SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A INFORMATION

Proxy Statement Pursuant to Section 14(a) of the

Securities Exchange Act of 1934

Filed by the Registrantx

Filed by a Party other than the Registrant¨

Check the appropriate box:

| ¨ | | Preliminary Proxy Statement |

| ¨ | | Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) |

| x | | Definitive Proxy Statement |

| ¨ | | Definitive Additional Materials |

| ¨ | | Soliciting Material Under Rule 14a-12 |

ICOS CORPORATION

(Name of Registrant as Specified In Its Charter)

(Name of Person(s) Filing Proxy Statement, if other than the Registrant)

Payment of Filing Fee (Check the appropriate box):

| ¨ | | Fee computed on table below per Exchange Act Rules 14a-6(i)(1) and 0-11. |

| | (1) | | Title of each class of securities to which transaction applies: |

| | (2) | | Aggregate number of securities to which transaction applies: |

| | (3) | | Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined): |

| | (4) | | Proposed maximum aggregate value of transaction: |

| ¨ | | Fee paid previously with preliminary materials. |

| ¨ | | Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing. |

| | (1) | | Amount Previously Paid: |

| | (2) | | Form, Schedule or Registration Statement No.: |

March 16, 2006

Dear ICOS Shareholder:

I cordially invite you to ICOS Corporation’s Annual Meeting of Shareholders, to be held on Thursday, May 11, 2006, at 1:30 p.m., at ICOS Corporation, 22021 – 20th Avenue S.E., Bothell, Washington 98021.

This year you are asked to (1) elect three members to our Board of Directors, (2) ratify the appointment of KPMG LLP as our independent registered public accounting firm for the year ending December 31, 2006, and (3) consider and act upon two shareholder proposals described in the enclosed Proxy Statement.

As ICOS’ Chairman, I urge you to elect the three nominated directors, ratify the appointment of KPMG LLP as ICOS’ independent registered public accounting firm for the year ending December 31, 2006, and vote “Against” the shareholder proposals described in the enclosed Proxy Statement. It is important that your shares be represented, whether or not you plan to attend the meeting. Therefore, please take a few minutes to vote now. To vote, please mark, sign and date the enclosed proxy card, and return it in the enclosed prepaid envelope as promptly as possible.

After the transaction of formal business at the meeting, management will respond to questions from shareholders. You can find other detailed information about ICOS, including our audited financial statements, in the enclosed Annual Report on Form 10-K for the year ended December 31, 2005.

On behalf of ICOS, thank you for your support.

|

Regards, |

|

|

Paul N. Clark |

| Chairman of the Board of Directors, President and Chief Executive Officer |

22021 – 20th Avenue S.E., Bothell, Washington 98021

Notice of 2006 Annual Meeting of Shareholders

TOTHE SHAREHOLDERS:

The Annual Meeting of Shareholders of ICOS Corporation will be held at ICOS Corporation, 22021 – 20th Avenue S.E., Bothell, Washington 98021, on Thursday, May 11, 2006, at 1:30 p.m., for the following purposes:

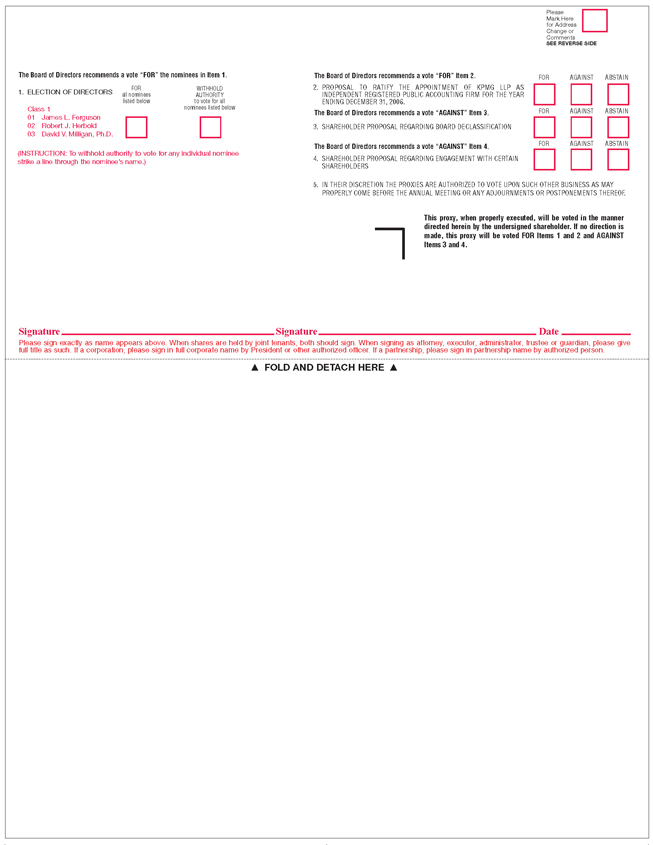

| | 1. | To elect three directors to serve until the third Annual Meeting of Shareholders following their election and until their successors are elected and qualified; |

| | 2. | To ratify the appointment of KPMG LLP as our independent registered public accounting firm for the year ending December 31, 2006; |

| | 3. | To consider and act upon a shareholder proposal regarding board declassification; |

| | 4. | To consider and act upon a shareholder proposal regarding engagement with certain shareholders; and |

| | 5. | To transact such other business as may properly come before the Annual Meeting. |

Your Board of Directors recommends that you vote to elect the three nominated directors, ratify the appointment of KPMG LLP as our independent registered public accounting firm for the year ending December 31, 2006, and vote “Against” the shareholder proposals outlined in the enclosed Proxy Statement.

Your attention is directed to the accompanying Proxy Statement for further information with respect to the matters to be acted upon at the Annual Meeting. To constitute a quorum for the conduct of business at the Annual Meeting, it is necessary that holders of a majority of all outstanding shares of ICOS’ Common Stock be present in person or represented by proxy. To ensure representation at the Annual Meeting, you are urged to mark, sign and date the enclosed proxy card and return it promptly in the enclosed prepaid envelope.

Only shareholders of record at the close of business on March 7, 2006 are entitled to notice of, and to vote at, the Annual Meeting and all adjournments and postponements thereof. Please also note that attendance at the annual meeting will be limited to shareholders as of the record date, or their authorized representatives, and guests of ICOS.

|

BY ORDEROFTHE BOARDOF DIRECTORS |

|

|

John B. Kliewer |

| Secretary |

March 16, 2006

Bothell, Washington

YOUR VOTE IS IMPORTANT. ACCORDINGLY, YOU ARE URGED TO MARK, SIGN, DATE

AND RETURN THE ENCLOSED PROXY CARD, WHETHER OR NOT YOU PLAN TO

ATTEND THE ANNUAL MEETING.

CONTENTS

PROXY STATEMENT

INFORMATION CONCERNING SOLICITATION AND VOTING

General

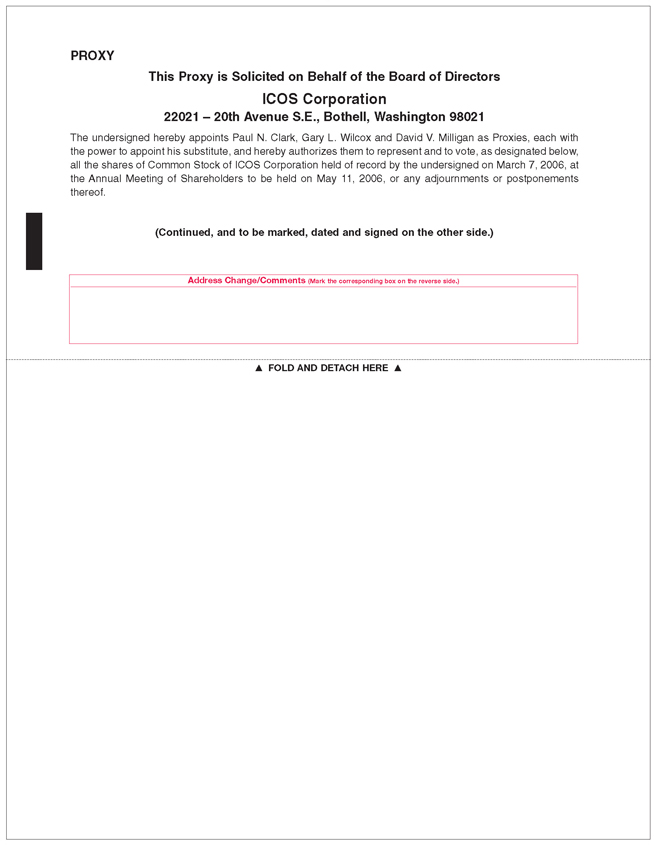

This Proxy Statement is furnished in connection with the solicitation by the Board of Directors of ICOS Corporation, the principal address of which is 22021 – 20th Avenue S.E., Bothell, Washington 98021, of proxies in the accompanying form for use at the 2006 Annual Meeting of Shareholders, to be held on Thursday, May 11, 2006, at 1:30 p.m., at ICOS Corporation, 22021 – 20th Avenue S.E., Bothell, Washington 98021. The approximate date of mailing this Proxy Statement and the enclosed form of proxy is March 23, 2006.

Each share of ICOS Common Stock outstanding at the close of business on March 7, 2006 is entitled to one vote at the Annual Meeting. Proxies are solicited so that each shareholder may have an opportunity to vote on all matters that are scheduled to come before the Annual Meeting. When properly executed proxies are voted, the shares represented thereby will be voted in accordance with the shareholders’ directions. Shareholders are urged to specify their choices by marking the appropriate boxes on the enclosed proxy card, or, if no choice has been specified, the shares will be voted as recommended by ICOS’ Board of Directors.

Record Date

Only those shareholders who owned Common Stock at the close of business on March 7, 2006, the record date, can vote at the Annual Meeting. At that date, there were 65,250,901 issued and outstanding shares of Common Stock.

Voting and Quorum

Holders of Common Stock are entitled to vote at the Annual Meeting on the basis of one vote for each share of Common Stock held of record.

Under Washington law and ICOS’ amended and restated bylaws, the presence in person or by proxy of holders of record of a majority of the outstanding shares of Common Stock entitled to vote is required to constitute a quorum for the transaction of business at the Annual Meeting. If a quorum is present at the Annual Meeting: (a) the three nominees for election as directors who receive the greatest number of votes cast in the election of directors will be elected, (b) Proposal 2 described herein relating to ratification of our independent registered public accounting firm will be approved if the votes cast in favor of ratification by shares of Common Stock, present in person or represented by proxy and entitled to vote at the Annual Meeting and on the subject matter, exceed the votes cast against such proposal, and (c) if the votes cast in favor of either of the shareholder proposals described herein (Proposal 3 and Proposal 4) by shares of Common Stock, present in person or represented by proxy and entitled to vote on the subject matter, exceed the votes cast against that proposal, the proposal will be approved. Means have been provided whereby a shareholder may withhold the vote for any director and may vote against, or refrain from voting on, any matter other than the election of directors.

Abstentions (or withheld votes in the case of directors) and shares for which brokers do not have discretionary authority to vote on certain matters in the absence of directions from the beneficial owners, or broker nonvotes, will be counted as shares that are present and entitled to vote for the purpose of determining the presence of a quorum. Withheld votes do not affect the election of directors. In the case of the other proposals, abstentions will have no effect because they are not treated as votes cast. Because fiduciaries will have

1

discretionary voting authority with respect to the election of directors and ratification of the appointment of the independent public accounting firm, there will be no broker nonvotes with respect to those matters. Broker nonvotes may occur with respect to either shareholder proposal, Proposal 3 or Proposal 4, but they will not affect the outcome because they are not treated as votes cast.

The enclosed proxy card also confers discretionary authority to vote the shares authorized to be voted thereby on any matter that was not known on the date of mailing this Proxy Statement, but that may properly be presented for action at the Annual Meeting. Shares of Common Stock represented by properly executed proxy cards for which no voting instruction is given will be voted “For” the election of the nominees for director, “For” Proposal 2 relating to ratification of the independent registered public accounting firm and “Against” the shareholder proposals listed as Proposals 3 and 4.

Revocability of Proxies

Any shareholder returning a proxy has the power to revoke it at any time before shares represented thereby are voted at the Annual Meeting. Any shares represented by an unrevoked proxy will be voted according to that proxy unless the shareholder attends the Annual Meeting and votes in person. A shareholder’s right to revoke a proxy is not limited by or subject to compliance with a specified formal procedure, but written notice of such revocation should be given to ICOS’ Secretary at or before the Annual Meeting.

Solicitation of Proxies

The expense of printing and mailing proxy material will be borne by ICOS. In addition to the solicitation of proxies by mail, solicitation may be made by certain directors, officers and other employees of ICOS in person or by telephone, facsimile transmission, telegraph, telex or electronic mail. No compensation will be paid for such solicitation.

Arrangements will also be made with brokerage firms and other custodians, nominees and fiduciaries to forward proxy solicitation materials to certain beneficial owners of Common Stock. ICOS will reimburse such brokerage firms, custodians, nominees and fiduciaries for reasonable out-of-pocket expenses incurred by them in connection therewith.

2

SECURITY OWNERSHIP OF PRINCIPAL SHAREHOLDERS AND MANAGEMENT

The following table sets forth certain information regarding the beneficial ownership, as of February 10, 2006, of Common Stock by: (i) each person known by ICOS to beneficially own more than 5% of the outstanding Common Stock; (ii) each director and nominee for director; (iii) each of the Named Executive Officers included in the Summary Compensation Table; and (iv) all directors and executive officers as a group.

| | | | | |

Name of Beneficial Owner

| | Shares

Beneficially

Owned (1) (2)

| | Percentage of

Common

Stock

| |

Wellington Management Company, LLP (3) 75 State Street Boston, MA 02109 | | 8,897,162 | | 13.6 | % |

PRIMECAP Management Company (4) 225 South Lake Avenue #400 Pasadena, CA 91101 | | 6,949,116 | | 10.7 | % |

William H. Gates III c/o Michael Larson 2365 Carillon Point Kirkland, WA 98033 | | 5,420,678 | | 8.3 | % |

OrbiMed Advisors LLC (5) 767 Third Avenue, 30th Floor New York, NY 10017 | | 3,462,006 | | 5.3 | % |

Teresa Beck | | 18,540 | | * | |

Vaughn D. Bryson | | 20,000 | | * | |

Paul N. Clark (6) | | 2,927,075 | | 4.5 | % |

James L. Ferguson | | 132,298 | | * | |

Robert J. Herbold | | 0 | | — | |

David V. Milligan (7) | | 77,646 | | * | |

Robert W. Pangia | | 115,763 | | * | |

Jack W. Schuler | | 45,000 | | * | |

Gary L. Wilcox (8) | | 713,492 | | 1.1 | % |

David A. Goodkin (9) | | 289,490 | | * | |

Michael A. Stein | | 419,742 | | * | |

Thomas P. St. John | | 436,562 | | * | |

All directors and executive officers as a group (16 persons) | | 6,213,318 | | 9.5 | % |

| (1) | Unless otherwise indicated, the persons named have sole voting and investment power with respect to all shares shown as beneficially owned by them, subject to applicable community property laws. Amounts shown include shares owned and stock options that may be exercised within 60 days of February 10, 2006, which are deemed outstanding for purposes of computing the percentage ownership of the person holding the option, but are not deemed outstanding for purposes of computing the percentage ownership of any other person. |

| (2) | Includes options that may be exercised for Common Stock within 60 days of February 10, 2006, for each individual as follows: William H. Gates III, 61,177; Teresa Beck, 15,000 shares; Vaughn D. Bryson, 15,000 shares; Paul N. Clark, 2,723,350 shares; James L. Ferguson, 115,763 shares; David V. Milligan, 77,646 shares; Robert W. Pangia, 115,763 shares; Jack W. Schuler, 15,000 shares; Gary L. Wilcox, 450,670 shares; Michael A. Stein, 341,142 shares; David A. Goodkin, 198,390 shares; Thomas P. St. John, 319,878 shares; and all directors and executive officers as a group, 5,174,812 shares. |

| (3) | The information provided relating to Wellington Management Company, LLP is based exclusively on a Schedule 13G filed with the Securities and Exchange Commission, or SEC, on February 14, 2006. This |

3

| | filing reported that, of the 8,897,162 shares of Common Stock beneficially owned by Wellington Management Company, LLP, Wellington Management Company, LLP has shared voting power over 6,311,689 shares and shared dispositive power over all 8,897,162 shares. |

| (4) | The information provided relating to PRIMECAP Management Company is based exclusively on a Schedule 13G filed with the SEC on February 14, 2006. This filing reported that, of the 6,949,116 shares of Common Stock beneficially owned by PRIMECAP Management Company, PRIMECAP Management Company has sole voting power over 3,202,016 shares and sole dispositive power over all 6,949,116 shares. |

| (5) | The information provided relating to OrbiMed Advisors LLC is based exclusively on a Schedule 13G filed with the SEC on February 2, 2006. This filing reported that, of the 3,462,006 shares of Common Stock beneficially owned by OrbiMed Advisors LLC, OrbiMed Advisors LLC has shared voting power over all 3,462,006 shares and shared dispositive power over all 3,462,006 shares. |

| (6) | Includes 116,032 shares, in the form of options, held by the Clark Family Limited Partnership, of which Paul N. Clark is partner. |

| (7) | Includes 20,339 shares held by the David V. Milligan Trust, of which David V. Milligan is trustee. |

| (8) | Includes 180,822 shares held by the Gary and Susan Wilcox Living Trust, of which Gary L. Wilcox is a trustee. |

| (9) | Includes 1,000 shares held by the Goodkin-Wetmore Trust 1996, of which David A. Goodkin is a trustee. |

PROPOSAL 1: ELECTION OF DIRECTORS

The Board of Directors consists of nine members. The Board of Directors is divided into three classes, with one class of directors elected to a three-year term at each Annual Meeting of Shareholders. Six of the directors are serving terms that continue beyond the Annual Meeting. Of the continuing directors, three are Class 2 directors and are serving terms that will not expire until the 2007 Annual Meeting of Shareholders and three are Class 3 directors and are serving terms that will not expire until the 2008 Annual Meeting of Shareholders. At the 2006 Annual Meeting, three directors will be elected, each of whom will hold office for a term of three years and until his or her successor is elected and qualified.

The Board of Directors has unanimously nominated James L. Ferguson, Robert J. Herbold and David V. Milligan, Ph.D. for election at the Annual Meeting. Unless otherwise instructed, it is the intention of the persons named as proxies on the enclosed proxy card to vote shares represented by properly executed proxies for the three nominees to the Board of Directors named above. If any nominee shall not be a candidate for election as a director at the Annual Meeting, it is intended that votes will be cast pursuant to the enclosed proxy for such substitute nominee as may be nominated by the Board of Directors. No circumstances are presently known that would render any nominee named herein unavailable to serve. To fill the vacancy created by the increase in the size of the Board of Directors, in March 2005, the Board appointed Robert J. Herbold as a Class 1 director.

Nominees for Election as Class 1 Directors

The following are the nominees to serve as Class 1 directors until the 2009 Annual Meeting of Shareholders and until their respective successors are elected and qualified:

James L. Ferguson (age 80) has been a director since January 1990. From 1973 to 1989, he served in various capacities at General Foods Corporation, a food manufacturing company, including Chief Executive Officer and President. Mr. Ferguson is a member of The Business Council and the Council on Foreign Relations, a Trustee of the Aspen Institute and a Life Trustee of Hamilton College.

Robert J. (Bob) Herbold (age 63)has been a director since March 2005. From 1994 to 2001, he held the position of Executive Vice President and Chief Operating Officer of Microsoft Corporation. Prior to joining

4

Microsoft in 1994, he was Senior Vice President, Advertising and Information Services at the Procter & Gamble Company. Currently, Mr. Herbold is the Managing Director of Herbold Group, LLC, a consulting firm focused on profitability. Mr. Herbold currently serves on the board of directors of Weyerhaeuser Corporation, Agilent Technologies, First Mutual Bank, and Cintas Corporation. In addition, he is a member of the President’s Council of Advisors on Science and Technology.

David V. Milligan, Ph.D. (age 65) has been a director since October 1995. From May 1998 to the present, he has served as a Vice President of Bay City Capital, a San Francisco-based merchant bank. From 1979 to 1996, he served in various capacities at Abbott Laboratories, retiring as Senior Vice President and Chief Scientific Officer after previously heading both the diagnostics and the pharmaceutical research and development sectors. Dr. Milligan is currently Vice Chairman of the board of directors of Caliper Life Sciences, Inc., Chairman of the Board of Galileo Laboratories, Inc., as well as a director of Pathway Diagnostics and Reliant Pharmaceuticals.

THE BOARD OF DIRECTORS RECOMMENDS A VOTEFOR

THE ELECTION OF THE ABOVE-NAMED NOMINEES

TO THE BOARD OF DIRECTORS.

Continuing Class 2 Directors (until 2007)

The three Class 2 directors, Paul N. Clark, Vaughn D. Bryson and Robert W. Pangia, are currently serving terms that expire at the 2007 Annual Meeting of Shareholders and until their respective successors are elected and qualified.

Paul N. Clark (age 59) has been a director, Chief Executive Officer and President since June 1999, and the Chairman of the Board of Directors since February 2000. From 1984 to December 1998, Mr. Clark worked in various capacities for Abbott Laboratories, a health care products manufacturer, retiring from Abbott Laboratories as Executive Vice President and board member after serving previously as Vice President from 1984 to 1990 and Senior Vice President from 1990 to 1998. His previous experience included senior positions with Marion Laboratories, a pharmaceutical company, and Sandoz Pharmaceuticals (now Novartis Corporation), a pharmaceutical company. Mr. Clark received his M.B.A. from Dartmouth College, Amos Tuck School, and his B.S. in finance from the University of Alabama.

Vaughn D. Bryson (age 67) has been a director since March 2004. He is President of Clinical Products, Inc., a medical foods company. Mr. Bryson was a 32-year employee of Eli Lilly and Company, a pharmaceutical company, where he served as President and Chief Executive Officer from 1991 until 1993. He was Executive Vice President from 1986 until 1991 and served as a member of the board of directors of Lilly from 1984 until his retirement in 1993. From 1994 to 1996, Mr. Bryson was Vice Chairman of Vector Securities International, Inc., an investment banking firm. He is currently a director of Amylin Pharmaceuticals, Inc., AtheroGenics, Inc. and Chiron Corporation.

Robert W. Pangia (age 54) has been a director since April 1990. Mr. Pangia is currently a partner in Ivy Capital Partners, a private equity fund specializing in healthcare investments. From 1987 to 1997, Mr. Pangia served in various positions at PaineWebber Incorporated, an investment banking and securities brokerage firm, including Director of Investment Banking from 1989-1997 and Executive Vice President from 1990-1997. From 1986 to 1987, he was a Managing Director with Drexel Burnham Lambert, an investment banking firm. From 1977 to 1986, Mr. Pangia worked in various positions in the Corporate Financing Department at Kidder Peabody & Co., an investment banking and securities brokerage firm, including serving as Director of the Technology Finance Group. He is currently a director for Biogen IDEC Pharmaceuticals, Inc. and McAfee, Inc.

Continuing Class 3 Directors (until 2008)

The three Class 3 directors, Teresa Beck, Jack W. Schuler and Gary L. Wilcox, Ph.D., are currently serving terms that expire at the 2008 Annual Meeting of Shareholders and until their respective successors are elected and qualified.

5

Teresa Beck (age 51) has been a director since March 2004. Ms. Beck served as President of American Stores Co. from 1998 to 1999 and as Chief Financial Officer from 1993 to 1998. Prior to joining American Stores Co. in 1982, Ms. Beck served as an audit manager for Ernst & Young LLP. Ms. Beck currently serves as a director of Albertson’s, Inc., Lexmark International, Inc., and Questar Corporation.

Jack W. Schuler (age 65) has been a director since January 2004. From 1972 to 1989, he served in various capacities at Abbott Laboratories, retiring as President and Chief Operating Officer, a position he held from 1987 to 1989. Mr. Schuler is a partner in Crabtree Partners, a Chicago-based venture capital firm. He currently serves as the Chairman of the Boards of Ventana Medical Systems, Inc. and Stericycle, Inc. and as a director of Medtronic, Inc.

Gary L. Wilcox, Ph.D. (age 59) has been Executive Vice President, Operations, and a director since 1993. From 1989 to 1993, Dr. Wilcox served as Vice Chairman, Executive Vice President and director of XOMA Corporation, a biotechnology company. From 1982 to December 1989, he was the President and Chief Executive Officer of International Genetic Engineering, Inc. (known as Ingene), a biotechnology company, which he co-founded. In 1989, Ingene was acquired by XOMA Corporation. Dr. Wilcox received his Ph.D. and M.A. in molecular biology and biochemistry and his B.A. in cellular and molecular biology from the University of California at Santa Barbara.

Director Nominations Process

The Board of Directors has adopted a Charter of the Nominating and Corporate Governance Committee that describes the process by which candidates for possible inclusion in our recommended slate of director nominees are selected. The Board of Directors may amend this charter at any time, in which case the most current version will be available on our website at http://www.icos.com. As noted earlier, one of our current directors, Mr. Herbold, was appointed by the Board of Directors to fill a newly created board seat and has not been elected by the shareholders. Mr. Herbold was recommended by one of our non-management directors.

Minimum Criteria for Board Members

The Board of Directors has approved qualifications recommended by the Nominating and Corporate Governance Committee for evaluating future director candidates. As a baseline measure, a qualified non-employee director would have sound business judgment, solid moral character, independence from management and meaningful and relevant experience. The relevant backgrounds that would most benefit the Board of Directors would include a proper balance over time of experience in the commercial, finance and research areas. This meaningful experience would involve working at the highest executive levels and, possibly, current public company board service. The Nominating and Corporate Governance Committee has determined that it is highly desirable that some directors have relevant pharmaceutical and/or biotechnology experience. In addition to these qualities, the Nominating and Corporate Governance Committee considers the diversity of the Board of Directors as a whole and views having directors of varying backgrounds and perspectives to be highly important.

The following factors are among those weighed by the Nominating and Corporate Governance Committee in assessing potential non-employee directors with the goal that new directors would enhance the effectiveness of the Board of Directors while minimizing the possibility of conflicts or other significant issues:

| | • | | Family relationship with any employee or director; |

| | • | | Business relationships with ICOS; |

| | • | | Relationships with investment banks, accounting firms or law firms that provide or have recently provided services to ICOS; |

| | • | | Involvement in substantive legal, ethical or moral issues or controversies that could call into question personal or professional integrity; |

6

| | • | | Ability and intent to commit appropriate time and attention to board needs; |

| | • | | Personal or business factors that would be deleterious to board involvement and/or bring possible disrepute through association to ICOS and its board; and |

| | • | | Lack of current involvement in activities that are directly competitive with or adversarial to ICOS. |

Process for Identifying Candidates

Our Nominating and Corporate Governance Committee has two primary methods for identifying candidates beyond those proposed by our shareholders. On a periodic basis, the Nominating and Corporate Governance Committee solicits ideas for possible candidates from a number of sources, including members of the Board of Directors, senior-level management, individuals personally known to the members of the Board and research, including publications, databases and Internet searches. In addition, the Nominating and Corporate Governance Committee may, from time to time, use its authority under its charter to retain a search firm to identify candidates.

Nomination Right of Shareholders

In accordance with our amended and restated bylaws and applicable law, recommendations for nominations for the election of directors for consideration by the Nominating and Corporate Governance Committee may be made by any shareholder of record entitled to vote for the election of directors at shareholder meetings held for such purpose. The requirements a shareholder must follow for recommending persons for consideration by the Nominating and Corporate Governance Committee for election as directors are set forth in our amended and restated bylaws and the section of this Proxy Statement entitled PROPOSALS OF SHAREHOLDERS FOR 2007 ANNUAL MEETING.

Subject to the superior rights, if any, of the holders of any class or series of stock having a preference over our Common Stock that we may issue in the future, if a shareholder complies with these procedures for recommending persons for consideration by the Nominating and Corporate Governance Committee for election as directors, the Nominating and Corporate Governance Committee will conduct the appropriate and necessary inquiries into the backgrounds, qualifications and skills of the shareholder-recommended candidates and, in the exercise of the Nominating and Corporate Governance Committee’s independent judgment in accordance with the policies and procedures adopted in the Nominating and Corporate Governance Committee charter, will determine whether to recommend the shareholder-recommended candidates to the Board of Directors for inclusion in the list of candidates for election as directors at the next shareholder meeting held for such purpose.

Evaluation of Candidates

The Nominating and Corporate Governance Committee will consider all candidates identified through the processes described above and will evaluate each of them, including incumbents, based on the same criteria. If, based on the Nominating and Corporate Governance Committee’s initial evaluation, a candidate continues to be of interest, the Nominating and Corporate Governance Committee will generally conduct interviews and arrange for appropriate background and reference checks.

Director Independence and Other Matters

The Board of Directors has determined each of the following directors is an “independent director” as such term is defined in Marketplace Rule 4200(a)(15) of the National Association of Securities Dealers, or NASD: Teresa Beck, Vaughn D. Bryson, James L. Ferguson, Robert J. Herbold, David V. Milligan, Ph.D., Robert W. Pangia and Jack W. Schuler.

The Board of Directors has also determined that each member of the three standing committees of the Board meets the independence requirements applicable to those committees prescribed by the NASD, the SEC, and the

7

Internal Revenue Service, or IRS. The Board of Directors has further determined that Teresa Beck and Robert W. Pangia, members of the Audit Committee of the Board of Directors, are both “audit committee financial experts,” as such term is defined in Item 401(h) of Regulation S-K promulgated by the SEC by virtue of the relevant experience listed in their biographical summaries provided above in the section entitled PROPOSAL 1: ELECTION OF DIRECTORS.

Dr. Milligan has been appointed the lead director of the Board and, in that role, chairs executive sessions of the independent directors.

The Board of Directors has established a policy regarding director education. Under this policy, the Chairman, in consultation with the lead director, is responsible for providing an orientation for new directors. The Chairman, through the scheduling of presentations at Board meetings and the provision of written materials, provides directors with information and continuing education on subjects that would assist them in discharging their duties, including regular presentations on our business, strategy, risks and opportunities, financial statements, and compliance and corporate governance activities. And, in fulfilling their responsibility to remain current on significant matters affecting ICOS, the directors independently evaluate the information provided by management and determine whether they desire additional information or continuing education from a third-party and directors may attend a reasonable (as determined by the lead director) amount of third-party continuing education programs at ICOS’ expense.

Information on Committees of the Board of Directors and Meetings

The Board of Directors met six times during the year ended December 31, 2005. All directors attended at least 75% of the meetings of the Board of Directors and of meetings held by all committees of the Board of Directors on which they served.

The Board of Directors has three standing committees: an Audit Committee, a Compensation Committee and a Nominating and Corporate Governance Committee. Each committee is governed by a written charter that may be amended by the Board of Directors at any time. The most current version of each committee’s charter is available on our website at http://www.icos.com.

The Audit Committee consists of three independent directors, Ms. Beck (Chairperson) and Messrs. Ferguson and Pangia. The Board of Directors has determined that Ms. Beck and Mr. Pangia are audit committee financial experts and each of the members of the Audit Committee is independent in accordance with applicable NASDAQ listing standards and SEC rules and regulations. Each member of the Audit Committee must meet certain independence and financial literacy requirements. The Audit Committee assists the Board of Directors in fulfilling its oversight responsibilities relating to the integrity of ICOS’ financial statements, ICOS’ compliance with legal and regulatory requirements, the independent registered public accounting firm’s qualifications and independence, and the performance of our internal audit function and the independent registered public accounting firm. Among the responsibilities outlined in its charter, the Audit Committee appoints, compensates, retains and oversees the work of the independent registered public accounting firm employed by ICOS to conduct the annual audit examinations of ICOS’ financial statements and internal control over financial reporting. The members meet with representatives of the independent registered public accounting firm, internal auditors and management to review: the scope of proposed audits for the year; audit fees; and, at the conclusion of the audits, the audit reports. In addition, the Audit Committee reviews the financial statements, the related footnotes, management’s report on internal control over financial reporting and the independent registered public accounting firm’s reports thereon, and makes related recommendations to the Board of Directors as the Audit Committee deems appropriate. The Audit Committee met seven times during the year ended December 31, 2005.

The Compensation Committee consists of three independent directors, Messrs. Bryson (Chairman) and Ferguson and Dr. Milligan. The Compensation Committee is responsible for establishing compensation levels for ICOS’ executive officers, establishing and administering performance-based compensation plans, evaluating the

8

performances of ICOS’ executive officers, considering management succession and related matters, and administering ICOS’ equity incentive plan. Under its charter, the Compensation Committee has the authority to retain independent compensation experts to assist the Committee with respect to establishing and implementing the compensation philosophy, assessing the reasonableness of executive compensation and benefits and with respect to making specific compensation decisions. The Committee appoints, compensates, retains and oversees the work of any such retained external compensation consultant(s) and such compensation consultants report directly and solely to the Committee. The Compensation Committee met five times during the year ended December 31, 2005.

The Nominating and Corporate Governance Committee consists of four independent directors, Dr. Milligan (Chairman) and Messrs. Herbold, Pangia and Schuler. The Nominating and Corporate Governance Committee makes recommendations to the Board of Directors concerning the criteria for membership on the Board of Directors and the qualifications of prospective candidates, including candidates identified by shareholders in accordance with our amended and restated bylaws, to fill vacancies on, or to be elected or reelected to, the Board of Directors. The Nominating and Corporate Governance Committee also takes a leadership role in shaping the corporate governance of ICOS. The Nominating and Corporate Governance Committee maintains a set of corporate governance principles and a code of conduct applicable to our directors, officers and employees and monitors modifications and waivers of the code of conduct. The Nominating and Corporate Governance Committee makes recommendations to the Board of Directors concerning the conduct of Board meetings, the reporting channels to the Board of Directors and the information it receives, and succession planning for senior management. Annually, the Nominating and Corporate Governance Committee oversees an evaluation of the performance of the Board and reviews the qualifications, requirements, membership, structure and performance of Board committees. The Nominating and Corporate Governance Committee met three times during the year ended December 31, 2005.

Compensation of Directors

ICOS has a policy of paying directors who are not employees of ICOS an annual fee of $45,000 for service on the Board of Directors, which is paid in quarterly installments. The Lead Non-Employee director receives an additional annual retainer of $15,000. The non-employee members, excluding the chairperson, of the following committees also receive the corresponding annual retainer fee, paid quarterly, in addition to any other compensation he or she may otherwise receive: Audit Committee, $19,000; Compensation Committee, $14,000; Nominating and Corporate Governance Committee, $7,000. The non-employee chairpersons of the following committees receive the corresponding annual retainer fee, paid quarterly, in addition to any other compensation he or she may otherwise receive: Audit Committee, $35,000; Compensation Committee, $25,500; Nominating and Corporate Governance Committee, $18,500.

Pursuant to ICOS’ amended and restated equity award program for non-employee directors, or the Director Program, upon initial election or appointment to the Board of Directors that occurs after December 13, 2005, each eligible director is entitled to receive an initial grant of nonqualified stock options for 30,000 shares of Common Stock. The program also provides that continuing eligible directors will receive annual grants of restricted stock and/or restricted stock units, and sets forth a process for determining the size of each annual restricted stock/restricted stock unit grant by comparison to peer company equity grant practices. However, if the date of a director’s initial option grant upon election or appointment to the Board of Directors falls within 150 days prior to an Annual Meeting of Shareholders, that director will not be eligible for an annual restricted stock/restricted stock unit grant until the second Annual Meeting of Shareholders following the director’s initial election or appointment. In January 2006, the Compensation Committee determined that the 2006 annual grant of restricted stock and/or restricted stock units for each continuing director under the Director Program will cover 7,000 common shares with such grants to be made as of the 2006 Annual Meeting of Shareholders.

Stock options and grants of restricted stock or restricted stock units that are granted under the Director Program vest and become exercisable in two equal amounts as of each of the first two anniversaries of the grant

9

date. Vesting schedules, for both initial and annual grants, assume continued service on the Board of Directors during the vesting periods. Outstanding unvested grants issued under the Director Program will also fully vest upon a change in control.

Stock options granted under the Director Program have an exercise price equal to the closing market price of the Common Stock on the date of the grant. The options have a ten-year term but cannot be exercised later than two years after termination of service as a director.

10

PROPOSAL 2: RATIFICATION OF THE APPOINTMENT

OF THE INDEPENDENT REGISTERED PUBLIC ACCOUNTING FIRM

The Board of Directors unanimously recommends that you vote “FOR” ratification of its selection of KPMG LLP, independent registered public accounting firm, to audit and report on the financial statements of ICOS for the year ending December 31, 2006, and internal control over financial reporting as of December 31, 2006. KPMG audited the financial statements of ICOS for the year ended December 31, 2005 and internal control over financial reporting as of December 31, 2005. Representatives of KPMG will be present at the Annual Meeting, to make a statement if they desire to do so and respond to questions of shareholders. Ratification of the Board of Directors’ selection of KPMG as ICOS’ independent registered public accounting firm requires that the votes cast in favor of ratification by shares represented at the Annual Meeting exceed the votes cast against ratification. If shareholders fail to ratify the selection of KPMG, the Audit Committee and the Board of Directors will consider whether to retain KPMG, and may retain that firm or another firm without resubmitting the matter to shareholders.

The aggregate fees and expenses billed for professional services rendered by KPMG for the years ended December 31, 2005 and 2004, respectively, were as follows:

| | | | | | |

| | | 2005

| | 2004

|

Audit | | $ | 265,500 | | $ | 273,500 |

Audit-related | | | 15,250 | | | 28,780 |

Tax | | | 3,500 | | | 3,700 |

| | |

|

| |

|

|

Total | | $ | 284,250 | | $ | 305,980 |

| | |

|

| |

|

|

In 2005, audit-related fees were for the audit of our 401(k) plan. In 2004, audit-related fees were for the audit of our 401(k) plan and consultation concerning reporting and internal control standards. Tax fees, in 2005 and 2004, were for preparation of compliance filings for our 401(k) plan.

The Audit Committee has considered whether the services listed above are compatible with maintaining the registered public accounting firm’s independence. All services rendered by KPMG were approved by the Audit Committee in accordance with the SEC’s requirements regarding auditor independence.

Pre-Approval Policy. The Audit Committee has established a policy requiring its pre-approval of all services provided by the independent registered public accounting firm. The policy is available at http://www.icos.com. The policy provides for the general pre-approval of specific types of services and gives detailed guidance to management as to the specific services that are eligible for general pre-approval. The policy requires specific pre-approval of all other permitted services. Consistent with the policy, the Audit Committee has delegated to its Chairperson the authority to pre-approve services, and the Chairperson must report any pre-approval decisions to the Audit Committee at its next scheduled meeting.

THE BOARD OF DIRECTORS RECOMMENDS A VOTEFOR

THE RATIFICATION OF THE APPOINTMENT OF THE

INDEPENDENT REGISTERED PUBLIC ACCOUNTING FIRM.

11

PROPOSAL 3: SHAREHOLDER PROPOSAL

REGARDING BOARD DECLASSIFICATION

The Comptroller of the City of New York, on behalf of the Boards of Trustees of the New York City Employees’ Retirement System, the New York City Teachers’ Retirement System, and New York City Board of Education Retirement System, 1 Centre Street, New York, New York 10007-2341, beneficial owner as of November 14, 2005, of approximately 116,825 shares of our Common Stock, has notified ICOS that it intends to present the following resolution at the Annual Meeting.

Shareholder Proposal

BE IT RESOLVED,that the stockholders of ICOS Corporation request that the Board of Directors take the necessary steps to declassify the Board of Directors and establish annual elections of directors, whereby directors would be elected annually and not by classes. This policy would take effect immediately, and be applicable to the reelection of any incumbent director whose term, under the current classified system, subsequently expires.

Supporting Statement

We believe that the ability to elect directors is the single most important use of the shareholder franchise. Accordingly, directors should be accountable to shareholders on an annual basis. The election of directors by classes, for three-year terms, in our opinion, minimizes accountability and precludes the full exercise of the rights of shareholders to approve or disapprove annually the performance of a director or directors.

In addition, since only one-third of the Board of Directors is elected annually, we believe that classified boards could frustrate, to the detriment of long-term shareholder interest, the efforts of a bidder to acquire control or a challenger to engage successfully in a proxy contest.

We urge your support for the proposal to repeal the classified board and establish that all directors be elected annually.

ICOS Statement in Opposition to the Proposal Regarding Board Declassification

ICOS Corporation, like the proponent, is committed to good corporate governance. We believe that part of good governance involves having directors with the proper knowledge and experience to oversee our affairs. Our classified Board provides continuity and facilitates long-term planning by the Board, enhances the independence of non-employee directors, and encourages potential acquirers to negotiate transactions with the Board that are fair to all shareholders. Further, the benefits of a classified board do not come at the expense of director accountability and responsiveness.

In 1993, our shareholders demonstrated agreement with our assessment when they decided that our Board should be divided into three classes, with directors from each class elected to staggered three-year terms, to help ensure that we would always have a certain number of experienced directors available. Our shareholders’ decision has worked well for the past thirteen years, in that it balances the need to have new directors to bring fresh ideas and perspectives to the company with the need for experience on the board. In 2005, our shareholders also approved our reincorporation from Delaware to Washington in a manner that maintained the classified board.

This same non-binding shareholder proposal was submitted at our 2005 annual meeting, but failed to receive the votes that would be necessary to implement an actual declassification of our board. As discussed below, declassification of our board would require the affirmative vote of a majority of our directors, as well as the affirmative vote of the holders of at least two-thirds of our outstanding shares of Common Stock. At our 2005 annual meeting, this non-binding proposal received 54% of the votes cast (including abstentions), which was not

12

even the affirmative vote of a third of our outstanding shares, much less the two-thirds of our outstanding shares that would be necessary to declassify the board. This vote supports the Board’s continued belief that the classified board structure is in the best interests of ICOS and our shareholders.

Continuity and Long-Term Strategic Planning. The election of directors by classes is designed to prevent sudden disruptive changes to the composition of the board by preventing the election of an entirely new board in any one year. Under the classified structure, a majority of the board members generally will be experienced directors that have in-depth knowledge of ICOS and its business and strategies. The Board believes that directors with such understanding are better able to make fundamental decisions about our business and guide management in implementing such decisions. Three-year staggered terms allow experienced directors to evaluate projects and policies that will affect the growth and vitality of ICOS well into the future.

Independence of Non-Employee Directors. We believe that the classified board structure enhances the independence of the non-employee directors who sit on the Board by providing them with a longer assured term of office, which allows directors to be outspoken without concern that their fellow directors must renominate them each year, and reduces management’s ability to pressure directors to act too quickly and in an uninformed manner. With three-year terms, directors do not have to continually consider an upcoming nomination for re-election the following year.

Negotiations With Potential Acquirers. We believe that a classified board reduces our vulnerability to certain unfriendly or unsolicited takeover tactics. Because potential acquirers cannot take control of a classified board in a single shareholder meeting, potential acquirers, if any, would find it necessary to rely on arm’s-length negotiations with the Board, placing the Board in a better position to seek the best possible outcome for all shareholders. Because at least two annual meetings of shareholders generally are required to effect a change in control of the Board, classification provides the incumbent directors with adequate time to review any takeover proposal, study appropriate alternatives and negotiate the best result for all shareholders.

Accountability. Regardless of the length of their term, our directors are required to uphold their fiduciary duties to ICOS and our shareholders. Thus, accountability depends on the selection of responsible and experienced individuals, not on whether they serve terms of one year or three years. Moreover, the Board believes that directors elected to a classified board are no less accountable to shareholders than they would be if all directors were elected annually. Since at least some directors must stand for election each year, shareholders have the annual opportunity to withhold votes from directors as a way of expressing any dissatisfaction they may have with the Board or management.

Effect of Proposal. Approval of this non-binding shareholder proposal would not in itself eliminate the classified board. Our shareholders voted to provide for a classified board in our articles of incorporation. The Board cannot change this provision of our articles of incorporation without shareholder approval. To declassify our board, our “Continuing Directors” (as defined in our articles of incorporation) would need to approve and recommend to our shareholders such an amendment to our articles of incorporation and holders of at least two-thirds of our outstanding shares of Common Stock would need to approve such an amendment at a subsequent meeting of shareholders. As discussed above, this non-binding proposal was submitted to shareholders at our 2005 annual meeting of shareholders and received approval of less than one third of our outstanding shares.

For the foregoing reasons, the Board has determined that retention of the classified board is in the best interests of ICOS and our shareholders.

THE BOARD OF DIRECTORS RECOMMENDS A VOTEAGAINST

PROPOSAL THREE.

13

PROPOSAL 4: SHAREHOLDER PROPOSAL REGARDING

ENGAGEMENT WITH CERTAIN SHAREHOLDERS

The Comptroller of the City of New York, on behalf of the Boards of Trustees of the New York City Fire Department Pension Fund and the New York City Police Pension Fund, 1 Centre Street, New York, New York 10007-2341, beneficial owner as of November 14, 2005, of approximately 37,500 shares of our Common Stock, has notified ICOS that it intends to present the following resolution at the Annual Meeting.

Shareholder Proposal

WHEREAS, in 2002, United States Congress, the Securities and Exchange Commission, and the stock exchanges, recognizing the urgent need to restore public trust and confidence in the capital markets, acted to strengthen accounting regulations, to improve corporate financial disclosure, independent oversight of auditors, and the independence and effectiveness of corporate boards; and

WHEREAS, we believe these reforms, albeit significant steps in the right direction, have not adequately addressed shareholder rights and the accountability of directors of corporate boards to the shareholders who elect them; and

WHEREAS, we believe the reforms have not addressed a major concern of institutional investors – the continuing failure of numerous boards of directors to adopt shareholder proposals on important corporate governance reforms despite the proposals being supported by increasingly large majorities of the totals of shareholder votes cast for and against the proposals;

WHEREAS, the Board of Directors of our company has not adopted shareholder proposals that were supported by majority votes;

NOW, THEREFORE, BE IT RESOLVED: That the shareholders request the Board of Directors initiate the appropriate process to amend the Company’s governance documents (certificate of incorporation or by-laws) to establish an engagement process with the proponents of shareholder proposals that are supported by a majority of the votes cast, excluding abstentions and broker non-votes, at any annual meeting.

In adopting such a policy, the Board of Directors should include the following steps:

| | • | | Within four months after the annual meeting, an independent board committee should schedule a meeting (which may be held telephonically) with the proponent of the proposal, to obtain any additional information to provide to the Board of Directors for its reconsideration of the proposal. The meeting with the proponent should be coordinated with the timing of a regularly scheduled board meeting. |

| | • | | Following the meeting with the proponent, the independent board committee should present the proposal with the committee’s recommendation, and information relevant to the proposal, to the full Board of Directors, for action consistent with the company’s charter and by-laws, which should necessarily include a consideration of the interest of the shareholders. |

ICOS Statement in Opposition to the Proposal Regarding Engagement With Shareholders

“If it’s not broken, don’t fix it.” The wisdom of this truism comes in part from a recognition that “fixes” come at a cost and can have unintended consequences. There is nothing broken with ICOS Corporation or with our approach to shareholder communication.

History of Communication and Careful Deliberations.

We have a long history of open communication with shareholders (including those who submit shareholder proposals), employees and customers on matters relevant to the operation of our business. Throughout the year,

14

our management regularly meets with significant shareholders regarding matters of concern to them, which can include shareholder proposals. In fact, during the 2005 proxy season, our management met extensively with significant institutional shareholders to discuss shareholder proposals, including the proposal to declassify our Board that is alluded to in the proponent’s statement. Because in one case it was warranted, the Chairman of our Nominating and Corporate Governance Committee attended these discussions. The tenor and content of these discussions was reported back to the full Board of Directors and incorporated into the Board’s consideration of the proposal.

In addition, as described elsewhere in this proxy statement, our Board has established a policy under which interested shareholders can send communications to the Board, to a committee of the Board and to individual directors by sending a written communication to our corporate Secretary. The Secretary will forward appropriate communication to the Board, the appropriate committee of the Board, or to individual directors. This procedure helps to ensure that our Board of Directors is accessible to hear the viewpoints of all of our shareholders, regardless of size.

The proponent asserts that “the Board of Directors of our company has not adopted shareholder proposals that were supported by majority votes.” This is not an accurate statement. Only one shareholder proposal received the affirmative vote of a majority of the votes cast. No shareholder proposal in our history has ever received the affirmative vote of a majority of our outstanding shares. The proponent indirectly refers to its own 2005 proposal recommending declassification of our Board which, while receiving the affirmative vote of 54% of the votes cast, received the affirmative vote of just 32% of our outstanding shares.

To declassify our Board of Directors, an amendment to our articles of incorporation would need to be approved by a majority of our directors, as well as the holders oftwo-thirds or more of our outstanding shares. Our Board of Directors has not approved or recommended declassification because, after considering the expressed views of certain shareholders and discussing the matter at meetings on December 7, 2004, January 27, 2005, July 19, 2005, December 13, 2005 and January 24, 2006, the Board continues to believe that a classified board is in the best interests of ICOS and our shareholders. Many of the reasons for this belief are outlined in our statement in opposition to Proposal Number 3. Furthermore, the shareholder vote on the non-binding 2005 declassification proposal fell far short of that which would be necessary to approve an amendment, even if the Board were to approve and recommend such a change.

Our Board has no choice but to act in accordance with its belief regarding what is in the best interest of shareholders. In fact, state law and the Board’s fiduciary duties demand that it do so. Reasonable people, including many of our valued shareholders, can disagree on the value of a classified board. In the end, the Board must act in accordance with its informed belief regarding the pros and cons of such a structure. The Board’s belief in the continued value of our classified board was formed after careful consideration. In fact, within four months after the May 2005 annual meeting, at the board meeting on July 19, 2005, the Board considered the shareholder voting on the 2005 declassification proposal and again considered its position on declassification. In reconsidering and reaffirming its viewpoint, the Board again reviewed the practices of other companies, including our peers, the positions of various constituents on the matter, specifics related to our classified board and the process for declassification, reasons to declassify and to retain the classified board, and our other takeover defenses.

With a full understanding of the history and context of the declassification proposal cited by the proponent, we hope that you will agree that our history of open communication with shareholders and careful deliberation regarding shareholder proposals shows that there is no broken process in need of fixing.

Costly and Unnecessary Procedural Requirement.

The proponent’s proposal, if adopted, would create an additional formal process that is unnecessary and duplicative of our existing practice of meeting with significant shareholders to discuss their concerns. This proposed process would impose an unnecessary and arbitrary burden on our independent directors.

15

We are committed to good corporate governance and the Board and its Nominating and Corporate Governance Committee routinely consider ways to maximize the Board’s effectiveness. In doing so, we are careful not to adopt practices that will elevate form over substance, as we believe is the case with this proposal.

In addition, establishing a new process for shareholder communications may not serve the interests of all of our shareholders, but may instead simply become a vehicle for special interest groups or individual shareholders to make demands that do not represent the interests of our shareholders as a whole.

Conclusion and Recommendation

Our management regularly consults with significant shareholders and reports the tenor and content of these discussions to our full Board of Directors. Our Board of Directors has met to consider every proposal that has been submitted by shareholders to determine whether the adoption of such proposal would be in the best interest of ICOS and our shareholders. In these meetings, the Board has always considered the views of the proponents and of our other shareholders, although the Board’s conclusions must and have always been based on the exercise of its fiduciary duties and its business judgment regarding the best interests of our shareholders. We will continue our commitment to open shareholder communications and to the careful consideration of every shareholder proposal. Substantively, the proposed amendment would not enhance our current practices, yet it would impose an unnecessary and arbitrary burden on our independent directors.

For the foregoing reasons, the Board has determined that this proposal is not in the best interests of ICOS and our shareholders.

THE BOARD OF DIRECTORS RECOMMENDS A VOTEAGAINST

PROPOSAL FOUR.

16

EXECUTIVE OFFICERS

The following persons are executive officers of ICOS. Each officer named below is expected to be reelected at the Board meeting to be held on May 11, 2006.

| | | | | | |

Name

| | Age

| | Positions and Offices with ICOS

| | Officer

Since

|

Paul N. Clark | | 59 | | Chief Executive Officer, President, Chairman | | 1999 |

Leonard M. Blum | | 45 | | Senior Vice President, Sales and Marketing | | 2000 |

David A. Goodkin, M.D., F.A.C.P. | | 50 | | Senior Vice President, Development; Chief Medical Officer | | 2002 |

John B. Kliewer | | 36 | | Vice President, General Counsel, Secretary | | 2005 |

Thomas P. St. John, Ph.D. | | 53 | | Vice President, Therapeutic Development | | 1993 |

Michael A. Stein | | 56 | | Senior Vice President, Chief Financial Officer | | 2001 |

Clifford J. Stocks | | 47 | | Vice President, Business Development | | 1999 |

Gary L. Wilcox, Ph.D. | | 59 | | Executive Vice President, Operations | | 1993 |

Michele K. Yetman | | 41 | | Vice President, Human Resources | | 2005 |

The biographical summaries of Mr. Clark and Dr. Wilcox are provided above in the section entitled PROPOSAL 1: ELECTION OF DIRECTORS.

Leonard M. Blum (age 45) joined ICOS as Vice President, Marketing in June 2000 and was appointed ICOS’ Vice President, Sales and Marketing in January 2001. He was named Senior Vice President in May 2005. From August 1997 to June 2000, Mr. Blum served in various capacities for Merck Sharp & Dohme Israel, a pharmaceutical company, including Marketing Director and Business Unit Director. He joined Merck and Co. in 1987, served in several positions in the United States, and led sales and marketing teams in Germany, Israel and Switzerland. His previous experience includes service as an officer in the United States Army Special Forces and as a Corporate Financial Analyst with the Investment Banking Division at Shearson Lehman American Express, a financial services company. Mr. Blum received his M.B.A. from the Stanford Graduate School of Business and his A.B. in economics, magna cum laude, from Princeton University. He was a Fulbright Scholar in international finance at the University of Zurich.

David A. Goodkin, M.D., F.A.C.P. (age 50) joined ICOS in August 2002 as Vice President, Development and Chief Medical Officer and was named Senior Vice President in May 2005. From 1992 to 2002, Dr. Goodkin was employed in various capacities for Amgen Inc., a biopharmaceutical company, serving as Vice President, Clinical Research from 2000 to 2002. Dr. Goodkin is board certified in nephrology and internal medicine. He completed nephrology fellowships at Albert Einstein Medical Center and Temple University Health Sciences Center, and an internal medicine residency at the University of Miami. He received his medical degree from the State University of New York at Syracuse and graduated summa cum laude from Dartmouth College.

John B. Kliewer (age 36) has been Vice President and General Counsel since August 2002. In July 2003, he was appointed Secretary and, in December 2003, became Corporate Compliance Officer. Mr. Kliewer was appointed an executive officer in September 2005. From January 2000 to July 2002, he held various positions at Immunex Corporation, a biopharmaceutical company, most recently as Associate General Counsel. Prior to joining Immunex, Mr. Kliewer was an Associate at the law firm of Cravath, Swaine & Moore. Mr. Kliewer graduated summa cum laude and received his J.D. from the Georgetown University Law Center and received his bachelor’s degree from the University of Washington.

Thomas P. St. John, Ph.D. (age 53) has been Vice President, Therapeutic Development, since October 1993. Dr. St. John joined ICOS in September 1990 as Director of the Structural Cell Biology Program and became a Senior Director, Science, in July 1992. Prior to joining ICOS, Dr. St. John was a faculty member of the Fred Hutchinson Cancer Research Center in Seattle, Washington, and an affiliate faculty member in the Department of

17

Medicine and Department of Genetics at the University of Washington. Dr. St. John received his Ph.D. in biochemistry from Stanford University and his B.S. in biology from California Institute of Technology.

Michael A. Stein (age 56) is Senior Vice President and has been Chief Financial Officer since January 2001. From October 1998 to September 2000, Mr. Stein was Chief Financial Officer of Nordstrom, Inc., a fashion specialty retailer. From 1989 to 1998, Mr. Stein was employed in various capacities for Marriott International, Inc., a global hospitality company, and its predecessor, Marriott Corporation, serving as Chief Financial Officer from 1993 to 1998. Prior to working with Marriott, Mr. Stein spent 18 years with Arthur Andersen LLP, where he was a partner based in the firm’s Washington, D.C. office. Mr. Stein serves on the board of trustees of the Fred Hutchinson Cancer Research Center and the board of directors of Apartment Investment and Management Company and Getty Images, Inc. He is a Certified Public Accountant and received his B.S. in business administration from the University of Maryland at College Park, Maryland.

Clifford J. Stocks (age 47) has been Vice President, Business Development, since January 1999. Mr. Stocks joined ICOS in February 1992 as a Business/Corporate Development Manager and became Director, Business Development in January 1993 and Senior Director, Business Development, in January 1997. From October 1989 to September 1991, Mr. Stocks was an Associate with Booz Allen & Hamilton, a management consulting firm. Mr. Stocks received his M.B.A. from the University of Chicago Graduate School of Business and his B.S. in biology from the University of Utah.

Michele K. Yetman (age 41) has been Vice President, Human Resources since April 2002 and was named an executive officer in January 2005. Ms. Yetman joined ICOS in August 1997 as Director, Human Resources and became Senior Director, Human Resources in November 2000. From 1995 to 1997, Ms. Yetman served in a Human Resources management role with International Data Group, or IDG, a media, research and exposition company. Prior to working with IDG, Ms. Yetman spent eight years with Genetics Institute, Inc., now a division of Wyeth Pharmaceuticals. Ms. Yetman received her B.A. in Human Resources and English from the University of Michigan.

The board has established a policy under which the Nominating and Corporate Governance Committee must provide its approval prior to our executive officers commencing service on the board of directors of any public company.

18

EXECUTIVE COMPENSATION

The following table sets forth information regarding compensation paid by ICOS during the past three years to its Chief Executive Officer and the other four most highly compensated individuals who were serving as executive officers at December 31, 2005, or the Named Executive Officers.

Summary Compensation Table

| | | | | | | | | | | | | | | | | | | |

Name and Principal Position

| | Year

| | Annual Compensation

| | Long-Term Compensation

Awards

| | All Other

Compensation

($) (5)

|

| | | Salary

($)

| | Bonus

($) (1)

| | Other Annual

Compensation

($) (2)

| | Restricted

Stock

Award

($) (3)

| | Securities

Underlying

Options (#) (4)

| |

Paul N. Clark Chairman of the Board, President and Chief Executive Officer | | 2005

2004

2003 | | $

| 900,000

850,000

750,000 | | $

| 809,800

825,000

— | | $

| 22,184

12,573

27,523 | | $

| 2,811,196

—

— | | 250,000

200,000

45,600 | | $

| 2,718

2,718

2,718 |

| | | | | | | |

Gary L. Wilcox Executive Vice President, Operations and Director | | 2005

2004

2003 | |

| 525,000

500,000

480,000 | |

| 226,200

191,200

— | |

| —

—

— | |

| 1,639,500

—

— | | 23,900

18,000

10,300 | |

| 2,718

2,718

2,718 |

| | | | | | | |

David A. Goodkin Senior Vice President, Development and Chief Medical Officer | | 2005

2004

2003 | |

| 435,000

415,000

370,000 | |

| 193,800

214,555

— | |

| —

—

— | |

| 1,357,506

—

— | | 87,000

36,000

10,200 | |

| 1,878

1,542

1,542 |

| | | | | | | |

Michael A. Stein Senior Vice President and Chief Financial Officer | | 2005

2004

2003 | |

| 445,000

425,000

370,000 | |

| 280,000

259,080

— | |

| —

—

— | |

| 1,390,296

—

— | | 86,000

46,500

14,100 | |

| 2,718

2,718

1,878 |

| | | | | | | |

Thomas P. St. John Vice President, Therapeutic Development | | 2005

2004

2003 | |

| 395,000

375,000

360,000 | |

| 151,200

156,900

— | |

| —

—

— | |

| 821,936

—

— | | 26,200

19,200

8,200 | |

| 1,878

1,878

1,878 |

| (1) | Amounts represent cash awards under performance-based incentive programs. For Mr. Clark, the 2005 award was based on his performance under the shareholder-approved ICOS Management Incentive Plan, or the MIP. Mr. Clark’s bonuses for 2004 and 2003, and those made to other Named Executive Officers for all periods presented, reflect amounts earned under a performance-based incentive program, or PIP, that is similar to the MIP. PIP awards for 2003 were settled with stock options, which are included in Long-Term Compensation Awards in the periods earned. See note (4) below for additional information regarding the PIP stock option grants for 2003. |

| (2) | Represents payments made by ICOS to, or for the benefit of, Mr. Clark for tax reimbursements, professional fees, and personal travel. The amounts shown included $8,086, $4,583 and $10,032 in tax reimbursement for 2005, 2004 and 2003, respectively, and $10,210, $7,226 and $15,000 in professional fees for 2005, 2004 and 2003, respectively. See related discussion in “EMPLOYMENT CONTRACTS, TERMINATION OF EMPLOYMENT AND CHANGE IN CONTROL ARRANGEMENTS.” |

| (3) | The amount shown represents the value of restricted stock shares granted to the Named Executive Officers on July 19, 2005, based on the $21.87 closing market price of our common stock as reported on The NASDAQ National Market, less the amount paid by the Named Executive Officer to ICOS for such shares. The shares of restricted stock vest, in their entirety, five years from the date of grant for Mr. Clark, Dr. Wilcox, Mr. Stein and Dr. Goodkin, and four years from the date of grant for Dr. St. John. The Named Executive Officers have the right to receive dividends that are paid on restricted shares, if any. |

The Named Executive Officers were granted the following shares of restricted stock, in July 2005, under the ICOS Corporation 1999 Long-Term Incentive Plan (Restated Plan). The year end values of the restricted stock awards are based on a per share price for our common stock of $27.63, reflecting the closing market

19

price as reported on The NASDAQ National Market on December 31, 2005, less the amount paid by the Named Executive Officer:

| | | | | |

| | | Restricted Stock Awards

|

| | | Shares granted

during 2005

| | Value at

December 31, 2005

|

Paul N. Clark | | 128,600 | | $ | 3,551,932 |

Gary L. Wilcox | | 75,000 | | | 2,071,500 |

David A. Goodkin | | 62,100 | | | 1,715,202 |

Michael A. Stein | | 63,600 | | | 1,756,632 |

Thomas P. St. John | | 37,600 | | | 1,038,512 |

| (4) | Represents options awarded to the Named Executive Officers pursuant to the periodic stock option grant program, for 2005 and 2004, and the PIP for 2003. Also includes 25,000 options awarded (in 2005) to both Mr. Stein and Dr. Goodkin upon their appointment as Senior Vice President. |

PIP Stock Option Grants

PIP awards for performance in 2003 were settled with stock options. The PIP awards for performance in 2005 and 2004 were settled in cash. Stock options granted pursuant to the PIP were reported in the year earned.

Periodic Stock Option Grant Program

There were no periodic stock options granted in 2003 to the Named Executive Officers, because the periodic stock option awards that normally would have been granted in January 2003, were made in December 2002.

| (5) | Reflects taxable compensation related to group term life insurance and long term disability insurance premiums paid by ICOS. |

2005 Option Grants

The following table sets forth certain information regarding stock options granted to the Named Executive Officers in 2005.

Option Grants in 2005

| | | | | | | | | | | | | | | | | |

| | | Individual Grants

| | Potential Realizable Value at

Assumed Annual Rates of Stock Price

Appreciation for Option Term (4)

|

Name

| | Number of

Securities

Underlying

Options

Granted

(#)

| | | Percent of

Total Options

Granted to

Employees in

2005

| | | Exercise Price

($/Share) (3)

| | Expiration

Date

| | 5% ($)

| | 10% ($)

|

Paul N. Clark | | 250,000 | (1) | | 17 | % | | $ | 25.38 | | 1/27/15 | | $ | 3,990,336 | | $ | 10,112,296 |

Gary L. Wilcox | | 23,900 | (1) | | 2 | % | | | 25.38 | | 1/27/15 | | | 381,476 | | | 966,735 |

David A. Goodkin | | 62,000 | (1) | | 4 | % | | | 25.38 | | 1/27/15 | | | 989,603 | | | 2,507,849 |

David A. Goodkin | | 25,000 | (2) | | 2 | % | | | 22.86 | | 5/04/15 | | | 359,413 | | | 910,824 |

Michael A. Stein | | 61,000 | (1) | | 4 | % | | | 25.38 | | 1/27/15 | | | 973,642 | | | 2,467,400 |

Michael A. Stein | | 25,000 | (2) | | 2 | % | | | 22.86 | | 5/04/15 | | | 359,413 | | | 910,824 |

Thomas P. St. John | | 26,200 | (1) | | 2 | % | | | 25.38 | | 1/27/15 | | | 418,187 | | | 1,059,769 |

Totals for: | | | | | | | | | | | | | | | | | |

Named Executive Officers | | 473,100 | | | 31 | % | | | — | | — | | $ | 7,472,070 | | $ | 18,935,697 |

All Shareholders (5) | | — | | | — | | | | — | | — | | $ | 1,027,331,785 | | $ | 2,603,460,447 |

| (1) | Represents options granted to the Named Executive Officers pursuant to the periodic stock option grant program. Options generally expire ten years from the date of the grant or three months after termination of |

20

| | employment, whichever is earlier, and become exercisable in forty-eight equal monthly installments, beginning one month after the grant date. The exercise price and tax withholding obligations relating to exercise may be paid by delivery of already-owned shares or, subject to certain conditions, by offsetting the underlying shares. According to the terms of our Restated Plan, certain changes in control of ICOS would provide optionees the right to exercise their options in whole, or in part, whether or not the vesting requirements set forth in their option agreements have been satisfied. See EMPLOYMENT CONTRACTS, TERMINATION OF EMPLOYMENT AND CHANGE IN CONTROL ARRANGEMENTS for a description of provisions regarding acceleration of vesting upon certain changes of control. |

| (2) | Represents options granted to Mr. Stein and Dr. Goodkin upon their respective appointments as Senior Vice President in May 2005. For description of option provisions, see Note (1) above. |

| (3) | The exercise price of each option is equal to the fair market value of the underlying Common Stock on the date of grant based on the closing price of our Common Stock as reported on The NASDAQ National Market. |

| (4) | The actual value, if any, that a Named Executive Officer or any other individual may realize will depend on the future performance of our Common Stock and overall market conditions, as well as the option holder’s continued employment through the vesting period. The realizable values presented above reflect assumed compounded annual growth rates of 5% and 10% in accordance with regulations of the SEC. These values are not intended to forecast possible future appreciation, if any, in the price of our Common Stock. There can be no assurance that the actual value realized by a Named Executive Officer or shareholder will approximate the potential realizable values set forth in the table. |

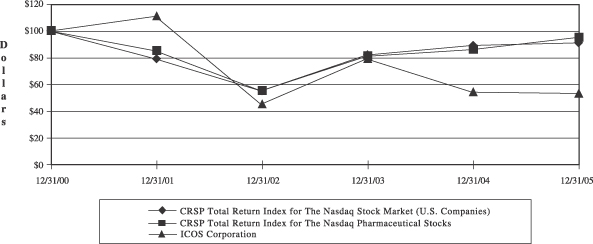

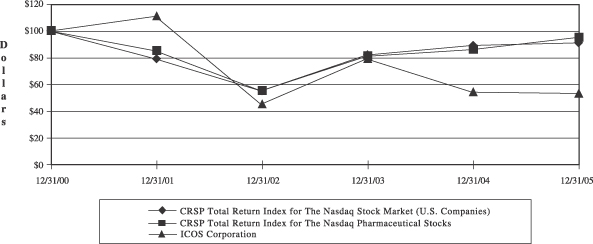

| (5) | The increase in the market value of the holdings of all of our shareholders over a ten-year period based on 65,046,305 shares of Common Stock outstanding as of December 31, 2005, at assumed annual rates of appreciation of 5% and 10% from a base price of $25.11 per share (which represents the weighted-average of the fair market value of the underlying Common Stock on the dates of the grants to the Named Executive Officers during 2005) would be $1,027,331,785 and $2,603,460,447, respectively. Thus, the potential realizable gain on options granted in 2005 to the Named Executive Officers represents 0.73% of the total realizable gain by all shareholders if the assumed appreciation rates of 5% and 10% are achieved. Actual gains, if any, depend on the future performance of our Common Stock and overall market conditions. The amounts reflected in the table may not be achieved. |