Annual Report

June 30, 2017

| | Quaker Event Arbitrage Fund |

| | Quaker Global Tactical Allocation Fund |

| | Quaker Mid-Cap Value Fund |

| | Quaker Small-Cap Value Fund |

| | Quaker Strategic Growth Fund |

| | Mutual fund investing involves risk. Principal loss is possible. | |

| | Investing in the Quaker Funds may involve special risk including, but not limited to, investments in smaller companies, short sales, foreign securities, special situations, debt securities and value growth investing. Please refer to the prospectus for more complete information. | |

| | This report must be preceded or accompanied by a current prospectus. | |

| | The opinions expressed are those of the adviser or sub-advisers through the end of the period for this report, are subject to change, are not a guarantee, and should not be considered investment advice. | |

| | Fund holdings are subject to change and should not be considered a recommendation to buy or sell any security. Current and future holdings are subject to risk. | |

Chairman’s Letter to the Shareholders (unaudited)

June 30, 2017

Dear Fellow Shareholder:

The premise upon which Quaker Funds, Inc. was founded was the desire to afford everyday investors access to the same tactical and allocation strategies used by professional money managers to augment traditional investing strategies within a holistic asset allocation mix. Our commitment to this principle is still as strong today as it was the day we opened our doors.

Our management team continually strives to provide our shareholders with innovative investment alternatives and advisers that constantly seek superior returns. Thank you for your trust and investment in the Quaker Funds.

Sincerely,

Jeffry H. King, Sr.

Chairman & CEO

Quaker Investment Trust

| | | | | |

| | | Table of Contents | | |

| | | | Page | |

| | | Chairman’s Letter to the Shareholders | 1 | |

| | | Performance Update: | | |

| | | Quaker Event Arbitrage Fund | 2 | |

| | | Quaker Global Tactical Allocation Fund | 5 | |

| | | Quaker Mid-Cap Value Fund | 8 | |

| | | Quaker Small-Cap Value Fund | 12 | |

| | | Quaker Strategic Growth Fund | 15 | |

| | | Expense Information | 18 | |

| | | Schedule of Investments | 20 | |

| | | Statements of Assets and Liabilities | 42 | |

| | | Statements of Operations | 44 | |

| | | Statements of Changes in Net Assets | 46 | |

| | | Financial Highlights | 48 | |

| | | Notes to the Financial Statements | 63 | |

| | | Report of Independent Registered Public | | |

| | | Accounting Firm | 82 | |

| | | Trustees and Officers | 83 | |

| | | Approval of Advisory and | | |

| | | Sub-Advisory Agreements | 85 | |

| | | General Information | 87 | |

| | | | | |

Performance Update (unaudited)

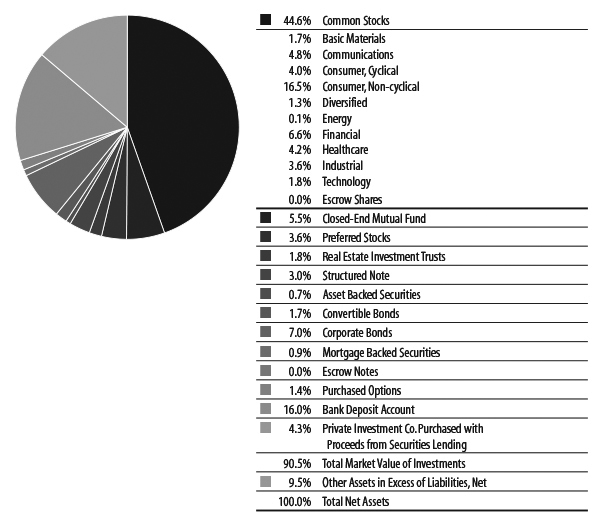

Quaker Event Arbitrage Fund (QEAAX, QEACX, QEAIX)

OBJECTIVES AND PRINCIPAL STRATEGIES

The Quaker Event Arbitrage Fund (“Fund”) seeks to provide long-term growth of capital. The Fund generally invests in the securities of publicly traded companies involved in mergers, takeovers, tender offers, leveraged buyouts, spin-offs, liquidations or similar events.

PERFORMANCE REVIEW AND MARKET OUTLOOK

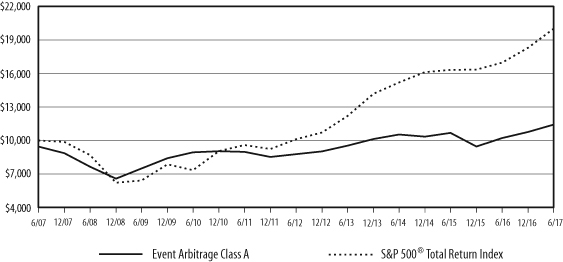

Over the last year the Fund returned 11.70% (before sales charges), whereas the total return of the S&P 500 was 17.90%. While the equity market gyrated over the last year, the Fund’s daily volatility was roughly one quarter lower than that of the S&P 500. The performance differential to the S&P 500 can be explained by the lower risk of the Fund, that translates into a lower volatility, as well as the different return characteristics of event-driven securities that the Fund invests in. Moreover, the Fund has a part of its portfolio invested in bonds that have a lower return than equities, whereas the S&P 500 index consists only of equities.

The past 12 months saw the event-driven asset class continue to recover from the turmoil it experienced in late 2015 and into early 2016. Many investments in distressed energy exploration & production companies not only recovered over the last year but reached their target levels and were sold. Nevertheless, while exploration and production companies may not be attractive at this point, distressed energy services companies such as deep sea equipment owners continue to provide attractive risk/reward profiles. Activity of activist investors has not yet reached the levels seen at its peak in 2014 and 2015 but nevertheless many investments in this area provide very attractive risk/return profiles. Merger arbitrage continued to have unattractive risk/return profiles throughout the period because its return potential depends on the level of interest rates, which generally remain near the recent historic lows. As a result, few positions in this sub-strategy were entered into throughout the year.

Looking forward, the portfolio management team believes the best risk/reward opportunities are likely to remain in activist investments, distressed investments and special situations such as spin-offs because the overall market environment is expected to persist for the foreseeable future. We believe that the prospect of a comprehensive corporate tax reform should support event-driven securities, because lower corporate taxes or repatriation of offshore profits would boost the cash reserves of corporations, some of which is likely to be used for corporate events such as mergers. In addition, we believe that the risk taking environment remains favorable, as evidenced by low credit spreads, which are important for corporate events because the availability of credit is an important factor for the completion of corporate events, that often require issuance of new debt or refinancing of existing debt.

I wish all investors a prosperous year and thank you for your continued support.

Sincerely,

Thomas Kirchner, Portfolio Manager

Quaker Funds, Inc.

Performance Update (unaudited) (continued)

Quaker Event Arbitrage Fund (QEAAX, QEACX, QEAIX)

ADVISER:

Quaker Funds, Inc.

TOTAL NET ASSETS:

AS OF JUNE 30, 2017

$29,701,092

| Top 10 Holdings* (% of net assets) | | |

| Altaba Inc. | 5.5% | |

| Diagnostic Services Holdings Inc. | 4.2% | |

| IEC Electronics Corp. | 3.6% | |

| Mondelez International Inc. | 3.3% | |

| CA Immobilien Anlagen AG | 3.2% | |

| Heineken Holding NV Structured Note, | | |

| Expiration: 2/27/2018 | 3.0% | |

| Conwert Immobilien Invest SE | 3.0% | |

| Pfizer Inc. | 2.8% | |

| Anheuser-Busch InBev NV - ADR | 2.2% | |

| Imperva Inc. | 2.1% | |

| % Fund Total | 32.9% | |

| * Includes Long-Term Investments only. | | |

| Sectors (% of net assets) |

Performance Update (unaudited) (continued)

Quaker Event Arbitrage Fund (QEAAX, QEACX, QEAIX)

Growth of a Hypothetical $10,000 Investment

June 30, 2017

| Average Annualized Total Return |

| | | | | | | | | | Commencement |

| | | | | | | | | | of operations |

| | Expense | Inception | | | | | | | through |

| | Ratio* | Date | One Year | Five Year | Ten Year | 6/30/2017 |

| | | | with | without | with | without | with | without | with | without |

| | | | sales | sales | sales | sales | sales | sales | sales | sales |

| | | | charge | charge | charge | charge | charge | charge | charge | charge |

| Class A | 1.99% | 11/21/03 | 5.57% | 11.70% | 4.22% | 5.40% | 1.33% | 1.90% | 5.24% | 5.68% |

| Class C | 2.74% | 6/7/10 | 10.91% | 10.91% | 4.62% | 4.62% | N/A | N/A | 2.99% | 2.99% |

| Institutional Class | 1.74% | 6/7/10 | 12.10% | 12.10% | 5.69% | 5.69% | N/A | N/A | 4.01% | 4.01% |

| S&P 500® Total Return Index** | | | 17.90% | 17.90% | 14.63% | 14.63% | 7.18% | 7.18% | 8.67% | 8.67% |

| * | As stated in the Prospectus dated November 1, 2016. Net Expense Ratio shown. Gross Expense Ratio: A:2.41%, C:3.16%, I:2.16%. The net expense ratio reflects a contractual commitment by the Fund’s investment adviser to waive fees and reimburse expenses through November 1, 2017. Absent the waiver and reimbursement, performance would have been less favorable. |

| ** | The benchmark since inception returns are calculated since commencement of November 21, 2003 through June 30, 2017. |

Performance data quoted represents past performance and is no guarantee of future results. Investment return and principal value will fluctuate so that shares, when redeemed, may be worth more or less than their original cost. Current performance may be lower or higher than performance data quoted. Performance data current to the most recent month end is available at www.quakerfunds.com or by calling us toll free at 800-220-8888. Total return includes reinvestment of dividends and capital gains.

Class A shares of the Fund have a maximum sales charge of 5.50%.

The performance table does not reflect the deduction of taxes that a shareholder might pay on fund distributions or the redemption of fund shares. Total return calculations reflect expense reimbursements and fee waivers in the applicable periods. See financial highlights for periods where fees were waived or reimbursed.

The Fund’s portfolio holdings may differ significantly from the securities held in the index and, unlike a mutual fund, an unmanaged index assumes no transaction costs, taxes, management fees or other expenses. You cannot invest directly in an index.

The S&P 500® Total Return Index (“S&P 500® Index”) is a widely recognized, unmanaged index consisting of the approximately 500 largest companies in the United States as measured by market capitalization. The S&P 500® Index assumes reinvestment of all dividends and distributions.

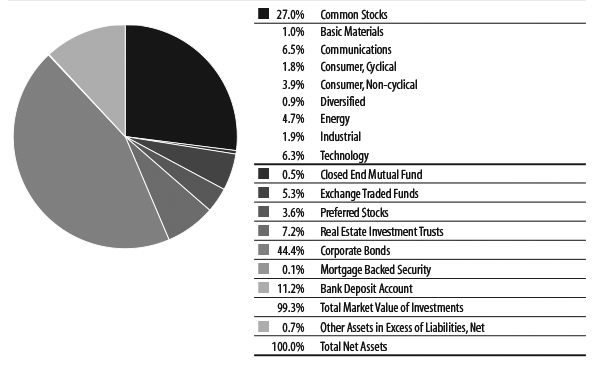

Performance Update (unaudited)

Quaker Global Tactical Allocation Fund (QTRAX, QTRCX, QTRIX)

OBJECTIVES AND PRINCIPAL STRATEGIES

The Fund seeks to provide long-term growth of capital. The Fund invests in ETFs and common stocks of U.S. companies, ETF’s and ADRs of foreign companies, and individual bonds and ETFs of fixed income securities, without regard to market capitalization.

PERFORMANCE REVIEW AND MARKET OUTLOOK

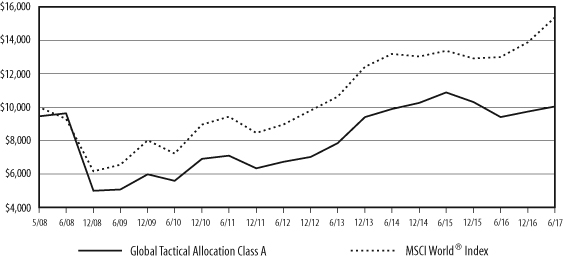

For the fiscal year ended June 30, 2017, the Fund returned 6.73% (before sales charges), whereas the total return of the MSCI World Index (“MSCI World”) was18.20%.

��

Since taking over management of the Fund in early 2017 the objective of the new management team has been to maintain the existing exposure of the Fund’s portfolio, which has the benefit of minimizing portfolio turnover. The result has been a relatively large exposure to bonds, which is atypical for funds in this category. However, the advantage of this exposure is a significantly reduced volatility compared to what a large exposure to equities would have produced. While we believe this portfolio allocation is likely to generate good income for investors in the future, it limits the prospects for capital gains, as evidenced by the underperformance compared to the benchmark, which has no bond allocation. The Fund’s dividend yield of 4% currently compares favorably with the benchmark’s 2.6%. Moreover, the Fund differs from the benchmark in its allocation to mid- and small cap stocks, which generally have seen less appreciation in recent quarters than large and mega-caps, to which the benchmark is overexposed.

Looking forward, the investment team expects to continue to seek to increase the international exposure of the Fund by acquiring the equity of a number of international portfolio companies. For the remainder of the year global equity markets are likely to be driven by interest rate policy as well as the potential for corporate tax reform in the U.S., which is likely to provide support to the equity markets.

Overall, the Fund is well positioned to produce income while providing price stability through its bond exposure.

I wish all investors a prosperous year and thank you for your continued support.

Sincerely,

Thomas Kirchner, Portfolio Manager

Quaker Funds, Inc.

Performance Update (unaudited) (continued)

Quaker Global Tactical Allocation Fund (QTRAX, QTRCX, QTRIX)

ADVISER:

Quaker Funds, Inc.

TOTAL NET ASSETS:

AS OF JUNE 30, 2017

$6,793,620

| Top 10 Holdings* (% of net assets) | | |

| iShares MSCI United Kingdom ETF | 3.0% | |

| Verizon Communications Inc. | 2.6% | |

| QUALCOMM Inc. | 2.6% | |

| AT&T Inc. | 2.4% | |

| PowerShares DB Commodity Index Tracking Fund | 2.3% | |

| Microsoft Corp. | 2.2% | |

| Molson Coors Brewing Co. | 2.2% | |

| General Electric Co. | 1.9% | |

| General Motors Co. | 1.6% | |

| Twenty-First Century Fox Inc. Cl B | 1.5% | |

| % Fund Total | 22.3% | |

| * Includes Long-Term Investments only. | | |

| Sectors (% of net assets) |

Performance Update (unaudited) (continued)

Quaker Global Tactical Allocation Fund (QTRAX, QTRCX, QTRIX)

Growth of a Hypothetical $10,000 Investment

June 30, 2017

| Average Annualized Total Return |

| | | | | | | | | | Commencement |

| | | | | | | | | | of operations |

| | Expense | Inception | | | | | | | through |

| | Ratio* | Date | One Year | Five Year | Ten Year | 6/30/2017 |

| | | | with | without | with | without | with | without | with | without |

| | | | sales | sales | sales | sales | sales | sales | sales | sales |

| | | | charge | charge | charge | charge | charge | charge | charge | charge |

| Class A | 1.80% | 5/1/08 | 0.85% | 6.73% | 7.12% | 8.33% | N/A | N/A | 0.04% | 0.66% |

| Class C | 2.55% | 5/1/08 | 5.88% | 5.88% | 7.51% | 7.51% | N/A | N/A | -0.10% | -0.10% |

| Institutional Class | 1.55% | 7/23/08 | 6.97% | 6.97% | 8.61% | 8.61% | N/A | N/A | 2.32% | 2.32% |

| MSCI World® Index** | | | 18.20% | 18.20% | 11.38% | 11.38% | N/A | N/A | 4.80% | 4.80% |

| * | As stated in the Prospectus dated November 1, 2016. Net Expense Ratio shown. Gross Expense Ratio: A:2.10%, C:2.85%, I:1.85%. The net expense ratio reflects a contractual commitment by the Fund’s investment adviser to waive fees and reimburse expenses through November 1, 2017. Absent the waiver and reimbursement, performance would have been less favorable. |

| ** | The benchmark since inception returns are calculated since commencement of May 1, 2008 through June 30, 2017. |

Performance data quoted represents past performance and is no guarantee of future results. Investment return and principal value will fluctuate so that shares, when redeemed, may be worth more or less than their original cost. Current performance may be lower or higher than performance data quoted. Performance data current to the most recent month end is available at www.quakerfunds.com or by calling us toll free at 800-220-8888. Total return includes reinvestment of dividends and capital gains.

Class A shares of the Fund have a maximum sales charge of 5.50%.

The performance table does not reflect the deduction of taxes that a shareholder might pay on fund distributions or the redemption of fund shares. Total return calculations reflect expense reimbursements and fee waivers in the applicable periods. See financial highlights for periods where fees were waived or reimbursed.

The Fund’s portfolio holdings may differ significantly from the securities held in the index and, unlike a mutual fund, an unmanaged index assumes no transaction costs, taxes, management fees or other expenses. You cannot invest directly in an index.

The Morgan Stanley Capital International World Index (“MSCI World® Index”) measures developed-market equity performance throughout the world. The MSCI World® Index assumes reinvestment of all dividends and distributions.

Performance Update (unaudited)

Quaker Mid-Cap Value Fund (QMCVX, QMCCX, QMVIX)

OBJECTIVES AND PRINCIPAL STRATEGIES

The Quaker Mid-Cap Value Fund (the “Fund”) seeks to provide long-term growth of capital. Current income is not a significant investment consideration and any such income realized will be considered incidental to the Fund’s investment objective. The Fund invests primarily in common stocks comparable to the companies included in the Russell Midcap® Value Index.

PERFORMANCE REVIEW AND MARKET OUTLOOK

For the fiscal year ended June 30, 2017, the Fund increased 19.00% (before sales charges), versus a gain of 15.93% for the Russell Midcap® Value Index. The past year saw dramatic changes to the drivers of performance for the Fund. In the previous fiscal year, utilities and real estate were two of the best performing sectors, while information technology and consumer discretionary were two of the worst. But this past year, that completely reversed. In the Fund, the information technology and consumer discretionary sectors were the leading contributors to performance with gains of 50% and 42%, versus gains in the benchmark of 41% and 22%, respectively. The largest detractors from performance were the energy and health care sectors, with returns of -9% and +5% versus the benchmark returns of -5% and +10%, respectively.

We believe the most notable changes in the environment over the past year were the change in interest rates, and the improved economic outlook following the surprise victory of President Trump in November. Last year at this time we wrote about the extraordinarily low interest rate environment and the headwinds that it created for the Fund over the prior year. We thought rates would go up and return to somewhat normalized levels, leading to a market that rewarded stock pickers like ourselves, but did not profess to know when that would happen. Not long after our writing, higher interest rates appeared, along with recognition of improved growth in the economy. The result was a robust stock market, with significant gains in several positions in the Fund.

Looking forward, we continue to expect modest growth for the U.S. economy for the balance of the year. Unemployment remains at post-recession lows, and most economic indicators appear supportive of a continued modest growth thesis. This modest growth outlook is without any help from proposed policy changes from the Trump administration. Anticipation of changes that would be stimulative to business while simultaneously reducing regulatory burdens helped the markets in the weeks immediately following the election, but we believe that optimism has diminished in the past few months on the failure of the administration to push through any changes thus far. So that remains a potential stimulus to the economy and to equity markets.

Offsetting that optimism somewhat is our recognition of the market’s valuation. We have talked frequently about equity values having been driven higher in part by a lowering of the discount rate being assigned to future cash flows. The current implied discount rate, as measured by Credit Suisse HOLT, has now reached its lowest level since the Tech bubble of 2000. However, that doesn’t have to suggest that a major decline in equity values is imminent. A low discount rate is explainable in the low interest rate environment where potential returns for other investment options appear quite low. In addition, should the economy accelerate, thus generating better than expected corporate performance, we would expect equities to follow suit. The point is simply to illustrate that in our opinion the tailwind for equities from a lower discount rate is increasingly unlikely. There may no longer be a “rising tide to lift all (most) boats”, making stock selection increasingly important. Our investment process continues to focus on identifying companies with improving corporate performance which

Performance Update (unaudited) (continued)

we believe will be increasingly important to generate performance should the discount rate begin to normalize back toward historical levels.

Sincerely,

Frank Latuda, Jr. CFA

Chief Investment Officer & Portfolio Manager

Kennedy Capital Management, Inc.

Performance Update (unaudited) (continued)

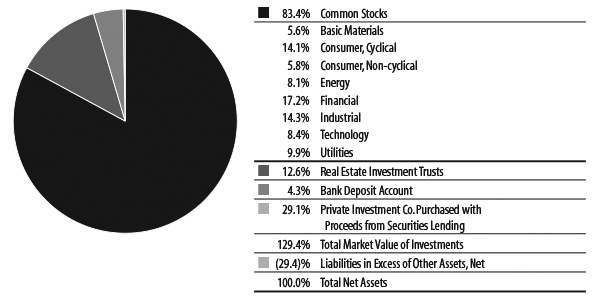

Quaker Mid-Cap Value Fund (QMCVX, QMCCX, QMVIX)

SUB-ADVISER:

Kennedy Capital Management, Inc.

TOTAL NET ASSETS:

AS OF JUNE 30, 2017

$7,088,807

| Top 10 Holdings* (% of net assets) | | |

| Reinsurance Group of America Inc. Cl A | 2.9% | |

| East West Bancorp Inc. | 2.7% | |

| Centene Corp. | 2.5% | |

| Old Dominion Freight Line Inc. | 2.4% | |

| Huntington Bancshares Inc. | 2.3% | |

| Torchmark Corp. | 2.2% | |

| Brunswick Corp. | 2.2% | |

| Lincoln National Corp. | 2.2% | |

| Western Digital Corp. | 2.2% | |

| DTE Energy Co. | 2.1% | |

| % Fund Total | 23.7% | |

| * Includes Long-Term Investments only. | | |

| Sectors (% of net assets) |

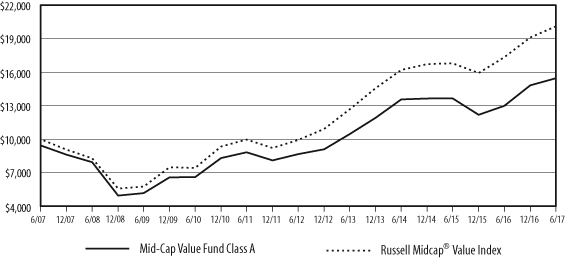

Performance Update (unaudited) (continued)

Quaker Mid-Cap Value Fund (QMCVX, QMCCX, QMVIX)

Growth of a Hypothetical $10,000 Investment

June 30, 2017

| Average Annualized Total Return |

| | | | | | | | | | Commencement |

| | | | | | | | | | of operations |

| | Expense | Inception | | | | | | | through |

| | Ratio* | Date | One Year | Five Year | Ten Year | 6/30/2017 |

| | | | with | without | with | without | with | without | with | without |

| | | | sales | sales | sales | sales | sales | sales | sales | sales |

| | | | charge | charge | charge | charge | charge | charge | charge | charge |

| Class A | 2.17% | 12/31/97 | 12.47% | 19.00% | 11.00% | 12.27% | 4.45% | 5.05% | 7.27% | 7.58% |

| Class C | 2.92% | 7/31/00 | 18.13% | 18.13% | 11.43% | 11.43% | 4.27% | 4.27% | 7.77% | 7.77% |

| Institutional Class | 1.92% | 11/21/00 | 19.31% | 19.31% | 12.55% | 12.55% | 5.31% | 5.31% | 9.03% | 9.03% |

| Russell Midcap® Value Index** | | | 15.93% | 15.93% | 15.14% | 15.14% | 7.23% | 7.23% | 9.48% | 9.48% |

| * | As stated in the Prospectus dated November 1, 2016. |

| ** | The benchmark since inception returns are calculated since commencement of December 31,1997 through June 30, 2017. |

Performance data quoted represents past performance and is no guarantee of future results. Investment return and principal value will fluctuate so that shares, when redeemed, may be worth more or less than their original cost. Current performance may be lower or higher than performance data quoted. Performance data current to the most recent month end is available at www.quakerfunds.com or by calling us toll free at 800-220-8888. Total return includes reinvestment of dividends and capital gains.

Class A shares of the Fund have a maximum sales charge of 5.50%.

The performance table does not reflect the deduction of taxes that a shareholder might pay on fund distributions or the redemption of fund shares. Total return calculations reflect expense reimbursements and fee waivers in the applicable periods. See financial highlights for periods where fees were waived or reimbursed.

The Fund’s portfolio holdings may differ significantly from the securities held in the index and, unlike a mutual fund, an unmanaged index assumes no transaction costs, taxes, management fees or other expenses. You cannot invest directly in an index.

The Russell Midcap® Value Index is a widely recognized, unmanaged index of companies included in the Russell 1000 Index with current market capitalizations between $1.2 billion to $28.2 billion. The Russell Midcap® Value index assumes reinvestment of all dividends.

Performance Update (unaudited)

Quaker Small-Cap Value Fund (QUSVX, QSVCX, QSVIX)

OBJECTIVES AND PRINCIPAL STRATEGIES

The Fund seeks to provide long-term growth of capital. Current income is not a significant investment consideration, and any such income realized will be considered incidental to the Fund’s investment objective. The Fund invests primarily in common stocks of U.S. companies with market capitalizations similar to the market capitalizations of companies included in the Russell 2000® Index and Russell 2500® Index. The Fund invests in companies considered by the Fund’s sub-adviser to have consistent earnings and above-average core assets, selling at relatively low market valuations, with attractive growth and momentum characteristics.

PERFORMANCE REVIEW AND MARKET OUTLOOK

For the fiscal year ended June 30, 2017, the Fund’s performance was 20.11% (before sales charges), while the Fund’s benchmark, the Russell 2000® Index (a broad-based cross-section of the entire U.S. small-cap market), returned 24.60%. Working from the bottom up, we evaluate companies relative to their industry peers using four broad categories of attractiveness: value, management, momentum, and sentiment. Value to us means fairly traditional ratios of price to fundamental value; management measures seek evidence that company management has produced and will continue to produce earnings power; momentum helps us determine when stocks might be expected to begin their ascent toward full valuation; and sentiment provides another level of understanding of the buying and selling behavior of key investor segments.

Our work produced mixed results over this period, during which our returns followed the value trend: when value recovered at the end of 2016, we outperformed; and when it faltered in the second quarter of 2017, our work was challenged. The bulk of our underperformance arose from poor stock selection in the health care sector where despite enthusiasm for the biotech industry, our more value oriented holdings lagged. The same theme carried through to the energy sector where attractively priced drillers suffered in the face of volatile oil supply dynamics. And to top it off, our REIT picks (mostly our bets in brick and mortar retail REITs) underperformed.

On a positive note, in the financials sector, our deeper-than-benchmark value orientation provided much needed relief, particularly in the insurance industry.

We remain firm in our conviction that superior results can be achieved through a consistent, systematic approach that focuses on low-priced companies with proven management, earnings power, and favorable investor sentiment.

The Portfolio Management Team

AJO, LP

Performance Update (unaudited) (continued)

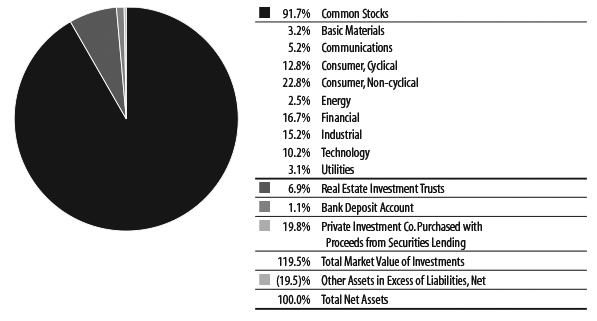

Quaker Small-Cap Value Fund (QUSVX, QSVCX, QSVIX)

SUB-ADVISER:

AJO, LP

TOTAL NET ASSETS:

AS OF JUNE 30, 2017

$28,688,345

| Top 10 Holdings* (% of net assets) | | |

| Owens Corning | 1.2% | |

| Reinsurance Group of America Inc. Cl A | 1.2% | |

| Vishay Intertechnology Inc. | 1.2% | |

| Synovus Financial Corp. | 1.1% | |

| Aspen Technology Inc. | 1.1% | |

| United Community Banks Inc. | 1.1% | |

| Assured Guaranty Ltd. | 1.1% | |

| Lear Corp. | 1.1% | |

| MicroStrategy Inc. | 1.1% | |

| Mack-Cali Realty Corp. | 1.1% | |

| % Fund Total | 11.3% | |

| * Includes Long-Term Investments only. | | |

| Sectors (% of net assets) |

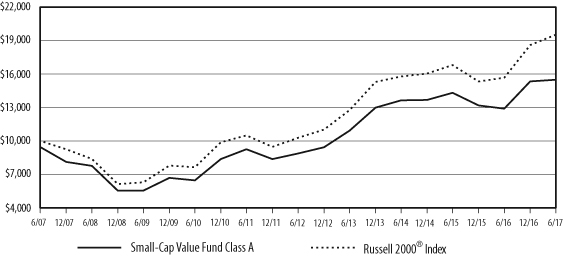

Performance Update (unaudited) (continued)

Quaker Small-Cap Value Fund (QUSVX, QSVCX, QSVIX)

Growth of a Hypothetical $10,000 Investment

June 30, 2017

| Average Annualized Total Return |

| | | | | | | | | | Commencement |

| | | | | | | | | | of operations |

| | Expense | Inception | | | | | | | through |

| | Ratio* | Date | One Year | Five Year | Ten Year | 6/30/2017 |

| | | | with | without | with | without | with | without | with | without |

| | | | sales | sales | sales | sales | sales | sales | sales | sales |

| | | | charge | charge | charge | charge | charge | charge | charge | charge |

| Class A | 1.98% | 11/25/96 | 13.50% | 20.11% | 10.53% | 11.79% | 4.47% | 5.06% | 9.47% | 9.77% |

| Class C | 2.73% | 7/28/00 | 19.21% | 19.21% | 10.96% | 10.96% | 4.27% | 4.27% | 8.48% | 8.48% |

| Institutional Class | 1.73% | 9/12/00 | 20.41% | 20.41% | 12.06% | 12.06% | 5.33% | 5.33% | 8.91% | 8.91% |

| Russell 2000® Index** | | | 24.60% | 24.60% | 13.70% | 13.70% | 6.92% | 6.92% | 8.42% | 8.42% |

| * | As stated in the Prospectus dated November 1, 2016. |

| ** | The benchmark since inception returns are calculated since commencement of November 25, 1996 through June 30, 2017. |

Performance data quoted represents past performance and is no guarantee of future results. Investment return and principal value will fluctuate so that shares, when redeemed, may be worth more or less than their original cost. Current performance may be lower or higher than performance data quoted. Performance data current to the most recent month end is available at www.quakerfunds.com or by calling us toll free at 800-220-8888. Total return includes reinvestment of dividends and capital gains.

Class A shares of the Fund have a maximum sales charge of 5.50%.

The performance table does not reflect the deduction of taxes that a shareholder might pay on fund distributions or the redemption of fund shares. Total return calculations reflect expense reimbursements and fee waivers in the applicable periods. See financial highlights for periods where fees were waived or reimbursed.

The Fund’s portfolio holdings may differ significantly from the securities held in the index and, unlike a mutual fund, an unmanaged index assumes no transaction costs, taxes, management fees or other expenses. You cannot invest directly in an index.

The Russell 2000® Index is a widely recognized, unmanaged index comprised of the smallest 2000 companies represented in the Russell 3000® Index. The Russell 2000® Index currently represents approximately 8% of the market capitalization of the Russell 3000® Index.

Performance Update (unaudited)

Quaker Strategic Growth Fund (QUAGX, QAGCX, QAGIX)

OBJECTIVES AND PRINCIPAL STRATEGIES

The Fund seeks to provide long-term growth of capital. The Fund invests primarily in the common stock of companies, which the Fund’s sub-adviser believes will provide a higher total return than that of the index.

PERFORMANCE REVIEW AND MARKET OUTLOOK

June marks the 10 year anniversary since the start of the financial crisis. Leveraged value stocks peaked in July 2007 before mortgage and high yield bonds began their 18 month slide, leading to the August quant crisis as the deleveraging process began and value stock prices contracted. The bull market in equities continued as the S&P 500® Index generated a 17.90% return for the fiscal year ended June 30, 2017. The Fund finished the fiscal year with a return of 17.01% (before sales charges).

In late 2016 we witnessed a round of investor optimism, and thus small capitalization value stocks outperformed large capitalization growth stocks. However, like similar rallies since the financial crisis, this confidence has unraveled. The first half of 2017 has again disappointed investors with lower than expected growth and inflation. In turn, interest rates remain very low and value stocks have continued to underperform. The value stocks that continue to disappoint are concentrated in sectors that are most sensitive to the lasting impacts of the financial crisis. Among the cheapest sectors on a Book-to-Price valuation basis are financials, energy, and materials.

The best performing stocks over the trailing one year were those with higher volatility and strong long term price momentum. Stocks with strong analyst expectations underperformed while stocks with financial risk outperformed as investors embraced risk. In a reversal from recent periods, higher yielding stocks underperformed as the market adjusted to rising rate expectations. In terms of sectors, financials offered the highest returns as investors initially anticipated a lower regulatory burden under the new administration, a sentiment which began to dissipate during the first quarter. Telecom, utilities, real estate and energy stocks lagged on expectations for rising rates and energy prices which began to stall following their rapid rise earlier in 2016.

While greater exposure to book-to-price added value, a general overweight to value characteristics detracted from return and the Fund reduced its exposure to value characteristics over the period. Additionally, overweights to stocks with greater financial risk and volatility added value as the market embraced risk. Over the period the Fund increased its exposure to stocks with strong long term momentum, however the shift did not capture the strong returns exhibited throughout the period and an average underweight detracted from performance. An underweight to the energy sector yielded positive returns relative to the benchmark while stock selection in technology detracted largely due to lower exposure to large cap technology names with strong returns.

Looking forward, larger cap stocks with higher levels of foreign revenue are increasingly attractive as foreign currency prices have stabilized and the dollar has weakened. We believe stocks with strong price momentum also continue to be favored. Return expectations for value oriented securities have come down as the market renews its focus on earnings growth and VIX remains at historically low levels. The Fund is tilted towards technology and health care and away from energy and capital goods.

The Portfolio Management Team

Los Angeles Capital Management and Equity Research, Inc.

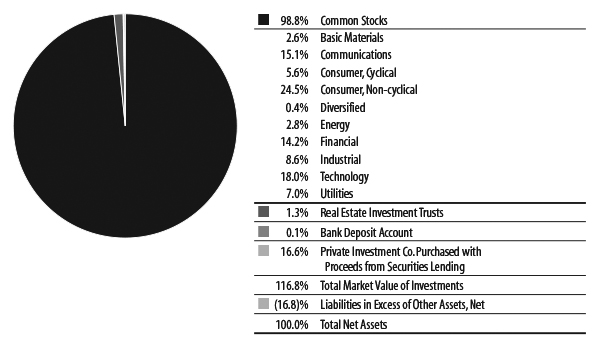

Performance Update (unaudited) (continued)

Quaker Strategic Growth Fund (QUAGX, QAGCX, QAGIX)

SUB-ADVISER:

Los Angeles Capital Management and Equity Research, Inc.

TOTAL NET ASSETS:

AS OF JUNE 30, 2017

$71,550,550

| Top 10 Holdings* (% of net assets) | | |

| Apple Inc. | 5.5% | |

| Amazon.com Inc. | 3.6% | |

| Facebook Inc. Cl A | 2.7% | |

| JPMorgan Chase & Co. | 2.1% | |

| Microsoft Corp. | 2.0% | |

| Deere & Co. | 2.0% | |

| Altria Group Inc. | 2.0% | |

| Alphabet Inc. Cl A&C | 1.8% | |

| The Dun & Bradstreet Corp. | 1.8% | |

| Broadcom Ltd. | 1.7% | |

| % Fund Total | 25.2% | |

| * Includes Long-Term Investments only. | | |

| Sectors (% of net assets) |

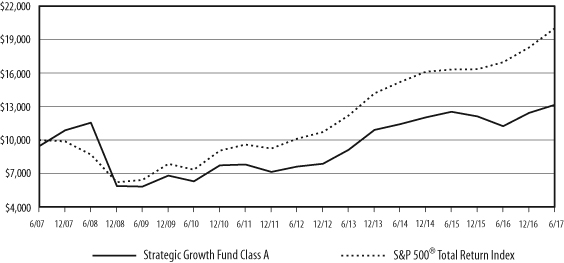

Performance Update (unaudited) (continued)

Quaker Strategic Growth Fund (QUAGX, QAGCX, QAGIX)

Growth of a Hypothetical $10,000 Investment

June 30, 2017

| Average Annualized Total Return |

| | | | | | | | | | Commencement |

| | | | | | | | | | of operations |

| | Expense | Inception | | | | | | | through |

| | Ratio* | Date | One Year | Five Year | Ten Year | 6/30/2017 |

| | | | with | without | with | without | with | without | with | without |

| | | | sales | sales | sales | sales | sales | sales | sales | sales |

| | | | charge | charge | charge | charge | charge | charge | charge | charge |

| Class A | 1.87% | 11/25/96 | 10.56% | 17.01% | 10.29% | 11.55% | 2.77% | 3.36% | 10.53% | 10.83% |

| Class C | 2.62% | 7/11/00 | 16.17% | 16.17% | 10.71% | 10.71% | 2.59% | 2.59% | 4.05% | 4.05% |

| Institutional Class | 1.62% | 7/20/00 | 17.32% | 17.32% | 11.82% | 11.82% | 3.63% | 3.63% | 5.00% | 5.00% |

| S&P 500® Total Return Index** | | | 17.90% | 17.90% | 14.63% | 14.63% | 7.18% | 7.18% | 7.82% | 7.82% |

| * | As stated in the Prospectus dated November 1, 2016. |

| ** | The benchmark since inception returns are calculated since commencement of November 25, 1996 through June 30, 2017. |

Performance data quoted represents past performance and is no guarantee of future results. Investment return and principal value will fluctuate so that shares, when redeemed, may be worth more or less than their original cost. Current performance may be lower or higher than performance data quoted. Performance data current to the most recent month end is available at www.quakerfunds.com or by calling us toll free at 800-220-8888. Total return includes reinvestment of dividends and capital gains.

Class A shares of the Fund have a maximum sales charge of 5.50%.

The performance table does not reflect the deduction of taxes that a shareholder might pay on fund distributions or the redemption of fund shares. Total return calculations reflect expense reimbursements and fee waivers in the applicable periods. See financial highlights for periods where fees were waived or reimbursed.

The Fund’s portfolio holdings may differ significantly from the securities held in the index and, unlike a mutual fund, an unmanaged index assumes no transaction costs, taxes, management fees or other expenses. You cannot invest directly in an index.

The S&P 500® Total Return Index (“S&P 500® Index”) is a widely recognized, unmanaged index consisting of the approximately 500 largest companies in the United States as measured by market capitalization. The S&P 500® Index assumes reinvestment of all dividends and distributions.

Expense Information (unaudited)

As a shareholder of the Fund, you incur two types of costs: (1) transaction costs, including applicable sales charges and redemption fees; and (2) ongoing costs, including management fees, distribution (12b-1) fees and other Fund expenses. This example is intended to help you understand your ongoing costs (in dollars) of investing in the Fund and to compare these costs with the ongoing costs of investing in other funds. The example is based on an investment of $1,000 invested at the beginning of the (six-month) period and held for the entire period January 1, 2017 through June 30, 2017.

ACTUAL EXPENSES

The first section of each table below provides information about actual account values and actual expenses for each of the Funds. You may use this information, together with the amount you invested, to estimate the expenses that you paid over the period. Simply divide your account value by $1,000 (for example, an $8,600 account value divided by $1,000 = 8.6), then multiply the result by the number in the applicable line under the heading entitled “Expenses Paid During the Period” to estimate the expenses you paid on your account during this period.

HYPOTHETICAL EXAMPLE FOR COMPARISON PURPOSES

The second section of each table below provides information about hypothetical account values and hypothetical expenses based on the Fund’s actual expense ratio and an assumed rate of return of 5% per year before expenses, which is not the Fund’s actual return. The hypothetical account values and expenses may not be used to estimate the actual ending account balance or expenses you paid for the period. You may use this information to compare the ongoing costs of investing in the Fund to other funds. To do so, compare this 5% hypothetical example with the 5% hypothetical examples that appear in the shareholder reports of the other funds. Please note that the expenses shown in the table are meant to highlight your ongoing costs only and do not reflect any transactional costs, such as sales charges (loads), redemption fees or exchange fees. Therefore, the second section of the table is useful in comparing ongoing costs only, and will not help you determine the relative total costs of owning different funds. In addition, if these transactional costs were included, your costs would have been higher.

| | | Beginning | Annualized | Ending | |

| | | Account Value | Expense Ratio | Account Value | Expenses Paid |

| | | (1/1/2017) | for the Period | (6/30/2017) | During Period* |

| Event Arbitrage | | | | | |

| Example based on actual return of: | | | | | |

| Class A | 6.03% | $1,000.00 | 1.99% | $1,060.30 | $10.17 |

| Class C | 5.59% | 1,000.00 | 2.74% | 1,055.90 | 13.97 |

| Institutional Class | 6.22% | 1,000.00 | 1.74% | 1,062.20 | 8.90 |

| Hypothetical example based on assumed 5% return: | | | | | |

| Class A | | 1,000.00 | 1.99% | 1,014.93 | 9.94 |

| Class C | | 1,000.00 | 2.74% | 1,011.21 | 13.66 |

| Institutional Class | | 1,000.00 | 1.74% | 1,016.17 | 8.70 |

Expense Information (unaudited) (continued)

| | | | Beginning | Annualized | Ending | |

| | | | Account Value | Expense Ratio | Account Value | Expenses Paid |

| | | | (1/1/2017) | for the Period | (6/30/2017) | During Period* |

| | Global Tactical Allocation | | | | | |

| | Example based on actual return of: | | | | | |

| | Class A | 3.11% | $1,000.00 | 1.90% | $1,031.10 | $ 9.57 |

| | Class C | 2.69% | 1,000.00 | 2.63% | 1,026.90 | 13.22 |

| | Institutional Class | 3.20% | 1,000.00 | 1.60% | 1,032.00 | 8.06 |

| | Hypothetical example based on assumed 5% return: | | | | | |

| | Class A | | 1,000.00 | 1.90% | 1,015.37 | 9.49 |

| | Class C | | 1,000.00 | 2.63% | 1,011.75 | 13.12 |

| | Institutional Class | | 1,000.00 | 1.60% | 1,016.86 | 8.00 |

| | Mid-Cap Value | | | | | |

| | Example based on actual return of: | | | | | |

| | Class A | 4.27% | 1,000.00 | 2.39% | 1,042.70 | 12.10 |

| | Class C | 3.90% | 1,000.00 | 3.14% | 1,039.00 | 15.87 |

| | Institutional Class | 4.41% | 1,000.00 | 2.15% | 1,044.10 | 10.90 |

| | Hypothetical example based on assumed 5% return: | | | | | |

| | Class A | | 1,000.00 | 2.39% | 1,012.94 | 11.93 |

| | Class C | | 1,000.00 | 3.14% | 1,009.22 | 15.64 |

| | Institutional Class | | 1,000.00 | 2.15% | 1,014.13 | 10.74 |

| | Small-Cap Value | | | | | |

| | Example based on actual return of: | | | | | |

| | Class A | 0.96% | 1,000.00 | 2.28% | 1,009.60 | 11.36 |

| | Class C | 0.63% | 1,000.00 | 3.03% | 1,006.30 | 15.07 |

| | Institutional Class | 1.07% | 1,000.00 | 2.03% | 1,010.70 | 10.12 |

| | Hypothetical example based on assumed 5% return: | | | | | |

| | Class A | | 1,000.00 | 2.28% | 1,013.49 | 11.38 |

| | Class C | | 1,000.00 | 3.03% | 1,009.77 | 15.10 |

| | Institutional Class | | 1,000.00 | 2.03% | 1,014.73 | 10.14 |

| | Strategic Growth | | | | | |

| | Example based on actual return of: | | | | | |

| | Class A | 5.77% | 1,000.00 | 2.19% | 1,057.70 | 11.17 |

| | Class C | 5.34% | 1,000.00 | 2.94% | 1,053.40 | 14.97 |

| | Institutional Class | 5.85% | 1,000.00 | 1.94% | 1,058.50 | 9.90 |

| | Hypothetical example based on assumed 5% return: | | | | | |

| | Class A | | 1,000.00 | 2.19% | 1,013.93 | 10.94 |

| | Class C | | 1,000.00 | 2.94% | 1,010.22 | 14.65 |

| | Institutional Class | | 1,000.00 | 1.94% | 1,015.17 | 9.69 |

| * | Expenses are equal to the Funds’ annualized six-month expense ratios multiplied by the average account value over the period multiplied by the number of days in the most recent fiscal half year (181) divided by 365 to reflect the one-half year period. |

Schedule of Investments

Quaker Event Arbitrage Fund

June 30, 2017

| | | Number | | | Fair | |

| | | of Shares | | | Value | |

| Long-Term Investments — 68.8% | | | | | | |

| Common Stocks — 44.6% | | | | | | |

| Basic Materials — 1.7% | | | | | | |

| Chemicals — 1.7% | | | | | | |

| MPM Holdings Inc. (a)(b) | | | 34,576 | | | $ | 515,182 | |

| Mining — 0.0% | | | | | | | | |

Sacre-Coeur Minerals Ltd. (a) f *^ | | | 109,444 | | | | 0 | |

Talvivaara Mining Co. PLC (a) f *^ | | | 123,845,509 | | | | 0 | |

| | | | | | | | 0 | |

| Total Basic Materials | | | | | | | | |

| (Cost $2,393,882) | | | | | | | 515,182 | |

| Communications — 4.8% | | | | | | | | |

| Internet — 4.6% | | | | | | | | |

30DC Inc. (a)• | | | 50,000 | | | | 353 | |

| comScore Inc. (a)(b) | | | 8,500 | | | | 223,125 | |

| Imperva Inc. (a) | | | 13,000 | | | | 622,050 | |

| Liberty Ventures (a) | | | 9,000 | | | | 470,610 | |

| WebMD Health Corp. (a)(b) | | | 1,071 | | | | 62,814 | |

| | | | | | | | 1,378,952 | |

| Telecommunications — 0.2% | | | | | | | | |

| NII Holdings Inc. (a) | | | 64,529 | | | | 51,881 | |

| Total Communications | | | | | | | | |

| (Cost $1,982,572) | | | | | | | 1,430,833 | |

| Consumer, Cyclical — 4.0% | | | | | | | | |

| Auto Parts & Equipment — 0.1% | | | | | | | | |

| Exide Technologies (a)^ | | | 5,926 | | | | 15,000 | |

| Distribution & Wholesale — 0.5% | | | | | | | | |

Medion AG f | | | 8,011 | | | | 160,030 | |

| Retail — 3.4% | | | | | | | | |

| Advance Auto Parts Inc. | | | 2,000 | | | | 233,180 | |

Punch Taverns PLC (a) f | | | 60,336 | | | | 140,667 | |

Signet Jewelers Ltd. (b) f | | | 2,500 | | | | 158,100 | |

| Walgreens Boots Alliance Inc. | | | 6,000 | | | | 469,860 | |

| | | | | | | | 1,001,807 | |

| Total Consumer, Cyclical | | | | | | | | |

| (Cost $1,848,825) | | | | | | | 1,176,837 | |

| Consumer, Non-cyclical — 16.5% | | | | | | | | |

| Agriculture — 0.6% | | | | | | | | |

Black Earth Farming Ltd. (a) f | | | 240,000 | | | | 197,989 | |

| Beverages — 2.2% | | | | | | | | |

Anheuser-Busch InBev NV - ADR f ** | | | 6,000 | | | | 662,160 | |

| Commercial Services — 1.1% | | | | | | | | |

GFK SE (a) f | | | 6,000 | | | | 320,065 | |

| Food — 3.3% | | | | | | | | |

| Mondelez International Inc. | | | 22,540 | | | | 973,503 | |

| Healthcare-Products — 0.1% | | | | | | | | |

| Strategic Environment Inc. (a)^ | | | 43,000 | | | | 19,002 | |

| Healthcare-Services — 2.5% | | | | | | | | |

| Brookdale Senior Living Inc. (a) | | | 29,650 | | | | 436,152 | |

| Envision Healthcare Corp. (a)(b) | | | 5,000 | | | | 313,350 | |

| | | | | | | | 749,502 | |

| Pharmaceuticals — 6.7% | | | | | | | | |

| AbbVie Inc. (b) | | | 3,030 | | | | 219,705 | |

| Bristol-Myers Squibb Co. | | | 4,000 | | | | 222,880 | |

Celesio AG f | | | 11,796 | | | | 360,398 | |

INYX Inc. (a)• | | | 167,850 | | | | 395 | |

Perrigo Co. PLC (b) f | | | 4,500 | | | | 339,840 | |

| Pfizer Inc. | | | 25,060 | | | | 841,765 | |

| | | | | | | | 1,984,983 | |

| Total Consumer, Non-cyclical | | | | | | | | |

| (Cost $4,827,354) | | | | | | | 4,907,204 | |

| Diversified — 1.3% | | | | | | | | |

| Holding Companies — 1.3% | | | | | | | | |

CF Corp. (a) f • | | | 11,400 | | | | 141,075 | |

Silver Run Acquisition Corp. II (a)• | | | 22,800 | | | | 243,846 | |

| Stoneleigh Partners | | | | | | | | |

| Acquisition Corp. (a)*^ | | | 400 | | | | 0 | |

| | | | | | | | 384,921 | |

| Total Diversified | | | | | | | | |

| (Cost $342,000) | | | | | | | 384,921 | |

| Energy — 0.1% | | | | | | | | |

| Oil & Gas — 0.1% | | | | | | | | |

| OGX Austria Petroleo e | | | | | | | | |

Gas SA-SP-ADR (a) f • | | | 55,075 | | | | 40,061 | |

| Total Energy | | | | | | | | |

| (Cost $667,925) | | | | | | | 40,061 | |

| Financial — 6.6% | | | | | | | | |

| Diversified Financial Services — 0.4% | | | | | | | | |

Guoco Group Ltd. f | | | 10,000 | | | | 114,634 | |

| Real Estate — 6.2% | | | | | | | | |

CA Immobilien Anlagen AG f | | | 38,800 | | | | 946,579 | |

Conwert Immobilien Invest SE f | | | 45,000 | | | | 877,345 | |

The accompanying notes are an integral part of the financial statements.

Schedule of Investments (continued)

Quaker Event Arbitrage Fund

June 30, 2017

| | | Number | | | Fair | |

| | | of Shares | | | Value | |

| Common Stocks — 44.6% (Continued) | | | | | | |

| Real Estate (Continued) | | | | | | |

| Safeway Casa Ley CVR (a)*^ | | | 47,000 | | | $ | 10,575 | |

| Safeway Property Development | | | | | | | | |

| Center LLC CVR (a)*^ | | | 47,000 | | | | 10,575 | |

| | | | | | | | 1,845,074 | |

| Total Financial | | | | | | | | |

| (Cost $1,357,972) | | | | | | | 1,959,708 | |

| Healthcare — 4.2% | | | | | | | | |

| Healthcare-Services — 4.2% | | | | | | | | |

| Diagnostic Services | | | | | | | | |

| Holdings Inc. (a)^ | | | 10,221 | | | | 1,240,529 | |

| Total Healthcare | | | | | | | | |

| (Cost $735,000) | | | | | | | 1,240,529 | |

| Industrial — 3.6% | | | | | | | | |

| Electronics — 3.6% | | | | | | | | |

| IEC Electronics Corp. (a) | | | 293,656 | | | | 1,057,162 | |

| Total Industrial | | | | | | | | |

| (Cost $1,263,275) | | | | | | | 1,057,162 | |

| Technology — 1.8% | | | | | | | | |

| Computers — 1.8% | | | | | | | | |

| Computer Horizons Corp. (a)*^ | | | 65,000 | | | | 0 | |

| Hewlett Packard Enterprise Co. | | | 32,500 | | | | 539,175 | |

| | | | | | | | 539,175 | |

| Total Technology | | | | | | | | |

| (Cost $545,525) | | | | | | | 539,175 | |

| Escrow Shares — 0.0% | | | | | | | | |

| Exide Technologies (a)*^ | | | 1,777 | | | | 0 | |

| Petrocorp Inc. (a)*^ | | | 200 | | | | 0 | |

| Total Escrow Shares | | | | | | | | |

| (Cost $1,687) | | | | | | | 0 | |

| Total Common Stocks | | | | | | | | |

| (Cost $15,966,017) | | | | | | | 13,251,612 | |

| Closed-End Mutual Fund — 5.5% | | | | | | | | |

| Altaba Inc. (a)** | | | 30,000 | | | | 1,634,400 | |

| Total Closed-End Mutual Fund | | | | | | | | |

| (Cost $1,601,700) | | | | | | | 1,634,400 | |

| Preferred Stocks — 3.6% | | | | | | | | |

| Energy — 0.0% | | | | | | | | |

| Oil & Gas — 0.0% | | | | | | | | |

| GeoMet Inc., Convertible Series A, | | | | | | | | |

12.500%, Perpetual*• | | | 3 | | | | 1 | |

| Total Energy | | | | | | | | |

| (Cost $17) | | | | | | | 1 | |

| Financial — 1.5% | | | | | | | | |

| Insurance — 0.1% | | | | | | | | |

| MBIA Insurance Corp., | | | | | | | | |

| 4.707%, Perpetual (a)*#^ | | | 10 | | | | 40,000 | |

| Mortgage Agencies — 1.4% | | | | | | | | |

| Federal Home Loan Mortgage Corp., | | | | | | | | |

| Series F, 5.000%, Perpetual (a) | | | 4,500 | | | | 37,125 | |

| Federal Home Loan Mortgage Corp., | | | | | | | | |

Series M, 0.000%, Perpetual (a)• | | | 9,500 | | | | 74,432 | |

| Federal Home Loan Mortgage Corp., | | | | | | | | |

Series Q, 0.000%, Perpetual (a)• | | | 1,000 | | | | 7,955 | |

| Federal Home Loan Mortgage Corp., | | | | | | | | |

Series S, 0.000%, Perpetual (a)• | | | 25,000 | | | | 203,500 | |

| Federal Home Loan Mortgage Corp., | | | | | | | | |

| Series V, 5.570%, Perpetual (a) | | | 8,300 | | | | 35,690 | |

| Federal Home Loan Mortgage Corp., | | | | | | | | |

| Series W, 5.660%, Perpetual (a) | | | 2,674 | | | | 11,124 | |

| Federal Home Loan Mortgage Corp., | | | | | | | | |

| Series X, 6.020%, Perpetual (a) | | | 10,000 | | | | 40,000 | |

| | | | | | | | 409,826 | |

| Total Financial | | | | | | | | |

| (Cost $1,099,271) | | | | | | | 449,826 | |

| Healthcare — 2.1% | | | | | | | | |

| Healthcare-Services — 2.1% | | | | | | | | |

| Diagnostic Services Holdings Inc., | | | | | | | | |

| 0.000% (a)*^ | | | 613 | | | | 613,000 | |

| Total Healthcare | | | | | | | | |

| (Cost $613,000) | | | | | | | 613,000 | |

| Total Preferred Stocks | | | | | | | | |

| (Cost $1,712,288) | | | | | | | 1,062,827 | |

| Real Estate Investment Trusts — 1.8% | | | | | | | | |

| New York REIT Inc. (b) | | | 33,000 | | | | 285,120 | |

| Taubman Centers Inc. | | | 4,000 | | | | 238,200 | |

| | | | | | | | 523,320 | |

| Total Real Estate Investment Trusts | | | | | | | | |

| (Cost $565,022) | | | | | | | 523,320 | |

| Structured Note — 3.0% | | | | | | | | |

| Heineken Holding NV Structured Note, | | | | | | | | |

Expiration: 2/27/2018 (a)• | | | 212 | | | | 895,216 | |

| Total Structured Note | | | | | | | | |

| (Cost $940,223) | | | | | | | 895,216 | |

The accompanying notes are an integral part of the financial statements.

Schedule of Investments (continued)

Quaker Event Arbitrage Fund

June 30, 2017

| | | Par | | | Fair | |

| | | Value | | | Value | |

| Asset Backed Securities — 0.7% | | | | | | |

| AFC Home Equity Loan Trust | | | | | | |

| Class 1A, Series 2000-2, | | | | | | |

1.810%, 06/25/2030• | | $ | 7,309 | | | $ | 6,688 | |

| Citigroup Mortgage Loan Trust Inc. | | | | | | | | |

| Class M3, Series 2005-OPT1, | | | | | | | | |

1.730%, 02/25/2035• | | | 186,182 | | | | 170,259 | |

| Countrywide Asset-Backed Certificates | | | | | | | | |

| Class 2M2, Series 2007-11, | | | | | | | | |

1.340%, 06/25/2047+• | | | 954,363 | | | | 14,338 | |

| Countrywide Home Equity Loan Trust | | | | | | | | |

| Class 2A, Series 2005-A, | | | | | | | | |

1.400%, 04/15/2035• | | | 15,358 | | | | 13,562 | |

| | | | | | | | 204,847 | |

| Total Asset Backed Securities | | | | | | | | |

| (Cost $202,688) | | | | | | | 204,847 | |

| Convertible Bonds — 1.7% | | | | | | | | |

| Consumer, Cyclical — 0.3% | | | | | | | | |

| Auto Parts & Equipment — 0.3% | | | | | | | | |

| Exide Technologies, | | | | | | | | |

7.000%, 04/30/2025• | | | 170,991 | | | | 94,045 | |

| Total Consumer, Cyclical | | | | | | | | |

| (Cost $164,698) | | | | | | | 94,045 | |

| Financial — 1.4% | | | | | | | | |

| Banks — 1.4% | | | | | | | | |

| BNP Paribas Fortis SA, 1.671%, | | | | | | | | |

Perpetual f • | | € | 500,000 | | | | 428,181 | |

| Total Financial | | | | | | | | |

| (Cost $557,174) | | | | | | | 428,181 | |

| Total Convertible Bonds | | | | | | | | |

| (Cost $721,872) | | | | | | | 522,226 | |

| Corporate Bonds — 7.0% | | | | | | | | |

| Consumer, Cyclical — 2.4% | | | | | | | | |

| Auto Parts & Equipment — 1.3% | | | | | | | | |

| Exide Technologies, | | | | | | | | |

| 8.625%, 02/12/2018*+^ | | $ | 1,000,000 | | | | 0 | |

| Exide Technologies, | | | | | | | | |

11.000%, 04/30/2022#• | | | 459,797 | | | | 383,930 | |

| | | | | | | | 383,930 | |

| Retail — 1.1% | | | | | | | | |

| The Neiman Marcus Group LLC, | | | | | | | | |

7.125%, 06/01/2028• | | | 500,000 | | | | 342,500 | |

| Total Consumer, Cyclical | | | | | | | | |

| (Cost $829,634) | | | | | | | 726,430 | |

| Consumer, Non-cyclical — 1.4% | | | | | | | | |

| Pharmaceuticals — 1.4% | | | | | | | | |

| Valeant Pharmaceuticals | | | | | | | | |

| International Inc., | | | | | | | | |

5.500%, 03/01/2023 f #• | | | 500,000 | | | | 424,370 | |

| Total Consumer, Non-cyclical | | | | | | | | |

| (Cost $382,782) | | | | | | | 424,370 | |

| Energy — 1.5% | | | | | | | | |

| Oil & Gas — 1.5% | | | | | | | | |

| Drill Rigs Holdings Inc., | | | | | | | | |

6.500%, 10/01/2017 f +#• | | | 1,000,000 | | | | 281,250 | |

| OGX Austria GMBH, | | | | | | | | |

8.500%, 06/01/2018 f *+• | | | 3,500,000 | | | | 35 | |

| Seadrill Ltd., | | | | | | | | |

5.625%, 09/15/2017 f #• | | | 550,000 | | | | 170,500 | |

| | | | | | | | 451,785 | |

| Total Energy | | | | | | | | |

| (Cost $700,105) | | | | | | | 451,785 | |

| Financial — 1.7% | | | | | | | | |

| Diversified Financial Services — 1.7% | | | | | | | | |

| Hellas Telecommunications | | | | | | | | |

| Luxembourg II SCA, | | | | | | | | |

0.000%, 01/15/2015 f *+#^ | | | 5,000,000 | | | | 25,000 | |

| Lehman Brothers Holdings Inc., | | | | | | | | |

7.000%, 01/28/2020*+• | | | 100,000 | | | | 6,125 | |

| Lehman Brothers Holdings Inc., | | | | | | | | |

5.500%, 02/27/2020*+• | | | 100,000 | | | | 6,125 | |

| Lehman Brothers Holdings Inc., | | | | | | | | |

8.250%, 09/23/2020*+• | | | 100,000 | | | | 6,125 | |

| Lehman Brothers Holdings Inc., | | | | | | | | |

8.750%, 02/14/2023*+• | | | 200,000 | | | | 12,250 | |

| Lehman Brothers Holdings Inc., | | | | | | | | |

4.550%, 12/29/2099*+• | | | 110,000 | | | | 6,875 | |

| Lehman Brothers Holdings Inc., | | | | | | | | |

5.320%, 12/29/2099*+• | | | 130,000 | | | | 7,963 | |

| Twin Reefs Pass-Through Trust, | | | | | | | | |

| 0.000%, Perpetual*+#^ | | | 1,000,000 | | | | 420,000 | |

| | | | | | | | 490,463 | |

The accompanying notes are an integral part of the financial statements.

Schedule of Investments (continued)

Quaker Event Arbitrage Fund

June 30, 2017

| | | Par | | | Fair | |

| | | Value | | | Value | |

| Corporate Bonds — 7.0% (Continued) | | | | | | |

| Venture Capital — 0.0% | | | | | | |

| Infinity Capital Group, | | | | | | |

| 7.000%, 12/31/2049*+^ | | $ | 25,000 | | | $ | 0 | |

| Total Financial | | | | | | | | |

| (Cost $610,000) | | | | | | | 490,463 | |

| Total Corporate Bonds | | | | | | | | |

| (Cost $2,522,521) | | | | | | | 2,093,048 | |

| Mortgage Backed Securities — 0.9% | | | | | | | | |

| Federal Home Loan Mortgage | | | | | | | | |

| Corp. Class IG, Series 3756, | | | | | | | | |

4.000%, 11/15/2037• | | | 650,339 | | | | 11,837 | |

| GSR Mortgage Loan Trust | | | | | | | | |

| Class B2, Series 2005-5F, | | | | | | | | |

5.740%, 06/25/2035• | | | 616,266 | | | | 246,495 | |

| | | | | | | | 258,332 | |

| Total Mortgage Backed Securities | | | | | | | | |

| (Cost $577,150) | | | | | | | 258,332 | |

| Escrow Notes — 0.0% | | | | | | | | |

| Mirant Corp.*+^ | | | 20,000 | | | | 0 | |

| NewPage Corp.*+^ | | | 300,000 | | | | 0 | |

| | | | | | | | 0 | |

| Total Escrow Notes | | | | | | | | |

| (Cost $198,770) | | | | | | | 0 | |

| Total Long-Term Investments | | | | | | | | |

| (Cost $25,008,251) | | | | | | | 20,445,828 | |

| | | | | | | | | |

| | | Number | | | | | |

| | | of Contracts | | | | | |

| | | (100 Shares | | | | | |

| | | Per Contract) | | | | | |

| Purchased Options — 1.4% | | | | | | | | |

| Call Options — 1.1% | | | | | | | | |

| Advance Auto Parts Inc., | | | | | | | | |

| Expiration: September, 2017 | | | | | | | | |

| Exercise Price: $135.00 | | | 45 | | | | 7,200 | |

| Buffalo Wild Wings Inc., | | | | | | | | |

| Expiration: September, 2017 | | | | | | | | |

| Exercise Price: $145.00 | | | 45 | | | | 11,250 | |

| Chipotle Mexican Grill Inc., | | | | | | | | |

| Expiration: September, 2017 | | | | | | | | |

| Exercise Price: $450.00 | | | 20 | | | | 17,120 | |

| Depomed Inc., | | | | | | | | |

| Expiration: September, 2017 | | | | | | | | |

Exercise Price: $11.00• | | | 280 | | | | 34,300 | |

| The Hain Celestial Group Inc., | | | | | | | | |

| Expiration: November, 2017 | | | | | | | | |

| Exercise Price: $38.00 | | | 400 | | | | 155,200 | |

| Hess Corp., | | | | | | | | |

| Expiration: July, 2017 | | | | | | | | |

| Exercise Price: $43.50 | | | 173 | | | | 29,410 | |

| The Kraft Heinz Co., | | | | | | | | |

| Expiration: October, 2017 | | | | | | | | |

| Exercise Price: $90.00 | | | 400 | | | | 64,800 | |

| SPDR S&P500 ETF Trust, | | | | | | | | |

| Expiration: September, 2017 | | | | | | | | |

| Exercise Price: $260.00 | | | 200 | | | | 2,200 | |

| Valeant Pharmaceuticals International Inc., | | | | | | | | |

| Expiration: January, 2018 | | | | | | | | |

| Exercise Price: $30.00 | | | 100 | | | | 6,100 | |

| Total Call Options | | | | | | | | |

| (Cost $330,438) | | | | | | | 327,580 | |

| Put Options — 0.3% | | | | | | | | |

| Cisco Systems Inc., | | | | | | | | |

| Expiration: September, 2017 | | | | | | | | |

| Exercise Price: $32.00 | | | 24 | | | | 3,648 | |

| CurrencyShares Euro Trust, | | | | | | | | |

| Expiration: September, 2017 | | | | | | | | |

| Exercise Price: $109.00 | | | 370 | | | | 25,530 | |

| International Business Machines Corp., | | | | | | | | |

| Expiration: September, 2017 | | | | | | | | |

| Exercise Price: $155.00 | | | 4 | | | | 2,256 | |

| Juniper Networks Inc., | | | | | | | | |

| Expiration: October, 2017 | | | | | | | | |

| Exercise Price: $28.00 | | | 29 | | | | 4,582 | |

| NetApp Inc., | | | | | | | | |

| Expiration: September, 2017 | | | | | | | | |

| Exercise Price: $40.00 | | | 19 | | | | 3,610 | |

| Oracle Corp., | | | | | | | | |

| Expiration: September, 2017 | | | | | | | | |

| Exercise Price: $50.00 | | | 17 | | | | 2,635 | |

| SPDR S&P500 ETF Trust, | | | | | | | | |

| Expiration: September, 2017 | | | | | | | | |

| Exercise Price: $230.00 | | | 200 | | | | 47,200 | |

| Total Put Options | | | | | | | | |

| (Cost $127,078) | | | | | | | 89,461 | |

| Total Purchased Options | | | | | | | | |

| (Cost $457,516) | | | | | | | 417,041 | |

The accompanying notes are an integral part of the financial statements.

Schedule of Investments (continued)

Quaker Event Arbitrage Fund

June 30, 2017

| | | Par | | | Fair | |

| | | Value | | | Value | |

| Bank Deposit Account — 16.0% | | | | | | |

| U.S. Bank, N.A., 0.30% | | $ | 4,741,307 | | | $ | 4,741,307 | |

| Total Bank Deposit Account | | | | | | | | |

| (Cost $4,741,307) | | | | | | | 4,741,307 | |

| | | Units | | | | | |

| Private Investment Co. Purchased with | | | | | | | | |

| Proceeds from Securities Lending — 4.3% | | | | | | | | |

| Mount Vernon Liquid Assets | | | | | | | | |

| Portfolio LLC, 1.33% (c)(d) | | | 1,268,709 | | | | 1,268,709 | |

| Total Private Investment Co. Purchased | | | | | | | | |

| with Proceeds from Securities Lending | | | | | | | | |

| (Cost $1,268,709) | | | | | | | 1,268,709 | |

| Total Investments | | | | | | | | |

| (Cost $31,475,783) — 90.5% | | | | | | | 26,872,885 | |

| Other Assets in Excess | | | | | | | | |

| of Liabilities, Net 9.5% | | | | | | | 2,828,207 | |

| Total Net Assets — 100.0% | | | | | | $ | 29,701,092 | |

| | | Number | | | | | |

| | | of Shares | | | | | |

| Schedule of Securities Sold Short (a) | | | | | | | | |

| Common Stocks — 6.8% | | | | | | | | |

| Communications — 6.8% | | | | | | | | |

| Internet —5.5 % | | | | | | | | |

Alibaba Group Holding Ltd. - ADR f | | | 11,540 | | | | 1,625,986 | |

| Media —1.3 % | | | | | | | | |

| Liberty Broadband Corp. Series C | | | 4,452 | | | | 386,211 | |

| Total Common Stocks | | | | | | | 2,012,197 | |

| Total Securities Sold Short | | | | | | | | |

| (Proceeds $1,771,098) | | | | | | $ | 2,012,197 | |

| | | | | | | | | |

| | | Number | | | | | |

| | | of Contracts | | | | | |

| | | (100 Shares | | | | | |

| | | Per Contract) | | | | | |

| Written Options | | | | | | | | |

| Call Options | | | | | | | | |

| AbbVie Inc., Expiration: July, 2017 | | | | | | | | |

Exercise Price: $71.00• | | | 30 | | | | 5,340 | |

| Advance Auto Parts Inc., | | | | | | | | |

| Expiration: September, 2017 | | | | | | | | |

| Exercise Price: $140.00 | | | 45 | | | | 3,825 | |

| Buffalo Wild Wings Inc., | | | | | | | | |

| Expiration: September, 2017 | | | | | | | | |

Exercise Price: $150.00• | | | 45 | | | | 7,200 | |

| Chipotle Mexican Grill Inc., | | | | | | | | |

| Expiration: September, 2017 | | | | | | | | |

| Exercise Price: $470.00 | | | 20 | | | | 9,000 | |

| Cisco Systems Inc., | | | | | | | | |

| Expiration: September, 2017 | | | | | | | | |

| Exercise Price: $32.00 | | | 24 | | | | 1,776 | |

| CurrencyShares Euro Trust, | | | | | | | | |

| Expiration: September, 2017 | | | | | | | | |

| Exercise Price: $109.00 | | | 370 | | | | 87,320 | |

| Envision Healthcare Corp., | | | | | | | | |

| Expiration: July, 2017 | | | | | | | | |

| Exercise Price: $65.00 | | | 50 | | | | 2,600 | |

| The Hain Celestial Group Inc., | | | | | | | | |

| Expiration: November, 2017 | | | | | | | | |

| Exercise Price: $41.00 | | | 400 | | | | 101,600 | |

| International Business Machines Corp., | | | | | | | | |

| Expiration: September, 2017 | | | | | | | | |

| Exercise Price: $155.00 | | | 4 | | | | 1,508 | |

| Juniper Networks Inc., | | | | | | | | |

| Expiration: October, 2017 | | | | | | | | |

| Exercise Price: $28.00 | | | 29 | | | | 4,176 | |

| The Kraft Heinz Co., | | | | | | | | |

| Expiration: October, 2017 | | | | | | | | |

| Exercise Price: $92.50 | | | 400 | | | | 40,400 | |

| Mondelez International Inc., | | | | | | | | |

| Expiration: July, 2017 | | | | | | | | |

| Exercise Price: $45.00 | | | 225 | | | | 5,850 | |

| NetApp Inc., | | | | | | | | |

| Expiration: September, 2017 | | | | | | | | |

Exercise Price: $40.00• | | | 19 | | | | 3,715 | |

| Oracle Corp., | | | | | | | | |

| Expiration: September, 2017 | | | | | | | | |

| Exercise Price: $50.00 | | | 17 | | | | 3,111 | |

| Perrigo Co. PLC, | | | | | | | | |

| Expiration: July, 2017 | | | | | | | | |

Exercise Price: $73.50• | | | 45 | | | | 13,500 | |

| Pfizer Inc., | | | | | | | | |

| Expiration: July, 2017 | | | | | | | | |

| Exercise Price: $33.50 | | | 100 | | | | 4,500 | |

| Pfizer Inc., | | | | | | | | |

| Expiration: July, 2017 | | | | | | | | |

| Exercise Price: $34.50 | | | 100 | | | | 900 | |

| Total Call Options | | | | | | | | |

| (Premiums Received $215,918) | | | | | | | 296,321 | |

The accompanying notes are an integral part of the financial statements.

Schedule of Investments (continued)

Quaker Event Arbitrage Fund

June 30, 2017

| | | Number | | | | |

| | | of Contracts | | | | |

| | | (100 Shares | | | Fair | |

| | | Per Contract) | | | Value | |

| Written Options (Continued) | | | | | | |

| Put Options | | | | | | |

| Advance Auto Parts Inc., | | | | | | |

| Expiration: July, 2017 | | | | | | |

| Exercise Price: $120.00 | | | 20 | | | $ | 9,700 | |

| Buffalo Wild Wings Inc., | | | | | | | | |

| Expiration: July, 2017 | | | | | | | | |

| Exercise Price: $130.00 | | | 30 | | | | 14,100 | |

| Chipotle Mexican Grill Inc., | | | | | | | | |

| Expiration: July, 2017 | | | | | | | | |

| Exercise Price: $420.00 | | | 10 | | | | 10,020 | |

| Depomed Inc., | | | | | | | | |

| Expiration: September, 2017 | | | | | | | | |

Exercise Price: $11.00• | | | 280 | | | | 39,900 | |

| Encana Corp., | | | | | | | | |

| Expiration: July, 2017 | | | | | | | | |

| Exercise Price: $8.00 | | | 250 | | | | 2,500 | |

| Gigamon Inc., | | | | | | | | |

| Expiration: July, 2017 | | | | | | | | |

| Exercise Price: $40.00 | | | 100 | | | | 16,700 | |

| The Procter & Gamble Co., | | | | | | | | |

| Expiration: July, 2017 | | | | | | | | |

Exercise Price: $89.50• | | | 60 | | | | 17,910 | |

| Total Put Options | | | | | | | | |

| (Premiums Received $85,583) | | | | | | | 110,830 | |

| Total Written Options | | | | | | | | |

| (Premiums Received $301,501) | | | | | | $ | 407,151 | |

ADR - American Depositary Receipt

CVR - Contingent Value Rights

€ - Euro

| (a) | Non-income producing security. |

| (b) | All or a portion of the security is out on loan. The total market value of securities on loan was $1,243,416. The remaining contractual maturity of all of the securities lending transactions is overnight and continuous. |

| (c) | Rate shown is the annualized seven-day yield at period end. |

| (d) | Represents investments of collateral received from securities lending transactions. Refer to Note 12 of Notes to the Financial Statements for additional information. |

| f | Foreign issued security. |

| * | Indicates an illiquid security. Total market value for illiquid securities is $1,164,649, representing 3.9% of net assets. |

| ** | All or a portion of the shares have been committed as collateral for open securities sold short or written options. |

| + | Defaulted bonds. |

| # | Restricted security that may be sold to “qualified institutional buyers” pursuant to the conditions of Rule 144A under the Securities Act of 1933, as amended. |

| | The coupon rate shown on floating or adjustable rate securities represents the rate at period end. |

| • | Level 2 securities. |

| ^ | Indicates a fair valued security. Total market value for fair valued securities is $2,393,681 representing 8.1% of net assets and Level 3 securities. |

The accompanying notes are an integral part of the financial statements.

Schedule of Investments

Quaker Global Tactical Allocation Fund

June 30, 2017

| | | Number | | | Fair | |

| | | of Shares | | | Value | |

| Long-Term Investments — 88.1% | | | | | | |

| Common Stocks — 27.0% | | | | | | |

| Basic Materials — 1.0% | | | | | | |

| Chemicals — 1.0% | | | | | | |

| The Mosaic Co. | | | 3,000 | | | $ | 68,490 | |

| Total Basic Materials (Cost $81,430) | | | | | | | 68,490 | |

| Communications — 6.5% | | | | | | | | |

| Media — 1.5% | | | | | | | | |

| Twenty-First Century Fox Inc. Cl B | | | 3,700 | | | | 103,119 | |

| Telecommunications — 5.0% | | | | | | | | |

| AT&T Inc. | | | 4,200 | | | | 158,466 | |

| Verizon Communications Inc. | | | 4,000 | | | | 178,640 | |

| | | | | | | | 337,106 | |

| Total Communications | | | | | | | | |

| (Cost $474,579) | | | | | | | 440,225 | |

| Consumer, Cyclical — 1.8% | | | | | | | | |

| Airlines — 0.2% | | | | | | | | |

| AMR Corp. Escrow (a)*^ | | | 7,600 | | | | 14,364 | |

| Auto Manufacturers — 1.6% | | | | | | | | |

| General Motors Co. | | | 3,000 | | | | 104,790 | |

| Total Consumer, Cyclical | | | | | | | | |

| (Cost $106,023) | | | | | | | 119,154 | |

| Consumer, Non-cyclical — 3.9% | | | | | | | | |

| Beverages — 2.2% | | | | | | | | |

| Molson Coors Brewing Co. | | | 1,700 | | | | 146,778 | |

| Food — 1.3% | | | | | | | | |

Nestle SA f | | | 1,000 | | | | 87,200 | |

| Pharmaceuticals — 0.4% | | | | | | | | |

Mallinckrodt PLC (a) f | | | 600 | | | | 26,886 | |

| Total Consumer, Non-cyclical | | | | | | | | |

| (Cost $274,028) | | | | | | | 260,864 | |

| Diversified — 0.9% | | | | | | | | |

| Holding Companies — 0.9% | | | | | | | | |

CK Hutchison Holdings Ltd. f | | | 5,000 | | | | 62,625 | |

| Total Diversified (Cost $60,044) | | | | | | | 62,625 | |

| Energy — 4.7% | | | | | | | | |

| Pipelines — 4.7% | | | | | | | | |

| Cheniere Energy Partners LP | | | 1,229 | | | | 39,820 | |

Enbridge Inc. f | | | 831 | | | | 33,082 | |

| Enterprise Products Partners LP | | | 1,392 | | | | 37,696 | |

| Magellan Midstream Partners LP | | | 522 | | | | 37,203 | |

| MPLX LP | | | 980 | | | | 32,732 | |

| ONEOK Partners LP | | | 845 | | | | 43,154 | |

| Plains All American Pipeline LP | | | 1,105 | | | | 29,028 | |

| Tesoro Logistics LP | | | 635 | | | | 32,823 | |

| Western Gas Partners LP | | | 615 | | | | 34,403 | |

| | | | | | | | 319,941 | |

| Total Energy (Cost $313,151) | | | | | | | 319,941 | |

| Industrial — 1.9% | | | | | | | | |

| Miscellaneous Manufacturing — 1.9% | | | | | | | | |

| General Electric Co. | | | 4,800 | | | | 129,648 | |

| Total Industrial (Cost $144,658) | | | | | | | 129,648 | |

| Technology — 6.3% | | | | | | | | |

| Semiconductors — 4.1% | | | | | | | | |

| Microsemi Corp. (a) | | | 2,200 | | | | 102,960 | |

| QUALCOMM Inc. | | | 3,200 | | | | 176,704 | |

| | | | | | | | 279,664 | |

| Software — 2.2% | | | | | | | | |

| Microsoft Corp. | | | 2,200 | | | | 151,646 | |

| Total Technology (Cost $436,386) | | | | | | | 431,310 | |

| Total Common Stocks | | | | | | | | |

| Cost ($1,890,299) | | | | | | | 1,832,257 | |

| Closed-End Mutual Fund — 0.5% | | | | | | | | |

| Ares Capital Corp. | | | 2,242 | | | | 36,724 | |

| Total Closed-End Mutual Fund | | | | | | | | |

| Cost ($35,547) | | | | | | | 36,724 | |

| Exchange Traded Funds — 5.3% | | | | | | | | |

| iShares MSCI United Kingdom ETF | | | 6,250 | | | | 208,312 | |

| PowerShares DB Commodity | | | | | | | | |

| Index Tracking Fund (a) | | | 10,760 | | | | 155,482 | |

| Total Exchange Traded Funds | | | | | | | | |

| Cost ($369,732) | | | | | | | 363,794 | |

| Preferred Stocks — 3.6% | | | | | | | | |

| Consumer, Cyclical — 0.8% | | | | | | | | |

| Auto Manufacturers — 0.8% | | | | | | | | |

| Porsche Automobil | | | | | | | | |

Holding SE - ADR f | | | 10,000 | | | | 55,800 | |

| Total Consumer, Cyclical | | | | | | | | |

| (Cost $52,502) | | | | | | | 55,800 | |

| Energy — 0.5% | | | | | | | | |

| Pipelines — 0.5% | | | | | | | | |

| Kinder Morgan Inc., | | | | | | | | |

| Convertible, Series A, 9.750% | | | 729 | | | | 31,989 | |

| Total Energy (Cost $35,518) | | | | | | | 31,989 | |

The accompanying notes are an integral part of the financial statements.

Schedule of Investments (continued)

Quaker Global Tactical Allocation Fund

June 30, 2017

| | | Number | | | Fair | |

| | | of Shares | | | Value | |

| Preferred Stocks — 3.6% (Continued) | | | | | | |

| Financial — 1.1% | | | | | | |

| Banks — 0.5% | | | | | | |

| Barclays Bank PLC, | | | | | | |

Series 5, 8.125%, Perpetual f | | | 1,365 | | | $ | 36,295 | |

| Insurance — 0.6% | | | | | | | | |

| PartnerRe Ltd., | | | | | | | | |

Series I, 5.875%, Perpetual f | | | 1,485 | | | | 38,966 | |

| Total Financial (Cost $72,065) | | | | | | | 75,261 | |

| Real Estate Investment Trusts — 1.2% | | | | | | | | |

| Public Storage, | | | | | | | | |

| Series V, 5.375%, Perpetual | | | 1,620 | | | | 40,905 | |

| Taubman Centers Inc., | | | | | | | | |

| Series K, 6.250%, Perpetual | | | 1,490 | | | | 37,757 | |

| | | | | | | | 78,662 | |

| Total Real Estate Investment Trusts | | | | | | | | |

| (Cost $75,073) | | | | | | | 78,662 | |

| Total Preferred Stocks | | | | | | | | |

| (Cost $235,158) | | | | | | | 241,712 | |

| Real Estate Investment Trusts — 7.2% | | | | | | | | |

| Apartment Investment & | | | | | | | | |

| Management Co. | | | 1,514 | | | | 65,057 | |

| Colony NorthStar Inc., Cl A | | | 4,344 | | | | 61,207 | |

| Dupont Fabros Technology Inc. | | | 1,365 | | | | 83,483 | |

| Lamar Advertising Co. | | | 921 | | | | 67,758 | |

| MGM Growth Properties LLC | | | 2,500 | | | | 72,975 | |

| Prologis Inc. | | | 1,244 | | | | 72,948 | |

| Weyerhaeuser Co. | | | 1,960 | | | | 65,660 | |

| | | | | | | | 489,088 | |

| Total Real Estate Investment Trusts | | | | | | | | |

| (Cost $426,643) | | | | | | | 489,088 | |

| | | Par | | | | | |

| | | Value | | | | | |

| Corporate Bonds — 44.4% | | | | | | | | |

| Basic Materials — 2.0% | | | | | | | | |

| Chemicals — 2.0% | | | | | | | | |

| CF Industries Inc., | | | | | | | | |

3.450%, 06/01/2023• | | $ | 70,000 | | | | 66,150 | |

| Monsanto Co., | | | | | | | | |

2.750%, 07/15/2021• | | | 70,000 | | | | 70,660 | |

| | | | | | | | 136,810 | |

| Total Basic Materials (Cost $133,565) | | | | | | | 136,810 | |

| Communications — 5.2% | | | | | | | | |

| Internet — 1.0% | | | | | | | | |

eBay Inc., 2.200%, 08/01/2019• | | | 70,000 | | | | 70,280 | |

| Media — 1.1% | | | | | | | | |

| Discovery Communications LLC, | | | | | | | | |

4.375%, 06/15/2021• | | | 70,000 | | | | 73,885 | |

| Telecommunications — 3.1% | | | | | | | | |

AT&T Inc., 2.800%, 02/17/2021• | | | 70,000 | | | | 70,743 | |

| CenturyLink Inc., | | | | | | | | |

7.500%, 04/01/2024• | | | 70,000 | | | | 76,650 | |

| Frontier Communications Corp., | | | | | | | | |

11.000%, 09/15/2025• | | | 70,000 | | | | 64,925 | |

| | | | | | | | 212,318 | |

| Total Communications | | | | | | | | |

| (Cost $359,218) | | | | | | | 356,483 | |

| Consumer, Cyclical — 3.1% | | | | | | | | |

| Home Builders — 1.2% | | | | | | | | |

KB Home, 7.500%, 09/15/2022• | | | 70,000 | | | | 79,013 | |

| Retail — 1.9% | | | | | | | | |

| JC Penney Corp. Inc., | | | | | | | | |

5.650%, 06/01/2020• | | | 70,000 | | | | 68,863 | |

| Toys R Us Inc., | | | | | | | | |

7.375%, 10/15/2018• | | | 66,000 | | | | 59,400 | |

| | | | | | | | 128,263 | |

| Total Consumer, Cyclical | | | | | | | | |

| (Cost $210,051) | | | | | | | 207,276 | |

| Consumer, Non-cyclical — 9.5% | | | | | | | | |

| Agriculture — 1.1% | | | | | | | | |

| Altria Group Inc., | | | | | | | | |

4.750%, 05/05/2021• | | | 70,000 | | | | 76,350 | |

| Beverages — 1.0% | | | | | | | | |

| Molson Coors Brewing Co., | | | | | | | | |

2.100%, 07/15/2021• | | | 70,000 | | | | 68,836 | |

| Biotechnology — 1.1% | | | | | | | | |

| Gilead Sciences Inc., | | | | | | | | |

4.400%, 12/01/2021• | | | 70,000 | | | | 75,516 | |

| Commercial Services — 2.1% | | | | | | | | |

| Quad/Graphics Inc., | | | | | | | | |

7.000%, 05/01/2022• | | | 70,000 | | | | 71,283 | |

| RR Donnelley & Sons Co., | | | | | | | | |

7.000%, 02/15/2022• | | | 70,000 | | | | 73,237 | |

| | | | | | | | 144,520 | |

The accompanying notes are an integral part of the financial statements.

Schedule of Investments (continued)

Quaker Global Tactical Allocation Fund

June 30, 2017

| | | Par | | | Fair | |

| | | Value | | | Value | |

| Corporate Bonds — 44.4% (Continued) | | | | | | |

| Food — 2.1% | | | | | | |

| Campbell Soup Co., | | | | | | |

4.250%, 04/15/2021• | | $ | 70,000 | | | $ | 74,486 | |