UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED

MANAGEMENT INVESTMENT COMPANIES

Investment Company Act file number 811-6318

Consulting Group Capital Markets Funds

(Exact name of registrant as specified in charter)

125 Broad Street, New York, NY 10004

(Address of principal executive offices) (Zip code)

Robert I. Frenkel, Esq.

Smith Barney Fund Management LLC

300 First Stamford Place

Stamford, CT 06902

(Name and address of agent for service)

Registrant’s telephone number, including area code: (800) 451-2010

Date of fiscal year end: August 31

Date of reporting period: August 31, 2004

ITEM 1. REPORT TO STOCKHOLDERS.

The Annual Report to Stockholders is filed herewith.

Consulting Group

Capital Markets Funds

Large Capitalization Value Equity Investments

Large Capitalization Growth Investments

Small Capitalization Value Equity Investments

Small Capitalization Growth Investments

International Equity Investments

Emerging Markets Equity Investments

Government Money Investments

Core Fixed Income Investments

High Yield Investments

Municipal Bond Investments

International Fixed Income Investments

Annual Report

August 31, 2004

NOT FDIC INSURED • NOT BANK GUARANTEED • MAY LOSE VALUE

Table of Contents

Consulting Group

Capital Markets Funds

DEAR SHAREHOLDER,

Opportunities in the global financial markets allowed each of the portfolios of the Consulting Group Capital Markets Funds (or collectively the “Funds”) to post positive returns for the fiscal year ending August 31, 2004. The fundamental environment was generally positive for investing with global economic growth, very strong corporate profit comparisons, and low interest rates. The most significant fundamental development was the beginning of a change in the Federal Reserve Board’s (the “Fed”) interest rate policy. In June 2004, the Fed reversed the falling interest rate policy and began a process of regular increases in interest rates. The returns for the asset classes benefited from the favorable environment. US equities, as represented by the Standard & Poor’s 500 Indexi, rose 11.45%, international equities increased 22.64% as measured by the MSCI EAFE Indexii , and fixed income securities rose 6.13% according to the Lehman Brothers Aggregate Bond Index.iii

While the broad equity and bond indices rose, factors within those indices, such as quality, sectors, and style greatly influenced returns. Until the Fed changed its stance on the direction of future interest rate moves, lower quality and riskier securities led the market. From March 2003 through March 2004, the advantage to these types of securities was significantly greater than higher quality and lower risk securities. As interest rates began to increase in April 2004, higher risk styles and sectors, such as information technology companies and small cap growth stocks, began to fall through most of the summer of 2004. Many market participants entered the calendar year 2004 anticipating a change in interest rate policy, but fewer investors anticipated the continued rise in energy costs during 2004. Economic growth continued into 2004, although at a slower pace, as these two factors began to affect the economy.

From the period that the market peaked in 2000, fell into a bear market, and then began recovery in 2003, smaller stocks and value oriented stocks produced returns greater than larger and growth oriented stocks. This effect was in both the United States and the international markets. Smaller and value stocks outperformed due to many factors, including the valuation anomaly between growth and value stocks, the impact of the global economic recovery on commodity and materials based companies, the sharp slowdown in technology based spending, and the benefit of low interest rates for many smaller financial institutions.

During the year ended August 31, 2004, Consulting Group recommended, and the Board of Trustees approved, the following changes to the Funds:

Large Capitalization Value Equity Investments:

| | Ÿ | The termination of The Boston Company Asset Management LLC and the hiring of Cambiar Investors LLC as an investment adviser effective July 1, 2004 with an investment advisory fee of 0.30% on the first $250 million and 0.25% thereafter. |

Large Capitalization Growth Investments:

| | Ÿ | The addition of Sands Capital Management Inc. as an investment adviser effective January 2, 2004 with an investment advisory fee of 0.35% on the first $300 million and 0.30% thereafter. |

| | Ÿ | The termination of Alliance Capital Management L.P. and the hiring of Westfield Capital Management Company, Inc. as an investment adviser effective April 1, 2004 with an investment advisory fee of 0.35% on the first $300 million and 0.30% thereafter. |

Small Capitalization Growth Investments:

| | Ÿ | The termination of Westpeak Global Advisors, L.P. effective April 16, 2004. |

1

International Equity Investments:

| | Ÿ | The termination of Oechlsle International Advisors, LLC and the hiring of William Blair & Company, LLC as an investment adviser effective April 1, 2004 with an investment advisory fee of 0.40% on the first $100 million and 0.35% thereafter. |

Emerging Markets Equity Investments:

| | Ÿ | The termination of F&C Emerging Markets Ltd. and the hiring of Newgate LLP as an investment adviser effective April 1, 2004 with an investment advisory fee of 0.50%. |

Core Fixed Income Investments (formerly known as Intermediate Fixed Income Investments):

| | Ÿ | The addition of Western Asset Management Company as an investment adviser effective June 7, 2004 with an investment advisory fee 0.20%. |

High Yield Investments:

| | Ÿ | A new investment advisory agreement with Seix Investment Advisors Inc. following its acquisition by Trusco Capital Management, Inc. effective May 28, 2004. |

Subsequent to the reporting period, the Board of Trustees terminated Julius Baer Investments Ltd., and hired Pacific Investment Management Company as an investment adviser to International Fixed Income Investments effective October 6, 2004 with an investment advisory fee of 0.25%.

A summary of the Funds’ performance for the year ended August 31, 2004 can be found on page 4.

Shareholder Notice

On March 22, 2004, the shareholders of Mortgage Backed Investments, Multi-Sector Fixed Income Investments and Long-Term Bond Investments (the “Acquired Funds”) approved a Plan of Reorganization providing for (i) the acquisition of all of the assets of each of the Acquired Funds in exchange for shares of beneficial interest of Intermediate Fixed Income Investments (the “Acquiring Fund”) and the assumption by the Acquiring Fund of all the liabilities of each of the Acquired Funds and (ii) the distribution to shareholders of each Acquired Fund of such shares of beneficial interest of the Acquiring Fund in liquidation of each Acquired Fund and the cancellation of each Acquired Fund’s outstanding shares.

On March 22, 2004, the shareholders of the Acquiring Fund also approved a change in its investment objective from “current income and reasonable stability of principal” to “maximum total return, consistent with preservation of capital and prudent investment management.” The reorganization and change in investment objective occurred on June 4, 2004 at which time the Acquiring Fund was renamed Core Fixed Income Investments.

Information About Your Funds

As previously reported to you, the mutual fund industry has come under the scrutiny of federal and state regulators. Along with others in the industry, Smith Barney Fund Management LLC (“SBFM”), the adviser to your fund, and some of its affiliates have responded to requests for information from various government regulators regarding market timing, late trading, fees and other mutual fund issues. The regulators appear to be examining, among other things, how fund managers dealt with market timing and shareholder exchange activity, including compliance with prospectus disclosure related to these subjects. We have identified market timing in your fund, including an arrangement with an investor that permitted frequent trading to occur in your fund. We do not believe that arrangement involved selective portfolio disclosure or late trading. The arrangement was terminated early in 2001. Governmental review of these matters is continuing. Any resolution of this matter is not expected to have a financial impact on the fund. We thank you for your continued support and encourage you to contact your Financial Consultant for further assistance and guidance.

In November 2003, Citigroup Asset Management (“CAM”) disclosed an investigation by the Securities and Exchange Commission (“SEC”) and the U.S. Attorney relating to Citigroup Asset Management’s entry into the transfer agency business during 1997-1999. Citigroup has disclosed that the Staff of the SEC is considering

2

recommending a civil injunctive action and/or an administrative proceeding against certain advisory and transfer agent entities affiliated with Citigroup, the former CEO of CAM, a former employee and a current employee of CAM, relating to the creation, operation and fees of its internal transfer agent unit that serves various CAM-managed funds. Citigroup is cooperating with the SEC and will seek to resolve this matter in discussion with the SEC Staff. Although there can be no assurance, Citigroup does not believe that this matter will have a material adverse effect on the fund.

The recent twelve-month period offered investors positive opportunities across all asset classes. The importance of asset allocation and diversification of assets remains at the core of our process. We thank you for your continued support and encourage you to contact your Financial Consultant for further assistance and guidance.

Sincerely,

|

|

R. Jay Gerken, CFA Chairman, President and Chief Executive Officer |

October 10, 2004

| i | | The S&P 500 Index is a market-value weighted index comprised of 500 widely held common stocks. An investor cannot invest directly in an index. |

| ii | | The Morgan Stanley Capital International EAFE (Europe, Australasia and Far East) Index is a market capitalization-weighted index that measures the performance of the leading stocks in 21 developed countries outside of North America. (The 21 countries include Austria, Belgium, Denmark, Finland, France, Germany, Greece, Ireland, Italy, Netherlands, Norway, Portugal, Spain, Sweden, Switzerland, United Kingdom, Australia, New Zealand, Hong Kong, Japan and Singapore.) An investor cannot invest directly in an index. |

| iii | | The Lehman Brothers Aggregate Bond Index is a broad-based bond index comprised of Government, Corporate, Mortgage and Asset-backed issues, rated investment grade or higher, and having at least one year to maturity. An investor cannot invest directly in an index. |

3

Performance of the Consulting Group Capital Markets Funds for the Year Ended August 31, 2004†* (unaudited)

| | | |

Large Capitalization Value Equity Investments | | 12.89 | % |

Russell 1000 Value Index (1) | | 17.52 | |

| |

Large Capitalization Growth Investments | | 4.14 | |

Russell 1000 Growth Index (2) | | 5.36 | |

| |

Small Capitalization Value Equity Investments | | 23.24 | |

Russell 2000 Value Index (3) | | 19.49 | |

| |

Small Capitalization Growth Investments | | 1.18 | |

Russell 2000 Growth Index (4) | | 3.38 | |

| |

International Equity Investments | | 16.90 | |

Morgan Stanley Capital International EAFE-Capitalization Weighted Index (5) | | 22.64 | |

| |

Emerging Markets Equity Investments | | 17.71 | |

Morgan Stanley Capital International Emerging Markets Free Index (6) | | 20.50 | |

| |

Government Money Investments‡ | | 0.48 | |

90-day Treasury Bill Index | | 1.06 | |

| |

Core Fixed Income Investments | | 5.17 | |

Lehman Brothers Aggregate Bond Index (7) | | 6.13 | |

Lehman Brothers Intermediate Government/Credit Bond Index (8) | | 5.07 | |

| |

High Yield Investments | | 11.81 | |

Lehman Brothers High Yield Index (9) | | 13.98 | |

| |

Municipal Bond Investments | | 7.12 | |

Lehman Brothers Municipal Bond Index (10) | | 7.11 | |

| |

International Fixed Income Investments | | 14.00 | |

Citigroup Non-U.S. Government Bond Index (11) | | 13.12 | |

See pages 26 through 28 for all footnotes.

4

Large Capitalization Value Equity Investments

ABOUTTHE SUB-ADVISERS

| | Ÿ | | Cambiar Investors LLC (“CI”) | |

Cambiar applies a disciplined, relative-value approach to investing with the Large Cap Value universe. They conduct a detailed, independent analysis of a company’s future prospects, often focusing on specific products or business initiatives. The team looks to uncover catalysts than can unlock the valuation potential and focus on companies that are leaders, offering strong brands or valuable and unique intellectual property.

| | Ÿ | | Chartwell Investment Partners (“Chartwell”)

| |

Employs “top-down” and “bottom-up” management techniques in managing its portion of the Portfolio’s assets. Chartwell focuses on a combination of low price-to-sales, price-to-earnings, price-to-cash flow and price-to-book ratios, along with a preference for premium yielding issues. The sub-adviser then shifts its focus to identifying those companies with evidence of a major catalyst for change.

| | Ÿ | | Alliance Capital Management L.P., through its Bernstein Investment Research and Management unit (“Alliance”)

| |

Seeks to exploit security mispricings and the opportunities this creates. The screening process begins by searching for undervalued securities within a universe of stocks comprising the S&P 500 Index and 200 additional large/mid-cap stocks not contained in the S&P 500 Index. Quantitative ranks in quintiles are then applied based on a stock’s expected return and risk considerations. Alliance also takes into consideration earnings estimate revisions and relative price trend determinations in attempting to avoid the classic value trap of buying too early.

During the year of September 1, 2003 through August 31, 2004, there was a change in the sub-adviser line-up for the Large Capitalization Value Equity Investments (“Portfolio”). Cambiar Investors (“CI”) replaced The Boston Company Asset Management. The allocation among the sub-advisers at the end of the period was Alliance Bernstein (“Alliance”) 34%, CI 33% and Chartwell Investment Partners (“Chartwell”) 33%. The Portfolio underperformed the Russell 1000 Value Index.

The powerful rally that began in 2003 and continued into January of 2004 moderated as the year progressed. During the period of September 1, 2003 through August 31, 2004, the S&P 500 Index posted an 11.45% gain. Value stocks outperformed growth stocks for the period with the Russell 1000 Value up 17.52% while the Growth Index was up 5.36%. Against this backdrop, your Portfolio returned 12.89%, underperforming its benchmark, but outperforming both the Growth Index and the S&P 500.

In the Alliance allocation, much of the positive performance for the period resulted from good stock selection in the energy sector. Within the utilities sector, the majority of our holdings posted double digit gains. On the negative side, stock selection in the Consumer Cyclicals sector was the largest detractor to performance. The Consumer Staples sector also detracted from performance.

CI began managing their allocation in July 2004 and during this time Utilities, Energy and REITS were the strong performers within the Index; each of these sectors were underweight in the CI allocation. The CI allocation has positioned its allocation to have overweight positions in Healthcare, Consumer Cyclicals and Consumer Staples.

The Chartwell allocation was overweight in the Industrials sector, which contributed favorably to performance due to increased spending on capital goods. In addition, stock selection in the Basic Materials and Healthcare sectors benefited performance. Alternatively, the Chartwell overweight position in the Technology sector detracted from performance, as signs of improved demand in this sector are slow to develop.

The Portfolio and each of its sub-advisers remain committed to the asset class and their individual investment styles.

5

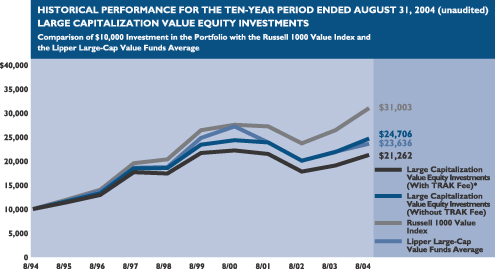

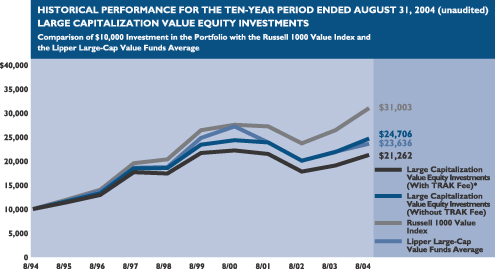

The following graph depicts the performance of the Large Capitalization Value Equity Investments vs. the Russell 1000 Value Index1 and the Lipper Large-Cap Value Funds Average.12

The performance shown above represents past performance. Past performance is no guarantee of future results and current performance may be higher or lower than the performance shown above. Principal value and investment returns will fluctuate and investors’ shares, when redeemed, may be worth more or less than their original cost. To obtain performance data current to the most recent month-end, please visit our website at www.smithbarney.com.

The graph above and returns shown below do not reflect the deduction of taxes that a shareholder would pay on fund distributions or the redemption of fund shares.

LARGE CAPITALIZATION VALUE EQUITY INVESTMENTS (unaudited)

Average Annual Total Returns for the Period Ended August 31, 2004

| | | | | | |

| | | Without TRAK Fee | | | With TRAK Fee* | |

Since inception (11/18/91) | | 9.03 | % | | 7.41 | % |

10 year | | 9.47 | | | 7.84 | |

5 year | | 1.08 | | | (0.43 | ) |

3 year | | 1.15 | | | (0.36 | ) |

1 year | | 12.89 | | | 11.21 | |

|

|

See pages 26 through 28 for all footnotes.

RISKS: The Portfolio may use derivatives, such as options and futures, which can be illiquid, may disproportionately increase losses and have a potentially large impact on performance. Foreign securities are subject to certain risks of overseas investing, including currency fluctuations and changes in political and economic conditions, which could result in significant market fluctuations. Investments in small and medium-capitalizations companies may involve a higher degree of risk and volatility than investments in larger, more established companies.

6

Large Capitalization

Growth Investments

ABOUTTHE SUB-ADVISERS

| | Ÿ | | Turner Investment Partners, Inc. (“Turner”) | |

Employs an active management style and seeks to invest in companies with improving earnings dynamics in each of ten broad market sectors. In order to identify potential investments, Turner utilizes (i) a proprietary computer model which ranks stocks by sector and size by examining 80 factors; (ii) fundamental analysis of stocks selected by the proprietary model, including communications with company management, industry experts and competitors; and (iii) technical analysis, including examination of money flow and relative strength. Turner will sell a stock because of a poor ranking from the model, concern about the fundamentals of a stock, a downward revision in earnings estimates from Wall Street analysts or company management, or changes in money flow for a stock.

| | Ÿ | | TCW Investment Management Co. (“TCW”) | |

Seeks to maximize total return with an emphasis on capital appreciation. Their investment philosophy stresses investment in high-quality companies with opportunities for growth that are not fully reflected in stock market valuations. TCW utilizes a “bottom-up” investment strategy that focuses primarily on assessing the operating prospects of each prospective holding. Companies targeted for investment typically are those believed to have strong and enduring business models and inherent advantages over their competitors.

| | Ÿ | | Sands Capital Management, Inc (“SCM”): | |

Sands Capital Management’s goal is to manage assets for the long-term by owning the best ideas in a focused portfolio of generally 25 to 30 companies. The Investment Team is a firm believer in the simple, yet powerful idea that over the long-term stock prices eventually follow earnings growth.

| | Ÿ | | Westfield Capital Management Co., LLC (“Westfield”) | |

Uses an active management style and favors investing in earnings stocks given its conviction that stock prices follow earnings progress and that they offer the best opportunity for superior real rates of return. The sub-adviser believes that reasonably priced stocks with high earnings potential are best identified through in-depth, fundamental research. The sub-adviser believes that the small cap portion of the market is under-researched, and therefore less efficient than the large cap sector. It generally sells a security when a stock price exceeds full value as calculated by the sub-adviser or as evidenced by declining earnings growth rates and balance sheet trends.

During the year of September 1, 2003 through August 31, 2004, there was a change in the sub-adviser line-up for the Large Capitalization Growth Equity Investments (“Portfolio”). Sands Capital Management (“SCM”) replaced Alliance Capital Management and Westfield Capital Management (“Westfield”) was retained as an additional sub-adviser. The allocation among the sub-advisers at the end of the period was SCM 25%, TCW Investment Management (“TCW”) 25%, Turner Investment (“Turner”) 25% and Westfield 25%. The Portfolio underperformed the Russell 1000 Growth Index.

The stock market set a torrid pace in the first half of the period, but then cooled considerably over the next six months as investors’ psychology turned pessimistic and increasingly risk averse. Among the developments putting a damper on stocks: rising oil prices, softening retail sales, the threat of renewed terrorist attacks, weak earnings reports by bellwether companies, the Iraq quagmire and the outcome of the Bush-Kerry presidential race in November. For the entire period, 9 of the 10 market sectors of the Russell 1000 Growth Index generated positive returns, the only exception being Technology.

The SCM allocation concluded the period overweight in the Healthcare sector, owning securities in the three sub-sectors of Biotechnology, Medical Devices, and Pharmaceuticals. Noticeably absent were positions in any of the large pharmaceutical companies, which no longer can fit the definition of a growth company as defined by SCM. The other major contributing sector was Consumer Discretionary, which held a significantly overweight position. The added value or outperformance of the SCM allocation came from superior stock selection. The SCM turnover is typically less than 25% per year, giving them an average holding period of approximately four to five years. This low turnover means they generally own the same businesses throughout the year and beyond, with minimal trading activity. Earnings growth was balanced across all growth sectors represented in the portfolio, including Consumer/Retail (EPS +40% year-over-year), Financial Services (+27%), Healthcare (+28%), and Technology (+30%). Results like these do not go unnoticed for long.

In the Turner Large Cap Growth allocation the underperformance was mainly due to poor results in the Healthcare, Producer Durable, Financials, and Auto and Transportation sectors, which amounted to a 40% average weighting over the year. The Consumer Discretionary sector contributed the most to performance, while Energy and Materials added modest gains for the year. In the Turner Mid Cap Growth allocation, leading the way was the underperformance in the Consumer Discretionary, Producer Durable, Financials and Healthcare sectors. Significant industry detractors included Commercial Services within the Consumer Discretionary sector and Production Technology within the Producer Durable sector.

In the Westfield allocation the Industrial sector was the largest detractor from performance. Within the Information Technology sector the underweight

7

allocation still had negative performance due to stock selection. The allocation to the Energy and Healthcare sectors added value during the year.

For the TCW allocation, for the 12 months ended August 31, 2004, holdings within the Information Technology and Consumer Discretionary sectors were the strongest positive contributors to performance. These areas were also the largest sectors within the TCW portion of the Portfolio. Financials, a sector that is overweight versus the Russell 1000 Growth, also provided a boost to performance for the period. The weakest performing sector for the period was Healthcare, where the TCW portion is underweight versus the benchmark, followed by industrials. Consumer Staples also underperformed for the period. Finally, small net underperformance can be attributed to Energy, Materials, Telecommunications and Utilities, to which the TCW portion of the Portfolio had no exposure.

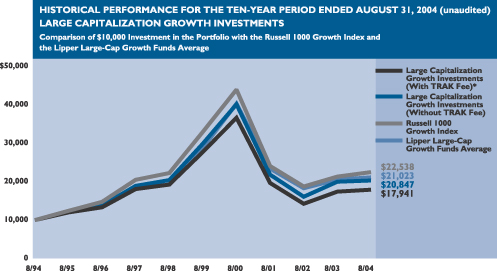

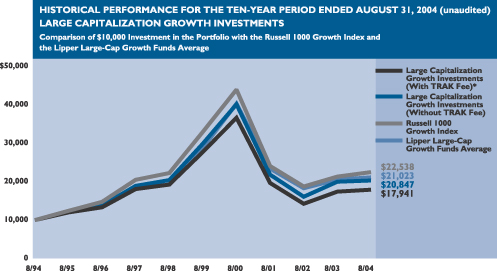

The following graph depicts the performance of the Large Capitalization Growth Investments vs. the Russell 1000 Growth Index2 and the Lipper Large-Cap Growth Funds Average.13

The performance shown above represents past performance. Past performance is no guarantee of future results and current performance may be higher or lower than the performance shown above. Principal value and investment returns will fluctuate and investors’ shares, when redeemed, may be worth more or less than their original cost. To obtain performance data current to the most recent month-end, please visit our website at www.smithbarney.com.

The graph above and returns shown below do not reflect the deduction of taxes that a shareholder would pay on fund distributions or the redemption of fund shares.

LARGE CAPITALIZATION GROWTH INVESTMENTS (unaudited)

Average Annual Total Returns for the Period Ended August 31, 2004

| | | | | | |

| | | Without TRAK Fee | | | With TRAK Fee* | |

Since inception (11/18/91) | | 7.79 | % | | 6.18 | % |

10 year | | 7.62 | | | 6.02 | |

5 year | | (6.98 | ) | | (8.37 | ) |

3 year | | (1.58 | ) | | (3.05 | ) |

1 year | | 4.14 | | | 2.59 | |

|

|

See pages 26 through 28 for all footnotes.

RISKS: The Portfolio may use derivatives, such as options and futures, which can be illiquid, may disproportionately increase losses and have a potentially large impact on performance. Foreign securities are subject to certain risks of overseas investing, including currency fluctuations and changes in political and economic conditions, which could result in significant market fluctuations. Investments in small and medium-capitalizations companies may involve a higher degree of risk and volatility than investments in larger, more established companies.

8

Small Capitalization Value Equity Investments

ABOUTTHE SUB-ADVISERS

| | Ÿ | | Rutabaga Capital Management LLC (“RCM”) | |

Focuses exclusively on micro and small capitalization stocks and looks to unearth uncommon or currently unfavored stocks. The firm’s analysts employ extensive bottom-up fundamental research to identify high quality companies with catalysts to increase margins and intrinsic value but are neglected or misperceived by the market.

| | Ÿ | | ING Investment Management Co. (“ING”) | |

Selects stocks on a bottom-up basis utilizing fundamental research in order to identify stocks of companies undergoing a material change that may be purchased at a reasonable price in relation to their earnings growth rate.

| | Ÿ | | NFJ Investment Group (“NFJ”) | |

An active management style that invests in a diversified portfolio of small capitalization common stocks that it believes are undervalued in the marketplace generally and within their respective industries. The sub-adviser also considers valuation factors such as price-to-book, price-to-cash flow, dividend policy and industry outlook in selecting stocks for investment.

During the year of September 1, 2003 through August 31, 2004, the sub-advisers to Small Capitalization Value Equity Investments (“Portfolio”) were Rutabaga Capital Management (“RCM”) 33%, ING Investment Management, formerly known as Furman Selz Capital Management, (“ING”) 33% and NFJ Investment Group (“NFJ”) 34%. The Portfolio significantly outperformed the Russell 2000 Value Index.

Small Cap stocks generally tracked the performance of Large Cap stocks during the period under review, with the Dow, S&P and the Russell 2000 all up between ten to eleven percentage points. Within the Small Cap sector, value stocks outpaced growth stocks as the Technology sector significantly underperformed the other sectors.

The RCM allocation benefited from their sector weights, specifically, by being equal or overweight in the two best performing sectors — Energy and Materials and Processing, and by being underweight in Technology, the worst performing sector. Favorable sector weightings, coupled with solid stock selection helped the RCM outperform the Russell 2000 Value Index.

The ING allocation during the period was diversified among all sectors, with Financials, Industrials, and Consumer Discretionary the three largest allocations. The ING allocation trailed the index due to stock selection within the Consumer Discretionary and Information Technology. The underweight to Financials was also a drag on performance. Reallocation benefited from the overweight in the Healthcare and Materials sector.

The NFJ allocation maintained a portfolio of approximately 100 names that are broadly diversified by economic sector and industry. In addition, all companies at the time of purchase had a dividend policy. The allocation has consistently maintained a smaller weight to the Finance sector, which hindered performance. The overweight allocation to the Energy sector provided strong returns as strong stock selection generated significant value added. With the Technology sector posting the worst gain within the Index, the underweight helped performance.

The Portfolio and each of the sub-advisers remain committed to the asset class and their individual investment styles.

9

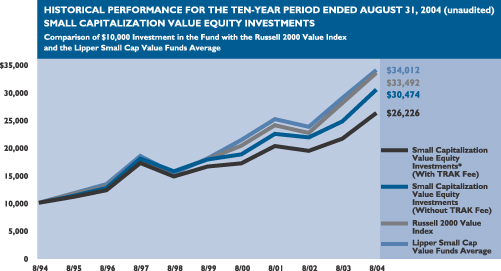

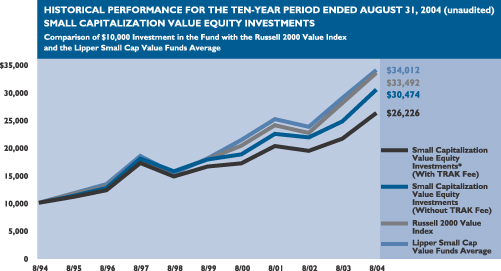

The following graph depicts the performance of the Small Capitalization Value Equity Investments vs. the Russell 2000 Value Index3 and the Lipper Small Cap Value Funds Average.14

The performance shown above represents past performance. Past performance is no guarantee of future results and current performance may be higher or lower than the performance shown above. Principal value and investment returns will fluctuate and investors’ shares, when redeemed, may be worth more or less than their original cost. To obtain performance data current to the most recent month-end, please visit our website at www.smithbarney.com.

The graph above and returns shown below do not reflect the deduction of taxes that a shareholder would pay on fund distributions or the redemption of fund shares.

SMALL CAPITALIZATION VALUE EQUITY INVESTMENTS (unaudited)

Average Annual Total Returns for Period Ended August 31, 2004

| | | | | | |

| | | Without TRAK Fee | | | With TRAK Fee* | |

Since inception (11/18/91) | | 10.77 | % | | 9.12 | % |

10 year | | 11.79 | | | 10.12 | |

5 year | | 11.30 | | | 9.64 | |

3 year | | 10.64 | | | 8.99 | |

1 year | | 23.24 | | | 21.41 | |

|

|

See pages 26 through 28 for all footnotes.

RISKS: The Portfolio may use derivatives, such as options and futures, which can be illiquid, may disproportionately increase losses and have a potentially large impact on performance. Foreign securities are subject to certain risks of overseas investing, including currency fluctuations and changes in political and economic conditions, which could result in significant market fluctuations. Investments in small and medium-capitalizations companies may involve a higher degree of risk and volatility than investments in larger, more established companies.

10

Small Capitalization

Growth Investments

ABOUTTHE SUB-ADVISERS

| | Ÿ | | Wall Street Associates (“WSA”) | |

Follows a bottom-up investment style. It looks for companies with superior earnings growth, strong balance sheets, attractive valuations and potentially positive earning surprises.

| | Ÿ | | Westfield Capital Management Co., LLC (“Westfield”) | |

Favors investing in earnings growth stocks given their conviction that stock prices follow earnings progress and that they offer the best opportunity for superior real rates of return. Reasonably priced stocks of companies with high foreseen earnings potential are best identified through in-depth, fundamental research. It is their belief that the small cap portion of the market is under-researched, and therefore less efficient, than the large cap sector.

During the year of September 1, 2003 through August 31, 2004 there was a change in the sub-adviser line-up for the Small Capitalization Growth Equity Investments (“Portfolio”). Westpeak Global Advisors, LP was terminated and the assets were reallocated to the remaining sub-advisers. The allocation among the sub-advisers at the end of the period was Wall Street Associates (“WSA”) 50% and Westfield Capital Management (“Westfield”) 50%. The Portfolio underperformed the Russell 2000 Growth Index.

The twelve-month period proved to be fairly volatile within the asset class. The market exhibited strength in the fourth quarter of 2003 and early 2004. However, equity prices softened during the second quarter of 2004 as investors digested the implications of record oil prices, a restrictive monetary policy and continued terrorist threats.

WSA’s technology position diminished performance, as these stocks experienced a bit of consolidation following the large gain in 2003. The WSA’s Technology and Producer Durable stocks produced double-digit declines for the year-end. By comparison, the Energy sector gained 19%, while Materials and Processing stocks rose 52%, with Healthcare stocks returning 9% for the period.

The Westfield allocation outperformance was driven primarily by the Healthcare sector. Within the Healthcare sector, the allocation was well diversified through Biotechnology, Service Equipment and Facilities industries. An overweight to Financials contributed positively to performance, while the allocation within the Industrial, and Consumer Discretionary sectors detracted from performance.

The portfolio and each of the sub-advisers remain committed to the asset class and their individual investment styles.

11

The following graph depicts the performance of the Small Capitalization Growth Investments vs. the Russell 2000 Growth Index4 and the Lipper Small Cap Growth Funds Average.15

The performance shown above represents past performance. Past performance is no guarantee of future results and current performance may be higher or lower than the performance shown above. Principal value and investment returns will fluctuate and investors’ shares, when redeemed, may be worth more or less than their original cost. To obtain performance data current to the most recent month-end, please visit our website at www.smithbarney.com.

The graph above and returns shown below do not reflect the deduction of taxes that a shareholder would pay on fund distributions or the redemption of fund shares.

SMALL CAPITALIZATION GROWTH INVESTMENTS (unaudited)

Average Annual Total Returns for Period Ended August 31, 2004

| | | | | | |

| | | Without TRAK Fee | | | With TRAK Fee* | |

Since inception (11/18/91) | | 9.71 | % | | 8.07 | % |

10 year | | 7.50 | | | 5.90 | |

5 year | | (0.67 | ) | | (2.15 | ) |

3 year | | (0.79 | ) | | (2.27 | ) |

1 year | | 1.18 | | | (0.32 | ) |

|

|

See pages 26 through 28 for all footnotes.

RISKS: The Portfolio may use derivatives, such as options and futures, which can be illiquid, may disproportionately increase losses and have a potentially large impact on performance. Foreign securities are subject to certain risks of overseas investing, including currency fluctuations and changes in political and economic conditions, which could result in significant market fluctuations. Investments in small and medium-capitalizations companies may involve a higher degree of risk and volatility than investments in larger, more established companies.

12

International Equity Investments

ABOUTTHE SUB-ADVISERS

| | Ÿ | | William Blair & Co., LLC (“WBC”) | |

William Blair & Company’s investment approach is focused on a conservative, long-term approach to growth investing. They seek companies with growth characteristics that include high benchmark revenue growth, EPS growth, DPS growth and consensus long-term growth estimates.

| | Ÿ | | Philadelphia International Advisors, LP (“PIA”) | |

PIA utilizes a bottom-up approach to international investing. It selects stocks to buy and sell by evaluating a company’s growth outlook and market valuation based on traditional value characteristics, positive company-specific catalysts and other operating and financial conditions. It selects countries primarily by evaluating a country’s valuation ratios such as price-to-earnings and dividend yield, prospective economic growth, government policies and other factors.

| | Ÿ | | Brandywine Asset Management, Inc. (“BAM”) | |

With regard to stock selection, Brandywine employs a quantitative screen which takes into account country, industry and company valuation history. Brandywine seeks stocks whose performance has deviated from their historical mean and likely will revert to this historical mean.

During the year of September 1, 2003 through August 31, 2004 there was a change in the sub-adviser line-up for International Equity investments (“Portfolio”). William Blair & Company (“WBC”) replaced Oechsle International Advisors. The allocation among the sub-advisers at the end of the period was Brandywine Asset Management (“BAM”) 30%, Philadelphia International Advisors (“PIA”) 40% and WBC 30%. The Portfolio underperformed its benchmark.

The market environment during the period can be divided into two distinct six-month periods. From September 2003 to February 2004, equities around the world were recovering, strongly in responses to signs of broad economic growth and a significant rebound in corporate profits. By March 2004 this “acceleration” phase was fully discounted and investors became increasingly concerned. Surging oil prices, rising interest rates, a slowdown in China and terrorism were issues that halted the once strong recovery. As a result, markets moved sideways within a five to ten percentage point trading range through August 2004.

The BAM assets were allocated to be positioned with an overweighting in the Consumer Cyclical, Technology and Basic Materials sectors. The allocation was overweight to the MSCI EAFE Index in Energy, Financials, Industrial and Telecommunications. From a country perspective, performance was dominated by Austria, Belgium, Ireland, Norway and Portugal. The allocations to Germany, Switzerland and Japan all registered sub-par results.

The PIA assets, allocated to overweight Continental Europe, generated strong returns relative to France, Germany, Netherlands, and Switzerland. These were offset somewhat, however, by stock selection in Japan. From a sector perspective, stock selection in Consumer Staples, Industrials, and Information Technology added to the performance relative to the benchmark while an underweight in Financial stocks modestly detracted from performance.

With respect to the WBC allocation, there were setbacks in individual stocks during the period, particularly in Japan and the UK. However, the overweight positions in the emerging markets had a positive influence on the Portfolio and helped performance. Stock selection in the emerging markets as well as the allocation to these regions benefited the Portfolio. Sectorally, Information Technology and Telecommunication Services helped performance, in relation to the benchmark. The selection of stocks in these sectors helped to improve performance. The largest detractors from performance were the Consumer Discretionary and Healthcare sectors. The selection of securities in these sectors hurt overall performance.

The Portfolio and each of the sub-advisers are committed to the asset class and their individual investment styles.

13

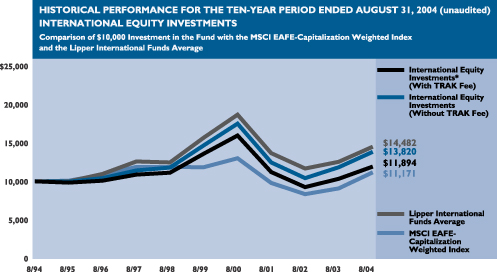

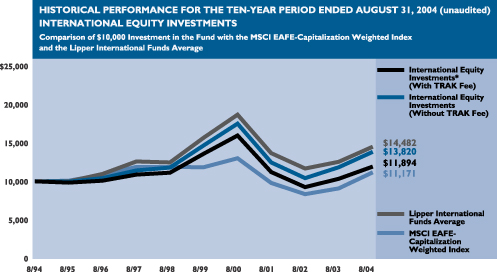

The following graph depicts the performance of the International Equity Investments vs. the MSCI EAFE-Capitalization Weighted Index5 and the Lipper International Funds Average.16

The performance shown above represents past performance. Past performance is no guarantee of future results and current performance may be higher or lower than the performance shown above. Principal value and investment returns will fluctuate and investors’ shares, when redeemed, may be worth more or less than their original cost. To obtain performance data current to the most recent month-end, please visit our website at www.smithbarney.com.

The graph above and returns shown below do not reflect the deduction of taxes that a shareholder would pay on fund distributions or the redemption of fund shares.

INTERNATIONAL EQUITY INVESTMENTS (unaudited)

Average Annual Total Returns for Period Ended August 31, 2004

| | | | | | |

| | | Without TRAK Fee | | | With TRAK Fee* | |

Since inception (11/18/91) | | 5.30 | % | | 3.74 | % |

10 year | | 3.29 | | | 1.75 | |

5 year | | (1.14 | ) | | (2.62 | ) |

3 year | | 3.56 | | | 2.02 | |

1 year | | 16.90 | | | 15.16 | |

|

|

See pages 26 through 28 for all footnotes.

RISKS: The Portfolio may use derivatives, such as options and futures, which can be illiquid, may disproportionately increase losses and have a potentially large impact on performance. Foreign securities are subject to certain risks of overseas investing, including currency fluctuations and changes in political and economic conditions, which could result in significant market fluctuations. Investments in small and medium-capitalizations companies may involve a higher degree of risk and volatility than investments in larger, more established companies.

14

Emerging Markets

Equity Investments

ABOUTTHE SUB-ADVISERS

| | Ÿ | | SSgA Funds Management, Inc. (“SSgA”) | |

Uses quantitative analysis to identify countries and stocks which are undervalued relative to their growth rates. It employs an investment process that combines top-down country selection with bottom-up stock selection to determine an optimal country and security mix.

| | Ÿ | | Newgate LLP (“Newgate”) | |

Newgate seeks long-term growth of capital by utilizing a top-down value approach in identifying undervalued economic countries, regions and sectors. Newgate incorporates both geopolitical and macroeconomic factors into its investment strategy through fundamental quantitative analysis, investment experience and professional judgment.

During the year of September 1, 2003 through August 31, 2004 there was a change in the sub-adviser line-up for Emerging Markets Equity Investments (“Portfolio”). Newgate LLP (“Newgate”) replaced F&C Emerging Markets. The allocation among the sub-advisers at the end of the period was State Street Global Advisors (“SSgA”) 50% and Newgate 50%. The Portfolio underperformed its benchmark.

In general, investors’ appetite for risk has fallen off and their focus has shifted towards quality of corporate earnings. Global economic growth has moderated from its rapid pace in late 2003 due to slowdowns in China and the US, but still remains above long-term average growth rates. The emerging markets’ strong first quarter was negated by a disappointing second quarter, but then recovered slightly through August. Some emerging countries offered an interesting mix of highlights. For example, Russia has benefited from higher oil prices, robust GDP growth and attractive stock market valuations, although these positive results have been offset primarily by the Yukos saga. The government takeover of the oil giant has shaken the confidence of many foreign investors despite the country’s recent growth and valuation levels. In addition, although China’s recent rapid growth has slowed, it still remains higher than most countries. China is running a current account surplus, and inflation remains low.

The Newgate allocation had an overweight within Latin America and specifically their overweight position in Brazil hurt performance during the second quarter as US interest rate fears pushed Brazilian shares lower by 12%. The Brazilian economy now appears healthier than ever, with a $28 billion dollar trade surplus, accelerating GDP growth and record tax collections. In July and August, Brazilian shares have rallied over 15%. Stocks, however, are still priced at just 7 times 2004 earnings, a significant discount to most of its Latin American peers. In Latin America, we remain bullish in Brazil and Argentina, with a fairly neutral position in Mexico. Trading at just 8 times earnings, Brazil currently offers a unique combination of vibrant domestic growth and global trade participation.

Newgate has been underweight Israel for the past year based on their negative outlook for technology related companies and ongoing geopolitical concerns. This underweight reduced portfolio performance in second quarter, but enhanced performance in the third. The Newgate allocation rebounded in July and August as global investors shrugged off higher oil prices and snapped up assets on the cheap. Presidential elections, re-elections and election surprises all faded into the background as emerging market growth continued to accelerate. According to the International Monetary Fund, world GDP growth is now expected to hit 5% this year, the fastest pace in nearly 3 decades. Global demand for raw materials, natural resources and cheaper labor could easily fuel emerging markets for the next five years.

In Asia, Newgate continues to favor India and Taiwan over China. There is no doubt that Chinese growth leads the world, but they prefer to access that growth via Taiwanese and Hong Kong companies trading at much lower relative multiples. In Southeast Asia, Newgate remains overweight Thailand and Indonesia while avoiding the Malaysian market entirely. And in the EMEA, they continue to underweight South Africa and Israel, while focusing the portfolio on Russia and Turkey.

For the SSgA allocation, the overweight to Thailand and Brazil were positive for performance. The underweight for India was also a positive to performance as the market remained expensive, and already jittery investors were surprised when India’s ruling BJP party unexpectedly lost power in parliamentary elections. The allocations to Taiwan, Russia and Chile were all detractors to performance.

15

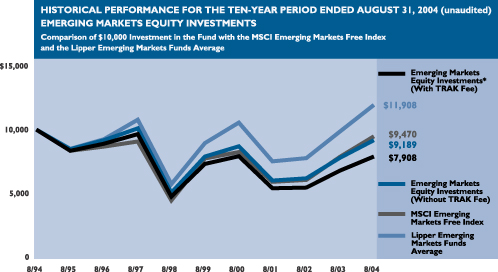

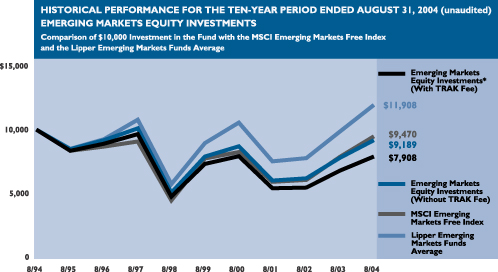

The following graph depicts the performance of the Emerging Markets Equity Investments vs. the MSCI Emerging Markets Free Index6 and the Lipper Emerging Markets Funds Average.17

The performance shown above represents past performance. Past performance is no guarantee of future results and current performance may be higher or lower than the performance shown above. Principal value and investment returns will fluctuate and investors’ shares, when redeemed, may be worth more or less than their original cost. To obtain performance data current to the most recent month-end, please visit our website at www.smithbarney.com.

The graph above and returns shown below do not reflect the deduction of taxes that a shareholder would pay on fund distributions or the redemption of fund shares.

EMERGING MARKETS EQUITY INVESTMENTS (unaudited)

Average Annual Total Returns for Period Ended August 31, 2004

| | | | | | |

| | | Without TRAK Fee | | | With TRAK Fee* | |

Since inception (4/20/94) | | 0.84 | % | | (0.67 | )% |

10 year | | (0.84 | ) | | (2.32 | ) |

5 year | | 3.00 | | | 1.47 | |

3 year | | 14.88 | | | 13.17 | |

1 year | | 17.71 | | | 15.95 | |

|

|

See pages 26 through 28 for all footnotes.

RISKS: The Portfolio may use derivatives, such as options and futures, which can be illiquid, may disproportionately increase losses and have a potentially large impact on performance. Foreign securities are subject to certain risks of overseas investing, including currency fluctuations and changes in political and economic conditions, which could result in significant market fluctuations. Investments in small and medium-capitalizations companies may involve a higher degree of risk and volatility than investments in larger, more established companies.

16

Government Money Investments

ABOUTTHE SUB-ADVISER

| | Ÿ | | Standish Mellon Financial Management LLC (“Standish”) | |

The Portfolio invests exclusively in U.S. Treasury securities and other U.S. government securities rated by a nationally recognized rating organization in the two highest short-term rating categories or, if unrated, of equivalent quality as determined by the sub-adviser. Individual securities must have remaining maturities of 397 days or less. Standish seeks to improve the Portfolio’s yield through actively managing sector allocations and the average maturity of the Portfolio. Standish monitors the spread relationships between U.S. Treasury and government agency issues, and purchases agencies when they provide a yield advantage. In addition, Standish will change the maturity structure modestly to reflect its outlook on interest rates.

During the year of September 1, 2003 through August 31, 2004, the sub-adviser to the Government Money Investments (“Portfolio”) was Standish Mellon Financial Management (“Standish”). The Portfolio underperformed its benchmark.

GOVERNMENT MONEY INVESTMENTS (unaudited)

Average Annual Total Returns for the Period Ended August 31, 2004‡

| | | | | | |

| | | Without TRAK Fee | | | With TRAK Fee* | |

Since inception (11/18/91) | | 3.67 | % | | 2.12 | % |

10 year | | 3.83 | | | 2.28 | |

5 year | | 2.70 | | | 1.17 | |

3 year | | 1.04 | | | (0.46 | ) |

1 year | | 0.48 | | | (1.02 | ) |

|

|

The returns shown do not reflect the deduction of taxes that a shareholder would pay on fund distributions or the redemption of fund shares.

See pages 26 through 28 for all footnotes.

RISKS: An investment in a money market fund is neither insured nor guaranteed by the FDIC or any other government agency. Although the Portfolio seeks to preserve the value of your investment at one dollar per share, it is possible to lose money by investing in the Portfolio.

17

Core Fixed

Income Investments

ABOUTTHE SUB-ADVISERS

| | Ÿ | | BlackRock Financial Management, Inc. (“BlackRock”) | |

Employs a relative value approach which entails portfolio duration within a narrow range and value added through sector and sub-sector rotation within the corporate and mortgage sectors. BlackRock evaluates securities within a risk management framework which consists of determining interest rate risk, yield curve risk, cash flow risk, credit risk and liquidity risk of securities.

| | Ÿ | | Pacific Investment Management Co. (“PIMCO”) | |

Employs “top-down” and “bottom-up” investment techniques. It implements the following “top-down” strategies: duration and volatility analysis, sector evaluation and yield curve shape analysis. The sub-adviser also employs the following “bottom-up” strategies: credit analysis, quantitative research, issue selection and cost-effective trading.

| | Ÿ | | Western Asset Management Co. (“Western”) | |

Emphasizes three key strategies to enhance the Portfolio’s total return: (i) adjusting the allocation of the Portfolio among the key sectors of the fixed-income market depending on its forecast of relative values; (ii) tracking the duration of the overall Portfolio so that it falls within a narrow band relative to the benchmark index, with adjustment made to reflect its long-term outlook for interest rates; and (iii) purchasing under-valued securities in each of the key sectors of the bond market while keeping overall quality high.

During the period of June 4, 2004 through August 31, 2004, the sub-advisers to the Core Fixed Income Investments (“Portfolio”) were Pacific Investment Management Co. (“PIMCO”) 30%, Western Asset Management Company (“Western”) 30% and BlackRock Financial Management (“BlackRock”) 40%. The Portfolio slightly underperformed its benchmark for the period.

The fiscal year was marked by continued volatility across all fixed income sectors. In the first half of the period there were several shifts in sentiment as the market experienced both optimism regarding strengthening economic data and pessimism regarding US dollar weakness, softness in the equity markets, and the lack of job creation. Strong employment figures in March 2004 ended a string of disappointing releases and triggered a sharp rise in 10-year Treasury yields in April and May. Weaker economic data released in July and August caused a reevaluation of the pace and magnitude of assumed future rate hikes. The Federal Reserve Board’s (the “Fed”) statement from their August meeting acknowledged recent economic softness and attributed it to the rise in energy prices. They expressed a view that price pressures were likely to be transitory and that the economy was poised to resume a stronger pace of expansion. The Fed still considers current monetary policy to be accommodative and continues to believe that this accommodation can be removed gradually.

Within the PIMCO allocation the targeted duration is below-index when rates are near the bottom of their range and move toward neutral as they rise. There was also a modest emphasis on short/intermediate maturities and while there was a under weight to mortgage and corporates. Also during the period PIMCO sought to exploit other structural strategies such as buying bonds forward and investing the cash backing these positions in short maturities.

The Western allocation exceeded that of its benchmark as most strategies produced positive results. An overweight exposure to corporate bonds added to performance as credit spreads generally tightened, and a focus on the BBB subsector was rewarded by strong performance. Moderate exposure to the high-yield and emerging market sectors benefited substantially from tighter credit spreads. A moderate position in inflation-indexed bonds benefited from declining real yields and higher-than-expected inflation. The allocation’s largely neutral duration exposure during the past year had little impact on returns, but an emphasis on the longer end of the yield curve benefited as the yield curve flattened.

The BlackRock allocation was positioned in anticipation of a flattening yield curve, whereby the difference in yields between short and long-term bonds would decrease. This bias benefited performance as yields on the 2-year Treasuries increased 42 basis points (“bps”) over the period while 10-year yields fell by 34 bps. BlackRock’s overall duration positioning was also a positive contributor to performance as they tactically traded interest rates. Believing that interest rates were too low given the economic situation, BlackRock maintained their shorter duration relative to the benchmark for the majority of the period. The BlackRock allocation maintained an underweight in the corporate sector throughout the reporting period. This hurt relative performance as corporate bonds outperformed other sectors during the fiscal year. However, the individual security selection within the sector helped mitigate the negative impact.

18

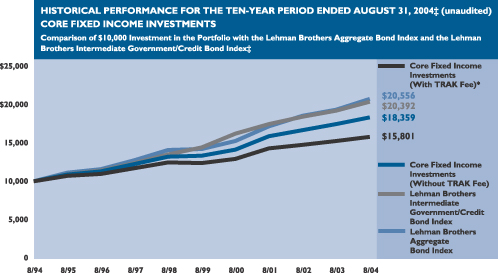

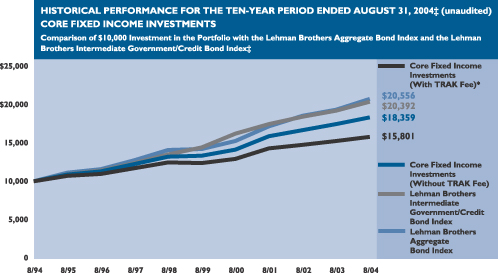

The following graph depicts the performance of the Core Fixed Income Investments vs. the Lehman Brothers Aggregate Bond Index7 and the Lehman Brothers Intermediate Government/Credit Bond Index.8

The performance shown above represents past performance. Past performance is no guarantee of future results and current performance may be higher or lower than the performance shown above. Principal value and investment returns will fluctuate and investors’ shares, when redeemed, may be worth more or less than their original cost. To obtain performance data current to the most recent month-end, please visit our website at www.smithbarney.com.

The graph above and returns shown below do not reflect the deduction of taxes that a shareholder would pay on fund distributions or the redemption of fund shares.

CORE FIXED INCOME INVESTMENTS (unaudited)

Average Annual Total Returns for the Period Ended August 31, 2004‡

| | | | | | |

| | | Without TRAK Fee | | | With TRAK Fee* | |

Since inception (11/18/91) | | 6.20 | % | | 4.62 | % |

10 year | | 6.26 | | | 4.68 | |

5 year | | 6.55 | | | 4.97 | |

3 year | | 4.89 | | | 3.33 | |

1 year | | 5.17 | | | 3.60 | |

|

|

See pages 26 through 28 for all footnotes.

RISKS: The Portfolio may use derivatives, such as options and futures, which can be illiquid, may disproportionately increase losses and have a potentially large impact on performance. Foreign securities are subject to certain risks of overseas investing, including currency fluctuations and changes in political and economic conditions, which could result in significant market fluctuations. Investments in small and medium-capitalizations companies may involve a higher degree of risk and volatility than investments in larger, more established companies. The Portfolio may invest in high yield bonds, which involve greater credit and liquidity risks than investment grade bonds.

19

High Yield Investments

ABOUTTHE SUB-ADVISERS

| | Ÿ | | Seix Investment Advisors, Inc. (“Seix”) | |

Targets the healthiest segment of the high yield market (those securities rated “BB” and strong “B”). The Seix high yield portfolio seeks multiple sources of value through in-depth company research, active industry weightings and security selection.

| | Ÿ | | Western Asset Management Co. (“Western”) | |

Combines traditional analysis with innovative technology applied to all sectors of the market. Western believes inefficiencies exist in the fixed-income market and attempts to add incremental value by exploiting these inefficiencies across all eligible market sectors. The key areas of focus are (i) sector and sub-sector allocation; (ii) issue selection; (iii) duration; and (iv) term structure.

During the year of September 1, 2003 through August 31, 2004 there were no changes in the sub-adviser line-up for High Yield Investments (“Portfolio”). The allocation of sub-advisers was Seix Investment Advisors (“Seix”) 50% and Western Asset Management Company (“Western”) 50%. The Portfolio underperformed its benchmark.

Over the past year, the US economy’s strength has generally exceeded most forecasts, with a growth rate of approximately 5%. High Yield bonds did well in this environment as easy money, stronger economic growth and corporate restructuring led to increasing profitability and reduced default risk, resulting in solid restoration of the asset class. The Seix allocation remained overweight in the Cable TV, Energy and Media sectors. With the price of oil reaching new highs, the oil related industries did quite well. Seix continued to avoid issues that they feel will not see strong improvement in the near future - Auto Supply, Airlines and Supermarkets.

The Western allocation was structured to incorporate their view that economic activity would exceed market expectations. This resulted in their allocation being overweight in the most economically sensitive industries, and maintaining a short duration position in anticipation of higher interest rates. An overweight to the Basic Industry composites, which returned 17%, aided relative performance. However, the short duration of the allocation hurt performance as the general level of interest rates declined during the period.

The portfolio and each of the sub-advisers remain committed to the asset class and their individual investment style.

20

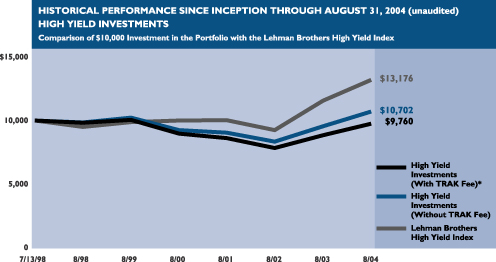

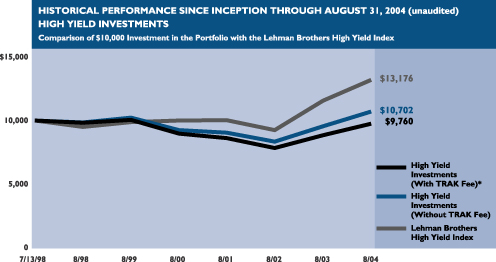

The following graph depicts the performance of the High Yield Investments vs. the Lehman Brothers High Yield Index.9

The performance shown above represents past performance. Past performance is no guarantee of future results and current performance may be higher or lower than the performance shown above. Principal value and investment returns will fluctuate and investors’ shares, when redeemed, may be worth more or less than their original cost. To obtain performance data current to the most recent month-end, please visit our website at www.smithbarney.com.

The graph above and returns shown below do not reflect the deduction of taxes that a shareholder would pay on fund distributions or the redemption of fund shares.

HIGH YIELD INVESTMENTS (unaudited)

Average Annual Total Returns for the Period Ended August 31, 2004

| | | | | | |

| | | Without TRAK Fee | | | With TRAK Fee* | |

Since inception (7/13/98) | | 1.11 | % | | (0.39 | )% |

5 year | | 0.92 | | | (0.59 | ) |

3 year | | 5.73 | | | 4.15 | |

1 year | | 11.81 | | | 10.14 | |

|

|

See pages 26 through 28 for all footnotes.

RISKS: The Portfolio may use derivatives, such as options and futures, which can be illiquid, may disproportionately increase losses and have a potentially large impact on performance. Foreign securities are subject to certain risks of overseas investing, including currency fluctuations and changes in political and economic conditions, which could result in significant market fluctuations. Investments in small and medium-capitalizations companies may involve a higher degree of risk and volatility than investments in larger, more established companies. The Portfolio may invest in high yield bonds, which involve greater credit and liquidity risks than investment grade bonds.

21

Municipal Bond Investments

ABOUTTHE SUB-ADVISER

| | Ÿ | | Smith Affiliated Capital Corp. (“Smith”) | |

Uses an active fixed-income management style that focuses first on the appropriate maturity allocation for the Portfolio within a given market environment. The maturity allocation is supplemented by a long-term market sector rotation. The sub-adviser focuses primarily on “vital service” revenue bonds and secondarily on general obligation bonds of high-quality issuers.

During the year of September 1, 2003 through August 31, 2004, the sub-adviser to the Municipal Bond Investments (“Portfolio”) was Smith Affiliated Capital (“Smith”). The Portfolio outperformed its benchmark.

During the year ended August 31, 2004 the fixed income markets witnessed a change in Federal Reserve (“Fed”) policy from one of accommodation in the face of threatening deflation, to the beginning of a steady, “measured”, series of Fed Funds increases aimed towards a loosely defined “neutral” stance. However, contrary to consensus opinion, this has not resulted in a uniform rise in rates across the curve, but in a flattening of both the taxable and tax-exempt curves about a pivot point situated between three and four years. Municipals in the intermediate maturity range have, therefore, actually had their yields decline by about 50 basis points during this time, albeit with some volatility.

The Portfolio has performed well given our policy of taking prudent call-protected maturity risk on high quality credits, while emphasizing cash flow from coupon income. While having allowed duration to decline slightly, we continue to use relative analysis to take advantage of yield enhancement opportunities when they arise, both with respect to specialty state valuations and bond structures that are attractive to different investment classes.

The Portfolio and sub-adviser remain committed to the asset class and their investment style.

22

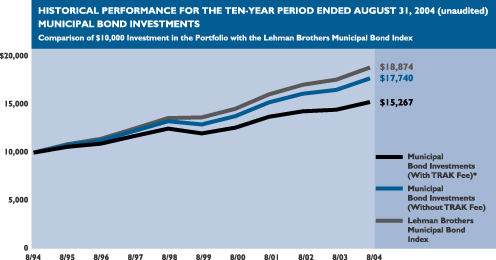

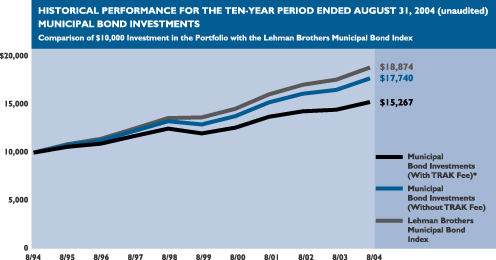

The following graph depicts the performance of the Municipal Bond Investments vs. the Lehman Brothers Municipal Bond Index.10

The performance shown above represents past performance. Past performance is no guarantee of future results and current performance may be higher or lower than the performance shown above. Principal value and investment returns will fluctuate and investors’ shares, when redeemed, may be worth more or less than their original cost. To obtain performance data current to the most recent month-end, please visit our website at www.smithbarney.com.

The graph above and returns shown below do not reflect the deduction of taxes that a shareholder would pay on fund distributions or the redemption of fund shares.

MUNICIPAL BOND INVESTMENTS (unaudited)

Average Annual Total Returns for the Period Ended August 31, 2004

| | | | | | |

| | | Without TRAK Fee | | | With TRAK Fee* | |

Since inception (11/18/91) | | 5.83 | % | | 4.25 | % |

10 year | | 5.90 | | | 4.32 | |

5 year | | 6.52 | | | 4.93 | |

3 year | | 5.16 | | | 3.59 | |

1 year | | 7.12 | | | 5.53 | |

|

|

See pages 26 through 28 for all footnotes.

RISKS: The Portfolio may use derivatives, such as options and futures, which can be illiquid, may disproportionately increase losses and have a potentially large impact on performance. Foreign securities are subject to certain risks of overseas investing, including currency fluctuations and changes in political and economic conditions, which could result in significant market fluctuations. Investments in small and medium-capitalizations companies may involve a higher degree of risk and volatility than investments in larger, more established companies. The Portfolio may invest in high yield bonds, which involve greater credit and liquidity risks than investment grade bonds.

23

International Fixed

Income Investments

ABOUTTHE SUB-ADVISER

| | Ÿ | | Julius Baer Investments Ltd. (“Julius Baer”) | |

Applies portfolio economic analysis to select a portfolio of high-quality, well-diversified foreign bonds. From a universe of 20 developed countries outside the U.S., the sub-adviser forecasts which bond markets offer the best opportunity to outperform the U.S. bond market, considering factors such as currencies, local bond market conditions, issuers and instruments. It pays particular attention to markets that offer attractive yields. The sub-adviser employs a proprietary computer model to analyze exchange rates to assist in its forecasts and to help manage the risk of the Portfolio.

During the year of September 1, 2003 through August 31, 2004, the sub-adviser to the International Fixed Income Investments (“Portfolio”) was Julius Baer Investments Ltd. (“Julius Baer”). The Portfolio outperformed its benchmark.

The key theme in global markets over the past year has been the cyclical upturn in the global economy, driven by the U.S. and Asia (especially China) markets. As a result, global interest rates have begun to rise. In the U.S., the Federal Reserve began raising rates in June, initially in 25 basis point increments. Bond markets have been generally well behaved in spite of the increase in official rates, as the rate rises have been well telegraphed by central banks and global inflation remains generally well subdued. The other key feature of the past year has been the sharp increase in oil prices, driven primarily by strong growth in emerging economies.

2004 was a good year for bond returns, with a large portion of the gains earnings in the front half of the period under review. The biggest contributor to returns was the strength of the Euro, which toward the end of December 2003, was close to 1.301, approximately more than 15%. The growth in the budget and current account deficits took a toll on the dollar. The Portfolio was well situated to take advantage of this. Overseas purchases of U.S. treasuries have scaled back some of the Euro’s gains (which has kept the ten-year bond at a high price/low yield), but the deficits remains a threat to the level of the U.S. dollar. The other main sources of return, duration and country selection, were also positive. The Portfolio benefits from being exposed to these countries, which could benefit from growth, as well as those countries in Europe that could benefit from membership in the expanded European Union.

The Portfolio and the sub-adviser remain committed to the asset class and its investment style.

24

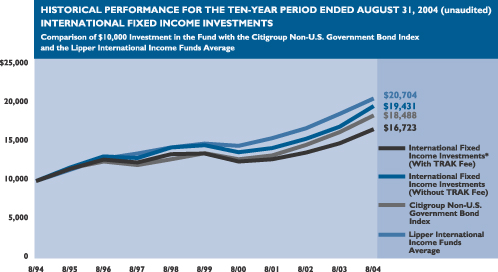

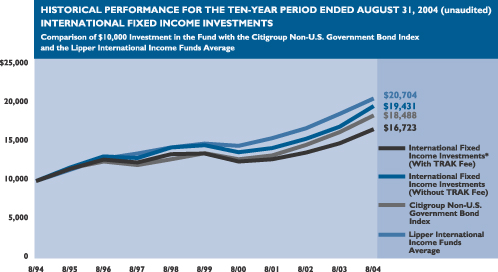

The following graph depicts the performance of the International Fixed Income Investments vs. the Citigroup Non-U.S. Government Bond Index11 and the Lipper International Income Funds Average.18

The performance shown above represents past performance. Past performance is no guarantee of future results and current performance may be higher or lower than the performance shown above. Principal value and investment returns will fluctuate and investors’ shares, when redeemed, may be worth more or less than their original cost. To obtain performance data current to the most recent month-end, please visit our website at www.smithbarney.com.

The graph above and returns shown below do not reflect the deduction of taxes that a shareholder would pay on fund distributions or the redemption of fund shares.

INTERNATIONAL FIXED INCOME INVESTMENTS (unaudited)

Average Annual Total Returns for Period Ended August 31, 2004

| | | | | | |

| | | Without TRAK Fee | | | With TRAK Fee* | |

Since inception (11/18/91) | | 7.19 | % | | 5.59 | % |

10 year | | 6.87 | | | 5.28 | |

5 year | | 5.83 | | | 4.26 | |

3 year | | 10.87 | | | 9.22 | |

1 year | | 14.00 | | | 12.30 | |

|

|

See pages 26 through 28 for all footnotes.

RISKS: The Portfolio may use derivatives, such as options and futures, which can be illiquid, may disproportionately increase losses and have a potentially large impact on performance. Foreign securities are subject to certain risks of overseas investing, including currency fluctuations and changes in political and economic conditions, which could result in significant market fluctuations. Investments in small and medium-capitalizations companies may involve a higher degree of risk and volatility than investments in larger, more established companies. The Portfolio may invest in high yield bonds, which involve greater credit and liquidity risks than investment grade bonds.

25

FOOTNOTES

| † | | The performance shown represents past performance. Past performance is no guarantee of future results and current performance may be higher or lower than the performance shown above. Principal value and investment returns will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost. The returns shown do not reflect the deduction of taxes that a shareholder would pay on fund distributions or the redemption of fund shares. To obtain performance data current to the most recent month-end, please visit our website at www.smithbarney.com. |

| * | | The Funds are available only to investors participating in an advisory program. These programs charge an annual fee, which in the case of TRAK® may be up to 1.50%. The performance data shown does not reflect this fee, which would reduce returns. |

| ‡ | | Performance figures may reflect fee waivers and/or expense reimbursements. Past performance is no guarantee of future results. In the absence of fee waivers and/or expense reimbursements, the total return would be reduced. |

| 1 | | The Russell 1000 Value Index is a capitalization weighted total return index which is comprised of 1,000 of the largest capitalized U.S. domiciled companies with greater-than-average value orientation whose common stock is traded in the United States on the New York Stock Exchange, American Stock Exchange and NASDAQ. Because the index is not a managed portfolio, there are no advisory fees or internal management expenses reflected in the index’s performance. Please note that an investor cannot invest directly in an index. |

| 2 | | The Russell 1000 Growth Index is a capitalization weighted total return index which is comprised of 1,000 of the largest capitalized U.S. domiciled companies with greater-than-average growth orientation whose common stock is traded in the United States on the New York Stock Exchange, American Stock Exchange and NASDAQ. Because the index is not a managed portfolio, there are no advisory fees or internal management expenses reflected in the index’s performance. Please note that an investor cannot invest directly in an index. |

| 3 | | The Russell 2000 Value Index is a capitalization weighted total return index which is comprised of 2,000 of the smallest capitalized U.S. domiciled companies with less-than-average growth orientation whose common stock is traded in the United States on the New York Stock Exchange, American Stock Exchange and NASDAQ. Because the index is not a managed portfolio, there are no advisory fees or internal management expenses reflected in the index’s performance. Please note that an investor cannot invest directly in an index. |

| 4 | | The Russell 2000 Growth Index is a capitalization weighted total return index which is comprised of 2,000 of the smallest capitalized U.S. domiciled companies with greater-than-average growth orientation whose common stock is traded in the United States on the New York Stock Exchange, American Stock Exchange and NASDAQ. Because the index is not a managed portfolio, there are no advisory fees or internal management expenses reflected in the index’s performance. Please note that an investor cannot invest directly in an index. |

| 5 | | The Morgan Stanley Capital International EAFE-Capitalization Weighted Index is a composite portfolio of equity total returns for the countries of Australia, New Zealand and countries in Europe and the Far East, weighted based on each country’s market capitalization. Because |

26

| | the index is not a managed portfolio, there are no advisory fees or internal management expenses reflected in the index’s performance. Please note that an investor cannot invest directly in an index. |

| 6 | | The Morgan Stanley Capital International Emerging Markets Free Index is an index comprised of thirteen emerging markets open to direct foreign participation. Because the index is not a managed portfolio, there are no advisory fees or internal management expenses reflected in the index’s performance. Please note that an investor cannot invest directly in an index. |

| 7 | | The Lehman Brothers Aggregate Bond Index is composed of the Lehman Brothers Intermediate Government/Credit Bond Index and the Lehman Brothers Mortgage-Backed Securities Index and includes treasury issues, agency issues, corporate bond issues and mortgage-backed securities. Because the index is not a managed portfolio, there are no advisory fees or internal management expenses reflected in the index’s performance. Please note that an investor cannot invest directly in an index. |

| 8 | | The Lehman Brothers Intermediate Government/Credit Bond Index is a weighted composite of: (i) Lehman Brothers Government Bond Index, which is comprised of all publicly issued, non-convertible debt of the U.S. government or any agency thereof, quasi-federal corporations, and corporate debt guaranteed by the U.S. government with a maturity between one and ten years; and (ii) Lehman Brothers Credit Bond Index, which is comprised of all public fixed-rate, non-convertible investment-grade domestic corporate debt with a maturity of between one and ten years, excluding collateralized mortgage obligations. Because the index is not a managed portfolio, there are no advisory fees or internal management expenses reflected in the index’s performance. Please note that an investor cannot invest directly in an index. |

| 9 | | The Lehman Brothers High Yield Index is composed of fixed rate, publicly issued, non-investment grade debt registered with the SEC. All bonds must be dollar-denominated, non-convertible, and have at least one year remaining to maturity as well as an outstanding par value of $100 million. Because the index is not a managed portfolio, there are no advisory fees or internal management expenses reflected in the index’s performance. Please note that an investor cannot invest directly in an index. |

| 10 | | The Lehman Brothers Municipal Bond Index is a weighted composite which is comprised of more than 15,000 bonds issued within the last five years, having a minimum credit rating of at least Baa and maturity of at least two years, excluding all bonds subject to the Alternative Minimum Tax and bonds with floating or zero coupons. Because the index is not a managed portfolio, there are no advisory fees or internal management expenses reflected in the index’s performance. Please note that an investor cannot invest directly in an index. |

| 11 | | The Citigroup Non-U.S. Government Bond Index is an index subset of the Citigroup World Bond Index that excludes corporate bonds denominated in U.S. dollars. It contains foreign government and supranational bonds denominated in Australian, Austrian, Belgian, British, Canadian, Danish, Dutch, French, German, Italian, Japanese, Spanish and Swedish currencies. Because the index is not a managed portfolio, there are no advisory fees or internal management expenses reflected in the index’s performance. Please note that an investor cannot invest directly in an index. |

| 12 | | The Lipper Large-Cap Value Funds Average is comprised of the Fund’s peer group of mutual funds investing in value oriented funds. |

27

| 13 | | The Lipper Large-Cap Growth Funds Average is comprised of the Portfolio’s peer group of mutual funds investing in growth oriented funds. |

| 14 | | The Lipper Small Cap Value Funds Average is comprised of the Portfolio’s peer group of mutual funds which limit their investments to small cap value companies. |

| 15 | | The Lipper Small Cap Growth Funds Average is comprised of the Portfolio’s peer group of mutual funds which limit their investments to small cap growth companies. |

| 16 | | The Lipper International Funds Average is an equally weighted average of the funds that invest their assets in securities with primary trading markets outside of the United States. |