % | | | -5.34 | % | | | 5.45 | % | | | 5.45 | % | | | 2.63 | % | | | 2.63 | % | |

| Institutional Class | | | 2.05 | % | | 7/20/2000 | | | 19.99 | % | | | 19.99 | % | | | -4.42 | % | | | -4.42 | % | | | 6.50 | % | | | 6.50 | % | | | 3.54 | % | | | 3.54 | % | |

| S&P 500® Total Return Index* | | | 20.60 | % | | | 20.60 | % | | | 7.01 | % | | | 7.01 | % | | | 7.30 | % | | | 7.30 | % | | | 6.56 | % | | | 6.56 | % | |

Performance data quoted represents past performance and is no guarantee of future results. Investment return and principal value will fluctuate so that shares, when redeemed, may be worth more or less than their original cost. Current performance may be lower or higher than performance data quoted. Performance data current to the most recent month end is available at www.quakerfunds.com or by calling us toll free at 800-220-8888. Total return includes reinvestment of dividends and capital gains.

Class A shares of the Fund have a maximum sales charge of 5.50%.

The line graph and performance table do not reflect the deduction of taxes that a shareholder might pay on fund distributions or the redemption of fund shares. Total return calculations reflect expense reimbursements and fee waivers in the applicable periods. See financial highlights for periods where fees were waived or reimbursed.

The Fund’s portfolio holdings may differ significantly from the securities held in the index and, unlike a mutual fund, an unmanaged index assumes no transaction costs, taxes, management fees or other expenses. You cannot invest directly in an index.

The S&P 500® Total Return Index (“Index”) is a widely recognized, unmanaged index consisting of the approximately 500 largest companies in the United States as measured by market capitalization. The index assumes reinvestment of all dividends and distributions.

2 0 1 3 A N N U A L R E P O R T | 15

Expense Information (Unaudited)

As a shareholder of the Fund, you incur two types of costs: (1) transaction costs, including applicable sales charges and redemption fees; and (2) ongoing costs, including management fees, distribution (12b-1) fees and other Fund expenses. This example is intended to help you understand you ongoing costs (in dollars) of investing in the Fund and to compare these costs with the ongoing costs of investing in other funds. The example is based on an investment of $1,000 invested at the beginning of the (six-month) period and held for the entire period January 1, 2013 through June 30, 2013.

ACTUAL EXPENSES

The first section of each table below provides information about actual account values and actual expenses for each of the Funds. You may use this information, together with the amount you invested, to estimate the expenses that you paid over the period. Simply divide your account value by $1,000 (for example, an $8,600 account value divided by $1,000 = 8.6), then multiply the result by the number in the applicable line under the heading entitled “Expenses Paid During the Period” to estimate the expenses you paid on your account during this period.

HYPOTHETICAL EXAMPLE FOR COMPARISON PURPOSES

The second section of each table below provides information about hypothetical account values and hypothetical expenses based on the Fund’s actual expense ratio and an assumed rate of return of 5% per year before expenses, which is not the Fund’s actual return. The hypothetical account values and expenses may not be used to estimate the actual ending account balance or expenses you paid for the period. You may use this information to compare the ongoing costs of investing in the Fund to other funds. To do so, compare this 5% hypothetical example with the 5% hypothetical examples that appear in the shareholder reports of the other funds. Please note that the expenses shown in the table are meant to highlight your ongoing costs only and do not reflect any transactional costs, such as sales charges (loads), redemption fees or exchange fees. Therefore, the second section of the table is useful in comparing ongoing costs only, and will not help you determine the relative total costs of owning different funds. In addition, if these transactional costs were included, your costs would have been higher.

16 | 2 0 1 3 A N N U A L R E P O R T

| | | | | Beginning Account

Value (01/01/2013) | | Annualized Expense

Ratio for the Period | | Ending Account

Value (06/30/2013) | | Expenses Paid

During Period* |

| | | | | | | | | | | | | | | | | | | | | | | | | |

| Akros Absolute Return | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | | | |

| Actual return based on actual return of: | | | | | | | | | | | | | | | | | |

| Class A | | | -3.50 | % | | | $ | 1,000.00 | | | | | 1.99 | % | | | $ | 965.00 | | | | $ | 9.70 | |

| Class C | | | -3.82 | % | | | | 1,000.00 | | | | | 2.74 | % | | | | 961.80 | | | | | 13.33 | |

| Institutional Class | | | -3.23 | % | | | | 1,000.00 | | | | | 1.74 | % | | | | 967.70 | | | | | 8.49 | |

| | | | | | | | | | | | | | | | | | | | | | | | | |

| Hypothetical return based on assumed 5% return: | | | | | | | | | | | | | | | | |

| Class A | | | | | | | | 1,000.00 | | | | | 1.99 | % | | | | 1,014.93 | | | | | 9.94 | |

| Class C | | | | | | | | 1,000.00 | | | | | 2.74 | % | | | | 1,011.21 | | | | | 13.66 | |

| Institutional Class | | | | | | | | 1,000.00 | | | | | 1.74 | % | | | | 1,016.17 | | | | | 8.70 | |

| | | | | | | | | | | | | | | | | | | | | | | | | |

| Event Arbitrage | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | | | |

| Actual return based on actual return of: | | | | | | | | | | | | | | | | | |

| Class A | | | 5.69 | % | | | | 1,000.00 | | | | | 1.99 | % | | | | 1,056.90 | | | | | 10.15 | |

| Class C | | | 5.28 | % | | | | 1,000.00 | | | | | 2.74 | % | | | | 1,052.80 | | | | | 13.95 | |

| Institutional Class | | | 5.84 | % | | | | 1,000.00 | | | | | 1.74 | % | | | | 1,058.40 | | | | | 8.88 | |

| | | | | | | | | | | | | | | | | | | | | | | | | |

| Hypothetical return based on assumed 5% return: | | | | | | | | | | | | | | | | |

| Class A | | | | | | | | 1,000.00 | | | | | 1.99 | % | | | | 1,014.93 | | | | | 9.94 | |

| Class C | | | | | | | | 1,000.00 | | | | | 2.74 | % | | | | 1,011.21 | | | | | 13.66 | |

| Institutional Class | | | | | | | | 1,000.00 | | | | | 1.74 | % | | | | 1,016.17 | | | | | 8.70 | |

| | | | | | | | | | | | | | | | | | | | | | | | | |

| Global Tactical Allocation | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | | | |

| Actual return based on actual return of: | | | | | | | | | | | | | | | | | |

| Class A | | | 11.71 | % | | | | 1,000.00 | | | | | 2.69 | % | | | | 1,117.10 | | | | | 14.12 | |

| Class C | | | 11.30 | % | | | | 1,000.00 | | | | | 3.44 | % | | | | 1,113.00 | | | | | 18.02 | |

| Institutional Class | | | 11.91 | % | | | | 1,000.00 | | | | | 2.44 | % | | | | 1,119.10 | | | | | 12.82 | |

| | | | | | | | | | | | | | | | | | | | | | | | | |

| Hypothetical return based on assumed 5% return: | | | | | | | | | | | | | | | | |

| Class A | | | | | | | | 1,000.00 | | | | | 2.69 | % | | | | 1,011.46 | | | | | 13.42 | |

| Class C | | | | | | | | 1,000.00 | | | | | 3.44 | % | | | | 1,007.74 | | | | | 17.12 | |

| Institutional Class | | | | | | | | 1,000.00 | | | | | 2.44 | % | | | | 1,012.69 | | | | | 12.18 | |

| | | | | | | | | | | | | | | | | | | | | | | | | |

| Mid-Cap Value | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | | | |

| Actual return based on actual return of: | | | | | | | | | | | | | | | | | |

| Class A | | | 14.95 | % | | | | 1,000.00 | | | | | 2.11 | % | | | | 1,149.50 | | | | | 11.25 | |

| Class C | | | 14.57 | % | | | | 1,000.00 | | | | | 2.86 | % | | | | 1,145.70 | | | | | 15.22 | |

| Institutional Class | | | 15.09 | % | | | | 1,000.00 | | | | | 1.86 | % | | | | 1,150.90 | | | | | 9.92 | |

| | | | | | | | | | | | | | | | | | | | | | | | | |

| Hypothetical return based on assumed 5% return: | | | | | | | | | | | | | | | | |

| Class A | | | | | | | | 1,000.00 | | | | | 2.11 | % | | | | 1,014.33 | | | | | 10.54 | |

| Class C | | | | | | | | 1,000.00 | | | | | 2.86 | % | | | | 1,010.61 | | | | | 14.26 | |

| Institutional Class | | | | | | | | 1,000.00 | | | | | 1.86 | % | | | | 1,015.57 | | | | | 9.30 | |

| | | | | | | | | | | | | | | | | | | | | | | | | |

| Small-Cap Growth Tactical Allocation | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | | | |

| Actual return based on actual return of: | | | | | | | | | | | | | | | | | |

| Class A | | | 7.39 | % | | | | 1,000.00 | | | | | 2.44 | % | | | | 1,073.90 | | | | | 12.55 | |

| Class C | | | 6.96 | % | | | | 1,000.00 | | | | | 3.19 | % | | | | 1,069.60 | | | | | 16.37 | |

| Institutional Class | | | 7.52 | % | | | | 1,000.00 | | | | | 2.19 | % | | | | 1,075.20 | | | | | 11.27 | |

| | | | | | | | | | | | | | | | | | | | | | | | | |

| Hypothetical return based on assumed 5% return: | | | | | | | | | | | | | | | | |

| Class A | | | | | | | | 1,000.00 | | | | | 2.44 | % | | | | 1,012.69 | | | | | 12.18 | |

| Class C | | | | | | | | 1,000.00 | | | | | 3.19 | % | | | | 1,008.98 | | | | | 15.89 | |

| Institutional Class | | | | | | | | 1,000.00 | | | | | 2.19 | % | | | | 1,013.93 | | | | | 10.94 | |

| | | | | | | | | | | | | | | | | | | | | | | | | |

| Small-Cap Value | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | | | |

| Actual return based on actual return of: | | | | | | | | | | | | | | | | | |

| Class A | | | 15.86 | % | | | | 1,000.00 | | | | | 1.88 | % | | | | 1,158.60 | | | | | 10.06 | |

| Class C | | | 15.40 | % | | | | 1,000.00 | | | | | 2.63 | % | | | | 1,154.00 | | | | | 14.05 | |

| Institutional Class | | | 16.01 | % | | | | 1,000.00 | | | | | 1.63 | % | | | | 1,160.10 | | | | | 8.73 | |

| | | | | | | | | | | | | | | | | | | | | | | | | |

| Hypothetical return based on assumed 5% return: | | | | | | | | | | | | | | | | |

| Class A | | | | | | | | 1,000.00 | | | | | 1.88 | % | | | | 1,015.47 | | | | | 9.39 | |

| Class C | | | | | | | | 1,000.00 | | | | | 2.63 | % | | | | 1,011.75 | | | | | 13.12 | |

| Institutional Class | | | | | | | | 1,000.00 | | | | | 1.63 | % | | | | 1,016.71 | | | | | 8.15 | |

| | | | | | | | | | | | | | | | | | | | | | | | | |

| Strategic Growth | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | | | |

| Actual return based on actual return of: | | | | | | | | | | | | | | | | | |

| Class A | | | 15.84 | % | | | | 1,000.00 | | | | | 2.04 | % | | | | 1,158.40 | | | | | 10.92 | |

| Class C | | | 15.37 | % | | | | 1,000.00 | | | | | 2.79 | % | | | | 1,153.70 | | | | | 14.90 | |

| Institutional Class | | | 15.95 | % | | | | 1,000.00 | | | | | 1.79 | % | | | | 1,159.50 | | | | | 9.58 | |

| | | | | | | | | | | | | | | | | | | | | | | | | |

| Hypothetical return based on assumed 5% return: | | | | | | | | | | | | | | | | |

| Class A | | | | | | | | 1,000.00 | | | | | 2.04 | % | | | | 1,014.68 | | | | | 10.19 | |

| Class C | | | | | | | | 1,000.00 | | | | | 2.79 | % | | | | 1,010.96 | | | | | 13.91 | |

| Institutional Class | | | | | | | | 1,000.00 | | | | | 1.79 | % | | | | 1,015.92 | | | | | 8.95 | |

| * | Expenses are equal to the Funds’ annualized six-month expense ratios (excluding reimbursements) multiplied by the average account value over the period multiplied by the number of days in the most recent fiscal half year (181) divided by 365 to reflect the one-half year period. |

2 0 1 3 A N N U A L R E P O R T | 17

Schedule of Investments

Quaker Akros Absolute Return Fund

June 30, 2013

| | | Number

of Shares | | | Fair

Value | |

| Domestic Common Stocks — 19.02% | | | | | | | | |

| | | | | | | | | |

| Basic Materials — 0.71% | | | | | | | | |

| Mining — 0.71% | | | | | | | | |

| Newmont Mining Corp. | | | 1,000 | | | $ | 29,950 | |

| Total Basic Materials (Cost: $43,106) | | | | | | | 29,950 | |

| | | | | | | | | |

| Communications — 0.18% | | | | | | | | |

| Internet — 0.18% | | | | | | | | |

| IZEA, Inc. (a) • | | | 24,500 | | | | 7,619 | |

| Total Communications (Cost: $13,121) | | | | | | | 7,619 | |

| | | | | | | | | |

| Consumer Staple — 1.78% | | | | | | | | |

| Commercial Services — 1.78% | | | | | | | | |

| Professional Diversity Network, Inc. (a)(b) | | | 19,000 | | | | 74,670 | |

| Total Consumer Staple (Cost: $118,991) | | | | | | | 74,670 | |

| | | | | | | | | |

| Consumer, Cyclical — 0.00% | | | | | | | | |

| Leisure Time — 0.00% | | | | | | | | |

| TableMAX Corp. ^*(a) | | | 13,911 | | | | 8 | |

| Total Consumer, Cyclical (Cost: $24,344) | | | | | | | 8 | |

| | | | | | | | | |

| Consumer, Non-cyclical — 1.27% | | | | | | | | |

| Beverages — 0.56% | | | | | | | | |

| Pulse Beverage Corp. (a) | | | 30,000 | | | | 23,700 | |

| | | | | | | | | |

| Pharmaceuticals — 0.71% | | | | | | | | |

| Echo Therapeutics, Inc. (a) | | | 12,000 | | | | 29,880 | |

| Total Consumer, Non-cyclical (Cost: $70,613) | | | | | | | 53,580 | |

| | | | | | | | | |

| Diversified — 0.53% | | | | | | | | |

| Holding Companies-Diversified — 0.53% | | | | | | | | |

| Universal Business Payment Solutions Acquisition Corp. (a) • | | | 7,000 | | | | 22,400 | |

| Total Diversified (Cost: $34,273) | | | | | | | 22,400 | |

| | | | | | | | | |

| Energy — 2.54% | | | | | | | | |

| Coal — 0.49% | | | | | | | | |

| Peabody Energy Corp. | | | 1,400 | | | | 20,496 | |

| | | | | | | | | |

| Oil & Gas — 2.05% | | | | | | | | |

| Devon Energy Corp. | | | 1,000 | | | | 51,880 | |

| Marathon Oil Corp. | | | 1,000 | | | | 34,580 | |

| | | | | | | | 86,460 | |

| Total Energy (Cost: $136,523) | | | | | | | 106,956 | |

| | | | | | | | | |

| Financial — 1.41% | | | | | | | | |

| Savings & Loans — 1.41% | | | | | | | | |

| First Pactrust Bancorp, Inc. | | | 2,500 | | | | 33,950 | |

| HF Financial Corp. | | | 1,934 | | | | 25,181 | |

| | | | | | | | 59,131 | |

| Total Financial (Cost: $58,073) | | | | | | | 59,131 | |

| | | | | | | | | |

| Health Care — 6.02% | | | | | | | | |

| Biotechnology — 2.20% | | | | | | | | |

| InterMune, Inc. (a)(b) | | | 4,000 | | | | 38,480 | |

| Omeros Corp. (a)(b) | | | 4,000 | | | | 20,160 | |

| Venaxis, Inc. (a)(b) | | | 28,000 | | | | 33,600 | |

| | | | | | | | 92,240 | |

| | | | | | | | | |

| Pharmaceuticals — 3.82% | | | | | | | | |

| Anthera Pharmaceuticals, Inc. (a) | | | 40,000 | | | | 18,524 | |

| Medivation, Inc. (a) | | | 1,000 | | | | 49,200 | |

| Northwest Biotherapeutics, Inc. (a)(b) | | | 500 | | | | 1,670 | |

| Synergy Pharmaceuticals, Inc. (a)(b) | | | 20,000 | | | | 86,400 | |

| Ventrus Biosciences, Inc. (a) | | | 2,000 | | | | 4,800 | |

| | | | | | | | 160,594 | |

| Total Health Care (Cost: $403,056) | | | | | | | 252,834 | |

| | | Number

of Shares | | | Fair

Value | |

| Domestic Common Stocks (Continued) | | | | | | | | |

| | | | | | | | | |

| Technology — 4.58% | | | | | | | | |

| Computers — 2.83% | | | | | | | | |

| Apple, Inc. | | | 300 | | | $ | 118,824 | |

| | | | | | | | | |

| Software — 1.75% | | | | | | | | |

| Nuance Communications, Inc. (a) | | | 4,000 | | | | 73,520 | |

| Total Technology (Cost: $206,412) | | | | | | | 192,344 | |

Total Domestic Common Stocks

(Cost $1,108,512) | | | | | | | 799,492 | |

| | | | | | | | | |

| Foreign Common Stocks — 12.01% | | | | | | | | |

| | | | | | | | | |

| Bermuda — 3.01% | | | | | | | | |

| Semiconductors — 2.25% | | | | | | | | |

| Marvell Technology Group Ltd. | | | 8,100 | | | | 94,851 | |

| | | | | | | | | |

| Transportation — 0.76% | | | | | | | | |

| Golar LNG, Ltd. | | | 1,000 | | | | 31,890 | |

| Total Bermuda (Cost: $151,730) | | | | | | | 126,741 | |

| | | | | | | | | |

| Canada — 5.74% | | | | | | | | |

| Mining — 4.13% | | | | | | | | |

| Agnico Eagle Mines, Ltd. (b) | | | 2,000 | | | | 55,080 | |

| Barrick Gold Corp. (b) | | | 6,000 | | | | 94,440 | |

| Polymet Mining Corp. (a)(b) | | | 34,000 | | | | 23,800 | |

| | | | | | | | 173,320 | |

| | | | | | | | | |

| Oil & Gas — 1.61% | | | | | | | | |

| Encana Corp. | | | 4,000 | | | | 67,760 | |

| Total Canada (Cost: $325,990) | | | | | | | 241,080 | |

| | | | | | | | | |

| Israel — 2.28% | | | | | | | | |

| Biotechnology — 0.21% | | | | | | | | |

| Rosetta Genomics, Ltd. (a) | | | 2,522 | | | | 8,550 | |

| | | | | | | | | |

| Mining — 1.14% | | | | | | | | |

| Alcobra. Ltd. (a) | | | 7,000 | | | | 47,950 | |

| | | | | | | | | |

| Pharmaceuticals — 0.93% | | | | | | | | |

| Teva Pharmaceutical Industries Ltd.- ADR | | | 1,000 | | | | 39,200 | |