UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED

MANAGEMENT INVESTMENT COMPANIES

Investment Company Act file number 811-6318

Consulting Group Capital Markets Funds

(Exact name of registrant as specified in charter)

| | |

| 125 Broad Street, New York, NY | | 10004 |

|

| (Address of principal executive offices) | | (Zip code) |

Robert I. Frenkel, Esq.

Smith Barney Fund Management LLC

300 First Stamford Place

Stamford, CT 06902

(Name and address of agent for service)

Registrant’s telephone number, including area code: (800) 451-2010

Date of fiscal year end: March 31

Date of reporting period: March 31, 2005

| ITEM | 1. REPORT TO STOCKHOLDERS. |

The Annual Report to Stockholders is filed herewith.

Consulting Group

Capital Markets Funds

Multi-Strategy Market Neutral Investments

| | |

Annual Report March 31, 2005 | |  |

NOT FDIC INSURED • NOT BANK GUARANTEED • MAY LOSE VALUE

Table of Contents

Consulting Group

Capital Markets Funds

DEAR SHAREHOLDER:

The fiscal year for the Consulting Group Capital Markets Funds – Multi-Strategy Market Neutral Investments (“Fund”) ended March 31, 2005 with the Fund posting a return of –1.23%. During this time period, the Three Month Treasury Bill Indexi rose 1.75%, and the S&P 500 Indexii rose 6.69%. The macro-economic environment during this period was steady economic growth and rising short-term interest rates. The Federal Reserve Boardiii implemented a rising interest rate strategy to return rates to a more normal level and fight the potential rise in inflation.

Consulting Group, in its capacity as Investment Manager of the Fund, is responsible for overseeing and implementing the strategies utilized in the Fund. At the beginning of the fiscal year, the Fund employed two strategies: convertible arbitrage and equity market neutral. Franklin Portfolio Associates LLC, Freeman Associates Investment Management LLC, and SSI Investment Management Inc. (“SSI”) sub-advise the equity market neutral strategy. Calamos Asset Management, Inc. and SSI sub-advise convertible arbitrage. Camden Asset Management L.P. was terminated during the year from the convertible arbitrage strategy.

The convertible arbitrage strategy consists of buying debt securities, preferred stocks, and other securities convertible into common stock. A hedge is constructed by selling short the common stock of the company. There were several factors that negatively impacted the convertible securities markets and the opportunities to achieve positive returns in a hedged strategy.

Issuance of convertible securities diminished during the year, redemptions increased over the previous year, and equity market volatility declined. These factors combined with the recent widening of the credit spread (the premium investors demand over a comparable Treasury security) late in the fiscal year and helped produce negative returns.

The equity market neutral strategy consists of buying stock in the companies the sub-adviser believes to be undervalued and will outperform the broad equity market return. Concurrently, short sales are initiated in the stocks that the sub-adviser believes to be overvalued and will underperform the broad equity market. This strategy produced very low positive to negative returns during this period.

There are two very important equity market factors to understand when analyzing the contribution of the equity market neutral strategy. The volatility of the market, and how differently the stocks in the market move, create opportunity for the sub-adviser. Generally, during the fiscal year, market volatility was lower than previous years. The positive returns the equity market generated during the period were primarily a function of energy and other commodity related companies. Most of the equity market struggled together during the period. Valuation sensitive models by some sub-advisers were able to create low levels of positive returns, but not enough to overcome the negative returns of other equity market neutral strategies and the convertible arbitrage strategy.

The negative return generated by the Fund is disappointing, but must be understood in context of the structure, objectives and opportunities. The Fund does not employ leverage. Very low levels of short-term interest rates have limited the short-rebate opportunity. Equity market volatility has been lower than the previous several years. The Fund is structured as a portfolio risk-reducing vehicle. Given the recent positive returns in both the fixed income and equity markets, the role and importance of market neutral investments was diminished. The long-term role of risk reduction remains in place.

1

Information About Your Fund

As you may be aware, several issues in the mutual fund industry have recently come under the scrutiny of federal and state regulators. The Fund’s Adviser and some of its affiliates have received requests for information from various government regulators regarding market timing, late trading, fees and other mutual fund issues in connection with various investigations. The regulators appear to be examining, among other things, the Fund’s response to market timing and shareholder exchange activity, including compliance with prospectus disclosure related to these subjects. The Fund has been informed that the Adviser and its affiliates are responding to those information requests, but are not in a position to predict the outcome of these requests and investigations.

Important information concerning the Fund and its Adviser with regard to recent regulatory developments is contained in the “Additional Information” note in the Notes to the Financial Statements included in this report.

We thank you for your continued support and encourage you to contact your Financial Consultant for further assistance and guidance.

Sincerely,

R. Jay Gerken, CFA

Chairman, President and Chief Executive Officer

April 29, 2005

All figures represent past performance and are not a guarantee of future results. Investment return and principal value of an investment will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost. The returns shown also do not reflect the deduction of taxes that a shareholder would pay on fund distributions or the redemption of fund shares. Performance figures may reflect fee waivers and/or expense reimbursements. In the absence of fee waivers and/or expense reimbursements, the total return would have been lower. To obtain performance data current to the most recent month-end, please visit our website at www.citigroupam.com.

The Fund is only available to investors participating in an advisory program. These programs charge an annual fee, which in the case of TRAK® may be up to 1.50%. The performance data shown does not reflect this fee, which would reduce returns.

All index performance reflects no deduction for fees, expenses or taxes. Please note an investor cannot invest directly in an index.

The information provided is not intended to be a forecast of future events, a guarantee of future results or investment advice. Views expressed my differ from those of the firm as a whole.

RISKS: The Fund makes short sales of securities, which may result in losses greater than the amount invested. Although the Fund’s strategies attempt to neutralize the effect of general trends in the equity markets, an investment in the Fund is subject to the risks associated with investing in equity securities generally. Equity securities, particularly common stocks, have historically generated higher average returns than fixed income securities, but have also experienced significantly more volatility on those returns. In addition to the risks associated with equity securities, convertible arbitrage also entails risks associated with fixed income securities, such as interest rate and credit risk. The Fund may engage in active and frequent trading which would increase the investor’s tax liability and increase transaction costs, which would in turn, reduce the Fund’s performance.

| i | | The Three Month Treasury Bill Index is composed of one three-month U.S. Treasury Bill whose return is tracked until its maturity. |

| ii | | The S&P 500 Index is a market capitalization-weighted index of 500 widely held common stocks. |

| iii | | The Federal Reserve Board is responsible for the formulation of a policy designed to promote economic growth, full employment, stable prices, and a sustainable pattern of international trade and payments. |

2

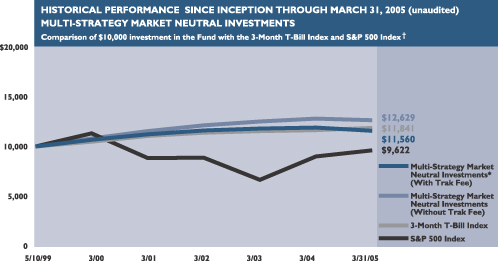

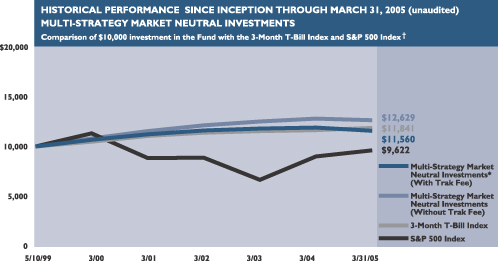

The following graph depicts the performance of the Multi-Strategy Market Neutral Investments vs. the 3-Month T-Bill Index and S&P 500 Index.

The 3-Month T-Bill Index is composed of one 3-Month U.S. T-Bill whose return is tracked until its maturity. The S&P 500 Index is an index composed of 500 widely held common stocks listed on the New York Stock Exchange, American Stock Exchange and over-the-counter market. Because the index is not a managed portfolio, there are no advisory fees or internal management expenses reflected in the index’s performance. Please note that an investor cannot invest directly in an index.

Average Annual Total Returns For the Period Ended March 31, 2005†‡ (unaudited)

| | | | | | |

Multi-Strategy Market Neutral

Investments | | Without TRAK Fee | | | With TRAK Fee* | |

Since inception (5/10/99) | | 4.04 | % | | 2.49 | % |

5 Year | | 3.18 | | | 1.64 | |

3 Year | | 1.38 | | | (0.13 | ) |

1 Year | | (1.23 | ) | | (2.70 | ) |

|

|

| † | All figures represent past performance and are not a guarantee of future results. Investment return and principal value of an investment will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost. The returns shown also do not reflect the deduction of taxes that a shareholder would pay on fund distributions or the redemption of fund shares. Performance figures may reflect fee waivers and/or expense reimbursements. In the absence of fee waivers and/or expense reimbursements, the total return would have been lower. To obtain performance data current to the most recent month-end, please visit our website at www. citigroupam.com. |

| ‡ | Assumes the reinvestment of all distributions. |

| * | The Fund is available only to investors participating in an advisory program. These programs charge an annual fee, which in the case of TRAK® may be up to 1.50%. |

3

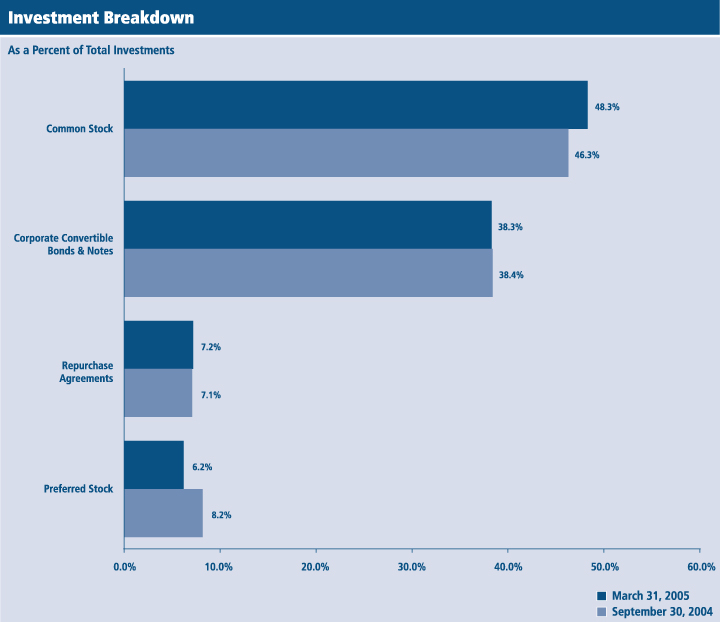

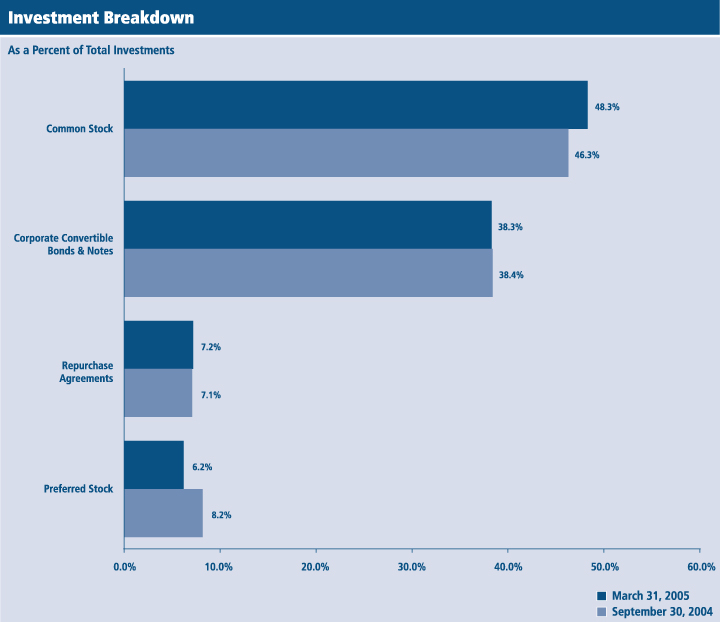

Fund at a Glance (unaudited)

4

Fund Expenses (unaudited)

Example

As a shareholder of the Fund, you may incur two types of costs: (1) advisory program annual fees, which in the case of TRAK® may be up to 1.50%; and (2) ongoing costs, including management fees and other Fund expenses. This example is intended to help you understand your ongoing costs (in dollars) of investing in the Fund and to compare these costs with the ongoing costs of investing in other mutual funds.

This example is based on an investment of $1,000 invested on October 1, 2004 and held for the six months ended March 31, 2005.

Actual Expenses

The table below titled “Based on Actual Total Return” provides information about actual account values and actual expenses. You may use the information provided in this table, together with the amount you invested, to estimate the expenses that you paid over the period. To estimate the expenses you paid on your account, divide your ending account value by $1,000 (for example, an $8,600 ending account value divided by $1,000 = 8.6), then multiply the result by the number under the heading entitled “Expenses Paid During the Period”.

Based on Actual Total Return(1)

| | | | | | | | | | | | | | | |

| | | Actual

Total

Return(2) | | | Beginning

Account

Value | | Ending

Account

Value | | Annualized

Expense

Ratio | | | Expenses

Paid During

the Period(3) |

| | | (0.77 | )% | | $ | 1,000.00 | | $ | 992.30 | | 1.77 | % | | $ | 8.79 |

|

| (1) | For the six months ended March 31, 2005. |

| (2) | Assumes reinvestment of all dividends and capital gain distributions, if any, at net asset value and does not reflect the deduction of the applicable advisory program charge, which in the case of TRAK® may be up to 1.50%. Total return is not annualized as it may not be representative of the total return for the year. Performance figures may reflect voluntary fee waivers and/or expense reimbursements. Past performance is no guarantee of future results. In the absence of voluntary fee waivers and/or expense reimbursements, the total return would have been lower. |

| (3) | Expenses (net of voluntary fee waiver) are equal to the Fund’s annualized expense ratio multiplied by the average account value over the period, multiplied by the number of days in the most recent fiscal half-year, then divided by 365. |

5

Fund Expenses (unaudited) (continued)

Hypothetical Example for Comparison Purposes

The table below titled “Based on Hypothetical Total Return” provides information about hypothetical account values and hypothetical expenses based on the actual expense ratio and an assumed rate of return of 5.00% per year before expenses, which is not the Fund’s actual return. The hypothetical account values and expenses may not be used to estimate the actual ending account balance or expenses you paid for the period. You may use the information provided in this table to compare the ongoing costs of investing in the Fund and other funds. To do so, compare the 5.00% hypothetical example relating to the Fund with the 5.00% hypothetical examples that appear in the shareholder reports of the other funds.

Please note that the expenses shown in the table below are meant to highlight your ongoing costs only and do not reflect any transactional costs such as front-end or back-end sales charges (loads). Therefore, the table is useful in comparing ongoing costs only, and will not help you determine the relative total costs of owning different funds. In addition, if these transaction costs were included, your costs would have been higher.

Based on Hypothetical Total Return(1)

| | | | | | | | | | | | | | | |

| | | Hypothetical

Annualized

Total Return | | | Beginning

Account

Value | | Ending

Account

Value | | Annualized

Expense

Ratio | | | Expenses

Paid During

the Period(2) |

| | | 5.00 | % | | $ | 1,000.00 | | $ | 1,016.11 | | 1.77 | % | | $ | 8.90 |

|

| (1) | For the six months ended March 31, 2005. |

| (2) | Expenses (net of voluntary fee waiver) are equal to the Fund’s annualized expense ratio multiplied by the average account value over the period, multiplied by the number of days in the most recent fiscal half-year, then divided by 365. |

6

Schedule of Investments

March 31, 2005

| | | | | |

| | |

| Shares | | Security | | Value |

COMMON STOCK (a) — 51.1 % | | | |

CONSUMER DISCRETIONARY — 12.1% | | | |

| |

Auto Components — 0.9% | | | |

| 2,500 | | American Axle & Manufacturing Holdings, Inc. | | $ | 61,250 |

| 12,550 | | Autoliv, Inc. | | | 598,008 |

| 3,670 | | Cooper Tire & Rubber Co. | | | 67,381 |

| 1,435 | | Dana Corp. | | | 18,354 |

| 14,800 | | The Goodyear Tire & Rubber Co. (b) | | | 197,580 |

| 1,600 | | Lear Corp. | | | 70,976 |

| 700 | | Magna International Inc., Class A Shares | | | 46,830 |

| 3,440 | | Tenneco Automotive Inc. (b) | | | 42,862 |

| 2,400 | | Wabtec Corp. | | | 49,176 |

| | | | |

|

|

| | | | | | 1,152,417 |

| | | | |

|

|

| |

Automobiles — 0.6% | | | |

| 13,400 | | Ford Motor Co. | | | 151,822 |

| 4,200 | | General Motors Corp. | | | 123,438 |

| 6,500 | | Harley-Davidson, Inc. | | | 375,440 |

| 2,100 | | Toyota Motor Corp., Sponsored ADR | | | 156,198 |

| | | | |

|

|

| | | | | | 806,898 |

| | | | |

|

|

| |

Distributors — 0.1% | | | |

| 2,050 | | WESCO International, Inc. (b) | | | 57,400 |

| | | | |

|

|

| |

Hotels, Restaurants & Leisure — 0.8% | | | |

| 1,700 | | Ameristar Casinos, Inc. | | | 92,956 |

| 1,400 | | Boyd Gaming Corp. | | | 73,010 |

| 3,380 | | CKE Restaurants, Inc. (b) | | | 53,573 |

| 8,195 | | Darden Restaurants, Inc. | | | 251,423 |

| 7,625 | | Hilton Hotels Corp. | | | 170,419 |

| 1,060 | | Jack in the Box Inc. (b) | | | 39,326 |

| 4,895 | | McDonald's Corp. | | | 152,430 |

| 8,250 | | Penn National Gaming, Inc. (b) | | | 242,385 |

| 1,300 | | Ruby Tuesday, Inc. | | | 31,577 |

| | | | |

|

|

| | | | | | 1,107,099 |

| | | | |

|

|

| |

Household Durables — 2.5% | | | |

| 17,950 | | American Greetings Corp., Class A Shares | | | 457,366 |

| 3,600 | | The Black & Decker Corp. | | | 284,364 |

| 2,333 | | D.R. Horton, Inc. | | | 68,217 |

| 6,655 | | Ethan Allen Interiors Inc. | | | 212,960 |

| 10,800 | | Furniture Brands International, Inc. | | | 235,548 |

| 900 | | Harman International Industries, Inc. | | | 79,614 |

| 1,600 | | KB HOME | | | 187,936 |

| 1,026 | | M.D.C. Holdings, Inc. | | | 71,461 |

| 10,525 | | Newell Rubbermaid Inc. | | | 230,919 |

| 100 | | NVR, Inc. (b) | | | 78,500 |

| 2,740 | | Snap-on Inc. | | | 87,105 |

| 2,600 | | Standard Pacific Corp. | | | 187,694 |

| 7,600 | | The Stanley Works | | | 344,052 |

| 1,600 | | Tempur-Pedic International Inc. (b) | | | 29,856 |

| 4,500 | | Toll Brothers, Inc. (b) | | | 354,825 |

| 1,000 | | The Toro Co. | | | 88,500 |

See Notes to Financial Statements.

7

Schedule of Investments

(continued)

| | | | | |

| | |

| Shares | | Security | | Value |

| |

Household Durables — 2.5% (continued) | | | |

| 11,500 | | Tupperware Corp. | | $ | 234,140 |

| 1,400 | | Whirlpool Corp. | | | 94,822 |

| | | | |

|

|

| | | | | | 3,327,879 |

| | | | |

|

|

| |

Leisure Equipment & Products — 0.7% | | | |

| 3,465 | | JAKKS Pacific, Inc. (b) | | | 74,394 |

| 28,945 | | Marvel Enterprises, Inc. (b) | | | 578,900 |

| 3,395 | | Polaris Industries Inc. | | | 238,431 |

| 2,400 | | SCP Pool Corp. | | | 76,464 |

| | | | |

|

|

| | | | | | 968,189 |

| | | | |

|

|

| |

Media — 1.4% | | | |

| 4,000 | | Catalina Marketing Corp. | | | 103,600 |

| 14,900 | | Citadel Broadcasting Co. (b) | | | 204,577 |

| 3,800 | | Clear Channel Communications, Inc. | | | 130,986 |

| 1,115 | | Entercom Communications Corp. (b) | | | 39,605 |

| 15,400 | | Gemstar-TV Guide International, Inc. (b) | | | 66,990 |

| 1,000 | | Grupo Televisa S.A., Sponsored ADR | | | 58,800 |

| 2,900 | | John Wiley & Sons, Inc., Class A Shares | | | 102,225 |

| 1,200 | | Lamar Advertising Co., Class A Shares (b) | | | 48,348 |

| 6,700 | | Lions Gate Entertainment Corp. (b) | | | 74,035 |

| 1,835 | | The McGraw-Hill Cos., Inc. | | | 160,104 |

| 2,100 | | Meredith Corp. | | | 98,175 |

| 1,000 | | Pixar (b) | | | 97,550 |

| 1,400 | | R.H. Donnelley Corp. (b) | | | 81,326 |

| 4,200 | | The Reader's Digest Association, Inc. | | | 72,702 |

| 7,120 | | Sinclair Broadcast Group, Inc., Class A Shares | | | 57,174 |

| 17,200 | | Sirius Satellite Radio Inc. (b) | | | 96,664 |

| 4,370 | | Time Warner Inc. (b) | | | 76,694 |

| 7,300 | | TV Azteca, S.A. de C.V., Sponsored ADR | | | 63,145 |

| 5,900 | | The Walt Disney Co. | | | 169,507 |

| 3,900 | | XM Satellite Radio Holdings Inc., Class A Shares (b) | | | 122,850 |

| | | | |

|

|

| | | | | | 1,925,057 |

| | | | |

|

|

| |

Multi-Line Retail — 1.4% | | | |

| 7,600 | | BJ's Wholesale Club, Inc. (b) | | | 236,056 |

| 7,500 | | Costco Wholesale Corp. | | | 331,350 |

| 3,100 | | Dillard's, Inc., Class A Shares | | | 83,390 |

| 5,200 | | Federated Department Stores, Inc. | | | 330,928 |

| 3,990 | | J. C. Penney Co., Inc. | | | 207,161 |

| 4,230 | | Nordstrom, Inc. | | | 234,257 |

| 3,100 | | Sears Holdings Corp. (b) | | | 412,827 |

| 1,200 | | Wal-Mart Stores, Inc. | | | 60,132 |

| | | | |

|

|

| | | | | | 1,896,101 |

| | | | |

|

|

| |

Specialty Retail — 3.3% | | | |

| 7,000 | | Abercrombie & Fitch Co., Class A Shares | | | 400,680 |

| 6,000 | | Aeropostale, Inc. (b) | | | 196,500 |

| 20,200 | | American Eagle Outfitters, Inc. | | | 596,910 |

| 23,100 | | AutoNation, Inc. (b) | | | 437,514 |

| 900 | | AutoZone, Inc. (b) | | | 77,130 |

| 11,860 | | Barnes & Noble, Inc. (b) | | | 409,051 |

| 2,100 | | Bebe Stores, Inc. | | | 71,295 |

| 4,240 | | Best Buy Co., Inc. | | | 229,002 |

See Notes to Financial Statements.

8

Schedule of Investments

(continued)

| | | | | |

| | |

| Shares | | Security | | Value |

| |

Specialty Retail — 3.3% (continued) | | | |

| 3,900 | | Borders Group, Inc. | | $ | 103,818 |

| 3,130 | | Casual Male Retail Group Inc. (b) | | | 20,314 |

| 3,545 | | Charming Shoppes, Inc. (b) | | | 28,821 |

| 11,785 | | The Gap, Inc. | | | 257,384 |

| 5,600 | | The Gymboree Corp. (b) | | | 70,224 |

| 9,100 | | Linens 'n Things, Inc. (b) | | | 225,953 |

| 9,585 | | Michaels Stores, Inc. | | | 347,936 |

| 2,400 | | Movie Gallery, Inc. | | | 68,832 |

| 6,800 | | OfficeMax Inc. | | | 227,800 |

| 2,700 | | Payless ShoeSource, Inc. (b) | | | 42,633 |

| 12,300 | | Pier 1 Imports, Inc. | | | 224,229 |

| 12,650 | | Staples, Inc. | | | 397,590 |

| | | | |

|

|

| | | | | | 4,433,616 |

| | | | |

|

|

| |

Textiles & Apparel — 0.4% | | | |

| 2,235 | | K-Swiss Inc., Class A Shares | | | 73,822 |

| 2,300 | | NIKE, Inc., Class B Shares | | | 191,613 |

| 21,340 | | Tommy Hilfiger Corp. (b) | | | 249,678 |

| 2,000 | | Wolverine World Wide, Inc. | | | 42,860 |

| | | | |

|

|

| | | | | | 557,973 |

| | | | |

|

|

| | | TOTAL CONSUMER DISCRETIONARY | | | 16,232,629 |

| | | | |

|

|

CONSUMER STAPLES — 2.6% | | | |

| |

Beverages — 0.8% | | | |

| 1,400 | | Diageo PLC, Sponsored ADR | | | 79,660 |

| 1,400 | | Fomento Economico Mexicano, S.A. de C.V., Sponsored ADR | | | 74,970 |

| 615 | | Molson Coors Brewing Co., Class B Shares | | | 47,460 |

| 14,715 | | The Pepsi Bottling Group, Inc. | | | 409,813 |

| 21,000 | | PepsiAmericas, Inc. | | | 475,860 |

| | | | |

|

|

| | | | | | 1,087,763 |

| | | | |

|

|

| |

Food & Drug Retailing — 0.5% | | | |

| 11,975 | | 7-Eleven, Inc. (b) | | | 287,640 |

| 300 | | CVS Corp. | | | 15,786 |

| 3,100 | | The Great Atlantic & Pacific Tea Co., Inc. (b) | | | 46,190 |

| 11,900 | | The Kroger Co. (b) | | | 190,757 |

| 8,100 | | Rite Aid Corp. (b) | | | 32,076 |

| 2,900 | | SUPERVALU INC. | | | 96,715 |

| | | | |

|

|

| | | | | | 669,164 |

| | | | |

|

|

| |

Food Products — 1.1% | | | |

| 7,830 | | Archer-Daniels-Midland Co. | | | 192,461 |

| 3,675 | | Cadbury Schweppes PLC, Sponsored ADR | | | 149,573 |

| 4,100 | | General Mills, Inc. | | | 201,515 |

| 6,800 | | Hormel Foods Corp. | | | 211,548 |

| 750 | | McCormick & Co., Inc., Non-voting Shares | | | 25,822 |

| 6,620 | | Pilgrim's Pride Corp. | | | 236,466 |

| 5,900 | | Sara Lee Corp. | | | 130,744 |

| 5,700 | | Sensient Technologies Corp. | | | 122,892 |

| 2,500 | | Smithfield Foods, Inc. (b) | | | 78,875 |

| 2,100 | | Tyson Foods, Inc., Class A Shares | | | 35,028 |

| | | | |

|

|

| | | | | | 1,384,924 |

| | | | |

|

|

See Notes to Financial Statements.

9

Schedule of Investments

(continued)

| | | | | |

| | |

| Shares | | Security | | Value |

| |

Personal Products — 0.2% | | | |

| 4,200 | | Avon Products, Inc. | | $ | 180,348 |

| 910 | | The Gillette Co. | | | 45,937 |

| 6,100 | | Playtex Products, Inc. (b) | | | 54,900 |

| | | | |

|

|

| | | | | | 281,185 |

| | | | |

|

|

| | | TOTAL CONSUMER STAPLES | | | 3,423,036 |

| | | | |

|

|

ENERGY — 4.2% | | | |

| |

Energy Equipment & Services — 1.4% | | | |

| 1,400 | | BJ Services Co. | | | 72,632 |

| 1,800 | | Cal Dive International, Inc. (b) | | | 81,540 |

| 1,690 | | Cooper Cameron Corp. (b) | | | 96,685 |

| 4,400 | | ENSCO International Inc. | | | 165,704 |

| 3,400 | | Grant Prideco, Inc. (b) | | | 82,144 |

| 2,850 | | Halliburton Co. | | | 123,262 |

| 1,200 | | Lone Star Technologies, Inc. (b) | | | 47,316 |

| 1,400 | | Maverick Tube Corp. (b) | | | 45,514 |

| 2,700 | | Nabors Industries, Ltd. (b) | | | 159,684 |

| 9,300 | | Patterson-UTI Energy, Inc. | | | 232,686 |

| 1,620 | | Precision Drilling Corp. (b) | | | 120,949 |

| 2,800 | | Schlumberger Ltd. | | | 197,344 |

| 4,300 | | Transocean Inc. (b) | | | 221,278 |

| 1,600 | | Unit Corp. (b) | | | 72,272 |

| 2,100 | | Universal Compression Holdings, Inc. (b) | | | 79,527 |

| 2,650 | | Weatherford International Ltd. (b) | | | 153,541 |

| | | | |

|

|

| | | | | | 1,952,078 |

| | | | |

|

|

| |

Oil & Gas — 2.8% | | | |

| 1,100 | | Amerada Hess Corp. | | | 105,831 |

| 6,400 | | Anadarko Petroleum Corp. | | | 487,040 |

| 1,500 | | Ashland Inc. | | | 101,205 |

| 2,600 | | Burlington Resources Inc. | | | 130,182 |

| 17,200 | | Chesapeake Energy Corp. | | | 377,368 |

| 2,800 | | ConocoPhillips | | | 301,952 |

| 3,600 | | Devon Energy Corp. | | | 171,900 |

| 2,400 | | Exxon Mobil Corp. | | | 143,040 |

| 1,500 | | General Maritime Corp. (b) | | | 72,660 |

| 1,510 | | The Houston Exploration Co. (b) | | | 85,994 |

| 5,500 | | Marathon Oil Corp. | | | 258,060 |

| 1,100 | | Murphy Oil Corp. | | | 108,603 |

| 1,000 | | Newfield Exploration Co. (b) | | | 74,260 |

| 1,300 | | Nordic American Tanker Shipping Ltd. | | | 61,685 |

| 1,700 | | Premcor Inc. | | | 101,456 |

| 3,400 | | Sunoco, Inc. | | | 351,968 |

| 5,695 | | Tesoro Corp. (b) | | | 210,829 |

| 2,775 | | Ultra Petroleum Corp. (b) | | | 140,970 |

| 5,650 | | Valero Energy Corp. | | | 413,975 |

| | | | |

|

|

| | | | | | 3,698,978 |

| | | | |

|

|

| | | TOTAL ENERGY | | | 5,651,056 |

| | | | |

|

|

See Notes to Financial Statements.

10

Schedule of Investments

(continued)

| | | | | |

| | |

| Shares | | Security | | Value |

FINANCIALS — 7.4% | | | |

| |

Banks — 1.8% | | | |

| 1,600 | | Associated Banc-Corp. | | $ | 49,968 |

| 3,700 | | Bank of America Corp. | | | 163,170 |

| 4,275 | | The Bank of New York Co., Inc. | | | 124,189 |

| 3,115 | | BankUnited Financial Corp., Class A Shares (b) | | | 83,669 |

| 2,300 | | City National Corp. | | | 160,586 |

| 500 | | First BanCorp. | | | 21,125 |

| 2,000 | | Golden West Financial Corp. | | | 121,000 |

| 1,000 | | M&T Bank Corp. | | | 102,060 |

| 9,060 | | National City Corp. | | | 303,510 |

| 3,570 | | Northern Trust Corp. | | | 155,081 |

| 6,292 | | SunTrust Banks, Inc. | | | 453,464 |

| 2,300 | | TD Banknorth, Inc. (b) | | | 71,852 |

| 2,400 | | UnionBanCal Corp. | | | 147,000 |

| 6,800 | | W Holding Co., Inc. | | | 68,476 |

| 3,100 | | Wachovia Corp. | | | 157,821 |

| 1,900 | | Washington Mutual, Inc. | | | 75,050 |

| 2,000 | | Westcorp | | | 84,500 |

| 1,200 | | Zions Bancorp. | | | 82,824 |

| | | | |

|

|

| | | | | | 2,425,345 |

| | | | |

|

|

| |

Diversified Financials — 2.5% | | | |

| 2,935 | | A.G. Edwards, Inc. | | | 131,488 |

| 1,400 | | Affiliated Managers Group, Inc. (b) | | | 86,842 |

| 2,700 | | American Capital Strategies, Ltd. | | | 84,807 |

| 6,715 | | AmeriCredit Corp. (b) | | | 157,400 |

| 15,600 | | Ameritrade Holding Corp. (b) | | | 159,276 |

| 1,100 | | The Bear Stearns Cos. Inc. | | | 109,890 |

| 3,000 | | Calamos Asset Management, Inc., Class A Shares (c) | | | 80,760 |

| 2,825 | | Capital One Financial Corp. | | | 211,225 |

| 200 | | The Chicago Mercantile Exchange | | | 38,806 |

| 200 | | CIT Group Inc. | | | 7,600 |

| 11,023 | | Countrywide Financial Corp. | | | 357,807 |

| 4,690 | | Doral Financial Corp. | | | 102,664 |

| 10,800 | | E*TRADE Financial Corp. (b) | | | 129,600 |

| 5,000 | | Friedman, Billings, Ramsey Group, Inc., Class A Shares | | | 79,350 |

| 2,425 | | GFI Group Inc. (b) | | | 65,063 |

| 900 | | The Goldman Sachs Group, Inc. | | | 98,991 |

| 4,000 | | JPMorgan Chase & Co. | | | 138,400 |

| 21,200 | | Knight Trading Group, Inc., Class A Shares (b) | | | 204,368 |

| 2,475 | | Legg Mason, Inc. | | | 193,396 |

| 1,795 | | Lehman Brothers Holdings Inc. | | | 169,017 |

| 6,120 | | MBNA Corp. | | | 150,246 |

| 1,100 | | Moody's Corp. | | | 88,946 |

| 5,200 | | Providian Financial Corp. (b) | | | 89,232 |

| 5,800 | | State Street Corp. | | | 253,576 |

| 2,200 | | Walter Industries, Inc. | | | 93,610 |

| 1,200 | | WFS Financial Inc. (b) | | | 51,780 |

| | | | |

|

|

| | | | | | 3,334,140 |

| | | | |

|

|

| |

Insurance — 2.1% | | | |

| 2,200 | | ACE Ltd. | | | 90,794 |

| 1,800 | | The Allstate Corp. | | | 97,308 |

| 2,300 | | American Financial Group, Inc. | | | 70,840 |

See Notes to Financial Statements.

11

Schedule of Investments

(continued)

| | | | | |

| | |

| Shares | | Security | | Value |

| |

Insurance — 2.1% (continued) | | | |

| 1,800 | | AmerUs Group Co. | | $ | 85,050 |

| 700 | | The Chubb Corp. | | | 55,489 |

| 11,180 | | Cincinnati Financial Corp. | | | 487,560 |

| 1,400 | | The Commerce Group, Inc. | | | 86,772 |

| 725 | | Everest Re Group, Ltd. | | | 61,705 |

| 10,400 | | First American Corp. | | | 342,576 |

| 3,700 | | Fremont General Corp. | | | 81,363 |

| 900 | | Infinity Property & Casualty Corp. | | | 28,134 |

| 7,305 | | Lincoln National Corp. | | | 329,748 |

| 2,380 | | MetLife, Inc. | | | 93,058 |

| 6,400 | | Nationwide Financial Services, Inc., Class A Shares | | | 229,760 |

| 2,600 | | Protective Life Corp. | | | 102,180 |

| 1,850 | | Prudential Financial, Inc. | | | 106,190 |

| 1,800 | | Reinsurance Group of America, Inc. | | | 76,644 |

| 2,490 | | SAFECO Corp. | | | 121,288 |

| 1,850 | | W. R. Berkley Corp. | | | 91,760 |

| 2,050 | | Willis Group Holdings Ltd. | | | 75,583 |

| 1,100 | | XL Capital Ltd., Class A Shares | | | 79,607 |

| | | | |

|

|

| | | | | | 2,793,409 |

| | | | |

|

|

| |

Real Estate — 1.0% | | | |

| 12,325 | | Annaly Mortgage Management Inc. | | | 231,217 |

| 4,400 | | Archstone-Smith Trust | | | 150,084 |

| 1,200 | | Avalonbay Communities, Inc. | | | 80,268 |

| 4,235 | | Bluegreen Corp. (b) | | | 54,420 |

| 1,300 | | Boston Properties, Inc. | | | 78,299 |

| 1,300 | | CBL & Associates Properties, Inc. | | | 92,963 |

| 2,000 | | Cousins Properties, Inc. | | | 51,740 |

| 1,900 | | Developers Diversified Realty Corp. | | | 75,525 |

| 3,000 | | Impac Mortgage Holdings, Inc. | | | 57,540 |

| 1,900 | | New Century Financial Corp. | | | 88,958 |

| 3,000 | | Plum Creek Timber Co., Inc. | | | 107,100 |

| 1,600 | | Regency Centers Corp. | | | 76,208 |

| 2,500 | | Saxon Capital Inc. | | | 43,000 |

| 1,500 | | SL Green Realty Corp. | | | 84,330 |

| 3,200 | | Thornburg Mortgage, Inc. | | | 89,728 |

| | | | |

|

|

| | | | | | 1,361,380 |

| | | | |

|

|

| | | TOTAL FINANCIALS | | | 9,914,274 |

| | | | |

|

|

HEALTHCARE — 5.1% | | | |

|

Biotechnology — 0.4% |

| 1,600 | | Affymetrix, Inc. (b) | | | 68,544 |

| 2,825 | | Charles River Laboratories International, Inc. (b) | | | 132,888 |

| 2,200 | | CV Therapeutics, Inc. (b) | | | 44,792 |

| 3,200 | | Gilead Sciences, Inc. (b) | | | 114,560 |

| 2,700 | | Human Genome Sciences, Inc. (b) | | | 24,894 |

| 2,750 | | Invitrogen Corp. (b) | | | 190,300 |

| 600 | | OSI Pharmaceuticals, Inc. (b) | | | 24,804 |

| | | | |

|

|

| | | | | | 600,782 |

| | | | |

|

|

|

Healthcare Equipment & Supplies — 1.3% |

| 1,370 | | Alcon, Inc. | | | 122,327 |

| 6,930 | | Applera Corp.—Applied Biosystems Group | | | 136,798 |

| 1,695 | | Bausch & Lomb Inc. | | | 124,243 |

See Notes to Financial Statements.

12

Schedule of Investments

(continued)

| | | | | |

| | |

| Shares | | Security | | Value |

|

Healthcare Equipment & Supplies — 1.3% (continued) |

| 7,000 | | Baxter International Inc. | | $ | 237,860 |

| 6,600 | | Becton, Dickinson and Co. | | | 385,572 |

| 2,050 | | Boston Scientific Corp.(b) | | | 60,044 |

| 1,100 | | C. R. Bard, Inc. | | | 74,888 |

| 1,200 | | The Cooper Cos., Inc. | | | 87,480 |

| 1,200 | | Cyberonics, Inc. (b) | | | 53,004 |

| 1,700 | | Haemonetics Corp. (b) | | | 71,672 |

| 2,000 | | Hologic, Inc. (b) | | | 63,750 |

| 1,960 | | Kyphon Inc. (b) | | | 49,333 |

| 805 | | Medtronic, Inc. | | | 41,015 |

| 5,100 | | STERIS Corp. (b) | | | 128,775 |

| 2,800 | | Wilson Greatbatch Technologies, Inc. (b) | | | 51,072 |

| | | | |

|

|

| | | | | | 1,687,833 |

| | | | |

|

|

|

Healthcare Providers & Services — 2.3% |

| 2,200 | | Aetna Inc. | | | 164,890 |

| 6,200 | | AmerisourceBergen Corp. | | | 355,198 |

| 2,400 | | Cantel Medical Corp. (b) | | | 69,504 |

| 3,000 | | Cardinal Health, Inc. | | | 167,400 |

| 2,370 | | CIGNA Corp. | | | 211,641 |

| 4,100 | | Coventry Health Care, Inc. (b) | | | 279,374 |

| 1,035 | | Express Scripts, Inc. (b) | | | 90,242 |

| 2,300 | | First Horizon Pharmaceutical Corp. (b) | | | 38,824 |

| 300 | | HCA, Inc. | | | 16,071 |

| 14,700 | | Health Management Associates, Inc., Class A Shares | | | 384,846 |

| 10,400 | | Humana Inc. (b) | | | 332,176 |

| 9,400 | | Lincare Holdings Inc. (b) | | | 415,762 |

| 3,300 | | Manor Care, Inc. | | | 119,988 |

| 7,900 | | McKesson Corp. | | | 298,225 |

| 100 | | PacifiCare Health Systems, Inc. (b) | | | 5,692 |

| 10,050 | | Service Corp. International (b) | | | 75,174 |

| 1,605 | | Sierra Health Services, Inc. (b) | | | 102,463 |

| | | | |

|

|

| | | | | | 3,127,470 |

| | | | |

|

|

|

Pharmaceuticals — 1.1% |

| 7,200 | | Forest Laboratories, Inc. (b) | | | 266,040 |

| 3,900 | | Hospira, Inc. (b) | | | 125,853 |

| 8,100 | | Johnson & Johnson | | | 543,996 |

| 3,470 | | Medicis Pharmaceutical Corp., Class A Shares | | | 104,031 |

| 1,800 | | Merck & Co. Inc. | | | 58,266 |

| 2,200 | | Sepracor Inc. (b) | | | 126,302 |

| 3,600 | | Shire Pharmaceuticals Group PLC, Sponsored ADR | | | 123,408 |

| 2,900 | | Watson Pharmaceuticals, Inc. (b) | | | 89,117 |

| | | | |

|

|

| | | | | | 1,437,013 |

| | | | |

|

|

| | | TOTAL HEALTHCARE | | | 6,853,098 |

| | | | |

|

|

INDUSTRIALS — 6.5% |

|

Aerospace & Defense — 1.1% |

| 6,075 | | BE Aerospace, Inc. (b) | | | 72,900 |

| 1,825 | | The Boeing Co. | | | 106,689 |

| 3,925 | | Engineered Support Systems, Inc. | | | 210,066 |

| 350 | | General Dynamics Corp. | | | 37,467 |

| 5,775 | | L-3 Communications Holdings, Inc. | | | 410,140 |

| 4,100 | | Lockheed Martin Corp. | | | 250,346 |

See Notes to Financial Statements.

13

Schedule of Investments

(continued)

| | | | | |

| | |

| Shares | | Security | | Value |

|

Aerospace & Defense — 1.1% (continued) |

| 6,470 | | Orbital Sciences Corp. (b) | | $ | 62,630 |

| 1,600 | | Raytheon Co. | | | 61,920 |

| 2,700 | | United Defense Industries, Inc. | | | 198,234 |

| | | | |

|

|

| | | | | | 1,410,392 |

| | | | |

|

|

| |

Air Freight & Couriers — 0.1% | | | |

| 1,275 | | EGL, Inc. (b) | | | 29,070 |

| 2,200 | | Ryder System, Inc. | | | 91,740 |

| | | | |

|

|

| | | | | | 120,810 |

| | | | |

|

|

| |

Airlines — 0.2% | | | |

| 5,310 | | Alaska Air Group, Inc. (b) | | | 156,326 |

| 6,900 | | AMR Corp. (b) | | | 73,830 |

| 5,020 | | Continental Airlines, Inc., Class B Shares (b) | | | 60,441 |

| 1,600 | | ExpressJet Holdings, Inc. (b) | | | 18,256 |

| | | | |

|

|

| | | | | | 308,853 |

| | | | |

|

|

| |

Building Products — 0.2% | | | |

| 6,300 | | Masco Corp. | | | 218,421 |

| | | | |

|

|

| |

Commercial Services & Supplies — 1.8% | | | |

| 1,900 | | Adesa, Inc. | | | 44,384 |

| 3,400 | | Alliance Data Systems Corp. (b) | | | 137,360 |

| 4,570 | | The Brink's Co. | | | 158,122 |

| 3,000 | | Career Education Corp. (b) | | | 102,780 |

| 25,000 | | Cendant Corp. | | | 513,500 |

| 2,200 | | Deluxe Corp. | | | 87,692 |

| 850 | | First Data Corp. | | | 33,413 |

| 2,375 | | Headwaters Inc. (b) | | | 77,947 |

| 1,400 | | ITT Educational Services, Inc. (b) | | | 67,900 |

| 15,600 | | Korn/Ferry International (b) | | | 296,868 |

| 1,600 | | Monster Worldwide Inc. (b) | | | 44,880 |

| 3,100 | | Robert Half International Inc. | | | 83,576 |

| 24,930 | | Sabre Holdings Corp., Class A Shares | | | 545,468 |

| 5,500 | | Waste Management, Inc. | | | 158,675 |

| 2,900 | | West Corp. (b) | | | 92,800 |

| | | | |

|

|

| | | | | | 2,445,365 |

| | | | |

|

|

| |

Electrical Equipment — 0.6% | | | |

| 2,300 | | AMETEK, Inc. | | | 92,575 |

| 2,325 | | Cooper Industries, Ltd., Class A Shares | | | 166,284 |

| 4,200 | | Energizer Holdings, Inc. (b) | | | 251,160 |

| 2,800 | | Rockwell Automation, Inc. | | | 158,592 |

| 4,000 | | Thomas & Betts Corp. (b) | | | 129,200 |

| | | | |

|

|

| | | | | | 797,811 |

| | | | |

|

|

| |

Industrial Conglomerates — 0.2% | | | |

| 1,155 | | 3M Co. | | | 98,972 |

| 2,850 | | Honeywell International Inc. | | | 106,048 |

| 3,700 | | Tyco International Ltd. | | | 125,060 |

| | | | |

|

|

| | | | | | 330,080 |

| | | | |

|

|

| |

Machinery — 0.8% | | | |

| 3,650 | | AGCO Corp. (b) | | | 66,612 |

| 1,300 | | Cummins Inc. | | | 91,455 |

See Notes to Financial Statements.

14

Schedule of Investments

(continued)

| | | | | |

| | |

| Shares | | Security | | Value |

| |

Machinery — 0.8% (continued) | | | |

| 785 | | Deere & Co. | | $ | 52,697 |

| 1,765 | | Ingersoll-Rand Co. Ltd., Class A Shares | | | 140,582 |

| 1,525 | | Joy Global Inc. | | | 53,466 |

| 1,595 | | Kennametal Inc. | | | 75,747 |

| 1,550 | | The Manitowoc Co., Inc. | | | 62,604 |

| 5,460 | | PACCAR Inc. | | | 395,249 |

| 2,015 | | Terex Corp. (b) | | | 87,249 |

| 2,700 | | Wabash National Corp. (b) | | | 65,880 |

| | | | |

|

|

| | | | | | 1,091,541 |

| | | | |

|

|

| |

Marine — 0.4% | | | |

| 5,500 | | CP Ships Ltd. | | | 77,990 |

| 6,800 | | Overseas Shipholding Group, Inc. | | | 427,788 |

| | | | |

|

|

| | | | | | 505,778 |

| | | | |

|

|

| |

Road & Rail — 0.7% | | | |

| 2,500 | | Arkansas Best Corp. | | | 94,450 |

| 1,850 | | Burlington Northern Santa Fe Corp. | | | 99,770 |

| 4,995 | | Heartland Express, Inc. | | | 95,654 |

| 3,400 | | J.B. Hunt Transport Services, Inc. | | | 148,818 |

| 3,245 | | Norfolk Southern Corp. | | | 120,227 |

| 12,300 | | Swift Transportation Co., Inc. (b) | | | 272,322 |

| 1,500 | | Yellow Roadway Corp. (b) | | | 87,810 |

| | | | |

|

|

| | | | | | 919,051 |

| | | | |

|

|

| |

Trading Companies & Distributors — 0.4% | | | |

| 1,500 | | MSC Industrial Direct Co., Inc., Class A Shares | | | 45,840 |

| 7,310 | | W.W. Grainger, Inc. | | | 455,194 |

| | | | |

|

|

| | | | | | 501,034 |

| | | | |

|

|

| | | TOTAL INDUSTRIALS | | | 8,649,136 |

| | | | |

|

|

INFORMATION TECHNOLOGY — 6.3% | | | |

| |

Communications Equipment — 1.2% | | | |

| 4,900 | | ADTRAN, Inc. | | | 86,436 |

| 4,400 | | Cisco Systems, Inc. (b) | | | 78,716 |

| 17,900 | | CommScope, Inc. (b) | | | 267,784 |

| 18,100 | | Harris Corp. | | | 590,965 |

| 16,500 | | Lucent Technologies Inc. (b) | | | 45,375 |

| 5,700 | | McDATA Corp., Class A Shares (b) | | | 21,489 |

| 23,400 | | Motorola, Inc. | | | 350,298 |

| 2,000 | | Plantronics, Inc. | | | 76,160 |

| 2,300 | | Scientific-Atlanta, Inc. | | | 64,906 |

| | | | |

|

|

| | | | | | 1,582,129 |

| | | | |

|

|

| |

Computers & Peripherals — 0.8% | | | |

| 2,000 | | Apple Computer, Inc. (b) | | | 83,340 |

| 1,300 | | Avid Technology, Inc. (b) | | | 70,356 |

| 3,600 | | Dell Inc. (b) | | | 138,312 |

| 2,350 | | Lexmark International, Inc., Class A Shares (b) | | | 187,929 |

| 9,300 | | NCR Corp. (b) | | | 313,782 |

| 1,600 | | Network Appliance, Inc. (b) | | | 44,256 |

| 8,100 | | Quantum Corp. (b) | | | 23,571 |

| 14,500 | | Western Digital Corp. (b) | | | 184,875 |

| | | | |

|

|

| | | | | | 1,046,421 |

| | | | |

|

|

See Notes to Financial Statements.

15

Schedule of Investments

(continued)

| | | | | |

| | |

| Shares | | Security | | Value |

| |

Electronic Equipment & Instruments — 1.5% | | | |

| 5,445 | | Amphenol Corp., Class A Shares | | $ | 201,683 |

| 7,200 | | Arrow Electronics, Inc. (b) | | | 182,520 |

| 6,900 | | Avnet, Inc. (b) | | | 127,098 |

| 1,100 | | FLIR Systems, Inc. (b) | | | 33,330 |

| 29,000 | | Ingram Micro Inc., Class A Shares (b) | | | 483,430 |

| 4,500 | | Jabil Circuit, Inc. (b) | | | 128,340 |

| 2,475 | | Littelfuse, Inc. (b) | | | 70,909 |

| 1,600 | | Mettler-Toledo International Inc. (b) | | | 76,000 |

| 14,100 | | PerkinElmer, Inc. | | | 290,883 |

| 2,300 | | Tech Data Corp. (b) | | | 85,238 |

| 7,100 | | Tektronix, Inc. | | | 174,163 |

| 2,295 | | Thermo Electron Corp. (b) | | | 58,041 |

| 8,230 | | Vishay Intertechnology, Inc. (b) | | | 102,299 |

| | | | |

|

|

| | | | | | 2,013,934 |

| | | | |

|

|

|

Information Technology Consulting & Services — 0.5% |

| 16,500 | | Acxiom Corp. | | | 345,345 |

| 1,700 | | Cognizant Technology Solutions Corp., Class A Shares (b) | | | 78,540 |

| 2,200 | | Computer Sciences Corp. (b) | | | 100,870 |

| 4,800 | | Perot Systems Corp., Class A Shares (b) | | | 64,512 |

| 4,200 | | The Titan Corp. (b) | | | 76,272 |

| | | | |

|

|

| | | | | | 665,539 |

| | | | |

|

|

|

Internet Software & Services — 0.2% |

| 7,200 | | EarthLink, Inc. (b) | | | 64,800 |

| 1,300 | | InterActiveCorp (b) | | | 28,951 |

| 7,600 | | McAfee Inc. (b) | | | 171,456 |

| 200 | | VeriSign, Inc. (b) | | | 5,740 |

| | | | |

|

|

| | | | | | 270,947 |

| | | | |

|

|

|

Office Electronics — 0.1% |

| 9,310 | | Xerox Corp. (b) | | | 141,046 |

| | | | |

|

|

|

Semiconductor Equipment & Products — 1.0% |

| 9,700 | | Applied Materials, Inc. (b) | | | 157,625 |

| 11,000 | | Cree, Inc. (b) | | | 239,250 |

| 6,300 | | Intel Corp. | | | 146,349 |

| 9,600 | | Kulicke and Soffa Industries, Inc. (b) | | | 60,384 |

| 2,600 | | Lam Research Corp. (b) | | | 75,036 |

| 7,100 | | MEMC Electronic Materials, Inc. (b) | | | 95,495 |

| 9,300 | | Micron Technology, Inc. (b) | | | 96,162 |

| 11,500 | | National Semiconductor Corp. | | | 237,015 |

| 18,600 | | Taiwan Semiconductor Manufacturing Co. Ltd., Sponsored ADR | | | 157,728 |

| 8,700 | | Teradyne, Inc. (b) | | | 127,020 |

| | | | |

|

|

| | | | | | 1,392,064 |

| | | | |

|

|

|

Software — 1.0% |

| 32,800 | | Activision, Inc. (b) | | | 485,440 |

| 9,200 | | Autodesk, Inc. | | | 273,792 |

| 850 | | Cerner Corp. (b) | | | 44,633 |

| 1,345 | | Hyperion Solutions Corp. (b) | | | 59,328 |

| 5,480 | | Magma Design Automation, Inc. (b) | | | 65,048 |

| 4,600 | | Quest Software, Inc. (b) | | | 63,664 |

| 5,000 | | SERENA Software, Inc. (b) | | | 118,800 |

See Notes to Financial Statements.

16

Schedule of Investments

(continued)

| | | | | |

| | |

| Shares | | Security | | Value |

|

Software — 1.0% (continued) |

| 5,200 | | Symantec Corp. (b) | | $ | 110,916 |

| 6,500 | | Wind River Systems, Inc. (b) | | | 98,020 |

| | | | |

|

|

| | | | | | 1,319,641 |

| | | | |

|

|

| | | TOTAL INFORMATION TECHNOLOGY | | | 8,431,721 |

| | | | |

|

|

MATERIALS — 3.9% |

|

Chemicals — 1.2% |

| 1,200 | | Air Products and Chemicals, Inc. | | | 75,948 |

| 1,500 | | The Dow Chemical Co. | | | 74,775 |

| 3,675 | | Eastman Chemical Co. | | | 216,825 |

| 1,700 | | FMC Corp. (b) | | | 90,865 |

| 1,000 | | International Flavors & Fragrances Inc. | | | 39,500 |

| 1,900 | | Kronos Worldwide, Inc. | | | 80,769 |

| 900 | | Monsanto Co. | | | 58,050 |

| 900 | | Potash Corp. of Saskatchewan Inc. | | | 78,759 |

| 3,300 | | PPG Industries, Inc. | | | 236,016 |

| 1,875 | | Rohm and Haas Co. | | | 90,000 |

| 7,675 | | Sigma-Aldrich Corp. | | | 470,094 |

| 3,800 | | Valhi, Inc. | | | 74,670 |

| | | | |

|

|

| | | | | | 1,586,271 |

| | | | |

|

|

|

Construction Materials — 0.2% |

| 2,100 | | Cemex S.A. de C.V., Participation Certificate, Sponsored ADR | | | 76,125 |

| 1,285 | | Martin Marietta Materials, Inc. | | | 71,857 |

| 750 | | Texas Industries, Inc. | | | 40,312 |

| 1,465 | | Vulcan Materials Co. | | | 83,256 |

| | | | |

|

|

| | | | | | 271,550 |

| | | | |

|

|

| |

Containers & Packaging — 0.3% | | | |

| 6,050 | | Ball Corp. | | | 250,954 |

| 4,100 | | Bemis Co., Inc. | | | 127,592 |

| 3,450 | | Owens-Illinois, Inc. (b) | | | 86,733 |

| | | | |

|

|

| | | | | | 465,279 |

| | | | |

|

|

| |

Metals & Mining — 1.5% | | | |

| 9,900 | | AK Steel Holding Corp. (b) | | | 109,494 |

| 1,425 | | Carpenter Technology Corp. | | | 84,659 |

| 650 | | Cleveland-Cliffs Inc. | | | 47,365 |

| 2,100 | | Commercial Metals Co. | | | 71,169 |

| 3,725 | | Newmont Mining Corp. | | | 157,381 |

| 7,000 | | Nucor Corp. | | | 402,920 |

| 2,400 | | Peabody Energy Corp. | | | 111,264 |

| 2,375 | | Phelps Dodge Corp. | | | 241,609 |

| 2,150 | | Quanex Corp. | | | 114,638 |

| 2,200 | | Steel Dynamics, Inc. | | | 75,790 |

| 6,000 | | United States Steel Corp. | | | 305,100 |

| 15,500 | | Worthington Industries, Inc. | | | 298,840 |

| | | | |

|

|

| | | | | | 2,020,229 |

| | | | |

|

|

See Notes to Financial Statements.

17

Schedule of Investments

(continued)

| | | | | |

| | |

| Shares | | Security | | Value |

| |

Paper & Forest Products — 0.7% | | | |

| 2,700 | | Georgia-Pacific Corp. | | $ | 95,823 |

| 19,300 | | Louisiana-Pacific Corp. | | | 485,202 |

| 4,350 | | MeadWestvaco Corp. | | | 138,417 |

| 2,525 | | Weyerhaeuser Co. | | | 172,962 |

| | | | |

|

|

| | | | | | 892,404 |

| | | | |

|

|

| | | TOTAL MATERIALS | | | 5,235,733 |

| | | | |

|

|

TELECOMMUNICATION SERVICES — 1.1% | | | |

| |

Diversified Telecommunication Services — 0.6% | | | |

| 6,600 | | Alaska Communications Systems Group Inc. | | | 66,330 |

| 4,860 | | ALLTEL Corp. | | | 266,571 |

| 5,450 | | CenturyTel, Inc. | | | 178,978 |

| 7,300 | | Verizon Communications Inc. | | | 259,150 |

| | | | |

|

|

| | | | | | 771,029 |

| | | | |

|

|

| |

Wireless Telecommunication Services — 0.5% | | | |

| 18,200 | | Crown Castle International Corp. (b) | | | 292,292 |

| 1,500 | | Nextel Communications, Inc., Class A Shares (b) | | | 42,630 |

| 13,100 | | Nextel Partners, Inc., Class A Shares (b) | | | 287,676 |

| | | | |

|

|

| | | | | | 622,598 |

| | | | |

|

|

| | | TOTAL TELECOMMUNICATION SERVICES | | | 1,393,627 |

| | | | |

|

|

UTILITIES — 1.9% | | | |

| |

Electric Utilities — 0.8% | | | |

| 2,740 | | American Electric Power Co., Inc. | | | 93,324 |

| 11,800 | | CMS Energy Corp. (b) | | | 153,872 |

| 13,400 | | DPL Inc. | | | 335,000 |

| 3,805 | | FirstEnergy Corp. | | | 159,620 |

| 2,800 | | FPL Group, Inc. | | | 112,420 |

| 3,200 | | PG&E Corp. | | | 109,120 |

| 1,280 | | TXU Corp. | | | 101,926 |

| 2,405 | | Wisconsin Energy Corp. | | | 85,377 |

| | | | |

|

|

| | | | | | 1,150,659 |

| | | | |

|

|

| |

Gas Utilities — 0.8% | | | |

| 11,300 | | National Fuel Gas Co. | | | 323,067 |

| 9,900 | | ONEOK, Inc. | | | 305,118 |

| 3,300 | | Sempra Energy | | | 131,472 |

| 3,175 | | Southwestern Energy Co. (b) | | | 180,213 |

| 3,400 | | WGL Holdings Inc. | | | 105,264 |

| | | | |

|

|

| | | | | | 1,045,134 |

| | | | |

|

|

| |

Multi-Utilities — 0.3% | | | |

| 3,115 | | Duke Energy Corp. | | | 87,251 |

| 10,235 | | Dynegy Inc., Class A Shares (b) | | | 40,019 |

| 2,600 | | Questar Corp. | | | 154,050 |

| 5,050 | | The Williams Cos., Inc. | | | 94,991 |

| | | | |

|

|

| | | | | | 376,311 |

| | | | |

|

|

| | | TOTAL UTILITIES | | | 2,572,104 |

| | | | |

|

|

| | | TOTAL COMMON STOCK

(Cost — $63,773,294) | | | 68,356,414 |

| | | | |

|

|

See Notes to Financial Statements.

18

Schedule of Investments

(continued)

| | | | | |

| | |

| Shares | | Security | | Value |

PREFERRED STOCK (a) — 6.5% | | | |

CONSUMER DISCRETIONARY — 2.0% | | | |

| |

Automobiles — 2.0% | | | |

| 48,928 | | Ford Motor Co. Capital Trust II, 6.500% | | $ | 2,218,396 |

| 26,673 | | General Motors Corp., 5.250% Sr. Series B Cumulative Trust Preferred Securities | | | 498,252 |

| | | | |

|

|

| | | | | | 2,716,648 |

| | | | |

|

|

| |

Media — 0.0% | | | |

| 132 | | Sinclair Broadcast Group Inc., 6.000% Exchangeable 12/31/49 | | | 5,527 |

| | | | |

|

|

| | | TOTAL CONSUMER DISCRETIONARY | | | 2,722,175 |

| | | | |

|

|

CONSUMER STAPLES — 0.3% | | | |

| |

Food & Drug Retailing — 0.3% | | | |

| 17,317 | | Albertson's Inc., 7.250% HITSTM | | | 391,711 |

| | | | |

|

|

FINANCIALS — 1.3% | | | |

| |

Banks — 0.6% | | | |

| 1,666 | | Boston Private Capital Trust, 4.875% Exchangeable 10/1/34 (d) | | | 81,009 |

| 12,200 | | IndyMac Capital Trust I, 6.000% WIRESSM | | | 696,620 |

| | | | |

|

|

| | | | | | 777,629 |

| | | | |

|

|

| |

Diversified Financials — 0.1% | | | |

| 4,224 | | Lehman Brothers Holdings Inc., 6.250% Exchangeable 10/15/07 | | | 111,514 |

| | | | |

|

|

| |

Insurance — 0.6% | | | |

| 31,800 | | Conseco Inc., 5.500% Mandatorily Convertible Series B | | | 842,700 |

| | | | |

|

|

| | | TOTAL FINANCIALS | | | 1,731,843 |

| | | | |

|

|

HEALTHCARE — 0.3% | | | |

| |

Pharmaceuticals — 0.3% | | | |

| 9,459 | | Schering-Plough Corp., 6.000% Mandatory Convertible | | | 475,788 |

| | | | |

|

|

INDUSTRIALS — 1.7% | | | |

| |

Aerospace/Defense — 1.2% | | | |

| 12,400 | | Northrop Grumman Corp., 7.000% Exchangeable 4/4/21 | | | 1,612,000 |

| | | | |

|

|

| |

Electrical Components & Equipment — 0.3% | | | |

| 5,339 | | General Cable Corp., 5.750% Exchangeable 11/24/13 | | | 383,073 |

| | | | |

|

|

| |

Road & Retail — 0.2% | | | |

| 358 | | Kansas City Southern, 4.250% Redeemable Cumulative Perpetual Series C | | | 251,137 |

| | | | |

|

|

| | | TOTAL INDUSTRIALS | | | 2,246,210 |

| | | | |

|

|

MATERIALS — 0.7% | | | |

| |

Chemicals — 0.4% | | | |

| 11,390 | | Celanese Corp., 4.250% Exchangeable 12/31/49 | | | 316,073 |

| 256 | | Terra Industries Inc., 4.250% Exchangeable 12/31/49 (d) | | | 245,888 |

| | | | |

|

|

| | | | | | 561,961 |

| | | | |

|

|

| |

Metals & Mining — 0.3% | | | |

| 337 | | Freeport-McMoRan Copper & Gold Inc., 5.500% Perpetual (d) | | | 334,051 |

| | | | |

|

|

| | | TOTAL MATERIALS | | | 896,012 |

| | | | |

|

|

See Notes to Financial Statements.

19

Schedule of Investments

(continued)

| | | | | |

| | |

| Shares | | Security | | Value |

TELECOMMUNICATION SERVICES — 0.2% | | | |

| |

Diversified Telecommunication Services — 0.2% | | | |

| 5,244 | | Alltel Corp., 7.750% Equity units 5/17/05 | | $ | 264,770 |

| | | | |

|

|

| | | TOTAL PREFERRED STOCK

(Cost — $8,842,767) | | | 8,728,509 |

| | | | |

|

|

| | |

Face

Amount

| | | | |

CORPORATE CONVERTIBLE BONDS & NOTES (a) — 40.5% | | | |

| |

Advertising — 1.1% | | | |

| $ 138,000 | | Getty Images Inc., Sub. Debentures, 0.500% due 6/9/23 | | | 214,935 |

| 1,200,000 | | Lamar Advertising Co., Sr. Notes, 2.875% due 12/31/10 | | | 1,222,500 |

| | | | |

|

|

| | | | | | 1,437,435 |

| | | | |

|

|

| |

Aerospace/Defense — 1.6% | | | |

| 1,600,000 | | Alliant Techsystems Inc., Sr. Sub. Notes, 2.750% due 2/15/24 | | | 1,776,000 |

| 92,000 | | Armor Holdings Inc., Sr. Sub. Notes, step bond to yield 2.459% due 11/1/24 (e) | | | 88,320 |

| 217,000 | | GenCorp Inc., Sub. Notes, 4.000% due 1/16/24 | | | 301,088 |

| | | | |

|

|

| | | | | | 2,165,408 |

| | | | |

|

|

| |

Airlines — 1.0% | | | |

| 144,000 | | Airtran Holdings Inc., Sr. Notes, 7.000% due 7/1/23 | | | 154,620 |

| 118,000 | | Alaska Air Group Inc., Sr. Notes, 5.550% due 3/21/23 (e) | | | 150,529 |

| 835,000 | | ExpressJet Holdings Inc., 4.250% due 8/1/23 | | | 770,288 |

| 212,000 | | Mesa Air Group Inc., Sr. Notes, step bond to yield 7.117% due 6/16/23 (e) | | | 81,090 |

| 129,000 | | Pinnacle Airlines Corp., Sr. Notes, 3.250% due 2/15/25 (d) | | | 127,388 |

| | | | |

|

|

| | | | | | 1,283,915 |

| | | | |

|

|

| |

Biotechnology — 2.1% | | | |

| 22,000 | | Alexion Pharmaceuticals Inc., Sr. Notes, 1.375% due 2/1/12 (d) | | | 20,432 |

| 129,000 | | Cell Genesys Inc., Sr. Notes, 3.125% due 11/1/11 (d) | | | 109,489 |

| 308,000 | | Chiron Corp., Sr. Notes, 2.750% due 6/30/34 | | | 296,065 |

| | | CuraGen Corp., Sub. Notes: | | | |

| 57,000 | | 4.000% due 2/15/11 | | | 43,391 |

| 250,000 | | 4.000% due 2/15/11 (d) | | | 190,312 |

| | | deCODE genetics Inc., Sr. Notes: | | | |

| 17,000 | | 3.500% due 4/15/11 | | | 14,174 |

| 90,000 | | 3.500% due 4/15/11 (d) | | | 75,038 |

| 134,000 | | Human Genome Sciences Inc., Sub. Notes, 2.250% due 10/15/11 (d) | | | 114,403 |

| 1,269,000 | | Invitrogen Corp., Sr. Notes, 1.500% due 2/15/24 | | | 1,142,100 |

| 794,000 | | Protein Design Labs Inc., Sub. Notes, 2.750% due 8/16/23 | | | 815,835 |

| | | | |

|

|

| | | | | | 2,821,239 |

| | | | |

|

|

| |

Building Materials — 0.1% | | | |

| 150,000 | | NCI Building Systems Inc., Sr. Sub. Notes, 2.125% due 11/15/24 (d) | | | 170,438 |

| | | | |

|

|

| |

Commercial Services — 0.8% | | | |

| 258,000 | | BearingPoint Inc., Sub. Notes, 2.750% due 12/15/24 (d) | | | 278,962 |

| 506,000 | | Quanta Services Inc., Sub. Debentures, 4.500% due 10/1/23 | | | 522,445 |

| 285,000 | | SFBC International Inc., Sr. Notes, 2.250% due 8/15/24 (d) | | | 325,969 |

| | | | |

|

|

| | | | | | 1,127,376 |

| | | | |

|

|

See Notes to Financial Statements.

20

Schedule of Investments

(continued)

| | | | | |

Face

Amount | | Security | | Value |

| |

Computers — 1.6% | | | |

| $ 322,000 | | Ciber Inc., Sr. Sub. Debentures, 2.875% due 12/15/23 | | $ | 291,007 |

| 450,000 | | Gateway Inc., Sr. Notes, 1.500% due 12/31/09 (d) | | | 363,937 |

| 210,000 | | Hutchinson Technology Inc., Sub. Notes, 2.250% due 3/15/10 | | | 270,113 |

| 315,000 | | Quantum Corp., Sub. Notes, 4.375% due 8/1/10 | | | 311,850 |

| 900,000 | | Radisys Corp., Sub. Notes, 1.375% due 11/15/23 (d) | | | 837,000 |

| | | | |

|

|

| | | | | | 2,073,907 |

| | | | |

|

|

| |

Distribution/Wholesale — 0.9% | | | |

| 1,193,000 | | Bell Microproducts Inc., Sub. Notes, 3.750% due 3/5/24 | | | 1,142,297 |

| | | | |

|

|

| |

Diversified Financials — 1.2% | | | |

| 194,000 | | AmeriCredit Corp., Bonds, 1.750% due 11/15/23 (d) | | | 265,052 |

| 389,000 | | CapitalSource Inc., Sr. Notes, 3.500% due 7/15/34 (d) | | | 384,137 |

| 810,000 | | Dress Barn, Sr. Notes, 2.500% due 12/15/24 (d) | | | 879,863 |

| 38,000 | | Providian Financial Corp., Sr. Notes, step bond to yield 1.823% due 3/15/16 (e) | | | 45,363 |

| | | | |

|

|

| | | | | | 1,574,415 |

| | | | |

|

|

| |

Electrical Components & Equipment — 0.2% | | | |

| 119,000 | | GrafTech International Ltd., Sr. Notes, 1.625% due 1/15/24 | | | 87,911 |

| 164,000 | | Wilson Greatbatch Technologies Inc., Sub. Debentures, 2.250% due 6/15/13 | | | 135,915 |

| | | | |

|

|

| | | | | | 223,826 |

| | | | |

|

|

|

Electronics — 1.1% |

| 1,150,000 | | Flextronics International Ltd., Sub. Notes, 1.000% due 8/1/10 | | | 1,151,437 |

| | | Vishay Intertechnology Inc., Sub. Notes: | | | |

| 259,000 | | 3.625% due 8/1/23 | | | 253,820 |

| 125,000 | | 3.625% due 8/1/23 (d) | | | 122,500 |

| | | | |

|

|

| | | | | | 1,527,757 |

| | | | |

|

|

|

Entertainment — 0.6% |

| 177,000 | | Six Flags Inc., Notes, 4.500% due 5/15/15 | | | 164,831 |

| 600,000 | | Sunterra Corp., Sr. Sub. Notes, 3.750% due 3/29/24 | | | 680,250 |

| | | | |

|

|

| | | | | | 845,081 |

| | | | |

|

|

|

Environmental Control — 0.3% |

| 546,000 | | Allied Waste North America, Sr. Sub. Debentures, 4.250% due 4/15/34 | | | 462,052 |

| | | | |

|

|

|

Healthcare-Products — 4.2% |

| 403,000 | | Advanced Medical Optics, Inc., 2.500% due 7/15/24 (d) | | | 401,992 |

| 215,000 | | Conmed Corp., Sr. Sub. Notes, 2.500% due 11/15/24 (d) | | | 232,200 |

| 965,000 | | Cytyc Corp., Sr. Notes, 2.250% due 3/15/24 | | | 1,021,694 |

| 650,000 | | Edwards Lifesciences Corp., Debentures, 3.875% due 5/15/33 | | | 670,313 |

| 1,650,000 | | Henry Schein Inc., Bonds, 3.000% due 8/15/34 (d) | | | 1,724,250 |

| 800,000 | | PSS World Medical Inc., Sr. Notes, 2.250% due 3/15/24 | | | 760,000 |

| 1,400,000 | | Thoratec Corp., Sr. Sub. Notes, step bond to yield 4.232% due 5/16/34 (d)(e) | | | 743,750 |

| | | | |

|

|

| | | | | | 5,554,199 |

| | | | |

|

|

|

Healthcare-Services — 1.6% |

| 276,000 | | Apria Healthcare Group Inc., Sr. Notes, 3.375% due 9/1/33 | | | 305,670 |

| 260,000 | | Beverly Enterprises Inc., Bonds, 2.750% due 11/1/33 | | | 444,925 |

| | | LabOne Inc., Sr. Notes: | | | |

| 300,000 | | 3.500% due 6/15/34 | | | 342,375 |

| 800,000 | | 3.500% due 6/15/34 (d) | | | 913,000 |

| 110,000 | | Option Care Inc., Sr. Notes, 2.250% due 11/1/24 (d) | | | 146,713 |

| | | | |

|

|

| | | | | | 2,152,683 |

| | | | |

|

|

See Notes to Financial Statements.

21

Schedule of Investments

(continued)

| | | | | |

Face

Amount | | Security | | Value |

|

Home Builders — 0.3% |

| | | WCI Communities, Inc., Sr. Sub. Notes: | | | |

| $ 150,000 | | 4.000% due 8/5/23 | | $ | 185,625 |

| 155,000 | | 4.000% due 8/5/23 (d) | | | 191,813 |

| | | | |

|

|

| | | | | | 377,438 |

| | | | |

|

|

|

Insurance — 0.7% |

| 783,000 | | American Equity Investment Life Holding Co., Sr. Notes, 5.250% due 12/6/24 (d) | | | 927,855 |

| 54 | | Fortis Insurance, 7.750% due 1/26/08 (d) | | | 57,654 |

| | | | |

|

|

| | | | | | 985,509 |

| | | | |

|

|

|

Internet — 1.4% |

| 304,000 | | CNET Networks Inc., Debentures, 0.750% due 4/15/24 | | | 283,480 |

| 750,000 | | Equinix Inc., Sub. Notes, 2.500% due 2/15/24 (d) | | | 906,563 |

| 750,000 | | Openwave Systems Inc., Sub. Notes, 2.750% due 9/9/08 | | | 744,375 |

| | | | |

|

|

| | | | | | 1,934,418 |

| | | | |

|

|

|

Leisure Time — 0.6% |

| 720,000 | | Navigant International Inc., Sub. Notes, 4.875% due 11/1/23 (d) | | | 774,900 |

| | | | |

|

|

|

Lodging — 1.0% |

| 1,190,000 | | Hilton Hotels Corp., Sr. Notes, 3.375% due 4/15/23 | | | 1,383,375 |

| | | | |

|

|

|

Machinery-Diversified — 0.6% |

| 850,000 | | AGCO Corp., Sr. Sub. Notes, 1.750% due 12/31/33 | | | 842,562 |

| | | | |

|

|

|

Media — 0.4% |

| 479,000 | | Citadel Broadcasting Corp., Sub. Notes, 1.875% due 2/15/11 | | | 404,156 |

| 117,000 | | Playboy Enterprises Inc., Sr. Sub. Notes, 3.000% due 3/15/25 (d) | | | 117,585 |

| | | | |

|

|

| | | | | | 521,741 |

| | | | |

|

|

|

Miscellaneous Manufacturers — 1.6% |

| 250,000 | | Eastman Kodak Co., Sr. Notes, 3.375% due 10/15/33 | | | 305,000 |

| 725,000 | | Griffon Corp., Sub. Notes, 4.000% due 7/18/23 | | | 860,031 |

| 2,025,000 | | Roper Industries Inc., Bonds, step bond to yield 4.842% due 1/15/34 (e) | | | 977,063 |

| | | | |

|

|

| | | | | | 2,142,094 |

| | | | |

|

|

| |

Oil & Gas — 1.6% | | | |

| 800,000 | | Grey Wolf Inc., 3.750% due 5/7/23 | | | 948,000 |

| 1,085,000 | | Hanover Compressor Co., Sr. Notes, 4.750% due 1/15/14 | | | 1,207,063 |

| | | | |

|

|

| | | | | | 2,155,063 |

| | | | |

|

|

| |

Pharmaceuticals — 3.0% | | | |

| 141,000 | | Amylin Pharmaceuticals Inc., Sr. Notes, 2.500% due 4/15/11 | | | 125,314 |

| 400,000 | | Connetics Corp., Sr. Notes, 2.000% due 3/30/15 (d) | | | 392,500 |

| 73,000 | | CV Therapeutics Inc., Sr. Sub. Notes, 2.750% due 5/16/12 | | | 99,462 |

| | | First Horizon Pharmaceutical Corp., Sr. Sub. Notes: | | | |

| 133,000 | | 1.750% due 3/8/24 | | | 129,841 |

| 140,000 | | 1.750% due 3/8/24 (d) | | | 136,675 |

| | | ImClone Systems Inc., Sr. Notes: | | | |

| 54,000 | | 1.375% due 5/15/24 | | | 46,035 |

| 330,000 | | 1.375% due 5/15/24 (d) | | | 281,325 |

| | | IVAX Corp., Sr. Notes: | | | |

| 115,000 | | 1.500% due 3/1/24 | | | 118,019 |

| 614,000 | | 1.500% due 3/1/24 (d) | | | 630,118 |

| 174,000 | | NPS Pharmaceuticals Inc., Sr. Notes, 3.000% due 6/15/08 | | | 150,510 |

See Notes to Financial Statements.

22

Schedule of Investments

(continued)

| | | | | |

Face

Amount | | Security | | Value |

| |

Pharmaceuticals — 3.0% (continued) | | | |

| $ 765,000 | | Par Pharmaceutical Cos. Inc., Sr. Sub. Notes, 2.875% due 9/30/10 | | $ | 663,638 |

| 300,000 | | QLT Inc., Notes, 3.000% due 9/15/23 | | | 303,750 |

| | | Valeant Pharmaceuticals International, Sub. Notes: | | | |

| 195,000 | | 4.000% due 11/15/13 | | | 188,419 |

| 435,000 | | 4.000% due 11/15/13 (d) | | | 420,319 |

| 277,000 | | Watson Pharmaceuticals Inc., Debentures, 1.750% due 3/15/23 | | | 264,535 |

| | | | |

|

|

| | | | | | 3,950,460 |

| | | | |

|

|

| |

Pipelines — 0.8% | | | |

| 867,000 | | Dynegy Inc., Sub. Notes, 4.750% due 8/15/23 (d) | | | 1,063,159 |

| | | | |

|

|

| |

Retail — 2.8% | | | |

| 66,000 | | Casual Male Retail Group Inc., Sr. Sub. Notes, 5.000% due 1/1/24 | | | 60,802 |

| 200,000 | | Charming Shoppes, Bonds, 4.750% due 6/1/12 | | | 211,000 |

| 28,000 | | CKE Restaurants, Inc., Sub. Notes, 4.000% due 10/1/23 (d) | | | 53,165 |

| | | Dick’s Sporting Goods Inc., Sr. Notes: | | | |

| 1,758,000 | | Step bond to yield 2.767% due 2/18/24 (d)(e) | | | 1,292,130 |

| 39,000 | | Step bond to yield 3.182% due 2/18/24 (e) | | | 28,665 |

| | | Genesco Inc., Sub. Notes: | | | |

| 149,000 | | 4.125% due 6/15/23 | | | 213,443 |

| 13,000 | | 4.125% due 6/15/23 (d) | | | 18,623 |

| | | Lithia Motors Inc., Sr. Sub. Notes: | | | |

| 350,000 | | 2.875% due 5/1/14 | | | 342,563 |

| 200,000 | | 2.875% due 5/1/14 (d) | | | 195,750 |

| 1,200,000 | | Men’s Wearhouse Inc., Sr. Notes, 3.125% due 10/15/23 | | | 1,389,000 |

| | | | |

|

|

| | | | | | 3,805,141 |

| | | | |

|

|

| |

Semiconductors — 0.6% | | | |

| 79,000 | | Advanced Micro Devices Inc., Debentures, 4.750% due 2/1/22 (e) | | | 78,506 |

| 198,000 | | Credence Systems Corp., Sub. Notes, 1.500% due 5/15/08 | | | 190,822 |

| 103,000 | | Kulicke & Soffa Industries Inc., Sub. Notes, 0.500% due 11/30/08 | | | 77,636 |

| | | ON Semiconductor Corp., Sr. Sub. Notes: | | | |

| 110,000 | | Zero coupon bond to yield 1.753% due 4/15/24 (e) | | | 82,225 |

| 110,000 | | Zero coupon bond to yield 1.965% due 4/15/24 (d)(e) | | | 82,225 |

| 238,000 | | Vitesse Semiconductor Corp., Sub. Notes, 1.500% due 10/1/24 (d) | | | 239,190 |

| | | | |

|

|

| | | | | | 750,604 |

| | | | |

|

|

| |

Software — 2.7% | | | |

| | | Allscripts Healthcare Solutions Inc., Sr. Notes: | | | |

| 650,000 | | 3.500% due 7/15/24 | | | 941,687 |

| 425,000 | | 3.500% due 7/15/24 (d) | | | 615,719 |

| 850,000 | | CSG Systems International, Notes, 2.500% due 6/15/24 (d) | | | 769,250 |

| 152,000 | | Open Solutions Inc., Sr. Sub. Notes, step bond to yield 3.326% due 2/2/35 (d)(e) | | | 78,090 |

| 600,000 | | Per-Se Technologies Inc., Notes, 3.250% due 6/30/24 (d) | | | 656,250 |

| | | Red Hat Inc., Sub. Debentures: | | | |

| 93,000 | | 0.500% due 1/15/24 | | | 76,260 |

| 173,000 | | 0.500% due 1/15/24 (d) | | | 141,860 |

| 283,000 | | Serena Software Inc., Sub. Notes, 1.500% due 12/15/23 | | | 336,416 |

| 53,000 | | Sybase Inc., Sub. Notes, 1.750% due 2/22/25 (d) | | | 51,609 |

| | | | |

|

|

| | | | | | 3,667,141 |

| | | | |

|

|

See Notes to Financial Statements.

23

Schedule of Investments

(continued)

| | | | | | |

Face

Amount | | Security | | Value | |

| |

Telecommunications — 3.3% | | | | |

| $ 186,000 | | Adaptec Inc., Sr. Sub. Notes, 0.750% due 12/22/23 | | $ | 152,287 | |

| 223,000 | | ADC Telecommunications Inc., Sub. Notes, 3.065% due 6/15/13 (e) | | | 205,439 | |

| 285,000 | | Andrew Corp., Sub. Notes, 3.250% due 8/15/13 | | | 313,500 | |

| 750,000 | | CenturyTel Inc., Debentures, 4.750% due 8/1/32 | | | 800,625 | |

| 900,000 | | Commonwealth Telephone Enterprises Inc., Bonds, 3.250% due 7/15/23 (d) | | | 906,750 | |

| | | CommScope Inc., Sr. Sub. Bonds: | | | | |

| 15,000 | | 1.000% due 3/15/24 | | | 14,006 | |

| 287,000 | | 1.000% due 3/15/24 (d) | | | 267,986 | |

| 167,000 | | Comtech Telecommunications Corp., Sr. Notes, step bond to yield 2.225% due 2/1/24 (e) | | | 211,464 | |

| 1,050,000 | | NII Holdings Inc., Sr. Notes, 2.875% due 2/1/34 | | | 1,326,938 | |

| 248,000 | | Powerwave Technologies Inc., Sub. Notes, 1.875% due 11/15/24 (d) | | | 234,670 | |

| | | | |

|

|

|

| | | | | | 4,433,665 | |

| | | | |

|

|

|

| |

Toys/Games/Hobbies — 0.3% | | | | |

| 271,000 | | Jakks Pacific Inc., Sr. Notes, 4.625% due 6/15/23 | | | 355,349 | |

| | | | |

|

|

|

| |

Transportation — 0.4% | | | | |

| | | CP Ships Ltd., Sr. Sub. Notes: | | | | |

| 68,000 | | 4.000% due 6/30/24 | | | 64,685 | |

| 239,000 | | 4.000% due 6/30/24 (d) | | | 227,349 | |

| 220,000 | | OMI Corp., Sr. Notes, 2.875% due 12/1/24 (d) | | | 210,375 | |

| | | | |

|

|

|

| | | | | | 502,409 | |

| | | | |

|

|

|

| | | TOTAL CORPORATE CONVERTIBLE BONDS & NOTES

(Cost — $54,491,077) | | | 54,207,056 | |

| | | | |

|

|

|

| | | SUB-TOTAL INVESTMENTS

(Cost — $127,107,138) | | | 131,291,979 | |

| | | | |

|

|

|

REPURCHASE AGREEMENTS — 7.6% | | | | |

| 1,377,000 | | Interest in $617,607,000 joint tri-party repurchase agreement dated 3/31/05 with Goldman, Sachs & Co.,

2.850% due 4/1/05; Proceeds at maturity — $1,377,109; (Fully collateralized by various U.S. Government Agency Obligations, 0.000% to 8.750% due 4/28/05 to 5/15/20; Market value — $1,404,540) | | | 1,377,000 | |

| 8,728,000 | | State Street Bank and Trust Co. dated 3/31/05, 2.3800% due 4/1/05; Proceeds at maturity — $8,728,577;

(Fully collateralized by U.S. Treasury Bills and Notes, 0.000% to 2.250% due 8/18/05 to 4/30/06;

Market value — $8,912,860) | | | 8,728,000 | |

| | | | |

|

|

|

| | | TOTAL REPURCHASE AGREEMENTS

(Cost — $10,105,000) | | | 10,105,000 | |

| | | | |

|

|

|

| | | TOTAL INVESTMENTS — 105.7% (Cost — $137,212,138*) | | | 141,396,979 | |

| | | Liabilities in Excess of Other Assets — (5.7)% | | | (7,568,796 | ) |

| | | | |

|

|

|

| | | TOTAL NET ASSETS — 100.0% | | $ | 133,828,183 | |

| | | | |

|

|

|

| (a) | | Securities have been segregated for short sale transactions. |

| (b) | | Non-income producing security. |

| (c) | | Security issued by Calamos Asset Management, Inc., which is an affiliate of one of the Fund’s sub-advisers. |

| (d) | | Security is exempt from registration under Rule 144A of the Securities Act of 1933. This security may be resold in transactions that are exempt from registration, normally to qualified institutional buyers. This security has been deemed liquid pursuant to guidelines approved by the Board of Trustees. |

| (e) | | Rate shown reflects rate in effect at March 31, 2005 on instrument with variable rate or step coupon rates. |

| * | | Aggregate cost for federal income tax purposes is $138,174,373. |

Abbreviations used in this schedule:

| | | | |

| ADR | | — | | American Depositary Receipt |

| HITSTM | | — | | Hybrid Income Term Security Units — Trademark of Banc of America Securities LLC |

| WIRES | | — | | Warrants and Income Redeemable Equity Securities — Servicemark of Morgan Stanley |

See Notes to Financial Statements.

24

Schedule of Securities Sold Short

March 31, 2005

| | | | | |

| | |

| Shares | | Security | | Value |

COMMON STOCK |

| 17,465 | | 99 Cents Only Stores* | | $ | 230,014 |

| 1,745 | | A.O. Smith Corp. | | | 50,378 |

| 1,500 | | Accredo Health, Inc.* | | | 66,615 |

| 5,200 | | Action Performance Cos., Inc. | | | 68,796 |

| 2,750 | | Acuity Brands, Inc. | | | 74,250 |

| 7,779 | | Adaptec, Inc.* | | | 37,261 |

| 35,774 | | ADC Telecommunications, Inc.* | | | 71,190 |

| 3,471 | | Advanced Medical Optics, Inc.* | | | 125,685 |

| 9,238 | | Advanced Micro Devices, Inc.* | | | 148,917 |

| 2,300 | | AFLAC Inc. | | | 85,698 |

| 24,700 | | AGCO Corp.* | | | 450,775 |

| 23,200 | | Agere Systems Inc., Class A Shares* | | | 33,176 |

| 2,600 | | Agilent Technologies, Inc.* | | | 57,720 |

| 3,200 | | Airgas, Inc. | | | 76,448 |

| 19,908 | | AirTran Holdings, Inc.* | | | 180,167 |

| 3,517 | | Alaska Air Group, Inc.* | | | 103,540 |

| 20,500 | | Albertson's, Inc. | | | 423,325 |

| 9,125 | | Alcoa Inc. | | | 277,309 |

| 6,350 | | Alexander & Baldwin, Inc. | | | 261,620 |

| 537 | | Alexion Pharmaceuticals, Inc.* | | | 11,634 |

| 1,400 | | Allergan, Inc. | | | 97,258 |

| 1,300 | | ALLETE, Inc. | | | 54,405 |

| 3,100 | | Alliance Gaming Corp.* | | | 29,729 |

| 10,050 | | Alliant Techsystems Inc.* | | | 718,072 |

| 12,025 | | Allied Waste Industries, Inc.* | | | 87,903 |

| 1,800 | | Allmerica Financial Corp.* | | | 64,710 |

| 67,000 | | Allscripts Healthcare Solutions, Inc.* | | | 958,100 |

| 3,105 | | ALLTEL Corp. | | | 170,309 |

| 2,000 | | Amazon.com, Inc.* | | | 68,540 |

| 6,325 | | Ameren Corp. | | | 309,988 |

| 1,200 | | America Movil S.A. de C.V., Series L Shares, ADR | | | 61,920 |

| 3,470 | | American Capital Strategies, Ltd. | | | 108,993 |

| 29,813 | | American Equity Investment Life Holding Co. | | | 381,308 |

| 2,490 | | American International Group, Inc. | | | 137,971 |

| 5,100 | | American Power Conversion Corp. | | | 133,161 |

| 410 | | AMETEK, Inc. | | | 16,503 |

| 2,525 | | AmSouth Bancorp. | | | 65,524 |

| 6,392 | | Amylin Pharmaceuticals, Inc.* | | | 111,796 |

| 2,600 | | Analog Devices, Inc. | | | 93,964 |

| 29,610 | | Andrew Corp.* | | | 346,733 |

| 7,450 | | Anheuser-Busch Cos., Inc. | | | 353,056 |

| 14,100 | | AnnTaylor Stores Corp.* | | | 360,819 |

| 1,850 | | Apache Corp. | | | 113,276 |

| 1,092 | | Apollo Group, Inc., Class A Shares* | | | 80,874 |

| 6,580 | | Applebee's International, Inc. | | | 181,345 |

| 5,537 | | Apria Healthcare Group Inc.* | | | 177,738 |

| 3,700 | | Aqua America Inc. | | | 90,132 |

| 3,830 | | Arch Coal, Inc. | | | 164,728 |

| 2,200 | | Arden Realty, Inc. | | | 74,470 |

| 1,192 | | Armor Holdings, Inc.* | | | 44,211 |

| 1,200 | | Arthur J. Gallagher & Co. | | | 34,560 |

| 4,225 | | ArvinMeritor, Inc. | | | 65,361 |

| 1,138 | | Assurant, Inc. | | | 38,351 |

| 1,300 | | Avery Dennison Corp. | | | 80,509 |

See Notes to Financial Statements.

25

Schedule of Securities Sold Short

(continued)

| | | | | |