UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED

MANAGEMENT INVESTMENT COMPANIES

Investment Company Act file number | 811-06279 |

|

Harris Associates Investment Trust |

(Exact name of registrant as specified in charter) |

|

Two North La Salle Street, Suite 500

Chicago, Illinois | | 60602-3790 |

(Address of principal executive offices) | | (Zip code) |

|

John R. Raitt

Harris Associates L.P.

Two North La Salle Street, #500

Chicago, Illinois 60602 | Cameron S. Avery

Bell, Boyd & Lloyd LLC

Three First National Plaza, #3100

Chicago, Illinois 60602 |

(Name and address of agent for service) |

|

Registrant’s telephone number, including area code: | (312) 621-0600 | |

|

Date of fiscal year end: | 9/30/06 | |

|

Date of reporting period: | 3/31/06 | |

| | | | | | | | | |

Item 1. Reports to Shareholders.

SEMI-ANNUAL REPORT

MARCH 31, 2006

Advised by Harris Associates L.P.

THE OAKMARK FUNDS

2006 Semi-Annual Report

| President's Letter | | | 1 | | |

|

| Summary Information | | | 2 | | |

|

| Fund Expenses | | | 4 | | |

|

| Commentary on The Oakmark and Oakmark Select Funds | | | 6 | | |

|

| The Oakmark Fund | |

|

| Letter from the Portfolio Managers | | | 8 | | |

|

| Schedule of Investments | | | 9 | | |

|

| The Oakmark Select Fund | |

|

| Letter from the Portfolio Managers | | | 13 | | |

|

| Schedule of Investments | | | 14 | | |

|

| The Oakmark Equity and Income Fund | |

|

| Letter from the Portfolio Managers | | | 16 | | |

|

| Schedule of Investments | | | 18 | | |

|

| The Oakmark Global Fund | |

|

| Letter from the Portfolio Managers | | | 24 | | |

|

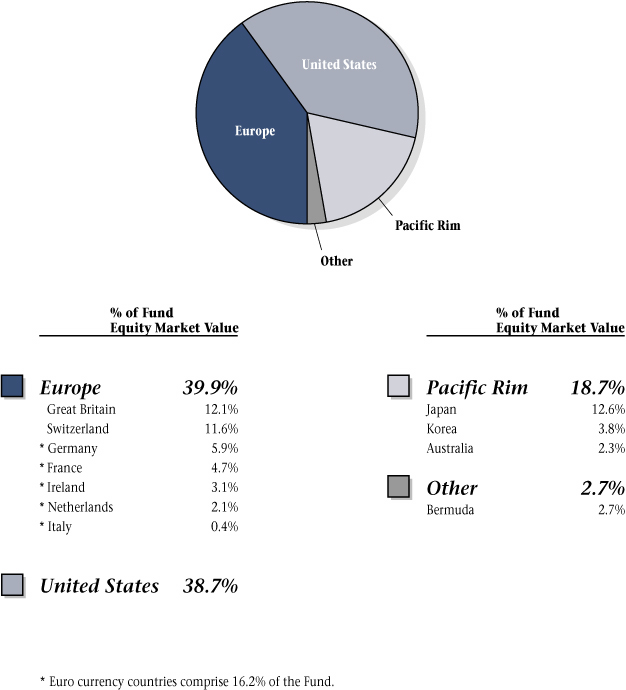

| Global Diversification Chart | | | 26 | | |

|

| Schedule of Investments | | | 27 | | |

|

| Commentary on The International and International Small Cap Funds | | | 32 | | |

|

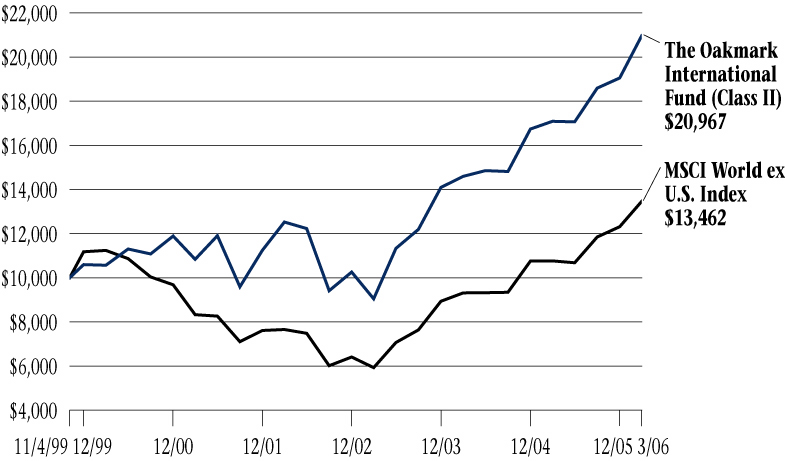

| The Oakmark International Fund | |

|

| Letter from the Portfolio Manager | | | 33 | | |

|

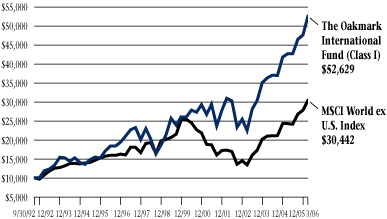

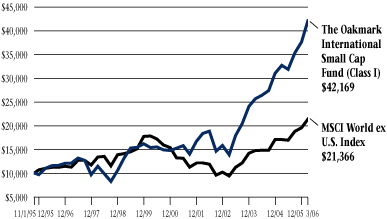

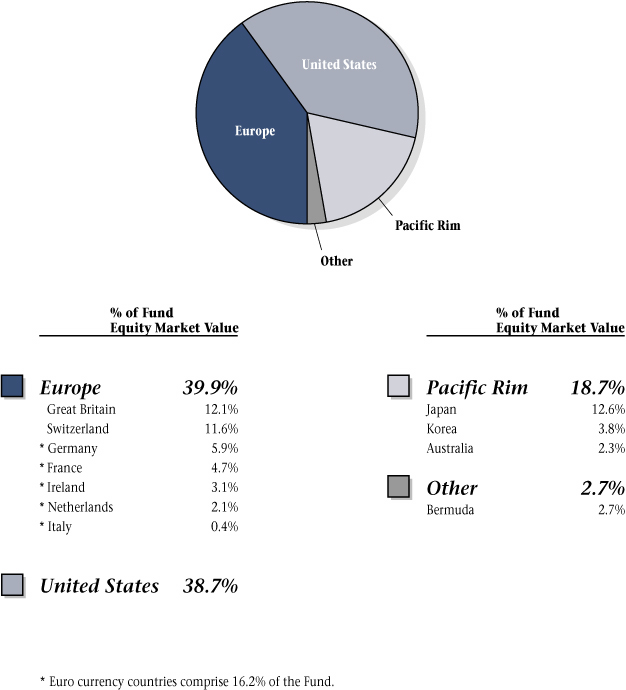

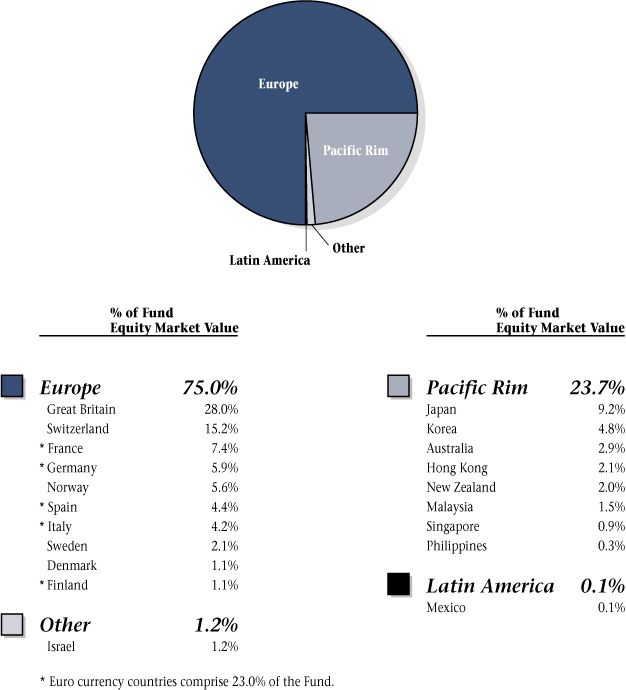

| International Diversification Chart | | | 34 | | |

|

| Schedule of Investments | | | 35 | | |

|

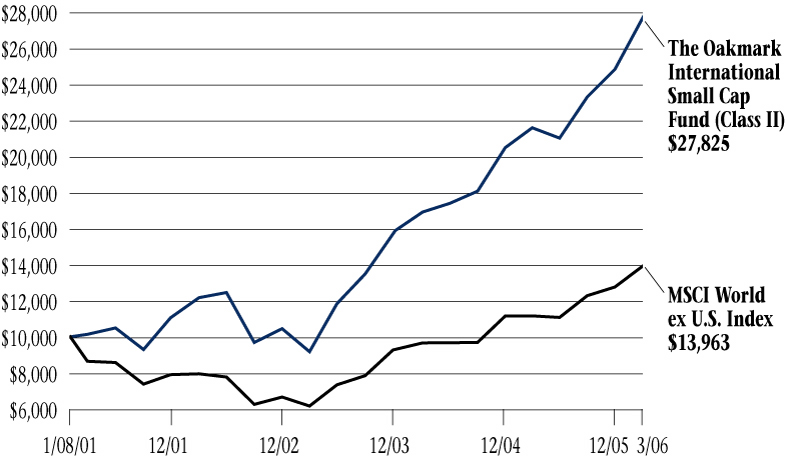

| The Oakmark International Small Cap Fund | |

|

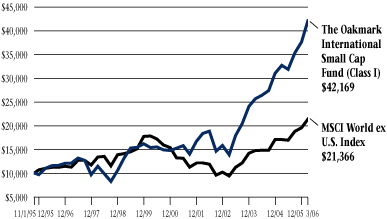

| Letter from the Portfolio Managers | | | 41 | | |

|

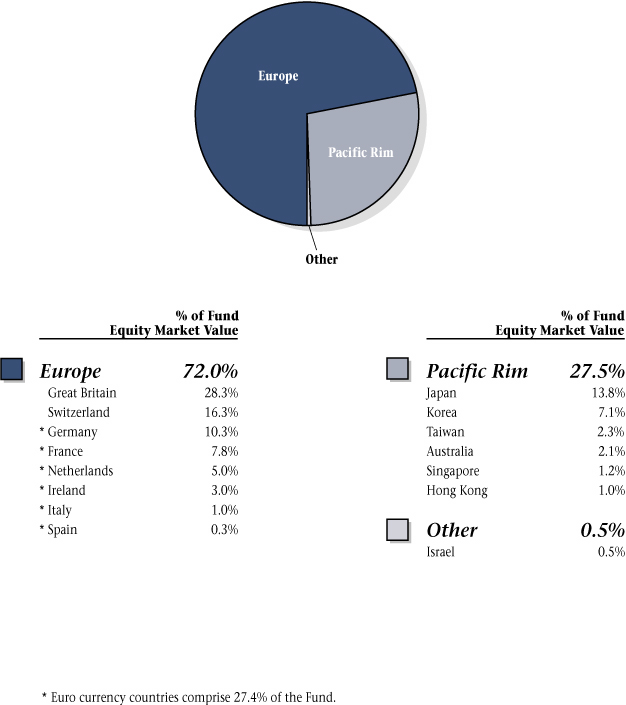

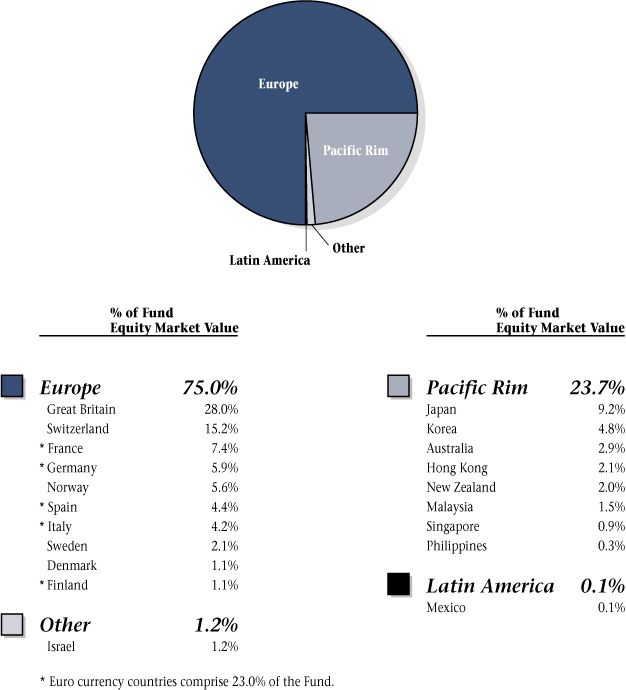

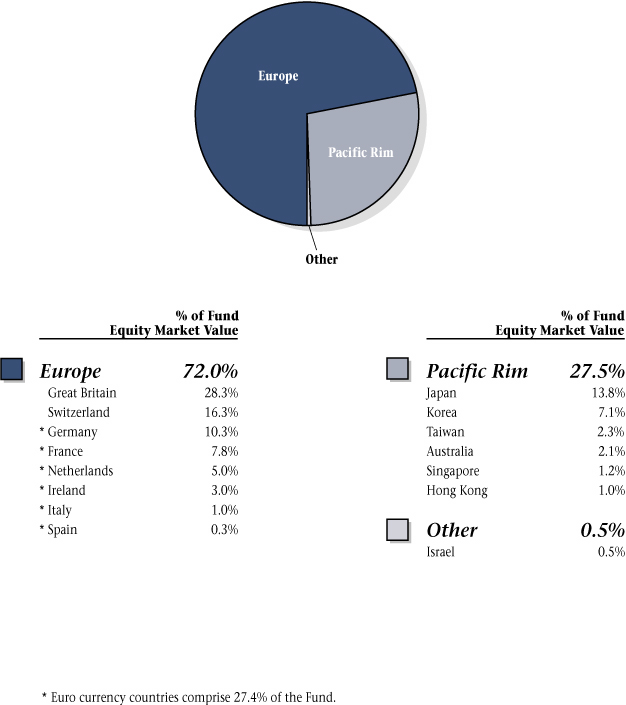

| International Diversification Chart | | | 43 | | |

|

| Schedule of Investments | | | 44 | | |

|

| Financial Statements | |

|

| Statements of Assets and Liabilities | | | 50 | | |

|

| Statements of Operations | | | 52 | | |

|

| Statements of Changes in Net Assets | | | 54 | | |

|

| Notes to Financial Statements | | | 60 | | |

|

| Disclosure Regarding Investment Advisory Contract Approval | | | 76 | | |

|

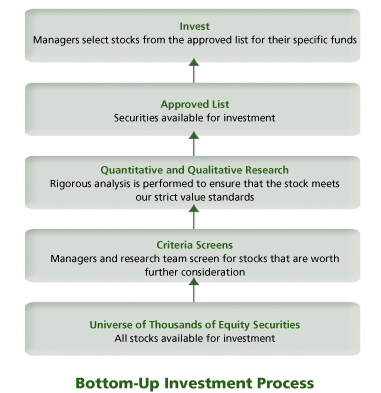

| Oakmark Philosophy and Process | | | 79 | | |

|

| The Oakmark Glossary | | | 80 | | |

|

| Trustees and Officers | | | 81 | | |

|

FORWARD-LOOKING STATEMENT DISCLOSURE

One of our most important responsibilities as mutual fund managers is to communicate with shareholders in an open and direct manner. Some of our comments in our letters to shareholders are based on current management expectations and are considered "forward-looking statements". Actual future results, however, may prove to be different from our expectations. You can identify forward-looking statements by words such as "estimate", "may", "will", "expect", "believe", "plan" and other similar terms. We cannot promise future returns. Our opinions are a reflection of our best judgment at the time this report is compiled, and we disclaim any obligation to update or alter forward-looking statements as a result of new information, future events, or otherwise.

President's Letter

Dear Fellow Shareholders,

Both domestic and international stock markets increased significantly in the first quarter. Most major market indexes enjoyed returns in the mid to high single digits. Each of our Funds also produced significant positive returns during the quarter. More importantly, every one of our Funds achieved a new all-time high net asset value during the quarter.

Benchmarks, Performance Goals and Long Term Investing

During the first quarter, our Funds as a group achieved mixed results relative to their "benchmark" indexes. Some Funds outperformed the benchmarks, some were in line, and some lagged. This mix is not unusual. While we often mention relative performance as a point of reference in our quarterly reports, quarterly benchmarks do not drive our investment process. Instead, our primary focus is to provide positive returns, protecting our investors' capital from loss. Second, while we strive to significantly outperform the returns earned by our peers—our focus is on doing so over the long run.

Many fund managers are evaluated on the basis of their funds' short-term performance relative to their benchmarks, and their compensation is tied to this relative performance. For fear of underperforming the benchmark, they often create a broadly diversified portfolio that looks a lot like the market index, and have little chance of achieving returns much different from the benchmark in any given quarter.

At Oakmark, we understand that good investment ideas are scarce. We pick out-of-favor stocks about which investors often have near-term concerns. We then concentrate our portfolios in our most attractive ideas. We recognize that our portfolio concentration and choice of unloved stocks may increase the chances that our portfolios lag behind the broader indexes for several quarters. At the same time, we believe that our selectivity and disciplined stock analysis dramatically increase the chances for long-term outperformance. Studies of the most successful money managers of the past several decades reveal a similar pattern. While their long-term performance far exceeded their peers, there were periods of as long as two or three years when their performance significantly lagged behind market indexes and their peers.

The compression in market valuations, which we have mentioned in recent quarters, still persists. In our view, companies with strong balance sheets, leading market positions, and excellent growth prospects are being valued in the market at earnings multiples similar to those of average companies. Similarly, in the credit markets, yields on lower quality bonds are at historically low premiums to high quality bonds. We sold most of our high yield bonds from the Equity and Income Fund last year, and over the past two years we have populated our portfolios with many high quality companies that are selling at average market multiples. While we cannot predict the exact moment when these trends will change, we strongly believe that the market will recognize these differences in fundamentals by establishing premium market values for quality businesses, including our holdings.

In the meantime, just as the managers discussed above went through significant periods when the market did not recognize their portfolios' values, we recognize that our Funds may lag behind the broader market indexes at times. As always, we encourage patience from our Fund investors. At times when performance does lag, it is important to have a disciplined long-term plan and the patience to let that plan work.

Thank you for your continued investment and confidence in The Oakmark Funds. We welcome your comments and questions. You can reach us via e-mail at ContactOakmark@oakmark.com.

John R. Raitt

President of The Oakmark Funds

President and CEO of Harris Associates L.P.

1

THE OAKMARK FUNDS

Summary Information

Performance for Period

Ended March 31, 20061 | | The Oakmark

Fund—Class I

(OAKMX) | | The Oakmark

Select Fund—Class I

(OAKLX) | | The Oakmark

Equity and Income

Fund—Class I

(OAKBX) | | The Oakmark

Global Fund—Class I

(OAKGX) | | The Oakmark

International

Fund—Class I

(OAKIX) | | The Oakmark

International

Small Cap Fund—Class I

(OAKEX) | |

| 3 Months* | | | 3.82 | % | | | 2.52 | % | | | 2.00 | % | | | 6.86 | % | | | 10.17 | % | | | 11.86 | % | |

|

| 1 Year | | | 4.76 | % | | | 7.36 | % | | | 11.49 | % | | | 20.28 | % | | | 23.10 | % | | | 28.65 | % | |

|

Average Annual Total

Return for: | |

|

| 3 Year | | | 14.36 | % | | | 15.21 | % | | | 15.51 | % | | | 32.58 | % | | | 32.78 | % | | | 44.83 | % | |

|

| 5 Year | | | 6.23 | % | | | 8.67 | % | | | 10.81 | % | | | 19.79 | % | | | 14.48 | % | | | 22.59 | % | |

|

| 10 Year | | | 8.41 | % | | | N/A | | | | 13.66 | % | | | N/A | | | | 11.95 | % | | | 14.41 | % | |

|

| Since inception | | | 15.40%

(8/5/91) | | | | 18.58%

(11/1/96) | | | | 13.61%

(11/1/95) | | | | 16.92%

(8/4/99) | | | | 13.09%

(9/30/92) | | | | 14.82%

(11/1/95) | | |

|

Top Five Equity

Holdings as of

March 31, 20062

Company and % of Total

Net Assets | | | Washington

Mutual, Inc. 3.3%

McDonald's

Corporation 3.0%

Yum! Brands, Inc. 2.6%

The Walt Disney

Company 2.5%

First Data

Corporation 2.4% | | | | Washington

Mutual, Inc. 15.3%

Yum! Brands, Inc. 7.3%

First Data

Corporation 5.9%

H&R Block, Inc. 5.8%

The Dun &

Bradstreet

Corporation 4.9% | | | | XTO Energy, Inc. 4.4%

Burlington

Resources Inc. 3.5%

EnCana Corp 2.9%

General Dynamics

Corporation 2.9%

Nestle SA 2.8% | | | | Bayerische Motoren

Werke (BMW) AG 3.5%

GlaxoSmithKline plc 3.3%

Takeda

Pharmaceutical

Company Limited 3.3%

Nestle SA 3.2%

Diageo plc 3.1% | | | | Bayerische Motoren

Werke (BMW) AG 3.6%

GlaxoSmithKline plc 3.6%

NTT DoCoMo, Inc. 2.9%

Bank of Ireland 2.9%

SK Telecom Co., Ltd. 2.9% | | | | Matalan PLC 3.9%

Carpetright plc 3.5%

JJB Sports plc 3.4%

MLP AG 3.1%

Interpump Group

S.p.A. 3.1% | | |

|

Sector

Allocation as of

March 31, 2006

Sector and %

of Market Value | | | Consumer

Discretionary 44.3%

Financials 14.4%

Information

Technology 12.9%

Consumer Staples 12.1%

Industrials 7.6%

Health Care 6.3%

Energy 2.4% | | | | Consumer

Discretionary 48.7%

Financials 20.9%

Information

Technology 17.1%

Health Care 8.2%

Industrials 5.1% | | | | U.S. Government

Securities 28.1%

Energy 13.8%

Consumer

Discretionary 12.3%

Consumer Staples 11.5%

Industrials 11.5%

Financials 6.7%

Foreign Government

Securities 6.5%

Health Care 6.0%

Information

Technology 3.2%

Materials 0.4% | | | | Consumer

Discretionary 26.4%

Information

Technology 14.2%

Health Care 12.6%

Consumer Staples 12.1%

Industrials 10.4%

Financials 8.7%

Telecommunication

Services 7.3%

Materials 4.2%

Energy 4.1% | | | | Consumer

Discretionary 26.0%

Financials 18.7%

Consumer Staples 17.1%

Health Care 9.6%

Telecommunication

Services 9.3%

Industrials 8.5%

Materials 7.1%

Information

Technology 2.1%

Energy 1.6% | | | | Consumer

Discretionary 28.8%

Industrials 24.0%

Information

Technology 17.0%

Financials 15.0%

Materials 5.1%

Consumer Staples 4.4%

Health Care 4.1%

Telecommunication

Services 1.6% | | |

|

The performance data quoted represents past performance. The above performance information for the Funds does not reflect the imposition of a 2% redemption fee on shares held for 90 days or less to deter market timers. If reflected, the fee would reduce the performance quoted. Past performance does not guarantee future results. The investment return and principal value will fluctuate so that an investor's shares, when redeemed, may be worth more or less than their original cost. Current performance may be lower or higher than the performance data quoted. Average annual total return measures annualized change, while total return measures aggregate change. To obtain most recent month-end performance data, visit www.oakmark.com.

* Not annualized

THE OAKMARK FUNDS

2

THE OAKMARK FUNDS

3

FUND EXPENSES

A shareholder of each Fund incurs two types of costs: (1) transaction costs, such as redemption fees, and (2) ongoing costs, including investment advisory fees, transfer agent fees, and other fund expenses. The examples below are intended to help shareholders understand the ongoing cost (in dollars) of investing in each Fund and to compare these costs with the ongoing costs of investing in other funds.

Actual Expenses

The following table provides information about actual account values and actual fund expenses for Class I of each Fund. The table shows the expenses a Class I shareholder would have paid on a $1,000 investment in each Fund from October 1, 2005, to March 31, 2006, as well as how much a $1,000 investment would be worth at the close of the period, assuming actual fund returns and expenses. A Class I shareholder can estimate expenses incurred for the period by dividing the account value at March 31, 2006, by $1,000 and multiplying the result by the number in the Expenses Paid During Period row as shown below.

Certain accounts invested for 90 days or less may be charged a 2% redemption fee. Please consult the Funds' prospectus at www.oakmark.com for more information.

| | | The Oakmark Fund | | The Oakmark Select Fund | | The Oakmark Equity and Income Fund | | The Oakmark Global Fund | | The Oakmark International Fund | | The Oakmark International Small Cap Fund | |

Beginning

Account Value | | $ | 1,000.00 | | | $ | 1,000.00 | | | $ | 1,000.00 | | | $ | 1,000.00 | | | $ | 1,000.00 | | | $ | 1,000.00 | | |

Ending

Account Value | | $ | 1,050.20 | | | $ | 1,072.00 | | | $ | 1,024.50 | | | $ | 1,103.70 | | | $ | 1,129.50 | | | $ | 1,192.20 | | |

Expenses Paid

During Period* | | $ | 5.47 | | | $ | 5.17 | | | $ | 4.39 | | | $ | 6.24 | | | $ | 5.79 | | | $ | 7.54 | | |

Annualized

Expense Ratio | | | 1.07 | % | | | 1.00 | % | | | 0.87 | % | | | 1.19 | % | | | 1.09 | % | | | 1.38 | % | |

* Expenses are equal to each Fund's annualized expense ratio for Class I, multiplied by the average account value over the period, multiplied by the number of days in the most recent fiscal half-year divided by 365 (to reflect the one-half year period).

THE OAKMARK FUNDS

4

Hypothetical Example for Comparison Purposes

The following table provides information about hypothetical account values and hypothetical expenses for Class I of each Fund based on actual expense ratios and an assumed rate of return of 5% per year before expenses, which are not the Funds' actual returns. The hypothetical account values and expenses may not be used to estimate the actual ending account balances or expenses shareholders paid for the period. Shareholders may use this information to compare the ongoing costs of investing in a Fund and other funds. To do so, compare this 5% hypothetical example with the 5% hypothetical examples that appear in the shareholder reports of the other funds.

Please note that the expenses shown in the table are meant to highlight your ongoing costs only and do not reflect any transaction costs, such as redemption fees. Therefore, the third line of the table is useful in comparing ongoing costs only, and will not help you determine the relative total costs of owning different funds. In addition, if these transaction costs were included, the total costs would have been higher.

| | | The Oakmark Fund | | The Oakmark Select Fund | | The Oakmark Equity and Income Fund | | The Oakmark Global Fund | | The Oakmark International Fund | | The Oakmark International Small Cap Fund | |

Beginning

Account Value | | $ | 1,000.00 | | | $ | 1,000.00 | | | $ | 1,000.00 | | | $ | 1,000.00 | | | $ | 1,000.00 | | | $ | 1,000.00 | | |

Ending

Account Value | | $ | 1,019.60 | | | $ | 1,019.95 | | | $ | 1,020.59 | | | $ | 1,019.00 | | | $ | 1,019.50 | | | $ | 1,018.05 | | |

Expenses Paid

During Period* | | $ | 5.39 | | | $ | 5.04 | | | $ | 4.38 | | | $ | 5.99 | | | $ | 5.49 | | | $ | 6.94 | | |

Annualized

Expense Ratio | | | 1.07 | % | | | 1.00 | % | | | 0.87 | % | | | 1.19 | % | | | 1.09 | % | | | 1.38 | % | |

* Expenses are equal to each Fund's annualized expense ratio for Class I, multiplied by the average account value over the period, multiplied by the number of days in the most recent fiscal half-year divided by 365 (to reflect the one-half year period).

THE OAKMARK FUNDS

5

THE OAKMARK AND OAKMARK SELECT FUNDS

At Oakmark, we are long-term investors. We attempt to identify growing businesses that are managed to benefit their shareholders. We will purchase stock in those businesses only when priced substantially below our estimate of intrinsic value. After purchase, we patiently wait for the gap between stock price and intrinsic value to close.

Are you a patient investor?

Try this quick test.

1) A bat and a ball cost $1.10 in total. The bat costs a dollar more than the ball. How much does the ball cost?

2) If it takes 5 machines 5 minutes to make 5 widgets, how long would it take 100 machines to make 100 widgets?

3) In a lake, there is a patch of lily pads. Every day, the patch doubles in size. If it takes 48 days for the patch to cover the entire lake, how long would it take for the patch to cover half the lake?

(Answers at the end of this commentary.)

Just the phrase "standardized testing" is enough to cause some to break into a cold sweat. The pressure of having years of work summarized by one test score can be enormous! I've had discussions with my high-school-aged children about upcoming ACT exams and their importance for college admission. The nation's colleges will use this four-hour test, with 215 questions, to decide who is and who isn't worthy of admission. It is amazing that a four-hour test is considered more predictive of college success than is a four-year grade point average! And standardized testing doesn't end with one's academic career. Many employers now use such tests to influence who does or doesn't get hired. Even in the NFL, a profession not often mistaken for rocket science, players are given an intelligence test before they get drafted. Last month a college star was rumored to have hurt his draft position by scoring barely higher than a rock on his exam.

The Wonderlic, named for its founder, is a 50-question exam given over 12 minutes to college players who are entering the NFL draft. According to Wonderlic's website, "For the NFL, years of testing shows that the higher a player scores on the Wonderlic, the more likely he is to be in the starting lineup—for any position." Again, it's interesting that a 12-minute test has more predictive value than does a four-year grade transcript! If a player who is projected to be drafted fifth scores poorly on the test and falls to tenth, it results in him earning about $3 million less in annual salary. Talk about pressure! (Note: There is a limit to how much the test can help one's NFL potential. My colleague Jim Benson had to settle for an investment job with us despite his perfect Wonderlic score!)

With testing in the news, it caught my eye when the New York Times ran an article about a test that could predict whether or not one was a patient investor. I found this interesting, because patience is one of the most valuable traits an investor can possess. If it takes 215 questions to see whether or not you're smart enough for college, and 50 questions to see if you're smart enough for the NFL, then how many does it take to identify a patient investor? It turns out that the three questions at the top of this page is all it takes to separate the patient investors from the crowd. Each question has a logical answer that quickly pops into one's head, but is wrong. Test takers that are more patient avoid this intuitive answer and calculate the correct one. And patient decision-making in the test seems to correlate with patient decision-making in other endeavors, including investing. On the Ball: Cognitive Reflection and Decision Making3 by MIT professor Shane Frederick explores the correlation between one's score on this three-question test and one's preferences about money. As an example, those taking the exam, mostly college students, were asked if they would rather get $3400 this month or $3800 next month. Of those who went three-for-three on the test, a solid majority said they'd wait for the $3800—a good choice given the implied annualized return of 280%. Of those who scored zero, only about one-third were willing to wait.

I think there are important similarities between this quiz and being a value investor. To succeed on the quiz, subjects need to ignore the obvious intuitive answers that end up being wrong. Similarly, successful value investors need to ignore obvious negative news that has been more than fully reflected in a stock's price. Recently, I received an e-mail from a shareholder who was concerned about our Fund, saying he questioned every single stock we owned because anyone watching the news was aware that these companies all had problems. He's right. The reality is that value investors are always invested in companies that have problems—that's why stocks become undervalued. Where we differ from consensus is in our assessment of the magnitude and duration of these problems.

THE OAKMARK AND OAKMARK SELECT FUNDS

6

As consumers, we are all used to the trade-off between price and quality. Not everyone drives a Ferrari, shops at Tiffany's, and wears Armani suits. If not for price, they probably would. Consumers who choose other products aren't making negative statements about these prestigious brands, but rather are simply saying that their price premiums are too high. In consumer purchases, price prevents the best products from achieving 100% market share. But for some reason, when consumers invest their money, they seem to forget the importance of price. When we bought Pulte Homes, shareholders asked, "Haven't you read about the housing bubble?" We have. If all stocks were priced the same, then an investor's job would simply be to identify the companies with the highest combination of growth and dividends. In that world, believing that new home construction would decline would be sufficient reason to avoid owning a homebuilder like Pulte. But in realit y, stocks aren't all priced the same. Pulte is one of the very few stocks now selling at less than half the S&P 5004 P/E5 multiple. At that valuation, a significant housing decline appears to be discounted in the stock price. Just like in the test, the intuitive answer—that housing stocks are bad—may not be the right answer.

Our portfolios are full of similar stocks: media companies that are losing advertising dollars to Google; H&R Block, which is losing market share to other tax preparers; financial stocks that earn less when short-term interest rates rise; and retailers that missed last season's styles. By simply reading the newspaper, an investor could avoid investing in companies that are experiencing such problems. But, by the time these problems are common knowledge, it is nearly certain that other investors have already reacted, forcing stock prices lower. And at that point, even mildly negative news can be viewed by the market as positive. Although it is natural to want to avoid investing in companies that have had disappointments, this may be the same response that produced the wrong answers on the test. It is important to remember that a great business can reach a high enough price that it becomes a bad investment, and an average business can reac h a low enough price that it becomes a great investment. Value investors normally own the latter: stocks priced so low that even mediocre-at-best businesses can become good investments. Most times, we believe superior businesses are priced too highly to merit consideration for our portfolios. However, today, many of what we consider to be the best businesses have lost their premium price due to uncertainty about the sustainability of their growth rates. So our portfolios now have an uncharacteristically high percentage of assets in such names. When Ferraris get priced like Fords, we'll gladly purchase them!

At Oakmark, we recognize that most investors use a shorter investment time horizon than we use. We also realize that while we're trying to anticipate change that may be several years away, most investors, relying on their intuition, try to steer by watching in the rear-view mirror. They assume the road will continue on its present course. We assume that long-term economics will require most trends to eventually reverse their direction. This is why our portfolios rarely include those stocks that have been performing the best and have become the most popular. If you didn't do well on the quiz, hopefully you found it an entertaining, and perhaps thought-provoking exercise. If you did well on it, congratulations! Your patience is a good match for this fund family, and we continue to strive to make that patience rewarding.

Best wishes,

William C. Nygren, CFA

Portfolio Manager

bnygren@oakmark.com

Answers:

1) The ball costs 5¢. The bat costs $1.00 more, or $1.05.

2) It takes 5 minutes. Five machines make five widgets in five minutes. Effectively, five machine-minutes are required to produce each widget. Making 100 widgets thus requires 500 machine-minutes, with 100 machines, requires 5 minutes of time.

3) 47 days. If 100% of the lake is covered on day 48, after the pond doubled in size that day, it must have covered 50% of the lake on day 47.

THE OAKMARK AND OAKMARK SELECT FUNDS

7

THE OAKMARK FUND

Report from Bill Nygren and Kevin Grant, Portfolio Managers

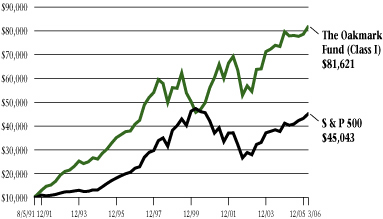

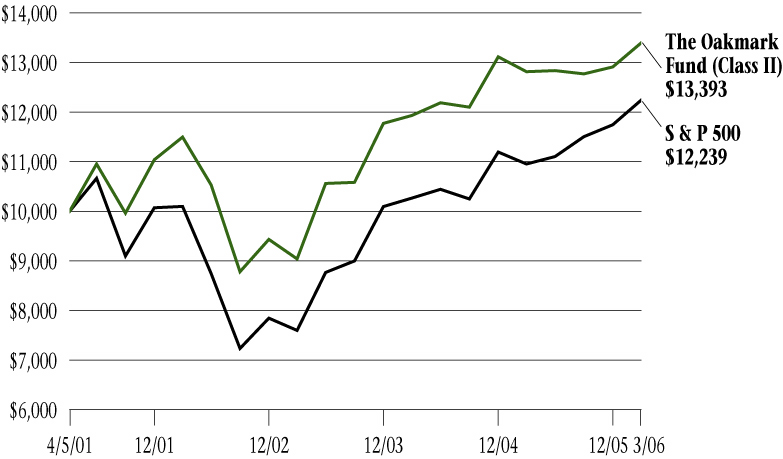

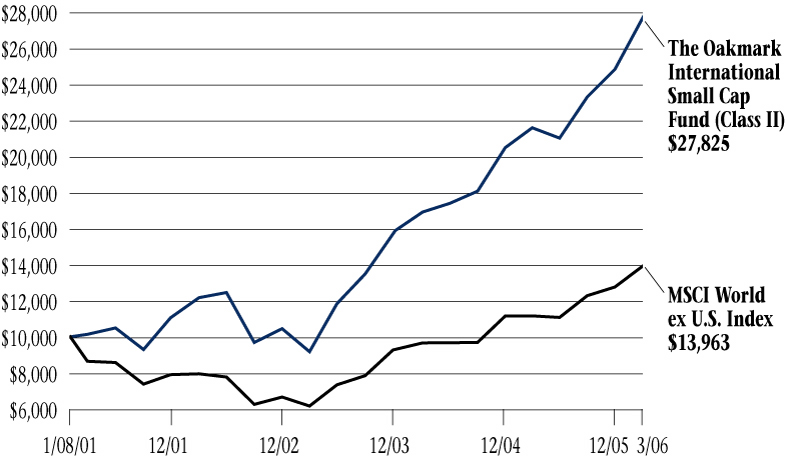

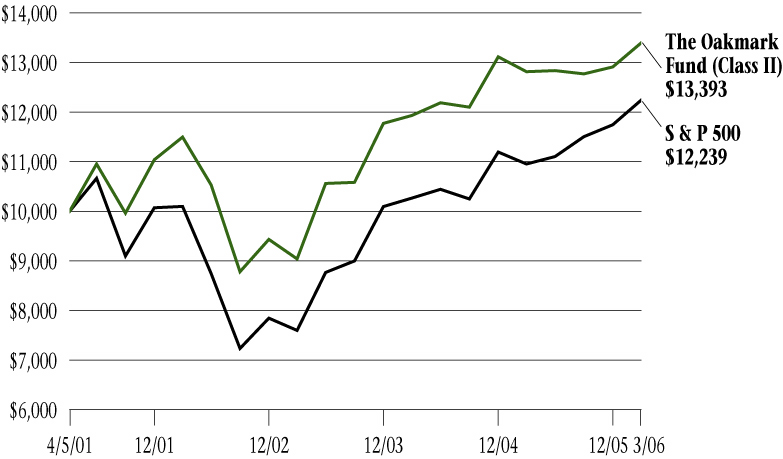

THE VALUE OF A $10,000 INVESTMENT IN THE

OAKMARK FUND FROM ITS INCEPTION (8/5/91) TO PRESENT (3/31/06) AS COMPARED TO THE STANDARD & POOR'S 500 INDEX4

| | | Average Annual Total Returns | |

| | | (as of 3/31/06) | |

| | | Total Return

Last 3 Months* | | 1-year | | 5-year | | 10-year | | Since

Inception

(8/5/91) | |

| Oakmark Fund (Class I) | | | 3.82 | % | | | 4.76 | % | | | 6.23 | % | | | 8.41 | % | | | 15.40 | % | |

| S&P 500 | | | 4.21 | % | | | 11.73 | % | | | 3.97 | % | | | 8.95 | % | | | 10.82 | % | |

| Dow Jones Average6 | | | 4.24 | % | | | 8.26 | % | | | 4.59 | % | | | 9.23 | % | | | 11.85 | % | |

Lipper Large Cap

Value Index7 | | | 4.40 | % | | | 11.86 | % | | | 4.83 | % | | | 8.70 | % | | | 10.61 | % | |

The graph and table do not reflect the deduction of taxes that a shareholder would pay on fund distributions or the redemption of fund shares.

The performance data quoted represents past performance. The above performance information for the Fund does not reflect the imposition of a 2% redemption fee on shares held for 90 days or less to deter market timers. If reflected, the fee would reduce the performance quoted. Past performance does not guarantee future results. The investment return and principal value will fluctuate so that an investor's shares, when redeemed, may be worth more or less than their original cost. Current performance may be lower or higher than the performance data quoted. Average annual total return measures annualized change, while total return measures aggregate change. To obtain most recent month-end performance data, visit www.oakmark.com.

* Not annualized

The Oakmark Fund achieved another new all-time high NAV8 last quarter, advancing by 4%. This increase was consistent with the 4% gain achieved by the S&P 500. Twelve stocks in the portfolio increased by 10% or more. Sun Microsystems was our best performer, advancing by 22% as Sun's new products finally lived up to expectations. We've endured some false starts—and a lot of volatility—since our initial purchase of Sun three-and-a-half years ago, when it was considered a dying company, but it has been an excellent stock. Our worst performer for the quarter, Intel, reported results that were, to us, modestly disappointing. The market reacted as if the shortfall was much more serious. We believed the stock was cheap before the bad news. So, after the market's overreaction, we incr eased our position. During the quarter we sold our shares of Knight Ridder and added Dell Computer.

Dell Computer (DELL—$30)

When we started managing The Oakmark Fund we viewed Dell as one of those great businesses that was unlikely to ever get priced cheaply enough for us to own it. In March of 2000, Dell stock peaked at $60—a robust 88 times trailing earnings. Dell's business has performed well since then, with sales and EPS9 both more than doubling. Dell's stock, however, hasn't done so well, now selling for just half the price it did six years ago. The world's largest manufacturer and distributor of PCs is now priced at less than 16 times expected 2007 earnings. At this price, Dell is selling at only a slight premium to the average company's P/E5 mult iple, and it actually sells at a discount after adjusting for its large cash balance. We think Dell's brand name and low cost structure will provide an enduring competitive advantage that will allow the company to continue growing faster than most businesses, which will warrant the stock selling at a significant premium.

Best wishes,

| |  | |

|

William C. Nygren, CFA

Portfolio Manager

bnygren@oakmark.com | | Kevin G. Grant, CFA

Portfolio Manager

kgrant@oakmark.com | |

|

THE OAKMARK FUND

8

THE OAKMARK FUND

Schedule of Investments—March 31, 2006 (Unaudited)

Name | |

Shares Held | |

Market Value | |

| Common Stocks—95.0% | |

| Apparel Retail—4.2% | |

| Limited Brands | | | 4,828,047 | | | $ | 118,094,030 | | |

| The Gap, Inc. | | | 6,266,700 | | | | 117,061,956 | | |

| | | | 235,155,986 | | |

| Broadcasting & Cable TV—9.0% | |

| Liberty Media Corporation, Class A (a) | | | 15,299,400 | | | $ | 125,608,074 | | |

| The DIRECTV Group, Inc. (a) | | | 6,950,000 | | | | 113,980,000 | | |

| Comcast Corporation, Special Class A (a) | | | 3,925,000 | | | | 102,521,000 | | |

| EchoStar Communications Corporation, Class A (a) | | | 2,775,000 | | | | 82,889,250 | | |

| CBS Corporation, Class B | | | 2,239,745 | | | | 53,709,085 | | |

| Discovery Holding Company, Class A (a) | | | 1,878,140 | | | | 28,172,100 | | |

| | | | 506,879,509 | | |

| Department Stores—2.0% | |

| Kohl's Corporation (a) | | | 2,150,000 | | | $ | 113,971,500 | | |

| Home Improvement Retail—2.4% | |

| The Home Depot, Inc. | | | 3,231,500 | | | $ | 136,692,450 | | |

| Homebuilding—2.0% | |

| Pulte Homes, Inc. | | | 2,900,000 | | | $ | 111,418,000 | | |

| Household Appliances—1.8% | |

| The Black & Decker Corporation | | | 1,150,000 | | | $ | 99,923,500 | | |

| Housewares & Specialties—2.1% | |

| Fortune Brands, Inc. | | | 1,450,000 | | | $ | 116,913,500 | | |

| Leisure Products—1.1% | |

| Mattel, Inc. | | | 3,474,300 | | | $ | 62,989,059 | | |

| Motorcycle Manufacturers—2.1% | |

| Harley-Davidson, Inc. | | | 2,250,000 | | | $ | 116,730,000 | | |

| Movies & Entertainment—6.2% | |

| The Walt Disney Company | | | 5,100,000 | | | $ | 142,239,000 | | |

| Time Warner, Inc. | | | 7,647,700 | | | | 128,404,883 | | |

| Viacom, Inc., Class B (a) | | | 2,039,745 | | | | 79,142,106 | | |

| | | | 349,785,989 | | |

| Publishing—1.4% | |

| Gannett Co., Inc. | | | 1,334,500 | | | $ | 79,963,240 | | |

| Restaurants—5.6% | |

| McDonald's Corporation | | | 4,850,000 | | | $ | 166,646,000 | | |

| Yum! Brands, Inc. | | | 2,974,000 | | | | 145,309,640 | | |

| | | | 311,955,640 | | |

THE OAKMARK FUND

9

THE OAKMARK FUND

Schedule of Investments—March 31, 2006 (Unaudited) cont.

Name | |

Shares Held | |

Market Value | |

| Common Stocks—95.0% (cont.) | |

| Specialized Consumer Services—2.2% | |

| H&R Block, Inc. | | | 5,658,600 | | | $ | 122,508,690 | | |

| Brewers—3.6% | |

| Anheuser-Busch Companies, Inc. | | | 2,750,000 | | | $ | 117,617,500 | | |

| InBev NV (b) | | | 1,850,000 | | | | 86,748,082 | | |

| | | | 204,365,582 | | |

| Distillers & Vintners—1.5% | |

| Diageo plc (c) | | | 1,371,000 | | | $ | 86,962,530 | | |

| Hypermarkets & Super Centers—2.2% | |

| Wal-Mart Stores, Inc. | | | 2,600,000 | | | $ | 122,824,000 | | |

| Packaged Foods & Meats—2.9% | |

| General Mills, Inc. | | | 1,806,000 | | | $ | 91,528,080 | | |

| H.J. Heinz Company | | | 1,950,000 | | | | 73,944,000 | | |

| | | | 165,472,080 | | |

| Soft Drinks—1.2% | |

| Coca-Cola Enterprises, Inc. | | | 3,300,000 | | | $ | 67,122,000 | | |

| Integrated Oil & Gas—0.7% | |

| ConocoPhillips | | | 620,670 | | | $ | 39,195,310 | | |

| Oil & Gas Exploration & Production—1.5% | |

| Burlington Resources, Inc. | | | 942,200 | | | $ | 86,597,602 | | |

| Asset Management & Custody Banks—1.4% | |

| The Bank of New York Company, Inc. | | | 2,150,000 | | | $ | 77,486,000 | | |

| Diversified Banks—1.9% | |

| U.S. Bancorp | | | 3,550,000 | | | $ | 108,275,000 | | |

| Life & Health Insurance—1.5% | |

| AFLAC Incorporated | | | 1,817,000 | | | $ | 82,001,210 | | |

| Other Diversified Financial Services—4.3% | |

| JP Morgan Chase & Co. | | | 3,000,000 | | | $ | 124,920,000 | | |

| Citigroup, Inc. | | | 2,450,000 | | | | 115,713,500 | | |

| | | | 240,633,500 | | |

| Thrifts & Mortgage Finance—4.7% | |

| Washington Mutual, Inc. | | | 4,387,300 | | | $ | 186,986,726 | | |

| MGIC Investment Corporation | | | 1,140,600 | | | | 75,998,178 | | |

| | | | 262,984,904 | | |

| Health Care Equipment—2.1% | |

| Baxter International, Inc. | | | 3,050,000 | | | $ | 118,370,500 | | |

THE OAKMARK FUND

10

THE OAKMARK FUND

Schedule of Investments—March 31, 2006 (Unaudited) cont.

Name | | Shares Held/

Par Value | |

Market Value | |

| Common Stocks—95.0% (cont.) | |

| Pharmaceuticals—3.9% | |

| Bristol-Myers Squibb Company | | | 4,500,000 | | | $ | 110,745,000 | | |

| Abbott Laboratories | | | 2,537,300 | | | | 107,759,131 | | |

| | | | 218,504,131 | | |

| Aerospace & Defense—3.9% | |

| Raytheon Company | | | 2,800,000 | | | $ | 128,352,000 | | |

| Honeywell International, Inc. | | | 2,100,000 | | | | 89,817,000 | | |

| | | | 218,169,000 | | |

| Building Products—2.2% | |

| Masco Corporation | | | 3,733,600 | | | $ | 121,304,664 | | |

| Industrial Conglomerates—1.2% | |

| Tyco International Ltd. (b) | | | 2,558,000 | | | $ | 68,759,040 | | |

| Computer Hardware—5.3% | |

| Sun Microsystems, Inc. (a) | | | 21,270,000 | | | $ | 109,115,100 | | |

| Hewlett-Packard Company | | | 3,025,000 | | | | 99,522,500 | | |

| Dell Inc. (a) | | | 3,000,000 | | | | 89,280,000 | | |

| | | | 297,917,600 | | |

| Data Processing & Outsourced Services—2.4% | |

| First Data Corporation | | | 2,925,000 | | | $ | 136,948,500 | | |

| Office Electronics—1.4% | |

| Xerox Corporation (a) | | | 5,272,400 | | | $ | 80,140,480 | | |

| Semiconductors—3.1% | |

| Texas Instruments Incorporated | | | 2,800,000 | | | $ | 90,916,000 | | |

| Intel Corp. | | | 4,200,000 | | | | 81,270,000 | | |

| | | | 172,186,000 | | |

| Total Common Stocks (Cost: $4,000,351,488) | | | | | | | 5,341,106,696 | | |

| Short Term Investments—5.1% | |

| U.S. Government Bills—2.6% | |

United States Treasury Bills, 4.34% - 4.585%

due 4/13/2006 - 4/27/2006 | | $ | 150,000,000 | | | $ | 149,645,195 | | |

| Total U.S. Government Bills (Cost: $149,645,195) | | | | | | | 149,645,195 | | |

THE OAKMARK FUND

11

THE OAKMARK FUND

Schedule of Investments—March 31, 2006 (Unaudited) cont.

Name | |

Par Value | |

Market Value | |

| Short Term Investments—5.1% (cont.) | |

| Repurchase Agreements—2.5% | |

IBT Repurchase Agreement, 4.55% dated 3/31/2006

due 4/3/2006, repurchase price $137,552,135,

collateralized by a Government National Mortgage

Association Bond with a rate of 5.000%, with a

maturity date of 8/20/2034, and with a market

value plus accrued interest of $22,819,712, and by

Small Business Administration Bonds, with rates

of 7.000% - 8.080%, with maturities from

10/25/2022 - 8/25/2030, and with an aggregate

market value plus accrued interest of $121,555,288 | | $ | 137,500,000 | | | $ | 137,500,000 | | |

IBT Repurchase Agreement, 3.25% dated 3/31/2006

due 4/3/2006, repurchase price $1,941,427,

collateralized by a Small Business Administration

Bond, with a rate of 7.125%, with a maturity

date of 7/25/2025, and with a market value plus

accrued interest of $2,037,946 | | | 1,940,901 | | | | 1,940,901 | | |

| Total Repurchase Agreements (Cost: $139,440,901) | | | | | 139,440,901 | | |

| Total Short Term Investments (Cost: $289,086,096) | | | | | 289,086,096 | | |

| Total Investments (Cost $4,289,437,584)—100.1% | | | | $ | 5,630,192,792 | | |

| Other Liabilities In Excess Of Other Assets—(0.1%) | | | | | (6,592,166 | ) | |

| Total Net Assets—100% | | | | $ | 5,623,600,626 | | |

(a) Non-income producing security.

(b) Represents a foreign domiciled corporation.

(c) Represents an American Depository Receipt.

THE OAKMARK FUND

See accompanying notes to financial statements.

12

THE OAKMARK SELECT FUND

Report from Bill Nygren and Henry Berghoef, Portfolio Managers

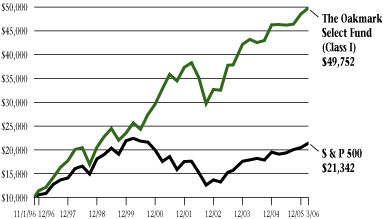

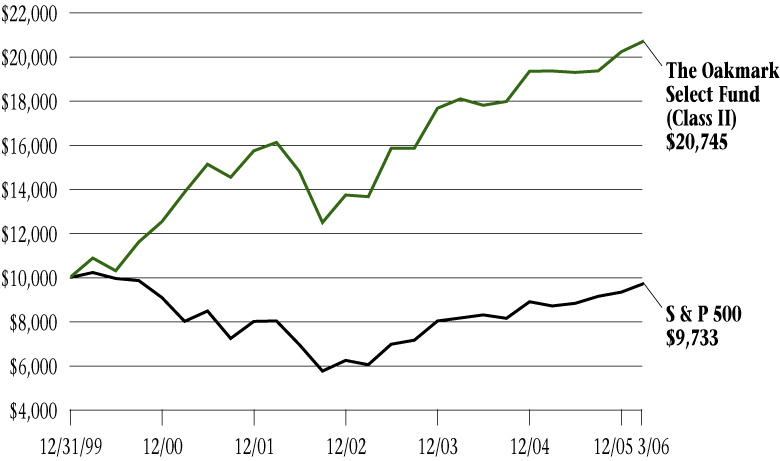

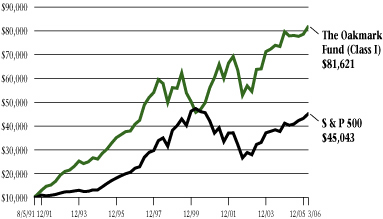

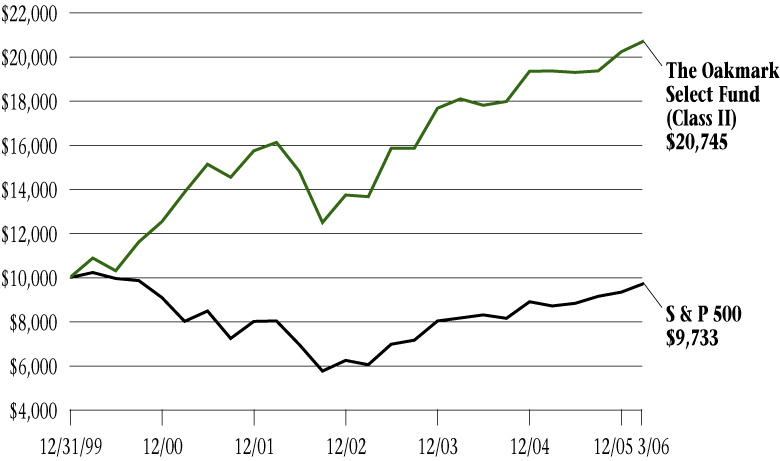

THE VALUE OF A $10,000 INVESTMENT IN THE

OAKMARK SELECT FUND FROM ITS INCEPTION (11/1/96) TO PRESENT (3/31/06) AS COMPARED TO THE STANDARD & POOR'S 500 INDEX4

| | | Average Annual Total Returns | |

| | | (as of 3/31/06) | |

| | | Total Return

Last 3 Months* | | 1-year | | 5-year | | Since

Inception

(11/1/96) | |

| Oakmark Select Fund (Class I) | | | 2.52 | % | | | 7.36 | % | | | 8.67 | % | | | 18.58 | % | |

| S&P 500 | | | 4.21 | % | | | 11.73 | % | | | 3.97 | % | | | 8.38 | % | |

| S&P MidCap 40010 | | | 7.63 | % | | | 21.62 | % | | | 12.75 | % | | | 14.74 | % | |

| Lipper Mid Cap Value Index11 | | | 6.77 | % | | | 16.38 | % | | | 12.84 | % | | | 11.48 | % | |

The graph and table do not reflect the deduction of taxes that a shareholder would pay on fund distributions or the redemption of fund shares.

The performance data quoted represents past performance. The above performance information for the Fund does not reflect the imposition of a 2% redemption fee on shares held for 90 days or less to deter market timers. If reflected, the fee would reduce the performance quoted. Past performance does not guarantee future results. The investment return and principal value will fluctuate so that an investor's shares, when redeemed, may be worth more or less than their original cost. Current performance may be lower or higher than the performance data quoted. Average annual total return measures annualized change, while total return measures aggregate change. To obtain most recent month-end performance data, visit www.oakmark.com.

* Not annualized

The Oakmark Select Fund increased by 3% during the quarter compared to 4% for the S&P 500, and it again achieved another new all-time high NAV8. Though returns relative to other funds have recently been disappointing, the plus sign that has preceded our returns has allowed us to continue compounding our shareholders' capital. As we have often said, we consider avoiding significant losses to be the most important requirement for achieving long-term financial goals, and we believe our approach is well suited for that.

Our best performing stock in the quarter was Mattel, up 15%. Mattel had been one of our worst performers, but it responded well to early signs that the Bratz doll fad may be nearing an end. That would be very welcome news for Barbie! Our worst performer was H&R Block, whose tax preparation business lost market share to a competitor that offered customers earlier access to their refunds. We believe that Block will take steps to prevent that problem next year, and we continue to believe the stock is an attractive investment.

During the quarter, we completed our sale of Burlington Resources, which is being acquired by ConocoPhillips. We also finished selling Moody's. Moody's is a great business and was one of Select's all-time best performing stocks. But at 35 times earnings, we are no longer confident it is a great value. We also sold Knight Ridder after it agreed to be acquired for $67.25 per share. We were pleased that the acquisition price, though not as high as past newspaper transactions, was a 30% premium to Knight Ridder's price before its largest shareholders requested this action. We added three companies to the portfolio last quarter: Dell, Intel, and Pulte Homes. We believe Dell and Intel are great businesses that are selling at average prices. Pulte sells at less than seven times estimated 2006 earnings, and we believe the market is being too pessimistic about how far earnings will fall when housing price increases moderate.

Best wishes,

| |  | |

|

William C. Nygren, CFA

Portfolio Manager

bnygren@oakmark.com | | Henry R. Berghoef, CFA

Portfolio Manager

berghoef@oakmark.com | |

|

THE OAKMARK SELECT FUND

13

THE OAKMARK SELECT FUND

Schedule of Investments—March 31, 2006 (Unaudited)

Name | |

Shares Held | |

Market Value | |

| Common Stocks—94.8% | |

| Apparel Retail—7.4% | |

| Limited Brands | | | 9,580,981 | | | $ | 234,350,795 | | |

| The Gap, Inc. | | | 12,060,000 | | | | 225,280,800 | | |

| | | | 459,631,595 | | |

| Broadcasting & Cable TV—8.2% | |

| Liberty Media Corporation, Class A (a) | | | 31,000,000 | | | $ | 254,510,000 | | |

| Discovery Holding Company, Class A (a) | | | 11,224,300 | | | | 168,364,500 | | |

| CBS Corporation, Class B | | | 3,675,000 | | | | 88,126,500 | | |

| | | | 511,001,000 | | |

| Homebuilding—3.4% | |

| Pulte Homes, Inc. | | | 5,500,000 | | | $ | 211,310,000 | | |

| Leisure Products—2.8% | |

| Mattel, Inc. | | | 9,670,900 | | | $ | 175,333,417 | | |

| Movies & Entertainment—6.7% | |

| Time Warner, Inc. | | | 16,240,000 | | | $ | 272,669,600 | | |

| Viacom, Inc., Class B (a) | | | 3,675,000 | | | | 142,590,000 | | |

| | | | 415,259,600 | | |

| Restaurants—11.8% | |

| Yum! Brands, Inc. | | | 9,207,000 | | | $ | 449,854,020 | | |

| McDonald's Corporation | | | 8,300,000 | | | | 285,188,000 | | |

| | | | 735,042,020 | | |

| Specialized Consumer Services—5.8% | |

| H&R Block, Inc. (b) | | | 16,519,600 | | | $ | 357,649,340 | | |

| Other Diversified Financial Services—4.5% | |

| JP Morgan Chase & Co. | | | 6,750,000 | | | $ | 281,070,000 | | |

| Thrifts & Mortgage Finance—15.3% | |

| Washington Mutual, Inc. | | | 22,217,400 | | | $ | 946,905,588 | | |

| Health Care Services—3.4% | |

| IMS Health Incorporated | | | 8,303,441 | | | $ | 213,979,675 | | |

| Pharmaceuticals—4.4% | |

| Bristol-Myers Squibb Company | | | 10,990,200 | | | $ | 270,468,822 | | |

| Diversified Commercial and Professional Services—4.9% | |

| The Dun & Bradstreet Corporation (a)(b) | | | 3,934,900 | | | $ | 301,728,132 | | |

| Computer Hardware—3.4% | |

| Dell Inc. (a) | | | 7,000,000 | | | $ | 208,320,000 | | |

| Data Processing & Outsourced Services—5.9% | |

| First Data Corporation | | | 7,815,400 | | | $ | 365,917,028 | | |

THE OAKMARK SELECT FUND

14

THE OAKMARK SELECT FUND

Schedule of Investments—March 31, 2006 (Unaudited) cont.

Name | | Shares Held/

Par Value | |

Market Value | |

| Common Stocks—94.8% (cont.) | |

| Office Electronics—4.1% | |

| Xerox Corporation (a) | | | 16,746,400 | | | $ | 254,545,280 | | |

| Semiconductors—2.8% | |

| Intel Corp. | | | 9,000,000 | | | $ | 174,150,000 | | |

| Total Common Stocks (Cost: $4,270,392,238) | | | | | | | 5,882,311,497 | | |

| Short Term Investments—5.0% | |

| U.S. Government Bills—2.4% | |

United States Treasury Bills, 4.385% - 4.43%

due 4/6/2006 - 4/20/2006 | | $ | 150,000,000 | | | $ | 149,779,396 | | |

| Total U.S. Government Bills (Cost: $149,779,396) | | | | | | | 149,779,396 | | |

| Repurchase Agreements—2.6% | |

IBT Repurchase Agreement, 4.55% dated 3/31/2006

due 4/3/2006, repurchase price $155,058,771

collateralized by a Government National Mortgage

Association Bond with a rate of 5.375%, with

a maturity date of 7/20/2034, and with a market

value plus accrued interest of $27,299,914, and by

Small Business Administration Bonds, with rates of

6.125% - 7.740%, with maturities from

6/25/2019 - 11/25/2030, and with an aggregate

market value plus accrued interest of $135,450,086 | | $ | 155,000,000 | | | $ | 155,000,000 | | |

IBT Repurchase Agreement, 3.25% dated 3/31/2006

due 4/3/2006, repurchase price $1,822,337,

collateralized by a Small Business Administration

Bond, with a rate of 6.625%, with a maturity

date of 4/25/2024, and with a market value plus

accrued interest of $1,912,936 | | | 1,821,844 | | | | 1,821,844 | | |

| Total Repurchase Agreements (Cost: $156,821,844) | | | | | | | 156,821,844 | | |

| Total Short Term Investments (Cost: $306,601,240) | | | | | | | 306,601,240 | | |

| Total Investments (Cost $4,576,993,478)—99.8% | | | | | | $ | 6,188,912,737 | | |

| Other Assets In Excess Of Other Liabilities—0.2% | | | | | | | 13,594,619 | | |

| Total Net Assets—100% | | | | | | $ | 6,202,507,356 | | |

(a) Non-income producing security.

(b) See footnote number five in the Notes to the Financial Statements regarding investments in affiliated issuers.

See accompanying notes to financial statements.

THE OAKMARK SELECT FUND

15

THE OAKMARK EQUITY AND INCOME FUND

Report from Clyde S. McGregor and Edward A. Studzinski, Portfolio Managers

THE VALUE OF A $10,000 INVESTMENT IN THE

OAKMARK EQUITY AND INCOME FUND FROM ITS INCEPTION (11/1/95) TO PRESENT (3/31/06) AS COMPARED TO THE LIPPER BALANCED FUND INDEX12

| | | Average Annual Total Returns | |

| | | (as of 3/31/06) | |

| | | Total Return

Last 3 Months* | | 1-year | | 5-year | | 10-year | | Since

Inception

(11/1/95) | |

Oakmark Equity &

Income Fund (Class I) | | | 2.00 | % | | | 11.49 | % | | | 10.81 | % | | | 13.66 | % | | | 13.61 | % | |

Lipper Balanced

Fund Index | | | 3.25 | % | | | 10.02 | % | | | 5.25 | % | | | 7.68 | % | | | 8.02 | % | |

| S&P 5004 | | | 4.21 | % | | | 11.73 | % | | | 3.97 | % | | | 8.95 | % | | | 9.73 | % | |

Lehman Govt./

Corp. Bond13 | | | -1.01 | % | | | 2.02 | % | | | 5.23 | % | | | 6.32 | % | | | 6.10 | % | |

The graph and table do not reflect the deduction of taxes that a shareholder would pay on fund distributions or the redemption of fund shares.

The performance data quoted represents past performance. The above performance information for the Fund does not reflect the imposition of a 2% redemption fee on shares held for 90 days or less to deter market timers. If reflected, the fee would reduce the performance quoted. Past performance does not guarantee future results. The investment return and principal value will fluctuate so that an investor's shares, when redeemed, may be worth more or less than their original cost. Current performance may be lower or higher than the performance data quoted. Average annual total return measures annualized change, while total return measures aggregate change. To obtain most recent month-end performance data, visit www.oakmark.com.

* Not annualized

Quarter Review

The Equity and Income Fund returned 2% in the quarter ended March 31, which contrasts to the 3% result Lipper reported for its Balanced Fund Index. Equities provided virtually all of the Equity and Income Fund's return as rising interest rates caused the prices of fixed income investments to weaken. The shortfall compared to the Lipper Balanced Fund Index does not diminish our pleasure in reporting another positive quarter. As we have often said in these letters, we present the Lipper Balanced Fund Index as a standard for comparison, but our personal benchmark is to earn substantial, persistent positive returns. Persistent positive returns over time build wealth faster than volatile return streams, and the persistent stream demands less psychological fortitude from the investor.

Nonetheless, during this quarter, many of you communicated discomfiture with our progress. Most comments pertained to 2006 year-to-date returns, while one individual was quite particular, highlighting the period September 15, 2005 through January 31, 2006. Some correspondents asked if the Fund was lagging because we had restructured the portfolio prematurely, while others suggested that we should restructure the portfolio immediately in order to escape our malaise. We have always said that we welcome your e-mailed comments and queries, and we are almost as glad for the unhappy tidings as we are for the compliments. This past quarter's e-mails suggest that we need once again to discuss our core principles in managing this Fund.

Core Principles

The Equity and Income Fund is a balanced fund intended to produce income while preserving and growing capital. The Fund's asset allocation has tended to stay in the general neighborhood of 60% equity and 40% fixed income, a common structure for balanced funds. Asset allocations of this sort are responsive to the universal need to mediate between goals for current income and long-term growth, and, happily, they ask little of human nature. For an asset allocation to be effective, it must provide its greatest utility in times of stress. Experience has demonstrated that investors who maintain a well-balanced asset allocation are less likely to panic. Equity and Income's similarities with most other balanced funds end with our average asset allocation, however.

The factor that most distinguishes the Fund is our investment philosophy. To manage the Equity and Income Fund, we use the same value investment philosophy that undergirds all of the Funds in the Oakmark group. We continually ask "what are our holdings worth" and "what are their prices." In addition for our equity investments, we seek to determine if the issuing company shows persistent growth in intrinsic value per

THE OAKMARK EQUITY AND INCOME FUND

16

share and if its management team treats its shareholders as though they are partners.

Second, our concept of a balanced fund differs from most other fund managers. We understand a balanced fund to be an integrated portfolio, not an aggregation of independent pieces. All of the Fund's holdings compete with every other holding for space. Accordingly, our ability to identify attractive investment opportunities affects the Fund's asset allocation. Over the Fund's more than ten-year history, the equity allocation percentage has ranged from the low 50's to the mid-60's, always a function of our ability to identify undervalued equities. In the same manner, the allocation to corporate debt instruments has varied widely depending on our evaluation of opportunities in that sector.

Other Differentiating Characteristics Include:

• Benchmarks do not drive our investing. Investors in the Fund should expect results to differ from benchmarks, especially over short time periods. We are pretty much congenitally unable to do anything other than buy and own securities at a discount to intrinsic value. And, we accept that periods of underperformance will occur when the market does not recognize the values we have identified.

• We are relatively indifferent to the size of the opportunity. We have the ability to invest the Fund in stocks of small-cap, mid-cap, and large-cap companies, as well as foreign-domiciled concerns.

• While income is always desirable, value is determinative. What this means is that income is a characteristic to which we assign value and, like most characteristics, it can be over-priced or under-valued.

• Quality, like income, is a factor to which we ascribe value. We can and will own low grade bonds and/or preferred stocks in the Fund, but only when we perceive their potential return to be competitive with equities.

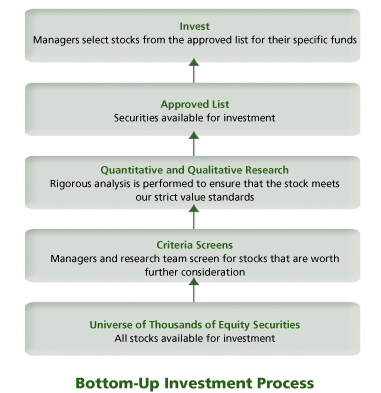

• The Fund's diversification is an outcome of our bottom-up investment process. We will generally invest the Fund in a more concentrated fashion than other balanced funds. Outstanding investment opportunities are scarce, in our opinion.

• Our investment horizon is very long-term. The ability to think and act with a long-term horizon is a great advantage. At the same time, we can be rather inactive for long periods. In our view, sometimes the best course of action is to do nothing.

For investors in mutual funds the question of "fit" is paramount. Investors make the best decisions when they have invested with funds whose style and philosophy mesh well with their own character and needs. Perhaps the most useful advice we can give fund investors is that they should often check to see if they understand their funds and, if so, consider whether their funds still fit their investing needs.

Fixed Income Update

In any given time period our shareholders' e-mails tend to coalesce around specific issues. While recently the flow of e-mails has focused on short-term results, three years ago the flow overwhelmingly centered on the question of how to protect against rising interest rates. We wrote then about our efforts to protect the portfolio through the use of short duration securities and inflation-indexed bonds. How has this worked out? In an unexpected and not particularly satisfying fashion, we would say.

To all of our correspondents who warned us that the Federal Reserve would substantially increase short-term interest rates, you were correct. The effect on the fixed income market, however, has been quite limited. For example, ten-year U.S. Treasury notes trade for yields almost unchanged from two years ago. Our defensive posture in our fixed income holdings has, to date, reduced both risk and return.

Nevertheless, we remain risk-averse in our fixed income allocation, both in terms of sensitivity to interest rate changes and in terms of quality. The fixed income duration is just under two years and the portfolio has no high yield debt. We will happily change these portfolio characteristics when we perceive that value has returned to the sector.

A Note on Activity

As mentioned above, during the quarter shareholders asked us repeatedly if we were substantially restructuring the portfolio. Merely looking at the number of equity holdings that left the portfolio in the quarter (nine), one could easily come to this conclusion. This is misleading, however. Eight of the holdings were of minimal size, collectively comprising less than 2% of the portfolio. The ninth, Burlington Resources, completed its sale to ConocoPhillips on March 31 (effective 4/3/06). The portfolio ended the quarter somewhat more concentrated but little changed in fundamental character.

In closing, we should note that we also receive many complimentary e-mails for which we are grateful. As always, we thank you for entrusting us with your assets.

| |  | |

|

Clyde S. McGregor, CFA

Portfolio Manager

mcgregor@oakmark.com | | Edward A. Studzinski, CFA

Portfolio Manager

estudzinski@oakmark.com | |

|

THE OAKMARK EQUITY AND INCOME FUND

17

THE OAKMARK EQUITY AND INCOME FUND

Schedule of Investments—March 31, 2006 (Unaudited)

Name | |

Shares Held | |

Market Value | |

| Equity and Equivalents—62.3% | |

| Common Stocks—62.3% | |

| Apparel Retail—1.7% | |

| The TJX Companies, Inc. | | | 7,240,000 | | | $ | 179,696,800 | | |

| Broadcasting & Cable TV—5.6% | |

| EchoStar Communications Corporation, Class A (a) | | | 8,250,000 | | | $ | 246,427,500 | | |

| The E.W. Scripps Company, Class A | | | 4,200,000 | | | | 187,782,000 | | |

| The DIRECTV Group, Inc. (a) | | | 8,026,722 | | | | 131,638,241 | | |

| CBS Corporation, Class A | | | 823,800 | | | | 19,853,580 | | |

| | | | 585,701,321 | | |

| Homebuilding—0.1% | |

| Pulte Homes, Inc. | | | 200,000 | | | $ | 7,684,000 | | |

| Movies & Entertainment—1.5% | |

| News Corporation, Class B | | | 9,000,000 | | | $ | 158,040,000 | | |

| Publishing—1.8% | |

| The Washington Post Company, Class B | | | 235,500 | | | $ | 182,924,625 | | |

| Restaurants—1.0% | |

| McDonald's Corporation | | | 3,000,000 | | | $ | 103,080,000 | | |

| Brewers—0.6% | |

| InBev NV (b) | | | 1,250,000 | | | $ | 58,613,569 | | |

| Distillers & Vintners—2.5% | |

| Diageo plc (c) | | | 4,100,000 | | | $ | 260,063,000 | | |

| Hypermarkets & Super Centers—1.7% | |

| Costco Wholesale Corporation | | | 3,200,000 | | | $ | 173,312,000 | | |

| Packaged Foods & Meats—3.6% | |

| Nestle SA (c) | | | 3,900,000 | | | $ | 289,403,400 | | |

| Smithfield Foods, Inc. (a) | | | 2,800,000 | | | | 82,152,000 | | |

| | | | 371,555,400 | | |

| Personal Products—1.4% | |

| Avon Products, Inc. | | | 4,520,000 | | | $ | 140,888,400 | | |

| Tobacco—1.3% | |

| UST, Inc. | | | 3,300,000 | | | $ | 137,280,000 | | |

| Integrated Oil & Gas—1.2% | |

| ConocoPhillips | | | 2,000,000 | | | $ | 126,300,000 | | |

THE OAKMARK EQUITY AND INCOME FUND

18

THE OAKMARK EQUITY AND INCOME FUND

Schedule of Investments—March 31, 2006 (Unaudited) cont.

Name | |

Shares Held | |

Market Value | |

| Equity and Equivalents—62.3% (cont.) | |

| Oil & Gas Exploration & Production—12.0% | |

| XTO Energy, Inc. | | | 10,561,338 | | | $ | 460,157,497 | | |

| Burlington Resources, Inc. | | | 4,000,000 | | | | 367,640,000 | | |

| EnCana Corp. (b) | | | 6,500,000 | | | | 303,745,000 | | |

| St. Mary Land & Exploration Company (d) | | | 2,900,000 | | | | 118,407,000 | | |

| | | | 1,249,949,497 | | |

| Investment Banking & Brokerage—1.9% | |

| Morgan Stanley | | | 3,200,000 | | | $ | 201,024,000 | | |

| Property & Casualty Insurance—4.4% | |

| SAFECO Corporation | | | 4,610,000 | | | $ | 231,468,100 | | |

| The Progressive Corporation | | | 1,125,000 | | | | 117,292,500 | | |

| MBIA, Inc. | | | 1,850,000 | | | | 111,240,500 | | |

| | | | 460,001,100 | | |

| Real Estate Investment Trusts—0.0% | |

| Plum Creek Timber Company, Inc. | | | 140,000 | | | $ | 5,170,200 | | |

| Biotechnology—2.1% | |

| MedImmune, Inc. (a) | | | 6,000,000 | | | $ | 219,480,000 | | |

| Health Care Equipment—1.2% | |

| Varian, Inc. (a)(d) | | | 1,649,400 | | | $ | 67,922,292 | | |

| Hospira, Inc. (a) | | | 1,350,000 | | | | 53,271,000 | | |

| | | | 121,193,292 | | |

| Health Care Services—2.5% | |

| Caremark Rx, Inc. (a) | | | 5,301,300 | | | $ | 260,717,934 | | |

| Aerospace & Defense—7.1% | |

| General Dynamics Corporation | | | 4,700,000 | | | $ | 300,706,000 | | |

| Raytheon Company | | | 3,599,700 | | | | 165,010,248 | | |

| Alliant Techsystems, Inc. (a) | | | 1,325,000 | | | | 102,250,250 | | |

| Rockwell Collins, Inc. | | | 1,600,000 | | | | 90,160,000 | | |

| Honeywell International, Inc. | | | 1,889,500 | | | | 80,813,915 | | |

| | | | 738,940,413 | | |

| Commercial Printing—1.5% | |

| R.R. Donnelley & Sons Company | | | 4,909,500 | | | $ | 160,638,840 | | |

| Human Resource & Employment Services—0.4% | |

| Watson Wyatt & Company Holdings | | | 1,236,100 | | | $ | 40,272,138 | | |

| Industrial Conglomerates—1.9% | |

| Tyco International Ltd. (b) | | | 7,500,000 | | | $ | 201,600,000 | | |

THE OAKMARK EQUITY AND INCOME FUND

19

THE OAKMARK EQUITY AND INCOME FUND

Schedule of Investments—March 31, 2006 (Unaudited) cont.

| Name | | Shares Held/

Par Value | |

Market Value | |

| Equity and Equivalents—62.3% (cont.) | |

| Application Software—0.4% | |

| Mentor Graphics Corporation (a) | | | 3,640,000 | | | $ | 40,222,000 | | |

| Data Processing & Outsourced Services—1.2% | |

| Ceridian Corporation (a) | | | 4,800,000 | | | $ | 122,160,000 | | |

| Internet Software & Services—0.8% | |

| Jupiter Telecommunications Co., Ltd. (a)(b) | | | 125,000 | | | $ | 88,356,484 | | |

| Technology Distributors—0.7% | |

| CDW Corporation | | | 1,200,000 | | | $ | 70,620,000 | | |

| Paper Products—0.2% | |

| Schweitzer-Mauduit International, Inc. | | | 700,000 | | | $ | 16,800,000 | | |

| Total Common Stocks (Cost: $4,795,442,630) | | | | | | | 6,482,285,013 | | |

| Total Equity and Equivalents (Cost: $4,795,442,630) | | | | | | | 6,482,285,013 | | |

| Fixed Income—33.4% | |

| Corporate Bonds—0.2% | |

| Automobile Manufacturers—0.0% | |

Toyota Motor Credit Corp., Series B, (MTN),

4.75% due 4/20/2009 | | $ | 5,000,000 | | | $ | 4,948,190 | | |

| Paper Packaging—0.2% | |

Sealed Air Corporation, 144A,

5.625% due 7/15/2013 (e) | | $ | 20,000,000 | | | $ | 19,438,140 | | |

| Total Corporate Bonds (Cost: $25,184,655) | | | | | | | 24,386,330 | | |

| Government and Agency Securities—33.2% | |

| Canadian Government Bonds—6.1% | |

| Canada Government, 3.25% due 12/1/2006 | | CAD | 250,000,000 | | | $ | 213,053,438 | | |

| Canada Government, 3.00% due 6/1/2007 | | CAD | 250,000,000 | | | | 211,631,840 | | |

| Canada Government, 2.75% due 12/1/2007 | | CAD | 250,000,000 | | | | 209,812,024 | | |

| | | | 634,497,302 | | |

| Norwegian Government Bonds—0.1% | |

| Norway Government, 6.75% due 1/15/2007 | | NOK | 50,000,000 | | | $ | 7,849,377 | | |

| Swedish Government Bonds—0.1% | |

| Kingdom of Sweden, 3.50% due 4/20/2006 | | SEK | 50,000,000 | | | $ | 6,422,996 | | |

THE OAKMARK EQUITY AND INCOME FUND

20

THE OAKMARK EQUITY AND INCOME FUND

Schedule of Investments—March 31, 2006 (Unaudited) cont.

Name | |

Par Value | |

Market Value | |

| Fixed Income—33.4% (cont.) | |

| U.S. Government Notes—19.7% | |

| United States Treasury Notes, 4.625% due 2/29/2008 | | $ | 500,000,000 | | | $ | 497,988,500 | | |

| United States Treasury Notes, 4.125% due 8/15/2008 (f) | | | 500,000,000 | | | | 492,851,500 | | |

United States Treasury Notes, 3.375% due 1/15/2007,

Inflation Indexed | | | 266,529,030 | | | | 269,381,690 | | |

| United States Treasury Notes, 4.50% due 2/15/2009 | | | 250,000,000 | | | | 247,832,000 | | |

| United States Treasury Notes, 4.25% due 10/31/2007 | | | 250,000,000 | | | | 247,714,750 | | |

| United States Treasury Notes, 4.50% due 2/28/2011 (f) | | | 250,000,000 | | | | 246,357,500 | | |

| United States Treasury Notes, 4.25% due 11/30/2007 | | | 50,000,000 | | | | 49,521,500 | | |

| | | | 2,051,647,440 | | |

| U.S. Government Agencies—7.2% | |

| Fannie Mae, 5.25% due 4/15/2007 | | $ | 50,000,000 | | | $ | 50,054,850 | | |

Federal Home Loan Mortgage Corporation,

3.75% due 11/15/2006 | | | 50,000,000 | | | | 49,581,250 | | |

| Fannie Mae, 3.875% due 5/15/2007 | | | 50,000,000 | | | | 49,323,700 | | |

Federal Home Loan Mortgage Corporation,

4.00% due 8/17/2007 | | | 50,000,000 | | | | 49,266,350 | | |

| Federal Home Loan Bank, 3.625% due 6/20/2007 | | | 50,000,000 | | | | 49,124,300 | | |

| Federal Home Loan Bank, 4.125% due 4/18/2008 | | | 50,000,000 | | | | 49,114,300 | | |

| Federal Home Loan Bank, 3.875% due 8/22/2008 | | | 50,000,000 | | | | 48,688,100 | | |

| Federal Home Loan Bank, 5.00% due 12/20/2011 | | | 34,555,000 | | | | 33,735,563 | | |

| Federal Home Loan Bank, 2.875% due 9/15/2006 | | | 25,000,000 | | | | 24,758,000 | | |

| Fannie Mae, 4.25% due 7/15/2007 | | | 25,000,000 | | | | 24,730,700 | | |

| Federal Home Loan Bank, 2.625% due 10/16/2006 | | | 25,000,000 | | | | 24,671,375 | | |

Federal Home Loan Mortgage Corporation,

3.75% due 4/15/2007 | | | 25,000,000 | | | | 24,654,825 | | |

| Federal Home Loan Bank, 2.75% due 12/15/2006 | | | 25,000,000 | | | | 24,593,225 | | |

| Fannie Mae, 4.25% due 5/15/2009 | | | 25,000,000 | | | | 24,388,325 | | |

| Fannie Mae, 3.25% due 11/15/2007 | | | 25,000,000 | | | | 24,290,050 | | |

| Fannie Mae, 3.625% due 12/28/2009 | | | 24,435,000 | | | | 23,966,679 | | |

| Federal Home Loan Bank, 2.50% due 4/20/2009 | | | 20,000,000 | | | | 19,975,920 | | |

Federal Home Loan Mortgage Corporation,

3.625% due 3/24/2008 | | | 20,000,000 | | | | 19,876,780 | | |

Federal Home Loan Mortgage Corporation,

5.00% due 10/18/2010 | | | 20,000,000 | | | | 19,646,180 | | |

| Fannie Mae, 2.60% due 4/28/2009 | | | 18,800,000 | | | | 18,768,115 | | |

| Fannie Mae, 3.125% due 11/30/2009 | | | 12,697,000 | | | | 12,538,148 | | |

| Fannie Mae, 4.25% due 2/19/2010 | | | 12,888,000 | | | | 12,452,734 | | |

Federal Home Loan Mortgage Corporation,

3.00% due 11/17/2006 | | | 10,000,000 | | | | 9,870,230 | | |

| Fannie Mae, 3.00% due 10/6/2009 | | | 10,000,000 | | | | 9,817,420 | | |

| Fannie Mae, 3.375% due 3/3/2008 | | | 9,300,000 | | | | 9,202,964 | | |

| Fannie Mae, 3.50% due 10/14/2010 | | | 7,550,000 | | | | 7,443,379 | | |

THE OAKMARK EQUITY AND INCOME FUND

21

THE OAKMARK EQUITY AND INCOME FUND

Schedule of Investments—March 31, 2006 (Unaudited) cont.

Name | |

Par Value | |

Market Value | |

| Fixed Income—33.4% (cont.) | |

| U.S. Government Agencies—7.2% (cont.) | |

| Federal Home Loan Bank, 3.00% due 8/17/2007 | | $ | 7,500,000 | | | $ | 7,389,952 | | |

| Fannie Mae, 4.00% due 4/13/2009 | | | 5,000,000 | | | | 4,981,565 | | |

| Federal Home Loan Bank, 4.30% due 8/16/2010 | | | 5,000,000 | | | | 4,959,975 | | |

| Federal Home Loan Bank, 4.52% due 8/26/2009 | | | 4,825,000 | | | | 4,715,617 | | |

| Federal Home Loan Bank, 2.25% due 2/22/2007 | | | 4,000,000 | | | | 3,969,508 | | |

| Fannie Mae, 5.125% due 5/4/2012 | | | 4,013,000 | | | | 3,928,779 | | |

| Fannie Mae, 3.75% due 6/23/2009 | | | 2,820,000 | | | | 2,807,818 | | |

| | | | 747,286,676 | | |

| Total Government and Agency Securities (Cost: $3,457,906,238) | | | | | | | 3,447,703,791 | | |

| Total Fixed Income (Cost: $3,483,090,893) | | | | | | | 3,472,090,121 | | |

| Short Term Investments—3.8% | |

| U.S. Government Bills—0.9% | |

| United States Treasury Bills, 4.395%-4.43% | | $ | 100,000,000 | | | $ | 99,724,389 | | |

| due 4/20/2006 - 4/27/2006 | | | | | | | | | |

| Total U.S. Government Bills (Cost: $99,724,389) | | | | | | | 99,724,389 | | |

| Repurchase Agreements—2.9% | |

IBT Repurchase Agreement, 4.55% dated 3/31/2006 due

4/3/2006, repurchase price $297,112,612, collateralized

by Government National Mortgage Association Bonds

with a rate of 4.000% - 4.875%, with maturities from

1/20/2033 - 2/20/2035, and with a market

value plus accrued interest of $78,836,304, and by Small

Business Administration Bonds, with rates of

6.765% - 8.625%, with maturities from

12/25/2013 - 9/25/2030, and with an aggregate

market value plus accrued interest of $233,013,696 | | $ | 297,000,000 | | | $ | 297,000,000 | | |

IBT Repurchase Agreement, 3.25% dated 3/31/2006 due

4/3/2006, repurchase price $2,200,458, collateralized

by a Small Business Administration Bond,

with a rate of 7.875%, with a maturity date of

4/25/2027, and with a market value plus accrued

interest of $2,309,856 | | | 2,199,863 | | | | 2,199,863 | | |

| Total Repurchase Agreements (Cost: $299,199,863) | | | | | | | 299,199,863 | | |

| Total Short Term Investments (Cost: $398,924,252) | | | | | | | 398,924,252 | | |

| Total Investments (Cost $8,677,457,775)—99.5% | | | | | | $ | 10,353,299,386 | | |

| Other Assets In Excess Of Other Liabilities—0.5% | | | | | | | 51,747,902 | | |

| Total Net Assets—100% | | | | | | $ | 10,405,047,288 | | |

THE OAKMARK EQUITY AND INCOME FUND

22

THE OAKMARK EQUITY AND INCOME FUND

Schedule of Investments—March 31, 2006 (Unaudited) cont.

(a) Non-income producing security.

(b) Represents a foreign domiciled corporation.

(c) Represents an American Depository Receipt.

(d) See footnote number five in the Notes to the Financial Statements regarding investments in affiliated issuers.

(e) Security exempt from registration under Rule 144A of the Securities Act of 1933. These securities may be resold in transactions exempt from registration, normally to qualified institutional buyers.

(f) All or a portion of security out on loan.

Key to abbreviations:

CAD: Canadian Dollar

MTN: Medium Term Note

NOK: Norwegian Krone

SEK: Swedish Krona

See accompanying notes to financial statements.

THE OAKMARK EQUITY AND INCOME FUND

23

THE OAKMARK GLOBAL FUND

Report from Clyde S. McGregor and Robert A. Taylor, Portfolio Managers

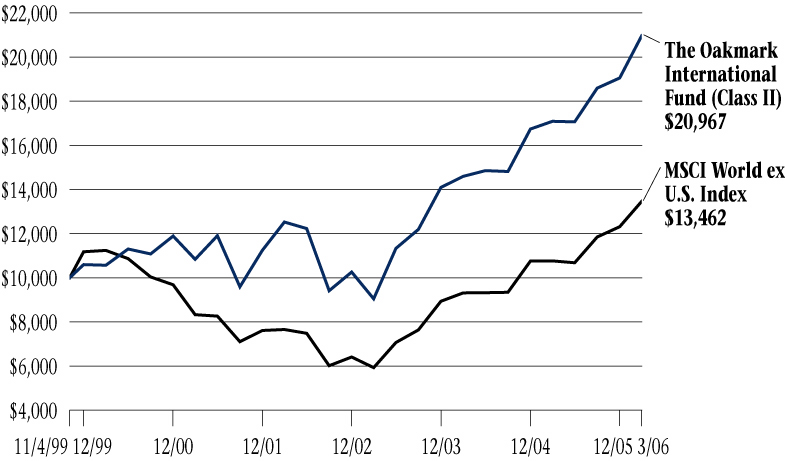

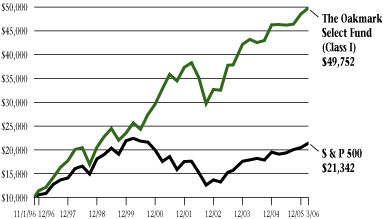

THE VALUE OF A $10,000 INVESTMENT IN THE

OAKMARK GLOBAL FUND FROM ITS INCEPTION (8/4/99) TO PRESENT (3/31/06) AS COMPARED TO THE MSCI WORLD INDEX14

| | | Average Annual Total Returns | |

| | | (as of 3/31/06) | |

| | | Total Return

Last 3 Months* | | 1-year | | 5-year | | Since

Inception

(8/4/99) | |

| Oakmark Global Fund (Class I) | | | 6.86 | % | | | 20.28 | % | | | 19.79 | % | | | 16.92 | % | |

| MSCI World | | | 6.60 | % | | | 18.02 | % | | | 6.38 | % | | | 2.83 | % | |

| Lipper Global Fund Index15 | | | 7.08 | % | | | 20.87 | % | | | 7.17 | % | | | 5.14 | % | |

The graph and table do not reflect the deduction of taxes that a shareholder would pay on fund distributions or the redemption of fund shares.

The performance data quoted represents past performance. The above performance information for the Fund does not reflect the imposition of a 2% redemption fee on shares held for 90 days or less to deter market timers. If reflected, the fee would reduce the performance quoted. Past performance does not guarantee future results. The investment return and principal value will fluctuate so that an investor's shares, when redeemed, may be worth more or less than their original cost. Current performance may be lower or higher than the performance data quoted. Average annual total return measures annualized change, while total return measures aggregate change. To obtain most recent month-end performance data, visit www.oakmark.com.

* Not annualized

Quarter Review

The Oakmark Global Fund posted a return of 7% for the quarter ended March 31, 2006, in line with the figures for the Lipper Global Fund Index and the MSCI World Index.

International stock markets showed considerable strength during the quarter. While some international markets enjoyed double-digit increases, the U.S., though positive, trailed. In our view, these returns indicate a continuation and even amplification of 2005 trends. As is often the case, the U.S. is somewhat out-of-phase with the economies of other developed nations. Coming out of the 2002 downturn, the U.S. economy rebounded vigorously, while most other developed nations experienced more modest improvement. Now the situation is reversed. As much of the world experiences accelerating economic growth, in the U.S., the Federal Reserve is attempting to reduce speculation in some sectors, especially housing, without pushing the entire economy into recession. After 15 short-term interest rate increases over the past two years, U.S. government securities now have some of the highest yields in the world. For example, yields on U.S. ten-year bonds exceed not only those of all other G7 nations but also those from smaller countries, including Greece and the Czech Republic. The Fed's moves have not prevented corporate earnings from growing rapidly, however.

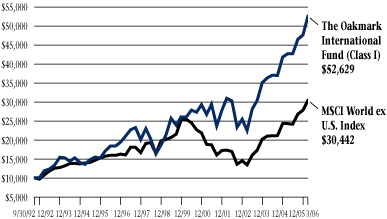

As we have often noted in these letters, we construct the Fund from the bottom up, populating the portfolio with the most attractive issues available to us from across the globe. Because of this approach, our country weightings will change over time as our perception of value evolves. This can be seen clearly in our weighting for U.S. stocks. Several years ago the Fund was split 50:50 between the U.S. and the rest of the world. As U.S. issues attained our price targets, we found that the dominant new opportunities had shifted abroad. For example, at the end of 2000, the Fund had no Japanese issues compared to seven holdings and a 13% weighting as of this writing. The necessary outcome after 2000 was that the U.S. allocation declined, eventually reaching a nadir of 34%.

However, over the past two years relative price movements in combination with strong earnings growth in the U.S. have changed the valuation calculus. We believe U.S. issues are generically more competitive today. The Fund's asset allocation

THE OAKMARK GLOBAL FUND

24

expresses this observation as the U.S. weighting has risen to approximately 40%. All other things being equal, we expect the U.S. allocation to continue to grow; then again, how often are all other things equal? In any event, you may be assured we will continue to take the Fund wherever value leads us.

Activity

Our trading activity was rather high in the quarter. We sold two holdings that met our price objectives, Banco Popolare di Verona and Euronext, while Burlington Resources completed its sale to ConocoPhillips on the last day of the quarter (effective 4/3/06). We also eliminated the Fund's holding of Tribune, believing that News Corp. (discussed below) was a superior opportunity among diversified media companies. We added six new names to the portfolio: three international and three U.S.-domiciled.

Beginning alphabetically, Swiss-headquartered Adecco is one of the largest temporary employment agencies in the world. We have long admired the company's franchise, but management's capital allocation decisions had limited our interest. Apparently, the company's Board came to a similar conclusion. Adecco recently completed the acquisition of DIS, a German temporary help agency, and installed the DIS management team at the helm of Adecco. We view this change to be very positive as DIS had produced industry-leading margins and demonstrated a strong shareholder orientation.

News Corp. is one of the largest global media conglomerates. The company has interests in TV and satellite broadcasting, film production, magazines, newspapers, books, and cable television networks. The company benefits from growing free cash flow and, as a result, enjoys a strong balance sheet. We find News to be unusually cheap relative to the value of its individual pieces.

Until very recently, a name like Oracle would not have shown up in a value-based portfolio. But, for value investors, a bargain price combined with strong cash generation and a solid balance sheet overcomes any initial inhibitions. Oracle is the world's largest enterprise software company and maintains a dominant position in database software. Previously a distant second place in enterprise application software, we believe Oracle's acquisitions of Peoplesoft and Seibel Systems have greatly enhanced the company's market position.

Uni-Charm is a Japanese company with interests in hygiene products and pet food. The company's brands are well established with large market shares, resulting in attractive returns on capital and substantial free cash generation. Uni-Charm's management's words and deeds demonstrate their shareholder-friendly orientation.

Vodafone is another former growth favorite that recently afforded us the opportunity to purchase shares at an attractive price. The company is one of the leading mobile phone operators in the world enjoying strong market positions in the UK, Germany, and Italy as well as an important joint venture with Verizon in the U.S. Soon after our investment in Vodafone, management announced the sale of the company's operations in Japan, a market where the company had never been able to prosper. We believe that this sale and other recent actions demonstrate the company's improved capital allocation. Combined with the effects of the completion of the rollout of 3G, the new industry standard, we believe Vodafone's earnings should begin to experience accelerating growth.

Last but not least, XTO Energy is an independent energy exploration and production company focused on onshore North America basins. Management is unusually adept at purchasing properties from the major oil companies and re-engineering the fields to enhance their value. Management has been able to grow the company's production and reserves at rates we find far superior to most competitors.

Hopefully, the diversity of this list of new names for the portfolio demonstrates that we continue to find value in a wide variety of industries and locales. We thank you for your trust and patience.

| |  | |

|

Clyde S. McGregor, CFA

Portfolio Manager

mcgregor@oakmark.com | | Robert A. Taylor, CFA

Portfolio Manager

rtaylor@oakmark.com | |

|