UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

________

FORM N-CSR

________

CERTIFIED SHAREHOLDER REPORT OF REGISTERED MANAGEMENT

INVESTMENT COMPANIES

Investment Company Act File Number 811-06260

Quaker Investment Trust

(Exact name of Registrant as specified in charter)

________

261 North University Drive

Suite 520

Ft. Lauderdale, FL 33324

(Address of principal executive offices) (Zip code)

Alyssa D. Greenspan

Quaker Investment Trust

261 North University Drive, Suite 520

Ft. Lauderdale, FL 33324

(Name and address of agent for service)

Registrant’s telephone number, including area code: 1-888-272-0007

Date of fiscal year end: June 30, 2023

Date of reporting period: June 30, 2023

Form N-CSR is to be used by management investment companies to file reports with the Commission not later than 10 days after the transmission to stockholders of any report that is required to be transmitted to stockholders under Rule 30e-1 under the Investment Company Act of 1940 (17 CFR 270.30e-1). The Commission may use the information provided on Form N-CSR in its regulatory, disclosure review, inspection, and policymaking roles.

A Registrant is required to disclose the information specified by Form N-CSR, and the Commission will make this information public. A registrant is not required to respond to the collection of information contained in Form N-CSR unless the Form displays a currently valid Office of Management and Budget ("OMB") control number. Please direct comments concerning the accuracy of the information collection burden estimate and any suggestions for reducing the burden to Secretary, Securities and Exchange Commission, 450 Fifth Street, NW, Washington, DC 20549-0609. The OMB has reviewed this collection of information under the clearance requirements of 44 U.S.C. ss. 3507.

Item 1. Report to Stockholders.

| (a) | A copy of the report transmitted to Stockholders pursuant to Rule 30e-1 under the Investment Company Act of 1940, as amended (the “Act”) (17 CFR 270.30e-1) is attached hereto. |

Annual Report 2023

QUAKER INVESTMENT TRUST

June 30, 2023

CCM Core Impact Equity Fund

CCM Small/Mid-Cap Impact Value Fund

June 30, 2023

Dear Shareholders:

On behalf of the Board of Trustees of the Quaker Investment Trust, I am pleased to present the Annual Report to Shareholders for the year ended June 30, 2023.

We applaud the disciplined and productive efforts of Community Capital Management, LLC, registered investment advisor to the Trust, and we thank you, our shareholders, for your investments. We appreciate your continued confidence.

Sincerely,

James R. Brinton

Chair and Lead Independent Trustee

Quaker Investment Trust

2023

TABLE OF CONTENTS

Letter to Shareholders | 1 |

Manager’s Discussion & Analysis | 3 |

Disclosures of Fund Expenses | 11 |

Fund Profile | 13 |

Schedules of Investments | 16 |

Statements of Assets and Liabilities | 23 |

Statements of Operations | 25 |

Statements of Changes in Net Assets | 27 |

Financial Highlights | 29 |

Notes to Financial Statements | 33 |

Report of Independent Registered Public Accounting Firm | 43 |

Notice to Shareholders | 45 |

Trustees and Officers | 46 |

Additional Information | 48 |

Manager’s Discussion & Analysis (Unaudited) June 30, 2023

CCM Core Impact Equity Fund

(QUAGX, QAGIX)

Equity markets had another volatile 12-month period ending June 30, 2023. The S&P 500 Index bottomed out in early October 2022 and has since risen over 25%, despite increasing interest rates, quantitative tightening, a debt ceiling debacle, an earnings recession, and a healthy dose of inflation. Adjusted earnings per share of the S&P 500 are expected to be down 5.2% year over year in the June 2023 quarter, despite gross domestic product (GDP) growth of 2.4% in the same period, according to FactSet.

Improving corporate earnings combined with low interest rates, quantitative easing, and a renewed interest in stocks by retail investors led to excessive valuations in 2021, which were multi-decade highs. This environment collapsed in 2022. And although there has been a rise in the S&P 500 in early 2023, it has been dominated by a few stocks — with 75% of year-to-date returns (as of June 30, 2023) attributable to the top seven names in the S&P 500 index. The popularity of large-cap technology and stocks exposed to generative artificial intelligence have driven these seven names to valuation highs not seen since the dot-com boom.

On the plus side for more diversified funds, the returns of the market have become broader based with inflation seemingly falling under control and the economy growing.

In the bond markets, the Federal Reserve seems close to ending its rate hike campaign. However, the potential increase in supply of Treasuries, plus a recent downgrade of U.S. government debt to AA+ from AAA by Fitch, has impacted yields. Indeed, the yield on the 10-year U.S. Treasury rose to 4.1% today (August 7, 2023) from 3.0% on June 30, 2022.

In the year ending June 30, 2023, the institutional share class of the CCM Core Impact Equity Fund (the Fund) returned 13.9%, underperforming the S&P 500 Fossil Fuel Free Index’s (the “Benchmark Index”) return of 19.6% by 5.7%.

The Fund’s underperformance versus its benchmark was partially driven by an underweight allocation to large-cap technology companies and consumer cyclicals, where most returns have been generated. Compared with the Equal Weighted S&P 500, however, the Fund has outperformed by 0.4%. The Fund has benefited from strong security selection in its industrial, consumer discretionary, and healthcare sector holdings.

As always, the portfolio management team seeks to invest in high-quality companies that not only generate positive earnings but also have demonstrated a history of above-average earnings growth over time. The team also anticipates that these companies will potentially grow their earnings for several years above the average of companies in the S&P 500. Typically, these companies are trading at lower price-to-earnings (PE) ratios1 than the market or to their historical averages. In general, we believe

that companies with these attributes have the potential to produce market beating returns when held over a longer-term time horizon.

Moving forward, we believe inflation will continue to ease and the direction of the economy will dictate near- to intermediate-term stock market results. The aggressive rate of interest rate increases so far has had little impact on a consumer who is still employed and continues to have excess savings. But as those savings naturally deplete and high rates make durables more expensive to buy, economic headwinds could be looming.

While the labor market is strong today with near-record unemployment, leading economic indicators point to slowing or potentially even negative economic growth in the future. The spread between the 2-year and 10-year Treasury is also inverted, often a signal that a recession may be on the horizon.

And although significant uncertainty exists, equity markets tend to be forward looking and valuations among our selected securities are well below market averages. Our bias toward owning what we deem to be high-quality companies with strong balance sheets gives us confidence that even though the portfolios holdings may experience volatility, these companies have the potential to perform well over long periods of time

Sincerely,

The Portfolio Management Team

1 The price to earnings ratio simply the stock price divided by the company's earnings per share for a designated period like the past 12 months. The price/earnings ratio conveys how much investors will pay per share for $1 of earnings.

Past performance is no guarantee of future results.

Mutual fund investing involves risk. Principal loss is possible. The Adviser may select or exclude securities of certain companies for reasons other than performance and, as a result, the Fund may underperform other funds that do not use an impact/ESG screening process. Small- and mid-cap stocks involve greater risks and volatility than large-cap stocks. The Funds’ exposure to (MLPs) may subject the Funds to greater volatility than investments in traditional securities.

This report must be preceded or accompanied by a current prospectus.

The opinions expressed are those of the adviser through the end of the period for this report, are subject to change, are not a guarantee, and should not be considered investment advice.

Fund holdings and sector allocations are subject to change and should not be considered a recommendation to buy or sell any security. Current and future holdings are subject to risk.

The CCM Funds are distributed by Foreside Fund Services, LLC.

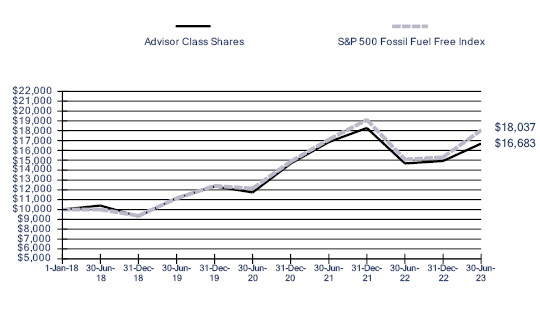

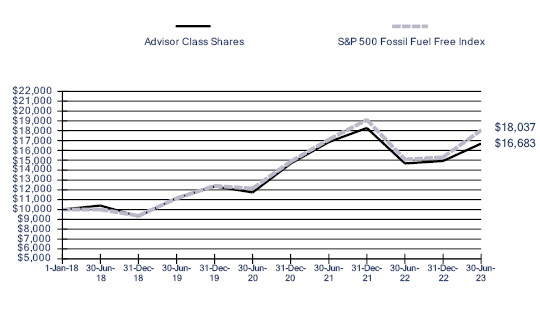

Annual Total Returns | One Year | Three Years | Five Years | Inception

to Date+ |

The CCM Core Impact Equity Fund —Advisor Class Shares‡ | 13.65% | 12.45% | 9.91% | 9.75% |

The CCM Core Impact Equity Fund — Institutional Class Shares‡ | 13.90% | 12.71% | 10.18% | 10.02% |

S&P 500 Fossil Fuel Free Index* | 19.59% | 14.11% | 12.51% | 11.64% |

| | | | | |

The above chart compares a hypothetical $10,000 investment made in the Fund's Advisor Share Class and the S&P 500 Fossil Fuel Free Index on January 1, 2018. This chart does not imply any future performance.

* The benchmark since inception returns are calculated since commencement of January 1, 2018 through June 30, 2023.

+ The Fund amended and restated its Registration Statement to change the performance reporting history. The inception date for the Fund’s performance history is now January 1, 2018, the date Community Capital Management, LLC became the new investment adviser to the Fund.

‡ As stated in the October 28, 2022 prospectus, the Fund’s annualized ratios of expenses in relation to average net assets were 1.95% and 1.70% for the Advisor Class Shares and Institutional Class Shares, respectively.

Performance data quoted represents past performance and is no guarantee of future results. Investment return and principal value will fluctuate so that shares, when redeemed, may be worth more or less than their original cost. Current performance may be lower or higher than performance data quoted. Performance data current to the most recent month end is available at www.ccminvests.com or by calling us toll free at 888-272-0007. Total return includes reinvestment of dividends and capital gains.

The performance table and chart do not reflect the deduction of taxes that a shareholder might

pay on fund distributions or the redemption of fund shares. Total return calculations reflect expense reimbursements and fee waivers in the applicable periods. See financial highlights for periods where fees were waived or reimbursed.

The Fund’s portfolio holdings may differ significantly from the securities held in the index and, unlike a mutual fund, an unmanaged index assumes no transaction costs, taxes, management fees or other expenses. You cannot invest directly in an index.

The S&P 500 Fossil Fuel Free Index is designed to measure the performance of companies in the S&P 500 that do not own fossil fuel reserves.

Manager’s Discussion & Analysis (Unaudited) June 30, 2023

CCM Small/Mid-Cap Impact Value Fund

(QUSVX, QSVIX)

The CCM Small/Mid-Cap Impact Value Fund institutional share class (the Fund) returned 9.67% for the fiscal year ended June 30, 2023, underperforming the Russell 2500 Value Index return of 10.37% by 0.70% and the Russell 2500 Index’s return of 13.58% by 3.91%.

The Fund outperformed the Russell 2500 Value Index in the third quarter of 2022 by 0.04% and by 3.05% in the second quarter of 2023. We believe the fund benefited from favorable security selection and sector allocation in these periods, particularly in the second quarter of 2023.

We believe the fund’s second quarter outperformance is explained by the outperformance of high-quality companies with strong financial profiles, which the fund generally seeks to own. We define such companies as those with high margins, low capital intensity, low leverage, and attractive growth prospects. Concerns about higher interest rates were coupled with concerns about access to credit given the stress in the banking sector. As a result, companies with low leverage and strong free cash flow generation can continue to fund their growth without the need for external capital. These companies are also seeing less of an impact to their interest expense because of their low debt loads.

Unfortunately, the Fund owned some names that were impacted by rising interest rates, concerns around availability of capital, and/or idiosyncratic events. The allocation to these names detracted from performance that resulted in the underperformance of the fund during the year. Generally, the sectors in which these challenges occurred were concentrated in utilities, real estate, and energy.

Outlook

During the next 12 months, we believe economic growth will be positive, but is likely to be in line if not lower than the rates it has grown over the past year. While the Fed Funds lower bound has increased 3.5% over the last year, many parts of the economy remain resilient. Consumers appear to be relying on credit and excess savings that have kept their spending more resilient than many had anticipated. Many homeowners during the pandemic were able to refinance their mortgages at record low levels, which has protected them from the pressures experienced in housing over the past few years. Finally, while the labor market has cooled since last year, demand for labor is still strong as the U.S. still has over 9.5 million job openings, well above pre-pandemic levels.

Inflation in the U.S. has trended in the right direction since peaking in September of last year, and we think that is potentially going to continue. The decline in inflation has been two faceted. Higher interest rates have reduced demand for big ticket durable goods, which experienced large price increases during the pandemic. At the same time, supply chains continue to normalize allowing producers to rebuild inventories back to more normalized

levels. This has been partially offset by sticky services inflation, which is the result of a shift in spending back to services as economies have opened. We think there’s potential for inflation to fall further as it’s unlikely that the Fed will preemptively reduce rates given its hawkish rhetoric. Additionally, companies continue to work to improve their supply chains and we think this will continue to increase the availability of goods, which should reduce upward pressures on prices.

While economic data have surprised to the upside for most of the last year, we recognize that uncertainty does exist as it relates to the outlook. The yield curve continues to experience a near record inversion, the war in Ukraine presents geopolitical risks, and 2024 is presidential election year, which tends to lead to increased volatility within markets. Additionally, higher rates continue to work their way through the economy and could potentially start to have larger negative impacts on the economy than they have over the last year.

While uncertainty exists, we believe our strategy of owning high quality companies that can outgrow the market, but trade at valuation discounts is a strategy that can capitalize on weak and strong economic times. While the portfolio’s holdings may experience volatility, we are confident that these companies have the potential to come out of a weak macroeconomic environment in strong positions to create shareholder value.

Sincerely,

The Portfolio Management Team

Past performance is no guarantee of future results.

Mutual fund investing involves risk. Principal loss is possible. The Adviser may select or exclude securities of certain companies for reasons other than performance and, as a result, the Fund may underperform other funds that do not use an impact/ESG screening process. Small- and mid-cap stocks involve greater risks and volatility than large-cap stocks. The Funds’ exposure to (MLPs) may subject the Funds to greater volatility than investments in traditional securities.

This report must be preceded or accompanied by a current prospectus.

The opinions expressed are those of the adviser through the end of the period for this report, are subject to change, are not a guarantee, and should not be considered investment advice.

Fund holdings and sector allocations are subject to change and should not be considered a recommendation to buy or sell any security. Current and future holdings are subject to risk.

The CCM Funds are distributed by Foreside Fund Services, LLC.

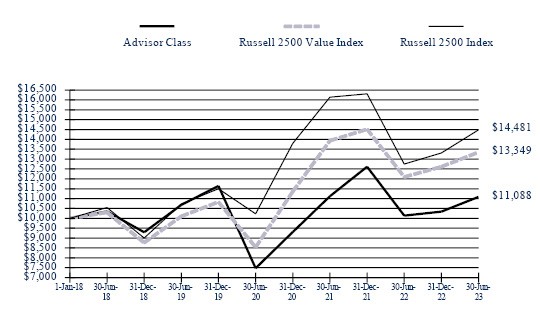

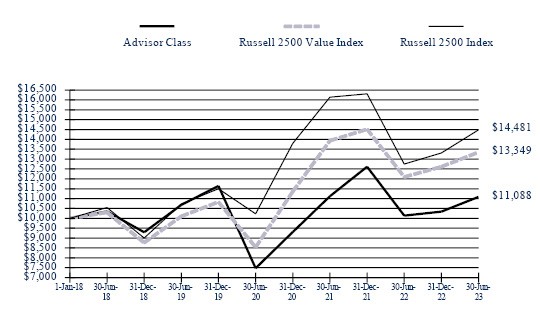

Annual Total Returns | One Year | Three Years | Five Years | Inception

to Date+ |

The CCM Small/Mid-Cap Impact Value Fund —Advisor Class Shares‡ | 9.39% | 14.06% | 1.38% | 1.90% |

The CCM Small/Mid-Cap Impact Value Fund — Institutional Class Shares‡ | 9.67% | 14.36% | 1.64% | 2.16% |

Russell 2500 Value Index* | 10.37% | 16.07% | 5.32% | 5.39% |

Russell 2500 Index* | 13.58% | 12.29% | 6.55% | 6.97% |

The above chart compares a hypothetical $10,000 investment made in the Fund's Advisor Shares Class, the Russell 2500 Index, and the Russell 2500 Value Index on January 1, 2018. This chart does not imply any future performance.

* The benchmark since inception returns are calculated since commencement of January 1, 2018 through June 30, 2023.

+ The Fund amended and restated its Registration Statement to change the performance reporting history. The inception date for the Fund’s performance history is now January 1, 2018, the date Community Capital Management, LLC became the new investment adviser to the Fund.

‡ As stated in the October 28, 2022 prospectus, the Adviser has contractually agreed to waive all or a portion of its investment advisory fees and/or pay/reimburse expenses (excluding any Rule 12b-1 fees, taxes, interest, acquired fund fees and expenses, short sale dividend and interest expenses, brokerage fees, certain insurance costs, and non-routine expenses or costs, including, but not limited to, those relating to reorganizations, litigation, conducting shareholder meetings, liquidations and other extraordinary expenses). The contractual expense limits are in effect until October 28, 2023. Pursuant to the current October 28, 2022 prospectus, the Fund’s annualized gross ratios of expenses in relation to average net assets were 2.43% and 2.18% for the Advisory Class Shares and the Institutional Class Shares, respectively, and the Fund’s annualized ratios of expenses in relation to net assets after fee waivers and reimbursements were 1.55% and 1.30% for the Advisory Class Shares and the Institutional

10 | Quaker Investment Trust |

Class Shares, respectively. Pursuant to its expense limitation agreement with the Fund, the Adviser is entitled to recoup any fees that it waived and/or Fund expenses that it paid for a period of three years following such fee waivers and expense payments, to the extent that such recoupment by the Adviser will not cause the Fund to exceed any applicable expense limitation that was in place for the Fund when the fees were waived or expenses were paid. These waivers and reimbursements may be terminated at any time with respect to the Fund by its Board of Trustees upon sixty (60) days’ written notice to the Adviser without payment of any penalty and shall automatically terminate upon the termination of the Fund’s advisory contract with the Adviser.

Performance data quoted represents past performance and is no guarantee of future results. Investment return and principal value will fluctuate so that shares, when redeemed, may be worth more or less than their original cost. Current performance may be lower or higher than performance data quoted. Performance data current to the most recent month end is available at www.ccminvests.com or by calling us toll free at 888-272-0007. Total return includes reinvestment of dividends and capital gains.

The performance table and chart do not reflect the deduction of taxes that a shareholder might pay on fund distributions or the redemption of fund shares. Total return calculations reflect expense reimbursements and fee waivers in the applicable periods.

The Fund’s portfolio holdings may differ significantly from the securities held in the index and, unlike a mutual fund, an unmanaged index assumes no transaction costs, taxes, management fees or other expenses. You cannot invest directly in an index.

The Russell 2500 Value Index measures the performance of the small to mid-cap value segment of the US equity universe. The Russell 2500 Index measures the performance of the 2,500 smallest companies in the Russell 3000 Index.

Disclosure of Fund Expenses June 30, 2023

As a shareholder of the Fund, you incur two types of costs: transaction costs, such as wire fees; and ongoing costs, including management fees and other Fund operating expenses. This example is intended to help you understand your ongoing costs (in dollars) of investing in the Fund and to compare these costs with the ongoing costs of investing in other mutual funds.

This example is based on an investment of $1,000 invested on January 1, 2023 and held for the six-month period ended June 30, 2023.

Actual expenses

The first line of the table below provides information about actual account values and actual expenses. You may use the information in this line, together with the amount you invested at the beginning of the period, to estimate the expenses that you paid over the period. Simply divide your account value by $1,000 (for example, an $8,600 account value divided by $1,000 = 8.6), then multiply the result by the number in the first line under the heading “Expenses Paid During Period” to estimate the expenses you paid on your account during this period.

Hypothetical example for comparison purposes

The second line of the table provides information about hypothetical account values and hypothetical expenses based on the Fund’s actual expense ratio and an assumed rate of return of 5% per year before expenses, which is not the Fund’s actual return. The hypothetical account values and expenses may not be used to estimate the actual ending account balance or expenses you paid for the period. You may use this information to compare ongoing costs of investing in the Fund and other funds. To do so, compare this 5% hypothetical example with the 5% hypothetical examples that appear in the shareholder reports of other funds.

Please note that the expenses shown in the table are meant to highlight your ongoing costs only and do not reflect any transactional costs, such as wire fees or low balance fees. Therefore, the second line of the table is useful in comparing ongoing costs only and will not help you determine the relative total costs of owning different funds. In addition, if these transactional costs were included, your costs would be higher.

12 | Quaker Investment Trust |

| | | Beginning Account Value 1/01/23 | | | Ending Account Value 6/30/23 | | | Expenses Paid During Period* | |

CCM Core Impact Equity Fund(1) |

Actual Fund Return |

Advisor Class Shares | | $ | 1,000.00 | | | $ | 1,131.90 | | | $ | 10.20 | |

Institutional Class Shares | | | 1,000.00 | | | | 1,133.00 | | | | 8.88 | |

Hypothetical 5% Return |

Advisor Class Shares | | $ | 1,000.00 | | | $ | 1,015.22 | | | $ | 9.64 | |

Institutional Class Shares | | | 1,000.00 | | | | 1,016.46 | | | | 8.40 | |

CCM Small/Mid-Cap Impact Value Fund(2) |

Actual Fund Return |

Advisor Class Shares | | $ | 1,000.00 | | | $ | 1,072.60 | | | $ | 7.97 | |

Institutional Class Shares | | | 1,000.00 | | | | 1,074.10 | | | | 6.69 | |

Hypothetical 5% Return |

Advisor Class Shares | | $ | 1,000.00 | | | $ | 1,017.11 | | | $ | 7.75 | |

Institutional Class Shares | | | 1,000.00 | | | | 1,018.35 | | | | 6.51 | |

* | Expenses are equal to the annualized six month expense ratio multiplied by the average account value over the period, multiplied by 181 days/365 days (to reflect the one-half year period).

|

(1) | Expenses are equal to the annualized expense ratio of 1.93% and 1.68% for the Advisor Class Shares and the Institutional Class Shares, respectively, multiplied by the average account value over the period. |

(2) | Expenses are equal to the annualized expense ratio of 1.55% and 1.30% for the Advisor Class Shares and the Institutional Class Shares, respectively, multiplied by the average account value over the period. |

Fund Profile June 30, 2023 (Unaudited)

CCM Core Impact Equity Fund

Top Ten Holdings* |

(% of Net Assets) |

Microsoft | | | 6.76% | |

Quanta Services | | | 4.30% | |

Adobe | | | 4.28% | |

Alphabet, Cl A | | | 3.14% | |

Broadcom | | | 3.03% | |

AmerisourceBergen, Cl A | | | 2.96% | |

Boston Scientific | | | 2.93% | |

Global Payments | | | 2.86% | |

Alphabet, Cl C | | | 2.78% | |

Unilever PLC ADR | | | 2.74% | |

| | | | 35.78% | |

| | | | | |

*Excludes Short-Term Investments. |

Asset Allocation | | | |

(% of Net Assets) | | | | |

Communication Services | | | 5.92% | |

Consumer Discretionary | | | 8.58% | |

Consumer Staples | | | 6.65% | |

Financials | | | 17.98% | |

Health Care | | | 18.55% | |

Industrials | | | 10.79% | |

Information Technology | | | 22.12% | |

Materials | | | 1.86% | |

Money Market Fund | | | 1.75% | |

Real Estate | | | 1.32% | |

Utilities | | | 4.69% | |

Liabilities in Excess of Other Assets | | | (0.21 | )% |

| | | | 100.00% | |

| | | | | |

| |

14 | Quaker Investment Trust |

Fund Profile June 30, 2023 (Unaudited)

CCM Small/Mid-Cap Impact Value Fund

Top Ten Holdings* |

(% of Net Assets) |

Quanta Services | | | 3.97% | |

Owens Corning | | | 3.95% | |

First Citizens BancShares, Cl A | | | 3.85% | |

Asbury Automotive Group | | | 3.74% | |

FleetCor Technologies | | | 3.62% | |

Ameriprise Financial | | | 3.45% | |

Molina Healthcare | | | 3.30% | |

Raymond James Financial | | | 3.29% | |

Berry Global Group | | | 3.27% | |

TD SYNNEX | | | 3.25% | |

| | | | 35.69% | |

| | | | | |

*Excludes Short-Term Investments. |

Asset Allocation | | | |

(% of Net Assets) | | | | |

Communication Services | | | 2.47% | |

Consumer Discretionary | | | 14.17% | |

Consumer Staples | | | 3.07% | |

Financials | | | 22.19% | |

Health Care | | | 11.32% | |

Industrials | | | 19.38% | |

Information Technology | | | 4.22% | |

Materials | | | 3.27% | |

Money Market Fund | | | 4.48% | |

Real Estate | | | 7.72% | |

Utilities | | | 7.77% | |

Liabilities in Excess of Other Assets | | | (0.06 | )% |

| | | | 100.00% | |

| | | | | |

| |

this page intentionally left blank.

16 | CCM Core Impact Equity Fund |

Schedule of Investments June 30, 2023

| | | Shares | | | Value | |

COMMON STOCK - 98.45% |

Communication Services - 5.92% | | | | | | | | |

Web Portals/ISP - 5.92% | | | | | | | | |

Alphabet, Cl A (a) | | | 15,000 | | | $ | 1,795,500 | |

Alphabet, Cl C (a) | | | 13,100 | | | | 1,584,707 | |

| | | | | | | | 3,380,207 | |

| |

Consumer Discretionary - 8.58% | | | | | | | | |

Bldg-Residential/Commer - 2.81% | | | | | | | | |

Lennar, Cl B | | | 10,000 | | | | 1,129,800 | |

NVR (a) | | | 75 | | | | 476,297 | |

Retail-Automobile - 4.40% | | | | | | | | |

Asbury Automotive Group (a) | | | 5,400 | | | | 1,298,268 | |

Lithia Motors, Cl A | | | 4,000 | | | | 1,216,440 | |

Retail-Restaurants - 1.37% | | | | | | | | |

Jack in the Box | | | 8,000 | | | | 780,240 | |

| | | | | | | | 4,901,045 | |

| |

Consumer Staples - 6.65% | | | | | | | | |

Brewery - 1.42% | | | | | | | | |

Constellation Brands, Cl A | | | 3,300 | | | | 812,229 | |

Cosmetics&Toiletries - 2.74% | | | | | | | | |

Unilever PLC ADR | | | 30,000 | | | | 1,563,900 | |

Food-Confectionery - 2.49% | | | | | | | | |

Mondelez International, Cl A | | | 19,500 | | | | 1,422,330 | |

| | | | | | | | 3,798,459 | |

| |

Financials - 17.98% | | | | | | | | |

Commercial Serv-Finance - 5.50% | | | | | | | | |

FleetCor Technologies (a) | | | 6,000 | | | | 1,506,480 | |

Global Payments | | | 16,600 | | | | 1,635,432 | |

Diversified Banking Inst - 0.97% | | | | | | | | |

JPMorgan Chase | | | 3,800 | | | | 552,672 | |

Finance-Credit Card - 2.55% | | | | | | | | |

Discover Financial Services | | | 12,500 | | | | 1,460,625 | |

Invest Mgmnt/Advis Serv - 5.38% | | | | | | | | |

Ameriprise Financial | | | 4,000 | | | | 1,328,640 | |

BlackRock, Cl A | | | 1,700 | | | | 1,174,938 | |

Raymond James Financial | | | 5,500 | | | | 570,735 | |

Property/Casualty Ins - 3.58% | | | | | | | | |

Assurant | | | 6,250 | | | | 785,750 | |

Berkshire Hathaway, Cl B (a) | | | 3,700 | | | | 1,261,700 | |

| | | | | | | | 10,276,972 | |

| |

Health Care - 18.55% | | | | | | | | |

Diagnostic Equipment - 1.37% | | | | | | | | |

Thermo Fisher Scientific | | | 1,500 | | | | 782,625 | |

Medical Instruments - 2.93% | | | | | | | | |

Boston Scientific (a) | | | 31,000 | | | | 1,676,790 | |

Medical Labs&Testing Srv - 3.49% | | | | | | | | |

Charles River Laboratories International (a) | | | 5,000 | | | | 1,051,250 | |

Laboratory Corp of America Holdings | | | 3,900 | | | | 941,187 | |

The accompanying notes are an integral part of the financial statements.

| | Shares | | | Value | |

COMMON STOCK — continued |

Medical-HMO - 3.24% | | | | | | | | |

Elevance Health | | | 2,950 | | | $ | 1,310,655 | |

Molina Healthcare (a) | | | 1,800 | | | | 542,232 | |

Medical-Hospitals - 2.13% | | | | | | | | |

Universal Health Services, Cl B | | | 7,700 | | | | 1,214,829 | |

Medical-Whsle Drug Dist - 2.96% | | | | | | | | |

AmerisourceBergen, Cl A | | | 8,800 | | | | 1,693,384 | |

Pharmacy Services - 2.43% | | | | | | | | |

Cigna Group | | | 4,950 | | | | 1,388,970 | |

| | | | | | | | 10,601,922 | |

| |

Industrials - 10.78% | | | | | | | | |

Airport Develop/Maint - 1.59% | | | | | | | | |

Grupo Aeroportuario del Pacifico | | | 5,100 | | | | 911,472 | |

Bldg&Construct Prod-Misc - 1.73% | | | | | | | | |

Owens Corning | | | 7,600 | | | | 991,800 | |

Commercial Services - 4.30% | | | | | | | | |

Quanta Services | | | 12,500 | | | | 2,455,625 | |

Diversified Manufact Op - 2.05% | | | | | | | | |

Parker-Hannifin | | | 3,000 | | | | 1,170,120 | |

Machinery-Pumps - 1.11% | | | | | | | | |

Zurn Elkay Water Solutions | | | 23,500 | | | | 631,915 | |

| | | | | | | | 6,160,932 | |

| |

Information Technology - 22.12% | | | | | | | | |

Applications Software - 8.68% | | | | | | | | |

Intuit | | | 2,400 | | | | 1,099,656 | |

Microsoft | | | 11,350 | | | | 3,865,129 | |

Electronic Compo-Semicon - 3.03% | | | | | | | | |

Broadcom | | | 2,000 | | | | 1,734,860 | |

Electronic Forms - 4.28% | | | | | | | | |

Adobe (a) | | | 5,000 | | | | 2,444,950 | |

Electronic Parts Distrib - 2.32% | | | | | | | | |

TD SYNNEX | | | 14,100 | | | | 1,325,400 | |

Energy-Alternate Sources - 0.50% | | | | | | | | |

Enphase Energy (a) | | | 1,700 | | | | 284,716 | |

Networking Products - 1.08% | | | | | | | | |

Arista Networks (a) | | | 3,800 | | | | 615,828 | |

Semicon Compo-Intg Circu - 2.23% | | | | | | | | |

Taiwan Semiconductor Manufacturing | | | 12,600 | | | | 1,271,592 | |

| | | | | | | | 12,642,131 | |

| |

Materials - 1.86% | | | | | | | | |

Containers-Paper/Plastic - 1.86% | | | | | | | | |

Berry Global Group | | | 16,500 | | | | 1,061,610 | |

| | | | | | | | | |

| |

Real Estate - 1.32% | | | | | | | | |

REITS-Diversified - 1.32% | | | | | | | | |

WP Carey | | | 11,200 | | | | 756,672 | |

| | | | | | | | | |

| |

Utilities - 4.69% | | | | | | | | |

Electric-Generation - 1.03% | | | | | | | | |

Brookfield Renewable Partners | | | 20,000 | | | | 589,800 | |

The accompanying notes are an integral part of the financial statements.

18 | CCM Core Impact Equity Fund |

| | Shares | | | Value | |

COMMON STOCK — continued |

Electric-Integrated - 1.03% | | | | | | | | |

CMS Energy | | | 10,000 | | | $ | 587,500 | |

Energy-Alternate Sources - 2.00% | | | | | | | | |

NextEra Energy Partners | | | 19,540 | | | | 1,145,826 | |

Water - 0.63% | | | | | | | | |

Veolia Environnement | | | 22,600 | | | | 359,792 | |

| | | | | | | | 2,682,918 | |

| |

TOTAL COMMON STOCK | | | | |

(Cost $41,656,931) | | | | | | | 56,262,868 | |

| |

| | | | | | | | | |

ESCROW SHARES - 0.01% |

Industrials - 0.01% | | | | | | | | |

Airlines - 0.01% | | | | | | | | |

American Airlines Escrow (a) (b) | | | 218,835 | | | | 6,565 | |

| | | | | | | | | |

TOTAL ESCROW SHARES | | | | |

(Cost $24,536) | | | | | | | 6,565 | |

| |

| | | | | | | | | |

SHORT-TERM INVESTMENT - 1.75% | | | | | | | | |

Money Market Fund - 1.75% |

First American Government Obligations Fund, Cl X, 5.01%, (c) | | | 1,002,248 | | | | 1,002,248 | |

TOTAL SHORT-TERM INVESTMENT | | | | |

(Cost $1,002,248) | | | | | | | 1,002,248 | |

| |

Total Investments (Cost $42,683,715) - 100.21% | | $ | 57,271,681 | |

Liabilities in Excess of Other Assets, Net - (0.21)% | | | (119,783 | ) |

NET ASSETS - 100.00% | | $ | 57,151,898 | |

(a) | Non-income producing security. |

(b) | Level 3 security in accordance with fair value hierarchy. |

(c) | The rate shown is the 7-day effective yield as of June 30, 2023. |

ADR — American Depositary Receipt |

Cl — Class |

PLC — Public Limited Company |

REIT — Real Estate investment Trust |

The following table sets forth information about the level within the fair value hierarchy at which the Fund’s investments are measured at June 30, 2023:

Assets | | Level 1 | | | Level 2 | | | Level 3* | | | Total | |

Common Stock | | $ | 56,262,868 | | | $ | — | | | $ | — | | | $ | 56,262,868 | |

Escrow Shares | | | — | | | | — | | | | 6,565 | | | | 6,565 | |

Short-Term Investment | | | 1,002,248 | | | | — | | | | — | | | | 1,002,248 | |

Total Investments in Securities | | $ | 57,265,116 | | | $ | — | | | $ | 6,565 | | | $ | 57,271,681 | |

* | A reconciliation of Level 3 investments is presented when the Fund has a significant amount of Level 3 investments at the end of the period in relation to net assets. Management has concluded that Level 3 investments are not material in relation to net assets. |

The accompanying notes are an integral part of the financial statements.

this page intentionally left blank.

20 | CCM Small/Mid-Cap Impact Value Fund |

Schedule of Investments June 30, 2023

| | | Shares | | | Value | |

COMMON STOCK - 95.58% |

Communication Services - 2.47% | | | | | | | | |

Advertising Agencies - 2.47% | | | | | | | | |

Omnicom Group | | | 4,500 | | | $ | 428,175 | |

| | | | | | | | | |

| |

Consumer Discretionary - 14.17% | | | | | | | | |

Bldg-Residential/Commer - 3.19% | | | | | | | | |

Lennar, Cl B | | | 2,650 | | | | 299,397 | |

NVR (a) | | | 40 | | | | 254,025 | |

Recreational Vehicles - 2.40% | | | | | | | | |

Brunswick | | | 4,800 | | | | 415,872 | |

Retail-Automobile - 6.33% | | | | | | | | |

Asbury Automotive Group (a) | | | 2,700 | | | | 649,134 | |

Lithia Motors, Cl A | | | 1,475 | | | | 448,562 | |

Retail-Restaurants - 2.25% | | | | | | | | |

Jack in the Box | | | 4,000 | | | | 390,120 | |

| | | | | | | | 2,457,110 | |

| |

Consumer Staples - 3.07% | | | | | | | | |

Beverages-Non-alcoholic - 3.07% | | | | | | | | |

Coca-Cola Femsa ADR | | | 6,400 | | | | 533,184 | |

| | | | | | | | | |

| |

Financials - 22.19% | | | | | | | | |

Commer Banks-Southern US - 3.85% | | | | | | | | |

First Citizens BancShares, Cl A | | | 520 | | | | 667,394 | |

Commercial Serv-Finance - 3.62% | | | | | | | | |

FleetCor Technologies (a) | | | 2,500 | | | | 627,700 | |

Finance-Credit Card - 2.56% | | | | | | | | |

Discover Financial Services | | | 3,800 | | | | 444,030 | |

Invest Mgmnt/Advis Serv - 6.74% | | | | | | | | |

Ameriprise Financial | | | 1,800 | | | | 597,888 | |

Raymond James Financial | | | 5,500 | | | | 570,735 | |

Life/Health Insurance - 1.53% | | | | | | | | |

F&G Annuities & Life | | | 10,695 | | | | 265,022 | |

Property/Casualty Ins - 3.89% | | | | | | | | |

Assurant | | | 2,300 | | | | 289,156 | |

Fidelity National Financial | | | 10,750 | | | | 387,000 | |

| | | | | | | | 3,848,925 | |

| |

Health Care - 11.32% | | | | | | | | |

Medical Labs&Testing Srv - 4.93% | | | | | | | | |

Charles River Laboratories International (a) | | | 2,000 | | | | 420,500 | |

Laboratory Corp of America Holdings | | | 1,800 | | | | 434,394 | |

Medical-HMO - 3.30% | | | | | | | | |

Molina Healthcare (a) | | | 1,900 | | | | 572,356 | |

Medical-Hospitals - 3.09% | | | | | | | | |

Nobilis Health (a) (b) | | | 38,393 | | | | — | |

Universal Health Services, Cl B | | | 3,400 | | | | 536,418 | |

| | | | | | | | 1,963,668 | |

| |

Industrials - 19.38% | | | | | | | | |

Airport Develop/Maint - 3.09% | | | | | | | | |

Grupo Aeroportuario del Pacifico | | | 3,000 | | | | 536,160 | |

The accompanying notes are an integral part of the financial statements.

| | Shares | | | Value | |

COMMON STOCK — continued |

Bldg&Construct Prod-Misc - 3.95% | | | | | | | | |

Owens Corning | | | 5,250 | | | $ | 685,125 | |

Commercial Services - 3.97% | | | | | | | | |

Quanta Services | | | 3,500 | | | | 687,575 | |

Diversified Manufact Op - 2.08% | | | | | | | | |

Parker-Hannifin | | | 925 | | | | 360,787 | |

Enterprise Software/Serv - 1.75% | | | | | | | | |

SS&C Technologies Holdings | | | 5,000 | | | | 303,000 | |

Machinery-Farm - 0.76% | | | | | | | | |

Toro | | | 1,300 | | | | 132,145 | |

Machinery-General Indust - 1.96% | | | | | | | | |

ATS (a) | | | 7,400 | | | | 340,464 | |

Machinery-Pumps - 1.82% | | | | | | | | |

Dover | | | 900 | | | | 132,885 | |

Zurn Elkay Water Solutions | | | 6,800 | | | | 182,852 | |

| | | | | | | | 3,360,993 | |

| |

Information Technology - 4.22% | | | | | | | | |

Electronic Parts Distrib - 3.25% | | | | | | | | |

TD SYNNEX | | | 6,000 | | | | 564,000 | |

Energy-Alternate Sources - 0.97% | | | | | | | | |

Enphase Energy (a) | | | 1,000 | | | | 167,480 | |

| | | | | | | | 731,480 | |

| |

Materials - 3.27% | | | | | | | | |

Containers-Paper/Plastic - 3.27% | | | | | | | | |

Berry Global Group | | | 8,800 | | | | 566,192 | |

| | | | | | | | | |

| |

Real Estate - 7.72% | | | | | | | | |

REITS-Diversified - 2.81% | | | | | | | | |

WP Carey | | | 7,200 | | | | 486,432 | |

REITS-Office Property - 2.49% | | | | | | | | |

Alexandria Real Estate Equities | | | 2,250 | | | | 255,353 | |

Highwoods Properties | | | 7,400 | | | | 176,934 | |

REITS-Single Tenant - 2.42% | | | | | | | | |

NNN REIT | | | 9,800 | | | | 419,342 | |

| | | | | | | | 1,338,061 | |

| |

Utilities - 7.77% | | | | | | | | |

Electric-Generation - 2.73% | | | | | | | | |

Clearway Energy, Cl A | | | 4,000 | | | | 108,000 | |

Clearway Energy, Cl C | | | 12,800 | | | | 365,568 | |

Electric-Integrated - 2.71% | | | | | | | | |

CMS Energy | | | 8,000 | | | | 470,000 | |

Energy-Alternate Sources - 2.33% | | | | | | | | |

NextEra Energy Partners | | | 6,886 | | | | 403,795 | |

| | | | | | | | 1,347,363 | |

| |

TOTAL COMMON STOCK | | | | |

(Cost $14,139,729) | | | | | | | 16,575,151 | |

| |

The accompanying notes are an integral part of the financial statements.

22 | CCM Small/Mid-Cap Impact Value Fund |

| | | Shares | | | Value | |

SHORT-TERM INVESTMENT - 4.48% | | | | | | | | |

Money Market Fund - 4.48% |

First American Government Obligations Fund, Cl X, 5.01%, (c) | | | 776,842 | | | $ | 776,842 | |

TOTAL SHORT-TERM INVESTMENT | | | | |

(Cost $776,842) | | | | | | | 776,842 | |

| |

Total Investments (Cost $14,916,571) - 100.06% | | $ | 17,351,993 | |

Liabilities in Excess of Other Assets, Net - (0.06)% | | | (10,245 | ) |

NET ASSETS - 100.00% | | $ | 17,341,748 | |

(a) | Non-income producing security. |

(b) | Level 3 security in accordance with fair value hierarchy. |

(c) | The rate shown is the 7-day effective yield as of June 30, 2023. |

ADR — American Depositary Receipt |

Cl — Class |

REIT — Real Estate investment Trust |

The following table sets forth information about the level within the fair value hierarchy at which the Fund’s investments are measured at June 30, 2023:

Assets | | Level 1 | | | Level 2 | | | Level 3* | | | Total | |

Common Stock | | $ | 16,575,151 | | | $ | — | | | $ | — | (1) | | $ | 16,575,151 | |

Short-Term Investment | | | 776,842 | | | | — | | | | — | | | | 776,842 | |

Total Investments in Securities | | $ | 17,351,993 | | | $ | — | | | $ | — | | | $ | 17,351,993 | |

* | A reconciliation of Level 3 investments is presented when the Fund has a significant amount of Level 3 investments at the end of the period in relation to net assets. Management has concluded that Level 3 investments are not material in relation to net assets. |

(1) | Level 3 security valued at zero. |

The accompanying notes are an integral part of the financial statements.

Statements of Assets and Liabilities as of June 30, 2023

| | | CCM Core Impact Equity Fund | |

Assets: | | | | |

Investments, at fair value (identified cost — $42,683,715) | | $ | 57,271,681 | |

Cash | | | 6,796 | |

Receivables: | | | | |

Dividends and interest | | | 33,442 | |

Reclaims | | | 1,204 | |

Capital shares sold | | | 246 | |

Prepaid expenses | | | 31,146 | |

Total Assets | | | 57,344,515 | |

Liabilities: | | | | |

Payables: | | | | |

Legal Fees | | | 40,853 | |

Investment advisory fees | | | 34,389 | |

Audit fees | | | 26,163 | |

Miscellaneous Fees | | | 19,215 | |

Transfer agent fees | | | 17,248 | |

Trustees' fees | | | 14,428 | |

Printing fees | | | 13,761 | |

Shareholder servicing fees | | | 9,958 | |

Distribution fees — Advisor Class Shares | | | 9,632 | |

Administration fees | | | 2,293 | |

Other accrued expenses | | | 4,677 | |

Total Liabilities | | $ | 192,617 | |

Net Assets: | | $ | 57,151,898 | |

Net Assets consist of: | | | | |

Paid-in capital | | $ | 44,276,745 | |

Total distributable earnings | | | 12,875,153 | |

Net Assets | | $ | 57,151,898 | |

Net Assets — Advisor Class Shares (Unlimited shares of beneficial interest with no par value authorized; 1,378,579 shares outstanding) | | $ | 48,023,128 | |

Net Assets — Institutional Class Shares (Unlimited shares of beneficial interest with no par value authorized; 240,794 shares outstanding) | | $ | 9,128,770 | |

Net Asset Value, offering and redemption price per share —

Advisor Class Shares | | $ | 34.84 | |

Net Asset Value, offering and redemption price per share —

Institutional Class Shares | | $ | 37.91 | |

The accompanying notes are an integral part of the financial statements.

24 | Quaker Investment Trust |

Statements of Assets and Liabilities as of June 30, 2023

| | | CCM Small/Mid-Cap Impact Value Fund | |

Assets: | | | | |

Investments, at fair value (identified cost — $14,916,571) | | $ | 17,351,993 | |

Receivables: | | | | |

Capital shares sold | | | 30,600 | |

Dividends and interest | | | 19,945 | |

Prepaid expenses | | | 9,613 | |

Total Assets | | | 17,412,151 | |

Liabilities: | | | | |

Payables: | | | | |

Legal Fees | | | 12,238 | |

Transfer agent fees | | | 10,077 | |

Capital shares redeemed | | | 9,500 | |

Printing fees | | | 9,320 | |

Audit fees | | | 7,837 | |

Miscellaneous Fees | | | 5,756 | |

Trustees' fees | | | 4,322 | |

Shareholder servicing fees | | | 3,088 | |

Investment advisory fees | | | 3,001 | |

Administration fees | | | 2,123 | |

Distribution fees — Advisor Class Shares | | | 776 | |

Other accrued expenses | | | 2,365 | |

Total Liabilities | | $ | 70,403 | |

Net Assets: | | $ | 17,341,748 | |

Net Assets consist of: | | | | |

Paid-in capital | | $ | 18,133,065 | |

Total distributable loss | | | (791,317 | ) |

Net Assets | | $ | 17,341,748 | |

Net Assets — Advisor Class Shares (Unlimited shares of beneficial interest with no par value authorized; 305,337 shares outstanding) | | $ | 5,100,140 | |

Net Assets — Institutional Class Shares (Unlimited shares of beneficial interest with no par value authorized; 660,095 shares outstanding) | | $ | 12,241,608 | |

Net Asset Value, offering and redemption price per share —

Advisor Class Shares | | $ | 16.70 | |

Net Asset Value, offering and redemption price per share —

Institutional Class Shares | | $ | 18.55 | |

The accompanying notes are an integral part of the financial statements.

Statements of Operations for the year ended June 30, 2023

| | | CCM Core Impact Equity Fund | |

Investment Income: | | | | |

Dividends | | $ | 737,540 | |

Interest | | | 53,767 | |

Less: Foreign Taxes Withheld | | | (9,678 | ) |

Total investment income | | | 781,629 | |

Expenses: | | | | |

Investment advisory fees | | | 415,828 | |

Distribution fees — Advisor Class Shares | | | 116,283 | |

Shareholder Servicing Fees | | | 58,440 | |

Insurance expense | | | 98,930 | |

Legal Fess | | | 80,977 | |

Transfer agent fees | | | 62,434 | |

Trustees' fees | | | 57,373 | |

Registration and filing expenses | | | 57,099 | |

Chief Compliance Officer fees | | | 48,754 | |

Accounting and administration fees | | | 27,723 | |

Audit Fees | | | 26,163 | |

Printing fees | | | 8,357 | |

Custodian fees | | | 6,768 | |

Other | | | 12,806 | |

Total expenses | | | 1,077,935 | |

Net expenses | | | 1,077,935 | |

Net investment income (loss) | | | (296,306 | ) |

Realized and unrealized gain (loss) on: | | | | |

Net realized loss on investments | | | (1,488,126 | ) |

Net realized gain (loss) | | | (1,488,126 | ) |

Unrealized appreciation (depreciation) on: | | | | |

Net change in unrealized appreciation (depreciation) on investments | | | 8,884,883 | |

Net unrealized appreciation (depreciation) | | | 8,884,883 | |

Net realized and unrealized gain (loss) | | | 7,396,757 | |

Net increase in net assets resulting from operations: | | $ | 7,100,451 | |

The accompanying notes are an integral part of the financial statements.

26 | Quaker Investment Trust |

Statements of Operations for the year ended June 30, 2023

| | | CCM Small/Mid-Cap Impact Value Fund | |

Investment Income: | | | | |

Dividends | | $ | 300,077 | |

Interest | | | 24,601 | |

Less: Foreign Taxes Withheld | | | (2,531 | ) |

Total investment income | | | 322,147 | |

Expenses: | | | | |

Investment advisory fees | | | 153,073 | |

Distribution fees — Advisor Class Shares | | | 13,490 | |

Shareholder Servicing Fees | | | 16,769 | |

Transfer agent fees | | | 49,391 | |

Insurance expense | | | 29,455 | |

Accounting and administration fees | | | 25,069 | |

Legal Fess | | | 24,738 | |

Chief Compliance Officer fees | | | 23,246 | |

Trustees' fees | | | 17,627 | |

Registration and filing expenses | | | 17,380 | |

Audit Fees | | | 7,837 | |

Custodian fees | | | 4,456 | |

Printing fees | | | 2,648 | |

Other | | | 3,942 | |

Total expenses | | | 389,121 | |

Less: | | | | |

Investment advisory fees waived and other expenses absorbed | | | (153,896 | ) |

Net expenses | | | 235,225 | |

Net investment income | | | 86,922 | |

Realized and unrealized gain (loss) on: | | | | |

Net realized loss on investments | | | (1,175,706 | ) |

Net realized gain on foreign currency transactions | | | 285 | |

Net realized gain (loss) | | | (1,175,421 | ) |

Unrealized appreciation (depreciation) | | | | |

Net change in unrealized appreciation (depreciation) on investments | | | 2,638,175 | |

Net unrealized appreciation (depreciation) | | | 2,638,175 | |

Net realized and unrealized gain (loss) | | | 1,462,754 | |

Net increase in net assets resulting from operations: | | $ | 1,549,676 | |

The accompanying notes are an integral part of the financial statements.

Statements of Changes in Net Assets

| | | CCM Core Impact Equity Fund | |

| | | For the

Fiscal Year Ended

June 30, 2023 | | | For the

Fiscal Year Ended

June 30, 2022 | |

Operations: | | | | | | | | |

Net investment income (loss) | | $ | (296,306 | ) | | $ | (488,218 | ) |

Net realized gain (loss) | | | (1,488,126 | ) | | | 10,564,974 | |

Net change in unrealized appreciation (depreciation) | | | 8,884,883 | | | | (18,281,427 | ) |

Net increase (decrease) in net assets resulting from operations | | | 7,100,451 | | | | (8,204,671 | ) |

Distributions | | | | | | | | |

Advisor Class Shares | | | (8,608,881 | ) | | | (8,671,674 | ) |

Institutional Class Shares | | | (1,575,868 | ) | | | (1,606,507 | ) |

Total distributions | | | (10,184,749 | ) | | | (10,278,181 | ) |

Capital share transactions: | | | | | | | | |

Advisor Class Shares | | | | | | | | |

Shares issued | | | 339,141 | | | | 904,148 | |

Shares reinvested | | | 7,896,515 | | | | 7,910,266 | |

Shares redeemed | | | (5,266,501 | ) | | | (5,299,133 | ) |

| | | | 2,969,155 | | | | 3,515,281 | |

Institutional Class Shares | | | | | | | | |

Shares issued | | | 243,105 | | | | 314,889 | |

Shares reinvested | | | 1,449,368 | | | | 1,542,918 | |

Shares redeemed | | | (1,264,452 | ) | | | (1,404,529 | ) |

| | | | 428,021 | | | | 453,278 | |

Increase in net assets from capital share transactions | | | 3,397,176 | | | | 3,968,559 | |

Increase (decrease) in net assets | | | 312,878 | | | | (14,514,293 | ) |

Net Assets: | | | | | | | | |

Beginning of year | | | 56,839,020 | | | | 71,353,313 | |

End of year | | $ | 57,151,898 | | | $ | 56,839,020 | |

Share Transactions: | | | | | | | | |

Advisor Class Shares | | | | | | | | |

Shares Issued | | | 9,613 | | | | 18,499 | |

Shares reinvested | | | 255,468 | | | | 167,271 | |

Shares redeemed | | | (148,059 | ) | | | (110,817 | ) |

| | | | 117,022 | | | | 74,953 | |

Institutional Class Shares | | | | | | | | |

Shares Issued | | | 6,039 | | | | 6,078 | |

Shares reinvested | | | 43,136 | | | | 30,553 | |

Shares redeemed | | | (33,991 | ) | | | (28,174 | ) |

| | | | 15,184 | | | | 8,457 | |

Increase in shares | | | 132,206 | | | | 83,410 | |

The accompanying notes are an integral part of the financial statements.

28 | Quaker Investment Trust |

Statements of Changes in Net Assets

| | | CCM Small/Mid-Cap Impact Value Fund | |

| | | For the

Fiscal Year Ended

June 30, 2023 | | | For the

Fiscal Year Ended

June 30, 2022 | |

Operations: | | | | | | | | |

Net investment income (loss) | | $ | 86,922 | | | $ | 44,365 | |

Net realized gain (loss) | | | (1,175,421 | ) | | | 937,968 | |

Net change in unrealized appreciation (depreciation) | | | 2,638,175 | | | | (2,487,324 | ) |

Net increase (decrease) in net assets resulting from operations | | | 1,549,676 | | | | (1,504,991 | ) |

Distributions | | | | | | | | |

Advisor Class Shares | | | (41,735 | ) | | | — | |

Institutional Class Shares | | | (84,056 | ) | | | — | |

Total distributions | | | (125,791 | ) | | | — | |

Capital share transactions: | | | | | | | | |

Advisor Class Shares | | | | | | | | |

Shares issued | | | 255,648 | | | | 912,653 | |

Shares reinvested | | | 38,635 | | | | — | |

Shares redeemed | | | (1,139,386 | ) | | | (1,540,365 | ) |

| | | | (845,103 | ) | | | (627,712 | ) |

Institutional Class Shares | | | | | | | | |

Shares issued | | | 842,942 | | | | 633,560 | |

Shares reinvested | | | 81,071 | | | | — | |

Shares redeemed | | | (917,609 | ) | | | (934,832 | ) |

| | | | 6,404 | | | | (301,272 | ) |

Decrease in net assets from capital share transactions | | | (838,699 | ) | | | (928,984 | ) |

Increase (decrease) in net assets | | | 585,186 | | | | (2,433,975 | ) |

Net Assets: | | | | | | | | |

Beginning of year | | | 16,756,562 | | | | 19,190,537 | |

End of year | | $ | 17,341,748 | | | $ | 16,756,562 | |

Share Transactions: | | | | | | | | |

Advisor Class Shares | | | | | | | | |

Shares Issued | | | 15,740 | | | | 50,746 | |

Shares reinvested | | | 2,470 | | | | — | |

Shares redeemed | | | (71,877 | ) | | | (85,087 | ) |

| | | | (53,667 | ) | | | (34,341 | ) |

Institutional Class Shares | | | | | | | | |

Shares Issued | | | 48,133 | | | | 32,275 | |

Shares reinvested | | | 4,675 | | | | — | |

Shares redeemed | | | (51,784 | ) | | | (46,873 | ) |

| | | | 1,024 | | | | (14,598 | ) |

Decrease in shares | | | (52,643 | ) | | | (48,939 | ) |

The accompanying notes are an integral part of the financial statements.

Financial Highlights - Per share data (for a share outstanding throughout the year)

| | | Advisor Class Shares | |

CCM Core Impact Equity Fund | | For the

Fiscal Year

Ended

June 30, 2023 | | | For the

Fiscal Year

Ended

June 30, 2022 | | | For the

Fiscal Year

Ended

June 30, 2021 | | | For the

Fiscal Year

Ended

June 30, 2020 | | | For the

Fiscal Year

Ended

June 30, 2019 | |

Net Asset Value, Beginning of Year | | $ | 37.82 | | | $ | 50.38 | | | $ | 35.31 | | | $ | 34.22 | | | $ | 31.87 | |

Investment Operations:

Net investment Income (loss)(a) | | | (0.20 | ) | | | (0.35 | ) | | | (0.50 | ) | | | (0.34 | ) | | | (0.30 | ) |

Net realized and unrealized gain (loss) on investments | | | 4.44 | | | | (4.63 | ) | | | 15.86 | | | | 2.10 | | | | 2.65 | |

Total from investment operations | | | 4.24 | | | | (4.98 | ) | | | 15.36 | | | | 1.76 | | | | 2.35 | |

Distributions from: | | | | | | | | | | | | | | | | | | | | |

Net investment income | | | — | | | | — | | | | — | | | | — | | | | — | |

Net capital gains | | | (7.22 | ) | | | (7.58 | ) | | | (0.29 | ) | | | (0.67 | ) | | | — | |

Total distributions | | | (7.22 | ) | | | (7.58 | ) | | | (0.29 | ) | | | (0.67 | ) | | | — | |

Net Asset Value, End of Year | | $ | 34.84 | | | $ | 37.82 | | | $ | 50.38 | | | $ | 35.31 | | | $ | 34.22 | |

Total return | | | 13.65 | % | | | (12.90 | )% | | | 43.65 | %(1) | | | 5.05 | %(1) | | | 7.37 | %(1) |

Ratios/Supplemental Data | | | | | | | | | | | | | | | | | | | | |

Net assets, end of year (in 000s) | | $ | 48,023 | | | $ | 47,716 | | | $ | 59,786 | | | $ | 47,731 | | | $ | 53,292 | |

Ratio of expenses to average net assets

Before fee waiver | | | 1.98 | % | | | 1.95 | % | | | 2.03 | % | | | 2.09 | % | | | 2.48 | % |

After fee waiver | | | 1.98 | % | | | 1.95 | % | | | 2.03 | % | | | 2.09 | % | | | 2.48 | % |

Ratio of net investment income (loss) to average net assets

Before fee waiver | | | (0.58 | )% | | | (0.74 | )% | | | (1.14 | )% | | | (0.97 | )% | | | (0.99 | )% |

After fee waiver | | | (0.58 | )% | | | (0.74 | )% | | | (1.14 | )% | | | (0.97 | )% | | | (0.99 | )% |

Portfolio turnover rate | | | 25 | % | | | 47 | % | | | 56 | % | | | 69 | % | | | 24 | % |

(a) | Based on the average daily number of shares outstanding during the year. |

(1) | Total investment return is based on the change in net asset value of a share during the year, assumes reinvestment of dividends and distributions at net asset value and does not reflect the impact of a sales charge. As of September 30, 2018 the Fund no longer charges a sales charge. |

The accompanying notes are an integral part of the financial statements.

30 | Quaker Investment Trust |

Financial Highlights - Per share data (for a share outstanding throughout the year)

| | | Institutional Class Shares | |

CCM Core Impact Equity Fund | | For the

Fiscal Year

Ended

June 30, 2023 | | | For the

Fiscal Year

Ended

June 30, 2022 | | | For the

Fiscal Year

Ended

June 30, 2021 | | | For the

Fiscal Year

Ended

June 30, 2020 | | | For the

Fiscal Year

Ended

June 30, 2019 | |

Net Asset Value, Beginning of Year | | $ | 40.44 | | | $ | 53.27 | | | $ | 37.23 | | | $ | 35.96 | | | $ | 33.40 | |

Investment Operations:

Net investment Income (loss)(a) | | | (0.12 | ) | | | (0.25 | ) | | | (0.41 | ) | | | (0.26 | ) | | | (0.25 | ) |

Net realized and unrealized gain (loss) on investments | | | 4.81 | | | | (5.00 | ) | | | 16.74 | | | | 2.20 | | | | 2.81 | |

Total from investment operations | | | 4.69 | | | | (5.25 | ) | | | 16.33 | | | | 1.94 | | | | 2.56 | |

Distributions from: | | | | | | | | | | | | | | | | | | | | |

Net investment income | | | — | | | | — | | | | — | | | | — | | | | — | |

Net capital gains | | | (7.22 | ) | | | (7.58 | ) | | | (0.29 | ) | | | (0.67 | ) | | | — | |

Total distributions | | | (7.22 | ) | | | (7.58 | ) | | | (0.29 | ) | | | (0.67 | ) | | | — | |

Net Asset Value, End of Year | | $ | 37.91 | | | $ | 40.44 | | | $ | 53.27 | | | $ | 37.23 | | | $ | 35.96 | |

Total return | | | 13.90 | % | | | (12.69 | )% | | | 44.00 | %(1) | | | 5.31 | %(1) | | | 7.66 | %(1) |

Ratios/Supplemental Data | | | | | | | | | | | | | | | | | | | | |

Net assets, end of year (in 000s) | | $ | 9,129 | | | $ | 9,123 | | | $ | 11,567 | | | $ | 8,606 | | | $ | 8,746 | |

Ratio of expenses to average net assets

Before fee waiver | | | 1.73 | % | | | 1.70 | % | | | 1.78 | % | | | 1.84 | % | | | 2.23 | % |

After fee waiver | | | 1.73 | % | | | 1.70 | % | | | 1.78 | % | | | 1.84 | % | | | 2.23 | % |

Ratio of net investment income (loss) to average net assets

Before fee waiver | | | (0.32 | )% | | | (0.49 | )% | | | (0.89 | )% | | | (0.72 | )% | | | (0.74 | )% |

After fee waiver | | | (0.32 | )% | | | (0.49 | )% | | | (0.89 | )% | | | (0.72 | )% | | | (0.74 | )% |

Portfolio turnover rate | | | 25 | % | | | 47 | % | | | 56 | % | | | 69 | % | | | 24 | % |

(a) | Based on the average daily number of shares outstanding during the year. |

(1) | Total investment return is based on the change in net asset value of a share during the year, assumes reinvestment of dividends and distributions at net asset value. |

The accompanying notes are an integral part of the financial statements.

Financial Highlights - Per share data (for a share outstanding throughout the year)

| | | Advisor Class Shares | |

CCM Small/Mid-Cap Impact Value Fund | | For the

Fiscal Year

Ended

June 30, 2023 | | | For the

Fiscal Year

Ended

June 30, 2022 | | | For the

Fiscal Year

Ended

June 30, 2021 | | | For the

Fiscal Year

Ended

June 30, 2020 | | | For the

Fiscal Year

Ended

June 30, 2019 | |

Net Asset Value, Beginning of Year | | $ | 15.39 | | | $ | 16.88 | | | $ | 11.49 | | | $ | 17.65 | | | $ | 23.23 | |

Investment Operations:

Net investment Income (loss)(a) | | | 0.06 | | | | 0.01 | | | | 0.02 | | | | 0.09 | | | | 0.08 | |

Net realized and unrealized gain (loss) on investments | | | 1.38 | | | | (1.50 | ) | | | 5.55 | | | | (4.91 | ) | | | 0.12 | |

Total from investment operations | | | 1.44 | | | | (1.49 | ) | | | 5.57 | | | | (4.82 | ) | | | 0.20 | |

Distributions from: | | | | | | | | | | | | | | | | | | | | |

Net investment income | | | (0.13 | ) | | | — | | | | (0.18 | ) | | | (0.34 | ) | | | — | |

Net capital gains | | | — | | | | — | | | | — | | | | (1.00 | ) | | | (5.78 | ) |

Total distributions | | | (0.13 | ) | | | — | | | | (0.18 | ) | | | (1.34 | ) | | | (5.78 | ) |

Net Asset Value, End of Year | | $ | 16.70 | | | $ | 15.39 | | | $ | 16.88 | | | $ | 11.49 | | | $ | 17.65 | |

Total return | | | 9.39 | % | | | (8.83 | )% | | | 48.79 | %(1) | | | (30.04 | )%(1) | | | 3.17 | %(1) |

Ratios/Supplemental Data | | | | | | | | | | | | | | | | | | | | |

Net assets, end of year (in 000s) | | $ | 5,100 | | | $ | 5,527 | | | $ | 6,639 | | | $ | 5,890 | | | $ | 9,176 | |

Ratio of expenses to average net assets

Before fee waiver | | | 2.46 | %(b) | | | 2.43 | %(b) | | | 2.55 | %(b) | | | 2.38 | %(b) | | | 2.84 | %(b) |

After fee waiver | | | 1.55 | %(b) | | | 1.55 | %(b) | | | 1.55 | %(b) | | | 1.55 | %(b) | | | 2.65 | %(b) |

Ratio of net investment income to average net assets

Before fee waiver | | | (0.54 | )% (b) | | | (0.82 | )% (b) | | | (0.87 | )%(b) | | | (0.28 | )%(b) | | | 0.28 | %(b) |

After fee waiver | | | 0.37 | %(b) | | | 0.06 | %(b) | | | 0.13 | %(b) | | | 0.55 | %(b) | | | 0.47 | %(b) |

Portfolio turnover rate | | | 27 | % | | | 49 | % | | | 96 | % | | | 117 | % | | | 111 | % |

(a) | Based on the average daily number of shares outstanding during the year. |

(b) | Expense waived or reimbursed reflect reductions to total expenses, as discussed in the notes to the financial statements. These reimbursed amounts would increase the net investment loss ratio or decrease the net investment income ratio and recovered amounts would decrease the net investment loss ratio or increase the net investment income ratio, as applicable, had such reductions or increases not occurred. |

(1) | Total investment return is based on the change in net asset value of a share during the year, assumes reinvestment of dividends and distributions at net asset value and does not reflect the impact of a sales charge. As of September 30, 2018 the Fund no longer charges a sales charge. |

The accompanying notes are an integral part of the financial statements.

32 | Quaker Investment Trust |

Financial Highlights - Per share data (for a share outstanding throughout the year)

| | | Institutional Class Shares | |

CCM Small/Mid-Cap Impact Value Fund | | For the

Fiscal Year

Ended

June 30, 2023 | | | For the

Fiscal Year

Ended

June 30, 2022 | | | For the

Fiscal Year

Ended

June 30, 2021 | | | For the

Fiscal Year

Ended

June 30, 2020 | | | For the

Fiscal Year

Ended

June 30, 2019 | |

Net Asset Value, Beginning of Year | | $ | 17.04 | | | $ | 18.63 | | | $ | 12.67 | | | $ | 19.36 | | | $ | 24.83 | |

Investment Operations:

Net investment Income (loss)(a) | | | 0.10 | | | | 0.06 | | | | 0.06 | | | | 0.13 | | | | 0.15 | |

Net realized and unrealized gain (loss) on investments | | | 1.54 | | | | (1.65 | ) | | | 6.12 | | | | (5.41 | ) | | | 0.16 | |

Total from investment operations | | | 1.64 | | | | (1.59 | ) | | | 6.18 | | | | (5.28 | ) | | | 0.31 | |

Distributions from: | | | | | | | | | | | | | | | | | | | | |

Net investment income | | | (0.13 | ) | | | — | | | | (0.22 | ) | | | (0.41 | ) | | | — | |

Net capital gains | | | — | | | | — | | | | — | | | | (1.00 | ) | | | (5.78 | ) |

Total distributions | | | (0.13 | ) | | | — | | | | (0.22 | ) | | | (1.41 | ) | | | (5.78 | ) |

Net Asset Value, End of Year | | $ | 18.55 | | | $ | 17.04 | | | $ | 18.63 | | | $ | 12.67 | | | $ | 19.36 | |

Total return | | | 9.67 | % | | | (8.53 | )% | | | 49.10 | %(1) | | | (29.89 | )%(1) | | | 3.47 | %(1) |

Ratios/Supplemental Data | | | | | | | | | | | | | | | | | | | | |

Net assets, end of year (in 000s) | | $ | 12,242 | | | $ | 11,230 | | | $ | 12,552 | | | $ | 12,699 | | | $ | 10,811 | |

Ratio of expenses to average net assets

Before fee waiver | | | 2.21 | %(b) | | | 2.18 | %(b) | | | 2.30 | %(b) | | | 2.13 | %(b) | | | 2.58 | %(b) |

After fee waiver | | | 1.30 | %(b) | | | 1.30 | %(b) | | | 1.30 | %(b) | | | 1.30 | %(b) | | | 2.39 | %(b) |

Ratio of net investment income to average net assets

Before fee waiver | | | (0.33 | )% (b) | | | (0.57 | )% (b) | | | (0.62 | )%(b) | | | (0.03 | )%(b) | | | 0.53 | %(b) |

After fee waiver | | | 0.58 | %(b) | | | 0.31 | %(b) | | | 0.38 | %(b) | | | 0.80 | %(b) | | | 0.72 | %(b) |

Portfolio turnover rate | | | 27 | % | | | 49 | % | | | 96 | % | | | 117 | % | | | 111 | % |

(a) | Based on the average daily number of shares outstanding during the year. |

(b) | Expense waived or reimbursed reflect reductions to total expenses, as discussed in the notes to the financial statements. These reimbursed amounts would increase the net investment loss ratio or decrease the net investment income ratio and recovered amounts would decrease the net investment loss ratio or increase the net investment income ratio, as applicable, had such reductions or increases not occurred. |

(1) | Total investment return is based on the change in net asset value of a share during the year, assumes reinvestment of dividends and distributions at net asset value and does not reflect the impact of a sales charge. As of September 30, 2018 the Fund no longer charges a sales charge. |

The accompanying notes are an integral part of the financial statements.

Notes to Financial Statements June 30, 2023

Note 1 – ORGANIZATION AND SIGNIFICANT ACCOUNTING POLICIES

The Quaker Investment Trust (the “Trust”), a diversified, open-end management investment company, was originally organized as a Massachusetts business trust on October 24, 1990, and was reorganized as a Delaware statutory trust on September 30, 2018. The Trust is registered under the Investment Company Act of 1940, as amended (the “Act”). The Trust’s Declaration of Trust permits the Trustees to issue an unlimited number of shares of beneficial interest for each of its series. Currently, the Trust offers two series: CCM Core Impact Equity Fund (“Core Impact Equity Fund”) and CCM Small/Mid-Cap Impact Value Fund (“Small/Mid-Cap Impact Value Fund”) (each a “Fund” and collectively, “Funds”). Both Funds are diversified. The investment objectives of each Fund are set forth below. Community Capital Management, LLC (“CCM” or “Adviser”) has managed the Funds since January 1, 2018.

Core Impact Equity Fund and Small/Mid-Cap Impact Value Fund commenced operations on November 25, 1996. The investment objective of these Funds is to seek long-term growth of capital. The investment objective of these Funds is non-fundamental in that this objective may be changed by the Board of Trustees (“Board” or “Trustees”) without shareholder approval.

The Funds offer two classes of shares: Advisor Class and Institutional Class. The Advisor Class shares are charged a distribution and service fee; and Institutional Class shares bear no distribution fee but have higher minimum investment thresholds. CCM has the ability to waive the minimum investment for Institutional Class shares at its discretion.

On February 1, 2019 the Trust amended and restated its Registration Statement to change each of the Funds’ performance reporting history. The inception date for each of the Fund’s performance reporting history is now January 1, 2018, the date CCM became the Adviser to the Funds.

Each Fund is an investment company and accordingly follows the investment company accounting and reporting guidance of the Financial Accounting Standards Board (“FASB”) Accounting Standards Codification Topic 946 “Financial Services – Investment Companies.” The following is a summary of significant accounting policies consistently followed by the Funds in the preparation of their financial statements. The policies are in conformity with accounting principles generally accepted in the United States of America (“U.S. GAAP”).

Security Valuation. The Funds’ investments in securities are carried at market value. Securities listed on an exchange or quoted on a national market system are generally valued at the last quoted sales price at the time of valuation. Other securities traded in the over-the-counter market and listed securities for which no sale was reported on that date are valued at the most

34 | Quaker Investment Trust |

recent bid price. Each security reported on the NASDAQ National Market System is valued at the NASDAQ Official Closing Price.

Debt securities are valued by market bid quotation or independent pricing services which use bid prices provided by market makers or estimates of market values obtained from yield data relating to instruments or securities with similar characteristics. Discounts or premiums on debt securities are amortized to income over their prospective lives, using the effective interest method.

The Funds may hold foreign securities that trade on weekends or other days when the Fund does not price its shares. Therefore, the value of such securities may change on days when shareholders will not be able to purchase or redeem shares.

In accordance with the authoritative guidance on fair value measurements and disclosure under U.S. GAAP, the Fund discloses the fair value of its investments in a hierarchy that prioritizes the inputs to evaluation techniques used to measure the fair value. The objective of a fair value measurement is to determine the price that would be received to sell an asset or paid to transfer a liability in an orderly transaction between willing market participants at the measurement date (an exit price). Accordingly, the fair value hierarchy gives the highest priority to quoted prices (unadjusted) in active markets for identical assets or liabilities (Level 1) and the lowest priority to unobservable inputs (Level 3). The three levels of the fair value hierarchy are described below:

| | ● | Level 1 — Unadjusted quoted prices in active markets for identical, unrestricted assets or liabilities that the Fund has the ability to access at the measurement date; |

| | ● | Level 2 — Quoted prices which are not active, or inputs that are observable (either directly or indirectly) for substantially the full term of the asset or liability; and |

| | ● | Level 3 — Prices, inputs or exotic modeling techniques which are both significant to the fair value measurement and unobservable (supported by little or no market activity). |

Investments are classified within the level of the lowest significant input considered in determining fair value. Investments classified within Level 3 whose fair value measurement considers several inputs may include Level 1 or Level 2 inputs as components of the overall fair value measurement.

For the year ended June 30, 2023, there have been no significant changes to the Funds’ fair value methodologies.

Investment Income and Securities Transactions. Security transactions are accounted for on the date the securities are purchased or sold. Realized gains and losses on sales of investments are determined on the basis of the identified cost for both financial statement and federal income tax purposes. Dividend income is recognized on the ex-dividend date or as soon

as information is available to the Fund. Interest income is recognized on an accrual basis.

Determination of Net Asset Value and Calculation of Expenses. In calculating the net asset value (“NAV”) per share of the Fund, investment income, realized and unrealized gains and losses, and expenses are allocated daily to each share based upon the proportion of net assets of each share.

Federal Income Taxes. It is the policy of the Funds to comply with all requirements of the Internal Revenue Code of 1986, as amended (the “IRC”) applicable to regulated investment companies and to distribute substantially all of its taxable income to its shareholders. Therefore, no Federal income tax provision is required.

Each Fund evaluates tax positions taken or expected to be taken in the course of preparing a Fund’s tax returns to determine whether it is “more-likely-than-not” (i.e., greater than 50-percent) that each tax position will be sustained upon examination by a taxing authority based on the technical merits of the position. Tax positions deemed to meet the more-likely-than-not threshold are recorded as a tax benefit in the current year. However, management’s conclusions regarding tax positions taken may be subject to review and adjustment at a later date based on factors including, but not limited to, examination by tax authorities (i.e., all open tax year ends, as applicable), ongoing analysis of and changes to tax laws, regulations and interpretations thereof.

Distributions to Shareholders. Each Fund generally declares dividends at least annually, payable in December, on a date selected by the Board. In addition, distributions may be made annually in December out of net realized gains through October 31 of that calendar year. Distributions to shareholders are recorded on the ex-dividend date. Each Fund may make a supplemental distribution subsequent to the end of its fiscal year ending June 30. Income and capital gain distributions are determined in accordance with income tax regulations, which may differ from U.S. GAAP.

Use of Estimates. In preparing financial statements in conformity with U.S. GAAP, management makes estimates and assumptions that affect the reported amounts of assets and liabilities at the date of the financial statements, as well as the reported amount of revenues and expenses during the reporting period. Actual results could differ from those estimates.

Indemnifications. Under each Fund’s organizational documents, its officers and Trustees are indemnified against certain liabilities arising out of the performance of their duties to the Fund. In the normal course of business, each Fund enters into contracts that contain a variety of representations that provide general indemnifications. Each Fund’s maximum liability exposure under these arrangements is unknown, as future claims that have not yet occurred may be made against the Fund. However, based on experience, the Fund expects the risk of loss to be remote.

36 | Quaker Investment Trust |

Note 2 – INVESTMENT TRANSACTIONS

The aggregate purchases and sales and maturities of investments, excluding short-term investments, short sales, purchases to cover, options premiums paid and received, and futures, by each of the Funds for the year ended June 30, 2023, were as follows:

Core Impact Equity Fund

Purchases: | | | |

U.S. Government | | $ | – | |

Other | | | 13,527,146 | |

Sales and Maturities: | | | | |

U.S. Government | | $ | – | |

Other | | | 18,567,233 | |

Small/Mid-Cap Impact Value Fund

Purchases: | | | |

U.S. Government | | $ | – | |

Other | | | 4,467,132 | |

Sales and Maturities: | | | | |

U.S. Government | | $ | – | |

Other | | | 4,609,530 | |

At June 30, 2023, the cost of securities for income purposes and the gross unrealized appreciation and depreciation of investments for tax purposes was a follows:

| | | CCM Core Impact Equity Fund | | | CCM Small/Mid-Cap Impact Value Fund | |

Cost of investments | | $ | 42,729,978 | | | $ | 14,916,571 | |

Gross unrealized appreciation | | | 16,030,559 | | | | 3,099,371 | |

Gross unrealized depreciation | | | (1,488,856 | ) | | | (663,949 | ) |

Net appreciation on investments | | $ | 14,541,703 | | | $ | 2,435,422 | |

The material book/tax difference is deferred losses from partnership investments.

Note 3 – ADVISORY, SPECIAL ADMINISTRATIVE SERVICES, DISTRIBUTION AND SERVICE FEES

Each Fund paid advisory fees shown in the table below for the year ended June 30, 2023. Amounts paid and reimbursed are expressed as dollar amounts and annualized percentages of average net assets.

| | | Advisory Fees Paid | | | Percentage of Advisory Fees Paid | | | Advisory Fees Reimbursed and other expenses absorbed | | | Percentage of Advisory Fees Reimbursed | |

Core Impact Equity Fund | | $ | 415,828 | | | | 0.75 | % | | | N/A | | | | N/A | |

Small/Mid-Cap Impact Value Fund | | $ | 153,073 | | | | 0.90 | % | | $ | 153,896 | | | | 0.90 | % |