UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED

MANAGEMENT INVESTMENT COMPANIES

Investment Company Act file number: 811-06241

Loomis Sayles Funds II

(Exact name of Registrant as specified in charter)

399 Boylston Street, Boston, Massachusetts 02116

(Address of principal executive offices) (Zip code)

Coleen Downs Dinneen, Esq.

NGAM Distribution, L.P.

399 Boylston Street

Boston, Massachusetts 02116

(Name and address of agent for service)

Registrant’s telephone number, including area code: (617) 449-2810

Date of fiscal year end: September 30

Date of reporting period: September 30, 2015

Item 1. Reports to Stockholders.

The Registrant’s annual report transmitted to shareholders pursuant to Rule 30e-1 under the Investment Company Act of 1940 is as follows:

ANNUAL REPORT

September 30, 2015

Loomis Sayles Global Equity and Income Fund

Loomis Sayles Growth Fund

Loomis Sayles Value Fund

TABLE OF CONTENTS

Portfolio Review page 1

Portfolio of Investments page 23

Financial Statements page 49

Notes to Financial Statements page 68

LOOMIS SAYLES GLOBAL EQUITY AND INCOME FUND

| | |

| Managers | | Symbols |

| Daniel J. Fuss, CFA®, CIC | | Class A LGMAX |

| Eileen N. Riley, CFA® | | Class C LGMCX |

| David W. Rolley, CFA® | | Class Y LSWWX |

| Lee M. Rosenbaum | | |

| Loomis, Sayles & Company, L.P. | | |

Objective

The Fund seeks high total investment return through a combination of capital appreciation and current income

Market Conditions

Falling commodity prices and a strengthening U.S. dollar characterized the 12-month reporting period. For the first nine months of the period, global equity markets performed reasonably well, while core government bond yields remained near historic lows. In mid-August, however, concerns about commodity prices, emerging market currencies and the economic health of China led to a widely felt correction, with many equity markets declining 10% or more for the first time since 2011. Although the magnitude of China’s currency devaluation was small, it generated concerns about possible further negative adjustments. This, coupled with uncertainty linked to China’s stock market decline and economic slowdown, led to a broad decline among global stocks. The sell-off resulted in major markets turning negative for the year, with Japan close to flat, the S&P 500® Index down mid-single digits and emerging markets down in the mid-teens. Though central bankers around the world remained accommodative, investors were uncertain as to their next steps. Europe and Japan remained on their current course of monetary easing, while the Federal Reserve (the Fed) delayed a rate hike.

Performance Results

For the 12 months ended September 30, 2015, Class A shares of Loomis Sayles Global Equity and Income Fund returned -0.91% at net asset value. The Fund held up better than its primary benchmark, the Morgan Stanley Capital International (MSCI) World Index, which returned -4.57%. The Fund also outpaced its secondary benchmark, the Citigroup World Government Bond Index, which returned -3.83%.

Explanation of Fund Performance

The Fund started the year off with approximately 70% in equities and 30% in fixed income. As equities valuations started to become fairly valued, the Fund scaled back its exposure and redeployed some of its assets to fixed income where valuations started to look more attractive. This allowed the Fund to weather the market volatility.

Within the Fund’s equity component, positive stock selection, particularly in Europe and North America and within the consumer discretionary, financials and information technology sectors, contributed to performance. Autozone, a leading auto parts retailer,

1 |

continued to deliver impressive sales growth, expand margins and successfully deploy capital in a manner consistent with its long-term track record. The company was a major contributor to the Fund’s performance and remains a high-conviction holding. Autozone continues to make bolt-on acquisitions, which we believe will strengthen the firm further, and initiate stock buybacks. Valeant Pharmaceuticals, a specialty drug company, also contributed to Fund performance. We believe our ongoing investment thesis continues to be supported as the company demonstrated strong and focused business development, a diversified product portfolio operating in a decentralized environment and a highly favorable tax structure. Valeant successfully integrated its key investments of the past year, including Salix Pharmaceuticals and Solta Holdings, while deals completed more than a year ago (including Bausch and Lomb) continued to grow. Amazon, the web retailer, delivered strong top-line growth and impressive margin improvement, allocated capital wisely and increased the transparency of its financial divisions. Amazon Prime delivered impressive results, and the platform continued to build customer loyalty. We believe the stock remains undervalued relative to our expectations for future cash flow per share.

Within fixed income, the positioning along the longer end of the U.S. yield curve (a curve that shows the relationship among bond yields across the maturity spectrum) added value as the yield curve flattened throughout the period. Our allocation to longer-dated euro zone sovereigns also lifted results, as yields fell near the end of the reporting period due to Greece’s debt crisis moving out of the headlines. Although security selection detracted overall, we were able to find pockets of positive performance among retail, consumer goods and healthcare issuers – particularly among names with longer durations (greater price sensitivity to interest rate changes). Additionally, selected intermediate-maturity issuers from emerging market countries less vulnerable to the oil price decline, such as Hungary and India, also contributed positively. Elsewhere, a general bias toward the U.S. dollar was beneficial as the dollar rallied for the majority of the period. Although the dollar rally peaked during the second quarter of 2015, it maintained most of its strength throughout the final months of the fiscal year. Additionally, currency forwards, which are contracts that lock in exchange rates on future dates, were used to actively manage currency exposure and aided results.

Not surprisingly, energy was the largest detractor within the Fund’s equity component, as lower commodity prices continued to pressure energy stocks. A small out-of-Benchmark allocation to emerging markets also held back performance. Alibaba, the Chinese e-commerce company, detracted from results. The company’s stock struggled on concerns about deteriorating macroeconomic conditions in China, the banning of online lottery offerings, a declining monetization rate, bad press around fraud management and increased competition from JD.com. We believe these risks are more than adequately reflected in the stock’s valuation and the company is taking steps to deliver strong results in 2016. Genesee & Wyoming, a regional freight railroad company, performed poorly due to weakening end markets in coal, energy and iron ore. This pressure resulted in a reduction in forward earnings and cash flow estimates and muted the positive impact of the Freightliner acquisition announced earlier this year. We continue to see long-term value in the company’s rail and logistics assets. Lower oil prices forced Noble Energy to ration capital, which negatively affected growth in production and cash flow. In addition, increased scrutiny from the Israeli Antitrust Commissioner toward Noble and its partners in Israel

| 2

LOOMIS SAYLES GLOBAL EQUITY AND INCOME FUND

introduced material risk around the timing and economic value of the proposed Leviathan development. As a result, we exited the position during the first quarter of 2015.

Within fixed income, exposure to emerging markets currencies weighed on performance, specifically the currencies of commodity-driven countries such as Brazil, Mexico and Indonesia. Holdings in the New Zealand dollar, British pound, Canadian dollar and Norwegian krone also detracted due to U.S. dollar strength. Our allocation to corporate bonds had a negative effect on performance as spreads (the difference in yield between U.S. Treasury and non-Treasury securities of similar maturity) widened to multi-year highs due, in part, to increasing new issuance. Equity market volatility and concerns about global growth also played a role, creating a challenging environment for spread (non-Treasury) products. Security selection among energy and basic industry companies detracted, as industries sensitive to commodity prices generally underperformed. Additionally, the high-yield names held within these sectors faced intense selling pressure.

Outlook

We believe the Fed will slowly raise rates over the next year, with the first hike still on the table for 2015. However, the Fed may once again delay due to subdued U.S. inflation and increasing deflation risks from abroad. We believe equity investors have largely built in an initial rate hike and further rate increases will be considered at a deliberate pace. Rate hikes associated with a healthy economy are generally not considered a negative for stocks, and we expect the equity markets to take measured policy actions in stride. We expect the U.S. dollar to remain near current levels or strengthen modestly, as Fed policy diverges from that of other leading central banks, with the Bank of England the possible exception.

We believe energy earnings will continue to drag on U.S. aggregate earnings in 2016. However, healthy earnings growth outside of energy should continue. We anticipate that 2016 aggregate earnings growth may be in the mid-single digits. U.S. equity fundamentals remain supported by healthy dividend growth, ongoing shareholder activism and continued mergers and acquisitions (M&A) activity. High-yield bonds, on the other hand, could suffer if oil prices do not gain traction or higher U.S. rates trigger additional outflows. We believe there are pockets of opportunity in less vulnerable sectors, including finance and healthcare, or where market weakness has created attractive issuer-specific valuations.

We believe the global credit cycle favors developed over emerging markets. Emerging markets face challenges unlikely to abate in the near term, including deleveraging and a manufacturing slowdown in China, waning global trade and lower commodity prices. Emerging market currencies should recover at some point, but we do not expect short-term conditions to be broadly supportive.

Potential risks to our equity view include reversing global economic fundamentals, commodity price swings, volatility related to U.S. rate increases and geopolitics. Still, moderate price corrections should create selective buying opportunities for discerning investors. The primary risks for our fixed-income view include the potential for a more hawkish Fed, increasingly aggressive corporate behavior and further commodity weakness on continued negative China news flow.

3 |

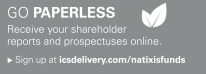

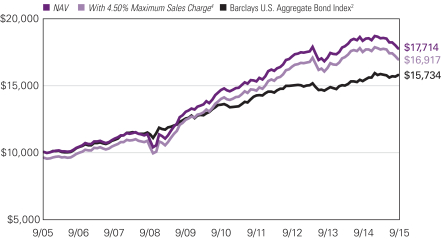

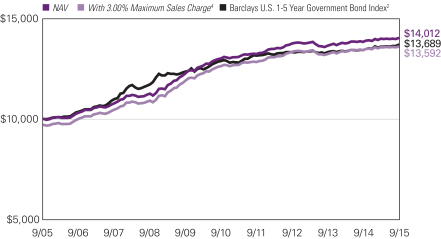

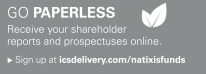

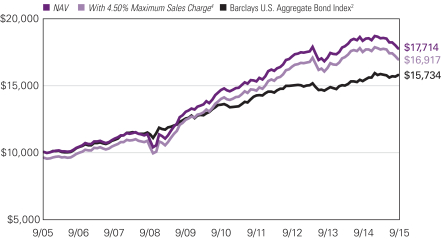

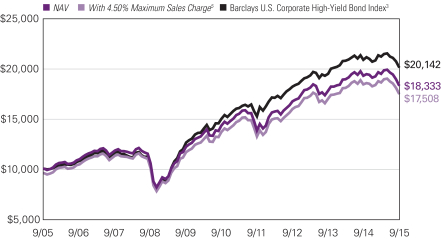

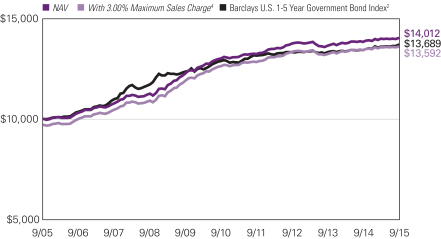

Growth of $10,000 Investment in Class A Shares1,5

September 30, 2005 through September 30, 2015

See notes to chart on page 5.

| 4

LOOMIS SAYLES GLOBAL EQUITY AND INCOME FUND

Average Annual Total Returns — September 30, 20155

| | | | | | | | | | | | |

| | | | |

| | | 1 Year | | | 5 Years | | | 10 Years | |

| | | | |

| Class A (Inception 2/1/06)1 | | | | | | | | | | | | |

| NAV | | | -0.91 | % | | | 7.53 | % | | | 7.49 | % |

| With 5.75% Maximum Sales Charge | | | -6.62 | | | | 6.26 | | | | 6.86 | |

| | | | |

| Class C (Inception 2/1/06)1 | | | | | | | | | | | | |

| NAV | | | -1.66 | | | | 6.71 | | | | 6.69 | |

| With CDSC2 | | | -2.59 | | | | 6.71 | | | | 6.69 | |

| | | | |

| Class Y (Inception 5/1/96) | | | | | | | | | | | | |

| NAV | | | -0.72 | | | | 7.78 | | | | 7.75 | |

| | | | |

| Comparative Performance | | | | | | | | | | | | |

| MSCI World Index3 | | | -4.57 | | | | 8.89 | | | | 5.31 | |

| Citigroup World Government Bond Index4 | | | -3.83 | | | | -0.19 | | | | 3.37 | |

Past performance does not guarantee future results. The table(s) do not reflect taxes shareholders might owe on any Fund distributions or when they redeem their shares. Performance for periods less than one year is cumulative, not annualized. Returns reflect changes in share price and reinvestment of dividends and capital gains, if any. Unlike a fund, an index is not managed and does not reflect fees and expenses. It is not possible to invest directly in an index.

| 1 | Prior to the inception of Class A and C shares (2/1/06), performance is that of Institutional Class shares, which were redesignated as Class Y shares, restated to reflect the higher net expenses and sales loads of Class A and C shares. |

| 2 | Performance for Class C shares assumes a 1% contingent deferred sales charge (“CDSC”) applied when you sell shares within one year of purchase. |

| 3 | MSCI World Index is an unmanaged index that is designed to measure the equity market performance of developed markets. |

| 4 | Citigroup World Government Bond Index is an unmanaged index that includes the most significant and liquid government bond markets globally that carry at least an investment-grade rating. |

| 5 | Fund performance has been increased by fee waivers and/or expense reimbursements, if any, without which performance would have been lower. |

5 |

LOOMIS SAYLES GROWTH FUND

| | |

| Manager | | Symbols |

| Aziz V. Hamzaogullari, CFA® | | Class A LGRRX |

| Loomis, Sayles & Company, L.P. | | Class B LGRBX |

| | Class C LGRCX |

| | Class N LGRNX |

| | Class Y LSGRX |

Objective

The Fund seeks long-term growth of capital

Market Conditions

Despite achieving steady gains through much of the twelve months ending September 30, 2015, large-cap U.S. equities ended the period in negative territory. The U.S. led global equity performance until January, when aggressive accommodative actions from central banks in Europe and Japan helped those markets pull ahead. The U.S. market stabilized in February and continued on a path of respectable gains until August, with only a brief interruption in June, which was tied to Greek debt challenges. However, equities fell sharply in August, with the S&P 500® Index experiencing a 10% correction for the first time since 2011. The sell-off was triggered by concerns over the health of China’s economy, sharply falling commodity prices and a generally uncertain outlook for global growth. U.S. equities remained challenged through the end of the period as negative investor sentiment overshadowed healthy dividend yields, continued mergers and acquisitions activity (M&A), and more attractive valuations.

Performance Results

For the 12 months ended September 30, 2015, Class A shares of Loomis Sayles Growth Fund returned 5.30% at net asset value. The Fund outperformed its benchmark, the Russell 1000® Growth Index, which returned 3.17%.

Explanation of Fund Performance

Positions in Amazon, Monster Beverage and Visa drove the Fund’s absolute return. While our lower-than-benchmark allocation to the consumer discretionary sector weighed on results, strong stock selection in the sector significantly aided performance. Stock selection in industrials and our allocation to consumer staples also supported relative return. Positions in Alibaba, Qualcomm and Schlumberger detracted from performance, as did stock selection in information technology and healthcare.

Online retailer Amazon became a top contributor after rebounding from lows early in the period when we added to our position. The company reported strong revenue growth and better-than-expected margins and free cash flow growth, even as it continued strategic investments in key growth areas. High-margin third-party sales, today just 17% of total revenue, have been growing nearly three times faster than Amazon’s first-party sales and represented one of the largest drivers of expanding gross margins. With estimated gross

| 6

LOOMIS SAYLES GROWTH FUND

merchandise volume (GMV) growth nearly double the U.S. e-commerce industry, Amazon continued to take market share. The company began disclosing Amazon Web Services results during the period, reporting impressive growth and margins that were much higher than market expectations.

Energy drink company Monster Beverage was also a top contributor and reported solid global sales growth during the period. Monster’s strategic partnership with Coca-Cola, announced in August 2014, closed in June 2015. International sales growth generally outpaced U.S. growth, but each region experienced pockets of short-term weakness as global distribution was transitioned to Coke. We expect the deal will allow Monster to realize faster global expansion and profitability, which led us to increase our initial appraisal of intrinsic value (our estimate of the true worth of a business, which we define as the present value of all expected future net cash flows to the company). Gross margins increased each quarter compared to the year-ago quarter, due to scale gains in new markets, an increase in lower cost local production, and a positive mix of product sales and lower quarterly operating expenses.

Another top contributor, Visa, the leader in global digital payments technology, reported strong results that were above market expectations. The company’s low double-digit growth in payment volumes exceeded the increase in global consumer spending, demonstrating the strength of the long-term secular growth in the global shift from cash to electronic payments. Through its initiatives such as Visa Checkout, Token Services and Apple Pay, Visa is also aggressively pursuing growth in online and digital transactions. We believe attractive and improving margins, impressive free cash flow growth and the ability to implement a recent price increase reflect the strength of Visa’s business model.

China-based e-commerce company Alibaba reported fundamentally strong results during the period with the GMV increasing at a higher rate than the growth in China’s retail commerce. Mobile platform GMV increased by triple digits each quarter during the period compared to the year-ago quarter and accounted for 55% of the company’s total GMV. Most recently, Alibaba reported 367 million active monthly users with 307 million active monthly mobile users, a 63% increase compared with last year. Alibaba generated attractive operating margins and strong free cash flow. Although near-term macroeconomic concerns negatively affected its share price, we believe Alibaba is well positioned to potentially benefit from long-term structural growth in China’s e-commerce market. Based on this outlook, we took advantage of the price weakness to add to our position.

Shares of Qualcomm, a mobile device chip designer and manufacturer, were under pressure due to near-term slowdowns in the company’s licensing and chipset businesses. The implementation of new licensing agreements and improved device reporting and royalty payments progressed more slowly than anticipated following the company’s settlement with Chinese antitrust regulators. In Qualcomm’s chipset business, we believe the loss of market share in the premium tier market and higher-than-expected share in the low tier market will negatively skew the near-term sales mix. During the most recent quarter, the company announced the commencement of a strategic review to improve shareholder value. We

7 |

believe the market remains focused on the recent volatility of Qualcomm’s chipset business performance, ignoring the reaffirmation of its licensing and royalty business, which generates more than 60% of operating profits and an even greater portion of the company’s free cash flow. Therefore, we took advantage of current price weakness to add to our position.

Although Schlumberger reported solid fundamentals early in the period, increased oil production by OPEC countries coupled with weakening global demand triggered a sharp decline in oil prices and a slowdown in demand for Schlumberger’s oilfield services, particularly in North America. Accordingly, company revenues, margins and earnings declined significantly year-over-year. However, Schlumberger’s margins, especially internationally, proved more resilient than market expectations, and in the most recent quarter, Schlumberger generated $1.5 billion of free cash flow, representing 132% of earnings. We believe these results highlight the company’s high-quality characteristics, its strong execution and its proactive management of costs and resources. We believe current global production levels will not be sufficient to meet the increasing long-term global demand for oil. With its strong competitive advantages, we believe Schlumberger is well positioned to weather the downturn and capitalize on services demand when the market normalizes. We added to our position based on near-term price weakness.

Outlook

Our investment process is characterized by bottom-up, fundamental research and a long-term investment time horizon. The nature of the process leads to a lower-turnover portfolio in which sector positioning is the result of stock selection. The Fund ended the year with overweight positions in the information technology, consumer staples and energy sectors and underweight positions in the consumer discretionary, industrials, healthcare and financials sectors. We did not have positions in the materials, telecommunication services and utilities sectors.

| 8

LOOMIS SAYLES GROWTH FUND

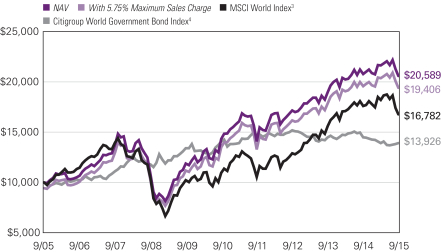

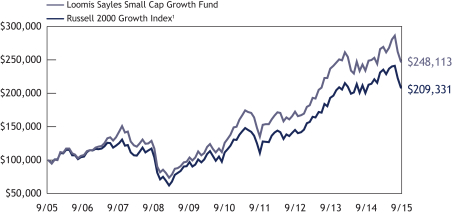

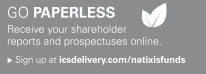

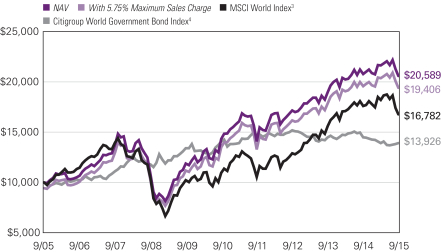

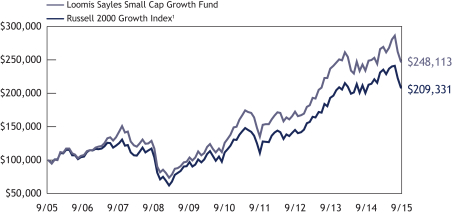

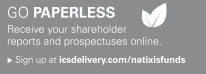

Growth of $10,000 Investment in Class A Shares3

September 30, 2005 through September 30, 2015

9 |

Average Annual Total Returns — September 30, 20153

| | | | | | | | | | | | | | | | |

| | | | | |

| | | 1 Year | | | 5 Years | | | 10 Years | | | Life of

Class N | |

| | | | | |

| Class A (Inception 12/31/96) | | | | | | | | | | | | | | | | |

| NAV | | | 5.30 | % | | | 14.38 | % | | | 5.25 | % | | | — | % |

| With 5.75% Maximum Sales Charge | | | -0.79 | | | | 13.05 | | | | 4.63 | | | | — | |

| | | | | |

| Class B (Inception 9/12/03) | | | | | | | | | | | | | | | | |

| NAV | | | 4.55 | | | | 13.54 | | | | 4.46 | | | | — | |

| With CDSC1 | | | -0.45 | | | | 13.30 | | | | 4.46 | | | | — | |

| | | | | |

| Class C (Inception 9/12/03) | | | | | | | | | | | | | | | | |

| NAV | | | 4.44 | | | | 13.56 | | | | 4.47 | | | | — | |

| With CDSC1 | | | 3.44 | | | | 13.56 | | | | 4.47 | | | | — | |

| | | | | |

| Class N (Inception 2/1/13) | | | | | | | | | | | | | | | | |

| NAV | | | 5.65 | | | | — | | | | — | | | | 13.43 | |

| | | | | |

| Class Y (Inception 5/16/91) | | | | | | | | | | | | | | | | |

| NAV | | | 5.59 | | | | 14.67 | | | | 5.59 | | | | — | |

| | | | | |

| Comparative Performance | | | | | | | | | | | | | | | | |

| Russell 1000® Growth Index2 | | | 3.17 | | | | 14.47 | | | | 8.09 | | | | 13.83 | |

Past performance does not guarantee future results. The table(s) do not reflect taxes shareholders might owe on any Fund distributions or when they redeem their shares. Performance for periods less than one year is cumulative, not annualized. Returns reflect changes in share price and reinvestment of dividends and capital gains, if any. Unlike a fund, an index is not managed and does not reflect fees and expenses. It is not possible to invest directly in an index.

| 1 | Performance for Class B shares assumes a maximum of 5% contingent deferred sales charge (“CDSC”) applied when you sell shares, which declines annually between years 1-6 according to the following schedule: 5, 4, 3, 3, 2, 1, 0%. Class C shares performance assumes a 1% CDSC applied when you sell shares within one year of purchase. |

| 2 | Russell 1000® Growth Index is an unmanaged index that measures the performance of the large-cap growth segment of the U.S. equity universe. It includes those Russell 1000 companies with higher price-to-book ratios and higher forecasted growth values. |

| 3 | Fund performance has been increased by fee waivers and/or expense reimbursements, if any, without which performance would have been lower. |

| 10

LOOMIS SAYLES VALUE FUND

| | | | |

| Managers | | Symbols | | |

| Arthur J. Barry, CFA® | | Class A | | LSVRX |

| Adam C. Liebhoff | | Class B | | LSVBX |

| Loomis, Sayles & Company, L.P. | | Class C | | LSCVX |

| | Class N | | LSVNX |

| | Class Y | | LSGIX |

| | Admin Class | | LSAVX |

Objective

The Fund seeks long-term growth of capital and income

Market Conditions

Despite steady gains for most of the one-year period, large-cap U.S. equities landed in negative territory, as equity markets worldwide came under increasing pressure toward the end of the period. Given mounting concerns about China’s growth, falling commodity prices and uncertainty around the timing of the Federal Reserve’s (the Fed) first interest rate increases, market volatility spiked in August and triggered a broad equity market correction, with many benchmarks declining 10% or more for the first time since 2011. Therefore, despite positive U.S. economic data, major domestic indices erased strong performance for the year during the third quarter of 2015.

Performance Results

For the 12 months ended September 30, 2015, Class A shares of Loomis Sayles Value Fund returned -5.59% at net asset value. The Fund underperformed its benchmark, the Russell 1000® Value Index, which returned -4.42%.

Explanation of Fund Performance

The healthcare, materials and consumer staples sectors contributed meaningfully to the Fund’s absolute performance, reflecting the steady equity market performance for much of the period. Stock selection was also strong within these sectors. Falling oil prices pressured the energy sector, and while the Fund was underweight, our energy holdings detracted from results given their higher relative volatility. Individual stock underperformance in the financials and industrials sectors also weighed on return, especially as the latter had a very difficult earnings season.

In terms of individual holdings, the strongest contributors to performance were United Health Group, Vulcan Materials Company and Eli Lilly. United Health Group, a managed care company, contributed significantly to results because of stronger-than-expected earnings and an improving growth outlook, particularly in its Medicare Advantage and Optum health care services businesses. Vulcan Materials Company, a producer of construction aggregates, benefited from improving volumes and accelerating pricing gains in its core markets due to strengthening U.S. residential and non-residential construction.

11 |

Several strong earnings reports, a positive analyst day and a U.S.-centric business model also supported results. Eli Lilly, a pharmaceutical company, also performed well due to strong new product launches in its diabetes and oncology franchises. The stock price also benefited from increased investor optimism regarding its late-stage pipeline of potential new therapies in the areas of immunology, cholesterol management and Alzheimer’s.

Energy companies Marathon Oil, National Oilwell Varco and Hess Corporation were the largest laggards. Not surprisingly, all three companies underperformed as oil prices declined approximately 50% during the 12-month period. Investors were also concerned that Marathon Oil would reduce its dividend to boost liquidity. Fears that the offshore oilfield equipment market has entered a protracted downturn also put additional pressure on National Oilwell Varco, a worldwide provider of oil and gas equipment.

Outlook

Investors are unclear if the Fed will raise rates by year-end 2015 or early 2016. We believe that once initiated, the Fed will hike rates at a very deliberate pace as they assess global market conditions and economic data. We expect stocks to take policy actions in stride.

We believe energy earnings will continue to drag on U.S. aggregate earnings in 2016. However, healthy earnings growth outside of energy should continue, and we anticipate 2016 earnings growth to be in the mid-single digits. Domestic equity fundamentals remain supported by healthy dividend growth, growing shareholder activism and continued mergers and acquisitions (M&A) activity.

Despite the rapid pace of the August sell-off, we continue to focus on security selection to populate our portfolio. The pullback provided potential opportunities to adjust the position sizes of our current holdings. As always, we define our opportunities by our risk/reward analysis, regardless of the direction of the markets.

Potential risks include reversing global economic fundamentals, commodity price swings, volatility related to U.S. rate increases and geopolitics. Still, valuations appear attractive after the correction in August, which we believe has created opportunities for discerning investors.

| 12

LOOMIS SAYLES VALUE FUND

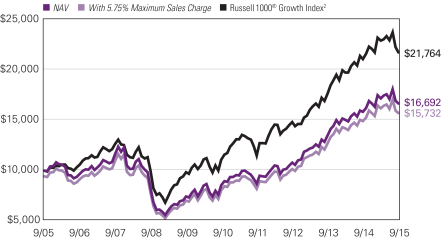

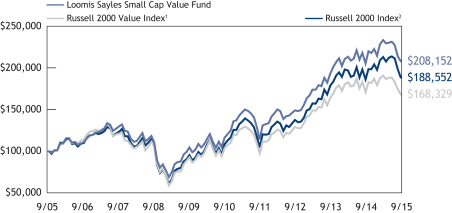

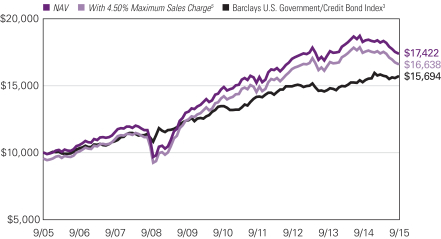

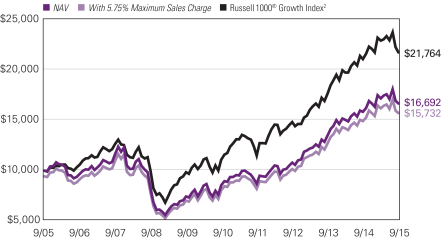

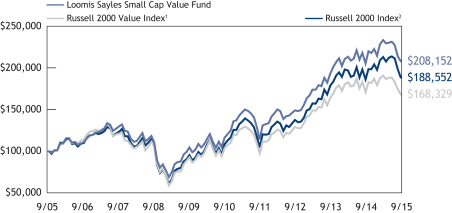

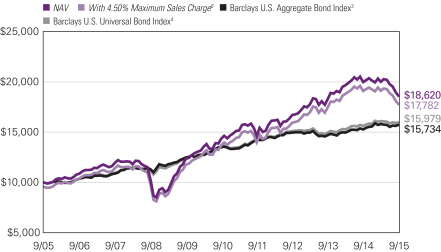

Growth of $10,000 Investment in Class A Shares1,4

September 30, 2005 through September 30, 2015

13 |

Average Annual Total Returns — September 30, 20154

| | | | | | | | | | | | | | | | |

| | | | | |

| | | 1 Year | | | 5 Years | | | 10 Years | | | Life of

Class N | |

| | | | | |

| Class A (Inception 6/30/06)1 | | | | | | | | | | | | | | | | |

| NAV | | | -5.59 | % | | | 12.02 | % | | | 6.62 | % | | | — | % |

| With 5.75% Maximum Sales Charge | | | -11.03 | | | | 10.71 | | | | 5.99 | | | | — | |

| | | | | |

| Class B (Inception 6/1/07)1 | | | | | | | | | | | | | | | | |

| NAV | | | -6.32 | | | | 11.18 | | | | 5.79 | | | | — | |

| With CDSC2 | | | -10.58 | | | | 10.92 | | | | 5.79 | | | | — | |

| | | | | |

| Class C (Inception 6/1/07)1 | | | | | | | | | | | | | | | | |

| NAV | | | -6.30 | | | | 11.19 | | | | 5.80 | | | | — | |

| With CDSC2 | | | -7.14 | | | | 11.19 | | | | 5.80 | | | | — | |

| | | | | |

| Class N (Inception 2/1/13) | | | | | | | | | | | | | | | | |

| NAV | | | -5.23 | | | | — | | | | — | | | | 9.54 | |

| | | | | |

| Class Y (Inception 5/13/91) | | | | | | | | | | | | | | | | |

| NAV | | | -5.37 | | | | 12.30 | | | | 6.92 | | | | — | |

| | | | | |

| Admin Class (Inception 2/1/10)1 | | | | | | | | | | | | | | | | |

| NAV | | | -5.83 | | | | 11.77 | | | | 6.34 | | | | — | |

| | | | | |

| Comparative Performance | | | | | | | | | | | | | | | | |

| Russell 1000® Value Index3 | | | -4.42 | | | | 12.29 | | | | 5.71 | | | | 9.54 | |

Past performance does not guarantee future results. The table(s) do not reflect taxes shareholders might owe on any Fund distributions or when they redeem their shares. Performance for periods less than one year is cumulative, not annualized. Returns reflect changes in share price and reinvestment of dividends and capital gains, if any. Unlike a fund, an index is not managed and does not reflect fees and expenses. It is not possible to invest directly in an index.

| 1 | Prior to 6/1/07, performance of Class A shares is that of Retail Class shares, which were redesignated as Class A shares, restated to reflect the sales load of Class A shares. Prior to the inception of Retail Class shares (6/30/06), performance is that of Institutional Class shares, which were redesignated as Class Y shares, restated to reflect the higher net expenses and sales loads of Class A shares. Prior to the inception of Class B and C shares (6/1/07), performance is that of Institutional Class shares, restated to reflect the higher net expenses and sales loads of Class B and C shares. Prior to the inception of Admin Class shares (2/1/10), performance is that of Class A shares, restated to reflect the higher net expenses of Admin Class shares. |

| 2 | Performance for Class B shares assumes a maximum of 5% contingent deferred sales charge (“CDSC”) applied when you sell shares, which declines annually between years 1-6 according to the following schedule: 5, 4, 3, 3, 2, 1, 0%. Class C shares performance assumes a 1% CDSC applied when you sell shares within one year of purchase. |

| 3 | Russell 1000® Value Index is an unmanaged index that measures the performance of the large-cap value segment of the U.S. equity universe. It includes those Russell 1000 companies with lower price-to-book ratios and higher forecasted growth values. |

| 4 | Fund performance has been increased by fee waivers and/or expense reimbursements, if any, without which performance would have been lower. |

| 14

ADDITIONAL INFORMATION

The views expressed in this report reflect those of the portfolio managers as of the dates indicated. The managers’ views are subject to change at any time without notice based on changes in market or other conditions. References to specific securities or industries should not be regarded as investment advice. Because the Funds are actively managed, there is no assurance that they will continue to invest in the securities or industries mentioned.

ADDITIONAL INDEX INFORMATION

This document may contain references to third party copyrights, indexes, and trademarks, each of which is the property of its respective owner. Such owner is not affiliated with Natixis Global Asset Management or any of its related or affiliated companies (collectively “NGAM”) and does not sponsor, endorse or participate in the provision of any NGAM services, funds or other financial products.

The index information contained herein is derived from third parties and is provided on an “as is” basis. The user of this information assumes the entire risk of use of this information. Each of the third party entities involved in compiling, computing or creating index information disclaims all warranties (including, without limitation, any warranties of originality, accuracy, completeness, timeliness, non-infringement, merchantability and fitness for a particular purpose) with respect to such information.

PROXY VOTING INFORMATION

A description of the Funds’ proxy voting policies and procedures is available without charge, upon request, by calling Natixis Funds at 800-225-5478; on the funds’ website at ngam.natixis.com; and on the Securities and Exchange Commission’s (“SEC’s”) website at www.sec.gov. Information regarding how the funds voted proxies relating to portfolio securities during the 12 months ended June 30, 2015 is available from the funds’ website and the SEC’s website.

QUARTERLY PORTFOLIO SCHEDULES

The funds file a complete schedule of portfolio holdings with the SEC for the first and third quarters of each fiscal year on Form N-Q. The funds’ Forms N-Q are available on the SEC’s website at www.sec.gov and may be reviewed and copied at the SEC’s Public Reference Room in Washington, DC. Information on the operation of the Public Reference Room may be obtained by calling 800-SEC-0330.

15 |

UNDERSTANDING FUND EXPENSES

As a mutual fund shareholder, you incur different types of costs: transaction costs, including sales charges (loads) on purchases and contingent deferred sales charges on redemptions, and ongoing costs, including management fees, distribution and/or service fees (12b-1 fees), and other fund expenses. Certain exemptions may apply. These costs are described in more detail in the Fund’s prospectus. The examples below are intended to help you understand the ongoing costs of investing in the Funds and help you compare these with the ongoing costs of investing in other mutual funds.

The first line in the table for each class of Fund shares shows the actual account values and actual fund expenses you would have paid on a $1,000 investment in the Fund from April 1, 2015 through September 30, 2015. To estimate the expenses you paid over the period, simply divide your account value by $1,000 (for example, $8,600 account value divided by $1,000 = 8.6) and multiply the result by the number in the Expenses Paid During Period row as shown below for your class.

The second line in the table for each class of Fund shares provides information about hypothetical account values and hypothetical expenses based on the Fund’s actual expense ratios and an assumed rate of return of 5% per year before expenses, which is not the Fund’s actual return. The hypothetical account values and expenses may not be used to estimate the actual ending account balance or expenses you paid on your investment for the period. You may use this information to compare the ongoing costs of investing in the Funds to other funds. To do so, compare this 5% hypothetical example with the 5% hypothetical examples that appear in the shareholder reports of the other funds.

Please note that the expenses shown reflect ongoing costs only, and do not include any transaction costs, such as sales charges. Therefore, the second line in the table of each fund is useful in comparing ongoing costs only, and will not help you determine the relative costs of owning different funds. If transaction costs were included, total costs would be higher.

| | | | | | | | | | | | |

LOOMIS SAYLES GLOBAL EQUITY AND

INCOME FUND | | BEGINNING

ACCOUNT VALUE

4/1/2015 | | | ENDING

ACCOUNT VALUE

9/30/2015 | | | EXPENSES PAID

DURING PERIOD*

4/1/2015 – 9/30/2015 | |

| Class A | | | | | | | | | | | | |

| Actual | | | $1,000.00 | | | | $952.00 | | | | $5.77 | |

| Hypothetical (5% return before expenses) | | | $1,000.00 | | | | $1,019.15 | | | | $5.97 | |

| Class C | | | | | | | | | | | | |

| Actual | | | $1,000.00 | | | | $948.40 | | | | $9.43 | |

| Hypothetical (5% return before expenses) | | | $1,000.00 | | | | $1,015.39 | | | | $9.75 | |

| Class Y | | | | | | | | | | | | |

| Actual | | | $1,000.00 | | | | $952.70 | | | | $4.50 | |

| Hypothetical (5% return before expenses) | | | $1,000.00 | | | | $1,020.46 | | | | $4.66 | |

| * | Expenses are equal to the Fund's annualized expense ratio: 1.18%, 1.93% and 0.92% for Class A, C and Y, respectively, multiplied by the average account value over the period, multiplied by the number of days in the most recent fiscal half-year (183), divided by 365 (to reflect the half-year period). |

| 16

| | | | | | | | | | | | |

| LOOMIS SAYLES GROWTH FUND | | BEGINNING

ACCOUNT VALUE

4/1/2015 | | | ENDING

ACCOUNT VALUE

9/30/2015 | | | EXPENSES PAID

DURING PERIOD*

4/1/2015 – 9/30/2015 | |

| Class A | | | | | | | | | | | | |

| Actual | | | $1,000.00 | | | | $971.50 | | | | $4.55 | |

| Hypothetical (5% return before expenses) | | | $1,000.00 | | | | $1,020.46 | | | | $4.66 | |

| Class B | | | | | | | | | | | | |

| Actual | | | $1,000.00 | | | | $968.40 | | | | $8.19 | |

| Hypothetical (5% return before expenses) | | | $1,000.00 | | | | $1,016.75 | | | | $8.39 | |

| Class C | | | | | | | | | | | | |

| Actual | | | $1,000.00 | | | | $968.40 | | | | $8.24 | |

| Hypothetical (5% return before expenses) | | | $1,000.00 | | | | $1,016.70 | | | | $8.44 | |

| Class N | | | | | | | | | | | | |

| Actual | | | $1,000.00 | | | | $974.10 | | | | $2.57 | |

| Hypothetical (5% return before expenses) | | | $1,000.00 | | | | $1,022.46 | | | | $2.64 | |

| Class Y | | | | | | | | | | | | |

| Actual | | | $1,000.00 | | | | $973.20 | | | | $3.31 | |

| Hypothetical (5% return before expenses) | | | $1,000.00 | | | | $1,021.71 | | | | $3.40 | |

| * | Expenses are equal to the Fund's annualized expense ratio (after waiver/reimbursement): 0.92%, 1.66%, 1.67%, 0.52% and 0.67% for Class A, B, C, N and Y, respectively, multiplied by the average account value over the period, multiplied by the number of days in the most recent fiscal half-year (183), divided by 365 (to reflect the half-year period). |

17 |

| | | | | | | | | | | | |

| LOOMIS SAYLES VALUE FUND | | BEGINNING

ACCOUNT VALUE

4/1/2015 | | | ENDING

ACCOUNT VALUE

9/30/2015 | | | EXPENSES PAID

DURING PERIOD*

4/1/2015 – 9/30/2015 | |

| Class A | | | | | | | | | | | | |

| Actual | | | $1,000.00 | | | | $913.90 | | | | $4.56 | |

| Hypothetical (5% return before expenses) | | | $1,000.00 | | | | $1,020.31 | | | | $4.81 | |

| Class B | | | | | | | | | | | | |

| Actual | | | $1,000.00 | | | | $910.20 | | | | $8.09 | |

| Hypothetical (5% return before expenses) | | | $1,000.00 | | | | $1,016.60 | | | | $8.54 | |

| Class C | | | | | | | | | | | | |

| Actual | | | $1,000.00 | | | | $910.50 | | | | $8.14 | |

| Hypothetical (5% return before expenses) | | | $1,000.00 | | | | $1,016.55 | | | | $8.59 | |

| Class N | | | | | | | | | | | | |

| Actual | | | $1,000.00 | | | | $915.60 | | | | $2.79 | |

| Hypothetical (5% return before expenses) | | | $1,000.00 | | | | $1,022.16 | | | | $2.94 | |

| Class Y | | | | | | | | | | | | |

| Actual | | | $1,000.00 | | | | $915.00 | | | | $3.36 | |

| Hypothetical (5% return before expenses) | | | $1,000.00 | | | | $1,021.56 | | | | $3.55 | |

| Admin Class | | | | | | | | | | | | |

| Actual | | | $1,000.00 | | | | $912.60 | | | | $5.90 | |

| Hypothetical (5% return before expenses) | | | $1,000.00 | | | | $1,018.90 | | | | $6.23 | |

| * | Expenses are equal to the Fund's annualized expense ratio: 0.95%, 1.69%, 1.70%, 0.58%, 0.70% and 1.23% for Class A, B, C, N, Y and Admin Class, respectively, multiplied by the average account value over the period, multiplied by the number of days in the most recent fiscal half-year (183), divided by 365 (to reflect the half-year period). |

| 18

BOARD APPROVAL OF THE EXISTING

ADVISORY AGREEMENTS

The Board of Trustees of the Trust (the “Board”), including the Independent Trustees, considers matters bearing on each Fund’s advisory agreement (collectively, the “Agreements”) at most of its meetings throughout the year. Each year, usually in the spring, the Contract Review Committee of the Board meets to review the Agreements to determine whether to recommend that the full Board approve the continuation of the Agreements, typically for an additional one-year period. After the Committee has made its recommendation, the full Board, including the Independent Trustees, determines whether to approve the continuation of the Agreements.

In connection with these meetings, the Trustees receive materials that the Funds’ investment adviser (the “Adviser”) believes to be reasonably necessary for the Trustees to evaluate the Agreements. These materials generally include, among other items, (i) information on the investment performance of the Funds and the performance of peer groups of funds and the Funds’ performance benchmarks, (ii) information on the Funds’ advisory fees and other expenses, including information comparing the Funds’ expenses to the fees charged to institutional accounts with similar strategies managed by the Adviser, if any, and to those of peer groups of funds and information about any applicable expense caps and/or fee “breakpoints,” (iii) sales and redemption data in respect of the Funds, (iv) information about the profitability of the Agreements to the Adviser and (v) information obtained through the completion by the Adviser of a questionnaire distributed on behalf of the Trustees. The Board, including the Independent Trustees, also considers other matters such as (i) the Adviser’s financial results and financial condition, (ii) each Fund’s investment objective and strategies and the size, education and experience of the Adviser’s investment staff and its use of technology, external research and trading cost measurement tools, (iii) arrangements in respect of the distribution of the Funds’ shares and the related costs, (iv) the procedures employed to determine the value of the Funds’ assets, (v) the allocation of the Funds’ brokerage, if any, including, if applicable, allocations to brokers affiliated with the Adviser and the use of “soft” commission dollars to pay Fund expenses and to pay for research and other similar services, (vi) the resources devoted to, and the record of compliance with, the Funds’ investment policies and restrictions, policies on personal securities transactions and other compliance policies, (vii) information about amounts invested by the Funds’ portfolio managers in the Funds or in similar accounts that they manage and (viii) the general economic outlook with particular emphasis on the mutual fund industry. Throughout the process, the Trustees are afforded the opportunity to ask questions of and request additional materials from the Adviser.

In addition to the materials requested by the Trustees in connection with their annual consideration of the continuation of the Agreements, the Trustees receive materials in advance of each regular quarterly meeting of the Board that provide detailed information about the Funds’ investment performance and the fees charged to the Funds for advisory and other services. This information generally includes, among other things, an internal performance rating for each Fund based on agreed-upon criteria, graphs showing each Fund’s performance and fee differentials against each Fund’s peer group/category, performance ratings provided by a third-party, total return information for various periods,

19 |

and third-party performance rankings for various periods comparing a Fund against similarly categorized funds. The portfolio management team for each Fund or other representatives of the Adviser make periodic presentations to the Contract Review Committee and/or the full Board, and Funds identified as presenting possible performance concerns may be subject to more frequent board presentations and reviews. In addition, each quarter the Trustees are provided with detailed statistical information about each Fund’s portfolio. The Trustees also receive periodic updates between meetings.

The Board most recently approved the continuation of the Agreements at its meeting held in June 2015. The Agreements were continued for a one-year period for the Funds. In considering whether to approve the continuation of the Agreements, the Board, including the Independent Trustees, did not identify any single factor as determinative. Individual Trustees may have evaluated the information presented differently from one another, giving different weights to various factors. Matters considered by the Trustees, including the Independent Trustees, in connection with their approval of the Agreements included, but were not limited to, the factors listed below.

The nature, extent and quality of the services provided to the Funds under the Agreements. The Trustees considered the nature, extent and quality of the services provided by the Adviser and its affiliates to the Funds and the resources dedicated to the Funds by the Adviser and its affiliates.

The Trustees considered not only the advisory services provided by the Adviser to the Funds, but also the monitoring and oversight services provided by NGAM Advisors, L.P. (“NGAM Advisors”). They also considered the administrative services provided by NGAM Advisors and its affiliates to the Funds. For each Fund, the Trustees also considered the benefits to shareholders of investing in a mutual fund that is part of a family of funds that offers shareholders the right to exchange shares of one type of fund for shares of another type of fund, and provides a variety of fund and shareholder services.

After reviewing these and related factors, the Trustees concluded, within the context of their overall conclusions regarding each of the Agreements, that the nature, extent and quality of services provided supported the renewal of the Agreements.

Investment performance of the Funds and the Adviser. As noted above, the Trustees received information about the performance of the Funds over various time periods, including information that compared the performance of the Funds to the performance of peer groups and categories of funds and the Funds’ respective performance benchmarks. In addition, the Trustees also reviewed data prepared by an independent third party that analyzed the performance of the Funds using a variety of performance metrics, including metrics that also measured the performance of the Funds on a risk adjusted basis.

With respect to each Fund, the Board concluded that the Fund’s performance or other relevant factors supported the renewal of the Agreement relating to that Fund. In the case of the Loomis Sayles Value Fund, the performance of which lagged that of a relevant peer group median and/or category median for certain (although not all) periods, the Board concluded that other factors relevant to performance supported renewal of the Agreements. These factors included the following: (1) that the underperformance was attributable, to a significant extent, to investment decisions (such as security selection or sector allocation) by the Adviser that were reasonable and consistent with the Fund’s investment objective and

| 20

policies; and (2) that the Fund’s long-term performance was competitive when compared to relevant performance benchmarks or peer groups.

The Trustees also considered the Adviser’s performance and reputation generally, the performance of the fund family generally, and the historical responsiveness of the Adviser to Trustee concerns about performance and the willingness of the Adviser to take steps intended to improve performance.

After reviewing these and related factors, the Trustees concluded, within the context of their overall conclusions regarding each of the Agreements, that the performance of the Funds and the Adviser supported the renewal of the Agreements.

The costs of the services to be provided and profits to be realized by the Adviser and its affiliates from their respective relationships with the Funds. The Trustees considered the fees charged to the Funds for advisory services as well as the total expense levels of the Funds. This information included comparisons (provided both by management and also by an independent third party) of the Funds’ advisory fees and total expense levels to those of their peer groups and information about the advisory fees charged by the Adviser to comparable accounts (such as institutional separate accounts), as well as information about differences in such fees and the reasons for any such differences. In considering the fees charged to comparable accounts, the Trustees considered, among other things, management’s representations about the differences between managing mutual funds as compared to other types of accounts, including the additional resources required to effectively manage mutual fund assets and the greater regulatory costs associated with the management of such assets. In evaluating each Fund’s advisory fee, the Trustees also took into account the demands, complexity and quality of the investment management of such Fund and the need for the Adviser to offer competitive compensation and to expend additional resources as the Funds grow in size. The Trustees considered that over the past several years, management had made recommendations regarding reductions in advisory fee rates, implementation of advisory fee breakpoints and the institution of advisory fee waivers and expense caps for various funds in the fund family. They noted that all three of the Funds included in this report have expense caps in place, and the Trustees considered that the current expenses of each Fund are below the cap.

The Trustees also considered the compensation directly or indirectly received by the Adviser and its affiliates from their relationships with the Funds. The Trustees reviewed information provided by management as to the profitability of the Adviser’s and its affiliates’ relationships with the Funds, and information about the allocation of expenses used to calculate profitability. They also reviewed information provided by management about the effect of distribution costs and changes in asset levels on Adviser profitability, including information regarding resources spent on distribution activities. When reviewing profitability, the Trustees also considered information about court cases in which adviser compensation or profitability were issues, the performance of the relevant Funds, the expense levels of the Funds, and whether the Adviser had implemented breakpoints and/or expense caps with respect to such Funds.

After reviewing these and related factors, the Trustees concluded, within the context of their overall conclusions regarding each of the Agreements, that the advisory fee charged to each of the Funds was fair and reasonable, and that the costs of these services generally and

21 |

the related profitability of the Adviser and its affiliates in respect of their relationships with the Funds supported the renewal of the Agreements.

Economies of Scale. The Trustees considered the existence of any economies of scale in the provision of services by the Adviser and whether those economies are shared with the Funds through breakpoints in their investment advisory fees or other means, such as expense waivers or caps. The Trustees also discussed with management the factors considered with respect to the implementation of breakpoints in investment advisory fees or expense waivers or caps for certain funds. Management explained that a number of factors are taken into account in considering the possible implementation of breakpoints or an expense cap for a fund, including, among other things, factors such as a fund’s assets, the projected growth of a fund, projected profitability and a fund’s fees and performance. With respect to economies of scale, the Trustees noted that each of the Funds was subject to an expense cap or waiver. In considering these issues, the Trustees also took note of the costs of the services provided (both on an absolute and a relative basis) and the profitability to the Adviser and its affiliates of their relationships with the Funds, as discussed above.

After reviewing these and related factors, the Trustees concluded, within the context of their overall conclusions regarding each of the Agreements, that the extent to which economies of scale were shared with the Funds supported the renewal of the Agreements.

The Trustees also considered other factors, which included but were not limited to the following:

| · | | The effect of recent market and economic events on the performance, asset levels and expense ratios of each Fund. |

| · | | Whether each Fund has operated in accordance with its investment objective and the Fund’s record of compliance with its investment restrictions, and the compliance programs of the Funds and the Adviser. They also considered the compliance-related resources the Adviser and its affiliates were providing to the Funds. |

| · | | Plans for maintaining continuity of portfolio management where that was thought to be a potential issue. |

| · | | The nature, quality, cost and extent of administrative and shareholder services performed by the Adviser and its affiliates, both under the Agreements and under separate agreements covering administrative services. |

| · | | So-called “fallout benefits” to the Adviser, such as the engagement of affiliates of the Adviser to provide distribution, administrative and brokerage services to the Funds, and the benefits of research made available to the Adviser by reason of brokerage commissions (if any) generated by the Funds’ securities transactions. The Trustees also considered the benefits to the parent company of NGAM Advisors from the retention of the Adviser. The Trustees considered the possible conflicts of interest associated with these fallout and other benefits, and the reporting, disclosure and other processes in place to disclose and monitor such possible conflicts of interest. |

| · | | The Trustees’ review and discussion of the Funds’ advisory arrangements in prior years, and management’s record of responding to Trustee concerns raised during the year and in prior years. |

Based on their evaluation of all factors that they deemed to be material, including those factors described above, and assisted by the advice of independent counsel, the Trustees, including the Independent Trustees, concluded that each of the existing Agreements should be continued through June 30, 2016.

| 22

Portfolio of Investments – as of September 30, 2015

Loomis Sayles Global Equity and Income Fund

| | | | | | | | |

Shares | | | Description | | Value (†) | |

| | Common Stocks — 61.7% of Net Assets | | | | |

| | | | Belgium — 1.5% | | | | |

| | 176,024 | | | Anheuser-Busch InBev SA/NV | | $ | 18,721,113 | |

| | | | | | | | |

| | | | Canada — 1.4% | | | | |

| | 479,600 | | | CGI Group, Inc., Class A(b) | | | 17,376,291 | |

| | | | | | | | |

| | | | China — 2.7% | | | | |

| | 339,283 | | | Alibaba Group Holding Ltd., Sponsored ADR(b) | | | 20,007,518 | |

| | 1,362,500 | | | Hengan International Group Co. Ltd. | | | 13,313,947 | |

| | | | | | | | |

| | | | | | | 33,321,465 | |

| | | | | | | | |

| | | | Denmark — 1.2% | | | | |

| | 279,074 | | | Novo Nordisk AS, Class B | | | 15,060,105 | |

| | | | | | | | |

| | | | France — 1.5% | | | | |

| | 258,257 | | | Thales S.A. | | | 18,006,952 | |

| | | | | | | | |

| | | | Germany — 0.3% | | | | |

| | 78,663 | | | Brenntag AG | | | 4,244,166 | |

| | | | | | | | |

| | | | Hong Kong — 1.4% | | | | |

| | 3,278,000 | | | AIA Group Ltd. | | | 17,048,044 | |

| | | | | | | | |

| | | | India — 2.3% | | | | |

| | 940,386 | | | HCL Technologies Ltd. | | | 14,103,053 | |

| | 724,642 | | | HDFC Bank Ltd. | | | 14,232,396 | |

| | | | | | | | |

| | | | | | | 28,335,449 | |

| | | | | | | | |

| | | | Italy — 0.7% | | | | |

| | 132,237 | | | Luxottica Group S.p.A. | | | 9,164,625 | |

| | | | | | | | |

| | | | Japan — 3.1% | | | | |

| | 326,000 | | | Asahi Group Holdings Ltd. | | | 10,576,501 | |

| | 2,286,600 | | | Mitsubishi UFJ Financial Group, Inc. | | | 13,816,182 | |

| | 373,670 | | | Nomura Research Institute Ltd. | | | 14,344,149 | |

| | | | | | | | |

| | | | | | | 38,736,832 | |

| | | | | | | | |

| | | | Netherlands — 1.5% | | | | |

| | 1,340,209 | | | ING Groep NV | | | 18,987,413 | |

| | | | | | | | |

| | | | Philippines — 0.7% | | | | |

| | 2,202,650 | | | Universal Robina Corp. | | | 9,056,184 | |

| | | | | | | | |

| | | | Sweden — 1.6% | | | | |

| | 440,273 | | | Assa Abloy AB | | | 7,896,638 | |

| | 519,588 | | | Atlas Copco AB, A Shares | | | 12,495,579 | |

| | | | | | | | |

| | | | | | | 20,392,217 | |

| | | | | | | | |

| | | | Switzerland — 1.9% | | | | |

| | 32,589 | | | Geberit AG, (Registered) | | | 9,969,484 | |

| | 49,881 | | | Roche Holding AG | | | 13,241,987 | |

| | | | | | | | |

| | | | | | | 23,211,471 | |

| | | | | | | | |

| | | | United Kingdom — 2.7% | | | | |

| | 4,468,565 | | | Legal & General Group PLC | | | 16,112,604 | |

| | 461,989 | | | London Stock Exchange Group PLC | | | 16,933,849 | |

| | | | | | | | |

| | | | | | | 33,046,453 | |

| | | | | | | | |

See accompanying notes to financial statements.

23 |

Portfolio of Investments – as of September 30, 2015

Loomis Sayles Global Equity and Income Fund – (continued)

| | | | | | | | |

Shares | | | Description | | Value (†) | |

| | | | United States — 37.2% | | | | |

| | 113,632 | | | Alexion Pharmaceuticals, Inc.(b) | | $ | 17,770,908 | |

| | 110,482 | | | Allergan PLC(b) | | | 30,030,112 | |

| | 35,840 | | | Amazon.com, Inc.(b) | | | 18,346,138 | |

| | 45,839 | | | AutoZone, Inc.(b) | | | 33,179,643 | |

| | 316,052 | | | Comcast Corp., Class A | | | 17,977,038 | |

| | 237,422 | | | Facebook, Inc., Class A(b) | | | 21,344,238 | |

| | 94,140 | | | FactSet Research Systems, Inc. | | | 15,044,513 | |

| | 211,847 | | | Genesee & Wyoming, Inc., Class A(b) | | | 12,515,921 | |

| | 97,473 | | | Goldman Sachs Group, Inc. (The) | | | 16,936,908 | |

| | 35,729 | | | Google, Inc., Class A(b) | | | 22,808,322 | |

| | 24,420 | | | Google, Inc., Class C(b) | | | 14,857,616 | |

| | 955 | | | Hawaiian Telcom Holdco, Inc.(b) | | | 19,845 | |

| | 556,441 | | | Jarden Corp.(b) | | | 27,198,836 | |

| | 512,886 | | | Kinder Morgan, Inc. | | | 14,196,684 | |

| | 106,695 | | | M&T Bank Corp. | | | 13,011,455 | |

| | 20,465 | | | Priceline Group, Inc. (The)(b) | | | 25,312,340 | |

| | 198,742 | | | Schlumberger Ltd. | | | 13,707,236 | |

| | 81,842 | | | Signet Jewelers Ltd. | | | 11,141,151 | |

| | 241,176 | | | Texas Instruments, Inc. | | | 11,943,036 | |

| | 137,777 | | | TransDigm Group, Inc.(b) | | | 29,265,213 | |

| | 170,467 | | | Travelers Cos., Inc. (The) | | | 16,966,581 | |

| | 163,321 | | | UnitedHealth Group, Inc. | | | 18,946,869 | |

| | 174,729 | | | Valeant Pharmaceuticals International, Inc.(b) | | | 31,168,159 | |

| | 63,461 | | | W.W. Grainger, Inc. | | | 13,644,750 | |

| | 295,611 | | | Wells Fargo & Co. | | | 15,179,625 | |

| | | | | | | | |

| | | | | | | 462,513,137 | |

| | | | | | | | |

| | | | Total Common Stocks (Identified Cost $694,312,966) | | | 767,221,917 | |

| | | | | | | | |

| | | | | | | | |

Principal

Amount (‡) | | | | | | |

| | Bonds and Notes — 32.1% | | | | |

| | Non-Convertible Bonds — 31.4% | | | | |

| | | | Argentina — 0.2% | | | | |

| $ | 382,136 | | | Transportadora de Gas del Sur S.A., 9.625%, 5/14/2020, 144A | | | 381,181 | |

| | 1,755,000 | | | YPF S.A., 8.750%, 4/04/2024, 144A | | | 1,551,069 | |

| | | | | | | | |

| | | | | | | 1,932,250 | |

| | | | | | | | |

| | | | Australia — 0.1% | | | | |

| | 110,000 | | | Incitec Pivot Finance LLC, 6.000%, 12/10/2019, 144A | | | 120,380 | |

| | 500,000 | | | Macquarie Bank Ltd., 6.625%, 4/07/2021, 144A | | | 560,443 | |

| | 95,000 | | | Sydney Airport Finance Co. Pty Ltd., 3.375%, 4/30/2025, 144A | | | 91,666 | |

| | 120,000 | | | Sydney Airport Finance Co. Pty Ltd., 5.125%, 2/22/2021, 144A | | | 131,861 | |

| | 950,000 | | | Telstra Corp. Ltd., 3.125%, 4/07/2025, 144A | | | 921,908 | |

| | | | | | | | |

| | | | | | | 1,826,258 | |

| | | | | | | | |

See accompanying notes to financial statements.

| 24

Portfolio of Investments – as of September 30, 2015

Loomis Sayles Global Equity and Income Fund – (continued)

| | | | | | | | |

Principal

Amount (‡) | | | Description | | Value (†) | |

| | | | Belgium — 0.0% | | | | |

| | 350,000 | | | Anheuser-Busch InBev SA/NV, EMTN, 6.500%, 6/23/2017, (GBP) | | $ | 568,813 | |

| | | | | | | | |

| | | | Brazil — 1.1% | | | | |

| | 800,000 | | | Banco do Brasil S.A., 3.875%, 10/10/2022 | | | 617,000 | |

| | 600,000 | | | Banco Santander Brasil S.A., 4.625%, 2/13/2017, 144A | | | 598,200 | |

| | 2,239,815 | | | Banco Votorantim S.A., 6.250%, 5/16/2016, 144A, (BRL) | | | 518,366 | |

| | 800,000 | | | Braskem Finance Ltd., 5.750%, 4/15/2021, 144A | | | 656,000 | |

| | 6,600(††) | | | Brazil Letras do Tesouro Nacional, Zero Coupon, 7/01/2016, (BRL)(c) | | | 1,496,486 | |

| | 2,250(††) | | | Brazil Notas do Tesouro Nacional, Series F, 10.000%, 1/01/2019, (BRL) | | | 491,169 | |

| | 1,115(††) | | | Brazil Notas do Tesouro Nacional, Series F, 10.000%, 1/01/2021, (BRL) | | | 228,887 | |

| | 2,300,000 | | | BRF S.A., 7.750%, 5/22/2018, 144A, (BRL) | | | 472,821 | |

| | 1,000,000 | | | CIMPOR Financial Operations BV, 5.750%, 7/17/2024, 144A | | | 671,000 | |

| | 400,000 | | | Cosan Luxembourg S.A., 5.000%, 3/14/2023, 144A | | | 300,000 | |

| | 240,000 | | | Embraer Netherlands Finance BV, 5.050%, 6/15/2025 | | | 222,060 | |

| | 800,000 | | | Gerdau Trade, Inc., 5.750%, 1/30/2021, 144A | | | 696,000 | |

| | 226,000 | | | GTL Trade Finance, Inc., 5.893%, 4/29/2024, 144A | | | 187,580 | |

| | 915,000 | | | Itau Unibanco Holding S.A., 2.850%, 5/26/2018, 144A | | | 857,081 | |

| | 300,000 | | | Itau Unibanco Holding S.A., 6.200%, 12/21/2021, 144A | | | 284,250 | |

| | 100,000 | | | LPG International, Inc., 7.250%, 12/20/2015 | | | 100,847 | |

| | 1,205,000 | | | Oi S.A., 9.750%, 9/15/2016, 144A, (BRL) | | | 204,496 | |

| | 1,825,000 | | | Petrobras Global Finance BV, 4.375%, 5/20/2023(c) | | | 1,190,812 | |

| | 320,000 | | | Petrobras Global Finance BV, 5.375%, 1/27/2021 | | | 232,800 | |

| | 775,000 | | | Petrobras Global Finance BV, 5.750%, 1/20/2020 | | | 578,111 | |

| | 1,125,000 | | | Petrobras Global Finance BV, 6.850%, 6/05/2115 | | | 717,188 | |

| | 300,000 | | | Petrobras Global Finance BV, 6.875%, 1/20/2040 | | | 195,000 | |

| | 800,000 | | | Samarco Mineracao S.A., 4.125%, 11/01/2022, 144A | | | 636,000 | |

| | 500,000 | | | Tupy Overseas S.A., 6.625%, 7/17/2024, 144A | | | 440,000 | |

| | 1,106,000 | | | Vale Overseas Ltd., 6.875%, 11/21/2036(c) | | | 868,321 | |

| | 470,000 | | | Vale S.A., 5.625%, 9/11/2042 | | | 321,950 | |

| | | | | | | | |

| | | | | | | 13,782,425 | |

| | | | | | | | |

| | | | Canada — 0.5% | | | | |

| | 1,085,000 | | | Air Canada, 7.625%, 10/01/2019, 144A, (CAD) | | | 863,853 | |

| | 3,000,000 | | | Canadian Government, 1.250%, 9/01/2018, (CAD)(c) | | | 2,293,466 | |

| | 2,065,000 | | | Canadian Government, 3.000%, 12/01/2015, (CAD)(c) | | | 1,553,678 | |

| | 1,335,000 | | | Institutional Mortgage Securities Canada, Inc., Series 2014-5A, Class A2, 2.616%, 7/12/2047, 144A, (CAD) | | | 1,019,892 | |

| | 600,000 | | | Telus Corp., Series CG, 5.050%, 12/04/2019, (CAD) | | | 498,187 | |

| | | | | | | | |

| | | | | | | 6,229,076 | |

| | | | | | | | |

| | | | Chile — 0.5% | | | | |

| | 1,450,000 | | | Banco de Credito e Inversiones, 3.000%, 9/13/2017, 144A(c) | | | 1,463,048 | |

| | 200,000 | | | Celulosa Arauco y Constitucion S.A., 4.750%, 1/11/2022 | | | 203,158 | |

| | 300,000,000 | | | Chile Government International Bond, 5.500%, 8/05/2020, (CLP)(c) | | | 445,883 | |

| | 1,160,000 | | | CODELCO, Inc., 4.500%, 9/16/2025, 144A | | | 1,114,324 | |

| | 550,000 | | | Corpbanca S.A., 3.125%, 1/15/2018 | | | 547,862 | |

| | 250,000 | | | E.CL S.A., 5.625%, 1/15/2021, 144A | | | 272,805 | |

| | 800,000 | | | Inversiones CMPC S.A., 4.375%, 5/15/2023, 144A | | | 781,909 | |

| | 1,120,000 | | | Transelec S.A., 4.250%, 1/14/2025, 144A(c) | | | 1,103,052 | |

See accompanying notes to financial statements.

25 |

Portfolio of Investments – as of September 30, 2015

Loomis Sayles Global Equity and Income Fund – (continued)

| | | | | | | | |

Principal

Amount (‡) | | | Description | | Value (†) | |

| | | | Chile — continued | | | | |

| $ | 400,000 | | | VTR Finance BV, 6.875%, 1/15/2024, 144A | | $ | 363,000 | |

| | | | | | | | |

| | | | | | | 6,295,041 | |

| | | | | | | | |

| | | | China — 0.4% | | | | |

| | 800,000 | | | Baidu, Inc., 2.250%, 11/28/2017 | | | 799,192 | |

| | 700,000 | | | Baidu, Inc., 3.250%, 8/06/2018 | | | 713,510 | |

| | 400,000 | | | China Resources Gas Group Ltd., 4.500%, 4/05/2022, 144A | | | 414,143 | |

| | 1,200,000 | | | CNOOC Finance 2013 Ltd., 3.000%, 5/09/2023(c) | | | 1,123,969 | |

| | 485,000 | | | CNOOC Finance 2015 Australia Pty Ltd., 2.625%, 5/05/2020 | | | 478,056 | |

| | 480,000 | | | CNOOC Finance 2015 USA LLC, 3.500%, 5/05/2025 | | | 456,791 | |

| | 1,000,000 | | | Parkson Retail Group Ltd., 4.500%, 5/03/2018 | | | 895,579 | |

| | | | | | | | |

| | | | | | | 4,881,240 | |

| | | | | | | | |

| | | | Colombia — 0.3% | | | | |

| | 555,000 | | | Colombia Telecomunicaciones S.A. E.S.P., 5.375%, 9/27/2022, 144A | | | 490,897 | |

| | 610,000 | | | Ecopetrol S.A., 4.125%, 1/16/2025 | | | 513,925 | |

| | 600,000 | | | Ecopetrol S.A., 5.875%, 9/18/2023(c) | | | 577,500 | |

| | 490,000 | | | Ecopetrol S.A., 5.875%, 5/28/2045 | | | 373,625 | |

| | 1,265,000,000 | | | Emgesa S.A. E.S.P., 8.750%, 1/25/2021, 144A, (COP) | | | 413,773 | |

| | 2,140,000,000 | | | Empresas Publicas de Medellin E.S.P., 8.375%, 2/01/2021, 144A, (COP) | | | 694,120 | |

| | 1,220,000 | | | Pacific Exploration and Production Corp., 5.125%, 3/28/2023, 144A | | | 420,900 | |

| | 580,000 | | | Pacific Exploration and Production Corp., 5.625%, 1/19/2025, 144A | | | 202,826 | |

| | 200,000,000 | | | Republic of Colombia, 7.750%, 4/14/2021, (COP) | | | 65,419 | |

| | | | | | | | |

| | | | | | | 3,752,985 | |

| | | | | | | | |

| | | | Dominican Republic — 0.1% | | | | |

| | 1,410,000 | | | Dominican Republic International Bond, 5.500%, 1/27/2025, 144A | | | 1,360,650 | |

| | 425,000 | | | Dominican Republic International Bond, 8.625%, 4/20/2027, 144A | | | 491,938 | |

| | | | | | | | |

| | | | | | | 1,852,588 | |

| | | | | | | | |

| | | | France — 0.3% | | | | |

| | 425,000 | | | Alcatel-Lucent USA, Inc., 6.450%, 3/15/2029 | | | 420,750 | |

| | 15,000 | | | Alcatel-Lucent USA, Inc., 6.500%, 1/15/2028 | | | 15,000 | |

| | 200,000 | | | AXA S.A., 7.125%, 12/15/2020, (GBP) | | | 351,611 | |

| | 435,000 | | | Credit Agricole S.A., 4.375%, 3/17/2025, 144A | | | 417,870 | |

| | 390,000 | | | Credit Agricole S.A., (fixed rate to 6/23/2026, variable rate thereafter), 7.500%, (GBP)(d) | | | 568,367 | |

| | 2,080,000 | | | Societe Generale S.A., 4.250%, 4/14/2025, 144A | | | 1,974,898 | |

| | 475,000 | | | Societe Generale S.A., (fixed rate to 4/07/2021, variable rate thereafter), 6.750%, (EUR)(d) | | | 520,149 | |

| | | | | | | | |

| | | | | | | 4,268,645 | |

| | | | | | | | |

| | | | Germany — 0.0% | | | | |

| | 515,000 | | | Volkswagen Group of America Finance LLC, 2.400%, 5/22/2020, 144A | | | 477,770 | |

| | | | | | | | |

| | | | Hong Kong — 0.1% | | | | |

| | 355,000 | | | AIA Group Ltd., 3.200%, 3/11/2025, 144A | | | 340,714 | |

| | 400,000 | | | Hutchison Whampoa International 11 Ltd., 3.500%, 1/13/2017, 144A | | | 410,217 | |

| | | | | | | | |

| | | | | | | 750,931 | |

| | | | | | | | |

See accompanying notes to financial statements.

| 26

Portfolio of Investments – as of September 30, 2015

Loomis Sayles Global Equity and Income Fund – (continued)

| | | | | | | | |

Principal

Amount (‡) | | | Description | | Value (†) | |

| | | | Hungary — 0.2% | | | | |

| $ | 1,330,000 | | | Hungary Government International Bond, 5.375%, 3/25/2024 | | $ | 1,443,050 | |

| | 980,000 | | | Hungary Government International Bond, 5.750%, 11/22/2023 | | | 1,090,250 | |

| | | | | | | | |

| | | | | | | 2,533,300 | |

| | | | | | | | |

| | | | Iceland — 0.1% | | | | |

| | 1,000,000 | | | Republic of Iceland, 5.875%, 5/11/2022, 144A(c) | | | 1,138,846 | |

| | | | | | | | |

| | | | India — 0.5% | | | | |

| | 550,000 | | | Axis Bank Ltd., 3.250%, 5/21/2020, 144A | | | 550,982 | |

| | 1,155,000 | | | Bharti Airtel International BV, 5.125%, 3/11/2023, 144A(c) | | | 1,217,924 | |

| | 990,000 | | | Bharti Airtel International BV, 5.350%, 5/20/2024, 144A | | | 1,059,828 | |

| | 1,400,000 | | | ICICI Bank Ltd., (fixed rate to 4/30/2017, variable rate thereafter), 6.375%, 4/30/2022, 144A | | | 1,418,166 | |

| | 750,000 | | | Reliance Holdings USA, Inc., 5.400%, 2/14/2022, 144A | | | 818,386 | |

| | 700,000 | | | State Bank of India/London, 4.125%, 8/01/2017, 144A | | | 723,654 | |

| | | | | | | | |

| | | | | | | 5,788,940 | |

| | | | | | | | |

| | | | Indonesia — 0.7% | | | | |

| | 300,000 | | | Indonesia Government International Bond, 4.125%, 1/15/2025, 144A | | | 278,013 | |

| | 725,000 | | | Indonesia Government International Bond, 5.125%, 1/15/2045, 144A | | | 636,067 | |

| | 3,500,000,000 | | | Indonesia Government International Bond, 9.500%, 7/15/2023, (IDR) | | | 234,815 | |

| | 781,000,000 | | | Indonesia Government International Bond, 11.500%, 9/15/2019, (IDR) | | | 56,463 | |

| | 12,100,000,000 | | | Indonesia Treasury Bond, 6.125%, 5/15/2028, (IDR) | | | 604,149 | |

| | 24,000,000,000 | | | Indonesia Treasury Bond, 7.875%, 4/15/2019, (IDR)(c) | | | 1,555,708 | |

| | 14,000,000,000 | | | Indonesia Treasury Bond, 8.375%, 3/15/2024, (IDR)(c) | | | 883,176 | |

| | 400,000 | | | Listrindo Capital BV, 6.950%, 2/21/2019, 144A | | | 405,000 | |

| | 2,800,000 | | | Pertamina Persero PT, 4.300%, 5/20/2023, 144A(c) | | | 2,554,575 | |

| | 545,000 | | | Republic of Indonesia, 2.875%, 7/08/2021, 144A, (EUR) | | | 583,101 | |

| | 500,000 | | | TBG Global Pte Ltd., 4.625%, 4/03/2018, 144A | | | 486,250 | |

| | | | | | | | |

| | | | | | | 8,277,317 | |

| | | | | | | | |

| | | | Italy — 0.7% | | | | |

| | 440,000 | | | Italy Buoni Poliennali Del Tesoro, 1.500%, 6/01/2025, (EUR) | | | 482,470 | |

| | 2,860,000 | | | Italy Buoni Poliennali Del Tesoro, 4.500%, 8/01/2018, (EUR)(c) | | | 3,572,863 | |

| | 2,295,000 | | | Italy Buoni Poliennali Del Tesoro, 4.750%, 8/01/2023, 144A, (EUR)(c) | | | 3,184,358 | |

| | 725,000 | | | UniCredit SpA, EMTN, 6.950%, 10/31/2022, (EUR) | | | 927,504 | |

| | 870,000 | | | Wind Acquisition Finance S.A., 7.375%, 4/23/2021, 144A | | | 859,125 | |

| | | | | | | | |

| | | | | | | 9,026,320 | |

| | | | | | | | |

| | | | Jamaica — 0.1% | | | | |

| | 665,000 | | | Jamaica Government International Bond, 6.750%, 4/28/2028 | | | 668,325 | |

| | | | | | | | |

| | | | Japan — 0.3% | | | | |

| | 940,000 | | | Bank of Tokyo-Mitsubishi UFJ Ltd., 2.150%, 9/14/2018, 144A | | | 946,325 | |

| | 900,000 | | | Bank of Tokyo-Mitsubishi UFJ Ltd. (The), 1.700%, 3/05/2018, 144A | | | 894,702 | |

| | 1,165,000 | | | Nomura Holdings, Inc., GMTN, 2.750%, 3/19/2019(c) | | | 1,183,337 | |

| | 850,000 | | | SoftBank Group Corp., 4.500%, 4/15/2020, 144A | | | 823,140 | |

| | | | | | | | |

| | | | | | | 3,847,504 | |

| | | | | | | | |

| | | | Korea — 0.7% | | | | |

| | 3,700,000 | | | Export-Import Bank of Korea, 3.000%, 5/22/2018, 144A, (NOK) | | | 449,401 | |

See accompanying notes to financial statements.

27 |

Portfolio of Investments – as of September 30, 2015

Loomis Sayles Global Equity and Income Fund – (continued)

| | | | | | | | |

Principal

Amount (‡) | | | Description | | Value (†) | |

| | | | Korea — continued | | | | |

| $ | 600,000 | | | Hyundai Capital Services, Inc., 3.500%, 9/13/2017, 144A | | $ | 618,461 | |

| | 600,000 | | | Hyundai Steel Co., 4.625%, 4/21/2016, 144A | | | 609,609 | |

| | 600,000 | | | Industrial Bank of Korea, 2.375%, 7/17/2017, 144A | | | 608,065 | |

| | 400,000 | | | KEB Hana Bank, 4.000%, 11/03/2016, 144A | | | 411,068 | |

| | 400,000 | | | Kia Motors Corp., 3.625%, 6/14/2016, 144A(c) | | | 405,348 | |

| | 400,000 | | | Korea Development Bank (The), 4.625%, 11/16/2021 | | | 443,442 | |

| | 400,000 | | | Korea National Oil Corp., 3.125%, 4/03/2017, 144A | | | 409,000 | |

| | 2,589,140,000 | | | Korea Treasury Bond, 2.750%, 9/10/2017, (KRW)(c) | | | 2,234,198 | |

| | 1,125,000 | | | Minera y Metalurgica del Boleo S.A. de CV, 2.875%, 5/07/2019, 144A(c) | | | 1,141,863 | |

| | 950,000 | | | Shinhan Bank, 2.250%, 4/15/2020, 144A | | | 945,060 | |

| | 140,000 | | | SK Telecom Co. Ltd., 6.625%, 7/20/2027, 144A | | | 181,216 | |

| | 200,000 | | | Woori Bank, 5.875%, 4/13/2021, 144A | | | 229,025 | |

| | | | | | | | |

| | | | | | | 8,685,756 | |

| | | | | | | | |

| | | | Luxembourg — 0.2% | | | | |

| | 500,000 | | | Altice Luxembourg S.A., 7.750%, 5/15/2022, 144A | | | 455,000 | |

| | 970,000 | | | ArcelorMittal, 7.500%, 3/01/2041 | | | 780,850 | |

| | 430,000 | | | INEOS Group Holdings S.A., 5.750%, 2/15/2019, (EUR) | | | 461,339 | |

| | 500,000 | | | Millicom International Cellular S.A., 4.750%, 5/22/2020, 144A | | | 477,600 | |

| | | | | | | | |

| | | | | | | 2,174,789 | |

| | | | | | | | |

| | | | Mexico — 1.2% | | | | |

| | 10,000,000 | | | America Movil SAB de CV, 6.450%, 12/05/2022, (MXN) | | | 563,683 | |

| | 300,000 | | | Banco Santander Mexico S.A. Institucion de Banca Multiple Grupo Financiero Santander, 4.125%, 11/09/2022, 144A | | | 296,220 | |

| | 640,000 | | | Cemex Finance LLC, 6.000%, 4/01/2024, 144A | | | 582,400 | |

| | 300,000 | | | Cemex SAB de CV, 4.375%, 3/05/2023, 144A, (EUR) | | | 301,698 | |

| | 505,000 | | | Cemex SAB de CV, 5.700%, 1/11/2025, 144A | | | 451,975 | |

| | 10,000,000 | | | Grupo Televisa SAB, EMTN, 7.250%, 5/14/2043, (MXN) | | | 499,584 | |

| | 746,500(†††) | | | Mexican Fixed Rate Bonds, Series M, 6.500%, 6/10/2021, (MXN)(c) | | | 4,624,009 | |

| | 186,200(†††) | | | Mexican Fixed Rate Bonds, Series M, 6.500%, 6/09/2022, (MXN)(c) | | | 1,142,294 | |

| | 395,000(†††) | | | Mexican Fixed Rate Bonds, Series M-10, 8.500%, 12/13/2018, (MXN)(c) | | | 2,589,886 | |

| | 135,113(†††) | | | Mexican Fixed Rate Bonds, Series M-20, 8.000%, 12/07/2023, (MXN) | | | 900,673 | |

| | 196,000 | | | Mexico Government International Bond, 4.000%, 3/15/2115, (EUR) | | | 180,410 | |

| | 780,000 | | | Petroleos Mexicanos, 4.250%, 1/15/2025, 144A | | | 713,700 | |

| | 625,000 | | | Petroleos Mexicanos, 5.625%, 1/23/2046, 144A | | | 508,656 | |

| | 135,000(†††) | | | Petroleos Mexicanos, 7.470%, 11/12/2026, (MXN) | | | 735,585 | |