UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED

MANAGEMENT INVESTMENT COMPANIES

Investment Company Act file number: 811-06318

CONSULTING GROUP CAPITAL MARKETS FUNDS

(Exact name of registrant as specified in charter)

2000 Westchester Avenue

Purchase, NY 10577

(Address of principal executive offices)(Zip code)

CT Corp

155 Federal Street Suite 700

Boston, MA 02110

(Name and address of agent for service)

Registrant’s telephone number, including area code: (877) 937-6739

Date of fiscal year end: 8/31

Date of reporting period: 8/31/2012

Form N-CSR is to be used by management investment companies to file reports with the Commission not later than 10 days after the transmission to stockholders of any report that is required to be transmitted to stockholders under Rule 30e-1 under the Investment Company Act of 1940 (17 CFR 270.30e-1). The Commission may use the information provided on Form N-CSR in its regulatory, disclosure review, inspection, and policymaking rules.

A registrant is required to disclose the information specified by Form N-CSR, and the Commission will make this information public. A registrant is not required to respond to the collection of information contained in Form N-CSR unless the Form displays a currently valid Office of Management and Budget (“OMB”) control number. Please direct comments concerning the accuracy of the information collection burden estimate and any suggestions for reducing the burden to Secretary, Securities and Exchange Commission, 450 Fifth Street, NW, Washington, DC 20549-0609. The OMB has reviewed this collection of information under clearance requirements of 44 U.S.C. § 3507.

ITEM 1. REPORTS TO STOCKHOLDERS

Consulting Group

Capital Markets Funds

TRAK®

Annual Report

>>August 31, 2012

| | • | | Large Capitalization Growth Investments |

| | • | | Large Capitalization Value Equity Investments |

| | • | | Small Capitalization Growth Investments |

| | • | | Small Capitalization Value Equity Investments |

| | • | | International Equity Investments |

| | • | | Emerging Markets Equity Investments |

| | • | | Core Fixed Income Investments |

| | • | | International Fixed Income Investments |

| | • | | Municipal Bond Investments |

| | • | | Money Market Investments |

INVESTMENT PRODUCTS: NOT FDIC INSURED • NO BANK GUARANTEE • MAY LOSE VALUE

Table of Contents

Consulting Group

Capital Markets Funds

DEAR SHAREHOLDER,

Political elections and global economic growth, as well as the monetary union and debt crisis in the Eurozone, were among the dominant topics that persistently confronted the financial markets during the fiscal annual reporting period ended August 31, 2012. Increased volatility in the equity and fixed income markets, encompassing ebbs and flows reflecting “risk-on” or “risk-off” investor shifts in global sentiments, defined the one-year period as investors continued to deal with uncertainties related to the global environment.

Despite a tumultuous year, domestic U.S. equities delivered strong performance results during the period. Better-than-expected economic data in the United States (“U.S.”), combined with accommodative Federal Reserve policies, created a general tone of cautious optimism throughout the year. Given that backdrop, it was not surprising to see large market capitalization stocks in the U.S. among the performance leaders from a market capitalization perspective, as investors sought and rewarded companies perceived to have greater relative stability in their earnings.

U.S. investors in overseas stocks were not as fortunate. Developed international and emerging markets equities generally ended the annual period in negative territory. Although foreign equities appeared to have been invigorated at times during the year, boosted in large part by a belief that Europe had made some progress toward containing its sovereign debt woes, a European recession and signs of a slowdown in global economic growth diminished investor enthusiasm. Notably, developed equities in the Pacific region and in Japan came under pressure, while emerging markets stocks in countries such as China and Russia typically lost value. At the same time, currency effects generally had a negative impact on performance, as the U.S. dollar strengthened relative to foreign currencies, hurting unhedged U.S.-based investors venturing into international and emerging markets.

Fueled by falling yields and rising prices, domestic taxable and tax-exempt bonds generated solid advances over the fiscal year. Investors in long-term maturing Treasury bonds were especially rewarded during the year, as negative headline news generally prompted intermittent “flight-to-safety” trades that sparked rallies in the Treasury market. Yields in other bond market segments also contracted to lower levels in the period, benefiting investments in municipal bonds, corporate issues, mortgage-backed securities, and high yield debt. Returns on money market funds continued to remain depressed, reflecting the Federal Reserve Board’s 0% to 0.25% target range for short-term interest rates.

The positive and negative confidence disposition expressed by investors, as they appeared to embrace risk or gravitate toward risk aversion over the fiscal year, draws attention to the challenges clearly faced by the Consulting Group Capital Markets (“CGCM”) Funds and active investment advisers managing portfolios through periods of uncertainty and characterized by rapidly rotating risk environments.

Consulting Group Capital Markets Funds

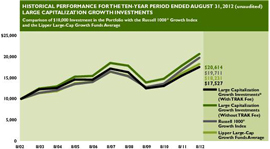

CGCM Large Capitalization Growth Investments gained +15.7% in the annual period, exceeding the average +14.1% total return of mutual funds included in the Lipper Large-Cap Growth Funds Average investment category i, but lower than the +17.4% increase in the Russell 1000® Growth Index ii. An overweight exposure to the Information Technology sector, combined with positive stock selections in the Information Technology (IT services) and Telecommunication Services (wireless) sectors, contributed to returns, while investments in the Consumer Discretionary (specialty retail, hotels restaurants & leisure) and Health Care (biotechnology) sectors unfavorably affected performance in the yearly period.

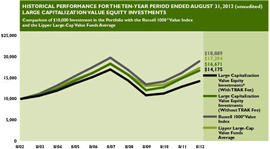

i

Large Capitalization Value Equity Investments registered a total return of +12.5% in the fiscal year, trailing the average +14.6% rise in the performance of mutual funds included in the Lipper Large-Cap Value Funds Average investment category iii and the +17.3% advance in the Russell 1000® Value Index iv. An overweight allocation to the Energy sector and an underweight exposure to the Consumer Discretionary sector, in addition to stock selections in the Information Technology (semiconductors & semiconductor equipment), Health Care (pharmaceuticals), Energy (equipment & services), Telecommunication Services (wireless), and Industrials (commercial services & supplies) sectors, negatively impacted relative returns in the annual fiscal period.

Small Capitalization Growth Investments generated an +11.5% return in the twelve-month fiscal period ending August 31, 2012, as compared to the average +11.9% increase in mutual funds included in the Lipper Small-Cap Growth Funds Average investment category v and the +12.7% gain in the Russell 2000® Growth Index vi. An underweight exposure to the Health Care sector, combined with underperforming security selections in the Health Care (biotechnology), Energy (equipment & services), and Consumer Discretionary (specialty retail) sectors, adversely affected one-year relative performance.

Small Capitalization Value Equity Investments experienced an increase of +16.9% in the fiscal year, exceeding the average +11.7% rise in mutual fund included in the Lipper Small-Cap Value Funds Average investment category vii and the +14.1% gain in the Russell 2000® Value Index viii. Favorable contributions from holdings in the Materials (chemicals), Information Technology (semiconductors & semiconductor equipment), Industrials (electrical equipment, marine), Energy (equipment & services), and Consumer Discretionary (leisure equipment & products) sectors helped relative performance over the period.

International Equity Investments fell slightly on an absolute basis, posting a decline of -0.1% in the fiscal period. Relative performance was marginally lower than the negligible -0.0% retreat in the MSCI EAFE® Index ix (Net), as well as the average +0.1% rise in mutual funds included in the Lipper International Large-Cap Core Average investment categoryx. Stock selections in the Information Technology (semiconductors & semiconductor equipment) sector, in addition to selective country exposures, contributed to one-year returns in the fiscal period. In particular, overweight allocations to China and South Korea, respectively, combined with an underweight position in Japan and Spain, added value. However, a concurrent overweight exposure to Brazil, combined with investments in Australia, China, and Hong Kong, as well as in various sectors including Energy (oil gas & consumable fuels) and Financials (commercial banks), detracted from performance during the year.

Emerging Markets Equity Investments declined -6.5% in the one-year period, marginally surpassing the average -6.8% decline in mutual funds included in the Lipper Emerging Markets Average investment category xi, but lagging the -5.8% decline in the MSCI Emerging Markets Index xii (Net). An overweight position to Turkey and an underweight exposure to India, combined with favorable stock selections in the Telecommunication Services (wireless), Information Technology (IT Services), and Industrials (construction & engineering) sectors, enhanced relative performance in period. Sector exposures, including an underweight allocation to the Materials sector, as well as selective investments in Brazil, Russia, and South Africa, also benefited relative returns. Conversely, an exposure to Argentina and an underweight allocation to Malaysia, in combination with unsuccessful stock selections in the Energy (oil gas & consumable fuels), Financials (real estate management & development, commercial banks), Materials (chemicals, metals & mining), and Consumer Discretionary (hotels restaurants & leisure) sectors, hurt relative performance over the year. Selective investments in China and Hong Kong also detracted from relative returns in the fiscal period.

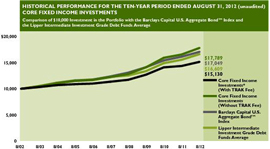

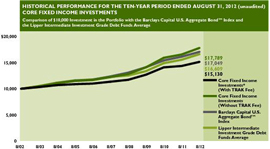

Core Fixed Income Investments advanced +7.6% in the fiscal performance period, outperforming both the average +7.0% rise in mutual funds included in the Lipper Intermediate Investment Grade Debt Funds Average investment category xiii and the +5.8% increase in the Barclays Capital U.S. Aggregate BondTM Index xiv. Contributions from investment grade and high yield sector selections helped relative performance in the period, offsetting declines from interest rate management and individual bond selections.

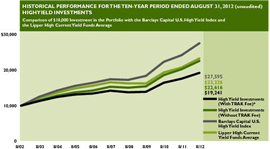

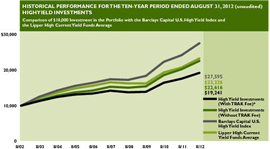

High Yield Investments gained +11.6% in the annual fiscal reporting period, trailing the average +12.1% increase in mutual funds included in the Lipper High Current Yield Funds Average investment category xv and the +13.9% return of the Barclays Capital U.S. High Yield Index xvi. Interest rate management, sector, and individual bond selections all detracted from relative performance over the period.

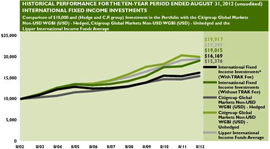

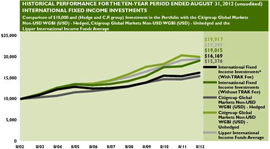

ii

International Fixed Income Investments experienced a total return of +7.5% in the fiscal period, outperforming the +5.2% increase in the Citigroup Non-USD World Government Bond Index (USD) Hedged xvii and significantly above the average +0.3% rise in mutual funds included in the Lipper International Income Funds Average investment category xviii. Selective developed and emerging market country exposures, sector selections (investment grade, high yield, and mortgage-backed securities), and bond selections generally contributed to relative performance in the period. The strong performance of the U.S. dollar, as well as the fund’s mandate to hedge a majority of its foreign currency exposure, also impacted relative returns.

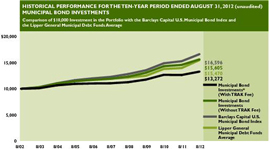

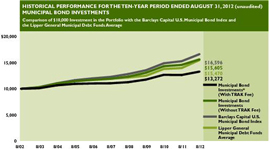

Municipal Bond Investments’ twelve-month performance of +7.2% lagged the +8.8% return of the Barclays Capital U.S. Municipal Bond Index xix and also underperformed the average +11.0% gain in mutual funds included in the Lipper General Municipal Debt Funds Average investment category xx. Yield curve positioning and a higher quality bias affected relative returns unfavorably over the fiscal year. Investors who sought higher yields in lower-quality municipal securities and in longer-maturing bonds benefited, as lower-quality municipal issues generally outperformed higher-quality ones and the prices of longer-term maturing debt rallied in the period.

Information regarding the sub-advisers of the CGCM Funds and commentary specific to each individual investment manager is available in the Annual Report following this Shareholder Letter.

As the fiscal reporting period came to an end, central bank intervention globally provided the ignition needed to inspire a summer rally in risk assets. Investors, at least for the moment, generally appeared to put aside unease related to the monetary union and debt crisis in the Eurozone and a deceleration in various national economies. In addition, the U.S. continued to cope with a slow economy, high unemployment, as well uncertainty surrounding approaching political elections and a potential “fiscal cliff” scheduled to take effect on January 1, 2013. Although we remain optimistic over the long-term prospects for the CGCM Funds going forward, challenges certainly remain, and diversified investors should bear in mind that market volatility may potentially provide opportunities for patient investors who maintain a long-term orientation. Investors who require individualized assistance should seek guidance from their Financial Advisor.

We thank you for your continued confidence in Morgan Stanley Wealth Management and support as shareholders of the CGCM Funds.

Sincerely,

James F. Walker

Chief Executive Officer

October 19, 2012

iii

The performance shown represents past performance. Past performance is no guarantee of future results and current performance may be higher or lower than the performance shown above. Principal value and investment returns will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost. The returns shown do not reflect the deduction of taxes that a shareholder would pay on fund distributions or the redemption of fund shares. To obtain performance data current to the most recent month-end, please visit our website at https://www.smithbarney.com/products_services/managed_money/trak/trak_cgcm.html.

Shares of the Funds are available to participants in advisory programs or asset based fee programs sponsored by Morgan Stanley Smith Barney LLC (“Morgan Stanley”), including the TRAK® Personalized Investment Advisory Service (“TRAK®”), or other investment advisory programs approved by Morgan Stanley. The advisory services provide investors with asset allocation recommendations, which are implemented through the Funds. The fees and expenses of these other investment advisory programs may vary, but are generally expected to be comparable to the annual fees paid by TRAK® participants, which may be up to 2.00%. Shareholders who acquire shares of the Funds through an investment advisory program other than through TRAK® may pay higher or lower fees.

All index performance reflects no deduction for fees, expenses or taxes. Please note an investor cannot invest directly in an index.

RISKS: Certain of the Funds may invest in derivatives, such as options and futures, which can be illiquid, may disproportionately increase losses, and have a potentially large impact on Fund performance. Foreign securities are subject to certain risks of overseas investing including currency fluctuations and changes in political and economic conditions, which could result in significant market fluctuations. These risks are magnified in emerging or developing markets. Investments in small or medium-capitalization companies may involve a higher degree of risk and volatility than investments in larger, more established companies. Certain of the Funds may invest in high yield bonds, which involve greater credit and liquidity risks than investment grade bonds.

| i | The Lipper Large-Cap Growth Funds Average investment category — Funds that, by portfolio practice, invest at least 75% of their equity assets in companies with market capitalizations (on a three-year weighted basis) above Lipper’s USDE large-cap floor. Large-cap growth funds typically have an above-average price-to-earnings ratio, price-to-book ratio, and three-year sales-per-share growth value, compared to the S&P 500® Index. |

| ii | The Russell 1000® Growth Index is a capitalization weighted total return index which is comprised of 1,000 of the largest capitalized U.S.-domiciled companies with greater-than-average growth orientation whose common stock is traded in the U.S. on the New York Stock Exchange, American Stock Exchange and NASDAQ. |

| iii | The Lipper Large-Cap Value Funds Average investment category — Funds that, by portfolio practice, invest at least 75% of their equity assets in companies with market capitalizations (on a three-year weighted basis) above Lipper’s USDE large-cap floor. Large-cap value funds typically have a below average price-to-earnings ratio, price-to-book ratio, and three-year sales-per-share growth value, compared to the S&P 500® Index. |

| iv | The Russell 1000® Value Index is a capitalization weighted total return index which is comprised of 1,000 of the largest capitalized U.S.-domiciled companies with greater than average value orientation whose common stock is traded in the U.S. on the New York Stock Exchange, American Stock Exchange and NASDAQ. |

| v | The Lipper Small-Cap Growth Funds Average investment category — Funds that, by portfolio practice, invest at least 75% of their equity assets in companies with market capitalizations (on a three-year weighted basis) below Lipper’s USDE small-cap ceiling. Small-cap growth funds typically have an above-average price-to-earnings ratio, price-to-book ratio, and three year sales-per-share growth value, compared to the S&P Small-Cap 600 Index. |

| vi | The Russell 2000® Growth Index is a capitalization weighted total return index which is comprised of 2,000 of the smallest capitalized U.S.-domiciled companies with greater-than-average growth orientation whose common stock is traded in the U.S. on the New York Stock Exchange, American Stock Exchange and NASDAQ. |

| vii | The Lipper Small-Cap Value Funds Average investment category — Funds that, by portfolio practice, invest at least 75% of their equity assets in companies with market capitalizations (on a three-year weighted basis) below Lipper’s USDE small-cap ceiling. Small-cap value funds typically have a below-average price-to-earnings ratio, price-to-book ratio, and three-year sales-per-share growth value, compared to the S&P Small-Cap 600 Index. |

| viii | The Russell 2000® Value Index is a capitalization weighted total return index which is comprised of 2,000 of the smallest capitalized U.S.-domiciled companies with less-than-average growth orientation whose common stock is traded in the U.S. on the New York Stock Exchange, American Stock Exchange and NASDAQ. |

| ix | The MSCI EAFE® Index is a composite portfolio or equity total returns for the countries of Australia, New Zealand and countries in Europe and the Far East, weighted based on each country’s market capitalization. MSCI EAFE® Index is a registered trademark of MSCI Inc. |

| x | The Lipper International Large-Cap Core Average investment category — Funds that, by portfolio practice, invest at least 75% of their equity assets in companies strictly outside of the U.S. with market capitalizations (on a three-year weighted basis) above Lipper’s international large-cap floor. International large-cap core funds typically have an average price-to-cash flow ratio, price-to-book ratio, and three-year sales-per-share growth value compared to their large-cap-specific subset of the S&P/Citigroup World ex-U.S. BMI. |

| xi | The Lipper Emerging Markets Funds Average investment category — Funds that seek long-term capital appreciation by investing at least 65% of total assets in emerging market equity securities, where “emerging market” is defined by a country’s GNP per capita or other economic measures. |

| xii | The MSCI Emerging Markets Index is an index comprised of thirteen emerging markets open to direct foreign participation. |

| xiii | The Lipper Intermediate Investment Grade Debt Funds Average investment category – Funds that invest primarily in investment-grade debt issues (rated in the top four grades) with dollar-weighted average maturities of five to ten years. |

| xiv | The Barclays Capital U.S. Aggregate BondTM Index is composed of the Barclays Capital Intermediate Government/Credit Bond Index and the Barclays Capital Mortgage-Backed Securities Index and includes treasury issues, agency issues, Corporate bond issues and mortgage-backed securities. Barclays Capital U.S. Aggregate Bond Index is a trademark of Barclays Capital. |

| xv | The Lipper High Current Yield Funds Average investment category – Funds that aim to provide a high level of current yield from fixed income securities, with a substantial portion in medium- or lower-grade debt issues. The funds may invest in high-yielding government bonds (typically, of developing markets or higher-yielding OECD countries), Corporate and municipal bonds, eurobonds, convertible bonds, and preferred shares. |

| xvi | The Barclays Capital U.S. High Yield Index is composed of fixed rate, publicly issued, non-investment grade debt registered with the SEC. All bonds must be dollar-denominated, non-convertible and have at least one year remaining to maturity as well as an outstanding par value of $100 million. |

| xvii | The Citigroup Non-USD WGBI (World Government Bond Index) (USD) Hedged and Unhedged are market capitalization weighted indexes that are designed to represent the hedged performance of the government bond markets in thirteen developed countries, excluding the U.S. |

| xviii | The Lipper International Income Funds Average investment category – Funds that state in their prospectus that they invest primarily in U.S. dollar and non-U.S. dollar debt securities of issuers located in at least three countries, excluding the United States, except in periods of market weakness. |

| xix | The Barclays Capital U.S. Municipal Bond Index is a weighted composite which is comprised of more than 15,000 bonds issued within the last five years, having a minimum credit rating of at least Baa and maturity of at least two years, excluding all bonds subject to the Alternative Minimum Tax and bonds with floating or zero coupons. |

| xx | The Lipper General Municipal Debt Funds Average investment category – Funds that invest primarily in municipal debt issues in the top four credit ratings. |

iv

| | | | |

Performance of the Consulting Group Capital Markets Funds For the Year Ended August 31, 2012†* (unaudited) | | | | |

| |

Large Capitalization Growth Investments | | | 15.71 | % |

Russell 1000® Growth Index (1) | | | 17.37 | |

| |

Large Capitalization Value Equity Investments | | | 12.50 | |

Russell 1000® Value Index (2) | | | 17.30 | |

| |

Small Capitalization Growth Investments | | | 11.54 | |

Russell 2000® Growth Index (3) | | | 12.72 | |

| |

Small Capitalization Value Equity Investments | | | 16.93 | |

Russell 2000® Value Index (4) | | | 14.08 | |

| |

International Equity Investments | | | -0.06 | |

MSCI EAFE® Index (5) | | | -0.04 | |

| |

Emerging Markets Equity Investments | | | -6.52 | |

MSCI Emerging Markets Index (6) | | | -5.80 | |

| |

Core Fixed Income Investments | | | 7.58 | |

Barclays Capital U.S. Aggregate Bond™ Index (7) | | | 5.78 | |

| |

High Yield Investments | | | 11.57 | |

Barclays Capital U.S. High Yield Index (8) | | | 13.89 | |

| |

International Fixed Income Investments | | | 7.53 | |

Citigroup Non-USD WGB (USD) — Hedged (9) | | | 5.18 | |

| |

Municipal Bond Investments | | | 7.23 | |

Barclays Capital U.S. Municipal Bond Index (10) | | | 8.78 | |

| |

Money Market Investments** | | | 0.02 | |

90-day Treasury Bill Index | | | 0.06 | |

See pages 26 through 27 for all footnotes.

v

Large Capitalization Growth Investments

ABOUTTHE SUBADVISERS

| | • | | Delaware Management Company (“Delaware”) |

Delaware invests primarily in common stocks of large capitalization growth-oriented companies that Delaware believes have long-term capital appreciation potential and are expected to grow faster than the U.S. economy. Using a bottom up approach, Delaware seeks to select securities of companies that it believes have attractive end market potential, dominant business models and strong free cash flow generation that are attractively priced compared to the intrinsic value of the securities. Delaware also considers a company’s operational efficiencies, management’s plans for capital allocation and the company’s shareholder orientation. Delaware currently defines large capitalization companies as those that, at the time of investment, have market capitalizations within the range of market capitalizations of companies in the Russell 1000® Growth Index. While the market capitalization of companies in the Russell 1000® Growth Index ranged from approximately $746 million to $624 billion as of August 31, 2012, Delaware will normally invest in common stocks of companies with market capitalizations of at least $3 billion at the time of purchase.

| | • | | Wells Capital Management, Inc. (“WellsCap”) |

WellsCap employs both proprietary screens and intensive grassroots research in order to identify high-growth companies expected to outperform their peers. Their investment philosophy is firmly rooted in the belief that successful investing is the result of focusing on companies with favorable underlying fundamentals, strong growth potential and solid management teams. Security selection is based on fundamental research. This research process works to “surround” an investment by focusing on the company’s financials and verifying fundamentals with the management team, mid-level employees, customers, competitors, suppliers and/or distributors.

| | • | | Westfield Capital Management Company, L.P. (“Westfield”) |

Westfield uses an active management style and favors investing in earnings stocks given its conviction that stock prices follow earnings progress and that they offer the best opportunity for superior real rates of return. Westfield believes that reasonably priced stocks with high earnings potential are best identified through in-depth, fundamental research.

For the period of September 1, 2011, through August 31, 2012, the Sub-advisers for CGCM Large Capitalization Growth Investments (“Fund”) were Delaware Management Company (“Delaware”), Wells Capital Management, Inc. (“WellsCap”), Westfield Capital Management Company, L.P. (“Westfield”) and Frontier Capital Management Co., LLC (“Frontier”).

The portion of the Fund managed by Delaware outperformed the Fund’s benchmark, the Russell 1000® Growth Index (“benchmark”), during the year ended August 31, 2012. Typical of Delaware’s concentrated portfolio approach, stock selection was a significant factor in the Portfolio’s performance. Solid stock selection in the Technology and Energy sectors was meaningful to returns. Stock selection also helped performance in the Financial sector, and an overweight in that sector increased relative performance. Regarding the portfolio holdings in the Financial sector, it is important to note that Delaware seeks companies that are transaction-based, as opposed to “spread lending” companies, preferring business model characteristics that include high incremental margins and the ability to self-fund their businesses. In Delaware’s view, transaction-based Financials generally lack the need to access funding through the capital markets — a feature that it believes has plagued many spread lenders in the last few years.

The portion of the Fund managed by WellsCap outperformed the benchmark for the year ended August 31, 2012. Emerging from uncertainty created by debates over budget deficits and the downgrade of U.S. government debt, the economy showed continued signs of recovery and growth. Strength in corporate earnings combined with moderate, but not stellar, growth in Growth Domestic Product (“GDP”) and employment provided the backdrop for healthy returns. The return progression was not consistently positive, however, as bouts of “risk-off” mitigated clear periods of “risk-on”. Concerns over the European debt crisis, a slowdown in U.S. job growth and fears of a hard landing in China weighed on investor sentiment. By working within WellsCap’s process to manage risk and return through portfolio construction, the portfolio was tilted toward “core holdings”, domestic exposure and secular growth. This positioning stabilized returns allowing for portfolio outperformance. As can be expected from a fundamentally driven, bottom-up manager, stock selection was the primary contributor to investment returns. Portfolio holdings in the computer and peripheral and IT services industries within Information Technology were the primary drivers of sector returns. Also contributing nicely to relative returns for the year was stock selection in the Materials, Telecommunications Services and Industrials sectors. World oil prices were volatile throughout the period, with dramatic swings from quarter to quarter based on changes in attitude toward global growth or availability of supply. As a result, stock selection within the Energy sector was challenged resulting in a performance headwind.

1

• Frontier Capital Management Co., LLC (“Frontier”)

Frontier is a research-driven firm specializing in the management of growth-oriented U.S. equity portfolios. They believe that growth must be purchased at a reasonable price and that fundamental, bottom-up research is the cornerstone to adding value. The firm’s philosophy since its founding in 1980 is that stock prices ultimately follow earnings growth. Frontier believes that there are three key drivers of long-term, consistent performance and look for companies that possess 1) improving business models, 2) unrecognized earnings power and 3) attractive valuations.

The portion of the Fund managed by Westfield underperformed the Fund’s benchmark during the year ended August 31, 2012. Portfolio investments within the Industrials and Consumer Staples sectors were the most significant positive contributors to relative returns. Health Care was the largest detractor from relative results, while investments within the Energy and Financials sectors also hindered relative performance. Concerns about a double-dip recession intensified during the second half of 2011, prompting a retreat from risky assets of all types. Investors hid in slower growth names that provided stable yet predictable earnings growth at higher earnings multiples. Given Westfield’s growth-at-a-reasonable price process, many of these outperformers did not fit its investment criteria, and therefore Westfield had only limited exposure to them. Market dynamics reversed sharply as 2012 began. A strengthening domestic economy and accommodative monetary policy around the globe helped revive investor appetite for stocks. However, as the year progressed, the risk-off environment returned and “bond proxies” were again the big outperformers. The portfolio lagged its benchmark during the market selloff. During July and August, the market began to climb higher, despite wavering economic indicators. Cyclically-oriented sectors, namely Energy and Materials, experienced solid advances. The portfolio’s exposure to these sectors, combined with positive stock selection, added to relative returns during this two-month period. When searching for new investment candidates, Westfield typically focuses on firms that can deliver consistent organic revenue growth, based on the belief that solid operational performance will eventually manifest itself in above-average financial performance. Defensive stocks with little-to-no growth are very expensive and have outperformed during the last two years. Westfield continues to see far better risk/rewards in high-quality growth companies reliant on some global GDP growth.

The portion of the Fund managed by Frontier, with an emphasis on midcap growth stocks, underperformed the Fund’s large cap growth benchmark, but outperformed the Russell Midcap® Growth Index, for the year ended August 31, 2012. Healthy corporate profits and coordinated global easing by central banks helped to propel the markets forward. Frontier’s relative performance was aided by the Consumer Discretionary, Energy and Financials sectors. Consumer Discretionary stocks performed well and Energy holdings performed well due to a focus on exploration and production companies with reliable, fast growing domestic shale positions. Financials prospered by identifying the need for greater outsourcing by major financial services firms to processing companies. Looking forward, Frontier’s discipline continues to balance valuation with growth. It is likely that economic activity will remain muted given greater fiscal constraints, questionable economic conditions abroad, as well as persistent unemployment continuing domestically. As such, Frontier remains focused on companies that show sustained earnings improvement driven by favorable secular demand and innovation, market share gains in growth markets, margin expansion initiatives, and opportunities to utilize balance sheet and cash flow resources. Frontier believes such businesses will be accorded premium equity valuations in a period of low growth and expects the portfolio to benefit from this dynamic.

The performance shown above and below represents past performance. Past performance is no guarantee of future results and current performance may be higher or lower than the performance shown above and below. Performance figures may reflect voluntary fee waivers and/or expense reimbursements. In the absence of voluntary fee waivers and/or expense reimbursements, the total return would have been lower. Principal value and investment returns will fluctuate and investors’ shares, when redeemed, may be worth more or less than their original cost. To obtain performance data current to the most recent month-end, please visit our website at www.smithbarney.com.

2

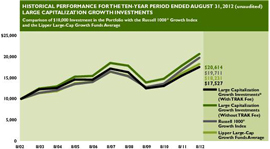

The following graph depicts the performance of Large Capitalization Growth Investments vs. the Russell 1000® Growth Index1 and the Lipper Large-Cap Growth Funds Average.11

The graph above and returns shown below do not reflect the deduction of taxes that a shareholder would pay on fund distributions or the redemption of fund shares.

LARGE CAPITALIZATION GROWTH INVESTMENTS (unaudited)

Average Annual Total Returns for the Period Ended August 31, 2012†

| | | | | | | | |

| | | Without TRAK Fee | | | With TRAK Fee* | |

Since inception (11/18/1991) | | | 7.09 | % | | | 5.43 | % |

10 year | | | 7.50 | | | | 5.77 | |

5 year | | | 2.21 | | | | 0.44 | |

3 year | | | 14.13 | | | | 11.98 | |

1 year | | | 15.71 | | | | 13.42 | |

See pages 26 through 27 for all footnotes.

3

Large Capitalization Value Equity Investments

ABOUTTHE SUBADVISERS

| | • | | Cambiar Investors, LLC (“Cambiar”) |

Cambiar utilizes a bottom-up process that seeks to identify companies that are attractively priced, demonstrate positive developments not yet recognized by the market and offer significant appreciation potential within a one- to two-year time frame.

| | • | | NFJ Investment Group, LLC (“NFJ”) |

The NFJ investment process initially screens for positive fundamentals by applying a screen over a universe of approximately 800 stocks in order to identify companies with positive fundamental characteristics. After the screen has been applied, NFJ then conducts in-depth research and analysis by reviewing each of the remaining 150-200 possible investments for low price-to-earnings multiples, high dividend yields, positive prospective earnings and quality operations. As part of the portfolio construction process, industry concentration is mitigated by avoiding overexposure to any one sector by restricting the number of stocks held within a single industry. The portfolio generally holds 40 to 50 companies. NFJ’s process involves regular portfolio and universe monitoring for buy and sell candidates. NFJ continually repeats its research process in order to identify new buy and sell candidates. The sell discipline is an important part of NFJ’s process. A stock is sold when an alternative stock with equally strong fundamentals demonstrates a substantially lower price-to-earnings ratio, and/or a substantially higher dividend yield.

| | • | | Artisan Partners Limited Partnership (“Artisan”) |

The Artisan mid-cap value strategy employs a bottom-up investment process to construct a diversified portfolio of U.S. mid-cap value companies that Artisan’s mid-cap value investment team believes are undervalued, in solid financial condition and have attractive business economics. Artisan believes companies with these characteristics are less likely to experience eroding values over the long-term.

For the period from September 1, 2011, through August 31, 2012, the Sub-advisers for Large Capitalization Value Equity Investments (“Fund”) were Cambiar Investors, LLC (“Cambiar”), NFJ Investment Group, LLC (“NFJ”), Cullen Capital Management, LLC (“Cullen”), Artisan Partners Limited Partnership (“Artisan”) and HGK Asset Management, Inc. (“HGK”).

The portion of the Fund managed by Cambiar Investors LLC (“Cambiar”) underperformed the Fund’s benchmark, the Russell 1000® Value Index, for the year ended August 31, 2012. Risk aversion and a strong preference for dividend yield were dominant investment themes over the past year; Telecom, Consumer Staples and Utilities were three of the top-performing sectors in the index over this timeframe. Although Cambiar had exposure to companies in these more defensive sectors, such holdings were overshadowed by Cambiar’s higher exposure to cyclical sectors such as Energy, Materials and Technology. As part of Cambiar’s ongoing portfolio reviews, it made select changes where its original thesis was no longer intact, or if a more attractive opportunity presented itself. In other cases, Cambiar continues to stay the course with a given holding – despite underperformance in the short-term. It would be an unforced error to move into Utilities and related safe-haven stocks at this juncture, as the valuations accorded to businesses with perceived stability are very high – relative to their own history as well as to Cambiar’s other holdings. A key element to Cambiar’s investment discipline is mean reversion; at present, many such “bunker” stocks are at or near their historical peak valuations, while many of Cambiar’s positions are trading at levels last seen in the 2008-2009 timeframe. Convergence is likely at some point, with timing likely tied to the abatement in the various macro issues on which the market is currently focused.

The portion of the Fund managed by NFJ outperformed the benchmark for the year ended August 31, 2012. This reporting period was marked by volatile equity returns, as investors were whipsawed by news of U.S. fiscal policy and Europe’s seemingly intractable sovereign debt crisis. Investors kicked off 2012 in a celebratory mood, amid better-than-consensus economic reports and fresh waves of monetary easing in Europe and Asia. As the period commenced, the strategy generally protected on the downside when the market was down, and trailed when the benchmark spiked into double-digit returns. Outperformance can be attributed to strong stock selection, though negative sector weight deviations detracted somewhat from returns. Issue selection was strongest in Financials, Consumer Staples and Information Technology. Stock picks in Industrials and Health Care performed well but lagged those sectors within the benchmark. The strategy’s overweight in Energy and Materials presented a headwind as these sectors delivered the weakest returns in the benchmark due largely to macroeconomic and global growth concerns. NFJ has been overweight in these two sectors as a consequence of finding attractive valuations and sizable defensible yields among many Energy and Materials names. Conversely, NFJ’s underweight in Utilities and Financials was beneficial for the period. During the period, NFJ has found many Utilities securities to be overvalued as investors pile into the sector seeking a replacement for bond yields, while the Financials sector continues to be plagued by unappealing dividends, balance sheet concerns and regulatory uncertainty.

4

| | • | | Cullen Capital Management, LLC (“Cullen”) |

Cullen is a boutique investment adviser who has specialized in value investing since 1983. Cullen utilizes a disciplined approach in constructing investment portfolios. Individual securities are first screened for attractive price to earnings and price to book ratios as well as high absolute dividend yields. Dividend yields, payout ratios and dividend policies of screened securities are then reviewed to ensure the company can maintain and grow the dividend. Additionally, an independent assessment of the company is made through financial analysis, comparative and competitive evaluation, and management capabilities to specifically identify catalysts to encourage above average earnings and dividend growth over the anticipated three-to-five year investment horizon.

| | • | | HGK Asset Management, Inc. (“HGK”) |

HGK invests in undervalued securities through disciplined, fundamentally driven quantitative and qualitative security analysis. This analysis is coupled with a risk adverse approach to portfolio construction. HGK’s value driven domestic equity investment process has been employed in its current form since 1991. The equity team screens for disciplined companies with improving cash flows selling below their discounted present value. Rigorous qualitative fundamental analysis is applied to make the final security selection. During this analysis, the equity team focuses on undervalued companies that operate from a position of competitive advantage and whose management teams understand the principles of shareholder wealth creation.

The portion of the Fund managed by Artisan with an emphasis on midcap value stocks underperformed the Fund’s large cap value benchmark, as well as the Russell Midcap® Value Index, for the year ended August 31, 2012. U.S. mid-cap stocks turned in healthy gains despite persistent worries about Euro zone sovereign debt issues and sluggish economic growth around the world. The bulk of portfolio underperformance during the period was driven by Technology holdings. Artisan remains substantially overweight in the Technology sector due to its belief that the sector represents among the best risk/reward tradeoffs available based on a bottom-up assessment of business economics, balance sheet strength, and valuations. Accordingly, an overweight position in the sector contributed negatively to relative results, as Technology shares were up, but by less than the broader benchmark. Stock selection in the sector was also weak, driven by select holdings. The portfolio’s Energy and Consumer Staples stocks also contributed negatively to relative underperformance. Partially offsetting these weaknesses was strong stock selection in the Industrials, Utilities and Financials sectors. Artisan’s investment team is always mindful of macroeconomic risks and having appropriate economic diversification, but its process is not driven by benchmark sector weights. While this worked against relative results during the period, it is a reminder of how important it is for the team to remain committed to its process and maintain a long-term perspective.

The portion of the Fund managed by Cullen outperformed the Fund’s benchmark for the year ended August 31, 2012. Similar to the experience in 2010 and 2011, a turbulent year led into a strong first quarter of market performance, followed by a volatile and difficult second quarter. Outperformance during the period was primarily attributable to the portfolio’s defensive nature and strong stock selection. Cullen’s adherence to a fundamental, valuation-based methodology that focuses on price discipline, dividend yield and dividend growth has given a significant degree of downside protection during heightened periods of volatility. From an allocation perspective, the portfolio benefitted from its continued overweight to non-cyclical sectors, Consumer Staples and Health Care and underweight to cyclical sectors, Energy, Financials, and Materials. An underweight allocation to Information Technology and Consumer Discretionary was a small detractor as stocks in these sectors were top performers in the first quarter. Stock selection was however the core driver to outperformance, with notable strength in Consumer Staples, Industrials, and Utilities. Since inception, Cullen’s investment team has adhered to a philosophy focused on the long-term prospect of companies trading at attractive valuation levels, have leading market positions, and a strong commitment to enhancing shareholder value through responsible dividend policies.

The portion of the Fund managed by HGK performed in-line with the Fund’s benchmark for the year ended August 31, 2012. The fiscal year was marked by a number of unusual events including Standard and Poor’s credit rating downgrade of U.S. sovereign debt, concerns over global recession, and the potential breakup of Europe’s monetary union. In light of these macroeconomic conditions, the portfolio maintained a relatively defensive sector allocation for most of the year. Despite the Fund’s cautious stance towards the market, the portfolio was able to perform in line with its benchmark due to strong security selection. Security selection in most sectors was positive, though it was most significant in the Financials and Energy sectors. Conversely, on a relative basis, security selection in the Consumer Discretionary sector was the largest detractor, as HGK’s holdings provided strongly positive returns but trailed the benchmark.

HGK continues to maintain a conservatively-positioned portfolio as it finds an exceptional number of high-quality companies with strong balance sheets pricing in unusually conservative expectations. Currently, HGK favors securities in the Technology and Health Care sectors. These securities are supported by attractive valuations, adequately supported dividend yields and relatively inelastic demand for their products.

5

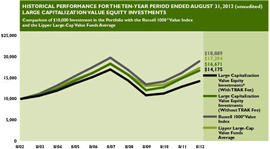

The following graph depicts the performance of the Large Capitalization Value Equity Investments vs. the Russell 1000® Value Index2 and the Lipper Large-Cap Value Funds Average.12

The performance shown above and below represents past performance. Past performance is no guarantee of future results and current performance may be higher or lower than the performance shown above and below. Performance figures may reflect voluntary fee waivers and/or expense reimbursements. In the absence of voluntary fee waivers and/or expense reimbursements, the total return would have been lower. Principal value and investment returns will fluctuate and investors’ shares, when redeemed, may be worth more or less than their original cost. To obtain performance data current to the most recent month-end, please visit our website at www.smithbarney.com.

The graph above and returns shown below do not reflect the deduction of taxes that a shareholder would pay on fund distributions or the redemption of fund shares.

LARGE CAPITALIZATION VALUE EQUITY INVESTMENTS (unaudited)

Average Annual Total Returns for the Period Ended August 31, 2012†

| | | | | | | | |

| | | Without TRAK Fee | | | With TRAK Fee* | |

Since inception (11/18/1991) | | | 7.02 | % | | | 5.36 | % |

10 year | | | 5.24 | | | | 3.55 | |

5 year | | | -1.81 | | | | -3.50 | |

3 year | | | 11.45 | | | | 9.34 | |

1 year | | | 12.50 | | | | 10.27 | |

See pages 26 through 27 for all footnotes.

6

Small Capitalization Growth Investments

ABOUTTHE SUBADVISERS

| | • | | Wall Street Associates (“WSA”) |

WSA follows a bottom-up investment style. It looks for companies with superior earnings growth, strong balance sheets, attractive valuations and potentially positive earning surprises.

| | • | | Westfield Capital Management Company, L.P. (“Westfield”) |

Westfield favors investing in earnings growth stocks given its conviction that stock prices follow earnings progress and that they offer the best opportunity for superior real rates of return. Reasonably priced stocks of companies with high foreseen earnings potential are best identified through in-depth, fundamental research. It is Westfield’s belief that the small capitalization portion of the market is under-researched, and therefore less efficient, than the large capitalization sector.

For the period of September 1, 2011, through August 31, 2012, the Sub-advisers for the CGCM Small Capitalization Growth Investments (“Fund”) were Wall Street Associates (“WSA”), and Westfield Capital Management Company, L.P. (“Westfield”).

The portion of the Fund managed by WSA underperformed the benchmark, the Russell 2000® Growth Index, during the period. Throughout much of the year ended August 31, 2012, equity markets gyrated as recurrent concerns over the expanding Eurozone crisis, worries about how much emerging economies might slow in the coming months, weak jobs reports and “fiscal cliff” fears caused investors’ appetite for risk to wax and wane. The Fund outperformed its benchmark for the first six months of the fiscal year, as the equity market generally moved higher. As spring approached the market swooned and was primarily moved by political and global macro-economic news flow. Investments in the Technology sector provided the greatest contribution to portfolio return, driven by strong stock selection. The portfolio benefitted from exposure to the semiconductor and software groups. Stock selection was also additive in the Consumer Discretionary sector. Specialty Retail, Education, Gaming and Entertainment added to portfolio returns. Investments in the Health Care sector produced double-digit returns and added to performance. Energy stocks declined significantly during the period amid falling commodity prices, abundant supply and curtailed global demand. This group, which had been the top performing sector in the prior fiscal year, declined significantly during the period. Although WSA decreased its exposure to the group, the stocks had a negative impact on portfolio performance.

The portion of the Fund managed by Westfield underperformed the Fund’s benchmark for the year. Portfolio investments within the Information Technology, Materials, and Financials sectors were the most significant positive contributors to relative returns. Health Care was the largest detractor from relative results, while investments within the Industrials and Consumer Discretionary sectors also hindered relative performance. Concerns over a double-dip recession intensified during the second half of 2011, prompting a retreat from all types of higher-risk assets. Investors hid in slower-growth names that provided stable yet predictable earnings growth at higher earnings multiples. Given Westfield’s growth-at-a-reasonable price process, many of these outperformers did not fit its investment criteria, and therefore it had only limited exposure to them. Market dynamics reversed sharply with the start of 2012. A strengthening domestic economy and accommodative monetary policy around the globe helped revive investor appetite for stocks. As the year progressed, the risk-off environment returned and “bond proxies” were again the big outperformers. When searching for new investment candidates, Westfield typically focuses on firms that can deliver consistent organic revenue growth, based on the belief that stellar operational performance will eventually manifest itself in above-average financial performance. Defensive stocks with little-to-no growth are very expensive and have outperformed during the last two years. Westfield continues to see far better risk/rewards in high-quality growth companies reliant on some global GDP growth.

7

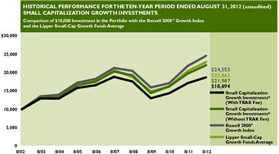

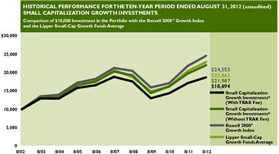

The following graph depicts the performance of Small Capitalization Growth Investments vs. the Russell 2000® Growth Index3 and the Lipper Small-Cap Growth Funds Average.13

The performance shown above and below represents past performance. Past performance is no guarantee of future results and current performance may be higher or lower than the performance shown above and below. Performance figures may reflect voluntary fee waivers and/or expense reimbursements. In the absence of voluntary fee waivers and/or expense reimbursements, the total return would have been lower. Principal value and investment returns will fluctuate and investors’ shares, when redeemed, may be worth more or less than their original cost. To obtain performance data current to the most recent month-end, please visit our website at www.smithbarney.com.

The graph above and returns shown below do not reflect the deduction of taxes that a shareholder would pay on fund distributions or the redemption of fund shares.

SMALL CAPITALIZATION GROWTH INVESTMENTS (unaudited)

Average Annual Total Returns for the Period Ended August 31, 2012†

| | | | | | | | |

| | | Without TRAK Fee | | | With TRAK Fee* | |

Since inception (11/18/1991) | | | 8.45 | % | | | 6.77 | % |

10 year | | | 8.19 | | | | 6.45 | |

5 year | | | 1.62 | | | | -0.14 | |

3 year | | | 15.09 | | | | 12.92 | |

1 year | | | 11.54 | | | | 9.33 | |

See pages 26 through 27 for all footnotes.

8

Small Capitalization Value Equity Investments

ABOUTTHE SUBADVISERS

| | • | | Rutabaga Capital Management, LLC (“Rutabaga”) |

Rutabaga focuses exclusively on micro- and small capitalization stocks and looks to unearth uncommon or currently out-of-favor stocks. The firm’s analysts employ extensive bottom-up fundamental research to identify high quality companies with catalysts to increase margins and intrinsic value but are neglected or misperceived by the market.

| | • | | NFJ Investment Group, LLC (“NFJ”) |

NFJ employs an active management style that invests in a diversified portfolio of small capitalization common stocks that it believes are undervalued in the marketplace generally and within their respective industries. NFJ also considers valuation factors such as price-to-book, price-to-cash flow, dividend policy and industry outlook in selecting stocks for investment.

| | • | | Delaware Management Company (“Delaware”) |

Delaware will invest, under normal market conditions, at least 80% of its net assets, plus any borrowings for investment purposes, in the equity securities of small capitalization companies or in other investments with similar economic characteristics. Delaware will consider small capitalization companies to be companies with market capitalizations not exceeding $3 billion or the highest month-end market capitalization value of any stock in the Russell 2000® Index for the previous 12 months, whichever is greater. Securities of companies whose market capitalizations no longer meet this definition after purchase by the Fund still will be considered to be securities of small capitalization companies for purpose of the Fund’s 80% investment policy. The size of the companies in the Index change with market conditions and the composition of the Index.

For the period September 1, 2011, through August 31, 2012, the Sub-advisers for CGCM Small Capitalization Value Equity Investments (“Fund”) were Rutabaga Capital Management LLC (“Rutabaga”), NFJ Investment Group LLC (“NFJ”), and Delaware Management Company (“Delaware”).

The portion of the Fund managed by Rutabaga substantially outperformed the Fund’s benchmark, the Russell 2000® Value Index, for the year ended August 31, 2012. The portfolio had underperformed the previous fiscal year, primarily as a result of the poor performance of some of Rutabaga’s economically sensitive stocks due to investor concerns about the prospects of another global recession in late 2011 and early 2012. However, the global economy did not collapse and many of those economically sensitive stocks rebounded in late 2011 and into 2012, helping to drive the strong investment performance. Additionally, three of Rutabaga’s top nine performing stocks were acquired by strategic competitors at healthy premiums to their recent stock prices. Over the past twelve months, Rutabaga’s investment team replenished the portfolio with several new investment ideas, and the team feels comfortable with the overall risk/reward of the portfolio.

The portion of the Fund managed by NFJ underperformed the benchmark for the year ended August 31, 2012. The first half of the period presented a difficult environment, as the strategy generally lagged during months characterized by optimistic investor sentiment and strong benchmark returns. During the second half of the period, news of Europe’s seemingly intractable sovereign debt crisis and slowing growth in China drove investors into more defensive and high yielding sectors, causing valuations to jump among many REITs, limited partnerships, and issuers in the Telecommunications and Utilities sectors. Allocations to more attractively valued securities presented a headwind, as macro-economic concerns overshadowed fundamentals. Underperformance can be attributed to negative sector weight deviations and stock selection. Issue selection was strongest in Consumer Discretionary and Consumer Staples. Stock picks lagged in the Industrials and Telecommunications sectors. The strategy’s overweight in Energy and Materials, and underweight in Financials dragged on returns. NFJ has been overweight in these two sectors as a consequence of finding attractive valuations and sizable defensible yields among many Energy and Materials names. The underweight in the Financials sector resulted from the hefty benchmark weight in this sector (over 35%), combined with balance sheet concerns and low yields relative to the rest of the market. Conversely, an underweight in the Information Technology sector contributed to returns.

The portion of the Fund managed by Delaware outperformed the Fund’s benchmark for the year ended August 31, 2012. U.S. economic growth remains subpar following the recession with GDP growth, hovering in the 1.5 – 2.0% range, and unemployment remains above 8.0%. The housing market began to show signs of stability, which Delaware believes should add to GDP growth in future quarters. Corporate profitability and cash flow remain strong, but revenue growth remains subdued. Company balance sheets generally continue to be very solid, with many companies paying down debt and buying back stock and paying dividends. Delaware was again disappointed by the lack of significant merger and acquisition (“M&A”) activity in the companies reflected in its portfolio holdings. However, it still believes that M&A activity could increase as companies gain more clarity on future regulatory and tax policy. The outperformance resulted from strong stock selection in the Consumer Services, Financials, Technology and Basic Industry sectors. Detractors from performance were an underweight position and poor stock selection in REITs and poor stock selection in the Energy sector. In general, stock selection was the most significant factor in the portfolio’s outperformance.

9

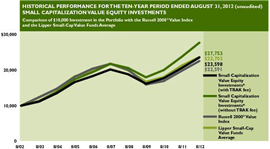

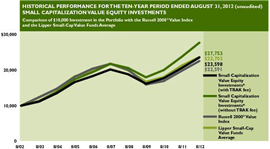

The following graph depicts the performance of Small Capitalization Value Equity Investments vs. the Russell 2000® Value Index4 and the Lipper Small-Cap Value Funds Average.14

The performance shown above and below represents past performance. Past performance is no guarantee of future results and current performance may be higher or lower than the performance shown above and below. Performance figures may reflect voluntary fee waivers and/or expense reimbursements. In the absence of voluntary fee waivers and/or expense reimbursements, the total return would have been lower. Principal value and investment returns will fluctuate and investors’ shares, when redeemed, may be worth more or less than their original cost. To obtain performance data current to the most recent month-end, please visit our website at www.smithbarney.com.

The graph above and returns shown below do not reflect the deduction of taxes that a shareholder would pay on fund distributions or the redemption of fund shares.

SMALL CAPITALIZATION VALUE EQUITY INVESTMENTS (unaudited)

Average Annual Total Returns for the Period Ended August 31, 2012†

| | | | | | | | |

| | | Without TRAK Fee | | | With TRAK Fee* | |

Since inception (11/18/1991) | | | 10.08 | % | | | 8.37 | % |

10 year | | | 10.74 | | | | 8.96 | |

5 year | | | 4.96 | | | | 3.15 | |

3 year | | | 15.54 | | | | 13.36 | |

1 year | | | 16.93 | | | | 14.61 | |

See pages 26 through 27 for all footnotes.

10

International Equity Investments

ABOUTTHE SUBADVISERS

| | • | | Schroder Investment Management North America, Inc. (“Schroder”) |

Schroder uses a bottom-up growth oriented strategy for stock selection. Schroder employs a fundamental, research driven approach to identify quality growth companies with attractive medium-term growth and valuation, quality management and financial position, and a sustainable competitive advantage. Schroder’s concentrated, “best ideas” portfolio blends both core and opportunistic holdings.

| | • | | Philadelphia International Advisors LP (“PIA”) |

PIA utilizes a fundamental bottom-up process and quantitative screening in its approach to international investing. It selects stocks to buy and sell by evaluating a company’s growth outlook and market valuation based on traditional value characteristics, positive company-specific catalysts and other operating and financial conditions. It selects countries primarily by evaluating a country’s valuation ratios such as price-to-earnings and dividend yield, prospective economic growth, government policies and other factors.

| | • | | Thornburg Investment Management, Inc. (“Thornburg”) |

Thornburg employs a bottom-up investment process that seeks to acquire promising companies with sound business fundamentals at a time when their intrinsic value is not fully recognized by the marketplace. Thornburg’s idea of value centers on its assessment of the intrinsic worth of an investment, as compared to today’s price, based on intensive fundamental research.

| | • | | Marsico Capital Management, LLC (“Marsico”) |

Marsico uses an approach that combines top-down macroeconomic analysis with bottom-up stock selection. The top-down approach takes into consideration such macro-economic factors as interest rates, inflation, demographics, the regulatory environment and the global competitive landscape. In determining whether a particular company may be a suitable investment, Marsico may focus on any of a number of different attributes that may include the company’s specific market expertise or dominance; its franchise durability and pricing power; solid fundamentals; strong and ethical management; commitment to shareholder interests; and reasonable valuations in the context of projected growth rates.

For the period of September 1, 2011, through August 31, 2012, the Sub-advisers for CGCM International Equity Investments (“Fund”) were Schroder Investment Management North America Inc. (“Schroder”), Philadelphia International Advisors LP (“PIA”), Thornburg Investment Management, Inc. (“Thornburg”) and Marsico Capital Management, LLC (“Marsico”).

The portion of the Fund managed by Schroder during the year ended August 31, 2012, was in-line with the Fund’s benchmark, the MSCI EAFE® Index. Markets began the period with extreme volatility, as the Eurozone’s debt problems reached crisis point. For the remainder of the period, markets swung between optimism and disappointment regarding the region. International markets ended the period broadly flat, helped by central bank policies and a summer rally. Performance in Utilities was the largest source of added value by sector. Investors valued more stable growth opportunities given the turbulent market conditions. Exposure to Information Technology was also rewarding. Performance in Materials was the main detractor. The slowdown in global growth and in China in particular, weighed on the portfolio’s mining stocks as investors worried about the strength of demand for raw materials. Schroder has continued to pursue companies which, irrespective of the short-term market uncertainties, are benefiting from longer-term global trends. The portfolio is balanced between growth defensives and more cyclical industries, and Schroder’s trading activity has, as ever, focused on stock-specific situations where it feels there is potential for good growth, valuation upside and catalysts ahead.

The portion of the Fund managed by PIA underperformed the Fund’s benchmark during the year ended August 31, 2012. The majority of the PIA’s relative underperformance can be attributed to stock selection in the Industrials and Financials sectors. While Financials stocks overall held up reasonably well over the course of the year, results within the sector were quite mixed. Insurance companies outperformed the index; however, these positive results were overshadowed by poor performance within European bank holdings. Volatile markets driven in large part to the European sovereign debt crisis, combined with economic uncertainty, have led to a flight to safety and as such, the defensively oriented Consumer Staples and Health Care sectors significantly outperformed the overall market. The portfolio’s underweight positions within these sectors, particularly in the richly priced Consumer Staples, also had a negative impact on returns. Holdings within the UK, Canada, and Korea performed well. The portfolio’s modest exposure to emerging markets, which underperformed their develop market counterparts, weighed on returns; however, the allocation to international small cap stocks aided returns on both an absolute and relative basis.

The portion of the Fund managed by Thornburg performed in-line with the Fund’s benchmark for the year ended August 31, 2012. Concerns about the fate of the euro zone, slowing growth in China, and muted U.S. economic recovery weighed on markets during the period. This led investors to seek safety in more defensively oriented stocks. Allocation and currency effect were positive relative to the benchmark, but the impact of stock selection offset these gains. Stock selection in the Consumer Discretionary sector and an underweight allocation in the Materials sector, the worst-performing sector in the benchmark, helped the portfolio during the period. In addition, underweight positions in Japan and Spain contributed to relative performance. Stock selection in the Financials, Energy, and Information Technology sectors were the main drag on portfolio performance during the period. Three of the top five detractors came from these sectors. The European financial crisis and potential hard landing in China weighed on the Financials sector, particularly European and Chinese bank holdings. Emerging market stocks also detracted from relative performance, particularly in Russia and Taiwan. While is it not possible to know the magnitude and duration of global economic headwinds, Thornburg has constructed the portfolio to avoid some of the more likely and severe downside risks in Europe. With its bottom-up investment process, Thornburg will continue to evaluate opportunities one stock at a time, and balance the portfolio accordingly across our three baskets: basic values, consistent earners, and emerging franchises.

11

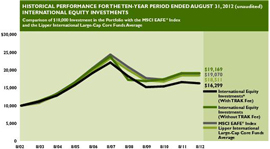

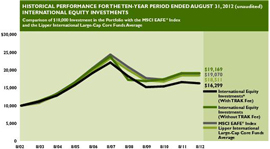

The following graph depicts the performance of International Equity Investments vs. the MSCI EAFE® Index5 and the Lipper International Large-Cap Core Funds Average.15

The portion of the Fund managed by Marsico outperformed the Fund’s benchmark for the year ended August 31, 2012. Stock selection in a number of sectors had a positive effect on performance. In particular, stock selection in the Information Technology, Consumer Staples and Industrials sectors was strong. Several of Marsico’s Information Technology holdings also posted solid gains. An underweight allocation to the weak-performing Materials sector benefited performance relative to the benchmark. The Fund also benefited from currency effect. In particular, an underweighted posture to equities denominated in the weak-performing euro added to returns. An overweight allocation to the weak-performing Information Technology sector and no exposure to Utilities, the strongest-performing sector in the benchmark, hampered performance.

The performance shown above and below represents past performance. Past performance is no guarantee of future results and current performance may be higher or lower than the performance shown above and below. Performance figures may reflect voluntary fee waivers and/or expense reimbursements. In the absence of voluntary fee waivers and/or expense reimbursements, the total return would have been lower. Principal value and investment returns will fluctuate and investors’ shares, when redeemed, may be worth more or less than their original cost. To obtain performance data current to the most recent month-end, please visit our website at www.smithbarney.com.

The graph above and returns shown below do not reflect the deduction of taxes that a shareholder would pay on fund distributions or the redemption of fund shares.

INTERNATIONAL EQUITY INVESTMENTS (unaudited)

Average Annual Total Returns for the Period Ended August 31, 2012†

| | | | | | | | |

| | | Without TRAK Fee | | | With TRAK Fee* | |

Since inception (11/18/1991) | | | 5.08 | % | | | 3.46 | % |

10 year | | | 6.72 | | | | 5 | |

5 year | | | -4.3 | | | | -5.95 | |

3 year | | | 4.25 | | | | 2.29 | |

1 year | | | -0.06 | | | | -2.04 | |

See pages 26 through 27 for all footnotes.

12

Emerging Markets Equity Investments

ABOUTTHE SUBADVISERS

| | • | | SSgA Funds Management, Inc. (“SSgA”) |

SSgA uses quantitative analysis to identify countries and stocks which are undervalued relative to their growth rates. It employs an investment process that combines top-down country selection with bottom-up stock selection to determine an optimal country and security mix.

| | • | | Newgate Capital Management, LLC (“Newgate”) |

Newgate seeks long-term growth of capital by using a top-down value approach to identify undervalued countries, regions and sectors. Newgate incorporates geopolitical and macroeconomic factors into its strategy through fundamental quantitative analysis and more than 150 years combined investment experience of its professionals.

| | • | | Lazard Asset Management, LLC (“Lazard”) |

Lazard, an indirect, wholly-owned subsidiary of Lazard Ltd., is known for its global perspective on investing and years of experience with global, regional and domestic portfolios. With more than 235 investment personnel worldwide, Lazard offers investors of all types an array of equity, fixed income, and alternative investment solutions from its network of local offices in ten different countries. Its team-based approach to portfolio management helps Lazard to deliver robust and consistent performance over time, and strong client relationships allow them to understand how to employ their capabilities to its clients’ advantage.

For the period of September 1, 2011, through August 31, 2012, the Sub-advisers for the CGCM Emerging Markets Equity Investments (“Fund”) were SSgA Funds Management, Inc. (“SSgA”), Newgate Capital Management LLC (“Newgate”), and Lazard Asset Management LLC (“Lazard”).

The portion of the Fund managed by SSgA underperformed the Fund’s benchmark, the MSCI Emerging Markets Index, for the year ended August 31, 2012. The Fund utilizes both a country selection and a stock selection model in its investment process. The underperformance of the portfolio over the year was largely a result of stock selection, while country selection was only marginally negative. The drivers of this underperformance were various positions in Taiwan, China, Poland and Brazil. Stock selection in these countries was quite weak, and the model was not able to determine in which names to invest. In some of the smaller countries, such as Poland and Malaysia, SSgA’s portfolio was hurt by both its country positioning and stock selection within those countries. SSgA’s stock selection in Korea contributed positively to overall performance, Korea has a breadth of names that can positively impact the portfolio. Additionally, the Fund benefitted from its overweight position in Thailand. The Thai market has been one of the best-performing Asian markets, as its domestic economy has been resilient in the face of the global slowdown. The year ended August 31, 2012, was difficult due to the risk-on/risk-off theme that has dominated global markets. As the year progressed, it became increasingly evident that economic activity in the United States, the Eurozone and China slowed significantly. Emerging markets investors faced and will continue to face policy-driven markets, with the risk-on/risk-off trade leading to choppy trading. The Eurozone crisis impacts emerging markets via several channels: trade, investment, commodities and finance. The Europe/Middle East/Africa region will be the most seriously affected region in emerging markets should the Eurozone recession intensify. Earnings revisions in emerging markets have been negative in recent months, but earnings were expected to grow by +12% in 2012 and +15.5% in 2013. At fiscal year-end, emerging equities traded at roughly 9.4 times next 12-month earnings. A high degree of policy uncertainty continues to characterize the global economy, and in general, a “flight to safety” to the U.S. dollar is not emerging market friendly.

The portion of the Fund managed by Newgate underperformed the Fund’s benchmark for the year ended August 31, 2012. Newgate employs a top-down, thematic approach to investing that seeks to find undervalued companies given its view on the global economy and other geopolitical considerations. At the beginning of the period, the portfolio was positioned for modest economic expansion, with a substantial weighting in materials stocks and in countries where natural resources are central to the economy and market returns, especially Brazil. Newgate’s “more optimistic than most” view proved correct for the first seven months of the year. However, as the Chinese economy slowed and economic considerations regarding Europe and the United States began to weigh heavily on investor sentiment, equity prices faltered and materials positions underperformed the markets. Newgate reduced allocations to Materials companies, resulting in less exposure to Brazil and China. The portfolio continues to hold Materials, but with greater concentration in gold stocks and less reliance on copper and coal stocks that are highly correlated with the global economy. Newgate’s allocation to Chinese companies was the largest detractor from benchmark-relative performance. Newgate believes that the market has overreacted to an economic slowdown that was thoroughly telegraphed by the government, and also believes that the government has the policy tools necessary to prevent further economic deterioration. Newgate ended the new fiscal year with an overallocation to India and Korea and a reduced, though still overweight, allocation to Chinese equities.

13

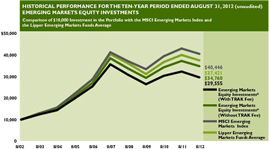

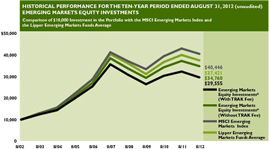

The following graph depicts the performance of Emerging Markets Equity Investments vs. the MSCI Emerging Markets Index6 and the Lipper Emerging Markets Funds Average.16

The portion of the Fund managed by Lazard outperformed the Fund’s benchmark for the year ended August 31, 2012. Equities in the developing world were buffeted by investor concerns over a European sovereign debt default. This ultimately resulted in relatively little change in the markets. The benchmark declined by approximately -5.5%, in U.S. dollar terms, with Asian stocks performing considerably better than either eastern European equities or Latin American shares. Latin American markets diverged dramatically with Brazilian shares selling off heavily due to risk aversion. Mexican and Colombian equities finished higher during the period, aided by decent earnings. The Consumer Staples, Health Care, Information Technology, and Telecom Services sectors performed relatively well. The Materials, Energy, and Industrials sectors underperformed the benchmark. Stock selection in the Telecom Services and Consumer Staples sectors, as well as in Brazil, Russia, and South Africa, benefited performance. A higher-than-benchmark exposure to Turkey also helped performance. On the other hand, exposure to Argentina (which is not a constituent country of the benchmark) hurt performance.

The performance shown above and below represents past performance. Past performance is no guarantee of future results and current performance may be higher or lower than the performance shown above and below. Performance figures may reflect voluntary fee waivers and/or expense reimbursements. In the absence of voluntary fee waivers and/or expense reimbursements, the total return would have been lower. Principal value and investment returns will fluctuate and investors’ shares, when redeemed, may be worth more or less than their original cost. To obtain performance data current to the most recent month-end, please visit our website at www.smithbarney.com.

The graph above and returns shown below do not reflect the deduction of taxes that a shareholder would pay on fund distributions or the redemption of fund shares.

EMERGING MARKETS EQUITY INVESTMENTS (unaudited)

Average Annual Total Returns for the Period Ended August 31, 2012†

| | | | | | | | |

| | | Without TRAK Fee | | | With TRAK Fee* | |