UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED

MANAGEMENT INVESTMENT COMPANIES

Investment Company Act file number (811-06260)

Quaker Investment Trust

(Exact name of registrant as specified in charter)

309 Technology Drive

Malvern, PA 19355

(Address of principal executive offices) (Zip code)

Jeffry H. King, Sr.

Quaker Investment Trust

309 Technology Drive

Malvern, PA 19355

(Name and address of agent for service)

(800) 220-8888

Registrant’s telephone number, including area code

Date of fiscal year end: June 30, 2014

Date of reporting period: June 30, 2014

Item 1. Report to Stockholders.

Annual Report

2 0 1 4

Quaker Event Arbitrage Fund

Quaker Global Tactical Allocation Fund

Quaker Mid-Cap Value Fund

Quaker Small-Cap Value Fund

Quaker Strategic Growth Fund

Mutual fund investing involves risk. Principal loss is possible.

Investing in the Quaker Funds may involve special risk including, but not limited to, investments in smaller companies, short sales, foreign securities, special situations, debt securities and value growth investing. Please refer to the prospectus for more complete information.

This report must be preceded or accompanied by a current prospectus.

The opinions expressed are those of the adviser or sub-adviser through the end of the period for this report, are subject to change, are not a guarantee, and should not be considered investment advice.

Fund holdings are subject to change and should not be considered a recommendation to buy or sell any security. Current and future holdings are subject to risk.

Chairman’s Letter to the Shareholders (Unaudited)

June 30, 2014

Dear Fellow Shareholder,

The premise on which Quaker Funds, Inc. was founded was the desire to afford everyday investors access to the same tactical allocation used by professional money managers to augment traditional investing strategies within a holistic asset allocation mix. Our commitment to this principle is still as strong today as it was the day we opened our doors.

Our management team continually strives to provide our shareholders with innovative investment alternatives and advisers that constantly seek superior returns. Thank you for your trust and investment in the Quaker Funds.

Sincerely,

Jeffry King

Chairman & CEO

Quaker Investment Trust

Performance Update (Unaudited)

Quaker Event Arbitrage Fund (QEAAX, QEACX, QEAIX)

OBJECTIVES AND PRINCIPAL STRATEGIES

The Quaker Event Arbitrage Fund (“Fund”) seeks to provide long-term growth of capital. The Fund generally invests in the securities of publicly traded companies involved in mergers, takeovers, tender offers, leveraged buyouts, spin-offs, liquidations or similar events.

PERFORMANCE REVIEW AND MARKET OUTLOOK

For the fiscal year ended June 30, 2014, the Fund returned 10.47%, and the total return of the S&P 500® was 24.61%. While the equity market gyrated over the last year, the Fund’s daily volatility was roughly 48% lower than that of the S&P 500.

The past 12 months proved again favorable for event driven investing. This is evident in looking at the HFRI Event Driven (Total) Index which returned 11.24%. The HFRI Event Driven (Total) Index is a good barometer for the asset class as it aggregates many hedge funds into one index that represents event driven investing. With the monetary environment likely to become less accommodative over the next several years the Investment Team anticipates that the favorable backdrop for the event-driven investment style will persist.

Looking forward, the portfolio management team sees opportunities in proxy fights, distressed investments and special situations such as spin-offs, REIT conversions or tax inversions. Activist investors continue to exert pressure on underperforming companies to sell themselves or optimize their structure through spin-offs and other divestitures. But even in the absence of pressure from activist investors many company managers see changes in company structure as the only remaining area in which efficiency gains can be achieved when all conceivable other productivity improvements have been implemented over the last few years. As a result, we expect that special situations will continue to provide attractive opportunities.

Over the last year, the Fund has found many new opportunities in distressed securities of corporate issues. These investments are spread over a wide range of sectors, ranging from industries as diverse as shipping or banking to natural resources.

Finally, we expect merger arbitrage to remain a small portion of the portfolio. Despite the recent surge in activity including many mergers of large size, this strategy in general generates unattractive returns while interest rates remain near historic lows, in particular in light of the risks incurred. Nevertheless, opportunities appear from time to time and the Investment Team may invest in merger arbitrage opportunities on such occasions.

I wish all investors a prosperous year and thank you for your continued support.

Sincerely,

Thomas Kirchner, Portfolio Manager

Quaker Funds, Inc.

| ADVISER:

Quaker Funds, Inc.

TOTAL NET ASSETS:

AS OF JUNE 30, 2014

$119,064,457 |

| Top 10 Holdings ** (% of net assets) |

| | | | | |

| Sprint Corp., Expiration: June, 2015 Warrant | | | 2.5 | % |

| Twenty-First Century Fox, Inc. | | | 2.2 | % |

| API Technologies Corp. | | | 2.1 | % |

| CST Brands, Inc. | | | 1.8 | % |

| Hologic, Inc. | | | 1.7 | % |

| Liberty Media Corp. | | | 1.7 | % |

| Pfizer Inc. | | | 1.7 | % |

| News Corp. Class A | | | 1.7 | % |

| CommonWealth REIT | | | 1.6 | % |

| Ambac Financial Group, Inc. | | | 1.6 | % |

| % Fund Total | | | 18.6 | % |

| ** | | Includes Long Holdings Only and Excludes Short-Term Investments |

| Sectors (% of net assets) |

| | | | |

| 46.6% | | Domestic Common Stocks |

| | 0.5% | | Basic Materials |

| | 11.0% | | Communications |

| | 6.4% | | Consumer, Cyclical |

| | 10.5% | | Consumer, Non-cyclical |

| | 1.1% | | Diversified |

| | 2.8% | | Energy |

| | 3.5% | | Financial |

| | 0.8% | | Healthcare |

| | 8.9% | | Industrial |

| | 1.1% | | Technology |

| 5.6% | | Foreign Common Stocks |

| 2.6% | | Preferred Stocks |

| 4.4% | | Real Estate Investment Trusts |

| 0.3% | | Rights |

| 3.4% | | Warrants |

| 0.7% | | Asset Backed Securities |

| 1.2% | | Convertible Bonds |

| 4.8% | | Corporate Bonds |

| 0.8% | | Mortgage Backed Securities |

| 1.0% | | Municipal Bonds |

| 0.4% | | Term Loan |

| 3.3% | | Purchased Options |

| 6.5% | | Investments Purchased with Proceeds from Securities Lending |

| | 81.6% | | Total Market Value of Investments |

| 18.4% | | Other Assets in Excess of Liabilities, Net |

| | 100.0% | | Total Net Assets |

2 | 2 0 1 4 A N N U A L R E P O R T

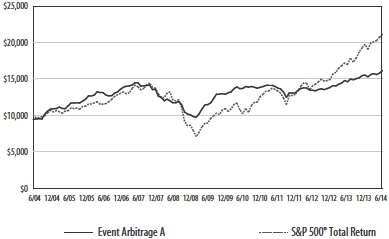

| * | The benchmark since inception returns are calculated for the period November 21, 2003 through June 30, 2014. |

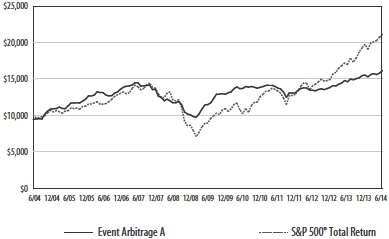

Quaker Event Arbitrage Fund

Growth of a Hypothetical $10,000 Investment

June 30, 2014

| Average Annualized Total Return |

| | | Expense

Ratio | | Inception

Date | | One Year | | Five Year | | Ten Year | | Commencement

of operations

through 6/30/2014 | |

| | | | | | | with

sales charge | | without

sales

charge | | with

sales

charge | | without

sales

charge | | with

sales

charge | | without

sales

charge | | with

sales

charge | | without

sales

charge | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Class A | | | 1.99% | | | 11/21/2003 | | | 4.36 | % | | | 10.47 | % | | | 5.85 | % | | | 7.06 | % | | | 4.91 | % | | | 5.50 | % | | | 5.97 | % | | | 6.54 | % | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Class C | | | 2.74% | | | 6/7/2010 | | | 9.72 | % | | | 9.72 | % | | | N/A | | | | N/A | | | | N/A | | | | N/A | | | | 3.78 | % | | | 3.78 | % | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Institutional Class | | | 1.74% | | | 6/7/2010 | | | 10.77 | % | | | 10.77 | % | | | N/A | | | | N/A | | | | N/A | | | | N/A | | | | 4.78 | % | | | 4.78 | % | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| S&P 500® Total Return Index* | | | 24.61 | % | | | 24.61 | % | | | 18.83 | % | | | 18.83 | % | | | 7.78 | % | | | 7.78 | % | | | 8.41 | % | | | 8.41 | % | |

Performance data quoted represents past performance and is no guarantee of future results. Investment return and principal value will fluctuate so that shares, when redeemed, may be worth more or less than their original cost. Current performance may be lower or higher than performance data quoted. Performance data current to the most recent month end is available at www.quakerfunds.com or by calling us toll free at 800-220-8888. Total return includes reinvestment of dividends and capital gains.

Class A shares of the Fund have a maximum sales charge of 5.50%.

The line graph and performance table do not reflect the deduction of taxes that a shareholder might pay on fund distributions or the redemption of fund shares. Total return calculations reflect expense reimbursements and fee waivers in the applicable periods. See financial highlights for periods where fees were waived or reimbursed.

The Fund’s portfolio holdings may differ significantly from the securities held in the index and, unlike a mutual fund, an unmanaged index assumes no transaction costs, taxes, management fees or other expenses. You cannot invest directly in an index.

The S&P 500® Total Return Index (“Index”) is a widely recognized, unmanaged index consisting of the approximately 500 largest companies in the United States as measured by market capitalization. The Index assumes reinvestment of all dividends and distributions.

2 0 1 4 A N N U A L R E P O R T | 3

Performance Update (Unaudited)

Quaker Global Tactical Allocation Fund (QTRAX, QTRCX, QTRIX)

OBJECTIVES AND PRINCIPAL STRATEGIES

The Quaker Global Tactical Allocation Fund (“Fund”) seeks to provide long-term growth of capital. The Fund invests in common stocks of U.S. companies and American Depositary Receipts (“ADRs”) of foreign companies without regard to market capitalization. Under normal circumstances, the Fund will invest at least 40% of its total assets in common stocks and ADRs of foreign companies.

PERFORMANCE REVIEW AND MARKET OUTLOOK

For the fiscal year ended June 30, 2014, the MSCI World Index (“MSCI World”, a global market proxy) gained 24.05% while the Quaker Global Tactical Allocation Fund finished the fiscal year with a gain of 26.02%. For the first half of the 2014 calendar year, the MSCI World rose 6.18% while the Quaker Global Tactical Allocation Fund gained 5.13%.

The first half of the fiscal year was characterized by a period of optimism in global markets as Europe emerged from a shallow recession and the US moved forward with modest but stable growth. Even developed Asian markets were upbeat with Japan’s Nikkei Index hitting a multiyear high (boosted by the “Abenomics” weak-yen strategy). This period of relative calm boosted investor confidence and encouraged a rotation of investment assets out of fixed-income securities and into equities.

The latter half of the fiscal year, however, saw a sharp uptick in US market volatility as a harsh winter hurt domestic consumption, investor concern over diminishing returns from “Abenomics” coupled with a sales tax hike in Japan spooked Asian markets and imperialist ambitions by Russia on the Crimean peninsula rattled Europe. However, the continued “dovishness” on the part of the US Federal Reserve coupled with the ECB’s negative interest rate policy stabilized developed global equity markets as the fiscal year ended. In the emerging markets, continued Chinese central government expansionist economic policies and a change in the political leadership in India led to stability in the emerging equity markets as well.

All sectors posted strong gains for the fiscal year with the technology, energy and healthcare (an overweight) sectors advancing the most and financials, consumer staples (both underweights) and consumer discretionaries trailing other sectors. During the fiscal year, the portfolio was helped by stock picks in the consumer discretionary, healthcare and industrial sectors and hurt by stock picks in the materials and technology sectors and an underweight to the energy sector.

Going forward, we expect to continue to have an overweight in the healthcare sector, concentrating on global biotech and pharmaceutical companies with large and expanding drug pipelines, the potential (via FDA approval) to expand sales of existing products via new applications and by tapping new global markets. In technology, we are also currently overweight, focusing on companies with particular strength in creating innovative productivity enhancing solutions for both businesses and consumers, especially in the mobility and cloud computing areas. We currently have significant investments in the consumer discretionary sector (mainly in the media space) and in the industrial sector (concentrated in US legacy airlines which we believe are benefitting from industry consolidation and relatively low valuations).

We continue to strive to provide a good risk adjusted return for our clients through the intensive evaluation of opportunities domestically and worldwide. At the same time the Fund will continue to seek to fulfill its mandate to protect capital by tactically raising cash and by utilizing short-selling strategies.

Respectfully,

Manu P. Daftary, Portfolio Manager

DG Capital Management, Inc.

SUB-ADVISER: DG Capital Management, Inc. TOTAL NET ASSETS: AS OF JUNE 30, 2014 $7,325,138 |

| Top 10 Holdings ** (% of net assets) |

| | | | | |

| Biogen Idec, Inc. | | | 4.6 | % |

| Roche Holdings, Ltd.- ADR | | | 3.6 | % |

| American Airlines Group, Inc. | | | 3.4 | % |

| Amgen, Inc. | | | 3.1 | % |

| Abengoa SA - ADR | | | 2.8 | % |

| Bayerische Motoren Werke AG - ADR | | | 2.7 | % |

| Sanofi - ADR | | | 2.5 | % |

| Adobe Systems Inc. | | | 2.3 | % |

| FedEx Corp. | | | 2.3 | % |

| Micron Technology, Inc. | | | 2.3 | % |

| % Fund Total | | | 29.6 | % |

| ** Excludes Short-Term Investments |

| Country Allocation (% of net assets) |

| | | | |

| 97.7% | | Common Stocks |

| | 1.6% | | Belgium |

| | 0.6% | | Bermuda |

| | 2.0% | | Cayman Islands |

| | 1.5% | | Curacao |

| | 1.7% | | Finland |

| | 2.5% | | France |

| | 2.9% | | Germany |

| | 1.5% | | India |

| | 2.1% | | Ireland |

| | 2.2% | | Netherlands |

| | 2.8% | | Spain |

| | 9.0% | | Switzerland |

| | 6.8% | | United Kingdom |

| | 60.5% | | United States |

| 7.0% | | Investments Purchased with Proceeds from Securities Lending |

| | 104.7% | | Total Market Value of Investments |

| (4.7)% | | Liabilities in Excess of Other Assets, Net |

| | 100.0% | | Total Net Assets |

4 | 2 0 1 4 A N N U A L R E P O R T

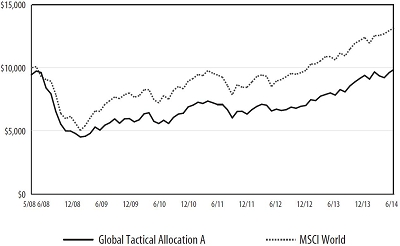

| | |

| * | The benchmark since inception returns are calculated since commencement of May 1, 2008 through June 30, 2014. |

| | |

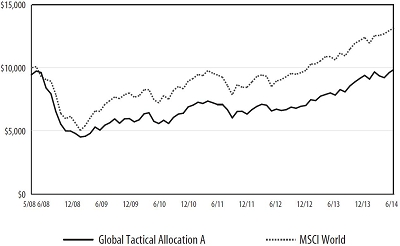

Quaker Global Tactical Allocation Fund

Growth of a Hypothetical $10,000 Investment June 30, 2014

| Average Annualized Total Return |

| | | Expense

Ratio | | Inception

Date | | One Year | | Five Year | | Ten Year | | Commencement

of operations

through 6/30/2014 |

| | | | | | | | | | with

sales

charge | | | without

sales

charge | | | with

sales

charge | | | without

sales

charge | | with

sales

charge | | without

sales

charge | | | with

sales

charge | | | without

sales

charge |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Class A | | | 2.83% | | | 5/1/2008 | | | 19.13 | % | | | 26.02 | % | | | 12.99 | % | | | 14.26 | % | | N/A | | N/A | | | -0.18 | % | | | 0.73 | % |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Class C | | | 3.58% | | | 5/1/2008 | | | 25.19 | % | | | 25.19 | % | | | 13.43 | % | | | 13.43 | % | | N/A | | N/A | | | -0.02 | % | | | -0.02 | % |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Institutional Class | | | 2.58% | | | 7/23/2008 | | | 26.45 | % | | | 26.45 | % | | | 14.57 | % | | | 14.57 | % | | N/A | | N/A | | | 3.12 | % | | | 3.12 | % |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| MSCI World Index* | | | | | | 24.05 | % | | | 24.05 | % | | | 14.99 | % | | | 14.99 | % | | N/A | | N/A | | | 4.58 | % | | | 4.58 | % |

Performance data quoted represents past performance and is no guarantee of future results. Investment return and principal value will fluctuate so that shares, when redeemed, may be worth more or less than their original cost. Current performance may be lower or higher than performance data quoted. Performance data current to the most recent month end is available at www.quakerfunds.com or by calling us toll free at 800-220-8888. Total return includes reinvestment of dividends and capital gains.

Class A shares of the Fund have a maximum sales charge of 5.50%.

The line graph and performance table do not reflect the deduction of taxes that a shareholder might pay on fund distributions or the redemption of fund shares. Total return calculations reflect expense reimbursements and fee waivers in the applicable periods. See financial highlights for periods where fees were waived or reimbursed.

The Fund’s portfolio holdings may differ significantly from the securities held in the index and, unlike a mutual fund, an unmanaged index assumes no transaction costs, taxes, management fees or other expenses. You cannot invest directly in an index.

The Morgan Stanley Capital International World Index (“MSCI World Index”) measures developed-market equity performance throughout the world. The MSCI Index assumes reinvestment of all dividends and distributions.

2 0 1 4 A N N U A L R E P O R T | 5

Performance Update (Unaudited)

Quaker Mid-Cap Value Fund (QMCVX, QMCCX, QMVIX)

OBJECTIVES AND PRINCIPAL STRATEGIES

The Quaker Mid-Cap Value Fund (“Fund”) seeks to provide long-term growth of capital. Current income is not a significant investment consideration and any such income realized will be considered incidental to the Fund’s investment objective. The Fund invests primarily in common stocks comparable to the companies included in the Russell Midcap® Value Index.

PERFORMANCE REVIEW AND MARKET OUTLOOK

For the period from July 1, 2013 through June 30, 2014, the Fund generated a gain of 29.65% versus a gain of 27.76% for the Russell Midcap® Value Index. Like the previous year, every sector in the benchmark was up double-digits; all but one was up more than 20%. The same was true for the Fund. Stock selection provided the majority of the Fund’s outperformance with particular strength in Consumer Discretionary, which was up 40% in the Fund versus a gain of 26% in the benchmark, led by Harman International Industries, Inc., which more than doubled. The Technology sector was one of the strongest sectors in the benchmark with a gain of 40%, but was the largest detractor from the Fund’s relative performance with a gain of 27%.

As we stated in last year’s letter, we believe a large part of the rally in equities over the past year has been the result of the massive amount of liquidity the Fed has injected through its $85 billion per month bond buying program. At times, it seems like the equity markets have been behaving like revelers at a party, with the Federal Reserve supplying the music and the punch bowl. No one knows what time the party will end, no one wants to be the last to leave, but no one wants to leave too early. At times, when comments from the Fed have been interpreted to indicate a change in tone, they have often been met with quick sell-offs in both equity and fixed income markets. The Fed has in fact been turning the music down ever so slowly as it continues its measured reductions or “tapering” of its massive bond buying program, but the cumulative effect of its purchases continues to expand the Fed’s balance sheet. The Fed’s most-recent minutes have indicated it plans to “stop the music” in October as it stops its bond purchases completely, but with the growth in the Federal Reserve’s balance sheet to unprecedented levels, there still looks like a lot of punch in the punch bowl.

We believe the economy is likely to continue to show modest growth for the balance of the year. Despite the weather-related softness to start the year, unemployment has continued to trend lower, now standing at 6.1%,down from 6.7% at the beginning of the year. Auto sales have remained strong, and housing starts have maintained their upward trajectory. As such, we continue to target our investments in companies likely to achieve improving returns on invested capital in this low-growth environment. We would expect the Fed’s reduced intervention in debt markets to allow interest rates to gradually move higher, but we are cautious that this process could result in increased market volatility.

Sincerely,

Frank Latuda, Jr. CFA

Chief Investment Officer & Portfolio Manager

Kennedy Capital Management, Inc.

| SUB-ADVISER:

Kennedy Capital Management, Inc.

TOTAL NET ASSETS:

AS OF JUNE 30, 2014

$10,025,865 |

| Top 10 Holdings ** (% of net assets) |

| |

| Foot Locker, Inc. | | | 2.5 | % |

| Hospira, Inc. | | | 2.4 | % |

| Helmerich & Payne, Inc. | | | 2.4 | % |

| Ultra Petroleum Corp. | | | 2.3 | % |

| Cadence Design Systems, Inc. | | | 2.3 | % |

| Reinsurance Group of America, Inc., Class A | | | 2.2 | % |

| Dana Holding Corp. | | | 2.1 | % |

| Parker Hannifin Corp. | | | 2.1 | % |

| Steel Dynamics, Inc. | | | 2.1 | % |

| Trinity Industries, Inc. | | | 2.1 | % |

| % Fund Total | | | 22.5 | % |

| ** | | Excludes Short-Term Investments |

| Sectors (% of net assets) |

| |

| 80.7% | | Domestic Common Stocks |

| | 5.2% | | Basic Materials |

| | 1.9% | | Communications |

| | 13.9% | | Consumer, Cyclical |

| | 7.4% | | Consumer, Non-cyclical |

| | 7.6% | | Energy |

| | 11.3% | | Financial |

| | 15.6% | | Industrial |

| | 8.8% | | Technology |

| | 9.0% | | Utilities |

| 5.5% | | Foreign Common Stocks |

| 9.3% | | Real Estate Investment Trusts |

| 15.6% | | Investments Purchased with Proceeds from Securities Lending |

| | 111.1% | | Total Market Value of Investments |

| (11.1)% | | Liabilities in Excess of Other Assets, Net |

| | 100.0% | | Total Net Assets |

6 | 2 0 1 4 A N N U A L R E P O R T

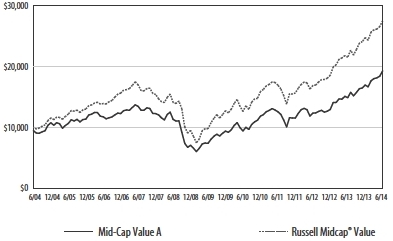

| * | The benchmark since inception returns are calculated since commencement of December 31, 1997 through June 30, 2014. |

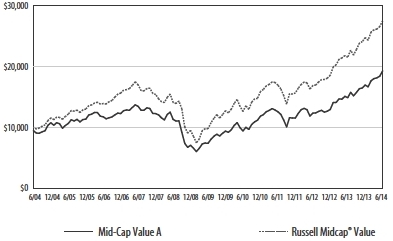

Quaker Mid-Cap Value Fund

Growth of a Hypothetical $10,000 Investment

June 30, 2014

| Average Annualized Total Return |

| | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | |

| | | Expense

Ratio | | Inception

Date | | One Year | | Five Year | | Ten Year | | Commencement

of operations

through 6/30/2014 |

| | | | | | | with | | without | | with | | without | | with | | without | | with | | without |

| | | | | | | sales | | sales | | sales | | sales | | sales | | sales | | sales | | sales |

| | | | | | | charge | | charge | | charge | | charge | | charge | | charge | | charge | | charge |

| | | | | | | | | | | | | | | | | | | | | |

| Class A | | 2.19% | | 12/31/1997 | | 22.49% | | 29.65% | | 19.89% | | 21.26% | | 6.79% | | 7.40% | | 7.79% | | 8.16% |

| | | | | | | | | | | | | | | | | | | | | |

| Class C | | 2.94% | | 7/31/2000 | | 28.62% | | 28.62% | | 20.36% | | 20.36% | | 6.60% | | 6.60% | | 8.67% | | 8.67% |

| | | | | | | | | | | | | | | | | | | | | |

| Institutional Class | | 1.94% | | 11/21/2000 | | 29.95% | | 29.95% | | 21.58% | | 21.58% | | 7.67% | | 7.67% | | 10.00% | | 10.00% |

| | | | | | | | | | | | | | | | | |

| Russell Midcap® Value Index* | | 27.76% | | 27.76% | | 22.97% | | 22.97% | | 10.66% | | 10.66% | | 9.85% | | 9.85% |

Performance data quoted represents past performance and is no guarantee of future results. Investment return and principal value will fluctuate so that shares, when redeemed, may be worth more or less than their original cost. Current performance may be lower or higher than performance data quoted. Performance data current to the most recent month end is available at www.quakerfunds.com or by calling us toll free at 800-220-8888. Total return includes reinvestment of dividends and capital gains.

Class A shares of the Fund have a maximum sales charge of 5.50%.

The line graph and performance table do not reflect the deduction of taxes that a shareholder might pay on fund distributions or the redemption of fund shares. Total return calculations reflect expense reimbursements and fee waivers in the applicable periods. See financial highlights for periods where fees were waived or reimbursed.

The Fund’s portfolio holdings may differ significantly from the securities held in the index and, unlike a mutual fund, an unmanaged index assumes no transaction costs, taxes, management fees or other expenses. You cannot invest directly in an index.

The Russell Midcap® Value Index is a widely recognized, unmanaged index of companies included in the Russell 1000 Index with current market capitalizations between $888.21 million to $26.16 billion. The Russell Midcap® Value Index assumes reinvestment of all dividends.

2 0 1 4 A N N U A L R E P O R T | 7

Performance Update (Unaudited)

Quaker Small-Cap Value Fund (QUSVX, QSVCX, QSVIX)

OBJECTIVES AND PRINCIPAL STRATEGIES

The Quaker Small-Cap Value Fund (“Fund”) seeks to provide long-term growth of capital. Current income is not a significant investment consideration, and any such income realized will be considered incidental to the Fund’s investment objective. The Fund invests primarily in common stocks of U.S. companies with market capitalizations similar to the market capitalizations of companies included in the Russell 2000® Index and Russell 2500® Index. The Fund invests in companies considered by the Fund’s sub-adviser to have consistent earnings and above-average core assets, selling at relatively low market valuations, with attractive growth and momentum characteristics.

PERFORMANCE REVIEW AND MARKET OUTLOOK

For the fiscal year ended June 30, 2014, the Fund’s performance was 24.89%, while the Fund’s benchmark, the Russell 2000® Index (a broad-based cross-section of the entire U.S. small-cap market), returned 23.64%. Working from the bottom up, we evaluate companies relative to their industry peers using four broad categories of attractiveness: value, management, momentum, and sentiment. Value to us means fairly traditional ratios of price to fundamental value; management measures seek evidence that company management has produced and will continue to produce earnings power; momentum helps us determine when stocks might be expected to begin their ascent toward full valuation; and sentiment provides another level of understanding of the buying and selling behavior of key investor segments.

All four broad categories of attractiveness contributed to our positive relative return. While industrials, materials and consumer discretionary sectors added the most to our outperformance, eight out of the 10 sectors added value. Value measures were consistent contributors, particularly in the industrials sector. Our evaluation of management was aided by the strong performance of companies with evidence of efficient growth and positive share repurchase. Companies with rising earnings estimates, one of our momentum signals, added to the bottom line in nearly all economic sectors. Performance was also supported by factors measuring the sentiment of market participants, especially within the information technology sector.

We remain firm in our conviction that superior results can be achieved through a consistent, systematic approach that focuses on low-priced companies with proven management and earnings power.

The Portfolio Management Team

Aronson Johnson Ortiz, LP

| | SUB-ADVISER:

Aronson Johnson Ortiz, LP TOTAL NET ASSETS:

AS OF JUNE 30, 2014

$38,187,153 |

| | |

| Top 10 Holdings ** (% of net assets) |

| | | | |

| Lexmark International, Inc. | | | 1.4 | % |

| RLJ Lodging Trust REIT | | | 1.4 | % |

| Tower International, Inc. | | | 1.4 | % |

| SM Energy Co. | | | 1.4 | % |

| PDL BioPharma, Inc. | | | 1.4 | % |

| SPX Corp. | | | 1.4 | % |

| Dupont Fabros Technology, Inc. REIT | | | 1.3 | % |

| Foot Locker, Inc. | | | 1.3 | % |

| Global Cash Access Holdings, Inc. | | | 1.3 | % |

| Aspen Insurance Holdings Ltd. | | | 1.3 | % |

| % Fund Total | | | 13.6 | % |

| ** Excludes Short-Term Investments | | | | |

| Sectors (% of net assets) |

| | | | |

| 79.1% | | Domestic Common Stocks |

| | 5.0% | | Basic Materials |

| | 3.7% | | Communications |

| | 14.8% | | Consumer, Cyclical |

| | 15.4% | | Consumer, Non-cyclical |

| | 6.3% | | Energy |

| | 9.8% | | Financial |

| | 13.5% | | Industrial |

| | 7.5% | | Technology |

| | 3.1% | | Utilities |

| 15.5% | | Foreign Common Stocks |

| 4.0% | | Real Estate Investment Trusts |

| 13.9% | | Investments Purchased with Proceeds from Securities Lending |

| | 112.5% | | Total Market Value of Investments |

| (12.5)% | | Liabilities in Excess of Other Assets, Net |

| | 100.0% | | Total Net Assets |

8 | 2 0 1 4 A N N U A L R E P O R T

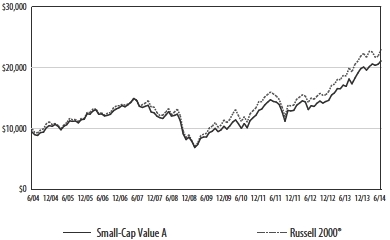

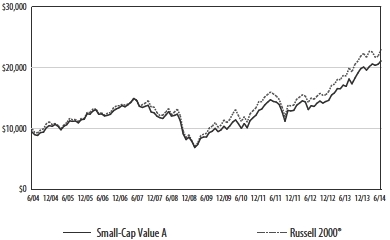

| | * | The benchmark since inception returns are calculated since commencement of November 25, 1996 through June 30, 2014. |

Quaker Small-Cap Value Fund

Growth of a Hypothetical $10,000 Investment

June 30, 2014

| Average Annualized Total Return |

| | | Expense

Ratio | | Inception

Date | | One Year | | Five Year | | Ten Year | | Commencement

of operations

through 6/30/2014 |

| | | | | | | | with

sales

charge | | without

sales

charge | | with

sales

charge | | without

sales

charge | | with

sales

charge | | without

sales

charge | | with

sales

charge | | without

sales

charge |

| | | | | | | | | | | | | | | | | | | | | | |

| Class A | | | 1.93% | | | 11/25/1996 | | | 18.05 | % | | | 24.89 | % | | | 18.38 | % | | | 19.74 | % | | | 7.76 | % | | | 8.37 | % | | | 10.37 | % | | | 10.72 | % |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Class C | | | 2.68% | | | 7/28/2000 | | | 23.89 | % | | | 23.89 | % | | | 18.84 | % | | | 18.84 | % | | | 7.57 | % | | | 7.57 | % | | | 9.58 | % | | | 9.58 | % |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Institutional Class | | | 1.68% | | | 9/12/2000 | | | 25.13 | % | | | 25.13 | % | | | 20.03 | % | | | 20.03 | % | | | 8.64 | % | | | 8.64 | % | | | 9.87 | % | | | 9.87 | % |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Russell 2000® Index* | | | | | 23.64 | % | | | 23.64 | % | | | 20.21 | % | | | 20.21 | % | | | 8.70 | % | | | 8.70 | % | | | 8.60 | % | | | 8.60 | % |

Performance data quoted represents past performance and is no guarantee of future results. Investment return and principal value will fluctuate so that shares, when redeemed, may be worth more or less than their original cost. Current performance may be lower or higher than performance data quoted. Performance data current to the most recent month end is available at www.quakerfunds.com or by calling us toll free at 800-220-8888. Total return includes reinvestment of dividends and capital gains.

Class A shares of the Fund have a maximum sales charge of 5.50%.

The line graph and performance table do not reflect the deduction of taxes that a shareholder might pay on fund distributions or the redemption of fund shares. Total return calculations reflect expense reimbursements and fee waivers in the applicable periods. See financial highlights for periods where fees were waived or reimbursed.

The Fund’s portfolio holdings may differ significantly from the securities held in the index and, unlike a mutual fund, an unmanaged index assumes no transaction costs, taxes, management fees or other expenses. You cannot invest directly in an index.

The Russell 2000® Index is a widely recognized, unmanaged index comprised of the smallest 2000 companies represented in the Russell 3000® Index. The Russell 2000® Index currently represents approximately 8% of the market capitalization of the Russell 3000® Index

2 0 1 4 A N N U A L R E P O R T | 9

Performance Update (Unaudited)

Quaker Strategic Growth Fund (QUAGX, QAGCX, QAGIX)

OBJECTIVES AND PRINCIPAL STRATEGIES

The Quaker Strategic Growth Fund (“Fund”) seeks to provide long-term growth of capital. Current income is not a significant investment consideration. The Fund invests primarily in equity securities of domestic U.S. companies which the Fund’s sub-adviser believes show a high probability for superior growth.

PERFORMANCE REVIEW AND MARKET OUTLOOK

For the fiscal year ended June 30, 2014, the S&P 500®Total Return Index (the “S&P 500”),a broad based market proxy, gained 24.61% while the Quaker Strategic Growth Fund finished the fiscal year with a total return of 25.27%. For the first half of calendar year 2014, the S&P 500 gained 7.14% while the Fund rose 4.72%.

The first half of the fiscal year was characterized by a market price/earning multiple expansion and was also accompanied by low market volatility. At the beginning of the fiscal year, the trailing S&P 500 Index multiple stood at 15.7X and by the mid-point of the fiscal year it had expanded to 17.5X (at the end of the fiscal year the multiple stood at 18.2X). We believe that this multiple expansion was the result of increasing investor confidence in the economic recovery and the rotation of investment assets out of fixed-income securities into equities.

Unlike the first half of the fiscal year, the second half saw increased volatility in the market due to macro events (Russia/Ukraine) and also concern about the Federal Reserve draining liquidity from the economic system as the economy slowly recovered. Offsetting these negative issues was the fact that US corporate earnings and revenue continued to grow modestly and the largest surge in corporate M&A activity occurred since 2007.

Market sectors that posted strong gains during the fiscal year were the materials, technology and healthcare (a fund overweight) sectors while the financial, consumer staples and telecom sectors (which were fund underweights) underperformed the general market. During the fiscal year, the portfolio was helped by stock picks in the healthcare and industrial sectors and hurt by stock picks in consumer discretionaries and an underweight to the sector.

Going forward, we expect to continue to have an overweight in the healthcare sector, concentrating on biotech and pharmaceutical companies with large and expanding drug pipelines, the potential (via FDA approval) to expand sales of existing products via new applications and by tapping new markets overseas. In technology, we are also currently overweight, focusing on companies with particular strength in creating innovative productivity enhancing solutions for both businesses and consumers, especially in the mobility and cloud computing areas. We currently have significant investments in the consumer discretionary sector (mainly in the media space) and in the industrials sector (concentrated in US legacy airlines which we believe are benefitting from industry consolidation and relatively low valuations).

We continue to strive to provide a good risk adjusted return for our clients going forward through intensive stock selection and at the same time the Fund will seek to continue to fulfill its mandate to protect capital by tactically raising cash and by utilizing short-selling strategies.

Thank you for your continued support.

Respectfully,

Manu P. Daftary, Portfolio Manager

DG Capital Management, Inc.

| SUB-ADVISER: |

| DG Capital Management, Inc. |

| |

| TOTAL NET ASSETS: |

| AS OF JUNE 30, 2014 |

| $168,983,016 |

| |

| Top 10 Holdings ** (% of net assets) |

| | | | | |

| Biogen Idec, Inc. | | | 4.6 | % |

| Roche Holdings, Ltd. | | | 3.5 | % |

| American Airlines Group, Inc. | | | 3.4 | % |

| Amgen, Inc. | | | 3.0 | % |

| Micron Technology, Inc. | | | 2.3 | % |

| Adobe Systems Inc. | | | 2.3 | % |

| FedEx Corp. | | | 2.3 | % |

| Eli Lilly & Company | | | 2.0 | % |

| Novartis AG - ADR | | | 2.0 | % |

| Gilead Sciences, Inc. | | | 2.0 | % |

| % Fund Total | | | 27.4 | % |

** Excludes Short-Term Investments

| Sectors (% of net assets) |

| | | |

| 78.9% | | Domestic Common Stocks |

| | 2.0% | | Basic Materials |

| | 13.4% | | Communications |

| | 9.9% | | Consumer, Cyclical |

| | 23.5% | | Consumer, Non-cyclical |

| | 3.0% | | Energy |

| | 7.5% | | Financial |

| | 3.8% | | Industrial |

| | 15.8% | | Technology |

| 16.9% | | Foreign Common Stocks |

| 12.4% | | Investments Purchased with Proceeds

from Securities Lending |

| | 108.2% | | Total Market Value of Investments |

| (8.2)% | | Liabilities in Excess of Other Assets, Net |

| | 100.0% | | Total Net Assets |

10 | 2 0 1 4 A N N U A L R E P O R T

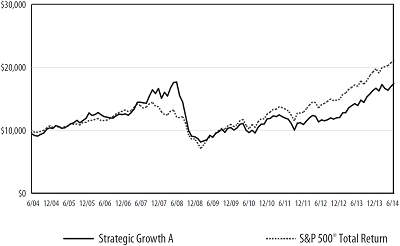

| | |

| * | The benchmark since inception returns are calculated since commencement of November 25, 1996 through June 30, 2014. |

| | |

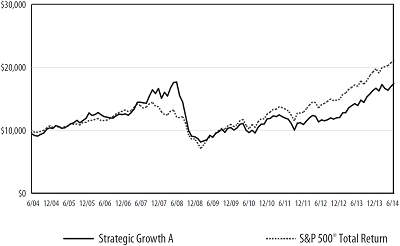

Quaker Strategic Growth Fund

Growth of a Hypothetical $10,000 Investment

June 30, 2014

| | | Average Annualized Total Return | |

| | | Expense

Ratio | | Inception

Date | | One Year | | Five Year | | Ten Year | | Commencement

of operations

through 6/30/2014 | |

| | | | | | | with

sales

charge | | without

sales

charge | | with

sales charge | | without

sales

charge | | with

sales

charge | | without

sales

charge | | with

sales

charge | | without

sales

charge | |

| | | | | | | | | | | | | | | | | | | | | | |

| Class A | | | 2.24% | | | | 11/25/1996 | | | | 18.40 | % | | | 25.27 | % | | | 13.14 | % | | | 14.43 | % | | | 5.73 | % | | | 6.33 | % | | | 11.53 | % | | | 11.89 | % | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Class C | | | 2.99% | | | | 7/11/2000 | | | | 24.32 | % | | | 24.32 | % | | | 13.57 | % | | | 13.57 | % | | | 5.53 | % | | | 5.53 | % | | | 4.05 | % | | | 4.05 | % | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Institutional Class | | | 1.99% | | | | 7/20/2000 | | | | 25.56 | % | | | 25.56 | % | | | 14.69 | % | | | 14.69 | % | | | 6.58 | % | | | 6.58 | % | | | 4.98 | % | | | 4.98 | % | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| S&P 500® Total Return Index* | | | | 24.61 | % | | | 24.61 | % | | | 18.83 | % | | | 18.83 | % | | | 7.78 | % | | | 7.78 | % | | | 7.51 | % | | | 7.51 | % | |

Performance data quoted represents past performance and is no guarantee of future results. Investment return and principal value will fluctuate so that shares, when redeemed, may be worth more or less than their original cost. Current performance may be lower or higher than performance data quoted. Performance data current to the most recent month end is available at www.quakerfunds.com or by calling us toll free at 800-220-8888. Total return includes reinvestment of dividends and capital gains.

Class A shares of the Fund have a maximum sales charge of 5.50%.

The line graph and performance table do not reflect the deduction of taxes that a shareholder might pay on fund distributions or the redemption of fund shares. Total return calculations reflect expense reimbursements or recoveries in the applicable periods. See financial highlights for periods where fees were reimbursed or recovered.

The Fund’s portfolio holdings may differ significantly from the securities held in the index and, unlike a mutual fund, an unmanaged index assumes no transaction costs, taxes, management fees or other expenses. You cannot invest directly in an index.

The S&P 500® Total Return Index (“Index”) is a widely recognized, unmanaged index consisting of the approximately 500 largest companies in the United States as measured by market capitalization. The Index assumes reinvestment of all dividends and distributions.

2 0 1 4 A N N U A L R E P O R T | 11

Expense Information (Unaudited)

As a shareholder of the Fund, you incur two types of costs: (1) transaction costs, including applicable sales charges and redemption fees; and (2) ongoing costs, including management fees, distribution (12b-1) fees and other Fund expenses. This example is intended to help you understand your ongoing costs (in dollars) of investing in the Fund and to compare these costs with the ongoing costs of investing in other funds. The example is based on an investment of $1,000 invested at the beginning of the (six-month) period and held for the entire period January 1, 2014 through June 30, 2014.

ACTUAL EXPENSES

The first section of each table below provides information about actual account values and actual expenses for each of the Funds. You may use this information, together with the amount you invested, to estimate the expenses that you paid over the period. Simply divide your account value by $1,000 (for example, an $8,600 account value divided by $1,000 = 8.6), then multiply the result by the number in the applicable line under the heading entitled “Expenses Paid During the Period” to estimate the expenses you paid on your account during this period.

HYPOTHETICAL EXAMPLE FOR COMPARISON PURPOSES

The second section of each table below provides information about hypothetical account values and hypothetical expenses based on the Fund’s actual expense ratio and an assumed rate of return of 5% per year before expenses, which is not the Fund’s actual return. The hypothetical account values and expenses may not be used to estimate the actual ending account balance or expenses you paid for the period. You may use this information to compare the ongoing costs of investing in the Fund to other funds. To do so, compare this 5% hypothetical example with the 5% hypothetical examples that appear in the shareholder reports of the other funds. Please note that the expenses shown in the table are meant to highlight your ongoing costs only and do not reflect any transactional costs, such as sales charges (loads), redemption fees or exchange fees. Therefore, the second section of the table is useful in comparing ongoing costs only, and will not help you determine the relative total costs of owning different funds. In addition, if these transactional costs were included, your costs would have been higher.

12 | 2 0 1 4 A N N U A L R E P O R T

| | | | | | | | | | | |

| | | | | | | | | | | |

| | | | | Beginning Account

Value (01/01/2014) | | Annualized Expense

Ratio for the Period | | Ending Account

Value (06/30/2014) | | Expenses Paid

During Period* |

| Event Arbitrage | | | | | | | | | | | | | | |

| Actual return based on actual return of: | | | | | | | | | | |

| Class A | | 3.99% | | $1,000.00 | | | 1.99% | | | $1,039.90 | | | $10.07 | |

| Class C | | 3.55% | | 1,000.00 | | | 2.74% | | | 1,035.50 | | | 13.83 | |

| Institutional Class | | 4.12% | | 1,000.00 | | | 1.74% | | | 1,041.20 | | | 8.81 | |

| Hypothetical return based on assumed 5% return: | | | | | | | | | | |

| Class A | | | | 1,000.00 | | | 1.99% | | | 1,014.93 | | | 9.94 | |

| Class C | | | | 1,000.00 | | | 2.74% | | | 1,011.21 | | | 13.66 | |

| Institutional Class | | | | 1,000.00 | | | 1.74% | | | 1,016.17 | | | 8.70 | |

| Global Tactical Allocation | | | | | | | | | | | |

| Actual return based on actual return of: | | | | | | | | | | |

| Class A | | 5.13% | | 1,000.00 | | | 2.00% | | | 1,051.30 | | | 10.17 | |

| Class C | | 4.83% | | 1,000.00 | | | 2.75% | | | 1,048.30 | | | 13.97 | |

| Institutional Class | | 5.36% | | 1,000.00 | | | 1.75% | | | 1,053.60 | | | 8.91 | |

| Hypothetical return based on assumed 5% return: | | | | | | | | | | |

| Class A | | | | 1,000.00 | | | 2.00% | | | 1,014.88 | | | 9.99 | |

| Class C | | | | 1,000.00 | | | 2.75% | | | 1,011.16 | | | 13.71 | |

| Institutional Class | | | | 1,000.00 | | | 1.75% | | | 1,016.12 | | | 8.75 | |

| Mid-Cap Value | | | | | | | | | | | | | | |

| Actual return based on actual return of: | | | | | | | | | | |

| Class A | | 13.77% | | 1,000.00 | | | 2.07% | | | 1,137.70 | | | 10.97 | |

| Class C | | 13.34% | | 1,000.00 | | | 2.82% | | | 1,133.40 | | | 14.92 | |

| Institutional Class | | 13.88% | | 1,000.00 | | | 1.82% | | | 1,138.80 | | | 9.65 | |

| Hypothetical return based on assumed 5% return: | | | | | | | | | | |

| Class A | | | | 1,000.00 | | | 2.07% | | | 1,014.53 | | | 10.34 | |

| Class C | | | | 1,000.00 | | | 2.82% | | | 1,010.81 | | | 14.06 | |

| Institutional Class | | | | 1,000.00 | | | 1.82% | | | 1,015.77 | | | 9.10 | |

| Small-Cap Value | | | | | | | | | | | | | | |

| Actual return based on actual return of: | | | | | | | | | | |

| Class A | | 5.06% | | 1,000.00 | | | 1.86% | | | 1,050.60 | | | 9.46 | |

| Class C | | 4.66% | | 1,000.00 | | | 2.61% | | | 1,046.60 | | | 13.24 | |

| Institutional Class | | 5.20% | | 1,000.00 | | | 1.61% | | | 1,052.00 | | | 8.19 | |

| Hypothetical return based on assumed 5% return: | | | | | | | | | | |

| Class A | | | | 1,000.00 | | | 1.86% | | | 1,015.57 | | | 9.30 | |

| Class C | | | | 1,000.00 | | | 2.61% | | | 1,011.85 | | | 13.02 | |

| Institutional Class | | | | 1,000.00 | | | 1.61% | | | 1,016.81 | | | 8.05 | |

| Strategic Growth | | | | | | | | | | | | | | |

| Actual return based on actual return of: | | | | | | | | | | |

| Class A | | 4.72% | | 1,000.00 | | | 2.30% | | | 1,047.20 | | | 11.67 | |

| Class C | | 4.29% | | 1,000.00 | | | 3.05% | | | 1,042.90 | | | 15.45 | |

| Institutional Class | | 4.85% | | 1,000.00 | | | 2.05% | | | 1,048.50 | | | 10.41 | |

| Hypothetical return based on assumed 5% return: | | | | | | | | | | |

| Class A | | | | 1,000.00 | | | 2.30% | | | 1,013.39 | | | 11.48 | |

| Class C | | | | 1,000.00 | | | 3.05% | | | 1,009.67 | | | 15.20 | |

| Institutional Class | | | | 1,000.00 | | | 2.05% | | | 1,014.63 | | | 10.24 | |

| * | Expenses are equal to the Funds’ annualized six-month expense ratios multiplied by the average account value over the period multiplied by the number of days in the most recent fiscal half year (181) divided by 365 to reflect the one-half year period. |

2 0 1 4 A N N U A L R E P O R T | 13

Schedule of Investments

Quaker Event Arbitrage Fund

June 30, 2014

| | | Number

of Shares | | | Fair

Value | |

| Domestic Common Stocks — 46.6% | | | | | |

| | | | | | | | | |

| Basic Materials — 0.5% | | | | | | | | |

| Forest Products & Paper — 0.5% | | | | | | | | |

| International Paper Co. | | | 6,100 | | | $ | 307,867 | |

| KapStone Paper and Packaging Corp. (a) | | | 9,800 | | | | 324,674 | |

| | | | | | | | 632,541 | |

| Total Basic Materials (Cost $503,431) | | | | | | | 632,541 | |

| | | | | | | | | |

| Communications — 11.0% | | | | | | | | |

| Internet — 1.6% | | | | | | | | |

| 30DC, Inc. (a) • | | | 50,000 | | | | 5,275 | |

| eBay, Inc. (a) | | | 26,800 | | | | 1,341,608 | |

| Unwired Planet, Inc. (a)(b) | | | 271,372 | | | | 605,160 | |

| | | | | | | | 1,952,043 | |

| | | | | | | | | |

| Media — 7.8% | | | | | | | | |

| Comcast Corp. (b) | | | 19,480 | | | | 1,045,686 | |

| The Dolan Co. (a)^ | | | 500,000 | | | | 19,000 | |

| Liberty Media Corp. (a) | | | 15,000 | | | | 2,050,200 | |

| News Corp. Class A (a) | | | 112,200 | | | | 2,012,868 | |

| Tribune Co. Class A (a) | | | 17,800 | | | | 1,513,890 | |

| Twenty-First Century Fox, Inc. | | | 78,217 | | | | 2,677,368 | |

| | | | | | | | 9,319,012 | |

| | | | | | | | | |

| Telecommunications — 1.6% | | | | | | | | |

| Telephone & Data Systems, Inc. | | | 71,100 | | | | 1,856,421 | |

| Total Communications (Cost $12,379,117) | | | | | | | 13,127,476 | |

| | | | | | | | | |

| Consumer, Cyclical — 6.4% | | | | | | | | |

| Auto Parts & Equipment — 0.8% | | | | | | | | |

| Allison Transmission Holdings, Inc. | | | 30,000 | | | | 933,000 | |

| | | | | | | | | |

| Lodging — 0.0% | | | | | | | | |

| Trump Entertainment Resorts, Inc. (a)^* | | | 8,949 | | | | 0 | |

| Trump Entertainment Resorts, Inc. (a)^* | | | 135 | | | | 409 | |

| | | | | | | | 409 | |

| | | | | | | | | |

| Retail — 5.6% | | | | | | | | |

| Bob Evans Farms, Inc. (b) | | | 37,500 | | | | 1,876,875 | |

| CST Brands, Inc. | | | 60,600 | | | | 2,090,700 | |

| GNC Holdings, Inc. (b) | | | 37,000 | | | | 1,261,700 | |

| Walgreen Co. | | | 20,000 | | | | 1,482,600 | |

| | | | | | | | 6,711,875 | |

| Total Consumer, Cyclical (Cost $7,420,624) | | | | | | | 7,645,284 | |

| | | | | | | | | |

| Consumer, Non-cyclical — 10.5% | | | | | | | | |

| Beverages — 0.2% | | | | | | | | |

| PepsiCo, Inc. | | | 2,300 | | | | 205,482 | |

| | | | | | | | | |

| Commercial Services — 3.9% | | | | | | | | |

| Hertz Global Holdings, Inc. (a) | | | 61,500 | | | | 1,723,845 | |

| Iron Mountain Inc. | | | 43,000 | | | | 1,524,350 | |

| The Western Union Co. (b) | | | 83,200 | | | | 1,442,688 | |

| | | | | | | | 4,690,883 | |

| | | | | | | | | |

| Food — 1.8% | | | | | | | | |

| Mondelez International, Inc. | | | 42,800 | | | | 1,609,708 | |

| Pinnacle Foods, Inc. | | | 16,700 | | | | 549,430 | |

| | | | | | | | 2,159,138 | |

| | | | | | | | | |

| Healthcare-Products — 2.0% | | | | | | | | |

| Hologic, Inc. (a) | | | 81,300 | | | | 2,060,955 | |

| Synovis Life Technologies, Inc. (a)^ | | | 43,000 | | | | 39,474 | |

| Volcano Corp. (a)(b) | | | 11,500 | | | | 202,515 | |

| | | | | | | | 2,302,944 | |

| | | Number

of Shares | | | Fair

Value | |

| Domestic Common Stocks (Continued) | | | | | | |

| | | | | | | | | |

| Pharmaceuticals — 2.6% | | | | | | | | |

| Forest Laboratories, Inc. (a) | | | 10,850 | | | $ | 1,074,150 | |

| INYX, Inc. (a) | | | 167,850 | | | | 252 | |

| Pfizer Inc. | | | 68,000 | | | | 2,018,240 | |

| Savient Pharmaceuticals, Inc.^*# | | | 1,000 | | | | 2,025 | |

| | | | | | | | 3,094,667 | |

| Total Consumer, Non-cyclical (Cost $11,748,610) | | | | | | | 12,453,114 | |

| | | | | | | | | |

| Diversified — 1.1% | | | | | | | | |

| Holding Companies-Diversified — 1.1% | | | | | | | | |

| Boulevard Acquisition Corp. (a) | | | 75,000 | | | | 757,500 | |

| Levy Acquisition Corp. (a)(b) • | | | 52,800 | | | | 532,488 | |

| Stoneleigh Partners Acquisition Corp. (a)^* | | | 400 | | | | 0 | |

| | | | | | | | 1,289,988 | |

| Total Diversified (Cost $1,277,088) | | | | | | | 1,289,988 | |

| | | | | | | | | |

| Energy — 2.8% | | | | | | | | |

| Oil & Gas — 2.8% | | | | | | | | |

| Dresser-Rand Group, Inc. (a)(b) | | | 24,400 | | | | 1,555,012 | |

| QEP Resources, Inc. | | | 50,750 | | | | 1,750,875 | |

| | | | | | | | 3,305,887 | |

| Total Energy (Cost $3,014,507) | | | | | | | 3,305,887 | |

| | | | | | | | | |

| Financial — 3.5% | | | | | | | | |

| Diversified Financial Services — 0.8% | | | | | | | | |

| Ally Financial Inc. (a) | | | 40,000 | | | | 956,400 | |

| | | | | | | | | |

| Insurance — 1.6% | | | | | | | | |

| Ambac Financial Group, Inc. (a) | | | 69,200 | | | | 1,889,852 | |

| | | | | | | | | |

| Savings & Loans — 1.1% | | | | | | | | |

| Fox Chase Bancorp, Inc. | | | 77,800 | | | | 1,311,708 | |

| Total Financial (Cost $3,928,839) | | | | | | | 4,157,960 | |

| | | | | | | | | |

| Healthcare — 0.8% | | | | | | | | |

| Healthcare-Services — 0.8% | | | | | | | | |

| Diagnostic Services Holdings, Inc. (a)^ | | | 10,221 | | | | 934,138 | |

| Total Healthcare (Cost $735,000) | | | | | | | 934,138 | |

| | | | | | | | | |

| Industrial — 8.9% | | | | | | | | |

| Aerospace & Defense — 2.1% | | | | | | | | |

| API Technologies Corp. (a)(b) | | | 917,970 | | | | 2,515,238 | |

| | | | | | | | | |

| Electronics — 2.7% | | | | | | | | |

| Agilent Technologies, Inc. | | | 26,500 | | | | 1,522,160 | |

| IEC Electronics Corp. (a) | | | 400,000 | | | | 1,740,000 | |

| | | | | | | | 3,262,160 | |

| | | | | | | | | |

| Engineering & Construction — 1.3% | | | | | | | | |

| URS Corp. | | | 32,600 | | | | 1,494,710 | |

| | | | | | | | | |

| Machinery-Diversified — 1.3% | | | | | | | | |

| The Babcock & Wilcox Co. | | | 46,000 | | | | 1,493,160 | |

| | | | | | | | | |

| Miscellaneous Manufacturing — 1.2% | | | | | | | | |

| LSB Industries, Inc. (a) | | | 35,000 | | | | 1,458,450 | |

| | | | | | | | | |

| Packaging & Containers — 0.3% | | | | | | | | |

| Rock Tenn Co. | | | 3,800 | | | | 401,242 | |

| Total Industrial (Cost $10,810,049) | | | | | | | 10,624,960 | |

| | | | | | | | | |

| Technology — 1.1% | | | | | | | | |

| Computers — 1.1% | | | | | | | | |

| Computer Horizons Corp. (a)^* | | | 65,000 | | | | 0 | |

| EMC Corp. | | | 48,000 | | | | 1,264,320 | |

| | | | | | | | 1,264,320 | |

The accompanying notes are an integral part of the financial statements.

14 | 2 0 1 4 A N N U A L R E P O R T

Schedule of Investments

Quaker Event Arbitrage Fund

June 30, 2014

| | | Number

of Shares | | | Fair

Value | |

| Domestic Common Stocks (Continued) | | | | | | | | |

| | | | | | | | | |

| Software — 0.0% | | | | | | | | |

| Contra Softbrands, Inc. (a)^* | | | 5,000 | | | $ | 0 | |

| Total Technology (Cost $1,138,893) | | | | | | | 1,264,320 | |

Total Domestic Common Stocks

(Cost $52,956,158) | | | | | | | 55,435,668 | |

| | | | | | | | | |

| Foreign Common Stocks — 5.6% | | | | | | | | |

| | | | | | | | | |

| Canada — 1.8% | | | | | | | | |

| Healthcare-Products — 1.0% | | | | | | | | |

| Nordion, Inc. (a) | | | 90,000 | | | | 1,130,400 | |

| | | | | | | | | |

| Mining — 0.0% | | | | | | | | |

| Sacre-Coeur Minerals Ltd. (a) | | | 109,444 | | | | 2,564 | |

| | | | | | | | | |

| Real Estate — 0.8% | | | | | | | | |

| Brookfield Property Partners LP | | | 47,000 | | | | 980,890 | |

| Total Canada (Cost $2,063,839) | | | | | | | 2,113,854 | |

| | | | | | | | | |

| Germany — 0.3% | | | | | | | | |

| Pharmaceuticals — 0.3% | | | | | | | | |

| Celesio AG | | | 9,996 | | | | 355,875 | |

| Total Germany (Cost $314,427) | | | | | | | 355,875 | |

| | | | | | | | | |

| Italy — 0.1% | | | | | | | | |

| Banks — 0.1% | | | | | | | | |

| Banca Monte dei Paschi di Siena SpA (a) | | | 63,130 | | | | 122,318 | |

| Total Italy (Cost $86,163) | | | | | | | 122,318 | |

| | | | | | | | | |

| Jersey — 1.2% | | | | | | | | |

| Media — 1.2% | | | | | | | | |

| UBM PLC | | | 120,000 | | | | 1,366,717 | |

| Total Jersey (Cost $1,344,129) | | | | | | | 1,366,717 | |

| | | | | | | | | |

| Marshall Islands — 2.2% | | | | | | | | |

| Transportation — 2.2% | | | | | | | | |

| Scorpio Tankers Inc. | | | 130,000 | | | | 1,322,100 | |

| Teekay LNG Partners LP (b) | | | 18,415 | | | | 849,668 | |

| Teekay Offshore Partners LP | | | 12,616 | | | | 455,438 | |

| Teekay Tankers Ltd. (b) | | | 9,107 | | | | 39,069 | |

| | | | | | | | 2,666,275 | |

| Total Marshall Islands (Cost $2,357,403) | | | | | | | 2,666,275 | |

Total Foreign Common Stocks

(Cost $6,165,961) | | | | | | | 6,625,039 | |

| | | | | | | | | |

| Preferred Stocks — 2.6% | | | | | | | | |

| | | | | | | | | |

| Diagnostic Services Holdings, Inc. (a)^* | | | 613 | | | | 613,000 | |

Federal Home Loan Mortgage Corp., 0.00%,

Series G (a)p | | | 3,000 | | | | 50,700 | |

Federal Home Loan Mortgage Corp., 5.00%,

Series F (a) | | | 4,500 | | | | 78,750 | |

Federal Home Loan Mortgage Corp., 0.00%,

Series S (a)p | | | 25,000 | | | | 440,000 | |

Federal Home Loan Mortgage Corp., 0.00%,

Series Q (a)p | | | 1,000 | | | | 16,430 | |

Federal Home Loan Mortgage Corp., 0.00%,

Series M (a) | | | 9,500 | | | | 159,125 | |

| GeoMet, Inc., 9.60% (a) | | | 3 | | | | 9 | |

| JPMorgan Chase & Co., 6.30% (a)(b) | | | 50,000 | | | | 1,250,000 | |

| MBIA Insurance Corp. (a)^*# | | | 10 | | | | 440,000 | |

| | | | | | | | 3,048,014 | |

Total Preferred Stocks

(Cost $2,914,316) | | | | | | | 3,048,014 | |

| | | Number

of Shares | | | Fair

Value | |

| Real Estate Investment Trusts — 4.4% | | | | | | | | |

| | | | | | | | | |

| American Realty Capital HealthcareTrust, Inc. | | | 100,000 | | | $ | 1,089,000 | |

| Brookfield DTLA Fund Office Trust Investor, Inc. - Preferred (a) | | | 30,000 | | | | 852,000 | |

| CommonWealth | | | 74,600 | | | | 1,963,472 | |

| Weyerhaeuser Co. | | | 40,000 | | | | 1,323,600 | |

| | | | | | | | 5,228,072 | |

Total Real Estate Investment Trusts

(Cost $4,952,702) | | | | | | | 5,228,072 | |

| | | | | | | | | |

| Rights — 0.3% | | | | | | | | |

| | | | | | | | | |

| Petrocorp, Inc. Escrow (a)^* | | | 200 | | | | 0 | |

| Sanofi (a) | | | 650,000 | | | | 325,000 | |

| | | | | | | | 325,000 | |

Total Rights

(Cost $215,670) | | | | | | | 325,000 | |

| | | | | | | | | |

| Warrants — 3.4% | | | | | | | | |

| | | | | | | | | |

| Heineken Holding NV, Expiration: January, 2015 (a)^ | | | 1,000 | | | | 1,141,370 | |

| Sprint Corp., Expiration: June, 2015 (a)^ | | | 111,000 | | | | 2,919,633 | |

| | | | | | | | 4,061,003 | |

Total Warrants

(Cost $4,214,051) | | | | | | | 4,061,003 | |

| | | | Par

Value | | | | Fair

Value | |

| Asset Backed Securities — 0.7% | | | | | | | | |

| | | | | | | | | |

| United States — 0.7% | | | | | | | | |

AFC Home Equity Loan Trust

Class 1A, Series 2000-2, 0.94%, 06/25/2030 p• | | $ | 12,951 | | | | 11,871 | |

Citigroup Mortgage Loan Trust, Inc.

Class M3, Series 2005-OPT1, 0.86%, 02/25/2035 p• | | | 264,508 | | | | 215,671 | |

Countrywide Asset-Backed Certificates

Class 2M2, Series 2007-11, 0.47%, 06/25/2047 p• | | | 403,042 | | | | 190 | |

Countrywide Asset-Backed Certificates

Class A1, Series 2006-SD4, 0.49%, 12/25/2036 #p• | | | 106,166 | | | | 62,110 | |

Countrywide Asset-Backed Certificates

Class A6, Series 2006-S6, 5.66%, 03/25/2034 p• | | | 60,167 | | | | 88,130 | |

Countrywide Asset-Backed Certificates

Class M2, Series 2006-BC4, 0.47%, 11/25/2036 p• | | | 727,095 | | | | 27,814 | |

Countrywide Home Equity Loan Trust

Class 2A, Series 2005-A, 0.39%, 04/15/2035 p• | | | 35,988 | | | | 30,410 | |

Structured Asset Investment Loan Trust

Class M1, Series 2003-BC9, 1.20%, 08/25/2033 p• | | | 483,405 | | | | 455,235 | |

| | | | | | | | 891,431 | |

| Total United States (Cost $932,098) | | | | | | | 891,431 | |

Total Asset Backed Securities

(Cost $932,098) | | | | | | | 891,431 | |

| | | | | | | | | |

| Convertible Bonds — 1.2% | | | | | | | | |

| | | | | | | | | |

| Belgium — 0.4% | | | | | | | | |

| BNP Paribas Fortis SA, 2.22%, 12/29/2049 p• | | | 500,000 | | | | 556,121 | |

| Total Belgium (Cost $551,759) | | | | | | | 556,121 | |

| | | | | | | | | |

| Finland — 0.4% | | | | | | | | |

| Talvivaara Mining Co. PLC, 4.00%, 12/16/2015 *+• | | | 3,200,000 | | | | 438,176 | |

| Total Finland (Cost $705,626) | | | | | | | 438,176 | |

The accompanying notes are an integral part of the financial statements.

2 0 1 4 A N N U A L R E P O R T | 15

Schedule of Investments

Quaker Event Arbitrage Fund

June 30, 2014

| | | Par

Value | | | Fair

Value | |

| Convertible Bonds (Continued) | | | | | | | | |

| | | | | | | | | |

| Luxembourg — 0.3% | | | | | | | | |

The Bank of New York Mellon Luxembourg SA,

4.58%, 12/30/2099 +p• | | $ | 500,000 | | | $ | 345,748 | |

| Total Luxembourg (Cost $301,609) | | | | | | | 345,748 | |

| United States — 0.1% | | | | | | | | |

| | | | | | | | | |

| U.S. Concrete, Inc., 9.50%, 08/31/2015 ^*+# | | | 100,000 | | | | 100,000 | |

| Total United States (Cost $100,000) | | | | | | | 100,000 | |

Total Convertible Bonds

(Cost $1,658,994) | | | | | | | 1,440,045 | |

| | | | | | | | | |

| Corporate Bonds — 4.8% | | | | | | | | |

| | | | | | | | | |

| Basic Materials — 0.7% | | | | | | | | |

| | | | | | | | | |

| Chemicals — 0.7% | | | | | | | | |

| Momentive Performance Materials, Inc., 9.00%, 01/15/2021 (b)+• | | | 1,000,000 | | | | 830,000 | |

| | | | | | | | | |

| Forest Products & Paper — 0.0% | | | | | | | | |

| | | | | | | | | |

| NewPage Corp., 0.00%, 05/01/2012 ^*+ | | | 300,000 | | | | 0 | |

| Total Basic Materials (Cost $943,322) | | | | | | | 830,000 | |

| | | | | | | | | |

| Consumer, Cyclical — 0.5% | | | | | | | | |

| | | | | | | | | |

| Auto Parts & Equipment — 0.5% | | | | | | | | |

| | | | | | | | | |

| Exide Technologies, 8.625%, 02/01/2018 +• | | | 1,000,000 | | | | 600,000 | |

| Total Consumer, Cyclical (Cost $583,750) | | | | | | | 600,000 | |

| | | | | | | | | |

| Energy — 1.0% | | | | | | | | |

| | | | | | | | | |

| Oil & Gas — 0.8% | | | | | | | | |

| | | | | | | | | |

| National JSC Naftogaz of Ukraine, 9.50%, 09/30/2014 • | | | 1,000,000 | | | | 980,000 | |

| | | | | | | | | |

| Oil, Gas & Coal — 0.2% | | | | | | | | |

| | | | | | | | | |

| OGX Petroleo e Gas Participacoes SA, 8.50%, 06/01/2018 +• | | | 3,500,000 | | | | 210,000 | |

| Total Energy (Cost $1,615,786) | | | | | | | 1,190,000 | |

| | | | | | | | | |

| Financial — 2.1% | | | | | | | | |

| | | | | | | | | |

| Diversified Financial Services — 1.8% | | | | | | | | |

| | | | | | | | | |

| DEPFA Funding II LP, 6.50%, 10/29/2049 +• | | | 1,000,000 | | | | 739,422 | |

| DEPFA Funding III LP, 1.72%, 06/29/2049 +• | | | 1,000,000 | | | | 698,343 | |

Hellas Telecommunications Luxembourg II SCA,

0.00%, 01/15/2015 ^*+#p | | | 5,000,000 | | | | 100,000 | |

| Lehman Brothers Holdings, Inc., 4.55%, 07/08/2014 +• | | | 110,000 | | | | 21,588 | |

| Lehman Brothers Holdings, Inc., 5.32%, 02/17/2015 +• | | | 130,000 | | | | 25,350 | |

| Lehman Brothers Holdings, Inc., 5.50%, 02/27/2020 +• | | | 100,000 | | | | 19,500 | |

| Lehman Brothers Holdings, Inc., 7.00%, 01/28/2020 +• | | | 100,000 | | | | 19,500 | |

| Lehman Brothers Holdings, Inc., 8.25%, 09/23/2020 +• | | | 100,000 | | | | 19,500 | |

| Lehman Brothers Holdings, Inc., 8.75%, 02/14/2023 +• | | | 200,000 | | | | 39,000 | |

| Twin Reefs Pass-Through Trust, 0.00%, 12/29/2049 ^+#p | | | 1,000,000 | | | | 530,000 | |

| | | | | | | | 2,212,203 | |

| Insurance — 0.3% | | | | | | | | |

| | | | | | | | | |

| Ambac Assurance Corp., 5.10%, 06/07/2020 +#• | | | 300,000 | | | | 341,250 | |

| | | | | | | | | |

| Venture Capital — 0.0% | | | | | | | | |

| | | | | | | | | |

| Infinity Capital Group, 7.00%, 12/31/2049 ^*+ | | | 25,000 | | | | 0 | |

| Total Financial (Cost $2,661,937) | | | | | | | 2,553,453 | |

| | | | | | | | | |

| Industrial — 0.5% | | | | | | | | |

| | | | | | | | | |

| Transportation — 0.5% | | | | | | | | |

| | | | | | | | | |

Overseas Shipholding Group Inc., 8.125%,

03/30/2018 +• | | | 500,000 | | | | 605,000 | |

| Total Industrial (Cost $593,979) | | | | | | | 605,000 | |

| | | Par

Value | | | Fair

Value | |

| Corporate Bonds (Continued) | | | | | | | | |

| | | | | | | | | |

| Utilities — 0.0% | | | | | | | | |

| | | | | | | | | |

| Electric — 0.0% | | | | | | | | |

| | | | | | | | | |

| Mirant Corp., 2.50%, 06/15/2021 ^*+ | | $ | 20,000 | | | $ | 0 | |

| Total Utilities (Cost $0) | | | | | | | 0 | |

Total Corporate Bonds

(Cost $6,398,774) | | | | | | | 5,778,453 | |

| | | | | | | | | |

| Mortgage Backed Securities — 0.8% | | | | | | | | |

| | | | | | | | | |

| United States — 0.8% | | | | | | | | |

| | | | | | | | | |

Countrywide Alternative Loan Trust

Class 2A2A, Series 2006-OC5, 0.32%, 06/25/2046 p• | | | 79,539 | | | | 66,940 | |

GSR Mortgage Loan Trust

Class B2, Series 2005-5F, 5.75%, 06/25/2035 p• | | | 628,584 | | | | 384,994 | |

Wachovia Commercial Mortgage Securities Inc. Pass-Thru Certificates

Class E, Series 2003-C9, 5.29%, 12/15/2035 p• | | | 500,000 | | | | 499,826 | |

| | | | | | | | 951,760 | |

| Total United States (Cost $1,009,617) | | | | | | | 951,760 | |

Total Mortgage Backed Securities

(Cost $1,009,617) | | | | | | | 951,760 | |

| | | | | | | | | |

| Municipal Bonds — 1.0% | | | | | | | | |

| | | | | | | | | |

| United States — 1.0% | | | | | | | | |

| | | | | | | | | |

City of Detroit MI Sewage Disposal System Revenue, Second Lien,

Series A, 4.50%, 07/01/2035 • | | | 355,000 | | | | 317,625 | |

City of Detroit MI Water Supply System Revenue, Senior Lien,

Series A, 5.00%, 07/01/2034 • | | | 500,000 | | | | 495,630 | |

City of Detroit MI Water Supply System Revenue, Senior Lien,

Series A, 4.50%, 07/01/2035 • | | | 75,000 | | | | 67,807 | |

City of Detroit MI Water Supply System Revenue, Senior Lien,

Series A, 5.00%, 07/01/2036 • | | | 200,000 | | | | 194,538 | |

City of Detroit MI Water Supply System Revenue, Senior Lien,

Series C, 5.00%, 07/01/2041 • | | | 95,000 | | | | 92,799 | |

| | | | | | | | 1,168,399 | |

| Total United States (Cost $1,186,393) | | | | | | | 1,168,399 | |

Total Municipal Bonds

(Cost $1,186,393) | | | | | | | 1,168,399 | |

| | | | | | | | | |

| Term Loan — 0.4% | | | | | | | | |

| | | | | | | | | |

| United States — 0.4% | | | | | | | | |

| | | | | | | | | |

Diagnostic Services Holdings, Inc. 14.50%,

05/05/2016 ^* | | | 511,054 | | | | 511,054 | |

| Total United States (Cost $511,054) | | | | | | | 511,054 | |

Total Term Loan

(Cost $511,054) | | | | | | | 511,054 | |

| | | | | | | | |

| | | Number

of Contracts | | | | Fair

Value | |

| Purchased Options — 3.3% | | | | | | | | |

| | | | | | | | | |

| Call Options — 2.7% | | | | | | | | |

| | | | | | | | | |

CommonWealth REIT, Expiration: July, 2014

Exercise Price:$27.50 | | | 180 | | | | 1,800 | |

Comverse, Inc., Expiration: August, 2014

Exercise Price:$25.00 • | | | 439 | | | | 96,580 | |

Darden Restaurants, Inc., Expiration: August, 2014

Exercise Price:$46.00 | | | 325 | | | | 35,750 | |

The accompanying notes are an integral part of the financial statements.

16 | 2 0 1 4 A N N U A L R E P O R T

Schedule of Investments

Quaker Event Arbitrage Fund

June 30, 2014

| | | Number

of Contracts | | | Fair

Value | |

| Purchased Options (Continued) | | | | | | | | |

| | | | | | | | | |

| Call Options (Continued) | | | | | | | | |

Dean Foods Co., Expiration: September, 2014

Exercise Price: $15.00 • | | | 1,500 | | | $ | 427,500 | |

eBay, Inc., Expiration: January, 2015

Exercise Price: $50.00 | | | 1,200 | | | | 444,000 | |

FTD Cos. Inc., Expiration: August, 2014

Exercise Price: $30.00 • | | | 475 | | | | 122,312 | |

General Motors Co., Expiration: January, 2015

Exercise Price: $35.00 | | | 600 | | | | 180,000 | |

Lorillard, Inc., Expiration: December, 2014

Exercise Price: $70.00 | | | 550 | | | | 77,000 | |

Noble Corp. PLC, Expiration: August, 2014

Exercise Price: $40.00 • | | | 380 | | | | 2,470 | |

PepsiCo., Inc., Expiration: January, 2015

Exercise Price: $80.00 | | | 1,150 | | | | 1,121,250 | |

Regis Corp., Expiration: August, 2014

Exercise Price: $12.50 • | | | 1,190 | | | | 181,475 | |

Safeway, Inc., Expiration: August, 2014

Exercise Price: $36.00 • | | | 470 | | | | 2,350 | |

Sotheby’s, Inc., Expiration: August, 2014

Exercise Price: $40.00 | | | 423 | | | | 115,902 | |

Talisman Energy, Inc., Expiration: August, 2014

Exercise Price: $11.00 | | | 845 | | | | 29,575 | |

Time Warner Cable, Inc., Expiration: October, 2014

Exercise Price: $135.00 • | | | 125 | | | | 171,250 | |

Volcano Corp., Expiration: August, 2014

Exercise Price: $17.50 • | | | 796 | | | | 101,490 | |

Yahoo! Inc., Expiration: October, 2014

Exercise Price: $37.00 | | | 500 | | | | 110,500 | |

| Total Call Options (Cost $2,190,300) | | | | | | | 3,221,204 | |

| | | | | | | | | |

| Put Options — 0.6% | | | | | | | | |

Comcast Corp., Expiration: January, 2015

Exercise Price: $55.00 • | | | 200 | | | | 77,000 | |

CurrencyShares Euro Trust, Expiration: September, 2014

Exercise Price: $137.00 | | | 150 | | | | 39,750 | |

eBay, Inc., Expiration: January, 2015

Exercise Price: $40.00 | | | 1,200 | | | | 67,200 | |

Packaging Corp. of America, Expiration: July, 2014

Exercise Price: $67.50 • | | | 150 | | | | 4,875 | |

Teekay Corp., Expiration: October, 2014

Exercise Price: $62.50 | | | 400 | | | | 144,000 | |

Time Warner Cable, Inc., Expiration: October, 2014

Exercise Price: $100.00 • | | | 125 | | | | 2,188 | |

TRI Pointe Homes, Inc., Expiration: July, 2014

Exercise Price: $20.00 • | | | 317 | | | | 145,820 | |

Twenty-First Century Fox, Inc., Expiration: October, 2014

Exercise Price: $34.00 | | | 758 | | | | 94,750 | |

Weyerhaeuser Co., Expiration: July, 2014

Exercise Price: $38.00 | | | 256 | | | | 130,560 | |

Yahoo! Inc., Expiration: October, 2014

Exercise Price: $30.00 | | | 500 | | | | 39,500 | |

| Total Put Options (Cost $1,123,193) | | | | | | | 745,643 | |

Total Purchased Options

(Cost $3,313,493) | | | | | | | 3,966,847 | |

| | | Number

of Shares | | | Fair

Value | |

Investments Purchased with Proceeds from Securities

Lending — 6.5% | | | | | |

| | | | | | | | | |

| Money Market Funds — 6.5% | | | | | | | | |

Mount Vernon Securities Lending Trust Prime Portfolio,

0.18% (c)(d) | | | 7,688,944 | | | $ | 7,688,944 | |

Total Investments Purchased with Proceeds from

Securities Lending (Cost $7,688,944) | | | | | | | 7,688,944 | |

Total Investments

(Cost $94,118,225) — 81.6% | | | | | | | 97,119,729 | |

| Other Assets in Excess of Liabilities, Net 18.4% | | | | | | | 21,944,728 | |

| Total Net Assets — 100.0% | | | | | | $ | 119,064,457 | |

| | | | | | | | | |

| Schedule of Securities Sold Short (e) | | | | | | | | |

| Common Stocks | | | | | | | | |

| | | | | | | | | |

| Actavis PLC | | | 3,600 | | | | 802,980 | |

| Charter Communications, Inc. | | | 3,634 | | | | 575,553 | |

| Live Nation Entertainment, Inc. | | | 6,771 | | | | 167,176 | |

| Sirius XM Holdings, Inc. | | | 409,770 | | | | 1,417,804 | |

| VMware, Inc. | | | 7,680 | | | | 743,501 | |

Total Common Stocks

(Proceeds $3,512,220) | | | | | | | 3,707,014 | |

| | | | | | | | | |

| Real Estate Investment Trusts | | | | | | | | |

| | | | | | | | | |

| General Growth Properties, Inc. | | | 17,400 | | | | 409,944 | |

Total Real Estate Investment Trusts

(Proceeds $370,797) | | | | | | | 409,944 | |

| Total Securities Sold Short (Proceeds $3,883,017) | | | | | | $ | 4,116,958 | |

| | | | | | | |

| | | Number

of Contracts | | | Fair

Value | |

| Written Options | | | | | | | | |

| | | | | | | | | |

| Call Options | | | | | | | | |

Agilent Technologies, Inc., Expiration: July, 2014

Exercise Price: $55.00 • | | | 265 | | | | 70,622 | |

Allison Transmission Holdings, Inc., Expiration: July, 2014

Exercise Price: $30.00 • | | | 300 | | | | 42,000 | |

Ambac Financial Group, Inc., Expiration: July, 2014

Exercise Price: $25.00 • | | | 225 | | | | 55,687 | |

Ambac Financial Group, Inc., Expiration: August, 2014

Exercise Price: $22.50 • | | | 220 | | | | 112,200 | |

Bob Evans Farms, Inc., Expiration: July, 2014

Exercise Price: $42.00 ^ | | | 375 | | | | 310,500 | |

Comcast Corp., Expiration: January, 2015

Exercise Price: $55.00 • | | | 200 | | | | 37,000 | |

CommonWealth REIT, Expiration: July, 2014

Exercise Price: $29.00 ^ | | | 360 | | | | 1,080 | |

CST Brands, Inc., Expiration: July, 2014

Exercise Price: $32.00 • | | | 173 | | | | 41,953 | |

CST Brands, Inc., Expiration: July, 2014

Exercise Price: $34.00 | | | 433 | | | | 31,609 | |

CurrencyShares Euro Trust, Expiration: September, 2014

Exercise Price: $137.00 | | | 150 | | | | 6,600 | |

Dean Foods Co., Expiration: September, 2014

Exercise Price: $19.00 • | | | 1,500 | | | | 75,000 | |

The accompanying notes are an integral part of the financial statements.

2 0 1 4 A N N U A L R E P O R T | 17

Schedule of Investments

Quaker Event Arbitrage Fund

June 30, 2014

| | | Number

of Contracts | | | Fair

Value | |

| Written Options (Continued) | | | | | | | | |

| | | | | | | | | |

| Call Options (Continued) | | | | | | | | |

Dresser-Rand Group, Inc., Expiration: July, 2014

Exercise Price: $57.50 ^ | | | 244 | | | $ | 153,964 | |

eBay, Inc., Expiration: January, 2015

Exercise Price: $55.00 | | | 1,200 | | | | 212,400 | |

eBay, Inc., Expiration: July, 2014

Exercise Price: $48.00 | | | 53 | | | | 13,939 | |

General Motors Co., Expiration: January, 2015

Exercise Price: $40.00 | | | 600 | | | | 60,000 | |

GNC Holdings, Inc., Expiration: July, 2014

Exercise Price: $35.00 | | | 170 | | | | 8,500 | |

Hertz Global Holdings, Inc., Expiration: July, 2014

Exercise Price: $27.00 | | | 185 | | | | 30,340 | |

Hologic, Inc., Expiration: July, 2014

Exercise Price: $24.00 • | | | 547 | | | | 76,580 | |

Iron Mountain, Inc., Expiration: August, 2014

Exercise Price: $35.00 | | | 215 | | | | 32,250 | |

Lorillard, Inc., Expiration: December, 2014

Exercise Price: $80.00 • | | | 550 | | | | 8,800 | |

Mondelez International, Inc., Expiration: July, 2014

Exercise Price: $37.00 | | | 170 | | | | 13,940 | |

News Corp., Expiration: July, 2014

Exercise Price: $17.00 • | | | 250 | | | | 25,625 | |

Packaging Corp. of America, Expiration: July, 2014

Exercise Price: $67.50 | | | 150 | | | | 63,000 | |

PepsiCo, Inc., Expiration: January, 2015

Exercise Price: $87.50 • | | | 1,150 | | | | 491,625 | |

PepsiCo, Inc., Expiration: July, 2014

Exercise Price: $87.50 | | | 23 | | | | 5,060 | |

Pfizer, Inc., Expiration: July, 2014

Exercise Price: $29.60 ^ | | | 170 | | | | 5,610 | |

Pinnacle Foods, Inc., Expiration: August, 2014

Exercise Price: $30.00 • | | | 167 | | | | 52,605 | |

Scorpio Tankers, Inc., Expiration: August, 2014

Exercise Price: $10.00 | | | 300 | | | | 18,000 | |

Teekay Corp., Expiration: October, 2014

Exercise Price: $62.50 | | | 400 | | | | 120,000 | |

Telephone & Data Systems, Inc., Expiration: July, 2014

Exercise Price: $25.00 • | | | 200 | | | | 24,500 | |

Time Warner Cable, Inc., Expiration: October, 2014

Exercise Price: $150.00 | | | 125 | | | | 50,000 | |

TRI Pointe Homes, Inc., Expiration: July, 2014

Exercise Price: $20.00 • | | | 317 | | | | 1,585 | |

Twenty-First Century Fox, Inc., Expiration: October, 2014

Exercise Price: $34.00 | | | 758 | | | | 187,226 | |

Volcano Corp., Expiration: July, 2014