SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A INFORMATION

Proxy Statement Pursuant to Section 14(a) of the

Securities Exchange Act of 1934

Filed by the Registrantx

Filed by a Party other than the Registrant¨

Check the appropriate box:

| ¨ | | Preliminary Proxy Statement |

| ¨ | | Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) |

| x | | Definitive Proxy Statement |

| ¨ | | Definitive Additional Materials |

| ¨ | | Soliciting Material Under Rule 14a-12 |

ICOS CORPORATION

(Name of Registrant as Specified In Its Charter)

(Name of Person(s) Filing Proxy Statement, if other than the Registrant)

Payment of Filing Fee (Check the appropriate box):

| ¨ | | Fee computed on table below per Exchange Act Rules 14a-6(i)(1) and 0-11. |

| | (1) | | Title of each class of securities to which transaction applies: |

| | (2) | | Aggregate number of securities to which transaction applies: |

| | (3) | | Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined): |

| | (4) | | Proposed maximum aggregate value of transaction: |

| ¨ | | Fee paid previously with preliminary materials. |

| ¨ | | Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing. |

| | (1) | | Amount Previously Paid: |

| | (2) | | Form, Schedule or Registration Statement No.: |

March 18, 2004

Dear ICOS Stockholder:

I cordially invite you to ICOS Corporation’s Annual Meeting of Stockholders, to be held on Friday, May 14, 2004, at 9:30 a.m., at the Benaroya Hall, Illsley Ball Nordstrom Recital Hall, 200 University Street, Seattle, Washington 98101.

This year you are asked to (1) elect four members to our Board of Directors, (2) ratify the appointment of KPMG LLP as independent auditors for the year ending December 31, 2004, and (3) consider and act upon a stockholder’s proposal described in the enclosed proxy statement.

As ICOS’ Chairman, I urge you to elect the four nominated directors, vote “For” the proposal to ratify the appointment of KPMG LLP as independent auditors for the year ending December 31, 2004, and vote “Against” the stockholder’s proposal described in the enclosed proxy statement. It is important that your shares be represented, whether or not you plan to attend the meeting. Therefore, please take a few minutes to vote now. To vote, please mark, sign and date the enclosed proxy card, and return it in the enclosed prepaid envelope as promptly as possible.

After the transaction of formal business at the meeting, management will provide an update on ICOS’ progress and respond to questions from stockholders. You can find other detailed information about ICOS and our operations, including our audited financial statements, in the enclosed Annual Report on Form 10-K for the year ended December 31, 2003.

On behalf of ICOS, thank you for your support.

|

Regards, |

|

|

Paul N. Clark Chairman of the Board of Directors,

President and Chief Executive Officer |

22021 – 20th Avenue S.E., Bothell, Washington 98021

Notice of 2004 Annual Meeting of Stockholders

TOTHE STOCKHOLDERS:

The Annual Meeting of Stockholders of ICOS Corporation will be held at the Benaroya Hall, Illsley Ball Nordstrom Recital Hall, 200 University Street, Seattle, Washington 98101, on Friday, May 14, 2004, at 9:30 a.m., for the following purposes:

| | 1. | | To elect four directors to serve until the third Annual Meeting of Stockholders following their election and until their successors are elected and qualified; |

| | 2. | | To ratify the appointment of KPMG LLP as independent auditors for the year ending December 31, 2004; |

| | 3. | | To consider and act upon the stockholder’s proposal described herein; and |

| | 4. | | To transact such other business as may properly come before the Annual Meeting. |

Your Board of Directors recommends that you vote to elect the four nominated directors, vote “For” the proposal to ratify the appointment of KPMG LLP as our independent auditors for the year ended December 31, 2004, and vote “Against” the stockholder proposal outlined in this Proxy Statement.

Your attention is directed to the accompanying Proxy Statement for further information with respect to the matters to be acted upon at the Annual Meeting. To constitute a quorum for the conduct of business at the Annual Meeting, it is necessary that holders of a majority of all outstanding shares of ICOS’ Common Stock be present in person or represented by proxy. To ensure representation at the Annual Meeting, you are urged to mark, sign and date the enclosed proxy card and return it promptly in the enclosed prepaid envelope.

Only stockholders of record at the close of business on March 17, 2004 are entitled to notice of, and to vote at, the Annual Meeting and all adjournments and postponements thereof.

|

| BY ORDEROFTHE BOARDOF DIRECTORS |

|

|

John B. Kliewer Secretary |

March 18, 2004

Bothell, Washington

YOUR VOTE IS IMPORTANT. ACCORDINGLY, YOU ARE URGED TO MARK, SIGN, DATE

AND RETURN THE ACCOMPANYING PROXY CARD, WHETHER OR NOT YOU PLAN TO ATTEND THE ANNUAL MEETING.

CONTENTS

i

PROXY STATEMENT

INFORMATION CONCERNING SOLICITATION AND VOTING

General

This Proxy Statement is furnished in connection with the solicitation by the Board of Directors of ICOS Corporation, the principal address of which is 22021 — 20th Avenue S.E., Bothell, Washington 98021, of proxies in the accompanying form for use at the 2004 Annual Meeting of Stockholders, to be held on Friday, May 14, 2004, at 9:30 a.m., at the Benaroya Hall, Illsley Ball Nordstrom Recital Hall, 200 University Street, Seattle, Washington 98101. The approximate date of mailing this Proxy Statement and the enclosed form of proxy is March 30, 2004.

Each share of ICOS’ $.01 par value Common Stock outstanding at the close of business on March 17, 2004 is entitled to one vote at the Annual Meeting. Proxies are solicited so that each stockholder may have an opportunity to vote on all matters that are scheduled to come before the Annual Meeting. When properly executed proxies are voted, the shares represented thereby will be voted in accordance with the stockholders’ directions. Stockholders are urged to specify their choices by marking the appropriate boxes on the enclosed proxy card, or, if no choice has been specified, the shares will be voted as recommended by ICOS’ Board of Directors.

Record Date

Only those stockholders who owned Common Stock at the close of business on March 17, 2004, the record date, can vote at the Annual Meeting. At that date, there were 63,302,727 issued and outstanding shares of Common Stock.

Voting and Quorum

Holders of Common Stock are entitled to vote at the Annual Meeting on the basis of one vote for each share of Common Stock held of record.

Under Delaware law and ICOS’ Amended and Restated Bylaws, the presence in person or by proxy of holders of record of a majority of the outstanding shares of Common Stock is required to constitute a quorum for the transaction of business at the Annual Meeting. If a quorum is present at the Annual Meeting: (1) the four nominees for election as directors who receive the greatest number of votes cast in the election of directors will be elected, (2) matter 2, listed in the accompanying Notice of 2004 Annual Meeting of Stockholders, will be approved if a majority of shares of Common Stock, present in person or represented by proxy and entitled to vote at the meeting, vote in favor of such matter, and (3) the stockholder proposal, listed as matter 3 in the accompanying Notice of 2004 Annual Meeting of Stockholders, will be approved if a majority of shares of Common Stock, present in person or represented by proxy and entitled to vote at the meeting, vote in favor of the proposal. Means have been provided whereby a stockholder may withhold the vote for any director and may vote against, or refrain from voting on, any matter other than the election of directors. Under Delaware law and the Bylaws:

| | • | | shares represented by proxies that reflect abstentions or “broker non-votes” (i.e., shares held by a broker or nominee that are represented at the meeting, but with respect to which such broker or nominee is not empowered to vote on a particular proposal) will be counted as shares that are present and entitled to vote for purposes of determining the presence of a quorum and for determining the number of shares representing a majority of the shares present in person or represented by proxy at the meeting; |

1

| | • | | there is no cumulative voting, and the director nominees receiving the highest number of votes, up to the number of directors to be elected, will be elected, and, accordingly, abstentions and broker non-votes will not affect the election of directors; and |

| | • | | proxies that reflect abstentions or broker non-votes as to a particular proposal (other than the election of directors) will be treated as present for purposes of determining the approval of that proposal and will have the same effect as a vote against that proposal. |

Any broker, bank, nominee, fiduciary or other custodian which holds shares of our Common Stock for the account of a customer who is the beneficial owner of those shares, and which does not receive specific instructions from the customer on how to vote, has the power to vote those shares at its discretion in the election of directors and for other routine matters for which it has not received voting instructions. Custodians do not have discretionary voting authority, however, with respect to nonroutine matters. Because custodians will have discretionary voting authority with respect to election of directors and ratification of independent auditors, there will be no broker non-votes with respect to those matters. With respect to the stockholder proposal listed as matter number 3 in the accompanying Notice of 2004 Annual Meeting of Stockholders, however, broker non-votes will have the same effect as votes against that proposal. The enclosed proxy card also confers discretionary authority to vote the shares authorized to be voted thereby on any matter that was not known on the date of mailing this Proxy Statement, but that may properly be presented for action at the Annual Meeting. Shares of Common Stock represented by properly executed proxy cards for which no voting instruction is given will be voted “for” election of the nominees for director, “for” the proposal listed as matter 2, and “against” the stockholder proposal listed as matter 3.

Revocability of Proxies

Any stockholder returning a proxy has the power to revoke it at any time before shares represented thereby are voted at the Annual Meeting. Any shares represented by an unrevoked proxy will be voted according to that proxy unless the stockholder attends the Annual Meeting and votes in person. A stockholder’s right to revoke a proxy is not limited by or subject to compliance with a specified formal procedure, but written notice of such revocation should be given to ICOS’ Corporate Secretary at or before the Annual Meeting.

Solicitation of Proxies

The expense of printing and mailing proxy material will be borne by ICOS. In addition to the solicitation of proxies by mail, solicitation may be made by certain directors, officers and other employees of ICOS in person or by telephone, facsimile transmission, telegraph, telex or electronic mail. No compensation will be paid for such solicitation.

Arrangements also will be made with brokerage firms and other custodians, nominees and fiduciaries to forward proxy solicitation materials to certain beneficial owners of Common Stock. ICOS will reimburse such brokerage firms, custodians, nominees and fiduciaries for reasonable out-of-pocket expenses incurred by them in connection therewith.

2

SECURITY OWNERSHIP OF PRINCIPAL STOCKHOLDERS AND MANAGEMENT

The following table sets forth certain information regarding the beneficial ownership, as of February 10, 2004, of Common Stock by (i) each person known by ICOS to beneficially own more than 5% of the outstanding Common Stock; (ii) each director and nominee for director; (iii) each of the Named Executive Officers included in the Summary Compensation Table; and (iv) all directors and executive officers as a group.

| | | | | |

Name of Beneficial Owner

| | Shares

Beneficially

Owned (1) (2)

| | Percentage of

Common

Stock

| |

William H. Gates III c/o Michael Larson 2365 Carillon Point Kirkland, WA 98033 | | 5,727,303 | | 9.0 | % |

| | |

PRIMECAP Management Company (3) 225 South Lake Avenue #400 Pasadena, CA 91101 | | 5,584,500 | | 8.8 | % |

| | |

Teresa Beck | | 0 | | * | |

| | |

Vaughn D. Bryson | | 0 | | * | |

| | |

Frank T. Cary (4) | | 205,507 | | * | |

| | |

Paul N. Clark (5) | | 2,062,909 | | 3.2 | % |

| | |

James L. Ferguson | | 102,454 | | * | |

| | |

David V. Milligan (6) | | 60,241 | | * | |

| | |

Robert W. Pangia | | 138,027 | | * | |

| | |

Jack W. Schuler | | 30,000 | | * | |

| | |

Gary L. Wilcox (7) | | 565,148 | | * | |

| | |

Walter B. Wriston | | 149,692 | | * | |

| | |

W. Michael Gallatin | | 326,335 | | * | |

| | |

David A. Goodkin (8) | | 97,384 | | * | |

| | |

Michael A. Stein | | 203,138 | | * | |

| | |

All directors and executive officers as a group (17 persons) | | 10,515,946 | | 15.5 | % |

| (1) | | Unless otherwise indicated, the persons named have sole voting and investment power with respect to all shares shown as beneficially owned by them, subject to applicable community property laws. Amounts shown include shares owned and stock options and warrants that may be exercised within 60 days of February 10, 2004, which are deemed outstanding for purposes of computing the percentage ownership of the person holding the option or warrant, but are not deemed outstanding for purposes of computing the percentage ownership of any other person. |

| (2) | | Includes options and warrants that may be exercised for Common Stock within 60 days of February 10, 2004, for each individual as follows: William H. Gates III, 367,802 shares; Frank T. Cary, 138,027 shares; Paul N. Clark, 2,042,784 shares; James L. Ferguson, 85,919 shares; David V. Milligan, 39,802 shares; Robert W. Pangia, 138,027 shares; Gary L. Wilcox, 409,560 shares; Walter B. Wriston, 130,027 shares; W. Michael Gallatin, 274,844 shares; Michael A. Stein, 198,138 shares; David A. Goodkin, 76,384 shares; and all directors and executive officers as a group, 4,590,334 shares. |

| (3) | | The information provided relating to PRIMECAP Management Company is based exclusively on a Schedule 13G/A filed with the Securities and Exchange Commission on November 8, 2002. This filing reported that, of the 5,584,500 shares of Common Stock beneficially owned by PRIMECAP Management Company, PRIMECAP Management Company has sole voting power over 2,591,600 of these shares and sole dispositive power over all 5,584,500 of these shares. |

3

| (4) | | Includes 22,730 shares held by the Cary Family Trust, LLC, of which Frank T. Cary is trustee. |

| (5) | | Includes 116,032 shares, in the form of options, held by the Clark Family Limited Partnership, of which Paul N. Clark is trustee. |

| (6) | | Includes 20,339 shares held by the David V. Milligan Trust, of which David V. Milligan is trustee. |

| (7) | | Includes 155,588 shares held by the Gary and Susan Wilcox Living Trust, of which Gary L. Wilcox is a trustee. |

| (8) | | Includes 1,000 shares held by the Goodkin-Wetmore Trust 1996, of which David A. Goodkin is a trustee. |

PROPOSAL 1: ELECTION OF DIRECTORS

In January 2004, in accordance with our restated certificate of incorporation, the Board of Directors adopted a resolution increasing the size of the Board from eight to nine members. Again, in March 2004, the Board likewise increased the size of the Board from nine to eleven members. The Board of Directors is divided into three classes, with one class of directors elected to three-year terms at each Annual Meeting of Stockholders. Seven of the directors are serving terms that continue beyond the Annual Meeting. Of the continuing directors, four are Class 3 directors and are serving terms that will not expire until the 2005 Annual Meeting of Stockholders and three are Class 1 directors and are serving terms that will not expire until the 2006 Annual Meeting of Stockholders. At the Annual Meeting, four directors will be elected, each of whom will hold office for a term of three years and until his successor is elected and qualified.

The Board of Directors has unanimously nominated Paul N. Clark, Vaughn D. Bryson, William H. Gates III and Robert W. Pangia for election at the Annual Meeting. Unless otherwise instructed, it is the intention of the persons named as proxies on the enclosed proxy card to vote shares represented by properly executed proxies for the four nominees to the Board of Directors named above. If any nominee shall not be a candidate for election as a director at the Annual Meeting, it is intended that votes will be cast pursuant to the enclosed proxy for such substitute nominee as may be nominated by the Board of Directors. No circumstances are presently known that would render any nominee named herein unavailable to serve. To fill the vacancy created by the increase in the size of the Board from ten to eleven members, in March 2004, the Board elected Vaughn D. Bryson as a Class 2 director.

Nominees for Election as Class 2 Directors

The following are the nominees to serve as Class 2 directors until the 2007 Annual Meeting of Stockholders and until their respective successors are elected and qualified:

Paul N. Clark (age 57) has been a director, Chief Executive Officer and President since June 1999, and the Chairman of the Board since February 2000. From 1984 to December 1998, Mr. Clark worked in various capacities for Abbott Laboratories, a health care products manufacturer, retiring from Abbott Laboratories as Executive Vice President and board member after serving previously as Vice President from 1984 to 1990 and Senior Vice President from 1990 to 1998. His previous experience included senior positions with Marion Laboratories, a pharmaceutical company, and Sandoz Pharmaceuticals (now Novartis Corporation), a pharmaceutical company. Mr. Clark received his M.B.A. from Dartmouth College, Amos Tuck School, and his B.S. in finance from the University of Alabama.

Vaughn D. Bryson (age 65) has been a director since March 2004. He is President of Clinical Products, Inc., a medical foods company. Mr. Bryson was a 32 year-employee of Eli Lilly and Company, a pharmaceutical company, where he served as President and Chief Executive Officer from 1991 until 1993. He was Executive Vice President from 1986 until 1991 and served as a member of the board of directors of Lilly from 1984 until his retirement in 1993. From 1994 to 1996, Mr. Bryson was Vice Chairman of Vector Securities International, Inc., an investment banking firm. He is currently a director of Amylin Pharmaceuticals, Inc., AtheroGenics, Inc. and Chiron Corporation.

4

William H. Gates III (age 48) has been a director since July 1990. Mr. Gates is a co-founder of Microsoft Corporation, a software company, and was its Chief Executive Officer and Chairman of the Board from its incorporation in 1981 until January 2000, and he has been its Chief Software Architect and Chairman of the Board since January 2000.

Robert W. Pangia (age 52) has been a director since April 1990. Mr. Pangia is currently a partner of Ivy Capital Partners, a private equity fund specializing in healthcare investments. From 1987 to 1996, Mr. Pangia served as Executive Vice President and Director of Investment Banking at PaineWebber Incorporated, an investment banking and securities brokerage firm. From 1986 to 1987, he was a Managing Director with Drexel Burnham Lambert, an investment banking firm. From 1977 to 1986, Mr. Pangia worked in various positions in the Corporate Financing Department at Kidder Peabody & Co., an investment banking and securities brokerage firm, including serving as Director of the Technology Finance Group. He is currently a director of Biogen IDEC, Inc. and Network Associates, Inc.

THE BOARD OF DIRECTORS RECOMMENDS A VOTEFOR

THE ELECTION OF THE ABOVE-NAMED NOMINEES

TO THE BOARD OF DIRECTORS.

Continuing Class 1 Directors (until 2006)

The three Class 1 directors, Frank T. Cary, James L. Ferguson and David V. Milligan, Ph.D., are currently serving terms that expire at the 2006 Annual Meeting of Stockholders and until their respective successors are elected and qualified.

Frank T. Cary (age 83)has been a director since January 1990. He was Chief Executive Officer and Chairman of the Board of International Business Machines Corporation, a business equipment manufacturer, from 1973 to 1980. Mr. Cary currently serves as a director of Celgene Corporation, Cygnus, Inc., Lexmark International, Inc., Lincare, Inc. and Vion Pharmaceuticals, Inc.

James L. Ferguson (age 78) has been a director since January 1990. From 1973 to 1989, he served in various capacities at General Foods Corporation, a food manufacturing company, including Chief Executive Officer and President. Mr. Ferguson is a member of The Business Council and the Council on Foreign Relations, a Trustee of the Aspen Institute and a Life Trustee of Hamilton College.

David V. Milligan, Ph.D. (age 63) has been a director since October 1995. From May 1998 to the present, he has served as a Vice President of Bay City Capital, a San Francisco-based merchant bank. From 1979 to 1996, he served in various capacities at Abbott Laboratories, retiring as Senior Vice President and Chief Scientific Officer after previously heading both the diagnostics and the pharmaceutical research and development sectors. Dr. Milligan is currently Vice Chairman of the Board of Caliper Life Sciences Inc., as well as a director of Galileo Laboratories Inc., Pathway Diagnostics, Reliant Pharmaceuticals and Vicuron Pharmaceuticals Inc.

Continuing Class 3 Directors (until 2005)

The four Class 3 directors, Teresa Beck, Jack W. Schuler, Gary L. Wilcox, Ph.D., and Walter B. Wriston, are currently serving terms that expire at the 2005 Annual Meeting of Stockholders and until their respective successors are elected and qualified. To fill the vacancy created by the increase in the size of the Board from eight to nine members, in January 2004, the Board elected Jack W. Schuler as a Class 3 director. Similarly, to fill the vacancy created by the increase in the size of the Board from nine to ten members, in March 2004, the Board elected Teresa Beck as a Class 3 director.

Teresa Beck (age 49) has been a director since March 2004. Ms. Beck served as President of American Stores Co. from 1998 to 1999 and as Chief Financial Officer from 1993 to 1998. Prior to joining American Stores Co., Ms. Beck served as an audit manager for Ernst & Young LLP. Ms. Beck currently serves as a director of Albertson’s, Inc., Lexmark International, Inc., Questar Corporation and Textron, Inc.

5

Jack W. Schuler (age 63) has been a director since January 2004. From 1972 to 1989, he served in various capacities at Abbott Laboratories, retiring as President and Chief Operating Officer, a position he held from 1987 to 1989. Mr. Schuler is a partner in Crabtree Partners, a Chicago based venture capital firm. He currently serves as the Chairman of the Boards of Ventana Medical Systems, Inc. and Stericycle, Inc. and is a member of the board of directors of Medtronic, Inc.

Gary L. Wilcox, Ph.D. (age 57) joined ICOS in September 1993 as Executive Vice President, Operations, and has been a director since 1993. From 1989 to 1993, Dr. Wilcox served as Vice Chairman, Executive Vice President and director of XOMA Corporation, a biotechnology company. From 1982 to December 1989, he was the President and Chief Executive Officer of International Genetic Engineering, Inc. (known as Ingene), a biotechnology company, which he co-founded. In 1989, Ingene was acquired by XOMA Corporation. Dr. Wilcox received his Ph.D. and M.A. in molecular biology and biochemistry and his B.A. in cellular and molecular biology from the University of California at Santa Barbara.

Walter B. Wriston (age 84) has been a director since January 1990. From 1967 to 1984, he served as Chief Executive Officer of Citicorp and its subsidiary Citibank, N.A. He was Chairman of President Reagan’s Economic Policy Advisory Board and Chairman of The Business Council. Mr. Wriston currently serves as a director of Cygnus, Inc. and Vion Pharmaceuticals, Inc.

Director Nominations Process

The Board of Directors has adopted a Charter of the Nominating and Corporate Governance Committee, or Nominating Committee, that describes the process by which candidates for possible inclusion in our recommended slate of director nominees are selected. The Board of Directors may amend this charter at any time, in which case the most current version will be available on our web site at http://www.icos.com. As noted earlier, three of our current directors, Ms. Beck, Mr. Bryson and Mr. Schuler, were elected by the Board of Directors to fill newly created board seats and have not been elected by the stockholders. Ms. Beck, Mr. Bryson and Mr. Schuler were each recommended by one of our non-management directors.

Minimum Criteria for Board Members

The Board of Directors has approved qualifications recommended by the Nominating Committee for evaluating future director candidates. As a base line measure, a qualified non-employee director would have sound business judgment, solid moral character, independence from management and meaningful and relevant experience. The relevant backgrounds that would most benefit the Board of Directors would include a proper balance over time of experience in the commercial, finance and research areas. This meaningful experience would involve working at the highest executive levels and, possibly, current public company board service. The Nominating Committee has identified having some directors with relevant pharmaceutical and/or biotechnology experience as highly desirable. In addition to these qualities, the Nominating Committee considers the diversity of the Board of Directors as a whole and views having directors of varying backgrounds and perspectives to be highly important.

The following factors are among those weighed by the Nominating Committee in assessing potential non-employee directors with the goal that new directors would enhance the effectiveness of the Board of Directors while minimizing the possibility of conflicts or other significant issues:

| | • | | Family relationship with any employee or director; |

| | • | | Business relationships with ICOS; |

| | • | | Relationships with investment banks, accounting or law firms that provide or have recently provided services to ICOS; |

| | • | | Involvement in substantive legal, ethical or moral issues or controversies that could call into question personal or professional integrity; |

| | • | | Ability and intent to commit appropriate time and attention to board needs; |

| | • | | Personal or business factors that would be deleterious to board involvement and/or bring possible disrepute through association to ICOS and its board; and |

| | • | | Lack of current involvement in activities that are directly competitive with or adversarial to ICOS. |

6

Process for Identifying Candidates

Our Nominating Committee has two primary methods for identifying candidates, beyond those proposed by our stockholders. On a periodic basis, the Nominating Committee solicits ideas for possible candidates from a number of sources, including members of the Board, senior level management, individuals personally known to the members of the Board and research, including publications, databases and Internet searches. In addition, the Nominating Committee may from time to time use its authority under its charter to retain a search firm to identify candidates.

Nomination Right of Stockholders

In accordance with our Bylaws and applicable law, recommendations for nominations for the election of directors for consideration by the Nominating Committee may be made by any stockholder of record entitled to vote for the election of directors at stockholder meetings held for such purpose. The requirements a stockholder must follow for recommending persons for consideration by the Committee for election as directors are set forth in our Bylaws and the section of this proxy statement titled Proposals of Stockholders for 2005 Annual Meeting.

Subject to the superior rights, if any, of the holders of any class or series of stock having a preference over our Common Stock that we may issue in the future, if a stockholder complies with these procedures for recommending persons for consideration by the Nominating Committee for election as directors, the Nominating Committee will conduct the appropriate and necessary inquiries into the backgrounds, qualifications and skills of the stockholder recommended candidates and, in the exercise of the Nominating Committee’s independent judgment in accordance with the policies and procedures adopted in the Nominating Committee charter, will determine whether to recommend the stockholder recommended candidates to the Board for inclusion in the list of candidates for election as directors at the next stockholder meetings held for such purpose.

Evaluation of Candidates

The Nominating Committee will consider all candidates identified through the processes described above, and will evaluate each of them, including incumbents, based on the same criteria. If, based on the Nominating Committee’s initial evaluation, a candidate continues to be of interest, the Nominating Committee will generally conduct interviews and arrange for appropriate background and reference checks.

Director Independence and Other Matters

The Board of Directors has determined each of the following directors is an “independent director” as such term is defined in Marketplace Rule 4200(a)(15) of the National Association of Securities Dealers, or NASD: Teresa Beck, Vaughn D. Bryson, Frank T. Cary, James L. Ferguson, William H. Gates III, David V. Milligan, Ph.D., Robert W. Pangia, Jack W. Schuler and Walter B. Wriston.

The Board of Directors has also determined that each member of the three standing committees of the Board meets the independence requirements applicable to those committees prescribed by the NASD, the Securities and Exchange Commission, or SEC, and the Internal Revenue Service. The Board of Directors has further determined that Robert W. Pangia, a member of the Audit Committee of the Board of Directors, is an “audit committee financial expert,” as such term is defined in Item 401(h) of Regulation S-K promulgated by the SEC, by virtue of his relevant experience listed in his biographical summary provided above in the section entitled PROPOSAL 1: ELECTION OF DIRECTORS.

Information on Committees of the Board of Directors and Meetings

The Board of Directors met six times during the year ended December 31, 2003. All directors attended at least 75% of the meetings of the Board of Directors and of meetings held by all committees of the Board of Directors on which they served.

The Board of Directors has three standing committees: an Audit Committee, a Compensation Committee and a Nominating Committee.

7

The Audit Committee consists of three independent directors, Messrs. Wriston (Chairman), Ferguson and Pangia. The Board of Directors has determined that Mr. Pangia is an audit committee financial expert and each of the members of the Audit Committee is independent in accordance with applicable NASDAQ listing standards and SEC rules and regulations. The Committee is governed by an Audit Committee Charter that may be amended by the Board of Directors at any time. The most current version of the Audit Committee Charter will be available on our web site at http://www.icos.com. Each member of the Audit Committee must meet certain independence and financial literacy requirements. The Audit Committee assists the Board of Directors in fulfilling its oversight responsibilities relating to the integrity of ICOS’ financial statements, ICOS’ compliance with legal and regulatory requirements, the independent auditor’s qualifications and independence, and the performance of our internal audit function and independent auditors. Among the responsibilities outlined in its charter, the Committee appoints, compensates, retains and oversees the work of the firm of independent auditors employed by ICOS to conduct the annual audit examination of ICOS’ financial statements. The members meet with the independent auditors, internal auditors and management to review: the scope of proposed audits for the year; audit fees; and, at the conclusion of the audits, the audit reports. In addition, the Audit Committee reviews the financial statements, the related footnotes and the independent auditors’ report thereon and makes related recommendations to the Board of Directors as the Committee deems appropriate. The Audit Committee met six times during the year ended December 31, 2003.

The Compensation Committee consists of three independent directors, Messrs. Cary (Chairman) and Ferguson and Dr. Milligan. The Compensation Committee is responsible for establishing compensation levels for ICOS’ executive officers, establishing and administering performance-based compensation plans, evaluating the performances of ICOS’ executive officers, considering management succession and related matters, and administering ICOS’ stock option plan. The Compensation Committee met once during the year ended December 31, 2003.

The Nominating Committee consists of three independent directors, Dr. Milligan (Chairman) and Messrs. Pangia and Wriston. The Nominating Committee makes recommendations to the Board of Directors concerning the criteria for membership on the Board of Directors and the qualifications of prospective candidates, including candidates identified by stockholders in accordance with our Bylaws, to fill vacancies on, or to be elected or reelected to, the Board of Directors. The Nominating Committee also makes recommendations to the Board of Directors concerning our corporate governance policies and procedures, including code of conduct applicable to directors, officers and employees, the reporting channels to the Board of Directors and the information it receives, and succession planning for senior management. The Nominating Committee met once during the year ended December 31, 2003.

Compensation of Directors

ICOS has a policy of paying directors who are not employees of ICOS an annual fee of $24,000 for service on the Board of Directors, $2,000 for each Board meeting attended and $1,000 for each Board committee meeting attended. In addition, the nonemployee chairperson of the Audit Committee receives an annual retainer fee of $5,000 in addition to any other compensation he or she may otherwise receive and the nonemployee chairperson of each committee of the Board of Directors other than the Audit Committee receives an annual retainer fee of $3,250 in addition to any other compensation he or she may otherwise receive.

Pursuant to ICOS’ stock option grant program for non-employee directors (the Director Program), each non-employee director is entitled to receive nonqualified stock option grants upon their initial election or appointment to the Board of Directors and, subject to certain limitations, at each Annual Meeting of Stockholders thereafter, assuming continued service on the Board.

Under the Director Program, upon their initial election or appointment to the Board of Directors, each eligible director is entitled to receive an initial grant of nonqualified stock options for 30,000 shares of Common Stock. Beginning with the 2004 Annual Meeting of Stockholders, each eligible director is also entitled to receive an annual grant of nonqualified stock options for 12,000 shares. However, if the date of a director’s initial grant upon election or appointment to the Board of Directors falls within the five-month period prior to an Annual

8

Meeting of Stockholders, that director will not be eligible for an annual grant until the second Annual Meeting of Stockholders following the director’s initial election or appointment.

Stock options granted under the Director Program vest and become exercisable in two equal amounts as of each of the next two Annual Meetings of Stockholders. However, if a director’s initial grant upon election or appointment to the Board of Directors falls within the five-month period prior to an Annual Meeting of Stockholders, vesting does not commence until the second Annual Meeting of Stockholders following the director’s election or appointment. Vesting schedules, for both initial and annual grants, assume continued service on the Board of Directors during the vesting periods.

Stock options granted under the Director Program have an exercise price equal to the closing market price of the Common Stock on the date of the grant. The options have a ten-year term but cannot be exercised later than two years after termination of service as a director.

During 2003, when a prior system of calculating the amount of grants based on dollar value was being used, ICOS granted each non-employee director a stock option representing the right to purchase 20,939 shares of Common Stock pursuant to the Director Program.

PROPOSAL 2: RATIFICATION OF

THE APPOINTMENT OF THE INDEPENDENT AUDITORS

The Board of Directors unanimously recommends that you vote “FOR” ratification of its selection of KPMG, independent auditors, to audit and report on the financial statements of ICOS for the year ending December 31, 2004. KPMG audited the financial statements of ICOS for the year ended December 31, 2003. Representatives of KPMG will be present at the Annual Meeting to make a statement if they desire to do so and respond to questions of stockholders. The affirmative vote of a majority of the shares represented at the Annual Meeting is required for the ratification of the Board’s selection of KPMG as ICOS’ independent auditors. If stockholders fail to ratify the selection of KPMG, the Audit Committee and the Board of Directors will consider whether to retain KPMG, and may retain that firm or another firm without resubmitting the matter to stockholders.

The aggregate fees and expenses billed for professional services rendered by KPMG for the years ended December 31, 2003 and December 31, 2002 were as follows:

| | | | | | |

| | | 2003

| | 2002

|

Audit | | $ | 153,109 | | $ | 88,236 |

Audit-related | | | 12,265 | | | 18,539 |

Tax | | | 3,250 | | | 157,348 |

All other | | | — | | | — |

| | |

|

| |

|

|

Total | | $ | 168,624 | | $ | 264,123 |

| | |

|

| |

|

|

2003 audit fees include $63,859 in connection with the private placement of convertible subordinated debt and related filings with the SEC. Audit-related fees were for the audit of our 401(k) plan and consultation concerning financial accounting and reporting standards. Tax fees were primarily for miscellaneous tax planning and tax compliance services.

The Audit Committee has considered whether the services listed above are compatible with maintaining the auditors’ independence. All services rendered by KPMG were approved by the Audit Committee in accordance with the SEC’s requirements regarding auditor independence. The Audit Committee’s current policy is to pre-approve all of KPMG’s services.

THE BOARD OF DIRECTORS RECOMMENDS A VOTEFOR

THE RATIFICATION OF THE APPOINTMENT OF THE

INDEPENDENT AUDITORS.

9

PROPOSAL 3: STOCKHOLDER PROPOSAL

REGARDING PERFORMANCE AND TIME-BASED RESTRICTED SHARES

The Massachusetts State Carpenters Pension Fund, 350 Fordham Road, Wilmington, Massachusetts 01887, beneficial owner as of December 8, 2003, of 700 common shares, has notified ICOS that it intends to present the following resolution at the Annual Meeting.

Stockholder Proposal

Resolved, that the shareholders of ICOS Corporation (“Company”) hereby request that the Board of Directors’ Compensation Committee, in developing future senior executive equity compensation plans, utilize performance and time-based restricted share programs in lieu of stock options. Restricted shares issued by the Company should include the following features:

| | (1) | | Operational Performance Measures — The restricted share program should utilize justifiable operational performance criteria combined with challenging performance benchmarks for each criteria utilized. The performance criteria and associated performance benchmarks selected by the Compensation Committee should be clearly disclosed to shareholders. |

| | (2) | | Time-Based Vesting — A time-based vesting requirement of at least three years should also be a feature of the restricted shares program. That is, in addition to the operational performance criteria, no restricted shares should vest in less than three years from the date of grant. |

| | (3) | | Dividend Limitation — No dividend or proxy voting rights should be granted or exercised prior to the vesting of the restricted shares. |

| | (4) | | Share Retention — In order to link shareholder and management interests, a retention feature should also be included; that is, all shares granted pursuant to the restricted share program should be retained by the senior executives for the duration of their tenure with the Company. |

The Board and Compensation Committee should implement this restricted share program in a manner that does not violate any existing employment agreement or equity compensation plan.

Supporting statement: As long-term shareholders of the Company, we support executive compensation policies and practices that provide challenging performance objectives and serve to motivate executives to achieve long-term corporate value creation goals. The Company’s executive compensation program should include a long-term equity compensation component with clearly defined operational performance criteria and challenging performance benchmarks.

We believe that performance and time-based restricted shares are a preferred mechanism for providing senior executives long-term equity compensation. We believe that stock option plans, as generally constituted, all too often provide extraordinary pay for ordinary performance. In our opinion, performance and time-based restricted shares provide a better means to tie the levels of equity compensation to meaningful financial performance beyond stock price performance and to condition equity compensation on performance above that of peer companies.

Our proposal recognizes that the Compensation Committee is in the best position to determine the appropriate performance measures and benchmarks. It is requested that detailed disclosure of the criteria be made so that shareholders may assess whether, in their opinion, the equity compensation system provides challenging targets for senior executives to meet. In addition, the restricted share program prohibits the receipt of dividends and the exercise of voting rights until shares vest.

We believe that a performance and time-based restricted share program with the features described above offers senior executives the opportunity to acquire significant levels of equity commensurate with their long-term contributions. We believe such a system best advances the long-term interests of our Company, its shareholders, employees and other important constituents. We urge shareholders to support this reform.

10

ICOS Statement in Opposition to the Proposal Regarding Performance and Time-Based Restricted Shares

For the reasons described below, the Board of Directors believes that the stockholder proposal is not in the best interests of ICOS and its stockholders and therefore recommends a vote “AGAINST” the proposal.

ICOS’ executive compensation programs are intended to attract, retain and motivate talented executives who are critical to our success. The Board of Directors and the Compensation Committee believe that this stockholder proposal may significantly impair ICOS’ ability and flexibility to recruit and retain key senior executives by limiting the Compensation Committee’s ability to offer effective and competitive incentive compensation programs.

As discussed below in the Compensation Committee’s report on executive compensation, in determining appropriate executive compensation, the Compensation Committee considers, among other things, goals the Board of Directors has established for ICOS and management, the tax consequences of various equity compensation arrangements, and compensation practices of competing companies in our industry. The Compensation Committee reviews, at least annually, our executive compensation practices to assess both their reasonableness and competitiveness in the marketplace. The Board of Directors and the Compensation Committee believe it is essential that ICOS retain its flexibility to offer appropriate, competitive, carefully considered and balanced executive compensation programs. In this regard, the stockholder’s proposal requests that we implement unnecessarily restrictive parameters on our executive compensation programs. Those restrictions may inappropriately and competitively disadvantage the flexibility of the Compensation Committee to choose incentives that best balance the goals that ICOS seeks to address through its senior executive compensation arrangements.

The Board of Directors and the Compensation Committee support the concept of performance-based executive compensation arrangements. As described in the Compensation Committee’s report on executive compensation, the Committee currently takes into account some of the features described in the stockholder proposal in granting stock options to executive officers under both the ICOS MIP, a performance-based incentive program, and the periodic stock option grant program. These factors, taken into consideration by the Compensation Committee in awarding annual performance-based stock option grants, include a combination of company performance and individual executive performance goals, measured against predetermined incentive objectives, or benchmarks, that reflect aggressive performance goals, both for our company and the individual executives.

The stockholder proposal could result in potentially burdensome tax consequences to our senior executives. If we were to implement the “retention” component of the stockholder’s proposal as it is stated, our senior executives would not be able to sell any shares of the ICOS stock they receive in order to satisfy their tax obligations. Further, they would be denied the possibility of realizing any of the value in the stock they earn at any time during their tenure with ICOS.

For the foregoing reasons, among others, the Board of Directors and the Compensation Committee believe that the stockholder’s proposal is not in the best interests of ICOS or its stockholders and that the proposal, if implemented, could adversely affect our ability to recruit and retain key executives in our fiercely competitive industry.

In summary, the Board of Directors believes that ICOS’ current practices regarding senior executive cash and equity compensation effectively align senior executive incentives with the long-term interests of our stockholders by tying executive compensation to company performance. The Compensation Committee will continue to evaluate these programs in an effort to ensure that effective alignment continues. The Board of Directors believes it is important that, in developing and maintaining senior executive compensation programs, the Compensation Committee continues to have the flexibility necessary to enable it to design programs that will enable us to recruit and retain executives in a competitive environment.

THE BOARD OF DIRECTORS RECOMMENDS A VOTEAGAINST

PROPOSAL NUMBER THREE.

11

EXECUTIVE OFFICERS

The following persons are executive officers of ICOS. Each officer named below is expected to be reelected at the Board meeting to be held on May 13, 2004.

| | | | | | |

Name

| | Age

| | Positions and Offices with ICOS

| | Officer

Since

|

Paul N. Clark | | 57 | | Chief Executive Officer, President | | 1999 |

Leonard M. Blum | | 43 | | Vice President, Sales and Marketing | | 2000 |

W. Michael Gallatin, Ph.D. | | 50 | | Vice President, Scientific Director | | 1993 |

David A. Goodkin, M.D., FACP | | 48 | | Vice President, Development; Chief Medical Officer | | 2002 |

Thomas P. St. John, Ph.D. | | 51 | | Vice President, Therapeutic Development | | 1993 |

Michael A. Stein | | 54 | | Vice President, Chief Financial Officer | | 2001 |

Clifford J. Stocks | | 45 | | Vice President, Business Development | | 1999 |

Gary L. Wilcox, Ph.D. | | 57 | | Executive Vice President, Operations | | 1993 |

The biographical summaries of Mr. Clark and Dr. Wilcox are provided above in the section entitled PROPOSAL 1: ELECTION OF DIRECTORS.

Leonard M. Blum (age 43) joined ICOS as Vice President, Marketing in June 2000 and was appointed ICOS’ Vice President, Sales and Marketing in January 2001. From August 1997 to June 2000, Mr. Blum served in various capacities for Merck Sharp & Dohme Israel, a pharmaceutical company, including Marketing Director and Business Unit Director. He joined Merck and Co. in 1987, served in several positions in the United States, and led sales and marketing teams in Germany, Israel and Switzerland. His previous experience includes service as an officer in the United States Army Special Forces and a Corporate Financial Analyst with the Investment Banking Division at Shearson Lehman American Express, a financial services company. Mr. Blum received his M.B.A. from the Stanford Graduate School of Business and his A.B. in economics, magna cum laude, from Princeton University. He was a Fulbright Scholar in international finance at the University of Zurich.

W. Michael Gallatin, Ph.D. (age 50) has been Vice President and Scientific Director since April 1995. Dr. Gallatin joined ICOS in 1990 as Director of the Cell Adhesion Program and became a Senior Director, Science, in July 1992. He was appointed Vice President, Biological Research, in October 1993. Prior to joining ICOS, Dr. Gallatin was a faculty member of the Fred Hutchinson Cancer Research Center in Seattle, Washington, and an affiliate faculty member of the Department of Microbiology at the University of Washington. He received his Ph.D. in immunology from the University of Alberta and his B.S. in zoology from Truman State University (formerly Northeast Missouri State University).

David A. Goodkin, M.D., F.A.C.P., (age 48) joined ICOS in August 2002 as Vice President, Development and Chief Medical Officer. From 1992 to 2002, Dr. Goodkin was employed in various capacities for Amgen Inc., a biopharmaceutical company, serving as Vice President, Clinical Research from 2000 to 2002. Dr. Goodkin is board certified in nephrology and internal medicine. He completed nephrology fellowships at Albert Einstein Medical Center and Temple University Health Sciences Center, and an internal medicine residency at the University of Miami. He received his medical degree from the State University of New York at Syracuse and graduated summa cum laude from Dartmouth College.

Thomas P. St. John, Ph.D. (age 51) has been Vice President, Therapeutic Development, since October 1993. Dr. St. John joined ICOS in September 1990 as Director of the Structural Cell Biology Program and became a Senior Director, Science, in July 1992. Prior to joining ICOS, Dr. St. John was a faculty member of the Fred Hutchinson Cancer Research Center in Seattle, Washington, and an affiliate faculty member in the Department of Medicine and Department of Genetics at the University of Washington. Dr. St. John received his Ph.D. in biochemistry from Stanford University and his B.S. in biology from California Institute of Technology.

Michael A. Stein (age 54) has been Vice President and Chief Financial Officer since January 2001. From October 1998 to September 2000, Mr. Stein was Executive Vice President and Chief Financial Officer of

12

Nordstrom, Inc., a fashion specialty retailer. From 1989 to 1998, Mr. Stein was employed in various capacities for Marriott International, Inc., a global hospitality company, and its predecessor, Marriott Corporation, serving as Executive Vice President and Chief Financial Officer from 1993 to 1998. Prior to working with Marriott, Mr. Stein spent 18 years with Arthur Andersen LLP, where he was a partner based in the firm’s Washington, DC office. Mr. Stein serves on the board of trustees of the Fred Hutchinson Cancer Research Center and the board of directors of Getty Images, Inc. He received his B.S. in business administration from the University of Maryland at College Park, Maryland.

Clifford J. Stocks (age 45) has been Vice President, Business Development, since January 1999. Mr. Stocks joined ICOS in February 1992 as a Business/Corporate Development Manager and became Director, Business Development, in January 1993 and Senior Director, Business Development, in January 1997. From October 1989 to September 1991, Mr. Stocks was an Associate with Booz Allen & Hamilton, a management consulting firm. Mr. Stocks received his M.B.A. from the University of Chicago Graduate School of Business and his B.S. in biology from the University of Utah.

EXECUTIVE COMPENSATION

The following table sets forth information regarding compensation paid by ICOS during the past three years to its Chief Executive Officer and the other four most highly compensated individuals who were serving as executive officers at December 31, 2003 (the Named Executive Officers).

Summary Compensation Table

| | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | Annual Compensation

| | | Long-Term Compensation

Awards

| | | |

Name and Principal Position

| | Year

| | Salary ($)

| | | Bonus ($)

| | | Other Annual

Compensation ($)

| | | Restricted

Stock

Award ($)

| | | Securities

Underlying

Options (#) (5)

| | All Other

Compensation ($)

| |

Paul N. Clark Chairman of the Board, President and Chief Executive Officer | | 2003

2002

2001 | | $

| 750,000

650,000

600,000 |

| | $

| —

—

— |

| | $

| 25,032

146,870

61,287 | (3)

| | $

| —

—

— |

| | 45,600

800,330

172,859 | | $

| 4,297

6,671

29,014 | (6)

|

| | | | | | | |

Gary L. Wilcox Executive Vice President, Operations and Director | | 2003

2002

2001 | |

| 480,000

462,000

440,000 |

| |

| —

—

— |

| |

| —

—

— |

| |

| —

—

— |

| | 10,300

114,060

62,350 | |

| 1,806

1,806

506 | (7)

|

| | | | | | | |

W. Michael Gallatin Vice President and Scientific Director | | 2003

2002

2001 | |

| 370,000

353,000

333,000 |

| |

| —

—

— |

| |

| —

—

— |

| |

| —

—

— |

| | 9,300

114,220

54,132 | |

| 966

630

330 | (7)

|

| | | | | | | |

David A. Goodkin Vice President, Development and Chief Medical Officer | | 2003

2002

2001 | |

| 370,000

134,000

— |

(1)

| |

| —

100,000

— |

(1)

| |

| —

—

— |

| |

| —

550,000

— |

(4)

| | 10,200

162,300

— | |

| 630

236

— | (7)

|

| | | | | | | |

Michael A. Stein Vice President and Chief Financial Officer | | 2003

2002

2001 | |

| 370,000

350,000

319,000 |

(2) | |

| —

—

30,000 |

(2) | |

| —

—

— |

| |

| —

—

— |

| | 14,100

174,990

117,090 | |

| 966

966

506 | (7)

|

| (1) | | Dr. Goodkin became Vice President, Development and Chief Medical Officer of ICOS on August 14, 2002 and received a $100,000 bonus upon the commencement of his employment. |

| (2) | | Mr. Stein became Vice President and Chief Financial Officer of ICOS on January 8, 2001 and received a $30,000 bonus upon the commencement of his employment. |

13

| (3) | | Represents payments made by ICOS to, or for the benefit of, Mr. Clark as summarized below. |

| | | | | | | | | |

| | | 2003

| | 2002

| | 2001

|

Club initiation fees | | $ | — | | $ | 69,000 | | $ | — |

Professional fees | | | 15,000 | | | 17,100 | | | 24,875 |

Tax reimbursement | | | 10,032 | | | 60,770 | | | 36,412 |

| | |

|

| |

|

| |

|

|

| | | $ | 25,032 | | $ | 146,870 | | $ | 61,287 |

| | |

|

| |

|

| |

|

|

| | | See related discussion in “Employment Contracts, Termination of Employment and Change of Control Arrangements.” |

| (4) | | Dr. Goodkin was granted 20,000 shares of restricted stock on August 14, 2002, upon the commencement of his employment. The value attributable to restricted stock was calculated by multiplying the number of shares of restricted stock awarded by $27.50, the closing market price on the date of the restricted stock grant. Dr. Goodkin’s restricted stock vests at the rate of 50% per year, beginning on the first anniversary of the date of grant. At December 31, 2003, Dr. Goodkin held 10,000 shares of restricted stock, with an attributed value on that date of $412,800, based on the closing market price of $41.28. |

| (5) | | Represents options awarded to the Named Executive Officers pursuant to the Management Incentive Program (MIP) and periodic stock option grant program. In the case of Mr. Stein and Dr. Goodkin, amounts below also include stock options awarded in conjunction with their commencement of employment, in 2001 and 2002, respectively. |

| | | Options granted pursuant to the MIP are reported in the year earned for all years presented. The total number of MIP options earned by the Named Executive Officers for performance in 2003, 2002 and 2001 were as follows: |

| | | | | | |

| | | 2003

| | 2002

| | 2001

|

Paul N. Clark | | 45,600 | | 70,200 | | 50,459 |

Gary L. Wilcox | | 10,300 | | 16,800 | | 15,550 |

W. Michael Gallatin | | 9,300 | | 15,500 | | 12,732 |

David A. Goodkin | | 10,200 | | 6,500 | | — |

Michael A. Stein | | 14,100 | | 21,400 | | 17,090 |

| | | Periodic Stock Option Grant Program |

| | | The decrease in stock option awards for 2003 was primarily due to the timing of ICOS’ periodic stock option grants and, in the case of Mr. Clark, 300,000 options awarded in 2002 in relation to his employment contract. Periodic stock options awarded in 2001 were granted in January of that year. ICOS granted periodic stock option awards in January and December of 2002. Because the December 2002 stock option awards would normally have been granted in January of 2003, no periodic stock options were granted in 2003. |

| (6) | | All other compensation for 2003 represents reimbursement of personal travel, in accordance with Mr. Clark’s employment agreement, and subsequent arrangements approved by the Board of Directors, as well as taxable compensation related to group term life insurance premiums paid by ICOS. See “Employment Contracts, Termination of Employment and Change of Control Arrangements.” |

| (7) | | Reflects taxable compensation related to group term life insurance premiums paid by ICOS for Drs. Wilcox, Gallatin and Goodkin and Mr. Stein. |

2003 Option Grants

We made no individual grants of stock options or stock appreciation rights to any of our Named Executive Officers in 2003.

14

2003 Aggregate Option Exercises and Year-End Option Values

The following table sets forth-certain information regarding option exercises during 2003 and options held by Named Executive Officers as of December 31, 2003.

| | | | | | | | | | | | | | | |

| | | | | | | Number of Securities

Underlying Unexercised

Options at Year-End (#)

| | Value of Unexercised In-the-Money Options at

Year-End ($) (1)

|

Name

| | Shares Acquired on Exercise (#)

| | Value

Realized ($)

| | Exercisable

| | Unexercisable

| | Exercisable

| | Unexercisable

|

Paul N. Clark | | — | | $ | — | | 2,051,032 | | 507,739 | | $ | 4,267,704 | | $ | 5,837,933 |

Gary L. Wilcox | | 232,300 | | | 8,350,195 | | 391,414 | | 74,647 | | | 7,111,887 | | | 416,163 |

W. Michael Gallatin | | 52,150 | | | 1,691,344 | | 254,440 | | 75,419 | | | 3,920,994 | | | 476,614 |

David A. Goodkin | | — | | | — | | 53,784 | | 108,516 | | | 695,540 | | | 1,402,025 |

Michael A. Stein | | — | | | — | | 162,082 | | 129,998 | | | 535,920 | | | 866,250 |

| (1) | | Based on the closing price of a share of Common Stock as reported on The Nasdaq Stock Market on December 31, 2003 ($41.28). There is no guarantee that, if and when these options are exercised, they will have this value. |

Compensation Committee Interlocks and Insider Participation

During 2003, the Compensation Committee consisted of Messrs. Cary and Ferguson and Dr. Milligan. None of ICOS’ executive officers served during the year ending December 31, 2003, as a member of the compensation committee or board of directors of any entity that has an executive officer serving as a member of the Compensation Committee or Board of Directors.

REPORT OF THE COMPENSATION COMMITTEE ON EXECUTIVE COMPENSATION

The Compensation Committee of the Board of Directors is responsible for establishing compensation levels for ICOS’ executive officers, including the chief executive officer, establishing and administering performance-based compensation plans, evaluating the performances of ICOS’ executive officers, considering management succession and related matters, and administering ICOS’ stock option plans. The Compensation Committee is comprised of Frank T. Cary (Chairman), James L. Ferguson and David V. Milligan, all of whom are independent directors of ICOS. The Compensation Committee reviews with the other nonemployee directors all aspects of compensation for the executive officers.

The Compensation Committee takes into account the compensation paid by competing companies in the industry to assist it in determining the reasonableness of compensation for executive officers of ICOS and to ensure that ICOS is able to attract and retain key executive talent.

The Compensation Committee’s compensation policy is to structure executive compensation such that a substantial portion of the annual compensation of each executive officer is related to a combination of ICOS’ overall performance and each officer’s individual contributions. As a result, much of an executive officer’s compensation is comprised of stock options that, by their nature, provide value to that officer in direct proportion to the performance of the Common Stock price over time. These stock options are granted to executive officers pursuant to two separate performance-based programs—the MIP, an incentive program, and a periodic grant program.

Base Salaries. Executive officer salary levels are based on an evaluation of the executive’s performance in achieving specific objectives as well as competitive salaries of individuals in similar positions in the biopharmaceutical industry. Executive officer salaries are not tied to a specific level of comparable compensation, but are compared to the salary level equal to the 75th percentile of data available for each position.

In fulfilling its duties, the Compensation Committee relies on compensation statistics from various sources, including two surveys of executive compensation that, in total, include more than 100 public and private companies in the biopharmaceutical industry. For 2003 compensation, 2002 survey data for matching positions

15

was provided by a third party. As discussed in further detail below, the Compensation Committee determined Mr. Clark’s 2003 salary considering competitive market data from sources in addition to the surveys.

Annual and Long-Term Incentive Compensation. Historically, the Compensation Committee has not awarded cash performance bonuses. Instead, the MIP was established in 1994 for certain executive officers of ICOS. For 2003, Messrs. Clark, Blum, Stein and Stocks and Drs. Gallatin, Goodkin, St. John and Wilcox participated in this performance-based incentive program. Under the MIP, a competitive market value target is established to determine the number of options available for grant to participants based on their respective levels of responsibility. Option grants to MIP participants are based on a combination of company performance and individual performance, measured against predetermined incentive objectives, that reflect aggressive goals, which, in general, exceed expected results for the year. For 2003 performance, the total number of stock options awarded to participants was based on the successful completion of a series of corporate goals, as well as the individual achievements of the participants. The corporate goals included specific accomplishments in the clinical, research, business development, operations and finance areas. The size of participants’ individual grants, for performance in 2003, was based on a combination of ICOS’ success in achieving corporate goals as well as the extent to which the individuals achieved or exceeded objectives related to their areas of responsibility. Stock option grants under the MIP have an exercise price equal to the fair market value of the Common Stock on the grant date, are immediately vested and generally expire after ten years or three months after termination of employment, whichever is earlier. MIP option grants for 2003 performance were made in January 2004.

The majority of ICOS employees, including executive officers, are eligible for a periodic stock option grant program. The program’s primary purpose is to offer an incentive for long-term performance of ICOS through increases in the market price of the Common Stock, and related return on equity to ICOS’ stockholders. Under the program, stock options are granted to employees on a periodic schedule, on the basis of market data, each employee’s position within ICOS and performance. In determining the size of stock option grants to executive officers under the periodic program, the Compensation Committee considers data provided by a third party and the price of the Common Stock, but does not consider the outstanding number of stock options held by each individual. Grants are not tied to a specific level of comparable compensation, but are compared to the grant amount equal to the 50th percentile of data available for each position. The options granted through the program have an exercise price equal to the fair market value of the Common Stock on the grant date, vest monthly over a four-year period and generally terminate after ten years or three months after termination of employment, whichever is earlier.

2003 Compensation of the Chief Executive Officer. In establishing 2003 compensation for the Chief Executive Officer, the Compensation Committee considered, in part, Mr. Clark’s employment agreement, which is described in this proxy statement under the heading “Employment Contracts, Termination of Employment and Change of Control Arrangements.” The Compensation Committee also considered Mr. Clark’s overall compensation in comparison to market data regarding the compensation of other chief executive officers in a group of 15 peer biotechnology companies, as well as ICOS’ relative success in achieving key strategic goals. For 2003 compensation, 2002 peer group data for chief executive officers provided by a third party was used.

In December 2002, the Compensation Committee reviewed Mr. Clark’s accomplishments over the previous year, particularly as they related to overall ICOS achievements in 2002. Considering all of the above, the Compensation Committee established Mr. Clark’s annual base salary for 2003 at $750,000.

In January 2004, as a result of his participation in the MIP for 2003, Mr. Clark was awarded a stock option to purchase 45,600 shares of Common Stock. The MIP award was based on a combination of Mr. Clark’s individual performance and the achievement of 2003 corporate objectives, including: market performance goals for Cialis® (tadalafil) in Europe; regulatory approval of Cialis in the United States; completion of a Phase 2a clinical study of IC747; initiation of a Phase 2 clinical study of IC485; enrollment completed in a Phase 2 clinical study of RTX™ (resiniferatoxin); completion of various preclinical studies; fulfillment of formulation and manufacturing goals; and, various financial goals.

16

In December 2002, Mr. Clark was awarded options to purchase 300,000 shares of Common Stock under ICOS’ periodic stock option grant program. The December 2002 award was in lieu of the periodic grant that historically would have been awarded in early 2003.

Section 162(m) Limitations on Executive Compensation. Compensation payments in excess of $1 million to each of the Chief Executive Officer and the four other most highly compensated executive officers are subject to a limitation on deductibility for ICOS under Section 162(m) of the Internal Revenue Code of 1986, as amended. Certain performance-based compensation is not subject to the limitation on deductibility. The Compensation Committee does not expect cash compensation in 2004 to the Chief Executive Officer or any other executive officer to be in excess of $1 million. The 1999 Stock Option Plan is designed to qualify stock option awards for the performance-based exception to the $1 million limitation on deductibility of compensation payments.

Submitted by the Compensation Committee of ICOS’ Board of Directors

Frank T. Cary, Chairman

James L. Ferguson

David V. Milligan, Ph.D.

17

STOCK PRICE PERFORMANCE GRAPH

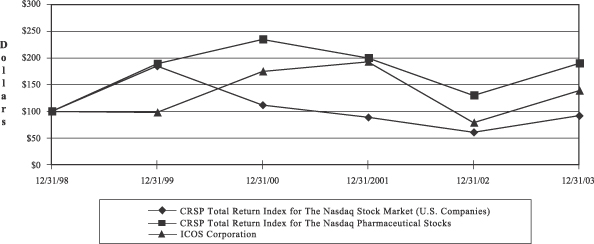

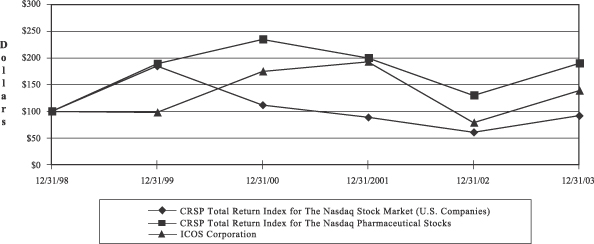

The graph below compares the cumulative total stockholder return on ICOS’ Common Stock with the cumulative total stockholder return of the CRSP Total Return Index for The Nasdaq Stock Market (U.S. Companies) and the CRSP Total Return Index for The Nasdaq Pharmaceutical Stocks, an index of approximately 258 companies, the stocks of which are quoted on The Nasdaq Stock Market and the Primary Standard Industrial Classification Code Number of which is 283, Pharmaceutical Companies. Upon request, ICOS will provide to stockholders a list of companies that comprise The Nasdaq Pharmaceutical Stock Index. Stock price performance shown for ICOS is historical and not necessarily indicative of future price performance.

Comparison of Cumulative Total Return Among ICOS Corporation,

the CRSP Total Return Index for The Nasdaq Stock Market (U.S. Companies)

and the CRSP Total Return Index for The Nasdaq Pharmaceutical Stocks (1)

| | | | | | | | | | | | | | | | | | |

|

| | | | | | |

| | | 12/31/98 | | 12/31/99 | | 12/31/00 | | 12/31/01 | | 12/31/02 | | 12/31/03 |

|

| | | | | | |

ICOS Corporation | | $ | 100 | | $ | 98 | | $ | 175 | | $ | 193 | | $ | 79 | | $ | 139 |

|

| | | | | | |

CRSP Total Return Index for The Nasdaq Stock Market (U.S. Companies) | | $ | 100 | | $ | 185 | | $ | 112 | | $ | 89 | | $ | 61 | | $ | 92 |

|

| | | | | | |

CRSP Total Return Index for The Nasdaq Pharmaceutical Stocks | | $ | 100 | | $ | 189 | | $ | 235 | | $ | 200 | | $ | 130 | | $ | 190 |

|

| (1) | | Assumes $100 was invested on December 31, 1998 in the Common Stock, the CRSP Total Return Index for The Nasdaq Stock Market (U.S. Companies) and CRSP Total Return Index for The Nasdaq Pharmaceutical Stocks. Total return performance for the CRSP Total Return Index for The Nasdaq Stock Market (U.S. Companies) and the CRSP Total Return Index for The Nasdaq Pharmaceutical Stocks is weighted based on the market capitalization of the firms included in each index and assumes that dividends are reinvested. The CRSP Total Return Index for The Nasdaq Stock Market (U.S. Companies) and CRSP Total Return Index for The Nasdaq Pharmaceutical Stocks are produced and published by the Center for Research in Security Prices at the University of Chicago, Graduate School of Business, 725 South Wells Street, Suite 800, Chicago, Illinois 60607. |

18

REPORT OF THE AUDIT COMMITTEE

The Board of Directors has determined that members of the Audit Committee of the Board of Directors are independent, as that term is defined in Rule 4200(a)(15) of the National Association of Securities DealersMarketplace Rules, and carry out their responsibilities in accordance with an Audit Committee Charter adopted on March 17, 2004. The Audit Committee has reviewed and discussed the audited financial statements for the year ended December 31, 2003, with ICOS’ management. In addition, the Audit Committee has discussed with ICOS’ independent auditors, KPMG, all of the matters required by U.S. generally accepted auditing standards. The Audit Committee has received the written disclosures and the letter from KPMG required by Independence Standards Board Standard No. 1, and has discussed, with KPMG, their independence. Based on these discussions and reviews, the Audit Committee recommended to ICOS’ Board of Directors that the audited financial statements, for the year ended December 31, 2003, be included in ICOS’ Annual Report on Form 10-K for 2003. The Committee also evaluated the performance of KPMG and recommended to the Board of Directors that KPMG be selected as ICOS’ independent auditors, to audit and report on ICOS’ financial statements for the year ending December 31, 2004.

Submitted by the Audit Committee of the Board of Directors

Walter B. Wriston, Chairman

James L. Ferguson

Robert W. Pangia

CORPORATE GOVERNANCE

Current copies of the following materials related to our corporate governance policies and practices are available publicly on our web site at http://www.icos.com.

| | • | | Amended and Restated Certificate of Incorporation |

| | • | | Amended and Restated Bylaws |

| | • | | Audit Committee Charter |

| | • | | Nominating and Corporate Governance Committee Charter |

| | • | | Code of Conduct (applicable to directors, officers and employees) |

Copies may also be obtained, free of charge, by writing to: Vice President, General Counsel and Secretary, 22021 — 20th Avenue S.E., Bothell, Washington 98021.

The Board of Directors has also established a policy under which interested stockholders can send communications to the Board of Directors, a committee of the Board of Directors and to individual directors pursuant to which stockholders may send written communication to the Corporate Secretary, ICOS Corporation, 22021-20th Avenue S.E., Bothell, Washington 98021. The Corporate Secretary will forward appropriate communication to the Board of Directors, the appropriate committee of the Board of Directors, or to individual directors. The Corporate Secretary, in consultation with the Chairman of the Board, will determine which communications are appropriate. The Board of Directors has established a policy requiring each Board member to attend ICOS’ Annual Meeting of Stockholders except for absences due to causes beyond the reasonable control of the director. There were eight directors at the time of the 2003 Annual Meeting of Stockholders and all eight attended the meeting.

RELATED PARTY TRANSACTIONS

One of ICOS’ directors and principal stockholders, Mr. Gates, is Chief Software Architect, Chairman of the Board and a principal shareholder of Microsoft Corporation. In 2003, ICOS paid Microsoft approximately $193,000 for a software license. ICOS’ total obligation to Microsoft for this license, payable over the course of three years, is estimated at $575,000.

19

EMPLOYMENT CONTRACTS, TERMINATION OF EMPLOYMENT AND

CHANGE OF CONTROL ARRANGEMENTS

Employment Agreement Between ICOS Corporation and Paul N. Clark

On June 11, 1999, ICOS entered into an employment agreement with Paul N. Clark, in which he agreed to serve as President and Chief Executive Officer of ICOS, be elected a director of ICOS, and have overall charge of and responsibility for the business and affairs of ICOS. Mr. Clark’s employment agreement is for a term of five years; however, starting with the second anniversary of the agreement, it will be extended under a daily three-year “evergreen” feature such that the remaining term of the agreement will always be at least three years unless either party gives notice of discontinuation of the “evergreen” feature. The agreement established Mr. Clark’s initial annual salary, subject to future increase at the sole discretion of the Board of Directors, and Mr. Clark was granted a ten-year stock option, vesting ratably over a 60-month period, to purchase 1,500,000 shares of Common Stock. When ICOS received FDA approval of Cialis, the remaining unvested shares under this option vested. In addition, subject to certain limitations, the agreement also provides that Mr. Clark will be granted certain replacement stock options in the event that the exercise of the 1,500,000 share option, the exercise of a previously granted replacement stock option, or the payment of taxes related to such exercises is affected by the surrender of other Common Stock held by Mr. Clark.