UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED

MANAGEMENT INVESTMENT COMPANIES

Investment Company Act file number: 811-06241

Loomis Sayles Funds II

(Exact name of Registrant as specified in charter)

| | |

| 399 Boylston Street, Boston, Massachusetts | | 02116 |

| (Address of principal executive offices) | | (Zip code) |

Coleen Downs Dinneen, Esq.

NGAM Distribution, L.P.

399 Boylston Street

Boston, Massachusetts 02116

(Name and address of agent for service)

Registrant’s telephone number, including area code: (617) 449-2810

Date of fiscal year end: September 30

Date of reporting period: September 30, 2014

| Item 1. | Reports to Stockholders. |

The Registrant’s annual report transmitted to shareholders pursuant to Rule 30e-1 under the Investment Company Act of 1940 is as follows:

ANNUAL REPORT

September 30, 2014

Loomis Sayles Global Equity and Income Fund

Loomis Sayles Growth Fund

Loomis Sayles Value Fund

TABLE OF CONTENTS

Portfolio Review page 1

Portfolio of Investments page 21

Financial Statements page 46

Notes to Financial Statements page 65

Barron’s/Lipper 2013 one-year ranking is based on 64 qualifying U.S. fund companies. Award recipient must have at least three funds in Lipper’s general U.S.-stock category (including at least one world and one mixed asset/balanced), two taxable bond and one tax-exempt bond fund. Natixis was not ranked for the 5- and 10-year periods. Past performance is no guarantee of future results.

For more details visit ngam.natixis.com/TopFundFamily

LOOMIS SAYLES GLOBAL EQUITY AND INCOME FUND

| | |

| Managers | | Symbols |

| Daniel J. Fuss, CFA®, CIC | | Class A LGMAX |

| Eileen N. Riley, CFA® | | Class C LGMCX |

| David W. Rolley, CFA® | | Class Y LSWWX |

| Lee M. Rosenbaum | | |

| Loomis, Sayles & Company, L.P. | | |

Objective

Seeks high total investment return through a combination of capital appreciation and current income

Market Conditions

Developed equity markets posted relatively strong gains during the 12-month period ending September 30, 2014 in U.S. dollar terms. The S&P 500® Index was one of the best performing markets globally due to improving economic data including rising consumer confidence and lower unemployment. In Europe, the mixed pace of economic recovery resulted in muted, albeit positive, returns. Emerging market stocks delivered gains in aggregate terms following their lows in January, demonstrating some resilience to recent challenging macroeconomic events. Weakness in Russia and other Eastern European markets was offset by strength in India and several other Southeast Asian markets and in Mexico and Peru.

Bond market themes included general spread tightening, significant central bank involvement and rising geopolitical tensions. U.S. rates initially trended higher before declining through the first half of 2014 as expectations surrounding the timing of interest rate hikes changed.

In terms of global macroeconomic drivers, softer economic data at the beginning of 2014, harsh winter weather in the United States, and lingering concerns across Asia and several emerging market economies contributed to moderate but uneven global growth. The euro zone recovery has been timid overall, and progress has varied considerably across the region. In Japan, economic data were mixed while the country’s commitment to the prime minister’s reform agenda remained strong. Finally, emerging markets performed well for most of the period, as valuations improved following last year’s selloff.

Performance Results

For the 12 months ended September 30, 2014, Class A shares of Loomis Sayles Global Equity and Income Fund returned 9.62% at net asset value. The Fund underperformed its primary benchmark, the Morgan Stanley Capital International (MSCI) World Index, which returned 12.80%. The Fund outpaced its secondary benchmark, the Citigroup World Government Bond Index, which returned -0.07%.

1 |

Explanation of Fund Performance

Although the Fund delivered a strong absolute return, it underperformed its primary, all-equity benchmark due to its blended equity and fixed-income exposure in what were ultimately strong prevailing equity market conditions.

Within the Fund’s equity component, individual stocks in the consumer staples, information technology and financials sectors detracted from performance, as did the energy sector in general. Hengan International, a China-based manufacturer of paper products, was a prominent detractor. The stock lagged as competitive intensity increased; however, proactive steps to expand internationally and reduce capital spending are underway. Adidas, a global sport apparel company, underperformed as conditions in Russia deteriorated, competition increased, and the company’s golf business disappointed, which led to below-forecast operating margins. A position in a Turkey-based bank, Turkiye Garanti Bankasi, launched last year on expectations for stabilization in the Turkish economy, deteriorated when the currency devalued sharply in January prompting us to exit the position.

Within the fixed-income component, a position in shorter-maturity U.S. Treasury notes weighed on performance. These holdings did not perform as well as longer-maturity Treasury bonds, nor did they keep pace with corporate bonds and euro zone government securities. Elsewhere, holdings in sovereign bonds backed by the governments of Canada, South Africa and Japan underperformed broader markets due to currency weakness. In addition, our strategy of managing currency risk via forwards detracted from results.

The equity component performed well due largely to strong stock selection in the healthcare, consumer discretionary and materials sectors. From a regional perspective, strong stock selection in European stocks, combined with a large underweight to developed Asia, aided performance. On a security level, Shire, Transdigm Group and Google were among the strongest contributors to absolute return. Under a new CEO, Shire, a global pharmaceutical company, streamlined its existing businesses and used its strong balance sheet to augment internal growth via acquisitions. Transdigm Group, a U.S. aircraft parts manufacturer, benefited from a combination of strong end-market demand in commercial aerospace, two acquisitions, and a sizable special dividend that helped drive shares higher. Google, a U.S. based Internet company, showed strong stock performance driven by a reacceleration in its advertising revenue, an increase in mobile search revenue, and a more effective monetization of its YouTube video site.

Within the Fund’s fixed-income component, exposure to global corporate bonds drove the majority of the positive performance. Corporate bond spreads (the difference in yields between corporate bonds and government bonds of similar maturity) touched and remained near historically low levels, with the exception of below-investment-grade bonds, which experienced some weakness late in the period. Positioning in the banking, metals and mining, and wireless industries was particularly advantageous. Government bonds from Spain, Italy and other peripheral euro zone countries posted strong returns, as yield-starved investors were willing to move lower on the quality spectrum to increase return potential. Elsewhere, selected positions in emerging market bonds aided results, including hard currency bonds issued by government-related enterprises in Brazil, Turkey and Hungary.

| 2

LOOMIS SAYLES GLOBAL EQUITY AND INCOME FUND

Outlook

U.S. economic data continues to outpace data from other economies around the world, so much so that the Federal Reserve (the Fed) remains on a path to raise its federal funds rate target sometime in 2015, for the first time since before the financial crisis began. At the same time, with other central banks moving toward further stimulus, the relative outperformance of the U.S. dollar versus many global currencies may continue for the near term. This currency advantage, on top of the arguably superior relative fundamental prospects for large U.S. companies, has supported U.S. equities in recent months. While third-quarter results may have disappointed, we should keep in mind that U.S. equities have posted strong longer-term, multi-year returns across all market capitalizations.

In the fixed-income market, we believe the U.S. remains the best poised of the industrialized economies to expand in the near term, lead the global recovery forward and raise short-term interest rates in 2015. Growth, in tandem with the Fed’s decision to end quantitative easing in October, should lead to higher U.S. yields, all else being equal. As U.S. growth increases, selected countries may benefit due to their close trading ties with the U.S.

Geopolitical stress and lackluster growth have generated concerns about Europe’s short-term prospects. We believe an accommodative European Central Bank should support local bond markets and likely cap yields in the near and medium term. Meanwhile, in Japan we believe there is an inflection point at which yen weakness will start having an adverse effect on Japan’s import pricing and profitability. In emerging markets, we believe country and currency selections will remain crucial in coming quarters, as certain economies may face slower growth. We will closely monitor China’s growth, but we do not anticipate any major financial incidents.

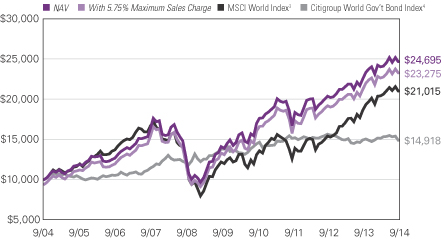

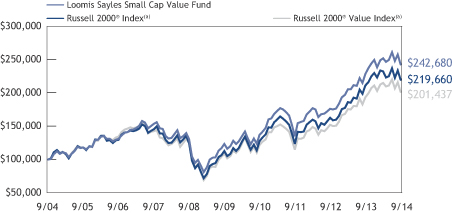

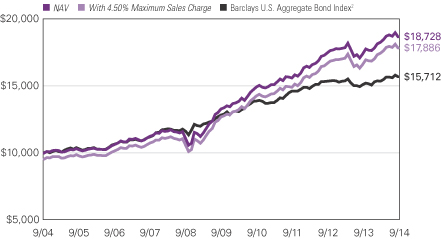

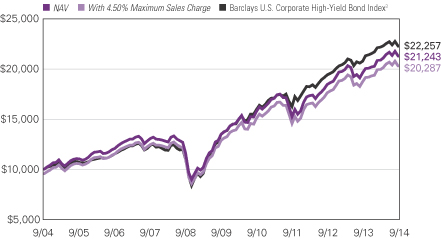

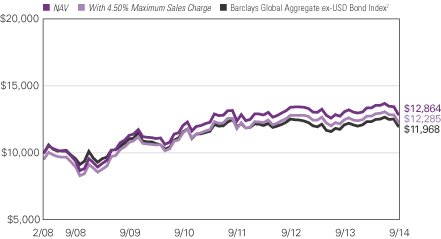

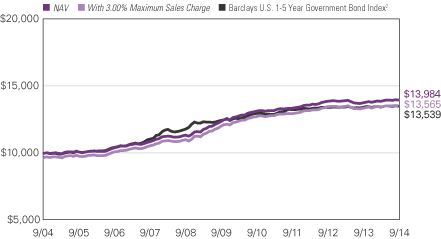

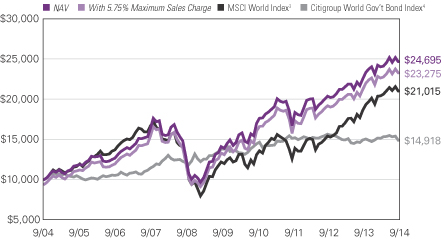

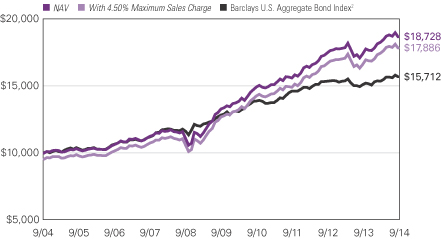

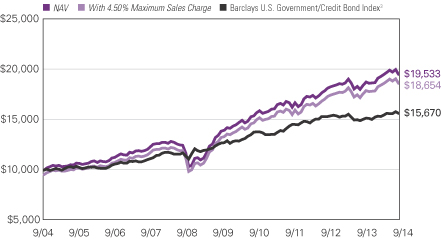

Growth of $10,000 Investment in Class A Shares1,5

September 30, 2004 through September 30, 2014

3 |

Average Annual Total Returns — September 30, 20145

| | | | | | | | | | | | |

| | | | |

| | | 1 Year | | | 5 Years | | | 10 Years | |

| | | | |

| Class A (Inception 2/1/06)1 | | | | | | | | | | | | |

| NAV | | | 9.62 | % | | | 11.84 | % | | | 9.46 | % |

| With 5.75% Maximum Sales Charge | | | 3.33 | | | | 10.53 | | | | 8.82 | |

| | | | |

| Class C (Inception 2/1/06)1 | | | | | | | | | | | | |

| NAV | | | 8.72 | | | | 11.01 | | | | 8.65 | |

| With CDSC2 | | | 7.72 | | | | 11.01 | | | | 8.65 | |

| | | | |

| Class Y (Inception 5/1/96) | | | | | | | | | | | | |

| NAV | | | 9.87 | | | | 12.13 | | | | 9.73 | |

| | | | |

| Comparative Performance | | | | | | | | | | | | |

| MSCI World Index3 | | | 12.80 | | | | 11.47 | | | | 7.71 | |

| Citigroup World Government Bond Index4 | | | -0.07 | | | | 1.58 | | | | 4.08 | |

Past performance does not guarantee future results. The table(s) do not reflect taxes shareholders might owe on any Fund distributions or when they redeem their shares. Performance for periods less than one year is cumulative, not annualized. Returns reflect changes in share price and reinvestment of dividends and capital gains, if any. Unlike a fund, an index is not managed and does not reflect fees and expenses.

| 1 | Prior to the inception of Class A and C shares (2/1/06), performance is that of Institutional Class shares, which were redesignated as Class Y shares, and restated to reflect the higher net expenses and sales loads of Class A and C shares. |

| 2 | Performance for Class C shares assumes a 1% contingent deferred sales charge (“CDSC”) applied when you sell shares within one year of purchase. |

| 3 | MSCI World Index is an unmanaged index that is designed to measure the equity market performance of developed markets. |

| 4 | Citigroup World Government Bond Index is an unmanaged index that includes the most significant and liquid government bond markets globally that carry at least an investment-grade rating. |

| 5 | Fund performance has been increased by fee waivers and/or expense reimbursements, if any, without which performance would have been lower. |

| 4

LOOMIS SAYLES GROWTH FUND

| | |

| Manager | | Symbols |

| Aziz V. Hamzaogullari, CFA® | | Class A LGRRX |

| Loomis, Sayles & Company, L.P. | | Class B LGRBX |

| | Class C LGRCX |

| | Class N LGRNX |

| | Class Y LSGRX |

Objective

Long-term growth of capital

Market Conditions

Following strong performance in 2013, equity market returns were modest overall for the first quarter of 2014. U.S. large-cap stocks moved higher with few interruptions in the second quarter, supported by the U.S. economic recovery. U.S. corporate earnings growth remained positive, and domestic companies continued to return capital to shareholders in the form of stock repurchases and dividends. Equity returns closed the period with mixed results. Large-cap stocks sustained their constructive, lower-volatility uptrend, posting modest third-quarter returns. By contrast, results were generally negative for the small- and mid-cap segments of the market.

Performance Results

For the 12 months ended September 30, 2014, Class A shares of Loomis Sayles Growth Fund returned 17.23% at net asset value. The Fund underperformed its benchmark, the Russell 1000® Growth Index, which returned 19.15%.

Explanation of Fund Performance

The Fund returned strong absolute performance due primarily to contributions from its holdings in Facebook, Google, and Monster Beverage. The Fund’s positions in Danone, ARM Holdings, and Expeditors International of Washington detracted slightly from return. Stock selection in the healthcare, industrials, information technology, and consumer discretionary sectors detracted from relative performance. Stock selection in the consumer staples and financials sectors as well as our allocation to the information technology, consumer discretionary, and energy sectors contributed to relative performance.

Social media company Facebook was a top contributor, with advertising revenue again accelerating growth for all key metrics. In particular, mobile advertising represented more than 57% of advertising revenue and a $5.1 billion business for Facebook. Facebook grew much faster than the overall advertising industry. More importantly, the company grew much faster than the online advertising segment, gaining significant market share during the period. We continue to see attractive upside potential in this large, growing and underpenetrated market. We believe Facebook is well-positioned for strong, sustained growth and shares remain priced significantly below intrinsic value, offering an attractive, long-term reward-to-risk opportunity.

5 |

Global online search and advertising leader Google reported robust organic growth above that of the overall online advertising industry. Increased advertising in mobile, video and online channels continued to drive fundamentally strong revenue growth. The company is focusing on helping clients build their digital brand by providing trustworthy ad technology to publishers and advertisers and continuing to roll out digital content on a global basis through Google Play. YouTube continues to gain traction with users and advertisers and will play a major role in helping clients build their brand. We believe the market continues to underestimate Google’s long-term sustainable growth rate.

Monster Beverage, an energy drink company, reported solid results during the period. In the most recent quarter, sales growth in the U.S. was just below its recent double-digit run rate and in line with growth in the energy drink category. Gross and operating margins improved in North America due to positive product mix, selective pricing strategies and reduced ingredient costs. International gross and operating margins improved as a result of cost benefits associated with local production, right-sizing of international operations, particularly in Europe, and scale. In mid-August, Monster and Coca-Cola entered into a long-term strategic partnership that we believe will benefit both parties and accelerate growth. As part of the deal, Monster becomes Coca-Cola’s exclusive energy drink partner and Coca-Cola will become Monster’s preferred global distributor.

Danone, a food company based in France, posted a slight increase in revenue but a decline in net operating income year-over-year due to record milk price inflation, softness in North American and European fresh dairy markets, and mixed performance in China’s early nutrition business. We believe the company has taken the necessary actions to address the issue of milk price inflation, and we anticipate continued improvements in Europe and China. With market expectations for revenue and profit growth well below our estimates, we believe the company’s shares are trading at a significant discount to our estimate of intrinsic value, offering an attractive reward-to-risk profile.

Although U.K.-based semiconductor designer ARM Holdings reported mixed results, it has continued to gain market share across all its markets. Licensing revenue was strong, but the company reported ongoing weakness in royalty revenues caused by an inventory correction in the mobile industry early in 2014 and continued rapid growth in lower-valued non-mobile chips—ARM’s fastest-growing segment. We believe the royalty revenues will improve with continued rapid adoption of 4G technology in China and the ongoing replacement of entry-level phones with smartphones. Furthermore, we recognize the uptick in licensing as an important driver of longer-term growth in higher-margin royalty revenue. Going forward, we believe the company should benefit from higher royalty fees associated with the licensing of its new technologies. ARM is beginning to see traction in the enterprise server and networking business where the combined total addressable market is similar to that of smartphones. We believe ARM remains well-positioned to benefit from the long-term growth in mobile devices and the shift to outsourcing of chip architecture design. Company shares currently sell at a discount to our estimate of intrinsic value, and therefore, we believe ARM offers a compelling reward-to-risk opportunity.

| 6

LOOMIS SAYLES GROWTH FUND

Logistics company Expeditors International of Washington reported strong volume growth in its air and ocean freight forwarding operations and its customs services business. However, ongoing near-term pricing weakness and an uptick in certain costs led to some margin pressure year-over-year. Geographically, Europe and the US saw strong growth in net revenues, while Asia reported negative net revenue growth due to pricing pressure. While ocean freight volume growth was stronger than airfreight volume growth, both segments performed well compared to competitors, and allowed the company to gain market share. The pricing environment remained challenging, as pricing power lagged the cyclical recovery in volumes. Based on our analysis, we expect pricing to improve over time and drive margin expansion. We believe Expeditors will continue to gain share and benefit from the cyclical rebound in international trade and structural tailwinds in the industry. Expeditors’ shares are trading at a significant discount to our estimate of its intrinsic value, and we believe they offer a compelling reward-to-risk opportunity.

Outlook

Our investment process is characterized by bottom-up, fundamental research and a long-term investment time horizon. The nature of the process leads to a lower-turnover portfolio in which sector positioning is the result of stock selection. The Fund ended the period with overweight positions in the information technology, consumer staples, healthcare and financials sectors and underweight positions in the consumer discretionary, industrials, energy, materials, telecommunication services, and utilities sectors.

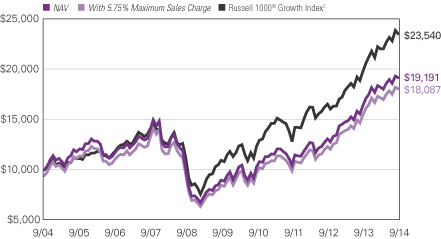

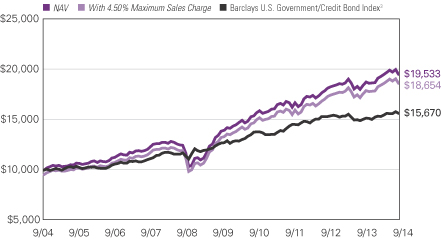

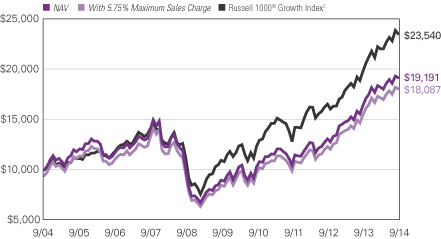

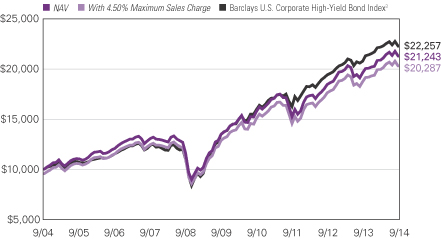

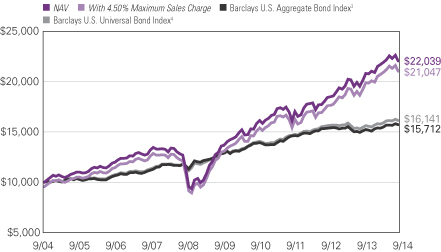

Growth of $10,000 Investment in Class A Shares3

September 30, 2004 through September 30, 2014

7 |

Average Annual Total Returns — September 30, 20143

| | | | | | | | | | | | | | | | |

| | | | | |

| | | 1 Year | | | 5 Years | | | 10 Years | | | Life of

Class N | |

| | | | | |

| Class A (Inception 12/31/96) | | | | | | | | | | | | | | | | |

| NAV | | | 17.23 | % | | | 16.36 | % | | | 6.73 | % | | | — | % |

| With 5.75% Maximum Sales Charge | | | 10.52 | | | | 15.01 | | | | 6.11 | | | | — | |

| | | | | |

| Class B (Inception 9/12/03) | | | | | | | | | | | | | | | | |

| NAV | | | 16.27 | | | | 15.48 | | | | 5.93 | | | | — | |

| With CDSC1 | | | 11.27 | | | | 15.25 | | | | 5.93 | | | | — | |

| | | | | |

| Class C (Inception 9/12/03) | | | | | | | | | | | | | | | | |

| NAV | | | 16.42 | | | | 15.53 | | | | 5.95 | | | | — | |

| With CDSC1 | | | 15.42 | | | | 15.53 | | | | 5.95 | | | | — | |

| | | | | |

| Class N (Inception 2/1/13) | | | | | | | | | | | | | | | | |

| NAV | | | 17.21 | | | | — | | | | — | | | | 18.40 | |

| | | | | |

| Class Y (Inception 5/16/91) | | | | | | | | | | | | | | | | |

| NAV | | | 17.51 | | | | 16.65 | | | | 7.09 | | | | — | |

| | | | | |

| Comparative Performance | | | | | | | | | | | | | | | | |

| Russell 1000® Growth Index2 | | | 19.15 | | | | 16.50 | | | | 8.94 | | | | 20.79 | |

Past performance does not guarantee future results. The table(s) do not reflect taxes shareholders might owe on any Fund distributions or when they redeem their shares. Performance for periods less than one year is cumulative, not annualized. Returns reflect changes in share price and reinvestment of dividends and capital gains, if any. Unlike a fund, an index is not managed and does not reflect fees and expenses.

| 1 | Performance for Class B shares assumes a maximum of 5% contingent deferred sales charge (“CDSC”) applied when you sell shares, which declines annually between years 1-6 according to the following schedule: 5, 4, 3, 3, 2, 1, 0%. Class C shares performance assumes a 1% CDSC applied when you sell shares within one year of purchase. |

| 2 | Russell 1000® Growth Index is an unmanaged index that measures the performance of the large-cap growth segment of the U.S. equity universe. It includes those Russell 1000 companies with higher price-to-book ratios and higher forecasted growth values. |

| 3 | Fund performance has been increased by fee waivers and/or expense reimbursements, if any, without which performance would have been lower. |

| 8

LOOMIS SAYLES VALUE FUND

| | | | |

| Managers | | Symbols | | |

| Arthur J. Barry, CFA® | | Class A | | LSVRX |

Adam C. Liebhoff* | | Class B | | LSVBX |

| Warren N. Koontz, CFA®, CIC** | | Class C | | LSCVX |

| Loomis, Sayles & Company, L.P. | | Class N | | LSVNX |

| | Class Y | | LSGIX |

| | Admin Class | | LSAVX |

| * | Adam C. Liebhoff became a co-portfolio manager of the Fund effective September 12, 2014. |

| ** | Effective August 25, 2014 Warren Koontz no longer serves as co-portfolio manager of the Fund. |

Objective

Long-term growth of capital and income

Market Conditions

The U.S. equity markets performed well during the 12 months ended September 30, 2014, but the period was not without its ups and downs. After a strong end to 2013, the historical tendency for the market to outperform in January was instead replaced by a period of profit taking. A substantial rebound followed in February and March. However, the markets fell again in early April on news of the Ukrainian crisis and Russia’s annexation of the Crimean peninsula. From mid-April through the end of the second quarter, stocks generally rallied, partly due to the U.S. economy showing signs of a strong rebound from the weather-ravaged first quarter. Throughout the third quarter, stocks oscillated around a flat return, as economic data showed mixed signs. Improving consumer sentiment and a recent uptick in household income were encouraging, but the price of oil declined sharply in the third quarter on a strong dollar and robust U.S. supply.

Performance Results

For the 12 months ended September 30, 2014, Class A shares of Loomis Sayles Value Fund returned 17.97% at net asset value. The Fund underperformed its benchmark, the Russell 1000® Value Index, which returned 18.89%.

Explanation of Fund Performance

Although the Fund delivered a strong absolute return, it slightly underperformed due to stock selection in the information technology sector on a relative basis. Every sector contributed positively to total return over the past year. Stock selection, particularly in the financial and healthcare sectors, aided Fund performance. Underweight positions in the financial and energy sectors also boosted return. Other sectors that underperformed compared with the Benchmark included the consumer discretionary, industrials and utilities sectors.

9 |

Among the largest detractors to Fund performance was General Motors, the vehicle manufacturer, which lagged for several reasons. The company announced weaker-than-expected fourth quarter 2013 earnings and disappointing guidance for the first quarter of 2014. Severe winter weather in the first quarter of 2014 hampered vehicle sales. In addition, a highly publicized recall weighed on stock performance. Initially the recall focused on faulty ignition switches on several older models, but GM soon expanded it to include other issues. A position in First Energy, a public utility company, was also a prominent detractor, underperforming due to pressure on power markets caused by low regional natural gas prices. The company attempted to offset this headwind with a shift to more regulated growth, but the move was insufficient and caused the company to reduce its dividend to help fund the regulated growth investments. Finally, Knowles Corp, a designer and manufacturer of advanced acoustic components, underperformed due to an industry practice called a “teardown,” which resulted in an in-depth look at how the iPhone was made. The teardown insinuates that the company lost market share for its microphones used in the phone, causing a drag on performance.

In terms of individual contributors, Forest Laboratories, a pharmaceutical company, was the Fund’s best-performing stock for the period. The company’s new CEO announced in late 2013 a thorough review of business operations followed by an updated strategy. The new strategy included a $500 million cost savings program, the acquisition of Saphris, a schizophrenia and bipolar disorder drug from Merck, an accelerated share repurchase program and the issuance of $1.2 billion in debt. Forest’s strong balance sheet and decent pipeline led to an acquisition agreement with Actavis in February. Actavis’s acquisition of Forest, which was finalized in July, should generate significant benefits, including approximately $1 billion in operating and tax synergies to be realized within three years following the close of the deal.

Two financial sector companies, Wells Fargo and Ameriprise Financial, were also among the Fund’s top contributors. Wells Fargo, a diversified financial services company, benefited from superior revenue growth compared to its more challenged industry. Despite losing a big tailwind from mortgage refinancing in mid-2013, the company’s broad diversification in commercial lending, retail brokerage, investment banking/trading, commercial finance and insurance brokerage fueled top line growth. In addition, Wells Fargo passed regulatory stress tests while many peers failed, allowing the company to raise its dividend payout more than 30% and reduce share count via buybacks. Ameriprise Financial, a financial planning and services firm, outperformed due to continued strong results in its financial planning unit and improvements in its asset management subsidiary. The company also boosted its dividend and reduced its share base through stock repurchases.

Outlook

While valuations are on the high side compared with recent years, we believe they are reasonably in line with our market view given historically low inflation and interest rates.

Although the lower unemployment rate remains encouraging, the declining labor force participation rate is concerning, and housing affordability is deteriorating. Despite these issues, we feel a boost in consumer spending is likely to occur. Household balance sheets are strong,

| 10

LOOMIS SAYLES VALUE FUND

and household income is showing a slight improvement. A stronger dollar and lower commodity costs may aid consumption if imports become cheaper and inflation stays muted.

We believe the market is long overdue for a correction, and we will view any such occurrence as a buying opportunity. Valuations are such that any market correction should yield an attractive entry point. As always, we will focus on individual stock selection during these buying opportunities.

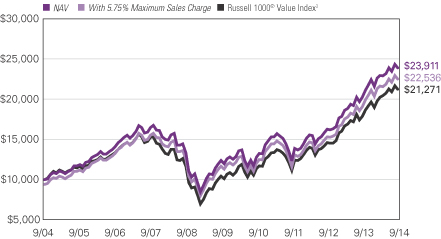

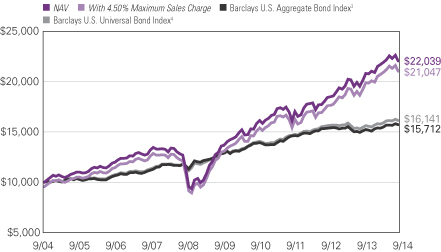

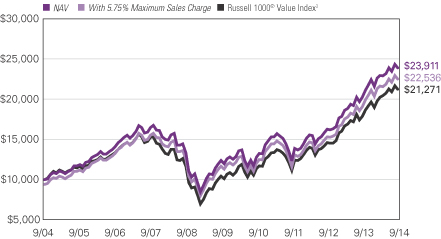

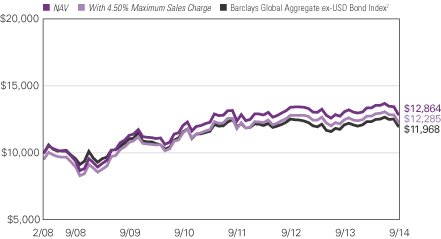

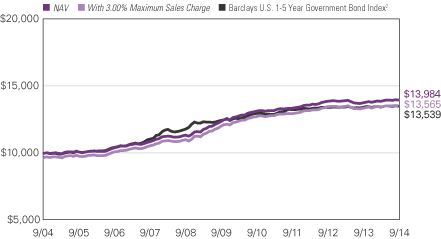

Growth of $10,000 Investment in Class A Shares1,4

September 30, 2004 through September 30, 2014

11 |

Average Annual Total Returns — September 30, 20144

| | | | | | | | | | | | | | | | |

| | | | | |

| | | 1 Year | | | 5 Years | | | 10 Years | | | Life of

Class N | |

| | | | | |

| Class A (Inception 6/30/06)1 | | | | | | | | | | | | | | | | |

| NAV | | | 17.97 | % | | | 14.00 | % | | | 9.11 | % | | | — | % |

| With 5.75% Maximum Sales Charge | | | 11.19 | | | | 12.66 | | | | 8.46 | | | | — | |

| | | | | |

| Class B (Inception 6/1/07)1 | | | | | | | | | | | | | | | | |

| NAV | | | 17.08 | | | | 13.15 | | | | 8.25 | | | | — | |

| With CDSC2 | | | 12.08 | | | | 12.90 | | | | 8.25 | | | | — | |

| | | | | |

| Class C (Inception 6/1/07)1 | | | | | | | | | | | | | | | | |

| NAV | | | 17.07 | | | | 13.14 | | | | 8.25 | | | | — | |

| With CDSC2 | | | 16.07 | | | | 13.14 | | | | 8.25 | | | | — | |

| | | | | |

| Class N (Inception 2/1/13) | | | | | | | | | | | | | | | | |

| NAV | | | 18.43 | | | | — | | | | — | | | | 19.53 | |

| | | | | |

| Class Y (Inception 5/13/91) | | | | | | | | | | | | | | | | |

| NAV | | | 18.27 | | | | 14.28 | | | | 9.42 | | | | — | |

| | | | | |

| Admin Class (Inception 2/1/10)1 | | | | | | | | | | | | | | | | |

| NAV | | | 17.68 | | | | 13.73 | | | | 8.82 | | | | — | |

| | | | | |

| Comparative Performance | | | | | | | | | | | | | | | | |

| Russell 1000® Value Index3 | | | 18.89 | | | | 15.26 | | | | 7.84 | | | | 18.95 | |

Past performance does not guarantee future results. The table(s) do not reflect taxes shareholders might owe on any Fund distributions or when they redeem their shares. Performance for periods less than one year is cumulative, not annualized. Returns reflect changes in share price and reinvestment of dividends and capital gains, if any. Unlike a fund, an index is not managed and does not reflect fees and expenses.

| 1 | Prior to 6/1/07, performance of Class A shares is that of Retail Class shares, which were redesignated as Class A shares, restated to reflect the sales load of Class A shares. Prior to the inception of Retail Class shares (6/30/06), performance is that of Institutional Class shares, which were redesignated as Class Y shares, restated to reflect the higher net expenses and sales loads of Class A shares. Prior to the inception of Class B and C shares (6/1/07), performance is that of Institutional Class shares, restated to reflect the higher net expenses and sales loads of Class B and C shares. Prior to the inception of Admin Class shares (2/1/10), performance is that of Class A shares, restated to reflect the higher net expenses of Admin Class shares. |

| 2 | Performance for Class B shares assumes a maximum of 5% contingent deferred sales charge (“CDSC”) applied when you sell shares, which declines annually between years 1-6 according to the following schedule: 5, 4, 3, 3, 2, 1, 0%. Class C shares performance assumes a 1% CDSC applied when you sell shares within one year of purchase. |

| 3 | Russell 1000® Value Index is an unmanaged index that measures the performance of the large-cap value segment of the U.S. equity universe. It includes those Russell 1000 companies with lower price-to-book ratios and higher forecasted growth values. |

| 4 | Fund performance has been increased by fee waivers and/or expense reimbursements, if any, without which performance would have been lower. |

| 12

ADDITIONAL INFORMATION

The views expressed in this report reflect those of the portfolio managers as of the dates indicated. The managers’ views are subject to change at any time without notice based on changes in market or other conditions. References to specific securities or industries should not be regarded as investment advice. Because the fund is actively managed, there is no assurance that it will continue to invest in the securities or industries mentioned.

ADDITIONAL INDEX INFORMATION

This document may contain references to third party copyrights, indexes, and trademarks, each of which is the property of its respective owner. Such owner is not affiliated with Natixis Global Asset Management or any of its related or affiliated companies (collectively “NGAM”) and does not sponsor, endorse or participate in the provision of any NGAM services, funds or other financial products.

The index information contained herein is derived from third parties and is provided on an “as is” basis. The user of this information assumes the entire risk of use of this information. Each of the third party entities involved in compiling, computing or creating index information disclaims all warranties (including, without limitation, any warranties of originality, accuracy, completeness, timeliness, non-infringement, merchantability and fitness for a particular purpose) with respect to such information.

PROXY VOTING INFORMATION

A description of the funds’ proxy voting policies and procedures is available without charge, upon request, by calling Natixis Funds at 800-225-5478; on the funds’ website at ngam.natixis.com; and on the Securities and Exchange Commission’s (“SEC’s”) website at www.sec.gov. Information regarding how the funds voted proxies relating to portfolio securities during the 12 months ended June 30, 2014 is available from the funds’ website and the SEC’s website.

QUARTERLY PORTFOLIO SCHEDULES

The funds file a complete schedule of portfolio holdings with the SEC for the first and third quarters of each fiscal year on Form N-Q. The funds’ Forms N-Q are available on the SEC’s website at www.sec.gov and may be reviewed and copied at the SEC’s Public Reference Room in Washington, DC. Information on the operation of the Public Reference Room may be obtained by calling 800-SEC-0330.

13 |

UNDERSTANDING FUND EXPENSES

As a mutual fund shareholder, you incur different types of costs: transaction costs, including sales charges (loads) on purchases and contingent deferred sales charges on redemptions, and ongoing costs, including management fees, distribution and/or service fees (12b-1 fees), and other fund expenses. Certain exemptions may apply. These costs are described in more detail in the Fund’s prospectus. The examples below are intended to help you understand the ongoing costs of investing in the Funds and help you compare these with the ongoing costs of investing in other mutual funds.

The first line in the table for each class of Fund shares shows the actual account values and actual fund expenses you would have paid on a $1,000 investment in the Fund from April 1, 2014 through September 30, 2014. To estimate the expenses you paid over the period, simply divide your account value by $1,000 (for example, $8,600 account value divided by $1,000 = 8.6) and multiply the result by the number in the Expenses Paid During Period row as shown below for your class.

The second line in the table for each class of Fund shares provides information about hypothetical account values and hypothetical expenses based on the Fund’s actual expense ratios and an assumed rate of return of 5% per year before expenses, which is not the Fund’s actual return. The hypothetical account values and expenses may not be used to estimate the actual ending account balance or expenses you paid on your investment for the period. You may use this information to compare the ongoing costs of investing in the Funds to other funds. To do so, compare this 5% hypothetical example with the 5% hypothetical examples that appear in the shareholder reports of the other funds.

Please note that the expenses shown reflect ongoing costs only, and do not include any transaction costs, such as sales charges. Therefore, the second line in the table of each fund is useful in comparing ongoing costs only, and will not help you determine the relative costs of owning different funds. If transaction costs were included, total costs would be higher.

| | | | | | | | | | | | |

LOOMIS SAYLES GLOBAL EQUITY AND

INCOME FUND | | BEGINNING

ACCOUNT VALUE

4/1/2014 | | | ENDING

ACCOUNT VALUE

9/30/2014 | | | EXPENSES PAID

DURING PERIOD*

4/1/2014 – 9/30/2014 | |

| Class A | | | | | | | | | | | | |

| Actual | | $ | 1,000.00 | | | $ | 1,027.00 | | | $ | 5.95 | |

| Hypothetical (5% return before expenses) | | $ | 1,000.00 | | | $ | 1,019.20 | | | $ | 5.92 | |

| Class C | | | | | | | | | | | | |

| Actual | | $ | 1,000.00 | | | $ | 1,023.10 | | | $ | 9.74 | |

| Hypothetical (5% return before expenses) | | $ | 1,000.00 | | | $ | 1,015.44 | | | $ | 9.70 | |

| Class Y | | | | | | | | | | | | |

| Actual | | $ | 1,000.00 | | | $ | 1,028.40 | | | $ | 4.68 | |

| Hypothetical (5% return before expenses) | | $ | 1,000.00 | | | $ | 1,020.46 | | | $ | 4.66 | |

| * | Expenses are equal to the Fund's annualized expense ratio: 1.17%, 1.92% and 0.92% for Class A, C and Y, respectively, multiplied by the average account value over the period, multiplied by the number of days in the most recent fiscal half-year (183), divided by 365 (to reflect the half-year period). |

| 14

| | | | | | | | | | | | |

| LOOMIS SAYLES GROWTH FUND | | BEGINNING

ACCOUNT VALUE

4/1/2014 | | | ENDING

ACCOUNT VALUE

9/30/2014 | | | EXPENSES PAID

DURING PERIOD*

4/1/2014 – 9/30/2014 | |

| Class A | | | | | | | | | | | | |

| Actual | | | $1,000.00 | | | | $1,052.30 | | | | $4.78 | |

| Hypothetical (5% return before expenses) | | | $1,000.00 | | | | $1,020.41 | | | | $4.71 | |

| Class B | | | | | | | | | | | | |

| Actual | | | $1,000.00 | | | | $1,048.90 | | | | $8.63 | |

| Hypothetical (5% return before expenses) | | | $1,000.00 | | | | $1,016.65 | | | | $8.49 | |

| Class C | | | | | | | | | | | | |

| Actual | | | $1,000.00 | | | | $1,048.90 | | | | $8.63 | |

| Hypothetical (5% return before expenses) | | | $1,000.00 | | | | $1,016.65 | | | | $8.49 | |

| Class N | | | | | | | | | | | | |

| Actual | | | $1,000.00 | | | | $1,053.70 | | | | $4.89 | |

| Hypothetical (5% return before expenses) | | | $1,000.00 | | | | $1,020.31 | | | | $4.81 | |

| Class Y | | | | | | | | | | | | |

| Actual | | | $1,000.00 | | | | $1,054.60 | | | | $3.50 | |

| Hypothetical (5% return before expenses) | | | $1,000.00 | | | | $1,021.66 | | | | $3.45 | |

| * | Expenses are equal to the Fund's annualized expense ratio (after waiver/reimbursement): 0.93%, 1.68%, 1.68%, 0.95% and 0.68% for Class A, B, C, N and Y, respectively, multiplied by the average account value over the period, multiplied by the number of days in the most recent fiscal half-year (183), divided by 365 (to reflect the half-year period). |

15 |

| | | | | | | | | | | | |

| LOOMIS SAYLES VALUE FUND | | BEGINNING

ACCOUNT VALUE

4/1/2014 | | | ENDING

ACCOUNT VALUE

9/30/2014 | | | EXPENSES PAID

DURING PERIOD*

4/1/2014 – 9/30/2014 | |

| Class A | | | | | | | | | | | | |

| Actual | | $ | 1,000.00 | | | $ | 1,040.20 | | | $ | 4.91 | |

| Hypothetical (5% return before expenses) | | $ | 1,000.00 | | | $ | 1,020.26 | | | $ | 4.86 | |

| Class B | | | | | | | | | | | | |

| Actual | | $ | 1,000.00 | | | $ | 1,036.00 | | | $ | 8.73 | |

| Hypothetical (5% return before expenses) | | $ | 1,000.00 | | | $ | 1,016.50 | | | $ | 8.64 | |

| Class C | | | | | | | | | | | | |

| Actual | | $ | 1,000.00 | | | $ | 1,036.10 | | | $ | 8.73 | |

| Hypothetical (5% return before expenses) | | $ | 1,000.00 | | | $ | 1,016.50 | | | $ | 8.64 | |

| Class N | | | | | | | | | | | | |

| Actual | | $ | 1,000.00 | | | $ | 1,041.90 | | | $ | 2.92 | |

| Hypothetical (5% return before expenses) | | $ | 1,000.00 | | | $ | 1,022.21 | | | $ | 2.89 | |

| Class Y | | | | | | | | | | | | |

| Actual | | $ | 1,000.00 | | | $ | 1,041.20 | | | $ | 3.63 | |

| Hypothetical (5% return before expenses) | | $ | 1,000.00 | | | $ | 1,021.51 | | | $ | 3.60 | |

| Admin Class | | | | | | | | | | | | |

| Actual | | $ | 1,000.00 | | | $ | 1,038.90 | | | $ | 6.18 | |

| Hypothetical (5% return before expenses) | | $ | 1,000.00 | | | $ | 1,019.00 | | | $ | 6.12 | |

| * | Expenses are equal to the Fund's annualized expense ratio: 0.96%, 1.71%, 1.71%, 0.57%, 0.71% and 1.21% for Class A, B, C, N, Y and Admin Class, respectively, multiplied by the average account value over the period, multiplied by the number of days in the most recent fiscal half-year (183), divided by 365 (to reflect the half-year period). |

| 16

BOARD APPROVAL OF THE EXISTING ADVISORY AGREEMENTS

The Board of Trustees of the Trust (the “Board”), including the Independent Trustees, considers matters bearing on each Fund’s advisory agreement (collectively, the “Agreements”) at most of its meetings throughout the year. Each year, usually in the spring, the Contract Review Committee of the Board meets to review the Agreements to determine whether to recommend that the full Board approve the continuation of the Agreements, typically for an additional one-year period. After the Committee has made its recommendation, the full Board, including the Independent Trustees, determines whether to approve the continuation of the Agreements.

In connection with these meetings, the Trustees receive materials that the Funds’ investment adviser (the “Adviser”) believes to be reasonably necessary for the Trustees to evaluate the Agreements. These materials generally include, among other items, (i) information on the investment performance of the Funds and the performance of peer groups of funds and the Funds’ performance benchmarks, (ii) information on the Funds’ advisory fees and other expenses, including information comparing the Funds’ expenses to the fees charged to institutional accounts with similar strategies managed by the Adviser, if any, and to those of peer groups of funds and information about any applicable expense caps and fee “breakpoints,” (iii) sales and redemption data in respect of the Funds, (iv) information about the profitability of the Agreements to the Adviser and (v) information obtained through the completion by the Adviser of a questionnaire distributed on behalf of the Trustees. The Board, including the Independent Trustees, also considers other matters such as (i) the Adviser’s financial results and financial condition, (ii) each Fund’s investment objective and strategies and the size, education and experience of the Adviser’s investment staff and its use of technology, external research and trading cost measurement tools, (iii) arrangements in respect of the distribution of the Funds’ shares and the related costs, (iv) the procedures employed to determine the value of the Funds’ assets, (v) the allocation of the Funds’ brokerage, if any, including, if applicable, allocations to brokers affiliated with the Adviser and the use of “soft” commission dollars to pay Fund expenses and to pay for research and other similar services, (vi) the resources devoted to, and the record of compliance with, the Funds’ investment policies and restrictions, policies on personal securities transactions and other compliance policies, (vii) information about amounts invested by the Funds’ portfolio managers in the Funds or in similar accounts that they manage and (viii) the general economic outlook with particular emphasis on the mutual fund industry. Throughout the process, the Trustees are afforded the opportunity to ask questions of and request additional materials from the Adviser.

In addition to the materials requested by the Trustees in connection with their annual consideration of the continuation of the Agreements, the Trustees receive materials in advance of each regular quarterly meeting of the Board that provide detailed information about the Funds’ investment performance and the fees charged to the Funds for advisory and other services. This information generally includes, among other things, an internal performance rating for each Fund based on agreed-upon criteria, graphs showing each Fund’s performance and fee differentials against each Fund’s peer group/category, performance ratings provided by a third-party, total return information for various periods,

17 |

and third-party performance rankings for various periods comparing a Fund against similarly categorized funds. The portfolio management team for each Fund or other representatives of the Adviser make periodic presentations to the Contract Review Committee and/or the full Board, and Funds identified as presenting possible performance concerns may be subject to more frequent board presentations and reviews. In addition, each quarter the Trustees are provided with detailed statistical information about each Fund’s portfolio. The Trustees also receive periodic updates between meetings.

The Board most recently approved the continuation of the Agreements at its meeting held in June 2014. The Agreements were continued for a one-year period for the Funds. In considering whether to approve the continuation of the Agreements, the Board, including the Independent Trustees, did not identify any single factor as determinative. Individual Trustees may have evaluated the information presented differently from one another, giving different weights to various factors. Matters considered by the Trustees, including the Independent Trustees, in connection with their approval of the Agreements included, but were not limited to, the factors listed below.

The nature, extent and quality of the services provided to the Funds under the Agreements. The Trustees considered the nature, extent and quality of the services provided by the Adviser and its affiliates to the Funds and the resources dedicated to the Funds by the Adviser and its affiliates.

The Trustees considered not only the advisory services provided by the Adviser to the Funds, but also the administrative services provided by NGAM Advisors, L.P. (“NGAM Advisors”) and its affiliates to the Funds. For each Fund, the Trustees also considered the benefits to shareholders of investing in a mutual fund that is part of a family of funds that offers shareholders the right to exchange shares of one type of fund for shares of another type of fund, and provides a variety of fund and shareholder services.

After reviewing these and related factors, the Trustees concluded, within the context of their overall conclusions regarding each of the Agreements, that the nature, extent and quality of services provided supported the renewal of the Agreements.

Investment performance of the Funds and the Adviser. As noted above, the Trustees received information about the performance of the Funds over various time periods, including information that compared the performance of the Funds to the performance of peer groups and categories of funds and the Funds’ respective performance benchmarks. In addition, the Trustees also reviewed data prepared by an independent third party that analyzed the performance of the Funds using a variety of performance metrics, including metrics that also measured the performance of the Funds on a risk adjusted basis. With respect to each Fund, the Board concluded that the Fund’s performance or other relevant factors supported the renewal of the Agreement relating to that Fund.

The Trustees also considered the Adviser’s performance and reputation generally, the performance of the fund family generally, and the historical responsiveness of the Adviser to Trustee concerns about performance and the willingness of the Adviser to take steps intended to improve performance.

After reviewing these and related factors, the Trustees concluded, within the context of their overall conclusions regarding each of the Agreements, that the performance of the Funds and the Adviser supported the renewal of the Agreements.

| 18

The costs of the services to be provided and profits to be realized by the Adviser and its affiliates from their respective relationships with the Funds. The Trustees considered the fees charged to the Funds for advisory services as well as the total expense levels of the Funds. This information included comparisons (provided both by management and also by an independent third party) of the Funds’ advisory fees and total expense levels to those of their peer groups and information about the advisory fees charged by the Adviser to comparable accounts (such as institutional separate accounts), as well as information about differences in such fees and the reasons for any such differences. In considering the fees charged to comparable accounts, the Trustees considered, among other things, management’s representations about the differences between managing mutual funds as compared to other types of accounts, including the additional resources required to effectively manage mutual fund assets and the greater regulatory costs associated with the management of such assets. In evaluating each Fund’s advisory fee, the Trustees also took into account the demands, complexity and quality of the investment management of such Fund and the need for the Adviser to offer competitive compensation. The Trustees considered that over the past several years, management had made recommendations regarding reductions in advisory fee rates, implementation of advisory fee breakpoints and the institution of advisory fee waivers and expense caps for various funds in the fund family. They noted that the Funds in this report have expense caps in place and the Trustees considered that the Funds’ current expenses are below their respective caps. The Trustees also considered management’s proposal to add a breakpoint to the advisory fee for the Loomis Sayles Global Equity and Income Fund.

The Trustees also considered the compensation directly or indirectly received by the Adviser and its affiliates from their relationships with the Funds. The Trustees reviewed information provided by management as to the profitability of the Adviser’s and its affiliates’ relationships with the Funds, and information about the allocation of expenses used to calculate profitability. They also reviewed information provided by management about the effect of distribution costs and changes in asset levels on Adviser profitability, including information regarding resources spent on distribution activities. When reviewing profitability, the Trustees also considered information about court cases in which adviser compensation or profitability were issues, the performance of the relevant Funds, the expense levels of the Funds, and whether the Adviser had implemented breakpoints and/or expense caps with respect to such Funds.

After reviewing these and related factors, the Trustees concluded, within the context of their overall conclusions regarding each of the Agreements, that the advisory fee charged to each of the Funds was fair and reasonable, and that the costs of these services generally and the related profitability of the Adviser and its affiliates in respect of their relationships with the Funds supported the renewal of the Agreements.

Economies of Scale. The Trustees considered the existence of any economies of scale in the provision of services by the Adviser and whether those economies are shared with the Funds through breakpoints in their investment advisory fees or other means, such as expense waivers or caps. The Trustees also discussed with management the factors considered with respect to the implementation of breakpoints in investment advisory fees or expense waivers or caps for certain funds. Management explained that a number of factors are taken into account in considering the possible implementation of breakpoints or an expense cap for a

19 |

fund, including, among other things, factors such as a fund’s assets, the projected growth of a fund, projected profitability and a fund’s fees and performance. With respect to economies of scale, the Trustees noted that each of the Funds was subject to an expense cap or waiver. The Trustees also noted that management had proposed the implementation of a breakpoint for the Loomis Sayles Global Equity and Income Fund. In considering these issues, the Trustees also took note of the costs of the services provided (both on an absolute and a relative basis) and the profitability to the Adviser and its affiliates of their relationships with the Funds, as discussed above.

After reviewing these and related factors, the Trustees concluded, within the context of their overall conclusions regarding each of the Agreements, that the extent to which economies of scale were shared with the Funds supported the renewal of the Agreements.

The Trustees also considered other factors, which included but were not limited to the following:

| · | | The effect of recent market and economic events on the performance, asset levels and expense ratios of each Fund. |

| · | | Whether each Fund has operated in accordance with its investment objective and the Fund’s record of compliance with its investment restrictions, and the compliance programs of the Funds and the Adviser. They also considered the compliance-related resources the Adviser and its affiliates were providing to the Funds. |

| · | | The nature, quality, cost and extent of administrative and shareholder services performed by the Adviser and its affiliates, both under the Agreements and under separate agreements covering administrative services. |

| · | | So-called “fallout benefits” to the Adviser, such as the engagement of affiliates of the Adviser to provide distribution, administrative and brokerage services to the Funds, and the benefits of research made available to the Adviser by reason of brokerage commissions (if any) generated by the Funds’ securities transactions. The Trustees also considered the benefits to the parent company of NGAM Advisors from the retention of the Adviser. The Trustees considered the possible conflicts of interest associated with these fallout and other benefits, and the reporting, disclosure and other processes in place to disclose and monitor such possible conflicts of interest. |

| · | | The Trustees’ review and discussion of the Funds’ advisory arrangements in prior years, and management’s record of responding to Trustee concerns raised during the year and in prior years. |

Based on their evaluation of all factors that they deemed to be material, including those factors described above, and assisted by the advice of independent counsel, the Trustees, including the Independent Trustees, concluded that each of the existing Agreements, with the addition of the breakpoint with respect to the Loomis Sayles Global Equity and Income Fund described above, should be continued through June 30, 2015.

| 20

Portfolio of Investments – as of September 30, 2014

Loomis Sayles Global Equity and Income Fund

| | | | | | | | |

Shares | | | Description | | Value (†) | |

| | Common Stocks — 68.6% of Net Assets | |

| | | | Belgium — 1.5% | | | | |

| | 167,680 | | | Anheuser-Busch InBev NV | | $ | 18,595,356 | |

| | | | | | | | |

| | | | Canada — 1.7% | | | | |

| | 617,200 | | | CGI Group, Inc., Class A(b) | | | 20,853,474 | |

| | | | | | | | |

| | | | China — 2.6% | | | | |

| | 195,836 | | | Alibaba Group Holding Ltd., Sponsored ADR(b) | | | 17,400,028 | |

| | 1,572,000 | | | Hengan International Group Co. Ltd. | | | 15,465,001 | |

| | | | | | | | |

| | | | | | | 32,865,029 | |

| | | | | | | | |

| | | | Denmark — 1.4% | | | | |

| | 362,698 | | | Novo Nordisk AS, Class B | | | 17,268,698 | |

| | | | | | | | |

| | | | Germany — 2.4% | | | | |

| | 118,194 | | | Bayer AG, (Registered) | | | 16,445,311 | |

| | 272,253 | | | Brenntag AG | | | 13,325,203 | |

| | | | | | | | |

| | | | | | | 29,770,514 | |

| | | | | | | | |

| | | | India — 2.3% | | | | |

| | 486,464 | | | HCL Technologies Ltd. | | | 13,493,078 | |

| | 714,030 | | | HDFC Bank Ltd. | | | 10,617,022 | |

| | 718,916 | | | Motherson Sumi Systems Ltd. | | | 4,592,812 | |

| | | | | | | | |

| | | | | | | 28,702,912 | |

| | | | | | | | |

| | | | Italy — 1.1% | | | | |

| | 277,845 | | | Luxottica Group S.p.A. | | | 14,441,791 | |

| | | | | | | | |

| | | | Japan — 3.7% | | | | |

| | 399,500 | | | Asahi Group Holdings Ltd. | | | 11,556,001 | |

| | 2,461,800 | | | Mitsubishi UFJ Financial Group, Inc. | | | 13,874,000 | |

| | 433,900 | | | Nomura Research Institute Ltd. | | | 14,032,354 | |

| | 197,300 | | | Suzuki Motor Corp. | | | 6,543,495 | |

| | | | | | | | |

| | | | | | | 46,005,850 | |

| | | | | | | | |

| | | | Mexico — 1.2% | | | | |

| | 6,492,732 | | | Genomma Lab Internacional S.A. de CV, Class B(b) | | | 15,600,347 | |

| | | | | | | | |

| | | | Sweden — 1.4% | | | | |

| | 609,499 | | | Atlas Copco AB, Class A | | | 17,391,261 | |

| | | | | | | | |

| | | | Switzerland — 2.4% | | | | |

| | 99,604 | | | Roche Holding AG | | | 29,413,352 | |

| | | | | | | | |

| | | | Thailand — 1.1% | | | | |

| | 1,230,700 | | | Bangkok Bank PCL | | | 7,959,148 | |

| | 397,000 | | | Siam Cement PCL (The) | | | 5,501,070 | |

| | | | | | | | |

| | | | | | | 13,460,218 | |

| | | | | | | | |

| | | | United Kingdom — 4.7% | | | | |

| | 434,270 | | | Diageo PLC | | | 12,525,269 | |

| | 7,457,754 | | | Legal & General Group PLC | | | 27,596,081 | |

| | 598,716 | | | London Stock Exchange Group PLC | | | 18,067,654 | |

| | | | | | | | |

| | | | | | | 58,189,004 | |

| | | | | | | | |

See accompanying notes to financial statements.

21 |

Portfolio of Investments – as of September 30, 2014

Loomis Sayles Global Equity and Income Fund – (continued)

| | | | | | | | |

Shares | | | Description | | Value (†) | |

| | | | United States — 41.1% | | | | |

| | 136,119 | | | ACE Ltd. | | $ | 14,274,800 | |

| | 47,893 | | | Amazon.com, Inc.(b) | | | 15,442,619 | |

| | 193,145 | | | American Express Co. | | | 16,907,913 | |

| | 45,899 | | | AutoZone, Inc.(b) | | | 23,392,884 | |

| | 424,680 | | | Citigroup, Inc. | | | 22,006,918 | |

| | 73,617 | | | Core Laboratories NV | | | 10,773,848 | |

| | 152,555 | | | Facebook, Inc., Class A(b) | | | 12,057,947 | |

| | 100,644 | | | FactSet Research Systems, Inc. | | | 12,231,265 | |

| | 182,039 | | | Genesee & Wyoming, Inc., Class A(b) | | | 17,350,137 | |

| | 164,748 | | | Gilead Sciences, Inc.(b) | | | 17,537,425 | |

| | 131,215 | | | Goldman Sachs Group, Inc. (The) | | | 24,087,138 | |

| | 26,035 | | | Google, Inc., Class A(b) | | | 15,319,254 | |

| | 26,035 | | | Google, Inc., Class C(b) | | | 15,031,568 | |

| | 162,030 | | | Gulfport Energy Corp.(b) | | | 8,652,402 | |

| | 955 | | | Hawaiian Telcom Holdco, Inc.(b) | | | 24,534 | |

| | 181,348 | | | Lowe’s Cos., Inc. | | | 9,596,936 | |

| | 114,060 | | | M&T Bank Corp. | | | 14,062,457 | |

| | 119,591 | | | National Oilwell Varco, Inc. | | | 9,100,875 | |

| | 277,440 | | | Noble Energy, Inc. | | | 18,965,798 | |

| | 205,906 | | | Oceaneering International, Inc. | | | 13,418,894 | |

| | 102,816 | | | Praxair, Inc. | | | 13,263,264 | |

| | 92,162 | | | Precision Castparts Corp. | | | 21,831,335 | |

| | 25,346 | | | Priceline Group, Inc. (The)(b) | | | 29,365,369 | |

| | 93,340 | | | QUALCOMM, Inc. | | | 6,979,032 | |

| | 199,034 | | | Schlumberger Ltd. | | | 20,239,767 | |

| | 80,430 | | | Signet Jewelers Ltd. | | | 9,161,781 | |

| | 211,309 | | | Texas Instruments, Inc. | | | 10,077,326 | |

| | 147,300 | | | TransDigm Group, Inc. | | | 27,151,809 | |

| | 200,867 | | | UnitedHealth Group, Inc. | | | 17,324,779 | |

| | 174,094 | | | Valeant Pharmaceuticals International, Inc.(b) | | | 22,841,133 | |

| | 147,490 | | | Valspar Corp. (The) | | | 11,650,235 | |

| | 66,010 | | | W.W. Grainger, Inc. | | | 16,611,416 | |

| | 203,776 | | | Wyndham Worldwide Corp. | | | 16,558,838 | |

| | | | | | | | |

| | | | | | | 513,291,696 | |

| | | | | | | | |

| | | | Total Common Stocks

(Identified Cost $723,409,467) | | | 855,849,502 | |

| | | | | | | | |

| | | | | | | | |

Principal

Amount (‡) | | | | | | |

| | Bonds and Notes — 28.3% | |

| | Non-Convertible Bonds — 27.6% | |

| | | | Argentina — 0.1% | | | | |

| $ | 382,136 | | | Transportadora de Gas del Sur S.A., 9.625%, 5/14/2020, 144A | | | 378,315 | |

| | 1,180,000 | | | YPF S.A., 8.750%, 4/04/2024, 144A(c) | | | 1,203,600 | |

| | | | | | | | |

| | | | | | | 1,581,915 | |

| | | | | | | | |

| | | | Australia — 0.3% | | | | |

| | 110,000 | | | Incitec Pivot Finance LLC, 6.000%, 12/10/2019, 144A | | | 123,679 | |

| | 1,200,000 | | | Macquarie Bank Ltd., 5.000%, 2/22/2017, 144A(c) | | | 1,293,176 | |

See accompanying notes to financial statements.

| 22

Portfolio of Investments – as of September 30, 2014

Loomis Sayles Global Equity and Income Fund – (continued)

| | | | | | | | |

Principal

Amount (‡) | | | Description | | Value (†) | |

| | | | Australia — continued | | | | |

| $ | 500,000 | | | Macquarie Bank Ltd., 6.625%, 4/07/2021, 144A | | $ | 569,735 | |

| | 2,185,000 | | | New South Wales Treasury Corp., 6.000%, 2/01/2018, (AUD)(c) | | | 2,094,293 | |

| | 155,000 | | | Sydney Airport Finance Co., 5.125%, 2/22/2021, 144A | | | 172,505 | |

| | | | | | | | |

| | | | | | | 4,253,388 | |

| | | | | | | | |

| | | | Barbados — 0.0% | | | | |

| | 200,000 | | | Columbus International, Inc., 7.375%, 3/30/2021, 144A | | | 208,000 | |

| | | | | | | | |

| | | | Belgium — 0.1% | | | | |

| | 350,000 | | | Anheuser-Busch InBev NV, EMTN, 6.500%, 6/23/2017, (GBP) | | | 635,079 | |

| | | | | | | | |

| | | | Brazil — 1.9% | | | | |

| | 800,000 | | | Banco do Brasil S.A., 3.875%, 10/10/2022 | | | 742,000 | |

| | 1,100,000 | | | Banco Nacional de Desenvolvimento Economico e Social,

5.750%, 9/26/2023, 144A | | | 1,174,580 | |

| | 400,000 | | | Banco Santander Brasil S.A., 4.500%, 4/06/2015, 144A | | | 404,500 | |

| | 600,000 | | | Banco Santander Brasil S.A., 4.625%, 2/13/2017, 144A | | | 626,250 | |

| | 2,045,017 | | | Banco Votorantim S.A., 6.250%, 5/16/2016, 144A, (BRL) | | | 799,799 | |

| | 800,000 | | | Braskem Finance Ltd., 5.750%, 4/15/2021, 144A | | | 818,400 | |

| | 6,600(††) | | | Brazil Letras do Tesouro Nacional, Zero Coupon, 7/01/2016, (BRL)(c) | | | 2,200,643 | |

| | 591,287(†††) | | | Brazil Notas do Tesouro Nacional, Series B, 6.000%, 5/15/2015, (BRL) | | | 246,245 | |

| | 2,250(††) | | | Brazil Notas do Tesouro Nacional, Series F, 10.000%, 1/01/2019, (BRL) | | | 850,487 | |

| | 1,115(††) | | | Brazil Notas do Tesouro Nacional, Series F, 10.000%, 1/01/2021, (BRL) | | | 411,182 | |

| | 2,250,000 | | | Brazilian Government International Bond, 10.250%, 1/10/2028, (BRL) | | | 910,019 | |

| | 1,700,000 | | | BRF S.A., 3.950%, 5/22/2023, 144A(c) | | | 1,599,615 | |

| | 600,000 | | | BRF S.A., 5.875%, 6/06/2022, 144A | | | 648,000 | |

| | 2,300,000 | | | BRF S.A., 7.750%, 5/22/2018, 144A, (BRL) | | | 822,184 | |

| | 1,255,000 | | | Cielo S.A./Cielo USA, Inc., 3.750%, 11/16/2022, 144A | | | 1,164,013 | |

| | 1,000,000 | | | CIMPOR Financial Operations BV, 5.750%, 7/17/2024, 144A | | | 967,500 | |

| | 400,000 | | | Cosan Luxembourg S.A., 5.000%, 3/14/2023, 144A | | | 384,000 | |

| | 400,000 | | | CSN Resources S.A., 6.500%, 7/21/2020, 144A | | | 408,800 | |

| | 800,000 | | | Gerdau Trade, Inc., 5.750%, 1/30/2021, 144A | | | 825,000 | |

| | 226,000 | | | GTL Trade Finance, Inc., 5.893%, 4/29/2024, 144A | | | 228,511 | |

| | 300,000 | | | Itau Unibanco Holding S.A., 6.200%, 12/21/2021, 144A | | | 312,750 | |

| | 100,000 | | | LPG International, Inc., 7.250%, 12/20/2015 | | | 106,223 | |

| | 175,000 | | | Odebrecht Drilling Norbe VIII/IX Ltd., 6.350%, 6/30/2021, 144A | | | 180,075 | |

| | 858,330 | | | Odebrecht Offshore Drilling Finance Ltd., 6.750%, 10/01/2022, 144A | | | 890,517 | |

| | 2,400,000 | | | Oi S.A., 9.750%, 9/15/2016, 144A, (BRL) | | | 893,032 | |

| | 1,750,000 | | | Petrobras Global Finance BV, 4.375%, 5/20/2023(c) | | | 1,639,802 | |

| | 320,000 | | | Petrobras International Finance Co., 5.375%, 1/27/2021 | | | 323,462 | |

| | 775,000 | | | Petrobras International Finance Co., 5.750%, 1/20/2020 | | | 815,463 | |

| | 300,000 | | | Petrobras International Finance Co., 6.875%, 1/20/2040 | | | 309,852 | |

| | 800,000 | | | Samarco Mineracao S.A., 4.125%, 11/01/2022, 144A | | | 744,960 | |

| | 500,000 | | | Tupy Overseas S.A., 6.625%, 7/17/2024, 144A | | | 508,750 | |

| | 1,106,000 | | | Vale Overseas Ltd., 6.875%, 11/21/2036(c) | | | 1,247,015 | |

| | | | | | | | |

| | | | | | | 24,203,629 | |

| | | | | | | | |

| | | | Canada — 0.8% | | | | |

| | 1,085,000 | | | Air Canada, 7.625%, 10/01/2019, 144A, (CAD) | | | 1,036,338 | |

| | 1,570,000 | | | Bank of Nova Scotia, 1.450%, 4/25/2018(c) | | | 1,548,026 | |

See accompanying notes to financial statements.

23 |

Portfolio of Investments – as of September 30, 2014

Loomis Sayles Global Equity and Income Fund – (continued)

| | | | | | | | |

Principal

Amount (‡) | | | Description | | Value (†) | |

| | | | Canada — continued | | | | |

| | 650,000 | | | Canadian Government, 1.000%, 8/01/2016, (CAD) | | $ | 579,002 | |

| | 3,000,000 | | | Canadian Government, 1.250%, 9/01/2018, (CAD)(c) | | | 2,655,601 | |

| | 70,000 | | | Canadian Government, 1.750%, 9/01/2019, (CAD) | | | 62,853 | |

| | 2,065,000 | | | Canadian Government, 3.000%, 12/01/2015, (CAD)(c) | | | 1,886,093 | |

| | 1,335,000 | | | Institutional Mortgage Securities Canada, Inc., Series 2014-5A, Class A2,

2.616%, 1/12/2024, 144A, (CAD) | | | 1,191,719 | |

| | 600,000 | | | Telus Corp., Series CG, 5.050%, 12/04/2019, (CAD) | | | 594,171 | |

| | | | | | | | |

| | | | | | | 9,553,803 | |

| | | | | | | | |

| | | | Chile — 0.5% | | | | |

| | 1,450,000 | | | Banco de Credito e Inversiones, 3.000%, 9/13/2017, 144A(c) | | | 1,488,425 | |

| | 200,000 | | | Celulosa Arauco y Constitucion S.A., 4.750%, 1/11/2022 | | | 202,321 | |

| | 300,000,000 | | | Chile Government International Bond, 5.500%, 8/05/2020, (CLP)(c) | | | 529,210 | |

| | 1,135,000 | | | Corpbanca S.A., 3.125%, 1/15/2018 | | | 1,137,329 | |

| | 250,000 | | | E.CL S.A., 5.625%, 1/15/2021, 144A | | | 273,763 | |

| | 800,000 | | | Inversiones CMPC S.A., 4.375%, 5/15/2023, 144A | | | 776,647 | |

| | 1,120,000 | | | Transelec S.A., 4.250%, 1/14/2025, 144A | | | 1,111,517 | |

| | 400,000 | | | VTR Finance BV, 6.875%, 1/15/2024, 144A | | | 414,000 | |

| | | | | | | | |

| | | | | | | 5,933,212 | |

| | | | | | | | |

| | | | China — 0.3% | | | | |

| | 800,000 | | | Baidu, Inc., 2.250%, 11/28/2017 | | | 804,839 | |

| | 700,000 | | | Baidu, Inc., 3.250%, 8/06/2018 | | | 720,712 | |

| | 400,000 | | | China Resources Gas Group Ltd., 4.500%, 4/05/2022, 144A | | | 412,694 | |

| | 1,200,000 | | | CNOOC Finance 2013 Ltd., 3.000%, 5/09/2023 | | | 1,115,063 | |

| | 1,000,000 | | | Parkson Retail Group Ltd., 4.500%, 5/03/2018 | | | 929,920 | |

| | | | | | | | |

| | | | | | | 3,983,228 | |

| | | | | | | | |

| | | | Colombia — 0.6% | | | | |

| | 555,000 | | | Colombia Telecomunicaciones S.A. E.S.P., 5.375%, 9/27/2022, 144A | | | 557,775 | |

| | 610,000 | | | Ecopetrol S.A., 4.125%, 1/16/2025 | | | 590,175 | |

| | 1,180,000 | | | Ecopetrol S.A., 5.875%, 9/18/2023(c) | | | 1,302,425 | |

| | 435,000,000 | | | Emgesa S.A. E.S.P., 8.750%, 1/25/2021, (COP) | | | 232,495 | |

| | 830,000,000 | | | Emgesa S.A. E.S.P., 8.750%, 1/25/2021, 144A, (COP) | | | 443,610 | |

| | 2,140,000,000 | | | Empresas Publicas de Medellin E.S.P., 8.375%, 2/01/2021, 144A, (COP) | | | 1,112,908 | |

| | 875,000 | | | Pacific Rubiales Energy Corp., 5.125%, 3/28/2023, 144A | | | 835,888 | |

| | 580,000 | | | Pacific Rubiales Energy Corp., 5.625%, 1/19/2025, 144A | | | 557,351 | |

| | 200,000,000 | | | Republic of Colombia, 7.750%, 4/14/2021, (COP) | | | 106,963 | |

| | 1,150,000 | | | SUAM Finance BV, 4.875%, 4/17/2024, 144A | | | 1,170,125 | |

| | | | | | | | |

| | | | | | | 6,909,715 | |

| | | | | | | | |

| | | | Czech Republic — 0.0% | | | | |

| | 400,000 | | | CEZ AS, 4.250%, 4/03/2022, 144A | | | 420,494 | |

| | | | | | | | |

| | | | Dominican Republic — 0.0% | | | | |

| | 425,000 | | | Dominican Republic International Bond, 8.625%, 4/20/2027, 144A | | | 514,250 | |

| | | | | | | | |

| | | | Finland — 0.1% | | | | |

| | 1,015,000 | | | Finland Government Bond, 1.500%, 4/15/2023, 144A, (EUR)(c) | | | 1,345,455 | |

| | | | | | | | |

See accompanying notes to financial statements.

| 24

Portfolio of Investments – as of September 30, 2014

Loomis Sayles Global Equity and Income Fund – (continued)

| | | | | | | | |

Principal

Amount (‡) | | | Description | | Value (†) | |

| | | | France — 0.2% | | | | |

| $ | 425,000 | | | Alcatel-Lucent USA, Inc., 6.450%, 3/15/2029 | | $ | 400,562 | |

| | 15,000 | | | Alcatel-Lucent USA, Inc., 6.500%, 1/15/2028 | | | 14,138 | |

| | 200,000 | | | AXA S.A., 7.125%, 12/15/2020, (GBP) | | | 382,855 | |

| | 1,130,000 | | | Societe Generale S.A., 5.000%, 1/17/2024, 144A | | | 1,137,615 | |

| | | | | | | | |

| | | | | | | 1,935,170 | |

| | | | | | | | |

| | | | Hong Kong — 0.1% | | | | |

| | 400,000 | | | Hutchison Whampoa International 11 Ltd., 3.500%, 1/13/2017, 144A | | | 418,736 | |

| | 400,000 | | | Noble Group Ltd., 6.750%, 1/29/2020, 144A | | | 446,000 | |

| | | | | | | | |

| | | | | | | 864,736 | |

| | | | | | | | |

| | | | Hungary — 0.2% | | | | |

| | 1,330,000 | | | Hungary Government International Bond, 5.375%, 3/25/2024 | | | 1,403,150 | |

| | 980,000 | | | Hungary Government International Bond, 5.750%, 11/22/2023 | | | 1,062,075 | |

| | 520,000 | | | Hungary Government International Bond, 7.625%, 3/29/2041 | | | 663,000 | |

| | | | | | | | |

| | | | | | | 3,128,225 | |

| | | | | | | | |

| | | | Iceland — 0.1% | | | | |

| | 1,000,000 | | | Republic of Iceland, 5.875%, 5/11/2022, 144A | | | 1,126,424 | |

| | | | | | | | |

| | | | India — 0.5% | | | | |

| | 1,155,000 | | | Bharti Airtel International Netherlands BV, 5.125%, 3/11/2023, 144A | | | 1,214,321 | |

| | 990,000 | | | Bharti Airtel International Netherlands BV, 5.350%, 5/20/2024, 144A | | | 1,054,934 | |

| | 200,000 | | | Canara Bank Ltd., (fixed rate to 11/28/2016, variable rate thereafter),

6.365%, 11/28/2021 | | | 204,766 | |

| | 780,000 | | | ICICI Bank Ltd., 3.500%, 3/18/2020, 144A | | | 780,906 | |

| | 1,400,000 | | | ICICI Bank Ltd., (fixed rate to 4/30/2017, variable rate thereafter),

6.375%, 4/30/2022, 144A(c) | | | 1,460,200 | |

| | 750,000 | | | Reliance Holdings USA, Inc., 5.400%, 2/14/2022, 144A | | | 818,724 | |

| | 700,000 | | | State Bank of India/London, 4.125%, 8/01/2017, 144A | | | 729,667 | |

| | | | | | | | |

| | | | | | | 6,263,518 | |

| | | | | | | | |

| | | | Indonesia — 0.6% | | | | |

| | 200,000 | | | Adaro Indonesia PT, 7.625%, 10/22/2019, 144A | | | 208,200 | |

| | 800,000 | | | Gajah Tunggal Tbk PT, 7.750%, 2/06/2018, 144A | | | 804,000 | |

| | 3,500,000,000 | | | Indonesia Government International Bond, 9.500%, 7/15/2023, (IDR) | | | 303,324 | |

| | 781,000,000 | | | Indonesia Government International Bond, 11.500%, 9/15/2019, (IDR) | | | 72,728 | |

| | 12,100,000,000 | | | Indonesia Treasury Bond, 6.125%, 5/15/2028, (IDR) | | | 797,100 | |

| | 14,000,000,000 | | | Indonesia Treasury Bond, 8.375%, 3/15/2024, (IDR) | | | 1,140,336 | |

| | 200,000 | | | Indosat Palapa Co. BV, 7.375%, 7/29/2020, 144A | | | 212,000 | |

| | 400,000 | | | Listrindo Capital BV, 6.950%, 2/21/2019, 144A | | | 423,000 | |

| | 2,800,000 | | | Pertamina Persero PT, 4.300%, 5/20/2023, 144A(c) | | | 2,653,000 | |

| | 545,000 | | | Republic of Indonesia, 2.875%, 7/08/2021, 144A, (EUR) | | | 695,246 | |

| | 500,000 | | | TBG Global Pte Ltd., 4.625%, 4/03/2018, 144A | | | 496,250 | |

| | | | | | | | |

| | | | | | | 7,805,184 | |

| | | | | | | | |

| | | | Ireland — 0.2% | | | | |

| | 1,600,000 | | | AIB Mortgage Bank, EMTN, 4.875%, 6/29/2017, (EUR)(c) | | | 2,268,564 | |

| | | | | | | | |

| | | | Italy — 1.0% | | | | |

| | 2,860,000 | | | Italy Buoni Poliennali Del Tesoro, 4.500%, 8/01/2018, (EUR)(c) | | | 4,111,338 | |

| | 2,295,000 | | | Italy Buoni Poliennali Del Tesoro, 4.750%, 8/01/2023, 144A, (EUR)(c) | | | 3,509,092 | |

See accompanying notes to financial statements.

25 |

Portfolio of Investments – as of September 30, 2014

Loomis Sayles Global Equity and Income Fund – (continued)

| | | | | | | | |

Principal

Amount (‡) | | | Description | | Value (†) | |

| | | | Italy — continued | | | | |

| | 1,925,000 | | | Italy Buoni Poliennali Del Tesoro, 5.000%, 3/01/2022, (EUR) | | $ | 2,962,286 | |

| | 125,000 | | | Telecom Italia Capital S.A., 6.000%, 9/30/2034 | | | 122,344 | |

| | 10,000 | | | Telecom Italia Capital S.A., 6.375%, 11/15/2033 | | | 9,950 | |

| | 725,000 | | | UniCredit SpA, EMTN, 6.950%, 10/31/2022, (EUR) | | | 1,076,820 | |

| | 870,000 | | | Wind Acquisition Finance S.A., 7.375%, 4/23/2021, 144A | | | 874,350 | |

| | | | | | | | |

| | | | 12,666,180 | |

| | | | | | | | |

| | | | Japan — 0.2% | | | | |

| | 1,165,000 | | | Nomura Holdings, Inc., GMTN, 2.750%, 3/19/2019 | | | 1,167,041 | |

| | 850,000 | | | Softbank Corp., 4.500%, 4/15/2020, 144A(c) | | | 847,875 | |

| | | | | | | | |

| | | | 2,014,916 | |

| | | | | | | | |

| | | | Korea — 0.8% | | | | |

| | 3,700,000 | | | Export-Import Bank of Korea, 3.000%, 5/22/2018, 144A, (NOK) | | | 586,379 | |

| | 400,000 | | | Hana Bank, 4.000%, 11/03/2016, 144A | | | 420,588 | |

| | 600,000 | | | Hyundai Capital Services, Inc., 3.500%, 9/13/2017, 144A | | | 626,064 | |

| | 600,000 | | | Hyundai Steel Co., 4.625%, 4/21/2016, 144A | | | 624,741 | |

| | 600,000 | | | Industrial Bank of Korea, 2.375%, 7/17/2017, 144A | | | 609,652 | |

| | 400,000 | | | Kia Motors Corp., 3.625%, 6/14/2016, 144A(c) | | | 415,194 | |

| | 400,000 | | | Korea Finance Corp., 4.625%, 11/16/2021 | | | 435,017 | |

| | 400,000 | | | Korea National Oil Corp., 3.125%, 4/03/2017, 144A | | | 413,240 | |

| | 3,784,140,000 | | | Korea Treasury Bond, 2.750%, 9/10/2017, (KRW)(c) | | | 3,626,250 | |

| | 970,000,000 | | | Korea Treasury Bond, 4.000%, 3/10/2016, (KRW) | | | 941,744 | |

| | 250,000 | | | Lotte Shopping Co. Ltd., 3.375%, 5/09/2017, 144A | | | 258,320 | |

| | 1,125,000 | | | Minera y Metalurgica del Boleo S.A. de CV, 2.875%, 5/07/2019, 144A | | | 1,136,293 | |

| | 140,000 | | | SK Telecom Co. Ltd., 6.625%, 7/20/2027, 144A | | | 175,678 | |

| | 200,000 | | | Woori Bank, 5.875%, 4/13/2021, 144A | | | 226,534 | |

| | | | | | | | |

| | | | 10,495,694 | |

| | | | | | | | |

| | | | Luxembourg — 0.2% | | | | |

| | 400,000 | | | Altice Financing S.A., 7.875%, 12/15/2019, 144A | | | 426,500 | |

| | 500,000 | | | Altice S.A., 7.750%, 5/15/2022, 144A | | | 516,250 | |

| | 970,000 | | | ArcelorMittal, 7.250%, 3/01/2041 | | | 972,425 | |

| | 500,000 | | | Millicom International Cellular S.A., 4.750%, 5/22/2020, 144A | | | 476,250 | |

| | | | | | | | |

| | | | | | | 2,391,425 | |

| | | | | | | | |

| | | | Mexico — 1.2% | | | | |

| | 1,020,000 | | | Alfa SAB de CV, 5.250%, 3/25/2024, 144A | | | 1,087,830 | |

| | 10,000,000 | | | America Movil SAB de CV, 6.450%, 12/05/2022, (MXN) | | | 720,665 | |

| | 300,000 | | | Banco Santander Mexico S.A. Institucion de Banca Multiple Grupo Financiero Santander, 4.125%, 11/09/2022, 144A | | | 301,500 | |

| | 640,000 | | | Cemex Finance LLC, 6.000%, 4/01/2024, 144A | | | 638,208 | |

| | 10,000,000 | | | Grupo Televisa SAB, EMTN, 7.250%, 5/14/2043, (MXN) | | | 626,493 | |

| | 364,500(††††) | | | Mexican Fixed Rate Bonds, Series M, 6.500%, 6/10/2021, (MXN)(c) | | | 2,829,864 | |

| | 186,200(††††) | | | Mexican Fixed Rate Bonds, Series M, 6.500%, 6/09/2022, (MXN)(c) | | | 1,435,287 | |

| | 395,000(††††) | | | Mexican Fixed Rate Bonds, Series M-10, 8.500%, 12/13/2018, (MXN)(c) | | | 3,319,512 | |

| | 265,000(††††) | | | Mexican Fixed Rate Bonds, Series M-20, 8.000%, 12/07/2023, (MXN)(c) | | | 2,234,739 | |

| | 480,000 | | | Petroleos Mexicanos, 3.500%, 7/18/2018 | | | 497,760 | |

| | 925,000 | | | Unifin Financiera S.A.P.I. de CV SOFOM ENR, 6.250%, 7/22/2019, 144A | | | 901,875 | |

| | | | | | | | |

| | | | | | | 14,593,733 | |

| | | | | | | | |

See accompanying notes to financial statements.

| 26