UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED

MANAGEMENT INVESTMENT COMPANIES

Investment Company Act file number: 811-06318

CONSULTING GROUP CAPITAL MARKETS FUNDS

(Exact name of registrant as specified in charter)

222 Delaware Avenue

Wilmington, Delaware 19801

(Address of principal executive offices) (Zip code)

CT Corporation System

155 Federal Street

Suite 700

Boston MA, 02110

(Name and address of agent for service)

Registrant’s telephone number, including area code: (800) 444-4273

Date of fiscal year end:

8/31

Date of reporting period:

8/31/2007

Form N-CSR is to be used by management investment companies to file reports with the Commission not later than 10 days after the transmission to stockholders of any report that is required to be transmitted to stockholders under Rule 30e-1 under the Investment Company Act of 1940 (17 CFR 270.30e-1). The Commission may use the information provided on Form N-CSR in its regulatory, disclosure review, inspection, and policymaking rules.

A registrant is required to disclose the information specified by Form N-CSR, and the Commission will make this information public. A registrant is not required to respond to the collection of information contained in Form N-CSR unless the Form displays a currently valid Office of Management and Budget (“OMB”) control number. Please direct all comments concerning the accuracy of the information collection burden estimate and any suggestions for reducing the burden to Secretary, Securities and Exchange Commission, 100 F. Street, NE, Washington, DC 20549. The OMB has reviewed this collection of information under clearance requirements of 44 U.S.C. ss. 3507.

| ITEM 1. | REPORTS TO STOCKHOLDERS |

Consulting Group Capital Markets Funds

TRAK®

Annual Report

» August 31, 2007

| Ÿ | | Large Capitalization Growth Investments |

| Ÿ | | Large Capitalization Value Equity Investments |

| Ÿ | | Small Capitalization Growth Investments |

| Ÿ | | Small Capitalization Value Equity Investments |

| Ÿ | | International Equity Investments |

| Ÿ | | Emerging Markets Equity Investments |

| Ÿ | | Core Fixed Income Investments |

| Ÿ | | International Fixed Income Investments |

| Ÿ | | Municipal Bond Investments |

| Ÿ | | Money Market Investments |

INVESTMENT PRODUCTS: NOT FDIC INSURED • NO BANK GUARANTEE • MAY LOSE VALUE

Table of Contents

Consulting Group

Capital Markets Funds

DEAR SHAREHOLDER,

The fiscal year for the Consulting Group Capital Markets Funds (“Fund”) ended August 31, 2007, with all portfolios posting positive returns for the year then ended. The equity portfolios generally posted higher returns than the fixed income portfolios, as stocks continued to perform well globally. Emerging Markets Equity Investments continued to lead among the equity portfolios. Global economic strength in a period of stable interest rates benefited financial assets.

The relatively stable financial markets of the past several years had their first major and potentially serious disruption in July and August, as the slowdown in the US housing sector impacted global financial markets. Rising defaults in the sub-prime portion of the mortgage market resulted in billions of dollars of losses in portfolios of esoteric mortgage repackagings. Central banks were forced to enact emergency measures in order to calm the markets and provide liquidity to the system.

The US Federal Reserve Board cut its key-lending rate in response to the aforementioned market turmoil, and, as we write this letter following the Funds’ fiscal year end, markets are calmer, but are paying greater attention to risk management and they are unsure as to the potential fallout.

The broad economic and financial environment during the past fiscal year reflected continued economic growth, steady interest rates, continued rising energy and commodity prices, downward pressure on the US dollar, and ample liquidity to continue to drive up the prices for many of the equity strategies. Relative economic strength shifted to many overseas economies as the housing market in the US slowed sharply. The effect was that both the international developed equity markets and emerging equity markets outperformed the US market. The large cap company US market, as represented by the S&P 500® Index (S&P 500), rose 15.13%. The Morgan Stanley Capital International (“MSCI”) EAFE® Index, net of dividends, rose 18.71%. The MSCI Emerging Markets index rose 44.05%.

Within the US equity market, a shift in leadership occurred. Small cap value stocks posted the highest performance for much of the prior decade. Financial companies and real estate investment trusts (“REITs”) comprise a major component of the Russell 2000® Value Index, the relevant benchmark for the small cap value style. The recent poor returns in the financial and REIT companies led the small cap value index down and were the major reason smaller companies underperformed larger companies in this reporting period. Large cap stocks, as represented by the S&P 500, rose 15.13% over the past fiscal year, and small cap stocks as represented by the Russell 2000 (Ru2000) rose 11.37%.

Over much of the last decade value strategies also outperformed growth strategies in the US equity market. Value strategies in both the large cap and small cap investment styles particularly benefited from cyclical companies, helped by strong economic growth and high commodity prices, especially the rise in energy prices over the past several years. In contrast, over the past fiscal year, growth strategies outperformed value strategies in various company size categories. Growth indices benefited from sharp downturns in financial and real estate related companies that hurt the respective value indices. The growth indices also started to show better performance as many technology companies benefited from strong overseas profits.

Consulting Group Capital Markets Funds

Core Fixed Income Investments returned 4.82% for the fiscal year ended August 31, 2007, as compared to its benchmark, the Lehman Bothers (“LB”) U.S. Aggregate Bond™ Index, which returned 5.25% during that period. The

I

portfolio’s subadvisers are BlackRock Financial Management, Inc., Pacific Investment Management Company LLC (“PIMCO”), Western Asset Management Company (“WAMCo”), and Metropolitan West Asset Management (“MWAM”), which became a subadviser to the portfolio in April 2007. The key factor contributing to portfolio underperformance was the subadvisers having in aggregate, an overweight position in mortgage-backed securities (“MBS”). MBS suffered during the increased market volatility that ensued during the sub-prime mortgage market crisis that occurred later in the fiscal year.

High Yield Investments returned 7.56% for the fiscal year ended August 31, 2007, beating the LB High Yield Bond Index return of 6.29%. The portfolio’s subadvisers are Penn Capital Management Co., Inc. (“Penn Capital”), and WAMCo. Both subadvisers benefited from the continued strength in the economy that generally aids the high yield market and, in particular, the higher-risk companies within that market.

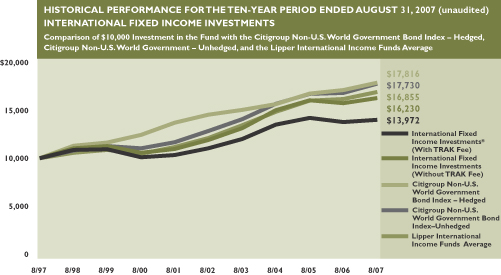

International Fixed Income Investments returned 2.33%, trailing the Citigroup Non-U.S. World Government Hedged Index return of 3.98%. PIMCO is the portfolio’s sole subadviser. The portfolio’s underperformance was due to several decisions having a minimal impact individually, but in aggregate, enough to produce an underperformance. Among these decisions was a positioning in the US and UK along the yield curve as the mortgage-induced credit crisis developed. Outside of several country allocation decisions, another negative determinant was an allocation to bank notes.

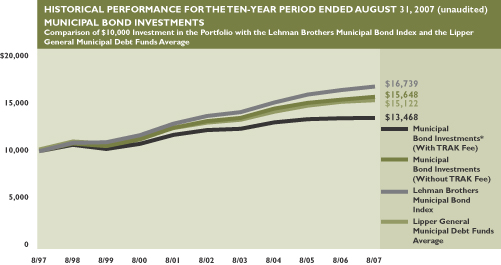

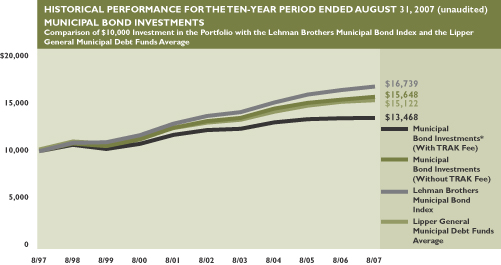

Municipal Bond Investments returned 1.77% for the fiscal year ended August 31, 2007, versus the LB Municipal Bond Index return of 2.30%. McDonnell Investment Management, LLC, is the portfolio’s sole subadviser. The main reason for the portfolio’s negative relative performance versus its benchmark became a relative positive later in the fiscal year. The fund maintained a bias to higher-quality issues during the year. This decision had a negative impact earlier in the year, as the market continued to favor lower-quality issues. When the market preference shifted during the credit crisis, this position benefited the portfolio.

Large Capitalization Growth Investments returned 19.95% for the fiscal year ended August 31, 2007, versus the comparative return of 17.71% for its benchmark, the Russell 1000® Growth Index. The portfolio’s advisors are Wells Capital Management, Westfield Capital Management Company, LLC (“Westfield”), and Delaware Management Company (“Delaware”). The value added to the portfolio was primarily due to two factors: (1) overall, the subadvisers were overweighted to the energy sector and also picked several leading performers; and (2) within a generally difficult healthcare sector, the portfolio’s individual stock selections added value.

Large Capitalization Value Equity Investments rose 13.58% for the fiscal year ended August 31, 2007, as compared to the return of 12.84% of its benchmark, the Russell 1000 Value Index. The portfolio’s subadvisers are Cambiar Investors LLC, AllianceBernstein LP and NFJ Investment Group (“NFJ”). The value added of the subadvisers was from the continued emphasis on the companies that benefit from strong global growth. This overweight resulted from an underweighting of the financial sector, the sector hit hardest by the mortgage market turmoil.

Small Capitalization Growth Investments returned 15.48% for the fiscal year ended August 31, 2007, as compared to a 16.35% return of its benchmark, the Russell 2000 Growth Index. The portfolio’s subadvisers are Wall Street Associates and Westfield. The portfolio underperformance was primarily due to stocks selected in the industrial cyclical portions of the portfolio not matching the benchmark. The decision to overweight the area was advantageous, but they did not get the full impact as some of their stocks lagged the benchmark in the sectors.

Small Capitalization Value Equity Investments gained 11.94% for the fiscal year ended August 31, 2007, as compared to the 6.65% return of its benchmark, the Russell 2000 Value Index. The portfolio’s subadvisers are NFJ, Delaware and Rutabaga Capital Management. The significant declines in financial company and REIT stocks negatively impacted the benchmark but did not hurt the portfolio to the same degree, as the subadvisers had large underweights to those areas. Small advantages in the individual stock holdings within the industrial portions of the portfolio added to the significant portfolio outperformance.

International Equity Investments returned 17.21% for the fiscal year ended August 31, 2007, trailing the 18.71% of its benchmark, the MSCI EAFE Index (net of taxes). The portfolio’s subadvisers during the past fiscal year were

II

Philadelphia International Advisors LP (“PIA”), Brandywine Global Investment Management, LLC (“Brandywine”), and William Blair & Company, LLC (“William Blair”). The relative performance of the portfolio compared to the index turned negative, as such factors as the smaller and mid-cap companies underperformed the large cap stocks. Like the US market, holdings in the financial sector hurt the portfolio return. Following the fiscal year end, Schroder Investment Management replaced William Blair as subadviser to the portfolio; PIA and Brandywine continue as subadvisers. This change in subadviser will produce a generally more diversified portfolio and substitute a Growth at a Reasonable Price investment philosophy for a more traditional Growth strategy.

Emerging Markets Investments gained 42.41% for the fiscal year ended August 31, 2007. Its benchmark, the MSCI Emerging Markets Index, rose 44.05% during this period. The portfolio’s subadvisers are Newgate Capital Management LLC and SSgA Funds Management, Inc. The portfolio could not keep pace with the benchmark’s returns due to the market behavior in China and India. Fueling this strong rise in the emerging markets have been market returns in China and India. Both countries are slightly underweight in both subadvisers’ portfolios. The subadvisers chose to control total portfolio risk by limiting exposure to these fast-moving markets.

We thank you for continued support of the Consulting Group Capital Markets Funds. For additional information regarding the portfolios and the asset allocation advice that guides the portfolio creation, we urge you to discuss these issues with your financial adviser.

The performance shown represents past performance. Past performance is no guarantee of future results and current performance may be higher or lower than the performance shown above. Principal value and investment returns will fluctuate so that investors’ shares, when redeemed, may be worth more or less than their original cost. The returns shown do not reflect the deduction of taxes that a shareholder would pay on fund distributions or the redemption of fund shares. To obtain performance data current to the most recent month-end, please visit our website at www.smithbarney.com.

The portfolios are only available to investors participating in an advisory program. These programs charge an annual fee, which in the case of TRAK® may be up to 1.50%. The performance data shown does not reflect this fee, which would reduce returns.

All index performance reflects no deduction for fees, expenses or taxes. Please note an investor cannot invest directly in an index.

Risks

Certain of the portfolios may invest in derivatives, such as options and futures, which may be illiquid, may disproportionately increase losses, and have a potentially large impact on fund performance. Foreign securities are subject to certain risks of overseas investing including currency fluctuations and changes in political and economic conditions, which could result in significant market fluctuations. These risks are magnifies in emerging or developing markets. Investments in small or medium-capitalization companies may involve a higher degree of risk and volatility than investments in larger, more established companies. Certain of the portfolios may invest in high yield bonds, which involve greater credit and liquidity risks than investment grade bonds.

Sincerely,

| | |

| |

James J. Tracy Chief Executive Officer October 17, 2007 | | |

III

The performance shown represents past performance. Past performance is no guarantee of future results, and current performance may be higher or lower than the performance shown above. Performance figures may reflect voluntary fee waivers and/or expense reimbursements. In the absence of voluntary fee waivers and/or expense reimbursements, the total return would have been lower. Principal value and investment returns will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost. The returns shown do not reflect the deduction of taxes that a shareholder would pay on fund distributions or the redemption of fund shares. To obtain performance data current to the most recent month-end, please visit our website at www.smithbarney.com.

The portfolios are only available to investors participating in an advisory program. These programs charge an annual fee, which in the case of TRAK® may be up to 1.50%. The performance data shown does not reflect this fee, which would reduce returns.

All index performance reflects no deduction for fees, expenses or taxes. Please note an investor cannot invest directly in an index.

RISKS: Certain of the portfolios may invest in derivatives, such as options and futures, which can be illiquid, may disproportionately increase losses, and have a potentially large impact on fund performance. Foreign securities are subject to certain risks of overseas investing including currency fluctuations and changes in political and economic conditions, which could result in significant market fluctuations. These risks are magnified in emerging or developing markets. Investments in small or medium-capitalization companies may involve a higher degree of risk and volatility than investments in larger, more established companies. Certain of the portfolios may invest in high yield bonds, which involve greater credit and liquidity risks than investment grade bonds.

i | The US Federal Reserve Board is responsible for the formulation of a policy designed to promote economic growth, full employment, stable prices and a sustainable pattern of international trade and payments. |

ii | The S&P 500® Index is a market capitalization-weighted index of 500 widely-held common stocks. Standard & Poor’s 500 and S&P 500® are registered trademarks of the McGraw-Hill Companies, Inc. |

iii | The Russell 1000® Value Index is a capitalization weighted total return index which is comprised of 1,000 of the largest capitalized U.S.-domiciled companies with greater than average value orientation whose common stock is traded in the U.S. on the New York Stock Exchange, American Stock Exchange and NASDAQ. Russell 1000® Index is a registered trademark of the Frank Russell Company. |

iv | The Russell 2000® Value Index is a capitalization weighted total return index which is comprised of 2,000 of the smallest capitalized U.S.-domiciled companies with less-than-average growth orientation whose common stock is traded in the U.S. on the New York Stock Exchange, American Stock Exchange and NASDAQ. |

v | The Russell 2000® Growth Index is a capitalization weighted total return index which is comprised of 2,000 of the smallest capitalized U.S.-domiciled companies with greater-than-average growth orientation whose common stock is traded in the U.S. on the New York Stock Exchange, American Stock Exchange and NASDAQ. Russell 2000® Index is a registered trademark of the Frank Russell Company. |

vi | The Russell 1000® Growth Index is a capitalization weighted total return index which is comprised of 1,000 of the largest capitalized U.S.-domiciled companies with greater-than-average growth orientation whose common stock is traded in the U.S. on the New York Stock Exchange, American Stock Exchange and NASDAQ. |

vii | The MSCI EAFE® — Capitalization Weighted Index is a composite portfolio or equity total returns for the countries of Australia, New Zealand and countries in Europe and the Far East, weighted based on each country’s market capitalization. MSCI EAFE® — Capitalization Weighted Index is a registered trademark of Morgan Stanley Capital International Inc. |

viii | The MSCI Emerging Markets Index is an index comprised of thirteen emerging markets open to direct foreign participation. |

ix | The Lehman Brothers U.S. Aggregate Index is composed of the Lehman Brothers Intermediate Government/Credit Bond Index and the Lehman Brothers Mortgage-Backed Securities Index and includes treasury issues, agency issues, corporate bond issues and mortgage-backed securities. Lehman Brothers U.S. Aggregate Index is a trademark of Lehman Brothers Inc. |

x | The Lehman Brothers High Yield Index is composed of fixed rate, publicly issued, non-investment grade debt registered with the SEC. All bonds must be dollar-denominated, non-convertible and have at least one year remaining to maturity as well as an outstanding par value of $100 million. |

xi | The Citigroup Non-U.S. World Government Bond Index-Hedged is a market capitalization weighted index that is designed to represent the hedged performance of the government bond markets in thirteen developed countries, excluding the U.S. |

xii | The Lehman Brothers Municipal Bond Index is a weighted composite which is comprised of more than 15,000 bonds issued within the last five years, having a minimum credit rating of at least Baa and maturity of at least two years, excluding all bonds subject to the Alternative Minimum Tax and bonds with floating or zero coupons. |

IV

Performance of the Consulting Group Capital Markets Funds For the Year Ended August 31, 2007†* (unaudited)

| | | |

Large Capitalization Growth Investments | | 19.95 | % |

Russell 1000® Growth Index (2) | | 17.71 | |

| |

Large Capitalization Value Equity Investments | | 13.58 | |

Russell 1000® Value Index (1) | | 12.84 | |

| |

Small Capitalization Growth Investments | | 15.48 | |

Russell 2000® Growth Index (4) | | 16.35 | |

| |

Small Capitalization Value Equity Investments | | 11.94 | |

Russell 2000® Value Index (3) | | 6.65 | |

| |

International Equity Investments | | 17.21 | |

MSCI EAFE® — Capitalization Weighted Index (5) | | 18.71 | |

| |

Emerging Markets Equity Investments | | 42.41 | |

MSCI Emerging Markets Index (6) | | 44.05 | |

| |

Core Fixed Income Investments | | 4.82 | |

Lehman Brothers U.S. Aggregate Index (7) | | 5.25 | |

Lehman Brothers Intermediate Government/Credit Bond Index (8) | | 5.44 | |

| |

High Yield Investments | | 7.56 | |

Lehman Brothers High Yield Index (9) | | 6.29 | |

| |

International Fixed Income Investments | | 2.33 | |

Citigroup Non-U.S. World Government Bond Index — Hedged (11) | | 3.98 | |

| |

Municipal Bond Investments | | 1.77 | |

Lehman Brothers Municipal Bond Index (10) | | 2.30 | |

| |

Money Market Investments | | 4.86 | |

90-day Treasury Bill | | 4.90 | |

See pages 22 through 23 for all footnotes.

V

Large Capitalization

Growth Investments

ABOUTTHE SUBADVISERS

| | Ÿ | | Delaware Management Company (“Delaware”) | |

Delaware invests primarily in common stocks of large capitalization growth-oriented companies that Delaware believes have long-term capital appreciation potential and are expected to grow faster than the US economy. Using a bottom up approach, Delaware seeks to select securities of companies that it believes have attractive end market potential, dominant business models and strong free cash flow generation that are attractively priced compared to the intrinsic value of the securities. Delaware also considers a company’s operational efficiencies, management’s plans for capital allocation and the company’s shareholder orientation. Delaware currently defines large capitalization companies as those that, at the time of investment, have market capitalizations within the range of market capitalizations of companies in the Russell 1000® Growth Index. While the market capitalization of companies in the Russell 1000 Growth Index ranged from approximately $1.2 billion to $406 billion as of September 30, 2006, Delaware will normally invest in common stocks of companies with market capitalizations of at least $3 billion at the time of purchase.

| | Ÿ | | Wells Capital Management Inc. (“Wells Capital”) | |

Wells Capital employs both proprietary screens and intensive grassroots research in order to identify high growth companies expected to outperform their peers. Their investment philosophy is firmly rooted in the belief that successful investing is the result of focusing on companies with favorable underlying fundamentals, strong growth potential and solid management teams. Security selection is based on fundamental research. This research process works to “surround” an investment by focusing on the company’s financials and verifying fundamentals with the management team, mid-level employees, customers, competitors, suppliers and/or distributors.

For the period of September 1, 2006, through August 31, 2007, except as noted below, the subadvisers for the portfolio were Wells Capital, Delaware and Westfield.

The Delaware portion of the portfolio underperformed the Russell 1000 Growth Index during the one-year period ending August 31, 2007, primarily due to sector allocations and, to a lesser extent, Delaware’s security selection. Sector allocation was a significant factor as Delaware’s portion of the portfolio was underweighted in Energy (which had the highest absolute performance of any sector), Materials, and Producer Durables. Delaware tends to avoid owning stocks in those sectors where a commodity price or the direction and magnitude of an economic cycle is the key driver of the company’s results. In contrast, they tend to own businesses that have a unique, sustainable competitive advantage that help them to manage their way through various economic cycles, and whose returns are not subject to the cyclical swings in an underlying commodity price. While facing market headwinds by not owning many of the high return sectors during the period, contribution was added in specific security selection in Consumer Discretionary and in Financial Services. In Financial Services, Delaware focused owned transaction-based business models and avoided the spread-based financial companies that were punished by the sub-prime mortgage problems in July and August 2007.

Wells Capital Management began managing a portion of the portfolio on October 12, 2006. Since that time, the strategy slightly trailed the Russell 1000 Growth Index despite solid absolute returns. Stock selection in areas of materials and financials, specifically allocations to companies within precious metals and capital markets, was the primary source of relative underperformance. In addition, holdings in the consumer discretionary sector, namely in the media and retail industries, detracted as well. Weakness experienced in certain portions of the portfolio was mitigated by decent contribution from holdings found elsewhere - especially in the telecommunications and energy sectors. In both cases, sector overweights relative to the index provided a portion of the relative gains. Finally, stock selection in the Consumer Staples sector provided an additional source of gains for the strategy.

The Westfield portion of the portfolio, stock selection in 7 of the 9 sectors in which the Portfolio was invested accounted for the vast majority of outperformance. Stock selection within Healthcare provided the most excess return for the period, as positions in Biotechnology continued to register strong returns. Energy also provided positive relative returns during the period, as positions within Oil & Gas Equipment Services continued to benefit from positive capital expenditure trends. Being underweight coupled with solid stock selection within the Consumer Staples sector was additive to relative returns. Investments in the Drugstore space were mixed, but exposure to a global Food Products company was positive for the Portfolio. The Materials sector, specifically the Metals and Mining names held in the portfolio, posted strong returns as global demand for commodities continues to grow. The Consumer Discretionary sector also contributed to relative performance. Westfield has been able to identify companies within the Hotels and Leisure industry that have continued to exhibit strong growth characteristics despite the strains on the consumer. Concerns about aggressive lending standards in sub-prime and Alt-A mortgage markets minimized Portfolio exposure to Financial Services. Strong stock selection within the Capital Markets area and a lack of exposure to Commercial Banks added to relative performance. Information Technology was the main source of weakness in the Portfolio during the period. Holdings within the Semiconductors space hurt performance and being underweight to Computer Hardware also detracted from returns.

1

| | Ÿ | | Westfield Capital Management Co., LLC (“Westfield”) | |

Uses an active management style and favors investing in earnings stocks given its conviction that stock prices follow earnings progress and that they offer the best opportunity for superior real rates of return. The sub-adviser believes that reasonably priced stocks with high earnings potential are best identified through in-depth, fundamental research.

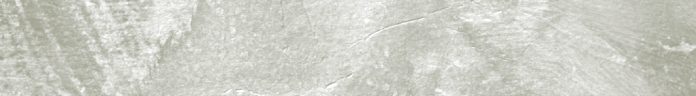

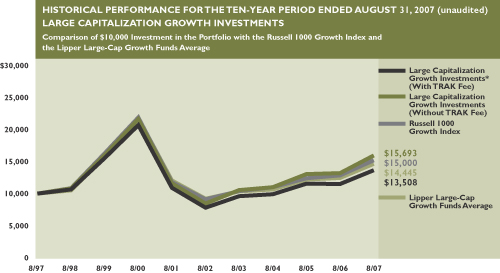

The following graph depicts the performance of the Large Capitalization Growth Investments vs. the Russell 1000 Growth Index2 and the Lipper Large-Cap Growth Funds Average.13

The performance shown above and below represents past performance. Past performance is no guarantee of future results and current performance may be higher or lower than the performance shown above. Performance figures may reflect voluntary fee waivers and/or expense reimbursements. In the absence of voluntary fee waivers and/or expense reimbursements, the total return would have been lower. Principal value and investment returns will fluctuate and investors’ shares, when redeemed, may be worth more or less than their original cost. To obtain performance data current to the most recent month-end, please visit our website at www.smithbarney.com.

The graph above and returns shown below do not reflect the deduction of taxes that a shareholder would pay on fund distributions or the redemption of fund shares.

LARGE CAPITALIZATION GROWTH INVESTMENTS (unaudited)

Average Annual Total Returns for the Period Ended August 31, 2007†

| | | | | | |

| | | Without TRAK Fee* | | | With TRAK Fee | |

Since inception (11/18/91) | | 8.69 | % | | 7.06 | % |

10 year | | 4.61 | | | 3.05 | |

5 year | | 13.06 | | | 11.38 | |

3 year | | 12.64 | | | 10.96 | |

1 year | | 19.95 | | | 18.17 | |

|

|

See pages 22 through 23 for all footnotes.

2

Large Capitalization Value Equity Investments

ABOUTTHE SUBADVISERS

| | Ÿ | | Cambiar Investors LLC (“Cambiar”) | |

Cambiar utilizes a bottom-up process that seeks to identify companies that are attractively priced, demonstrate positive developments not yet recognized by the market and offer significant appreciation potential within a one- to two-year time frame.

| | Ÿ | | NFJ Investment Group (“NFJ”) | |

The NFJ investment process initially screens for positive fundamentals by applying a screen over a universe of approximately 800 stocks in order to identify companies with positive fundamental characteristics. After the screen has been applied, NFJ then conducts in-depth research and analysis by reviewing each of the remaining 150-200 possible investments for low price-to-earnings multiples, high dividend yields, positive prospective earnings and quality operations. As part of the portfolio construction process, industry concentration is mitigated by avoiding overexposure to any one sector by restricting the number of stocks held within a single industry. The portfolio generally holds 40 to 50 companies. NFJ’s process involves regular portfolio and universe monitoring for buy and sell candidates. NFJ continually repeats its research process in order to identify new buy and sell candidates. The sell discipline is an important part of NFJ’s process. A stock is sold when an alternative stock with equally strong fundamentals demonstrates a substantially lower price-to-earnings ratio, and/or a substantially higher dividend yield.

For the period of September 1, 2006, through August 31, 2007, the subadvisers for the portfolio were Cambiar, NFJ and AllianceBernstein.

For the Cambiar portion, an active overweight and positive stock selection within the Consumer Discretionary and Consumer Staple sectors were amongst the notable positive contributors to performance. Cambiar also benefited from an underweight allocation to Financials, and a subsequent overweight position in the Information Technology sector. Detractors for the portfolio included Cambiar’s stock selection within Healthcare, as well as an underweight allocation to Industrials and Materials. While Cambiar has maintained a market-weight in Energy the portfolio’s stock selection was a drag on performance; this was due to Cambiar’s higher exposure to oilfield services companies, vs. the larger integrated companies.

The NFJ portion of the portfolio posted an annual return that exceeded the Russell 1000® Value performance benchmark for the annual period ended August 31, 2007. All economic sectors within the large-cap value arena posted positive returns except for the Finance sector. Positive portfolio results can mainly be attributed to stock selection, which account for just over one-half of the excess returns. This was particularly true in the Consumer Staples, Information Technology, and Consumer Discretionary sectors. Financial sector stock selection had a negative impact on the portfolio. Favorable sector strategy also contributed positively as the underweighting in the Financial sector was most beneficial as was an overweighting in the Energy sector. The portfolio maintains low valuation and above average dividend yield. The economy and equity markets should continue to move forward unless there should occur adverse changes to monetary, tax, incomes and/or trade policies. Heightened geo-political tensions in the Middle East could also be disruptive to equity markets. Market valuations remain compressed in a more narrow range of earnings multiples than in times past. This presents a unique challenge for the periods to come. We are looking towards positive and sustainable free cash flow yields (after capital expenditures and dividends) and growing dividend payouts as a favorable attributes.

The AllianceBernstein portion of the portfolio outperformed its benchmark, the Russell 1000® Value Index. Much of this period’s positive portfolio performance resulted from strong stock selection in the technology and industrial resources sectors. In the technology sector, Nokia, the world’s largest maker of mobile phones, rose as new, higher-priced models continued to gain market share. Meanwhile, in the industrial resources sector, Arcelor Mittal and Owens-Illinois stood out. Steel producer Arcelor Mittal moved higher due to rising demand for raw materials and a positive outlook for an already strong steel market. Owens-Illinois posted second-quarter earnings that exceeded estimates, driven by better-than-expected price recovery, good volume growth and operating performance improvements. The company’s restructuring remains on track as the packaging products manufacturer closed on the sale of its non-core plastics division, enabling it to substantially reduce its debt burden. Relative returns were hurt by several of the portfolio’s financial holdings, including Countrywide Financial, Genworth Financial and National City Corp., amid ongoing turmoil in the global credit markets. AllianceBernstein has significantly reduced the portfolio’s position in Countrywide Financial as its research concluded that the risks associated with Countrywide’s financing needs increased, and its recent change in strategy — specifically its plans to scale back its presence in some of the more lucrative segments of the mortgage market — reduced estimates of the company’s long-term earnings power. Also detracting from returns was the portfolio’s position in Macy’s Inc. Macy’s posted disappointing April same-store-sales,

3

| | Ÿ | | AllianceBernstein L.P. (“AllianceBernstein”) | |

AllianceBernstein seeks to exploit undervalued securities and the opportunities these create. The screening process begins by searching for undervalued securities within a universe of stocks comprising the S&P 500® Index and 150 additional large/mid-cap stocks not contained in the S&P 500 Index. Quantitative ranks in quintiles are then applied based on a stock’s expected return and risk considerations. AllianceBernstein also takes into consideration earnings estimate revisions and relative price trend determinations in attempting to avoid the classic value trap of buying too early.

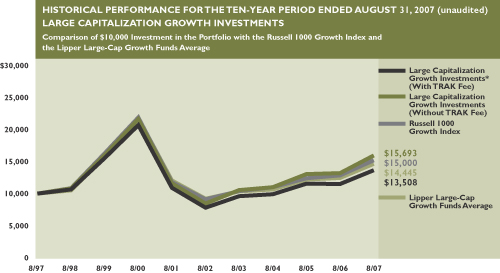

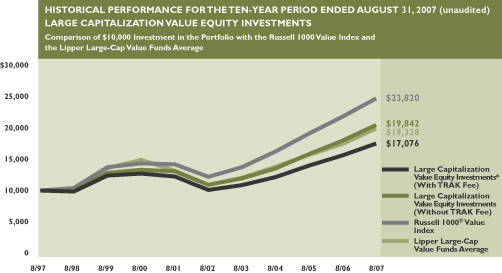

The following graph depicts the performance of the Large Capitalization Value Equity Investments vs. the Russell 1000® Value Index1 and the Lipper Large-Cap Value Funds Average.12

heightening concerns surrounding the slower-than-expected turnaround of recently integrated May Department Stores.

The performance shown above and below represents past performance. Past performance is no guarantee of future results and current performance may be higher or lower than the performance shown above. Performance figures may reflect voluntary fee waivers and/or expense reimbursements. In the absence of voluntary fee waivers and/or expense reimbursements, the total return would have been lower. Principal value and investment returns will fluctuate and investors’ shares, when redeemed, may be worth more or less than their original cost. To obtain performance data current to the most recent month-end, please visit our website at www.smithbarney.com.

The graph above and returns shown below do not reflect the deduction of taxes that a shareholder would pay on fund distributions or the redemption of fund shares.

LARGE CAPITALIZATION VALUE EQUITY INVESTMENTS (unaudited)

Average Annual Total Returns for the Period Ended August 31, 2007†

| | | | | | |

| | | Without TRAK Fee* | | | With TRAK Fee | |

Since inception (11/18/91) | | 9.98 | % | | 8.34 | % |

10 year | | 7.09 | | | 5.50 | |

5 year | | 12.80 | | | 11.12 | |

3 year | | 14.16 | | | 12.46 | |

1 year | | 13.58 | | | 11.89 | |

|

|

See pages 22 through 23 for all footnotes.

4

Small Capitalization

Growth Investments

ABOUTTHE SUBADVISERS

| | Ÿ | | Wall Street Associates (“WSA”) | |

WSA follows a bottom-up investment style. It looks for companies with superior earnings growth, strong balance sheets, attractive valuations and potentially positive earning surprises.

| | Ÿ | | Westfield Capital Management Co., LLC (“Westfield”) | |

Westfield favors investing in earnings growth stocks given their conviction that stock prices follow earnings progress and that they offer the best opportunity for superior real rates of return. Reasonably priced stocks of companies with high foreseen earnings potential are best identified through in-depth, fundamental research. It is their belief that the small capitalization portion of the market is under-researched, and therefore less efficient, than the large capitalization sector.

For the period of September 1, 2006, through August 31, 2007, the subadvisers for the portfolio were WSA and Westfield.

WSA’s portion of the portfolio outperformed the benchmark return of the Russell 2000® Growth Index. Investments in the Technology sector provided the largest contribution to portfolio return during the period. The Fund benefited from an over-weighted position in the sector and strong stock selection. Investments in the Health Care sector reduced returns, as this area languished and faced political headwinds. Energy stocks as a group declined during the period and negatively impacted performance. WSA’s outlook for the small-cap segment of the market remains optimistic, and there is a belief that growth stocks are currently attractive and will be increasingly favored relative to value stocks. There is anticipation that a slower growth environment should favor growth issues, as investors are willing to pay a premium for strong earnings.

Westfield’s portion underperformed the Russell 2000® Growth Index, as positive stock selection in Energy and Information Technology was outweighed by challenges in the Industrials and Consumer Discretionary sectors. Positive stock selection within the Energy Equipment and Services sectors added to positive results, and the portfolio continues to be overweight Oil, Gas & Consumable Fuels, with a focus upon coal companies. Strong stock selection in Information Technology, including Software and Communications Equipment holdings, as well as within the Capital Markets sector, added to absolute performance. Results within Healthcare were mixed over the period, with gains in Pharmaceuticals and setbacks for Biotechnology stocks. The portfolio continues to be underweight in the Financial Services and Consumer Discretionary sectors, which faced challenges during the period, with Media and Specialty Retailing weighing down performance. Additionally, disappointing results within the Industrials sector detracted from overall returns, and holdings within the Commercial Services & Supply segment accounted for the majority of Westfield’s underperformance.

5

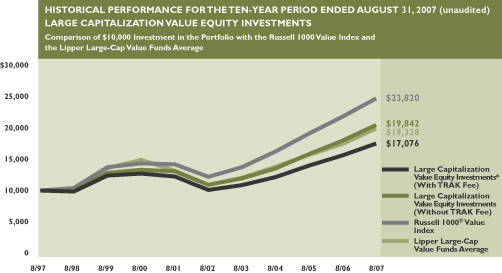

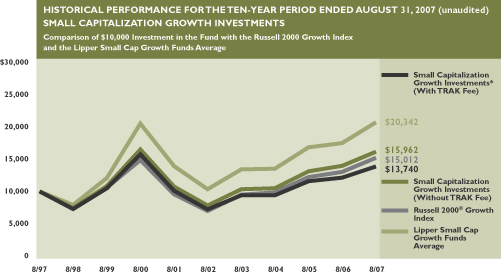

The following graph depicts the performance of the Small Capitalization Growth Investments vs. the Russell 2000® Growth Index4 and the Lipper Small Cap Growth Funds Average.15

The performance shown above and below represents past performance. Past performance is no guarantee of future results and current performance may be higher or lower than the performance shown above. Performance figures may reflect voluntary fee waivers and/or expense reimbursements. In the absence of voluntary fee waivers and/or expense reimbursements, the total return would have been lower. Principal value and investment returns will fluctuate and investors’ shares, when redeemed, may be worth more or less than their original cost. To obtain performance data current to the most recent month-end, please visit our website at www.smithbarney.com.

The graph above and returns shown below do not reflect the deduction of taxes that a shareholder would pay on fund distributions or the redemption of fund shares.

SMALL CAPITALIZATION GROWTH INVESTMENTS (unaudited)

Average Annual Total Returns for Period Ended August 31, 2007†

| | | | | | |

| | | Without TRAK Fee* | | | With TRAK Fee | |

Since inception (11/18/91) | | 10.72 | % | | 9.06 | % |

10 year | | 4.79 | | | 3.23 | |

5 year | | 15.19 | | | 13.48 | |

3 year | | 15.16 | | | 13.44 | |

1 year | | 15.48 | | | 13.76 | |

|

|

See pages 22 through 23 for all footnotes.

6

Small Capitalization Value Equity Investments

ABOUTTHE SUBADVISERS

| | Ÿ | | Rutabaga Capital Management LLC (“Rutabaga”) | |

Focuses exclusively on micro- and small capitalization stocks and looks to unearth uncommon or currently out-of-favor stocks. The firm’s analysts employ extensive bottom-up fundamental research to identify high quality companies with catalysts to increase margins and intrinsic value but are neglected or misperceived by the market.

| | Ÿ | | NFJ Investment Group (“NFJ”) | |

An active management style that invests in a diversified portfolio of small capitalization common stocks that it believes are undervalued in the marketplace generally and within their respective industries. The subadviser also considers valuation factors such as price-to-book, price-to-cash flow, dividend policy and industry outlook in selecting stocks for investment.

| | Ÿ | | Delaware Management Company (“Delaware”) | |

Delaware believes that markets can misprice securities. Delaware seeks to exploit this inefficiency on a consistent basis through active, research-based management. Delaware identifies companies with market capitalizations typically less than $2 billion at the time of purchase whose values it believes are not currently recognized in the market. In order to do so, Delaware considers a variety of factors, including, the financial strength of a company, its management, the prospects for its industry and any anticipated changes within the company that might suggest a more favorable outlook going forward. Delaware’s focus is on value stocks whose prices are historically low on a given financial measure, such as profits, book value or cash flow.

For the period of September 1, 2006, through August 31, 2007, the subadvisers for the portfolio were NFJ, Rutabaga and Delaware.

The NFJ portion of the portfolio posted an annual return that exceeded the Russell 2000® Value performance benchmark for the annual period ending August 31, 2007. All economic sectors within the small-cap value arena posted positive returns except for the Financial Services sector. The Utilities sector was virtually unchanged. Positive portfolio results were mainly attributable to favorable sector strategy, which accounted for just over one-half of the excess return. An underweighted position in Financial Services was beneficial, as were overweightings in the Industrials and Materials sectors. Returns for the portfolio were positive in all economic sectors except Telecom services, which accounts for a very small position size within the portfolio. Favorable issue selection also contributed positively and was significant in the Financial, Energy, and Industrial sectors. Issue selection within the Materials sector was a negative due very strong performance from three positions in the benchmark portfolio that were not in the managed portfolio. The portfolio had approximately a 23% turnover in the positions for the period. The portfolio held two positions that received tender offers during the period. The portfolio is underweighted in the Finance and Technology related sectors. The portfolio maintains low valuation, with a P/E ratio of 14. The dividend yield was 2.7% as of August 31, 2007. Average market capitalization is $1.9 billion. The economy and equity markets should continue to move forward unless there should occur adverse changes to monetary, tax, incomes and/or trade policies. Heightened geo-political tensions in the Middle East could also be disruptive to equity markets. Market valuations remain compressed in a more narrow range of earnings multiples than in times past. This presents a unique challenge for the periods to come. NFJ looks towards positive and sustainable free cash flow yields (after capital expenditures and dividends) and growing dividend payouts as favorable attributes.

In Rutabaga’s portion of the portfolio, major US stock indices rose, with small cap stocks as a whole underperforming large caps. Within small cap, growth stocks outperformed value stocks by a wide margin. For the fiscal year, Rutabaga’s portfolio outperformed both the Russell 2000 and the Russell 2000 Value indices. Broadly speaking, being underweight within the poorly performing Financials and REIT sectors and overweight in the better performing Materials & Processing area helped to boost performance for the period. As the market continues to sort out the impact of the housing softness, high commodity costs, the credit crunch and the Federal Reserve’s actions, Rutabaga’s focus remains on identifying and owning attractively valued companies with strong market positions and internal catalysts to drive improved margins and earnings in the future.

For the Delaware portion, the return based upon the Russell 2000 Value Index modest. Continued global economic growth coupled with a general slowdown in US economic growth, as well as a significant decline in housing prices and sales, led to distinct sector differences in gains and losses during this period. The sectors that seemed to benefit most were those that were in economically sensitive areas that also had broad exposure to exports and also had the ability to raise prices. Conversely, those industries that generally performed poorly were more directly tied to discretionary consumer spending and those dependent on loan growth and the success of the housing markets. As a result, Basic Industries and Capital Spending sectors posted strong returns, while Financial Services and Real Estate Investment Trusts (“REITs”) were the worst performing sectors in the Russell 2000 Value Index, and were in fact the only sectors with negative total returns during this time frame. From a performance standpoint, the

7

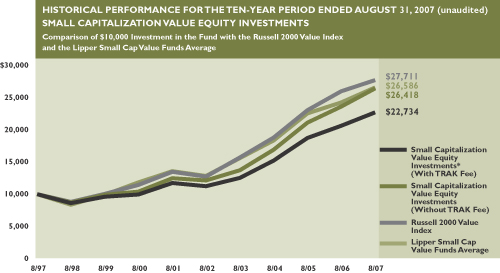

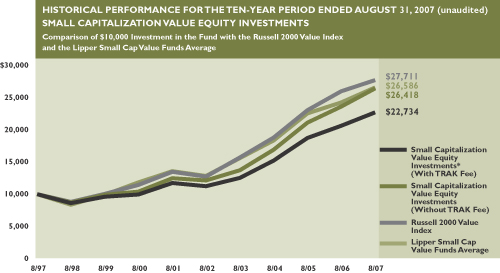

The following graph depicts the performance of the Small Capitalization Value Equity Investments vs. the Russell 2000 Value Index3 and the Lipper Small Cap Value Funds Average.14

overweighting in Technology and Health care combined with strong stock selection had a positive impact on performance during the fiscal year. Additionally, the underweighting in Financial Services and REITs also had a positive impact on performance. Poor stock selection in several areas including Basic Industries, Consumer Cyclicals, Consumer Staples and Energy negated much of the previously mentioned positive impact. As a result, overall stock selection was a negative factor on performance while overall sector weightings were a positive contribution.

The performance shown above and below represents past performance. Past performance is no guarantee of future results and current performance may be higher or lower than the performance shown above. Performance figures may reflect voluntary fee waivers and/or expense reimbursements. In the absence of voluntary fee waivers and/or expense reimbursements, the total return would have been lower. Principal value and investment returns will fluctuate and investors’ shares, when redeemed, may be worth more or less than their original cost. To obtain performance data current to the most recent month-end, please visit our website at www.smithbarney.com.

The graph above and returns shown below do not reflect the deduction of taxes that a shareholder would pay on fund distributions or the redemption of fund shares.

SMALL CAPITALIZATION VALUE EQUITY INVESTMENTS (unaudited)

Average Annual Total Returns for Period Ended August 31, 2007†

| | | | | | |

| | | Without TRAK Fee* | | �� | With TRAK Fee | |

Since inception (11/18/91) | | 11.75 | % | | 10.08 | % |

10 year | | 10.19 | | | 8.55 | |

5 year | | 16.83 | | | 15.09 | |

3 year | | 16.03 | | | 14.30 | |

1 year | | 11.94 | | | 10.27 | |

|

|

See pages 22 through 23 for all footnotes.

8

International Equity Investments

ABOUTTHE SUBADVISERS

| | Ÿ | | William Blair & Co., LLC (“William Blair”) | |

William Blair’s investment approach is focused upon a conservative, long-term approach to growth investing. They seek companies with growth characteristics that include high benchmark revenue growth, earnings-per-share growth, dividends-per-share growth and consensus long-term growth estimates.

| | Ÿ | | Philadelphia International Advisors, LP (“PIA”) | |

PIA utilizes a bottom-up approach to international investing. It selects stocks to buy and sell by evaluating a company’s growth outlook and market valuation based on traditional value characteristics, positive company-specific catalysts and other operating and financial conditions. It selects countries primarily by evaluating a country’s valuation ratios such as price-to-earnings and dividend yield, prospective economic growth, government policies and other factors.

| | Ÿ | | Brandywine Global Investment Management, LLC (“Brandywine”) | |

With regard to stock selection, Brandywine employs a quantitative screen which takes into account country, industry and company valuation history. Brandywine seeks stocks whose performance has deviated from their historical mean and likely will revert to this historical mean.

For the period of September 1, 2006, through August 31, 2007, the subadvisers for the portfolio were PIA, William Blair and Brandywine.

PIA’s portion of the portfolio underperformed the portfolio’s benchmark index, the MSCI EAFE® Index. From a regional allocation perspective, the portfolio was well-positioned, being overweight Continental Europe and underweight Japan. However, security selection at the individual country level, particularly in Japan, Hong Kong, and the UK, more than offset these gains and the solid stock picking in Australia. Sector level security selection drove the relative return shortfall. Gains from positive stock selection in Financials and Telecommunications were eliminated by poor selection in Consumer and Materials stocks. Additionally, in early 2007, the portfolio had lighter portfolio exposure to some sectors that had been in the M&A spotlight — particularly utilities, food, and beverage/tobacco — and none of PIA’s portfolio names were highlighted in takeover stories. The M&A rally continued in the second quarter of 2007 where some of the portfolio names indeed benefited from buyout offers or speculations of takeover.

For the William Blair portion, the portfolio’s results approximated the MSCI EAFE® Index (“the benchmark”). Augmenting annual results was strong stock selection in Energy, Industrials, and Information Technology (“IT”), coupled with their overweightings relative to the benchmark, in addition to Telecommunication Services stock selection. Within Energy, the portfolio’s focus on exploration and production companies with strong production growth enhanced performance, while Industrials exposure was bolstered by companies such as ABB, which are exposed to global infrastructure spend and industrial production. IT stock selection was enhanced by performance in Japan and Canada, while Telecom Services stock selection benefited from strong cell phone demand in Latin America. Regionally, stock selection and weightings in Japan, Canada and Latin America also drove absolute and relative results. The largest detractors from the portfolio’s performance during the year was the portfolio’s underweighting in Materials, as the sector performed well, coupled with Consumer Staples stock selection. As of August 31, 2007, the portfolio maintained an 19.31% exposure to emerging markets and 16.76% exposure to Canada as compared to other developed regions. Its primary focus was in Industrials and IT stocks, which each represented approximately 17% of the portfolio, higher than the benchmark. Financials, which totaled 14.65% of the Index, was underweighted relative to the 28.02% weighting in benchmark. These regional and sector weightings are largely the result of William Blair’s bottom-up, fundamental process focused on finding quality growth companies.

Brandywine’s portion of the portfolio underperformed the MSCI EAFE index. From a stock selection perspective, on a sector basis, stock selection was most positive in Financials, Energy and Consumer Discretionary stocks, offset by Technology, Materials and Industrials stocks. On a country basis, positive selections in UK, Taiwan, Switzerland and Ireland were partially offset by selections in Germany and Japan. The portfolio also benefited from an underweight in Financials but was impacted from being underweight Utilities and Australia.

9

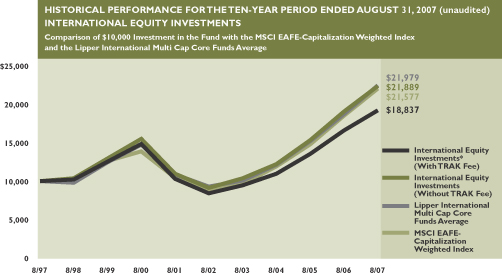

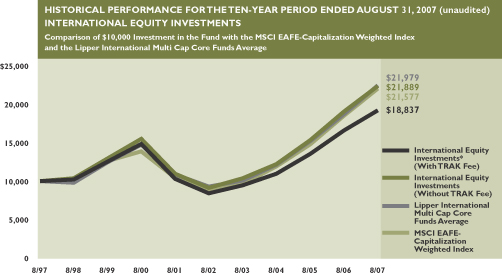

The following graph depicts the performance of the International Equity Investments vs. the MSCI EAFE-Capitalization Weighted Index 5 and the Lipper International Multi Cap Core Funds Average.16

The performance shown above and below represents past performance. Past performance is no guarantee of future results and current performance may be higher or lower than the performance shown above. Performance figures may reflect voluntary fee waivers and/or expense reimbursements. In the absence of voluntary fee waivers and/or expense reimbursements, the total return would have been lower. Principal value and investment returns will fluctuate and investors’ shares, when redeemed, may be worth more or less than their original cost. To obtain performance data current to the most recent month-end, please visit our website at www.smithbarney.com.

The graph above and returns shown below do not reflect the deduction of taxes that a shareholder would pay on fund distributions or the redemption of fund shares.

INTERNATIONAL EQUITY INVESTMENTS (unaudited)

Average Annual Total Returns for Period Ended August 31, 2007†

| | | | | | |

| | | Without TRAK Fee* | | | With TRAK Fee | |

Since inception (11/18/91) | | 8.25 | % | | 6.63 | % |

10 year | | 8.14 | | | 6.53 | |

5 year | | 19.01 | | | 17.24 | |

3 year | | 21.76 | | | 19.95 | |

1 year | | 17.21 | | | 15.46 | |

|

|

See pages 22 through 23 for all footnotes.

10

Emerging Markets

Equity Investments

ABOUTTHE SUBADVISERS

| | Ÿ | | SSgA Funds Management, Inc. (“SSgA”) | |

Uses quantitative analysis to identify countries and stocks which are undervalued relative to their growth rates. It employs an investment process that combines top-down country selection with bottom-up stock selection to determine an optimal country and security mix.

| | Ÿ | | Newgate Capital Management LLC (“Newgate”) | |

Newgate seeks long-term growth of capital by utilizing a top-down value approach in identifying undervalued economic countries, regions and sectors. Newgate incorporates both geopolitical and macroeconomic factors into its investment strategy through fundamental quantitative analysis, investment experience and professional judgment.

For the period of September 1, 2006, through August 31, 2007, the subadvisers for the portfolio were SSgA and Newgate.

The SSgA portion of the portfolio outperformed the benchmark, the MSCI Emerging Markets Index. The portfolio benefited from positions taken in China, Brazil, and Korea. The portfolio was modestly overweight in China over the last year, which, along with other stock selection models in Korea and Russia, added to overall outperformance. Brazil, the largest country overweight, was helpful due to its significant outperformance as the MSCI Brazil returned 61.3% over the year ended August 31, 2007, versus the benchmark’s 44.05% return. Detrimental to portfolio returns was the underweight position in India. Although, models suggested that Indian equities were expensive relative to their growth potential, the global investors remain willing to pay increasingly higher multiples for Indian stocks. The Indian market now trades at 4.4 times book value and pays a dividend yield of only 1.0%. The focus within the emerging market space is upon country allocation and stock selection.

Newgate’s portion of the portfolio over the past twelve months has been substantially invested in Asia, specifically China. Although the market has been subject to volatility, we have maintained substantial positions in Chinese companies to capture growth in the economy. Newgate has maintained allocations to the energy sector across all regions of emerging markets. Increasing energy demand, combined with supply constraints and fears of supply disruption, have led to higher energy prices and higher profits for energy companies. This strategy was executed by investing in companies from a number of countries, including Brazil, Russia, and South Africa. During the past twelve months, basic materials and energy stocks contributed positively to the fund’s performance relative to the emerging markets benchmark. Newgate’s positions in Brazil and China also contributed to performance. The technology stocks had positive returns, but detracted from the Fund’s performance relative to the Index. Most of Newgate’s holdings in this sector were in Taiwan and South Korea.

11

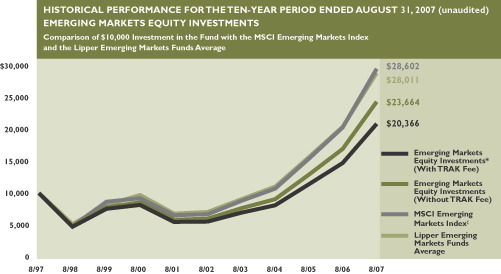

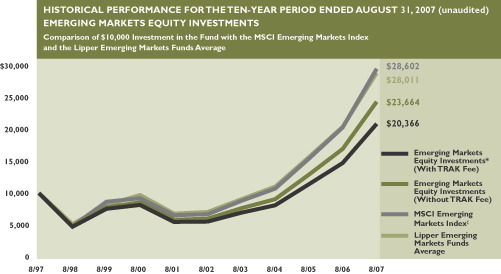

The following graph depicts the performance of the Emerging Markets Equity Investments vs. the MSCI Emerging Markets Index6 and the Lipper Emerging Markets Funds Average.17

The performance shown above and below represents past performance. Past performance is no guarantee of future results and current performance may be higher or lower than the performance shown above. Performance figures may reflect voluntary fee waivers and/or expense reimbursements. In the absence of voluntary fee waivers and/or expense reimbursements, the total return would have been lower. Principal value and investment returns will fluctuate and investors’ shares, when redeemed, may be worth more or less than their original cost. To obtain performance data current to the most recent month-end, please visit our website at www.smithbarney.com.

The graph above and returns shown below do not reflect the deduction of taxes that a shareholder would pay on fund distributions or the redemption of fund shares.

| ‡ | | Gross returns used for MSCI Emerging Markets Index from 1997 to 1999. Net returns used for MSCI Emerging Markets Index from 2000 to 2007. |

EMERGING MARKETS EQUITY INVESTMENTS (unaudited)

Average Annual Total Returns for Period Ended August 31, 2007†

| | | | | | |

| | | Without TRAK Fee* | | | With TRAK Fee | |

Since inception (4/20/94) | | 8.10 | % | | 6.48 | % |

10 year | | 8.99 | | | 7.36 | |

5 year | | 30.86 | | | 28.91 | |

3 year | | 37.50 | | | 35.45 | |

1 year | | 42.41 | | | 40.28 | |

|

|

See pages 22 through 23 for all footnotes.

12

Core Fixed

Income Investments

ABOUTTHE SUBADVISERS

| | Ÿ | | BlackRock Financial Management, Inc. (“BlackRock”) | |

Employs a relative value approach which entails portfolio duration within a narrow range and value added through sector and sub-sector rotation within the corporate and mortgage sectors. BlackRock evaluates securities within a risk management framework which consists of determining interest rate risk, yield curve risk, cash flow risk, credit risk and liquidity risk of securities.

| | Ÿ | | Pacific Investment Management Co. (“PIMCO”) | |

Employs “top-down” and “bottom-up” investment techniques. It implements the following “top-down” strategies: duration and volatility analysis, sector evaluation and yield curve shape analysis. The subadviser also employs the following “bottom-up” strategies: credit analysis, quantitative research, issue selection and cost-effective trading.

| | Ÿ | | Western Asset Management Co. (“WAMCo”) | |

Emphasizes three key strategies to enhance the Portfolio’s total return: (i) adjusting the allocation of the Portfolio among the key sectors of the fixed-income market depending on its forecast of relative values; (ii) tracking the duration of the overall Portfolio so that it falls within a narrow band relative to the benchmark index, with adjustment made to reflect its long-term outlook for interest rates; and (iii) purchasing under-valued securities in each of the key sectors of the bond market while keeping overall quality high.

For the period of September 1, 2006, through August 31, 2007, the subadvisers for the portfolio were BlackRock, PIMCO, WAMCo and MetWest was added as a new subadviser on April 10, 2007.

Throughout the period, BlackRock’s portion of the portfolio outperformed the benchmark, the Lehman Brothers Aggregate Bond™ Index, during the period. The re-pricing of risk and an escalation of the credit crunch led to a liquidity crisis at the end of the period with all spread sectors underperforming Treasuries. The portfolio’s sector allocations produced mixed returns. A defensive Credit posture was advantageous as Corporates underperformed during the period. Financial institutions were the worst performer in the Corporate sector, posting a negative return of 2.91% during the period. The portfolio maintained an overweight to Commercial Mortgage Backed Securities (“CMBS”) as the higher-rated classes represent attractive relative value. The overweight to CMBS detracted from performance as the sector experienced dramatic spread widening at the end of the period. The portfolio maintained an underweight to Agency securities, as the potential for increased regulatory scrutiny persists. The Agency underweight contributed to the positive performance.

The PIMCO portion outperformed the benchmark during the period. Specific strategies aiding performance included, a focus on the front end of the US yield curve, as investors raised expectations for cuts by the Federal Reserve (“Fed”) on the back of a slowing US economy led by the recession in the housing market. Additionally, an above-benchmark duration, as yields fell following the Fed’s decision to hold Fed funds at 5.25% and as investors fled to quality assets amid subprime concerns and the global credit crunch. Lastly, a below benchmark credit exposure strategy added performance as spreads widened on a flight to quality during the economic uncertainty of the months leading up to August 2007. Strategies that detracted from returns included an above-benchmark exposure to mortgage-backed securities, as volatility soared amid rising interest rates for mortgage borrowers and rising defaults among Alt-A and subprime homeowners. Also adversely affecting performance was a curve-steepening bias in the United Kingdom via Liffe futures, as investors pushed back expectations for the end of interest rate hikes by the Bank of England amid rising inflation and a strong economy.

The various strategies within WAMCo’s portion of the portfolio produced mixed but generally negative results during the period. A tactically-driven duration posture had a negligible impact on returns as rates oscillated during the period in a fairly flat trend. A curve-steepening strategy had a small positive impact upon performance as the spread between the two- and ten-year yields widened in the latter part of the period. Overweight exposure to the mortgage-backed sector detracted significantly from returns as spreads widened and volatility surged. An emphasis on lower-quality issues was a negative as spreads spiked higher toward the end of the period and erased the gains from earlier in the year. A modest exposure to dollar-denominated emerging market debt subtracted from returns as spreads widened.

MetWest’s outperformance of the funds benchmark since it began managing its portion of the portfolio on April 10, 2007, was attributable to its defensive positioning in the credit markets in expectation of both late credit-cycle spread widening and subprime market problems. Furthermore, the portfolio’s curve steepening exposure reflected MetWest’s view that there would ultimately be a flight to quality and a steeper yield curve. Given these conditions, MetWest had focused on high quality, primarily shorter duration corporate bonds with strong covenants, as

13

| | Ÿ | | Metropolitan West Asset Management (“MetWest”) | |

MetWest seeks to achieve consistent outperformance through the measured and diversified application of five fixed income management strategies, including (i) duration management, (ii) yield curve positioning, (iii) sector allocation, (iv) security selection, and (v) opportunistic execution. The philosophy is predicated on a long-term economic outlook. Portfolio risk is addressed through the limitation of duration to within one year of the benchmark. Investments are characterized by diversification amongst all US-Dollar denominated sectors of the fixed income marketplace. Finally, the philosophy recognizes the over-the-counter nature of the fixed income markets and the attendant potential for pricing inefficiencies that can be exploited to the portfolio’s advantage.

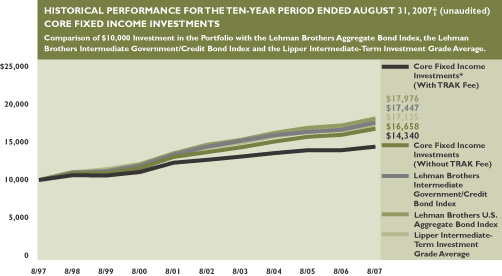

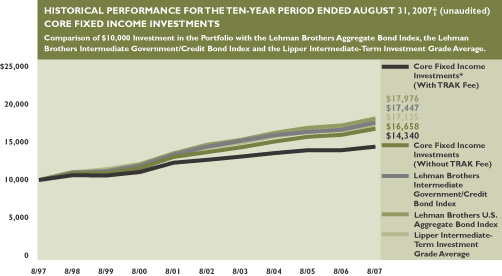

The following graph depicts the performance of the Core Fixed Income Investments vs. the Lehman Brothers U.S. Aggregate Index7, Lehman Brothers Intermediate Government/Credit Bond Index8 and the Lipper Intermediate-Term Investment Grade Average.19

well as seasoned MBS and ABS bonds with conservative underwriting, high levels of credit enhancement, and strong servicing. Although systemic widening in all of the credit markets muted performance, the fund’s conservative positioning enabled the portfolio to weather the storm and outperform the benchmark since inception. Going forward, the managers’ defensive strategy will afford the fund the ability to take advantage of wider credit market spreads if and as those conditions occur. Although the managers believe that the subprime difficulties are likely to dampen economic activity and challenge the financial markets, they will cautiously look for opportunities to take advantage of the market’s high liquidity premium by adding high quality, well-structured cash flows at much wider spreads to the Treasury market.

The performance shown above and below represents past performance. Past performance is no guarantee of future results and current performance may be higher or lower than the performance shown above. Performance figures may reflect voluntary fee waivers and/or expense reimbursements. In the absence of voluntary fee waivers and/or expense reimbursements, the total return would have been lower. Principal value and investment returns will fluctuate and investors’ shares, when redeemed, may be worth more or less than their original cost. To obtain performance data current to the most recent month-end, please visit our website at www.smithbarney.com.

The graph above and returns shown below do not reflect the deduction of taxes that a shareholder would pay on fund distributions or the redemption of fund shares.

CORE FIXED INCOME INVESTMENTS (unaudited)

Average Annual Total Returns for the Period Ended August 31, 2007†

| | | | | | |

| | | Without TRAK Fee* | | | With TRAK Fee | |

Since inception (11/18/91) | | 5.69 | % | | 4.11 | % |

10 year | | 5.22 | | | 3.66 | |

5 year | | 4.10 | | | 2.56 | |

3 year | | 3.53 | | | 1.99 | |

1 year | | 4.82 | | | 3.26 | |

|

|

See pages 22 through 23 for all footnotes.

14

High Yield Investments

ABOUTTHE SUBADVISERS

| | Ÿ | | Penn Capital Management Co., Inc. (“Penn”) | |

Penn’s initial universe is well-defined and includes all domestic, corporate cash paying dollar denominated bond issues that have spread-to-treasury and yield characteristics that are consistent with or wider than the single-B credit tier. Penn’s investment team determines sectors/industries that may offer relative value based on its macro-economic outlook. The team will review and evaluate the economic cycle, business environment, industry/sector analysis and interest rates. Penn then scans this group for companies with spreads to treasury that are wider than comparable companies, industry averages and historical averages. The team analyzes the liquidity outlook of the company through qualitative research, including bank loan facility analysis, covenant review analysis and asset value analysis. After the high yield bond universe has been narrowed and potential relative value is identified, the team performs its qualitative research to confirm or justify the credit’s value. The team determines whether or not the credit is suitable for the portfolio given its impact on Penn’s current industry weightings and the diversification it brings to the basket of credits currently held within an industry.

| | Ÿ | | Western Asset Management Co. (“WAMCo”) | |

Combines traditional analysis with innovative technology applied to all sectors of the market. WAMCo believes inefficiencies exist in the fixed-income market and attempts to add incremental value by exploiting these inefficiencies across all eligible market sectors. The key areas of focus are (i) sector and sub-sector allocation; (ii) issue selection; (iii) duration; and (iv) term structure.

For the period of September 1, 2006, through August 31, 2007, the subadvisers for the portfolio were WAMCo and Penn Capital Management, as of October 4, 2006.

WAMCo’s portion of the portfolio outperformed its primary benchmark, the Lehman Brothers High Yield Index. The portfolio was positioned to incorporate WAMCo’s view that economic activity and credit fundamentals would remain supportive of the high yield asset class. This resulted in the portfolio being overweight lower rated issues, which are disproportionately leveraged to economic activity. The primary factors contributing to the Fund’s outperformance included an overweight to CCC-rated issues which in general returned 8.71%, sub-sector allocation including overweights to Capital Goods and Wireless, which returned 7.84% and 10.78%, respectively, and a cash inflow related to the settlement of WorldCom litigation. Issue selection was neutral to performance.

Penn’s portion of the portfolio has outperformed the high yield broad market over the last 12 months thanks to strong security selection and opportunistic investments in the stressed and distressed segments of the markets. During the past 12-18 months Penn took profits primarily in the stressed segment of the market place (bonds trading below their par value, offering both income and capital appreciation potential) and gradually rotated up in credit quality in anticipation of a rise in future default rates. Despite the defensive positioning, Penn continues to find both distressed and defaulted opportunities that can contribute to short term returns, and volatility. This volatility is magnified during times of concern in the credit markets, which occurred in August 2007. This credit concern, driven largely by fears of how deeply sub-prime problems would extend, started to diminish as the quarter ended. Although the fund has no direct exposure to sub-prime mortgage credit, it did have material weakness in a credit related to the prime mortgage market. This credit was sold at a loss to minimize further weakness associated with sentiment. On the positive side, the portfolio continues to benefit from the consolidation of both the fixed and wireless segments of the telecommunications market, as four merger & acquisition transactions among Penn’s names provided positive contribution. Overall, Penn remains conservatively positioned going into the fund’s first fiscal quarter and will look to add to total return and distressed opportunities as they develop.

15

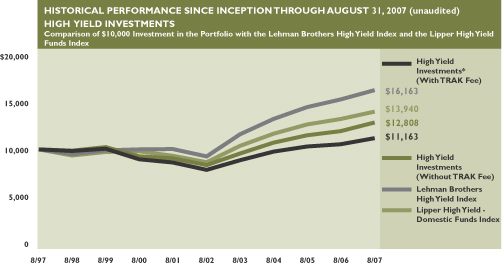

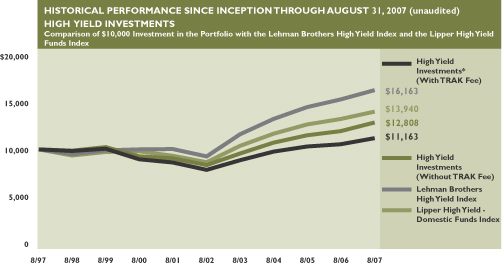

The following graph depicts the performance of the High Yield Investments vs. the Lehman Brothers High Yield Index9 and the Lipper High Yield Funds Index.20

The performance shown above and below represents past performance. Past performance is no guarantee of future results and current performance may be higher or lower than the performance shown above. Performance figures may reflect voluntary fee waivers and/or expense reimbursements. In the absence of voluntary fee waivers and/or expense reimbursements, the total return would have been lower. Principal value and investment returns will fluctuate and investors’ shares, when redeemed, may be worth more or less than their original cost. To obtain performance data current to the most recent month-end, please visit our website at www.smithbarney.com.

The graph above and returns shown below do not reflect the deduction of taxes that a shareholder would pay on fund distributions or the redemption of fund shares.

HIGH YIELD INVESTMENTS (unaudited)

Average Annual Total Returns for the Period Ended August 31, 2007†

| | | | | | |

| | | Without TRAK Fee* | | | With TRAK Fee | |

Since inception (7/13/98) | | 2.74 | % | | 1.21 | % |

5 year | | 8.91 | | | 7.29 | |

3 year | | 6.16 | | | 4.59 | |

1 year | | 7.56 | | | 5.97 | |

|

|

See pages 22 through 23 for all footnotes.

16

International Fixed

Income Investments

ABOUTTHE SUBADVISER

| | Ÿ | | Pacific Investment Management Company (“PIMCO”) | |

PIMCO’s total return approach focuses on both capital appreciation and income while managing overall risk. PIMCO employs a core philosophy toward managing global bonds focusing on both economic and credit fundamentals as key determinants of value in fixed income markets, limiting volatility with respect to the benchmark index.

For the period of September 1, 2006, through August 31, 2007, the subadviser for the portfolio was PIMCO.

The portfolio underperformed its benchmark, the Citigroup World Global Bond Index ex-US USD hedged, over the last twelve months. US yields fell sharply as subprime concerns led to a flight to quality. Euroland and UK bonds lagged Treasuries as the European Central Bank and Bank of England continued to hike while the Fed left rates unchanged at 5.25%. US Treasuries returned 6.02% over the year. Yields fell on a slowing housing market, subprime concerns and falling core inflation. The US yield curve steepened significantly over the past 12 months as investors raised expectations for cuts by the Federal Reserve. Rising spreads on mortgage-backed securities, investment-grade and high yield corporate bonds due to rising volatility, slowing growth in the US economy, and a global credit crunch, caused most other sectors to underperform Treasuries over the year ended August 31, 2007. Euroland government bonds returned 2.64% on a hedged basis, underperforming US Treasuries over the year. Yields rose across the curve while the 2-30s differential was unchanged as the ECB hiked overnight rates from 3% to 4% over the year. The ECB remains cautious of upside risks to inflation in the medium and long term but judges that risks to the outlook for growth lie on the downside due to the liquidity crisis. The market substantially reduced the probability of further rate hikes. The Euro strengthened 6.38% versus the US dollar on a narrowing interest rate differential. UK gilts underperformed US Treasuries, posting a 0.75% return on a hedged basis. Yields rose across the curve as strong credit growth and limited spare capacity kept the Bank of England (“BOE”) in tightening mode. The BOE raised rates from 4.75% to 5.75% while the Pound sterling rallied 5.91% versus the US dollar over the year. Japanese government bonds (“JGBs”) returned 6.90% during the year. The JGB curve flattened, as the Bank of Japan (“BOJ”) raised the overnight rate to 50 bps. Income growth and consumer confidence remain strong while inflation remains benign, keeping the BOJ on the sidelines and data-dependent for its next rate move. The yen rose nearly 1.4% versus the US dollar over the year on rising risk aversion and a reversal of the carry trade.

Important contributors to performance included: US duration, as US bonds outperformed the index on weak economic data and falling core inflation, a curve steepening bias in the US as short maturity yields fell more than long maturities on rising expectations of Fed easing, and an overweight to the Japanese Yen, as it strengthened on a global flight to quality. The following strategies detracted from returns: strategies that benefit when US & UK short maturity swap spreads narrow as a liquidity crunch and subprime concerns led to wider swap spreads, pay fixed swap positions on the back end of the US and UK curves as the swap curve flattened over the year, curve steepening bias in the UK as the BOE hiked rates due to limited spare capacity, tactical holdings of mortgage securities as mortgage spreads widened due to the pickup in rate volatility, and an allocation to bank capital notes as spreads widened for financial companies on rising risk aversion.

17

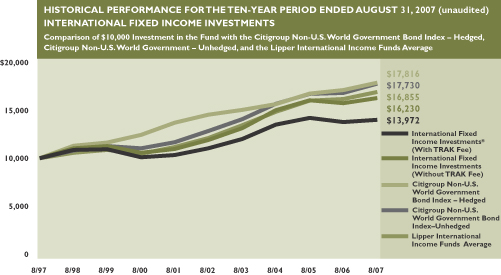

The following graph depicts the performance of the International Fixed Income Investments vs. the Citigroup Non-U.S. World Government Bond Index - Hedged11, the Citigroup Non-U.S. World Government Bond Index - Unhedged11 and the Lipper International Income Funds Average.18