SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A INFORMATION

Proxy Statement Pursuant to Section 14(a) of the

Securities Exchange Act of 1934

Filed by the Registrantx

Filed by a Party other than the Registrant¨

Check the appropriate box:

| ¨ | | Preliminary Proxy Statement |

| ¨ | | Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) |

| x | | Definitive Proxy Statement |

| ¨ | | Definitive Additional Materials |

| ¨ | | Soliciting Material Under Rule 14a-12 |

ICOS CORPORATION

(Name of Registrant as Specified In Its Charter)

(Name of Person(s) Filing Proxy Statement, if other than the Registrant)

Payment of Filing Fee (Check the appropriate box):

| ¨ | | Fee computed on table below per Exchange Act Rules 14a-6(i)(1) and 0-11. |

| | (1) | | Title of each class of securities to which transaction applies: |

| | (2) | | Aggregate number of securities to which transaction applies: |

| | (3) | | Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined): |

| | (4) | | Proposed maximum aggregate value of transaction: |

| ¨ | | Fee paid previously with preliminary materials. |

| ¨ | | Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing. |

| | (1) | | Amount Previously Paid: |

| | (2) | | Form, Schedule or Registration Statement No.: |

March 17, 2005

Dear ICOS Stockholder:

I cordially invite you to ICOS Corporation’s Annual Meeting of Stockholders, to be held on Wednesday, May 4, 2005, at 9:30 a.m., at The Fairmont Olympic Hotel, 411 University Street, Seattle, Washington 98101.

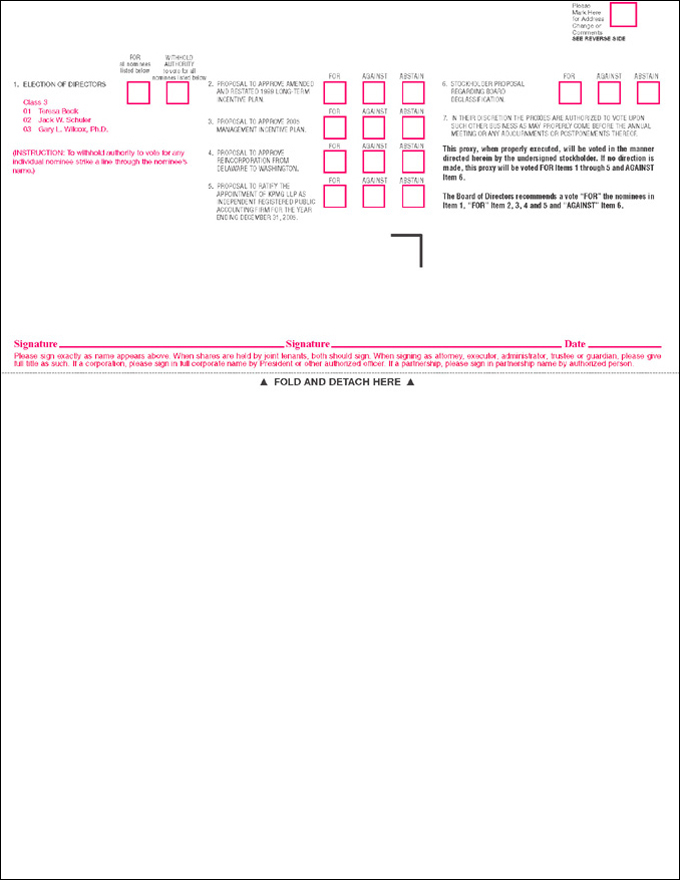

This year you are asked to (1) elect three members to our Board of Directors, (2) approve the amended and restated ICOS Corporation 1999 Long-Term Incentive Plan, (3) approve the ICOS Corporation 2005 Management Incentive Plan, (4) approve our reincorporation from Delaware to Washington, (5) ratify the appointment of KPMG LLP as our independent registered public accounting firm for the year ending December 31, 2005, and (6) consider and act upon a stockholder proposal described in the enclosed Proxy Statement.

As ICOS’ Chairman, I urge you to elect the three nominated directors, vote “For” the proposals to approve the amended and restated ICOS Corporation 1999 Long-Term Incentive Plan, the ICOS Corporation 2005 Management Incentive Plan, and the reincorporation in Washington, and to ratify the appointment of KPMG LLP as ICOS’ independent registered public accounting firm for the year ending December 31, 2005, and vote “Against” the stockholder proposal described in the enclosed Proxy Statement. It is important that your shares be represented, whether or not you plan to attend the meeting. Therefore, please take a few minutes to vote now. To vote, please mark, sign and date the enclosed proxy card, and return it in the enclosed prepaid envelope as promptly as possible.

After the transaction of formal business at the meeting, management will provide an update on ICOS’ progress and respond to questions from stockholders. You can find other detailed information about ICOS and our operations, including our audited financial statements, in the enclosed Annual Report on Form 10-K for the year ended December 31, 2004.

On behalf of ICOS, thank you for your support.

|

Regards, |

|

|

Paul N. Clark |

| Chairman of the Board of Directors, President and Chief Executive Officer |

22021 – 20th Avenue S.E., Bothell, Washington 98021

Notice of 2005 Annual Meeting of Stockholders

TOTHE STOCKHOLDERS:

The Annual Meeting of Stockholders of ICOS Corporation will be held at The Fairmont Olympic Hotel, 411 University Street, Seattle, Washington 98101, on Wednesday, May 4, 2005, at 9:30 a.m., for the following purposes:

| | 1. | To elect three directors to serve until the third Annual Meeting of Stockholders following their election and until their successors are elected and qualified; |

| | 2. | To approve the amended and restated ICOS Corporation 1999 Long-Term Incentive Plan, or Restated Plan, which includes amendments to increase the number of shares authorized for issuance under the Restated Plan, provide for the award of stock, stock units and/or stock appreciation rights (in addition to the award of stock options) in our discretion, extend the term of the Restated Plan, revise the share grant limits and make other modifications; |

| | 3. | To approve the ICOS Corporation 2005 Management Incentive Plan; |

| | 4. | To approve our reincorporation from Delaware to Washington; |

| | 5. | To ratify the appointment of KPMG LLP as our independent registered public accounting firm for the year ending December 31, 2005; |

| | 6. | To consider and act upon a stockholder proposal regarding board declassification; and |

| | 7. | To transact such other business as may properly come before the Annual Meeting. |

Your Board of Directors recommends that you vote to elect the three nominated directors, vote “For” the proposals to approve the amended and restated ICOS Corporation 1999 Long-Term Incentive Plan, the ICOS Corporation 2005 Management Incentive Plan and the reincorporation in Washington, and also to ratify the appointment of KPMG LLP as our independent registered public accounting firm for the year ending December 31, 2005, and vote “Against” the stockholder proposal outlined in the enclosed Proxy Statement.

Your attention is directed to the accompanying Proxy Statement for further information with respect to the matters to be acted upon at the Annual Meeting. To constitute a quorum for the conduct of business at the Annual Meeting, it is necessary that holders of a majority of all outstanding shares of ICOS’ Common Stock be present in person or represented by proxy. To ensure representation at the Annual Meeting, you are urged to mark, sign and date the enclosed proxy card and return it promptly in the enclosed prepaid envelope.

Only stockholders of record at the close of business on March 7, 2005 are entitled to notice of, and to vote at, the Annual Meeting and all adjournments and postponements thereof.

|

BY ORDEROFTHE BOARDOF DIRECTORS |

|

|

John B. Kliewer |

| Secretary |

March 17, 2005

Bothell, Washington

YOUR VOTE IS IMPORTANT. ACCORDINGLY, YOU ARE URGED TO MARK, SIGN, DATE

AND RETURN THE ENCLOSED PROXY CARD, WHETHER OR NOT YOU PLAN TO

ATTEND THE ANNUAL MEETING.

CONTENTS

PROXY STATEMENT

INFORMATION CONCERNING SOLICITATION AND VOTING

General

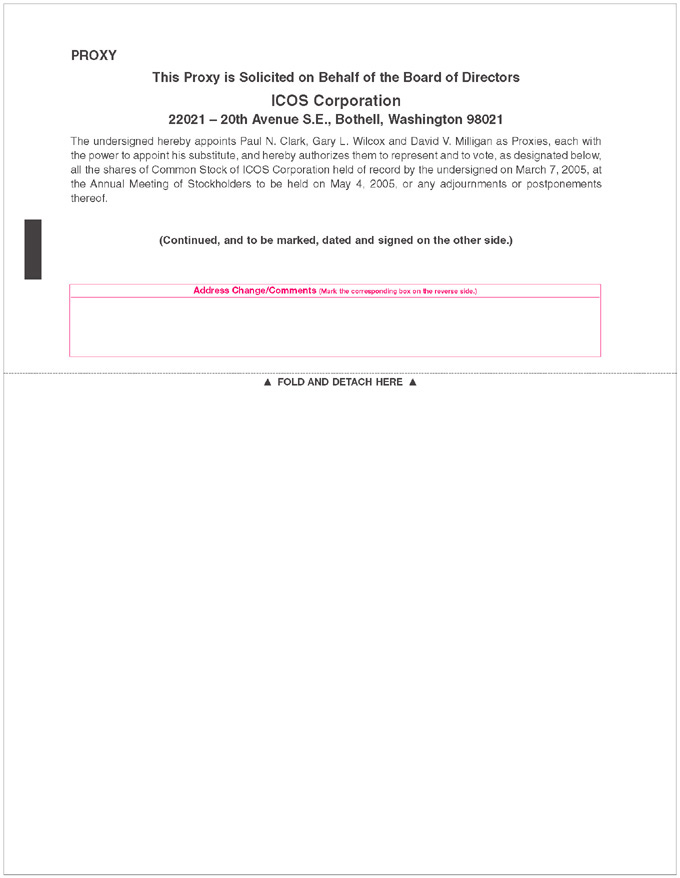

This Proxy Statement is furnished in connection with the solicitation by the Board of Directors of ICOS Corporation, the principal address of which is 22021 – 20th Avenue S.E., Bothell, Washington 98021, of proxies in the accompanying form for use at the 2005 Annual Meeting of Stockholders, to be held on Wednesday, May 4, 2005, at 9:30 a.m., at The Fairmont Olympic Hotel, 411 University Street, Seattle, Washington 98101. The approximate date of mailing this Proxy Statement and the enclosed form of proxy is March 24, 2005.

Each share of ICOS Common Stock outstanding at the close of business on March 7, 2005 is entitled to one vote at the Annual Meeting. Proxies are solicited so that each stockholder may have an opportunity to vote on all matters that are scheduled to come before the Annual Meeting. When properly executed proxies are voted, the shares represented thereby will be voted in accordance with the stockholders’ directions. Stockholders are urged to specify their choices by marking the appropriate boxes on the enclosed proxy card, or, if no choice has been specified, the shares will be voted as recommended by ICOS’ Board of Directors.

Record Date

Only those stockholders who owned Common Stock at the close of business on March 7, 2005, the record date, can vote at the Annual Meeting. At that date, there were 63,831,254 issued and outstanding shares of Common Stock.

Voting and Quorum

Holders of Common Stock are entitled to vote at the Annual Meeting on the basis of one vote for each share of Common Stock held of record.

Under Delaware law and ICOS’ amended and restated bylaws, the presence in person or by proxy of holders of record of a majority of the outstanding shares of Common Stock entitled to vote is required to constitute a quorum for the transaction of business at the Annual Meeting. If a quorum is present at the Annual Meeting: (a) the three nominees for election as directors who receive the greatest number of votes cast in the election of directors will be elected, (b) Proposals 2, 3 and 5 described herein relating to approval of the amended and restated ICOS Corporation 1999 Long-Term Incentive Plan, or Restated Plan, approval of the ICOS Corporation 2005 Management Incentive Plan, or MIP Plan, and ratification of our independent registered public accounting firm, respectively, will be approved if a majority of shares of Common Stock, present in person or represented by proxy and entitled to vote at the Annual Meeting and on the subject matter, vote in favor of each such proposal, (c) Proposal 4 described herein relating to the reincorporation of ICOS from Delaware to Washington will be approved if a majority of the outstanding shares of Common Stock vote in favor of that proposal and (d) the stockholder proposal, Proposal 6 described herein, will be approved if a majority of shares of Common Stock, present in person or represented by proxy and entitled to vote on the subject matter, vote in favor of that proposal. Means have been provided whereby a stockholder may withhold the vote for any director and may vote against, or refrain from voting on, any matter other than the election of directors.

Abstentions (or withheld votes in the case of directors) and shares for which brokers do not have discretionary authority to vote on certain matters in the absence of directions from the beneficial owners, or broker nonvotes, will be counted as shares that are present and entitled to vote for the purpose of determining the presence of a quorum. Withheld votes do not affect the election of directors, and abstentions in the case of the

1

other proposals have the effect of a vote against the proposal. Because broker nonvotes are not entitled to vote on a subject matter, they will not affect the outcome of any proposal except Proposal 4 (for which approval requires the affirmative vote of a majority of the outstanding shares of Common Stock), in which case they will have the effect of a vote against that proposal.

The enclosed proxy card also confers discretionary authority to vote the shares authorized to be voted thereby on any matter that was not known on the date of mailing this Proxy Statement, but that may properly be presented for action at the Annual Meeting. Shares of Common Stock represented by properly executed proxy cards for which no voting instruction is given will be voted “For” the election of the nominees for director, “For” Proposals 2, 3, 4 and 5 relating to approval of the Restated Plan, approval of the MIP Plan, approval of the reincorporation and ratification of the independent registered public accounting firm, respectively, and “Against” the stockholder proposal listed as Proposal 6.

Revocability of Proxies

Any stockholder returning a proxy has the power to revoke it at any time before shares represented thereby are voted at the Annual Meeting. Any shares represented by an unrevoked proxy will be voted according to that proxy unless the stockholder attends the Annual Meeting and votes in person. A stockholder’s right to revoke a proxy is not limited by or subject to compliance with a specified formal procedure, but written notice of such revocation should be given to ICOS’ Secretary at or before the Annual Meeting.

Solicitation of Proxies

The expense of printing and mailing proxy material will be borne by ICOS. We retained The Altman Group, Inc., 1275 Valley Brook Avenue, Lyndhurst, New Jersey 07071, to help solicit proxies. We will pay the cost of their services, which is estimated at approximately $9,500, plus expenses. In addition to the solicitation of proxies by mail, solicitation may be made by certain directors, officers and other employees of ICOS in person or by telephone, facsimile transmission, telegraph, telex or electronic mail. No compensation will be paid for such solicitation.

Arrangements also will be made with brokerage firms and other custodians, nominees and fiduciaries to forward proxy solicitation materials to certain beneficial owners of Common Stock. ICOS will reimburse such brokerage firms, custodians, nominees and fiduciaries for reasonable out-of-pocket expenses incurred by them in connection therewith.

2

SECURITY OWNERSHIP OF PRINCIPAL STOCKHOLDERS AND MANAGEMENT

The following table sets forth certain information regarding the beneficial ownership, as of February 10, 2005, of Common Stock by: (i) each person known by ICOS to beneficially own more than 5% of the outstanding Common Stock; (ii) each director and nominee for director; (iii) each of the Named Executive Officers included in the Summary Compensation Table; and (iv) all directors and executive officers as a group.

| | | | |

Name of Beneficial Owner

| | Shares

Beneficially

Owned (1) (2)

| | Percentage of

Common

Stock

|

William H. Gates III c/o Michael Larson 2365 Carillon Point Kirkland, WA 98033 | | 5,420,678 | | 8.5% |

PRIMECAP Management Company (3) 225 South Lake Avenue #400 Pasadena, CA 91101 | | 6,481,716 | | 10.2% |

Wellington Management Company, LLP (4) 75 State Street Boston, MA 02109 | | 6,260,449 | | 9.8% |

Teresa Beck | | 0 | | — |

Vaughn D. Bryson | | 0 | | — |

Frank T. Cary | | 120,152 | | * |

Paul N. Clark (5) | | 2,447,398 | | 3.8% |

James L. Ferguson | | 115,829 | | * |

Robert J. Herbold | | 0 | | — |

David V. Milligan (6) | | 81,616 | | * |

Robert W. Pangia | | 127,402 | | * |

Jack W. Schuler | | 30,000 | | * |

Gary L. Wilcox (7) | | 604,711 | | * |

W. Michael Gallatin | | 366,737 | | * |

David A. Goodkin (8) | | 147,918 | | * |

Michael A. Stein | | 274,453 | | * |

All directors and executive officers as a group (17 persons) | | 5,353,690 | | 8.4% |

| (1) | | Unless otherwise indicated, the persons named have sole voting and investment power with respect to all shares shown as beneficially owned by them, subject to applicable community property laws. Amounts shown include shares owned and stock options that may be exercised within 60 days of February 10, 2005, which are deemed outstanding for purposes of computing the percentage ownership of the person holding the option, but are not deemed outstanding for purposes of computing the percentage ownership of any other person. |

| (2) | Includes options that may be exercised for Common Stock within 60 days of February 10, 2005, for each individual as follows: William H. Gates III, 61,177 shares; Frank T. Cary, 17,767 shares; Paul N. Clark, 2,427,273 shares; James L. Ferguson, 99,294 shares; David V. Milligan, 61,177 shares; Robert W. Pangia, 127,402 shares; Gary L. Wilcox, 447,121 shares; W. Michael Gallatin, 307,698 shares; Michael A. Stein, 269,453 shares; David A. Goodkin, 126,918 shares; and all directors and executive officers as a group, 4,781,914 shares. |

| (3) | The information provided relating to PRIMECAP Management Company is based exclusively on a Schedule 13G filed with the Securities and Exchange Commission, or SEC, on September 17, 2004. This filing reported that, of the 6,481,716 shares of Common Stock beneficially owned by PRIMECAP Management Company, PRIMECAP Management Company has sole voting power over 2,920,316 shares and sole dispositive power over all 6,481,716 shares. |

3

| (4) | The information provided relating to Wellington Management Company, LLP is based exclusively on a Schedule 13G filed with the SEC on February 14, 2005. This filing reported that, of the 6,260,449 shares of Common Stock beneficially owned by Wellington Management Company, LLP, Wellington Management Company, LLP has shared voting power over 4,195,099 shares and shared dispositive power over all 6,260,449 shares. |

| (5) | Includes 116,032 shares, in the form of options, held by the Clark Family Limited Partnership, of which Paul N. Clark is trustee. |

| (6) | Includes 20,339 shares held by the David V. Milligan Trust, of which David V. Milligan is trustee. |

| (7) | Includes 157,590 shares held by the Gary and Susan Wilcox Living Trust, of which Gary L. Wilcox is a trustee. |

| (8) | Includes 1,000 shares held by the Goodkin-Wetmore Trust 1996, of which David A. Goodkin is a trustee. |

PROPOSAL 1: ELECTION OF DIRECTORS

The Board of Directors consists of ten members. The Board of Directors is divided into three classes, with one class of directors elected to a three-year term at each Annual Meeting of Stockholders. Seven of the directors are serving terms that continue beyond the Annual Meeting. Of the continuing directors, four are Class 1 directors and are serving terms that will not expire until the 2006 Annual Meeting of Stockholders and three are Class 2 directors and are serving terms that will not expire until the 2007 Annual Meeting of Stockholders. At the 2005 Annual Meeting, three directors will be elected, each of whom will hold office for a term of three years and until his or her successor is elected and qualified.

The Board of Directors has unanimously nominated Teresa Beck, Jack W. Schuler and Gary L. Wilcox, Ph.D. for election at the Annual Meeting. Unless otherwise instructed, it is the intention of the persons named as proxies on the enclosed proxy card to vote shares represented by properly executed proxies for the three nominees to the Board of Directors named above. If any nominee shall not be a candidate for election as a director at the Annual Meeting, it is intended that votes will be cast pursuant to the enclosed proxy for such substitute nominee as may be nominated by the Board of Directors. No circumstances are presently known that would render any nominee named herein unavailable to serve. To fill the vacancy created by the increase in the size of the Board of Directors, in January 2004, the Board appointed Jack W. Schuler as a Class 3 director. Similarly, to fill the vacancy created by the increase in the size of the Board of Directors, in March 2004, the Board appointed Teresa Beck as a Class 3 director.

Nominees for Election as Class 3 Directors

The following are the nominees to serve as Class 3 directors until the 2008 Annual Meeting of Stockholders and until their respective successors are elected and qualified:

Teresa Beck (age 50) has been a director since March 2004. Ms. Beck served as President of American Stores Co. from 1998 to 1999 and as Chief Financial Officer from 1993 to 1998. Prior to joining American Stores Co., Ms. Beck served as an audit manager for Ernst & Young LLP. Ms. Beck currently serves as a director of Albertson’s, Inc., Lexmark International, Inc., and Questar Corporation.

Jack W. Schuler (age 64) has been a director since January 2004. From 1972 to 1989, he served in various capacities at Abbott Laboratories, a healthcare products manufacturer, retiring as President and Chief Operating Officer, a position he held from 1987 to 1989. Mr. Schuler is a partner in Crabtree Partners, a Chicago-based venture capital firm. He currently serves as the Chairman of the boards of Ventana Medical Systems, Inc. and Stericycle, Inc. and as a director of Medtronic, Inc.

Gary L. Wilcox, Ph.D. (age 58) has been Executive Vice President, Operations, and a director since 1993. From 1989 to 1993, Dr. Wilcox served as Vice Chairman, Executive Vice President and director of XOMA

4

Corporation, a biotechnology company. From 1982 to December 1989, he was the President and Chief Executive Officer of International Genetic Engineering, Inc. (known as Ingene), a biotechnology company, which he co-founded. In 1989, Ingene was acquired by XOMA Corporation. Dr. Wilcox received his Ph.D. and M.A. in molecular biology and biochemistry and his B.A. in cellular and molecular biology from the University of California at Santa Barbara.

THE BOARD OF DIRECTORS RECOMMENDS A VOTEFOR

THE ELECTION OF THE ABOVE-NAMED NOMINEES

TO THE BOARD OF DIRECTORS.

Continuing Class 1 Directors (until 2006)

The four Class 1 directors, Frank T. Cary, James L. Ferguson, Robert J. Herbold and David V. Milligan, Ph.D., are currently serving terms that expire at the 2006 Annual Meeting of Stockholders and until their respective successors are elected and qualified. To fill the vacancy created by the increase in the size of the Board of Directors, in March 2005, the Board appointed Robert J. Herbold as a Class 1 director.

Frank T. Cary (age 84)has been a director since January 1990. He was Chief Executive Officer and Chairman of the Board of International Business Machines Corporation, a business equipment manufacturer, from 1973 to 1980. Mr. Cary currently serves as a director of Celgene Corporation, Cygnus, Inc., Lexmark International, Inc., Lincare, Inc. and Vion Pharmaceuticals, Inc.

James L. Ferguson (age 79) has been a director since January 1990. From 1973 to 1989, he served in various capacities at General Foods Corporation, a food manufacturing company, including Chief Executive Officer and President. Mr. Ferguson is a member of The Business Council and the Council on Foreign Relations, a Trustee of the Aspen Institute and a Life Trustee of Hamilton College.

Robert J. (Bob) Herbold (age 62)has been a director since March 2005. From 1994 to 2001, he held the position of Executive Vice President and Chief Operating Officer of Microsoft Corporation. Prior to joining Microsoft in 1994, he was Senior Vice President, Advertising and Information Services at the Procter & Gamble Company. Currently, Mr. Herbold is the Managing Director of Herbold Group, LLC, a consulting firm focused on profitability. Mr. Herbold currently serves on the board of directors of Weyerhaeuser Corporation, Agilent Technologies, First Mutual Bank, and Cintas Corporation. In addition, he is a member of the President’s Council of Advisors on Science and Technology.

David V. Milligan, Ph.D. (age 64) has been a director since October 1995. From May 1998 to the present, he has served as a Vice President of Bay City Capital, a San Francisco-based merchant bank. From 1979 to 1996, he served in various capacities at Abbott Laboratories, retiring as Senior Vice President and Chief Scientific Officer after previously heading both the diagnostics and the pharmaceutical research and development sectors. Dr. Milligan is currently Vice Chairman of the board of directors of Caliper Life Sciences, Inc., as well as a director of Galileo Laboratories, Inc., Pathway Diagnostics, Reliant Pharmaceuticals and Vicuron Pharmaceuticals, Inc.

Continuing Class 2 Directors (until 2007)

The three Class 2 directors, Paul N. Clark, Vaughn D. Bryson and Robert W. Pangia, are currently serving terms that expire at the 2007 Annual Meeting of Stockholders and until their respective successors are elected and qualified.

Paul N. Clark (age 58) has been a director, Chief Executive Officer and President since June 1999, and the Chairman of the Board of Directors since February 2000. From 1984 to December 1998, Mr. Clark worked in various capacities for Abbott Laboratories, a health care products manufacturer, retiring from Abbott Laboratories as Executive Vice President and board member after serving previously as Vice President from

5

1984 to 1990 and Senior Vice President from 1990 to 1998. His previous experience included senior positions with Marion Laboratories, a pharmaceutical company, and Sandoz Pharmaceuticals (now Novartis Corporation), a pharmaceutical company. Mr. Clark received his M.B.A. from Dartmouth College, Amos Tuck School, and his B.S. in finance from the University of Alabama.

Vaughn D. Bryson (age 66) has been a director since March 2004. He is President of Clinical Products, Inc., a medical foods company. Mr. Bryson was a 32-year employee of Eli Lilly and Company, a pharmaceutical company, where he served as President and Chief Executive Officer from 1991 until 1993. He was Executive Vice President from 1986 until 1991 and served as a member of the board of directors of Lilly from 1984 until his retirement in 1993. From 1994 to 1996, Mr. Bryson was Vice Chairman of Vector Securities International, Inc., an investment banking firm. He is currently a director of Amylin Pharmaceuticals, Inc., AtheroGenics, Inc. and Chiron Corporation.

Robert W. Pangia (age 53) has been a director since April 1990. Mr. Pangia is currently a partner of Ivy Capital Partners, a private equity fund specializing in healthcare investments. From 1987 to 1996, Mr. Pangia served as Executive Vice President and Director of Investment Banking at PaineWebber Incorporated, an investment banking and securities brokerage firm. From 1986 to 1987, he was a Managing Director with Drexel Burnham Lambert, an investment banking firm. From 1977 to 1986, Mr. Pangia worked in various positions in the Corporate Financing Department at Kidder Peabody & Co., an investment banking and securities brokerage firm, including serving as Director of the Technology Finance Group. He is currently a director of Biogen IDEC, Inc. and Network Associates, Inc.

Director Nominations Process

The Board of Directors has adopted a Charter of the Nominating and Corporate Governance Committee that describes the process by which candidates for possible inclusion in our recommended slate of director nominees are selected. The Board of Directors may amend this charter at any time, in which case the most current version will be available on our website at http://www.icos.com. As noted earlier, three of our current directors, Ms. Beck, Mr. Herbold and Mr. Schuler, were appointed by the Board of Directors to fill newly created board seats and have not been elected by the stockholders. Ms. Beck and Messrs. Herbold and Schuler were each recommended by one of our non-management directors.

Minimum Criteria for Board Members

The Board of Directors has approved qualifications recommended by the Nominating and Corporate Governance Committee for evaluating future director candidates. As a baseline measure, a qualified non-employee director would have sound business judgment, solid moral character, independence from management and meaningful and relevant experience. The relevant backgrounds that would most benefit the Board of Directors would include a proper balance over time of experience in the commercial, finance and research areas. This meaningful experience would involve working at the highest executive levels and, possibly, current public company board service. The Nominating and Corporate Governance Committee has determined that it is highly desirable that some directors have relevant pharmaceutical and/or biotechnology experience. In addition to these qualities, the Nominating and Corporate Governance Committee considers the diversity of the Board of Directors as a whole and views having directors of varying backgrounds and perspectives to be highly important.

The following factors are among those weighed by the Nominating and Corporate Governance Committee in assessing potential non-employee directors with the goal that new directors would enhance the effectiveness of the Board of Directors while minimizing the possibility of conflicts or other significant issues:

| | • | | Family relationship with any employee or director; |

| | • | | Business relationships with ICOS; |

| | • | | Relationships with investment banks, accounting firms or law firms that provide or have recently provided services to ICOS; |

6

| | • | | Involvement in substantive legal, ethical or moral issues or controversies that could call into question personal or professional integrity; |

| | • | | Ability and intent to commit appropriate time and attention to board needs; |

| | • | | Personal or business factors that would be deleterious to board involvement and/or bring possible disrepute through association to ICOS and its board; and |

| | • | | Lack of current involvement in activities that are directly competitive with or adversarial to ICOS. |

Process for Identifying Candidates

Our Nominating and Corporate Governance Committee has two primary methods for identifying candidates beyond those proposed by our stockholders. On a periodic basis, the Nominating and Corporate Governance Committee solicits ideas for possible candidates from a number of sources, including members of the Board of Directors, senior-level management, individuals personally known to the members of the Board and research, including publications, databases and Internet searches. In addition, the Nominating and Corporate Governance Committee may, from time to time, use its authority under its charter to retain a search firm to identify candidates.

Nomination Right of Stockholders

In accordance with our amended and restated bylaws and applicable law, recommendations for nominations for the election of directors for consideration by the Nominating and Corporate Governance Committee may be made by any stockholder of record entitled to vote for the election of directors at stockholder meetings held for such purpose. The requirements a stockholder must follow for recommending persons for consideration by the Nominating and Corporate Governance Committee for election as directors are set forth in our amended and restated bylaws and the section of this Proxy Statement entitled PROPOSALS OF STOCKHOLDERS FOR 2006 ANNUAL MEETING.

Subject to the superior rights, if any, of the holders of any class or series of stock having a preference over our Common Stock that we may issue in the future, if a stockholder complies with these procedures for recommending persons for consideration by the Nominating and Corporate Governance Committee for election as directors, the Nominating and Corporate Governance Committee will conduct the appropriate and necessary inquiries into the backgrounds, qualifications and skills of the stockholder-recommended candidates and, in the exercise of the Nominating and Corporate Governance Committee’s independent judgment in accordance with the policies and procedures adopted in the Nominating and Corporate Governance Committee charter, will determine whether to recommend the stockholder-recommended candidates to the Board of Directors for inclusion in the list of candidates for election as directors at the next stockholder meeting held for such purpose.

Evaluation of Candidates

The Nominating and Corporate Governance Committee will consider all candidates identified through the processes described above and will evaluate each of them, including incumbents, based on the same criteria. If, based on the Nominating and Corporate Governance Committee’s initial evaluation, a candidate continues to be of interest, the Nominating and Corporate Governance Committee will generally conduct interviews and arrange for appropriate background and reference checks.

Director Independence and Other Matters

The Board of Directors has determined each of the following directors is an “independent director” as such term is defined in Marketplace Rule 4200(a)(15) of the National Association of Securities Dealers, or NASD: Teresa Beck, Vaughn D. Bryson, Frank T. Cary, James L. Ferguson, Robert J. Herbold, David V. Milligan, Ph.D., Robert W. Pangia, and Jack W. Schuler.

7

The Board of Directors has also determined that each member of the three standing committees of the Board meets the independence requirements applicable to those committees prescribed by the NASD, the SEC, and the Internal Revenue Service, or IRS. The Board of Directors has further determined that Teresa Beck and Robert W. Pangia, members of the Audit Committee of the Board of Directors, is each an “audit committee financial expert,” as such term is defined in Item 401(h) of Regulation S-K promulgated by the SEC, and in the case of Mr. Pangia, by virtue of his relevant experience listed in his biographical summary provided above in the section entitled PROPOSAL 1: ELECTION OF DIRECTORS.

Dr. Milligan has been appointed the lead director of the Board and, in that role, chairs executive sessions of the independent directors.

Information on Committees of the Board of Directors and Meetings

The Board of Directors met six times during the year ended December 31, 2004. All directors, with the exception of Mr. Bryson, attended at least 75% of the meetings of the Board of Directors and of meetings held by all committees of the Board of Directors on which they served.

The Board of Directors has three standing committees: an Audit Committee, a Compensation Committee and a Nominating and Corporate Governance Committee. Each committee is governed by a written charter that may be amended by the Board of Directors at any time. The most current version of each committee’s charter is available on our website at http://www.icos.com.

The Audit Committee consists of three independent directors, Ms. Beck (Chairperson) and Messrs. Ferguson and Pangia. The Board of Directors has determined that Ms. Beck and Mr. Pangia are audit committee financial experts and each of the members of the Audit Committee is independent in accordance with applicable NASDAQ listing standards and SEC rules and regulations. Each member of the Audit Committee must meet certain independence and financial literacy requirements. The Audit Committee assists the Board of Directors in fulfilling its oversight responsibilities relating to the integrity of ICOS’ financial statements, ICOS’ compliance with legal and regulatory requirements, the independent registered public accounting firm’s qualifications and independence, and the performance of our internal audit function and the independent registered public accounting firm. Among the responsibilities outlined in its charter, the Audit Committee appoints, compensates, retains and oversees the work of the independent registered public accounting firm employed by ICOS to conduct the annual audit examinations of ICOS’ financial statements and internal control over financial reporting. The members meet with representatives of the independent registered public accounting firm, internal auditors and management to review: the scope of proposed audits for the year; audit fees; and, at the conclusion of the audits, the audit reports. In addition, the Audit Committee reviews the financial statements, the related footnotes, management’s report on internal control over financial reporting and the independent registered public accounting firm’s reports thereon, and makes related recommendations to the Board of Directors as the Audit Committee deems appropriate. The Audit Committee met seven times during the year ended December 31, 2004.

The Compensation Committee consists of four independent directors, Messrs. Cary (Chairman), Bryson and Ferguson and Dr. Milligan. The Compensation Committee is responsible for establishing compensation levels for ICOS’ executive officers, establishing and administering performance-based compensation plans, evaluating the performances of ICOS’ executive officers, considering management succession and related matters, and administering ICOS’ equity incentive plan. The Compensation Committee met four times during the year ended December 31, 2004.

The Nominating and Corporate Governance Committee consists of four independent directors, Dr. Milligan (Chairman) and Messrs. Herbold, Pangia and Schuler. The Nominating and Corporate Governance Committee makes recommendations to the Board of Directors concerning the criteria for membership on the Board of Directors and the qualifications of prospective candidates, including candidates identified by stockholders in accordance with our amended and restated bylaws, to fill vacancies on, or to be elected or reelected to, the Board of Directors. The Nominating and Corporate Governance Committee also takes a leadership role in shaping the

8

corporate governance of ICOS. The Nominating and Corporate Governance Committee maintains a set of corporate governance principles and a code of conduct applicable to our directors, officers and employees and monitors modifications and waivers of the code of conduct. The Nominating and Corporate Governance Committee makes recommendations to the Board of Directors concerning the conduct of Board meetings, the reporting channels to the Board of Directors and the information it receives, and succession planning for senior management. Annually, the Nominating and Corporate Governance Committee oversees an evaluation of the performance of the Board and reviews the qualifications, requirements, membership, structure and performance of Board committees. The Nominating and Corporate Governance Committee met four times during the year ended December 31, 2004.

Compensation of Directors

ICOS has a policy of paying directors who are not employees of ICOS an annual fee of $30,000 for service on the Board of Directors, $2,000 for each Board meeting attended and $1,000 for each Board committee meeting attended. The non-employee chairperson of the Audit Committee receives an annual retainer fee of $10,000 in addition to any other compensation he or she may otherwise receive and the non-employee chairperson of each committee of the Board of Directors other than the Audit Committee receives an annual retainer fee of $8,000 in addition to any other compensation he or she may otherwise receive.

Pursuant to ICOS’ stock option grant program for non-employee directors, or the Director Program, each non-employee director is entitled to receive nonqualified stock option grants upon their initial election or appointment to the Board of Directors and, subject to certain limitations, at each Annual Meeting of Stockholders thereafter, assuming continued service on the Board.

Under the Director Program, upon initial election or appointment to the Board of Directors, each eligible director is entitled to receive an initial grant of nonqualified stock options for 30,000 shares of Common Stock. Each eligible director is also entitled to receive an annual grant of nonqualified stock options for 12,000 shares. However, if the date of a director’s initial grant upon election or appointment to the Board of Directors falls within the five-month period prior to an Annual Meeting of Stockholders, that director will not be eligible for an annual grant until the second Annual Meeting of Stockholders following the director’s initial election or appointment.

Stock options granted under the Director Program vest and become exercisable in two equal amounts as of each of the next two Annual Meetings of Stockholders. However, if a director’s initial grant upon election or appointment to the Board of Directors falls within the five-month period prior to an Annual Meeting of Stockholders, vesting does not commence until the second Annual Meeting of Stockholders following the director’s election or appointment. Vesting schedules, for both initial and annual grants, assume continued service on the Board of Directors during the vesting periods.

Stock options granted under the Director Program have an exercise price equal to the closing market price of the Common Stock on the date of the grant. The options have a ten-year term but cannot be exercised later than two years after termination of service as a director.

9

PROPOSAL 2: APPROVAL OF AMENDED AND RESTATED 1999 LONG-TERM INCENTIVE PLAN

General

ICOS currently maintains the 1999 Stock Option Plan, or the Option Plan, under which we can award stock options to purchase shares of Common Stock to our employees, directors and other key service providers. The Option Plan was originally adopted and approved by stockholders in 1999. The Option Plan has subsequently been amended on several instances with the last amendment and restatement by the Board of Directors occurring on January 21, 2004. The last stockholder approval of the Option Plan occurred in May 2001.

At the Annual Meeting, stockholders will be asked to approve the amended and restated ICOS Corporation 1999 Long-Term Incentive Plan, or Restated Plan. The Restated Plan was approved by the Board of Directors on January 27, 2005 subject to stockholder approval within one year. The Restated Plan amends and entirely restates the Option Plan and renames it as the ICOS Corporation 1999 Long-Term Incentive Plan. The Restated Plan will entirely replace and supersede the Option Plan with respect to future compensatory equity grants. The Restated Plan is attached to this Proxy Statement as Appendix A.

Whereas the Option Plan provided for the award of stock options, the Restated Plan will, among other things, permit the award of stock, stock units and/or stock appreciation rights (in addition to the award of stock options) in our discretion and will also extend the term of the Restated Plan until January 27, 2015. Stockholder approval of the Restated Plan will allow ICOS to continue to provide long-term incentives to employees and key service providers who are responsible for the success and growth of ICOS, to further align the interests of our employees with the interests of the stockholders through increased employee stock ownership and to assist ICOS in attracting and retaining employees of experience and outstanding ability. Stockholder approval will also enable stock option, stock appreciation rights, or SARs, stock units and stock grants to employees covered by Section 162(m) of the Internal Revenue Code of 1986, or the Code, to be eligible to qualify as performance-based compensation and enable “incentive stock option,” as defined by Code Section 422, or ISO, grants to employees to continue to qualify for favorable federal income tax treatment. If our stockholders do not approve the Restated Plan by January 27, 2006, the Restated Plan will terminate with no awards being granted thereunder and the Option Plan will continue to remain in effect in accordance with its terms.

No awards have been granted under the Restated Plan and no awards are expected to be granted under the Restated Plan unless and until the Restated Plan is timely approved by the stockholders. As of March 1, 2005, the fair market value of a share of our Common Stock (as determined by the last transaction price quoted by the NASDAQ National Market on such date) was $22.43.

Highlights of Material Changes to the Option Plan

The Restated Plan includes, among other things, the following changes to the Option Plan. A further overview of the proposed terms in the Restated Plan is provided below in the sections summarizing the Restated Plan:

| | • | | Available Shares and Grant Limits. The Option Plan contained aggregate and individual share grant limits. Below is a summary of the proposed changes to the share grant limits under the Option Plan. |

The Option Plan currently imposes the following share grant limits:

| | • | | Total shares under the Option Plan – 17,412,048 |

| | • | | Total shares under ISOs – 12,412,048 |

| | • | | Options per person per any consecutive three years – 2,500,000 |

10

The Restated Plan would impose the following share grant limits:

| | • | | Total shares under the Restated Plan – 15,371,522 shares, which includes 2,900,000 new shares |

| | • | | Total shares under ISOs – 15,371,522 |

| | • | | Options per person per fiscal year – 2,000,000 |

| | • | | Plan Term. The term of the Option Plan is currently scheduled to expire on May 6, 2009. The Restated Plan would extend this term and would instead be scheduled to expire on January 27, 2015. |

| | • | | Re-Pricing of Options/SARs and Minimum Exercise Price. The Option Plan provided that we had the discretionary ability to re-price stock options (e.g., lower the exercise price of an option). The Restated Plan provides that, unless there is stockholder approval, we may not re-price stock options or SARs. The Restated Plan also provides that the per share exercise price for an option or SAR cannot be less than the fair market value of a share of Common Stock on the date of grant. The Option Plan contained such a limitation only with respect to ISOs, which is a requirement of the Code. |

| | • | | Certain Definitions. There are minor changes to certain defined terms, including the definitions of Good Reason, Cause, Retirement, Disability, Change in Control, and others. The revised definitions are generally similar to the definitions included in the Option Plan and are intended to reflect current custom and practice. |

| | • | | Performance Goals. The Restated Plan expressly adds specified criteria for performance goals and objectives that the Compensation Committee can use and include with respect to any award. These performance goals are discussed in more detail below. |

| | • | | Director Retainer Fees Paid with Stock. The Restated Plan provides that, upon affirmative implementation by the Board of Directors, non-employee directors may elect to receive some or all of their annual retainer fees in the form of stock rather than cash. Payment of fees in the form of stock preserves our cash and further aligns directors’ interests with that of the stockholders. |

The following is a summary of the principal features of the Restated Plan. If there is any inconsistency between the summary below and the terms of the Restated Plan, or if there is any inaccuracy in the following summary, the terms of the attached Restated Plan shall govern.

Long-Term Incentive Plan Eligibility

Employees (including those who are officers and/or directors), directors and consultants of ICOS, its subsidiaries and affiliates are eligible to participate in the Restated Plan and receive awards. The Restated Plan provides that such eligible participants can receive discretionary awards of: (i) stock option grants and (ii) other equity-based awards, including grants of stock, stock units and SARs, or, collectively, equity-based awards). Unless otherwise provided in the applicable agreement between the participant and ICOS, such equity-based awards are generally not transferable by the participant and any permitted transfers must be effected with our consent.

As of February 10, 2005, approximately 660 employees (including officers and employee directors) and eight non-employee members of the Board of Directors were eligible to participate in the Restated Plan. Consultants of ICOS are also eligible.

Share Reserve and Grant Limits

The proposed aggregate number of shares of Common Stock that are authorized for issuance under the Restated Plan is 15,371,522 shares of Common Stock.

11

The Option Plan’s aggregate number of shares limit is 17,412,048 shares of Common Stock. This 17,412,048 share limit is comprised of: (i) 10,000,000 shares plus (ii) up to 7,412,048 additional shares that could be carried over to the Option Plan from ICOS’ prior stock option plans due to shares being released from such prior stock option plans as a result of unissued shares and/or shares being released from canceled/forfeited stock options. To the extent that options outstanding under ICOS’ prior stock option plans were actually exercised for ICOS shares, then such shares would not be carried over to the Option Plan and would not be available for issuance under the Option Plan.

The Restated Plan’s proposed maximum share limit of 15,371,522 shares is derived by taking the Option Plan’s authorized limit of 17,412,048 shares and (i) adding the 2,900,000 new shares of Common Stock to be approved under this proposal and (ii) subtracting 4,940,526 shares of Common Stock that were issued after the Option Plan’s adoption by the Board of Directors pursuant to stock option exercises under ICOS’ prior stock option plans. Shares, stock units, SARs or options that are forfeited or unexercised under the Restated Plan or the Option Plan (including our prior option plans) generally become available again for award under the Restated Plan. In addition, only shares actually issued to settle SARs or stock units shall count toward the share grant limits. Shares withheld or surrendered to pay the exercise price or to satisfy tax withholding for awards granted under the Restated Plan (or the Option Plan or prior option plans) shall become available for award and not count toward the Restated Plan’s share grant limits. We may grant awards under other plans or programs and such awards may be settled in the form of shares issued under the Restated Plan, which will have the effect of reducing the number of shares available for award. As of January 31, 2005, 362,321 shares of Common Stock remained available for issuance pursuant to awards under the Option Plan.

The Restated Plan would impose the following share grant limits:

| | • | | Options per person per fiscal year – 2,000,000 |

| | • | | SARs per person per fiscal year – 2,000,000 |

| | • | | Stock grants per person per fiscal year – 1,000,000 |

| | • | | Stock units per person per fiscal year – 1,000,000 |

Approval of the material terms of the Restated Plan (including the above grant limits) by stockholders is necessary in order for awards to employees covered by the Code Section 162(m) to be eligible to qualify for the performance-based compensation exception to the tax deduction limitations of Section 162(m).

Administration

The Board of Directors may appoint one or more committees to administer the Restated Plan. These committees, or the Restated Plan Committee, shall consist of two or more directors selected by the Board of Directors and will be responsible for administering the Restated Plan. The composition of the Restated Plan Committee shall meet the requirements of (i) Section 16 of the Securities Exchange Act of 1934, as amended, or the Exchange Act, with respect to awards issued to individuals who are subject to the short-swing profit restrictions of Section 16(b) of the Exchange Act and (ii) Code Section 162(m) with respect to awards issued to individuals covered by Section 162(m). The Restated Plan Committee has complete discretion, subject to the provisions of the Restated Plan, to authorize, modify, extend, exchange or assume stock options, restricted stock, stock units and SAR awards under the Restated Plan, to select participants, to prescribe award terms and conditions, to interpret plan provisions and to adopt applicable rules and procedures. The Board’s Compensation Committee shall be the Restated Plan Committee unless the Board of Directors provides otherwise. The Board may also authorize one or more officers to have the ability to make grants of options and equity-based awards to employees (who are not subject to Section 16 or Code Section 162(m)) within specified limits and parameters. The members of the Restated Plan Committee shall be indemnified by ICOS to the maximum extent permitted by applicable law for actions taken (or actions that were not taken) with respect to the Restated Plan. The Restated Plan Committee may at any time offer to buy out or cash out outstanding awards in exchange for cash and/or cash equivalents.

12

Stock Option Grants

The Restated Plan Committee may, in its discretion, grant nonstatutory stock options, incentive stock options, which are entitled to favorable income tax treatment under the Code, or a combination thereof under the Restated Plan. Grants of incentive stock options shall comply with the applicable provisions of the Code. Non-employees are not eligible to receive incentive stock options. The number of shares of Common Stock covered by each stock option granted to a participant will be determined by the Restated Plan Committee, but no participant may be granted stock options in any fiscal year that exceed the Restated Plan’s annual individual grant limits.

Stock option grants will be evidenced by an option agreement, which may contain varying terms and conditions. Stock options vest and become exercisable at the times and on the terms established by the Restated Plan Committee. The stock option exercise price will be set by the Restated Plan Committee and is generally equal to the fair market value of a share of Common Stock on the date the option was granted, although the Restated Plan Committee may establish a higher exercise price. Payment of the exercise price shall be in a form specified by the option agreement which may include cash, surrender of previously owned stock, cashless exercise, or other forms as determined by the Restated Plan Committee. Stock options expire at the times established by the Restated Plan Committee, but not later than ten years after the date of grant. The Restated Plan Committee may extend the maximum term of any stock option granted under the Restated Plan, subject to such ten-year limit from the date of grant. The Restated Plan Committee may at any time offer to buy out for a payment in cash or cash equivalents an option previously granted or authorize a participant to elect to cash out an option previously granted, in either case at such time and based upon such terms and conditions as the Restated Plan Committee shall establish. Stock options cannot be re-priced under the Restated Plan without stockholder approval.

Other Equity-Based Awards

Discretionary grants of equity-based awards will be evidenced by an award agreement which may contain varying terms and conditions. Payment of the purchase price, if any, shall be in a form specified by the applicable agreement which may include cash, surrender of previously owned stock, or other forms as determined by the Restated Plan Committee.

The Restated Plan Committee may award shares of Common Stock that are generally not paid for and which are not transferable unless certain conditions are met. Such an award is called restricted stock. When the restricted stock award conditions (which may include performance conditions) are satisfied, then the participant is vested in the shares and has complete ownership of the shares. At any particular time, a participant may be partially vested, fully vested or not vested at all in the restricted stock that was awarded. The holders of restricted stock awarded under the Restated Plan shall generally have the same voting, dividend and other rights as our other stockholders.

The Restated Plan Committee may also award stock units. A stock unit is a bookkeeping entry that represents the equivalent of a share of Common Stock. A stock unit is similar to restricted stock in that the Restated Plan Committee may establish performance goals and/or other conditions that must be satisfied before the participant can receive any benefit from the stock unit. When the participant satisfies the conditions of the stock unit award, ICOS will pay the participant for the vested stock units with cash and/or shares. The amount received may depend upon the degree of achievement of the performance goals, although the Restated Plan Committee has discretion to reduce or waive any performance objectives.

Additionally, the Restated Plan Committee may grant stock appreciation rights, and such grants may be made in conjunction with stock options. The number of shares covered by each stock appreciation right will be determined by the Restated Plan Committee. The stock appreciation right exercise price will be set by the Restated Plan Committee and is generally equal to the fair market value of a share of Common Stock on the date the SAR was granted although the Restated Plan Committee may establish a higher exercise price. Upon exercise

13

of a stock appreciation right, the participant will receive payment from ICOS in an amount determined by multiplying (a) the difference between (i) the fair market value of a share of Common Stock on the date of exercise and (ii) the grant price (generally the fair market value of shares on the grant date) times (b) the number of shares with respect to which the stock appreciation right is exercised. Stock appreciation rights may be paid in cash and/or shares of ICOS Common Stock, as determined by the Restated Plan Committee. Stock appreciation rights vest and are exercisable at the times and on the terms established by the Restated Plan Committee. An unexercised stock appreciation right may be deemed to be automatically exercised on its expiration date if its per share exercise price is less than the fair market value of a share on such date to the extent provided in the applicable SAR agreement. Stock appreciation rights cannot be re-priced under the Restated Plan without stockholder approval.

Performance Goals

The Restated Plan specifies performance goals that the Restated Plan Committee may use in awards to persons subject to the limitations of Code Section 162(m). These performance goals are defined as one or more objective measurable performance factors determined by the Restated Plan Committee with respect to each performance period based upon one or more factors, including, but not limited to: (i) operating income; (ii) earnings before interest, taxes, depreciation and amortization, or EBITDA; (iii) earnings; (iv) cash flow; (v) market share; (vi) sales or revenue; (vii) expenses; (viii) cost of goods sold; (ix) profit/loss or profit margin; (x) working capital; (xi) return on equity or assets; (xii) earnings per share; (xiii) economic value added, or EVA; (xiv) stock price; (xv) price/earnings ratio; (xvi) debt or debt-to-equity; (xvii) accounts receivable; (xviii) writeoffs; (xix) cash; (xx) assets; (xxi) liquidity; (xxii) operations; (xxiii) research or related milestones; (xxiv) synthesis of specified materials; (xxv) intellectual property (e.g., patents); (xxvi) product development; (xxvii) regulatory activity; (xxviii) clinical studies; (xxix) manufacturing, production or inventory; (xxx) product quality control; (xxxi) management; (xxxii) human resources; (xxxiii) corporate governance; (xxxiv) compliance program; (xxxv) legal matters; (xxxvi) internal controls; (xxxvii) policies and procedures; (xxxviii) accounting and reporting; (xxxix) information technology; (xl) site, plant or building development; (xli) business development; (xlii) strategic alliances, licensing and partnering; (xliii) mergers and acquisitions or divestitures; and/or (xliv) financings. The Restated Plan also establishes that a “performance period” can be any period of time up to thirty-six months in duration.

The inclusion of performance goals in awards of stock and/or stock units to persons subject to the limitations of Code Section 162(m) can permit such equity awards to qualify for the performance-based compensation exception to the tax deduction limitations. Approval of the material terms of the Restated Plan (including the specified performance goal criteria) by stockholders is necessary in order for grants of stock and/or stock units to employees covered by Code Section 162(m) to be eligible to qualify for the performance-based compensation exception to the tax deduction limitations of Section 162(m).

Payment of Director Fees in Securities

Upon the Board of Director’s affirmative determination to authorize such a provision, a non-employee director may elect to receive from 25% to 100% of his or her annual retainer payments in the form of shares of Common Stock granted under the Restated Plan. The terms and conditions of such an arrangement shall be determined by the Board of Directors.

Termination of Service

While the Restated Plan Committee generally has discretionary authority with respect to determining terms and conditions on a grant-by-grant basis, the Restated Plan provides for certain default provisions related to a participant’s termination of service in the event that the Restated Plan Committee does not provide otherwise. In general, a participant will be permitted to exercise his/her vested option or SAR for up to three months after termination of service. However, in the event of a participant’s retirement, the participant can exercise his/her vested options/SARs for up to three years after retirement. If termination of service is due to death or disability,

14

then the participant’s vested options/SARs can be exercised for up to eighteen months after termination. Termination of service due to cause shall cause forfeiture of all outstanding awards. In all cases, any post-service exercise periods shall be subject to the specified term of the option and/or SAR.

Change in Control

In the event of a Change in Control of ICOS, a participant’s outstanding awards shall fully vest if such awards are not assumed, substituted or otherwise replaced by the acquirer or successor. In addition, an award may at the time of grant or any time thereafter, in the discretion of the Restated Plan Committee, provide for acceleration of vesting upon a Change in Control or due to other events.

Amendment and Termination

The Board of Directors may amend or modify the Restated Plan, in any or all respects whatsoever, subject to any required stockholder approval. The Restated Plan will terminate on January 27, 2015 unless terminated earlier by the Board of Directors.

Adjustments Upon Changes in Capitalization

In the event of a subdivision of the outstanding shares, stock dividend, dividend payable in a form other than shares in an amount that has a material effect on the price of the shares, consolidation, combination or reclassification of the shares, recapitalization, spin-off, or other similar occurrence, then the exercise price of each outstanding option/SAR, the number and class of shares subject to each award, the share limitations on grants, as well as the number and class of shares available for issuance under the Restated Plan shall be appropriately adjusted (if at all) by the Restated Plan Committee in its sole discretion.

New Plan Benefits

All awards of the Restated Plan are granted at the discretion of the Restated Plan Committee. Therefore, the benefits and amounts that will be received or allocated under the Restated Plan are not determinable. The following table sets forth the number of shares subject to options granted under the Option Plan during our fiscal year ended December 31, 2004.

| | | | | |

Name of Individual or Group

| | Number of Shares Subject

to Option Grants

| | Potential Realizable Value at 5%

Assumed Annual Rates of Stock

Price Appreciation for Option

Term (1)

|

Paul N. Clark Chairman, President and Chief Executive Officer | | 245,600 | | $ | 6,533,511 |

| | |

Gary L. Wilcox Executive Vice President, Operations and Director | | 28,300 | | | 752,843 |

| | |

W. Michael Gallatin Vice President and Scientific Director | | 32,200 | | | 856,592 |

| | |

David A. Goodkin Vice President, Development and Chief Medical Officer | | 46,200 | | | 1,229,024 |

| | |

Michael A. Stein Vice President and Chief Financial Officer | | 60,600 | | | 1,612,096 |

| | |

All current executive officers as a group | | 523,500 | | | 13,926,273 |

| | |

| All current directors who are not executive officers as a group | | 138,000 | | | 3,212,193 |

| | |

| All employees in 2004, including officers who were not executive officers, as a group | | 572,991 | | | 14,518,540 |

15

| (1) | The actual value, if any, that any individual may realize will depend on the future performance of the Common Stock and overall market conditions, as well as the option holder’s continued employment through the vesting period. The realizable values presented above reflect the assumed compounded annual growth rate of 5%. These values are not intended to forecast possible future appreciation, if any, in the price of the Common Stock. There can be no assurance that the actual value realized by an officer, director, employee or stockholder will approximate the potential realizable values set forth in the table. |

In January 2005, options to purchase shares of Common Stock were awarded in the following amounts: Mr. Clark, 250,000; Dr. Wilcox, 23,900 shares; Dr. Gallatin, 32,900 shares; Dr. Goodkin, 62,000 shares; Mr. Stein, 61,000 shares; all executive officers as a group 564,000 shares; and all employees, including current officers who are not executive officers, 737,958 shares. The amounts shown for 2004 and 2005 are not necessarily indicative of future grants under the Restated Plan.

The following table sets forth information as of December 31, 2004, with respect to our compensation plans, for which our Common Stock is authorized for issuance. All of our compensation plans have been approved by security holders.

| | | | | | | | | |

| | | Number of Securities

to be Issued Upon

Exercise of

Outstanding Options

| | Weighted-

Average Exercise

Price per Share

of Outstanding

Options

| | Weighted- Average Term

Remaining

| | Number of Securities

Remaining Available

for Future Issuance

Under Equity

Compensation Plans

|

Equity compensation plans approved by security holders | | 10,712,237 | | $ | 33.76 | | 6.00 years | | 1,611,062 |

|

The following table sets forth similar information as of January 31, 2005. |

| | | | |

| | | Number of Securities

to be Issued Upon

Exercise of

Outstanding Options

| | Weighted-

Average Exercise

Price per Share

of Outstanding

Options

| | Weighted-

Average Term

Remaining

| | Number of Securities

Remaining Available

for Future Issuance

Under Equity

Compensation Plans

|

Equity compensation plans approved by security holders | | 11,803,904 | | $ | 33.12 | | 6.41 years | | 362,322 |

Federal Income Tax Consequences

The following is a brief summary of the United States federal income tax consequences of certain transactions under the Restated Plan based on federal income tax laws in effect as of February 10, 2005. This summary is not intended to be exhaustive and does not discuss the tax consequences of an optionee’s death or provisions of the income tax laws of any municipality, state or other country in which an optionee may reside. This summary does not purport to be complete. ICOS advises all participants to consult their own tax advisors concerning the tax implications relating to their awards under the Restated Plan.

A recipient of a stock option or stock appreciation right will not have taxable income upon the grant of the option. For nonstatutory stock options and stock appreciation rights, the participant will recognize ordinary income, which is subject to withholding taxes, upon exercise in an amount equal to the difference between the aggregate fair market value of the shares and the aggregate exercise price on the date of exercise. Any gain or loss recognized upon any later disposition of the shares generally will be capital gain or loss.

The acquisition of shares upon exercise of an incentive stock option will not result in any taxable income to the participant, except possibly for purposes of the alternative minimum tax. Gain or loss recognized by the participant on a later sale or other disposition of such shares will either be long-term capital gain or loss or ordinary income, depending upon whether the participant holds the shares transferred upon the exercise for at least the legally required minimum holding periods of one year after option exercise and two years after grant.

16

A participant is not deemed to receive any taxable income at the time an award of unvested stock units is granted, nor are we entitled to a tax deduction at that time. When vested stock units and any dividend equivalents are settled and distributed, the participant is deemed to receive an amount of ordinary income equal to the amount of cash and/or the fair market value of shares received. This income is subject to withholding taxes for employees or former employees.

For restricted stock awards, unless the participant elects under Code Section 83(b) to be taxed at the time of receipt of the restricted stock, the participant will not have taxable income upon the receipt of the award, but upon vesting will recognize ordinary income equal to the fair market value of the shares or cash received (that exceeds the amount paid, if any, for such shares) at the time of vesting.

At the discretion of the Restated Plan Committee, the Restated Plan allows a participant to satisfy tax withholding requirements under federal and state tax laws in connection with the exercise, receipt or vesting of an award by electing to have shares of Common Stock withheld, and/or by delivering to us already-owned shares.

ICOS will generally be entitled to a tax deduction in connection with an award under the Restated Plan only in an amount equal to the ordinary income recognized by the participant and at the time the participant recognizes such income, and if applicable withholding requirements are met. In addition, Code Section 162(m) contains special rules regarding the federal income tax deductibility of compensation paid to our Chief Executive Officer and to each of our other four most highly compensated executive officers. The general rule is that annual compensation paid to any of these specified executives will be deductible only to the extent that it does not exceed $1,000,000. However, we can preserve the deductibility of certain compensation in excess of $1,000,000 if it complies with certain conditions imposed by the Code Section 162(m) rules and if the material terms of such compensation are disclosed to and approved by our stockholders. We have structured the Restated Plan with the intention that compensation resulting from awards under the Restated Plan can qualify as “performance-based compensation” and, if so qualified, would be deductible. Such favorable tax treatment is subject to, among other things, approval of the Restated Plan by our stockholders and, accordingly, we are seeking such approval.

Governing Law

The governing state law of the Restated Plan (except for choice-of-law provisions) is Washington, which is the state of our headquarters and the place of residence for most of our employees.

Required Vote

The affirmative vote of a majority of shares of voting stock present in person or represented by proxy and entitled to vote at the Annual Meeting is required for approval of the Restated Plan. If the Restated Plan is not approved by stockholders, then the Option Plan will remain in effect.

THE BOARD OF DIRECTORS RECOMMENDS A VOTEFOR

THE APPROVAL OF THE AMENDED AND

RESTATED 1999 LONG-TERM INCENTIVE PLAN.

17

PROPOSAL 3: APPROVAL OF THE ICOS CORPORATION

2005 MANAGEMENT INCENTIVE PLAN

Purpose of the Request for Approval

Our Board of Directors believes that a well designed incentive compensation plan for our managers is a significant factor in improving our operating and financial performance, thereby enhancing stockholder value. Important elements of such a plan include:

| | • | | goals and objectives specified in advance for each performance period; |

| | • | | objective, measurable factors as the basis for any payments made under the plan; and |

| | • | | administrative oversight of the plan by a committee of the Board of Directors comprised of independent directors. |

Our Board of Directors’ intention is that amounts paid pursuant to such a specific plan should be deductible as business expenses. Code Section 162(m) limits deductibility of bonuses paid to senior executives, as explained below, unless such a plan meets certain criteria, including stockholder approval.

At its meeting on January 27, 2005, our Board of Directors adopted our ICOS Corporation 2005 Management Incentive Plan, or the MIP. The MIP is consistent with the criteria stated above and fully complies with Code Section 162(m), if approved by our stockholders. We reserve the right, however, to pay bonuses outside of and independent of the MIP.

Briefly, Code Section 162(m) requires:

| | • | | bonuses to be paid pursuant to an objective formula; |

| | • | | certification by the Compensation Committee that the performance goals in the formula have been satisfied; and |

| | • | | that our stockholders have approved the material terms of the MIP, which include: the participants covered by the MIP, the individual bonus limit and the objective performance goals listed in (i) through (xli) under the heading “Maximum Bonus and Payout Criteria” below, to ensure that all bonuses paid, including those paid to our Chief Executive Officer and our four other most highly compensated executive officers (covered employees) are fully deductible. |

By approval of the material terms of the MIP by our stockholders, bonuses paid to each “covered employee” may be exempt from the $1 million annual deduction limit under Code Section 162(m) as performance-based compensation. Accordingly, our Board of Directors believes adoption of the MIP to be in the interests of our stockholders and recommends approval.

The following is a summary of the material terms of the MIP. A copy of the MIP is attached to this Proxy Statement as Appendix B. If there is any discrepancy between this summary and the MIP, the terms of the MIP will control.

Purpose of the MIP

The purpose of the MIP is to motivate and reward our eligible employees for good performance by making a portion of their cash compensation dependent on the achievement of certain objective performance goals related to our performance.

Administration

The MIP will be administered by the Compensation Committee, the members of which each qualify as “outside directors” under Code Section 162(m). Our Compensation Committee will have the sole discretion and authority to administer and interpret the MIP.

18

Participants

Individuals eligible for MIP awards are our officers and key employees, as determined by the Compensation Committee. However, since the determination of eligibility by the Compensation Committee may vary from time to time, the number of our officers and key employees who will participate in the MIP and the amount of such MIP awards are not presently determinable.

Maximum Bonus and Payout Criteria

Bonus payments under the MIP may be made not only in cash, but also in awards available under our 1999 Plan or, if approved, our Restated Plan, as determined by the Compensation Committee. The payment to each participant is based on an individual bonus target for the performance period set by the Compensation Committee in writing and is directly related to the satisfaction of the applicable performance goal(s) set by the Compensation Committee for such performance period. The performance goals may include one or more of the following: (i) operating income; (ii) EBITDA; (iii) earnings; (iv) cash flow; (v) market share; (vi) sales or revenue; (vii) expenses; (viii) cost of goods sold; (ix) profit/loss or profit margin; (x) working capital; (xi) return on equity or assets; (xii) earnings per share; (xiii) EVA; (xiv) stock price; (xv) price/earnings ratio; (xvi) debt or debt-to-equity; (xvii) accounts receivable; (xviii) writeoffs; (xix) cash; (xx) assets; (xxi) liquidity; (xxii) operations; (xxiii) research or related milestones; (xxiv) synthesis of specified materials; (xxv) intellectual property (e.g., patents); (xxvi) product development; (xxvii) regulatory activity; (xxviii) clinical studies; (xxix) manufacturing, production or inventory; (xxx) product quality control; (xxxi) management; (xxxii) human resources; (xxxiii) corporate governance; (xxxiv) compliance program; (xxxv) legal matters; (xxxvi) information technology; (xxxvii) site, plant or building development; (xxxviii) business development; (xxxix) strategic alliances, licensing and partnering; (xl) mergers and acquisitions or divestitures; and/or (xli) financings, each with respect ICOS and/or one or more of its affiliates or operating units. The bonus payable to a participant who is not a covered employee may also be based on other factors. A performance period is any period up to thirty-six months in duration. The performance period(s), individual bonus target(s) and performance goal(s) will be adopted by the Compensation Committee in its sole discretion with respect to each performance period and must be adopted no later than the latest time permitted by the Code in order for bonus payments pursuant to the MIP to be deductible under Code Section 162(m).

The actual amount of future bonus payments under the MIP is not presently determinable. However, the MIP provides that no bonus in excess of $2,000,000 will be paid to any participant for any performance period. Further, the Compensation Committee, in its sole discretion, may reduce the amount of a participant’s bonus under the MIP to an amount below the amount otherwise payable pursuant to the MIP formula.

Bonuses will not be paid to covered employees unless and until the Compensation Committee makes a certification in writing with respect to the attainment of the objective performance standards as required by Code Section 162(m).

The payment of a bonus for a given performance period generally requires the participant to be employed by us as of the date the bonus is paid. If a participant dies following the conclusion of a performance period but prior to payment of the corresponding bonus, however, the bonus will be paid to the participant’s beneficiary.

Required Vote

The affirmative vote of a majority of shares of voting stock present in person or represented by proxy and entitled to vote at the Annual Meeting is required for approval of the MIP. If the MIP and its performance goals are not approved by the stockholders, no bonuses will be paid thereunder to covered employees within the meaning of Code Section 162(m).

THE BOARD OF DIRECTORS RECOMMENDS A VOTEFOR

THE APPROVAL OF THE 2005 MANAGEMENT INCENTIVE PLAN.

19

PROPOSAL 4: APPROVAL OF OUR REINCORPORATION

FROM DELAWARE TO WASHINGTON